UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4571

Name of Registrant: Vanguard Pennsylvania Tax-Free Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2010 – May 31, 2011

Item 1: Reports to Shareholders

|

|

| Vanguard Pennsylvania Tax-Exempt |

| Funds Semiannual Report |

|

| May 31, 2011 |

|

| |

| Vanguard Pennsylvania Tax-Exempt Money Market Fund |

| Vanguard Pennsylvania Long-Term Tax-Exempt Fund |

|

> While money market rates remained near zero in the first half of the fiscal year, the broad U.S. municipal bond market overcame an early slide to return about 2%.

> Vanguard Pennsylvania Tax-Exempt Money Market Fund returned 0.05% for the six months ended May 31, 2011, just ahead of the average return of its state peer group.

> Vanguard Pennsylvania Long-Term Tax-Exempt Fund returned 1.79% for Investor Shares—ahead of the average return of its state peer group and in line with the broad U.S. muni market, but behind its national benchmark index.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 8 |

| Pennsylvania Tax-Exempt Money Market Fund. | 12 |

| Pennsylvania Long-Term Tax-Exempt Fund. | 27 |

| About Your Fund’s Expenses. | 53 |

| Trustees Approve Advisory Arrangement. | 55 |

| Glossary. | 56 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

Cover photograph: Jean Maher.

Your Fund’s Total Returns

Six Months Ended May 31, 2011

| | | | | |

| | | Taxable- | | | |

| | SEC | Equivalent | Income | Capital | Total |

| | Yields | Yields | Returns | Returns | Returns |

| Vanguard Pennsylvania Tax-Exempt Money | | | | | |

| Market Fund | 0.05% | 0.08% | 0.05% | 0.00% | 0.05% |

| Pennsylvania Tax-Exempt Money Market Funds | | | | | |

| Average | | | | | 0.00 |

| Pennsylvania Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper Inc. |

| Vanguard Pennsylvania Long-Term Tax-Exempt Fund | | | | | |

| Investor Shares | 3.45% | 5.48% | 2.06% | -0.27% | 1.79% |

| Admiral™ Shares | 3.53 | 5.60 | 2.10 | -0.27 | 1.83 |

| Barclays Capital 10 Year Municipal Bond Index | | | | | 2.73 |

| Pennsylvania Municipal Debt Funds Average | | | | | 1.28 |

| Pennsylvania Municipal Debt Funds Average: Derived from data provided by Lipper Inc. |

7-day SEC yield for the Pennsylvania Tax-Exempt Money Market Fund; 30-day SEC yield for the Pennsylvania Long-Term Tax-Exempt Fund. The calculation of taxable-equivalent yield assumes a typical itemized tax return and is based on the maximum federal tax rate of 35% and the maximum income tax rate for the state. Local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

Your Fund’s Performance at a Glance

November 30, 2010 , Through May 31, 2011

| | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Pennsylvania Tax-Exempt Money | | | | |

| Market Fund | $1.00 | $1.00 | $0.001 | $0.000 |

| Vanguard Pennsylvania Long-Term Tax-Exempt | | | | |

| Fund | | | | |

| Investor Shares | $10.99 | $10.96 | $0.220 | $0.000 |

| Admiral Shares | 10.99 | 10.96 | 0.224 | 0.000 |

1

Chairman’s Letter

Dear Shareholder,

A springtime rally helped the broad U.S. municipal bond market rebound from an inauspicious start and return about 2% for the six months ended May 31. Sensational headlines in December predicting large-scale municipal defaults were followed by reports of rising state revenues and more focus on fiscal discipline, which encouraged demand amid unusually low supply.

Against this backdrop, Vanguard Pennsylvania Long-Term Tax-Exempt Fund returned 1.79% for Investor Shares and 1.83% for Admiral Shares. Interest income more than offset the fund’s slightly negative capital return (its holdings did not fully recover from price declines in December and January).

The advisor’s high-quality focus helped the Long-Term Fund outperform its state peers: In a reversal from last year, higher-rated bonds outperformed lower-quality securities. The fund lagged its market benchmark, the Barclays Capital 10 Year Municipal Bond Index, which is a reasonable but imperfect standard of comparison. For example, in contrast to the index, your fund invests across the maturity spectrum. Intermediate-term bonds fared particularly well during the six months as investors sought higher yields without the greater interest rate risk of the longest-maturity bonds.

2

As the Federal Reserve kept its target for short-term interest rates anchored near zero, Vanguard Pennsylvania Tax-Exempt Money Market Fund returned a scant 0.05%—ahead of the average return of its state peer group. The fund’s 7-day SEC yield on May 31 was 0.05%, down from six months ago. In contrast, the Long-Term Fund’s 30-day SEC yield for Investor Shares rose to 3.45%. As shown on page 1, each fund’s taxable-equivalent yield was higher than its SEC yield.

Note: The funds are permitted to invest in securities whose income is subject to the alternative minimum tax (AMT). As of May 31, the Long-Term Fund owned no securities that would generate income distributions subject to the AMT, but the Money Market Fund did.

In the broad U.S. bond market, a late-stage change of direction

Through much of the fiscal half-year, bond market returns hovered near— or below—0%. With the economy seeming to find its footing, interest rates rose slowly but steadily. Investors were concerned that accelerating growth might eventually lead to higher inflation, perhaps sooner rather than later. Rising rates put pressure on bond prices.

Later in the period, however, disappointing economic news—including in the housing and labor markets—doused worries about inflation. Perhaps counterintuitively, bad news for the economy spells good news for bonds: As yields retreated, bond prices rallied.

| | | |

| Market Barometer | | | |

| | | | Total Returns |

| | | Periods Ended May 31, 2011 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index (Broad | | | |

| taxable market) | 1.91% | 5.84% | 6.63% |

| Barclays Capital Municipal Bond Index (Broad tax-exempt | | | |

| market) | 2.04 | 3.18 | 4.78 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.06 | 0.15 | 1.94 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 15.49% | 26.81% | 3.69% |

| Russell 2000 Index (Small-caps) | 17.34 | 29.75 | 4.70 |

| Dow Jones U.S. Total Stock Market Index | 15.20 | 27.10 | 4.07 |

| MSCI All Country World Index ex USA (International) | 13.58 | 29.95 | 3.95 |

| |

| CPI | | | |

| Consumer Price Index | 3.27% | 3.57% | 2.22% |

3

For the full six months, the broad U.S. taxable bond market returned about 2%, roughly matching the performance of the municipal market.

Stock prices followed corporate profits higher

During the six months, global stock markets powered past a series of unnerving developments—financial drama in Europe, natural and nuclear disaster in Japan, and geopolitical upheaval in commodity markets. The broad U.S. stock market returned more than 15% for the six months, buoyed by surprising strength in corporate profits. Toward the end of the period, however, a pullback in the manufacturing sector and unexpected weakness in the labor market sounded notes of caution.

International stocks followed a similar trajectory, returning almost 14% for the period. In emerging markets and in most developed markets, strength in local currencies boosted returns for U.S.-based investors.

An inauspicious start capped by a strong finish

As I noted in our annual report to you six months ago, November 2010 was the most volatile month in the municipal market since the 2008 financial crisis. The key forces that converged to create the volatility and lower muni bond prices continued into the first months of the new fiscal year: abundant new-issue supply (through December), concerns about inflation as the economy gathered steam, and anxiety about prospects for municipal

Expense Ratios

Your Fund Compared With Its Peer Group

| | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| Pennsylvania Tax-Exempt Money | | | |

| Market Fund | 0.17% | — | 0.46% |

| Pennsylvania Long-Term Tax-Exempt | | | |

| Fund | 0.20 | 0.12% | 1.10 |

The fund expense ratios shown are from the prospectus dated March 29, 2011, and represent estimated costs for the current fiscal year. For the six months ended May 31, 2011, the funds’ annualized expense ratios were: for the Pennsylvania Tax-Exempt Money Market Fund, 0.17%; and for the Pennsylvania Long-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares. Peer-group expense ratios are derived from data provided by Lipper Inc. and capture information through year-end 2010.

Peer groups: For the Pennsylvania Tax-Exempt Money Market Fund, Pennsylvania Tax-Exempt Money Market Funds; for the Pennsylvania Long-Term Tax-Exempt Fund, Pennsylvania Municipal Debt Funds.

4

bond defaults. (As to the likelihood of widespread defaults, Vanguard believes the dire predictions of some analysts are overblown. For a brief discussion of our view, see the box below.)

Several factors contributed to the late-2010 supply surge. Some tax-exempt borrowers that might otherwise have come to market in 2011 accelerated their plans in anticipation of rising interest rates. Others took advantage of the temporary AMT exemption for private-activity bonds, such as those used to finance airports. And the stampede to issue taxable Build

America Bonds (BABs) before the end-of-year deadline flustered an already skittish tax-exempt market, especially the long-term segment. (BABs offered an attractive federal subsidy that lowered issuers’ borrowing costs. The BABs and AMT incentives, part of the 2009 federal stimulus act, expired on December 31.)

This flood of new supply pushed tax-exempt bond prices down, and yields up, in December—the worst of the past six months for the broad municipal market and for Pennsylvania bonds.

|

| Investment insight |

|

| Perspective on default risk |

| Although state tax collections are recovering, worries about default are still making |

| headlines. Here’s why we think the threat is overstated: |

| |

| • Long, strong repayment history. In the 40 years through 2009, the average |

| default rate for investment-grade municipal bonds was a minuscule 0.03%. |

| The rate was 30 times higher for corporate bonds. |

| |

| • Issuers’ ability to pay. Most municipals are revenue bonds—often backed |

| by fees for essential services such as water, sewers, and electricity—or general |

| obligation bonds (backed by the issuer’s full taxing power). Households try to |

| pay utility bills even in tough times, and issuers can raise taxes if need be. |

| |

| • Issuers’ willingness to pay. Issuers who default to avoid debt payments could |

| lose access to funding for everyday operations and capital projects—a poor risk/ |

| reward tradeoff, given their typically low debt burdens. For example, across the |

| 50 states, debt secured by state operating resources as a percentage of the state’s |

| economic output currently averages only about 4.5%. Pennsylvania’s debt burden is |

| even lower, at about 2.5%. |

| Source: Moody’s Investors Service. For more discussion, see the research paper California Is Not Greece at |

| vanguard.com/jumppage/researchpapers/tab1.html. |

5

Bond returns were also hurt by a significant exodus from tax-exempt funds, which experienced some of the largest—and longest-lasting—cash outflows in decades. Some investors were spooked by headlines warning of defaults and by concerns about higher interest rates (which could depress near-term returns); others wanted to participate in the stock market rally.

Market conditions began improving, however, as winter turned to spring. Most notably, the supply of new bonds dried up. From January through May, nationwide new-issue volume was less than $85 billion, the lowest for this five-month period since 2000. In part, this reflected deferral of nonessential projects because of budget constraints.

Investors seeking to buy scarce new tax-exempt bonds bid up prices. And as the U.S. economic recovery slowed, investors’ concern about rising interest rates receded. At the same time, confidence improved as states and municipalities gained credibility in their budget-balancing efforts. The realization that municipal bonds were attractively valued led to strong returns in April and May, both nationally and in your fund.

For a discussion of the funds’ management during the period, please see the Advisor’s Report following this letter.

State revenues improve but local revenues lag

Across most of the nation, state tax revenues have been recovering from the Great Recession but still have not caught up. In Pennsylvania, combined revenue from personal and corporate income taxes plus sales tax increased about 3% in the first calendar quarter of 2011 compared with 2010, according to preliminary data from The Nelson A. Rockefeller Institute of Government.

The picture is a bit more complicated at the local level. Typically, state revenues from various sources lag the broad U.S. economy during downturns and recoveries, and local revenues lag state receipts. This time, the slowdown at the local level has been exacerbated by significant reductions in assessed home values, hurting property tax receipts—while demand for many services has risen and the flow of federal stimulus dollars has ended.

Pennsylvania, along with most states, faces tough budget and policy choices. As I write this letter, state legislators are working to resolve the budget for the new fiscal year starting July 1. [Editor’s note: The budget was signed on June 30.]

6

Discipline and diversification are more important than ever

In April, Vanguard Pennsylvania Long-Term Tax-Exempt Fund marked its 25th anniversary (the Money Market Fund is two years younger). The funds’ longevity is a testament to the experience and skills of their advisor, Vanguard Fixed Income Group, and the close teamwork among its portfolio managers, traders, and credit analysts.

We hope that state and local governments will continue to make the tough decisions necessary to balance spending in lean times, and that they will be more prudent in better times. But optimism is no substitute for rigorous, independent credit analysis. And while we think the grim forecasts about looming defaults have been overstated, we acknowledge that there may be some uptick in defaults, especially among smaller issuers and less creditworthy projects, which our screening process helps us weed out.

As always, we believe investors will be well-served by holding a balanced portfolio of low-cost mutual funds that is diversified across and within asset classes. For Pennsylvania investors in higher tax brackets, the Vanguard Pennsylvania Tax-Exempt Funds can play a helpful role in such a portfolio, providing exemption from state as well as federal income taxes.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

June 13, 2011

7

Advisor’s Report

For the fiscal half-year ended May 31, 2011, Vanguard Pennsylvania Tax-Exempt Money Market Fund returned 0.05%, as the Federal Reserve continued to keep short-term interest rates near zero. By comparison, the average return of peer-group state funds was 0%. The Pennsylvania Long-Term Tax-Exempt Fund returned 1.79% for Investor Shares and 1.83% for Admiral Shares, trailing the return of its national benchmark index but ahead of the average return of competing state funds.

The investment environment

The funds successfully navigated a particularly challenging investment environment in recent months, a volatile period for the municipal bond market because of credit, market, and supply concerns.

The period began with yields pushing higher and prices falling (bond prices and yields move inversely). For example, the yields of 10-year AAA general-obligation tax-exempt bonds at the national level rose by about half a percentage point from November 30 to January 31, then declined by more than that from February through May. Yields of comparable 30-year bonds followed a similar pattern, but ended the period a bit higher than where they began. These are large moves in a very short time, relative to the historical experience of this market.

Yields of Tax-Exempt Municipal Bonds

(AAA-Rated General-Obligation Issues)

| | |

| | November 30, | May 31, |

| Maturity | 2010 | 2011 |

| 2 years | 0.60% | 0.44% |

| 5 years | 1.36 | 1.23 |

| 10 years | 2.79 | 2.65 |

| 30 years | 4.28 | 4.30 |

| Source: Vanguard. |

8

Concurrent with the market volatility was a tide of withdrawals from tax-exempt bond funds, Vanguard’s included, that began in November 2010 and peaked in January 2011 as yields spiked. Outflows then began to ease substantially.

The price and redemption trends early on were consequences of a variety of market forces, including investors’ concern about the fiscal struggles of state and local governments. That worry was stoked by gloomy media reports in the early part of the reporting period, including, quite frankly, some commentary we consider irresponsible. The strong stock market rally also drew some investors away from bonds.

More upward pressure on long-term yields came from investors who were cautious about the outlook for inflation, as well as from a flood of Build America Bonds (BABs)—including issues from Pennsyl-vania—that came to market before the program ended on December 31. Indeed, almost a quarter of all BABs nationwide were issued during the final three months of 2010. (Our tax-exempt funds do not invest in these bonds because they are taxable.) With the end of the BABs program, there was an expectation that the supply of traditional munis would get a boost. This had the immediate effect of pushing up yields, especially those of long-term bonds.

At the other end of the yield spectrum, money market funds remained anchored to flat returns, a result of the Fed’s near-zero target for the shortest-term interest rates. After more than two years of this policy, many muni investors have turned to short-term and intermediate-term bonds, especially those in the 5- to 7-year portion of the yield curve. (Intermediate-term bonds were top performers during the six-month period.) We don’t expect the Fed to raise its target federal funds rate before the second half of 2012. The combined effect of near-zero short-term rates and upward pressure on long-term rates has produced one of the steepest yield curves in years.

The credit environment

State and local governments continued the difficult process of striking a balance between spending needs and lower tax revenues. The impact of both has been magnified by the severity of the Great Recession: Because of slow growth and high unemployment, people have required more services while tax revenues of all kinds have shrunk.

In the face of these challenges, states and municipalities have been taking a variety of difficult steps to bring spending and revenues in line. For example, state and local governments cut payrolls by almost 300,000 over the year ended May 31, even while private-sector employment grew. Meanwhile, tax revenues have begun to rise nationwide—for the fifth straight

9

quarter as of March 31, according to preliminary results from The Nelson A. Rockefeller Institute of Government—although they still have not recovered to pre-recession levels. The financial stress has in many cases also turned serious attention to longer-term concerns, such as the underfunding of retiree benefits.

As noted in more detail in the Chairman’s Letter (see especially the Investment Insight box on page 5), we’re confident that state and local governments will be able to manage their way through their financial difficulties. At the same time, it wouldn’t be surprising for a few smaller issuers to run into trouble, and we acknowledge that this will be a challenging process for some time.

Management of the funds

Our investment strategy during the half- year reflected our assessment of several important developments. These included a steep yield curve, ongoing fiscal challenges faced by tax-exempt issuers, less liquidity in the market, and short supply.

We have positioned the Long-Term Fund to benefit whenever the Federal Reserve begins to raise its target rate, which will lift the short end of the yield curve. The long end is likely to experience less volatility—resulting in a somewhat flatter and more typically shaped yield curve—because the market has already priced in its expectation of eventual rate increases. In anticipation of the eventual rise in short-term rates, we have increased our allocation to the intermediate part of the yield curve.

We continue to favor bonds that rely on revenues from essential services, such as providing electricity and water, to fund payments. Our credit analysts, who monitor the financial condition of states and municipalities, keep a constant eye on the credit quality of the portfolios and recommend repositioning when merited.

For some time, we have prepared for the possibility of heavy redemptions so that long-term shareholders would not be adversely affected. We have done so by dedicating a portion of the Long-Term Fund’s assets, across the yield curve, to holdings that are liquid enough to be tapped if needed to meet redemptions. (They can also be tapped to take advantage of good investment opportunities.)

Liquidity is also an issue because of the structure of the municipal bond market. The 2008 financial crisis reduced the number of broker-dealers who deal with institutional investors, putting stress on these counterparties’ ability to provide much-needed liquidity when necessary. As a result, part of our overall decision to purchase a security is an evaluation of how easy it will be to trade it.

A supportive factor for prices has been the supply of traditional municipal bonds during the first half of fiscal 2011, which, counter to expectations, has been unusually light. In Pennsylvania, for example, about $5 billion in traditional municipal bonds were issued in the six months ended May 31, almost 40% less than a year earlier. Fiscal caution among municipal issuers, which

10

are taking another look at capital projects as they strive to balance their budgets, may also be a factor.

The decline in trades resulting from lower supply made it difficult for market participants to establish market-clearing prices during the period, presenting a challenge that was met successfully by our talented team of traders. Looking forward, we’re confident that we can tackle whatever lies ahead because of the skill and dedication of our experienced portfolio managers, traders, and credit analysts. Together, they bring to the task a high level of rigor and discipline that we believe will continue to serve our shareholders well.

Marlin G. Brown, Portfolio Manager

John M. Carbone, Principal, Portfolio Manager

Pamela Wisehaupt Tynan, Principal, Head of Municipal Money Market Funds

Christopher W. Alwine, CFA, Principal, Head of Municipal Bond Funds

Vanguard Fixed Income Group

June 22, 2011

11

Pennsylvania Tax-Exempt Money Market Fund

Fund Profile

As of May 31, 2011

| |

| Financial Attributes | |

| Ticker Symbol | VPTXX |

| Expense Ratio1 | 0.17% |

| 7-Day SEC Yield | 0.05% |

| Average Weighted | |

| Maturity | 27 days |

| |

| Distribution by Credit Quality (% of portfolio) |

| First Tier | 100.0% |

| For information about these ratings, see the Glossary entry for Credit Quality. |

1 The expense ratio shown is from the prospectus dated March 29, 2011, and represents estimated costs for the current fiscal year. For the six months ended May 31, 2011, the annualized expense ratio was 0.17%.

12

Pennsylvania Tax-Exempt Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

Fiscal-Year Total Returns (%): November 30, 2000, Through May 31, 2011

| | |

| | | PA Tax-Exempt |

| | | Money Mkt |

| | | Funds Avg |

| Fiscal Year | Total Returns | Total Returns |

| 2001 | 2.89% | 2.53% |

| 2002 | 1.32 | 0.98 |

| 2003 | 0.91 | 0.56 |

| 2004 | 1.05 | 0.60 |

| 2005 | 2.19 | 1.72 |

| 2006 | 3.31 | 2.85 |

| 2007 | 3.64 | 3.14 |

| 2008 | 2.42 | 1.93 |

| 2009 | 0.50 | 0.22 |

| 2010 | 0.12 | 0.00 |

| 2011 | 0.05 | 0.00 |

7-day SEC yield (5/31/2011): 0.05% Pennsylvania Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper Inc.

Note: For 2011, performance data reflect the six months ended May 31, 2011.

Average Annual Total Returns: Periods Ended March 31, 2011

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Pennsylvania Tax-Exempt Money | | | | |

| Market Fund | 6/13/1988 | 0.13% | 1.80% | 1.72% |

See Financial Highlights for dividend information.

13

Pennsylvania Tax-Exempt Money Market Fund

Financial Statements (unaudited)

Statement of Net Assets

As of May 31, 2011

The fund reports a complete list of its holdings in various monthly and quarterly regulatory filings. The fund publishes its holdings on a monthly basis at vanguard.com and files them with the Securities and Exchange Commission on Form N-MFP. The fund’s Form N-MFP filings become public 60 days after the relevant month-end, and may be viewed at sec.gov or via a link on the “Portfolio Holdings” page on vanguard.com. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (100.4%) | | | | |

| Pennsylvania (94.5%) | | | | |

| 1 Abington PA School District GO TOB VRDO | 0.180% | 6/7/11 LOC | 14,920 | 14,920 |

| Allegheny County PA GO VRDO | 0.200% | 6/7/11 LOC | 14,455 | 14,455 |

| Allegheny County PA GO VRDO | 0.200% | 6/7/11 LOC | 37,290 | 37,290 |

| Allegheny County PA Higher Education Building | | | | |

| Authority University Revenue | | | | |

| (Carnegie Mellon University) VRDO | 0.110% | 6/1/11 | 89,320 | 89,320 |

| Allegheny County PA Higher Education Building | | | | |

| Authority University Revenue | | | | |

| (Point Park University) VRDO | 0.180% | 6/7/11 LOC | 15,300 | 15,300 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of Pittsburgh | | | | |

| Medical Center) | 4.000% | 5/15/12 | 1,000 | 1,033 |

| 1 Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of Pittsburgh | | | | |

| Medical Center) TOB VRDO | 0.180% | 6/7/11 | 72,395 | 72,395 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of Pittsburgh | | | | |

| Medical Center) VRDO | 0.150% | 6/7/11 LOC | 34,600 | 34,600 |

| Allegheny County PA Industrial Development | | | | |

| Authority Revenue (Western Pennsylvania | | | | |

| School for Blind Children) PUT | 0.700% | 7/1/11 | 14,500 | 14,500 |

| Beaver County PA Industrial Development | | | | |

| Authority Pollution Control Revenue (FirstEnergy | | | | |

| Nuclear Generation Corp. Project) VRDO | 0.130% | 6/1/11 LOC | 17,200 | 17,200 |

| Beaver County PA Industrial Development | | | | |

| Authority Pollution Control Revenue (FirstEnergy | | | | |

| Nuclear Generation Corp. Project) VRDO | 0.140% | 6/7/11 LOC | 40,000 | 40,000 |

| Beaver County PA Industrial Development | | | | |

| Authority Pollution Control Revenue (FirstEnergy | | | | |

| Nuclear Generation Corp. Project) VRDO | 0.170% | 6/7/11 LOC | 60,500 | 60,500 |

| Beaver County PA Industrial Development | | | | |

| Authority Pollution Control Revenue | | | | |

| (Metropolitan Edison Co. Project) VRDO | 0.180% | 6/7/11 LOC | 10,000 | 10,000 |

| Berks County PA Industrial Development | | | | |

| Authority Revenue (Kutztown University) VRDO | 0.180% | 6/7/11 LOC | 13,040 | 13,040 |

14

Pennsylvania Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Berks County PA Municipal Authority Revenue | | | | |

| (Reading Hospital & Medical Center Project) PUT | 0.380% | 7/14/11 | 10,250 | 10,250 |

| Berks County PA Municipal Authority Revenue | | | | |

| (Reading Hospital & Medical Center Project) | | | | |

| TOB VRDO | 0.190% | 6/7/11 | 9,750 | 9,750 |

| Berks County PA Municipal Authority Revenue | | | | |

| (Reading Hospital & Medical Center Project) | | | | |

| TOB VRDO | 0.190% | 6/7/11 | 98,990 | 98,990 |

| Berks County PA Municipal Authority Revenue | | | | |

| (Reading Hospital & Medical Center | | | | |

| Project) VRDO | 0.200% | 6/7/11 | 9,900 | 9,900 |

| Bethlehem PA Area School District GO | | | | |

| TOB VRDO | 0.180% | 6/7/11 LOC | 6,990 | 6,990 |

| Blackrock Muniyield PA Quality Fund VRDP VRDO | 0.380% | 6/7/11 LOC | 15,300 | 15,300 |

| Bucks County PA Industrial Development | | | | |

| Authority Hospital Revenue (Grand View | | | | |

| Hospital) VRDO | 0.110% | 6/7/11 LOC | 40,935 | 40,935 |

| Butler County PA General Authority Revenue | | | | |

| (Hampton Township School District | | | | |

| Project) VRDO | 0.230% | 6/7/11 (4) | 21,120 | 21,120 |

| Cambria County PA Industrial Development | | | | |

| Authority Revenue (American National | | | | |

| Red Cross) VRDO | 0.160% | 6/7/11 LOC | 16,145 | 16,145 |

| Carlisle PA Area School District GO | 5.375% | 3/1/12 (Prere.) | 1,550 | 1,608 |

| Carlisle PA Area School District GO | 5.375% | 3/1/12 (Prere.) | 1,635 | 1,696 |

| Carlisle PA Area School District GO | 5.375% | 3/1/12 (Prere.) | 1,725 | 1,789 |

| Carlisle PA Area School District GO | 5.375% | 3/1/12 (Prere.) | 1,820 | 1,888 |

| Chambersburg PA Authority Revenue | | | | |

| (Wilson College Project) VRDO | 0.190% | 6/7/11 LOC | 31,180 | 31,180 |

| Chester County PA Industrial Development | | | | |

| Authority Revenue (Archdiocese of | | | | |

| Philadelphia) VRDO | 0.120% | 6/1/11 LOC | 8,050 | 8,050 |

| Chester County PA Industrial Development | | | | |

| Authority Student Housing Revenue (University | | | | |

| Student Housing LLC Project) VRDO | 0.160% | 6/7/11 LOC | 9,900 | 9,900 |

| Chester County PA Industrial Development | | | | |

| Authority Student Housing Revenue (University | | | | |

| Student Housing LLC Project) VRDO | 0.170% | 6/7/11 LOC | 8,000 | 8,000 |

| Chester County PA Industrial Development | | | | |

| Authority Water Facilities Revenue (Aqua | | | | |

| Pennsylvania Inc. Project) TOB VRDO | 0.230% | 6/7/11 (13) | 15,935 | 15,935 |

| Dauphin County PA General Authority Hospital | | | | |

| Revenue (Reading Hospital & Medical | | | | |

| Center Project) VRDO | 0.200% | 6/7/11 | 6,205 | 6,205 |

| Delaware County PA Authority Hospital Revenue | | | | |

| (Crozer-Chester Medical Center Obligated | | | | |

| Group) VRDO | 0.180% | 6/7/11 LOC | 10,855 | 10,855 |

| Delaware County PA Authority Revenue | | | | |

| (Haverford College) VRDO | 0.120% | 6/7/11 | 29,545 | 29,545 |

| Delaware County PA Industrial Development | | | | |

| Authority Airport Facilities Revenue | | | | |

| (United Parcel Service Inc.) VRDO | 0.110% | 6/1/11 | 14,800 | 14,800 |

| Delaware County PA Industrial Development | | | | |

| Authority Resource Recovery Facility Revenue | | | | |

| (General Electric Capital Corp.) VRDO | 0.180% | 6/7/11 | 7,395 | 7,395 |

15

Pennsylvania Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Delaware County PA Industrial Development | | | | |

| Authority Resource Recovery Facility Revenue | | | | |

| (General Electric Capital Corp.) VRDO | 0.180% | 6/7/11 | 16,200 | 16,200 |

| Delaware County PA Industrial Development | | | | |

| Authority Resource Recovery Facility Revenue | | | | |

| (General Electric Capital Corp.) VRDO | 0.180% | 6/7/11 | 11,630 | 11,630 |

| 1 Delaware County PA Industrial Development | | | | |

| Authority Revenue (Aqua Pennsylvania Inc. | | | | |

| Project) TOB VRDO | 0.230% | 6/7/11 (13) | 2,515 | 2,515 |

| Delaware County PA Industrial Development | | | | |

| Authority Revenue (Resource Recovery) VRDO | 0.180% | 6/7/11 | 7,955 | 7,955 |

| Delaware County PA Industrial Development | | | | |

| Authority Revenue (Resource Recovery) VRDO | 0.180% | 6/7/11 | 17,250 | 17,250 |

| Delaware County PA Industrial Development | | | | |

| Authority Solid Waste Revenue | | | | |

| (Scott Paper Co.) VRDO | 0.220% | 6/7/11 | 21,675 | 21,675 |

| Delaware County PA Industrial Development | | | | |

| Authority Solid Waste Revenue | | | | |

| (Scott Paper Co.) VRDO | 0.220% | 6/7/11 | 20,000 | 20,000 |

| Delaware County PA Industrial Development | | | | |

| Authority Solid Waste Revenue | | | | |

| (Scott Paper Co.) VRDO | 0.220% | 6/7/11 | 14,900 | 14,900 |

| Delaware River Port Authority Pennsylvania & | | | | |

| New Jersey Revenue VRDO | 0.110% | 6/7/11 LOC | 1,685 | 1,685 |

| Delaware River Port Authority Pennsylvania & | | | | |

| New Jersey Revenue VRDO | 0.180% | 6/7/11 LOC | 5,000 | 5,000 |

| 1 Downingtown PA Area School District | | | | |

| GO TOB VRDO | 0.180% | 6/7/11 | 8,500 | 8,500 |

| Emmaus PA General Authority Revenue VRDO | 0.190% | 6/7/11 LOC | 90,700 | 90,700 |

| Emmaus PA General Authority Revenue VRDO | 0.200% | 6/7/11 LOC | 4,800 | 4,800 |

| Emmaus PA General Authority Revenue VRDO | 0.200% | 6/7/11 LOC | 2,200 | 2,200 |

| Emmaus PA General Authority Revenue VRDO | 0.200% | 6/7/11 LOC | 9,600 | 9,600 |

| Emmaus PA General Authority Revenue VRDO | 0.200% | 6/7/11 LOC | 15,600 | 15,600 |

| Emmaus PA General Authority Revenue VRDO | 0.200% | 6/7/11 LOC | 5,485 | 5,485 |

| Emmaus PA General Authority Revenue VRDO | 0.200% | 6/7/11 LOC | 4,000 | 4,000 |

| Erie County PA Hospital Authority Revenue | | | | |

| (Hamot Health Foundation) VRDO | 0.110% | 6/1/11 LOC | 2,420 | 2,420 |

| Fayette County PA Hospital Authority Revenue | | | | |

| (Fayette Regional Health System) VRDO | 0.150% | 6/7/11 LOC | 14,200 | 14,200 |

| Geisinger Health System Authority of | | | | |

| Pennsylvania Revenue (Penn State Geisinger | | | | |

| Health System) VRDO | 0.110% | 6/1/11 | 4,300 | 4,300 |

| 1 Geisinger Health System Authority of | | | | |

| Pennsylvania Revenue TOB VRDO | 0.180% | 6/7/11 | 3,450 | 3,450 |

| Haverford Township PA School District GO VRDO | 0.190% | 6/7/11 LOC | 5,000 | 5,000 |

| Lancaster County PA Convention Center Authority | | | | |

| Revenue (Hotel Room Rental Tax) VRDO | 0.180% | 6/7/11 LOC | 39,670 | 39,670 |

| Lancaster County PA Convention Center Authority | | | | |

| Revenue (Hotel Room Rental Tax) VRDO | 0.180% | 6/7/11 LOC | 1,500 | 1,500 |

| Lancaster County PA Hospital Authority Health | | | | |

| System Revenue (Lancaster General | | | | |

| Hospital) VRDO | 0.150% | 6/1/11 LOC | 2,065 | 2,065 |

16

Pennsylvania Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Lehigh County PA General Purpose Hospital | | | | |

| Authority Revenue (Good Shephard | | | | |

| Group) VRDO | 0.180% | 6/7/11 LOC | 10,625 | 10,625 |

| Lehigh County PA General Purpose Hospital | | | | |

| Authority Revenue (Muhlenberg College) VRDO | 0.180% | 6/7/11 LOC | 28,755 | 28,755 |

| Lower Merion PA School District GO VRDO | 0.170% | 6/7/11 LOC | 11,490 | 11,490 |

| Lower Merion PA School District GO VRDO | 0.170% | 6/7/11 LOC | 6,200 | 6,200 |

| 1 Luzerne County PA Industrial Development | | | | |

| Authority Water Facility Revenue | | | | |

| (Pennsylvania-American Water Co.) TOB VRDO | 0.240% | 6/7/11 (13) | 5,000 | 5,000 |

| Manheim Township PA School District GO VRDO | 0.340% | 6/7/11 (4) | 11,770 | 11,770 |

| Montgomery County PA Industrial Development | | | | |

| Authority Revenue (Friends’ Central School | | | | |

| Project) VRDO | 0.180% | 6/7/11 LOC | 2,615 | 2,615 |

| 1 Montgomery County PA Industrial Development | | | | |

| Authority Revenue (New Regional Medical | | | | |

| Center Project) TOB VRDO | 0.190% | 6/7/11 | 11,090 | 11,090 |

| Moon Industrial Development Authority | | | | |

| Pennsylvania Mortgage Revenue (Providence | | | | |

| Point Project) VRDO | 0.200% | 6/7/11 LOC | 59,425 | 59,425 |

| 1 Northampton County PA General Purpose | | | | |

| Authority University Revenue (Lafayette | | | | |

| College) TOB VRDO | 0.190% | 6/7/11 | 17,600 | 17,600 |

| Northampton County PA General Purpose | | | | |

| Authority University Revenue (Lafayette | | | | |

| College) VRDO | 0.140% | 6/7/11 | 19,290 | 19,290 |

| 1 Northampton County PA General Purpose | | | | |

| Authority University Revenue (Lehigh | | | | |

| University) TOB VRDO | 0.170% | 6/7/11 LOC | 21,365 | 21,365 |

| Northampton County PA General Purpose | | | | |

| Authority University Revenue | | | | |

| (Lehigh University) VRDO | 0.140% | 6/7/11 | 20,650 | 20,650 |

| Northampton County PA General Purpose | | | | |

| Authority University Revenue (Lehigh | | | | |

| University) VRDO | 0.180% | 6/7/11 | 6,200 | 6,200 |

| 1 Nuveen Pennsylvania Investment Quality | | | | |

| Municipal Fund VRDP VRDO | 0.380% | 6/7/11 LOC | 25,000 | 25,000 |

| 1 Pennsylvania Economic Development | | | | |

| Financing Authority Exempt Facilities Revenue | | | | |

| (PPL Energy Supply LLC Project) TOB VRDO | 0.190% | 6/7/11 LOC | 9,995 | 9,995 |

| Pennsylvania Economic Development Financing | | | | |

| Authority Exempt Facilities Revenue (PSEG | | | | |

| Power LLC Project) VRDO | 0.200% | 6/7/11 LOC | 28,000 | 28,000 |

| Pennsylvania Economic Development Financing | | | | |

| Authority Exempt Facilities Revenue | | | | |

| (York Water Co. Project) VRDO | 0.190% | 6/7/11 LOC | 5,000 | 5,000 |

| Pennsylvania Economic Development Financing | | | | |

| Authority Revenue (Wenger’s Feed Mill) VRDO | 0.400% | 6/7/11 LOC | 5,670 | 5,670 |

| Pennsylvania Economic Development Financing | | | | |

| Authority Revenue (Wenger’s Feed Mill) VRDO | 0.400% | 6/7/11 LOC | 5,190 | 5,190 |

| 1 Pennsylvania Economic Development Financing | | | | |

| Authority Water Facilities Revenue | | | | |

| (Aqua Pennsylvania Inc. Project) TOB PUT | 0.480% | 8/18/11 | 7,495 | 7,495 |

| 1 Pennsylvania Economic Development Financing | | | | |

| Authority Water Facilities Revenue (Aqua | | | | |

| Pennsylvania Inc. Project) TOB VRDO | 0.190% | 6/7/11 (13) | 9,900 | 9,900 |

17

Pennsylvania Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Pennsylvania GO | 5.000% | 7/1/11 | 2,000 | 2,008 |

| Pennsylvania GO | 5.000% | 8/1/11 | 4,900 | 4,938 |

| Pennsylvania GO | 5.000% | 8/1/11 | 5,000 | 5,039 |

| Pennsylvania GO | 5.000% | 8/1/11 | 17,000 | 17,133 |

| Pennsylvania GO | 5.000% | 10/1/11 | 3,250 | 3,300 |

| Pennsylvania GO | 5.000% | 10/1/11 | 1,300 | 1,320 |

| Pennsylvania GO | 5.000% | 11/1/11 | 1,250 | 1,274 |

| Pennsylvania GO | 5.000% | 2/15/12 | 9,865 | 10,189 |

| Pennsylvania GO | 5.000% | 2/15/12 | 20,525 | 21,193 |

| Pennsylvania GO TOB VRDO | 0.150% | 6/1/11 | 25,000 | 25,000 |

| 1 Pennsylvania GO TOB VRDO | 0.200% | 6/7/11 | 11,495 | 11,495 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Bryn Mawr College) PUT | 0.430% | 2/2/12 | 7,500 | 7,500 |

| 1 Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Drexel University) | | | | |

| TOB VRDO | 0.190% | 6/7/11 LOC | 7,450 | 7,450 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Drexel University) VRDO | 0.140% | 6/1/11 LOC | 29,825 | 29,825 |

| 1 Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Foundation for Indiana | | | | |

| University of Pennsylvania Student Housing) | | | | |

| TOB VRDO | 0.180% | 6/7/11 LOC | 11,995 | 11,995 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Foundation for Indiana | | | | |

| University of Pennsylvania Student Housing) | | | | |

| VRDO | 0.160% | 6/7/11 LOC | 46,295 | 46,295 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Higher Education System) | 2.000% | 6/15/11 | 4,645 | 4,648 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (St. Joseph’s University) | | | | |

| VRDO | 0.170% | 6/7/11 LOC | 8,700 | 8,700 |

| 1 Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Trustees of the | | | | |

| University of Pennsylvania) TOB VRDO | 0.190% | 6/7/11 | 5,000 | 5,000 |

| 1 Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue TOB VRDO | 0.240% | 6/7/11 | 4,855 | 4,855 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.160% | 6/7/11 | 45,000 | 45,000 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.170% | 6/7/11 LOC | 27,395 | 27,395 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.170% | 6/7/11 LOC | 15,420 | 15,420 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.170% | 6/7/11 LOC | 5,320 | 5,320 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.180% | 6/7/11 LOC | 12,715 | 12,715 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.180% | 6/7/11 LOC | 10,000 | 10,000 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.180% | 6/7/11 LOC | 8,850 | 8,850 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.180% | 6/7/11 LOC | 11,700 | 11,700 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.190% | 6/7/11 | 10,000 | 10,000 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.190% | 6/7/11 | 10,220 | 10,220 |

18

Pennsylvania Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Pennsylvania Intergovernmental Cooperation | | | | |

| Authority Special Tax Revenue | | | | |

| (Philadelphia Funding Program) | 4.000% | 6/15/11 | 3,000 | 3,004 |

| 1 Pennsylvania Intergovernmental Cooperation | | | | |

| Authority Special Tax Revenue | | | | |

| (Philadelphia Funding Program) TOB VRDO | 0.180% | 6/7/11 | 5,050 | 5,050 |

| Pennsylvania State University Revenue PUT | 0.300% | 6/1/12 | 41,250 | 41,250 |

| 1 Pennsylvania State University Revenue | | | | |

| TOB VRDO | 0.170% | 6/7/11 LOC | 48,965 | 48,965 |

| 1 Pennsylvania State University Revenue | | | | |

| TOB VRDO | 0.180% | 6/7/11 | 6,095 | 6,095 |

| 1 Pennsylvania State University Revenue | | | | |

| TOB VRDO | 0.180% | 6/7/11 | 5,500 | 5,500 |

| Pennsylvania Turnpike Commission Revenue | 5.375% | 7/15/11 (Prere.) | 1,000 | 1,016 |

| Pennsylvania Turnpike Commission Revenue | 5.375% | 7/15/11 (Prere.) | 1,505 | 1,529 |

| Pennsylvania Turnpike Commission Revenue | 5.375% | 7/15/11 (Prere.) | 2,500 | 2,540 |

| Pennsylvania Turnpike Commission Revenue | 0.700% | 12/1/11 | 3,000 | 3,002 |

| 1 Pennsylvania Turnpike Commission Revenue | | | | |

| TOB VRDO | 0.280% | 6/7/11 (12) | 4,325 | 4,325 |

| 1 Pennsylvania Turnpike Commission Toll | | | | |

| Revenue TOB VRDO | 0.190% | 6/7/11 LOC | 9,920 | 9,920 |

| Pennsylvania Infrastructure & Investment | | | | |

| Authority CP | 0.210% | 7/27/11 LOC | 15,000 | 15,000 |

| 1 Philadelphia PA Airport Revenue TOB VRDO | 0.380% | 6/7/11 (4) | 7,000 | 7,000 |

| Philadelphia PA Airport Revenue VRDO | 0.180% | 6/7/11 LOC | 68,115 | 68,115 |

| 1 Philadelphia PA Authority Industrial Development | | | | |

| Revenue (Girard Estate Aramark Project) VRDO | 0.250% | 6/7/11 LOC | 3,400 | 3,400 |

| Philadelphia PA Authority Industrial Development | | | | |

| Revenue (Greater Philadelphia Health Action | | | | |

| Project) VRDO | 0.220% | 6/7/11 LOC | 8,635 | 8,635 |

| Philadelphia PA Authority Industrial Development | | | | |

| Revenue (Inglis House Project) VRDO | 0.170% | 6/7/11 | 10,500 | 10,500 |

| Philadelphia PA Gas Works Revenue | 5.250% | 8/1/11 (Prere.) | 8,000 | 8,067 |

| Philadelphia PA Gas Works Revenue VRDO | 0.160% | 6/7/11 LOC | 12,400 | 12,400 |

| Philadelphia PA Hospitals & Higher Education | | | | |

| Facilities Authority Hospital Revenue (Children’s | | | | |

| Hospital of Philadelphia Project) VRDO | 0.120% | 6/1/11 | 9,600 | 9,600 |

| Philadelphia PA Hospitals & Higher Education | | | | |

| Facilities Authority Hospital Revenue (Children’s | | | | |

| Hospital of Philadelphia Project) VRDO | 0.120% | 6/1/11 | 10,200 | 10,200 |

| Philadelphia PA Hospitals & Higher Education | | | | |

| Facilities Authority Hospital Revenue (Children’s | | | | |

| Hospital of Philadelphia Project) VRDO | 0.120% | 6/1/11 | 10,900 | 10,900 |

| Philadelphia PA Hospitals & Higher Education | | | | |

| Facilities Authority Hospital Revenue (Children’s | | | | |

| Hospital of Philadelphia Project) VRDO | 0.120% | 6/1/11 | 1,100 | 1,100 |

| 1 Philadelphia PA Hospitals & Higher Education | | | | |

| Facilities Authority Revenue (Wills Eye | | | | |

| Hospital Project) VRDO | 0.200% | 6/7/11 LOC | 11,115 | 11,115 |

| 1 Philadelphia PA Industrial Development Authority | | | | |

| Lease Revenue (Fox Chase Cancer Center) | | | | |

| TOB VRDO | 0.150% | 6/1/11 LOC | 22,800 | 22,800 |

| Philadelphia PA Industrial Development | | | | |

| Authority Lease Revenue VRDO | 0.160% | 6/7/11 LOC | 28,775 | 28,775 |

| Philadelphia PA Industrial Development Authority | | | | |

| Lease Revenue VRDO | 0.180% | 6/7/11 LOC | 20,000 | 20,000 |

19

| | | | |

| Pennsylvania Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Philadelphia PA Industrial Development Authority | | | | |

| Revenue (William Penn Charter School) VRDO | 0.180% | 6/7/11 LOC | 4,800 | 4,800 |

| Philadelphia PA School District GO | 5.500% | 2/1/12 (Prere.) | 4,000 | 4,139 |

| Philadelphia PA School District GO VRDO | 0.110% | 6/7/11 LOC | 24,100 | 24,100 |

| Philadelphia PA School District GO VRDO | 0.160% | 6/7/11 LOC | 21,200 | 21,200 |

| Philadelphia PA Water & Waste Water Revenue | 7.000% | 6/15/11 | 14,685 | 14,721 |

| 1 Philadelphia PA Water & Waste Water | | | | |

| Revenue TOB VRDO | 0.190% | 6/7/11 (13) | 45,210 | 45,210 |

| Philadelphia PA Water & Waste Water | | | | |

| Revenue VRDO | 0.180% | 6/7/11 LOC | 9,630 | 9,630 |

| Ridley PA School District GO VRDO | 0.190% | 6/7/11 LOC | 10,070 | 10,070 |

| Sayre PA Health Care Facilities Authority | | | | |

| Revenue (Guthrie Health Care System) | 5.850% | 12/1/11 (Prere.) | 4,860 | 5,038 |

| South Fork PA Hospital Authority Hospital | | | | |

| Revenue (Conemaugh Valley Memorial | | | | |

| Hospital Project) VRDO | 0.190% | 6/7/11 LOC | 25,275 | 25,275 |

| Southcentral Pennsylvania General Authority | | | | |

| Revenue (WellSpan Health Obligated Group) | 5.000% | 6/1/11 | 1,310 | 1,310 |

| 1 Southcentral Pennsylvania General Authority | | | | |

| Revenue (WellSpan Health Obligated Group) | | | | |

| TOB VRDO | 0.190% | 6/7/11 | 9,970 | 9,970 |

| St. Mary’s Hospital Authority Bucks County PA | | | | |

| Revenue (Catholic Health Initiatives) VRDO | 0.210% | 6/7/11 | 24,200 | 24,200 |

| State Public School Building Authority | | | | |

| Pennsylvania School Revenue (City of | | | | |

| Harrisburg School District Project) VRDO | 0.180% | 6/7/11 LOC | 24,645 | 24,645 |

| State Public School Building Authority | | | | |

| Pennsylvania School Revenue (North Allegheny | | | | |

| School District Project) VRDO | 0.160% | 6/7/11 | 18,135 | 18,135 |

| Temple University of the Commonwealth | | | | |

| System of Higher Education Pennsylvania | | | | |

| University Funding Obligation RAN | 1.500% | 4/4/12 | 60,000 | 60,513 |

| Union County PA Higher Educational Facilities | | | | |

| Financing Authority University Revenue | | | | |

| (Bucknell University) VRDO | 0.150% | 6/7/11 | 4,890 | 4,890 |

| University of Pittsburgh of the Commonwealth | | | | |

| System of Higher Education Pennsylvania | | | | |

| (University Capital Project) RAN | 2.000% | 6/18/12 | 30,000 | 30,525 |

| University of Pittsburgh PA Revenue CP | 0.300% | 6/1/11 | 12,750 | 12,750 |

| University of Pittsburgh PA Revenue CP | 0.250% | 6/9/11 | 25,000 | 25,000 |

| University of Pittsburgh PA Revenue CP | 0.260% | 8/3/11 | 8,950 | 8,950 |

| 1 University of Pittsburgh PA Revenue TOB VRDO | 0.180% | 6/7/11 | 6,660 | 6,660 |

| 1 University of Pittsburgh PA Revenue TOB VRDO | 0.190% | 6/7/11 | 6,665 | 6,665 |

| 1 University of Pittsburgh PA Revenue TOB VRDO | 0.190% | 6/7/11 | 5,395 | 5,395 |

| Upper St. Clair Township PA GO VRDO | 0.290% | 6/7/11 (4) | 24,585 | 24,585 |

| Washington County PA Hospital Authority Revenue | | | | |

| (Washington Hospital Project) VRDO | 0.180% | 6/7/11 LOC | 9,460 | 9,460 |

| West Chester PA Area School District GO | 2.000% | 11/15/11 | 1,450 | 1,461 |

| Wilkes-Barre PA Finance Authority College | | | | |

| Revenue (King’s College Project) VRDO | 0.180% | 6/7/11 LOC | 10,320 | 10,320 |

| York County PA Industrial Development Authority | | | | |

| Revenue (Crescent Industries Inc. Project) VRDO | 0.280% | 6/7/11 LOC | 4,015 | 4,015 |

| | | | | 2,692,616 |

20

| | | | | |

| Pennsylvania Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | | Face | Market |

| | | | Maturity | Amount | Value |

| | | Coupon | Date | ($000) | ($000) |

| Puerto Rico (5.9%) | | | | |

| 1 | Puerto Rico Housing Finance Authority | | | | |

| | Revenue TOB VRDO | 0.180% | 6/7/11 | 2,500 | 2,500 |

| 1 | Puerto Rico Industrial Medical & Environmental | | | | |

| | Pollution Control Facilities Financing Authority | | | | |

| | Revenue (Abbott Laboratories Project) PUT | 0.950% | 3/1/12 | 8,280 | 8,280 |

| | Puerto Rico Public Finance Corp. Revenue | 5.500% | 2/1/12 (Prere.) | 14,750 | 15,237 |

| | Puerto Rico Public Finance Corp. Revenue | 5.500% | 2/1/12 (Prere.) | 3,500 | 3,617 |

| | Puerto Rico Sales Tax Financing Corp. | | | | |

| | Revenue PUT | 5.000% | 8/1/11 (Prere.) | 59,225 | 59,685 |

| 1 | Puerto Rico Sales Tax Financing Corp. | | | | |

| | Revenue TOB VRDO | 0.170% | 6/7/11 | 9,300 | 9,300 |

| 1 | Puerto Rico Sales Tax Financing Corp. | | | | |

| | Revenue TOB VRDO | 0.170% | 6/7/11 LOC | 1,410 | 1,410 |

| 1 | Puerto Rico Sales Tax Financing Corp. | | | | |

| | Revenue TOB VRDO | 0.170% | 6/7/11 LOC | 1,680 | 1,680 |

| 1 | Puerto Rico Sales Tax Financing Corp. | | | | |

| | Revenue TOB VRDO | 0.170% | 6/7/11 LOC | 1,710 | 1,710 |

| 1 | Puerto Rico Sales Tax Financing Corp. | | | | |

| | Revenue TOB VRDO | 0.180% | 6/7/11 | 5,900 | 5,900 |

| 1 | Puerto Rico Sales Tax Financing Corp. | | | | |

| | Revenue TOB VRDO | 0.230% | 6/7/11 | 45,900 | 45,900 |

| 1 | Puerto Rico Sales Tax Financing Corp. | | | | |

| | Revenue TOB VRDO | 0.280% | 6/7/11 | 13,855 | 13,855 |

| | | | | | 169,074 |

| Total Tax-Exempt Municipal Bonds (Cost $2,861,690) | | | | 2,861,690 |

| Other Assets and Liabilities (-0.4%) | | | | |

| Other Assets | | | | 19,518 |

| Liabilities | | | | (30,123) |

| | | | | | (10,605) |

| Net Assets (100%) | | | | |

| Applicable to 2,851,156,362 outstanding $.001 par value shares of | | | |

| beneficial interest (unlimited authorization) | | | | 2,851,085 |

| Net Asset Value Per Share | | | | $1.00 |

| |

| |

| At May 31, 2011, net assets consisted of: | | | | |

| | | | | | Amount |

| | | | | | ($000) |

| Paid-in Capital | | | | 2,851,225 |

| Undistributed Net Investment Income | | | | — |

| Accumulated Net Realized Losses | | | | (140) |

| Net Assets | | | | 2,851,085 |

See Note A in Notes to Financial Statements.

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At May 31, 2011, the aggregate value of these securities was $685,590,000, representing 24.0% of net assets.

A key to abbreviations and other references follows the Statement of Net Assets.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Pennsylvania Tax-Exempt Money Market Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

VRDO—Variable Rate Demand Obligation.

VRDP—Variable Rate Demand Preferred.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Investors Assurance).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) AGM (Assured Guaranty Municipal Corporation).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.

(11) CIFG (CDC IXIS Financial Guaranty).

(12) Assured Guaranty Corporation.

(13) Berkshire Hathaway Assurance Corporation.

(14) National Public Finance Guarantee Corporation.

The insurance does not guarantee the market value of the municipal bonds.

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit.

22

Pennsylvania Tax-Exempt Money Market Fund

Statement of Operations

| |

| | Six Months Ended |

| | May 31, 2011 |

| | ($000) |

| Investment Income | |

| Income | |

| Interest | 4,142 |

| Total Income | 4,142 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 429 |

| Management and Administrative | 1,571 |

| Marketing and Distribution | 495 |

| Custodian Fees | 22 |

| Shareholders’ Reports | 5 |

| Trustees’ Fees and Expenses | 2 |

| Total Expenses | 2,524 |

| Net Investment Income | 1,618 |

| Realized Net Gain (Loss) on Investment Securities Sold | 6 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,624 |

See accompanying Notes, which are an integral part of the Financial Statements.

23

Pennsylvania Tax-Exempt Money Market Fund

Statement of Changes in Net Assets

| | |

| | Six Months Ended | Year Ended |

| | May 31, | November 30, |

| | 2011 | 2010 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 1,618 | 3,613 |

| Realized Net Gain (Loss) | 6 | (15) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,624 | 3,598 |

| Distributions | | |

| Net Investment Income | (1,618) | (3,613) |

| Realized Capital Gain | — | — |

| Total Distributions | (1,618) | (3,613) |

| Capital Share Transactions (at $1.00) | | |

| Issued | 1,091,907 | 1,931,518 |

| Issued in Lieu of Cash Distributions | 1,562 | 3,486 |

| Redeemed | (1,249,355) | (2,256,037) |

| Net Increase (Decrease) from Capital Share Transactions | (155,886) | (321,033) |

| Total Increase (Decrease) | (155,880) | (321,048) |

| Net Assets | | |

| Beginning of Period | 3,006,965 | 3,328,013 |

| End of Period | 2,851,085 | 3,006,965 |

See accompanying Notes, which are an integral part of the Financial Statements.

24

Pennsylvania Tax-Exempt Money Market Fund

Financial Highlights

| | | | | | |

| Six Months | | | | | |

| | Ended | | | | | |

| For a Share Outstanding | May 31, | | | Year Ended November 30, |

| Throughout Each Period | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | | | | | | |

| Net Investment Income | .001 | .001 | .005 | .024 | .036 | .033 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | — | — | — | — | — | — |

| Total from Investment Operations | .001 | .001 | .005 | .024 | .036 | .033 |

| Distributions | | | | | | |

| Dividends from Net Investment Income | (.001) | (.001) | (.005) | (.024) | (.036) | (.033) |

| Distributions from Realized Capital Gains | — | — | — | — | — | — |

| Total Distributions | (.001) | (.001) | (.005) | (.024) | (.036) | (.033) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| |

| Total Return1 | 0.05% | 0.12% | 0.50% | 2.42% | 3.64% | 3.31% |

| |

| Ratios/Supplemental Data | | | | | | |

| Net Assets, End of Period (Millions) | $2,851 | $3,007 | $3,328 | $3,867 | $4,167 | $3,390 |

| Ratio of Total Expenses to | | | | | | |

| Average Net Assets | 0.17% | 0.17% | 0.17%2 | 0.11%2 | 0.10% | 0.13% |

| Ratio of Net Investment Income to | | | | | | |

| Average Net Assets | 0.11% | 0.12% | 0.51% | 2.39% | 3.57% | 3.27% |

The expense ratio and net income ratio for the current period have been annualized.

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

2 Includes fees to participate in the Treasury Temporary Guarantee Program for Money Market Funds of 0.04% for 2009 and 0.01% for 2008.

See accompanying Notes, which are an integral part of the Financial Statements.

25

Pennsylvania Tax-Exempt Money Market Fund

Notes to Financial Statements

Vanguard Pennsylvania Tax-Exempt Money Market Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of municipal issuers whose ability to meet their obligations may be affected by economic and political developments in the state.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued at amortized cost, which approximates market value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (November 30, 2007–2010), and for the period ended May 31, 2011, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

3. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month.

4. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. The Vanguard Group furnishes at cost investment advisory, corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At May 31, 2011, the fund had contributed capital of $452,000 to Vanguard (included in Other Assets), representing 0.02% of the fund’s net assets and 0.18% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard. Vanguard and the board of trustees have agreed to temporarily limit certain net operating expenses in excess of the fund’s daily yield so as to maintain a zero or positive yield for the fund. Vanguard and the board of trustees may terminate the temporary expense limitation at any time.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At May 31, 2011, 100% of the fund’s investments were valued using amortized cost, in accordance with rules under the Investment Company Act of 1940. Amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, securities valued at amortized cost are considered to be valued using Level 2 inputs.

D. In preparing the financial statements as of May 31, 2011, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

26

Pennsylvania Long-Term Tax-Exempt Fund

Fund Profile

As of May 31, 2011

| | | |

| Share-Class Characteristics | | |

| | | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VPAIX | VPALX |

| Expense Ratio1 | 0.20% | 0.12% |

| 30-Day SEC Yield | 3.45% | 3.53% |

| |

| Financial Attributes | | | |

| | | Barclays | Barclays |

| | | 10 Year | Municipal |

| | | Municipal | Bond |

| | Fund | Index | Index |

| Number of Bonds | 469 | 8,667 | 45,699 |

| Yield to Maturity | | | |

| (before expenses) | 3.5% | 3.3% | 3.5% |

| Average Coupon | 4.7% | 4.9% | 4.9% |

| Average Duration | 6.7 years | 7.1 years | 8.4 years |

| Average Effective | | | |

| Maturity | 8.2 years | 9.9 years | 13.3 years |

| Short-Term | | | |

| Reserves | 4.1% | — | — |

| | |

| Volatility Measures | | |

| | Barclays | Barclays |

| | 10 Year | Municipal |

| | Municipal | Bond |

| | Index | Index |

| R-Squared | 0.90 | 0.99 |

| Beta | 0.85 | 0.94 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

|

| |

| Distribution by Maturity (% of portfolio) | |

| Under 1 Year | | 10.0% |

| 1 - 3 Years | | 7.2 |

| 3 - 5 Years | | 17.3 |

| 5 - 10 Years | | 46.2 |

| 10 - 20 Years | | 7.1 |

| 20 - 30 Years | | 10.9 |

| Over 30 Years | | 1.3 |

| |

| Distribution by Credit Quality (% of portfolio) |

| AAA | | 5.0% |

| AA | | 54.0 |

| A | | 30.4 |

| BBB | | 8.4 |

| BB | | 0.3 |

| Not Rated | | 1.9 |

| For information about these ratings, see the Glossary entry for Credit Quality. |

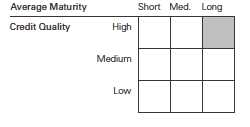

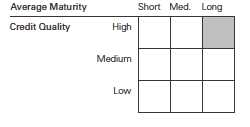

Investment Focus

1 The expense ratios shown are from the prospectus dated March 29, 2011, and represent estimated costs for the current fiscal year. For the six months ended May 31, 2011, the annualized expense ratios were 0.20% for Investor Shares and 0.12% for Admiral Shares.

27

Pennsylvania Long-Term Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Fiscal-Year Total Returns (%): November 30, 2000, Through May 31, 2011

| | | | |

| | | | | Barclays |

| | | | | 10 Year |

| | | | | Municipal |

| | | | Investor Shares | Index |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2001 | 5.33% | 3.46% | 8.79% | 8.22% |

| 2002 | 4.99 | 1.50 | 6.49 | 6.67 |

| 2003 | 4.62 | 2.68 | 7.30 | 6.88 |

| 2004 | 4.59 | -1.27 | 3.32 | 4.03 |

| 2005 | 4.54 | -1.44 | 3.10 | 3.01 |

| 2006 | 4.72 | 1.58 | 6.30 | 6.17 |

| 2007 | 4.50 | -2.20 | 2.30 | 3.51 |

| 2008 | 4.19 | -8.67 | -4.48 | -0.42 |

| 2009 | 4.67 | 7.65 | 12.32 | 12.67 |

| 2010 | 4.10 | 0.18 | 4.28 | 5.51 |

| 2011 | 2.06 | -0.27 | 1.79 | 2.73 |

| Note: For 2011, performance data reflect the six months ended May 31, 2011. |

Average Annual Total Returns: Periods Ended March 31, 2011

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | | Ten Years |

| | Inception Date | One Year | Five Years | Income | Capital | Total |

| Investor Shares | 4/7/1986 | 1.15% | 3.47% | 4.56% | -0.34% | 4.22% |

| Admiral Shares | 5/14/2001 | 1.23 | 3.55 | 4.621 | -0.211 | 4.411 |

| 1 Return since inception. |

See Financial Highlights for dividend and capital gains information.

28

Pennsylvania Long-Term Tax-Exempt Fund

Financial Statements (unaudited)

Statement of Net Assets

As of May 31, 2011

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (98.8%) | | | | |

| Pennsylvania (96.5%) | | | | |

| Abington PA School District GO | 5.000% | 4/1/32 (4) | 1,495 | 1,526 |

| Allegheny County PA GO | 5.375% | 11/1/12 (Prere.) | 2,645 | 2,827 |

| Allegheny County PA GO | 5.375% | 11/1/12 (Prere.) | 2,000 | 2,138 |

| Allegheny County PA GO | 5.375% | 11/1/12 (Prere.) | 2,880 | 3,078 |

| Allegheny County PA GO | 5.375% | 11/1/12 (Prere.) | 3,725 | 3,981 |

| Allegheny County PA GO | 5.375% | 11/1/16 (14) | 4,100 | 4,315 |

| Allegheny County PA GO | 5.375% | 11/1/17 (14) | 3,600 | 3,783 |

| Allegheny County PA GO | 5.000% | 11/1/29 | 4,000 | 4,063 |

| Allegheny County PA Higher Education Building | | | | |

| Authority University Revenue | | | | |

| (Carnegie Mellon University) | 5.125% | 3/1/32 | 3,000 | 3,008 |

| Allegheny County PA Higher Education Building | | | | |

| Authority University Revenue | | | | |

| (Carnegie Mellon University) VRDO | 0.110% | 6/1/11 | 12,100 | 12,100 |

| Allegheny County PA Higher Education Building | | | | |

| Authority University Revenue | | | | |

| (Duquesne University) | 5.250% | 3/1/26 | 4,005 | 4,211 |

| Allegheny County PA Higher Education Building | | | | |

| Authority University Revenue | | | | |

| (Duquesne University) | 5.500% | 3/1/28 | 1,940 | 2,057 |

| Allegheny County PA Higher Education Building | | | | |

| Authority University Revenue | | | | |

| (Duquesne University) | 5.500% | 3/1/29 | 1,700 | 1,792 |

| Allegheny County PA Higher Education Building | | | | |

| Authority University Revenue | | | | |

| (Duquesne University) | 5.500% | 3/1/31 | 770 | 804 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of | | | | |

| Pittsburgh Medical Center) | 5.000% | 6/15/13 | 2,000 | 2,157 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of | | | | |

| Pittsburgh Medical Center) | 5.000% | 6/15/14 | 1,500 | 1,657 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of | | | | |

| Pittsburgh Medical Center) | 5.000% | 9/1/14 | 25,000 | 27,770 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of | | | | |

| Pittsburgh Medical Center) | 5.000% | 6/15/15 | 2,000 | 2,246 |

29

| | | | |

| Pennsylvania Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value |

| | Coupon | Date | ($000) | ($000) |

| Allegheny County PA Hospital | | | | |

| Development Authority Revenue | | | | |

| (University of Pittsburgh Medical Center) | 5.000% | 5/15/18 | 7,000 | 7,935 |

| Allegheny County PA Hospital | | | | |

| Development Authority Revenue | | | | |

| (University of Pittsburgh Medical Center) | 5.000% | 6/15/18 | 7,000 | 7,431 |

| Allegheny County PA Hospital | | | | |

| Development Authority Revenue | | | | |

| (University of Pittsburgh Medical Center) | 6.000% | 7/1/23 (14) | 5,745 | 6,741 |

| Allegheny County PA Hospital | | | | |

| Development Authority Revenue | | | | |

| (University of Pittsburgh Medical Center) | 6.000% | 7/1/26 (14) | 4,625 | 5,210 |

| Allegheny County PA Hospital | | | | |

| Development Authority Revenue | | | | |

| (University of Pittsburgh Medical Center) | 6.000% | 7/1/27 (14) | 9,325 | 10,468 |

| Allegheny County PA Hospital | | | | |

| Development Authority Revenue | | | | |

| (University of Pittsburgh Medical Center) | 5.375% | 8/15/29 | 4,000 | 4,070 |

| Allegheny County PA Hospital | | | | |

| Development Authority Revenue | | | | |

| (University of Pittsburgh Medical Center) | 5.625% | 8/15/39 | 10,800 | 10,937 |

| 1 Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of Pittsburgh | | | | |

| Medical Center) TOB VRDO | 0.180% | 6/7/11 | 4,700 | 4,700 |

| Allegheny County PA Port Authority Revenue | 5.750% | 3/1/29 | 6,000 | 6,454 |

| Allegheny County PA Sanitation Authority | | | | |

| Sewer Revenue | 5.375% | 12/1/16 (14) | 3,545 | 3,635 |

| Allegheny County PA Sanitation Authority | | | | |

| Sewer Revenue | 5.500% | 12/1/16 (ETM) | 11,295 | 12,546 |

| Allegheny County PA Sanitation Authority | | | | |

| Sewer Revenue | 5.375% | 12/1/18 (14) | 15,000 | 15,321 |

| Allegheny County PA Sanitation Authority | | | | |

| Sewer Revenue | 5.000% | 12/1/24 (14) | 6,000 | 6,226 |

| Allegheny County PA Sanitation Authority | | | | |

| Sewer Revenue | 5.000% | 6/1/26 (4) | 4,925 | 5,176 |

| Allegheny County PA Sanitation Authority | | | | |

| Sewer Revenue | 5.000% | 6/1/30 (4) | 3,500 | 3,653 |

| Allegheny County PA Sanitation Authority | | | | |

| Sewer Revenue | 5.000% | 12/1/32 (14) | 12,000 | 12,068 |

| Annville Cleona PA School District GO | 6.000% | 3/1/28 (4) | 1,500 | 1,599 |

| Annville Cleona PA School District GO | 6.000% | 3/1/31 (4) | 2,475 | 2,614 |

| Beaver County PA Industrial Development | | | | |

| Authority Pollution Control Revenue | | | | |

| (FirstEnergy Nuclear Generation Corp. | | | | |

| Project) PUT | 3.000% | 4/2/12 | 7,000 | 7,069 |

| Beaver County PA Industrial Development | | | | |

| Authority Pollution Control Revenue (FirstEnergy | | | | |

| Nuclear Generation Corp. Project) VRDO | 0.150% | 6/7/11 LOC | 10,600 | 10,600 |

| Bensalem Township PA School District GO | 5.250% | 6/15/24 (14) | 3,700 | 3,991 |

| Berks County PA GO | 0.000% | 11/15/13 (14) | 7,250 | 7,003 |

| Berks County PA GO | 0.000% | 11/15/14 (14) | 8,615 | 8,112 |

| Berks County PA GO | 0.000% | 11/15/15 (14) | 6,250 | 5,694 |

| Berks County PA Municipal Authority Hospital | | | | |

| Revenue (Reading Hospital & Medical | | | | |

| Center Project) | 5.700% | 10/1/14 (14) | 3,160 | 3,381 |

| Berks County PA Municipal Authority Revenue | | | | |

| (Reading Hospital & Medical Center Project) | 5.500% | 11/1/31 | 3,500 | 3,626 |

30

| | | | |

| Pennsylvania Long-Term Tax-Exempt Fund | | | | |

| |