March 5, 2013 Cowen Health Care Conference Boston, MA Copyright © 2012 Acura Pharmaceuticals. All rights reserved.

Caution Regarding Forward Looking Statements Certain statements in this presentation constitute "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements expressed or implied by such forward - looking statements . Forward - looking statements may include, but are not limited to, our and our licensee’s ability to successfully launch and commercialize our products and technologies including Oxecta ® Tablets and Nexafed ® Tablets, the price discounting that may be offered by Pfizer for Oxecta ®, the ability of us or our licensee’s to obtain necessary regulatory approvals and commercialize products utilizing our technologies and the market acceptance of and competitive environment for any of our products, expectations regarding potential market share for our products and the timing of first sales, our ability to enter into additional license agreements for our other product candidates, the ability to avoid infringement of patents, trademarks and other proprietary rights of third parties, and the ability of our patents to protect our products from generic competition, and the ability to fulfill the U . S . Food and Drug Administration’s, or FDA, requirements for approving our product candidates for commercial manufacturing and distribution in the United States, including, without limitation, the adequacy of the results of the laboratory and clinical studies completed to date, the results of laboratory and clinical studies we may complete in the future to support FDA approval of our product candidates and the sufficiency of our development to meet over - the - counter, or OTC, Monograph standards as applicable, the adequacy of the development program for our product candidates, including whether additional clinical studies will be required to support FDA approval of our product candidates, changes in regulatory requirements, adverse safety findings relating to our product candidates, whether the FDA will agree with our analysis of our clinical and laboratory studies and how it may evaluate the results of these studies or whether further studies of our product candidates will be required to support FDA approval, whether or when we are able to obtain FDA approval of labeling for our product candidates for the proposed indications and will be able to promote the features of our abuse discouraging technologies, whether our product candidates will ultimately deter abuse in commercial settings and whether our Impede™ technology will disrupt the processing of pseudoephedrine into methamphetamine . In some cases, you can identify forward - looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions intended to identify forward - looking statements . These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties . Given these uncertainties, you should not place undue reliance on these forward - looking statements . We discuss many of these risks in greater detail in our filings with the Securities and Exchange Commission . 2

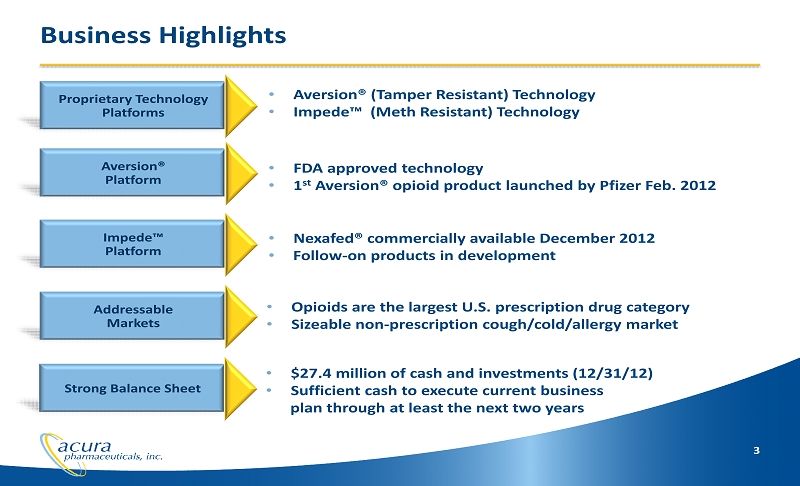

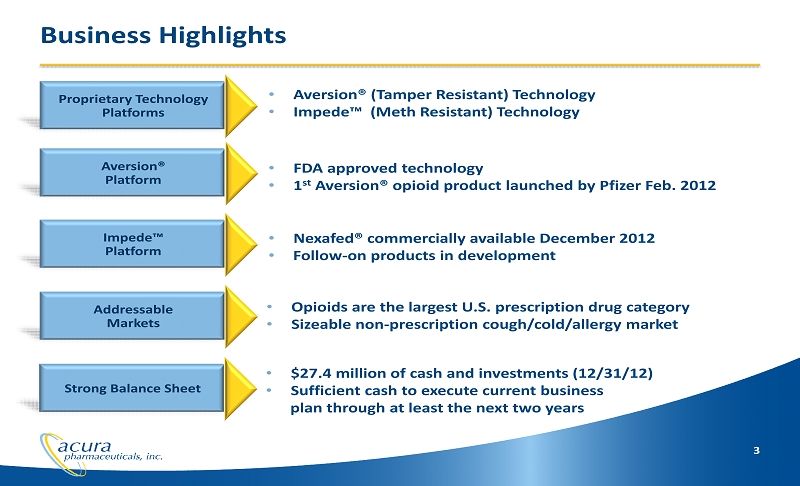

Business Highlights • FDA approved technology • 1 st Aversion® opioid product launched by Pfizer Feb. 2012 • Aversion® (Tamper Resistant) Technology • Impede™ (Meth Resistant) Technology • Nexafed ® commercially available December 2012 • Follow - on products in development • Opioids are the largest U.S. prescription drug category • Sizeable non - prescription cough/cold/allergy market • $27.4 million of cash and investments (12/31/12) • Sufficient cash to execute current business plan through at least the next two years 3

Product Portfolio Summary • Broad pipeline of product candidates • Two proprietary technologies: Aversion® and Impede™ Product Area Technology Licensee Status Oxycodone HCL, USP CII Opioid Aversion Pfizer Marketed in the U.S. Hydrocodone/APAP Opioid Aversion IND Active (Jan. 2013) 6 Additional Opioids Opioid Aversion Proof of Concept Complete Nexafed ® Cold/Allergy Impede Marketed in the U.S. Nexafed ® Combo #1 Cold/Allergy Impede On Stability Nexafed ® Combo #2 Cold/Allergy Impede Under evaluation 4 Proof of concept = stability and bioavailability (some formulations include niacin)

Aversion ® Technology Proprietary mixture of inactive ingredients Aversive ingredients intended to deter snorting Physical/chemical properties intended to deter injection 5

Physician Perception of Opioid Abuse Source: Company Research, 400 Primary Care, Surgeon, Pain Specialists & Emergency Room Physicians, December 2011 • Snorting and Injecting are the methods with the highest concern for serious adverse health consequences with immediate release opioids 6

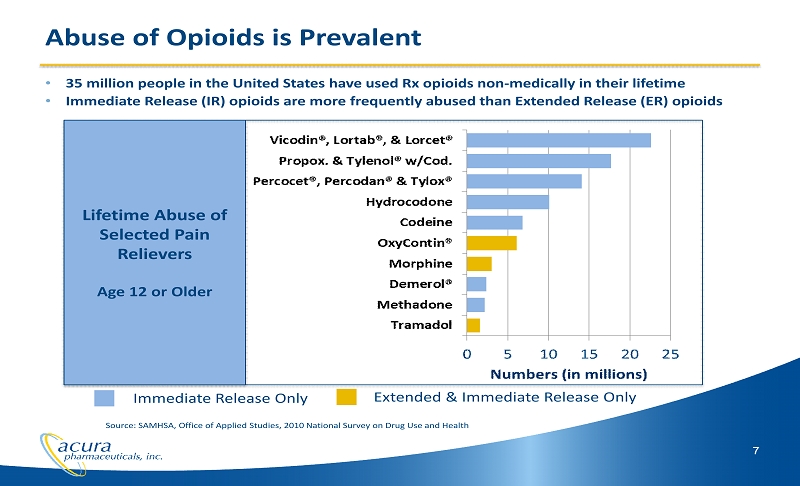

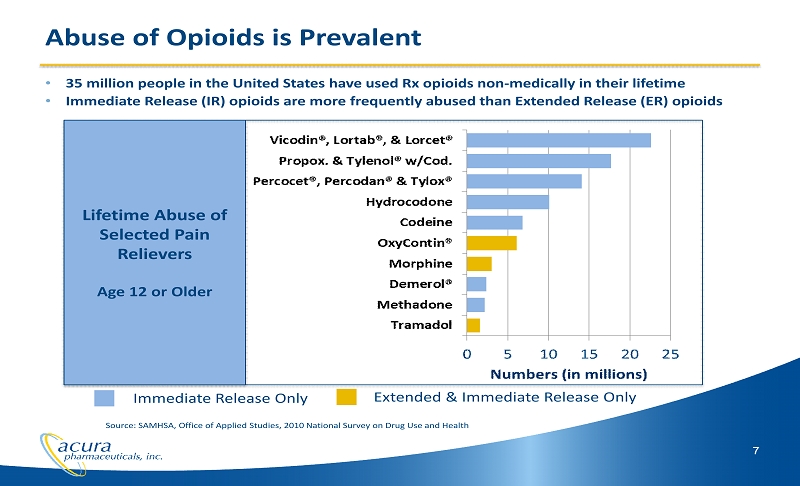

7 • 35 million people in the United States have used Rx opioids non - medically in their lifetime • Immediate Release (IR) opioids are more frequently abused than Extended Release (ER) opioids Abuse of Opioids is Prevalent Source: SAMHSA, Office of Applied Studies, 2010 National Survey on Drug Use and Health Immediate Release Only Extended & Immediate Release Only Lifetime Abuse of Selected Pain Relievers Age 12 or Older

Aversion® IR Product Markets Hydrocodone/ Acetaminophen Source: IMS NPA, MAT Dec. 2012 • 229 million dispensed prescriptions in 2012 • $2.1 billion in sales (mostly generic prices) 8 Oxycodone Oxycodone/ Acetaminophen

9 Aversion® Opioid Product Portfolio • Focus on rapid development of Hydrocodone/APAP • Demonstrated application to multiple opioid formulations • All are immediate - release tablets Product Area Technology Licensee Status Oxycodone HCL, USP CII Opioid Aversion Pfizer Marketed in the U.S. Hydrocodone/APAP Opioid Aversion IND Active (Jan. 2013) 6 Additional Opioids Opioid Aversion Proof of Concept Complete * Proof of concept = stability and bioavailability (some include niacin)

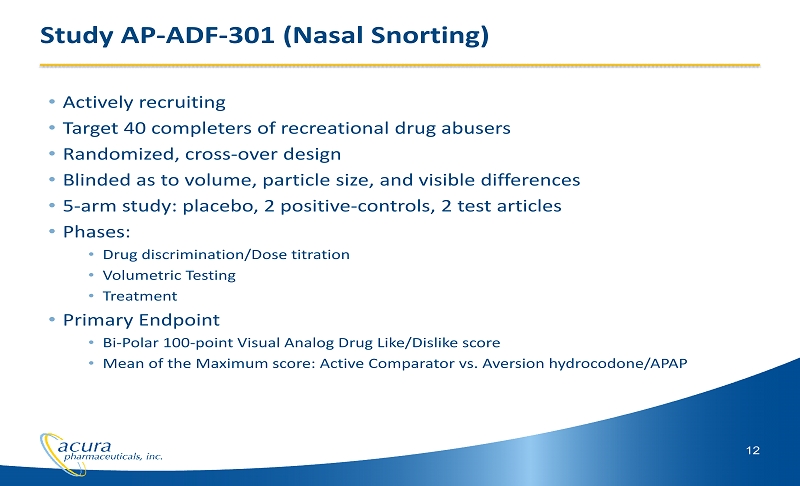

10 Hydrocodone/APAP Development Program • Reinitiated Development Sept. 2012 • IND active Jan. 2013 • Three In Vitro Laboratory Studies • Syringing Study (Complete) • Extraction Study (Complete) • Particle Size Study • Four Clinical Studies with 124 subjects in aggregate • 301 – Nasal Abuse Liability Study (n=40) (Recruiting) • 302 – BA/BE – Food Effect PK Study (n=36) • 303 – Dose Proportionality PK Study (n=24) • 304 – Safety Bridging PK Study (n=24) • NDA Submission Targeted 1 st Half of 2014 • Priority r eview to be requested CONFIDENTIAL

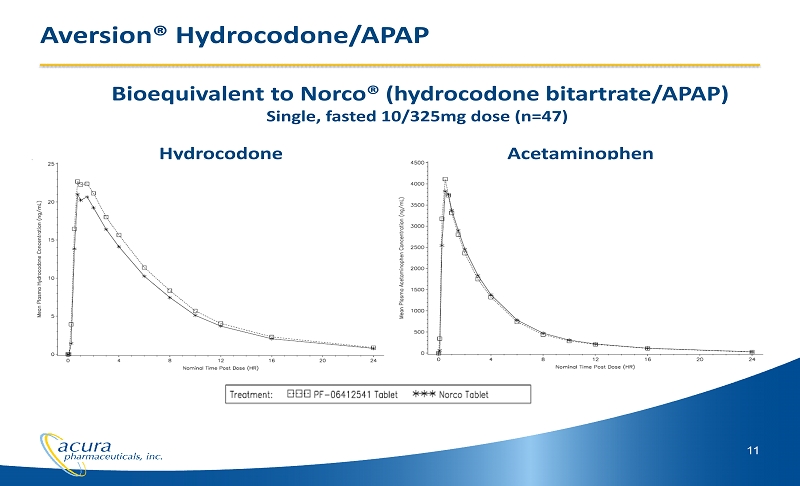

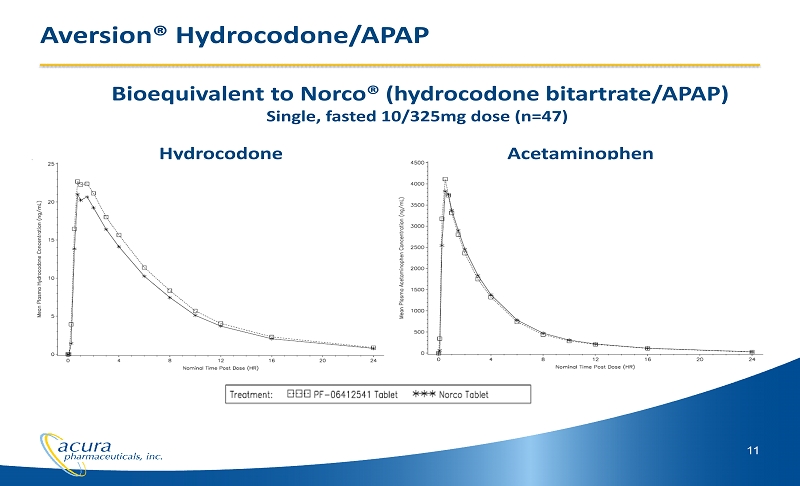

11 Hydrocodone Acetaminophen Aversion® Hydrocodone/APAP Bioequivalent to Norco® (hydrocodone bitartrate /APAP) Single, fasted 10/325mg dose (n=47)

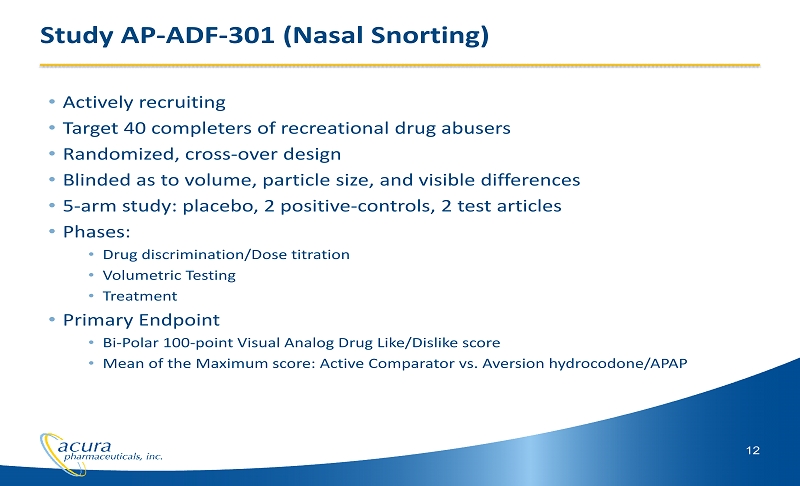

Study AP - ADF - 301 (Nasal Snorting) • Actively recruiting • Target 40 completers of recreational drug abusers • Randomized, cross - over design • Blinded as to volume, particle size, and visible differences • 5 - arm study: placebo, 2 positive - controls, 2 test articles • Phases: • Drug discrimination/Dose titration • Volumetric Testing • Treatment • Primary Endpoint • Bi - Polar 100 - point Visual Analog Drug Like/Dislike score • Mean of the Maximum score: Active Comparator vs. Aversion hydrocodone/APAP 12

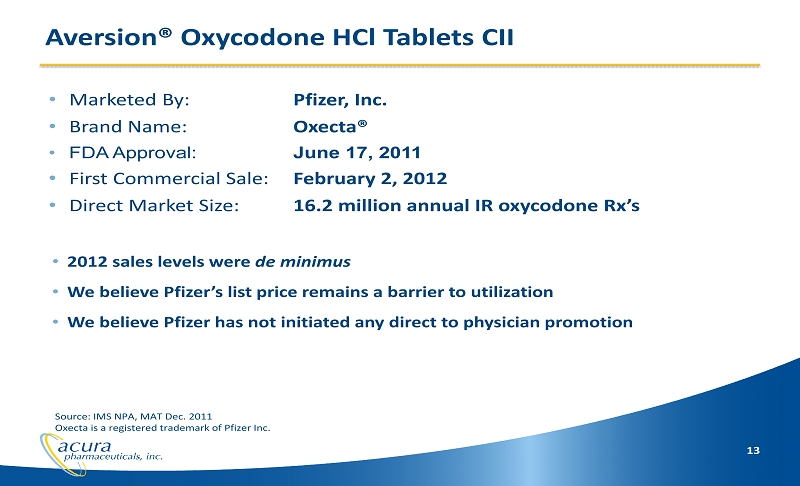

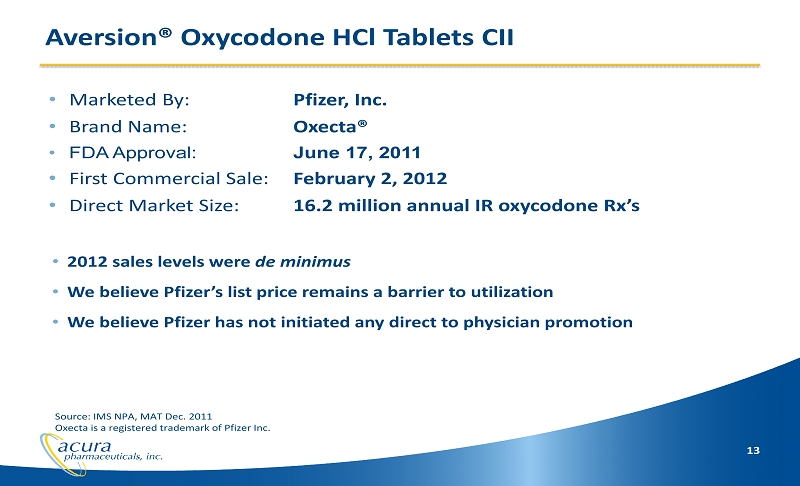

• Marketed By: Pfizer, Inc. • Brand Name: Oxecta ® • FDA Approval: June 17, 2011 • First Commercial Sale: February 2, 2012 • Direct Market Size: 16.2 million annual IR oxycodone Rx’s Aversion® Oxycodone HCl Tablets CII Source: IMS NPA, MAT Dec. 2011 Oxecta is a registered trademark of Pfizer Inc. 13 • 2012 sales levels were de minimus • We believe Pfizer’s list price remains a barrier to utilization • We believe Pfizer has not initiated any direct to physician promotion

14 …..The Revolution Begins

15 (Pseudoephedrine HCl ) 30 mg Tablets • Launched December 2012 • Pseudoephedrine HCl 30 mg Tablets • With Impede™ Technology • Efficacy Demonstrated • Bioequivalent to leading branded PSE tablets • Temporary relief of nasal congestion • Meth Resistance Testing • no extraction of pseudoephedrine for further processing in two common Meth extraction methods • 50% reduced Meth yield in direct conversion method compared to that of existing PSE tablets

16 Nexafed® Bioequivalence Mean pseudoephedrine plasma concentrations (n=30) Single, fasted two 30mg tablet dose Meets FDA Guideline standards for Bioequivalence

17 Nexafed® Launch Strategy Launch Objectives • Generate stocking at independent pharmacies through wholesalers • Generate pharmacist recommendations to create consumer demand • Initiate chain store awareness Retail Distribution RPh Recommendations Consumer Demand • Traditional selling (wholesalers/chains) • Wholesaler Promotion (independents) • Pharmacists awareness and request • Advertising and Promotion • Public Relations • Public Relations

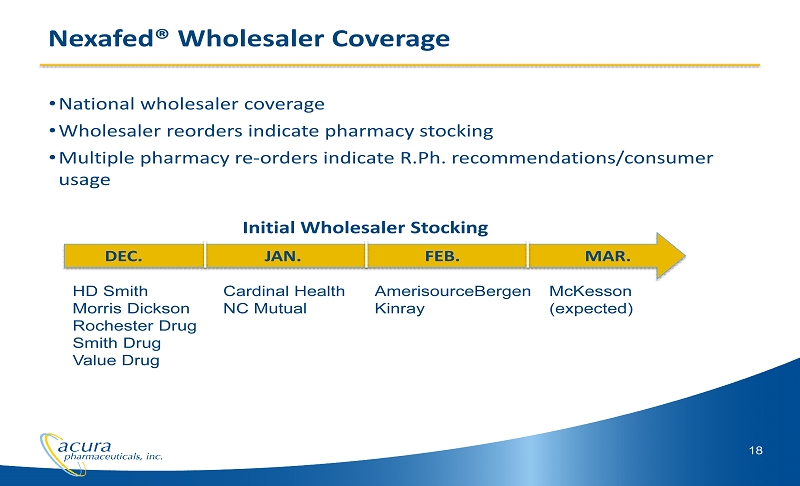

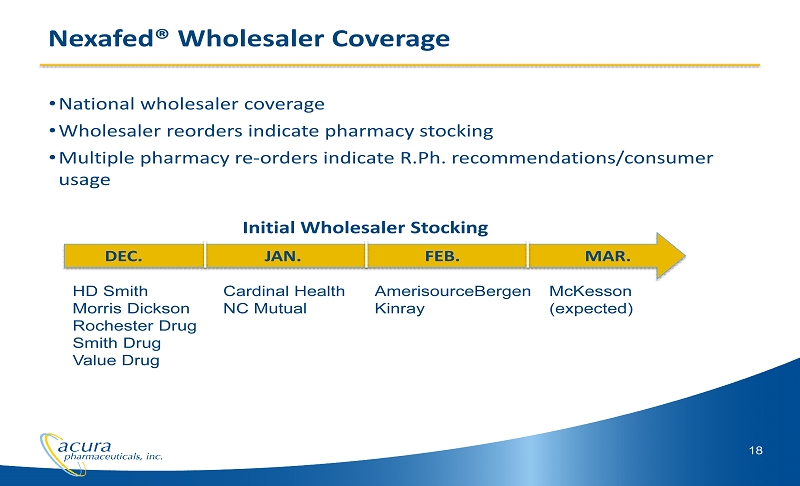

18 • National wholesaler coverage • Wholesaler reorders indicate pharmacy stocking • Multiple pharmacy re - orders indicate R.Ph . recommendations/consumer usage DEC. JAN. FEB. MAR. Nexafed® Wholesaler Coverage HD Smith Morris Dickson Rochester Drug Smith Drug Value Drug Cardinal Health NC Mutual AmerisourceBergen Kinray McKesson (expected) Initial Wholesaler Stocking

19 Pharmacist Impressions: 657,762 • Direct Mail Launch Email Online and Print Ads Searches Engines Nexafed.com Consumer Impressions: 36,598,601 • Original Articles (47) TV/Radio Airings (429) Press releases reproductions (924) MAT Article reproductions (924) Nexafed® Launch Advertising/Promotion/PR

20 “Join the Fight” Network Evolving, organic clearinghouse of Nexafed ® feedback • Pharmacists commitment to recommend Nexafed • Deliver current news on Nexafed, PSE, meth, legislation activity, network promotions and contests, surveys • Pharmacists tell us what is working best – consumer messaging, retail promotions, become Nexafed spokespersons • We share info with other pharmacists in network, and incorporate learning into existing marketing and promotion • Provide incentives to continue recommending Nexafed and ingrain Nexafed as their PSE of choice

21 Nexafed® Opportunities • Ingrain pharmacist recommending of Nexafed • Expansion in chain pharmacy outlets • Chain pharmacists ordering direct from wholesalers • Explore direct - to - consumer advertising and promotion • Line Extensions/Technology Improvements • Impede™ 2.0 Technology in development • New active ingredients combinations, both OTC Monograph and prior FDA approval, are actively being developed • Expands our opportunity to address consumer needs in the $1 billion nasal decongestant category

22 Nexafed® Other Stakeholders • Law Enforcement/Drug Enforcement Administration • 2006 Combat Methamphetamine Act • Legislative • Potential regulations supporting use of abuse - deterrent technologies • Food and Drug Administration • Indicated possible regulatory action if [opioid] abuse - deterrent products demonstrate actual reductions in abuse

Intellectual Property and Financial Information 23

• Aversion® Technology patents expire in 2025 • 3 U.S. patents issued covering compositions of opioids and certain other abused drugs with functional inactive ingredients • 1 U.S. Patent issued covering an extended release opioid dosage form • Impede™ Technology patents pending • Additional U.S. and foreign patents • Multiple patent applications pending in the United States and internationally Intellectual Property Position 24

25 Selected Financial Information $ Millions Cash, Cash Equivalents and Marketable Securities $27.4 Debt None Shares Outstanding Millions Total Common Shares Outstanding 45.867 Shares Held by 3 Largest Shareholders (72.1%) 33.062 • Sufficient cash to execute current business plan through at least the next two years • ~ $7.0 million of Net Cash Used for Operations in 2012 Financial and Share Summary @ 12/31/2012

Acura Pharmaceuticals, Inc. 616 N. North Court, Suite 120 Palatine, IL 60067 (847) 705 - 7709 NASDAQ: ACUR www.AcuraPharm.com Copyright © 2012 Acura Pharmaceuticals. All rights reserved.