As filed with the SEC on January 9, 2008.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: | 811-04556 |

|

TRANSAMERICA IDEX MUTUAL FUNDS |

(Exact name of registrant as specified in charter) |

|

570 Carillon Parkway, St. Petersburg, Florida | | 33716 |

(Address of principal executive offices) | | (Zip code) |

|

Dennis P. Gallagher, Esq. P.O. Box 9012, Clearwater, Florida 33758-9771 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (727) 299-1800 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | November 1, 2006 - October 31, 2007 | |

| | | | | | | | |

Item 1: Report(s) to Shareholders. The Annual Report is attached.

2

Closed Funds

Annual Report

October 31, 2007

www.transamericaidex.com

Customer Service 1-888-233-IDEX (4339)

P.O. Box 9012 · Clearwater, FL 33758-9012

Distributor: Transamerica Capital, Inc.

Dear Fellow Shareholder,

On behalf of Transamerica IDEX Mutual Funds, I would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all shareholders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a discussion of accounting policies as well as matters presented to shareholders that may have required their vote.

We believe it is important to recognize and understand current market conditions in order to provide a context for reading this report. The positive returns experienced in the equity markets for the trailing 12 months ending October 31, 2007, mask the volatility experienced along the way, with significant pullbacks occurring in February-March and July-August. The Federal Reserve was on hold for most of the past twelve months but more recently in September and October lowered its target for the federal funds rate by 0.50% and 0.25% respectively. The rate reductions by the Federal Reserve signaled an effort to inject liquidity and stability to the markets which have been adversely affected by concerns over subprime debt. While Gross Domestic Product growth remains positive, investor concerns over the extent to which subprime debt may affect consumer spending and persistently high oil prices have been a check on market returns. For the 12 months ending October 31, 2007, the Dow Jones Industrial Average returned 17.94%, the Standard & Poor’s 500 Index returned 14.56%, and the Lehman Aggregate Bond Index returned 5.38%. Please keep in mind it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a complete picture of your current and future financial needs. Financial advisers are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial advisor, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

John K. Carter | Christopher A. Staples |

President & Chief Executive Officer | Vice President & Chief Investment Officer |

Transamerica IDEX Mutual Funds | Transamerica IDEX Mutual Funds |

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of Transamerica IDEX Mutual Funds. These views are subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of the Transamerica IDEX Mutual Funds.

TA IDEX American Century Large Company Value

MARKET ENVIRONMENT

The portfolio provided solid returns despite a challenging market environment. Over the period, growth stocks significantly outperformed value across the capitalization spectrum. Investors generally favored companies that were already strong performers; this momentum bias did not fit well with the portfolio’s investment approach, which seeks stocks that are undervalued by the market.

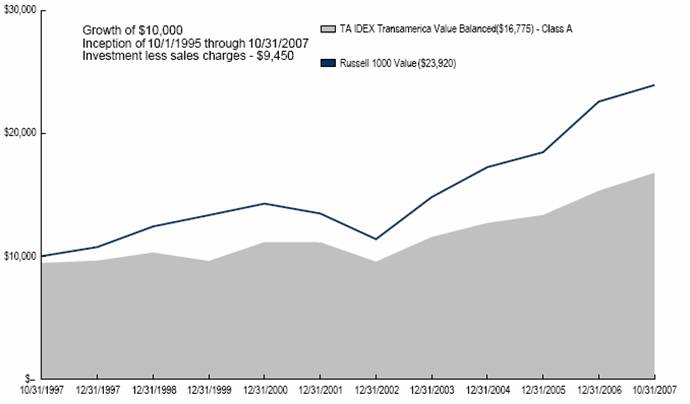

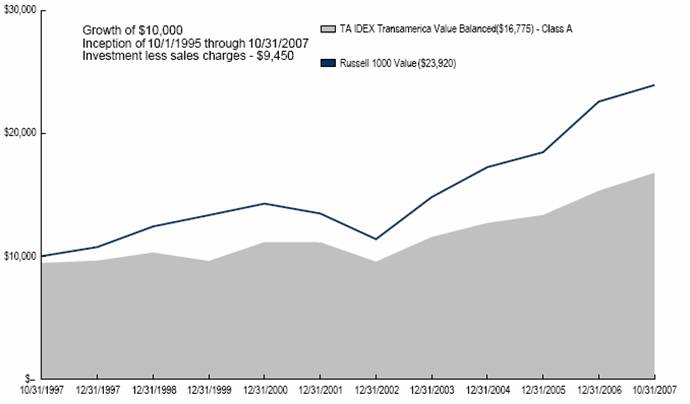

PERFORMANCE

For the year ended October 31, 2007, TA IDEX American Century Large Company Value Class A returned 9.54%. By comparison its primary and secondary benchmarks, the Standard and Poor’s 500 Composite Stock Index (“S&P 500”) and the Russell 1000 Value Index (“Russell 1000 Value”), returned 14.56% and 10.83%, respectively. As of October 31, 2007, the Fund’s net expense ratios for Class A, Class B, Class C, and Class I were 1.17%, 1.19%, 1.07%, and 0.85%, respectively.

STRATEGY REVIEW

The portfolio’s stake in the information technology (“IT”) sector was a top contributor to performance versus the benchmark. A significant holding was software giant Microsoft Corporation (“Microsoft”), which benefited from strong sales of its new Vista operating system and Office 2007. Microsoft’s announcement last summer of a $20-billion stock buyback also boosted its shares.

Hewlett-Packard Company was another strong IT contributor. The company raised its financial forecast as it continued to gain ground in the personal computer (“PC”) market and moved into high-end enterprise printing equipment.

In consumer staples, a preference for large industry leaders proved to be advantageous as many of these names outperformed the benchmark. One top performer was Unilever plc, a foreign-based, global supplier of foods, home goods, and personal products with a strong presence in the U.S. market. Its stock benefited from the company’s stronger-than-expected revenue growth and its progress in cost-cutting efforts.

The portfolio also held a large position in The Kroger Co. (“Kroger”), the second-largest food retailer in the U.S. Kroger’s stock rose 35% as the company regained market share by tailoring its products and service offerings to its customers’ buying behaviors.

The utilities sector provided PPL Corporation (“PPL”) and Exelon Corporation (“Exelon”), two of the portfolio’s strongest performers relative to the benchmark. Headquartered in Pennsylvania, and a low-cost producer of nuclear- and coal-generated energy, PPL produces and delivers electricity to customers in the U.S., the UK and Latin America. The company reported solid 2006 earnings and reaffirmed its positive outlook for 2007.

Exelon, which distributes electricity to customers in Illinois and Pennsylvania and gas to customers in the Philadelphia area, is the nation’s largest nuclear generator. The company’s nuclear plants benefited as the cost of power from competitors’ gas-fired plants increased.

An underweight in materials hampered results as the sector generated strong returns for the Russell 1000 Value. While a position in steel producer, Nucor Corporation was a bright spot (as the company reported growing sales and pricing power), the portfolio generally held smaller-than-the-benchmark positions in metals, mining, and chemical stocks. Many of these companies have reported exceptionally strong earnings, which has in turn attracted a large number of investors. (The metals and mining segment was up nearly 50% over the period; chemicals rose 25%.) Because the management team believes these current earnings are unsustainable, it has limited the portfolio’s exposure to these industries.

The financials sector was the portfolio’s weakest performer. Many financial firms came under pressure amid the fallout in the sub-prime lending category. Although the management team’s valuation work led the portfolio away from real estate investment trusts, its holdings among thrifts and mortgage finance companies were a drag on relative results. Federal Home Loan Mortgage Corporation (“Freddie Mac”), a top-detracting stock, made slow progress in implementing new accounting systems, which dampened its near-term prospects for reduced regulatory oversight.

A modest position in MGIC Investment Corporation, the nation’s largest private mortgage insurer, hurt performance as the company was hampered by the housing slowdown and significant financial losses from a joint venture involved in restructuring sub-prime mortgages.

Charles A. Ritter, CFA

Brendan Healy, CFA

Co-Fund Managers

American Century Investment Management Inc.

Transamerica IDEX Mutual Funds | Annual Report 2007 |

1

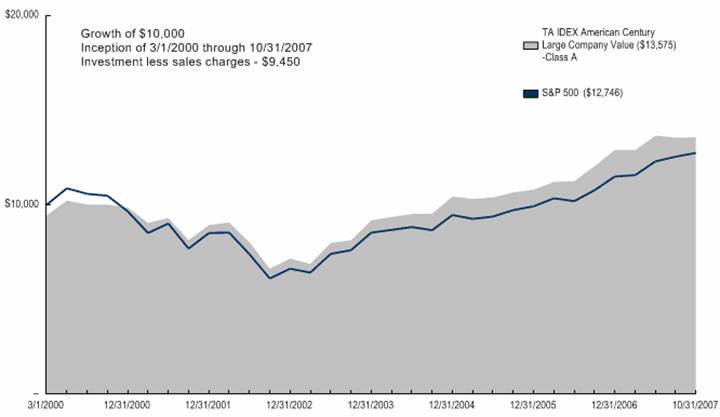

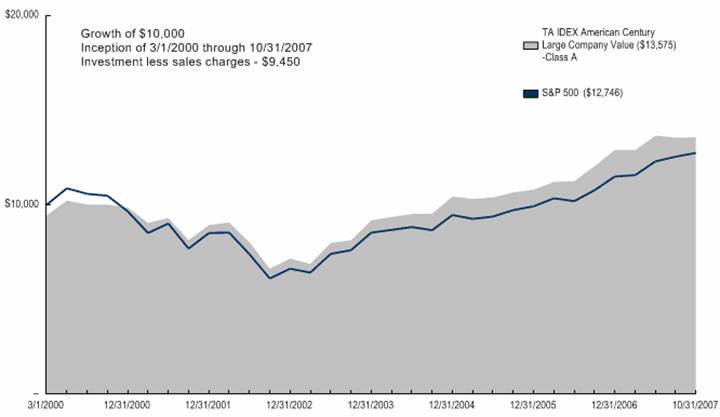

(unaudited)

Average Annual Total Return for Periods Ended 10/31/2007

| | | | | | From | | Inception | |

| | 1 Year | | 5 Years | | Inception | | Date | |

Class A (NAV) | | 9.54 | % | 13.73 | % | 4.83 | % | 3/1/00 | |

Class A (POP) | | 3.54 | % | 12.44 | % | 4.06 | % | 3/1/00 | |

S&P 500 (1) | | 14.56 | % | 13.88 | % | 3.34 | % | 3/1/00 | |

Russell 1000 Value (1) | | 10.83 | % | 16.39 | % | 9.47 | % | 3/1/00 | |

| | | | | | | | | |

Class B (NAV) | | 9.55 | % | 13.13 | % | 4.22 | % | 3/1/00 | |

Class B (POP) | | 4.55 | % | 13.01 | % | 4.22 | % | 3/1/00 | |

| | | | | | | | | |

Class C (NAV) | | 9.66 | % | — | % | 13.49 | % | 11/11/02 | |

Class C (POP) | | 8.66 | % | — | % | 13.49 | % | 11/11/02 | |

| | | | | | | | | |

Class I (NAV) | | 9.95 | % | — | % | 13.26 | % | 11/15/05 | |

NOTES

(1) The Standard and Poor’s 500 Composite Stock (S&P 500) Index and the Russell 1000 Value (Russell 1000 Value) Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception calculation is based on life of Class A shares. You cannot invest directly in an Index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return; and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than performance quoted. Please see www.transamericaidex.com for performance data current to the most recent month-end.

Public Offering Price (POP) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. Net Asset Value (NAV) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this Fund. This Fund is closed to new investments.

2

UNDERSTANDING YOUR FUNDS EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions and redemption fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, and other fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at May 1, 2007 and held for the entire period until October 31, 2007

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA, your expenses could have included a $15 annual fee. The amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

| | Beginning | | Ending | | Annualized | | Expenses | |

| | Account | | Account | | Expense | | Paid During | |

| | Value | | Value | | Ratio | | Period (a) | |

Class A | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,008.65 | | 1.14 | % | $ | 5.76 | |

Hypothetical (b) | | 1,000.00 | | 1,019.41 | | 1.14 | | 5.79 | |

| | | | | | | | | |

Class B | | | | | | | | | |

Actual | | 1,000.00 | | 1,008.14 | | 1.13 | | 5.70 | |

Hypothetical (b) | | 1,000.00 | | 1,019.46 | | 1.13 | | 5.74 | |

| | | | | | | | | |

Class C | | | | | | | | | |

Actual | | 1,000.00 | | 1,009.80 | | 1.04 | | 5.25 | |

Hypothetical (b) | | 1,000.00 | | 1,019.91 | | 1.04 | | 5.28 | |

| | | | | | | | | |

Class I | | | | | | | | | |

Actual | | 1,000.00 | | 1,010.24 | | 0.85 | | 4.30 | |

Hypothetical (b) | | 1,000.00 | | 1,020.86 | | 0.85 | | 4.32 | |

| | | | | | | | | | | | |

(a) Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (365 days).

(b) 5% return per year before expenses.

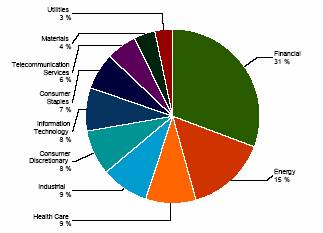

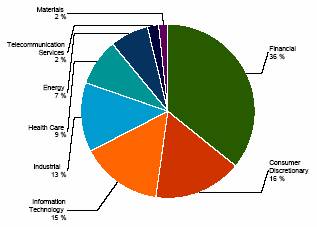

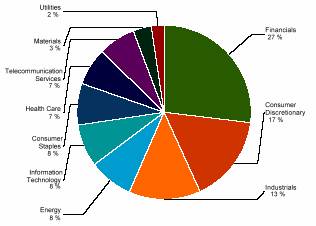

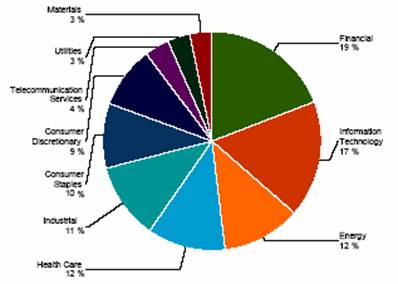

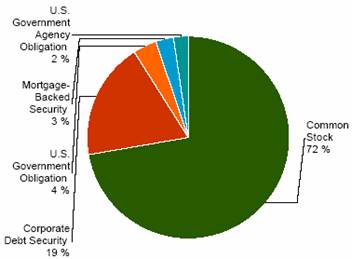

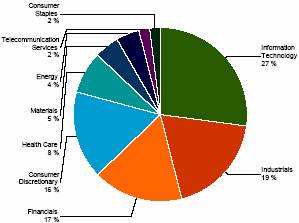

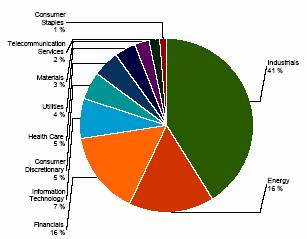

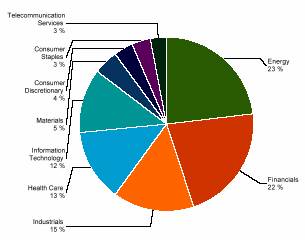

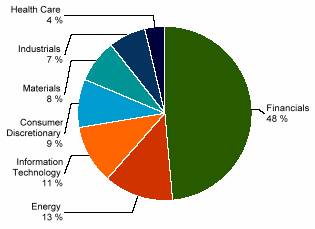

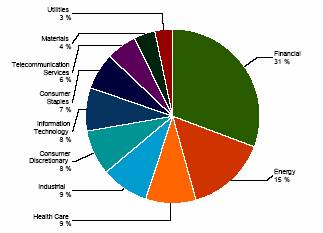

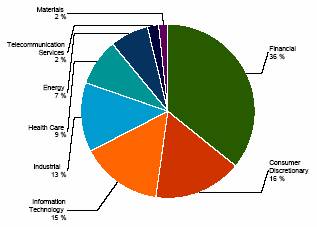

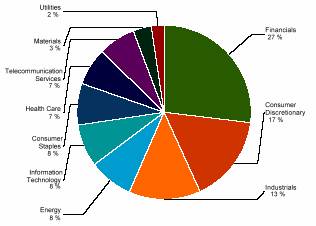

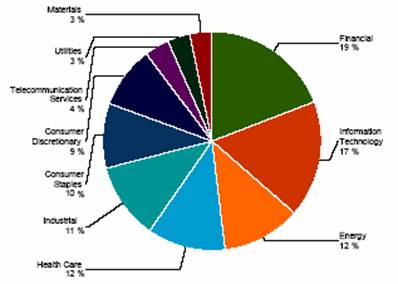

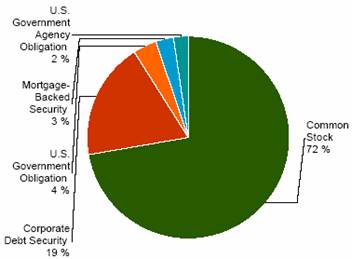

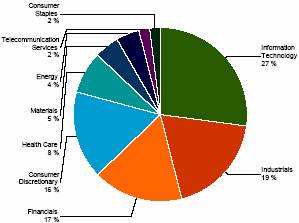

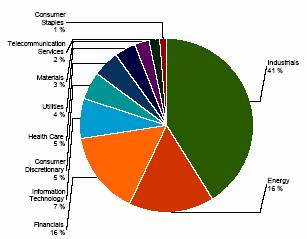

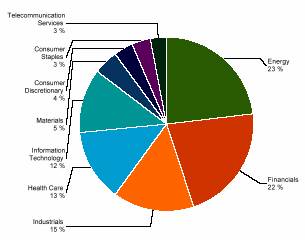

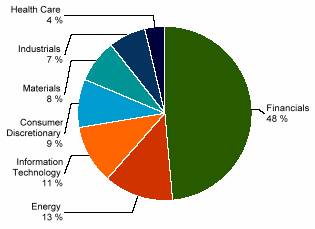

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Sector

At October 31, 2007

This chart shows the percentage breakdown by sector of the Fund’s total investment securities.

3

SCHEDULE OF INVESTMENTS

At October 31, 2007

(all amounts except share amounts in thousands)

| | Shares | | Value | |

COMMON STOCKS (94.7%) | | | | | |

Aerospace & Defense (1.0%) | | | | | |

Northrop Grumman Corp. | | 85,200 | | $ | 7,124 | |

Beverages (2.3%) | | | | | |

Coca-Cola Co. (The) | | 151,000 | | 9,326 | |

Pepsi Bottling Group, Inc. | | 166,700 | | 7,181 | |

Biotechnology (0.6%) | | | | | |

Amgen, Inc. ‡ | | 70,800 | | 4,114 | |

Capital Markets (2.9%) | | | | | |

Bear Stearns Cos., Inc. (The) | | 14,800 | | 1,681 | |

Merrill Lynch & Co., Inc. | | 142,400 | | 9,401 | |

Morgan Stanley | | 147,200 | | 9,901 | |

Chemicals (2.1%) | | | | | |

Ei DU Pont de Nemours & Co. | | 134,300 | | 6,649 | |

PPG Industries, Inc. | | 114,500 | | 8,558 | |

Commercial Banks (6.5%) | | | | | |

Bank of New York Mellon Corp. | | 110,500 | | 5,398 | |

National City Corp. | | 112,800 | | 2,735 | |

PNC Financial Services Group, Inc. | | 61,900 | | 4,467 | |

US Bancorp | | 277,400 | | 9,199 | |

Wachovia Corp. | | 217,800 | | 9,960 | |

Wells Fargo & Co. | | 432,500 | | 14,709 | |

Commercial Services & Supplies (1.4%) | | | | | |

Avery Dennison Corp. | | 28,200 | | 1,633 | |

RR Donnelley & Sons Co. | | 112,500 | | 4,532 | |

Waste Management, Inc. | | 112,800 | | 4,105 | |

Communications Equipment (0.2%) | | | | | |

Motorola, Inc. | | 95,100 | | 1,787 | |

Computers & Peripherals (2.7%) | | | | | |

Hewlett-Packard Co. | | 202,800 | | 10,481 | |

International Business Machines Corp. | | 73,900 | | 8,581 | |

Consumer Finance (0.2%) | | | | | |

Discover Financial Services | | 82,100 | | 1,585 | |

Diversified Consumer Services (0.6%) | | | | | |

H&R Block, Inc. | | 183,000 | | 3,989 | |

Diversified Financial Services (9.6%) | | | | | |

Bank of America Corp. (1) | | 478,300 | | 23,092 | |

Citigroup, Inc. | | 686,400 | | 28,760 | |

JPMorgan Chase & Co. | | 365,500 | | 17,179 | |

Diversified Telecommunication Services (4.6%) | | | | | |

AT&T, Inc. (1) | | 523,600 | | 21,881 | |

Verizon Communications, Inc. | | 242,100 | | 11,154 | |

Electric Utilities (2.9%) | | | | | |

Exelon Corp. | | 135,600 | | 11,225 | |

PPL Corp. | | 185,300 | | 9,580 | |

Electronic Equipment & Instruments (0.8%) | | | | | |

Tyco Electronics, Ltd. | | 71,700 | | 2,558 | |

Tyco International, Ltd. | | 75,500 | | 3,108 | |

Energy Equipment & Services (0.5%) | | | | | |

National Oilwell Varco, Inc. ‡ | | 49,000 | | 3,589 | |

Food & Staples Retailing (1.9%) | | | | | |

Kroger Co. (The) | | 158,900 | | 4,670 | |

Walgreen Co. | | 35,800 | | 1,419 | |

Wal-Mart Stores, Inc. | | 162,100 | | 7,329 | |

Food Products (1.1%) | | | | | |

Unilever NV | | 251,600 | | $ | 8,167 | |

Health Care Equipment & Supplies (0.4%) | | | | | |

Medtronic, Inc. | | 65,500 | | 3,107 | |

Health Care Providers & Services (0.3%) | | | | | |

Quest Diagnostics, Inc. | | 38,700 | | 2,058 | |

Hotels, Restaurants & Leisure (0.6%) | | | | | |

McDonald’s Corp. | | 77,000 | | 4,597 | |

Household Durables (0.7%) | | | | | |

Newell Rubbermaid, Inc. | | 165,800 | | 4,835 | |

Independent Power Producers & Energy Traders (0.3%) | | | | | |

NRG Energy, Inc. ‡ | | 41,700 | | 1,904 | |

Industrial Conglomerates (2.4%) | | | | | |

General Electric Co. | | 411,400 | | 16,933 | |

Insurance (6.0%) | | | | | |

Allstate Corp. (The) | | 140,800 | | 7,378 | |

American International Group, Inc. | | 224,000 | | 14,139 | |

Hartford Financial Services Group, Inc. | | 86,800 | | 8,422 | |

Loews Corp. | | 102,700 | | 5,041 | |

Marsh & McLennan Cos., Inc. | | 137,200 | | 3,552 | |

Torchmark Corp. | | 63,900 | | 4,164 | |

IT Services (0.4%) | | | | | |

Fiserv, Inc. ‡ | | 53,300 | | 2,953 | |

Machinery (3.2%) | | | | | |

Caterpillar, Inc. | | 59,300 | | 4,424 | |

Deere & Co. | | 19,400 | | 3,005 | |

Dover Corp. | | 98,500 | | 4,531 | |

Ingersoll-Rand Co., Ltd. Class A | | 113,500 | | 5,715 | |

Parker Hannifin Corp. | | 69,300 | | 5,570 | |

Media (3.2%) | | | | | |

Gannett Co., Inc. | | 163,100 | | 6,917 | |

Time Warner, Inc. | | 544,700 | | 9,946 | |

Viacom, Inc. Class B ‡ | | 145,500 | | 6,008 | |

Metals & Mining (0.6%) | | | | | |

Nucor Corp. | | 65,400 | | 4,056 | |

Multiline Retail (0.2%) | | | | | |

Kohl’s Corp. ‡ | | 31,500 | | 1,732 | |

Office Electronics (0.6%) | | | | | |

Xerox Corp. ‡ | | 228,900 | | 3,992 | |

Oil, Gas & Consumable Fuels (13.8%) | | | | | |

Chevron Corp. | | 249,000 | | 22,786 | |

ConocoPhillips | | 180,300 | | 15,318 | |

Devon Energy Corp. | | 27,000 | | 2,522 | |

Exxon Mobil Corp. | | 396,500 | | 36,474 | |

Royal Dutch Shell PLC Class A | | 249,600 | | 21,843 | |

Paper & Forest Products (1.1%) | | | | | |

Weyerhaeuser Co. | | 101,500 | | 7,705 | |

Pharmaceuticals (7.7%) | | | | | |

Abbott Laboratories | | 182,700 | | 9,979 | |

Eli Lilly & Co. | | 84,700 | | 4,586 | |

Johnson & Johnson | | 204,800 | | 13,347 | |

Merck & Co., Inc. | | 95,400 | | 5,558 | |

Pfizer, Inc. | | 520,500 | | 12,810 | |

Wyeth | | 175,500 | | 8,535 | |

The notes to the financial statements are an integral part of this report.

4

| | Shares | | Value | |

Semiconductors & Semiconductor Equipment (0.8%) | | | | | |

Applied Materials, Inc. | | 122,000 | | $ | 2,369 | |

Intel Corp. | | 130,000 | | 3,497 | |

Software (2.6%) | | | | | |

Microsoft Corp. | | 373,100 | | 13,734 | |

Oracle Corp. ‡ | | 235,600 | | 5,223 | |

Specialty Retail (2.1%) | | | | | |

Best Buy Co., Inc. ^ | | 93,200 | | 4,522 | |

Gap, Inc. (The) | | 213,700 | | 4,039 | |

Home Depot, Inc. ^ | | 77,600 | | 2,445 | |

Staples, Inc. | | 174,800 | | 4,080 | |

Textiles, Apparel & Luxury Goods (0.6%) | | | | | |

V.F. Corp. | | 48,800 | | 4,252 | |

Thrifts & Mortgage Finance (3.2%) | | | | | |

Countrywide Financial Corp. ^ | | 64,100 | | 995 | |

Freddie Mac | | 272,400 | | 14,228 | |

MGIC Investment Corp. ^ | | 105,600 | | 2,044 | |

Washington Mutual, Inc. | | 200,400 | | 5,587 | |

Tobacco (1.2%) | | | | | |

Altria Group, Inc. | | 118,000 | | 8,606 | |

Wireless Telecommunication Services (0.8%) | | | | | |

Sprint Nextel Corp. | | 322,300 | | 5,511 | |

Total Common Stocks (cost $612,176) | | | | 678,381 | |

| | | | | |

INVESTMENT COMPANIES (0.9%) | | | | | |

Capital Markets (0.9%) | | | | | |

SPDR Trust Series 1 Series T, Class T ^ | | 43,500 | | $ | 6,727 | |

Total Investment Companies (cost $5,579) | | | | 6,727 | |

Total Security Lending Collateral (cost $17,187) ± | | | | 17,187 | |

Total Investment Securities (cost $634,942) # | | | | $ | 702,295 | |

| | | | | | | |

FUTURES CONTRACTS:

| | | | | | | | Net Unrealized | |

| | | | Settlement | | | | Appreciation | |

| | Contracts (·) | | Date | | Amount | | (Depreciation) | |

S&P500 E-mini Index | | 151 | | 12/21/2007 | | $ | 1,742 | | 521 | |

| | | | | | $ | 1,742 | | $ | 521 | |

| | | | | | | | | | | |

NOTES TO SCHEDULE OF INVESTMENTS

^ At October 31, 2007, all or a portion of this security is on loan (see Note 1). The value at October 31, 2007, of all securities on loan is $16,592.

± Cash collateral for the Repurchase Agreements, valued at $3,137, that serves as collateral for securities lending, is invested in corporate and government bonds with interest rates and maturity dates ranging from 0.00% - 8.125% and 11/14/2007 - 9/15/2037.

‡ Non Income Producing

· Contract Amounts are not in thousands

1 At October 31, 2007, all or a portion of this security is segregated with the custodian to cover margin requirements for open futures contracts. The value of all securities segregated at October 31, 2007 is $2,071.

# Aggregate cost for federal income tax purposes is $635,939. Aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value were $97,361 and $31,005, respectively. Net unrealized appreciation for tax purposes is $66,356.

The notes to the financial statements are an integral part of this report.

5

TA IDEX Clarion Global Real Estate Securities

MARKET ENVIRONMENT

By region, Asia-Pacific was the strongest performing region for the period followed by North America and Europe. Performance in the Asia-Pacific region was broad-based with total returns achieved in each of the major countries within this region: Hong Kong 73.78%, Singapore 56.62%, Australia 42.97% and Japan 12.21%. These strong returns were fueled by robust economic growth being generated by emerging economies within the region and those countries which benefit from this growth. The rapid urbanization of China in particular benefited property companies that were able to take advantage of this growth, including Hong Kong-based property developers of residential and commercial space which have expanded into mainland China.

Within Europe, the United Kingdom (“UK”) property stocks were particular laggards returning (13.05)% during the period. The UK has been beset by concerns of decelerating job growth, particularly in the financial district of London. Sentiment has turned for the worse as the expectation increases that property yields will increase in the coming year. As valuations become increasingly attractive, portfolio strategy of being underweight the UK property stocks may be reconsidered during the coming year.

Relative outperformance versus the benchmark was generated primarily by stock picking in Hong Kong, Japan, the United States and Canada. In Hong Kong, overweight positions in mainland residential developers Agile Property Holdings Limited and Guangzhou R&F Properties Co., Ltd. contributed to relative returns as each of these positions returned over 100% during the year. In Japan, an overweight position in Tokyo-based office companies also contributed to relative performance, including Mitsui Fudosan Co., Ltd. which is primarily a developer and landlord of office and condominium properties in the five central wards of Tokyo. Office fundamentals in Tokyo continue to improve, with increasing rent increases and low vacancy levels. Top performers in the U.S. included Hilton Hotels Corporation which appreciated sharply as a result of the announcement during the summer that it would be taken private by the The Blackstone Group, Inc. Archstone Communities Inc., a national apartment Real Estate Investment Trust (“REIT”), appreciated as the result of being taken private at a sharp premium. Federal Realty Investment Trust and Ventas, Inc., U.S. shopping center and healthcare REITs, respectively, also contributed to relative performance. Canadian holding Sunrise Senior Living, Inc. significantly contributed to relative performance as the result of being acquired at a sharp premium by a U.S. healthcare REIT during the year.

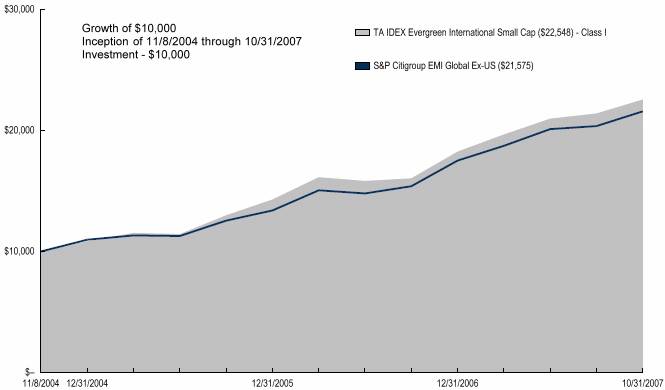

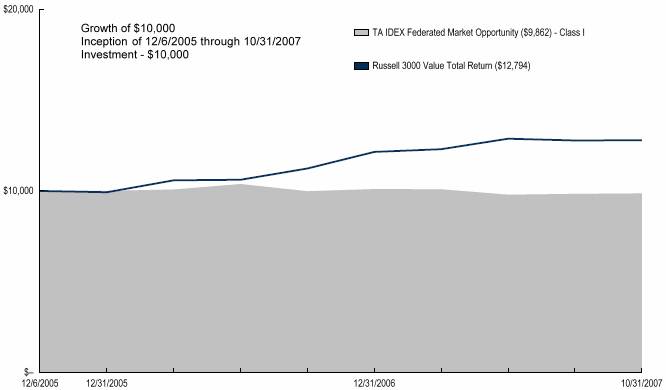

PERFORMANCE

For the year ended October 31, 2007, TA IDEX Clarion Global Real Estate Securities Class A returned 14.79%. By comparison its benchmark, the S&P/Citigroup World Property Index (“WPI”), returned 13.91%. As of October 31, 2007, the Fund’s net expense ratios for Class A, Class B, Class C, and Class I were 1.13%, 1.14%, 1.06%, and 0.88%, respectively.

STRATEGY REVIEW

TA IDEX Clarion Global Real Estate Securities offers a global strategy for real estate securities investors in the U.S. The portfolio generally owns between 80-110 real estate stocks with the goal of outperforming the WPI. The portfolio seeks to own attractively priced stocks that own property in markets with favorable underlying real estate fundamentals. The global universe of public real estate companies is approximately three times the size of the U.S. public company universe, which offers additional choices and diversification opportunities to the manager.

The rationale for a global listed property strategy remains very much intact including diversification via low correlation to broad equities and bonds, attractive current yield, attractive valuations and the spread of the REIT structure globally. This remains true even under the possible scenario of slowing global economic growth over the coming year. Investment themes looking out to 2008 include a continuing emphasis on investing in higher growth regions of the world, including the Asia-Pacific region, and looking for opportunities in select markets which are currently under-represented in the listed markets but which show stable to improving property fundamentals. Given the increased volatility in global equity markets, portfolio strategy will be to position itself with an orientation to top quality both by management team, strategy and physical properties.

T. Ritson Ferguson, CFA

Joseph P. Smith, CFA

Steven D. Burton, CFA

Co-Fund Managers

ING Clarion Real Estate Securities LP

6

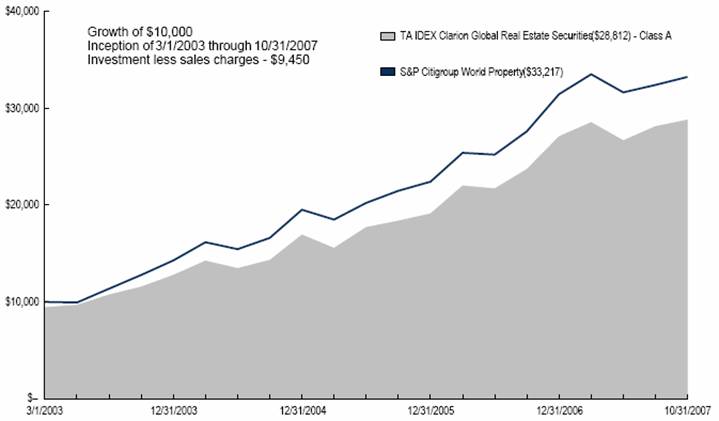

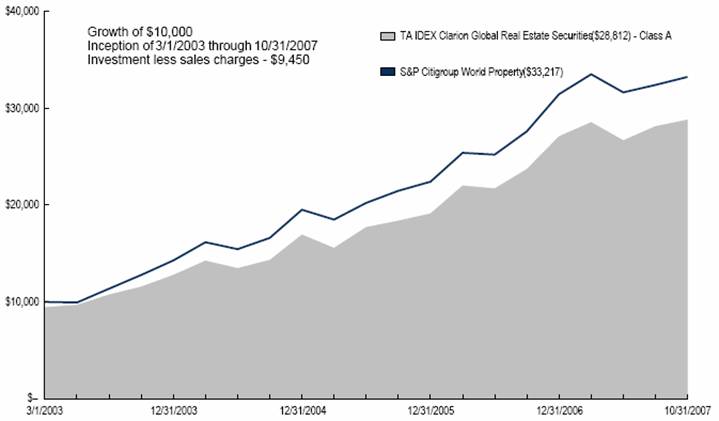

(unaudited)

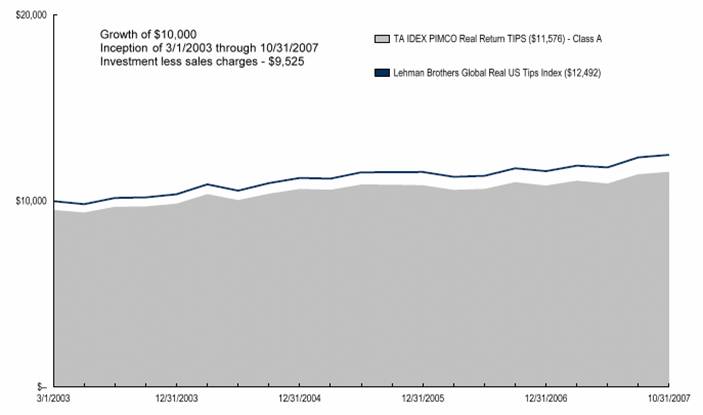

Average Annual Total Return for Periods Ended 10/31/2007

| | | | From | | Inception | |

| | 1 Year | | Inception | | Date | |

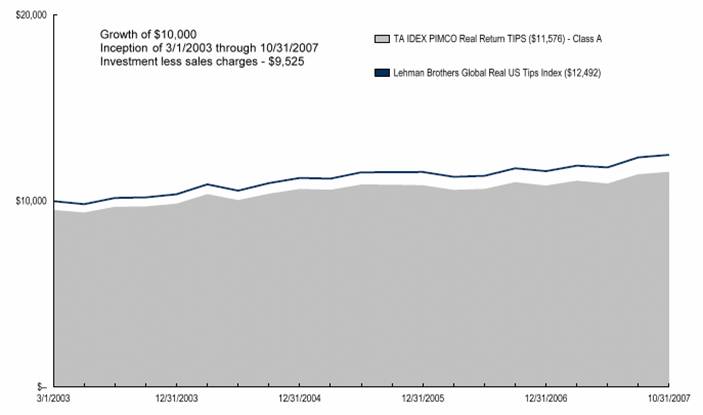

Class A (NAV) | | 14.79 | % | 26.95 | % | 3/1/03 | |

Class A (POP) | | 8.49 | % | 25.42 | % | 3/1/03 | |

S&P Citigroup World Property(1) | | 13.91 | % | 29.31 | % | 3/1/03 | |

| | | | | | | |

Class B (NAV) | | 14.77 | % | 26.41 | % | 3/1/03 | |

Class B (POP) | | 9.77 | % | 26.32 | % | 3/1/03 | |

| | | | | | | |

Class C (NAV) | | 14.95 | % | 26.35 | % | 3/1/03 | |

Class C (POP) | | 13.95 | % | 26.35 | % | 3/1/03 | |

| | | | | | | |

Class I (NAV) | | 15.11 | % | 28.20 | % | 11/15/05 | |

NOTES

(1) The S&P/Citigroup World Property (Citigroup World Property) Index is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception calculation is based on life of Class A shares. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than performance quoted. Please see www.transamericaidex.com for performance data current to the most recent month-end.

Public Offering Price (POP) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. Net Asset Value (NAV) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges.

The Fund is non-diversified. Investments in a “non-diversified” fund may be subject to specific risks such as susceptibility to single economic, political or regulatory events and may be subject to greater loss than investments in a diversified fund. The risks of investing in REITs are similar to investing directly in real estate. Investing in real estate presents its own risks, including declining property values, overbuilding, low occupancy rates from commercial properties, rising operating expenses and interest rates, as well as taxes and other regulatory issues. This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this Fund. Investments in global securities involve risks relating to political, social and economic developments abroad, foreign currency contracts for hedging, as well as risks resulting from the differences between the regulations to which U.S. and foreign issuer markets are subject. This Fund is closed to new investments.

7

UNDERSTANDING YOUR FUNDS EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions and redemption fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, and other fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at May 1, 2007 and held for the entire period until October 31, 2007.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA, your expenses could have included a $15 annual fee. The amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

| | Beginning | | Ending | | Annualized | | Expenses | |

| | Account | | Account | | Expense | | Paid During | |

| | Value | | Value | | Ratio | | Period (a) | |

Class A | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,004.82 | | 1.12 | % | $ | 5.64 | |

Hypothetical (b) | | 1,000.00 | | 1,019.51 | | 1.12 | | 5.69 | |

| | | | | | | | | |

Class B | | | | | | | | | |

Actual | | 1,000.00 | | 1,004.71 | | 1.13 | | 5.69 | |

Hypothetical (b) | | 1,000.00 | | 1,019.46 | | 1.13 | | 5.74 | |

| | | | | | | | | |

Class C | | | | | | | | | |

Actual | | 1,000.00 | | 1,005.80 | | 1.04 | | 5.24 | |

Hypothetical (b) | | 1,000.00 | | 1,019.91 | | 1.04 | | 5.28 | |

| | | | | | | | | |

Class I | | | | | | | | | |

Actual | | 1,000.00 | | 1,006.24 | | 0.88 | | 4.44 | |

Hypothetical (b) | | 1,000.00 | | 1,020.71 | | 0.88 | | 4.47 | |

| | | | | | | | | | | | |

(a) Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (365 days).

(b) 5% return per year before expenses.

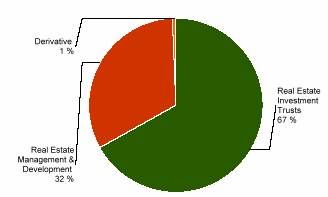

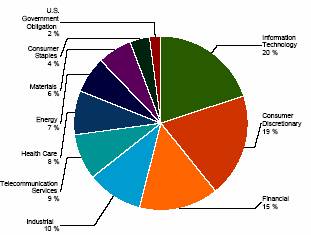

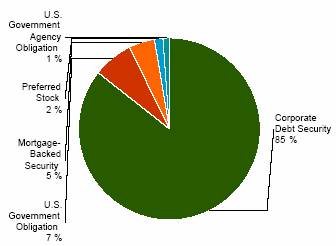

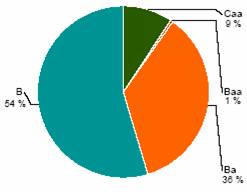

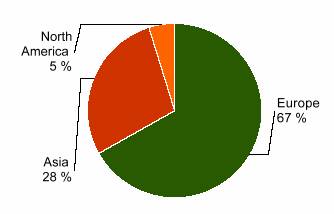

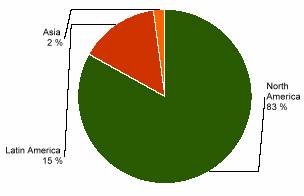

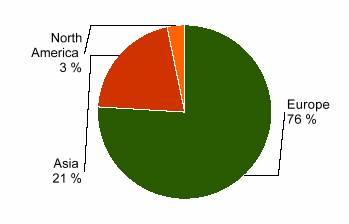

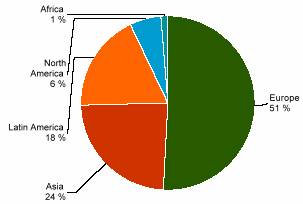

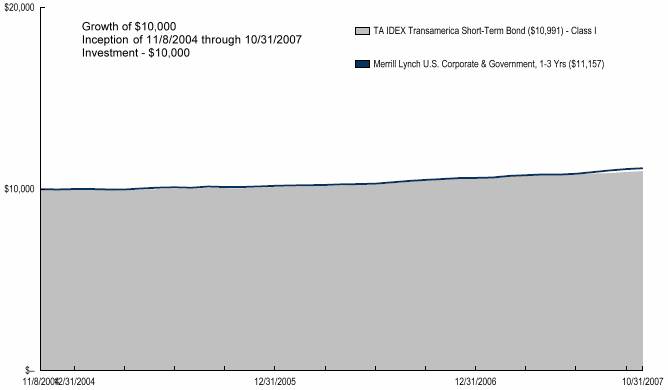

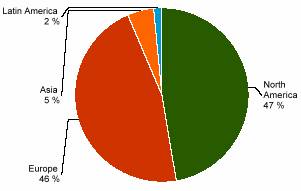

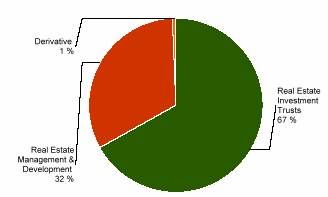

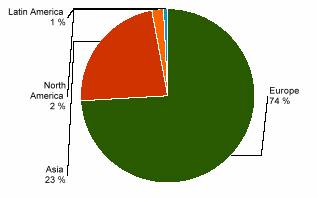

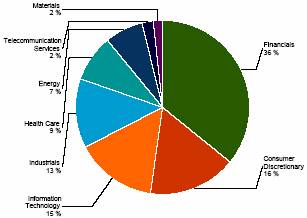

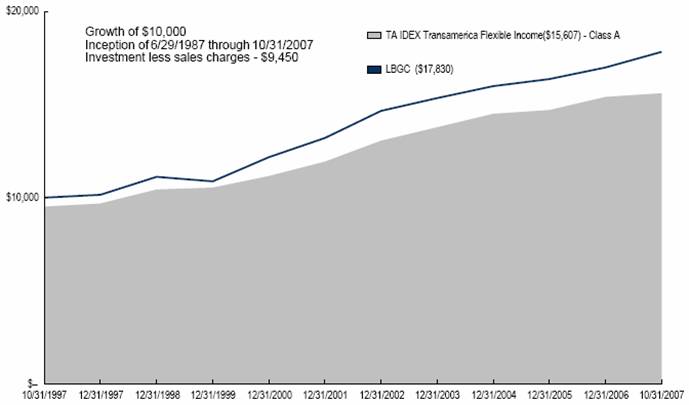

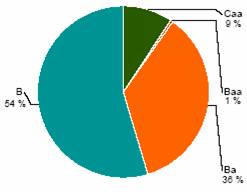

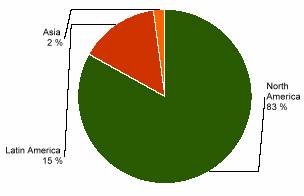

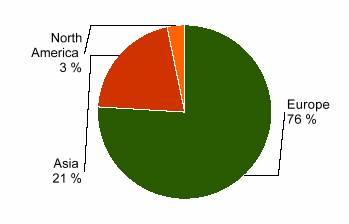

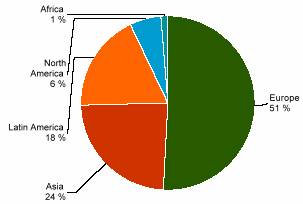

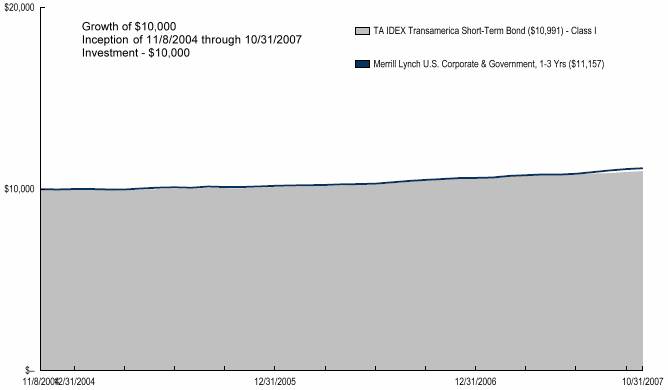

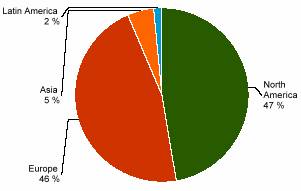

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Real Estate Property Breakdown

At October 31, 2007

This chart shows the percentage breakdown by real estate property breakdown of the Fund’s total investment securities.

8

SCHEDULE OF INVESTMENTS

At October 31, 2007

(all amounts except share amounts in thousands)

| | Shares | | Value | |

CONVERTIBLE PREFERRED STOCKS (1.3%) | | | | | |

Real Estate Investment Trusts (1.3%) | | | | | |

CFS Retail Property Trust | | 896,400 | | $ | 2,027 | |

Macquarie Countrywide Trust | | 1,192,170 | | 2,221 | |

Macquarie Ddr Trust | | 681,700 | | 742 | |

Total Convertible Preferred Stocks (cost $4,266) | | | | 4,990 | |

| | | | | |

COMMON STOCKS (95.7%) | | | | | |

Hotels, Restaurants & Leisure (0.5%) | | | | | |

Mandarin Oriental International, Ltd. | | 318,900 | | 794 | |

Shangri-La Asia, Ltd. | | 266,900 | | 847 | |

Real Estate Investment Trusts (63.7%) | | | | | |

AMB Property Corp. (1) | | 45,600 | | 2,980 | |

Ascendas ‡, (1) | | 440,000 | | 787 | |

AvalonBay Communities, Inc. (1) | | 48,890 | | 5,996 | |

BioMed Realty Trust, Inc. (1) | | 48,200 | | 1,151 | |

Boston Properties, Inc. (1) | | 83,000 | | 8,992 | |

BRE Properties, Inc. Class A ^ (1) | | 46,000 | | 2,521 | |

British Land Co. PLC (1) | | 188,100 | | 4,236 | |

Brixton PLC (1) | | 86,500 | | 666 | |

Calloway Trust ‡ | | 40,600 | | 1,073 | |

Camden Property Trust (1) | | 30,660 | | 1,912 | |

CapitaMall Trust ‡, (1) | | 1,170,500 | | 2,957 | |

Centro Properties Group | | 155,778 | | 1,010 | |

Corio NV | | 51,670 | | 4,523 | |

Corporate Office Properties Trust SBI MD ^ (1) | | 32,800 | | 1,356 | |

DB Rreef Trust | | 1,007,154 | | 1,951 | |

Derwent London PLC | | 147,929 | | 5,107 | |

Douglas Emmett, Inc. ^ (1) | | 67,300 | | 1,771 | |

Equity One, Inc. ^ (1) | | 39,300 | | 1,029 | |

Equity Residential ^ (1) | | 18,600 | | 777 | |

Essex Property Trust, Inc. (1) | | 12,300 | | 1,518 | |

Eurocommercial Properties NV | | 25,180 | | 1,482 | |

Extra Space Storage, Inc. (1) | | 70,500 | | 1,108 | |

Federal Realty Investment Trust (1) | | 63,300 | | 5,584 | |

Felcor Lodging Trust, Inc. (1) | | 54,100 | | 1,133 | |

General Growth Properties, Inc. (1) | | 121,160 | | 6,586 | |

Goodman Group | | 1,117,184 | | 7,144 | |

GPT Group | | 797,684 | | 3,415 | |

Great Portland Estates PLC (1) | | 118,900 | | 1,412 | |

Hammerson PLC (1) | | 206,600 | | 4,772 | |

Health Care Property Investors, Inc. (1) | | 40,500 | | 1,379 | |

Highwoods Properties, Inc. (1) | | 51,800 | | 1,863 | |

Home Properties, Inc. ^ (1) | | 50,500 | | 2,597 | |

Host Hotels & Resorts, Inc. ^ (1) | | 274,543 | | 6,084 | |

Japan Logistics Fund, Inc. Class A (1) | | 269 | | 1,918 | |

Japan Real Estate Investment Corp. Class A (1) | | 159 | | 1,958 | |

Japan Retail Fund Investment Corp. Class A (1) | | 236 | | 1,736 | |

Kenedix Realty Investment Corp. Class A (1) | | 138 | | $ | 952 | |

Kilroy Realty Corp. (1) | | 27,700 | | 1,802 | |

Kimco Realty Corp. ^ (1) | | 56,700 | | 2,354 | |

Klepierre | | 28,440 | | 1,540 | |

Land Securities Group PLC (1) | | 193,980 | | 6,625 | |

LaSalle Hotel Properties (1) | | 21,700 | | 897 | |

Link (The) (1) | | 1,024,800 | | 2,311 | |

Macerich Co. (The) (1) | | 52,600 | | $ | 4,508 | |

Mercialys SA | | 55,320 | | 2,160 | |

Mirvac Group | | 649,364 | | 3,478 | |

Nationwide Health Properties, Inc. ^ (1) | | 106,700 | | 3,331 | |

New City Residence Investment Corp. Class A (1) | | 249 | | 1,153 | |

Nippon Accommodations Fund, Inc. Class A (1) | | 149 | | 887 | |

Nippon Building Fund, Inc. Class A (1) | | 247 | | 3,556 | |

Nomura Real Estate Residential Fund, Inc. Class A (1) | | 137 | | 844 | |

Omega Healthcare Investors, Inc. (1) | | 107,100 | | 1,792 | |

Post Properties, Inc. ^ (1) | | 29,600 | | 1,214 | |

ProLogis (1) | | 116,600 | | 8,365 | |

Public Storage, Inc. (1) | | 17,100 | | 1,384 | |

Regency Centers Corp. ^ (1) | | 71,700 | | 5,125 | |

RioCan Trust (1) | | 126,900 | | 3,105 | |

Segro PLC | | 151,500 | | 1,470 | |

SILIC | | 9,797 | | 1,511 | |

Simon Property Group, Inc. (1) | | 122,300 | | 12,733 | |

SL Green Realty Corp. ^ (1) | | 53,800 | | 6,491 | |

Societe de La Tour Eiffel | | 8,120 | | 1,359 | |

Stockland | | 658,700 | | 5,463 | |

Strategic Hotels & Resorts, Inc. (1) | | 42,200 | | 922 | |

Tanger Factory Outlet Centers (1) | | 46,300 | | 1,950 | |

Taubman Centers, Inc. (1) | | 44,600 | | 2,626 | |

Unibail-Rodamco | | 47,740 | | 11,853 | |

Valad Property Group | | 1,475,925 | | 2,585 | |

Ventas, Inc. (1) | | 131,100 | | 5,623 | |

Vornado Realty Trust ^ (1) | | 72,000 | | 8,044 | |

Westfield Group | | 979,943 | | 19,798 | |

Real Estate Management & Development (31.5%) | | | | | |

Agile Property Holdings, Ltd. | | 1,232,900 | | 2,952 | |

Allgreen Properties, Ltd. | | 143,500 | | 156 | |

Ascott Group, Ltd. (The) | | 589,800 | | 668 | |

Br Malls Participacoes SA ‡ | | 130,700 | | 1,908 | |

Brookfield Properties Corp. ^ | | 114,050 | | 2,848 | |

Capitaland, Ltd. | | 1,349,000 | | 7,496 | |

Cheung Kong Holdings, Ltd. ‡ | | 477,300 | | 9,280 | |

Citycon OYJ ^ @ | | 543,885 | | 3,541 | |

Conwert Immobilien Invest AG ‡ | | 154,700 | | 2,923 | |

DIC Asset AG | | 20,830 | | $ | 707 | |

Greentown China Holdings, Ltd. | | 311,700 | | 662 | |

Guangzhou R&F Properties Co., Ltd. Class H | | 476,000 | | 2,472 | |

Hang Lung Group, Ltd. | | 642,848 | | 3,765 | |

Hang Lung Properties, Ltd. | | 805,100 | | 3,828 | |

Hongkong Land Holdings, Ltd. | | 339,100 | | 1,689 | |

Hufvudstaden Class A ‡ | | 118,900 | | 1,304 | |

Keppel Land, Ltd. | | 120,100 | | 688 | |

Kerry Properties, Ltd. | | 466,200 | | 4,003 | |

Mitsubishi Estate Co., Ltd. | | 523,800 | | 15,539 | |

Mitsui Fudosan Co., Ltd. | | 592,600 | | 16,243 | |

Norwegian Property ASA | | 108,500 | | 1,348 | |

NTT Urban Development Corp. | | 551 | | 1,228 | |

Safestore Holdings, Ltd. | | 851,000 | | 3,116 | |

Shiamo Property Holdings, Ltd. | | 936,800 | | 3,306 | |

Shui On Land, Ltd. | | 2,033,900 | | 2,808 | |

The notes to the financial statements are an integral part of this report.

9

| | Shares | | Value | |

Real Estate Management & Development (continued) | | | | | | |

Sponda OYJ | | 168,680 | | $ | 2,309 | |

Sumitomo Realty & Development Co., | | 208,200 | | 7,278 | |

Sun Hung KAI Properties, Ltd. | | 655,545 | | 12,416 | |

Wharf Holdings, Ltd. ‡ | | 371,600 | | 2,220 | |

Wing Tai Holdings, Ltd. @ | | 460,300 | | 1,099 | |

Total Common Stocks (cost $293,382) | | | | 363,736 | |

| | Contracts (•) | | Value | |

PURCHASED OPTIONS (0.6%) | | | | | |

Covered Call Options (0.6%) | | | | | |

Brascan Residential Properties | | 306,100 | | 2,428 | |

Call Strike $(0.00) | | | | | |

Expires 10/22/2008 | | | | | |

Total Purchased Options (cost $2,155) | | | | 2,428 | |

| | Shares | | Value | |

WARRANTS (0.0%) | | | | | |

Real Estate Management & Development (0.0%) | | | | | |

China Overseas Land & Investment, Ltd. | | | | | |

Expiration: 08/27/2008, Exercise | | 39,050 | | $ | 33 | |

Price: $(12.50 HKD) | | | | | |

Total Warrants (cost $0) | | | | 33 | |

Total Security Lending Collateral (cost $43,412) ± | | | | 43,412 | |

Total Investment Securities (cost $343,215) # | | | | $ | 414,599 | |

| | Percentage of | | | |

(unaudited) | | Total Investments | | Value | |

INVESTMENTS BY INDUSTRY: | | | | | |

Real Estate Investment Trusts | | 59.6 | % | $ | 247,285 | |

Real Estate Management & Development | | 28.9 | % | 119,832 | |

Derivative | | 0.6 | % | 2,428 | |

Hotels, Restaurants & Leisure | | 0.4 | % | 1,642 | |

Investment Securities, at value | | 89.5 | % | 371,187 | |

Short-Term Investments | | 10.5 | % | 43,412 | |

Total Investments | | 100.0 | % | $ | 414,599 | |

NOTES TO SCHEDULE OF INVESTMENTS

^ | | At October 31, 2007, all or a portion of this security is on loan (see Note 1). The value at October 31, 2007, of all securities on loan is $41,935. |

± | | Cash collateral for the Repurchase Agreements, valued at $7,922, that serves as collateral for securities lending, is invested in corporate and government bonds with interest rates and maturity dates ranging from 0.00% - 8.125% and 11/14/2007 - 9/15/2037. |

‡ | | Non Income Producing |

· | | Contract Amounts are not in thousands |

@ | | Securities valued as determined in good faith in accordance with procedures established by the Fund’s Board of Trustees. |

# | | Aggregate cost for federal income tax purposes is $360,763. Aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value were $57,746 and $3,910, respectively. Net unrealized appreciation for tax purposes is $53,836. |

(1) | | Real Estate Investment Trust |

| | |

DEFINITIONS: |

SBI | | Shares Beneficial Interest |

BRL | | Brazil Real |

HKD | | Hong Kong dollar |

The notes to the financial statements are an integral part of this report.

10

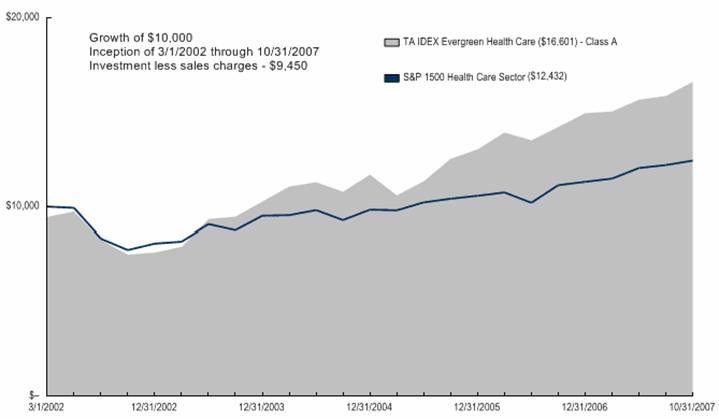

TA IDEX Evergreen Health Care

MARKET ENVIRONMENT

During the 2007 fiscal year ending October 31, 2007 the overall market posted solid returns but with higher levels of volatility than seen in several years due to numerous global and domestic factors. Despite the short term sell-off in the Chinese market in early 2007 and a building evidence of a slowing U.S. economy, the first half of the period saw positive performance across sectors. During the second half of the year, investors generally began to favor larger cap more liquid investments as the dual U.S. housing market downturn and sub-prime credit driven liquidity crisis delivered capital market consequences felt on a global basis. U.S. financial and consumer stocks generally posted negative returns while returns in health care were mixed.

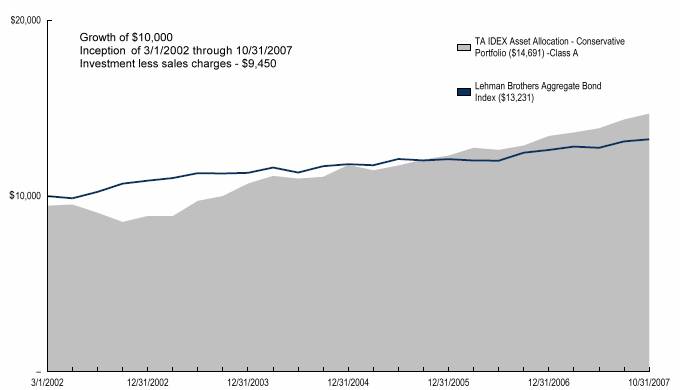

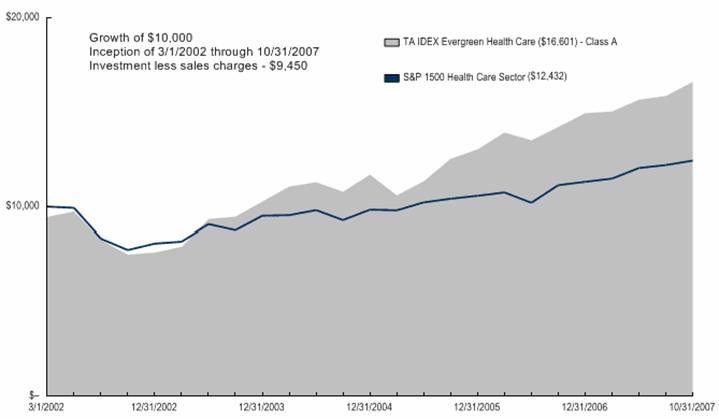

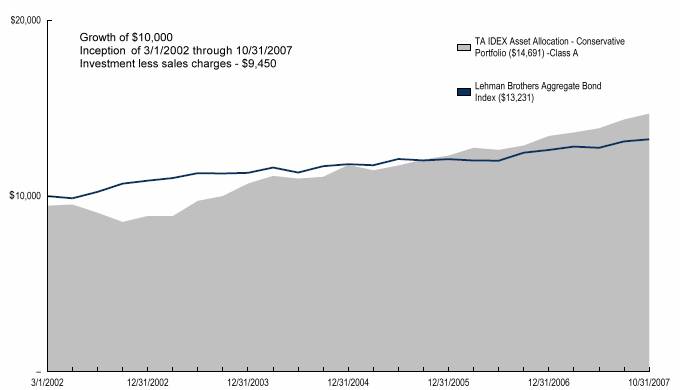

PERFORMANCE

For the year ended October 31, 2007, TA IDEX Evergreen Health Care, Class A returned 13.71%. By comparison its benchmark, Standard and Poor’s 1500 Super Composite Health Care Index (“S&P 1500 Health Care”), returned 11.12%. As of October 31, 2007, the Fund’s net expense ratios for Class A, Class B, Class C, and Class I were 1.24%, 1.24%, 1.24%, and 0.90%, respectively.

STRATEGY REVIEW

The portfolio outperformed the S&P 1500 Health Care over the fiscal year due to diversification across market caps, geographies and industry groups as well as our continued focus on intensive bottom-up research. Our investment process is disciplined in our focus on growth opportunities trading at significant discounts to intrinsic worth. We emphasize positive business momentum in the medium and long terms as well as the overall financial strength of the company. We made significant industry reallocations as we lowered exposure to biotechnology and pharmaceutical companies by consolidating into high conviction stocks such as BioMarin Pharmaceutical Inc. (“BioMarin”), Isis Pharmaceuticals, Inc. and Merck & Co., Inc., while selling companies such as Wyeth, Genzyme Corporation and Johnson & Johnson where growth prospects were lackluster. We increased weights in equipment and supplies companies such as Hologic, Inc. and Inverness Medical Innovations, Inc. as well as life sciences tools and services entity Thermo Fisher Scientific Inc., all of which exhibited attractive growth and valuation characteristics.

Our largest contributor to performance during the course of the year was superior stock selection in a number of areas including chemicals, biotechnology, pharmaceuticals and equipment and supplies. The top performer was Bayer AG, the German chemical concern engaged in successful transformation to a health care company, which benefited from synergies gained through 2006’s acquisition of Schering AG. Several biotechnology companies including BioMarin and Alexion Pharmaceuticals, Inc. provided strong upside based on good product momentum. Within major pharmaceuticals, our underweight allocations to Pfizer Inc., Johnson & Johnson and Eli Lilly and Company aided relative performance. In the equipment industry, strong product momentum from defibrillator manufacturer ZOLL Medical Corporation and from genetic diagnostic test manufacturer Gen-Probe Incorporated led those companies to post revenue and earnings growth above market expectations leading to price increases.

The largest individual stock detractor was Inyx, Inc., an emerging pharmaceutical company engaged in developing proprietary medication delivery technologies and products for the respiratory and dermatological markets. The company filed for Chapter 11 bankruptcy protection after a buyout offer fell through sending shares tumbling. Our lack of exposure to specific niches in the providers and services area also proved detrimental to performance as several of the pharmaceutical benefit managers, including Express Scripts, Inc. and Medco Health Solutions, Inc., sustained strong gains during the year. Finally, several of our foreign holdings underperformed during the period after several years of strong performance. These included Novartis AG (ADS), Chugai Pharmaceutical Co., Ltd. and AstraZeneca PLC.

Our investment approach continues to be diversified with respect to countries and market capitalizations. Our process is research driven focusing on a bottom-up look at each company to determine its growth potential underscored by valuation support prior to its inclusion in the portfolio. We will also be seeking opportunities across the health care sector to take advantage of non-mainstream investments including restructurings, asset stories, spin-offs and other special situations. As always, we pay close attention to risk analysis and management.

Our current exposure is in line with previous time periods in that we have diversification across several health care industries with high absolute weights in biotechnology and pharmaceuticals.

Robert Junkin

Fund Manager

Evergreen Investment Management Company, LLC

11

(unaudited)

Average Annual Total Return for Periods Ended 10/31/2007

| | | | | | From | | Inception | |

| | 1 Year | | 5 Years | | Inception | | Date | |

Class A (NAV) | | 13.71 | % | 16.23 | % | 10.44 | % | 3/1/02 | |

Class A (POP) | | 7.45 | % | 14.93 | % | 9.35 | % | 3/1/02 | |

S&P 1500 Super Health Care Sector (1) | | 11.12 | % | 8.73 | % | 4.17 | % | 3/1/02 | |

| | | | | | | | | |

Class B (NAV) | | 13.73 | % | 15.64 | % | 9.86 | % | 3/1/02 | |

Class B (POP) | | 8.80 | % | 15.53 | % | 9.86 | % | 3/1/02 | |

| | | | | | | | | |

Class C (NAV) | | 13.71 | % | — | % | 16.03 | % | 11/11/02 | |

Class C (POP) | | 12.72 | % | — | % | 16.03 | % | 11/11/02 | |

| | | | | | | | | |

Class I (NAV) | | 14.04 | % | — | % | 15.44 | % | 11/8/04 | |

NOTES

(1) The S&P 1500 Super Composite Health Care (S&P Super Composite Health Care) Index is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception calculation is based on life of Class A shares. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than performance quoted. Please see www.transamericaidex.com for performance data current to the most recent month-end.

Public Offering Price (POP) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. Net Asset Value (NAV) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges.

The Fund is non-diversified. Investments in a “non-diversified” fund and sector funds may be subject to specific risks such as susceptibility to single economic, political, or regulatory events, and may be subject to greater loss than investments in a diversified fund. This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this Fund. This Fund is closed to new investments.

12

UNDERSTANDING YOUR FUNDS EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions and redemption fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, and other fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at May 1, 2007 and held for the entire period until October 31, 2007.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA, your expenses could have included a $15 annual fee. The amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

| | Beginning | | Ending | | Annualized | | Expenses | |

| | Account | | Account | | Expense | | Paid During | |

| | Value | | Value | | Ratio | | Period (a) | |

Class A | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,032.62 | | 1.20 | % | $ | 6.13 | |

Hypothetical (b) | | 1,000.00 | | 1,019.10 | | 1.20 | | 6.09 | |

| | | | | | | | | |

Class B | | | | | | | | | |

Actual | | 1,000.00 | | 1,033.10 | | 1.20 | | 6.13 | |

Hypothetical (b) | | 1,000.00 | | 1,019.10 | | 1.20 | | 6.09 | |

| | | | | | | | | |

Class C | | | | | | | | | |

Actual | | 1,000.00 | | 1,033.28 | | 1.09 | | 5.57 | |

Hypothetical (b) | | 1,000.00 | | 1,019.66 | | 1.09 | | 5.53 | |

| | | | | | | | | |

Class I | | | | | | | | | |

Actual | | 1,000.00 | | 1,033.60 | | 0.90 | | 4.60 | |

Hypothetical (b) | | 1,000.00 | | 1,020.61 | | 0.90 | | 4.57 | |

| | | | | | | | | | | | |

(a) Expenses are calculated using the Fund’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (365 days).

(b) 5% return per year before expenses.

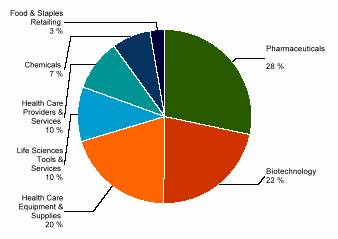

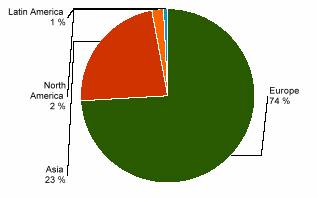

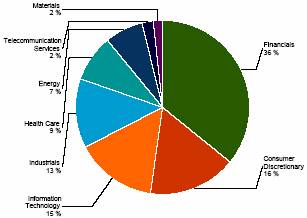

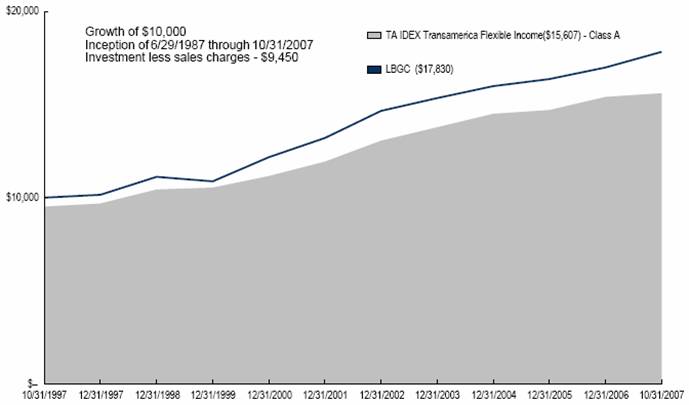

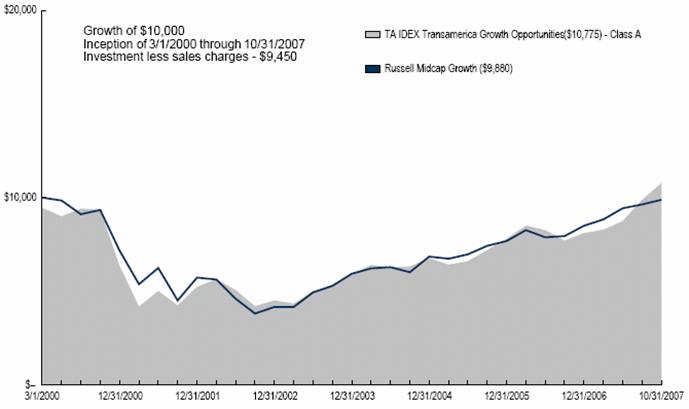

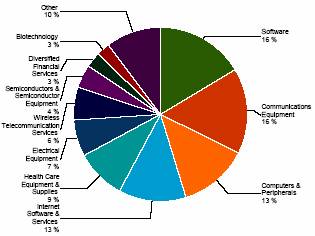

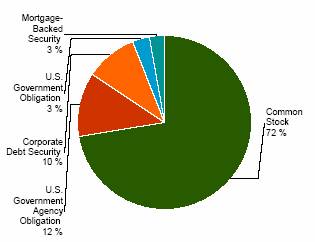

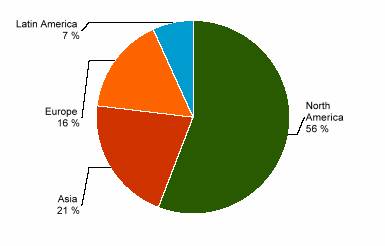

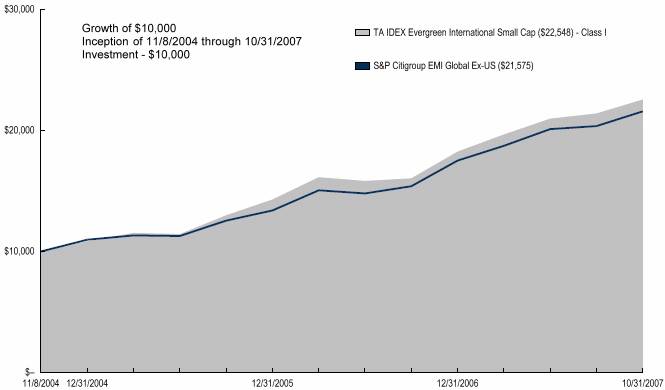

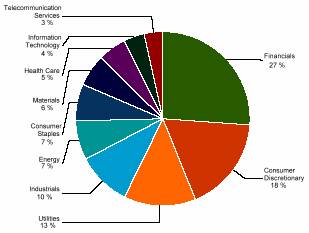

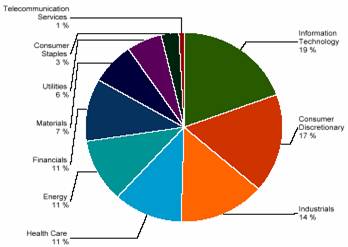

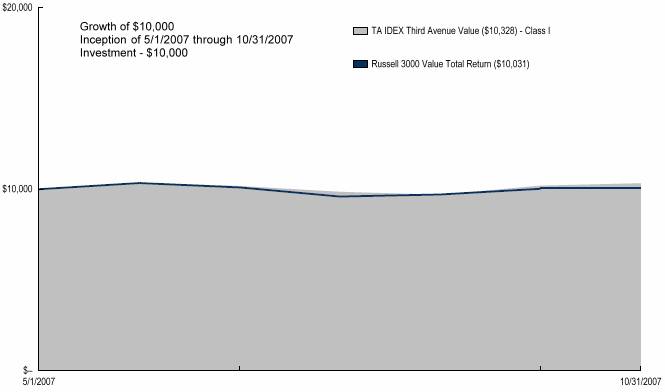

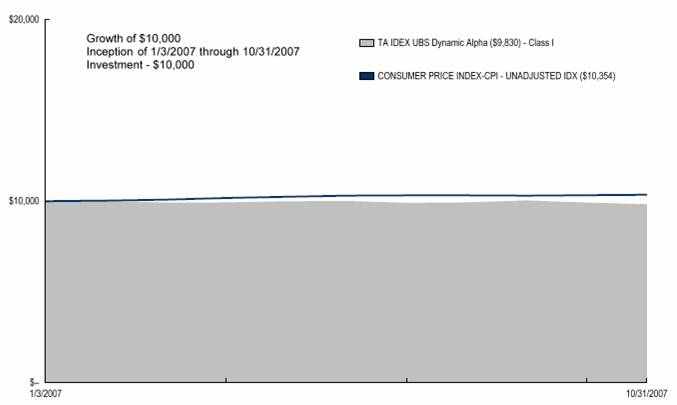

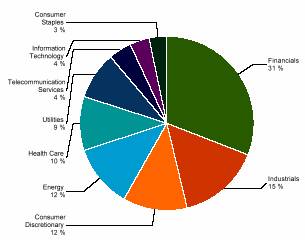

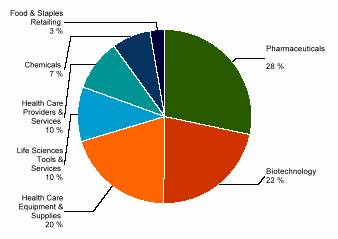

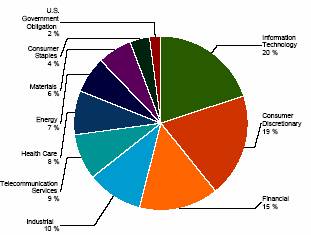

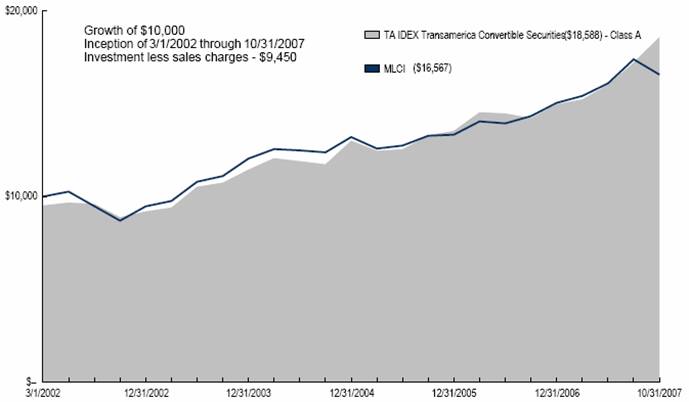

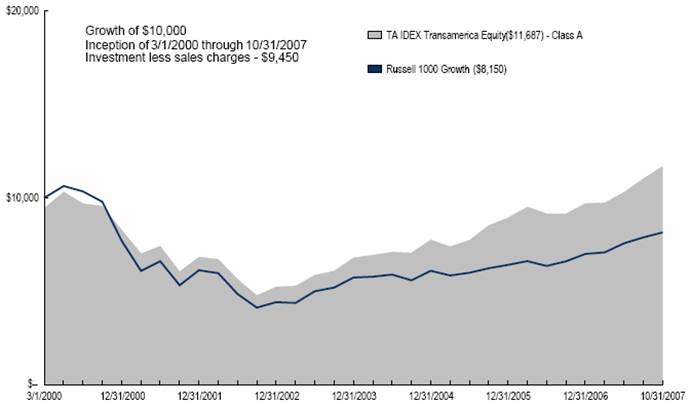

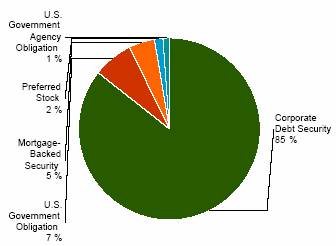

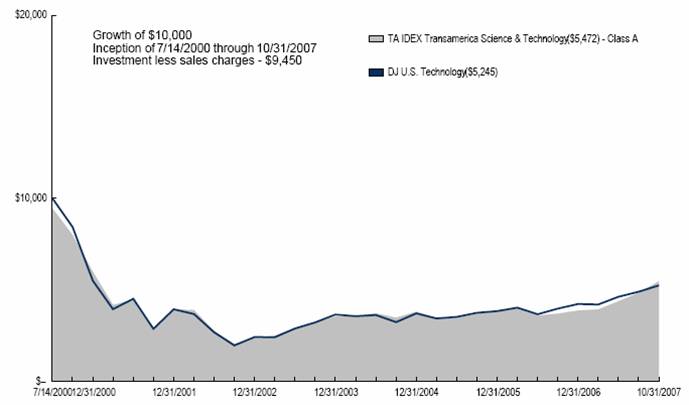

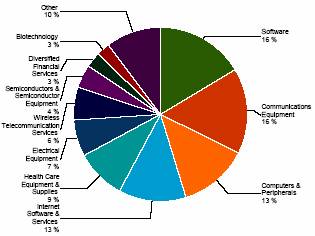

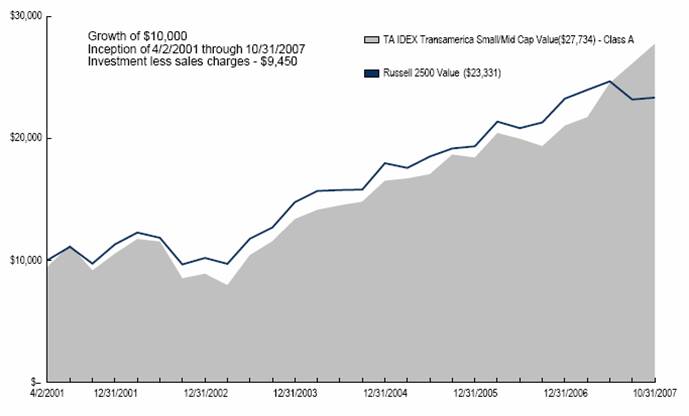

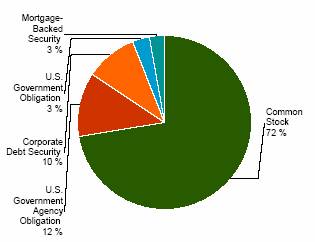

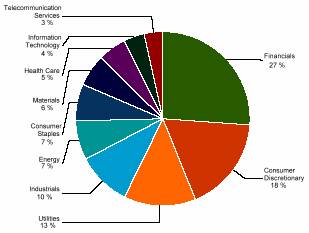

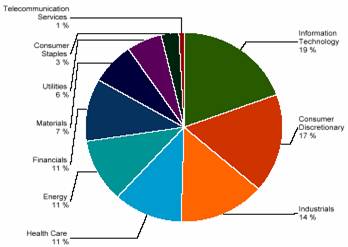

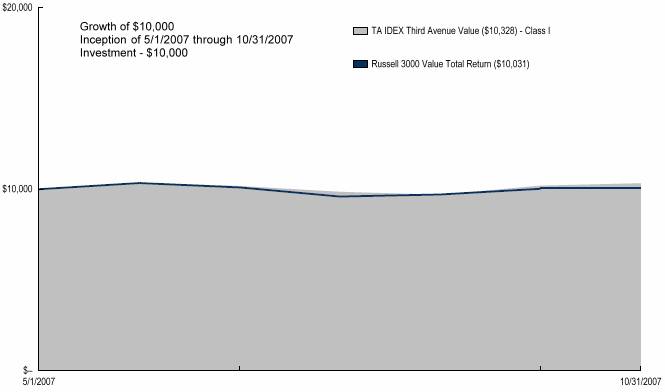

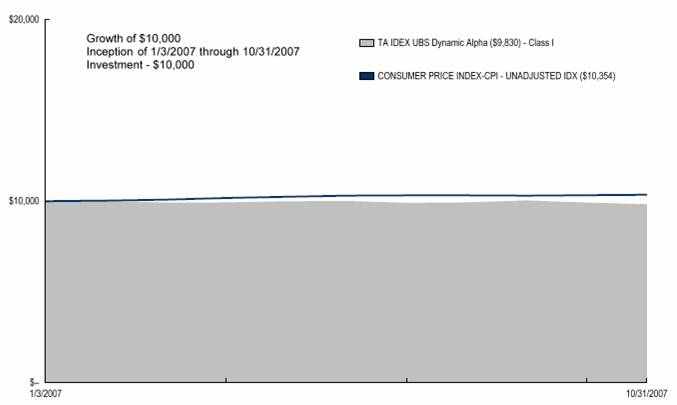

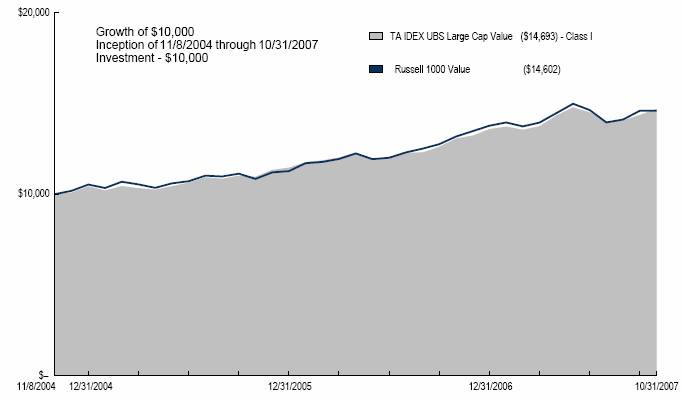

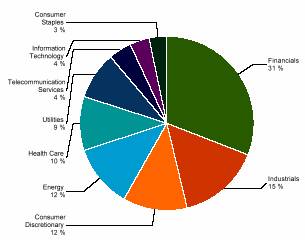

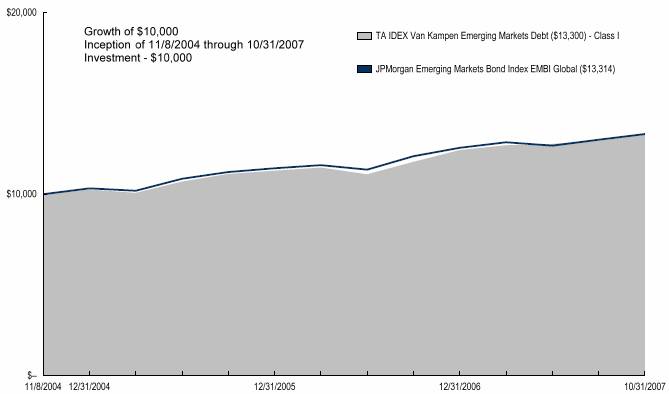

GRAPHICAL PRESENTATION OF SCHEDULE OF INVESTMENTS

By Industry

At October 31, 2007

This chart shows the percentage breakdown by industry of the Fund’s total investment securities.

13

SCHEDULE OF INVESTMENTS

At October 31, 2007

(all amounts except share amounts in thousands)

| | Shares | | Value | |

PREFERRED STOCKS (0.9%) | | | | | |

Health Care Equipment & Supplies (0.9%) | | | | | |

Fresenius AG | | 42,630 | | $ | 3,375 | |

Total Preferred Stocks (cost $2,298) | | | | 3,375 | |

| | | | | |

COMMON STOCKS (90.8%) | | | | | |

Biotechnology (20.0%) | | | | | |

Alexion Pharmaceuticals, Inc. ‡^ | | 82,428 | | 6,306 | |

Altus Pharmaceuticals, Inc. ‡^ | | 25,000 | | 346 | |

Amgen, Inc. ‡ | | 130,114 | | 7,561 | |

Antisoma PLC ‡ | | 1,805,000 | | 1,125 | |

Applera Corp. - Celera Group ‡ | | 144,985 | | 2,365 | |

Arqule, Inc. ‡ | | 172,015 | | 1,350 | |

Array Biopharma, Inc. ‡ | | 59,000 | | 661 | |

Biogen IDEC, Inc. ‡ | | 40,147 | | 2,989 | |

BioMarin Pharmaceuticals, Inc. ‡^ | | 167,156 | | 4,635 | |

Celgene Corp. ‡ | | 57,067 | | 3,766 | |

Cephalon, Inc. ‡^ | | 63,500 | | 4,682 | |

Cepheid, Inc. ‡ | | 143,960 | | 3,726 | |

Cubist Pharmaceuticals, Inc. ‡ | | 22,097 | | 517 | |

Genentech, Inc. ‡ | | 46,523 | | 3,449 | |

Human Genome Sciences, Inc. ‡^ | | 192,653 | | 1,822 | |

Incyte Corp. ‡^ | | 310,510 | | 2,689 | |

Indevus Pharmaceuticals, Inc. ‡^ 1@ | | 282,704 | | 2,177 | |

Indevus Pharmaceuticals, Inc. ‡, §,1 | | 188,440 | | q | |

Isis Pharmaceuticals, Inc. ‡^ | | 268,477 | | 4,731 | |

Medarex, Inc. ‡^ | | 4,614 | | 55 | |

Orchid Cellmark, Inc. ‡ | | 323,251 | | 1,797 | |

OSI Pharmaceuticals, Inc. ‡^ | | 103,164 | | 4,289 | |

Panacos Pharmaceuticals, Inc. ‡^ | | 407,783 | | 1,019 | |

Regeneron Pharmaceuticals, Inc. ‡ | | 97,595 | | 2,147 | |

Theratechnologies, Inc. ‡ | | 550,000 | | 6,636 | |

Vertex Pharmaceuticals, Inc. ‡ | | 109,500 | | 3,541 | |

Chemicals (6.6%) | | | | | |

Bayer AG | | 242,277 | | 20,169 | |

Monsanto Co. | | 14,000 | | 1,367 | |

Syngenta AG | | 12,748 | | 3,060 | |

Computers & Peripherals (0.1%) | | | | | |

Medipattern Corp. (The) ‡ | | 159,723 | | 200 | |

Food & Staples Retailing (2.5%) | | | | | |

CVS Caremark Corp. | | 222,487 | | 9,293 | |

Health Care Equipment & Supplies (17.6%) | | | | | |

Abiomed, Inc. ‡^ | | 125,712 | | 1,718 | |

Beckman Coulter, Inc. | | 52,000 | | 3,683 | |

Boston Scientific Corp. ‡ | | 256,000 | | 3,551 | |

Covidien, Ltd. | | 56,000 | | 2,330 | |

CR Bard, Inc. | | 11,000 | | 920 | |

Ev3, Inc. ‡^ | | 223,500 | | 3,281 | |

GEN-Probe, Inc. ‡ | | 100,607 | | 7,045 | |

Hologic, Inc. ‡^ | | 49,000 | | 3,329 | |

Hospira, Inc. ‡ | | 75,136 | | 3,105 | |

Invacare Corp. | | 98,500 | | 2,665 | |

Inverness Medical Innovations, Inc. ‡ | | 98,000 | | 5,889 | |

Medtronic, Inc. | | 65,000 | | 3,084 | |

Nmt Medical, Inc. ‡^ | | 232,041 | | 1,731 | |

Smith & Nephew PLC | | 229,122 | | 3,091 | |

St Jude Medical, Inc. ‡ | | 82,709 | | $ | 3,369 | |

Synthes, Inc. | | 24,000 | | 2,994 | |

Thoratec Corp. ‡^ | | 189,000 | | 3,774 | |

Trans1, Inc. ‡^ | | 20,000 | | 500 | |

Varian Medical Systems, Inc. ‡ | | 65,000 | | 3,170 | |

Vital Signs, Inc. | | 39,515 | | 2,090 | |

Zoll Medical Corp. ‡ | | 166,000 | | 4,060 | |

Health Care Providers & Services (8.7%) | | | | | |

Brookdale Senior Living, Inc. ^ | | 45,042 | | 1,662 | |

Cardinal Health, Inc. | | 112,000 | | 7,619 | |

Emeritus Corp. ‡ | | 187,000 | | 6,171 | |

Fresenius Medical Care AG | | 63,348 | | 3,341 | |

McKesson Corp. | | 59,000 | | 3,900 | |

Medco Health Solutions, Inc. ‡ | | 25,500 | | 2,407 | |

WellPoint, Inc. ‡ | | 92,208 | | 7,306 | |

Life Sciences Tools & Services (9.3%) | | | | | |

Amag Pharmaceuticals, Inc. ‡^ | | 99,859 | | 6,526 | |

Applera Corp. - Applied Biosystems | | 97,924 | | 3,637 | |

Bio-Rad Laboratories, Inc. Class A ‡ | | 33,391 | | 3,225 | |

ENZO Biochem, Inc. ‡^ | | 350,000 | | 4,239 | |

Helicos Biosciences Corp. ‡ | | 100,500 | | 1,421 | |

Pharmaceutical Product Development | | 90,500 | | 3,823 | |

Qiagen NV ‡^ | | 89,000 | | 2,095 | |

Sequenom, Inc. ‡, §, ^ | | 102,108 | | 991 | |

Sequenom, Inc. ‡ | | 100,200 | | 973 | |

Thermo Fisher Scientific, Inc. ‡ | | 129,542 | | 7,618 | |

Pharmaceuticals (26.0%) | | | | | |

Abbott Laboratories | | 118,251 | | 6,459 | |

Adams Respiratory Therapeutics, Inc. ‡ ^ | | 121,000 | | 5,317 | |

Auxilium Pharmaceuticals, Inc. ‡ | | 169,000 | | 4,463 | |

Bristol-Myers Squibb Co. | | 148,398 | | 4,450 | |

Chugai Pharmaceutical Co., Ltd. | | 151,500 | | 2,615 | |

Eurand NV ‡^ | | 185,164 | | 2,546 | |

Forest Laboratories, Inc. ‡ | | 140,000 | | 5,470 | |

Inspire Pharmaceuticals, Inc. ‡ | | 130,000 | | 811 | |

Ipsen | | 124,505 | | 7,084 | |

Merck & Co., Inc. | | 270,395 | | 15,753 | |

Merck KGAA | | 41,986 | | 5,245 | |

Novartis AG | | 65,377 | | 3,476 | |

NOVO Nordisk A/S Class B | | 29,600 | | 3,666 | |

Pfizer, Inc. | | 151,000 | | 3,716 | |

Roche Holding AG | | 19,235 | | 3,279 | |

Schering-Plough Corp. | | 303,205 | | 9,254 | |

Sepracor, Inc. ‡ | | 102,000 | | 2,809 | |

Shire PLC | | 260,000 | | 6,487 | |

Sirtris Pharmaceuticals, Inc. ‡^ | | 49,400 | | 838 | |

Spectrum Pharmaceuticals, Inc. ‡^ | | 287,034 | | 1,088 | |

Xenoport, Inc. ‡ | | 32,000 | | 1,571 | |

Total Common Stocks (cost $276,144) | | | | 337,200 | |

The notes to the financial statements are an integral part of this report.

14

| | Shares | | Value | |

WARRANTS (0.0%) | | | | | |

Pharmaceuticals (0.0%) | | | | | |

MannKind Corp., | | | | | |

Expiration: (8/5/2020) § | | 30,624 | | $ | q | |

Poniard Pharmaceuticals, Inc. | | | | | |

Expiration: (12/08/2008) § | | 1,200 | | q | |

Total Warrants (cost $1) | | | | — | |

| | | | | |

Total Security Lending Collateral (cost $58,335) ± | | | | 58,335 | |

Total Investment Securities (cost $336,778) # | | | | $ | 398,910 | |

| | | | | | | |

NOTES TO SCHEDULE OF INVESTMENTS

q | | Value is less than $1 |

^ | | At October 31, 2007, all or a portion of this security is on loan (see Note 1). The value at October 31, 2007, of all securities on loan is $56,194. |

± | | Cash collateral for the Repurchase Agreements, valued at $10,646, that serves as collateral for securities lending, is invested in corporate and government bonds with interest rates and maturity dates ranging from 0.00% - 8.125% and 11/14/2007 - 9/15/2037. |

‡ | | Non Income Producing |

@ | | Securities valued as determined in good faith in accordance with procedures established by the Fund’s Board of Trustees. |

§ | | Illiquid |

(1) | | Right |

# | | Aggregate cost for federal income tax purposes is $336,949. Aggregate gross unrealized appreciation for all securities in which there is an excess ofvalue over tax cost and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value were $70,519 and$8,896, respectively. Net unrealized appreciation for tax purposes is $61,961. |

The notes to the financial statements are an integral part of this report.

15

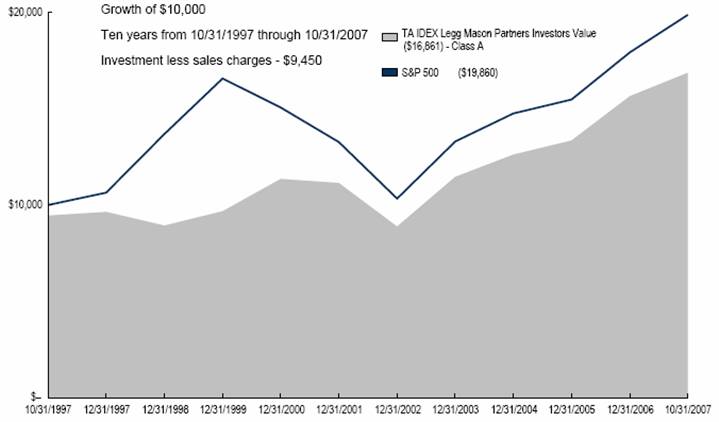

TA IDEX Jennison Growth

MARKET ENVIRONMENT

Equity markets posted strong returns in the fiscal year ended October 31, 2007. The Russell 1000® Growth Index (“Russell 1000 Growth”) advanced 19.23% while the Standard and Poor’s 500 Composite Stock Index (“S&P 500”) rose 14.56%, marking the first time in several years that growth stocks outperformed the broader market. Strong US economic growth began to slow, but continued strength overseas, especially in emerging markets, helped drive US expansion. Reflecting in part the rapid development of emerging economies, the prices of commodities, such as metals and agricultural products, maintained elevated levels. Oil prices continued to rise – to record highs – and have shown no signs of abating. At the same time, the US dollar weakened against most major currencies. Inflation, while still largely contained, remains a risk. Corporate earnings growth began to slow, with S&P 500 earnings growth failing to break into the double digits for the first time in several years in 2007’s third quarter. Negative earnings revisions became less uncommon, with financial, retail, and homebuilding companies, along with some energy names, bearing the brunt. Rising energy prices, higher mortgage payments, and reduced home equity, combined to help bring on a much heralded slowdown in consumer spending. Employment, however, remained healthy. Problems in the sub-prime mortgage market, evident early in the year, spread as 2007 progressed. The ensuing credit crunch led to heightened market volatility, especially in July and August. Major financial institutions with balance sheets exposed to structured investment vehicles were hit, some hard. With fears of a serious slowdown in economic growth, the Federal Reserve Board lowered the federal funds rate in September for the first time since June 2003. The 50-basis-point cut spurred a stock market rally at the end of the portfolio’s fiscal year.

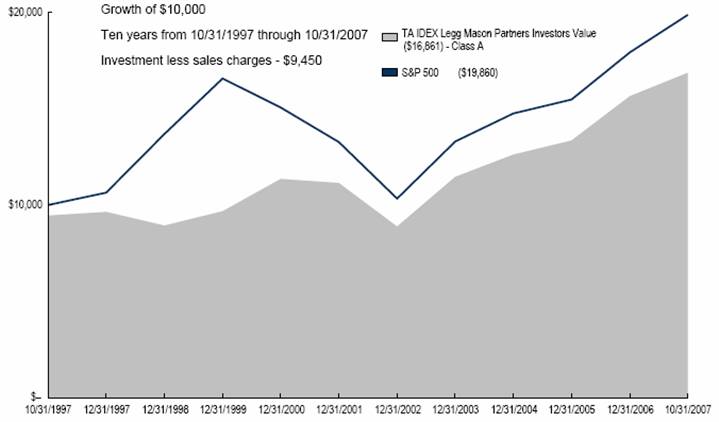

PERFORMANCE

For the year ended October 31, 2007, TA IDEX Jennison Growth Class A returned 18.59%. By comparison its benchmark, the Russell 1000 Growth, returned 19.23%. As of October 31, 2007, the Fund’s net expense ratios for Class A, Class B, Class C, and Class I were 1.30%, 1.23%, 1.20%, and 0.87%, respectively.

STRATEGY REVIEW

The portfolio is built from the bottom up, with stocks selected one at a time, based on the fundamentals of individual companies rather than on overarching themes. Stock selection in the information technology sector was the greatest contributor to positive relative performance, as Research in Motion Limited (“RIMM”), Apple Inc. (“Apple”), and Juniper Networks, Inc. (“Juniper”) posted impressive gains. RIMM advanced on the strength of the BlackBerry brand, as new subscribers grew at a solid pace and existing users embraced new product designs. Apple’s growth has been driven by the strength of iPod sales and a resurgence in Macintosh computer sales. The company should continue to benefit from its creativity and innovation in product design and marketing, most recently exhibited in the iPhone. Juniper’s investments in products, and sales force and channel strategy are yielding operating leverage, spurring acceleration in revenue and earnings per share (“EPS”) growth at the telecommunications equipment provider.

Stock selection was also strong in materials, where Monsanto Company (“Monsanto”) posted a triple-digit advance. The agricultural-seed and biotechnology company’s leading market share position, brand strength, first-mover advantage, operational performance, and technological innovation are helping Monsanto benefit from a bullish agriculture cycle.

Schlumberger Limited was a chief contributor in energy. The company has benefited from a resurgence in capital spending on energy-producing activity and from its business and geographic mix. Suncor Energy Inc. and Occidental Petroleum Corporation also performed well.

The consumer sectors were the greatest detractors from performance, as retailers, including Macy’s, Inc. (“Macy’s”) and Kohl’s Corporation, were weak. Declines in other consumer names, such as Whole Foods Market, Inc. (“Whole Foods”) and Starbucks Corporation (“Starbucks”), reflected company transitioning from stages of rapid expansion and high growth to more modest growth. We still like Whole Foods’ numerous competitive advantages within the rapidly growing natural products industry – size and scale of operations, strong brand image, and marketing and merchandising expertise. We eliminated our positions in Starbucks and Macy’s.

Spiros Segalas

Michael A. Del Balso

Blair A. Boyer

Co-Fund Managers

Jennison Associates LLC

16

(unaudited)

Average Annual Total Return for Periods Ended 10/31/2007

| | | | | | | | From | | Inception | |

| | 1 Year | | 5 Years | | 10 Years | | Inception | | Date | |

Class A (NAV) | | 18.59 | % | 14.77 | % | 3.73 | % | 5.85 | % | 2/1/96 | |

Class A (POP) | | 12.07 | % | 13.48 | % | 3.14 | % | 5.35 | % | 2/1/96 | |

Russell 1000 Growth (1) | | 19.23 | % | 12.61 | % | 4.81 | % | 7.58 | % | 2/1/96 | |

| | | | | | | | | | | |

Class B (NAV) | | 18.72 | % | 14.27 | % | 3.18 | % | 5.42 | % | 2/1/96 | |

Class B (POP) | | 13.72 | % | 14.15 | % | 3.18 | % | 5.42 | % | 2/1/96 | |

| | | | | | | | | | | |

Class C (NAV) | | 18.67 | % | — | % | — | % | 14.41 | % | 11/11/02 | |

Class C (POP) | | 17.67 | % | — | % | — | % | 14.41 | % | 11/11/02 | |

| | | | | | | | | | | |

Class I (NAV) | | 19.14 | % | — | % | — | % | 10.17 | % | 11/15/05 | |

NOTES

(1) The Russell 1000 Growth (Russell 1000 Growth) Index is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. From inception calculation is based on life of Class A shares. You cannot invest directly in an index.

The performance data presented represents past performance, future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions nor the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than performance quoted. Please see www.transamericaidex.com for performance data current to the most recent month-end.

Public Offering Price (POP) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. Net Asset Value (NAV) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this Fund. This Fund is closed to new investments.

17

UNDERSTANDING YOUR FUNDS EXPENSES

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions and redemption fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, and other fund expenses.

The following Example is intended to help you understand your ongoing costs (in dollars and cents) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at May 1, 2007 and held for the entire period until October 31, 2007.

ACTUAL EXPENSES

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA, your expenses could have included a $15 annual fee. The amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of fund shares. Therefore, the second line under the Fund in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

| | Beginning | | Ending | | Annualized | | Expenses | |

| | Account | | Account | | Expense | | Paid During | |

| | Value | | Value | | Ratio | | Period (a) | |

Class A | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,121.42 | | 1.27 | % | $ | 6.79 | |

Hypothetical (b) | | 1,000.00 | | 1,018.74 | | 1.27 | | 6.46 | |

| | | | | | | | | |

Class B | | | | | | | | | |

Actual | | 1,000.00 | | 1,121.52 | | 1.18 | | 6.30 | |

Hypothetical (b) | | 1,000.00 | | 1,019.20 | | 1.18 | | 6.00 | |

| | | | | | | | | |

Class C | | | | | | | | | |

Actual | | 1,000.00 | | 1,122.23 | | 1.14 | | 6.09 | |

Hypothetical (b) | | 1,000.00 | | 1,019.40 | | 1.14 | | 5.79 | |

| | | | | | | | | |

Class I | | | | | | | | | |

Actual | | 1,000.00 | | 1,124.04 | | 0.87 | | 4.66 | |

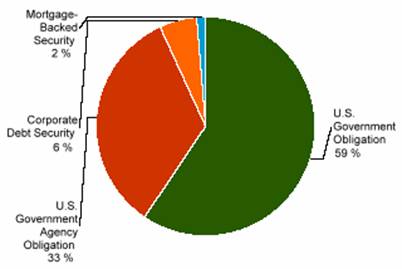

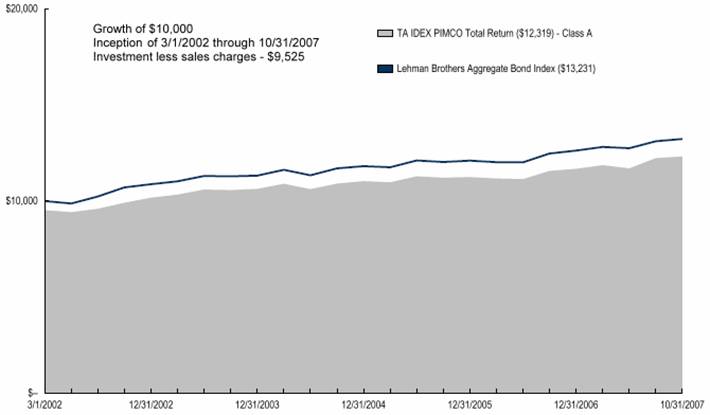

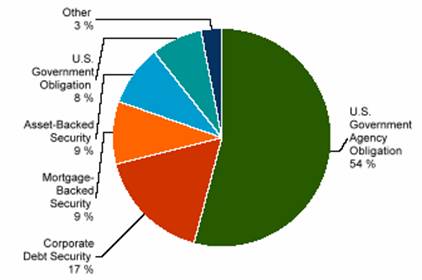

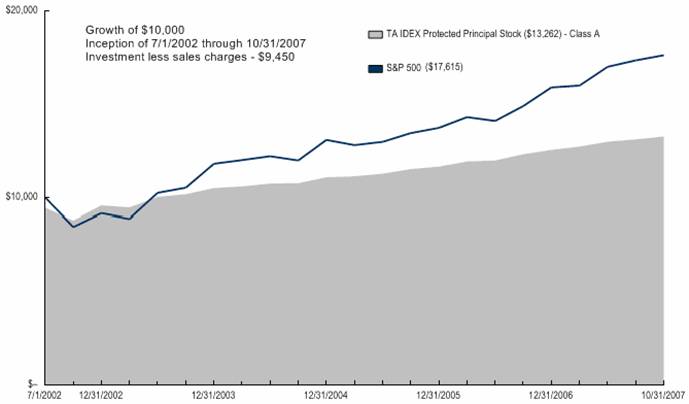

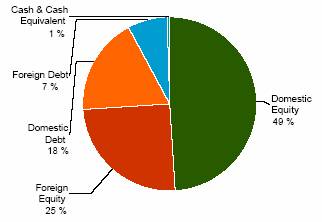

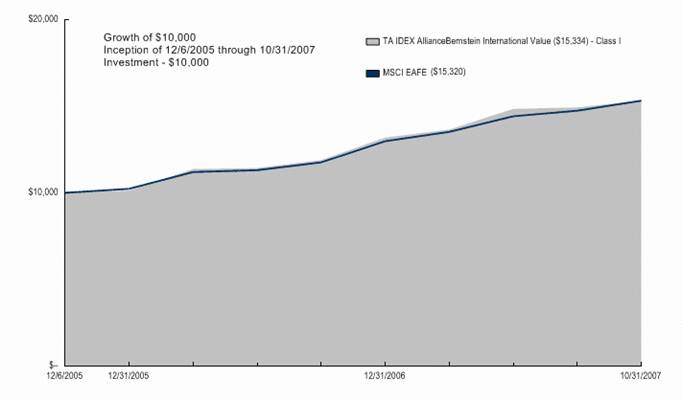

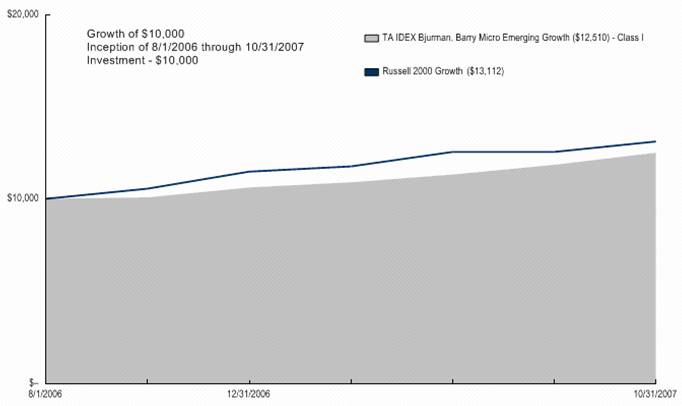

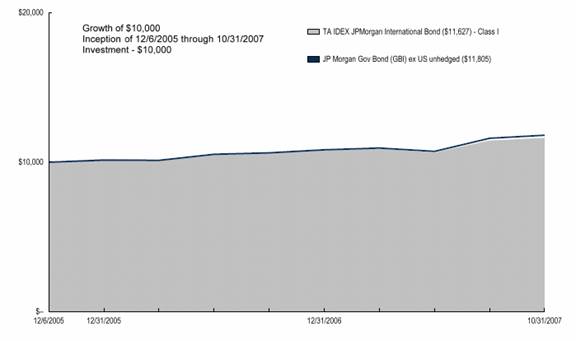

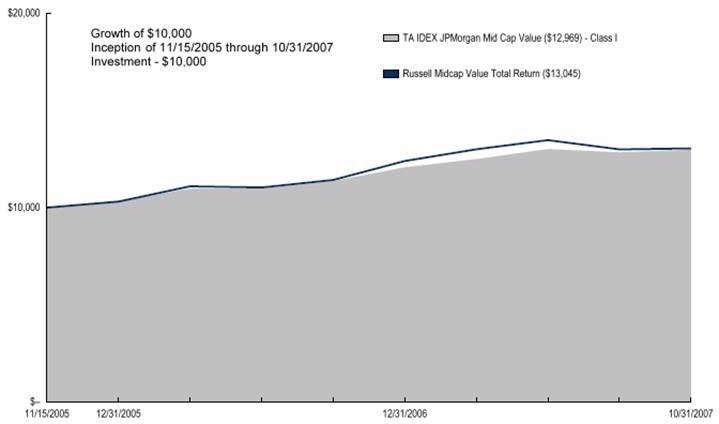

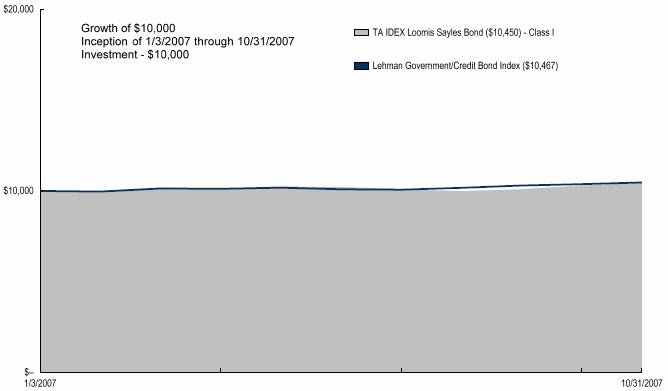

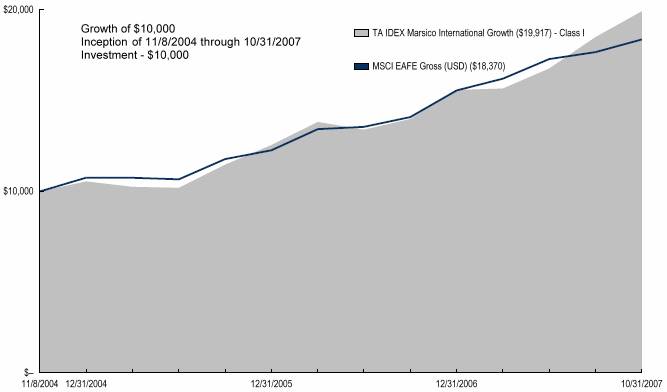

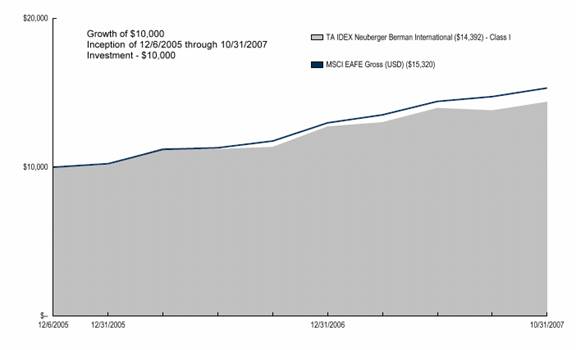

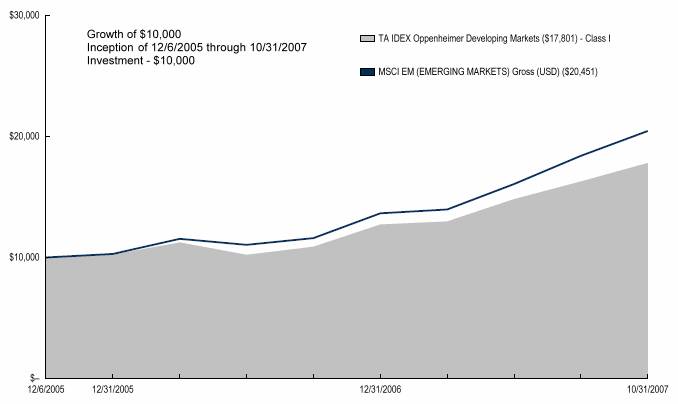

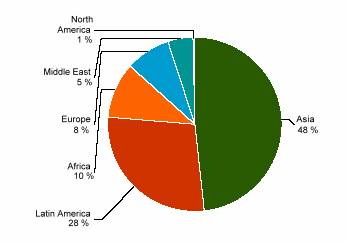

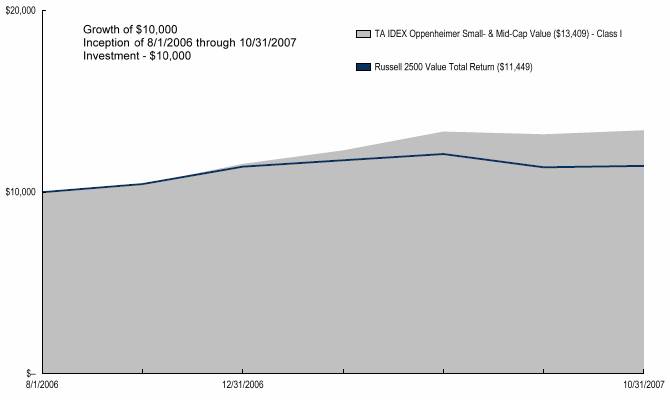

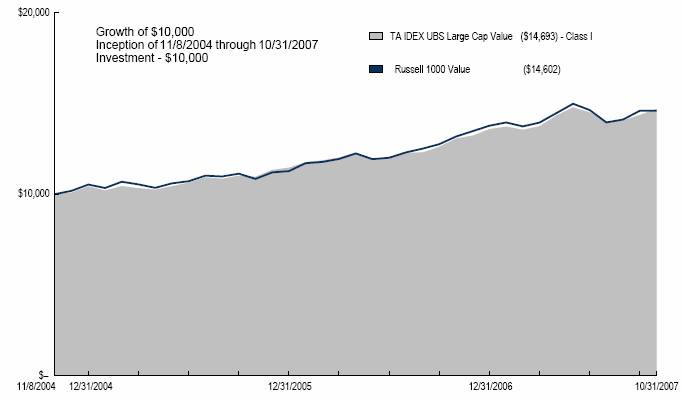

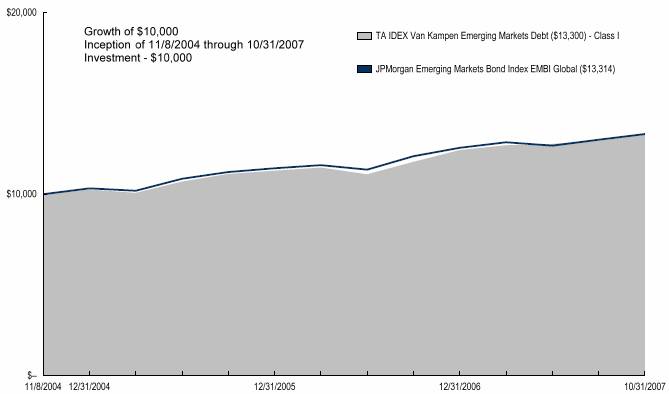

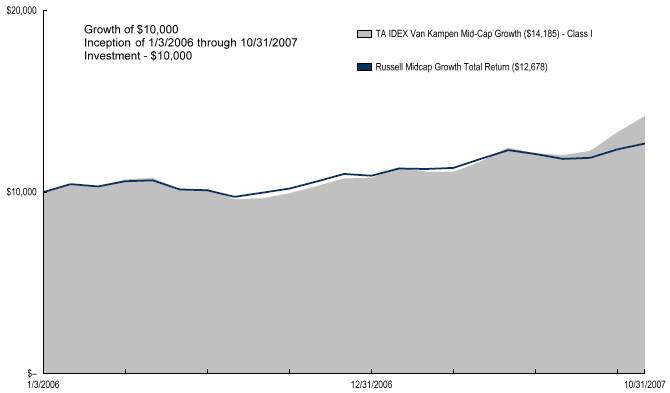

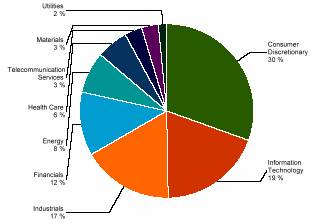

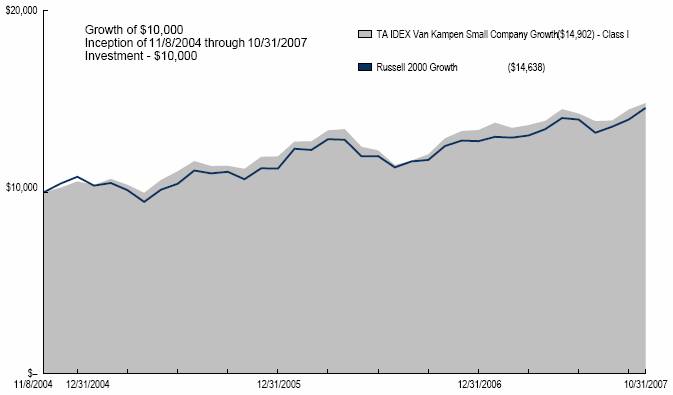

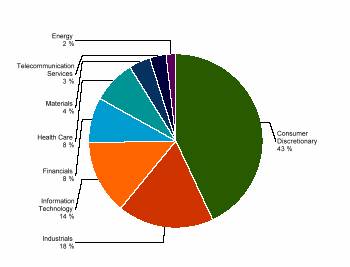

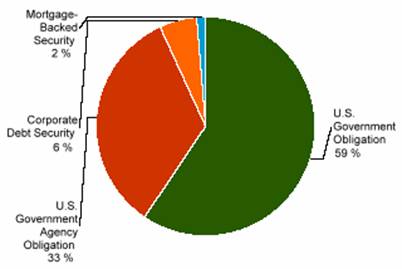

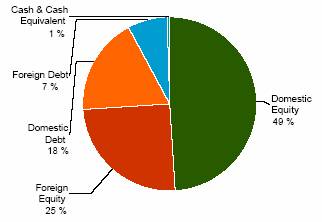

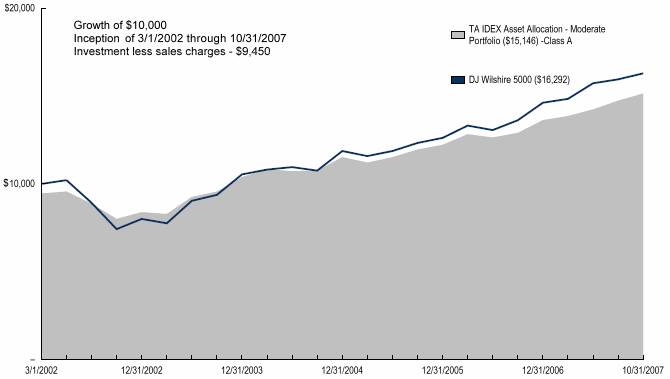

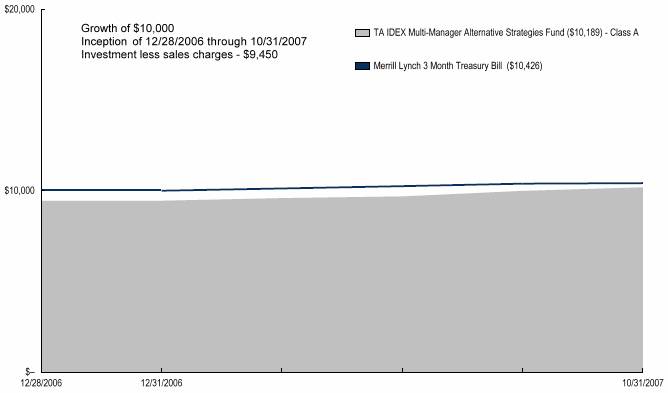

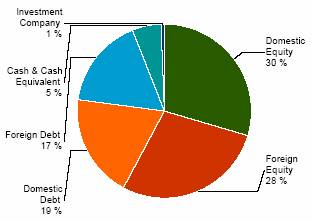

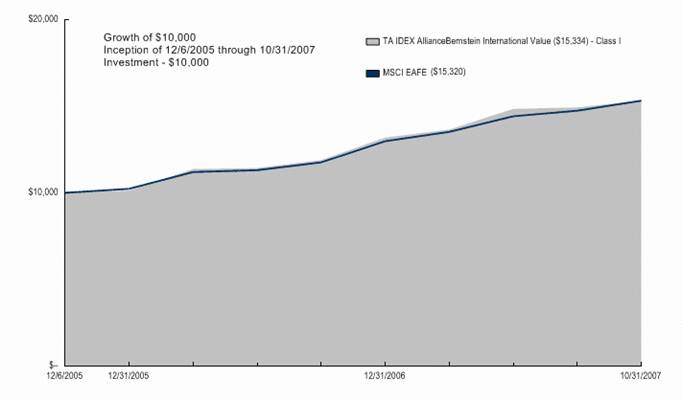

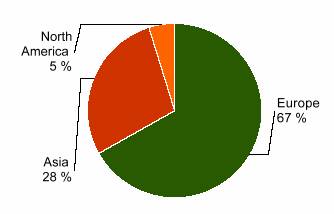

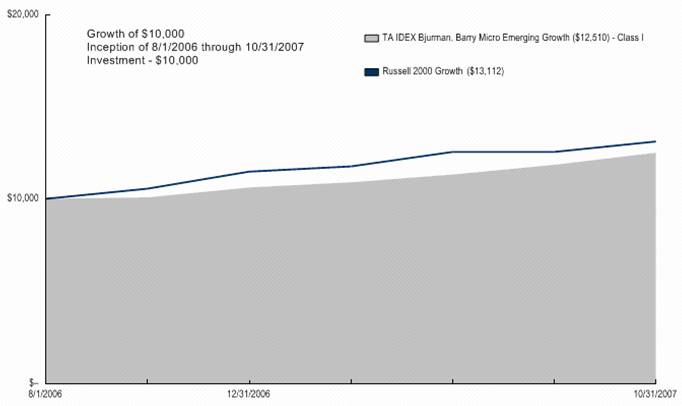

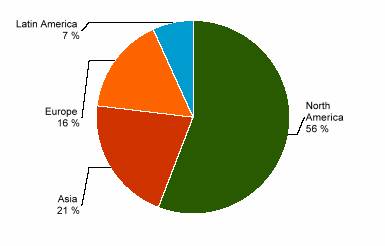

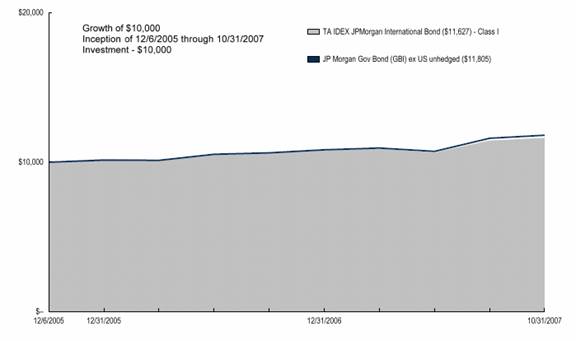

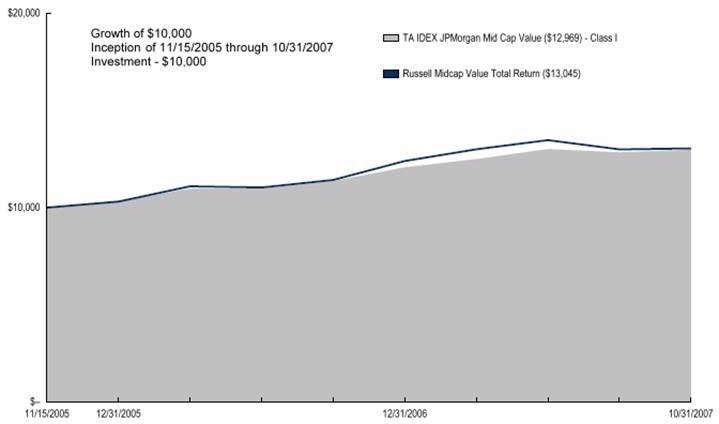

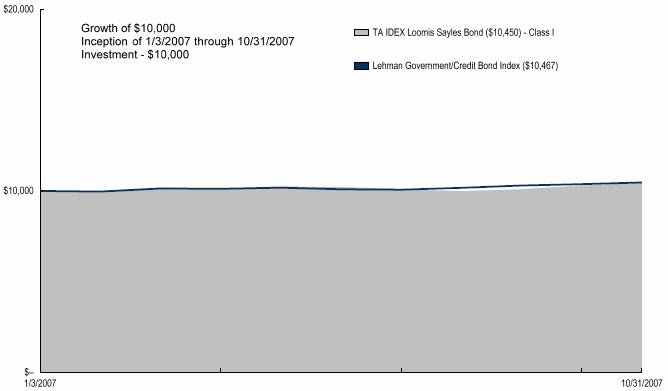

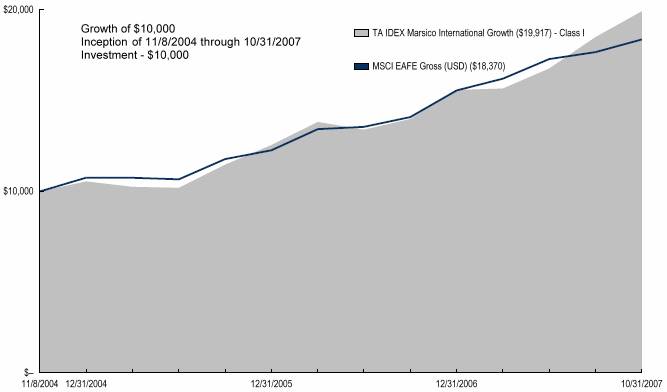

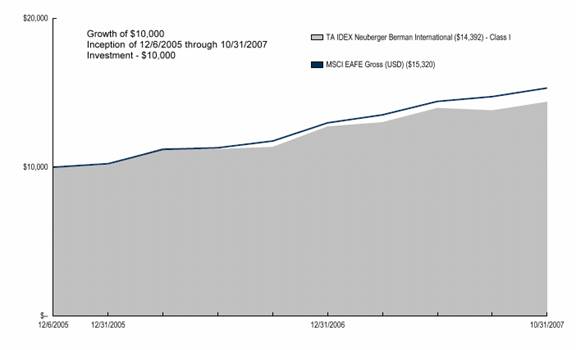

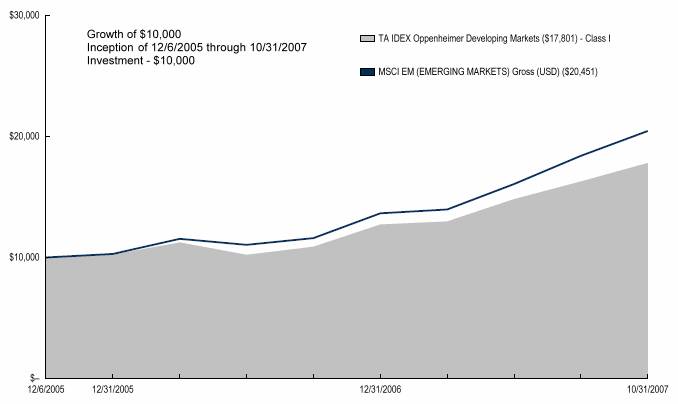

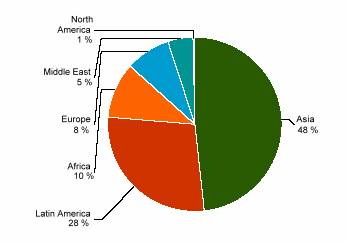

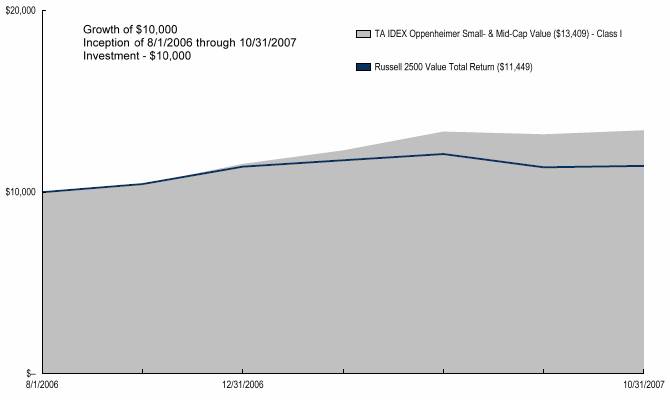

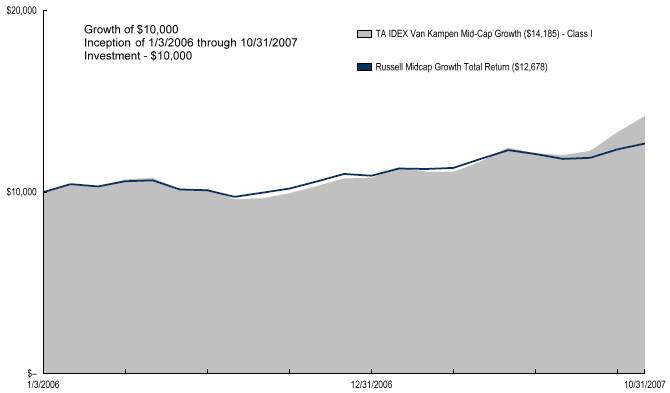

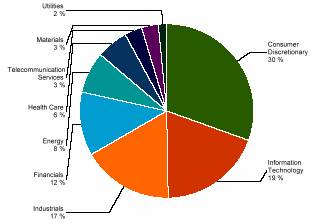

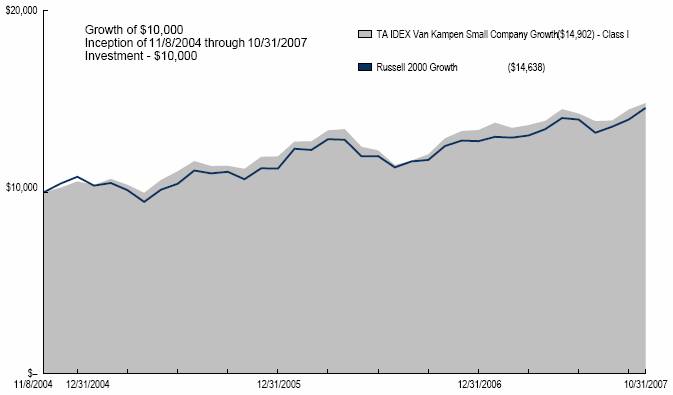

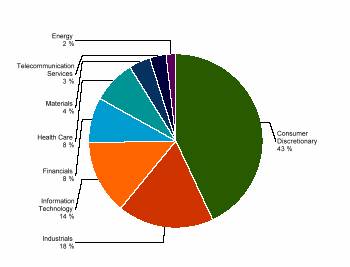

Hypothetical (b) | | 1,000.00 | | 1,020.75 | | 0.87 | | 4.44 | |