(17)(2)(i) Prospectus dated March 1, 2011, as supplemented March 22, 2011, as supplemented through October 14, 2011

TRANSAMERICA FUNDS

Supplement to the Currently Effective Prospectuses

* * *

Transamerica AEGON High Yield Bond

The following replaces the information in the Prospectuses under the section entitled “Management – Portfolio Managers” relating to Transamerica AEGON High Yield Bond:

Portfolio Managers:

Bradley J. Beman, CFA, Lead Portfolio Manager since 1997

Kevin Bakker, CFA, Portfolio Manager since 2007

Benjamin D. Miller, CFA, Portfolio Manager since 2006

Jim Schaeffer, Portfolio Manager since 2011

The following replaces the information in the Prospectuses under the section entitled “Shareholder Information – Portfolio Manager(s)” relating to Transamerica AEGON High Yield Bond:

| | | | | | | | |

Name/Year Joined Fund | | Role | | Employer | | Positions Over Past Five Years | | |

| Bradley J. Beman, CFA/1997 | | Portfolio Manager (Lead) | | AUIM | | Chief Investment Officer, Senior Vice President, Director of High Yield | | |

| Kevin Bakker, CFA/2007 | | Portfolio Manager | | AUIM | | High Yield Portfolio Manager | | |

| Benjamin D. Miller, CFA/2006 | | Portfolio Manager | | AUIM | | High Yield Portfolio Manager | | |

| Jim Schaeffer/2011 | | Portfolio Manager | | AUIM | | Senior Vice President, Director of Distressed Debt | | |

* * *

Investors Should Retain this Supplement for Future Reference

October 14, 2011

Transamerica Funds

Supplement to the Currently Effective Prospectus, Summary Prospectus

and Statement of Additional Information, as supplemented

* * *

Transamerica Morgan Stanley Mid-Cap Growth

Transamerica WMC Diversified Growth (each a “Fund”)

The Board of Trustees has approved reorganizations pursuant to which each Fund’s assets would be acquired, and its liabilities would be assumed, by the Destination Fund listed opposite the Fund in the chart below in exchange for shares of the Destination Fund. The Fund would then be liquidated, and shares of the Destination Fund would be distributed to Fund shareholders.

| | |

Fund | | Destination Fund |

Transamerica Morgan Stanley Mid-Cap Growth | | Transamerica Morgan Stanley Growth

Opportunities |

Transamerica WMC Diversified Growth | | Transamerica WMC Diversified Equity |

Under each reorganization, Fund shareholders would receive shares of the Destination Fund with the same aggregate net asset value as their shares of the Fund. It is anticipated that no gain or loss for Federal income tax purposes would be recognized by Fund shareholders as a result of the reorganization.

Each reorganization does not require shareholder approval but is subject to the satisfaction of certain conditions. An information statement describing the reorganizations will be mailed to shareholders of the Funds in advance of the closing of the reorganizations, which is expected to occur in the first quarter of 2012. Prior to the reorganizations, shareholders can continue to purchase, redeem and exchange shares subject to the limitations described in the Prospectus.

* * *

Investors Should Retain this Supplement for Future Reference

October 13, 2011

TRANSAMERICA FUNDS

Supplement to the Currently Effective Retail Prospectus

* * *

The ninth bullet point under the section of the Prospectus entitled “Waivers and/or Reductions of Charges – Waiver of Class A and Class T Initial Sales Charges” is deleted in its entirety and replaced with the following:

| | • | | Other retirement plans, non-qualified brokerage accounts, and other accounts that are opened through an arrangement with Diversified Investment Advisors, Transamerica Retirement Services, Clark Consulting or Transamerica Retirement Management; and | |

* * *

Investors Should Retain this Supplement for Future Reference

August 10, 2011

TRANSAMERICA FUNDS

Supplement to the Currently Effective Prospectuses

* * *

Transamerica AEGON Flexible Income

The following replaces the information in the Retail and Class I2 Prospectuses under the section entitled “Management – Portfolio Managers” relating to Transamerica AEGON Flexible Income:

Portfolio Managers:

Brian W. Westhoff, CFA, Portfolio Manager (Lead) since 2005

Greg Haendel, CFA, Portfolio Manager since 2005

Bradley J. Beman, CFA, CPA, Portfolio Manager since 2011

David Halfpap, Portfolio Manager since 2011

Rick Perry, Portfolio Manager since 2011

Jim Schaeffer, Portfolio Manager since 2011

The following replaces the information in the Retail and Class I2 Prospectuses under the section entitled “Shareholder Information – Portfolio Manager(s)” relating to Transamerica AEGON Flexible Income:

| | | | | | | | |

| Name/Year Joined Fund | | Role | | Employer | | Positions Over Past Five Years | | |

| Brian W. Westhoff, CFA/2005 | | Portfolio Manager (Lead) | | AUIM | | Portfolio Manager | | |

| Greg Haendel, CFA/2005 | | Portfolio Manager | | AUIM | | Portfolio Manager | | |

| Bradley J. Beman, CFA, CPA/2011 | | Portfolio Manager | | AUIM | | Senior Vice President, Director – High Yield | | |

| David Halfpap/2011 | | Portfolio Manager | | AUIM | | Executive Vice President, Portfolio Manager | | |

| Rick Perry/2011 | | Portfolio Manager | | AUIM | | Senior Vice President, Director of Investment Grade Credit | | |

| Jim Schaeffer/2011 | | Portfolio Manager | | AUIM | | Senior Vice President, Director of Distressed Debt | | |

* * *

Transamerica Asset Allocation – Conservative Portfolio

Transamerica Asset Allocation – Growth Portfolio

Transamerica Asset Allocation – Moderate Growth Portfolio

Transamerica Asset Allocation – Moderate Portfolio

Transamerica Multi-Manager Alternative Strategies Portfolio

Transamerica Multi-Manager International Portfolio

Effective April 1, 2011, the information under the section entitled “Shareholder Information – Advisory Fees – Portfolio Construction Manager Compensation” on page 106 of the Retail Prospectus is deleted and replaced with the following:

Portfolio Construction Manager Compensation†

For the fiscal year ended October 31, 2010, the portfolio construction manager received the following fees as a percentage of a fund’s average daily net assets:

| | |

Transamerica Asset Allocation – Conservative Portfolio | | 0.10% |

Transamerica Asset Allocation – Growth Portfolio | | 0.10% |

Transamerica Asset Allocation – Moderate Growth Portfolio | | 0.10% |

Transamerica Asset Allocation – Moderate Portfolio | | 0.10% |

Transamerica Multi-Manager Alternative Strategies Portfolio | | 0.20% |

Transamerica Multi-Manager International Portfolio | | 0.10% |

| | † | Effective April 1, 2011, the portfolio construction manager’s fee for each of the funds is 0.10% of the first $20 billion of average daily net assets; 0.09% of average daily net assets over $20 billion up to $30 billion; and 0.08% over $30 billion. The average daily net assets for the purpose of calculating fees will be determined on a combined basis with all series of Transamerica Series Trust for which Morningstar serves as the portfolio construction manager; and with all series of Transamerica Funds for which Morningstar serves as the portfolio construction manager except Transamerica Multi-Manager Alternative Strategies Portfolio. |

* * *

Transamerica AQR Managed Futures Strategy

The following replaces the information in the Class I2 Prospectus under the section entitled “Management – Portfolio Managers” relating to Transamerica AQR Managed Futures Strategy:

Portfolio Managers:

Clifford S. Asness, Portfolio Manager since 2010

John M. Liew, Portfolio Manager since 2010

Brian K. Hurst, Portfolio Manager since 2010

Yao Hua Ooi, Portfolio Manager since 2010

The following replaces the information in the Class I2 Prospectus under the section entitled “Shareholder Information – Portfolio Manager(s)” relating to Transamerica AQR Managed Futures Strategy:

| | | | | | | | |

| Name/Year Joined Fund | | Role | | Employer | | Positions Over Past Five Years | | |

| Clifford S. Asness/2010 | | Portfolio Manager | | AQR | | Portfolio Manager, Managing and Founding Principal | | |

| John M. Liew/2010 | | Portfolio Manager | | AQR | | Portfolio Manager, Founding Principal | | |

| Brian K. Hurst/2010 | | Portfolio Manager | | AQR | | Portfolio Manager, Principal | | |

| Yao Hua Ooi/2010 | | Portfolio Manager | | AQR | | Portfolio Manager, Vice President | | |

* * *

Transamerica Federated Market Opportunity

The following information supplements and amends information in the Retail and Class I2 Prospectuses:

Transamerica Federated Market Opportunity is deleted in its entirety from the Class I2 Prospectus.

References to Transamerica Federated Market Opportunity are deleted from the section entitled “List and Description of Certain Underlying Funds” in the Retail Prospectus.

* * *

Transamerica Multi-Manager Alternative Strategies Portfolio

The following information replaces information in the Fee Table portion of the section entitled “Fees and Expenses” relating to Transamerica Multi-Manager Alternative Strategies Portfolio in the Retail Prospectus:

| | | | | | |

| Shareholder Fees (fees paid directly from your investment) |

| | | Class of Shares |

| | | A | | C | | I |

| Maximum sales charge (load) imposed on purchases (as a % of offering price) | | 5.50% | | None | | None |

| Maximum deferred sales charge (load) (as a percentage of purchase price or redemption proceeds, whichever is lower) | | None | | 1.00% | | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | | Class of Shares |

| | | A | | C | | I |

Management fees | | 0.20% | | 0.20% | | 0.20% |

Distribution and service (12b-1) fees | | 0.35% | | 1.00% | | None |

Other expenses | | 0.25% | | 0.24% | | 0.30% |

Acquired Fund Fees and Expenses (fees and expenses of underlying funds) | | 1.15% | | 1.15% | | 1.15% |

Total annual fund operating expensesa | | 1.95% | | 2.59% | | 1.65% |

| | a | Fund operating expenses do not correlate to the ratios of expenses to average net assets in the financial highlights table, which do not include acquired (i.e., underlying) funds’ fees and expenses. |

2

The following information supplements and amends information in the section entitled “Example” relating to Transamerica Multi-Manager Alternative Strategies Portfolio in the Retail Prospectus:

Example: This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000. The Example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | |

| |

If the shares are redeemed at the end of each period: |

Share Class | | 1 year | | 3 years | | 5 years | | 10 years |

A | | $737 | | $1,129 | | $1,544 | | $2,700 |

C | | $362 | | $ 805 | | $1,375 | | $2,925 |

I | | $168 | | $ 520 | | $ 897 | | $1,955 |

If the shares are not redeemed: |

Share Class | | 1 year | | 3 years | | 5 years | | 10 years |

A | | $737 | | $1,129 | | $1,544 | | $2,700 |

C | | $262 | | $ 805 | | $1,375 | | $2,925 |

I | | $168 | | $ 520 | | $ 897 | | $1,955 |

The Example does not reflect sales charges (loads) on reinvested dividends (and other distributions). If these sales charges (loads) were included, your costs would be higher.

* * *

Transamerica Water Island Arbitrage Strategy

The following information supplements and amends information in the section entitled “List and Description of Certain Underlying Funds” beginning on page 133 of the Retail Prospectus:

Effective May 1, 2011, Transamerica Water Island Arbitrage Strategy will be an underlying fund option for Transamerica Asset Allocation – Conservative Portfolio, Transamerica Asset Allocation – Growth Portfolio, Transamerica Asset Allocation – Moderate Growth Portfolio, Transamerica Asset Allocation – Moderate Portfolio and Transamerica Multi-Manager Alternative Strategies Portfolio.

The description of Transamerica Water Island Arbitrage Strategy is added as follows:

| | • | | Transamerica Water Island Arbitrage Strategy seeks to achieve capital growth by engaging in merger arbitrage. The fund invests, under normal circumstances, at least 80% of its net assets in equity securities and other investments with similar economic characteristics of companies (both domestic and foreign) that are involved in publicly announced mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations and other corporate reorganizations. Equity securities include common and preferred stock and options. The fund’s sub-adviser uses investment strategies designed to minimize market exposure including short selling and purchasing and selling options. The most common arbitrage activity, and the approach the fund generally will use, involves purchasing the shares of an announced acquisition target company at a discount to their expected value upon completion of the acquisition. The principal risks of investing in this underlying fund are: active trading; arbitrage; cash management and defensive investing; currency; currency hedging; derivatives; foreign securities; increase in expenses; leveraging; liquidity; market; merger arbitrage; portfolio selection; portfolio turnover; preferred stock; sector concentration; short sales; and stocks. |

* * *

All Funds

(except Transamerica AEGON Money Market)

The following paragraph replaces the risk disclosure labeled “Interest Rate” in the section of the Prospectuses entitled “Principal Risks” of each applicable fund:

| | n | Interest Rate – Debt securities have varying levels of sensitivity to changes in interest rates. In general, the price of a debt security tends to fall when interest rates rise and can rise when interest rates fall. Securities with longer maturities and mortgage securities can be more sensitive to interest rate changes. |

* * *

Investors Should Retain this Supplement for Future Reference

June 16, 2011

3

Transamerica Funds

Prospectus March 1, 2011, supplemented as of March 22, 2011

| | | | | | | | | | | | |

| Fund | | Class A

Ticker | | Class B

Ticker | | Class C

Ticker | | Class I

Ticker | | Class R

Ticker | | Class T

Ticker |

| | | | | | |

Transamerica AEGON Flexible Income | | IDITX | | IFLBX | | IFLLX | | TFXIX | | None | | None |

Transamerica AEGON High Yield Bond | | IHIYX | | INCBX | | INCLX | | TDHIX | | None | | None |

Transamerica AEGON Money Market | | IATXX | | IBTXX | | IMLXX | | TAMXX | | None | | None |

Transamerica AEGON Short-Term Bond | | ITAAX | | None | | ITACX | | TSTIX | | None | | None |

Transamerica Asset Allocation-Conservative Portfolio | | ICLAX | | ICLBX | | ICLLX | | TACIX | | ICVRX | | None |

Transamerica Asset Allocation-Growth Portfolio | | IAAAX | | IAABX | | IAALX | | TAGIX | | IGWRX | | None |

Transamerica Asset Allocation-Moderate Growth Portfolio | | IMLAX | | IMLBX | | IMLLX | | TMGIX | | IMGRX | | None |

Transamerica Asset Allocation-Moderate Portfolio | | IMOAX | | IMOBX | | IMOLX | | TMMIX | | IMDRX | | None |

Transamerica Morgan Stanley Capital Growth | | IALAX | | IACBX | | ILLLX | | TFOIX | | None | | None |

Transamerica Morgan Stanley Growth Opportunities | | ITSAX | | ITCBX | | ITSLX | | TGPIX | | None | | None |

Transamerica Multi-Managed Balanced | | IBALX | | IBABX | | IBLLX | | TBLIX | | None | | None |

Transamerica Multi-Manager Alternative Strategies Portfolio | | IMUAX | | None | | IMUCX | | TASIX | | None | | None |

Transamerica Multi-Manager International Portfolio | | IMNAX | | IMNBX | | IMNCX | | TMUIX | | None | | None |

Transamerica Systematic Small/Mid Cap Value | | IIVAX | | IIVBX | | IIVLX | | TSVIX | | None | | None |

Transamerica TS&W International Equity | | TRWAX | | None | | TRWCX | | TSWIX | | None | | None |

Transamerica WMC Diversified Equity | | TADAX | | TADBX | | TADCX | | TDEIX | | None | | None |

Transamerica WMC Diversified Growth | | ITQAX | | ITQBX | | ITQLX | | TETYX | | None | | IEQTX |

Transamerica WMC Quality Value | | TWQAX | | None | | TWQCX | | TWQIX | | None | | None |

| | |

| | Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. |

| | | | |

Not insured by FDIC or any federal government agency. | | May lose value. | | Not a deposit of or guaranteed by any bank, bank affiliate, or credit union. |

MPCA0311-A

TABLE OF CONTENTS

|

| TRANSAMERICA AEGON FLEXIBLE INCOME |

Investment Objective: Seeks to provide high total return through a combination of current income and capital appreciation.

Fees and Expenses: This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Transamerica Funds. More information about these and other discounts is available from your financial professional and in the “Waivers and/or Reductions of Charges” section on page 120 of the fund’s prospectus and in the fund’s statement of additional information (SAI) under the heading “Purchase of Shares.”

| | | | | | | | |

| Shareholder Fees (fees paid directly from your investment) |

| | | Class of Shares |

| | | A | | B* | | C | | I |

Maximum sales charge (load) imposed on purchases (as a % of offering price) | | 4.75% | | None | | None | | None |

| Maximum deferred sales charge (load) (as a percentage of purchase price or redemption proceeds, whichever is lower) | | None | | 5.00% | | 1.00% | | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)a |

| | | Class of Shares |

| | | A | | B* | | C | | I |

| Management fees | | 0.48% | | 0.48% | | 0.48% | | 0.48% |

| Distribution and service (12b-1) fees | | 0.35% | | 1.00% | | 1.00% | | None |

| Other expensesb | | 0.26% | | 0.34% | | 0.20% | | 0.26% |

| Total annual fund operating expenses | | 1.09% | | 1.82% | | 1.68% | | 0.74% |

| Expense reductionc | | 0.10% | | 0.00% | | 0.00% | | 0.00% |

| Total annual fund operating expenses after expense reduction | | 0.99% | | 1.82% | | 1.68% | | 0.74% |

| * | Not available to new investors. |

| a | Annual fund operating expenses have been restated to reflect current contractual advisory fees. |

| b | Other expenses do not include extraordinary expenses. If extraordinary expenses were included, other expenses would be 0.27%, 0.35%, 0.21%, and 0.27% for Class A, Class B, Class C and Class I, respectively. |

| c | Contractual arrangements have been made with the fund’s investment adviser, Transamerica Asset Management, Inc. (“TAM”), through March 1, 2012, to waive fees and/or reimburse fund expenses to the extent that the fund’s total operating expenses exceed 1.00%, excluding 12b-1 fees and extraordinary expenses. TAM is entitled to reimbursement by the fund of fees waived or expenses reduced during any of the previous 36 months if on any day the estimated annualized fund operating expenses are less than the cap, excluding 12b-1 fees and extraordinary expenses. In addition, TAM has contractually agreed, through March 1, 2012, to waive 0.10% of the 0.35% 12b-1 fee on Class A shares. |

Example: This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000. The Example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | |

| |

| If the shares are redeemed at the end of each period: |

| Share Class | | 1 year | | 3 years | | 5 years | | 10 years |

A | | $571 | | $796 | | $1,038 | | $1,732 |

B+ | | $685 | | $873 | | $1,085 | | $1,946 |

C | | $271 | | $530 | | $ 913 | | $1,987 |

I | | $ 76 | | $237 | | $ 411 | | $ 918 |

| If the shares are not redeemed: |

| Share Class | | 1 year | | 3 years | | 5 years | | 10 years |

A | | $571 | | $796 | | $1,038 | | $1,732 |

B+ | | $185 | | $573 | | $ 985 | | $1,946 |

C | | $171 | | $530 | | $ 913 | | $1,987 |

I | | $ 76 | | $237 | | $ 411 | | $ 918 |

| + | Examples for Class B shares assume conversion into Class A shares eight years after purchase. Class B shares are not available to new investors. |

The Example does not reflect sales charges (loads) on reinvested dividends (and other distributions). If these sales charges (loads) were included, your costs would be higher.

Portfolio Turnover: The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example,

1

affect the fund’s performance. During the most recent fiscal year, the portfolio turnover rate was 120% of the average value of the fund’s portfolio.

Principal Investment Strategies: AEGON USA Investment Management, LLC (“AUIM”), the fund’s sub-adviser, invests, under normal circumstances, at least 80% of the fund’s net assets in fixed-income securities, including U.S. Government and foreign government bonds and notes (including emerging markets); mortgage-backed, commercial mortgage-backed, and asset-backed securities (including collateralized mortgage obligations); corporate bonds of issuers in the U.S. and foreign countries (including emerging markets); convertible bonds and other convertible securities; bank loans and loan participations; structured notes; and preferred securities.

Under normal circumstances, at least 50% of the value of the fund’s assets will be invested in (a) debt securities which have a rating within the four highest grades as determined by Moody’s Investors Services, Inc. (“Moody’s”) (“Aaa, Aa, A or Baa”) or Standard & Poor’s Corporation (“S&P”) (“AAA, AA, A or BBB”); (b) securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities; (c) commercial paper rated Prime, Prime-1 or Prime-2 by NCO/Moody’s Commercial Paper Division, Moody’s or A-1 or A-2 by S&P; or (d) cash or cash equivalents. Up to 50% of the value of the fund’s assets may be invested in other debt securities which are not rated by Moody’s or S&P or, if so rated, are not within the grades or ratings referred to above. The fund may engage in options and futures transactions, foreign currency transactions, and swap transactions. The fund may invest up to 20% of its total assets in equity securities, such as common stocks, rights, warrants or preferred stock. The fund may invest in securities of any maturity and does not have a target average duration.

The fund may use short-term trading as a means of managing its portfolio to achieve its investment objectives.

By virtue of short-term trading, the fund may engage in greater buying and selling activity than investment companies which are not permitted to employ such a policy in seeking their investment objectives. Such activity can result in greater costs of operation than is the case with other investment companies, and risks of loss in portfolio value could be greater. Accordingly, an investment in fund shares may be more speculative than an investment in shares of an investment company which cannot engage in short-term trading.

The fund may invest its assets in cash, cash equivalent securities or short-term debt securities, repurchase agreements and money market instruments. Under adverse or unstable market, economic or political conditions, the fund may take temporary defensive positions in cash and short-term debt securities without limit.

Principal Risks: Many factors affect the fund’s performance. There is no assurance the fund will meet its investment objective. The value of your investment in the fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the fund or your investment may not perform as well as other similar investments. The following is a summary of certain risks (in alphabetical order) of investing in the fund. You may lose money if you invest in this fund.

| • | | Active Trading – Certain funds are actively managed and, under appropriate circumstances, may purchase and sell securities without regard to the length of time held. A high portfolio turnover rate may have a negative impact on performance by increasing transaction costs and may generate greater tax liabilities for shareholders holding shares in taxable accounts. |

| • | | Cash Management and Defensive Investing – Money market instruments or short-term debt securities held by the fund for cash management or defensive investing purposes can fluctuate in value. Like other fixed income securities, they are subject to risk, including market, interest rate and credit risk. If the fund holds cash uninvested, the fund will not earn income on the cash and the fund’s yield will go down. If a significant amount of the fund’s assets are used for cash management or defensive investing purposes, it will be more difficult for the fund to achieve its objective. |

| • | | Convertible Securities – The market value of convertible securities tends to decline as interest rates increase. Convertible securities generally offer lower interest or dividend yields than non-convertible securities of similar quality. The fund could lose money if the issuer of a convertible security is unable to meet its financial obligations or goes bankrupt. |

| • | | Credit – If an issuer or guarantor of a security held by the fund or a counterparty to a financial contract with the fund defaults or is downgraded, or if the value of the assets underlying a security declines, the value of your investment will decline. Junk bonds have a higher risk of default and are considered speculative. A default or downgrade will have a greater impact on subordinated securities. |

| • | | Currency – When the fund invests in securities denominated in foreign currencies, the fund may incur currency conversion costs and may be affected favorably or unfavorably by changes in the rates of exchange between those currencies and the U.S. dollar. Currency exchange rates can be volatile and are affected by, among other factors, the general economics of a country, the actions of the U.S. and foreign governments or control banks, the imposition of currency controls, and speculation. |

2

| • | | Derivatives – Using derivatives can increase fund losses and reduce opportunities for gains when market prices, interest rates or the derivative instruments themselves behave in a way not anticipated by the fund. Using derivatives also can have a leveraging effect and increase fund volatility. Derivatives may be difficult to sell, unwind or value, and the counterparty may default on its obligations to the fund. The fund’s investments in derivative instruments may involve a small investment relative to the amount of investment exposure assumed and may result in losses exceeding the amounts invested in those instruments. Recent legislation calls for new regulation of the derivatives markets. The extent and impact of the regulation are not yet fully known and may not be for some time. New regulation of derivatives may make them more costly, may limit their availability, or may otherwise adversely affect their value or performance. |

| • | | Emerging Markets – Investing in the securities of issuers located in or principally doing business in emerging markets are subject to foreign securities risks. These risks are greater for investments in emerging markets. Emerging market countries tend to have economic, political and legal systems that are less fully developed and are less stable than those of more advanced countries. Low trading volumes may result in a lack of liquidity and in extreme price volatility. |

| • | | Fixed-Income Securities – The market prices of fixed-income securities may go up or down, sometimes rapidly or unpredictably due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. When market prices fall, the value of your investment will go down. A rise in rates tends to have a greater impact on the prices of longer term or duration securities. |

If interest rates rise, repayments of fixed-income securities may occur more slowly than anticipated by the market. This may drive the prices of these securities down because their interest rates are lower than the current interest rate and they remain outstanding longer. This is sometimes referred to as extension risk.

Many issuers have a right to prepay their securities. If interest rates fall, an issuer may exercise this right. If this happens, the fund will be forced to reinvest prepayment proceeds at a time when yields on securities available in the market are lower than the yield on the prepaid security. This is sometimes referred to as prepayment or call risk.

| • | | Foreign Securities – Foreign securities are subject to a number of additional risks, including nationalization or expropriation of assets, imposition of currency controls or restrictions, confiscatory taxation, political or financial instability and other adverse economic or political developments. Lack of information and less market regulation also may affect the value of these securities. |

| • | | High-Yield Debt Securities – High-yield debt securities, or junk bonds, are securities that are rated below “investment grade” (that is, securities rated below Baa/BBB) or, if unrated, are considered by the sub-adviser to be of equivalent quality. Changes in interest rates, the market’s perception of the issuers and the creditworthiness of the issuers may significantly affect the value of these bonds. Junk bonds have a higher risk of default, tend to be less liquid and may be more difficult to value. |

| • | | Increase in Expenses – Your actual costs of investing in the fund may be higher than the expenses shown in “Annual Fund Operating Expenses” for a variety of reasons. For example, expense ratios may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and fund expense ratios are more likely to increase when markets are volatile. |

| • | | Interest Rate – Fixed-income securities have varying levels of sensitivity to changes in interest rates. In general, the price of a fixed-income security tends to fall when interest rates rise and can rise when interest rates fall. A change in interest rates will not have the same impact on all fixed-income securities. Generally, the longer the maturity or duration of a fixed-income security, the greater the impact of a rise in interest rates on the security’s value. In addition, different interest rate measures (such as short- and long-term interest rates and U.S. and foreign interest rates), or interest rates on different types of securities or securities of different issuers, may not necessarily change in the same amount or in the same direction. When interest rates go down, the income received by the fund, and the fund’s yield, may decline. |

| • | | Liquidity – Some securities held by the fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the fund may be forced to sell at a loss. |

| • | | Loans – Loans are subject to the credit risk of nonpayment of principal or interest. Economic downturns or increases in interest rates may cause an increase in defaults, interest rate risk and liquidity risk. Loans may or may not be collateralized at the time of acquisition, and any collateral may be relatively illiquid or lose all or substantially all of its value subsequent to investment. In the event of bankruptcy of a borrower, the fund could experience delays or limitations with respect to its ability to realize the benefits of any collateral securing a loan. The fund’s investments in loans are also subject to prepayment or call risk. |

3

| • | | Market – The market prices of the fund’s securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates or currency rates, lack of liquidity in the markets or adverse investor sentiment. Market prices of securities also may go down due to events or conditions that affect particular sectors or issuers. When market prices fall, the value of your investment will go down. The fund may experience a substantial or complete loss on any individual security. The recent financial crisis has caused a significant decline in the value and liquidity of many securities. In response to the financial crisis, the U.S. and other governments and the Federal Reserve and certain foreign central banks have taken steps to support financial markets. The withdrawal of this support could negatively affect the value and liquidity of certain securities. In addition, legislation recently enacted in the U.S. calls for changes in many aspects of financial regulation. The impact of the legislation on the markets, and the practical implications for market participants, may not be fully known for some time. |

| • | | Mortgage-Related and Asset-Backed Securities – Mortgage-backed securities may be issued by private issuers, by government-sponsored entities such as Fannie Mae or Freddie Mac or by agencies of the U.S. government, such as Ginnie Mae. Mortgage-backed securities represent direct or indirect participations in, or are collateralized by and payable from, mortgage loans secured by real property. Unlike mortgage-related securities issued or guaranteed by agencies of the U.S. government or government-sponsored entities, mortgage-related securities issued by private issuers do not have a government or government-sponsored entity guarantee (but may have other credit enhancement), and may, and frequently do, have less favorable collateral, credit risk or other underwriting characteristics. Mortgage-backed securities are also particularly susceptible to prepayment and extension risks. Asset-backed securities represent participations in, or are secured by and payable from, assets such as installment sales or loan contracts, leases, credit card receivables and other categories of receivables. Certain asset-backed securities present a heightened level of risk because, in the event of default, the liquidation value of the underlying assets may be inadequate to pay any unpaid principal or interest. The value of mortgage-backed and asset-backed securities may be affected by changes in credit quality or value of the mortgage loans or other assets that support the securities. |

| • | | Portfolio Selection – The sub-adviser’s judgment about a particular security or issuer, or about the economy or a particular sector, region or market segment, or about an investment strategy, may prove to be incorrect. |

| • | | Preferred Stock – Preferred stock’s right to dividends and liquidation proceeds is junior to the rights of a company’s debt securities. The value of preferred stock may be subject to factors that affect fixed income and equity securities, including changes in interest rates and in a company’s creditworthiness. Shareholders of preferred stock may suffer a loss of value if dividends are not paid and have limited voting rights. |

| • | | Stocks – Stocks may be volatile – their prices may go up and down dramatically over the shorter term. These price movements may result from factors affecting individual companies, industries, the securities market as a whole or the overall economy. |

| • | | Structured Instruments – The fund may invest in various types of structured instruments, including securities that have demand, tender or put features, or interest rate reset features. Structured instruments are a type of derivative instrument and the payment and credit qualities of these instruments derive from the assets embedded in the structure from which they are issued. Structured instruments may behave in ways not anticipated by the fund, or they may not receive tax, accounting or regulatory treatment anticipated by the fund. |

| • | | Valuation – The sales price the fund could receive for any particular portfolio investment may differ from the fund’s valuation of the investment, particularly for securities that trade in thin or volatile markets or that are valued using a fair value methodology. |

| • | | Warrants and Rights – Warrants and rights may be considered more speculative than certain other types of investments because they do not entitle a holder to the dividends or voting rights for the securities that may be purchased. They do not represent any rights in the assets of the issuing company, and cease to have value if not exercised prior to the expiration date. |

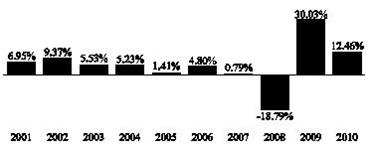

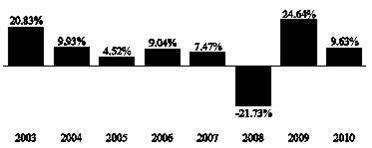

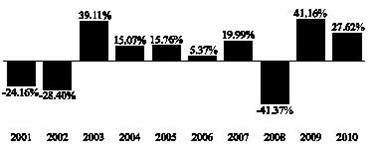

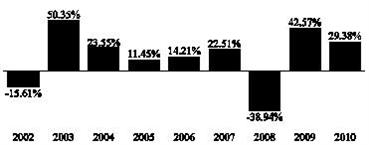

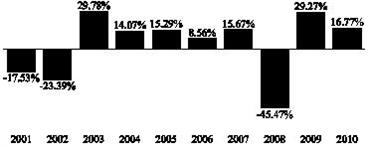

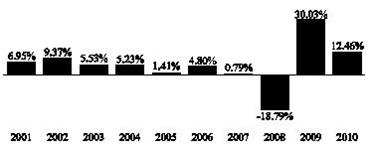

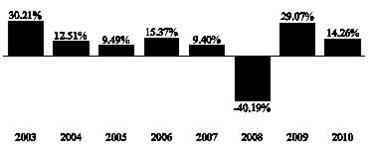

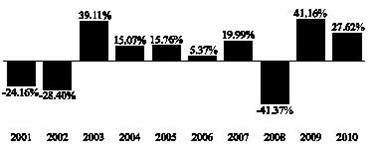

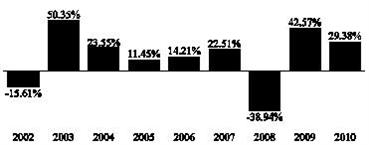

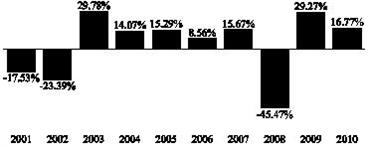

Performance: The bar chart and the table below provide some indication of the risks of investing in the fund by showing you how the fund’s performance has varied from year to year, and how the fund’s average annual total returns for different periods compare to the returns of a broad measure of market performance. The bar chart does not reflect the impact of sales charges, which, if reflected, would lower the returns. The table, which shows average annual total returns for each class of shares of the fund, includes deduction of applicable sales charges. Absent any limitation of the fund’s expenses, total returns would be lower. As with all mutual funds, past performance (before and after taxes) is not a prediction of future results. Updated performance information is available on our website at www.transamericafunds.com or by calling 1-888-233-4339.

4

Prior to March 22, 2011, the fund was named Transamerica Flexible Income and had a different sub-adviser. The performance set forth prior to that date is attributable to the previous sub-adviser.

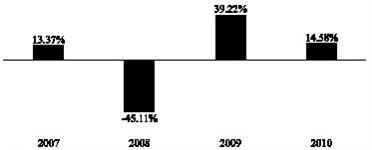

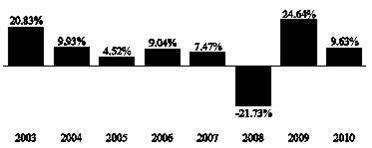

Annual Total Returns (calendar years ended December 31) – Class A

| | | | |

| | | Quarter Ended | | Return |

Best Quarter: | | 6/30/2009 | | 12.36% |

Worst Quarter: | | 12/31/2008 | | -12.66% |

Average Annual Total Returns (periods ended December 31, 2010)1

| | | | | | |

| | | 1 Year | | 5 Years | | 10 Years or

Inception* |

| Class A (commenced operations on June 29, 1987) |

Return before taxes | | 7.14% | | 3.62% | | 4.64% |

Return after taxes on distributions2 | | 4.89% | | 1.66% | | 2.69% |

Return after taxes on distributions and sale of fund shares2 | | 4.58% | | 1.89% | | 2.81% |

| Class B (Return before taxes only) (commenced operations on October 1, 1995) | | 6.60% | | 3.79% | | 4.57% |

| Class C (Return before taxes only) (commenced operations on November 11, 2002) | | 10.61% | | 4.01% | | 3.84% |

| Class I (Return before taxes only) (commenced operations on November 30, 2009) | | 12.88% | | N/A | | 12.79% |

| Barclays Capital U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | | 6.54% | | 5.80% | | 5.84% |

| 1 | Actual returns may depend on the investor’s individual tax situation. After-tax returns may not be relevant if the investment is made through a tax-exempt or tax-deferred account, such as a 401(k) plan. After-tax returns are presented for only one class and returns for other classes will vary. |

| 2 | The after-tax returns are calculated using the historic highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. |

| * | Fund returns are for past 10 years or since inception, whichever is less. Index returns are for 10 years or since inception of oldest share class, whichever is less. |

Management:

| | |

| Investment Adviser: | | Sub-Adviser: |

| |

| Transamerica Asset Management, Inc. | | AEGON USA Investment Management, LLC |

| |

| | Portfolio Managers: |

| |

| | Brian W. Westhoff, CFA, Portfolio Manager (Lead) since 2005 |

| |

| | Bradley J. Beman, CFA, CPA, Portfolio Manager since 2011 |

| |

| | Jim Schaeffer, Portfolio Manager since 2011 |

| |

| | David Halfpap, Portfolio Manager since 2011 |

| |

| | Rick Perry, Portfolio Manager since 2011 |

Purchase and Sale of Fund Shares: You may purchase, exchange or redeem shares of the fund on any day the New York Stock Exchange is open for business, online or through our website at www.transamericafunds.com, by mail to Transamerica Fund Services, Inc., P.O. Box 219945, Kansas City, MO 64121-9945, by telephone at 1-888-233-4339, or overnight mail to Transamerica Fund Services, Inc., 330 W. 9th Street, Kansas City, MO 64105. Shares may also be purchased through a financial intermediary. The minimum initial purchase for Class A and C shares is $1,000; the minimum subsequent investment is $50. The minimum initial purchase for payroll deduction and automatic investment plan is $500; the minimum subsequent

5

investment is $50 per monthly fund account investment. The minimum investment for Class I shares is $1,000,000. Class B shares are not available for purchase, including to existing Class B shareholders, except in the limited circumstances described in this prospectus under the section entitled “Shareholder Information – Buying Shares”.

Tax Information: Fund distributions may be taxable as ordinary income or capital gains, except when your investment is in an IRA, 401(k) or other tax-advantaged investment plan.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase the fund through a broker-dealer or other financial intermediary, the fund and/or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

6

|

| TRANSAMERICA AEGON HIGH YIELD BOND |

Investment Objective: Seeks a high level of current income by investing in high-yield debt securities.

Fees and Expenses: This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Transamerica Funds. More information about these and other discounts is available from your financial professional and in the “Waivers and/or Reductions of Charges” section on page 120 of the fund’s prospectus and in the fund’s statement of additional information (SAI) under the heading “Purchase of Shares.”

| | | | | | | | |

Shareholder Fees (fees paid directly from your investment) |

| | | | | Class of Shares | | |

| | | A | | B* | | C | | I |

Maximum sales charge (load) imposed on purchases (as a % of offering price) | | 4.75% | | None | | None | | None |

| Maximum deferred sales charge (load) (as a percentage of purchase price or redemption proceeds, whichever is lower) | | None | | 5.00% | | 1.00% | | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | | | | Class of Shares | | |

| | | A | | B* | | C | | I |

| Management fees | | 0.58% | | 0.58% | | 0.58% | | 0.58% |

| Distribution and service (12b-1) fees | | 0.35% | | 1.00% | | 1.00% | | None |

| Other expenses | | 0.22% | | 0.25% | | 0.19% | | 0.25% |

Total annual fund operating expenses | | 1.15% | | 1.83% | | 1.77% | | 0.83% |

| * | Not available to new investors. |

Example: This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000. The Example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | |

If the shares are redeemed at the end of each period: |

Share Class | | 1 year | | 3 years | | 5 years | | 10 years |

A | | $587 | | $823 | | $1,078 | | $1,806 |

B+ | | $686 | | $876 | | $1,090 | | $1,970 |

C | | $280 | | $557 | | $ 959 | | $2,084 |

I | | $ 85 | | $265 | | $ 460 | | $1,025 |

If the shares are not redeemed: |

Share Class | | 1 year | | 3 years | | 5 years | | 10 years |

A | | $587 | | $823 | | $1,078 | | $1,806 |

B+ | | $186 | | $576 | | $ 990 | | $1,970 |

C | | $180 | | $557 | | $ 959 | | $2,084 |

I | | $ 85 | | $265 | | $ 460 | | $1,025 |

| + | Examples for Class B shares assume conversion into Class A shares eight years after purchase. Class B shares are not available to new investors. |

The Example does not reflect sales charges (loads) on reinvested dividends (and other distributions). If these sales charges (loads) were included, your costs would be higher.

Portfolio Turnover: The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the fund’s performance. During the most recent fiscal year, the portfolio turnover rate was 91% of the average value of the fund’s portfolio.

Principal Investment Strategies: AEGON USA Investment Management, LLC (“AUIM”), the fund’s sub-adviser, seeks to achieve the fund’s objective by investing, under normal circumstances, at least 80% of the fund’s net assets in high-yield/high-risk bonds (commonly known as “junk bonds”).

Junk bonds are high risk debt securities rated in medium or lower rating categories or determined by AUIM to be of comparable quality. AUIM’s strategy is to seek to achieve yields as high as possible while seeking to manage risk. AUIM uses a “top-

7

down/bottom-up” approach in managing the fund’s assets. The “top-down” approach is to adjust the risk profile of the fund. AUIM analyzes four factors that affect the movement of the fixed-income bond prices which include: economic indicators; technical indicators that are specific to the high-yield market; investor sentiment and valuation. Analysis of these factors assists AUIM in its decision regarding the fund’s portfolio allocations. In a “top-down” approach, the sub-adviser looks at broad market factors and chooses certain sectors or industries within the market, based on those factors. It then looks at individual companies within those sectors or industries.

AUIM has developed a proprietary credit model that is the foundation of its “bottom-up” analysis. The model tracks historical cash flow numbers and calculates credit financial ratios. Because high-yield companies are of higher financial risk, AUIM does a thorough credit analysis of all companies in the fund’s portfolio, as well as all potential acquisitions. A “bottom-up” approach is looking at individual companies against the context of broader market factors.

AUIM may sell fund securities when it determines there are changes in economic indicators, technical indicators or valuation.

The fund may invest its assets in cash, cash equivalent securities or short-term debt securities, repurchase agreements and money market instruments. Under adverse or unstable market, economic or political conditions, the fund may take temporary defensive positions in cash and short-term debt securities without limit.

Principal Risks: Many factors affect the fund’s performance. There is no assurance the fund will meet its investment objective. The value of your investment in the fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the fund or your investment may not perform as well as other similar investments. The following is a summary of certain risks (in alphabetical order) of investing in the fund. You may lose money if you invest in this fund.

| • | | Cash Management and Defensive Investing – Money market instruments or short-term debt securities held by the fund for cash management or defensive investing purposes can fluctuate in value. Like other fixed income securities, they are subject to risk, including market, interest rate and credit risk. If the fund holds cash uninvested, the fund will not earn income on the cash and the fund’s yield will go down. If a significant amount of the fund’s assets are used for cash management or defensive investing purposes, it will be more difficult for the fund to achieve its objective. |

| • | | Credit – If an issuer or guarantor of a security held by the fund or a counterparty to a financial contract with the fund defaults or is downgraded, or if the value of the assets underlying a security declines, the value of your investment will decline. Junk bonds have a higher risk of default and are considered speculative. A default or downgrade will have a greater impact on subordinated securities. |

| • | | Fixed-Income Securities – The market prices of fixed-income securities may go up or down, sometimes rapidly or unpredictably due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. When market prices fall, the value of your investment will go down. A rise in rates tends to have a greater impact on the prices of longer term or duration securities. |

If interest rates rise, repayments of fixed-income securities may occur more slowly than anticipated by the market. This may drive the prices of these securities down because their interest rates are lower than the current interest rate and they remain outstanding longer. This is sometimes referred to as extension risk.

Many issuers have a right to prepay their securities. If interest rates fall, an issuer may exercise this right. If this happens, the fund will be forced to reinvest prepayment proceeds at a time when yields on securities available in the market are lower than the yield on the prepaid security. This is sometimes referred to as prepayment or call risk.

| • | | Foreign Securities – Foreign securities are subject to a number of additional risks, including nationalization or expropriation of assets, imposition of currency controls or restrictions, confiscatory taxation, political or financial instability and other adverse economic or political developments. Lack of information and less market regulation also may affect the value of these securities. |

| • | | High-Yield Debt Securities – High-yield debt securities, or junk bonds, are securities that are rated below “investment grade” (that is, securities rated below Baa/BBB) or, if unrated, are considered by the sub-adviser to be of equivalent quality. Changes in interest rates, the market’s perception of the issuers and the creditworthiness of the issuers may significantly affect the value of these bonds. Junk bonds have a higher risk of default, tend to be less liquid and may be more difficult to value. |

| • | | Increase in Expenses – Your actual costs of investing in the fund may be higher than the expenses shown in “Annual Fund Operating Expenses” for a variety of reasons. For example, expense ratios may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and fund expense ratios are more likely to increase when markets are volatile. |

8

| • | | Interest Rate – Fixed-income securities have varying levels of sensitivity to changes in interest rates. In general, the price of a fixed-income security tends to fall when interest rates rise and can rise when interest rates fall. A change in interest rates will not have the same impact on all fixed-income securities. Generally, the longer the maturity or duration of a fixed-income security, the greater the impact of a rise in interest rates on the security’s value. In addition, different interest rate measures (such as short- and long-term interest rates and U.S. and foreign interest rates), or interest rates on different types of securities or securities of different issuers, may not necessarily change in the same amount or in the same direction. When interest rates go down, the income received by the fund, and the fund’s yield, may decline. |

| • | | Liquidity – Some securities held by the fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the fund may be forced to sell at a loss. |

| • | | Market – The market prices of the fund’s securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates or currency rates, lack of liquidity in the markets or adverse investor sentiment. Market prices of securities also may go down due to events or conditions that affect particular sectors or issuers. When market prices fall, the value of your investment will go down. The fund may experience a substantial or complete loss on any individual security. The recent financial crisis has caused a significant decline in the value and liquidity of many securities. In response to the financial crisis, the U.S. and other governments and the Federal Reserve and certain foreign central banks have taken steps to support financial markets. The withdrawal of this support could negatively affect the value and liquidity of certain securities. In addition, legislation recently enacted in the U.S. calls for changes in many aspects of financial regulation. The impact of the legislation on the markets, and the practical implications for market participants, may not be fully known for some time. |

| • | | Portfolio Selection – The sub-adviser’s judgment about a particular security or issuer, or about the economy or a particular sector, region or market segment, or about an investment strategy, may prove to be incorrect. |

| • | | Valuation – The sales price the fund could receive for any particular portfolio investment may differ from the fund’s valuation of the investment, particularly for securities that trade in thin or volatile markets or that are valued using a fair value methodology. |

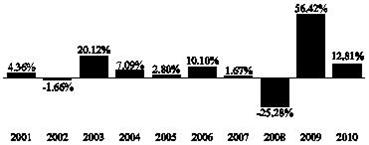

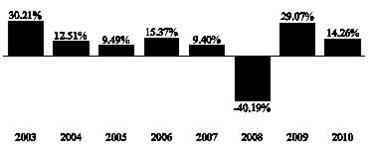

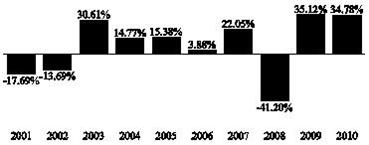

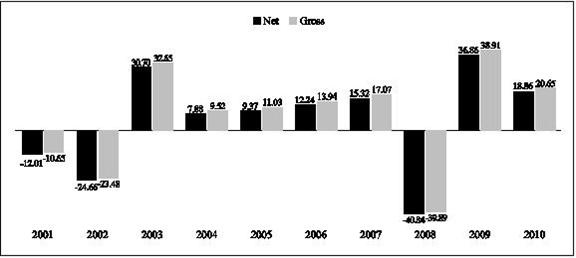

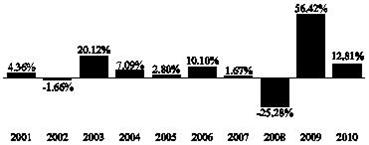

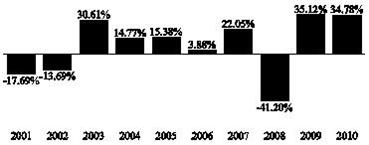

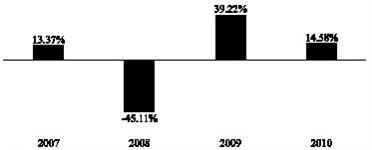

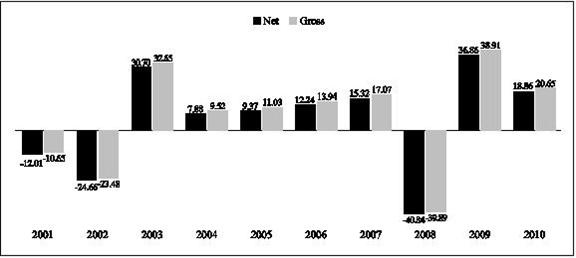

Performance: The bar chart and the table below provide some indication of the risks of investing in the fund by showing you how the fund’s performance has varied from year to year, and how the fund’s average annual total returns for different periods compare to the returns of a broad measure of market performance. The bar chart does not reflect the impact of sales charges, which, if reflected, would lower the returns. The table, which shows average annual total returns for each class of shares of the fund, includes deduction of applicable sales charges. Absent any limitation of the fund’s expenses, total returns would be lower. As with all mutual funds, past performance (before and after taxes) is not a prediction of future results. Updated performance information is available on our website at www.transamericafunds.com or by calling 1-888-233-4339.

Annual Total Returns (calendar years ended December 31) – Class A

| | | | |

| | | Quarter Ended | | Return |

| Best Quarter: | | 6/30/2009 | | 22.80% |

| Worst Quarter: | | 12/31/2008 | | -16.73% |

9

Average Annual Total Returns (periods ended December 31, 2010)1

| | | | | | |

| | | 1 Year | | 5 Years | | 10 Years or Inception* |

Class A (commenced operations on June 14, 1985) | | | | | | |

Return before taxes | | 7.47% | | 7.05% | | 6.68% |

Return after taxes on distributions2 | | 4.77% | | 4.22% | | 4.01% |

Return after taxes on distributions and sale of fund shares2 | | 4.76% | | 4.26% | | 4.04% |

| Class B (Return before taxes only) (commenced operations on October 1, 1995) | | 7.01% | | 7.18% | | 6.60% |

| Class C (Return before taxes only) (commenced operations on November 11, 2002) | | 11.04% | | 7.38% | | 8.23% |

| Class I (Return before taxes only) (commenced operations on November 30, 2009) | | 13.25% | | N/A | | 15.28% |

| Barclays Capital U.S. Corporate High Yield 2% Issuer Capped Index (reflects no deduction for fees, expenses, or taxes) | | 14.94% | | 8.90% | | 9.01% |

| Bank of America Merrill Lynch U.S. High-Yield, Cash Pay Index (reflects no deduction for fees, expenses, or taxes)3 | | 15.24% | | 8.67% | | 8.71% |

| 1 | Actual returns may depend on the investor’s individual tax situation. After-tax returns may not be relevant if the investment is made through a tax-exempt or tax-deferred account, such as a 401(k) plan. After-tax returns are presented for only one class and returns for other classes will vary. |

| 2 | The after-tax returns are calculated using the historic highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. |

| 3 | This index served as the benchmark for the fund prior to January 15, 2011, at which time it was replaced with the Barclays Capital U.S. Corporate High Yield 2% Issuer Capped Index. This benchmark change was made to more accurately reflect the principal strategies of the fund. |

| * | Fund returns are for past 10 years or since inception, whichever is less. Index returns are for 10 years or since inception of oldest share class, whichever is less. |

Management:

| | |

| Investment Adviser: | | Sub-Adviser: |

| |

| Transamerica Asset Management, Inc. | | AEGON USA Investment Management, LLC |

| |

| | Portfolio Managers: |

| |

| | Kevin Bakker, CFA, Portfolio Manager since 2007 |

| |

| | Bradley J. Beman, CFA, CPA, Portfolio Manager since 1997 |

| |

| | Benjamin D. Miller, CFA, Portfolio Manager since 2006 |

Purchase and Sale of Fund Shares: You may purchase, exchange or redeem shares of the fund on any day the New York Stock Exchange is open for business, online or through our website at www.transamericafunds.com, by mail to Transamerica Fund Services, Inc., P.O. Box 219945, Kansas City, MO 64121-9945, by telephone at 1-888-233-4339, or overnight mail to Transamerica Fund Services, Inc., 330 W. 9th Street, Kansas City, MO 64105. Shares may also be purchased through a financial intermediary. The minimum initial purchase for Class A and C shares is $1,000; the minimum subsequent investment is $50. The minimum initial purchase for payroll deduction and automatic investment plan is $500; the minimum subsequent investment is $50 per monthly fund account investment. The minimum investment for Class I shares is $1,000,000. Class B shares are not available for purchase, including to existing Class B shareholders, except in the limited circumstances described in this prospectus under the section entitled “Shareholder Information – Buying Shares”.

Tax Information: Fund distributions may be taxable as ordinary income or capital gains, except when your investment is in an IRA, 401(k) or other tax-advantaged investment plan.

Payments to Broker-Dealers and Other Financial Intermediaries: If you purchase the fund through a broker-dealer or other financial intermediary, the fund and/or its affiliates may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

10

|

| TRANSAMERICA AEGON MONEY MARKET |

Investment Objective: Seeks maximum current income from money market securities consistent with liquidity and preservation of principal.

Fees and Expenses: This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in Transamerica Funds. More information about these and other discounts is available from your financial professional and in the “Waivers and/or Reductions of Charges” section on page 120 of the fund’s prospectus and in the fund’s statement of additional information (SAI) under the heading “Purchase of Shares.”

| | | | | | | | |

Shareholder Fees (fees paid directly from your investment) |

| | | | | Class of Shares | | |

| | | A | | B* | | C | | I |

Maximum sales charge (load) imposed on purchases (as a % of offering price) | | None | | None | | None | | None |

| Maximum deferred sales charge (load) (as a percentage of purchase price or redemption proceeds, whichever is lower) | | None | | 5.00% | | 1.00% | | None |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

| | | | | Class of Shares | | |

| | | A | | B* | | C | | I |

| Management fees | | 0.40% | | 0.40% | | 0.40% | | 0.40% |

| Distribution and service (12b-1) fees | | 0.35% | | 1.00% | | 1.00% | | None |

| Other expenses | | 0.44% | | 0.41% | | 0.26% | | 2.76% |

| Total annual fund operating expenses | | 1.19% | | 1.81% | | 1.66% | | 3.16% |

| Expense reductiona,b | | 0.36% | | 0.33% | | 0.18% | | 2.68% |

| Total annual fund operating expenses after expense reduction | | 0.83% | | 1.48% | | 1.48% | | 0.48% |

| * | Not available to new investors. |

| a | Contractual arrangements have been made with the fund’s investment adviser, Transamerica Asset Management, Inc. (“TAM”), through March 1, 2012, to waive fees and/or reimburse fund expenses to the extent that the fund’s total operating expenses exceed 0.48%, excluding 12b-1 fees and extraordinary expenses. TAM is entitled to reimbursement by the fund of fees waived or expenses reduced during any of the previous 36 months if on any day the estimated annualized fund operating expenses are less than the cap, excluding 12b-1 fees and extraordinary expenses. |

| b | In addition to the contractual fee waiver, TAM or any of its affiliates may waive fees or reimburse expenses of one or more classes of the fund in order to avoid a negative yield. Any such waiver or expense reimbursement would be voluntary, could be discontinued at any time, and is subject in certain circumstances to reimbursement by the fund to TAM or its affiliates. There is no guarantee that the fund will be able to avoid a negative yield. |

Example: This Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000. The Example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | |

If the shares are redeemed at the end of each period: |

Share Class | | 1 year | | 3 years | | 5 years | | 10 years |

| A | | $ 85 | | $342 | | $ 620 | | $1,411 |

| B+ | | $651 | | $837 | | $1,049 | | $1,936 |

| C | | $251 | | $506 | | $ 885 | | $1,950 |

| I | | $ 49 | | $722 | | $1,420 | | $3,280 |

If the shares are not redeemed: |

Share Class | | 1 year | | 3 years | | 5 years | | 10 years |

| A | | $ 85 | | $342 | | $ 620 | | $1,411 |

| B+ | | $151 | | $537 | | $ 949 | | $1,936 |

| C | | $151 | | $506 | | $ 885 | | $1,950 |

| I | | $ 49 | | $722 | | $1,420 | | $3,280 |

| + | Examples for Class B shares assume conversion into Class A shares eight years after purchase. Class B shares are not available to new investors. |

The Example does not reflect sales charges (loads) on reinvested dividends (and other distributions). If these sales charges (loads) were included, your costs would be higher.

Principal Investment Strategies: The fund’s sub-adviser, AEGON USA Investment Management, LLC (“AUIM”), invests the fund’s assets in the following high quality, short-term U.S. dollar-denominated money market instruments:

| • | | short-term corporate obligations, including commercial paper, notes and bonds |

11

| • | | obligations issued or guaranteed by the U.S. and foreign governments and their agencies and instrumentalities |

| • | | obligations of U.S. and foreign banks, or their foreign branches, and U.S. savings banks |

| • | | repurchase agreements involving any of the securities mentioned above |

Bank obligations purchased for the fund are limited to U.S. or foreign banks with total assets of $1.5 billion or more. Similarly, savings association obligations purchased for the fund are limited to U.S. savings association obligations issued by U.S. savings banks with total assets of $1.5 billion or more. Foreign securities purchased for the fund must be U.S. dollar-denominated and issued by foreign governments, agencies or instrumentalities, or banks that meet the minimum $1.5 billion capital requirement. These foreign obligations must also meet the same quality requirements as U.S. obligations. Each security, at the time of purchase by the fund, has been determined by the sub-adviser to present minimal credit risk.

As a money market fund, the fund tries to maintain a share price of $1.00, and must follow strict rules as to the credit quality, diversification, liquidity and maturity of its investments. If, after purchase, the credit rating on a security held by the fund is downgraded or the credit quality deteriorates, or if the maturity on a security is extended, the fund’s sub-adviser or Board of Trustees (where required by applicable regulations) will decide whether the security should be held or sold.

Principal Risks: An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund.

There is no assurance that the fund will meet its investment objectives. The fund could underperform other short-term debt instruments or money market funds, or you could lose money.

In addition, you should be aware that there have been money market funds in other fund complexes that, in the past, have failed to pay investors $1.00 per share for their investment in those funds (this is referred to as “breaking the buck”), and any money market fund may do so in the future. You should also be aware that TAM and its affiliates are under no obligation to provide financial support to the fund or take other measures to ensure that you receive $1.00 per share for your investment in the fund. You should not invest in the fund with the expectation that any such action will be taken.

The following is a summary of certain risks (in alphabetical order) of investing in the fund:

| • | | Bank Obligations – To the extent the fund invests in U.S. bank obligations, the fund will be more susceptible to adverse events affecting the U.S. banking industry. Banks are sensitive to changes in money market and general economic conditions, as well as decisions by regulators that can affect banks’ profitability. |

| • | | Credit – An issuer or obligor of a security held by the fund or a counterparty to a financial contract with the fund may default or its credit may be downgraded, or the value of assets underlying a security may decline. Subordinated securities will be disproportionately affected by a default or downgrade. |

| • | | Fixed-Income Securities – The market prices of fixed-income securities may go up or down, sometimes rapidly or unpredictably due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. When market prices fall, the value of your investment will go down. A rise in rates tends to have a greater impact on the prices of longer term or duration securities. |

If interest rates rise, repayments of fixed-income securities may occur more slowly than anticipated by the market. This may drive the prices of these securities down because their interest rates are lower than the current interest rate and they remain outstanding longer. This is sometimes referred to as extension risk.

Many issuers have a right to prepay their securities. If interest rates fall, an issuer may exercise this right. If this happens, the fund will be forced to reinvest prepayment proceeds at a time when yields on securities available in the market are lower than the yield on the prepaid security. This is sometimes referred to as prepayment or call risk.

| • | | Foreign Securities – Foreign securities are subject to a number of additional risks, including nationalization or expropriation of assets, imposition of currency controls or restrictions, confiscatory taxation, political or financial instability and other adverse economic or political developments. Lack of information and less market regulation also may affect the value of these securities. |

| • | | Increase in Expenses – Your actual costs of investing in the fund may be higher than the expenses shown in “Annual Fund Operating Expenses” for a variety of reasons. For example, expense ratios may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and fund expense ratios are more likely to increase when markets are volatile. |

12

| • | | Interest Rate – The interest rates on short-term obligations held in the fund will vary, rising or falling with short-term interest rates generally. The fund’s yield will tend to lag behind general changes in interest rates. The ability of the fund’s yield to reflect current market rates will depend on how quickly the obligations in its portfolio mature and how much money is available for investment at current market rates. |

| • | | Market – The market prices of the fund’s securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates or currency rates, lack of liquidity in the markets or adverse investor sentiment. Market prices of securities also may go down due to events or conditions that affect particular sectors or issuers. When market prices fall, the value of your investment will go down. The fund may experience a substantial or complete loss on any individual security. The recent financial crisis has caused a significant decline in the value and liquidity of many securities. In response to the financial crisis, the U.S. and other governments and the Federal Reserve and certain foreign central banks have taken steps to support financial markets. The withdrawal of this support could negatively affect the value and liquidity of certain securities. In addition, legislation recently enacted in the U.S. calls for changes in many aspects of financial regulation. The impact of the legislation on the markets, and the practical implications for market participants, may not be fully known for some time. |

| • | | Redemption – The fund may experience periods of heavy redemptions that could cause the fund to liquidate its assets at inopportune times or at a loss or depressed value particularly during periods of declining or illiquid markets. Redemption risk is greater to the extent that the fund has investors with large shareholdings, short investment horizons, or unpredictable cash flow needs. The redemption by one or more large shareholders of their holdings in the fund could have an adverse impact on the remaining shareholders in the fund. In addition, the fund may suspend redemptions when permitted by applicable regulations. |

| • | | Repurchase Agreements – If the other party to a repurchase agreement defaults on its obligation, the fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. If the seller fails to repurchase the security and the market value declines, the fund could lose money. If the seller becomes insolvent and subject to liquidation or reorganization under applicable bankruptcy or other laws, the fund’s ability to dispose of the underlying securities may be restricted. |

| • | | U.S. Government Agency Obligations – Government agency obligations have different levels of credit support and, therefore, different degrees of credit risk. Securities issued by agencies and instrumentalities of the U.S. government that are supported by the full faith and credit of the United States generally present a lesser degree of credit risk than securities issued by agencies and instrumentalities sponsored by the U.S. government that are supported only by the issuer’s right to borrow from the U.S. Treasury and securities issued by agencies and instrumentalities sponsored by the U.S. government that are supported only by the credit of the issuing agencies. |

| • | | Yield – The amount of income you receive from the fund will go up or down depending on day-to-day variations in short-term interest rates, and when interest rates are very low the fund’s expenses could absorb all or a significant portion of the fund’s income. If interest rates increase, the fund’s yield may not increase proportionately. For example, TAM or its affiliates may discontinue any temporary voluntary fee limitation or recoup expenses previously foregone or reimbursed. In addition, the recent adoption of more stringent regulations governing the management of money market funds could have a negative effect on yields. |

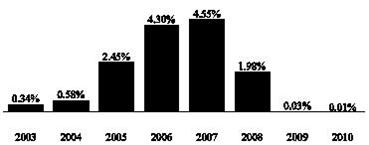

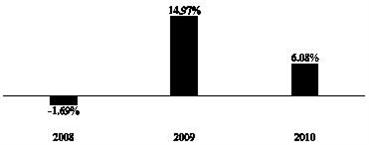

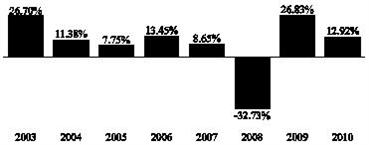

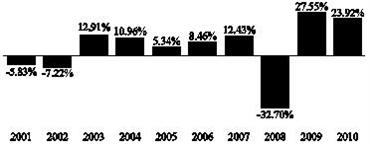

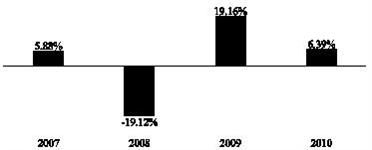

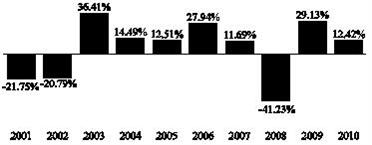

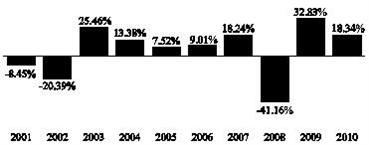

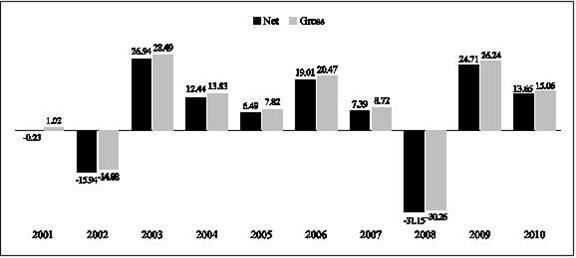

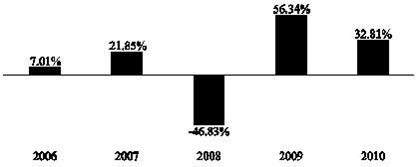

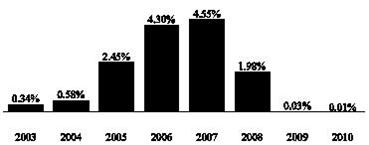

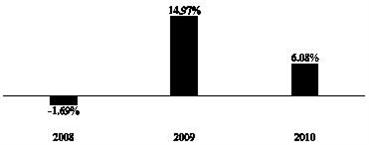

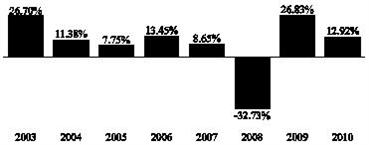

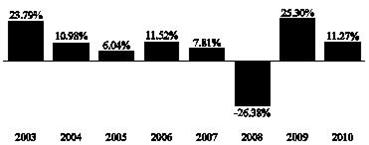

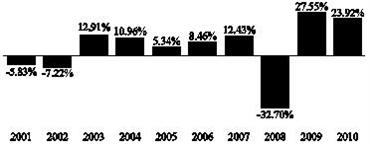

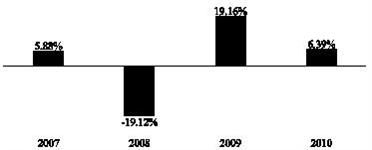

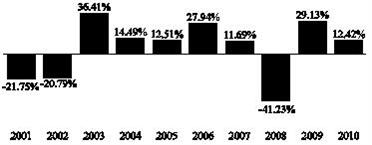

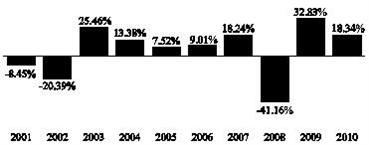

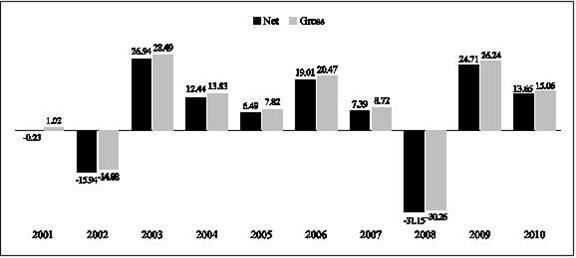

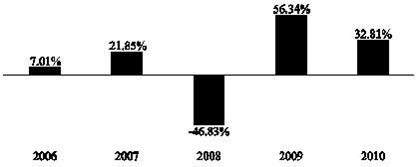

Performance: The bar chart and the table below provide some indication of the risks of investing in the fund by showing you how the fund’s performance and average annual total returns have varied from year to year. The table shows average annual total returns for each class of shares of the fund. Performance reflects any fee waivers or expense reimbursements in effect during the relevant periods. Absent any limitation of the fund’s expenses, total returns would be lower. As with all mutual funds, past performance (before and after taxes) is not a prediction of future results. Updated performance information is available on our website at www.transamericafunds.com or by calling 1-888-233-4339.

Prior to March 22, 2011, the fund was named Transamerica Money Market and had a different sub-adviser. The performance set forth prior to that date is attributable to the previous sub-adviser.

13

Annual Total Returns (calendar years ended December 31) – Class A

7-DAY YIELD1

(as of December 31, 2010)

Class A = 0.01%

| | | | |

| | | Quarter Ended | | Return |

Best Quarter: | | 9/30/2006 | | 1.15% |

Worst Quarter: | | 6/30/2009 | | 0.00% |

Average Annual Total Returns (periods ended December 31, 2010)2

| | | | | | |

| Return before taxes | | 1 Year | | 5 Years | | 10 Years or

Inception* |

Class A (commenced operations on March 1, 2002) | | 0.01% | | 2.16% | | 1.67% |

Class B (commenced operations on March 1, 2002) | | -4.99% | | 1.56% | | 1.28% |

Class C (commenced operations on November 11, 2002) | | -1.00% | | 1.70% | | 1.36% |

Class I (commenced operations on November 30, 2009) | | 0.01% | | N/A | | 0.01% |

| 1 | Call Customer Service (1-888-233-4339) for the current 7-day yield. |

| 2 | Actual returns may depend on the investor’s individual tax situation. |

| * | Fund returns are for past 10 years or since inception, whichever is less. Index returns are for 10 years or since inception of oldest share class, whichever is less. |

Management:

| | |

| Investment Adviser: | | Sub-Adviser: |

| |

| Transamerica Asset Management, Inc. | | AEGON USA Investment Management, LLC |