UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04537

Liberty All-Star Growth Fund, Inc.

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Sareena Khwaja-Dixon, Esq.

ALPS Fund Services, Inc.

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: December 31

Date of reporting period: January 1, 2020 - December 31, 2020

Item 1. Report to Stockholders.

(a)

Contents

| 1 | President’s Letter |

| 6 | Unique Fund Attributes |

| 8 | Table of Distributions and Rights Offerings |

| 9 | Investment Growth |

| 10 | Major Stock Changes in the Quarter |

| 11 | Top 20 Holdings and Economic Sectors |

| 12 | Investment Managers/ Portfolio Characteristics |

| 13 | Manager Roundtable |

| 18 | Schedule of Investments |

| 24 | Statement of Assets and Liabilities |

| 25 | Statement of Operations |

| 26 | Statements of Changes in Net Assets |

| 28 | Financial Highlights |

| 30 | Notes to Financial Statements |

| 39 | Report of Independent Registered Public Accounting Firm |

| 40 | Automatic Dividend Reinvestment and Direct Purchase Plan |

| 42 | Additional Information |

| 43 | Directors and Officers |

| 49 | Board Consideration of the Renewal of the Fund Management & Portfolio Management Agreements |

| 54 | Summary of Updated Information Regarding the Fund |

| 59 | Privacy Policy |

| 61 | Description of Lipper Benchmark and Market Indices |

| Inside Back Cover: Fund Information | |

A SINGLE INVESTMENT...

A DIVERSIFIED GROWTH PORTFOLIO

A single fund that offers:

| • | A diversified, multi-managed portfolio of small-, mid- and large-cap growth stocks |

| • | Exposure to many of the industries that make the U.S. economy one of the world’s most dynamic |

| • | Access to institutional quality investment managers |

| • | Objective and ongoing manager evaluation |

| • | Active portfolio rebalancing |

| • | A quarterly fixed distribution policy |

| • | Actively managed, exchange-traded, closed-end fund listed on the New York Stock Exchange (ticker symbol: ASG) |

LIBERTY ALL-STAR® GROWTH FUND, INC.

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website at www.all-starfunds.com, and you will be notified each time a report is posted and provided with a website link to access the report.

You may elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you receive paper copies of your shareholder reports. If you invest directly with the Fund and your shares are held with the Fund’s transfer agent, Computershare, you can call 1-800-542-3863 to let the Fund know you wish to receive paper copies of your shareholder reports or you may log into your Investor Center account at www.computershare.com/investor and change your communication preferences.

| Liberty All-Star® Growth Fund | President's Letter |

| (Unaudited) |

| Fellow Shareholders: | February 2021 |

Despite a first quarter sell-off that saw stocks tumble into bear market territory and concerns over the COVID-19 virus that endured throughout the year, key equity benchmarks recorded good to exceptional gains in 2020. The S&P 500® Index returned 18.40 percent, the Dow Jones Industrial Average (DJIA) gained 9.72 percent and the technology-heavy NASDAQ Composite Index led the way with a return of 44.92 percent. All recorded multiple record highs throughout the year, including 33 by the S&P 500® alone.

Positive economic reports and solid corporate earnings propelled stocks upward as 2020 began. But early reports of a virus with potentially serious consequences for human health and, hence, equally serious implications for the global economy began to erode investor confidence and the S&P 500® and DJIA closed January moderately lower. As more became known, investors fled the markets en masse, leading to declines in the S&P 500® of 8.23 percent in February and 12.35 percent in March. Trading was highly volatile, as the DJIA recorded day-over-day swings of 2,000 points or more and the VIX, a measure of expected volatility in the S&P 500®, rose to a record of 82.69 in March (by comparison, in 2019 the VIX averaged 15.39).

In April the markets reversed course—dramatically—with the arrival of actions by Congress and the Federal Reserve to slash interest rates, boost liquidity and provide broad economic stimulus, including relief for consumers. Investors flocked to mega-cap tech stocks and those issues that stood to benefit from trends like working and shopping from home. The S&P 500® rose 12.82 percent for the month and went on to post gains in six of the remaining eight months of the year. By August, the S&P 500® had recouped all of its losses and reached a new record high—marking the fastest recovery in history from the depths of a bear market to the heights of an all-time high.

Stocks pushed higher through the first three weeks of the fourth quarter despite choppy trading that reflected good news—strong corporate earnings and the economy growing at an annualized rate of 33.4 percent in the third quarter, the fastest pace on record—offset by concerns over the coronavirus, a stimulus package that was stalled in Congress and uncertainties surrounding the upcoming presidential election.

The election itself was accompanied by strong upward moves in the market, even during the period after election day when the final outcome remained in doubt. The S&P 500® ended election week up 7.3 percent. Reports had Mr. Biden holding the lead in popular and electoral votes but with Republicans appearing to maintain control of the Senate investors felt that with power in Washington divided major policy shifts were unlikely to be enacted. On the heels of the election came news from Pfizer and BioNTech that their COVID-19 vaccine candidate proved to be 95 percent effective in phase 3 clinical trials. The news drove the S&P 500® and the DJIA higher but saw the NASDAQ Composite decline, reflecting a belief that pandemic relief would most benefit companies hardest-hit by the virus. Prospects of a vaccine fueled a rotation into cyclical and value style stocks as well as small-cap issues. At mid-month stocks rallied again on news that a second COVID-19 vaccine, from Moderna, proved to be more than 94 percent effective in phase 3 trials.

| Annual Report | December 31, 2020 | 1 |

Liberty All-Star® Growth Fund | President's Letter |

| (Unaudited) |

November saw the Russell 2000® Index—a widely followed barometer of small-cap performance— advance 18.43 percent and post its biggest monthly gain since the inception of that index more than 40 years ago. The index far outpaced larger-cap indices although the DJIA traded above 30000 for the first time ever. After the strong November, markets were once again choppy in December. News of the first doses of the Pfizer/BioNTech vaccine shipping to healthcare providers and Congress approving a $900 billion financial rescue package were offset by a surge in coronavirus cases across the country and weak economic reports.

Liberty All-Star® Growth Fund

Liberty All-Star Growth Fund posted strong returns in 2020. The Fund returned 42.42 percent with shares valued at net asset value (NAV) with dividends reinvested and 39.37 percent when shares are valued at market price with dividends reinvested. (Fund returns are net of expenses.) The Fund’s NAV return kept pace with its primary benchmark, the Lipper Multi-Cap Growth Mutual Fund Average, which returned 42.83 percent, and exceeded the passive Russell Growth Benchmark by 5.90 percentage points. The NAV and market price return on Fund shares (with dividends reinvested) were ahead of returns posted by the S&P 500® and the DJIA and trailed only the exceptionally strong 44.92 percent return of the NASDAQ Composite.

The Fund finished 2020 with a strong fourth quarter, returning 18.60 percent with shares valued at NAV with dividends reinvested and 19.30 percent with shares valued at market price with dividends reinvested. For the same period, the Lipper benchmark returned 14.61 percent. The Fund’s return also exceeded those of the S&P 500®, the DJIA and the NASDAQ Composite.

Analyzing growth stocks by market capitalization shows that returns in 2020 were more equal than they have been in recent years, particularly for small-cap stocks. The latter, measured by the Russell 2000® Growth Index, returned 34.63 percent while the large-cap Russell 1000® Growth Index returned 38.49 percent—a difference of 3.86 percentage points. Last year, the spread was 7.91 percentage points. The Russell Midcap® Growth Index also performed well, returning 35.59 percent.

Fund shares traded at a premium to their underlying NAV that ranged from 1.0 percent to 13.2 percent in the fourth quarter; by comparison the range in the third quarter was a -2.6 percent discount to a 9.2 percent premium. For the year, the range went from a -9.5 percent discount to a 13.2 percent premium.

In the fourth quarter the Fund paid its regular quarterly distribution based on the Fund’s distribution policy, which was $0.12 per share, plus a one-time year-end distribution of $0.14 for a total of $0.26. The additional amount was based on the Fund’s realized capital gains and was the amount necessary to fulfill the Fund’s excise distribution requirement to avoid paying an excise tax.

| 2 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | President's Letter |

| (Unaudited) |

With this distribution, the total distributed to shareholders since 1997, when the distribution policy commenced, increased to $14.98 per share. The Fund’s distribution policy is a major component of the Fund’s total return, and we emphasize that shareholders should include these distributions when determining the total return on their investment in the Fund.

One of the key principles on which the Fund was founded is multi-management, or the practice of allocating the Fund’s assets to carefully selected growth style managers investing across the capitalization spectrum of large-, mid- and small-cap growth stocks. Thus, we are once again offering insights into the managers’ thinking through our annual Manager Roundtable and invite shareholders to read the managers’ comments beginning on page 13.

We are pleased with the Fund’s fine performance in the exceptionally challenging environment that 2020 presented. Of greater significance, the Fund has outperformed its Lipper benchmark and Russell Growth Benchmark for the trailing three-, five- and 10-year periods. We thank shareholders for supporting the Fund and pledge our best efforts to maintain our record, consistent with prudent management, as we go forward.

Sincerely,

|

|

William R. Parmentier, Jr. |

| President and Chief Executive Officer |

| Liberty All-Star® Growth Fund, Inc. |

| Annual Report | December 31, 2020 | 3 |

| Liberty All-Star® Growth Fund | President's Letter |

| (Unaudited) |

| FUND STATISTICS AND SHORT-TERM PERFORMANCE |

| PERIODS ENDED DECEMBER 31, 2020 |

| FUND STATISTICS: | |

| Net Asset Value (NAV) | $7.98 |

| Market Price | $8.20 |

| Premium | 2.8% |

| Quarter | 2020 | |

| Distributions* | $0.26 | $0.63 |

| Market Price Trading Range | $7.03 to $8.94 | $3.90 to $8.94 |

| Premium/(Discount) Range | 1.0% to 13.2% | -9.5% to 13.2% |

| PERFORMANCE: | ||

| Shares Valued at NAV with Dividends Reinvested | 18.60% | 42.42% |

| Shares Valued at Market Price with Dividends Reinvested | 19.30% | 39.37% |

| Dow Jones Industrial Average | 10.73% | 9.72% |

| Lipper Multi-Cap Growth Mutual Fund Average | 14.61% | 42.83% |

| NASDAQ Composite Index | 15.63% | 44.92% |

| Russell Growth Benchmark | 19.48% | 36.52% |

| S&P 500® Index | 12.15% | 18.40% |

| * | All 2020 distributions consist of ordinary dividends and long-term capital gains. The fourth quarter distribution of $0.26 includes $0.12 to fulfill the Fund’s excise distribution requirement to avoid paying an excise tax. A breakdown of each 2020 distribution for federal income tax purposes can be found in the table on page 42. |

The views expressed in the President’s Letter, Unique Fund Attributes and Manager Roundtable reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions, and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for the Fund are based on numerous factors, may not be relied on as an indication of trading intent. References to specific company securities should not be construed as a recommendation or investment advice.

| 4 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | President's Letter |

| (Unaudited) |

| ANNUALIZED RATES OF RETURN | |||

| LONG-TERM PERFORMANCE SUMMARY AND DISTRIBUTIONS PERIODS ENDED DECEMBER 31, 2020 | 3 YEARS | 5 YEARS | 10 YEARS |

LIBERTY ALL-STAR® GROWTH FUND, INC.

| Distributions | $1.55 | $2.33 | $4.28 |

| Shares Valued at NAV with Dividends Reinvested | 24.19% | 20.87% | 15.75% |

| Shares Valued at Market Price with Dividends Reinvested | 26.29% | 23.63% | 16.91% |

| Dow Jones Industrial Average | 9.90% | 14.65% | 12.97% |

| Lipper Multi-Cap Growth Mutual Fund Average | 21.79% | 18.84% | 15.13% |

| NASDAQ Composite Index | 24.39% | 22.12% | 18.46% |

| Russell Growth Benchmark | 20.13% | 18.91% | 15.51% |

| S&P 500® Index | 14.18% | 15.22% | 13.88% |

Performance returns for the Fund are calculated assuming all distributions are reinvested at actual reinvestment prices and all primary rights in the Fund's rights offering were exercised. Returns are net of management fees and other Fund expenses.

The returns shown for the Lipper Multi-Cap Growth Mutual Fund Average are based on open-end mutual funds’ total returns, which include dividends, and are net of fund expenses. Returns for the unmanaged Dow Jones Industrial Average, NASDAQ Composite Index, the Russell Growth Benchmark and the S&P 500® Index are total returns, including dividends. A description of the Lipper benchmark and the market indices can be found on page 61.

Past performance cannot predict future results. Performance will fluctuate with market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

Closed-end funds raise money in an initial public offering and shares are listed and traded on an exchange. Open-end mutual funds continuously issue and redeem shares at net asset value. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value.

| Annual Report | December 31, 2020 | 5 |

| Liberty All-Star® Growth Fund | Unique Fund Attributes |

| (Unaudited) |

UNIQUE ATTRIBUTES OF Liberty All-Star® Growth Fund

Several attributes help to make the Fund a core equity holding for investors seeking a diversified growth portfolio, income and the potential for long-term appreciation.

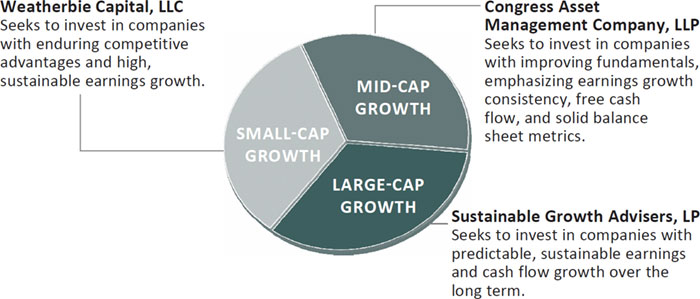

| MULTI-MANAGEMENT FOR INDIVIDUAL INVESTORS |

| Large institutional investors have traditionally employed multiple investment managers. With three investment managers investing across the full capitalization range of growth stocks, the Fund brings multi-management to individual investors. |

| REAL-TIME TRADING AND LIQUIDITY |

| The Fund has a fixed number of shares that trade on the New York Stock Exchange and other exchanges. Share pricing is continuous—not just end-of-day, as it is with open-end mutual funds. Fund shares offer immediate liquidity, there are no annual sales fees and can often be traded commission free. |

| 6 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Unique Fund Attributes |

| (Unaudited) |

| ACCESS TO INSTITUTIONAL MANAGERS |

| The Fund’s investment managers invest primarily for pension funds, endowments, foundations and other institutions. Because institutional managers are closely monitored by their clients, they tend to be more disciplined and consistent in their investment process. |

| MONITORING AND REBALANCING |

| ALPS Advisors continuously monitors these investment managers to ensure that they are performing as expected and adhering to their style and strategy, and will replace the managers when warranted. Periodic rebalancing maintains the Fund’s structural integrity and is a well-recognized investment discipline. |

| ALIGNMENT AND OBJECTIVITY |

| Alignment with shareholders’ best interests and objective decision-making help to ensure that the Fund is managed openly and equitably. In addition, the Fund is governed by a Board of Directors that is elected by and responsible to shareholders. |

| DISTRIBUTION POLICY |

| Since 1997, the Fund has followed a policy of paying annual distributions on its shares at a rate that approximates historical equity market returns. The current annual distribution rate is 8 percent of the Fund’s net asset value (paid quarterly at 2 percent per quarter), providing a systematic mechanism for distributing funds to shareholders. |

| Annual Report | December 31, 2020 | 7 |

| Liberty All-Star® Growth Fund | Table of Distributions and Rights Offerings |

(Unaudited)

| RIGHTS OFFERINGS | ||||

| YEAR | PER SHARE DISTRIBUTIONS | MONTH COMPLETED | SHARES NEEDED TO PURCHASE ONE ADDITIONAL SHARE | SUBSCRIPTION PRICE |

| 1997 | $1.24 | |||

| 1998 | 1.35 | July | 10 | $12.41 |

| 1999 | 1.23 | |||

| 2000 | 1.34 | |||

| 2001 | 0.92 | September | 8 | 6.64 |

| 2002 | 0.67 | |||

| 2003 | 0.58 | September | 81 | 5.72 |

| 2004 | 0.63 | |||

| 2005 | 0.58 | |||

| 2006 | 0.59 | |||

| 2007 | 0.61 | |||

| 2008 | 0.47 | |||

| 20092 | 0.24 | |||

| 2010 | 0.25 | |||

| 2011 | 0.27 | |||

| 2012 | 0.27 | |||

| 2013 | 0.31 | |||

| 2014 | 0.33 | |||

| 20153 | 0.77 | |||

| 2016 | 0.36 | |||

| 2017 | 0.42 | |||

| 2018 | 0.46 | November | 3 | 4.81 |

| 2019 | 0.46 | |||

| 2020 | 0.63 | March | 5 | 4.34 |

| Total | $14.98 |

| 1 | The number of shares offered was increased by an additional 25 percent to cover a portion of the over-subscription requests. |

| 2 | Effective with the second quarter distribution, the annual distribution rate was changed from 10 percent to 6 percent. |

| 3 | Effective with the second quarter distribution, the annual distribution rate was changed from 6 percent to 8 percent. |

DISTRIBUTION POLICY

The current policy is to pay distributions on its shares totaling approximately 8 percent of its net asset value per year, payable in four quarterly installments of 2 percent of the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. Sources of distributions to shareholders may include ordinary dividends, long-term capital gains and return of capital. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during its fiscal year and may be subject to changes based on tax regulations. If a distribution includes anything other than net investment income, the Fund provides a Section 19(a) notice of the best estimate of its distribution sources at that time. These estimates may not match the final tax characterization (for the full year’s distributions) contained in shareholder 1099-DIV forms after the end of the year. If the Fund’s ordinary dividends and long-term capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain and not distribute capital gains and pay income tax thereon to the extent of such excess.

| 8 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Investment Growth |

(Unaudited)

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of shares of common stock at the closing market price (NYSE: ASG) of $9.25 on December 31, 1996, and tracking its progress through December 31, 2020. For certain information, it also assumes that a shareholder exercised all primary rights in the Fund’s rights offerings (see below). This graph covers the period since the Fund commenced its distribution policy in 1997.

| The growth of the investment assuming all distributions were received in cash and not reinvested back into the Fund. The value of the investment under this scenario grew to $25,060 (including the December 31, 2020 value of the original investment of $8,865, plus distributions during the period of $16,195). |

| The additional value realized through reinvestment of all distributions. The value of the investment under this scenario grew to $88,077. |

| The additional value realized by exercising all primary rights in the Fund’s rights offerings. The value of the investment under this scenario grew to $166,833 excluding the cost to exercise all primary rights in the rights offerings which was $52,121. |

Past performance cannot predict future results. Performance will fluctuate with changes in market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

| Annual Report | December 31, 2020 | 9 |

| Liberty All-Star® Growth Fund | Major Stock Changes in the Quarter |

December 31, 2020 (Unaudited)

The following are the major ($1 million or more) stock changes - both purchases and sales - that were made in the Fund’s portfolio during the fourth quarter of 2020.

| SHARES | ||

| SECURITY NAME | PURCHASE (SALES) | HELD AS OF 12/31/20 |

| PURCHASES | ||

| American Express Co. | 17,615 | 17,615 |

| Core Laboratories NV | 36,794 | 91,664 |

| Entegris, Inc. | 31,000 | 31,000 |

| Floor & Decor Holdings, Inc. | 27,500 | 27,500 |

| Masco Corp. | 50,000 | 50,000 |

| MSCI, Inc. | 5,257 | 5,257 |

| Natera, Inc. | 16,142 | 56,925 |

| Ollie's Bargain Outlet Holdings, Inc. | 17,093 | 59,870 |

| Regeneron Pharmaceuticals, Inc. | 1,966 | 5,319 |

| salesforce.com, Inc. | 5,477 | 18,815 |

| StepStone Group, Inc. | 41,616 | 79,169 |

| Upstart Holdings, Inc. | 51,410 | 51,410 |

| Walt Disney Co. | 12,307 | 12,307 |

| SALES | ||

| Alphabet, Inc. | (715) | 2,075 |

| Becton Dickinson and Co. | (11,165) | 0 |

| Ecolab, Inc. | (13,942) | 0 |

| Etsy, Inc. | (9,000) | 18,500 |

| Generac Holdings, Inc. | (5,500) | 14,000 |

| HD Supply Holdings, Inc. | (60,000) | 0 |

| HubSpot, Inc. | (8,216) | 0 |

| Insulet Corp. | (19,182) | 0 |

| Lennox International, Inc. | (8,500) | 0 |

| Pluralsight, Inc. | (65,943) | 0 |

| Varian Medical Systems, Inc. | (15,000) | 0 |

| Xilinx, Inc. | (28,307) | 0 |

| 10 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Top 20 Holdings and Economic Sectors |

December 31, 2020 (Unaudited)

| TOP 20 HOLDINGS* | PERCENT OF NET ASSETS |

| Chegg, Inc. | 2.21% |

| Progyny, Inc. | 2.16 |

| Paylocity Holding Corp. | 1.90 |

| FirstService Corp. | 1.88 |

| Nevro Corp. | 1.86 |

| Natera, Inc. | 1.68 |

| Amazon.com, Inc. | 1.58 |

| Visa, Inc. | 1.57 |

| Microsoft Corp. | 1.55 |

| UnitedHealth Group, Inc. | 1.45 |

| Ollie's Bargain Outlet Holdings, Inc. | 1.45 |

| ACADIA Pharmaceuticals, Inc. | 1.38 |

| Casella Waste Systems, Inc. | 1.36 |

| FleetCor Technologies, Inc. | 1.32 |

| Facebook, Inc. | 1.31 |

| Abbott Laboratories | 1.28 |

| Yum! Brands, Inc. | 1.27 |

| PayPal Holdings, Inc. | 1.27 |

| Everbridge, Inc. | 1.25 |

| salesforce.com, Inc. | 1.24 |

| 30.97% |

| ECONOMIC SECTORS* | PERCENT OF NET ASSETS |

| Information Technology | 29.81% |

| Health Care | 24.46 |

| Consumer Discretionary | 13.38 |

| Industrials | 11.21 |

| Financials | 7.44 |

| Communication Services | 4.47 |

| Real Estate | 3.44 |

| Materials | 1.92 |

| Consumer Staples | 1.88 |

| Energy | 0.72 |

| Other Net Assets | 1.27 |

| 100.00% |

| * | Because the Fund is actively managed, there can be no guarantee that the Fund will continue to hold securities of the indicated issuers and sectors in the future. |

| Annual Report | December 31, 2020 | 11 |

| Liberty All-Star® Growth Fund | Investment Managers/Portfolio Characteristics |

(Unaudited)

THE FUND’S THREE GROWTH INVESTMENT MANAGERS

AND THE MARKET CAPITALIZATION ON WHICH EACH FOCUSES:

ALPS Advisors, Inc., the investment advisor to the Fund, has the ultimate authority (subject to oversight by the Board of Directors) to oversee the investment managers and recommend their hiring, termination and replacement.

MANAGERS’ DIFFERING INVESTMENT STRATEGIES ARE

REFLECTED IN PORTFOLIO CHARACTERISTICS

The portfolio characteristics table below is a regular feature of the Fund’s shareholder reports. It serves as a useful tool for understanding the value of the Fund’s multi-managed portfolio. The characteristics are different for each of the Fund’s three investment managers. These differences are a reflection of the fact that each has a different capitalization focus and investment strategy. The shaded column highlights the characteristics of the Fund as a whole, while the first three columns show portfolio characteristics for the Russell Smallcap, Midcap and Largecap Growth indices. See page 61 for a description of these indices.

| MARKET CAPITALIZATION SPECTRUM | |||||||

| PORTFOLIO CHARACTERISTICS AS OF DECEMBER 31, 2020 | SMALL | LARGE | |||||

| |||||||

| RUSSELL GROWTH: | |||||||

| Smallcap Index | Midcap Index | Largecap Index | Weatherbie | Congress | Sustainable | Total Fund | |

| Number of Holdings | 1,128 | 347 | 453 | 50 | 40 | 29 | 119 |

| Weighted Average Market Capitalization (billions) | $4.1 | $24.9 | $722.8 | $6.0 | $18.6 | $364.8 | $123.1 |

| Average Five-Year Earnings Per Share Growth | 11% | 19% | 19% | 17% | 19% | 19% | 19% |

| Average Five-Year Sales Per Share Growth | 9% | 13% | 15% | 15% | 11% | 12% | 13% |

| Price/Earnings Ratio* | 32x | 41x | 40x | 64x | 36x | 43x | 43x |

| Price/Book Value Ratio | 5.9x | 11.7x | 12.7x | 9.1x | 7.2x | 9.4x | 8.5x |

| * | Excludes negative earnings. |

| 12 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Manager Roundtable |

(Unaudited)

MANAGER ROUNDTABLE

A tumultuous 2020 saw the S&P 500® Index and other benchmarks go from bear market to record highs in the span of a few months. For the Fund’s investment managers, it was a year that proved the value of staying on course and adhering to their style, strategy and investment process.

Liberty All-Star Growth Fund’s three investment managers have long experience, in-depth knowledge, proven track records and a commitment to growth style investing. After a year without equal in the memory of many investors, this experience and commitment proved invaluable in navigating through a volatile investment environment. Once again, we are grateful to be able to call upon this resource to provide Fund shareholders with timely commentary and insight. The Fund’s Investment Advisor, ALPS Advisors, serves as moderator of the roundtable. Participating investment management firms, the portfolio manager for each and their respective capitalization ranges are:

CONGRESS ASSET MANAGEMENT COMPANY, LLP

Portfolio Manager/Todd Solomon, CFA

Senior Vice President/Portfolio Manager

Capitalization Focus/Mid-Cap Growth—Congress Asset Management’s mid-cap growth strategy focuses on established, high-quality companies that are growing earnings and generating attractive levels of free cash flow. The firm also strives to construct portfolios with relatively low levels of volatility.

SUSTAINABLE GROWTH ADVISERS, LP

Portfolio Manager/Kishore D. Rao

Principal and Portfolio Manager

Capitalization Focus/Large-Cap Growth—Sustainable focuses on companies that have unique characteristics that lead to a high degree of predictability, strong profitability and above-average earnings and cash flow growth over the long term.

WEATHERBIE CAPITAL, LLC

Portfolio Manager/Matthew A. Weatherbie, CFA

President and Founder

Capitalization Focus/Small-Cap Growth—Weatherbie practices a small capitalization growth investment style focusing on high quality companies that demonstrate superior earnings growth prospects, yet are reasonably priced relative to their intrinsic value. The firm seeks to provide superior returns relative to small capitalization growth indices over a full market cycle.

From the perspective of your style and strategy, what had the most impact on your portfolio in 2020? Many investors would say it was COVID-19. But while considering macro factors to varying degrees in their investment process, Liberty All-Star Growth Fund managers generally build their portfolios bottom-up based on company fundamentals. For you, there may have been another less visible influencer—or influencers—that impacted portfolio performance.

| Annual Report | December 31, 2020 | 13 |

| Liberty All-Star® Growth Fund | Manager Roundtable |

(Unaudited)

Matt Weatherbie, small-cap stocks were resurgent in 2020, so let us turn to you to begin.

Weatherbie (Weatherbie – Small-Cap Growth): During the sharp market downturn prompted by COVID-19 in February and March one institutional client asked, “How are you changing your playbook in response to this?” My reply was that “the team is not changing its ‘playbook’ in any way—we are relying on it.” This characterizes the year for the portfolio as the team has always sought to identify what we believe are the 50 highest quality smaller growth companies in America.

Prior to COVID-19, positions like EPAM Systems, Inc. (EPAM), Casella Waste Systems, Inc. (CWST), Chegg, Inc. (CHGG) or Wayfair Inc. (W) performed well, held up during the first quarter downturn and accelerated during the market rebound. Just as we have across our 25-year history, Weatherbie Capital invested in some great companies during 2020—with exceptional management teams performing well operationally—and we built a diversified, balanced portfolio.

Todd, mid-cap growth stocks also turned in a strong year, so let us hear from you.

Solomon (Congress – Mid-Cap Growth): Congress Asset Management constructs diversified “growth at a reasonable risk” portfolios. For most of 2020, these characteristics proved to be headwinds. While there was a short time in February that the market rewarded solid balance sheets and other quality characteristics, the winners for the rest of the year were concentrated in nonearner, high beta and low return on equity, many in the technology and health care buckets. We have managed our portfolios through such times before and remained steadfast in our philosophy and process. Despite these headwinds, the portfolio was a beneficiary of M&A activity, as two portfolio holdings were acquired at significant premiums to their market capitalization during the year.

“We have managed our portfolios through times like 2020 before and remain steadfast in our philosophy and process.”

—Todd Solomon

(Congress – Mid-Cap Growth)

Kishore, large-cap stocks have led the way in recent years and performed well again in 2020. How did Sustainable steer its way through the year?

Rao (Sustainable – Large-Cap Growth): The large rise in market volatility associated with the uncertainty and economic dislocations generated by the COVID-19 pandemic created many opportunities for long-term investors who had done their research and were able to look through the short-term issues and high emotions to leverage a longer-term perspective and take advantage of opportunities in some great businesses. We were able to buy some attractive growth businesses early in the year on weakness then trim and sell stocks that rebounded strongly in the summer and fall. While turnover in the portfolio has averaged about 35 percent over time, this year our turnover approximated 51 percent due to accentuated market movements and our ability to capitalize upon them.

The S&P 500® Index increased 18.40 percent in 2020. But the median stock in the index was ahead just 8.66 percent, indicating how narrow the stock market’s advance was. Other disparities have existed as well: the outperformance of growth over value and large-cap outperforming small/mid-cap. In recent months, however, there has been a shift toward value stocks and small/mid-caps, narrowing the performance gap. What do you see in the coming year for market breadth, growth v. value and large-cap relative to small/mid-cap? Kishore, we’ll stay with you.

| 14 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Manager Roundtable |

(Unaudited)

Rao (Sustainable – Large-Cap Growth): Our focus is on identifying high quality companies with above average predictable and sustainable growth and then purchasing them at attractive cash flow-based valuations. How the market is going to reward certain attributes or styles in the short term is an impossible thing to predict. It would not be surprising to see sections of the market that failed to participate in 2020’s strength catch-up in 2021 should the economic dislocations of this year begin to correct and the COVID-19 pandemic wind down as the vaccinations become more widely available globally. However, we do not see the ingredients in place to support a sustained change in market leadership given the low level of inflation, huge amounts of excess capacity and long-term demographic trends.

“Uncertainty and economic dislocations generated by the pandemic created many opportunities for long-term investors who had done their research.”

—Kishore Rao

(Sustainable – Large-Cap Growth)

Matt, how does Weatherbie see these trends as we move ahead?

Weatherbie (Weatherbie – Small-Cap Growth): With the early November announcement of two efficacious vaccines for COVID-19, U.S. markets saw a rebound among lower quality stocks, many with high levels of debt. Despite this our 50 portfolio holdings performed in line and outperformed across the remainder of the fourth quarter. As mentioned previously, we believe our portfolio is well-balanced—for example our financial and banking stocks did particularly well after mid-year underperformance.

Looking ahead to 2021 we will continue to seek smaller growth companies that meet all of our six criteria for growth and quality. As the vaccines are rolled out and the pandemic restrictions ease, we expect several holdings to potentially do well. Examples include medical device companies associated with temporarily suspended surgical procedures and artificial intelligence-enabled speech recognition technology for the auto industry. We seek innovative, exciting small companies with strong earnings projections, capable management and a significant competitive advantage.

Todd, what is Congress’ perspective?

Solomon (Congress – Mid-Cap Growth): We would expect to see market breadth continue to improve with sectors besides technology and health care showing solid gains. Growth rates in 2021 may be higher for those companies disrupted most by COVID-19 as we approach the anniversary of the greatest impact. Those companies that maintained financial discipline and have reasonable valuations are attractive investments for long-term investors.

Some stocks were clear beneficiaries of COVID-19 in 2020, e.g., the stay-at-home trade. What is a stock in the portion of the Liberty All-Star Growth Fund that you manage that produced good returns without being a direct beneficiary of the pandemic? Todd, start us off, please.

| Annual Report | December 31, 2020 | 15 |

| Liberty All-Star® Growth Fund | Manager Roundtable |

(Unaudited)

Solomon (Congress – Mid-Cap Growth): Despite the severe disruptions in the employment market and low interest rates, Paycom (PAYC) performed admirably. The company faced challenges of lower number of employees on client systems, bankruptcies and closures of clients, and lower income from interest on the carried cash balances. Management was able to offset this with strong performance of its sales teams, which were able to bring in new customers while transitioning to a fully remote business development process. Further, they were moving into new corporate headquarters during the year.

Kishore, what’s a holding that worked for Sustainable?

Rao (Sustainable – Large-Cap Growth): Ball Corp. (BLL) is the leader in the production of recyclable aluminum containers for use by the beverage and other industries that are switching from plastics. Today approximately 70 percent of new beverages in the U.S. are bottled in aluminum cans whereas five years ago it was about 30 percent. Ball is in an excellent position to capitalize on this trend.

Round it out for us, please, Matt.

Weatherbie (Weatherbie – Small-Cap Growth): An example of a stock in the portfolio that had good returns across the year with little impact from the stay-at-home trade is SiteOne Landscape Supply, Inc. (SITE). Recall that we look for quality growth companies in unexpected places like seemingly mundane services companies. SiteOne—a superb example—engages in the distribution of commercial and residential landscape supplies. Its products include outdoor lighting, nursery, landscape supplies, fertilizers, turf protection products, grass seed, turf care equipment and golf course accessories for green industry professionals. Across the year SiteOne saw steady demand for its best-in-class delivery of landscape supplies to construction sites. During the first quarter the stock did pull back with the rest of the market—but fundamentals remained solid and demonstrated improving control of inventory and pricing as well as better supply chain technology. Outdoor landscaping was uninterrupted—especially in the southern U.S.—and SiteOne’s stock rose about 70 percent for the year.

“The team has always sought to identify what we believe are the 50 highest quality smaller growth companies in America.”

—Matt Weatherbie

(Weatherbie – Small-Cap Growth)

Let’s close with a look ahead: What is a stock in the portion of the Liberty All-Star Growth Fund that you manage that you feel is well positioned for 2021 and why? Let’s go down the capitalization range large to small.

Rao (Sustainable – Large-Cap Growth): Intuitive Surgical (ISRG) is the leader in robotic surgeries, which result in lower costs and better outcomes for patients. The pandemic delayed many procedures from taking place in 2020 and we expect they’ll occur in 2021. Additionally, more procedures are being approved for robotic surgery, paving an attractive runway for growth in a cost-focused health care environment.

| 16 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Manager Roundtable |

(Unaudited)

Solomon (Congress – Mid-Cap Growth): Cooper Companies (COO), a provider of contact lenses and surgical products, will benefit as people begin to leave the house more. With Zoom calls and fewer social engagements, use of contact lenses fell in favor of wearing glasses. Non-critical surgeries were postponed as patients rued going to a hospital and facilities that were repurposed for COVID-19 treatment.

Weatherbie (Weatherbie – Small-Cap Growth): The Weatherbie team feels the portfolio is well positioned for 2021. One stock that we believe is poised to do well is Cerence Inc. (CRNC). CRNC is a business-to-business (B2B) provider of voice recognition software to the auto industry, having spun out of Nuance Communications in October 2019. We believe the stock has the potential to perform well over the medium-term due to its revenue growth, coupled with an expanding multiple as the market recognizes its strong competitive position and durable growth. Cerence is strategically aligned with its blue-chip OEM customers, including BMW, Toyota, Ford, Tata, Subaru and many others as the company seeks to provide a customized user experience. It is well positioned with respect to the continued adoption of artificial intelligence-powered voice assistants.

Many thanks for sharing your thinking. The term “2020” implies clarity of vision. That definition was put to the test in a year that was notable for how foggy it was. Your comments certainly underscore the value of discipline in an extraordinary investment environment.

| Annual Report | December 31, 2020 | 17 |

| Liberty All-Star® Growth Fund | Schedule of Investments |

December 31, 2020

| SHARES | MARKET VALUE | |||||||

| COMMON STOCKS (98.73%) | ||||||||

| COMMUNICATION SERVICES (4.47%) | ||||||||

| Entertainment (1.46%) | ||||||||

| Take-Two Interactive Software, Inc.(a) | 13,000 | $ | 2,701,270 | |||||

| Walt Disney Co.(a) | 12,307 | 2,229,782 | ||||||

| 4,931,052 | ||||||||

| Interactive Media & Services (3.01%) | ||||||||

| Alphabet, Inc., Class C(a) | 2,075 | 3,635,151 | ||||||

| Facebook, Inc., Class A(a) | 16,225 | 4,432,021 | ||||||

| Match Group, Inc.(a) | 13,907 | 2,102,600 | ||||||

| 10,169,772 | ||||||||

| CONSUMER DISCRETIONARY (13.38%) | ||||||||

| Distributors (0.99%) | ||||||||

| Pool Corp. | 9,000 | 3,352,500 | ||||||

| Diversified Consumer Services (2.21%) | ||||||||

| Chegg, Inc.(a) | 82,605 | 7,461,709 | ||||||

| Hotels, Restaurants & Leisure (2.43%) | ||||||||

| Planet Fitness, Inc., Class A(a) | 38,031 | 2,952,347 | ||||||

| Wingstop, Inc. | 7,410 | 982,195 | ||||||

| Yum! Brands, Inc. | 39,546 | 4,293,114 | ||||||

| 8,227,656 | ||||||||

| Internet & Direct Marketing Retail (2.55%) | ||||||||

| Amazon.com, Inc.(a) | 1,642 | 5,347,879 | ||||||

| Etsy, Inc.(a) | 18,500 | 3,291,335 | ||||||

| 8,639,214 | ||||||||

| Multiline Retail (1.45%) | ||||||||

| Ollie's Bargain Outlet Holdings, Inc.(a) | 59,870 | 4,895,570 | ||||||

| Specialty Retail (2.54%) | ||||||||

| Burlington Stores, Inc.(a) | 9,500 | 2,484,725 | ||||||

| Floor & Decor Holdings, Inc., Class A(a) | 27,500 | 2,553,375 | ||||||

| Williams-Sonoma, Inc. | 35,000 | 3,564,400 | ||||||

| 8,602,500 | ||||||||

| Textiles, Apparel & Luxury Goods (1.21%) | ||||||||

| Canada Goose Holdings, Inc.(a)(b) | 9,834 | 292,758 | ||||||

| NIKE, Inc., Class B | 26,776 | 3,788,001 | ||||||

| 4,080,759 | ||||||||

| CONSUMER STAPLES (1.88%) | ||||||||

| Food Products (1.23%) | ||||||||

| Lamb Weston Holdings, Inc. | 25,000 | 1,968,500 | ||||||

See Notes to Financial Statements.

| 18 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Schedule of Investments |

December 31, 2020

| SHARES | MARKET VALUE | |||||||

| COMMON STOCKS (continued) | ||||||||

| Food Products (continued) | ||||||||

| McCormick & Co., Inc. | 23,000 | $ | 2,198,800 | |||||

| 4,167,300 | ||||||||

| Household Products (0.65%) | ||||||||

| Church & Dwight Co., Inc. | 25,000 | 2,180,750 | ||||||

| ENERGY (0.72%) | ||||||||

| Energy Equipment & Services (0.72%) | ||||||||

| Core Laboratories NV | 91,664 | 2,430,013 | ||||||

| FINANCIALS (7.44%) | ||||||||

| Banks (1.77%) | ||||||||

| First Republic Bank | 18,000 | 2,644,740 | ||||||

| Signature Bank | 24,753 | 3,348,834 | ||||||

| 5,993,574 | ||||||||

| Capital Markets (3.22%) | ||||||||

| Hamilton Lane, Inc., Class A | 37,256 | 2,907,831 | ||||||

| MSCI, Inc. | 5,257 | 2,347,408 | ||||||

| Raymond James Financial, Inc. | 26,000 | 2,487,420 | ||||||

| StepStone Group, Inc.(a) | 79,169 | 3,150,926 | ||||||

| 10,893,585 | ||||||||

| Consumer Finance (1.47%) | ||||||||

| American Express Co. | 17,615 | 2,129,830 | ||||||

| LendingTree, Inc.(a) | 2,706 | 740,876 | ||||||

| Upstart Holdings, Inc.(a)(b) | 51,410 | 2,094,957 | ||||||

| 4,965,663 | ||||||||

| Insurance (0.80%) | ||||||||

| eHealth, Inc.(a) | 6,505 | 459,318 | ||||||

| Goosehead Insurance, Inc., Class A | 17,925 | 2,236,323 | ||||||

| 2,695,641 | ||||||||

| Thrifts & Mortgage Finance (0.18%) | ||||||||

| Axos Financial, Inc.(a) | 16,144 | 605,884 | ||||||

| HEALTH CARE (24.46%) | ||||||||

| Biotechnology (4.97%) | ||||||||

| ACADIA Pharmaceuticals, Inc.(a) | 87,066 | 4,654,548 | ||||||

| Natera, Inc.(a) | 56,925 | 5,665,176 | ||||||

| Neurocrine Biosciences, Inc.(a) | 16,000 | 1,533,600 | ||||||

| Puma Biotechnology, Inc.(a) | 133,356 | 1,368,233 | ||||||

| Regeneron Pharmaceuticals, Inc.(a) | 5,319 | 2,569,662 | ||||||

| Ultragenyx Pharmaceutical, Inc.(a) | 7,435 | 1,029,227 | ||||||

| 16,820,446 | ||||||||

See Notes to Financial Statements.

| Annual Report | December 31, 2020 | 19 |

| Liberty All-Star® Growth Fund | Schedule of Investments |

December 31, 2020

| SHARES | MARKET VALUE | |||||||

| COMMON STOCKS (continued) | ||||||||

| Health Care Equipment & Supplies (8.74%) | ||||||||

| Abbott Laboratories | 39,523 | $ | 4,327,373 | |||||

| BioLife Solutions Inc(a) | 1,221 | 48,706 | ||||||

| Cooper Cos., Inc. | 6,000 | 2,179,920 | ||||||

| Danaher Corp. | 14,146 | 3,142,392 | ||||||

| Eargo, Inc.(a) | 17,740 | 795,107 | ||||||

| Glaukos Corp.(a) | 18,068 | 1,359,798 | ||||||

| Intuitive Surgical, Inc.(a) | 3,235 | 2,646,553 | ||||||

| Nevro Corp.(a) | 36,285 | 6,280,934 | ||||||

| ResMed, Inc. | 13,000 | 2,763,280 | ||||||

| Silk Road Medical, Inc.(a) | 13,023 | 820,189 | ||||||

| STERIS PLC | 12,500 | 2,369,250 | ||||||

| West Pharmaceutical Services, Inc. | 10,000 | 2,833,100 | ||||||

| 29,566,602 | ||||||||

| Health Care Providers & Services (4.55%) | ||||||||

| PetIQ, Inc.(a)(b) | 50,027 | 1,923,538 | ||||||

| Progyny, Inc.(a) | 172,166 | 7,298,117 | ||||||

| UnitedHealth Group, Inc. | 13,962 | 4,896,194 | ||||||

| US Physical Therapy, Inc. | 10,601 | 1,274,770 | ||||||

| 15,392,619 | ||||||||

| Health Care Technology (0.63%) | ||||||||

| Inspire Medical Systems, Inc.(a) | 1,441 | 271,038 | ||||||

| Tabula Rasa HealthCare, Inc.(a) | 43,245 | 1,852,616 | ||||||

| 2,123,654 | ||||||||

| Life Sciences Tools & Services (4.64%) | ||||||||

| Charles River Laboratories International, Inc.(a) | 12,750 | 3,185,714 | ||||||

| Illumina, Inc.(a) | 7,849 | 2,904,130 | ||||||

| Mettler-Toledo International, Inc.(a) | 2,500 | 2,849,200 | ||||||

| NeoGenomics, Inc.(a) | 66,961 | 3,605,180 | ||||||

| Thermo Fisher Scientific, Inc. | 6,736 | 3,137,494 | ||||||

| 15,681,718 | ||||||||

| Pharmaceuticals (0.93%) | ||||||||

| Aerie Pharmaceuticals, Inc.(a) | 29,181 | 394,235 | ||||||

| Horizon Pharma Plc(a) | 37,500 | 2,743,125 | ||||||

| 3,137,360 | ||||||||

| INDUSTRIALS (11.21%) | ||||||||

| Aerospace & Defense (1.96%) | ||||||||

| Huntington Ingalls Industries, Inc. | 12,300 | 2,096,904 | ||||||

| Kratos Defense & Security Solutions, Inc.(a) | 79,556 | 2,182,221 | ||||||

| Teledyne Technologies, Inc.(a) | 6,000 | 2,351,880 | ||||||

| 6,631,005 | ||||||||

See Notes to Financial Statements.

| 20 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Schedule of Investments |

December 31, 2020

| SHARES | MARKET VALUE | |||||||

| COMMON STOCKS (continued) | ||||||||

| Air Freight & Logistics (0.52%) | ||||||||

| XPO Logistics, Inc.(a) | 14,673 | $ | 1,749,022 | |||||

| Building Products (0.81%) | ||||||||

| Masco Corp. | 50,000 | 2,746,500 | ||||||

| Commercial Services & Supplies (3.24%) | ||||||||

| Casella Waste Systems, Inc., Class A(a) | 74,107 | 4,590,929 | ||||||

| Cintas Corp. | 9,000 | 3,181,140 | ||||||

| Copart, Inc.(a) | 25,000 | 3,181,250 | ||||||

| 10,953,319 | ||||||||

| Electrical Equipment (0.94%) | ||||||||

| Generac Holdings, Inc.(a) | 14,000 | 3,183,740 | ||||||

| Machinery (0.71%) | ||||||||

| IDEX Corp. | 12,000 | 2,390,400 | ||||||

| Professional Services (0.95%) | ||||||||

| IHS Markit, Ltd. | 35,800 | 3,215,914 | ||||||

| Road & Rail (1.10%) | ||||||||

| Union Pacific Corp. | 17,891 | 3,725,264 | ||||||

| Trading Companies & Distributors (0.98%) | ||||||||

| SiteOne Landscape Supply, Inc.(a) | 20,969 | 3,326,312 | ||||||

| INFORMATION TECHNOLOGY (29.81%) | ||||||||

| Communications Equipment (0.63%) | ||||||||

| Ciena Corp.(a) | 40,000 | 2,114,000 | ||||||

| Electronic Equipment, Instruments & Components (2.01%) | ||||||||

| Keysight Technologies, Inc.(a) | 20,000 | 2,641,800 | ||||||

| Novanta, Inc.(a) | 6,020 | 711,684 | ||||||

| Zebra Technologies Corp., Class A(a) | 9,000 | 3,458,970 | ||||||

| 6,812,454 | ||||||||

| IT Services (6.32%) | ||||||||

| Akamai Technologies, Inc.(a) | 18,000 | 1,889,820 | ||||||

| Booz Allen Hamilton Holding Corp. | 23,000 | 2,005,140 | ||||||

| FleetCor Technologies, Inc.(a) | 16,353 | 4,461,589 | ||||||

| Globant SA(a) | 15,663 | 3,408,426 | ||||||

| PayPal Holdings, Inc.(a) | 18,307 | 4,287,499 | ||||||

| Visa, Inc., Class A | 24,293 | 5,313,608 | ||||||

| 21,366,082 | ||||||||

See Notes to Financial Statements.

| Annual Report | December 31, 2020 | 21 |

| Liberty All-Star® Growth Fund | Schedule of Investments |

December 31, 2020

| SHARES | MARKET VALUE | |||||||

| COMMON STOCKS (continued) | ||||||||

| Semiconductors & Semiconductor Equipment (3.87%) | ||||||||

| Diodes, Inc.(a) | 44,901 | $ | 3,165,520 | |||||

| Entegris, Inc. | 31,000 | 2,979,100 | ||||||

| Impinj, Inc.(a) | 23,580 | 987,295 | ||||||

| Monolithic Power Systems, Inc. | 9,000 | 3,296,070 | ||||||

| Skyworks Solutions, Inc. | 17,500 | 2,675,400 | ||||||

| 13,103,385 | ||||||||

| Software (16.98%) | ||||||||

| Altair Engineering, Inc., Class A(a) | 6,998 | 407,144 | ||||||

| Autodesk, Inc.(a) | 13,102 | 4,000,565 | ||||||

| Avalara, Inc.(a) | 18,161 | 2,994,567 | ||||||

| Bill.com Holdings, Inc.(a) | 4,399 | 600,463 | ||||||

| Cerence, Inc.(a) | 31,698 | 3,185,015 | ||||||

| Ebix, Inc. | 38,249 | 1,452,314 | ||||||

| Everbridge, Inc.(a) | 28,433 | 4,238,507 | ||||||

| Fortinet, Inc.(a) | 20,000 | 2,970,600 | ||||||

| Intuit, Inc. | 6,225 | 2,364,566 | ||||||

| LivePerson, Inc.(a) | 8,746 | 544,264 | ||||||

| Microsoft Corp. | 23,534 | 5,234,432 | ||||||

| Mimecast, Ltd.(a) | 18,162 | 1,032,328 | ||||||

| Paycom Software, Inc.(a) | 7,000 | 3,165,750 | ||||||

| Paylocity Holding Corp.(a) | 31,278 | 6,440,453 | ||||||

| Qualys, Inc.(a) | 20,000 | 2,437,400 | ||||||

| Rapid7, Inc.(a) | 14,860 | 1,339,778 | ||||||

| salesforce.com, Inc.(a) | 18,815 | 4,186,902 | ||||||

| SPS Commerce, Inc.(a) | 12,393 | 1,345,756 | ||||||

| Synopsys, Inc.(a) | 11,500 | 2,981,260 | ||||||

| Vertex, Inc.(a) | 68,889 | 2,400,782 | ||||||

| Workday, Inc., Class A(a) | 17,033 | 4,081,277 | ||||||

| 57,404,123 | ||||||||

| MATERIALS (1.92%) | ||||||||

| Chemicals (0.83%) | ||||||||

| Linde PLC | 10,606 | 2,794,787 | ||||||

| Containers & Packaging (1.09%) | ||||||||

| Ball Corp. | 39,666 | 3,696,078 | ||||||

| REAL ESTATE (3.44%) | ||||||||

| Equity Real Estate Investment Trusts (REITs) (1.56%) | 4,516 | 3,225,237 | ||||||

| Equinix, Inc. | 13,500 | 2,051,325 | ||||||

| Sun Communities, Inc. | 5,276,562 | |||||||

See Notes to Financial Statements.

| 22 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Schedule of Investments |

December 31, 2020

| SHARES | MARKET VALUE | |||||||

| COMMON STOCKS (continued) | ||||||||

| Real Estate Management & Development (1.88%) | ||||||||

| FirstService Corp. | 46,371 | $ | 6,341,698 | |||||

| TOTAL COMMON STOCKS | ||||||||

| (COST OF $189,634,054) | 333,846,186 | |||||||

| SHORT TERM INVESTMENTS (3.99%) | ||||||||

| MONEY MARKET FUND (2.92%) | ||||||||

| State Street Institutional US Government Money | ||||||||

| Market Fund, 0.03%(c) | ||||||||

| (COST OF $9,880,812) | 9,880,812 | 9,880,812 | ||||||

| INVESTMENTS PURCHASED WITH COLLATERAL FROM SECURITIES LOANED (1.07%) | ||||||||

| State Street Navigator Securities Lending Government | ||||||||

| Money Market Portfolio, 0.08% | ||||||||

| (COST OF $3,608,049) | 3,608,049 | 3,608,049 | ||||||

| TOTAL SHORT TERM INVESTMENTS | ||||||||

| (COST OF $13,488,861) | 13,488,861 | |||||||

| TOTAL INVESTMENTS (102.72%) | ||||||||

| (COST OF $203,122,915) | 347,335,047 | |||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS (-2.72%) | (9,194,130 | ) | ||||||

| NET ASSETS (100.00%) | $ | 338,140,917 | ||||||

| NET ASSET VALUE PER SHARE | ||||||||

| (42,375,065 SHARES OUTSTANDING) | $ | 7.98 | ||||||

| (a) | Non-income producing security. |

| (b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $3,669,341. |

| (c) | Rate reflects seven-day effective yield on December 31, 2020. |

See Notes to Financial Statements.

| Annual Report | December 31, 2020 | 23 |

| Liberty All-Star® Growth Fund | Statement of Assets and Liabilities |

December 31, 2020

| ASSETS: | ||||

| Investments at market value (Cost $203,122,915) (a) | $ | 347,335,047 | ||

| Receivable for investment securities sold | 2,043,301 | |||

| Dividends and interest receivable | 50,948 | |||

| Tax reclaim receivable | 19,356 | |||

| Prepaid and other assets | 340 | |||

| TOTAL ASSETS | 349,448,992 | |||

| LIABILITIES: | ||||

| Payable for investments purchased | 182,155 | |||

| Distributions payable to shareholders | 7,152,809 | |||

| Investment advisory fee payable | 218,754 | |||

| Payable for administration, pricing and bookkeeping fees | 64,767 | |||

| Payable for collateral upon return of securities loaned | 3,608,049 | |||

| Accrued expenses | 81,541 | |||

| TOTAL LIABILITIES | 11,308,075 | |||

| NET ASSETS | $ | 338,140,917 | ||

| NET ASSETS REPRESENTED BY: | ||||

| Paid-in capital | $ | 175,328,997 | ||

| Total distributable earnings | 162,811,920 | |||

| NET ASSETS | $ | 338,140,917 | ||

| Shares of common stock outstanding | ||||

| (authorized 60,000,000 shares at $0.10 Par) | 42,375,065 | |||

| NET ASSET VALUE PER SHARE | $ | 7.98 | ||

| (a) | Includes securities on loan of $3,669,341. |

See Notes to Financial Statements.

| 24 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Statement of Operations |

For the Year Ended December 31, 2020

| INVESTMENT INCOME: | ||||

| Dividends (Net of foreign taxes withheld at source which amounted to $4,872) | $ | 1,216,336 | ||

| Securities lending income | 128,381 | |||

| TOTAL INVESTMENT INCOME | 1,344,717 | |||

| EXPENSES: | ||||

| Investment advisory fee | 2,133,474 | |||

| Administration fee | 533,993 | |||

| Pricing and bookkeeping fees | 92,577 | |||

| Audit fee | 27,457 | |||

| Custodian fee | 47,810 | |||

| Directors' fees and expenses | 109,430 | |||

| Insurance expense | 8,820 | |||

| Legal fees | 66,059 | |||

| NYSE fee | 36,797 | |||

| Shareholder communication expenses | 35,458 | |||

| Transfer agent fees | 66,654 | |||

| Proxy fees | 26,594 | |||

| Miscellaneous expenses | 13,300 | |||

| TOTAL EXPENSES | 3,198,423 | |||

| NET INVESTMENT LOSS | (1,853,706 | ) | ||

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | ||||

| Net realized gain on investments | 44,464,729 | |||

| Net change in unrealized appreciation on investments | 64,059,457 | |||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 108,524,186 | |||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 106,670,480 | ||

See Notes to Financial Statements.

| Annual Report | December 31, 2020 | 25 |

| Liberty All-Star® Growth Fund | Statements of Changes in Net Assets |

| For the Year Ended December 31, 2020 | For the Year Ended December 31, 2019 | |||||||

| FROM OPERATIONS: | ||||||||

| Net investment loss | $ | (1,853,706 | ) | $ | (1,260,981 | ) | ||

| Net realized gain on investments | 44,464,729 | 15,310,254 | ||||||

| Net change in unrealized appreciation on investments | 64,059,457 | 49,957,427 | ||||||

| Net Increase in Net Assets From Operations | 106,670,480 | 64,006,700 | ||||||

| DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

| From distributable earnings | (25,798,075 | ) | (17,226,881 | ) | ||||

| Total Distributions | (25,798,075 | ) | (17,226,881 | ) | ||||

| CAPITAL SHARE TRANSACTIONS: | ||||||||

| Proceeds from rights offering, net of offering cost | 13,230,787 | – | ||||||

| Dividend reinvestments | 8,712,285 | 5,195,479 | ||||||

| Net increase resulting from Capital Share Transactions | 21,943,072 | 5,195,479 | ||||||

| Total Increase in Net Assets | 102,815,477 | 51,975,298 | ||||||

| NET ASSETS: | ||||||||

| Beginning of period | 235,325,440 | 183,350,142 | ||||||

| End of period | $ | 338,140,917 | $ | 235,325,440 | ||||

See Notes to Financial Statements.

| 26 | www.all-starfunds.com |

Intentionally Left Blank

| Liberty All-Star® Growth Fund |

| Financial Highlights |

| PER SHARE OPERATING PERFORMANCE: |

| Net asset value at beginning of period |

| INCOME FROM INVESTMENT OPERATIONS: |

| Net investment loss(a) |

| Net realized and unrealized gain/(loss) on investments |

| Total from Investment Operations |

| LESS DISTRIBUTIONS TO SHAREHOLDERS: |

| Net realized gain on investments |

| Total Distributions |

| Change due to rights offering(b) |

| Net asset value at end of period |

| Market price at end of period |

| TOTAL INVESTMENT RETURN FOR SHAREHOLDERS:(c) |

| Based on net asset value |

| Based on market price |

| RATIOS AND SUPPLEMENTAL DATA: |

| Net assets at end of period (millions) |

| Ratio of expenses to average net assets |

| Ratio of net investment loss to average net assets |

| Portfolio turnover rate |

| (a) | Calculated using average shares outstanding during the period. |

| (b) | Effect of Fund's rights offering for shares at a price below net asset value, net of costs. |

| (c) | Calculated assuming all distributions are reinvested at actual reinvestment prices and all primary rights in the Fund's rights offering were exercised, and does not include a sales load. The net asset value and market price returns will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares traded during the period. Past performance is not a guarantee of future results. |

| See Notes to Financial Statements. | |

| 28 | www.all-starfunds.com |

| Financial Highlights | |

| For the Year Ended December 31, | ||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||

| $ | 6.19 | $ | 4.94 | $ | 5.67 | $ | 4.80 | $ | 4.99 | |||||||||

| (0.05 | ) | (0.03 | ) | (0.03 | ) | (0.02 | ) | (0.02 | ) | |||||||||

| 2.51 | 1.74 | (0.01 | ) | 1.31 | 0.19 | |||||||||||||

| 2.46 | 1.71 | (0.04 | ) | 1.29 | 0.17 | |||||||||||||

| (0.63 | ) | (0.46 | ) | (0.46 | ) | (0.42 | ) | (0.36 | ) | |||||||||

| (0.63 | ) | (0.46 | ) | (0.46 | ) | (0.42 | ) | (0.36 | ) | |||||||||

| (0.04 | ) | — | (0.23 | ) | — | — | ||||||||||||

| $ | 7.98 | $ | 6.19 | $ | 4.94 | $ | 5.67 | $ | 4.80 | |||||||||

| $ | 8.20 | $ | 6.50 | $ | 4.39 | $ | 5.54 | $ | 4.18 | |||||||||

| 42.4 | % | 35.8 | % | (1.0 | %) | 28.6 | % | 4.8 | % | |||||||||

| 39.4 | % | 60.5 | % | (9.9 | %) | 44.3 | % | (0.6 | %) | |||||||||

| $ | 338 | $ | 235 | $ | 183 | $ | 154 | $ | 126 | |||||||||

| 1.20 | % | 1.22 | % | 1.25 | % | 1.26 | % | 1.35 | % | |||||||||

| (0.69 | %) | (0.57 | %) | (0.47 | %) | (0.46 | %) | (0.34 | %) | |||||||||

| 55 | % | 34 | % | 49 | % | 40 | % | 100 | % | |||||||||

| Annual Report | December 31, 2020 | 29 |

| Liberty All-Star® Growth Fund | Notes to Financial Statements |

| December 31, 2020 |

NOTE 1. ORGANIZATION

Liberty All-Star® Growth Fund, Inc. (the “Fund”) is a Maryland corporation registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as a diversified, closed-end management investment company.

Investment Goal

The Fund seeks long-term capital appreciation.

Fund Shares

The Fund may issue 60,000,000 shares of common stock at $0.10 par.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is considered an investment company under U.S. generally accepted accounting principles (“GAAP”) and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

Security Valuation

Equity securities are valued at the last sale price at the close of the principal exchange on which they trade, except for securities listed on the NASDAQ Stock Market LLC (“NASDAQ”), which are valued at the NASDAQ official closing price. Unlisted securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges or over-the-counter markets.

Cash collateral from securities lending activity is reinvested in the State Street Navigator Securities Lending Government Money Market Portfolio (“State Street Navigator”), a registered investment company under the 1940 Act, which operates as a money market fund in compliance with Rule 2a-7 under the 1940 Act. Shares of registered investment companies are valued daily at that investment company’s net asset value per share.

The Fund’s investments are valued at market value or, in the absence of market value with respect to any portfolio securities, at fair value according to procedures adopted by the Fund's Board of Directors (the "Board"). When market quotations are not readily available, or in management’s judgment they do not accurately reflect fair value of a security, or an event occurs after the market close but before the Fund is priced that materially affects the value of a security, the securities will be valued by the Fund’s Fair Valuation Committee, using fair valuation procedures established by the Board. Examples of potentially significant events that could materially impact the value of a security include, but are not limited to: single issuer events such as corporate actions, reorganizations, mergers, spin-offs, liquidations, acquisitions and buyouts; corporate announcements on earnings or product offerings; regulatory news; and litigation and multiple issuer events such as governmental actions; natural disasters or armed conflicts that affect a country or a region; or significant market fluctuations. Potential significant events are monitored by the Advisor, ALPS Advisors, Inc. (the “Advisor” and “AAI”), Sub-Advisers and/or the Valuation Committee through independent reviews of market indicators, general news sources and communications from the Fund’s custodian. As of December 31, 2020, the Fund held no securities that were fair valued.

| 30 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Notes to Financial Statements |

| December 31, 2020 | |

Security Transactions

Security transactions are recorded on trade date. Cost is determined and gains/(losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income Recognition

Interest income is recorded on the accrual basis. Corporate actions and dividend income are recorded on the ex-date.

The Fund estimates components of distributions from real estate investment trusts (“REITs”). Distributions received in excess of income are recorded as a reduction of the cost of the related investments. Once the REIT reports annually the tax character of its distributions, the Fund revises its estimates. If the Fund no longer owns the applicable securities, any distributions received in excess of income are recorded as realized gains.

Lending of Portfolio Securities

The Fund may lend its portfolio securities only to borrowers that are approved by the Fund’s securities lending agent, State Street Bank & Trust Co. (“SSB”). The Fund will limit such lending to not more than 20% of the value of its total assets. The borrower pledges and maintains with the Fund collateral consisting of cash (U.S. Dollar only), securities issued or guaranteed by the U.S. government or its agencies or instrumentalities, or by irrevocable bank letters of credit issued by a person other than the borrower or an affiliate of the borrower. The initial collateral received by the Fund is required to have a value of no less than 102% of the market value of the loaned securities for securities traded on U.S. exchanges and a value of no less than 105% of the market value for all other securities. The collateral is maintained thereafter, at a market value equal to no less than 100% of the current value of the securities on loan. The market value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. During the term of the loan, the Fund is entitled to all distributions made on or in respect of the loaned securities. Loans of securities are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time period for settlement of securities transactions.

Any cash collateral received is reinvested in State Street Navigator. Non-cash collateral, in the form of securities issued or guaranteed by the U.S. government or its agencies or instrumentalities, is not disclosed in the Fund’s Statement of Assets and Liabilities as it is held by the lending agent on behalf of the Fund and the Fund does not have the ability to re-hypothecate these securities. Income earned by the Fund from securities lending activity is disclosed in the Statement of Operations.

| Annual Report | December 31, 2020 | 31 |

| Liberty All-Star® Growth Fund | Notes to Financial Statements |

| December 31, 2020 |

The following is a summary of the Fund's securities lending positions and related cash and non-cash collateral received as of December 31, 2020:

Market Value of Securities on Loan | Cash Collateral Received | Non-Cash Collateral Received | Total Collateral Received | |||||||||||

| $ | 3,669,341 | $ | 3,608,049 | $ | – | $ | 3,608,049 | |||||||

The risks of securities lending include the risk that the borrower may not provide additional collateral when required or may not return the securities when due. To mitigate these risks, the Fund benefits from a borrower default indemnity provided by SSB. SSB’s indemnity allows for full replacement of securities lent wherein SSB will purchase the unreturned loaned securities on the open market by applying the proceeds of the collateral or to the extent such proceeds are insufficient or the collateral is unavailable, SSB will purchase the unreturned loan securities at SSB’s expense. However, the Fund could suffer a loss if the value of the investments purchased with cash collateral falls below the value of the cash collateral received.

The following table reflects a breakdown of transactions accounted for as secured borrowings, the gross obligation by the type of collateral pledged or securities loaned, and the remaining contractual maturity of those transactions as of December 31, 2020:

| Remaining contractual maturity of the agreements | ||||||||||||||||||||

Securities Lending Transactions | Overnight & Continuous | Up to 30 days | 30-90 days | Greater than 90 days | Total | |||||||||||||||

| Common Stocks | $ | 3,608,049 | $ | – | $ | – | $ | – | $ | 3,608,049 | ||||||||||

| Total Borrowings | $ | 3,608,049 | ||||||||||||||||||

| Gross amount of recognized liabilities for securities lending (collateral received) | $ | 3,608,049 | ||||||||||||||||||

Fair Value Measurements

The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities that are valued based on unadjusted quoted prices in active markets are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the mean of the most recent quoted bid and ask prices on such day and are generally categorized as Level 2 in the hierarchy. Investments in open-end mutual funds are valued at their closing NAV each business day and are categorized as Level 1 in the hierarchy.

| 32 | www.all-starfunds.com |

| Liberty All-Star® Growth Fund | Notes to Financial Statements |

| December 31, 2020 |

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments.

These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2020:

| Valuation Inputs | |||||||||||||

| Investments in Securities at Value | Level 1 | Level 2 | Level 3 | Total | |||||||||

| Common Stocks* | $ | 333,846,186 | $ | – | $ | – | $ | 333,846,186 | |||||

| Short Term Investments | 13,488,861 | – | – | 13,488,861 | |||||||||

| Total | $ | 347,335,047 | $ | – | $ | – | $ | 347,335,047 | |||||

| * | See Schedule of Investments for industry classifications. |

The Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value during the period.

Distributions to Shareholders

The Fund currently has a policy of paying distributions on its common shares totaling approximately 8% of its net asset value per year. The distributions are payable in four quarterly distributions of 2% of the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. Distributions to shareholders are recorded on ex-date.

NOTE 3. RISKS

Investment and Market Risk

An investment in shares is subject to investment risk, including the possible loss of the entire amount invested. An investment in shares represents an indirect investment in the securities owned by the Fund, most of which are anticipated to be traded on a national securities exchange or in the over-the-counter markets. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably. Shares at any point in time may be worth less than their original cost, even after taking into account the reinvestment of dividends and other distributions.

| Annual Report | December 31, 2020 | 33 |

| Liberty All-Star® Growth Fund | Notes to Financial Statements |

| December 31, 2020 |

Common Stock Risk

The Fund is not limited in the percentage of its assets that may be invested in common stocks and other equity securities, and therefore a risk of investing in the Fund is common stock or equity risk. Equity risk is the risk that the market value of securities held by the Fund will fall due to general market or economic conditions, perceptions regarding the industries in which the issuers of securities held by the Fund participate, and the particular circumstances and performance of particular companies whose securities the Fund holds. In addition, common stock of an issuer in the Fund’s portfolio may decline in price if the issuer fails to make anticipated dividend payments because, among other reasons, the issuer of the security experiences a decline in its financial condition. Common equity securities in which the Fund will invest are structurally subordinated to preferred stocks, bonds and other debt instruments in a company’s capital structure, in terms of priority to corporate income, and therefore will be subject to greater payment risk than preferred stocks or debt instruments of such issuers. In addition, while broad market measures of common stocks have historically generated higher average returns than fixed income securities, common stocks have also experienced significantly more volatility in their returns.

Growth stocks are stocks of companies believed to have above-average potential for growth in revenue and earnings. In certain market conditions, prices of growth stocks may be more sensitive to changes in current or expected earnings than the prices of other stocks. Growth stocks may not perform as well as the stock market in general.

COVID-19 Risk

The outbreak of the novel coronavirus that causes the respiratory disease COVID-19, (the “Coronavirus”) began in late 2019. The Coronavirus subsequently spread globally in early 2020. The impact of the outbreak has evolved during the Fund’s fiscal year and continues to change. The virus has impacted the U.S and countries throughout the world, resulting in travel restrictions, quarantines, and significant portions of the population working from home, temporary or permanent layoffs, and adverse economic impacts on many industries. There have been fluctuations of consumer demand in certain sectors, disruptions in supply chains and economic output, and other adverse economic impacts of the Coronavirus. Further developments could result in additional disruptions and uncertainty and could generally have significant impacts on economies and financial markets and could impact the value and performance of the Fund.

NOTE 4. FEDERAL TAX INFORMATION