Table of Contents

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 | |

TRANSAMERICA FUNDS

TRANSAMERICA SERIES TRUST

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

TRANSAMERICA FUNDS

TRANSAMERICA SERIES TRUST

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

1801 California Street, Suite 5200

Denver, Colorado 80202

September 1, 2021

Dear Investor:

A special meeting of holders of your Transamerica fund is scheduled to be held as a virtual meeting on November 1, 2021 at 10:00 a.m. (Mountain time).

In light of the public health concerns regarding the COVID-19 pandemic and to support the health and safety of fund holders, the Board Members responsible for your fund have determined that the special meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. The details on how to participate in the virtual special meeting are included in the enclosed joint proxy statement.

At the special meeting, you are being asked to elect Board members of your fund. Nine of the eleven nominees are independent of Transamerica management, and nine of the eleven nominees already serve as Board Members of your fund.

We are seeking your approval of this proposal through the enclosed joint proxy statement, which we invite you to review closely.

Importantly, after careful consideration, the Board Members responsible for your fund have considered the proposal and have determined it is in the best interest of your fund, and unanimously recommend that you vote “FOR” the proposal. However, before you vote, please read the full text of the joint proxy statement for an explanation of the proposal.

Holders of record of your fund as of the close of business on August 6, 2021 are entitled to vote at the special meeting and any adjournments or postponements thereof. Whether or not you plan to virtually attend the special meeting and regardless of the size of the interests you hold, your vote is very important to us. By responding promptly, you will save the expense of additional follow-up mailings and solicitations. Please vote today.

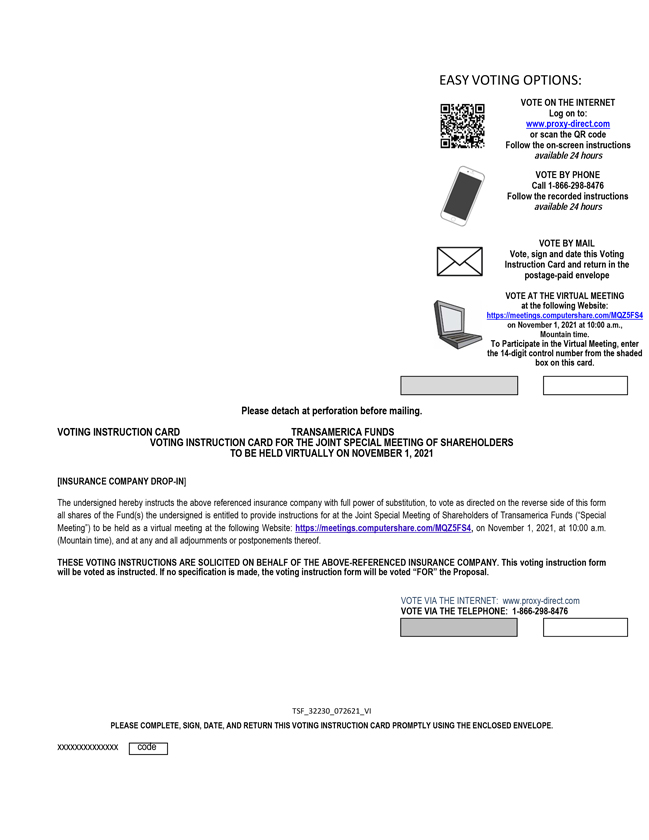

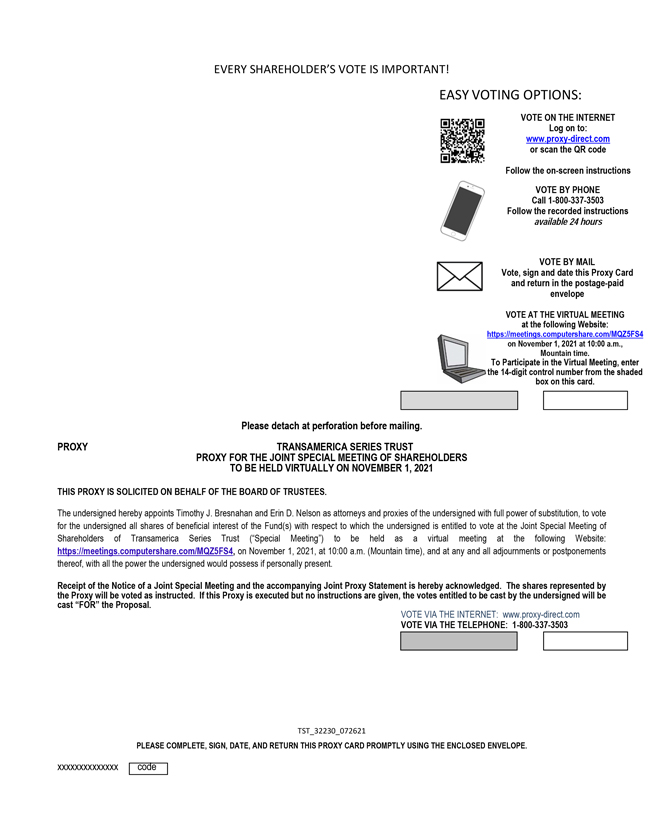

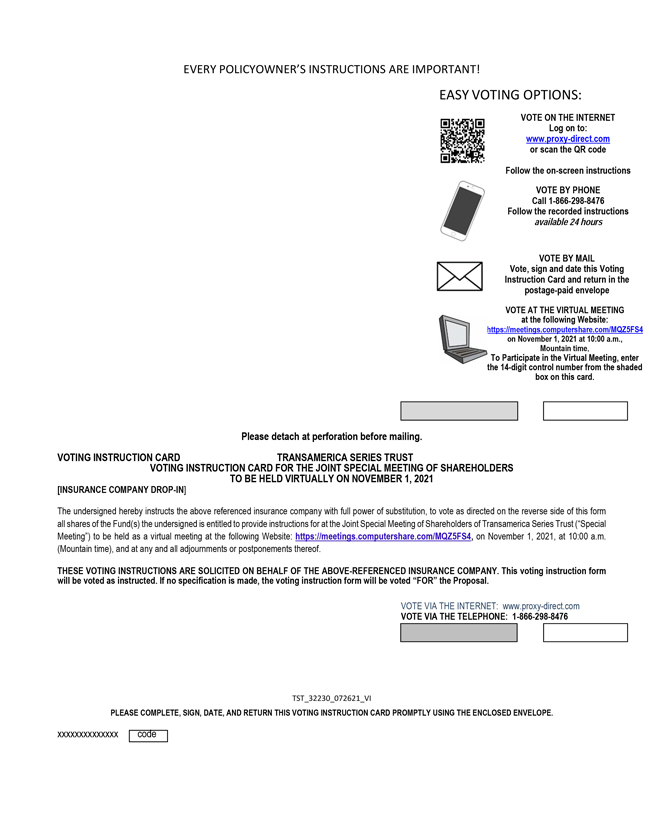

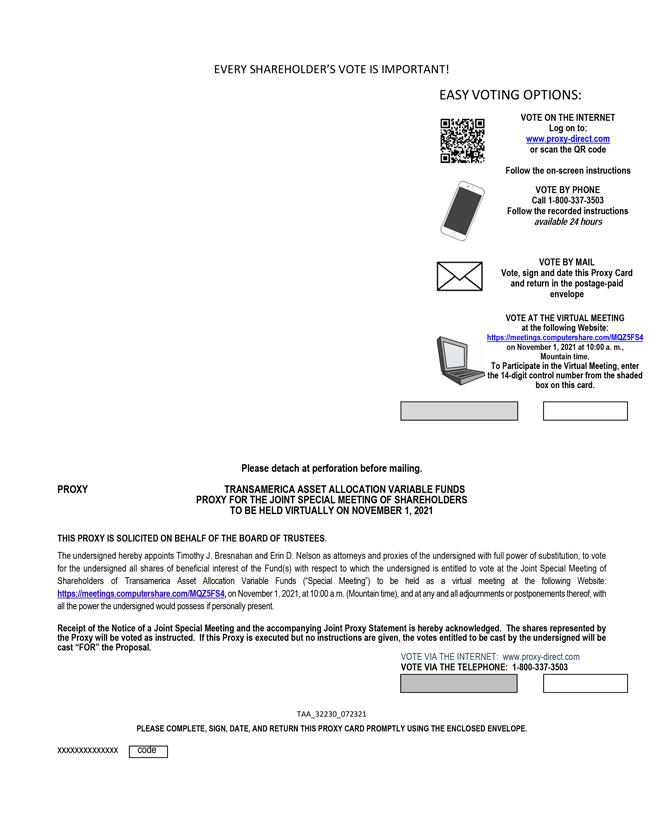

Voting is quick and easy. You may vote by telephone, via the internet or by simply completing and signing the enclosed proxy card (your ballot) and mailing it in the accompanying postage-paid return envelope. Please follow the voting instructions on your proxy card or voting instruction form.

If you have any questions about voting, please call Computershare Fund Services, Inc. (“Computershare”), the funds’ proxy solicitor, toll-free at 866-963-6126.

| Sincerely, |

/s/ Marijn P. Smit |

| Chairman of the Boards |

| President and Chief Executive Officer |

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 15 | ||||

| 15 | ||||

Investment Manager, Transfer Agent and Principal Underwriter | 15 | |||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| D-1 | ||||

| E-1 | ||||

| F-1 | ||||

i

Table of Contents

IMPORTANT INFORMATION FOR FUND HOLDERS

Please read the full text of the enclosed Joint Proxy Statement.

Below is a brief overview of the proposal to be voted on. Your vote is important.

| Q. | Why am I receiving the Joint Proxy Statement? |

| A. | As a shareholder of one or more of the Transamerica Funds, or as a policyowner or contract holder investing in, one or more series of Transamerica Series Trust or Transamerica Asset Allocation Variable Funds through a variable annuity contract or variable life insurance policy, you are being asked to vote “FOR” the election of your fund’s Board of Trustees or Managing Board. |

The Investment Company Act of 1940 requires that holders elect a fund’s Board Members under certain circumstances. As a general matter, the Board may fill vacancies as long as, after the Board fills the vacancy, at least two-thirds of the Board Members have been elected by shareholders. Six of the current nine Board Members were elected by holders. Nine of the eleven nominees, including these six, already serve as Board Members of your fund. The two new nominees, both of whom are independent of Transamerica management, could not be appointed by the Board without the Board falling below the two-thirds requirement. In addition, by electing Board Members now, the Board will be able to appoint new Board Members for a longer period of time without holder approval and the expense and delay of conducting additional holder meetings.

| Q. | Why am I being asked to vote on the proposal? |

| A. | The proposal requires the approval of holders of your fund. Your fund’s Board has approved the proposal, believes it is in holders’ best interests and recommends you vote “FOR” the proposal. |

| Q. | Will my vote make a difference? |

| A. | Your vote is very important and can make a difference in the governance of the funds, no matter the interests you hold. Your vote can help ensure that the proposal recommended by the Board can be implemented. We encourage all holders to participate in the governance of their funds. |

| Q. | Who is paying for the preparation, printing and mailing of the joint proxy statement and solicitation of proxies? |

| A. | It is anticipated that the total cost of preparing, printing and mailing the joint proxy statement and soliciting proxies will be approximately $1,657,325 ($942,173 for Transamerica Funds, $708,831 for Transamerica Series Trust and $6,321 for Transamerica Asset Allocation Variable Funds), which will be borne by the funds. These costs will be allocated among the funds on the basis of their respective net assets, except when direct costs can be reasonably attributed to one or more particular funds. |

| Q. | Who do I call if I have questions? |

| A. | If you have any questions about voting, please call Computershare, the funds’ proxy solicitor, at 866-963-6126. |

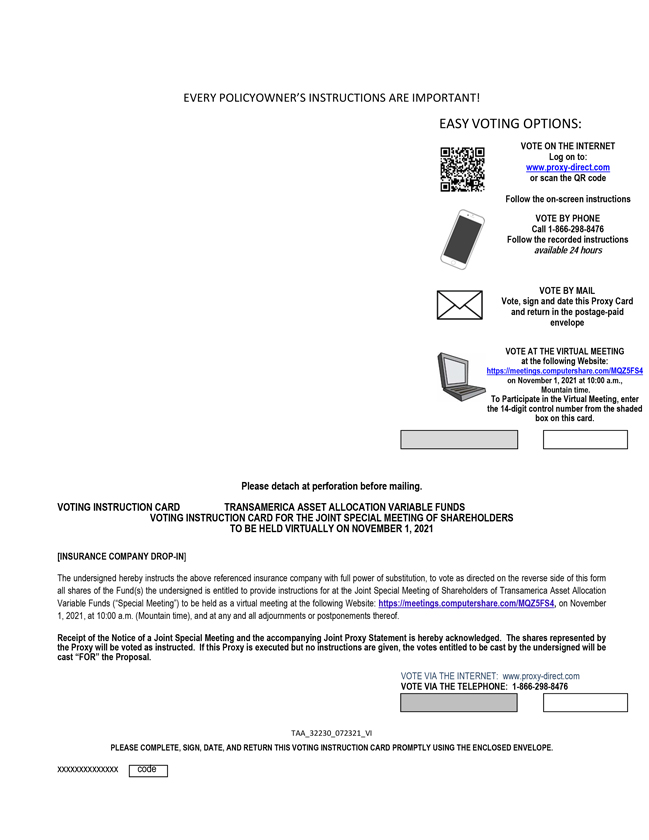

| Q. | How do I vote? |

| A. | You can provide voting instructions by telephone by calling the toll-free number on the enclosed proxy card or by computer by going to the internet address provided on the proxy card and following the instructions, using your proxy card as a guide. Alternatively, you can vote your shares by signing and dating the enclosed proxy card and mailing it in the enclosed postage-paid envelope. |

You may also virtually attend the special meeting and vote at the meeting. However, even if you intend to do so, we encourage you to provide voting instructions in advance by one of the methods described above.

| Q: | When and where will the special meeting be held? |

| A. | We intend to hold the special meeting as a virtual meeting on November 1, 2021 at 10:00 a.m. (Mountain time). In light of the public health concerns regarding the COVID-19 pandemic, and to support the health and safety of fund holders, the Board of your fund has determined that the special meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. The details on how to participate in the virtual special meeting are included in the enclosed joint proxy statement. |

PLEASE CAST YOUR VOTE NOW

1

Table of Contents

TRANSAMERICA FUNDS

TRANSAMERICA SERIES TRUST

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

1801 California Street, Suite 5200

Denver, Colorado 80202

NOTICE OF A JOINT SPECIAL MEETING OF HOLDERS

To be held Virtually on November 1, 2021

Please take notice that a joint special meeting of holders of each series of Transamerica Funds, Transamerica Series Trust and Transamerica Asset Allocation Variable Funds identified below (each series, a “Fund” and collectively, the “Funds”) is scheduled to be held as a virtual meeting on November 1, 2021 at 10:00 a.m. (Mountain time) (the “Special Meeting”), to consider and vote on the following proposals:

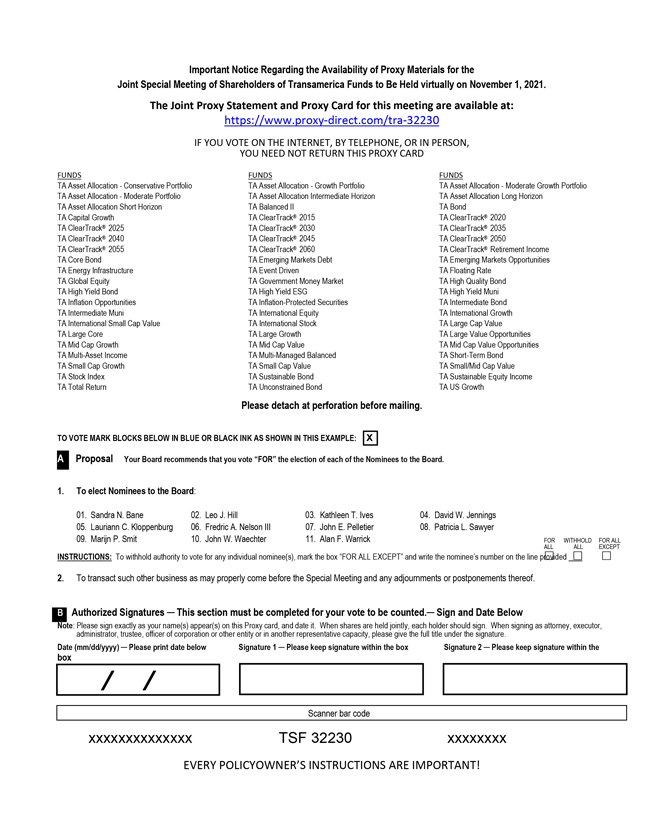

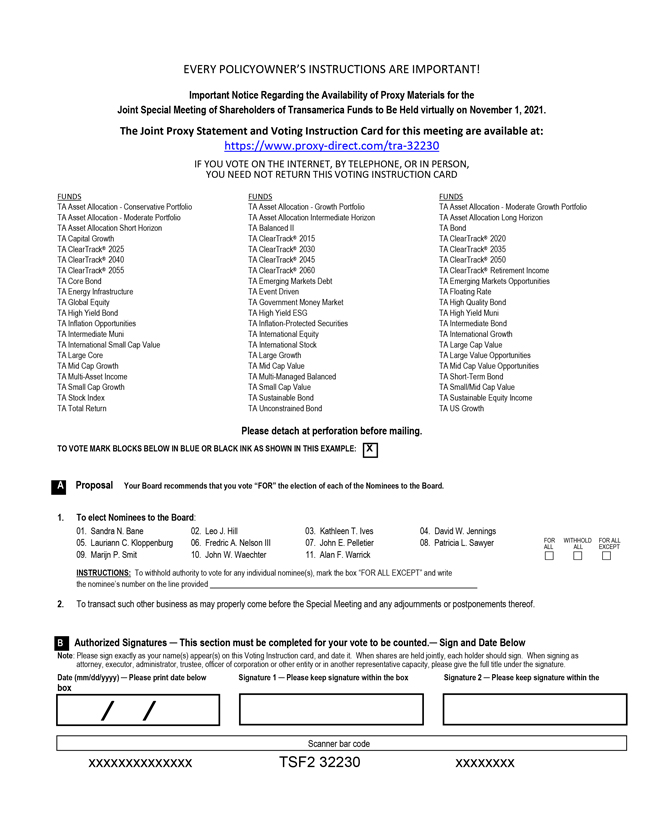

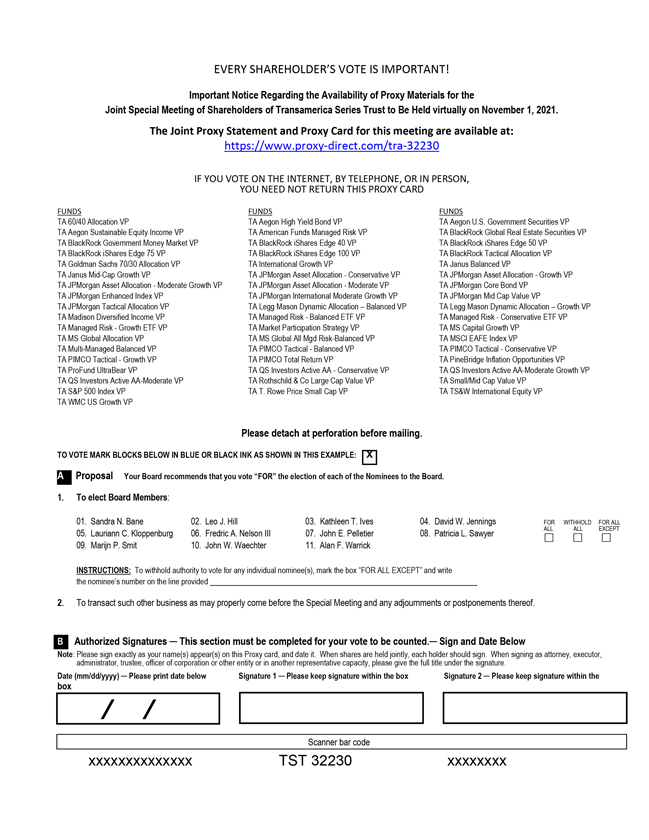

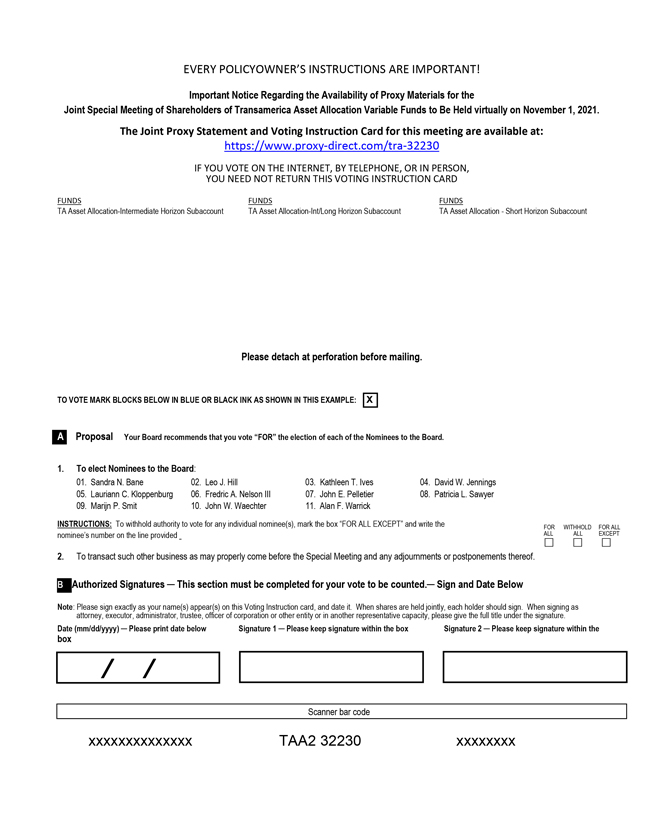

| I. | To elect Board Members; |

| II. | To transact such other business as may properly come before the Special Meeting and any adjournments or postponements thereof. |

After careful consideration, the Board of your Fund approved Proposal I and recommends that you vote “FOR” the proposal.

Holders of record of each Fund at the close of business on August 6, 2021 are entitled to notice of and to vote at the Special Meeting and any adjournments or postponements thereof.

PLEASE NOTE: In light of the public health concerns regarding the COVID-19 pandemic, and to support the health and safety of Fund shareholders, the Board of your Fund has determined that the Special Meeting will be held in a virtual meeting format only, via the internet, with no physical in-person meeting. The details on how to participate in the virtual Special Meeting are included in the Joint Proxy Statement.

| By Order of the Boards, |

/s/ Erin D. Nelson |

Erin D. Nelson Chief Legal Officer and Secretary |

September 1, 2021

HOLDERS ARE INVITED TO ATTEND THE SPECIAL MEETING VIRTUALLY. YOU MAY VOTE PRIOR TO THE SPECIAL MEETING BY TELEPHONE, VIA THE INTERNET OR BY RETURNING YOUR COMPLETED PROXY CARD. YOUR VOTE IS IMPORTANT NO MATTER THE INTERESTS YOU HOLD.

The proxy materials for the Funds will be available to review at https://www.transamerica.com/media/tf-trustee-election-proxy-statement_tcm145-123705.pdf . A paper or email copy of the proxy materials may be obtained, without charge, by contacting the Funds’ proxy solicitor, Computershare, at 866-963-6126.

YOU CAN HELP YOUR FUND AVOID THE EXPENSE OF FURTHER PROXY SOLICITATION BY PROMPTLY VOTING YOUR SHARES USING ONE OF THREE CONVENIENT METHODS: (A) BY CALLING THE TOLL-FREE NUMBER AS DESCRIBED IN THE ENCLOSED PROXY CARD; (B) BY ACCESSING THE INTERNET WEBSITE AS DESCRIBED IN THE ENCLOSED PROXY CARD; OR (C) BY SIGNING, DATING AND RETURNING THE ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE.

2

Table of Contents

Funds Holding a Special Meeting on November 1, 2021

Transamerica Funds

| Transamerica ClearTrack® 2015 | Transamerica High Yield ESG | |

| Transamerica ClearTrack® 2020 | Transamerica High Yield Muni | |

| Transamerica ClearTrack® 2025 | Transamerica Inflation Opportunities | |

| Transamerica ClearTrack® 2030 | Transamerica Inflation-Protected Securities | |

| Transamerica ClearTrack® 2035 | Transamerica Intermediate Bond | |

| Transamerica ClearTrack® 2040 | Transamerica Intermediate Muni | |

| Transamerica ClearTrack® 2045 | Transamerica International Equity | |

| Transamerica ClearTrack® 2050 | Transamerica International Growth (effective | |

| Transamerica ClearTrack® 2055 | November 1, 2021, this fund will be named | |

| Transamerica ClearTrack® 2060 | Transamerica International Focus) | |

| Transamerica ClearTrack® Retirement Income | Transamerica International Small Cap Value | |

| Transamerica Asset Allocation Intermediate Horizon | Transamerica International Stock | |

| Transamerica Asset Allocation Long Horizon | Transamerica Large Cap Value | |

| Transamerica Asset Allocation Short Horizon | Transamerica Large Core | |

| Transamerica Asset Allocation – Conservative Portfolio | Transamerica Large Growth | |

| Transamerica Asset Allocation – Growth Portfolio | Transamerica Large Value Opportunities | |

| Transamerica Asset Allocation – Moderate Growth Portfolio | Transamerica Mid Cap Growth | |

| Transamerica Asset Allocation - Moderate Portfolio | Transamerica Mid Cap Value | |

| Transamerica Balanced II | Transamerica Mid Cap Value Opportunities | |

| Transamerica Bond | Transamerica Multi-Asset Income | |

| Transamerica Capital Growth | Transamerica Multi-Managed Balanced | |

| Transamerica Core Bond | Transamerica Short-Term Bond | |

| Transamerica Emerging Markets Debt | Transamerica Small Cap Growth | |

| Transamerica Emerging Markets Opportunities | Transamerica Small Cap Value | |

| Transamerica Energy Infrastructure | Transamerica Small/Mid Cap Value | |

| Transamerica Event Driven | Transamerica Stock Index | |

| Transamerica Floating Rate | Transamerica Sustainable Bond | |

| Transamerica Global Equity | Transamerica Sustainable Equity Income | |

| Transamerica Government Money Market | Transamerica Total Return | |

| Transamerica High Quality Bond | Transamerica Unconstrained Bond | |

| Transamerica High Yield Bond | Transamerica US Growth | |

| Transamerica Series Trust | ||

| Transamerica 60/40 Allocation VP | Transamerica Goldman Sachs 70/30 Allocation VP | |

| Transamerica Aegon High Yield Bond VP | Transamerica International Growth VP (effective November 1, 2021, | |

| Transamerica Aegon Sustainable Equity Income VP | this portfolio will be named Transamerica International Focus VP) | |

| Transamerica Aegon U.S. Government Securities VP | Transamerica Janus Balanced VP | |

| Transamerica American Funds Managed Risk VP | Transamerica Janus Mid-Cap Growth VP | |

| Transamerica BlackRock Global Real Estate Securities VP | Transamerica JPMorgan Asset Allocation – Conservative VP | |

| Transamerica BlackRock Government Money Market VP | Transamerica JPMorgan Asset Allocation – Growth VP | |

| Transamerica BlackRock iShares Edge 40 VP | Transamerica JPMorgan Asset Allocation – Moderate Growth VP | |

| Transamerica BlackRock iShares Edge 50 VP | Transamerica JPMorgan Asset Allocation – Moderate VP | |

| Transamerica BlackRock iShares Edge 75 VP | Transamerica JPMorgan Core Bond VP | |

| Transamerica BlackRock iShares Edge 100 VP | Transamerica JPMorgan Enhanced Index VP | |

| Transamerica BlackRock Tactical Allocation VP | Transamerica JPMorgan International Moderate Growth VP | |

3

Table of Contents

| Transamerica JPMorgan Mid Cap Value VP | Transamerica PIMCO Total Return VP | |

| Transamerica JPMorgan Tactical Allocation VP | Transamerica PineBridge Inflation Opportunities VP | |

| Transamerica Legg Mason Dynamic Allocation - Balanced VP | Transamerica ProFund UltraBear VP | |

| (effective November 1, 2021, this portfolio will be named Transamerica BlackRock iShares Dynamic Allocation – Balanced VP) | Transamerica QS Investors Active Asset Allocation – Conservative VP (effective November 1, 2021, this portfolio will be named Transamerica BlackRock iShares Active Asset Allocation – Conservative VP) | |

| Transamerica Legg Mason Dynamic Allocation – Growth VP (effective November 1, 2021, this portfolio will be named | Transamerica QS Investors Active Asset Allocation – Moderate | |

| Transamerica BlackRock iShares Dynamic Allocation – Moderate | Growth VP (effective November 1, 2021, this portfolio will be | |

| Growth VP) | named Transamerica BlackRock iShares Active Asset Allocation – | |

| Transamerica Madison Diversified Income VP | Moderate Growth VP) | |

| Transamerica Managed Risk – Balanced ETF VP | Transamerica QS Investors Active Asset Allocation – Moderate VP | |

| Transamerica Managed Risk – Conservative ETF VP | (effective November 1, 2021, this portfolio will be named | |

| Transamerica Managed Risk – Growth ETF VP | Transamerica BlackRock iShares Active Asset Allocation – | |

| Transamerica Market Participation Strategy VP | Moderate VP) | |

| Transamerica Morgan Stanley Capital Growth VP | Transamerica Rothschild & Co Large Cap Value VP | |

| Transamerica Morgan Stanley Global Allocation VP | Transamerica S&P 500 Index VP | |

| Transamerica Morgan Stanley Global Allocation Managed Risk – | Transamerica Small/Mid Cap Value VP | |

| Balanced VP | Transamerica T. Rowe Price Small Cap VP | |

| Transamerica MSCI EAFE Index VP | Transamerica TS&W International Equity VP | |

| Transamerica Multi-Managed Balanced VP | Transamerica WMC US Growth VP | |

| Transamerica PIMCO Tactical – Balanced VP | ||

| Transamerica PIMCO Tactical – Conservative VP | ||

| Transamerica PIMCO Tactical – Growth VP | ||

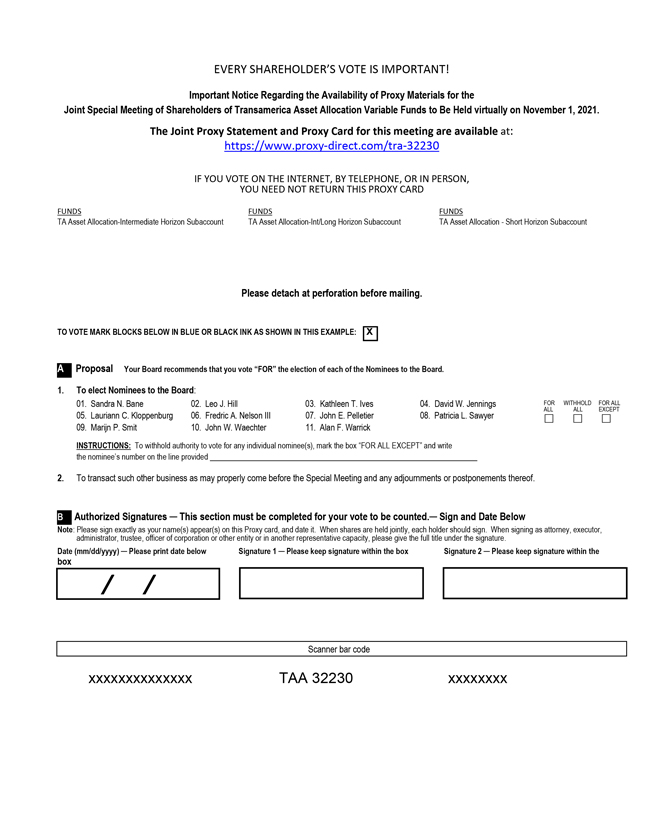

| Transamerica Asset Allocation Variable Funds | ||

| Transamerica Asset Allocation — Intermediate Horizon | ||

| Transamerica Asset Allocation — Intermediate/Long Horizon | ||

| Transamerica Asset Allocation — Short Horizon | ||

4

Table of Contents

TRANSAMERICA FUNDS

TRANSAMERICA SERIES TRUST

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

1801 California Street, Suite 5200

Denver, Colorado 80202

This Joint Proxy Statement is furnished in connection with the solicitation of proxies by the Boards of Trustees or the Managing Board (each a “Board” and each Trustee, a “Board Member”) of each of the Transamerica Funds (“TF”), Transamerica Series Trust (“TST”) and Transamerica Asset Allocation Variable Funds (“TAAVF”) (each, a “Trust”; together, the “Trusts”) funds or subaccounts listed in the accompanying Notice of a Joint Special Meeting of Holders (each, a “Fund”; together, the “Funds”). The proxies are being solicited for use at a joint special meeting of shareholders, policyowners or contract holders of the Funds to be held as a virtual meeting at 10:00 a.m. (Mountain time) on November 1, 2021 (each, a “Special Meeting”), and at any and all adjournments or postponements thereof. The Special Meeting will be held for the purposes set forth in the accompanying Notice of a Joint Special Meeting of Holders.

The Board of each Trust has determined that the use of this Joint Proxy Statement for each Trust’s Special Meeting is in the best interests of each Trust, the applicable Funds and their holders in light of the similar matters being considered and voted on by the holders of each of the Funds. The Special Meetings are being held together for convenience, but each Special Meeting is a separate meeting of the relevant Trust. At each Special Meeting of a Trust, holders of each Fund in the Trust will vote together on the election of Board Members for that Trust. This Joint Proxy Statement and the accompanying materials (for TST and TAAVF) or a Notice of Internet Availability of Proxy Materials (for TF) are being first mailed by the Boards to holders on or about September 1, 2021.

PLEASE NOTE: The Special Meeting will be held virtually over the internet. To attend, vote, and submit any questions at the Special Meeting, please register using your control number located on the proxy card or voting instruction form at https://meetings.computershare.com/MQZ5FS4.

In order for beneficial owners of shares held through an intermediary, such as a bank or broker, or other nominee to attend, participate, and vote at the virtual Special Meeting, you must register in advance. To register you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Computershare, the Funds’ proxy solicitor. You may forward an email from your intermediary or attach an image of your legal proxy to shareholdermeetings@computershare.com. Requests for registration must be received no later than 5:00 p.m., Eastern Time, three business days prior to the meeting date. You will receive a confirmation email from Computershare of your registration and a control number that will allow you to vote at the Special Meeting.

TF and TST are each organized as a Delaware statutory trust. TAAVF is a segregated investment account of Transamerica Financial Life Insurance Company (“TFLIC”). The Trusts are investment companies registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Funds that are series of TST are offered to variable annuity and variable life insurance separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies. Funds that are series of TAAVF are group variable annuity contracts offered as funding vehicles for certain retirement plans and other investors.

In certain cases, for ease of comprehension, the term “Fund” is used in this Joint Proxy Statement where it may be more precise to refer to the “Trust” of which the Fund is a series. In addition, for purposes of this Joint Proxy Statement, the term “shareholder” (when used to refer to the beneficial holder of ownership interests in a Fund) shall also be deemed to include holders of variable annuity contracts and variable life insurance policies.

You are entitled to vote at the Special Meeting of each Fund of which you are a shareholder as of the close of business on August 6, 2021 (the “Record Date”). Shareholders of record of the Fund that are series of TF and TST at the close of business on the Record Date are entitled to one vote for each dollar of net asset value of the Fund represented by the shareholder’s shares of the applicable Fund (with proportional fractional votes for fractional shares). Shareholders of record of the Funds that are series of TAAVF at the close of business on the Record Date are entitled to one vote per $100 (with proportional fractional votes for amounts less than $100) of the dollar value of the accumulation account for the shareholder’s credit in a contract held in the applicable fund subaccount. The net assets and total number of shares of each Fund outstanding at the close of business on the Record Date is shown in Appendix A.

The Fund(s) with respect to which your vote is being solicited is named on the proxy card included with this Joint Proxy Statement (references herein to proxy cards include voting instruction forms provided to the holders of variable annuity contracts and variable life insurance policies). If you have the right to vote with respect to more than one Fund as of the Record Date, you may receive more than one proxy card. Please sign, date and return each proxy card, or if you prefer to provide voting instructions by telephone or over the internet, please vote on the proposal with respect to each applicable Fund. If you vote by telephone or over the internet, you will be asked to enter a unique control number that has been assigned to you, which is printed on your proxy card(s). This control number is designed to confirm your identity, provide access to the voting sites and confirm that your voting instructions are properly recorded.

5

Table of Contents

All properly executed proxies received prior to a Trust’s Special Meeting will be voted at that Special Meeting. On the matters coming before each Special Meeting as to which a shareholder has specified a choice on that shareholder’s proxy, the shareholder’s shares will be voted accordingly. If a proxy is properly executed and returned and no choice is specified with respect to Proposal I, the shares will be voted “FOR” the proposal. The duly appointed proxies may, in their discretion, vote upon such other matters as may properly come before the Special Meeting.

Shareholders who execute proxies or provide voting instructions by telephone or the internet may revoke them with respect to the proposal at any time before a vote is taken on the proposal by filing with the applicable Fund a written notice of revocation (addressed to the Secretary at the principal executive offices of the Funds at the address above), by delivering a duly executed proxy bearing a later date or by virtually attending the Special Meeting and voting, in all cases prior to the exercise of the authority granted in the proxy card. Merely virtually attending the Special Meeting by itself will not revoke any previously executed proxy. If you hold your shares through a bank or other intermediary or if you are the holder of a variable annuity contract or variable life insurance policy (as discussed below), please consult your bank or intermediary or your participating insurance company regarding your ability to revoke voting instructions after such instructions have been provided.

Quorum, Vote Required and Manner of Voting Proxies

Quorum

A quorum of shareholders is required to take action at the Special Meeting. For the purposes of taking action on Proposal I, with respect to TF and TST, shareholders entitled to vote and present at the Special Meeting or by proxy representing at least thirty percent (30%) of the voting power of the Trust shall constitute a quorum at the Special Meeting. With respect to TAAVF, shareholders of at least thirty percent (30%) of the outstanding interests of TAAVF, present in person or by proxy, shall constitute a quorum at the Special Meeting with respect to Proposal I.

Only proxies that are voted, abstentions and “broker non-votes” will be counted toward establishing a quorum. “Broker non-votes” are shares held by a broker or nominee as to which proxies have been returned but (a) instructions have not been received from the beneficial owners or persons entitled to vote and (b) the broker or nominee does not have discretionary voting power on a particular matter. The Trusts understand that a broker or nominee may exercise discretionary voting power with respect to Proposal I, as this proposal is considered a “routine” matter under the rules of the New York Stock Exchange, and there are no other proposals expected to come before the Special Meeting for which a broker or nominee would not have discretionary voting authority. As a result, the Trusts do not anticipate that there will be any broker non-votes at the Special Meeting. Abstentions and broker non-votes are not considered “votes cast” and, therefore, do not constitute a vote “FOR” Proposal I. Abstentions and broker non-votes will have no effect on the results of the voting on Proposal I.

Votes cast at the Special Meeting will be tabulated by the inspectors of election appointed for the Special Meeting. The inspectors of election will determine whether or not a quorum is present at the Special Meeting. The inspectors of election will treat abstentions as present for purposes of determining a quorum.

In the absence of a quorum, the Special Meeting may be adjourned by the motion of the person presiding at the Special Meeting. If a quorum is present but sufficient votes to approve a proposal are not received, the Special Meeting may be adjourned by the affirmative vote of a majority of the shares present at the Special Meeting or represented by proxy at the Special Meeting. The persons named as proxies may, at their discretion, vote those proxies in favor of an adjournment of the Special Meeting. A vote may be taken on any proposal prior to any such adjournment if sufficient votes have been received.

Vote Required

Proposal I. In the case of each Trust, shareholders of all of the Funds that are series of the Trust vote together as a single class with respect to the election of nominees to the Board of the Trust. Each nominee must be elected by a plurality of the votes cast on the proposal by shareholders of the applicable Trust. Accordingly, assuming the presence of a quorum, abstentions and broker non-votes will have no effect on Proposal I.

The election of Board Members by one Trust is not contingent upon approval of Proposal I by any other Trust. If the shareholders of a Trust do not ultimately approve Proposal I, the current Board Members will continue to oversee that Trust and its Funds as they currently do pending any further action by the Trust.

Manner of Voting

The Funds expect that, before the Special Meeting, broker-dealer firms holding shares of the Funds in “street name” for their customers will request voting instructions from their customers and beneficial owners. If these instructions are not received by the date specified in the broker-dealer firms’ proxy solicitation materials, the Funds understand that broker-dealers may vote on Proposal I on behalf of their customers and beneficial owners. A signed proxy card or other authorization by a beneficial owner of shares in a Fund that does not specify how the beneficial owner’s shares should be voted on a proposal may be deemed an instruction to vote such shares in favor of the proposal.

If you hold shares in a Fund through a bank or other financial institution or intermediary (called a service agent) that has entered into a service agreement with the Fund or a distributor of the Fund, the service agent may be the record shareholder of your shares. At the Special Meeting, a service agent will vote shares for which it receives instructions from its customers in accordance with those instructions. A signed proxy card or other authorization by a beneficial shareholder that does not specify how the beneficial shareholder’s shares should be voted on the proposal may be deemed an instruction to vote such shares in favor of Proposal I. Depending on its policies, applicable law or contractual or other restrictions, a service agent may be permitted to vote shares with respect to which it has not received specific voting instructions from its customers. In those cases, the service agent may, but may not be required to, vote such shares in the same proportion as those shares for

6

Table of Contents

which the service agent has received voting instructions or in the same proportion as those shares for which the Fund receives voting instructions from other shareholders. This practice is sometimes called “proportional voting” or “echo voting.” Because of this practice, a small number of shareholders could determine how a Fund votes, if other shareholders fail to vote.

In the case of shares of Funds (such as the Funds that are series of TST or TAAVF) that are not offered to the public, but only sold to certain asset allocation portfolios, certain retirement plans and to variable annuity separate accounts established by insurance companies (including Transamerica Life Insurance Company and Transamerica Financial Life Insurance Company, Inc. (collectively, the “Insurance Companies”)) to fund variable annuity contracts and variable life insurance policies, ownership of the shares is legally vested in the separate accounts. The Insurance Companies will vote shares held by these separate accounts in a manner consistent with voting instructions timely received from the shareholders of the variable annuity contracts and variable life insurance policies used to fund the accounts. A signed proxy card or other authorization by a shareholder that does not specify how the shareholder’s shares should be voted on the proposal may be deemed an instruction to vote such shares in favor of Proposal I. The Insurance Companies will use proportional voting to vote shares held by separate accounts for which no timely instructions are received from the shareholders of variable annuity contracts and variable life insurance policies. The Insurance Companies do not require that a specified number of variable annuity contracts and variable life insurance policies submit voting instructions before the Insurance Companies will vote the shares of the Funds held by their respective separate accounts at the Special Meeting. As a result, a small number of owners of variable annuity contracts and variable life insurance policies could determine how the Insurance Companies vote, if other owners fail to vote. Other participating insurance companies may follow similar voting procedures.

If you beneficially own shares that are held in “street name” through a broker-dealer or that are held of record by a service agent, or if you hold shares through a variable annuity contract or a variable life insurance policy, and if you do not give specific voting instructions for your shares, they may not be voted at all or, as described above, they may be voted in a manner that you may not intend. Therefore, you are strongly encouraged to give your broker-dealer, service agent or participating insurance company specific instructions as to how you want your shares to be voted.

If you hold shares in a Fund directly (not through a broker-dealer, bank, insurance company or other intermediary), and if you return a signed proxy card that does not specify how you wish to vote on Proposal I, your shares will be voted in favor of the proposal.

Transamerica Asset Management, Inc. (“TAM”), the Funds’ investment manager or adviser, exercises proxy voting discretion for certain asset allocation Funds that invest their assets in other Funds. Consistent with TAM’s proxy voting policies and procedures, TAM will echo vote the shares of each applicable underlying Fund in the same proportion as the vote of all of the other voting holders of the underlying Fund’s shares. Should there be no other voting holders of an underlying Fund so TAM cannot echo vote, TAM will vote the shares of the underlying Fund in accordance with the recommendation of the relevant asset allocation Fund’s Board. The Boards have recommended that, in any such cases, the applicable underlying Fund shares be voted “FOR” the election of each nominee described in Proposal I.

If you need more information or have any questions about Proposal I or about voting, please call Computershare at 866-963-6126.

Each shareholder signing and returning a proxy has the power to revoke it at any time before it is exercised:

| • | By filing a written notice of revocation with the Secretary of the Trusts; |

| • | By returning a duly executed proxy bearing a later date; |

| • | By voting by telephone or over the Internet at a later date; or |

| • | By virtually attending and voting at the Special Meeting and giving oral notice of revocation to the chairman of the Special Meeting. |

However, attendance at the Special Meeting, by itself, will not revoke a previously executed and returned proxy.

If you hold your shares through a bank or other intermediary or if you are the holder of a variable annuity contract or variable life policy, please consult your bank or intermediary or your participating insurance company regarding your ability to revoke voting instructions after such instructions have been provided.

7

Table of Contents

PROPOSAL I - TO ELECT BOARD MEMBERS

The purpose of this Proposal I is to elect Board Members of TF, TST and TAAVF.

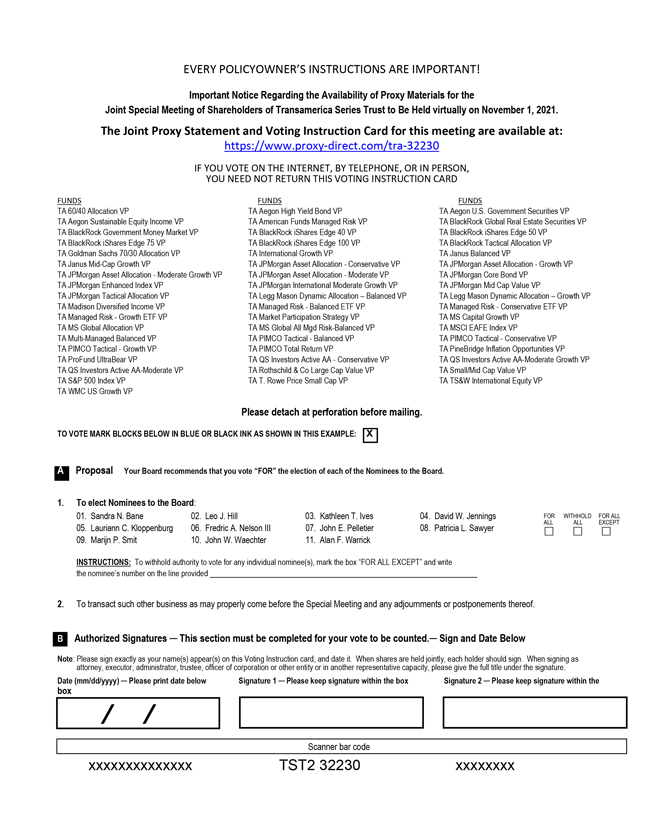

At a Board meeting held on March 10-11, 2021, the current Board Members of each Trust nominated for election the eleven nominees listed below (the “Nominees”) to serve on the Board of the applicable Trust. Nine of the Nominees, Sandra N. Bane, Leo J. Hill, David W. Jennings, Fredric A. Nelson III, John E. Pelletier, Patricia L. Sawyer, Marijn P. Smit, John W. Waechter and Alan F. Warrick, currently serve as Board Members of each Trust. Nine of the Nominees, Ms. Bane, Mr. Hill, Kathleen T. Ives, Mr. Jennings, Lauriann C. Kloppenburg, Mr. Nelson, Mr. Pelletier, Ms. Sawyer and Mr. Waechter, are not “interested persons” of the Funds within the meaning of the 1940 Act (the “Independent Nominees”). Mr. Smit, the President and Chief Executive Officer of the Funds and TAM, and Mr. Warrick are “interested persons” of the Funds as defined in the 1940 Act (the “Interested Nominees”).

Ms. Bane, Mr. Hill, Mr. Jennings, Ms. Sawyer, Mr. Waechter and Mr. Warrick were elected by Fund shareholders in 2012. Mr. Smit was appointed to the Board of each Trust in 2015 and Messrs. Nelson and Pelletier were appointed to the Boards in 2017. Mses. Ives and Kloppenburg are new nominees to the Boards and have not previously served as Board Members of the Funds (Mses. Ives and Kloppenburg, together, the “New Nominees”). Information about the Nominees for the Boards is set forth below.

Mr. Smit, an Interested Nominee, is an “interested person” of the Funds as defined in the 1940 Act by virtue of his position with TAM and its affiliates described below. Mr. Warrick, the other Interested Nominee, is considered an “interested person” of the Funds as defined in the 1940 Act due to his former service in various executive positions for certain Transamerica affiliates as described below. Each of the other Nominees is an Independent Nominee. Each Independent Nominee was nominated by the applicable Trust’s Nominating Committee comprised of the current Board Members who are not “interested persons” of the Funds within the meaning of the 1940 Act (the “Independent Board Members”).

The Nominees’ term of office would commence upon their elections, which, if the Nominees are elected by shareholders, is expected to occur on November 1, 2021. If elected, the Nominees will comprise the entire Board of each Trust, and each of them will hold office until his or her successor has been duly elected or appointed, until the end of the calendar year in which he or she reaches the mandatory retirement age of 75, or until his or her earlier death, resignation or removal.

Each Nominee has consented to serve on the Board of each Trust if elected by shareholders. If, however, before the election, any Nominee refuses or is unable to serve, proxies may be voted for a replacement nominee, if any, designated by Board Members of the applicable Trust(s).

The enclosed proxy card will be voted for all Nominees unless a proxy contains specific instructions to the contrary.

Reason for Proposed Election of Nominees

The 1940 Act requires that shareholders elect a fund’s board under certain circumstances. As a general matter, a fund’s board may fill vacancies as long as, after the board fills the vacancy, at least two-thirds of the board members would be elected by shareholders. The New Nominees could not be appointed by the Boards without the Boards falling below the two-thirds requirement. The other nine Nominees already serve as Board Members of each Trust, all of whom, with the exception of Messrs. Nelson, Pelletier and Smit have been elected by shareholders (representing two-thirds of the current Board Members). Electing each Nominee to the Boards would provide the Boards the flexibility to add new Board Members or to fill any future vacancies created by the departure of one or more shareholder-elected Board Members, if necessary, without the expense and delay of conducting additional shareholder meetings.

Information about the Nominees

The table below sets forth each Nominee’s name, age (as of the shareholder meeting date), positions and length of service with the Trusts, each Nominee’s principal occupation for at least the past five years (titles may have varied during that period), the number of funds in the Transamerica Fund Family each Nominee will oversee if elected, and any other board memberships held by each Nominee. The length of time served is provided for the current Board Members from the date the Board Member became a member of the Boards. The Transamerica Fund Family consists of TF, TST, TAAVF and Transamerica ETF Trust (“TET”). TET is overseen by a separate Board of Trustees. The mailing address of each Nominee is c/o Secretary of the Funds, 1801 California Street, Suite 5200, Denver, Colorado 80202.

8

Table of Contents

Name and Age | Position(s) Held | Term of Office | Principal Occupation(s) | Number of | Other Directorships Held | |||||

| INTERESTED NOMINEES | ||||||||||

Marijn P. Smit (48) | Chairman of the Boards, President and Chief Executive Officer | Since 2014 (all Trusts) | Chairman of the Board, President and Chief Executive Officer, TF, TST and TAAVF (2014 – present); Chairman of the Board, President and Chief Executive Officer, TET (2017 – present); Chairman of the Board, President and Chief Executive Officer, Transamerica Partners Portfolio (“TPP”), Transamerica Partners Funds Group (“TPFG”) and Transamerica Partners Funds Group II (“TPFG II”) (2014 – 2018); Director, Chairman of the Board, President and Chief Executive Officer, Transamerica Asset Management, Inc. (“TAM”) and Transamerica Fund Services, Inc. (“TFS”) (2014 – present); Senior Vice President, Transamerica Retirement Solutions LLC (2012 - present); Trust Officer, Massachusetts Fidelity Trust Company (2014 - 2021); President, Investment Solutions, Transamerica Investments & Retirement (2014 – 2016); Vice President, Transamerica Life Insurance Company (2010 – 2016); Vice President, Transamerica Premier Life Insurance Company (2010 – 2016); Senior Vice President, Transamerica Financial Life Insurance Company (2013 – 2016); Senior Vice President, Transamerica Retirement Advisors, Inc. (2013 – 2016) and President and Director, Transamerica Stable Value Solutions, Inc. (2010 – 2016). | 120 | Director, Massachusetts Fidelity Trust Company (2014 -2021); Director, Aegon Global Funds (2016 - present) | |||||

| Alan F. Warrick (73) | Board Member | Since 2012 (all Trusts) | Board Member, TF, TST and TAAVF (2012 – present); Board Member, TPP, TPFG and TPFG II (2012 – 2018); Senior Advisor, Lovell Minnick Equity Partners (2010 – present); and Retired (2010). | 115 | N/A | |||||

| INDEPENDENT NOMINEES | ||||||||||

| Sandra N. Bane (69) | Board Member | Since 2008 (all Trusts) | Retired (1999 – present); Board Member, TF, TST and TAAVF (2008 – present); Board Member, TPP, TPFG and TPFG II (2008 – 2018); and Partner, KPMG (1975 – 1999). | 115 | Big 5 Sporting Goods (2002 – present); Southern Company Gas (energy services holding company) (2008 – present) | |||||

9

Table of Contents

Name and Age | Position(s) Held | Term of Office | Principal Occupation(s) | Number of | Other Directorships Held | |||||

| Leo J. Hill (65) | Lead Independent Board Member | Since 2002 (TF & TAAVF) Since 2001 (TST) | Principal, Advisor Network Solutions, LLC (business consulting) (2006 – present); Board Member, TST (2001 – present); Board Member, TF (2002 – present); Board Member, TAAVF (2007 – present); Board Member, TPP, TPFG and TPFG II (2007 – 2018); Market President, Nations Bank of Sun Coast Florida (1998 – 1999); Chairman, President and Chief Executive Officer, Barnett Banks of Treasure Coast Florida (1994 – 1998); Executive Vice President and Senior Credit Officer, Barnett Banks of Jacksonville, Florida (1991 – 1994); and Senior Vice President and Senior Loan Administration Officer, Wachovia Bank of Georgia (1976 – 1991). | 115 | Ameris Bancorp (2013 – present); Ameris Bank (2013 – present) | |||||

| Kathleen T. Ives (56) | Board Member Nominee | N/A | Proposed Board Member, TF, TST and TAAVF (2021 – present); Retired (2019 – present); Senior Vice President & Director of Internal Audit (2011-2019), Senior Vice President & Deputy General Counsel (2008 – 2011), OFI Global Asset Management, Inc. | None currently; 115 if elected as to all Trusts | Junior Achievement Rocky Mountain (non-profit organization) (2013 – present); Institute of Internal Auditors, Denver Chapter (audit organization) (2017 – 2021). | |||||

| David W. Jennings (75) | Board Member | Since 2009 (all Trusts) | Board Member, TF, TST and TAAVF (2009 – present); Board Member, TPP, TPFG and TPFG II (2009 – 2018); Managing Director, Hilton Capital Management, LLC (2010 – present). | 115 | N/A | |||||

| Lauriann C. Kloppenburg (61) | Board Member Nominee | N/A | Proposed Board Member, TF, TST and TAAVF (2021 – present); Director, Adams Funds (investment companies) (2017 – present); Investment Committee Member, 1991 Office, LLC (family office) (2017 – Present); Executive in Residence and Student Fund Advisory Board Member, Champlain College (2016 – present); Executive in Residence, Bentley University (2015 – 2017); Chief Strategy Officer (2012 – 2013), Chief Investment Officer – Equity Group (2004 – 2012), Loomis Sayles & Company, L.P. | None currently; 115 if elected as to all Trusts | Trustees of Donations to the Protestant Episcopal Church (non-profit organization) (2010 – present); Forte Foundation (non-profit organization) (2016 – present) |

10

Table of Contents

Name and Age | Position(s) Held | Term of Office | Principal Occupation(s) | Number of | Other Directorships Held | |||||

| Fredric A. Nelson III (64) | Board Member | Since 2017 (all Trusts) | Board Member, TF, TST and TAAVF (2017 – present); Board Member, TPP, TPFG and TPFG II (2017 – 2018); Chief Investment Officer (“CIO”), Commonfund (2011 – 2015); Vice Chairman, CIO, ING Investment Management Americas (2003 – 2009); Managing Director, Head of U.S. Equity, JP Morgan Investment Management (1994 – 2003); and Managing Director, Head of Global Quantitative Investments Group, Bankers Trust Global Investment Management (1981 – 1994). | 115 | N/A | |||||

| John E. Pelletier (57) | Board Member | Since 2017 (all Trusts) | Board Member, TF, TST and TAAVF (2017 – present); Board Member, TPP, TPFG and TPFG II (2017 – 2018); Director, Center for Financial Literacy, Champlain College (2010 – present); Co- Chair, Vermont Financial Literacy Commission with Vermont State Treasurer (2015 – 2018); Chairman, Vermont Universal Children’s Higher Education Savings Account Program Advisory Committee (2015 – 2021); Founder and Principal, Sterling Valley Consulting LLC (a financial services consulting firm) (2009 – 2017); Independent Director, The Sentinel Funds and Sentinel Variable Products Trust (2013 – 2017); Chief Legal Officer, Eaton Vance Corp. (2007 – 2008); and Executive Vice President and Chief Operating Officer (2004 - 2007), General Counsel (1997 – 2004), Natixis Global Associates. | 115 | N/A |

11

Table of Contents

Name and Age | Position(s) Held | Term of Office | Principal Occupation(s) | Number of | Other Directorships Held | |||||

| Patricia L. Sawyer (71) | Board Member | Since 1993 (TAAVF) Since 2007 (TF & TST) | Retired (2007 – present); President/Founder, Smith & Sawyer LLC (management consulting) (1989 – 2007); Board Member, TF and TST (2007 – present); Board Member, TAAVF (1993 – present); Board Member, TPP, TPFG and TPFG II (1993 – 2018); and Trustee, Chair of Finance Committee and Chair of Nominating Committee (1987 – 1996), Bryant University. | 115 | Honorary Trustee, Bryant University (1996 – present) | |||||

| John W. Waechter (69) | Board Member | Since 2004 (TST) Since 2005 (TF & TAAVF) | Partner, Englander Fischer (2016 – present) (law firm); Attorney, Englander Fischer (2008 – 2015); Retired (2004 – 2008); Board Member, TST (2004 – present); Board Member, TF (2005 – present); Board Member, TAAVF (2007 – present); Board Member, TPP, TPFG and TPFG II (2007 – 2018); Employee, RBC Dain Rauscher (securities dealer) (2004); Executive Vice President, Chief Financial Officer and Chief Compliance Officer, William R. Hough & Co. (securities dealer) (1979 – 2004); and Treasurer, The Hough Group of Funds (1993 – 2004) (fund accounting). | 115 | Board Member, Operation PAR, Inc. (non-profit organization) (2008 – present); Board Member, Boley PAR, Inc. (non-profit organization) (2016 - present); Board Member, Remember Honor Support, Inc. (non-profit organization) ( 2013 - 2020); Board Member, WRH Income Properties, Inc. (real estate) (2014 - present) |

| * | Each Board Member shall hold office until: 1) his or her successor is elected and qualified or 2) he or she resigns, retires or his or her term as a Board Member is terminated in accordance with each Trust’s Declaration of Trust. |

To the knowledge of the Trusts, as of August 6, 2021, all Board Members and officers as a group owned less than 1% of the outstanding shares of each Fund.

Each Board believes that each Nominee’s experience, qualifications, attributes or skills on an individual basis and in combination with those of the other Nominees lead to the conclusion that the Boards will possess the requisite skills and attributes. Each Board believes that the Nominees’ ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with TAM, the sub-advisers, other services providers, counsel and independent auditors, and to exercise effective business judgment in the performance of their duties, support this conclusion. Each Board also has considered the following experience, qualifications, attributes and/or skills, among others, of the Nominees in reaching its conclusion: his or her character and integrity; such person’s service as a board member of a predecessor fund family (other than Mses. Ives and Kloppenburg, and Messrs. Jennings, Nelson, Pelletier, Smit and Warrick); such person’s willingness to serve and willingness and ability to commit the time necessary to perform the duties of a Board Member; the fact that such person’s service would be consistent with the requirements of the retirement policies of the Trusts; as to each Nominee other than Mr. Smit and Mr. Warrick, his or her status as not being an “interested person” of the Funds as defined in the 1940 Act; as to Mr. Smit, his status as a representative of TAM; and, as to Mr. Warrick, his former service in various executive positions for certain affiliates of TAM. In addition, the following specific experience, qualifications, attributes and/or skills apply as to each Board Member: Ms. Bane, accounting experience and experience as a board member of multiple organizations; Mr. Hill, financial and entrepreneurial experience as an executive, owner and consultant and experience as a board member of multiple organizations; Ms. Ives, audit, securities industry and compliance experience as a fund executive; Mr. Jennings, investment management experience as an executive of investment management organizations and portfolio manager; Ms. Kloppenburg, investment management experience as an executive and board experience; Mr. Nelson, business experience, securities industry and fund executive experience; Mr. Pelletier, securities industry and fund legal and operations experience, entrepreneurial experience as an executive, owner and

12

Table of Contents

consultant, and board experience; Ms. Sawyer, management consulting and board experience; Mr. Waechter, securities industry and fund accounting and fund compliance experience, legal experience and board experience; Mr. Smit, investment management and insurance experience as an executive and leadership roles with TAM and affiliated entities; and Mr. Warrick, financial services industry experience as an executive and consultant with various TAM affiliates and other entities. References to the qualifications, attributes and skills of the Nominees are pursuant to requirements of the Securities and Exchange Commission, do not constitute holding out of the Boards or any Nominee as having any special expertise or experience, and shall not impose any greater responsibility or liability on any such person or on the Boards by reason thereof.

The nominations of Mses. Ives and Kloppenburg were recommended to the Nominating Committee of each Board by certain Independent Board Members serving on that Nominating Committee. The remaining Nominees currently serve on the Boards and are being submitted for election or reelection, as applicable.

Each Board is responsible for overseeing the management and operations of the Funds. Mr. Smit serves as Chairman of the Boards. Mr. Smit is an interested person of the Funds. Independent Board Members currently constitute more than 77% of each Board, and if all Nominees are elected, Independent Board Members would comprise more than 81% of the Boards.

The Boards currently believe that an interested Chairman is appropriate and is in the best interests of the Funds and their shareholders, and that its committees, as further described below, help ensure that the Funds have effective and independent governance and oversight. The Boards believe that an interested Chairman has a professional interest in the quality of the services provided to the Funds and that the Chairman is best equipped to provide oversight of such services on a day-to-day basis because of TAM’s sponsorship of the Funds and TAM’s ongoing monitoring of the investment sub-advisers that manage the assets of each Fund. The Boards also believe that its leadership structure facilitates the orderly and efficient flow of information to the Independent Board Members from management. The Independent Board Members also believe that they can effectively act independently without having an Independent Board Member act as Chairman. Among other reasons, this belief is based on the fact that the Independent Board Members currently represent over 77% of each Board.

Board Committees and Membership

Each Board has two standing committees: the Audit Committee and Nominating Committee. The Audit Committee and Nominating Committee of each Board is chaired by an Independent Board Member and composed of all of the Independent Board Members. In addition, each Board has a Lead Independent Board Member.

The Lead Independent Board Member and the chairs of the Audit and Nominating Committees work with the Chairman to set the agendas for Board and committee meetings. The Lead Independent Board Member also serves as a key point person for dealings between management and the Independent Board Members. Through the Funds’ Board committees, the Independent Board Members consider and address important matters involving the Funds, including those presenting conflicts or potential conflicts of interest for management, and they believe they can act independently and effectively. Each Board believes that its leadership structure is appropriate and facilitates the orderly and efficient flow of information to the Independent Board Members from management. Except for any duties specifically assigned by the Board or in relevant documents, the designation of a Board Member as Chairman of the Board, Lead Independent Board Member or chair of a committee does not impose on such Board Member any duties, obligations or liability that is greater than the duties, obligations or liability imposed on such person as a Board Member, generally.

Audit Committee

Each Audit Committee, among other things, oversees the accounting and reporting policies and practices and internal controls of the applicable Trust, oversees the quality and integrity of the financial statements of the Trust, approves, prior to appointment, the engagement of the Trust’s independent registered public accounting firm, reviews and evaluates the independent registered public accounting firm’s qualifications, independence and performance, and approves the compensation of the independent registered public accounting firm.

Each Audit Committee also approves all audit and permissible non-audit services provided to each Fund within the applicable Trust by the independent registered public accounting firm and all permissible non-audit services provided by each applicable Fund’s independent registered public accounting firm to TAM and any affiliated service providers if the engagement relates directly to each Fund’s operations and financial reporting. Each Audit Committee acts pursuant to a written charter.

During the fiscal year ended October 31, 2020, the Audit Committee of the TF Board met 4 times. During the fiscal year ended December 31, 2020, the Audit Committee of each of the TST and TAAVF Board met 3 times. Each Nominee then in office attended more than 75% of the aggregate number of such committee meetings.

Nominating Committee

Each Nominating Committee is a forum for identifying, considering, selecting and nominating, or recommending for nomination by the Board of that Trust, candidates to fill vacancies on the Board. The Nominating Committee may consider diversity in identifying potential candidates, including race, gender, differences of viewpoint, professional experience and skill, as well as such other individual qualities and attributes as it may deem relevant. Each Nominating Committee has not adopted a formal procedure for the implementation, or for assessing the effectiveness, of its policy with regard to the consideration of diversity in identifying potential candidates.

13

Table of Contents

When addressing vacancies, each Nominating Committee sets any necessary standards or qualifications for service on the Board of that Trust and may consider nominees recommended by any source it deems appropriate, including management and shareholders. Shareholders who wish to recommend a nominee should send recommendations to the Trusts’ Secretary that include all information relating to such person that is required to be disclosed in solicitations of proxies for the election of Board Members. A recommendation must be accompanied by a written consent of the individual to stand for election if nominated by the Board(s) and to serve if elected by the shareholders. Each Nominating Committee will consider all submissions meeting the applicable requirements stated herein that are received by December 31 of the most recently completed calendar year.

Each Nominating Committee also identifies potential nominees through its network of contacts and may also engage, if it deems appropriate, a professional search firm. Each Nominating Committee meets to discuss and consider such candidates’ qualifications and then chooses a candidate by majority vote.

Each Nominating Committee acts pursuant to a written charter, as set forth in Appendix B. The charter sets forth procedures for each Nominating Committee’s consideration of candidates submitted by shareholders.

During the fiscal year ended October 31, 2020, the Nominating Committee of the TF Board met 3 times. During the fiscal year ended December 31, 2020, the Nominating Committee of each of TST and TAAVF met 4 times. Each Nominee then in office attended more than 75% of the aggregate number of such committee meetings.

Risk Oversight

Through its oversight of the management and operations of the applicable Funds, each Board also has a risk oversight function, which includes (without limitation) the following: (i) requesting and reviewing reports on the operations of the Funds (such as reports about the performance of the Funds); (ii) reviewing compliance reports and approving compliance policies and procedures of the Funds and their service providers; (iii) meeting with management to consider areas of risk and to seek assurances that adequate resources are available to address risks; (iv) meeting with service providers, including Fund auditors, to review Fund activities; and (v) meeting with the Chief Compliance Officer and other officers of the Funds and the Funds’ service providers to receive information about compliance, and risk assessment and management matters. Such oversight is exercised primarily through the Boards and their Audit Committees but, on an ad hoc basis, also can be exercised by the Independent Board Members during executive sessions. Each Board has emphasized to TAM and the sub-advisers the importance of maintaining vigorous risk management.

The Boards recognize that not all risks that may affect the Funds can be identified, that it may not be practical or cost-effective to eliminate or mitigate certain risks, that it may be necessary to bear certain risks (such as investment-related risks) to achieve the Funds’ goals, and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. Moreover, reports received by the Board Members as to risk management matters are typically summaries of the relevant information. Most of the Funds’ investment management and business affairs are carried out by or through TAM, its affiliates, the sub-adviser and other service providers each of which has an independent interest in risk management but whose policies and the methods by which one or more risk management functions are carried out may differ from the Funds’ and each other’s in the setting of priorities, the resources available or the effectiveness of relevant controls. As a result of the foregoing and other factors, the Boards’ risk management oversight is subject to substantial limitations. In addition, some risks may be beyond the reasonable control of the Boards, the Funds, TAM, its affiliates, the sub-advisers or other service providers.

In addition, it is important to note that each Fund is designed for investors that are prepared to accept investment risk, including the possibility that unforeseen risks may emerge in the future.

Officers of the Trusts

The officers of each Trust, including their ages, their positions held with the Trust and their principal occupations during the past five years (their titles may have varied during that period) are set forth in Appendix C. Each officer is elected by and serves at the pleasure of the Trust’s Board. Each officer will hold office until his or her successor has been duly elected or appointed or until his or her earlier death, resignation or removal.

If an officer has held offices for different Funds for different periods of time, the earliest applicable date is shown. No officer of the Trusts, except for the Chief Compliance Officer, receives any compensation from the Trusts.

General Information Regarding the Boards

Compensation: Information relating to compensation paid to the Board Members for the most recent fiscal year ends of the Funds they will oversee is set forth in Appendix D.

Equity Securities Owned by the Nominees: Information relating to the amount of equity securities owned by the Nominees in the Funds that they will oversee and in the other funds in the Transamerica Fund Family, as well as certain additional information regarding the Independent Nominees, is set forth in Appendix E.

Attendance of Board Members at Annual Meeting: The Trusts do not hold annual meetings of shareholders, and therefore do not have a policy regarding attendance of Board Members at annual meetings. No annual meeting for any of the Trusts was held during the most recent fiscal year ends of the Funds.

14

Table of Contents

Board Meetings: During the fiscal year ended October 31, 2020, the Board of TF met 5 times. During the fiscal year ended December 31, 2020, the Board of each of TST and TAAVF met 5 times. Each Nominee then in office attended more than 75% of the aggregate number of such meetings of the Boards.

Indemnification of Board Members and Officers

The governing documents of each Trust generally provide that, to the fullest extent permitted by applicable law, the Trust will indemnify its Board Members and officers against liabilities and expenses incurred in connection with litigation in which they may be involved because of their offices with the Trust, unless it is finally adjudicated that they engaged in willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in their offices.

Required Vote

This Proposal I must be approved by a plurality of the votes cast at the Special Meeting or by proxy at which a quorum exists. The votes of each Fund in the same Trust will be counted together with respect to the election of the Nominees to the Board and the shareholders of each Fund will vote together as a single class with the shareholders of all other Funds that are series of the same Trust.

Your Board recommends that you vote “FOR” the election of each of the Nominees to the Boards.

The Board Members do not know of any matters to be presented at the Special Meeting other than those set forth in this Joint Proxy Statement. If other business should properly come before a Special Meeting, including any questions as to an adjournment of postponement of the Special Meeting, any such matter will be voted in accordance with the judgment of the persons named in the accompanying proxy card.

Investment Manager, Transfer Agent and Principal Underwriter

TAM serves as the investment manager for the Funds in TF and TST. TF and TST have entered into an Investment Management Agreement with TAM, on behalf of each Fund. TAM serves as the investment adviser for the Funds in TAAVF pursuant to an Investment Advisory Agreement. TAM, located at 1801 California Street, Suite 5200, Denver, CO 80202, provides continuous and regular investment management services to the Funds.

TAM has been a registered investment adviser since 1996. As of December 31, 2020, TAM has approximately $88 billion in total assets under management. TAM is directly owned by Transamerica Life Insurance Company (“TLIC”) (77%) and AUSA Holding, LLC (“AUSA”) (23%), both of which are indirect, wholly owned subsidiaries of Aegon NV. TLIC is owned by Commonwealth General Corporation (“Commonwealth”). Commonwealth and AUSA are wholly owned by Transamerica Corporation (DE).

Transamerica Corporation (DE) is wholly owned by Aegon International B.V., which is wholly owned by Aegon NV, a Netherlands corporation, and a publicly traded international insurance group. Transamerica Fund Services, Inc. (“TFS”), the transfer agent of TF and TST, is located at 1801 California Street, Suite 5200, Denver, Colorado 80202. The current principal underwriter and distributor of the TF and TST Funds is Transamerica Capital, Inc. (“TCI”), located at 1801 California Street, Suite 5200, Denver, CO 80202. TAM, TFS and TCI are all affiliated due to their common ultimate ownership by AEGON, N.V.

Legal Proceedings

On September 30, 2020, Transamerica Asset Management, Inc. (“TAM”), the investment manager of the funds, entered into a settlement with the Securities and Exchange Commission (the “SEC”) relating to expense recaptures. The recaptures at issue, which TAM self-reported to the SEC, involved amounts previously voluntarily waived and/or reimbursed to four money market funds to prevent the funds from experiencing a negative yield. In some cases recaptures under the voluntary yield waiver arrangements exceeded contractual expense limits. The recaptured amounts were not reflected in the funds’ prospectus fee tables. The funds involved were Transamerica Government Money Market, Transamerica BlackRock Government Money Market VP, Transamerica Partners Government Money Market and Transamerica Partners Institutional Government Money Market. The two Transamerica Partners Government Money Market funds reorganized into Transamerica Government Money Market in October of 2017.

Under the settlement order, TAM agreed to pay affected fund investors approximately $5.3 million in disgorgement and approximately $690,000 in prejudgment interest. These amounts represent expenses incurred above the applicable expense limit (plus interest). TAM was also censured and ordered to cease and desist from committing or causing any violations of certain statutory provisions and SEC rules. The settlement order imposes no civil penalty on TAM based upon TAM having self-reported the matter, the prompt remedial steps taken by TAM, and TAM’s cooperation in the SEC staff ’s investigation. The settlement order does not affect TAM’s ability to manage the funds.

The foregoing is only a brief summary of the settlement order. A copy of the settlement order is available on the SEC’s website at https://www.sec.gov.

State Street Bank & Trust (“State Street”), located at One Lincoln Street, Boston, MA 02111, serves as each Fund’s custodian.

15

Table of Contents

Annual and Semi-Annual Reports

Shareholders of TF can find important information about the Funds in their annual reports dated October 31, 2020 and their semi-annual reports dated April 30, 2021 (or, for Transamerica Stock Index, the annual report dated December 31, 2020 and semi-annual report dated June 30, 2021), which have been previously mailed or made available to shareholders. Shareholders of TST and TAAVF can find important information about TST’s portfolios and TAAVF’s sub-accounts in their respective annual reports dated December 31, 2020 and semi-annual reports dated June 30, 2021, which have been previously mailed or made available to shareholders. You may obtain copies of these reports without charge by writing to the Funds at the address shown on the first page of this Joint Proxy Statement or by calling the following numbers: 1-800-851-9777 for TST, 1-888-233-4339 for TF and 1-800-755-5801 for TAAVF.

The principal solicitation of proxies will be by the mailing of this Joint Proxy Statement beginning on or about September 1, 2021, but proxies may also be solicited by telephone and/or by representatives of the Funds, regular employees of TAM or its affiliate(s), or Computershare, a private proxy services firm. It is anticipated that the total cost of preparing, printing and mailing the joint proxy statement and soliciting proxies will be approximately $1,657,325 ($942,173 for TF, $708,831 for TST and $6,321 for TAAVF), which will be borne by the Funds. These costs will be allocated among the Funds on the basis of their respective net assets, except when direct costs can be reasonably attributed to one or more particular Funds. If we have not received your vote as the date of the Special Meeting approaches, you may receive a call from these parties to ask for your vote. Arrangements will be made with brokerage houses and custodians, nominees and fiduciaries to forward proxies and proxy materials to their clients.

The cost of the Special Meeting, including the preparation and mailing of the Notice, Joint Proxy Statement and the solicitation of proxies, including reimbursement to brokerage firms and others for their expenses in forwarding proxy materials to the beneficial owners and soliciting them to execute proxies, will be borne by the Funds.

Independent Registered Public Accounting Firm

The Audit Committee and Board Members, including a majority of the independent Board Members, of each Fund have selected Ernst & Young LLP (“E&Y”) as the independent registered public accounting firm for such Fund. E&Y, in accordance with Independence Standards Board Standard No. 1 (ISB No. 1), has confirmed to each applicable Audit Committee that it is an independent registered public accounting firm with respect to the Funds.

Each Fund’s Audit Committee approved the engagement of E&Y as each Fund’s independent registered public accounting firm for the applicable Fund’s current fiscal year. E&Y provides audit and accounting services including audit of the annual financial statements, assistance and consultation with respect to filings with the SEC, and preparation for annual income tax returns.

The reports of E&Y on each Fund’s financial statements for each of the last two fiscal years audited by E&Y contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. There have been no disagreements with E&Y during such fiscal years and any subsequent interim period on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure which, if not resolved to the satisfaction of E&Y, would have caused them to make reference thereto in their reports on the financial statements for such years.

Representatives of E&Y are not expected to be present at the Special Meeting but have been given the opportunity to make a statement if they so desire and will be available should any matter arise requiring their response.

Shown below for each Fund’s two most recent fiscal years, are the fees billed by the Fund’s independent registered public accounting firm for all audit and non-audit services provided directly to the Fund. The fee information is presented under the following captions:

(a) Audit Fees - fees related to the audit and review of the financial statements included in annual reports and registration statements, and other services that are normally provided in connection with statutory and regulatory filings or engagements.

(b) Audit-Related Fees - fees related to assurance and related services that are reasonably related to the performance of the audit or review of financial statements, but not reported under “Audit Fees” including accounting consultations, agreed-upon procedure reports, attestation reports, comfort letters and internal control reviews not required by regulators.

(c) Tax Fees - fees associated with tax compliance, tax advice and tax planning, including services relating to the filing or amendment of federal, state or local income tax returns, regulated investment company qualification reviews and tax distribution and analysis reviews.

(d) All Other Fees - fees for products and services provided to the Fund other than those reported under “Audit Fees,” “Audit-Related Fees” and “Tax Fees.”

The charter of each Audit Committee requires that the Audit Committee shall approve (a) all audit and permissible non-audit services to be provided to each Fund and (b) all permissible non-audit services to be provided by the Fund’s independent registered public accounting firm to TAM and any service providers controlling, controlled by or under common control with TAM that provide ongoing services to the Fund (“Covered Service Providers”) if the engagement relates directly to the operations and financial reporting of the Fund. The Audit Committee may implement policies and procedures by which such services are approved other than by the full Audit Committee. The pre-approval of these services also is intended to assure that the provision of the services does not impair the accounting firm’s independence.

16

Table of Contents

No Audit Committee may approve non-audit services that the Audit Committee believes may impair the independence of the independent registered public accounting firms. Permissible non-audit services include any professional services (including tax services) that are not prohibited services as described below provided to the Fund by the independent registered public accounting firms, other than those provided to a Fund in connection with an audit or a review of the financial statements of the Fund. Permissible non-audit services may not include (a) bookkeeping or other services related to the accounting records or financial statements of the Fund; (b) financial information systems design and implementation; (c) appraisal or valuation services, fairness opinions or contribution-in-kind reports; (d) actuarial services; (e) internal audit outsourcing services; (f) management functions or human resources; (g) broker or dealer, investment adviser or investment banking services; (h) legal services and expert services unrelated to the audit; and (i) any other service the Public Company Accounting Oversight Board determines, by regulation, is impermissible.

Unless a type of service to be provided by the independent registered public accounting firm has received pre-approval, it will require separate pre-approval by the Audit Committee. Also, any proposed services exceeding pre-approved cost levels will require separate pre-approval by the Audit Committee. The Audit Committee is not required to pre-approve services for which pre-approval is not required by applicable law, including de minimis and grandfathered services.

Each Audit Committee has considered whether the provision of non-audit services that were rendered by E&Y to TAM and Covered Service Providers that were not pre-approved (not requiring pre-approval) is compatible with maintaining such auditor’s independence. All services provided by E&Y to each Fund, TAM or Covered Service Providers that were required to be pre-approved were pre-approved as required.

For each Fund’s two most recent fiscal years, there were no services rendered by E&Y to a Fund for which the pre-approval requirement was waived.

There were no non-audit fees billed by E&Y for services rendered to TF in each of the last two fiscal years ended October 31, 2019 and October 31, 2020, respectively. In addition, there were no non-audit fees billed by E&Y for services rendered to TAM or any Covered Service Provider(s) that provide ongoing services to TF in each of the last two fiscal years ended October 31, 2019 and October 31, 2020, respectively.

There were no non-audit fees billed by E&Y for services rendered to each of TST or TAAVF in each of the last two fiscal years ended December 31, 2019 and December 31, 2020, respectively. In addition, there were no non-audit fees billed by E&Y for services rendered to TAM or any Covered Service Provider(s) that provide ongoing services to TST or TAAVF in each of the last two fiscal years ended December 31, 2019 and December 31, 2020, respectively.

Transamerica Funds

| Fiscal Year Ended 10/31 (in thousands) | ||||||||

| 2020 | 2019 | |||||||

Audit Fees | $ | 1,346 | $ | 1,445 | ||||

Audit-Related Fees(1) | $ | 11 | $ | 48 | ||||

Tax Fees(2) | $ | 284 | $ | 158 | ||||

All Other Fees(3) | $ | 61 | $ | 64 | ||||

| (1) | Audit-Related Fees represent assurance and related services provided that are reasonably related to the performance of the audit of the financial statements including review of documents and issuances of consents related to Securities and Exchange Commission Form N-1A filing of the Funds comprising TF. |