QuickLinks -- Click here to rapidly navigate through this document

![]()

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion is based on Central Fund's financial statements which are prepared in accordance with accounting principles generally accepted in Canada.

Results of Operations — Changes in Net Assets

The change in net assets as reported in U.S. dollars from period to period is primarily a result of the changing market prices of gold and silver and the proportion of each held by the Company. Also, because gold and silver are initially denominated in U.S. dollars, changes in the value of the U.S. dollar relative to the Canadian dollar will also have an impact on net assets when reported in Canadian dollars. The following table summarizes the changes in net assets in both U.S. and Canadian dollars, gold and silver prices, and the exchange rate between U.S. and Canadian dollars:

| | Years ended October 31 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2002 | 2001 | 2000 | ||||||||||||||||

| | U.S. $ | Cdn. $ | U.S. $ | Cdn. $ | U.S. $ | Cdn. $ | |||||||||||||

| Change in net assets from prior year (in millions) | $ | 66.1 | $ | 101.5 | $ | (2.0 | ) | $ | 0.9 | $ | (7.8 | ) | $ | (7.1 | ) | ||||

| % change from prior year | 99.6 | % | 96.3 | % | (2.9 | )% | 0.9 | % | (10.3 | )% | (6.4 | )% | |||||||

Change in net assets per Class A share from prior year | $ | 0.28 | $ | 0.35 | $ | (0.10 | ) | $ | 0.04 | $ | (0.46 | ) | $ | (0.48 | ) | ||||

| % change per Class A share from prior year | 8.2 | % | 6.5 | % | (2.8 | )% | 0.7 | % | (11.6 | )% | (8.2 | )% | |||||||

Gold price (U.S. $ per fine ounce) | $ 316.90 | $ 278.75 | $ 64.50 | ||||||||||||||||

| % change from prior year | 13.7% | 5.4% | (11.6)% | ||||||||||||||||

Silver price (U.S. $ per ounce) | $ 4.4750 | $ 4.2750 | $ 4.74 | ||||||||||||||||

| % change from prior year | 4.7% | (9.8)% | (10.4)% | ||||||||||||||||

Exchange rate: $1.00 U.S. = Cdn. $ | $ 1.5603 | $ 1.5867 | $ 1.5271 | ||||||||||||||||

| % change from prior year | (1.7)% | 3.9% | 3.8% | ||||||||||||||||

In 2002, net assets as reported in U.S. dollars increased by $66.1 million or 99.6%. A significant portion of this increase was the result of two private placements and a public offering of Class A shares during the year as described in note 3 to the financial statements. In all cases, these share offerings were issued at a premium over the net asset value per Class A share at the time, such that there was no dilution of the interests of existing Class A shareholders. Of the net proceeds from these share issues ($63,647,461), $33,947,143 was used to purchase 106,701 fine ounces of gold bullion, and $26,298,275 was used to purchase 5,330,613 ounces of silver bullion, primarily in physical bar form. The balance of the proceeds, $3,402,043 was retained in interest-bearing cash deposits for working capital purposes.

The increase in net assets resulting from the factors described above was nominally offset by the net loss incurred during the year and the dividend paid on Class A shares. Though subject to the same effects as described above, net assets, as reported in Canadian dollars, increased at a slightly lower rate of 96.3%, as a result of the 1.7% decrease in the U.S. dollar relative to the Canadian dollar.

1

In 2001, net assets as reported in U.S. dollars decreased by 2.9%. Gold prices increased by 5.4% whereas silver prices decreased by 9.8% during the year. Also contributing to this decrease were the net loss incurred during the year and the dividend paid on Class A shares. Though subject to the same effects as described above, net assets as reported in Canadian dollars increased by 0.9% as the 3.9% increase in the U.S. dollar relative to the Canadian dollar more than offset the net decline resulting from the aforementioned items.

There were no purchases or sales of gold or silver bullion during the 2001 fiscal year.

In 2000, net assets as reported in U.S. dollars and Canadian dollars decreased by 10.3% and 6.4% respectively. Gold prices decreased by 11.6% and silver prices by 10.4% during the year. Also contributing to this decrease were the net loss incurred during the year and the dividend paid on Class A shares. These decreases in net assets were partially offset by the net proceeds from exercise of the Series 2 Warrants in November 1999 of $1,187,860 (Cdn. $1,749,480), a 1.6% (Cdn. 1.6%) increase over net assets as at October 31, 1999. The percentage decrease in net assets as reported in Canadian dollars, while subject to the same effects described above, was lower than in U.S. dollars as a result of the 3.8% increase in the U.S. dollar relative to the Canadian dollar.

The proceeds from the exercise of the Series 2 Warrants were held in interest-bearing deposits for subsequent use in meeting requirements for operating expenses, tax payments and Class A share dividends.

There were no purchases or sales of gold or silver bullion during the 2000 fiscal year.

It is possible to predict the impact that changes in the market prices of gold and silver will have on the net asset value per Class A share. Assuming as a constant exchange rate the rate which existed on October 31, 2002 of $1.5603 Cdn. for each U.S. dollar together with holdings of gold and silver bullion which existed on that date, a 10% change in the price of gold would increase or decrease the net asset value per share by approximately $0.21 per share or Cdn. $0.33 per share. A 10% change in the price of silver would increase or decrease the net asset value per share by approximately $0.15 per share or Cdn. $0.23 per share. If both gold and silver prices were to change by 10% simultaneously in the same direction, the net asset value per share would increase or decrease by approximately $0.36 per share or Cdn. $0.56 per share.

When expressed in U.S. dollar terms, Central Fund's net asset value per Class A share is largely unaffected by changes in the U.S./Canadian dollar exchange rate due to the fact that nearly all of Central Fund's net assets are priced internationally in U.S. dollar terms. However, changes in the value of the U.S. dollar relative to the Canadian dollar have a direct impact on net assets as expressed in Canadian dollars. This arises because over 99% of Central Fund's net assets are initially denominated in U.S. dollars as at October 31, 2002, including gold and silver bullion and some U.S. cash. An increase in the value of the Canadian dollar versus the U.S. dollar means that the aforementioned U.S. dollar denominated assets are worth less when expressed in Canadian dollar terms.

It is also possible to predict the impact that changes in the value of the U.S. dollar relative to the Canadian dollar will have on the net asset value per Class A share as reported in Canadian dollars. As previously mentioned, over 99% of Central Fund's net assets are denominated in U.S. dollars. Assuming constant gold and silver prices, a 10% increase or decrease in the value of the U.S. dollar relative to the Canadian dollar would change the net asset value per share as expressed in Canadian dollars in the same direction by approximately the same percentage.

Results of Operations — Net Loss

Central Fund's income objective is secondary to its investment objective of holding the vast majority of its net assets in gold and silver bullion. Generally, Central Fund only seeks to maintain adequate cash reserves to enable it to pay operating expenses, taxes and Class A share dividends.

2

Because gold and silver bullion do not generate revenue, Central Fund's revenues are a low percentage of its net assets. Accordingly, in the last three fiscal years, Central Fund has incurred net losses. Central Fund expects to generate cash flow from its holdings of cash equivalents and marketable securities, and sells bullion certificates only if necessary to replenish cash reserves. Administration fees, which have ranged from 58% to 60% of Central Fund's operating expenses before income taxes in the three-year period ended October 31, 2002, are calculated monthly based on an annualized percentage (not exceeding1/2 of 1%) of Central Fund's net assets. Accordingly, these fees vary directly with changes in net assets.

Fiscal 2002 Compared to Fiscal 2001

The net loss of $1,895,800 during the 2002 fiscal year is 198.8% higher than the 2001 loss of $634,412. Interest income during the year was sharply reduced due to lower average balances of interest-bearing cash deposits combined with declining interest rates during the year as compared with the prior year. However, cash balances have increased significantly as a result of the Class A share issues which have resulted in higher interest income in recent months and should continue to have a positive impact on interest earned in subsequent periods.

Management has made the decision to focus its small portfolio of equity securities on high quality, senior gold and/or silver producers. As such, a portion of the existing older portfolio representing junior mining companies was sold, resulting in a realized loss representing approximately one-half of the net loss incurred during the year.

Operating expenses (which exclude income taxes) increased by 30.7% over the prior year. The increase in net assets during the year as a result of the two private placements and public share offering referred to above had an impact on several expense categories. Administration fees, which are calculated monthly based on net assets at each month end, increased during the year as a direct result of the higher level of net assets attributable to the issuances of Class A shares. Safekeeping fees and bullion insurance costs have increased to reflect the larger quantities and dollar values of gold and silver bullion being held as a result of bullion purchases from the proceeds of the share issues. Shareholder information costs increased as U.S. and Canadian stock exchange fees were increased at the time of filing the share issues. Directors' fees have increased as a result of the addition of an independent director (formerly an officer and inside director).

Operating expenses (which exclude income taxes) were less than 1.0%, being 0.6% of net assets at October 31, 2002.

Income taxes, or more specifically the federal Large Corporations Tax, are based on the Company's total net assets as at its fiscal year end. The increase in income taxes is directly related to the higher net asset level which existed at October 31, 2002.

Fiscal 2001 Compared to Fiscal 2000

The net loss of $634,412 during the 2001 fiscal year is 6.2% higher than the 2000 loss of $597,597. Interest income decreased by 45.3% as interest-bearing cash deposits were used to fund ongoing operating expenses, taxes and the Class A share dividend. A gradual reduction in interest rates throughout the year also contributed to the reduction in interest income.

Operating expenses (which exclude income taxes) declined by 4.8% over the prior year. Also, administration fees, which are calculated monthly based on net assets, were 6.7% lower in 2001 as average monthly net assets declined during the year, relative to the net asset levels in 2000.

Operating expenses (which exclude income taxes) were less than 1.0%, being 0.9% of net assets at October 31, 2001.

3

United States Generally Accepted Accounting Principles

Net income (loss) as it would be determined under accounting principles generally accepted in the United States (whereby the change in unrealized appreciation/depreciation of investments is reflected in the statement of loss) has been, and is expected to be, volatile, as a result of the changing market prices of gold and silver.

Liquidity and Capital Resources

Central Fund's liquidity objective is to hold cash reserves primarily for the generation of cash flow to be applied to pay operating expenses, tax payments and Class A share dividends. At October 31, 2002, Central Fund's cash reserves including cash equivalents were $3,898,000. The comparable figure at October 31, 2001 was $1,457,000.

The ability of Central Fund to have sufficient cash for operating expenses, tax and dividend payments, and demands for redemption (if any), is primarily dependent upon its ability to realize cash flow from its cash equivalents and marketable securities. Should Central Fund not have sufficient cash to meet its needs, portions of Central Fund's bullion holdings and/or marketable securities portfolio may be sold to fund tax and dividend payments, provide working capital and pay for redemptions (if any) of Class A shares. Sales of such investments could result in Central Fund realizing capital losses or gains. Central Fund qualifies as a Mutual Fund Corporation for Canadian income tax purposes. As a Mutual Fund Corporation, any Canadian tax payable by Central Fund to the extent that it relates to taxable capital gains is fully refundable when the realized gains are distributed to shareholders through redemptions. Should Central Fund not qualify as a Mutual Fund Corporation at any time in the future, Central Fund would have to pay non-refundable tax on such capital gains, if any. Payments for such distributions or tax would be a further use of Central Fund's cash resources.

During the fiscal year ended October 31, 2002, Central Fund's cash reserves increased by $2,442,000 from those which existed at October 31, 2001. The primary sources and uses of cash are as follows:

Sources of Cash

The primary inflow of cash resulted from the proceeds (net of share issue costs of $550,000) from the issuance of Class A shares during the year of $63,647,000. An additional $44,000 was generated from interest on short-term securities, and $31,000 received upon the sale of marketable securities.

Uses of Cash

The primary outflow of cash involved the purchase of gold and silver bullion with the proceeds from the share issues referred to above. Central Fund paid $33,947,000 to purchase 106,701 fine ounces of gold and $26,298,000 to purchase 5,330,613 ounces of silver.

Central Fund paid $673,000 during the 2002 fiscal year for operating expenses, $123,000 of which related to amounts which had been accrued at October 31, 2001 and were reflected in the accounts of that year. Other cash outflows during the year included $145,000 in payments of the Canadian federal large corporations tax, $194,000 paid in the 2002 fiscal year with respect to Central Fund's October 31, 2001 Class A share dividend declared, and $24,000 paid to purchase marketable securities.

Central Fund's board of directors made the decision to build up cash reserves by maintaining a portion of the proceeds from share issues in recent years in cash and cash equivalents. Consistent with this objective, $3,402,000 of the $63,647,000 received on the issuance of Class A shares this year was kept in interest-bearing cash deposits. These amounts are to be used to pay operating expenses, tax and dividend payments, and demands for redemption (if any). Management is mindful of Central Fund's normal trend of diminishing cash reserves, but monitors its cash position with an emphasis on

4

maintaining its gold and silver bullion holdings as opposed to generating income. Management's mandate and Central Fund's stated objective are to hold the maximum portion of its assets in the form of gold and silver bullion as it deems reasonable. Although holding bullion does not generate income as noted above, Central Fund has the ability to generate any necessary cash by liquidating a small portion of its holdings. At low cash reserve levels and in the absence of other sources of capital, liquidations may be made regardless of market conditions and could result in Central Fund realizing losses on its bullion or marketable security holdings.

Inflation

Because Central Fund's financial statements are prepared on a market price basis, the impact of inflation and changing prices on the price of gold and silver is reflected in these financial statements.

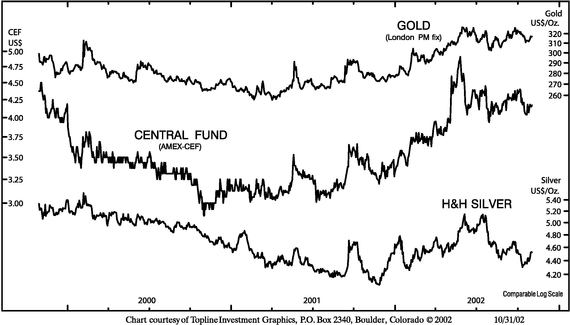

The Relationship between Gold, Silver and Central Fund

The following chart shows the price movements of gold, silver and Central Fund's Class A shares (in U.S. dollars) over the past three years:

5