As filed with the Securities and Exchange Commission on January 9, 2015

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04556

TRANSAMERICA FUNDS

(Exact Name of Registrant as Specified in Charter)

570 Carillon Parkway, St. Petersburg, Florida 33716

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 299-1800

Tané T. Tyler, Esq., 4600 S. Syracuse St., Suite 1100, Denver, Colorado 80237

(Name and Address of Agent for Service)

Date of fiscal year end: October 31

Date of reporting period: October 31, 2014

Item 1: Report(s) to Shareholders. The Annual Report is attached.

Fund of Funds

Annual Report

October 31, 2014

www.transamerica.com

Customer Service 1-888-233-4339

P.O. Box 9012 • Clearwater, FL 33758-9012

Distributor: Transamerica Capital, Inc.

Dear Fellow Shareholder,

On behalf of Transamerica Funds, I would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your Funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all shareholders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a discussion of accounting policies as well as matters presented to shareholders that may have required their vote.

We believe it is important to understand market conditions over the last year in order to provide a context for reading this report. At the beginning of this year, markets were focused on the possibility that 2014 would be the year that quantitative easing—the extraordinary monetary accommodation enacted by the U.S. Federal Reserve (“Fed”)—would finally be coming to an end. Fed officials had widely publicized their intentions to end the quantitative easing program as long as they saw continued improvement in the economy. In a welcomed development, the economy and the all-important labor market continued to make gains throughout 2014, with the Bureau of Labor Statistics reporting that the unemployment rate falling below six percent in September, the first time this has occurred since July 2008.

For all of the economic improvements witnessed in the U.S., much of the rest of the world seems to have been on a different path. Europe produced anemic economic growth, as it continued to grapple with weak internal demand and structural imbalances. Japan, a very indebted country, has been attempting to boost its economy through aggressive Central Bank stimulus. Finally, China has been working to slowly let the air out of speculative areas of its economy while trying to avoid damaging its broader economy.

Given the notable differences in Central Bank policy and the different degrees of economic health in which major economies find themselves, it is little surprise that the returns from major asset classes have varied. For the year ended October 31, 2014, the S&P 500® returned 17.27% while the Morgan Stanley Capital International Europe, Australasia, Far East Index, representing international developed market equities, lost 0.17%. During the same period, the Barclays U.S. Aggregate Bond Index returned 4.14%. Please keep in mind that it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a complete picture of your current and future financial needs. Financial advisers are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial adviser, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

Marijn Smit

President & Chief Executive Officer

Transamerica Funds

Tom Wald, CFA

Chief Investment Officer

Transamerica Funds

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of Transamerica Funds. These views are subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of Transamerica Funds.

Transamerica Asset Allocation – Conservative Portfolio

(unaudited)

MARKET ENVIRONMENT

With a few minor setbacks in January, July, and late September/early October, the U.S. stock market advanced during the year ended October 31, 2014. The underlying impetus for the gains was mainly steady improvement in the U.S. economy, which by the end of the period appeared finally to be on steady footing. Employment continually improved throughout the period, with private payrolls adding an average of more than 200,000 jobs per month, and the official unemployment rate falling to 5.80% by October 2014 from 7.20% a year earlier. The Institute of Supply Management surveys for both manufacturing and services painted an increasingly positive picture of the economy’s strength, and corporate earnings continued to grow. Thus, despite the psychological overhang of the U.S. Federal Reserve’s (“Fed”) stimulative bond-buying program coming to an end and the threat of interest-rate hikes around the bend in 2015, the U.S. large-cap focused S&P 500® recorded a robust 17.27% gain for the year. Smaller-cap stocks didn’t fare as well as the small-cap Russell 2000® Index only gained 8.06% for the year.

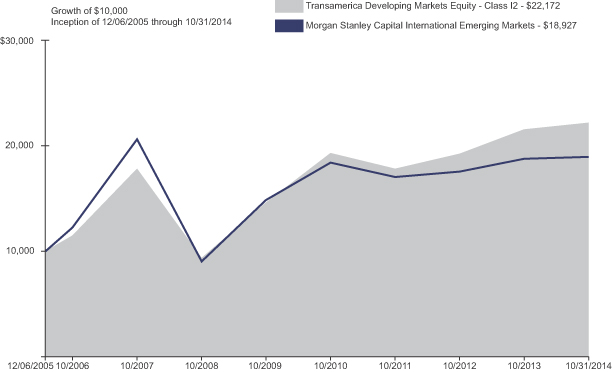

While the U.S. economy improved, conditions remained much worse abroad. The Eurozone economies continued to struggle with slow or negative real Gross Domestic Product (“GDP”) growth and high unemployment. Even stalwart Germany, which had been carrying the region to some degree, ultimately felt the Eurozone’s malaise, posting slightly negative real GDP growth in 2014’s second quarter. Meanwhile Eurozone unemployment still hovered at 11.50% as of October 2014. In Japan, the government’s stimulus efforts were significantly hampered by an April sales-tax increase that put a dent in consumer spending and caused GDP growth there to turn sharply negative. Amid this weak environment, the Morgan Stanley Capital International Europe, Australasia, Far East Index of foreign developed markets declined 0.60% for the year, underperforming the S&P 500® by nearly 18 percentage points. Appreciation in the U.S. dollar against the euro and yen—as investors anticipated higher U.S. interest rates while the European Central Bank and Bank of Japan pursued currency-weakening monetary policies to spur growth—was also a major driver of the negative returns when translated into dollars. The rise in the dollar also depressed the Morgan Stanley Capital International Emerging Markets Index. Emerging markets had been lagging developed markets early in the year; while they made an upward dash over the summer, the Morgan Stanley Capital International Emerging Markets Index significantly underperformed U.S. stocks for the year, eking out only a 0.64% gain.

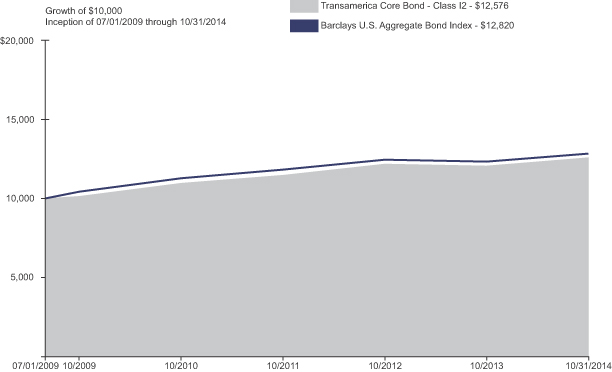

Bonds, on the other hand, were reasonably strong, with the Barclays U.S. Aggregate Bond Index returning 4.14%. The gain was largely a rebound from a 2013 bond sell-off sparked by the Fed’s announcement that it would scale down and then end a bond-buying program that had encouraged low market yields. Investors’ concern seemed to ease after the turn of the year, allowing bond prices to recover. Meanwhile the drumbeat of mostly positive U.S. economic news and healthy corporate earnings allowed credit-sensitive bonds to rise alongside the equity markets; the Barclays U.S. Corporate High Yield Index was up 5.82% and the Barclays U.S. Corporate Investment Grade Index returned 6.29%. Foreign bonds were generally weak, however, owing largely to currency movements, and Treasury Inflation-Protected Securities (“TIPS”) did not keep up with other domestic bonds given subdued U.S. inflation and fear of deflation in Europe.

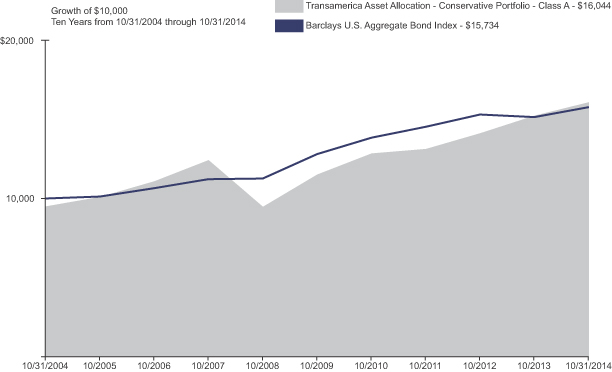

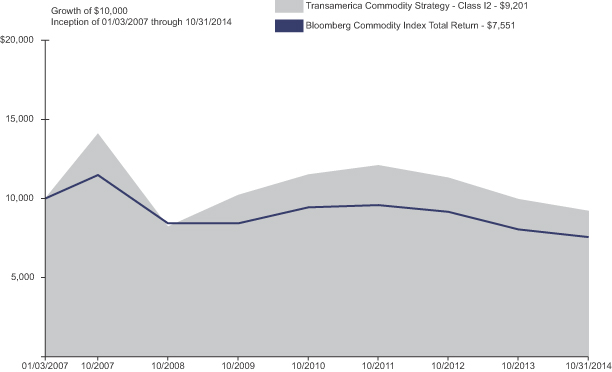

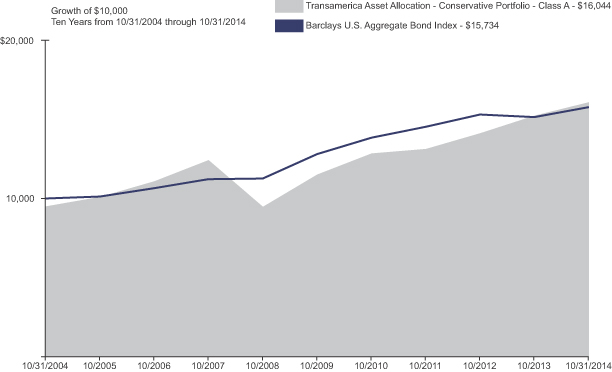

PERFORMANCE

For the year ended October 31, 2014, Transamerica Asset Allocation—Conservative Portfolio Class A returned 5.65%. By comparison, its primary and secondary benchmarks, the Barclays U.S. Aggregate Bond Index and the Wilshire 5000® Total Market Index, returned 4.14% and 15.78%, respectively.

STRATEGY REVIEW

The goal of the Transamerica Asset Allocation Portfolios is to provide investors one-stop participation in the broad financial markets. Transamerica Asset Allocation—Conservative Portfolio is designed to provide a mix of approximately 35% equity and 65% fixed-income securities over time. The equity side covers both domestic and international markets across the entire range of investment styles, including both value and growth stocks and large and small companies. The fixed-income portion includes investment-grade and credit-sensitive holdings, as well as international bonds. The Fund also diversifies into emerging markets, global real estate, commodities, and alternative strategies. Our specific asset-class targets are derived from asset-allocation modeling designed to optimize expected long-term returns for a given level of risk. While this strategic blueprint forms the backbone of our asset allocation, we may actively over- and underweight asset classes relative to their long-term targets in response to market and economic conditions. Meanwhile we endeavor to find and use strong investment managers in each asset class and investment style. We carefully monitor these underlying managers for performance and style issues, and adjust their weightings both to manage our asset-class exposures and to reflect the managers’ relative merit.

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 1

Transamerica Asset Allocation – Conservative Portfolio

(unaudited)

STRATEGY REVIEW (continued)

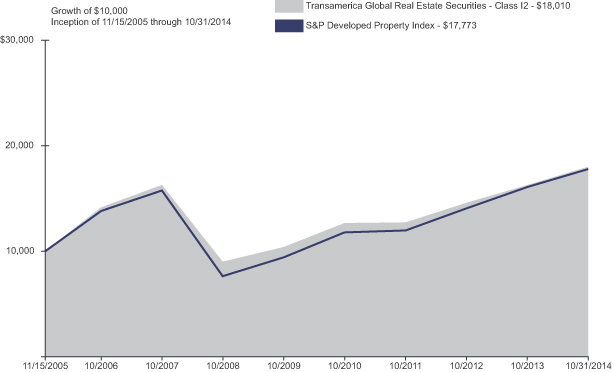

The Fund’s diversification blueprint is optimized for long-term risk-adjusted performance. Broad diversification was something of a headwind for this particular reporting period, in which the largest gains came in narrow slices of the stock and bond markets. Diversification into equity asset classes beyond U.S. large-cap stocks, and into bond asset classes other than plain-vanilla investment-grade bonds, in some instances diluted returns. Most notably, stocks in foreign developed markets and emerging markets both dramatically lagged the U.S. market. And both U.S. small caps and global real estate underperformed U.S. large caps. Commodities declined as well. On the fixed income side, the Fund was penalized by its diversification into TIPS and developed-market foreign bonds, but it was aided by its exposures to high-yield and emerging-markets bonds.

Our active over- and underweights relative to the long-term targets were mostly helpful. Within bonds, tactical overweights to the lower end of the credit spectrum and emerging-markets bonds were helpful, as both high-yield and emerging-markets bonds outperformed. Meanwhile the Fund was underweight struggling foreign developed-market equities and overweight strong-performing U.S. large-cap stocks. And it was underweight commodities due to soft global demand and certain structural issues facing commodity strategies, and thus sidestepped some of that asset class’ losses. We also maintained an underweight to global real estate given the historically low yields for real estate investment trusts (“REITs”), a position that aided performance.

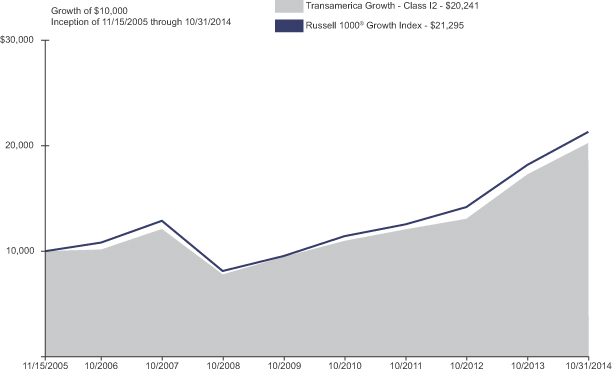

The underlying funds performed decently on the whole. Although none of the six U.S. large-cap funds could quite match the S&P 500®’s gain, most were competitive within their styles, and on balance the international funds delivered respectable relative returns within their disciplines. Meanwhile the absolute-return funds pulled their weight in terms of the role we expected them to play. On the bond side, the only notable disappointment was Transamerica Total Return, managed by Pacific Investment Management Company LLC; this core bond holding, which has an admirable longer-term record, experienced a lagging year. But Transamerica Core Bond—another large fixed-income holding—turned in a strong performance.

As of this writing we’re holding the bond Fund’s duration below that of the Barclays U.S. Aggregate Bond Index as a cautionary measure against a potential rising-rate environment. We’re also substituting absolute-return strategies for part of the bond Fund; we believe absolute-return strategies could produce bond-like returns without the same vulnerability as bonds to rising interest rates. We remain underweight in foreign developed-market equities, global real estate, commodities, and longer-duration bonds (including TIPS). We’re more sanguine about U.S. large caps given the strength of the U.S. economy, although we’re also cognizant of the run these stocks have had. We’re optimistic toward emerging markets; they still exhibit robust growth rates and, having lagged the broader market over the past three years, sport attractive valuations. We will continue to follow the overall diversification blueprint, while using our flexibility in making make prudent adjustments in response to market conditions.

Dario Castagna, CFA

Dan McNeela, CFA

Michael Stout, CFA

Co-Portfolio Managers

Morningstar Associates, LLC

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 2

Transamerica Asset Allocation – Conservative Portfolio

(unaudited)

| | | | | | | | | | | | | | | | |

| Average Annual Total Return for Periods Ended 10/31/2014 | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception Date | |

Class A (NAV) | | | 5.65 | % | | | 6.94 | % | | | 5.43 | % | | | 03/01/2002 | |

Class A (POP) | | | (0.17 | )% | | | 5.73 | % | | | 4.84 | % | | | 03/01/2002 | |

Barclays U.S. Aggregate Bond Index (A) | | | 4.14 | % | | | 4.22 | % | | | 4.64 | % | | | | |

Wilshire 5000® Total Market Index (A) | | | 15.78 | % | | | 17.06 | % | | | 8.76 | % | | | | |

Class B (NAV) | | | 4.96 | % | | | 6.20 | % | | | 4.88 | % | | | 03/01/2002 | |

Class B (POP) | | | (0.04 | )% | | | 6.04 | % | | | 4.88 | % | | | 03/01/2002 | |

Class C (NAV) | | | 4.97 | % | | | 6.26 | % | | | 4.78 | % | | | 11/11/2002 | |

Class C (POP) | | | 3.97 | % | | | 6.26 | % | | | 4.78 | % | | | 11/11/2002 | |

Class I (NAV) | | | 5.94 | % | | | N/A | | | | 6.88 | % | | | 11/30/2009 | |

Class R (NAV) | | | 5.40 | % | | | 6.65 | % | | | 4.98 | % | | | 06/15/2006 | |

(A) The Barclays U.S. Aggregate Bond Index and the Wilshire 5000® Total Market Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the previous 10 years or since the inception date of the class, whichever is more recent. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamerica.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.50% for Class A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. There are no sales charges on Class I and R shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

Asset allocation does not ensure a profit or protect against a loss. An investment in the Fund is subject to all of the risks associated with the underlying funds.

Please refer to page 15 for index descriptions.

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 3

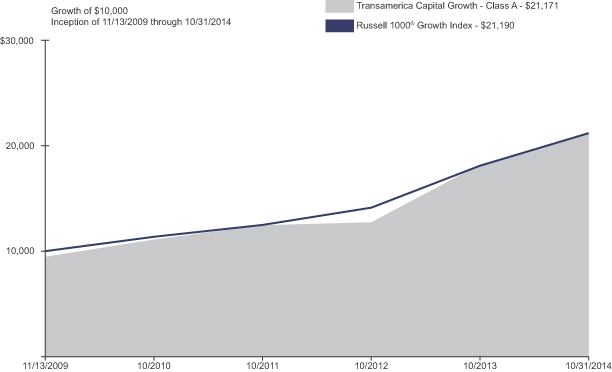

Transamerica Asset Allocation – Growth Portfolio

(unaudited)

MARKET ENVIRONMENT

With a few minor setbacks in January, July, and late September/early October, the U.S. stock market advanced during the year ended October 31, 2014. The underlying impetus for the gains was mainly steady improvement in the U.S. economy, which by the end of the period appeared finally to be on steady footing. Employment continually improved throughout the period, with private payrolls adding an average of more than 200,000 jobs per month, and the official unemployment rate falling to 5.80% by October 2014 from 7.20% a year earlier. The Institute of Supply Management surveys for both manufacturing and services painted an increasingly positive picture of the economy’s strength, and corporate earnings continued to grow. Thus, despite the psychological overhang of the U.S. Federal Reserve’s (“Fed”) stimulative bond-buying program coming to an end and the threat of interest-rate hikes around the bend in 2015, the U.S. large-cap focused S&P 500® recorded a robust 17.27% gain for the year. Smaller-cap stocks didn’t fare as well as the small-cap Russell 2000® Index only gained 8.06% for the year.

While the U.S. economy improved, conditions remained much worse abroad. The Eurozone economies continued to struggle with slow or negative real Gross Domestic Product (“GDP”) growth and high unemployment. Even stalwart Germany, which had been carrying the region to some degree, ultimately felt the Eurozone’s malaise, posting slightly negative real GDP growth in 2014’s second quarter. Meanwhile Eurozone unemployment still hovered at 11.50% as of October 2014. In Japan, the government’s stimulus efforts were significantly hampered by an April sales-tax increase that put a dent in consumer spending and caused GDP growth there to turn sharply negative. Amid this weak environment, the Morgan Stanley Capital International Europe, Australasia, Far East Index of foreign developed markets declined 0.60% for the year, underperforming the S&P 500® by nearly 18 percentage points. Appreciation in the U.S. dollar against the euro and yen—as investors anticipated higher U.S. interest rates while the European Central Bank and Bank of Japan pursued currency-weakening monetary policies to spur growth—was also a major driver of the negative returns when translated into dollars. The rise in the dollar also depressed the Morgan Stanley Capital International Emerging Markets Index. Emerging markets had been lagging developed markets early in the year; while they made an upward dash over the summer, the Morgan Stanley Capital International Emerging Markets Index significantly underperformed U.S. stocks for the year, eking out only a 0.64% gain.

Bonds, on the other hand, were reasonably strong, with the Barclays U.S. Aggregate Bond Index returning 4.14%. The gain was largely a rebound from a 2013 bond sell-off sparked by the Fed’s announcement that it would scale down and then end a bond-buying program that had encouraged low market yields. Investors’ concern seemed to ease after the turn of the year, allowing bond prices to recover. Meanwhile the drumbeat of mostly positive U.S. economic news and healthy corporate earnings allowed credit-sensitive bonds to rise alongside the equity markets; the Barclays U.S. Corporate High Yield Index was up 5.82% and the Barclays U.S. Corporate Investment Grade Index returned 6.29%. Foreign bonds were generally weak, however, owing largely to currency movements, and Treasury Inflation-Protected Securities (“TIPS”) did not keep up with other domestic bonds given subdued U.S. inflation and fear of deflation in Europe.

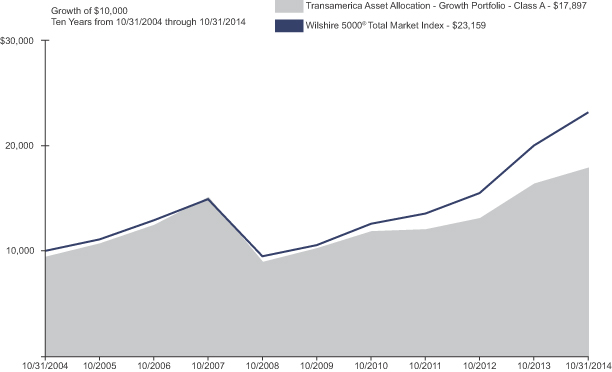

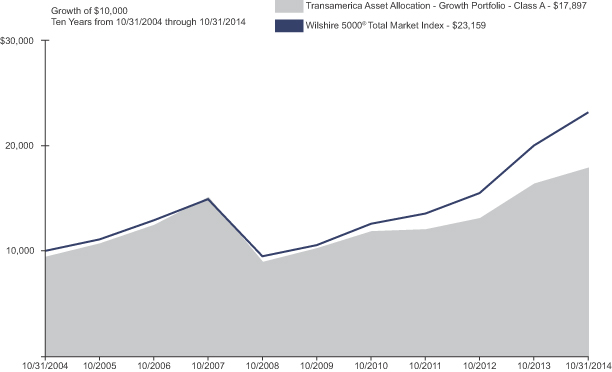

PERFORMANCE

For the year ended October 31, 2014, Transamerica Asset Allocation—Growth Portfolio Class A returned 9.30%. By comparison, its benchmark, the Wilshire 5000® Total Market Index, returned 15.78%.

STRATEGY REVIEW

The goal of the Transamerica Asset Allocation Portfolios is to provide investors one-stop participation in the broad financial markets. Transamerica Asset Allocation—Growth Portfolio targets mainly equities, but also alternative strategies. It is designed to provide diversified, global coverage of equities, while employing absolute-return funds to manage portfolio risk. By design, the Fund invests in both domestic and international stocks across the entire range of investment styles, including both value and growth stocks and large and small companies. The Fund also diversifies into emerging markets, global real estate, commodities, and as mentioned, alternative strategies. Our specific asset-class targets are derived from asset-allocation modeling designed to optimize expected long-term returns for a given level of risk. While this strategic blueprint forms the backbone of our asset allocation, we may actively over- and underweight asset classes relative to their long-term targets in response to market and economic conditions. Meanwhile we endeavor to find and use strong investment managers in each asset class and investment style. We carefully monitor these underlying managers for performance and style issues, and adjust their weightings both to manage our asset-class exposures and to reflect the managers’ relative merit.

The Fund’s diversification blueprint is optimized for long-term risk-adjusted performance. Broad diversification was something of a headwind for this particular reporting period, in which the largest gains came in narrow slices of the equity markets. Diversification into

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 4

Transamerica Asset Allocation – Growth Portfolio

(unaudited)

STRATEGY REVIEW (continued)

equity asset classes beyond U.S. large-cap stocks in some instances diluted returns. Stocks in foreign developed markets and emerging markets both dramatically lagged the U.S. market. And both U.S. small caps and global real estate underperformed U.S. large caps.

Our active over- and underweights relative to the long-term targets were mostly helpful. The Fund was underweight struggling foreign developed-market equities and overweight strong-performing U.S. large-cap stocks. We also maintained an underweight to global real estate given the historically low yields for real estate investment trusts (“REITs”), and we held U.S. small caps somewhat underweight in favor of U.S. large caps based on relative valuations. Both of those positions added to performance.

The underlying funds performed decently on the whole. Although none of the six U.S. large-cap funds could quite match the S&P 500®’s gain, most were competitive within their styles. On balance, the international funds delivered respectable relative returns within their disciplines; Transamerica Developing Markets Equity and Transamerica International Small Cap performed particularly well. Meanwhile the absolute-return funds pulled their weight in terms of the role we expected them to play.

As of this writing we remain underweight in foreign developed-market equities and global real estate. We’re more sanguine about U.S. large caps given the strength of the U.S. economy, although we’re also cognizant of the run these stocks have had. We’re optimistic toward emerging markets; they still exhibit robust growth rates and, having lagged the broader market over the past three years, sport attractive valuations. Alternative strategies—in the form of Transamerica Managed Futures Strategy, Transamerica Arbitrage Strategy, and Transamerica Long/Short Strategy—make up about 10% of the Fund. We will continue to follow the overall diversification blueprint, while using our flexibility in making make prudent adjustments in response to market conditions.

Dario Castagna, CFA

Dan McNeela, CFA

Michael Stout, CFA

Co-Portfolio Managers

Morningstar Associates, LLC

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 5

Transamerica Asset Allocation – Growth Portfolio

(unaudited)

| | | | | | | | | | | | | | | | |

| Average Annual Total Return for Periods Ended 10/31/2014 | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception Date | |

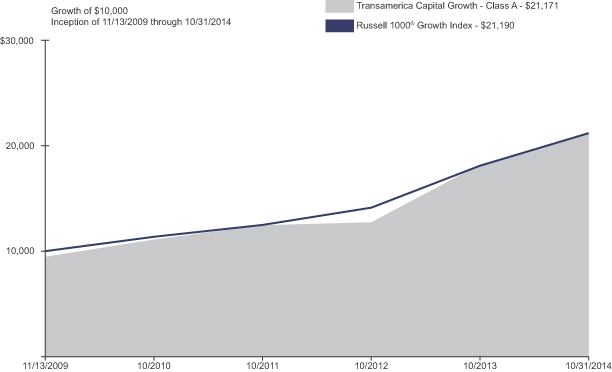

Class A (NAV) | | | 9.30 | % | | | 11.77 | % | | | 6.60 | % | | | 03/01/2002 | |

Class A (POP) | | | 3.27 | % | | | 10.50 | % | | | 5.99 | % | | | 03/01/2002 | |

Wilshire 5000® Total Market Index (A) | | | 15.78 | % | | | 17.06 | % | | | 8.76 | % | | | | |

Class B (NAV) | | | 8.49 | % | | | 10.95 | % | | | 6.01 | % | | | 03/01/2002 | |

Class B (POP) | | | 3.49 | % | | | 10.82 | % | | | 6.01 | % | | | 03/01/2002 | |

Class C (NAV) | | | 8.51 | % | | | 11.04 | % | | | 5.93 | % | | | 11/11/2002 | |

Class C (POP) | | | 7.51 | % | | | 11.04 | % | | | 5.93 | % | | | 11/11/2002 | |

Class I (NAV) | | | 9.64 | % | | | N/A | | | | 11.51 | % | | | 11/30/2009 | |

Class R (NAV) | | | 9.01 | % | | | 11.55 | % | | | 5.28 | % | | | 06/15/2006 | |

(A) The Wilshire 5000® Total Market Index is an unmanaged index used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the previous 10 years or since the inception date of the class, whichever is more recent. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamerica.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.50% for Class A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. There are no sales charges on Class I and R shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

Asset allocation does not ensure a profit or protect against a loss. An investment in the Fund is subject to all of the risks associated with the underlying funds.

Please refer to page 15 for index descriptions.

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 6

Transamerica Asset Allocation – Moderate Growth Portfolio

(unaudited)

MARKET ENVIRONMENT

With a few minor setbacks in January, July, and late September/early October, the U.S. stock market advanced during the year ended October 31, 2014. The underlying impetus for the gains was mainly steady improvement in the U.S. economy, which by the end of the period appeared finally to be on steady footing. Employment continually improved throughout the period, with private payrolls adding an average of more than 200,000 jobs per month, and the official unemployment rate falling to 5.80% by October 2014 from 7.20% a year earlier. The Institute of Supply Management surveys for both manufacturing and services painted an increasingly positive picture of the economy’s strength, and corporate earnings continued to grow. Thus, despite the psychological overhang of the U.S. Federal Reserve’s (“Fed”) stimulative bond-buying program coming to an end and the threat of interest-rate hikes around the bend in 2015, the U.S. large-cap focused S&P 500® recorded a robust 17.27% gain for the year. Smaller-cap stocks didn’t fare as well as the small-cap Russell 2000® Index only gained 8.06% for the year.

While the U.S. economy improved, conditions remained much worse abroad. The Eurozone economies continued to struggle with slow or negative real Gross Domestic Product (“GDP”) growth and high unemployment. Even stalwart Germany, which had been carrying the region to some degree, ultimately felt the Eurozone’s malaise, posting slightly negative real GDP growth in 2014’s second quarter. Meanwhile Eurozone unemployment still hovered at 11.50% as of October 2014. In Japan, the government’s stimulus efforts were significantly hampered by an April sales-tax increase that put a dent in consumer spending and caused GDP growth there to turn sharply negative. Amid this weak environment, the Morgan Stanley Capital International Europe, Australasia, Far East Index of foreign developed markets declined 0.60% for the year, underperforming the S&P 500® by nearly 18 percentage points. Appreciation in the U.S. dollar against the euro and yen—as investors anticipated higher U.S. interest rates while the European Central Bank and Bank of Japan pursued currency-weakening monetary policies to spur growth—was also a major driver of the negative returns when translated into dollars. The rise in the dollar also depressed the Morgan Stanley Capital International Emerging Markets Index. Emerging markets had been lagging developed markets early in the year; while they made an upward dash over the summer, the Morgan Stanley Capital International Emerging Markets Index significantly underperformed U.S. stocks for the year, eking out only a 0.64% gain.

Bonds, on the other hand, were reasonably strong, with the Barclays U.S. Aggregate Bond Index returning 4.14%. The gain was largely a rebound from a 2013 bond sell-off sparked by the Fed’s announcement that it would scale down and then end a bond-buying program that had encouraged low market yields. Investors’ concern seemed to ease after the turn of the year, allowing bond prices to recover. Meanwhile the drumbeat of mostly positive U.S. economic news and healthy corporate earnings allowed credit-sensitive bonds to rise alongside the equity markets; the Barclays U.S. Corporate High Yield Index was up 5.82% and the Barclays U.S. Corporate Investment Grade Index returned 6.29%. Foreign bonds were generally weak, however, owing largely to currency movements, and Treasury Inflation-Protected Securities (“TIPS”) did not keep up with other domestic bonds given subdued U.S. inflation and fear of deflation in Europe.

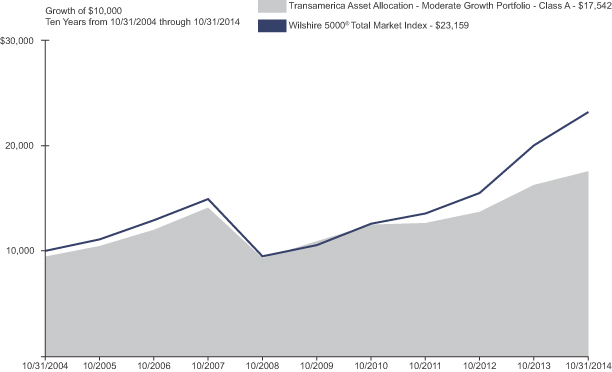

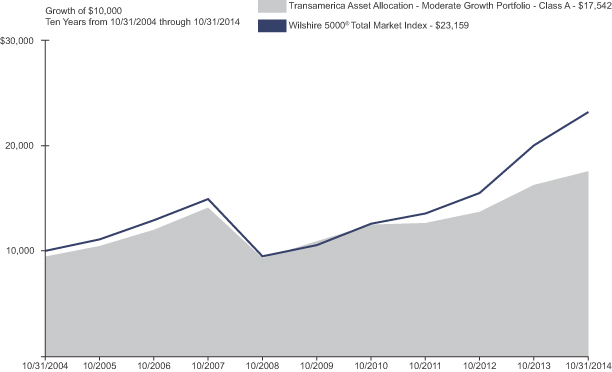

PERFORMANCE

For the year ended October 31, 2014, Transamerica Asset Allocation—Moderate Growth Portfolio Class A returned 8.01%. By comparison, its primary and secondary benchmarks the Wilshire 5000® Total Market Index and the Barclays U.S. Aggregate Bond Index, returned 15.78% and 4.14%, respectively.

STRATEGY REVIEW

The goal of the Transamerica Asset Allocation Portfolios is to provide investors one-stop participation in the broad financial markets. Transamerica Asset Allocation—Moderate Growth Portfolio is designed to provide a mix of approximately 70% equity and 30% fixed-income securities over time. The equity side covers both domestic and international markets across the entire range of investment styles, including both value and growth stocks and large and small companies. The fixed-income portion includes investment-grade and credit-sensitive holdings, as well as international bonds. The Fund also diversifies into emerging markets, global real estate, commodities, and alternative strategies. Our specific asset-class targets are derived from asset-allocation modeling designed to optimize expected long-term returns for a given level of risk. While this strategic blueprint forms the backbone of our asset allocation, we may actively over- and underweight asset classes relative to their long-term targets in response to market and economic conditions. Meanwhile we endeavor to find and use strong investment managers in each asset class and investment style. We carefully monitor these underlying managers for performance and style issues, and adjust their weightings both to manage our asset-class exposures and to reflect the managers’ relative merit.

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 7

Transamerica Asset Allocation – Moderate Growth Portfolio

(unaudited)

STRATEGY REVIEW (continued)

The Fund’s diversification blueprint is optimized for long-term risk-adjusted performance. Broad diversification was something of a headwind for this particular reporting period, in which the largest gains came in narrow slices of the stock and bond markets. Diversification into equity asset classes beyond U.S. large-cap stocks, and into bond asset classes other than plain-vanilla investment-grade bonds, in some instances diluted returns. Most notably, stocks in foreign developed markets and emerging markets both dramatically lagged the U.S. market. And both U.S. small caps and global real estate underperformed U.S. large caps. Commodities declined as well. On the fixed income side, the Fund was penalized by its diversification into TIPS and developed-market foreign bonds, but it was aided by its exposures to high-yield and emerging-markets bonds.

Our active over- and underweights relative to the long-term targets were mostly helpful. The Fund was underweight struggling foreign developed-market equities and overweight strong-performing U.S. large-cap stocks. And it was underweight commodities due to soft global demand and certain structural issues facing commodity strategies, and thus sidestepped some of that asset class’ losses. We also maintained an underweight to global real estate given the historically low yields for real estate investment trusts (“REITs”), and we held U.S. small caps somewhat underweight in favor of U.S. large caps based on relative valuations. Both positions added to performance. Within bonds, a tactical overweight to the lower end of the credit spectrum was helpful.

The underlying funds performed decently on the whole. Although none of the six U.S. large-cap funds could quite match the S&P 500®’s gain, most were competitive within their styles, and on balance the international funds delivered respectable relative returns within their disciplines. Meanwhile the absolute-return funds pulled their weight in terms of the role we expected them to play. On the bond side, the only notable disappointment was Transamerica Total Return, managed by Pacific Investment Management Company LLC; this core bond holding, which has an admirable longer-term record, experienced a lagging year. But Transamerica Core Bond—another large fixed-income holding—turned in a strong performance.

As of this writing we remain underweight in foreign developed-market equities, global real estate, commodities, and longer-duration bonds (including TIPS). We’re more sanguine about U.S. large caps given the strength of the U.S. economy, although we’re also cognizant of the run these stocks have had. We’re optimistic toward emerging markets; they still exhibit robust growth rates and, having lagged the broader market over the past three years, sport attractive valuations. Within the bond Fund we’re holding duration below that of the Barclays U.S. Aggregate Bond Index as a cautionary measure against a potential rising-rate environment. We’re also substituting absolute-return strategies for part of the bond Fund; we believe absolute-return strategies could produce bond-like returns without the same vulnerability as bonds to rising interest rates. We will continue to follow the overall diversification blueprint, while using our flexibility in making prudent adjustments in response to market conditions.

Dario Castagna, CFA

Dan McNeela, CFA

Michael Stout, CFA

Co-Portfolio Managers

Morningstar Associates, LLC

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 8

Transamerica Asset Allocation – Moderate Growth Portfolio

(unaudited)

| | | | | | | | | | | | | | | | |

| Average Annual Total Return for Periods Ended 10/31/2014 | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception Date | |

Class A (NAV) | | | 8.01 | % | | | 9.96 | % | | | 6.38 | % | | | 03/01/2002 | |

Class A (POP) | | | 2.05 | % | | | 8.73 | % | | | 5.78 | % | | | 03/01/2002 | |

Wilshire 5000® Total Market Index (A) | | | 15.78 | % | | | 17.06 | % | | | 8.76 | % | | | | |

Barclays U.S. Aggregate Bond Index (A) | | | 4.14 | % | | | 4.22 | % | | | 4.64 | % | | | | |

Class B (NAV) | | | 7.16 | % | | | 9.16 | % | | | 5.82 | % | | | 03/01/2002 | |

Class B (POP) | | | 2.16 | % | | | 9.02 | % | | | 5.82 | % | | | 03/01/2002 | |

Class C (NAV) | | | 7.23 | % | | | 9.24 | % | | | 5.70 | % | | | 11/11/2002 | |

Class C (POP) | | | 6.23 | % | | | 9.24 | % | | | 5.70 | % | | | 11/11/2002 | |

Class I (NAV) | | | 8.27 | % | | | N/A | | | | 9.76 | % | | | 11/30/2009 | |

Class R (NAV) | | | 7.77 | % | | | 9.76 | % | | | 5.40 | % | | | 06/15/2006 | |

(A) The Wilshire 5000® Total Market Index and the Barclays U.S. Aggregate Bond Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the previous 10 years or since the inception date of the class, whichever is more recent. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamerica.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.50% for Class A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. There are no sales charges on Class I and R shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

Asset allocation does not ensure a profit or protect against a loss. An investment in the Fund is subject to all of the risks associated with the underlying funds.

Please refer to page 15 for index descriptions.

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 9

Transamerica Asset Allocation – Moderate Portfolio

(unaudited)

MARKET ENVIRONMENT

With a few minor setbacks in January, July, and late September/early October, the U.S. stock market advanced during the year ended October 31, 2014. The underlying impetus for the gains was mainly steady improvement in the U.S. economy, which by the end of the period appeared finally to be on steady footing. Employment continually improved throughout the period, with private payrolls adding an average of more than 200,000 jobs per month, and the official unemployment rate falling to 5.80% by October 2014 from 7.20% a year earlier. The Institute of Supply Management surveys for both manufacturing and services painted an increasingly positive picture of the economy’s strength, and corporate earnings continued to grow. Thus, despite the psychological overhang of the U.S. Federal Reserve’s (“Fed”) stimulative bond-buying program coming to an end and the threat of interest-rate hikes around the bend in 2015, the U.S. large-cap focused S&P 500® Index recorded a robust 17.27% gain for the year. Smaller-cap stocks didn’t fare as well as the small-cap Russell 2000® Index only gained 8.06% for the year.

While the U.S. economy improved, conditions remained much worse abroad. The Eurozone economies continued to struggle with slow or negative real Gross Domestic Product (“GDP”) growth and high unemployment. Even stalwart Germany, which had been carrying the region to some degree, ultimately felt the Eurozone’s malaise, posting slightly negative real GDP growth in 2014’s second quarter. Meanwhile Eurozone unemployment still hovered at 11.50% as of October 2014. In Japan, the government’s stimulus efforts were significantly hampered by an April sales-tax increase that put a dent in consumer spending and caused GDP growth there to turn sharply negative. Amid this weak environment, the Morgan Stanley Capital International Europe, Australasia, Far East Index of foreign developed markets declined 0.60% for the year, underperforming the S&P 500® by nearly 18 percentage points. Appreciation in the U.S. dollar against the euro and yen—as investors anticipated higher U.S. interest rates while the European Central Bank and Bank of Japan pursued currency-weakening monetary policies to spur growth—was also a major driver of the negative returns when translated into dollars. The rise in the dollar also depressed the Morgan Stanley Capital International Emerging Markets Index. Emerging markets had been lagging developed markets early in the year; while they made an upward dash over the summer, the Morgan Stanley Capital International Emerging Markets Index significantly underperformed U.S. stocks for the year, eking out only a 0.64% gain.

Bonds, on the other hand, were reasonably strong, with the Barclays U.S. Aggregate Bond Index returning 4.14%. The gain was largely a rebound from a 2013 bond sell-off sparked by the Fed’s announcement that it would scale down and then end a bond-buying program that had encouraged low market yields. Investors’ concern seemed to ease after the turn of the year, allowing bond prices to recover. Meanwhile the drumbeat of mostly positive U.S. economic news and healthy corporate earnings allowed credit-sensitive bonds to rise alongside the equity markets; the Barclays U.S. Corporate High Yield Index was up 5.82% and the Barclays U.S. Corporate Investment Grade Index returned 6.29%. Foreign bonds were generally weak, however, owing largely to currency movements, and Treasury Inflation-Protected Securities (“TIPS”) did not keep up with other domestic bonds given subdued U.S. inflation and fear of deflation in Europe.

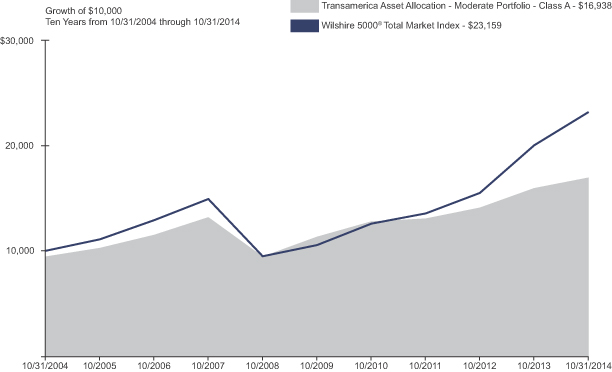

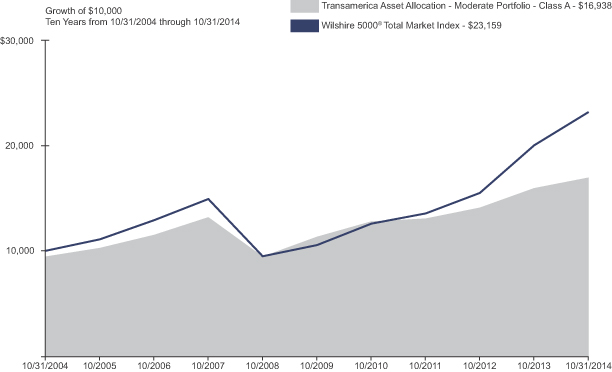

PERFORMANCE

For the year ended October 31, 2014, Transamerica Asset Allocation—Moderate Portfolio Class A returned 6.20%. By comparison, its primary and secondary benchmarks, the Wilshire 5000® Total Market Index and the Barclays U.S. Aggregate Bond Index, returned 15.78% and 4.14%, respectively.

STRATEGY REVIEW

The goal of the Transamerica Asset Allocation Portfolios is to provide investors one-stop participation in the broad financial markets. Transamerica Asset Allocation—Moderate Portfolio is designed to provide a mix of approximately 50% equity and 50% fixed-income securities over time. The equity side covers both domestic and international markets across the entire range of investment styles, including both value and growth stocks and large and small companies. The fixed-income portion includes investment-grade and credit-sensitive holdings, as well as international bonds. The Fund also diversifies into emerging markets, global real estate, commodities, and alternative strategies. Our specific asset-class targets are derived from asset-allocation modeling designed to optimize expected long-term returns for a given level of risk. While this strategic blueprint forms the backbone of our asset allocation, we may actively over- and underweight asset classes relative to their long-term targets in response to market and economic conditions. Meanwhile we endeavor to find and use strong investment managers in each asset class and investment style. We carefully monitor these underlying managers for performance and style issues, and adjust their weightings both to manage our asset-class exposures and to reflect the managers’ relative merit.

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 10

Transamerica Asset Allocation – Moderate Portfolio

(unaudited)

STRATEGY REVIEW (continued)

The Fund’s diversification blueprint is optimized for long-term risk-adjusted performance. Broad diversification was something of a headwind for this particular reporting period, in which the largest gains came in narrow slices of the stock and bond markets. Diversification into equity asset classes beyond U.S. large-cap stocks, and into bond asset classes other than plain-vanilla investment-grade bonds, in some instances diluted returns. Most notably, stocks in foreign developed markets and emerging markets both dramatically lagged the U.S. market. And both U.S. small caps and global real estate underperformed U.S. large caps. Commodities declined as well. On the fixed income side, the Fund was penalized by its diversification into TIPS and developed-market foreign bonds, but it was aided by its exposures to high-yield and emerging-markets bonds.

Our active over- and underweights relative to the long-term targets were mostly helpful. The Fund was underweight struggling foreign developed-market equities and overweight strong-performing U.S. large-cap stocks. And it was underweight commodities due to soft global demand and certain structural issues facing commodity strategies, and thus sidestepped some of that asset class’ losses. We also maintained an underweight to global real estate given the historically low yields for real estate investment trusts (“REITs”), and we held U.S. small caps somewhat underweight in favor of U.S. large caps based on relative valuations. Both positions aided performance. Within bonds, tactical overweights to the lower end of the credit spectrum and emerging-markets bonds were helpful.

The underlying funds performed decently on the whole. Although none of the six U.S. large-cap funds could quite match the S&P 500®’s gain, most were competitive within their styles, and on balance the international funds delivered respectable relative returns within their disciplines. Meanwhile the absolute-return funds pulled their weight in terms of the role we expected them to play. On the bond side, the only notable disappointment was Transamerica Total Return, managed by Pacific Investment Management Company LLC; this core bond holding, which has an admirable longer-term record, experienced a lagging year. But Transamerica Core Bond—another large fixed-income holding—turned in a strong performance.

As of this writing we remain underweight in foreign developed-market equities, global real estate, commodities, and longer-duration bonds (including TIPS). We’re more sanguine about U.S. large caps given the strength of the U.S. economy, although we’re also cognizant of the run these stocks have had. We’re optimistic toward emerging markets; they still exhibit robust growth rates and, having lagged the broader market over the past three years, sport attractive valuations. Within the bond Fund we’re holding duration below that of the Barclays U.S. Aggregate Bond Index as a cautionary measure against a potential rising-rate environment. We’re also substituting absolute-return strategies for part of the bond Fund; we believe absolute-return strategies could produce bond-like returns without the same vulnerability as bonds to rising interest rates. We will continue to follow the overall diversification blueprint, while using our flexibility in making make prudent adjustments in response to market conditions.

Dario Castagna, CFA

Dan McNeela, CFA

Michael Stout, CFA

Co-Portfolio Managers

Morningstar Associates, LLC

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 11

Transamerica Asset Allocation – Moderate Portfolio

(unaudited)

| | | | | | | | | | | | | | | | |

| Average Annual Total Return for Periods Ended 10/31/2014 | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception Date | |

Class A (NAV) | | | 6.20 | % | | | 8.38 | % | | | 6.01 | % | | | 03/01/2002 | |

Class A (POP) | | | 0.36 | % | | | 7.16 | % | | | 5.41 | % | | | 03/01/2002 | |

Wilshire 5000® Total Market Index (A) | | | 15.78 | % | | | 17.06 | % | | | 8.76 | % | | | | |

Barclays U.S. Aggregate Bond Index (A) | | | 4.14 | % | | | 4.22 | % | | | 4.64 | % | | | | |

Class B (NAV) | | | 5.32 | % | | | 7.59 | % | | | 5.43 | % | | | 03/01/2002 | |

Class B (POP) | | | 0.32 | % | | | 7.44 | % | | | 5.43 | % | | | 03/01/2002 | |

Class C (NAV) | | | 5.39 | % | | | 7.67 | % | | | 5.32 | % | | | 11/11/2002 | |

Class C (POP) | | | 4.39 | % | | | 7.67 | % | | | 5.32 | % | | | 11/11/2002 | |

Class I (NAV) | | | 6.45 | % | | | N/A | | | | 8.26 | % | | | 11/30/2009 | |

Class R (NAV) | | | 5.88 | % | | | 8.15 | % | | | 5.31 | % | | | 06/15/2006 | |

(A) The Wilshire 5000® Total Market Index and the Barclays U.S. Aggregate Bond Index are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the previous 10 years or since the inception date of the class, whichever is more recent. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamerica.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.50% for Class A shares or the maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 6 years) for Class B shares and 1% (during the first 12 months) for Class C shares. Shares purchased prior to March 1, 2004 are subject to a maximum applicable contingent deferred sales charge (5% in the 1st year, decreasing to 0% after 7 years) for Class B shares and (2% in the 1st year, decreasing to 0% after 2 years) for Class C shares. There are no sales charges on Class I and R shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

Asset allocation does not ensure a profit or protect against a loss. An investment in the Fund is subject to all of the risks associated with the underlying funds.

Please refer to page 15 for index descriptions.

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 12

Transamerica Multi-Manager Alternative Strategies Portfolio

(unaudited)

MARKET ENVIRONMENT

The year ended October 31, 2014 can be summarized as great expectations that were never met. This narrative applies most directly to the economic recovery and the expected sell-off in fixed income markets, especially long duration assets.

The expectations were building throughout 2013 as the 10-year Treasury rate almost doubled, briefly piercing the three percent threshold. This move was intertwined with the consensus thinking that the annual growth rate of the U.S. economy was finally going to hit terminal velocity close to three percent. All was perceived to be going as planned until Mother Nature chimed in. The cold weather and snow sent inventory accumulation into hibernation. What magnified the weather event was that in the second half of 2013, factories were participating in the consensus view that the economy was accelerating by rapidly ramping up their inventories in anticipation of higher demand in 2014. The literal freeze in economic activity in 1st quarter of 2014 created such a drag that it was quickly made apparent that the full-year growth numbers were not going to be attainable.

The underwhelming economic performance was not just a U.S. event. The consensus in the eurozone had also been calling for a healthy acceleration. However, the necessary balance sheet moves in order for banks to pass the asset quality review test meant that lending to the region would be very limited. Such restriction of private credit, especially to the small and medium sized enterprises, was completely contrary to what was required for an economic expansion. The ensuing slowdown was not limited to the periphery, even the German growth engine lost steam.

The most recent policy answer to the European growth problem created a new global narrative—divergent monetary policy in the developed world. At a time when U.S. and U.K. are winding down quantitative easing (“QE”) and talking about raising interest rates, Japan and Europe are going the other way—either increasing the QE pace or seeking alternative ways to implement QE policy. Even the largest emerging market country (China) is adding stimulus through numerous channels. This divergence of policy has resulted in a huge rate differential in sovereign bonds and has incentivized, in part, investors domiciled in low yielding countries to buy debt instruments in (relatively) higher interest bearing countries.

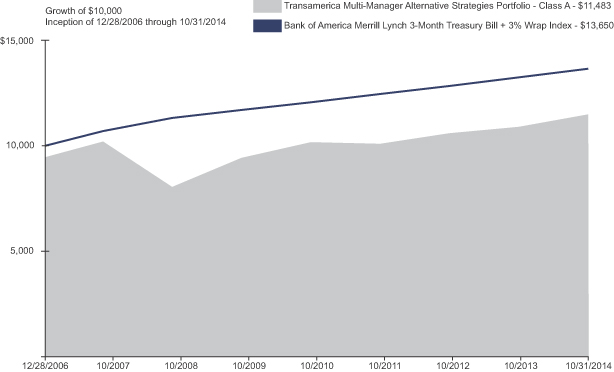

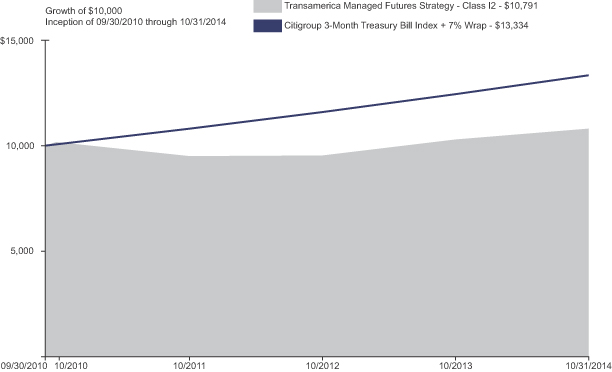

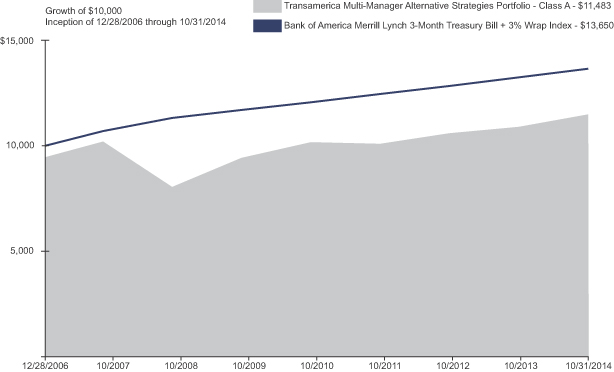

PERFORMANCE

For the year ended October 31, 2014, Transamerica Multi-Manager Alternative Strategies Portfolio Class A, returned 5.46%. By comparison, its primary and secondary benchmarks, the Bank of America Merrill Lynch 3-Month Treasury Bill + 3% Wrap Index and the HFRX Global Hedge Fund Index, returned 3.10% and 0.96%, respectively.

STRATEGY REVIEW

The Fund outperformed its benchmark for the period, largely due to our equity hedge allocation. Our allocation to the category focused primarily on long/short equities, master limited partnerships (“MLPs”) and energy companies. Macro strategies generally positioned for declines in commodity prices, U.S. dollar strength, and tighter European sovereign spreads, also contributed to performance. The relative value and event -driven strategies were reduced in size throughout the year in the face of limited opportunity.

Aside from trading and re-positioning the Fund in response to market conditions, there were three significant changes during the year. One, Transamerica Asset Management terminated the global macro strategy at the end of the year ended on October 31, 2014. Secondly, as a result the Fund’s cash allocation ended the period significantly higher than it entered the fiscal year and current market conditions and opportunities will dictate the pace at which that cash balance finds compelling opportunities. Thirdly, the Fund’s allocation to arbitrage strategies was lowered as the abundance of liquidity and low interest rates continued to weigh on merger arbitrage deal spreads, creating a negative skew to the strategy’s risk/return profile.

Timothy S. Galbraith

Prat Patel, CFA

Co-Portfolio Managers

Aegon USA Investment Management, LLC

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 13

Transamerica Multi-Manager Alternative Strategies Portfolio

(unaudited)

| | | | | | | | | | | | | | | | |

| Average Annual Total Return for Periods Ended 10/31/2014 | |

| | | 1 Year | | | 5 Years | | | 10 Years or

Life of Class | | | Inception Date | |

Class A (NAV) | | | 5.46 | % | | | 4.03 | % | | | 2.51 | % | | | 12/28/2006 | |

Class A (POP) | | | (0.32 | )% | | | 2.87 | % | | | 1.78 | % | | | 12/28/2006 | |

Bank of America Merrill Lynch 3-Month Treasury Bill + 3% Wrap Index (A) | | | 3.10 | % | | | 3.14 | % | | | 4.05 | % | | | | |

HFRX Global Hedge Fund Index (A) | | | 0.96 | % | | | 1.57 | % | | | (0.50 | )% | | | | |

Class C (NAV) | | | 4.64 | % | | | 3.32 | % | | | 1.83 | % | | | 12/28/2006 | |

Class C (POP) | | | 3.64 | % | | | 3.32 | % | | | 1.83 | % | | | 12/28/2006 | |

Class I (NAV) | | | 5.81 | % | | | N/A | | | | 4.22 | % | | | 11/30/2009 | |

(A) The Bank of America Merrill Lynch 3-Month Treasury Bill + 3% Wrap Index is an unmanaged index used as a general measure of market performance. The HFRX Global Hedge Fund Index is a passively-managed index that is compiled by Hedge Fund Research, Inc. It is designed to measure the daily performance of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. Returns of funds within the composition of the HFRX Global Hedge Fund Index presented are net of underlying manager fees, but do not reflect the deduction of management fees, taxes and other expenses. Calculations for the Bank of America Merrill Lynch 3-Month Treasury Bill + 3% Wrap Index assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or Life of Class calculation is based on the inception date of the class. You cannot invest directly in an index.

The performance data presented represents past performance; future results may vary. Performance data does not reflect the deduction of taxes that would be paid on Fund distributions or the redemption of Fund shares. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.transamerica.com for performance data current to the most recent month-end. Net Asset Value (“NAV”) returns include the reinvestment of dividends and capital gains but do not reflect any sales charges. Public Offering Price (“POP”) returns include the reinvestment of dividends and capital gains and reflect the maximum sales charge of 5.50% for Class A shares or the maximum applicable contingent deferred sales charge of 1% (during the first 12 months) for Class C shares. There are no sales charges on Class I shares.

Performance figures reflect any fee waivers and/or expense reimbursements by the Investment Adviser. Without such waivers and/or reimbursements, the performance would be lower. Future waivers and/or reimbursements are at the discretion of the Investment Adviser.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

Alternative strategies are not suitable for all investors. Many alternative strategies use sophisticated and aggressive investment techniques. Certain alternative strategies may be tied to hard assets such as commodities, currencies and real estate and may be subject to greater volatility as they may be affected by overall market movements, changes in interest rates or factors affecting a particular industry, commodity or currency, and international economic, political, and regulatory developments.

Please refer to page 15 for index descriptions.

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 14

Index Descriptions

(unaudited)

| | |

| Index | | Description |

| |

| Bank of America Merrill Lynch 3-Month Treasury Bill + 3% Wrap Index | | The Bank of America Merrill Lynch 3-Month Treasury Bill + 3% Wrap Index assumes a 3% wrap fee and is comprised of a single issue purchased at the beginning of the month, which is subsequently sold at the end of the month and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date. |

| |

| Barclays U.S. Aggregate Bond Index | | The Barclays U.S. Aggregate Bond Index measures investment grade, U.S. dollar-denominated, fixed-rate taxable bonds, including Treasuries, government-related and corporate securities, as well as both mortgage- and asset-backed securities. |

| |

| HFRX Global Hedge Fund Index | | The HFRX Global Hedge Fund Index is a passively-managed index that is compiled by Hedge Fund Research, Inc. It is designed to measure the daily performance of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. |

| |

| Wilshire 5000® Total Market Index | | The Wilshire 5000® Total Market Index measures the performance of most U.S. domiciled public securities with readily available price data. Companies in the index are weighted by available float and market-capitalization. |

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 15

Understanding Your Funds’ Expenses

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases, contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees, and other fund expenses.

The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at May 1, 2014, and held for the entire period until October 31, 2014.

ACTUAL EXPENSES

The information in the table under the heading “Actual Expenses” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA, your expenses could have included a $15 annual fee. The amount of any fee paid during the period can decrease your ending account value.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The information in the table under the heading “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund versus other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges and brokerage commissions paid on purchases and sales of Fund shares. Therefore, the information under the heading “Hypothetical Expenses” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries, or other financial institutions.

Expense ratios may vary period to period because of various factors, such as an increase in expenses that are not covered by the advisory and administrative fees, expenses and fees of the trustees and their counsel, extraordinary expenses and interest expense.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Actual Expenses | | | Hypothetical Expenses (A) | | | | |

| Fund Name | | Beginning

Account Value | | | Ending Account

Value | | | Expenses Paid

During Period (B) | | | Ending Account

Value | | | Expenses Paid

During Period (B) | | | Annualized

Expense Ratio (C) | |

| | | | | |

Transamerica Asset Allocation - Conservative Portfolio | | | | | | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,027.30 | | | $ | 2.55 | | | $ | 1,022.70 | | | $ | 2.55 | | | | 0.50 | % |

Class B | | | 1,000.00 | | | | 1,024.10 | | | | 6.48 | | | | 1,018.80 | | | | 6.46 | | | | 1.27 | |

Class C | | | 1,000.00 | | | | 1,023.90 | | | | 6.17 | | | | 1,019.10 | | | | 6.16 | | | | 1.21 | |

Class I | | | 1,000.00 | | | | 1,028.60 | | | | 1.28 | | | | 1,023.90 | | | | 1.28 | | | | 0.25 | |

Class R | | | 1,000.00 | | | | 1,026.20 | | | | 4.24 | | | | 1,021.00 | | | | 4.23 | | | | 0.83 | |

| | | | | |

Transamerica Asset Allocation - Growth Portfolio | | | | | | | | | | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | 1,046.70 | | | | 2.79 | | | | 1,022.50 | | | | 2.75 | | | | 0.54 | |

Class B | | | 1,000.00 | | | | 1,043.10 | | | | 6.80 | | | | 1,018.60 | | | | 6.72 | | | | 1.32 | |

Class C | | | 1,000.00 | | | | 1,043.30 | | | | 6.44 | | | | 1,018.90 | | | | 6.36 | | | | 1.25 | |

Class I | | | 1,000.00 | | | | 1,048.00 | | | | 1.34 | | | | 1,023.90 | | | | 1.33 | | | | 0.26 | |

Class R | | | 1,000.00 | | | | 1,045.70 | | | | 4.43 | | | | 1,020.90 | | | | 4.38 | | | | 0.86 | |

| | | | |

Transamerica Asset Allocation - Moderate Growth Portfolio | | | | | | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | 1,038.20 | | | | 2.57 | | | | 1,022.70 | | | | 2.55 | | | | 0.50 | |

Class B | | | 1,000.00 | | | | 1,033.90 | | | | 6.61 | | | | 1,018.70 | | | | 6.56 | | | | 1.29 | |

Class C | | | 1,000.00 | | | | 1,034.20 | | | | 6.31 | | | | 1,019.00 | | | | 6.26 | | | | 1.23 | |

Class I | | | 1,000.00 | | | | 1,038.90 | | | | 1.28 | | | | 1,023.90 | | | | 1.28 | | | | 0.25 | |

Class R | | | 1,000.00 | | | | 1,037.00 | | | | 3.80 | | | | 1,021.50 | | | | 3.77 | | | | 0.74 | |

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 16

Understanding Your Funds’ Expenses (continued)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Actual Expenses | | | Hypothetical Expenses (A) | | | | |

| Fund Name | | Beginning

Account Value | | | Ending Account

Value | | | Expenses Paid

During Period (B) | | | Ending Account

Value | | | Expenses Paid

During Period (B) | | | Annualized

Expense Ratio (C) | |

| | | | | |

Transamerica Asset Allocation - Moderate Portfolio | | | | | | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,029.60 | | | $ | 2.56 | | | $ | 1,022.70 | | | $ | 2.55 | | | | 0.50 | % |

Class B | | | 1,000.00 | | | | 1,025.60 | | | | 6.59 | | | | 1,018.70 | | | | 6.56 | | | | 1.29 | |

Class C | | | 1,000.00 | | | | 1,026.00 | | | | 6.23 | | | | 1,019.10 | | | | 6.21 | | | | 1.22 | |

Class I | | | 1,000.00 | | | | 1,030.40 | | | | 1.28 | | | | 1,023.90 | | | | 1.28 | | | | 0.25 | |

Class R | | | 1,000.00 | | | | 1,028.20 | | | | 3.73 | | | | 1,021.50 | | | | 3.72 | | | | 0.73 | |

| | | | |

Transamerica Multi-Manager Alternative Strategies Portfolio | | | | | | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | 1,026.40 | | | | 3.63 | | | | 1,021.60 | | | | 3.62 | | | | 0.71 | |

Class C | | | 1,000.00 | | | | 1,021.70 | | | | 7.49 | | | | 1,017.80 | | | | 7.48 | | | | 1.47 | |

Class I | | | 1,000.00 | | | | 1,028.30 | | | | 2.20 | | | | 1,023.00 | | | | 2.19 | | | | 0.43 | |

| (A) | 5% return per year before expenses. |

| (B) | Expenses are calculated using the Funds’ annualized expense ratios (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (365 days). |

| (C) | During the period ended October 31, 2014, expense ratios do not include expenses of the investment companies in which the Funds invest. |

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 17

Schedules of Investments Composition

At October 31, 2014

(unaudited)

| | | | |

| Transamerica Asset Allocation - Conservative Portfolio | |

| |

| Asset Allocation | | % of Net

Assets | |

Fixed Income | | | 55.1 | % |

U.S. Equity | | | 26.6 | |

Global/International Equity | | | 7.8 | |

Tactical and Specialty | | | 5.8 | |

Inflation-Protected Securities | | | 4.9 | |

Net Other Assets (Liabilities) | | | (0.2 | ) |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Asset Allocation - Growth Portfolio | |

| |

| Asset Allocation | | % of Net

Assets | |

U.S. Equity | | | 68.8 | % |

Global/International Equity | | | 21.2 | |

Tactical and Specialty | | | 10.1 | |

Fixed Income | | | 0.0 | * |

Net Other Assets (Liabilities) | | | (0.1 | ) |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Asset Allocation - Moderate Growth Portfolio | |

| |

| Asset Allocation | | % of Net

Assets | |

U.S. Equity | | | 53.0 | % |

Fixed Income | | | 23.2 | |

Global/International Equity | | | 15.1 | |

Tactical and Specialty | | | 6.9 | |

Inflation-Protected Securities | | | 1.9 | |

Net Other Assets (Liabilities) | | | (0.1 | ) |

Total | | | 100.0 | % |

| | | | |

| | | | |

| Transamerica Asset Allocation - Moderate Portfolio | |

| |

| Asset Allocation | | % of Net

Assets | |

Fixed Income | | | 43.2 | % |

U.S. Equity | | | 35.9 | |

Global/International Equity | | | 10.3 | |

Tactical and Specialty | | | 7.7 | |

Inflation-Protected Securities | | | 3.0 | |

Net Other Assets (Liabilities) | | | (0.1 | ) |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Multi-Manager Alternative Strategies Portfolio | |

| |

| Asset Allocation | | % of Net

Assets | |

Tactical and Specialty | | | 47.9 | % |

Repurchase Agreement | | | 22.0 | |

Fixed Income | | | 17.6 | |

Alternative Investments | | | 9.8 | |

Global/International Equity | | | 2.8 | |

Net Other Assets (Liabilities) | | | (0.1 | ) |

Total | | | 100.0 | % |

| | | | |

| * | Percentage rounds to less than 0.1% or (0.1)%. |

| | |

| Transamerica Funds | | Annual Report 2014 |

Page 18

Transamerica Asset Allocation – Conservative Portfolio

SCHEDULE OF INVESTMENTS

At October 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES - 100.2% | | | | | |

Fixed Income - 55.1% | | | | | | | | |

Transamerica Bond (A) | | | 5,366,259 | | | | $ 58,009,260 | |

Transamerica Core Bond (A) | | | 17,034,409 | | | | 173,069,596 | |

Transamerica Emerging Markets Debt (A) | | | 1,387,062 | | | | 14,966,400 | |

Transamerica Flexible Income (A) | | | 2,279,307 | | | | 21,607,831 | |

Transamerica High Yield Bond (A) | | | 2,519,452 | | | | 24,615,051 | |

Transamerica Short-Term Bond (A) | | | 7,882,411 | | | | 80,242,941 | |

Transamerica Total Return (A) | | | 16,571,780 | | | | 176,323,736 | |

| | | | | | | | |

| | | | | | | 548,834,815 | |

| | | | | | | | |

Global/International Equity - 7.8% | | | | | | | | |

Transamerica Developing Markets Equity (A) | | | 1,802,703 | | | | 22,083,110 | |

Transamerica Emerging Markets Equity (A) | | | 650,210 | | | | 6,697,165 | |

Transamerica International Equity (A) | | | 697,731 | | | | 12,426,584 | |

Transamerica International Equity Opportunities (A) | | | 2,173,576 | | | | 18,497,135 | |

Transamerica International Small Cap (A) | | | 1,368,162 | | | | 13,626,890 | |

Transamerica International Small Cap Value (A) | | | 361,618 | | | | 4,274,328 | |

| | | | | | | | |

| | | | | | | 77,605,212 | |

| | | | | | | | |

Inflation-Protected Securities - 4.9% | | | | | |

Transamerica Inflation Opportunities (A) | | | 4,913,336 | | | | 48,936,825 | |

| | | | | | | | |

Tactical and Specialty - 5.8% | | | | | | | | |

Transamerica Arbitrage Strategy (A) | | | 1,548,302 | | | | 15,498,502 | |

Transamerica Commodity

Strategy (A) (B) | | | 906,286 | | | | 7,132,473 | |

Transamerica Global Allocation Liquidating Trust (B) (C) (D) (E) (F) | | | 7,891 | | | | 72,178 | |

Transamerica Global Real Estate Securities (A) | | | 1,553 | | | | 22,392 | |

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES (continued) | | | | | |

Tactical and Specialty (continued) | | | | | |

Transamerica Long/Short Strategy (A) (B) | | | 933,502 | | | | $ 8,924,278 | |

Transamerica Managed Futures Strategy (A) | | | 2,525,356 | | | | 25,960,658 | |

| | | | | | | | |

| | | | | | | 57,610,481 | |

| | | | | | | | |

U.S. Equity - 26.6% | | | | | | | | |

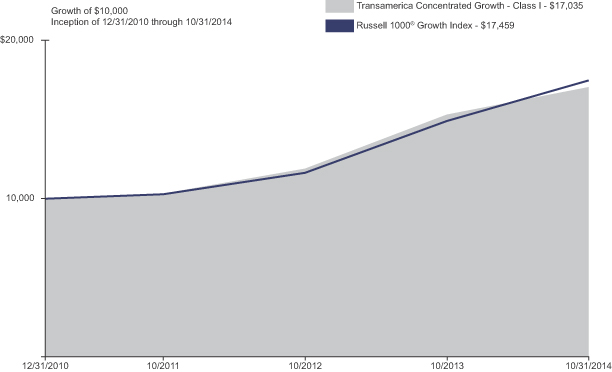

Transamerica Capital Growth (A) | | | 1,456,515 | | | | 24,585,975 | |

Transamerica Concentrated Growth (A) | | | 1,091,877 | | | | 17,753,918 | |

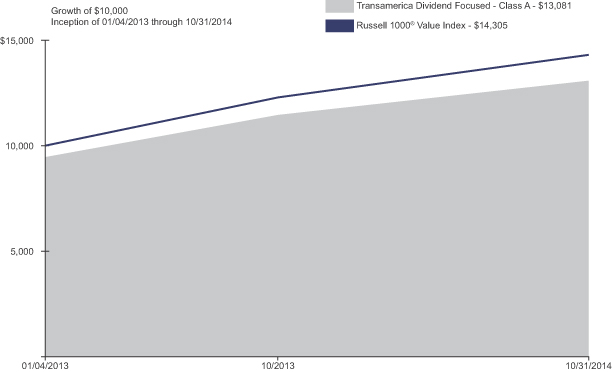

Transamerica Dividend Focused (A) | | | 4,227,037 | | | | 56,473,208 | |

Transamerica Growth (A) | | | 2,334,007 | | | | 37,764,237 | |

Transamerica Growth Opportunities (A) | | | 1,482,026 | | | | 17,932,515 | |

Transamerica Large Cap Value (A) | | | 4,168,046 | | | | 55,601,729 | |

Transamerica Mid Cap Value (A) | | | 583,102 | | | | 10,361,716 | |

Transamerica Mid Cap Value Opportunities (A) | | | 435,311 | | | | 4,653,475 | |

Transamerica Small Cap Core (A) | | | 545,105 | | | | 5,903,484 | |

Transamerica Small Cap Growth (A) | | | 536,459 | | | | 6,957,874 | |

Transamerica Small Cap Value (A) | | | 69,559 | | | | 907,043 | |

Transamerica Small Company Growth Liquidating

Trust (B) (C) (D) (E) (F) | | | 1,529 | | | | 6,378 | |

Transamerica US Growth (A) | | | 1,338,755 | | | | 26,078,954 | |

| | | | | | | | |

| | | | | | | 264,980,506 | |

| | | | | | | | |

Total Investment Companies

(Cost $895,527,867) | | | | 997,967,839 | |

| | | | | | | | |

Total Investments

(Cost $895,527,867) (G) | | | | 997,967,839 | |