As filed with the SEC on January 4, 2013.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04556

TRANSAMERICA FUNDS

(Exact Name of Registrant as Specified in Charter)

570 Carillon Parkway, St. Petersburg, Florida 33716

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 299-1800

Dennis P. Gallagher, Esq. P.O. Box 9012, Clearwater, Florida 33758-9771

(Name and Address of Agent for Service)

Date of fiscal year end: October 31

Date of reporting period: November 1, 2011- October 31, 2012

Item 1: Report(s) to Shareholders. The Annual Report is attached.

Fund of Funds

Annual Report

October 31, 2012

www.transamericainvestments.com

Customer Service 1-888-233-4339

P.O. Box 9012 • Clearwater, FL 33758-9012

Distributor: Transamerica Capital, Inc.

Dear Fellow Shareholder,

On behalf of Transamerica Funds, we would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all shareholders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a discussion of accounting policies as well as matters presented to shareholders that may have required their vote.

We believe it is important to understand market conditions over the last year in order to provide a context for reading this report. One year ago, fears that a sovereign default or a large bank failure in Europe would precipitate a global crisis had driven U.S. and many international markets down. In late 2011, the European Central Bank responded by making unlimited loans available to European banks, which used this money to honor deposits and to purchase sovereign bonds. Market fears subsided and global economies improved modestly, helping markets to rally strongly throughout the first three months of 2012.

Then, in early spring, positive economic trends in both the United States and abroad faded, causing most equity markets to dip from their March 2012 highs. The onset of summer brought resurgence in both U.S. economics and markets and, at the same time, economic weakness in Europe and Asia moderated. These events, combined with additional easing by global central banks, helped to drive most international equities higher through the end of summer. In September, unlimited quantitative easing was announced by the Federal Reserve which pushed U.S. markets to their highs for the year. In October, disappointing corporate earnings caused U.S. markets to retreat modestly, leaving the Standard & Poor’s 500® Index up 15.21% for the year ended October 31, 2012. During this same period, the Morgan Stanley Capital International—Europe, Australasia, Far East Index (“MSCI-EAFE”), a measure of international stock returns, gained 5.15% and the Barclays U.S. Aggregate Bond Index gained 5.25%. Please keep in mind it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a complete picture of your current and future financial needs. Financial advisers are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial adviser, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

| | |

Thomas A. Swank President & Chief Executive Officer Transamerica Funds | | Christopher A. Staples Vice President & Chief Investment Officer Transamerica Funds |

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of Transamerica Funds. These views are subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of Transamerica Funds.

Transamerica Asset Allocation—Conservative Portfolio

(unaudited)

MARKET ENVIRONMENT

The November 1, 2011 to October 31, 2012 reporting period encompassed an overall rising market for U.S. and international stocks, but with downdrafts in November 2011 and again in the spring of 2012. As the period began, the Standard & Poor’s 500® Index (“S&P 500®) posted a small loss in November 2011, but the Morgan Stanley Capital International-Europe, Australasia, and Far East Index (“MSCI-EAFE”) of developed-market foreign stocks dropped 4.83% amid volatility surrounding the eurozone sovereign debt crisis. The Morgan Stanley Capital International Emerging Markets Index (“MSCI-EMI”) plummeted 6.66% in November. Although U.S. stocks recovered ground in December, the international indices fell further.

The mood brightened in 2012’s first quarter. The U.S. economy showed some vigor with U.S. Gross Domestic Product (“GDP”) growth initially being reported at 3.0% (later revised down to 1.9%). Meanwhile, the European Central Bank’s (“ECB”) Long Term Refinancing Operations flooded the eurozone with liquidity by lending nearly $1.3 trillion to European banks, a move that comforted international equity markets. Both U.S. and international stocks enjoyed double-digit gains in 2012’s first quarter.

The eurozone crisis returned to haunt markets in the spring; however, as Spanish and Italian bond yields climbed and Spain’s government requested a large bailout for its banks from the European Union. Meanwhile, other data indicated deepening recessions in several European countries. Stocks sold off globally in April and May, with the S&P 500® losing 6.60% over those two months and the MSCI-EAFE plunging 12.99%. The MSCI-EMI fell 12.20%.

Following the spring selloff, the markets began a sustained climb through the summer on the back of a number of moves and announcements by European and U.S. policymakers. A late June Euro Area Summit ended with a positive statement from the participants supporting the future establishment of a eurozone banking supervisor and the recapitalization of Spanish banks. In a July speech from London, ECB president Mario Draghi said the ECB would do “whatever it takes to preserve the Euro. And believe me, it will be enough.” This statement helped assuage the nervous markets. In August and September global equity markets rose further, boosted by an expectation that the ECB would buy Spanish and Italian bonds in the open market to hold down the bonds’ yields, and thus hold down the countries’ borrowing costs. The equity markets were also bolstered by anticipation that the U.S. Federal Reserve Board (“Fed”) would launch a third round of quantitative easing dubbed “QE3”. When the ECB did indeed announce a bond-buying program in early September, and the Fed followed with formally launching QE3 a few days later, the markets rallied some more.

Overall, the S&P 500® returned 15.21% for the 12-month period. But Europe’s troubles took a toll; the MSCI-EAFE rose only 5.15% for the 12-month period. Emerging markets performed even worse with only a 2.98% return for the MSCI-EMI. Amid the market volatility, higher-quality bonds delivered decent gains; the Barclays U.S. Aggregate Bond Index (“Barclays U.S. Aggregate Bond”) notched a 5.25% return for the 12-month period. Credit-sensitive bonds were up more strongly, having benefited from the overall positive environment for equities; the Barclays U.S. Corporate High Yield Index gained 13.61%.

PERFORMANCE

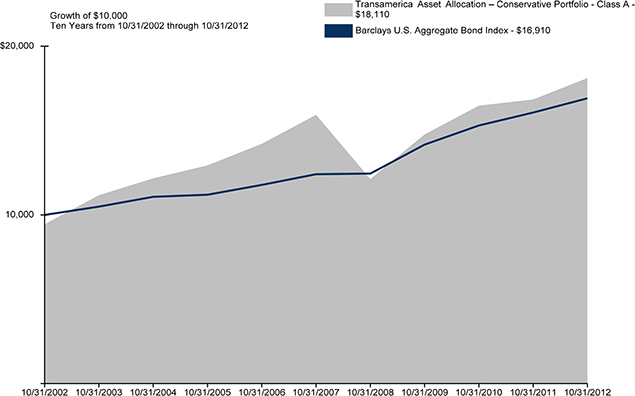

For the year ended October 31, 2012, Transamerica Asset Allocation—Conservative Portfolio, Class A returned 7.55% after all expenses. Its primary and secondary benchmarks, the Barclays U.S. Aggregate Bond and the Wilshire 5000® Total Market Index, returned 5.25% and 14.30%, respectively.

STRATEGY REVIEW

The goal of the Transamerica Asset Allocation Portfolios is to provide investors one-stop participation in the broad financial markets. Transamerica Asset Allocation—Conservative Portfolio is designed to provide a mix of approximately 65% fixed-income securities and 35% equity over time. The fixed-income part of the portfolio includes investment-grade and credit-sensitive holdings, as well as international bonds. The equity side covers both domestic and international markets across the entire range of investment styles, including both value and growth stocks and large and small companies. The portfolio also diversifies into emerging markets, global real estate, commodities, and alternative strategies. Our specific asset-class targets are derived from years of asset-allocation modeling—research that consistently indicates that the mix we target is close to optimal in terms of expected long-term returns per unit of risk taken. While this strategic blueprint forms the backbone of our asset allocation, we may actively over- and underweight asset classes relative to the normal targets as we deem prudent in response to present or expected market conditions. We endeavor to find and use quality money managers specializing in each asset class and investment style. We carefully monitor these underlying managers for performance and style issues, and adjust their weightings both to manage our asset-class exposures and to reflect the managers’ relative merit.

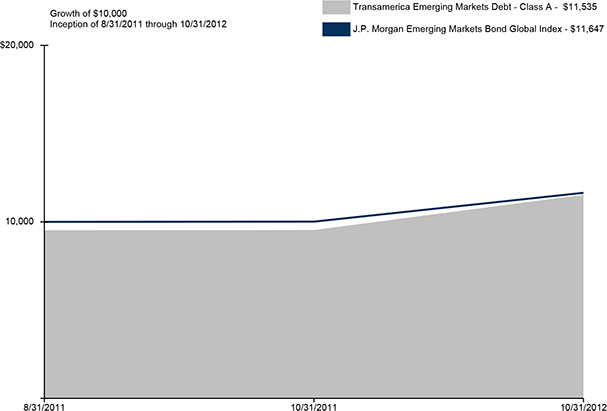

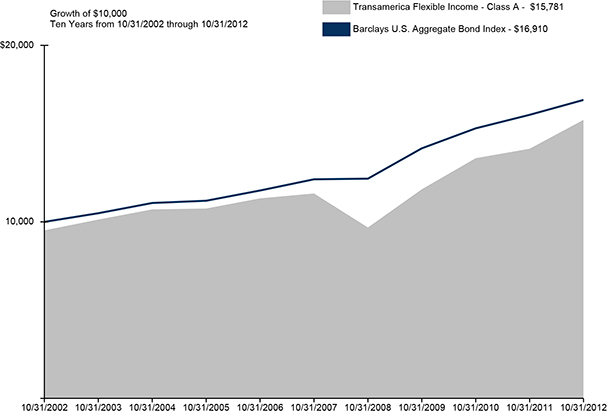

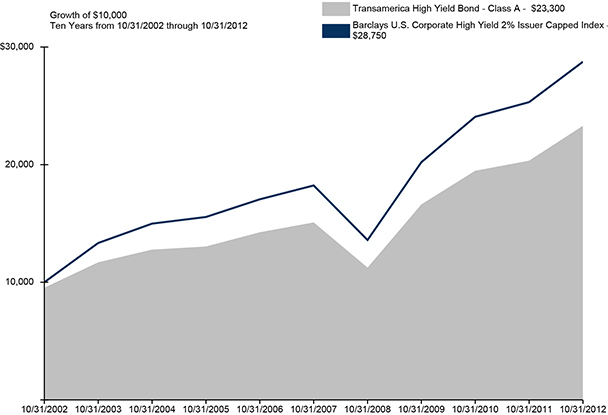

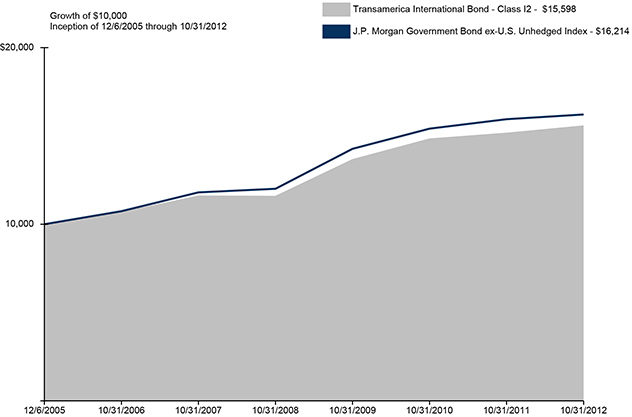

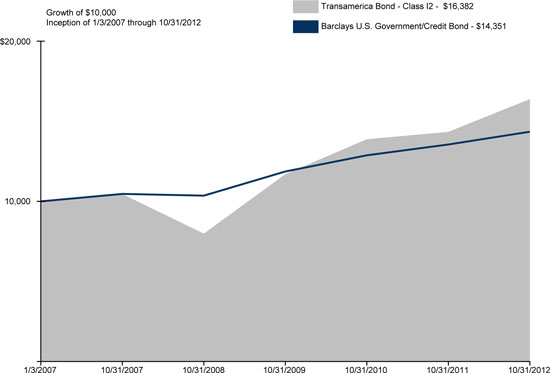

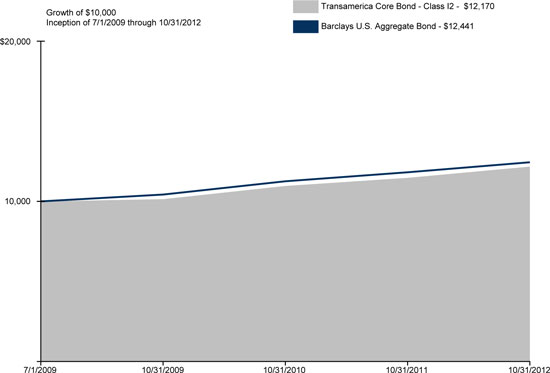

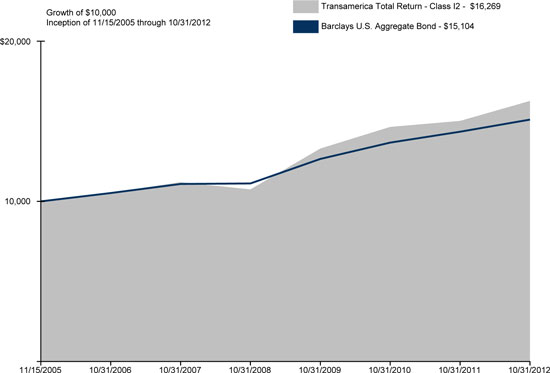

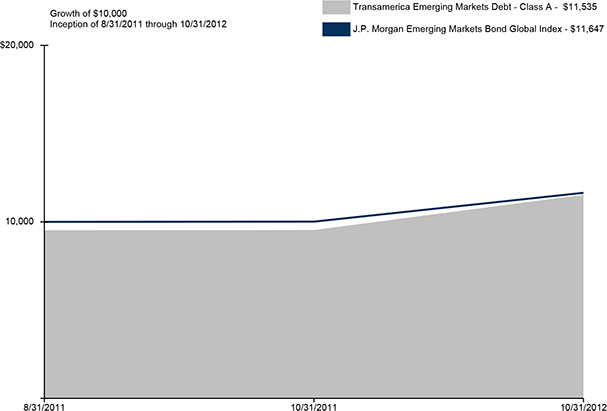

The fixed-income portion of the portfolio performed well during the November 1, 2011 – October 31, 2012 reporting period. Eight of the nine underlying bond funds that were owned for the entire period outpaced the Barclays U.S. Aggregate Bond (“the Index”). Even Transamerica Short-Term Bond, which targets shorter-term maturities, managed to outpace the Index. Transamerica Emerging Markets Debt and Transamerica High Yield Bond were the clear winners among the bond funds. Those are modest positions in the portfolio, but the two anchor funds—Transamerica Total Return and Transamerica Core Bond—both also beat the Index. Meanwhile, the portfolio’s two multi-sector bond funds, Transamerica Bond and Transamerica Flexible Income posted double-digit returns. The bond portfolio’s sole laggard relative to the Index was Transamerica International Bond, but its position size is small given that Transamerica Total Return and the two multi-sector funds have international stakes that already contribute a good amount toward our international bond target.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 1 | | |

Transamerica Asset Allocation—Conservative Portfolio

(unaudited)

STRATEGY REVIEW (continued)

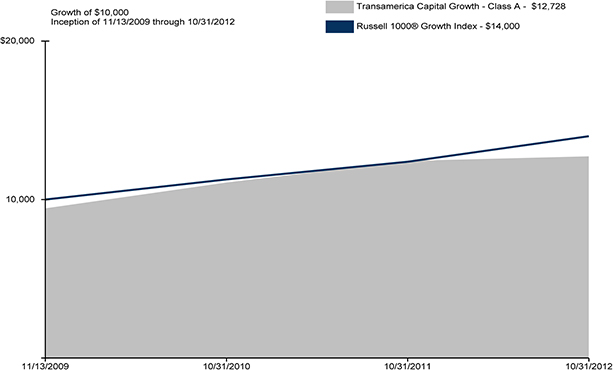

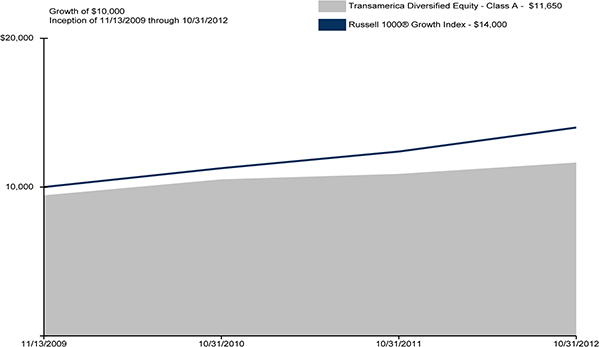

As outlined above, international equities underperformed U.S. equities during the reporting period. The portfolio’s built-in diversification into international equities, including both developed and emerging markets, was thus a drag relative to its U.S. exposure. We significantly underweighted developed foreign markets during the year, holding that weighting at only about two thirds of the normal target for much of the period, and also maintained an underweight in emerging markets in 2012. Even so, more than a fifth of the portfolio’s equity was in foreign developed and emerging markets equity as of October 31, 2012. The U.S. portion of the equity portfolio naturally enjoyed stronger returns, although its smaller-cap exposure diluted the gains somewhat. Significantly, the portfolio’s three main underlying U.S. large-cap growth funds, which are fairly sizable positions, lagged the S&P 500® in a meaningful way. While the S&P 500® was up 15.21% for the 12-month period, Transamerica Capital Growth eked out a small gain as a number of its Internet-related stocks struggled. Transamerica Diversified Equity and Transamerica Growth gained as well but lagged the S&P 500®. By contrast, the portfolio’s three U.S. large-cap value funds performed more in line with the S&P 500® .

During the year we worked to upgrade the roster of underlying managers. Transamerica Asset Management, Inc. (“TAM”) added what we consider an excellent large-cap value manager, Levin Capital Strategies, L.P., to run Transamerica Large Cap Value. TAM also added a pair of small-cap managers: Lombardia Capital Partners, LLC manages the new Transamerica Small Cap Value, and Ranger Investment Management, L.P. now runs Transamerica Small Cap Growth. Finally, we eliminated a couple of poor-performing international funds that we had been underweighting, and reallocated the assets to other managers in the same styles.

We still see macroeconomic events driving the markets more than the types of company fundamentals our underlying managers tend to emphasize in their security selection. Regarding the macroeconomic picture, we believe the U.S. economy is in a trend of gradual improvement while Europe is fighting to stave off a regional recession in 2013. Meanwhile, emerging markets have been hampered by slowing growth rates in heavyweights China, India, and Brazil. We; therefore, remain positioned with an international-equity underweight relative to our normal targets, and an overweight to the U.S. Valuations abroad have become somewhat attractive to us, however, so we must continuously weigh the economic risks abroad against the buying opportunity. In general, we have been and will continue to be flexible in this evolving environment.

Jon Hale, CFA

Dan McNeela, CFA

Michael Stout, CFA

Co-Portfolio Managers

Morningstar Associates, LLC

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 2 | | |

Transamerica Asset Allocation—Conservative Portfolio

(unaudited)

Average Annual Total Return for Periods Ended 10/31/2012

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception Date | |

Class A (NAV) | | | 7.55 | % | | | 2.60 | % | | | 6.73 | % | | | 03/01/2002 | |

Class A (POP) | | | 1.64 | % | | | 1.45 | % | | | 6.12 | % | | | 03/01/2002 | |

Barclays U.S. Aggregate Bond * | | | 5.25 | % | | | 6.38 | % | | | 5.39 | % | | | | |

Wilshire 5000 * | | | 14.30 | % | | | 0.77 | % | | | 7.79 | % | | | | |

| | | | | | | | | | | | | | | | |

Class B (NAV) | | | 6.81 | % | | | 1.92 | % | | | 6.17 | % | | | 03/01/2002 | |

Class B (POP) | | | 1.81 | % | | | 1.75 | % | | | 6.17 | % | | | 03/01/2002 | |

| | | | | | | | | | | | | | | | |

Class C (NAV) | | | 6.90 | % | | | 1.98 | % | | | 6.06 | % | | | 11/11/2002 | |

Class C (POP) | | | 5.90 | % | | | 1.98 | % | | | 6.06 | % | | | 11/11/2002 | |

| | | | | | | | | | | | | | | | |

Class I (NAV) | | | 7.87 | % | | | N/A | | | | 6.68 | % | | | 11/30/2009 | |

| | | | | | | | | | | | | | | | |

Class R (NAV) | | | 7.30 | % | | | 2.37 | % | | | 4.51 | % | | | 06/15/2006 | |

| | | | | | | | | | | | | | | | |

NOTES

| * | The Barclays U.S. Aggregate Bond Index (“Barclays U.S. Aggregate Bond”) and the Wilshire 5000® Total Market Index (“Wilshire 5000”) are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the previous 10 years or since the inception date of the class, whichever is more recent. You cannot invest directly in an index. |

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for Class A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. There are no sales charges on Class I and R shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Asset allocation does not ensure a profit or protect against a loss. An investment in the fund is subject to all of the risks associated with the underlying funds. This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this fund.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 3 | | |

Transamerica Asset Allocation—Growth Portfolio

(unaudited)

MARKET ENVIRONMENT

The November 1, 2011 to October 31, 2012 reporting period encompassed an overall rising market for U.S. and international stocks, but with downdrafts in November 2011 and again in the spring of 2012. As the period began, the Standard & Poor’s 500® Index (“S&P 500®) posted a small loss in November 2011, but the Morgan Stanley Capital International-Europe, Australasia, and Far East Index (“MSCI-EAFE”) of developed-market foreign stocks dropped 4.83% amid volatility surrounding the eurozone sovereign debt crisis. The Morgan Stanley Capital International Emerging Markets Index (“MSCI-EMI”) plummeted 6.66% in November. Although U.S. stocks recovered ground in December, the international indices fell further.

The mood brightened in 2012’s first quarter. The U.S. economy showed some vigor with U.S. Gross Domestic Product (“GDP”) growth initially being reported at 3.0% (later revised down to 1.9%). Meanwhile, the European Central Bank’s (“ECB”) Long Term Refinancing Operations flooded the eurozone with liquidity by lending nearly $1.3 trillion to European banks, a move that comforted international equity markets. Both U.S. and international stocks enjoyed double-digit gains in 2012’s first quarter.

The eurozone crisis returned to haunt markets in the spring; however, as Spanish and Italian bond yields climbed and Spain’s government requested a large bailout for its banks from the European Union. Meanwhile, other data indicated deepening recessions in several European countries. Stocks sold off globally in April and May, with the S&P 500® losing 6.60% over those two months and the MSCI-EAFE plunging 12.99%. The MSCI-EMI fell 12.20%.

Following the spring selloff, the markets began a sustained climb through the summer on the back of a number of moves and announcements by European and U.S. policymakers. A late June Euro Area Summit ended with a positive statement from the participants supporting the future establishment of a eurozone banking supervisor and the recapitalization of Spanish banks. In a July speech from London, ECB president Mario Draghi said the ECB would do “whatever it takes to preserve the Euro. And believe me, it will be enough.” This statement helped assuage the nervous markets. In August and September global equity markets rose further, boosted by an expectation that the ECB would buy Spanish and Italian bonds in the open market to hold down the bonds’ yields, and thus hold down the countries’ borrowing costs. The equity markets were also bolstered by anticipation that the U.S. Federal Reserve Board (“Fed”) would launch a third round of quantitative easing dubbed “QE3”. When the ECB did indeed announce a bond-buying program in early September, and the Fed followed with formally launching QE3 a few days later, the markets rallied some more.

Overall, the S&P 500® returned 15.21% for the 12-month period. But Europe’s troubles took a toll; the MSCI-EAFE rose only 5.15% for the 12-month period. Emerging markets performed even worse with only a 2.98% return for the MSCI-EMI. Amid the market volatility, higher-quality bonds delivered decent gains; the Barclays U.S. Aggregate Bond Index notched a 5.25% return for the 12-month period. Credit-sensitive bonds were up more strongly, having benefited from the overall positive environment for equities; the Barclays U.S. Corporate High Yield Index gained 13.61%.

PERFORMANCE

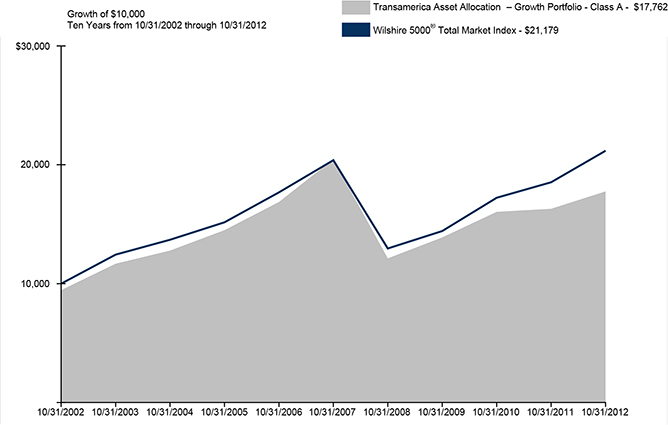

For the year ended October 31, 2012, Transamerica Asset Allocation – Growth Portfolio, Class A returned 8.96% after all expenses. Its benchmark, the Wilshire 5000® Total Market Index, returned 14.30%.

STRATEGY REVIEW

The goal of the Transamerica Asset Allocation Portfolios is to provide investors one-stop participation in the broad financial markets. Transamerica Asset Allocation—Growth Portfolio, which is meant for aggressive investors, exclusively targets equity securities and alternative strategies. It is designed to provide diversified, global coverage of equities. It includes domestic and international markets, and spans the entire range of investment styles, including both large and small companies and value and growth stocks. The portfolio incorporates emerging markets, global real estate, commodities, and several alternative strategies. Our specific asset-class targets are derived from years of asset-allocation modeling–research that consistently indicates that the mix we target is close to optimal in terms of expected long-term returns per unit of risk taken. While this strategic blueprint forms the backbone of our asset allocation, we may actively over- and underweight asset classes relative to the normal targets as we deem prudent in response to present or expected market conditions. We endeavor to find and use quality money managers specializing in each asset class and investment style. We carefully monitor these underlying managers for performance and style issues, and adjust their weightings both to manage our asset-class exposures and to reflect the managers’ relative merit.

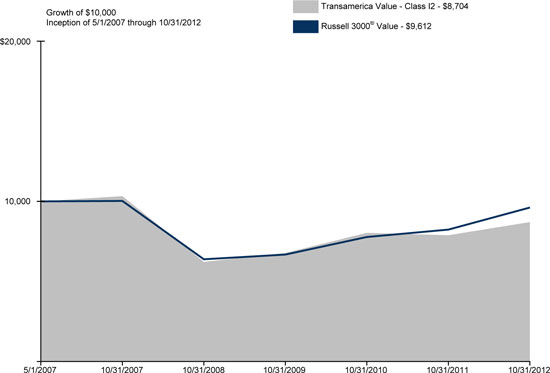

During the reporting period, international equities underperformed U.S. equities as outlined above. The portfolio’s built-in diversification into international equities, including both developed and emerging markets, was thus a drag relative to its U.S. exposure. We significantly underweighted developed foreign markets during the year, holding that weighting at only about two thirds of the normal target for much of the period, and also maintained an underweight in emerging markets in 2012. Even so, about 22.8% of the portfolio was in foreign developed- and emerging-markets equity as of October 31, 2012. U.S. stocks made up about 69% of assets, with an overweight toward large-cap stocks. The U.S. portion of the portfolio naturally enjoyed stronger returns, although its smaller-cap exposure diluted the gains somewhat (the 12.08% return of the Russell 2000® Index of smaller companies lagged the S&P 500®).

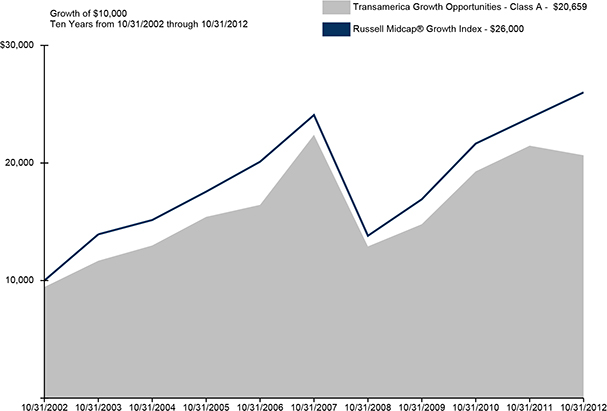

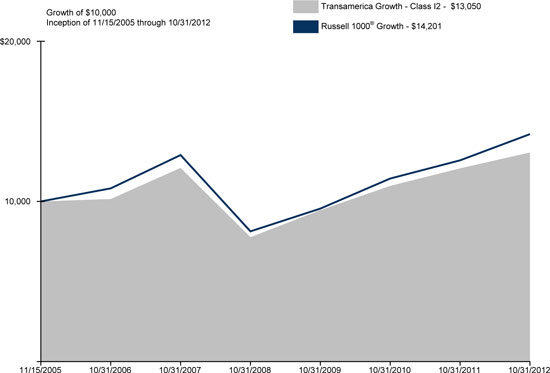

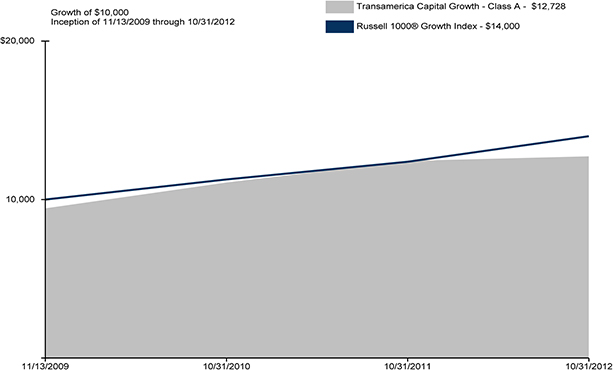

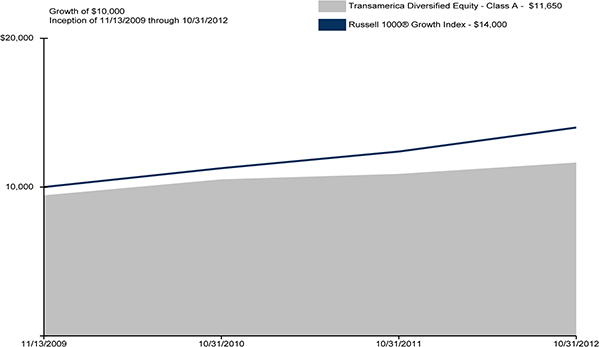

Significantly, the portfolio’s three main underlying U.S. large-cap growth funds, which constitute major positions, lagged the S&P 500® in a meaningful way. While the S&P 500® was up 15.21% for the 12-month period, Transamerica Capital Growth eked out a small gain as a number of its Internet-related stocks struggled. Transamerica Diversified Equity and Transamerica Growth gained as well but lagged the S&P 500® . The portfolio’s three U.S. large-cap value funds performed more in line with the S&P 500® .

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 4 | | |

Transamerica Asset Allocation—Growth Portfolio

(unaudited)

STRATEGY REVIEW (continued)

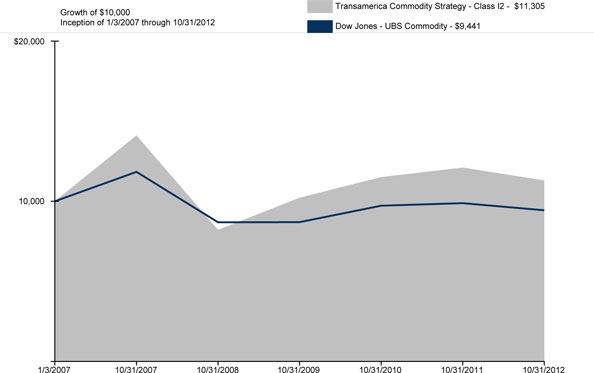

However, the roughly 4% stake in alternative strategies was a drag on performance amid the period’s rising market. As absolute-return strategies designed to exhibit reduced correlation with the equity market, none of those funds could be expected to keep up with the U.S. market’s sharp gains, and a couple funds even posted negative returns. In addition, Transamerica Commodity Strategy (1.5% of assets as of October 31, 2012) detracted from performance as a result of weakness in commodities prices throughout the year.

Over the course of the year we worked to upgrade the roster of underlying managers. Transamerica Asset Management, Inc. (“TAM”) added what we consider an excellent large-cap value manager, Levin Capital Strategies, L.P., to run Transamerica Large Cap Value. TAM also added a pair of small-cap managers: Lombardia Capital Partners, LLC manages the new Transamerica Small Cap Value, and Ranger Investment Management, L.P. now runs Transamerica Small Cap Growth. Finally, we eliminated a couple of poor-performing international funds that we had been underweighting, and reallocated the assets to other managers in the same styles.

We still see macroeconomic events driving the markets more than the types of company fundamentals our underlying managers tend to emphasize in their security selection. Regarding the macroeconomic picture, we believe the U.S. economy is in a trend of gradual improvement while Europe is fighting to stave off a regional recession in 2013. Meanwhile, emerging markets have been hampered by slowing growth rates in heavyweights China, India, and Brazil. We; therefore, remain positioned with an international-equity underweight relative to our normal targets, and an overweight to the U.S. Valuations abroad have become somewhat attractive to us, however, so we must continuously weigh the economic risks abroad against the buying opportunity. In general, we have been and will continue to be flexible in this evolving environment.

Jon Hale, CFA

Dan McNeela, CFA

Michael Stout, CFA

Co-Portfolio Managers

Morningstar Associates, LLC

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 5 | | |

Transamerica Asset Allocation—Growth Portfolio

(unaudited)

Average Annual Total Return for Periods Ended 10/31/2012

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception

Date | |

Class A (NAV) | | | 8.96 | % | | | (2.80 | )% | | | 6.51 | % | | | 03/01/2002 | |

Class A (POP) | | | 2.96 | % | | | (3.90 | )% | | | 5.91 | % | | | 03/01/2002 | |

Wilshire 5000 * | | | 14.30 | % | | | 0.77 | % | | | 7.79 | % | | | | |

| | | | | | | | | | | | | | | | |

Class B (NAV) | | | 8.08 | % | | | (3.47 | )% | | | 5.96 | % | | | 03/01/2002 | |

Class B (POP) | | | 3.08 | % | | | (3.66 | )% | | | 5.96 | % | | | 03/01/2002 | |

| | | | | | | | | | | | | | | | |

Class C (NAV) | | | 8.22 | % | | | (3.40 | )% | | | 5.95 | % | | | 11/11/2002 | |

Class C (POP) | | | 7.22 | % | | | (3.40 | )% | | | 5.95 | % | | | 11/11/2002 | |

| | | | | | | | | | | | | | | | |

Class I (NAV) | | | 9.28 | % | | | N/A | | | | 7.65 | % | | | 11/30/2009 | |

| | | | | | | | | | | | | | | | |

Class R (NAV) | | | 8.76 | % | | | (2.94 | )% | | | 2.00 | % | | | 06/15/2006 | |

| | | | | | | | | | | | | | | | |

NOTES

| * | The Wilshire 5000® Total Market Index (“Wilshire 5000”) is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the previous 10 years or since the inception date of the class, whichever is more recent. You cannot invest directly in an index. |

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for Class A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. There are no sales charges on Class I and R shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Asset allocation does not ensure a profit or protect against a loss. An investment in the fund is subject to all of the risks associated with the underlying funds. This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this fund.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 6 | | |

Transamerica Asset Allocation—Moderate Growth Portfolio

(unaudited)

MARKET ENVIRONMENT

The November 1, 2011 to October 31, 2012 reporting period encompassed an overall rising market for U.S. and international stocks, but with downdrafts in November 2011 and again in the spring of 2012. As the period began, the Standard & Poor’s 500® Index (“S&P 500®”) posted a small loss in November 2011, but the Morgan Stanley Capital International-Europe, Australasia, and Far East Index (“MSCI-EAFE”) of developed-market foreign stocks dropped 4.83% amid volatility surrounding the eurozone sovereign debt crisis. The Morgan Stanley Capital International Emerging Markets Index (“MSCI-EMI”) plummeted 6.66% in November. Although U.S. stocks recovered ground in December, the international indices fell further.

The mood brightened in 2012’s first quarter. The U.S. economy showed some vigor with U.S, Gross Domestic Product (“GDP”) growth initially being reported at 3.0% (later revised down to 1.9%). Meanwhile, the European Central Bank’s (“ECB”) Long Term Refinancing Operations flooded the eurozone with liquidity by lending nearly $1.3 trillion to European banks, a move that comforted international equity markets. Both U.S. and international stocks enjoyed double-digit gains in 2012’s first quarter.

The eurozone crisis returned to haunt markets in the spring; however, as Spanish and Italian bond yields climbed and Spain’s government requested a large bailout for its banks from the European Union. Meanwhile, other data indicated deepening recessions in several European countries. Stocks sold off globally in April and May, with the S&P 500® losing 6.60% over those two months and the MSCI-EAFE plunging 12.99%. The MSCI-EMI fell 12.20%.

Following the spring selloff, the markets began a sustained climb through the summer on the back of a number of moves and announcements by European and U.S. policymakers. A late June Euro Area Summit ended with a positive statement from the participants supporting the future establishment of a eurozone banking supervisor and the recapitalization of Spanish banks. In a July speech from London, ECB president Mario Draghi said the ECB would do “whatever it takes to preserve the Euro. And believe me, it will be enough.” This statement helped assuage the nervous markets. In August and September global equity markets rose further, boosted by an expectation that the ECB would buy Spanish and Italian bonds in the open market to hold down the bonds’ yields, and thus hold down the countries’ borrowing costs. The equity markets were also bolstered by anticipation that the U.S. Federal Reserve Board (“Fed”) would launch a third round of quantitative easing dubbed “QE3”. When the ECB did indeed announce a bond-buying program in early September, and the Fed followed with formally launching QE3 a few days later, the markets rallied some more.

Overall, the S&P 500® returned 15.21% for the 12-month period. But Europe’s troubles took a toll; the MSCI-EAFE rose only 5.15% for the 12-month period. Emerging markets performed even worse with only a 2.98% return for the MSCI-EMI. Amid the market volatility, higher-quality bonds delivered decent gains; the Barclays U.S. Aggregate Bond Index (“Barclays U.S. Aggregate Bond”) notched a 5.25% return for the 12-month period. Credit-sensitive bonds were up more strongly, having benefited from the overall positive environment for equities; the Barclays U.S. Corporate High Yield Index gained 13.61%.

PERFORMANCE

For the year ended October 31, 2012, Transamerica Asset Allocation—Moderate Growth Portfolio, Class A returned 8.48% after all expenses. Its primary and secondary benchmarks, the Wilshire 5000® Total Market Index and the Barclays U.S. Aggregate Bond, returned 14.30% and 5.25%, respectively.

STRATEGY REVIEW

The goal of the Transamerica Asset Allocation Portfolios is to provide investors one-stop participation in the broad financial markets. Transamerica Asset Allocation—Moderate Growth Portfolio is designed to provide a mix of approximately 70% equity and 30% fixed-income securities over time. The equity side covers both domestic and international markets across the entire range of investment styles, including both value and growth stocks and large and small companies. The fixed-income portion includes investment-grade and credit-sensitive holdings, as well as international bonds. The portfolio also diversifies into emerging markets, global real estate, commodities, and alternative strategies. Our specific asset-class targets are derived from years of asset-allocation modeling – research that consistently indicates that the mix we target is close to optimal in terms of expected long-term returns per unit of risk taken. While this strategic blueprint forms the backbone of our asset allocation, we may actively over- and underweight asset classes relative to the normal targets as we deem prudent in response to present or expected market conditions. We endeavor to find and use quality money managers specializing in each asset class and investment style. We carefully monitor these underlying managers for performance and style issues, and adjust their weightings both to manage our asset-class exposures and to reflect the managers’ relative merit.

During the reporting period, international equities underperformed U.S. equities as outlined above. The portfolio’s built-in diversification into international equities, including both developed and emerging markets, was thus a drag relative to its U.S. exposure. We significantly underweighted developed foreign markets during the year, holding that weighting at only about two thirds of the normal target for much of the period, and also maintained an underweight in emerging markets in 2012. Even so, about 16% of the portfolio was in foreign developed- and emerging-markets equity as of October 31, 2012. U.S. stocks made up about 51.3% of assets, with an overweight toward large-cap stocks. The U.S. portion of the portfolio naturally enjoyed stronger returns, although its smaller-cap exposure diluted the gains somewhat (the 12.08% return of the Russell 2000® Index of smaller companies lagged the S&P 500®). Significantly, the portfolio’s three main underlying U.S. large-cap growth funds, which constitute major positions, lagged the S&P 500® in a meaningful way. While the S&P 500® was up 15.21% for the 12-month period, Transamerica Capital Growth eked out a small gain as a number of its Internet-related stocks struggled. Transamerica Diversified Equity and Transamerica Growth gained as well, but lagged the S&P 500®. By contrast, the portfolio’s three U.S. large-cap value funds performed more in line with the S&P 500®.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 7 | | |

Transamerica Asset Allocation—Moderate Growth Portfolio

(unaudited)

STRATEGY REVIEW (continued)

The fixed-income portion of the portfolio fared better. Seven of the eight underlying bond funds that were owned for the entire period outpaced the Barclays U.S. Aggregate Bond. Transamerica Emerging Markets Debt and Transamerica High Yield Bond were the clear winners. The two anchor bond funds—Transamerica Total Return and Transamerica Core Bond—both also beat the Barclays U.S. Aggregate Bond’s return. Meanwhile, the multi-sector Transamerica Bond notched a 14.24% gain.

During the year we worked to upgrade the roster of underlying managers. Transamerica Asset Management, Inc. (“TAM”) added what we consider an excellent large-cap value manager, Levin Capital Strategies, L.P., to run Transamerica Large Cap Value. TAM also added a pair of small-cap managers: Lombardia Capital Partners, LLC manages the new Transamerica Small Cap Value, and Ranger Investment Management, L.P. now runs Transamerica Small Cap Growth. Finally, we eliminated a couple of poor-performing international funds that we had been underweighting, and reallocated the assets to other managers in the same styles.

We still see macroeconomic events driving the markets more than the types of company fundamentals our underlying managers tend to emphasize in their security selection. Regarding the macroeconomic picture, we believe the U.S. economy is in a trend of gradual improvement while Europe is fighting to stave off a regional recession in 2013. Meanwhile, emerging markets have been hampered by slowing growth rates in heavyweights China, India, and Brazil. We; therefore, remain positioned with an international-equity underweight relative to our normal targets, and an overweight to the U.S. Valuations abroad have become somewhat attractive to us, however, so we must continuously weigh the economic risks abroad against the buying opportunity. In general, we have been and will continue to be flexible in this evolving environment.

Jon Hale, CFA

Dan McNeela, CFA

Michael Stout, CFA

Co-Portfolio Managers

Morningstar Associates, LLC

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 8 | | |

Transamerica Asset Allocation—Moderate Growth Portfolio

(unaudited)

Average Annual Total Return for Periods Ended 10/31/2012

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception Date | |

Class A (NAV) | | | 8.48 | % | | | (0.57 | )% | | | 6.76 | % | | | 03/01/2002 | |

Class A (POP) | | | 2.53 | % | | | (1.69 | )% | | | 6.16 | % | | | 03/01/2002 | |

Wilshire 5000 * | | | 14.30 | % | | | 0.77 | % | | | 7.79 | % | | | | |

Barclays U.S. Aggregate Bond * | | | 5.25 | % | | | 6.38 | % | | | 5.39 | % | | | | |

| | | | | | | | | | | | | | | | |

Class B (NAV) | | | 7.73 | % | | | (1.23 | )% | | | 6.20 | % | | | 03/01/2002 | |

Class B (POP) | | | 2.73 | % | | | (1.41 | )% | | | 6.20 | % | | | 03/01/2002 | |

| | | | | | | | | | | | | | | | |

Class C (NAV) | | | 7.74 | % | | | (1.19 | )% | | | 6.15 | % | | | 11/11/2002 | |

Class C (POP) | | | 6.74 | % | | | (1.19 | )% | | | 6.15 | % | | | 11/11/2002 | |

| | | | | | | | | | | | | | | | |

Class I (NAV) | | | 8.82 | % | | | N/A | | | | 7.17 | % | | | 11/30/2009 | |

| | | | | | | | | | | | | | | | |

Class R (NAV) | | | 8.21 | % | | | (0.72 | )% | | | 3.13 | % | | | 06/15/2006 | |

| | | | | | | | | | | | | | | | |

NOTES

| * | The Wilshire 5000® Total Market Index (“Wilshire 5000”) and the Barclays U.S. Aggregate Bond Index (“Barclays U.S. Aggregate Bond”) are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the previous 10 years or since the inception date of the class, whichever is more recent. You cannot invest directly in an index. |

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for Class A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. There are no sales charges on Class I and R shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Asset allocation does not ensure a profit or protect against a loss. An investment in the fund is subject to all of the risks associated with the underlying funds. This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this fund.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 9 | | |

Transamerica Asset Allocation—Moderate Portfolio

(unaudited)

MARKET ENVIRONMENT

The November 1, 2011 to October 31, 2012 reporting period encompassed an overall rising market for U.S. and international stocks, but with downdrafts in November 2011 and again in the spring of 2012. As the period began, the Standard & Poor’s 500® Index (“S&P 500®) posted a small loss in November 2011, but the Morgan Stanley Capital International-Europe, Australasia, and Far East Index (“MSCI-EAFE”) of developed-market foreign stocks dropped 4.83% amid volatility surrounding the eurozone sovereign debt crisis. The Morgan Stanley Capital International Emerging Markets Index (“MSCI-EMI”) plummeted 6.66% in November. Although U.S. stocks recovered ground in December, the international indices fell further.

The mood brightened in 2012’s first quarter. The U.S. economy showed some vigor with U.S. Gross Domestic Product (“GDP”) growth initially being reported at 3.0% (later revised down to 1.9%). Meanwhile, the European Central Bank’s (“ECB”) Long Term Refinancing Operations flooded the eurozone with liquidity by lending nearly $1.3 trillion to European banks, a move that comforted international equity markets. Both U.S. and international stocks enjoyed double-digit gains in 2012’s first quarter.

The eurozone crisis returned to haunt markets in the spring; however, as Spanish and Italian bond yields climbed and Spain’s government requested a large bailout for its banks from the European Union. Meanwhile, other data indicated deepening recessions in several European countries. Stocks sold off globally in April and May, with the S&P 500® losing 6.60% over those two months and the MSCI-EAFE plunging 12.99%. The MSCI-EMI fell 12.20%.

Following the spring selloff, the markets began a sustained climb through the summer on the back of a number of moves and announcements by European and U.S. policymakers. A late June Euro Area Summit ended with a positive statement from the participants supporting the future establishment of a eurozone banking supervisor and the recapitalization of Spanish banks. In a July speech from London, ECB president Mario Draghi said the ECB would do “whatever it takes to preserve the Euro. And believe me, it will be enough.” This statement helped assuage the nervous markets. In August and September global equity markets rose further, boosted by an expectation that the ECB would buy Spanish and Italian bonds in the open market to hold down the bonds’ yields, and thus hold down the countries’ borrowing costs. The equity markets were also bolstered by anticipation that the U.S. Federal Reserve Board (“Fed”) would launch a third round of quantitative easing dubbed “QE3”. When the ECB did indeed announce a bond-buying program in early September, and the Fed followed with formally launching QE3 a few days later, the markets rallied some more.

Overall, the S&P 500® returned 15.21% for the 12-month period. But Europe’s troubles took a toll; the MSCI-EAFE Index rose only 5.15% for the 12-month period. Emerging markets performed even worse with only a 2.98% return for the MSCI EMI. Amid the market volatility, higher-quality bonds delivered decent gains; the Barclays U.S. Aggregate Bond Index (“Barclays U.S. Aggregate Bond”) notched a 5.25% return for the 12-month period. Credit-sensitive bonds were up more strongly, having benefited from the overall positive environment for equities; the Barclays U.S. Corporate High Yield Index gained 13.61%.

PERFORMANCE

For the year ended October 31, 2012, Transamerica Asset Allocation—Moderate Portfolio, Class A returned 7.95% after all expenses. Its primary and secondary benchmarks, the Wilshire 5000® Total Market Index and the Barclays U.S. Aggregate Bond, returned 14.30% and 5.25%, respectively.

STRATEGY REVIEW

The goal of the Transamerica Asset Allocation Portfolios is to provide investors one-stop participation in the broad financial markets. Transamerica Asset Allocation—Moderate Portfolio is designed to provide a mix of approximately 50% equity and 50% fixed-income securities over time. The equity side covers both domestic and international markets across the entire range of investment styles, including both value and growth stocks and large and small companies. The fixed-income portion includes investment-grade and credit-sensitive holdings, as well as international bonds. The portfolio also diversifies into emerging markets, global real estate, commodities, and alternative strategies. Our specific asset-class targets are derived from years of asset-allocation modeling—research that consistently indicates that the mix we target is close to optimal in terms of expected long-term returns per unit of risk taken. While this strategic blueprint forms the backbone of our asset allocation, we may actively over- and underweight asset classes relative to the normal targets as we deem prudent in response to present or expected market conditions. We endeavor to find and use quality money managers specializing in each asset class and investment style. We carefully monitor these underlying managers for performance and style issues, and adjust their weightings both to manage our asset-class exposures and to reflect the managers’ relative merit.

During the reporting period, international equities underperformed U.S. equities as outlined above. The portfolio’s built-in diversification into international equities, including both developed and emerging markets, was thus a drag relative to its U.S. exposure. We significantly underweighted developed foreign markets during the year, holding that weighting at only about two thirds of the normal target for much of the period, and also maintained an underweight in emerging markets in 2012. Even so, about 10.2% of the portfolio was in foreign developed- and emerging-markets equity as of October 31, 2012. U.S. stocks made up about 38.8% of assets, with an overweight toward large-cap stocks. The U.S. portion of the fund naturally enjoyed stronger returns, although its smaller-cap exposure diluted the gains somewhat (the 12.08% return of the Russell 2000® Index of smaller companies lagged the S&P 500®). Significantly, the portfolio’s three main underlying U.S. large-cap growth funds, which constitute major positions, lagged the S&P 500® in a meaningful way. While the S&P 500® was up 15.21% for the 12-month period, Transamerica Capital Growth eked out a small gain as a number of its Internet-related stocks struggled. Transamerica Diversified Equity and Transamerica Growth gained as well but lagged the S&P 500®. By contrast, the portfolio’s three U.S. large-cap value funds performed more in line with the S&P 500®.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 10 | | |

Transamerica Asset Allocation—Moderate Portfolio

(unaudited)

STRATEGY REVIEW (continued)

The fixed-income half of the portfolio fared better. Eight of the nine underlying bond funds that were owned for the entire period outpaced the Barclays U.S. Aggregate Bond. Transamerica Emerging Markets Debt and Transamerica High Yield Bond were the clear winners. Those are modest positions in the portfolio, but the two anchor bond funds—Transamerica Total Return and Transamerica Core Bond—both also beat the Barclays U.S. Aggregate Bond’s return. Meanwhile, the portfolio’s two multi-sector bond funds, Transamerica Bond and Transamerica Flexible Income posted double-digit returns.

During the year we worked to upgrade the roster of underlying managers. Transamerica Asset Management, Inc. (“TAM”) added what we consider an excellent large-cap value manager, Levin Capital Strategies, L.P., to run Transamerica Large Cap Value. TAM also added a pair of small-cap managers: Lombardia Capital Partners, LLC manages the new Transamerica Small Cap Value, and Ranger Investment Management, L.P. now runs Transamerica Small Cap Growth. Finally, we eliminated a couple of poor-performing international funds that we had been underweighting, and reallocated the assets to other managers in the same styles.

We still see macroeconomic events driving the markets more than the types of company fundamentals our underlying managers tend to emphasize in their security selection. Regarding the macroeconomic picture, we believe the U.S. economy is in a trend of gradual improvement while Europe is fighting to stave off a regional recession in 2013. Meanwhile, emerging markets have been hampered by slowing growth rates in heavyweights China, India, and Brazil. We; therefore, remain positioned with an international-equity underweight relative to our normal targets, and an overweight to the U.S. Valuations abroad have become somewhat attractive to us, however, so we must continuously weigh the economic risks abroad against the buying opportunity. In general, we have been and will continue to be flexible in this evolving environment.

Jon Hale, CFA

Dan McNeela, CFA

Michael Stout, CFA

Co-Portfolio Managers

Morningstar Associates, LLC

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 11 | | |

Transamerica Asset Allocation—Moderate Portfolio

(unaudited)

Average Annual Total Return for Periods Ended 10/31/2012

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception Date | |

Class A (NAV) | | | 7.95 | % | | | 1.35 | % | | | 6.94 | % | | | 03/01/2002 | |

Class A (POP) | | | 1.97 | % | | | 0.21 | % | | | 6.34 | % | | | 03/01/2002 | |

Wilshire 5000 * | | | 14.30 | % | | | 0.77 | % | | | 7.79 | % | | | | |

Barclays U.S. Aggregate Bond * | | | 5.25 | % | | | 6.38 | % | | | 5.39 | % | | | | |

| | | | | | | | | | | | | | | | |

Class B (NAV) | | | 7.06 | % | | | 0.65 | % | | | 6.39 | % | | | 03/01/2002 | |

Class B (POP) | | | 2.06 | % | | | 0.47 | % | | | 6.39 | % | | | 03/01/2002 | |

| | | | | | | | | | | | | | | | |

Class C (NAV) | | | 7.17 | % | | | 0.71 | % | | | 6.31 | % | | | 11/11/2002 | |

Class C (POP) | | | 6.17 | % | | | 0.71 | % | | | 6.31 | % | | | 11/11/2002 | |

| | | | | | | | | | | | | | | | |

Class I (NAV) | | | 8.26 | % | | | N/A | | | | 7.07 | % | | | 11/30/2009 | |

| | | | | | | | | | | | | | | | |

Class R (NAV) | | | 7.72 | % | | | 1.15 | % | | | 4.07 | % | | | 06/15/2006 | |

| | | | | | | | | | | | | | | | |

NOTES

| * | The Wilshire 5000® Total Market Index (“Wilshire 5000”) and the Barclays U.S. Aggregate Bond Index (“Barclays U.S. Aggregate Bond”) are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the previous 10 years or since the inception date of the class, whichever is more recent. You cannot invest directly in an index. |

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for Class A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. There are no sales charges on Class I and R shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Asset allocation does not ensure a profit or protect against a loss. An investment in the fund is subject to all of the risks associated with the underlying funds. This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this fund.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 12 | | |

Transamerica Multi-Manager Alternative Strategies Portfolio

(unaudited)

MARKET ENVIRONMENT

The November 1, 2011 to October 31, 2012 reporting period encompassed very different market environments. In the beginning of the period, fears of a European sovereign default continued to plague the markets. Concerns about poor job growth in the U.S., Greek elections and a slowing economy in China also weighed on investors. In response to deteriorating conditions, central bankers around the world continued to pump additional liquidity into financial markets throughout the year. The U.S. Federal Reserve Board (“Fed”) announced a third round of quantitative easing, with a focus on purchasing mortgages. The European Central Bank (“ECB”) removed liquidity concerns from the region’s debt crisis by providing banks with unlimited access to loans from the central bank, and also announced an aggressive bond-buying program. Similarly, the Bank of Japan, Bank of England, and the People’s Bank of China enacted plans to boost liquidity. The net result was higher asset prices across asset classes.

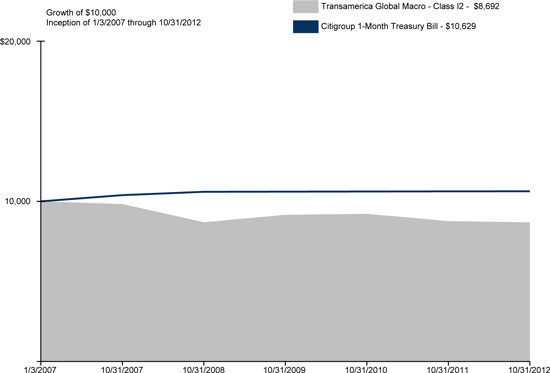

PERFORMANCE

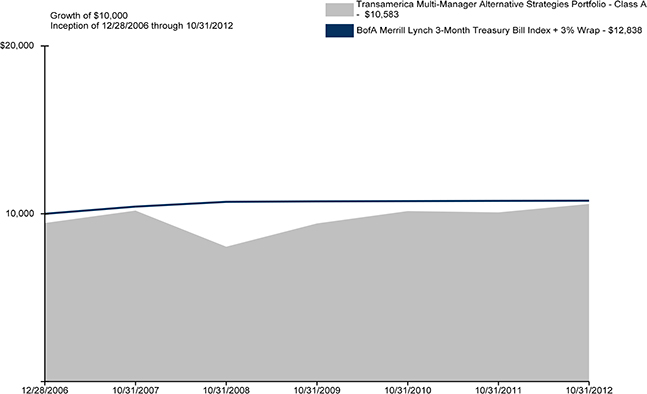

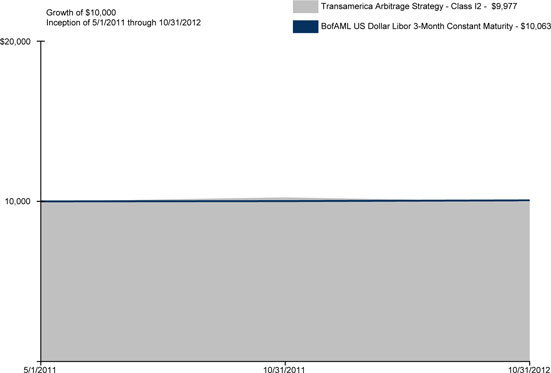

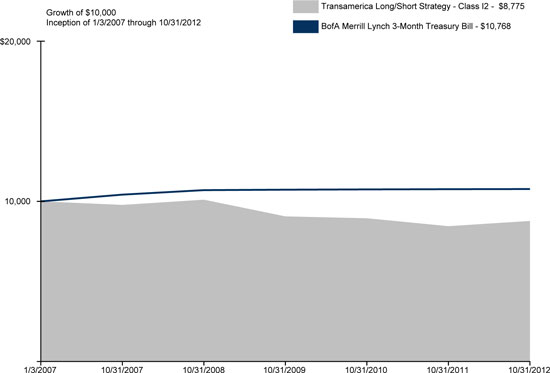

For the year ended October 31, 2012, Transamerica Multi-Manager Alternative Strategies Portfolio, Class A, returned 4.95%. By comparison, its primary and secondary benchmarks, the Bank of America Merrill Lynch 3-Month Treasury Bill + 3% Wrap Index and the Hedge Fund Research (“HFRX”) Global Hedge Fund Index, returned 3.12% and 0.84%, respectively.

STRATEGY REVIEW

Transamerica Multi-Manager Alternative Strategies Portfolio is designed to provide diversification relative to a core stock/bond portfolio. A reference benchmark for the strategy is the HFRX Global Hedge Fund Index. The portfolio’s allocations can be broken into four broad HFRX categories: Equity Hedge, Event Driven, Macro, and Relative Value.

The fund outperformed its reference benchmark for the period, largely due to gains in Relative Value and Equity Hedge strategies, which benefited from a general return to risk and tightening of spreads. These gains were only partially offset by allocations in Macro and Event Driven, as commodity prices declined and merger arbitrage deal volatility increased. The largest contributors included Transamerica Bond, Transamerica Emerging Markets Debt, Transamerica Developing Markets Debt, and Transamerica Global Real Estate Securities. The largest detractors included Transamerica Commodity Strategy and Transamerica Arbitrage Strategy.

Throughout the year, we continued to stay true to our dynamic investment philosophy, which benefited the strategy as we tactically reallocated assets between categories and within categories. For instance, we built up our non-U.S. dollar exposure in Equity Hedge and Relative Value as we saw signs of further monetary easing and weakening of the U.S. dollar. We also reduced our exposure to trend-following strategy as we saw volatility rising across asset classes, and we reduced our exposure to arbitrage strategies in response to lower rates and an unfavorable risk/return profile. We took a “barbell risk” investment approach at times throughout the year, investing in strategies that complement each other and providing investors a smoother ride than tactical shifts between “risk on” and “risk off”.

Going forward, we continue to be cautious about growth and market directions. Much of the fundamental data about manufacturing, job creation, and commodity prices point to soft demand and make economic growth slow and elusive. Yield curves and rates around the world also tell a similar story: record low rates in Germany, Japan, and the U.S. point to a massive risk-off appetite. That said, the rate cutting in Europe and China and continued policy intervention is likely to get markets (if not economies) moving. The risk of being completely defensive or short with much stimulus potential is not prudent. Rallies tend to be fierce and brief and we do not want to be in a position to chase a temporarily rising market just to catch it at the top. We remain broadly allocated and believe we can provide protection on the downside while still participating on the upside.

Tim Galbraith

Portfolio Manager

Transamerica Asset Management, Inc.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 13 | | |

Transamerica Multi-Manager Alternative Strategies Portfolio

(unaudited)

Average Annual Total Return for Periods Ended 10/31/2012

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception Date | |

Class A (NAV) | | | 4.95 | % | | | 0.76 | % | | | 1.95 | % | | | 12/28/2006 | |

Class A (POP) | | | (0.79 | )% | | | (0.38 | )% | | | 0.98 | % | | | 12/28/2006 | |

BofA Merrill Lynch 3-Month Treasury Bill Index + 3% Wrap * | | | 3.12 | % | | | 3.72 | % | | | 4.37 | % | | | | |

HFRX Global Hedge Fund * | | | 0.84 | % | | | (3.65 | )% | | | (1.98 | )% | | | | |

| | | | | | | | | | | | | | | | |

Class C (NAV) | | | 4.21 | % | | | 0.11 | % | | | 1.30 | % | | | 12/28/2006 | |

Class C (POP) | | | 3.21 | % | | | 0.11 | % | | | 1.30 | % | | | 12/28/2006 | |

| | | | | | | | | | | | | | | | |

Class I (NAV) | | | 5.34 | % | | | N/A | | | | 3.91 | % | | | 11/30/2009 | |

| | | | | | | | | | | | | | | | |

NOTES

| * | The Bank of America Merrill Lynch 3-Month Treasury Bill Index + 3% Wrap Fee (“BofA Merrill Lynch 3-Month Treasury Bill Index + 3% Wrap”) is an unmanaged index used as a general measure of market performance. The Hedge Fund Research Global Hedge Fund Index (“HFRX Global Hedge Fund”) is a passively-managed index that is compiled by Hedge Fund Research, Inc. It is designed to measure the daily performance of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. Returns of funds within the composition of the HFRX Global Hedge Fund presented are net of underlying manager fees, but do not reflect the deduction of management fees, taxes and other expenses. Calculations for the BofA Merrill Lynch 3-Month Treasury Bill Index + 3% Wrap assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the inception date of the class. You cannot invest directly in an index. |

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 2.5% for Class A shares or the maximum applicable contingent deferred sales charge and 1% (during the first 12 months) for Class C shares. There are no sales charges on Class I shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Alternative strategies are not suitable for all investors. Many alternative strategies use sophisticated and aggressive investment techniques. Certain alternative strategies may be tied to hard assets such as commodities, currencies and real estate and may be subject to greater volatility as they may be affected by overall market movements, changes in interest rates or factors affecting a particular industry, commodity or currency, and international economic, political, and regulatory developments. This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this portfolio.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 14 | | |

Transamerica Multi-Manager International Portfolio

(unaudited)

MARKET ENVIRONMENT

The November 1, 2011 to October 31, 2012 reporting period encompassed an overall rising market for U.S. and international stocks, but with downdrafts in November 2011 and again in the spring of 2012. As the period began, the Standard & Poor’s 500® Index (“S&P 500®) posted a small loss in November 2011, but the Morgan Stanley Capital International World ex-U.S. Index (“MSCI World ex-U.S.”) of developed-market foreign stocks dropped 4.59% amid volatility surrounding the eurozone sovereign debt crisis. The Morgan Stanley Capital International Emerging Markets Index (“MSCI-EMI”) plummeted 6.66% in November. Although U.S. stocks recovered ground in December, the international indices fell further.

The mood brightened in 2012’s first quarter. The U.S. economy showed some vigor and the European Central Bank’s (“ECB”) Long Term Refinancing Operations flooded the eurozone with liquidity by lending nearly $1.3 trillion to European banks, a move that comforted international equity markets. Both U.S. and international stocks enjoyed double-digit gains in 2012’s first quarter. The MSCI World ex-U.S. rose 10.50% while the MSCI-EMI added 14.13%.

The eurozone crisis returned to haunt markets in the spring; however, as Spanish and Italian bond yields climbed and Spain’s government requested a large bailout for its banks from the European Union. Meanwhile, other data indicated deepening recessions in several European countries. Stocks sold off globally in April and May, with the S&P 500® losing 6.60% over those two months and the MSCI World ex-U.S. plunging 12.69%. The MSCI-EMI fell 12.20%.

Following the spring selloff, the markets began a sustained climb through the summer on the back of a number of moves and announcements by European and U.S. policymakers. A late-June Euro Area Summit ended with a positive statement from the participants supporting the future establishment of a eurozone banking supervisor and the recapitalization of Spanish banks. In a July speech from London, ECB president Mario Draghi said the ECB would do “whatever it takes to preserve the Euro. And believe me, it will be enough.” This statement helped assuage the nervous markets. In August and September global equity markets rose further, boosted by an expectation that the ECB would buy Spanish and Italian bonds in the open market to hold down the bonds’ yields, and thus hold down the countries’ borrowing costs. The equity markets were also bolstered by anticipation that the U.S. Federal Reserve Board (“Fed”) would launch a third round of quantitative easing dubbed “QE3”. When the ECB did indeed announce a bond-buying program in early September, and the Fed followed with formally launching QE3 a few days later, the markets rallied some more. Thanks to this string of policy developments, from June 1 to October 31, 2012 the S&P 500® rose 8.69% and the MSCI World ex-U.S. gained 15.27%. The MSCI-EMI was up a little less, at 11.43%.

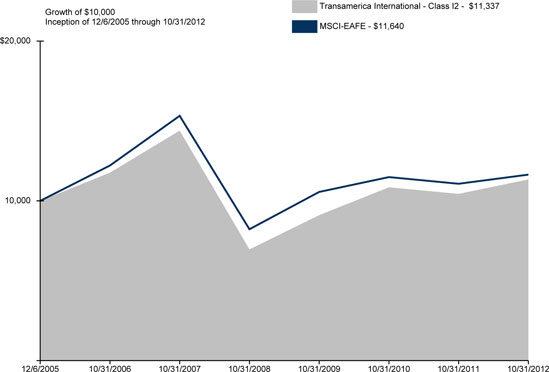

Overall, the S&P 500® returned 15.21% for the 12-month period as a whole. But Europe’s troubles took a toll; the MSCI World ex-U.S. Index rose only 4.96% for the one-year period. Emerging markets performed even worse, with a 2.98% return for the MSCI-EMI.

PERFORMANCE

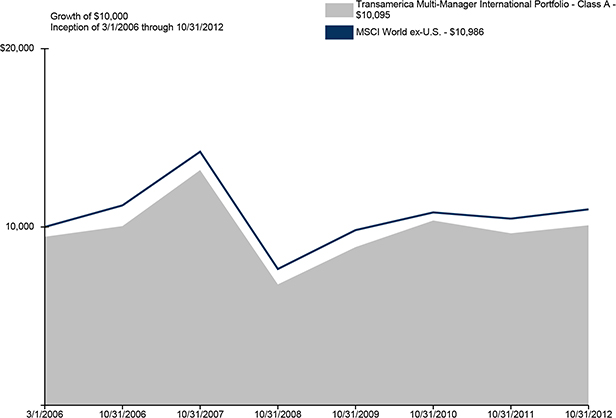

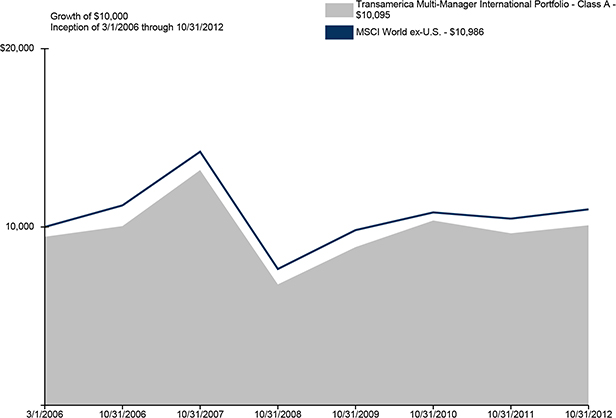

For the year ended October 31, 2012, Transamerica Multi-Manager International Portfolio, Class A returned 4.65% after all expenses. Its benchmark, the MSCI World ex-U.S., returned 4.96%.

STRATEGY REVIEW

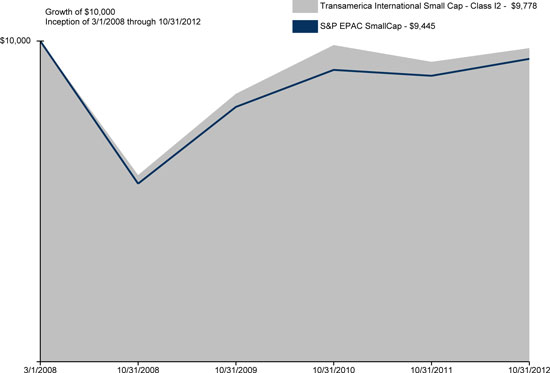

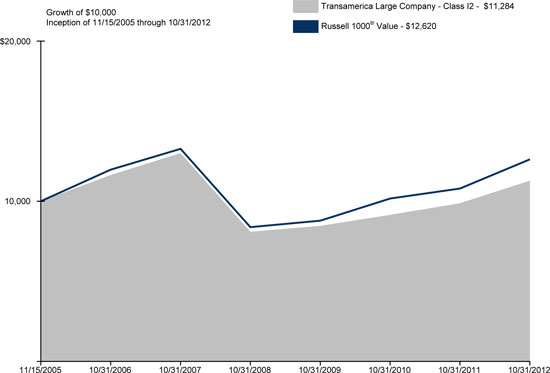

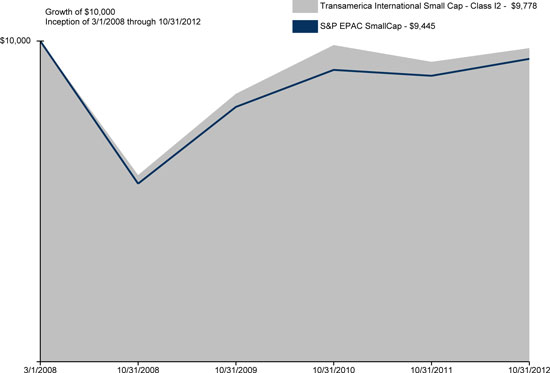

The goal of the Transamerica Multi-Manager International Portfolio is to provide broad coverage of international equity markets. The 10 underlying funds in the portfolio cover a range of international investing styles, including foreign large-cap value, blend, and growth stocks, as well as mid-cap and small-cap stocks; emerging-markets stocks; global real estate; and global tactical asset allocation. The portfolio normally targets approximately three fourths of assets in developed markets and a fourth in emerging markets. Large-cap stocks typically make up about two thirds of assets, with mid- and small-cap stocks comprising the other third. The portfolio also often contains smaller positions of 4% to 5% each in global real estate and global tactical asset-allocation funds. Its objective is to provide investors with comprehensive coverage of international markets in a single investment vehicle. As a result, the portfolio is more broadly diversified than most international funds or indexes. While we generally hew closely to our strategic targets, we will actively over- and underweight asset classes as we feel necessary in response to shorter-term market conditions. We endeavor to find and use quality money managers specializing in each asset class and style. We carefully monitor these underlying managers for performance and style issues, and adjust their weightings both to manage our style exposures and to reflect the managers’ relative merit.

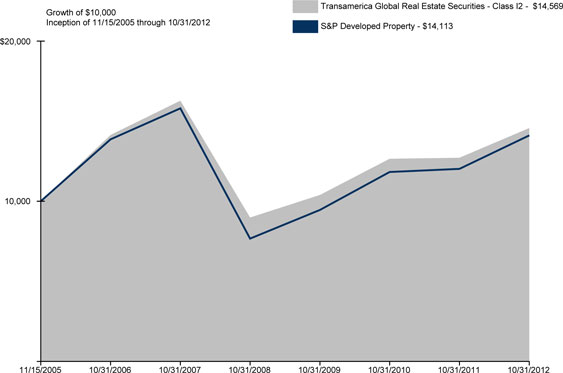

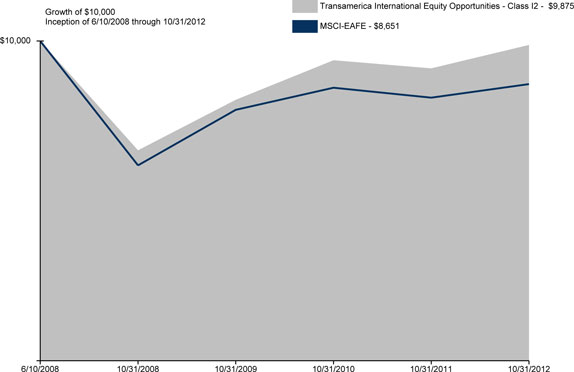

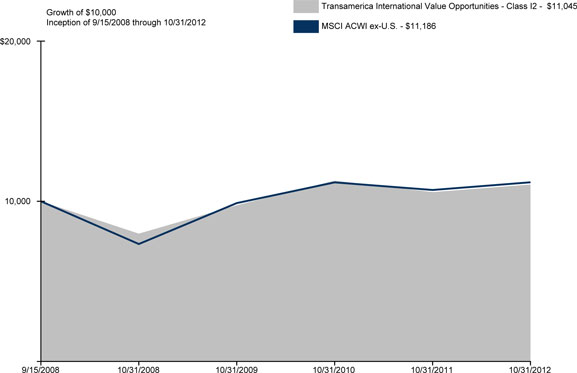

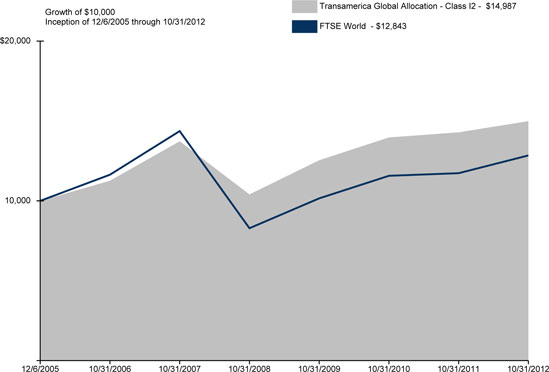

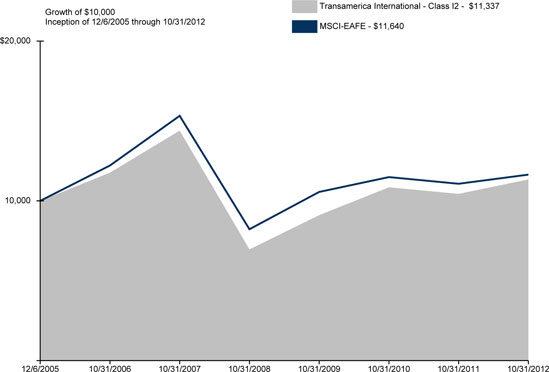

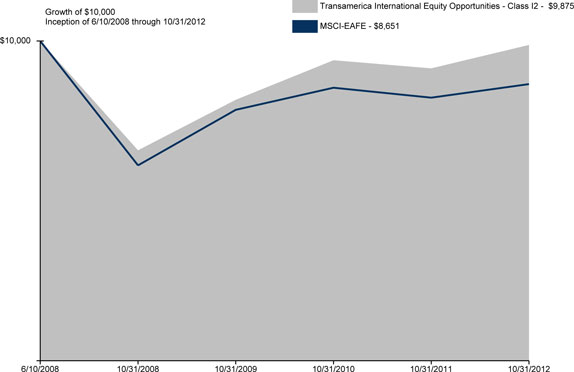

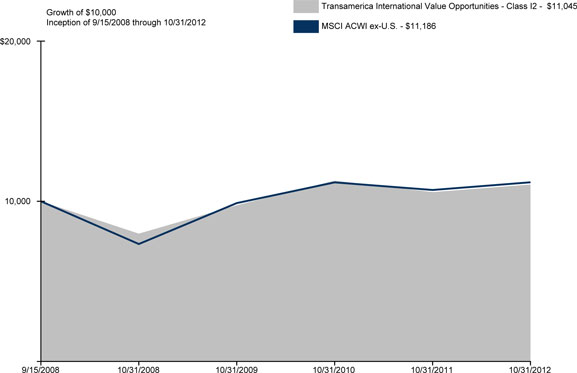

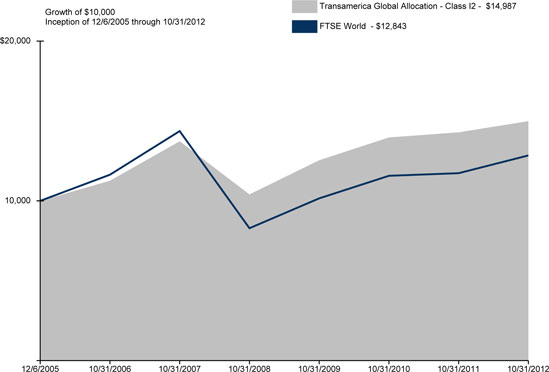

Given the economic challenges in Europe and slowing growth in emerging markets, the portfolio was positioned somewhat defensively for much of the year. Throughout the period, the portfolio’s positions in Transamerica Global Allocation (a hybrid stock/bond fund) and Transamerica Global Macro (a long/short absolute-return strategy) helped lessen the fund’s losses during the downturns and mute overall volatility, but they also diluted upside returns. As it happened, most of our underlying pure-equity funds were able to match or beat the MSCI World ex-U.S.’s (“the Index”) 4.96% return. All three of the main large-cap diversified funds that were owned for the full year surpassed the Index’s return, with Transamerica International (run by Neuberger Berman Management LLC) and Transamerica International Equity Opportunities (managed by MFS® Investment Management) both roughly doubling the Index’s gain. Transamerica International Value Opportunities (run by Thornburg Investment Management, Inc.) posted the smallest gain, but was still outpaced the Index by a few basis points. A fourth large-cap holding, Transamerica International Equity (managed by Thompson, Siegel & Walmsley LLC), boasts the best full-period return among the large-cap funds, but it was not owned in the fund the entire time.

Overall, the portfolio’s strongest performer was Transamerica Global Real Estate (managed by CBRE Clarion Securities LLC). Riding a global rally in real-estate investment trusts—spurred in part by investors’ search for yield in a low-rate environment.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 15 | | |

Transamerica Multi-Manager International Portfolio

(unaudited)

STRATEGY REVIEW (continued)

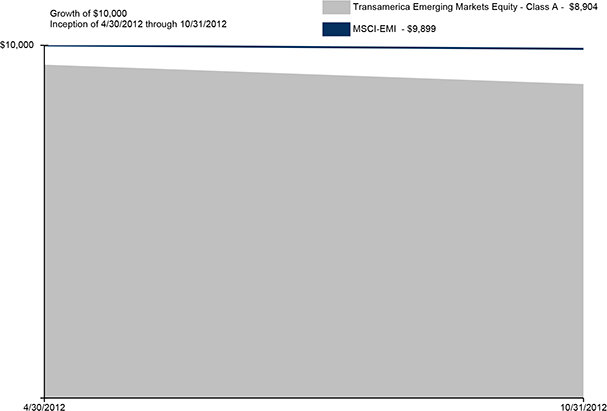

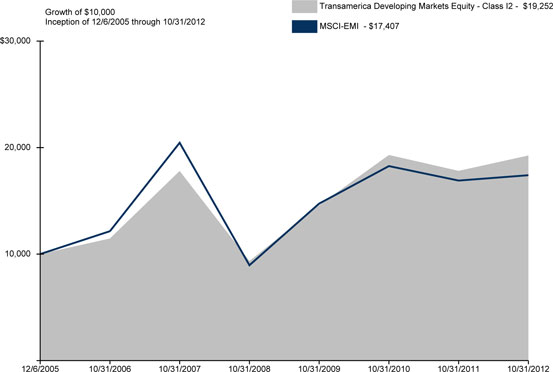

Over the course of the year we eliminated a couple of poor-performing funds. One was a foreign large-cap value fund called Transamerica International Value, run by Hansberger Global Investors, Inc. That fund was liquidated. The other liquidation was Transamerica Emerging Markets, run by Wellington Management Company, LLP. At the time there were three emerging-markets funds. One was this Wellington-run fund. Another was Transamerica Developing Markets Equity, managed by OppenhiemerFunds, Inc., which we view as a strong performer and which continues to merit the bulk of our emerging-markets assets. We had also added a third fund in May run by ClariVest Asset Management, LLC called Transamerica Emerging Markets Equity. We thus had a surplus of emerging-markets funds, and as the Wellington fund was the least impressive to us.

We still see macroeconomic events driving the markets more than the types of company fundamentals our underlying managers tend to emphasize in their security selection. Regarding the macroeconomic picture, we believe that while the U.S. economy is in a trend of gradual improvement, Europe is fighting to stave off a regional recession in 2013. Meanwhile, emerging markets have been hampered by slowing growth rates in heavyweights China, India, and Brazil. As of October 31, 2012; therefore, the fund remained somewhat defensively positioned. It was near its normal emerging-markets target because, while growth rates have slowed in emerging markets, they are still greater than those of most developed markets. However, the portfolio remains underweight foreign developed markets owing to our view of Europe’s present economy, with the offset taken up by modest positions in Transamerica Global Allocation, Transamerica Global Macro, and residual cash and domestic stocks within some of the underlying equity funds. In all, about 94% of assets were in equity at the period’s end (90% being foreign equity). We are also overweighting large-cap stocks in the fund and underweighting small caps. Given Europe’s difficult economic environment, we find larger companies with global revenue streams to be less vulnerable than smaller companies focused more on their local and regional markets.

While we are very much aware of the challenges facing the major European economies, valuations abroad have become more attractive in our estimation. We therefore continuously weigh the economic risks against the buying opportunity. In general, we have been and will remain flexible in this evolving environment.

Jon Hale, CFA

Dan McNeela, CFA

Michael Stout, CFA

Co-Portfolio Managers

Morningstar Associates, LLC

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 16 | | |

Transamerica Multi-Manager International Portfolio

(unaudited)

Average Annual Total Return for Periods Ended 10/31/2012

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception Date | |

Class A (NAV) | | | 4.65 | % | | | (5.21 | )% | | | 0.99 | % | | | 03/01/2006 | |

Class A (POP) | | | (1.12 | )% | | | (6.28 | )% | | | 0.14 | % | | | 03/01/2006 | |

MSCI World ex-U.S. * | | | 4.96 | % | | | (5.03 | )% | | | 1.42 | % | | | | |

| | | | | | | | | | | | | | | | |

Class B (NAV) | | | 3.92 | % | | | (5.90 | )% | | | 0.27 | % | | | 03/01/2006 | |

Class B (POP) | | | (1.08 | )% | | | (6.08 | )% | | | 0.27 | % | | | 03/01/2006 | |

| | | | | | | | | | | | | | | | |

Class C (NAV) | | | 3.87 | % | | | (5.83 | )% | | | 0.33 | % | | | 03/01/2006 | |

Class C (POP) | | | 2.87 | % | | | (5.83 | )% | | | 0.33 | % | | | 03/01/2006 | |

| | | | | | | | | | | | | | | | |

Class I (NAV) | | | 5.07 | % | | | N/A | | | | 3.70 | % | | | 11/30/2009 | |

| | | | | | | | | | | | | | | | |

NOTES

| * | The Morgan Stanley Capital International World ex-U.S. Index (“MSCI World ex-U.S.”) is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the inception date of the class. You cannot invest directly in an index. |

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on fund distributions or the redemption of portfolio shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamericafunds.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.5% for Class A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. There are no sales charges on Class I shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Asset allocation does not ensure a profit or protect against a loss. Investments in global/international markets involve risks not associated with U.S. markets, such as currency fluctuations, adverse social and political developments, and the relatively small size and lesser liquidity of the markets. This material must be preceded or accompanied by a current prospectus, which includes specific contents regarding the investment objectives and policies of this portfolio.

| | | | |

| Transamerica Funds | | | | Annual Report 2012 |

| | Page 17 | | |

Understanding Your Funds’ Expenses

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees, and other fund expenses.

The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the funds and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at May 1, 2012 and held for the entire period until October 31, 2012.

ACTUAL EXPENSES