UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C., 20549

SCHEDULE 14A

AMENDMENT NO. 1

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| x | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

MAXCO, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of Securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

MAXCO, INC.

1118 CENTENNIAL WAY

LANSING, MICHIGAN 48917

(517) 321-3130

_____________ __, 2006

Dear Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders of Maxco, Inc. on ____________, 2006, at 3:30 p.m. eastern time, at the Company's corporate office at 1118 Centennial Way, Lansing, Michigan. We look forward to greeting those stockholders who are able to attend.

At this important meeting, you will be asked to vote upon a proposal to amend our Articles of Incorporation, as amended. The proposal is to effect a 1-for-1,000 reverse split followed immediately by a 1,000 for 1 forward stock split, of our outstanding common stock. Under the reverse split, each one (1) whole share of our common stock will be converted into one-thousand (1/1,000) of a share of common stock (“Reverse Split”), and in lieu of us issuing any fractional shares, we will pay $6.00 in cash for each share of common stock traceable to a shareholder holding less than 1,000 shares of common stock immediately before the Reverse Split. Immediately following completion of the Reverse Split, there will be a 1,000-for-1 forward stock split of the resulting whole shares of common stock (“Forward Split”). We refer to the Reverse Split and the Forward Split collectively as, the Transaction.

Shareholders are also being asked to vote upon the proposals to grant the Company’s Board of Directors discretionary authority to adjourn the Special Meeting if necessary to satisfy the conditions to completing the Transaction, including for the purpose of soliciting proxies to vote in favor of the Transaction, and in their discretion to vote upon such other matters as may properly come before the Special Meeting.

If Transaction is approved, holders of less than 1,000 shares of common stock immediately before the Reverse Split no longer will be shareholders of the Company, and will be entitled only to receive payment of $6.00 per share of our common stock held immediately before the Reverse Split. Shareholders holding more than 1,000 shares of our common stock immediately before the Reverse Split will not receive any cash payment; instead, the Forward Split to immediately follow the Reverse Split will reconvert their fractional share interests back into the same number of shares of common stock held immediately before the Reverse Split. As a result, the total number of common shares held by a stockholder holding 1,000 or more common shares immediately before the Transaction will not change after completion of the Transaction. The proposed Transaction is expected to reduce the number of common stockholders of record to fewer than 300, and we presently have less than 300 series three preferred shareholders of record. If the Transaction is approved, we intend to terminate our registration of our common stock and series three preferred stock and further reporting obligations under the Securities Exchange Act of 1934 (“Act”), as soon as possible following the Transaction.

Because Maxco has a large number of stockholders who own fewer than 1,000 common shares, we expect that the number of common stockholders of record will be reduced from approximately 530 to approximately 70, while the number of outstanding common shares will decrease by only approximately 1.6%, a reduction of approximately 57,000 shares from the 3,446,995 shares outstanding as of December 31, 2005. This proposal will have no effect on any of our preferred shares.

After careful consideration, the board of directors has concluded that the costs associated with being an SEC reporting company, especially in light of the additional costs associated with compliance with the Sarbanes-Oxley Act of 2002 (which was originally to take effect for our next fiscal year end March 31, 2006, but was delayed by the SEC until our fiscal year end March 31, 2007), are not justified by the benefits in view of our common stock's limited trading activity. Maxco estimates that it will save approximately $450,000 in the first full year after deregistration as an SEC reporting company and approximately $350,000 annually thereafter. We believe that these cost-savings will be in the best interest of Maxco and its stockholders who remain after the Transaction. Although our common stock will no longer be quoted on the Nasdaq SmallCap Market if the Transaction is completed, we anticipate that our common shares would be quoted on the "pink sheets." Quotation on the “pink sheets” will involve us engaging a market maker willing to qualify to quote our common stock. None of our series three, four, five or six preferred shares are presently quoted over any public markets, and we do not anticipate any change in this regard. In addition, the Transaction would allow our stockholders who hold fewer than 1,000 common shares immediately before the Transaction the opportunity to receive cash for their shares at a premium to our common stock's trading price prior to announcement of the Transaction, without having to pay brokerage commissions and other Transaction costs.

A special committee of the board of directors has reviewed the proposed Transaction and considered its fairness to stockholders who hold fewer than 1,000 common shares as well as those holding 1,000 or more common shares, and received a fairness opinion from its financial advisor with regard to the per share cash amount to be paid to the stockholders holding fewer than 1,000 common shares in the Transaction.

ACCORDINGLY, AFTER CONSIDERING THE RECOMMENDATION OF THE SPECIAL COMMITTEE AND CONDUCTING ITS OWN DELIBERATIONS OF THE ISSUES IT DEEMED PERTINENT, INCLUDING ALTERNATIVES TO THE TRANSACTION, THE COSTS AND BENEFITS OF REMAINING AN SEC REPORTING COMPANY AND THE FAIRNESS OF THE TRANSACTION TO STOCKHOLDERS, YOUR BOARD OF DIRECTORS BELIEVES THIS TRANSACTION IS IN THE BEST INTEREST OF MAXCO AND ITS STOCKHOLDERS AND UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE PROPOSALS.

The enclosed proxy statement includes a discussion of the alternatives and factors considered by the board in connection with the board's approval of the Transaction. See "Special Factors - Background of the Transaction" and "Special Factors - Recommendation of the Board; Fairness of the Proposed Transaction."

Consummation of the Transaction is subject to certain conditions, including the affirmative vote of at least a majority of the shares of Maxco's common stock and voting preferred stock entitled to vote at the Special Meeting. It is anticipated that the Transaction will become effective as soon as reasonably practicable after the Special Meeting and the Certificate of Amendment to the Articles of Incorporation is received, and deemed filed, by the State of Michigan. Details of the proposed Transaction are set forth in the accompanying proxy statement, which we urge you to read carefully in its entirety.

IT IS VERY IMPORTANT THAT YOUR SHARES ARE REPRESENTED AND VOTED AT THE MEETING, WHETHER OR NOT YOU PLAN TO ATTEND. ACCORDINGLY, PLEASE SIGN, DATE AND RETURN YOUR PROXY IN THE ENCLOSED ENVELOPE AT YOUR EARLIEST CONVENIENCE.

Your interest and participation in the affairs of the Company are greatly appreciated. Thank you for your continued support.

Sincerely,

Max A. Coon

Chairman of the Board,

Chief Executive Officer and President

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD _________________, 2006

To the Stockholders of Maxco, Inc.:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders (the "Special Meeting") of Maxco, Inc., a Michigan corporation (the "Company" or "Maxco"), will be held at the Company's corporate office at 1118 Centennial Way, Lansing, Michigan, on the __th day of ____________, 2006, at 3:30 p.m., eastern time, for the following purposes:

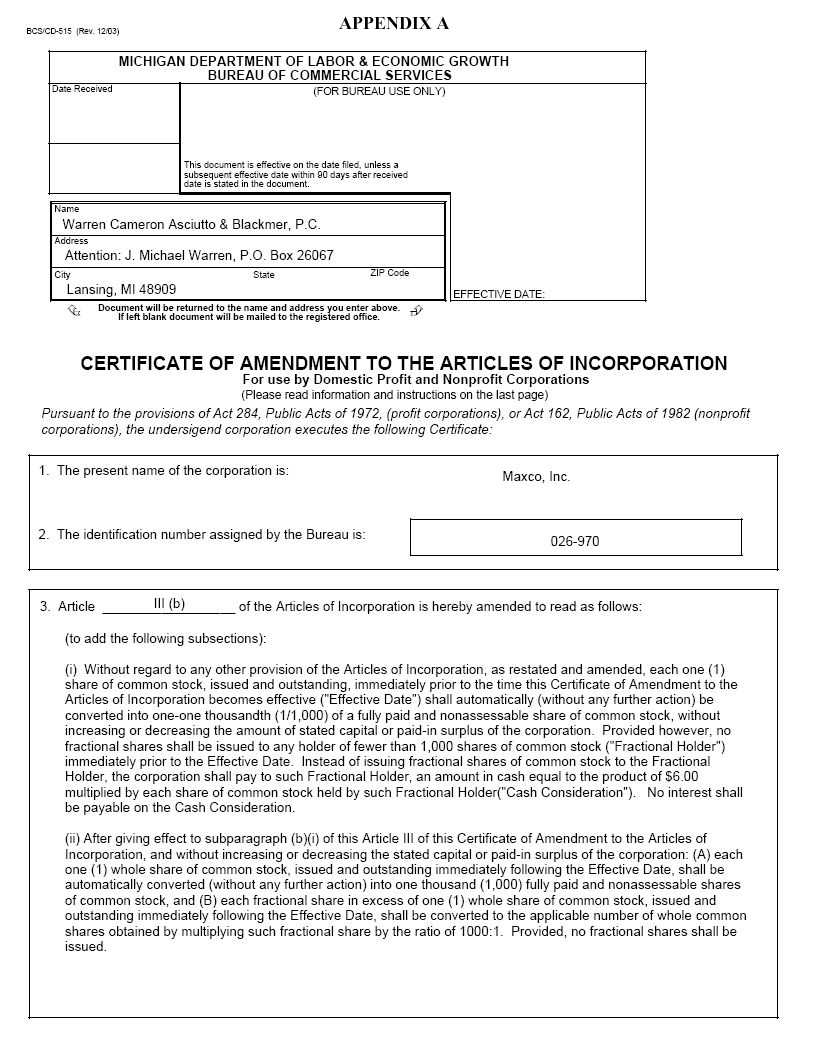

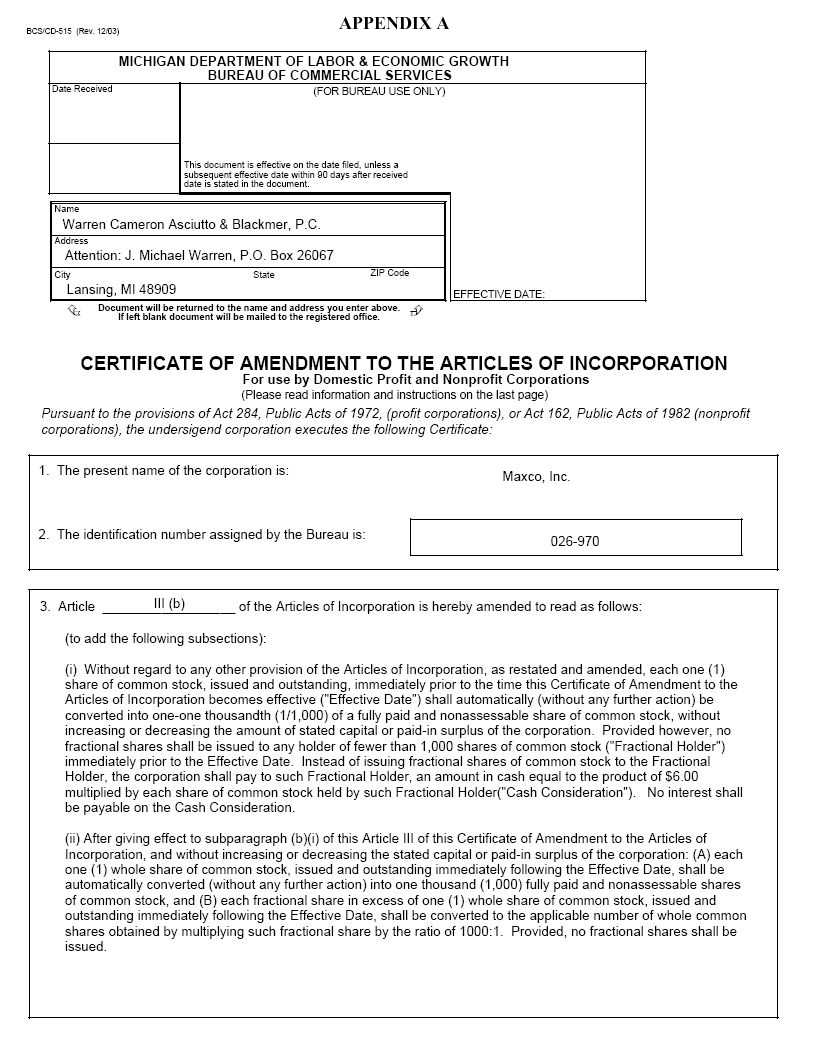

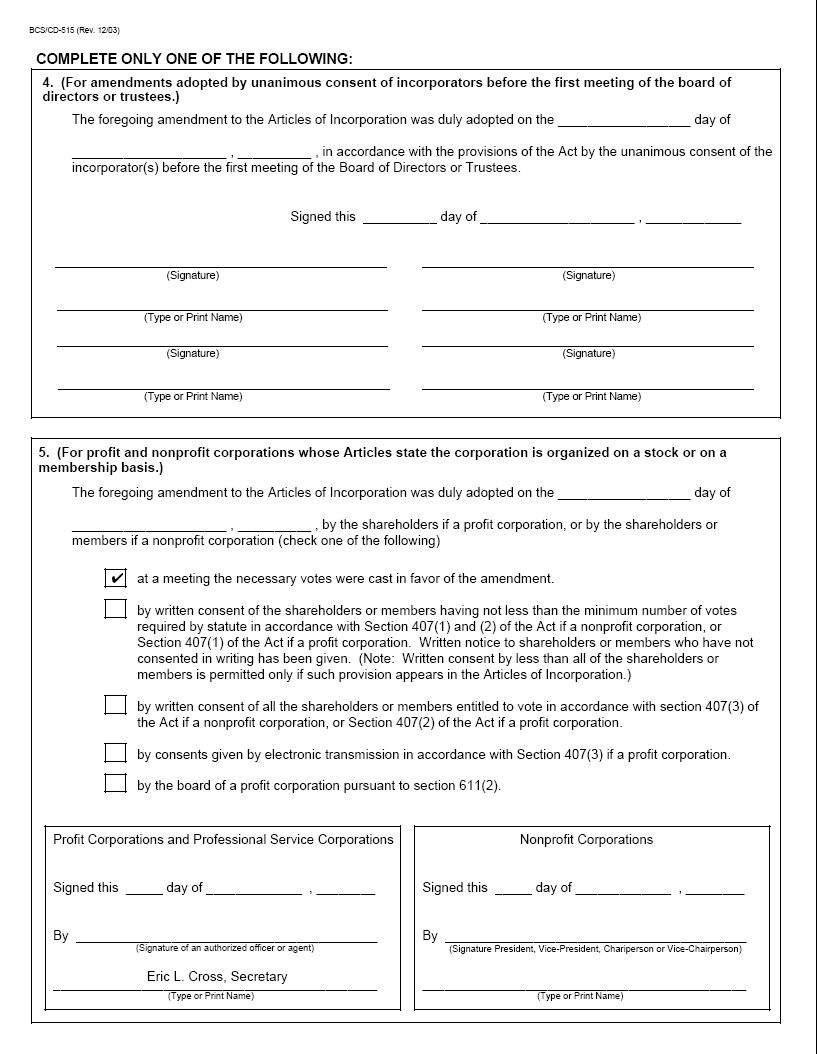

To consider and vote upon a proposal to amend the Company’s Articles of Incorporation, as amended. The proposal is to effect a 1-for-1,000 reverse stock split of the Company’s common stock (“Reverse Split”), followed immediately by effectuating a 1,000-for-1 forward stock split of the Company's common stock upon completion of the Reverse Split (“Forward Split”). The Reverse Split and the Forward Split, are collectively, the "Transaction"). As a result of the Transaction, (a) each stockholder owning fewer than 1,000 shares immediately before the Transaction will receive from the Company $6.00 in cash, without interest, for each of such stockholder's shares of the Company's common stock; and (b) each share of common stock held by a stockholder owning 1,000 or more shares will continue to represent one share of the Company after completion of the Transaction. The proposed Certificate of Amendment to the Articles of Incorporation is attached as Appendix A to this proxy statement.

To consider and vote upon the proposal to grant the Company’s Board of Directors discretionary authority to adjourn the special meeting if necessary to satisfy the conditions to completing the Transaction, including for the purpose of soliciting proxies to vote in favor of the Transaction.

To transact such other business as may properly come before the meeting or any adjournment thereof.

Owners of record of the Company's common stock and voting preferred stock (series three and six) at the close of business on January 16, 2006, the record date, will be entitled to vote at the Special Meeting. If your shares are held in the name of a broker, trust or other nominee (often referred to as held in "street name"), you must instruct them on how to vote your shares. Whether or not you plan to attend the Special Meeting, please date, sign and mail the enclosed proxy in the envelope provided. Thank you for your cooperation.

The board of directors has carefully considered the terms of the proposed Transaction and believes that it is fair to, and in the best interest of, Maxco and its stockholders. The board of directors unanimously recommends that you vote "FOR" the Transaction.

By Order of the Board of Directors of Maxco, Inc.

Max A. Coon

Chairman of the Board,

Chief Executive Officer and President

PLEASE SIGN AND MAIL THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE NO POSTAGE NECESSARY IF MAILED IN THE UNITED STATES

MAXCO, INC.

1118 CENTENNIAL WAY

LANSING, MICHIGAN 48917

(517) 321-3130

PROXY STATEMENT

__________ _____, 2006

Neither the Securities and Exchange Commission nor any state securities commission has: approved or disapproved of the Transaction; passed upon the merits or fairness of the Transaction; or passed upon the adequacy or accuracy of the disclosure in this document. Any representation to the contrary is a criminal offense.

This Proxy Statement and accompanying materials are being furnished to the stockholders of Maxco, Inc. (“Company”) in connection with the solicitation by the board of directors of the Company of proxies to be used at the Special Meeting of the Stockholders (the “Special Meeting”) to be held at the Company’s corporate office at 1118 Centennial Way, Lansing, Michigan on the ___th day of __________, 2006, at 3:30 p.m., eastern time, and at any adjournment thereof, and is being mailed to the stockholders on or about __________. 2006.

TABLE OF CONTENTS

| | | | |

SUMMARY TERM SHEET | | 1 | |

| THE TRANSACTION | | 1 | |

| VOTE REQUIRED | | 2 | |

| NO APPRAISAL OR DISSENTERS' RIGHTS | | 3 | |

| THE PURPOSE AND REASONS FOR THE TRANSACTION | | 3 | |

| DISADVANTAGES OF THE TRANSACTION | | 4 | |

| RECENT MARKET PRICE OF MAXCO'S COMMON STOCK AND MARKET PRICE FOLLOWING ANNOUNCEMENT OF THE PROPOSED TRANSACTION | | 5 | |

| AFFILIATES ENGAGED IN THE TRANSACTION | | 5 | |

| RECOMMENDATIONS OF THE SPECIAL COMMITTEE AND THE BOARD OF DIRECTORS | | 5 | |

| FAIRNESS OPINION OF FINANCIAL ADVISOR | | 6 | |

| CERTAIN EFFECTS OF THE TRANSACTION | | 7 | |

| CONDITIONS TO COMPLETION OF THE TRANSACTION | | 8 | |

| RESERVATION OF RIGHTS | | 8 | |

| SOURCE OF FUNDS; FINANCING OF THE TRANSACTION | | 8 | |

| CONFLICTS OF INTEREST OF DIRECTORS AND EXECUTIVE OFFICERS | | 8 | |

| U.S. FEDERAL INCOME TAX CONSEQUENCES | | 9 | |

SPECIAL FACTORS | | 9 | |

| BACKGROUND OF THE TRANSACTION | | 9 | |

| PURPOSE AND REASONS FOR THE TRANSACTION | | 13 | |

| ALTERNATIVES CONSIDERED | | 16 | |

| RECOMMENDATION OF THE SPECIAL COMMITTEE | | 18 | |

| RECOMMENDATION OF THE BOARD; FAIRNESS OF THE TRANSACTION | | 23 | |

| OPINION OF THE FINANCIAL ADVISOR | | 29 | |

| POSITION OF MESSRS. COON AND CROSS AS TO FAIRNESS | | 43 | |

| CERTAIN EFFECTS OF THE TRANSACTION | | 44 | |

| INTERESTS OF OFFICERS AND DIRECTORS IN THE TRANSACTION | | 49 | |

| CONDUCT OF MAXCO'S BUSINESS AFTER THE TRANSACTION | | 50 | |

| CONDITIONS TO THE COMPLETION OF THE TRANSACTION | | 50 | |

| SOURCE OF FUNDS AND FINANCING OF THE TRANSACTION | | 51 | |

| ANTICIPATED ACCOUNTING TREATMENT | | 52 | |

| POSSIBLE CORPORATE TRANSACTIONS | | 52 | |

| U.S. FEDERAL INCOME TAX CONSEQUENCES | | 52 | |

| | | | |

| REGULATORY APPROVALS | | 55 | |

| NO APPRAISAL OR DISSENTERS' RIGHTS | | 55 | |

| ADJOURNMENT OF MEETING | | 56 | |

| RESERVATION OF RIGHTS | | 56 | |

| EXAMPLES | | 56 | |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION | | 58 | |

SUMMARY FINANCIAL INFORMATION | | 59 | |

| SUMMARY HISTORICAL FINANCIAL INFORMATION | | 59 | |

| SUMMARY UNAUDITED PRO FORMA FINANCIAL INFORMATION | | 60 | |

QUESTIONS AND ANSWERS ABOUT THE MEETING AND TRANSACTION | | 61 | |

THE SPECIAL MEETING | | 66 | |

| GENERAL | | 66 | |

| WHO CAN VOTE AT AND ATTEND THE SPECIAL MEETING | | 66 | |

| ANNUAL REPORT | | 67 | |

| VOTE REQUIRED | | 67 | |

| VOTING AND REVOCATION OF PROXIES | | 69 | |

| RECOMMENDATION OF THE BOARD OF DIRECTORS | | 69 | |

MARKET FOR COMMON STOCK AND RELATED STOCKHOLDER MATTERS | | 69 | |

THE PROPOSED AMENDMENT | | 70 | |

| THE STRUCTURE OF THE TRANSACTION | | 71 | |

| CONVERSION OF SHARES IN THE TRANSACTION | | 71 | |

| EXCHANGE OF CERTIFICATES | | 73 | |

| TIME OF CLOSING | | 73 | |

| RESERVATION OF RIGHTS | | 74 | |

PROPOSAL FOR DISCRETIONARY ADJOURNMENT OF THE SPECIAL MEETING | | 74 | |

DIRECTORS AND EXECUTIVE OFFICERS | | 74 | |

| STOCK OPTIONS | | 75 | |

| EQUITY COMPENSATION PLAN INFORMATION | | 75 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 76 | |

SECURITIES TRANSACTIONS | | 79 | |

CERTAIN TRANSACTIONS | | 79 | |

COST OF SOLICITATION OF PROXIES | | 81 | |

STOCKHOLDER PROPOSALS | | 81 | |

CODE OF BUSINESS CONDUCT AND ETHICS | | 81 | |

OTHER MATTERS | | 82 | |

WHERE YOU CAN FIND MORE INFORMATION | | 82 | |

DOCUMENTS INCORPORATED BY REFERENCE | | 82 | |

APPENDIX A | | 84 | |

APPENDIX B | | 88 | |

SUMMARY TERM SHEET

THIS SUMMARY TERM SHEET HIGHLIGHTS SELECTED INFORMATION FROM THE PROXY STATEMENT, INCLUDING THE MATERIAL TERMS OF THE PROPOSED TRANSACTION. FOR A MORE COMPLETE DESCRIPTION YOU SHOULD CAREFULLY READ THIS PROXY STATEMENT AND ALL OF ITS APPENDICES BEFORE YOU VOTE. FOR YOUR CONVENIENCE, WE HAVE CROSS-REFERENCED TO THE LOCATION IN THIS PROXY STATEMENT WHERE YOU CAN FIND A MORE COMPLETE DISCUSSION OF EACH ITEM BELOW.

AS USED IN THIS PROXY STATEMENT, "MAXCO," THE "COMPANY," "WE," "OUR," "OURS" AND "US" REFER TO MAXCO, INC., A MICHIGAN CORPORATION, AND THE "TRANSACTION" REFERS TO THE 1-FOR-1,000 REVERSE STOCK SPLIT AND THE 1,000-FOR-1 FORWARD STOCK SPLIT, TOGETHER WITH THE RELATED CASH PAYMENTS TO STOCKHOLDERS HOLDING FEWER THAN 1,000 SHARES IMMEDIATELY PRIOR TO THE TRANSACTION.

►THE TRANSACTION

If the Transaction is approved and completed:

- Maxco’s stockholders holding fewer than 1,000 shares of Maxco's common stock at the effective time of the Transaction will receive a cash payment from Maxco of $6.00 per share, without interest, for each share of common stock held immediately prior to the Transaction;

- Maxco's stockholders holding 1,000 or more shares of Maxco common stock at the effective time of the Transaction will continue to hold the same number of shares of Maxco’s common stock after completion of the Transaction and will not receive any cash payment;

- The officers and directors of Maxco at the effective time will continue to serve as the officers and directors of Maxco immediately after the Transaction;

- We believe we will have fewer than 300 holders of record of common stock and therefore be eligible to terminate registration of our common stock with the Securities and Exchange Commission ("SEC"). If we have fewer than 300 stockholders of record of common stock, coupled with fewer than 300 series three preferred stockholders of record, we intend to proceed to terminate our obligation to continue filing periodic reports and proxy statements pursuant to the Securities Exchange Act of 1934 (the "Exchange Act");

- Our common stock will no longer be quoted on the Nasdaq SmallCap Market System, any trading in our common stock will likely only be through quotation of our common stock in the "pink sheets", or through privately negotiated sales. We anticipate that our preferred shares will continue to be eligible to be traded in privately negotiated sales;

- Outstanding options held by our employees, officers, and directors to acquire Maxco’s common stock, unless exercised or expire, will remain outstanding following the Transaction;

- The number of our common stockholders of record will be reduced from approximately 530 to 70, and the number of outstanding shares of Maxco’s common stock will be reduced by approximately 1.6%, from 3,446,995 shares, as of December 31, 2005, to approximately 3,389,000 shares;

- Based on the shares outstanding as of December 31, 2005: we expect that (i) the percentage ownership of Maxco’s common stock beneficially owned by the directors and executive officers of Maxco as a group will increase from approximately 37.5% to approximately 38.2%, and (ii) the percentage of voting stock (which includes common, series three preferred and series six preferred) beneficially owned by the directors and executive officers of Maxco as a group, will increase from approximately 41.8% to approximately 42.4%, which will not affect control of Maxco;

- Aggregate stockholders' common equity of Maxco as of September 30, 2005, will be reduced from $5,108,043 on a historical basis to approximately $4,658,000 on a pro forma basis;

- The book value per share of common stock as of September 30, 2005, will be reduced from $1.48 per share on a historical basis to approximately $1.37 per share on a pro forma basis;

- Maxco will pay cash of approximately $450,000 in the aggregate to pay the costs of the Transaction; and

- Net income per share of common stock (including nonrecurring income and expense) for the six months ended September 30, 2005, will change from $0.05 on a historical basis (on both a basic and fully-diluted basis, respectively) to approximately $0.07 on a pro forma basis (on both a basic and fully-diluted basis, respectively).

For a more detailed discussion on the Transaction, see "Special Factors" beginning on page 9. For a description of the provisions regarding the treatment of shares held in street name, please see "Special Factors - Certain Effects of the Transaction" beginning on page 44 (Shares held in "street name" are held in a stock brokerage account or by a bank or other nominee.)

►VOTE REQUIRED

The required vote for the Transaction requires the affirmative vote of holders of a majority of the outstanding shares of our common stock and voting preferred stock (series three and six). Each share of common stock is entitled to one vote, and each share of series three preferred and series six preferred are entitled to 20 votes. Series four and five preferred stock are non-voting stock.

As of the January 16, 2006, the record date, the Company had 3,446,995 shares of common stock outstanding and entitled to vote, 14,784 shares of series three preferred outstanding and entitled to vote, and 7,812.5 shares of series six preferred outstanding and entitled to vote, for a total of 3,898,925 shareholder votes. As of December 31, 2005, our current directors and executive officers beneficially owned the right to vote 1,322,112 shares of Maxco’s outstanding common stock as well as beneficially owned the right to vote shares of series three and series six preferred stock with an aggregate of 307,550 votes, with a beneficial ownership of the right to vote a total of 1,629,662 shareholder votes, or 41.8% of the total votes available that would be entitled to vote at the Special Meeting. If all of these shares are voted in favor of the Transaction, an additional affirmative vote of approximately 8.2% of the voting shares will be required in order for the Transaction to be approved. If our directors and executive officers exercised presently exercisable options they hold prior to the record date for the Special Meeting, they would beneficially own and have voting rights of approximately 1,669,662 shares or approximately 42.4% of the outstanding shares of common stock entitled to vote at the Special Meeting, leaving an additional necessary affirmative vote of 7.6% of the voting shares. See "Security Ownership of Certain Beneficial Owners and Management" on page 76, and "Special Factors - Interests of Officers and Directors in the Transaction" on page 49.

The officers and directors of Maxco have indicated that they intend to vote "FOR" the approval of the Transaction. Other than such expressed intent of the officers and directors to vote their shares for the Transaction, Maxco has not obtained any assurances or agreements from any of its stockholders as to how they will vote on the Transaction.

►NO APPRAISAL OR DISSENTERS' RIGHTS

Stockholders do not have appraisal or dissenters' rights under Michigan state law in connection with the Transaction. There may exist other rights or actions under federal or state securities laws for stockholders who are aggrieved by the Transaction generally. Although the nature and extent of such rights or actions are uncertain and may vary depending upon facts or circumstances, stockholder challenges to corporate action in general are related to fiduciary responsibilities of corporate officers and directors and to the fairness of corporate transactions.

►THE PURPOSE AND REASONS FOR THE TRANSACTION

If approved, the Transaction will enable Maxco to terminate its registration as an SEC reporting company and thus terminate its obligations to file annual and periodic reports and make other filings with the SEC. The reasons for the proposed Transaction and subsequent termination of SEC registration include:

- eliminating the costs associated with filing reports and documents under the Exchange Act with the SEC;

- eliminating the costs of compliance with the Sarbanes-Oxley Act of 2002 and related regulations;

- reducing the direct and indirect cost of administering stockholder accounts and responding to stockholder requests;

- affording stockholders holding fewer than 1,000 common shares immediately before the Transaction the opportunity to receive cash for their shares at a price that represents a premium of 26.3% and 47.5% over the average 30 day and one year closing prices, respectively, before the public announcement of the proposed Transaction, without having to pay brokerage commissions and other Transaction costs; and

- eliminating the competitive disadvantages associated with filing reports with the SEC and otherwise complying with the requirements of the Exchange Act.

Please read "Special Factors - Purpose and Reasons for the Transaction" beginning on page 13.

►DISADVANTAGES OF THE TRANSACTION

The disadvantages of the Transaction are that:

- Maxco’s working capital assets will be decreased to fund the purchase of fractional shares and the costs of the Transaction;

- Maxco will have less ability to raise capital in the public security markets;

- Maxco will be less likely to be able to use shares of its common stock to acquire other companies;

- Maxco may have less flexibility in attracting and retaining executives and employees because equity-based incentives (such as stock options) tend not to be as attractive in a non-SEC reporting company;

- remaining stockholders may experience reduced liquidity for their shares of common stock;

- less public information about Maxco will be available after the Transaction to remaining stockholders; and

- stockholders who are cashed-out will not have an opportunity to liquidate their shares at a time and for a price of their choosing, and will be unable to participate in the future earnings or growth of Maxco.

Please read "Special Factors - Certain Effects of the Transaction" beginning on page 44.

►RECENT MARKET PRICE OF MAXCO’S COMMON STOCK AND MARKET PRICE FOLLOWING ANNOUNCEMENT OF THE PROPOSED TRANSACTION

The closing price of Maxco’s common stock on October 31, 2005, the last day Maxco traded before the public announcement of the proposed Transaction, was $5.07 per share. The public announcement of the proposed Transaction was made on November 11, 2005. Following the announcement and through __________________ there were approximately _______ shares traded at prices ranging from $_______ to $______ per share. The closing price on _____________ was $____ per share.

►AFFILIATES ENGAGED IN THE TRANSACTION

As used in this proxy statement, the term "affiliated stockholder" means any stockholder who is a director or executive officer of Maxco, and the term "unaffiliated stockholder" means any stockholder other than an affiliated stockholder. The term "executive officer" means any persons named under "Executive Officers" beginning on page 74.

Under an interpretatation of the Securities Exchange Act of 1934 rules governing “going private” transactions, each of Max A. Coon, Director, Chairman of the Board, and Chief Executive Officer of the Company, and Eric L. Cross, Executive Vice-President and Secretary of the Company may be deemed affiliates of the Company who are engaged in a “going private” transaction. Each of Mssers. Coon and Cross believes the proposed Transaction is substantively and procedurally fair to our shareholders. Other than participating as a Board member in the Board’s evaluation of the factors to determine fairness, and in discussions with other senior management of the Company as to the cash consideration under the Reverse Split, Mr. Coon did not undertake an independent formal evaluation of the fairness of the Transaction or independently engage a financial advisor for such purposes. Other than participating in discussions with other senior management of the Company, Mr. Cross did not undertake an independent formal evaluation of the fairness of the Transaction or independently engage a financial advisor for such purposes. See “Special Factors - Background of the Transaction - Board Deliberations” beginning on page 10; and “Special Factors - Position of Messrs. Coon and Cross as to Fairness” on page 43.

►RECOMMENDATIONS OF THE SPECIAL COMMITTEE AND THE BOARD OF DIRECTORS

As a result of a meeting held on October 17, 2005, subsequent discussions among the special committee members, and as a result of meeting held on November 8, 2005, the special committee unanimously determined that the Transaction and the $6.00 cash consideration per pre-split share to be paid to stockholders who hold less than one whole share of common stock following the reverse stock split ("cash consideration") are advisable, fair to and in the best interests of Maxco and all its common and preferred stockholders, whether affiliated or unaffiliated, including those receiving cash consideration and those remaining as stockholders following the Transaction. The special committee recommended that the board approve the Transaction. See "Special Factors - Recommendation of the Special Committee," beginning on page 18.

At a meeting held on November 8, 2005, the board of directors determined that the Transaction is advisable, substantively fair to, and in the best interest of Maxco and all its common and preferred stockholders, whether affiliated or unaffiliated, including the group of holders of common stock who would retain their interest in Maxco as well as to those who would not, and unanimously recommends you vote "FOR" the Transaction.

The special committee of the board of directors and the board of directors itself, considered a number of factors that they believe supports their determination that the Transaction is substantively and procedurally fair to all of Maxco’s common and preferred stockholders, whether affiliated or unaffiliated, including each of the following factors:

- current and historical market prices;

- net book value and net tangible book value;

- going concern value;

- liquidation value;

- earnings of Maxco;

- the opinion and presentation of the special committee's financial advisor;

- limited liquidity of Maxco’s common stock;

- future cost savings;

- interests of stockholders who will remain;

- certain negative considerations; and

- procedural fairness.

As a result of their evaluations, the special committee and our board of directors, and Messrs. Coon and Cross, believe that the Transaction is substantively and procedurally fair to all shareholders, because: (i) whether a shareholder is cashed out, or not cashed out, under the Tranasction does not depend on whether that shareholder is affiliated or not affiliated; (ii) affiliated or unaffiliated common stockholders that remain after the Transaction, and all preferred stockholders, will benefit from the reduction of costs borne by Maxco to maintain its status as an SEC reporting company, and (iii) affiliated or unaffiliated stockholders that are cashed out will receive a premium to the pre-announcement market value of our common stock, without incurring brokerage costs. For a more complete and detailed discussion of the above factors that were considered by the special committee and the board of directors and Mr. Cross and Mr. Coon, to determine fairness, see "Special Factors - Recommendation of the Special Committee" and "Special Factors - Recommendation of the Board; Fairness of the Transaction"; and “Special Factors - Position of Messrs. Coon and Cross as to Fairness.”

►FAIRNESS OPINION OF FINANCIAL ADVISOR

GBQ Consulting, LLC ("GBQ"), financial advisor to the special committee, has delivered to the special committee of our board of directors its written opinion to the effect that, as of the date of such opinion and based upon and subject to the matters stated in the opinion, the cash consideration to be paid in the proposed Transaction is fair, from a financial point of view, to those common stockholders receiving the cash consideration. The full text of the written opinion of GBQ, which sets forth the assumptions made, matters considered and limitations on the review undertaken, is attached as Appendix B to this proxy statement. You should read the opinion carefully and in its entirety, along with the discussion under "Special Factors - Opinion of the Financial Advisor" beginning on page 29.

The opinion of GBQ is directed to the special committee of Maxco’s board of directors, addresses only the fairness to holders of Maxco’s common stock from a financial point of view of the cash consideration to be paid in the proposed Transaction, and does not constitute a recommendation to any stockholder as to how such stockholder should vote at the Special Meeting.

►CERTAIN EFFECTS OF THE TRANSACTION

As a result of the Transaction, we anticipate that:

- Maxco will no longer be an SEC reporting company subject to the reporting and other requirements of the Exchange Act and the Sarbanes-Oxley Act of 2002;

- Maxco’s common stock will no longer be traded on the Nasdaq SmallCap Market, any trading in our common stock after the Transaction will likely only be through quotation of our common stock in the "pink sheets" and any trading of our preferred shares will likely continue to be by privately negotiated sales;

- stockholders who own fewer than 1,000 common shares at the effective time of the Transaction will no longer have an interest in or be a stockholder of Maxco and will not be able to participate in Maxco’s future earnings and growth, if any, unless they subsequently acquire shares of our common stock or our preferred shares;

- the number of our common stockholders of record will be reduced from approximately 530 to 70, and the number of outstanding shares of Maxco’s common stock will decreased by approximately 1.6%, from 3,446,995 shares, as of December 31, 2005, to approximately 3,389,000 shares;

- Based on the shares outstanding as of December 31, 2005: (i) the percentage of ownership of Maxco’s common stock beneficially owned by the current executive officers and directors of Maxco as a group will increase from approximately 37.5% to approximately 38.2%, and (ii) the percentage of voting stock (which includes common, series three preferred and series six preferred) beneficially owned by the directors and executive officers of Maxco as a group, will increase from approximately 41.8% to approximately 42.4%, which will not affect control of Maxco;

- the aggregate common stockholders' equity of Maxco as of September 30, 2005, will be reduced from approximately $5,108,043 on a historical basis to approximately $4,658,000 on a pro forma basis;

- the book value per share of common stock as of September 30, 2005, will decrease from $1.48 per share on a historical basis to $1.37 per share on a pro forma basis; and

- outstanding options held by our employees, including officers and directors, to acquire Maxco’s common stock will, unless exercised or expire, remain outstanding, following the Transaction.

See "Special Factors - Certain Effects of the Transaction" beginning on page 44.

►CONDITIONS TO COMPLETION OF THE TRANSACTION

The completion of the Transaction depends, among other things, upon the approval of the proposed amendment to our Articles of Incorporation that will implement the Transaction by the holders of at least a majority of our outstanding shares entitled to vote. A copy of the proposed Certificate of Amendment to the Articles of Incorporation effecting both the Reverse Split followed immediately thereafter by the Forward Split is attached as Appendix A to this proxy statement.

Please see “Conditions to Completion of the Transaction” on page 50.

►RESERVATION OF RIGHTS

The Board of Directors has reserved the right to abandon the Transaction without further action by our stockholders at any time before the filing of the necessary Certificate of Amendment to the Articles of Incorporation with the Michigan Department of Labor and Economic Growth, Bureau of Commercial Services, Corporation Division, even if the Transaction has been authorized by our stockholders at the Special Meeting, and by voting in favor of the Transaction you are also expressly authorizing us to determine not to proceed with the Transaction if we so decide. See "The Proposed Amendment - Reservation of Rights" beginning on page 74.

►SOURCE OF FUNDS; FINANCING OF THE TRANSACTION

We estimate that the total funds required to pay the consideration to stockholders entitled to receive cash for their shares and to pay the costs of the Transaction will be approximately $450,000. The consideration to stockholders and the costs of the Transaction will be paid from working capital of Maxco. See "Special Factors - Source of Funds and Financing of the Transaction" on page 51.

►CONFLICTS OF INTEREST OF DIRECTORS AND EXECUTIVE OFFICERS

Our directors and executive officers may have interests in the Transaction that are different from your interests as a stockholder, and have relationships that may present conflicts of interest, including the following:

- each member of our board of directors and each of our executive officers that hold 1,000 or more shares of Maxco’s common stock will retain their shares after the Transaction, with the exception of our Chief Financial Officer and Treasurer, Lawrence O. Fields who will direct the sale of 700 common shares from his IRA ;

- one member of our board of directors, Sanjeev Deshpande, holds options to purchase 40,000 shares of Maxco’s common stock, which, unless exercised or expire, will remain outstanding after the Transaction; and

- as a result of the reduction of the number of shares of our common stock outstanding by approximately 57,000 shares in the Transaction, the common stockholders who own of record 1,000 or more shares at the effective time of the Transaction, such as our board members and executive officers, will increase their percentage ownership in Maxco as a result of the Transaction. For example, assuming the Transaction is approved, based on the shares outstanding as of December 31, 2005: (i) the percentage ownership of Maxco’s common stock beneficially owned by the current directors and executive officers of Maxco as a group will increase from approximately 37.5% to approximately 38.2%, and (ii) the percentage of voting stock (which includes common, series three preferred and series six preferred) beneficially owned by the directors and executive officers of Maxco as a group will increase from approximately 41.8% to approximately 42.4%.

See "Special Factors - Interests of Officers and Directors in the Transaction" on page 49.

►U.S. FEDERAL INCOME TAX CONSEQUENCES

Generally, for stockholders who hold fewer than 1,000 shares of common stock before the Transaction, the receipt of cash for fractional shares will be treated for tax purposes in the same manner as if the shares were sold in the market for cash. Stockholders who will remain stockholders of Maxco following the Transaction should not be subject to taxation as a result of the Transaction. Tax matters are very complicated, and the tax consequences to you of the Transaction will depend on your own situation. Please read "Special Factors - U.S. Federal Income Tax Consequences" beginning on page 52.

SPECIAL FACTORS

BACKGROUND OF THE TRANSACTION

Stockholder Information

As of December 31, 2005, Maxco had approximately 530 record holders of its common stock, of which approximately 460 record holders, or approximately 86.7% of the total number of record holders, owned fewer than 1,000 shares of common stock. These record holders owning fewer than 1,000 shares own, in the aggregate, approximately 57,000 or approximately 1.6% of the outstanding shares of our common stock.

We have no direct knowledge of the number of shares of our common stock owned beneficially (but not of record) by persons who own fewer than 1,000 shares of our common stock and who hold the shares in street name.

In summary, we estimate that there are approximately 57,000 shares of our common stock, representing approximately 1.6% of our outstanding common shares, held by approximately 460 record stockholders holding fewer than 1,000 shares. If the number of record common stock holders is reduced to fewer than 300, Maxco would be able to deregister its common stock under the Exchange Act, intends to proceed to terminate registration of its series three preferred stock, and would no longer be subject to the SEC filing and reporting requirements imposed on SEC reporting companies.

Board Deliberations

Since as early as April 2001, senior management of the Company, Max A. Coon, President, Chief Executive Officer and Chairman of the Board, Eric L. Cross, Executive Vice-President and former Director, and Vincent Shunsky, former Director, and the former Chief Financial Officer and Vice-President of Finance, have considered the topic of SEC deregistration in the context of an overall capitalization and business strategy. Their interest in deregistration as an SEC reporting company was the result of continuing discussions regarding the high costs of being an SEC reporting company, especially after the passage of the Sarbanes-Oxley Act of 2002 and additional SEC and Nasdaq regulations. Mssers. Coon, Cross and Shunsky considered the cost-savings benefits of SEC deregistration in light of the lack of liquidity in the Company’s stock and limited benefits of remaining an SEC reporting company. They also considered that the Company's common stock would likely be quoted on the "pink sheets."

On February 10, 2005, there was a meeting of the Company’s audit committee. Present at the meeting were David R. Layton, independent Director and Audit Committee Chairman of the Company, Dr. Samuel O. Mallory, independent Director and Audit Committee member of the Company, and invited guests, Vincent Shunsky, then the Vice-President of Finance and Chief Financial Officer of the Company, Lawrence O. Fields, then Controller and current Chief Financial Officer and Treasurer of the Company, and Jeff Kolb, financial analyst of the Company. Also present by telephone was William Holtman, representing the Company’s auditors, Rehmann Robson. Discussions included that unless the Company completed deregistration as an SEC reporting company, the Company would be subject to Section 404 of the Sarbanes-Oxley Act of 2002 (which was originally to take effect for its next fiscal year end March 31, 2006, but was delayed by the SEC until its fiscal year end March 31, 2007); that this would involve meeting all requirements of the Sarbanes-Oxley Act of 2002 with respect to internal controls over financial reporting, including an audit committee report, and opinion of the auditors as to the effectiveness of the Company’s internal controls. Those present also discussed that the Company would need to begin planning for compliance immediately in order to meet these requirements.

On February 22, 2005, Max A. Coon (via telephone) and Vincent Shunsky discussed the topic of compliance with the Sarbanes-Oxley Act of 2002 with Maxco’s outside legal counsel, Warren Cameron Asciutto & Blackmer, P.C. ("Warren Cameron"), and potential methods for deregistration as an SEC reporting company, which would require Maxco to reduce the number of common stockholders of record to less than 300. Warren Cameron stated that a tender offer or reverse stock split would be two methods of achieving the goal of reducing the number of common stockholders of record to less than 300.

The independent directors of Maxco, Dr. Samuel O. Mallory, Joel I. Ferguson, and David R. Layton, discussed the topic of deregistration at a meeting of the independent directors held on March 4, 2005 as part of discussions of the capital structure of the Company. Also present at the meeting were invited guests, Eric L. Cross, Vincent Shunsky, and from the Company’s outside legal counsel, J. Michael Warren. The independent board members deferred the decision on deregistration as compliance with the internal controls’ requirements of Section 404 of Sarbanes-Oxley Act of 2002 had been delayed by the SEC.

At a board meeting on August 11, 2005, Vincent Shunsky reported to the board that although implementation of Section 404 of Sarbanes-Oxley Act of 2002 had been previously delayed, the Company needed to make preparations for the new compliance date. Present at this meeting were Company directors, Max A. Coon, Sanjeev Deshpande, and Dr. Samuel O. Mallory, along with invited guests, Eric L. Cross, Vincent Shunsky, and J. Michael Warren. As the result of considering the costs associated with such preparation and continued compliance, the lack of liquidity in the Company’s stock, the costs in general of being a registered company, and the inability to effectively utilize the capital market, the board appointed the independent directors to serve as the special committee to further explore the possibility of deregistration as an SEC reporting company. The special committee appointed was the independent directors, Dr. Samuel O. Mallory, David R. Layton and Joel I. Ferguson. Discussions were held amongst those present at the August 11, 2005 meeting, regarding the various methods of effectuating SEC deregistration. After discussion of the various alternative methods, the conclusion of the group, including Dr. Mallory, was that a reverse stock split seemed apparent as the most practical method.

On August 13, 2005 and August 14, 2005, Mr. Coon met with the special committee members, Joel I. Ferguson and Dr. Samuel Mallory, and then spoke to David R. Layton. These discussions concluded that a pre-split price per share of $6.00 in a reverse stock split immediately followed by a forward stock split would appear to be fair and reasonable to the common shareholders. Mr. Coon indicated to the special committee members that he thought it was advisable that the special committee obtain a fairness opinion as to proposing a pre-split price per share of $6.00. All members of the special committee agreed, and decided it was appropriate to explore hiring a financial advisor to opine on the fairness of the Transaction to those receiving cash.

In mid-August 2005, the special committee began considering proposals from two different firms to serve as financial advisor, one of which was GBQ. On August 25, 2005, special committee members, Joel I. Ferguson and Dr. Samuel Mallory, met with GBQ to discuss their engagement. At this meeting, Mr. Ferguson and Dr. Mallory decided that GBQ should be engaged as financial advisor to the special committee because of GBQ’s experience and credentials in the valuation area. This was discussed with Mr. Layton by Mr. Coon, and Mr. Layton concurred. On September 1, 2005, the special committee engaged GBQ to serve as its financial advisor.

On October 17, 2005, the special committee chairman, Dr. Samuel Mallory met telephonically with GBQ representatives, Brian D. Bornino and Robert M. Stutz II, in order for GBQ to provide its presentation and opinion. The full text of the opinion had been previously delivered to all members of the special committee and is attached as Appendix B. During the telephone meeting, GBQ reviewed its valuation based on two methods, the discounted cash flow method (Income Approach), and the guideline public company method (Market Approach). In addition to the valuation, GBQ reviewed the premiums paid in historical going-private transactions. GBQ discussed the various assumptions made in the preliminary valuation and in the use of management's projections. GBQ also discussed how companies were selected for the market valuation approach. Vincent Shunsky, then Vice President of the Company, presented a reverse stock split analysis based on 1 for 100, 1 for 200, and 1 for 1,000 reverse splits. Mr. Shunsky discussed the costs for cashing out fractional stockholders at each of these levels and the estimated number of stockholders of record that would remain at each reverse split level. In considering the cash consideration for fractional shares, Dr. Mallory reviewed a number of factors as discussed in "Special Factors - Recommendation of the Special Committee" beginning on page 18. The special committee chairman also considered the findings of GBQ, including GBQ’s valuation range of $2.70 to $5.60 per share of Maxco’s common stock. Additionally, the special committee chairman considered that the offer price of $6.00 per share reflects a premium of 18.3% over the Company’s October 12, 2005 stock price. After a lengthy discussion, the consensus was that $6.00 per pre-split share appeared reasonable and fair as the cash consideration to be paid for fractional shares in the Transaction at the 1 for 1,000 ratio. Upon conclusion of the meeting, Dr. Mallory indicated his position to recommend to the board of directors that the board determine: (i) that both the Transaction and cash consideration are advisable, fair and in the best interests of Maxco and all of its stockholders, including all unaffiliated stockholders, and (ii) that the cash consideration and Transaction both be approved. Dr. Mallory indicated that he would consult with the other special committee members to seek their concurrence with his conclusion. Within several days thereafter, Dr. Mallory informed Mr. Coon and Mr. Shunsky that he had consulted with the other special committee members, and that they had unanimously agreed to his recommendation.

At a meeting of the special committee on November 8, 2005, the special committee members, David R. Layton and Dr. Samuel Mallory, reconsidered the factors discussed in “Special Factors - Recommendation of the Special Committee” in light of the September 30, 2005 financial information, and unanimously reconfirmed its determination to recommend the Transaction to the board of directors.

At a board meeting on November 8, 2005, Dr. Mallory, chairman of the special committee, reported on the special committee meetings held on October 17, 2005, his conversations with the other special committee members, and the meeting of November 8, 2005. In addition to Dr. Mallory, others present at this board meeting were_directors, Mr. Coon, Sanjeev Deshpande, and David R. Layton, and invited guests, Eric L. Cross, Vincent Shunsky, and J. Michael Warren. The board discussed extensively the status of the committee's review of the reverse stock split, the estimated cost to accomplish the Transaction, and the cost savings that would be realized by SEC deregistration. The board also considered the proposed Transaction and the cash consideration of $6.00 per pre-split share to be paid to stockholders who would otherwise receive less than one share in the reverse stock split. In considering the price for the cash consideration, the board reviewed a number of factors as discussed in "Special Factors - Recommendation of the Board of Directors; Fairness of the Proposed Transaction" beginning on page 23. The board also considered the special committee's recommendation and the opinion of the special committee's financial advisor. The board unanimously voted to approve the Transaction and directed that the Transaction be submitted to stockholders for a vote at the upcoming Special Meeting of Stockholders. The board recommended that stockholders approve the Transaction.

PURPOSE AND REASONS FOR THE TRANSACTION

The purpose of the Transaction is to cash-out the equity interests in Maxco of stockholders who, as of the effective date, hold fewer than 1,000 shares of common stock in any discrete account at a price determined to be fair by the entire board in order to enable Maxco to deregister its common stock under the Exchange Act. If the Transaction is approved, Maxco intends to also terminate registration of its series three preferred stock and thus terminate its obligation to file annual and periodic reports and make other filings with the SEC.

Summary of Reasons

The reasons for the Transaction and subsequent deregistration of Maxco as an SEC reporting company include:

- eliminating the costs and administrative burden associated with filing periodic reports and other documents under the Exchange Act with the SEC;

- eliminating the costs and investment of management time associated with compliance with the Sarbanes-Oxley Act of 2002 and related regulations;

- reducing the direct and indirect costs of administering stockholder accounts and responding to stockholder requests by reducing the number of small stockholder accounts;

- affording stockholders holding fewer than 1,000 common shares immediately before the Transaction the opportunity to receive cash for their shares at a price that represents a premium of 26.3% and 47.5% over the average 30 day and one year closing prices, respectively, before the public announcement of the proposed Transaction, without having to pay brokerage commissions and other Transaction costs; and

- eliminating the competitive disadvantages associated with filing reports with the SEC and otherwise complying with the requirements under the Exchange Act.

Benefits and Cost Savings of Termination as an SEC Reporting Company

Maxco incurs direct and indirect costs associated with the filing and reporting requirements imposed on SEC reporting companies. As an SEC reporting company, Maxco is required to prepare and file with the SEC, among other items, the following:

- Annual Reports on Form 10-K;

- Quarterly Reports on Form 10-Q;

- Proxy statements and stockholder reports as required by Regulation 14A under the Exchange Act; and

- Current Reports on Form 8-K.

In addition, Maxco also pays for the costs of its directors' and officers' Section 16(a) reports (Forms 3, 4 and 5) and Section 13(d) reports (Schedule 13D or Schedule 13G, if such director or officer is a 5% stockholder).

The costs associated with these reports and other filing obligations are a significant overhead expense. These costs include professional fees for our auditors and legal counsel, printing and mailing costs, internal compliance costs, Nasdaq listing fees and transfer agent costs. These SEC registration-related costs have been increasing over the years, and Maxco believes that they will continue to increase, particularly as a result of the additional reporting and disclosure obligations imposed on SEC reporting companies by the recently enacted Sarbanes-Oxley Act of 2002.

Maxco also incurs substantial indirect costs as a result of, among other things, management's time expended in preparing and reviewing such filings. Because Maxco has relatively few executive personnel, these activities consume a disproportionate amount of resources compared to value generating efforts. The annual savings that Maxco expects to realize as a result of the Transaction are estimated as follows:

| Independent Auditors and Other Compliance Costs | | $ | 100,000 | |

| Compliance with Section 404 of the Sarbanes-Oxley Act* | | $ | 150,000 | |

| Legal Costs Attributable to SEC Reporting | | $ | 50,000 | |

| Nasdaq Fees | | $ | 25,000 | |

| Transfer Agent, Printing and Mailing | | $ | 5,000 | |

| Other | | $ | 20,000 | |

| Total** | | $ | 350,000 | |

| * | Initial compliance with Section 404 of the Sarbanes-Oxley is estimated to cost $250,000. |

| ** | Special savings in year one following the Transaction will be approximately $450,000, as a result of the increased compliance costs for year-one compliance with Section 404 of the Sarbanes Oxley-Act. This figure does not take into account any additional costs that may be necessary to remediate any deficiencies, if any, in Maxco’s internal controls. |

Estimates of the annual savings expected to be realized if the Transaction is implemented are based upon in some instances, Maxco’s management's estimates, information provided by others, or upon verifiable assumptions. For example, its auditors have informed Maxco informally, there will not be a need for incurring auditing fees relating to filing reports with the SEC or for the auditor to attest to internal controls pursuant to Section 404 of the Sarbanes-Oxley Act. In addition, there will be more limited needs for legal counsel for SEC matters and for a financial printer if Maxco no longer files reports with the SEC.

Other estimates were more subjective, such as: possible savings in transfer agent's fees, the lower printing and mailing costs attributable to such reduction and the less complicated disclosure required by Maxco’s private status; the need for fewer directors' and committee meetings; and the consequent reduction in associated expenses (e.g., word processing, edgarizing, telephone and fax charges associated with SEC filings, and the elimination of charges by brokers and banks to forward materials to beneficial holders).

The estimates set forth above are just that - estimates, and the actual savings to be realized may be higher or lower than estimated above. In addition, Maxco expects the various costs associated with remaining an SEC reporting company will continue to increase as a result of enactment of the Sarbanes-Oxley Act of 2002 and regulations adopted pursuant to that legislation. Based on Maxco’s size and resources, the board does not believe the costs associated with remaining an SEC reporting company are justified. In light of these disproportionate costs, the board believes that it is in the best interests of Maxco and all of its stockholders to eliminate the administrative burden and costs associated with these small record accounts.

Comparing the Benefits of Termination versus Remaining an SEC Reporting Company

The board believes that Maxco will not benefit significantly from remaining an SEC reporting company. Even as an SEC reporting company that is listed on the Nasdaq SmallCap Market, there is a very limited trading market for our common shares, especially for sales of larger blocks of our common shares, and stockholders derive little benefit from Maxco’s status as an SEC reporting company that is listed on the Nasdaq SmallCap Market. During the 12-month period prior to announcement of the proposed Transaction, from November 11, 2004 to November 10, 2005, the average daily trading volume on the Nasdaq SmallCap Market of Maxco’s common stock was approximately 1300 shares (rounded to the nearest 100 shares). Our small public float and limited trading volume have limited the ability of our common stockholders to sell their shares without also reducing our trading price.

Further, the board has no present intention to raise capital through sales of securities in a public offering in the future or to acquire other business entities using Maxco’s common stock as the consideration for any acquisition, and Maxco is therefore unlikely to have the opportunity to take advantage of its current status as an SEC for these purposes. If for any reason the board of directors decides in the future to access the public capital markets, Maxco could do so by filing a registration statement for such securities.

Other Benefits

The cost of administering each stockholder's account and the amount of time spent by Maxco’s management in responding to stockholder requests is the same regardless of the number of shares held in the account. Accordingly, the burden to Maxco maintaining many small accounts is disproportionately high when compared to the number of shares involved. Unlike many larger SEC reporting companies, Maxco does not have employees assigned to managing investor relations. Instead, Maxco’s executive officers respond directly to stockholder requests, and time spent fulfilling these duties limits the time that such officers are able to allocate to other aspects of managing Maxco. Therefore, Maxco’s management believes that it would be beneficial to Maxco and its stockholders as a whole to eliminate the administrative burden and cost associated with the approximately 460 record stockholders accounts containing fewer than 1,000 shares of common stock.

In certain respects, moreover, registration under the Exchange Act has resulted in Maxco being at a competitive disadvantage with respect to its privately-held competitors. In the board's view, some of Maxco’s competitors have a cost advantage in that they do not have the operating expenses associated with being an SEC reporting company. Further, Maxco’s competitors can use publicly disclosed information that Maxco files under the Exchange Act to the detriment of Maxco. Publicly available information on Maxco can be readily analyzed by privately-held competitors rendering Maxco at a competitive disadvantage in the marketplace. Conversely, Maxco does not have access to similar information with respect to non-SEC reporting competitors nor can it protect information about its business if it is mandated by federal securities laws to publish such information on an annual or quarterly basis.

Timing of the Transaction

The new legal requirements imposed on public companies under Section 404 of the Sarbanes-Oxley Act, including requirements relating to our system of internal controls, add to the administrative burden and costs of being a public company. The expenses associated with implementing the additional processes and procedures necessary for compliance with Section 404 (which was originally to take effect for our next fiscal year end March 31, 2006, but was delayed by the SEC until our fiscal year end March 31, 2007) and the required attestation of those controls have been estimated in year one to cost an additional $250,000, and thereafter approximately an additional $150,000 over our historical costs incurred as a result of being a public company. Accordingly, the board believes that it is in the best interests of Maxco and its stockholders, including unaffiliated stockholders, to undertake the proposed transaction at this time so that the Company may change its status to a SEC non- reporting company, because the sooner the proposal can be implemented, the sooner Maxco will cease to incur the expenses and burdens of maintaining its status as an SEC reporting company, including the time of management involved in such tasks (which are only expected to increase in the near future as a result of having to make preparations to comply with the Sarbanes-Oxley Act of 2002) and the sooner stockholders who are to receive cash in the Transaction will receive and be able to reinvest or otherwise make use of such cash payments.

ALTERNATIVES CONSIDERED

The board considered several other alternatives to accomplish the reduction in the number of record common stockholders to fewer than 300, but ultimately rejected these alternatives because the board believed that the proposed Transaction consisting of a reverse stock split followed immediately by a forward stock split structure would be the simplest and least costly method as compared to other alternatives, which would more than likely be more difficult to accomplish, may not accomplish the objective of SEC deregistration, and more than likely be more expensive to complete. The other alternatives considered were:

- CASH TENDER OFFER AT A SIMILAR PRICE PER SHARE. The board did not believe that a tender offer would necessarily result in the purchase of a sufficient number of common shares to reduce the number of record common stock holders to fewer than 300 because many stockholders with a small number of common shares might not make the effort to tender their shares and the cost of completing the tender offer could be significant in relation to the value of the shares that are sought to be purchased. Alternatively, if most of the holders of our common stock tendered their shares, we would be required to purchase shares from all tendering stockholders, which would result in a substantially greater cash amount necessary to complete the Transaction. Regardless, a tender offer would provide no guarantee that the number of record holders of common stock would ultimately be reduced to fewer than 300. In comparison, the Transaction, if successfully completed, is likely to allow Maxco to accomplish its SEC deregistration objectives.

- CASH-OUT MERGER. A cash-out merger would more than likely involve affiliated shareholders, or new shareholders as a result of the merger, receiving more consideration than unaffiliated shareholders would in the proposed Transaction (such as employment or option considerations), be more difficult to complete, and result in more legal costs than the proposed Transaction. The board considered and rejected this alternative because the proposed Transaction would be simpler, more cost-effective, and more than likely more fair to all shareholders, whether affiliate or unaffiliated, than a cash-out merger.

- PURCHASE OF SHARES IN THE OPEN MARKET. The board rejected this alternative because it concluded it was unlikely that Maxco could acquire shares from a sufficient number of record holders of common stock to accomplish the board's objectives in large part because Maxco would not be able to dictate that open share purchases only be from record holders selling all of their common shares. Even if enough open market purchases resulted in lowering the number of record holders of common stock to less than 300, such purchases would likely be more costly than the proposed Transaction.

- REVERSE STOCK SPLIT WITHOUT A FORWARD STOCK SPLIT. This alternative would accomplish the objective of reducing the number of record holders of common stock below the 300 threshold, assuming approval of the reverse stock split by Maxco’s stockholders. In a reverse stock split without a subsequent forward stock split, Maxco would acquire the interests of the cashed-out stockholders and the fractional share interests of those stockholders who own 1,000 shares or more whose holdings are not evenly divisible by 1,000 and are not cashed-out (as compared to the proposed Transaction in which only those stockholders whose shares are converted to less than one whole share after the reverse stock split would have their fractional interests cashed-out; and all fractional interests held by stockholders holding more than one whole share after the reverse stock split would be reconverted to whole shares in the forward stock split). Thus, the board rejected this alternative due to the higher cost involved of conducting a reverse stock split without a forward stock split.

- SALE OF THE COMPANY. From time to time, the board has explored the possibility of a sale of Maxco. While certain efforts within the last three years led to discussions and preliminary proposals, no firm offers were received. See "Special Factors - Possible Corporate Transactions" beginning on page 52.

RECOMMENDATION OF THE SPECIAL COMMITTEE

The composition of the special committee consisted of three directors, Messrs. Ferguson, Layton and Mallory. Each of these directors has been deemed independent by the board of directors as independence is defined in NASD Rule 4200(a)(15) and Rule 10A-3(b)(1) of the Exchange Act. The special committee retained GBQ as its financial advisor.

In evaluating the proposed Transaction and the cash consideration, the special committee relied on its knowledge of the business, financial condition and prospects of Maxco as well as the advice of its financial advisor. In view of the wide variety of factors considered in connection with the evaluation of the Transaction and cash consideration, the special committee did not find it practicable to, and did not, quantify or otherwise attempt to assign relative weights to the specific factors it considered it reaching its determinations.

The discussion herein of the information and factors considered by the special committee is not intended to be exhaustive, but is believed to include all material factors considered by the special committee. In determining that the special committee would recommend the Transaction and the cash consideration to the board of directors, the special committee considered the following substantive factors in the aggregate, which in the view of the special committee, supported such determination.

- CURRENT AND HISTORICAL PRICES OF MAXCO’S COMMON STOCK. The special committee considered both the historical market prices and recent trading activity and current market prices of Maxco’s common stock.

The special committee reviewed the high and low sales prices for the common stock from October 1, 2003 to September 30, 2005, which ranged from $1.99 to $5.58 per share. You should read the discussion under "Market for Common Stock and Related Stockholder Matters" on page 69 for more information about our stock prices. The sales price of Maxco’s common stock on October 31, 2005, the last day Maxco traded before we announced the Transaction, was $5.07 per share.

The special committee noted that, as a positive factor, the cash payment of $6.00 per share payable to common stockholders in lieu of fractional shares represents a premium of approximately 26.3% and 47.5% over the average closing sales price of Maxco’s common stock for the 30-day and one year periods, respectively, immediately prior to October 12, 2005. In addition to stockholders receiving a premium to the trading price of Maxco’s common stock on any shares redeemed as a result of the reverse stock split, such stockholders will achieve liquidity without incurring brokerage costs.

- GOING CONCERN VALUE. In determining the cash amount to be paid to cashed-out stockholders in the Transaction, the special committee considered the valuation of Maxco and Maxco’s shares as of October 2005 on the basis of a going concern (what it is expected to earn in the future) as presented in the financial advisor's discounted cash flow model, without giving effect to any anticipated effects of the Transaction. In considering going concern value, the special committee considered the financial projections of management for fiscal years 2006 through 2010 which were provided to the financial advisor, GBQ’s present value of those financial projections, as well as GBQ’s present value of Maxco’s earnings beyond 5 years, the estimates of GBQ as to a reasonable rate of return that an investor could expect by investing in Maxco, the estimate of GBQ as to the cost of debt to Maxco, GBQ’s estimate of the average weighted cost of equity and debt to Maxco and GBQ’s estimate of the Company’s total adjusted value. The special committee also considered GBQ’s analysis of the appropriate multiples to apply to Maxco based upon the revenues and other characteristics of comparable SEC reporting metal treating companies as presented in GBQ’s guideline public company method analysis.

Also, the special committee did not consider the amount per share that might be realized in a sale of all or substantially all of the stock or assets of Maxco, believing that consideration of such amount was inappropriate in the context of a Transaction that would not result in a change in control of Maxco. In considering the going concern value of Maxco' shares, the special committee adopted the analyses and conclusions of its financial advisor, which indicated a share price range of $2.70 - $5.60 and which are described below under "Special Factors - Opinion of the Financial Advisor" beginning on page 29, and the special committee believes that the going concern analysis supports its determination that the Transaction is fair to those stockholders receiving the cash consideration of $6.00 per share of common stock (a premium of approximately 18.3% over the Company’s October 12, 2005 stock trading price).

- NET BOOK VALUE. The special committee considered that as of June 30, 2005, the net book value per common share was $1.55, and the tangible net book value per common share (excluding intangibles) was $1.14. The special committee considered that as of September 30, 2005, the net book value per common share was $1.48, and the tangible net book value per common share (excluding intangibles) was $1.07. The special committee noted that book value per common share is an historical accounting value which may be more or less than the net market value of Maxco’s assets after payment of its liabilities, and a liquidation would not necessarily produce a higher book value per common share. See "Special Factors - Recommendation of the Board; Fairness of the Transaction - Liquidation Value." Accordingly, the special committee believes that because the proposed offer price of $6.00 per common share under the Reverse Split is more than the book value per common share and the historical trading prices of the Company’s common stock, the Transaction is fair to those stockholders receiving the cash consideration.

- LIQUIDATION VALUE. Although no valuation of total assets was undertaken, the special committee believes that a liquidation or other transaction designed to monetize Maxco’s assets would likely result in recovery of a price that is less than the cash price being offered. The special committee considered that the Company's non-operating assets totaling in the aggregate approximately $9.9 million, consisted primarily of investments in one publicly held company and several privately held entities, accounts receivable, furniture and fixtures, buildings, and land. Any liquidation would entail the marketing and sale of several disparate businesses with their attendant selling costs and tax liabilities. The special committee also noted the financial liabilities of the Company, including incentive compensation, interest bearing debt, and liabilities to preferred shareholders, totaled in the aggregate of approximately $22.7 million. The special committee also considered that any amounts received in a liquidation of the Company would be paid first to secured creditors, then to unsecured creditors, then to holders of preferred stock and then to holders of common stock. The special committee noted that (i) in light of the required order of the payment of proceeds in any liquidation, and (ii) that as of September 30, 2005, the net book value per common share was $1.48, and the tangible net book value per common share (excluding intangibles) was $1.07, the net market value of Maxco’s assets after payment of its liabilities in a liquidation would not necessarily produce a higher book value per common share, nor would it produce the proposed $6.00 per common share being offered in the Reverse Split.

- EARNINGS. The special committee reviewed historic earnings of Maxco for the previous three years and the relevance of historic earnings to future prospects, and factored this review into the going concern analysis. For the six months ended September 30, 2005 and for the six months ended September 30, 2004, Maxco reported net income of $393,000, and $254,000, respectively, and for the two fiscal years ended March 31, 2005 and March 31, 2004, Maxco’s reported net income (loss) of $134,000 and $(1,531,000), respectively. Accordingly, earnings per common share for the six months ended September 30, 2004 and September 30, 2005 were $.02 and $.05, and pro forma data suggests that had the Transaction occurred on April 1, 2004, earnings for the same quarter endings would be $.03 and $.07 per common share. The special committee believed that the cash consideration of $6.00 per common share being offered in the Reverse Split is fair to those stockholders receiving the cash consideration because it reflects a premium over earnings per share than presently exists. The special committee also believes that as result of the Transaction it is anticipated that there will be fewer common stockholders, and as such, those stockholders remaining should benefit from higher earnings per share in the future.

- PRICES AT WHICH MAXCO HAS PURCHASED SHARES. This was not a factor since Maxco has not purchased any of its shares within the last three years.

- OPINION OF THE FINANCIAL ADVISOR. The special committee considered the opinion of GBQ rendered to the special committee dated October 17, 2005, to the effect that, as of the date of such opinion and based upon and subject to certain matters stated therein, the $6.00 per share in cash to be received the holders of common stock who will hold only fractional shares following the Reverse Split, is fair, from a financial point of view. For more information about the opinion you should read the discussion below under "Special Factors - Opinion of the Financial Advisor" beginning on page 29 and a copy of the opinion of GBQ attached as Appendix B to this proxy statement. The Transaction price falls above the range of $2.70 to $5.60 per common share referenced in the financial advisor's opinion, and the special committee believes the opinion of the financial advisor supports its determination that the $6.00 per share to those being cashed out (an approximate 18.3% premium over the October 12, 2005 trading price) is fair to those stockholders.

- PRESENTATION OF THE SPECIAL COMMITTEE'S FINANCIAL ADVISOR. The special committee also considered the various financial information, valuation analyses and other factors set forth in the written presentation delivered to the special committee dated October 17, 2005.