UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4474

Name of Registrant: Vanguard California Tax-Free Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2011 – May 31, 2012

Item 1: Reports to Shareholders

Semiannual Report | May 31, 2012

Vanguard California Tax-Exempt Funds

Vanguard California Tax-Exempt Money Market Fund

Vanguard California Intermediate-Term Tax-Exempt Fund

Vanguard California Long-Term Tax-Exempt Fund

> For the six months ended May 31, 2012, Vanguard California Tax-Exempt Money Market Fund returned 0.02%, reflecting the Federal Reserve’s policy of low interest rates.

> Investor Shares of Vanguard California Intermediate-Term Tax-Exempt Fund returned 5.79%, while the Admiral Shares returned 5.83%, well ahead of the return of the fund’s benchmark and the average return of its peers.

> For the Vanguard California Long-Term Tax-Exempt Fund, Investor Shares returned 7.25% and Admiral Shares returned 7.29%. These results were better than the return of the fund’s benchmark but lagged the average return of its peer group.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 9 |

| California Tax-Exempt Money Market Fund. | 12 |

| California Intermediate-Term Tax-Exempt Fund. | 31 |

| California Long-Term Tax-Exempt Fund. | 69 |

| About Your Fund’s Expenses. | 95 |

| Trustees Approve Advisory Agreement. | 97 |

| Glossary. | 98 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Vanguard was named for the HMS Vanguard, flagship of British Admiral Horatio Nelson. A ship—whose performance and safety depend on the work of all hands—has served as a fitting metaphor for the Vanguard crew as we strive to help clients reach their financial goals.

Your Fund’s Total Returns

| | | | | |

| Six Months Ended May 31, 2012 | | | | | |

| | | Taxable- | | | |

| | SEC Equivalent | Income | Capital | Total |

| | Yields | Yields | Returns | Returns | Returns |

| Vanguard California Tax-Exempt Money Market | | | | | |

| Fund | 0.05% | 0.09% | 0.02% | 0.00% | 0.02% |

| California Tax-Exempt Money Market Funds | | | | | |

| Average | | | | | 0.00 |

| California Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper Inc. |

| Vanguard California Intermediate-Term Tax-Exempt Fund | | | | |

| Investor Shares | 1.79% | 3.07% | 1.76% | 4.03% | 5.79% |

| Admiral™ Shares | 1.87 | 3.21 | 1.80 | 4.03 | 5.83 |

| Barclays Municipal California Intermediate Bond | | | | | |

| Index | | | | | 5.13 |

| California Intermediate Municipal Debt Funds | | | | | |

| Average | | | | | 4.79 |

| California Intermediate Municipal Debt Funds Average: Derived from data provided by Lipper Inc. |

| Vanguard California Long-Term Tax-Exempt Fund | | | | | |

| Investor Shares | 2.55% | 4.37% | 2.09% | 5.16% | 7.25% |

| Admiral Shares | 2.63 | 4.51 | 2.13 | 5.16 | 7.29 |

| Barclays CA Municipal Bond Index | | | | | 6.48 |

| California Municipal Debt Funds Average | | | | | 8.38 |

California Municipal Debt Funds Average: Derived from data provided by Lipper Inc.

7-day SEC yield for the California Tax-Exempt Money Market Fund; 30-day SEC yield for the California Intermediate-Term Tax-Exempt Fund and California Long-Term Tax-Exempt Fund.

The calculation of taxable-equivalent yield assumes a typical itemized tax return and is based on the maximum federal tax rate of 35% and the maximum income tax rate for the state. Local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

1

Chairman’s Letter

Dear Shareholder,

The California municipal bond market turned in a strong performance for the six months ended May 31, 2012, outpacing the broad U.S. taxable bond market by around 3 percentage points even as the fiscal situation of the state and local governments remained challenging.

For the half-year, Vanguard California Intermediate-Term Tax-Exempt Fund returned 5.79% for Investor Shares and 5.83% for Admiral Shares. Over the same period, Vanguard California Long-Term Tax-Exempt Fund returned 7.25% for Investor Shares and 7.29% for Admiral Shares. Both funds’ holdings in longer bonds, where investor demand was especially strong, helped them outpace their benchmarks, which returned 5.13% and 6.48%, respectively. While the intermediate fund outpaced the 4.79% average return of its peer group as well, the long-term fund’s focus on higher-quality bonds led it to underperform its peer group’s average return of 8.38%.

Because of the Federal Reserve’s efforts to keep short-term interest rates anchored near zero, returns were far more modest for shorter-term securities, especially money market instruments. Vanguard California Tax-Exempt Money Market Fund returned 0.02%, compared with the 0.00% average return of its state peer group for the half-year.

2

Lower-quality and longer-maturity bonds performed best, as many investors were willing to take on greater credit and interest rate risk for more potential yield. As a result of the solid demand for munis, capital appreciation accounted for more than two-thirds of the Intermediate- and Long-Term Funds’ total returns.

As bond prices rose, the 30-day SEC yield for the Intermediate-Term Fund’s Investor Shares fell to 1.79% by May 31, from 2.63% six months earlier. The figures were 2.55% versus 3.42% for the Long-Term Fund’s Investor Shares. (Bond yields and prices move in opposite directions.) The Money Market Fund’s 7-day SEC yield of 0.05% on May 31 was a bit higher than the 0.01% yield of a half-year earlier.

Please note that in March we replaced the benchmark indexes for the California Intermediate-Term Tax-Exempt Fund and the California Long-Term Tax-Exempt Fund. The new indexes are better gauges for the funds because, unlike the prior benchmarks, they are limited to tax-exempt bonds from California issuers. There are no changes to the funds’ objectives, investment strategies, or policies.

All three funds are permitted to invest in securities whose income is subject to the alternative minimum tax (AMT). As of May 31, neither the Intermediate-Term nor the Long-Term Fund owned securities that would generate income distributions subject to the AMT, but the Money Market Fund did.

| | | |

| Market Barometer | | | |

| | | | Total Returns |

| | | Periods Ended May 31, 2012 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable | | | |

| market) | 3.46% | 7.12% | 6.72% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 5.75 | 10.40 | 5.87 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.02 | 0.04 | 0.95 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 6.23% | -1.23% | -0.75% |

| Russell 2000 Index (Small-caps) | 4.06 | -8.88 | -0.73 |

| Dow Jones U.S. Total Stock Market Index | 6.06 | -1.88 | -0.45 |

| MSCI All Country World Index ex USA (International) | -4.04 | -20.49 | -5.55 |

| |

| CPI | | | |

| Consumer Price Index | 1.58% | 1.70% | 2.02% |

3

Bonds benefited from investors

seeking safety and yields

California municipal bonds’ return of more than 6% was well ahead of the broad U.S. taxable bond market’s return of about 3.5% for the half-year.

The yields of U.S. Treasury bonds, which flirted with higher levels early in the period, reached record lows by the end of the six months as some investors fled to the perceived safety of government-issued securities, helping them post a solid return of just under 3%. At the same time, corporate bonds, which found favor with investors seeking higher yields, returned well over 6%.

U.S. stocks significantly outpaced

their international counterparts

The six months ended May 31 were marked by volatility in a pattern that has become all too familiar. At the start of the period, global stock markets rose as the U.S. economy seemed to be strengthening and Europe experienced a temporary lull in its debt crisis.

Stocks later reversed course amid news of dwindling economic growth at home and trouble abroad as Europe’s debt drama once again intensified, causing renewed concern among investors. Despite erasing some earlier gains, U.S. stocks returned more than 6% for the six months.

Expense Ratios

Your Fund Compared With Its Peer Group

| | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| California Tax-Exempt Money Market | | | |

| Fund | 0.17% | — | 0.29% |

| California Intermediate-Term | | | |

| Tax-Exempt Fund | 0.20 | 0.12% | 0.82 |

| California Long-Term Tax-Exempt Fund | 0.20 | 0.12 | 0.98 |

The fund expense ratios shown are from the prospectus dated March 28, 2012, and represent estimated costs for the current fiscal year. For the six months ended May 31, 2012, the funds’ annualized expense ratios were: for the California Tax-Exempt Money Market Fund, 0.15%; for the California Intermediate-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares; and for the California Long-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares. The six-month expense ratio for California Tax-Exempt Money Market Fund reflects a temporary reduction in operating expenses (described in Note B of the Notes to Financial Statements). Before this reduction, the fund’s annualized six-month expense ratio was 0.16%. Peer-group expense ratios are derived from data provided by Lipper Inc. and capture information through year-end 2011.

Peer groups: For the California Tax-Exempt Money Market Fund, California Tax-Exempt Money Market Funds; for the California Intermediate-Term Tax-Exempt Fund, California Intermediate Municipal Debt Funds; for the California Long-Term Tax-Exempt Fund, California Municipal Debt Funds.

4

International stocks didn’t fare as well, returning about –4% for the half-year. European companies were the worst performers. Concerns focused on Greece and Spain, but healthier markets throughout Europe felt the effects of resurgent investor worries about indebtedness. Emerging markets and the developed markets of the Pacific region were also hurt by signs of slowing growth.

For municipal bonds, rising supply

was matched by increased demand

The severity of the Great Recession has left the finances of many state and local governments in disarray. The sharp drop in tax revenues had these entities scrambling to make similar cuts to their expenditures, ratcheting up uncertainty in some quarters about their creditworthiness. The situation has remained strained, especially for local governments, because they depend heavily on property tax revenues. Such revenues have continued to fall as they respond with a lag to the declines seen in property values. Many states are also cutting back on their aid to local governments as they try to get their own financial houses in order.

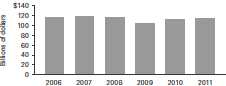

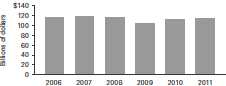

However, overall tax revenues have continued the upward, if uneven, trend that began in 2010 for most states, according to data from The Nelson A. Rockefeller Institute of Government. During the past six months, the U.S. economy inched forward, the employment situation showed some improvement, and consumer spending ticked up, all of which helped drive tax revenues higher for many states, including the Golden State (see the accompanying chart).

At the same time, California state and local governments have shied away from initiating significant new spending projects. Although issuance of municipal bonds increased significantly from a year earlier, much of this issuance refinanced existing debt at lower rates of interest. States and municipalities benefit from refinancing because it reduces their debt servicing costs.

While overall supply rose in the California municipal bond market, so too did demand. The hunt for yield spurred many investors to move into bonds with longer maturities (despite the potential for sharp declines in price should interest rates rise) and lower credit ratings.

California tax revenues are recovering

Sources: Vanguard and The Nelson A. Rockefeller Institute of Government.

5

Yields—particularly for long-term issues—hit levels that made municipal bonds attractive even to unconventional investors such as banks.

The outperformance of longer-maturity bonds supported the Intermediate- and Long-Term Funds relative to their benchmarks during the period. Demand for the substantially higher yields offered by these bonds drove their prices up, which translated into capital appreciation for the funds.

Another contributor to the funds’ relative performance was their exposure to essential-service bonds, such as those that finance water and sewer treatment facilities, which benefit from a consistent income stream dedicated to servicing the debt. (Their general-obligation counterparts, which depend on general tax revenues, are more affected by economic cycles.) The funds also benefited from their holdings in the health care sector, especially hospital bonds, where the funds’ advisor saw attractive returns for the level of risk involved.

As I mentioned earlier, the Long-Term Fund’s performance for the period was held back somewhat by its orientation toward higher-quality securities.

During the six months under review, the advisor maintained its systematic and rigorous approach to assessing the credit quality of each security considered for purchase. With hundreds of issuers in this fragmented market, such fundamental credit analysis remained critical in determining where the best opportunities might be for the advisor to add value to the funds.

With yields so low for so long,

what’s a bond investor to do?

Bond yields sure aren’t what they used to be. Those of some Treasuries hit all-time lows during the past six months, and municipal bond yields fell to levels not seen since the 1960s. This is unhappy news for investors who count on bond income for their spending needs.

An alternative approach to the income question is based on “total return.” With this approach, you rely not only on income from your holdings but on cash realized by selling some of them according to a careful plan. The goal is to maintain your preferred asset mix and, thus, a more diversified and stable risk profile. An income-only spending strategy, by contrast, can lead you to tilt your asset mix away from your target in favor of bonds and narrow segments of the stock market, such as stocks with high dividend yields.

For more information on this topic, you may want to read the Vanguard research paper Spending From a Portfolio: Implications of a Total-Return Approach Versus an Income Approach for Taxable Investors. It is available at vanguard.com/ research.

6

Whether yields are high or low, rising or falling, we believe that holding bonds in a portfolio is always useful. They are there to help cushion volatility when, not if, more risky assets such as stocks happen to perform poorly.

As always, thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

June 15, 2012

7

Your Fund’s Performance at a Glance

November 30, 2011, Through May 31, 2012

| | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard California Tax-Exempt Money Market | | | | |

| Fund | $1.00 | $1.00 | $0.000 | $0.000 |

| Vanguard California Intermediate-Term | | | | |

| Tax-Exempt Fund | | | | |

| Investor Shares | $11.18 | $11.63 | $0.194 | $0.000 |

| Admiral Shares | 11.18 | 11.63 | 0.199 | 0.000 |

| Vanguard California Long-Term Tax-Exempt | | | | |

| Fund | | | | |

| Investor Shares | $11.24 | $11.82 | $0.231 | $0.000 |

| Admiral Shares | 11.24 | 11.82 | 0.235 | 0.000 |

8

Advisor’s Report

For the six months ended May 31, 2012, Vanguard California Tax-Exempt Money Market Fund returned 0.02%. Vanguard California Long-Term Tax-Exempt Fund returned 7.25% for Investor Shares and 7.29% for Admiral Shares. The Long-Term Fund outpaced its new benchmark index, which returned 6.48%, but lagged the 8.38% average return of peer-group funds. Vanguard California Intermediate-Term Tax-Exempt Fund returned 5.79% for Investor Shares and 5.83% for Admiral Shares, ahead of both the 5.13% return of its new benchmark index and the 4.79% average return of peer-group funds. (The new benchmarks are discussed in the Chairman’s Letter.)

The investment environment

The half-year saw generally declining yields in the municipal bond market. The Federal Reserve continued to anchor the shortest-term yields near zero and reiterated its view that rates would remain very low through late 2014. The most direct impact of this policy, of course, has been on money market funds, including the California Tax-Exempt Money Market Fund. At the opposite end of the maturity spectrum, the Fed continued to execute a bond-buying program aimed at lowering longer-term yields. (Yields fall as demand for bonds rises, boosting prices.)

Economic concerns also contributed to the slide in yields. Investors nervous about the uneven pace of U.S. economic growth and the further unraveling of Europe’s fiscal

Yields of Tax-Exempt Municipal Securities

(AAA-Rated General-Obligation Issues)

| | |

| | November 30, | May 31, |

| Maturity | 2011 | 2012 |

| 2 years | 0.42% | 0.33% |

| 5 years | 1.12 | 0.75 |

| 10 years | 2.22 | 1.79 |

| 30 years | 3.84 | 3.08 |

| Source: Vanguard. |

9

situation fled to the perceived safety of U.S. Treasury securities and municipal bonds. Moreover, demand for municipal bonds has been robust since early 2011, when the muni market recovered from a five-month slide in prices and a wave of fund withdrawals accompanied by overblown fears of systemic defaults.

Patient investors in the California Long-Term and Intermediate-Term Tax-Exempt Funds have done well since then: From January 31, 2011, to May 31, 2012, the Long-Term Fund returned about 18% and the Intermediate-Term Fund 15%, compared with about 10% for taxable bonds and not quite 4% for stocks (based on the Barclays U.S. Aggregate Bond Index and the Dow Jones U.S. Total Stock Market Index).

Municipal bonds’ strong performance took place as most state and local governments continued to wrestle with finances tattered by the Great Recession. Although the state passed its fiscal 2012 budget (ended June 30) on time—a first in many years because of new legislative powers—budgeted revenues have failed to materialize. Overly optimistic assumptions were a factor, even as California’s economy appears to be recovering at about the same pace as the nation’s. According to a gauge of current economic conditions for each state that is published by the Federal Reserve Bank of Philadelphia, the California economy improved by 6% from its low point in November 2009 through May 2012, a figure almost identical to that for the national economy. (The index combines data on jobs, manufacturing, and wages and salaries.)

An extra element of uncertainty surrounds the fiscal 2013 budget: In November Californians must decide whether to vote for a temporary tax increase aimed at closing the budget gap; if rejected, automatic spending cuts, mostly in school funding, will be triggered. (A rejection won’t impair the payment streams for school-district general obligation bonds, although there may be negative rating implications.)

Like many other issuers nationwide, California state and local governments are taking advantage of low interest rates to call in (redeem early) and replace higher-interest bonds; at the same time, they are limiting outlays for new projects, resulting in lighter bond issuance than in previous years. Nationally, during the six months ended May 31, about two-thirds of the $160 billion in new issues were refin-ancings, compared with an average of one-third over the 15 years through 2010.

Management of the funds

As the Federal Reserve’s operations at both ends of the maturity spectrum lowered yields, many muni investors grew willing to accept greater risk to obtain higher yields. Many have turned to high-yield municipal bonds, exposing themselves to greater credit risk, while others have moved to longer-maturity munis, which would respond with greater price declines should interest rates rise. It’s a phenomenon we

10

would normally look for in the later stages of an economic recovery, when the typical pace of expansion would be stronger, state and local finances healthier, and confidence higher.

Nonetheless, the Long-Term and Intermediate-Term Funds have benefited from this market environment. The demand for longer-term bonds has boosted the prices of holdings in our portfolio. We have also taken advantage of the steep yield curve—that is, the wide difference between shorter- and longer-term yields that has resulted from the Fed’s policies—by underweighting bonds with maturities of 1–5 years and overweighting bonds with maturities of 10–15 years. A steep yield curve can produce price gains as bonds move closer to their maturity.

In all market conditions, of course, in-depth credit analysis is a key aspect of our process. In selecting bonds to add to or sell from our portfolios, we combine our traders’ focus on finding value with our credit analysts’ prudent views about the financial structure and economic environment of issuers.

Two broad themes in the current market are an emphasis on essential-service bonds and a move away from local-government general-obligation issues, although there are always exceptions. For example, our analysts have identified highly rated general obligation bonds issued by local governments that, while under stress, have been minimally affected by the decline in property tax revenue and cutbacks in state aid. In addition, we have focused on attractively valued issues in health care, with an emphasis on hospitals.

The offerings in which we’ve participated during the reporting period have included those of the Sutter, Stanford, and Kaiser Permanente health care systems. Among other performance drivers was an emphasis on premium bonds with call features. These bonds can provide added income given the level of risk, and can be less vulnerable to volatility should interest rates rise.

As we noted earlier, the Fed has tamped down short-term interest rates to an unprecedented degree, a policy that has understandably concerned shareholders in the California Tax-Exempt Money Market Fund. Despite the difficulties presented by near-zero yields, we have not altered our strategy of emphasizing investment in high-quality money market assets. At the same time, the low short-term rates have provided another source of debt-service savings to fiscally stressed state and local governments.

James M. D’Arcy, Portfolio Manager

Pamela Wisehaupt Tynan, Principal, Head of Municipal Money Market Funds

Christopher W. Alwine, CFA, Principal, Head of Municipal Bond Funds

Vanguard Fixed Income Group

June 20, 2012

11

California Tax-Exempt Money Market Fund

Fund Profile

As of May 31, 2012

| |

| Financial Attributes | |

| Ticker Symbol | VCTXX |

| Expense Ratio1 | 0.17% |

| 7-Day SEC Yield | 0.05% |

| Average Weighted | |

| Maturity | 26 days |

| |

| Distribution by Credit Quality (% of portfolio) | |

| First Tier | 100.0% |

| For information about these ratings, see the Glossary entry for Credit Quality. |

| |

1 The expense ratio shown is from the prospectus dated March 28, 2012, and represents estimated costs for the current fiscal year. For the six months ended May 31, 2012, the annualized expense ratio was 0.15%. For the six months ended May 31, 2012, the annualized expense ratio was 0.15%, reflecting a temporary reduction in operating expenses (described in Note B of the Notes to Financial Statements). Before this reduction, the expense ratio was 0.16%.

12

California Tax-Exempt Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

| | |

| Fiscal-Year Total Returns (%): November 30, 2001, Through May 31, 2012 | |

| | | CA Tax-Exempt |

| | | Money Mkt |

| | | Funds Avg |

| Fiscal Year | Total Returns | Total Returns |

| 2002 | 1.33% | 0.92% |

| 2003 | 0.91 | 0.54 |

| 2004 | 1.05 | 0.60 |

| 2005 | 2.17 | 1.70 |

| 2006 | 3.24 | 2.78 |

| 2007 | 3.55 | 3.06 |

| 2008 | 2.21 | 1.81 |

| 2009 | 0.37 | 0.17 |

| 2010 | 0.11 | 0.01 |

| 2011 | 0.07 | 0.01 |

| 2012 | 0.02 | 0.00 |

7-day SEC yield (5/31/2012): 0.05% California Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper Inc.

Note: For 2012, performance data reflect the six months ended May 31, 2012.

Average Annual Total Returns: Periods Ended March 31, 2012

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| California Tax-Exempt Money | | | | |

| Market Fund | 6/1/1987 | 0.03% | 1.02% | 1.45% |

See Financial Highlights for dividend information.

13

California Tax-Exempt Money Market Fund

Financial Statements (unaudited)

Statement of Net Assets

As of May 31, 2012

The fund reports a complete list of its holdings in various monthly and quarterly regulatory filings. The fund publishes its holdings on a monthly basis at vanguard.com and files them with the Securities and Exchange Commission on Form N-MFP. The fund’s Form N-MFP filings become public 60 days after the relevant month-end, and may be viewed at sec.gov or via a link on the “Portfolio Holdings” page on vanguard.com. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (103.1%) | | | | |

| California (103.1%) | | | | |

| ABAG Finance Authority for | | | | |

| Nonprofit Corps. California Revenue | | | | |

| (Francis Parker School Project) | | | | |

| VRDO | 0.170% | 6/7/12 LOC | 17,315 | 17,315 |

| ABAG Finance Authority for | | | | |

| Nonprofit Corps. California Revenue | | | | |

| (Institute for Defense Analyses) VRDO | 0.160% | 6/7/12 LOC | 11,945 | 11,945 |

| ABAG Finance Authority for | | | | |

| Nonprofit Corps. California Revenue | | | | |

| (Lakeside Village Apartments) VRDO | 0.140% | 6/7/12 LOC | 12,000 | 12,000 |

| ABAG Finance Authority for | | | | |

| Nonprofit Corps. California Revenue | | | | |

| (Public Policy Institute) VRDO | 0.180% | 6/7/12 LOC | 12,705 | 12,705 |

| Anaheim CA Housing Finance Agency | | | | |

| Home Mortgage Revenue VRDO | 0.180% | 6/7/12 LOC | 5,485 | 5,485 |

| 1 Anaheim CA Public Financing Authority | | | | |

| Lease Revenue (Anaheim Public | | | | |

| Improvements Project) TOB VRDO | 0.170% | 6/7/12 LOC | 47,115 | 47,115 |

| 1 Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) TOB PUT | 0.300% | 1/23/13 | 9,865 | 9,865 |

| 1 Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) TOB VRDO | 0.180% | 6/7/12 | 43,340 | 43,340 |

| 1 Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) TOB VRDO | 0.250% | 6/7/12 | 5,000 | 5,000 |

| Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) VRDO | 0.130% | 6/7/12 LOC | 17,280 | 17,280 |

| Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) VRDO | 0.140% | 6/7/12 LOC | 87,500 | 87,500 |

| Bay Area Toll Authority California Toll Bridge | | | | |

| Revenue (San Francisco Bay Area) VRDO | 0.150% | 6/7/12 LOC | 8,000 | 8,000 |

| Berkeley CA TRAN | 2.000% | 7/5/12 | 48,000 | 48,078 |

| 1 BlackRock MuniYield California Fund, Inc. | | | | |

| VRDP VRDO | 0.300% | 6/7/12 LOC | 15,000 | 15,000 |

14

| | | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Coupon | Date | ($000) | ($000) |

| 1 | BlackRock MuniYield California Quality Fund, Inc. | | | | |

| | VRDP VRDO | 0.300% | 6/7/12 LOC | 30,000 | 30,000 |

| | Butte County CA TRAN | 2.000% | 6/29/12 | 5,000 | 5,006 |

| 1 | California Department of Water Resources | | | | |

| | Water System Revenue (Central Valley Project) | | | | |

| | TOB VRDO | 0.180% | 6/7/12 | 4,100 | 4,100 |

| | California Educational Facilities Authority Revenue | | | | |

| | (California Institute of Technology) VRDO | 0.140% | 6/7/12 | 55,800 | 55,800 |

| | California Educational Facilities Authority Revenue | | | | |

| | (Stanford Hospital) CP | 0.130% | 7/18/12 | 10,000 | 10,000 |

| 1 | California Educational Facilities Authority Revenue | | | | |

| | (Stanford Hospital) TOB VRDO | 0.200% | 6/7/12 LOC | 5,800 | 5,800 |

| | California Educational Facilities Authority Revenue | | | | |

| | (Stanford University) CP | 0.240% | 7/17/12 | 40,000 | 40,000 |

| | California Educational Facilities Authority Revenue | | | | |

| | (Stanford University) CP | 0.250% | 7/17/12 | 1,200 | 1,200 |

| | California Educational Facilities Authority Revenue | | | | |

| | (Stanford University) CP | 0.250% | 8/9/12 | 40,000 | 40,000 |

| 1 | California Educational Facilities Authority Revenue | | | | |

| | (Stanford University) TOB PUT | 0.270% | 11/8/12 | 37,185 | 37,185 |

| 1 | California Educational Facilities Authority Revenue | | | | |

| | (Stanford University) TOB VRDO | 0.160% | 6/7/12 | 4,450 | 4,450 |

| 1 | California Educational Facilities Authority Revenue | | | | |

| | (Stanford University) TOB VRDO | 0.200% | 6/7/12 | 7,645 | 7,645 |

| 1 | California Educational Facilities Authority Revenue | | | | |

| | (University of Southern California) TOB PUT | 0.310% | 8/16/12 | 15,035 | 15,035 |

| 1 | California Educational Facilities Authority Revenue | | | | |

| | (University of Southern California) TOB VRDO | 0.180% | 6/7/12 | 4,135 | 4,135 |

| | California GO VRDO | 0.140% | 6/1/12 LOC | 6,525 | 6,525 |

| | California Health Facilities Financing Authority | | | | |

| | Revenue (Catholic Healthcare West) VRDO | 0.160% | 6/7/12 LOC | 6,725 | 6,725 |

| | California Health Facilities Financing Authority | | | | |

| | Revenue (Children’s Hospital of Orange County) | | | | |

| | VRDO | 0.150% | 6/7/12 LOC | 21,700 | 21,700 |

| | California Health Facilities Financing Authority | | | | |

| | Revenue (Children’s Hospital of Orange County) | | | | |

| | VRDO | 0.150% | 6/7/12 LOC | 16,900 | 16,900 |

| | California Health Facilities Financing Authority | | | | |

| | Revenue (Children’s Hospital of Orange County) | | | | |

| | VRDO | 0.150% | 6/7/12 LOC | 50,000 | 50,000 |

| 1,2 | California Health Facilities Financing Authority | | | | |

| | Revenue (Kaiser Foundation Hospitals) TOB PUT | 0.220% | 9/4/12 LOC | 35,000 | 35,000 |

| | California Health Facilities Financing Authority | | | | |

| | Revenue (Memorial Health Services) VRDO | 0.170% | 6/7/12 | 64,400 | 64,400 |

| | California Health Facilities Financing Authority | | | | |

| | Revenue (Scripps Health) VRDO | 0.110% | 6/7/12 LOC | 4,200 | 4,200 |

| | California Health Facilities Financing Authority | | | | |

| | Revenue (Scripps Health) VRDO | 0.120% | 6/7/12 LOC | 12,715 | 12,715 |

| | California Health Facilities Financing Authority | | | | |

| | Revenue (Scripps Health) VRDO | 0.140% | 6/7/12 | 5,000 | 5,000 |

| 1 | California Health Facilities Financing Authority | | | | |

| | Revenue (Sutter Health) TOB VRDO | 0.150% | 6/7/12 | 12,210 | 12,210 |

| 1 | California Health Facilities Financing Authority | | | | |

| | Revenue (Sutter Health) TOB VRDO | 0.180% | 6/7/12 | 6,700 | 6,700 |

15

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| California Housing Finance Agency Home | | | | |

| Mortgage Revenue VRDO | 0.160% | 6/7/12 LOC | 5,030 | 5,030 |

| California Housing Finance Agency Home | | | | |

| Mortgage Revenue VRDO | 0.160% | 6/7/12 LOC | 12,000 | 12,000 |

| California Housing Finance Agency Home | | | | |

| Mortgage Revenue VRDO | 0.170% | 6/7/12 LOC | 24,500 | 24,500 |

| California Housing Finance Agency Home | | | | |

| Mortgage Revenue VRDO | 0.170% | 6/7/12 LOC | 38,230 | 38,230 |

| California Housing Finance Agency Home | | | | |

| Mortgage Revenue VRDO | 0.170% | 6/7/12 LOC | 6,895 | 6,895 |

| California Housing Finance Agency Multifamily | | | | |

| Housing Revenue VRDO | 0.160% | 6/7/12 LOC | 8,600 | 8,600 |

| California Infrastructure & Economic Development | | | | |

| Bank Revenue (Academy of Motion Picture Arts | | | | |

| & Sciences Obligated Group) VRDO | 0.150% | 6/7/12 LOC | 35,000 | 35,000 |

| California Infrastructure & Economic Development | | | | |

| Bank Revenue (Academy of Sciences) VRDO | 0.160% | 6/1/12 LOC | 10,325 | 10,325 |

| California Infrastructure & Economic Development | | | | |

| Bank Revenue (American National Red Cross) | | | | |

| VRDO | 0.150% | 6/7/12 LOC | 11,075 | 11,075 |

| 1 California Infrastructure & Economic Development | | | | |

| Bank Revenue (Bay Area Toll Bridges Seismic | | | | |

| Retrofit) TOB VRDO | 0.200% | 6/1/12 (ETM) | 16,865 | 16,865 |

| California Infrastructure & Economic Development | | | | |

| Bank Revenue (Buck Institute for Age Research) | | | | |

| VRDO | 0.150% | 6/7/12 LOC | 28,100 | 28,100 |

| California Infrastructure & Economic Development | | | | |

| Bank Revenue (JSerra Catholic High School | | | | |

| Project) VRDO | 0.130% | 6/7/12 LOC | 22,860 | 22,860 |

| California Infrastructure & Economic Development | | | | |

| Bank Revenue (Prinsco Inc. Project) VRDO | 0.350% | 6/7/12 LOC | 6,200 | 6,200 |

| California Municipal Finance Authority Revenue | | | | |

| (Notre Dame High School, San Jose) VRDO | 0.220% | 6/7/12 LOC | 5,425 | 5,425 |

| California Municipal Finance Authority Revenue | | | | |

| (Westmont College) VRDO | 0.170% | 6/7/12 LOC | 13,500 | 13,500 |

| California Pollution Control Financing Authority | | | | |

| Revenue (Pacific Gas & Electric Co.) VRDO | 0.160% | 6/1/12 LOC | 7,000 | 7,000 |

| 1 California Public Works Board Lease Revenue | | | | |

| (University of California) TOB VRDO | 0.240% | 6/7/12 | 6,655 | 6,655 |

| California School Cash Reserve Program | | | | |

| Authority Pool TRAN | 2.000% | 6/1/12 | 20,000 | 20,000 |

| California Statewide Communities Development | | | | |

| Authority Gas Supply Revenue VRDO | 0.170% | 6/7/12 | 79,245 | 79,245 |

| California Statewide Communities Development | | | | |

| Authority Multifamily Housing Revenue | | | | |

| (Canyon Springs Apartments Project) VRDO | 0.310% | 6/7/12 LOC | 10,105 | 10,105 |

| California Statewide Communities Development | | | | |

| Authority Multifamily Housing Revenue | | | | |

| (Knolls Apartments) VRDO | 0.160% | 6/7/12 LOC | 12,715 | 12,715 |

| California Statewide Communities Development | | | | |

| Authority Multifamily Housing Revenue | | | | |

| (Ridgeway Apartments) VRDO | 0.160% | 6/7/12 LOC | 8,585 | 8,585 |

16

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| California Statewide Communities Development | | | | |

| Authority Multifamily Housing Revenue | | | | |

| (Village Green Apartments) VRDO | 0.170% | 6/7/12 LOC | 5,800 | 5,800 |

| California Statewide Communities Development | | | | |

| Authority Revenue (Community Hospital of the | | | | |

| Monterey Peninsula) VRDO | 0.150% | 6/7/12 LOC | 12,750 | 12,750 |

| California Statewide Communities Development | | | | |

| Authority Revenue (Kaiser Permanente) PUT | 0.480% | 6/1/12 | 12,500 | 12,500 |

| California Statewide Communities Development | | | | |

| Authority Revenue (Kaiser Permanente) PUT | 0.480% | 6/1/12 | 12,500 | 12,500 |

| California Statewide Communities Development | | | | |

| Authority Revenue (Kaiser Permanente) VRDO | 0.170% | 6/7/12 | 13,700 | 13,700 |

| California Statewide Communities Development | | | | |

| Authority Revenue (Rady Children’s Hospital - | | | | |

| San Diego) VRDO | 0.140% | 6/1/12 LOC | 33,180 | 33,180 |

| California Statewide Communities Development | | | | |

| Authority Revenue (Rady Children’s Hospital - | | | | |

| San Diego) VRDO | 0.150% | 6/7/12 LOC | 25,000 | 25,000 |

| California Statewide Communities Development | | | | |

| Authority Revenue (Redlands Community | | | | |

| Hospital) VRDO | 0.160% | 6/7/12 LOC | 2,000 | 2,000 |

| 1 California Statewide Communities Development | | | | |

| Authority Revenue (Sutter Health) TOB VRDO | 0.250% | 6/7/12 | 13,200 | 13,200 |

| 1 California Statewide Communities Development | | | | |

| Authority Revenue (Sutter Health) TOB VRDO | 0.250% | 6/7/12 | 5,500 | 5,500 |

| 1 California Statewide Communities Development | | | | |

| Authority Revenue (Trinity Health) TOB VRDO | 0.180% | 6/7/12 | 2,175 | 2,175 |

| 1 Central Basin Municipal Water District California | | | | |

| COP TOB VRDO | 0.250% | 6/7/12 (4) | 7,500 | 7,500 |

| 1 Cerritos CA Community College District GO | | | | |

| TOB VRDO | 0.180% | 6/7/12 | 7,845 | 7,845 |

| 1 Cerritos CA Community College District GO | | | | |

| TOB VRDO | 0.200% | 6/7/12 | 13,000 | 13,000 |

| 1 Chabot-Las Positas CA Community College | | | | |

| District GO TOB VRDO | 0.200% | 6/7/12 | 6,000 | 6,000 |

| 1 Chabot-Las Positas CA Community College | | | | |

| District GO TOB VRDO | 0.310% | 6/7/12 | 8,725 | 8,725 |

| Chula Vista CA Multifamily Housing Revenue | | | | |

| (Teresina Apartments) VRDO | 0.170% | 6/7/12 LOC | 18,970 | 18,970 |

| 1 Contra Costa CA Community College District | | | | |

| GO TOB VRDO | 0.180% | 6/7/12 | 5,110 | 5,110 |

| 1 Contra Costa CA Community College District | | | | |

| GO TOB VRDO | 0.310% | 6/7/12 | 5,200 | 5,200 |

| 1 Contra Costa CA Transportation Authority | | | | |

| Sales Tax Revenue TOB VRDO | 0.180% | 6/7/12 | 20,000 | 20,000 |

| Contra Costa County CA Multifamily Housing | | | | |

| Revenue (Park Regency) VRDO | 0.170% | 6/7/12 LOC | 47,200 | 47,200 |

| 1 Desert CA Community College District GO | | | | |

| TOB VRDO | 0.250% | 6/7/12 | 11,000 | 11,000 |

| 2 East Bay CA Municipal Utility District Waste | | | | |

| Water System Revenue PUT | 0.180% | 2/1/13 | 23,435 | 23,435 |

| East Bay CA Municipal Utility District Water | | | | |

| System Revenue (Extendible) CP | 0.180% | 6/1/12 | 12,200 | 12,200 |

17

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| East Bay CA Municipal Utility District Water | | | | |

| System Revenue (Extendible) CP | 0.230% | 7/5/12 | 13,500 | 13,500 |

| East Bay CA Municipal Utility District Water | | | | |

| System Revenue (Extendible) CP | 0.220% | 7/9/12 | 26,300 | 26,300 |

| East Bay CA Municipal Utility District Water | | | | |

| System Revenue (Extendible) CP | 0.230% | 7/17/12 | 20,000 | 20,000 |

| East Bay CA Municipal Utility District Water | | | | |

| System Revenue (Extendible) CP | 0.250% | 7/23/12 | 20,800 | 20,800 |

| East Bay CA Municipal Utility District Water | | | | |

| System Revenue (Extendible) CP | 0.250% | 8/7/12 | 16,600 | 16,600 |

| East Bay CA Municipal Utility District Water | | | | |

| System Revenue (Extendible) CP | 0.260% | 9/12/12 | 20,000 | 20,000 |

| 2 East Bay CA Municipal Utility District Water | | | | |

| System Revenue PUT | 0.180% | 12/3/12 | 44,800 | 44,800 |

| 2 East Bay CA Municipal Utility District Water | | | | |

| System Revenue PUT | 0.190% | 3/1/13 | 49,200 | 49,200 |

| 1 Eastern California Municipal Water District | | | | |

| Water & Sewer COP TOB VRDO | 0.180% | 6/7/12 | 1,590 | 1,590 |

| Eastern California Municipal Water District | | | | |

| Water & Sewer Revenue | 2.000% | 7/1/12 | 7,485 | 7,496 |

| Eastern California Municipal Water District | | | | |

| Water & Sewer Revenue VRDO | 0.170% | 6/7/12 | 11,600 | 11,600 |

| Escondido CA Community Development | | | | |

| (Escondido Promenade Project) COP VRDO | 0.170% | 6/7/12 LOC | 9,400 | 9,400 |

| Escondido CA Community Development | | | | |

| Multifamily Revenue (Heritage Park | | | | |

| Apartments) VRDO | 0.180% | 6/7/12 LOC | 4,250 | 4,250 |

| Freemont CA Union High School District TRAN | 3.000% | 6/29/12 | 15,000 | 15,032 |

| Fremont CA COP VRDO | 0.150% | 6/7/12 LOC | 5,000 | 5,000 |

| Fremont CA COP VRDO | 0.150% | 6/7/12 LOC | 9,305 | 9,305 |

| Fremont CA COP VRDO | 0.150% | 6/7/12 LOC | 29,500 | 29,500 |

| 1 Fresno CA Unified School District Revenue | | | | |

| TOB VRDO | 0.200% | 6/7/12 LOC | 8,380 | 8,380 |

| Fresno County CA TRAN | 3.000% | 6/29/12 | 8,000 | 8,017 |

| Garden Grove CA Housing Authority Multifamily | | | | |

| Housing Revenue (Valley View Senior | | | | |

| Villas Project) VRDO | 0.180% | 6/7/12 LOC | 9,100 | 9,100 |

| 1 Grossmont CA Healthcare District Revenue | | | | |

| TOB VRDO | 0.200% | 6/7/12 | 8,600 | 8,600 |

| Irvine CA Assessment District No. 05-21 | | | | |

| Improvement Revenue VRDO | 0.180% | 6/1/12 LOC | 37,645 | 37,645 |

| Irvine CA Assessment District No. 89-10 | | | | |

| Improvement Revenue (Northwest Irvine) | | | | |

| VRDO | 0.180% | 6/1/12 LOC | 6,199 | 6,199 |

| Irvine CA Assessment District No. 97-17 | | | | |

| Improvement Revenue VRDO | 0.180% | 6/1/12 LOC | 19,104 | 19,104 |

| Irvine CA Public Facilities & Infrastructure | | | | |

| Authority Assessment Revenue VRDO | 0.180% | 6/1/12 LOC | 2,900 | 2,900 |

| Irvine CA Public Facilities & Infrastructure | | | | |

| Authority Assessment Revenue VRDO | 0.180% | 6/1/12 LOC | 5,200 | 5,200 |

| 2 Irvine CA Ranch Water District Revenue PUT | 0.170% | 3/1/13 | 10,000 | 10,000 |

| Irvine CA Reassessment District No. 85-7A | | | | |

| Improvement Revenue VRDO | 0.160% | 6/1/12 LOC | 11,755 | 11,755 |

| Livermore CA COP VRDO | 0.150% | 6/7/12 LOC | 13,990 | 13,990 |

18

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Livermore CA Redevelopment Agency | | | | |

| Multi-Family Housing Revenue | | | | |

| (Richards Manor) VRDO | 0.180% | 6/7/12 LOC | 4,770 | 4,770 |

| 1 Long Beach CA Harbor Revenue TOB VRDO | 0.380% | 6/7/12 | 15,740 | 15,740 |

| Long Beach CA Water Revenue CP | 0.140% | 6/5/12 | 11,000 | 11,000 |

| 1 Los Angeles CA Community College District | | | | |

| GO TOB VRDO | 0.150% | 6/7/12 | 3,500 | 3,500 |

| 1 Los Angeles CA Community College District | | | | |

| GO TOB VRDO | 0.200% | 6/7/12 | 5,200 | 5,200 |

| 1 Los Angeles CA Community College District | | | | |

| GO TOB VRDO | 0.240% | 6/7/12 | 9,575 | 9,575 |

| 1 Los Angeles CA Community College District | | | | |

| GO TOB VRDO | 0.250% | 6/7/12 | 16,130 | 16,130 |

| Los Angeles CA Community Redevelopment | | | | |

| Agency Multifamily Housing Revenue | | | | |

| (Academy Village Apartments) VRDO | 0.170% | 6/7/12 LOC | 3,300 | 3,300 |

| Los Angeles CA Community Redevelopment | | | | |

| Agency Multifamily Housing Revenue | | | | |

| (Hollywood & Vine Apartments) VRDO | 0.160% | 6/7/12 LOC | 19,200 | 19,200 |

| 1 Los Angeles CA Department of Airports | | | | |

| International Airport Revenue TOB VRDO | 0.150% | 6/7/12 | 8,750 | 8,750 |

| 1 Los Angeles CA Department of Airports | | | | |

| International Airport Revenue TOB VRDO | 0.180% | 6/7/12 | 5,000 | 5,000 |

| 1 Los Angeles CA Department of Airports | | | | |

| International Airport Revenue TOB VRDO | 0.200% | 6/7/12 | 6,000 | 6,000 |

| 1 Los Angeles CA Department of Airports | | | | |

| International Airport Revenue TOB VRDO | 0.240% | 6/7/12 | 7,975 | 7,975 |

| 1 Los Angeles CA Department of Airports | | | | |

| International Airport Revenue TOB VRDO | 0.240% | 6/7/12 | 18,880 | 18,880 |

| 1 Los Angeles CA Department of Water & | | | | |

| Power Revenue TOB VRDO | 0.170% | 6/7/12 LOC | 10,255 | 10,255 |

| 1 Los Angeles CA Department of Water & | | | | |

| Power Revenue TOB VRDO | 0.180% | 6/7/12 | 7,495 | 7,495 |

| 1 Los Angeles CA Department of Water & | | | | |

| Power Revenue TOB VRDO | 0.240% | 6/7/12 | 5,450 | 5,450 |

| 1 Los Angeles CA Department of Water & | | | | |

| Power Revenue TOB VRDO | 0.240% | 6/7/12 | 4,360 | 4,360 |

| Los Angeles CA Department of Water & | | | | |

| Power Revenue VRDO | 0.150% | 6/1/12 | 23,200 | 23,200 |

| Los Angeles CA Department of Water & | | | | |

| Power Revenue VRDO | 0.160% | 6/1/12 | 33,000 | 33,000 |

| Los Angeles CA Department of Water & | | | | |

| Power Revenue VRDO | 0.120% | 6/7/12 | 40,500 | 40,500 |

| Los Angeles CA Department of Water & | | | | |

| Power Revenue VRDO | 0.130% | 6/7/12 | 21,175 | 21,175 |

| Los Angeles CA Department of Water & | | | | |

| Power Revenue VRDO | 0.140% | 6/7/12 | 55,000 | 55,000 |

| Los Angeles CA Department of Water & | | | | |

| Power Revenue VRDO | 0.140% | 6/7/12 | 32,400 | 32,400 |

| Los Angeles CA Department of Water & | | | | |

| Power Revenue VRDO | 0.140% | 6/7/12 | 12,000 | 12,000 |

| Los Angeles CA Department of Water & | | | | |

| Power Revenue VRDO | 0.150% | 6/7/12 | 12,750 | 12,750 |

| Los Angeles CA Harbor Department Revenue CP | 0.220% | 7/19/12 | 10,000 | 10,000 |

19

| | | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Coupon | Date | ($000) | ($000) |

| 1 | Los Angeles CA Harbor Department Revenue | | | | |

| | TOB VRDO | 0.180% | 6/7/12 | 2,680 | 2,680 |

| 1 | Los Angeles CA Harbor Department Revenue | | | | |

| | TOB VRDO | 0.200% | 6/7/12 | 5,395 | 5,395 |

| | Los Angeles CA Multifamily Housing Revenue | | | | |

| | (Beverly Park Apartments) VRDO | 0.160% | 6/7/12 LOC | 15,500 | 15,500 |

| | Los Angeles CA Multifamily Housing Revenue | | | | |

| | (Fountain Park Project) VRDO | 0.180% | 6/7/12 LOC | 40,000 | 40,000 |

| | Los Angeles CA Multifamily Housing Revenue | | | | |

| | (Queen Portfolio Apartments Project) VRDO | 0.170% | 6/7/12 LOC | 6,895 | 6,895 |

| | Los Angeles CA Multifamily Housing Revenue | | | | |

| | (San Regis Project) VRDO | 0.190% | 6/7/12 LOC | 23,600 | 23,600 |

| 1 | Los Angeles CA Unified School District GO | | | | |

| | TOB VRDO | 0.160% | 6/7/12 | 9,040 | 9,040 |

| 1 | Los Angeles CA Unified School District GO | | | | |

| | TOB VRDO | 0.180% | 6/7/12 | 9,995 | 9,995 |

| 1 | Los Angeles CA Unified School District GO | | | | |

| | TOB VRDO | 0.180% | 6/7/12 | 6,660 | 6,660 |

| 1 | Los Angeles CA Wastewater System Revenue | | | | |

| | TOB VRDO | 0.180% | 6/7/12 | 25,000 | 25,000 |

| 1 | Los Angeles CA Wastewater System Revenue | | | | |

| | TOB VRDO | 0.180% | 6/7/12 | 7,500 | 7,500 |

| | Los Angeles CA Wastewater System Revenue | | | | |

| | VRDO | 0.170% | 6/7/12 LOC | 1,390 | 1,390 |

| 1,2 | Los Angeles County CA Metropolitan | | | | |

| | Transportation Authority Sales Tax Revenue | | | | |

| | TOB PUT | 0.220% | 8/1/12 LOC | 30,000 | 30,000 |

| 1 | Los Angeles County CA Sanitation Districts | | | | |

| | Financing Authority Capital Projects Revenue | | | | |

| | TOB VRDO | 0.170% | 6/7/12 LOC | 10,465 | 10,465 |

| 1 | Los Angeles County CA Unified School District | | | | |

| | GO TOB VRDO | 0.180% | 6/7/12 | 5,000 | 5,000 |

| | Manteca CA Redevelopment Agency Tax | | | | |

| | Allocation Revenue VRDO | 0.210% | 6/1/12 LOC | 22,745 | 22,745 |

| 2 | Metropolitan Water District of Southern | | | | |

| | California Revenue PUT | 0.180% | 7/9/12 | 15,000 | 15,000 |

| 1 | Metropolitan Water District of Southern | | | | |

| | California Revenue TOB VRDO | 0.180% | 6/7/12 | 6,435 | 6,435 |

| 1 | Metropolitan Water District of Southern | | | | |

| | California Revenue TOB VRDO | 0.180% | 6/7/12 | 5,000 | 5,000 |

| | Metropolitan Water District of Southern | | | | |

| | California Revenue VRDO | 0.160% | 6/7/12 | 11,700 | 11,700 |

| | Metropolitan Water District of Southern | | | | |

| | California Revenue VRDO | 0.170% | 6/7/12 | 26,900 | 26,900 |

| | Mission Viejo CA Community Development | | | | |

| | Financing Authority Revenue (Mission Viejo | | | | |

| | Mall Improvement) VRDO | 0.160% | 6/7/12 LOC | 23,900 | 23,900 |

| | Newport Beach CA Revenue (Hoag Memorial | | | | |

| | Hospital Presbyterian) VRDO | 0.160% | 6/7/12 LOC | 12,500 | 12,500 |

| 1 | Nuveen California Investment Quality | | | | |

| | Municipal Fund VRDP VRDO | 0.300% | 6/7/12 LOC | 18,000 | 18,000 |

| 1 | Nuveen California Performance Plus | | | | |

| | Municipal Fund VRDP VRDO | 0.300% | 6/7/12 LOC | 15,000 | 15,000 |

20

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| 1 Nuveen California Quality Income | | | | |

| Municipal Fund VRDP VRDO | 0.300% | 6/7/12 LOC | 26,000 | 26,000 |

| Nuveen Insured California AMT-Free | | | | |

| Municipal Income Fund VRDP VRDO | 0.300% | 6/7/12 LOC | 27,000 | 27,000 |

| 1 Oakland CA Redevelopment Agency Tax | | | | |

| Allocation Revenue (Central District Project) | | | | |

| TOB VRDO | 0.170% | 6/7/12 LOC | 13,710 | 13,710 |

| Oakland-Alameda County CA Coliseum Authority | | | | |

| Lease Revenue (Oakland Coliseum Project) | | | | |

| VRDO | 0.160% | 6/7/12 LOC | 64,100 | 64,100 |

| Orange County CA Apartment Development | | | | |

| Revenue VRDO | 0.140% | 6/7/12 LOC | 41,300 | 41,300 |

| Orange County CA Apartment Development | | | | |

| Revenue VRDO | 0.180% | 6/7/12 LOC | 9,550 | 9,550 |

| 1 Orange County CA Sanitation District COP | | | | |

| TOB VRDO | 0.200% | 6/7/12 | 10,925 | 10,925 |

| Orange County CA Sanitation District COP VRDO | 2.000% | 11/9/12 | 71,605 | 72,163 |

| Orange County CA Teeter Plan CP | 0.190% | 7/10/12 LOC | 20,000 | 20,000 |

| Pittsburg CA Redevelopment Agency Tax | | | | |

| Allocation Revenue (Los Medanos Community | | | | |

| Development Project) VRDO | 0.210% | 6/1/12 LOC | 38,255 | 38,255 |

| Riverside County CA Industrial Development | | | | |

| Authority Empowerment Zone Facility Revenue | | | | |

| (Guy Evans Inc. Project) VRDO | 0.170% | 6/7/12 LOC | 5,135 | 5,135 |

| Riverside County CA Public Facility Project | | | | |

| COP VRDO | 0.170% | 6/7/12 LOC | 9,200 | 9,200 |

| Riverside County CA Transportation | | | | |

| Commission Sales Tax Revenue VRDO | 0.160% | 6/7/12 | 9,275 | 9,275 |

| Riverside County CA Transportation | | | | |

| Commission Sales Tax Revenue VRDO | 0.160% | 6/7/12 | 10,225 | 10,225 |

| Sacramento CA Municipal Utility District | | | | |

| Revenue VRDO | 0.150% | 6/7/12 LOC | 1,200 | 1,200 |

| Sacramento CA Municipal Utility District | | | | |

| Revenue VRDO | 0.150% | 6/7/12 LOC | 16,400 | 16,400 |

| Sacramento County CA Multifamily Housing | | | | |

| Revenue (River Pointe Apartments) VRDO | 0.170% | 6/7/12 LOC | 12,300 | 12,300 |

| Sacramento County CA Multifamily Housing | | | | |

| Revenue (River Pointe Apartments) VRDO | 0.170% | 6/7/12 LOC | 10,200 | 10,200 |

| Sacramento County CA Sanitation Districts | | | | |

| Financing Authority Revenue VRDO | 0.160% | 6/7/12 LOC | 5,000 | 5,000 |

| 1 San Bernardino CA Community College | | | | |

| District GO TOB VRDO | 0.190% | 6/7/12 | 7,500 | 7,500 |

| 1 San Bernardino CA Community College | | | | |

| District GO TOB VRDO | 0.250% | 6/7/12 | 44,345 | 44,345 |

| San Bernardino County CA TRAN | 2.000% | 6/29/12 | 25,000 | 25,033 |

| San Diego CA Community College District GO | 1.500% | 8/1/12 | 6,050 | 6,062 |

| 1 San Diego CA Community College District GO | | | | |

| TOB VRDO | 0.150% | 6/7/12 | 5,710 | 5,710 |

| 1 San Diego CA Community College District GO | | | | |

| TOB VRDO | 0.180% | 6/7/12 | 5,000 | 5,000 |

| 1 San Diego CA Community College District GO | | | | |

| TOB VRDO | 0.180% | 6/7/12 | 5,000 | 5,000 |

| 1 San Diego CA Community College District GO | | | | |

| TOB VRDO | 0.200% | 6/7/12 | 4,100 | 4,100 |

21

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| San Diego CA County TRAN | 2.000% | 6/29/12 | 15,000 | 15,020 |

| San Diego CA Housing Authority Multifamily | | | | |

| Housing Revenue (Bay Vista Apartments Project) | | | | |

| VRDO | 0.160% | 6/7/12 LOC | 9,690 | 9,690 |

| San Diego CA Housing Authority Multifamily | | | | |

| Housing Revenue (Canyon Rim Apartments) | | | | |

| VRDO | 0.160% | 6/7/12 LOC | 32,440 | 32,440 |

| 1 San Diego CA Public Facilities Financing | | | | |

| Authority Water Revenue TOB VRDO | 0.180% | 6/7/12 | 10,310 | 10,310 |

| 1 San Diego CA Public Facilities Financing | | | | |

| Authority Water Revenue TOB VRDO | 0.180% | 6/7/12 | 7,495 | 7,495 |

| 1 San Diego CA Unified School District GO | | | | |

| TOB PUT | 0.360% | 8/16/12 | 26,190 | 26,190 |

| San Diego County CA Regional Transportation | | | | |

| Authority Sales Tax Revenue VRDO | 0.150% | 6/7/12 | 8,925 | 8,925 |

| 1 San Diego County CA Water Authority | | | | |

| Revenue COP TOB VRDO | 0.180% | 6/7/12 | 9,500 | 9,500 |

| 1 San Diego County CA Water Authority | | | | |

| Revenue COP TOB VRDO | 0.180% | 6/7/12 | 6,840 | 6,840 |

| 1 San Diego County CA Water Authority | | | | |

| Revenue COP TOB VRDO | 0.180% | 6/7/12 | 4,825 | 4,825 |

| 1 San Diego County CA Water Authority | | | | |

| Revenue COP TOB VRDO | 0.180% | 6/7/12 | 10,100 | 10,100 |

| 1 San Diego County CA Water Authority | | | | |

| Revenue COP TOB VRDO | 0.280% | 6/7/12 | 6,500 | 6,500 |

| 1 San Diego County CA Water Authority | | | | |

| Revenue COP TOB VRDO | 0.280% | 6/7/12 | 6,100 | 6,100 |

| 1 San Diego County CA Water Authority | | | | |

| Revenue COP TOB VRDO | 0.280% | 6/7/12 | 9,800 | 9,800 |

| San Diego County CA Water Authority | | | | |

| Revenue CP | 0.190% | 7/5/12 | 14,000 | 14,000 |

| San Diego County CA Water Authority | | | | |

| Revenue CP | 0.180% | 7/9/12 | 15,900 | 15,900 |

| San Diego County CA Water Authority | | | | |

| Revenue CP | 0.220% | 9/6/12 | 14,000 | 14,000 |

| 1 San Francisco CA Bay Area Rapid Transit | | | | |

| District Sales Tax Revenue TOB VRDO | 0.180% | 6/7/12 | 13,595 | 13,595 |

| 1 San Francisco CA City & County | | | | |

| (Laguna Honda Hospital) GO TOB VRDO | 0.240% | 6/7/12 | 6,700 | 6,700 |

| San Francisco CA City & County Airport | | | | |

| Commission International Airport Revenue | | | | |

| VRDO | 0.170% | 6/7/12 LOC | 8,000 | 8,000 |

| San Francisco CA City & County Finance Corp. | | | | |

| Lease Revenue (Moscone Center Expansion) | | | | |

| VRDO | 0.150% | 6/7/12 LOC | 46,145 | 46,145 |

| San Francisco CA City & County GO | 2.000% | 6/15/12 | 7,250 | 7,255 |

| San Francisco CA City & County International | | | | |

| Airport Revenue VRDO | 0.170% | 6/7/12 LOC | 5,000 | 5,000 |

| 1 San Francisco CA City & County Public Utilities | | | | |

| Commission Water Revenue TOB VRDO | 0.180% | 6/7/12 | 6,900 | 6,900 |

| San Francisco CA City & County Redevelopment | | | | |

| Agency Multifamily Housing Revenue | | | | |

| (Third & Mission Streets) VRDO | 0.170% | 6/7/12 LOC | 40,000 | 40,000 |

22

| | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| San Francisco CA City & County Unified | | | | |

| School District TRAN | 2.000% | 6/29/12 | 10,000 | 10,013 |

| San Jose CA Financing Authority Lease | | | | |

| Revenue CP | 0.160% | 6/13/12 LOC | 27,068 | 27,068 |

| 1 San Jose CA Financing Authority Lease | | | | |

| Revenue TOB VRDO | 0.190% | 6/7/12 (13) | 21,360 | 21,360 |

| San Jose CA Multifamily Housing Revenue | | | | |

| (Cinnabar Commons) VRDO | 0.160% | 6/7/12 LOC | 16,400 | 16,400 |

| San Jose CA Multifamily Housing Revenue | | | | |

| (Raintree Apartments) VRDO | 0.190% | 6/7/12 LOC | 10,000 | 10,000 |

| 1 San Jose CA Unified School District Santa | | | | |

| Clara County GO TOB VRDO | 0.180% | 6/7/12 | 7,310 | 7,310 |

| 1 San Marcos CA Public Facilities Authority | | | | |

| Tax Allocation Revenue TOB VRDO | 0.170% | 6/1/12 LOC | 3,100 | 3,100 |

| 1 San Mateo County CA Community College | | | | |

| District GO TOB VRDO | 0.180% | 6/7/12 | 4,315 | 4,315 |

| Santa Barbara County CA TRAN | 2.000% | 6/29/12 | 11,000 | 11,015 |

| Santa Clara County CA El Camino Hospital | | | | |

| District Facilities Authority Revenue | | | | |

| (Valley Medical Center Project) VRDO | 0.170% | 6/7/12 LOC | 12,600 | 12,600 |

| Santa Clara County CA El Camino Hospital | | | | |

| District Facilities Authority Revenue | | | | |

| (Valley Medical Center Project) VRDO | 0.170% | 6/7/12 LOC | 11,850 | 11,850 |

| Santa Clara Valley CA Transportation Authority | | | | |

| Sales Tax Revenue VRDO | 0.130% | 6/7/12 | 6,285 | 6,285 |

| 1 Sequoia CA Unified School District GO TOB | | | | |

| VRDO | 0.180% | 6/7/12 | 5,860 | 5,860 |

| Sequoia CA Union High School District TRAN | 3.000% | 7/5/12 | 13,000 | 13,033 |

| 1 Sonoma County CA Junior College District GO | | | | |

| TOB VRDO | 0.170% | 6/7/12 | 30,675 | 30,675 |

| South Placer CA Wastewater Authority Revenue | | | | |

| VRDO | 0.130% | 6/7/12 LOC | 8,000 | 8,000 |

| Southern California Public Power Authority | | | | |

| Revenue (Mead-Adelanto Project) VRDO | 0.180% | 6/1/12 | 30,100 | 30,100 |

| 1 Sunnyvale CA Wastewater Revenue TOB VRDO | 0.200% | 6/7/12 | 4,220 | 4,220 |

| Tobacco Securitization Authority Revenue | | | | |

| (Southern California Tobacco Settlement) | 5.500% | 6/1/12 (Prere.) | 4,900 | 4,900 |

| 1 Torrance CA Hospital Revenue (Torrance | | | | |

| Memorial Medical Center) TOB VRDO | 0.200% | 6/7/12 LOC | 5,200 | 5,200 |

| Torrance CA Hospital Revenue (Torrance | | | | |

| Memorial Medical Center) VRDO | 0.160% | 6/7/12 LOC | 9,100 | 9,100 |

| University of California Regents CP | 0.130% | 6/6/12 | 10,000 | 10,000 |

| University of California Regents CP | 0.200% | 6/7/12 | 24,000 | 24,000 |

| University of California Regents Medical | | | | |

| Center Revenue VRDO | 0.150% | 6/1/12 | 25,305 | 25,305 |

| University of California Revenue | 5.000% | 5/15/13 (14) | 5,460 | 5,710 |

| 1 University of California Revenue TOB VRDO | 0.200% | 6/1/12 | 5,200 | 5,200 |

| 1 University of California Revenue TOB VRDO | 0.150% | 6/7/12 | 10,875 | 10,875 |

| 1 University of California Revenue TOB VRDO | 0.180% | 6/7/12 | 1,890 | 1,890 |

| 1 University of California Revenue TOB VRDO | 0.180% | 6/7/12 | 3,470 | 3,470 |

| 1 University of California Revenue TOB VRDO | 0.180% | 6/7/12 | 6,000 | 6,000 |

| 1 University of California Revenue TOB VRDO | 0.180% | 6/7/12 | 3,495 | 3,495 |

| 1 University of California Revenue TOB VRDO | 0.180% | 6/7/12 | 15,195 | 15,195 |

| 1 University of California Revenue TOB VRDO | 0.240% | 6/7/12 | 7,300 | 7,300 |

23

| | | | | |

| California Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Coupon | Date | ($000) | ($000) |

| 1 | University of California Revenue TOB VRDO | 0.240% | 6/7/12 | 6,655 | 6,655 |

| 1 | University of California Revenue TOB VRDO | 0.240% | 6/7/12 | 12,010 | 12,010 |

| 1 | University of California Revenue TOB VRDO | 0.250% | 6/7/12 | 5,000 | 5,000 |

| | Ventura CA Public Financing Authority | | | | |

| | Lease Revenue CP | 0.210% | 8/10/12 LOC | 5,000 | 5,000 |

| | Ventura County CA Community College | | | | |

| | District GO | 5.000% | 8/1/12 (Prere.) | 8,835 | 8,994 |

| | Ventura County CA TRAN | 2.250% | 6/29/12 | 35,315 | 35,368 |

| | Westlands CA Water District COP VRDO | 0.150% | 6/7/12 LOC | 25,700 | 25,700 |

| | Whittier CA Health Facility Revenue | | | | |

| | (Presbyterian Intercommunity Hospital) VRDO | 0.140% | 6/7/12 LOC | 4,900 | 4,900 |

| | Whittier CA Health Facility Revenue | | | | |

| | (Presbyterian Intercommunity Hospital) VRDO | 0.150% | 6/7/12 LOC | 9,200 | 9,200 |

| | | | | | 4,090,216 |

| Total Tax-Exempt Municipal Bonds (Cost $4,090,216) | | | | 4,090,216 |

| Other Assets and Liabilities (-3.1%) | | | | |

| Other Assets | | | | 30,394 |

| Liabilities | | | | (155,246) |

| | | | | | (124,852) |

| Net Assets (100%) | | | | |

| Applicable to 3,964,820,464 outstanding $.001 par value shares of | | | |

| beneficial interest (unlimited authorization) | | | | 3,965,364 |

| Net Asset Value Per Share | | | | $1.00 |

| |

| |

| At May 31, 2012, net assets consisted of: | | | | |

| | | | | | Amount |

| | | | | | ($000) |

| Paid-in Capital | | | | 3,965,360 |

| Undistributed Net Investment Income | | | | — |

| Accumulated Net Realized Gains | | | | 4 |

| Net Assets | | | | 3,965,364 |

See Note A in Notes to Financial Statements.

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At May 31, 2012, the aggregate value of these securities was $1,116,680,000, representing 28.2% of net assets.

2 Adjustable-rate security.

A key to abbreviations and other references follows the Statement of Net Assets.

See accompanying Notes, which are an integral part of the Financial Statements.

24

California Tax-Exempt Money Market Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

VRDO—Variable Rate Demand Obligation.

VRDP—Variable Rate Demand Preferred.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Investors Assurance).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) AGM (Assured Guaranty Municipal Corporation).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.

(11) CIFG (CDC IXIS Financial Guaranty).

(12) Assured Guaranty Corporation.

(13) Berkshire Hathaway Assurance Corporation.

(14) National Public Finance Guarantee Corporation.

The insurance does not guarantee the market value of the municipal bonds.

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit.

25

California Tax-Exempt Money Market Fund

Statement of Operations

| |

| | Six Months Ended |

| | May 31, 2012 |

| | ($000) |

| Investment Income | |

| Income | |

| Interest | 3,642 |

| Total Income | 3,642 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 352 |

| Management and Administrative | 2,237 |

| Marketing and Distribution | 647 |

| Custodian Fees | 24 |

| Shareholders’ Reports | 11 |

| Trustees’ Fees and Expenses | 2 |

| Total Expenses | 3,273 |

| Expense Reduction—Note B | (287) |

| Net Expenses | 2,986 |

| Net Investment Income | 656 |

| Realized Net Gain (Loss) on Investment Securities Sold | (2) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 654 |

See accompanying Notes, which are an integral part of the Financial Statements.

26

California Tax-Exempt Money Market Fund

Statement of Changes in Net Assets

| | |

| | Six Months Ended | Year Ended |

| | May 31, | November 30, |

| | 2012 | 2011 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 656 | 2,969 |

| Realized Net Gain (Loss) | (2) | 26 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 654 | 2,995 |

| Distributions | | |

| Net Investment Income | (656) | (2,969) |

| Realized Capital Gain | — | — |

| Total Distributions | (656) | (2,969) |

| Capital Share Transactions (at $1.00) | | |

| Issued | 1,330,596 | 2,863,192 |

| Issued in Lieu of Cash Distributions | 625 | 2,862 |

| Redeemed | (1,497,099) | (3,344,624) |

| Net Increase (Decrease) from Capital Share Transactions | (165,878) | (478,570) |

| Total Increase (Decrease) | (165,880) | (478,544) |

| Net Assets | | |

| Beginning of Period | 4,131,244 | 4,609,788 |

| End of Period | 3,965,364 | 4,131,244 |

See accompanying Notes, which are an integral part of the Financial Statements.

27

California Tax-Exempt Money Market Fund

Financial Highlights

| | | | | | |

| Six Months | | | | | |

| | Ended | | | | | |

| For a Share Outstanding | May 31, | | | Year Ended November 30, |

| Throughout Each Period | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | | | | | | |

| Net Investment Income | .0002 | .001 | .001 | .004 | .022 | .035 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | — | — | — | — | — | — |

| Total from Investment Operations | .0002 | .001 | .001 | .004 | .022 | .035 |

| Distributions | | | | | | |

| Dividends from Net Investment Income | (.0002) | (.001) | (.001) | (.004) | (.022) | (.035) |

| Distributions from Realized Capital Gains | — | — | — | — | — | — |

| Total Distributions | (.0002) | (.001) | (.001) | (.004) | (.022) | (.035) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| |

| Total Return1 | 0.02% | 0.07% | 0.11% | 0.37% | 2.21% | 3.55% |

| |

| Ratios/Supplemental Data | | | | | | |

| Net Assets, End of Period (Millions) | $3,965 | $4,131 | $4,610 | $5,355 | $7,506 | $8,623 |

| Ratio of Expenses to | | | | | | |

| Average Net Assets | 0.15%2 | 0.16%2 | 0.17% | 0.17%3 | 0.11%3 | 0.10% |

| Ratio of Net Investment Income to | | | | | | |

| Average Net Assets | 0.03% | 0.07% | 0.11% | 0.39% | 2.19% | 3.49% |

The expense ratio and net income ratio for the current period have been annualized.

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

2 The ratio of total expenses to average net assets before an expense reduction was 0.16% for 2012 and 0.17% for 2011. See Note B in Notes to Financial Statements.

3 Includes fees to participate in the Treasury Temporary Guarantee Program for Money Market Funds of 0.04% for 2009 and 0.01% for 2008.

See accompanying Notes, which are an integral part of the Financial Statements.

28

California Tax-Exempt Money Market Fund

Notes to Financial Statements

Vanguard California Tax-Exempt Money Market Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of municipal issuers whose ability to meet their obligations may be affected by economic and political developments in the state.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued at amortized cost, which approximates market value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (November 30, 2008–2011), and for the period ended May 31, 2012, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

3. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month.

4. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At May 31, 2012, the fund had contributed capital of $580,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.23% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard. Vanguard and the board of trustees have agreed to temporarily limit certain net operating expenses in excess of the fund’s daily yield so as to maintain a zero or positive yield for the fund. Vanguard and the board of trustees may terminate the temporary expense limitation at any time.

For the period ended May 31, 2012, Vanguard’s management and administrative expenses were reduced by $287,000 (an effective annual rate of 0.01% of the fund’s average net assets).

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

29

California Tax-Exempt Money Market Fund

At May 31, 2012, 100% of the market value of the fund’s investments was determined using amortized cost, in accordance with rules under the Investment Company Act of 1940. Amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, securities valued at amortized cost are considered to be valued using Level 2 inputs.

D. In preparing the financial statements as of May 31, 2012, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

30

California Intermediate-Term Tax-Exempt Fund

Fund Profile

As of May 31, 2012

| | | |

| Share-Class Characteristics | | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VCAIX | VCADX |

| Expense Ratio1 | 0.20% | 0.12% |

| 30-Day SEC Yield | 1.79% | 1.87% |

| |

| Financial Attributes | | | |

| |

| | | Barclays | |

| | | Muni | Barclays |

| | | CA IT | Municipal |

| | | Bond | Bond |

| | Fund | Index | Index |

| Number of Bonds | 871 | 1,506 | 46,824 |

| Yield to Maturity | | | |

| (before expenses) | 2.0% | 2.6% | 2.4% |

| Average Coupon | 4.2% | 4.8% | 4.9% |

| Average Duration | 5.1 years | 4.9 years | 7.3 years |

| Average Effective | | | |

| Maturity | 5.4 years | 5.5 years | 5.7 years |

| Short-Term | | | |

| Reserves | 9.2% | — | — |

| | |

| Volatility Measures | | |

| | | Barclays |

| | Barclays Muni | Municipal |

| | CA IT | Bond |

| | Bond Index | Index |

| R-Squared | 0.88 | 0.98 |

| Beta | 0.90 | 1.02 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

|

| |

| Distribution by Maturity (% of portfolio) | |

| Under 1 Year | | 14.8% |

| 1 - 3 Years | | 15.1 |

| 3 - 5 Years | | 16.5 |

| 5 - 10 Years | | 45.0 |

| 10 - 20 Years | | 8.1 |

| 20 - 30 Years | | 0.5 |

| |