38th Annual J.P. Morgan Healthcare Conference Mark Tarr, President and Chief Executive Officer January 14, 2020

Forward-looking statements The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect Encompass Health’s current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, acquisition and other development activities, cyber security, dividend strategies, repurchases of securities, effective tax rates, financial performance, financial assumptions, business model, balance sheet and cash flow plans, market share, development of new information tools and models, and shareholder value-enhancing transactions. These estimates, projections and other forward-looking information are based on assumptions the Company believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. Encompass Health undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2018, Form 10-Q for the quarters ended March 31, 2019, June 30, 2019, and September 30, 2019, and in other documents Encompass Health previously filed with the SEC, many of which are beyond Encompass Health’s control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note regarding presentation of non-GAAP financial measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, leverage ratios, adjusted earnings per share, and adjusted free cash flow. The Company’s Form 8-K, dated January 13, 2020, to which the following presentation is attached as Exhibit 99.1, provides further explanation and disclosure regarding Encompass Health’s use of non-GAAP financial measures and should be read in conjunction with this presentation. Encompass Health 2

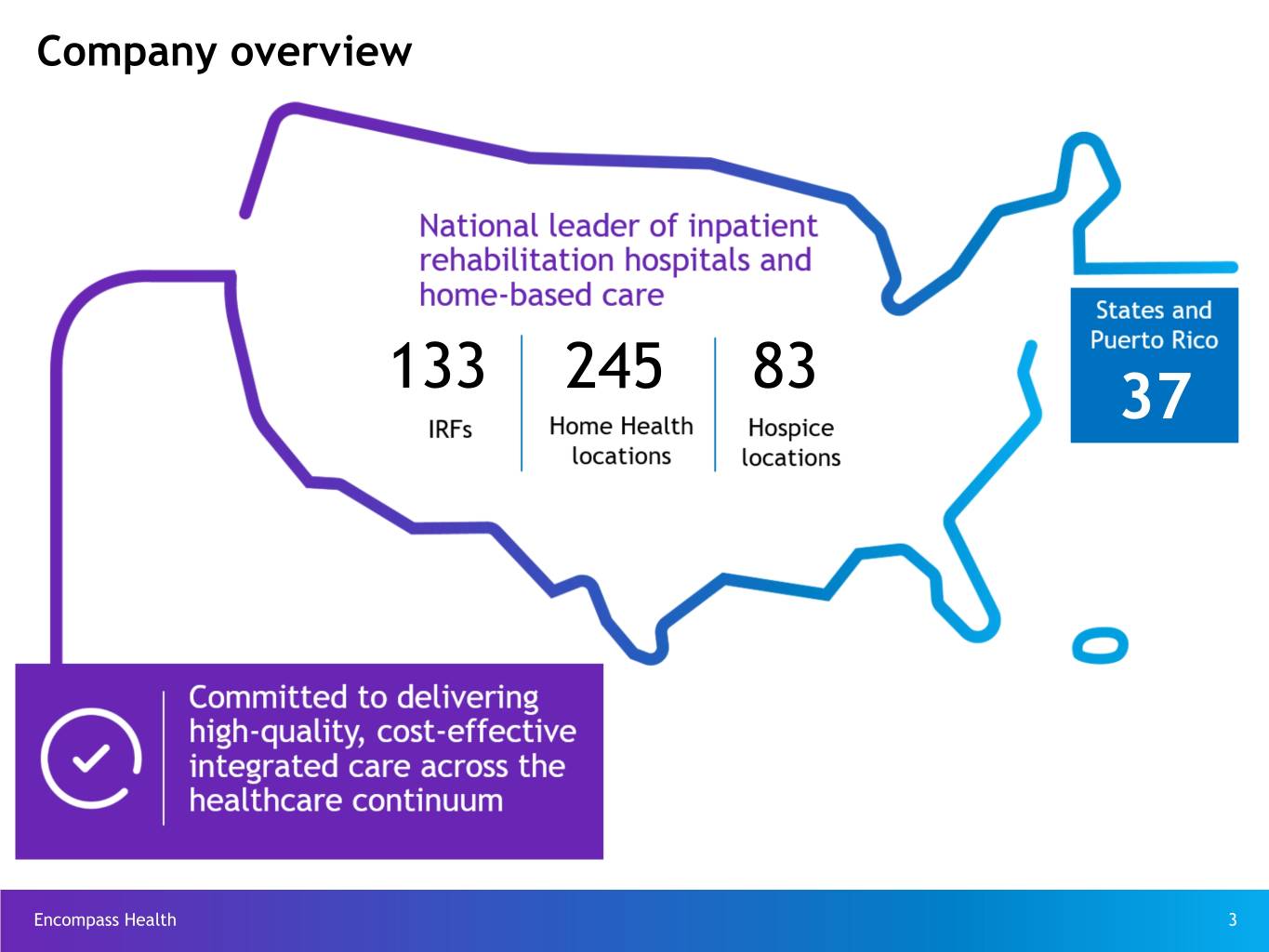

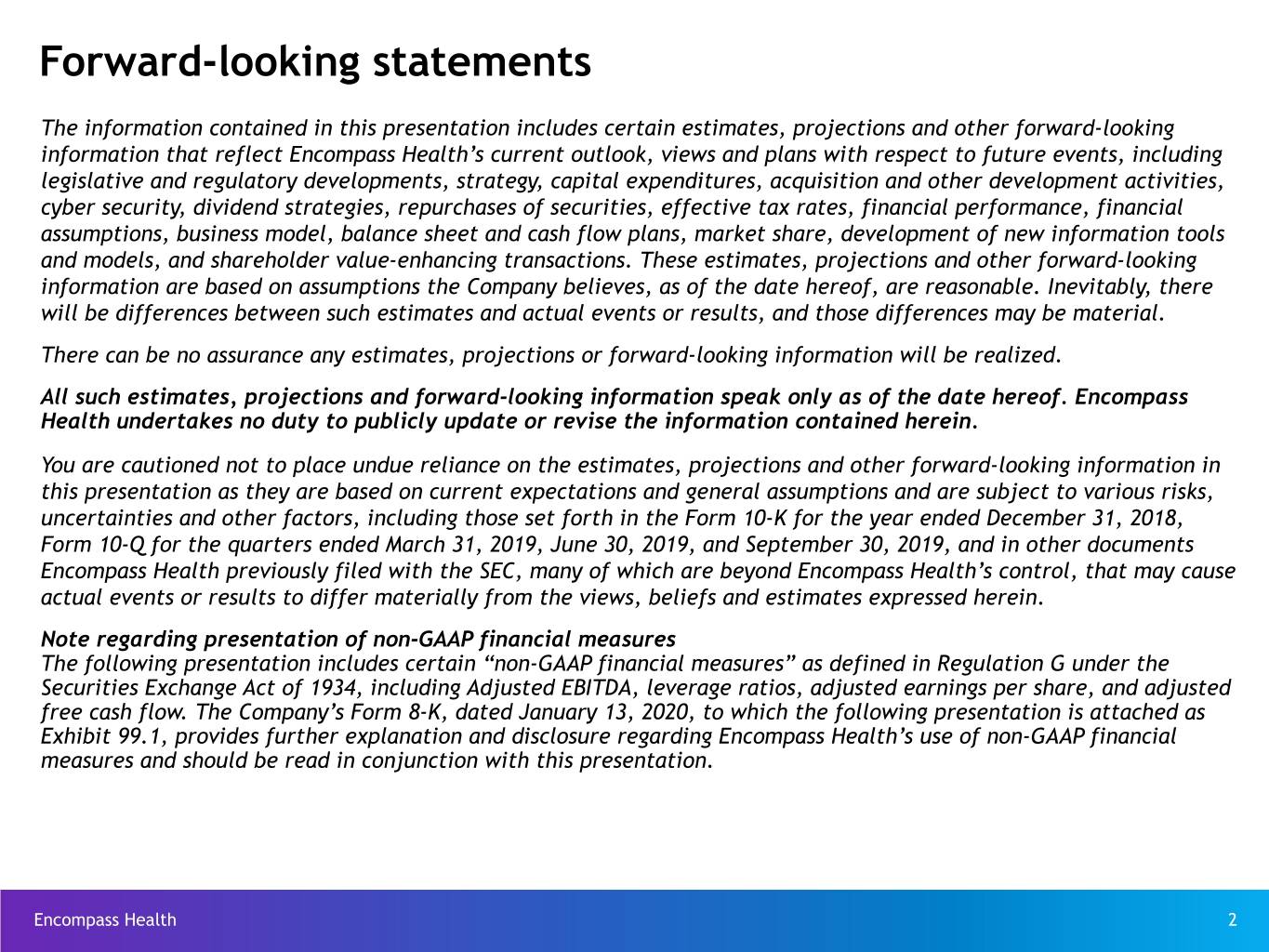

Company overview 133 245 83 37 Encompass Health 3

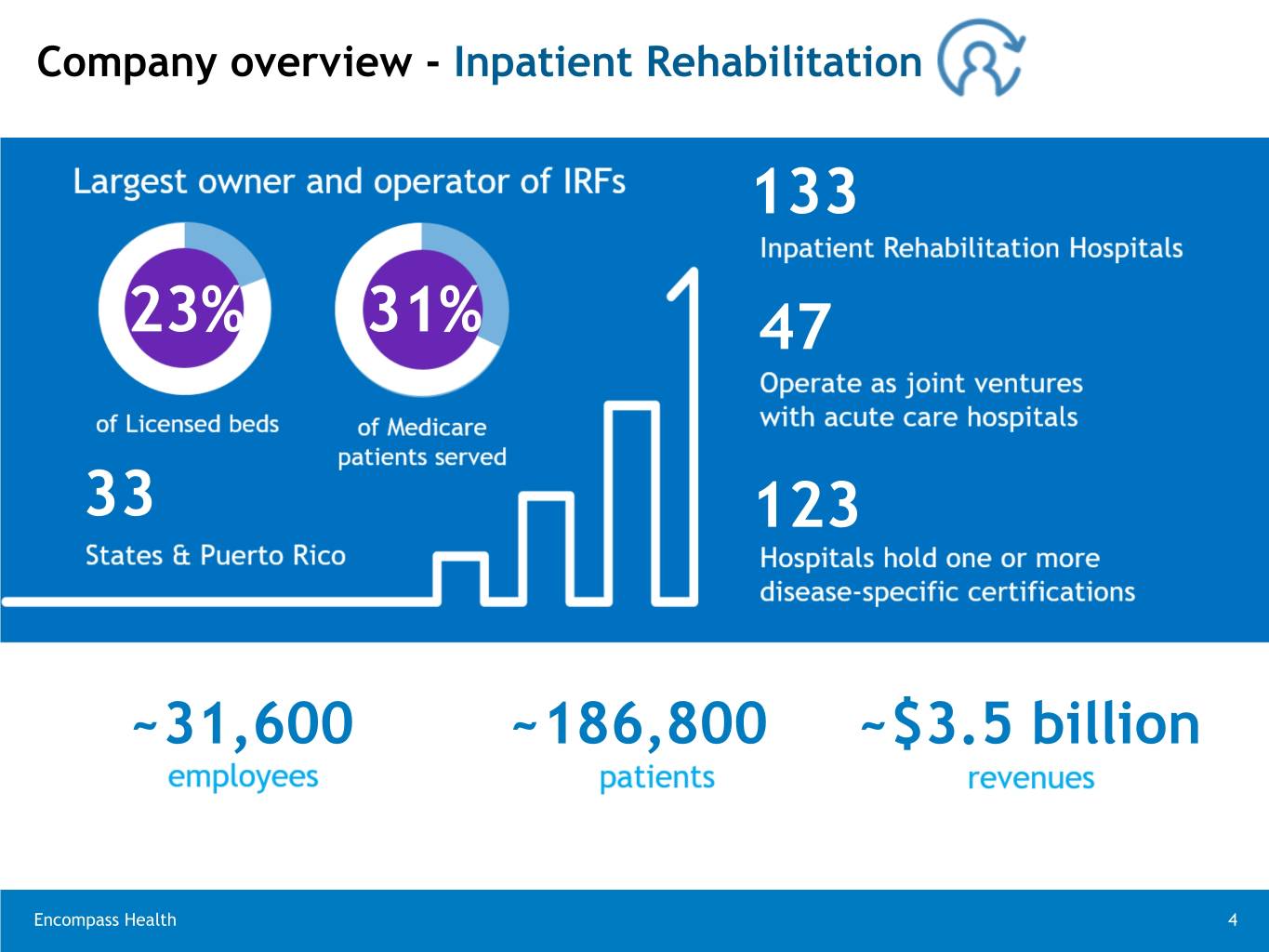

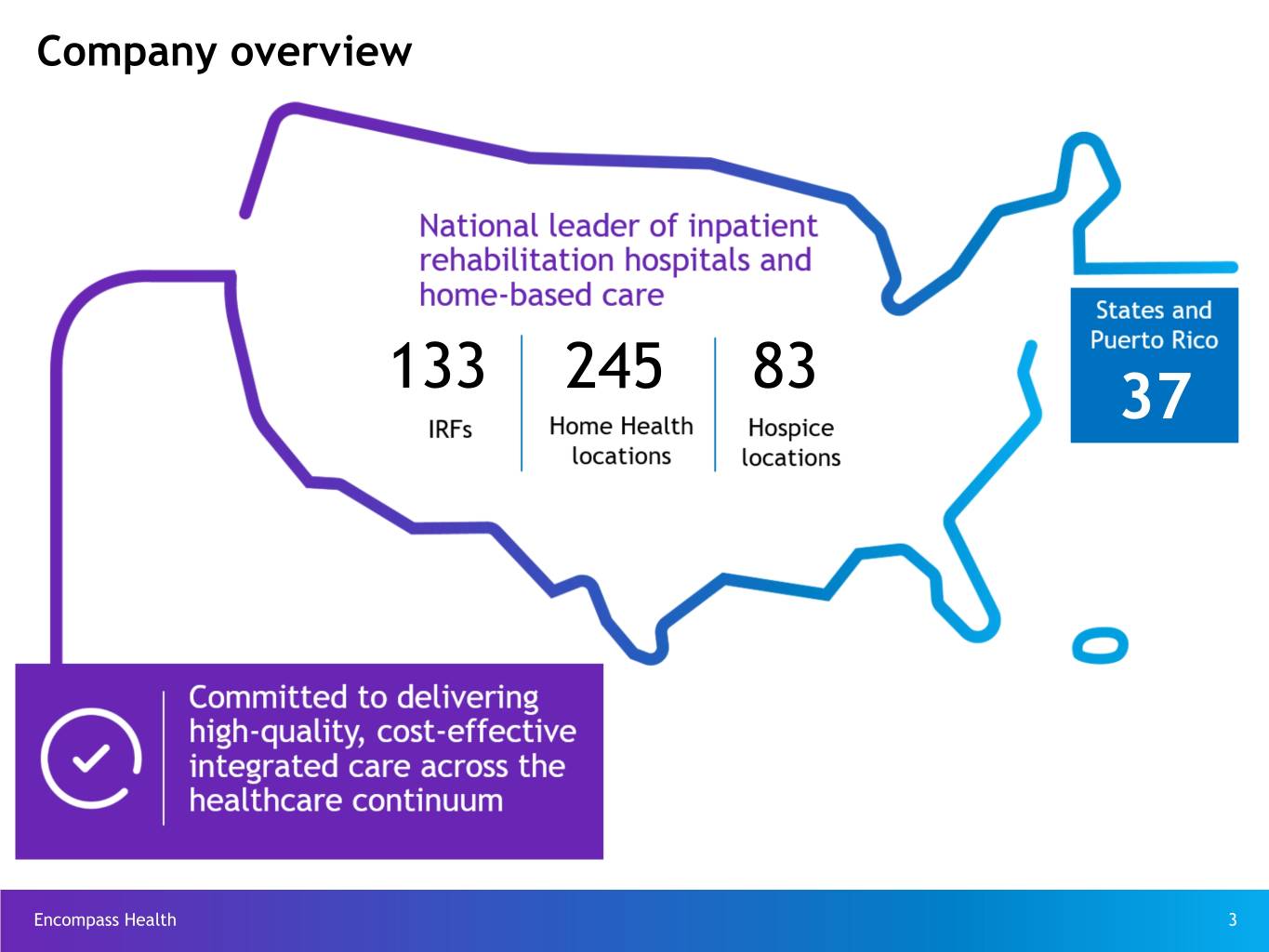

Company overview - Inpatient Rehabilitation 133 23% 31% 47 33 123 ~31,600 ~186,800 ~$3.5 billion Encompass Health 4

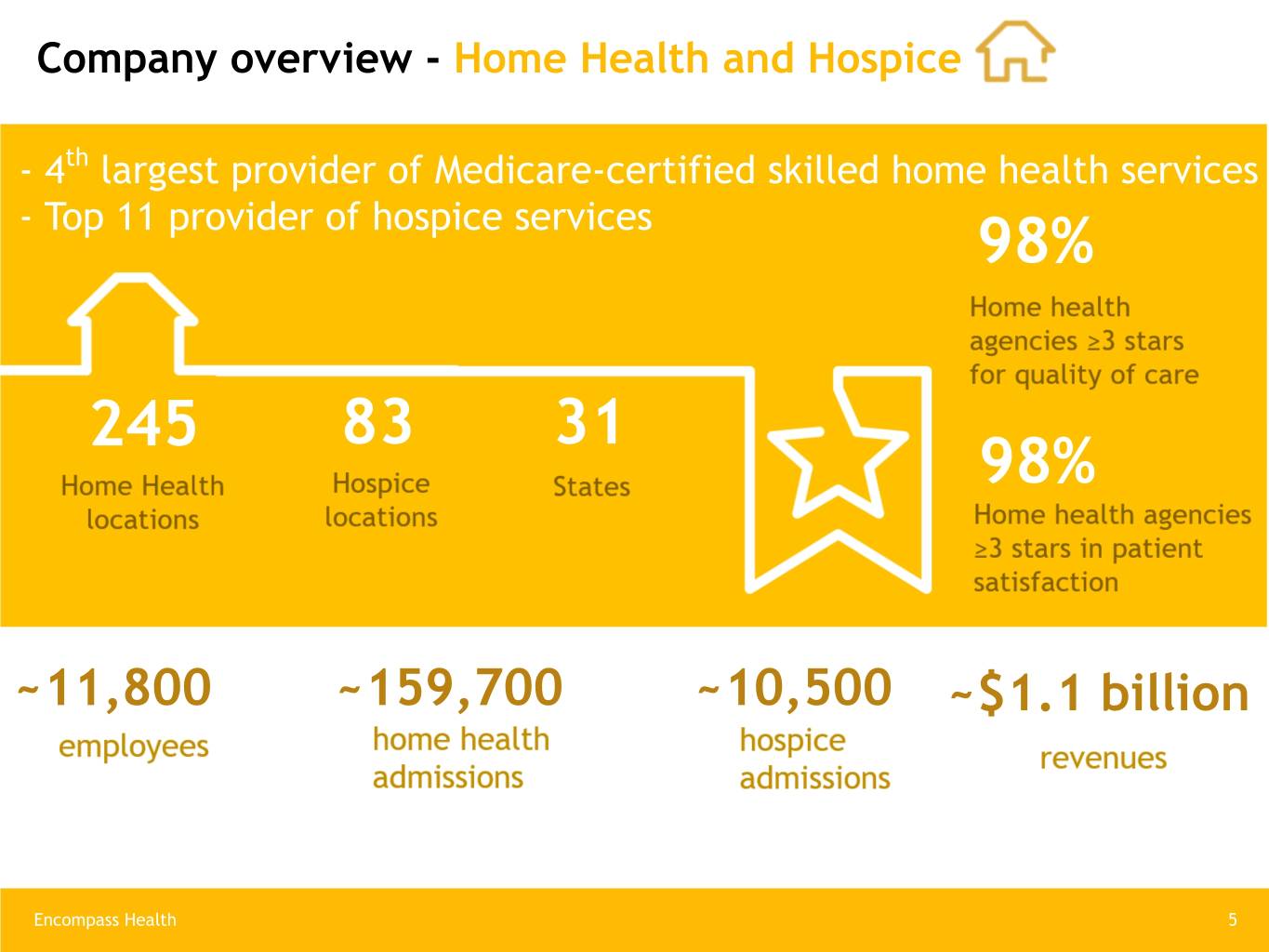

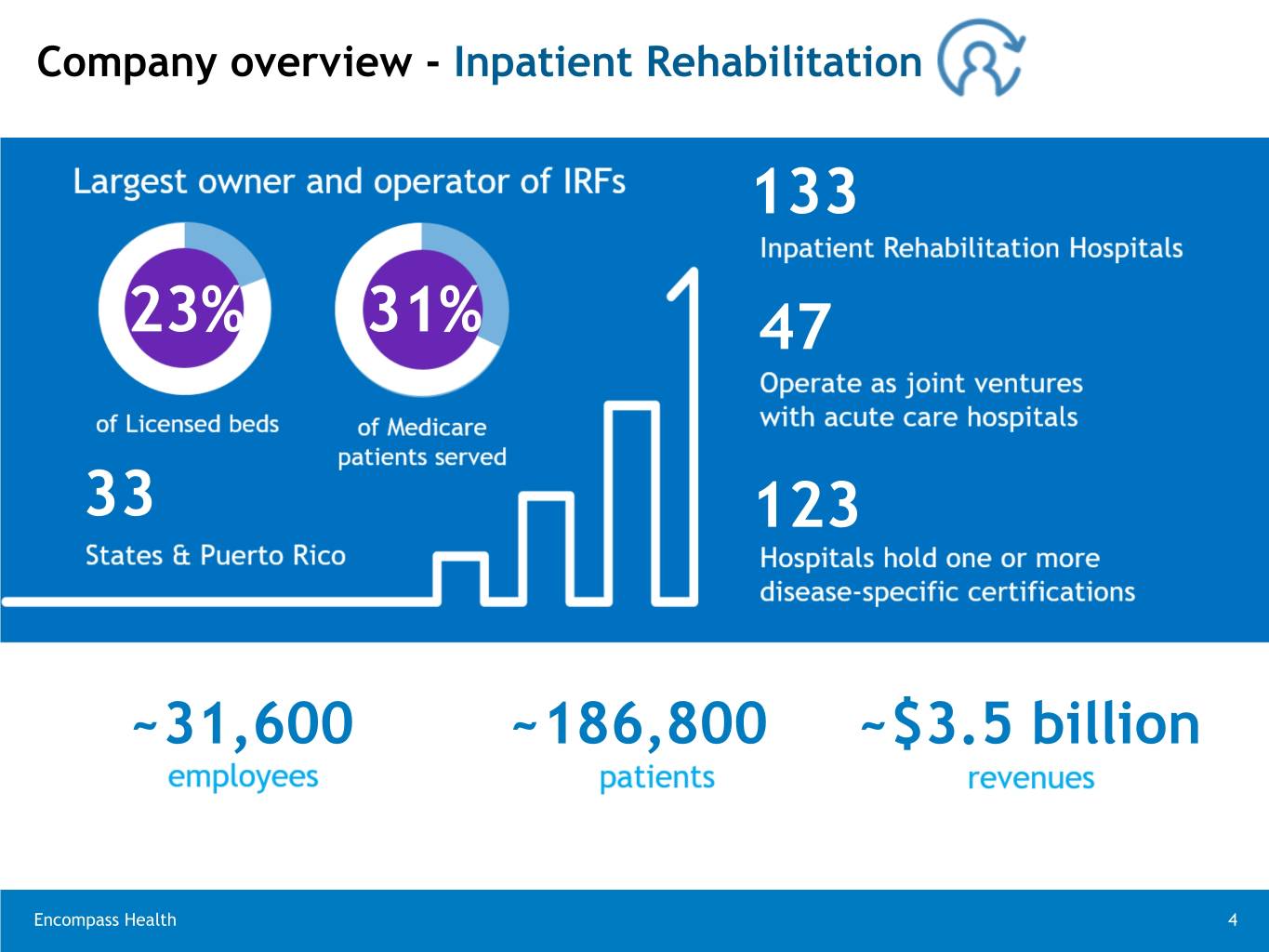

Company overview - Home Health and Hospice - 4th largest provider of Medicare-certified skilled home health services - Top 11 provider of hospice services 98% 245 83 31 98% ~11,800 ~159,700 ~10,500 ~$1.1 billion Encompass Health 5

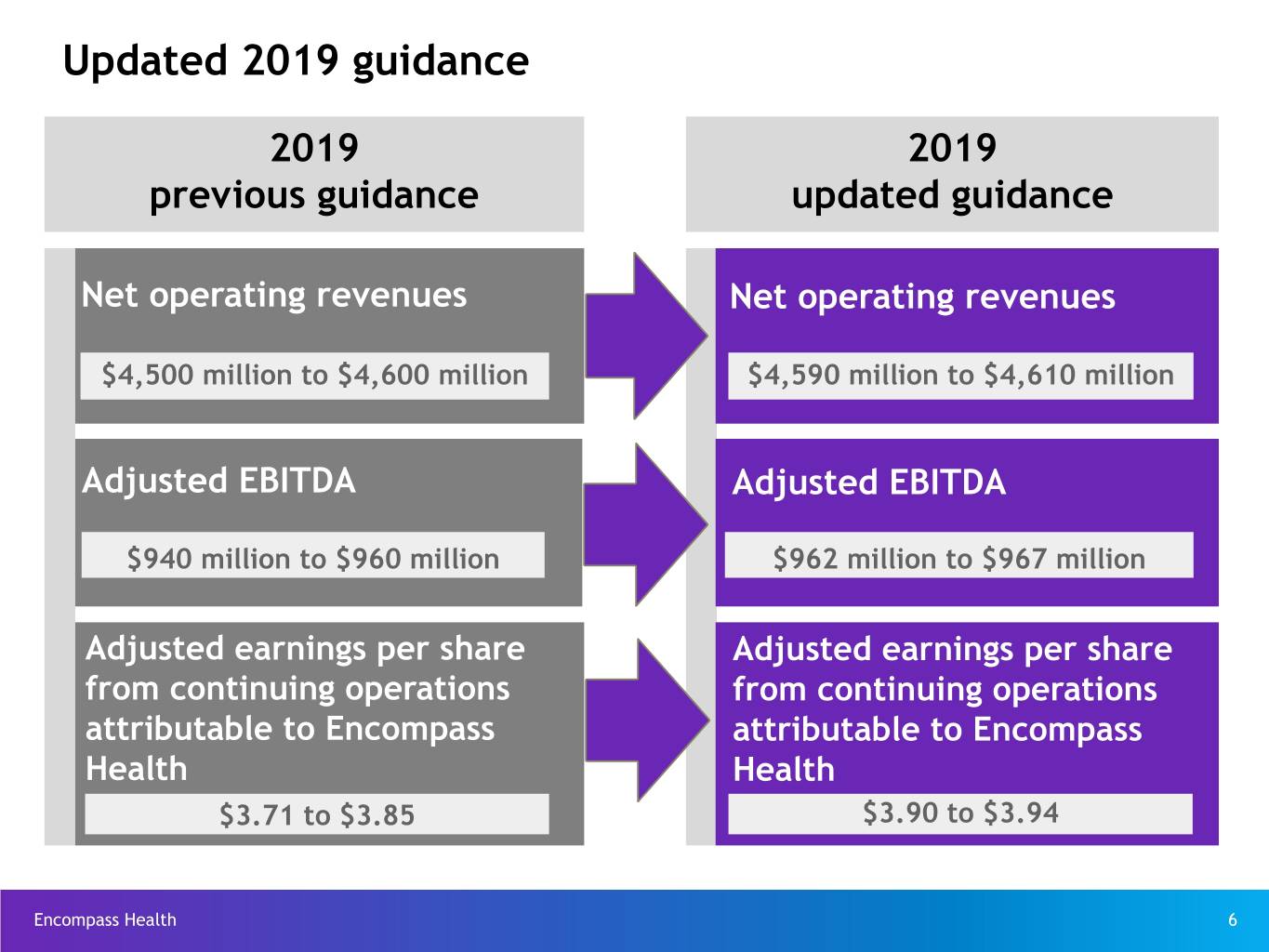

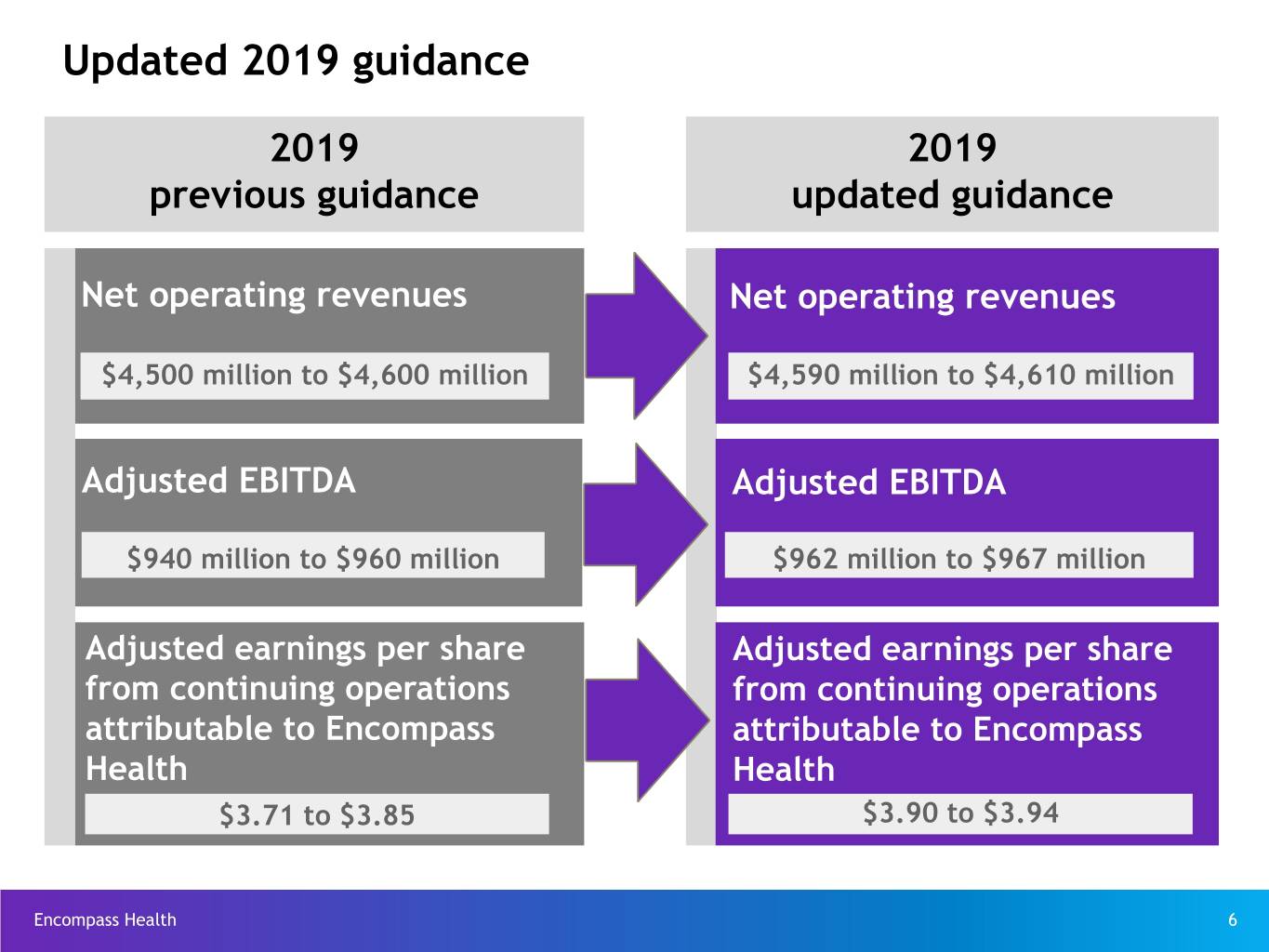

Updated 2019 guidance 2019 2019 previous guidance updated guidance Net operating revenues Net operating revenues $4,500 million to $4,600 million $4,590 million to $4,610 million Adjusted EBITDA Adjusted EBITDA $940 million to $960 million $962 million to $967 million Adjusted earnings per share Adjusted earnings per share from continuing operations from continuing operations attributable to Encompass attributable to Encompass Health Health $3.71 to $3.85 $3.90 to $3.94 Encompass Health 6

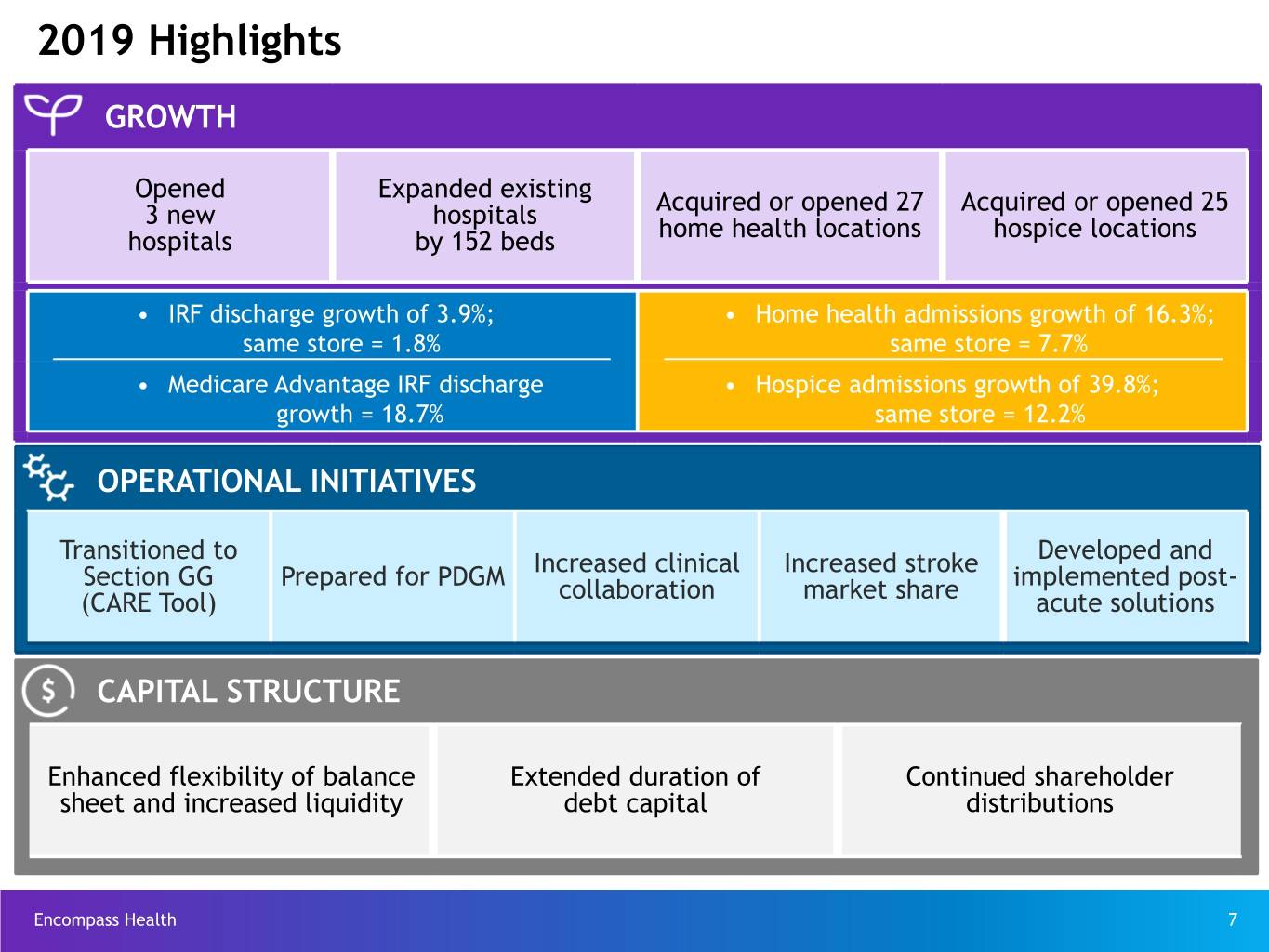

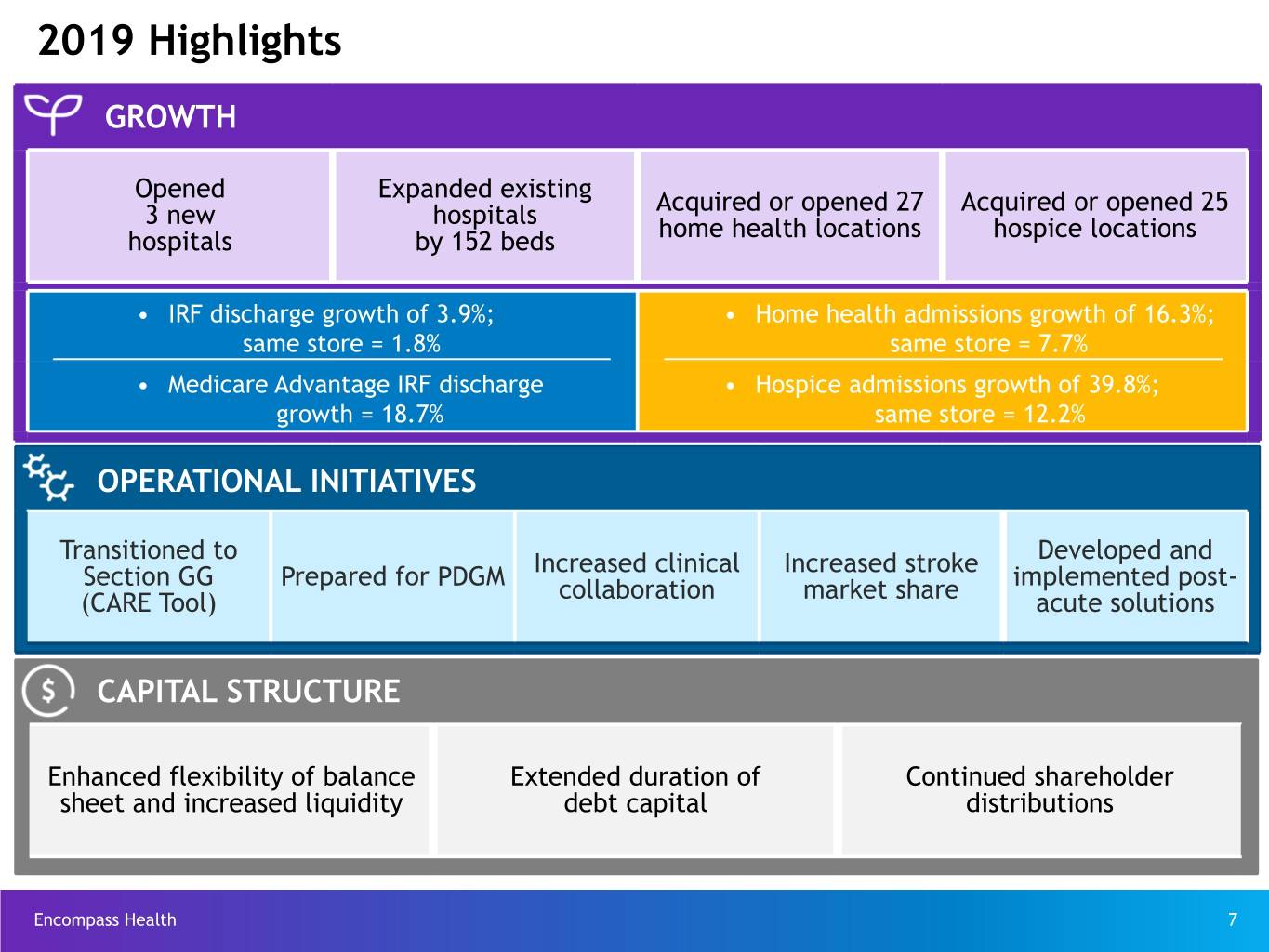

2019 Highlights GROWTH Opened Expanded existing 3 new hospitals Acquired or opened 27 Acquired or opened 25 hospitals by 152 beds home health locations hospice locations • IRF discharge growth of 3.9%; • Home health admissions growth of 16.3%; same store = 1.8% same store = 7.7% • Medicare Advantage IRF discharge • Hospice admissions growth of 39.8%; growth = 18.7% same store = 12.2% OPERATIONAL INITIATIVES Transitioned to Developed and Section GG Prepared for PDGM Increased clinical Increased stroke implemented post- (CARE Tool) collaboration market share acute solutions CAPITAL STRUCTURE Enhanced flexibility of balance Extended duration of Continued shareholder sheet and increased liquidity debt capital distributions Encompass Health 7

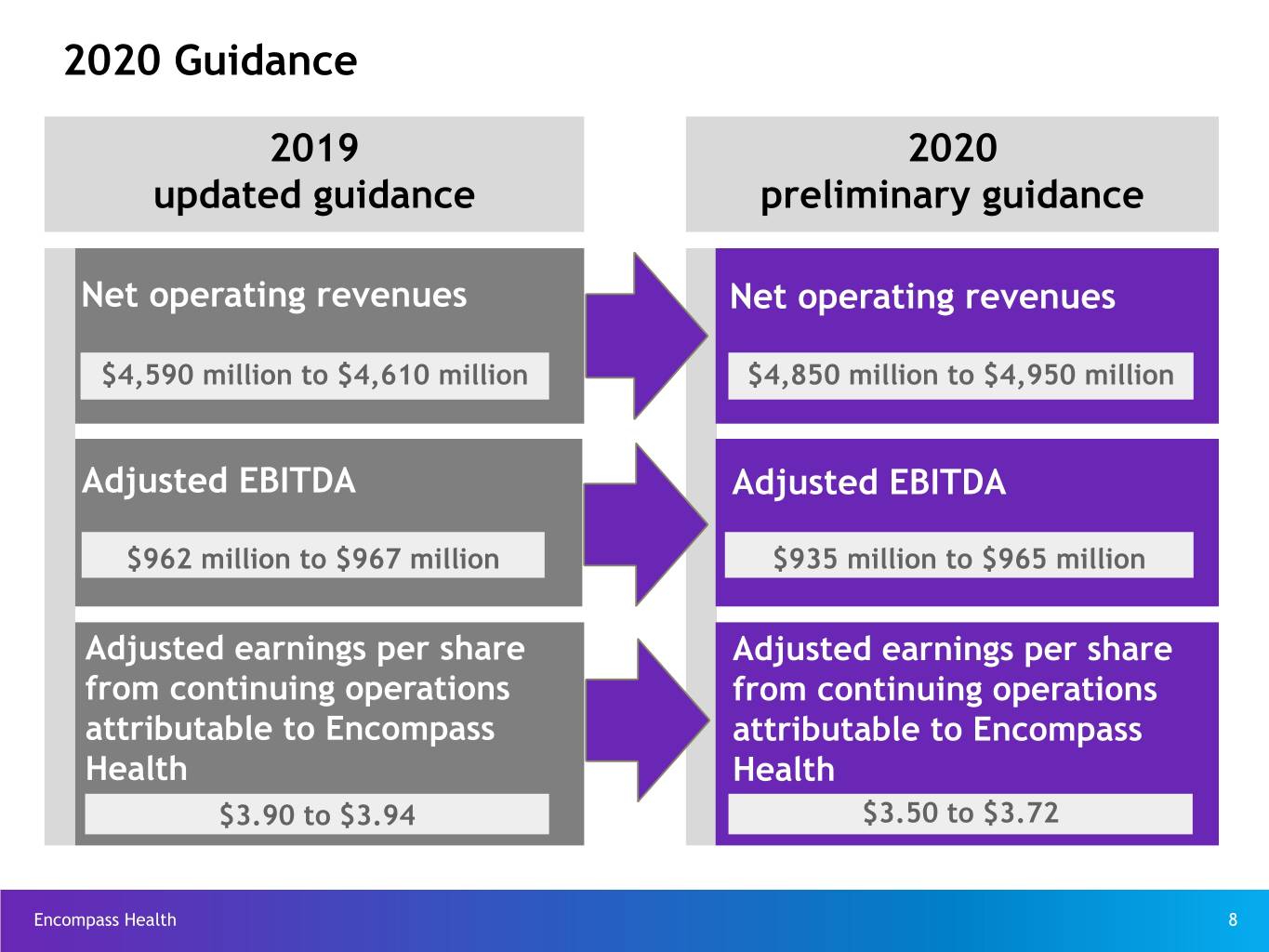

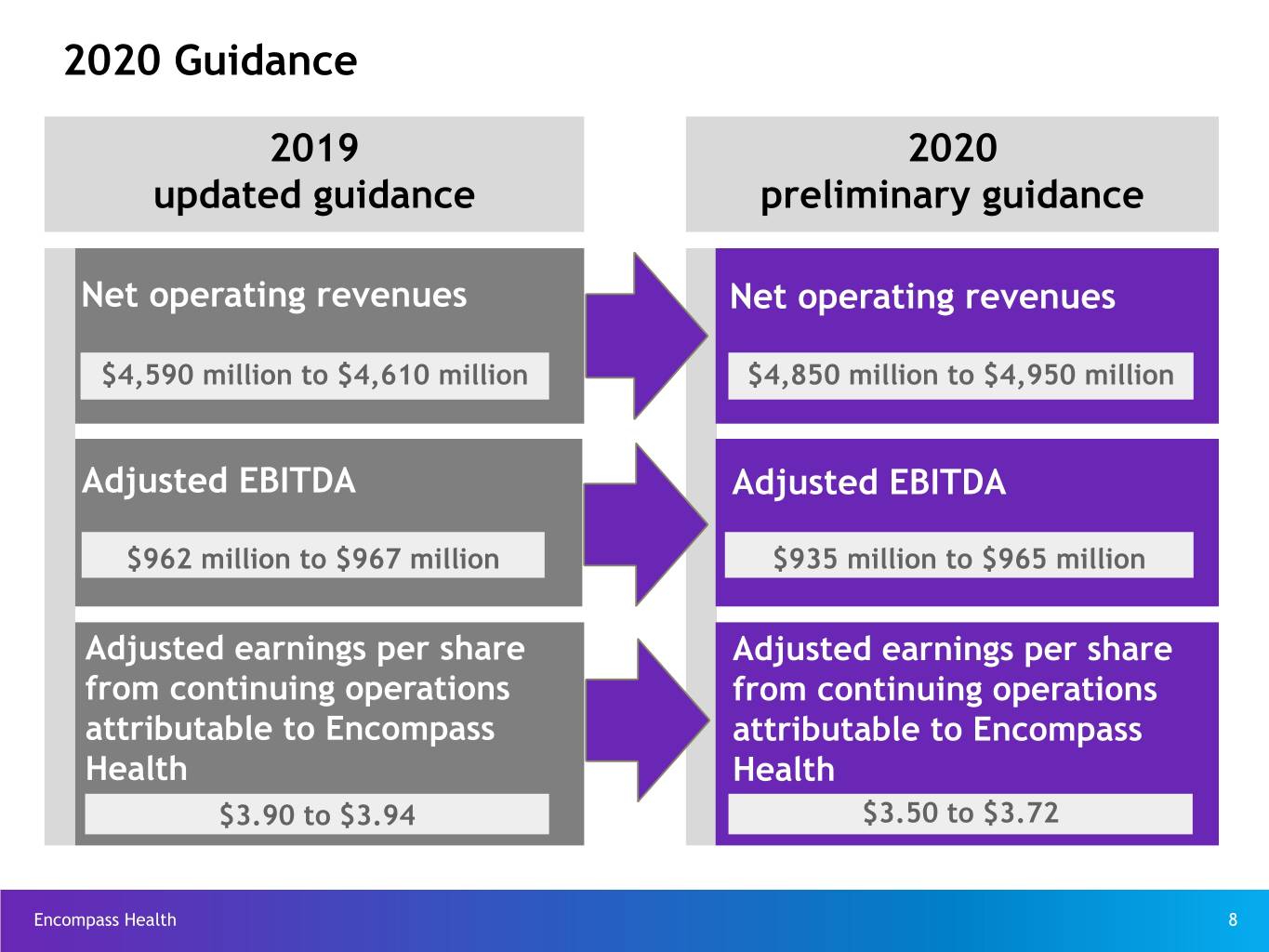

2020 Guidance 2019 2020 updated guidance preliminary guidance Net operating revenues Net operating revenues $4,590 million to $4,610 million $4,850 million to $4,950 million Adjusted EBITDA Adjusted EBITDA $962 million to $967 million $935 million to $965 million Adjusted earnings per share Adjusted earnings per share from continuing operations from continuing operations attributable to Encompass attributable to Encompass Health Health $3.90 to $3.94 $3.50 to $3.72 Encompass Health 8

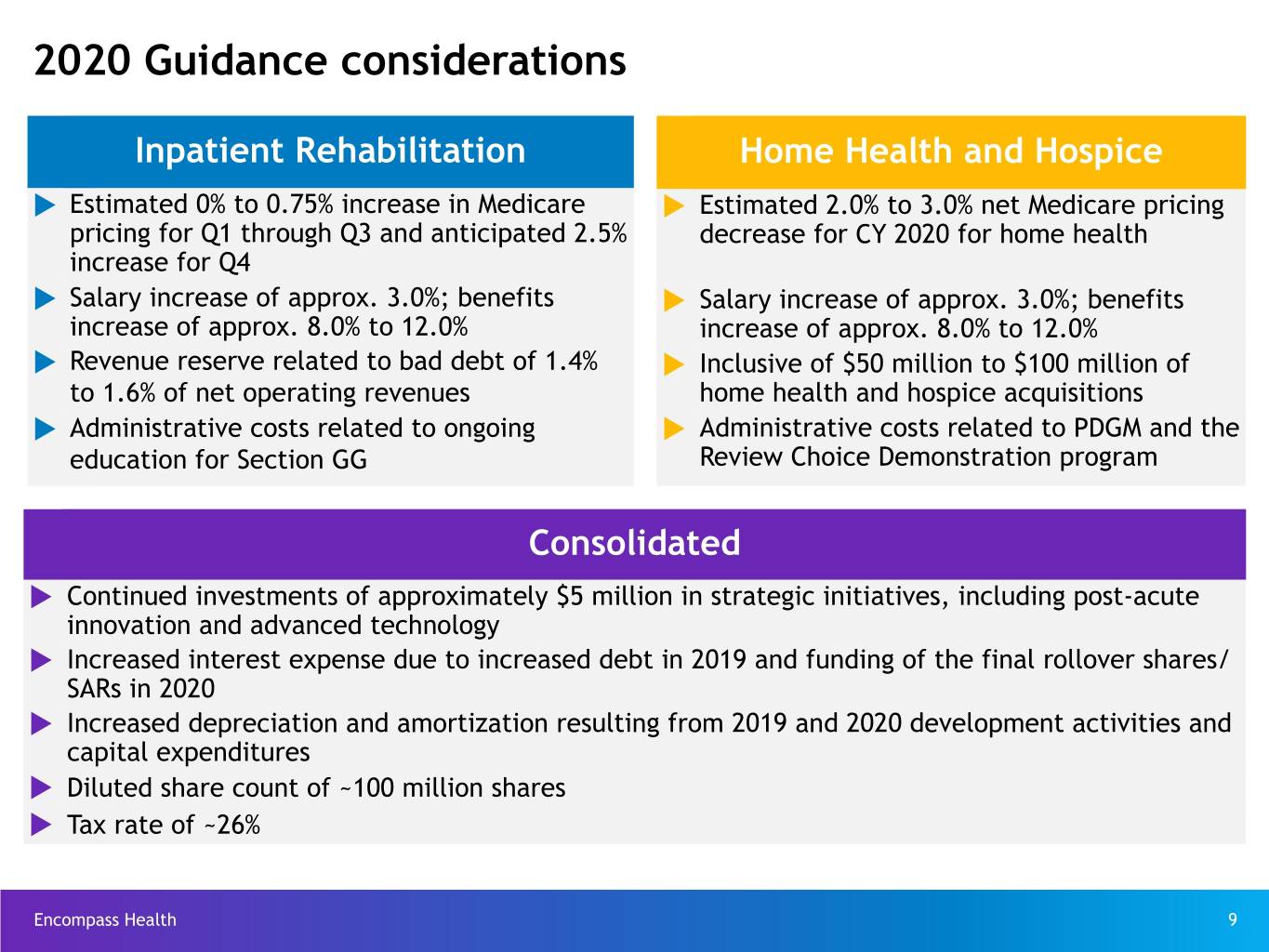

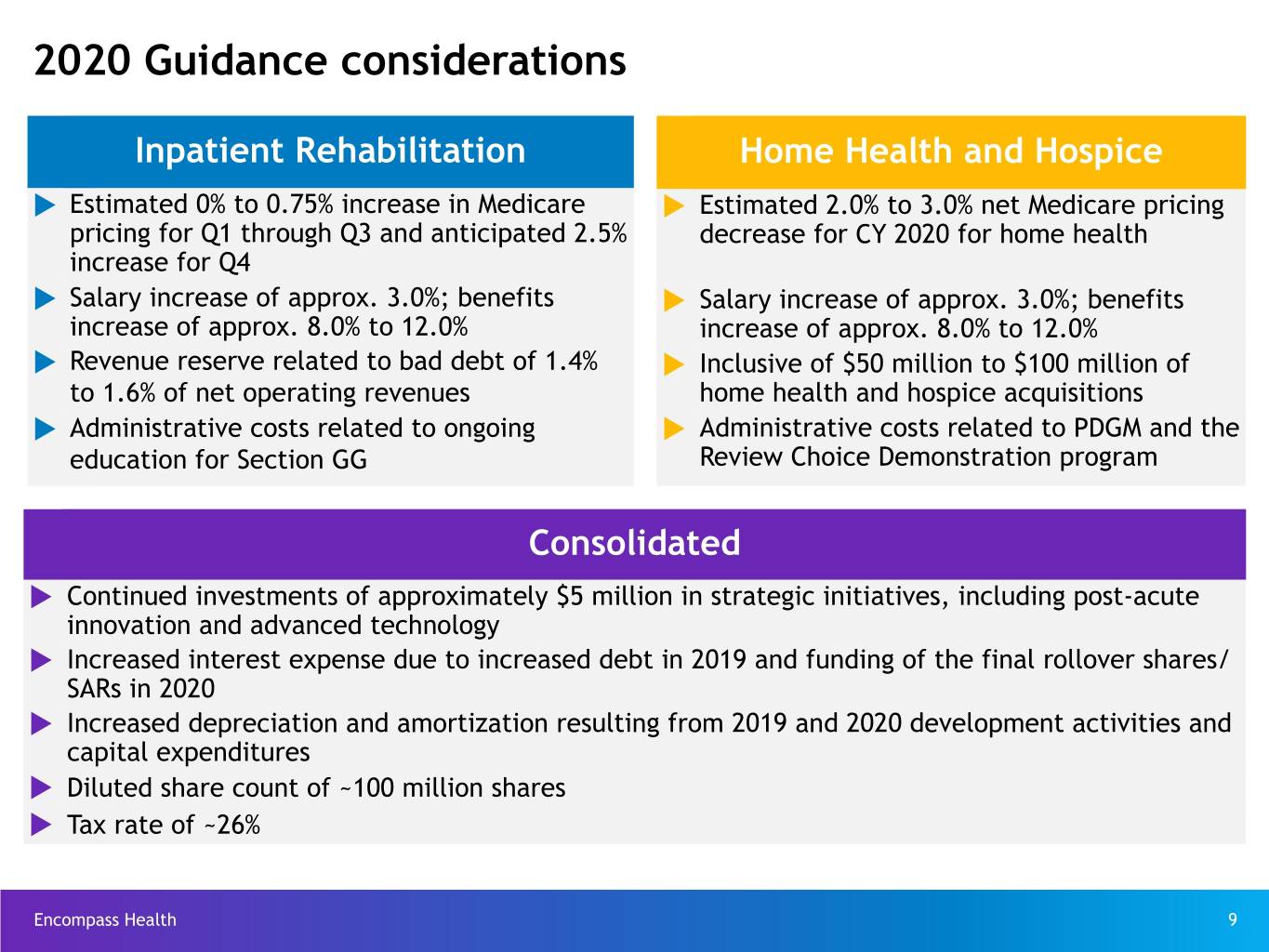

2020 Guidance considerations Inpatient Rehabilitation Home Health and Hospice u Estimated 0% to 0.75% increase in Medicare u Estimated 2.0% to 3.0% net Medicare pricing pricing for Q1 through Q3 and anticipated 2.5% decrease for CY 2020 for home health increase for Q4 u Salary increase of approx. 3.0%; benefits u Salary increase of approx. 3.0%; benefits increase of approx. 8.0% to 12.0% increase of approx. 8.0% to 12.0% u Revenue reserve related to bad debt of 1.4% u Inclusive of $50 million to $100 million of to 1.6% of net operating revenues home health and hospice acquisitions u Administrative costs related to ongoing u Administrative costs related to PDGM and the education for Section GG Review Choice Demonstration program Consolidated u Continued investments of approximately $5 million in strategic initiatives, including post-acute innovation and advanced technology u Increased interest expense due to increased debt in 2019 and funding of the final rollover shares/ SARs in 2020 u Increased depreciation and amortization resulting from 2019 and 2020 development activities and capital expenditures u Diluted share count of ~100 million shares u Tax rate of ~26% Encompass Health 9

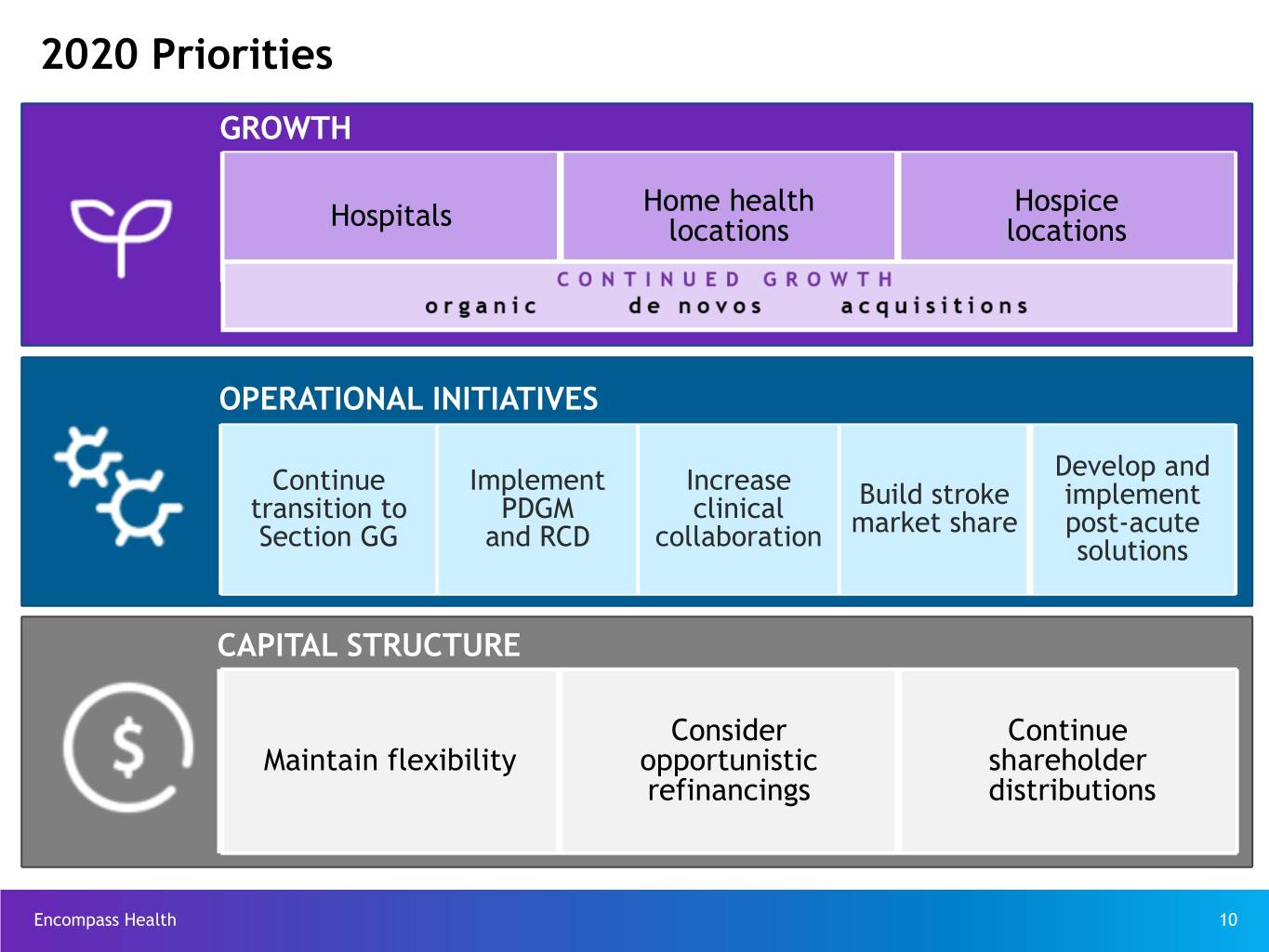

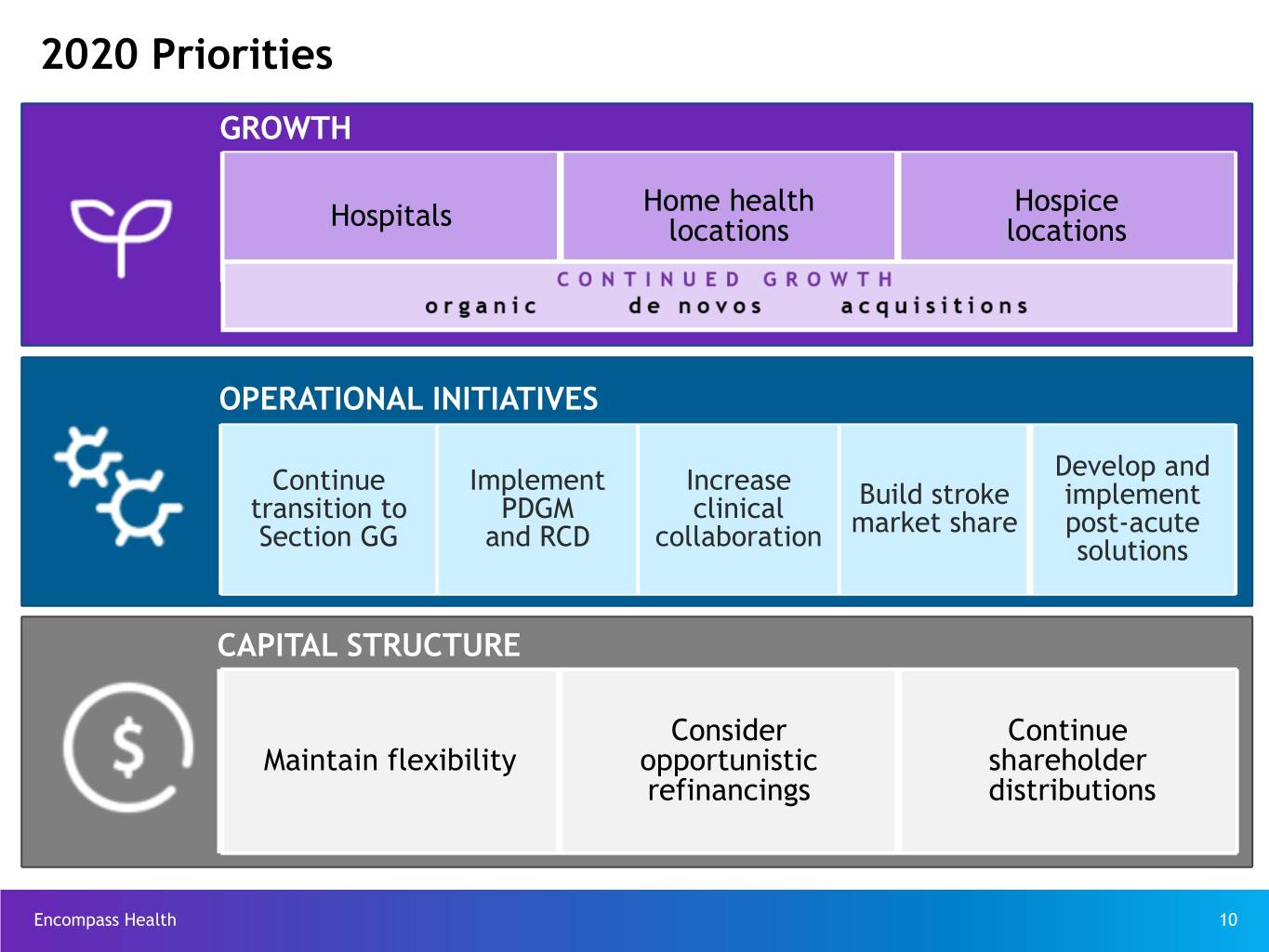

2020 Priorities GROWTH Home health Hospice Hospitals locations locations OPERATIONAL INITIATIVES Develop and Continue Implement Increase Build stroke implement transition to PDGM clinical market share post-acute Section GG and RCD collaboration solutions CAPITAL STRUCTURE Consider Continue Maintain flexibility opportunistic shareholder refinancings distributions Encompass Health 10

Responding to 2020 regulatory changes On Oct. 1, 2019, IRF-PAI Section GG functional measures replaced FIM™ Section GG for reporting and payment purposes. (CARE Tool) Ÿ This new payment system makes substantial changes to the case mix groups, thereby impacting Medicare revenue per discharge. On Jan. 1, 2020, the Patient-Driven Groupings Model became effective. This model relies more heavily on clinical characteristics. Ÿ implemented a 4.36% reduction in the base rate using assumed provider behavioral changes PDGM Ÿ eliminated therapy service use thresholds in case-mix adjustments Ÿ moved from 60-day to 30-day payment periods Ÿ reduced the Request for Anticipated Payment percentage in 2020 with full elimination in 2021 Inpatient Rehabilitation Home Health 2020 Pricing Estimated 0% to 0.75% increase in Estimated 2.0% to 3.0% net Medicare pricing for Q1 through Q3 Medicare pricing decrease for and anticipated 2.5% increase for Q4 CY 2020 Encompass Health 11

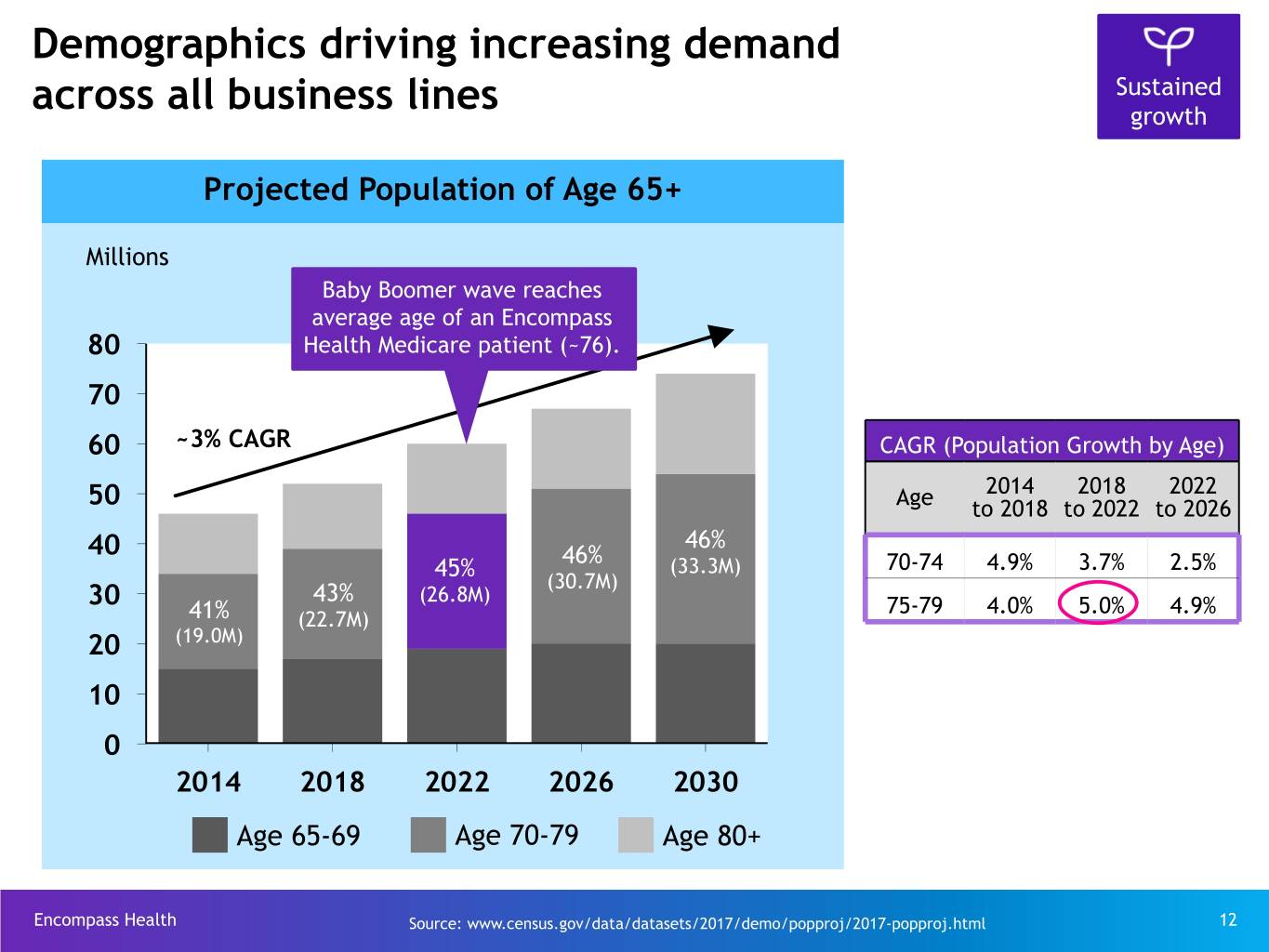

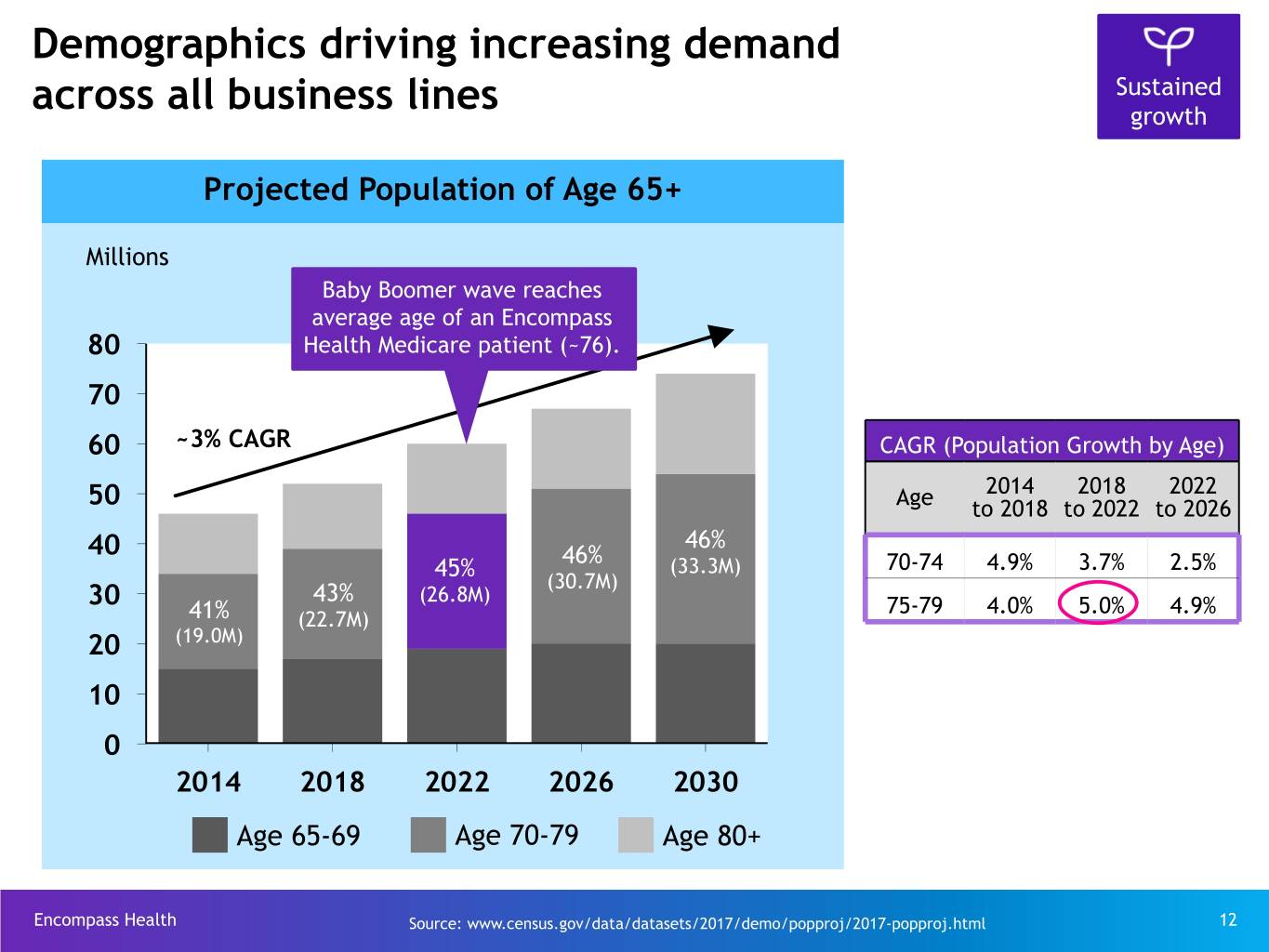

Demographics driving increasing demand Sustained across all business lines growth Projected Population of Age 65+ Millions Baby Boomer wave reaches average age of an Encompass 80 Health Medicare patient (~76). 70 60 ~3% CAGR CAGR (Population Growth by Age) 2014 2018 2022 50 Age to 2018 to 2022 to 2026 46% 40 46% 45% (33.3M) 70-74 4.9% 3.7% 2.5% (30.7M) 43% (26.8M) 30 75-79 4.0% 5.0% 4.9% 41% (22.7M) 20 (19.0M) 10 0 2014 2018 2022 2026 2030 Age 65-69 Age 70-79 Age 80+ Encompass Health Source: www.census.gov/data/datasets/2017/demo/popproj/2017-popproj.html 12

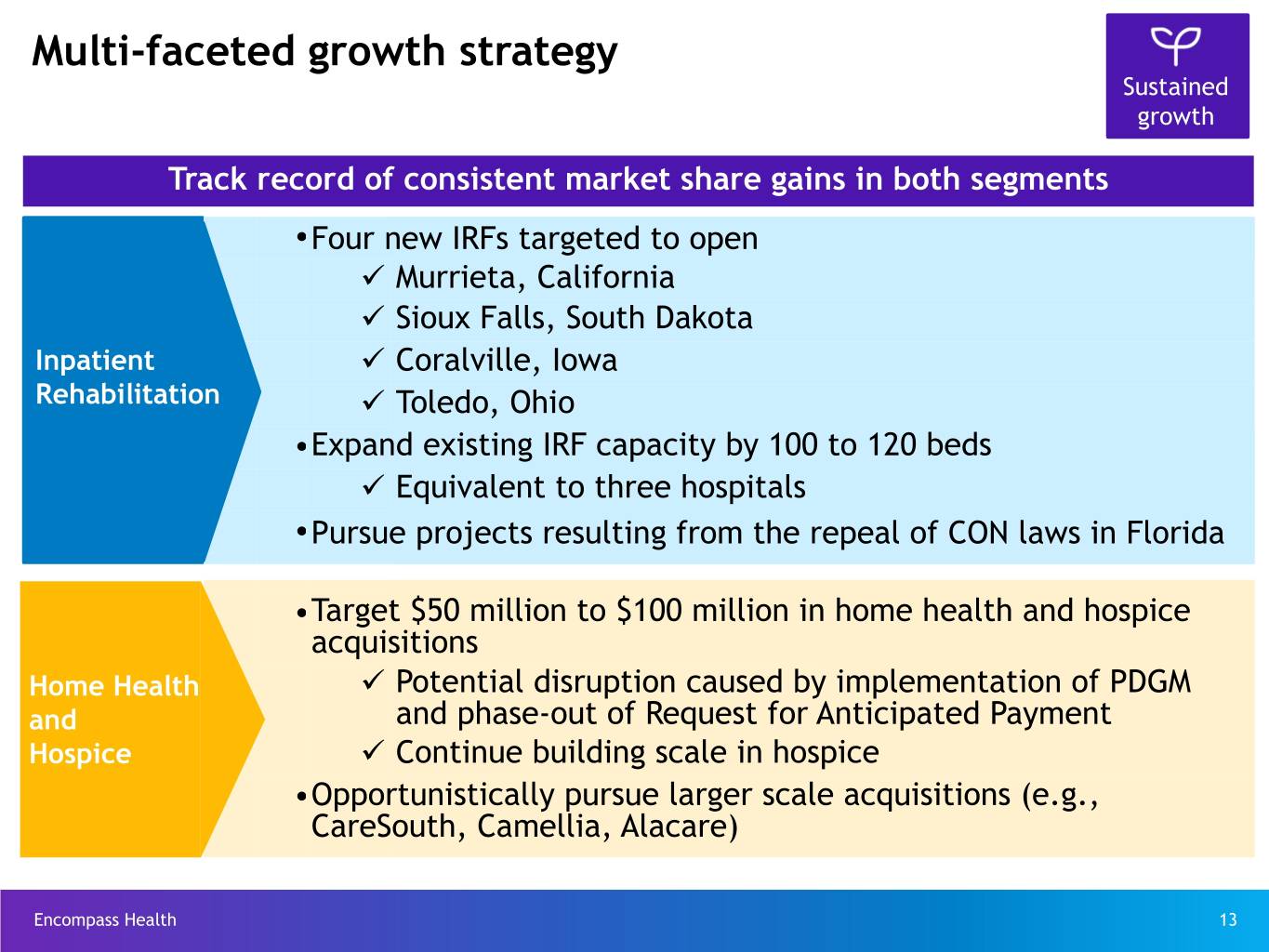

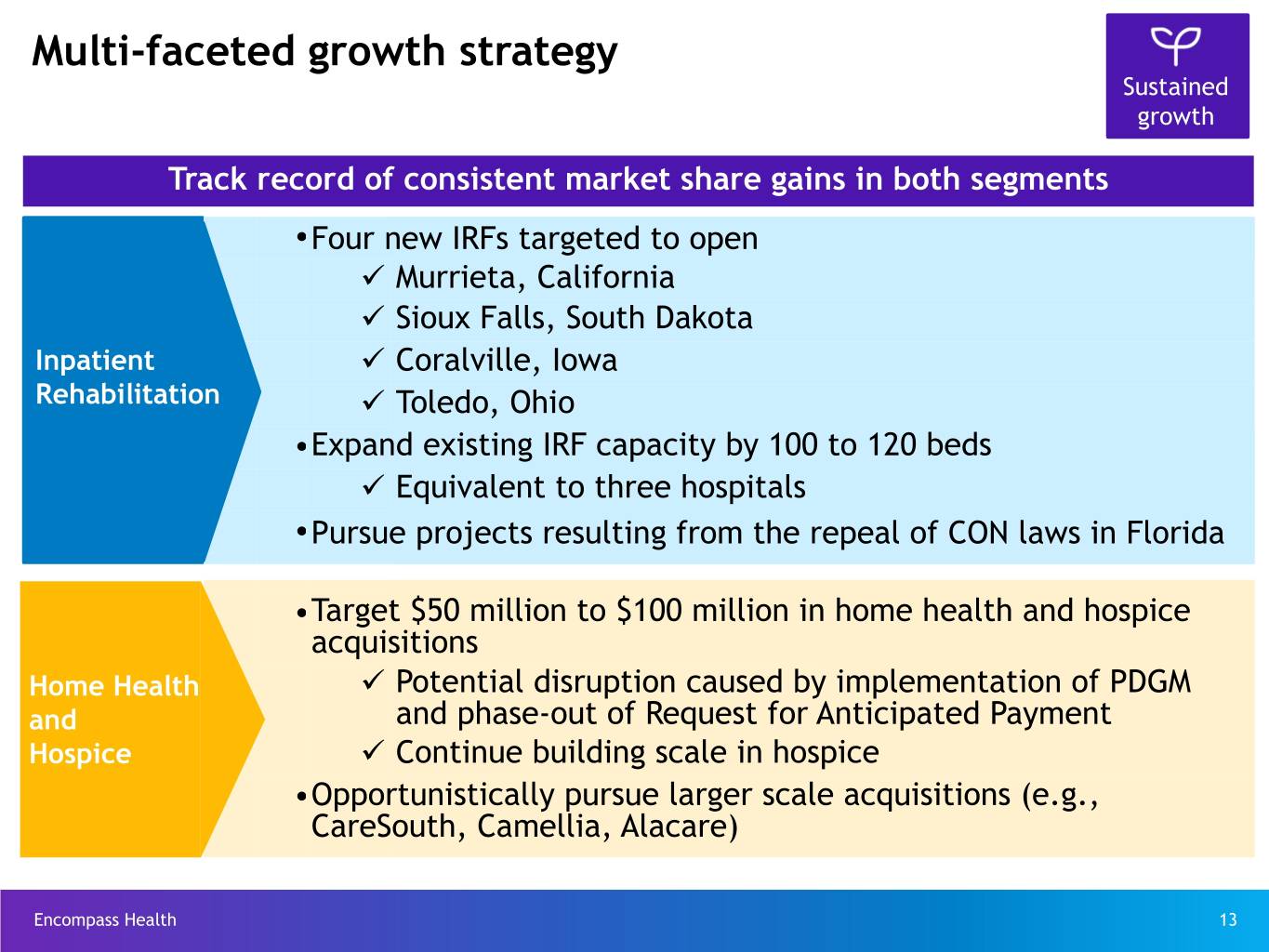

Multi-faceted growth strategy Sustained growth Track record of consistent market share gains in both segments •Four new IRFs targeted to open ü Murrieta, California ü Sioux Falls, South Dakota Inpatient ü Coralville, Iowa Rehabilitation ü Toledo, Ohio •Expand existing IRF capacity by 100 to 120 beds ü Equivalent to three hospitals •Pursue projects resulting from the repeal of CON laws in Florida •Target $50 million to $100 million in home health and hospice acquisitions ü Home Health Potential disruption caused by implementation of PDGM and and phase-out of Request for Anticipated Payment Hospice ü Continue building scale in hospice •Opportunistically pursue larger scale acquisitions (e.g., CareSouth, Camellia, Alacare) Encompass Health 13

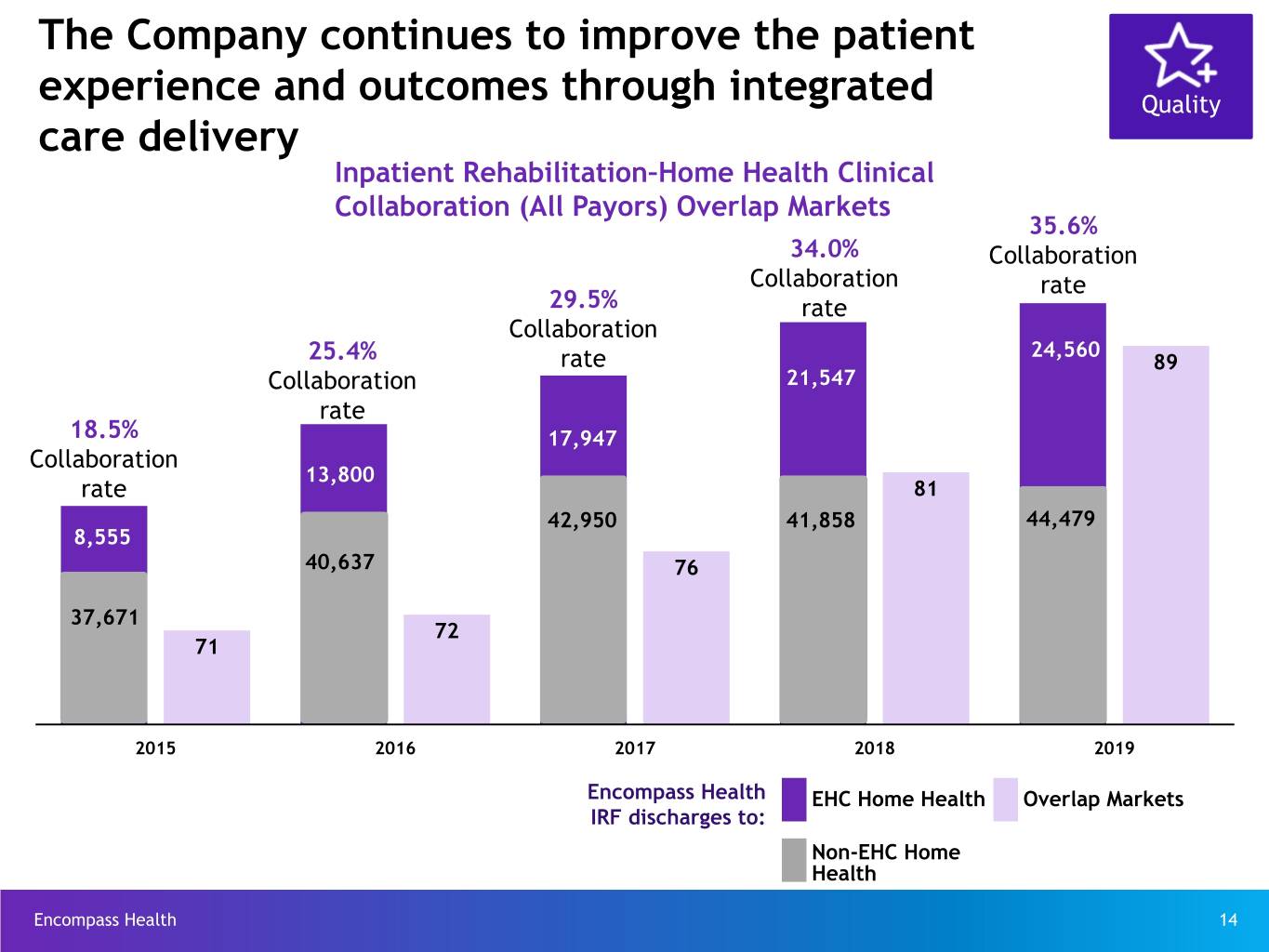

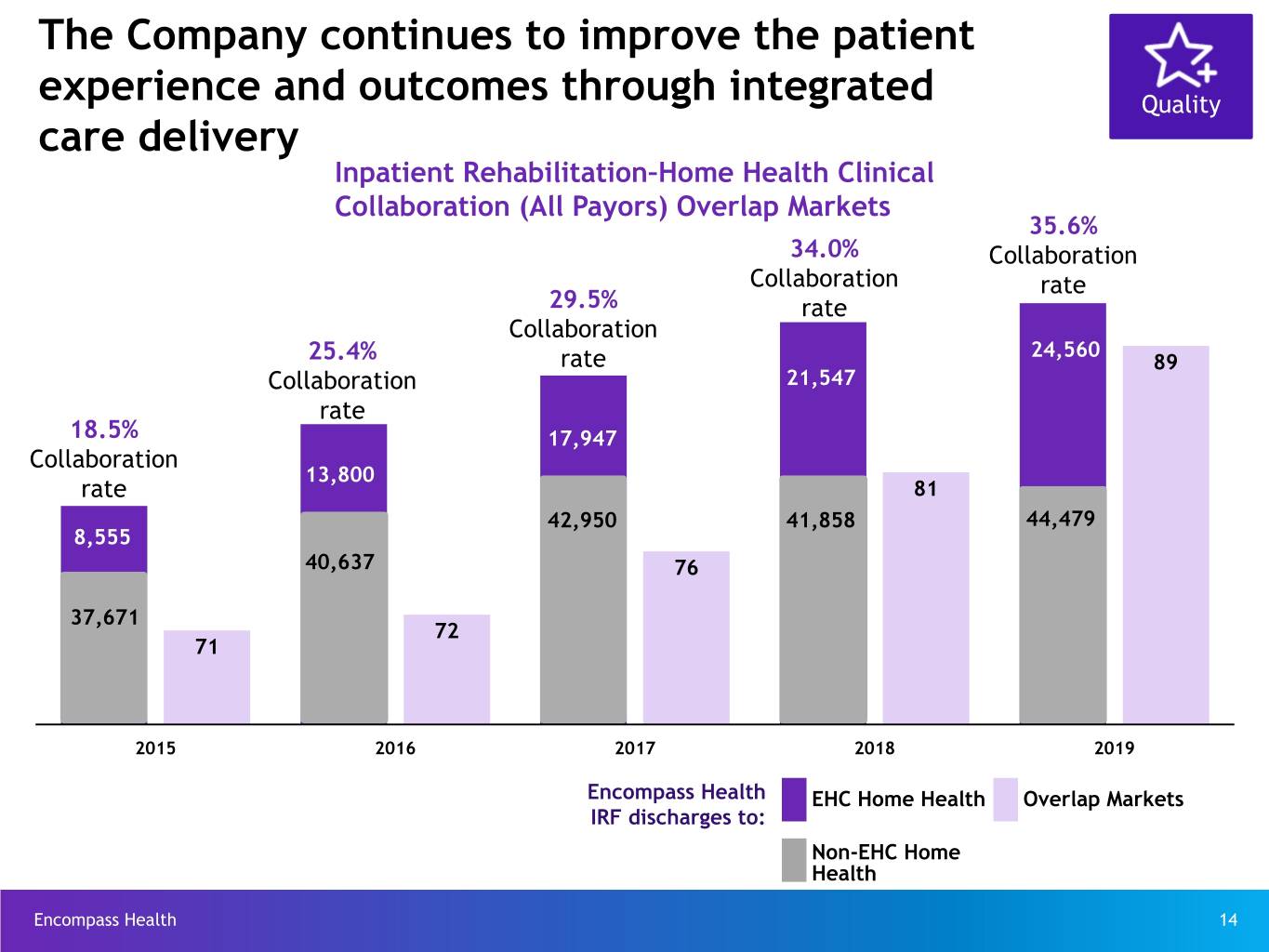

The Company continues to improve the patient experience and outcomes through integrated Quality care delivery Inpatient Rehabilitation–Home Health Clinical Collaboration (All Payors) Overlap Markets 35.6% 34.0% Collaboration Collaboration rate 29.5% rate Collaboration 24,560 25.4% rate 89 Collaboration 21,547 rate 18.5% 17,947 Collaboration 13,800 rate 81 42,950 41,858 44,479 8,555 40,637 76 37,671 72 71 2015 2016 2017 2018 2019 Encompass Health EHC Home Health Overlap Markets IRF discharges to: Non-EHC Home Health Encompass Health 14

Building stroke market share Sustained growth Leveraging our: Independent research concludes IRFs are a better rehabilitation option for stroke patients than SNFs. • strategic sponsorship of the AHA/ASA Focus on IRF-eligible patients going to SNFs and • clinical collaboration non-EHC IRFs • joint commission certifications 123 EHC IRFs hold stroke-specific certifications. • high-quality outcomes • value proposition across payors EHC’s three-year stroke CAGR is ~6%. Encompass Health 15

Post-acute innovation Post-acute innovation Our post-acute solutions leverage our clinical expertise, large post-acute datasets, EMR technologies, and strategic partnerships to drive improved patient outcomes and lower cost of care across the entire post-acute episode. 2020 Ÿ Deploy a post-acute readmission prediction model in all EHC hospitals, including rollout of a readmission reduction playbook Ÿ Deploy Medalogix to all EHC home health locations for home health care plan optimization and to reduce emergency room visits and hospital readmissions Ÿ Expand Post-Acute Care Strategic Assessments (PACSA) to include DRG level information on cost and quality Ÿ Deploy home health quality reporting tool for building preferred provider networks Ÿ Develop SNF quality reporting tools for building preferred provider networks Encompass Health 16

Committed to delivering high-quality, cost-effective care across the post-acute continuum