As filed with the SEC on December 30, 2009.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04556 |

|

TRANSAMERICA FUNDS |

(Exact name of registrant as specified in charter) |

|

570 Carillon Parkway, St. Petersburg, Florida | | 33716 |

(Address of principal executive offices) | | (Zip code) |

|

Dennis P. Gallagher, Esq. P.O. Box 9012, Clearwater, Florida 33758-9771 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (727) 299-1800 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | November 1, 2008 - October 31, 2009 | |

| | | | | | | | |

Item 1: Report(s) to Shareholders. The Annual Report is attached.

Fund of Funds

Annual Report

October 31, 2009

www.transamericafunds.com

Customer Service 1-888-233-4339

P.O. Box 9012 · Clearwater, FL 33758-9012

Distributor: Transamerica Capital, Inc.

Dear Fellow Shareholder:

On behalf of Transamerica Funds, we would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your portfolios. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all shareholders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a discussion of accounting policies as well as matters presented to shareholders that may have required their vote.

We believe it is important to recognize and understand current market conditions in order to provide a context for reading this report. During the past twelve months, markets have oscillated from significant weakness in conjunction with investors’ concerns over the health of the economy and the labor market to strength in conjunction with investor optimism of recovery and bargain hunting. The equity markets touched new lows in March 2009, and then subsequently rallied sharply. The period ended in October with positive twelve month returns for both the broad equity and bond markets. As economic recovery prospects have improved, the U.S. dollar has weakened versus the Euro, Pound Sterling, and Japanese Yen. Oil prices have been quite volatile over the past year, hitting their lows in January 2009 and recovering to end higher at the end of the period. From a rate of 1.00% at the beginning of the period, the Federal Reserve lowered the federal funds rate in December 2008 to a range of 0%-0.25% in an effort to stimulate the economy. The unemployment rate has continued to climb and reached 10.2% in October. Bargain hunting and an increased appetite for risk following market lows in March 2009 has led to strong gains for particular equity and fixed-income sectors, including emerging market stocks, technology stocks and high-yield bonds. Treasuries and money market securities have lagged on a relative basis. For the twelve months ending October 31, 2009, the Dow Jones Industrial Average returned 7.71%; the Standard & Poor’s 500 Index returned 9.80%; and the Barclays Capital U.S. Aggregate Bond Index returned 13.79%. Please keep in mind, it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a complete picture of your current and future financial needs. Financial advisers are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial adviser, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely, | |

| |

| |

John K. Carter | Christopher A. Staples |

Chairman of the Board, | Senior Vice President & Chief Investment Officer |

President & Chief Executive Officer | Transamerica Funds |

Transamerica Funds | |

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of Transamerica Funds. These views are subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of Transamerica Funds.

Transamerica Asset Allocation — Conservative Portfolio

(unaudited)

MARKET ENVIRONMENT

The 12-month period ending October 31, 2009 was an eventful one in the financial markets. Although the period does not include September and October 2008—when we witnessed the demise of Lehman Brothers, the Merrill Lynch and Wachovia rescues, and the government seizures of Fannie Mae, Freddie Mac, Washington Mutual, and AIG—the market fallout from the financial sector’s near-collapse persisted well into the winter. With the housing market sinking further, banks taking massive write-offs, and even credit-worthy companies struggling to secure routine daily financing, the stock and bond markets remained in their panicked state well into 2009. The Standard and Poor’s 500 Composite Stock Index (“S&P 500”) continued to plunge until finally bottoming on March 9, 2009, by which point it was off 55% from its 2007 peak.

Measured from November 1, 2008 (the start of the fiscal year covered by this report), the S&P 500 lost about 29% through March 9. The losses in international markets were in the same neighborhood, although emerging markets fell less, thanks partly to improving oil prices in 2009’s first quarter. Aside from U.S. Treasuries—whose prices had been driven up by safety-seeking investors—most bonds had faltered along with the stock market through October 2008. But starting in November, the broader bond market gradually reclaimed its traditional status as a relatively safe harbor. Treasuries still reigned, but eventually high-quality corporate bonds also performed well as investors fled equities. The Barclays Capital Corporate Investment Grade Index (“BC Corporate Investment Grade”), which had lost almost 14% in September and October, recouped about 8% from November 1 through March 9, 2009. Junk-rated corporates still lagged, however.

The turning point arrived in early March as fears of a total financial meltdown eased, myriad stimulus initiatives progressed, and several economic indicators showed initial hints of stabilizing. The market rebound steamrolled unabated straight through the spring, summer, and early fall, before easing off in October. The rally, which saw the S&P 500 rise more than 55% from March 10 through October 31, favored the most economically sensitive sectors as investors grew more confident that the economy’s nadir had come and gone. Cyclical sectors, including industrials, technology, and especially the ravaged financials arena, recorded the most dramatic gains. The S&P 500’s financials sector shot up almost 128% over that stretch, while industrials and information technology both rebounded nearly 69%. Basic materials were close behind with a 65% return. Traditionally, defensive sectors, such as health care, consumer staples, and utilities, rebounded only about half as much. Other risky asset classes were also rewarded. Small-cap stocks jumped more than 65% as measured by the Russell 2000® Index, and the Morgan Stanley Capital International Emerging Markets Index (“MSCI Emerging Markets”) soared nearly 92% in U.S. dollar terms. Even the Morgan Stanley Capital International-Europe, Australasia, and Far East Index (“MSCI-EAFE”) of developed foreign markets gained 72% on a dollar basis. Both international indices were significantly helped by the greenback’s fall as investors who had flocked to the dollar’s perceived safety began exiting after March.

Meanwhile, the credit markets continued to improve as lending activity gradually resumed. Treasuries were no longer in such demand, but bonds with credit risk basked in investors’ returning confidence. Investment-grade corporate bonds gained 21% according to the BC Corporate Investment Grade. The corresponding high-yield index rallied almost 54%.

For the 12-month period as a whole, the S&P 500 gained 9.80%. Within the U.S., mid-cap companies out-performed both large and small companies. In the large-cap realm, value stocks—which include the big banks, brokers, and insurers—dramatically underperformed growth stocks, although that relationship didn’t hold in the smaller-cap ranges. The MSCI-EAFE Index returned an impressive 27.71% in dollar terms (less than half that without factoring in the dollar’s depreciation). The MSCI Emerging Markets soared nearly 65% over the period. The Barclays Capital U.S. Aggregate Bond Index (“BCAB”) rose 13.79%, with junk bonds leading the rebound.

PERFORMANCE

For the year ended October 31, 2009, Transamerica Asset Allocation—Conservative Portfolio Class A returned 21.76%. By comparison, its primary and secondary benchmarks, the BCAB and the Wilshire 5000 Total Market Index, returned 13.79% and 11.33%, respectively.

STRATEGY REVIEW

This portfolio is structured to provide a mix of approximately 35% equity and 65% fixed-income securities (including cash) under normal conditions. The equity side provides broad coverage of both domestic and international markets, across a range of investment styles. The larger fixed-income portion covers investment-grade and lower-credit holdings, including government, investment-grade corporate, investment-grade foreign, high-yield corporate, convertible, and emerging-markets bonds. The portfolio also includes emerging-market stocks, global real estate, and alternative strategies. The goal is to provide investors one-stop coverage of the financial markets with a fixed-income emphasis, and the portfolio is more broadly diversified than most traditional balanced funds. No one can predict with consistency which asset classes and investment styles will out-perform in any given quarter or year. But by diversifying across all of them, one can capture the long-term performance of each.

Diversification can also smooth out risk, although it can not prevent losses in short-term periods when many asset classes drop simultaneously, as happened in the recent downturn. Nevertheless, the portfolio out-performed both its bond benchmark and its equity benchmark over the 12-month period, and ranked in the top quartile of its Morningstar category. Three main factors explain the out-performance. First, our bond portfolio, which had suffered through much of 2008, benefited from the strong rebound in the credit markets in 2009. The credit-sensitive holdings performed especially well. Transamerica High Yield Bond surged significantly and Transamerica Loomis Sayles Bond, a multi-sector bond fund that has exposure to high-yield and foreign bonds, was also up significantly.

Transamerica Funds | | Annual Report 2009 |

1

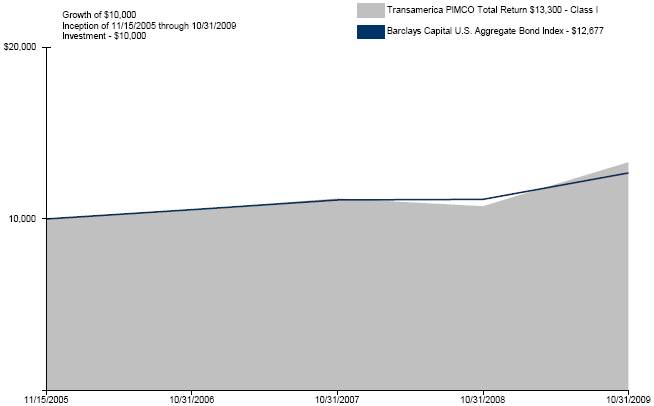

Transamerica Van Kampen Emerging Markets Debt also gained. The portfolio’s largest position, Transamerica PIMCO Total Return, rose an impressive amount and Transamerica PIMCO Real Return TIPS was up as well. Second, as part of our standard diversification, we hold about 30% of the equity stake in international stocks; and as mentioned, international markets gained more than the domestic stock market over the period. Also, we directed about a fourth of the international sleeve toward emerging markets, which soared. Indeed, our two emerging-markets funds, Transamerica Oppenheimer Developing Markets and Transamerica WMC Emerging Markets, were the portfolio’s two biggest gainers, and most of the other international funds were among the top performers. Finally, although our asset-allocation targets are strategic in nature rather than tactical, we did hold our equity weight between three and seven percentage points below the normal 35% target throughout the worst months of the stock market’s downturn. Given that fewer than half of our underlying funds beat their Morningstar category medians over the one-year period, we primarily credit the above factors for the portfolio’s out-performance.

During the period, we added three new underlying funds. Transamerica JPMorgan Core Bond, a historically successful bond strategy targeting high-quality bonds, was added to the Transamerica fund menu, enabling us to introduce it to the portfolio in July 2009. We invested in it both for its talented management and also to absorb some of the assets in Transamerica PIMCO Total Return, previously the only core bond fund available to us and thus a particularly large position. Transamerica Thornburg International Value has an outstanding record in the foreign large blend style. We added the fund in November 2008, primarily on the basis of the manager’s skill, but the fund also fleshes out our large-cap style coverage. Transamerica MFS International Equity was also added in late 2008 after an I share was created. Its parent fund has a strong history of investing with a growth-leaning style, and it complemented other foreign funds we already had in place.

We also eliminated several funds during the period. In late 2008, we decided to sell our position in Transamerica Small/Mid Cap Value after its sole manager resigned and was replaced by a team with more of a growth than value-style background. In the spring, we liquidated our position in Transamerica Bjurman, Barry Micro Emerging Growth after its management decided to close their firm. Then in September, we discontinued using five funds because of a change in the Transamerica fund-lineup rationalization. The funds were Transamerica American Century Large Company Value, Transamerica Marsico Growth, Transamerica Marsico International Growth, Transamerica Evergreen International Small Cap, and Transamerica Evergreen Health Care. Assets in those funds were distributed to various other portfolio holdings in a way that preserved the careful diversification and balance of the portfolio.

The question on many investors’ minds now is whether both stocks and credit-sensitive bonds have soared too fast and too high given economic conditions. When global security markets do settle down, we believe the stock- and bond-picking skills of our underlying managers will take on more importance.

Michael Stout, CFA

Jon Hale, Ph.D., CFA

Jeff McConnell, CFA

Maciej Kowara, Ph.D., CFA

Co-Portfolio Managers

Morningstar Associates, LLC

2

Average Annual Total Return for Periods Ended 10/31/2009

| | 1 Year | | 5 Years | | 10 Years or

Life of Portfolio | | Inception Date | |

Class A (NAV) | | 21.76 | % | 3.95 | % | 4.88 | % | 03/01/2002 | |

Class A (POP) | | 15.10 | % | 2.79 | % | 4.11 | % | 03/01/2002 | |

Barclays Capital U.S. Aggregate Bond Index* | | 13.79 | % | 5.05 | % | 5.46 | % | 03/01/2002 | |

Wilshire 5000* | | 11.33 | % | 1.05 | % | 2.17 | % | 03/01/2002 | |

Class B (NAV) | | 21.01 | % | 3.30 | % | 4.20 | % | 03/01/2002 | |

Class B (POP) | | 16.01 | % | 3.13 | % | 4.20 | % | 03/01/2002 | |

Class C (NAV) | | 21.09 | % | 3.32 | % | 5.93 | % | 11/11/2002 | |

Class C (POP) | | 20.09 | % | 3.32 | % | 5.93 | % | 11/11/2002 | |

Class R (NAV) | | 21.59 | % | N/A | | 2.57 | % | 06/15/2006 | |

NOTES

* The Barclays Capital U.S. Aggregate Bond Index and the Wilshire 5000 Total Market ("Wilshire 5000") Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Portfolio calculation is based on life of Class A shares. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on portfolio distributions or the redemption of portfolio shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflects the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares.

Performance figures may reflect fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this portfolio.

3

Transamerica Asset Allocation – Growth Portfolio

(unaudited)

MARKET ENVIRONMENT

The 12-month period ending October 31, 2009 was an eventful one in the financial markets. Although the period does not include September and October 2008—when we witnessed the demise of Lehman Brothers, the Merrill Lynch and Wachovia rescues, and the government seizures of Fannie Mae, Freddie Mac, Washington Mutual, and AIG—the market fallout from the financial sector’s near-collapse persisted well into the winter. With the housing market sinking further, banks taking massive write-offs, and even credit-worthy companies struggling to secure routine daily financing, the stock and bond markets remained in their panicked state well into 2009. The Standard and Poor’s 500 Composite Stock Index (“S&P 500”) continued to plunge until finally bottoming on March 9, 2009, by which point it was off 55% from its 2007 peak.

Measured from November 1, 2008 (the start of the fiscal year covered by this report), the S&P 500 lost about 29% through March 9. The losses in international markets were in the same neighborhood, although emerging markets fell less, thanks partly to improving oil prices in 2009’s first quarter.

The turning point arrived in early March as fears of a total financial meltdown eased, myriad stimulus initiatives progressed, and several economic indicators showed initial hints of stabilizing. The market rebound steamrolled unabated straight through the spring, summer, and early fall, before easing off in October. The rally, which saw the S&P 500 rise more than 55% from March 10 through October 31, favored the most economically sensitive sectors as investors grew more confident that the economy’s nadir had come and gone. Cyclical sectors, including industrials, technology, and especially the ravaged financials arena, recorded the most dramatic gains. The S&P 500’s financials sector shot up almost 128% over that stretch, while industrials and information technology both rebounded nearly 69%. Basic materials were close behind with a 65% return. Traditionally, defensive sectors, such as health care, consumer staples, and utilities, rebounded only about half as much. Other risky asset classes were also rewarded. Small-cap stocks jumped more than 65% as measured by the Russell 2000® Index, and the Morgan Stanley Capital International Emerging Markets Index (“MSCI Emerging Markets”) soared nearly 92% in U.S. dollar terms. Even the Morgan Stanley Capital International-Europe, Australasia, and Far East Index (“MSCI-EAFE”) of developed foreign markets gained 72% on a dollar basis. Both international indices were significantly helped by the greenback’s fall as investors who had flocked to the dollar’s perceived safety began exiting after March.

For the 12-month period as a whole, the S&P 500 gained 9.80%. Within the U.S., mid-cap companies out-performed both large and small companies. In the large-cap realm, value stocks—which include the big banks, brokers, and insurers—dramatically underperformed growth stocks, although that relationship didn’t hold in the smaller-cap ranges. The MSCI-EAFE Index returned an impressive 27.71% in dollar terms (less than half that without factoring in the dollar’s depreciation). The MSCI Emerging Markets Index soared nearly 65% over the period.

PERFORMANCE

For the year ended October 31, 2009, Transamerica Asset Allocation—Growth Portfolio Class A returned 14.46%. By comparison, its benchmark, the Wilshire 5000 Total Market Index, returned 11.33%.

STRATEGY REVIEW

This portfolio is structured to provide broadly diversified coverage of the domestic and international equity markets, across a range of market capitalizations and investment styles. The portfolio also includes emerging markets, global real estate, and alternative strategies. The goal is to provide investors one-stop coverage of the equity markets, and the portfolio is more broadly diversified across investment styles than most market indices. No one can predict with consistency which investment styles will out-perform in any given quarter or year. But by diversifying across all of them, one can capture the long-term performance of each.

Diversification can also smooth out risk, although it can not prevent losses in short-term periods when many asset classes drop simultaneously, as happened in the recent downturn. Nevertheless, the portfolio out-performed its benchmark and ranked in the top third of its Morningstar category. Two main factors explain the out-performance. First, as part of our standard diversification we hold about 30% of the diversified-equity stake in international stocks, and as mentioned, international markets gained more than the domestic stock market over the period. Also, we directed about a fourth of the international sleeve toward emerging markets, which soared. Indeed, our two emerging-markets funds, Transamerica Oppenheimer Developing Markets and Transamerica WMC Emerging Markets, were the portfolio’s two biggest gainers by far, and most of the other international funds were among the top performers. Second, our small- and mid-cap exposure helped, as Transamerica Van Kampen Mid-Cap Growth, Transamerica Van Kampen Small Company Growth, and Transamerica Oppenheimer Small- & Mid-Cap Value all rode the rebound to impressive gains for the one-year period. Finally, our alternative-strategy allocation helped soften losses during the market downturn—to a greater degree than they hindered the portfolio in the rebound. Given that fewer than half of our underlying funds beat their Morningstar category medians over the one-year period, we primarily credit the above factors for the portfolio’s out-performance.

During the period, we introduced one new underlying fund, Transamerica MFS International Equity, which was added in late 2008 after an I share was created. Its parent fund has a strong history of investing with a growth-leaning style, and it complemented other foreign funds we already had in place.

4

We also eliminated several funds during the period. In late 2008, we decided to sell our position in Transamerica Small/Mid Cap Value after its sole manager resigned and was replaced by a team with more of a growth than value-style background. In the spring, we liquidated our position in Transamerica Bjurman, Barry Micro Emerging Growth after its management decided to close their firm. Then in September, we discontinued using five funds because of a change in the Transamerica fund-lineup. The funds were Transamerica American Century Large Company Value, Transamerica Marsico Growth, Transamerica Marsico International Growth, Transamerica Evergreen International Small Cap, and Transamerica Evergreen Health Care. Assets in those funds were distributed to various other portfolio holdings in a way that preserved the careful diversification and balance of the portfolio.

The question on many investors’ minds now is whether stocks have soared too fast and too high given economic conditions. When global security markets do settle down, we believe the stock- and bond-picking skills of our underlying managers will take on more importance.

Michael Stout, CFA

Jon Hale, Ph.D., CFA

Jeff McConnell, CFA

Maciej Kowara, Ph.D., CFA

Co-Portfolio Managers

Morningstar Associates, LLC

5

Average Annual Total Return for Periods Ended 10/31/2009

| | 1 Year | | 5 Years | | 10 Years or

Life of Portfolio | | Inception Date | |

Class A (NAV) | | 14.46 | % | 1.67 | % | 2.04 | % | 03/01/2002 | |

Class A (POP) | | 8.12 | % | 0.52 | % | 1.30 | % | 03/01/2002 | |

Wilshire 5000* | | 11.33 | % | 1.05 | % | 2.17 | % | 03/01/2002 | |

Class B (NAV) | | 13.78 | % | 0.98 | % | 1.38 | % | 03/01/2002 | |

Class B (POP) | | 8.78 | % | 0.80 | % | 1.38 | % | 03/01/2002 | |

Class C (NAV) | | 13.72 | % | 1.06 | % | 5.13 | % | 11/11/2002 | |

Class C (POP) | | 12.72 | % | 1.06 | % | 5.13 | % | 11/11/2002 | |

Class R (NAV) | | 14.35 | % | N/A | | (3.34 | )% | 06/15/2006 | |

NOTES

* The Wilshire 5000 Total Market (“Wilshire 5000”) Index is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Portfolio calculation is based on life of Class A shares. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on portfolio distributions or the redemption of portfolio shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflects the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares.

Performance figures may reflect fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this portfolio.

6

Transamerica Asset Allocation — Moderate Growth Portfolio

(unaudited)

MARKET ENVIRONMENT

The 12-month period ending October 31, 2009 was an eventful one in the financial markets. Although the period does not include September and October 2008—when we witnessed the demise of Lehman Brothers, the Merrill Lynch and Wachovia rescues, and the government seizures of Fannie Mae, Freddie Mac, Washington Mutual, and AIG—the market fallout from the financial sector’s near-collapse persisted well into the winter. With the housing market sinking further, banks taking massive write-offs, and even credit-worthy companies struggling to secure routine daily financing, the stock and bond markets remained in their panicked state well into 2009. The Standard and Poor’s 500 Composite Stock Index (“S&P 500”) continued to plunge until finally bottoming on March 9, 2009, by which point it was off 55% from its 2007 peak.

Measured from November 1, 2008 (the start of the fiscal year covered by this report), the S&P 500 lost about 29% through March 9. The losses in international markets were in the same neighborhood, although emerging markets fell less, thanks partly to improving oil prices in 2009’s first quarter. Aside from U.S. Treasuries—whose prices had been driven up by safety-seeking investors—most bonds had faltered along with the stock market through October 2008. But starting in November, the broader bond market gradually reclaimed its traditional status as a relatively safe harbor. Treasuries still reigned, but eventually high-quality corporate bonds also performed well as investors fled equities. The Barclays Capital Corporate Investment Grade Index (“BC Corporate Investment Grade”), which had lost almost 14% in September and October, recouped about 8% from November 1 through March 9, 2009. Junk-rated corporates still lagged, however.

The turning point arrived in early March as fears of a total financial meltdown eased, myriad stimulus initiatives progressed, and several economic indicators showed initial hints of stabilizing. The market rebound steamrolled unabated straight through the spring, summer, and early fall, before easing off in October. The rally, which saw the S&P 500 rise more than 55% from March 10 through October 31, favored the most economically sensitive sectors as investors grew more confident that the economy’s nadir had come and gone. Cyclical sectors, including industrials, technology, and especially the ravaged financials arena, recorded the most dramatic gains. The S&P 500’s financials sector shot up almost 128% over that stretch, while industrials and information technology both rebounded nearly 69%. Basic materials were close behind with a 65% return. Traditionally, defensive sectors, such as health care, consumer staples, and utilities, rebounded only about half as much. Other risky asset classes were also rewarded. Small-cap stocks jumped more than 65% as measured by the Russell 2000® Index, and the Morgan Stanley Capital International Emerging Markets Index (“MSCI Emerging Markets”) soared nearly 92% in U.S. dollar terms. Even the Morgan Stanley Capital International-Europe, Australasia, and Far East Index (“MSCI-EAFE”) of developed foreign markets gained 72% on a dollar basis. Both international indices were significantly helped by the greenback’s fall as investors who had flocked to the dollar’s perceived safety began exiting after March.

Meanwhile, the credit markets continued to improve as lending activity gradually resumed. Treasuries were no longer in such demand, but bonds with credit risk basked in investors’ returning confidence. Investment-grade corporate bonds gained 21% according to the BC Corporate Investment Grade. The corresponding high-yield index rallied almost 54%.

For the 12-month period as a whole, the S&P 500 gained 9.80%. Within the U.S., mid-cap companies out-performed both large and small companies. In the large-cap realm, value stocks—which include the big banks, brokers, and insurers—dramatically underperformed growth stocks, although that relationship didn’t hold in the smaller-cap ranges. The MSCI-EAFE Index returned an impressive 27.71% in dollar terms (less than half that without factoring in the dollar’s depreciation). The MSCI Emerging Markets soared nearly 65% over the period. The Barclays Capital U.S. Aggregate Bond Index (“BCAB”) rose 13.79%, with junk bonds leading the rebound.

PERFORMANCE

For the year ended October 31, 2009, Transamerica Asset Allocation—Moderate Growth Portfolio Class A returned 17.47%. By comparison, its primary and secondary benchmarks, the Wilshire 5000 Total Market Index and the BCAB, returned 11.33% and 13.79%, respectively.

STRATEGY REVIEW

This portfolio is structured to provide a mix of approximately 70% equity and 30% fixed-income securities (including cash) under normal conditions. The equity side provides broad coverage of both domestic and international markets, across a range of investment styles. The fixed-income portion covers investment-grade and credit-sensitive holdings, as well as international bonds. The portfolio also includes emerging markets, global real estate, and alternative strategies. The goal is to provide investors one-stop coverage of the financial markets, and the portfolio is more broadly diversified than most traditional balanced funds. No one can predict with consistency which asset classes and investment styles will out-perform in any given quarter or year. But by diversifying across all of them, one can capture the long-term performance of each.

Diversification can also smooth out risk, although it can not prevent losses in short-term periods when many asset classes drop simultaneously, as happened in the recent downturn. Nevertheless, the portfolio out-performed both its equity benchmark and its bond benchmark over the 12-month period, and ranked in the top half of its Morningstar category. Three main factors explain the out-performance. First, as part of our standard diversification we hold about 30% of the equity stake in international stocks, and as mentioned, international markets gained more than the domestic stock market over the period. Also, we directed about a fourth of the international sleeve toward emerging markets, which soared.

7

Indeed, our two emerging-markets funds, Transamerica Oppenheimer Developing Markets and Transamerica WMC Emerging Markets, were the portfolio’s two biggest gainers, and most of the other international funds were among the top performers. Second, our bond portfolio, which had suffered through much of 2008, benefited from the strong rebound in the credit markets in 2009. Transamerica High Yield Bond surged significantly and Transamerica Loomis Sayles Bond, a multi-sector bond fund that has exposure to high-yield and foreign bonds, was up. Transamerica Van Kampen Emerging Markets Debt also gained significantly. Finally, although our asset-allocation targets are strategic in nature rather than tactical, we did hold our equity weight between six and 12 percentage points below the normal 70% target throughout the worst months of the stock market’s downturn. Given that fewer than half of our underlying funds beat their Morningstar category medians over the one-year period, we primarily credit the above factors for the portfolio’s out-performance.

During the period, we added two new underlying funds. Transamerica JPMorgan Core Bond, a historically successful bond strategy targeting high-quality bonds, was added to the Transamerica fund menu, enabling us to introduce it to the portfolio in July 2009. We invested in it both for its talented management and also to absorb some of the assets in Transamerica PIMCO Total Return, previously the only core bond fund available to us and thus a particularly large position. Transamerica MFS International Equity was also added in late 2008 after an I share was created. Its parent fund has a strong history of investing with a growth-leaning style, and it complemented other foreign funds we already had in place.

We also eliminated several funds during the period. In late 2008, we decided to sell our position in Transamerica Small/Mid Cap Value after its sole manager resigned and was replaced by a team with more of a growth than value-style background. In the spring, we liquidated our position in Transamerica Bjurman, Barry Micro Emerging Growth after its management decided to close their firm. Then in September, we discontinued using five funds because of a change in the Transamerica fund-lineup. The funds were Transamerica American Century Large Company Value, Transamerica Marsico Growth, Transamerica Marsico International Growth, Transamerica Evergreen International Small Cap, and Transamerica Evergreen Health Care. Assets in those funds were distributed to various other portfolio holdings in a way that preserved the careful diversification and balance of the portfolio.

The question on many investors’ minds now is whether stocks have soared too fast and too high given economic conditions. When global security markets do settle down, we believe the stock- and bond-picking skills of our underlying managers will take on more importance.

Michael Stout, CFA

Jon Hale, Ph.D., CFA

Jeff McConnell, CFA

Maciej Kowara, Ph.D., CFA

Co-Portfolio Managers

Morningstar Associates, LLC

8

Average Annual Total Return for Periods Ended 10/31/2009

| | 1 Year | | 5 Years | | 10 Years or

Life of Portfolio | | Inception Date | |

Class A (NAV) | | 17.47 | % | 2.93 | % | 3.32 | % | 03/01/2002 | |

Class A (POP) | | 10.96 | % | 1.77 | % | 2.56 | % | 03/01/2002 | |

Wilshire 5000* | | 11.33 | % | 1.05 | % | 2.17 | % | 03/01/2002 | |

Barclays Capital U.S. Aggregate Bond Index* | | 13.79 | % | 5.05 | % | 5.46 | % | 03/01/2002 | |

Class B (NAV) | | 16.69 | % | 2.24 | % | 2.63 | % | 03/01/2002 | |

Class B (POP) | | 11.69 | % | 2.07 | % | 2.63 | % | 03/01/2002 | |

Class C (NAV) | | 16.77 | % | 2.29 | % | 5.71 | % | 11/11/2002 | |

Class C (POP) | | 15.77 | % | 2.29 | % | 5.71 | % | 11/11/2002 | |

Class R (NAV) | | 17.29 | % | N/A | | (0.72 | )% | 06/15/2006 | |

NOTES

* The Wilshire 5000 Total Market (“Wilshire 5000”) Index and the Barclays Capital U.S. Aggregate Bond Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Portfolio calculation is based on life of Class A shares. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on portfolio distributions or the redemption of portfolio shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflects the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares.

Performance figures may reflect fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this portfolio.

9

Transamerica Asset Allocation — Moderate Portfolio

(unaudited)

MARKET ENVIRONMENT

The 12-month period ending October 31, 2009 was an eventful one in the financial markets. Although the period does not include September and October 2008—when we witnessed the demise of Lehman Brothers, the Merrill Lynch and Wachovia rescues, and the government seizures of Fannie Mae, Freddie Mac, Washington Mutual, and AIG—the market fallout from the financial sector’s near-collapse persisted well into the winter. With the housing market sinking further, banks taking massive write-offs, and even credit-worthy companies struggling to secure routine daily financing, the stock and bond markets remained in their panicked state well into 2009. The Standard and Poor’s 500 Composite Stock Index (“S&P 500”) continued to plunge until finally bottoming on March 9, 2009, by which point it was off 55% from its 2007 peak.

Measured from November 1, 2008 (the start of the fiscal year covered by this report), the S&P 500 lost about 29% through March 9. The losses in international markets were in the same neighborhood, although emerging markets fell less, thanks partly to improving oil prices in 2009’s first quarter. Aside from U.S. Treasuries—whose prices had been driven up by safety-seeking investors—most bonds had faltered along with the stock market through October 2008. But starting in November, the broader bond market gradually reclaimed its traditional status as a relatively safe harbor. Treasuries still reigned, but eventually high-quality corporate bonds also performed well as investors fled equities. The Barclays Capital Corporate Investment Grade Index (“BC Corporate Investment Grade”), which had lost almost 14% in September and October, recouped about 8% from November 1 through March 9, 2009. Junk-rated corporates still lagged, however.

The turning point arrived in early March as fears of a total financial meltdown eased, myriad stimulus initiatives progressed, and several economic indicators showed initial hints of stabilizing. The market rebound steamrolled unabated straight through the spring, summer, and early fall, before easing off in October. The rally, which saw the S&P 500 rise more than 55% from March 10 through October 31, favored the most economically sensitive sectors as investors grew more confident that the economy’s nadir had come and gone. Cyclical sectors, including industrials, technology, and especially the ravaged financials arena, recorded the most dramatic gains. The S&P 500’s financials sector shot up almost 128% over that stretch, while industrials and information technology both rebounded nearly 69%. Basic materials were close behind with a 65% return. Traditionally, defensive sectors, such as health care, consumer staples, and utilities, rebounded only about half as much. Other risky asset classes were also rewarded. Small-cap stocks jumped more than 65% as measured by the Russell 2000® Index, and the Morgan Stanley Capital International Emerging Markets Index (“MSCI Emerging Markets”) soared nearly 92% in U.S. dollar terms. Even the Morgan Stanley Capital International-Europe, Australasia, and Far East Index (“MSCI-EAFE”) of developed foreign markets gained 72% on a dollar basis. Both international indices were significantly helped by the greenback’s fall as investors who had flocked to the dollar’s perceived safety began exiting after March.

Meanwhile, the credit markets continued to improve as lending activity gradually resumed. Treasuries were no longer in such demand, but bonds with credit risk basked in investors’ returning confidence. Investment-grade corporate bonds gained 21% according to the BC Corporate Investment Grade. The corresponding high-yield index rallied almost 54%.

For the 12-month period as a whole, the S&P 500 gained 9.80%. Within the U.S., mid-cap companies out-performed both large and small companies. In the large-cap realm, value stocks—which include the big banks, brokers, and insurers—dramatically underperformed growth stocks, although that relationship didn’t hold in the smaller-cap ranges. The MSCI-EAFE Index returned an impressive 27.71% in dollar terms (less than half that without factoring in the dollar’s depreciation). The MSCI Emerging Markets soared nearly 65% over the period. The Barclays Capital U.S. Aggregate Bond Index (“BCAB”) rose 13.79%, with junk bonds leading the rebound.

PERFORMANCE

For the year ended October 31, 2009, Transamerica Asset Allocation—Moderate Portfolio Class A returned 19.99%. By comparison, its primary and secondary benchmarks, the Wilshire 5000 Total Market Index and the BCAB, returned 11.33% and 13.79%, respectively.

STRATEGY REVIEW

This portfolio is structured to provide a mix of approximately 50% equity and 50% fixed-income securities (including cash) under normal conditions. The equity side provides broad coverage of both domestic and international markets, across a range of investment styles. The fixed-income portion covers investment-grade and credit-sensitive holdings, as well as international bonds. The portfolio also includes emerging markets, global real estate, and alternative strategies. The goal is to provide investors one-stop coverage of the financial markets, and the portfolio is more broadly diversified than most traditional balanced funds. No one can predict with consistency which asset classes and investment styles will out-perform in any given quarter or year. But by diversifying across all of them, one can capture the long-term performance of each.

Diversification can also smooth out risk, although it can not prevent losses in short-term periods when many asset classes drop simultaneously, as happened in the recent downturn. Nevertheless, the portfolio out-performed both its equity benchmark and its bond benchmark over the 12-month period, and ranked in the top quartile of its Morningstar category. Three main factors explain the out-performance. First, as part of our standard diversification we hold about 30% of the equity stake in international stocks, and as mentioned, international markets gained more than the domestic stock market over the period. Also, we directed about a fourth of the international sleeve toward emerging markets, which soared.

10

Indeed, our two emerging-markets funds, Transamerica Oppenheimer Developing Markets and Transamerica WMC Emerging Markets, were the portfolio’s two biggest gainers, and most of the other international funds were among the top performers. Second, our bond portfolio, which had suffered through much of 2008, benefited from the strong rebound in the credit markets in 2009. Transamerica High Yield Bond surged significantly and Transamerica Loomis Sayles Bond, a multi-sector bond fund that has exposure to high-yield and foreign bonds, was up. Transamerica Van Kampen Emerging Markets Debt also gained significantly. Finally, although our asset-allocation targets are strategic in nature rather than tactical, we did hold our equity weight between six and 11 percentage points below the normal 50% target throughout the worst months of the stock market’s downturn. Given that fewer than half of our underlying funds beat their Morningstar category medians over the one-year period, we primarily credit the above factors for the portfolio’s out-performance.

During the period, we added three new underlying funds. Transamerica JPMorgan Core Bond, a historically successful bond strategy targeting high-quality bonds, was added to the Transamerica fund menu, enabling us to introduce it to the portfolio in July 2009. We invested in it both for its talented management and also to absorb some of the assets in Transamerica PIMCO Total Return, previously the only core bond fund available to us and thus a particularly large position. Transamerica Thornburg International Value has an outstanding record in the large-cap core style. We added the fund in November 2008, primarily on the basis of the manager’s skill, but the fund also fleshes out our large-cap style coverage. Transamerica MFS International Equity was also added in late 2008 after an I share was created. Its parent fund has a strong history of investing with a growth-leaning style, and it complemented other foreign funds we already had in place.

We also eliminated several funds during the period. In late 2008, we decided to sell our position in Transamerica Small/Mid Cap Value after its sole manager resigned and was replaced by a team with more of a growth than value-style background. In the spring, we liquidated our position in Transamerica Bjurman, Barry Micro Emerging Growth after its management decided to close their firm. Then in September, we discontinued using five funds because of a change in the Transamerica fund-lineup. The funds were Transamerica American Century Large Company Value, Transamerica Marsico Growth, Transamerica Marsico International Growth, Transamerica Evergreen International Small Cap, and Transamerica Evergreen Health Care. Assets in those funds were distributed to various other portfolio holdings in a way that preserved the careful diversification and balance of the portfolio.

The question on many investors’ minds now is whether stocks have soared too fast and too high given economic conditions. When global security markets do settle down, we believe the stock- and bond-picking skills of our underlying managers will take on more importance.

Michael Stout, CFA

Jon Hale, Ph.D., CFA

Jeff McConnell, CFA

Maciej Kowara, Ph.D., CFA

Co-Portfolio Managers

Morningstar Associates, LLC

11

Average Annual Total Return for Periods Ended 10/31/2009

| | 1 Year | | 5 Years | | 10 Years or

Life of Portfolio | | Inception Date | |

Class A (NAV) | | 19.99 | % | 3.68 | % | 4.25 | % | 03/01/2002 | |

Class A (POP) | | 13.40 | % | 2.52 | % | 3.49 | % | 03/01/2002 | |

Wilshire 5000* | | 11.33 | % | 1.05 | % | 2.17 | % | 03/01/2002 | |

Barclays Capital U.S. Aggregate Bond Index* | | 13.79 | % | 5.05 | % | 5.46 | % | 03/01/2002 | |

Class B (NAV) | | 19.16 | % | 3.00 | % | 3.57 | % | 03/01/2002 | |

Class B (POP) | | 14.16 | % | 2.83 | % | 3.57 | % | 03/01/2002 | |

Class C (NAV) | | 19.24 | % | 3.03 | % | 6.05 | % | 11/11/2002 | |

Class C (POP) | | 18.24 | % | 3.03 | % | 6.05 | % | 11/11/2002 | |

Class R (NAV) | | 19.81 | % | N/A | | 1.24 | % | 06/15/2006 | |

NOTES

* The Wilshire 5000 Total Market (“Wilshire 5000”) Index and the Barclays Capital U.S. Aggregate Bond Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Portfolio calculation is based on life of Class A shares. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on portfolio distributions or the redemption of portfolio shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflects the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares.

Performance figures may reflect fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this portfolio.

12

Transamerica Multi-Manager Alternative Strategies Portfolio

(unaudited)

MARKET ENVIRONMENT

The 12-month period ending October 31, 2009 was an eventful one in the financial markets. Although the period does not include September and October 2008—when we witnessed the demise of Lehman Brothers, the Merrill Lynch and Wachovia rescues, and the government seizures of Fannie Mae, Freddie Mac, Washington Mutual, and AIG—the market fallout from the financial sector’s near-collapse persisted well into the winter. With the housing market sinking further, banks taking massive write-offs, and even credit-worthy companies struggling to secure routine daily financing, the stock and bond markets remained in their panicked state well into 2009. The Standard and Poor’s 500 Composite Stock Index (“S&P 500”) continued to plunge until finally bottoming on March 9, 2009, by which point it was off 55% from its 2007 peak.

Measured from November 1, 2008 (the start of the fiscal year covered by this report), the S&P 500 lost about 29% through March 9. The losses in international markets were in the same neighborhood, although emerging markets fell less, thanks partly to improving oil prices in 2009’s first quarter. Aside from U.S. Treasuries—whose prices had been driven up by safety-seeking investors—most bonds had faltered along with the stock market through October 2008. But starting in November, the broader bond market gradually reclaimed its traditional status as a relatively safe harbor. Treasuries still reigned, but eventually high-quality corporate bonds also performed well as investors fled equities. The Barclays Capital Corporate Investment Grade Index (“BC Corporate Investment Grade”), which had lost almost 14% in September and October, recouped about 8% from November 1 through March 9, 2009. Junk-rated corporates still lagged, however.

The turning point arrived in early March as fears of a total financial meltdown eased, myriad stimulus initiatives progressed, and several economic indicators showed initial hints of stabilizing. The market rebound steamrolled unabated straight through the spring, summer, and early fall, before easing off in October. The rally, which saw the S&P 500 recover more than 55% from March 10 through October 31, favored the most economically sensitive sectors as investors grew more confident that the economy’s nadir had come and gone. Cyclical sectors, including industrials, technology, and especially the ravaged financials arena, recorded the most dramatic gains. The S&P 500’s financials sector shot up almost 128% over that stretch, while industrials and information technology both rebounded nearly 69%. Basic materials were close behind with a 65% return. Traditionally, defensive sectors, such as health care, consumer staples, and utilities, rebounded only about half as much. Other risky asset classes were also rewarded. Small-cap stocks jumped more than 65% as measured by the Russell 2000® Index, and the Morgan Stanley Capital International Emerging Markets Index (“MSCI Emerging Markets”) soared nearly 92% in U.S. dollar terms. Even the Morgan Stanley Capital International-Europe, Australasia, and Far East Index (“MSCI-EAFE”) of developed international markets gained 72% on a dollar basis; that result was significantly influenced by the greenback’s fall against most currencies as investors who had flocked to the dollar’s perceived safety began exiting after March.

Meanwhile, the credit markets continued to improve as lending activity gradually resumed. Treasuries were no longer in such demand, but bonds with credit risk basked in investors’ returning confidence. Investment-grade corporate bonds gained 21% according to the BC Corporate Investment Grade. The corresponding high-yield index rallied almost 54%.

For the 12-month period as a whole, the S&P 500 gained 9.80%. Within the U.S., mid-cap companies out-performed both large and small companies. In the large-cap realm, value stocks—which include the big banks, brokers, and insurers—dramatically underperformed growth stocks, although that relationship didn’t hold in the smaller-cap ranges. The MSCI-EAFE Index returned an impressive 27.71% in dollar terms (less than half that without factoring in the dollar’s depreciation). The MSCI Emerging Markets soared nearly 65% over the period. The Barclays Capital U.S. Aggregate Bond Index rose 13.79%, with junk bonds leading the rebound.

PERFORMANCE

For the year ended October 31, 2009, Transamerica Multi-Manager Alternative Strategies Portfolio Class A returned 17.21%. By comparison, its benchmark, the Bank of America Merrill Lynch 3-Month Treasury Bill + 3% Wrap (“BofA Merrill Lynch 3-Month Treasury Bill”), returned 3.35%.

STRATEGY REVIEW

This portfolio is meant to provide diversification away from the mainstream stock and bond asset classes by combining absolute-return, unconventional equity, and lower-correlated fixed-income sleeves. Even though replicating hedge-fund performance is not the portfolio’s objective, we aim to provide a hedge-like performance profile in a mutual-fund format.

Viewed in this light, the portfolio by and large achieved its objectives over the 12-month reporting period. From November 1, 2008 to the stock market’s low point on March 9, 2009, the S&P 500 lost about 29% and the portfolio lost less than 11%. In the subsequent rebound between March 10 and October 31, 2009, the S&P 500 rose slightly more than 55% while the portfolio gained more than 31%. It was essentially impossible to avoid high correlation with the equity market amid one of the sharpest global market moves in history, but the portfolio was less correlated with the stock market on the downside than it was on the upside. Its loss during the downturn amounted to about 37% of the S&P 500’s loss, while during the rebound the portfolio captured more than half of the index’s gain. Although the portfolio exhibited increased stock-market correlation over the 12-month period, it handily out-performed both the stock and bond markets, as well as its BofA Merrill Lynch 3 Month Treasury Bill benchmark.

13

This performance came despite disappointing showings from some of the underlying funds. In particular, three of the absolute-return managers lagged. Transamerica BNY Mellon Market Neutral Strategy posted a loss for the period, while Transamerica Federated Market Opportunity and Transamerica UBS Dynamic Alpha (the latter under new management as of this writing and renamed Transamerica First Quadrant Global Macro) underperformed both stocks and bonds. These funds did, however, live up to our expectation that they would be the least market-correlated among the underlying funds; and as a group, they were among the best performers in the downturn. Meanwhile other underlying funds delivered powerful returns. Transamerica Oppenheimer Developing Markets, Transamerica Loomis Sayles Bond, and Transamerica Schroders International Small Cap each returned in excess of 40% for the period. Solid gains from Transamerica BlackRock Natural Resources, Transamerica BlackRock Global Allocation, and Transamerica JPMorgan International Bond filled in the middle.

The portfolio is not tactical in nature, so we did not actively change the allocations during the period. Indeed, our most important decision of the year was to stick with our carefully designed strategic asset mix as the markets were plummeting. Over the year as a whole, our weightings of the underlying strategies resulted in a decent overall performance pattern under extreme circumstances.

The portfolio did undergo some small changes, however. In the spring, we liquidated our position in Transamerica Bjurman, Barry Micro Emerging Growth because its management decided to close their firm. We moved those assets to Transamerica Third Avenue Value. One of the more idiosyncratic equity managers around, Transamerica Third Avenue Value is a good fit for this portfolio. In late September, Transamerica Evergreen International Small Cap was no longer a part of the fund-lineup due to changes effected by Transamerica Asset Management, Inc., the fund’s adviser. The portfolio received shares of Transamerica Neuberger Berman International as part of that change. Those shares make up less than half a percent of the portfolio’s assets.

This past year’s extreme market volatility served as a fairly intense stress test for this portfolio’s approach, and we take some encouragement from the portfolio’s performance over the period despite certain disappointments. We cannot say whether the stock and credit markets’ heady gains of the last eight months are warranted by economic conditions, or poised to reverse to one degree or another. But the past year does afford greater confidence that the portfolio could reasonably withstand any residual aftershocks that might reverberate in the months ahead.

Michael Stout, CFA

Jon Hale, Ph.D., CFA

Jeff McConnell, CFA

Maciej Kowara, Ph.D.,CFA

Co-Portfolio Managers

Morningstar Associates, LLC

14

Average Annual Total Return for Periods Ended 10/31/2009

| | 1 Year | | 10 Years or

Life of Portfolio | | Inception Date | |

Class A (NAV) | | 17.21 | % | (0.10 | )% | 12/28/2006 | |

Class A (POP) | | 10.80 | % | (2.06 | )% | 12/28/2006 | |

BofA Merrill Lynch 3-Month Treasury Bill * | | 3.35 | % | 5.67 | % | 12/28/2006 | |

Class C (NAV) | | 16.37 | % | (0.74 | )% | 12/28/2006 | |

Class C (POP) | | 15.37 | % | (0.74 | )% | 12/28/2006 | |

NOTES

* The Bank of America Merrill Lynch 3-Month Treasury Bill + 3% Wrap (“BofA Merrill Lynch 3-Month Treasury Bill”) Index is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Portfolio calculation is based on life of Class A shares. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on portfolio distributions or the redemption of portfolio shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflects the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge of 1% (during the first 12 months) for Class C shares.

Performance figures may reflect fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

The portfolio may utilize strategies and hedging techniques in matched combinations that are designed to neutralize or offset the risks of each strategy employing these techniques separately. Some strategies include long/short and market neutral strategies; bear markets strategies; tactical investment strategies (debt and/or equity); foreign currency trading strategies; global real estate securities; commodities and/or natural resources and/or precious metals; and non-traditional investments (such as micro-cap stocks and emerging market stocks). There is no assurance that these strategies will protect against losses. Certain hedging techniques and leverage employed in the management of the portfolio may accelerate the velocity of possible losses. This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this portfolio.

15

Transamerica Multi-Manager International Portfolio

(unaudited)

MARKET ENVIRONMENT

The 12-month period ending October 31, 2009 was an eventful one in the global financial markets. Although the period does not include September and October 2008, when a number of major financial institutions were seized, rescued, or simply allowed to fail, the market fallout from the financial sector’s near-collapse persisted well into the winter. With the U.S. housing market sinking further, banks taking massive write-offs, and even credit-worthy companies struggling to secure routine daily financing, the stock and bond markets remained in their panicked state well into 2009.

From November 1, 2008 (the start of the fiscal year covered by this report), the Morgan Stanley Capital International World ex-US Index (“MSCI WORLD ex-US (USD)”) lost close to 26% through its bottom on March 9. The Morgan Stanley Capital International Emerging Markets Index (“MSCI Emerging Markets”) was down almost 23% from November 1, 2008 to its low point on March 2, 2009.

The turning point arrived in early March as fears of a total financial meltdown eased, myriad stimulus initiatives progressed, and several economic indicators showed initial hints of stabilizing. The market rebound steamrolled unabated straight through the spring, summer, and early fall, before easing off in October. The MSCI World ex-US (USD) rose more than 72% from March 10 through October 31 in U.S. dollar terms, helped significantly by the greenback’s fall as investors who had flocked to the dollar’s perceived safety began exiting after March. The rally favored cyclical sectors, and riskier stocks in general, as investors grew more confident that the economy’s nadir had come and gone. International small-cap stocks jumped more than 83% over that stretch in dollar terms, as measured by the Morgan Stanley Capital International EAFE Small Cap Index (“MSCI-EAFE Small Cap”). But emerging markets were the strongest. The MSCI Emerging Markets soared nearly 92%.

Over the 12-month period as a whole, the MSCI World ex-US (USD) gained 27.83%, the MSCI EAFE Small Cap rose 48.74%, and the MSCI Emerging Markets trumped both with a 64.13% return.

PERFORMANCE

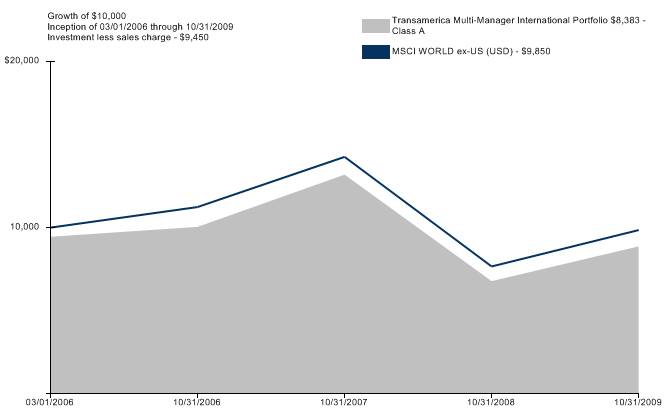

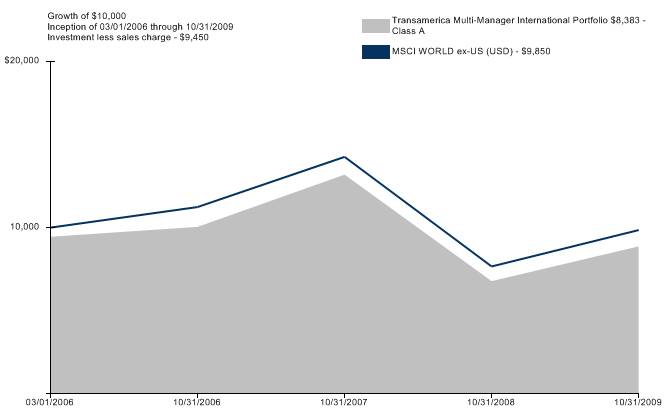

For the year ended October 31, 2009, Transamerica Multi-Manager International Portfolio Class A returned 30.86%. By comparison, its benchmark, the MSCI World ex-US (USD), returned 28.55%.

STRATEGY REVIEW

The portfolio is structured to provide broad coverage of international equity markets. Its nine underlying portfolio holdings cover a range of international investing styles, including large value, large growth, mid cap, small cap, emerging markets, global real estate, and global tactical asset allocation. The portfolio typically has approximately 75% of assets in developed-markets stocks and 25% in emerging markets. Large-cap stocks are targeted at 65% to 70% of the portfolio, with mid- and small-cap stocks comprising 30% to 35%. The portfolio typically contains smaller positions of about 5% each in the underlying global real estate and global tactical asset-allocation funds. Our objective is to provide investors with comprehensive coverage of international markets in a single investment vehicle. As such, the portfolio is more broadly diversified than most international portfolios or indices. No one can predict with consistency which investment styles will out-perform in any given quarter or year, but by diversifying across several of them, one can capture the long-term performance of each.

The portfolio outpaced its MSCI World ex-US (USD) benchmark over the 12-month reporting period. During the market’s downturn the portfolio lost less than the index as, interestingly, its small-cap and emerging-markets funds held up better than the broad benchmark, which is dominated by larger-cap stocks from developed markets. The hardest-hit stocks in most developed markets were the giant banks and other large financial institutions at the center of the global credit crisis and related government bailouts. Smaller-cap stocks were less affected, while emerging markets still boasted their strong long-term growth prospects and thus continued to attract investors. Transamerica BlackRock Global Allocation also held up better than the all-stock benchmark, as one would expect from a hybrid stock/bond fund, and Transamerica Neuberger Berman International performed relatively well on the downside. The portfolio trailed in the rebound phase, however. Its three major large-cap holdings—Transamerica Thornburg International Value, Transamerica MFS International Equity, and Transamerica Marsico International Growth (which was in the portfolio until late September)—didn’t quite keep pace with the index’s torrid rally from March to October. The rebound favored riskier fare that these portfolios don’t typically hold. And Transamerica BlackRock Global Allocation, while admirably capturing more of the market’s movement on the upside than it did on the downside, nevertheless diluted the portfolio’s gains owing to its bond exposure.

For the 12-month period as a whole, the majority of the underlying funds performed well, and the overall portfolio surpassed the MSCI World ex-US (USD) index by slightly more than two percentage points.

16

In September, we discontinued using Transamerica Marsico International Growth and Transamerica Evergreen International Small Cap because of a change in the Transamerica fund-lineup rationalization. Assets in those funds were distributed to other portfolio holdings in a way that preserved the diversification and balance of the portfolio.

The question on many investors’ minds now is whether stocks have soared too fast and too high given global economic conditions. If the security markets do settle down, as they surely must eventually, we believe the stock-picking skills of our underlying managers will take on more importance.

Michael Stout, CFA

Jon Hale, Ph.D., CFA

Jeff McConnell, CFA

Maciej Kowara, Ph.D., CFA

Co-Portfolio Managers

Morningstar Associates, LLC

17

Average Annual Total Return for Periods Ended 10/31/2009

| | 1 Year | | 10 Years or

Life of Portfolio | | Inception Date | |

Class A (NAV) | | 30.86 | % | (1.71 | )% | 03/01/2006 | |

Class A (POP) | | 23.71 | % | (3.21 | )% | 03/01/2006 | |

MSCI WORLD ex-US (USD)* | | 28.55 | % | 0.03 | % | 03/01/2006 | |

Class B (NAV) | | 30.00 | % | (2.41 | )% | 03/01/2006 | |

Class B (POP) | | 25.00 | % | (2.91 | )% | 03/01/2006 | |

Class C (NAV) | | 30.00 | % | (2.38 | )% | 03/01/2006 | |

Class C (POP) | | 29.00 | % | (2.38 | )% | 03/01/2006 | |

NOTES

* The Morgan Stanley Capital International World ex-US ("MSCI World ex-US (USD)") Index is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Portfolio calculation is based on life of Class A shares. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on portfolio distributions or the redemption of portfolio shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflects the maximum sales charge of 5.5% for A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares.

Performance figures may reflect fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Investments in global/international markets involve risks not associated with U.S. markets, such as currency fluctuations, adverse social and political developments, and the relatively small size and lesser liquidity of the markets. This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this portfolio.

18

Understanding Your Portfolios’ Expenses

(unaudited)

SHAREHOLDER EXPENSES

Portfolio shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions and redemption fees; and (2) ongoing costs, including management fees, and other portfolio expenses.

The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the portfolios and to compare these costs with the ongoing costs of investing in other portfolios.

The examples are based on an investment of $1,000 invested at May 1, 2009 and held for the entire period until October 31, 2009.

ACTUAL EXPENSES

The information in the table under the heading “Actual Expenses” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.6), then multiply the result by the number in the appropriate column for your share class titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA, your expenses could have included a $15 annual fee. The amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

HYPOTHETICAL EXAMPLES FOR COMPARISON PURPOSES

The information in the table under the heading “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the portfolios’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the portfolios’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your portfolios and other portfolios. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other portfolios. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges, redemption fees, brokerage commissions paid on purchases and sales of portfolio shares. Therefore, the information under the heading “Hypothetical Expenses” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different portfolios. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions.

| | | | Actual Expenses | | Hypothetical Expenses (b) | | | |

Portfolio Name | | Beginning

Account Value | | Ending Account

Value | | Expenses Paid

During Period (a) | | Ending Account

Value | | Expenses Paid

During Period (a) | | Annualized

Expense Ratio (c) | |

Transamerica Asset Allocation - Conservative Portfolio | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | $ | 1,171.50 | | $ | 3.56 | | $ | 1,021.93 | | $ | 3.31 | | 0.65 | % |

Class B | | 1,000.00 | | 1,167.90 | | 6.94 | | 1,018.80 | | 6.46 | | 1.27 | |

Class C | | 1,000.00 | | 1,168.30 | | 6.72 | | 1,019.00 | | 6.26 | | 1.23 | |

Class R | | 1,000.00 | | 1,170.50 | | 5.09 | | 1,020.52 | | 4.74 | | 0.93 | |

Transamerica Asset Allocation - Growth Portfolio | | | | | | | | | | | | | |

Class A | | 1,000.00 | | 1,209.80 | | 3.95 | | 1,021.63 | | 3.62 | | 0.71 | |

Class B | | 1,000.00 | | 1,206.50 | | 7.67 | | 1,018.25 | | 7.02 | | 1.38 | |

Class C | | 1,000.00 | | 1,205.20 | | 7.23 | | 1,018.65 | | 6.61 | | 1.30 | |

Class R | | 1,000.00 | | 1,208.60 | | 5.01 | | 1,020.67 | | 4.58 | | 0.90 | |

Transamerica Asset Allocation - Moderate Growth Portfolio | | | | | | | | | | | | | |

Class A | | 1,000.00 | | 1,190.20 | | 3.59 | | 1,021.93 | | 3.31 | | 0.65 | |

Class B | | 1,000.00 | | 1,185.80 | | 7.22 | | 1,018.60 | | 6.67 | | 1.31 | |

Class C | | 1,000.00 | | 1,186.20 | | 6.94 | | 1,018.85 | | 6.41 | | 1.26 | |

Class R | | 1,000.00 | | 1,189.40 | | 4.69 | | 1,020.92 | | 4.33 | | 0.85 | |

Transamerica Asset Allocation - Moderate Portfolio | | | | | | | | | | | | | |

Class A | | 1,000.00 | | 1,178.70 | | 3.40 | | 1,022.08 | | 3.16 | | 0.62 | |

Class B | | 1,000.00 | | 1,175.40 | | 7.02 | | 1,018.75 | | 6.51 | | 1.28 | |

Class C | | 1,000.00 | | 1,176.10 | | 6.75 | | 1,019.00 | | 6.26 | | 1.23 | |

Class R | | 1,000.00 | | 1,178.20 | | 4.94 | | 1,020.67 | | 4.58 | | 0.90 | |