UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(MARK ONE)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | FOR THE FISCAL YEAR ENDED FEBRUARY 2, 2008 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | FOR THE TRANSITION PERIOD FROM TO |

COMMISSION FILE NUMBER 000-21250

THE GYMBOREE CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| DELAWARE | | 94-2615258 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| |

500 Howard Street, San Francisco, California | | 94105 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (415) 278-7000

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

Title of Each Class | | Name of each exchange on which registered |

| COMMON STOCK, $0.001 PAR VALUE | | The NASDAQ Stock Market LLC |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

NONE.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of August 4, 2007, was approximately $1,208,000,000 based upon the last sales price reported for such date on The NASDAQ Stock Market LLC.

As of March 1, 2008, 28,463,887 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held on June 10, 2008 (hereinafter referred to as the “Proxy Statement”) are incorporated by reference into Part III.

THE GYMBOREE CORPORATION

TABLE OF CONTENTS

2

FORWARD LOOKING STATEMENTS

The discussion in this Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Inaccurate assumptions and known and unknown risks and uncertainties can affect the accuracy of forward-looking statements, and our actual results could differ materially from results that may be anticipated by such forward-looking statements. Certain risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in Item 1A, “Risk Factors.” That section, along with other sections of this Annual Report, describes some, but not all, of the factors that could cause actual results to differ significantly from management’s expectations. When used in this document, the words “believes,” “expects,” “estimates,” or “anticipates” and similar expressions are intended to identify certain of these forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. The cautionary statements made in this document should be read as being applicable to all forward-looking statements wherever they appear in this document. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on information available as of the date of this report. We do not intend to revise any forward-looking statements in order to reflect events or circumstances that may subsequently arise.

PART 1

The Gymboree Corporation is a specialty retailer operating stores selling high-quality apparel and accessories for children under the GYMBOREE®, GYMBOREE OUTLET, JANIE AND JACK® and Crazy 8™ brands, as well as play programs for children under the GYMBOREE PLAY & MUSIC® brand. The Company operates retail stores in the United States and Canada, primarily in regional shopping malls and in selected suburban and urban locations. All references to “we,” “our,” “us,” and the “Company” in this Annual Report mean The Gymboree Corporation and its subsidiaries.

GENERAL

As of February 2, 2008, the Company conducted its business through five primary divisions: Gymboree, Gymboree Outlet, Janie and Jack, Crazy 8, and Gymboree Play & Music.

Gymboree: Gymboree stores offer high-quality, fashionable, child-appropriate apparel and accessories characterized by bright colors, patterns and whimsical graphics, complex embellishments, comfort, functionality, and durability for children sizes newborn through 12. As of February 2, 2008, we operated 597 Gymboree stores, including 565 stores in the United States, 30 stores in Canada and 2 stores in Puerto Rico, as well as an online store atwww.gymboree.com.

Gymboree Outlet:Gymboree Outlet stores provide high-quality children’s apparel and accessories in the same size ranges as traditional Gymboree stores but at outlet prices. The majority of our Gymboree Outlet product is developed and manufactured exclusively for the Gymboree Outlet stores. As of February 2, 2008, we operated 82 Gymboree Outlet stores in the United States.

Janie and Jack: Janie and Jack shops are highly differentiated from Gymboree stores. Janie and Jack shops offer distinctive, finely crafted clothing and accessories for boys and girls sizes newborn through 8. Lush fabrics, a hand-made quality and details such as hand-embroidery, smocking and vintage prints are utilized to create classic looks. Shops have an old mercantile boutique style with special details such as wainscoting and distressed wooden armoires. As of February 2, 2008, we operated 93 Janie and Jack shops in the United States, as well as an online shop atwww.janieandjack.com.

3

Crazy 8:Crazy 8 stores provide wholesome age-appropriate fashion, at price points approximately 30% lower than Gymboree. Through merchandise design, product presentation, store environment, customer service and packaging, Crazy 8 stores reflect an upscale store experience at mass-market prices. Crazy 8 apparel is offered in sizes newborn through 14, and addresses a broader demographic customer base than Gymboree. The product assortment is a balanced offering of boy and girl product. As of February 2, 2008, we operated 14 Crazy 8 stores in the United States, as well as an online store atwww.crazy8.com.

Gymboree Play & Music. Gymboree Play & Music offers children ages newborn to 5 years the opportunity to explore, learn and play in an innovative parent-child program. Gymboree Play & Music offers an array of classes developed by early childhood experts, as well as birthday parties and developmental toys, books and music. As of February 2, 2008, Gymboree Play & Music programs included three Company-operated play centers in California and 556 franchisee-operated play centers, of which approximately 48% are located in the United States, and the remaining 52% are located in 29 other countries: Argentina, Australia, Canada, Chile, China, Colombia, Costa Rica, Ecuador, El Salvador, France, Hong Kong, Indonesia, Ireland, Japan, Malaysia, Mexico, Panama, Peru, Philippines, Portugal, Singapore, South Africa, South Korea, Spain, Switzerland, Taiwan, Thailand, Turkey and the United Kingdom.

Gymboree was organized in October 1979 as a California corporation and re-incorporated as a Delaware corporation in June 1992.

RETAIL STORES

As of February 2, 2008, the Company operated a total of 786 retail stores, including 754 stores in the United States (565 Gymboree stores, 82 Gymboree Outlet stores, 93 Janie and Jack shops, and 14 Crazy 8 stores), 30 Gymboree stores in Canada and 2 Gymboree stores in Puerto Rico. The Company also operates three online stores atwww.gymboree.com,www.janieandjack.com, andwww.crazy8.com.

In 2007, the Company opened 95 stores, including 24 Gymboree stores, 40 Gymboree Outlet stores, 13 Janie and Jack shops, 14 Crazy 8 stores in the United States, 2 Gymboree stores in Canada and 2 Gymboree stores in Puerto Rico. The Company also relocated or remodeled 52 Gymboree stores and closed 6 Gymboree stores and one Janie and Jack shop. During 2008, the Company plans to open approximately 100 new stores, including 20 Gymboree stores, 40 Gymboree Outlet stores, 20 Janie and Jack shops, and 20 Crazy 8 stores. The Company also plans to remodel, relocate or expand approximately 20 Gymboree and Janie and Jack stores.

The Gymboree online store atwww.gymboree.com offers the entire Gymboree product offering for children between the sizes of newborn through 12. The site also offers online registration for Gymboree Play & Music classes at selected U.S. locations. The Janie and Jack online store atwww.janieandjack.com offers the entire Janie and Jack product offering for children sizes newborn through 8. The Crazy 8 online store atwww.crazy8.com offers the entire Crazy 8 product offering for children sizes newborn through 14. The Company fully integrates its online stores and retail stores in determining pricing, product assortment and promotional strategies. The Company also has a “Save the Sale” policy, whereby retail stores order merchandise for customers from the online stores. In addition, customers are allowed to return merchandise purchased online at traditional retail stores and vice versa.

SUPPLIERS

The majority of our apparel is manufactured to our specifications by approximately 120 independent manufacturers in Asia (primarily China, Thailand, Indonesia and Vietnam), as well as in the United States, Central America, the Middle East, and South America. The Company purchases all products in U.S. dollars. One buying agent manages over 90% of our inventory purchases. We have no long-term contracts with suppliers and typically transact business on an order-by-order basis. All of our factories undergo annual audits for social accountability by an independent third party. In addition, all products undergo a quality audit performed by independent third parties.

4

SEASONALITY AND COMPETITION

The Company’s operations are seasonal in nature, with sales from our retail operations peaking during the fourth quarter, primarily during the holiday season in November and December. During fiscal 2007, 2006 and 2005, the fourth quarter accounted for approximately 30% of our net sales from retail operations.

Our Gymboree, Janie and Jack, and Crazy 8 brands compete on a national level with BabyGap and GapKids (divisions of The Gap, Inc.), and certain leading department stores operating in malls, outlet centers or street locations, as well as certain discount retail chains such as Old Navy (a division of The Gap, Inc.), The Children’s Place, Wal-Mart and Target. Our Gymboree, Janie and Jack, and Crazy 8 brands also compete with a wide variety of local and regional specialty stores, with certain other retail chains, and with children’s retailers that sell their products by mail order, over the Internet or through outlet malls. The principal factors of competition for retail sales are product design, product quality, brand image, customer service and pricing. Our goal is to provide our customers with high-quality apparel with an excellent price/value relationship. We design and produce our apparel exclusively for sale at our retail and online stores.

TRADEMARKS AND SERVICE MARKS

In the United States, the Company is the owner of the trademarks and service marks “GYMBOREE,” “JANIE AND JACK,” “CRAZY 8,” and “GYMBOREE PLAY & MUSIC,” and the trademarks “GYMBO,” and “GYMBUCKS.” These marks, other than “CRAZY 8,” and certain other of our marks are registered in the United States Patent and Trademark Office. The mark “GYMBOREE” is also registered, or is the subject of pending applications, in approximately 79 foreign countries. Each federal registration is renewable indefinitely if the mark is still in use at the time of renewal. Our rights in the “GYMBOREE,” “JANIE AND JACK,” and “CRAZY 8” marks and other marks are a significant part of our business. Accordingly, we intend to maintain the marks and the related registrations. We are not aware of any material claims of infringement or other material challenges to our right to use the “GYMBOREE,” “JANIE AND JACK,” and “CRAZY 8” marks in the United States.

The Company uses a number of other trademarks, certain of which have been registered with the United States Patent and Trademark Office and in certain foreign countries. We believe that our registered and common-law trademarks have significant value and that some of our trademarks are instrumental to our ability to both market our products and create and sustain demand for our products.

TEAM MEMBERS

As of February 2, 2008, the Company had approximately 10,400 full-time and part-time employees or 4,700 full-time equivalents. In addition, a significant number of seasonal employees are hired during each holiday selling season. None of the Company’s employees are represented by a labor union.

SEGMENT AND INTERNATIONAL FINANCIAL INFORMATION

Financial information for the Company’s two segments, retail stores and Gymboree Play & Music, and for its international subsidiary for each of the three fiscal years ended February 2, 2008, February 3, 2007, and January 28, 2006, is contained in Note 9 to the consolidated financial statements.

Less than 5% of the Company’s revenues were derived from outside the United States in fiscal 2007, 2006, and 2005, and less than 2% of the Company’s long-lived assets were located outside the United States in fiscal 2007, 2006 and 2005.

5

AVAILABLE INFORMATION

The Company makes available on its website atwww.gymboree.com, under “Our Company—Financial Resources & SEC filings,” free of charge, its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to such documents as soon as reasonably practicable after the Company electronically files or furnishes such materials to the U.S. Securities and Exchange Commission. The Company also makes available under “Our Company—Corporate Governance,” its code of ethics as well as other documents and materials relating to corporate governance.

EXECUTIVE OFFICERS OF THE REGISTRANT

The following table sets forth information regarding our executive officers as of March 27, 2008:

| | | | |

Matthew K. McCauley | | 35 | | Chief Executive Officer and Chairman of the Board |

Blair W. Lambert | | 50 | | Chief Operating Officer and Chief Financial Officer |

Kip M. Garcia | | 57 | | President |

Marina Armstrong | | 45 | | Senior Vice President, Stores, Human Resources, Play & Music, and Secretary |

Lynda G. Gustafson | | 43 | | Vice President, Corporate Controller |

Jeffrey P. Harris | | 45 | | Vice President, Finance |

Matthew K. McCauley has served as our Chief Executive Officer since January 2006 and Chairman of the Board since July 2006. Mr. McCauley joined The Gymboree Corporation in July 2001 as Director of Allocation and was named Vice President of Planning and Allocation in 2003, Senior Vice President and General Manager in February 2005, President in June 2005, Chief Executive Officer in January 2006, and Chairman of the Board in July 2006. Mr. McCauley has been on our Board of Directors since October 2005. Prior to joining The Gymboree Corporation, Mr. McCauley served in a variety of positions at The Gap, Inc., a clothing retailer, including Planning Manager from 2000 to 2001 and Manager of Business Solutions in 2001.

Blair W. Lambert has served as our Chief Operating Officer and Chief Financial Officer since January 2005, and has been on our Board of Directors since 2003. In August 2003, Mr. Lambert joined Illuminations.com, Inc., a candle and home decorating retailer, as the Chief Financial Officer. He was named to the Illuminations.com, Inc. Board of Directors in October 2003. Illuminations.com, Inc. filed for bankruptcy protection on January 9, 2004. Mr. Lambert has been a vineyard owner since October 2001 and, prior to becoming an officer of Illuminations.com, was a private consultant for specialty retail companies. Mr. Lambert served as the Chief Financial Officer of Bebe Stores, Inc., a clothing retailer, from June 1996 through October 2001. From 1988 to 1996, Mr. Lambert was employed by Esprit de Corp., a wholesaler and retailer of junior and children’s apparel, footwear and accessories, most recently serving as Corporate Vice President of Finance. Mr. Lambert is a Certified Public Accountant.

Kip M. Garcia joined The Gymboree Corporation in May 2004 as Senior Vice President of Merchandising—Kids and was named President in January 2006. Prior to joining The Gymboree Corporation, Mr. Garcia served as Senior Vice President for Gap Kids, a division of The Gap Inc., a children’s clothing retailer, from April 2002 to February 2003 and Senior Vice President for DFS Merchandising Ltd., a travel retail company, from February 1992 to February 2002.

Marina Armstronghas served as our Senior Vice President, Stores, Human Resources, and Play & Music since January 2006, and Secretary since December 2004. Ms. Armstrong joined The Gymboree Corporation in May 1997 as a District Manager and became a Human Resources Staffing Manager at the corporate office in 1998. Later that year she was promoted to Director, Recruiting and Staffing. Ms. Armstrong was named Vice President, Human Resources in 1999 and Senior Vice President, Stores, Human Resources and Loss Prevention in February 2005. Ms. Armstrong was named Assistant Secretary in March 2002 and Secretary in December

6

2004. Prior to joining The Gymboree Corporation, Ms. Armstrong held several human resources and store operations positions with other retailers including Saks Fifth Avenue, Robinsons-May and The Bon Marche.

Lynda G. Gustafsonhas served as our Vice President, Corporate Controller since February 2005. Ms. Gustafson joined The Gymboree Corporation in August 2001 as the Corporate Controller and was promoted to Vice President, Corporate Controller in February 2005. Ms. Gustafson was a business consultant for various companies from September 2000 to July 2001. From November 1993 to August 2000, Ms. Gustafson was at US Home & Garden, Inc., and was the Vice President, Finance and Principal Accounting Officer when she departed. Prior to that time, she spent five years in public accounting. Ms. Gustafson is a Certified Public Accountant.

Jeffrey P. Harris joined the Gymboree Corporation in July 2005 as Vice President, Finance. In 2004, Mr. Harris served as Vice President of Finance for CBS MarketWatch, a leading multimedia source of financial news and information, until its sale to Dow Jones in 2005. From 2001 to 2004, he was employed at Lucasfilm in the capacity of Corporate Controller. Prior to that time, Mr. Harris worked in the Consumer Products division of The Walt Disney Company, an entertainment company, as Controller and Director of Finance for its Art and Collectibles division. He also spent over seven years working in various finance and audit roles for the Tribune Company based in Chicago, Illinois. Mr. Harris is a Certified Public Accountant.

We may not be able to continue our current level of sales and earnings growth, which could cause the market price for our common stock to decline.

During the past three years, we realized substantial growth in both sales and earnings. Many factors have historically affected, and will continue to affect, our rate of growth and performance. We expect that future increases in net sales and net income will be dependent on our ability, among other factors, to expand our three newer growth concepts, Janie and Jack, Gymboree Outlet and Crazy 8; to continue to reduce product costs while maintaining high-quality standards; to generate more sales to existing customers in the core Gymboree division through appropriate size expansions, growth of the Boy department business and increased newborn product assortment; and to attract new customers through strategies such as direct mail campaigns and cross-brand marketing. Other factors that could impact our sales and earnings growth are discussed below in this section. There can be no assurance that we will be able to grow our sales or continue the earnings performance that we have recently experienced. In addition, labor costs are currently increasing in countries where our products are manufactured. Increased labor costs coupled with increasing costs of fuel and the devaluation of the United States dollar may impact our ability to reduce product costs. Additionally, any decline in our future growth or our rate of growth in sales or earnings could have a material adverse effect on the market price of our common stock.

Our results may be adversely affected by our failure to anticipate and respond to changes in fashion trends and consumer preferences in a timely manner.

Our sales and profitability depend upon the continued demand by customers for our apparel and accessories. We believe that our success depends in large part upon our ability to anticipate, gauge and respond in a timely manner to changing consumer demands and fashion trends and upon the appeal of our products. There can be no assurance that the demand for our apparel or accessories will not decline or that we will be able to anticipate, gauge and respond to changes in fashion trends. In addition, since much of our inventory is sourced from vendors located outside the United States, we usually must order merchandise, and enter into contracts for the purchase and manufacture of such merchandise, up to nine months in advance of the applicable selling season and frequently before trends are known. A decline in demand for our apparel and accessories or a misjudgment of fashion trends could, among other things, lead to lower sales, excess inventories and higher markdowns, each of which could have a material adverse effect on our business, financial condition and operating results.

7

Competition and the strength of our competitors may impair our ability to maintain and grow our sales and adversely affect our operating results.

The apparel segment of the specialty retail industry is highly competitive, and we may not be able to compete successfully in the future. The principal factors of competition for retail sales are product design, product quality, brand image, customer service and pricing. Our Gymboree, Janie and Jack and Crazy 8 brands compete on a national level with BabyGap and GapKids (divisions of The Gap, Inc.), and certain leading department stores operating in malls, outlet centers or street locations, as well as certain discount retail chains such as Old Navy (a division of The Gap, Inc.), The Children’s Place, Wal-Mart and Target. Our Gymboree, Janie and Jack and Crazy 8 brands also compete with a wide variety of local and regional specialty stores, with certain other retail chains, and with children’s retailers that sell their products by mail order, online or through outlet malls. Many of these competitors are larger than us and have substantially greater financial, marketing and other resources. Increased competition may reduce sales and gross margins, increase operating expenses and decrease profit margins.

We may not be able to operate successfully if we lose key personnel, are unable to hire qualified additional personnel, or experience turnover of our management team.

Our continued success is largely dependent on the individual efforts and abilities of our senior management team and certain other key personnel and on our ability to retain current management and to attract and retain qualified key personnel in the future. The loss of certain key employees or our inability to continue to attract and retain other qualified key employees could have a material adverse effect on our growth, operations and financial position.

Changes in economic conditions that impact consumer spending could harm our business.

Our financial performance is sensitive to changes in overall economic conditions that impact consumer spending, particularly discretionary spending. Economic conditions affecting disposable consumer income such as the current conditions in the housing and home mortgage markets and recessionary environment, employment levels, consumer debt levels, business conditions, interest rates, and tax rates could reduce consumer spending or cause consumers to shift their spending to other products. A general reduction in the level of discretionary spending or shifts in consumer discretionary spending to other types of products could have a material adverse effect on our growth, sales and profitability.

Our new concepts and businesses require a substantial commitment of resources and are not certain of ultimate success.

Our ongoing efforts to develop, launch and grow new divisions, businesses and brands require significant capital expenditures and management attention. Our commitment of management resources and capital to a new concept means that those resources and capital are unavailable for our other activities and operations.

Our decision to launch a new business is based on our assessment that a significant opportunity exists in the marketplace. Our ability to launch a new business successfully depends in part on our ability to appropriately identify, develop and effectively execute our strategies and initiatives. Failure to effectively identify, develop and execute our strategies and initiatives may lead to increased costs and could have a material adverse effect on our operating results. We anticipate losses in the Crazy 8 division in fiscal 2008. These losses may depress the share price of our stock.

We have opened new businesses in the past that were ultimately unsuccessful such as the Janeville division, which we opened in fiscal 2004 and closed in fiscal 2006. There can be no assurance that new business concepts we open in the future will be successful, and our incurrence of expenses in the launch of new business concepts that do not ultimately succeed could have a material adverse effect on our financial position.

8

Our business may be harmed by additional United States regulation of foreign trade or delays caused by additional United States customs requirements.

Our business is subject to the risk that the United States may adopt additional regulations relating to imported apparel products, including quotas, duties, taxes and other charges or restrictions on imported apparel. We cannot predict whether additional United States quotas, duties, taxes or other charges or restrictions will be imposed upon the importation of our products in the future, or what effect any such actions would have on our business, financial position and results of operations. If the United States government imposes any such charges or restrictions, our supply of products could be disrupted and their cost could substantially increase, either of which could have a material adverse effect on our operating results. Unforeseen delays in customs clearance of any goods could have a material adverse effect on our ability to deliver complete shipments to our stores in a timely manner, which in turn could have a material adverse effect on our business and operating results.

Because we purchase our products internationally, our business is sensitive to risks associated with international business.

Our products are currently manufactured to our specifications by independent factories located primarily in Asia, Central America, the Middle East, and South America. As a result, our business is subject to the risks generally associated with doing business abroad, such as foreign governmental regulations, currency fluctuations, adverse conditions such as epidemics, natural disasters, wars, acts of terrorism, social or political unrest, disruptions or delays in transportation or customs clearance, local business practices and changes in economic conditions in countries in which our suppliers are located. For example, we have incurred late deliveries in United States ports due to labor strikes. If related contract negotiations are not resolved, we could experience additional late deliveries, which could negatively impact our sales. We cannot predict the effect of such factors on our business relationships with foreign suppliers or on our ability to deliver products into our stores in a timely manner. If even a small portion of our current foreign manufacturing sources or textile mills were to cease doing business with us for any reason, such actions could have a material adverse effect on our operating results and financial position. In addition, we are currently pursuing strategies to reduce product costs. These strategies may result in sourcing product from factories from which we have not previously purchased products and which may be in countries in which we have not done business before. These efforts could result in greater risk to timely deliveries and quality control.

We must timely and effectively deliver merchandise to our stores and customers.

We cannot control all of the various factors that might affect our fulfillment rates for online sales and timely and effective merchandise delivery to our stores. We rely upon third-party carriers for our merchandise shipments to and from stores and reliable data regarding the timing of those shipments. We also rely upon a third party distribution facility for merchandise fulfillment to our Canadian stores. In addition, we are heavily dependent upon two carriers for the delivery of our merchandise to online customers. Labor disputes, union organizing activity, inclement weather, natural disasters, and acts of terrorism could affect those carriers’ ability to provide delivery services to meet our shipping needs. Failure to deliver merchandise in a timely and effective manner could damage our reputation and sales.

We are dependent on two facilities for distribution of product to all of our stores.

We handle merchandise distribution for all of our United States stores from a single facility in Dixon, California, and distribution for all of our Canadian stores from a third-party owned and operated facility in Burlington, Ontario. Any significant interruption in the operation of these distribution facilities due to natural disasters, accidents, system failures or other unforeseen causes could delay or impair our ability to distribute merchandise to our stores, which could cause sales to decline.

We may suffer negative publicity if any of our products are found to be unsafe.

We currently test products sold in our stores and at our Play & Music sites. We have in the past and may in the future need to recall products that we later determine may present safety issues. If these products have safety

9

problems of which we are not aware, or if the Consumer Product Safety Commission recalls a product sold in our stores, we could experience negative publicity and product liability lawsuits, which could have a material adverse effect on our reputation, business and financial position.

We may be subject to negative publicity or be sued if our manufacturers violate labor laws or engage in practices that our customers believe are unethical.

We require our independent manufacturers to operate their businesses in compliance with the laws and regulations that apply to them. Our sourcing personnel periodically visit and monitor the operations of our independent manufacturers, but we cannot control their business and labor practices. We also rely on an independent third party to audit all of our factories on an annual basis. If an independent manufacturer violates or is suspected of violating labor laws or other applicable regulations, or if a manufacturer engages in labor or other practices that diverge from those typically acceptable in the United States, Canada or Europe, we could in turn experience negative publicity or be sued. Negative publicity or legal actions regarding the production of our products could have a material adverse effect on our reputation, sales, business and financial position.

The loss of a key buying agent could disrupt our ability to deliver our inventory supply in a timely fashion, impacting its value.

In fiscal 2007, 2006 and 2005, one buying agent managed over 90% of our inventory purchases. Although we believe that other buying agents could be identified and retained to place our required foreign production, the loss of this buying agent could result in delays in procuring inventory which could result in a material adverse effect on our business and operating results.

Changes in seasonal consumer spending patterns that are beyond our control could harm our business.

Historically, a disproportionate amount of our retail sales and a significant portion of our net income have been realized during the holiday season in November and December. We have also experienced periods of increased sales activity in the early spring, during the period leading up to the Easter holiday, and in the early fall, in connection with back-to-school sales. In fiscal 2006 and 2007, we generated net income in the second quarter; however, we have historically generated net losses during the second quarter and could generate such losses in the future due to seasonal consumer spending patterns. Changes in seasonal consumer spending patterns for reasons beyond our control could result in lower-than-expected sales during these periods. Such a circumstance could cause us to have excess inventory, necessitating markdowns to dispose of these excess inventories, which would reduce our profitability. Any failure by us to meet our business plan for, in particular, the third or fourth quarter of any fiscal year would have a material adverse effect on our earnings, which in all likelihood would not be offset by satisfactory results achieved in other quarters of the same fiscal year. Also, because we typically spend more in labor costs during the holiday season to hire temporary store employees in anticipation of holiday spending, a shortfall in expected sales during that period could result in a disproportionate decrease in our net income.

Our ability to successfully implement significant information technology systems is critical to our business.

We plan to continue to upgrade our information technology infrastructure. In fiscal 2008, these initiatives include a program to continue the upgrade our point-of-sale system, upgrade our core production system and continue to support and enhance the functionality of our websites. Such technology systems changes are complex and could cause disruptions that would adversely affect our business. While management will make every effort to ensure the orderly implementation of various information technology systems, we cannot ensure that we will be able to successfully execute these changes without potentially incurring a significant disruption to our business. If we are not successful, we may not achieve the expected benefits from these initiatives, despite having expended significant capital. We may also determine that additional investment is required to bring our systems to their desired state; this could result in a significant additional investment of time and money and increased implementation risk. Furthermore, we intend to rely on third parties to fulfill contractual obligations related to the upgrade of these systems. Failure of these third parties to fulfill their contractual obligations could lead to significant expenses or losses due to a disruption in business operations.

10

Our business may be harmed if our computer network security is compromised.

Despite our considerable efforts and technology to secure our computer network, security could be compromised, confidential information, such as customer credit card numbers, could be misappropriated, or system disruptions could occur. These events could lead to adverse publicity, loss of sales and could cause us to incur significant costs to reimburse third parties for damages which could impact profits. We are currently in the process of upgrading our systems and procedures to meet the Payment Card Industry (“PCI”) data security standards, which require periodic audits by independent third parties to assess compliance. Failure to comply with the security requirements or rectify a security issue may result in fines and the imposition of restrictions on our ability to accept payment cards. There can be no assurance that we will be able to satisfy PCI security standards. In addition, PCI is controlled by a limited number of vendors who have the ability to impose changes in PCI’s fee structure and operational requirements on us without negotiation. Such changes in fees and operational requirements may result in our failure to comply with PCI security standards, as well as significant unanticipated expenses.

Damage to our computer systems could severely impair our ability to manage our business.

Our operations depend on our ability to maintain and protect our computer systems on which we rely to manage our purchase orders, store inventory levels, web applications, accounting functions and other aspects of our business. Our systems are vulnerable to damage from fire, floods, earthquakes, power loss, telecommunications failures and similar events. We have computer systems in each of our stores, with the main database servers for our systems located in San Francisco, California, which exists on or near known earthquake fault zones. An earthquake or other disaster could have a material adverse impact on our business and operating results not only by damaging our stores or corporate headquarters, but also by damaging our main servers, which could disrupt our business for an indeterminate length of time.

Our failure to successfully manage our online businesses could have a negative impact on our business.

The operation of our online businesses depends on our ability to maintain the efficient and uninterrupted operation of our order-taking and fulfillment operations for our online stores. Disruptions or slowdowns in these areas could result from disruptions in telephone service or power outages, inadequate system capacity, system issues, computer viruses, human error, changes in programming, natural disasters or adverse weather conditions. Our online businesses are generally vulnerable to additional risks and uncertainties associated with the Internet, including changes in required technology and other technical failures as well as changes in applicable federal and state regulation, security breaches, and consumer privacy concerns. Problems in any of these areas could result in a reduction in sales, increased selling, general and administrative expenses and damage to our reputation and brands.

Our growth will be hampered if we are unable to locate new stores and relocate existing stores in appropriate retail venues and shopping areas.

Our stores must be located in appropriate retail spaces in areas with demographic characteristics consistent with our customer base. These locations tend to be limited to malls and similar venues where the market for available space is very competitive. The location of acceptable store sites and the negotiation of acceptable lease arrangements require considerable time, effort and expense. Our ability to lease desirable retail space for expansion and relocation of stores, and to renew our existing store leases, on favorable economic terms is essential to our revenue and earnings growth. Approximately 100, 50, and 30 store leases will come up for renewal during fiscal 2008, 2009 and 2010, respectively. We are also in the process of negotiating lease terms for approximately 110 stores, which are currently operating under month-to-month terms. There can be no assurance that we will be able to achieve our store expansion goals, effectively manage our growth, successfully integrate the planned new stores into our operations, or profitably operate our new and remodeled stores. Failure to obtain and renew leases for a sufficient number of stores on acceptable terms would have a material adverse effect on our revenues and results of operations.

11

Our growth will be hampered if we are unable to successfully open new stores.

We plan to open approximately 100 new stores in fiscal 2008. Our growth depends in large part on our ability to successfully open new stores, which in turn is dependent on a number of factors, including our ability to hire and train skilled store operating and management teams and our ability to complete construction within planned timelines and budgets. There can be no assurance that we will successfully open the number of stores planned for fiscal 2008, and the resulting impact on our growth rate could materially affect the market price for our common stock.

Our comparable store sales fluctuate over time, which may cause the market price of our common stock to decline.

Our comparable store sales have fluctuated significantly in the past and are expected to fluctuate in the future. Our comparable store sales are affected by a number of factors including our merchandise assortment, economic conditions, weather conditions, timing of our promotional offerings, competition, and the overall retail environment. The investment community often tracks comparable store sales, so a decline or significant fluctuation in comparable store sales, or a failure to meet investor expectations of comparable store sales, could materially affect the market price of our common stock.

Our operating and financial performance in any given period might not meet the guidance that we have provided to the public.

We provide public guidance on our expected operating and financial results for future periods. Although we believe that this guidance gives investors and analysts a better understanding of management’s expectations for the future, and is useful to our shareholders and potential shareholders, such guidance is comprised of forward-looking statements that are subject to the risks and uncertainties described in this report and in our other public filings and public statements. Our guidance may not always be accurate. If in the future our operating or financial results for a particular period do not meet our guidance or the expectations of investment analysts, or if we reduce our guidance for future periods, the market price of our common stock could significantly decline. Further, frequent changes in guidance could increase the volatility of our stock price.

We may experience fluctuations in our tax obligations and effective tax rate.

We are subject to income taxes in many United States, Canadian and Puerto Rican jurisdictions. We record tax expense based on our estimates of future payments, which include reserves for estimates of uncertain tax positions. At any one time, many tax years are subject to audit by various taxing jurisdictions. The results of these audits and negotiations with taxing authorities may impact the ultimate settlement of these tax positions. As a result, we expect that there could be ongoing variability in our quarterly tax rates as taxable events occur and exposures are re-evaluated. Further, our effective tax rate in a given financial statement period may be materially impacted by changes in the mix and level of earnings.

We are also subject to sales and use taxes in many United States, Canadian and Puerto Rican jurisdictions. At any one time, many tax years are subject to audit by various taxing jurisdictions. The results of these audits and negotiations with taxing authorities may adversely impact the ultimate settlement of these tax positions and our financial results.

We may be a party to legal proceedings that could result in unexpected outcomes.

From time to time, we are a party to legal proceedings, including matters involving personnel and employment issues, personal injury, and other proceedings arising in the ordinary course of business. In addition, there are an increasing number of cases being filed against companies generally that contain class action allegations under federal and state wage and hour laws. We evaluate our exposure to these legal proceedings and establish reserves for the estimated liabilities in accordance with generally accepted accounting principles.

12

Assessing and predicting the outcome of these matters involve substantial uncertainties. Although not currently anticipated by management, unexpected outcomes in these legal proceedings, or changes in management’s evaluations or predictions, could have a material adverse impact on our financial results.

Any terrorist act that impacts consumer shopping could have a material adverse effect on our business.

We are dependent upon the continued popularity of malls as shopping destinations and the ability of mall anchor tenants and other attractions to generate customer traffic in the malls where our stores are located. Any terrorist act that decreases the level of mall traffic or other shopping traffic could have a material adverse effect on our business.

Our performance is dependent on attracting and retaining a large and growing number of quality team members.

Many of those team members are in entry-level or part-time positions with historically high rates of turnover. Our ability to meet our labor needs while controlling our costs is subject to external factors such as unemployment levels, minimum wage legislation, health care legislation and changing demographics. In addition, our labor costs are influenced by health care and workers’ compensation costs, both of which have been rising in recent years. If we cannot hire enough qualified employees, or if there is a disruption in the supply of personnel we hire from third-party providers, especially during our peak season or certain high-volume events, our customer service levels and our operations could be negatively impacted.

We may be unable to protect our trademarks and other intellectual property rights.

We believe that our trademarks and service marks are important to our success and our competitive position due to their name recognition with our customers. We devote substantial resources to the establishment and protection of our trademarks and service marks on a worldwide basis. In order to more effectively protect them from infringement and to defend against claims of infringement, the marks are owned by a separate subsidiary whose purpose is to maintain and manage existing and future marks, thereby increasing their value to us. We are not aware of any material claims of infringement or material challenges to our right to use any of our trademarks and service marks in the United States. Nevertheless, there can be no assurance that the actions we have taken to establish and protect our trademarks and service marks will be adequate to prevent imitation of our products by others or to prevent others from seeking to block sales of our products as a violation of the trademarks, service marks and proprietary rights of others. Also, others may assert rights in, or ownership of, trademarks and other proprietary rights of ours and we may not be able to successfully resolve these types of conflicts to our satisfaction. In addition, the laws of certain foreign countries may not protect proprietary rights to the same extent as do the laws of the United States.

We may require external funding sources for operating funds in the future.

We regularly review and evaluate our liquidity and capital needs. We currently believe that our available cash, cash equivalents, cash flow from operations and cash available under our existing and future credit facilities will be sufficient to finance our operations and expected capital requirements for at least the next 12 months. However, as we continue to grow, we might experience peak periods for our cash needs during the course of our fiscal year, and we might need additional external funding to support our operations. In addition, our current credit facility expires in August 2008. Although we believe we will have access to debt and/or capital market funding as needed, such funds may not be available to us on advantageous terms. If the cost of such funds is greater than expected, it could adversely affect our expenses and our operating results.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

13

The Company leases approximately 162,400 square feet of office space in a building in San Francisco, California, for its corporate offices. The lease expires on April 14, 2018. See Note 3 to the consolidated financial statements.

The Company owns a 444,000 square foot distribution center on 21 acres in Dixon, California. All products are distributed to our United States stores from this facility. The Company utilizes a third-party owned and operated distribution center in Burlington, Ontario, Canada for Canadian operations.

As of February 2, 2008, the Company’s 786 stores included an aggregate of approximately 1,513,000 square feet of space. Store leases typically have 10-year terms and include a cancellation clause if minimum revenue levels are not achieved during a specified 12-month period during the lease term. In most cases, leases are structured with a minimum rent component plus a percentage rent based on the store’s net sales in excess of a certain threshold. Substantially all of the leases require the Company to pay insurance, utilities, real estate taxes, and common area repair and maintenance expenses. Approximately 100, 50, and 30 store leases will come up for renewal during fiscal 2008, 2009 and 2010, respectively. The Company is also in the process of negotiating lease terms for approximately 110 stores, which are currently operating under month-to-month terms. As of February 2, 2008, we also operated three Gymboree Play & Music corporate-owned sites in California under leases that expire between fiscal 2008 and fiscal 2012. See Note 3 to Consolidated Financial Statements.

The Company is subject to various legal proceedings and claims arising in the ordinary course of business. Our management does not expect that the results of any of these legal proceedings, either individually or in the aggregate, would have a material adverse effect on our financial position, results of operations or cash flows.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

None.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Gymboree Corporation’s common stock is traded on The Nasdaq Stock Market LLC under the symbol “GYMB.” The following table sets forth the quarterly high and low sale prices per share of our common stock over the last two fiscal years, as reported on The Nasdaq Stock Market LLC.

| | | | | | | | | | | | |

| | | Fiscal 2007 | | Fiscal 2006 |

| | | High | | Low | | High | | Low |

First Quarter | | $ | 45.29 | | $ | 34.66 | | $ | 31.10 | | $ | 20.78 |

Second Quarter | | | 45.55 | | | 35.91 | | | 38.22 | | | 29.90 |

Third Quarter | | | 44.09 | | | 29.10 | | | 48.65 | | | 28.69 |

Fourth Quarter | | | 39.20 | | | 25.99 | | | 49.11 | | | 36.58 |

As of March 1, 2008, the number of holders of record of the Company’s common stock totaled approximately 660. The Company has never declared or paid cash dividends on its common stock and anticipates that all future earnings will be retained for development of its business or stock repurchases. The payment of any future dividends will be at the discretion of the Company’s Board of Directors and will depend upon, among other things, future earnings, capital requirements, our financial position and general business conditions. In addition, the Company is restricted from paying dividends under the terms of its existing credit facility. This credit facility also limits stock repurchases.

14

On January 23, 2007, the Board of Directors authorized the Company to utilize $50 million to purchase shares of the Company’s outstanding common stock under a share repurchase program. In the first quarter of fiscal 2007, the Company completed this share repurchase program, having purchased a total of 1,295,338 shares of Company stock at an aggregate cost of $50 million, or approximately $38.57 per share. The Company retired the repurchased shares.

On April 17, 2007, the Board of Directors authorized the Company to utilize $50 million to purchase shares of the Company’s outstanding common stock under an additional share repurchase program. In the second quarter of fiscal 2007, the Company completed this repurchase program, having purchased a total of 1,240,478 shares of Company stock at an aggregate cost of $50 million, or approximately $40.29 per share. The Company retired the repurchased shares.

On July 30, 2007, the Board of Directors authorized the Company to utilize $50 million to purchase shares of the Company’s outstanding common stock under an additional share repurchase program. In the fourth quarter of fiscal 2007, the Company completed this share repurchase program, having purchased a total of 1,393,166 shares of Company stock at an aggregate cost of $50 million, or approximately $35.87 per share. The Company retired the repurchased shares.

On November 26, 2007, the Company’s Board of Directors authorized the Company to utilize $25 million to purchase shares of the Company’s outstanding common stock under a new share repurchase program. In the first quarter of fiscal 2008, the Company completed the share repurchase program having purchased a total of 761,755 shares at a cost of $25 million, or approximately $32.80 per share. The Company retired the repurchased shares.

Stock repurchases for the quarter ended February 2, 2008, were as follows:

| | | | | | | | | | |

Period | | Total

Number

of Shares

Purchased | | Average

Price

Paid

per Share | | Total Number

of Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs | | Approximate Dollar

Value of Shares

that May

Yet be Purchased

Under the

Plans or Programs |

Month #1 (November 4 - December 1) | | 373,330 | | $ | 32.65 | | 373,330 | | $ | 13,747,000 |

Month #2 (December 2 - January 5) | | 400,000 | | $ | 32.48 | | 400,000 | | $ | 747,000 |

Month #3 (January 6 - February 2) | | — | | | — | | — | | $ | 747,000 |

| | | | | | | | | | |

Total, February 2, 2008 | | 773,330 | | $ | 32.56 | | 773,330 | | $ | 747,000 |

| | | | | | | | | | |

15

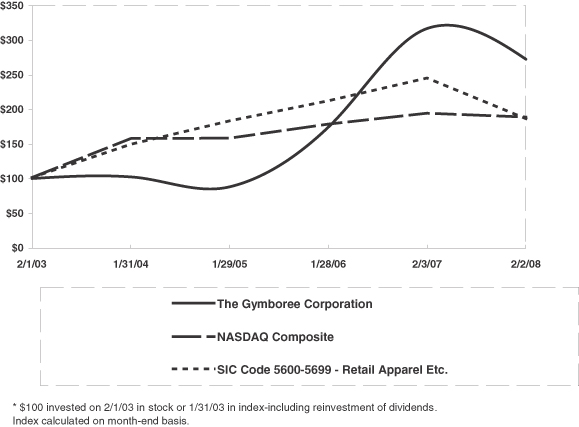

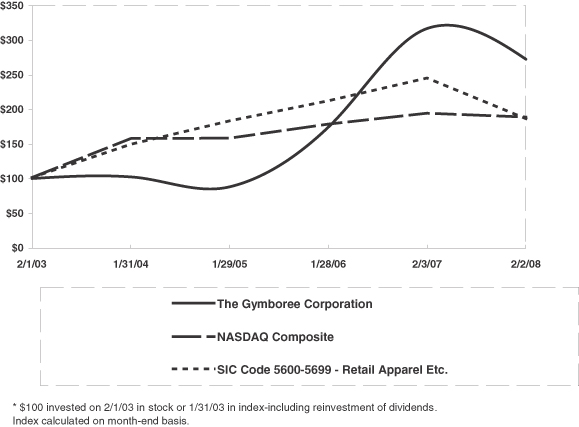

The following graph compares the cumulative five-year total return to shareholders on The Gymboree Corporation’s common stock relative to the cumulative total returns of the NASDAQ Composite index, and a peer group of 56 companies contained in SIC Codes 5600-5699. The graph assumes that the value of the investment in the Company’s common stock, in the peer group, and the index (including reinvestment of dividends) was $100 on February 1, 2003 and tracks it through February 2, 2008.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN*

AMONG THE GYMBOREE CORPORATION, THE NASDAQ COMPOSITE INDEX

AND A PEER GROUP

| | | | | | | | | | | | |

| | | 2/1/03 | | 1/31/04 | | 1/29/05 | | 1/28/06 | | 2/3/07 | | 2/2/08 |

THE GYMBOREE CORPORATION | | 100.00 | | 102.52 | | 88.01 | | 174.26 | | 316.83 | | 272.16 |

NASDAQ COMPOSITE | | 100.00 | | 156.40 | | 156.66 | | 177.31 | | 192.91 | | 187.21 |

SIC CODE 5600-5699 - RETAIL APPAREL ETC. | | 100.00 | | 147.96 | | 181.57 | | 211.02 | | 243.87 | | 184.88 |

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

The 56 companies included in the customized peer group are: Abercrombie & Fitch Company, Aeropostale Inc., American Eagle Outfitters, Ann Taylor Stores Corp., Bakers Footwear Group Inc., Big DOG Holdings Inc., Bluefly Inc., Brown Shoe Inc., Buckle Inc., Cache Inc., Carters Holdings Inc., Casual Male Retail Group Inc., Cato Corp., Charlotte Russe Holdings Inc., Charming Shoppes Inc., Chicos FAS Inc., Childrens Place Retail Stores Inc., Christopher & Banks Corp., Citi Trends Inc., Collective Brands Inc., Delias Inc., Dover Saddlery

16

Inc., Dress Barn Inc., DSW Inc., Eddie Bauer Holdings Inc., Finish Line Inc., Foot Locker Inc., Footstar Inc., Fredericks Of Hollywood Group Inc., The Gap Inc., Genesco Inc., The Gymboree Corporation, Harolds Stores Inc., Hartmarx Corp., Hot Topic Inc., J Crew Group Inc., Jo-Ann Stores Inc., Kuhlman Company Inc., Limited Brands Inc., Mothers Work Inc., New York & Company Inc., Nordstrom Inc., Pacific Sunwear California Inc., Parent Company, Ross Stores Inc., Shoe Carnival Inc., Shoe Pavilion Inc., Stage Stores Inc., Stein Mart Inc., Syms Corp., Talbots Inc., The Mens Wearhouse Inc., Tween Brands Inc., Wet Seal Inc., Wilsons The Leather Experts and Zumiez Inc.

17

| ITEM 6. | SELECTED CONSOLIDATED FINANCIAL DATA |

The following selected financial data has been derived from the Consolidated Financial Statements of the Company. The Company’s United Kingdom and Ireland (collectively “Europe”) operations and its Janeville division have been presented as discontinued operations in the accompanying financial statements for fiscal years 2003 through 2006. Results of the Europe and Janeville operations in fiscal 2007 are insignificant and are included in continuing operations. The data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Consolidated Financial Statements and Notes thereto.

| | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

(In thousands, except operating data and per share amounts) | | | | | | | | | | | | | | | | | | | | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales: | | | | | | | | | | | | | | | | | | | | |

Retail (1) | | $ | 909,410 | | | $ | 781,172 | | | $ | 656,546 | | | $ | 578,266 | | | $ | 537,625 | |

Play & Music | | | 11,404 | | | | 10,466 | | | | 10,946 | | | | 10,753 | | | | 11,647 | |

| | | | | | | | | | | | | | | | | | | | |

Total net sales | | | 920,814 | | | | 791,638 | | | | 667,492 | | | | 589,019 | | | | 549,272 | |

Cost of goods sold, including buying and occupancy expenses | | | (478,020 | ) | | | (407,180 | ) | | | (372,158 | ) | | | (353,510 | ) | | | (322,652 | ) |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 442,794 | | | | 384,458 | | | | 295,334 | | | | 235,509 | | | | 226,620 | |

Selling, general and administrative expenses | | | (312,549 | ) | | | (278,294 | ) | | | (233,481 | ) | | | (211,986 | ) | | | (185,255 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 130,245 | | | | 106,164 | | | | 61,853 | | | | 23,523 | | | | 41,365 | |

Interest income | | | 2,609 | | | | 5,314 | | | | 2,221 | | | | 1,022 | | | | 652 | |

Interest expense | | | (179 | ) | | | (232 | ) | | | (340 | ) | | | (355 | ) | | | (411 | ) |

Other income (expense), net | | | 769 | | | | 1,560 | | | | (75 | ) | | | (82 | ) | | | 137 | |

| | | | | | | | | | | | | | | | | | | | |

Income from continuing operations, before income tax | | | 133,444 | | | | 112,806 | | | | 63,659 | | | | 24,108 | | | | 41,743 | |

Income tax expense | | | (53,113 | ) | | | (41,655 | ) | | | (25,460 | ) | | | (2,550 | ) | | | (15,666 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income from continuing operations, net of income tax | | | 80,331 | | | | 71,151 | | | | 38,199 | | | | 21,558 | | | | 26,077 | |

Loss from discontinued operations, net of income tax | | | — | | | | (10,901 | ) | | | (4,515 | ) | | | (14,120 | ) | | | (416 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income before cumulative effect of change in accounting principle | | | 80,331 | | | | 60,250 | | | | 33,684 | | | | 7,438 | | | | 25,661 | |

Cumulative effect of change in accounting principle, net of income tax | | | — | | | | — | | | | — | | | | 1,206 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 80,331 | | | $ | 60,250 | | | $ | 33,684 | | | $ | 8,644 | | | $ | 25,661 | |

| | | | | | | | | | | | | | | | | | | | |

Basic income per share: | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations, net of income tax | | $ | 2.79 | | | $ | 2.25 | | | $ | 1.21 | | | $ | 0.70 | | | $ | 0.88 | |

Loss from discontinued operations, net of income tax | | | — | | | | (0.34 | ) | | | (0.14 | ) | | | (0.46 | ) | | | (0.01 | ) |

Cumulative effect of change in accounting principle, net of income tax | | | — | | | | — | | | | — | | | | 0.04 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 2.79 | | | $ | 1.90 | | | $ | 1.07 | | | $ | 0.28 | | | $ | 0.87 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted income per share: | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations, net of income tax | | $ | 2.67 | | | $ | 2.15 | | | $ | 1.19 | | | $ | 0.69 | | | $ | 0.85 | |

Loss from discontinued operations, net of income tax | | | — | | | | (0.33 | ) | | | (0.14 | ) | | | (0.45 | ) | | | (0.01 | ) |

Cumulative effect of change in accounting principle, net of income tax | | | — | | | | — | | | | — | | | | 0.04 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 2.67 | | | $ | 1.82 | | | $ | 1.05 | | | $ | 0.28 | | | $ | 0.83 | |

| | | | | | | | | | | | | | | | | | | | |

Basic weighted average shares outstanding | | | 28,797 | | | | 31,647 | | | | 31,485 | | | | 30,747 | | | | 29,656 | |

Diluted weighted average shares outstanding | | | 30,033 | | | | 33,099 | | | | 32,178 | | | | 31,391 | | | | 30,853 | |

| | | | | |

Operating Data: | | | | | | | | | | | | | | | | | | | | |

Number of stores at end of period | | | 786 | | | | 698 | | | | 642 | | | | 634 | | | | 596 | |

Net sales per gross square foot at period-end (2) | | $ | 595 | | | $ | 592 | | | $ | 549 | | | $ | 498 | | | $ | 498 | |

Net sales per average store (3) | | $ | 1,146,000 | | | $ | 1,111,000 | | | $ | 1,018,000 | | | $ | 911,000 | | | $ | 902,000 | |

Comparable store net sales increase (4) | | | 7 | % | | | 12 | % | | | 9 | % | | | 2 | % | | | 1 | % |

| | | | | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Working capital | | $ | 58,038 | | | $ | 161,710 | | | $ | 179,045 | | | $ | 106,538 | | | $ | 116,521 | |

Total assets | | | 397,184 | | | | 454,208 | | | | 424,778 | | | | 351,699 | | | | 302,400 | |

Stockholders’ equity | | | 208,295 | | | | 275,727 | | | | 275,077 | | | | 217,406 | | | | 200,214 | |

Notes:

| (1) | Net retail sales include revenues from the Company’s retail stores, online stores and the Gymboree Visa program. |

| (2) | Equals net retail sales, excluding revenues from the Gymboree Visa program, divided by total square feet of store space as of each fiscal year-end. |

| (3) | Equals net retail sales, excluding revenues from the Gymboree Visa program, divided by stores open as of each fiscal year-end. |

| (4) | A comparable store is one that has been open for a full 14 months. Stores that are relocated or expanded by more than 15% of their original square footage become comparable 14 months after final relocation or the completion of the expansion project. Comparable stores net sales include net sales from the Company’s online stores. Comparable stores net sales were calculated on a 52-week basis for all periods presented. |

18

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

You should read the following discussion and analysis in conjunction with our Consolidated Financial Statements and related Notes included elsewhere in this report. Except for historical information, the following discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Inaccurate assumptions and known and unknown risks and uncertainties can affect the accuracy of forward-looking statements, and our actual results could differ materially from results that may be anticipated by such forward-looking statements. The principal factors that could cause or contribute to such differences include, but are not limited to, those discussed in Item 1A, “Risk Factors” and those discussed elsewhere in this report. We do not intend to revise any forward-looking statements in order to reflect events or circumstances that may subsequently arise.

General

The Gymboree Corporation is a specialty retailer operating stores selling high-quality apparel and accessories for children under the GYMBOREE®, JANIE AND JACK®, and CRAZY 8™ brands, as well as play programs for children under the GYMBOREE PLAY & MUSIC® brand. As of February 2, 2008, the Company conducted its business through five primary divisions: Gymboree, Gymboree Outlet, Janie and Jack, Crazy 8, and Gymboree Play & Music. As of February 2, 2008, the Company had 786 stores, including 754 stores in the United States (including 565 Gymboree stores, 93 Janie and Jack shops, 82 Gymboree Outlet stores, and 14 Crazy 8 stores), 30 Gymboree stores in Canada and 2 stores in Puerto Rico. The Company also operates three online stores atwww.gymboree.com,www.janieandjack.com, and www.crazy8.com.

The Company’s net sales for fiscal 2007 increased to $920.8 million from $791.6 million in fiscal 2006 and $667.5 million in fiscal 2005. Net income totaled $80.3 million in fiscal 2007 compared to $60.3 million in fiscal 2006 and $33.7 million in fiscal 2005. Comparable store net sales (which include online stores), based on a 52-week period, increased 7% during fiscal 2007 versus 2006, 12% during fiscal 2006 versus 2005, and 9% during fiscal 2005 versus 2004.

The Company expects that future increases in net sales and net income will be dependent on, among other factors, its ability to:

| | • | | Expand its three newer growth concepts, Janie and Jack, Gymboree Outlet, and Crazy 8; |

| | • | | Continue to reduce product costs while maintaining high-quality standards; |

| | • | | Generate more sales to existing customers in the core Gymboree division through appropriate size expansions; growth of the Boy department business and increased Newborn product assortment; and |

| | • | | Attract new customers through strategies such as direct mail campaigns and cross-brand marketing. |

The Company’s long-term growth will depend on the development and implementation of newer retail concepts such as Janie and Jack, Gymboree Outlet, and Crazy 8, as well as continued investment in its core retail brand, Gymboree. As such, the Company expects to continue to devote time and effort to evaluating, developing, and testing new concepts when it perceives opportunities in the marketplace. Such efforts inevitably require significant management attention at all phases of the process and, for those concepts that the Company determines to launch, significant capital expenditures and losses during the early years of operation. Fiscal 2007 results include an operating loss of $0.11 per diluted share related to the Company’s new Crazy 8 concept. Such losses are expected to continue in fiscal 2008.

During 2008, the Company plans to open approximately 100 new stores, including 20 Gymboree stores, 40 Gymboree Outlet stores, 20 Janie and Jack shops, and 20 Crazy 8 stores. The Company also plans to remodel, relocate or expand approximately 20 Gymboree and Janie and Jack stores.

19

The Company’s year-end is on the Saturday closest to January 31. Fiscal 2007, which included 52 weeks, ended on February 2, 2008. Fiscal 2006, which included 53 weeks, ended on February 3, 2007. Fiscal 2005, which included 52 weeks, ended on January 28, 2006. Management estimates that the 53rd week of fiscal 2006 contributed approximately $0.05 per diluted share to income from continuing operations.

Critical Accounting Policies

Critical accounting policies are those accounting policies and estimates that management believes are important to the portrayal of the Company’s financial condition and results of operations and require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

Share-Based Compensation. In fiscal 2006, the Company adopted SFAS No. 123(R),Share-Based Compensation (“SFAS 123(R)”) using the modified prospective transition method and began accounting for share-based compensation using a fair-valued based recognition method. Under the provisions of SFAS 123(R), share-based compensation cost is estimated at the grant date based on the fair value of the award and expensed over the requisite service period of the award. The Company recognizes share-based compensation expense on a straight-line basis for options and awards with time-based service conditions, and on an accelerated basis for awards with performance conditions (see Note 7). Determining the appropriate fair-value model, calculating the fair value of share-based awards at the grant date and amortizing the fair value over the requisite service period requires considerable judgment, including estimating stock price volatility, expected term and forfeiture rates. The Company develops its estimates based on historical data and market information, which can change significantly over time.

The Company uses the Black-Scholes option valuation model to value options and shares issued under the Company’s Employee Stock Purchase Plan. Restricted stock units and shares are valued based on the fair market value of the Company’s common stock on the date of grant. The Company estimates stock price volatility based on an average historical volatility of its stock. Expected term and forfeiture rate assumptions are also derived from historical data, giving consideration to expectations of future employee behavior. Had the Company used alternative valuation methodologies or assumptions, the amount expensed for share-based awards could be significantly different.

Inventory Valuation.The Company reviews its inventory levels in order to identify slow-moving merchandise and broken assortments (items no longer in stock in a sufficient range of sizes) and reduces prices to sell that merchandise. The Company takes a physical count of inventories in all stores once a year, and in some stores twice a year. The Company performs cycle counts of inventory for its retail distribution center and online stores throughout the year. The Company records an inventory shrink adjustment upon physical counts and also provides for estimated shrink adjustments for the period between the last physical inventory count and each balance sheet date. Our inventory shrink estimate can be affected by changes in merchandise mix and changes in actual shrink trends.

Asset Impairment.The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. Long-lived assets at retail stores are reviewed for impairment once the related store has been open for a minimum of 18 to 36 months, depending on the brand. If the undiscounted future cash flows from the long-lived assets are less than the carrying value, the Company recognizes a loss equal to the difference between the carrying value and the fair value of the assets. Decisions to close a store or facility can also result in accelerated depreciation over the revised useful life. For locations to be closed that are under long-term leases, the Company records a charge for lease buyout expense or the difference between its rent and the rate at which it expects to be able to sublease the properties and related cost, as appropriate. Most closures occur upon the lease expiration. The Company’s estimate of future cash flows is based on experience and occasionally third-party advice or market data. However, these estimates can be affected by factors that are difficult to predict such as future store profitability, real estate demand and economic conditions.

20

Workers’ Compensation. The Company is partially self-insured for workers’ compensation insurance. The Company records a liability based on claims filed and an actuarially determined amount of claims incurred, but not yet reported. Any actuarial projection of losses concerning the Company’s liability is subject to a high degree of variability due to external factors, including future inflation rates, litigation trends, legal interpretations, benefit level changes and claim settlement patterns. If the actual amount of claims filed exceeds estimates, reserves recorded may not be sufficient and additional accruals may be required in future periods.

Co-Branded Credit Card. The Company has co-branded credit card agreements (the “Agreements”) with a third-party bank (the “Bank”) and Visa U.S.A. Inc. for the issuance of a Visa credit card bearing the Gymboree brand and administration of an associated incentive program for cardholders. The program offers incentives to cardholders, including a 5% discount on purchases from Gymboree using the Gymboree Visa card and rewards in the form of a Gymboree gift card equal to 1% of total non-Gymboree purchases. The Bank is the sole owner of the accounts issued under the program and absorbs all losses associated with non-payment by the cardholder and any fraudulent usage of the accounts by third parties. The Company is responsible for redeeming the incentives, including the issuance of any gift cards. The Bank pays fees to the Company based on the number of credit card accounts opened and card usage and makes certain guaranteed minimum annual payments. Visa U.S.A. Inc. also pays fees to the Company based on card usage. Cardholder incentives are funded from the fees paid by the Bank to the Company. The Company recognizes revenues related to the Agreements as follows:

| | • | | New account fees are recognized as retail revenues on a straight-line basis over the average estimated life of the credit card relationship, currently estimated to be three years. |

| | • | | Credit card usage fees are recognized as retail revenues as actual credit card usage occurs. |

| | • | | Minimum guaranteed annual payments, which exceed amounts earned based on the number of accounts opened and card usage, are recognized as retail revenues on a straight-line basis over the estimated life of the credit card relationship, currently estimated to be three years. |

| | • | | Rewards earned are recorded as gift card liabilities and recognized as retail revenues when the gift cards are redeemed. |

Revenue Recognition. Revenue is recognized at the point of sale in retail stores. Online revenue is recorded when the Company estimates merchandise is delivered to the customer. Customers generally receive merchandise within a few days of shipment. Shipping fees received from customers are included in net sales and the associated shipping costs are included in cost of goods sold. The Company also sells gift cards in its retail store locations and through its online stores. Revenue is recognized in the period that the gift card is redeemed. The Company recognizes unredeemed gift card balances over three years old as other income. Customers may earn Gymbucks and redeem them for merchandise at a discount during the redemption period. One-half of the Gymbucks coupon value is earned by customers when the minimum purchase requirement is met during the earning period, and the other half is earned when the additional purchase requirement is met during the redemption period. A liability is recorded for all Gymbucks earned, but not redeemed, within an accounting period. Sales are presented net of a sales return reserve, which is estimated based on historical return trends. If actual returns or Gymbucks redemptions exceed or fall short of estimates, adjustments to sales returns and markdowns may be recorded in the future.

Income Taxes.The Company provides for income taxes in accordance with Statement of Financial Accounting Standards No. 109,Accounting for Income Taxes (“SFAS 109”). SFAS 109 requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the financial statement carrying amounts and the tax bases of assets and liabilities. The Company maintains valuation allowances when it is more likely than not that all or a portion of a deferred tax asset will not be realized. Changes in valuation allowances from period to period are included in the tax provision in the period of change. In determining whether a valuation allowance is warranted, the Company takes into account such factors as prior earnings history, expected future earnings, carryback and carryforward periods, and tax strategies that could potentially enhance the likelihood of realization of a deferred tax asset. The Company is subject to periodic

21