UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended March 31, 2006 |

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission File Number 0-2762

MAXCO, INC.

(Exact Name of Registrant as Specified in its Charter)

Michigan | 38-1792842 |

| (State or other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) |

| | |

1118 Centennial Way, Lansing, Michigan | 48917 |

| (Address of principal executive offices) | (Zip Code) |

| Registrant's Telephone Number, including area code: | (517) 321-3130 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

NONE | NONE |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock | Series Three Preferred Stock |

| (Title of Class) | (Title of Class) |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No þ

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer �� | | Accelerated filer ¨ | | Non-accelerated filer þ |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act).

Yes ¨ No þ

The aggregate market value of the registrant’s common stock, $1.00 par value per share, held by non-affiliates of the registrant on September 30, 2005, the last business day of the registrant’s most recently completed second fiscal quarter, was $4,392,865 (based on the closing sales price of the registrant’s common stock on that date). Shares of the registrant’s common stock held by each officer and director and each person who owns 5% or more of the outstanding common stock of the registrant have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. At June 30, 2006, there were 3,454,039 outstanding shares of the Registrant's common stock.

Documents Incorporated By Reference

None

MAXCO, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

ITEM | | | | PAGE |

| | | | | |

| 10 | | Directors and Executive Officers of the Registrant | | 3 |

| | | | | |

| 11 | | Executive Compensation | | 4 |

| | | | | |

| 12 | | Security Ownership of Certain Beneficial Owners and Management | | 8 |

| | | | | |

| 13 | | Certain Relationships and Related Transactions | | 9 |

| | | | | |

| 14 | | Principal Accountant Fees and Services | | 10 |

| | | | | |

| | | | 13 |

EXPLANATORY NOTE

This Amendment on Form 10-K/A is filed solely for purposes of including items incorporated by reference in the Form 10-K originally filed on July 14, 2006. All other information in the Form 10-K remains unchanged and has not been repeated in this Amendment. Accordingly, this Form 10-K/A should be read in conjunction with the Form 10-K.

PART III

ITEM 10 - DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

The following information is given regarding the directors and executive officers of the Company.

Name | Present Position with the Company and Principal Occupation | Age | Served as Director of Maxco Since |

| Max A. Coon | Director, President and Chairman of the Board of MAXCO, INC. | 71 | 1969 |

| | | | |

| Eric L. Cross | Executive Vice President and Secretary of MAXCO, INC. | 63 | |

| | | | |

| Sanjeev Deshpande | Director of MAXCO, INC., President of Atmosphere Annealing, Inc., a Lansing, Michigan based provider of heat treating services which was acquired by Maxco, Inc. in January 1997. | 48 | 2003 |

| | | | |

| Joel I. Ferguson | Director of MAXCO, INC., President of F&S Development Company, a Lansing, Michigan based company which develops, contracts and/or owns and manages real estate properties. | 67 | 1985 |

| | | | |

| David R. Layton | Director of MAXCO, INC. and President of Layton & Richardson, P.C., a Lansing, Michigan based accounting firm. | 66 | 2001 |

| | | | |

| Samuel O. Mallory | Director of MAXCO, INC.; Retired in 1998 as a dentist who managed his own practice | 73 | 2002 |

| | | | |

| Lawrence O. Fields | Chief Financial Officer and Treasurer of MAXCO, INC. | 52 | |

All of the foregoing Directors and officers have been engaged in the principal occupation specified for the previous five (5) years except as follows:

Eric L. Cross resigned as Director of the Company, effective October 21, 2004, to allow the Company to be in compliance with NASDAQ marketplace rules. Mr. Cross had served as a Director since 1972.

Lawrence O. Fields was appointed Treasurer and Chief Financial Officer of the Company on November 29, 2005. Mr. Fields had been Controller of the Company for over twenty years prior to the appointment.

The address and telephone number for each person named in the table is in care of Maxco, Inc., 1118 Centennial Way, Lansing, MI 48917, telephone number (517)321-3130.

During the past five years, none of the above named persons has been convicted in a criminal proceeding or has been a party to any judicial or administrative proceeding that resulted in a judgment, decree or final order enjoining him form future violations of, or prohibiting activities subject to, federal or state securities laws, or a finding of any violation of federal of state securities laws. All of the above named persons are citizens of the United States except Sanjeev Deshpande who is a citizen of the Republic of India.

Mr. Coon is a Director of Integral Vision, Inc. whose stock is traded on the OTCBB. On June 30, 2006, Integral Vision, Inc. was an 8% owned investment of Maxco, Inc.

Mr. Coon and Mr. Cross are brothers-in-law. There are no other family relationships between any Directors or Executive Officers.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's Directors and Executive Officers or beneficial owners of over 10% of any class of the Company's equity securities to file certain reports regarding their ownership of the Company's securities or any changes in such ownership All such reports were filed on a timely basis during the fiscal year ended March 31, 2006. Max A. Coon , Eric L. Cross, and ROI Capital Management, Inc. are beneficial owners of more than 10% of Maxco’s voting securities. See table under Item 12 for further disclosure of security ownership of certain beneficial owners and management.

Code of Ethics

The Company has adopted a code of ethics that applies to its directors, officers, and employees. A paper copy of our code of ethics may be obtained free of charge by writing to the Company care of its Compliance Officer at our principal executive office located at 1118 Centennial Way, Lansing, MI 48917.

Audit Committee and Audit Committee Financial Expert

The members of the Audit Committee for the year ended March 31, 2006 were Joel I. Ferguson, David R. Layton and Samuel O. Mallory, each of whom are independent directors as defined by the rules of the Nasdaq Stock Market. In addition, our board of directors has determined that David R. Layton is an “audit committee financial expert” as defined by the Securities and Exchange Commission.

ITEM 11 - EXECUTIVE COMPENSATION

EXECUTIVE COMPENSATION

Compensation Committee Report on Executive Compensation

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board of Directors (the "Committee") consisted of David R. Layton, Joel I. Ferguson and Samuel O. Mallory for the year ended March 31, 2006.

Overview and Philosophy

The Committee is responsible for developing and making recommendations to the Board with respect to the Company's executive compensation policies. In addition, the Compensation Committee, pursuant to authority delegated by the Board, determines on an annual basis the compensation to be paid to the Chief Executive Officer and each of the other executive officers of the Company.

The objectives of the Company's executive compensation program are to:

| | ࿄ | Support the achievement of desired Company performance. |

| | ࿄ | Provide compensation that will attract and retain superior talent and reward performance. |

| | ࿄ | Align the executive officers' interests with the success of the Company by placing a portion of pay at risk, with payout dependent upon corporate performance. |

The executive compensation program provides an overall level of compensation opportunity that is competitive with companies of comparable size and complexity. The Compensation Committee will use its discretion to set executive compensation where in its judgment external, internal or an individual's circumstances warrant it.

Executive Officer Compensation Program

The Company's executive officer compensation program is comprised of base salary, annual cash incentive compensation, long-term incentive compensation in the form of stock options, and various benefits, including medical and deferred compensation plans, generally available to employees of the Company.

Base Salary

Base salary levels for the Company's executive officers are competitively set relative to other comparable companies. In determining salaries the Committee also takes into account individual experience and performance.

Annual Incentive Compensation

The Company's annual incentive program for executive officers and key managers provides direct financial incentives in the form of an annual cash bonus to executives to achieve the Company's annual goals. Goals for Company performance are set at the beginning of each fiscal year. In the year ended March 31, 2006, the following measures of Company performance were selected: net sales, operating earnings, consolidated net income, market penetration, and customer satisfaction.

Specific individual performance was also taken into account in determining bonuses, including meeting department goals, attitude, dependability, cooperation with co-workers, and creativity or ideas that benefit the Company.

Stock Option Program

The stock option program is the Company's long-term incentive plan for executive officers and key employees. The objectives of the program are to align executive and shareholder long-term interests by creating a strong and direct link between executive pay and shareholder return, and to enable executives to develop and maintain a significant, long-term stock ownership position in the Company's Common Stock.

On August 25, 1998, the Shareholders ratified an Employee Stock Option Plan to grant options on up to 500,000 shares of the Company's common stock to officers and key employees of the Company and its subsidiaries. The options which may be granted under this plan may either qualify as "incentive stock options" within the meaning of Section 422A of the Internal Revenue Code, as amended, or may be nonqualified options.

The stock option plan authorizes a committee of directors to award stock options to key employees, directors or agents of the Company. Stock options are granted at an option price equal to the fair market value of the Company's Common Stock on the date of grant, have ten year terms and can have exercise restrictions established by the Option Committee. Awards are made at a level calculated to be competitive with companies of comparable size and complexity.

Deferred Compensation

Effective January 1, 2005, the Maxco, Inc. 401(k) Employee Savings Plan was merged into Maxco’s wholly-owned subsidiary Atmosphere Annealing, Inc.’s 401(k) Plan which covers substantially all employees of the Company. The 401(k) plan is a "cash or deferred" plan under which employees may elect to contribute a certain portion of their annual compensation which they would otherwise be eligible to receive in cash. The Company has agreed to make a matching contribution in the percentages specified in the plan documents. In addition, a separate employer contribution may be made at the discretion of the Board. The plan does not contain an established termination date and it is not anticipated that it will be terminated at any time in the foreseeable future.

Benefits

The Company provides medical benefits to the executive officers that are generally available to Company employees. The amount of perquisites, as determined in accordance with the rules of the Securities and Exchange Commission relating to executive compensation, did not exceed 10% of salary for the year ended March 31, 2006.

Chief Executive Officer

Max A. Coon has served as the Company's Chief Executive Officer since 1969. His base salary for the year ended March 31, 2006 was $250,000, which was deferred. No bonus was paid to Mr. Coon for 2006.

Significant factors the Committee looked at in establishing Mr. Coon’s compensation for the year ended March 31, 2006 were his strategic and overall management direction of the Company. Specifically the Committee discussed that through his direction, the Company was positioned to have an improvement in financial results for the 2006 year. The Committee noted that sales and operating results have increased each of the last three years. In addition, the Committee felt that through Mr. Coon’s direction in the liquidation of its real estate investment, including the reduction of the majority of guarantees the Company had made on its real estate investments, was also a key factor in establishing his compensation. As a result of these factors, the committee felt the Company was poised to continue its sales growth and improvement in its financial results in 2006. This was achieved as operating earnings in 2006 improved to $2.2 million and net income was positive for the year.

The Compensation Committee

David R. Layton

Joel I. Ferguson

Samuel O. Mallory

Summary Compensation Table

The following table sets forth the cash and non-cash compensation for each of the last three fiscal years awarded to or earned by the Chief Executive Officer of the Company and to the others applicable to Item 402 of Regulation S-K:

| | Annual Compensation | Long Term Compensation |

Name and Principal Position | Year | Salary | Bonus | Other Annual Compensation 1 | Options | All Other Comp 2 |

Max A. Coon Chief Executive Officer | 2006 2005 2004 | 250,0003 250,000 200,000 | 0 0 0 | 400 300 200 | 0 0 0 | 0 0 1,000 |

Eric L. Cross Executive Vice President | 2006 2005 2004 | 150,000 150,000 150,000 | 0 0 0 | 0 200 200 | 0 0 0 | 3,750 3,750 1,947 |

Sanjeev Deshpande President of Atmosphere Annealing | 2006 2005 2004 | 171,751 165,998 156,398 | 82,381 45,000 45,000 | 400 400 200 | 0 0 0 | 6,319 5,034 5,000 |

Lawrence O. Fields Treasurer and CFO effective November 29, 2005 | 2006 2005 2004 | 106,667 95,000 90,000 | 30,000 20,000 20,000 | 0 0 0 | 0 0 0 | 3,167 2,875 2,603 |

(1) Represents annual director fees. Mr. Cross resigned as director of the company on October 21, 2004.

(2) Represents the Company's match of employee deferrals of currently earned income into the 401(k) Employee Savings Plan and a profit sharing contribution made by the Company for all of its eligible employees to the 401(k) Employee Savings Plan at the rate of 1% of eligible compensation.

(3) Max A. Coon is due approximately $517,000 for deferred compensation as of March 31, 2006.

Options

The following table summarizes the value of the options held by the above named individuals at the year end. No options were granted to or exercised by the named individuals during the year ended March 31, 2006. All of the options held by the named individuals are presently exercisable.

Year End Option Values

Name and Principal Position | Number of Unexercised Options at March 31, 2006 | Value of Unexercised Options at March 31, 2006 |

Max A. Coon Chief Executive Officer | 0 | 0 |

Eric L. Cross Executive Vice President | 0 | 0 |

Sanjeev Deshpande Director | 40,000 | 0 |

Lawrence O. Fields Controller | 0 | 0 |

Equity Compensation Plan Information

The following table summarizes information as of December 31, 2005 regarding the Company's common stock reserved for issuance under the Company's Employee Stock Option Plan. The Company's Employee Stock Option Plan is its only equity compensation plan and was approved by the shareholders in 1998.

Plan Category | Number of Securities to be Issued Upon Exercise of OutstandingOptions | Weighted-Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance Under the Stock Option Plan (Excluding Securities Reflected in Column a) |

Equity Compensation Plans Approved by Security Holders | 40,0001 | $7.13 | 470,000 |

1 Includes 10,000 issued under a prior stock option plan

COMPARATIVE STOCK PERFORMANCE

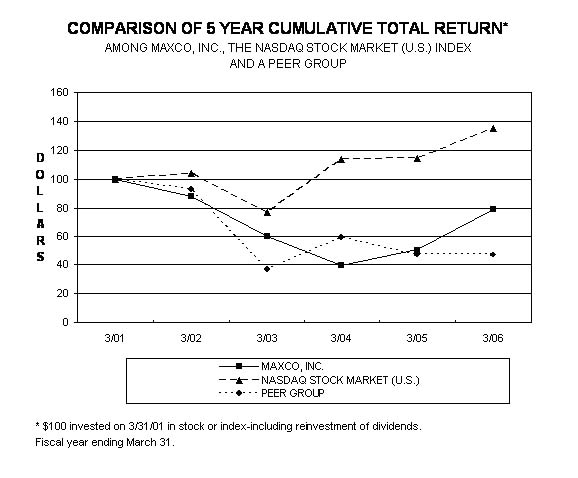

The graph below compares the cumulative total shareholder return on the Common Stock of the Company for the last five years with a cumulative total return on the CRSP Total Return Index for the NASDAQ Stock Market (US Companies) (1) and a peer group of companies (2) over the same period, assuming the investment of $100 in the Company’s Common Stock, the NASDAQ Index and the peer group on March 31, 2001, and reinvestment of all dividends.

| | | 3/01 | 3/02 | 3/03 | 3/04 | 3/05 | 3/06 |

| MAXCO, INC. | | 100.00 | 87.87 | 60.00 | 39.33 | 50.67 | 78.92 |

| NASDAQ STOCK MARKET (U.S.) | | 100.00 | 103.60 | 77.19 | 113.63 | 114.19 | 135.14 |

| PEER GROUP | | 100.00 | 93.05 | 36.87 | 59.72 | 47.33 | 46.82 |

| (1) | The CRSP Total Return Index for the NASDAQ Stock Market (US Companies) is composed of all domestic common shares traded on the NASDAQ National Market and the NASDAQ Small-Cap Market. |

| (2) | The peer group consists of ten companies whose stock is publicly traded and whose market capitalizations are slightly above and below the Company’s capitalization in a range from $20.4 million to $120.3 million. Because of the diversified nature of the business represented by its subsidiary companies, the Company is unable to identify a published industry or line of business index or a group of peer issuers in comparable businesses which are sufficiently similar to allow meaningful comparison. Therefore, the Company has elected to compare its performance with a group of issuers having similar market capitalizations as allowed by SEC rules. |

ITEM 12 - SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information as of March 31, 2006, as to the equity securities of the Company owned beneficially by beneficial owners of 5% or more of the Company's securities, by each Director and by Executive Officer, and by all Directors and Executive Officers of the Company as a group.

Each share of common stock entitles the holder thereof to one vote upon each matter to be voted on. Stockholders of series three preferred shares are entitled to 20 votes for each one of such shares. Series Four and Series Five Preferred Stock are both nonvoting. As of March 31, 2006, the Company had outstanding 3,454,039 shares of common stock, 14,784 shares of series three preferred stock, and 7,812.5 shares of series six preferred stock for a total of 3,905,969 shareholder votes.

| | | |

| | | Amount and Nature of Beneficial Ownership |

Name of Beneficial Owner | Title of Class | Sole Investment Power | Shared Investment Power1 | % of Class2 | Shared Voting Power | % of Total Votes |

Max A. Coon 3 | Common Stock | 878,456 | 988,1724 | 28.6% | 999,2045 | 25.6% |

| Eric L. Cross | Common Stock | 154,525 | 238,2106 | 6.9% | 280,2867 | 7.2% |

| Sanjeev Deshpande | Common Stock | 45,0898 | 45,0898 | 1.3% | 5,0898 | * |

| Joel I. Ferguson | Common Stock | 0 | 0 | * | 0 | * |

| Lawrence O. Fields | Common Stock | 14,333 | 14,333 | * | 14,333 | * |

| David R. Layton | Common Stock | 0 | 1,0009 | * | 1,000 | * |

| Samuel O. Mallory | Common Stock | 22,200 | 22,200 | * | 22,200 | * |

| All Directors and Officers as a group, including the above seven people | Common Stock | 1,114,603 | 1,309,004 | 37.5% | 1,322,112 | 33.8% |

| | | | | | | |

ROI Capital Management, Inc.10 | Common Stock | 878,492 | 945,95711 | 27.4% | 945,957 | 24.2% |

Daryle L. Doden12 | Common Stock | 250,00013 | 369,22714 | 10.7% | 345,800 | 8.9% |

| | | | | | | |

| | | 2,243,095 | 2,624,188 | 75.1% | 2,613,869 | 66.9% |

Max A. Coon 3 | Series Three Preferred Stock | 0 | 2,95616 | 20.0% | 75,65017 | 1.9% |

| Eric L. Cross | Series Three Preferred Stock | 0 | 63218 | 4.3% | 75,65019 | 1.9% |

Daryle L. Doden12 | Series Three Preferred Stock | 0 | 1,75420 | 11.9% | 0 | 0% |

Max A. Coon 3 | Series Four Preferred Stock 15 | 0 | 13,62916 | 29.4% | 0 | 0% |

| Eric L. Cross | Series Four Preferred Stock 15 | 0 | 2,91218 | 6.3% | 0 | 0% |

Daryle L. Doden12 | Series Four Preferred Stock 15 | 0 | 8,08820 | 17.4% | 0 | 0% |

Max A. Coon 3 | Series Five Preferred Stock 15 | 0 | 2,04316 | 30.7% | 0 | 0% |

| Eric L. Cross | Series Five Preferred Stock 15 | 0 | 43718 | 6.6% | 0 | 0% |

Daryle L. Doden12 | Series Five Preferred Stock 15 | 0 | 1,21320 | 18.2% | 0 | 0% |

Max A. Coon 3 | Series Six Preferred Stock | 0 | 3,05316 | 39.1% | 78,12517 | 2.0% |

| Eric L. Cross | Series Six Preferred Stock | 0 | 65218 | 8.4% | 78,12519 | 2.0% |

Daryle L. Doden12 | Series Six Preferred Stock | 0 | 1,81220 | 23.2% | 0 | 0% |

_________________________

| * | Beneficial ownership does not exceed one percent (1%). |

| (1) | Includes Sole Investment Power as well as shares beneficially owned. |

| (2) | Calculated based on Shared Investment Power. |

| (3) | Mr. Coon’s address is 1118 Centennial Way, Lansing, Michigan 49817. |

| (4) | Includes 18,487 shares owned by Mr. Coon's immediate family; a proportionate share of 155,250 shares held by a general partnership in which Mr. Coon is a 1/3 partner; and a proportionate share of 101,022 shares held by EM Investors, LLC in which Mr. Coon has a 39.1% ownership interest. |

| (5) | Includes 18,487 shares owned by Mr. Coon's immediate family; a proportionate share of 155,250 shares held by a general partnership in which Mr. Coon is a 1/3 partner; and a 50% share of 101,022 shares held by EM Investors, LLC representing Mr. Coon’s voting power of those shares. |

| (6) | Includes 23,500 shares owned by Mr. Cross’ wife; a proportionate share of 155,250 shares held by a general partnership in which Mr. Cross is a 1/3 partner; and a proportionate share of 101,022 shares held by EM Investors, LLC in which Mr. Cross has an 8.4% ownership interest. |

| (7) | Includes 23,500 shares owned by Mr. Cross’ wife; a proportionate share of 155,250 shares held by a general partnership in which Mr. Cross is a 1/3 partner; and a 50% share of 101,022 shares held by EM Investors, LLC representing Mr. Cross’ voting power of those shares. |

| (8) | Includes options to purchase 40,000 shares. Such options were not exercised as of March 31, 2006 and thus were not included in voting power. |

| (9) | Represents shares held in a pension fund of which Mr. Layton is one of the trustees. |

| (10) | Information obtained from Schedule 13D/A dated April 4, 2006 filed with the Securities and Exchange Commission. The address of ROI Capital Management, Inc. is 300 Drakes Landing Rd., Suite 175, Greenbrae, CA 94904. |

| (11) | Information obtained from Schedule 13D/A dated April 4, 2006 filed with the Securities and Exchange Commission. Includes 57,465 shares in a personal IRA of Mark T. Boyer and 10,000 shares in a personal IRA of Mitchell J. Soboleski. Messrs. Boyer and Soboleski are the owners of ROI Capital Management, Inc. and have dispositive authority of the reported securities held in advisory accounts of ROI Capital Management, Inc. |

| (12) | Mr. Doden’s address is 1610 S. Grandstaff Dr., Auburn, IN 46706 or P.O. Box 51, Auburn, IN 46706. |

| (13) | Represents shares in the name of Contractor Supply, Incorporated of which Mr. Doden owns 100%. |

| (14) | Includes 95,800 shares in the name of Master Works Foundation, Inc., an Indiana non-profit corporation in which Mr. Doden is one-third member and a proportionate share of 101,022 shares held by EM Investors, LLC in which Mr. Doden has an 23.2% ownership interest. |

| (15) | Series Four and Series Five Preferred Stock are both nonvoting. |

| (16) | Represents a proportionate share of shares held by EM Investors, LLC in which Mr. Coon has a 39.1% ownership interest. |

| (17) | Represents a 50% share of shares held by EM Investors, LLC representing Mr. Coon’s voting power of those shares. |

| (18) | Represents a proportionate share of shares held by EM Investors, LLC in which Mr. Cross has an 8.4% ownership interest. |

| (19) | Represents a 50% share of shares held by EM Investors, LLC representing Mr. Cross’ voting power of those shares. |

| (20) | Represents a proportionate share of shares held by EM Investors, LLC in which Mr. Doden has an 23.2% ownership interest |

ITEM 13 - CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In June 2003, the Company assumed a lease with CJC Leasing, a limited liability company in which Mr. Coon is a member, from Contractor Supply Incorporated, the purchaser of the Company’s formerly wholly owned subsidiary, Ersco Corporation. Contractor Supply Incorporated was required under the lease to pay CJC Leasing an aggregate of approximately $2.3 million in monthly installment payments over a period of approximately 4 years. In exchange for the Company assuming Contractors Supply Incorporated’s lease payments to CJC Leasing, Contractors Supply Incorporated and the Company agreed to reduce the amount then owed by the Company to Contractor Supply Incorporated by $2.3 million. The assumption of the lease obligations to CJC Leasing by the Company allowed the Company to retire a $2.3 million debt that was otherwise due and payable to Contractors Supply Incorporated, by making monthly payments of the approximate $2.3 million over four years. In June 2006, the Company paid off the obligation due CJC Leasing under this lease.

In April 2004 the Company entered into an incentive agreement with the President of its wholly-owned subsidiary Atmosphere Annealing, Inc. The agreement provides for compensation to the officer based on the increased value, as defined, of the subsidiary by March 31, 2006. The incentive is equal to 1% of the first $25 million in value plus 10% above that base amount. Since no such sale occurred by March 31, 2006, at the option of Maxco the incentive is payable in cash or its equivalent in stock of Atmosphere Annealing, Inc. held by Maxco. As party to the agreement, Maxco, Inc. is recognizing incentive compensation expense on a pro-rata basis under the terms of the agreement. As of March 31, 2006, the amount accrued was $2.0 million, including $1.4 million charged to operations during the year then ended.

Vincent Shunsky, former Vice President, Chief Financial Officer and Treasurer of the Company, is indebted to the Company in the amount of approximately $188,000, including accrued interest, as of March 31, 2006. The indebtedness was incurred at various times prior to April 2002 for the purchase of affiliate company stock and personal use. The Company has recently begun discussing a payment plan for the repayment of the indebtedness by Mr. Shunsky.

In October 2004, the Company entered into a Retention Agreement with Mr. Shunsky to provide him with a bonus of $200,000 to retain his services until at least March 31, 2006. The Retention Agreement provided that should he leave the employ of the Company prior to that date, the bonus must be repaid. Mr. Shunsky resigned from his positions as Vice-President, Chief Financial Officer and Treasurer, effective November 29, 2005, and is no longer employed by the Company. However, through March 31, 2006, Mr. Shunsky served as a consultant to the Company in exchange for retaining the bonus. The Company expensed the retention bonus ratably through March 31, 2006. As of March 31, 2006, the amount accrued was $200,000, including $130,000 charged to operations during the year then ended. The Company paid this retention bonus.

In February 2005, the Company issued 250,000 shares of restricted common stock of the Company to Contractor Supply Incorporated, and 95,800 shares of restricted common stock of the Company to Master Works Foundation, Inc. (a non-profit corporation in which the sole shareholder of Contractor Supply Incorporated is a one-third member) in exchange for further reduction of the amount owed by the Company to Contractor Supply Incorporated by $1.4 million. The remaining Company debt owed to Contractor Supply Incorporated was subsequently assigned by Contractor Supply Incorporated to Ambassador Steel Corporation, and then by Ambassador Steel Corporation to its President, Daryle E. Doden. On September 30, 2005, Mr. Doden assigned this Company debt, approximating $1.25 million, to EM Investors, LLC. EM Investors, LLC converted the Company payable, including all accrued interest, to 7,812.5 shares of the Company’s series six preferred stock. Messrs. Coon and Cross, are managers, and have indirect ownership interests, of 39.08% and 8.35%, respectively, of EM Investors, LLC.

In May 2005, the Company acquired the stock of Ledges Commerce Park, Inc. (“Ledges”) and two buildings owned by Ledges, for $200,000, plus the assumption of certain liabilities from L/M Associates, LLC (“L/M”). Prior to the transaction, L/M was the sole shareholder of Ledges, and Maxco was a 50% owner of L/M. After the transaction, Maxco became the sole shareholder of Ledges, and remains as a 50% owner of L/M.

Also in May 2005, Atmosphere Annealing acquired the stock of BCGW, Inc. (“BCGW”) for $200,000. BCGW owned the buildings that are Atmosphere Annealing’s operating facilities in Lansing, Michigan. The spouse of Maxco’s President, Max Coon, was a 25% owner of BCGW.

On August 11, 2005 the Company agreed to indemnify Max A. Coon for any amounts he would be required to pay as a result of a personal guaranty given for the Company’s real estate entities. Two of the Company’s real estate entities are L/M Associates, L.L.C., and Capital Center Associates, L.L.C. The Company is 50% owner of L/M and L/M is a 95% owner of Capital Center. On October 27, 2005, as the result of a personal guaranty by Mr. Coon for Capital Center, Capital Center, L/M, Mr. Coon, and the Company, entered into a settlement agreement with the mortgage holder on property owned by Capital Center. The settlement includes the opportunity for the sale of the underlying property by September 1, 2006 to accomplish a discounted payoff to the mortgage holder. To the extent the sale of the underlying property, or other arrangements, do not result in timely discounted payoff of the mortgage holder, the settlement also includes the obligation of Capital Center, L/M, the Company and Mr. Coon to pay the mortgage holder the full amount then owing under the mortgage loan documents less the net sale proceeds obtained by the mortgage holder in the sale of the underlying property.

On November 29, 2005, Vincent Shunsky resigned as Vice President, Chief Financial Officer, and Treasurer of Maxco, Inc. (the “Company”). Lawrence O. Fields, 52, who has been the Controller of the Company for over twenty years, was appointed Chief Financial Officer and Treasurer effective November 29, 2005.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

For the two years ended March 31, 2006 and 2005, the Company’s auditors, Rehmann Robson, billed the Company for its services as follows:

Audit Fees | 2006 | $80,000 for aggregate fees billed for professional services rendered by Rehmann Robson for the audit of the Company’s annual financial statements for the year ended March 31, 2006 and the reviews of the financial statements included in the Company’s quarterly reports filed with the Securities and Exchange Commission during the year. |

Audit Fees | 2005 | $80,000 for aggregate fees billed for professional services rendered by Rehmann Robson for the audit of the Company’s annual financial statements for the year ended March 31, 2005 and the reviews of the financial statements included in the Company’s quarterly reports filed with the Securities and Exchange Commission during the year. |

Audit-Related Fees | 2006 | $5,900 for aggregate fees billed for professional services rendered by Rehmann Robson for the review of documents necessary in order for the Company to complete a 1-for-1000 reverse stock split to be followed immediately by a 1000-for-1 forward stock split. The Board of Directors eventually abandoned its decision to propose this transaction to the Company’s common and voting preferred shareholders. The proposed transaction, if implemented, was expected to enable the Company to terminate the registration of its common stock. |

Tax Fees | | There were no such fees. |

All Other Fees | | There were no such fees. |

There were no additional fees billed for services to the Company other than the above.

The Audit Committee of the Company’s Board of Directors is of the opinion that the provision of services described above was compatible with maintaining the independence of Rehmann Robson. In 2004, the Audit Committee revised its charter to comply with the mandates of the Sarbanes-Oxley Act of 2002 and related rules and regulations of the Securities and Exchange Commission, including pre-approval policies and procedures. All services rendered to the Company by the Company’s auditors for the years ended March 31, 2005 and March 31, 2006 were permissible under applicable laws and regulations, and were pre-approved by the Audit Committee.

PART IV

ITEM 15 - EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

(a)(3) Listing of Exhibits

Exhibit Number

| 3 | Restated Articles of Incorporation are hereby incorporated by reference from Form 10-Q dated February 13, 1998. |

| 3.1 | By-laws are hereby incorporated by reference from Form S-4 dated November 4, 1991 (File No. 33-43855). |

| 4.2 | Resolution establishing Series Three Preferred Shares is hereby incorporated by reference from Form S-4 dated November 4, 1991 (File No. 33-43855). |

| 4.3 | Resolution authorizing the redemption of Series Two Preferred Stock, establishing Series Four Preferred Stock and the terms of the subordinated notes is hereby incorporated by reference from Form 10-Q dated February 14, 1997. |

| 4.4 | Resolution establishing Series Five Preferred Shares is hereby incorporated by reference from Form 10-K dated June 5, 1997. |

| 4.5 | Resolution establishing Series Six Preferred Shares is hereby incorporated by reference from Form 10-K dated June 23, 1999. |

| 10.1 | Incentive stock option plan adopted August 15, 1983, including the amendment (approved by shareholders August 25, 1987) to increase the authorized shares on which options may be granted by two hundred fifty thousand (250,000), up to five hundred thousand (500,000) shares of the common stock of the company is hereby incorporated by reference from the annual report on Form 10-K for the fiscal year ended March 31, 1988. |

| 10.11 | Asset purchase agreement for the purchase of Atmosphere Annealing, Inc. is hereby incorporated by reference from registrants Form 8-K dated January 17, 1997. |

| 10.12 | Asset Purchase Agreement - Axson North America Inc. is hereby incorporated by reference from registrants Form 10-Q dated February 14, 1997. |

| 10.18 | Maxco, Inc. 1998 Employee Stock Option Plan is hereby incorporated by reference from Form 10-Q dated November 12, 1998. |

| 10.29 | Obligor assignment agreement among Contractor Supply Incorporated, Maxco, Inc., and Ersco Corporation dated November 14, 2002 is hereby incorporated by reference from Form 10-Q dated November 25, 2002. |

| 10.30 | Stock purchase agreement between Ersco Corporation, Maxco, Inc., and Contractor Supply Incorporated dated November 14, 2002 is hereby incorporated by reference from Form 10-Q dated November 25, 2002. |

| 10.31 | Asset Purchase Agreement between Pak Sak Industries, Inc., Maxco, Inc., P-S Business Acquisition, Inc., and P&D Real Estate, LLC and Packaging Personified, Inc. dated September 27, 2002 is hereby incorporated by reference from Form 10-Q dated February 14, 2003. |

| 10.32 | First Amendment to Asset Purchase Agreement between Pak Sak Industries, Inc., Maxco, Inc., P-S Business Acquisition, Inc., and P&D Real Estate, LLC and Packaging Personified, Inc. dated October 30, 2002 is hereby incorporated by reference from Form 10-Q dated February 14, 2003. |

| 10.33 | Second Amendment to Asset Purchase Agreement between Pak Sak Industries, Inc., Maxco, Inc., P-S Business Acquisition, Inc., and P&D Real Estate, LLC and Packaging Personified, Inc. dated November 25, 2002 is hereby incorporated by reference from Form 10-Q dated February 14, 2003. |

| 10.34 | Credit Agreement between Atmosphere Annealing, Inc. and Huntington National Bank dated November 18, 2003 is hereby incorporated by reference from Form 10-Q dated November 19, 2003. |

| 10.35 | Subordination Agreement between Maxco, Inc., Atmosphere Annealing, Inc. and Comerica Bank and Huntington National Bank dated November 18, 2003 is hereby incorporated by reference from Form 10-Q dated November 19, 2003. |

| 10.36 | Incentive agreement between Sanjeev Deshpande and Maxco, Inc. dated April 20, 2004 is hereby incorporated by reference from Form 10-K dated July 13, 2004. |

| 10.37 | Business Loan Agreement between Capitol National Bank and Maxco, Inc. dated May 28, 2004 is hereby incorporated by reference from Form 10-K dated July 13, 2004. |

| 21 | Subsidiaries of the Registrant |

| 23 | Consent of Independent Registered Public Accounting Firm (Form S-8 filed June 2, 1992 - File No. 33-48351 and Form S-8 filed November 19, 1998 - File No. 333-67539). |

| 31.1 | Certification of Chief Executive Officer of periodic report pursuant to Rule 13a-15(e) or Rule 15d-15(e). |

| 31.2 | Certification of Chief Financial Officer of periodic report pursuant to Rule 13a-15(e) or Rule 15d-15(e). |

| 32.1 | Certification of Chief Executive Officer of periodic report pursuant to 18 U.S.C. §1350. |

| 32.2 | Certification of Chief Financial Officer of periodic report pursuant to 18 U.S.C. §1350. |

(b) Exhibits

- Subsidiaries of the Registrant (included with Form 10-K filed July 14, 2006)

- Consent of Independent Registered Public Accounting Firm (included with Form 10-K filed July 14, 2006)

- Certification of Chief Executive Officer of periodic report pursuant to Rule 13a-15(e) or Rule 15d-15(e)

- Certification of Chief Financial Officer of periodic report pursuant to Rule 13a-15(e) or Rule 15d-15(e)

- Certification of Chief Executive Officer of periodic report pursuant to 18 U.S.C. §1350

- Certification of Chief Financial Officer of periodic report pursuant to 18 U.S.C. §1350

(c) Financial Statement Schedules

None

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date July 26, 2006 | MAXCO, INC. |

| | |

| | By /S/ LAWRENCE O. FIELDS |

| | Lawrence O. Fields, Chief Financial Officer and Treasurer |

| | (Principal Financial and Accounting Officer) |

MAXCO, INC.

ANNUAL REPORT ON FORM 10-K/A

EXHIBIT INDEX

| Exhibit No. | Description |

| | |

| 21 | * Subsidiaries of the Registrant |

| | |

| 23 | * Consent of Independent Registered Public Accounting Firm (Form S-8 filed June 2, 1992 - File No. 33-48351 and Form S-8 filed November 19, 1998 - File No. 333-67539) |

| | |

| 31.1 | Certification of Chief Executive Officer of periodic report pursuant to Rule 13a-15(e) or Rule 15d-15(e). |

| | |

| 31.2 | Certification of Chief Financial Officer of periodic report pursuant to Rule 13a-15(e) or Rule 15d-15(e). |

| | |

| 32.1 | Certification of Chief Executive Officer of periodic report pursuant to 18 U.S.C. §1350. |

| | |

| 32.2 | Certification of Chief Financial Officer of periodic report pursuant to 18 U.S.C. §1350. |

* Included with Maxco, Inc. Form 10-K filed July 14, 2006