NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of Maxco, Inc.:

Notice is hereby given that the Annual Meeting of Shareholders of Maxco, Inc., a Michigan corporation, will be held at the corporate office, 1118 Centennial Way, Lansing, Michigan on March 14, 2006, at 10:30 a.m. local time for the following purposes, all of which are more completely set forth in the accompanying proxy statement.

| 1. | To elect five Directors; and |

| | 2. | To transact such other business as may properly come before the meeting. |

In accordance with the Bylaws of the Company and a resolution of the Board of Directors, the record date for the meeting has been fixed at February 8, 2006. Only Shareholders of record at the close of business on that date will be entitled to vote at the meeting.

By Order of the Board of Directors

Eric L. Cross

Secretary

Lansing, Michigan

February 21, 2006

YOUR VOTE IS IMPORTANT

YOU ARE URGED TO DATE AND SIGN THE ENCLOSED PROXY FORM, INDICATE YOUR CHOICE WITH RESPECT TO THE MATTERS TO BE VOTED UPON, AND PROMPTLY RETURN YOUR PROXY SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND IN ORDER THAT THE PRESENCE OF A QUORUM MAY BE ASSURED. THE PROMPT RETURN OF YOUR SIGNED PROXY, REGARDLESS OF THE NUMBER OF SHARES YOU HOLD WILL AID THE COMPANY IN REDUCING THE EXPENSE OF ADDITIONAL PROXY SOLICITATION. THE GIVING OF SUCH PROXY DOES NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IN THE EVENT YOU ATTEND THE MEETING.

MAXCO, INC.

1118 Centennial Way

Lansing, Michigan 48917

PROXY STATEMENT

This statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Maxco, Inc. (the Company), 1118 Centennial Way, Lansing, Michigan 48917, for use at the Annual Meeting of Shareholders of the Company to be held on March 14, 2006, at 10:30 a.m., or any adjournments thereof. This Proxy Statement is being mailed to Maxco Shareholders on or about February 21, 2006, to all holders of record of common stock of the Company as of the close of business on February 8, 2006.

PURPOSE OF THE MEETING

The purpose of this Annual Meeting of Shareholders shall be to elect Directors and to transact such other business as may properly come before the meeting.

VOTING

Common Stock, Series Three Preferred Shares, and Series Six Preferred Shares are the only voting stock of the Company. Holders of record at the close of business on February 8, 2006, are entitled to one (1) vote for each share of Common Stock held, and twenty (20) votes for each share of Series Three Preferred Stock held, and twenty (20) votes for each share of Series Six Preferred Stock held. As of February 8, 2006, the Company had 3,446,995 shares of Common Stock, 14,784 shares of Series Three Preferred Stock, and 7,812.5 shares of Series Six Preferred Stock outstanding. Holders of stock entitled to vote at the meeting do not have cumulative voting rights with respect to the election of Directors.

All shares represented by proxies shall be voted “FOR” each of the matters recommended by management unless the shareholder, or his duly authorized representative, specifies otherwise or unless the proxy is revoked. Any shareholder who executes the proxy referred to in this statement may revoke it before it is exercised, provided written notice of such revocation is received at the office of the Company in Lansing, Michigan at least twenty-four (24) hours before the commencement of the meeting, or provided the grantor of the proxy is present at the meeting and, having been recognized by the Chairman, announces such revocation in open meeting. All shareholders are encouraged to date and sign the enclosed proxy form, indicate your choice with respect to the matters to be voted upon and return it to the Company.

Directors are elected by plurality vote, meaning that the five persons receiving the most votes at the meeting, assuming a quorum is present, are elected as directors of the Company. Most other corporate governance actions, other than elections of directors, are authorized by a majority of the votes cast. Although state law and the articles of incorporation and bylaws of the Company are silent on the issue, it is the intent of the Company that proxies received which contain abstentions or broker non-votes as to any matter will be included in the calculation as to the presence of a quorum, but will not be counted as votes cast in such matter in the calculation as to the needed vote.

ELECTION OF DIRECTORS

It is the intention of the persons named in the proxy to vote for election of the following nominees to the Board of Directors to hold offices until the next Annual Meeting or until their successors are elected. In the event any nominee should be unavailable, which is not anticipated, the shares may, in the discretion of the proxy holders, be voted for the election of such persons as the Board of Directors may submit. Directors are elected for a term of one (1) year and until their successors are elected and qualified. Proxies will be voted only to the extent of the number of nominees named.

The following information is furnished concerning the nominees, all of whom have been nominated by the Board of Directors and are presently Directors of the Company:

| Name | | Present Position with the Company and Principal Occupation | | Age | | Served as Director of Maxco Since |

| | | | | | | |

| Max A. Coon | | Director, President and Chairman of the Board of MAXCO, INC. | | 71 | | 1969 |

| Sanjeev Deshpande | | Director of MAXCO, INC., President of Atmosphere Annealing, Inc., a Lansing, Michigan based provider of heat treating services which was acquired by Maxco, Inc. in January 1997. | | 48 | | 2003 |

| Joel I. Ferguson | | Director of MAXCO, INC., a Lansing, Michigan based developer of real estate properties | | 67 | | 1985 |

| David R. Layton | | Director of MAXCO, INC. and President of Layton & Richardson, P.C., a Lansing, Michigan based accounting firm. | | 65 | | 2001 |

| Samuel O. Mallory | | Director of MAXCO, INC.; Retired in 1998 as a dentist who managed his own practice | | 73 | | 2002 |

All of the foregoing Directors and nominees have been engaged in the principal occupation specified for the previous five (5) years.

The address and telephone number for each person named in the table is in care of Maxco, Inc., 1118 Centennial Way, Lansing, MI 48917, telephone number (517) 321-3130.

During the past five years, none of the above named persons has been convicted in a criminal proceeding or has been a party to any judicial or administrative proceeding that resulted in a judgment, decree or final order enjoining him form future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal of state securities laws. All of the above named persons are citizens of the United States except Sanjeev Deshpande who is a citizen of the Republic of India.

Mr. Coon, is also a Director of Integral Vision, Inc., an 8% owned investment of Maxco, Inc. whose stock is quoted on the OTCBB.

Mr. Coon and Mr. Cross are brothers-in-law. There are no other family relationships between any Directors or Executive Officers.

The Board of Directors has established a Compensation Committee whose members through October 20, 2004 were Max A. Coon and David R. Layton. Effective October 21, 2004 the composition of the Compensation Committee was changed and now consists of the three independent directors, Messrs. Ferguson, Layton, and Mallory. The Compensation Committee is also responsible for administering the Company's Stock Option Plan, including designating the recipients and terms of specific option grants. The Compensation Committee met one time during the fiscal year to establish compensation levels for the Executive Officers, and to authorize the levels and timing of bonuses. The Company has established a Nominating Committee whose members are Messrs. Ferguson, Layton, and Mallory.

Director Nominations

The Company has established a standing Nominating Committee to assist the Board by identifying individuals qualified to become Board members and recommend to the Board the director nominees for the next annual meeting of shareholders. The Nominating Committee met one time during the fiscal year. A charter has been adopted for the Nominating Committee, and it is available through the Company’s website at www.maxc.com.

The Nominating Committee will consider director nominees recommended by shareholders. A shareholder who wishes to recommend a person or persons for consideration as a nominee for election to the board of directors must send a written notice by mail, c/o Investor Relations, Maxco, Inc., 1118 Centennial Way, Lansing, Michigan 48917 that sets forth: (1) the name, address (business and residence), date of birth and principal occupation or employment (present and for the past five years) of each person whom the shareholder proposes to be considered as a nominee; (2) the number of shares of the common stock of the Company beneficially owned (as defined by section 13(d) of the Securities Exchange Act of 1934) by each such proposed nominee; (3) any other information regarding such proposed nominee that would be required to be disclosed in a definitive proxy statement to shareholders pursuant to section 14(a) of the Securities Exchange Act of 1934; and (4) the name and address (business and residence) of the shareholder making the recommendation and the number of shares of the common stock of the Company beneficially owned (as defined by section 13(d) of the Securities Exchange Act of 1934) by the shareholder making the recommendation. The Company may require any proposed nominee to furnish additional information as may be reasonably required to determine the qualifications of such proposed nominee to serve as a director of the Company. Shareholder recommendations will be considered only if received no less than 120 days before the date of the proxy statement sent to shareholders in connection with the previous year’s annual meeting of shareholders. The Company did not receive, by June 14, 2005, any recommended nominee from any shareholder.

The Nominating Committee will consider any nominee recommended by a shareholder in accordance with the preceding paragraph under the same criteria as any other potential nominee. The board of directors and the Nominating Committee believe that a nominee recommended for a position on the Company’s board of directors must have an appropriate mix of director characteristics, experience, diverse perspectives and skills. For a new potential board member, the board of directors and the Nominating Committee will in the first instance consider the independence of the potential member and the appropriate size of the board and then the qualifications of the proposed member. Qualifications of a prospective nominee that are considered by the board of directors and the Nominating Committee include:

| | · | Personal integrity, wisdom, and high ethical character; |

| | · | Ability to make independent analytical inquiries; |

| | · | Professional excellence; |

| | · | Accountability and responsiveness; |

| | · | Absence of conflicts of interest; |

| | · | Fresh intellectual perspectives and ideas; and |

| | · | Relevant expertise and experience, understanding of the Company’s business environment, and the ability to offer advice and guidance to management based on that expertise, understanding and experience. |

.

Audit Committee and Committee Report

The board of directors has adopted a Charter to govern the operations of its Audit Committee. A copy of this Charter was included as an exhibit to the Company's proxy statement for the year ended March 31, 2001. The Charter requires that the Audit Committee shall comprise at least three directors, each of whom are independent of management and the Company, which is defined to mean that they have no relationship that may interfere with the exercise of their independence from management and the Company.

For the year ended March 31, 2005, the board of directors appointed Joel I. Ferguson, David R. Layton and Samuel O. Mallory to the Audit Committee. It is the opinion of the board of directors that the members of the Audit Committee are each independent under the above definition. In addition, the board of directors has determined that David R. Layton is an “audit committee financial expert” as defined by the Securities and Exchange Commission. The Audit Committee oversees the Company’s financial reporting process on behalf of the board of directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the committee reviewed the audited financial statements to be included in the Company’s Annual Report with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards. In addition, the committee has discussed with the independent auditors the auditors’ independence from management and the Company including the matters in the written disclosures required by the Independence Standards Board.

The committee discussed with the Company’s independent auditors the overall scope and plans for their respective audits. The committee meets with the independent auditors, with and without management present, to discuss the results of the examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The committee held 4 meetings during the year ended March 31, 2005.

In reliance on the reviews and discussions referred to above, the committee recommended to the board of directors (and the board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended March 31, 2005 for filing with the Securities and Exchange Commission.

Joel I. Ferguson

David R. Layton

Samuel O. Mallory

During the last fiscal year there were a total of four meetings of the Board of Directors. Messrs. Ferguson, Layton and Mallory attended less than 75% of the meetings.

Director Compensation

The Directors of the Company are paid $100 per meeting attended. Fees are not paid to Directors for attendance at committee meetings.

Communication with the Board of Directors

Shareholders and other interested parties may communicate with the Board of Directors, including the independent directors, by sending written communication to the directors c/o the Chairman of the Board, Maxco, Inc., 1118 Centennial Way, Lansing, Michigan 48917. All such communications will be reviewed by the Chairman, or his designate, to determine which communications will be forwarded to the directors. All communications will be forwarded except those that are related to Company products and services, are solicitations, or otherwise relate to improper or irrelevant topics, as determined in the sole discretion of the Chairman, or his designate.

The Chairman shall maintain and provide copies of all such communications received and determined to be forwarded, to the Board of Directors in advance of each of its meetings. In addition, the Chairman will indicate to the board the general nature of communications that were not determined to be forwarded and such communications will be held until each board meeting to be reviewed by any interested director.

The Company has a policy and practice of all directors standing for election at an annual meeting of Shareholders to attend such meeting if available. Messrs. Ferguson and Layton did not attend the Company’s annual meeting of its Shareholders held on March 15, 2005.

EXECUTIVE OFFICERS

The following table sets forth information concerning the Executive Officers of the Company.

| | | Present Position With the | | |

| | | Company and Principal | | |

| Name | | Occupation | | Age |

| | | | | |

| Max A. Coon | | President, Director and Chairman of the Board of MAXCO, INC. | | 71 |

| | | | | |

| Eric L. Cross | | Executive Vice President and Secretary of MAXCO, INC. | | 62 |

| | | | | |

| Lawrence O. Fields | | Chief Financial Officer and Treasurer of MAXCO, INC. | | 52 |

| | | | | |

Messrs. Coon and Cross have been engaged in the principal occupations specified above for the previous five years. Lawrence O. Fields was appointed Treasurer and Chief Financial Officer of the Company on November 29, 2005. Mr. Fields had been Controller of the Company for over twenty years prior to the appointment.

Mr. Coon and Mr. Cross are brothers-in-law. There are no other family relationships between any Directors or Executive Officers.

Code of Ethics

The Company has adopted a code of ethics that applies to its directors, officers, and employees. A paper copy of our code of ethics may be obtained free of charge by writing to the Company care of its Compliance Officer at our principal executive office located at 1118 Centennial Way, Lansing, MI 48917.

EXECUTIVE COMPENSATION

Compensation Committee Report on Executive Compensation

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board of Directors (the "Committee") consisted of David R. Layton, Joel I. Ferguson and Samuel O. Mallory for the year ended March 31, 2005.

Overview and Philosophy

The Committee is responsible for developing and making recommendations to the Board with respect to the Company's executive compensation policies. In addition, the Compensation Committee, pursuant to authority delegated by the Board, determines on an annual basis the compensation to be paid to the Chief Executive Officer and each of the other executive officers of the Company.

The objectives of the Company's executive compensation program are to:

| Ø | Support the achievement of desired Company performance. |

| Ø | Provide compensation that will attract and retain superior talent and reward performance. |

| Ø | Align the executive officers' interests with the success of the Company by placing a portion of pay at risk, with payout dependent upon corporate performance. |

The executive compensation program provides an overall level of compensation opportunity that is competitive with companies of comparable size and complexity. The Compensation Committee will use its discretion to set executive compensation where in its judgment external, internal or an individual's circumstances warrant it.

Executive Officer Compensation Program

The Company's executive officer compensation program is comprised of base salary, annual cash incentive compensation, long-term incentive compensation in the form of stock options, and various benefits, including medical and deferred compensation plans, generally available to employees of the Company.

Base Salary

Base salary levels for the Company's executive officers are competitively set relative to other comparable companies. In determining salaries the Committee also takes into account individual experience and performance.

Annual Incentive Compensation

The Company's annual incentive program for executive officers and key managers provides direct financial incentives in the form of an annual cash bonus to executives to achieve the Company's annual goals. Goals for Company performance are set at the beginning of each fiscal year. In the year ended March 31, 2005, the following measures of Company performance were selected: net sales, operating earnings, consolidated net income, market penetration, and customer satisfaction.

Specific individual performance was also taken into account in determining bonuses, including meeting department goals, attitude, dependability, cooperation with co-workers, and creativity or ideas that benefit the Company.

Stock Option Program

The stock option program is the Company's long-term incentive plan for executive officers and key employees. The objectives of the program are to align executive and shareholder long-term interests by creating a strong and direct link between executive pay and shareholder return, and to enable executives to develop and maintain a significant, long-term stock ownership position in the Company's Common Stock.

On August 25, 1998, the Shareholders ratified an Employee Stock Option Plan to grant options on up to 500,000 shares of the Company's common stock to officers and key employees of the Company and its subsidiaries. The options which may be granted under this plan may either qualify as "incentive stock options" within the meaning of Section 422A of the Internal Revenue Code, as amended, or may be nonqualified options.

The stock option plan authorizes a committee of directors to award stock options to key employees, directors or agents of the Company. Stock options are granted at an option price equal to the fair market value of the Company's Common Stock on the date of grant, have ten year terms and can have exercise restrictions established by the Option Committee. Awards are made at a level calculated to be competitive with companies of comparable size and complexity.

Deferred Compensation

Effective January 1, 2005, the Maxco, Inc. 401(k) Employee Savings Plan was merged into Maxco’s wholly-owned subsidiary Atmosphere Annealing, Inc.’s 401(k) Plan which covers substantially all employees of the Company. The 401(k) plan is a "cash or deferred" plan under which employees may elect to contribute a certain portion of their annual compensation which they would otherwise be eligible to receive in cash. The Company has agreed to make a matching contribution in the percentages specified in the plan documents. In addition, a separate employer contribution may be made at the discretion of the Board. The plan does not contain an established termination date and it is not anticipated that it will be terminated at any time in the foreseeable future.

Benefits

The Company provides medical benefits to the executive officers that are generally available to Company employees. The amount of perquisites, as determined in accordance with the rules of the Securities and Exchange Commission relating to executive compensation, did not exceed 10% of salary for the year ended March 31, 2005.

Chief Executive Officer

Max A. Coon has served as the Company's Chief Executive Officer since 1969. His base salary for the year ended March 31, 2005 was $250,000, which was deferred. No bonus was paid to Mr. Coon for 2005.

Significant factors the Committee looked at in establishing Mr. Coon’s compensation for the year ended March 31, 2005, were his strategic and overall management direction of the Company. Specifically the Committee discussed that through his direction, the Company was positioned to have an improvement in financial results for the 2005 year. The Committee noted that sales have increased each of the last three years and operating results were positive in 2004 from losses sustained in 2003 and 2002. Despite being in a loss position, the net loss of the Company was reduced in 2004 from the prior two year period. In addition, the Committee felt that through Mr. Coon’s direction in the liquidation of its real estate investment, including the reduction of the majority of guarantees the Company had made on its real estate investments, was also a key factor in establishing his compensation. As a result of these factors, the committee felt the Company was poised to continue its sales growth and improvement in its financial results in 2005. This was achieved as operating earnings in 2005 improved to $2.0 million and net income was positive for the year.

The Compensation Committee

David R. Layton

Joel I. Ferguson

Samuel O. Mallory

Summary Compensation Table

The following table sets forth the cash and non-cash compensation for each of the last three fiscal years awarded to or earned by the Chief Executive Officer of the Company and to the others whose compensation exceeded $100,000:

| | | Annual Compensation | | Long Term Compensation | |

| Name and Principal Position | | Year | | Salary | | Bonus | | Other Annual Comp 1 | | Options | | All Other Comp 2 | |

Max A. Coon Chief Executive Officer | | | 2005 2004 2003 | | | 250,0003 200,000 200,000 | | | 0 0 0 | | | 300 200 300 | | | 0 0 0 | | | 0 1,000 3,600 | |

Eric L. Cross Executive Vice President | | | 2005 2004 2003 | | | 150,000 150,000 150,000 | | | 0 0 0 | | | 200 200 300 | | | 0 0 0 | | | 3,750 1,947 3,300 | |

Vincent Shunsky, former Vice President of Finance; resigned November 29, 2005 | | | 2005 2004 2003 | | | 150,000 150,000 150,000 | | | 0 0 25,000 | | | 200 200 300 | | | 0 0 0 | | | 3,750 3,788 3,550 | |

Sanjeev Deshpande President of Atmosphere Annealing | | | 2005 2004 2003 | | | 165,998 156,398 154,710 | | | 45,000 45,000 35,000 | | | 400 200 0 | | | 0 0 0 | | | 5,034 5,000 4,712 | |

Lawrence O. Fields Treasurer and CFO effective November 29, 2005 | | | 2005 2004 2003 | | | 95,000 90,000 90,000 | | | 20,000 15,000 18,000 | | | 0 0 0 | | | 0 0 0 | | | 3,925 2,633 1,296 | |

| | | | | | | | | | | | | | | | | | | | |

| 1 | Represents annual director fees. Messrs. Cross and Shunsky resigned as directors of the company on October 21, 2004. |

| 2 | Represents the Company's match of employee deferrals of currently earned income into the 401(k) Employee Savings Plan and a profit sharing contribution made by the Company for all of its eligible employees to the 401(k) Employee Savings Plan at the rate of 1% of eligible compensation. |

| 3 | Max A. Coon has deferred payment of his salary since December 1, 2004. |

In April 2004 the Company entered into an incentive agreement with the President of its wholly-owned subsidiary Atmosphere Annealing, Inc. The agreement provides for compensation to the officer based on the increased value, as defined, of the subsidiary by March 31, 2006. The incentive is equal to 1% of the first $25 million in value plus 10% above that base amount. Any incentive so earned is payable by Maxco, Inc. in cash assuming a sale by March 31, 2006. If no such sale occurs by that date, at the option of Maxco the incentive is payable in cash or its equivalent in stock of Atmosphere Annealing, Inc. held by Maxco. As party to the agreement, Maxco, Inc. is recognizing incentive compensation expense on a pro-rata basis under the terms of the agreement. The amount accrued during the year ended March 31, 2005 was $650,000.

Options

The following table summarizes the value of the options held by the above named individuals at the fiscal year end. No options were granted to or exercised by the named individuals during the fiscal year ended March 31, 2005. The options held by Messrs. Cross and Shunsky have expired as of the date of this proxy. The options held by Mr. Deshpande are presently exercisable.

Year End Option Values

| Name and Principal Position | | Number of Unexercised Options at Fiscal Year End | | Value of Unexercised Options at Fiscal Year End | |

Max A. Coon Chief Executive Officer | | | 0 | | | 0 | |

Eric L. Cross Executive Vice President | | | 42,5001 | | | 0 | |

Vincent Shunsky Former Vice President of Finance, resigned | | | 42,5001 | | | 0 | |

Sanjeev Deshpande President of Atmosphere Annealing | | | 40,000 | | | 0 | |

| | | | | | | | |

| 1 | Options granted by the Option Committee on December 21, 1995 with an exercise price equal to the fair market value of the Company's Common Stock on the date of grant which was $8.00. These options were granted under the 1998 Stock Option Plan as part of the long-term incentive program for executive officers and key employees. These options expired as of December 21, 2005. |

Equity Compensation Plan Information

The following table summarizes information as of March 31, 2005 regarding the Company's common stock reserved for issuance under the Company's Employee Stock Option Plan. The Company's Employee Stock Option Plan is its only equity compensation plan and was approved by the shareholders in 1998.

Plan Category | | Number of Securities to be Issued Upon Exercise of Outstanding Options | | Weighted-Average Exercise Price of Outstanding Options | | Number of Securities Remaining Available for Future Issuance Under the Stock Option Plan (Excluding Securities Reflected in Column a) | |

| Equity Compensation Plans Approved by Security Holders | | | 132,5001 | | $ | 7.74 | | | 470,000 | |

| | | | | | | | | | | |

| 1 | Includes 102,500 issued under a prior stock option plan, 92,500 of which expired on December 21, 2005. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's Directors and Executive Officers or beneficial owners of over 10% of any class of the Company's equity securities to file certain reports regarding their ownership of the Company's securities or any changes in such ownership. All such reports were filed on a timely basis during the fiscal year ended March 31, 2005. Max A. Coon, Daryle L. Doden, and ROI Capital Management, Inc. are beneficial owners of more then 10% of Maxco’s voting securities. See table under Item 12 for further disclosure of security ownership of certain beneficial owners and management.

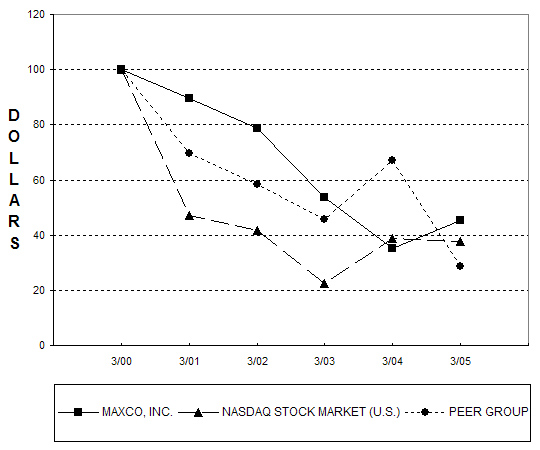

COMPARATIVE STOCK PERFORMANCE

The graph below compares the cumulative total shareholder return on the Common Stock of the Company for the last five years with a cumulative total return on the CRSP Total Return Index for the NASDAQ Stock Market (US Companies) (1) and a peer group of companies (2) over the same period, assuming the investment of $100 in the Company’s Common Stock, the NASDAQ Index and the peer group on March 31, 2000, and reinvestment of all dividends.

| | | | |

| | | 3/00 | | 3/01 | | 3/02 | | 3/03 | | 3/04 | | 3/05 | |

| MAXCO, INC. | | | 100.00 | | | 89.55 | | | 78.69 | | | 53.73 | | | 35.22 | | | 45.37 | |

| NASDAQ STOCK MARKET (U.S.) | | | 100.00 | | | 47.20 | | | 41.66 | | | 22.38 | | | 38.67 | | | 37.64 | |

| PEER GROUP | | | 100.00 | | | 69.78 | | | 58.44 | | | 45.64 | | | 66.99 | | | 28.82 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | The CRSP Total Return Index for the NASDAQ Stock Market (US Companies) is composed of all domestic common shares traded on the NASDAQ National Market and the NASDAQ Small-Cap Market. |

| (2) | The peer group consists of ten companies whose stock is publicly traded and whose market capitalizations are slightly above and below the Company’s capitalization in a range from $9.3 million to $20.96 million. Because of the diversified nature of the business represented by its subsidiary companies, the Company is unable to identify a published industry or line of business index or a group of peer issuers in comparable businesses which are sufficiently similar to allow meaningful comparison. Therefore, the Company has elected to compare its performance with a group of issuers having similar market capitalizations as allowed by SEC rules. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of February 8, 2006, as to the equity securities of the Company owned beneficially by beneficial owners of 5% or more of the Company's securities, by each Director and by Executive Officer, and by all Directors and Executive Officers of the Company as a group.

Each share of common stock so held entitles the holder thereof to one vote upon each matter to be voted on. Stockholders of series three and six preferred shares are entitled to 20 votes for each one of such shares. Series four and series five preferred stock are both nonvoting. As of February 8, 2006, the Company had outstanding 3,446,995 shares of common stock, 14,784 shares of series three preferred stock, and 7,812.5 shares of series six preferred stock for a total of 3,898,925 shareholder votes. As of February 8, 2006, our current directors and executive officers beneficially owned the right to vote 1,322,112 voting shares of Maxco’s outstanding common stock as well as beneficially owned the right to vote outstanding shares of series three and series six preferred stock with an aggregate of 307,550 votes, for a total beneficial ownership of the right to vote 1,629,662 shareholder votes, or 41.8% of the total votes available that would be entitled to vote at the Annual Meeting.

| | | | | Amount and Nature of Beneficial Ownership | |

Name of Beneficial Owner | | Title of Class | | Sole Investment Power | | Shared Investment Power1 | | % of Class2 | | Shared Voting Power | | % of Total Votes | |

Max A. Coon 3 | | | Common Stock | | | 878,456 | | | 988,1724 | | | 28.7 | % | | 999,2045 | | | 25.6 | % |

| Eric L. Cross | | | Common Stock | | | 154,525 | | | 238,2106 | | | 6.9 | % | | 280,2867 | | | 7.2 | % |

| Sanjeev Deshpande | | | Common Stock | | | 45,0898 | | | 45,0898 | | | 1.3 | % | | 5,0898 | | | * | |

| Joel I. Ferguson | | | Common Stock | | | 0 | | | 0 | | | * | | | 0 | | | * | |

| Lawrence O. Fields | | | Common Stock | | | 14,333 | | | 14,333 | | | * | | | 14,333 | | | * | |

| David R. Layton | | | Common Stock | | | 0 | | | 1,0009 | | | * | | | 1,000 | | | * | |

| Samuel O. Mallory | | | Common Stock | | | 22,200 | | | 22,200 | | | * | | | 22,200 | | | * | |

| All Directors and Officers as a group, including the above seven people | | | Common Stock | | | 1,114,603 | | | 1,309,004 | | | 37.5 | % | | 1,322,112 | | | 33.9 | % |

| | | | | | | | | | | | | | | | | | | | |

ROI Capital Management, Inc.10 | | | Common Stock | | | 860,998 | | | 928,46311 | | | 26.9 | % | | 928,463 | | | 23.8 | % |

Daryle L. Doden12 | | | Common Stock | | | 250,00013 | | | 345,80014 | | | 10.0 | % | | 345,800 | | | 8.9 | % |

| | | | | | | 2,225,601 | | | 2,583,268 | | | 74.1 | % | | 2,596,375 | | | 66.6 | % |

Max A. Coon 3 | | | Series Three Preferred Stock | | | 0 | | | 2,95616 | | | 20.0 | % | | 75,65017 | | | 1.9 | % |

| Eric L. Cross | | | Series Three Preferred Stock | | | 0 | | | 63218 | | | 4.3 | % | | 75,65019 | | | 1.9 | % |

Max A. Coon 3 | | | Series Four Preferred Stock 15 | | | 0 | | | 13,62916 | | | 29.4 | % | | 0 | | | 0 | % |

| Eric L. Cross | | | Series Four Preferred Stock 15 | | | 0 | | | 2,91218 | | | 6.3 | % | | 0 | | | 0 | % |

Max A. Coon 3 | | | Series Five Preferred Stock 15 | | | 0 | | | 2,03316 | | | 30.6 | % | | 0 | | | 0 | % |

| Eric L. Cross | | | Series Five Preferred Stock 15 | | | 0 | | | 43418 | | | 6.5 | % | | 0 | | | 0 | % |

Max A. Coon 3 | | | Series Six Preferred Stock | | | 0 | | | 3,05316 | | | 39.1 | % | | 78,12517 | | | 2.0 | % |

| Eric L. Cross | | | Series Six Preferred Stock | | | 0 | | | 65218 | | | 8.4 | % | | 78,12519 | | | 2.0 | % |

| * | Beneficial ownership does not exceed one percent (1%). |

| (1) | Includes Sole Investment Power as well as shares beneficially owned. |

| (2) | Calculated based on Shared Investment Power. |

| (3) | Mr. Coon’s address is 1118 Centennial Way, Lansing, Michigan 49817. |

| (4) | Includes 18,487 shares owned by Mr. Coon's immediate family; a proportionate share of 155,250 shares held by a general partnership in which Mr. Coon is a 1/3 partner; and a proportionate share of 101,022 shares held by EM Investors, LLC in which Mr. Coon has a 39.1% ownership interest. |

| (5) | Includes 18,487 shares owned by Mr. Coon's immediate family; a proportionate share of 155,250 shares held by a general partnership in which Mr. Coon is a 1/3 partner; and a 50% share of 101,022 shares held by EM Investors, LLC representing Mr. Coon’s voting power of those shares. |

| (6) | Includes 23,500 shares owned by Mr. Cross’ wife; a proportionate share of 155,250 shares held by a general partnership in which Mr. Cross is a 1/3 partner; and a proportionate share of 101,022 shares held by EM Investors, LLC in which Mr. Cross has an 8.4% ownership interest. |

| (7) | Includes 23,500 shares owned by Mr. Cross’ wife; a proportionate share of 155,250 shares held by a general partnership in which Mr. Cross is a 1/3 partner; and a 50% share of 101,022 shares held by EM Investors, LLC representing Mr. Cross’ voting power of those shares. |

| (8) | Includes options to purchase 40,000 shares. Such options were not exercised as of February 8, 2006 and thus were not included in voting power. |

| (9) | Represents shares held in a pension fund of which Mr. Layton is one of the trustees. |

| (10) | Information obtained from Schedule 13D/A dated April 5, 2005 filed with the Securities and Exchange Commission. The address of ROI Capital Management, Inc. is 300 Drakes Landing Rd., Suite 175, Greenbrae, CA 94904. |

| (11) | Information obtained from Schedule 13D/A dated April 5, 2005 filed with the Securities and Exchange Commission. Includes 57,465 shares in a personal IRA of Mark T. Boyer and 10,000 shares in a personal IRA of Mitchell J. Soboleski. Messrs. Boyer and Soboleski are the owners of ROI Capital Management, Inc. and have dispositive authority of the reported securities held in advisory accounts of ROI Capital Management, Inc. |

| (12) | Mr. Doden’s address is 1610 S. Grandstaff Dr., Auburn, IN 46706 or P.O. Box 51, Auburn, IN 46706. |

| (13) | Represents shares in the name of Contractor Supply, Incorporated of which Mr. Doden owns 100%. |

| (14) | Includes 95,800 shares in the name of Master Works Foundation, Inc., an Indiana non-profit corporation in which Mr. Doden is one-third member. |

| (15) | Series Four and Series Five Preferred Stock are both nonvoting. |

| (16) | Represents a proportionate share of shares held by EM Investors, LLC in which Mr. Coon has a 39.1% ownership interest. |

| (17) | Represents a 50% share of shares held by EM Investors, LLC representing Mr. Coon’s voting power of those shares. |

| (18) | Represents a proportionate share of shares held by EM Investors, LLC in which Mr. Cross has an 8.4% ownership interest. |

| (19) | Represents a 50% share of shares held by EM Investors, LLC representing Mr. Cross’ voting power of those shares. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In June 2003, the Company assumed a lease with CJC Leasing, a limited liability company in which Mr. Coon is a member, from Contractor Supply Incorporated, the purchaser of the Company’s formerly wholly owned subsidiary, Ersco Corporation. Contractor Supply Incorporated was required under the lease to pay CJC Leasing an aggregate of approximately $2.3 million in monthly installment payments over a period of approximately 4 years. In exchange for the Company assuming Contractors Supply Incorporated’s lease payments to CJC Leasing, Contractors Supply Incorporated and the Company agreed to reduce the amount then owed by the Company to Contractor Supply Incorporated by $2.3 million. The assumption of the lease obligations to CJC Leasing by the Company allowed the Company to retire a $2.3 million debt that was otherwise due and payable to Contractors Supply Incorporated, by making monthly payments of the approximate $2.3 million over four years. Subsequently, in the first quarter 2005, the Company issued 250,000 shares of restricted common stock of the Company to Contractor Supply Incorporated, and 95,800 shares of restricted common stock of the Company to Master Works Foundation, Inc. (a non-profit corporation in which the sole shareholder of Contractor Supply Incorporated is a one-third member) in exchange for further reduction of the amount owed by the Company to Contractor Supply Incorporated by $1.383 million. This Company debt owed to Contractor Supply Incorporated was subsequently assigned by Contractor Supply Incorporated to Ambassador Steel Corporation, and then by Ambassador Steel Corporation to its President, Daryle E. Doden. On September 30, 2005, Mr. Doden assigned this Company debt to EM Investors, LLC. EM Investors, LLC converted the Company payable, including all accrued interest, to the Company’s series six preferred shares. Messrs. Coon and Cross, are managers, and have indirect ownership interests, of 39.08% and 8.35%, respectively, of EM Investors, LLC.

Vincent Shunsky, former Vice President, Chief Financial Officer and Treasurer of the Company, is indebted to the Company in the amount of approximately $176,000, including accrued interest, as of December 31, 2005. The indebtedness was incurred at various times prior to April 2002 for the purchase of affiliate company stock and personal use. The Company has recently begun discussing a payment plan for the repayment of the indebtedness by Mr. Shunsky.

In October 2004, the Company entered into a Retention Agreement with Mr. Shunsky to provide him with a bonus of $200,000 to retain his services until at least March 31, 2006. The Retention Agreement provided that should he leave the employ of the Company prior to that date, the bonus must be repaid. Mr. Shunsky resigned from his positions as Vice-President, Chief Financial Officer and Treasurer, effective November 29, 2005, and is no longer employed by the Company. However, through March 31, 2006, Mr. Shunsky has agreed to serve as a consultant to the Company in exchange for retaining the bonus. The Company is expensing the retention bonus ratably through March 31, 2006. As of December 31, 2005, the amount accrued was $169,000, including $99,000 charged to operations during the nine months then ended.

In April 2004, the Company entered into an Incentive Agreement with Sanjeev Deshpande, President of Atmosphere Annealing, Inc., (a wholly owned subsidiary of the Company), and Director of the Company. The agreement provides for payment based on the increased value of Atmosphere Annealing by March 31, 2006. The incentive is equal to 1% of the first $25 million of value plus 10% of any excess above the threshold of $25 million. Any incentive so earned is payable in cash assuming a sale by March 31, 2006. If no such sale occurs by that date, at the option of the Company, the incentive is payable in cash or its equivalent in stock of Atmosphere Annealing. As party to the agreement, Maxco, Inc. is recognizing incentive compensation expense on a pro-rata basis under the terms of the agreement. As of December 31, 2005, the amount accrued was $1.2 million, including $525,000 charged to operations during the nine months then ended.

In April 2005, the Company acquired BCGW, Inc. ("BCGW"), the entity that owns the buildings the Company currently leases in Lansing, Michigan. Max A. Coon’s spouse was a 25% shareholder of BCGW. At March 31, 2004, the Company owed BCGW $1.6 million on an outstanding loan obligation which carried an interest rate of 10%. In May 2004 Atmosphere retired that obligation; Atmosphere and BCGW entered into an agreement whereby BCGW agreed to accept as payment in full the remaining outstanding balance less a discount of approximately $94,000. The amount the Company charged to rent expense related to the two buildings leased from BCGW totaled approximately $253,000 and $373,000 for the years ended March 31, 2005 and 2004, respectively. Interest on the debt to BCGW totaled $3,000 and $181,000 for the years ended March 31, 2005 and 2004, respectively.

RELATIONSHIP WITH INDEPENDENT PUBLIC ACCOUNTANTS

The firm of Ernst & Young LLP served as auditors for the Company for the fiscal year ended March 31, 2003. Effective May 7, 2004, the Company dismissed Ernst & Young LLP and engaged the accounting firm of Rehmann Robson as its new independent public accountants.

Rehmann Robson served as auditors for the Company for the fiscal years ended March 31, 2005 and 2004. The decision to change Maxco’s accounting firm was approved by the audit committee of the board of directors on May 6, 2004 and reported on Form 8-K/A dated May 7, 2004.

A representative of Rehmann Robson is expected to be present at the Annual Meeting of Shareholders, will be available to respond to appropriate questions, and will have the opportunity to make a statement if he desires to do so.

The reports of Ernst and Young LLP on the consolidated financial statements of Maxco for the fiscal year ended March 31, 2003 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles, except that the reports of Ernst & Young LLP on Maxco’s financial statements for the fiscal year ended March 31, 2003 contained a paragraph as to Maxco's ability to continue as a going concern.

In connection with the audits of Maxco's financial statements for the fiscal year ended March 31, 2003 and in the subsequent interim periods from March 31, 2003 through and including May 7, 2004, there were no disagreements between Maxco and its auditors, Ernst & Young LLP on any matter of accounting principles or practices, consolidated financial statement disclosure, or auditing scope and procedures, which, if not resolved to the satisfaction of Ernst & Young LLP, would have caused Ernst & Young LLP to make reference to the matter in its reports.

Maxco provided Ernst & Young LLP with a copy of the disclosure made in the 8-K/A and requested Ernst & Young LLP to furnish Maxco with a letter addressed to the Securities and Exchange Commission stating whether Ernst & Young LLP agrees with the statements made by Maxco in this disclosure. A copy of that letter, dated May 14, 2004, which stated they were in agreement, was filed as Exhibit 16 to the 8-K/A.

Principal Accountant Fees and Services

For the two years ended March 31, 2005 and 2004, the Company’s auditors billed the Company for its services as follows:

Audit Fees | 2005 | $57,500 for aggregate fees billed for professional services rendered by Rehmann Robson for the audit of the Company’s annual financial statements for the year ended March 31, 2005 and the reviews of the financial statements included in the Company’s quarterly reports filed with the Securities and Exchange Commission during the year. |

| | | |

Audit Fees | 2004 | $54,500 for aggregate fees billed for professional services rendered by Rehmann Robson for the audit of the Company’s annual financial statements for the year ended March 31, 2004. |

| | | |

| | 2004 | $25,500 for aggregate fees billed for professional services by Ernst & Young, LLP rendered for the reviews of the financial statements included in the Company’s quarterly reports filed with the Securities and Exchange Commission during the year. |

| | | |

Audit-Related Fees. | | There were no such fees. |

| | | |

Tax Fees. | | There were no such fees. |

| | | |

All Other Fees. | | There were no such fees. |

There were no additional fees billed for services to the Company other than the above.

The Audit Committee of the Company’s Board of Directors is of the opinion that the provision of services described above was compatible with maintaining the independence of Rehmann Robson and Ernst & Young LLP. In 2004, the Audit Committee revised its charter to comply with the mandates of the Sarbanes-Oxley Act of 2002 and related rules and regulations of the Securities and Exchange Commission, including pre-approval policies and procedures. All services rendered to the Company by the Company’s auditors for the years ended March 31, 2004, and March 31, 2005 were permissible under applicable laws and regulations, and were pre-approved by the Audit Committee.

SHAREHOLDER PROPOSALS

Any proposals which shareholders of the Company intend to present at the next annual meeting of the Company must be received by the Company by April 1, 2006, for inclusion in the Company's proxy statement and proxy form for that meeting. In cases where a shareholder does not seek to have their proposal included in the Company's proxy materials, no proposal will be considered timely for submission at the next Annual meeting unless it is received by the Company by June 14, 2006 and, in such case, the Company's Proxy will provide the management proxies with discretionary authority to vote on such proposal without any discussion of the matter in the Proxy Statement. Proposals should be directed to the attention of Investor Relations at the offices of the Company, 1118 Centennial Way, Lansing, Michigan 48917.

DELIVERY TO SHAREHOLDERS SHARING AN ADDRESS

Only one copy of this proxy statement is being delivered to two or more shareholders who share an address, unless the Company has received contrary instructions from one or more of such shareholders. A separate copy of this proxy statement will be promptly delivered upon written or oral request of a shareholder at a shared address directed to the attention of Investor Relations at the offices of the Company, 1118 Centennial Way, P.O. Box 80737, Lansing, MI 48917, telephone 517-321-3130. Shareholders at a shared address who wish to receive multiple copies of the Company’s proxy statement in the future, or alternatively who are receiving multiple copies and wish to receive only a single copy, may direct their request to the forgoing address.

OTHER BUSINESS

The management knows of no other matters that will come before the meeting. However, if other matters do come before the meeting, the proxy holders will vote in accordance with their best judgment. The cost of solicitation of proxies will be borne by the Company. In addition to solicitations by use of the mails, Officers and regular employees of the Company may solicit proxies by telephone or in person.

By Order of the Board of Directors

Eric L. Cross

Secretary

MAXCO, INC.

Proxy solicited on behalf of the Board of Directors

for Annual Meeting of Shareholders to be held March 14, 2006.

The undersigned hereby constitutes and appoints Max A. Coon and Eric L. Cross, and each or any of them, attorney and proxy for and in the names and stead of the undersigned, to vote all stock of Maxco, Inc. (Maxco) on all matters, unless the contrary is indicated herein, at the Annual Meeting of Shareholders to be held at the corporate office, 1118 Centennial Way, Lansing, Michigan, on March 14, 2006 at 10:30 a.m. local time or at any adjournments thereof, according to the number of votes that the undersigned could vote if personally present at said meeting. The undersigned directs that this proxy be voted as follows:

ELECTION OF DIRECTORS

FOR all nominees listed below (except as marked to the contrary below).

M. Coon

S. Deshpande

J. Ferguson

D. Layton

S. Mallory

WITHHOLD AUTHORITY to vote for all nominees listed below __________

INSTRUCTION: To WITHHOLD AUTHORITY to vote for any individual nominee write that nominee's name in the space provided below:

________________________________________________________________________

In their discretion, the Proxies are authorized to vote upon such other business as may come before the meeting.

This proxy, when properly executed will be voted in the manner directed herein by the undersigned shareholder. If no direction is made, this proxy will be voted for Proposal 1.

| SIGNED:________________________ | DATED:________________________ |

NOTE: When shares are held by joint tenants, both should sign. When signing as attorney, as executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by authorized person.

PLEASE MARK, SIGN, DATE, AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.