UNITEDSTATES

SECURITIESANDEXCHANGECOMMISSION

Washington,D.C.20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04612

Name of Fund: BlackRock EuroFund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Anne F. Ackerley, Chief Executive Officer, BlackRock

EuroFund, 55 East 52nd Street, New York, NY 10055.

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 06/30/2010

Date of reporting period: 12/31/2009

Item 1 – Report to Stockholders

EQUITIES FIXED INCOME REAL ESTATE LIQUIDITY ALTERNATIVES BLACKROCK SOLUTIONS

Semi-Annual Report

DECEMBER 31, 2009 I (UNAUDITED)

BlackRock EuroFund

BlackRock Focus Value Fund, Inc.

BlackRock Global SmallCap Fund, Inc.

BlackRock International Value Fund

OF BLACKROCK INTERNATIONAL VALUE TRUST

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

Table of Contents

| |

| | Page |

| Dear Shareholder | 3 |

| Semi-Annual Report: | |

| Fund Summaries | 4 |

| About Fund Performance | 12 |

| Disclosure of Expenses | 12 |

| Derivative Financial Instruments | 13 |

| Financial Statements: | |

| Schedules of Investments | 14 |

| Statements of Assets and Liabilities | 24 |

| Statements of Operations | 26 |

| Statements of Changes in Net Assets | 27 |

| Financial Highlights | 29 |

| Notes to Financial Statements | 49 |

| Officers and Directors | 58 |

| Additional Information | 59 |

| Mutual Fund Family | 62 |

2 SEMI-ANNUAL REPORT DECEMBER 31, 2009

Dear Shareholder

In 2009, investors worldwide witnessed a seismic shift in market sentiment as the fear and pessimism that characterized 2008 were replaced by guarded

optimism. The single most important reason for this change was the swing from a deep global recession to the beginnings of a global recovery.

At the outset of the year, markets were still reeling from 2008’s nearly unprecedented global financial and economic meltdown. The looming threat of further

collapse in global markets prompted stimulus packages and central bank interventions on an extraordinary scale worldwide. Ultimately, these actions

helped stabilize the financial system, and the economic contraction began to abate.

Stocks fell sharply to start 2009 as investor confidence remained low on fears of an economic depression. After touching their lows in March, stocks

galloped higher as massive, coordinated global monetary and fiscal stimulus began to reflate world economies. Sidelined cash poured into the markets,

triggering a dramatic and steep upward rerating of stocks and other risk assets. The financial sector and low-quality securities that had been battered

most in the downturn enjoyed the sharpest recovery. The experience in international markets was similar to that seen in the United States. European

stocks slightly edged out other developed markets for the year, but emerging markets were the clear winners in 2009. To some extent, this outperformance

reflected the stronger recoveries in emerging economies and corporate earnings, but emerging market stocks also saw significant expansion in valuations.

The improvement in the economic backdrop was reflected in fixed income markets as well, where non-Treasury assets made a robust recovery. One of the

major themes for 2009 was the reversal of the flight-to-quality trade seen in 2008. As investors grew more comfortable with risk, high yield finished the year

as the strongest-performing fixed income sector in both the taxable and tax-exempt space. Overall, the municipal market made a strong showing, outpacing

most taxable sectors. Despite fundamental challenges, the technical picture remained supportive of the asset class. Municipal fund inflows had a record-

setting year; investor expectations of higher taxes boosted demand; and the Build America Bonds program was deemed a success, adding $65 billion of

taxable supply to the municipal marketplace in 2009. Notably, the program has alleviated tax-exempt supply pressure and attracted the attention of a

global audience.

All told, the rebound in sentiment and global market conditions propelled virtually every major benchmark index into positive territory for both the 6- and

12-month periods, with the notable exception of Treasury bonds, which were negatively affected by rising long-term rates.

| | |

| Total Returns as of December 31, 2009 | 6-month | 12-month |

| US equities (S&P 500 Index) | 22.59% | 26.46% |

| Small cap US equities (Russell 2000 Index) | 23.90 | 27.17 |

| International equities (MSCI Europe, Australasia, Far East Index) | 22.07 | 31.78 |

| US Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index) | (1.06) | (9.71) |

| Taxable fixed income (Barclays Capital US Aggregate Bond Index) | 3.95 | 5.93 |

| Tax-exempt fixed income (Barclays Capital Municipal Bond Index) | 6.10 | 12.91 |

| High yield bonds (Barclays Capital US Corporate High Yield 2% Issuer Capped Index) | 21.27 | 58.76 |

| Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an index. | |

The market environment improved dramatically in the past year, but uncertainty and risk remain. Through periods of market turbulence, as ever, BlackRock’s

full resources are dedicated to the management of our clients’ assets. For additional market perspective and investment insight, visit the most recent issue

of our award-winning Shareholder® magazine at www.blackrock.com/shareholdermagazine. As always, we thank you for entrusting BlackRock with your

investments, and we look forward to continuing to serve you in the new year and beyond.

Announcement to Shareholders

On December 1, 2009, BlackRock, Inc. and Barclays Global Investors, N.A. combined to form one of the world’s preeminent investment management firms.

The new company, operating under the BlackRock name, manages $3.346 trillion in assets* and offers clients worldwide a full complement of active man-

agement, enhanced and index investment strategies and products, including individual and institutional separate accounts, mutual funds and other pooled

investment vehicles, and the industry-leading iShares platform of exchange traded funds.

* Data is as of December 31, 2009.

THIS PAGE NOT PART OF YOUR FUND REPORT DECEMBER 31, 2009 3

Fund Summary as of December 31, 2009 BlackRock EuroFund

Portfolio Management Commentary

How did the Fund perform?

•The Fund underperformed the benchmark MSCI Europe Index for the

six-month period.

What factors influenced performance?

•On the whole, stock selection was positive over the six months, but this

was offset by sector allocation results.

•Returns were hampered by the Fund’s underexposure to the materials

sector, which rallied on the back of strong commodities prices. Holding a

small amount of cash during a period of strong stock market gains also

detracted from performance. Elsewhere, stock selection in the energy

(Petroplus Holdings AG) and information technology (Nokia Oyj) sectors

was negative. Other individual positions that hampered performance

included overweights in medical equipment producer Fresenius AG and

defense contractor BAE Systems Plc, as well as an underweight in phar-

maceuticals maker GlaxoSmithKline Plc.

•On the positive side, the Fund benefited from successful stock selection

in the financials sector, where improved earnings and balance sheet con-

fidence resulted in a number of banks (KBC Bancassurance Holding,

Swedbank AB, UniCredit SpA and Lloyds TSB Group Plc) recovering after a

severe selloff early in the year. An overweight in this sector was rewarding

as well. Stock selection in the consumer discretionary sector was also

favorable, with airbag manufacturer Autoliv, Inc. benefiting from government

incentive schemes, which stimulated demand in the automobile industry.

Describe recent portfolio activity.

•During the six months, we increased the Fund’s industrials exposure by

purchasing logistics provider Deutsche Post AG and cargo handler Cargotec

Corp., both of which are likely to benefit from inventory restocking and an

increase in freight traffic. We also purchased French electricals company

Legrand Promesses and construction firm Vinci SA, which were trading at

attractive valuations with more stable earnings profiles. Elsewhere, we

increased exposure to the energy sector through the purchase of Petroplus

Holdings AG and an addition to Total SA, which we expect to benefit from

constrained supply and improving global demand.

•These transactions were largely funded by reductions in the financials

and consumer discretionary sectors. Within consumer discretionary, we

took profits in media companies, WPP Plc and Vivendi SA, as well as white

goods manufacturer Electrolux AB and performance car maker Porsche

Automobil Holding SE. The reduction in financials came mainly from our

cuts in banks Banco Santander SA and BNP Paribas SA, and our selling

of UniCredit SpA after strong performance.

Describe Fund positioning at period end.

•At period end, the Fund was overweight relative to the MSCI Europe Index

in the industrials, energy and financials sectors, and was underweight in

materials, consumer discretionary, utilities and consumer staples.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| |

| Portfolio Information | |

| | Percent of |

| | Long-Term |

| Ten Largest Holdings | Investments |

| BP Plc | 5% |

| HSBC Holdings Plc | 5 |

| Nestle SA, Registered Shares | 5 |

| Novartis AG, Registered Shares | 4 |

| Total SA | 4 |

| Sanofi-Aventis | 4 |

| Vodafone Group Plc | 3 |

| Banco Santander SA | 3 |

| E.ON AG | 3 |

| Vinci SA | 2 |

| |

| | Percent of |

| | Long-Term |

| Geographic Allocation | Investments |

| United Kingdom | 25% |

| France | 24 |

| Germany | 14 |

| Switzerland | 12 |

| Finland | 5 |

| Spain | 4 |

| Italy | 4 |

| Netherlands | 4 |

| Norway | 2 |

| Denmark | 2 |

| Other1 | 4 |

| 1 Other includes a 1% holding in each of the following countries: Belgium, Greece, |

| Ireland and Sweden. | |

4 SEMI-ANNUAL REPORT DECEMBER 31, 2009

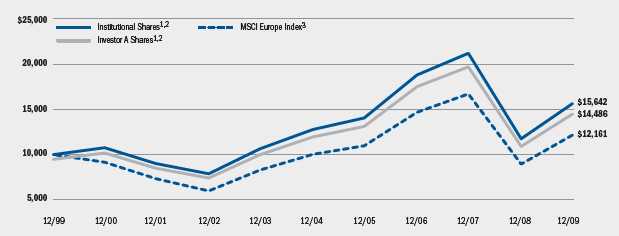

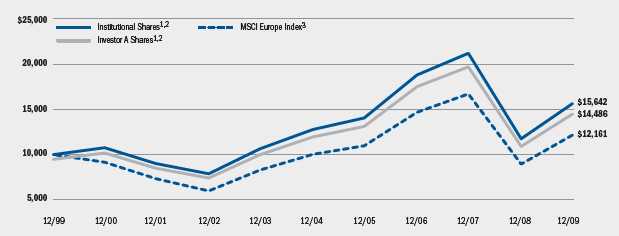

BlackRock EuroFund

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including advisory fees, if any. Institutional Shares do not have

a sales charge.

2 Under normal circumstances, the Fund will invest at least 80% of its net assets in equity securities, including common stock and convertible securities, of

companies located in Europe. The Fund currently expects that a majority of the Fund’s assets will be invested in equity securities of companies in Western

European countries, but may also invest in emerging markets in Eastern European countries.

3 This unmanaged capitalization-weighted index is comprised of a representative sampling of large-, medium- and small-capitalization companies in devel-

oped European countries.

| | | | | | | |

| Performance Summary for the Period Ended December 31, 2009 | | | | | | |

| | | | | Average Annual Total Returns4 | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales |

| | Total Returns | charge | charge | charge | charge | charge | charge |

| Institutional | 25.37% | 33.12% | N/A | 4.13% | N/A | 4.58% | N/A |

| Investor A | 25.21 | 32.83 | 25.85% | 3.92 | 2.80% | 4.34 | 3.78% |

| Investor B | 24.26 | 31.15 | 26.65 | 2.91 | 2.65 | 3.67 | 3.67 |

| Investor C | 24.61 | 31.70 | 30.70 | 3.07 | 3.07 | 3.50 | 3.50 |

| Class R | 25.00 | 32.01 | N/A | 3.45 | N/A | 4.10 | N/A |

| MSCI Europe Index | 26.91 | 35.83 | N/A | 3.93 | N/A | 1.98 | N/A |

4 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

| | | | | | |

| Expense Example | | | | | | |

| | | Actual | | | Hypothetical6 | |

| | Beginning | Ending | | Beginning | Ending | |

| | Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid |

| | July 1, 2009 | December 31, 2009 During the Period5 | July 1, 2009 | December 31, 2009 During the Period5 |

| Institutional | $1,000 | $1,253.70 | $ 6.14 | $1,000 | $1,019.76 | $ 5.50 |

| Investor A | $1,000 | $1,252.10 | $ 7.21 | $1,000 | $1,018.80 | $ 6.46 |

| Investor B | $1,000 | $1,242.60 | $14.87 | $1,000 | $1,011.94 | $13.34 |

| Investor C | $1,000 | $1,246.10 | $12.06 | $1,000 | $1,014.46 | $10.82 |

| Class R | $1,000 | $1,250.00 | $10.55 | $1,000 | $1,015.82 | $ 9.45 |

5 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.08% for Institutional, 1.27% for Investor A, 2.63% for Investor B, 2.13% for

Investor C and 1.86% for Class R), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown).

6 Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

SEMI-ANNUAL REPORT DECEMBER 31, 2009 5

Fund Summary as of December 31, 2009 BlackRock Focus Value Fund, Inc.

Portfolio Management Commentary

How did the Fund perform?

•The Fund underperformed the Russell 1000 Value Index for the six-month

period. Meanwhile, Institutional and Investor A Shares outperformed the

S&P 500 Index, while Investor B, Investor C and Class R Shares trailed

the index.

What factors influenced performance?

•Our underweight position and good stock selection in the energy sector

were the primary contributors to relative performance, led by strong gains

from positions in Peabody Energy Corp. and Halliburton Co. and by not

owning Exxon Mobil Corp., which declined in price over this period. Our

overweight position in the technology sector also proved beneficial as this

was one of the better-performing sectors over the six months. Favorable

stock selection in the consumer staples sector helped too, led by better-

than-25% gains from positions in Unilever NV ADR and Walgreen Co.

•These areas of strength were offset slightly by weakness in the financial

sector, where poor stock selection detracted from results as holdings in The

Bank of New York Mellon Corp. and Morgan Stanley performed poorly, and

because we did not own enough of the better-performing regional bank

stocks. Our underweight position and poor stock selection in the industrial

sector also detracted from performance. This was one of the better-per-

forming market sectors over the period, led in large part by a sharp recov-

ery in shares of the lower-quality companies in this space which we did not

own. Poor stock selection in the materials sector had a negative impact on

results for the same reason.

Describe recent portfolio activity.

•During the six months, we continued to adjust our holdings in response to

ongoing market activity. We increased our financial stock weighting, largely

through the introduction of new positions in Bank of America Corp. and

Citigroup, Inc. and an increase in our holding in Wells Fargo & Co.; mean-

while, we eliminated shares in The Bank of New York Mellon Corp. We

reduced and repositioned our technology holdings. Specifically, we

swapped a position in Applied Materials, Inc. for one in Novellus Systems

Inc.; sold Nokia Oyj, Microsoft Corp. and AOL, Inc.; increased our holding

in Maxim Integrated Products, Inc.; and, introduced Electronic Arts, Inc. We

added to our consumer discretionary weighting through the purchase of

CBS Corp., Comcast Corp. and Limited Brands, Inc.; we sold our position

in Viacom, Inc. after a better-than-50% gain in the stock and reduced our

Time Warner, Inc. holding as well. Lastly, health care exposure was reduced

following the completion of the takeovers of Wyeth and Schering-Plough

Corp., both of which we owned.

Describe Fund positioning at period end.

•At period end, the Fund was overweight relative to the Russell 1000 Value

Index in the information technology, consumer staples, consumer discre-

tionary and health care sectors; underweight in the utilities, industrials,

energy, telecommunications and financials sectors; and, neutral in the

materials sector.

•An accumulating body of evidence suggests that the US economy has

resumed growing at a healthy pace, while inflation and interest rate pres-

sures remain contained. Corporate profit growth continues to surprise to

the upside and equity market valuations remain reasonable. We expect

these conditions to help sustain the recent stock market advance in the

months ahead. We are increasingly wary, however, of the impact of the con-

tinued high level of unemployment, budgetary pressures at all levels of gov-

ernment, the still-fragile financial system and eventual risks posed by the

withdrawal of government fiscal and monetary stimulus. In addition, as

stock prices, expectations and valuations have increased, the market’s

overall risk/reward profile has deteriorated. As a result, we have migrated

the portfolio towards a more balanced posture, with cyclical exposure from

our overweight position in technology matched against more defensive

positions in consumer staples and healthcare and more limited exposure

to the economically-sensitive energy and industrial sectors. We believe this

is the appropriate strategy for the period ahead.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| |

| Portfolio Information | |

| | Percent of |

| | Long-Term |

| Ten Largest Holdings | Investments |

| LSI Corp. | 4% |

| The Travelers Cos., Inc. | 3 |

| Hewlett-Packard Co. | 3 |

| Coventry Health Care, Inc. | 3 |

| Bristol-Myers Squibb Co. | 3 |

| Halliburton Co. | 3 |

| ACE Ltd. | 3 |

| JPMorgan Chase & Co. | 3 |

| Invesco Ltd. | 3 |

| Verizon Communications, Inc. | 3 |

| |

| | Percent of |

| | Long-Term |

| Investment Criteria | Investments |

| Earnings Turnaround | 32% |

| Price-to-Earnings Per Share | 25 |

| Operational Restructuring | 17 |

| Above-Average Yield | 9 |

| Discount to Assets | 7 |

| Price-to-Book Value | 4 |

| Price-to-Cash Flow | 3 |

| Special Situations | 3 |

6 SEMI-ANNUAL REPORT DECEMBER 31, 2009

BlackRock Focus Value Fund, Inc.

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including advisory fees, if any. Institutional Shares do not have

a sales charge.

2 The Fund invests in a diversified portfolio of equity securities that Fund management believes are undervalued relative to its assessment of the current

or prospective condition of the issuer or relative to prevailing market ratios, including issuers that are experiencing poor operating conditions.

3 This unmanaged broad-based index is a subset of the Russell 1000 Index consisting of those Russell 1000 securities with lower price/book ratios and

lower forecasted growth values.

4 This unmanaged index covers 500 industrial, utility, transportation and financial companies of the US markets (mostly New York Stock Exchange (“NYSE”)

issues), representing about 75% of NYSE market capitalization and 30% of NYSE issues.

| | | | | | | |

| Performance Summary for the Period Ended December 31, 2009 | | | | | | |

| | | | | Average Annual Total Returns5 | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales |

| | Total Returns | charge | charge | charge | charge | charge | charge |

| Institutional | 23.15% | 35.19% | N/A | 0.67% | N/A | 2.89% | N/A |

| Investor A | 22.98 | 34.79 | 27.71% | 0.40 | (0.68)% | 2.62 | 2.07% |

| Investor B | 22.49 | 33.55 | 29.05 | (0.43) | (0.72) | 1.98 | 1.98 |

| Investor C | 22.52 | 33.62 | 32.62 | (0.41) | (0.41) | 1.81 | 1.81 |

| Class R | 22.52 | 33.59 | N/A | (0.14) | N/A | 2.29 | N/A |

| Russell 1000 Value Index | 23.23 | 19.69 | N/A | (0.25) | N/A | 2.47 | N/A |

| S&P 500 Index | 22.59 | 26.46 | N/A | 0.42 | N/A | (0.95) | N/A |

5 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

| | | | | | |

| Expense Example | | | | | | |

| | | Actual | | | Hypothetical7 | |

| | Beginning | Ending | | Beginning | Ending | |

| | Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid |

| | July 1, 2009 | December 31, 2009 During the Period6 | July 1, 2009 | December 31, 2009 During the Period6 |

| Institutional | $1,000 | $1,231.50 | $ 6.19 | $1,000 | $1,019.65 | $ 5.60 |

| Investor A | $1,000 | $1,229.80 | $ 7.87 | $1,000 | $1,018.14 | $ 7.12 |

| Investor B | $1,000 | $1,224.90 | $13.01 | $1,000 | $1,013.50 | $11.77 |

| Investor C | $1,000 | $1,225.20 | $12.51 | $1,000 | $1,013.96 | $11.32 |

| Class R | $1,000 | $1,225.20 | $11.78 | $1,000 | $1,014.61 | $10.66 |

6 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.10% for Institutional, 1.40% for Investor A, 2.32% for Investor B, 2.23% for

Investor C and 2.10% for Class R), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown).

7 Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

SEMI-ANNUAL REPORT DECEMBER 31, 2009 7

Fund Summary as of December 31, 2009 BlackRock Global SmallCap Fund, Inc.

Portfolio Management Commentary

How did the Fund perform?

•The Fund’s Institutional, Investor A and Class R Shares underperformed the

MSCI World Small Cap Index for the six-month period, but outperformed

the MSCI World Index; Investor B and Investor C Shares underperformed

both indexes.

What factors influenced performance?

•Relative to the MSCI World Small Cap Index, positive contributions to Fund

performance came from stock selection in the consumer discretionary,

materials and consumer staples sectors. Stock selection and an under-

weight in the utilities sector were also additive.

•Conversely, cash balances hindered Fund performance at the beginning of

the period. In addition, stock selection detracted in the financials, informa-

tion technology and energy sectors.

Describe recent portfolio activity.

•During the six months, the Fund’s cash balances were reduced from

earlier defensive levels to more normal levels. Exposure to the health care

and financials sectors was also reduced, and assets were put to work in

materials, utilities, industrials and energy. The largest purchases for the

reporting period included ITC Holdings Corp., JDS Uniphase Corp.,

ON Semiconductor Corp., Cliffs Natural Resources, Inc. and Avago

Technologies Ltd. Significant sales included Perusahaan Gas Negara

Tbk PT, Owens-Illinois, Inc., Informatica Corp., Addax Petroleum Corp.

and Dana Petroleum Plc.

Describe Fund positioning at period end.

•At period end, the Fund was overweight relative to the MSCI World

Small Cap Index in IT and materials; underweight in financials, consumer

discretionary and industrials; and neutral in the remaining sectors.

Geographically, the Fund was modestly underweight in the United States,

Europe and developed Asia, and it was overweight in the emerging markets

of China and India.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| |

| Portfolio Information | |

| | Percent of |

| | Long-Term |

| Ten Largest Holdings | Investments |

| PetroHawk Energy Corp. | 1% |

| Urban Outfitters, Inc. | 1 |

| Rheinmetall AG | 1 |

| Bonduelle SA | 1 |

| Blackboard, Inc. | 1 |

| Intersil Corp., Class A | 1 |

| ITC Holdings Corp. | 1 |

| Guess?, Inc. | 1 |

| Phillips-Van Heusen Corp. | 1 |

| Zoran Corp. | 1 |

| |

| | Percent of |

| | Long-Term |

| Geographic Allocation | Investments |

| United States | 48% |

| United Kingdom | 9 |

| Japan | 6 |

| Canada | 6 |

| Germany | 4 |

| France | 2 |

| Norway | 2 |

| Australia | 2 |

| Bermuda | 2 |

| China | 2 |

| Singapore | 2 |

| Cayman Islands | 2 |

| Other1 | 13 |

| 1 Other includes a 1% holding in each of the following countries: Austria, Brazil, |

| Denmark, Finland, Hong Kong, India, Ireland, Israel, Italy, Spain, Sweden, Switzerland |

| and Thailand. | |

8 SEMI-ANNUAL REPORT DECEMBER 31, 2009

BlackRock Global SmallCap Fund, Inc.

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including advisory fees, if any. Institutional Shares do

not have a sales charge.

2 The Fund invests primarily in a diversified portfolio of equity securities of small cap issuers located in various foreign countries and the United States.

3 This unmanaged market-capitalization weighted index is comprised of a representative sampling of stocks of large-, medium- and small-

capitalization companies in 23 countries, including the United States.

4 This unmanaged broad-based index is comprised of small cap companies from 23 developed markets.

| | | | | | | |

| Performance Summary for the Period Ended December 31, 2009 | | | | | | |

| | | | | Average Annual Total Returns5 | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | 6-Month�� | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales |

| | Total Returns | charge | charge | charge | charge | charge | charge |

| Institutional | 22.76% | 35.13% | N/A | 5.66% | N/A | 6.49% | N/A |

| Investor A | 22.59 | 34.72 | 27.64% | 5.37 | 4.24% | 6.21 | 5.63% |

| Investor B | 22.02 | 33.50 | 29.00 | 4.51 | 4.23 | 5.54 | 5.54 |

| Investor C | 22.07 | 33.63 | 32.63 | 4.52 | 4.52 | 5.36 | 5.36 |

| Class R | 22.40 | 34.15 | N/A | 4.99 | N/A | 5.95 | N/A |

| MSCI World Index | 22.23 | 29.99 | N/A | 2.01 | N/A | (0.24) | N/A |

| MSCI World Small Cap Index | 25.68 | 44.12 | N/A | 2.74 | N/A | 6.44 | N/A |

5 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

| | | | | | |

| Expense Example | | | | | | |

| | | Actual | | | Hypothetical7 | |

| | Beginning | Ending | | Beginning | Ending | |

| | Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid |

| | July 1, 2009 | December 31, 2009 During the Period6 | July 1, 2009 | December 31, 2009 During the Period6 |

| Institutional | $1,000 | $1,227.60 | $ 6.40 | $1,000 | $1,019.45 | $ 5.80 |

| Investor A | $1,000 | $1,225.90 | $ 8.08 | $1,000 | $1,017.94 | $ 7.32 |

| Investor B | $1,000 | $1,220.20 | $13.21 | $1,000 | $1,013.30 | $11.98 |

| Investor C | $1,000 | $1,220.70 | $12.82 | $1,000 | $1,013.66 | $11.62 |

| Class R | $1,000 | $1,224.00 | $10.54 | $1,000 | $1,015.72 | $ 9.55 |

6 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (1.14% for Institutional, 1.44% for Investor A, 2.36% for Investor B, 2.29% for

Investor C and 1.88% for Class R), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown).

7 Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

SEMI-ANNUAL REPORT DECEMBER 31, 2009 9

Fund Summary as of December 31, 2009 BlackRock International Value Fund

Portfolio Management Commentary

How did the Fund perform?

•The Fund underperformed the benchmark MSCI EAFE Index for the

six-month period.

What factors influenced performance?

•Fund returns were hampered by stock selection in the information technol-

ogy (IT) (HTC Corp.) and consumer staples (Japan Tobacco, Inc.) sectors.

Geographically, an underweight in the United Kingdom detracted from per-

formance, as did stock selection in Japan. The Japanese market lagged

other regions over the period as political uncertainty and economic weak-

ness offset the tailwind that value investing experienced elsewhere.

•On a positive note, the Fund benefited from successful stock selection in

the health care sector, where pharmaceuticals maker Bayer AG gained after

lagging the cyclical rally earlier in the year. Stock selection in the consumer

discretionary sector was also positive, as publisher Fairfax Media Ltd. ben-

efited from recovering demand in the Australian advertising market. The

Fund’s best-performing stocks included a number of banks that were sold

off earlier in the year, but then experienced a sharp recovery as earnings

improved and concerns regarding balance sheet strength and deteriorating

asset quality proved excessive (Swedbank AB, UniCredit SpA, Banco

Santander SA and Erste Bank der Oesterreichischen Sparkassen AG).

Geographically, the Fund’s allocation to emerging markets was beneficial

as those countries outperformed developed regions. Stock selection in

Europe also had a positive effect on returns.

Describe recent portfolio activity.

•During the six months, we increased the Fund’s exposure to the industrials

sector by purchasing a number of companies likely to benefit from inven-

tory restocking and an increase in freight traffic. Specifically, we purchased

airline Deutsche Lufthansa AG and logistics provider Deutsche Post AG. In

addition, we purchased a number of Japanese capital goods companies

that should benefit from a rebound in economic activity, including machin-

ery manufacturer Komatsu Ltd. and electronics producer Sumitomo Electric

Industries Ltd. Also within industrials, we purchased construction company

Vinci SA and crane manufacturer KCI Konecranes Oyj, which offered attrac-

tive valuations and more stable earnings profiles. Elsewhere, we added to

the energy sector, which should profit from constrained supply, improving

global demand and continued US dollar weakness. Specifically, we pur-

chased BP Plc, OAO Gazprom and Petroplus Holdings AG. The Fund’s IT

sector allocation was increased as well through the purchase of electronics

manufacturer TDK Corp. and mobile phone maker Nokia Oyj.

•These transactions were largely funded by profit-taking in the materials

sector, which surged on the back of higher commodities prices. Within this

sector, we reduced mining conglomerate BHP Billiton Ltd., and sold Xstrata

Plc and BASF SE. We also reduced the Fund’s weighting in the consumer

discretionary sector, where we locked in gains in advertising firm WPP Plc,

car producer DaimlerChrysler AG and white goods company Electrolux AB.

•Regionally, we took profits in emerging markets and also reduced our

Japanese holdings in favor of attractive investment opportunities in

developed Europe.

Describe Fund positioning at period end.

•At period end, the Fund was overweight relative to the MSCI EAFE Index

in industrials, energy and IT, and underweight in materials, financials, utili-

ties and consumer staples. At the regional level, the Fund was slightly

underweight in Europe, while it was overweight in Japan and selected

emerging markets.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| |

| Portfolio Information | |

| | Percent of |

| | Long-Term |

| Ten Largest Holdings | Investments |

| HSBC Holdings Plc | 4% |

| BP Plc | 4 |

| Nestle SA, Registered Shares | 3 |

| Novartis AG, Registered Shares | 3 |

| Eni SpA | 3 |

| Telstra Corp. Ltd. | 3 |

| Vodafone Group Plc | 3 |

| Sanofi-Aventis | 3 |

| E.ON AG | 3 |

| Honda Motor Co., Ltd. | 2 |

| |

| | Percent of |

| | Long-Term |

| Geographic Allocation | Investments |

| Japan | 22% |

| United Kingdom | 16 |

| Germany | 12 |

| France | 10 |

| Switzerland | 9 |

| Australia | 7 |

| Italy | 4 |

| Netherlands | 4 |

| Finland | 3 |

| Hong Kong | 3 |

| Norway | 2 |

| Denmark | 2 |

| India | 2 |

| Other1 | 4 |

| 1 Other includes a 1% holding in each of the following countries: Belgium, Brazil, |

| Greece and Russia. | |

10 SEMI-ANNUAL REPORT DECEMBER 31, 2009

BlackRock International Value Fund

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including advisory fees, if any. Institutional Shares do

not have a sales charge.

2 The Fund invests primarily in stocks of companies in developed countries located outside of the United States.

3 This unmanaged index measures the total returns of developed foreign stock markets in Europe, Australasia and the Far East (in US dollars).

| | | | | | | |

| Performance Summary for the Period Ended December 31, 2009 | | | | | | |

| | | | | Average Annual Total Returns4 | | |

| | | 1 Year | | 5 Years | | 10 Years |

| | 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales |

| | Total Returns | charge | charge | charge | charge | charge | charge |

| Institutional | 20.84% | 28.97% | N/A | 2.78% | N/A | 3.94% | N/A |

| Investor A | 20.57 | 28.41 | 21.67% | 2.47 | 1.37% | 3.65 | 3.10% |

| Investor B | 19.92 | 26.93 | 22.43 | 1.50 | 1.21 | 2.97 | 2.97 |

| Investor C | 19.92 | 26.96 | 25.96 | 1.50 | 1.50 | 2.81 | 2.81 |

| Class R | 20.37 | 27.92 | N/A | 2.15 | N/A | 3.42 | N/A |

| MSCI EAFE Index | 22.07 | 31.78 | N/A | 3.54 | N/A | 1.17 | N/A |

4 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

| | | | | | |

| Expense Example | | | | | | |

| | | Actual | | | Hypothetical6 | |

| | Beginning | Ending | | Beginning | Ending | |

| | Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid |

| | July 1, 2009 | December 31, 2009 During the Period5 | July 1, 2009 | December 31, 2009 During the Period5 |

| Institutional | $1,000 | $1,208.40 | $ 5.46 | $1,000 | $1,020.26 | $ 4.99 |

| Investor A | $1,000 | $1,205.70 | $ 7.73 | $1,000 | $1,018.19 | $ 7.07 |

| Investor B | $1,000 | $1,199.20 | $13.86 | $1,000 | $1,012.60 | $12.68 |

| Investor C | $1,000 | $1,199.20 | $13.69 | $1,000 | $1,012.75 | $12.53 |

| Class R | $1,000 | $1,203.70 | $ 9.66 | $1,000 | $1,016.43 | $ 8.84 |

5 For each class of the Fund, expenses are equal to the annualized expense ratio for the class (0.98% for Institutional, 1.39% for Investor A, 2.50% for Investor B, 2.47% for

Investor C and 1.74% for Class R), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown).

6 Hypothetical 5% annual return before expenses is calculated by pro-rating the number of days in the most recent fiscal half year divided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

SEMI-ANNUAL REPORT DECEMBER 31, 2009 11

About Fund Performance

•Institutional Shares are not subject to any sales charge. Institutional

Shares bear no ongoing distribution or service fees and are available only to

eligible investors.

•Investor A Shares incur a maximum initial sales charge (front-end load) of

5.25% and a service fee of 0.25% per year (but no distribution fee).

•Investor B Shares are subject to a maximum contingent deferred sales

charge of 4.50% declining to 0% after six years. In addition, Investor B

Shares are subject to a distribution fee of 0.75% per year and a service fee

of 0.25% per year. These shares automatically convert to Investor A Shares

after approximately eight years. (There is no initial sales charge for auto-

matic share conversions.) All returns for periods greater than eight years

reflect this conversion. Investor B Shares of the Funds are only available for

purchase through exchanges, dividend reinvestments or for purchase by cer-

tain qualified employee benefit plans.

•Investor C Shares are subject to a 1% contingent deferred sales charge if

redeemed within one year of purchase. In addition, Investor C Shares are

subject to a distribution fee of 0.75% per year and a service fee of 0.25%

per year.

•Class R Shares do not incur a maxium initial sales charge (front-end load)

or deferred sales charge. These shares are subject to a distribution fee of

0.25% per year and a service fee of 0.25% per year. Class R Shares are

available only to certain retirement plans. Prior to January 3, 2003 for

BlackRock EuroFund, BlackRock Focus Value Fund, Inc. and BlackRock

International Value Fund, and February 4, 2003 for BlackRock Global

SmallCap Fund, Inc., Class R Share performance results are those of the

Institutional Shares (which have no distribution or service fees) restated to

reflect Class R Share fees.

The returns for BlackRock International Value Fund’s Investor B, Investor C

and Class R Shares prior to their respective inception dates (October 6,

2000, October 6, 2000 and January 3, 2003, respectively), are based upon

performance of the Fund’s Institutional Shares. The returns for Investor B,

Investor C and Class R Shares, however, are adjusted to reflect the distribu-

tion and service (12b-1) fees applicable to each class of shares.

Performance information reflects past performance and does not guarantee

future results. Current performance may be lower or higher than the perform-

ance data quoted. Refer to www.blackrock.com/funds to obtain performance

data current to the most recent month-end. Performance results do not

reflect the deduction of taxes that a shareholder would pay on fund distri-

butions or the redemption of fund shares. The Funds may charge a 2%

redemption fee for sales or exchanges of shares within 30 days of purchase

or exchange. Performance data does not reflect this potential fee. Figures

shown in the performance tables on the previous pages assume reinvest-

ment of all dividends and capital gain distributions, if any, at net asset value

on the ex-dividend date. Investment return and principal value of shares will

fluctuate so that shares, when redeemed, may be worth more or less than

their original cost. Dividends paid to each class of shares will vary because

of the different levels of service, distribution and transfer agency fees appli-

cable to each class, which are deducted from the income available to be

paid to shareholders.

Disclosure of Expenses

Shareholders of these Funds may incur the following charges: (a) expenses

related to transactions, including sales charges, redemption fees and

exchange fees; and (b) operating expenses including advisory fees, distri-

bution fees including 12b-1 fees, and other Fund expenses. The expense

examples on the previous pages (which are based on hypothetical invest-

ments of $1,000 invested on July 1, 2009 and held through December 31,

2009) are intended to assist shareholders both in calculating expenses

based on investments in the Funds and in comparing these expenses with

similar costs of investing in other mutual funds.

The tables provide information about actual account values and actual

expenses. In order to estimate the expenses a shareholder paid during

the period covered by this report, shareholders can divide their account

value by $1,000 and then multiply the result by the number correspond-

ing to their share class under the heading entitled “Expenses Paid During

the Period.”

The tables also provide information about hypothetical account values and

hypothetical expenses based on each Fund’s actual expense ratio and an

assumed rate of return of 5% per year before expenses. In order to assist

shareholders in comparing the ongoing expenses of investing in these

Funds and other funds, compare the 5% hypothetical example with the 5%

hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the table are intended to highlight shareholders’

ongoing costs only and do not reflect any transactional expenses, such as

sales charges, redemption fees or exchange fees. Therefore, the hypotheti-

cal examples are useful in comparing ongoing expenses only, and will not

help shareholders determine the relative total expenses of owning different

funds. If these transactional expenses were included, shareholder expenses

would have been higher.

12 SEMI-ANNUAL REPORT DECEMBER 31, 2009

Derivative Financial Instruments

The Funds may invest in various derivative instruments, including foreign

currency exchange contracts, as specified in Note 2 of the Notes to Fin-

ancials Statements, which constitute forms of economic leverage. Such

instruments are used to obtain exposure to a market without owning or

taking physical custody of securities or to hedge market and/or foreign

currency exchange rate risk. Such derivative instruments involve risks,

including the imperfect correlation between the value of a derivative instru-

ment and the underlying asset, possible default of the counterparty to the

transaction or illiquidity of the derivative instrument. The Funds’ ability to

successfully use a derivative instrument depends on the investment

advisor’s ability to accurately predict pertinent market movements, which

cannot be assured. The use of derivative instruments may result in losses

greater than if they had not been used, may require the Funds to sell or

purchase portfolio securities at inopportune times or for distressed values,

may limit the amount of appreciation the Funds can realize on an invest-

ment or may cause the Funds to hold a security that it might otherwise

sell. The Funds’ investments in these instruments are discussed in detail

in the Notes to Financial Statements.

SEMI-ANNUAL REPORT DECEMBER 31, 2009 13

Schedule of Investments December 31, 2009 (Unaudited)

BlackRock EuroFund

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| Belgium — 1.4% | | |

| KBC Bancassurance Holding | 145,482 | $ 6,250,657 |

| Denmark — 1.8% | | |

| Carlsberg A/S | 110,324 | 8,121,462 |

| Finland — 4.8% | | |

| Cargotec Corp., Class B | 200,590 | 5,521,459 |

| KCI Konecranes Oyj | 253,112 | 6,908,740 |

| Nokia Oyj | 713,181 | 9,221,416 |

| | | 21,651,615 |

| France — 23.5% | | |

| AXA SA | 420,928 | 9,882,953 |

| BNP Paribas SA | 120,389 | 9,549,009 |

| Electricite de France SA | 144,431 | 8,584,007 |

| Eramet | 14,641 | 4,585,140 |

| European Aeronautic Defense and Space | 294,452 | 5,918,814 |

| France Telecom SA | 72,250 | 1,805,401 |

| Legrand Promesses | 175,565 | 4,886,261 |

| Renault SA | 138,076 | 7,083,270 |

| STMicroelectronics NV | 303,898 | 2,808,088 |

| Sanofi-Aventis | 198,628 | 15,620,655 |

| Thales SA | 143,408 | 7,370,491 |

| Total SA | 268,102 | 17,220,160 |

| Vinci SA | 197,783 | 11,129,452 |

| | | 106,443,701 |

| Germany — 14.0% | | |

| Allianz AG, Registered Shares | 57,564 | 7,135,628 |

| Bayer AG | 82,041 | 6,565,206 |

| Deutsche Lufthansa AG | 411,781 | 6,953,213 |

| Deutsche Post AG | 471,196 | 9,106,705 |

| Deutsche Telekom AG | 644,513 | 9,454,877 |

| E.ON AG | 275,960 | 11,583,154 |

| HeidelbergCement AG | 107,743 | 7,453,852 |

| MAN SE | 64,601 | 5,012,528 |

| | | 63,265,163 |

| Greece — 1.4% | | |

| EFG Eurobank Ergasias SA (a) | 570,959 | 6,380,904 |

| Ireland — 0.7% | | |

| Irish Life & Permanent Plc | 698,523 | 3,075,651 |

| Italy — 4.0% | | |

| Eni SpA | 411,647 | 10,482,910 |

| Fiat SpA | 528,364 | 7,732,049 |

| | | 18,214,959 |

| Netherlands — 3.6% | | |

| ING Groep NV-CVA | 823,418 | 7,929,827 |

| Koninklijke Ahold NV | 617,553 | 8,181,759 |

| | | 16,111,586 |

| Norway — 2.4% | | |

| Statoil ASA | 428,732 | 10,692,414 |

| Spain — 4.1% | | |

| Banco Bilbao Vizcaya Argentaria SA | 125,616 | 2,289,353 |

| Banco Santander SA | 763,141 | 12,610,639 |

| Telefonica SA | 129,530 | 3,625,418 |

| | | 18,525,410 |

| | | |

| Common Stocks | | Shares | Value |

| Sweden — 0.4% | | | |

| Telefonaktiebolaget LM Ericsson | | 199,840 $ | 1,839,737 |

| Switzerland — 11.9% | | | |

| Nestle SA, Registered Shares | | 433,698 | 21,048,940 |

| Novartis AG, Registered Shares | | 363,698 | 19,861,272 |

| Petroplus Holdings AG | | 276,640 | 5,061,103 |

| Swiss Reinsurance Co., Registered Shares | | 169,434 | 8,116,676 |

| | | | 54,087,991 |

| United Kingdom — 24.5% | | | |

| BHP Billiton Plc | | 326,474 | 10,407,969 |

| BP Plc | | 2,249,076 | 21,717,434 |

| BT Group Plc | | 3,127,827 | 6,811,864 |

| Barclays Plc | | 1,522,935 | 6,710,739 |

| HSBC Holdings Plc | | 1,885,916 | 21,515,137 |

| Lloyds TSB Group Plc | | 5,499,580 | 4,424,841 |

| Man Group Plc | | 1,011,937 | 4,994,256 |

| Meggitt Plc | | 1,262,324 | 5,284,490 |

| Redrow Plc (a) | | 1,349,801 | 2,888,593 |

| Tesco Plc | | 1,308,539 | 9,027,313 |

| Vodafone Group Plc | | 5,541,358 | 12,832,164 |

| Xstrata Plc | | 239,098 | 4,264,562 |

| | | | 110,879,362 |

| Total Long-Term Investments | | | |

| (Cost — $392,233,683) — 98.5% | | | 445,540,612 |

| Short-Term Securities | | | |

| BlackRock Liquidity Funds, TempFund, | | | |

| Institutional Class, 0.11% (b)(c) | | 7,274,540 | 7,274,540 |

| Total Short-Term Securities | | | |

| (Cost — $7,274,540) — 1.6% | | | 7,274,540 |

| Total Investments (Cost — $399,508,223*) — 100.1% | | 452,815,152 |

| Liabilities in Excess of Other Assets — (0.1)% | | | (620,970) |

| Net Assets — 100.0% | | $ 452,194,182 |

| * The cost and unrealized appreciation (depreciation) of investments as of |

| December 31, 2009, as computed for federal income tax purposes, were as follows: |

| Aggregate cost | | $ 406,925,817 |

| Gross unrealized appreciation | | $ 62,969,603 |

| Gross unrealized depreciation | | | (17,080,268) |

| Net unrealized appreciation | | $ 45,889,335 |

| (a) Non-income producing security. | | | |

| (b) Investments in companies considered to be an affiliate of the Fund, for purposes of |

| Section 2(a)(3) of the Investment Company Act of 1940, were as follows: |

| | | Net | |

| Affiliate | | Activity | Income |

| BlackRock Liquidity Funds, TempFund, | | | |

| Institutional Class | $ (1,277,386) | $ 11,610 |

| (c) Represents the current yield as of report date. | | |

| |

| Portfolio Abbreviations | |

| To simplify the listings of portfolio holdings in | ADR |

| the Schedules of Investments, the names and | AUD |

| descriptions of many of the securities have been | BRL |

| abbreviated according to the following list: | CHF |

| | EUR |

| | |

| American Depositary Receipts | GBP | British Pound |

| Australian Dollar | HKD | Hong Kong Dollar |

| Brazilian Real | JPY | Japanese Yen |

| Swiss Franc | SGD | Singapore Dollar |

| Euro | USD | US Dollar |

See Notes to Financial Statements.

14 SEMI-ANNUAL REPORT DECEMBER 31, 2009

Schedule of Investments (concluded) BlackRock EuroFund

•For Fund compliance purposes, the Fund’s industry classifications refer to any one

or more of the industry sub-classifications used by one or more widely recognized

market indexes or ratings group indexes, and/or as defined by Fund management.

This definition may not apply for purposes of this report, which may combine indus-

try sub-classifications for reporting ease.

•Foreign currency exchange contracts as of December 31, 2009 were as follows:

| | | | | | |

| | | | | | | Unrealized |

| Currency | Currency | | Settlement Appreciation |

| Purchased | | Sold | Counterparty | Date | (Depreciation) |

| EUR 13,793,955 | USD | 19,806,465 | State Street | 3/25/10 | $ (34,776) |

| | | | | Bank | | |

| | | | | & Trust Co. | | |

| GBP 46,835,753 | USD | 76,643,900 | State Street | 3/25/10 | (1,034,558) |

| | | | | Bank | | |

| | | | | & Trust Co. | | |

| USD | 68,521,300 | EUR 47,135,791 | State Street | 3/25/10 | 958,796 |

| | | | | Bank | | |

| | | | | & Trust Co. | | |

| USD | 22,397,965 | GBP 13,906,856 | State Street | 3/25/10 | (52,581) |

| | | | | Bank | | |

| | | | | & Trust Co. | | |

| Total | | | | | | $ (163,119) |

•Fair Value Measurements — Various inputs are used in determining the fair value of

investments, which are as follows:

•Level 1 — price quotations in active markets/exchanges for identical assets

and liabilities

•Level 2 — other observable inputs (including, but not limited to: quoted prices

for similar assets or liabilities in markets that are active, quoted prices for

identical or similar assets or liabilities in markets that are not active, inputs

other than quoted prices that are observable for the assets or liabilities (such

as interest rates, yield curves, volatilities, prepayment speeds, loss severities,

credit risks and default rates) or other market-corroborated inputs)

•Level 3 — unobservable inputs based on the best information available in the

circumstances, to the extent observable inputs are not available (including

the Fund’s own assumptions used in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indi-

cation of the risk associated with investing in those securities. For information

about the Fund’s policy regarding valuation of investments and other significant

accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following table summarizes the inputs used as of December 31, 2009 in deter-

mining the fair valuation of the Fund’s investments:

| | |

| Valuation | Investments in |

| Inputs | | Securities |

| | | Assets |

| Level 1 — Short-Term Securities | $ 7,274,540 |

| Level 2 — Long-Term Investments1 | | 445,540,612 |

| Level 3 | | — |

| Total | $ 452,815,152 |

| 1 See above Schedule of Investments for values in each country. | |

| Valuation | Other Financial |

| Inputs | Instruments2 |

| | Assets | Liabilities |

| Level 1 | — | — |

| Level 2 | $ 958,796 | $ (1,121,915) |

| Level 3 | — | — |

| Total | $ 958,796 | $ (1,121,915) |

| 2 Other financial instruments are foreign currency exchange contracts, which |

| are shown at the unrealized appreciation/depreciation on the instrument. |

SEMI-ANNUAL REPORT DECEMBER 31, 2009 15

Schedule of Investments December 31, 2009 (Unaudited)

BlackRock Focus Value Fund, Inc.

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| Above-Average Yield — 8.6% | | |

| Industrial Conglomerates — 2.2% | | |

| Tyco International Ltd. | 109,050 | $ 3,890,904 |

| Pharmaceuticals — 1.8% | | |

| Merck & Co, Inc. | 87,946 | 3,213,547 |

| Semiconductors & Semiconductor | | |

| Equipment — 2.0% | | |

| Maxim Integrated Products, Inc. | 172,500 | 3,501,750 |

| Specialty Retail — 2.6% | | |

| Limited Brands, Inc. | 240,000 | 4,617,600 |

| Total Above-Average Yield | | 15,223,801 |

| Discount to Assets — 6.9% | | |

| Diversified Telecommunication Services — 2.7% | | |

| Verizon Communications, Inc. | 141,500 | 4,687,895 |

| Hotels, Restaurants & Leisure — 1.7% | | |

| Carnival Corp. (a) | 94,500 | 2,994,705 |

| Oil, Gas & Consumable Fuels — 2.5% | | |

| Anadarko Petroleum Corp. | 71,500 | 4,463,030 |

| Total Discount to Assets | | 12,145,630 |

| Earnings Turnaround — 30.6% | | |

| Aerospace & Defense — 2.6% | | |

| Honeywell International, Inc. | 115,500 | 4,527,600 |

| Capital Markets — 2.2% | | |

| Morgan Stanley | 128,500 | 3,803,600 |

| Commercial Banks — 2.6% | | |

| Wells Fargo & Co. | 168,000 | 4,534,320 |

| Diversified Financial Services — 2.3% | | |

| Bank of America Corp. | 272,500 | 4,103,850 |

| Energy Equipment & Services — 2.8% | | |

| Halliburton Co. | 166,600 | 5,012,994 |

| Food Products — 2.2% | | |

| Unilever NV-ADR | 120,800 | 3,905,464 |

| Metals & Mining — 1.8% | | |

| Nucor Corp. | 67,900 | 3,167,535 |

| Oil, Gas & Consumable Fuels — 2.4% | | |

| Peabody Energy Corp. | 91,700 | 4,145,757 |

| Pharmaceuticals — 2.9% | | |

| Bristol-Myers Squibb Co. | 204,100 | 5,153,525 |

| Semiconductors & Semiconductor | | |

| Equipment — 8.8% | | |

| Analog Devices, Inc. | 140,600 | 4,440,148 |

| LSI Corp. (a) | 1,056,600 | 6,350,166 |

| Micron Technology, Inc. (a) | 436,500 | 4,609,440 |

| | | 15,399,754 |

| Total Earnings Turnaround | | 53,754,399 |

| Financial Restructuring — 0.0% | | |

| Semiconductors & Semiconductor | | |

| Equipment — 0.0% | | |

| Legacy Holdings, Inc. (a) | 1,500 | 3 |

| Total Financial Restructuring | | 3 |

| Operational Restructuring — 17.2% | | |

| Aerospace & Defense — 2.1% | | |

| Raytheon Co. | 72,000 | 3,709,440 |

| Chemicals — 2.4% | | |

| E.I. du Pont de Nemours & Co. | 125,000 | 4,208,750 |

| | |

| Common Stocks | Shares | Value |

| Operational Restructuring (concluded) | | |

| Computers & Peripherals — 3.1% | | |

| Hewlett-Packard Co. | 104,000 | $ 5,357,040 |

| Diversified Financial Services — 2.8% | | |

| JPMorgan Chase & Co. | 116,400 | 4,850,388 |

| Food & Staples Retailing — 2.3% | | |

| Walgreen Co. | 111,500 | 4,094,280 |

| Health Care Equipment & Supplies — 1.6% | | |

| Covidien Plc | 59,000 | 2,825,510 |

| Household Products — 2.0% | | |

| Kimberly-Clark Corp. | 55,500 | 3,535,905 |

| Media — 0.9% | | |

| Comcast Corp., Special Class A | 103,500 | 1,657,035 |

| Total Operational Restructuring | | 30,238,348 |

| Price-to-Book Value — 4.2% | | |

| Diversified Financial Services — 2.3% | | |

| Citigroup, Inc. | 1,218,400 | 4,032,904 |

| Semiconductors & Semiconductor | | |

| Equipment — 1.9% | | |

| Novellus Systems, Inc. (a) | 140,000 | 3,267,600 |

| Total Price-to-Book Value | | 7,300,504 |

| Price-to-Cash Flow — 2.9% | | |

| Health Care Providers & Services — 2.9% | | |

| Coventry Health Care, Inc. (a) | 212,500 | 5,161,625 |

| Total Price-to-Cash Flow | | 5,161,625 |

| Price-to-Earnings Per Share — 25.1% | | |

| Diversified Telecommunication Services — 2.4% | | |

| Qwest Communications International, Inc. (b) | 1,015,200 | 4,273,992 |

| Energy Equipment & Services — 4.9% | | |

| Noble Corp. | 102,600 | 4,175,820 |

| Weatherford International Ltd. (a) | 247,300 | 4,429,143 |

| | | 8,604,963 |

| Insurance — 8.5% | | |

| ACE Ltd. | 97,000 | 4,888,800 |

| MetLife, Inc. | 123,500 | 4,365,725 |

| The Travelers Cos., Inc. | 112,300 | 5,599,278 |

| | | 14,853,803 |

| Internet Software & Services — 0.0% | | |

| AOL, Inc. (a) | 1 | 21 |

| Media — 4.8% | | |

| CBS Corp., Class B | 310,000 | 4,355,500 |

| Time Warner, Inc. | 138,500 | 4,035,890 |

| | | 8,391,390 |

| Oil, Gas & Consumable Fuels — 2.5% | | |

| Chevron Corp. | 58,000 | 4,465,420 |

| Software — 2.0% | | |

| Electronic Arts, Inc. (a) | 197,000 | 3,496,750 |

| Total Price-to-Earnings Per Share | | 44,086,339 |

| Special Situations — 2.7% | | |

| Capital Markets — 2.7% | | |

| Invesco Ltd. | 201,000 | 4,721,490 |

| Total Special Situations | | 4,721,490 |

| Total Common Stocks — 98.2% | | 172,632,139 |

See Notes to Financial Statements.

16 SEMI-ANNUAL REPORT DECEMBER 31, 2009

Schedule of Investments (concluded)

BlackRock Focus Value Fund, Inc.

(Percentages shown are based on Net Assets)

| | | |

| Preferred Stock | Shares | | Value |

| Earnings Turnaround — 0.5% | | | |

| Diversified Financial Services — 0.5% | | | |

| Bank of America Corp., 10.00% (c)(d) | 62,100 | $ 926,532 |

| Total Preferred Stock — 0.5% | | | 926,532 |

| Total Long-Term Investments | | | |

| (Cost — $141,864,964) — 98.7% | | 173,558,671 |

| Short-Term Securities | | | |

| BlackRock Liquidity Funds, TempCash, | | | |

| Institutional Class, 0.17% (e)(f) | 2,201,749 | 2,201,749 |

| | Beneficial | | |

| | Interest | | |

| | (000) | | |

| BlackRock Liquidity Series, LLC | | | |

| Money Market Series, 0.29% (e)(f)(g) | $ 4,050 | 4,050,000 |

| Total Short-Term Securities | | | |

| (Cost — $6,251,749) — 3.6% | | 6,251,749 |

| Total Investments (Cost — $148,116,713*) — 102.3% | 179,810,420 |

| Liabilities in Excess of Other Assets — (2.3)% | | (3,975,632) |

| Net Assets — 100.0% | | $ 175,834,788 |

| * The cost and unrealized appreciation (depreciation) of investments as of | |

| December 31, 2009, as computed for federal income tax purposes, were as follows: |

| Aggregate cost | | $ 151,020,530 |

| Gross unrealized appreciation | | $ 33,899,029 |

| Gross unrealized depreciation | | (5,109,139) |

| Net unrealized appreciation | | $ 28,789,890 |

| (a) Non-income producing security. | | | |

| (b) Security, or a portion of security, is on loan. | | | |

| (c) Convertible security. | | | |

| (d) Variable rate security. Rate shown is as of report date. | | |

| (e) Investments in companies considered to be an affiliate of the Fund, for purposes of |

| Section 2(a)(3) of the Investment Company Act of 1940, were as follows: | |

| | Net | | |

| Affiliate | Activity | Income |

| BlackRock Liquidity Funds, TempCash, | | | |

| Institutional Class | $ (160,042) | $ 4,139 |

| BlackRock Liquidity Series, LLC | | | |

| Money Market Series | $(1,125,000) | $ 5,569 |

| (f) Represents the current yield as of report date. | | | |

| (g) Security was purchased with the cash collateral from securities loans. | |

•For Fund compliance purposes, the Fund’s industry classifications refer to any one

or more of the industry sub-classifications used by one or more widely recognized

market indexes or ratings group indexes, and/or as defined by Fund management.

This definition may not apply for purposes of this report, which may combine indus-

try sub-classifications for reporting ease.

•Fair Value Measurements — Various inputs are used in determining the fair value of

investments, which are as follows:

•Level 1 — price quotations in active markets/exchanges for identical assets

and liabilities

•Level 2 — other observable inputs (including, but not limited to: quoted prices

for similar assets or liabilities in markets that are active, quoted prices for

identical or similar assets or liabilities in markets that are not active, inputs

other than quoted prices that are observable for the assets or liabilities (such

as interest rates, yield curves, volatilities, prepayment speeds, loss severities,

credit risks and default rates) or other market-corroborated inputs)

•Level 3 — unobservable inputs based on the best information available in the

circumstances, to the extent observable inputs are not available (including the

Fund’s own assumptions used in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indi-

cation of the risk associated with investing in those securities. For information

about the Fund’s policy regarding valuation of investments and other significant

accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following table summarizes the inputs used as of December 31, 2009 in deter-

mining the fair valuation of the Fund’s investments:

| |

| Valuation | Investments in |

| Inputs | Securities |

| | Assets |

| Level 1 | |

| Long-Term Investments1 | $ 173,558,671 |

| Short-Term Securities | 2,201,749 |

| Total Level 1 | 175,760,420 |

| Level 2 — Short-Term Securities | 4,050,000 |

| Level 3 | — |

| Total | $ 179,810,420 |

| 1 See above Schedule of Investments for values in each industry excluding |

| Level 2 within the table. | |

See Notes to Financial Statements.

SEMI-ANNUAL REPORT DECEMBER 31, 2009 17

Schedule of Investments December 31, 2009 (Unaudited)

BlackRock Global SmallCap Fund, Inc.

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| Australia — 2.3% | | |

| CFS Retail Property Trust | 4,072,838 | $ 6,935,066 |

| Cochlear Ltd. | 88,800 | 5,483,727 |

| Goodman Fielder Ltd. | 3,523,000 | 5,130,191 |

| Mount Gibson Iron Ltd. (a) | 1,577,400 | 2,324,763 |

| Myer Holdings Ltd. (a) | 1,185,800 | 3,877,113 |

| | | 23,750,860 |

| Austria — 0.8% | | |

| Intercell AG (a) | 80,400 | 2,993,024 |

| Schoeller-Bleckmann Oilfield Equipment AG | 111,100 | 5,306,442 |

| | | 8,299,466 |

| Bermuda — 2.1% | | |

| Lazard Ltd., Class A | 195,900 | 7,438,323 |

| PartnerRe Ltd. | 95,200 | 7,107,632 |

| Ports Design Ltd. | 2,220,500 | 6,846,305 |

| | | 21,392,260 |

| Brazil — 1.0% | | |

| Lupatech SA (a) | 335,100 | 5,225,712 |

| Santos Brasil Participacoes SA (a) | 527,400 | 5,301,264 |

| | | 10,526,976 |

| Canada — 5.5% | | |

| Agnico-Eagle Mines Ltd. | 112,900 | 6,096,600 |

| Biovail Corp. | 231,200 | 3,227,552 |

| DiagnoCure, Inc. (a)(b) | 4,278,880 | 4,254,946 |

| Dollarama, Inc. (a) | 70,600 | 1,508,735 |

| Dollarama, Inc. (a)(c) | 203,600 | 4,350,968 |

| Eastern Platinum Ltd. (a) | 3,280,900 | 2,886,100 |

| Eldorado Gold Corp. (a) | 577,700 | 8,241,415 |

| Inmet Mining Corp. | 107,700 | 6,567,965 |

| Lundin Mining Corp. (a) | 1,214,800 | 4,994,636 |

| Quadra Mining Ltd. (a) | 274,000 | 3,801,444 |

| Taseko Mines Ltd. (a) | 1,168,200 | 4,929,804 |

| Thompson Creek Metals Co., Inc. (a) | 462,600 | 5,453,801 |

| | | 56,313,966 |

| Cayman Islands — 1.5% | | |

| Ming Fai International Holdings Ltd. | 18,753,700 | 3,192,778 |

| Parkson Retail Group Ltd. | 2,827,500 | 4,975,587 |

| Polarcus Ltd. (a) | 3,095,000 | 1,977,875 |

| XL Capital Ltd., Class A | 276,900 | 5,075,577 |

| | | 15,221,817 |

| China — 1.7% | | |

| 7 Days Group Holdings Ltd.-ADR (a) | 262,100 | 3,271,008 |

| Duoyuan Global Water, Inc.-ADR (a)(d) | 87,600 | 3,135,204 |

| Shenguan Holdings Group Ltd. (a) | 1,236,800 | 1,126,191 |

| Shenzhen Expressway Co., Ltd. | 8,423,100 | 4,129,676 |

| WuXi PharmaTech Cayman, Inc.-ADR (a)(d) | 389,300 | 6,213,228 |

| | | 17,875,307 |

| Denmark — 0.8% | | |

| TrygVesta A/S | 89,115 | 5,857,941 |

| Vestas Wind Systems A/S (a) | 34,216 | 2,083,166 |

| | | 7,941,107 |

| Finland — 0.6% | | |

| Ramirent Oyj | 648,750 | 6,304,326 |

| France — 2.4% | | |

| Bonduelle SA | 83,800 | 9,534,286 |

| Eurofins Scientific SA | 51,275 | 2,793,377 |

| Scor SE | 352,420 | 8,853,502 |

| UBISOFT Entertainment (a) | 247,200 | 3,500,135 |

| | | 24,681,300 |

| | |

| Common Stocks | Shares | Value |

| Germany — 4.3% | | |

| Deutsche Euroshop AG | 155,000 | $ 5,246,783 |

| GEA Group AG | 293,450 | 6,536,893 |

| Gerresheimer AG | 195,500 | 6,586,688 |

| Paion AG (a) | 475,886 | 1,739,624 |

| Rheinmetall AG | 170,200 | 10,805,791 |

| Salzgitter AG | 56,500 | 5,536,353 |

| Symrise AG | 361,600 | 7,707,577 |

| | | 44,159,709 |

| Hong Kong — 1.1% | | |

| Clear Media Ltd. (a) | 4,052,000 | 2,130,146 |

| Dah Sing Financial Group | 320,700 | 1,767,154 |

| Lu Ning Co. Ltd. | 1,854,400 | 7,031,542 |

| | | 10,928,842 |

| India — 1.1% | | |

| Container Corp. of India | 156,300 | 4,387,358 |

| Steel Authority of India | 473,800 | 2,445,832 |

| United Phosphorus Ltd. | 1,311,200 | 4,868,461 |

| | | 11,701,651 |

| Ireland — 0.9% | | |

| Ryanair Holdings Plc-ADR (a) | 328,196 | 8,802,217 |

| Israel — 1.2% | | |

| NICE Systems Ltd.-ADR (a) | 255,600 | 7,933,824 |

| Strauss-Elite Ltd. | 269,800 | 4,020,938 |

| | | 11,954,762 |

| Italy — 1.3% | | |

| Credito Emiliano SpA (a) | 474,869 | 3,657,263 |

| DiaSorin SpA | 145,300 | 5,163,885 |

| Iride SpA | 1,756,900 | 3,346,646 |

| Milano Assicurazioni SpA | 526,500 | 1,539,845 |

| | | 13,707,639 |

| Japan — 5.9% | | |

| Advantest Corp. | 126,000 | 3,282,426 |

| Asics Corp. | 432,950 | 3,885,669 |

| Don Quijote Co., Ltd. | 189,000 | 4,586,251 |

| Fukuoka Financial Group, Inc. | 1,511,300 | 5,266,880 |

| Hisaka Works Ltd. | 298,500 | 2,960,426 |

| Jupiter Telecommunications Co., Ltd. | 4,335 | 4,289,591 |

| Koito Manufacturing Co., Ltd. | 337,500 | 5,416,930 |

| Komori Corp. | 205,600 | 2,270,813 |

| Kureha Chemical Industry Co., Ltd. | 1,406,400 | 6,936,279 |

| MEGMILK SNOW BRAND Co Ltd. | 123,300 | 1,813,722 |

| Makita Corp. | 89,150 | 3,062,132 |

| NGK Insulators Ltd. | 208,400 | 4,557,583 |

| Nippon Building Fund, Inc. | 389 | 2,956,455 |

| Osaka Securities Exchange Co., Ltd. | 1,275 | 6,077,307 |

| PanaHome Corp. | 239,500 | 1,541,981 |

| Suruga Bank Ltd. | 207,400 | 1,807,358 |

| Toyo Suisan Kaisha, Ltd. | 14,100 | 325,155 |

| | | 61,036,958 |

| Malaysia — 0.4% | | |

| AirAsia Bhd (a) | 8,864,400 | 3,558,798 |

| Mexico — 0.3% | | |

| Embotelladoras Arca SA de CV | 1,013,400 | 3,369,737 |

| Netherlands — 0.2% | | |

| Fugro NV | 40,900 | 2,349,264 |

See Notes to Financial Statements.

18 SEMI-ANNUAL REPORT DECEMBER 31, 2009

Schedule of Investments (continued)

BlackRock Global SmallCap Fund, Inc.

(Percentages shown are based on Net Assets)

| | |

| Common Stocks | Shares | Value |

| Norway — 2.4% | | |

| Golden Ocean Group Ltd. (a) | 4,015,500 | $ 7,277,327 |

| ProSafe ASA | 415,500 | 2,635,855 |

| Sevan Marine ASA (a) | 2,097,400 | 3,659,961 |

| Songa Offshore SE (a) | 1,199,900 | 6,258,650 |

| TGS Nopec Geophysical Co. ASA (a) | 266,500 | 4,813,514 |

| | | 24,645,307 |

| Singapore — 1.7% | | |

| Avago Technologies Ltd. (a) | 442,100 | 8,086,009 |

| Cityspring Infrastructure Trust | 15,536,600 | 6,512,263 |

| Olam International Ltd. | 500 | 939 |

| UOL Group Ltd. | 934,600 | 2,693,343 |

| | | 17,292,554 |

| Spain — 0.9% | | |

| Bolsas y Mercados Espanoles | 42,800 | 1,380,448 |

| Laboratorios Farmaceuticos Rovi SA | 723,294 | 8,007,293 |

| | | 9,387,741 |

| Sweden — 0.9% | | |

| Axfood AB | 142,800 | 4,165,555 |

| Swedish Match AB | 215,100 | 4,702,791 |

| | | 8,868,346 |

| Switzerland — 1.2% | | |

| Addex Pharmaceuticals Ltd. (a) | 63,000 | 840,447 |

| Aryzta AG | 73,900 | 2,752,314 |

| Clariant AG | 217,500 | 2,571,962 |

| Foster Wheeler AG (a) | 96,700 | 2,846,848 |

| Rieter Holding AG | 15,231 | 3,440,244 |

| | | 12,451,815 |

| Thailand — 0.4% | | |

| Mermaid Maritime PCL (a) | 7,451,305 | 4,455,885 |

| United Kingdom — 8.6% | | |

| Amlin Plc | 1,320,215 | 7,623,045 |

| Antofagasta Plc | 178,000 | 2,831,544 |

| Britvic Plc | 1,091,800 | 7,159,471 |

| Cairn Energy Plc (a) | 1,302,000 | 6,969,973 |

| Charter International Plc | 571,200 | 6,616,962 |

| EasyJet Plc (a) | 771,000 | 4,373,009 |

| GKN Plc | 818,100 | 1,532,276 |

| Group 4 Securicor Plc | 1,640,097 | 6,874,576 |

| Halfords Group Plc | 847,700 | 5,455,169 |

| Hikma Pharmaceuticals Plc | 961,400 | 7,897,760 |

| Intertek Group Plc | 242,900 | 4,909,509 |

| Kesa Electricals Plc | 2,982,800 | 7,165,519 |

| QinetiQ Plc | 1,502,900 | 3,921,071 |

| Rexam Plc | 1,431,572 | 6,692,426 |

| Rightmove Plc | 323,700 | 2,628,622 |

| Schroders Plc | 259,600 | 5,548,030 |

| | | 88,198,962 |

| United States — 47.8% | | |

| ADC Telecommunications, Inc. (a) | 465,000 | 2,887,650 |

| AMB Property Corp. | 107,200 | 2,738,960 |

| Abercrombie & Fitch Co., Class A | 25,400 | 885,190 |

| Acadia Realty Trust | 159,600 | 2,692,452 |

| Advanced Energy Industries, Inc. (a) | 438,900 | 6,618,612 |

| AirTran Holdings, Inc. (a) | 57,800 | 301,716 |

| Alexion Pharmaceuticals, Inc. (a) | 56,400 | 2,753,448 |

| Alpha Natural Resources, Inc. (a) | 162,200 | 7,036,236 |

| Ancestry.com, Inc. (a) | 40,800 | 571,608 |

| Arch Capital Group Ltd. (a) | 71,800 | 5,137,290 |

| Autoliv, Inc. (d) | 82,700 | 3,585,872 |

| | |

| Common Stocks | Shares | Value |

| United States (continued) | | |

| BJ’s Restaurants, Inc. (a)(d) | 197,800 | $ 3,722,596 |

| BMC Software, Inc. (a) | 103,500 | 4,150,350 |

| BancorpSouth, Inc. (d) | 157,300 | 3,690,258 |

| Bank of Hawaii Corp. (d) | 130,300 | 6,131,918 |

| Blackboard, Inc. (a) | 205,300 | 9,318,567 |

| BorgWarner, Inc. (d) | 80,150 | 2,662,583 |

| Brooks Automation, Inc. (a) | 677,750 | 5,815,095 |

| Burger King Holdings, Inc. | 110,100 | 2,072,082 |

| Cadence Design Systems, Inc. (a) | 826,150 | 4,948,639 |

| CardioNet, Inc. (a)(d) | 270,500 | 1,606,770 |

| Celanese Corp., Series A | 247,400 | 7,941,540 |

| Citrix Systems, Inc. (a) | 122,400 | 5,093,064 |

| Cliffs Natural Resources, Inc. | 177,398 | 8,176,274 |

| ComScore, Inc. (a) | 200,700 | 3,522,285 |

| Commercial Vehicle Group, Inc. (a) | 411,600 | 2,465,484 |

| Core Laboratories NV | 26,400 | 3,118,368 |

| Corporate Office Properties Trust (d) | 100,200 | 3,670,326 |

| Covanta Holding Corp. (a)(d) | 292,550 | 5,292,230 |

| Coventry Health Care, Inc. (a) | 188,800 | 4,585,952 |

| Cullen/Frost Bankers, Inc. (d) | 181,600 | 9,080,000 |

| DSP Group, Inc. (a) | 793,800 | 4,469,094 |

| Delta Air Lines, Inc. (a) | 334,900 | 3,811,162 |

| Digital Realty Trust, Inc. (d) | 110,400 | 5,550,912 |

| Drew Industries, Inc. (a) | 211,800 | 4,373,670 |

| Duoyuan Printing, Inc. (a) | 153,000 | 1,231,650 |

| Electronics for Imaging, Inc. (a) | 507,200 | 6,598,672 |

| EnergySolutions, Inc. | 420,000 | 3,565,800 |

| FTI Consulting, Inc. (a) | 103,700 | 4,890,492 |

| Ferro Corp. | 709,900 | 5,849,576 |

| Fidelity National Title Group, Inc., Class A | 435,700 | 5,864,522 |

| Foot Locker, Inc. | 91,800 | 1,022,652 |

| Fortinet, Inc. (a) | 8,700 | 152,859 |

| Guess?, Inc. | 217,850 | 9,215,055 |

| Home Properties, Inc. | 60,000 | 2,862,600 |

| IDEX Corp. | 249,350 | 7,767,252 |

| IHS, Inc., Class A (a) | 29,500 | 1,616,895 |

| IPC The Hospitalist Co., Inc. (a) | 198,000 | 6,583,500 |

| ITC Holdings Corp. | 177,500 | 9,245,975 |

| Integrated Device Technology, Inc. (a) | 354,700 | 2,294,909 |

| Intersil Corp., Class A | 606,100 | 9,297,574 |

| j2 Global Communications, Inc. (a) | 319,600 | 6,503,860 |

| JDS Uniphase Corp. (a) | 1,034,900 | 8,537,925 |

| K-Swiss, Inc., Class A | 140,500 | 1,396,570 |

| Kindred Healthcare, Inc. (a) | 50,600 | 934,076 |

| Kinetic Concepts, Inc. (a) | 100,550 | 3,785,707 |

| King Pharmaceuticals, Inc. (a)(d) | 574,100 | 7,044,207 |

| Knight Capital Group, Inc., Class A (a) | 149,700 | 2,305,380 |

| LKQ Corp. (a) | 337,663 | 6,614,818 |

| Landstar System, Inc. | 129,350 | 5,014,900 |

| Linear Technology Corp. | 124,750 | 3,809,865 |

| The Macerich Co. (d) | 158,981 | 5,715,382 |

| Manpower, Inc. | 54,900 | 2,996,442 |

| Maxim Integrated Products, Inc. | 335,300 | 6,806,590 |

| Mentor Graphics Corp. (a) | 621,250 | 5,485,637 |

| Merit Medical Systems, Inc. (a) | 456,261 | 8,801,275 |

| MoSys, Inc. (a) | 52,450 | 205,604 |

| Nektar Therapeutics (a) | 290,000 | 2,702,800 |

| Nordson Corp. | 81,450 | 4,983,111 |

| Northeast Utilities, Inc. | 195,500 | 5,041,945 |

| Nuance Communications, Inc. (a) | 475,200 | 7,384,608 |

| ON Semiconductor Corp. (a) | 941,000 | 8,290,210 |

| PMC-Sierra, Inc. (a) | 859,300 | 7,441,538 |

| Packaging Corp. of America | 298,700 | 6,873,087 |

| People’s United Financial, Inc. | 319,174 | 5,330,206 |

| PetroHawk Energy Corp. (a)(d) | 477,300 | 11,450,427 |

See Notes to Financial Statements.

SEMI-ANNUAL REPORT DECEMBER 31, 2009 19

Schedule of Investments (continued)

BlackRock Global SmallCap Fund, Inc.

(Percentages shown are based on Net Assets)

| | | | | | |

| Common Stocks | | | Shares | | | Value |