As filed with the SEC on January 7, 2005.

| | | |

| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4556 |

|

TRANSAMERICA IDEX MUTUAL FUNDS |

(Exact name of registrant as specified in charter) |

|

570 Carillon Parkway, St. Petersburg, Florida | | 33716 |

(Address of principal executive offices) | | (Zip code) |

|

John K. Carter, Esq. P.O. Box 5068, Clearwater, Florida 33758-5068 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (727) 299-1800 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | November 1, 2003 - October 31, 2004 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1: Report(s) to Shareholders. The Annual Report is attached.

Annual Report

October 31, 2004

www.idexfunds.com

P.O. Box 9012 • Clearwater, FL 33758-9012

Distributor: AFSG Securities Corporation, Member NASD

Investor Services 1-888-233-IDEX (4339)

Dear Fellow Shareholder,

On behalf of Transamerica IDEX Mutual Funds, I would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial advisor in the future.

A financial professional can help you build a comprehensive picture of your current and future financial needs. What's more, financial advisors are familiar with the market's history, including long-term returns and volatility of various asset classes. With your financial advisor, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

The Securities and Exchange Commission requires that a semi-annual report be sent to all shareholders. The following pages provide a comprehensive review of the investments of each fund as well as the detailed accounting data. The report also provides a discussion of the accounting policies for the funds in addition to any matters presented to the shareholders that may have required their vote.

Please contact your financial advisor if you have any questions about the contents of this report.

Sincerely,

Brian C. Scott

President

Transamerica IDEX Mutual Funds

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of Transamerica IDEX Mutual Funds. These views are subject to change based upon market conditions. These views should not be relied on as investment advice and are not indicative of a trading intent on behalf of the Transamerica IDEX Mutual Funds.

TA IDEX American Century International

MARKET ENVIRONMENT

The twelve months ended October 31, 2004, provided both challenges and opportunities for international investors, with many of the world's equity markets advancing. But their gains were restrained by record-high oil prices, rising interest rates, continued violence in Iraq and the threat of terrorism. Those issues provided solid headwinds for the global economy, and they created uncertainty among investors and concern about corporate profits.

Against this backdrop, TA IDEX American Century International advanced but underperformed its benchmark, the Morgan Stanley Capital International EAFE Index ("MSCI EAFE"). Nine of the ten sectors in which we were invested advanced, with our complement of financial holdings posting the largest contribution to absolute return. On a relative basis, the portfolio's telecommunications services and consumer staples sectors outperformed, but a variety of sectors, notably health care and industrials, underperformed the MSCI EAFE, ultimately causing the portfolio to lag the benchmark.

PERFORMANCE

For the year ended October 31, 2004, TA IDEX American Century International, Class A returned 9.95%. By comparison its benchmark, the MSCI EAFE, returned 19.27%.

STRATEGY REVIEW

The best performance versus the benchmark came from TA IDEX American Century International's stake in the telecommunication services sector. We had exposure to several mobile-phone companies that advanced and are not in the MSCI EAFE. They include Mobile TeleSystems OJSC, Russia's largest mobile-phone company, which registered the portfolio's third-best relative performance, and America Movil SA, which provides wireless services in Mexico. Both companies benefited from a growing number of subscribers for wireless services. The portfolio's stake in the telecommunication services sector also registered the period's second-best absolute performance.

The second-best performance against the benchmark came from the consumer staples sector, which also contributed to the portfolio's return. The portfolio's stake in the food and staples retailing industry led the advance, with Canada's Shoppers Drug Mart Corporation topping the list of relative contributors in that group.

The health care sector, however, registered the period's worst relative performance. The portfolio's underweight pharmaceutical holdings detracted most, as Teva Pharmaceutical Industries Ltd., a generic drug maker in the portfolio but not the MSCI EAFE, declined. The portfolio's overweight stake in the health care equipment and supplies industry also underperformed.

The industrials sector turned in the second-worst performance against the MSCI EAFE, with holdings in the commercial services and supplies industry detracting most. Switzerland's Adecco SA ("Adecco"), one of the world's largest providers of temporary workers, led the retreat. Adecco came under investigation during the period for potential accounting irregularities. We eliminated the position, but it was among the period's top detractors from the portfolio's relative performance.

TA IDEX American Century International's financial holdings, the portfolio's largest sector stake on average during the period, contributed most to absolute performance. The advance came mostly on the strength of commercial banks, which represented the portfolio's heaviest average industry weighting. Austria's Erste Bank der Oesterreichischen Sparkassen AG led the contributors among banks. Our holdings in the insurance, diversified financial services and consumer finance industries also contributed to total return. However, the financial sector underperformed the MSCI EAFE, with holdings in the capital markets industry detracting most from relative performance.

Energy holdings also contributed to the portfolio's absolute performance, led by France's Total SA, Europe's biggest oil refiner. The company benefited from high oil prices and its potential for increased oil and gas production.

Regarding countries, investments in Mexico, France and Austria made the largest contribution relative to the MSCI EAFE, while those in the United Kingdom, Japan and Switzerland detracted most.

Henrik Strabo

Mark S. Kopinski

Keith Creveling, CFA

Co-Fund Managers

American Century Investment Management, Inc.

Transamerica IDEX Mutual Funds

Annual Report 2004

1

TA IDEX American Century International

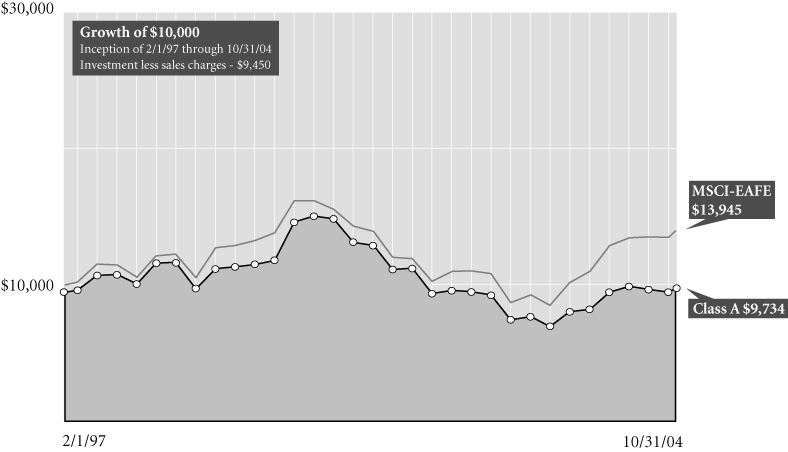

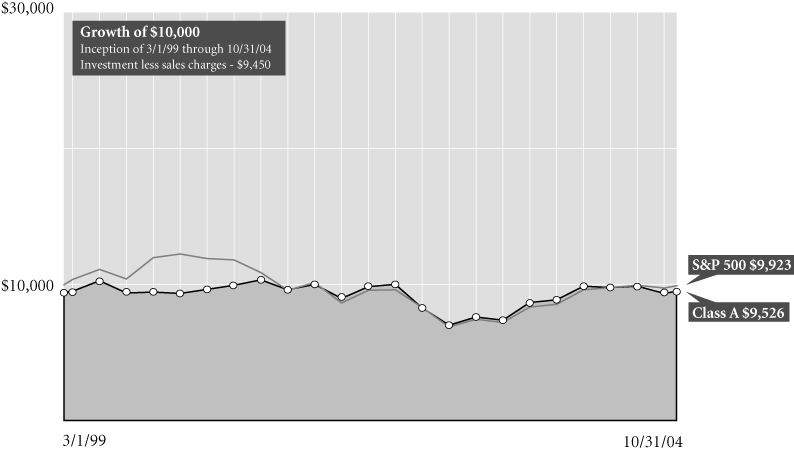

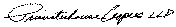

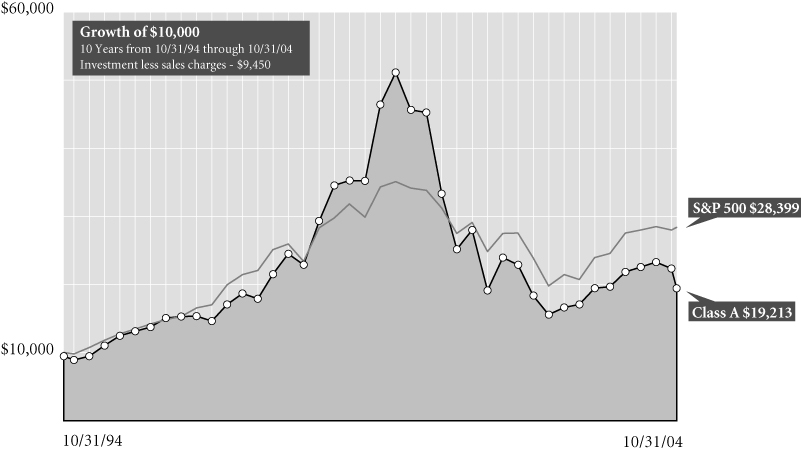

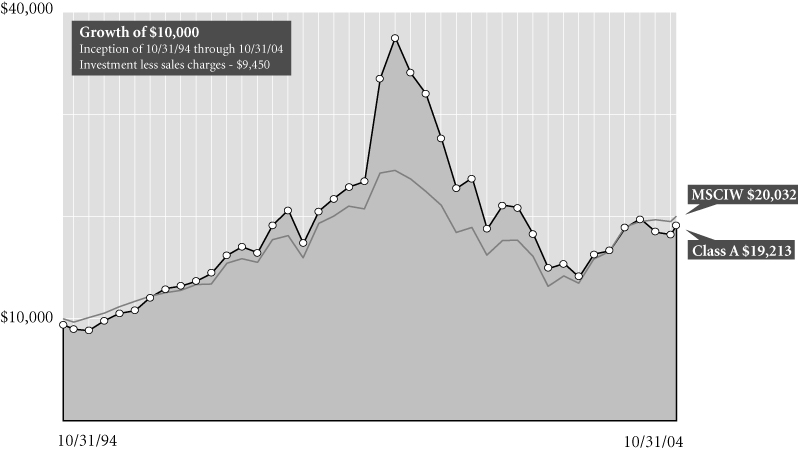

Comparison of change in value of $10,000 investment in Class A shares and its comparative index.

Average Annual Total Return for Periods Ended 10/31/04

| | | 1 year | | 5 years | | From

Inception | | Inception

Date | |

| Class A (NAV) | | | 9.95 | % | | | (4.46 | )% | | | 0.38 | % | | 2/1/97 | |

| Class A (POP) | | | 3.90 | % | | | (5.53 | )% | | | (0.35 | )% | | 2/1/97 | |

| MSCI-EAFE1 | | | 19.27 | % | | | (0.58 | )% | | | 4.39 | % | | 2/1/97 | |

| Class B (NAV) | | | 9.46 | % | | | (5.07 | )% | | | (0.26 | )% | | 2/1/97 | |

| Class B (POP) | | | 4.46 | % | | | (5.26 | )% | | | (0.26 | )% | | 2/1/97 | |

| Class C (NAV) | | | 9.33 | % | | | – | | | | 12.06 | % | | 11/11/02 | |

| Class C (POP) | | | 8.33 | % | | | – | | | | 12.06 | % | | 11/11/02 | |

NOTES

1 The Morgan Stanley Capital International – Europe, Asia, and Far East (MSCI-EAFE) Index is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception calculation is based on life of Class A shares. Source: Standard & Poor's Micropal®© Micropal, Inc. 2004 – 1-800-596-5323 – http://www.micropal.com.

The performance data presented represents past performance, future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted.

Public Offering Price (POP) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. Net Asset Value (NAV) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges.

International investing involves special risks including currency fluctuations, political instability, and different financial accounting standards.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this fund.

Transamerica IDEX Mutual Funds

Annual Report 2004

2

TA IDEX American Century International

UNDERSTANDING YOUR FUND'S EXPENSES (unaudited)

SHAREHOLDER EXPENSES

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2004 to October 31, 2004.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund un der the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on each Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compa re this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under each Fund in the table is useful in comparing on going costs only, and will not help you determine the relative total costs of owning different funds. In addition, note that the expenses shown in the table are meant to highlight your ongoing costs and do not reflect any transaction costs.

| | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | Expenses Paid

During Period (a) | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,020.70 | | | | 1.71 | % | | $ | 8.69 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,016.54 | | | | 1.71 | | | | 8.67 | | |

| Class B | |

| Actual | | | 1,000.00 | | | | 1,019.20 | | | | 2.04 | | | | 10.35 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,014.88 | | | | 2.04 | | | | 10.33 | | |

| Class C | |

| Actual | | | 1,000.00 | | | | 1,018.00 | | | | 2.60 | | | | 13.19 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,012.07 | | | | 2.60 | | | | 13.15 | | |

(a) Expenses are calculated using each Fund's annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by number of days in the period (184 days), and divided by the number of days in the year (366 days).

(b) 5% return per year before expenses.

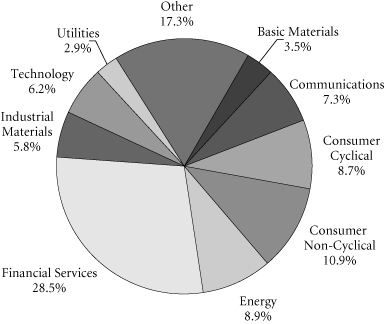

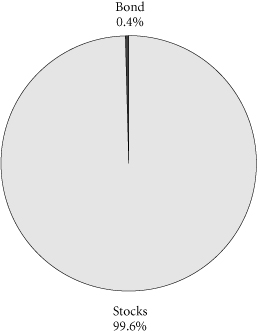

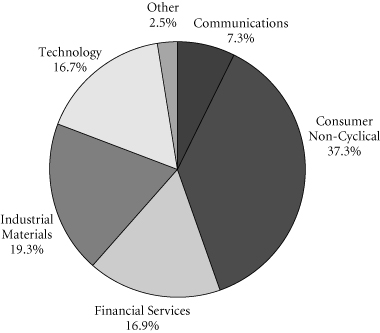

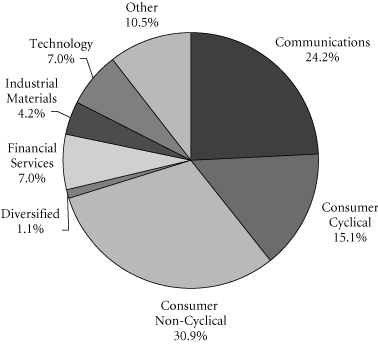

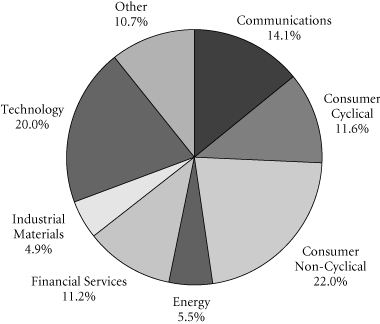

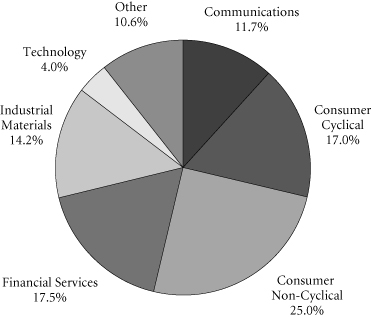

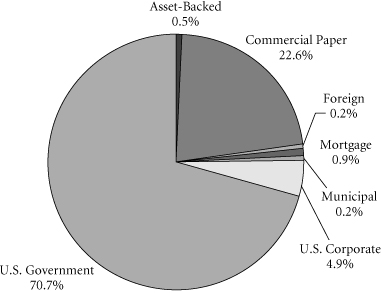

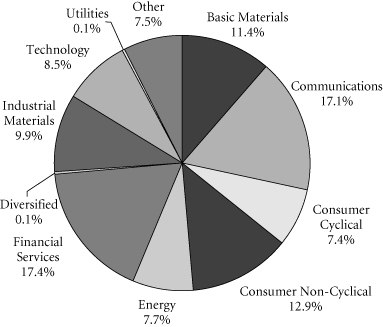

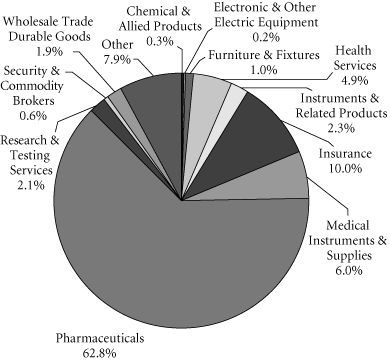

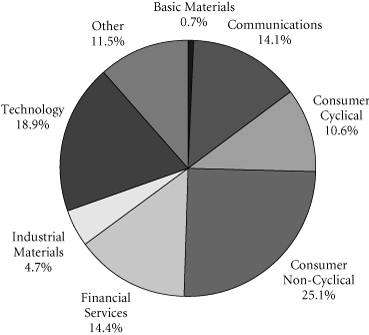

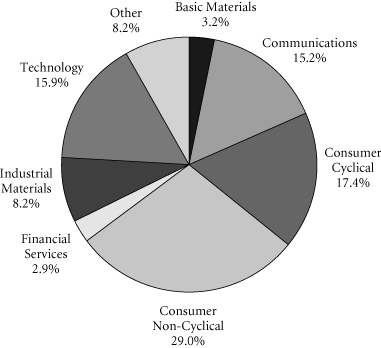

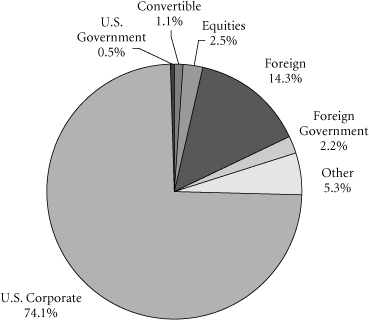

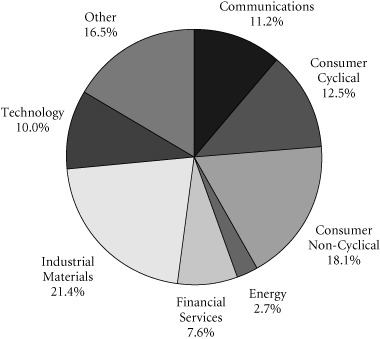

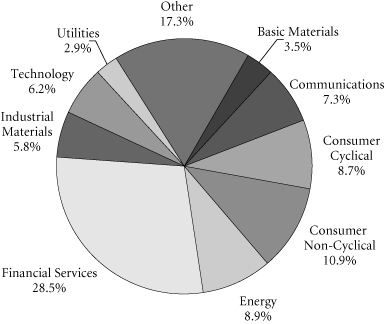

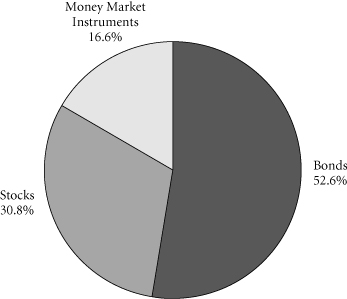

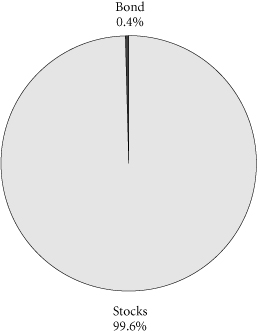

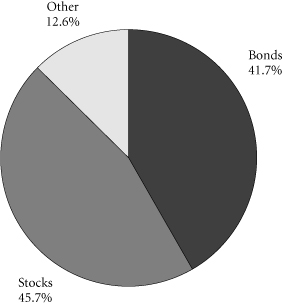

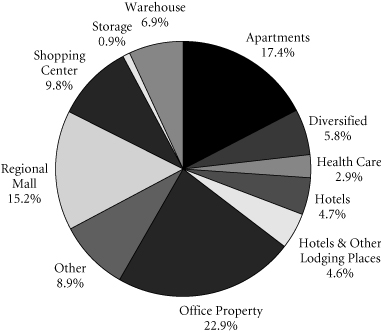

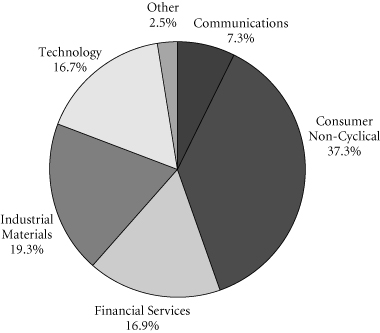

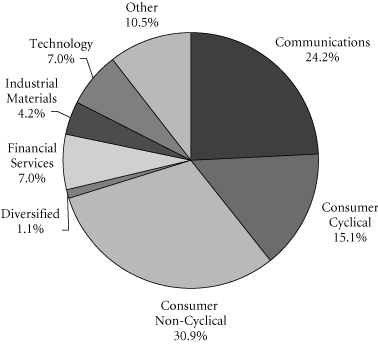

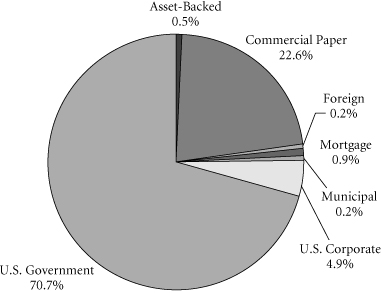

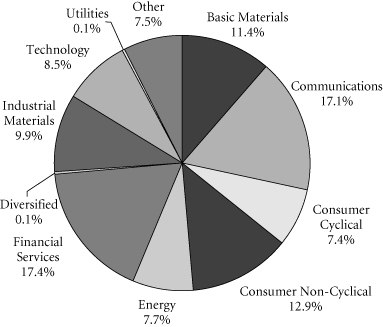

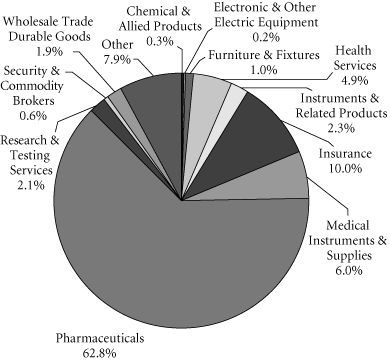

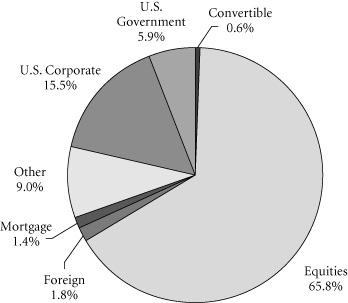

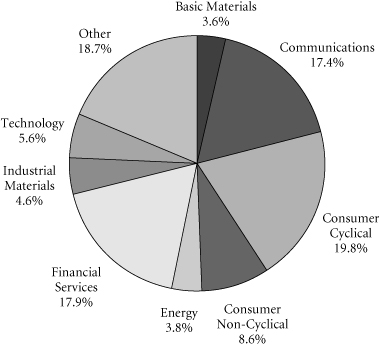

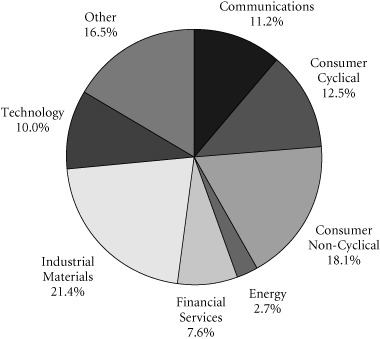

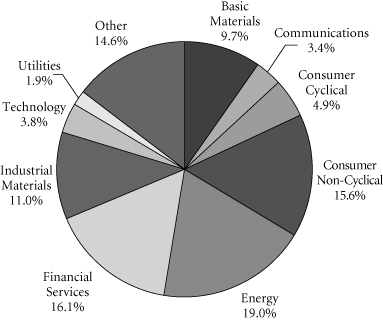

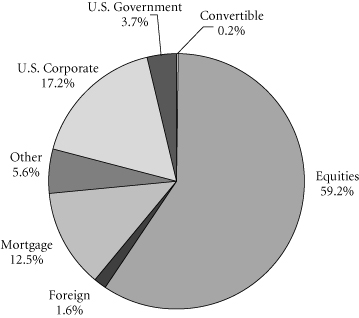

GRAPHIC PRESENTATION OF SCHEDULE OF INVESTMENTS

By Region

At October 31, 2004

This chart shows the percentage breakdown by region of the Fund's total investment securities.

Transamerica IDEX Mutual Funds

Annual Report 2004

3

TA IDEX American Century International

SCHEDULE OF INVESTMENTS

At October 31, 2004

(all amounts except share amounts in thousands)

| | | Shares | | Value | |

| CONVERTIBLE PREFERRED STOCKS ( 0.7%) | | | |

| Switzerland (0.7%) | | | |

| Compagnie Financiere Richemont AG–Class A | | | 50,860 | | | $ | 1,437 | | |

| Total Convertible Preferred Stocks (cost: $1,256) | | | | | | | 1,437 | | |

| COMMON STOCKS ( 96.7%) | | | |

| Australia (4.8%) | | | |

| Amcor, Ltd. | | | 157,280 | | | | 897 | | |

| BHP Billiton, Ltd. | | | 482,914 | | | | 4,998 | | |

| Commonwealth Bank of Australia | | | 110,500 | | | | 2,651 | | |

| QBE Insurance Group, Ltd. | | | 185,480 | | | | 1,903 | | |

| Austria (1.8%) | | | |

| Erste Bank der Oesterreichischen Sparkassen AG | | | 88,842 | | | | 3,943 | | |

| Belgium (0.6%) | | | |

| KBC Bancassurance Holding | | | 18,640 | | | | 1,362 | | |

| Bermuda (2.7%) | | | |

| Accenture, Ltd.–Class A (b) | | | 50,900 | | | | 1,232 | | |

| Esprit Holdings, Ltd. | | | 328,000 | | | | 1,753 | | |

| Tyco International, Ltd. (a) | | | 89,950 | | | | 2,802 | | |

| Canada (2.3%) | | | |

| EnCana Corp. | | | 61,790 | | | | 3,060 | | |

| Shoppers Drug Mart Corp. | | | 63,706 | | | | 1,935 | | |

| Denmark (0.5%) | | | |

| AP Moller-Maersk A/S | | | 160 | | | | 1,178 | | |

| France (14.1%) | | | |

| AXA | | | 153,088 | | | | 3,285 | | |

| Cie Generale D'Optique Essilor International SA | | | 20,230 | | | | 1,369 | | |

| Credit Agricole SA | | | 116,229 | | | | 3,396 | | |

| Lafarge SA | | | 29,620 | | | | 2,696 | | |

| Pernod-Ricard | | | 15,780 | | | | 2,178 | | |

| Schneider Electric SA | | | 33,100 | | | | 2,185 | | |

| Societe Generale–Class A | | | 29,877 | | | | 2,763 | | |

| Total SA | | | 31,070 | | | | 6,442 | | |

| Vinci SA | | | 23,213 | | | | 2,756 | | |

| Vivendi Universal SA (b) | | | 133,010 | | | | 3,622 | | |

| Germany (8.0%) | | | |

| Adidas-Salomon AG | | | 8,450 | | | | 1,177 | | |

| BASF AG | | | 30,720 | | | | 1,911 | | |

| Continental AG | | | 39,930 | | | | 2,174 | | |

| Deutsche Telekom AG | | | 66,110 | | | | 1,263 | | |

| E.ON AG | | | 22,370 | | | | 1,815 | | |

| Fresenius Medical Care AG | | | 17,240 | | | | 1,316 | | |

| Metro AG | | | 35,840 | | | | 1,706 | | |

| Puma AG Rudolf Dassler Sport | | | 9,227 | | | | 2,304 | | |

| SAP AG | | | 21,577 | | | | 3,665 | | |

| | | Shares | | Value | |

| Greece (1.4%) | | | |

| Alpha Bank A.E. | | | 62,000 | | | $ | 1,759 | | |

| OPAP SA | | | 59,274 | | | | 1,203 | | |

| Ireland (1.1%) | | | |

| Anglo Irish Bank Corp. PLC | | | 126,010 | | | | 2,388 | | |

| Israel (0.4%) | | | |

Teva Pharmaceutical Industries, Ltd.,

Sponsored ADR (a) | | | 35,536 | | | | 924 | | |

| Italy (2.3%) | | | |

| ENI-Ente Nazionale Idrocarburi SpA | | | 123,090 | | | | 2,787 | | |

| Terna SpA Rights | | | 931,009 | | | | 2,264 | | |

| Japan (17.4%) | | | |

| Aiful Corp. | | | 15,900 | | | | 1,585 | | |

| Bank of Yokohama, Ltd. (The) | | | 239,000 | | | | 1,427 | | |

| Canon, Inc. | | | 18,409 | | | | 907 | | |

| Chugai Pharmaceutical Co., Ltd. | | | 112,899 | | | | 1,765 | | |

| Daikin Industries, Ltd. | | | 39,000 | | | | 948 | | |

| Fast Retailing Co., Ltd. | | | 13,600 | | | | 863 | | |

| Hoya Corp. | | | 34,864 | | | | 3,573 | | |

| Komatsu, Ltd. | | | 196,000 | | | | 1,309 | | |

| Matsushita Electric Industrial Co., Ltd. | | | 91,000 | | | | 1,318 | | |

| Mitsubishi Tokyo Financial Group, Inc. | | | 160 | | | | 1,356 | | |

| Mitsui & Co., Ltd. | | | 408,000 | | | | 3,424 | | |

| Omron Corp. | | | 52,000 | | | | 1,178 | | |

| ORIX Corp. | | | 28,400 | | | | 3,325 | | |

| Rakuten, Inc. | | | 160 | | | | 1,198 | | |

| Sharp Corp. | | | 79,000 | | | | 1,089 | | |

| Shin-Etsu Chemical Co., Ltd. | | | 28,000 | | | | 1,063 | | |

| Sumitomo Metal Mining Co., Ltd. | | | 155,000 | | | | 1,044 | | |

| Sumitomo Mitsui Financial Group, Inc. (a) | | | 340 | | | | 2,207 | | |

| Toray Industries, Inc. | | | 441,000 | | | | 2,056 | | |

| Toto, Ltd. | | | 106,000 | | | | 949 | | |

| Toyota Motor Corp. | | | 82,900 | | | | 3,225 | | |

| Trend Micro, Inc. | | | 23,000 | | | | 1,101 | | |

| Yamaha Motor Co., Ltd. | | | 58,900 | | | | 895 | | |

| Luxembourg (0.7%) | | | |

| Arcelor | | | 77,710 | | | | 1,447 | | |

| Mexico (1.2%) | | | |

| America Movil SA de CV–Class L, ADR (a) | | | 60,087 | | | | 2,644 | | |

| Netherlands (3.3%) | | | |

| ING Groep NV | | | 145,414 | | | | 3,838 | | |

| Royal Numico NV | | | 67,510 | | | | 2,269 | | |

| Schlumberger, Ltd. | | | 15,550 | | | | 979 | | |

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2004

4

TA IDEX American Century International

SCHEDULE OF INVESTMENTS (continued)

At October 31, 2004

(all amounts except share amounts in thousands)

| | | Shares | | Value | |

| Norway (3.5%) | | | |

| DnB Nor ASA | | | 168,810 | | | $ | 1,427 | | |

| Norsk Hydro ASA | | | 33,980 | | | | 2,495 | | |

| Statoil ASA | | | 146,670 | | | | 2,118 | | |

| Telenor ASA | | | 184,920 | | | | 1,469 | | |

| Russia (0.6%) | | | |

| Mobile Telesystems, Sponsored ADR | | | 8,709 | | | | 1,264 | | |

| South Korea (0.7%) | | | |

| Hyundai Motor Co. | | | 32,120 | | | | 1,559 | | |

| Spain (3.5%) | | | |

| ACS Actividades de Construccion y Servicios SA | | | 82,387 | | | | 1,592 | | |

| Gamesa Corp. Tecnologica SA | | | 23,250 | | | | 320 | | |

| Grupo Ferrovial SA | | | 43,720 | | | | 1,930 | | |

| Telefonica SA | | | 233,257 | | | | 3,839 | | |

| Sweden (2.4%) | | | |

| Autoliv, Inc., SDR | | | 30,145 | | | | 1,276 | | |

| Telefonaktiebolaget LM Ericsson–Class B | | | 602,010 | | | | 1,744 | | |

| Volvo AB–Class B | | | 57,325 | | | | 2,165 | | |

| Switzerland (5.9%) | | | |

| ABB, Ltd. | | | 116,070 | | | | 669 | | |

| Novartis AG | | | 97,530 | | | | 4,635 | | |

| Roche Holding AG | | | 42,227 | | | | 4,302 | | |

| UBS AG | | | 45,136 | | | | 3,242 | | |

| United Kingdom (16.4%) | | | |

| Amdocs, Ltd. (b) | | | 52,150 | | | | 1,312 | | |

| BP PLC | | | 691,241 | | | | 6,684 | | |

| HSBC Holdings PLC | | | 147,590 | | | | 2,379 | | |

| Legal & General Group PLC | | | 1,363,570 | | | | 2,474 | | |

| mmO2 PLC | | | 64,709 | | | | 125 | | |

| Next PLC | | | 92,740 | | | | 2,839 | | |

| Pearson PLC | | | 177,290 | | | | 1,943 | | |

| Reckitt Benckiser PLC | | | 130,283 | | | | 3,568 | | |

| Royal Bank of Scotland Group PLC | | | 111,938 | | | | 3,293 | | |

| Smith & Nephew PLC | | | 250,475 | | | | 2,123 | | |

| Tesco PLC | | | 757,720 | | | | 3,986 | | |

| Vodafone Group PLC | | | 1,341,680 | | | | 3,431 | | |

| Wolseley PLC | | | 77,490 | | | | 1,337 | | |

| United States (1.1%) | | | |

| iShares MSCI EAFE Index Fund (a) | | | 5,000 | | | | 732 | | |

| Synthes, Inc. | | | 14,720 | | | | 1,563 | | |

| Total Common Stocks (cost: $188,415) | | | | | | | 209,879 | | |

| | | Principal | | Value | |

| SECURITY LENDING COLLATERAL ( 2.8%) | |

| Debt (2.6%) | |

| Bank Notes (0.5%) | |

Bank of America

1.77%, due 12/03/2004 | | $ | 299 | | | $ | 299 | | |

| 1.77%, due 01/18/2005 | | | 200 | | | | 200 | | |

| 1.88%, due 12/23/2004 | | | 100 | | | | 100 | | |

Canadian Imperial Bank of Commerce

1.86%, due 11/04/2004 | | | 449 | | | | 449 | | |

Credit Suisse First Boston Corp.

1.83%, due 09/09/2005 | | | 50 | | | | 50 | | |

| Commercial Paper (0.3%) | |

Clipper Receivables Corp.

1.79%, due 11/12/2004 | | | 149 | | | | 149 | | |

Delaware Funding Corp. 144A

1.85%, due 11/19/2004 | | | 50 | | | | 50 | | |

Falcon Asset Securitization Corp. 144A

1.75%, due 11/10/2004 | | | 200 | | | | 200 | | |

| 1.78%, due 11/04/2004 | | | 149 | | | | 149 | | |

Galaxy Funding 144A

1.88%, due 11/22/2004 | | | 50 | | | | 50 | | |

| Euro Dollar Terms (1.2%) | |

Bank of Montreal

1.88%, due 11/24/2004 | | | 473 | | | | 473 | | |

BNP Paribas

1.77%, due 11/10/2004 | | | 249 | | | | 249 | | |

| 1.80%, due 11/23/2004 | | | 200 | | | | 200 | | |

| 1.98%, due 12/27/2004 | | | 200 | | | | 200 | | |

Calyon

1.70%, due 11/24/2004 | | | 26 | | | | 26 | | |

Citigroup

2.06%, due 01/25/2005 | | | 499 | | | | 499 | | |

Den Danske Bank

1.82%, due 11/19/2004 | | | 250 | | | | 250 | | |

Dexia Group

2.04%, due 01/21/2005 | | | 116 | | | | 116 | | |

HBOS Halifax Bank of Scotland

2.03%, due 01/21/2005 | | | 100 | | | | 100 | | |

Royal Bank of Scotland

2.01%, due 01/20/2005 | | | 200 | | | | 200 | | |

Toronto Dominion Bank

1.70%, due 11/08/2004 | | | 100 | | | | 100 | | |

Wells Fargo

1.87%, due 11/22/2004 | | | 250 | | | | 250 | | |

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2004

5

TA IDEX American Century International

SCHEDULE OF INVESTMENTS (continued)

At October 31, 2004

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Promissory Notes (0.2%) | |

Goldman Sachs Group Inc.

1.88%, due 01/27/2005 | | $ | 349 | | | $ | 349 | | |

| 1.90%, due 12/29/2004 | | | 210 | | | | 210 | | |

| Repurchase Agreements (0.4%) | |

Merrill Lynch & Co., 1.92% Repurchase

Agreement dated 10/29/04 to be repurchased

at $799 on 11/01/04 (c) | | | 799 | | | | 799 | | |

| | | Shares | | Value | |

| Investment Companies (0.2%) | |

| Money Market Funds (0.2%) | |

Merrill Lynch Premier Institutional Fund

1-day yield of 1.71% | | | 245,648 | | | | $245 | | |

Merrimac Cash Fund, Premium Class

1-day yield of 1.46% | | | 179,763 | | | | 180 | | |

| Total Security Lending Collateral (cost: $6,142) | | | | | | | 6,142 | | |

| Total Investment Securities (cost: $195,813) | | | | | | $ | 217,458 | | |

| | | | | Value | |

| SUMMARY: | |

| Investments, at value | | | 100.2 | % | | $ | 217,458 | | |

| Liabilities in excess of other assets | | | (0.2 | )% | | | (531 | ) | |

| Net assets | | | 100.0 | % | | $ | 216,927 | | |

NOTES TO SCHEDULE OF INVESTMENTS:

(a) At October 31, 2004, all or a portion of this security is on loan (see Note 1). The value at October 31, 2004, of all securities on loan is $5,816.

(b) No dividends were paid during the preceding twelve months.

(c) Cash collateral for the Repurchase Agreements, valued at $815, that serve as collateral for securities lending are invested in corporate bonds with interest rates and maturity dates ranging from 0.00%–9.75% and 05/15/2005–9/15/2033, respectively.

DEFINITIONS:

144A 144A Securities are registered pursuant to the rule 144A of the Securities Act of 1933. These securities are deemed to be liquid for purposes of compliance limitations on holdings of illiquid securities and may be resold as transactions exempt from registration normally, to qualified institutional buyers. At October 31, 2004 these securities aggregated $449 or 0.2% of the net assets of the Fund.

ADR American Depositary Receipt

SDR Special Drawing Rights

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2004

6

TA IDEX American Century International

SCHEDULE OF INVESTMENTS (continued)

At October 31, 2004

(all amounts except share amounts in thousands)

| | | Percentage of

Net Assets | | Value | |

| INVESTMENTS BY INDUSTRY: | |

| Commercial Banks | | | 15.5 | % | | $ | 33,593 | | |

| Petroleum Refining | | | 8.2 | % | | | 17,739 | | |

| Telecommunications | | | 6.5 | % | | | 14,035 | | |

| Pharmaceuticals | | | 5.3 | % | | | 11,626 | | |

| Automotive | | | 3.8 | % | | | 8,225 | | |

| Computer & Data Processing Services | | | 3.4 | % | | | 7,276 | | |

| Life Insurance | | | 3.3 | % | | | 7,123 | | |

| Oil & Gas Extraction | | | 3.2 | % | | | 6,826 | | |

| Chemicals & Allied Products | | | 3.1 | % | | | 6,542 | | |

| Wholesale Trade Durable Goods | | | 3.0 | % | | | 6,514 | | |

| Construction | | | 2.9 | % | | | 6,278 | | |

| Metal Mining | | | 2.8 | % | | | 6,042 | | |

| Rubber & Misc. Plastic Products | | | 2.6 | % | | | 5,655 | | |

| Radio & Television Broadcasting | | | 2.6 | % | | | 5,565 | | |

| Electronic Components & Accessories | | | 2.3 | % | | | 5,069 | | |

| Medical Instruments & Supplies | | | 2.3 | % | | | 5,002 | | |

| Instruments & Related Products | | | 2.3 | % | | | 4,942 | | |

| Industrial Machinery & Equipment | | | 2.0 | % | | | 4,442 | | |

| Electric Services | | | 1.9 | % | | | 4,399 | | |

| Insurance | | | 2.0 | % | | | 4,377 | | |

| Food Stores | | | 1.8 | % | | | 3,986 | | |

| Shoe Stores | | | 1.7 | % | | | 3,702 | | |

| Business Credit Institutions | | | 1.5 | % | | | 3,325 | | |

| Communications Equipment | | | 1.4 | % | | | 3,062 | | |

| Stone, Clay & Glass Products | | | 1.2 | % | | | 2,696 | | |

| Food & Kindred Products | | | 1.0 | % | | | 2,269 | | |

| Beer, Wine & Distilled Beverages | | | 1.0 | % | | | 2,178 | | |

| Textile Mill Products | | | 1.0 | % | | | 2,056 | | |

| Drug Stores & Proprietary Stores | | | 0.9 | % | | | 1,935 | | |

| Department Stores | | | 0.8 | % | | | 1,706 | | |

| Personal Credit Institutions | | | 0.7 | % | | | 1,585 | | |

| Primary Metal Industries | | | 0.7 | % | | | 1,447 | | |

| Retail Trade | | | 0.7 | % | | | 1,437 | | |

| Management Services | | | 0.6 | % | | | 1,232 | | |

| Amusement & Recreation Services | | | 0.6 | % | | | 1,203 | | |

| Water Transportation | | | 0.5 | % | | | 1,178 | | |

| Furniture & Fixtures | | | 0.4 | % | | | 949 | | |

| Computer & Office Equipment | | | 0.4 | % | | | 907 | | |

| Metal Cans & Shipping Containers | | | 0.4 | % | | | 897 | | |

| Transportation Equipment | | | 0.4 | % | | | 895 | | |

| Investment Companies | | | 0.4 | % | | | 732 | | |

| Engineering & Management Services | | | 0.3 | % | | | 669 | | |

| Investments, at value | | | 97.4 | % | | | 211,316 | | |

| Short-term investments | | | 2.8 | % | | | 6,142 | | |

| Liabilities in excess of other assets | | | (0.2 | )% | | | (531 | ) | |

| Net assets | | | 100.0 | % | | $ | 216,927 | | |

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2004

7

TA IDEX American Century International

STATEMENT OF ASSETS AND LIABILITIES

At October 31, 2004

(all amounts except per share amounts in thousands)

| Assets: | | | |

Investment securities, at value (cost: $195,813)

(including securities loaned of $5,816) | | $ | 217,458 | | |

| Cash | | | 6,246 | | |

| Receivables: | |

| Investment securities sold | | | 1,446 | | |

| Shares of beneficial interest sold | | | 26 | | |

| Interest | | | 4 | | |

| Dividends | | | 193 | | |

| Dividend reclaims receivable | | | 161 | | |

| Other | | | 6 | | |

| | | | 225,540 | | |

| Liabilities: | | | |

| Investment securities purchased | | | 1,980 | | |

| Accounts payable and accrued liabilities: | |

| Shares of beneficial interest redeemed | | | 95 | | |

| Management and advisory fees | | | 185 | | |

| Distribution fees | | | 80 | | |

| Transfer agent fees | | | 43 | | |

| Payable for collateral for securities on loan | | | 6,142 | | |

| Other | | | 88 | | |

| | | | 8,613 | | |

| Net Assets | | $ | 216,927 | | |

| Net Assets Consist of: | | | |

Shares of beneficial interest, unlimited shares

authorized, no par value | | $ | 214,625 | | |

| Accumulated net investment income (loss) | | | 229 | | |

Accumulated net realized gain (loss) from investment

securities and foreign currency transactions | | | (19,585 | ) | |

| Net unrealized appreciation (depreciation) on: | |

| Investment securities | | | 21,645 | | |

Translation of assets and liabilites denominated in

foreign currencies | | | 13 | | |

| Net Assets | | $ | 216,927 | | |

| Net Assets by Class: | | | |

| Class A | | $ | 187,608 | | |

| Class B | | | 20,153 | | |

| Class C | | | 9,166 | | |

| Shares Outstanding: | | | |

| Class A | | | 21,287 | | |

| Class B | | | 2,396 | | |

| Class C | | | 1,092 | | |

| Net Asset Value Per Share: | | | |

| Class A | | $ | 8.81 | | |

| Class B | | | 8.41 | | |

| Class C | | | 8.40 | | |

| Maximum Offering Price Per Share (a): | | | |

| Class A | | $ | 9.32 | | |

(a) Includes the maximum selling commission (represented as a percentage of offering price) which is reduced on certain levels of sales as set forth in the Prospectus. Net asset value per share for Classes B and C shares represents offering price. The redemption price for Classes B and C shares equals net asset value less any applicable contingent deferred sales charge.

STATEMENT OF OPERATIONS

For the year ended October 31, 2004

(all amounts in thousands)

| Investment Income: | | | |

| Interest | | $ | 16 | | |

| Dividends | | | 3,968 | | |

| Income from loaned securities–net | | | 25 | | |

| Less withholding taxes on foreign dividends | | | (413 | ) | |

| | | | 3,596 | | |

| Expenses: | | | |

| Management and advisory fees | | | 2,040 | | |

| Transfer agent fees: | |

| Class A | | | 198 | | |

| Class B | | | 2 | | |

| Class C | | | – | | |

| Class C2 | | | 5 | | |

| Class M | | | 3 | | |

| Printing and shareholder reports | | | 30 | | |

| Custody fees | | | 281 | | |

| Administration fees | | | 35 | | |

| Legal fees | | | 8 | | |

| Audit and accounting fees | | | 25 | | |

| Trustees fees | | | 14 | | |

| Registration fees: | |

| Class A | | | 41 | | |

| Class B | | | – | | |

| Class C | | | 11 | | |

| Class C2 | | | 1 | | |

| Class M | | | 1 | | |

| Other | | | 13 | | |

| Distribution and service fees: | |

| Class A | | | 661 | | |

| Class B | | | 212 | | |

| Class C | | | 31 | | |

| Class C2 | | | 37 | | |

| Class M | | | 26 | | |

| Total expenses | | | 3,675 | | |

| Reimbursement of class expenses: | | | | | |

| Class C | | | (3 | ) | |

| Net expenses | | | 3,672 | | |

| Net Investment Income (Loss) | | | (76 | ) | |

| Net Realized Gain (Loss) from: | | | |

| Investment securities | | | 17,792 | | |

| Foreign currency transactions | | | (1,636 | ) | |

| | | | 16,156 | | |

| Net Increase (Decrease) in Unrealized Appreciation on: | | | |

| Investment securities | | | 4,501 | | |

Translation of assets and liabilities denominated in

foreign currencies | | | 5 | | |

| | | | 4,506 | | |

Net Gain (Loss) on Investments and Foreign

Currency Transactions | | | 20,662 | | |

Net Increase (Decrease) in Net Assets Resulting

from Operations | | $ | 20,586 | | |

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2004

8

TA IDEX American Century International

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended

(all amounts in thousands)

| | | October 31,

2004 | | October 31,

2003 | |

| Increase (Decrease) in Net Assets From: | | | |

| Operations: | | | |

| Net investment income (loss) | | $ | (76 | ) | | $ | 37 | | |

Net realized gain (loss) from

investment securities and foreign

currency transactions | | | 16,156 | | | | (8,282 | ) | |

Net unrealized appreciation

(depreciation) on investment

securities and foreign currency

transactions | | | 4,506 | | | | 27,819 | | |

| | | | 20,586 | | | | 19,574 | | |

| Distributions to Shareholders: | | | |

| From net investment income: | |

| Class A | | | (410 | ) | | | – | | |

| Class B | | | (47 | ) | | | – | | |

| Class C | | | (2 | ) | | | – | | |

| Class C2 | | | (12 | ) | | | – | | |

| Class M | | | (7 | ) | | | – | | |

| | | | (478 | ) | | | – | | |

| Capital Share Transactions: | | | |

| Proceeds from shares sold: | |

| Class A | | | 43,204 | | | | 166,990 | | |

| Class B | | | 2,535 | | | | 6,031 | | |

| Class C | | | 920 | | | | 499 | | |

| Class C2 | | | 476 | | | | 3,919 | | |

| Class M | | | 358 | | | | 1,197 | | |

| | | | 47,493 | | | | 178,636 | | |

| Proceeds from fund acquisition: | |

| Class A | | | – | | | | 11,819 | | |

| Class B | | | – | | | | 15,256 | | |

| Class C | | | – | | | | 43 | | |

| Class C2 | | | – | | | | 5,043 | | |

| Class M | | | – | | | | 2,412 | | |

| | | | – | | | | 34,573 | | |

Dividends and distributions

reinvested: | |

| Class A | | | 409 | | | | – | | |

| Class B | | | 44 | | | | – | | |

| Class C | | | 2 | | | | – | | |

| Class C2 | | | 11 | | | | – | | |

| Class M | | | 7 | | | | – | | |

| | | | 473 | | | | – | | |

| Cost of shares redeemed: | |

| Class A | | | (25,540 | ) | | | (63,205 | ) | |

| Class B | | | (5,662 | ) | | | (5,349 | ) | |

| Class C | | | (842 | ) | | | (119 | ) | |

| Class C2 | | | (1,501 | ) | | | (2,519 | ) | |

| Class M | | | (879 | ) | | | (770 | ) | |

| | | | (34,424 | ) | | | (71,962 | ) | |

| Class level exchanges: | |

| Class C | | | 8,249 | | | | – | | |

| Class C2 | | | (5,368 | ) | | | – | | |

| Class M | | | (2,881 | ) | | | – | | |

| | | | – | | | | – | | |

| Automatic conversions: | |

| Class A | | | 9 | | | | – | | |

| Class B | | | (9 | ) | | | – | | |

| | | | – | | | | – | | |

| | | | 13,542 | | | | 141,247 | | |

| Net increase (decrease) in net assets | | | 33,650 | | | | 160,821 | | |

| | | October 31,

2004 | | October 31,

2003 | |

| Net Assets: | | | |

| Beginning of year | | | 183,277 | | | | 22,456 | | |

| End of year | | $ | 216,927 | | | $ | 183,277 | | |

Accumulated Net Investment Income

(Loss) | | $ | 229 | | | $ | (2 | ) | |

| Share Activity: | | | |

| Shares issued: | |

| Class A | | | 5,293 | | | | 24,009 | | |

| Class B | | | 308 | | | | 332 | | |

| Class C | | | 112 | | | | 84 | | |

| Class C2 | | | 58 | | | | 134 | | |

| Class M | | | 43 | | | | 18 | | |

| | | | 5,814 | | | | 24,577 | | |

| Shares issued on fund acquisition: | |

| Class A | | | – | | | | 1,824 | | |

| Class B | | | – | | | | 2,449 | | |

| Class C | | | – | | | | 7 | | |

| Class C2 | | | – | | | | 809 | | |

| Class M | | | – | | | | 387 | | |

| | | | – | | | | 5,476 | | |

Shares issued–reinvested from

distributions: | |

| Class A | | | 47 | | | | – | | |

| Class B | | | 5 | | | | – | | |

| Class C2 | | | 1 | | | | – | | |

| Class M | | | 1 | | | | – | | |

| | | | 54 | | | | – | | |

| Shares redeemed: | |

| Class A | | | (2,998 | ) | | | (9,020 | ) | |

| Class B | | | (698 | ) | | | (787 | ) | |

| Class C | | | (103 | ) | | | (17 | ) | |

| Class C2 | | | (183 | ) | | | (369 | ) | |

| Class M | | | (105 | ) | | | (113 | ) | |

| | | | (4,087 | ) | | | (10,306 | ) | |

| Class level exchanges: | |

| Class C | | | 1,009 | | | | – | | |

| Class C2 | | | (654 | ) | | | – | | |

| Class M | | | (353 | ) | | | – | | |

| | | | 2 | | | | – | | |

| Automatic conversions: | |

| Class A | | | 1 | | | | – | | |

| Class B | | | (1 | ) | | | – | | |

| | | | – | | | | – | | |

Net increase (decrease) in shares

outstanding: | |

| Class A | | | 2,343 | | | | 16,813 | | |

| Class B | | | (386 | ) | | | 1,994 | | |

| Class C | | | 1,018 | | | | 74 | | |

| Class C2 | | | (778 | ) | | | 574 | | |

| Class M | | | (414 | ) | | | 292 | | |

| | | | 1,783 | | | | 19,747 | | |

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2004

9

TA IDEX American Century International

FINANCIAL HIGHLIGHTS

| | | | | For a share of beneficial interest outstanding throughout each period | |

| | | | | Net Asset | | Investment Operations | | Distributions | | Net Asset | |

| | | For the

Period

Ended (d)(g) | | Value,

Beginning

of Period | | Net

Investment

Income (Loss) | | Net Realized

and Unrealized

Gain (Loss) | | Total

Operations | | From Net

Investment

Income | | From Net

Realized

Gains | | Total

Distributions | | Value,

End

of Period | |

| Class A | | 10/31/2004 | | $ | 8.03 | | | $ | – | | | $ | 0.80 | | | $ | 0.80 | | | $ | (0.02 | ) | | $ | – | | | $ | (0.02 | ) | | $ | 8.81 | | |

| | | 10/31/2003 | | | 7.00 | | | | 0.02 | | | | 1.01 | | | | 1.03 | | | | – | | | | – | | | | – | | | | 8.03 | | |

| | | 10/31/2002 | | | 8.38 | | | | 0.01 | | | | (1.39 | ) | | | (1.38 | ) | | | – | | | | – | | | | – | | | | 7.00 | | |

| | | 10/31/2001 | | | 12.76 | | | | 0.05 | | | | (3.05 | ) | | | (3.00 | ) | | | – | | | | (1.38 | ) | | | (1.38 | ) | | | 8.38 | | |

| | | 10/31/2000 | | | 12.85 | | | | 0.05 | | | | 0.35 | | | | 0.40 | | | | – | | | | (0.49 | ) | | | (0.49 | ) | | | 12.76 | | |

| Class B | | 10/31/2004 | | | 7.70 | | | | (0.04 | ) | | | 0.77 | | | | 0.73 | | | | (0.02 | ) | | | – | | | | (0.02 | ) | | | 8.41 | | |

| | | 10/31/2003 | | | 6.76 | | | | (0.03 | ) | | | 0.97 | | | | 0.94 | | | | – | | | | – | | | | – | | | | 7.70 | | |

| | | 10/31/2002 | | | 8.15 | | | | (0.04 | ) | | | (1.35 | ) | | | (1.39 | ) | | | – | | | | – | | | | – | | | | 6.76 | | |

| | | 10/31/2001 | | | 12.53 | | | | (0.02 | ) | | | (2.98 | ) | | | (3.00 | ) | | | – | | | | (1.38 | ) | | | (1.38 | ) | | | 8.15 | | |

| | | 10/31/2000 | | | 12.70 | | | | (0.03 | ) | | | 0.35 | | | | 0.32 | | | | – | | | | (0.49 | ) | | | (0.49 | ) | | | 12.53 | | |

| Class C | | 10/31/2004 | | | 7.70 | | | | (0.09 | ) | | | 0.81 | | | | 0.72 | | | | (0.02 | ) | | | – | | | | (0.02 | ) | | | 8.40 | | |

| | | 10/31/2003 | | | 6.73 | | | | (0.03 | ) | | | 1.00 | | | | 0.97 | | | | – | | | | – | | | | – | | | | 7.70 | | |

| | | | | | | Ratios/Supplemental Data | |

| | | For the

Period | | Total | | Net Assets,

End of

Period | | Ratio of Expenses

to Average

Net Assets (a) | | Net Investment

Income (Loss)

to Average | | Portfolio

Turnover | |

| | | Ended (g) | | Return (c) | | (000's) | | Net (e) | | Total (f) | | Net Assets (a) | | Rate (b) | |

| Class A | | 10/31/2004 | | | 9.95 | % | | $ | 187,608 | | | | 1.59 | % | | | 1.59 | % | | | (0.05 | )% | | | 159 | % | |

| | | 10/31/2003 | | | 14.71 | | | | 152,086 | | | | 1.78 | | | | 2.39 | | | | 0.23 | | | | 220 | | |

| | | 10/31/2002 | | | (16.49 | ) | | | 14,921 | | | | 1.87 | | | | 3.68 | | | | 0.22 | | | | 241 | | |

| | | 10/31/2001 | | | (26.43 | ) | | | 5,209 | | | | 1.55 | | | | 2.77 | | | | 0.47 | | | | 129 | | |

| | | 10/31/2000 | | | 2.74 | | | | 6,977 | | | | 1.62 | | | | 3.56 | | | | 0.09 | | | | 108 | | |

| Class B | | 10/31/2004 | | | 9.46 | | | | 20,153 | | | | 2.09 | | | | 2.09 | | | | (0.46 | ) | | | 159 | | |

| | | 10/31/2003 | | | 13.91 | | | | 21,421 | | | | 2.44 | | | | 3.05 | | | | (0.42 | ) | | | 220 | | |

| | | 10/31/2002 | | | (17.09 | ) | | | 5,328 | | | | 2.52 | | | | 4.33 | | | | (0.43 | ) | | | 241 | | |

| | | 10/31/2001 | | | (26.96 | ) | | | 5,003 | | | | 2.20 | | | | 3.42 | | | | (0.18 | ) | | | 129 | | |

| | | 10/31/2000 | | | 2.09 | | | | 4,407 | | | | 2.27 | | | | 4.21 | | | | (0.56 | ) | | | 108 | | |

| Class C | | 10/31/2004 | | | 9.33 | | | | 9,166 | | | | 2.40 | | | | 2.49 | | | | (1.07 | ) | | | 159 | | |

| | | 10/31/2003 | | | 14.41 | | | | 568 | | | | 2.44 | | | | 3.04 | | | | (0.42 | ) | | | 220 | | |

NOTES TO FINANCIAL HIGHLIGHTS

(a) Annualized.

(b) Not annualized for periods of less than one year.

(c) Total Return has been calculated for the applicable period without deduction of a sales load, if any, on an initial purchase. Periods of less than one year are not annualized.

(d) Per share information is calculated based on average number of shares outstanding for the years ended 10/31/2001, 10/31/2002, 10/31/2003 and 10/31/2004.

(e) Ratio of Net Expenses to Average Net Assets is net of fee waivers and reimbursements by the investment adviser, if any (see note 2).

(f) Ratio of Total Expenses to Average Net Assets includes all expenses before fee waivers and reimbursements by the investment adviser.

(g) The inception date for the Fund's offering of share Class L was November 11, 2002. Class L was renamed Class C on March 1, 2004 (see note 1).

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2004

10

TA IDEX American Century International

NOTES TO FINANCIAL STATEMENTS

At October 31, 2004

(all amounts in thousands)

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Transamerica IDEX Mutual Funds, formerly IDEX Mutual Funds, is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company. TA IDEX American Century International ("the Fund"), part of Transamerica IDEX Mutual Funds, began operations on February 1, 1997.

On March 1, 2004, the Fund changed its name from IDEX American Century International to TA IDEX American Century International.

On March 1, 2003, the Fund acquired all the net assets of IDEX Gabelli Global Growth pursuant to a plan of reorganization approved by shareholders of IDEX Gabelli Growth on February 12, 2003. The acquisition was accomplished by a tax-free exchange of 5,476 shares of the Fund for the 6,190 shares of IDEX Gabelli Growth outstanding on February 28, 2003. IDEX Gabelli Global Growth's net assets at that date ($34,573), including ($10,073) of unrealized depreciation, were combined with those of the Fund. Proceeds in connection with the acquisition were as follows:

| | | Shares | | Amount | |

| Proceeds in connection with the acquisition | |

| Class A | | | 1,824 | | | $ | 11,819 | | |

| Class B | | | 2,449 | | | | 15,256 | | |

| Class C | | | 7 | | | | 43 | | |

| Class C2 | | | 809 | | | | 5,043 | | |

| Class M | | | 387 | | | | 2,412 | | |

| | | | | | | $ | 34,573 | | |

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties, which provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

See the Prospectus and Statement of Additional Information for a description of the Fund's investment objective.

In preparing the Fund's financial statements in accordance with accounting principles generally accepted in the United States of America ("GAAP"), estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following policies were consistently followed by the Fund, in accordance with GAAP.

Multiple class operations and expenses: The Fund currently offers three classes of shares, each with a public offering price that reflects different sales charges, if any, and expense levels. All shares designated as Class C shares prior to March 1, 2004, were renamed as Class C2 shares on that date. All shares designated as Class L shares prior to March 1, 2004, were renamed as Class C shares with different sales charges than the previous Class L shares. On June 15, 2004, Class C2 shares merged into Class C. On September 24, 2004, Class M shares merged into Class C. Class B shares will convert to Class A shares eight years after purchase. Income, non-class specific expenses and realized and unrealized gains and losses, are allo cated daily to each class, based upon the value of shares outstanding method as permitted under Rule 18f-3 of the 1940 Act. Each class bears its own specific expenses as well as a portion of general, common expenses.

Pricing of shares: The Fund prices its shares on the basis of the net asset value of each class of shares of the Fund, which is determined as of the close of the New York Stock Exchange ("NYSE") (generally 4:00 p.m. Eastern Time) on each day on which the NYSE is open for trading (other than a day on which there are insufficient changes in the value of the Fund's portfolio securities to materially affect the Fund's net asset value or a day on which no shares are tendered for redemption and no order to purchase any shares is received).

Security valuations: Fund investments traded on an exchange are valued at the closing price on the day of valuation on the exchange where the security is principally traded. With respect to securities traded on NASDAQ NMS, such closing price may be the last reported sales price or the NASDAQ Official Closing Price.

Securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the last quoted bid price.

Debt securities are valued by independent pricing services; however, those that mature in sixty days or less are valued at amortized cost, which approximates market.

Investment company securities are valued at net asset value of the underlying portfolio.

Foreign securities generally are valued based on quotations from the primary market in which they are traded and are translated from the local currency into U.S. dollars using closing exchange rates. Many foreign securities markets are open for trading at times when the U.S. markets are closed for trading, and many foreign securities markets close for trading before the close of the NYSE. The value of foreign securities may be affected significantly on a day that the NYSE is closed and an investor is unable to purchase or redeem shares. If a significant market event impacting the value of a portfolio security (e.g., natural disaster, company announcement, market volatility) occurs subsequent to the close of trading in the security, but prior to the calculation of the Fund's net asset value per share, market quotations for that security may be determined to be unreliable and, accordingly, not "readily

Transamerica IDEX Mutual Funds

Annual Report 2004

11

TA IDEX American Century International

NOTES TO FINANCIAL STATEMENTS (continued)

At October 31, 2004

(all amounts in thousands)

NOTE 1.–(continued)

available." If market quotations are not readily available, and the impact of such a significant market event materially effects the net asset value per share of the Fund, an affected portfolio security will be valued at fair market value as determined in good faith using guidelines adopted by the Board of Trustees of the Fund, under the supervision of the Fund's Valuation Committee. Factors that may be considered to value foreign securities at fair market value may include, among others: the value of other securities traded on other markets, foreign currency exchange activity and the trading of financial products tied to foreign securities.

Other securities for which quotations are not readily available are valued at fair market value as determined in good faith using guidelines adopted by the Board of Trustees of the Fund, under the supervision of the Fund's Valuation Committee.

The Fund values its investment securities at fair value based upon procedures approved by the Board of Trustees on days when significant events occur after the close of the principal exchange on which the securities are traded, and as a result, are expected to materially effect the value of investments.

Cash: The Fund may leave cash overnight in its cash account with the custodian, Investors Bank & Trust Company ("IBT"). IBT has been contracted on behalf of the Fund to invest the excess cash into a savings account, which at October 31, 2004, was paying an interest rate of 1.30%.

Throughout the year, the Fund may have a cash overdraft balance. A fee is incurred on this overdraft, calculated by multiplying the overdraft by a rate based on the federal funds rate. This fee is included in Custody fees in the Statement of Operations.

Repurchase agreements: The Fund is authorized to enter into repurchase agreements. The Fund, through IBT, receives delivery of the underlying securities, the value of which at the time of purchase is required to be an amount equal to at least 100% of the resale price. Repurchase agreements involve the risk that the seller will fail to repurchase the security, as agreed. In that case, the Fund will bear the risk of value fluctuations until the security can be sold and may encounter delays and incur costs in liquidating the security. In the event of bankruptcy or insolvency of the seller, delays and costs may be incurred.

Securities lending: The Fund may lend securities to enhance fund earnings from investing cash collateral in making such loans to qualified borrowers (typically broker/dealers). The Fund has engaged its custodian bank, IBT, as a lending agent to administer its securities lending program. IBT earned $11 of program income for its services. When the Fund makes a security loan, it receives cash collateral as protection against the risk that the borrower will default on the loan, and records an asset for the cash invested collateral and a liability for the return of the collateral.

Securities on loan are included in Investment securities at value in the Statement of Assets and Liabilities and remain on the Schedule of Investments.

Loans of securities are required to be secured by collateral at least equal to 102% of the value of the securities at inception of the loan, and not less then 100% thereafter. The Fund may invest cash collateral in short-term money market instruments including: U.S. Treasury Bills, U.S. agency obligations, commercial paper, money market mutual funds, repurchase agreements and other highly rated, liquid investments. During the life of securities loans, the collateral and securities loaned remain subject to fluctuation in value. IBT marks to market securities loaned and the collateral each business day. If additional collateral is due (at least $1), IBT collects additional cash collateral from the borrowers. Although securities loaned will be fully collateralized at all times, IBT may experience delays in, or may be prevented from, recovering the collateral on behalf of the Fund. The Fund may recall a loa ned security position at any time from the borrower through IBT. In the event the borrower fails to timely return a recalled security, IBT may indemnify the Fund by purchasing replacement securities for the Fund at its own expense and claiming the collateral to fund such a purchase. IBT absorbs the loss if the collateral value is not sufficient to cover the cost of the replacement securities. If replacement securities are not available, IBT will credit the equivalent cash value to the Fund.

While a security is on loan, the Fund does not have the right to vote that security. However, if time permits, the Fund will attempt to recall a security on loan and vote the proxy.

Income from securities lending is included in the Statement of Operations. The amount of collateral and value of securities on loan are included in the Statement of Assets and Liabilities as well as in the Schedule of Investments.

Security transactions and investment income: Security transactions are recorded on the trade date. Security gains and losses are calculated on the specific identification basis. Dividend income is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend date. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis commencing on the settlement date.

Foreign currency denominated investments: The accounting records of the Fund are maintained in U.S. dollars. Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the closing exchange rate each day. The cost of foreign securities is translated at the exchange rate in effect when the investment was acquired. The Fund combines fluctuations from currency exchange rates and fluctuations in value when computing net realized and unrealized gains or losses from investments.

Transamerica IDEX Mutual Funds

Annual Report 2004

12

TA IDEX American Century International

NOTES TO FINANCIAL STATEMENTS (continued)

At October 31, 2004

(all amounts in thousands)

NOTE 1.–(continued)

Net foreign currency gains and losses resulting from changes in exchange rates include: 1) foreign currency fluctuations between trade date and settlement date of investment security transactions; 2) gains and losses on forward foreign currency contracts; and 3) the difference between the receivable amounts of interest and dividends recorded in the accounting records in U.S. dollars and the amounts actually received.

Foreign currency denominated assets may involve risks not typically associated with domestic transactions, including unanticipated movements in exchange currency rates, the degree of government supervision and regulation of security markets, and the possibility of political or economic instability.

Foreign capital gains taxes: The Fund may be subject to taxes imposed by countries in which it invests, with respect to its investment in issuers existing or operating in such countries. Such taxes are generally based on income earned or repatriated and capital gains realized on the sale of such investments. The Fund accrues such taxes when the related income or capital gains are earned. Some countries require governmental approval for the repatriation of investment income, capital or the proceeds of sales earned by foreign investors. In addition, if there is deterioration in a country's balance of payments or for other reasons, a country may impose temporary restrictions on foreign capital remittances abroad.

Forward foreign currency contracts: The Fund may enter into forward foreign currency contracts to hedge against exchange rate risk arising from investments in securities denominated in foreign currencies. Contracts are valued at the contractual forward rate and are marked to market daily, with the change in value recorded as an unrealized gain or loss. When the contracts are closed a realized gain or loss is incurred. Risks may arise from changes in market value of the underlying currencies and from the possible inability of counterparties to meet the terms of their contracts.

Account maintenance fees: If the shareholder account balance falls below $1 by either shareholder action or as a result of market action, a $25 (not in thousands) fee is assessed every year until the balance reaches $1. The fee is assessed by redeeming shares in the shareholder's account.

No fee will be charged under the following conditions:

• accounts opened within the preceding 24 months

• accounts with an active monthly Automatic Investment Plan ($50 (not in thousands) minimum per fund)

• accounts owned by an individual which, when combined by social security number, have a balance of $5 or more

• accounts owned by individuals in the same household (by address) that have a combined balance of $5 or more

• UTMA/UGMA accounts

• Fiduciary accounts

• B-share accounts whose shares have started to convert to A-shares accounts (as long as combined value of both accounts is at least $1)

For the year ended October 31, 2004, this fee totaled $1. These fees are included in Paid in Capital in the Statement of Assets and Liabilities.

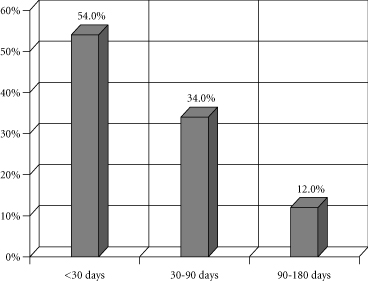

Redemption fees: A short-term trading redemption fee may be assessed on any fund shares in a fund account that are sold during the first five (5) New York Stock Exchange trading days following their purchase date. This redemption fee will equal 2% of the amount redeemed and shares held the longest will be treated as being redeemed first and shares held the shortest as being redeemed last. For the year ended October 31, 2004, the Fund received no redemption fees.

Dividend distributions: Distributions to shareholders are recorded on the ex-dividend date and are determined in accordance with Federal income tax regulations which may differ from GAAP.

NOTE 2. RELATED PARTY TRANSACTIONS

AEGON/Transamerica Fund Advisers, Inc. ("ATFA") is the Fund's investment adviser. AEGON/Transamerica Fund Services, Inc. ("ATFS") is the Fund's administrator. AFSG Securities Corp. ("AFSG") is the Fund's distributor/principal underwriter. AEGON/Transamerica Investor Services, Inc. ("ATIS") is the Fund's transfer agent. ATIS and AFSG are 100% owned by AUSA Holding Company ("AUSA"). ATFA is a directly owned subsidiary of Western Reserve Life Assurance Co. of Ohio (78%) ("WRL") and AUSA (22%). ATFS is a wholly owned subsidiary of WRL. AUSA and WRL are wholly owned indirect subsidiaries of AEGON NV, a Netherlands corporation.

The following schedule reflects the percentage of fund assets owned by affiliated mutual funds (i.e.: through the assets allocation funds):

| | | Net

Assets | | % of

Net Assets | |

TA IDEX Asset Allocation–

Growth Portfolio | | $ | 49,765 | | | | 23 | % | |

TA IDEX Asset Allocation–

Moderate Growth Portfolio | | | 88,854 | | | | 41 | % | |

TA IDEX Asset Allocation–

Moderate Portfolio | | | 35,186 | | | | 16 | % | |

| Total | | $ | 173,805 | | | | 80 | % | |

Transamerica IDEX Mutual Funds

Annual Report 2004

13

TA IDEX American Century International

NOTES TO FINANCIAL STATEMENTS (continued)

At October 31, 2004

(all amounts in thousands)

NOTE 2.–(continued)

Investment advisory fee: The Fund pays management fees to ATFA based on average daily net assets ("ANA") at the following breakpoints:

1.00% of the first $50 million of ANA

0.95% of the next $100 million of ANA

0.90% of the next $350 million of ANA

0.85% of the next $500 million of ANA

0.80% of ANA over $1 billion

ATFA has contractually agreed to waive its advisory fee and will reimburse the Fund to the extent that operating expenses, excluding 12b-1 fees, exceed the following stated annual limit:

1.40% Expense Limit

If total fund expenses fall below the annual expense limitation agreement agreed to by the adviser within the succeeding three years, the Fund may be required to pay that adviser a portion or all of the waived advisory fees.

| | | Advisory Fee

Waived | | Available for

Recapture Through | |

| Fiscal Year 2003 | | $ | 473 | | | 10/31/2006 | |

If total class expenses fall below the annual expense limitation agreement agreed to by the adviser within the succeeding three years, the Fund may be required to pay that adviser a portion or all of the reimbursed class expenses.

Reimbursement

Fiscal Year 2004 | | Available for

of Class Expenses | | Recapture Through | |

| Class C | | | 3 | | | 10/31/2007 | |

Distribution and service fees: The Fund has a 12b-1 distribution plan under the 1940 Act pursuant to which an annual fee, based on average daily net assets, is paid to the distributor for various disbursements such as broker-dealer account servicing fees and other promotional expenses of the Fund. The Fund is authorized under the 12b-1 plan to pay fees on each class up to the following limits:

| Class A | | | 0.35 | % | |

| Class B | | | 1.00 | % | |

| Class C | | | 1.00 | % | |

| Class C2 | | | 1.00 | % | |

| Class M | | | 0.90 | % | |

Class C2 and Class M merged into Class C on June 15, 2004 and September 24, 2004, respectively.

In the case the Fund or a class of shares of the Fund is closed to new investors or investments, the Fund is authorized to pay 12b-1 fees for past sales and distribution efforts and present and past investor services.

Underwriter commissions relate to front-end sales charges imposed for Class A and M shares and contingent deferred sales charges from Classes B, C, M and certain A share redemptions. For the year ended October 31, 2004, the underwriter commissions were as follows:

| Received by Underwriter | | $ | 245 | | |

| Retained by Underwriter | | | 9 | | |

| Contingent Deferred Sales Charge | | | 70 | | |

Administrative services: The Fund has entered into an agreement with ATFS for financial and legal fund administration services, which includes such items as compliance, expenses, financial statements and other reporting, distributions, tax returns, prospectus preparation, board of trustees meeting support and other legal matters. The Fund pays ATFS an annual fee of 0.015% of average net assets. The Legal fees on the Statement of Operations are for fees paid to external legal counsel.

The Fund paid ATFS $35 for the year ended October 31, 2004.

Transfer agent fees: The Fund pays ATIS an annual per-account charge of $20 (not in thousands) for each open account and $1.63 (not in thousands) for each closed account. There is no new account charge. The transfer agent fees on the Statement of Operations are made up of fees paid to ATIS and costs associated with shareholder statements. The Fund paid ATIS $208 for the year ended October 31, 2004.

Deferred compensation plan: Each eligible Fund Trustee may elect participation in the Deferred Compensation Plan ("the Plan"). Under the Plan, such Trustees may defer payment of a percentage of their total fees earned as a Fund Trustee. These deferred amounts may be invested in any Transamerica IDEX Mutual Fund. At October 31, 2004, the value of invested plan amounts was $5. Invested plan amounts and the total liability for deferred compensation to the Trustees under the Plan at October 31, 2004, are included in the accompanying Statement of Assets and Liabilities.

NOTE 3. INVESTMENT TRANSACTIONS

The cost of securities purchased and proceeds from securities sold (excluding short-term securities) for the year ended October 31, 2004, were as follows:

| Purchases of securities: | | | |

| Long-Term excluding U.S. Government | | $ | 354,768 | | |

| U.S. Government | | | – | | |

| Proceeds from maturities and sales of securities | | | |

| Long-Term excluding U.S. Government | | | 341,689 | | |

| U.S. Government | | | – | | |

Transamerica IDEX Mutual Funds

Annual Report 2004

14

TA IDEX American Century International

NOTES TO FINANCIAL STATEMENTS (continued)

At October 31, 2004

(all amounts in thousands)

NOTE 4. FEDERAL INCOME TAX MATTERS

The Fund has not made any provision for federal income or excise taxes due to its policy to distribute all of its taxable income and capital gains to its shareholders and otherwise qualify as a regulated investment company under the Internal Revenue Code. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatment for items including, but not limited to, wash sales, passive foreign investment companies and capital loss carryforwards.

Reclassifications between Undistributed net investment income (loss), Undistributed net realized capital gains (loss) and Shares of beneficial interest are made to reflect income and gains available for distribution under federal tax regulations. Results of operations and net assets are not effected by these reclassifications. These reclassifications are as follows:

Shares of beneficial interest, unlimited

shares authorized | | $ | (2 | ) | |

| Undistributed net investment income (loss) | | | 785 | | |

Accumulated net realized gain (loss) from investment

securities and foreign currency transactions | | | (783 | ) | |

The capital loss carryforwards are available to offset future realized capital gains through the period listed:

Capital Loss

Carryforward | | Available through | |

| $ | 7,221 | | | October 31, 2009 | |

| | 4,182 | | | October 31, 2010 | |

| | 8,018 | | | October 31, 2011 | |

The capital loss carryforward utilized during the year ended October 31, 2004 was $14,986. The capital loss carryforward was limited due to capital loss carryforward limitations related to fund acquisitions.

The tax character of distributions paid may differ from the character of distributions shown in the Statement of Changes in Net Assets due to short-term gains being treated as ordinary income for tax purposes. The tax character of distributions paid during 2003 and 2004 was as follows:

| 2003 Distributions paid from: | | | |

| Ordinary Income | | $ | – | | |

| Long-term capital gain | | | – | | |

| 2004 Distributions paid from: | | | |

| Ordinary Income | | $ | 478 | | |

| Long-term capital gain | | | – | | |

The tax basis components of distributable earnings as of October 31, 2004, are as follows:

| Undistributed Ordinary Income | | $ | 937 | | |

| Undistributed Long-term Capital Gains | | $ | – | | |

| Capital Loss Carryforward | | $ | (19,421 | ) | |

| Net Unrealized Appreciation (Depreciation) | | $ | 20,787 | * | |

* Amount includes unrealized appreciation (depreciation) from foreign currency and deferred compensation.

The aggregate cost of investments and composition of unrealized appreciation (depreciation) for federal income tax purposes as of October 31, 2004, are as follows:

| Federal Tax Cost Basis | | $ | 196,684 | | |

| Unrealized Appreciation | | $ | 20,774 | | |

| Unrealized (Depreciation) | | | – | | |

| Net Unrealized Appreciation (Depreciation) | | $ | 20,774 | | |

NOTE 5. OTHER MATTERS

Transamerica IDEX Mutual Funds ("TA IDEX"), and certain of its affiliated entities, have received requests for information from the Staff of the Securities and Exchange Commission in connection with market timing and late trading within the funds. TA IDEX and the affiliated entities have voluntarily cooperated in the investigation and have been providing the information as requested.

Transamerica IDEX Mutual Funds

Annual Report 2004

15

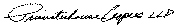

Report of Independent Registered Certified Public Accounting Firm

To the Board of Trustees and Shareholders of

TA IDEX American Century International

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of TA IDEX American Century International (the "Fund") (one of the portfolios constituting the Transamerica IDEX Mutual Funds) at October 31, 2004, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2004 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Tampa, Florida

December 28, 2004

Transamerica IDEX Mutual Funds

Annual Report 2004

16

TA IDEX American Century International

SUPPLEMENTAL INFORMATION (unaudited)

TAX INFORMATION

For dividends paid during the year ended October 31, 2004, the Fund designated $331 of qualified dividend income.

The information and distributions reported herein may differ from the information and distributions taxable to the shareholders for the calendar year ending December 31, 2004. Complete information will be computed and reported in conjunction with your 2004 Form 1099-DIV.

RESULTS OF SHAREHOLDER PROXY

At a special meeting of Class M shareholders of each series of Transamerica IDEX (except TA IDEX Federated Tax Exempt and TA IDEX Protected Principal Stock), as listed above, held on September 2, 2004, the results of the Proposal were as follows:

Proposal 1: Approval of a conversion of Class M shares into Class C shares of the Funds, which will result in bearing the distribution and service fees payable under the 12b-1 Plan of Distribution for the Class C shares of the Funds.

| For | | Against | | Abstentions/Broker Non-Votes | |

| | 81.95 | % | | | 2.71 | % | | | 15.34 | % | |

Transamerica IDEX Mutual Funds

Annual Report 2004

17

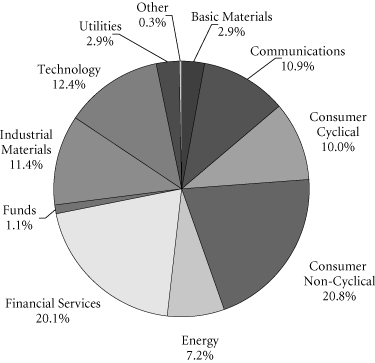

TA IDEX American Century Large Company Value

MARKET ENVIRONMENT

The major U.S. stock indices posted single-digit returns for the fiscal year ended October 31, 2004. Early on, the major indices jumped 10% to levels not seen since 2001. They were boosted by corporate earnings that reached 10-year highs in the fourth quarter of 2003 as the government reported strong economic growth and low inflation. But stock market gains eroded as the price of crude oil jumped 78% to $51.78 a barrel, short-term interest rates climbed, and the annual real rate of economic growth slipped from 8.2% in the third quarter of 2003 to 3.3% and 3.7%, respectively, in the second and third quarters of 2004.

In that environment, we remained true to our discipline of seeking fundamentally sound businesses that, because of transitory issues, are selling at prices we believe are below fair market value. Our investment process led us into each corner of the market, and TA IDEX American Century Large Company Value received positive contributions from all ten sectors in which it was invested.

PERFORMANCE

For the year ended October 31, 2004, TA IDEX American Century Large Company Value, Class A returned 12.38%. By comparison its benchmark, the Standard and Poor's 500 Composite Stock Index, returned 9.41%.

STRATEGY REVIEW

Energy: The Strongest Finish-Investments in the energy sector provided the greatest contribution to performance during the fiscal year. Anxiety over the tightening oil supply was generated by the increase in global demand, the continued conflict in Iraq in addition to the political turbulence in Nigeria, Africa's top oil exporter. These factors were powerful catalysts that sent oil prices to record highs and underpinned gains for major oil and gas companies. Though nearly all of our holdings advanced, ChevronTexaco Corporation ranked among the portfolio's top stocks. Exxon Mobil Corporation and Sunoco, Inc. also made substantial contributions.

Financials Provide Lift-The financials sector, our largest single stake on average, provided considerable lift. Much of this position was devoted to commercial banks, which produced a number of top contributors, including Bank of America Corporation and Wells Fargo & Company. Insurance companies also added value overall, and in that group, Fidelity National Financial, Inc. was a noteworthy name. However, late in the period, several companies in this industry came under regulatory and legal scrutiny, and some of our holdings were swept lower in the ensuing sell-off. Marsh & McLennan Companies, Inc. ranked among the portfolio's top-detracting stocks.

Consumer Stocks: Another Bright Spot-TA IDEX American Century Large Company Value's interest in the consumer discretionary sector also delivered a significant contribution to performance. Media companies were the strongest performers. One success from that group was The Walt Disney Company ("Disney"), which benefited from growth in each of its business segments. During the period, Disney enjoyed a 32% increase in revenues from its parks and resorts division driven by higher attendance and occupancy at Walt Disney World. Strength in its cable networks, including ESPN and The Disney Channel, also bolstered Disney's overall results.

Utilities Add Value-Our bottom-up strategy led us to select companies in the utilities sector. Electric utilities paced gains in the group, and Exelon Corporation and Edison International finished among the top contributors for the period.

Some Setbacks-Despite positive contributions overall from each of our sector positions, there were individual setbacks along the way, and some of our holdings retreated in this otherwise upbeat environment. One that fell short was Intel Corporation, the world's largest chipmaker, which reported second- and third-quarter earnings that were robust but slightly below forecasts. Hewlett-Packard Company also detracted during the period.

We will remain focused on our discipline of searching for large, fundamentally sound businesses that, for temporary reasons, are selling at a discount to what we believe are fair market values.

Mark Mallon

Charles A. Ritter

Brendan Healy, CFA

Co-Fund Managers

American Century Investment Management, Inc.

Transamerica IDEX Mutual Funds

Annual Report 2004

1

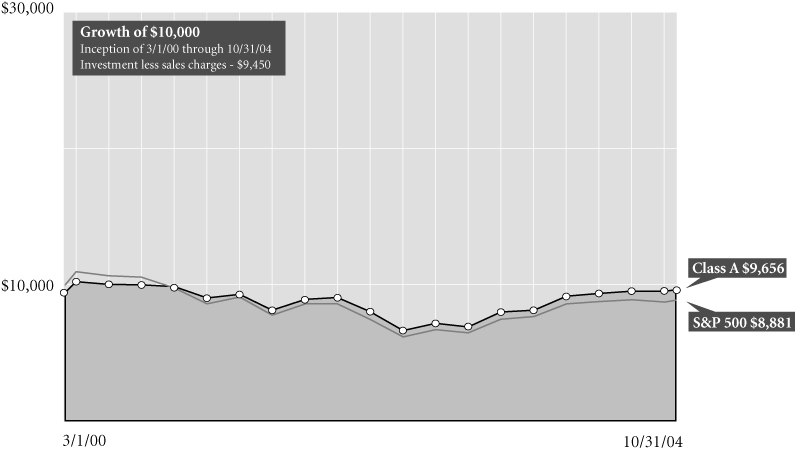

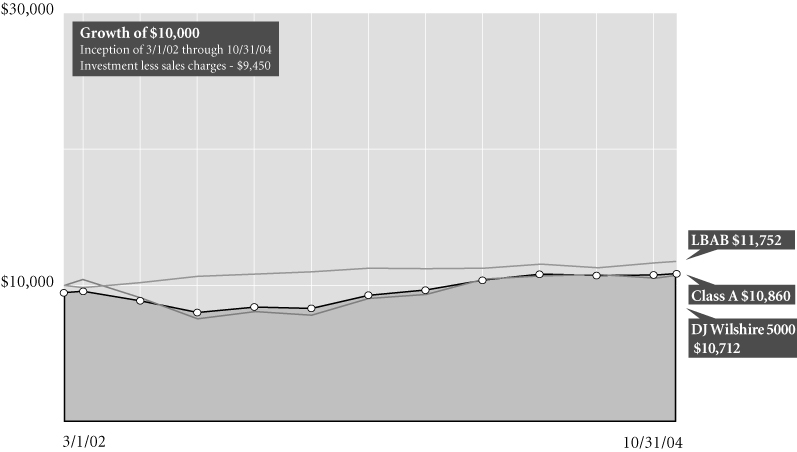

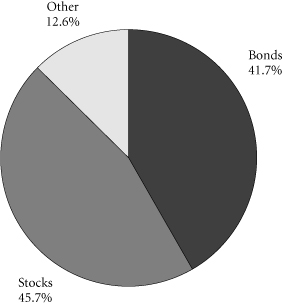

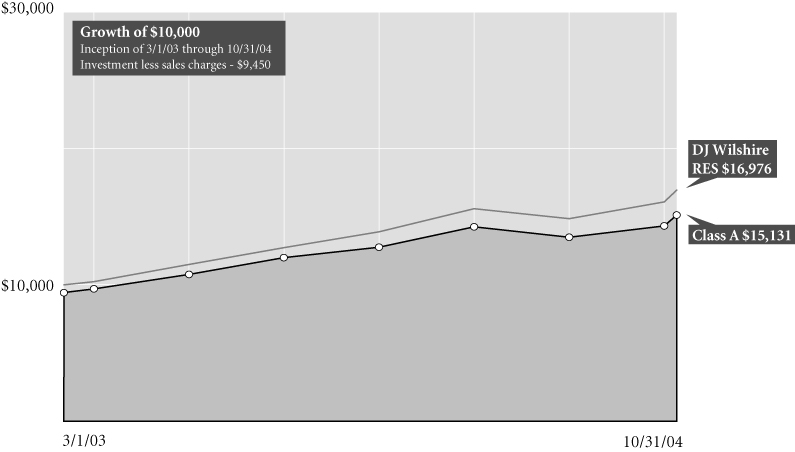

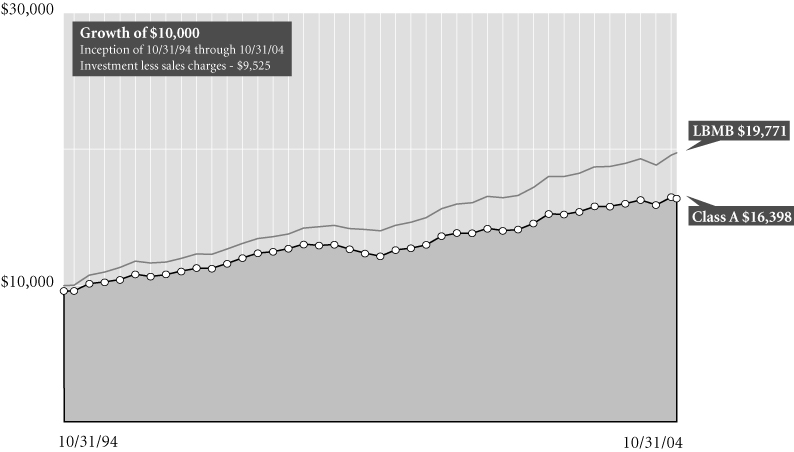

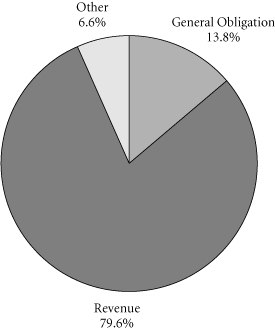

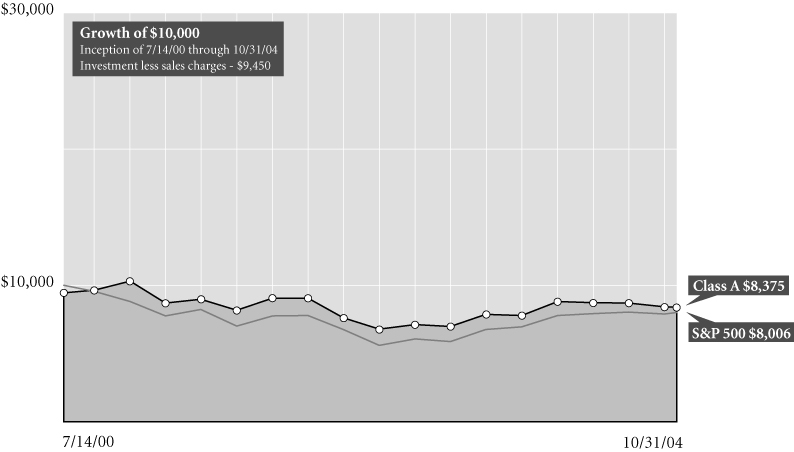

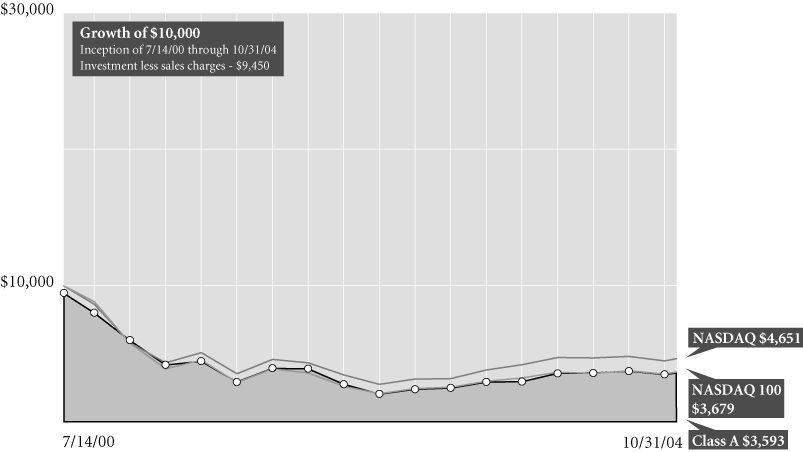

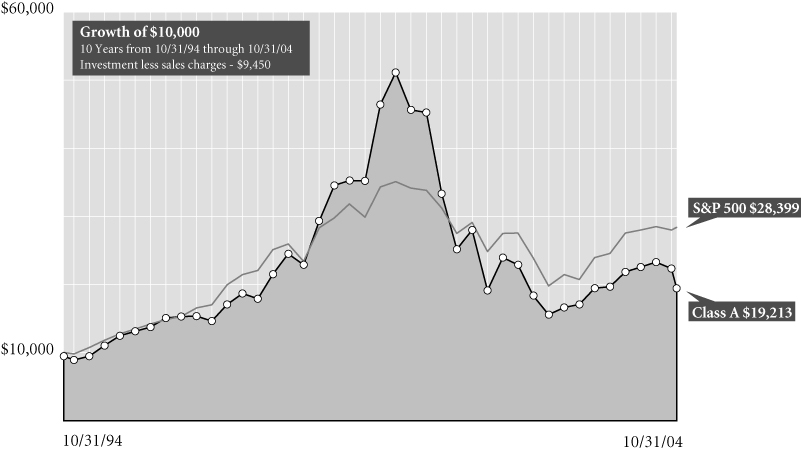

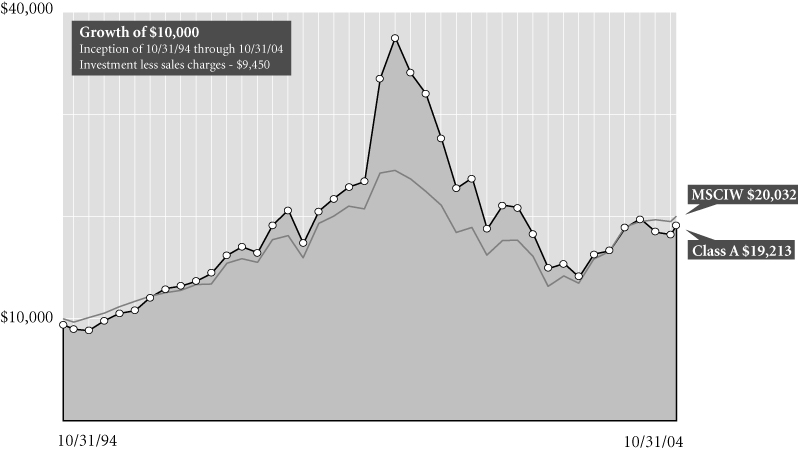

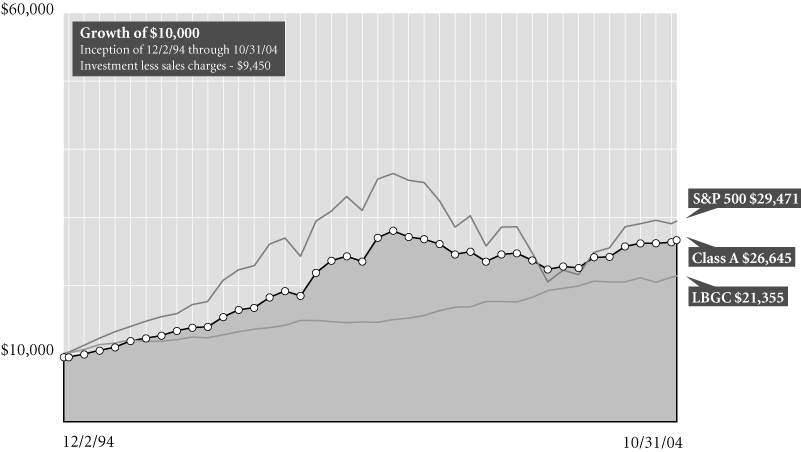

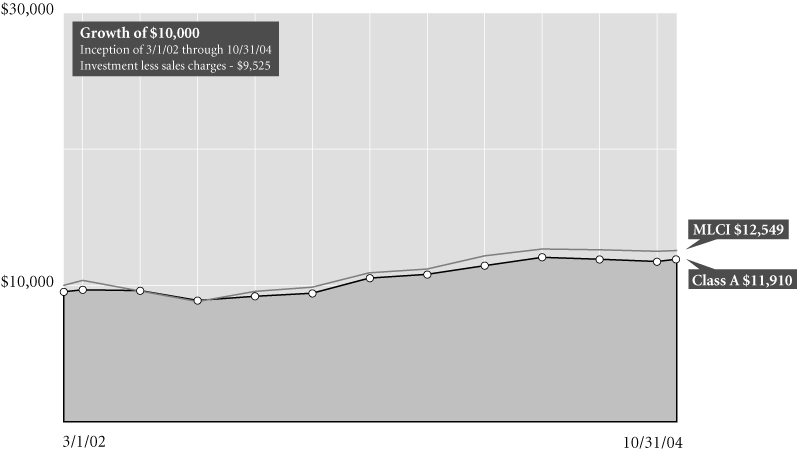

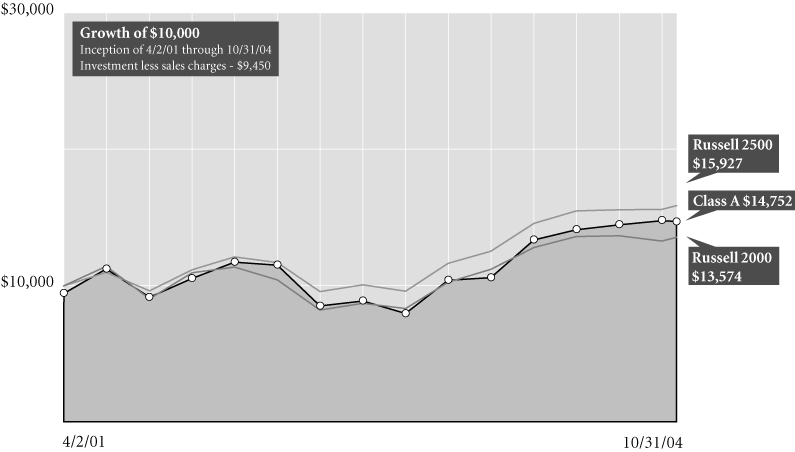

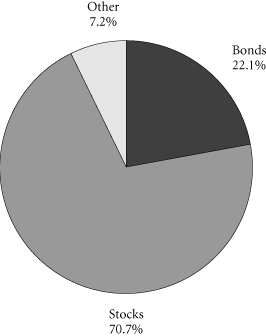

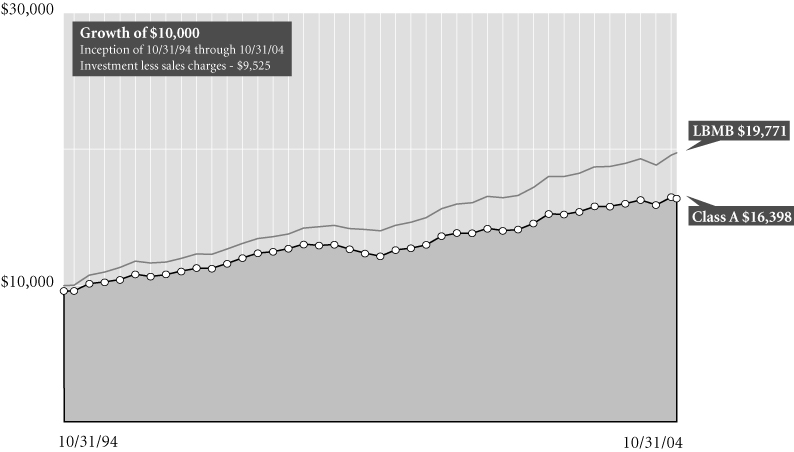

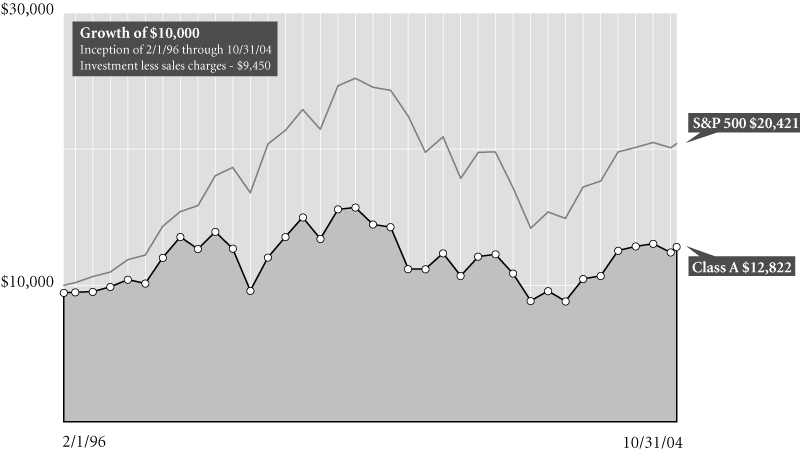

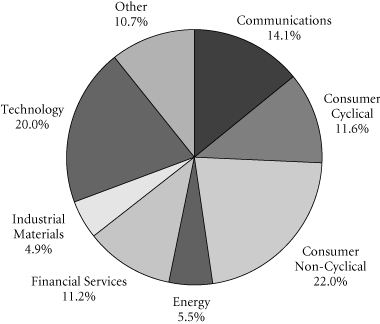

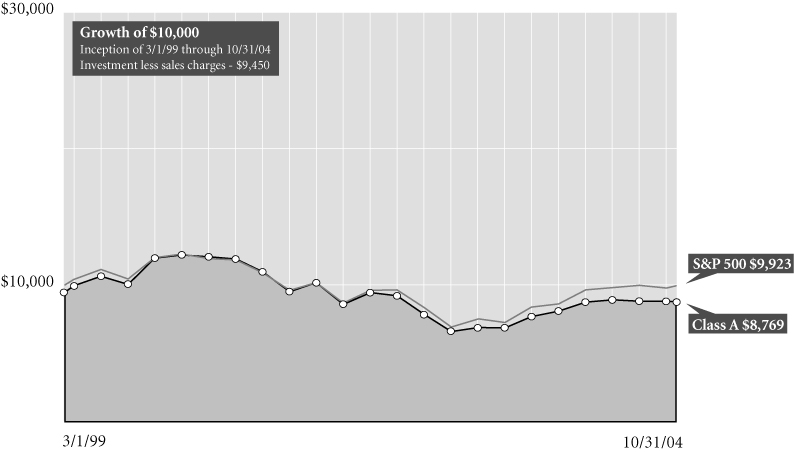

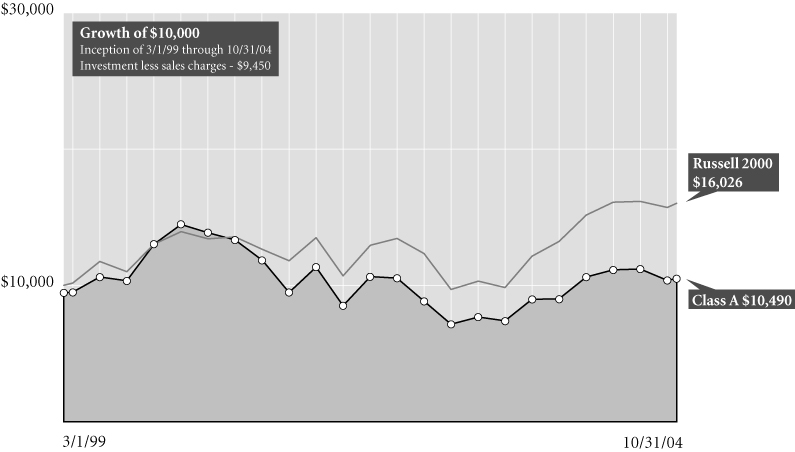

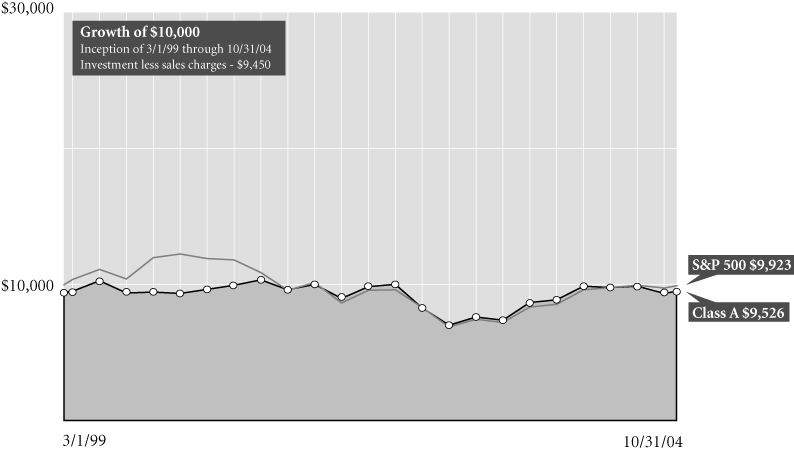

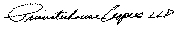

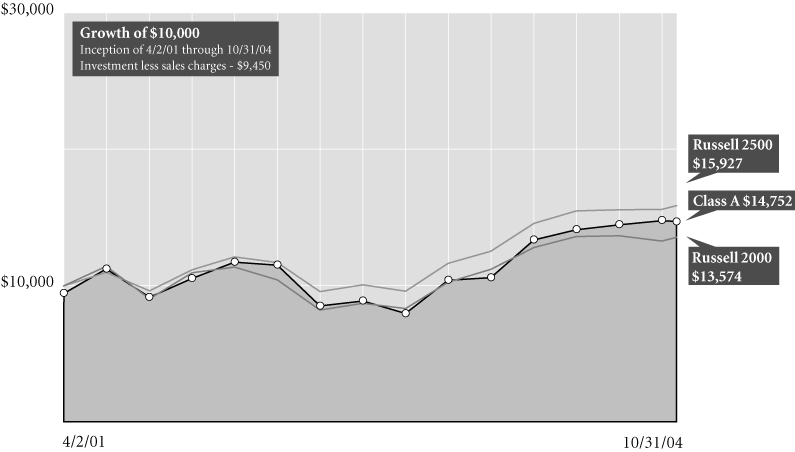

TA IDEX American Century Large Company Value

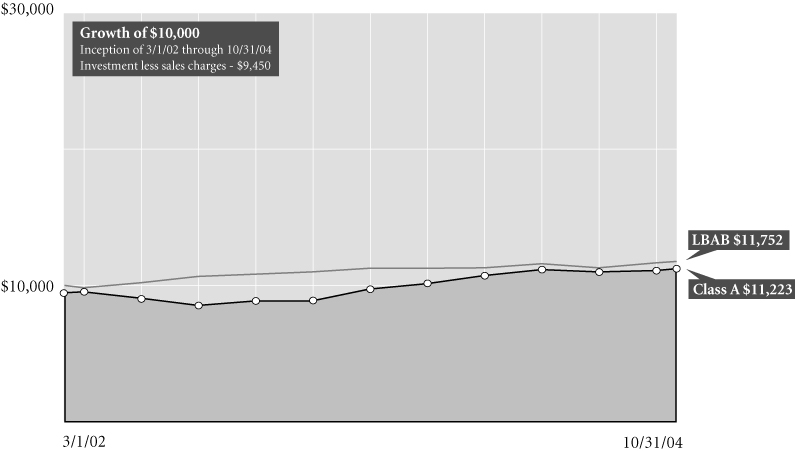

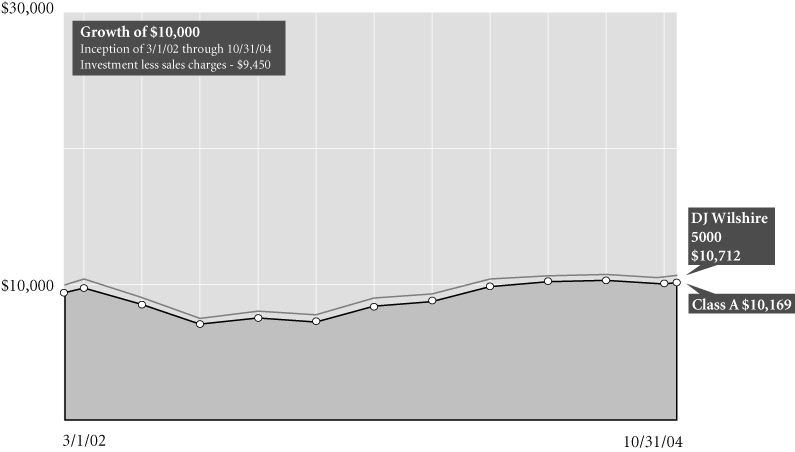

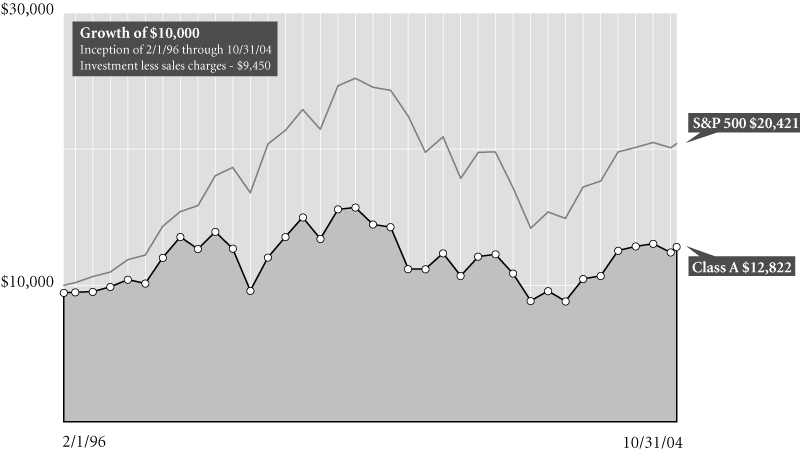

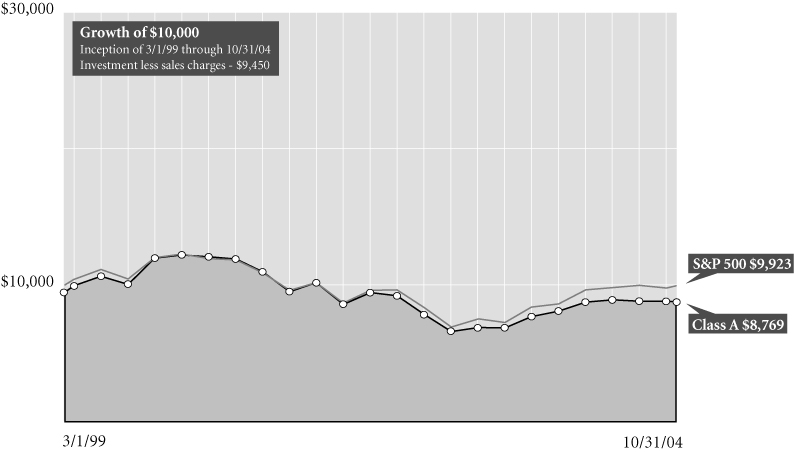

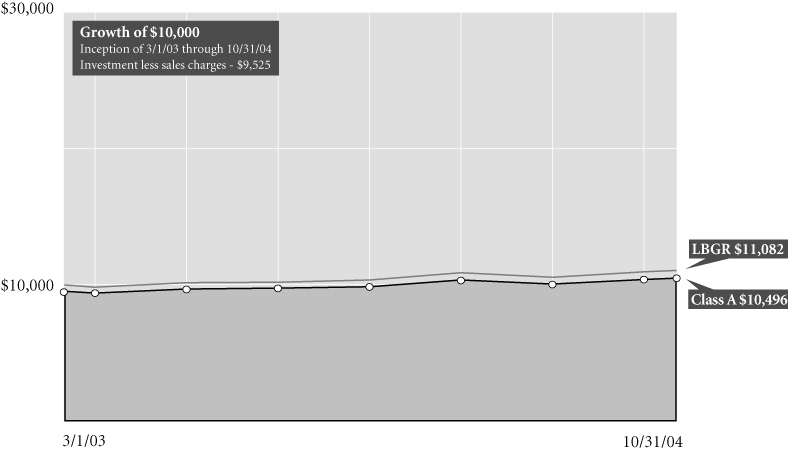

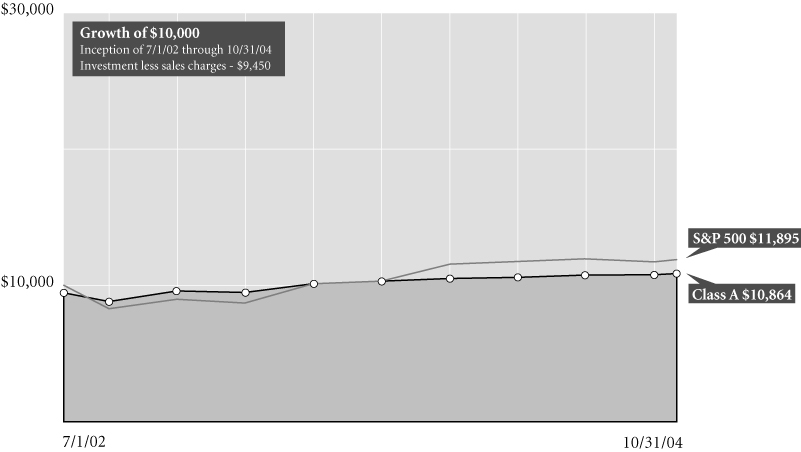

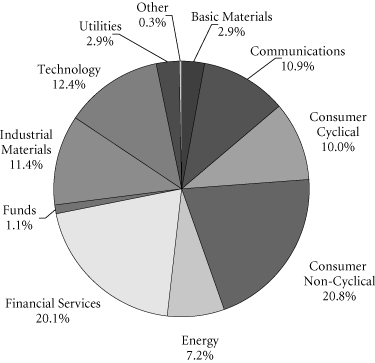

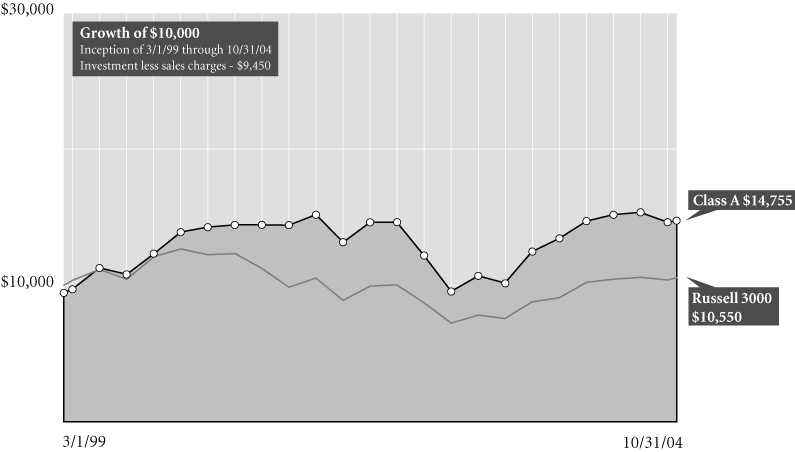

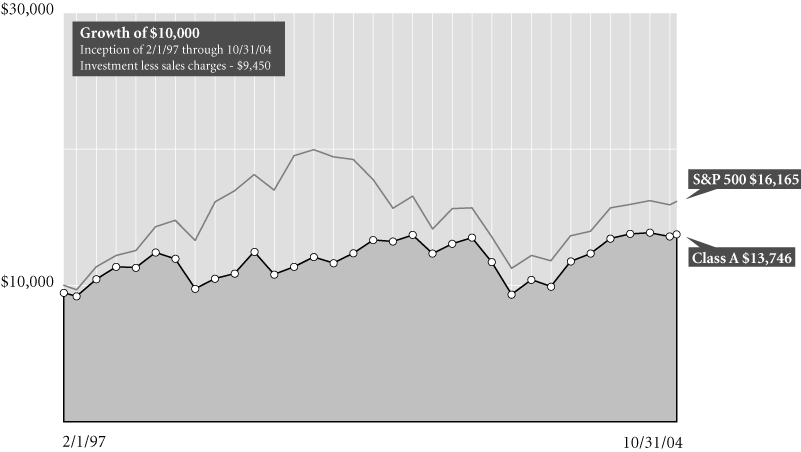

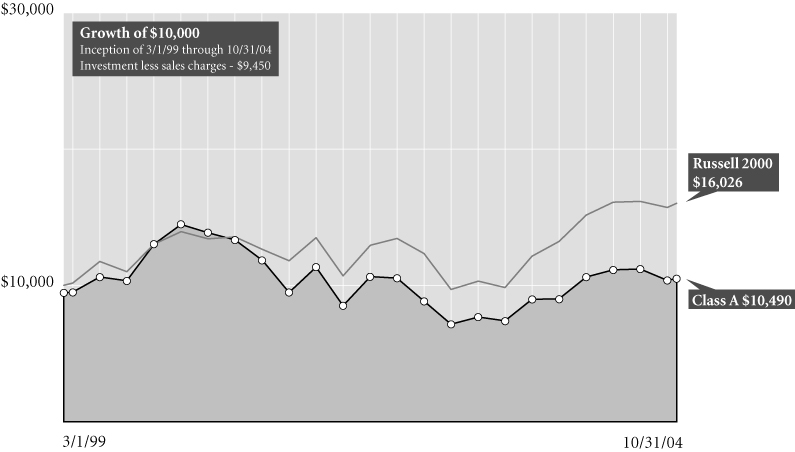

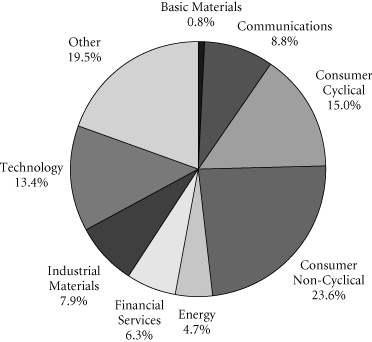

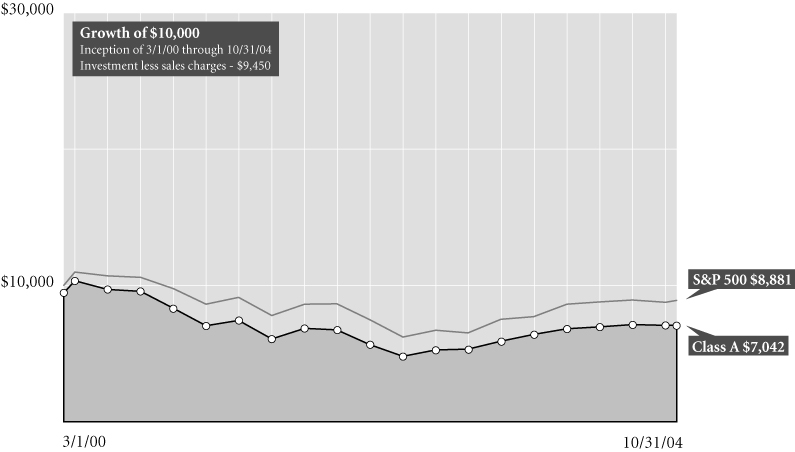

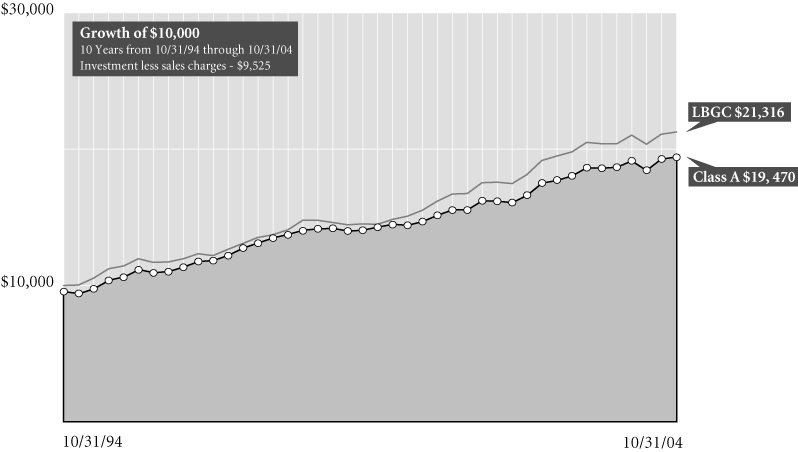

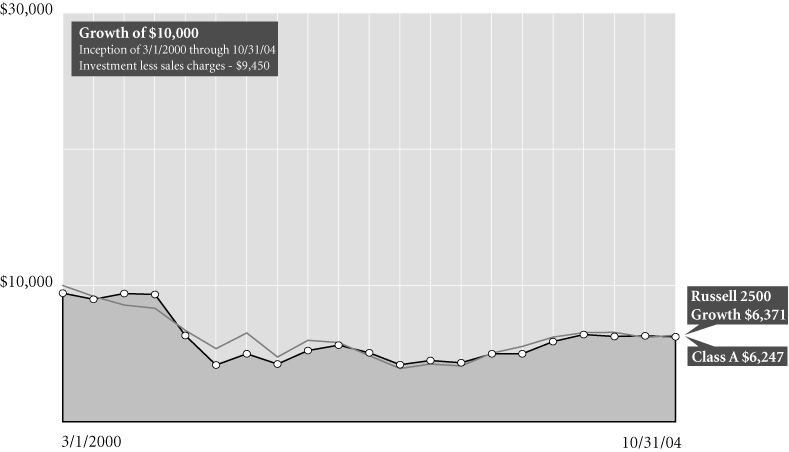

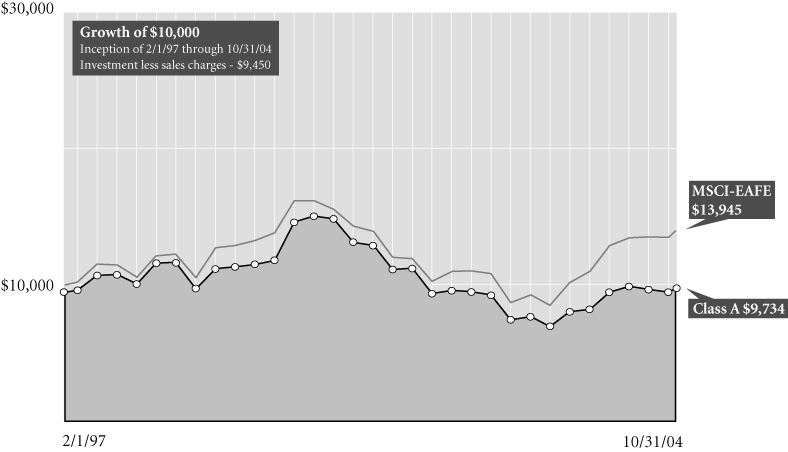

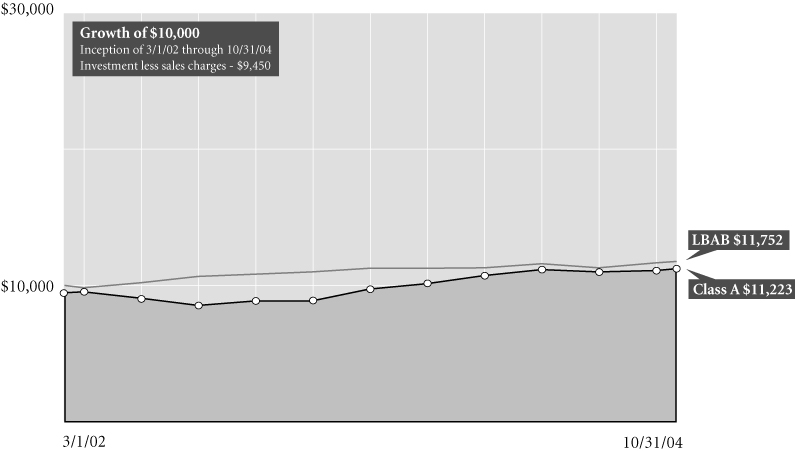

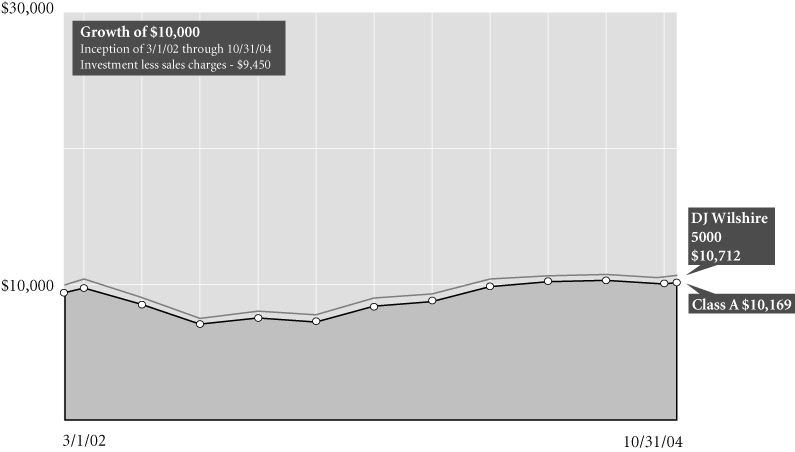

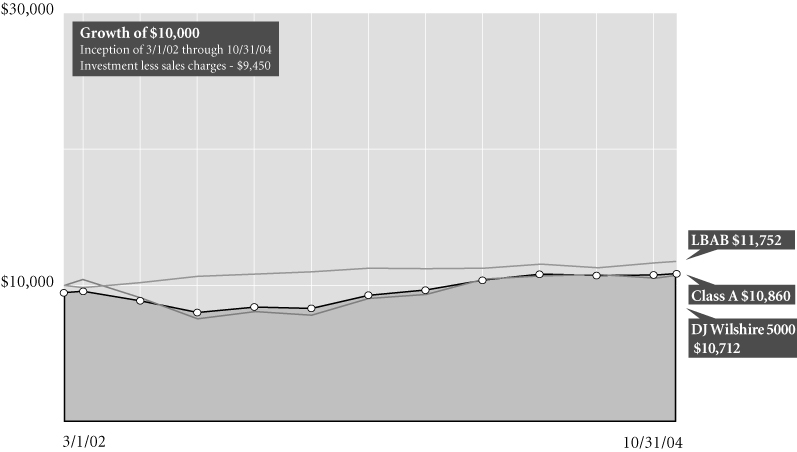

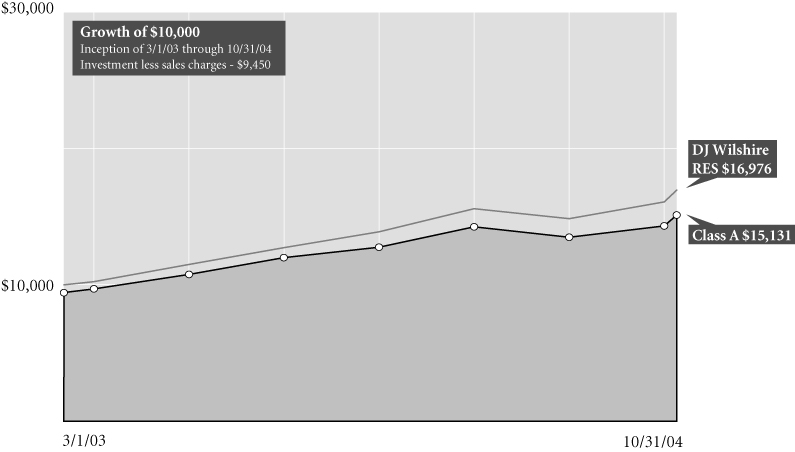

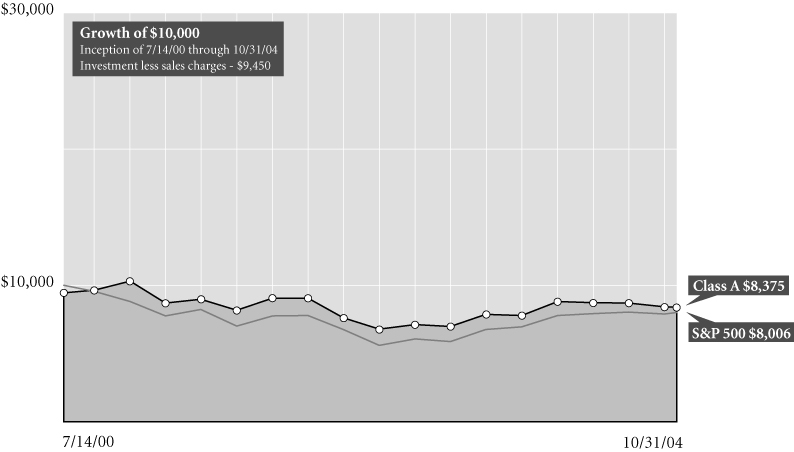

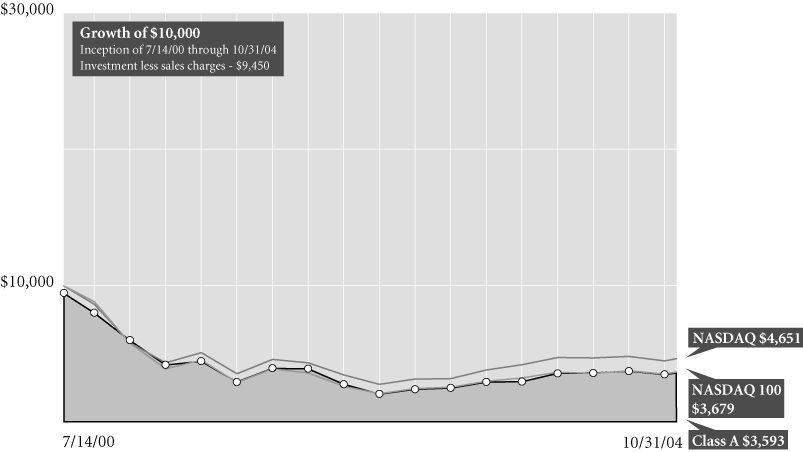

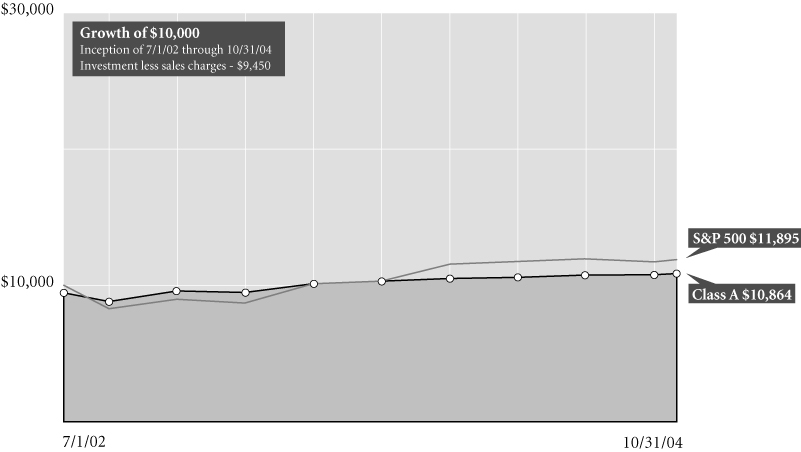

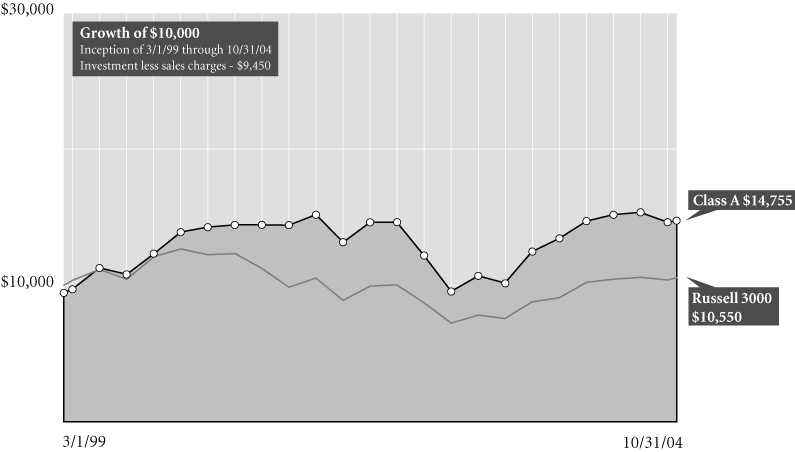

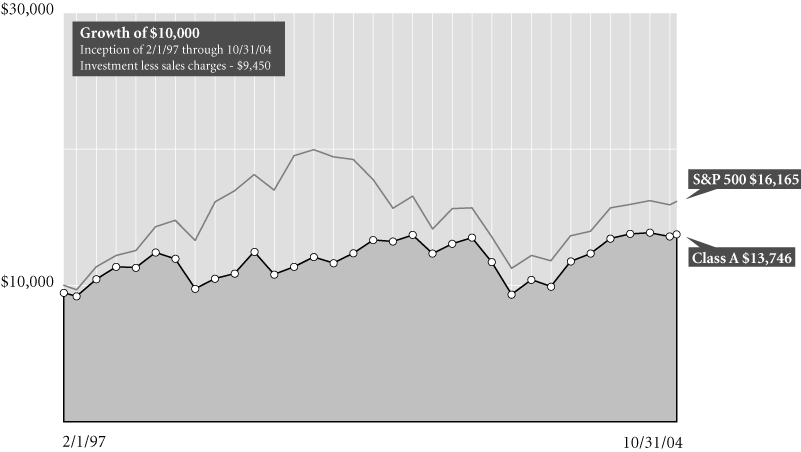

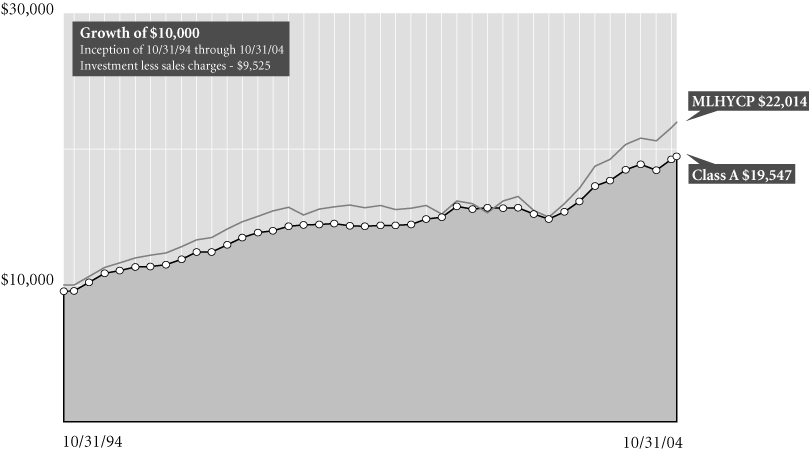

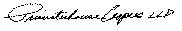

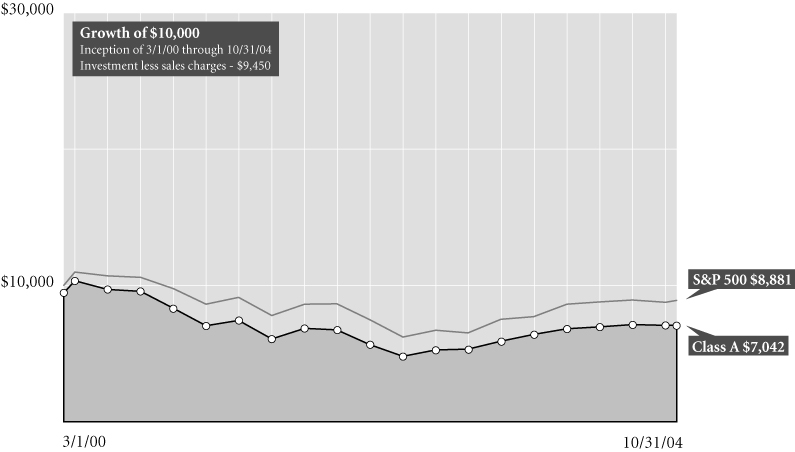

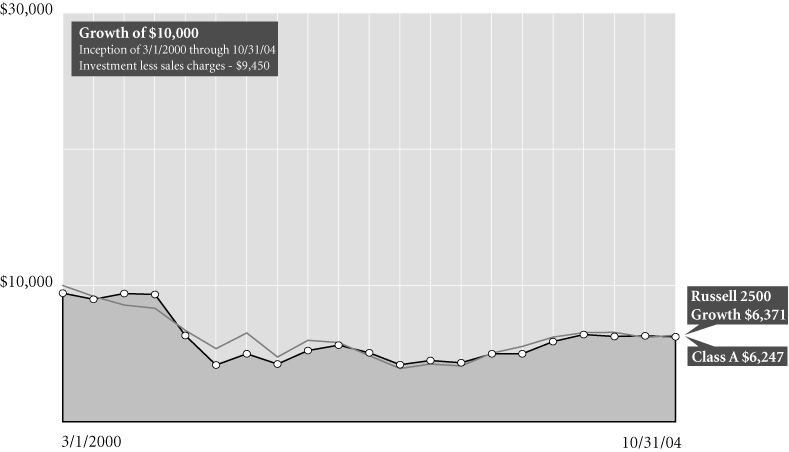

Comparison of change in value of $10,000 investment in Class A shares and its comparative index.

Average Annual Total Return for Periods Ended 10/31/04

| | | 1 year | | From

Inception | | Inception

Date | |

| Class A (NAV) | | | 12.38 | % | | | 0.46 | % | | 3/1/00 | |

| Class A (POP) | | | 6.19 | % | | | (0.75 | )% | | 3/1/00 | |