UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Amendment No. 1

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

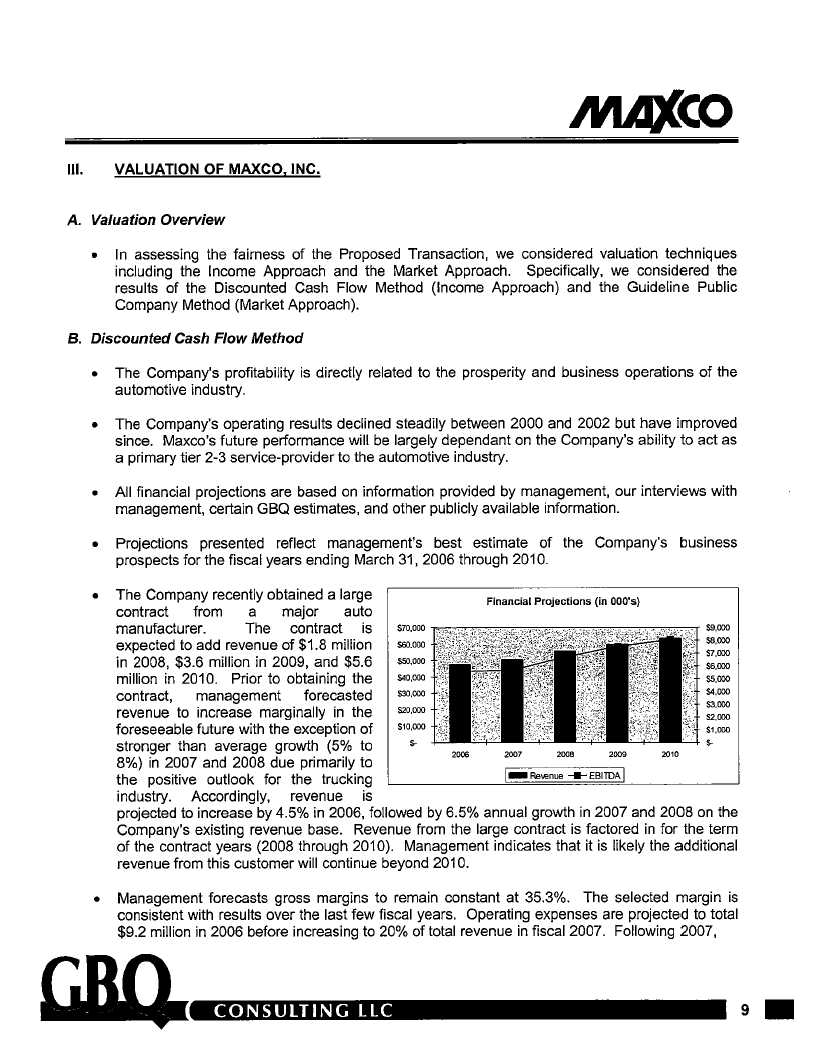

Check the appropriate box: |

o | | Preliminary Proxy Statement |

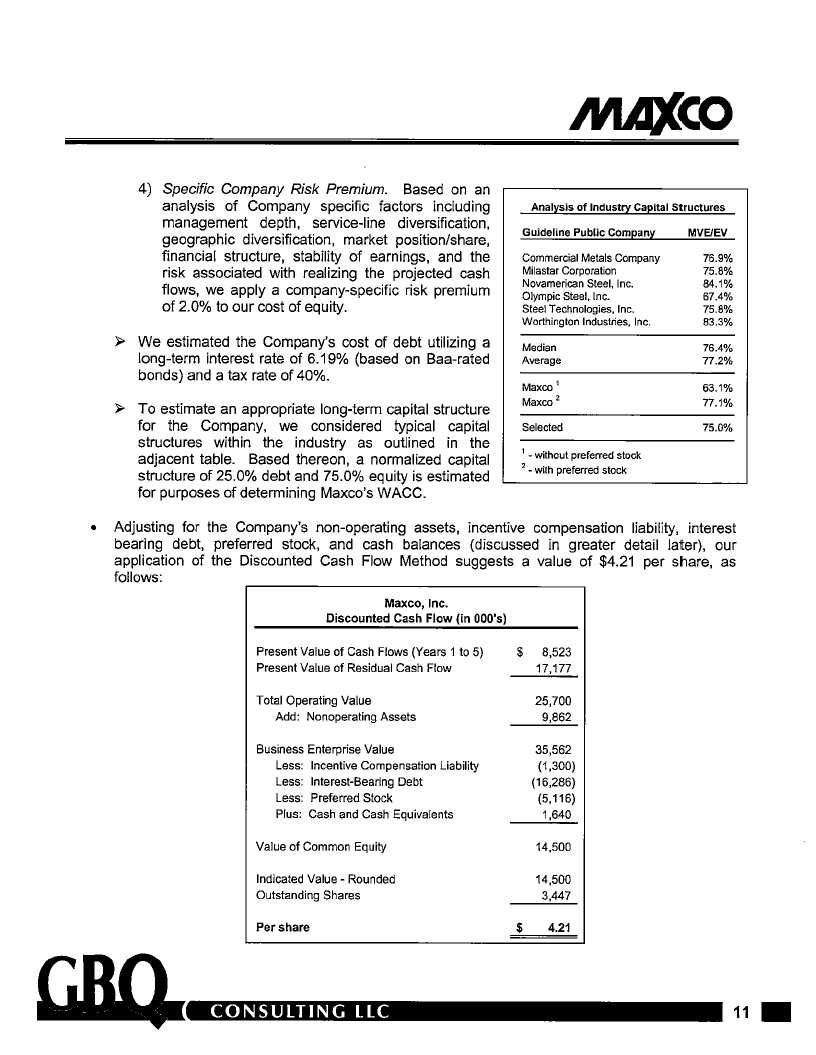

o | | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

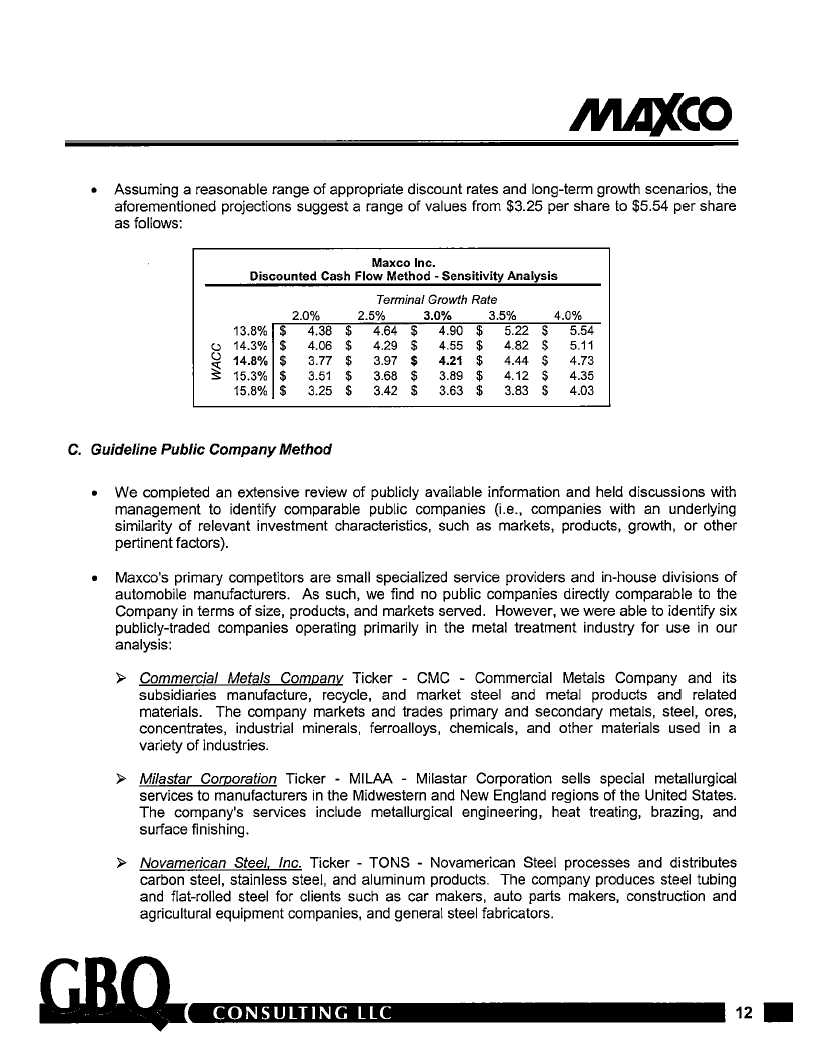

x | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material Under Rule 14a-12 |

Maxco, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

o | | No fee required. |

X | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): The proposed transaction is valued at $58,000,000.00 which is the maximum consideration to be paid for the sale of the assets described in the proxy statement. |

| | | (4) | | Proposed maximum aggregate value of transaction: $58,000,000.00 |

| | | (5) | | Total fee paid: $11,600.00 |

| | Fee paid previously with preliminary materials. |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

| | | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

1005 Charlevoix Drive Suite 100

Grand Ledge, Michigan 48837

January 11, 2007

To Our Stockholders:

You are cordially invited to attend an annual meeting of stockholders of Maxco, Inc. to be held at the corporate office, located at 1005 Charlevoix Drive, Suite 100, Grand Ledge, MI 48837, on Tuesday, January 30, 2007 at 10:30 a.m., local time.

The board of directors is soliciting your vote to (i) approve and adopt the sale of substantially all of the assets of our wholly owned subsidiary, Atmosphere Annealing, Inc. (“AAI”), and AAI’s wholly owned subsidiary, BCGW, Inc. (“BCGW”) to Quanex Technologies, Inc., the wholly owned subsidiary of Quanex Corporation, pursuant to the terms of the Asset Purchase and Sale Agreement, dated as of December 13, 2006, by and among Maxco, Inc., AAI, BCGW, Quanex Technologies, Inc. and Quanex Corporation (the “Asset Purchase Agreement”); (ii) to elect a board of directors to serve until the next annual meeting of stockholders or until their successors are elected and qualified; and (iii) to transact any other business as may properly come before the annual meeting or any adjournments or postponements of the annual meeting. More information about the asset sale is contained in the accompanying proxy statement, which we strongly encourage you to read in its entirety. A copy of the Asset Purchase Agreement is attached as Annex A to the proxy statement.

After careful consideration, our board of directors has approved the Asset Purchase Agreement and asset sale and determined that it is expedient and for the best interests of Maxco, Inc. and its stockholders that Maxco, Inc., AAI and BCGW enter into the Asset Purchase Agreement and consummate the asset sale. The asset sale cannot be completed unless, among other things, stockholders holding a majority of the outstanding shares of our common stock and voting preferred stock approve and adopt the transactions contemplated by the Asset Purchase Agreement.

Our board of directors recommends that you vote FOR the proposal to approve and adopt the sale of assets and FOR the election of each of the directors nominated.

Your vote is very important. If you are a stockholder of record, you have the right to vote by proxy or to vote in person at the annual meeting. Whether or not you plan to attend the annual meeting, we encourage you to mark, sign and date your proxy and return it promptly in the enclosed, pre-addressed, prepaid envelope to ensure that your shares will be represented and voted at the meeting. As a stockholder of record, if you sign, date and send us your proxy but do not indicate how you want to vote, your proxy will be voted "FOR" the approval and adoption of the transactions contemplated by the Asset Purchase Agreement, and “FOR” the election of the nominees to the Board of Directors and “FOR” the transaction of any other business as may properly come before the annual meeting, or any adjournments or postponements. If you are a beneficial owner of shares held in street name, such as your shares are held in an account at a brokerage firm, bank or other nominee, you should instruct your broker, bank or nominee how to vote on each proposal in accordance with the voting instruction form furnished by your broker, bank or nominee. If you do not instruct your broker, bank or other nominee how to vote on the particular proposals, your vote will not count as votes cast on the particular proposal.

Your interest and participation in the affairs of the Company are greatly appreciated. Thank you for your continued support.

Sincerely,

Max A. Coon

President and Chairman of the Board

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JANUARY 30, 2007

An annual meeting of the stockholders of Maxco, Inc. will be held at the corporate office, located at 1005 Charlevoix Drive, Suite 100, Grand Ledge, MI 48837, on Tuesday, January 30, 2007 at 10:30 a.m., local time, to consider and vote on the following matters:

1. To approve and adopt the asset purchase agreement among Maxco, Atmosphere Annealing, BCGW, and Quanex Technologies and Quanex Corporation pursuant to which Quanex Technologies will acquire substantially all of the assets of our wholly owned subsidiary, Atmosphere Annealing, and its wholly-owned subsidiary, BCGW;

2. Elect a board of directors to serve until the next annual meeting of stockholders;

3. To transact any other business as may properly come before the annual meeting or any adjournments or postponements of the annual meeting.

The foregoing items of business, including the proposed sale of assets, are more fully described in the proxy statement that is attached to, and a part of, this notice.

For more information about the asset sale and the other transactions contemplated by the Asset Purchase Agreement, we strongly encourage you to review the accompanying proxy statement and the Asset Purchase Agreement attached as Annex A to the proxy statement.

Our board of directors recommends that you vote FOR the proposal to approve and adopt the sale of assets and FOR the election of each of the directors nominated.

Only stockholders of record (common, Series Three Preferred and Series Six Preferred) at the close of business on December 18, 2006, the record date for the annual meeting, may vote at the annual meeting and any adjournments or postponements of the annual meeting. A complete list of stockholders of record entitled to vote at the annual meeting will be available for review during ordinary business hours for a period of 10 days before the annual meeting at our executive offices for any purpose germane to the annual meeting.

Your vote is very important. Whether or not you plan to attend the annual meeting, please submit your proxy or voting instructions as soon as possible to make sure that your shares are represented and voted. Whether or not you attend the annual meeting, you may revoke a proxy at any time before it is voted by filing with our corporate secretary a duly executed revocation of proxy, by submitting a duly executed proxy to our corporate secretary with a later date or by appearing at the annual meeting and voting in person, regardless of the method used to deliver your previous proxy. Attendance at the annual meeting without voting will not itself revoke a proxy. If your shares are held in an account at a brokerage firm, bank or other nominee, you must contact your broker, bank or nominee to revoke your proxy.

| | | By Order of the Board of Directors, |

| | |

| | Eric L. Cross Secretary |

| | | |

Grand Ledge, Michigan January 11, 2007 | | |

TABLE OF CONTENTS

| | | Page |

| | | |

| INTRODUCTION | | 1 |

| SUMMARY TERM SHEET | | 2 |

| The Companies | | 2 |

| Description of the Assets to be Sold | | 2 |

| Description of the Assets to be Retained by Maxco, Inc. | | 2 |

| Description of Liabilities to be Assumed | | 2 |

| Description of Liabilities to be Retained by Maxco, Inc. | | 2 |

| Purchase Price | | 3 |

| Reasons for the Transaction | | 3 |

| Terms of the Asset Purchase Agreement | | 3 |

| Recommendation of Our Board of Directors | | 3 |

| Vote Required to Approve the Transaction | | 3 |

| Representation, Warranties, and Covenants | | 3 |

| Conditions to Completion of the Transaction | | 4 |

| Termination of the Asset Purchase Agreement; Expense Reimbursement | | 4 |

| Interests of Management, Directors and Significant Stockholders in the Transaction | | 4 |

| Tax Consequences of the Transaction | | 4 |

| No Appraisal or Dissenters’ Rights | | 5 |

| Regulatory Approvals | | 5 |

| | | |

| QUESTIONS AND ANSWERS ABOUT THE TRANSACTION, THE ASSET PURCHASE AGREEMENT AND THE ANNUAL MEETING | | 6 |

| | | |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | | 9 |

| | | |

| PROPOSAL 1: THE TRANSACTION AND THE TERMS OF THE ASSET PURCHASE AGREEMENT | | 10 |

| The Companies | | 10 |

| Description of Assets to be Sold and Retained | | 11 |

| Description of Liabilities to be Assumed and Retained | | 12 |

| Purchase Price and Adjustments | | 13 |

| Representations and warranties | | 14 |

| Convenants | | 14 |

| Indemnification Provisions | | 14 |

| Conditions to Completion of the Transaction | | 15 |

| Termination of the Asset Purchase Agreement | | 16 |

| Effect of the Termination | | 16 |

| Background of the Transaction | | 16 |

| Reasons for the Transaction | | 18 |

| Use of Proceeds | | 19 |

| Transaction Risk Factors | | 20 |

| Recommendation of Our Board of Directors | | 21 |

| Our Financial Advisor | | 21 |

| Vote Required to Approve the Transaction and the Asset Purchase Agreement; Stockholder Voting Agreement | | 21 |

| | 21 |

| Interests of Certain Persons in the Transaction | | 22 |

| Tax Consequences of the Transaction | | 22 |

| Unaudited Selected Combined Financial Data of the AAI Business | | 22 |

| Selected Pro Forma Financial Information of Maxco, Inc. | | 22 |

| No Appraisal or Dissenters’ Rights | | 22 |

| Regulatory Approvals | | 22 |

| Past or Present Contacts with Quanex and Quanex Corporation | | 22 |

| PROPOSAL 2: ELECTION OF DIRECTORS | | 23 |

| Committees of the Board of Directors | | 24 |

| Communication with the Board of Directors | | 26 |

| Executive Officers | | 27 |

| Executive Compensation | | 27 |

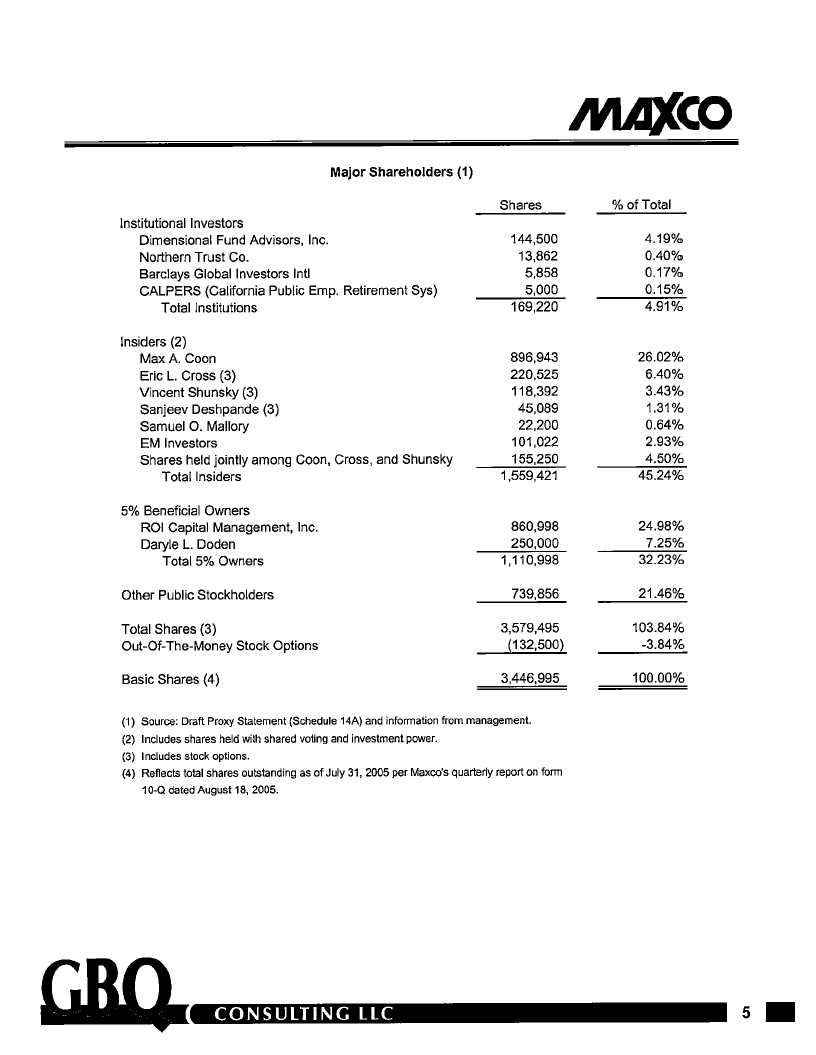

| Security Ownership of Certain Beneficial Owners and Management | | 29 |

| Compensation Committee Report on Executive Compensation | | 31 |

| Compensation Committee Interlocks and Insider Participation | | 32 |

| Section 16(a) Beneficial Ownership Reporting Compliance | | 32 |

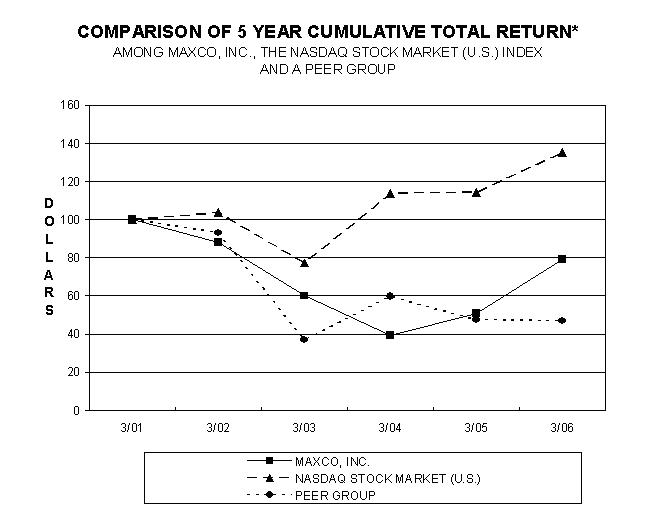

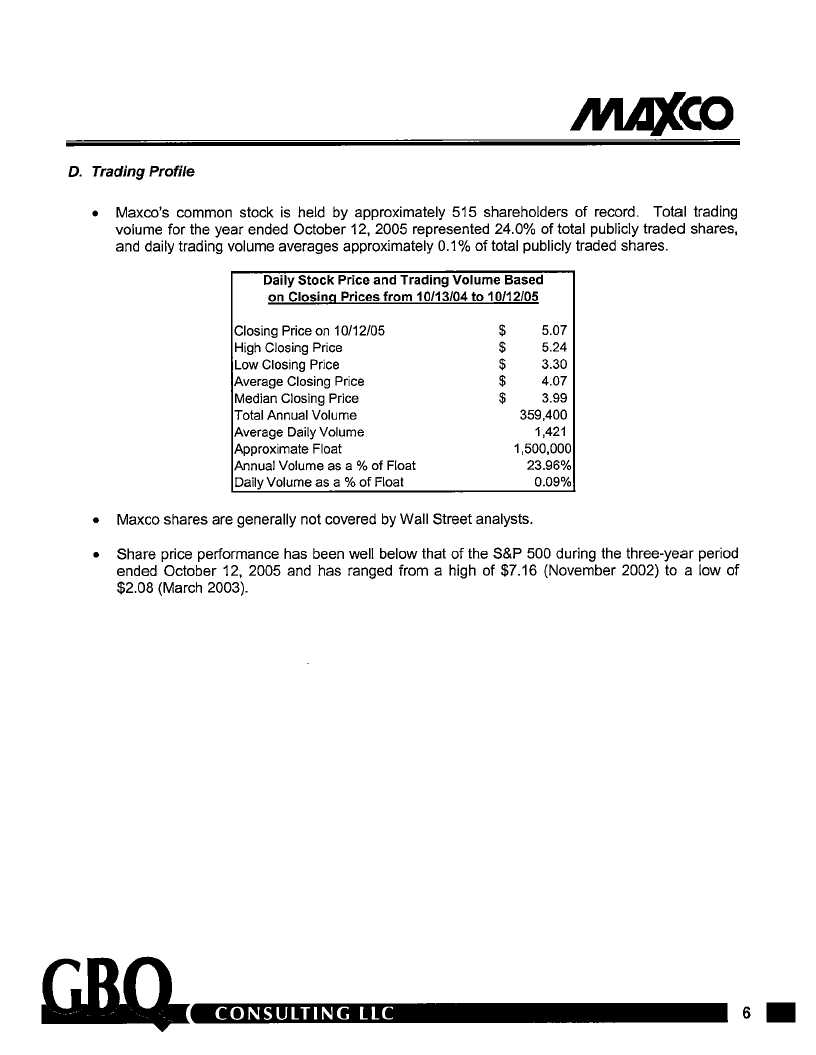

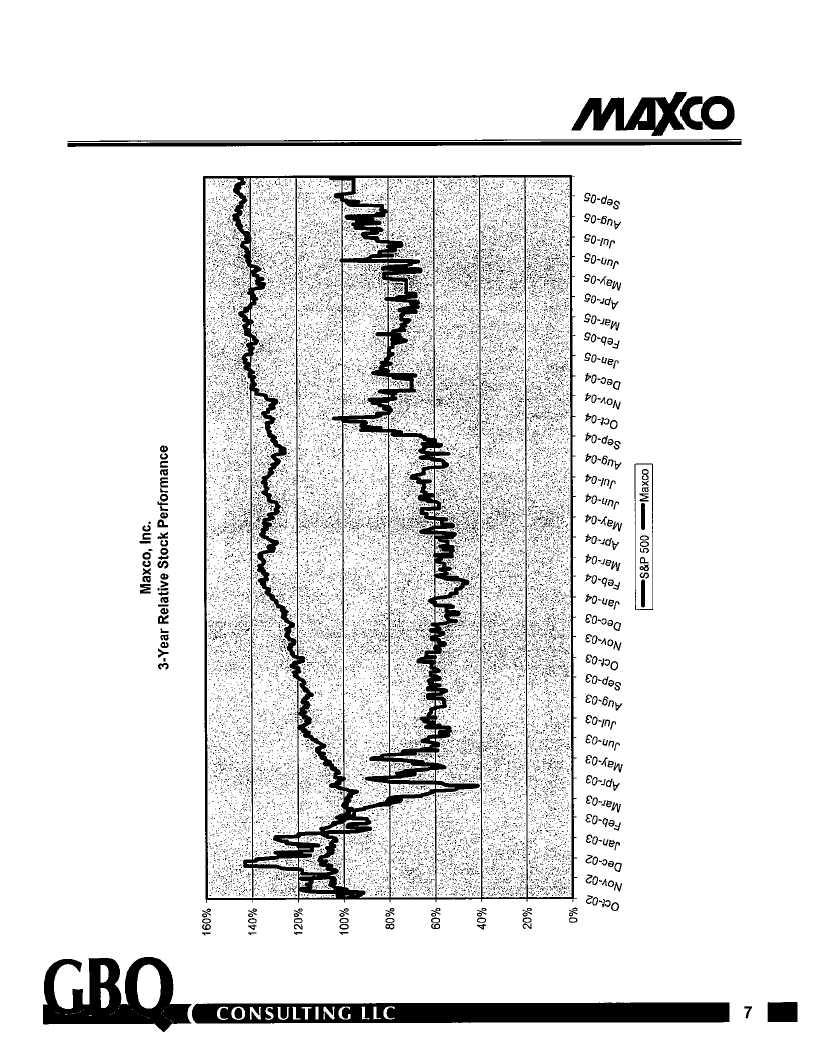

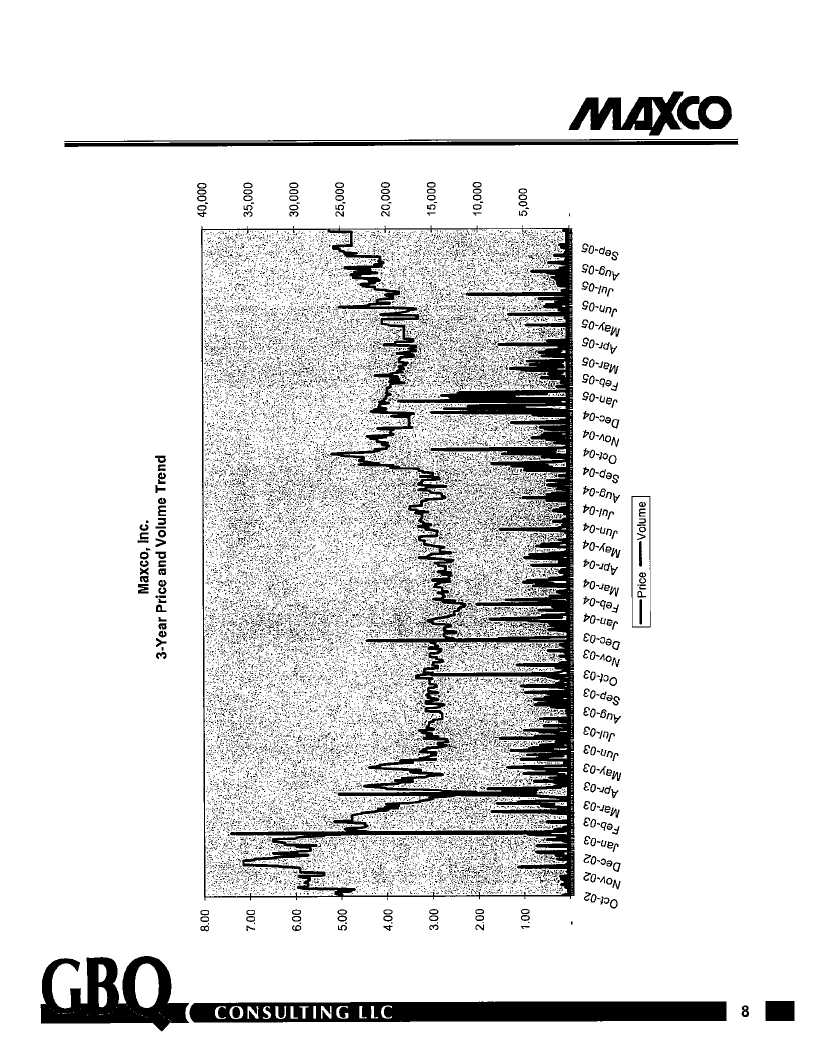

| Comparative Stock Performance | | 33 |

| Certain Relationships and Related Transactions | | 34 |

| Shareholder Proposals | | 35 |

| Delivery to Shareholders Sharing an Address | | 35 |

| | | |

| OTHER BUSINESS | | 36 |

| | | |

| PROXY CARD | | 37 |

| | | |

| SELECTED FINANCIAL DATA OF ATMOSPHERE ANNEALING, INC. | | 38 |

| | | |

ANNEXES | | |

| | | |

| Annex A Asset Purchase and Sale Agreement | | |

| Annex B Unaudited Pro Forma Condensed Consolidated Financial Statements | | |

| Annex C Selected Financial Data of Maxco, Inc. | | |

| Annex D Summary Historical Financial Data, Fiscal Year Ended March 31, 2006 | | |

| Annex E Summary Historical Financial Data, Three Months Ended September 30, 2006 | | |

| Annex F Audit Committee Charter | | |

| Annex G Opinion of the Financial Advisor | | |

MAXCO, INC.

1005 Charlevoix Dr., Suite 100

Grand Ledge, Michigan 48837

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Maxco, Inc. (the “Company”), 1005 Charlevoix Dr. Suite 100, Grand Ledge, Michigan 48837, for use at the Annual Meeting of Shareholders of the Company to be held on January 30, 2007, at 10:30 a.m., or any adjournments thereof. This proxy statement and the enclosed form of proxy are first being mailed to stockholders on or about January 16, 2007.

PURPOSE OF THE MEETING

The purpose of this Annual Meeting of Shareholders shall be (i) to approve and adopt the sale of substantially all of the assets (the “Transaction”) of our wholly owned subsidiary, Atmosphere Annealing, Inc. (“AAI”), and AAI’s wholly owned subsidiary, BCGW, Inc. (“BCGW”) to Quanex Technologies, Inc., the wholly owned subsidiary of Quanex Corporation, pursuant to the terms of the Asset Purchase and Sale Agreement, dated as of December 13, 2006, by and among Maxco, Inc., AAI, BCGW and Quanex Corporation (the “Asset Purchase Agreement”), (ii) to elect a board of directors and (iii) to transact such other business as may properly come before the annual meeting or any adjournments or postponements of the annual meeting.

VOTING

Common stock, par value $1.00 per share (the “Common Stock”), series three preferred shares, par value $60.00 per share (the “Series Three Preferred Stock”), and series six preferred shares, par value $160 per share (the “Series Six Preferred Stock”) are the only voting stock of the Company. Holders of record at the close of business on December 18, 2006, are entitled to one (1) vote for each share of Common Stock held, and twenty (20) votes for each share of Series Three Preferred Stock held, and twenty (20) votes for each share of Series Six Preferred Stock held. As of September 30, 2006, the Company had 3,454,039 shares of Common Stock, 14,784 shares of Series Three Preferred Stock, and 7,812.5 shares of Series Six Preferred Stock outstanding. Holders of stock entitled to vote at the meeting do not have cumulative voting rights with respect to the election of Directors.

All shares represented by proxies shall be voted FOR each of the matters recommended by management unless the shareholder, or his duly authorized representative, specifies otherwise or unless the proxy is revoked. Any shareholder of record who executes the proxy referred to in this statement may revoke it at any time before it is voted by filing with our corporate secretary a duly executed revocation of proxy, by submitting a duly executed proxy to our corporate secretary with a later date or by appearing at the annual meeting and voting in person. If you are a beneficial owner of our stock, you must contact your nominee as the procedure required to revoke your proxy. All shareholders are encouraged to date and sign the enclosed proxy form, indicate your choice with respect to the matters to be voted upon and return it to the Company.

For Proposal 1 relating to the Transaction, the affirmative vote of a majority of our outstanding voting shares is required in order for the proposal to be approved by our stockholders. For Proposal 2 relating to director elections, the nominees for election as directors will be elected by a plurality of the votes of the voting shares present in person or represented by proxy at the meeting, meaning that the five persons receiving the most votes at the meeting, assuming a quorum is present, are elected as directors of the Company. Most other corporate governance actions, other than elections of directors, are authorized by a majority of the votes cast. Although state law and the articles of incorporation and bylaws of the Company are silent on the issue, it is the intent of the Company that proxies received which contain abstentions or broker non-votes as to any matter will be included in the calculation as to the presence of a quorum, but will not be counted as votes cast in favor of such matter in the calculation as to the needed vote.

Max A. Coon, the Chairman of our Board, EM Investors, LLC(“EM”), and ROI Capital Management, Inc. (“ROI”) have each entered into a voting agreement indicating that they will vote, or cause to be voted, voting shares that they directly control, or indirectly control in a brokerage account, in favor of the Transaction. As of December 18, 2006, the shares of voting stock directly controlled or indirectly controlled in a brokerage account held by Mr. Coon, EM and ROI, represents approximately 55.44% of the voting power of our stock and, if voted as indicated in the voting agreements, will provide the requisite vote required for approval of the Transaction.

SUMMARY TERM SHEET

At the annual meeting, you will be asked to consider and vote upon a proposal to approve the Transaction, which may be deemed to be a sale of substantially all of our assets. This summary highlights selected information from this proxy statement and the Asset Purchase Agreement and may not contain all of the information about the Transaction that is important to you. To understand the Transaction fully and for a more complete description of the legal terms of the Transaction, you should carefully read this proxy statement, the Asset Purchase Agreement and the other documents to which we refer you in their entirety.

The parties to the Asset Purchase Agreement are Maxco, Inc. (“Maxco” or “Company”), and our subsidiary, Atmosphere Annealing, Inc. (“AAI”), and AAI’s subsidiary, BCGW, Inc. (“BCGW”), all of which are Michigan corporations, and Quanex Technologies, Inc. (“Quanex”) and Quanex Corporation, both of which are Delaware corporations. AAI and BCGW are the sellers, and Quanex is the purchaser. In this proxy statement, the terms “we,” “us,” our,” “our company” and “the Company” refer to Maxco.

| · | Description of the Assets to be Sold (page 11) |

We have agreed to sell to Quanex substantially all of the assets (except for certain assets to be retained discussed below) relating to our AAI and BCGW business (collectively, “AAI business”), including all tangible assets (including all machinery, equipment, fixed assets, furniture, tools, dies, automobiles, trucks, loaders, vehicles and other rolling stock, maintenance equipment and materials), data processing hardware and software, inventory, owned real estate, intangibles, other current assets, permits, accounts receivable, books and records, all contracts that relate to the AAI business, all purchase orders incurred in the ordinary course of business, certain insurance claims relating to assumed obligations, certain warranty and indemnification rights, the name “Atmosphere Annealing” and certain other assets. The business and assets of AAI and BCGW being sold accounted for 100% of our revenues for the fiscal year ending March 31, 2006 and the six months ending September 30, 2006.

| · | Description of the Assets to be Retained by Maxco (page 12) |

We will retain all other assets of AAI and BCGW not sold to Quanex, including the following: employee benefits and records, cash investments and cash equivalent items, certain corporate records, BCGW stock, foreign qualifications, taxpayer and other identification numbers, tax benefits and rights to refunds including rights to any net operating losses, rights under debt agreements, receivables by related parties, insurance contracts and policies or refunds, deposits or rights under such contracts, any assets, contracts or rights relating to AAI benefit plan rights and prepaid loan closing costs and related accumulated amortization. We will also retain all other assets that are owned by us, including our investments in other real estate and in other companies.

| · | Description of Liabilities to be Assumed (page 12) |

Quanex has agreed to assume certain liabilities relating to our AAI business, including: obligations under contracts and purchase orders assigned to Quanex except for obligations arising from a breach or default by AAI or BCGW, accounts payable, all warranty obligations to repurchase or replace products in process before consummation of the Transaction up to $75,000 and accrued employee compensation including vacation,, holiday pay, and bonuses as of the effective time of the Transaction.

| · | Description of Liabilities to be Retained by AAI, BCGW and Maxco (page 12) |

We will retain all liabilities not assumed by Quanex, including liabilities relating to: any liabilities or obligations relating to assets not being purchased by Quanex, all debt or other obligations relating to borrowed money or interest payable on such debt or prepayment which debt is estimated to be $11.5 million; any liability or obligation for any taxes of either AAI or BCGW including tax accruals for periods prior to closing plus any taxes due for the period prior to the sale or taxes caused by the sale, fees and expenses incurred as a result of the proposed Transaction, any obligation for employees or employee benefit plans except as specifically assumed, any environmental liabilities of AAI, BCGW, or any of their affiliates or relating to the operation of the AAI business or assets being sold arising before the Transaction, certain payables related to affiliates of AAI or BCGW, product liability claims if the replacement costs are over $75,000, certain litigation matters, any other general obligations not specifically assumed relating to events occurring, or arising from ownership or use of the assets being sold, or conduct of the AAI business prior to the effective time of the Closing, and any other liability not specifically assumed.

| · | Purchase Price (page 13) |

The total purchase price is $58 million, subject to an adjustment for the working capital of AAI as of the Closing Date and subject to an adjustment for the AAI earnings before income taxes, depreciation and amortization as of December 31, 2006 if below $9.6 million. Additionally, $2 million is to be held in escrow for three to four years, depending on the satisfaction of certain conditions, to assure compliance with environmental representations and warranties, and $3 million of the purchase price is to be held in escrow for 18 months to assure compliance with certain representations, warranties, and covenants, including environmental claims that exceed the environmental escrow. Upon consummation of the Transaction, at Closing, AAI will receive $49.975 million in cash, and BCGW will receive $3.025 million in cash, in each case, as adjusted pursuant to the Asset Purchase Agreement to prorate pre-and post-closing expenses, deposits and other liabilities.

| · | Reasons for the Transaction (page 18) |

We are proposing to sell our AAI business to Quanex because we believe that the Transaction and the terms of the Asset Purchase Agreement are in the best interests of Maxco and our stockholders. In reaching its determination to approve the Transaction, the Asset Purchase Agreement and related agreements, our board of directors consulted with senior management and our financial and legal advisors and considered a number of factors, including other potential strategic alternatives, the opportunities and challenges facing Maxco. and the terms of the Asset Purchase Agreement. Maxco has been in default since January 1, 2002 on the payments due to preferred stockholders, which is at a 10% rate. Without a sale, there is no immediate prospect of paying these dividends, and the liabilities will continue to accrue. We also reviewed the nature of the AAI business and the high capital requirements for that business and concluded that a sale would maximize the amount of cash available for distribution to stockholders.

| · | Terms of the Asset Purchase Agreement (page 10) |

The Asset Purchase Agreement is the primary legal document governing the rights and obligations of Maxco, AAI, BCGW, Quanex, and Quanex Corporation. In the Asset Purchase Agreement, we make certain representations and warranties and agree to perform or to refrain from performing certain actions. You are encouraged to carefully read the Asset Purchase Agreement, a copy of which is attached as Annex A to this proxy statement.

| · | Recommendation of Our Board of Directors (page 21) |

After careful consideration, our board recommends that you vote FOR the proposal to approve and adopt the Transaction (Proposal no. 1) pursuant to the Asset Purchase Agreement.

| · | Vote Required to Approve the Transaction (page 21) |

The Transaction requires approval and adoption by the holders of a majority of the outstanding shares of our common stock and voting preferred entitled to vote on the Transaction. If we fail to obtain the requisite vote for the proposal, we will not be able to consummate the Transaction

| · | Representations, Warranties and Covenants (page 14) |

Under the Asset Purchase Agreement, we have made a number of representations, warranties and covenants, including non-compete provisions and other customary representations, warranties and covenants governing the operation of our AAI business prior to the closing. Certain of the proceeds of the sale will be held in escrow to assure the compliance with the representation, warranties and covenants. $2 million will be held in escrow for three to four years, depending on the satisfaction of certain conditions, to assure compliance with the environmental warranties and covenants. $3 million will be held in escrow for a period of 18 months to assure Quanex and Quanex Corporation of the accuracy of the representations and warranties and the performance of the covenants, including environmental claims that exceed the environmental escrow. We have also agreed not to solicit or negotiate any other offers for the assets being sold under the Asset Purchase Agreement.

| · | Conditions to Completion of the Transaction (page 15) |

Each party’s obligations to consummate the Transaction are subject to the prior satisfaction or waiver of a number of closing conditions, including the following: the representations and warranties of the parties to the transaction shall be true and correct, each party shall have performed or complied with all of its covenants, obligations and agreements required by the Asset Purchase Agreement on or before the closing date, all applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 shall have expired or been terminated without any action to prevent the consummation of the Transaction, no temporary restraining order, preliminary injunction, injunction or other pending or threatened action by any third party or governmental authority shall be in effect that would restrain or prohibit the consummation of the Transaction and each party shall have delivered to the other party the documents required by the Asset Purchase Agreement.

Quanex’s obligations to effect the Transaction contemplated by the Asset Purchase Agreement are subject to the prior satisfaction or waiver of a number of additional conditions, including the following: Quanex shall have received a binding commitment to issue a policy of title insurance for the owned real property, AAI and BCGW shall have obtained all of the necessary consents required by the Asset Purchase Agreement, the findings of the environmental assessment shall be satisfactory to Quanex, AAI shall have obtained certain successor liability insurance policies, AAI shall have made certain amendments to its employee handbook and shall have satisfied certain obligations with respect to employee vacation pay, Sanjeev Deshpande shall have executed an employment agreement with Quanex and no material adverse effect on AAI or BCGW shall have occurred and be continuing.

Maxco’s obligations to effect the Transaction contemplated by the Asset Purchase Agreement are subject to the prior satisfaction or waiver of one additional condition, which is the approval of Maxco’s shareholders.

| · | Termination of the Asset Purchase Agreement; Expense Reimbursement (page 16) |

We and Quanex may terminate the Asset Purchase Agreement by mutual agreement and under other circumstances specified in the Asset Purchase Agreement, including by mutual written agreement, if under certain conditions, the closing shall not have occurred by February 28, 2007 through no fault of either party, in the event of a court or other governmental authority ruling prohibiting the Transaction, or in the event of an uncured breach of a material representation, warranty or covenant under the Asset Purchase Agreement.

| · | Interests of Certain Persons in the Transaction (page 22) |

On April 20, 2004 the Company entered into an incentive agreement with Sanjeev Deshpande, the President of AAI and a director of Maxco. The agreement provides for compensation Mr. Deshpande based on the increased value, as defined, of AAI by March 31, 2006. The incentive is equal to 1% of the first $25 million in value plus 10% above that base amount. Because of the special effort made by Mr. Deshpande, the Company intends to pay such incentive bonus even though the proposed sale of assets to Quanex is to occur after March 31, 2006. The total amount of such incentive compensation is expected to be approximately $3.44 million, subject to a final closing, certain adjustments to be made at closing on the sale price, and any adjustments resulting from escrow claims. As party to the agreement, Maxco has previously recognized incentive compensation expense on a pro-rata basis under the terms of the agreement. As of March 31, 2006, the amount accrued was $2.0 million. Other than these agreements, no director, executive officer, associate of any director or executive officer or any other person has any substantial interest, direct or indirect, by security holdings or otherwise, in the asset sale that is not otherwise shared on a pro rata basis by all other stockholders of the same class.

| · | Tax Consequences of the Transaction (page 22) |

The sale of assets by Maxco pursuant to the Asset Purchase Agreement will be a taxable transaction for United States federal income tax and state tax purposes as discussed in this proxy statement.

| · | No Appraisal or Dissenters’ Rights (page 22) |

Holders of stock are not entitled to appraisal or dissenters’ rights in connection with the Transaction under the Michigan Business Corporation Act, our Articles of Incorporation, as amended, or our Bylaws, as amended. There may exist other rights or actions under federal law or state securities law for stockholders who are aggrieved by the proposed Transaction generally. Although the nature and extent of such rights or actions are uncertain and may vary depending upon facts or circumstances, stockholder challenges to corporate action in general are related to fiduciary responsibilities of corporate officers and directors and to the fairness of corporate transactions.

| · | Regulatory Approvals (page 22) |

The Transaction is subject to review by the United States Federal Trade Commission and the Antitrust Division of the United States Department of Justice under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. The required filings were made in December 2006.

QUESTIONS AND ANSWERS ABOUT THE TRANSACTION,

THE ASSET PURCHASE AGREEMENT AND THE ANNUAL MEETING

Following are some commonly asked questions that may be raised by our stockholders and answers to each of those questions.

1. WHAT AM I BEING ASKED TO VOTE ON AT THE ANNUAL MEETING?

You are being asked to consider and vote on three proposals: 1) a proposal to approve and adopt the sale of substantially all of the assets relating to our AAI business to Quanex pursuant to the Asset Purchase Agreement among Maxco, AAI (our subsidiary), BCGW (AAI’s subsidiary) and Quanex and its parent company, Quanex Corporation, (for a purchase price of $58,000,000 in cash (subject to escrowed monies and adjustment), 2) a proposal to elect five directors to serve until the next annual meeting, and 3) a proposal to transact such other business as may properly come before the annual meeting or any adjournments or postponements of the annual meeting.

2. WHAT DOES IT MEAN TO SELL SUBSTANTIALLY ALL OF THE ASSETS RELATING TO OUR "AAI BUSINESS"?

We are proposing to sell to Quanex substantially all of the assets related to the AAI business we have historically conducted in the AAI subsidiary, including metal heat treating, phosphate coating and bar shearing and sawing services to the cold forming, stamping, forging and casting industries, as well as the real estate owned by AAI and BCGW upon which AAI conducts its operations. We refer to this as our AAI business in this proxy statement.

3. WHAT WILL HAPPEN IF THE TRANSACTION IS APPROVED AND ADOPTED BY OUR STOCKHOLDERS?

If the Transaction pursuant to the Asset Purchase Agreement is approved and adopted by our stockholders, we will sell substantially all of the assets relating to our AAI business to Quanex under the terms of the Asset Purchase Agreement, as more fully described in this proxy statement. In connection with the Transaction, we have made certain covenants, representations and warranties, as more fully described in this proxy statement. Following the sale of the assets relating to the AAI business, we will have no immediate significant operating product or services business but will only retain the Company’s interest in certain real estate ventures, its investments in Integral Vision, Inc, Phoenix Financial Group, Robinson Oil, Provant Inc., and other miscellaneous assets. We will continue our efforts to resolve outstanding liabilities and prosecute and pursue other claims as appropriate that we may have against third parties. We also intend to evaluate and potentially explore all available alternatives. We will continue to work to maximize stockholder interests with a goal of returning value to our stockholders. As part of the closing, the Company will be obligated to pay certain outstanding liabilities secured by the assets of AAI and BCGW, which are approximately $11.8 million. Although our board of directors has not yet made any determination, the alternatives then may include redemption of part or all outstanding preferred shares (with approximately $7.4 million outstanding face value and accrued dividends as of December 31, 2006), dissolution and liquidation of Maxco, a going private transaction effected through a reverse stock split or otherwise in order to reduce the costs associated with being a public company, an extraordinary dividend or other transactions to maximize stockholder value and manage our outstanding liabilities.

4. WHAT WILL HAPPEN IF THE TRANSACTION IS NOT APPROVED AND ADOPTED BY OUR STOCKHOLDERS?

If the Transaction is not approved by our stockholders, we will not sell our assets to Quanex and we will continue to conduct our business in the ordinary course and evaluate all available strategic alternatives. However, because of the voting agreements with Max A. Coon, EM, and ROI, we anticipate that the requisite approval of our shareholders will be obtained.

5. WHEN IS THE TRANSACTION EXPECTED TO BE COMPLETED?

6. HOW WAS THE PURCHASE PRICE FOR THE ASSETS DETERMINED?

The purchase price for the assets proposed to be sold to Quanex was negotiated between representatives of Maxco and representatives of Quanex. The Company also actively sought other purchasers through GBQ Consulting, LLC (“GBQ”) the Company’s financial consultants. After considering the financial wherewithal of other potential buyers and their respective levels of interest, we determined that Quanex’s offer provided the best value for the Company and its shareholders.

7. AM I ENTITLED TO APPRAISAL OR DISSENTERS’ RIGHTS IN CONNECTION WITH THE TRANSACTION?

No. Michigan law does not provide for stockholder appraisal or dissenters’ rights in connection with the sale of the Company's assets. There may exist other rights or actions under federal law or state securities law for stockholders who are aggrieved by the proposed Transaction generally. Although the nature and extent of such rights or actions are uncertain and may vary depending upon facts or circumstances, stockholder challenges to corporate action in general are related to fiduciary responsibilities of corporate officers and directors and to the fairness of corporate transactions.

8. WHAT WILL HAPPEN TO MY MAXCO SHARES IF THE TRANSACTION IS APPROVED?

The Transaction will not alter the rights, privileges or nature of the outstanding shares of Maxco. A stockholder who owns shares of Maxco common stock immediately prior to the closing of the Transaction will continue to hold the same number of shares immediately following the closing. It is possible that the Board may later determine to redeem part or all of the outstanding preferred stock which would eliminate those preferred shares so redeemed and decrease the obligation the Company has under such shares.

9. HOW DOES THE BOARD RECOMMEND THAT I VOTE ON THE PROPOSAL?

The board of directors recommends that you vote FOR the proposal to approve and adopt the Transaction pursuant to the Asset Purchase Agreement.

10. HOW DO I VOTE?

Sign and date each proxy card you receive and return it in the enclosed envelope prior to the annual meeting.

11. CAN I CHANGE MY VOTE?

Yes.

If you are a stockholder of record (other than Max A. Coon, EM, or ROI), you may change your proxy instructions at any time before your proxy is voted at the annual meeting. Proxies may be revoked by taking any of the following actions:

| · | filing a written notice of revocation with our corporate secretary at our principal executive office (1005 Charlevoix Drive, Suite 100, Grand Ledge, MI 48837); |

| · | filing a properly executed proxy showing a later date with our corporate secretary at our principal executive office; or |

| · | attending the annual meeting and voting in person (although attendance at the meeting will not, by itself, revoke a proxy). |

If you are a beneficial owner of our stock (other than Max A. Coon, EM, or ROI), you must contact your nominee as the procedure required to revoke your proxy.

12. WHAT SHARES ARE INCLUDED ON THE PROXY CARD(S)?

The shares on your proxy card(s) represent ALL of your shares. If you do not return your proxy card(s), your shares will not be voted.

13. WHAT DOES IT MEAN IF I GET MORE THAN ONE PROXY CARD?

If your shares are registered differently and are in more than one account, you will receive more than one proxy card. Sign and return all proxy cards to ensure that all your shares are voted.

14. WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING?

Only holders of record of our common stock and voting preferred stock (series three and six) as of the close of business on December 18, 2006 are entitled to vote at the annual meeting.

Each share of common stock is entitled to one vote, and each share of series three preferred and series six preferred is entitled to 20 votes. At the close of business on the record date, December 18, 2006, the Company had 3,454,039 shares of common stock outstanding and entitled to vote, 14,784 shares of series three preferred outstanding and entitled to vote, and 7,812.5 shares of series six preferred outstanding and entitled to vote, for a total of 3,905,969 shareholder votes. As of December 18, 2006, the shares of voting stock directly controlled or indirectly controlled in a brokerage account held by Mr. Coon, EM and ROI, represent approximately 55.44% of the voting power of our stock and, if voted as indicated in their voting agreements will provide the requisite vote required for approval of the Transaction. A stockholder may vote: (a) shares that are held of record directly in the stockholder's name, and (b) shares held for the stockholder, as the beneficial owner, through a broker, bank or other nominee.

16. WHAT IS A "QUORUM" FOR PURPOSES OF THE ANNUAL MEETING?

In order to conduct business at the annual meeting, a quorum must be present. A "quorum" is a majority of the outstanding shares entitled to be voted. The shares may be present in person or represented by proxy at the annual meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum.

17. WHAT VOTE IS REQUIRED TO APPROVE THE PROPOSAL?

Once a quorum has been established, for the Transaction to be approved and adopted, a majority of our outstanding voting shares (common shares, series three preferred shares, and series six preferred shares) must vote FOR the proposal.

If your shares are held in street name, your broker will vote your shares for you only if you provide instructions to your broker on how to vote your shares. You should follow the directions provided by your broker regarding how to instruct your broker to vote your shares. Your broker cannot vote your shares of Maxco common stock without specific instructions from you. Because the affirmative vote of a majority of the outstanding shares of Maxco common stock and voting preferred is required to approve and adopt the Transaction and the Asset Purchase Agreement, if you fail to provide your broker with instructions on how to vote your shares, your vote will not count as votes cast on the proposal to approve and adopt the Transaction pursuant to the Asset Purchase Agreement.

18. WHAT HAPPENS IF I ABSTAIN?

Proxies marked "abstain" will be counted as shares present for the purpose of determining the presence of a quorum, but for purposes of determining the outcome of a proposal, shares represented by such proxies will not be treated as votes cast on the proposal.

19. HOW WILL VOTING ON ANY OTHER BUSINESS BE CONDUCTED?

Although we do not know of any business to be considered at the annual meeting other than the proposals described in this proxy statement to (i) approve and adopt the Asset Purchase Agreement, (ii) elect a board of directors and (iii) transact any other business properly presented at the annual meeting, your signed proxy card in favor of transacting such business gives authority to the proxy holders, Max A. Coon and Eric L. Cross, to vote on such matters.

20. WHO WILL BEAR THE COST OF THIS SOLICITATION?

Maxco will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. We will provide copies of these proxy materials to banks, brokerages, fiduciaries and custodians holding in their names shares of our common stock and voting preferred beneficially owned by others so that they may forward these proxy materials to the beneficial owners. We may solicit proxies by personal interview, mail, telephone and electronic communications. Maxco has not retained a proxy solicitor to assist with the solicitation of proxies for the annual meeting. Our directors, officers, and employees (acting without additional compensation) may assist in soliciting proxies by telephone, email, or direct contact. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to the beneficial owners.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Those statements herein that involve expectations or intentions (such as those related to the closing of the Transaction contemplated by the Asset Purchase Agreement) are forward-looking statements within the meaning of the U.S. securities laws, involving risks and uncertainties, and are not guarantees of future performance. You are cautioned that these statements are only predictions and that forward-looking statements are subject to a number of risks, assumptions and uncertainties that could cause actual results to differ materially from those projected in such forward-looking statements. These risks, assumptions and uncertainties include, but are not limited to: future decisions by the SEC or other governmental or regulatory bodies; the vote of our stockholders; business disruptions resulting from the announcement of the Transaction; uncertainties related to litigation; economic and political conditions in the U.S. and abroad; and other risks outlined in our filings with the SEC, including the annual report on Form 10-K for the year ended March 31, 2006. All forward-looking statements are effective only as of the date they are made and we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PROPOSAL 1

This section of the proxy statement describes certain aspects of the sale of substantially all of the assets relating to our AAI business to Quanex. However, this description may not be complete or may not provide all the information that may be important to you. We highly recommend that you carefully read the complete Asset Purchase Agreement included as Annex A to this proxy statement for the precise legal terms of the agreement and other information that may be important to you.

The Companies

Maxco, AAI, and BCGW

Maxco is a Michigan corporation incorporated in 1946. Maxco currently operates in the heat-treating business segment through AAI, a production metal heat-treating service company. Maxco also has investments in real estate and investments representing less than majority interests in the following businesses: a registered broker-dealer of securities that is primarily focused on the trading of fixed income investments (Phoenix Financial Group); a developer, manufacturer and marketer of microprocessor-based process monitoring and inspection systems for use in industrial manufacturing environments (Integral Vision, Inc.); and an energy-related business (Robinson Oil). Maxco also has several investments in real estate and has money owed to it in the form of notes receivables. The address of Maxco’s principal executive office is 1005 Charlevoix Drive, Suite 100, Grand Ledge, MI 48837, and the telephone number of its principal executive office is (517) 627-1734.

Atmosphere Annealing, Inc., a Michigan corporation, provides metal heat treating, phosphate coating and bar shearing and sawing services to the cold forming, stamping, forging and casting industries. Its services are sold through AAI’s own sales personnel and outside sales representatives, primarily to automotive companies and automotive suppliers. This unit’s facilities are located in Lansing, Michigan; Canton, Ohio; and North Vernon, Indiana. The facilities in Ohio and Indiana are located on real estate owned by AAI. The facilities in Michigan are located on real estate owned by AAI’s wholly owned subsidiary, BCGW, also a Michigan corporation. The address of the principal executive office of both AAI and BCGW is 209 W. Mt. Hope Ave., Lansing, MI 48910, and the telephone number is (517) 485-5090.

Since AAI is a service business, inventory levels for this segment are traditionally small and consist mainly of steel inventory, various lubricants and other materials used in the heat treating, phosphate coating or bar shearing and sawing process. The majority of heat treating services are completed on customer owned parts shipped to AAI’s plants for heat treating. Title to these parts does not transfer to AAI and therefore customer owned parts heat treated by AAI are not included in AAI’s inventory. Inventories of this segment represent 100% of Maxco’s total inventories at March 31, 2006.

AAI is a service provider, not a manufacturer. With one exception, the parts processed are customer owned parts and therefore the right to return is not a material issue. Extended payment terms are not provided to customers.

The heat-treating industry is competitive with over 250 heat treaters in Michigan, Ohio, and Indiana. AAI specializes in high volume, ferrous heat-treating, using large furnaces. In its market niche of this type of heat-treating, AAI competes with only a limited number of competitors. Much of the commercial heat treating industry is comprised of smaller companies that specialize in batch heat-treating such as carburizing, nitriding, tool and die, brazing, salt bath or induction hardening.

Quanex Technologies, Inc. and Quanex Corporation

Quanex Corporation was organized in 1927 as a Michigan corporation under the name Michigan Seamless Tube Company. Quanex Corporation reincorporated in Delaware in 1968 under the same name and then changed its name to Quanex Corporation in 1977. Quanex Corporation’s businesses are focused on two end markets, vehicular products and building products, and are managed on a decentralized basis. Each business has administrative operating and marketing functions. Quanex Corporation measures each business’ return on investment and seeks to reward superior performance with incentive compensation, which is a significant portion of total compensation for salaried employees. Intercompany sales are conducted on an arms-length basis Operational activities and policies are managed by corporate officers and key division executives. Also, a small corporate staff provides corporate accounting, financial and treasury management, tax, legal, internal audit, information technology and human resource services to the operating divisions.

Quanex Corporation is a technological leader in the production of engineered carbon and alloy steel bars, heat treated bars, aluminum flat-rolled products, flexible insulating glass spacer systems, extruded profiles, and precision-formed metal and wood products which primarily serve the North American vehicular products and building products markets. Quanex Corporation uses state-of-the-art manufacturing technologies, low-cost production processes, and engineering and metallurgical expertise to provide customers with specialized products for specific applications. Quanex Corporation believes these capabilities also provide Quanex Corporation with unique competitive advantages. Quanex’s growth strategy is focused on the continued development of its two target markets, vehicular products and building materials, and protecting, nurturing and growing its core businesses that serve those markets.

Quanex Technologies, Inc. is a wholly owned subsidiary of Quanex Corporation and currently conducts no operations and has no material assets or obligations.

The address of the principal executive officer of Quanex Corporation and Quanex Technologies, Inc. is 1900 West Loop South, Suite 1500 Houston Texas 77027 and the telephone number of its principal executive officer is 713-961-4600.

Description of Assets to be Sold and Retained

Assets to be Sold to Quanex

Subject to and upon the terms and conditions set forth in the asset purchase agreement, we are selling to Quanex substantially all of the assets relating to our AAI business, including the following:

· Tangible assets, including all machinery, equipment, fixed assets, furniture, tools, dies, automobiles, trucks, loaders, vehicles and other rolling stock, and maintenance equipment and materials;

· Data processing hardware and software used in the operation of the AAI business;

· Inventory, including all supplies, materials, work-in-progress, semi-finished goods, finished goods, components, stores, goods in transit, spare parts, packaging materials and other consumables;

· All of the real property owned by AAI and BCGW upon which the AAI business is operated in Lansing, MI, Canton, OH and North Vernon, IN, and all buildings, structures, and improvements thereon,

· Intangibles, including all of the intellectual property of AAI and BCGW used in the AAI business;

· Goodwill and going concern value relating to the AAI business;

· Certain prepaid expenses and prepayments, credits, deposits, employee receivables, letters of credit, claims, certain refunds, rebates, warranties, choses-in-action, certain accounts and certain rights to payment, commodity contracts, and rights under derivative, hedging and similar certain contracts;

· Transferable permits;

· Accounts receivable due as a result of goods sold or services provided by the AAI business, except tax refunds or credits;

· Certain books and records of AAI and BCGW;

· Certain contracts to be assigned and insurance claims relating to our AAI business; and

· Certain warranty and indemnification rights from suppliers related to our AAI business.

Assets to be Retained by AAI and BCGW

We will retain all assets relating to our AAI business not sold to Quanex, including the following:

· All of the pension and employee benefit plan assets, and contracts or rights thereto, of AAI;

· All AAI employee records pertaining to employee performance ratings and evaluations, disciplinary records and medical records;

· All of our cash and cash equivalent items and all equity interests in BCGW;

· Corporate organizational documents and tax returns of AAI and BCGW;

· Foreign qualifications and taxpayer and other identification numbers of AAI and BCGW;

· Tax benefits and rights to refunds, including any rights to net operating losses;

· Rights under debt agreements relating to borrowed money;

· Related party receivables owing to AAI or BCGW;

· All of AAI’s and BCGW’s insurance contracts and policies, and prepaid insurance premiums, deposits, recoveries and rights under any current or prior insurance contracts or policies; and

· Pre-paid loan closing costs and related accumulated amortization.

Liabilities to be Assumed by Quanex

In connection with the purchase of the assets, Quanex will assume certain liabilities related to our AAI business, including:

· Obligations and liabilities of AAI and BCGW under or with respect to the assigned contracts and assigned purchase orders transferred to Quanex that are to be paid, discharged and performed after the closing of the Transaction, but only to the extent they do not arise from a previous default and are attributable to the period after the closing of the Transaction, except for certain taxes;

· Accounts payable, except certain taxes and accrued expenses relating to the assets not sold to Quanex;

· Certain warranty obligations to repurchase or replace products produced in the AAI business; and

· Certain employee compensation accruals, including vacation,, holiday pay, and bonuses, as of the effective time of the Transaction relating to employees offered employment by Quanex or a Quanex affiliate.

Liabilities to be Retained by AAI or Maxco.

We will retain all liabilities not assumed by Quanex, including liabilities relating to:

· All assets not sold to Quanex;

· All debt for borrowed money or interest payables on such debt or prepayment penalties (short and long term; external or inter-company) which is estimated to be $11.5 million as of December 31, 2006;

· Tax accruals for periods prior to closing;

· All employee benefit plans and obligations to employees other than obligations and liabilities relating to certain employee accruals for vacation, holiday pay, and bonuses of employees offered employment by Quanex or a Quanex affiliate;

· Our fees and expenses in connection with the sale;

· Environmental liabilities arising out of the AAI business prior to the effective time of the closing;

· Related party payables owed by AAI and BCGW;

· Certain product liabilities;

· Certain litigation;

· The conduct or operation of our AAI business or the ownership of the transferred assets during the period prior to the effective time of the closing, including contingent liabilities; and

· Any liability or obligation not expressly assumed by Quanex in the Asset Purchase Agreement.

Purchase Price and Adjustments

Quanex has agreed to pay a total of $58 million in cash to AAI and BCGW for the assets to be sold, subject to adjustment for the following:

| · | A performance guarantee that AAI will achieve $9.6 million of EBITDA (as adjusted under the Asset Purchase Agreement) for the 12 month period ending December 31, 2006. Any shortfall in this amount will be subtracted from the purchase price on a dollar-for-dollar basis. |

| · | The purchase price paid at closing is subject to adjustment based on changes in the Working Capital of AAI; “Working Capital” is defined as (i) accounts receivable, plus (ii) inventory, minus (iii) accounts payable, minus (iv) accrued employee compensation payables. The consolidated Working Capital of AAI as of June 30, 2006, less $446,453.00, is defined as the "Baseline Working Capital Amount". A “Statement of Working Capital” will be prepared as of the closing date using the same methodology as was used to prepare the calculation of the Baseline Working Capital Amount, except that the $446,453.00 will not be subtracted from the Statement of Working Capital. To the extent that the amount set forth in the Statement of Working Capital is greater than or less than the Baseline Working Capital Amount, the purchase price would be adjusted, upward or downward, on a dollar-for-dollar basis by the full amount of the difference between the amount set forth in the Statement of Working Capital and Baseline Working Capital Amount. For purposes of this adjustment, as well any post closing adjustments, Working Capital would be determined consistent with the past accounting principles, policies and practices of AAI’s business. |

| · | At least two (2) business days prior to the closing, we will deliver to Quanex a preliminary determination of the Statement of Working Capital described above. We will negotiate in good faith with Quanex to resolve any disputes and to reach an agreement prior to the closing date on the preliminary adjustments to the purchase price paid at closing. As soon as practicable, but not later than 30 days after the closing, we must prepare and supply to Quanex (i) unaudited consolidated financial statements of AAI as of the closing date, (ii) a final Statement of Working Capital and an EBITDA statement for the 12 month period ending December 31, 2006. Not later than thirty (30) days after receiving our final Statement of Working Capital and EBITDA statement, Quanex must notify us of any dispute it may have regarding those statements. If we determine that there are any discrepancies, we will negotiate in good faith with Quanex to resolve them. If we cannot resolve the discrepancies we and Quanex will jointly retain a mutually agreeable independent public accounting firm to make a final determination. |

| · | There will be two escrows established. An escrow of $2 million will be established, which is to cover any environmental problems for which we are responsible that may be discovered. This escrow is to last three years from the closing date if authoritative closure has been achieved with respect to any formalized environmental remediation plan filed before the third anniversary of the closing date with respect to the property located at 1801 Bassett Street, Lansing, Michigan and will last four years from the closing date if such closure is not achieved. Another escrow will be to provide funds to return to Quanex in the event that there is a breach of any representation, warranty or covenant (including environmental claims that exceed the environmental escrow), provided in the Asset Purchase Agreement by Maxco, AAI or BCGW. This escrow will contain $3 million, which is to be held for a maximum of 18 months from the closing date. All interest on each of the escrow funds will be paid to Maxco on a quarterly basis. |

Representations and Warranties

Under the terms of the Asset Purchase Agreement, each of Maxco, AAI and BCGW has made certain customary representations and warranties to Quanex and Quanex Corporation, including representations and warranties related to:

· their respective valid corporate existence, authorization and organization;

· the absence of conflicts to consummate the Transaction;

· the consents required in connection with the consummation of the Transaction;

· the accuracy and method of preparation of the balance sheets and related statements of income and cash flow of AAI for the year ended March 31, 2006 and the six months ended October 31, 2006 that we provided under the Asset Purchase Agreement;

· the validity of title and the sufficiency of the assets to be sold;

· their compliance with applicable laws relating to the AAI business;

· certain tax matters relating to the AAI business;

· pending or threatened litigation affecting the AAI business;

· the consulting agreement with GBQ Consulting, LLC;

· contracts relating to the AAI business that will be transferred to Quanex;

· certain employee information and employee benefit matters relating to AAI employees;

· certain environmental matters relating to the AAI business;

· the validity of the list of insurance policies and any unsettled or pending insurance claims;

· the absence of any adverse change since March 31, 2006 to the AAI business;

· the accuracy of the books and records and the listing of the inventory of the AAI business;

· the validity of the accounts receivable in the AAI business;

· customers and suppliers;

· transactions among affiliates; and

· the absence of undisclosed liabilities.

Under the Asset Purchase Agreement, each of Quanex and Quanex Corporation has made certain customary representations and warranties to Maxco, AAI and BCGW, including their valid corporate existence, authorization and organization, the absence of conflicts to consummate the Transaction, the consents which must be obtained to consummate the Transaction and the absence of any litigation to which they are a party that would prohibit consummation of the Transaction.

Covenants

Under the terms of the Asset Purchase Agreement, each of Maxco, AAI and BCGW has agreed to customary covenants, including that at all times prior to the closing of the Transaction, they will cause AAI and BCGW to carry on their business in the ordinary course consistent with past practice, including maintaining inventory levels, paying accounts payable, complying with AAI and BCGW warranty policies and using commercially reasonable efforts to preserve the goodwill of their business and customer, supplier and employee relationships.

Each of Maxco, AAI and BCGW has also agreed that unless Quanex and Quanex Corporation have given their consent, AAI and BCGW will not, and will not agree in writing to:

· enter into, modify or amend any material contracts of the AAI business;

· sell, transfer, lease, encumber or dispose of the assets being sold to Quanex outside of the ordinary course of business;

· increase any rate of compensation to any AAI employee, or amend any AAI employee benefit plan, except as otherwise disclosed;

· incur any obligation or liability except in the ordinary course of the AAI business which would not have a material adverse effect on the AAI business;

· forgive, cancel or compromise any material debt or claim, or intentionally waive or release any material right of substantial value;

· fail to maintain the tangible assets to be sold in normal operating repair, working order and maintenance, consistent with past practice

· make any cash payments or prepayments of accounts payable other than in the ordinary course of business;

· acquire any assets or assume any liabilities which would be transferred to Quanex, except in the ordinary course of business;

· change any accounting policies, principles, or methods or make any material changes to selling practices or product return policies;

· declare or pay any dividend or other capital stock distribution; and

· make any advances to any AAI or BCGW employee in excess of $10,000.

Toward consummation of the Transaction, Maxco, AAI, BCGW, Quanex and Quanex Corporation have also agreed to proceed with filings required by the Hart-Scott-Rodino Antitrust Improvements Act of 1976, obtain the consents needed to consummate the Transaction, provide Quanex and Quanex Corporation with reasonable access to perform due diligence, exchange title commitments and surveys for the real property to be sold, prepare documents to effectuate transfer of the assets to be sold, and pro-rate real and personal property taxes.

Each of Maxco, AAI, BCGW, Quanex and Quanex Corporation has also agreed that (i) any public announcements made relating to the Transaction must be agreed to by Quanex Corporation and Maxco and (ii) for a period of 5 years after closing, Maxco, AAI, BCGW, Quanex and Quanex Corporation, and their respective officers, directors, affiliates, employees, agents and representatives, will keep proprietary and other non-public information about each other confidential (except as otherwise required by law).

Under the terms of the Asset Purchase Agreement, neither Maxco, AAI nor BCGW, nor any of their directors, officers employees, representatives or agents, shall directly or indirectly solicit, encourage, respond to, negotiate or assist in any offers, bids, or proposals, involving the sale or other disposition of the AAI business (other than in the ordinary course of business), or the sale or exchange of the stock of AAI or BCGW, other than with Quanex and Quanex Corporation.

Indemnification Provisions

Our Indemnification Obligations. Under the terms of the Asset Purchase Agreement, Maxco, AAI and BCGW have agreed to indemnify Quanex and Quanex Corporation, certain of their affiliates, and their stockholders, officers, directors, employees, agents, representatives, successors and assigns, from and against any and all damages incurred or suffered by any of them, arising out of, or relating to any of the following:

· any breach of any of our representations or warranties made in the Asset Purchase Agreement and other transaction documents delivered in connection with the consummation of the Transaction;

· any breach or failure by us to perform any or our covenants or obligations under Asset Purchase Agreement and other Transaction documents delivered in connection with the consummation of the Transaction;

· the ownership of the assets or operation of the AAI business not being sold to Quanex;

· any failure to comply with any applicable bulk transfers or sales laws;

· any AAI employee benefit plan or other employee benefit liabilities not being assumed by Quanex;

· the employment of any of our employees by us;

· any employee termination matters arising from any of our acts or omissions or the decision by Quanex not to hire our employees;

· any COBRA liabilities arising from any employees not hired by Quanex;

· the ownership of the assets or operation of the AAI business prior to the effective time of the closing; and

· our liabilities not being assumed by Quanex; and

· any environmental liabilities relating the assets being sold, or the AAI business, arising from or attributable to any period before the effective time of the closing.

However, we are generally not required to indemnify Quanex or any other indemnified party described above for damages arising or incurred from the matters described above (except as to our liabilities not being assumed by Quanex or any breach of any or our representations, warranties or covenants relating to taxes) until such damages exceed $100,000 in the aggregate, but in such event, we will only be responsible for any such damages to the extent they exceed $100,000 in the aggregate, and then only up to a maximum of $5,800,000. We remain responsible to indemnify Quanex and any other indemnified party described above for all damages arising or incurred from any of our liabilities not being assumed by Quanex, and any breach of our representations, warranties or covenants relating to taxes. Further our indemnification obligations are subject to certain time frames, and subject to reduction by any recovery of applicable amounts from third parties by Quanex or any indemnified party described above.

Quanex and Quanex Corporation’s Indemnification Obligations. Under the terms of the Asset Purchase Agreement, Quanex and Quanex Corporation have agreed to indemnify Maxco, AAI, BCGW, certain of their affiliates, and their stockholders, officers, directors, employees, agents, representatives, successors and assigns, from and against any damages incurred or suffered by any of the foregoing, arising out of, or relating to any of the following:

· any breach of any of Quanex’s or Quanex Corporation’s representations or warranties made in the Asset Purchase Agreement and other Transaction documents delivered in connection with the consummation of the Transaction;

· any breach or failure by Quanex or Quanex Corporation to perform any of their covenants or obligations under the Asset Purchase Agreement and other Transaction documents delivered in connection with the consummation of the Transaction;

· any of our liabilities being assumed by Quanex; and

· certain losses directly caused by Quanex or Quanex Corporation’s access and inspections of the AAI business other than certain losses related to the detection, discovery or evaluation of hazardous substances in the course of those inspections.

However, Quanex and Quanex Corporation are generally not required to indemnify us or any other indemnified party described above for damages arising or incurred from the matters described above (except as to our liabilities assumed by Quanex) until such damages exceed $100,000 in the aggregate, but in such event, they will only be responsible for any such damages to the extent they exceed $100,000 in the aggregate, and then only up to a maximum of $3,000,000. Quanex and Quanex Corporation remain responsible for all damages arising or incurred from any of our liabilities being assumed by Quanex. Further, Quanex and Quanex Corporation’s indemnification obligations are subject to certain time frames, and subject to reduction by any recovery of applicable amounts from third parties by us or any indemnified party described above.

Conditions to Completion of the Asset Sale

The parties' obligations to consummate the asset sale are subject to the prior satisfaction, or waiver by the requiring party, of the conditions set forth below:

· the representations and warranties of Maxco, AAI, BCGW, Quanex, and Quanex Corporation in the Asset Purchase Agreement and other Transaction documents delivered in connection with the consummation of the Transaction must be true and correct as of specified times;

· Maxco, AAI, BCGW, Quanex and Quanex Corporation shall have performed and complied with all of their respective covenants, obligations and agreements contained in the Asset Purchase Agreement;

· all applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, shall have expired or been terminated without action by the Justice Department or the Federal Trade Commission to prevent the consummation of the Transaction described in the Asset Purchase Agreement and the documents to be delivered in connection therewith;

· there shall not be any injunctions, court or other governmental orders, issued, pending or threatened by any third party restraining or prohibiting the closing of the Transaction described in the Asset Purchase Agreement and the documents to be delivered in connection therewith;

· Quanex shall have received possession of the assets being purchased, and all documents required of Maxco, AAI and BCGW in connection with the Asset Purchase Agreement, including all documents to be delivered by Maxco, AAI and BCGW at closing, required consents, the required title insurance commitments and policies for the real estate it is purchasing, required documents of transfer for the assets being purchased, required documents related to unassignable permits or contracts; required officers’ certificates, and the required legal opinion of our counsel;

· We shall have received the payment of the purchase price to be paid at closing, and all documents required of Quanex and Quanex Corporation in connection with the Asset Purchase Agreement, including all documents to be delivered by them at closing, required consents, required officers’ certificates, and the required legal opinion of their counsel; and

· approval and adoption by our stockholders of the Transaction pursuant to the Asset Purchase Agreement.

· AAI shall have obtained successor liability and discountinued product liability insurrance coverage for commercial general liabilities and aviation related liabilities, including all liabilities related to product produced or in process before the closing of the Transaction, naming Quanex as an additional insured. Each of these policies shall provide limits of liability of $2.0 million, with no deductible, and shall be in force for 3 years beginning on the closing date.

· AAI shall have amended its employee manual and satisified all employee compensation obligations, including as to vacation pay, that are not being assumed by Quanex.

· Sanjeev Deshpande shall have executed an employment agreement with Quanex.

Termination of the Asset Purchase Agreement

The Asset Purchase Agreement may be terminated and the Transaction may be abandoned at any time prior to the closing (whether before or after stockholder approval) upon any of the following circumstances:

· by mutual written consent of Maxco, and Quanex Corporation;

· by Maxco or Quanex Corporation if the closing does not occur by March 1, 2007, other than as a result of a failure by the party proposing to terminate the Asset Purchase Agreement to perform any of its obligations;

· by Maxco or Quanex Corporation if any court of competent jurisdiction, or other governmental authority shall have issued a final and non-appealable order, decree or ruling permanently restraining, enjoining or otherwise prohibiting consummation of the Transaction described in the Asset Purchase Agreement;

· by Maxco, upon Quanex or Quanex Corporation's failure to timely cure a material breach of any of their representations, warranties, covenants or agreements contained within the Asset Purchase Agreement;

· by Quanex Corporation, upon Maxco, AAI or BCGW’s failure to timely cure a material breach of any their representations, warranties, covenants or agreements contained within the Asset Purchase Agreement.

Effect of Termination

If the Asset Purchase Agreement is properly terminated, all obligations of the parties thereto shall terminate, except for: (i) the indemnification provisions described above, (ii) certain dispute resolution provisions, (iii) certain miscellaneous provisions including amendment, interpretation, notice and other miscellaneous provisions and (iii) certain confidentiality provisions, including certain provisions regarding employee non-solicitation.

Background of the Transaction

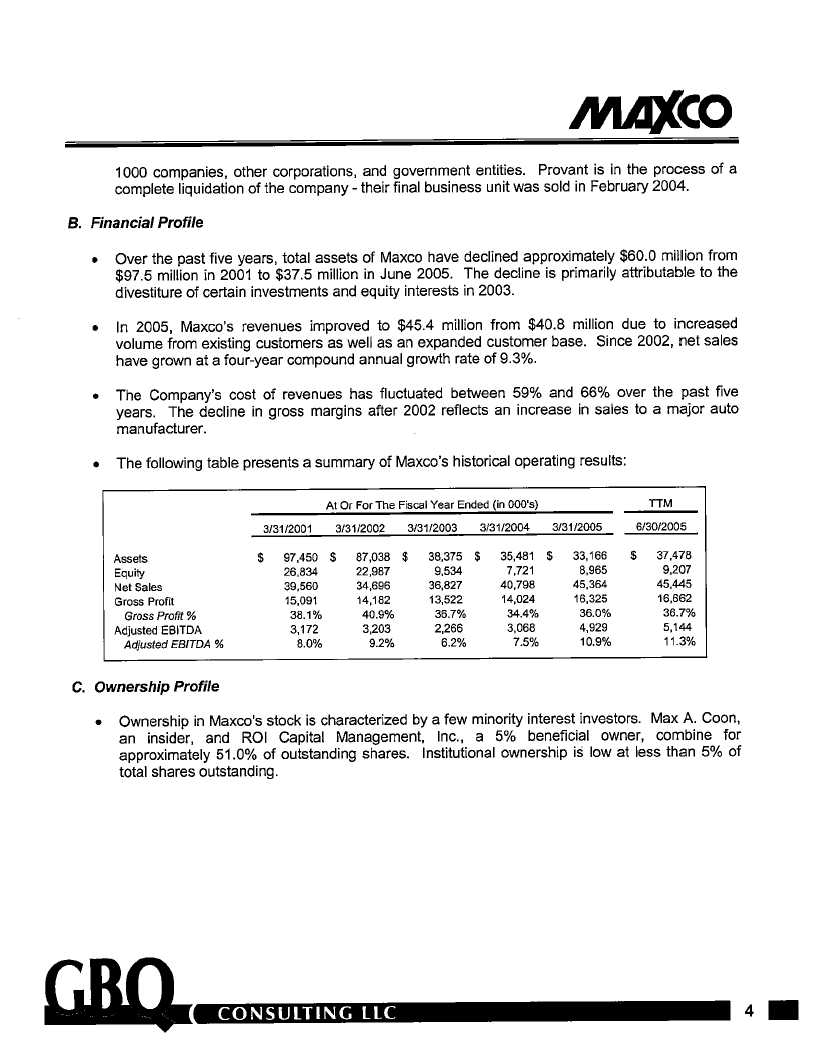

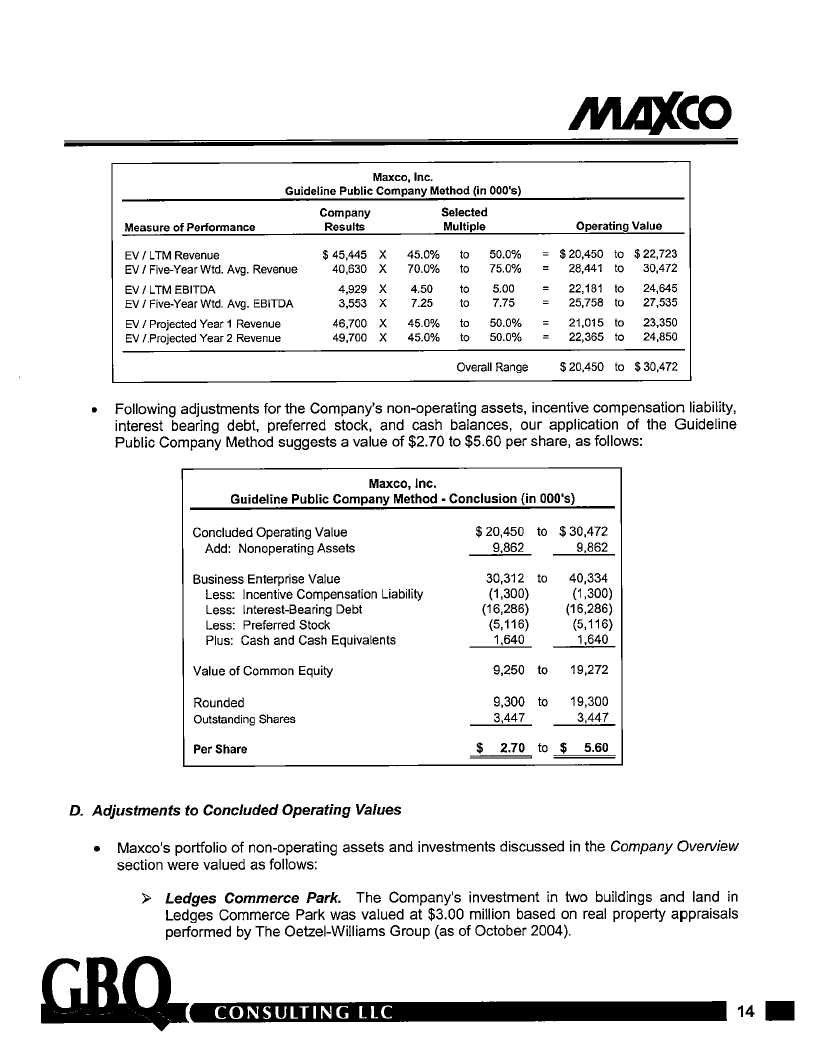

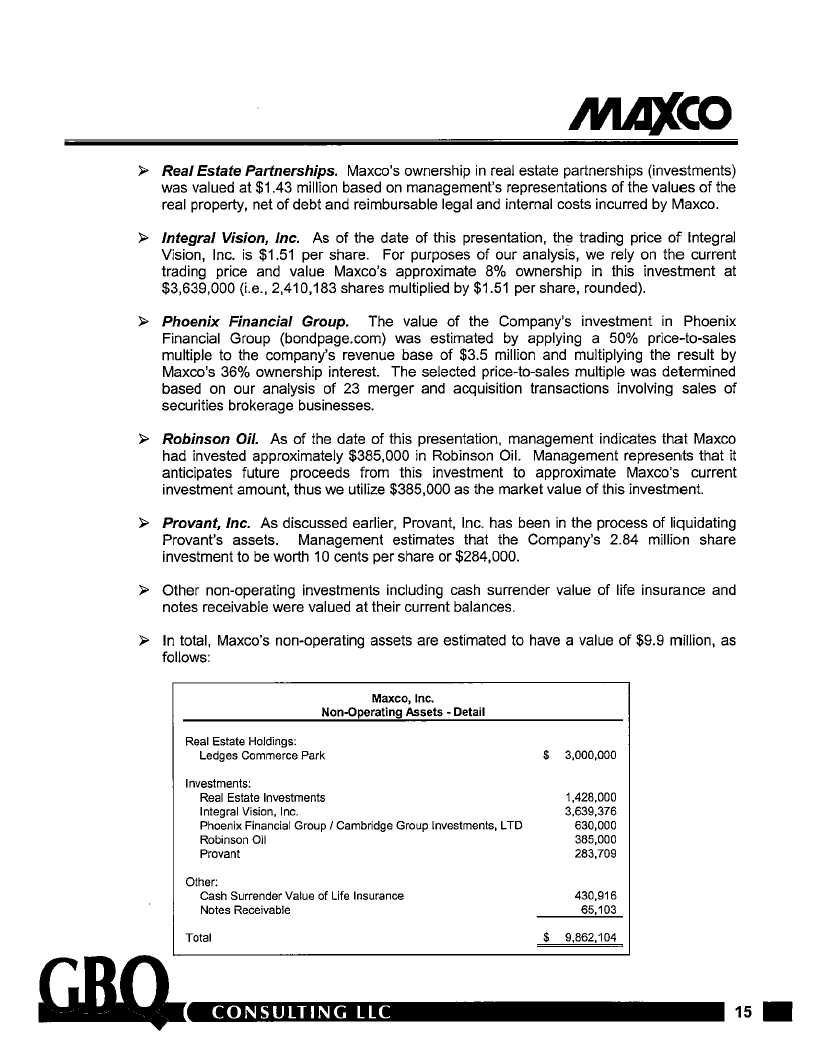

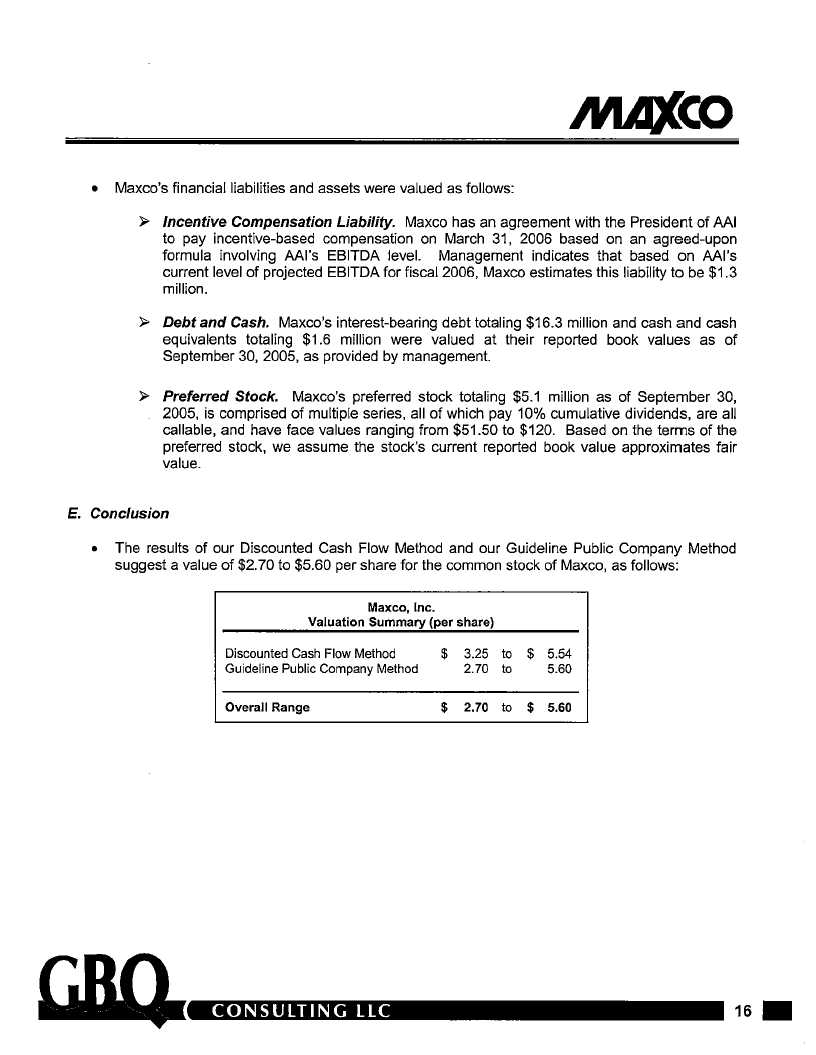

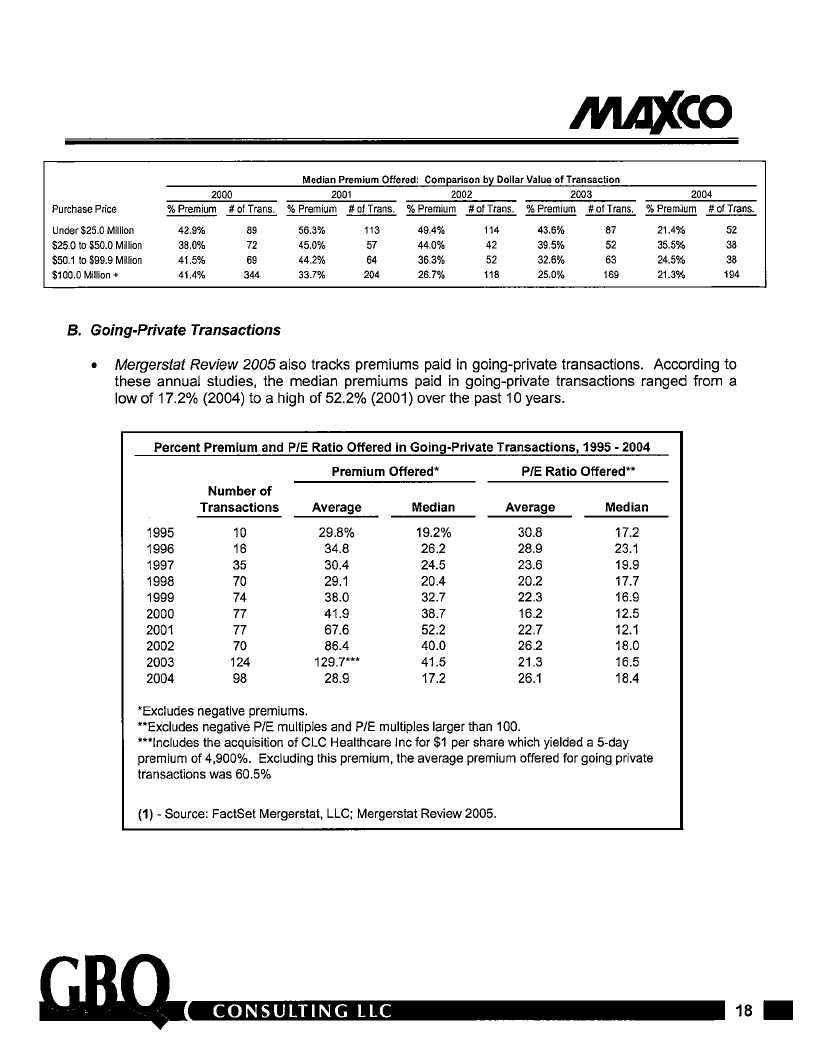

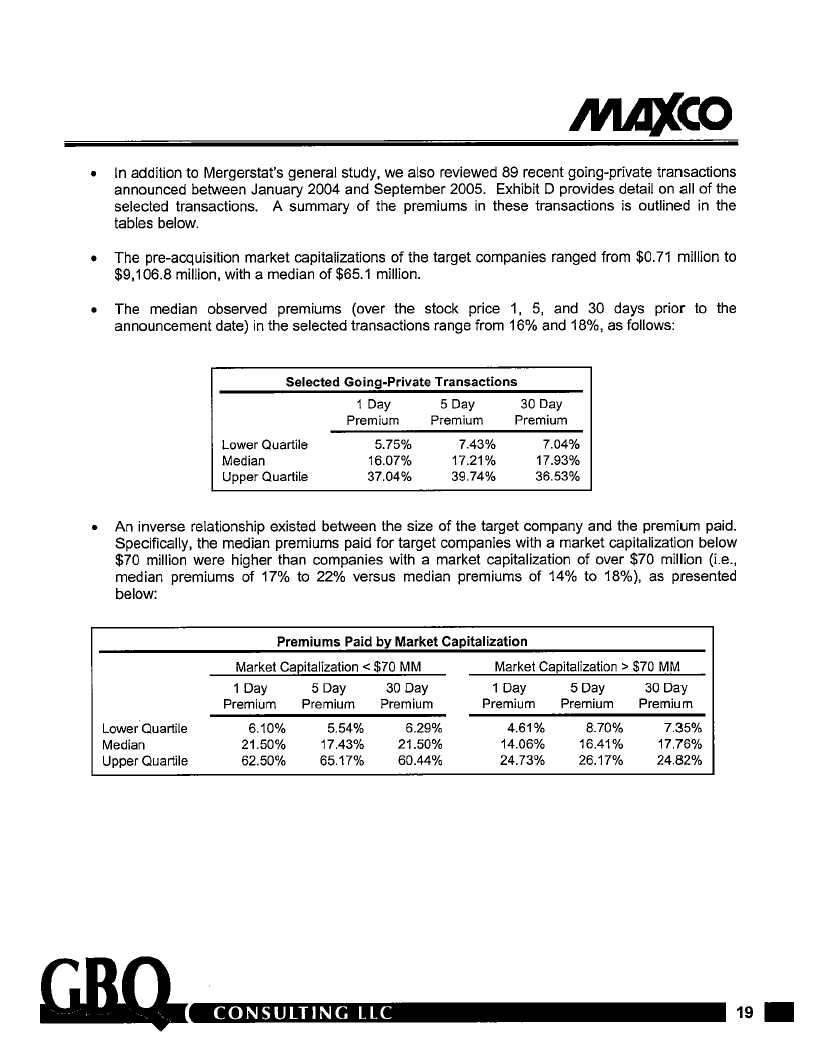

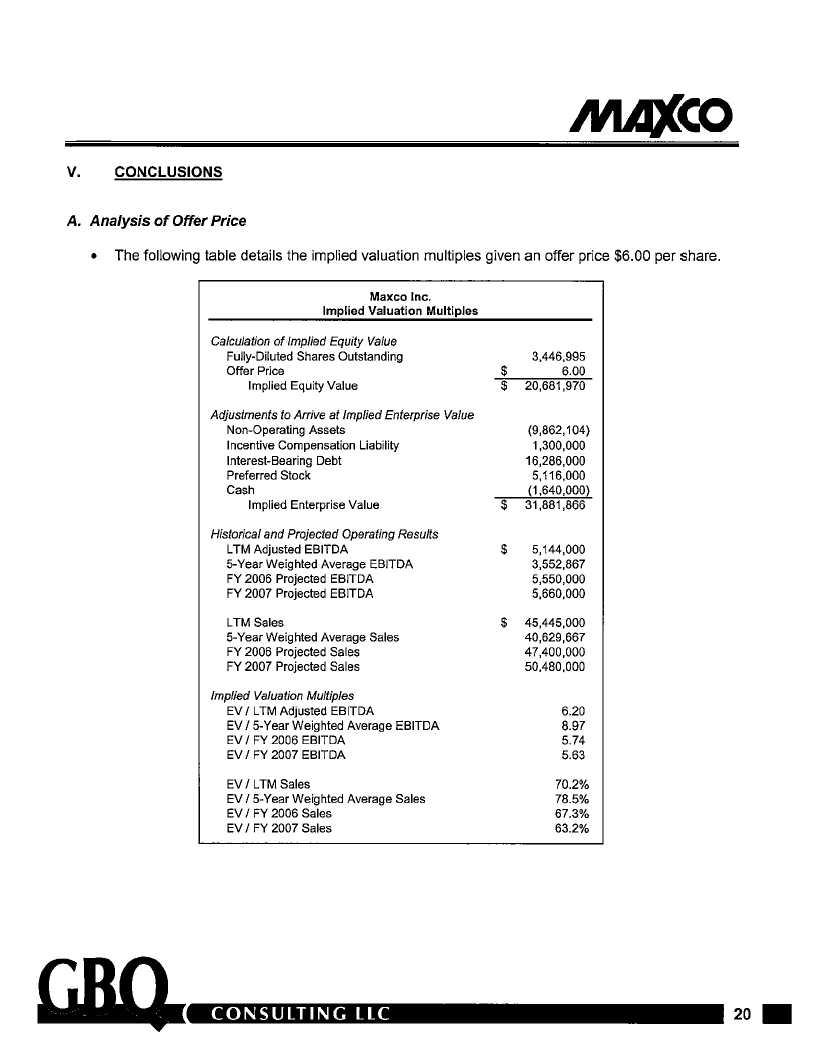

After several months of consideration, the Company announced on December 11, 2005 that the board of directors approved a proposed reverse and forward common stock split which would have had the effect of taking the Company private. Such an action would have required the Company to file a proxy statement and Schedule 13e-3 with the SEC. The Company had received a fairness opinion from GBQ that the proposed cash consideration of $6.00 per share to be paid to common stockholders in the proposed transaction was fair from a financial point of view.

Although the fairness opinion from GBQ dated October 17, 2005 addressed whether a per share value of $6.00 per share for the entire Company was fair, from financial point of view, to those common stockholders who would be receiving the cash contribution in the proposed reverse and forward common stock split and was not done for the present proposed Transaction, a discussion of that report is included in Annex G for review by the stockholders.

The required proxy statement and Schedule 13e-3 were filed with the SEC and comments were made by the SEC. During the period after the proposed reverse and forward common stock split was announced and changes were being made to the filings based upon SEC comments, the stock price began to gradually increase. By the beginning of April 2006, the stock was trading close to the proposed cash consideration of $6.00 per share to be paid in the proposed stock split transaction. As a result, the board of directors decided to abandon its proposed stock split in order to consider a sale option based upon the possibility that the Company would create more value for its shareholders by selling the AAI business than some of them would have received in the proposed stock split. The Company announced its abandonment of the proposed stock split to the public on April 3, 2006.

Additionally, on April 3, 2006, the Company announced that it had engaged GBQ to locate an investor or purchaser to acquire the AAI business.

On April 20, 2006, the board of directors met and discussed the Company and its general future outlook as to pursuing a transaction. The board of directors considered the continual challenges facing the Company including the Company’s inability to generate sufficient cash to pay the required dividends on, or redeem, the outstanding preferred stock, as well its inability to continue paying current obligations without the continued deferment of compensation owed to Mr. Coon, the Company’s Chairman and President.