SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 | |

TRANSAMERICA FUNDS

TRANSAMERICA SERIES TRUST

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

TRANSAMERICA FUNDS

Transamerica Dividend Focused

TRANSAMERICA SERIES TRUST

Transamerica Barrow Hanley Dividend Focused VP

1801 California Street, Suite 5200

Denver, Colorado 80202

October 21, 2020

Dear Shareholder or Policyowner:

A special meeting of shareholders of, or, as applicable, policyowners investing in (together, the “Shareholders”) Transamerica Dividend Focused, a series of Transamerica Funds, and Transamerica Barrow Hanley Dividend Focused VP, a series of Transamerica Series Trust (each series, a “Fund” and collectively, the “Funds”), is scheduled to be held as a virtual meeting on November 25, 2020, at 10:00 a.m. (Mountain Time) for Transamerica Dividend Focused, and on November 25, 2020, at 11:00 a.m. (Mountain Time) for Transamerica Barrow Hanley Dividend Focused VP (for each Fund a “Special Meeting” and collectively, the “Special Meetings”). In light of public health concerns regarding the ongoing coronavirus (COVID-19) pandemic, and taking into account related orders and guidance issued by federal, state and local governmental bodies, the Board of Trustees of each Fund has determined that the Fund’s Special Meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. The details on how to participate in the virtual Special Meetings are included in the following joint proxy statement.

At the respective Special Meeting:

Shareholders of Transamerica Dividend Focused are being asked to approve a new sub-advisory agreement with Aegon Asset Management UK plc (“AAM”), an affiliate of Transamerica Asset Management, Inc. (“TAM”), the Fund’s investment manager.

Shareholders of Transamerica Barrow Hanley Dividend Focused VP are being asked to approve a new sub-advisory agreement with AAM.

TAM acts as a manager of managers for the Funds pursuant to an exemptive order from the Securities and Exchange Commission. Under the terms of the exemptive order, TAM may not enter into a sub-advisory agreement with any affiliated sub-adviser without such agreement being approved by the shareholders of the fund.

We are seeking your approval of these proposals through the enclosed joint proxy statement, which we invite you to review closely.

AAM would replace Barrow, Hanley, Mewhinney & Strauss, LLC as the sub-adviser to each Fund. In connection with the proposed change in sub-adviser, there would be related changes to each Fund’s name, principal investment strategies, principal risks and management and sub-advisory fee schedules.

Importantly, after careful consideration, the Board of Trustees of Transamerica Funds and Transamerica Series Trust has considered the proposal for the respective Fund to be voted on at the Special Meeting and has determined it is in the best interest of the Fund, and unanimously recommends that you vote “FOR” the proposal with respect to your Fund. However, before you vote, please read the full text of the joint proxy statement for an explanation of the proposal with respect to your Fund.

Shareholders of record of each Fund as of the close of business on October 8, 2020 are entitled to vote at the relevant Special Meeting and any adjournments or postponements thereof. Whether or not you plan to virtually attend the meeting and regardless of how many shares you own or the size of the interest you hold, your vote is very important to us. By responding promptly, you will save the expense of additional follow-up mailings and solicitations. Please vote today.

Voting is quick and easy. You may vote by telephone, via the internet or by simply completing and signing the enclosed proxy card (your ballot) and mailing it in the accompanying postage-paid return envelope.

If you have any questions, please call 1-888-233-4339 for Transamerica Funds, or 1-800-851-9777 for Transamerica Series Trust.

| Sincerely, |

| /s/ Marijn P. Smit |

| Chairman of the Boards of Trustees, President and Chief Executive Officer |

| i | ||||

| I | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 4 | ||||

TRANSAMERICA FUNDS PROPOSAL I — APPROVAL OF A NEW SUB-ADVISORY AGREEMENT | 5 | |||

TRANSAMERICA SERIES TRUST PROPOSAL I — APPROVAL OF A NEW SUB-ADVISORY AGREEMENT | 13 | |||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| A-1 | ||||

| B-1 | ||||

IMPORTANT INFORMATION FOR SHAREHOLDERS

Please read the full text of the enclosed joint proxy statement.

Below is a brief overview of the proposals to be voted on. Your vote is important.

| Q. | Why am I receiving the joint proxy statement? |

| A. | As a shareholder of Transamerica Dividend Focused, a series of Transamerica Funds, or as a shareholder of or policyowner who invests in Transamerica Barrow Hanley Dividend Focused VP, a series of Transamerica Series Trust (each series, a “Fund” and collectively, the “Funds”), through a variable annuity contract or variable life insurance policy (each shareholder and policyowner referred to herein as a “Shareholder”), you are being asked to vote “FOR” the following proposal(s) as applicable to your Fund(s.) Each proposal has been approved by the applicable Fund’s Board of Trustees. |

Transamerica Funds Proposal I: Approve a New Sub-Advisory Agreement for Transamerica Dividend Focused (“TF Dividend Focused”): Shareholders are being asked to vote on a new sub-advisory agreement with a new sub-adviser, Aegon Asset Management UK plc (“AAM”). Transamerica Asset Management, Inc. (“TAM”) serves as investment manager to TF Dividend Focused, and AAM is affiliated with TAM. In connection with the proposed change in sub-adviser, there would also be changes to the name, principal investment strategies, management fee schedule and sub-advisory fee schedule for TF Dividend Focused as described in this joint proxy statement. If approved by Shareholders, it is anticipated that the change in sub-adviser and related changes would occur on or about December 1, 2020. At that time, among other things, TF Dividend Focused is expected to be renamed Transamerica Sustainable Equity Income.

Transamerica Series Trust Proposal I: Approve a New Sub-Advisory Agreement for Transamerica Barrow Hanley Dividend Focused VP (“TST Dividend Focused VP”): Shareholders are being asked to vote on a new sub-advisory agreement with a new sub-adviser, AAM. As noted above, AAM is affiliated with TAM, who serves as investment manager to TST Dividend Focused VP. In connection with the proposed change in sub-adviser, there would also be changes to the name, principal investment strategies, management fee schedules and sub-advisory fee schedules for TST Dividend Focused VP as described in this joint proxy statement. If approved by Shareholders, it is anticipated that the change in sub-adviser and related changes would occur on or about December 1, 2020. At that time, among other things, TST Dividend Focused VP is expected to be renamed Transamerica Aegon Sustainable Equity Income VP.

Under the terms of the TAM’s manager of managers exemptive order, TAM may not enter into a sub-advisory agreement with any affiliated sub-adviser without such agreement being approved by the shareholders of the fund.

The implementation of a proposal is not contingent upon the approval of the other proposal.

| Q. | Who is Aegon Asset Management UK plc? |

| A. | Aegon Asset Management UK plc (formerly, Kames Capital plc), located at 3 Lochside Crescent, Edinburgh EH12 9SA, has been a registered investment adviser since 2017. AAM, an affiliate of TAM, is a wholly owned subsidiary of Aegon N.V., a Netherlands corporation and publicly traded international insurance group. As of June 30, 2020, AAM had approximately $44.7 billion in assets under management. |

| Q. | If shareholders approve a new sub-advisory agreement with AAM, what changes are anticipated in connection with the change in sub-adviser for each Fund? |

In connection with the proposed appointment of AAM as sub-adviser to each of TF Dividend Focused and TST Dividend Focused VP, it is anticipated that TF Dividend Focused would be renamed “Transamerica Sustainable Equity Income” and TST Dividend Focused VP would be renamed “Transamerica Aegon Sustainable Equity Income VP.” There would also be changes to each Fund’s principal investment strategies and principal risks, as noted below and further described in each proposal. These changes do not require approval by the Fund shareholders.

i

If the new-sub-advisory agreement is approved, AAM would implement an active strategy that generally invests in large and middle U.S. capitalization companies, focusing on those that pay dividends and that the sub-adviser views as having a favorable sustainability profile. In pursuing each Fund’s investment objective, AAM would look to buy stocks and hold them over multi-year periods in an effort to benefit from the compounding effects of increasing dividends. In addition, the sub-adviser would seek to invest in stocks it views as having positive sustainability credentials. AAM considers stocks with positive sustainability credentials to be stocks that have been determined by AAM as likely to perform well based on environmental, social and/or governance (ESG) factors. Each Fund’s principal investment strategies would no longer include the current limitation to invest only in stocks that have a consecutive 25-year history of paying cash dividends. It is also expected that each Fund’s portfolio would include a significant technology weighting whereas the Funds currently have none. If the change in sub-adviser is approved, each Fund would be subject to the following additional principal risks: Sustainability Investing risk, Derivatives risk, Leveraging risk and Investments by Affiliated Funds and Unaffiliated Funds risk.

| Q. | Why am I being asked to vote on these proposals? |

| A. | You are being asked to vote as a Shareholder of one or both of the Funds. The enclosed joint proxy statement and proxy card identify the proposal(s) you are being asked to approve. Your Fund’s Board has approved the proposal, believes it is in Shareholders’ best interests and recommends you vote “FOR” the proposal with respect to your Fund. |

| Q. | Will my vote make a difference? |

| A. | Your vote is very important and can make a difference in the governance of your Fund, no matter how many shares you own or the interests you hold. Your vote can help ensure that the proposal recommended by your Fund’s Board can be implemented. We encourage all Shareholders to participate in the governance of their Funds. |

| Q. | Who is paying for the preparation, printing and mailing of the joint proxy statement and solicitation of proxies? |

| A. | It is anticipated that the total cost of preparing, printing and mailing the joint proxy statement and soliciting proxies will range from approximately $80,000 to $100,000, which cost will be borne by TAM and AAM and not the Funds. |

| Q. | Who do I call if I have questions? |

| A. | If you need more information, or have any questions about the proposals, please call 1-888-233-4339 for TF Dividend Focused or 1-800-851-9777 for TST Dividend Focused VP. If you have any questions about voting, please call AST Fund Solutions, LLC, the Funds’ proxy solicitor, at 1-888-605-1956. |

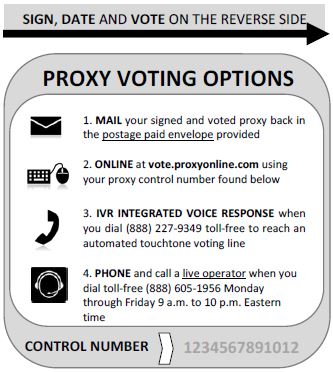

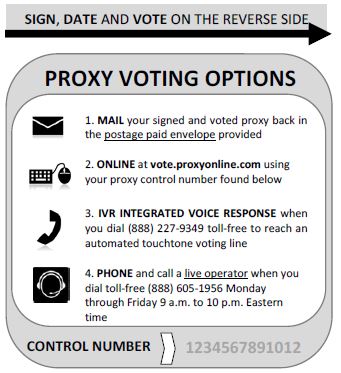

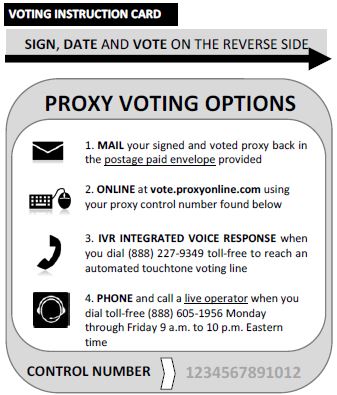

| Q. | How do I vote my interests? |

| A. | You can provide voting instructions by telephone by calling the toll-free number on the enclosed proxy card, or by computer by going to the internet address provided on the proxy card and following the instructions, using your proxy card as a guide. Alternatively, you can vote your shares or interests by signing and dating the enclosed proxy card and mailing it in the enclosed postage-paid envelope. |

You may also virtually attend the Special Meeting and vote your interests. However, even if you intend to do so, we encourage you to provide voting instructions by one of the methods described above.

| Q: | When and where will the Special Meetings be held? |

| A. | We intend to hold each Fund’s Special Meeting as a virtual meeting on November 25, 2020, at 10:00 a.m. Mountain Time for TF Dividend Focused, and at 11:00 a.m. Mountain Time for TST Dividend Focused VP. In light of public health concerns regarding the ongoing coronavirus (COVID-19) pandemic, and taking into account related orders and guidance issued by federal, state and local governmental bodies, the Board of each Fund has determined that the respective Special Meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. The details on how to participate in the virtual Special Meetings are included in this joint proxy statement. |

ii

TRANSAMERICA FUNDS

Transamerica Dividend Focused

TRANSAMERICA SERIES TRUST

Transamerica Barrow Hanley Dividend Focused VP

1801 California Street, Suite 5200

Denver, CO 80202

NOTICE OF SPECIAL MEETINGS OF SHAREHOLDERS

Scheduled to be Held Virtually on November 25, 2020

Please take notice that a Special Meeting of shareholders of, or, as applicable, policyowners investing in (together, the “Shareholders”) Transamerica Dividend Focused, a series of Transamerica Funds, and Transamerica Barrow Hanley Dividend Focused VP, a series of Transamerica Series Trust (each series, a “Fund” and collectively, the “Funds”), is scheduled to be held as a virtual meeting on November 25, 2020, at 10:00 a.m. (Mountain Time) for Transamerica Dividend Focused, and on November 25, 2020, at 11:00 a.m. (Mountain Time) for Transamerica Barrow Hanley Dividend Focused VP, to consider and vote on the following proposals:

Transamerica Funds:

| I. | To approve a new sub-advisory agreement for Transamerica Dividend Focused. Shareholders are being asked to approve a new sub-advisory agreement with Aegon Asset Management UK plc (“AAM”), an affiliate of TAM; and |

| II. | To transact such other business as may properly come before the Special Meeting and any adjournments or postponements thereof. |

Transamerica Series Trust:

| I. | To approve a new sub-advisory agreement for Transamerica Barrow Hanley Dividend Focused VP. Shareholders are being asked to approve a new sub-advisory agreement with AAM; and |

| II. | To transact such other business as may properly come before the Special Meeting and any adjournments or postponements thereof. |

After careful consideration of the proposal, the Board of Trustees of each Fund approved Proposal I for the Fund and recommends that Shareholders vote “FOR” the proposal for the Fund.

Each Shareholder of record of each Fund at the close of business on October 8, 2020 is entitled to notice of and to vote at the Fund’s Special Meeting and any adjournments or postponements thereof.

PLEASE NOTE: In light of public health concerns regarding the ongoing coronavirus (COVID-19) pandemic, and taking into account related orders and guidance issued by federal, state and local governmental bodies, the Board of Trustees of each Fund has determined that the Fund’s Special Meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. The details on how to participate in each virtual Special Meeting are included in this Joint Proxy Statement.

| By Order of the Boards, |

| /s/ Erin D. Nelson |

| Erin D. Nelson |

| Chief Legal Officer and Secretary |

October 21, 2020

SHAREHOLDERS ARE INVITED TO ATTEND THE VIRTUAL SPECIAL MEETINGS. HOWEVER, YOU MAY VOTE PRIOR TO THE SPECIAL MEETINGS BY TELEPHONE, VIA THE INTERNET OR BY RETURNING YOUR COMPLETED PROXY CARD. YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.

The proxy materials will be available to review at: http://vote.proxyonline.transamerica/docs/proxy2020.pdf. A paper or email copy of the proxy materials may be obtained, without charge, by contacting the Funds’ proxy solicitor, AST Fund Solutions, LLC at 1-888-605-1956.

I

YOU CAN HELP YOUR FUND AVOID THE EXPENSE OF FURTHER PROXY SOLICITATION BY PROMPTLY VOTING YOUR SHARES OR INTERESTS USING ONE OF THREE CONVENIENT METHODS: (A) BY CALLING THE TOLL-FREE NUMBER AS DESCRIBED IN THE ENCLOSED PROXY CARD; (B) BY ACCESSING THE INTERNET WEBSITE AS DESCRIBED IN THE ENCLOSED PROXY CARD; OR (C) BY SIGNING, DATING AND RETURNING THE ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

II

TRANSAMERICA FUNDS

Transamerica Dividend Focused

TRANSAMERICA SERIES TRUST

Transamerica Barrow Hanley Dividend Focused VP

1801 California Street, Suite 5200

Denver, CO 80202

This Joint Proxy Statement (“Joint Proxy Statement”) is furnished in connection with the solicitation of proxies by the Boards of Trustees (the “Board” and each member of a Board, a “Board Member”) of Transamerica Dividend Focused (“TF Dividend Focused”), a series of Transamerica Funds (“Transamerica Funds”), and Transamerica Barrow Hanley Dividend Focused VP (“TST Dividend Focused VP”), a series of Transamerica Series Trust (“TST”) (each, a “Fund” and, collectively, the “Funds”). The proxies are being solicited for use at a special meeting of shareholders of, or, as applicable, policyowners investing in (together, the “Shareholders”), each Fund to be held as a virtual meeting on November 25, 2020, at 10:00 a.m. (Mountain Time) for Transamerica Dividend Focused, and on November 25, 2020, at 11:00 a.m. (Mountain Time) for Transamerica Barrow Hanley Dividend Focused VP (for each Fund, a “Special Meeting” and collectively, the “Special Meetings”), and at any and all adjournments or postponements thereof. The Special Meetings will be held for the purposes set forth in the accompanying Notice of Special Meetings of Shareholders.

The Board of each of Transamerica Funds and TST, each an open-end management investment company that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), has determined that the use of this Joint Proxy Statement for each Fund’s Special Meeting is in the best interests of each Fund and its respective Shareholders in light of the similar matters being considered and voted on by the Shareholders with respect to each of the Funds. This Joint Proxy Statement and the accompanying materials are being first mailed by the Boards to Shareholders of each Fund on or about October 23, 2020.

PLEASE NOTE: The Special Meetings will be held virtually over the internet. To attend, vote, and submit any questions at the Special Meetings, please register at attendameeting@astfinancial.com.

In order for beneficial owners of shares registered in the name of a broker, bank, or other nominee to attend, participate, and vote at the virtual Special Meetings, you must first obtain a legal proxy from the relevant broker, bank, or other nominee and then register your attendance ahead of the applicable Special Meeting at attendameeting@astfinancial.com.

Each of Transamerica Funds and TST is organized as a Delaware statutory trust. TST Dividend Focused VP, a series of TST, is offered to variable annuity and variable life insurance separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies and to certain asset allocation portfolios. Though the only shareholders of TST Dividend Focused VP are the insurance company separate accounts and the asset allocation portfolios, and policyowners are not shareholders of the Fund, for ease of reference shareholders and policyowners are collectively referred in this Joint Proxy Statement as “Shareholders,” and the shares or beneficial interests that they hold in the Funds are sometimes referred to as “interests.”

In certain cases, for ease of comprehension, the term “Fund” is used in this Joint Proxy Statement where it may be more precise to refer to the Trust of which the Fund is a series.

You are being asked to vote at the Special Meeting of each Fund in which you held interests as of the close of business on October 8, 2020 (the “Record Date”). Each Shareholder of record of a Fund at the close of business on the Record Date is entitled to one vote for each dollar of net asset value of the Fund represented by the Shareholder’s shares of the applicable Fund (with proportional fractional votes for fractional shares). The net assets and total number of shares of each Fund outstanding and the net assets of each Fund at the close of business on the Record Date were as follows:

1

TF Dividend Focused

Class | Net Assets ($) | Total Shares Outstanding | Net Asset Value Per Share | |||||

A | $74,165,689.38 | 10,180,649.16 | $7.28 | |||||

C | $2,842,749.23 | 391,820.43 | $7.26 | |||||

I | $7,957,209.04 | 1,093,104.70 | $7.28 | |||||

I2 | $447,101,577.01 | 61,395,686.75 | $7.28 | |||||

R1* | $0 | 0 | $0 | |||||

R6 | $4,847,547.81 | 666,095.84 | $7.28 | |||||

T2* | $0 | 0 | $0 |

* Class R1 and Class T2 shares of the Fund are not currently offered to investors.

TST Dividend Focused VP

Class | Net Assets ($) | Total Shares Outstanding | Net Asset Value Per Share | |||||

Initial | $414,476,640.98 | 25,866,719.01 | $16.02 | |||||

Service | $213,061,888.29 | 13,266,342.58 | $16.06 |

The Fund with respect to which your vote is being solicited is named on the proxy card included with this Joint Proxy Statement. If you have the right to vote with respect to more than one Fund as of the Record Date, you may receive more than one proxy card. Please sign, date and return each proxy card, or if you prefer to provide voting instructions by telephone or over the internet, please vote on the proposal with respect to each applicable Fund. If you vote by telephone or over the internet, you will be asked to enter a unique code that has been assigned to you, which is printed on your proxy card(s). This code is designed to confirm your identity, provide access to the voting sites and confirm that your voting instructions are properly recorded.

All properly executed proxies received prior to a Fund’s Special Meeting will be voted at that Special Meeting. On the matters coming before each Special Meeting as to which a holder has specified a choice on that holder’s proxy, the holder’s shares will be voted accordingly. If a proxy is properly executed and returned and no choice is specified with respect to one or more proposal, the shares will be voted “FOR” each such proposal. The duly appointed proxies may, in their discretion, vote upon such other matters as may properly come before the Special Meetings.

Shareholders who execute proxies or provide voting instructions by telephone, mail, or the internet may revoke them with respect to any or all proposals at any time before a vote is taken on a proposal by filing with the applicable Fund a written notice of revocation (addressed to the Secretary at the principal executive offices of the Fund at the address above), by delivering a duly executed proxy bearing a later date or by attending and voting at the applicable Special Meeting, in all cases prior to the exercise of the authority granted in the proxy card. Merely attending a Special Meeting, however, will not revoke any previously executed proxy. If you hold your shares through a bank or other intermediary or if you are the holder of a variable annuity contract or variable life insurance policy (as discussed below), please consult your bank or intermediary or your participating insurance company regarding your ability to revoke voting instructions after such instructions have been provided.

Quorum, Vote Required and Manner of Voting Proxies

Quorum

A quorum of Shareholders of a Fund is required to take action at the Fund’s Special Meeting. For the purposes of taking action on Proposal I for each Fund, Shareholders entitled to vote and present at the Special Meeting or by proxy representing at least thirty percent (30%) of the voting power of the Fund shall constitute a quorum at a Special Meeting.

Votes cast at each Special Meeting will be tabulated by the inspectors of election appointed for each Special Meeting. The inspectors of election will determine whether or not a quorum is present at the Special Meetings. The inspectors of election will treat abstentions as present for purposes of determining a quorum.

2

In the absence of a quorum, a Special Meeting may be adjourned by the motion of the person presiding at the Special Meeting. If a quorum is present but sufficient votes to approve a proposal are not received, a Special Meeting may be adjourned by the affirmative vote of a majority of the shares present at the Special Meeting or represented by proxy at the Special Meeting. The persons named as proxies may, at their discretion, vote those proxies in favor of an adjournment of a Special Meeting. A vote may be taken on any proposal prior to any such adjournment if sufficient votes have been received.

Vote Required

The approval of Proposal I for each Fund requires the vote of a “majority of the outstanding voting securities” of the Fund within the meaning of the 1940 Act, which is defined as the affirmative vote of the lesser of (a) 67% or more of the voting power of the voting securities of the Fund that are present or represented by proxy at the Special Meeting if holders of shares representing more than 50% of the voting power of the outstanding voting securities of the Fund are present or represented by proxy, or (b) more than 50% of the voting power of the outstanding securities of the Fund.

If applicable, any abstentions or broker non-votes would effectively be treated as votes “AGAINST” Proposal I. “Broker non-votes” are shares held by brokers or nominees, typically in “street name,” as to which proxies have been returned but (a) instructions have not been received from the beneficial owners or persons entitled to vote and (b) the broker or nominee does not have discretionary voting power on a particular matter. Please note that broker non-votes are not expected with respect to Proposal I because brokers are required to receive instructions from the beneficial owners or persons entitled to vote in order to submit proxies on such a matter.

The following table shows how Fund shares will be treated for the purposes of quorum and voting requirements.

| Shares | Quorum | Voting | ||

| In General | All shares “present” at the meeting or by proxy are counted toward a quorum. | Shares “present” at the meeting will be voted at the meeting. Shares present by proxy will be voted in accordance with instructions. | ||

| Signed Proxy with No-Voting Instruction (other than Broker Non-Vote) | Considered “present” at the meeting for purposes of quorum. | Voted “for” Proposal I. | ||

| Broker Non-Vote (where the underlying beneficial owner or person entitled to vote had not voted and the broker or nominee does not have authority to vote the shares on the matter) | Because Proposal I is considered a non-routine matter, broker non-votes are not counted towards establishing a quorum at the meeting. | Broker non-votes do not count as a vote “for” Proposal I and have the same effect as a vote “against” the Proposal. Please note that broker non-votes are not expected with respect to Proposal I to be voted on because brokers are required to receive instructions from the beneficial owners or persons entitled to vote in order to submit proxies on the matter. | ||

| Vote to Abstain | Considered “present” at the meeting for purposes of quorum. | Abstentions do not count as a vote “for” Proposal I and have the same effect as a vote “against” the Proposal. | ||

Manner of Voting

If you hold your shares directly (not through a broker-dealer, bank, insurance company or other intermediary), and if you return a signed proxy card that does not specify how you wish to vote on a proposal, your shares will be voted “FOR” Proposal I with respect to your Fund.

The Funds expect that, before the Special Meetings, broker-dealer firms holding shares of a Fund in “street name” for their customers will request voting instructions from their customers and beneficial owners. The New York Stock Exchange (the “NYSE”) takes the position that a broker-dealer that is a member of the NYSE and that has not received instructions from a customer or client prior to the date specified in the broker-dealer firm’s request for voting instructions may not vote such customer or client’s shares with respect to non-routine proposals, including Proposal I.

3

If you hold shares in a Fund through a bank or other financial institution or intermediary (called a service agent) that has entered into a service agreement with the Fund or the distributor of the Fund, the service agent may be the record shareholder of your shares. At the Special Meetings, a service agent will vote shares for which it receives instructions from its customers in accordance with those instructions. A signed proxy card or other authorization by a beneficial Shareholder that does not specify how the beneficial Shareholder’s shares should be voted on the Proposal may be deemed an instruction to vote such shares in favor of the Proposal. Depending on its policies, applicable law or contractual or other restrictions, a service agent may be permitted to vote shares for which it has not received specific voting instructions from its customers in the same proportion as other shareholders with similar accounts that have submitted voting instructions to the service agent. This practice is commonly referred to as “proportional voting” or “echo voting.” Shareholders should consult their service agent for more information.

In the case of TST Dividend Focused VP, the interests in which are not offered directly to the public, but only sold to certain asset allocation portfolios and insurance companies and their separate accounts as the underlying investment medium for owners of variable annuity contracts and variable life policies (collectively, the “Policies”) (including Transamerica Life Insurance Company and Transamerica Financial Life Insurance Company, Inc. (collectively, the “Insurance Companies”)) to fund the Policies, ownership of the interests is legally vested in the separate accounts. It is the Fund’s understanding, that the Insurance Companies will vote shares held by these separate accounts in a manner consistent with voting instructions timely received from the Shareholders of the Policies used to fund the accounts. A signed proxy card or other authorization by a Shareholder that does not specify how the Shareholder’s interest should be voted may be deemed an instruction to vote such interest in favor of the proposal. The Insurance Companies will use proportional voting to vote interests for which no timely instructions are received from Shareholders of the Policies. It is the Fund’s understanding, that the Insurance Companies do not require that a specified number of owners submit voting instructions before the Insurance Companies will vote the interests in the Fund held by their registered separate accounts at the Special Meetings. As a result, a small number of owners of Policies could determine how the Insurance Companies vote, if other owners fail to vote. Other participating insurance companies may follow similar voting procedures.

If you beneficially own shares that are held in “street name” through a broker-dealer or that are held of record by a service agent, or if you hold shares through a Policy, and you do not provide specific voting instructions for your shares, they may not be voted at all or, as described above, they may be voted in a manner that you may not intend. In particular, failure to vote may not be an effective way to oppose a Proposal. Therefore, you are strongly encouraged to give your broker-dealer, service agent or participating insurance company specific instructions as to how you want your shares to be voted.

If you need more information or have any questions about the Proposals, please call 1-888-233-4339 for Transamerica Dividend Focused or 1-800-851-9777 for TST Dividend Focused VP. If you have any questions about voting, please call AST Fund Solutions, LLC, the Funds’ proxy solicitor at 1-888-605-1956.

Each Fund Shareholder signing and returning a proxy has the power to revoke it at any time before it is exercised:

| • | By filing a written notice of revocation with the Secretary of the Trust; |

| • | By returning a duly executed proxy bearing a later date; |

| • | By voting by telephone or over the Internet at a later date; or |

| • | By attending and voting at the Special Meeting and giving oral notice of revocation to the chairman of the Special Meeting. |

However, attendance at the Special Meetings, by itself, will not revoke a previously executed and returned proxy.

4

TRANSAMERICA FUNDS PROPOSAL I — APPROVAL OF A NEW INVESTMENT SUB-ADVISORY AGREEMENT

TRANSAMERICA DIVIDEND FOCUSED

To approve a new sub-advisory agreement with Aegon Asset Management UK plc (“AAM”) (to be voted on by Shareholders of Transamerica Dividend Focused).

This Proposal I is to be voted on by Shareholders of Transamerica Dividend Focused (for purposes of this proposal, the “Fund”), a series of Transamerica Funds (for purposes of this proposal, the “Trust”).

At the Special Meeting, Shareholders will be asked to approve a new sub-advisory agreement (the “New TF Sub-Advisory Agreement”) between Transamerica Asset Management, Inc. (“TAM”), the Fund’s investment manager, and AAM, the Fund’s proposed new sub-adviser. AAM is an affiliate of TAM. In connection with the proposed change of sub-adviser, there would be changes to the name, principal investment strategies, management fee schedules and sub-advisory fee schedules for the Fund, as discussed further below. TAM will continue to serve as the Fund’s investment manager.

Currently, Barrow, Hanley, Mewhinney & Strauss, LLC (“Barrow Hanley”) serves as the sub-adviser to the Fund and is a party to an investment sub-advisory agreement with TAM with respect to the Fund (the “Current TF Sub-Advisory Agreement”). Under the Current TF Sub-Advisory Agreement, dated November 10, 2017, as amended, Barrow Hanley provides sub-advisory services to the Fund in a manner consistent with the terms of the Current TF Sub-Advisory Agreement and the investment objective, strategies and policies of the Fund. The Current TF Sub-Advisory Agreement was last approved by the Trust’s Board on June 17 and 18, 20201.

A general description of the proposed New TF Sub-Advisory Agreement is included below. The terms of the New TF Sub-Advisory Agreement are substantially similar to those of the Current TF Sub-Advisory Agreement it replaces. The Trust’s Board approved the New TF Sub-Advisory Agreement at a virtual meeting held on August 5 and 6, 20201. Shareholder approval of the New TF Sub-Advisory Agreement must also be obtained, and the Board has authorized seeking such approval. The form of the New TF Sub-Advisory Agreement is included in Appendix A.

The Fund’s investment management agreement dated March 1, 2016, as amended, with TAM, a Florida corporation located at 1801 California Street, Suite 5200, Denver, CO 80202, was last approved by Shareholders on December 21, 2012 when certain changes were made to standardize terms across all the investment management agreements for funds in the Transamerica fund complex. The Board last approved the Fund’s investment management agreement with TAM on June 17 and 18, 20201. TAM is directly owned by Transamerica Life Insurance Company (“TLIC”) (77%) and AUSA Holding, LLC (“AUSA”) (23%), both of which are indirect, wholly owned subsidiaries of Aegon NV. TLIC is owned by Commonwealth General Corporation (“Commonwealth”). Commonwealth and AUSA are wholly owned by Transamerica Corporation (DE). Transamerica Corporation (DE) is wholly owned by The Aegon Trust, which is wholly owned by Aegon International B.V., which is wholly owned by Aegon NV, a Netherlands corporation and a publicly traded international insurance group.

Pursuant to the investment management agreement, TAM is responsible for providing continuous and regular investment management services, including management and supervision of the Fund’s investments and investment program, and providing supervisory, compliance and administrative services to the Fund. TAM is authorized to enter into contracts with one or more sub-advisers to perform certain duties of TAM under the investment management agreement. TAM has recommended, and the Board has approved (subject to Shareholder approval), the appointment of AAM as a new sub-adviser to the Fund, replacing Barrow Hanley. TAM will oversee AAM and monitor its buying and selling of portfolio securities, its management services and its investment performance. TAM is paid investment management fees for its service as investment manager to the Fund. The management fee is calculated based on the average daily net assets of the Fund. The Fund paid TAM $3,860,809 in management fees after waivers, reimbursements and recaptures for the fiscal year ended October 31, 2019. If this Proposal I is approved, TAM, not the Fund, will pay AAM a sub-advisory fee out of the investment management fee it receives from the Fund. It is anticipated that the Fund’s total operating expenses will be lower.

| 1 | Consistent with exemptive orders of the Securities and Exchange Commission (“SEC”) (Investment Company Act Rel. Nos. 33817 (March 13, 2020), 33824 (March 25, 2020) and 33897 (June 19, 2020)), the Board meeting was not held in person and was instead conducted by means of communication that allowed all Trustees participating to hear each other simultaneously during the meeting due to circumstances related to current or potential effects of COVID-19. |

5

TAM acts as a manager of managers for the Fund pursuant to an exemptive order from the SEC (Release IC- 23379 dated August 5, 1998). That exemptive order permits TAM, subject to certain conditions, and without the approval of shareholders, to employ a new unaffiliated sub-adviser for a fund pursuant to the terms of a new investment sub-advisory agreement, either as a replacement for an existing sub-adviser or as an additional sub-adviser. Under the terms of the exemptive order, TAM may not enter into a sub-advisory agreement with AAM, an affiliate of TAM, without such agreement being approved by the Shareholders of the Fund. This is the reason that Shareholder approval of this Proposal I is being sought. The appointment of AAM is not expected to result in any material changes in the nature or the level of investment management services provided to the Fund by TAM. TAM will continue to provide investment management services to the Fund, including, among other things: the design, development and ongoing review and evaluation of the Fund, its investment strategy, compliance program, valuation process and proxy voting process; the ongoing oversight and analysis of portfolio trading and risk management; preparation of the Fund’s prospectus and other disclosure materials; and the ongoing oversight and monitoring of AAM.

No officer or Board Member of the Trust is a director, officer or employee of AAM. No officer or Board Member of the Trust, through the ownership of securities or otherwise, has any other material direct or indirect interest in AAM or any other person controlling, controlled by or under common control with AAM. Since the Record Date, none of the Board Members of the Trust have had any material interest, direct or indirect, in any material transactions, or in any material proposed transactions, to which AAM or any of its affiliates was or is to be a party.

In connection with the proposed appointment of AAM as sub-adviser, there would be changes to the Fund’s principal investment strategies and principal risks. If the new sub-advisory agreement is approved, AAM would implement an active strategy that generally invests in large and middle U.S. capitalization companies, focusing on those that pay dividends and that the sub-adviser views as having a favorable sustainability profile. In pursuing the Fund’s investment objective, AAM would look to buy stocks and hold them over multi-year periods in an effort to benefit from the compounding effects of increasing dividends. In addition, the sub-adviser would seek to invest in stocks it views as having positive sustainability credentials.

AAM considers stocks with positive sustainability credentials to be stocks that have been determined by AAM as likely to perform well based on environmental, social and/or governance (ESG) factors. The Fund’s investment universe is defined by the sub-adviser’s Responsible Investing team, which consists of employees of the sub-adviser and affiliated entities within the global Aegon Asset Management organization, who have responsible investing expertise. AAM uses both proprietary exclusionary screening and fundamental ESG research carried out by the Responsible Investing team in an effort to ensure that stocks that are assessed by the team as scoring poorly on ESG factors (for example having a negative impact on the environment or producing products that cause harm to people, such as tobacco or weapons) are excluded from the Fund’s investible universe. In addition, the process seeks to identify stocks that are viewed by the Responsible Investing team as making a positive contribution to ESG factors, for example a utility company involved in the generation of renewable energy or a healthcare company providing treatment for a serious disease.

If AAM is approved as the Fund’s sub-adviser, the Fund’s principal investment strategies would no longer include the current limitation to invest only in stocks that have a consecutive 25-year history of paying cash dividends. It is also expected that the Fund’s portfolio would include a significant technology weighting whereas the Fund currently has none. If the change in sub-adviser is approved, the Fund would be subject to the following additional principal risks: Sustainability Investing risk, Derivatives risk, Leveraging risk and Investments by Affiliated Funds and Unaffiliated Funds risk.

AAM has asset management capabilities in sustainable investing, as well as large value, dividend-focused investing, and a depth of research and management staff and resources that will enable it to implement the proposed investment strategies of the Fund. AAM will utilize the expertise of its portfolio managers while leveraging the experience, scale, depth of talent and institutional resources of AAM.

In connection with the proposed appointment of AAM as sub-adviser, it is expected that there would be extensive purchases and sales of portfolio holdings to align the Fund with its revised investment strategies. This repositioning of the Fund may have a negative impact on performance by increasing brokerage commissions and/or other transaction costs, and may generate greater amounts of net short-term capital gains, which, for shareholders holding shares in taxable accounts, would generally be subject to tax at ordinary income tax rates upon distribution.

Based on AAM’s experience in both dividend and sustainability investing, among other things, TAM recommended to the Board that AAM be appointed as the Fund’s new sub-adviser and the Board has approved AAM’s appointment, subject to Shareholder approval.

If approved by Shareholders, the change in sub-adviser and related changes are anticipated to become effective on or about December 1, 2020. At that time, TAM would file new prospectuses and summary prospectuses for the Fund to reflect the Fund’s new name, new sub-adviser, new management fee and sub-advisory fee schedules, new principal investment strategies and principal risks (as described below). In addition, the Fund’s statement of additional information, dated March 1, 2020, as amended and restated on July 31, 2020, will also be revised to reflect applicable changes.

6

General Comparison of Sub-Advisory Agreements

Set forth below is a general description of certain terms of the New TF Sub-Advisory Agreement and a comparison with the terms of the Current Sub-Advisory Agreement. A copy of the form of New TF Sub-Advisory Agreement is attached to this Joint Proxy Statement as Appendix A, and you should refer to Appendix A for the complete terms of the New TF Sub-Advisory Agreement.

Investment Management Services. Under the terms of the New TF Sub-Advisory Agreement, subject to the supervision of the Trust’s Board and TAM, AAM will manage the investment and reinvestment of the portfolio assets of the Fund, all without prior consultation with TAM, subject to and in accordance with the investment objective and policies of the Fund set forth in the Fund’s current prospectus and statement of additional information, as may be amended from time to time, and any written instructions which TAM or the Fund’s Board may issue from time-to-time in accordance therewith. In pursuance of the foregoing, AAM will make all determinations with respect to the purchase and sale of portfolio securities and takes such action necessary to implement the same. AAM shall render regular reports as to the Trust’s Board of Trustees and TAM concerning the investment activities of the Fund. The Current TF Sub-Advisory Agreement addresses the services to be provided in a similar manner.

The New TF Sub-Advisory Agreement provides that AAM will place orders for the purchase and sale of portfolio securities with the issuer or with such broker-dealers who provide brokerage services to the Fund within the meaning of Section 28(e) of the Securities Exchange Act of 1934, to AAM, or to any other Fund or account over which AAM or its affiliates exercise investment discretion. The New TF Sub-Advisory Agreement also provides that, subject to such policies and procedures as may be adopted by the Board and officers of the Fund, AAM may pay a broker or dealer an amount of commission for effecting a securities transaction in excess of the amount of commission another broker or dealer would have charged for effecting that transaction, in such instances where AAM has determined in good faith that such amount of commission was reasonable in relation to the value of the brokerage services provided by such broker or dealer, viewed in terms of either that particular transaction or AAM’s overall responsibilities with respect to the Fund and to other portfolios and clients for which AAM exercises investment discretion. The Trust’s Board may adopt policies and procedures that modify and restrict AAM’s authority regarding the execution of the Fund’s portfolio transactions. The Current TF Sub-Advisory Agreement contains similar provisions.

The New TF Sub-Advisory Agreement states that in connection with the placement of orders for the execution of portfolio transactions of the Fund, AAM shall create and maintain all necessary records in accordance with applicable laws, rules and regulations. All records shall be the property of the Fund and shall be available for inspection and use by the SEC, the Fund, TAM or any person retained by the Fund at reasonable times. Where applicable, such records shall be maintained by AAM for the periods and in the places required by applicable recordkeeping rules under the 1940 Act. The Current TF Sub-Advisory Agreement contained similar provisions.

The New TF Sub-Advisory Agreement further provides that, unless TAM advises the sub-adviser in writing that the right to vote proxies has been expressly reserved to TAM or the Trust or otherwise delegated to another party, the sub-adviser will exercise voting rights incident to any securities purchased with, or comprising a portion of, the allocated assets, in accordance with the sub-adviser’s proxy voting policies and procedures without consultation with TAM or the Fund. The New TF Sub-Advisory Agreement further provides that the sub-adviser will furnish a copy of its proxy voting policies and procedures, and any amendments thereto, to TAM. The Current TF Sub-Advisory Agreement also contains these provisions.

The New TF Sub-Advisory Agreement provides that the sub-adviser will monitor the security valuations of the assets allocated to it and that if the sub-adviser believes that the carrying value for a security does not fairly represent the price that could be obtained for the security in a current market transaction, the sub-adviser will notify TAM promptly. In addition, the sub-adviser will be available to consult with TAM in the event of a pricing problem and to participate in the Fund’s valuation committee meetings. The Current TF Sub-Advisory Agreement also contains these provisions.

The New TF Sub-Advisory Agreement requires that AAM, at its expense, supply the Board, the officers of the Trust and TAM with all information and reports reasonably required by them and reasonably available to AAM relating to the services provided pursuant to the New TF Sub-Advisory Agreement, including such information that the Fund’s Chief Compliance Officer reasonably believes necessary for compliance with Rule 38a-1 under the 1940 Act. The Current TF Sub-Advisory Agreement also contains such provisions.

Sub-Advisory Fees. Under both the Current TF Sub-Advisory Agreement and the New TF Sub-Advisory Agreement, TAM pays the sub-adviser a fee out of the investment management fee TAM receives from the Fund. Fees paid to Barrow Hanley during the Fund’s most recent fiscal year ended October 31, 2019 were $995,008. The proposed investment management and sub-advisory fees for the Fund would result in a nominal net annual decrease in investment management fees retained by TAM. In conjunction with the proposed sub-adviser change, the investment management fee schedule for the Fund would be lower. Please see additional information under “Management Fees” below.

7

Under the New TF Sub-Advisory Agreement, if approved, TAM (not the Fund) will pay AAM sub-advisory fees, according to the following schedule, for its services with respect to the Fund’s average daily net assets on an annual basis:

0.20% of the first $200 million

0.15% over $200 million up to $500 million

0.13% in excess of $500 million

The average daily net assets for purposes of calculating the sub-advisory fees will be determined on a combined basis with Transamerica Barrow Hanley Dividend Focused VP.

Under the Current TF Sub-Advisory Agreement, TAM (not the Fund) pays Barrow Hanley sub-advisory fees, according to the following schedule, for its services with respect to the Fund’s average daily net assets on an annual basis:

0.30% of the first $200 million

0.20% over $200 million up to $500 million

0.15% in excess of $500 million

Payment of Expenses. The New TF Sub-Advisory Agreement requires the sub-adviser to pay all expenses incurred by it in the performance of its duties under the Agreement and requires TAM to pay all expenses incurred by it in the performance of TAM’s duties under the Agreement. Under the New TF Sub-Advisory Agreement, the Fund will bear all expenses not expressly assumed by TAM or the sub-adviser incurred in the operation of the Fund and the offering of its shares. The operating expenses of the Fund are expected to decrease as a result of entering into the New TF Sub-Advisory Agreement.

Conflicts of Interest. The New TF Sub-Advisory Agreement provides that the sub-adviser will not deal with itself, or with members of the Fund’s Board or any principal underwriter of the Fund, as principals or agents in making purchases or sales of securities or other property for the account of the Fund, nor will it purchase any securities from an underwriting or selling group in which the sub-adviser or its affiliates is participating, or arrange for purchases and sales of securities between the Fund and another account advised by the sub-adviser or its affiliates, except in each case as permitted by the 1940 Act and in accordance with such policies and procedures as may be adopted by the Fund from time to time. The New TF Sub-Advisory Agreement specifically provides that personnel of the sub-adviser may nonetheless engage in any other business or devote his or her time and attention in part to the management or other aspects of any other business, whether of a similar nature or a dissimilar nature. In addition, the sub-adviser may engage in any other business or render services of any kind, including investment advisory and management services, to any other fund, firm, individual or association. The New TF Sub-Advisory Agreement also provides that if the purchase or sale of securities consistent with the investment policies of the Fund or one or more other accounts of the sub-adviser are considered at or about the same time, transactions in such securities must be allocated among the accounts in a manner deemed equitable by the sub-adviser. In addition, if transactions of the Fund and another client are combined, as permitted by applicable laws and regulations, such transactions must be consistent with the sub-adviser’s policies and procedures as presented to the Board from time to time. The Current TF Sub-Advisory Agreement contains similar provisions.

Limitation on Liability. Under the New TF Sub-Advisory Agreement, the sub-adviser assumes no responsibility other than to render the services called for by the agreement in good faith, and the sub-adviser is not liable for any error of judgment or mistake of law or for any loss arising out of any investment or for any act or omission in the execution of securities transactions for the Fund. The sub-adviser is not protected, however, against liability by reason of willful misfeasance, bad faith, or gross negligence in the performance of its duties or by reason of its reckless disregard of its obligations and duties under the agreement. This same limitation of liability applies to affiliates of the sub-adviser who may provide services to the Fund as contemplated by the New TF Sub-Advisory Agreement. The Current TF Sub-Advisory Agreement also contains these provisions.

Term and Continuance. If approved by Shareholders of the Fund, the New TF Sub-Advisory Agreement for the Fund will continue in effect, unless sooner terminated as set forth therein, for two years from its effective date, and will continue in effect from year to year thereafter, if continuance is specifically approved at least annually by (i) the vote of a majority of the Board Members who are not parties thereto or interested persons of any party thereto, cast in person at a meeting called for the purpose of voting on the approval of the terms of renewal, and by (ii) either the Board or the affirmative vote of a majority of the outstanding voting securities of the Fund. Notwithstanding the foregoing, the New TF Sub-Advisory Agreement will be considered by the Board on the same calendar as the investment management agreement with TAM.

Termination. The New TF Sub-advisory Agreement provides that it: (i) may be terminated with respect to the Fund at any time, without penalty, either by vote of the Board or by vote of a majority of the outstanding voting securities of the Fund; (ii) may be terminated by TAM upon written notice to AAM, without the payment of any penalty; (iii) may be terminated by AAM upon 90 days’ advance written notice to TAM; and (iv) will terminate immediately in the event of its assignment (within the meaning of the 1940 Act) by AAM and shall not be assignable by TAM without the consent of AAM. The Current TF Sub-Advisory Agreement contains similar provisions.

8

MANAGEMENT FEES

In connection with and contingent upon the proposed change in sub-adviser, the management fee rate payable by the Fund to TAM will be reduced. Under the investment management agreement, the Fund would pay TAM on an annual basis the following management fee based on its average daily net assets:

First $500 million | 0.663 | % | ||

Over $500 million up to $1 billion | 0.58 | % | ||

Over $1 billion up to $1.5 billion | 0.55 | % | ||

In excess of $1.5 billion | 0.53 | % |

Currently, the Fund pays TAM a management fee of 0.78% the first $200 million; 0.68% over $200 million up to $500 million; 0.63% over $500 million up to $1.5 billion; 0.59% over $1.5 billion up to $2.5 billion; and 0.58% in excess of $2.5 billion for its services with respect to the Fund’s average daily net assets on an annual basis.

Management fees are accrued daily and paid by the Fund monthly. As of October 8, 2020, the net assets of the Fund were $536,914,772.47.

TAM has contractually agreed through March 1, 2021 to waive fees and/or reimburse Fund expenses to the extent that the total operating expenses exceed 1.15% for Class A shares, 1.90% for Class C shares, 0.90% for Class I shares, 0.85% for Class I2 shares, 1.40% for Class R1 shares, 0.85% for Class R6 shares and 1.15% for Class T2 shares, excluding, as applicable, acquired fund fees and expenses, interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, extraordinary expenses and other expenses not incurred in the ordinary course of the Fund’s business. TAM is permitted to recapture amounts waived and/or reimbursed to a class during any of the 36 months from the date on which TAM waived fees and/or reimbursed expenses for the class. A class may reimburse TAM amounts previously contractually waived or reimbursed only if such reimbursement does not cause, on any particular business day of the portfolio, the class’s total annual operating expenses (after the reimbursement is taken into account) to exceed the applicable expense cap described above or any other lower limit then in effect.

The following chart compares the actual management fees paid by the Fund to TAM (with and without regard to waivers/expense reimbursements) for the fiscal year ended October 31, 2019 to a hypothetical example of management fees that would have been paid by the Fund to TAM for the same period under the proposed new management fee schedule, and also shows the percentage difference between the actual and hypothetical values.

| Actual Management Fees Payable to TAM from November 1, 2018 through October 31, 2019 under Current Management Fee Schedule | Hypothetical Management Fees Payable to TAM from November 1, 2018 through October 31, 2019 under Proposed New Management Fee Schedule | Percent Difference | ||||

| Management Fees Payable to TAM Prior to Waivers/Expense Reimbursements and Recaptures | $3,861,296 | $3,555,634 | -7.92% | |||

Management Fees Payable to TAM After Waivers/Expense Reimbursements and Recaptures | $3,860,809 | $3,555,634 | -7.90% |

SUB-ADVISORY FEES

Under the Current TF Sub-Advisory Agreement, TAM (not the Fund) has agreed to pay Barrow Hanley 0.30% of the first $200 million, 0.20% over $200 million up to $500 million, and 0.15% in excess of $500 million with respect to the Fund’s average daily net assets on an annual basis.

9

Under the New TF Sub-Advisory Agreement, TAM (not the Fund) will pay AAM 0.20% of the first $200 million, 0.15% over $200 million up to $500 million, and 0.13% in excess of $500 million with respect to the Fund’s average daily net assets on an annual basis.

The following chart compares the actual sub-advisory fees paid by TAM to Barrow Hanley (net of fees reimbursed) for the fiscal year ended October 31, 2019 to a hypothetical example of sub-advisory fees that would have been paid by TAM to AAM for the same period under the New TF Sub-Advisory Agreement, and also shows the percentage difference between the actual and hypothetical values.

Actual Sub-Advisory Fees Payable by TAM to Barrow Hanley from November 1, 2018 through October 31, 2019 under Current TF Sub-Advisory Agreement | Hypothetical Sub-Advisory Fees Payable by TAM to AAM from November 1, 2018 through October 31, 2019 under New TF Sub-Advisory Agreement | Percent Difference | ||

| $995,008 | $785,187 | -21.09% |

Amounts paid to TAM and to affiliates of TAM during the fiscal year ended October 31, 2019 by the Fund and the services for which the amounts were paid, if any, are listed below. There were no other material payments by the Fund to Barrow Hanley, TAM, or any of their affiliates during that period.

| Payments to TAM (or affiliates) | ||||||

| As of Date: | Transfer Agent | Distribution | ||||

Transamerica Dividend Focused | 10/31/2019 | $82,952 | $311,087 | |||

Evaluation by the Board

At a meeting of the Board of Trustees of Transamerica Funds (for purposes of this section, the “Board”) held on August 5 and 6, 2020, the Board considered the termination of Barrow Hanley as sub-adviser to the Fund and the approval of the New TF Sub-Advisory Agreement for the Fund between TAM and AAM, the Fund’s proposed new sub-adviser, as well as the approval of a revised management fee schedule for the Fund.

Following their review and consideration, the Board Members determined that the terms of the New TF Sub-Advisory Agreement were reasonable and that the termination of Barrow Hanley as sub-adviser to the Fund and the approval of the New TF Sub-Advisory Agreement were in the best interests of the Fund and its Shareholders. The Board, including the independent members of the Board (“Independent Board Members”), authorized TAM to terminate the Current TF Sub-Advisory Agreement with Barrow Hanley and unanimously approved the New TF Sub-Advisory Agreement for an initial two-year period. The Board, including the Independent Board Members, also unanimously approved the revised management fee schedule for the Fund.

Prior to reaching their decision, the Board Members requested and received from TAM and AAM certain information. They then reviewed such information as they deemed reasonably necessary to evaluate the proposed New TF Sub-Advisory Agreement, including information they had previously received from TAM as part of their regular oversight of the Fund, and knowledge they gained over time through meeting with TAM. Among other materials, the Board Members considered fee, expense and profitability information prepared by TAM.

In their deliberations, the Independent Board Members met privately without representatives of TAM or AAM present and were represented throughout the process by their independent legal counsel. In considering whether to approve the New TF Sub-Advisory Agreement between TAM and AAM with respect to the Fund, the Board Members evaluated and weighed a number of considerations that they believed to be relevant in light of the legal advice furnished to them by counsel, including independent legal counsel, and made a decision in the exercise of their own business judgment. They based their decisions on the considerations discussed below, among others, although they did not identify any particular consideration or item of information that was controlling of their decisions, and each Board Member may have attributed different weights to the various factors.

10

Nature, Extent and Quality of the Services

In evaluating the nature, extent and quality of the services to be provided by AAM under the New TF Sub-Advisory Agreement, the Board considered, among other things, information provided by TAM and AAM regarding AAM’s operations, facilities, organization and personnel of AAM, the anticipated ability of AAM to perform its duties under the New TF Sub-Advisory Agreement, and the proposed changes to the Fund’s principal investment strategies. The Board further considered that: (i) AAM is an experienced asset management firm; (ii) TAM is recommending that AAM be appointed as sub-adviser to the Fund; and (iii) TAM believes that AAM has the capabilities, resources and personnel necessary to provide sub-advisory services to the Fund based on TAM’s assessment of AAM’s organization and investment personnel. The Board Members also considered AAM’s proposed responsibilities and experience with the Fund’s proposed principal investment strategies.

The Board noted that TAM had advised the Board Members that neither the approval of the New TF Sub-Advisory Agreement nor the approval of the revised management fee schedule was expected to result in any diminution in the nature, extent and quality of the services provided to the Fund and its Shareholders, including compliance services. Based on these and other considerations, the Board Members determined that AAM can provide sub-advisory services that are appropriate in scope and extent in light of the proposed investment program for the Fund and that AAM’s appointment is not expected to diminish the nature, extent and quality of services provided to the Fund.

Investment Performance

The Board considered AAM’s investment management experience, capabilities and resources. The Board reviewed the historical performance of the Fund for various trailing periods ended May 31, 2020 against the Fund’s benchmark. The Board Members noted that the Fund’s proposed strategy under AAM management was a custom strategy for which no historical performance data was available. The Board Members reviewed the historical performance of: (i) AAM Global Equity Income, an Irish domiciled open-end fund managed by AAM that uses the same dividend-focused philosophy as that proposed for the Fund; (ii) AAM Ethical Equity, a UK-domiciled open-end fund managed by AAM that employs a similar ESG dedicated strategy as that proposed for the Fund; and (iii) the U.S. sleeve of AAM Global Equity Income, as a way to demonstrate the team’s stock-picking skills in the U.S. market with a dividend approach. On the basis of this information and the Board Members’ assessment of the nature, extent and quality of the sub-advisory services to be provided by AAM, the Board Members concluded that AAM is capable of generating a level of investment performance that is appropriate in scope and extent in light of the Fund’s proposed new principal investment strategies, the competitive landscape of the investment company business and investor needs.

Management and Sub-Advisory Fees and Total Expense Ratio

The Board Members considered the revised management and new sub-advisory fee schedules (“Fee Changes”) for the Fund. The Board Members reviewed the management fee and total expense ratio of each class of the Fund, based on current assets and assuming implementation of the Fee Changes as compared to the applicable Broadridge and Morningstar peer group medians. The Board Members noted that although the management fee and for certain share classes the total expense ratio would be above the applicable Broadridge and/or Morningstar peer group medians, TAM believes the management fee and total expense ratio of each class of the Fund would be competitive relative to peers.

The Board Members considered that the revised management and new sub-advisory fee schedules would be lower at all asset levels than the current management and sub-advisory fee schedules. The Board Members also considered that TAM had negotiated with AAM to have the Fund’s assets aggregated with the assets of TST Dividend Focused VP for purposes of computing breakpoints in the new sub-advisory fee schedule and that TAM had agreed to reimburse 0.09% of sub-transfer agency fees on Class I shares for the Fund. The Board Members noted that if the Fee Changes are implemented, the total expense ratio of each class of the Fund is expected to decrease. The Board Members noted that as the Fund grows in size, the revised management and new sub-advisory fee schedules have the potential to result in additional savings for shareholders.

The Board Members considered the portion of the Fund’s management fee to be retained by TAM following payment of the sub-advisory fee by TAM to AAM and noted that TAM considered the amount to be reasonable compensation for its services. On the basis of these and other considerations, together with the other information it considered, the Board Members determined that the revised management fee schedule and new sub-advisory fee schedule were reasonable in light of the services to be provided.

Cost of Services to be Provided and Level of Profitability

The Board Members reviewed pro forma estimated profitability information provided by TAM for TAM and its affiliates, including AAM. The Board Members noted that, based on assets as of May 31, 2020, there was expected to be a decrease in the net management fees retained by TAM, but an increase in overall profitability to the Transamerica/Aegon organization due to the fact that, unlike Barrow Hanley, AAM is an affiliated sub-adviser. The Board Members also considered TAM’s view that the Fund’s proposed net management fee would allow TAM to be reasonably compensated for its services. The Board Members also considered the pro forma revenue, expense and pre-distribution profit margin information provided by TAM and determined that the profitability of TAM and its affiliates from their relationships with the Fund was not anticipated to be excessive.

11

Economies of Scale

In evaluating the extent to which the Fund’s revised management fee schedule and new sub-advisory fee schedule reflected economies of scale or would permit economies of scale to be realized in the future, the Board Members considered the existence of breakpoints in both the management and sub-advisory fee schedules. The Board Members noted that the revised management fee schedule and new sub-advisory fee schedule lower the asset levels for the last two breakpoints, which would benefit shareholders as the Fund grows in size. The Board Members concluded that they would have the opportunity to periodically reexamine the appropriateness of the management fees payable by the Fund to TAM, and the sub-advisory fees payable by TAM to AAM, in light of any economies of scale experienced in the future.

Fall-Out Benefits

The Board considered other benefits expected to be derived by AAM from its relationship with the Fund. The Board noted that TAM would not receive benefits from research obtained with commissions paid to broker-dealers for portfolio transactions (“soft dollars”) as a result of its relationships with AAM or the Fund, and that AAM had indicated it also would not engage in soft dollar arrangements and receive such benefits as a result of its relationships with TAM and the Fund.

Conclusion

After consideration of the factors described above, as well as other factors, the Board Members, including the Independent Board Members, concluded that the approval of the revised management fee schedule and the New TF Sub-Advisory Agreement was in the best interests of the Fund and its Shareholders and voted to approve the revised management fee schedule and the New TF Sub-Advisory Agreement.

In the event that Shareholders do not approve this Proposal I, the Board will determine the appropriate course of action with respect to the management of the Fund.

Your Board recommends that you vote “FOR” the approval of the New TF Sub-Advisory Agreement.

12

TRANSAMERICA SERIES TRUST PROPOSAL I — APPROVAL OF A NEW INVESTMENT SUB-ADVISORY AGREEMENT

TRANSAMERICA BARROW HANLEY DIVIDEND FOCUSED VP

To approve a new sub-advisory agreement with Aegon Asset Management UK plc (“AAM”) (to be voted on by Shareholders of Transamerica Barrow Hanley Dividend Focused VP).

This Proposal I is to be voted on by Shareholders of Transamerica Barrow Hanley Dividend Focused VP (for purposes of this proposal, the “Portfolio”), a series of Transamerica Series Trust (for purposes of this proposal, the “Trust”).

At the Special Meeting, Shareholders will be asked to approve a new sub-advisory agreement (the “New TST Sub-Advisory Agreement”) between Transamerica Asset Management, Inc. (“TAM”), the Portfolio’s investment manager, and AAM, the Portfolio’s proposed new sub-adviser. AAM is an affiliate of TAM. In connection with the proposed change of sub-adviser, there would be changes to the name, principal investment strategies, management fee schedules and sub-advisory fee schedules for the Portfolio, as discussed further below. TAM will continue to serve as the Portfolio’s investment manager.

Currently, Barrow, Hanley, Mewhinney & Strauss, LLC (“Barrow Hanley”) serves as the sub-adviser to the Portfolio and is a party to an investment sub-advisory agreement with TAM with respect to the Portfolio (the “Current TST Sub-Advisory Agreement”). Under the Current TST Sub-Advisory Agreement, dated November 10, 2017, as amended, Barrow Hanley provides sub-advisory services to the Portfolio in a manner consistent with the terms of the Current TST Sub-Advisory Agreement and the investment objective, strategies and policies of the Portfolio. The Current TST Sub-Advisory Agreement was last approved by the Trust’s Board on June 17 and 18, 20202.

A general description of the proposed New TST Sub-Advisory Agreement is included below. The terms of the New TST Sub-Advisory Agreement are substantially similar to those of the Current TST Sub-Advisory Agreement it replaces. The Trust’s Board approved the New TST Sub-Advisory Agreement at a virtual meeting held on August 5 and 6, 20202. Shareholder approval of the New TST Sub-Advisory Agreement must also be obtained, and the Board has authorized seeking such approval. The form of the New TST Sub-Advisory Agreement is included in Appendix A.

The Portfolio’s investment management agreement dated March 1, 2016, as amended, with TAM, a Florida corporation located at 1801 California Street, Suite 5200, Denver, CO 80202, was last approved by Shareholders on December 21, 2012 when certain changes were made to standardize terms across all the investment management agreements for funds in the Transamerica fund complex. The Board last approved the Portfolio’s investment management agreement with TAM on June 17 and 18, 20202. TAM is directly owned by Transamerica Life Insurance Company (“TLIC”) (77%) and AUSA Holding, LLC (“AUSA”) (23%), both of which are indirect, wholly owned subsidiaries of Aegon NV. TLIC is owned by Commonwealth General Corporation (“Commonwealth”). Commonwealth and AUSA are wholly owned by Transamerica Corporation (DE). Transamerica Corporation (DE) is wholly owned by The Aegon Trust, which is wholly owned by Aegon International B.V., which is wholly owned by Aegon NV, a Netherlands corporation and a publicly traded international insurance group.

Pursuant to the investment management agreement, TAM is responsible for providing continuous and regular investment management services, including management and supervision of the Portfolio’s investments and investment program, and providing supervisory, compliance and administrative services to the Portfolio. TAM is authorized to enter into contracts with one or more sub-advisers to perform certain duties of TAM under the investment management agreement. TAM has recommended, and the Board has approved (subject to Shareholder approval), the appointment of AAM as a new sub-adviser to the Portfolio, replacing Barrow Hanley. TAM will oversee AAM and monitor its buying and selling of portfolio securities, its management services and its investment performance. TAM is paid investment management fees for its service as investment manager to the Portfolio. The management fee is calculated based on the average daily net assets of the Portfolio. The Portfolio paid TAM $5,451,211 in management fees for the fiscal year ended December 31, 2019. If this Proposal I is approved, TAM, not the Portfolio, will pay AAM a sub-advisory fee out of the investment management fee it receives from the Portfolio. It is anticipated that the Portfolio’s total operating expenses will be lower.

| 2 | Consistent with exemptive orders of the Securities and Exchange Commission (“SEC”) (Investment Company Act Rel. Nos. 33817 (March 13, 2020), 33824 (March 25, 2020) and 33897 (June 19, 2020)), the Board meeting was not held in person and was instead conducted by means of communication that allowed all Trustees participating to hear each other simultaneously during the meeting due to circumstances related to current or potential effects of COVID-19. |

13