As filed with the SEC on January 9, 2006.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-4556 |

|

TRANSAMERICA IDEX MUTUAL FUNDS |

(Exact name of registrant as specified in charter) |

|

570 Carillon Parkway, St. Petersburg, Florida | | 33716 |

(Address of principal executive offices) | | (Zip code) |

|

John K. Carter, Esq. P.O. Box 9012, Clearwater, Florida 33758-9771 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (727) 299-1800 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | November 1, 2004 - October 31, 2005 | |

| | | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1: Report(s) to Shareholders.

Annual Report

October 31, 2005

www.transamericaidex.com

Investor Services 1-888-233-IDEX (4339)

P.O. Box 9012 • Clearwater, FL 33758-9012

Distributor: AFSG Securities Corporation, Member NASD

Dear Shareholder,

On behalf of Transamerica IDEX Mutual Funds, I would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial advisor in the future. We value the trust you have placed in us.

This annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your funds. The Securities and Exchange Commission requires that an annual report be sent to all shareholders, and we believe it to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a summary of significant accounting policies followed by the Fund in the preparation of the financial statements, and includes matters presented to shareholders that may have required their vote.

We believe it is important to recognize and understand current market conditions in order to provide a context for reading the contents of this report. During the past six months, the market environment has been closely tied to investor expectations of inflation and oil prices. Hurricanes Katrina and Rita have exerted additional pressure on oil prices, increased concern over consumer spending patterns, and have lowered expectations for Gross Domestic Product (GDP) growth in the near term. The Federal Reserve has continued to raise interest rates, which has raised investor fears of a slowdown in the economy. While economic growth continues to remain positive, creating investment opportunities, given this economic backdrop it is prudent to maintain a diversified portfolio and avoid speculation as investment returns have been historically difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial professional is the key resource to help you build a comprehensive picture of your current and future financial needs. In addition, financial advisors are familiar with the market's history, including long-term returns and volatility of various asset classes.

With your financial advisor, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial advisor if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

Brian C. Scott

President

Transamerica IDEX Mutual Funds | | Christopher Staples

Vice President – Investment Management

Transamerica IDEX Mutual Funds | |

|

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of Transamerica IDEX Mutual Funds. These views are subject to change based upon market conditions. These views should not be relied on as investment advice and are not indicative of a trading intent on behalf of the Transamerica IDEX Mutual Funds.

TA IDEX American Century International

MARKET ENVIRONMENT

Many of the world's equity markets advanced during the twelve months ended October 31, 2005, demonstrating their resilience in the face of: surging prices for commodities, especially oil; a terrorist attack in London; destructive hurricanes; and numerous interest-rate increases by the Federal Reserve Board ("Fed").

Against this backdrop, the portfolio advanced but underperformed its benchmark, the Morgan Stanley Capital International EAFE Index ("MSCI-EAFE"). Each of the ten sectors in which we were invested advanced, with our complement of financial holdings, the portfolio's heaviest sector stake, posting the largest contribution to absolute return.

On a relative basis, the portfolio's consumer discretionary and telecommunication services sectors contributed most. But several sectors, notably materials and consumer staples, underperformed the MSCI-EAFE, ultimately causing the portfolio to lag the benchmark.

PERFORMANCE

For the year ended October 31, 2005, TA IDEX American Century International, Class A returned 15.17%. By comparison its benchmark, the MSCI-EAFE returned 18.59%.

STRATEGY REVIEW

Financials contributed most to absolute return. The portfolio's position in commercial banks led the gains. Anglo Irish Bank Company plc made one of the period's largest contributions to total return. The bank reported record growth in lending during the period, partly due to strong loan demand in Ireland. Financials, however, lagged the MSCI-EAFE, due mostly to companies in the capital markets industry.

Our complement of holdings in the industrials sector made the second-largest contribution to absolute return. Companies in construction and engineering led the advance. Pacing the gains were Spain's Grupo Ferrovial S.A. ("Grupo"), one of Spain's largest construction companies, and Vinci SA ("Vinci"), a French construction company. Vinci benefited from concessions that manage parking lots, toll-road operations, and numerous construction projects in France and elsewhere. The industrials sector also made the period's third-largest relative contribution, outperforming the MSCI-EAFE partly on the strength of our overweight positions in Grupo and Vinci. Grupo was among the securities contributing most to absolute and relative performance during the period.

The portfolio's holdings in the consumer discretionary sector delivered the best performance against the MSCI-EAFE, due mostly to effective security selection among specialty retail companies. The portfolio's overweight position in electronics retailer Yamada Denki, Co., Ltd. ("Yamada") led the advance in the specialty retail industry. Japan's Yamada, which benefited from strong sales of thin-panel televisions, contributed more than any other security to relative performance, and also contributed most to absolute return. Our position in the household durables industry also beat the benchmark, partly due to lack of exposure to several Japanese electronics makers that detracted from the MSCI-EAFE.

The consumer discretionary sector, however, also included the position that detracted more than any other security from the portfolio's relative and absolute performance – Next PLC ("Next"). One of the largest clothing retailers in the United Kingdom ("U.K."), Next declined partly because of a slump in consumer spending in the U.K.

Our position in the telecommunications services sector made the second largest contribution to relative performance, mostly due to effective security selection in the wireless telecommunication services industry. We benefited from a portfolio-only position in America Movil, S.A. de C.V. ("America Movil"), Latin America's biggest mobile-phone company. America Movil topped the list of contributors in the wireless industry, and was also among the ten securities contributing most to performance against the MSCI-EAFE.

The materials sector detracted most from the portfolio's relative performance. Holdings in the construction materials industry did much of the damage, with France's Lafarge S.A. ("Lafarge"), one of the world's biggest cement makers, declining after reporting a drop in North American demand and a slowdown in German construction. The containers and packaging industry also declined. Australian packing company Amcor Limited ("Amcor") retreated after announcing that rising materials costs were cutting into profits. Both Lafarge and Amcor were among the securities that detracted most from our performance against the MSCI-EAFE during the period.

The portfolio's consumer staples holdings also detracted from relative performance. Overweight positions in the food staples and retailing, food products and household products industries all lagged the benchmark.

Regarding countries, investments in France, Ireland and Mexico made the largest contribution relative to the MSCI-EAFE, while those in the United Kingdom, Japan and Germany detracted most.

Keith Creveling, CFA

Michael Perelstein

Co-Fund Managers

American Century Global Investment Management, Inc.

Transamerica IDEX Mutual Funds

Annual Report 2005

1

TA IDEX American Century International

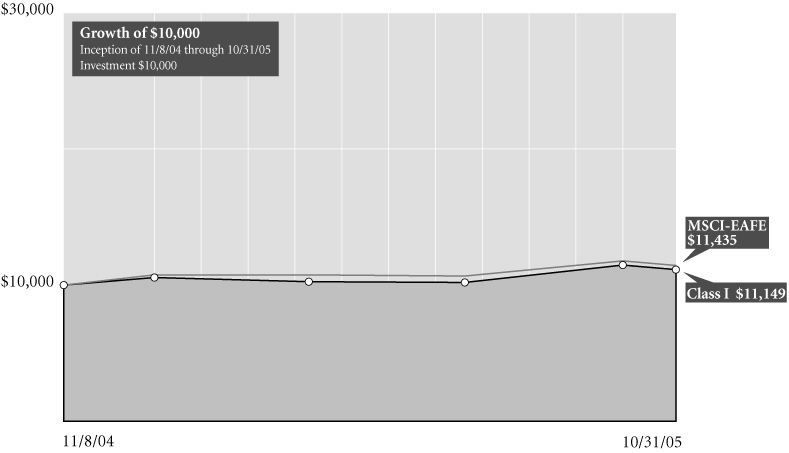

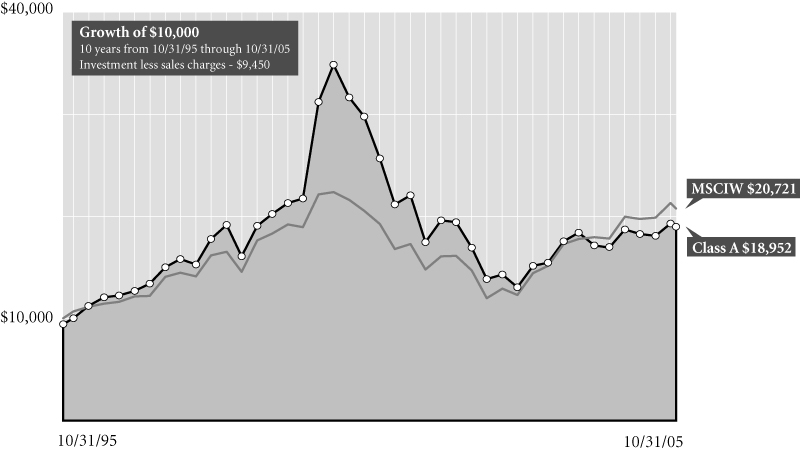

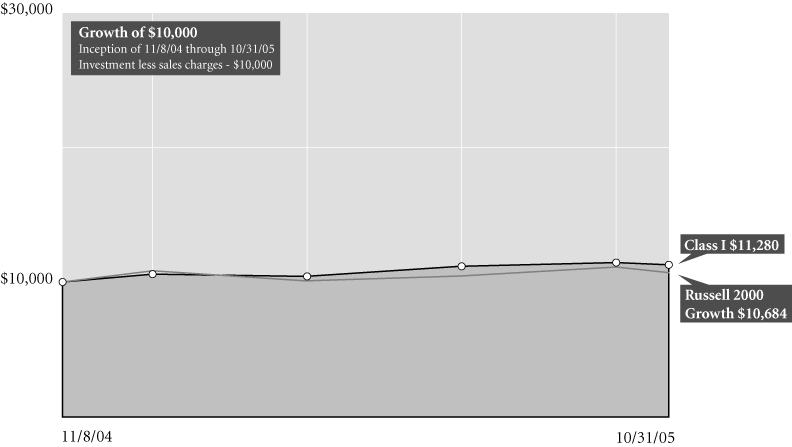

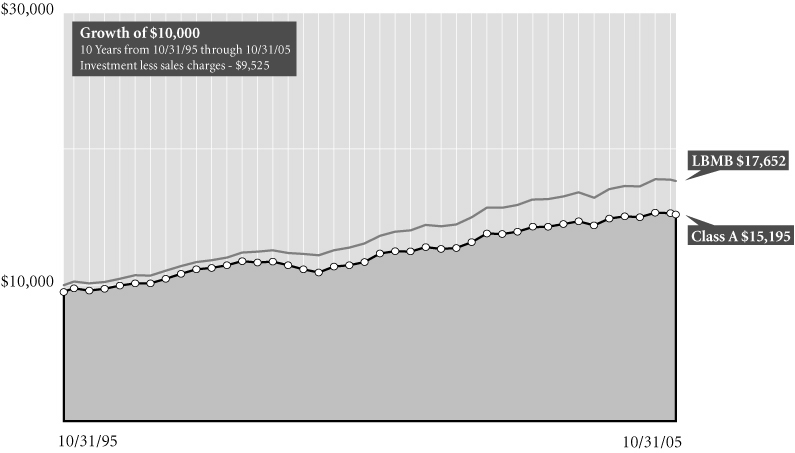

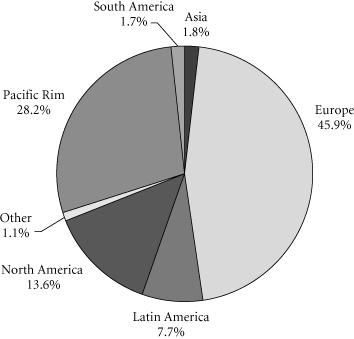

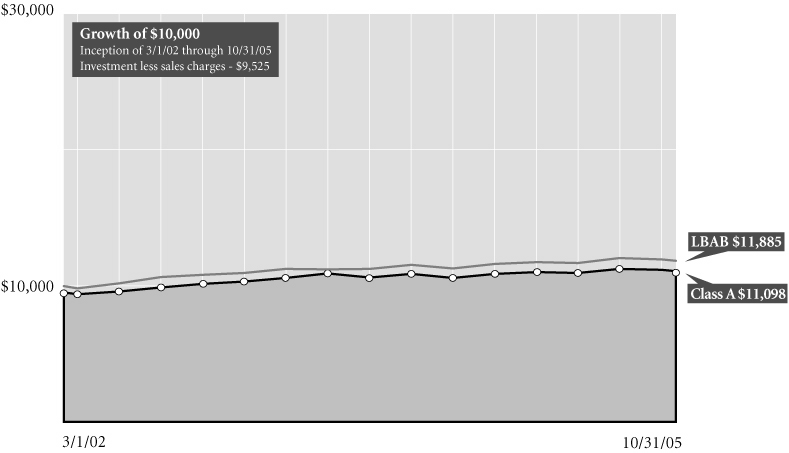

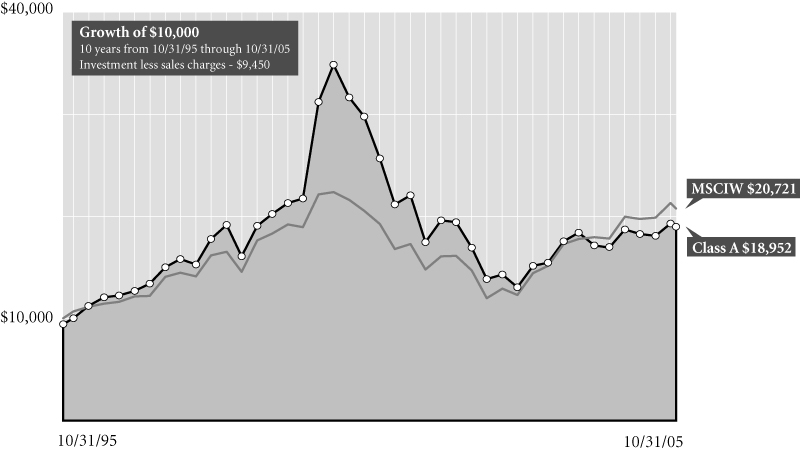

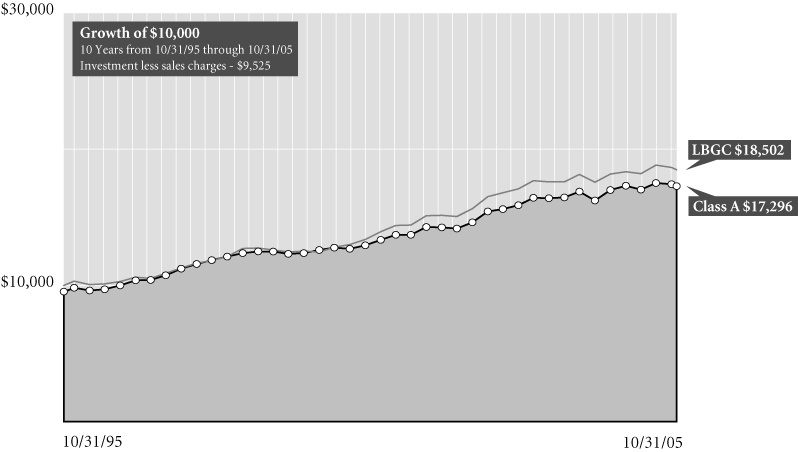

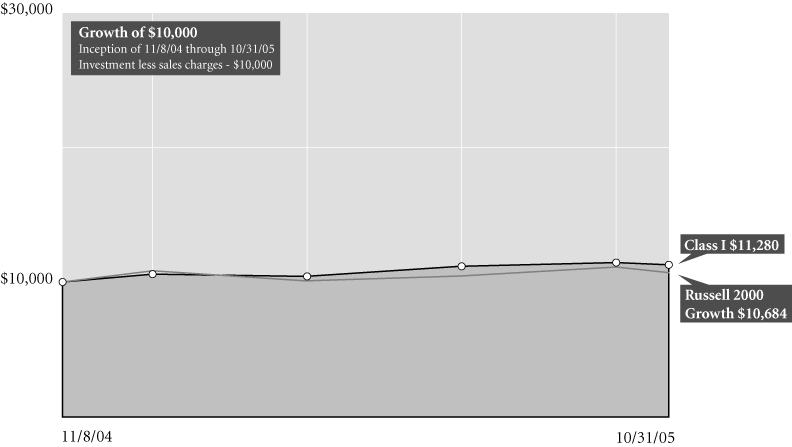

Comparison of change in value of $10,000 investment in Class A shares and its comparative index.

Average Annual Total Return for Periods Ended 10/31/05

| | | 1 year | | 5 years | | From

Inception | | Inception

Date | |

| Class A (NAV) | | | 15.17 | % | | | (2.25 | )% | | | 1.97 | % | | 2/1/97 | |

| Class A (POP) | | | 8.84 | % | | | (3.35 | )% | | | 1.31 | % | | 2/1/97 | |

| MSCI-EAFE1 | | | 18.59 | % | | | 3.42 | % | | | 5.92 | % | | 2/1/97 | |

| Class B (NAV) | | | 14.41 | % | | | (2.88 | )% | | | 1.32 | % | | 2/1/97 | |

| Class B (POP) | | | 9.41 | % | | | (3.06 | )% | | | 1.32 | % | | 2/1/97 | |

| Class C (NAV) | | | 14.36 | % | | | – | | | | 12.78 | % | | 11/11/02 | |

| Class C (POP) | | | 13.36 | % | | | – | | | | 12.78 | % | | 11/11/02 | |

NOTES

1 The Morgan Stanley Capital International-Europe, Australasia, and Far East (MSCI-EAFE) Index is a widely recognized unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception calculation is based on life of Class A shares. Source: Standard & Poor's Micropal®© Micropal, Inc. 2005 – 1-800-596-5323 – http://www.funds-sp.com.

The performance data presented represents past performance, future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericaidex.com for performance data current to the most recent month-end.

Public Offering Price (POP) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. Net Asset Value (NAV) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges.

International investing involves special risks including currency fluctuations, political instability, and different financial accounting standards.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this fund.

Transamerica IDEX Mutual Funds

Annual Report 2005

2

TA IDEX American Century International

UNDERSTANDING YOUR FUND'S EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions and redemption fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, and other fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at May 1, 2005 and held for the entire period until October 31, 2005.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. If your account is an IRA, your expenses could have included a $15 annual fee. The amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

| | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio | | Expenses Paid

During Period (a) | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,074.90 | | | | 1.78 | % | | $ | 9.31 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,016.23 | | | | 1.78 | | | | 9.05 | | |

| Class B | |

| Actual | | | 1,000.00 | | | | 1,071.30 | | | | 2.33 | | | | 12.16 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,013.46 | | | | 2.33 | | | | 11.82 | | |

| Class C | |

| Actual | | | 1,000.00 | | | | 1,071.90 | | | | 2.33 | | | | 12.17 | | |

| Hypothetical (b) | | | 1,000.00 | | | | 1,013.46 | | | | 2.33 | | | | 11.82 | | |

(a) Expenses are calculated using each Fund's annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by number of days in the period (184 days), and divided by the number of days in the year (365 days).

(b) 5% return per year before expenses.

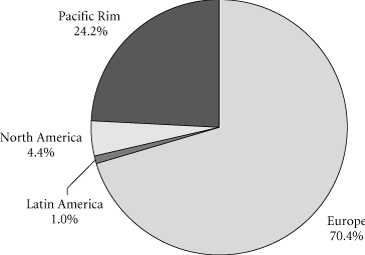

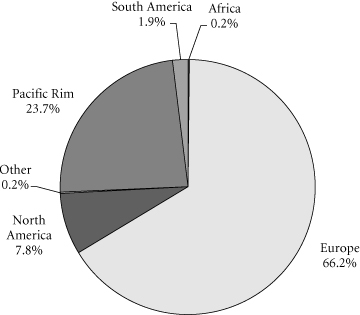

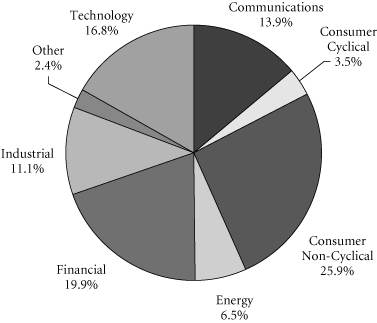

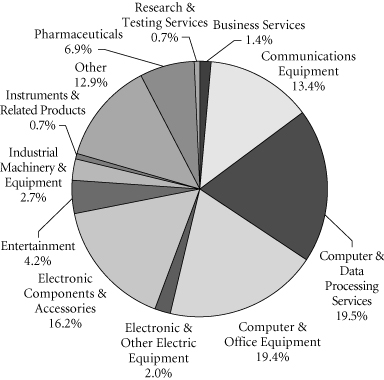

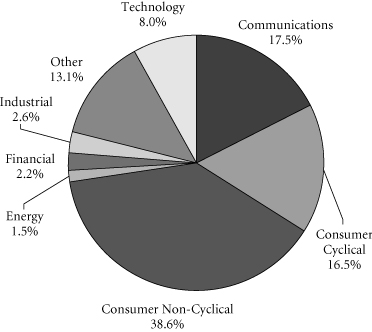

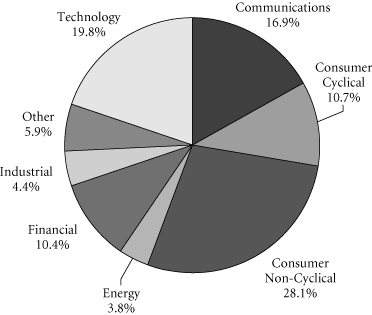

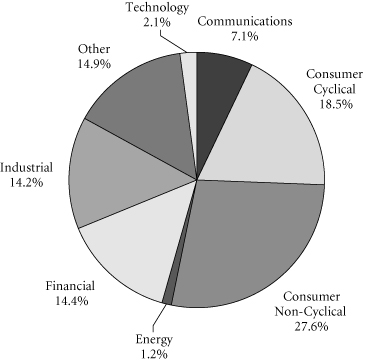

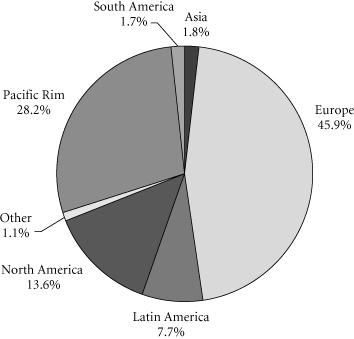

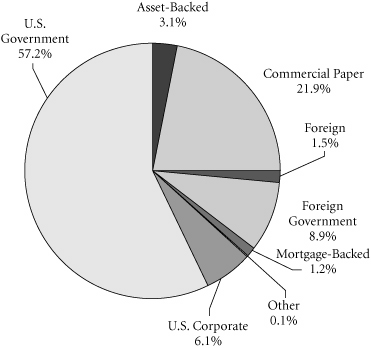

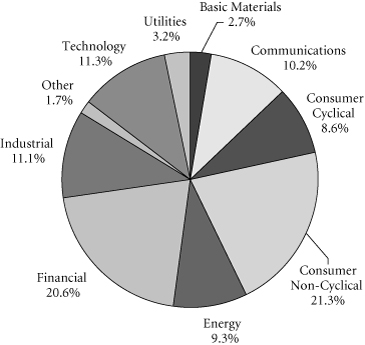

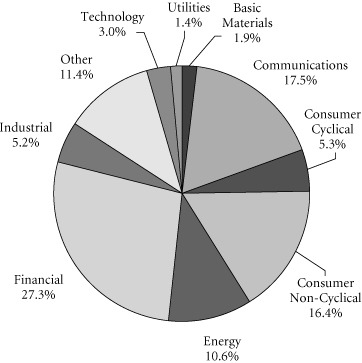

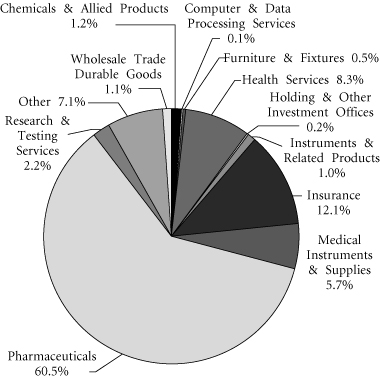

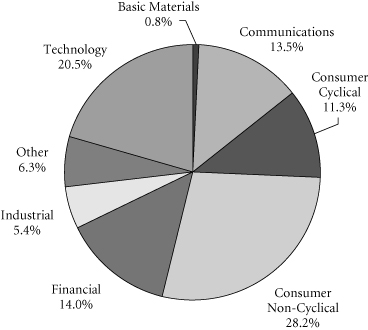

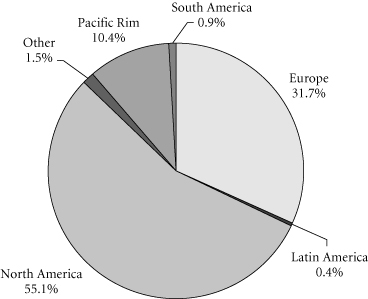

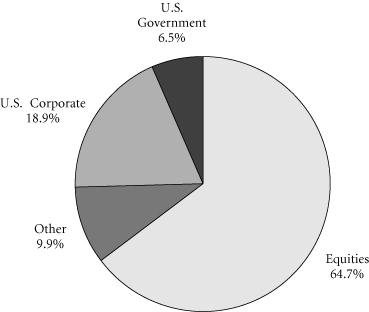

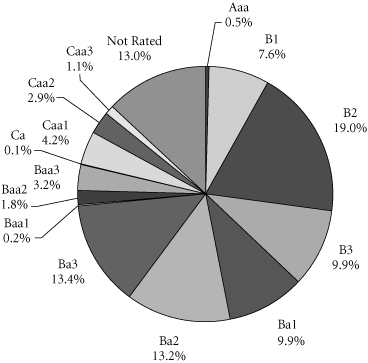

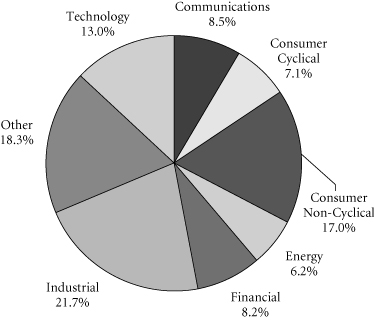

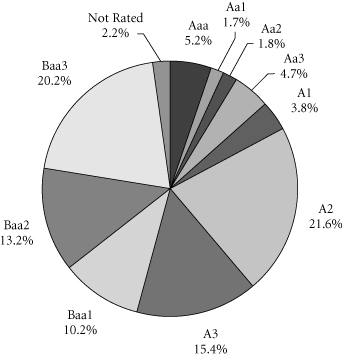

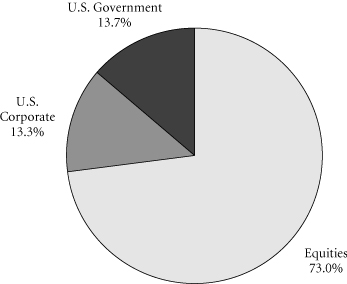

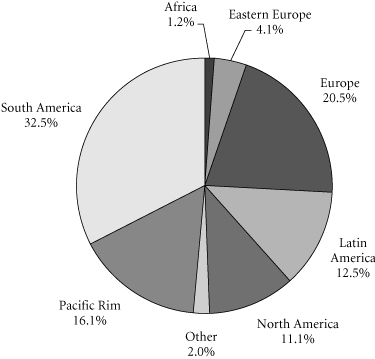

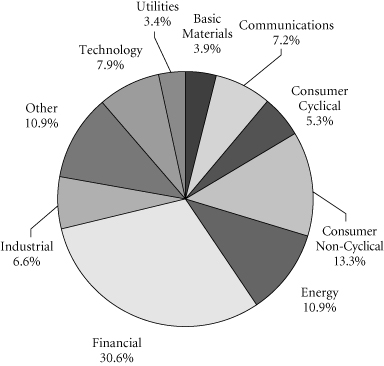

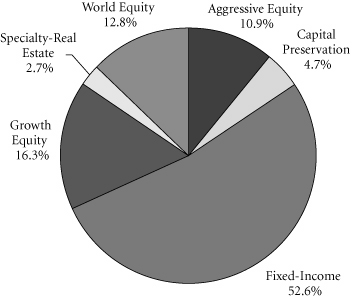

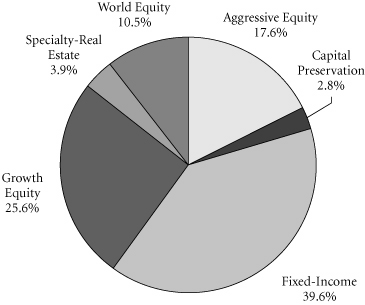

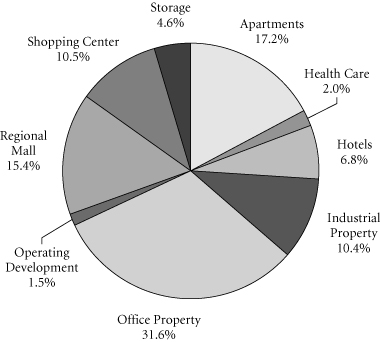

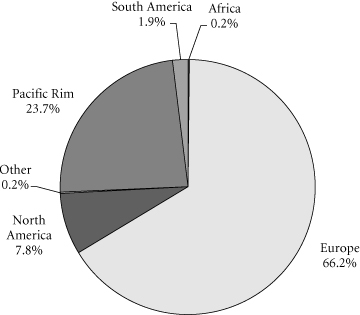

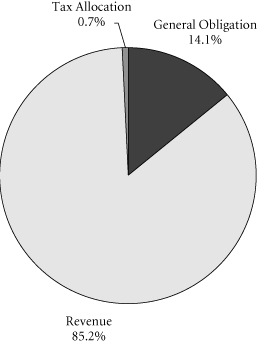

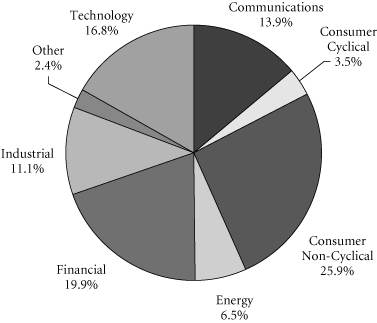

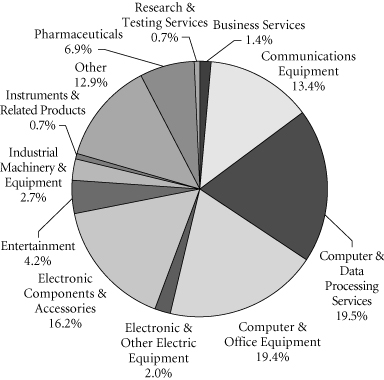

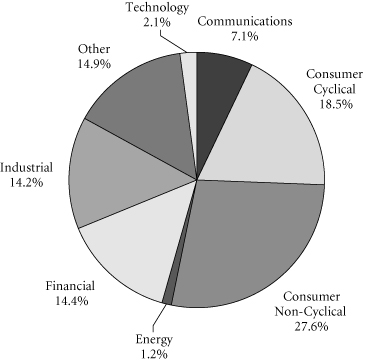

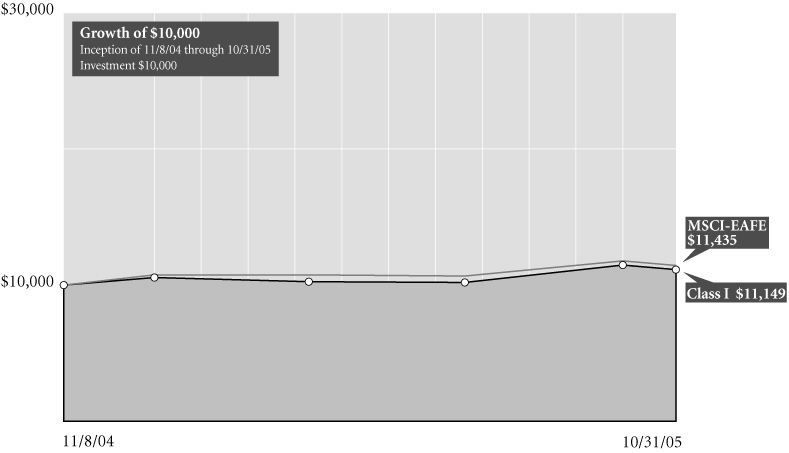

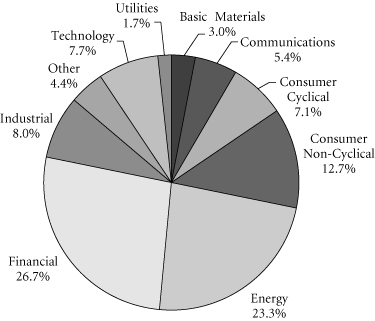

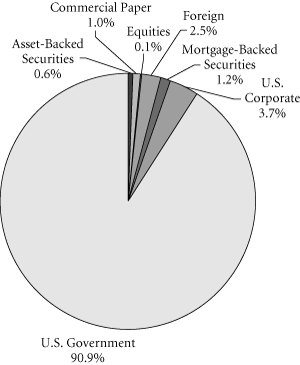

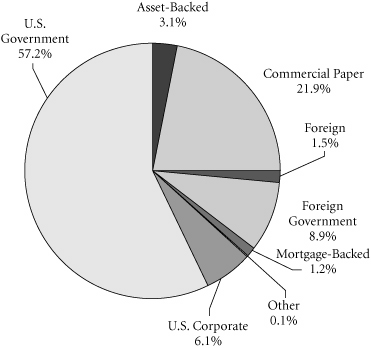

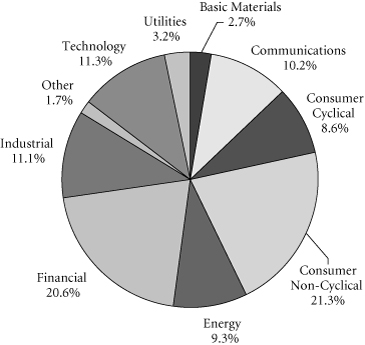

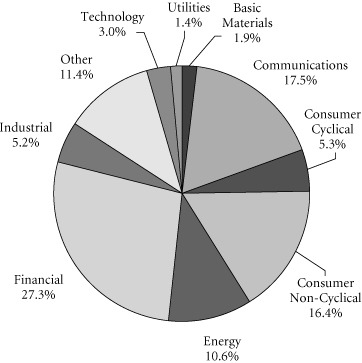

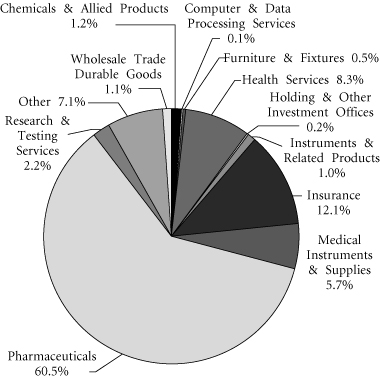

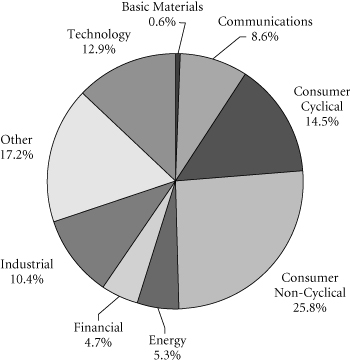

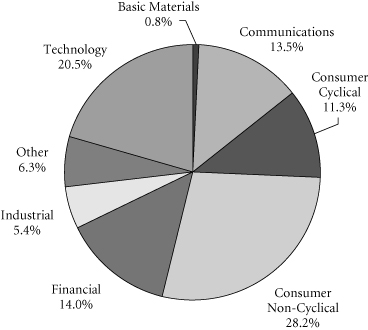

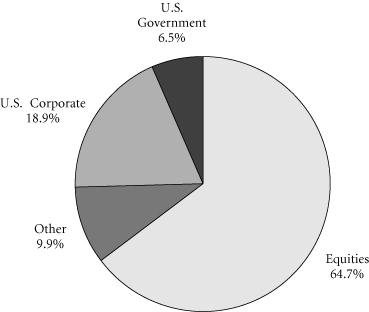

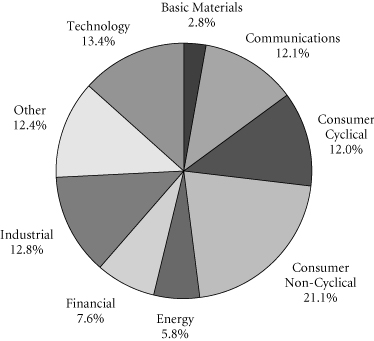

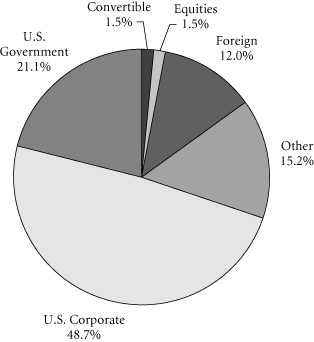

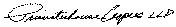

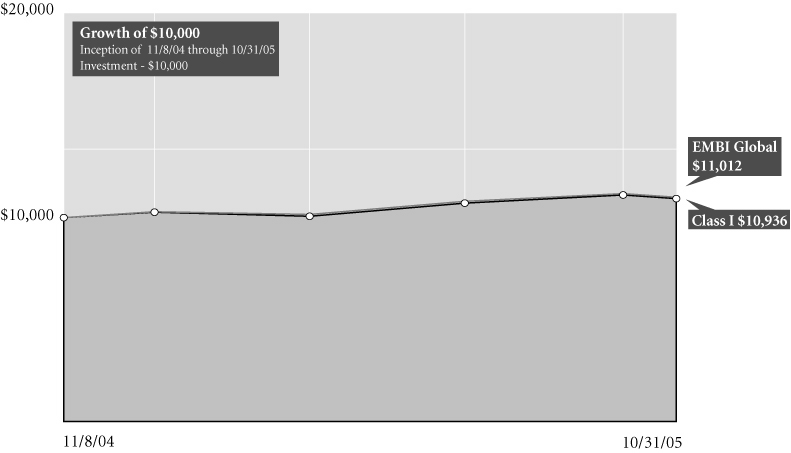

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Region

At October 31, 2005

This chart shows the percentage breakdown by region of the Fund's total investment securities.

Transamerica IDEX Mutual Funds

Annual Report 2005

3

TA IDEX American Century International

SCHEDULE OF INVESTMENTS

At October 31, 2005

(all amounts except share amounts in thousands)

| | | Shares | | Value | |

| COMMON STOCKS (98.6%) | |

| Australia (3.3%) | |

| BHP Billiton, Ltd. | | | 99,704 | | | $ | 1,547 | | |

| Macquarie Infrastructure Group (a) | | | 247,740 | | | | 635 | | |

| National Australia Bank, Ltd. | | | 41,110 | | | | 1,014 | | |

| Austria (1.1%) | |

Erste Bank der Oesterreichischen

Sparkassen AG | | | 20,492 | | | | 1,066 | | |

| Belgium (1.2%) | |

| KBC Groupe (a) | | | 14,810 | | | | 1,207 | | |

| Canada (1.4%) | |

| Canadian Pacific Railway, Ltd. | | | 6,380 | | | | 262 | | |

| Shoppers Drug Mart Corp. | | | 9,870 | | | | 329 | | |

| Thomson Corp. (The) | | | 23,480 | | | | 798 | | |

| China (0.6%) | |

| China Construction Bank–Class H ‡ | | | 1,814,427 | | | | 550 | | |

| Denmark (0.5%) | |

| Novo Nordisk A/S–Class B | | | 9,740 | | | | 499 | | |

| Finland (0.2%) | |

| Nokia OYJ | | | 10,620 | | | | 177 | | |

| France (15.5%) | |

| Accor SA | | | 19,260 | | | | 962 | | |

| AXA | | | 57,908 | | | | 1,677 | | |

Cie Generale D'Optique Essilor

International SA | | | 10,110 | | | | 833 | | |

| France Telecom SA | | | 40,560 | | | | 1,054 | | |

| Lafarge SA | | | 5,800 | | | | 477 | | |

| Pernod-Ricard | | | 3,020 | | | | 528 | | |

| PPR SA | | | 8,950 | | | | 940 | | |

| Sanofi-Aventis † | | | 12,630 | | | | 1,011 | | |

| Schneider Electric SA | | | 8,930 | | | | 734 | | |

| Societe Generale–Class A | | | 12,817 | | | | 1,463 | | |

| Total SA | | | 11,020 | | | | 2,766 | | |

| Veolia Environnement | | | 15,040 | | | | 626 | | |

| Vinci SA | | | 13,726 | | | | 1,073 | | |

| Vivendi Universal SA | | | 31,780 | | | | 1,001 | | |

| Germany (4.8%) | |

| Adidas-Salomon AG | | | 2,130 | | | | 357 | | |

| BASF AG | | | 13,500 | | | | 973 | | |

| Continental AG | | | 14,110 | | | | 1,079 | | |

| Deutsche Telekom AG | | | 10,690 | | | | 189 | | |

| E.ON AG | | | 8,740 | | | | 792 | | |

| Fresenius Medical Care AG † | | | 10,708 | | | | 963 | | |

| Metro AG | | | 6,940 | | | | 316 | | |

| | | Shares | | Value | |

| Greece (3.3%) | |

Hellenic Telecommunications

Organization SA ‡ | | | 44,120 | | | $ | 911 | | |

| National Bank of Greece SA | | | 37,980 | | | | 1,481 | | |

| OPAP SA | | | 29,414 | | | | 848 | | |

| Ireland (2.7%) | |

| Anglo Irish Bank Corp. PLC | | | 56,100 | | | | 761 | | |

| Bank of Ireland | | | 55,710 | | | | 849 | | |

| Ryanair Holdings PLC, ADR ‡† | | | 20,010 | | | | 992 | | |

| Italy (2.6%) | |

| Banco Popolare di Verona e Novara Scrl | | | 56,340 | | | | 1,040 | | |

| ENI-Ente Nazionale Idrocarburi SpA | | | 33,860 | | | | 907 | | |

| Saipem SpA | | | 39,180 | | | | 560 | | |

| Japan (20.5%) | |

| Advantest Corp. † | | | 6,200 | | | | 445 | | |

| Astellas Pharma, Inc. | | | 29,100 | | | | 1,038 | | |

| Bank of Yokohama, Ltd. (The) | | | 74,000 | | | | 600 | | |

| Daikin Industries, Ltd. | | | 34,400 | | | | 893 | | |

| East Japan Railway Co. | | | 200 | | | | 1,186 | | |

| Eisai Co., Ltd. | | | 22,000 | | | | 858 | | |

| Fuji Photo Film Co., Ltd. | | | 5,900 | | | | 186 | | |

| Honda Motor Co., Ltd. | | | 19,300 | | | | 1,052 | | |

| Hoya Corp. | | | 15,856 | | | | 550 | | |

| KDDI Corp. | | | 170 | | | | 970 | | |

| Keyence Corp. | | | 2,100 | | | | 481 | | |

| Komatsu, Ltd. | | | 38,000 | | | | 502 | | |

| Matsushita Electric Industrial Co., Ltd. | | | 72,000 | | | | 1,309 | | |

| Mitsubishi Tokyo Financial Group, Inc. | | | 80 | | | | 997 | | |

| Murata Manufacturing Co., Ltd. | | | 20,200 | | | | 1,002 | | |

| NGK Insulators, Ltd. | | | 12,000 | | | | 142 | | |

| Nippon Express Co., Ltd. | | | 18,000 | | | | 98 | | |

| Omron Corp. | | | 4,500 | | | | 106 | | |

| ORIX Corp. (a) | | | 6,300 | | | | 1,173 | | |

| Osaka Gas Co., Ltd. | | | 264,000 | | | | 964 | | |

| Shin-Etsu Chemical Co., Ltd. | | | 20,300 | | | | 967 | | |

| Taisei Corp. | | | 254,000 | | | | 1,120 | | |

| Takefuji Corp. | | | 12,420 | | | | 866 | | |

| Toray Industries, Inc. | | | 134,000 | | | | 742 | | |

| Toshiba Corp. | | | 62,000 | | | | 286 | | |

| Yamada Denki Co., Ltd. | | | 16,600 | | | | 1,451 | | |

| Mexico (1.0%) | |

| America Movil SA de CV–Class L, ADR | | | 26,931 | | | | 707 | | |

| Cemex SA de CV, Sponsored ADR | | | 4,820 | | | | 251 | | |

| Netherlands (2.9%) | |

| ASML Holding NV ‡ | | | 47,090 | | | | 796 | | |

| ING Groep NV | | | 38,544 | | | | 1,111 | | |

| Royal Numico NV ‡† | | | 23,360 | | | | 946 | | |

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2005

4

TA IDEX American Century International

SCHEDULE OF INVESTMENTS (continued)

At October 31, 2005

(all amounts except share amounts in thousands)

| | | Shares | | Value | |

| Norway (1.7%) | |

| DnB Nor ASA | | | 43,580 | | | $ | 446 | | |

| Telenor ASA | | | 120,030 | | | | 1,173 | | |

| South Korea (0.5%) | |

| Samsung Electronics Co., Ltd. | | | 900 | | | | 478 | | |

| Spain (3.9%) | |

| Banco Popular Espanol SA | | | 86,930 | | | | 1,055 | | |

Cintra Concesiones de Infraestructuras

de Transporte SA ‡ | | | 47,091 | | | | 558 | | |

| Grupo Ferrovial SA | | | 13,289 | | | | 981 | | |

| Inditex SA | | | 11,320 | | | | 335 | | |

| Telefonica SA | | | 53,753 | | | | 858 | | |

| Switzerland (8.6%) | |

| ABB, Ltd. ‡ | | | 13,120 | | | | 100 | | |

Compagnie Financiere Richemont

AG–Class A | | | 20,300 | | | | 771 | | |

| Credit Suisse Group | | | 13,610 | | | | 601 | | |

| Lonza Group AG | | | 10,730 | | | | 618 | | |

| Nestle SA | | | 4,820 | | | | 1,434 | | |

| Novartis AG | | | 31,290 | | | | 1,681 | | |

| Roche Holding AG-Genusschein | | | 9,417 | | | | 1,405 | | |

| Swiss Life Holding | | | 6,270 | | | | 969 | | |

| UBS AG | | | 9,876 | | | | 838 | | |

| United Kingdom (21.7%) | |

| AstraZeneca PLC | | | 38,710 | | | | 1,736 | | |

| BAA PLC | | | 76,820 | | | | 834 | | |

| BG Group PLC | | | 88,950 | | | | 781 | | |

| BP PLC | | | 243,521 | | | | 2,691 | | |

| British American Tobacco PLC | | | 47,990 | | | | 1,056 | | |

| Diageo PLC | | | 81,900 | | | | 1,211 | | |

| GlaxoSmithKline PLC | | | 96,250 | | | | 2,503 | | |

| Legal & General Group PLC | | | 153,860 | | | | 292 | | |

| Man Group PLC | | | 30,360 | | | | 828 | | |

| National Grid PLC | | | 60,854 | | | | 557 | | |

| Next PLC | | | 19,850 | | | | 469 | | |

| Reckitt Benckiser PLC | | | 31,583 | | | | 955 | | |

| Reed Elsevier PLC | | | 83,830 | | | | 766 | | |

| Royal Bank of Scotland Group PLC | | | 48,908 | | | | 1,354 | | |

| Smith & Nephew PLC | | | 87,765 | | | | 743 | | |

| Tesco PLC | | | 195,190 | | | | 1,039 | | |

| Unilever PLC | | | 128,920 | | | | 1,308 | | |

| Vodafone Group PLC | | | 540,050 | | | | 1,418 | | |

| WPP Group PLC | | | 67,740 | | | | 666 | | |

| United States (0.6%) | |

| iShares MSCI EAFE Index Fund | | | 10,000 | | | | 563 | | |

| Total Common Stocks (cost: $85,921) | | | | | | | 96,113 | | |

| | | Principal | | Value | |

| SECURITY LENDING COLLATERAL (3.6%) | |

| Debt (3.3%) | |

| Bank Notes (0.2%) | |

Bank of America

3.81%, due 06/07/2006 * | | $ | 98 | | | $ | 98 | | |

| 3.81%, due 08/10/2006 * | | | 98 | | | | 98 | | |

Credit Suisse First Boston Corp.

4.11%, due 03/10/2006 * | | | 20 | | | | 20 | | |

| Certificates of Deposit (0.2%) | |

Canadian Imperial Bank of Commerce

4.07%, due 11/04/2005 * | | | 78 | | | | 78 | | |

Harris Trust & Savings Bank

3.80%, due 11/04/2005 * | | | 62 | | | | 62 | | |

Rabobank Nederland

4.03%, due 05/31/2006 * | | | 98 | | | | 98 | | |

| Commercial Paper (0.7%) | |

Ciesco LLC

4.00%, due 11/03/2005 | | | 97 | | | | 97 | | |

General Electric Capital Corp.

3.96%, due 12/05/2005 | | | 78 | | | | 78 | | |

Paradigm Funding LLC–144A

4.01%, due 11/07/2005 | | | 78 | | | | 78 | | |

Park Avenue Receivables Corp.–144A

4.03%, due 12/02/2005 | | | 77 | | | | 77 | | |

Preferred Receivables Corp.–144A

4.04%, due 12/05/2005 | | | 59 | | | | 59 | | |

Ranger Funding Co. LLC–144A

3.99%, due 11/15/2005 | | | 58 | | | | 58 | | |

Sheffield Receivables Corp.–144A

4.01%, due 11/08/2005 | | | 59 | | | | 59 | | |

Yorktown Capital LLC

3.97%, due 11/09/2005

3.93%, due 11/17/2005 | | | 97

97 | | | | 97

97 | | |

| Euro Dollar Overnight (0.8%) | |

Bank of Montreal

3.79%, due 11/01/2005 | | | 59 | | | | 59 | | |

Barclays

3.80%, due 11/04/2005 | | | 78 | | | | 78 | | |

BNP Paribas

3.83%, due 11/02/2005 | | | 117 | | | | 117 | | |

Deutsche Bank

3.80%, due 11/02/2005 | | | 195 | | | | 195 | | |

HSBC Banking/Holdings PLC

3.84%, due 11/07/2005 | | | 59 | | | | 59 | | |

Royal Bank of Scotland

3.76%, due 11/01/2005 | | | 78 | | | | 78 | | |

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2005

5

TA IDEX American Century International

SCHEDULE OF INVESTMENTS (continued)

At October 31, 2005

(all amounts except share amounts in thousands)

| | | Principal | | Value | |

| Euro Dollar Overnight (continued) | |

Svenska Handlesbanken

4.03%, due 11/01/2005 | | $ | 100 | | | $ | 100 | | |

UBS AG

3.80%, due 11/03/2005 | | | 78 | | | | 78 | | |

| Euro Dollar Terms (0.3%) | |

Royal Bank of Scotland

4.00%, due 12/12/2005 | | | 78 | | | | 78 | | |

UBS AG

4.02%, due 12/01/2005 | | | 78 | | | | 78 | | |

Wells Fargo

3.96%, due 11/14/2005 | | | 117 | | | | 117 | | |

| Promissory Notes (0.1%) | |

Goldman Sachs Group, Inc.

4.02%, due 12/28/2005 | | | 82 | | | | 82 | | |

| Repurchase Agreements (1.0%) †† | |

Credit Suisse First Boston Corp.

4.10%, dated 10/31/2005 to be repurchased

at $133 on 11/01/2005 | | | 133 | | | | 133 | | |

Goldman Sachs Group, Inc. (The)

4.10%, dated 10/31/2005 to be repurchased

at $332 on 11/01/2005 | | | 332 | | | | 332 | | |

Lehman Brothers, Inc.

4.10%, dated 10/31/2005 to be repurchased

at $9 on 11/01/2005 | | | 9 | | | | 9 | | |

| | | Principal | | Value | |

| Repurchase Agreements (continued) | |

Merrill Lynch & Co. 4.10%, dated

10/31/2005 to be repurchased at $390 on

11/01/2005 | | $ | 390 | | | $ | 390 | | |

Morgan Stanley Dean Witter & Co.

4.17%, dated 10/31/2005 to be repurchased

at $117 on 11/01/2005 | | | 117 | | | | 117 | | |

| | | Shares | | Value | |

| Investment Companies (0.3%) | |

| Money Market Funds (0.3%) | |

American Beacon Fund

| |

| 1-day yield of 3.81% | | | 84,141 | | | $ | 84 | | |

Barclays Global Investors Institutional

Money Market Fund

1-day yield of 3.92% | | | 78,058 | | | | 78 | | |

Goldman Sachs Financial Square Prime

Obligations Fund

1-day yield of 3.79% | | | 12,159 | | | | 12 | | |

Merrimac Cash Fund, Premium Class

| |

| 1-day yield of 3.70% @ | | | 77,195 | | | | 77 | | |

| Total Security Lending Collateral (cost: $3,505) | | | | | | | 3,505 | | |

| Total Investment Securities (cost: $89,426) | | | | | | $ | 99,618 | | |

| SUMMARY: | |

| Investment securities, at value | | | 102.2 | % | | $ | 99,618 | | |

| Liabilities in excess of other assets | | | (2.2 | )% | | | (2,156 | ) | |

| Net assets | | | 100.0 | % | | $ | 97,462 | | |

NOTES TO SCHEDULE OF INVESTMENTS:

‡ Non-income producing.

† At October 31, 2005, all or a portion of this security is on loan (see Note 1). The value at October 31, 2005, of all securities on loan is $3,349.

* Floating or variable rate note. Rate is listed as of October 31, 2005.

†† Cash collateral for the Repurchase Agreements, valued at $1,000, that serve as collateral for securities lending are invested in corporate bonds with interest rates and maturity dates ranging from 0.00%–9.86% and 12/31/2005–11/15/2096, respectively.

@ Regulated investment company advised by Investors Bank and Trust Co. ("IBT"). IBT is also the accounting, custody and lending agent for the Fund.

(a) Passive Foreign Investment Company.

DEFINITIONS:

144A 144A Securities are registered pursuant to Rule 144A of the Securities Act of 1933. These securities are deemed to be liquid for purposes of compliance limitations on holdings of illiquid securities and may be resold as transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2005, these securities aggregated $331 or 0.3% of the net assets of the Fund.

ADR American Depositary Receipt

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2005

6

TA IDEX American Century International

SCHEDULE OF INVESTMENTS (continued)

At October 31, 2005

(all amounts except share amounts in thousands)

| | | Percentage of

Net Assets | | Value | |

| INVESTMENTS BY INDUSTRY: | |

| Commercial Banks | | | 15.7 | % | | $ | 15,323 | | |

| Pharmaceuticals | | | 11.0 | % | | | 10,733 | | |

| Telecommunications | | | 7.5 | % | | | 7,279 | | |

| Petroleum Refining | | | 5.6 | % | | | 5,456 | | |

| Life Insurance | | | 3.8 | % | | | 3,757 | | |

| Chemicals & Allied Products | | | 3.6 | % | | | 3,512 | | |

| Food & Kindred Products | | | 2.4 | % | | | 2,380 | | |

| Electronic Components & Accessories | | | 2.4 | % | | | 2,331 | | |

| Oil & Gas Extraction | | | 2.3 | % | | | 2,249 | | |

| Industrial Machinery & Equipment | | | 2.2 | % | | | 2,129 | | |

| Instruments & Related Products | | | 2.1 | % | | | 2,083 | | |

| Engineering & Management Services | | | 2.1 | % | | | 2,055 | | |

| Construction | | | 2.1 | % | | | 2,054 | | |

| Beer, Wine & Distilled Beverages | | | 1.8 | % | | | 1,739 | | |

| Medical Instruments & Supplies | | | 1.7 | % | | | 1,706 | | |

| Radio & Television Broadcasting | | | 1.7 | % | | | 1,627 | | |

| Metal Mining | | | 1.6 | % | | | 1,547 | | |

| Communications Equipment | | | 1.5 | % | | | 1,485 | | |

| Radio, Television & Computer Stores | | | 1.5 | % | | | 1,451 | | |

| Railroads | | | 1.5 | % | | | 1,449 | | |

| Rubber & Misc. Plastic Products | | | 1.5 | % | | | 1,436 | | |

| Electric Services | | | 1.4 | % | | | 1,348 | | |

| Wholesale Trade Nondurable Goods | | | 1.3 | % | | | 1,308 | | |

| Department Stores | | | 1.3 | % | | | 1,256 | | |

| Business Credit Institutions | | | 1.2 | % | | | 1,173 | | |

| Tobacco Products | | | 1.1 | % | | | 1,056 | | |

| Automotive | | | 1.1 | % | | | 1,052 | | |

| Food Stores | | | 1.1 | % | | | 1,039 | | |

| AIr Transportation | | | 1.0 | % | | | 992 | | |

| Gas Production & Distribution | | | 1.0 | % | | | 964 | | |

| Hotels & Other Lodging Places | | | 1.0 | % | | | 962 | | |

| Electronic & Other Electric Equipment | | | 0.9 | % | | | 890 | | |

| Personal Credit Institutions | | | 0.9 | % | | | 866 | | |

| Amusement & Recreation Services | | | 0.9 | % | | | 848 | | |

| Holding & Other Investment Offices | | | 0.8 | % | | | 828 | | |

| Shoe Stores | | | 0.8 | % | | | 804 | | |

| Computer & Data Processing Services | | | 0.8 | % | | | 798 | | |

| Retail Trade | | | 0.8 | % | | | 771 | | |

| Printing & Publishing | | | 0.8 | % | | | 766 | | |

| Textile Mill Products | | | 0.8 | % | | | 742 | | |

| Stone, Clay & Glass Products | | | 0.7 | % | | | 728 | | |

| Business Services | | | 0.7 | % | | | 666 | | |

| Security & Commodity Brokers | | | 0.7 | % | | | 635 | | |

| Investment Companies | | | 0.6 | % | | | 563 | | |

| Public Administration | | | 0.6 | % | | | 558 | | |

| Drug Stores & Proprietary Stores | | | 0.3 | % | | | 329 | | |

| Insurance | | | 0.3 | % | | | 292 | | |

| Trucking & Warehousing | | | 0.1 | % | | | 98 | | |

| Investment securities, at value | | | 98.6 | % | | | 96,113 | | |

| Security lending collateral | | | 3.6 | % | | | 3,505 | | |

| Liabilities in excess of other assets | | | (2.2 | )% | | | (2,156 | ) | |

| Net assets | | | 100.0 | % | | $ | 97,462 | | |

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2005

7

TA IDEX American Century International

STATEMENT OF ASSETS AND LIABILITIES

At October 31, 2005

(all amounts except per share amounts in thousands)

| Assets: | |

Investment securities, at value (cost: $89,426)

(including securities loaned of $3,349) | | $ | 99,618 | | |

| Cash | | | 1,337 | | |

| Foreign currencies (cost: $104) | | | 102 | | |

| Receivables: | |

| Investment securities sold | | | 929 | | |

| Shares of beneficial interest sold | | | 80 | | |

| Interest | | | 4 | | |

| Dividends | | | 97 | | |

| Dividend reclaims receivable | | | 125 | | |

| Other | | | 6 | | |

| | | | 102,298 | | |

| Liabilities: | |

| Investment securities purchased | | | 1,022 | | |

| Accounts payable and accrued liabilities: | |

| Shares of beneficial interest redeemed | | | 110 | | |

| Management and advisory fees | | | 77 | | |

| Distribution and service fees | | | 46 | | |

| Transfer agent fees | | | 23 | | |

| Administration fees | | | 2 | | |

| Payable for collateral for securities on loan | | | 3,505 | | |

Unrealized depreciation on forward

foreign currency contracts | | | 6 | | |

| Other | | | 45 | | |

| | | | 4,836 | | |

| Net Assets | | $ | 97,462 | | |

| Net Assets Consist of: | |

Shares of beneficial interest, unlimited shares

authorized, no par value | | $ | 68,502 | | |

| Accumulated net investment income (loss) | | | (455 | ) | |

Undistributed net realized gain (loss) from

investment securities and foreign

currency transactions | | | 19,231 | | |

Net unrealized appreciation (depreciation) on:

Investment securities | | | 10,191 | | |

Translation of assets and liabilites denominated

in foreign currencies | | | (7 | ) | |

| Net Assets | | $ | 97,462 | | |

| Net Assets by Class: | |

| Class A | | $ | 67,656 | | |

| Class B | | | 21,069 | | |

| Class C | | | 8,737 | | |

| Shares Outstanding: | |

| Class A | | | 6,716 | | |

| Class B | | | 2,190 | | |

| Class C | | | 915 | | |

| Net Asset Value Per Share: | |

| Class A | | $ | 10.07 | | |

| Class B | | | 9.62 | | |

| Class C | | | 9.55 | | |

| Maximum Offering Price Per Share (a): | |

| Class A | | $ | 10.66 | | |

(a) Includes the maximum selling commission (represented as a percentage of offering price) which is reduced on certain levels of sales as set forth in the Prospectus. Net asset value per share for Classes B and C shares represents offering price. The redemption price for Classes B and C shares equals net asset value less any applicable contingent deferred sales charge.

STATEMENT OF OPERATIONS

For the year ended October 31, 2005

(all amounts in thousands)

| Investment Income: | |

| Interest | | $ | 55 | | |

Dividends (net of withholding taxes on

foreign dividends of $201) | | | 2,893 | | |

| Income from loaned securities–net | | | 11 | | |

| | | | 2,959 | | |

| Expenses: | |

| Management and advisory fees | | | 1,352 | | |

| Distribution and service fees: | |

| Class A | | | 408 | | |

| Class B | | | 215 | | |

| Class C | | | 93 | | |

| Transfer agent fees: | |

| Class A | | | 101 | | |

| Class B | | | 109 | | |

| Class C | | | 36 | | |

| Printing and shareholder reports | | | 40 | | |

| Custody fees | | | 168 | | |

| Administration fees | | | 28 | | |

| Legal fees | | | 12 | | |

| Audit fees | | | 27 | | |

| Trustees fees | | | 9 | | |

| Registration fees: | |

| Class A | | | 20 | | |

| Class B | | | 11 | | |

| Class C | | | 14 | | |

| Other | | | 12 | | |

| Total expenses | | | 2,655 | | |

| Less: | |

| Reimbursement of class expenses: | |

| Class B | | | (83 | ) | |

| Class C | | | (33 | ) | |

| Total reimbursed expenses | | | (116 | ) | |

| Net expenses | | | 2,539 | | |

| Net Investment Income (Loss) | | | 420 | | |

| Net Realized Gain (Loss) from: | |

| Investment securities | | | 40,327 | | |

| Foreign currency transactions | | | (1,217 | ) | |

| | | | 39,110 | | |

Net Increase (Decrease) in Unrealized Appreciation

(Depreciation) on: | |

| Investment securities | | | (11,454 | ) | |

Translation of assets and liabilities denominated in

foreign currencies | | | (20 | ) | |

| | | | (11,474 | ) | |

Net Gain (Loss) on Investment Securities and

Foreign Currency Transactions | | | 27,636 | | |

Net Increase (Decrease) in Net Assets Resulting

from Operations | | $ | 28,056 | | |

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2005

8

TA IDEX American Century International

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended

(all amounts in thousands)

| | | October 31,

2005 | | October 31,

2004 | |

| Increase (Decrease) In Net Assets From: | |

| Operations: | |

| Net investment income (loss) | | $ | 420 | | | $ | (76 | ) | |

Net realized gain (loss) from

investment securities

and foreign currency

transactions | | | 39,110 | | | | 16,156 | | |

Net unrealized appreciation

(depreciation) on investment

securities and foreign currency

translation | | | (11,474 | ) | | | 4,506 | | |

| | | | 28,056 | | | | 20,586 | | |

| Distributions to Shareholders: | |

| From net investment income: | |

| Class A | | | (1,352 | ) | | | (410 | ) | |

| Class B | | | (3 | ) | | | (47 | ) | |

| Class C | | | (52 | ) | | | (2 | ) | |

| Class C2 | | | – | | | | (12 | ) | |

| Class M | | | – | | | | (7 | ) | |

| | | | (1,407 | ) | | | (478 | ) | |

| Capital Share Transactions: | |

| Proceeds from shares sold: | |

| Class A | | | 6,712 | | | | 43,204 | | |

| Class B | | | 3,382 | | | | 2,535 | | |

| Class C | | | 1,825 | | | | 920 | | |

| Class C2 | | | – | | | | 476 | | |

| Class M | | | – | | | | 358 | | |

| | | | 11,919 | | | | 47,493 | | |

Dividends and distributions

reinvested: | |

| Class A | | | 1,350 | | | | 409 | | |

| Class B | | | 3 | | | | 44 | | |

| Class C | | | 50 | | | | 2 | | |

| Class C2 | | | – | | | | 11 | | |

| Class M | | | – | | | | 7 | | |

| | | | 1,403 | | | | 473 | | |

| Cost of shares redeemed: | |

| Class A | | | (150,811 | ) | | | (25,540 | ) | |

| Class B | | | (5,137 | ) | | | (5,662 | ) | |

| Class C | | | (3,488 | ) | | | (842 | ) | |

| Class C2 | | | – | | | | (1,501 | ) | |

| Class M | | | – | | | | (879 | ) | |

| | | | (159,436 | ) | | | (34,424 | ) | |

| Class level exchanges: | |

| Class C | | | – | | | | 8,249 | | |

| Class C2 | | | – | | | | (5,368 | ) | |

| Class M | | | – | | | | (2,881 | ) | |

| | | | – | | | | – | | |

| Automatic conversions: | |

| Class A | | | 160 | | | | 9 | | |

| Class B | | | (160 | ) | | | (9 | ) | |

| | | | – | | | | – | | |

| | | | (146,114 | ) | | | 13,542 | | |

| Net increase (decrease) in net assets | | | (119,465 | ) | | | 33,650 | | |

| | | October 31,

2005 | | October 31,

2004 | |

| Net Assets: | |

| Beginning of year | | $ | 216,927 | | | $ | 183,277 | | |

| End of year | | $ | 97,462 | | | $ | 216,927 | | |

Accumulated Net Investment Income

(Loss) | | $ | (455 | ) | | $ | 229 | | |

| Share Activity: | |

| Shares issued: | |

| Class A | | | 692 | | | | 5,293 | | |

| Class B | | | 366 | | | | 308 | | |

| Class C | | | 200 | | | | 112 | | |

| Class C2 | | | – | | | | 58 | | |

| Class M | | | – | | | | 43 | | |

| | | | 1,258 | | | | 5,814 | | |

Shares issued–reinvested from

distributions: | |

| Class A | | | 143 | | | | 47 | | |

| Class B | | | – | | | | 5 | | |

| Class C | | | 6 | | | | – | | |

| Class C2 | | | – | | | | 1 | | |

| Class M | | | – | | | | 1 | | |

| | | | 149 | | | | 54 | | |

| Shares redeemed: | |

| Class A | | | (15,422 | ) | | | (2,998 | ) | |

| Class B | | | (555 | ) | | | (698 | ) | |

| Class C | | | (383 | ) | | | (103 | ) | |

| Class C2 | | | – | | | | (183 | ) | |

| Class M | | | – | | | | (105 | ) | |

| | | | (16,360 | ) | | | (4,087 | ) | |

| Class level exchanges: | |

| Class C | | | – | | | | 1,009 | | |

| Class C2 | | | – | | | | (654 | ) | |

| Class M | | | – | | | | (353 | ) | |

| | | | – | | | | 2 | | |

| Automatic conversions: | |

| Class A | | | 16 | | | | 1 | | |

| Class B | | | (17 | ) | | | (1 | ) | |

| | | | (1 | ) | | | – | | |

Net increase (decrease) in shares

outstanding: | |

| Class A | | | (14,571 | ) | | | 2,343 | | |

| Class B | | | (206 | ) | | | (386 | ) | |

| Class C | | | (177 | ) | | | 1,018 | | |

| Class C2 | | | – | | | | (778 | ) | |

| Class M | | | – | | | | (414 | ) | |

| | | | (14,954 | ) | | | 1,783 | | |

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2005

9

TA IDEX American Century International

FINANCIAL HIGHLIGHTS

| | | | | For a share of beneficial interest outstanding throughout each period | |

| | | | | Net Asset | | Investment Operations | | Distributions | | Net Asset | |

| | | For the

Period

Ended (d)(g) | | Value,

Beginning

of Period | | Net

Investment

Income (Loss) | | Net Realized

and Unrealized

Gain (Loss) | | Total

Operations | | From Net

Investment

Income | | From Net

Realized

Gains | | Total

Distributions | | Value,

End

of Period | |

| Class A | | 10/31/2005 | | $ | 8.81 | | | $ | 0.03 | | | $ | 1.30 | | | $ | 1.33 | | | $ | (0.07 | ) | | $ | – | | | $ | (0.07 | ) | | $ | 10.07 | | |

| | | 10/31/2004 | | | 8.03 | | | | – | (h) | | | 0.80 | | | | 0.80 | | | | (0.02 | ) | | | – | | | | (0.02 | ) | | | 8.81 | | |

| | | 10/31/2003 | | | 7.00 | | | | 0.02 | | | | 1.01 | | | | 1.03 | | | | – | | | | – | | | | – | | | | 8.03 | | |

| | | 10/31/2002 | | | 8.38 | | | | 0.01 | | | | (1.39 | ) | | | (1.38 | ) | | | – | | | | – | | | | – | | | | 7.00 | | |

| | | 10/31/2001 | | | 12.76 | | | | 0.05 | | | | (3.05 | ) | | | (3.00 | ) | | | – | | | | (1.38 | ) | | | (1.38 | ) | | | 8.38 | | |

| Class B | | 10/31/2005 | | | 8.41 | | | | – | (h) | | | 1.21 | | | | 1.21 | | | | – | (h) | | | – | | | | – | | | | 9.62 | | |

| | | 10/31/2004 | | | 7.70 | | | | (0.04 | ) | | | 0.77 | | | | 0.73 | | | | (0.02 | ) | | | – | | | | (0.02 | ) | | | 8.41 | | |

| | | 10/31/2003 | | | 6.76 | | | | (0.03 | ) | | | 0.97 | | | | 0.94 | | | | – | | | | – | | | | – | | | | 7.70 | | |

| | | 10/31/2002 | | | 8.15 | | | | (0.04 | ) | | | (1.35 | ) | | | (1.39 | ) | | | – | | | | – | | | | – | | | | 6.76 | | |

| | | 10/31/2001 | | | 12.53 | | | | (0.02 | ) | | | (2.98 | ) | | | (3.00 | ) | | | – | | | | (1.38 | ) | | | (1.38 | ) | | | 8.15 | | |

| Class C | | 10/31/2005 | | | 8.40 | | | | – | (h) | | | 1.20 | | | | 1.20 | | | | (0.05 | ) | | | – | | | | (0.05 | ) | | | 9.55 | | |

| | | 10/31/2004 | | | 7.70 | | | | (0.09 | ) | | | 0.81 | | | | 0.72 | | | | (0.02 | ) | | | – | | | | (0.02 | ) | | | 8.40 | | |

| | | 10/31/2003 | | | 6.73 | | | | (0.03 | ) | | | 1.00 | | | | 0.97 | | | | – | | | | – | | | | – | | | | 7.70 | | |

| | | | | | | Ratios/Supplemental Data | |

| | | For the

Period | | Total | | Net Assets,

End of

Period | | Ratio of Expenses

to Average

Net Assets (a) | | Net Investment

Income (Loss)

to Average | | Portfolio

Turnover | |

| | | Ended (g) | | Return (c) | | (000's) | | Net (e) | | Total (f) | | Net Assets (a) | | Rate (b) | |

| Class A | | 10/31/2005 | | | 15.17 | % | | $ | 67,656 | | | | 1.56 | % | | | 1.56 | % | | | 0.36 | % | | | 82 | % | |

| | | 10/31/2004 | | | 9.95 | | | | 187,608 | | | | 1.59 | | | | 1.59 | | | | (0.05 | ) | | | 159 | | |

| | | 10/31/2003 | | | 14.71 | | | | 152,086 | | | | 1.78 | | | | 2.39 | | | | 0.23 | | | | 220 | | |

| | | 10/31/2002 | | | (16.49 | ) | | | 14,921 | | | | 1.87 | | | | 3.68 | | | | 0.22 | | | | 241 | | |

| | | 10/31/2001 | | | (26.43 | ) | | | 5,209 | | | | 1.55 | | | | 2.77 | | | | 0.47 | | | | 129 | | |

| Class B | | 10/31/2005 | | | 14.41 | | | | 21,069 | | | | 2.34 | | | | 2.72 | | | | (0.01 | ) | | | 82 | | |

| | | 10/31/2004 | | | 9.46 | | | | 20,153 | | | | 2.09 | | | | 2.09 | | | | (0.46 | ) | | | 159 | | |

| | | 10/31/2003 | | | 13.91 | | | | 21,421 | | | | 2.44 | | | | 3.05 | | | | (0.42 | ) | | | 220 | | |

| | | 10/31/2002 | | | (17.09 | ) | | | 5,328 | | | | 2.52 | | | | 4.33 | | | | (0.43 | ) | | | 241 | | |

| | | 10/31/2001 | | | (26.96 | ) | | | 5,003 | | | | 2.20 | | | | 3.42 | | | | (0.18 | ) | | | 129 | | |

| Class C | | 10/31/2005 | | | 14.36 | | | | 8,737 | | | | 2.34 | | | | 2.70 | | | | (0.01 | ) | | | 82 | | |

| | | 10/31/2004 | | | 9.33 | | | | 9,166 | | | | 2.40 | | | | 2.49 | | | | (1.07 | ) | | | 159 | | |

| | | 10/31/2003 | | | 14.41 | | | | 568 | | | | 2.44 | | | | 3.04 | | | | (0.42 | ) | | | 220 | | |

NOTES TO FINANCIAL HIGHLIGHTS

(a) Annualized.

(b) Not annualized.

(c) Total Return has been calculated for the applicable period without deduction of a sales load, if any, on an initial purchase. Periods of less than one year are not annualized.

(d) Per share information is calculated based on average number of shares outstanding.

(e) Ratio of Net Expenses to Average Net Assets is net of fee waivers and reimbursements by the investment adviser, if any (see note 2.)

(f) Ratio of Total Expenses to Average Net Assets includes all expenses before fee waivers and reimbursements by the investment adviser.

(g) The inception date for the Fund's offering of share Class C was November 11, 2002.

(h) Rounds to less than $(0.01) per share.

The notes to the financial statements are an integral part of this report.

Transamerica IDEX Mutual Funds

Annual Report 2005

10

TA IDEX American Century International

NOTES TO FINANCIAL STATEMENTS

At October 31, 2005

(all amounts in thousands)

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Transamerica IDEX Mutual Funds is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the "1940 Act").

In the normal course of business, TA IDEX American Century International (the "Fund") enters into contracts that contain a variety of representations that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund and/or its affiliates that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

This report should be read in conjunction with the current Fund prospectus, which contains more complete information about the Fund.

The following is a summary of significant accounting policies followed by the Fund in the preparation of the financial statements. In preparing the Fund's financial statements in accordance with accounting principles generally accepted in the United States of America ("GAAP"), estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures.

Multiple class operations, income and expenses: The Fund currently offers three classes of shares, each with a public offering price that reflects different sales charges, if any, and expense levels. On June 15, 2004, Class C2 shares merged into Class C. On September 24, 2004, Class M shares merged into Class C. Class B shares will convert to Class A shares eight years after purchase. Income, non-class specific expenses and realized and unrealized gains and losses, are allocated daily to each class, based upon the value of shares outstanding method as permitted under Rule 18f-3 of the 1940 Act. Each class bears its own specific expenses as well as a portion of general, common expenses.

Security valuations: The Fund values its investments at the close of the New York Stock Exchange ("NYSE"), normally 4 p.m. ET, each day the NYSE is open for business. Fund investments are valued at the last sale price or closing price on the day of valuation taken from the primary exchange where the security is principally traded.

Securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the last quoted bid price.

Debt securities are valued based on a price quotation or other equivalent indication of value supplied by an exchange, a pricing service or a major market maker; however, those that mature in sixty days or less are valued at amortized cost, which approximates market.

Investment company securities are valued at the net asset value of the underlying portfolio.

Foreign securities generally are valued based on quotations from the primary market in which they are traded. Because many foreign securities markets and exchanges close prior to the close of the NYSE, closing prices for foreign securities in those markets or on those exchanges do not reflect the events that occur after that close. If a significant market event impacting the value of a portfolio security (e.g., natural disaster, company announcement, market volatility) occurs subsequent to the close of trading in the security, but prior to the calculation of the Fund's net asset value per share, market quotations for that security may be determined to be unreliable and, accordingly, not "readily available." As a result, foreign equity securities held by the Fund may be valued at fair market value as determined in good faith by the Fund's Administrative Valuation Committee, under the supervision of the Board's Valuation Committee , using guidelines adopted by the Board of Trustees.

Other securities for which quotations are not readily available or whose values have been determined to be unreliable are valued at fair market value as determined in good faith by the Fund's Administrative Valuation Committee, under the supervision of the Board's Valuation Committee, using guidelines adopted by the Board of Trustees.

Cash: The Fund may leave cash overnight in its cash account with the custodian, Investors Bank & Trust Company ("IBT"). IBT has been contracted on behalf of the Fund to invest the excess cash into a savings account, which at October 31, 2005, was paying an interest rate of 2.76%.

Repurchase agreements: The Fund is authorized to enter into repurchase agreements. The Fund, through its custodian, IBT, receives delivery of the underlying securities, the value of which at the time of purchase is required to be an amount equal to at least 100% of the resale price. The Fund will bear the risk of value fluctuations until the security can be sold and may encounter delays and incur costs in liquidating the security. In the event of bankruptcy or insolvency of the seller, delays and costs may be incurred.

Securities lending: The Fund may lend securities to qualified borrowers, with IBT acting as the Fund's lending agent. The Fund earns negotiated lenders' fees. The Fund receives cash and/or securities as collateral against the loaned securities. Cash collateral received is invested in short term, interest bearing securities. The Fund monitors the market value of securities loaned on a daily basis and requires collateral in an amount at least equal to the value of the securities loaned. Income from loaned securities on the Statement of Operations is net of fees, in the amount of $5, earned by IBT for its services.

Security transactions and investment income: Security transactions are recorded on the trade date. Security gains and losses are calculated

Transamerica IDEX Mutual Funds

Annual Report 2005

11

TA IDEX American Century International

NOTES TO FINANCIAL STATEMENTS (continued)

At October 31, 2005

(all amounts in thousands)

NOTE 1.–(continued)

on the specific identification basis. Dividend income, if any, is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend date. Interest income, including accretion of discounts and amortization of premiums, is recorded on the accrual basis commencing on the settlement date.

Foreign currency denominated investments: The accounting records of the Fund are maintained in U.S. dollars. Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the closing exchange rate each day. The cost of foreign securities is translated at the exchange rate in effect when the investment was acquired. The Fund combines fluctuations from currency exchange rates and fluctuations in value when computing net realized and unrealized gains or losses from investments.

Net foreign currency gains and losses resulting from changes in exchange rates include: 1) foreign currency fluctuations between trade date and settlement date of investment security transactions; 2) gains and losses on forward foreign currency contracts; and 3) the difference between the receivable amounts of interest and dividends recorded in the accounting records in U.S. dollars and the amounts actually received.

Foreign currency denominated assets may involve risks not typically associated with domestic transactions. These risks include revaluation of currencies, adverse fluctuations in foreign currency values and possible adverse political, social and economic developments, including those particular to a specific industry, country or region.

Foreign capital gains taxes: The Fund may be subject to taxes imposed by countries in which it invests, with respect to its investment in issuers existing or operating in such countries. Such taxes are generally based on income earned or repatriated and capital gains realized on the sale of such investments. The Fund accrues such taxes when the related income or capital gains are earned. Some countries require governmental approval for the repatriation of investment income, capital or the proceeds of sales earned by foreign investors. In addition, if there is deterioration in a country's balance of payments or for other reasons, a country may impose temporary restrictions on foreign capital remittances abroad.

Forward foreign currency contracts: The Fund may enter into forward foreign currency contracts to hedge against exchange rate risk arising from investments in securities denominated in foreign currencies. Contracts are valued at the contractual forward rate and are marked to market daily, with the change in value recorded as an unrealized gain or loss. When the contracts are settled a realized gain or loss is incurred. Risks may arise from changes in market value of the underlying currencies and from the possible inability of counterparties to meet the terms of their contracts.

At October 31, 2005, there were no outstanding forward foreign currency contracts.

Redemption fees: A short-term trading redemption fee may be assessed on any Fund shares in a fund account that are sold during the first five (5) NYSE trading days following their purchase date. This redemption fee will equal 2% of the amount redeemed and shares held the longest will be treated as being redeemed first and shares held the shortest as being redeemed last. For the year ended October 31, 2005, the Fund received less than $1 in redemption fees.

Dividend distributions: Distributions to shareholders are recorded on the ex-dividend date and are determined in accordance with Federal income tax regulations which may differ from GAAP.

NOTE 2. RELATED PARTY TRANSACTIONS

Effective January 1, 2005 AEGON/Transamerica Fund Advisors, Inc. was renamed Transamerica Fund Advisors, Inc. ("TFAI"); AEGON/Transamerica Fund Services, Inc. and AEGON/Transamerica Investor Services, Inc. merged into one entity and was renamed Transamerica Fund Services, Inc. ("TFS").

TFAI is the Fund's investment adviser. TFS is the Fund's administrator and transfer agent. AFSG Securities Corp. ("AFSG") is the Fund's distributor/principal underwriter. TFAI, TFS , and AFSG are affiliates of AEGON, NV, a Netherlands corporation.

The following schedule reflects the percentage of fund assets owned by affiliated mutual funds:

| | | Net

Assets | | % of

Net Assets | |

TA IDEX Asset Allocation–

Growth Portfolio | | $ | 27,167 | | | | 27.87 | % | |

TA IDEX Asset Allocation–

Moderate Growth Portfolio | | | 21,288 | | | | 21.84 | % | |

TA IDEX Asset Allocation–

Moderate Portfolio | | | 5,653 | | | | 5.80 | % | |

| Total | | $ | 54,108 | | | | 55.51 | % | |

Investment advisory fees: The Fund pays management fees to TFAI based on average daily net assets ("ANA") at the following breakpoints:

From November 1, 2004 to December 31, 2004:

1.00% of the first $50 million of ANA

0.95% of the next $100 million of ANA

0.90% of the next $350 million of ANA

0.85% of the next $500 million of ANA

0.80% of ANA over $1 billion

Transamerica IDEX Mutual Funds

Annual Report 2005

12

TA IDEX American Century International

NOTES TO FINANCIAL STATEMENTS (continued)

At October 31, 2005

(all amounts in thousands)

NOTE 2.–(continued)

From January 1, 2005 on:

0.925% of the first $250 million of ANA

0.90% of the next $250 million of ANA

0.85% of the next $500 million of ANA

0.80% of ANA over $1 billion

TFAI has contractually agreed to waive its advisory fee and will reimburse the Fund to the extent that operating expenses, excluding 12b-1 fees, exceed the following stated annual limit:

From November 1, 2004 to December 31, 2004:

1.40% Expense Limit

From January 1, 2005 on:

1.325% Expense Limit

If total Fund expenses fall below the annual expense limitation agreement agreed to by the adviser within the succeeding three years, the Fund may be required to pay that adviser a portion or all of the waived advisory fees.

| | | Advisory Fee

Waived | | Available for

Recapture Through | |

| Fiscal Year 2003 | | $ | 473 | | | | 10/31/2006 | | |

If total class expenses fall below the annual expense limitation agreement agreed to by the adviser within the succeeding three years, the Fund may be required to pay that adviser a portion or all of the reimbursed class expenses.

| Fiscal Year 2005: | | Reimbursement

of Class Expenses | | Available for

Recapture Through | |

| Class B | | $ | 83 | | | 10/31/2008 | |

| Class C | | | 33 | | | 10/31/2008 | |

| Fiscal Year 2004: | |

| Class C | | | 3 | | | 10/31/2007 | |

There were no amounts recaptured during the year ended October 31, 2005.

Distribution and service fees: The Fund has a 12b-1 distribution plan under the 1940 Act pursuant to which an annual fee, based on average daily net assets, is paid to the distributor for various disbursements such as broker-dealer account servicing fees and other promotional expenses of the Fund. The Fund is authorized under the 12b-1 plan to pay fees on each class up to the following limits:

| Class A | | | 0.35 | % | |

| Class B | | | 1.00 | % | |

| Class C | | | 1.00 | % | |

In the case the Fund or a class of shares of the Fund is closed to new investors or investments, the Fund is authorized to pay 12b-1 fees for past sales and distribution efforts and present and past investor services.

Underwriter commissions relate to front-end sales charges imposed for Class A shares and contingent deferred sales charges from Classes B, C and certain A share redemptions. For the year ended October 31, 2005, the underwriter commissions were as follows:

| Received by Underwriter | | $ | 203 | | |

| Retained by Underwriter | | | 6 | | |

| Contingent Deferred Sales Charge | | | 45 | | |

Administrative services: The Fund has entered into an agreement with TFS for financial and legal fund administration services. As of January 1, 2005 the Fund pays TFS an annual fee of 0.02% of ANA. Prior to January 1, 2005 the Fund paid TFS an annual fee of 0.015% of ANA. The Legal fees on the Statement of Operations are for fees paid to external legal counsel.

Transfer agent fees: The Fund pays TFS an annual per-account charge for each open and closed account. The Fund paid TFS $222 for the year ended October 31, 2005.

Deferred compensation plan: Each eligible independent Fund Trustee may elect to participate in a non-qualified deferred compensation plan maintained by Transamerica IDEX Mutual Funds (the "Plan"). Under the Plan, such Trustees may defer payment of all or a portion of their total fees earned as a Fund Trustee. Each Trustee who is a participant in the Plan may elect that the earnings, losses or gains credited to his or her deferred fee amounts be determined based on a deemed investment in any series of Transamerica IDEX Mutual Funds, including the Fund. The right of a participant to receive a distribution from the Plan of the deferred fees is an unsecured claim against the general assets of all series of Transamerica IDEX Mutual Funds. The pro rata liability to the Fund of all deferred fees in the Plan amounted, as of October 31, 2005, to $6.

Brokerage commissions: Brokerage commissions incurred on security transactions placed with an affiliate of the advisor for the year ended October 31, 2005, were $15.

Transamerica IDEX Mutual Funds

Annual Report 2005

13

TA IDEX American Century International

NOTES TO FINANCIAL STATEMENTS (continued)

At October 31, 2005

(all amounts in thousands)

NOTE 3. INVESTMENT TRANSACTIONS

The cost of securities purchased and proceeds from securities sold (excluding short-term securities) for the year ended October 31, 2005, were as follows:

| Purchases of securities: | |

| Long-Term | | $ | 119,521 | | |

| U.S. Government | | | – | | |

| Proceeds from maturities and sales of securities | |

| Long-Term | | | 263,599 | | |

| U.S. Government | | | – | | |

NOTE 4. FEDERAL INCOME TAX MATTERS

The Fund has not made any provision for federal income or excise taxes due to its policy to distribute all of its taxable income and capital gains to its shareholders and otherwise qualify as a regulated investment company under Subchapter M of the Internal Revenue Code. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatment for items including, but not limited to, wash sales, foreign currency transactions, passive foreign investment companies and capital loss carryforwards.

Therefore, distributions determined in accordance with tax regulations may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences. These reclassifications are as follows:

Shares of beneficial interest, unlimited

shares authorized | | $ | (9 | ) | |

| Accumulated net investment income (loss) | | | 303 | | |

Undistributed net realized gain (loss) from investment

securities | | | (294 | ) | |

The capital loss carryforwards are available to offset future realized capital gains through the periods listed:

Capital Loss

Carryforward | | Available through | |

| $ | 1,287 | | | October 31, 2009 | |

| | 3,177 | | | October 31, 2010 | |

The capital loss carryforward utilized during the year ended October 31, 2005 was $14,957.

The tax character of distributions paid may differ from the character of distributions shown in the Statement of Changes in Net Assets due to short-term gains being treated as ordinary income for tax purposes. The tax character of distributions paid during 2004 and 2005 was as follows:

| 2004 Distributions paid from: | |

| Ordinary Income | | $ | 478 | | |

| Long-term Capital Gain | | | – | | |

| 2005 Distributions paid from: | |

| Ordinary Income | | | 1,407 | | |

| Long-term Capital Gain | | | – | | |

The tax basis components of distributable earnings as of October 31, 2005, are as follows:

| Undistributed Ordinary Income | | $ | 74 | | |

| Undistributed Long-term Capital Gains | | $ | 23,904 | | |

| Capital Loss Carryforward | | $ | (4,464 | ) | |

| Net Unrealized Appreciation (Depreciation) | | $ | 9,448 | * | |

* Amount includes unrealized appreciation (depreciation) from foreign currency and deferred compensation.

The aggregate cost of investments and composition of unrealized appreciation (depreciation) for federal income tax purposes as of October 31, 2005, are as follows:

| Federal Tax Cost Basis | | $ | 90,161 | | |

| Unrealized Appreciation | | $ | 10,823 | | |

| Unrealized (Depreciation) | | | (1,366 | ) | |

| Net Unrealized Appreciation (Depreciation) | | $ | 9,457 | | |

NOTE 5. REGULATORY PROCEEDINGS

There continues to be significant federal and state regulatory activity relating to financial services companies, particularly mutual fund companies and their investment advisers. As part of an ongoing investigation regarding potential market timing, recordkeeping and trading compliance issues and matters affecting the Fund's investment adviser, TFAI, and certain affiliates and former employees of TFAI, the SEC staff has indicated that it is likely to take some action against TFAI and certain of its affiliates at the conclusion of the investigation. The potential timing and the scope of any such action is difficult to predict. Although the impact of any action brought against TFAI and/or its affiliates is difficult to assess at the present time, the Fund currently believes that the likelihood that any such action will have a material adverse impact on it is remote. It is important to note that the Fund is not aware of any allega tion of wrongdoing against it and its Board at the time this annual report is printed. Although it is not anticipated that these developments will have an adverse impact on the Fund, there can be no assurance at this time. TFAI and its affiliates are actively working with the SEC in regard to this matter; however, the exact resolution cannot be determined at this time. TFAI will take such actions that it deems necessary or appropriate to continue providing management services to the Fund and to bring all matters to an appropriate conclusion.

TFAI and/or its affiliates, and not the Fund, will bear the costs regarding these regulatory matters.

Transamerica IDEX Mutual Funds

Annual Report 2005

14

Report of Independent Registered Certified Public Accounting Firm

To the Board of Trustees and Shareholders of

TA IDEX American Century International

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of TA IDEX American Century International (the "Fund") (one of the portfolios constituting the Transamerica IDEX Mutual Funds) at October 31, 2005, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements bas ed on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2005 by correspondence with the custodian, provide a reasonable basis for our opinion.

December 22, 2005

Transamerica IDEX Mutual Funds

Annual Report 2005

15

TA IDEX American Century International

SUPPLEMENTAL INFORMATION (unaudited)

TAX INFORMATION

For dividends paid during the year ended October 31, 2005, the Fund designated $3,826 as qualified dividend income.

The information and distributions reported herein may differ from the information and distributions taxable to the shareholders for the calendar year ending December 31, 2005. Complete information will be computed and reported in conjunction with your 2005 Form 1099-DIV.

Transamerica IDEX Mutual Funds

Annual Report 2005

16

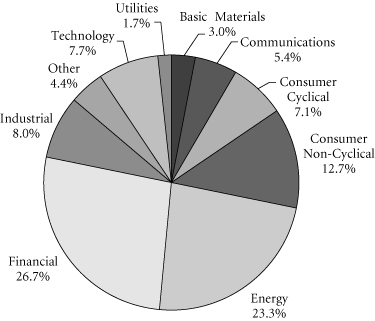

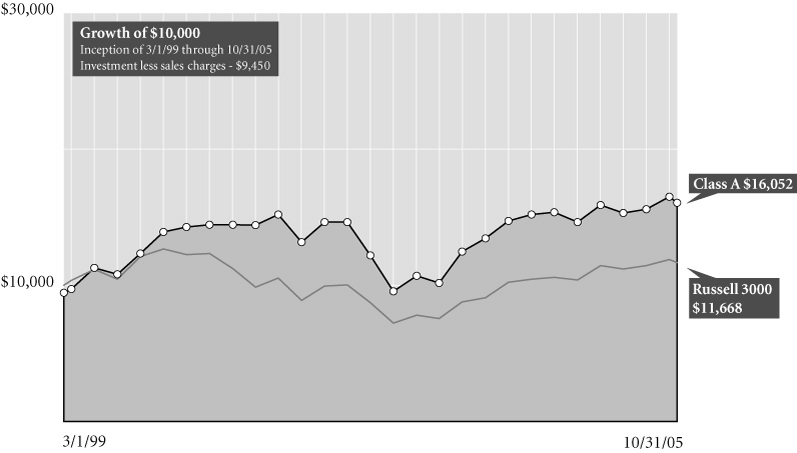

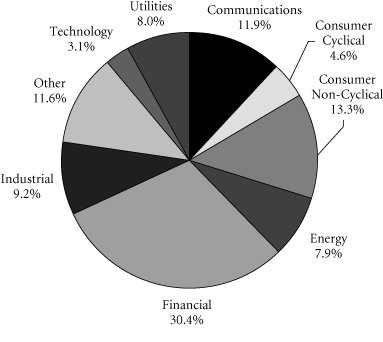

TA IDEX American Century Large Company Value

MARKET ENVIRONMENT

Equity investors faced numerous headwinds during the period covered by this report, a twelve-month stretch that saw a presidential election, eight increases in short-term interest rates, a new record high for oil and three major hurricanes.

Volatility characterized much of the period. Growing speculation about the impact of higher interest rates and energy prices on economic vitality and corporate profits frequently pressured the market. At the same time, numerous strong earnings reports and merger announcements helped stocks gain traction. Ultimately, investors were rewarded for their fortitude, and the equities market demonstrated considerable resilience, rebounding from troughs to secure gains.

In that environment, TA IDEX American Century Large Company Value produced overall gains in all of the sectors in which it was invested.

PERFORMANCE

For the year ended October 31, 2005, TA IDEX American Century Large Company Value, Class A returned 9.10%. By comparison its primary and secondary benchmarks, the Standard and Poor's 500 Composite Stock Index and the Russell 1000 Value Index, returned 8.71% and 11.86%, respectively.

STRATEGY REVIEW

The portfolio's interest in the energy sector, a position devoted entirely to the oil and gas industry, contributed significantly to absolute performance during the fiscal year. Soaring oil prices underpinned gains for numerous firms across the industry, and each of our holdings advanced. Major integrated energy companies ConocoPhillips, Exxon Mobil Corporation, Chevron Corporation, and Royal Dutch/Shell Group of Companies all ranked among the top contributors.

Nevertheless, many of the strongest performers in the sector did not meet our value criteria. For example, energy equipment and services companies recorded powerful gains, but were too richly valued by our standards to merit inclusion in the portfolio. Consequently, our relatively smaller exposure to the energy sector as a whole contributed to our overall underperformance versus our benchmark.

We also found success in the financials sector, on average our largest single stake. Insurance companies paced gains in the group, producing two more top contributors in Loews Corporation and The Hartford Financial Services Group, Inc. ("Hartford") In April, Hartford recorded its most profitable quarter ever driven by strength in its property and casualty insurance segment, where innovative technologies helped the firm maintain competitive pricing.

Elsewhere, our position in the information technology sector produced one of the portfolio's top-contributing stocks: Hewlett-Packard Company. News that the company had gained market share and emerged as the global leader in the server business further supported the stock's climb.

Despite those successes, we suffered some setbacks, one of which emerged from the consumer discretionary sector. On March 1, Lear Corporation, a leading automotive interior-systems supplier, lowered its earnings forecast, and then, on April 22, 2005 reported a steep drop in first-quarter profit, citing diminished production for light trucks and SUVs and higher raw-materials costs. The stock decreased sharply following each of these announcements.

Although investments in the materials area contributed overall, our position in the mining and metals industry slowed performance, led by aluminum giant Alcoa Inc., one of only two holdings. The stock came under pressure late in 2004-amid-concerns about high energy costs and sluggish demand in the auto market. And though the company in July 2005 reported its highest-ever quarterly income and revenue, it later reduced its earnings forecast, citing Hurricane Katrina, which temporarily closed two of its plants, weak pricing power and higher raw-materials costs. Nevertheless, we remain confident in this firm's long-term prospects and have maintained a position.

The TA IDEX American Century Large Company Value investment team will continue to follow its strategy of searching for large fundamentally sound businesses that, because of transitory issues, are selling at prices we believe are below fair market value.

Mark Mallon, CFA

Charles A. Ritter, CFA

Brendan Healy, CFA

Co-Fund Managers

American Century Investment Management Inc.

Transamerica IDEX Mutual Funds

Annual Report 2005

1

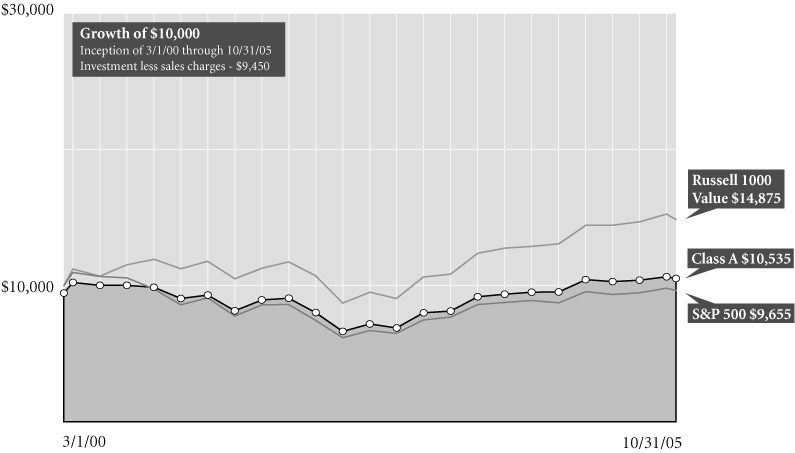

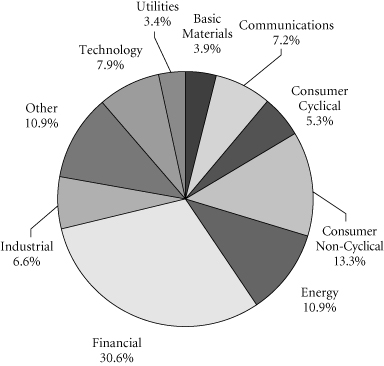

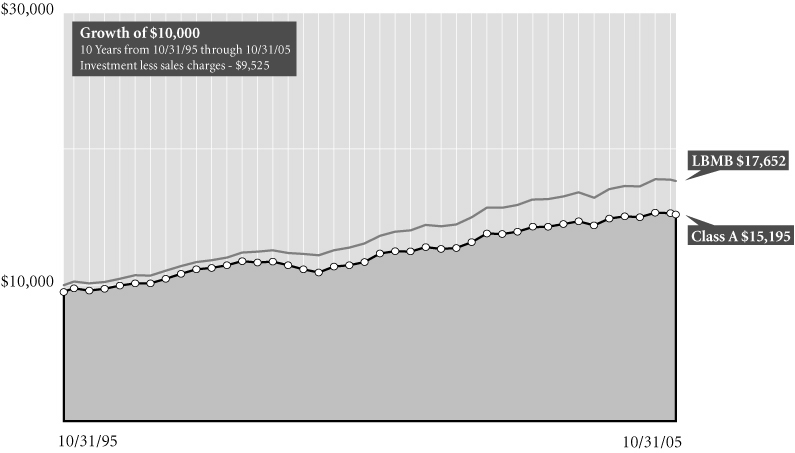

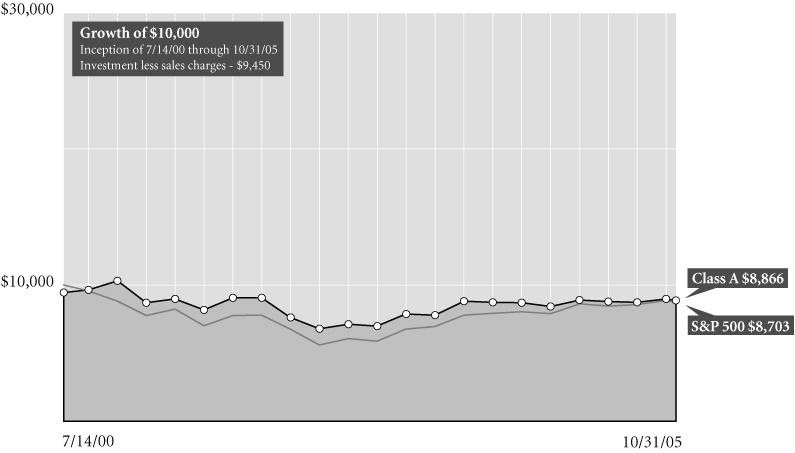

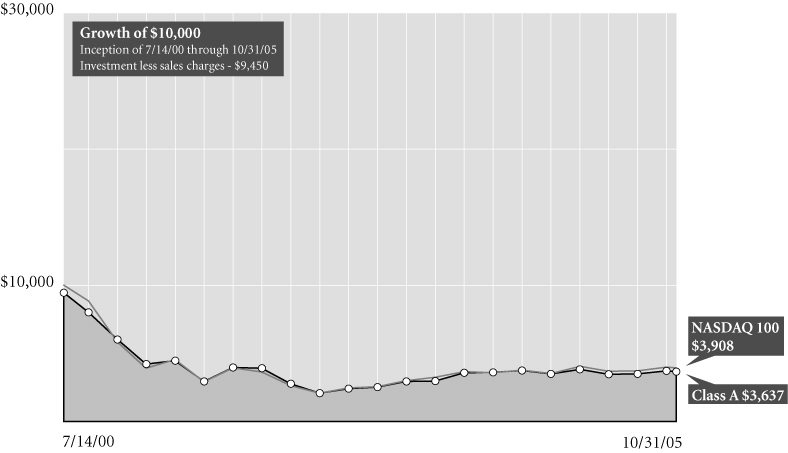

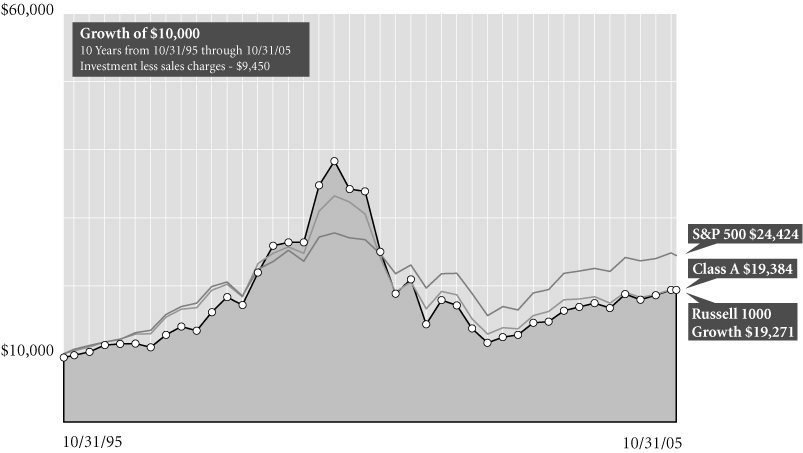

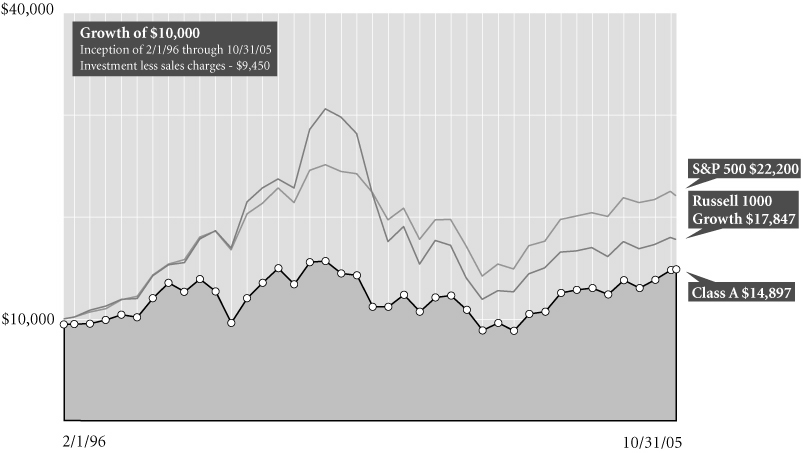

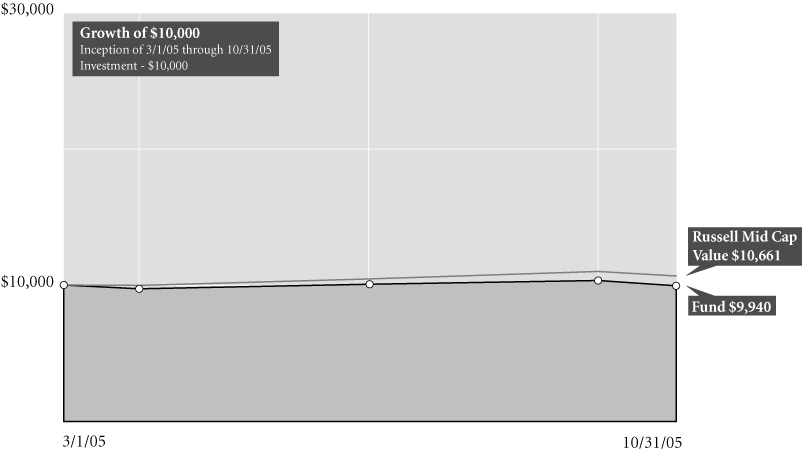

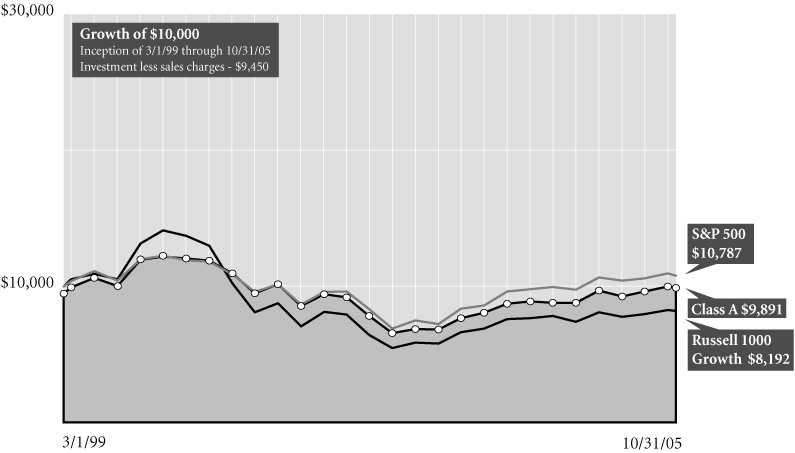

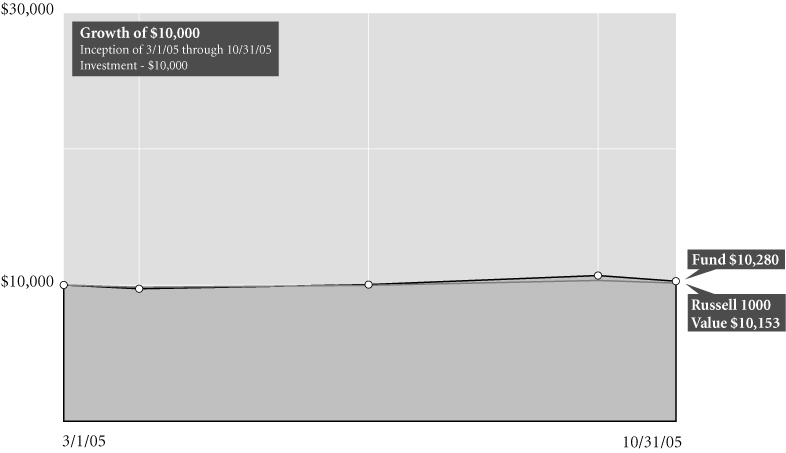

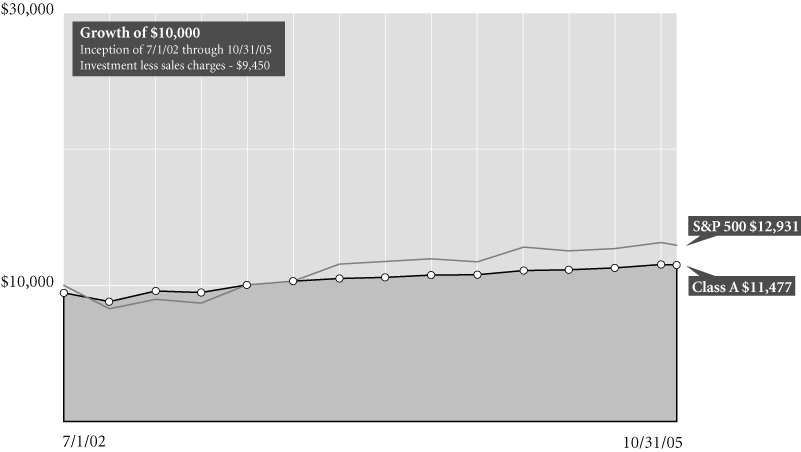

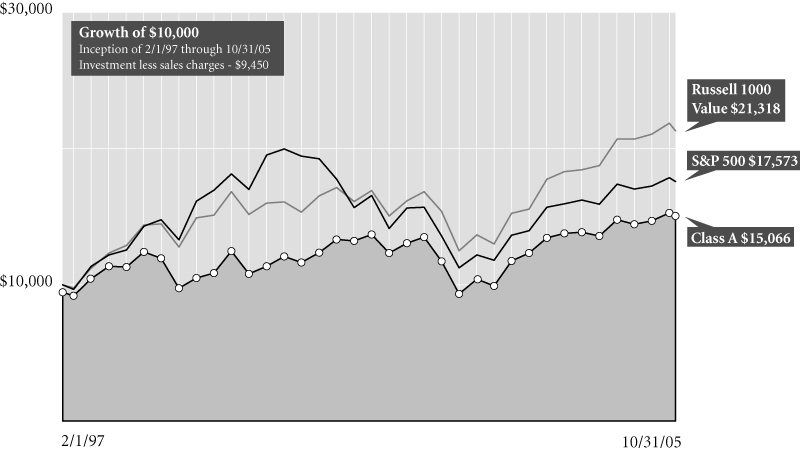

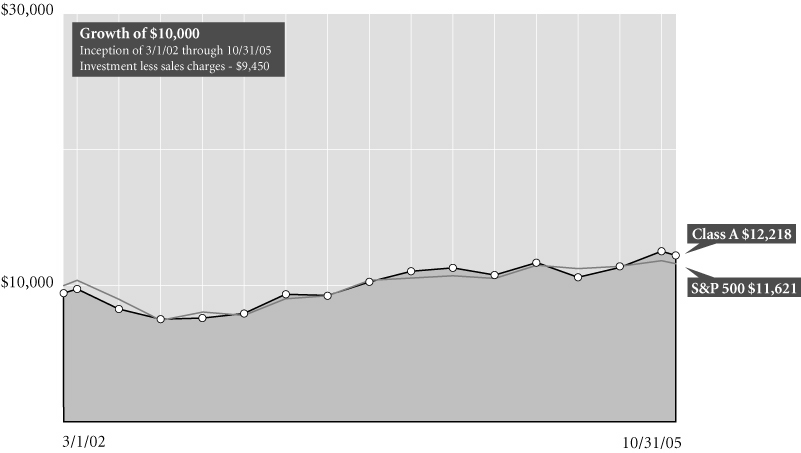

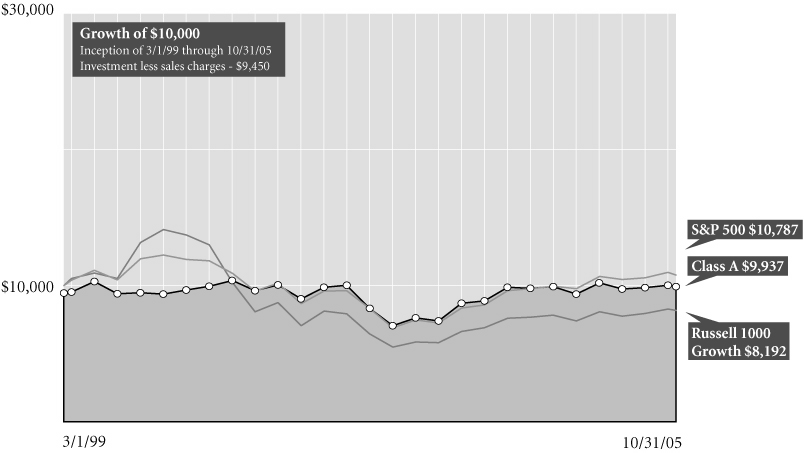

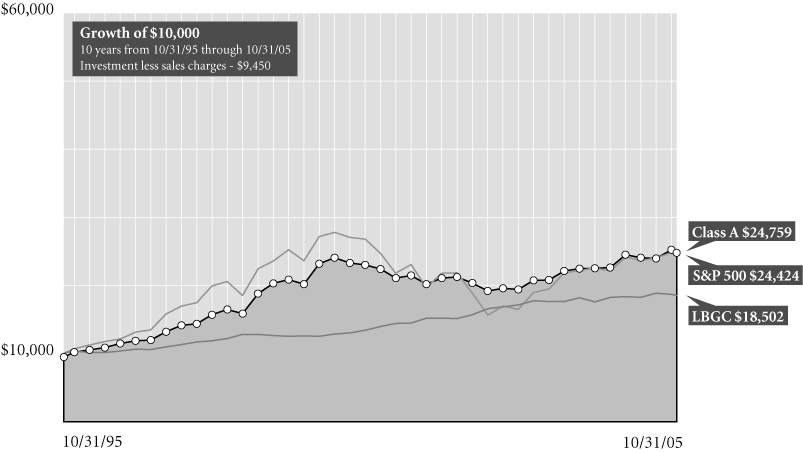

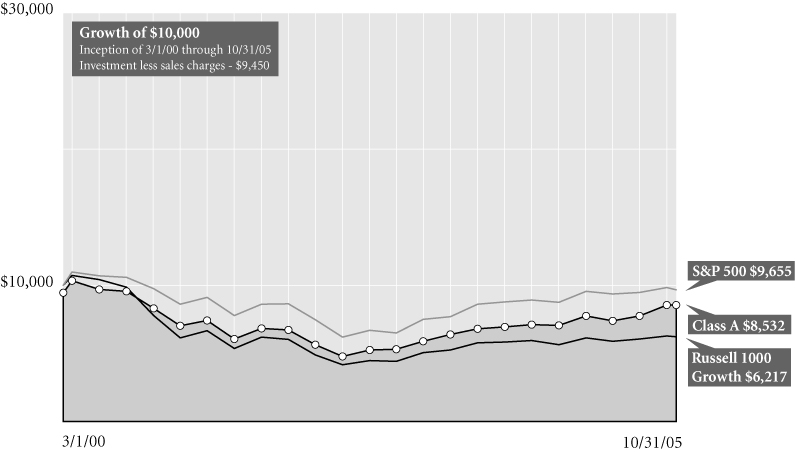

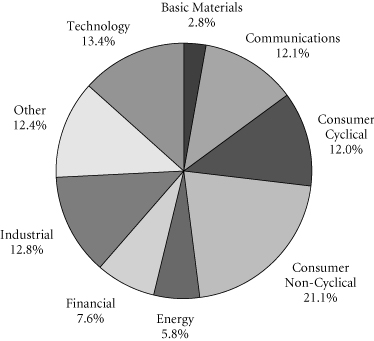

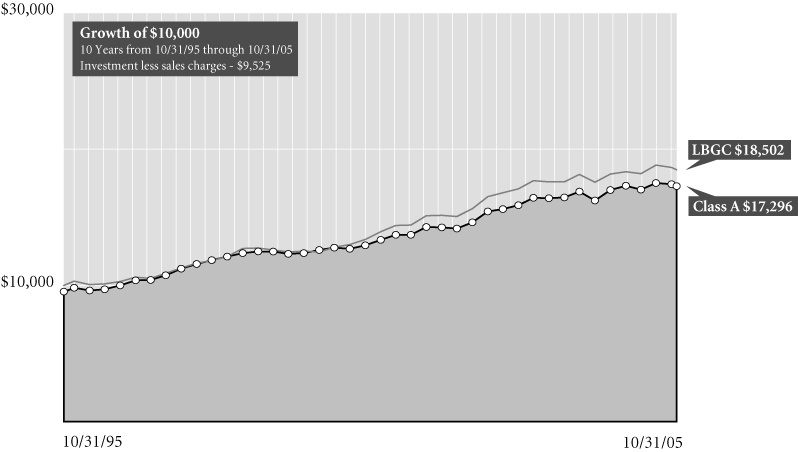

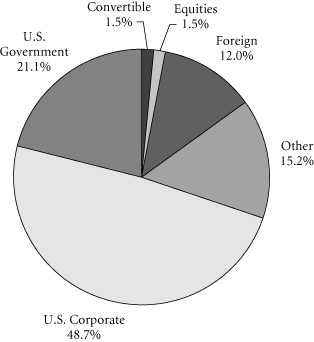

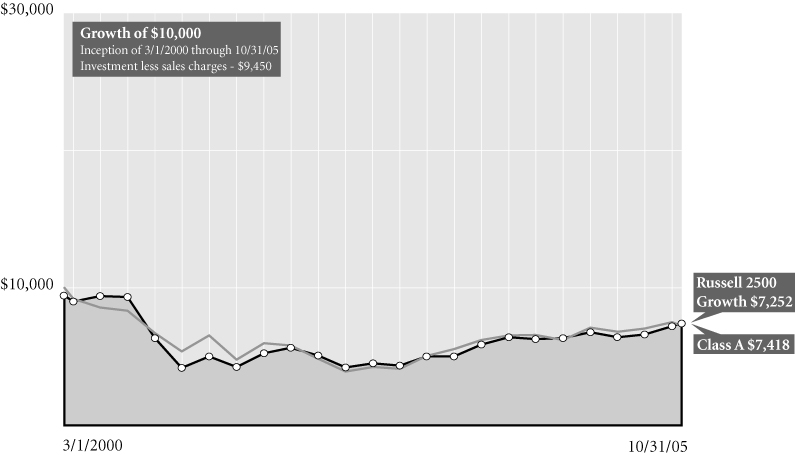

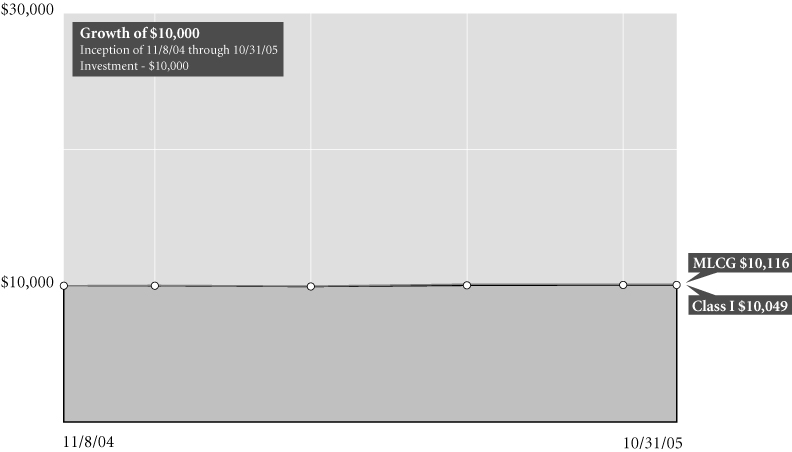

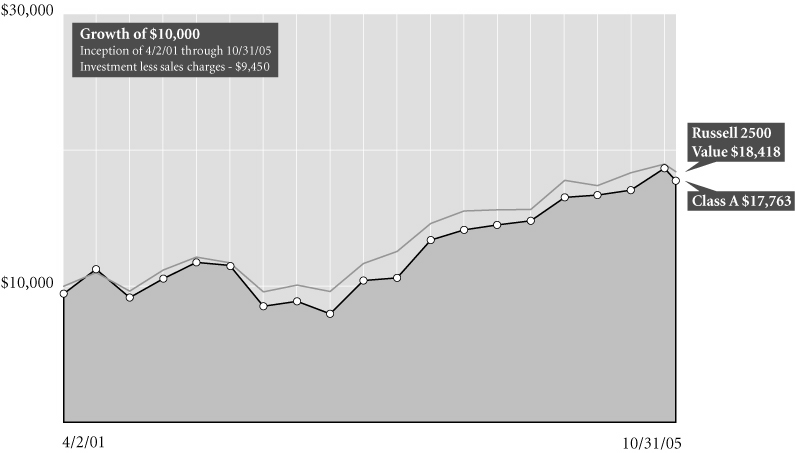

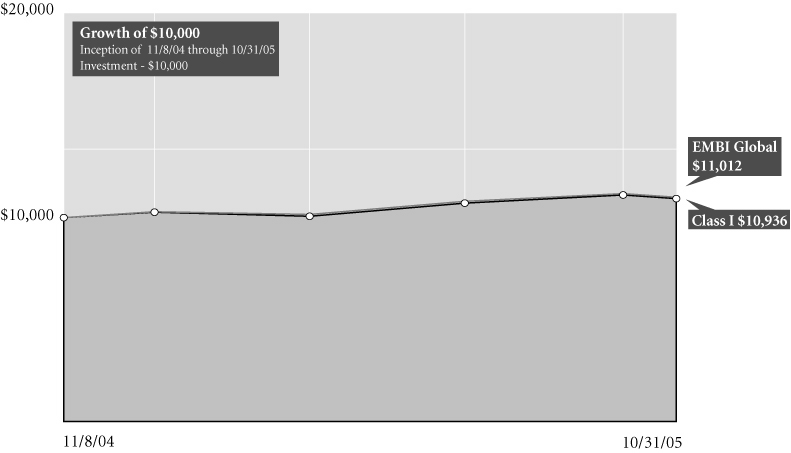

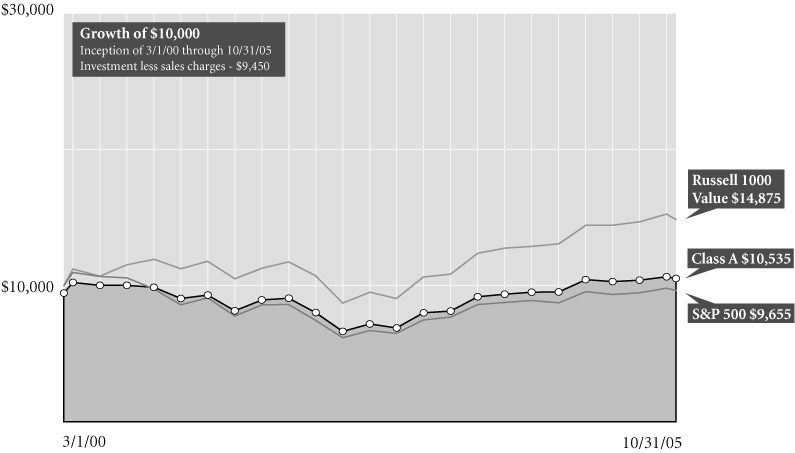

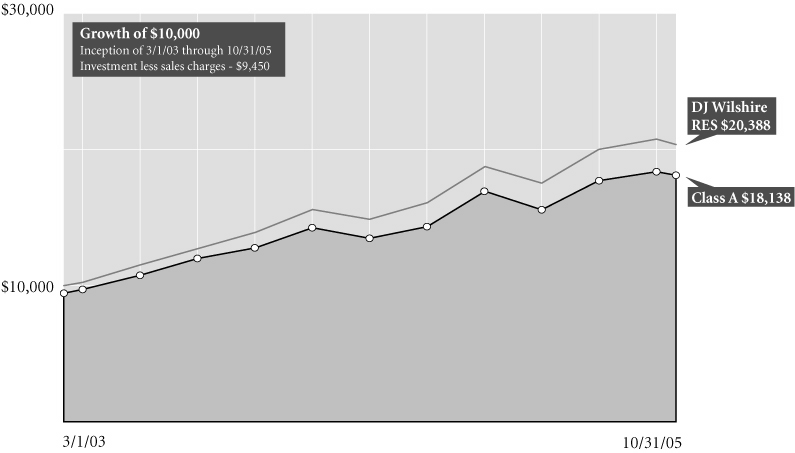

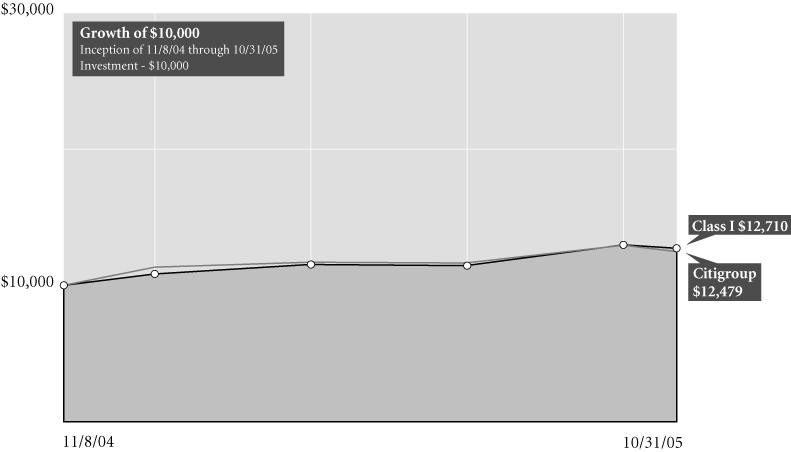

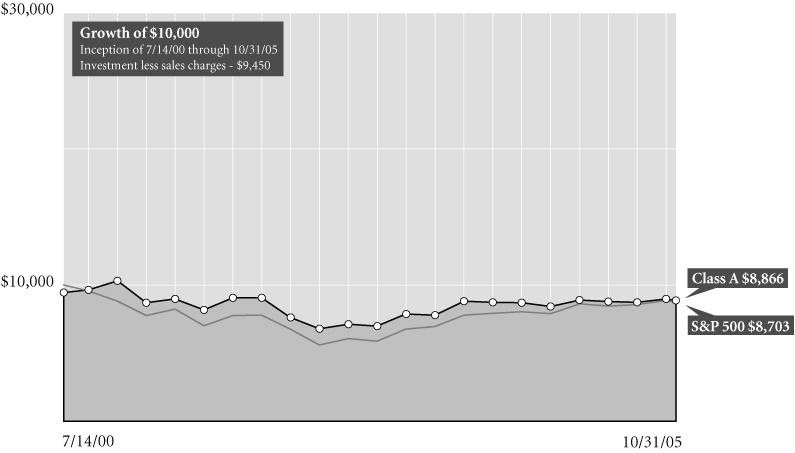

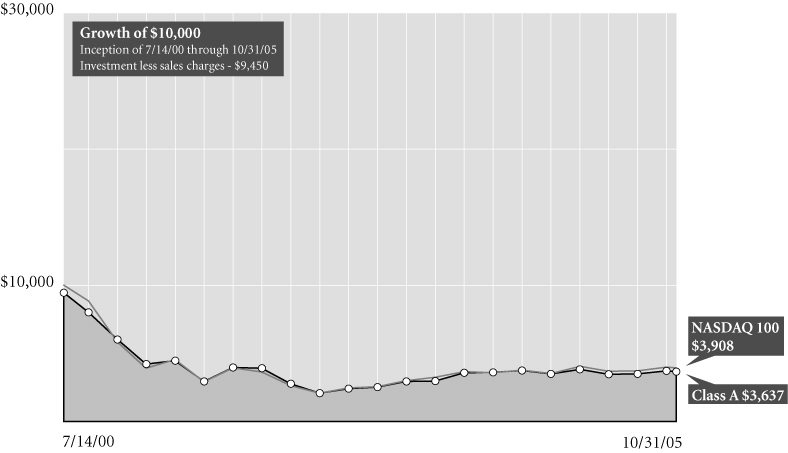

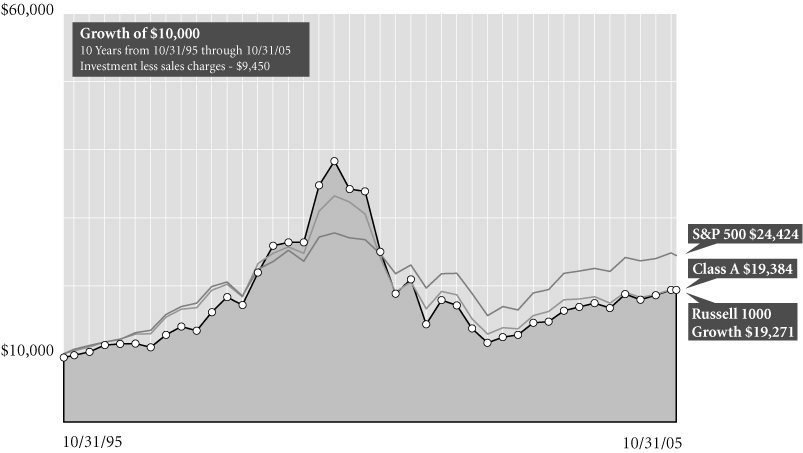

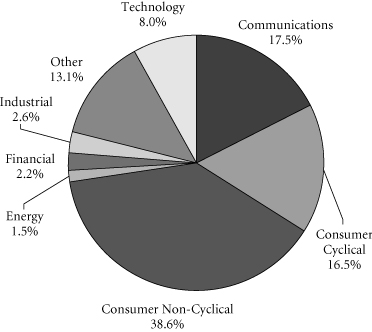

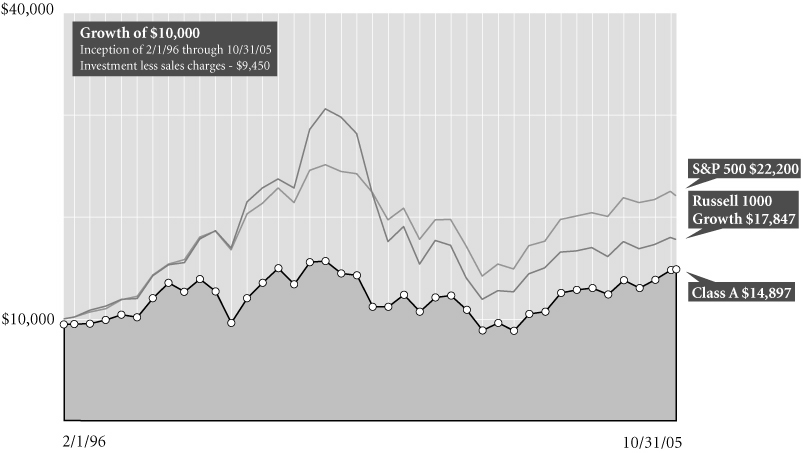

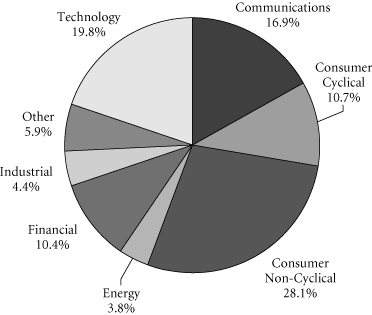

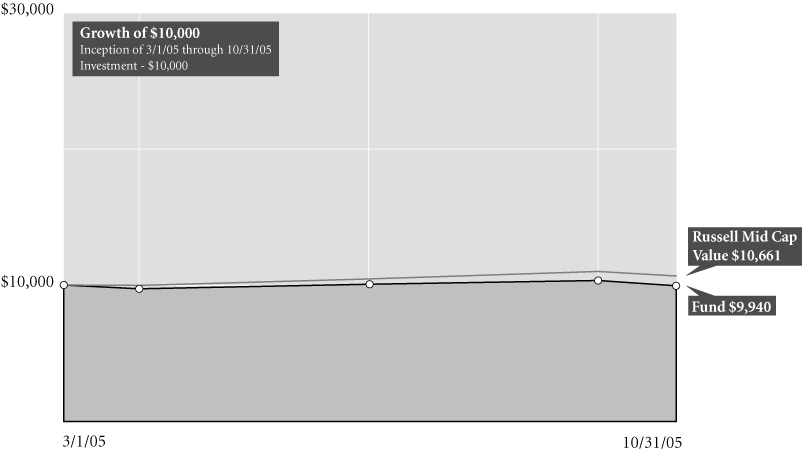

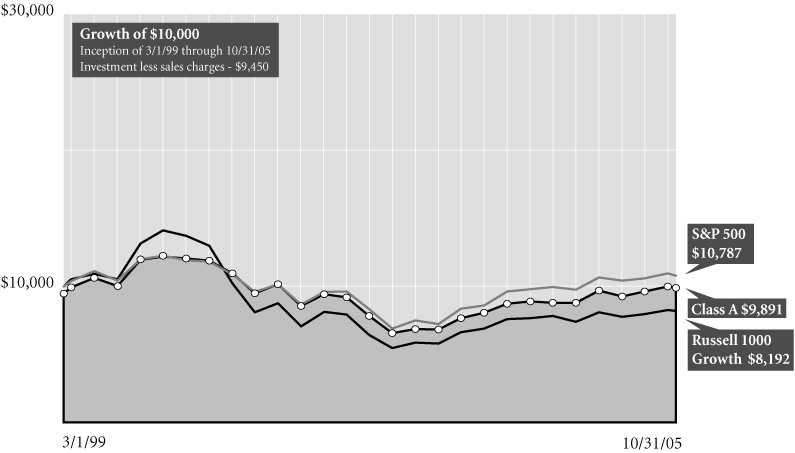

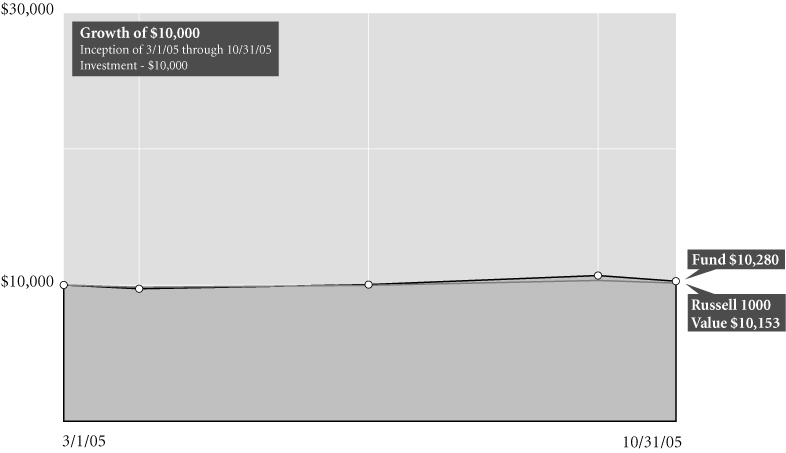

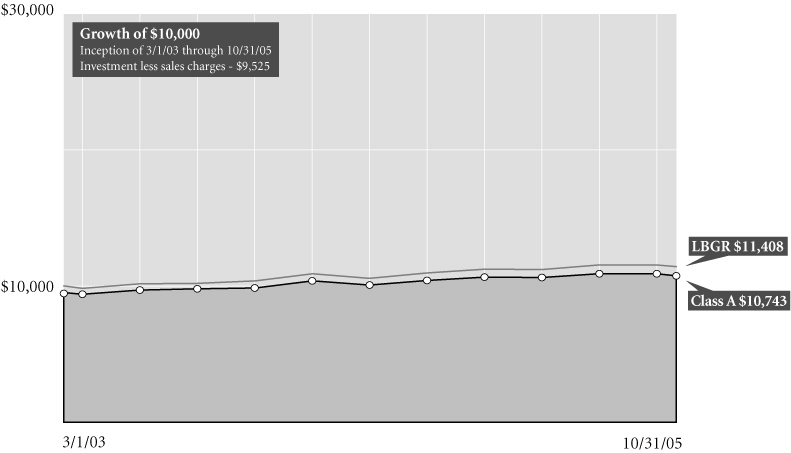

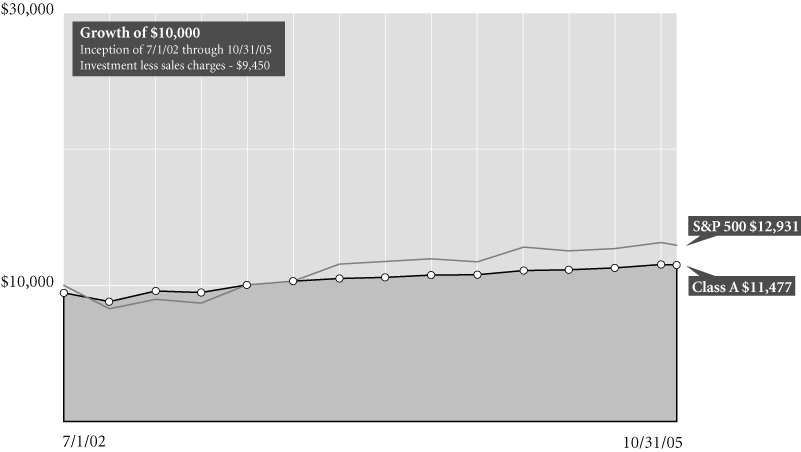

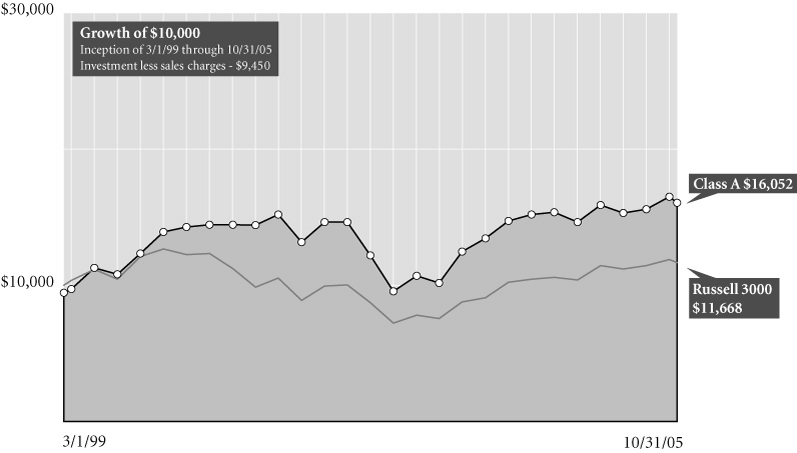

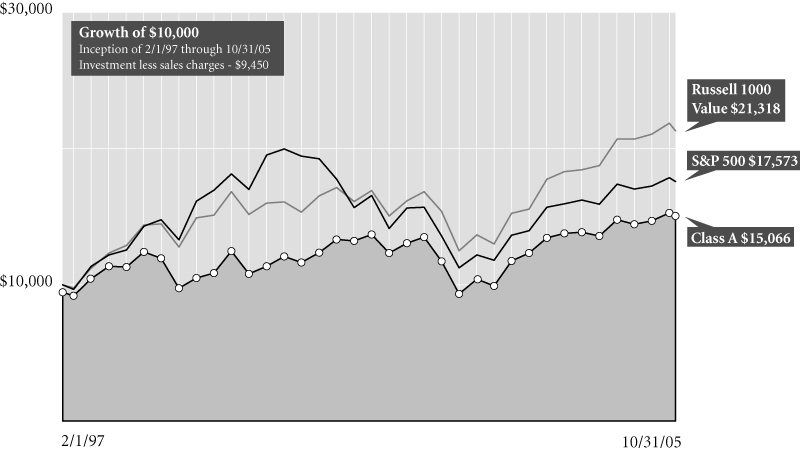

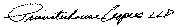

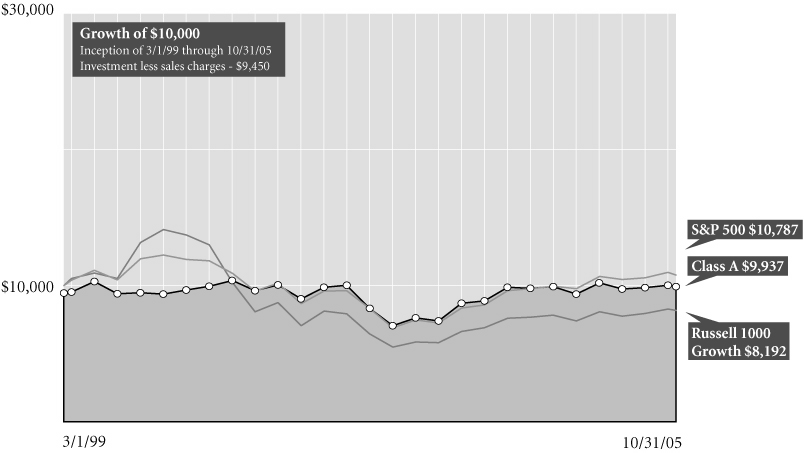

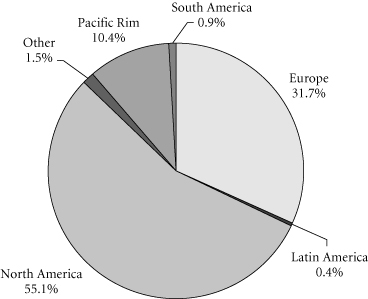

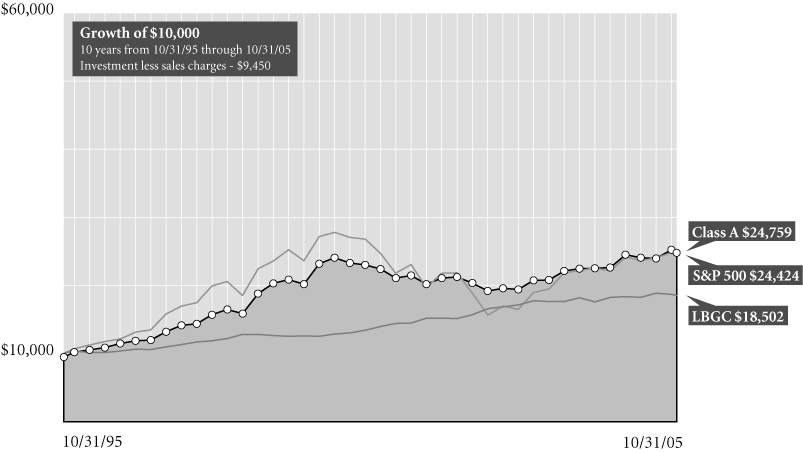

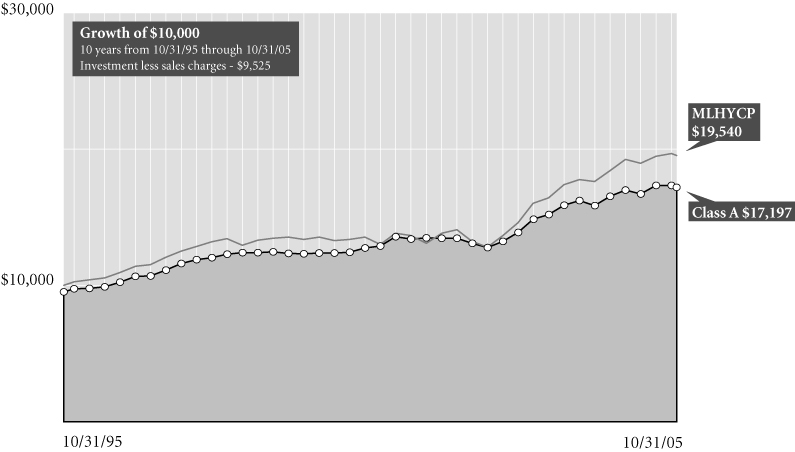

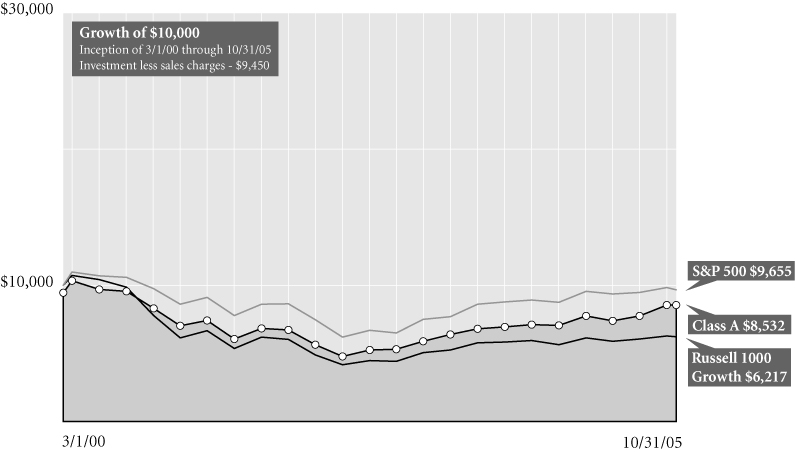

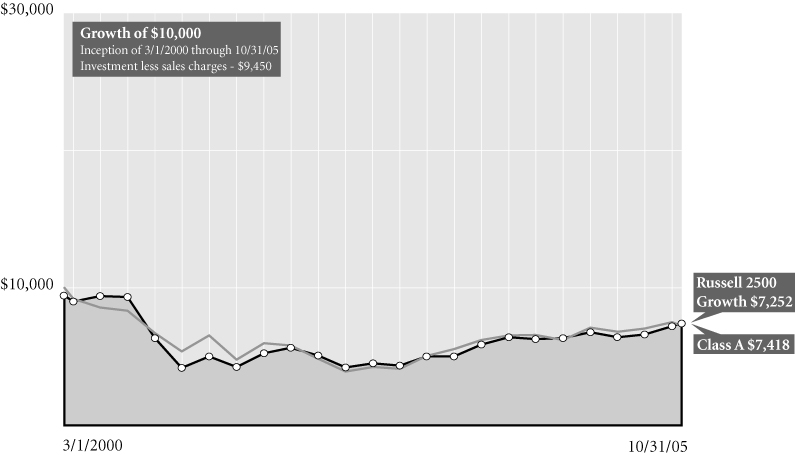

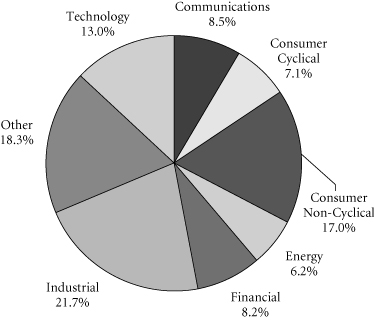

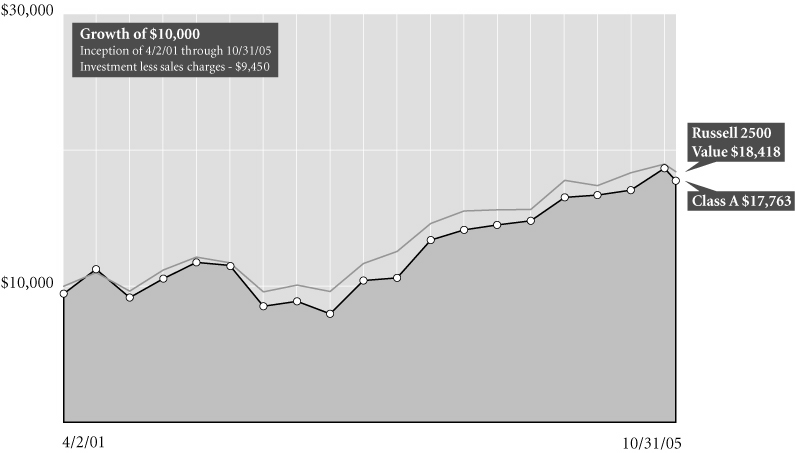

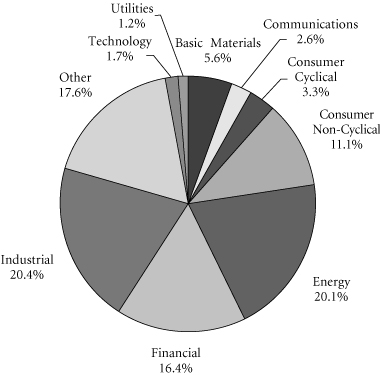

TA IDEX American Century Large Company Value

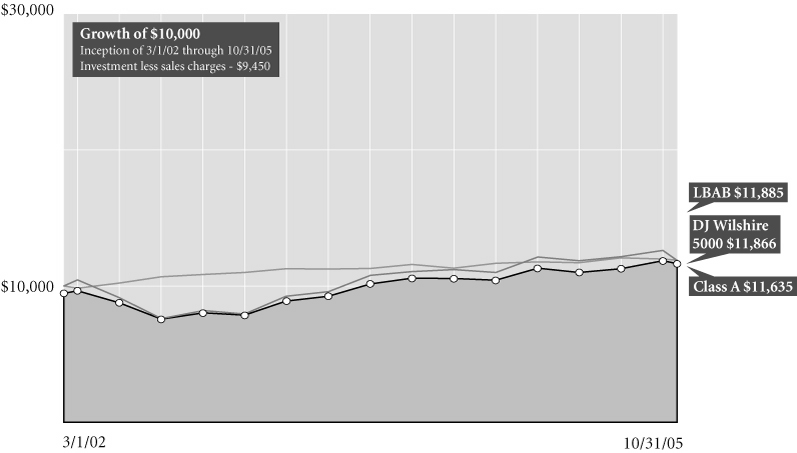

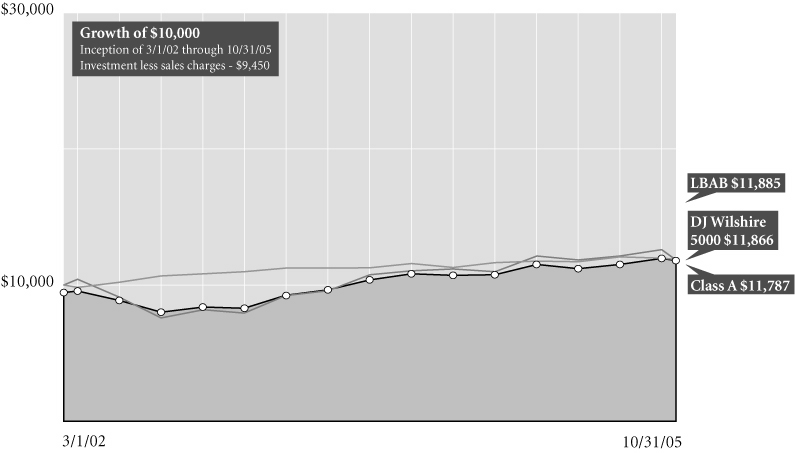

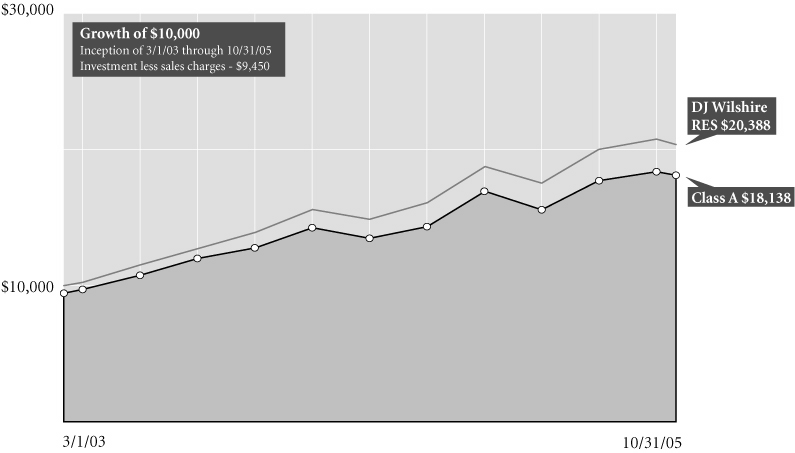

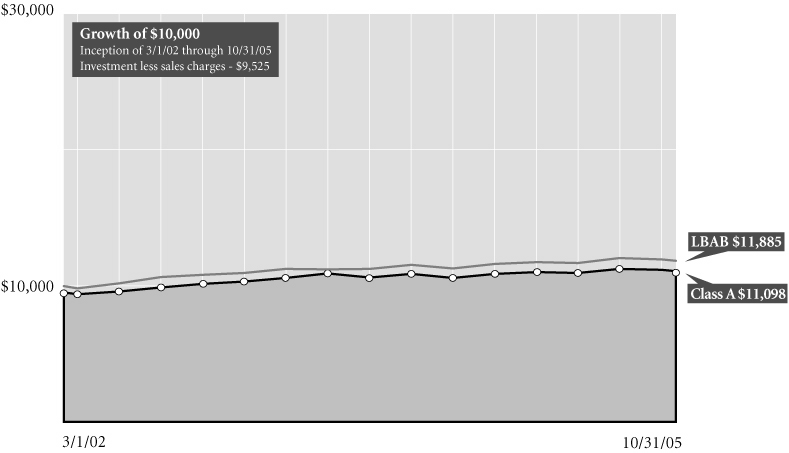

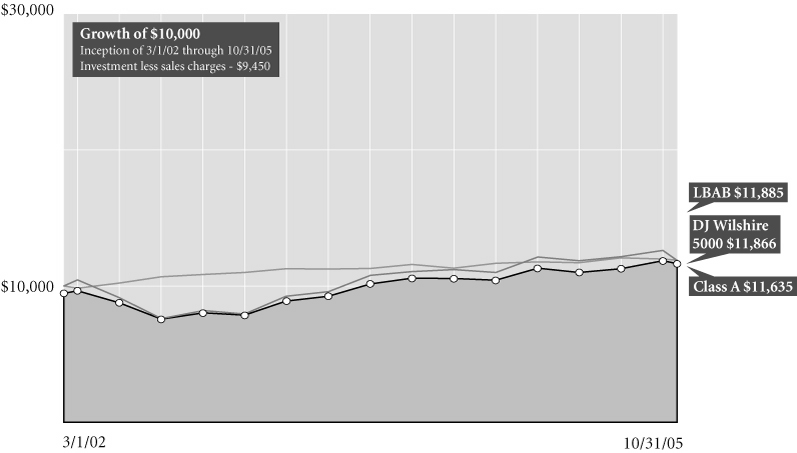

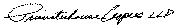

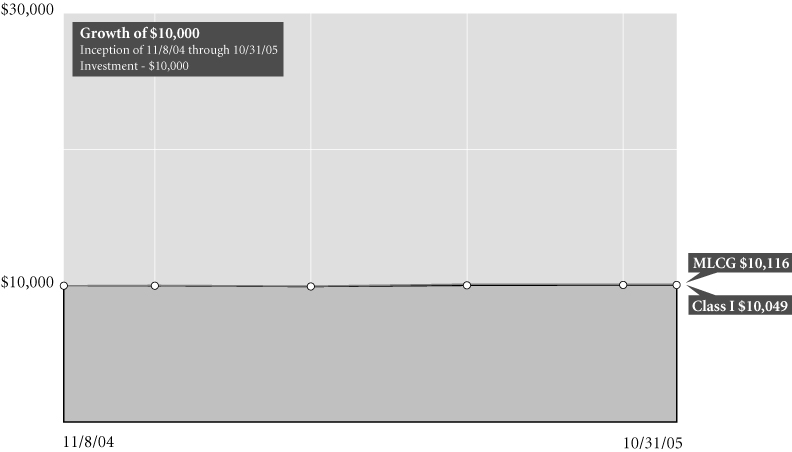

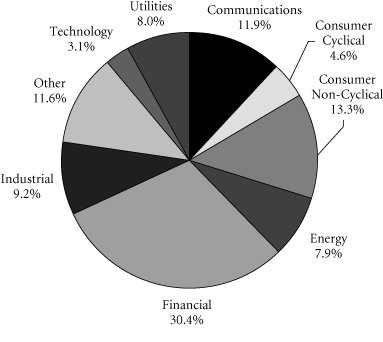

Comparison of change in value of $10,000 investment in Class A shares and its comparative indices.

Average Annual Total Return for Periods Ended 10/31/05

| | | 1 year | | 5 years | | From

Inception | | Inception

Date | |

| Class A (NAV) | | | 9.10 | % | | | 0.57 | % | | | 1.93 | % | | 3/1/00 | |

| Class A (POP) | | | 3.10 | % | | | (0.56 | )% | | | 0.92 | % | | 3/1/00 | |

| S&P 5001 | | | 8.71 | % | | | (1.73 | )% | | | (0.62 | )% | | 3/1/00 | |

| Russell 1000 Value1 | | | 11.86 | % | | | 4.71 | % | | | 7.25 | % | | 3/1/00 | |

| Class B (NAV) | | | 8.01 | % | | | (0.19 | )% | | | 1.18 | % | | 3/1/00 | |

| Class B (POP) | | | 3.01 | % | | | (0.39 | )% | | | 1.18 | % | | 3/1/00 | |

| Class C (NAV) | | | 7.93 | % | | | – | | | | 13.49 | % | | 11/11/02 | |

| Class C (POP) | | | 6.93 | % | | | – | | | | 13.49 | % | | 11/11/02 | |

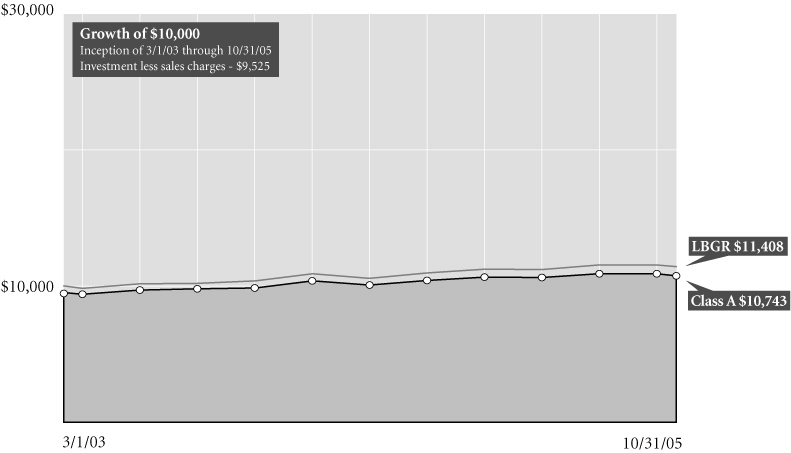

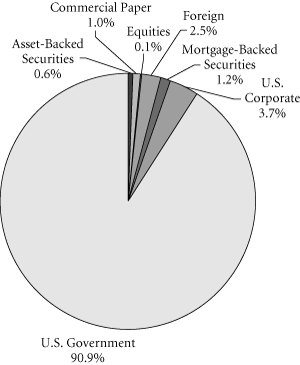

NOTES