Investor Reference Book Post Q3 2019 earnings release Last updated January 13, 2020 HealthSouth is a leading provider of post-acute healthcare services, offering both facility-based and home-based post-acute services in 34 states and Puerto Rico through its network of inpatient rehabilitation hospitals, home health agencies, and hospice agencies.

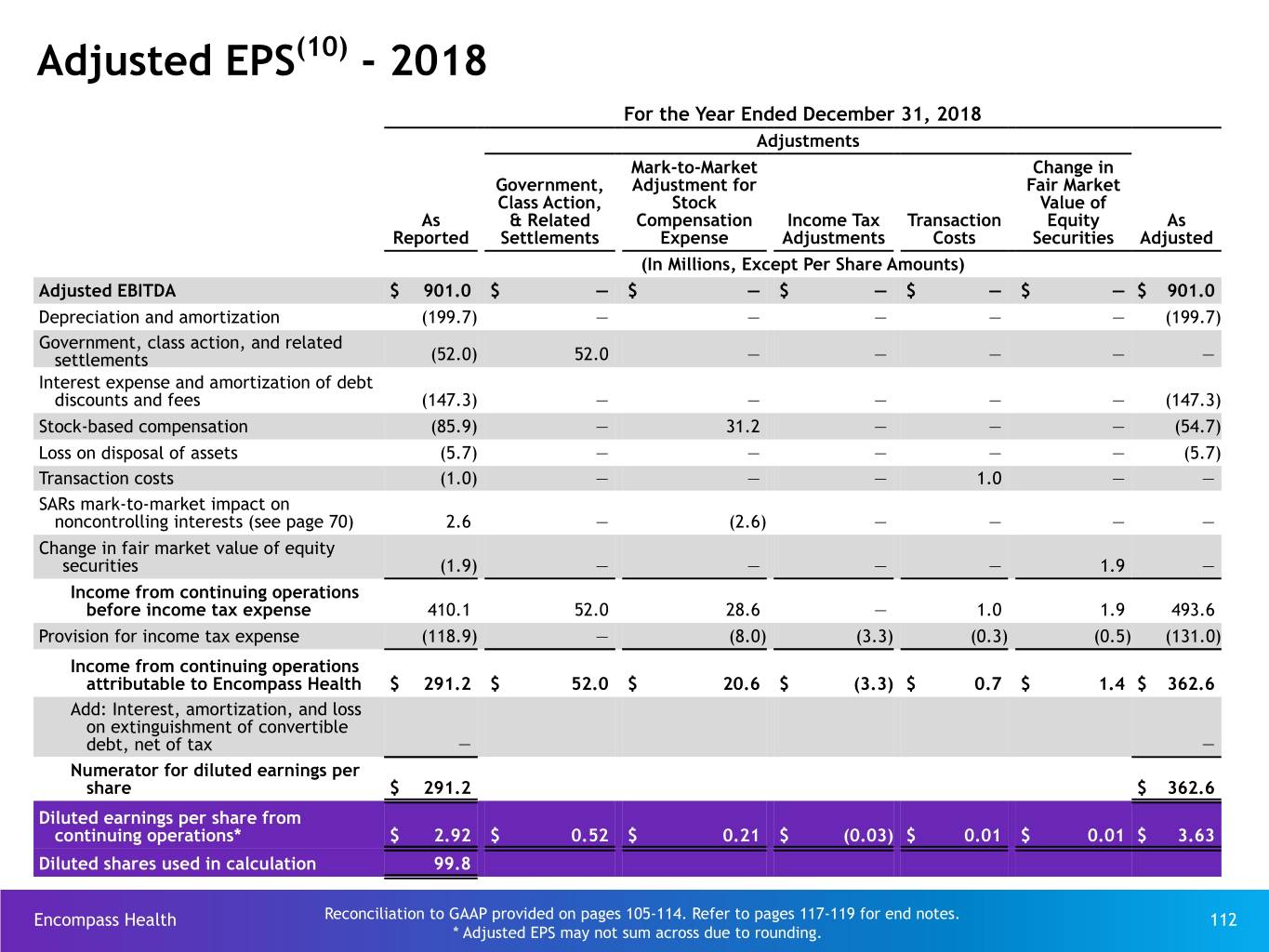

Forward-looking statements The information contained in this Investor Reference Book includes certain estimates, projections and other forward- looking information that reflect Encompass Health’s current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, acquisition and other development activities, cyber security, dividend strategies, repurchases of securities, effective tax rates, financial performance, financial assumptions, business model, balance sheet and cash flow plans, market share, development of new information tools and models, and shareholder value-enhancing transactions. These estimates, projections and other forward-looking information are based on assumptions the Company believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. Encompass Health undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this Investor Reference Book as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2018, the Form 10-Q for the quarters ended March 31, 2019, June 30, 2019, and September 30, 2019, and in other documents Encompass Health previously filed with the SEC, many of which are beyond Encompass Health’s control, that may cause actual events or results to differ materially from the views, beliefs, and estimates expressed herein. Note regarding presentation of non-GAAP financial measures The following Investor Reference Book includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, leverage ratios, adjusted earnings per share, and adjusted free cash flow. Schedules are attached that reconcile the non-GAAP financial measures included in the following Investor Reference Book to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. The Company’s Form 8-K, dated January 13, 2020, to which the following Investor Reference Book is attached as Exhibit 99.2, provides further explanation and disclosure regarding Encompass Health’s use of non-GAAP financial measures and should be read in conjunction with this Investor Reference Book. Encompass Health 2

Table of contents Company overview. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-17 Investment thesis and strategy. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18-23 Business outlook, including guidance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24-39 Growth . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40-51 Operational initiatives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52-64 Capital Structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65-70 Alternative payment models . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71-73 Information technology. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74-77 Operational metrics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78-84 Industry structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85-97 Segment operating results. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98-103 Reconciliations to GAAP and share information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104-115 End notes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 116-119 Encompass Health 3

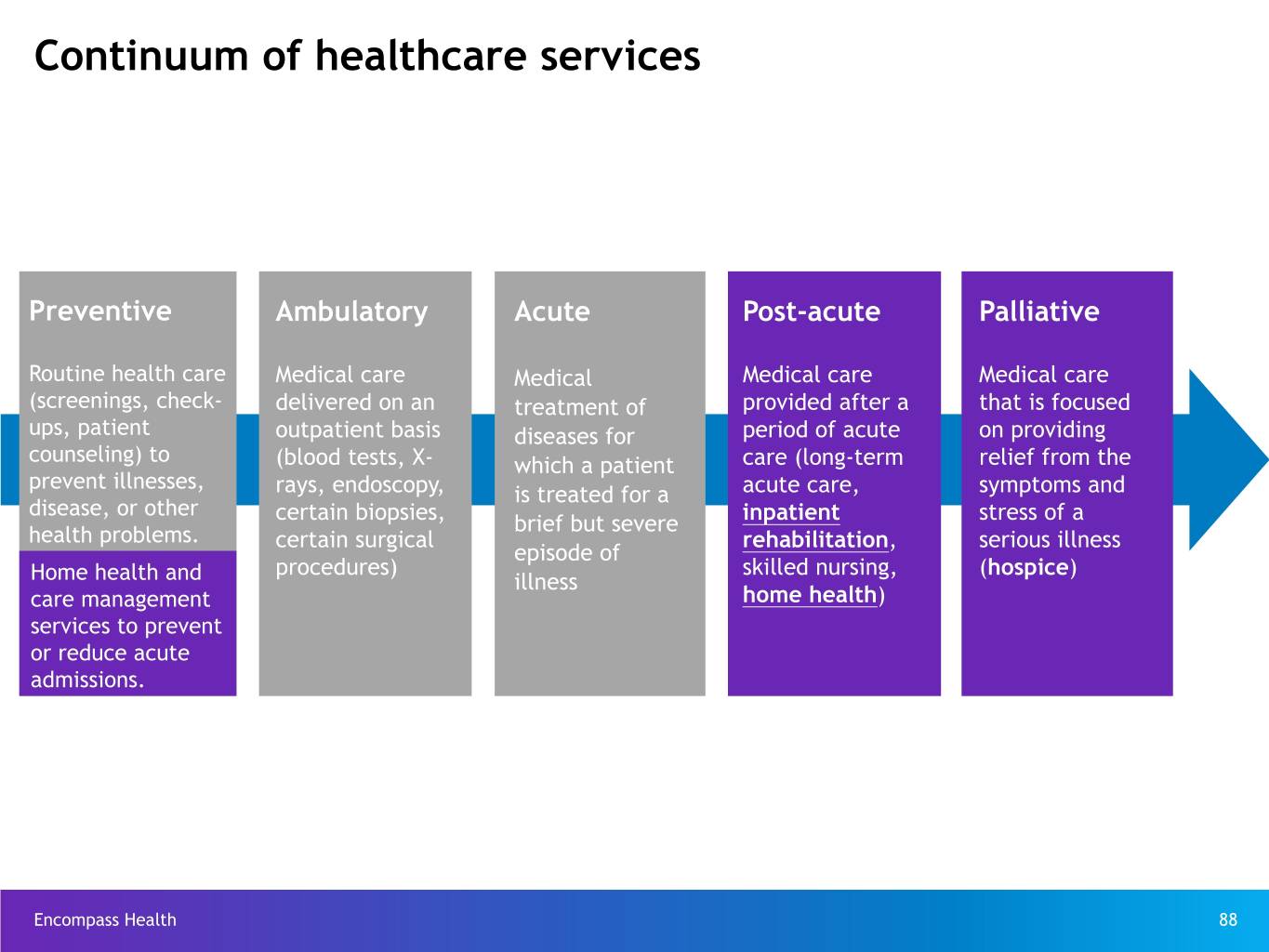

Company overview Encompass Health is a national leader in integrated healthcare services offering both facility-based and home-based patient care through its network of inpatient rehabilitation hospitals, home health agencies, and hospice agencies. The Company is committed to delivering high-quality, cost-effective, integrated care across the healthcare continuum. Encompass Health 4

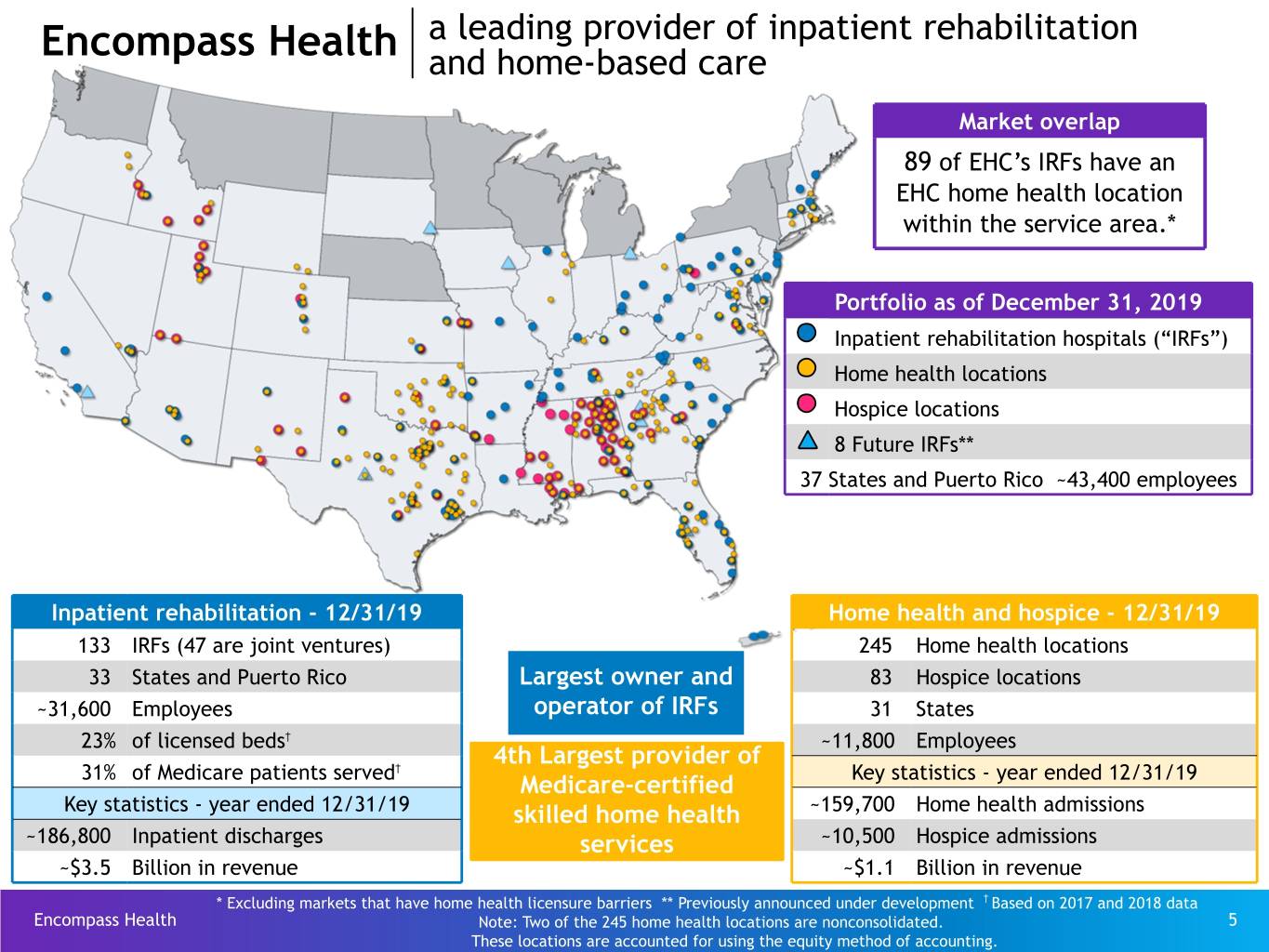

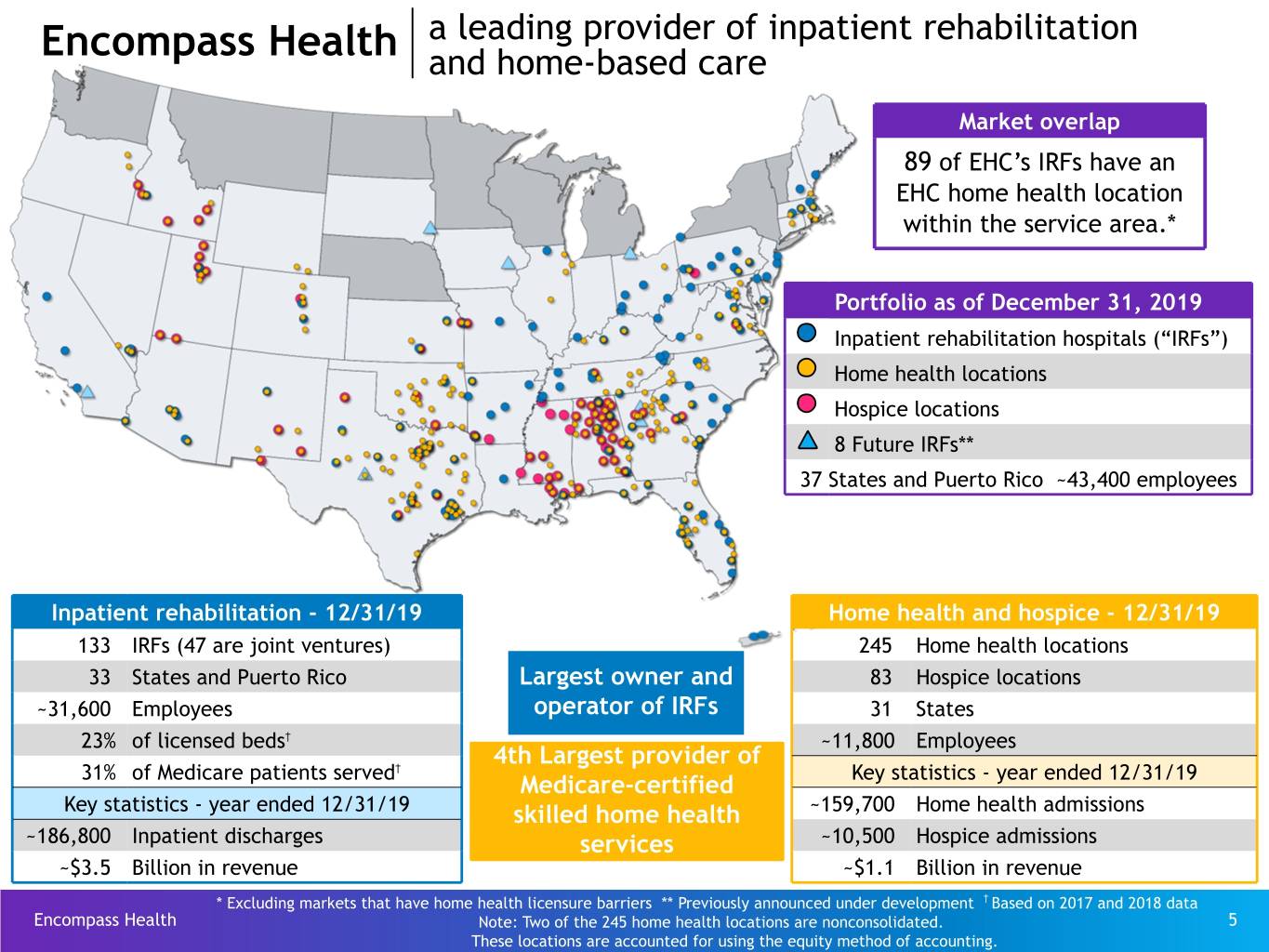

Encompass Health a leading provider of inpatient rehabilitation and home-based care Market overlap 89 of EHC’s IRFs have an EHC home health location within the service area.* Portfolio as of December 31, 2019 Inpatient rehabilitation hospitals (“IRFs”) Home health locations Hospice locations 8 Future IRFs** 37 States and Puerto Rico ~43,400 employees Inpatient rehabilitation - 12/31/19 Home health and hospice - 12/31/19 133 IRFs (47 are joint ventures) 245 Home health locations 33 States and Puerto Rico Largest owner and 83 Hospice locations ~31,600 Employees operator of IRFs 31 States 23% of licensed beds† ~11,800 Employees 4th Largest provider of 31% of Medicare patients served† Key statistics - year ended 12/31/19 Medicare-certified Key statistics - year ended 12/31/19 skilled home health ~159,700 Home health admissions ~186,800 Inpatient discharges services ~10,500 Hospice admissions ~$3.5 Billion in revenue ~$1.1 Billion in revenue † * Excluding markets that have home health licensure barriers ** Previously announced under development Based on 2017 and 2018 data Encompass Health Note: Two of the 245 home health locations are nonconsolidated. 5 These locations are accounted for using the equity method of accounting.

Company overview inpatient rehabilitation 123 of the Company’s IRFs hold one or more disease-specific Inpatient rehabilitation certifications from The Joint Commission’s Disease-Specific hospitals Care Certification Program.(1) Major services • Rehabilitation physicians: manage and treat medical conditions and oversee rehabilitation program • Rehabilitation nurses: provide personal care and oversee treatment plan for patients • Physical therapists: address physical function, mobility, strength, balance, and safety • Occupational therapists: promote independence through Activities of Daily Living • Speech-language therapists: address speech/voice functions, swallowing, memory/cognition, and language/ communication • Respiratory therapists: provide assessment and treatment of patients with both acute and chronic dysfunction of the cardioplumonary system • Case managers: coordinate care plan with physician, Care Transition Coordinators, caregivers and family • Post-discharge services: outpatient therapy and transition to home health Encompass Health Refer to pages 117-119 for end notes. 6

Company overview home health and hospice The Company offers evidence-based specialty programs Home health agencies related to: post-operative care, fall prevention, chronic disease management, and transitional care. Major services • Skilled nurses: comprehensively assess, teach, train, and manage care related to injury or illness • Home health aides: provide personal care and assistance with Activities of Daily Living • Physical therapists: address physical function, mobility, strength, balance, and safety • Occupational therapists: promote independence through training on self-management of ADLs • Speech-language therapists: address speech/voice functions, swallowing, memory/cognition, and language/communication • Medical social workers: provide assessment of social and emotional factors; assist with obtaining community resources Hospice: provides services to terminally ill patients and their families to address patients’ physical needs, including pain control and symptom management, and also provides emotional and spiritual support. Encompass Health 7

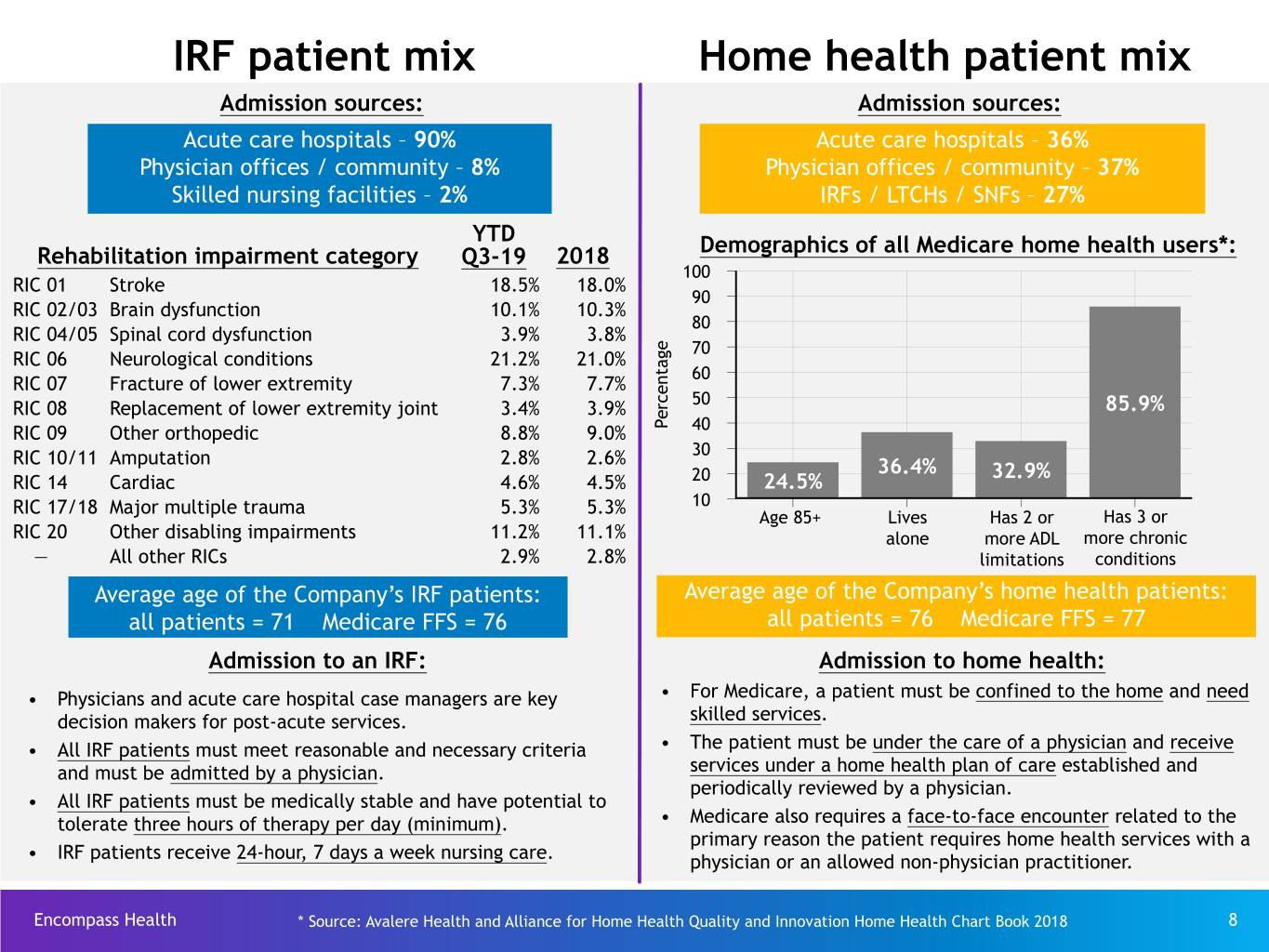

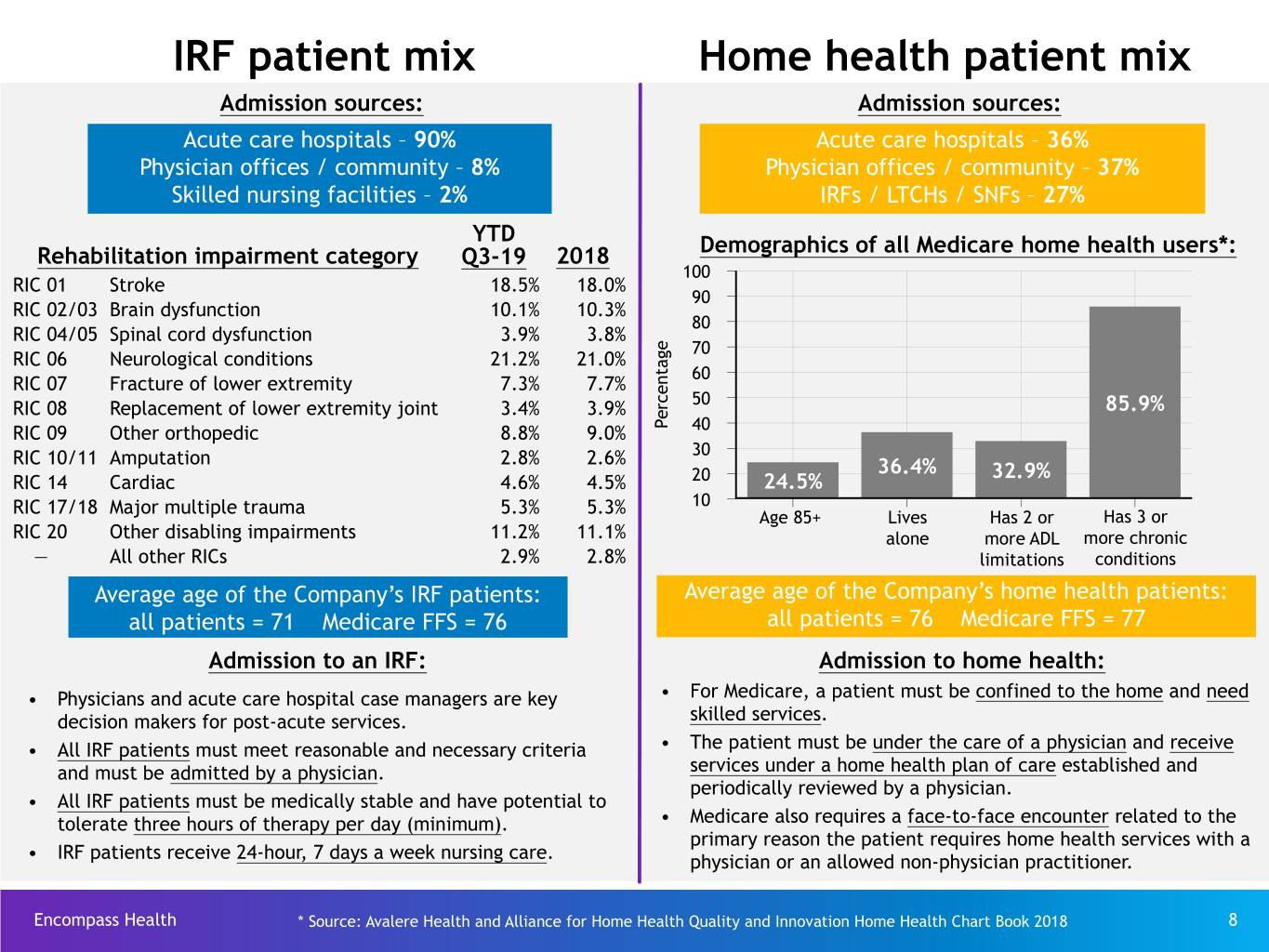

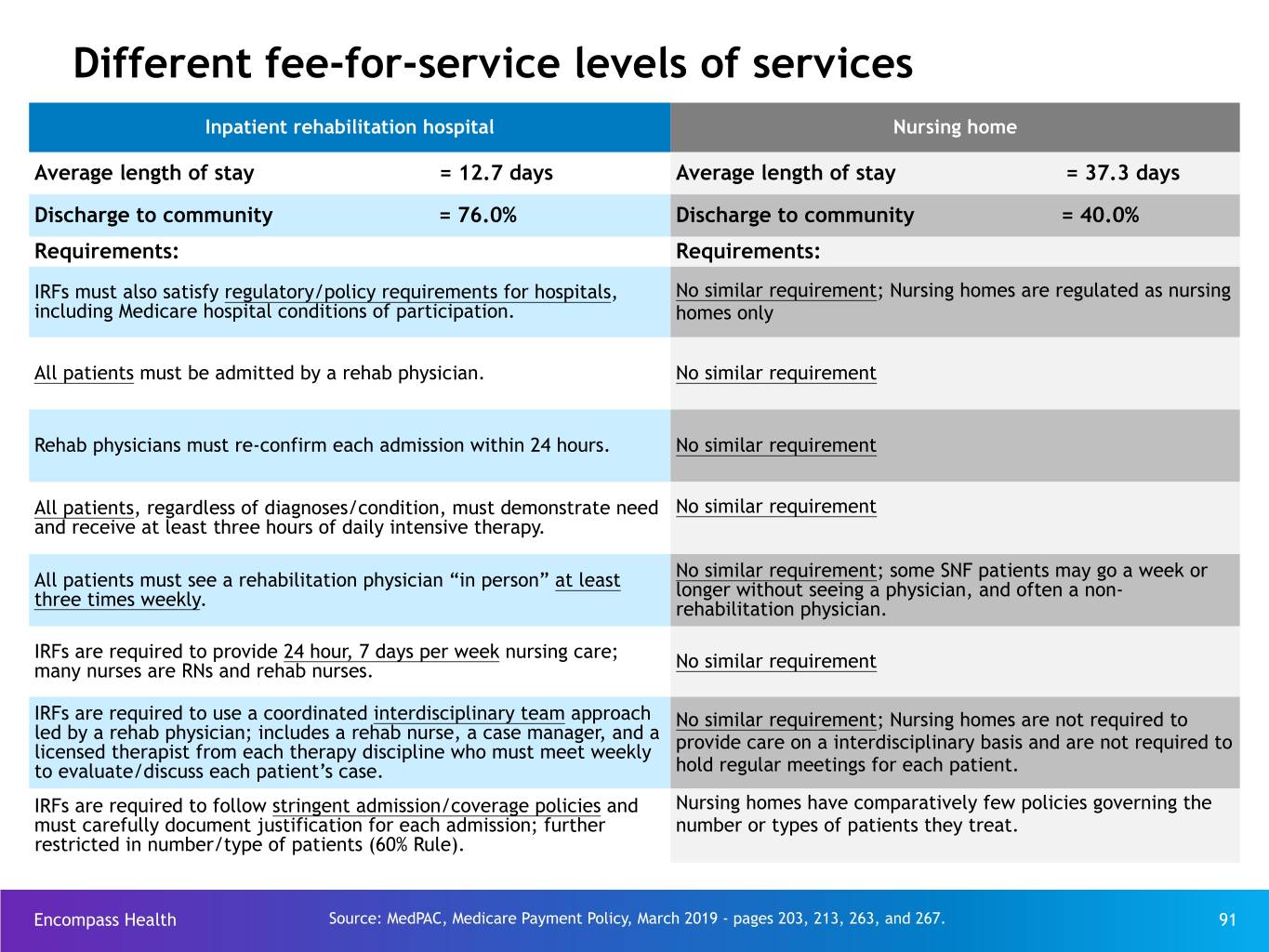

IRF patient mix Home health patient mix Admission sources: Admission sources: Acute care hospitals – 90% Acute care hospitals – 36% Physician offices / community – 8% Physician offices / community – 37% Skilled nursing facilities – 2% IRFs / LTCHs / SNFs – 27% YTD Demographics of all Medicare home health users*: Rehabilitation impairment category Q3-19 2018 100 RIC 01 Stroke 18.5% 18.0% 90 RIC 02/03 Brain dysfunction 10.1% 10.3% 80 RIC 04/05 Spinal cord dysfunction 3.9% 3.8% e 70 g RIC 06 Neurological conditions 21.2% 21.0% a t 60 RIC 07 Fracture of lower extremity 7.3% 7.7% n e c 50 RIC 08 Replacement of lower extremity joint 3.4% 3.9% r 85.9% e RIC 09 Other orthopedic 8.8% 9.0% P 40 RIC 10/11 Amputation 2.8% 2.6% 30 36.4% 32.9% RIC 14 Cardiac 4.6% 4.5% 20 24.5% RIC 17/18 Major multiple trauma 5.3% 5.3% 10 Age 85+ Lives Has 2 or Has 3 or RIC 20 Other disabling impairments 11.2% 11.1% alone more ADL more chronic — All other RICs 2.9% 2.8% limitations conditions Average age of the Company’s IRF patients: Average age of the Company’s home health patients: all patients = 71 Medicare FFS = 76 all patients = 76 Medicare FFS = 77 Admission to an IRF: Admission to home health: • Physicians and acute care hospital case managers are key • For Medicare, a patient must be confined to the home and need decision makers for post-acute services. skilled services. • All IRF patients must meet reasonable and necessary criteria • The patient must be under the care of a physician and receive and must be admitted by a physician. services under a home health plan of care established and periodically reviewed by a physician. • All IRF patients must be medically stable and have potential to tolerate three hours of therapy per day (minimum). • Medicare also requires a face-to-face encounter related to the primary reason the patient requires home health services with a • IRF patients receive 24-hour, 7 days a week nursing care. physician or an allowed non-physician practitioner. Encompass Health * Source: Avalere Health and Alliance for Home Health Quality and Innovation Home Health Chart Book 2018 8

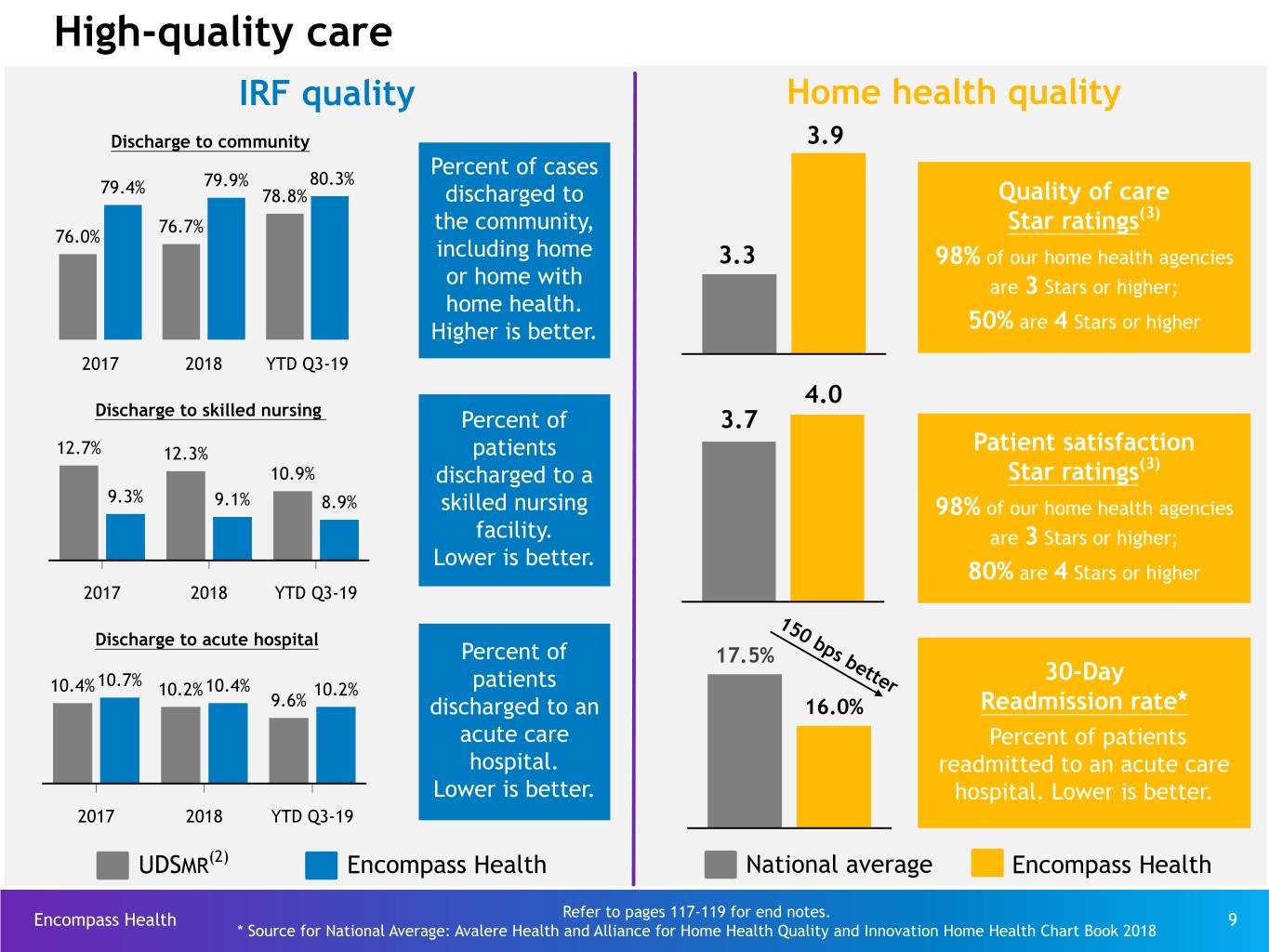

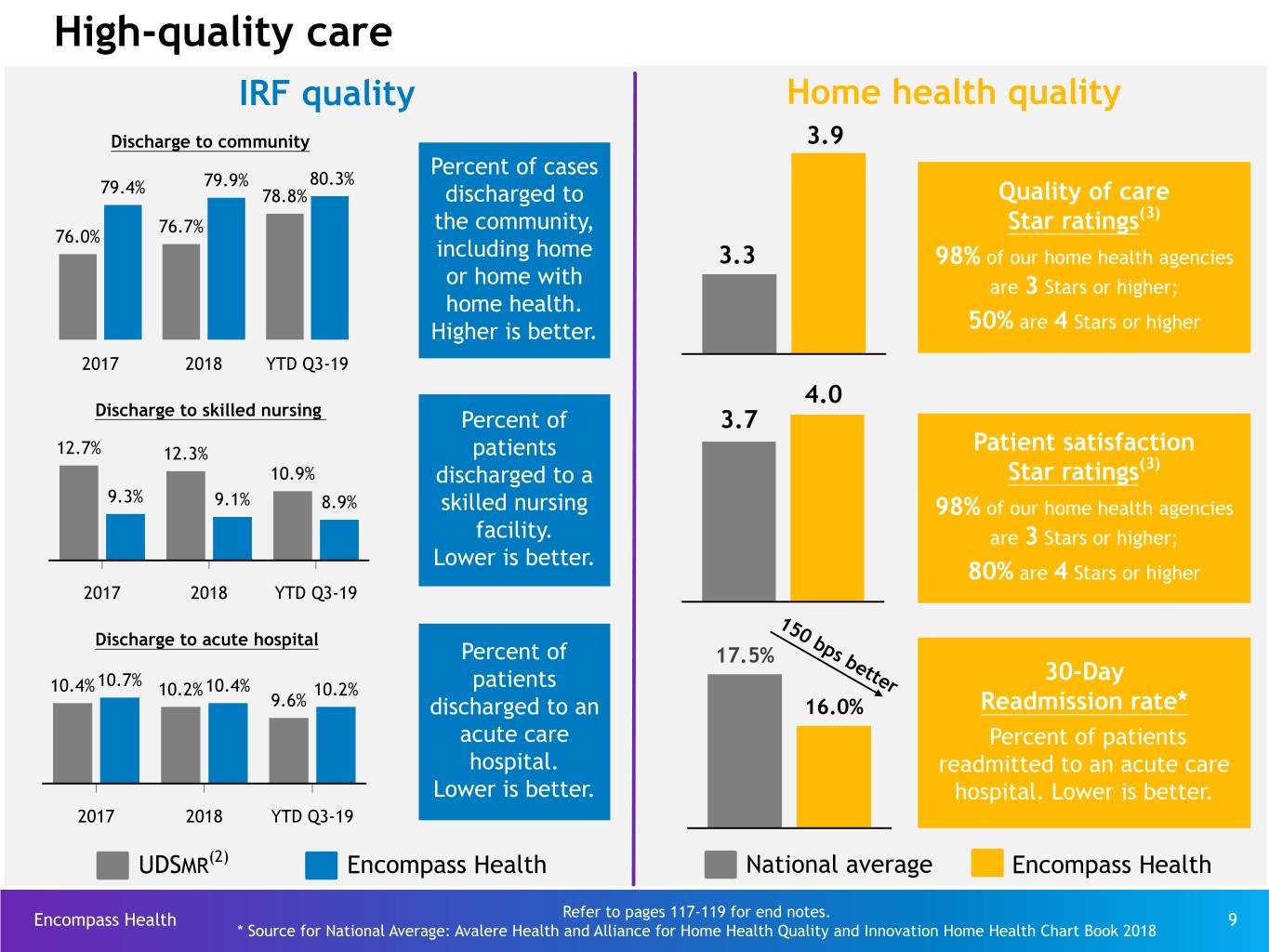

High-quality care IRF quality Home health quality Discharge to community 3.9 Percent of cases 79.9% 80.3% 79.4% 78.8% discharged to Quality of care (3) 76.7% the community, Star ratings 76.0% including home 3.3 98% of our home health agencies or home with are 3 Stars or higher; home health. Higher is better. 50% are 4 Stars or higher 2017 2018 YTD Q3-19 4.0 Discharge to skilled nursing Percent of 3.7 12.7% 12.3% patients Patient satisfaction (3) 10.9% discharged to a Star ratings 9.3% 9.1% 8.9% skilled nursing 98% of our home health agencies facility. are 3 Stars or higher; Lower is better. 80% are 4 Stars or higher 2017 2018 YTD Q3-19 150 bps better Discharge to acute hospital Percent of 17.5% 10.7% 30-Day 10.4% 10.2% 10.4% 10.2% patients 9.6% discharged to an 16.0% Readmission rate* acute care Percent of patients hospital. readmitted to an acute care Lower is better. hospital. Lower is better. 2017 2018 YTD Q3-19 UDSMR(2) Encompass Health National average Encompass Health Encompass Health Refer to pages 117-119 for end notes. 9 * Source for National Average: Avalere Health and Alliance for Home Health Quality and Innovation Home Health Chart Book 2018

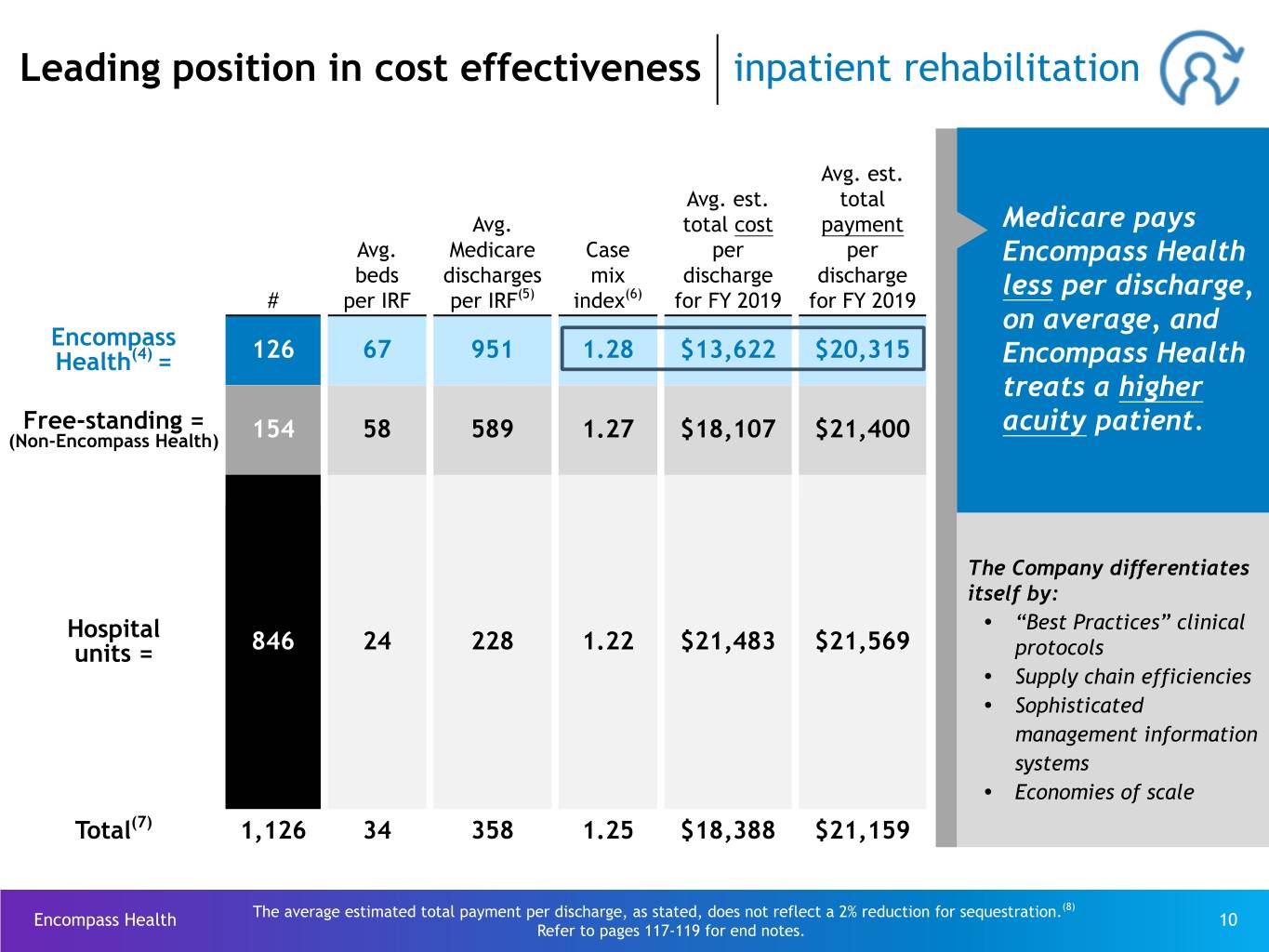

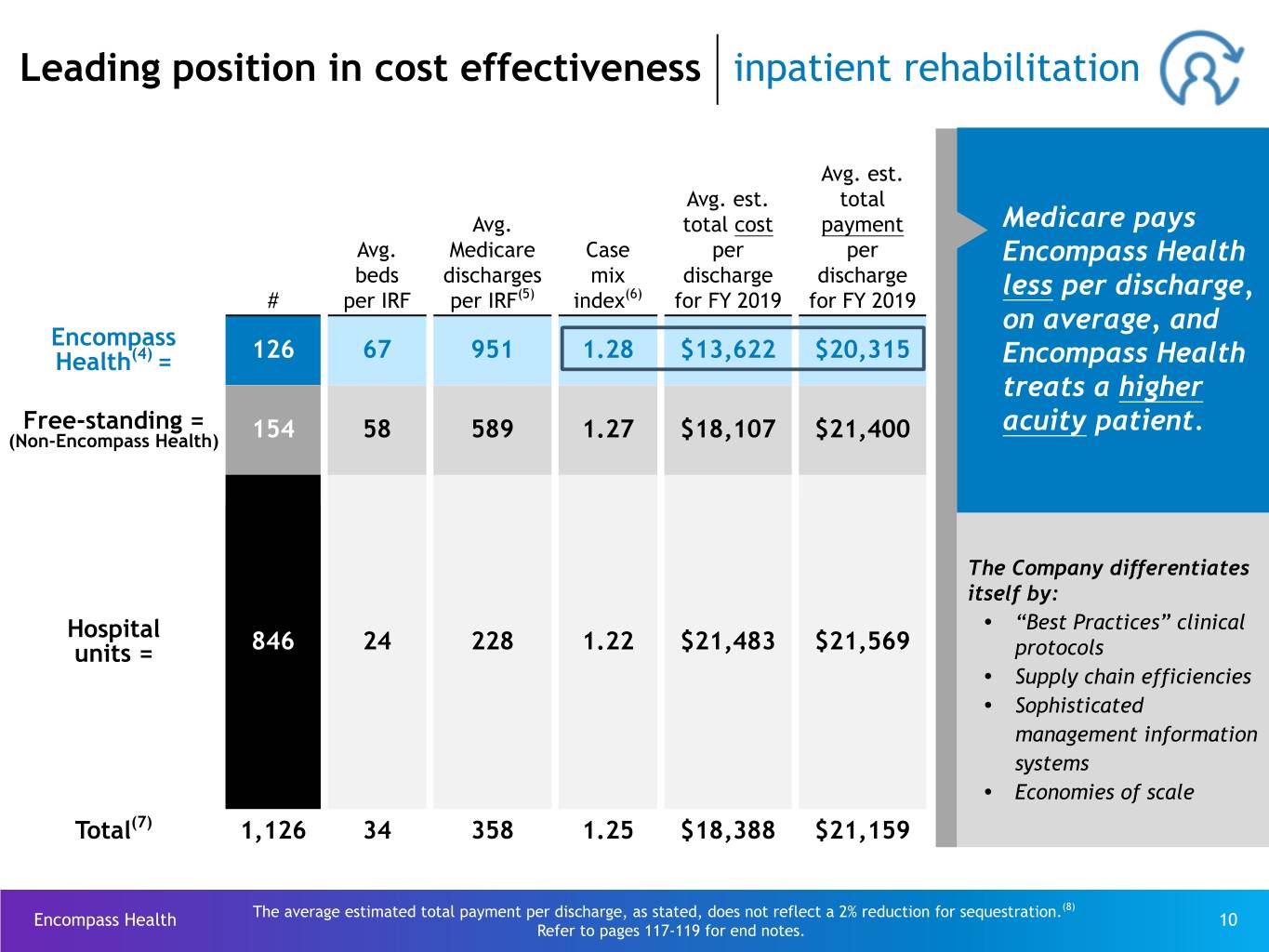

Leading position in cost effectiveness inpatient rehabilitation Avg. est. Avg. est. total Avg. total cost payment Medicare pays Avg. Medicare Case per per Encompass Health beds discharges mix discharge discharge less per discharge, # per IRF per IRF(5) index(6) for FY 2019 for FY 2019 on average, and Encompass Health(4) = 126 67 951 1.28 $13,622 $20,315 Encompass Health treats a higher Free-standing = acuity patient. (Non-Encompass Health) 154 58 589 1.27 $18,107 $21,400 The Company differentiates itself by: Ÿ Hospital “Best Practices” clinical units = 846 24 228 1.22 $21,483 $21,569 protocols Ÿ Supply chain efficiencies Ÿ Sophisticated management information systems Ÿ Economies of scale Total(7) 1,126 34 358 1.25 $18,388 $21,159 (8) Encompass Health The average estimated total payment per discharge, as stated, does not reflect a 2% reduction for sequestration. 10 Refer to pages 117-119 for end notes.

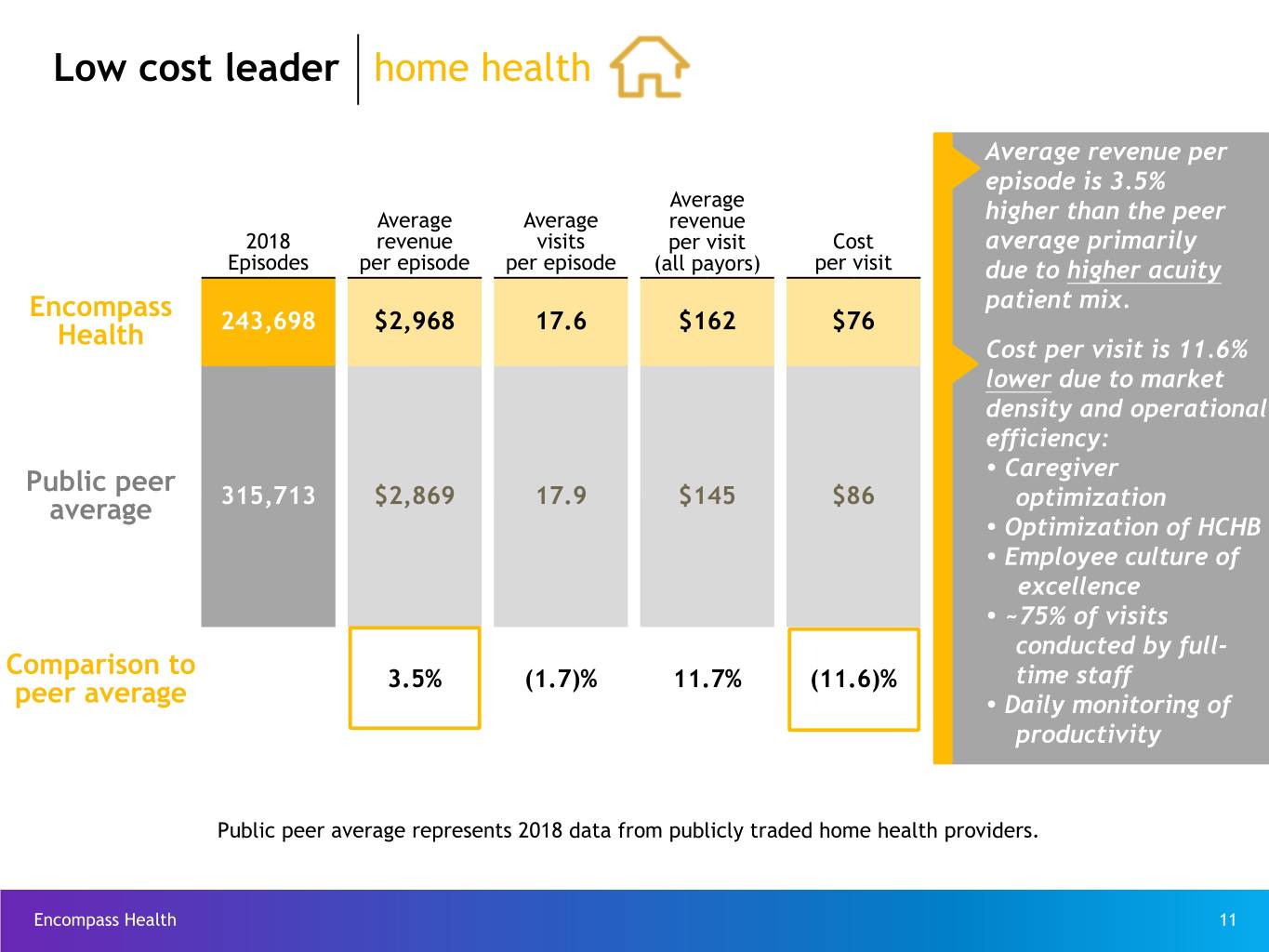

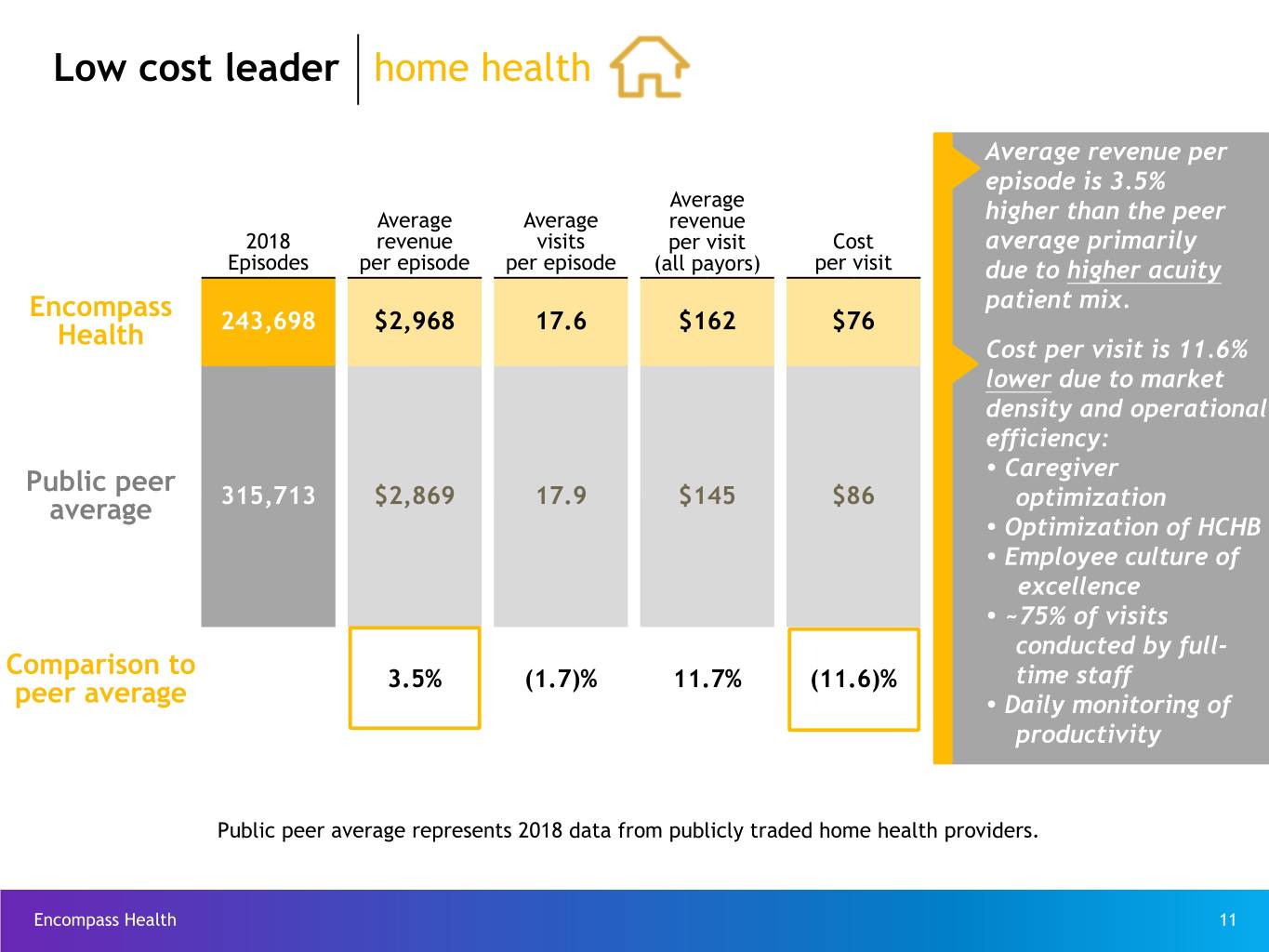

Low cost leader home health Average revenue per episode is 3.5% Average Average Average revenue higher than the peer 2018 revenue visits per visit Cost average primarily Episodes per episode per episode (all payors) per visit due to higher acuity Encompass patient mix. Health 243,698 $2,968 17.6 $162 $76 Cost per visit is 11.6% lower due to market density and operational efficiency: Ÿ Public peer Caregiver average 315,713 $2,869 17.9 $145 $86 optimization Ÿ Optimization of HCHB Ÿ Employee culture of excellence Ÿ ~75% of visits conducted by full- Comparison to 3.5% (1.7)% 11.7% (11.6)% time staff peer average Ÿ Daily monitoring of productivity Public peer average represents 2018 data from publicly traded home health providers. Encompass Health 11

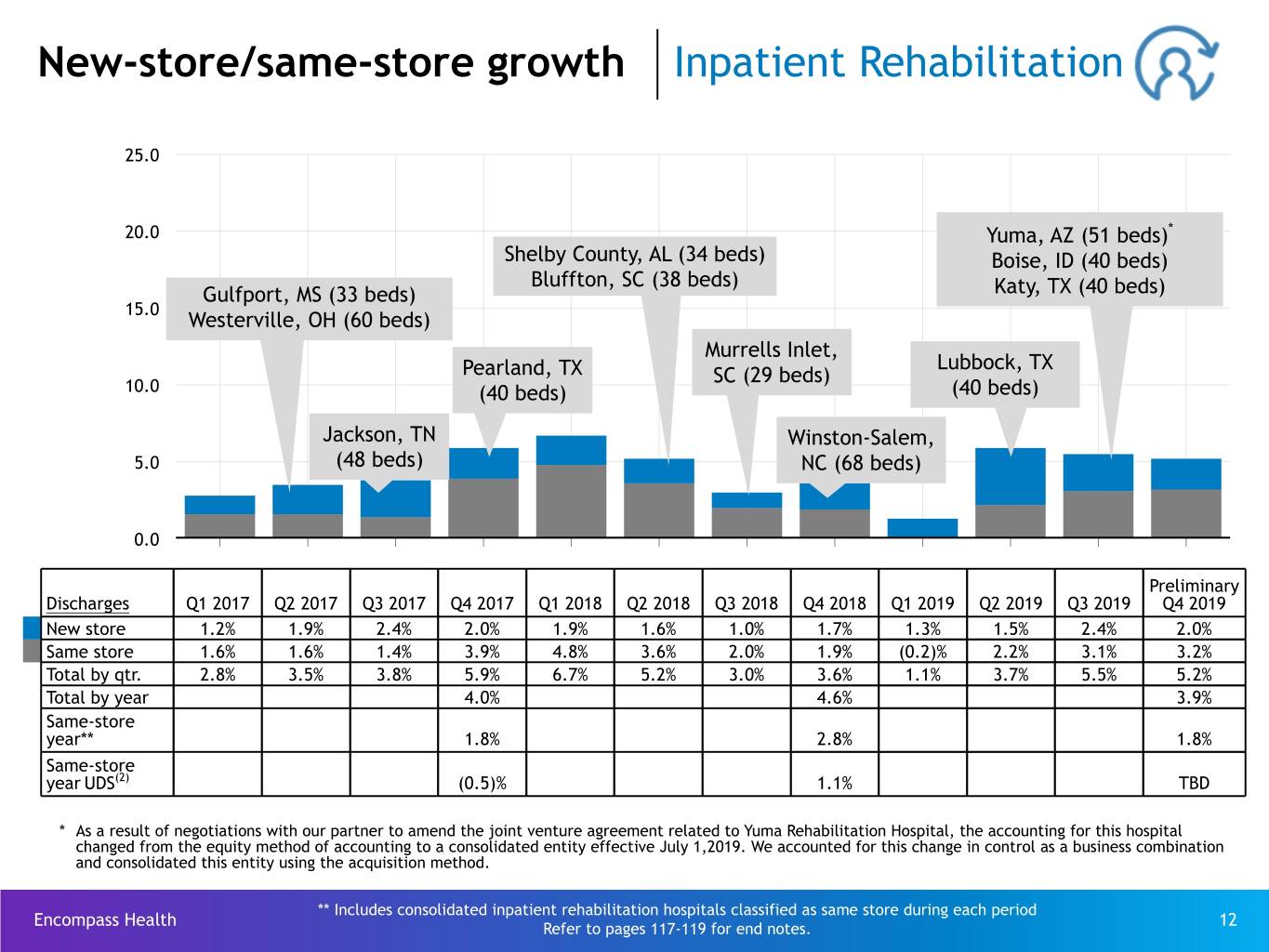

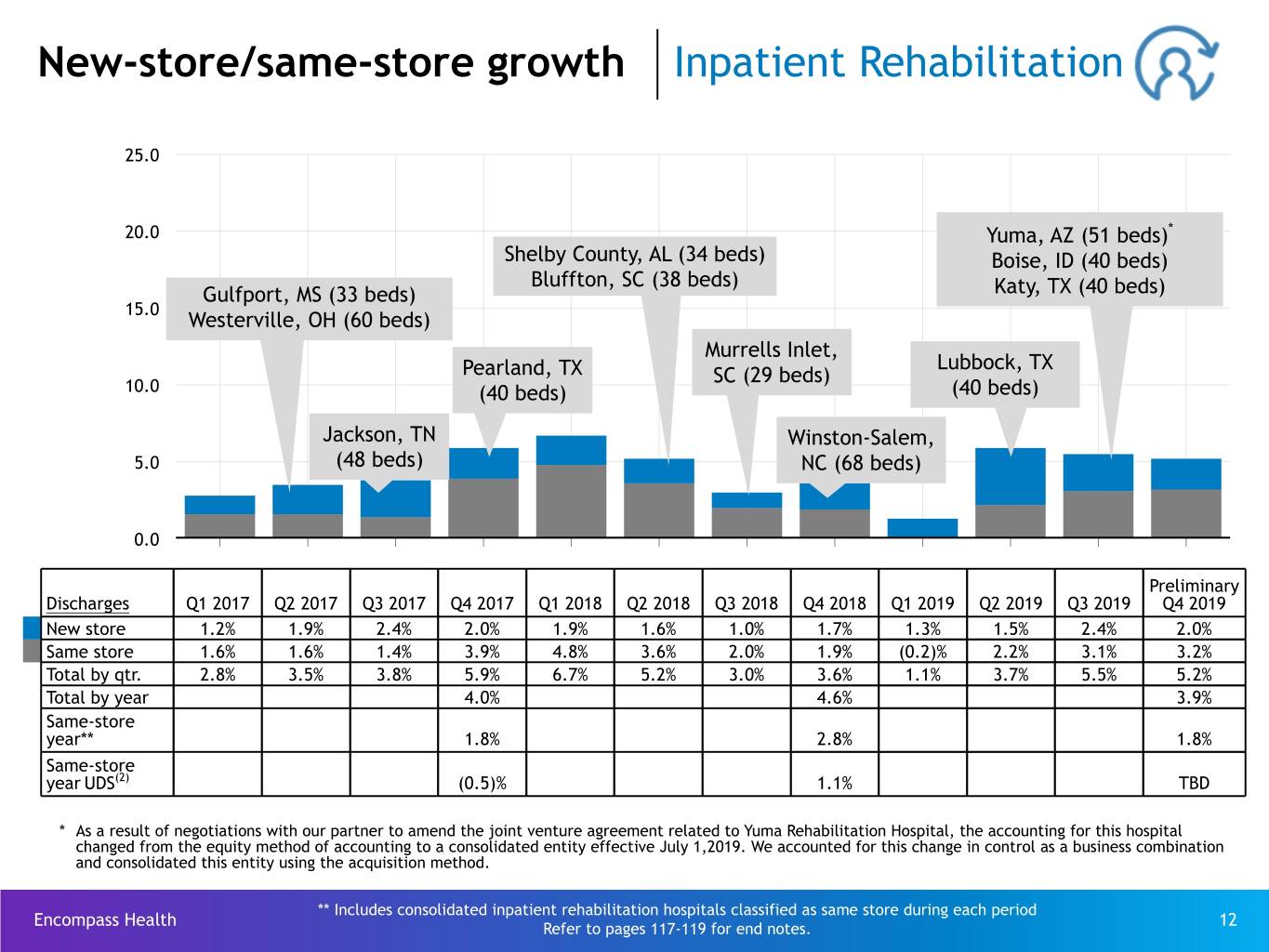

New-store/same-store growth Inpatient Rehabilitation 25.0 20.0 Yuma, AZ (51 beds)* Shelby County, AL (34 beds) Boise, ID (40 beds) Bluffton, SC (38 beds) Gulfport, MS (33 beds) Katy, TX (40 beds) 15.0 Westerville, OH (60 beds) Murrells Inlet, Lubbock, TX Pearland, TX SC (29 beds) 10.0 (40 beds) (40 beds) Jackson, TN Winston-Salem, 5.0 (48 beds) NC (68 beds) 0.0 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Preliminary QPreliminary4 2019 Discharges Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 New store 1.2% 1.9% 2.4% 2.0% 1.9% 1.6% 1.0% 1.7% 1.3% 1.5% 2.4% 2.0% Same store 1.6% 1.6% 1.4% 3.9% 4.8% 3.6% 2.0% 1.9% (0.2)% 2.2% 3.1% 3.2% Total by qtr. 2.8% 3.5% 3.8% 5.9% 6.7% 5.2% 3.0% 3.6% 1.1% 3.7% 5.5% 5.2% Total by year 4.0% 4.6% 3.9% Same-store year** 1.8% 2.8% 1.8% Same-store year UDS(2) (0.5)% 1.1% TBD * As a result of negotiations with our partner to amend the joint venture agreement related to Yuma Rehabilitation Hospital, the accounting for this hospital changed from the equity method of accounting to a consolidated entity effective July 1,2019. We accounted for this change in control as a business combination and consolidated this entity using the acquisition method. ** Includes consolidated inpatient rehabilitation hospitals classified as same store during each period Encompass Health 12 Refer to pages 117-119 for end notes.

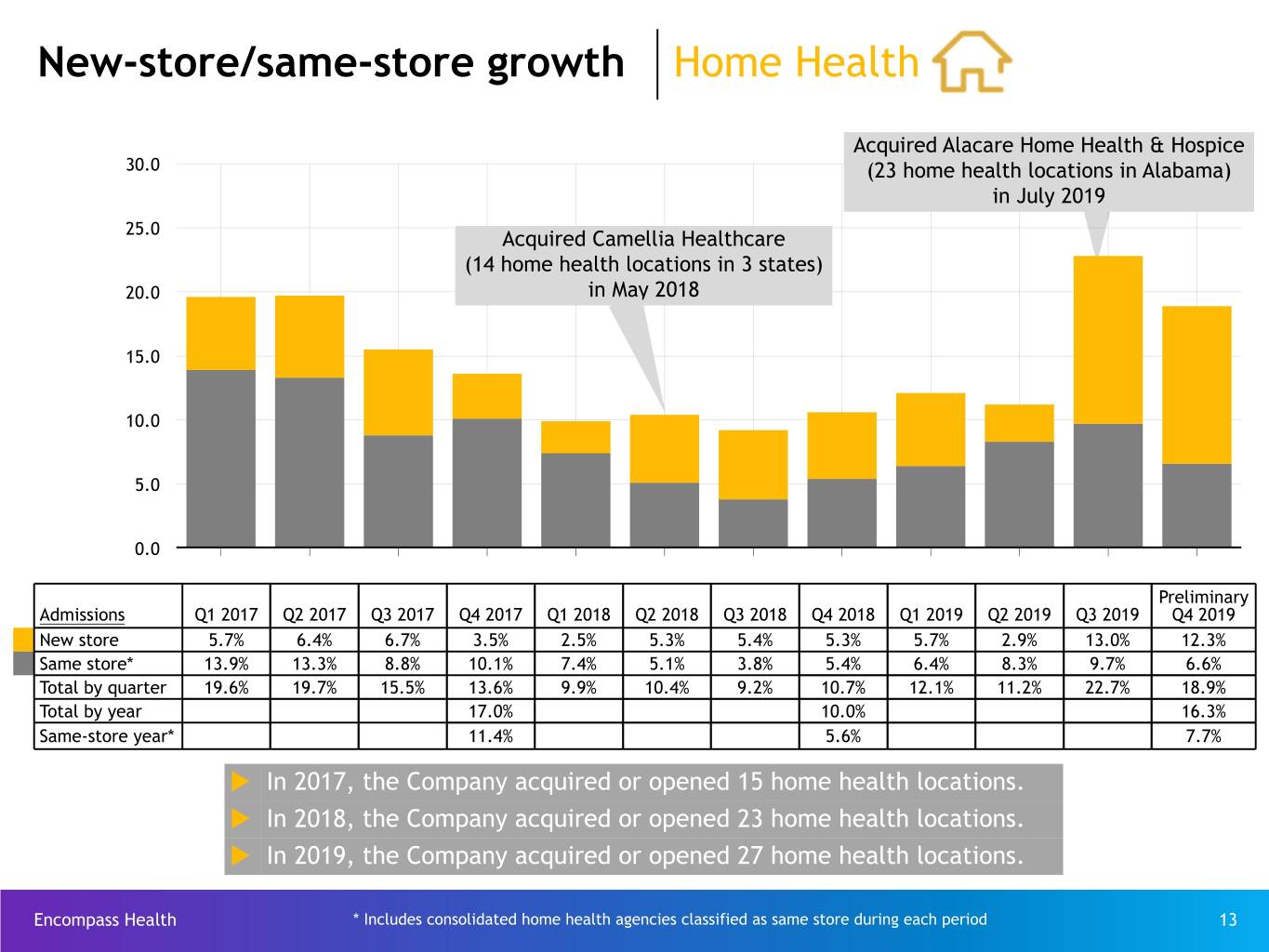

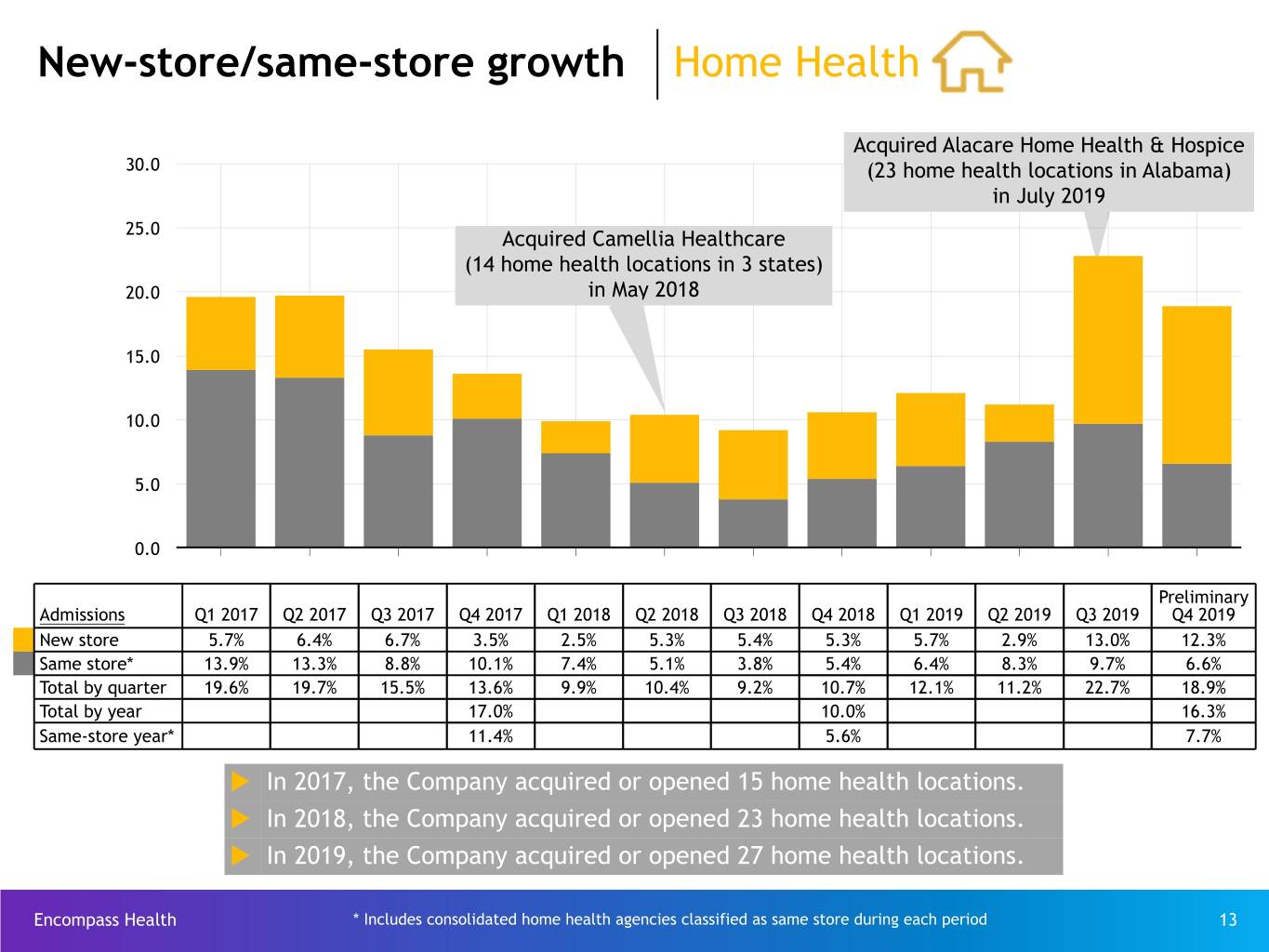

New-store/same-store growth Home Health Acquired Alacare Home Health & Hospice 30.0 (23 home health locations in Alabama) in July 2019 25.0 Acquired Camellia Healthcare (14 home health locations in 3 states) 20.0 in May 2018 15.0 10.0 5.0 0.0 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Preliminary QPreliminary4 2019 Admissions Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 New store 5.7% 6.4% 6.7% 3.5% 2.5% 5.3% 5.4% 5.3% 5.7% 2.9% 13.0% 12.3% Same store* 13.9% 13.3% 8.8% 10.1% 7.4% 5.1% 3.8% 5.4% 6.4% 8.3% 9.7% 6.6% Total by quarter 19.6% 19.7% 15.5% 13.6% 9.9% 10.4% 9.2% 10.7% 12.1% 11.2% 22.7% 18.9% Total by year 17.0% 10.0% 16.3% Same-store year* 11.4% 5.6% 7.7% u In 2017, the Company acquired or opened 15 home health locations. u In 2018, the Company acquired or opened 23 home health locations. u In 2019, the Company acquired or opened 27 home health locations. Encompass Health * Includes consolidated home health agencies classified as same store during each period 13

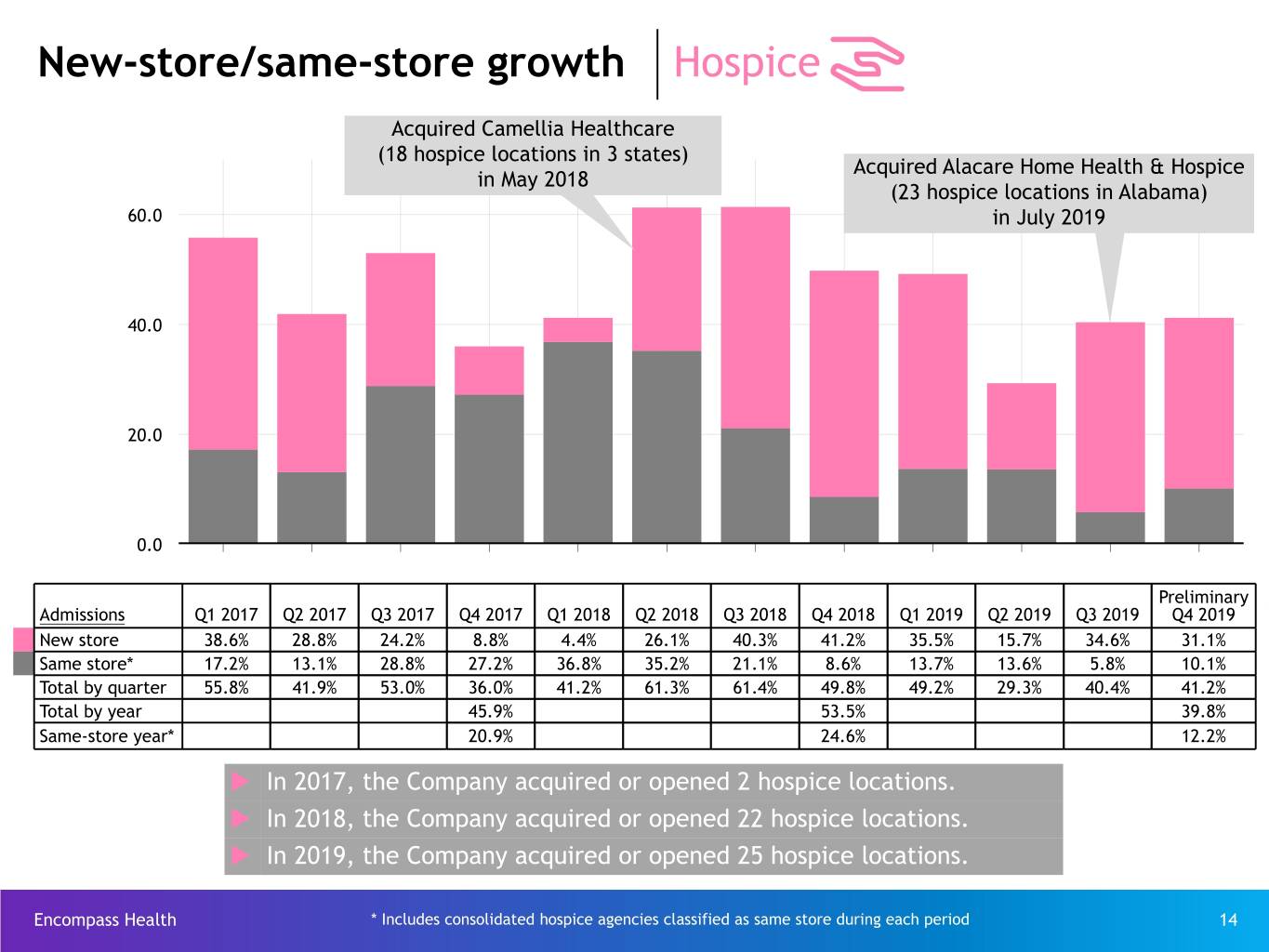

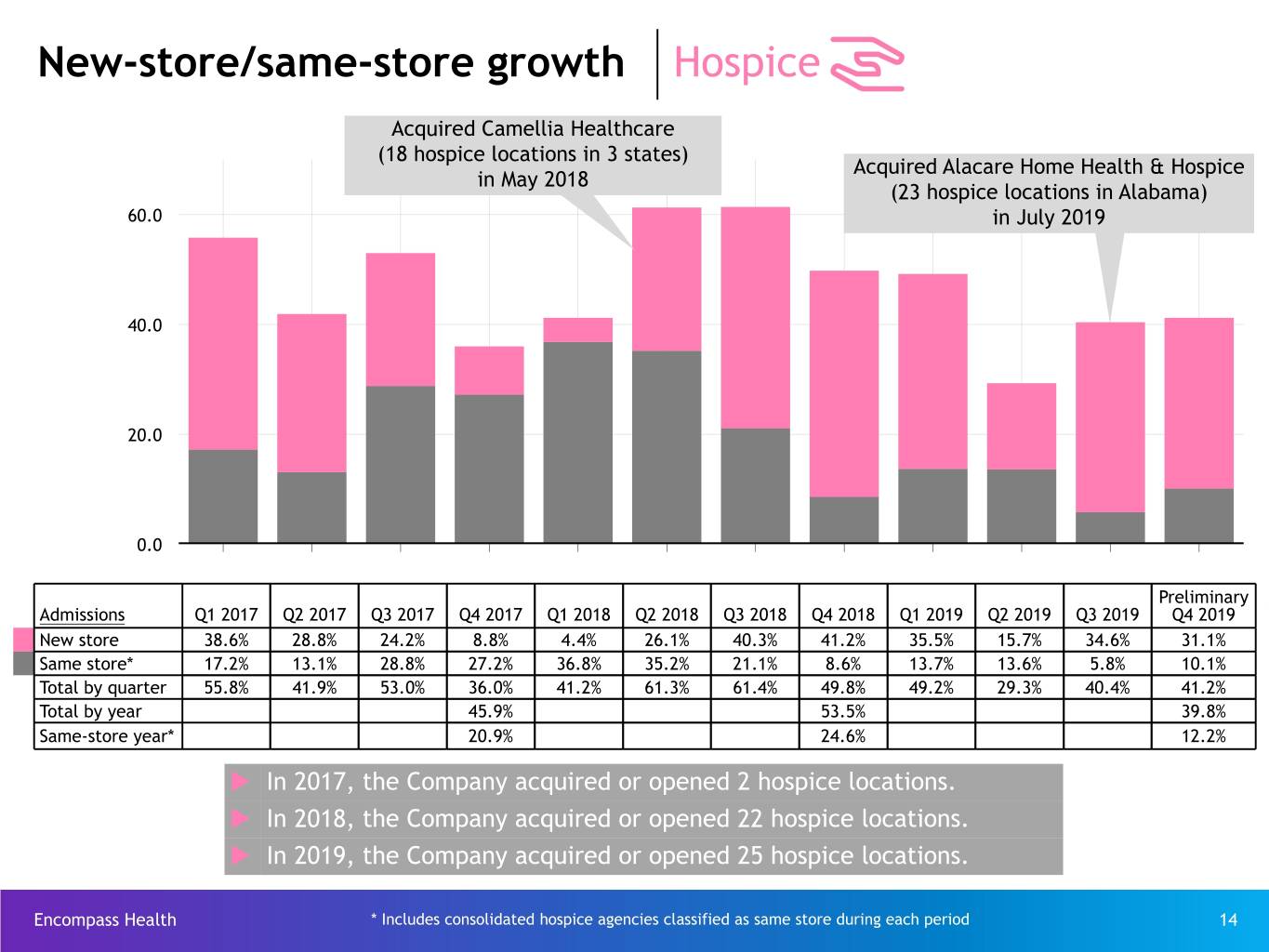

New-store/same-store growth Hospice Acquired Camellia Healthcare (18 hospice locations in 3 states) Acquired Alacare Home Health & Hospice in May 2018 (23 hospice locations in Alabama) 60.0 in July 2019 40.0 20.0 0.0 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Preliminary QPreliminary4 2019 Admissions Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 New store 38.6% 28.8% 24.2% 8.8% 4.4% 26.1% 40.3% 41.2% 35.5% 15.7% 34.6% 31.1% Same store* 17.2% 13.1% 28.8% 27.2% 36.8% 35.2% 21.1% 8.6% 13.7% 13.6% 5.8% 10.1% Total by quarter 55.8% 41.9% 53.0% 36.0% 41.2% 61.3% 61.4% 49.8% 49.2% 29.3% 40.4% 41.2% Total by year 45.9% 53.5% 39.8% Same-store year* 20.9% 24.6% 12.2% u In 2017, the Company acquired or opened 2 hospice locations. u In 2018, the Company acquired or opened 22 hospice locations. u In 2019, the Company acquired or opened 25 hospice locations. Encompass Health * Includes consolidated hospice agencies classified as same store during each period 14

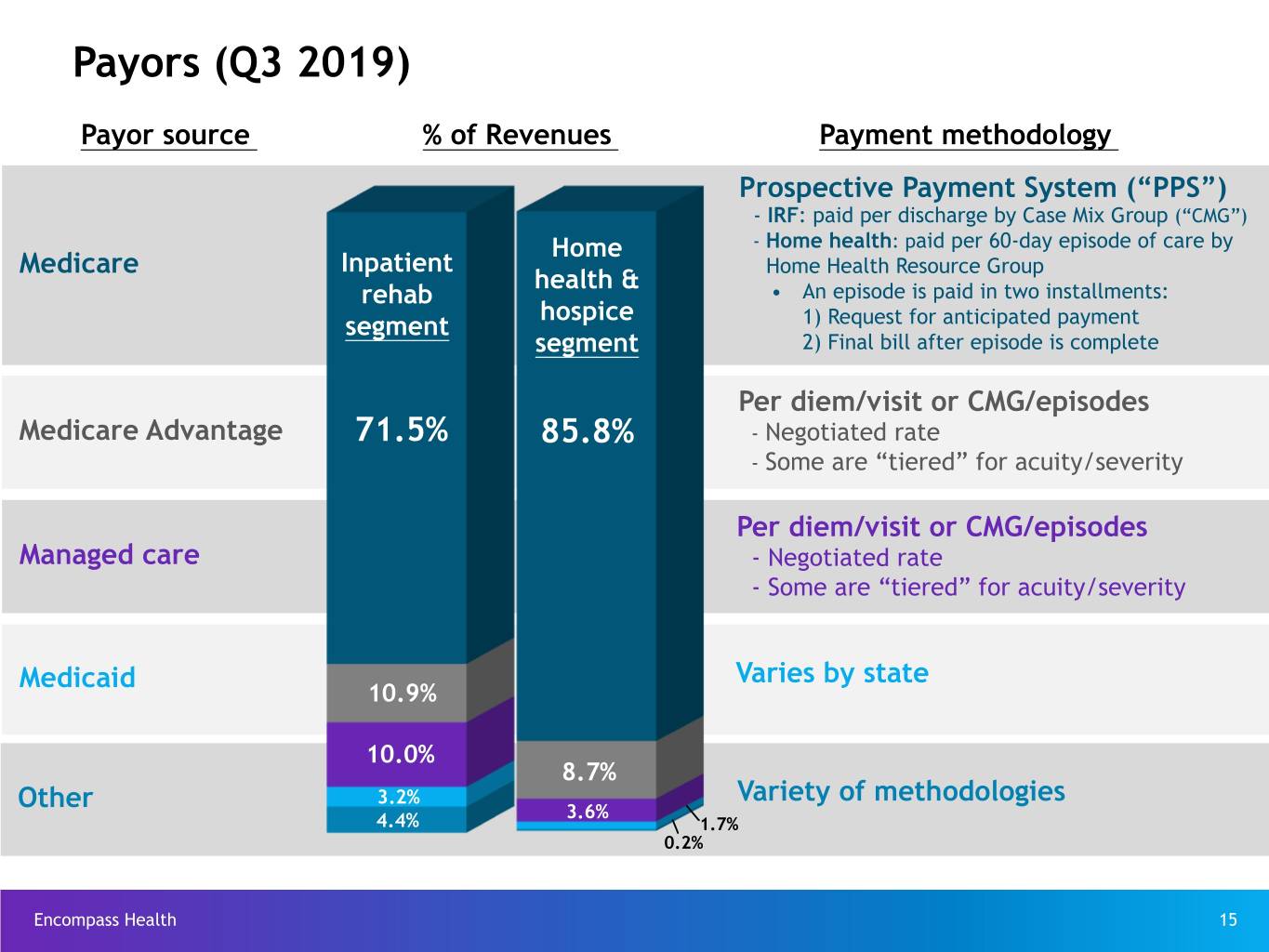

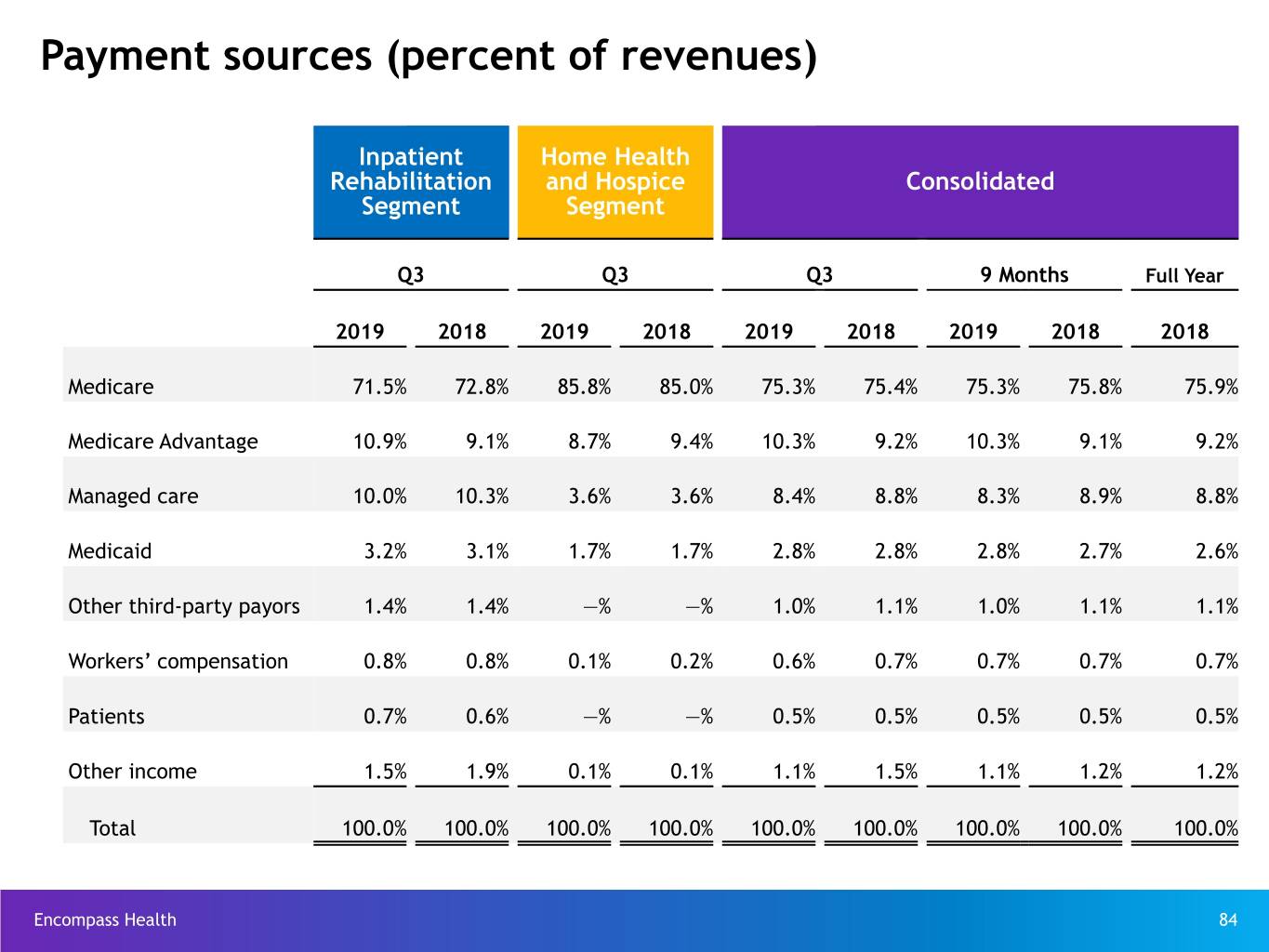

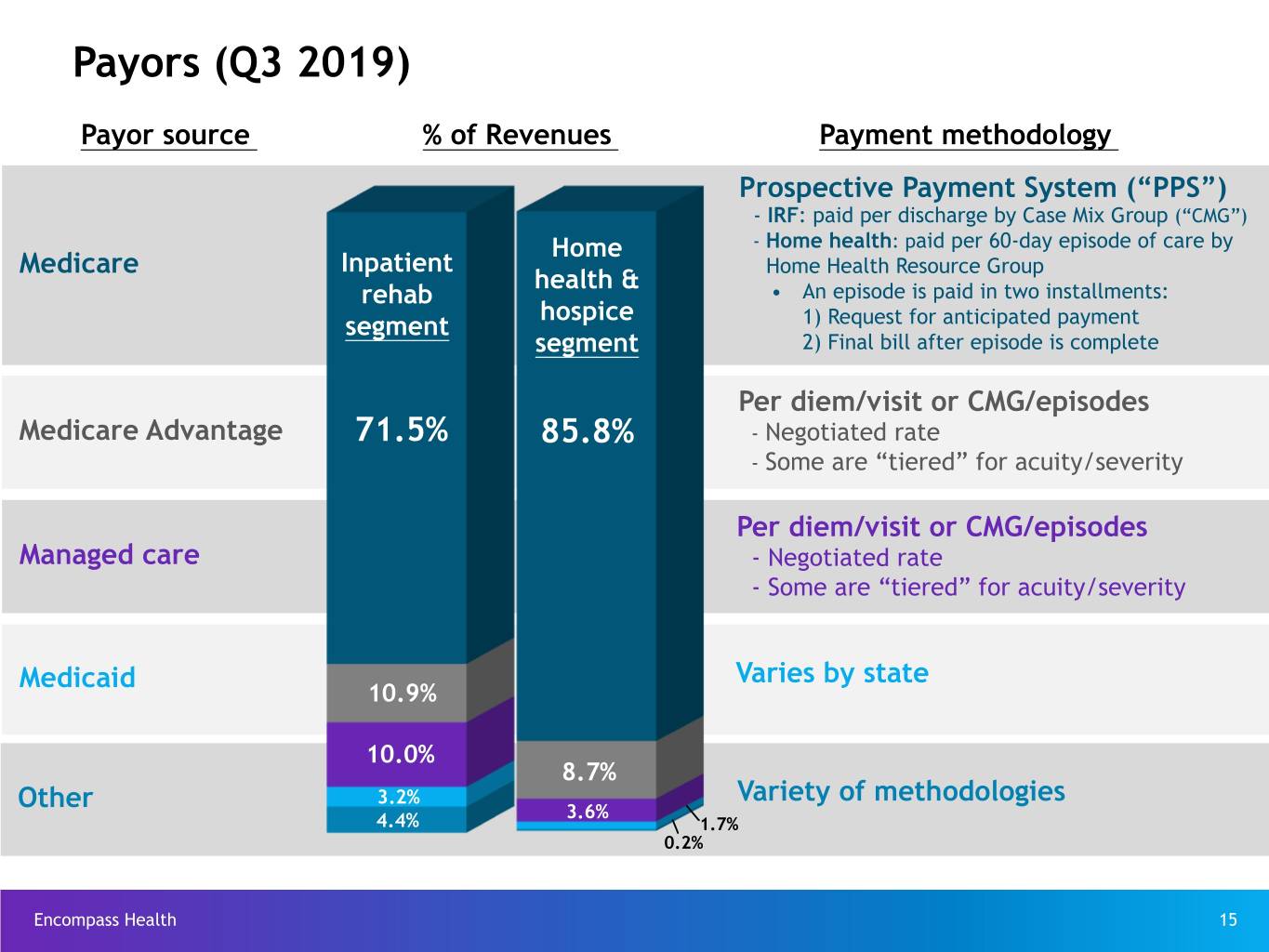

Payors (Q3 2019) Payor source % of Revenues Payment methodology Prospective Payment System (“PPS”) - IRF: paid per discharge by Case Mix Group (“CMG”) Home - Home health: paid per 60-day episode of care by Medicare Inpatient Home Health Resource Group health & rehab • An episode is paid in two installments: hospice segment 1) Request for anticipated payment segment 2) Final bill after episode is complete Per diem/visit or CMG/episodes Medicare Advantage 71.5% 85.8% - Negotiated rate - Some are “tiered” for acuity/severity Per diem/visit or CMG/episodes Managed care - Negotiated rate - Some are “tiered” for acuity/severity Medicaid Varies by state 10.9% 10.0% 8.7% 3.2% Variety of methodologies Other 3.6% 4.4% 1.7% 0.2% Encompass Health 15

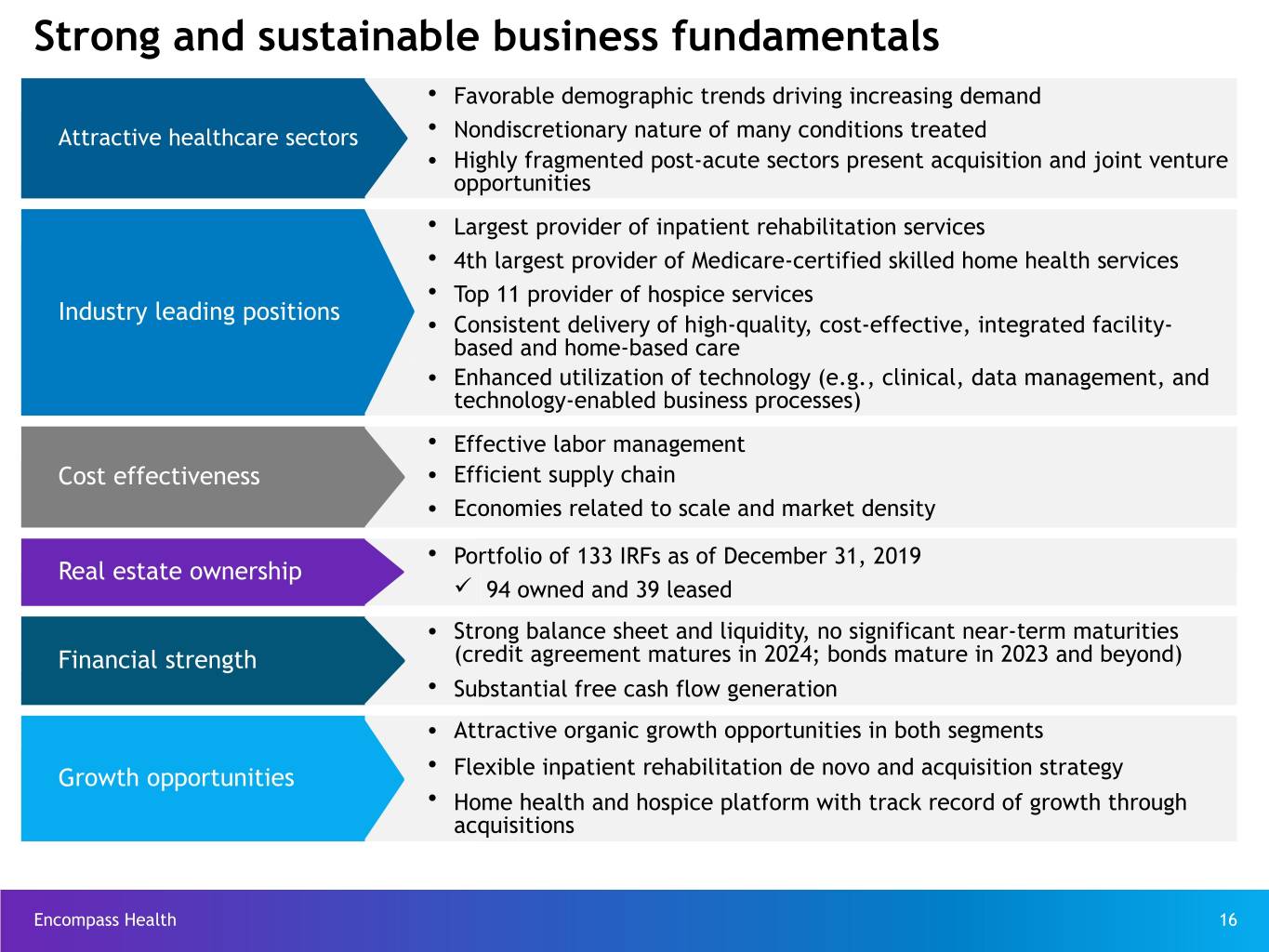

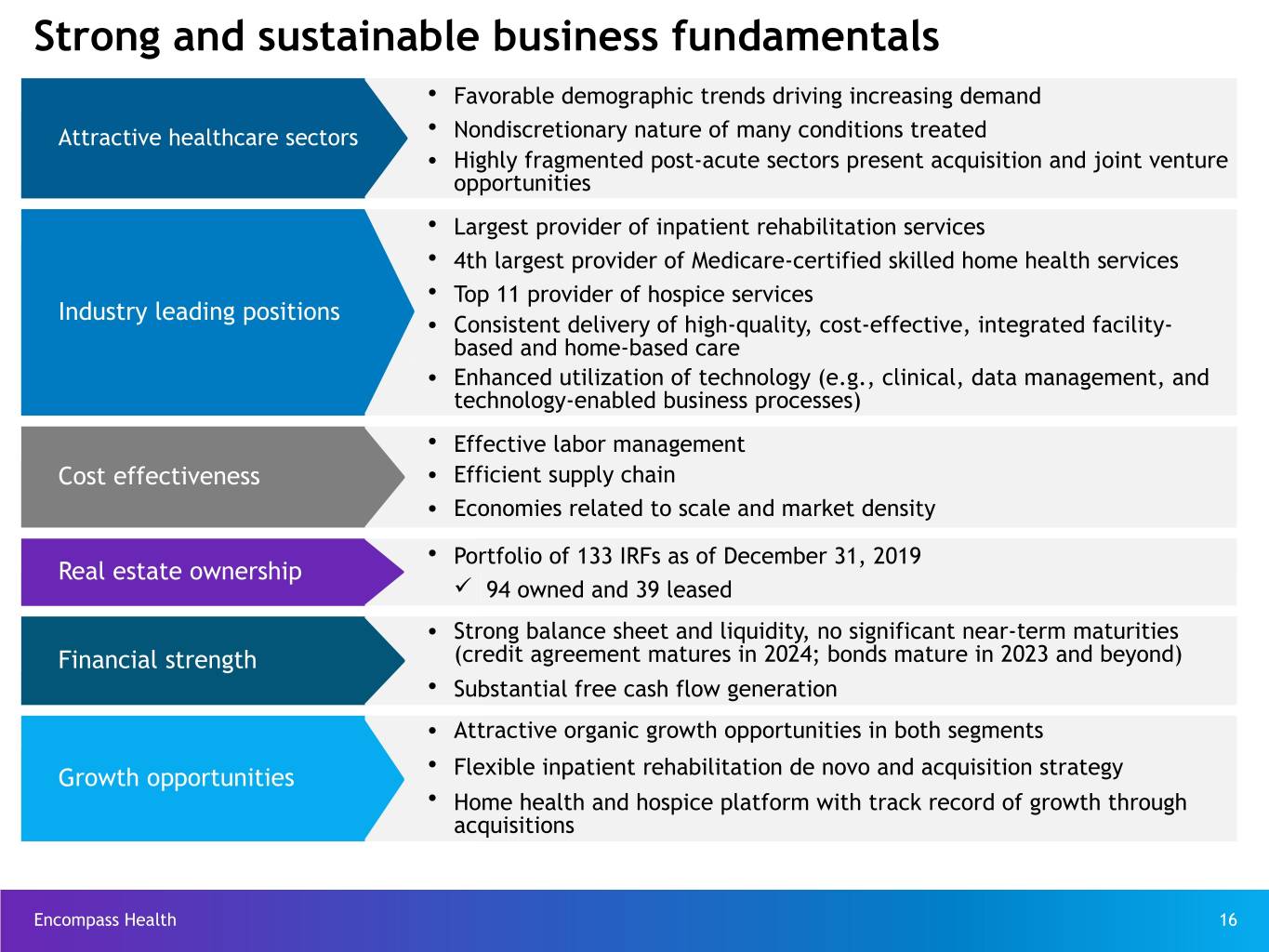

Strong and sustainable business fundamentals Ÿ Favorable demographic trends driving increasing demand Ÿ Attractive healthcare sectors Nondiscretionary nature of many conditions treated Ÿ Highly fragmented post-acute sectors present acquisition and joint venture opportunities Ÿ Largest provider of inpatient rehabilitation services Ÿ 4th largest provider of Medicare-certified skilled home health services Ÿ Top 11 provider of hospice services Industry leading positions Ÿ Consistent delivery of high-quality, cost-effective, integrated facility- based and home-based care Ÿ Enhanced utilization of technology (e.g., clinical, data management, and technology-enabled business processes) Ÿ Effective labor management Cost effectiveness Ÿ Efficient supply chain Ÿ Economies related to scale and market density Ÿ Portfolio of 133 IRFs as of December 31, 2019 Real estate ownership ü 94 owned and 39 leased Ÿ Strong balance sheet and liquidity, no significant near-term maturities Financial strength (credit agreement matures in 2024; bonds mature in 2023 and beyond) Ÿ Substantial free cash flow generation Ÿ Attractive organic growth opportunities in both segments Ÿ Flexible inpatient rehabilitation de novo and acquisition strategy Growth opportunities Ÿ Home health and hospice platform with track record of growth through acquisitions Encompass Health 16

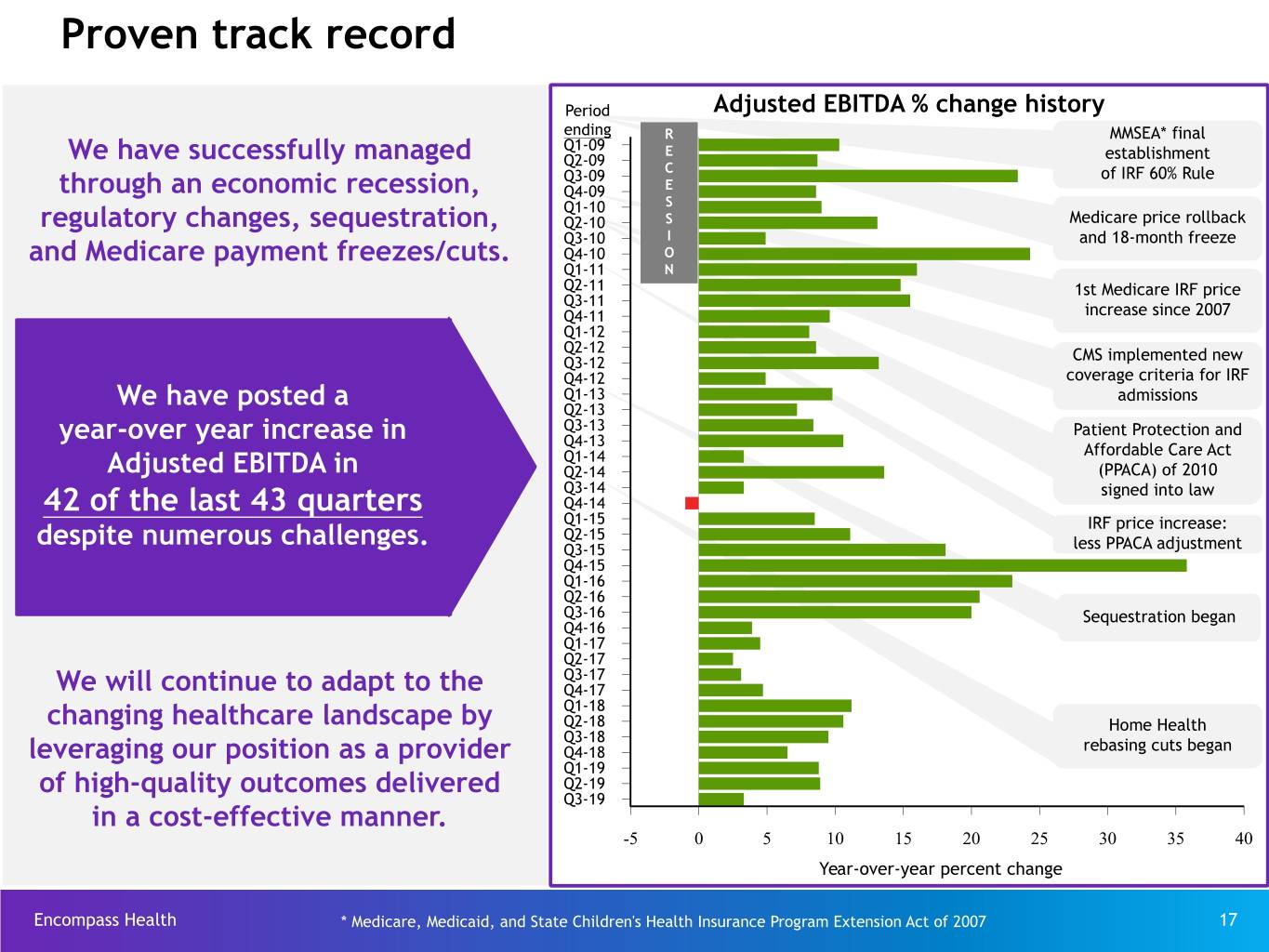

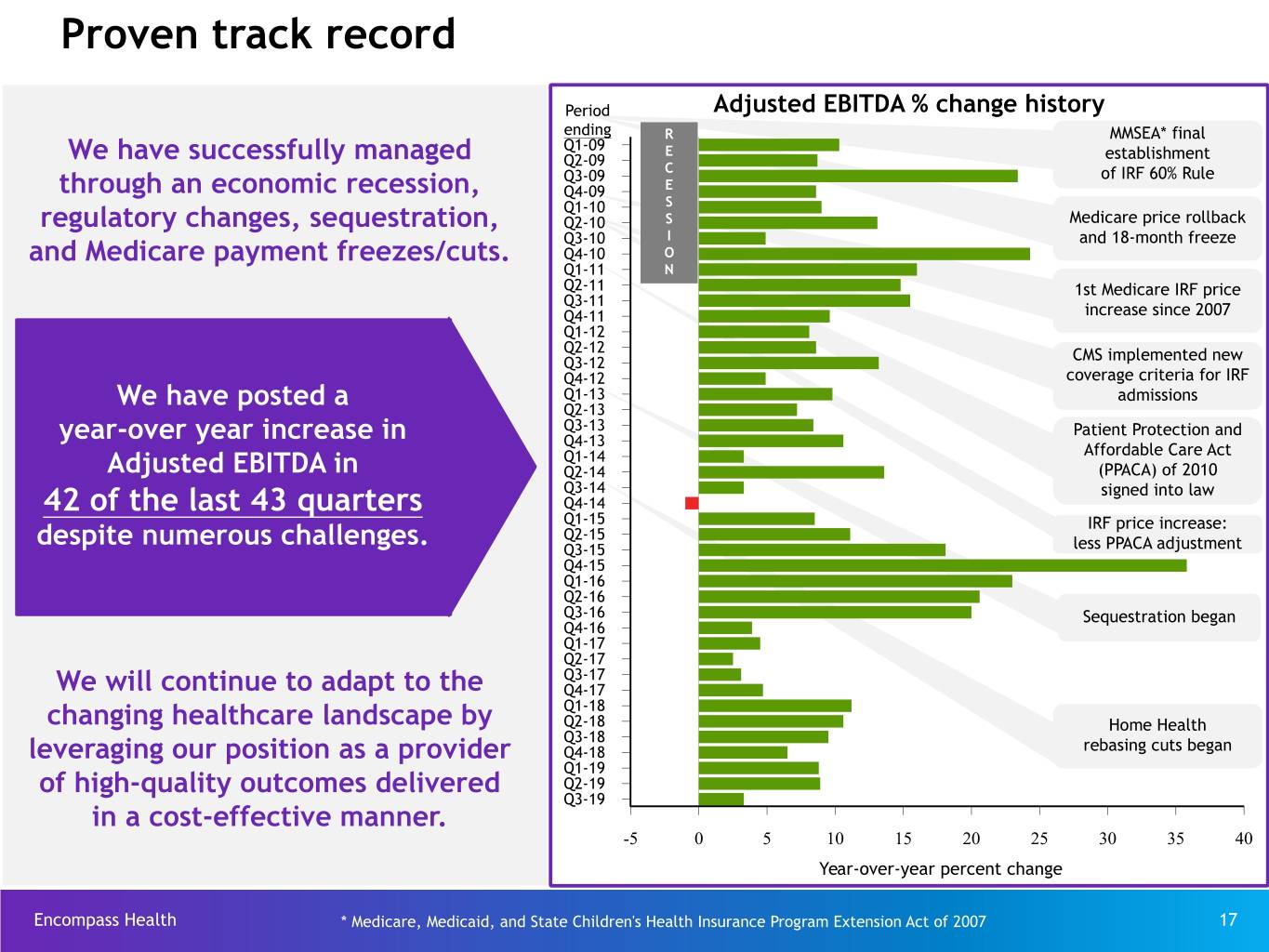

Proven track record Period Adjusted EBITDA % change history ending R MMSEA* final Q1-09 We have successfully managed E establishment Q2-09 C Q3-09 of IRF 60% Rule through an economic recession, Q4-09 E Q1-10 S regulatory changes, sequestration, Q2-10 S Medicare price rollback Q3-10 I and 18-month freeze and Medicare payment freezes/cuts. Q4-10 O Q1-11 N Q2-11 1st Medicare IRF price Q3-11 Q4-11 increase since 2007 Q1-12 Q2-12 Q3-12 CMS implemented new Q4-12 coverage criteria for IRF Q1-13 admissions We have posted a Q2-13 Q3-13 Patient Protection and year-over year increase in Q4-13 Q1-14 Affordable Care Act Adjusted EBITDA in Q2-14 (PPACA) of 2010 Q3-14 signed into law 42 of the last 43 quarters Q4-14 Q1-15 IRF price increase: despite numerous challenges. Q2-15 Q3-15 less PPACA adjustment Q4-15 Q1-16 Q2-16 Q3-16 Sequestration began Q4-16 Q1-17 Q2-17 Q3-17 We will continue to adapt to the Q4-17 Q1-18 changing healthcare landscape by Q2-18 Home Health Q3-18 leveraging our position as a provider Q4-18 rebasing cuts began Q1-19 of high-quality outcomes delivered Q2-19 Q3-19 in a cost-effective manner. -5 0 5 10 15 20 25 30 35 40 Year-over-year percent change Encompass Health * Medicare, Medicaid, and State Children's Health Insurance Program Extension Act of 2007 17

Investment thesis and strategy Encompass Health’s ability to adapt to changes, build strategic relationships, and consistently provide high-quality, cost-effective care positions the Company for success in the evolving healthcare industry. Encompass Health 18

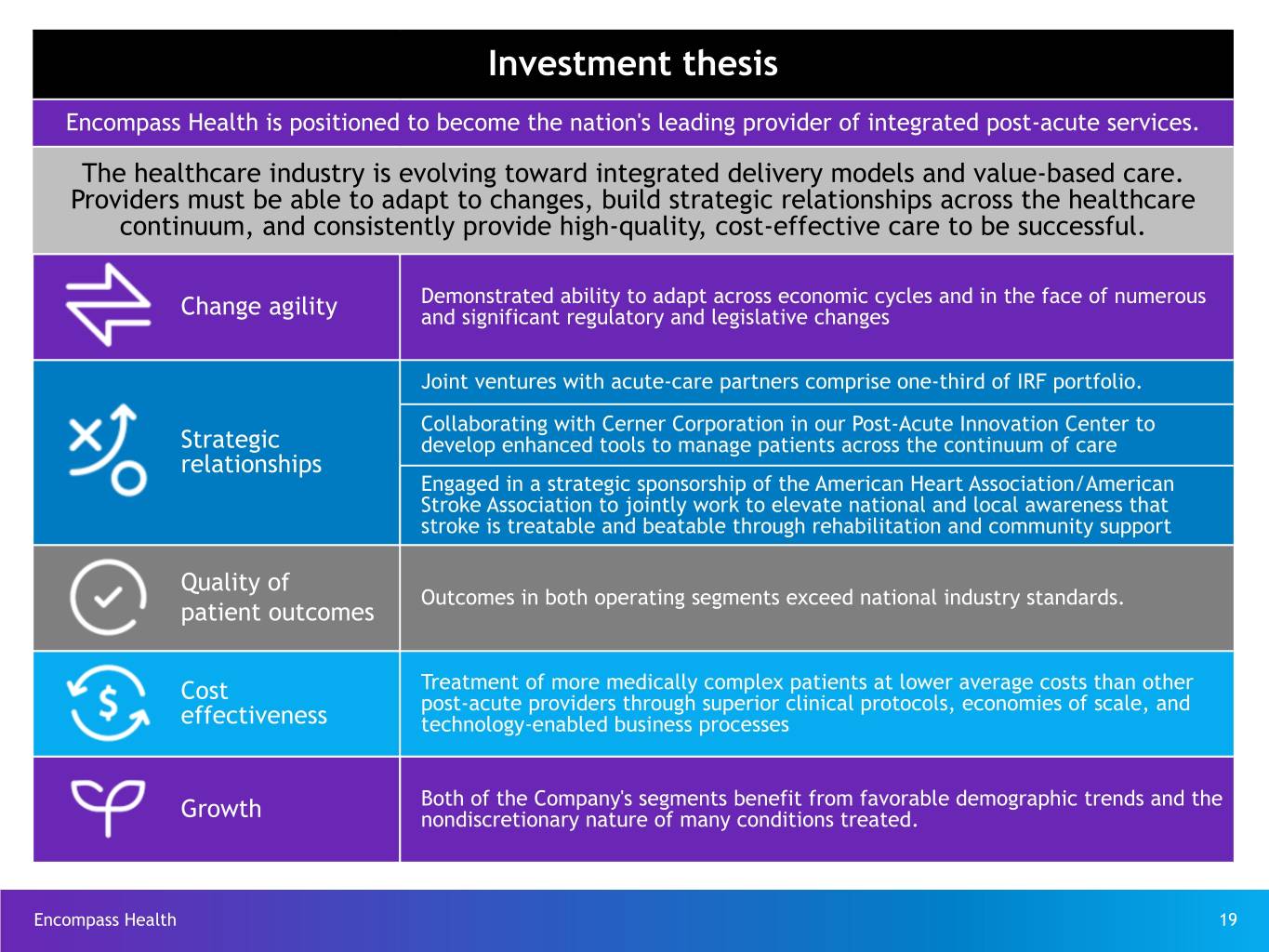

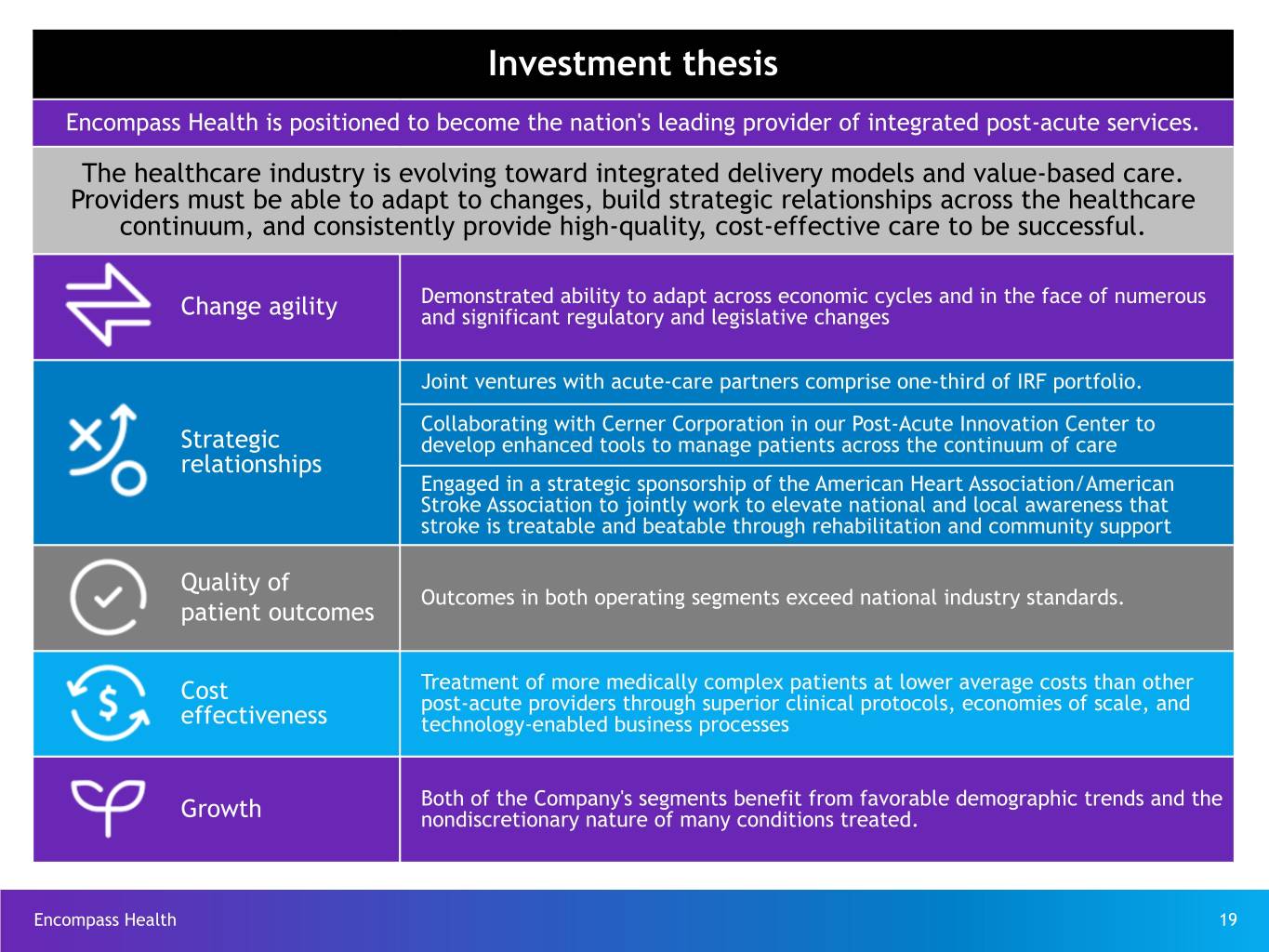

Investment thesis Encompass Health is positioned to become the nation's leading provider of integrated post-acute services. The healthcare industry is evolving toward integrated delivery models and value-based care. Providers must be able to adapt to changes, build strategic relationships across the healthcare continuum, and consistently provide high-quality, cost-effective care to be successful. Demonstrated ability to adapt across economic cycles and in the face of numerous Change agility and significant regulatory and legislative changes Joint ventures with acute-care partners comprise one-third of IRF portfolio. Collaborating with Cerner Corporation in our Post-Acute Innovation Center to Strategic develop enhanced tools to manage patients across the continuum of care relationships Engaged in a strategic sponsorship of the American Heart Association/American Stroke Association to jointly work to elevate national and local awareness that stroke is treatable and beatable through rehabilitation and community support Quality of Outcomes in both operating segments exceed national industry standards. patient outcomes Cost Treatment of more medically complex patients at lower average costs than other post-acute providers through superior clinical protocols, economies of scale, and effectiveness technology-enabled business processes Both of the Company's segments benefit from favorable demographic trends and the Growth nondiscretionary nature of many conditions treated. Encompass Health 19

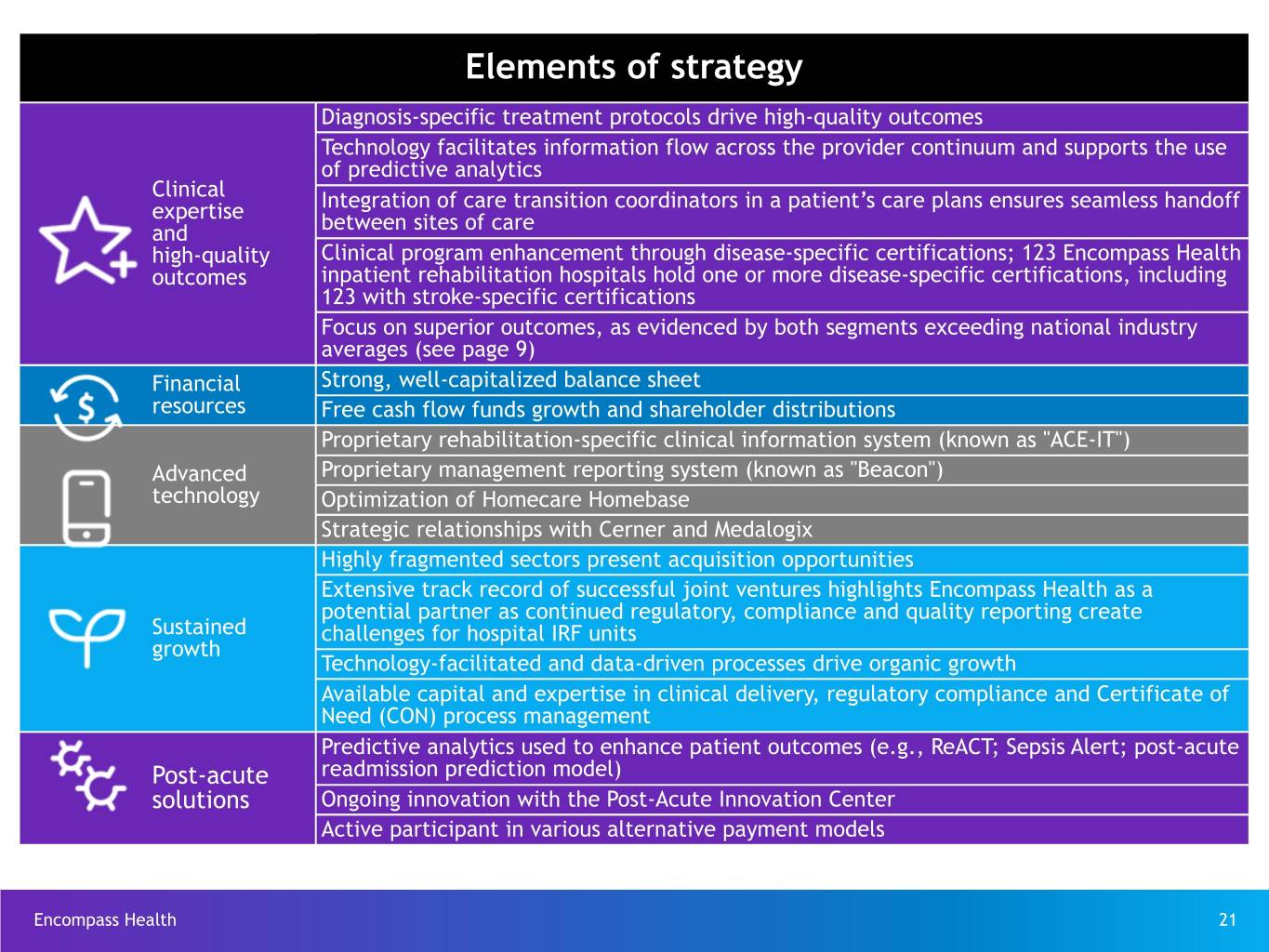

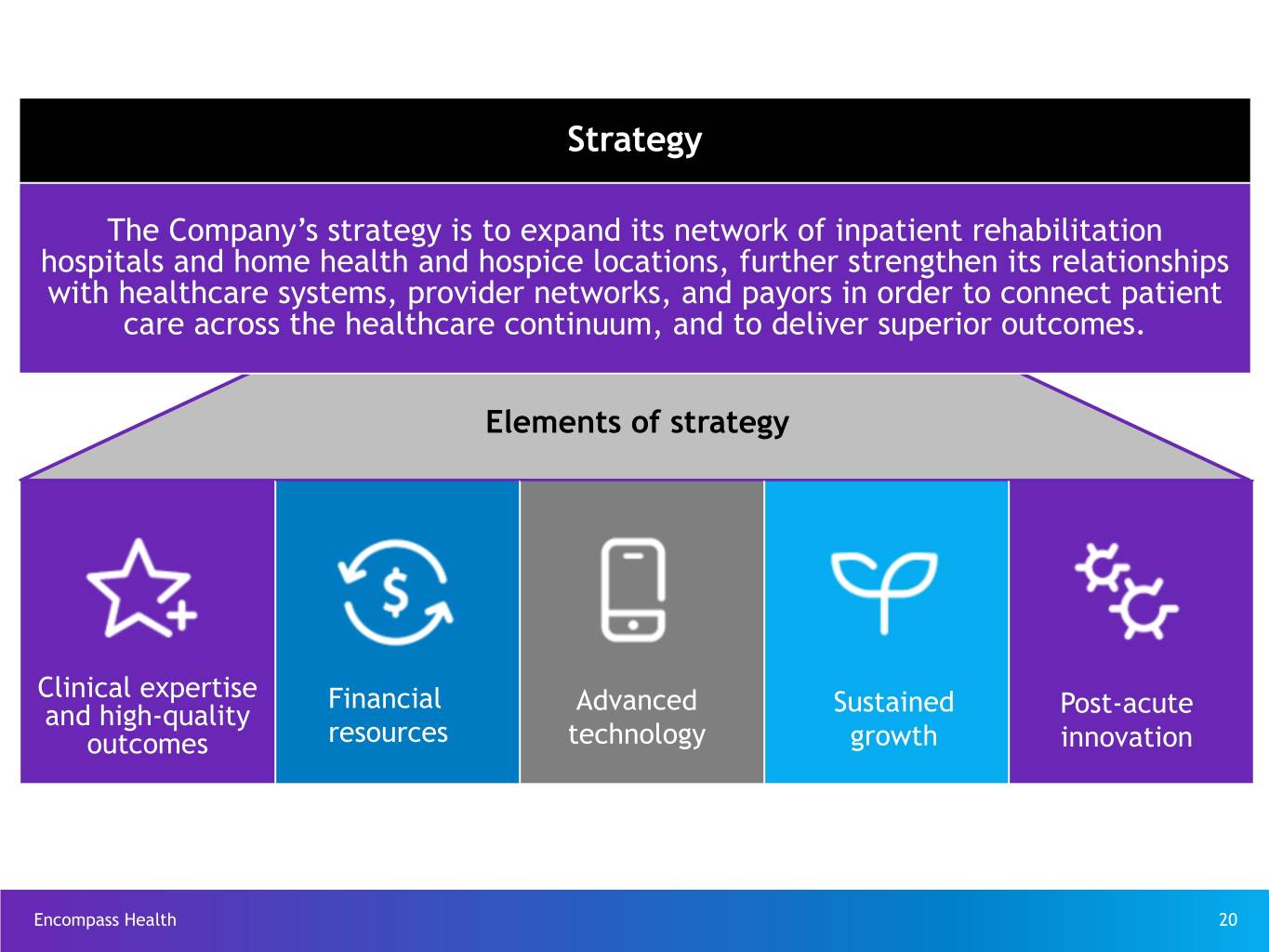

Strategy The Company’s strategy is to expand its network of inpatient rehabilitation hospitals and home health and hospice locations, further strengthen its relationships with healthcare systems, provider networks, and payors in order to connect patient care across the healthcare continuum, and to deliver superior outcomes. Elements of strategy Clinical expertise Financial Advanced and high-quality Sustained Post-acute outcomes resources technology growth innovation Encompass Health 20

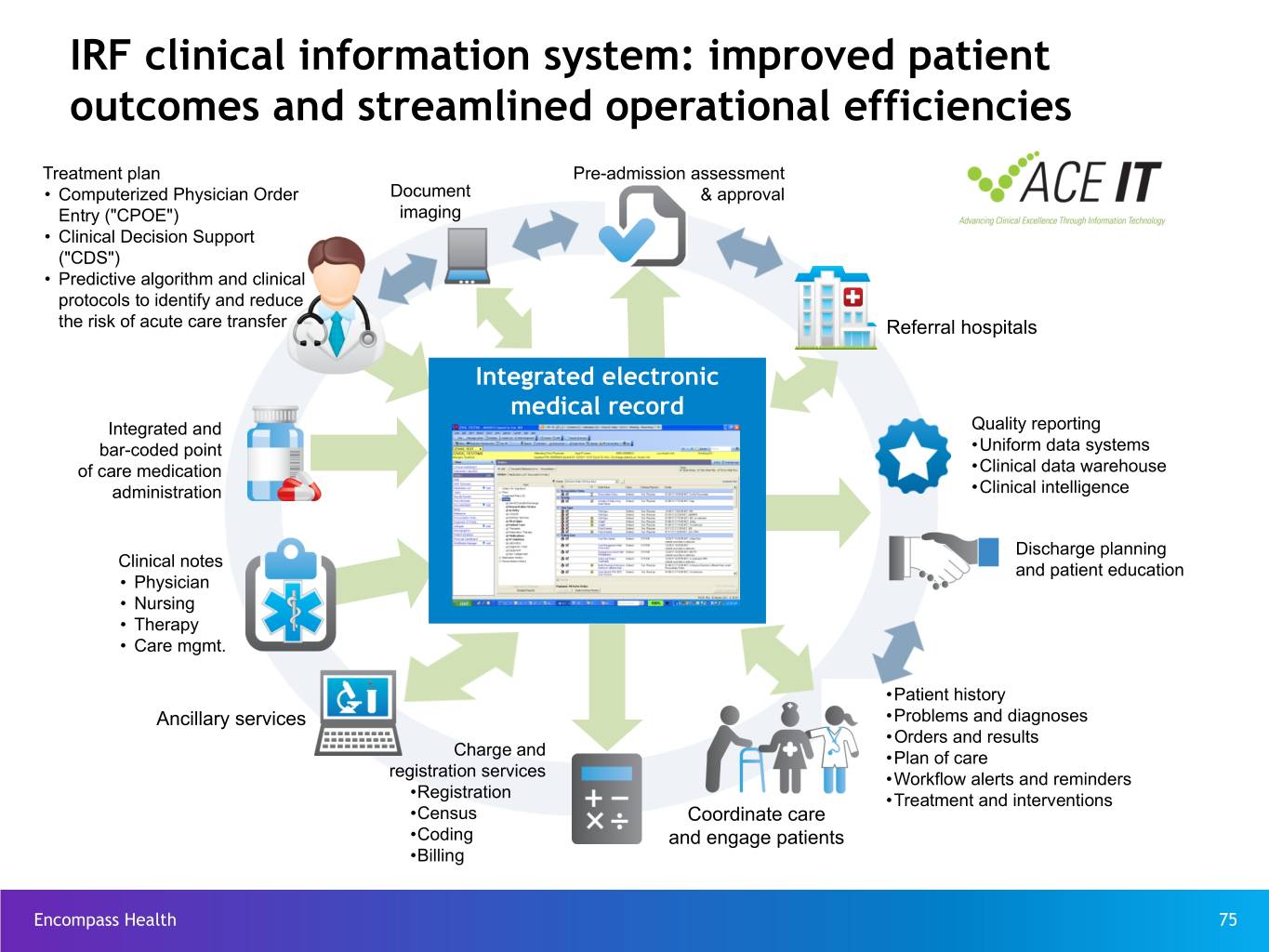

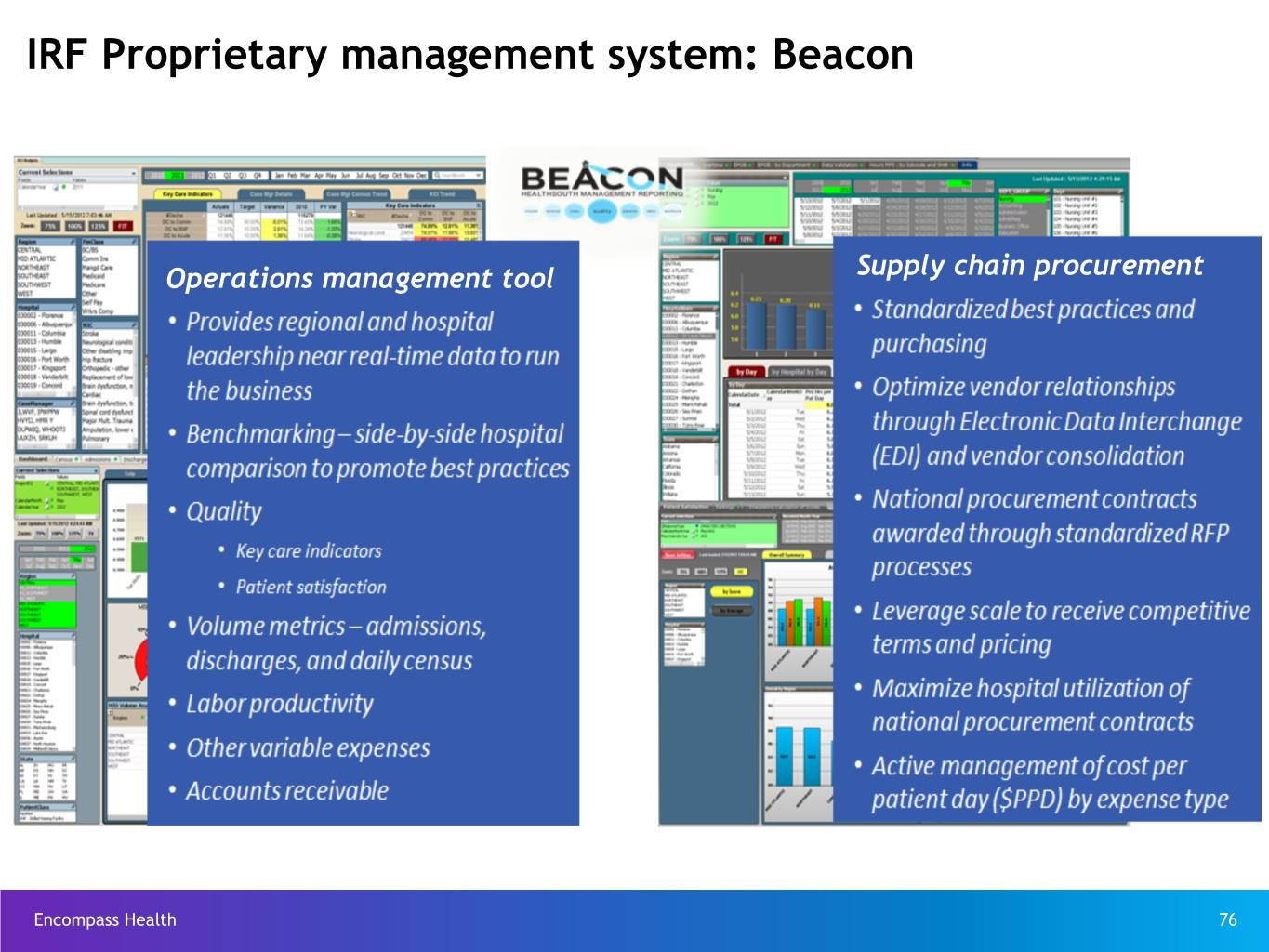

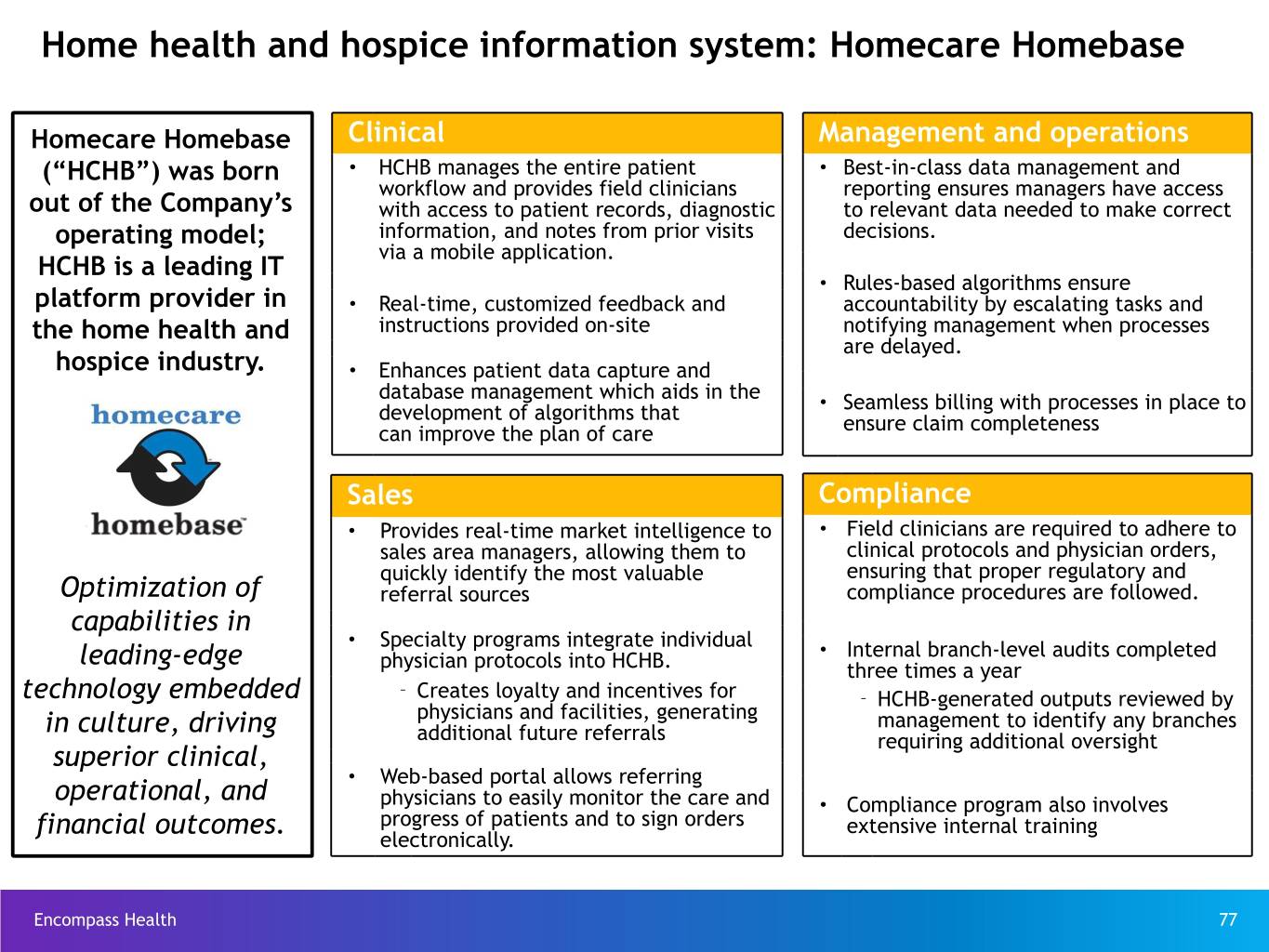

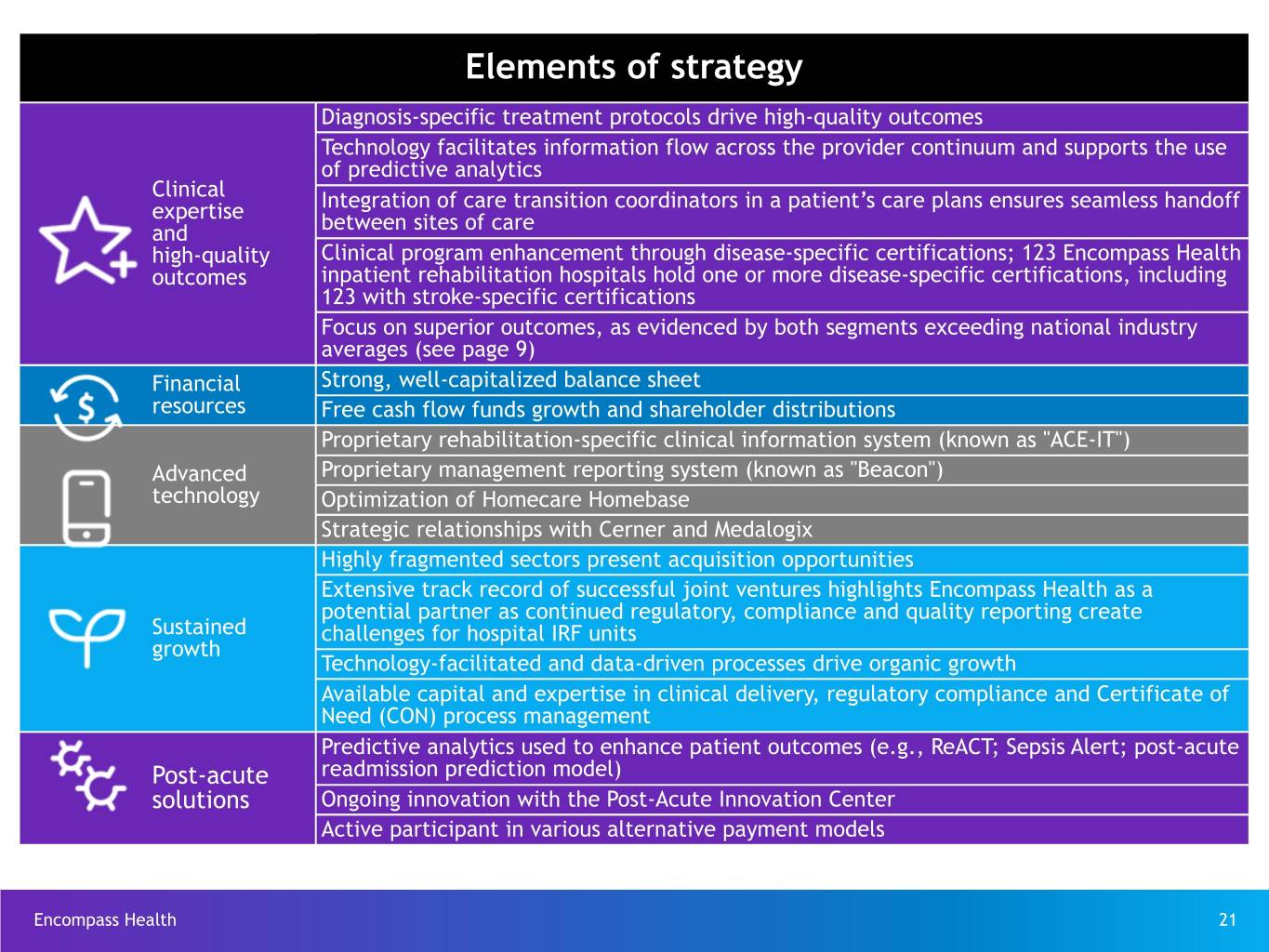

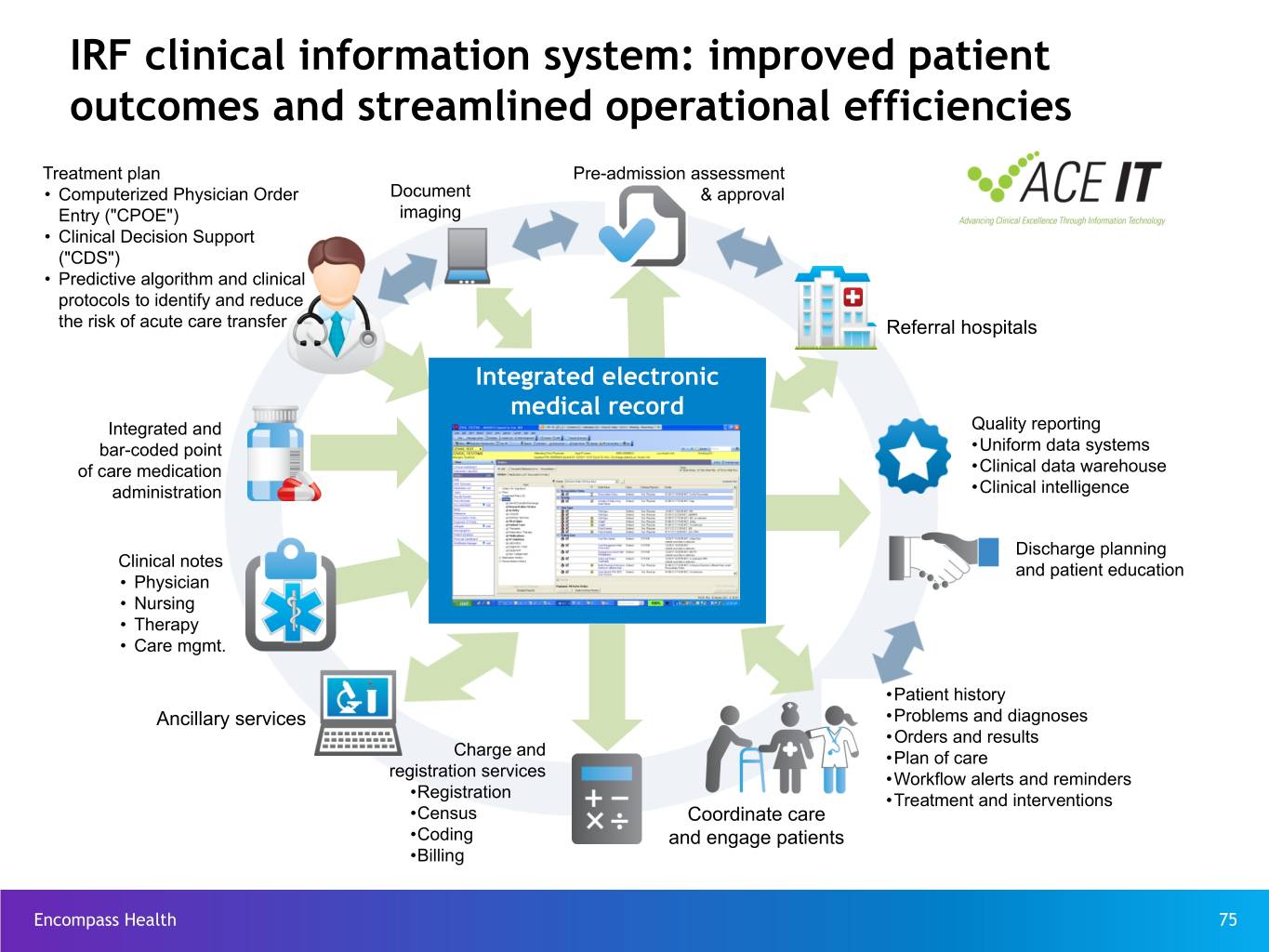

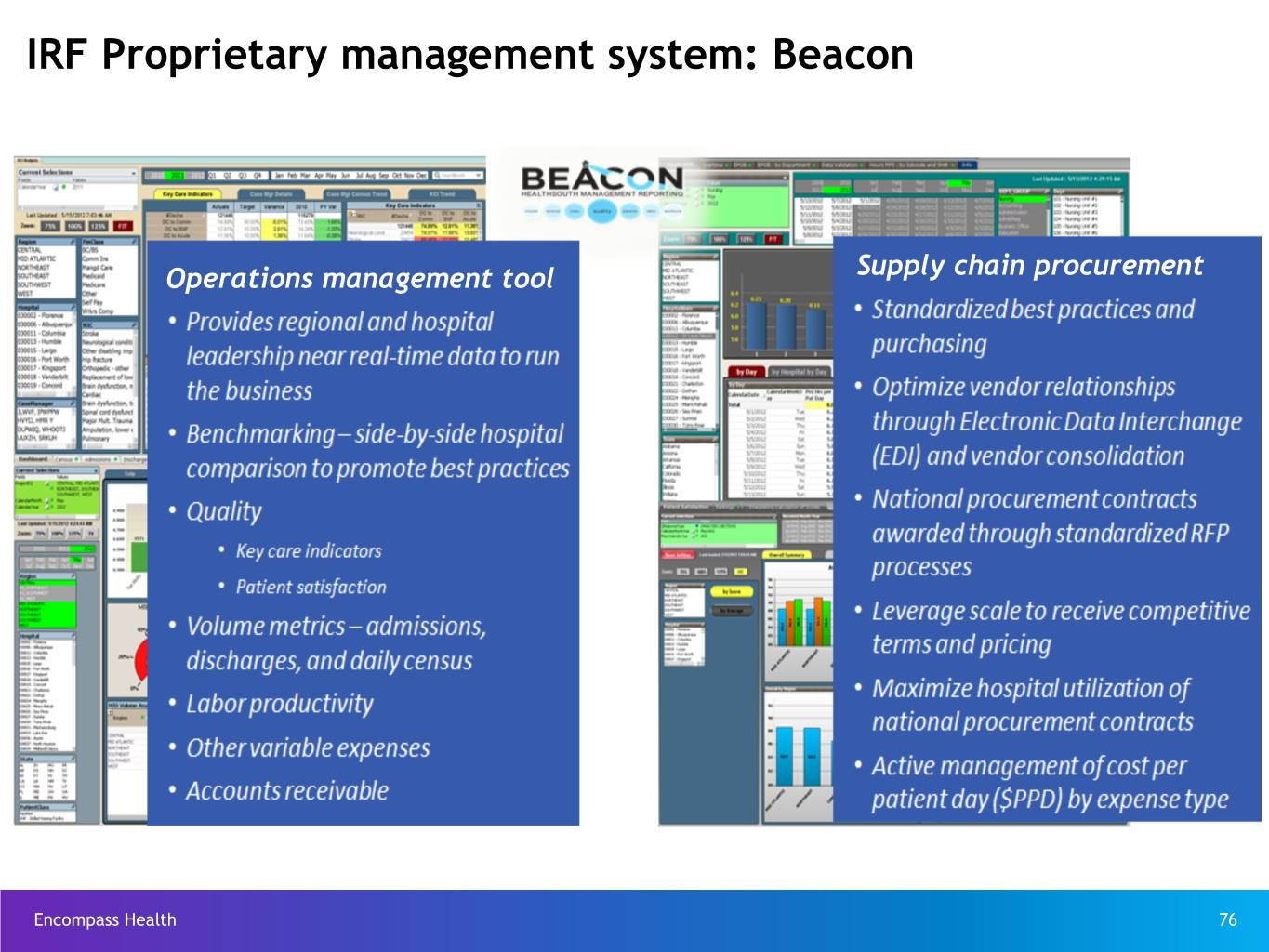

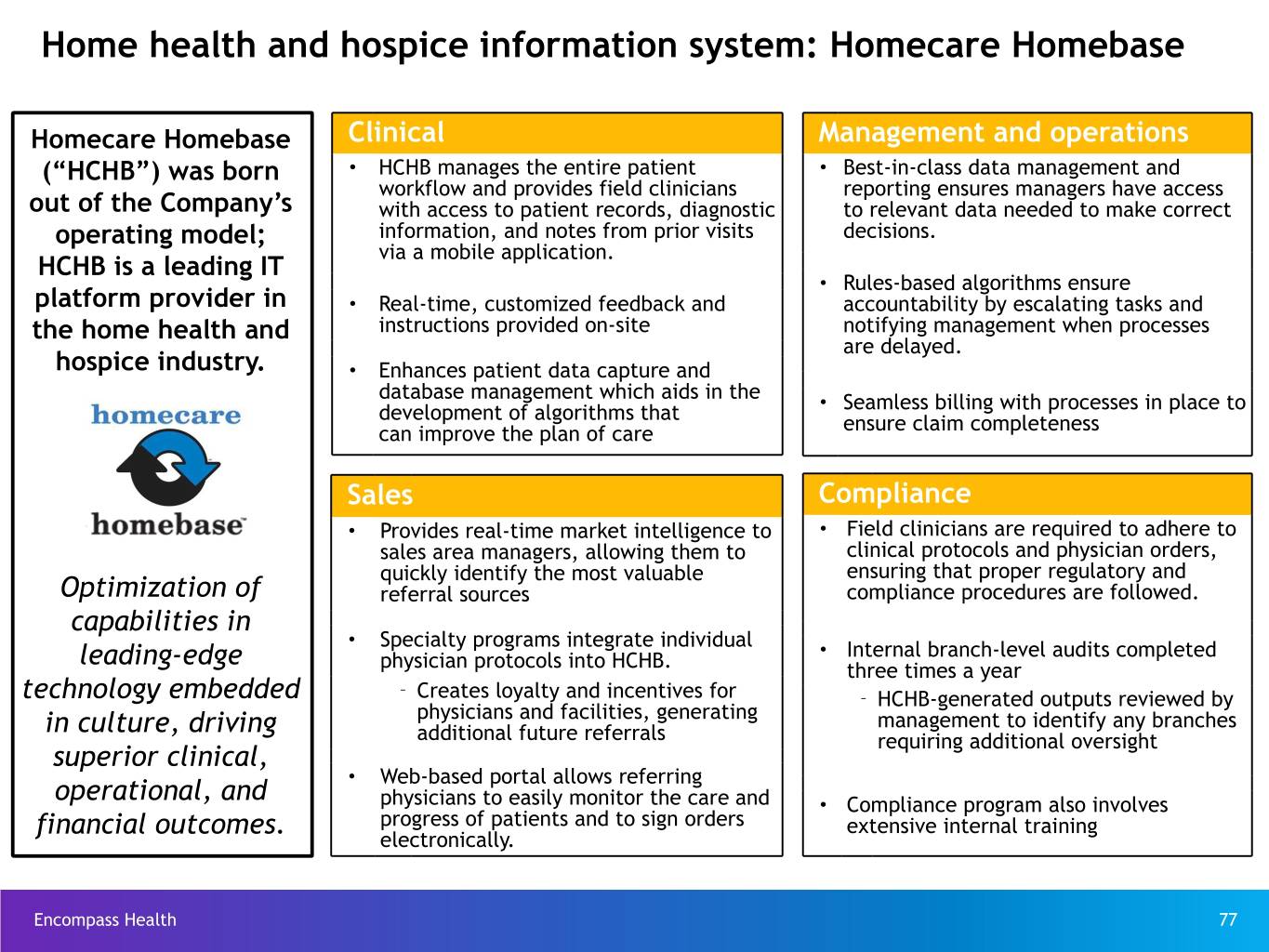

Elements of strategy Diagnosis-specific treatment protocols drive high-quality outcomes Technology facilitates information flow across the provider continuum and supports the use of predictive analytics Clinical expertise Integration of care transition coordinators in a patient’s care plans ensures seamless handoff and between sites of care high-quality Clinical program enhancement through disease-specific certifications; 123 Encompass Health outcomes inpatient rehabilitation hospitals hold one or more disease-specific certifications, including 123 with stroke-specific certifications Focus on superior outcomes, as evidenced by both segments exceeding national industry averages (see page 9) Financial Strong, well-capitalized balance sheet resources Free cash flow funds growth and shareholder distributions Proprietary rehabilitation-specific clinical information system (known as "ACE-IT") Advanced Proprietary management reporting system (known as "Beacon") technology Optimization of Homecare Homebase Strategic relationships with Cerner and Medalogix Highly fragmented sectors present acquisition opportunities Extensive track record of successful joint ventures highlights Encompass Health as a potential partner as continued regulatory, compliance and quality reporting create Sustained challenges for hospital IRF units growth Technology-facilitated and data-driven processes drive organic growth Available capital and expertise in clinical delivery, regulatory compliance and Certificate of Need (CON) process management Predictive analytics used to enhance patient outcomes (e.g., ReACT; Sepsis Alert; post-acute Post-acute readmission prediction model) solutions Ongoing innovation with the Post-Acute Innovation Center Active participant in various alternative payment models Encompass Health 21

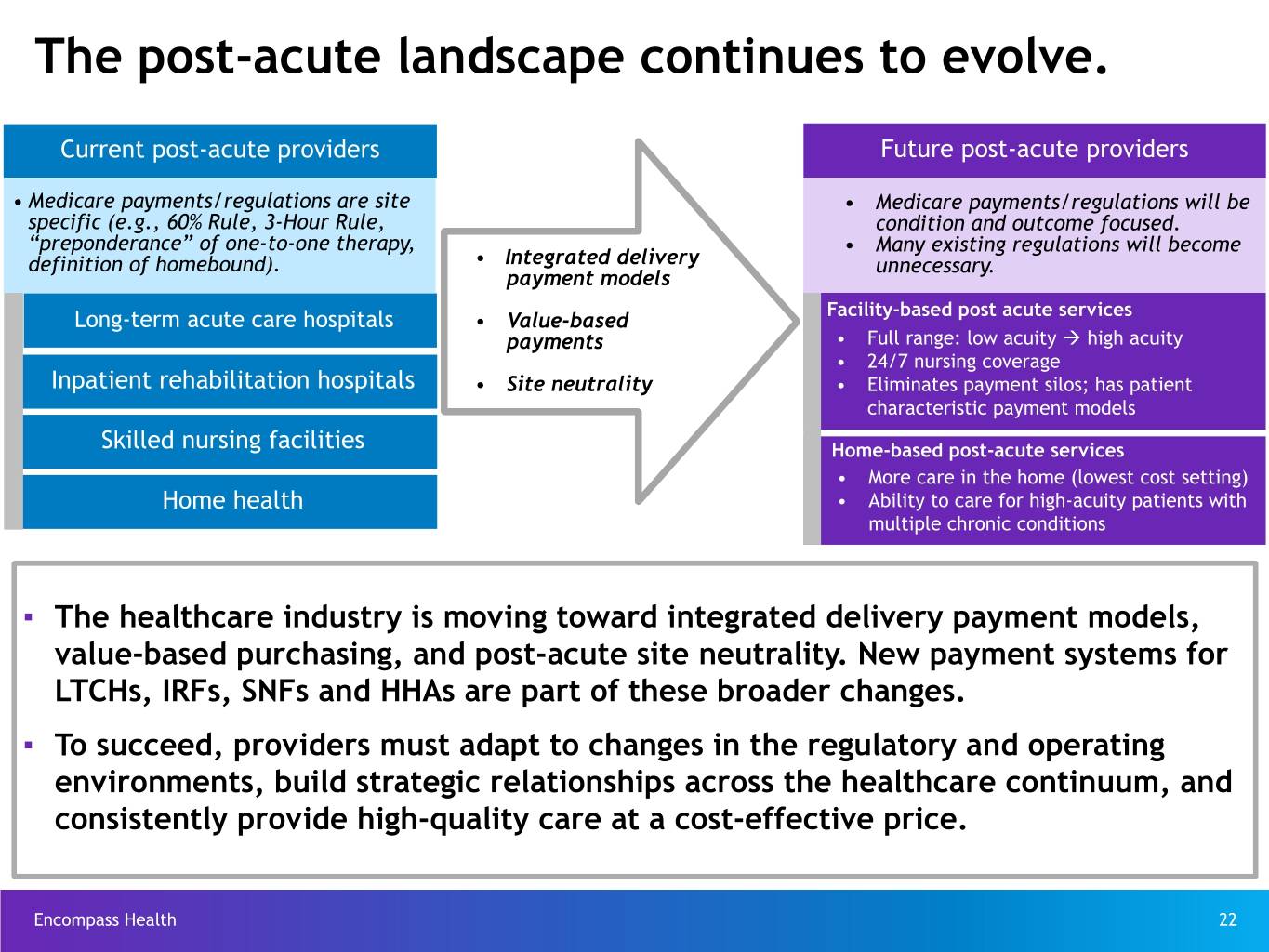

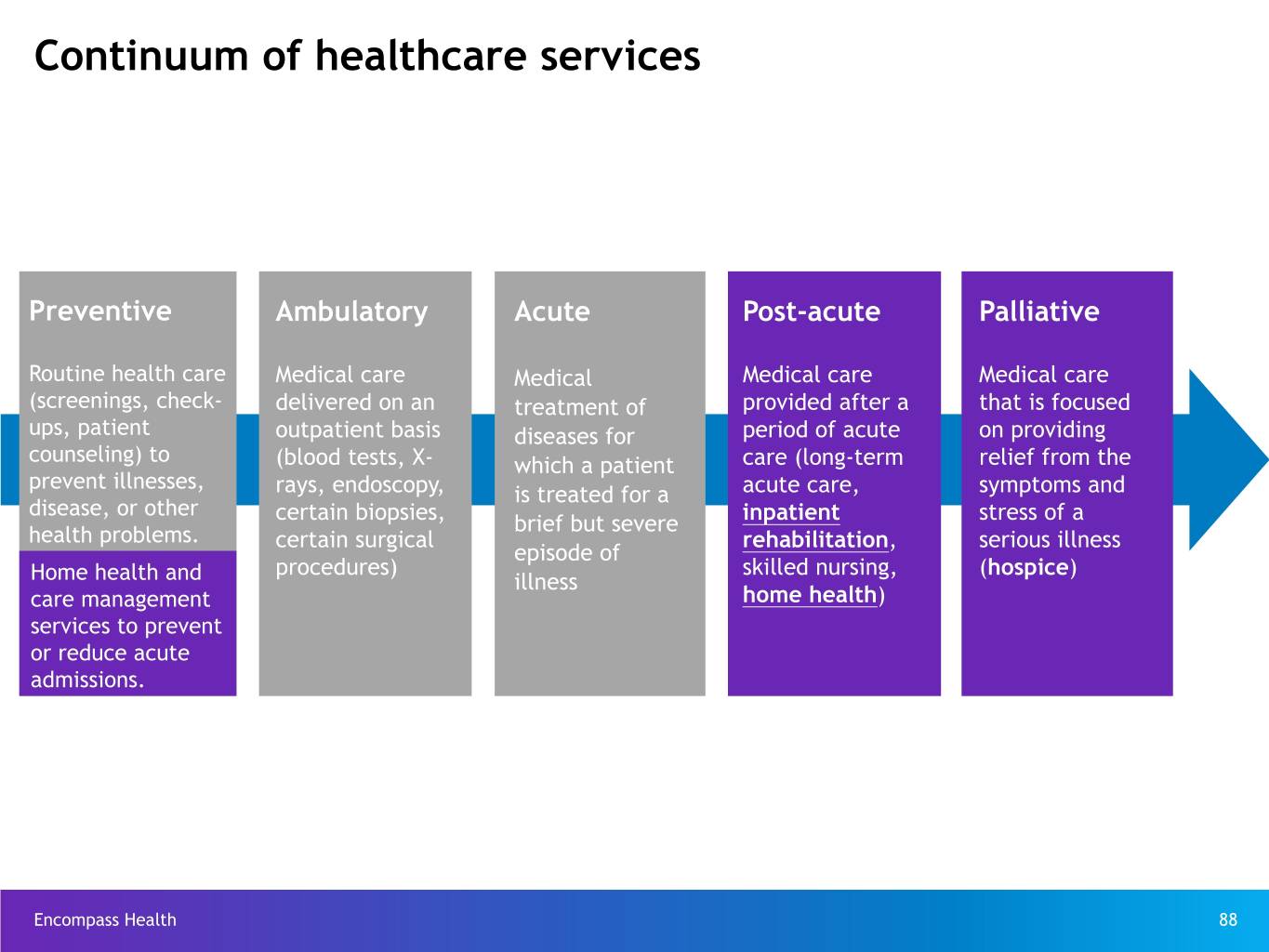

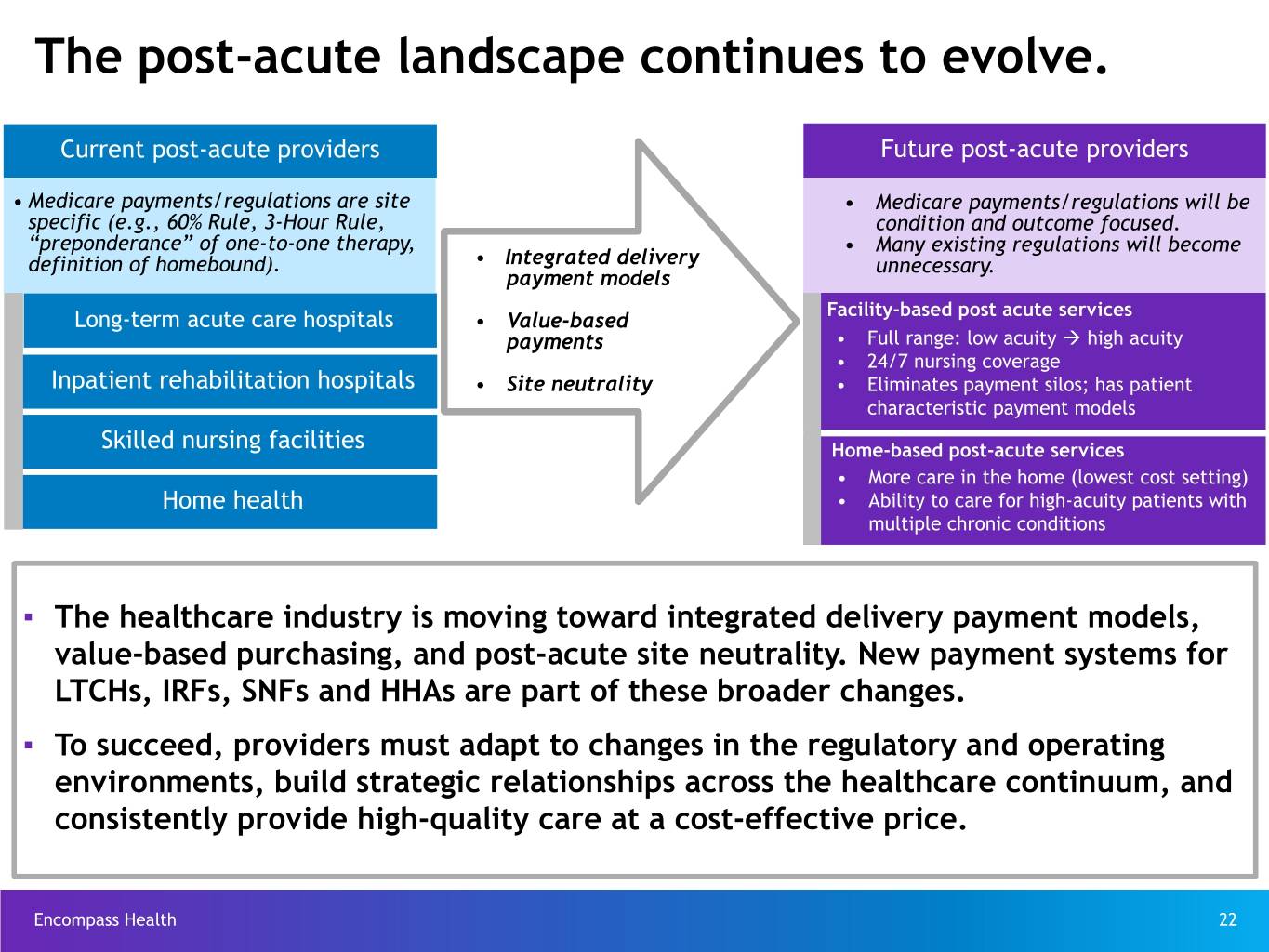

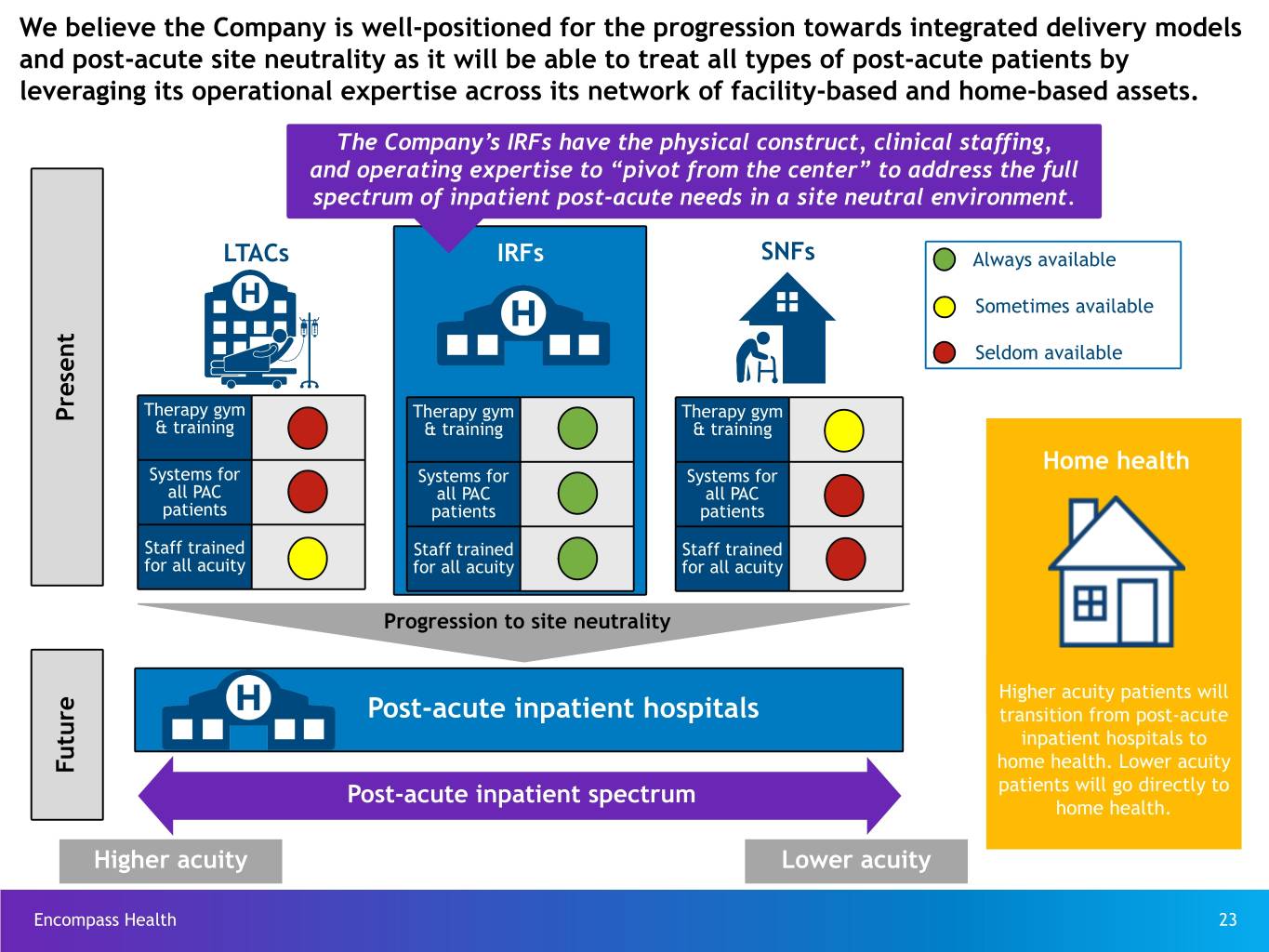

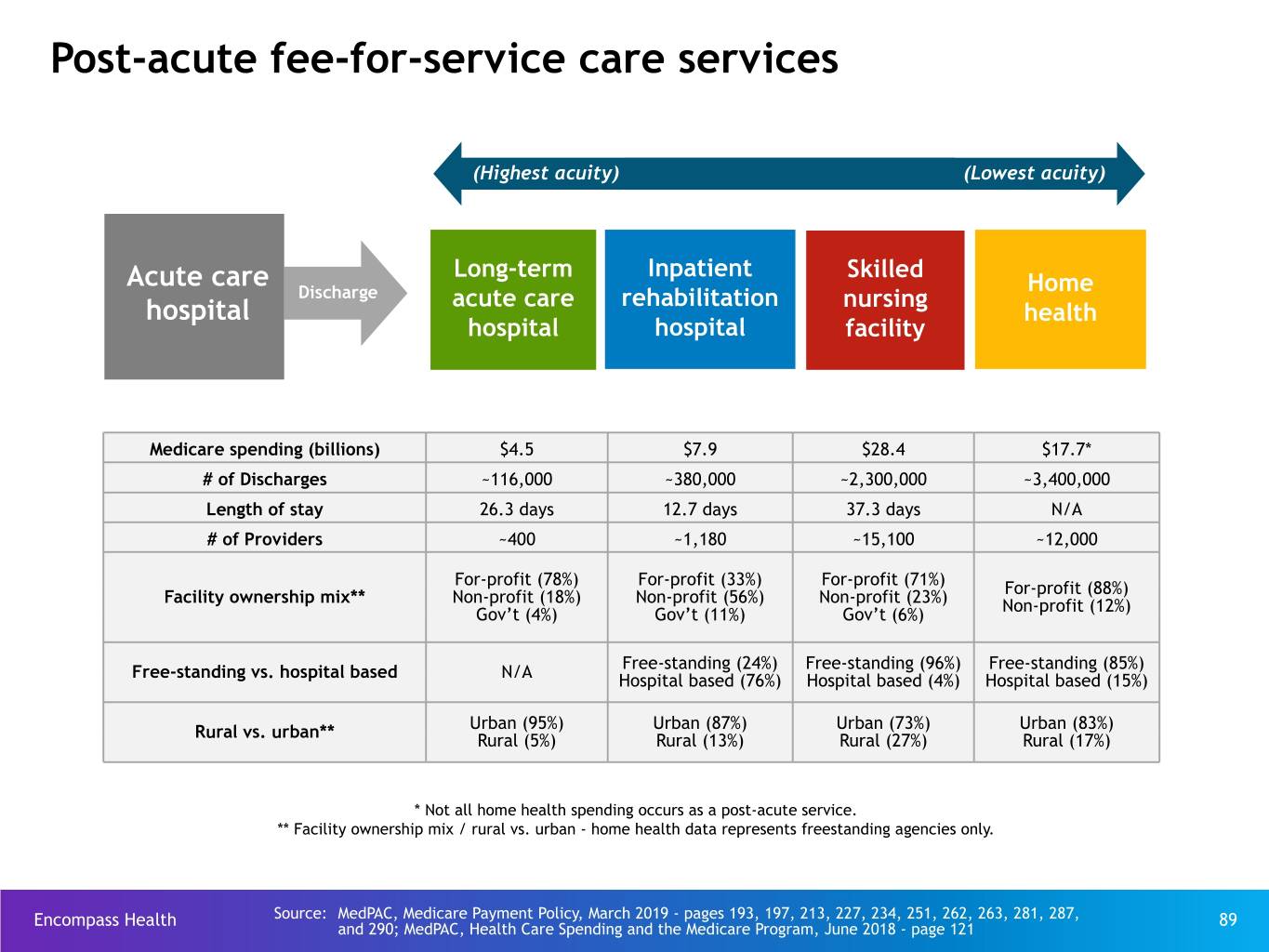

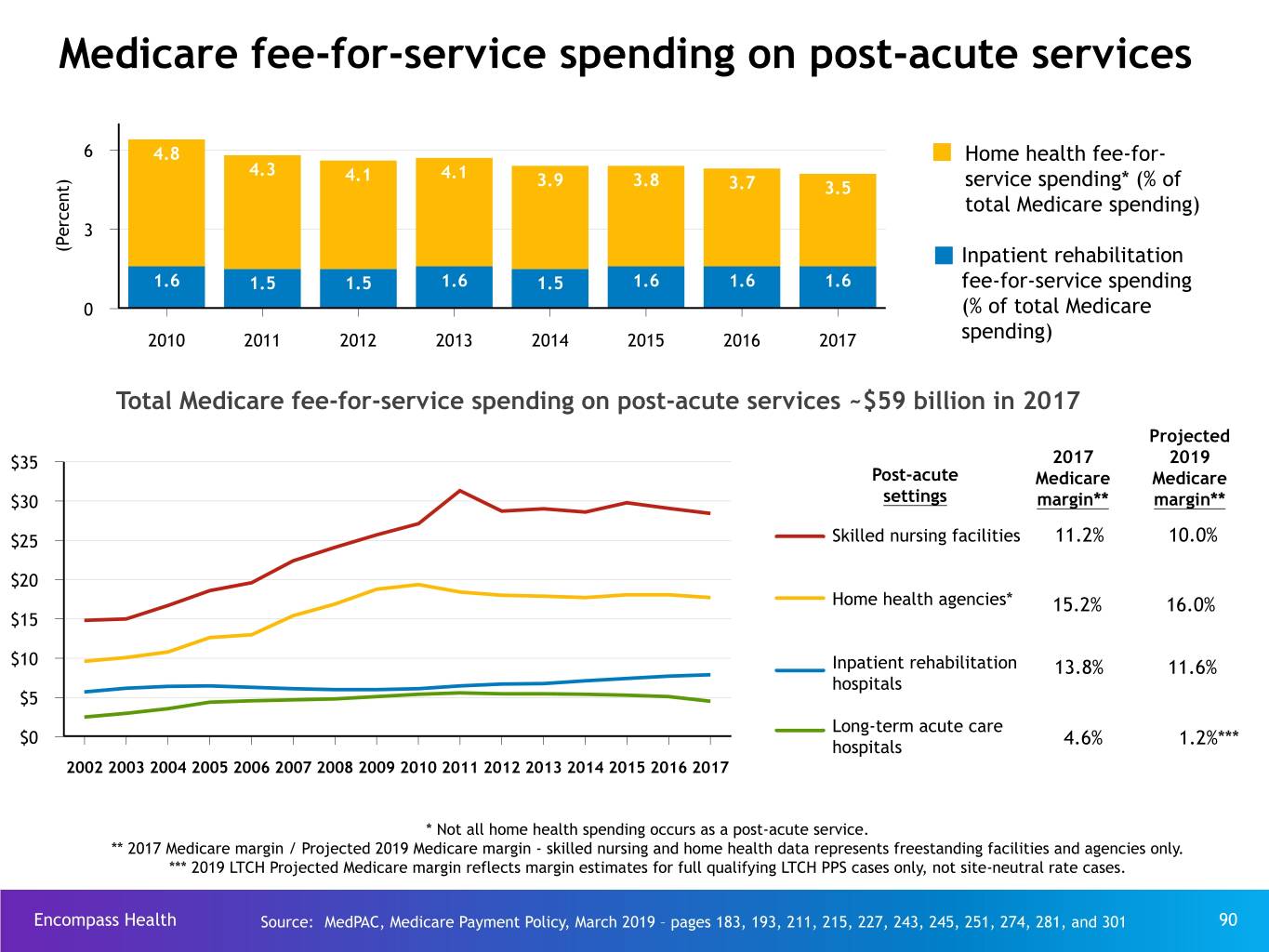

The post-acute landscape continues to evolve. Current post-acute providers Future post-acute providers • Medicare payments/regulations are site • Medicare payments/regulations will be specific (e.g., 60% Rule, 3-Hour Rule, condition and outcome focused. “preponderance” of one-to-one therapy, • Many existing regulations will become definition of homebound). • Integrated delivery unnecessary. payment models Facility-based post acute services Long-term acute care hospitals • Value-based à payments • Full range: low acuity high acuity • 24/7 nursing coverage Inpatient rehabilitation hospitals • Site neutrality • Eliminates payment silos; has patient characteristic payment models Skilled nursing facilities Home-based post-acute services • More care in the home (lowest cost setting) Home health • Ability to care for high-acuity patients with multiple chronic conditions ▪ The healthcare industry is moving toward integrated delivery payment models, value-based purchasing, and post-acute site neutrality. New payment systems for LTCHs, IRFs, SNFs and HHAs are part of these broader changes. ▪ To succeed, providers must adapt to changes in the regulatory and operating environments, build strategic relationships across the healthcare continuum, and consistently provide high-quality care at a cost-effective price. Encompass Health 22

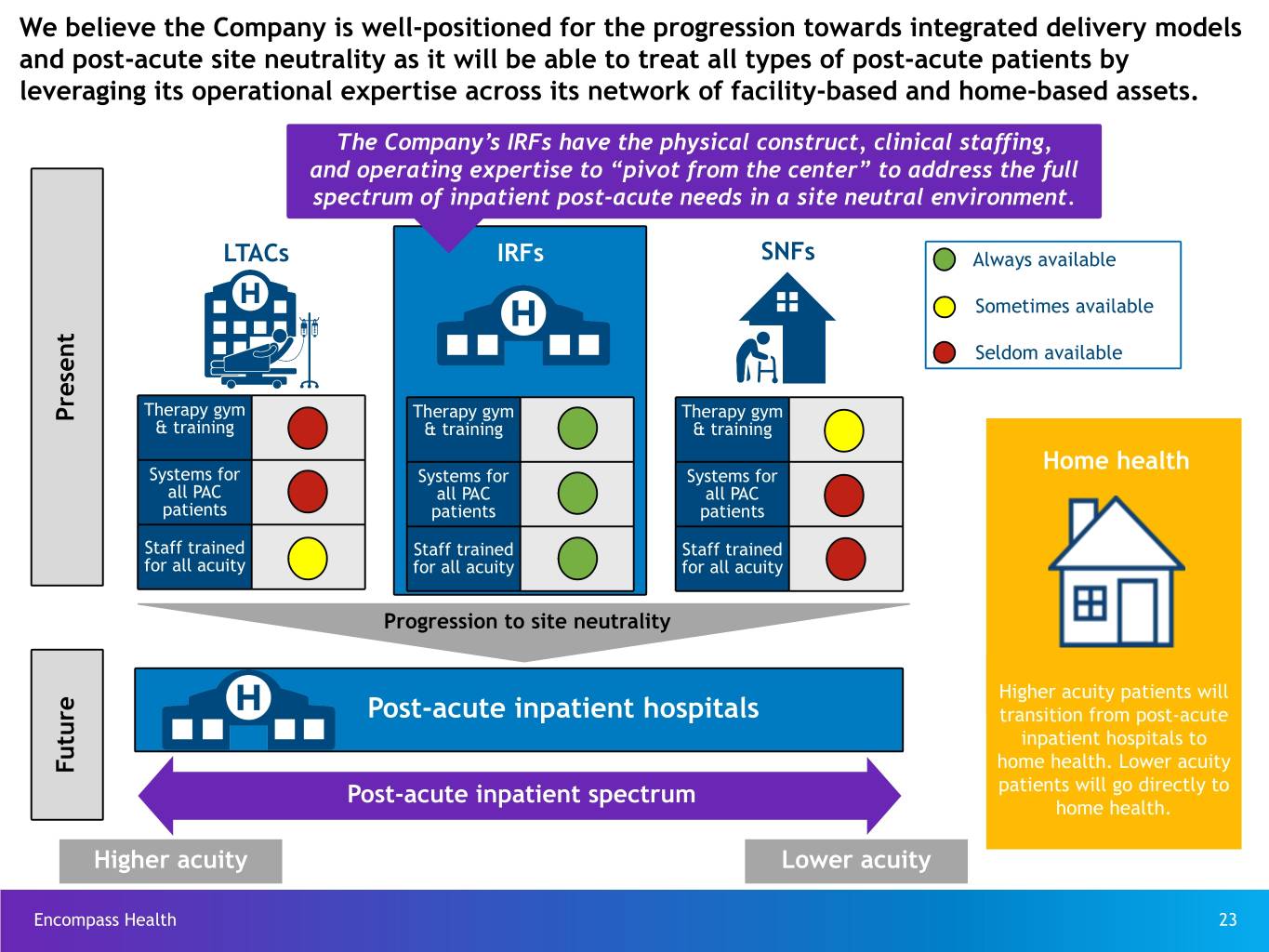

We believe the Company is well-positioned for the progression towards integrated delivery models and post-acute site neutrality as it will be able to treat all types of post-acute patients by leveraging its operational expertise across its network of facility-based and home-based assets. The Company’s IRFs have the physical construct, clinical staffing, and operating expertise to “pivot from the center” to address the full spectrum of inpatient post-acute needs in a site neutral environment. LTACs IRFs SNFs Always available Sometimes available Seldom available Therapy gym Therapy gym Therapy gym Present & training & training & training Home health Systems for Systems for Systems for all PAC all PAC all PAC patients patients patients Staff trained Staff trained Staff trained for all acuity for all acuity for all acuity Progression to site neutrality Higher acuity patients will Post-acute inpatient hospitals transition from post-acute inpatient hospitals to home health. Lower acuity Future Post-acute inpatient spectrum patients will go directly to home health. Higher acuity Lower acuity Encompass Health 23

Business outlook, including guidance (as of January 13, 2020) Encompass Health 24

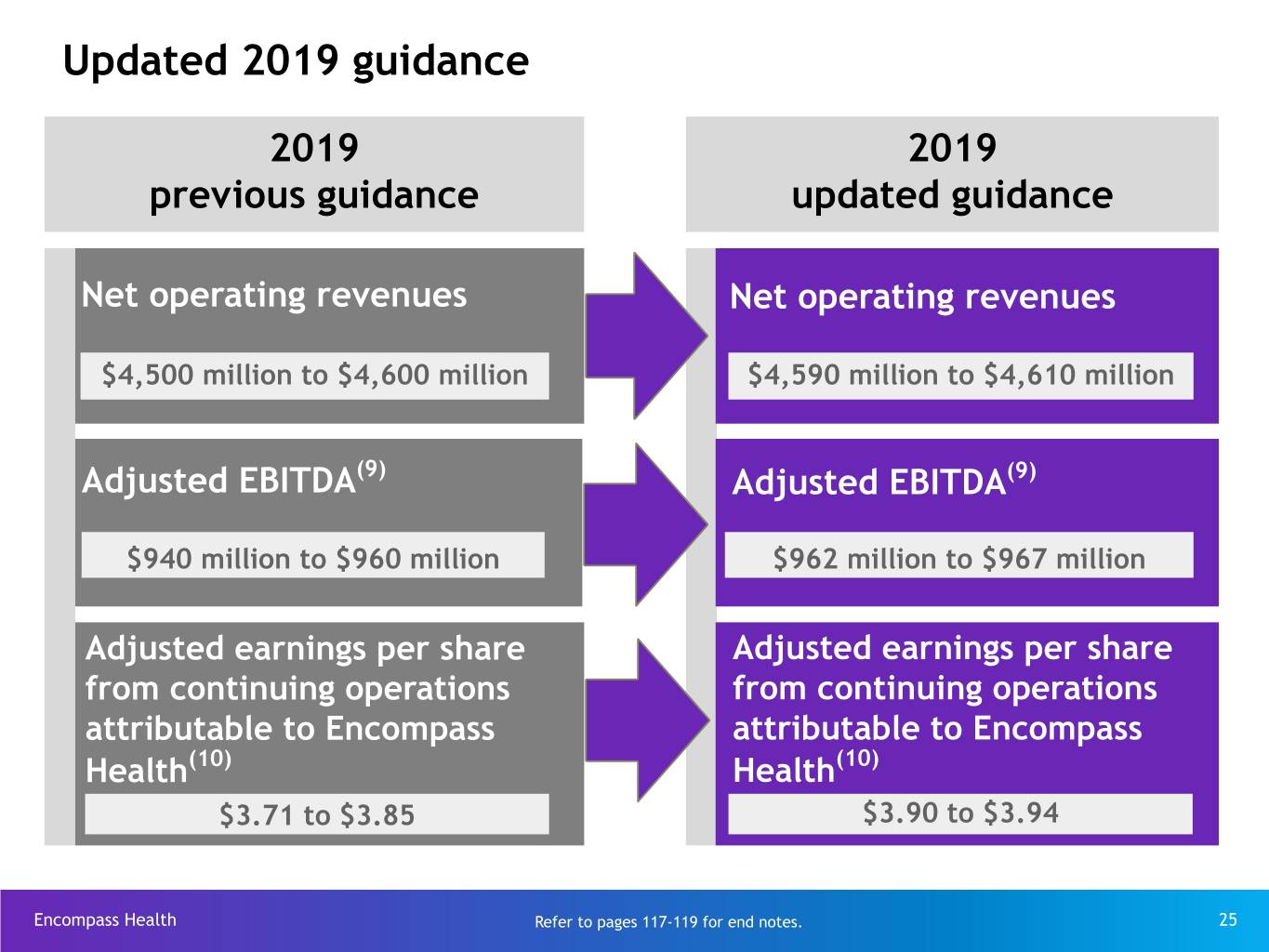

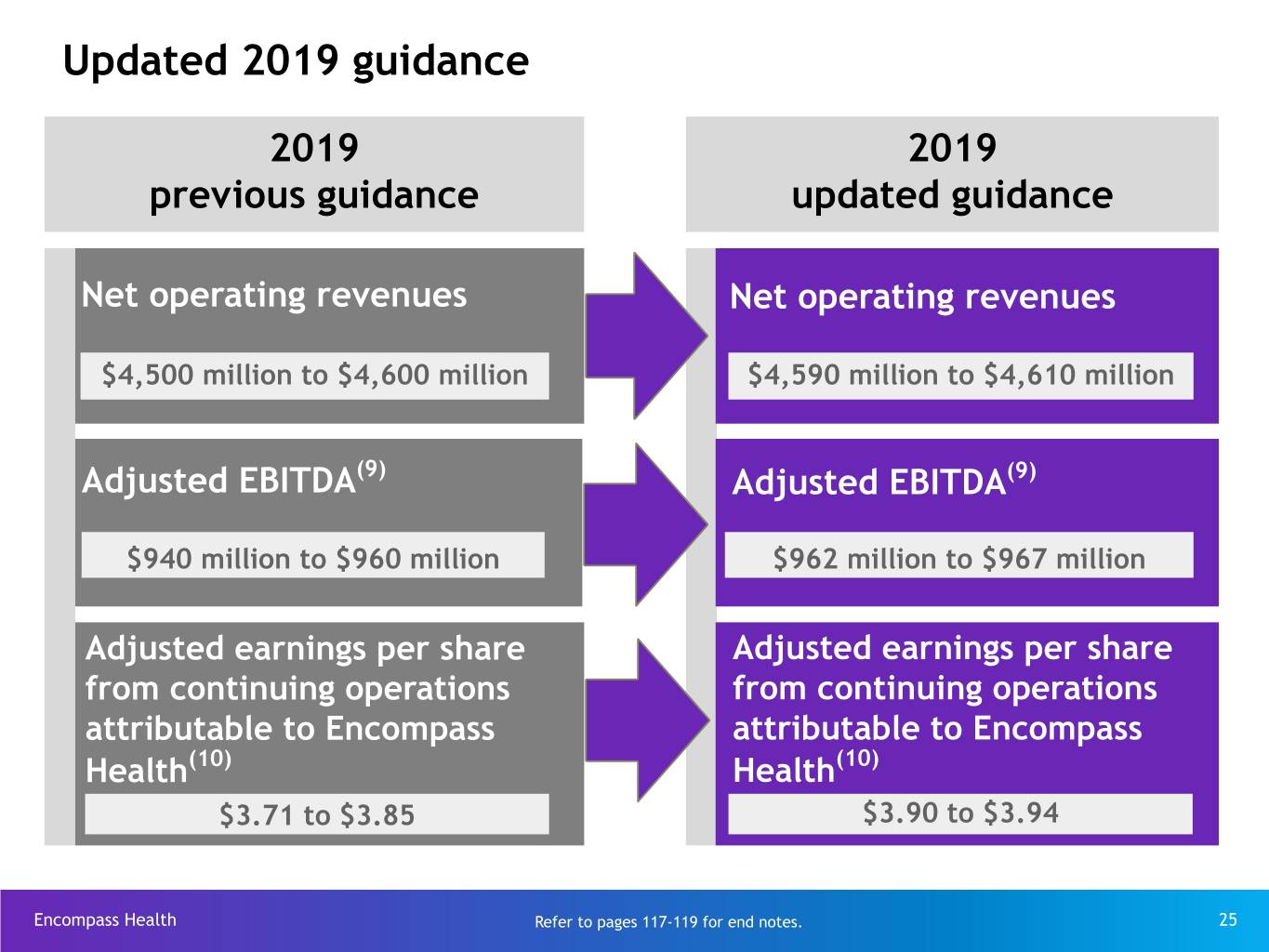

Updated 2019 guidance 2019 2019 previous guidance updated guidance Net operating revenues Net operating revenues $4,500 million to $4,600 million $4,590 million to $4,610 million Adjusted EBITDA(9) Adjusted EBITDA(9) $940 million to $960 million $962 million to $967 million Adjusted earnings per share Adjusted earnings per share from continuing operations from continuing operations attributable to Encompass attributable to Encompass Health(10) Health(10) $3.71 to $3.85 $3.90 to $3.94 Encompass Health Refer to pages 117-119 for end notes. 25

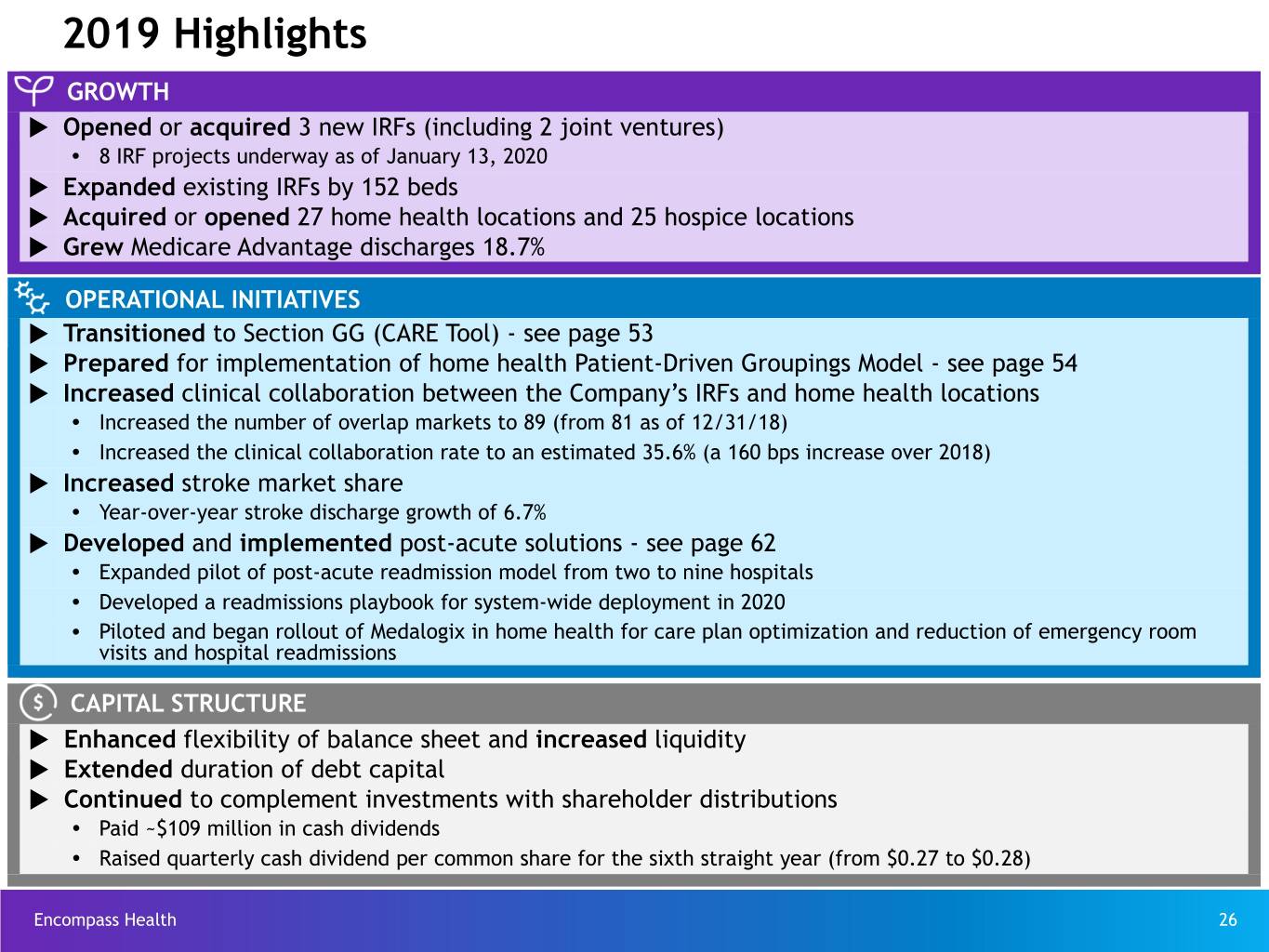

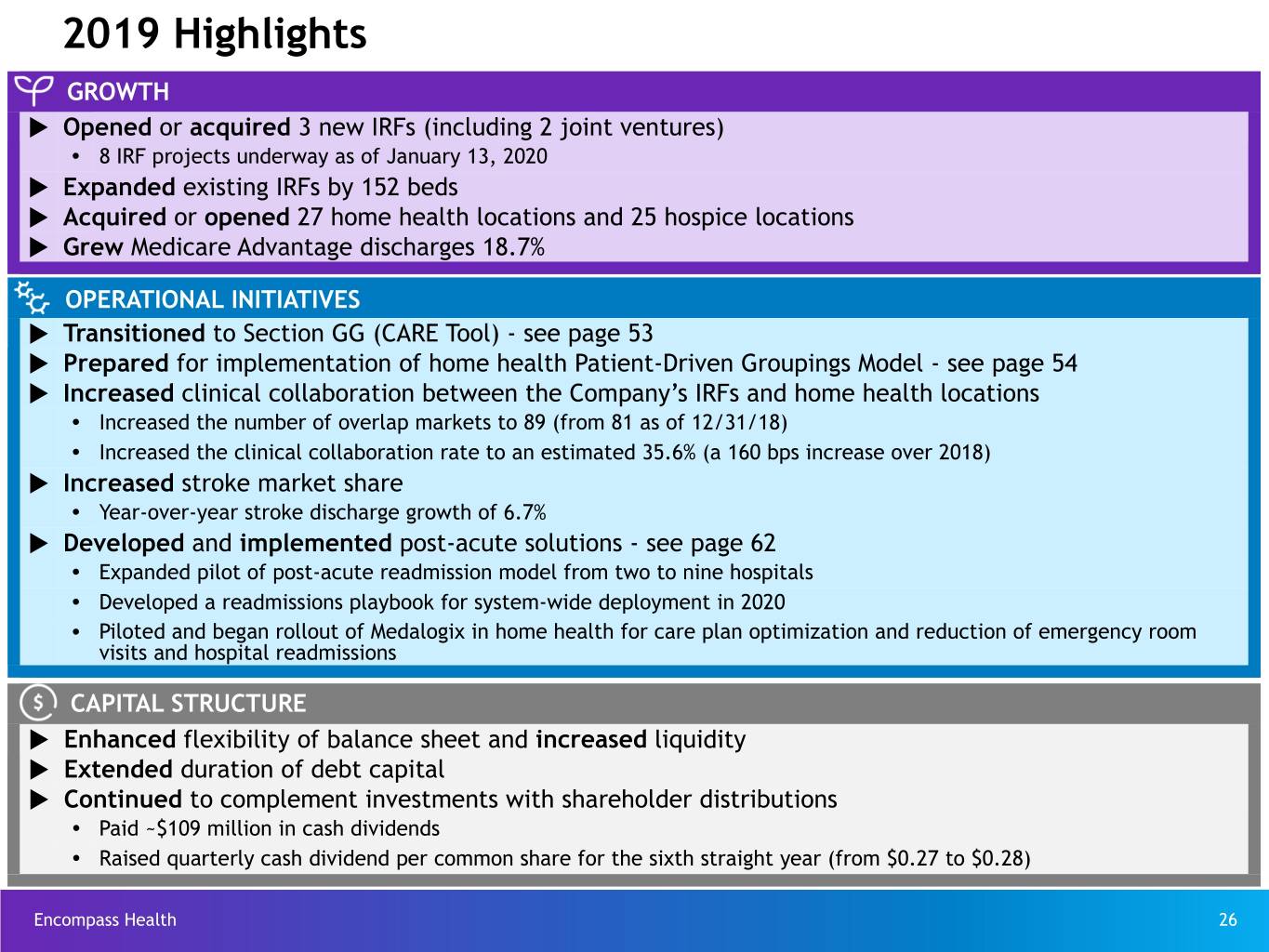

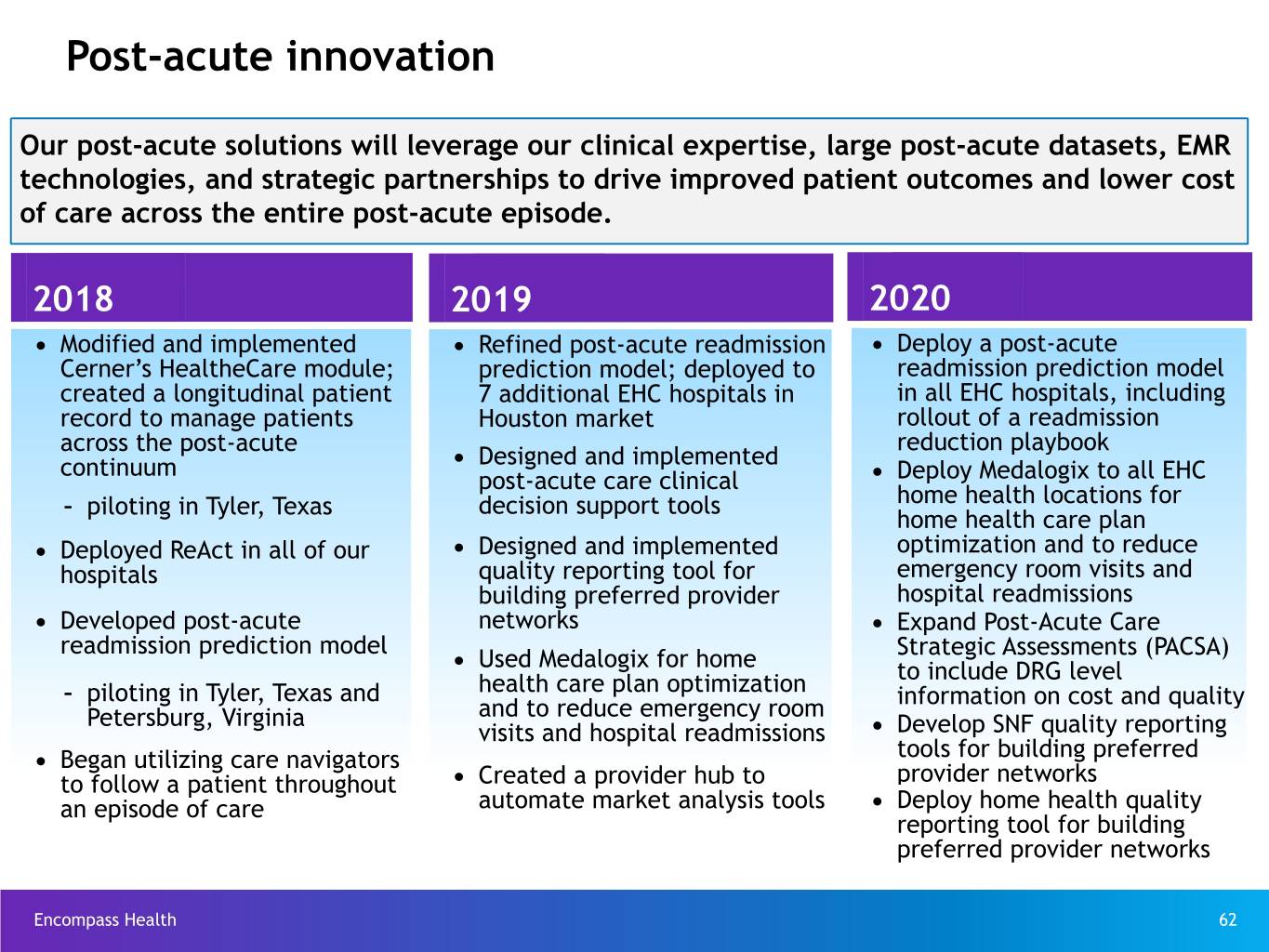

2019 Highlights GROWTH u Opened or acquired 3 new IRFs (including 2 joint ventures) Ÿ 8 IRF projects underway as of January 13, 2020 u Expanded existing IRFs by 152 beds u Acquired or opened 27 home health locations and 25 hospice locations u Grew Medicare Advantage discharges 18.7% OPERATIONAL INITIATIVES u Transitioned to Section GG (CARE Tool) - see page 53 u Prepared for implementation of home health Patient-Driven Groupings Model - see page 54 u Increased clinical collaboration between the Company’s IRFs and home health locations Ÿ Increased the number of overlap markets to 89 (from 81 as of 12/31/18) Ÿ Increased the clinical collaboration rate to an estimated 35.6% (a 160 bps increase over 2018) u Increased stroke market share Ÿ Year-over-year stroke discharge growth of 6.7% u Developed and implemented post-acute solutions - see page 62 Ÿ Expanded pilot of post-acute readmission model from two to nine hospitals Ÿ Developed a readmissions playbook for system-wide deployment in 2020 Ÿ Piloted and began rollout of Medalogix in home health for care plan optimization and reduction of emergency room visits and hospital readmissions CAPITAL STRUCTURE u Enhanced flexibility of balance sheet and increased liquidity u Extended duration of debt capital u Continued to complement investments with shareholder distributions Ÿ Paid ~$109 million in cash dividends Ÿ Raised quarterly cash dividend per common share for the sixth straight year (from $0.27 to $0.28) Encompass Health 26

2020 Guidance 2019 2020 updated guidance preliminary guidance Net operating revenues Net operating revenues $4,590 million to $4,610 million $4,850 million to $4,950 million Adjusted EBITDA(9) Adjusted EBITDA(9) $962 million to $967 million $935 million to $965 million Adjusted earnings per share Adjusted earnings per share from continuing operations from continuing operations attributable to Encompass attributable to Encompass Health(10) Health(10) $3.90 to $3.94 $3.50 to $3.72 Encompass Health Refer to pages 117-119 for end notes. 27

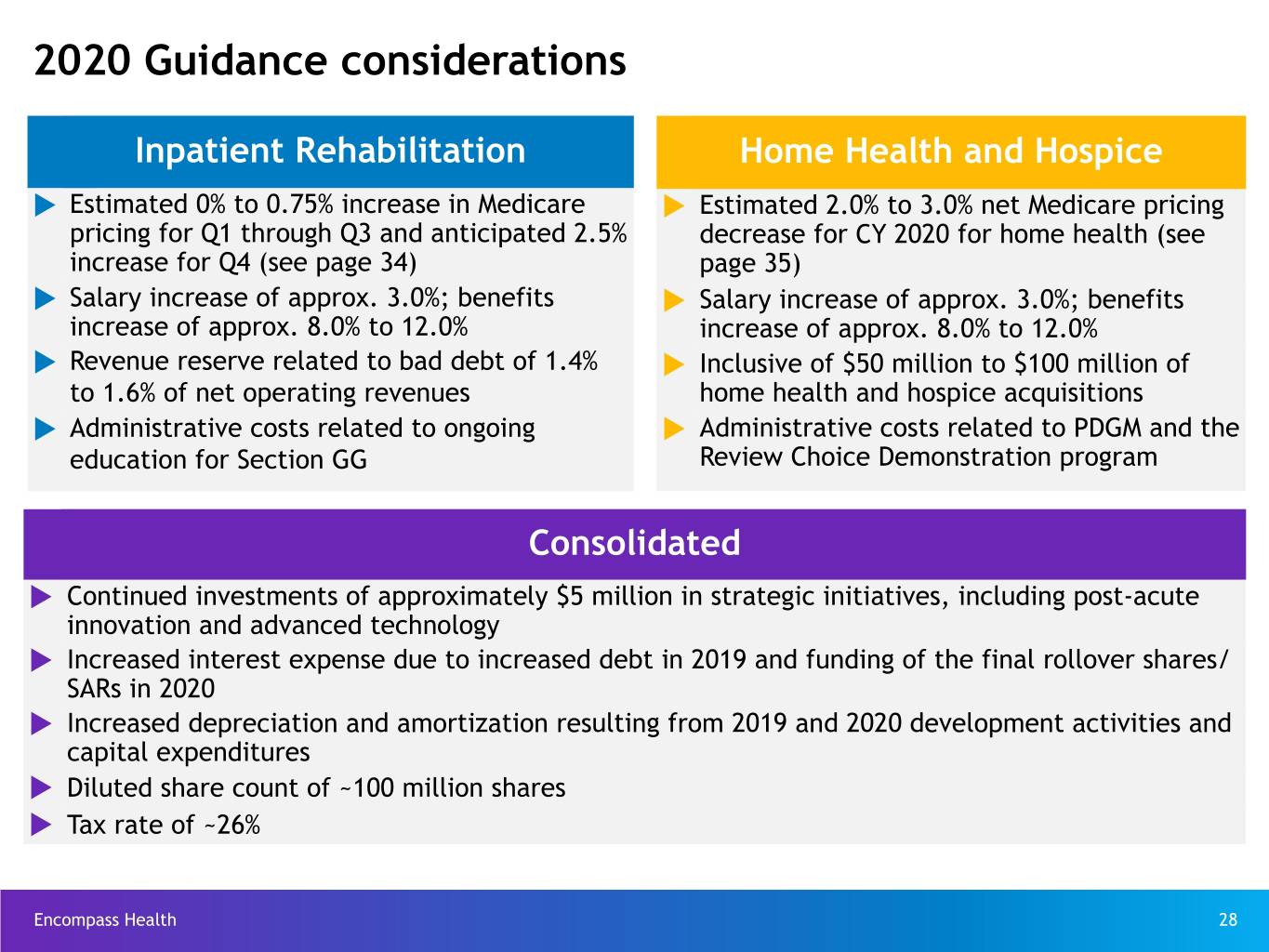

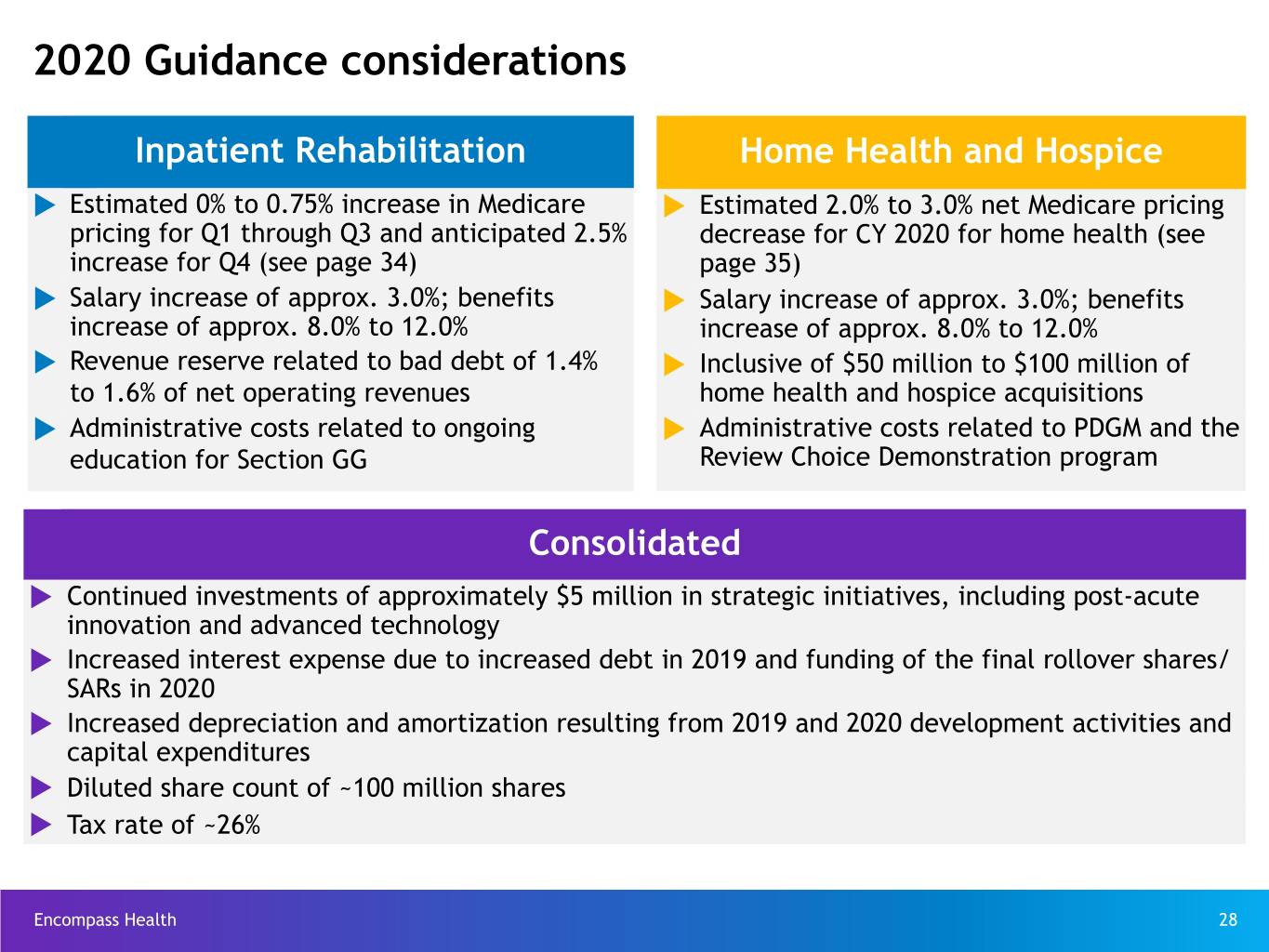

2020 Guidance considerations Inpatient Rehabilitation Home Health and Hospice u Estimated 0% to 0.75% increase in Medicare u Estimated 2.0% to 3.0% net Medicare pricing pricing for Q1 through Q3 and anticipated 2.5% decrease for CY 2020 for home health (see increase for Q4 (see page 34) page 35) u Salary increase of approx. 3.0%; benefits u Salary increase of approx. 3.0%; benefits increase of approx. 8.0% to 12.0% increase of approx. 8.0% to 12.0% u Revenue reserve related to bad debt of 1.4% u Inclusive of $50 million to $100 million of to 1.6% of net operating revenues home health and hospice acquisitions u Administrative costs related to ongoing u Administrative costs related to PDGM and the education for Section GG Review Choice Demonstration program Consolidated u Continued investments of approximately $5 million in strategic initiatives, including post-acute innovation and advanced technology u Increased interest expense due to increased debt in 2019 and funding of the final rollover shares/ SARs in 2020 u Increased depreciation and amortization resulting from 2019 and 2020 development activities and capital expenditures u Diluted share count of ~100 million shares u Tax rate of ~26% Encompass Health 28

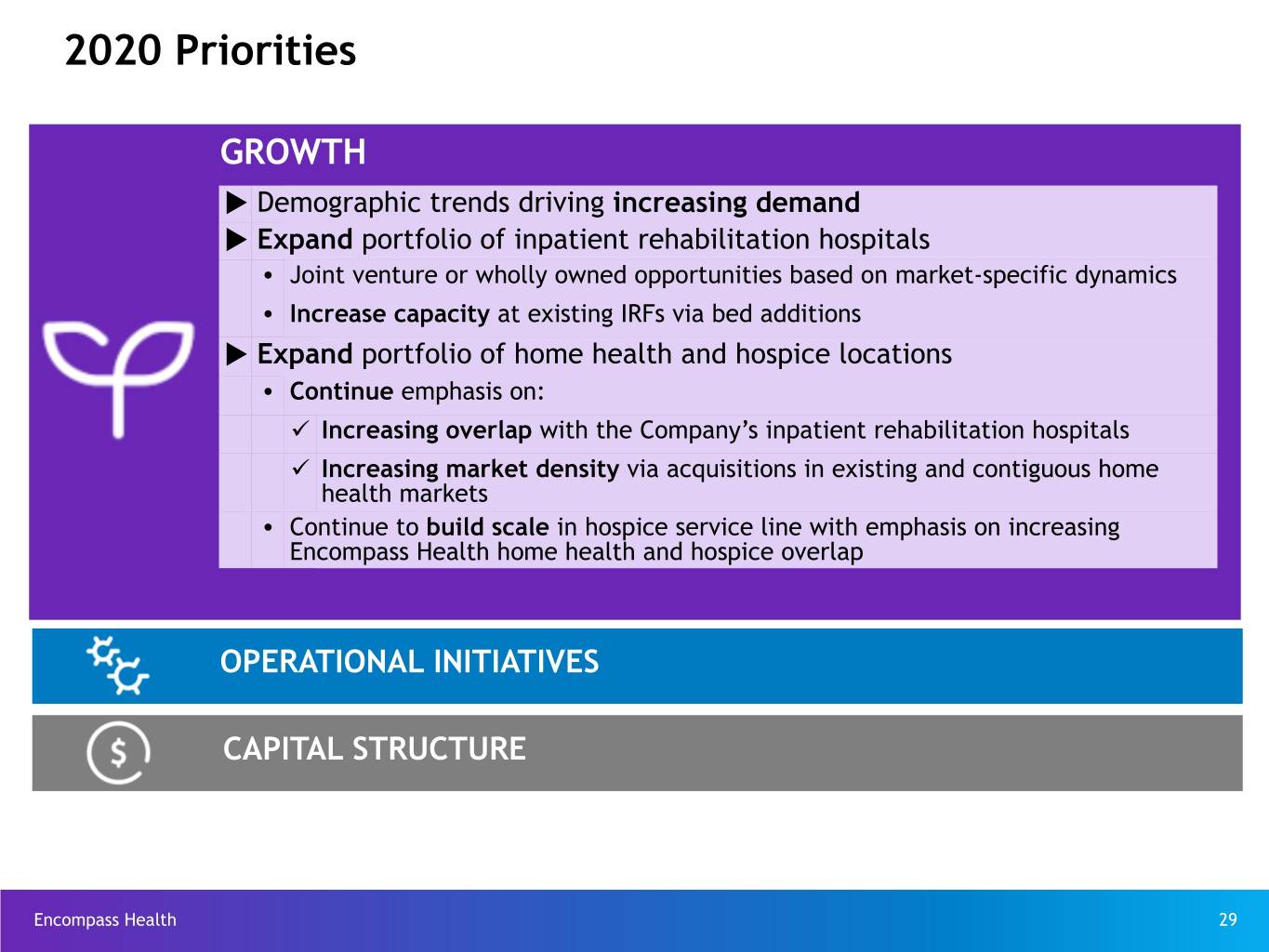

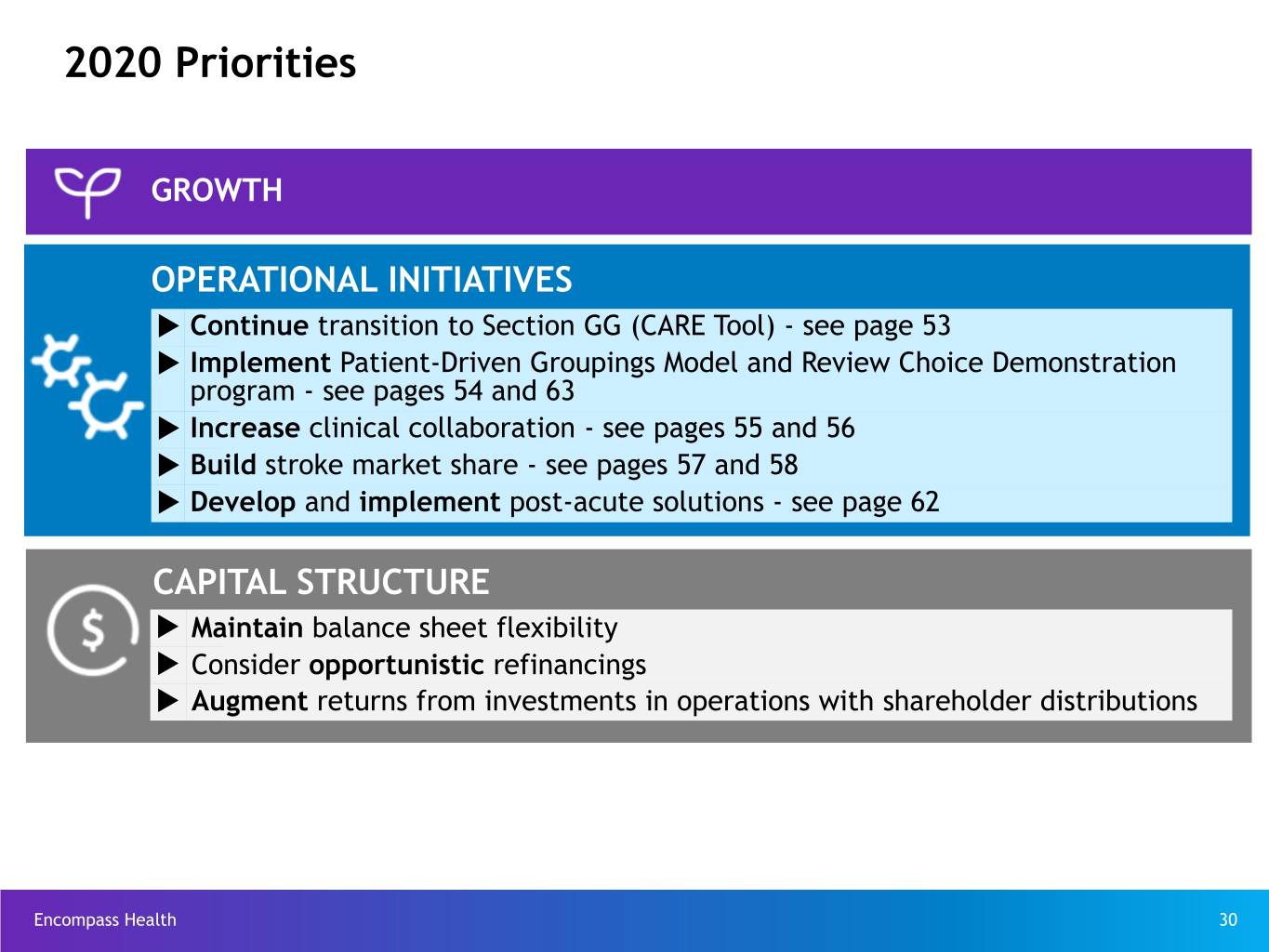

2020 Priorities GROWTH u Demographic trends driving increasing demand u Expand portfolio of inpatient rehabilitation hospitals Ÿ Joint venture or wholly owned opportunities based on market-specific dynamics Ÿ Increase capacity at existing IRFs via bed additions u Expand portfolio of home health and hospice locations Ÿ Continue emphasis on: ü Increasing overlap with the Company’s inpatient rehabilitation hospitals ü Increasing market density via acquisitions in existing and contiguous home health markets Ÿ Continue to build scale in hospice service line with emphasis on increasing Encompass Health home health and hospice overlap OPERATIONAL INITIATIVES CAPITAL STRUCTURE Encompass Health 29

2020 Priorities GROWTH OPERATIONAL INITIATIVES u Continue transition to Section GG (CARE Tool) - see page 53 u Implement Patient-Driven Groupings Model and Review Choice Demonstration program - see pages 54 and 63 u Increase clinical collaboration - see pages 55 and 56 u Build stroke market share - see pages 57 and 58 u Develop and implement post-acute solutions - see page 62 CAPITAL STRUCTURE u Maintain balance sheet flexibility u Consider opportunistic refinancings u Augment returns from investments in operations with shareholder distributions Encompass Health 30

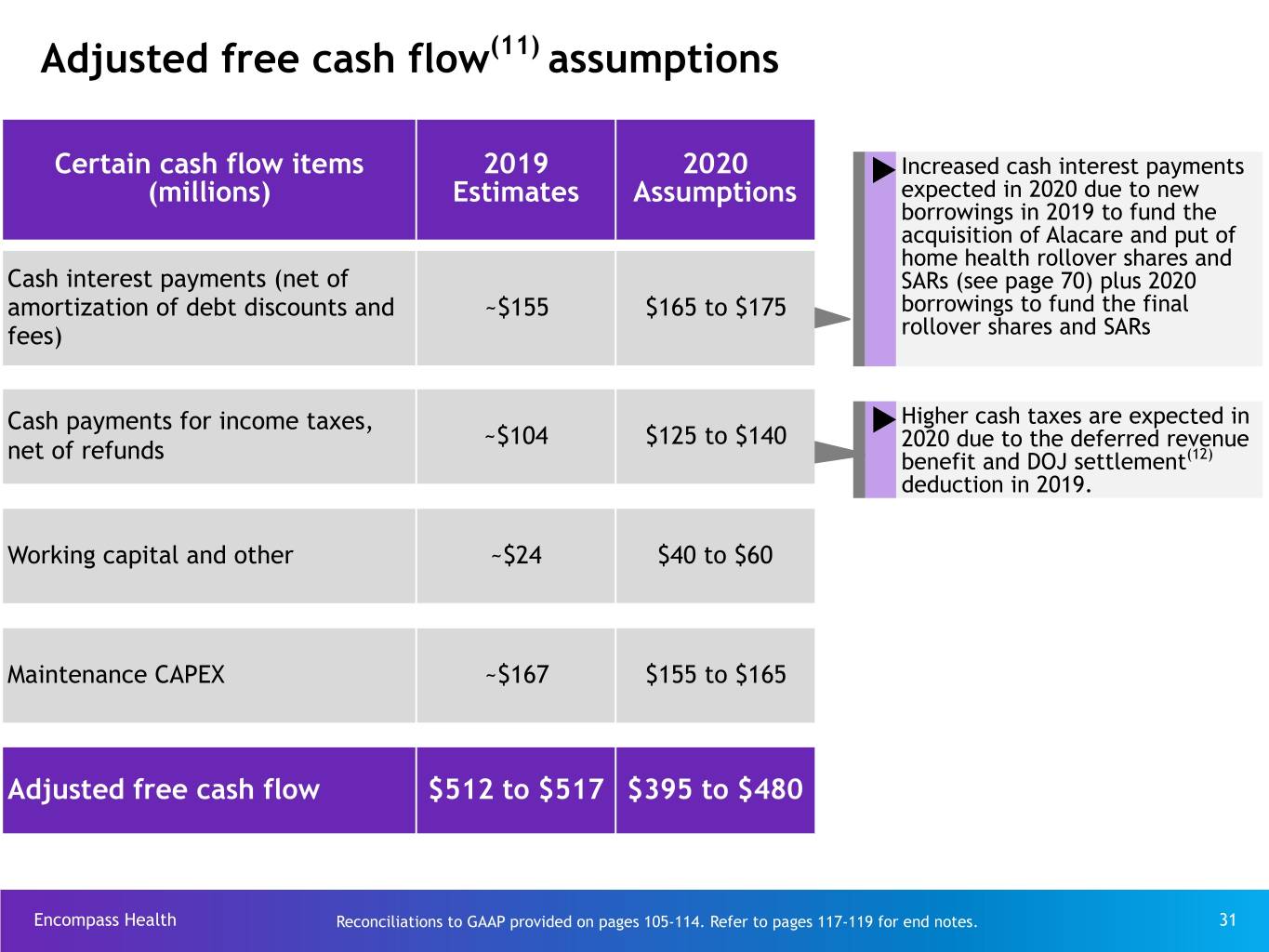

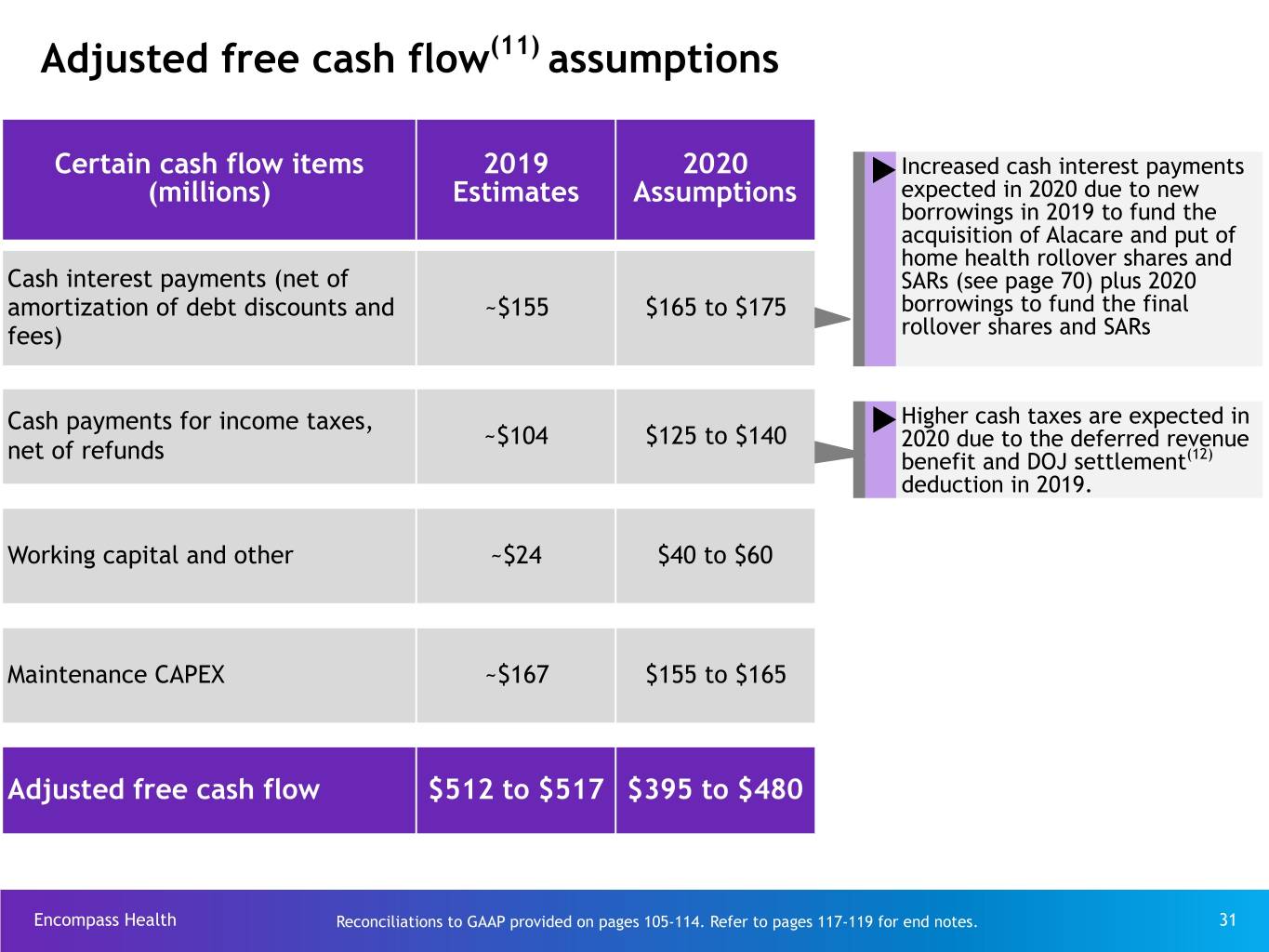

Adjusted free cash flow(11) assumptions Certain cash flow items 2019 2020 u Increased cash interest payments (millions) Estimates Assumptions expected in 2020 due to new borrowings in 2019 to fund the acquisition of Alacare and put of home health rollover shares and Cash interest payments (net of SARs (see page 70) plus 2020 amortization of debt discounts and ~$155 $165 to $175 borrowings to fund the final fees) rollover shares and SARs Cash payments for income taxes, uHigher cash taxes are expected in ~$104 $125 to $140 2020 due to the deferred revenue net of refunds benefit and DOJ settlement(12) deduction in 2019. Working capital and other ~$24 $40 to $60 Maintenance CAPEX ~$167 $155 to $165 Adjusted free cash flow $512 to $517 $395 to $480 Encompass Health Reconciliations to GAAP provided on pages 105-114. Refer to pages 117-119 for end notes. 31

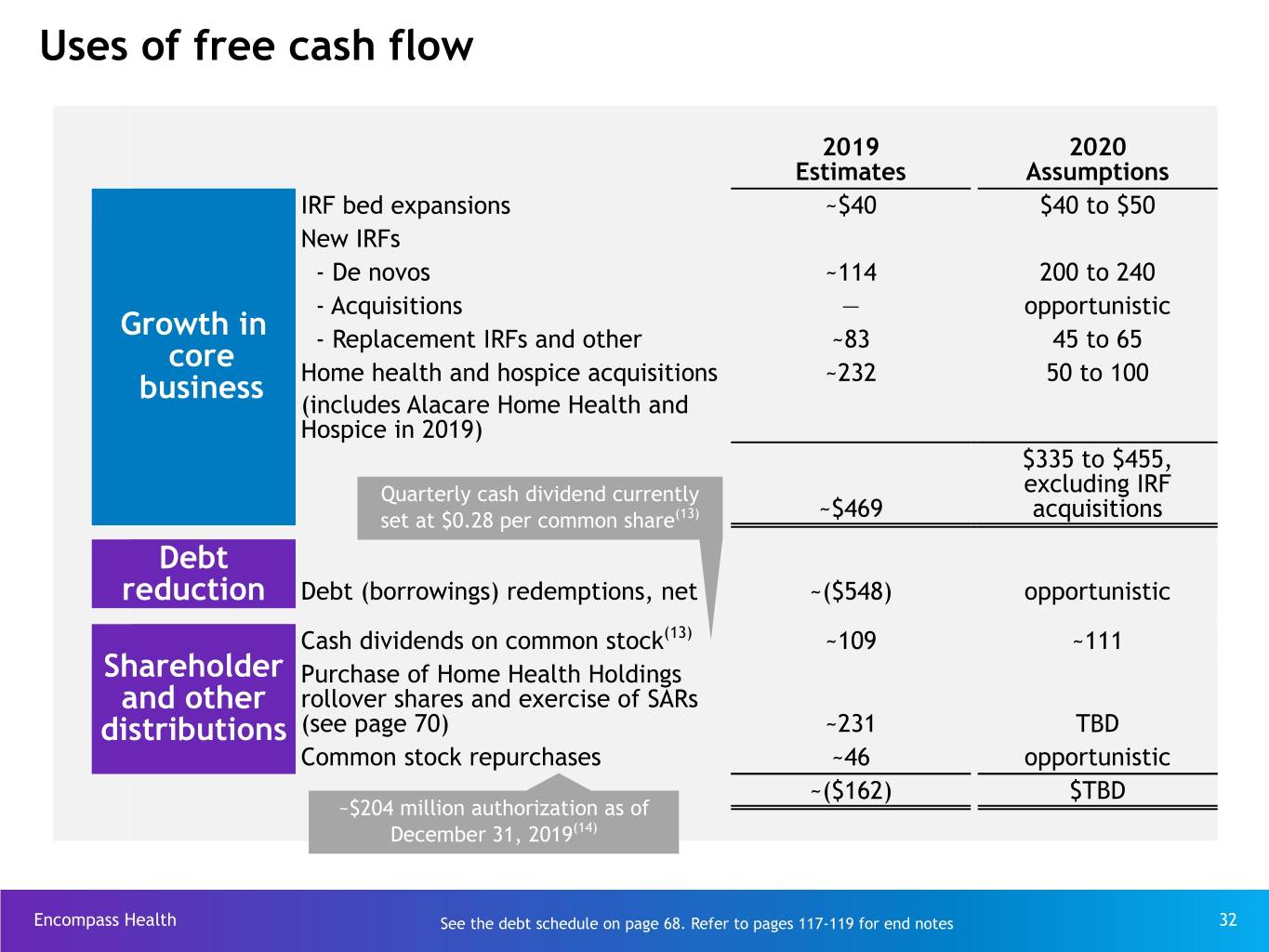

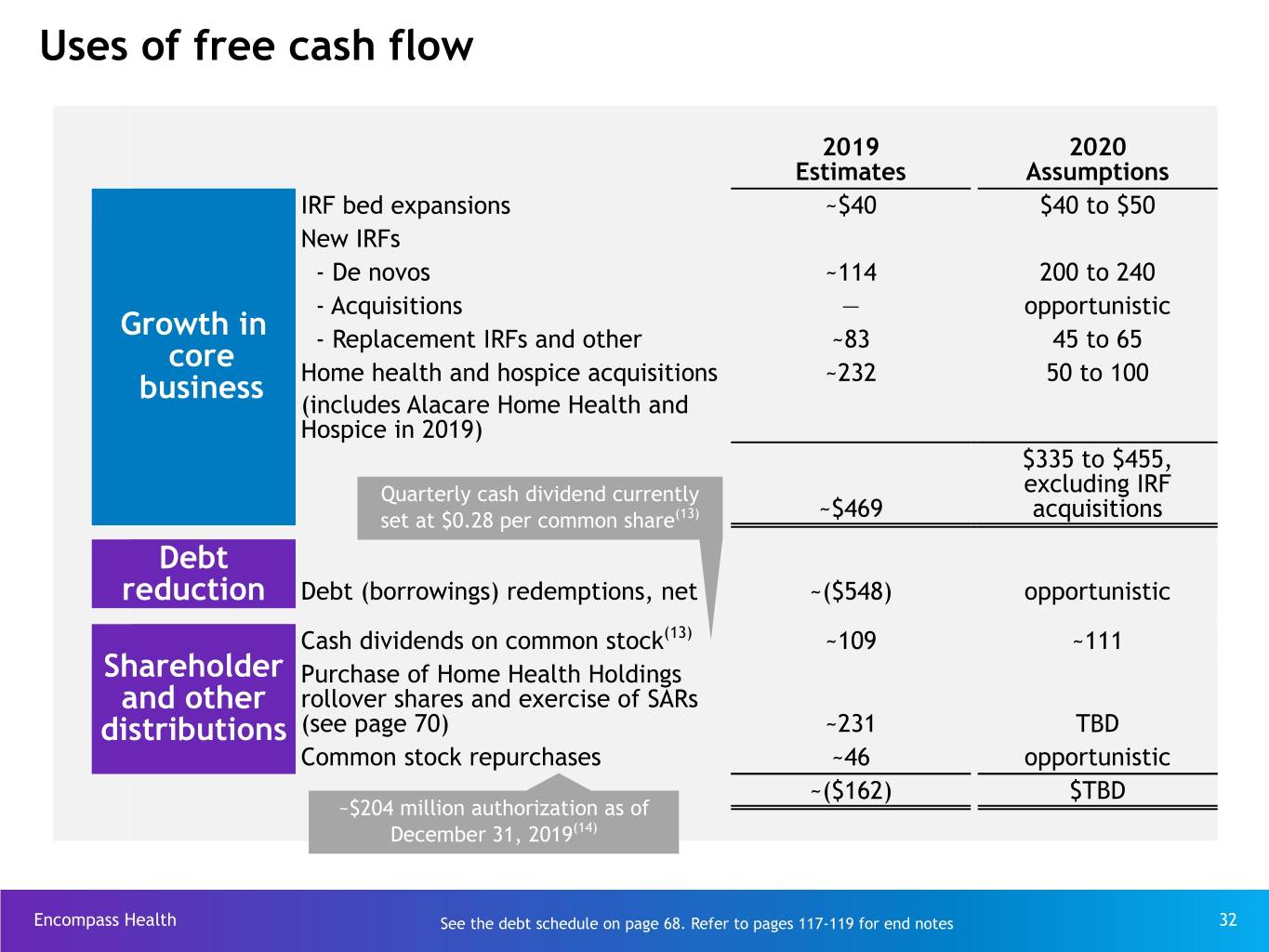

Uses of free cash flow 2019 2020 Estimates Assumptions IRF bed expansions ~$40 $40 to $50 New IRFs - De novos ~114 200 to 240 - Acquisitions — opportunistic Growth in - Replacement IRFs and other ~83 45 to 65 core business Home health and hospice acquisitions ~232 50 to 100 (includes Alacare Home Health and Hospice in 2019) $335 to $455, Quarterly cash dividend currently excluding IRF set at $0.28 per common share(13) ~$469 acquisitions Debt reduction Debt (borrowings) redemptions, net ~($548) opportunistic Cash dividends on common stock(13) ~109 ~111 Shareholder Purchase of Home Health Holdings and other rollover shares and exercise of SARs distributions (see page 70) ~231 TBD Common stock repurchases ~46 opportunistic ~($162) $TBD ~$204 million authorization as of December 31, 2019(14) Encompass Health See the debt schedule on page 68. Refer to pages 117-119 for end notes 32 for end notes.

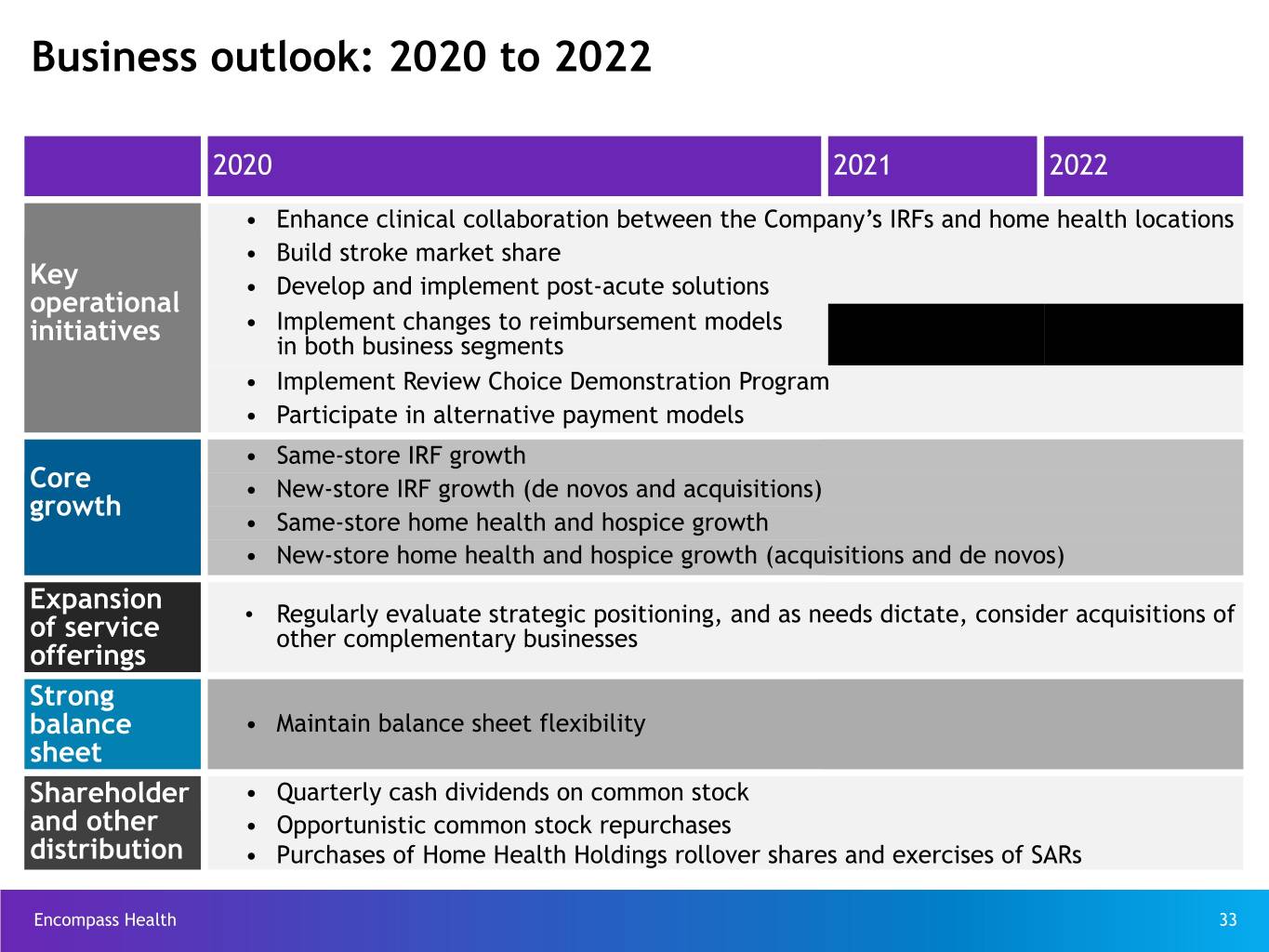

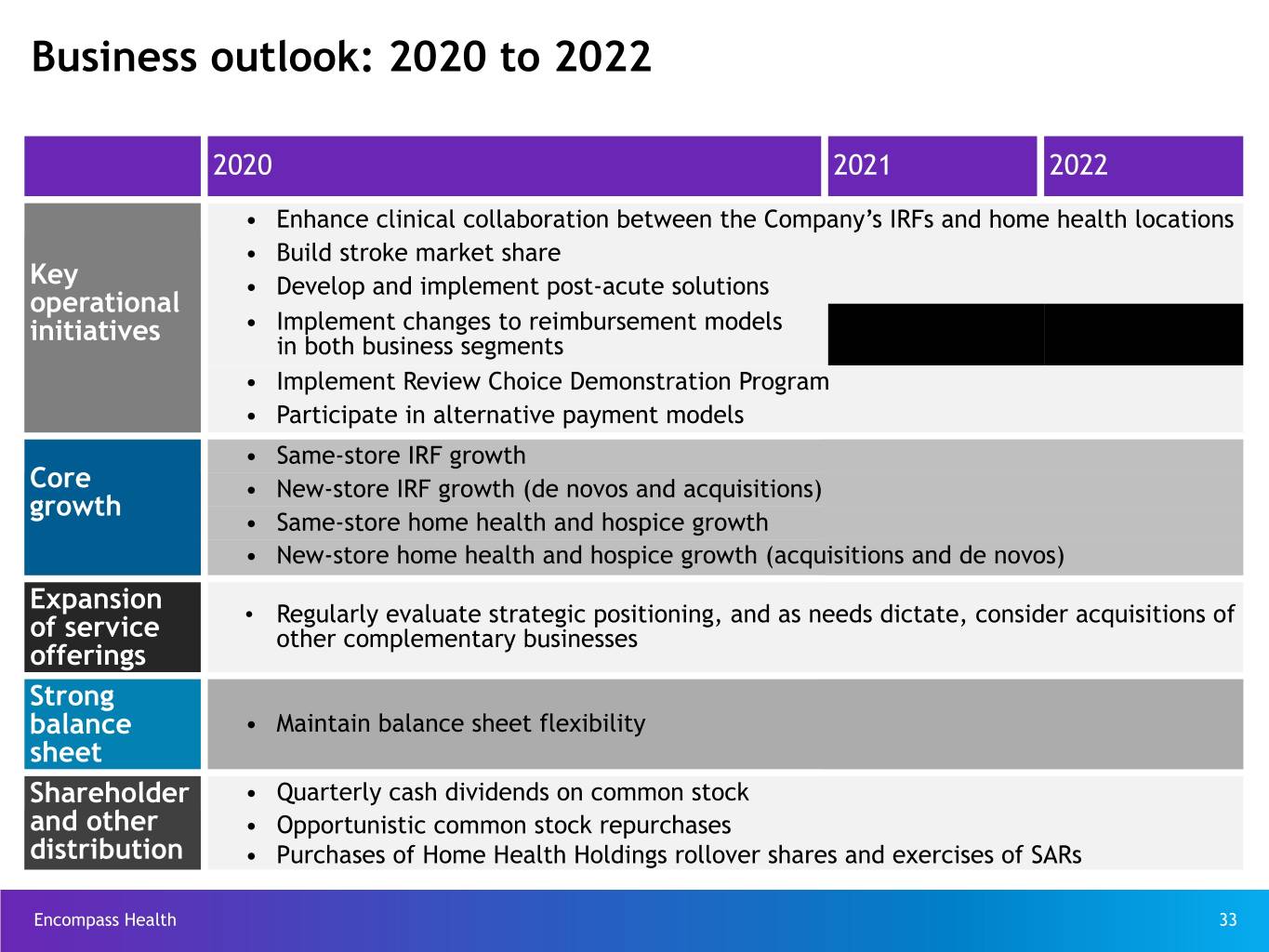

Business outlook: 2020 to 2022 2020 2021 2022 • Enhance clinical collaboration between the Company’s IRFs and home health locations • Build stroke market share Key • Develop and implement post-acute solutions operational initiatives • Implement changes to reimbursement models in both business segments • Implement Review Choice Demonstration Program • Participate in alternative payment models • Same-store IRF growth Core • New-store IRF growth (de novos and acquisitions) growth • Same-store home health and hospice growth • New-store home health and hospice growth (acquisitions and de novos) Expansion • Regularly evaluate strategic positioning, and as needs dictate, consider acquisitions of of service other complementary businesses offerings Strong balance • Maintain balance sheet flexibility sheet Shareholder • Quarterly cash dividends on common stock and other • Opportunistic common stock repurchases distribution • Purchases of Home Health Holdings rollover shares and exercises of SARs s Encompass Health 33

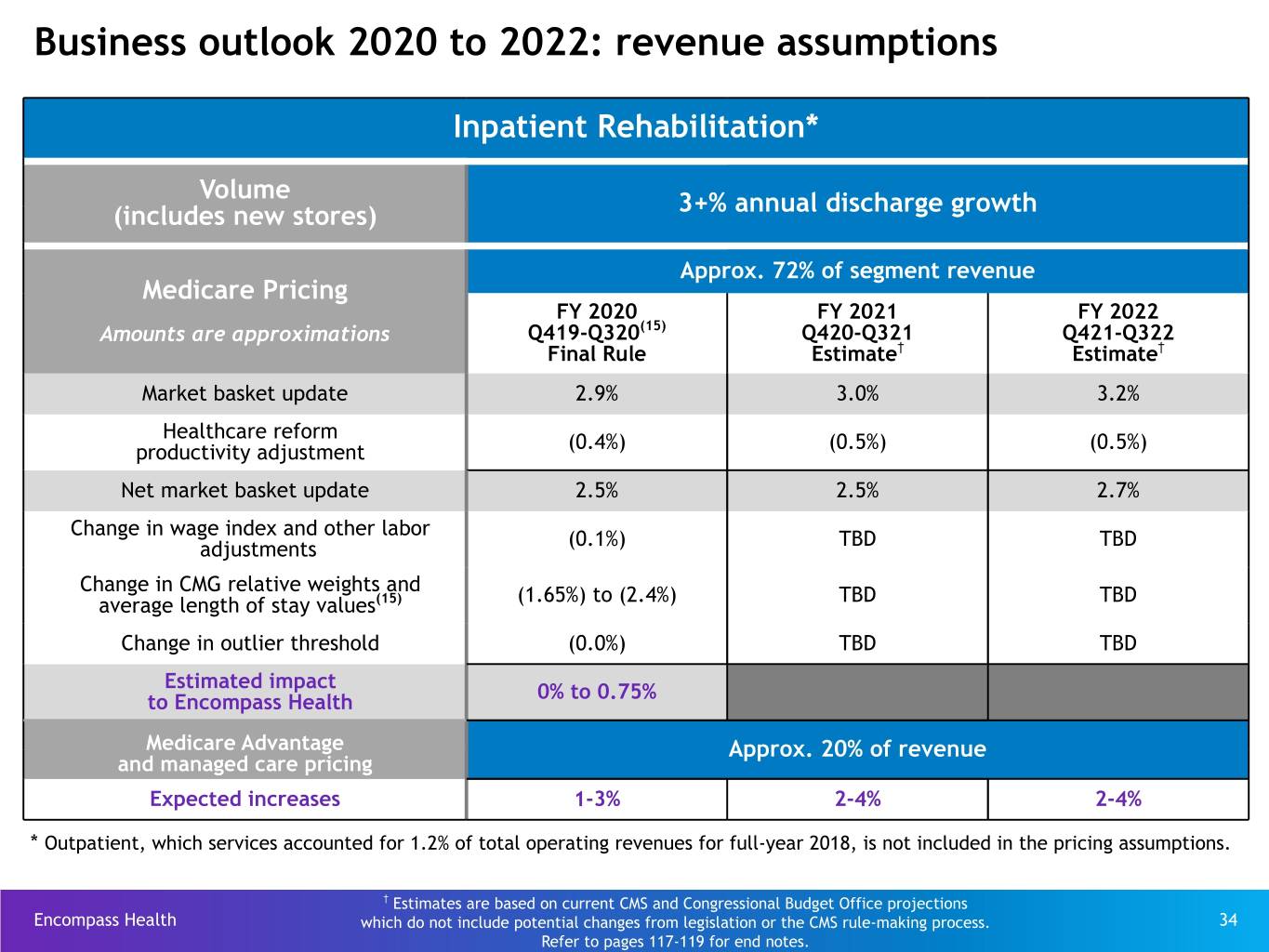

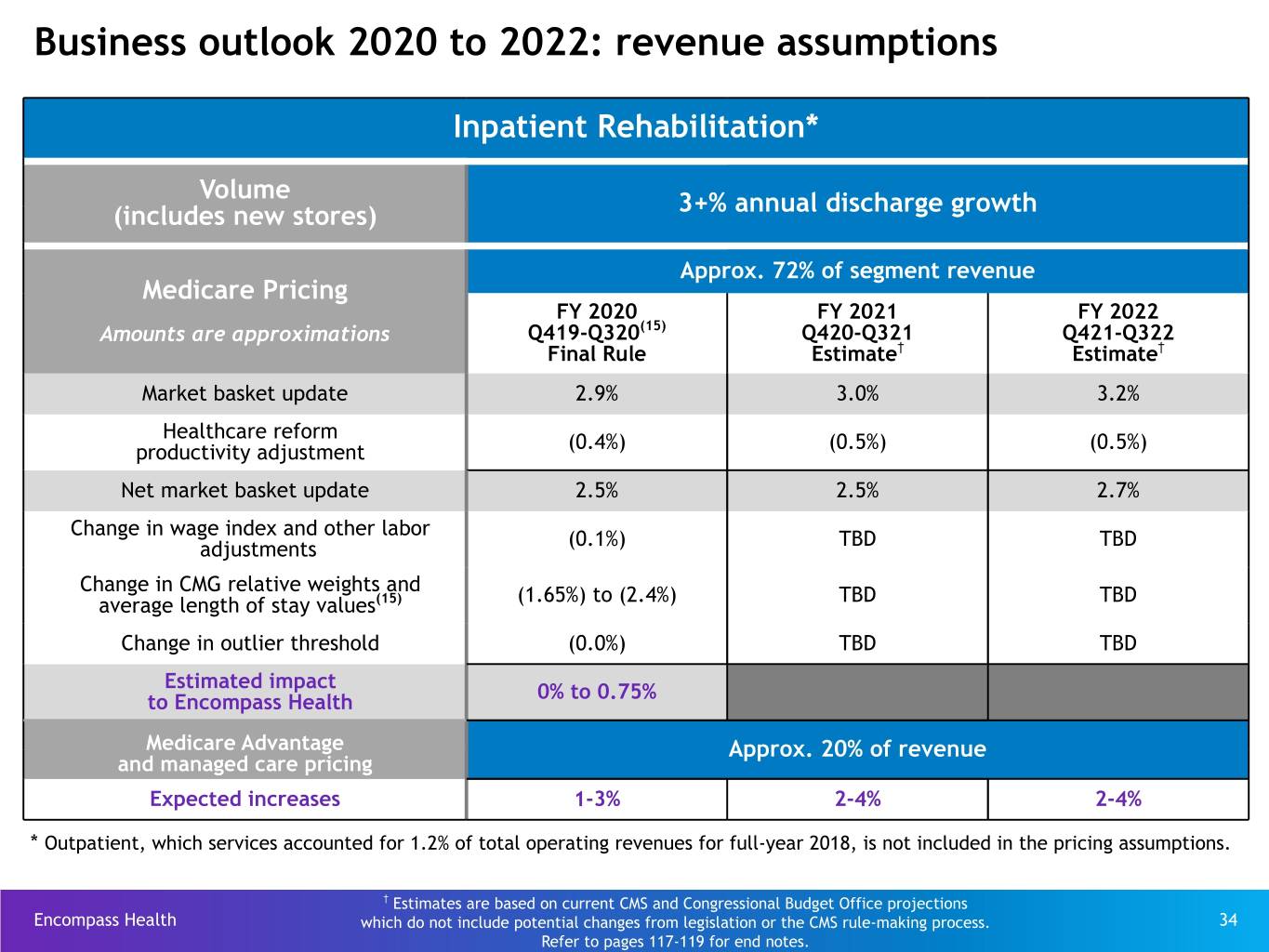

Business outlook 2020 to 2022: revenue assumptions Inpatient Rehabilitation* Volume (includes new stores) 3+% annual discharge growth Approx. 72% of segment revenue Medicare Pricing FY 2020 FY 2021 FY 2022 Amounts are approximations Q419-Q320(15) Q420-Q321 Q421-Q322 Final Rule Estimate† Estimate† Market basket update 2.9% 3.0% 3.2% Healthcare reform productivity adjustment (0.4%) (0.5%) (0.5%) Net market basket update 2.5% 2.5% 2.7% Change in wage index and other labor adjustments (0.1%) TBD TBD Change in CMG relative weights and average length of stay values(15) (1.65%) to (2.4%) TBD TBD Change in outlier threshold (0.0%) TBD TBD Estimated impact to Encompass Health 0% to 0.75% Medicare Advantage Approx. 20% of revenue and managed care pricing Expected increases 1-3% 2-4% 2-4% * Outpatient, which services accounted for 1.2% of total operating revenues for full-year 2018, is not included in the pricing assumptions. † Estimates are based on current CMS and Congressional Budget Office projections Encompass Health which do not include potential changes from legislation or the CMS rule-making process. 34 Refer to pages 117-119 for end notes.

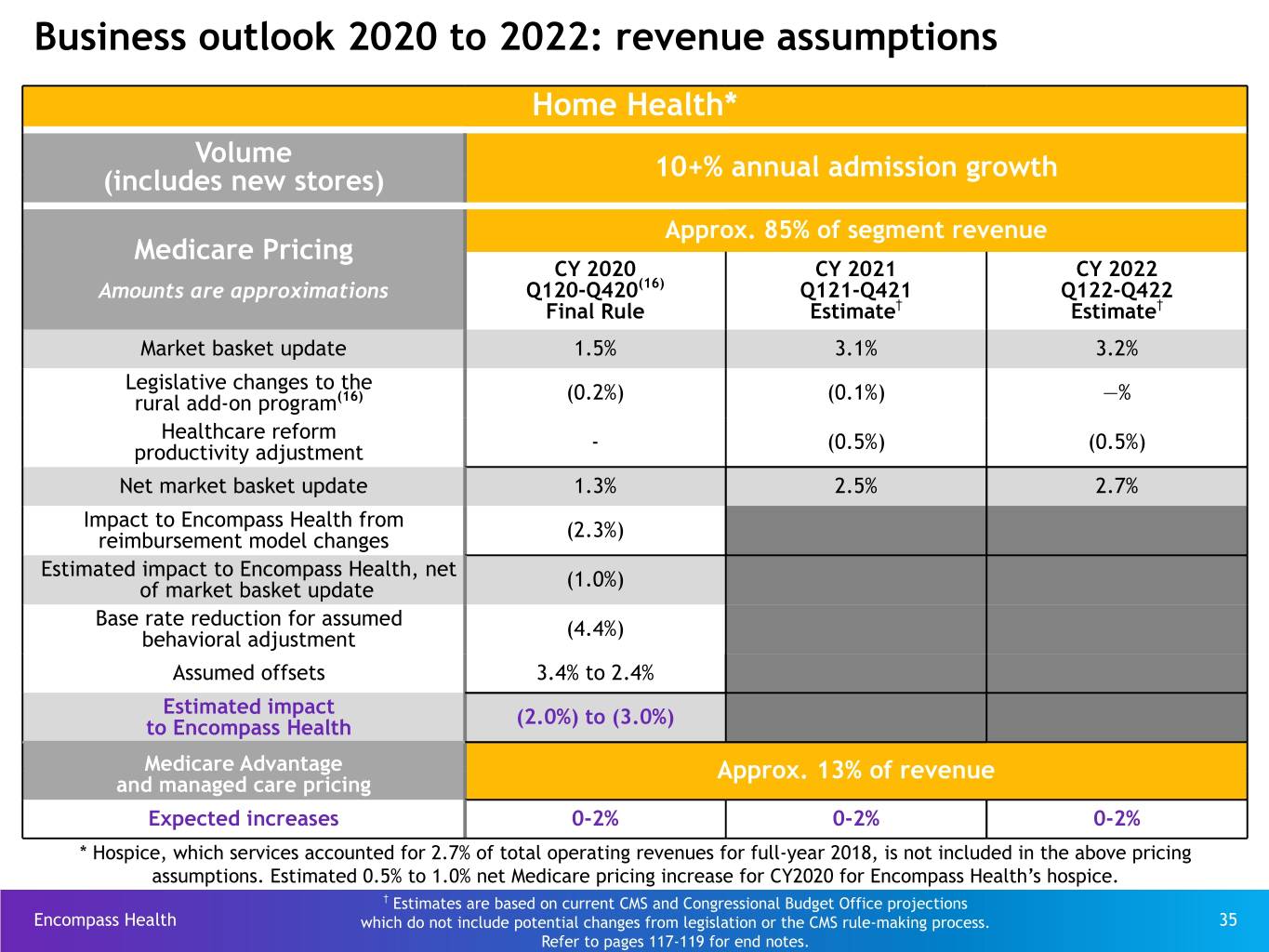

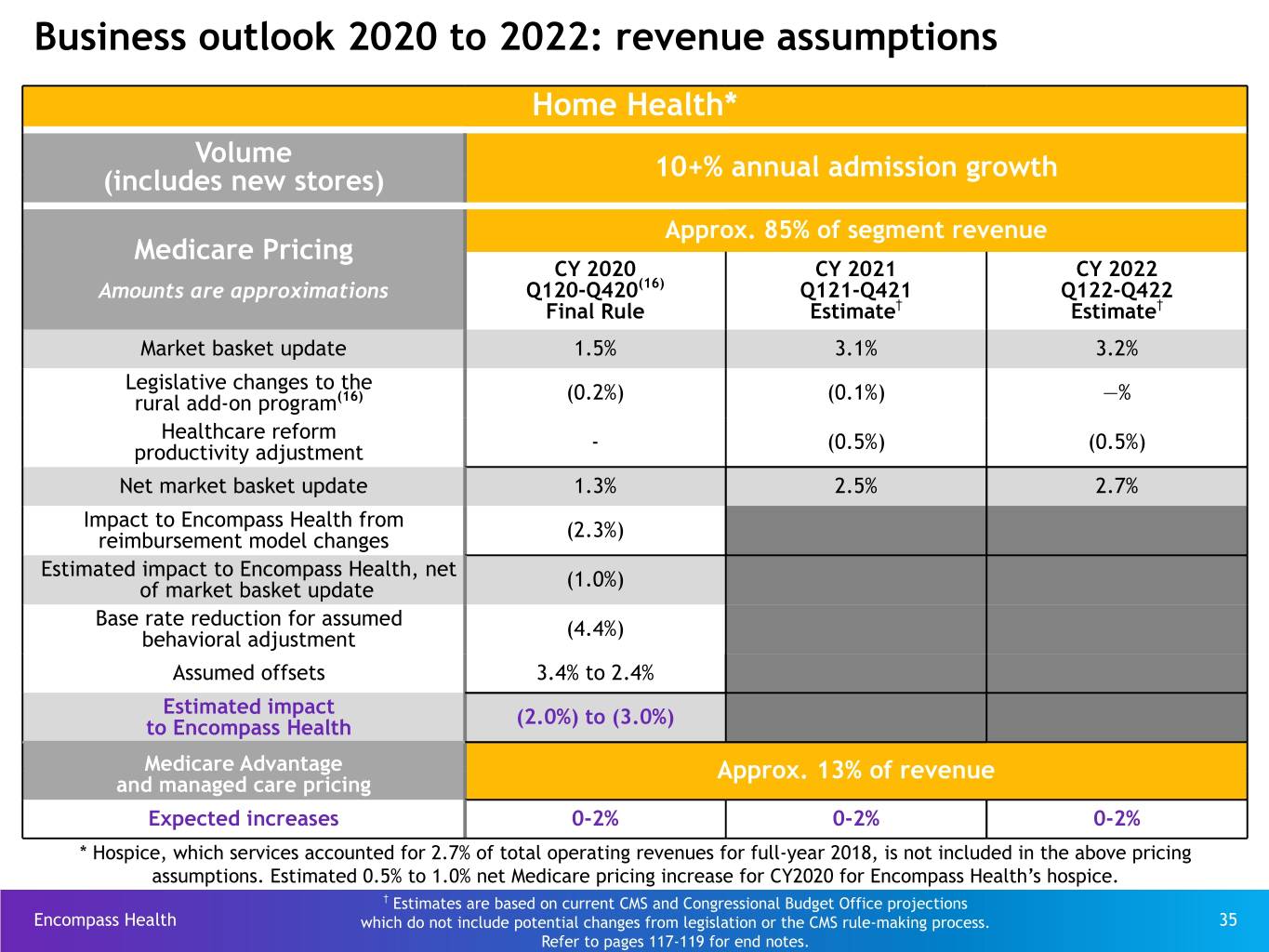

Business outlook 2020 to 2022: revenue assumptions Home Health* Volume (includes new stores) 10+% annual admission growth Approx. 85% of segment revenue Medicare Pricing CY 2020 CY 2021 CY 2022 Amounts are approximations Q120-Q420(16) Q121-Q421 Q122-Q422 Final Rule Estimate† Estimate† Market basket update 1.5% 3.1% 3.2% Legislative changes to the (16) (0.2%) (0.1%) —% rural add-on program Healthcare reform - (0.5%) (0.5%) productivity adjustment Net market basket update 1.3% 2.5% 2.7% Impact to Encompass Health from (2.3%) reimbursement model changes Estimated impact to Encompass Health, net (1.0%) of market basket update Base rate reduction for assumed (4.4%) behavioral adjustment Assumed offsets 3.4% to 2.4% Estimated impact (2.0%) to (3.0%) to Encompass Health Medicare Advantage Approx. 13% of revenue and managed care pricing Expected increases 0-2% 0-2% 0-2% * Hospice, which services accounted for 2.7% of total operating revenues for full-year 2018, is not included in the above pricing assumptions. Estimated 0.5% to 1.0% net Medicare pricing increase for CY2020 for Encompass Health’s hospice. † Estimates are based on current CMS and Congressional Budget Office projections Encompass Health which do not include potential changes from legislation or the CMS rule-making process. 35 Refer to pages 117-119 for end notes.

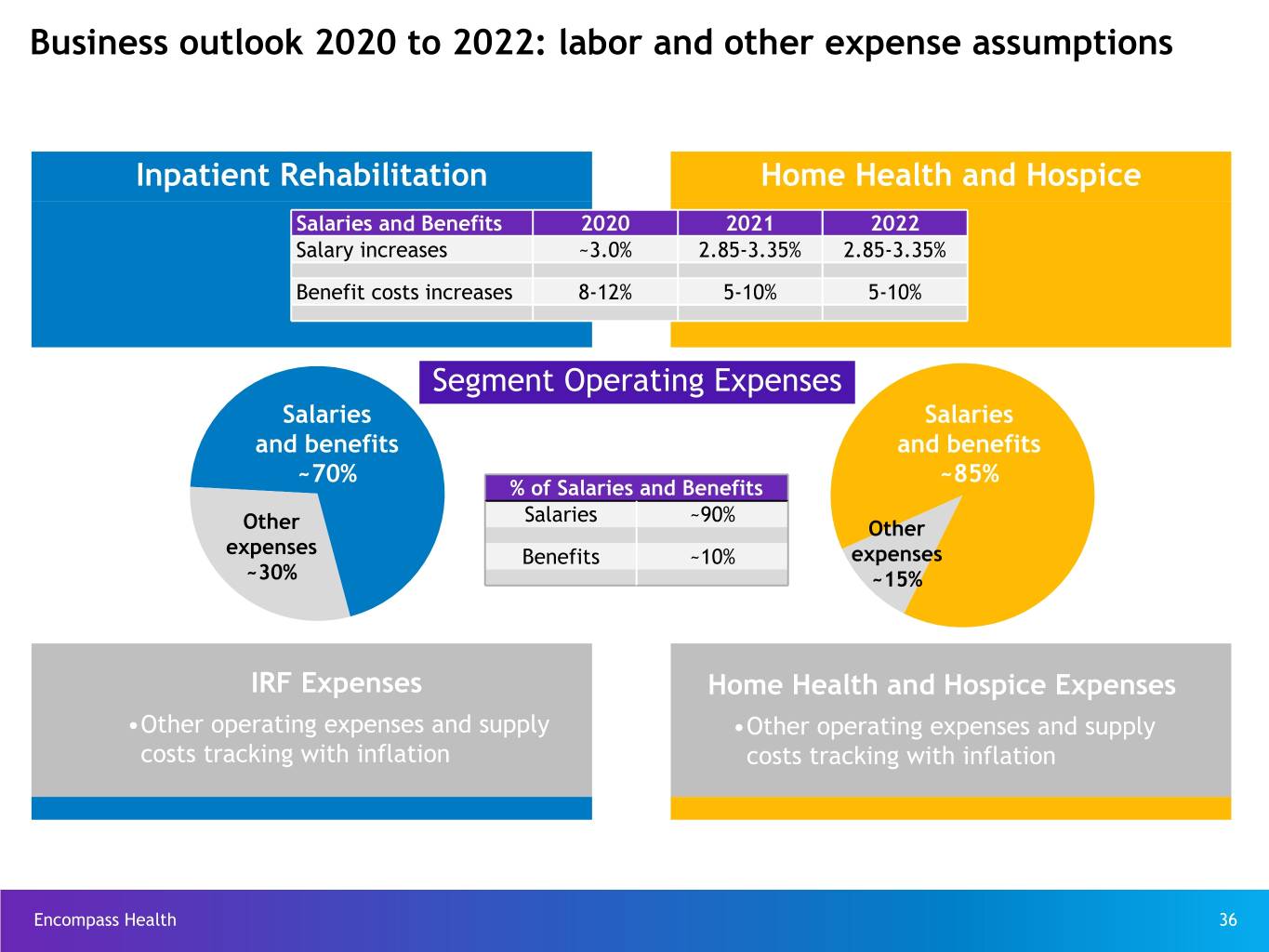

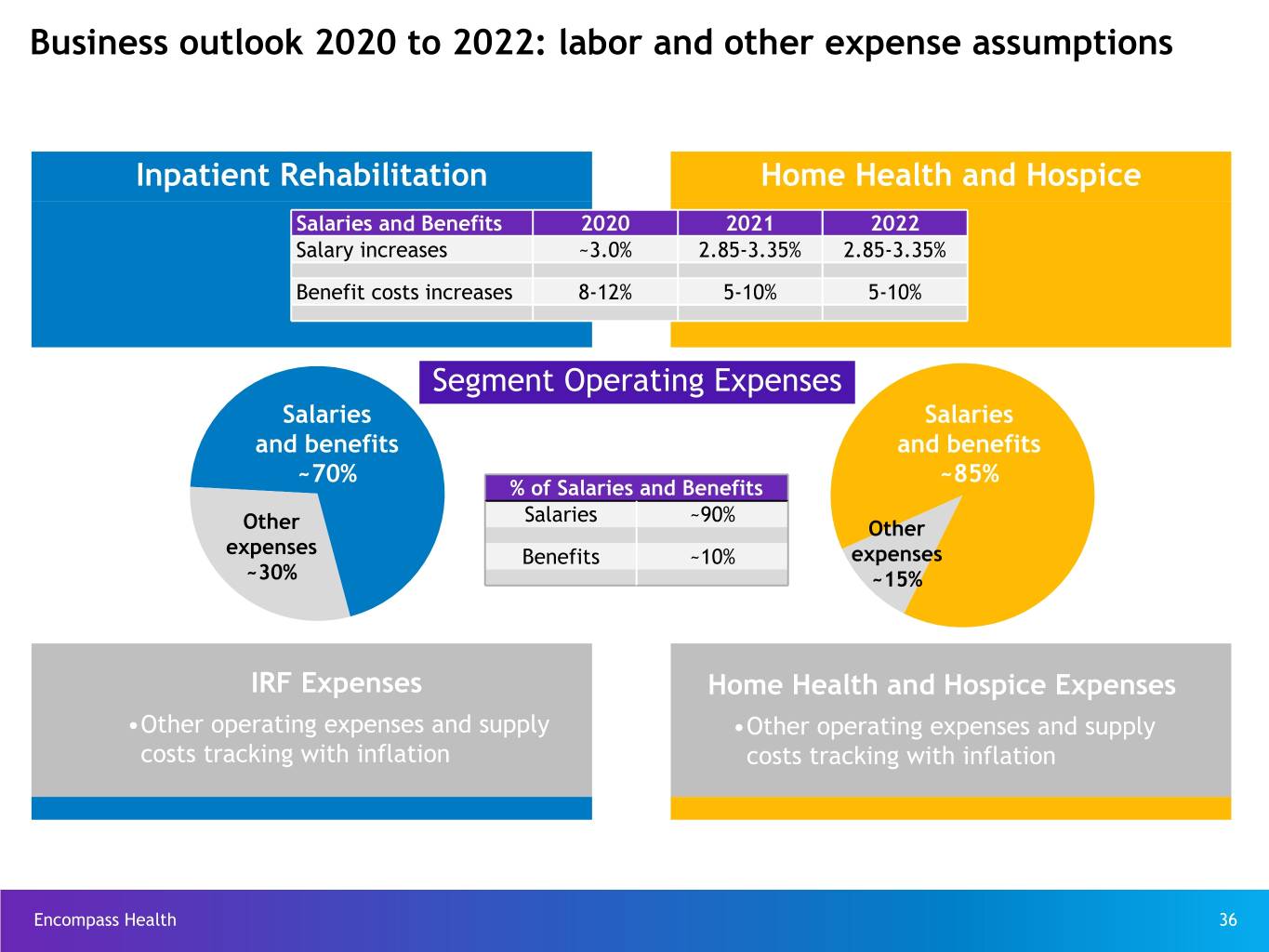

Business outlook 2020 to 2022: labor and other expense assumptions Inpatient Rehabilitation Home Health and Hospice Salaries and Benefits 2020 2021 2022 Salary increases ~3.0% 2.85-3.35% 2.85-3.35% Benefit costs increases 8-12% 5-10% 5-10% Segment Operating Expenses Salaries Salaries and benefits and benefits ~70% ~85% % of Salaries and Benefits Salaries ~90% Other Other expenses Benefits ~10% expenses ~30% ~15% IRF Expenses Home Health and Hospice Expenses •Other operating expenses and supply •Other operating expenses and supply costs tracking with inflation costs tracking with inflation Encompass Health 36

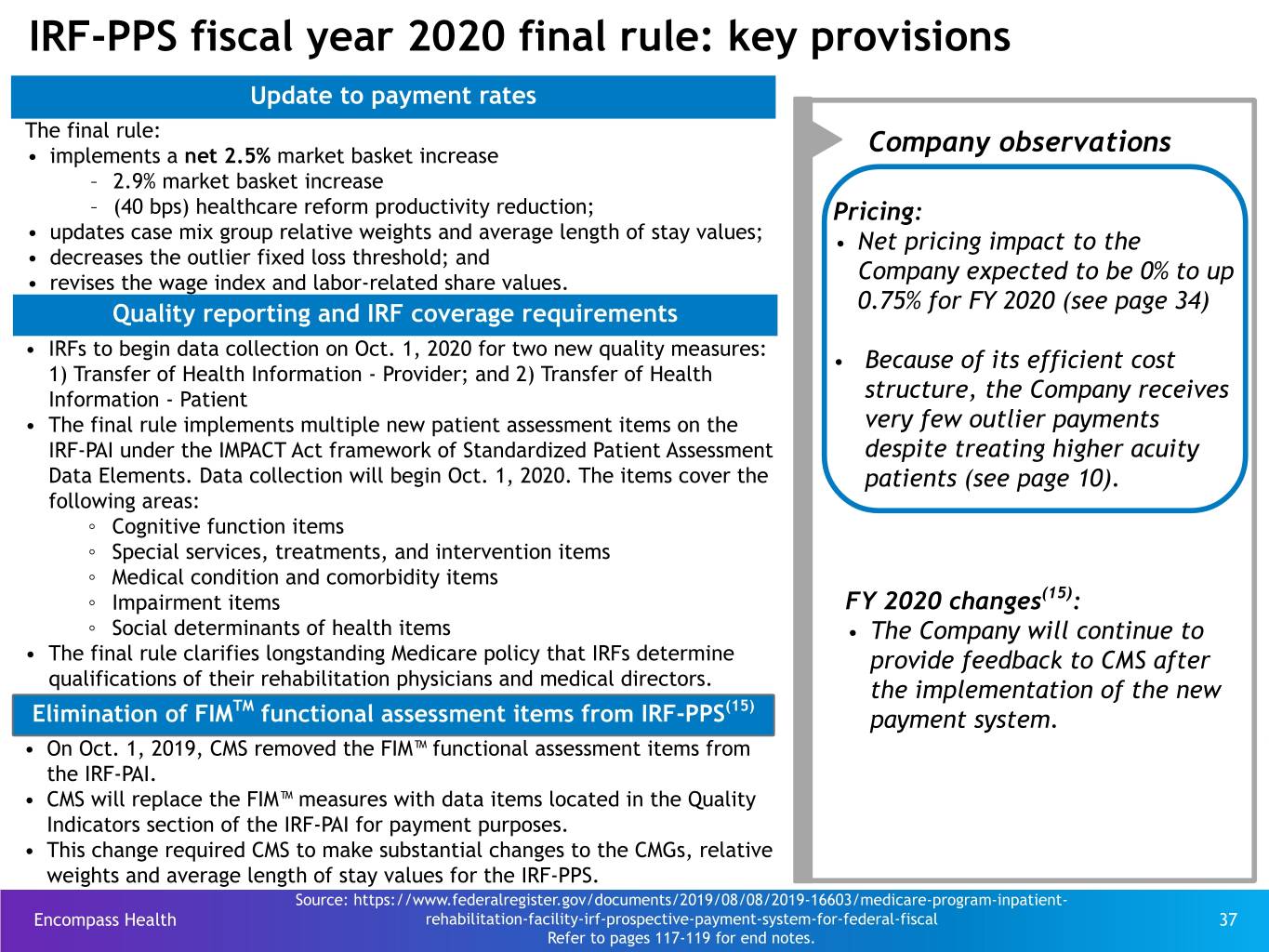

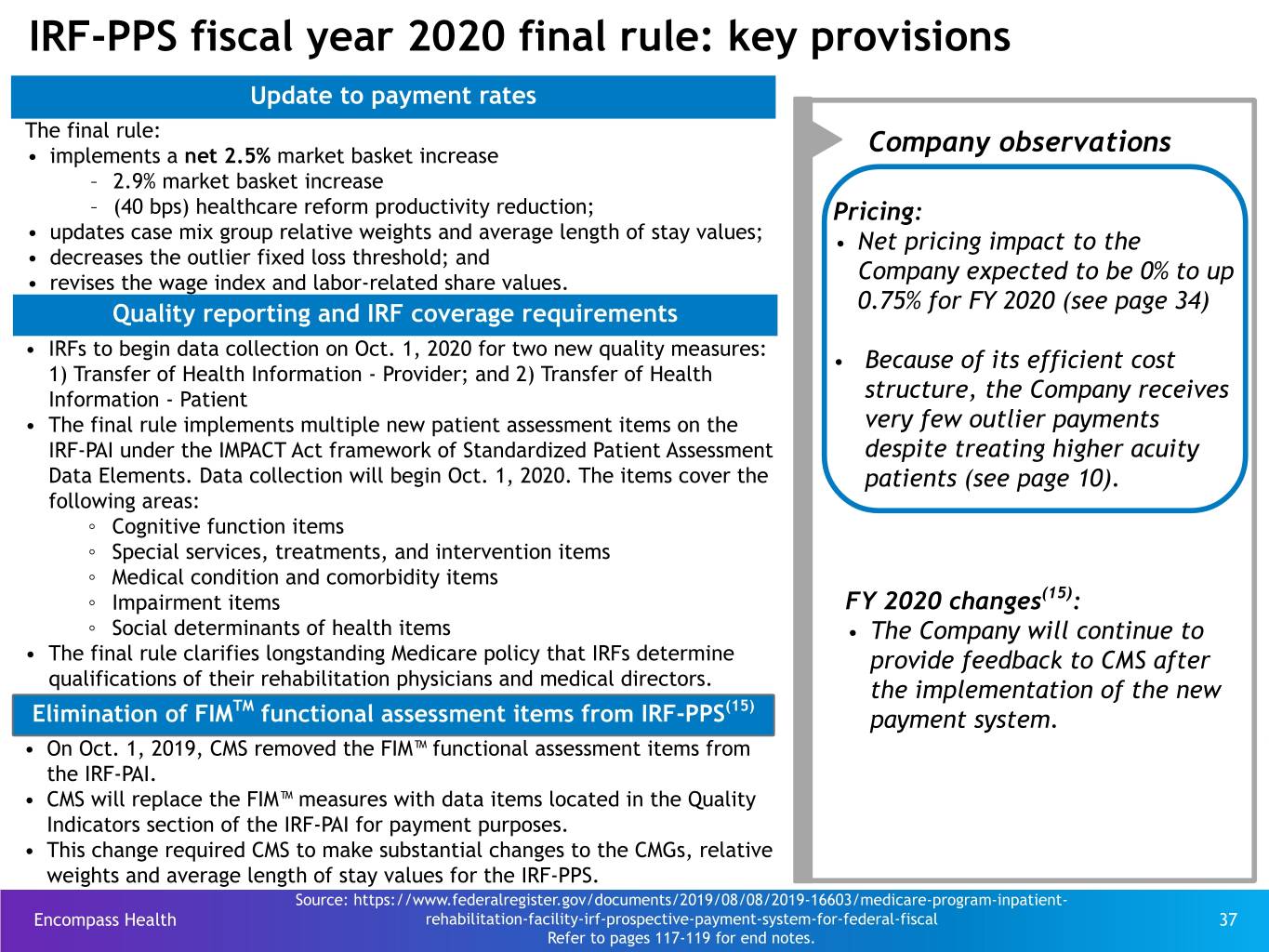

IRF-PPS fiscal year 2020 final rule: key provisions Update to payment rates The final rule: • implements a net 2.5% market basket increase Company observations – 2.9% market basket increase – (40 bps) healthcare reform productivity reduction; Pricing: • updates case mix group relative weights and average length of stay values; • Net pricing impact to the • decreases the outlier fixed loss threshold; and • revises the wage index and labor-related share values. Company expected to be 0% to up 0.75% for FY 2020 (see page 34) Quality reporting and IRF coverage requirements • IRFs to begin data collection on Oct. 1, 2020 for two new quality measures: • Because of its efficient cost 1) Transfer of Health Information - Provider; and 2) Transfer of Health Information - Patient structure, the Company receives • The final rule implements multiple new patient assessment items on the very few outlier payments IRF-PAI under the IMPACT Act framework of Standardized Patient Assessment despite treating higher acuity Data Elements. Data collection will begin Oct. 1, 2020. The items cover the patients (see page 10). following areas: ◦ Cognitive function items ◦ Special services, treatments, and intervention items ◦ Medical condition and comorbidity items ◦ Impairment items FY 2020 changes(15): ◦ Social determinants of health items • The Company will continue to • The final rule clarifies longstanding Medicare policy that IRFs determine provide feedback to CMS after qualifications of their rehabilitation physicians and medical directors. the implementation of the new TM (15) Elimination of FIM functional assessment items from IRF-PPS payment system. • On Oct. 1, 2019, CMS removed the FIM™ functional assessment items from the IRF-PAI. • CMS will replace the FIM™ measures with data items located in the Quality Indicators section of the IRF-PAI for payment purposes. • This change required CMS to make substantial changes to the CMGs, relative weights and average length of stay values for the IRF-PPS. Source: https://www.federalregister.gov/documents/2019/08/08/2019-16603/medicare-program-inpatient- Encompass Health rehabilitation-facility-irf-prospective-payment-system-for-federal-fiscal 37 Refer to pages 117-119 for end notes.

HH-PPS calendar year 2020 final rule: key provisions Final rule updates to 2020 payment rates The final rule will: Company observations • implement a net 1.3% market basket increase (1.5% market basket update less a 0.2% continued reduction related to the rural add-on modifications as required by the Bipartisan Budget Act (BBA) of 2018); Pricing: • reduce the Request for Anticipated Payment percentage in CY 2020 to • Net pricing impact to the 20% (from 50% to 60% historically) with full elimination of RAP in Company expected to be a 2021; and decrease of 2.0% to 3.0% for CY • implement the Patient-Driven Groupings Model effective January 1, 2020 (see page 35) 2020. Quality reporting Quality: CMS will: • The Company will modify existing • remove one quality measure, add two new quality reporting measures, processes and systems to meet the and modify one existing measure and changed requirements. • adopt 22 standardized assessment data elements plus 7 more data elements related to social determinants of care that would be captured on the OASIS beginning January 1, 2021. Payment System(16): (16) Patient-driven groupings model (PDGM) for CY 2020 • The Company will continue to engage with CMS, Congress, and For PDGM, the final rule will: • use 30-day payment periods; other stakeholders to ensure any • eliminate therapy service use thresholds currently used in case-mix change to the underlying payment adjustments and rely more heavily on clinical characteristics; system maintains patient access to • adjust payments for patients who had a prior inpatient stay within 14 needed home health services. days of the beginning of home health services; and • See page 54 for the Company’s • implement an 4.36% reduction in the base rate using assumed preparation strategies behavioral changes to achieve budget neutrality. Source: https://www.govinfo.gov/content/pkg/FR-2019-11-08/pdf/2019-24026.pdf Encompass Health Refer to pages 117-119 for end notes. 38

IMPACT Act of 2014 - enacted Oct. 6, 2014 Company observations and considerations with respect to the IMPACT Act: It was developed on a bi-partisan basis by the House Ways and Means and Senate Finance Committees ▪ and incorporated feedback from healthcare providers and provider organizations that responded to the Committees’ solicitation of post-acute payment reform ideas and proposals. It directs the United States Department of Health and Human Services (“HHS”), in consultation with ▪ healthcare stakeholders, to implement standardized data collection processes for post-acute quality and resource use measures. Although the IMPACT Act does not specifically call for the implementation of a new post-acute payment system, the Company believes this Act will lay the foundation for possible future post-acute ▪ payment policies that would be based on patients’ medical conditions and other clinical factors rather than the setting where the care is provided. It has created additional data collection and reporting requirements for the Company’s IRFs and home health agencies. While the Company cannot quantify the potential financial effect of the IMPACT Act on Encompass Health, the Company believes any post-acute payment system that is data driven and focuses on the ▪ needs and underlying medical conditions of post-acute patients will be positive for providers who offer high-quality, cost-effective care. Encompass Health believes it is doing just that and expects this act will be positive for the Company. However, it will likely take years for the quality data to be gathered, standardized patient assessment data to be assembled and disseminated, and potential payment policies to be developed, tested and ▪ promulgated. As the nation’s largest owner and operator of inpatient rehabilitation hospitals, the Company looks forward to working with HHS, the Medicare Payment Advisory Commission and other healthcare stakeholders on these initiatives. Encompass Health Source: https://www.govtrack.us/congress/bills/113/hr4994/text 39

Growth Encompass Health is a leader in serving the post-acute patient population and has multiple avenues available for sustained growth in both segments. Favorable demographic trends are driving increasing demand. Encompass Health 40

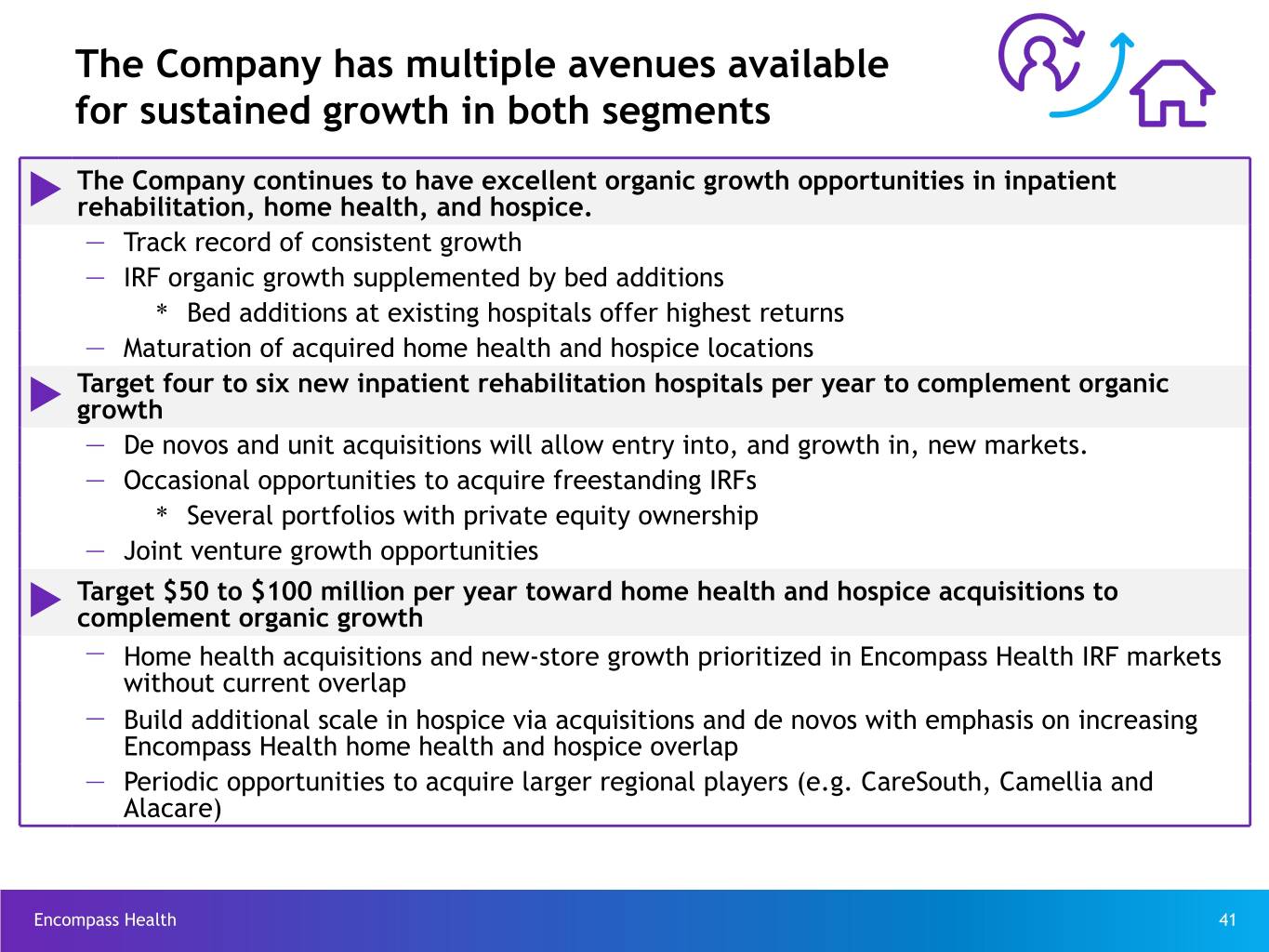

The Company has multiple avenues available for sustained growth in both segments u The Company continues to have excellent organic growth opportunities in inpatient rehabilitation, home health, and hospice. — Track record of consistent growth — IRF organic growth supplemented by bed additions * Bed additions at existing hospitals offer highest returns — Maturation of acquired home health and hospice locations u Target four to six new inpatient rehabilitation hospitals per year to complement organic growth — De novos and unit acquisitions will allow entry into, and growth in, new markets. — Occasional opportunities to acquire freestanding IRFs * Several portfolios with private equity ownership — Joint venture growth opportunities u Target $50 to $100 million per year toward home health and hospice acquisitions to complement organic growth — Home health acquisitions and new-store growth prioritized in Encompass Health IRF markets without current overlap — Build additional scale in hospice via acquisitions and de novos with emphasis on increasing Encompass Health home health and hospice overlap — Periodic opportunities to acquire larger regional players (e.g. CareSouth, Camellia and Alacare) Encompass Health 41

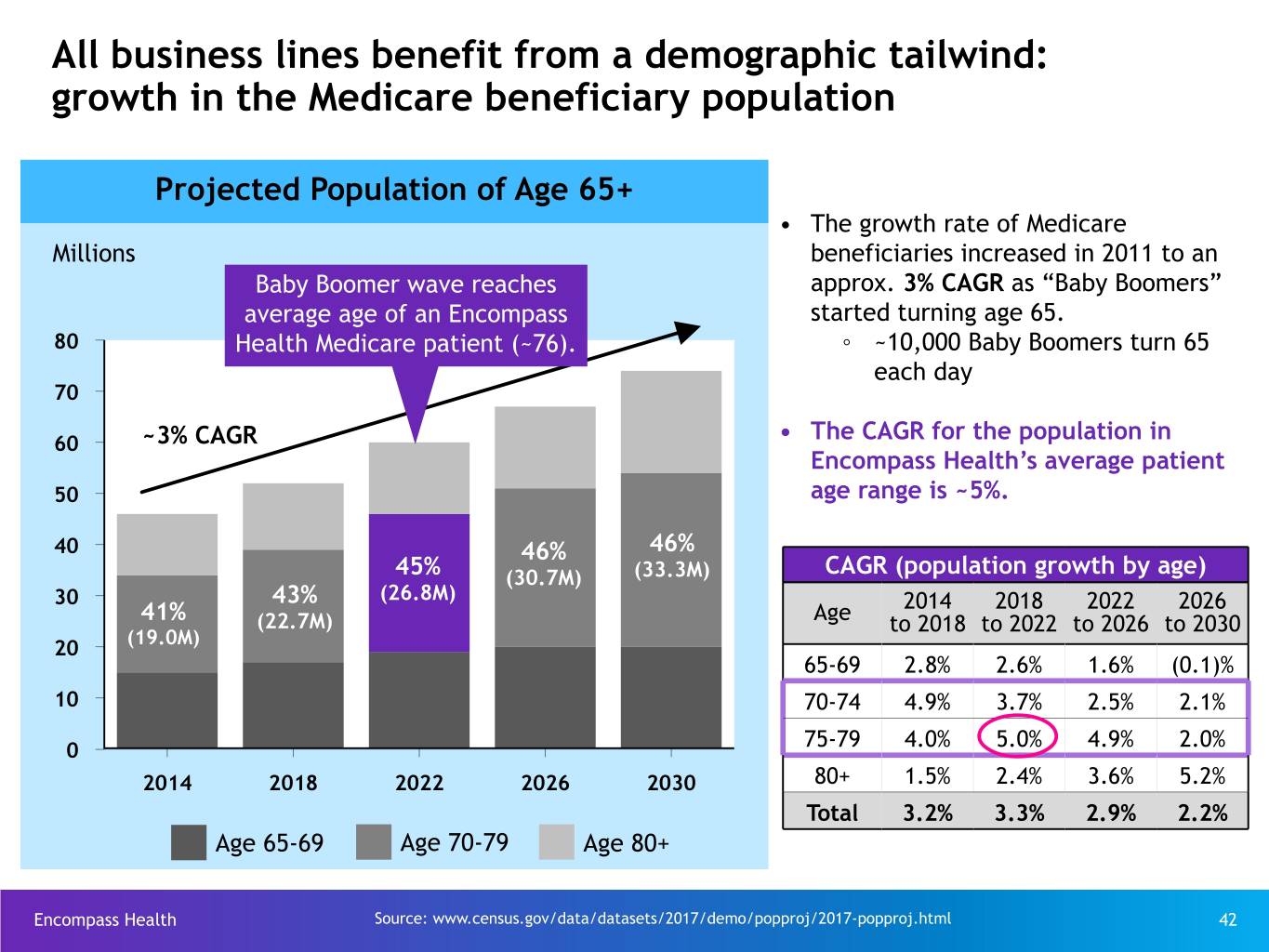

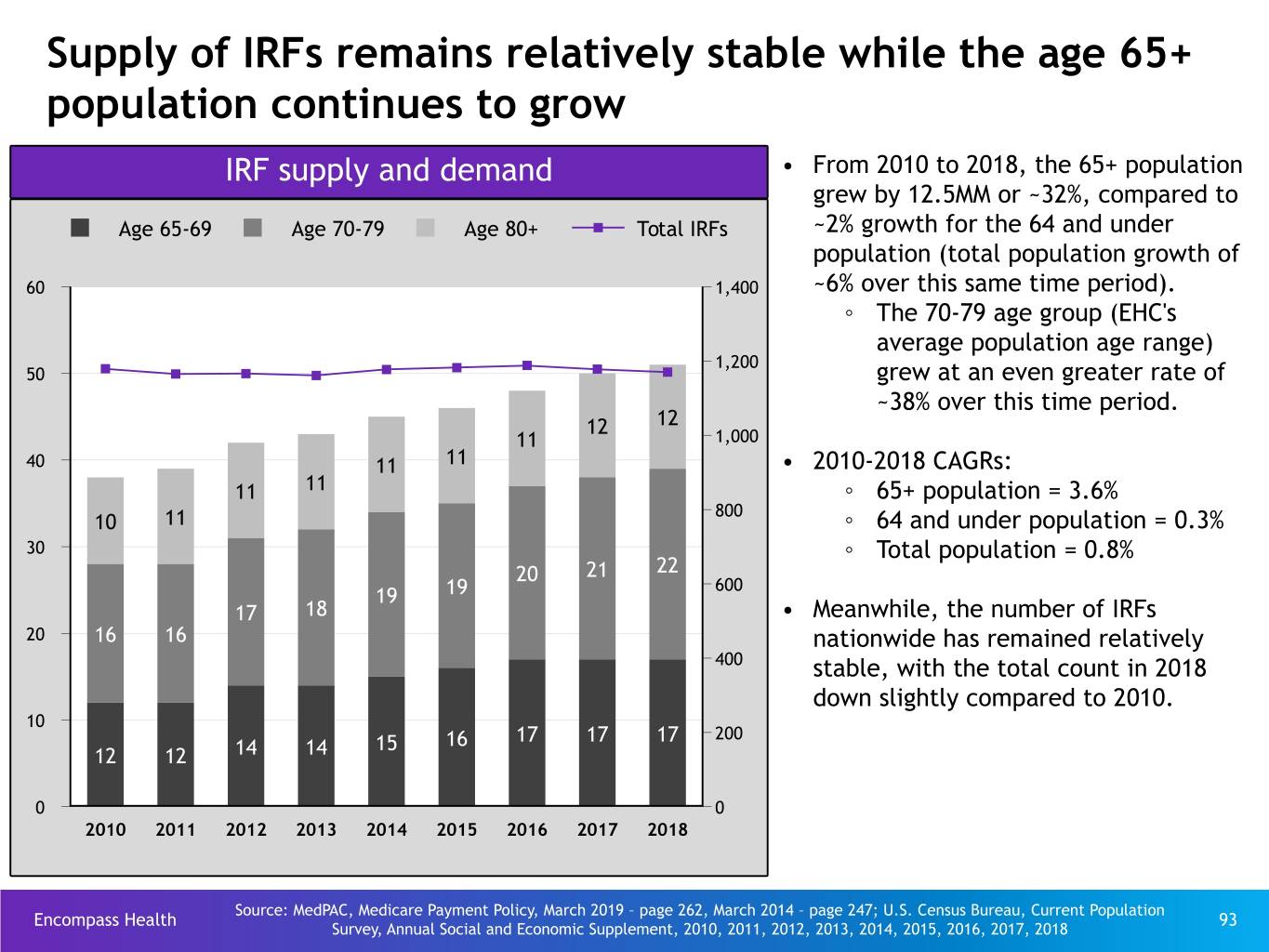

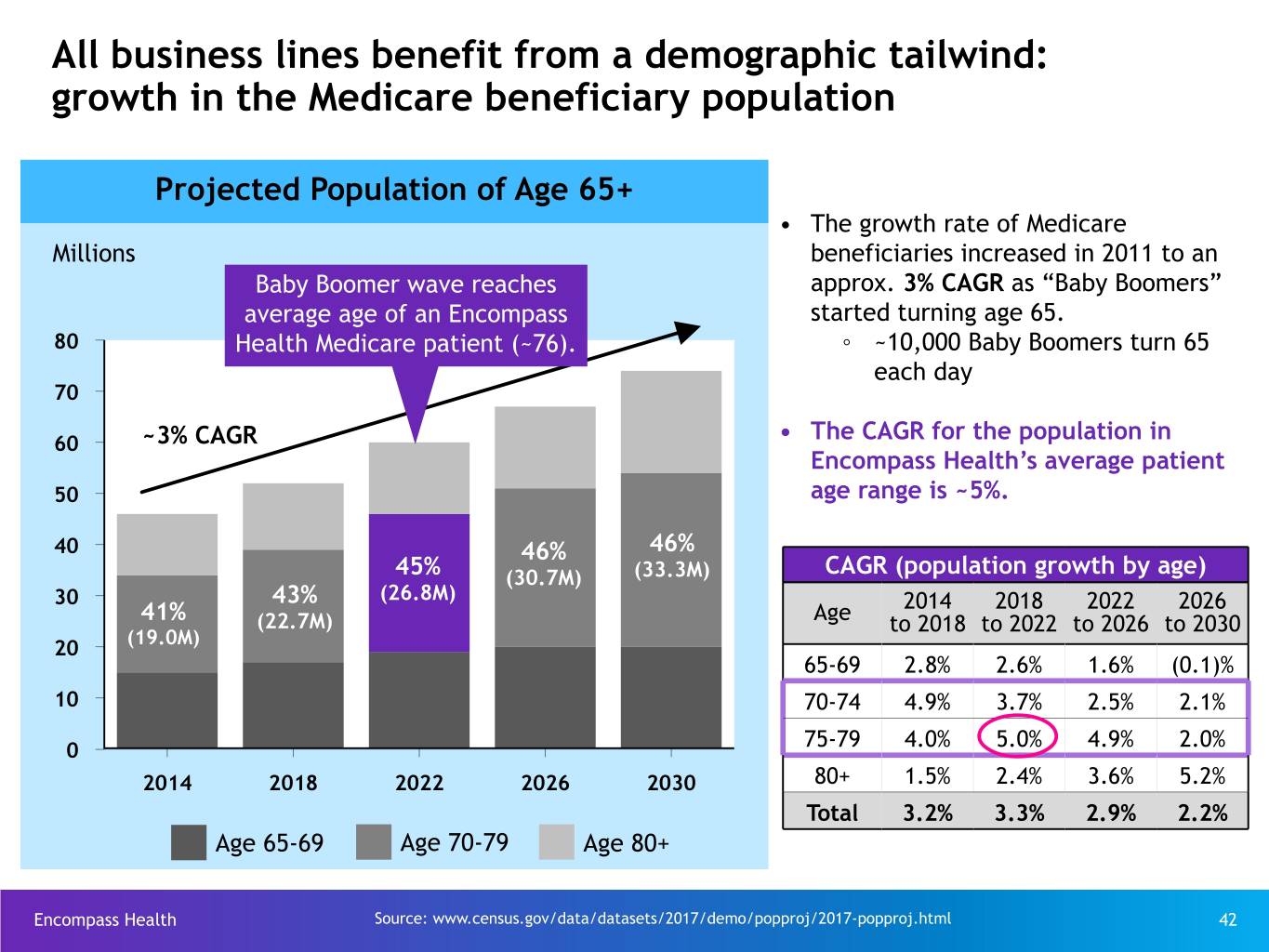

All business lines benefit from a demographic tailwind: growth in the Medicare beneficiary population Projected Population of Age 65+ • The growth rate of Medicare Millions beneficiaries increased in 2011 to an Baby Boomer wave reaches approx. 3% CAGR as “Baby Boomers” average age of an Encompass started turning age 65. 80 Health Medicare patient (~76). ◦ ~10,000 Baby Boomers turn 65 each day 70 • The CAGR for the population in 60 ~3% CAGR Encompass Health’s average patient 50 age range is ~5%. 40 46% 46% 45% (30.7M) (33.3M) CAGR (population growth by age) 30 43% (26.8M) 2014 2018 2022 2026 41% (22.7M) Age to 2018 to 2022 to 2026 to 2030 (19.0M) 20 65-69 2.8% 2.6% 1.6% (0.1)% 10 70-74 4.9% 3.7% 2.5% 2.1% 0 75-79 4.0% 5.0% 4.9% 2.0% 2014 2018 2022 2026 2030 80+ 1.5% 2.4% 3.6% 5.2% Total 3.2% 3.3% 2.9% 2.2% Age 65-69 Age 70-79 Age 80+ Encompass Health Source: www.census.gov/data/datasets/2017/demo/popproj/2017-popproj.html 42

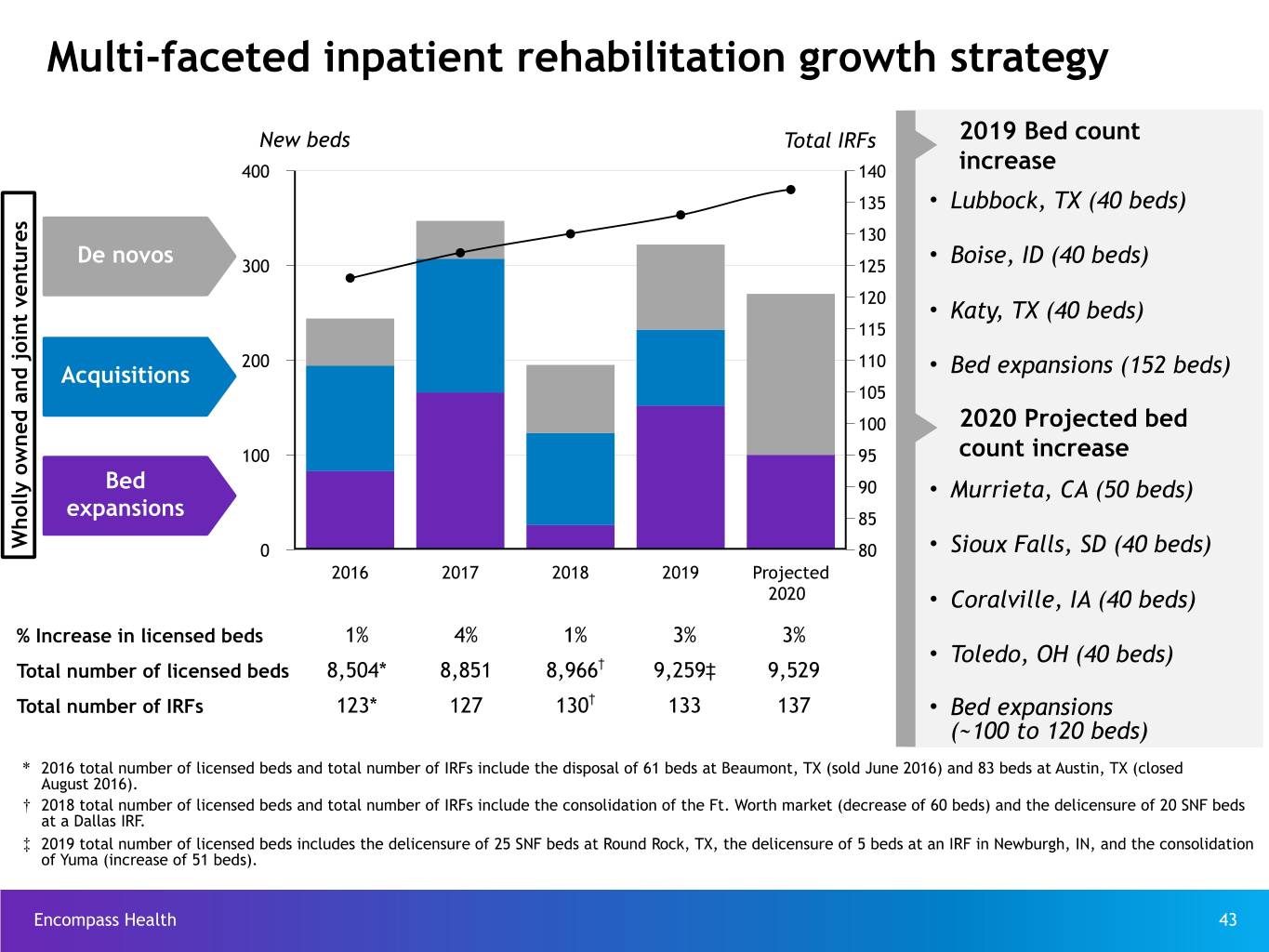

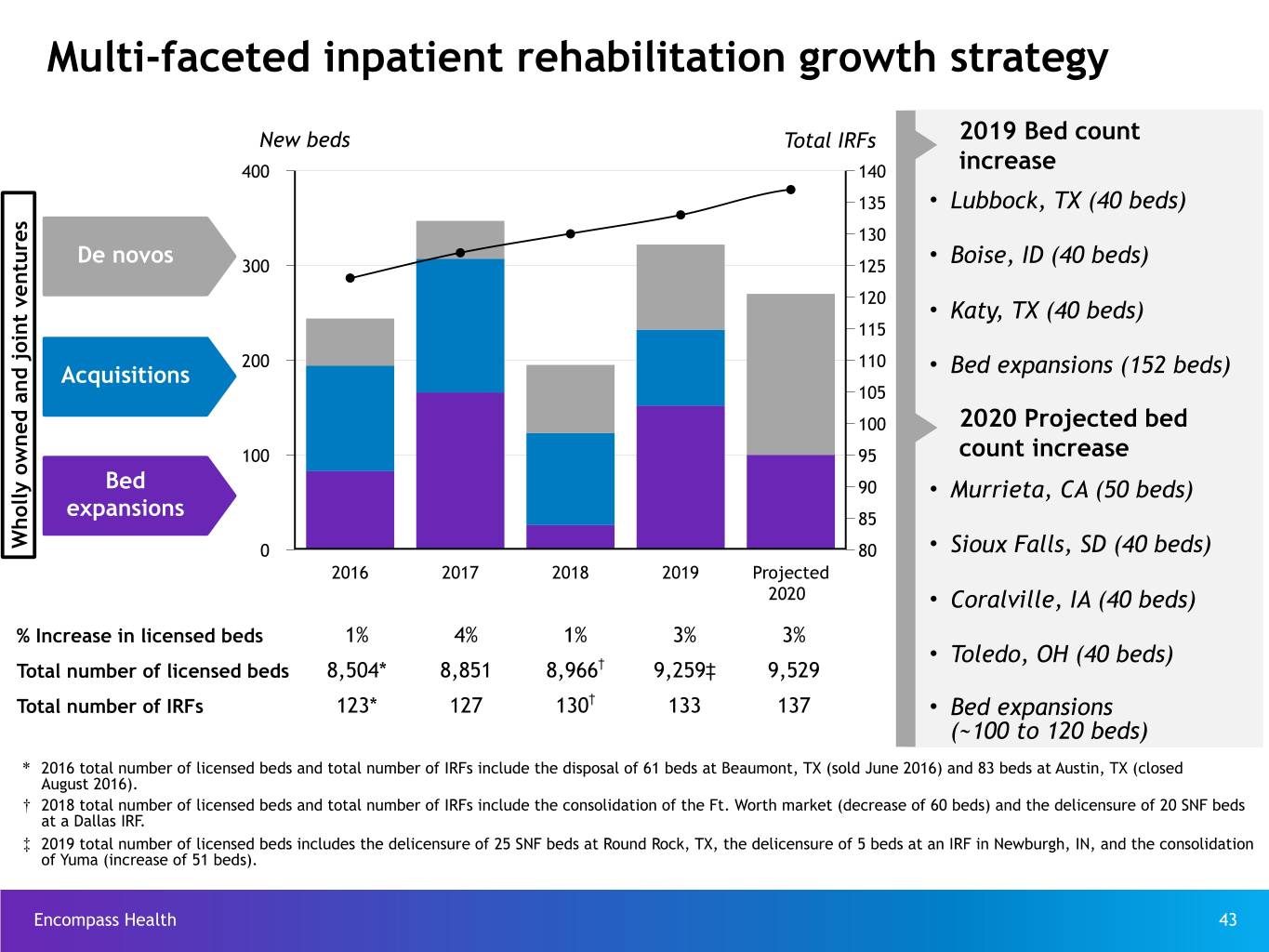

Multi-faceted inpatient rehabilitation growth strategy New beds Total IRFs 2019 Bed count 400 140 increase 135 • Lubbock, TX (40 beds) 130 • De novos 300 125 Boise, ID (40 beds) 120 • Katy, TX (40 beds) 115 200 110 Acquisitions • Bed expansions (152 beds) 105 100 2020 Projected bed 100 95 count increase Bed 90 • Murrieta, CA (50 beds) expansions 85 Wholly owned and joint ventures 0 80 • Sioux Falls, SD (40 beds) 2016 2017 2018 2019 Projected 2020 • Coralville, IA (40 beds) % Increase in licensed beds 1% 4% 1% 3% 3% • Toledo, OH (40 beds) Total number of licensed beds 8,504* 8,851 8,966† 9,259‡ 9,529 Total number of IRFs 123* 127 130† 133 137 • Bed expansions (~100 to 120 beds) * 2016 total number of licensed beds and total number of IRFs include the disposal of 61 beds at Beaumont, TX (sold June 2016) and 83 beds at Austin, TX (closed August 2016). † 2018 total number of licensed beds and total number of IRFs include the consolidation of the Ft. Worth market (decrease of 60 beds) and the delicensure of 20 SNF beds at a Dallas IRF. ‡ 2019 total number of licensed beds includes the delicensure of 25 SNF beds at Round Rock, TX, the delicensure of 5 beds at an IRF in Newburgh, IN, and the consolidation of Yuma (increase of 51 beds). Encompass Health 43

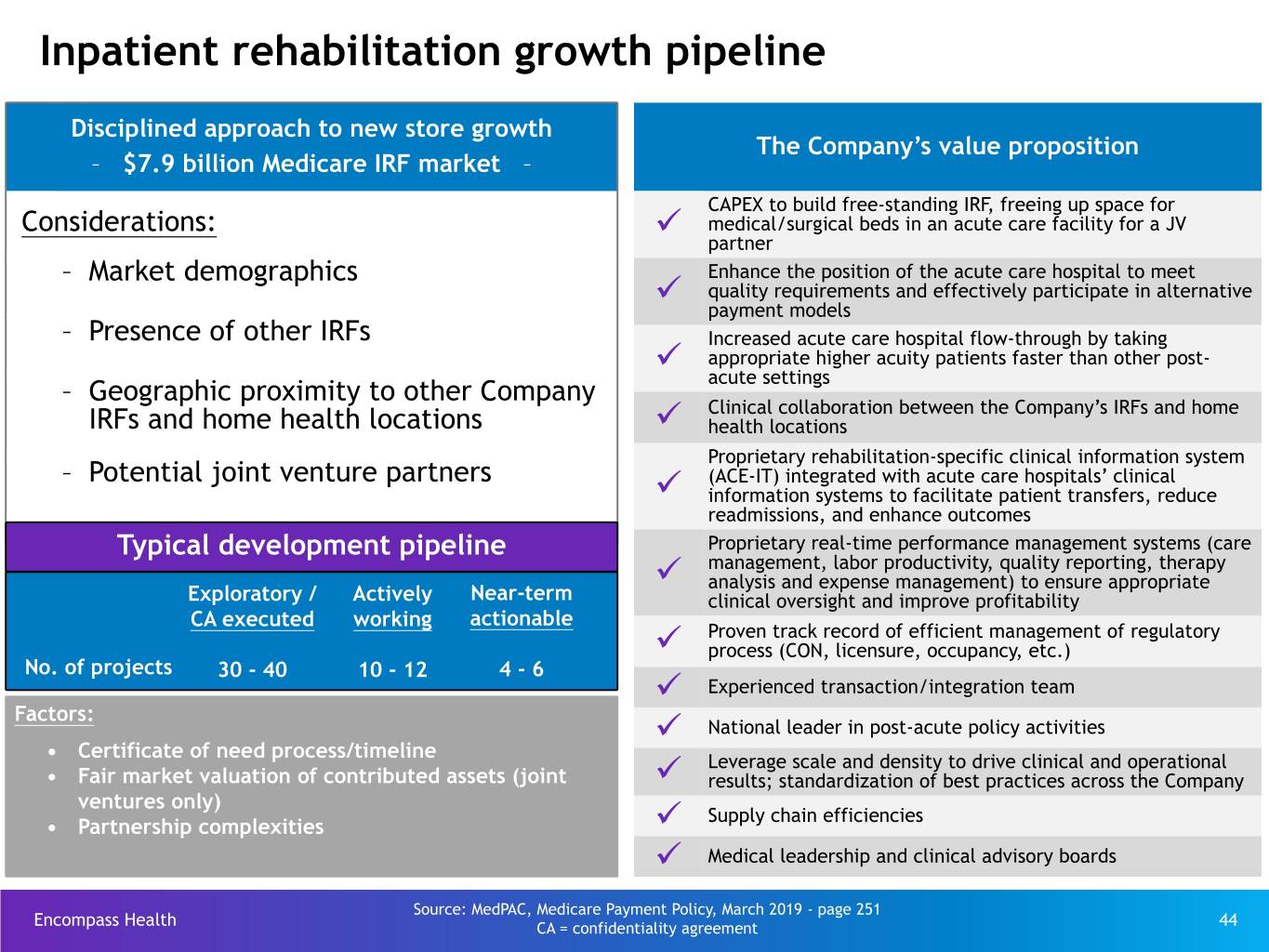

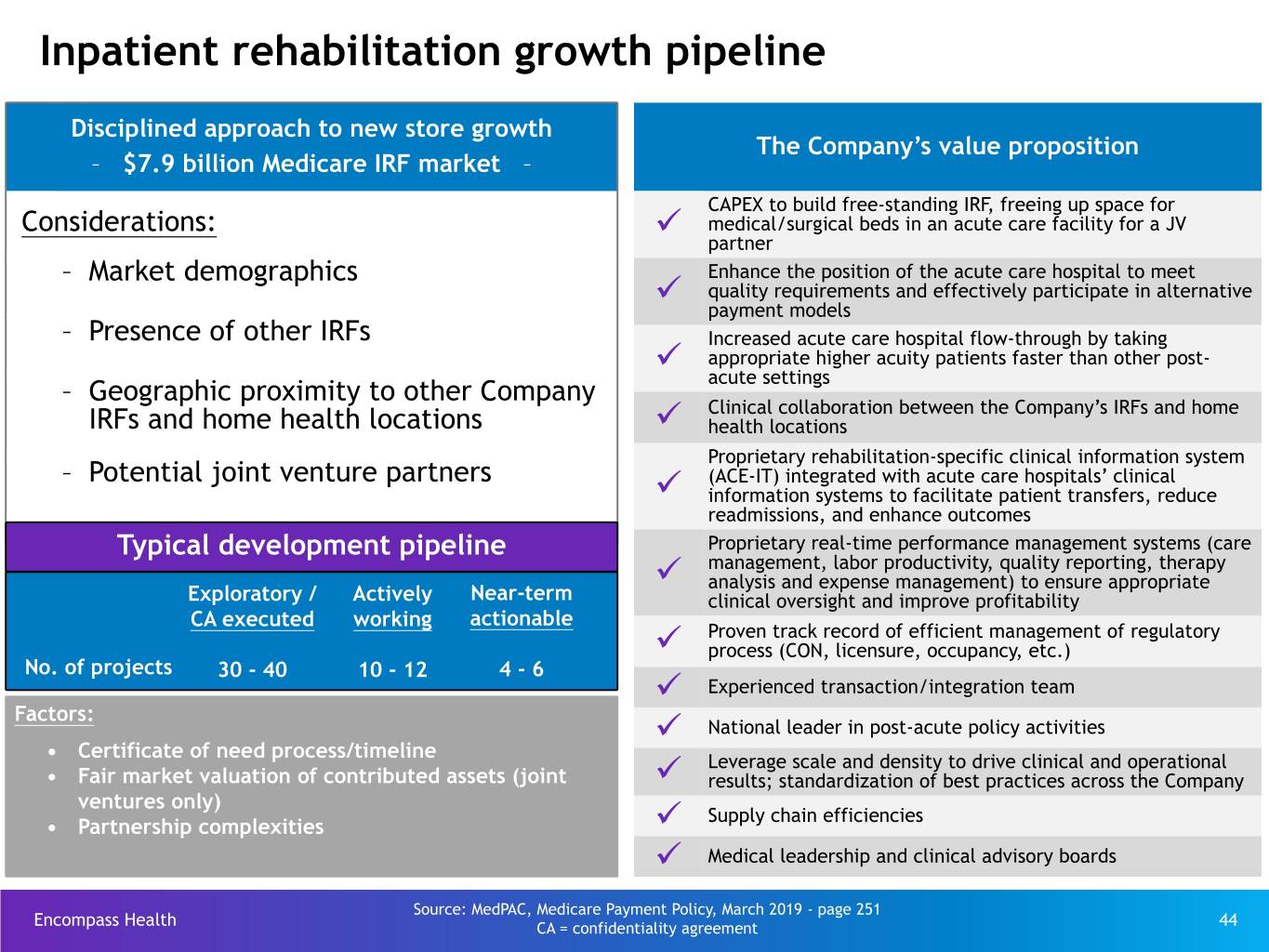

Inpatient rehabilitation growth pipeline Disciplined approach to new store growth The Company’s value proposition – $7.9 billion Medicare IRF market – CAPEX to build free-standing IRF, freeing up space for Considerations: ü medical/surgical beds in an acute care facility for a JV partner – Market demographics Enhance the position of the acute care hospital to meet ü quality requirements and effectively participate in alternative payment models – Presence of other IRFs Increased acute care hospital flow-through by taking ü appropriate higher acuity patients faster than other post- – Geographic proximity to other Company acute settings ü Clinical collaboration between the Company’s IRFs and home IRFs and home health locations health locations Proprietary rehabilitation-specific clinical information system – Potential joint venture partners ü (ACE-IT) integrated with acute care hospitals’ clinical information systems to facilitate patient transfers, reduce readmissions, and enhance outcomes Typical development pipeline Proprietary real-time performance management systems (care ü management, labor productivity, quality reporting, therapy analysis and expense management) to ensure appropriate Exploratory / Actively Near-term clinical oversight and improve profitability CA executed working actionable ü Proven track record of efficient management of regulatory process (CON, licensure, occupancy, etc.) No. of projects 30 - 40 10 - 12 4 - 6 ü Experienced transaction/integration team Factors: ü National leader in post-acute policy activities • Certificate of need process/timeline ü Leverage scale and density to drive clinical and operational • Fair market valuation of contributed assets (joint results; standardization of best practices across the Company ventures only) ü Supply chain efficiencies • Partnership complexities ü Medical leadership and clinical advisory boards Source: MedPAC, Medicare Payment Policy, March 2019 - page 251 Encompass Health CA = confidentiality agreement 44

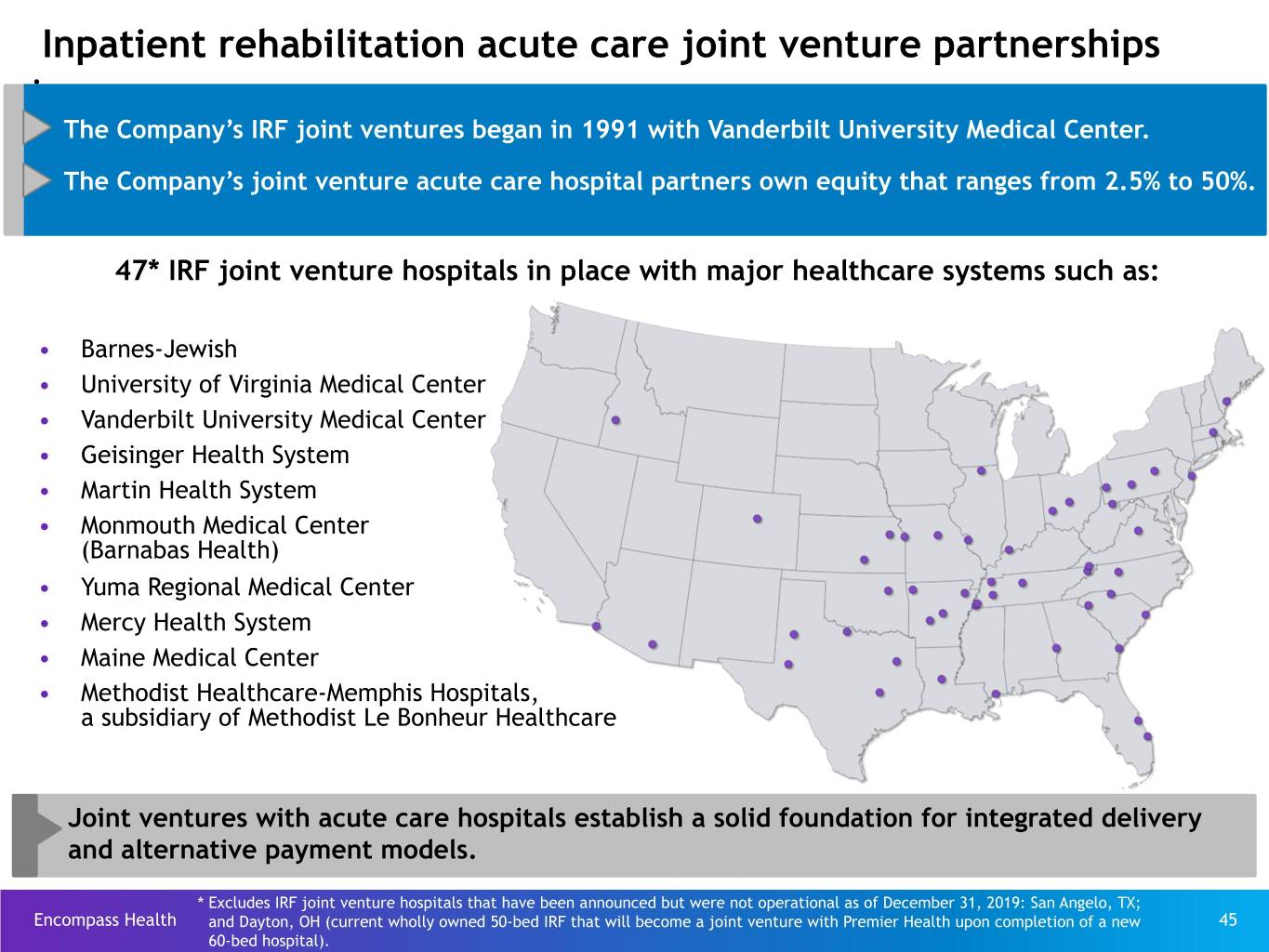

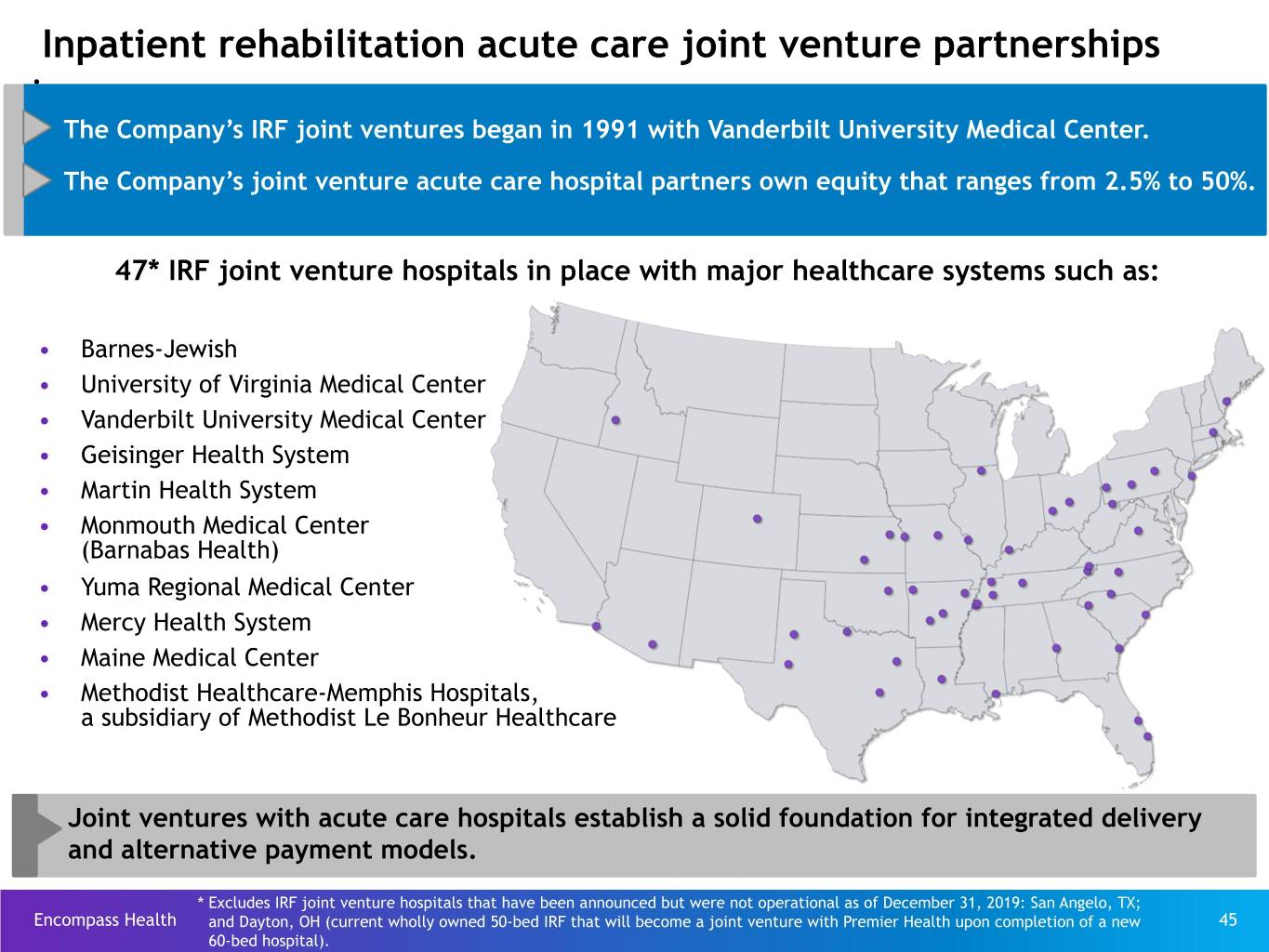

Inpatient rehabilitation acute care joint venture partnerships • • The Company’s IRF joint ventures began in 1991 with Vanderbilt University Medical Center. • The Company’s joint venture acute care hospital partners own equity that ranges from 2.5% to 50%. 47* IRF joint venture hospitals in place with major healthcare systems such as: • Barnes-Jewish • University of Virginia Medical Center • Vanderbilt University Medical Center • Geisinger Health System • Martin Health System • Monmouth Medical Center (Barnabas Health) • Yuma Regional Medical Center • Mercy Health System • Maine Medical Center • Methodist Healthcare-Memphis Hospitals, a subsidiary of Methodist Le Bonheur Healthcare Joint ventures with acute care hospitals establish a solid foundation for integrated delivery and alternative payment models. * Excludes IRF joint venture hospitals that have been announced but were not operational as of December 31, 2019: San Angelo, TX; Encompass Health and Dayton, OH (current wholly owned 50-bed IRF that will become a joint venture with Premier Health upon completion of a new 45 60-bed hospital).

De novo IRFs and acquisitions Operations Joint # of new beds Location date Investment considerations venture? 2018 2019 2020 2021 De novo IRFs: • IRR objective of 13% (after tax) Shelby County, AL Q2 2018 34 • Joint venture capitalization Bluffton, SC Q2 2018 38 • Certificate of need (“CON”) costs, Winston-Salem, NC Q4 2018 Yes 68 where applicable Lubbock, TX Q2 2019 Yes 40 • Clinical information system (“CIS”) installation costs Boise, ID Q3 2019 Yes 40 • Medicare certification for new hospitals Katy, TX Q3 2019 40 (minimum of 30 patients treated for 1 Murrieta, CA Q1 2020 50 zero revenue) 2 Sioux Falls, SD 2020 40 3 Coralville, IA 2020 40 4 Toledo, OH 2020 40 Previously announced IRF 8 5 development projects underway Cumming, GA 2021 50 6 North Tampa, FL 2021 50 4 New states 7 Stockbridge, GA 2021 50 – North Carolina in 2018 8 San Angelo, TX 2021 Yes 40 – Idaho in 2019 Acquisitions: – South Dakota and Iowa in Murrells Inlet, SC Q3 2018 Yes 29 2020 Bed expansions, net* 26 152 ~100 ~100 195 272 ~270 ~290 Encompass Health * Net bed expansions in each year may change due to the timing of certain regulatory approvals and/or construction delays. 46 For 2020, the currently expected range for bed expansions is 100 to 120.

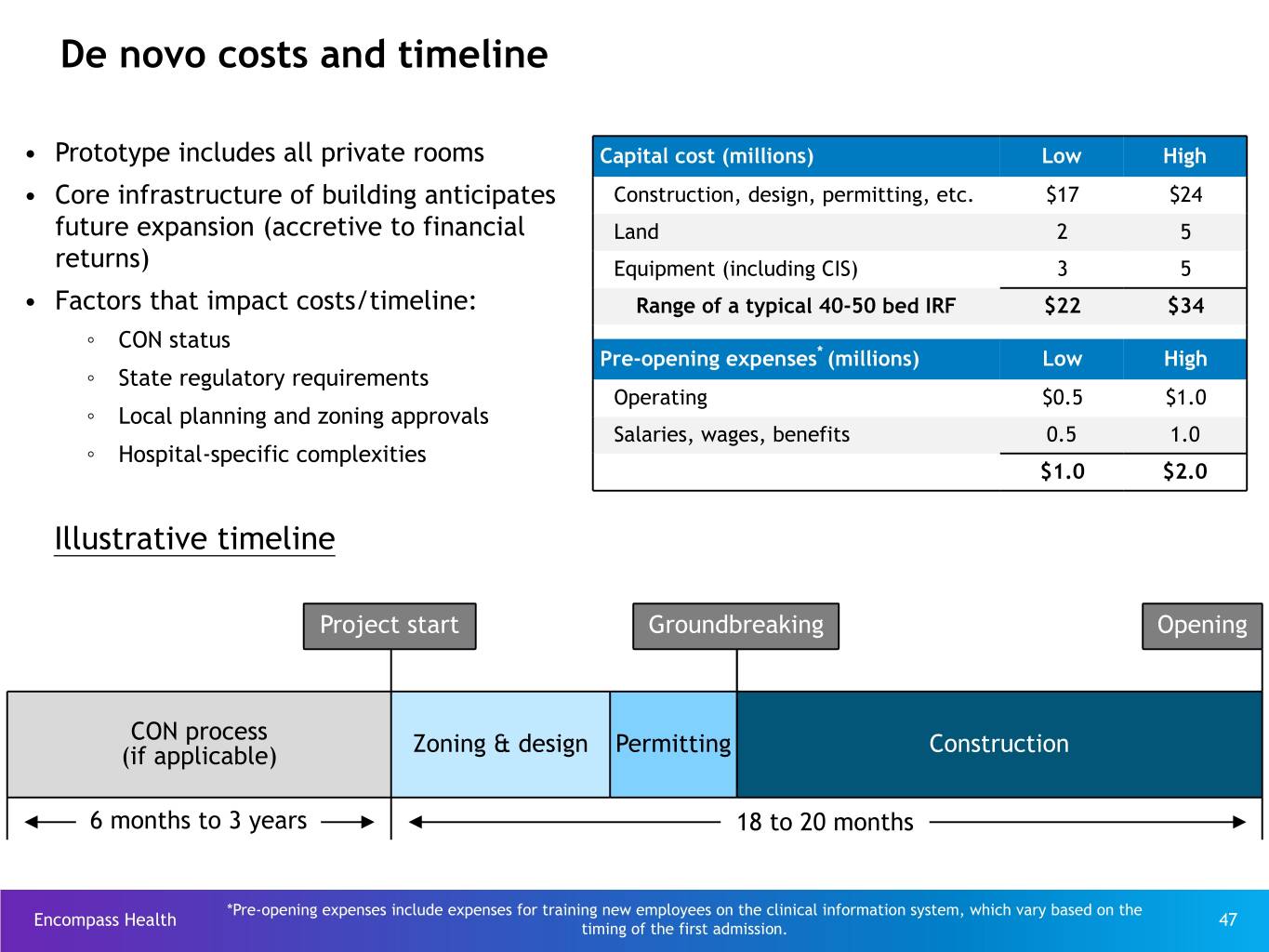

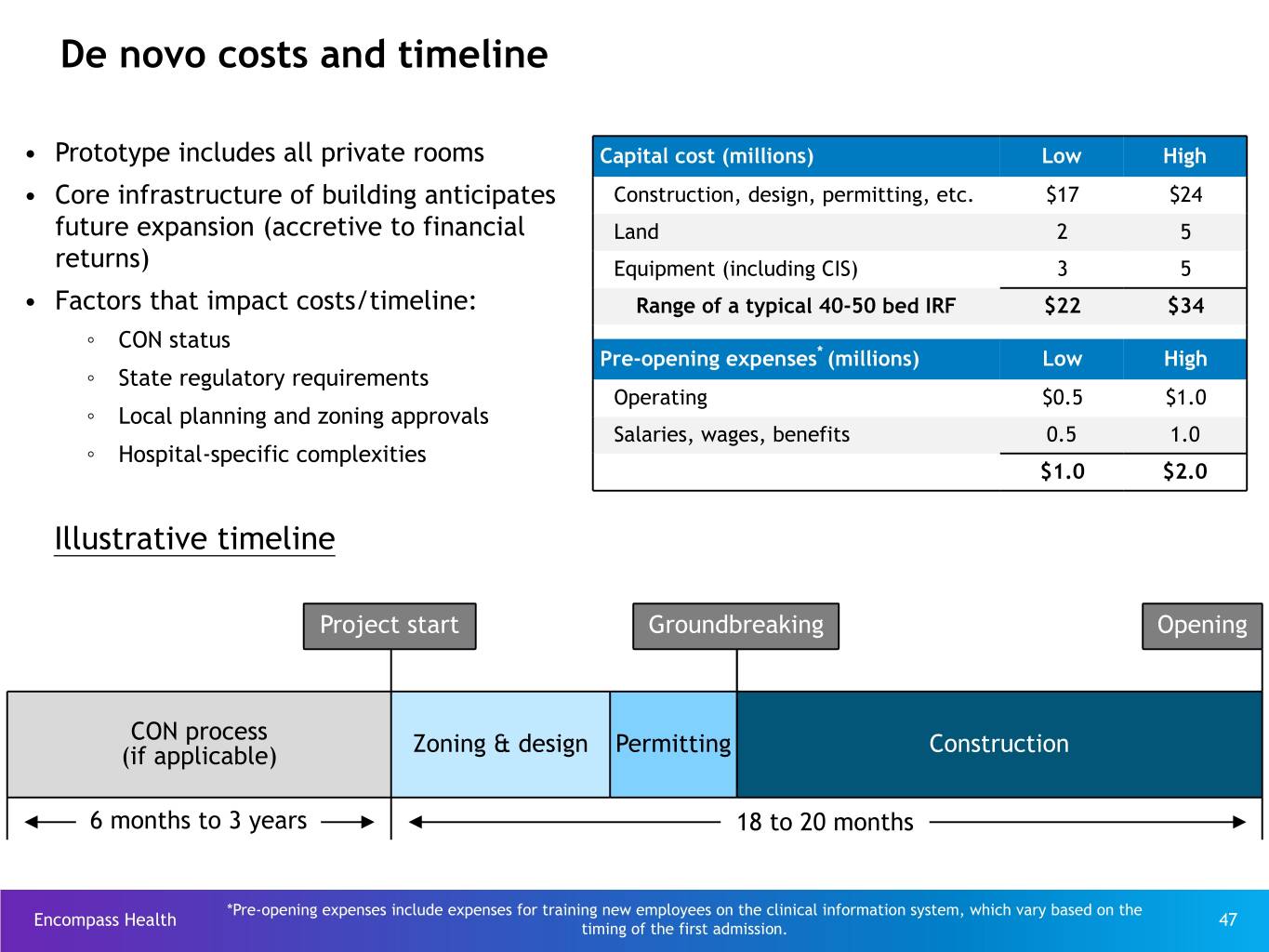

De novo costs and timeline • Prototype includes all private rooms Capital cost (millions) Low High • Core infrastructure of building anticipates Construction, design, permitting, etc. $17 $24 future expansion (accretive to financial Land 2 5 returns) Equipment (including CIS) 3 5 • Factors that impact costs/timeline: Range of a typical 40-50 bed IRF $22 $34 ◦ CON status Pre-opening expenses* (millions) Low High ◦ State regulatory requirements Operating $0.5 $1.0 ◦ Local planning and zoning approvals Salaries, wages, benefits 0.5 1.0 ◦ Hospital-specific complexities $1.0 $2.0 Illustrative timeline Project start Groundbreaking Opening CON process (if applicable) Zoning & design Permitting Construction 6 months to 3 years 18 to 20 months *Pre-opening expenses include expenses for training new employees on the clinical information system, which vary based on the Encompass Health 47 timing of the first admission.

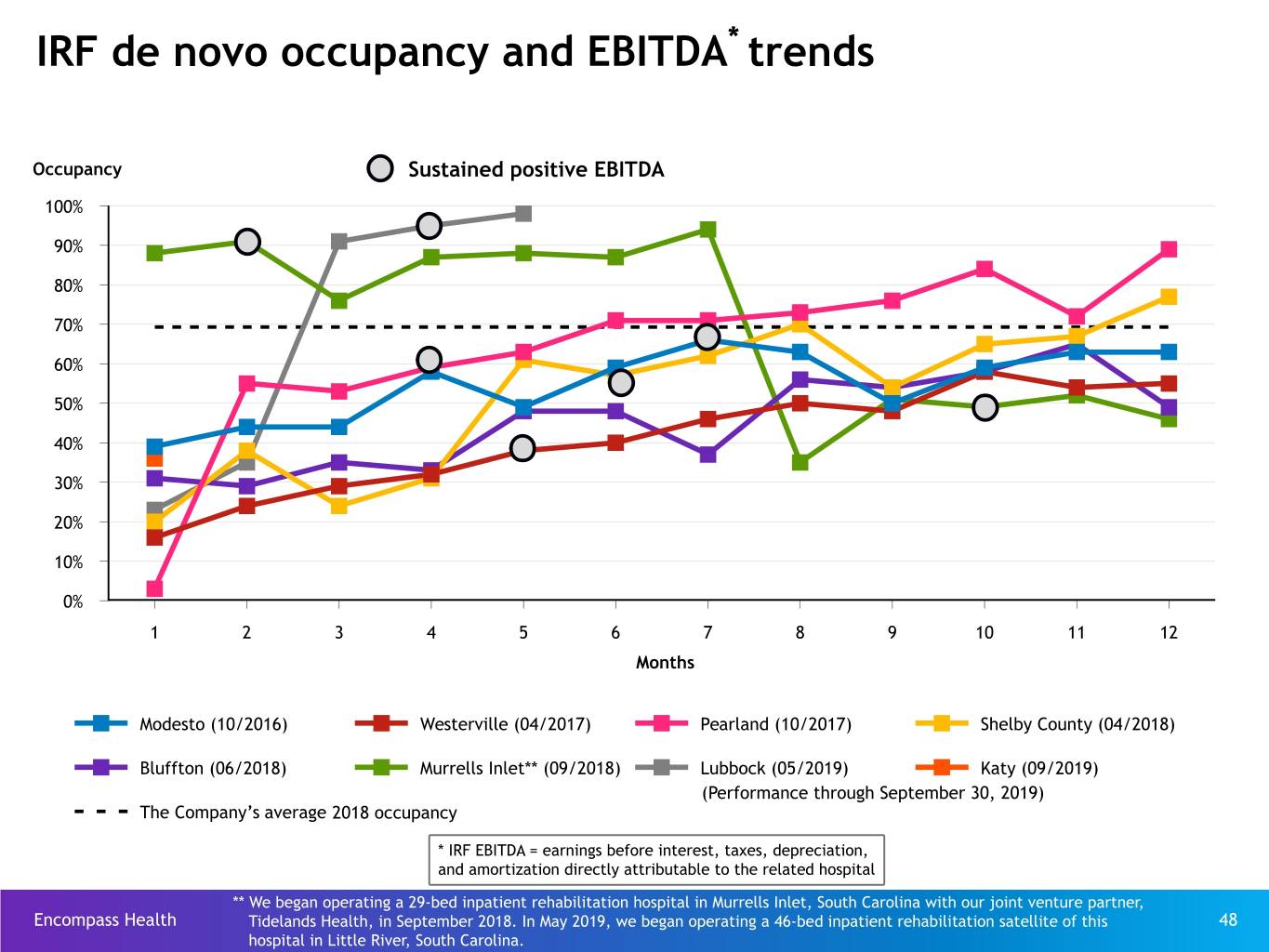

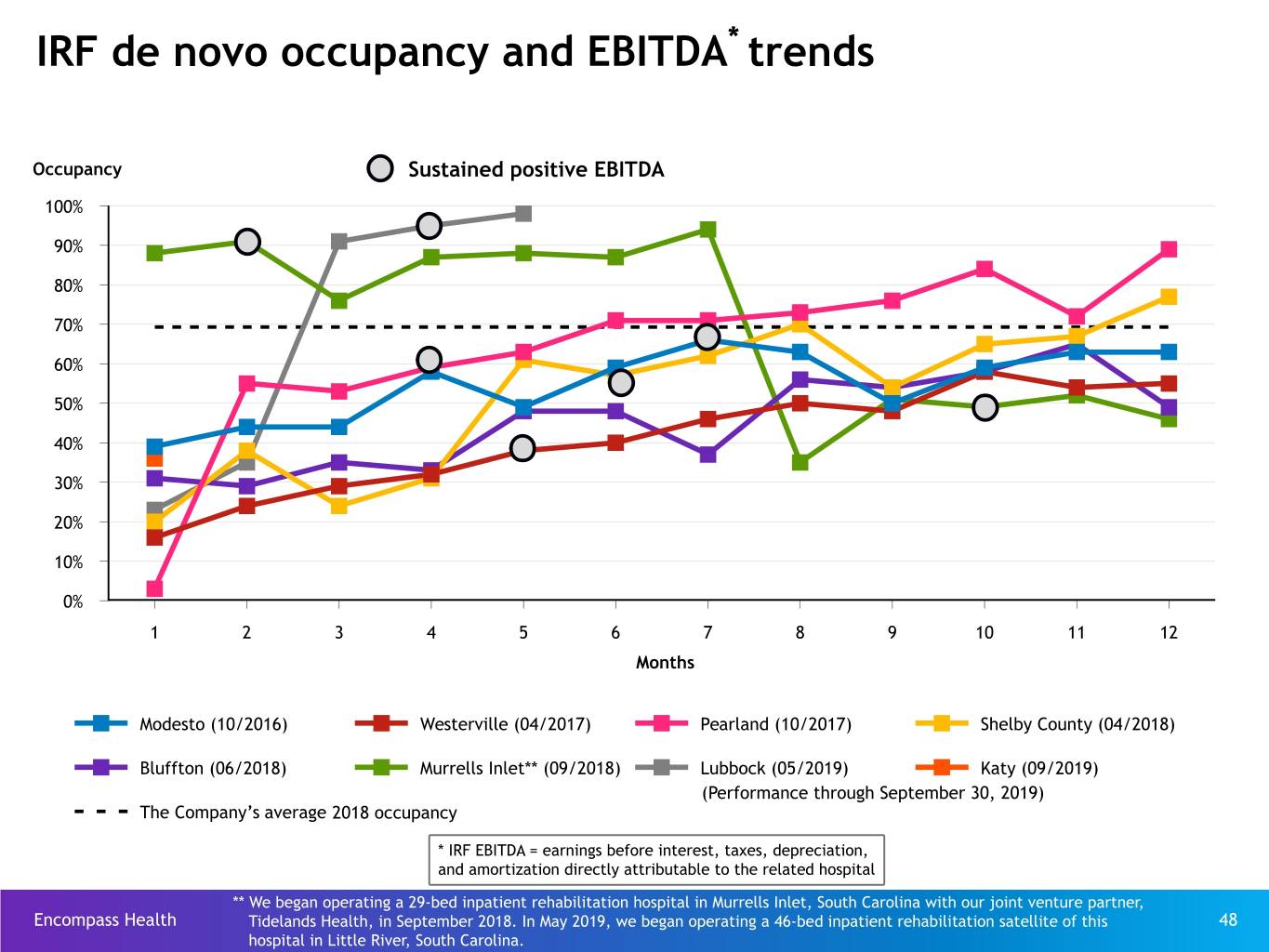

IRF de novo occupancy and EBITDA* trends Occupancy Sustained positive EBITDA 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 1 2 3 4 5 6 7 8 9 10 11 12 Months Modesto (10/2016) Westerville (04/2017) Pearland (10/2017) Shelby County (04/2018) Bluffton (06/2018) Murrells Inlet** (09/2018) Lubbock (05/2019) Katy (09/2019) (Performance through September 30, 2019) The Company’s average 2018 occupancy * IRF EBITDA = earnings before interest, taxes, depreciation, and amortization directly attributable to the related hospital ** We began operating a 29-bed inpatient rehabilitation hospital in Murrells Inlet, South Carolina with our joint venture partner, Encompass Health Tidelands Health, in September 2018. In May 2019, we began operating a 46-bed inpatient rehabilitation satellite of this 48 hospital in Little River, South Carolina.

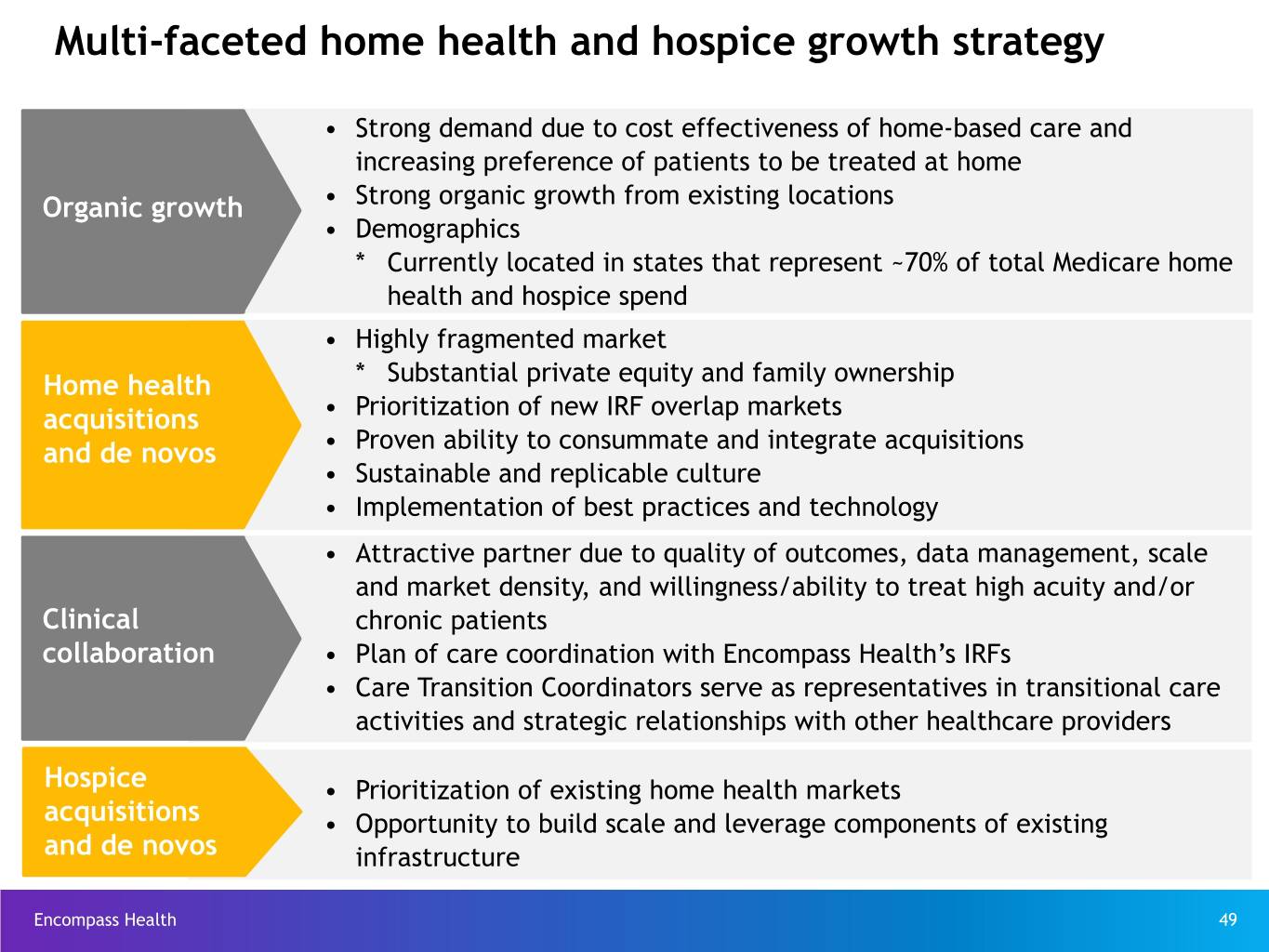

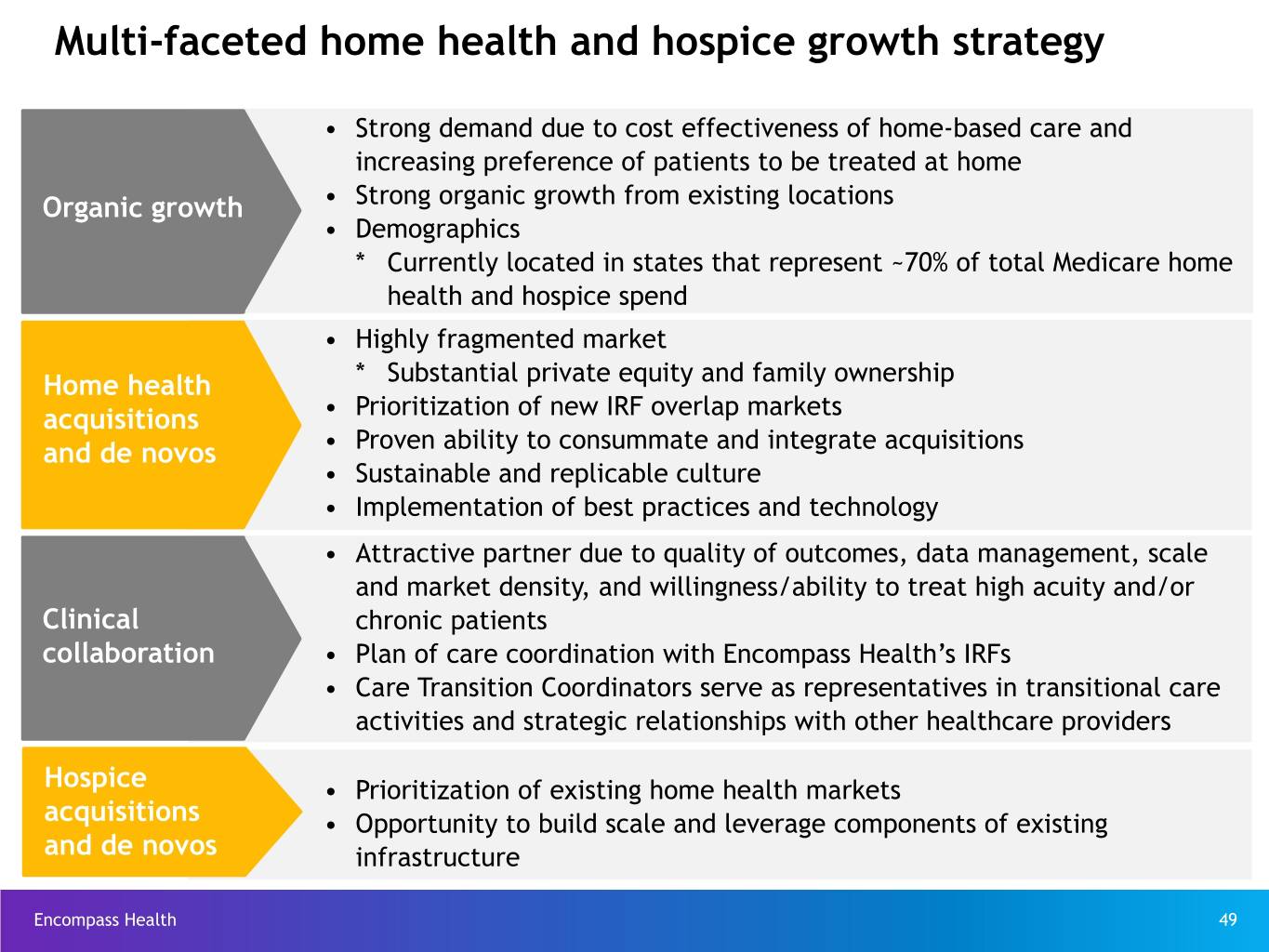

Multi-faceted home health and hospice growth strategy • Strong demand due to cost effectiveness of home-based care and increasing preference of patients to be treated at home Organic growth • Strong organic growth from existing locations • Demographics * Currently located in states that represent ~70% of total Medicare home health and hospice spend • Highly fragmented market Home health * Substantial private equity and family ownership acquisitions • Prioritization of new IRF overlap markets and de novos • Proven ability to consummate and integrate acquisitions • Sustainable and replicable culture • Implementation of best practices and technology • Attractive partner due to quality of outcomes, data management, scale and market density, and willingness/ability to treat high acuity and/or Clinical chronic patients collaboration • Plan of care coordination with Encompass Health’s IRFs • Care Transition Coordinators serve as representatives in transitional care activities and strategic relationships with other healthcare providers Hospice • Prioritization of existing home health markets acquisitions • Opportunity to build scale and leverage components of existing and de novos infrastructure Encompass Health 49

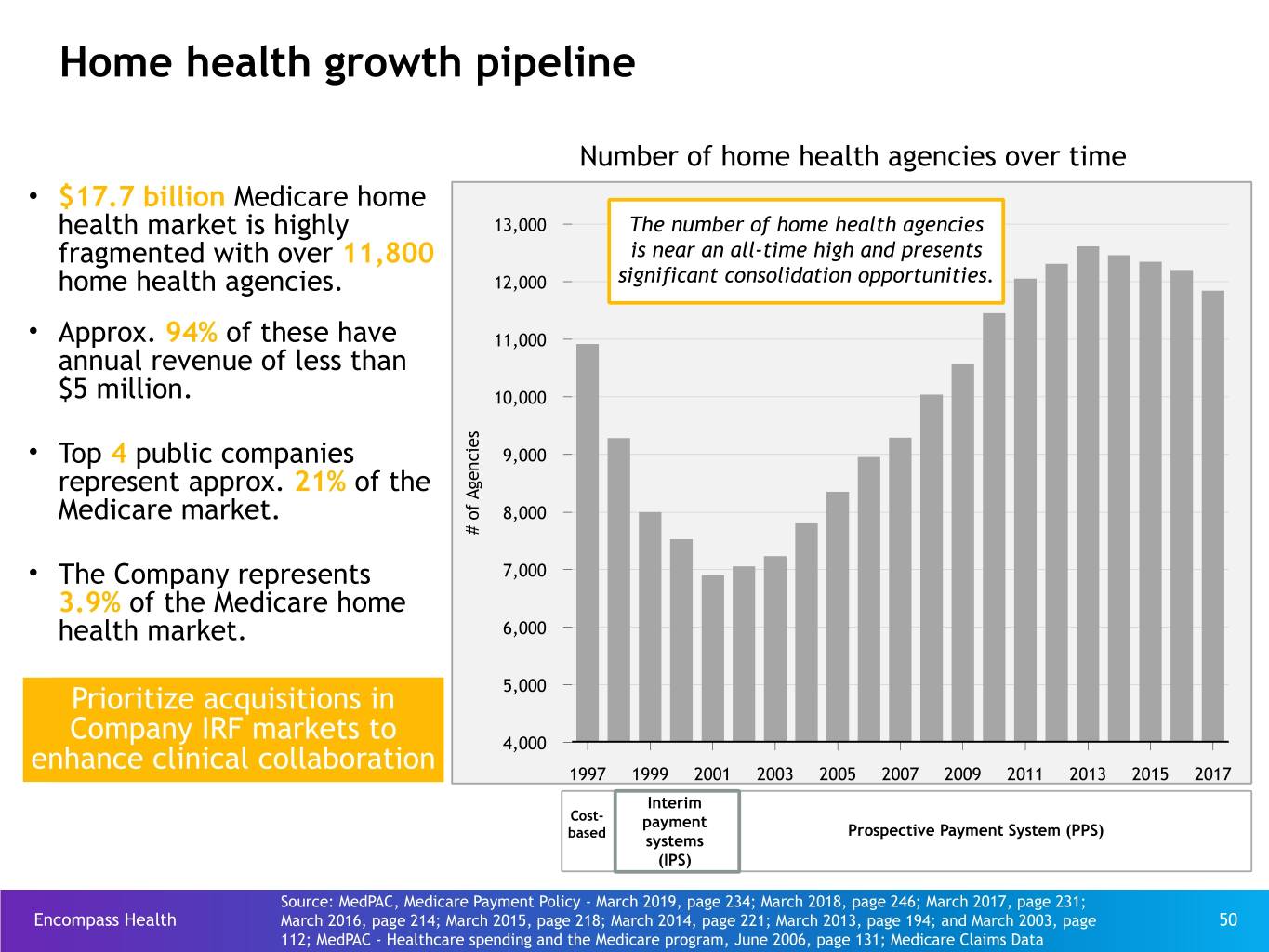

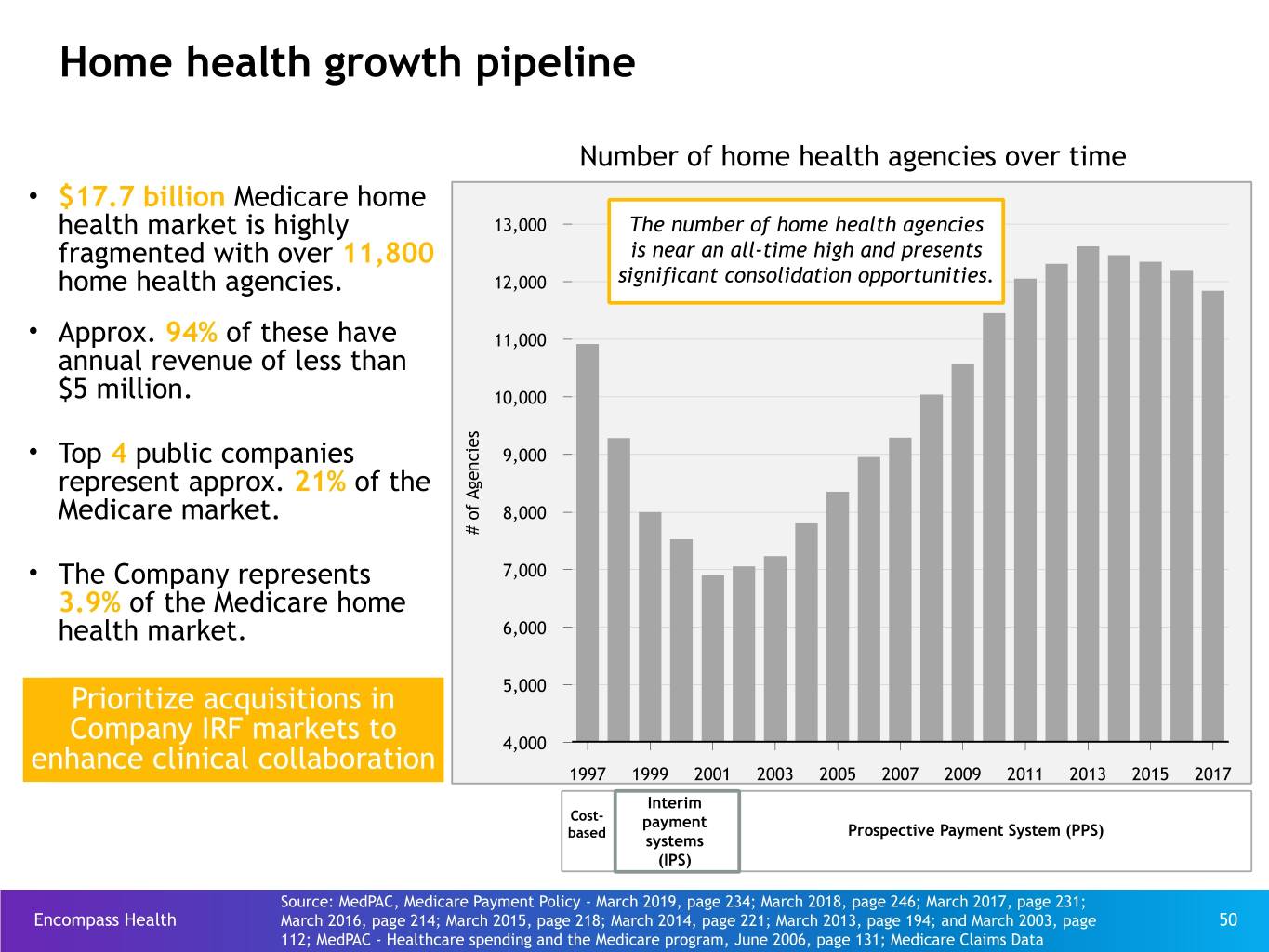

Home health growth pipeline Number of home health agencies over time • $17.7 billion Medicare home health market is highly 13,000 The number of home health agencies fragmented with over 11,800 is near an all-time high and presents home health agencies. 12,000 significant consolidation opportunities. • Approx. 94% of these have 11,000 annual revenue of less than $5 million. 10,000 s e i • Top 4 public companies c 9,000 n e represent approx. 21% of the g A f Medicare market. o 8,000 # • The Company represents 7,000 3.9% of the Medicare home health market. 6,000 Prioritize acquisitions in 5,000 Company IRF markets to 4,000 enhance clinical collaboration 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 Interim Cost- payment based Prospective Payment System (PPS) systems (IPS) Source: MedPAC, Medicare Payment Policy - March 2019, page 234; March 2018, page 246; March 2017, page 231; Encompass Health March 2016, page 214; March 2015, page 218; March 2014, page 221; March 2013, page 194; and March 2003, page 50 112; MedPAC - Healthcare spending and the Medicare program, June 2006, page 131; Medicare Claims Data

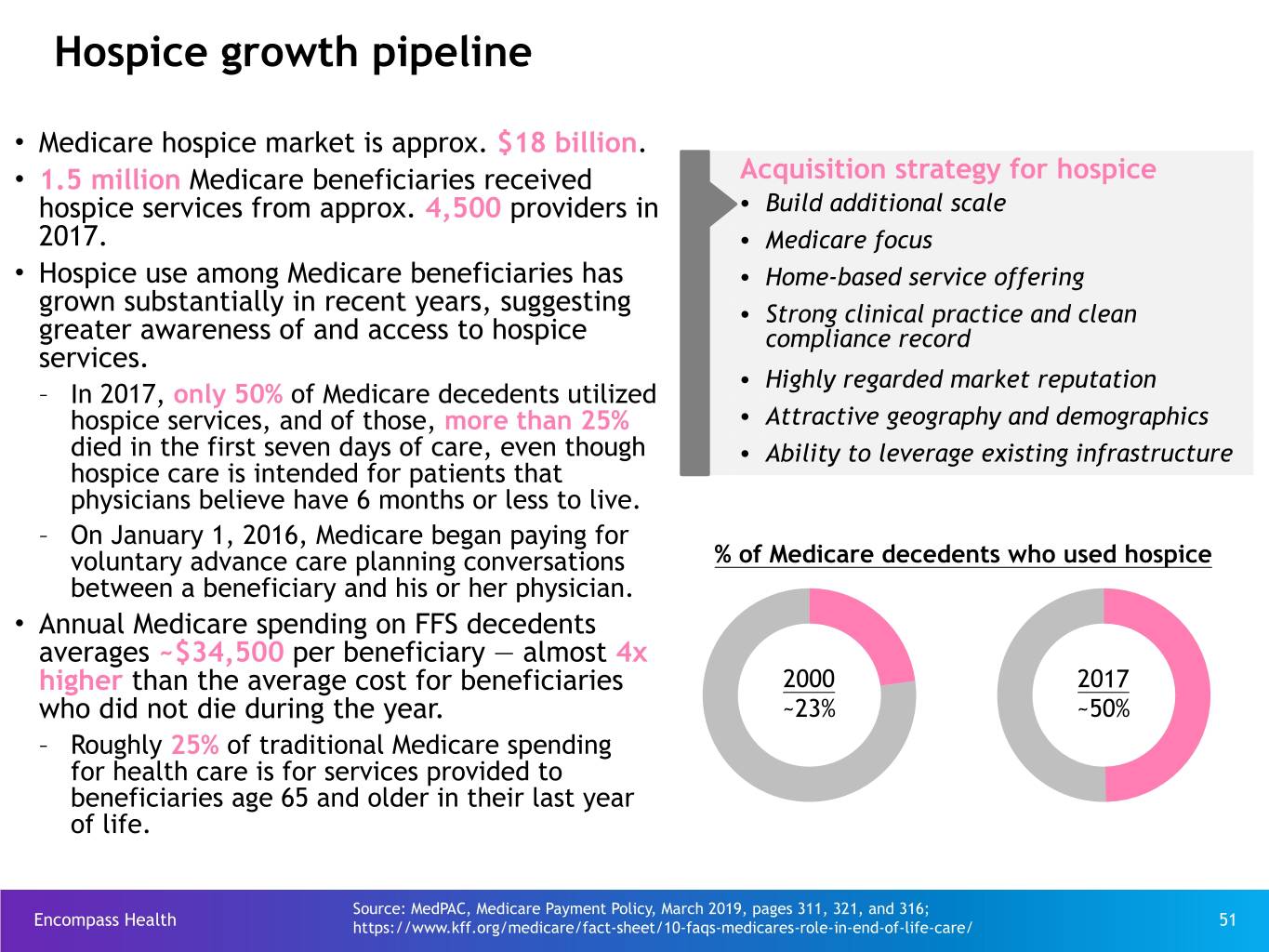

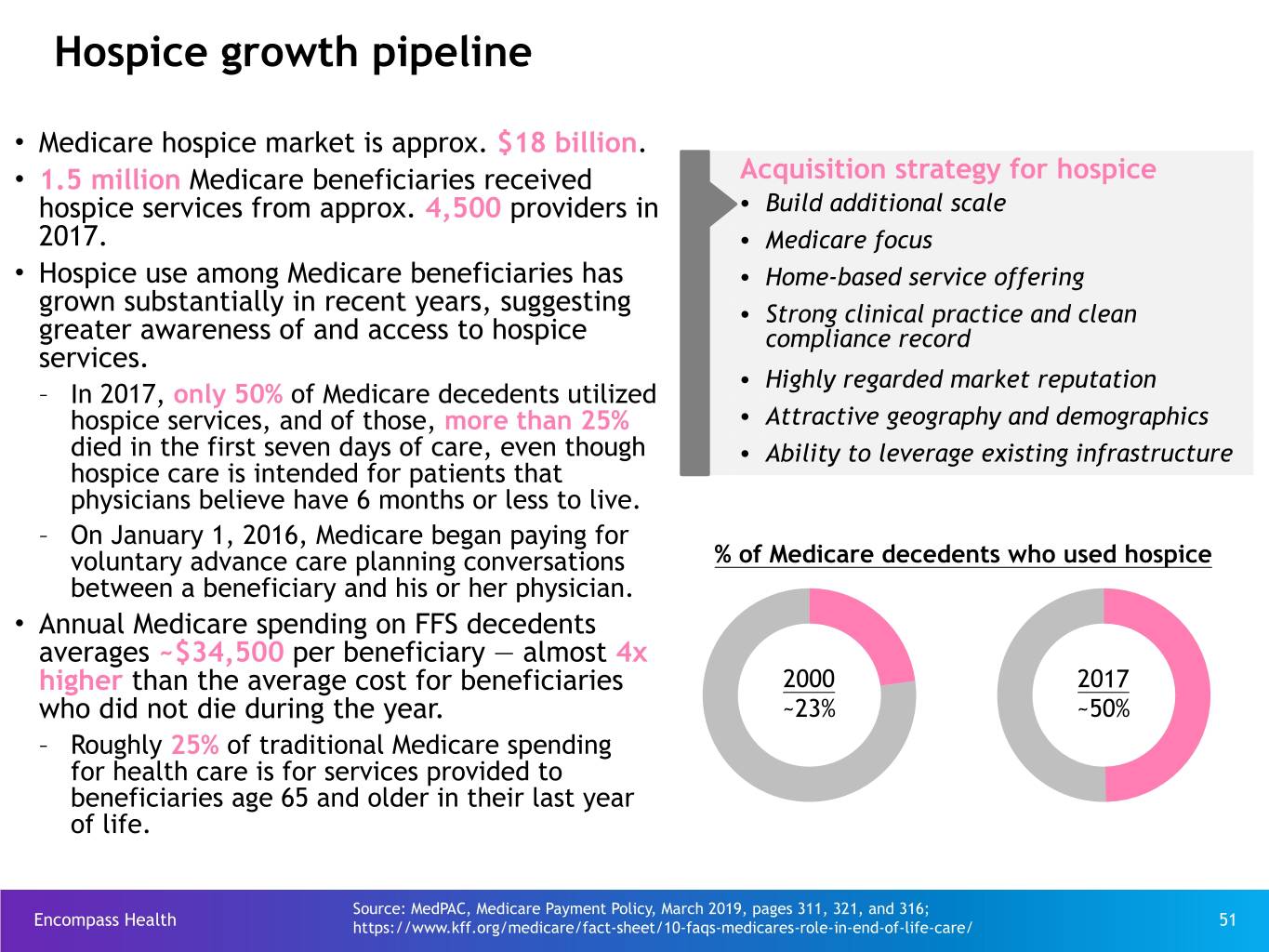

Hospice growth pipeline • Medicare hospice market is approx. $18 billion. • 1.5 million Medicare beneficiaries received Acquisition strategy for hospice hospice services from approx. 4,500 providers in • Build additional scale 2017. • Medicare focus • Hospice use among Medicare beneficiaries has • Home-based service offering grown substantially in recent years, suggesting • Strong clinical practice and clean greater awareness of and access to hospice compliance record services. • Highly regarded market reputation – In 2017, only 50% of Medicare decedents utilized hospice services, and of those, more than 25% • Attractive geography and demographics died in the first seven days of care, even though • Ability to leverage existing infrastructure hospice care is intended for patients that physicians believe have 6 months or less to live. – On January 1, 2016, Medicare began paying for voluntary advance care planning conversations % of Medicare decedents who used hospice between a beneficiary and his or her physician. • Annual Medicare spending on FFS decedents averages ~$34,500 per beneficiary — almost 4x higher than the average cost for beneficiaries 2000 2017 who did not die during the year. ~23% ~50% – Roughly 25% of traditional Medicare spending for health care is for services provided to beneficiaries age 65 and older in their last year of life. Source: MedPAC, Medicare Payment Policy, March 2019, pages 311, 321, and 316; Encompass Health https://www.kff.org/medicare/fact-sheet/10-faqs-medicares-role-in-end-of-life-care/ 51

Operational Initiatives Our operational initiatives are designed to respond to regulatory changes, expand our services to more patients in need of our higher level of care, enhance our clinical expertise, and ensure the delivery of high-quality outcomes. Encompass Health 52

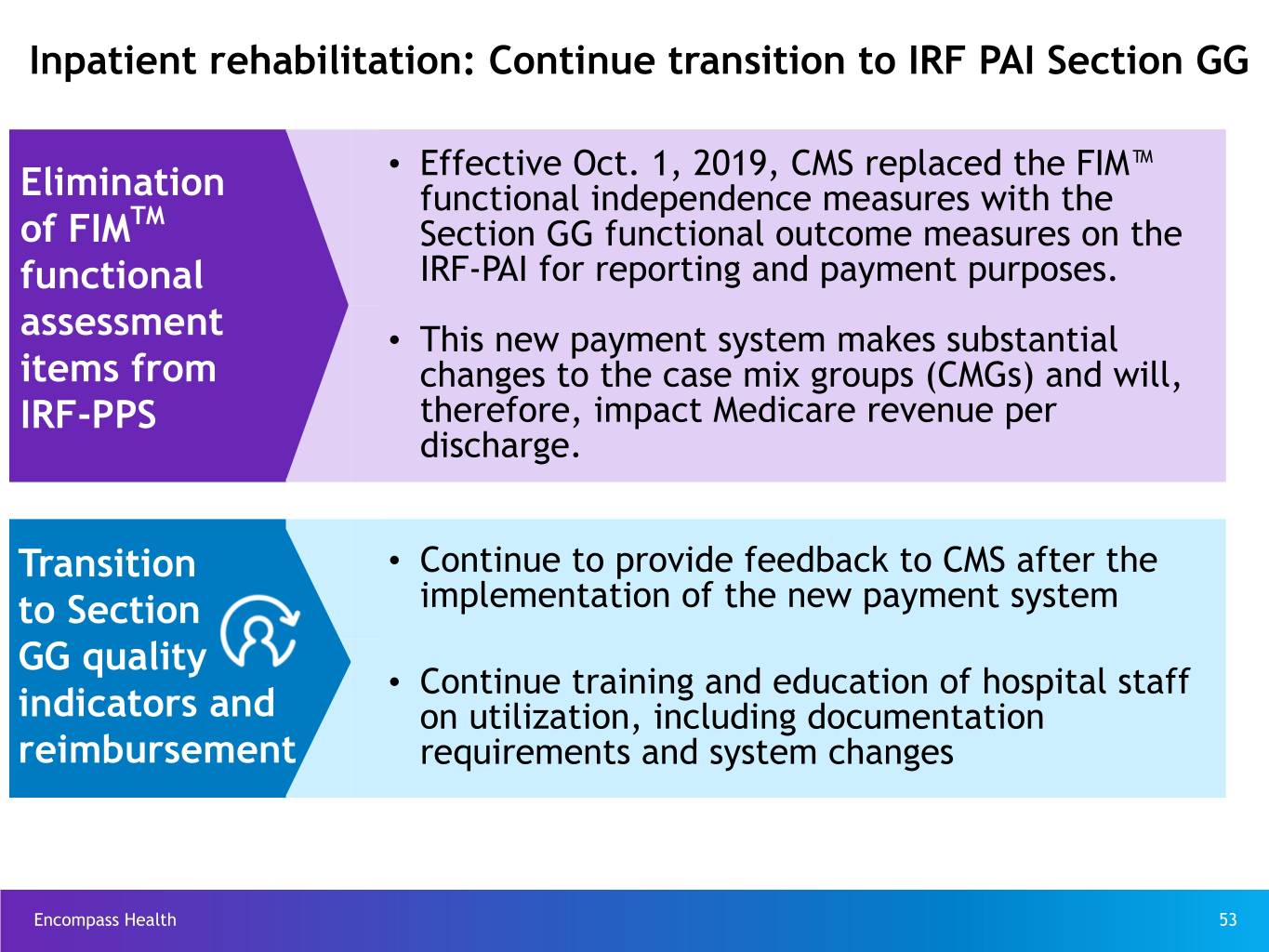

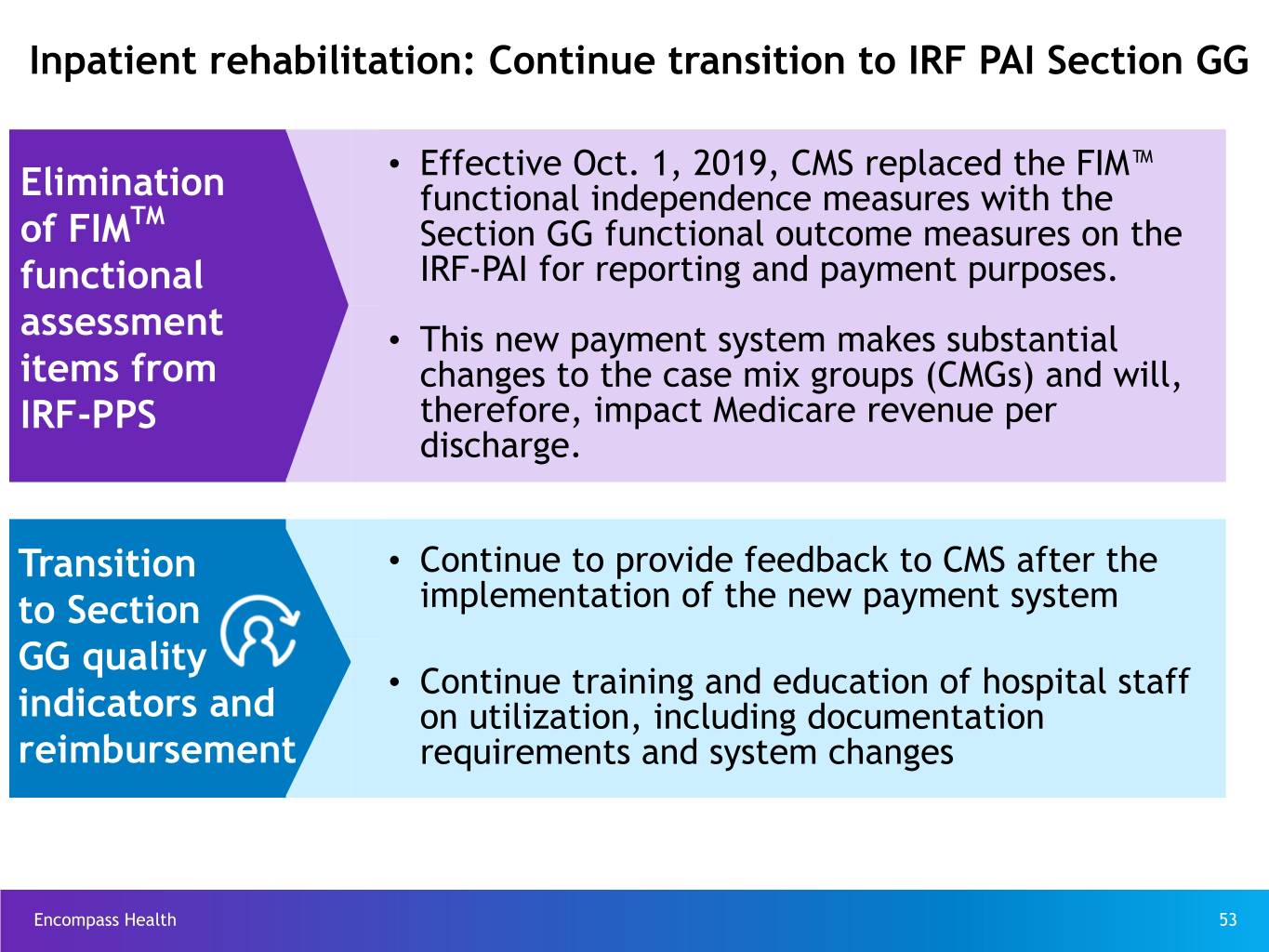

Inpatient rehabilitation: Continue transition to IRF PAI Section GG Elimination • Effective Oct. 1, 2019, CMS replaced the FIM™ TM functional independence measures with the of FIM Section GG functional outcome measures on the functional IRF-PAI for reporting and payment purposes. assessment • This new payment system makes substantial items from changes to the case mix groups (CMGs) and will, IRF-PPS therefore, impact Medicare revenue per discharge. Transition • Continue to provide feedback to CMS after the to Section implementation of the new payment system GG quality • Continue training and education of hospital staff indicators and on utilization, including documentation reimbursement requirements and system changes Encompass Health 53

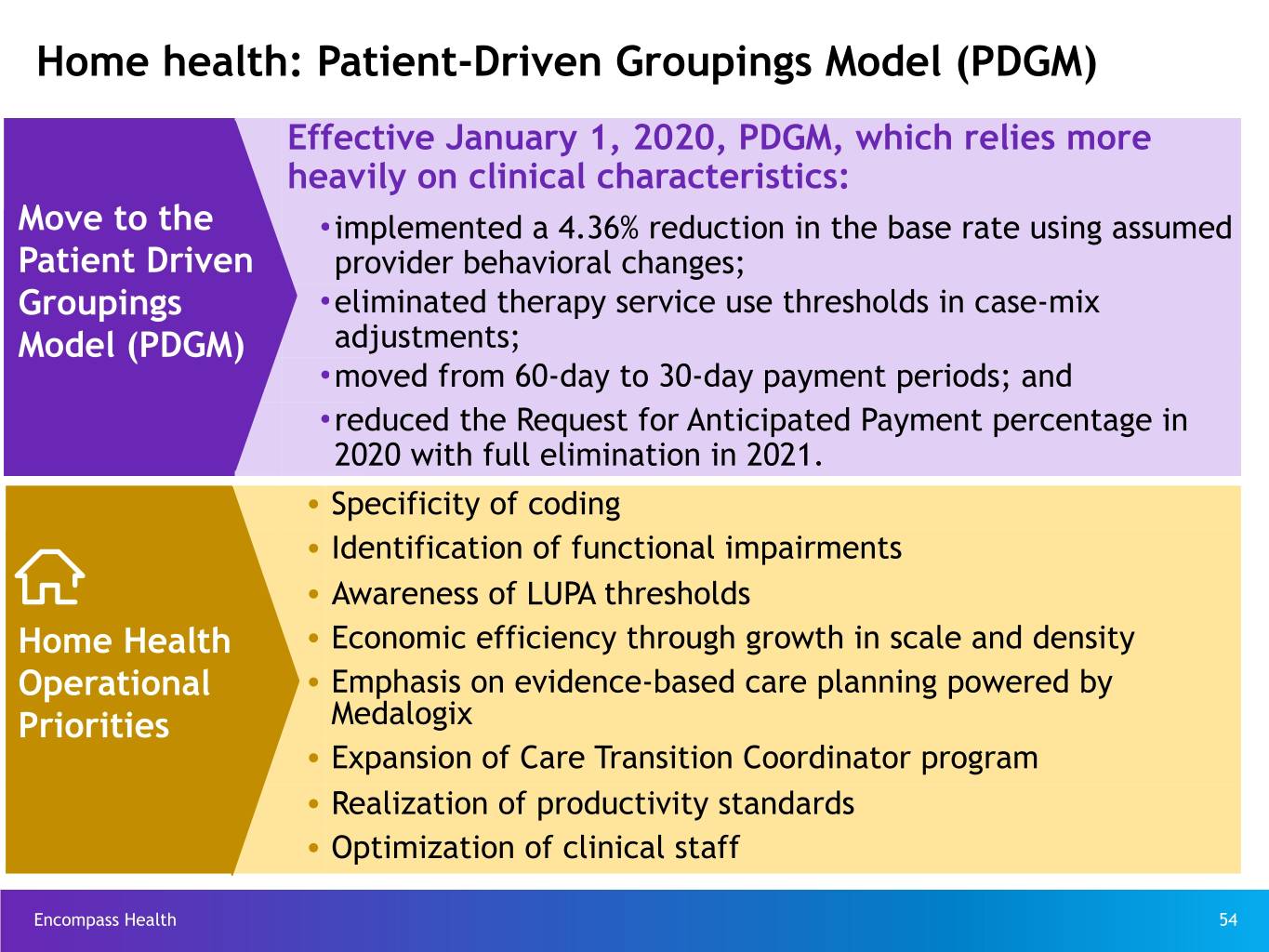

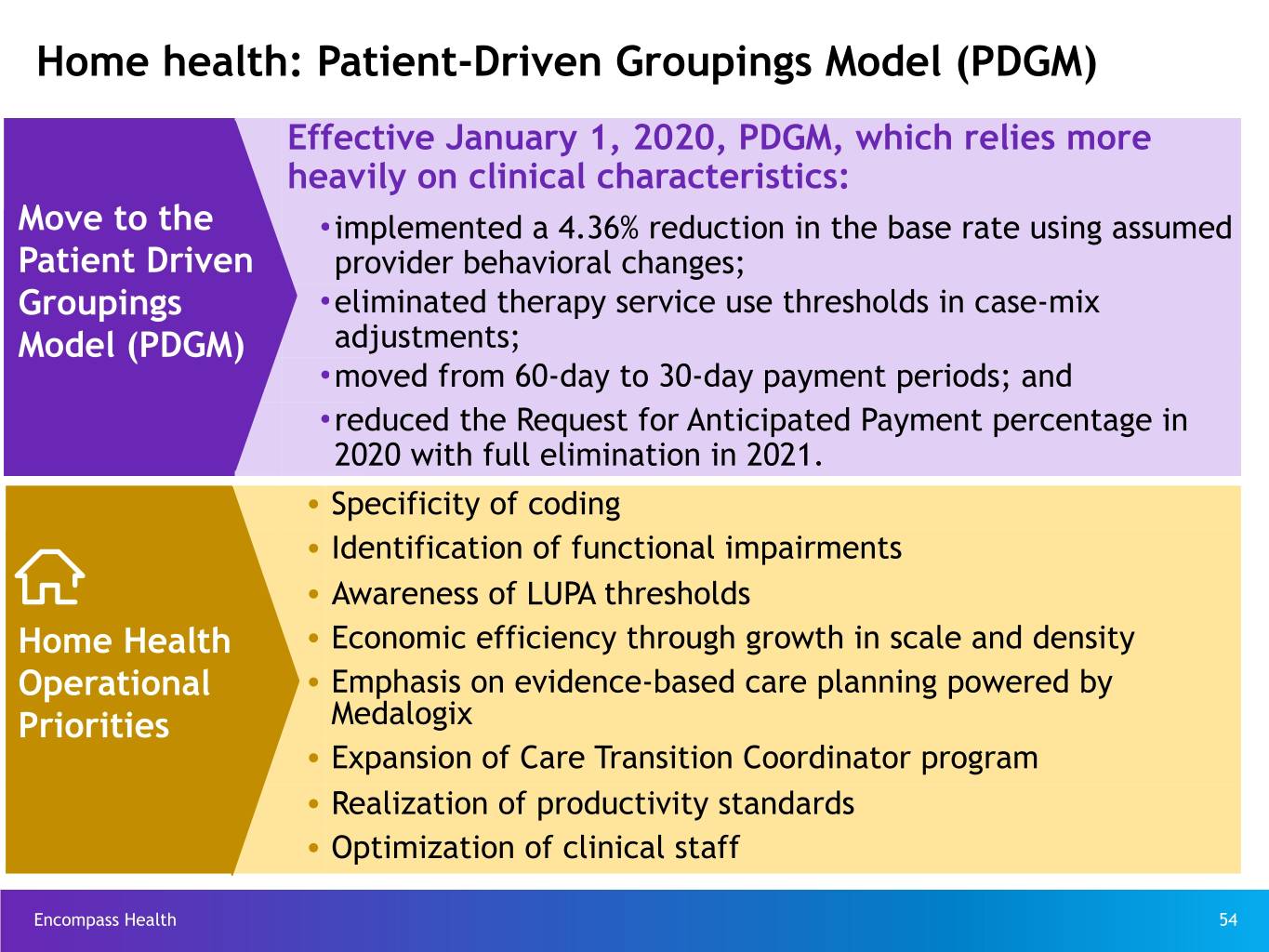

Home health: Patient-Driven Groupings Model (PDGM) Effective January 1, 2020, PDGM, which relies more heavily on clinical characteristics: Move to the Ÿimplemented a 4.36% reduction in the base rate using assumed Patient Driven provider behavioral changes; Groupings Ÿeliminated therapy service use thresholds in case-mix Model (PDGM) adjustments; Ÿmoved from 60-day to 30-day payment periods; and Ÿreduced the Request for Anticipated Payment percentage in 2020 with full elimination in 2021. Ÿ Specificity of coding Ÿ Identification of functional impairments Ÿ Awareness of LUPA thresholds Home Health Ÿ Economic efficiency through growth in scale and density Operational Ÿ Emphasis on evidence-based care planning powered by Priorities Medalogix Ÿ Expansion of Care Transition Coordinator program Ÿ Realization of productivity standards Ÿ Optimization of clinical staff Encompass Health 54

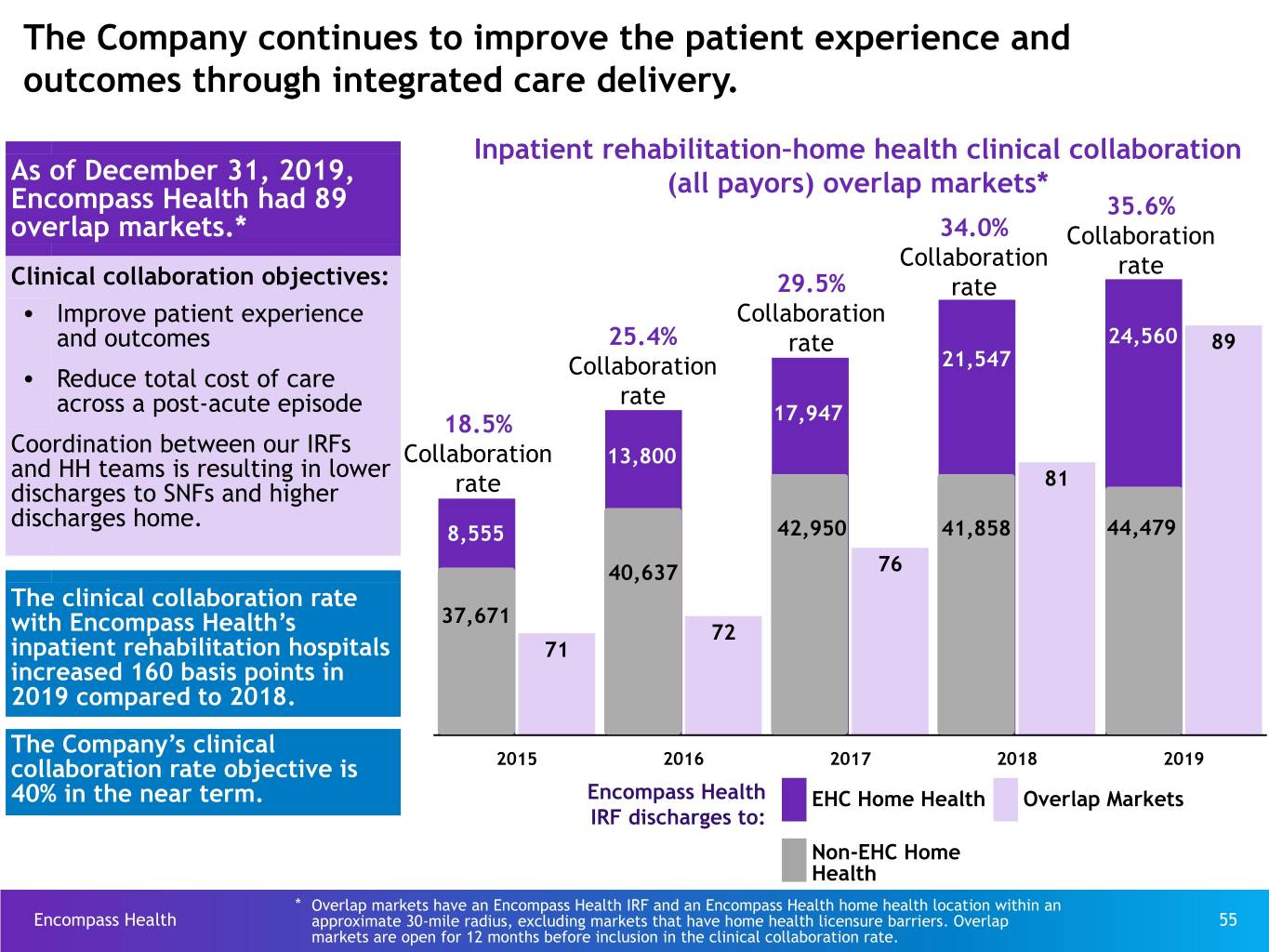

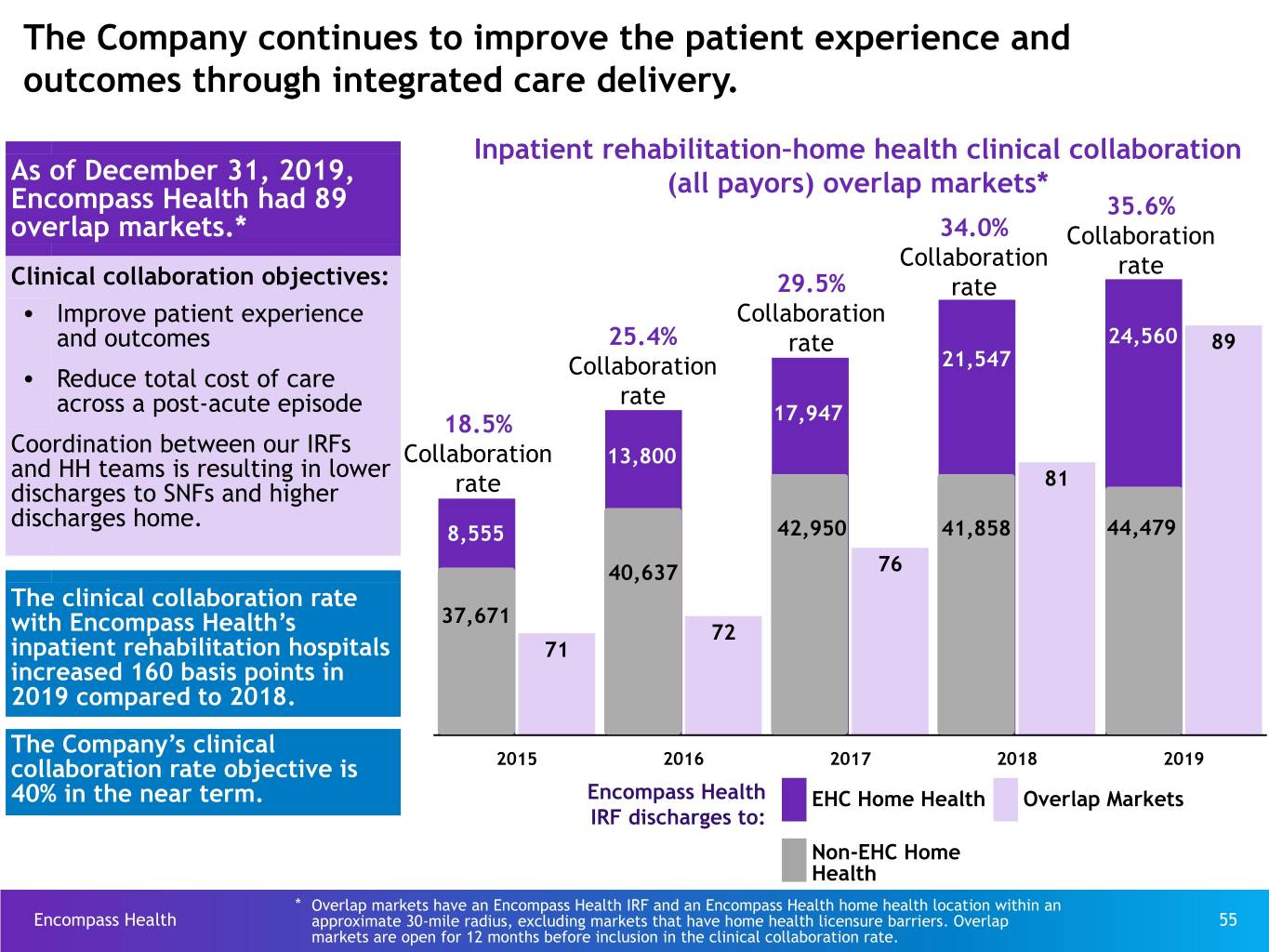

The Company continues to improve the patient experience and outcomes through integrated care delivery. Inpatient rehabilitation–home health clinical collaboration As of December 31, 2019, (all payors) overlap markets* Encompass Health had 89 35.6% overlap markets.* 34.0% Collaboration Collaboration rate Clinical collaboration objectives: 29.5% rate Ÿ Improve patient experience Collaboration and outcomes 25.4% rate 24,560 89 Collaboration 21,547 Ÿ Reduce total cost of care across a post-acute episode rate 18.5% 17,947 Coordination between our IRFs Collaboration 13,800 and HH teams is resulting in lower 81 discharges to SNFs and higher rate discharges home. 8,555 42,950 41,858 44,479 40,637 76 The clinical collaboration rate 37,671 with Encompass Health’s 72 inpatient rehabilitation hospitals 71 increased 160 basis points in 2019 compared to 2018. The Company’s clinical collaboration rate objective is 2015 2016 2017 2018 2019 40% in the near term. Encompass Health EHC Home Health Overlap Markets IRF discharges to: Non-EHC Home Health * Overlap markets have an Encompass Health IRF and an Encompass Health home health location within an Encompass Health approximate 30-mile radius, excluding markets that have home health licensure barriers. Overlap 55 markets are open for 12 months before inclusion in the clinical collaboration rate.

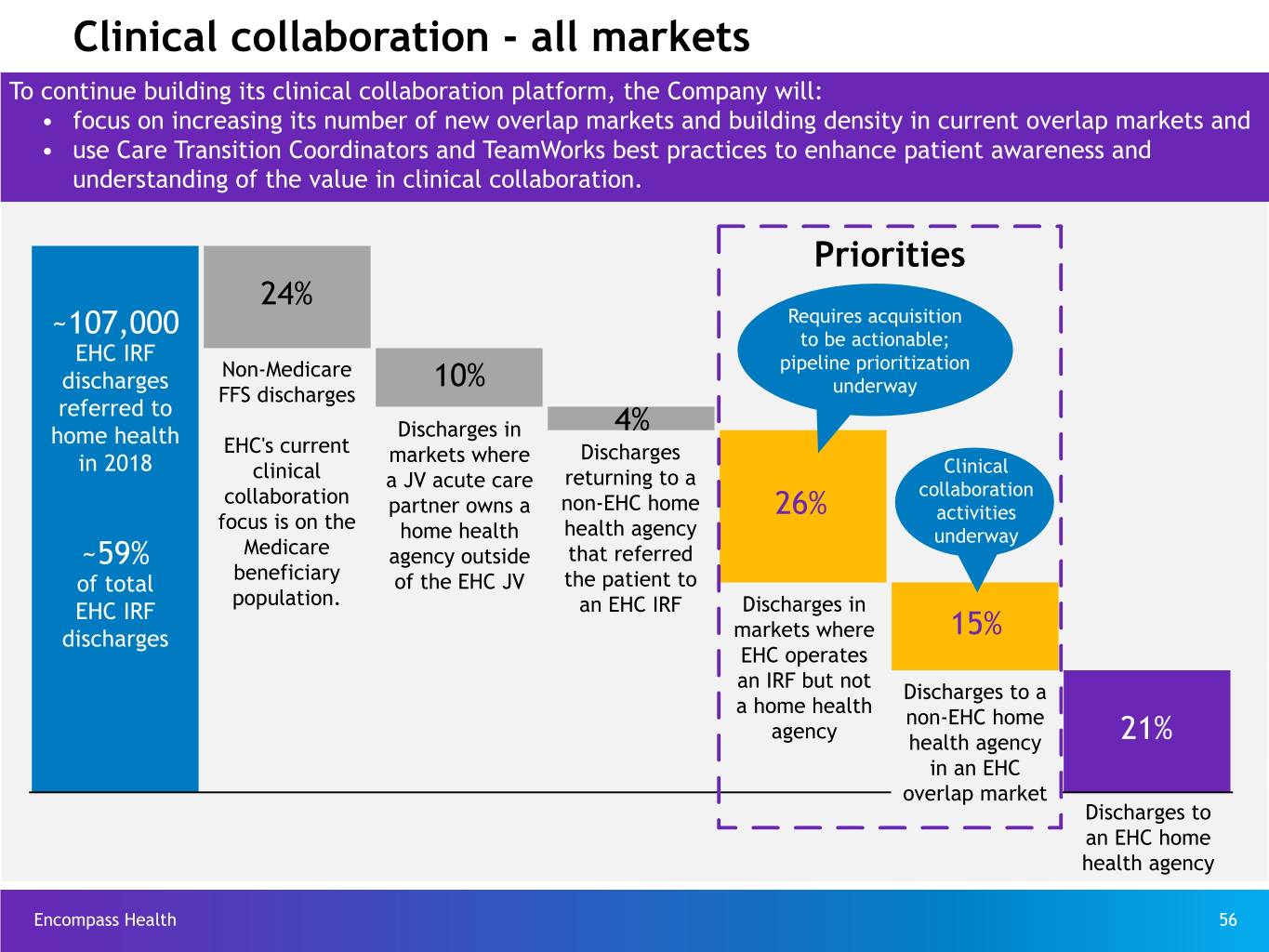

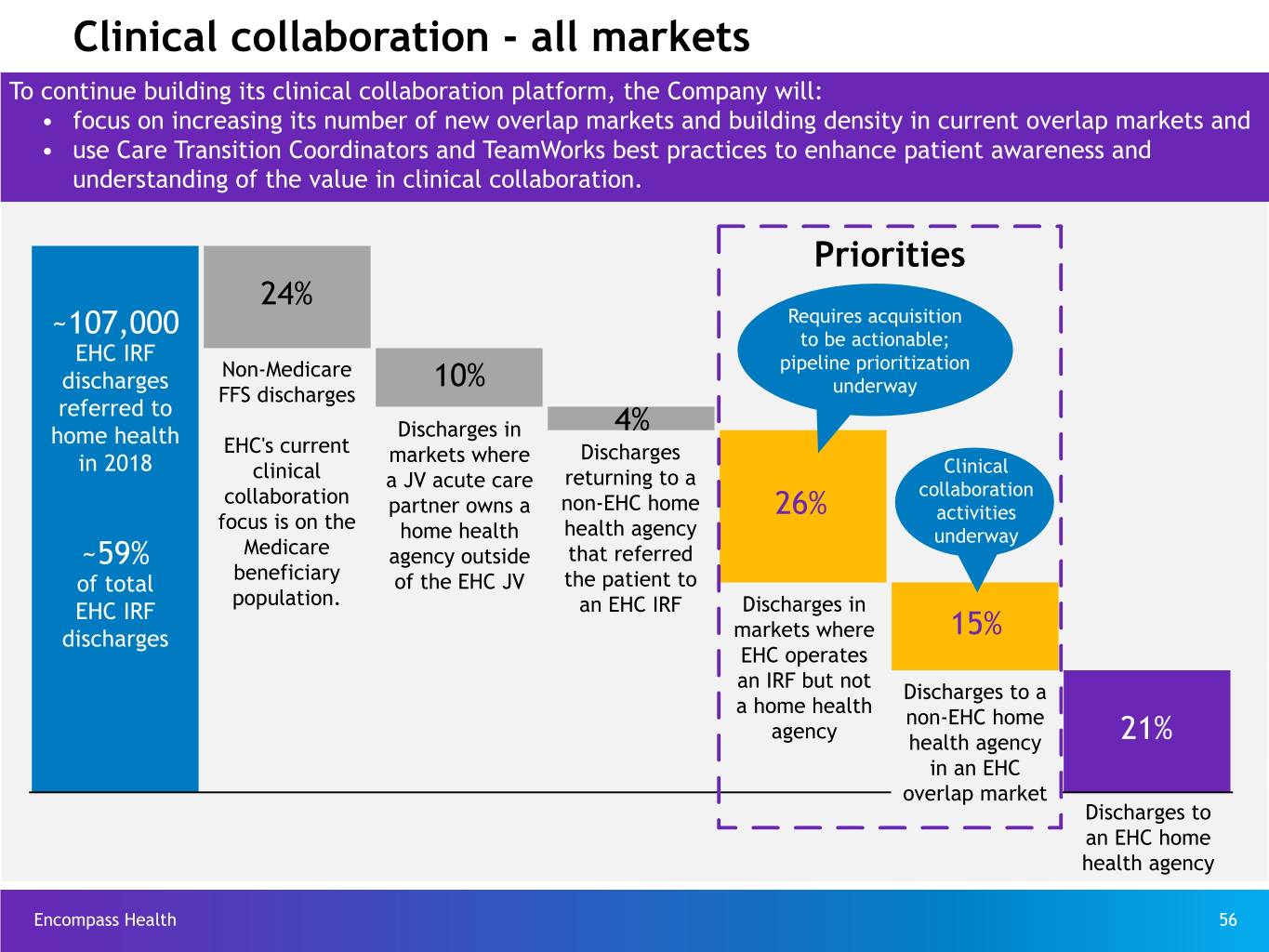

Clinical collaboration - all markets To continue building its clinical collaboration platform, the Company will: • focus on increasing its number of new overlap markets and building density in current overlap markets and • use Care Transition Coordinators and TeamWorks best practices to enhance patient awareness and understanding of the value in clinical collaboration. Priorities 24% ~107,000 Requires acquisition to be actionable; EHC IRF pipeline prioritization discharges Non-Medicare 10% FFS discharges underway referred to home health Discharges in 4% EHC's current markets where Discharges in 2018 Clinical clinical returning to a a JV acute care collaboration collaboration partner owns a non-EHC home 26% focus is on the activities home health health agency underway ~59% Medicare agency outside that referred of total beneficiary of the EHC JV the patient to population. EHC IRF an EHC IRF Discharges in discharges markets where 15% EHC operates an IRF but not Discharges to a a home health non-EHC home agency health agency 21% in an EHC overlap market Discharges to an EHC home health agency Encompass Health 56

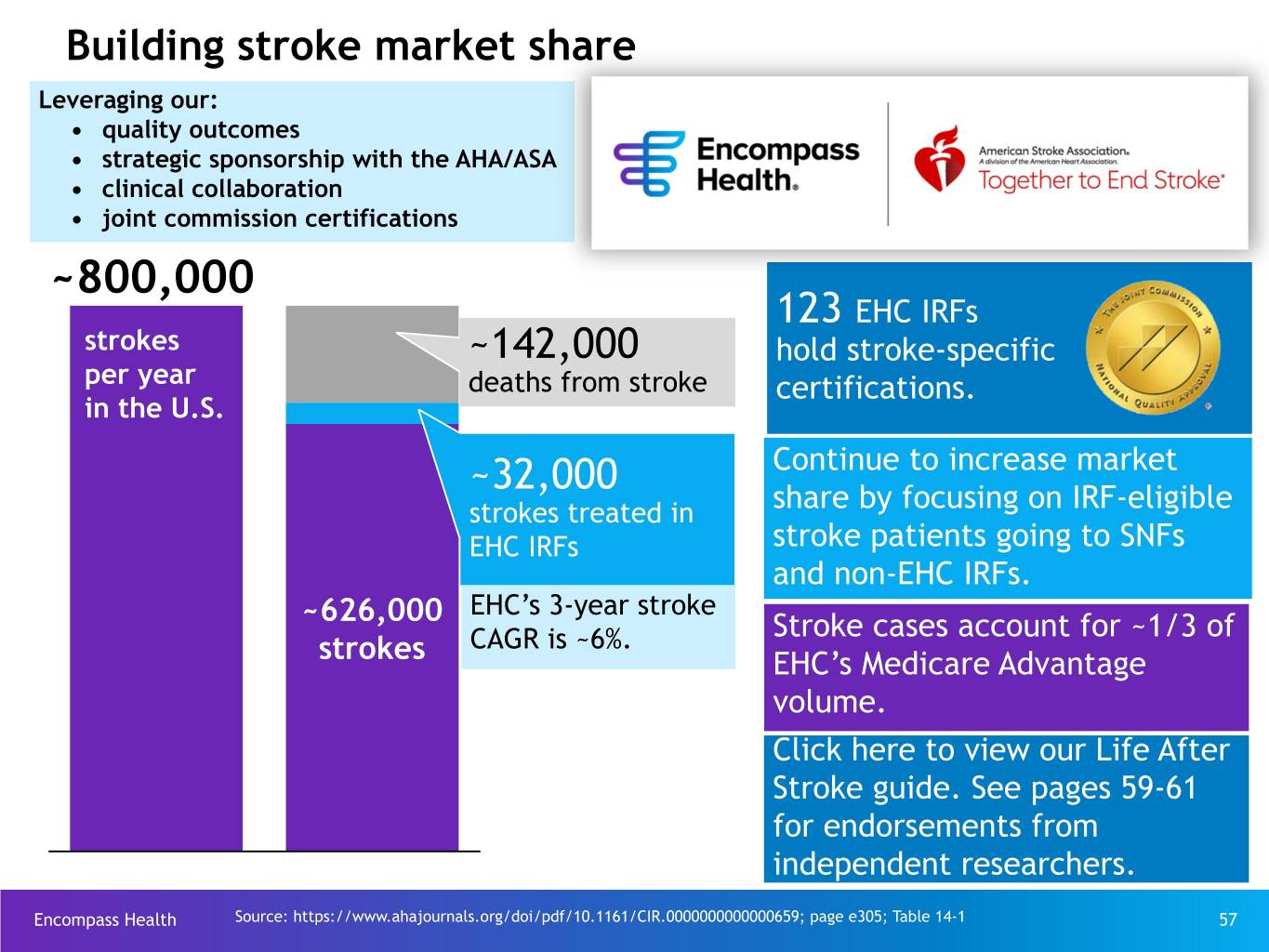

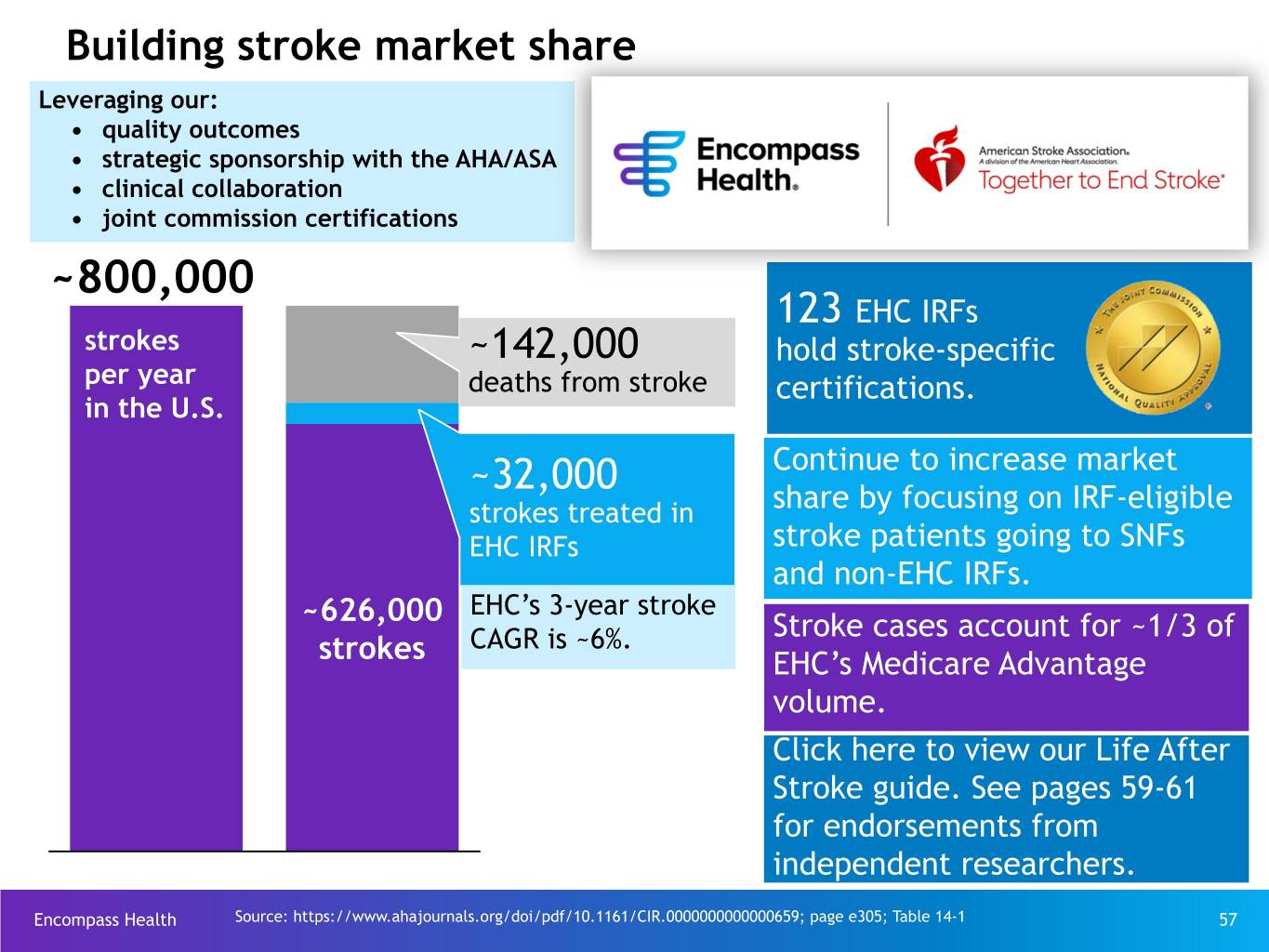

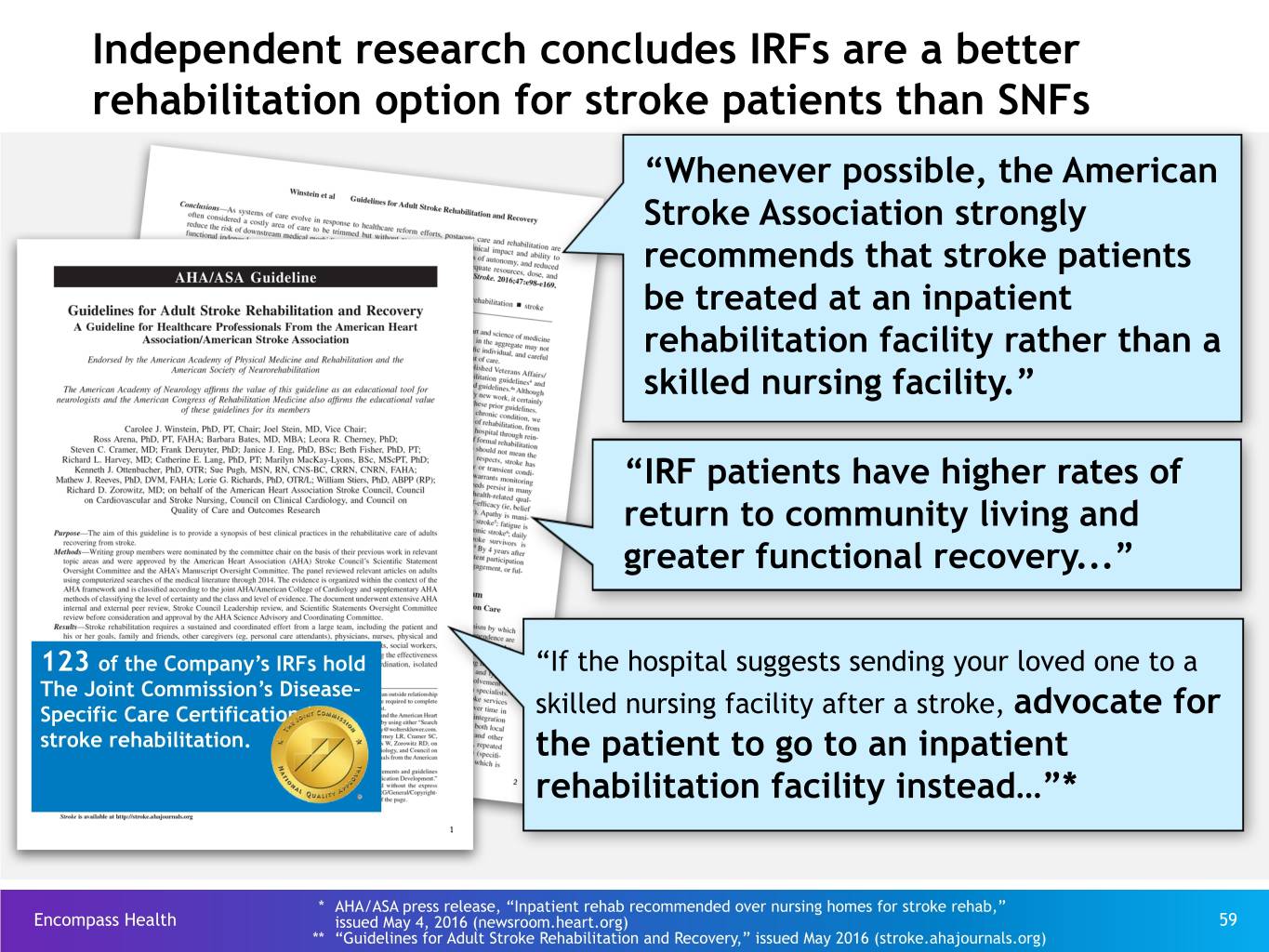

Building stroke market share Leveraging our: • quality outcomes • strategic sponsorship with the AHA/ASA • clinical collaboration • joint commission certifications ~800,000 123 EHC IRFs strokes ~142,000 hold stroke-specific per year deaths from stroke certifications. in the U.S. ~32,000 Continue to increase market strokes treated in share by focusing on IRF-eligible EHC IRFs stroke patients going to SNFs and non-EHC IRFs. ~626,000 EHC’s 3-year stroke CAGR is ~6%. Stroke cases account for ~1/3 of strokes EHC’s Medicare Advantage volume. Click here to view our Life After Stroke guide. See pages 59-61 for endorsements from independent researchers. Encompass Health Source: https://www.ahajournals.org/doi/pdf/10.1161/CIR.0000000000000659; page e305; Table 14-1 57

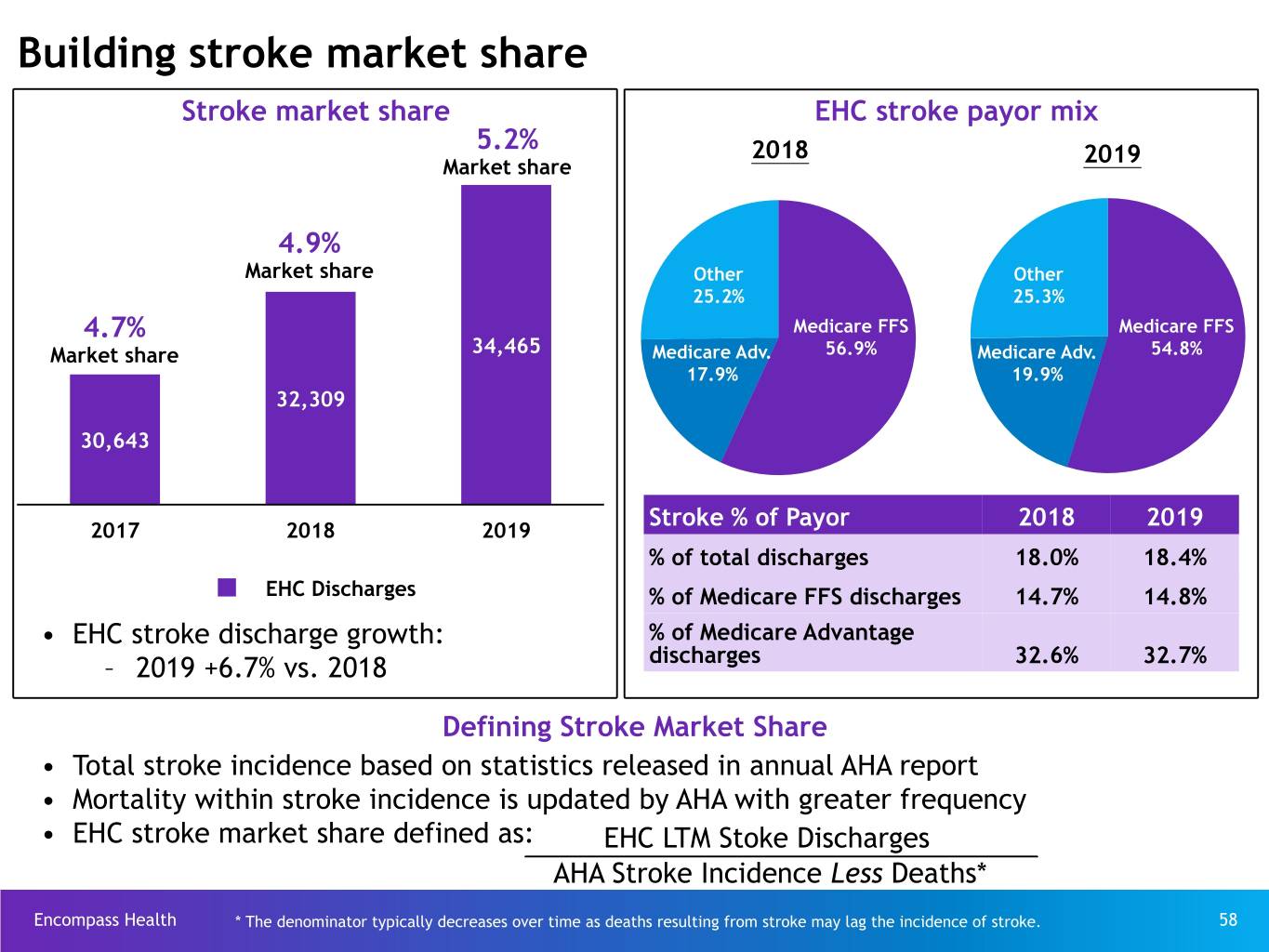

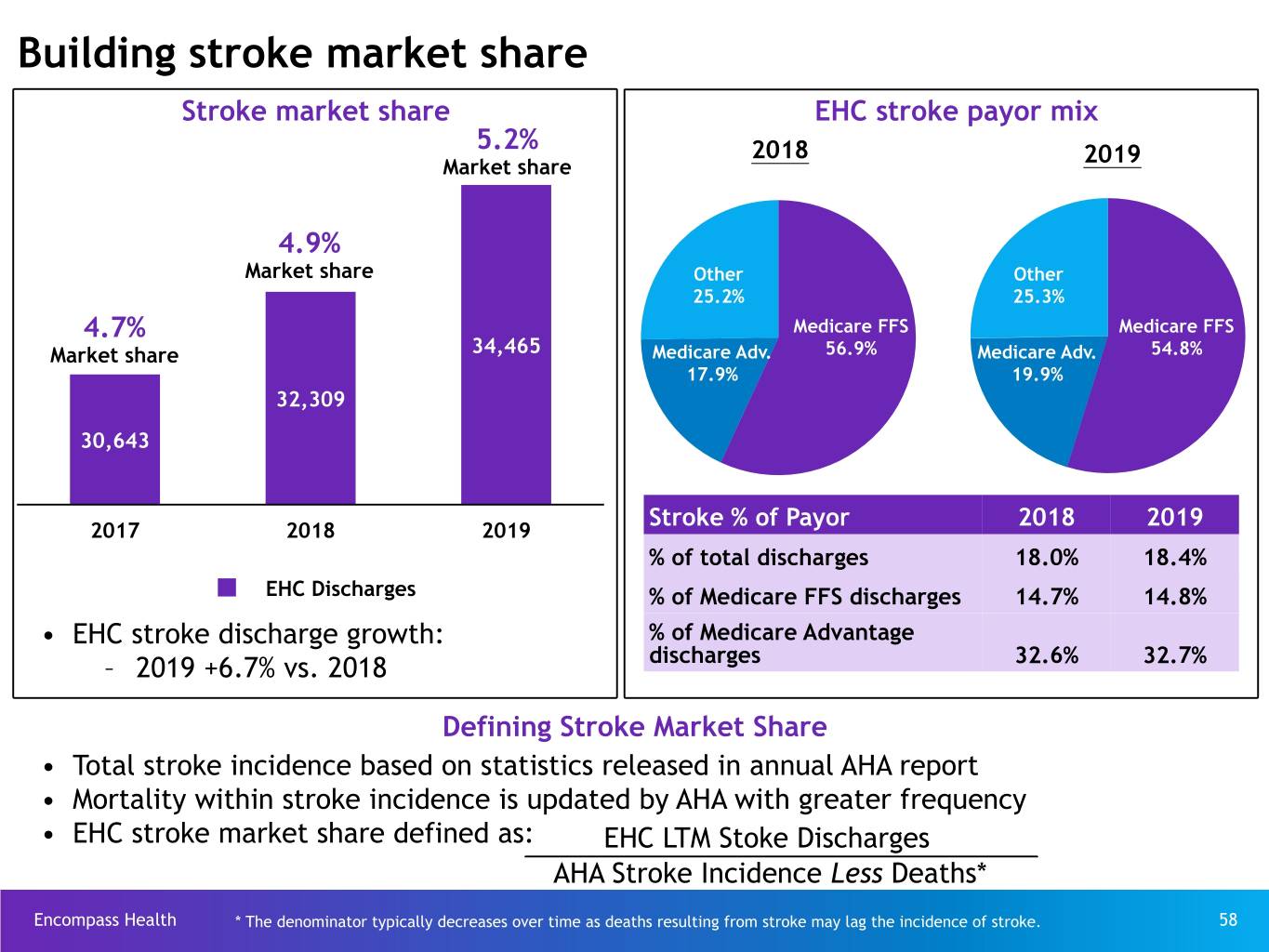

Building stroke market share Stroke market share EHC stroke payor mix 5.2% 2018 2019 Market share 4.9% Market share Other Other 25.2% 25.3% 4.7% Medicare FFS Medicare FFS Market share 34,465 Medicare Adv. 56.9% Medicare Adv. 54.8% 17.9% 19.9% 32,309 30,643 Stroke % of Payor 2018 2019 2017 2018 2019 % of total discharges 18.0% 18.4% EHC Discharges % of Medicare FFS discharges 14.7% 14.8% • EHC stroke discharge growth: % of Medicare Advantage – 2019 +6.7% vs. 2018 discharges 32.6% 32.7% Defining Stroke Market Share • Total stroke incidence based on statistics released in annual AHA report • Mortality within stroke incidence is updated by AHA with greater frequency • EHC stroke market share defined as: EHC LTM Stoke Discharges AHA Stroke Incidence Less Deaths* Encompass Health * The denominator typically decreases over time as deaths resulting from stroke may lag the incidence of stroke. 58

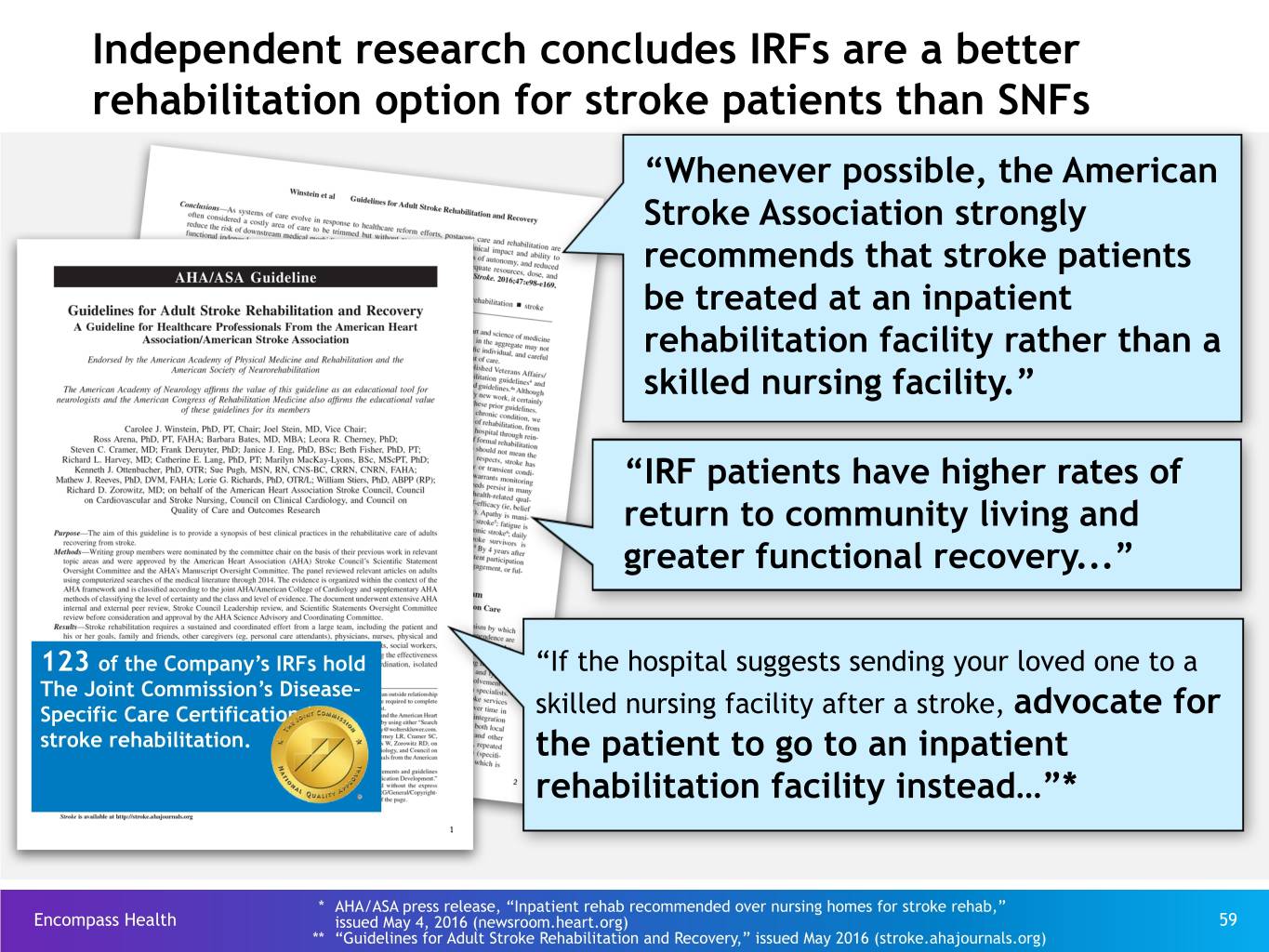

Independent research concludes IRFs are a better rehabilitation option for stroke patients than SNFs “Whenever possible, the American Stroke Association strongly recommends that stroke patients be treated at an inpatient rehabilitation facility rather than a skilled nursing facility.” “IRF patients have higher rates of return to community living and greater functional recovery...” 123 of the Company’s IRFs hold “If the hospital suggests sending your loved one to a The Joint Commission’s Disease- Specific Care Certification in skilled nursing facility after a stroke, advocate for stroke rehabilitation. the patient to go to an inpatient rehabilitation facility instead…”* * AHA/ASA press release, “Inpatient rehab recommended over nursing homes for stroke rehab,” Encompass Health issued May 4, 2016 (newsroom.heart.org) 59 ** “Guidelines for Adult Stroke Rehabilitation and Recovery,” issued May 2016 (stroke.ahajournals.org)

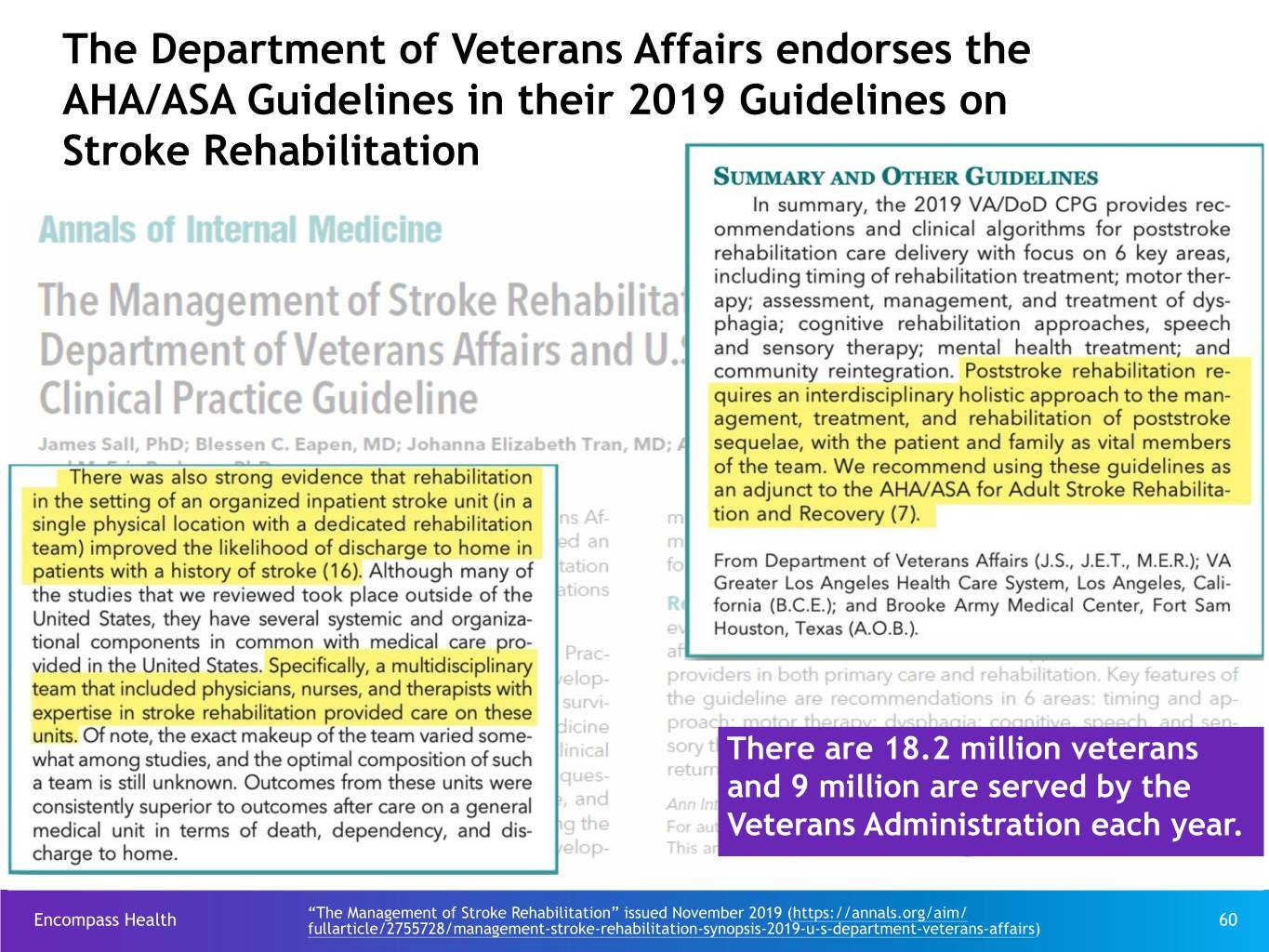

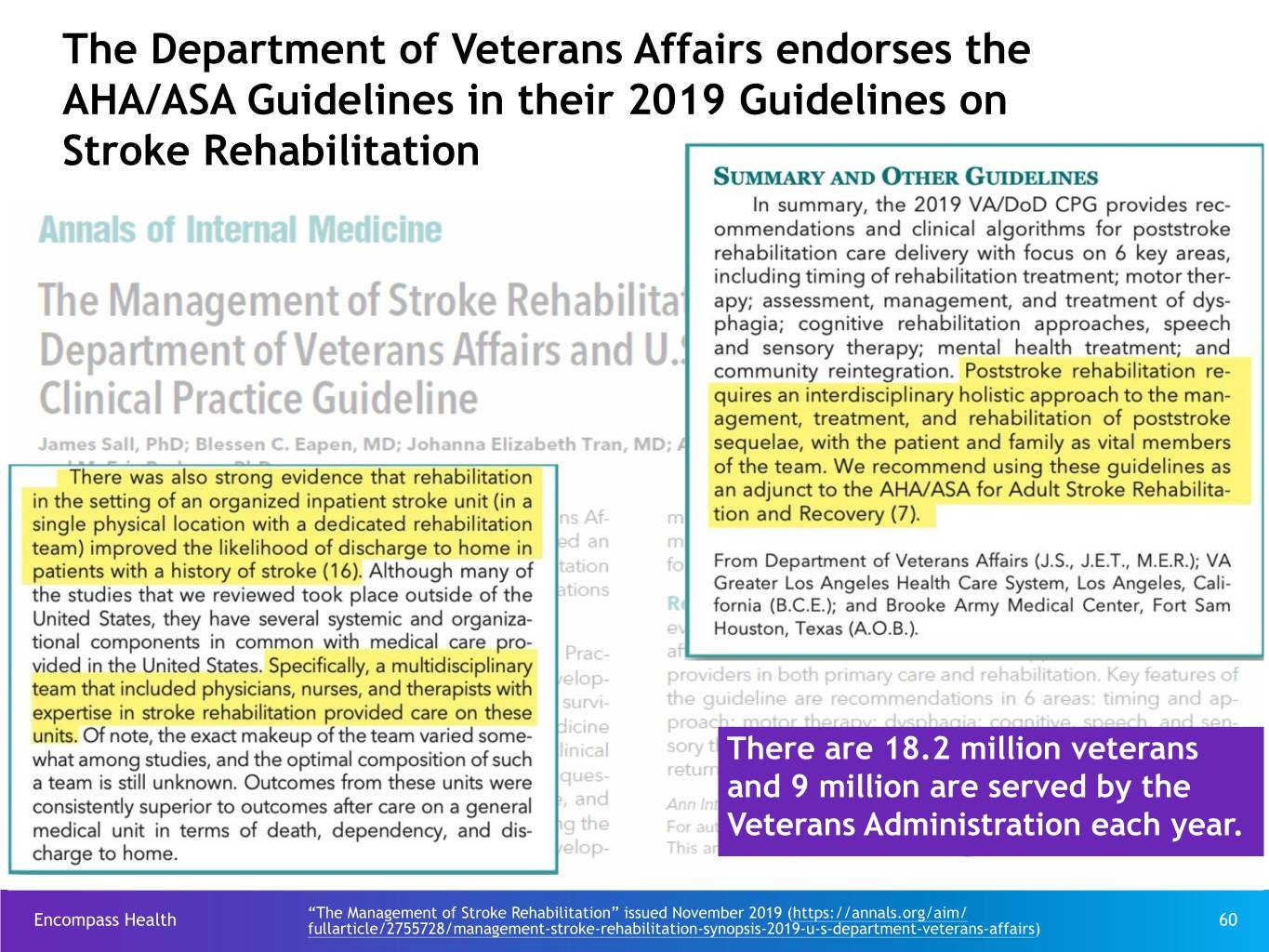

The Department of Veterans Affairs endorses the AHA/ASA Guidelines in their 2019 Guidelines on Stroke Rehabilitation There are 18.2 million veterans and 9 million are served by the Veterans Administration each year. “The Management of Stroke Rehabilitation” issued November 2019 (https://annals.org/aim/ Encompass Health fullarticle/2755728/management-stroke-rehabilitation-synopsis-2019-u-s-department-veterans-affairs) 60

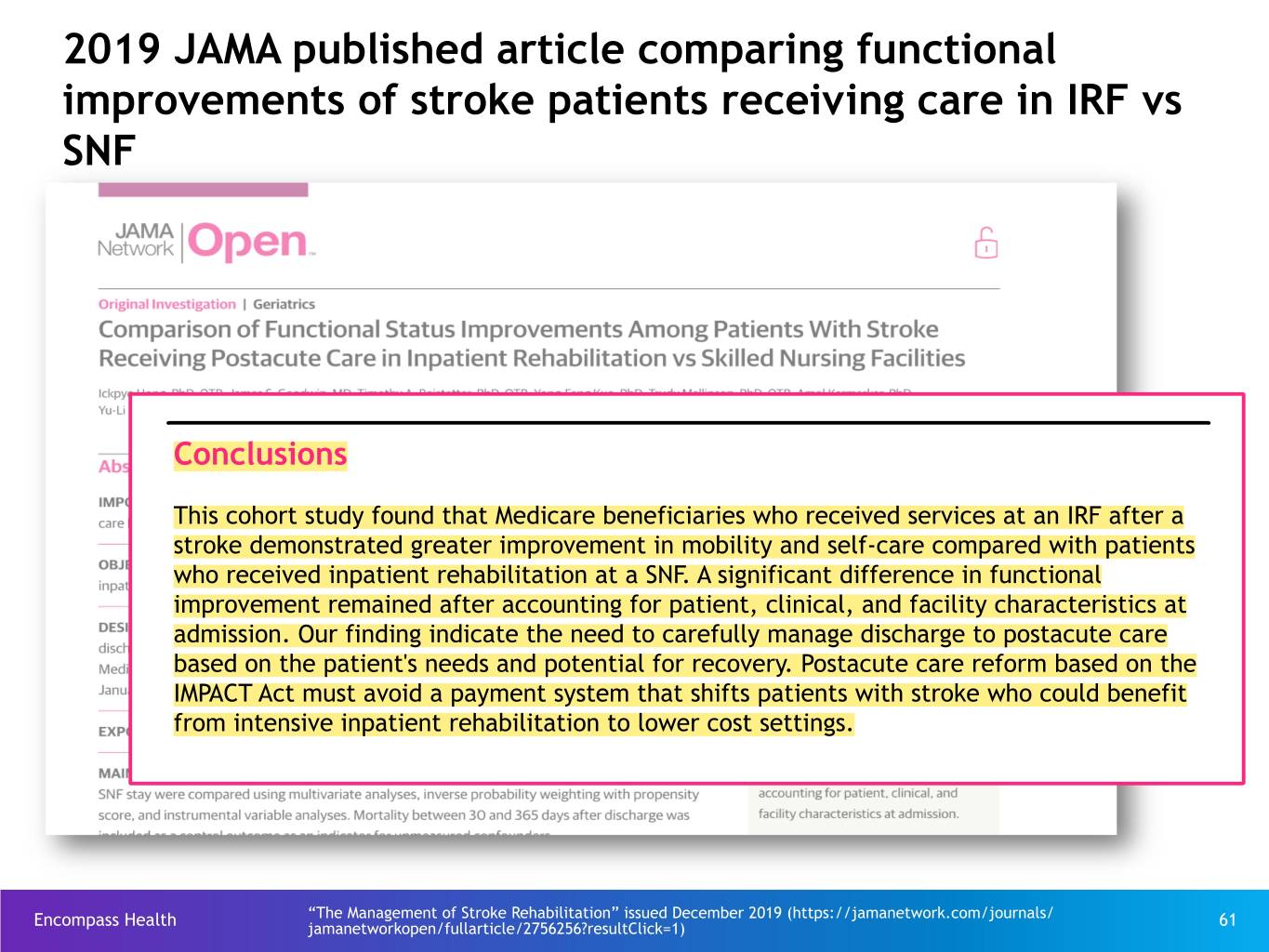

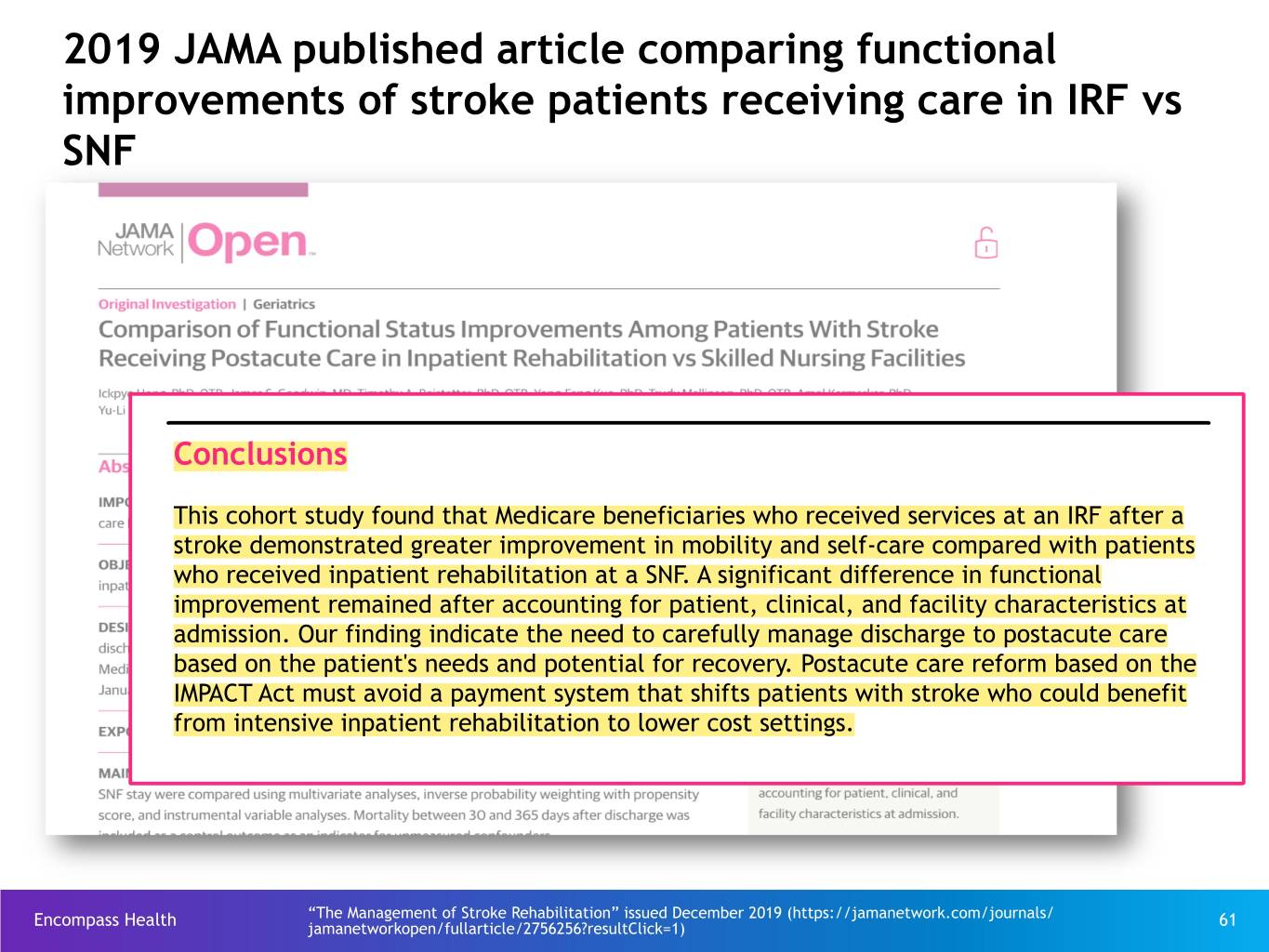

2019 JAMA published article comparing functional improvements of stroke patients receiving care in IRF vs SNF Conclusions This cohort study found that Medicare beneficiaries who received services at an IRF after a stroke demonstrated greater improvement in mobility and self-care compared with patients who received inpatient rehabilitation at a SNF. A significant difference in functional improvement remained after accounting for patient, clinical, and facility characteristics at admission. Our finding indicate the need to carefully manage discharge to postacute care based on the patient's needs and potential for recovery. Postacute care reform based on the IMPACT Act must avoid a payment system that shifts patients with stroke who could benefit from intensive inpatient rehabilitation to lower cost settings. “The Management of Stroke Rehabilitation” issued December 2019 (https://jamanetwork.com/journals/ Encompass Health jamanetworkopen/fullarticle/2756256?resultClick=1) 61

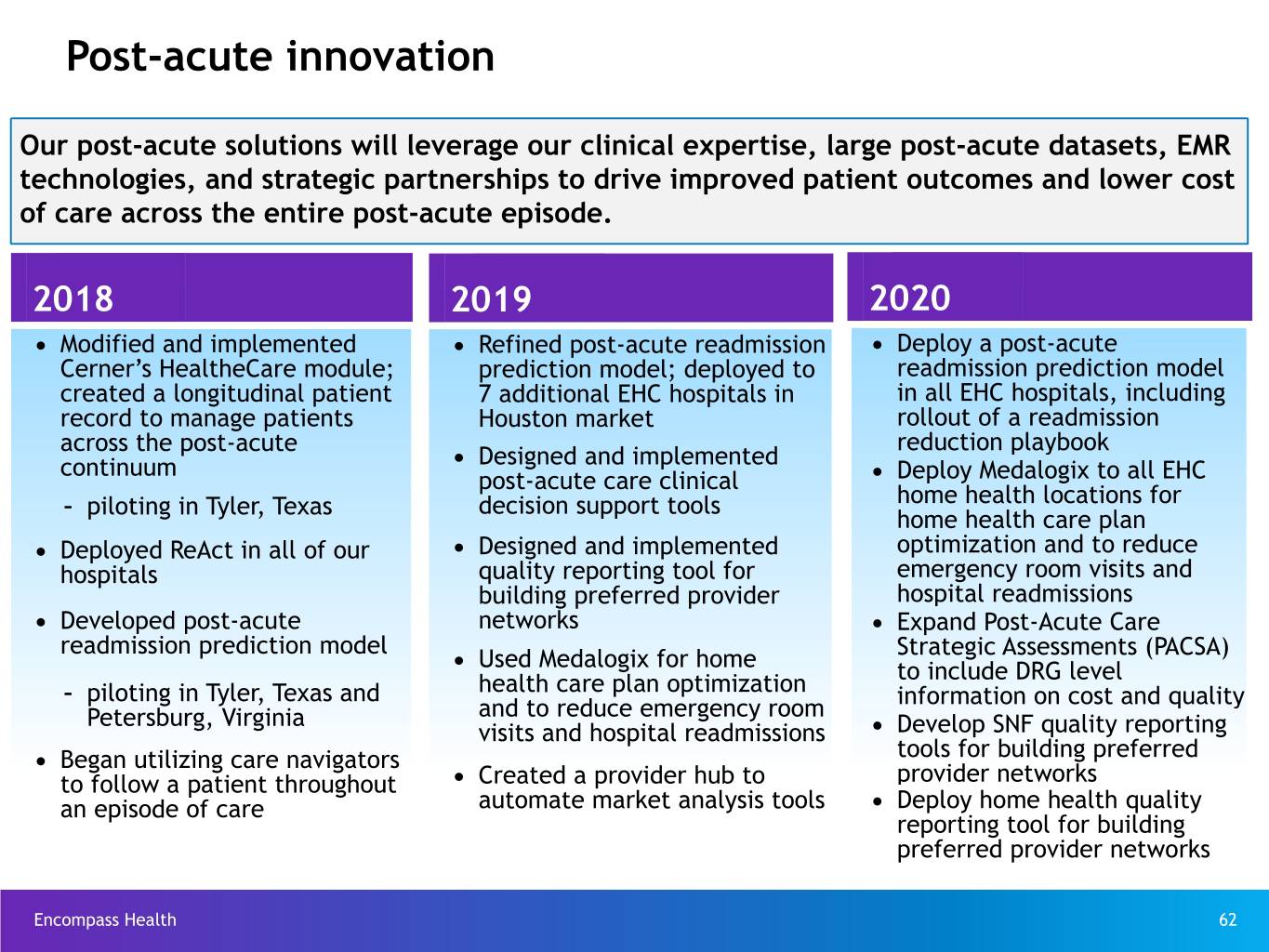

Post-acute innovation Our post-acute solutions will leverage our clinical expertise, large post-acute datasets, EMR technologies, and strategic partnerships to drive improved patient outcomes and lower cost of care across the entire post-acute episode. 2018 2019 2020 Ÿ Modified and implemented Ÿ Refined post-acute readmission Ÿ Deploy a post-acute Cerner’s HealtheCare module; prediction model; deployed to readmission prediction model created a longitudinal patient 7 additional EHC hospitals in in all EHC hospitals, including record to manage patients Houston market rollout of a readmission across the post-acute Ÿ reduction playbook continuum Designed and implemented Ÿ post-acute care clinical Deploy Medalogix to all EHC – piloting in Tyler, Texas decision support tools home health locations for home health care plan Ÿ Deployed ReAct in all of our Ÿ Designed and implemented optimization and to reduce hospitals quality reporting tool for emergency room visits and building preferred provider hospital readmissions Ÿ Developed post-acute networks Ÿ Expand Post-Acute Care readmission prediction model Ÿ Strategic Assessments (PACSA) Used Medalogix for home to include DRG level – piloting in Tyler, Texas and health care plan optimization information on cost and quality Petersburg, Virginia and to reduce emergency room Ÿ visits and hospital readmissions Develop SNF quality reporting Ÿ Began utilizing care navigators tools for building preferred Ÿ Created a provider hub to provider networks to follow a patient throughout Ÿ an episode of care automate market analysis tools Deploy home health quality reporting tool for building preferred provider networks Encompass Health 62

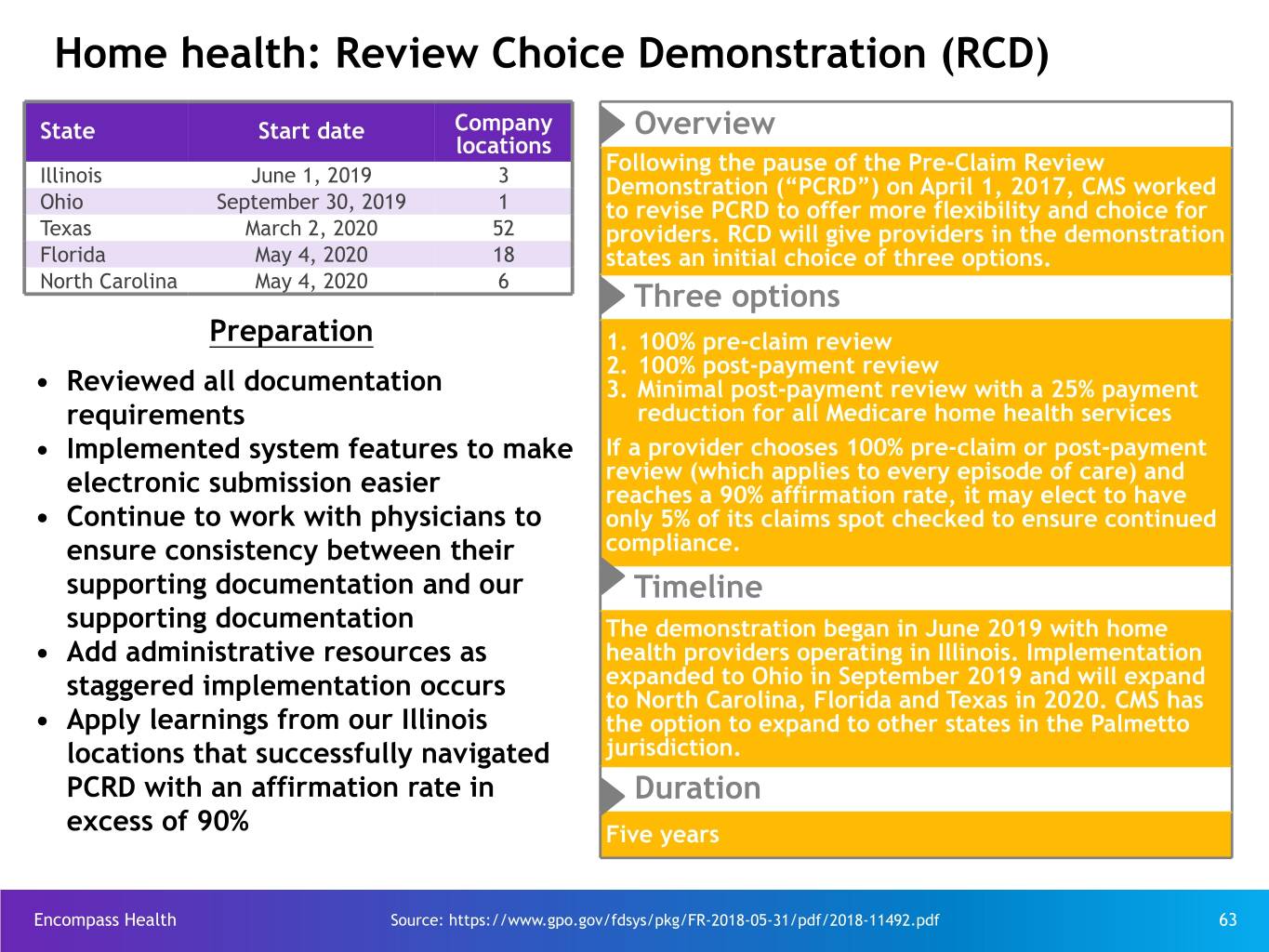

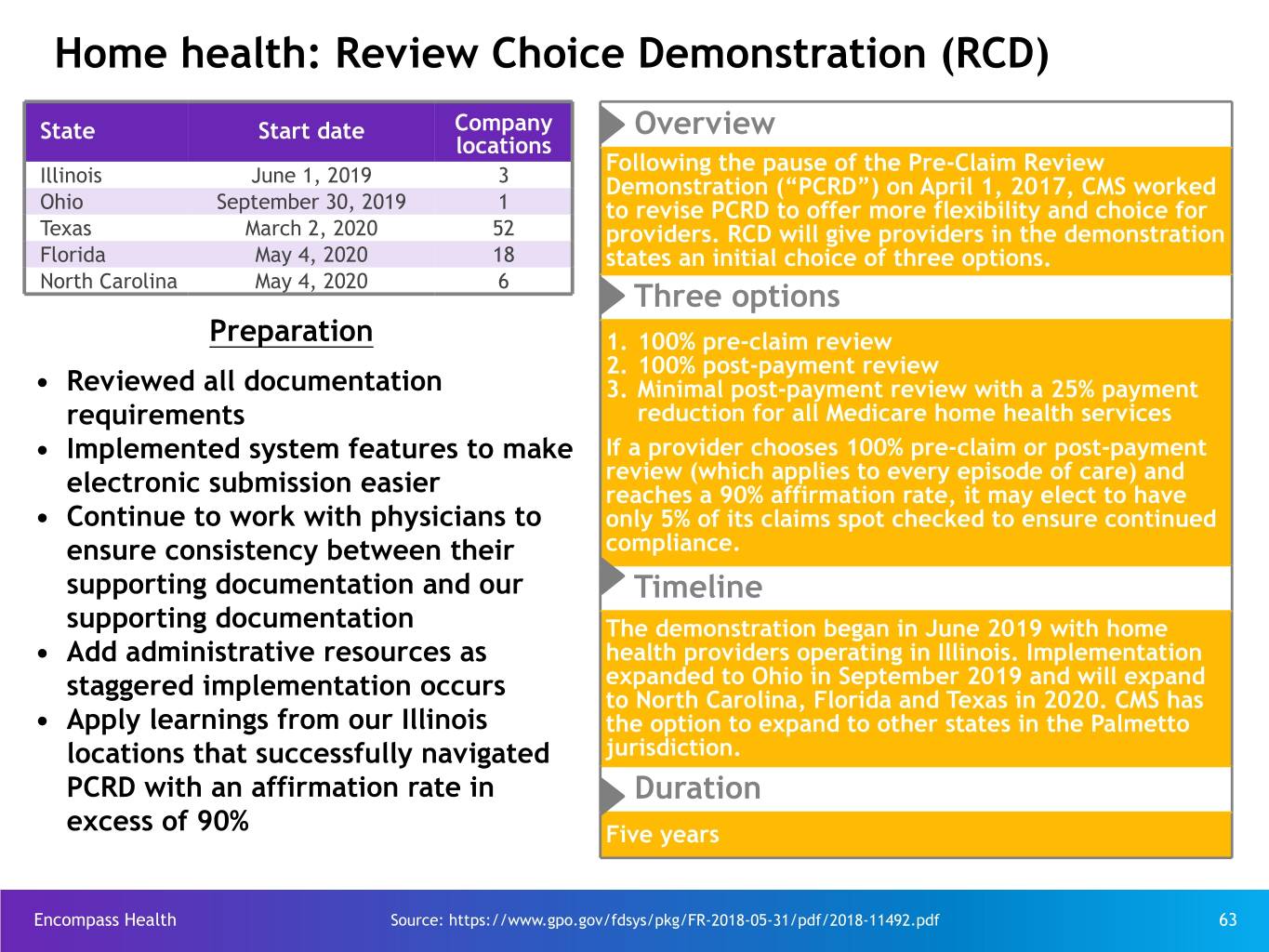

Home health: Review Choice Demonstration (RCD) State Start date Company Overview locations Following the pause of the Pre-Claim Review Illinois June 1, 2019 3 Demonstration (“PCRD”) on April 1, 2017, CMS worked Ohio September 30, 2019 1 to revise PCRD to offer more flexibility and choice for Texas March 2, 2020 52 providers. RCD will give providers in the demonstration Florida May 4, 2020 18 states an initial choice of three options. North Carolina May 4, 2020 6 Three options Preparation 1. 100% pre-claim review 2. 100% post-payment review • Reviewed all documentation 3. Minimal post-payment review with a 25% payment requirements reduction for all Medicare home health services • Implemented system features to make If a provider chooses 100% pre-claim or post-payment review (which applies to every episode of care) and electronic submission easier reaches a 90% affirmation rate, it may elect to have • Continue to work with physicians to only 5% of its claims spot checked to ensure continued ensure consistency between their compliance. supporting documentation and our Timeline supporting documentation The demonstration began in June 2019 with home • Add administrative resources as health providers operating in Illinois. Implementation expanded to Ohio in September 2019 and will expand staggered implementation occurs to North Carolina, Florida and Texas in 2020. CMS has • Apply learnings from our Illinois the option to expand to other states in the Palmetto locations that successfully navigated jurisdiction. PCRD with an affirmation rate in Duration excess of 90% Five years Encompass Health Source: https://www.gpo.gov/fdsys/pkg/FR-2018-05-31/pdf/2018-11492.pdf 63

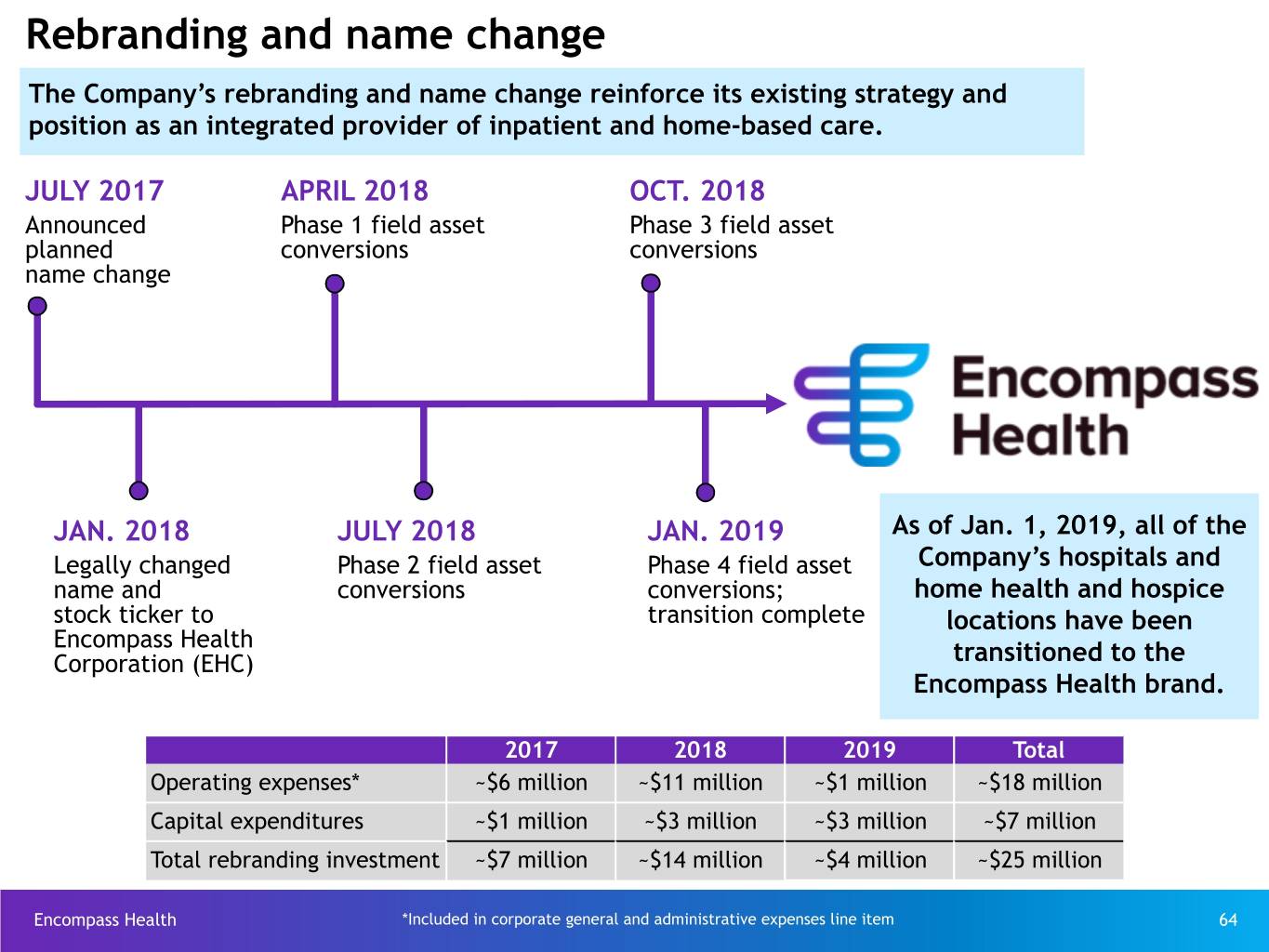

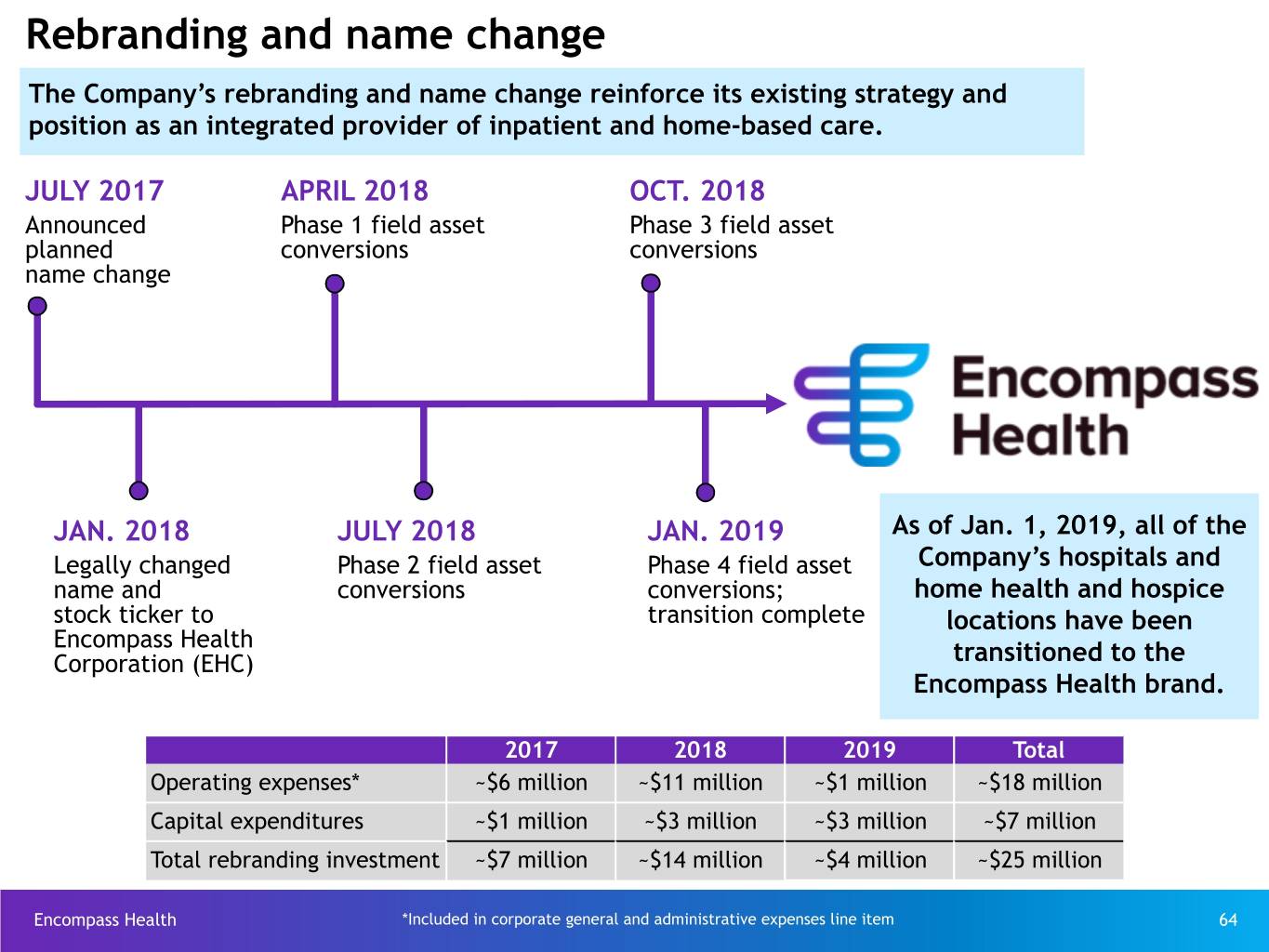

Rebranding and name change The Company’s rebranding and name change reinforce its existing strategy and position as an integrated provider of inpatient and home-based care. JULY 2017 APRIL 2018 OCT. 2018 Announced Phase 1 field asset Phase 3 field asset planned conversions conversions name change JAN. 2018 JULY 2018 JAN. 2019 As of Jan. 1, 2019, all of the Legally changed Phase 2 field asset Phase 4 field asset Company’s hospitals and name and conversions conversions; home health and hospice stock ticker to transition complete locations have been Encompass Health Corporation (EHC) transitioned to the Encompass Health brand. 2017 2018 2019 Total Operating expenses* ~$6 million ~$11 million ~$1 million ~$18 million Capital expenditures ~$1 million ~$3 million ~$3 million ~$7 million Total rebranding investment ~$7 million ~$14 million ~$4 million ~$25 million Encompass Health *Included in corporate general and administrative expenses line item 64

Capital structure Encompass Health is positioned with a cost-efficient, flexible capital structure. Encompass Health 65

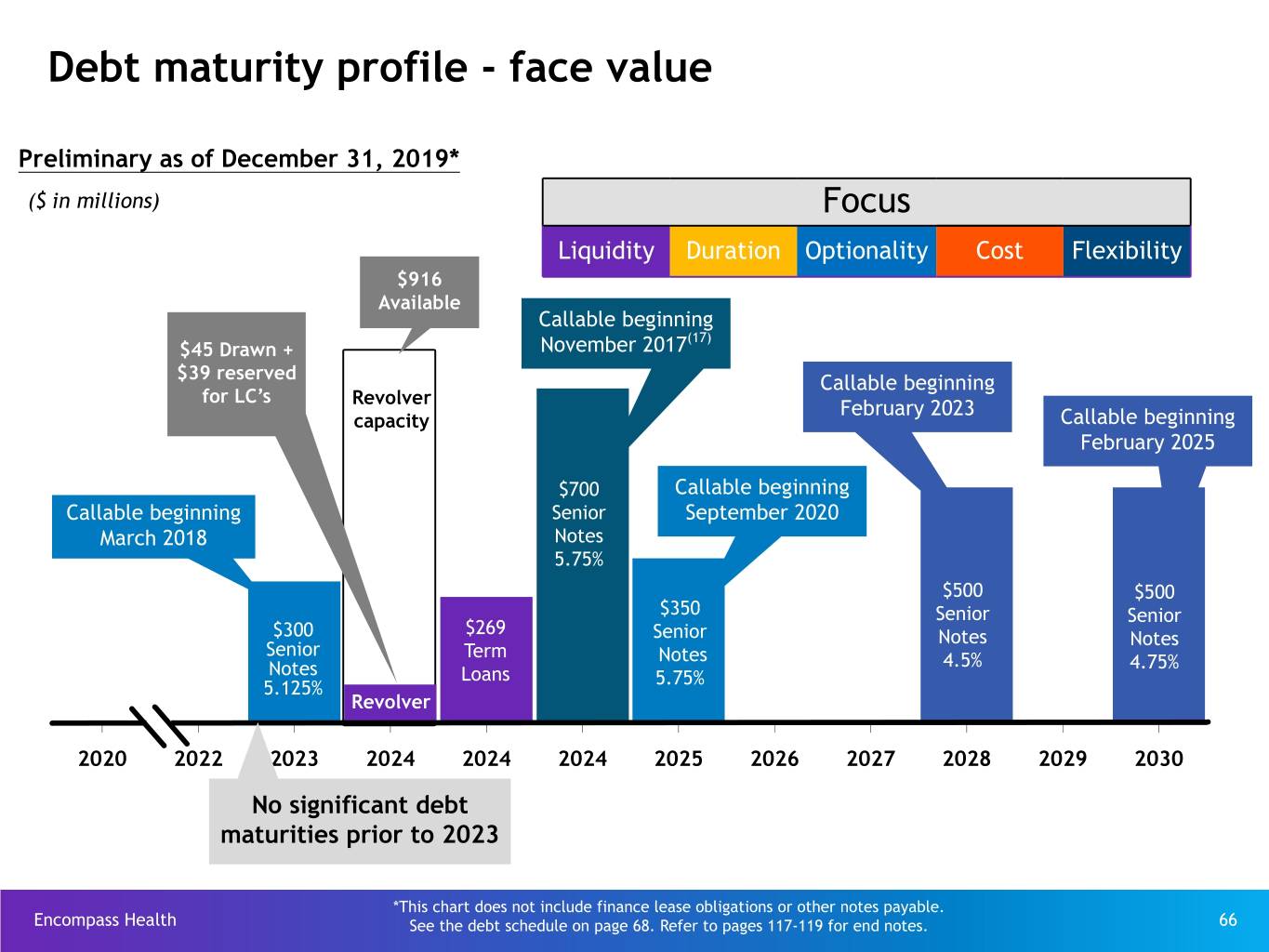

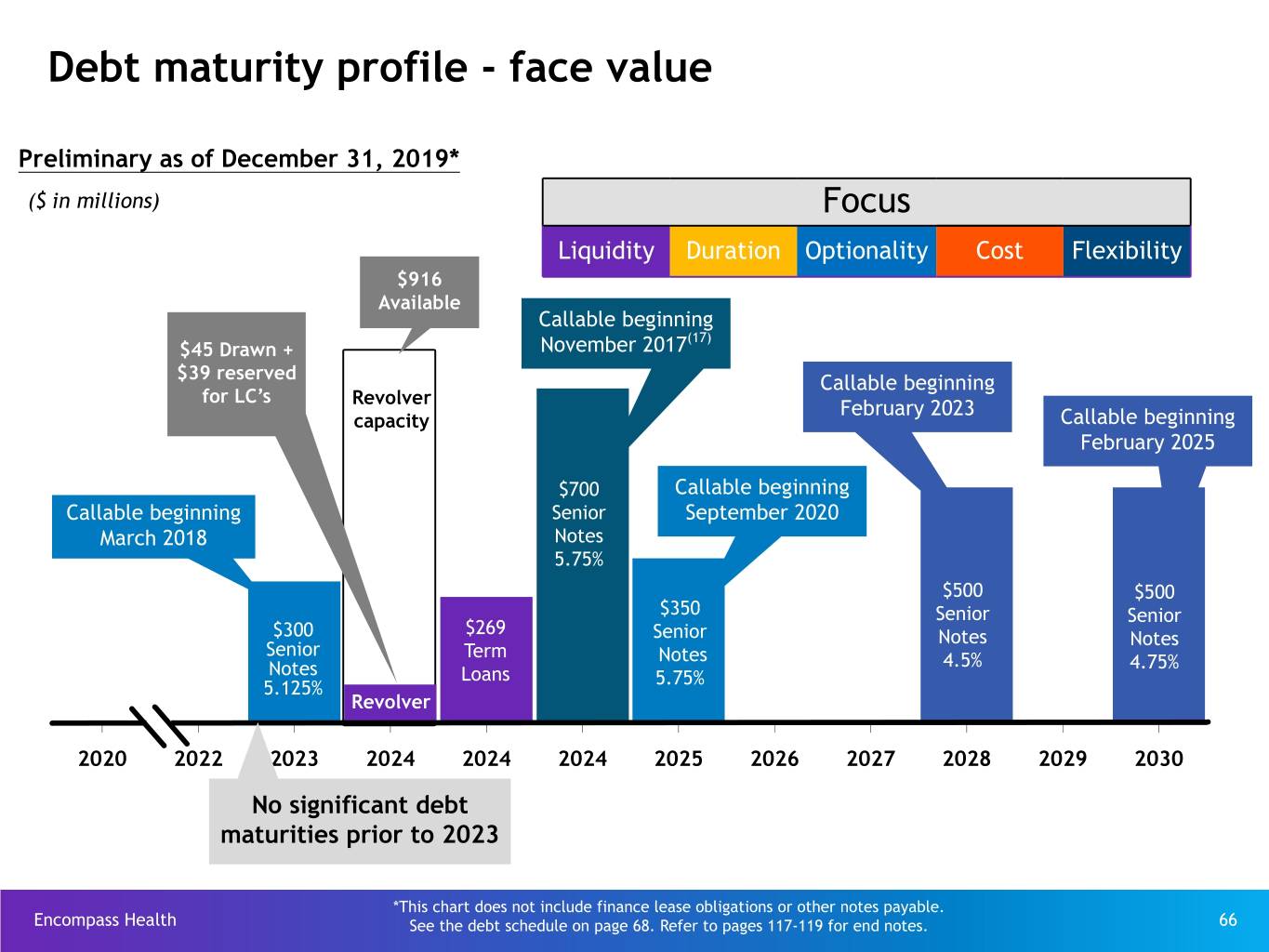

Debt maturity profile - face value Preliminary as of December 31, 2019* ($ in millions) Focus Liquidity Duration Optionality Cost Flexibility $916 Available Callable beginning (17) $45 Drawn + November 2017 $39 reserved Callable beginning for LC’s Revolver February 2023 capacity Callable beginning February 2025 $700 Callable beginning Callable beginning Senior September 2020 March 2018 Notes 5.75% $500 $500 $350 Senior Senior $269 $300 Senior Notes Notes Senior Term Notes 4.5% 4.75% Notes Loans 5.75% 5.125% Revolver 2020 2022 2023 2024 2024 2024 2025 2026 2027 2028 2029 2030 No significant debt maturities prior to 2023 *This chart does not include finance lease obligations or other notes payable. Encompass Health See the debt schedule on page 68. Refer to pages 117-119 for end notes. 66

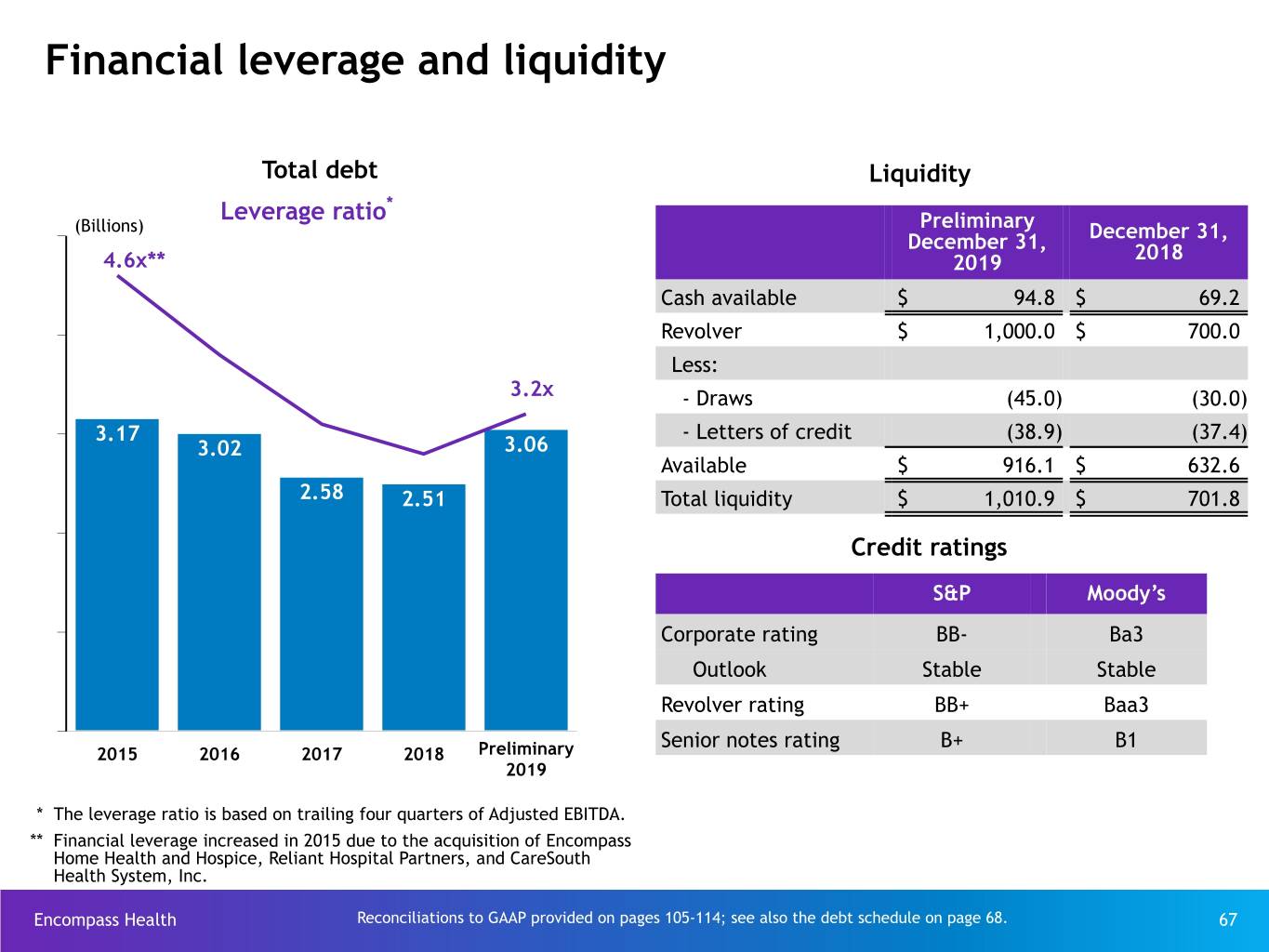

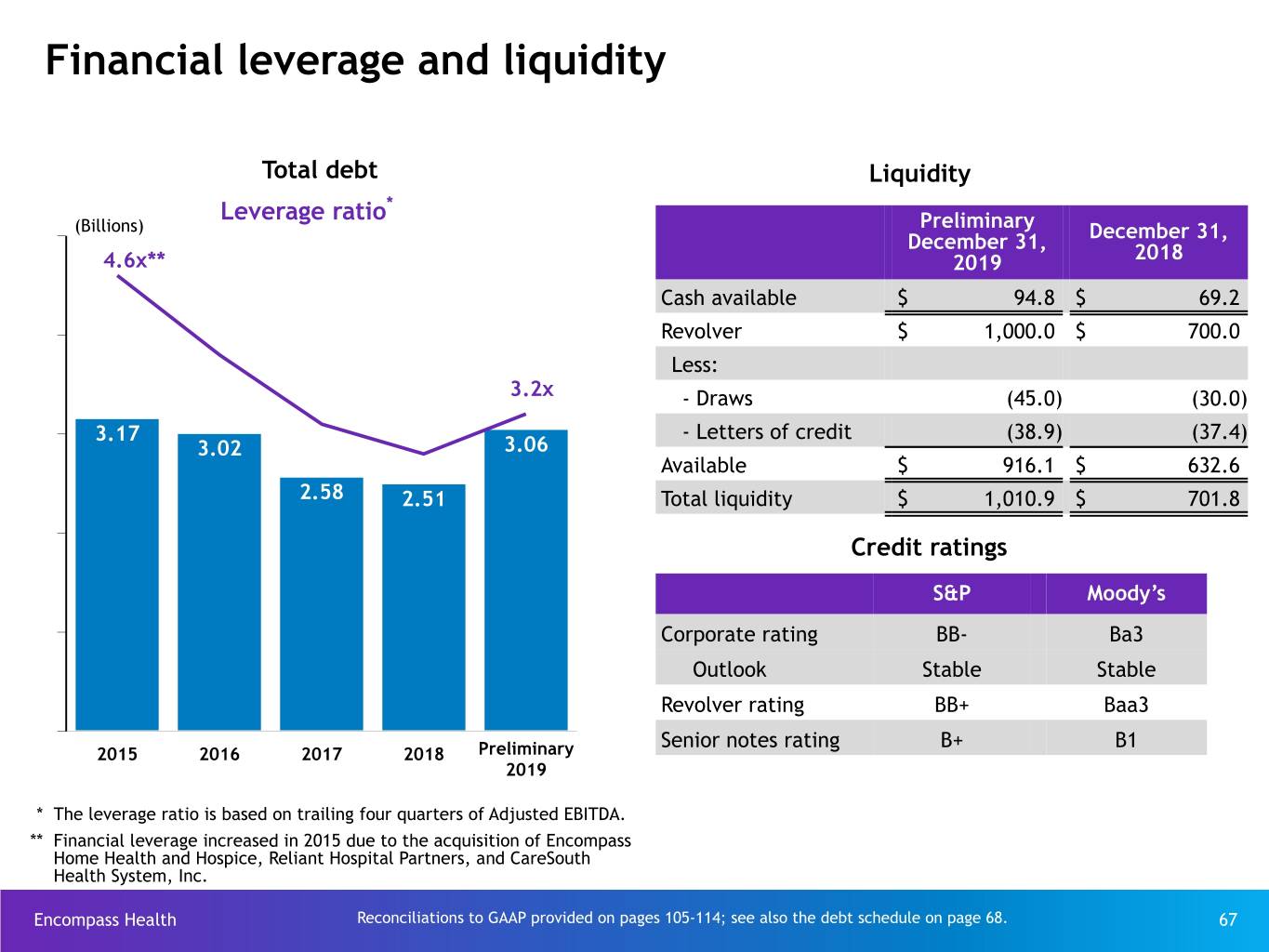

Financial leverage and liquidity Total debt Liquidity Leverage ratio* (Billions) Preliminary December 31, December 31, 4.6x** 2019 2018 Cash available $ 94.8 $ 69.2 Revolver $ 1,000.0 $ 700.0 Less: 3.2x - Draws (45.0) (30.0) 3.17 - Letters of credit (38.9) (37.4) 3.02 3.06 Available $ 916.1 $ 632.6 2.58 2.51 Total liquidity $ 1,010.9 $ 701.8 Credit ratings S&P Moody’s Corporate rating BB- Ba3 Outlook Stable Stable Revolver rating BB+ Baa3 Senior notes rating B+ B1 2015 2016 2017 2018 PPreliminaryreliminary 20120199 * The leverage ratio is based on trailing four quarters of Adjusted EBITDA. ** Financial leverage increased in 2015 due to the acquisition of Encompass Home Health and Hospice, Reliant Hospital Partners, and CareSouth Health System, Inc. Encompass Health Reconciliations to GAAP provided on pages 105-114; see also the debt schedule on page 68. 67 (1)

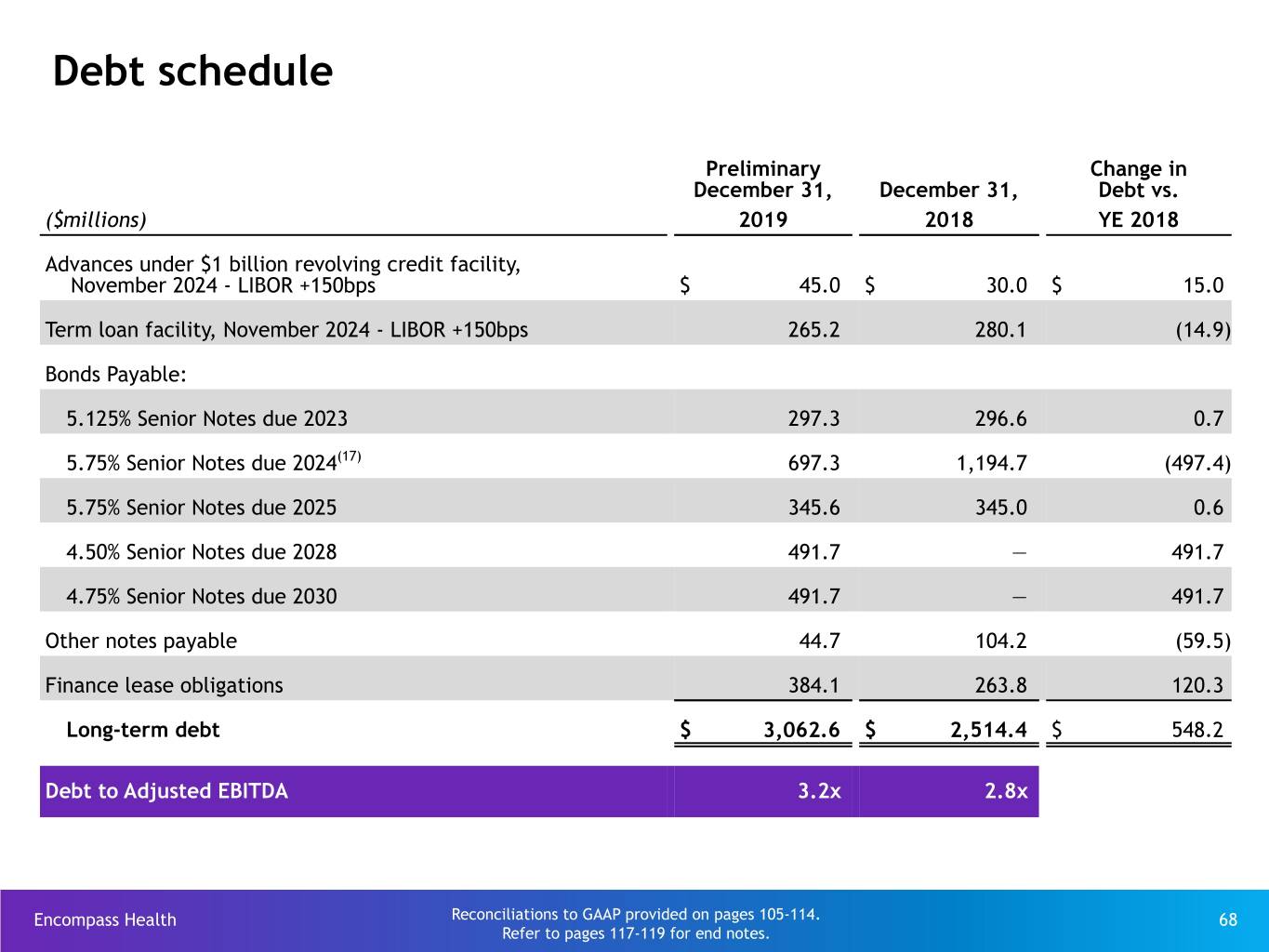

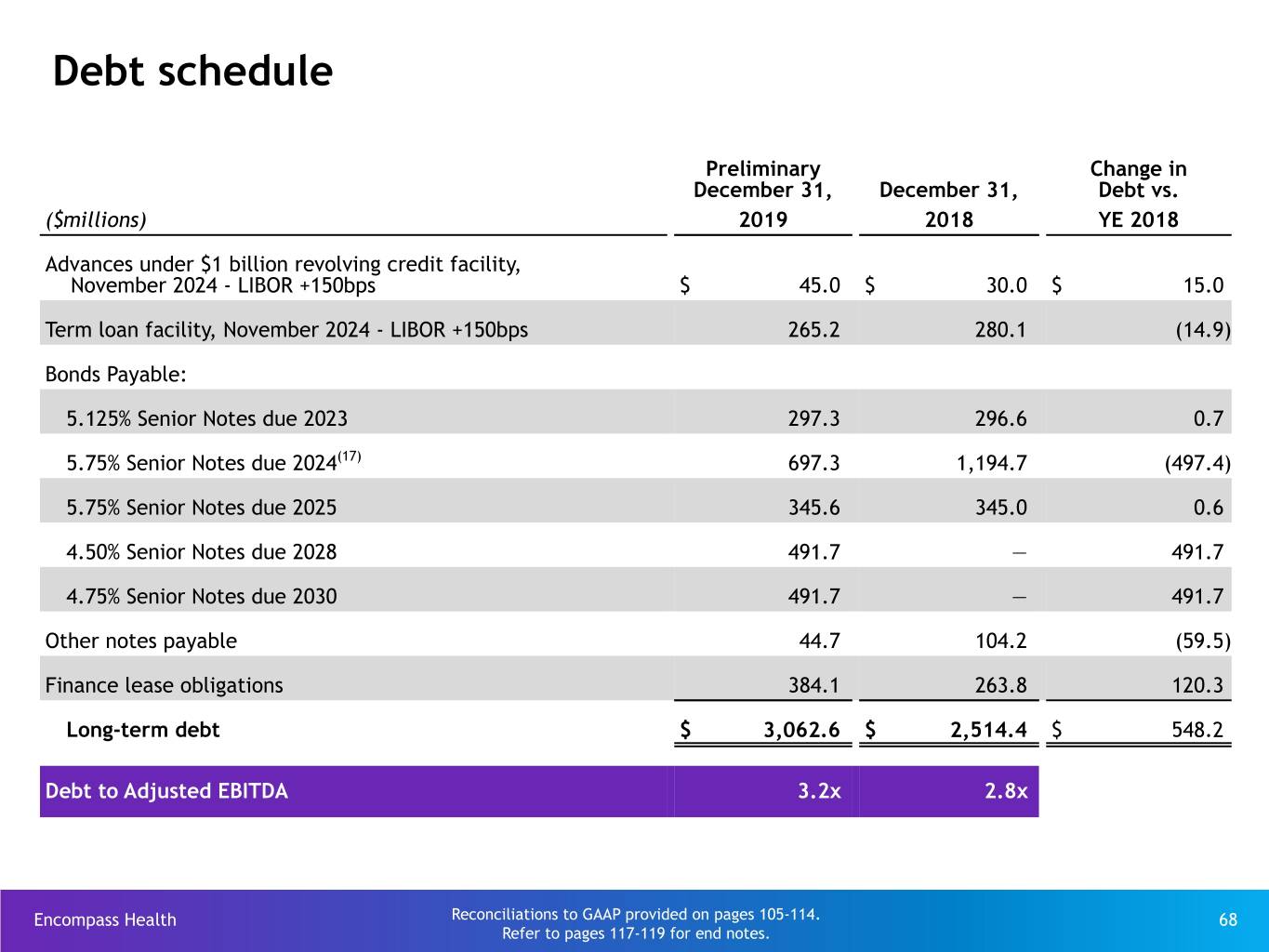

Debt schedule Preliminary Change in December 31, December 31, Debt vs. ($millions) 2019 2018 YE 2018 Advances under $1 billion revolving credit facility, November 2024 - LIBOR +150bps $ 45.0 $ 30.0 $ 15.0 Term loan facility, November 2024 - LIBOR +150bps 265.2 280.1 (14.9) Bonds Payable: 5.125% Senior Notes due 2023 297.3 296.6 0.7 5.75% Senior Notes due 2024(17) 697.3 1,194.7 (497.4) 5.75% Senior Notes due 2025 345.6 345.0 0.6 4.50% Senior Notes due 2028 491.7 — 491.7 4.75% Senior Notes due 2030 491.7 — 491.7 Other notes payable 44.7 104.2 (59.5) Finance lease obligations 384.1 263.8 120.3 Long-term debt $ 3,062.6 $ 2,514.4 $ 548.2 Debt to Adjusted EBITDA 3.2x 2.8x Encompass Health Reconciliations to GAAP provided on pages 105-114. 68 Refer to pages 117-119 for end notes.

IRF real estate portfolio 133 inpatient rehabilitation hospitals: 9,259 licensed beds 4,760 licensed beds Own ~70% of IRF real estate in CON states As of December 31, 2019 63 own building and land 31 own building; lease land 39 lease building and land 4,499 licensed beds in non-CON states A CON is a regulatory requirement in some states and federal jurisdictions that require state authorization prior to proposed acquisitions, expansions, or construction of new hospitals. Encompass Health 69

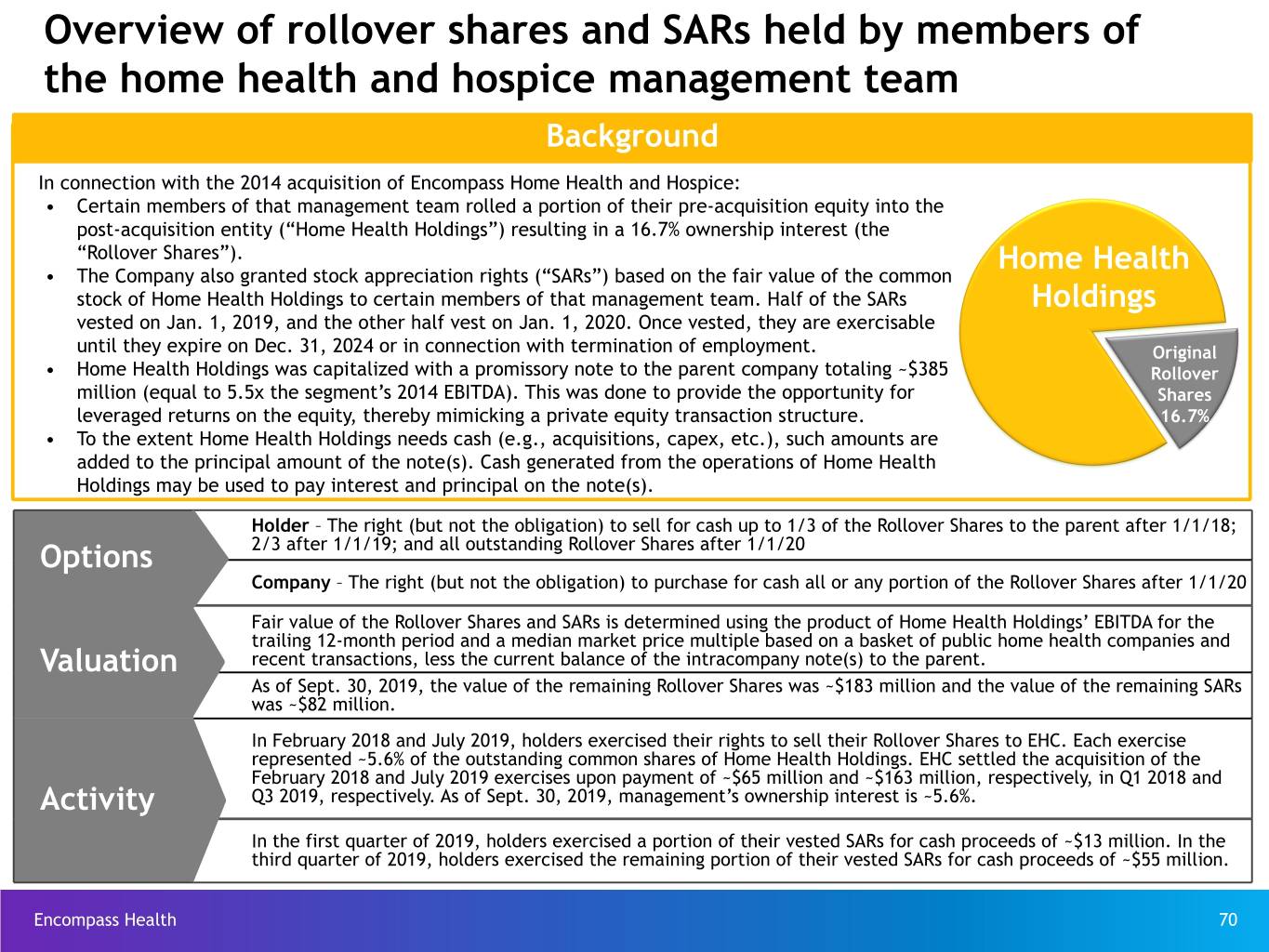

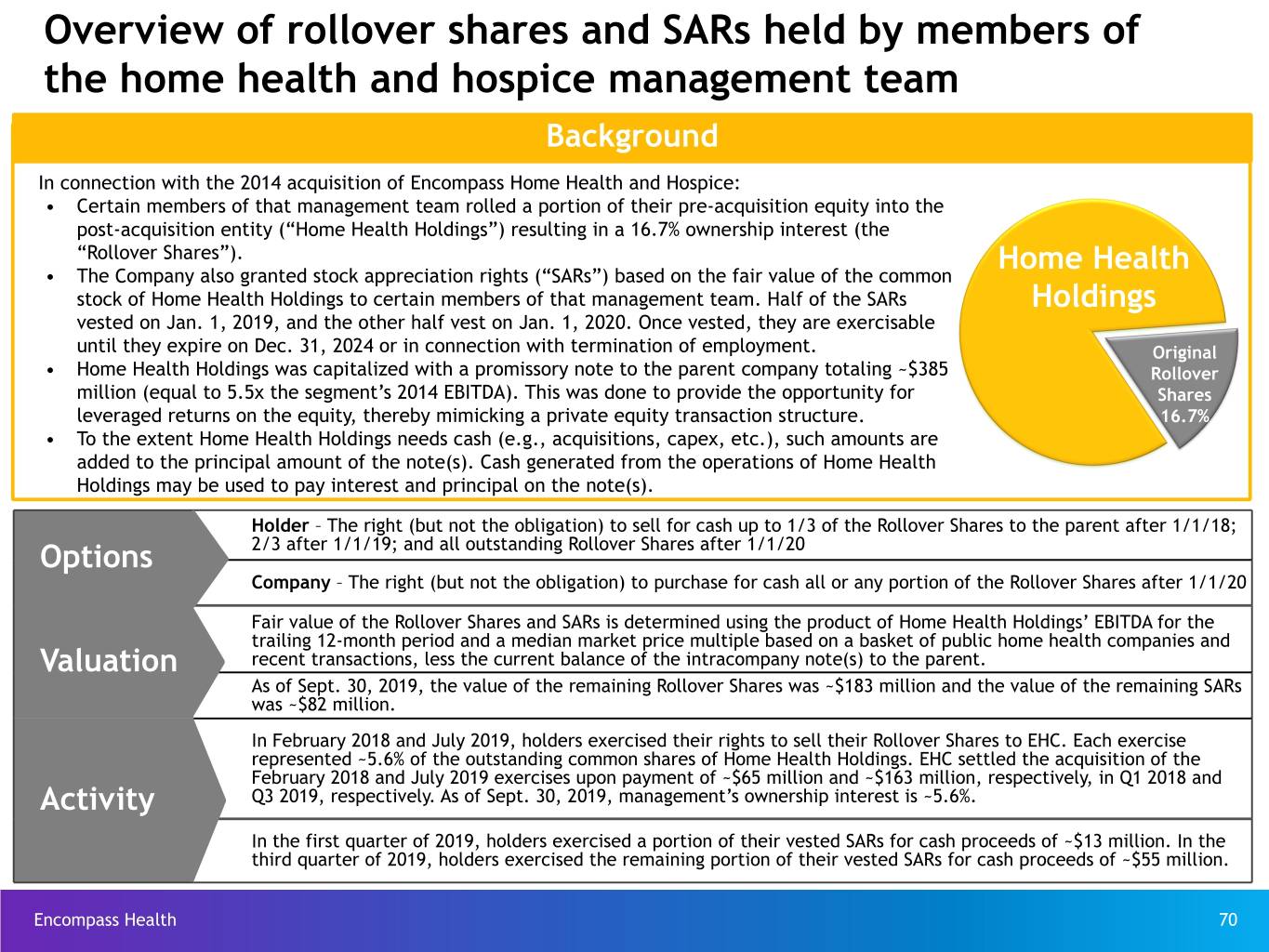

Overview of rollover shares and SARs held by members of the home health and hospice management team Background In connection with the 2014 acquisition of Encompass Home Health and Hospice: • Certain members of that management team rolled a portion of their pre-acquisition equity into the post-acquisition entity (“Home Health Holdings”) resulting in a 16.7% ownership interest (the “Rollover Shares”). Home Health • The Company also granted stock appreciation rights (“SARs”) based on the fair value of the common stock of Home Health Holdings to certain members of that management team. Half of the SARs Holdings vested on Jan. 1, 2019, and the other half vest on Jan. 1, 2020. Once vested, they are exercisable until they expire on Dec. 31, 2024 or in connection with termination of employment. Original • Home Health Holdings was capitalized with a promissory note to the parent company totaling ~$385 Rollover million (equal to 5.5x the segment’s 2014 EBITDA). This was done to provide the opportunity for Shares leveraged returns on the equity, thereby mimicking a private equity transaction structure. 16.7% • To the extent Home Health Holdings needs cash (e.g., acquisitions, capex, etc.), such amounts are added to the principal amount of the note(s). Cash generated from the operations of Home Health Holdings may be used to pay interest and principal on the note(s). Holder – The right (but not the obligation) to sell for cash up to 1/3 of the Rollover Shares to the parent after 1/1/18; Options 2/3 after 1/1/19; and all outstanding Rollover Shares after 1/1/20 Company – The right (but not the obligation) to purchase for cash all or any portion of the Rollover Shares after 1/1/20 Fair value of the Rollover Shares and SARs is determined using the product of Home Health Holdings’ EBITDA for the trailing 12-month period and a median market price multiple based on a basket of public home health companies and Valuation recent transactions, less the current balance of the intracompany note(s) to the parent. As of Sept. 30, 2019, the value of the remaining Rollover Shares was ~$183 million and the value of the remaining SARs was ~$82 million. In February 2018 and July 2019, holders exercised their rights to sell their Rollover Shares to EHC. Each exercise represented ~5.6% of the outstanding common shares of Home Health Holdings. EHC settled the acquisition of the February 2018 and July 2019 exercises upon payment of ~$65 million and ~$163 million, respectively, in Q1 2018 and Activity Q3 2019, respectively. As of Sept. 30, 2019, management’s ownership interest is ~5.6%. In the first quarter of 2019, holders exercised a portion of their vested SARs for cash proceeds of ~$13 million. In the third quarter of 2019, holders exercised the remaining portion of their vested SARs for cash proceeds of ~$55 million. Encompass Health 70

Alternative payment models Most models remain in the early or pilot stage and results have been mixed. Both of our segments continue to participate in various alternative payment model initiatives. Encompass Health 71

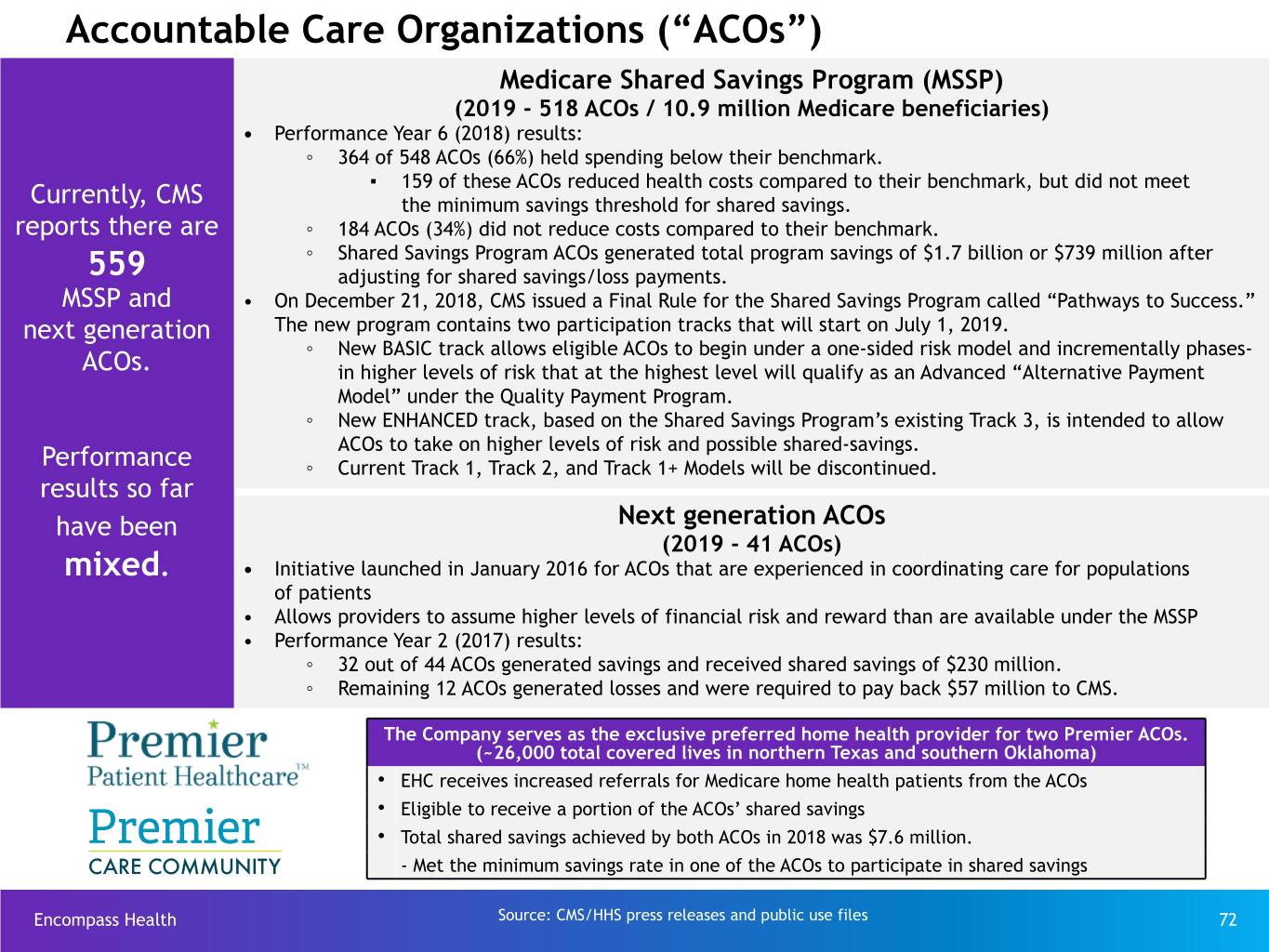

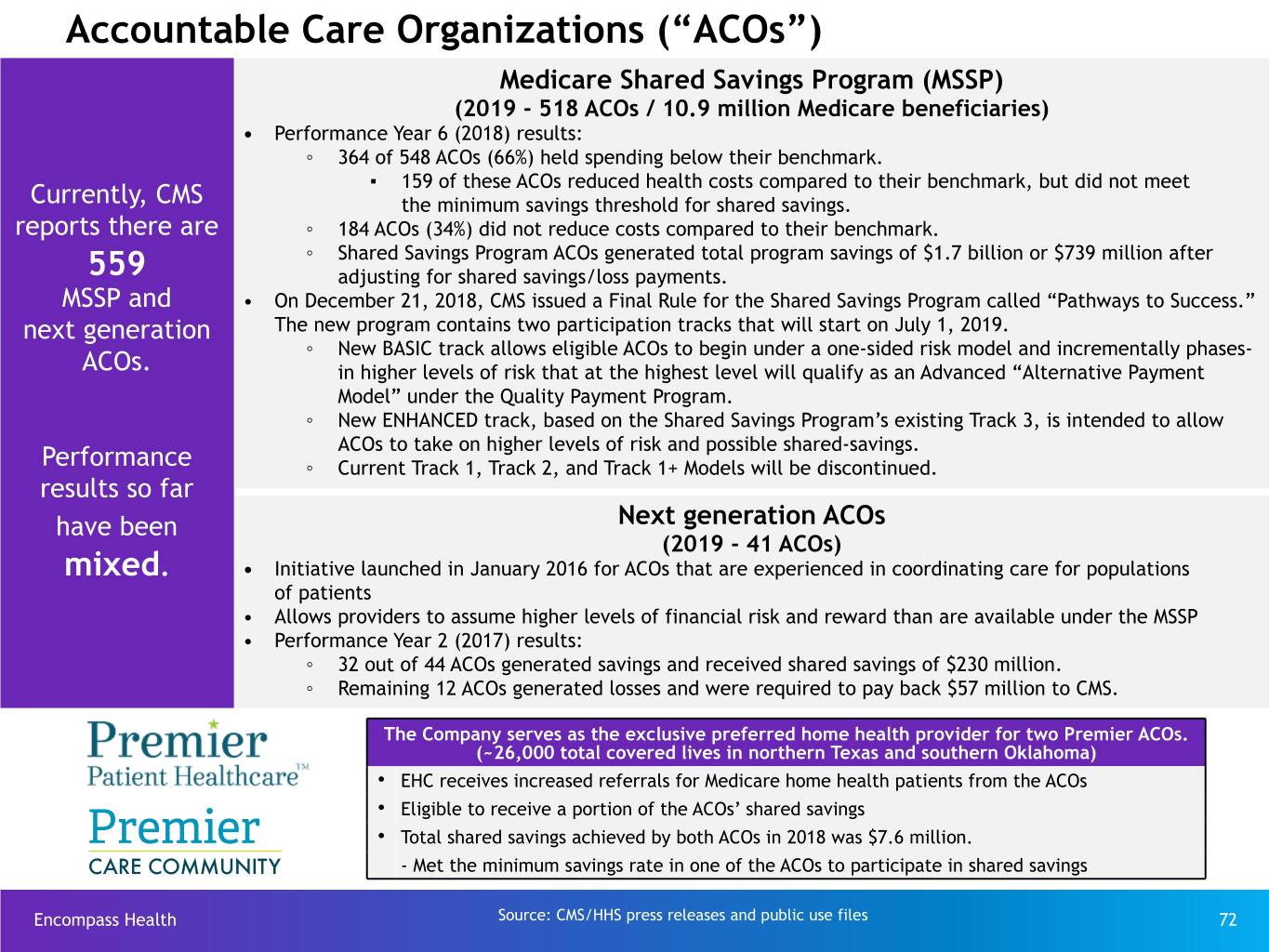

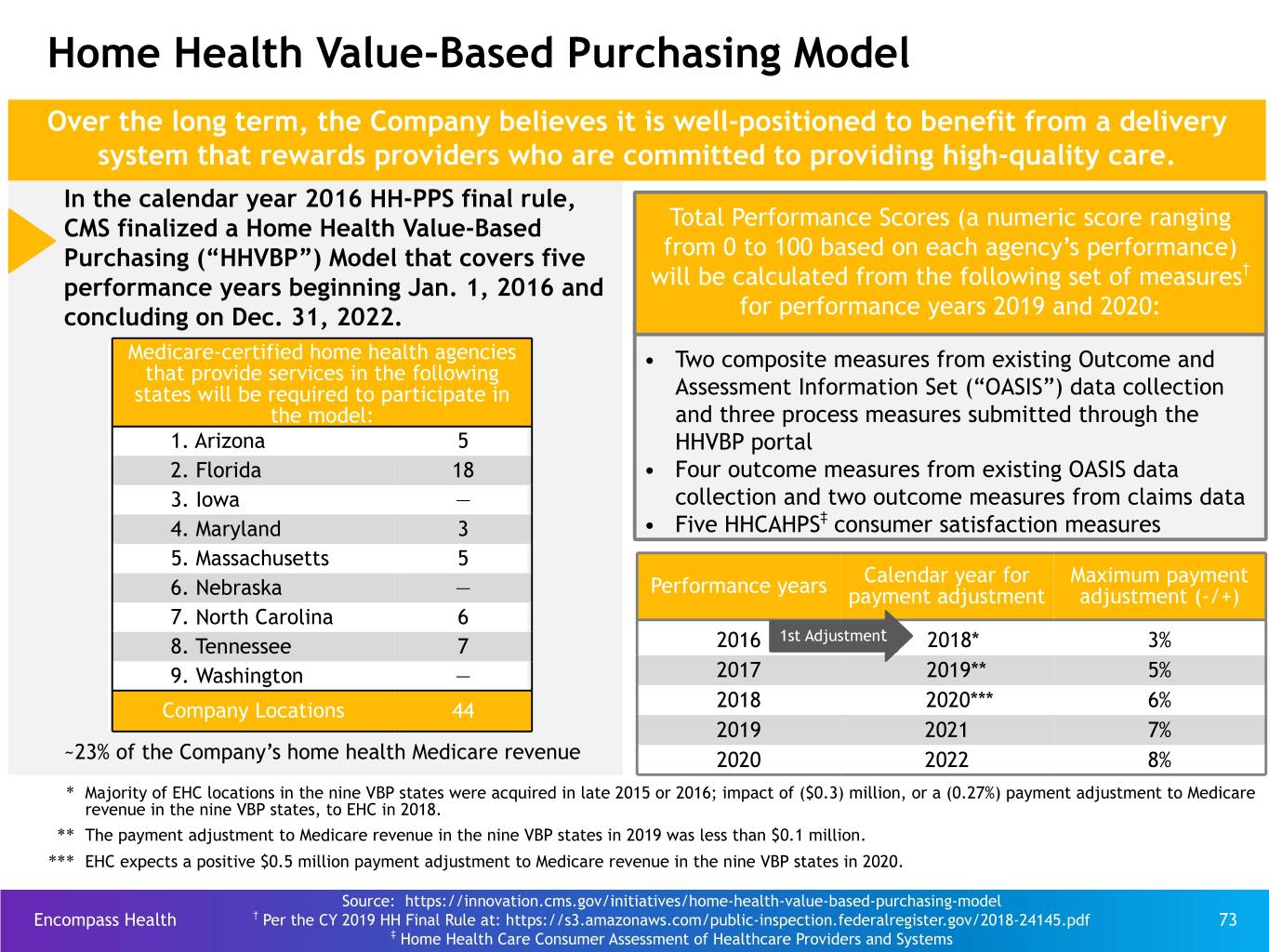

Accountable Care Organizations (“ACOs”) Medicare Shared Savings Program (MSSP) (2019 - 518 ACOs / 10.9 million Medicare beneficiaries) • Performance Year 6 (2018) results: ◦ 364 of 548 ACOs (66%) held spending below their benchmark. ▪ 159 of these ACOs reduced health costs compared to their benchmark, but did not meet Currently, CMS the minimum savings threshold for shared savings. reports there are ◦ 184 ACOs (34%) did not reduce costs compared to their benchmark. ◦ Shared Savings Program ACOs generated total program savings of $1.7 billion or $739 million after 559 adjusting for shared savings/loss payments. MSSP and • On December 21, 2018, CMS issued a Final Rule for the Shared Savings Program called “Pathways to Success.” next generation The new program contains two participation tracks that will start on July 1, 2019. ◦ New BASIC track allows eligible ACOs to begin under a one-sided risk model and incrementally phases- ACOs. in higher levels of risk that at the highest level will qualify as an Advanced “Alternative Payment Model” under the Quality Payment Program. ◦ New ENHANCED track, based on the Shared Savings Program’s existing Track 3, is intended to allow ACOs to take on higher levels of risk and possible shared-savings. Performance ◦ Current Track 1, Track 2, and Track 1+ Models will be discontinued. results so far have been Next generation ACOs (2019 - 41 ACOs) mixed. • Initiative launched in January 2016 for ACOs that are experienced in coordinating care for populations of patients • Allows providers to assume higher levels of financial risk and reward than are available under the MSSP • Performance Year 2 (2017) results: ◦ 32 out of 44 ACOs generated savings and received shared savings of $230 million. ◦ Remaining 12 ACOs generated losses and were required to pay back $57 million to CMS. The Company serves as the exclusive preferred home health provider for two Premier ACOs. (~26,000 total covered lives in northern Texas and southern Oklahoma) Ÿ EHC receives increased referrals for Medicare home health patients from the ACOs Ÿ Eligible to receive a portion of the ACOs’ shared savings Ÿ Total shared savings achieved by both ACOs in 2018 was $7.6 million. - Met the minimum savings rate in one of the ACOs to participate in shared savings Encompass Health Source: CMS/HHS press releases and public use files 72