UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the quarterly period ended March 31, 2008 | |

| | | |

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | for the transition period from | | to | | |

Commission file number 000-49846

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

(Exact name of small business issuer as specified in its charter)

| Nevada | | 87-0638750 |

(State of other jurisdiction of incorporation or organization) | | (IRS Employer identification No.) |

445 Park Avenue, New York, New York 10022

(Address of principal executive offices)

(212) 307-3568

(Issuer's telephone number)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerate filer, an accelerate filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Number of shares of common stock outstanding as of May 14, 2008: 19,224,080

EXLANATORY NOTE

This Amendment on Form 10-Q/A (the “Amended Filing”) amends the quarterly report on Form 10-Q for the quarter ended March 31, 2008, originally filed on May 15, 2008 (the “Original Filing”), of China North East Petroleum Holdings Limited. (the “Company”). The purpose of this amendment is to revise certain non-cash items in Part I, Item Financial Statements: (i) reclassify warrants issued in conjunction with a secured debenture issued on February 28, 2008, in accordance with FASB’s Emerging Issues Task force 00-19 as liability instruments rather than equity instruments; (ii) the change in fair value of those warrants from the date of issuance through the end of the reporting period; (iii) effective interest expense arising from amortization of the discount to the carrying value of the secured deben ture issued on February 28, 2008; (iv) the recording of warrants issued to investment consultants in connection with the secured debenture issued on February 28, 2008 as deferred financing costs instead of consulting fees; (v) the amount of amortization of deferred financing costs associated with the issuance of the secured debenture issued on February 28, 2008; and (vi) amount payable to a consultant included in accrued liabilities.

As a result of the revisions in Part I, Item 1 of this Amended Filing, Part I, Item 2, Management’s Discussion and Analysis of Financial condition and Results of Operation, is revised to incorporate all the revisions made to Part I, Item 1 as stated in the previous paragraph. Furthermore, due to the revisions described above, management has concluded that the Company did not maintain effective controls over financial reporting, and accordingly Part I, Item 4T is revised to state such conclusion and to state the remedial actions which the Company has taken and will take to attain effective control over its financial reporting.

In accordance with Rule 12b-15 under the Exchange Act, each item of the Original Filing that is amended by this Amended Filing is also restated in its entirety, and this Amended Filing is accompanied by currently dated certifications on Exhibits 31.1 and 32.1 by the Company’s Chief Executive Officer and Principal Financial Officer. Except as described above, this Amended Filing does not amend, update, or change any items, financial statements, or other disclosures in the Original Filing. Information not affected by the changes described above is unchanged and reflects the disclosures made at the time of the Original Filing. Accordingly, this Amended Filing should be read in conjunction with the Original Filing and our other SEC filings subsequent to the filing of the Original Filing, including any amendments to those fili ngs. Capitalized terms not defined in the Amended Filing are as defined by the Original Filing.

| INDEX TO FORM 10-Q/A | | |

| | | Page No. |

| PART I | | |

| Item | 1. | Financial Statements | | 2 |

| | | | | |

| | | Condensed Consolidated Balance Sheets – March 31, 2008 (Restated and unaudited) and December 31, 2007 (Audited) | | 2 |

| | | | | |

| | | Condensed Consolidated Statements of Operations and Comprehensive Income - three months ended March 31, 2008 (Restated and unaudited) and 2007 (Unaudited) | | 3 |

| | | | |

| | | Condensed Consolidated Statements of Cash Flows – three months ended March 31, 2008 (Restated and unaudited) and 2007 (Unaudited) | | 4 |

| | | |

| | | Notes to Condensed Consolidated Financial Statements as of March 31, 2008 (Unaudited) | | 5 |

| | | | | |

| Item | 2. | Management’s Discussion and Analysis of Financial Condition And Results of | | |

| | | Operations | | 17 |

| | | | | |

| Item | 4T. | Controls and Procedures | | 27 |

| | | |

| PART II | | |

| | | |

| Item | 1. | Legal Proceedings | | 29 |

| | | | | |

| Item | 2. | Unregistered Sales of Equity Securities and Use of Proceeds | | 29 |

| | | | | |

| Item | 3. | Defaults Upon Senior Securities | | 30 |

| | | | | |

| Item | 4. | Submission of Matters to a Vote of Security Holders | | 30 |

| | | | | |

| Item | 5. | Other Information | | 30 |

| | | | | |

| Item | 6. | Exhibits | | 30 |

| | | | | |

| SIGNATURES | | 31 |

SPECIAL NOTE REGARDING FORWARD—LOOKING STATEMENTS

On one or more occasions, we may make forward-looking statements in this amended and restated Quarterly Report on Form 10-Q/A regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events. Words or phrases such as “anticipates,” “may,” “will,” “should,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “targets,” “will likely result,” “will continue” or similar expressions identify forward-looking statements. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described elsewhere in this report and our other Securities and Exchange Commission filin gs.

Forward-looking statements involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed. We caution that while we make such statements in good faith and believe such statements are based on reasonable assumptions, including without limitation, management’s examination of historical operating trends, data contained in records and other data available from third parties, we cannot assure you that our projections will be achieved. Factors that may cause such differences include but are not limited to:

| | · | Our expectation of continued growth in the demand for our oil; |

| | · | Our expectation that we will have adequate liquidity from cash flows from operations; |

| | · | A variety of market, operational, geologic, permitting, labor and weather related factors; and |

| | · | The other risks and uncertainties which are described below under “RISK FACTORS”, including, but not limited to, the following: |

| | · | Unanticipated conditions may cause profitability to fluctuate. |

| | · | Decreases in purchases of oil by our customer will adversely affect our revenues. |

We have attempted to identify, in context, certain of the factors that we believe may cause actual future experience and results to differ materially from our current expectation regarding the relevant matter or subject area. In addition to the items specifically discussed above, our business and results of operations are subject to the uncertainties described under the caption “Risk Factors” which is a part of the disclosure included in Item 2 of this Report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

From time to time, oral or written forward-looking statements are also included in our reports on Forms 10-KSB, 10-QSB and 8-K, Proxy Statements on Schedule 14A, press releases, analyst and investor conference calls, and other communications released to the public. Although we believe that at the time made, the expectations reflected in all of these forward looking statements are and will be reasonable, any or all of the forward-looking statements in this amended and restated Quarterly Report on Form 10-Q/A, our reports on Forms 10-KSB and 8-K, our Proxy Statements on Schedule 14A and any other public statements that are made by us may prove to be incorrect. This may occur as a result of inaccurate assumptions or as a consequence of known or unknown risks and uncertainties. Many factors discussed in this amended and restated Quarterly Re port on Form 10-Q/A, certain of which are beyond our control, will be important in determining our future performance. Consequently, actual results may differ materially from those that might be anticipated from forward-looking statements. In light of these and other uncertainties, you should not regard the inclusion of a forward-looking statement in this amended and restated Quarterly Report on Form 10-Q/A or other public communications that we might make as a representation by us that our plans and objectives will be achieved, and you should not place undue reliance on such forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related subjects in our subsequent annual and periodic reports filed with the SEC on Forms 10-KSB, 10-QSB and 8-K and Proxy Statements on Schedule 14A.

Unless the context requires otherwise, references to “we,” “us,” “our,” the “Company” and “CNEH” refer specifically to China North East Petroleum Holdings Limited and its subsidiaries.

PART I

Item 1. Financial Statements

| CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED AND SUBSIDIARIES | |

| Condensed Consolidated Balance Sheets | |

| | | | March 31, | | | December 31, | |

| | | | 2008 | | | 2007 | |

| | | | (Unaudited) (Restated) | | | (Audited) | |

| ASSETS | |

| | | | | | | | |

| CURRENT ASSETS | | | | | | |

| Cash and cash equivalents | | $ | 12,734,345 | | | $ | 74,638 | |

| Accounts receivable, net | | | 5,981,125 | | | | 4,852,633 | |

| Prepaid expenses and other current assets | | | 682,928 | | | | 398,046 | |

| Value added tax recoverable | | | - | | | | 651,905 | |

| | Total Current Assets | | | 19,398,398 | | | | 5,977,222 | |

| | | | | | | | | | |

| PROPERTY AND EQUIPMENT | | | | | | | | |

| Oil properties, net | | | 42,616,236 | | | | 40,345,008 | |

| Fixed assets, net | | | 1,046,714 | | | | 885,474 | |

| Oil properties under construction | | | 1,127,198 | | | | 2,550,058 | |

| | Total Property and Equipment | | | 44,790,148 | | | | 43,780,540 | |

| | | | | | | | | | |

| LAND USE RIGHTS, NET | | | 44,045 | | | | 45,076 | |

| | | | | | | | | | |

| DEFERRED FINANCING COSTS, NET | | | 2,133,049 | | | | - | |

| | | | | | | | | | |

| TOTAL ASSETS | | $ | 66,365,640 | | | $ | 49,802,838 | |

| | | | | | | | | | |

| | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Accounts payable | | $ | 7,732,748 | | | $ | 6,580,930 | |

| Current portion of secured debenture | | | 1,500,000 | | | | - | |

| Other payables and accrued liabilities | | | 1,687,473 | | | | 1,020,980 | |

| Due to related parties | | | 14,241 | | | | 28,036 | |

| Note payable | | | 284,811 | | | | 273,444 | |

| Income tax and other taxes payable | | | 5,001,942 | | | | 2,687,449 | |

| Due to a stockholder | | | 131,387 | | | | 123,105 | |

| | Total Current Liabilities | | | 16,352,602 | | | | 10,713,944 | |

| | | | | | | | | | |

| LONG-TERM LIABILITIES | | | | | | | | |

| Accounts payable | | | 8,665,641 | | | | 15,467,661 | |

| Secured debenture, net of discount | | | 3,602,925 | | | | - | |

| Deferred tax liabilities | | | 475,445 | | | | 543,100 | |

| Due to a related party | | | 1,579,572 | | | | 3,118,085 | |

| Warrants | | | 13,295,850 | | | | - | |

| Total Long-term Liabilities | | | 27,619,433 | | | | 19,128,846 | |

| | | | | | | | | | |

| TOTAL LIABILITIES | | | 43,972,035 | | | | 29,842,790 | |

| | | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | - | | | | - | |

| | | | | | | | | | |

| MINORITY INTERESTS | | | 1,646,440 | | | | 1,124,964 | |

| | | | | | | | | | |

| STOCKHOLDERS' EQUITY | | | | | | | | |

| Common stock, $0.001 par value, 150,000,000 shares authorized, | | | | | | | | |

| 19,224,080 shares issued and outstanding | | | 19,224 | | | | 19,224 | |

| Additional paid-in capital | | | 11,397,388 | | | | 11,361,579 | |

| Deferred stock compensation | | | - | | | | (27,125 | ) |

| Retained earnings | | | | | | | | |

| Unappropriated | | | 6,112,495 | | | | 5,200,907 | |

| Appropriated | | | 916,263 | | | | 916,263 | |

| Accumulated other comprehensive income | | | 2,301,795 | | | | 1,364,236 | |

| Total Stockholders' Equity | | | 20,747,165 | | | | 18,835,084 | |

| | | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 66,365,640 | | | $ | 49,802,838 | |

| | | | | | | | | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements | |

| CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED AND SUBSIDIARIES | |

| Condensed Consolidated Statements of Operations and Comprehensive Income | |

| | | | | | | |

| | | (Unaudited) | |

| | | Three months ended March 31, | |

| | | 2008 | | | 2007 | |

| | | (Restated) | | | | |

| NET SALES | | $ | 10,823,974 | | | $ | 1,879,947 | |

| | | | | | | | | |

| COST OF SALES | | | | | | | | |

| Production costs | | | 712,305 | | | | 336,790 | |

| Depreciation, depletion and amortization of oil properties | | | 1,874,692 | | | | 389,227 | |

| Amortization of land use rights | | | 2,842 | | | | 2,624 | |

| Government oil surcharge | | | 2,211,320 | | | | 157,131 | |

| Total Cost of Sales | | | 4,801,159 | | | | 885,772 | |

| | | | | | | | | |

| GROSS PROFIT | | | 6,022,815 | | | | 994,175 | |

| | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | |

| Selling, general and administrative expenses | | | 257,594 | | | | 220,265 | |

| Professional fees | | | 66,425 | | | | 16,000 | |

| Consulting fees | | | 177,414 | | | | 27,125 | |

| Depreciation of fixed assets | | | 52,232 | | | | 36,027 | |

| Total Operating Expenses | | | 553,665 | | | | 299,417 | |

| | | | | | | | | |

| INCOME FROM OPERATIONS | | | 5,469,150 | | | | 694,758 | |

| | | | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | | | |

| Other expense | | | (2,311 | ) | | | - | |

| Interest expense | | | (119,697 | ) | | | (10,591 | ) |

| Amortization of deferred financing costs | | | (80,012 | ) | | | - | |

| Amortization of discount on debenture | | | (371,246 | ) | | | - | |

| Imputed interest expense | | | (26,896 | ) | | | (131,846 | ) |

| Interest income | | | 4,042 | | | | 248 | |

| Change in fair value of warrants | | | (2,000,697 | ) | | | - | |

| Total Other Expense, net | | | (2,596,817 | ) | | | (142,189 | ) |

| | | | | | | | | |

| NET INCOME BEFORE TAXES AND MINORITY INTERESTS | | | 2,872,333 | | | | 552,569 | |

| | | | | | | | | |

| Income tax expense | | | (1,439,269 | ) | | | (221,407 | ) |

| | | | | | | | | |

| Minority interests | | | (521,476 | ) | | | (43,799 | ) |

| | | | | | | | | |

| NET INCOME | | | 911,588 | | | | 287,363 | |

| | | | | | | | | |

| OTHER COMPREHENSIVE INCOME | | | | | | | | |

| Foreign currency translation gain | | | 937,559 | | | | 87,251 | |

| | | | | | | | | |

| COMPREHENSIVE INCOME | | $ | 1,849,147 | | | $ | 374,614 | |

| | | | | | | | | |

| Net income per share | | | | | | | | |

| - basic | | $ | 0.05 | | | $ | 0.01 | |

| - diluted | | $ | 0.04 | | | $ | 0.01 | |

| | | | | | | | | |

| Weighted average number of shares outstanding during the period | | | | | | | | |

| - basic | | | 19,224,080 | | | | 29,224,080 | |

| - diluted | | | 20,537,854 | | | | 29,224,080 | |

| | | | | | | | | |

| | | | | | | | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements | |

| CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED AND SUBSIDIARIES | |

| Condensed Consolidated Statements of Cash Flows | |

| For the three months ended March 31, 2008 and 2007 (Unaudited) | |

| | | | | | | |

| | | 2008 | | | 2007 | |

| | | (Restated) | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| Net income | | $ | 911,588 | | | $ | 287,363 | |

| Adjusted to reconcile net income to cash provided by | | | | | | | | |

| operating activities: | | | | | | | | |

| Depreciation, depletion and amortization of oil properties | | | 1,874,692 | | | | 389,227 | |

| Depreciation of fixed assets | | | 52,232 | | | | 36,027 | |

| Amortization of land use rights | | | 2,842 | | | | 2,624 | |

| Amortization of deferred financing costs | | | 80,012 | | | | - | |

| Amortization of discount on debenture | | | 371,246 | | | | - | |

| Change in fair value of warrants | | | 2,000,697 | | | | - | |

| Warrants issued for services | | | 8,913 | | | | - | |

| Minority interests | | | 521,476 | | | | 43,799 | |

| Stocks issued for services | | | 27,125 | | | | 27,125 | |

| Imputed interest expenses | | | 26,896 | | | | 131,846 | |

| Changes in operating assets and liabilities | | | | | | | | |

| (Increase) decrease in: | | | | | | | | |

| Accounts receivable | | | (1,128,492 | ) | | | 358,931 | |

| Prepaid expenses and other current assets | | | (284,882 | ) | | | (28,390 | ) |

| Due from related parties | | | - | | | | (49,836 | ) |

| Value added tax recoverable | | | 651,905 | | | | 58,901 | |

| Increase (decrease) in: | | | | | | | | |

| Accounts payable | | | (5,650,202 | ) | | | 490,089 | |

| Other payables and accrued liabilities | | | 666,493 | | | | 2,296 | |

| Income tax and other taxes payable | | | 2,314,493 | | | | 462,572 | |

| Deferred tax liabilities | | | (67,655 | ) | | | - | |

| Net cash provided by operating activities | | | 2,379,379 | | | | 2,212,574 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Additions to oil properties | | | (748,820 | ) | | | (2,742,832 | ) |

| Purchase of fixed assets | | | (174,005 | ) | | | (123,925 | ) |

| Additions to oil properties under construction | | | (211,709 | ) | | | - | |

| Net cash used in investing activities | | | (1,134,534 | ) | | | (2,866,757 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| Payment of deferred financing costs | | | (1,186,229 | ) | | | - | |

| Proceeds from issuance of secured debenture | | | 15,000,000 | | | | - | |

| Decrease in other loans payable | | | - | | | | (25,612 | ) |

| Increase in amount due to a stockholder | | | 8,282 | | | | 89,193 | |

| (Decrease) increase in amounts due to related parties | | | (1,552,308 | ) | | | 1,170,121 | |

| Net cash provided by financing activities | | | 12,269,745 | | | | 1,233,702 | |

| | | | | | | | | |

| EFFECT OF EXCHANGE RATE ON CASH | | | (854,883 | ) | | | (67,207 | ) |

| | | | | | | | | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | | | 12,659,707 | | | | 512,312 | |

| | | | | | | | | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | | | 74,638 | | | | 13,746 | |

| | | | | | | | | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | | $ | 12,734,345 | | | $ | 526,058 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Income tax expense | | $ | 1,283,180 | | | $ | 60,462 | |

| | | | | | | | | |

| Interest expense | | $ | 11,204 | | | $ | 10,591 | |

| | | | | | | | | |

| | | | | | | | | |

| SUPPLEMENTAL SCHEDULE OF NON-CASH OPERATING ACTIVITIES: | | | | | |

| | |

During 2008, the Company issued warrants in connection with the secured debenture to the investor and an investment consultant valued at $10,268,321 and $1,026,832, respectively. | |

| | | | | | | | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements | |

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 1 RESTATEMENT OF PREVIOUSLY REPORTED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

On February 23, 2010, China North East Petroleum Holdings Limited (the “Company”) determined that the Company’s financial statements as of March 31, 2008 and for the quarter then ended should no longer be relied upon and should be restated as a result of certain non-cash errors contained therein regarding the accounting for: (i) warrants issued in conjunction with a secured debenture on February 28, 2008, which warrants should have been classified according to Emerging Issues Task Force (“EITF”) 00-19 as liability instruments rather than equity instruments; (ii) the change in the fair value of those warrants from the date of issuance through the end of the reporting period; (iii) effective interest expense arising from amortization of the discount to the carrying value of the secured debenture; (iv) the re cording of warrants issued to investment consultants in connection with the issuance of the secured debenture as deferred financing costs instead of consulting fees; (v) the amount of amortization of deferred financing costs associated with the issuance of that secured debenture; and (vi) and amounts payable to a consultant included in accrued liabilities.

As a result, the accompanying unaudited condensed consolidated financial statements as of March 31, 2008 and for the three months then ended have been restated from the amounts previously reported. The information in the data table below represents only those income statement, balance sheet, cash flow and comprehensive income statement line items affected by the restatement.

STATEMENT OF OPERATIONS AND COMPREHENSIVE INCOME INFORMATION

| | | Three months ended March 31, 2008 | |

| | | As previously reported | | | Adjustments | | As restated | |

| Operating Expenses: | | | | | | | | |

| Professional fees | | $ | 57,512 | | $ | 8,913 | | $ | 66,425 | |

| Consulting fees | | | 81,630 | | | 95,784 | | | 177,414 | |

| Other Income (Expense): | | | | | | | | | | |

| Amortization of deferred financing costs | | | (24,713 | ) | | (55,299 | ) | | (80,012 | ) |

| Amortization of discount on debenture | | | (162,268 | ) | | (208,978 | ) | | (371,246 | ) |

| Change in fair value of warrants | | | - | | | (2,000,697 | ) | | (2,000,697 | ) |

| Net income | | | 3,281,259 | | | (2,369,671 | ) | | 911,588 | |

| Comprehensive income | | | 4,218,818 | | | (2,369,671 | ) | | 1,849,147 | |

| Net income per share -- Basic | | | 0.17 | | | (0.12 | ) | | 0.05 | |

| Net income per share -- Diluted | | | 0.17 | | | (0.13 | ) | | 0.04 | |

BALANCE SHEET INFORMATION

| | | As of March 31, 2008 | |

| | | As previously reported | | | Adjustments | | As restated | |

| Assets: | | | | | | | | |

| Deferred financing costs, net | | $ | 1,161,516 | | $ | 971,533 | | $ | 2,133,049 | |

| Current Liabilities: | | | | | | | | | | |

| Current portion of secured debenture | | | 737,342 | | | 762,658 | | | 1,500,000 | |

| Other payables and accrued liabilities | | | 1,561,934 | | | 125,539 | | | 1,687,473 | |

| Total current liabilities | | | 15,464,405 | | | 888,197 | | | 16,352,602 | |

| Long-term Liabilities: | | | | | | | | | | |

| Secured debenture, net of discount | | | 6,636,074 | | | (3,033,149 | ) | | 3,602,925 | |

| Warrants | | | - | | | 13,295,850 | | | 13,295,850 | |

| Total long-term liabilities | | | 17,356,732 | | | 10,262,701 | | | 27,619,433 | |

| Stockholders' Equity: | | | | | | | | | | |

| Additional paid-in capital | | | 19,207,082 | | | (7,809,694 | ) | | 11,397,388 | |

| Retained earnings, unappropriated | | | 8,482,166 | | | (2,369,671 | ) | | 6,112,495 | |

| Total stockholders’ equity | | | 30,926,530 | | | (10,179,365 | ) | | 20,747,165 | |

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 1 RESTATEMENT OF PREVIOUSLY REPORTED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

STATEMENT OF CASH FLOWS INFORMATION

| | | Three months ended March 31, 2008 | |

| | | As previously reported | | | Adjustments | | As restated | |

| Net income | | $ | 3,281,259 | | $ | (2,369,671 | ) | $ | 911,588 | |

| Adjustments to reconcile net income to cash provided by operating activities: | | | | | | | | | | |

| Amortization of deferred financing costs | | | 24,713 | | | 55,299 | | | 80,012 | |

| Amortization of discount on debenture | | | 162,268 | | | 208,978 | | | 371,246 | |

| Change in fair value of warrants | | | - | | | 2,000,697 | | | 2,000,697 | |

| Warrants issued for services | | | 29,755 | | | (20,842 | ) | | 8,913 | |

| Other payables and accrued liabilities | | | 540,954 | | | 125,539 | | | 666,493 | |

NOTE 2 BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and pursuant to the rules and regulations of the Securities and Exchange Commission. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements.

In the opinion of management, the unaudited condensed consolidated financial statements contain all adjustments consisting only of normal recurring accruals considered necessary to present fairly the Company's financial position at March 31, 2008, the results of operations for the three ended March 31, 2008 and 2007 and cash flows for the three months ended March 31, 2008 and 2007. The results for the three months ended March 31, 2008 are not necessarily indicative of the results to be expected for the entire fiscal year ending December 31, 2008.

These financial statements should be read in conjunction with the Company's annual report on Form 10-K as filed with the Securities and Exchange Commission.

NOTE 3 ORGANIZATION

China North East Petroleum Holdings Limited (“North East Petroleum”) is a US listed company which was incorporated in Nevada on August 20, 1999 under the name of Draco Holding Corporation (“Draco”).

Hong Xiang Petroleum Group Limited ("Hong Xiang Petroleum Group") was incorporated in the British Virgin Islands (“BVI”) on August 28, 2003 as an investment holding company.

On December 5, 2003, Song Yuan City Hong Xiang Petroleum Technical Services Co., Ltd. (“Hong Xiang Technical”) was incorporated in the People’s Republic of China (“PRC”) which provided technical advisory services to oil exploration companies in the PRC.

During 2004, Hong Xiang Petroleum Group acquired a 100% ownership of Hong Xiang Technical.

During 2004, Hong Xiang Technical acquired a 100% interest in Song Yuan City Yu Qiao Qianan Hong Xiang Oil Development Co., Ltd. (“Hong Xiang Oil Development”) which is engaged in the exploration and production of crude oil in the Jilin Oil Region of the PRC.

During 2004, Draco executed a Plan of Exchange to acquire 100% of Hong Xiang Petroleum Group.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 3 ORGANIZATION (CONTINUED)

On July 26, 2006, the Company entered into a Joint Venture Agreement (the “JV Agreement”) with a principal stockholder and a related party, hereafter referred to as the “Related Parties,” to acquire oil properties for the exploration of crude oil in the PRC. Pursuant to the JV Agreement, the Company and the Related Parties are obligated to contribute $1 million and $121,000, respectively, to the registered capital of Song Yuan North East Petroleum Technical Service Co., Ltd. (“Song Yuan Technical”), and the Company and the Related Parties will each share 90% and 10% respectively of the equity and profit interests of Song Yuan Technical.

On June 1, 2005, Song Yuan Technical acquired from third parties 100% equity interest of LongDe Oil & Gas Development Co. Ltd. (“LongDe”) at a consideration of $120,773 in cash. LongDe is engaged in the exploration and production of crude oil in the Jilin Oil Region of the PRC.

On January 26, 2007, Song Yuan Technical acquired 100% of the equity interest of Song Yuan City Yu Qiao Oil Development Limited Corporation (“Yu Qiao”) for 10,000,000 shares of the Company’s common stock having a fair value of $3,100,000 based on the preceding 30-day average of the high bid and the low ask price for the Company’s common stock as quoted on the Over-the-Counter Bulletin Board as of the date of the closing of the transaction. Prior to this transaction, Yu Qiao was owned 70% by a related party of the Company and 30% by third parties held on behalf of the related party.

Yu Qiao was incorporated in Song Yuan City, Jinlin Province, PRC on May 24, 2002 as a limited liability company. Yu Qiao is engaged in the extraction and production of crude oil in Jilin Province, PRC and operates 3 oilfields with a total exploration area of 39.2 square kilometers. Pursuant to a 20-year exclusive Cooperative Exploration Contract (the “Oil Lease”) which was entered into on May 28, 2002 with PetroChina Group, a corporation organized and existing under the laws of PRC (“PetroChina”), the Company has the right to explore, develop and extract oil at Qian’an 112, Da 34 and Gu 31 area. Pursuant to the Oil Lease, PetroChina is entitled to 20% of the Company’s oil production for the first ten years of the Oil Lease term and 40% of the Company’s oil production for the remaining ten years of the Oil Lease term. On May 28, 2002, the Company also executed an Agreement of leasing 20.7 square kilometers of Qian’an 112 area to Hong Xiang Oil Development and the Company is entitled to 2% of total sales revenue as consideration. This agreement was cancelled upon the dissolution of Hong Xiang Oil Development.

The acquisition of Yu Qiao was accounted for as a reorganization of entities under common control. Accordingly, the operations of Yu Qiao for the years ended December 31, 2007 and 2006 were included in the consolidated financial statements as if the transactions had occurred retroactively.

In March 2007, the Company approved the dissolution of its wholly owned subsidiaries, Hong Xiang Technical and Hong Xiang Oil Development.

North East Petroleum, Hong Xiang Petroleum Group, Song Yuan Technical, LongDe and Yu Qiao are hereinafter referred to as (“the Company”).

NOTE 4 SUMMARY OF SIGNFICANT ACCOUNTING POLICIES

Principles of consolidation

The accompanying unaudited condensed consolidated financial statements include the unaudited financial statements of North East Petroleum and its wholly owned subsidiary, Hong Xiang Petroleum Group and 90% equity interest owned subsidiaries, Song Yuan Technical, LongDe and Yu Qiao (collectively, “the Company”). The minority interests represent the minority shareholders’ 10% share of the results of Song Yuan Technical, LongDe and Yu Qiao.

All significant inter-company accounts and transactions have been eliminated in consolidation.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNFICANT ACCOUNTING POLICIES (CONTINUED)

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates include the value of the Company’s oil reserve quantities which are the basis for the calculation of the depletion, depreciation and amortization of oil properties and impairments of oil properties and estimates of the fair value of warrants. Actual results could differ from those estimates.

Foreign currency translation and other comprehensive income

The reporting currency of the Company is the US dollar. The functional currency of Song Yuan Technical, LongDe and Yu Qiao is the Chinese Renminbi (RMB).

For the subsidiaries whose functional currencies are other than the US dollar, all assets and liabilities accounts were translated at the exchange rate on the balance sheet date; stockholder's equity is translated at the historical rates and items in the statement of operations items and cash flow statements are translated at the average rate for the year. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of stockholders’ equity. The resulting translation gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

Accumulated other comprehensive income in the consolidated statement of stockholders’ equity amounted to $2,301,795 and $1,364,236 as of March 31, 2008 and December 31, 2007, respectively. The balance sheet amounts with the exception of equity at March 31, 2008 were translated at 7.0222 RMB to $1.00 USD. The average translation rates applied to income and cash flow statement amounts for the three months ended March 31, 2008 was 7.17568 RMB to $1.00 USD.

Cash and concentration of risk

The Company considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents, for cash flow statement purposes. Cash includes cash on hand and demand deposits in accounts maintained with state owned banks within the PRC and with banks the US.

The Company’s cash equivalents are exposed to concentration of credit risk. The Company maintains balances at financial institutions which, from time to time, may exceed Federal Deposit Insurance Corporation insured limits for the banks located in the United States. Balances at financial institutions or state owned banks within the PRC are not covered by insurance. As of March 31, 2008 and December 31, 2007, the Company had deposits in excess of federally insured limits totaling $658,975 and $0, respectively. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts.

Substantially all of the Company's operations are carried out in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environments in that country, and by the general state of that country’s economy. The Company's operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in the United States. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company's results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Revenue Recognition

The Company records revenues from the sales of oil when delivery to the customer ( PetroChina) has occurred and title has transferred. This occurs when oil has been delivered to a PetroChina depot.

Pursuant to oil leases entered into in 2002 and 2003 with PetroChina, each with twenty year terms, the Company is entitled to 80% of the Company’s oil production for the first ten years and 60% of the Company’s oil production for the remaining ten years. The Company receives payment for the net physical volume of oil delivered (either 80% or 60% by volume, depending upon the lease terms that are current at that point in time). The Company only records revenue for the production that the Company is entitled to.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNFICANT ACCOUNTING POLICIES (CONTINUED)

Major customers

We have only one customer – PetroChina’s Jilin Refinery branch, located in Song Yuan City, Jilin Province, PRC. Pursuant to our lease agreements with PetroChina we are unable to sell our oil production to any other customer.

Accounts receivables and allowance for doubtful accounts

The Company bills PetroChina on a monthly basis, at month-end, for the oil that we delivered to PetroChina during that month. We receive payment from PetroChina approximately 10 to 20 days following the end of each month. We receive payment in full for the prior month, less a holdback in the first and second months of each calendar quarter for the amount of oil surcharge tax (if any) due to the PRC government for the respective month’s oil sales. These oil surcharge tax holdbacks are paid to the Company with the normal monthly payment for the third month of each quarter, and therefore are timed to be received by us shortly before we are responsible for remitting the quarterly oil surcharge tax to the PRC government. Therefore, the amount we show as accounts receivable at the end of each reporting per iod will include the amounts due to us for sales in the prior month, as well as lesser amounts due from the two preceding months equal to the amount of oil surcharge tax payable by us. We do not recognize any allowance for doubtful accounts, as PetroChina has always paid our invoices on a correct, consistent and timely basis.

Long-lived assets

Long-lived assets to be held and used in the Company's operations are reviewed for impairment whenever events or changes in circumstances indicate that the related carrying amount may not be recoverable. When the carrying amounts of long-lived assets exceed the fair value, which is generally based upon discounted future cash flows, the Company records an impairment. No impairment was recorded during the quarters ended March 31, 2008 and 2007.

Financial instruments

The Company analyzes all financial instruments with features of both liabilities and equity under Statement of Financial Accounting Standards (“SFAS”) No. 150, “Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity,” SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities” and EITF 00-19, “Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock.” The warrants issued in conjunction with the issuance of the secured debenture in February 2008 are treated as liability instruments and will be recorded at fair value as of each reporting date. Additionally, the Company analyzes registration rights agreements associated with any equity instruments issued to determine if penalties triggered for late filing should be accrued under FSP EITF 00-19-2, “Accounting for Registration Payment Arrangements.”

Fair value of financial instruments

On January 1, 2008, the Company adopted SFAS No. 157. SFAS No. 157, “Fair Value Measurements”, defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosures requirements for fair value measures. The three levels are defined as follow:

| | · | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| | · | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments. |

| | · | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNFICANT ACCOUNTING POLICIES (CONTINUED)

The financial assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement requires judgment, and may affect the valuation of the fair value of assets and liabilities and their placement within the fair value hierarchy levels

Assets and liabilities measured at fair value on a recurring basis as of March 31, 2008 are summarized as follows (unaudited):

| | Fair value measurement using inputs |

| | Level 1 | | Level 2 | | Level 3 |

| | | | | | | | |

| Liabilities: | | | | | | | |

| Derivative instruments − Warrants | $ | - | | $ | - | | $ | 13,295,850 |

| Total | $ | | | $ | - | | $ | 13,295,850 |

The Company determines the fair value of the warrants using a Black-Scholes option model using inputs that are derived from observable and unobservable data and are therefore considered Level 3 in the fair value hierarchy. See Note 8 for further information.

The carrying values of cash and cash equivalents, trade receivables, current trade payables, and short-term bank loans and debts approximate their fair values due to the short maturities of these instruments. The Company believes that the carrying value of non-current accounts payable and the secured debenture at March 31, 2008 approximates fair value, after considering the various attributes of the debt and the Company’s current credit standing (see Note 5, “Secured Debenture,” for additional information regarding the carrying value of the secured debenture).

Deferred financing costs

The Company accounts for all third party costs incurred in associated with a material financing event as deferred financing costs. Deferred financing costs are capitalized and expensed over the term of the financing using the effective interest method. Deferred financing costs include the costs associated with the Company’s issuance of the $15,000,000 secured debenture dated February 28, 2008 (see Note 8). The Company recorded amortization expense of $80,012 related to these costs during the three months ended March 31, 2008.

Stock-Based Compensation

The Company follows SFAS No. 123R, “Share-Based Payments”. This Statement requires a company to measure the cost of services provided by employees in exchange for an award of equity instruments based on the grant-date fair value of the award. That cost will be recognized over the period during which services are received. Stock compensation for stock granted to non-employees has been determined in accordance with SFAS No. 123R and EITF No. 96-18, "Accounting for Equity Instruments that are issued to Other than Employees for Acquiring, or in Conjunction with Selling Goods or Services", as the fair value of the consideration received or the fair value of equity instruments issued, whichever is more reliably measured.

Property and equipment, net

The Company uses the full cost method of accounting for oil properties. As the Company currently maintains oil operations in only one country (the PRC), the Company has only one cost center. All costs incurred in the acquisition, exploration, and development of properties (including costs of surrendered and abandoned leaseholds, delay lease rentals, dry holes and overhead related to exploration and development activities) and estimated future costs of site restoration, dismantlement, and abandonment activities are capitalized.

Investments in unproved properties, including capitalized interest costs, are not depleted pending determination of the existence of proved reserves. Unproved reserves are assessed periodically to ascertain whether impairment has occurred. Unproved properties whose costs are individually significant are assessed individually by considering the primary lease terms of the properties, the holding periods of the properties, and geographic and geologic data obtained relating to the properties. Where it is not practicable to assess individually the amount of impairment of properties for which costs are not individually significant, such properties are grouped for purposes of assessing impairment. The amount of impairment assessed is added to the costs to be amortized. As of March 31, 2008&# 160;the Company did not have any investment in unproved oil properties.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNFICANT ACCOUNTING POLICIES (CONTINUED)

Pursuant to full cost accounting rules, the Company must perform a ceiling test each quarter on its proved oil assets within each separate cost center. The ceiling test provides that capitalized costs less related accumulated depletion and deferred income taxes for each cost center may not exceed the sum of (1) the present value of future net revenue from estimated production of proved oil reserves using current prices, excluding the future cash outflows associated with settling asset retirement obligations that have been accrued on the balance sheet, at a discount factor of 10%; plus (2) the cost of properties not being amortized, if any; plus (3) the lower of cost or estimated fair value of unproved properties included in the costs being amortized, if any; less (4) income tax effects related to the differences in the book and tax basis of oil properties. Should the net capitalized costs for a cost center exceed the sum of the components noted above, an impairment charge would be recognized to the extent of the excess capitalized costs. There were no provisions for impairment of proved oil properties in 2008 or 2007, although the Company’s ceiling test in its cost center could be adversely affected by declines in the price of oil.

Gain or loss is not recognized on the sale of oil properties unless the sale significantly alters the relationship between capitalized costs and estimated proved oil reserves attributable to a cost center.

Depletion of proved oil properties is computed on the unit-of-production method, whereby capitalized costs, as adjusted for future development costs and asset retirement obligations, net of salvage, are amortized over the total estimated proved reserves. Furniture and fixtures, leasehold improvements, computer hardware and software, and other equipment are depreciated on the straight-line method, based upon estimated useful lives of the assets ranging from three to fifteen years.

Asset Retirement Obligations

SFAS No. 143, “Accounting for Asset Retirement Obligations” requires entities to record the fair value of a liability for an asset retirement obligation in the period in which it is incurred with a corresponding increase in the carrying amount of the related long-lived asset. Subsequent to initial measurement, the asset retirement liability is required to be accreted each period to its present value. Capitalized costs are depleted as a component of the full cost pool using the unit-of-production method. Pursuant to our lease agreements with PetroChina, which terminate in 2022 and 2023, we do not recognize any asset retirement obligations, because at the end of the lease term we are obligated to hand over to PetroChina all of the physical assets we have erected on the leased properties, includin g all wells, facilities and equipment.

Earnings per share

The Company reports earnings per share in accordance with the provisions of SFAS No. 128, "Earnings Per Share." SFAS No. 128 requires presentation of basic and diluted earnings per share in conjunction with the disclosure of the methodology used in computing such earnings per share. Basic earnings per share excludes dilution and is computed by dividing income available to common stockholders by the weighted average common shares outstanding during the period. Diluted earnings per share takes into account the potential dilution that could occur if securities or other contracts to issue common stock were exercised and converted into common stock using the treasury method.

Income taxes

Income taxes are accounted for under the asset and liability method in accordance with SFAS No. 109, “Accounting for Income Taxes.” Deferred tax assets and liabilities are recognized for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using the enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company provides valuation allowance s against the net deferred tax asset for amounts that are not considered more likely than not to be realized.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNFICANT ACCOUNTING POLICIES (CONTINUED)

The Company adopted FASB Interpretation 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”), on January 1, 2007. A tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The adoption had no effect on the Company’s financial statements.

Deferred tax is accounted for using the balance sheet liability method in respect of temporary differences arising from differences between the carrying amount of assets and liabilities in the financial statements and the corresponding tax basis used in the computation of assessable tax profit. In principle, deferred tax liabilities are recognized for all taxable temporary differences, and deferred tax assets are recognized to the extent that it is probably that taxable profit will be available against which deductible temporary differences can be utilized. Deferred tax is calculated at the tax rates that are expected to apply to the period when the asset is realized or the liability is settled. Deferred tax is charged or credited in the income statement, except when it related to items credited or charged directly to equity, in which cas e the deferred tax is also dealt with in equity. Deferred tax assets and liabilities are offset when they relate to income taxes levied by the same taxation authority and the Company intends to settle its current tax assets and liabilities on a net basis. As of March 31, 2008, the Company’s deferred tax liabilities amounted to $475,445.

Value Added Tax

Sales revenue represents the invoiced value of oil, net of a value-added tax (“VAT”). All of the Company’s oil that is sold in the PRC are subject to a Chinese value-added tax at a rate of 17% of the gross sales price. This VAT may be offset by VAT paid by the Company on investment and operating costs associated with oil production. The Company records its net VAT Payable or VAT Recoverable balance in the financial statements. As of March 31, 2008 the Company had a net VAT Payable liability balance of $1,110,423, compared with a net VAT Recoverable asset balance of $651,905 as of December 31, 2007.

Recently issued accounting pronouncements

In February 2007, the Financial Accounting Standards Board (FASB) issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities – Including an Amendment of FASB Statement No. 115”. This statement permits entities to choose to measure many financial instruments and certain other items at fair value. Most of the provisions of SFAS No. 159 apply only to entities that elect the fair value option. However, the amendment to SFAS No. 115 “Accounting for Certain Investments in Debt and Equity Securities” applies to all entities with available-for-sale and trading securities. SFAS No. 159 is effective as of the beginning of an entity’s first fiscal year that begins after November 15, 2007. Early adoption is permitted as of the beginning of a fiscal year that begins on or b efore November 15, 2007, provided the entity also elects to apply the provision of SFAS No. 157, “Fair Value Measurements”. The adoption of this statement did not have a material effect on the Company's financial statements.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements – an amendment of ARB No. 51”. This statement improves the relevance, comparability, and transparency of the financial information that a reporting entity provides in its consolidated financial statements by establishing accounting and reporting standards that require; the ownership interests in subsidiaries held by parties other than the parent and the amount of consolidated net income attributable to the parent and to the noncontrolling interest be clearly identified and presented on the face of the consolidated statement of income, changes in a parent’s ownership interest while the parent retains its controlling financial interest in its subsidiary be accounted for consistently, when a subsid iary is deconsolidated, any retained noncontrolling equity investment in the former subsidiary be initially measured at fair value, entities provide sufficient disclosures that clearly identify and distinguish between the interests of the parent and the interests of the noncontrolling owners. SFAS No. 160 affects those entities that have an outstanding noncontrolling interest in one or more subsidiaries or that deconsolidate a subsidiary. SFAS No. 160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. Early adoption is prohibited. The adoption of this statement will result in the reclassification of “Minority interests” to equity as “Noncontrolling interests” and separate disclosures in the statements of operations.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNFICANT ACCOUNTING POLICIES (CONTINUED)

In December 2007, the FASB issued SFAS No. 141(R), “Business Combinations – a replacement of FASB Statement No. 141,” which significantly changes the principles and requirements of how the acquirer of a business recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree. The statement also provides guidance for recognizing and measuring the goodwill acquired in the business combination and determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination. This statement is effective prospectively, except for certain retrospective adjustments to deferred tax balances, for fiscal years beginning after December 15, 2008. This statement will be effective for the Company beginning in fiscal 2010. The adoption of SFAS No. 141(R) will only impact future acquisitions.

In March 2008, the FASB issued SFAS No. 161, “Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB Statement No. 133”. This statement amends and expands the disclosure requirements of SFAS No. 133 to require qualitative disclosure about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts and gains and losses on derivative instruments, and disclosures about credit-risk-related contingent features in derivative agreements. The statement will be effective for the Company beginning in fiscal 2009. We are currently evaluating the disclosure implications of this statement.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation. These reclassifications have no effect on net income or cash flows.

NOTE 5 SECURED DEBENTURE

The following is a summary of the secured debenture at March 31, 2008 and December 31, 2007:

| | | March 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| | | (Restated and Unaudited) | | | (Audited) | |

| | | | | | | |

| $15,000,000 8% Secured Debenture, net of unamortized discount of $9,897,075 | | | | | | |

| as of March 31, 2008 at 8% interest per annum, secured by 66% of the Company’s | | | | | | |

| equity interest in Song Yuan Technical and certain properties of the Company | | | | | | |

and 6,732,000 shares of common stock of the Company owned by a stockholder, due on February 27, 2012 | | $ | 5,102,925 | | | $ | - | |

| | | | | | | | | |

| Less: current maturities | | | (1,500,00 | ) | | | - | |

| Long-term portion | | $ | 3,602,925 | | | $ | - | |

On February 28, 2008, the Company entered into a Securities Purchase Agreement (the "Purchase Agreement") with Lotusbox Investments Limited (the "Investor"). Pursuant to the Purchase Agreement, the Company agreed to issue to the Investor an 8% Secured Debenture due 2012 (the "Debenture") in the aggregate principal amount of $15,000,000, and agreed to issue to the Investor five-year warrants exercisable for up to (i) 1,200,000 shares of the Company's common stock at an initial exercise price equal to $0.01 per share ("Class A Warrants"), (ii) 1,500,000 shares of the Company's common stock at an initial exercise price equal to $3.20 per share ("Class B Warrants") and (iii) 2,100,000 shares of the Company's common stock at an initial exercise price equal to $3.45 per share ("Class C Warrants"), with all warrant exercise prices bei ng subject to certain adjustments. The Class B Warrants are subject to certain call rights by the Company. As additional security provided to the Investor, the Company also granted the Investor the right to purchase up to 24% of the registered capital of Song Yuan Technical at fair market value which right shall only become enforcable immediately on the date following the occurrence of an event of a payment default.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 5 SECURED DEBENTURE (CONTINUED)

The Company accounts for these warrants as liability instruments in accordance with paragraph 8 of EITF 00-19, “Accounting for Derivative Financial Instruments Indexed to, and potentially settled in, a Company’s Own Stock.” Upon issuance, the warrants were recorded at fair value of $10,268,321, which was recognized as a discount to the carrying value of the debenture. The initial carrying value of the debenture, net of discount, was $4,731,679. The debenture will be accreted to liquidation value over four years, using the effective interest rate method.

Interest expense and discount amortized for the three months ended March 31, 2008 was $108,493 and $371,246, respectively. As of March 31, 2008, the carrying value of the debenture, net of unamortized discount, was $5,102,925.

NOTE 6 NET INCOME PER SHARE

The following is a reconciliation of the numerators and denominators used in computing basic and diluted net income per share (in thousands, except per share amounts):

| | | Three months ended March 31, | |

| | | 2008 (Restated) | | | 2007 | |

| Numerator: | | | | | | |

| Net income used in computing basic net income per share | | $ | 912 | | | $ | 287 | |

| Net income used in computing diluted net income per share | | | 912 | | | $ | 287 | |

| | | | | | | | | |

| Denominator: | | | | | | | | |

| Shares used in computation of basic net income per share | | | | | | | | |

| (weighted average common stock outstanding) | | | 19,224 | | | | 29,224 | |

| Dilutive potential common stock: | | | | | | | | |

| Warrants | | | 1,314 | | | | - | |

| Shares used in computation of diluted net income per share | | | 20,538 | | | | 29,224 | |

| Basic net income per share | | $ | 0.05 | | | $ | 0.01 | |

| Diluted net income per share | | $ | 0.04 | | | $ | 0.01 | |

For the three months ended March 31, 2008, warrants to purchase 4,010,000 shares of common stock with exercise prices greater than the average fair market value of the Company’s stock of $2.12 were not included in the calculation because the effect is anti-dilutive.

NOTE 7 COMMITMENTS AND CONTINGENCIES

(A) Lease commitment

The Company leases office spaces from a stockholder, land and office spaces from third parties under six operating leases which expire on September 20, 2023, June 30, 2015, April 10, 2010, November 14, 2008, June 1, 2008 and June 1, 2008 at annual rental of $178, $13,671, $8,687, $10,680, $3,418, and $1,396 respectively.

As of March 31, 2008, the Company had outstanding commitments with respect to the above operating leases, which are due as follows:

| 2008 | | $ | 24,825 | |

| 2009 | | | 22,536 | |

| 2010 | | | 16,021 | |

| 2011 | | | 13,849 | |

| Thereafter | | | 45,981 | |

| | | $ | 123,212 | |

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 7 COMMITMENTS AND CONTINGENCIES (CONTINUED)

(B) Capital commitments

As of March 31, 2008, the Company had capital commitments of $4,400,000 in respect of capital contribution to Song Yuan Technical.

As of March 31, 2008, the Company had capital commitments of $2,777,000 with two contractors for the completion of drilling of 15 oil wells under construction.

As of March 31, 2008, the Company had capital commitments of $300,000 with a contractor for purchase of office spaces.

NOTE 8 STOCKHOLDERS’ EQUITY

Issuance of warrants

On February 28, 2008, the Company issued three tranches of warrants in conjunction with the issuance of a secured debenture as discussed in Note 5. In addition, the Company issued an additional three tranches of warrants to investment consultants in conjunction with the issuance of the secured debenture. The Company analyzes all financial instruments with features of both liabilities and equity under SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity,” SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities” and EITF 00-19, “Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock.”

The Company treats these warrants as liabilities under EITF 00-19 and accordingly records the warrants at fair value with changes in fair values recorded in the statement of income until such time as the warrants are exercised or expire. The fair values were $11,295,153 and $13,295,850 at issuance and at March 31, 2008 respectively. For the three months ended March 31, 2008, the Company recorded $2,000,697 in changes in the fair value of the warrants in earnings.

The Company estimates the fair value of these warrants using the Black-Scholes option pricing model using the following assumptions:

| | | March 31, 2008 | | | February 28, 2008 | |

| Market price and estimated fair value of common stock: | | $ | 2.52 | | | $ | 2.14 | |

| Exercise price: | | $ | 0.01 - $3.45 | | | $ | 0.01 - $3.45 | |

| Remaining contractual life (years): | | | 4.92 | | | | 5 | |

| Dividend yield: | | | – | | | | – | |

| Expected volatility: | | | 300 | % | | | 316 | % |

| Risk-free interest rate: | | | 2.46 | % | | | 2.73 | % |

Also on February 28, 2008, the Company issued warrants to purchase 100,000 shares of Common Stock to a professional service provider in conjunction with a two year service agreement. The Company treats these warrants as equity instruments and is accordingly recognizing the grant date fair value of the warrants as professional fee expense ratably over the two year term. For the three months ended March 31, 2008, the Company recognized of expense of $8,913 associated with these warrants.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2008

(UNAUDITED)

NOTE 9 RELATED PARTY TRANSACTIONS

| | a) | As of March 31, 2008, the Company owed a stockholder of $131,387 which is repayable on demand. Imputed interest is computed at 5% per annum on the amount due. |

| | b) | As of March 31, 2008, the Company owed a related party of $14,241 which is repayable on demand. Imputed interest is computed at 5% per annum on the amount due. |

| | c) | As of March 31, 2008, the Company owed a related party of $1,579,572 which has no fixed terms of repayment. Imputed interest is computed at 5% per annum on the amount due. |

| | d) | Total imputed interest expenses recorded as additional paid-in capital amounted to $26,896 for the three months ended March 31, 2008. |

| | e) | The Company paid a stockholder $3,345 for leased office spaces for the three months ended March 31, 2008. |

NOTE 10 SUBSEQUENT EVENT

On April 22, 2008, the Company has fulfilled the outstanding capital contribution of $4,400,000 to Song Yuan Technical.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion and analysis of financial condition and results of operations should be read in conjunction with our financial statements and related notes included elsewhere in this report. This discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Forward-looking statements can be identified by the fact that they do not relate strictly to historic or current facts. They use words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. In particular, these include statements relating to:

| | • | Our expectation of continued growth in the demand for our oil; |

| | | |

| | • | Our expectation that we will continue to have adequate liquidity from cash flows from operations; |

| | | |

| | • | A variety of market, operational, geologic, permitting, labor and weather related factors; and |

| | | |

| | • | The other risks and uncertainties which are described below under “RISK FACTORS”, including, but not limited to, the following: |

| | | |

| | • | Unanticipated conditions may cause profitability to fluctuate. |

| | | |

| | • | Decreases in purchases of oil by our customer will adversely affect our revenues. |

Overview

We are engaged in the exploration and production of crude oil in Northern China. We have an arrangement with the Jilin Refinery of PetroChina Group to sell our crude oil production for use in the China marketplace. We currently operate 157 producing wells located in four oilfields in Northern China and have plans for additional drilling projects.

In particular, through two of our subsidiaries, Song Yuan City Yu Qiao Oil Development Co. Ltd. (“Yu Qiao”) and Chang Ling Longde Oil Development Co. Ltd. (“LongDe”), we have entered into binding sales agreements with the PetroChina Group, whereby we sell our crude oil production for use in the China marketplace.

We currently operate 4 oilfields located in Northern China, which include:

| Field | | Acreage (Gross developed and undeveloped) | | Producing Oil Wells | | Proved Reserves (Bbls) | |

| Qian’an 112 | | | 5,115 | | 140 | | | 1,963,319 | |

| Daan 34 | | | 2,298 | | 7 | | | 168,335 | |

| Gudian 31 | | | 1,779 | | 7 | | | 62,533 | |

| Hetingbao 301 | | | 2,471 | | 11 | | | 274,637 | |

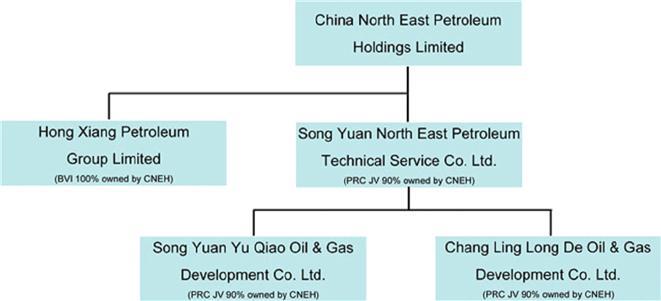

The following chart illustrates our company’s organizational structure.

Organizational History

We were incorporated in the State of Nevada on August 20, 1999 under the name Draco Holding Corporation. On March 29, 2004, we executed an Agreement for Share Exchange with Hong Xiang Petroleum Group Limited, a corporation organized and existing under the laws of the British Virgin Islands (“Hong Xiang”), and the individual shareholders owning 100% of the outstanding common shares of Hong Xiang (the “Hong Xiang Shareholders”).

Pursuant to the Agreement for Share Exchange, we issued 18,700,000 shares of our common stock to the Hong Xiang Shareholders in exchange for all of the shares of capital stock of Hong Xiang owned by the Hong Xiang Shareholders at closing, and Hong Xiang became our wholly-owned subsidiary. On June 28, 2004, we changed our name to China North East Petroleum Holdings Ltd.

During 2004, we acquired a 100% ownership in Song Yuan City Hong Xiang Petroleum Technical Services Co., Ltd. (“Hong Xiang Technical”), and Hong Xiang Technical in turn acquired a 100% interest in Song Yuan City Yu Qiao Qianan Hong Xiang Oil Development Co., Ltd. (“Hong Xiang Oil Development”), which was engaged in the exploration and production of crude oil in the Jilin region of the PRC.

As a result of the Yu Qiao acquisition discussed below, all operations, assets and liabilities of the Company’s subsidiary Hong Xiang Oil Development were transferred to Yu Qiao on March 19, 2007. Since Hong Xiang Oil Development and Hong Xiang Technical were no longer necessary elements of the Company’s corporate structure, and they were liquidated and dissolved.

PetroChina Oil Leases

Pursuant to a 20-year exclusive Cooperative Oil Lease (the “Oil Lease”), among PetroChina Group, Yu Qiao and the Company, entered into in May 2002, the Company has the right to explore, develop and produce oil at Qian’an 112 Oilfield. Pursuant to the Oil Lease, (i) PetroChina is entitled to 20% of the Company’s oil production for the first ten years of the Oil Lease term and 40% of the Company’s oil production for the remaining ten years of the Oil Lease term; and (ii) Yu Qiao is entitled to 2% of the Company’s oil production as a management fee. The payment of management fee was stopped following the acquisition of Yu Qiao by the Company.

LongDe is a party to a 20-year contract with PetroChina Group entered into in May 2003, pursuant to which LongDe has the right to explore, develop and produce oil at the Hetingbao 301 oilfield in the PRC. Pursuant to such between PetroChina and LongDe, PetroChina is entitled to 20% of LongDe’s output in the first ten years and 40% of LongDe’s output thereafter until the end of the contract.

As the controlling shareholder of Yu Qiao, the Company has the rights to extract and develop Qian’an 112 and other oil fields under contracts that Yu Qiao has entered into with PetroChina. These oilfields include the Daan 34 oilfield and Gudian 31 oilfield in Jilin Province.

Song Yuan Technical Joint Venture

On July 26, 2006, the Company entered into a joint venture agreement with Wang Hong Jung (“Mr. Wang”), the president and a stockholder of the Company and Ju Guizhi (“Ms. Ju”), mother of Mr. Wang, to contribute to the increased registered capital of Song Yuan North East Petroleum Technical Service Co. Ltd. (“Song Yuan Technical”). The purpose of Song Yuan Technical is to acquire oil properties and to engage in the exploration of crude oil in the PRC. On December 20, 2006, Mr. Wang transferred his interest (4.5%) in Song Yuan Technical to Ms. Ju and as result, the Company owns a 90% equity interest in Song Yuan Technical, and Ms. Ju owns the remaining 10% equity interest in Song Yuan Technical.

Acquisition of LongDe

In order to comply with certain PRC laws relating to foreign entities’ ownership of oil company in the PRC, prior to March 17, 2008, Song Yuan Technical directly owned a 70% equity interest in LongDe, while Sun Peng and Ai Chang Shan, respectively, owned 10% and 20% of the equity interests in Long De in trust for Song Yuan Technical. On March 17, 2008, Song Yuan Technical additionally acquired an additional 20% equity interest in LongDe, of which it acquired a 10% of the equity interest in LongDe from Sun Peng, and 10% of the equity interest in LongDe from Ai Chang Shan. Accordingly, Song Yuan Technical now owns directly 90% of the equity interests in LongDe, with Ai ChangShan holding the remaining 10% in trust for in trust for Song Yuan Technical. The acquisition of LongDe was made pursuant to the laws of the PRC. As a 90% owner o f Song Yuan Technical, the Company effectively controls LongDe.

This beneficial ownership structure is governed by two trust agreements: (i) Trust Agreement dated October 8, 2006 by and between Song Yuan Technical and Ai Chang Shan. Pursuant to the agreement, Ai Chang Shan holds 20% of the equity interest in Long De in trust for the benefit of Song Yuan Technical. On March 17, 2008, Ai Chang Shan entered into a transfer agreement whereby Ai Chang Shan transferred 10% of the equity interest of Long De held in trust pursuant to the trust agreement to Song Yuan Technical to be held directly by Song Yuan Technical. Currently under the trust agreement dated October 8, 2006, Ai Chang Shan holds 10% of the total equity interest of Long De in trust for the benefit of Song Yuan Technical and (ii) Trust Agreement dated April 18, 2008 by and between Song Yuan Technical and Wang Hongjun. Pursuant to the trust ag reement, Wang Hongjun holds 10% of the total outstanding equity interest in Long De in trust for the benefit of Song Yuan Technical.

Acquisition of Yu Qiao

The Company acquired beneficial interest of 100% of the equity interest in Yu Qiao from Yu Qiao’s shareholders, Ms. Ju (70%), Meng Xiangyun (20%) and Wang Bingwu (10%) on January 26, 2007. In order to comply with PRC laws which restrict ownership of oil and gas companies by foreign entities, following the acquisition, Meng Xiangyun and Wang Bingwu held 20% and 10% of the equity interest, respectively, in Yu Qiao in trust for the benefit of Song Yuan Technical.

On March 17, 2008, trust agreement with Meng Xiangyun was cancelled and the 20% equity interest in Yu Qiao held in trust by Meng Xiangyun was transferred to Song Yuan Technical. As a result of the termination of the trust agreement and the transfer, Song Yuan Technical became direct owner of the 20% of the equity interest in Yu Qiao held in trust by Meng Xiangyun.

On April 18, 2008, the 10% equity interest in Yu Qiao held by Wang Bingwu in trust was transferred to the Company’s President and Chairman, Wang Hongjun to hold in trust for the benefit of Song Yuan Technical.

Currently Yu Qiao is 90% directly held by Song Yuan Technical and 10% held in trust by Wang Hongjun for the benefit of Song Yuan Technical.

Oil Properties and Activities

As of March 31, 2008, the Company had a total of 165 producing wells, including 140 producing wells at the Qian’an 112 oilfield, 11 producing wells at the Hetingbao 301 oilfield, 7 producing wells at the Daan 34 oilfield and 7 producing wells at the Gudian 31 oilfield. There were 103 traditional sucker-rod pumping machines in operation.

All of the Company’s crude oil production is sold to the Jilin Refinery of PetroChina Group. The approximate distance of each of the Company’s oil fields from the Jilin Refinery is as follows: the Qian’an 112 oilfield is four kilometers away, the Hetingbao 301 oilfield is three kilometers away, the Daan 34 oilfield is fifteen kilometers away and the Gudian Oilfield 31 is thirty kilometers away.