UNITEDSTATES

SECURITIESANDEXCHANGECOMMISSION

Washington,D.C.20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04612

Name of Fund: BlackRock EuroFund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock

EuroFund, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 06/30/2011

Date of reporting period: 06/30/2011

Item 1 – Report to Stockholders

June 30, 2011

Annual Report

BlackRock EuroFund

BlackRock Focus Value Fund, Inc.

BlackRock Global SmallCap Fund, Inc.

BlackRock International Value Fund | of BlackRock International Value Trust

Not FDIC Insured • No Bank Guarantee • May Lose Value

| Table of Contents | |

| Page | |

| Dear Shareholder | 3 |

| Annual Report: | |

| Fund Summaries | 4 |

| About Fund Performance | 12 |

| Disclosure of Expenses | 12 |

| Derivative Instruments | 13 |

| Financial Statements: | |

| Schedules of Investments | 14 |

| Statements of Assets and Liabilities | 25 |

| Statements of Operations | 27 |

| Statements of Changes in Net Assets | 28 |

| Financial Highlights | 30 |

| Notes to Financial Statements | 50 |

| Report of Independent Registered Public Accounting Firm | 60 |

| Important Tax Information | 60 |

| Disclosure of Investment Advisory Agreements and Sub-Advisory Agreements | 61 |

| Officers and Directors | 65 |

| Additional Information | 68 |

| Mutual Fund Family | 70 |

| 2 | ANNUAL REPORT | JUNE | 30, 2011 |

Dear Shareholder

The recent downgrade of US long-term debt by Standard & Poor’s marked an historic event for financial

markets. Stocks tumbled in the days before and after the announcement on August 5 as investors con-

templated the pervasiveness of the lower US credit rating across asset classes and the future direction

of the global economy. BlackRock was well prepared for the possibility of a downgrade and the firm had

no need to execute any forced selling of securities in response to the S&P action.Through periods of

uncertainty, as ever, BlackRock’s full resources are dedicated to the management of our clients’ assets.

The pages that follow reflect your mutual fund’s reporting period ended June 30, 2011.Accordingly, the

below discussion is intended to provide you with perspective on the performance of your investments

during that period.

Economic conditions in the second quarter of 2011 were strikingly similar to the scenario of the same

quarter last year.The sovereign debt crisis in Europe, tightening monetary policy in China and a global

economic slowdown were again the key concerns that drove investors away from risky assets.The sec-

ond-quarter correction in 2010 was significant, but markets were revived toward the end of the summer

as positive economic news and robust corporate earnings whetted investor appetite for yield.The global

economy had finally gained traction and investor fear turned to optimism with the anticipation of a sec-

ond round of quantitative easing (“QE2”) from the US Federal Reserve Board (the “Fed”). Stock markets

rallied despite the ongoing European debt crisis and inflationary pressures looming over emerging mar-

kets. Fixed income markets, however, saw yields move sharply upward, pushing prices down, especially

on the long end of the historically steep yield curve.While high yield bonds benefited from the risk rally,

most fixed income sectors declined in the fourth quarter.The tax-exempt municipal market faced addi-

tional headwinds as it became evident that the Build America Bond program would not be extended and

municipal finance troubles abounded.

The new year brought spikes of volatility as political turmoil swept across the Middle East/North Africa

region and prices of oil and other commodities soared. Natural disasters in Japan disrupted industry

supply chains and concerns mounted over US debt and deficit issues. Equities quickly rebounded from

each of these events as investors chose to focus on the continuing stream of strong corporate earnings

and positive economic data. Global credit markets were surprisingly resilient in this environment and

yields regained relative stability in 2011.The tax-exempt market saw relief from its headwinds and

steadily recovered from its fourth-quarter lows. Equities, commodities and high yield bonds outpaced

higher-quality assets as investors responded to the Fed’s early 2011 reaffirmation that it will keep inter-

est rates low.

However, longer-term headwinds had been brewing. Inflationary pressures intensified in emerging

economies, many of which were overheating, and the European debt crisis was not over. Markets were

met with a sharp reversal in May when political unrest in Greece pushed the nation closer to defaulting

on its debt.This development rekindled fears about the broader debt crisis and its further contagion

among peripheral European countries. Concurrently, it became evident that the pace of global economic

growth had slowed. Higher oil prices and supply chain disruptions in Japan finally caught up with eco-

nomic data. Investors pulled back from riskier assets and stocks generally declined throughout most of

May and June, but year-to-date performance in global equity markets was positive, and 12-month

returns were remarkably strong. In bond markets, yields were volatile but generally moved lower for the

period as a whole (pushing prices up). Continued low short-term interest rates kept yields on money

market securities near their all-time lows.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

“Markets generally moved higher

despite heightened volatility during

the reporting period.”

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of June 30, 2011 | 6-month 12-month | |

| US large cap equities | 6.02% | 30.69% |

| (S&P 500® Index) | ||

| US small cap equities | 6.21 | 37.41 |

| (Russell 2000® Index) | ||

| International equities | 4.98 | 30.36 |

| (MSCI Europe,Australasia, | ||

| Far East Index) | ||

| Emerging market equities | 0.88 | 27.80 |

| (MSCI Emerging Markets Index) | ||

| 3-month Treasury bill | 0.08 | 0.16 |

| (BofA Merrill Lynch 3-Month | ||

| Treasury Bill Index) | ||

| US Treasury securities | 3.26 | 1.88 |

| (BofA Merrill Lynch 10-Year | ||

| US Treasury Index) | ||

| US investment grade bonds | 2.72 | 3.90 |

| (Barclays Capital US Aggregate | ||

| Bond Index) | ||

| Tax-exempt municipal bonds | 4.42 | 3.48 |

| (Barclays Capital Municipal | ||

| Bond Index) | ||

| US high yield bonds | 4.98 | 15.53 |

| (Barclays Capital US | ||

| Corporate High Yield 2% | ||

| Issuer Capped Index) | ||

Past performance is no guarantee of future results.

Index performance is shown for illustrative purposes only.

You cannot invest directly in an index.

| THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

Fund Summary as of June 30, 2011 BlackRock EuroFund

Investment Objective

BlackRock EuroFund's (the “Fund”) investment objective is to seek capital appreciation primarily through investment in equities of corporations domiciled

in European countries.

Portfolio Management Commentary

How did the Fund perform?

• For the 12-month period ended June 30, 2011, the Fund’s Institutional

and Investor A Shares slightly outperformed the benchmark Morgan Stanley

Capital International (MSCI) Europe Index, while the Investor B, Investor C

and Class R Shares underperformed the benchmark.

What factors influenced performance?

• Overall, stock selection had a positive impact on the Fund’s performance

relative to the MSCI Europe Index, while sector allocation detracted. The

Fund benefited from its holdings in the financials sector, where an over-

weight position in French bank Societe Generale SA and underweights in

British banks Barclays Plc and HSBC Holdings Plc were among the top con-

tributors to performance for the year. Stock selection in the materials sector

was also rewarding as miners BHP Billiton Plc and Xstrata Plc outper-

formed on the back of robust commodities demand. Elsewhere, overweight

positions in a number of automobile-related companies were beneficial

including tire manufacturers Continental AG and Nokian Renkaat Oyj.

• Conversely, stock selection in telecommunication services (telecom) and

industrials had a negative impact on performance, as did overall under-

weight exposures to the energy and health care sectors.

Describe recent portfolio activity.

• During the 12-month period, we reduced the Fund’s exposure to industrials

by selling capital goods companies Koninklijke Philips Electronics NV, Vinci

SA, Bilfinger Berger SE and Prysmian SpA as well as logistics company

Deutsche Post AG. We also moderately decreased the Fund’s weighting in

the consumer discretionary and telecom sectors. The proceeds were used

to add exposure to the energy sector, where we purchased oil services

firms Compagnie Générale de Géophysique-Veritas SA, Saipem SpA and

Technip SA. We substantially increased materials exposure by purchasing

soft commodities producers Syngenta AG and K+S AG, as well as specialty

chemicals firm AZ Electronic Materials SA and food enzyme maker Christian

Hansen Holding A/S. We also made a small addition to the information

technology sector through the purchase of software developer SAP AG.

Describe portfolio positioning at period end.

• As of period end, the Fund was overweight relative to the benchmark index

in the materials, consumer discretionary and energy sectors, and under-

weight in industrials, health care and financials. Geographically, the Fund

was overweight in Germany, Denmark and the United Kingdom, and under-

weight in Switzerland, Spain and Sweden.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changesin market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| Portfolio Information | |

| Percent of | |

| Long-Term | |

| Ten Largest Holdings | Investments |

| Royal Dutch Shell Plc, Class B | 4% |

| GlaxoSmithKline Plc | 4 |

| Rio Tinto Plc, Registered Shares | 3 |

| Bayer AG, Registered Shares | 3 |

| Danone | 3 |

| Imperial Tobacco Group Plc | 3 |

| Continental AG | 3 |

| Vodafone Group Plc | 3 |

| Carlsberg A/S, Class B | 3 |

| Xstrata Plc | 3 |

| Percent of | |

| Long-Term | |

| Geographic Allocations | Investments |

| United Kingdom | 34% |

| France | 17 |

| Germany | 17 |

| Switzerland | 7 |

| Denmark | 6 |

| Netherlands | 5 |

| Italy | 3 |

| Finland | 2 |

| Belgium | 2 |

| Norway | 2 |

| Spain | 2 |

| Luxembourg | 2 |

| Other1 | 1 |

1 Other includes a 1% or less investment in each of the following countries: Sweden

and Greece.

| 4 | ANNUAL REPORT | JUNE | 30, 2011 |

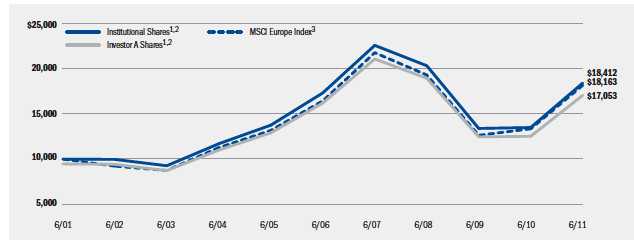

BlackRock EuroFund

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including investment advisory fees, if any. Institutional Shares do not

have a sales charge.

2 Under normal circumstances, the Fund will invest at least 80% of its net assets in equity securities, including common stock and convertible securities, of

companies located in Europe. The Fund currently expects that a majority of the Fund’s assets will be invested in equity securities of companies in Western

European countries, but may also invest in emerging markets in Eastern European countries.

3 This unmanaged broad-based capitalization-weighted index is comprised of a representative sampling of large-, medium- and small-capitalization compa-

nies in developed European countries.

Performance Summary for the Period Ended June 30, 2011

| Average Annual Total Returns4 | |||||||

| 1 Year | 5 Years | 10 Years | |||||

| 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |

| Total Returns | charge | charge | charge | charge | charge | charge | |

| Institutional | 8.63% | 36.42% | N/A | 1.23% | N/A | 6.29% | N/A |

| Investor A | 8.55 | 36.15 | 29.00% | 1.03 | (0.05)% | 6.05 | 5.48% |

| Investor B | 7.74 | 34.13 | 29.63 | (0.14) | (0.39) | 5.33 | 5.33 |

| Investor C | 8.06 | 35.01 | 34.01 | 0.19 | 0.19 | 5.20 | 5.20 |

| Class R | 8.28 | 35.54 | N/A | 0.47 | N/A | 5.77 | N/A |

| MSCI Europe Index | 9.05 | 36.02 | N/A | 2.02 | N/A | 6.15 | N/A |

4 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| Actual | Hypothetical6 | ||||||

| Beginning | Ending | Beginning | Ending | ||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized | |

| January 1, 2011 | June 30, 2011 | During the Period5 | January 1, 2011 | June 30, 2011 | During the Period5 | Expense Ratio | |

| Institutional | $1,000.00 | $1,086.30 | $ 5.28 | $1,000.00 | $1,019.74 | $ 5.11 | 1.02% |

| Investor A | $1,000.00 | $1,085.50 | $ 6.31 | $1,000.00 | $1,018.74 | $ 6.11 | 1.22% |

| Investor B | $1,000.00 | $1,077.40 | $14.11 | $1,000.00 | $1,011.21 | $13.66 | 2.74% |

| Investor C | $1,000.00 | $1,080.60 | $10.73 | $1,000.00 | $1,014.48 | $10.39 | 2.08% |

| Class R | $1,000.00 | $1,082.80 | $ 9.35 | $1,000.00 | $1,015.82 | $ 9.05 | 1.81% |

5 For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average accountvalue over the period, multiplied by 181/365

(to reflect the one-half year period shown).

6 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| ANNUAL | REPORT | JUNE | 30, 2011 | 5 |

Fund Summary as of June 30, 2011 BlackRock Focus Value Fund, Inc.

Investment Objective

BlackRock Focus Value Fund, Inc.'s (the “Fund”) investment objective is to seek long-term growth of capital.

Portfolio Management Commentary

How did the Fund perform?

• For the 12-month period ended June 30, 2011, the Fund posted double-

R Shares outperformed the Russell 1000® Value Index, but underper-

formed the S&P digit positive returns. The Fund’s Institutional and Investor A Shares outper-

formed the Fund’s benchmark, the Russell 1000® Value Index, and the

broad-market S&P 500® Index. The Fund’s Investor B, Investor C and

500® Index. The following discussion of relative perform-

ance pertains to the Russell 1000® Value Index.

What factors influenced performance?

• Stock selection was additive in the consumer discretionary sector, where

strong returns were derived from holdings in media, specialty retailers and

leisure companies. Standout performers included CBS Corp., Class B,

Limited Brands, Inc. and Comcast Corp., Special Class A. Metals & mining

holdings, most notably Alcoa, Inc., enhanced performance in the materials

sector. In financials, underweight exposure to commercial banks proved ben-

eficial, as did the avoidance of Berkshire Hathaway, Inc. The overall avoid-

ance of utilities companies also benefited performance.

• The Fund’s holdings in the information technology (IT) sector detracted

from relative performance. In particular, exposure to computers & peripher-

als, electronic equipment and semiconductors through holdings such as

Hewlett-Packard Co. and Micron Technology Co. had a negative impact. In

health care, the Fund’s underweight positions in the biotechnology, phar-

maceutical and health care providers & services industries hindered

returns, particularly with respect to Pfizer, Inc. and UnitedHealth Group, Inc.

Also in the sector, holdings in Bristol-Myers Squibb Co. detracted.

Describe recent portfolio activity.

• During the 12-month period, we increased exposure to the telecommunica-

tion services (telecom) sector with the addition of Sprint Nextel Corp. We

reduced exposure to IT, financials, consumer discretionary and energy.

Notable sales during the period included Micron Technology Co., Novellus

Systems, Inc., Limited Brands, Inc. and Weatherford International Ltd.

Describe portfolio positioning at period end.

• Relative to the Russell 1000® Value Index, the Fund ended the period over-

weight in materials, IT, energy, consumer discretionary, industrials, and tele-

com and underweight in health care, consumer staples and financials.

• The economy has improved, but trails the level of growth typically seen at

this point in the economic cycle. Unemployment remains high; state, local

and federal budget deficits are worrisome and the financial system is still

fragile. Meanwhile, political turmoil in the Middle East and North Africa has

impacted oil prices and natural disasters in Japan have disrupted supply

chains. These concerns are somewhat off-set by improving consumer

confidence, continued reasonable valuations in equity markets, cash-

heavy US corporate balance sheets and a more business-friendly tone

from Washington, DC. Given this backdrop, the Fund maintains cyclical

exposure through its IT holdings, balanced with more defensive positions

in consumer staples and health care. We favor large-cap companies and

companies that have a greater exposure to global growth.

•On March 18, 2011, the Board of Directors of the Fund approved a plan of

reorganization, whereby BlackRock Basic Value Fund, Inc. will acquire sub-

stantially all of the assets and assume certain stated liabilities of the Fund

in exchange for newly issued shares of BlackRock Basic Value Fund, Inc. At

a shareholder meeting on August 25, 2011, shareholders of the Fund

approved the plan of reorganization.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changesin market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| Portfolio Information | |

| Percent of | |

| Long-Term | |

| Ten Largest Holdings | Investments |

| Halliburton Co. | 3% |

| Sprint Nextel Corp. | 3 |

| Honeywell International, Inc. | 3 |

| Tyco International Ltd. | 3 |

| Comcast Corp., Special Class A | 3 |

| MetLife, Inc. | 3 |

| Invesco Ltd. | 3 |

| Merck & Co., Inc. | 3 |

| E.I. du Pont de Nemours & Co. | 3 |

| ACE Ltd. | 3 |

| Percent of | |

| Long-Term | |

| Investment Criteria | Investments |

| Price-to-Earnings Per Share | 28% |

| Earnings Turnaround | 25 |

| Operational Restructuring | 11 |

| Price-to-Cash Flow | 9 |

| Above-Average Yield | 8 |

| Special Situations | 5 |

| Discount to Assets | 5 |

| Price-to-Book Value | 5 |

| Below-Average Price/Earnings Ratio | 2 |

| Low Price-to-Book Value | 2 |

| 6 | ANNUAL REPORT | JUNE | 30, 2011 |

BlackRock Focus Value Fund, Inc.

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including investment advisory fees, if any. Institutional Shares do not

have a sales charge.

2 The Fund invests primarily in a diversified portfolio of equity securities that Fund management believes are undervalued relative to its assessment of the

current or prospective condition of the issuer or relative to prevailing market ratios, including issuers that are experiencingpoor operating conditions.

3 This unmanaged index is a subset of the Russell 1000® Index consisting of those Russell 1000® securities with lower price-to-book ratios and lower fore-

casted growth values.

4 This unmanaged index covers 500 industrial, utility, transportation and financial companies of the US markets (mostly New YorkStock Exchange (“NYSE”)

issues), representing about 75% of NYSE market capitalization and 30% of NYSE issues.

Performance Summary for the Period Ended June 30, 2011

| Average Annual Total Returns5 | |||||||

| 1 Year | 5 Years | 10 Years | |||||

| 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |

| Total Returns | charge | charge | charge | charge | charge | charge | |

| Institutional | 3.53% | 31.21% | N/A | 2.46% | N/A | 4.24% | N/A |

| Investor A | 3.30 | 30.80 | 23.93% | 2.15 | 1.05% | 3.95 | 3.40% |

| Investor B | 2.89 | 29.65 | 25.15 | 1.25 | 0.94 | 3.29 | 3.29 |

| Investor C | 2.92 | 29.82 | 28.82 | 1.33 | 1.33 | 3.14 | 3.14 |

| Class R | 3.06 | 29.97 | N/A | 1.48 | N/A | 3.56 | N/A |

| Russell 1000® Value Index | 5.92 | 28.94 | N/A | 1.15 | N/A | 3.99 | N/A |

| S&P 500® Index | 6.02 | 30.69 | N/A | 2.94 | N/A | 2.72 | N/A |

5 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| Actual | Hypothetical7 | ||||||

| Beginning | Ending | Beginning | Ending | ||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized | |

| January 1, 2011 | June 30, 2011 | During the Period6 | January 1, 2011 | June 30, 2011 | During the Period6 | Expense Ratio | |

| Institutional | $1,000.00 | $1,035.30 | $ 5.70 | $1,000.00 | $1,019.19 | $ 5.66 | 1.13% |

| Investor A | $1,000.00 | $1,033.00 | $ 7.26 | $1,000.00 | $1,017.65 | $ 7.20 | 1.44% |

| Investor B | $1,000.00 | $1,028.90 | $11.82 | $1,000.00 | $1,013.14 | $11.73 | 2.35% |

| Investor C | $1,000.00 | $1,029.20 | $11.32 | $1,000.00 | $1,013.64 | $11.23 | 2.25% |

| Class R | $1,000.00 | $1,030.60 | $10.12 | $1,000.00 | $1,014.83 | $10.04 | 2.01% |

6 For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average accountvalue over the period, multiplied by 181/365 (to

reflect the one-half year period shown).

7 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half year divided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| ANNUAL | REPORT | JUNE | 30, 2011 | 7 |

Fund Summary as of June 30, 2011 BlackRock Global SmallCap Fund, Inc.

Investment Objective

BlackRock Global SmallCap Fund, Inc.'s (the “Fund”) investment objective is to seek long-term growth of capital by investing primarily in a portfolio of

equity securities of small cap issuers located in various foreign countries and in the United States.

Portfolio Management Commentary

How did the Fund perform?

• For the 12-month period ended June 30, 2011, the Fund posted double-

digit positive returns. The Fund underperformed its benchmark, the Morgan

Stanley Capital International (MSCI) World Small Cap Index, but outper-

formed the broader MSCI World Index. The following discussion pertains to

the Fund’s performance relative to the MSCI World Small Cap Index.

What factors influenced performance?

• Stock selection was rewarding in the industrials sector, particularly among

airlines, machinery and transportation infrastructure stocks. Standout per-

formers included the Malaysian discount airline AirAsia Bhd and Brazilian

port operator Santos Brasil Participacoes SA. With respect to sector alloca-

tion, the Fund’s underweight (relative to the MSCI World Small Cap Index

composition) proved beneficial, as the sector underperformed during the

period, and an overweight to the energy sector had a positive impact.

• Conversely, stock selection in the consumer sectors detracted from returns

relative to the benchmark. In consumer discretionary, the Fund’s holdings in

retailers, textiles and automotive stocks hurt returns. Notable individual

detractors included Urban Outfitters, Inc., Halfords Group Plc, Li Ning Co.,

Ltd. and Ports Design Ltd. In consumer staples, the food and personal

products industries were areas of weakness for the Fund. Stock selection in

the materials sector also had a negative impact, particularly within chemi-

cals and metals.

Describe recent portfolio activity.

•During the period, we reduced the Fund’s exposure to consumer discre-

tionary, consumer staples and information technology (IT), and added to

positions in the industrials and health care sectors. The most significant

sales or reductions included Hikma Pharmaceuticals Plc, Urban Outfitters,

Inc., AdTran, Inc., Delhaize Group SA and Northeast Utilities, Inc. Major

purchases included Ingenico, Coventry Health Care, Inc., Sulzer AG, Radiant

Systems, Inc. and Albemarle Corp.

Describe portfolio positioning at period end.

•At period end, the Fund was overweight relative to the benchmark in the IT

and health care sectors, while it was underweight in industrials, financials

and consumer discretionary. Allocations to the remaining sectors were rela-

tively neutral to the benchmark weighting. The Fund remains diversified

globally, with an overweight in emerging markets at the expense of alloca-

tions to the United States and Japan.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changesin market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| Portfolio Information | |

| Percent of | |

| Long-Term | |

| Ten Largest Holdings | Investments |

| Rheinmetall AG | 1% |

| GEA Group AG | 1 |

| Ingenico | 1 |

| Avago Technologies Ltd. | 1 |

| Coventry Health Care, Inc. | 1 |

| Sulzer AG | 1 |

| Radiant Systems, Inc. | 1 |

| Timken Co. | 1 |

| IDEX Corp. | 1 |

| Celanese Corp., Series A | 1 |

| Percent of | |

| Long-Term | |

| Geographic Allocations | Investments |

| United States | 49% |

| Switzerland | 6 |

| United Kingdom | 6 |

| Canada | 5 |

| Germany | 4 |

| Japan | 4 |

| France | 3 |

| Australia | 3 |

| Singapore | 2 |

| Hong Kong | 2 |

| South Korea | 2 |

| Other1 | 14 |

1 Other includes a 1% or less investment in each of the following countries: Austria,

Bermuda, Brazil, China, Denmark, Finland, India, Ireland, Israel, Italy, Malaysia,

Netherlands, Spain and Taiwan.

| 8 | ANNUAL REPORT | JUNE | 30, 2011 |

BlackRock Global SmallCap Fund, Inc.

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including investment advisory fees, if any. Institutional Shares do

not have a sales charge.

2 The Fund invests primarily in a diversified portfolio of equity securities of small cap issuers located in various foreign countries and in the United States.

3 This unmanaged market-capitalization weighted index is comprised of a representative sampling of stocks of large-, medium- and small-capitalization com-

panies in 24 countries, including the United States.

4 This unmanaged broad-based index is comprised of small cap companies from 24 developed markets.

Performance Summary for the Period Ended June 30, 2011

| Average Annual Total Returns5 | |||||||

| 1 Year | 5 Years | 10 Years | |||||

| 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |

| Total Returns | charge | charge | charge | charge | charge | charge | |

| Institutional | 4.36% | 34.25% | N/A | 6.85% | N/A | 8.11% | N/A |

| Investor A | 4.27 | 33.88 | 26.85% | 6.54 | 5.40% | 7.82 | 7.24% |

| Investor B | 3.79 | 32.60 | 28.10 | 5.63 | 5.34 | 7.13 | 7.13 |

| Investor C | 3.80 | 32.71 | 31.71 | 5.66 | 5.66 | 6.95 | 6.95 |

| Class R | 4.03 | 33.24 | N/A | 6.10 | N/A | 7.53 | N/A |

| MSCI World Index | 5.29 | 30.51 | N/A | 2.28 | N/A | 3.99 | N/A |

| MSCI World Small Cap Index | 5.63 | 38.39 | N/A | 4.37 | N/A | 9.37 | N/A�� |

5 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| Actual | Hypothetical7 | ||||||

| Beginning | Ending | Beginning | Ending | ||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized | |

| January 1, 2011 | June 30, 2011 | During the Period6 | January 1, 2011 | June 30, 2011 | During the Period6 | Expense Ratio | |

| Institutional | $1,000.00 | $1,043.60 | $ 5.37 | $1,000.00 | $1,019.54 | $ 5.31 | 1.06% |

| Investor A | $1,000.00 | $1,042.70 | $ 6.89 | $1,000.00 | $1,018.05 | $ 6.81 | 1.36% |

| Investor B | $1,000.00 | $1,037.90 | $11.22 | $1,000.00 | $1,013.79 | $11.08 | 2.22% |

| Investor C | $1,000.00 | $1,038.00 | $11.02 | $1,000.00 | $1,013.98 | $10.89 | 2.18% |

| Class R | $1,000.00 | $1,040.30 | $ 9.06 | $1,000.00 | $1,015.92 | $ 8.95 | 1.79% |

6 For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average accountvalue over the period, multiplied by 181/365

(to reflect the one-half year period shown).

7 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half yeardivided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| ANNUAL | REPORT | JUNE | 30, 2011 | 9 |

Fund Summary as of June 30, 2011 BlackRock International Value Fund

Investment Objective

BlackRock International Value Fund's (the “Fund”) investment objective is to seek current income and long-term growth of income, accompanied by growth

of capital.

Portfolio Management Commentary

How did the Fund perform?

• For the 12-month period ended June 30, 2011, the Fund posted double-

digit positive returns and outperformed its benchmark, the Morgan Stanley

Capital International (MSCI) Europe, Australasia, Far East (EAFE) Index.

What factors influenced performance?

• Overall, the Fund’s outperformance relative to the MSCI EAFE Index is

attributable to both stock selection and sector allocation. Stock selection

was rewarding in the financials, health care, industrials, information

technology (IT) and materials sectors. With respect to sector allocation, the

Fund’s underweight allocations (relative to the benchmark composition)

to financials and utilities benefited performance during the period. From

a geographic perspective, stock selection within Continental European

and Japanese equities had a positive impact. The Fund’s holdings in

United Kingdom stocks also boosted returns.

• The Fund’s overweight exposure to emerging market equities had a negative

impact on performance during the period. Stock selection in the Asia-

Pacific region also detracted. On a sector basis, stock selection in

telecommunication services (telecom) disappointed.

Describe recent portfolio activity.

• During the 12-month period, we reduced exposure to financials, primarily

through sales of bank stocks. We also reduced the Fund’s allocations to

the energy and consumer discretionary sectors. The proceeds from these

reductions were used to increase exposure to materials, industrials and

telecom. On a geographic basis, we increased the Fund’s holdings in

Japanese stocks and increased exposure to France as well. We decreased

the Fund’s allocation to Swiss stocks and moderately reduced exposure

to Spain.

Describe portfolio positioning at period end.

• At period end, the Fund’s sector overweights relative to the MSCI EAFE

Index included industrials, IT, materials and telecom, while underweight

positions included financials, consumer discretionary and utilities.

Geographically, the Fund was overweight in Japan and select emerging

markets and underweight in European and Asia-Pacific stocks.

• On March 18, 2011, the Board of Trustees of the Trust approved a plan

of reorganization, whereby BlackRock International Fund, a series of

BlackRock Series, Inc., will acquire substantially all of the assets and

assume certain stated liabilities of the Fund in exchange for newly issued

shares of BlackRock International Fund. At a shareholder meeting on July

7, 2011, shareholders of the Fund approved the plan of reorganization.

The reorganization took place on August 15, 2011.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changesin market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

| Portfolio Information | |

| Percent of | |

| Long-Term | |

| Ten Largest Holdings | Investments |

| Royal Dutch Shell Plc, Class B | 4% |

| Novartis AG, Registered Shares | 4 |

| Bayer AG | 3 |

| British American Tobacco Plc | 3 |

| Schneider Electric SA | 3 |

| Repsol YPF SA | 3 |

| BHP Billiton Plc | 3 |

| Sanofi-Aventis | 3 |

| Telefonica SA | 2 |

| Mitsubishi UFJ Financial Group, Inc. | 2 |

| Percent of | |

| Long-Term | |

| Geographic Allocations | Investments |

| Japan | 22% |

| United Kingdom | 21 |

| France | 15 |

| Germany | 13 |

| Australia | 6 |

| Spain | 5 |

| Switzerland | 4 |

| Netherlands | 3 |

| South Korea | 2 |

| Taiwan | 2 |

| Italy | 2 |

| Sweden | 2 |

| Other ¹ | 3 |

1 Other includes a 1% holding in each of the following countries: Mexico, Finland

and India.

| 10 | ANNUAL REPORT | JUNE | 30, 2011 |

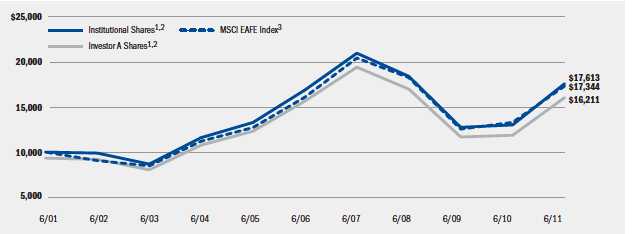

BlackRock International Value Fund

Total Return Based on a $10,000 Investment

1 Assuming maximum sales charge, transaction costs and other operating expenses, including investment advisory fees, if any. Institutional Shares do

not have a sales charge.

2 The Fund invests primarily in stocks of companies in developed countries located outside of the United States.

3 This index is an arithmetical average weighted by market value of the performance of over 1,000 non-US companies representing 22 stock markets in

Europe, Australasia and the Far East.

Performance Summary for the Period Ended June 30, 2011

| Average Annual Total Returns4 | |||||||

| 1 Year | 5 Years | 10 Years | |||||

| 6-Month | w/o sales | w/sales | w/o sales | w/sales | w/o sales | w/sales | |

| Total Returns | charge | charge | charge | charge | charge | charge | |

| Institutional | 7.67% | 35.25% | N/A | 0.81% | N/A | 5.82% | N/A |

| Investor A | 7.50 | 34.84 | 27.76% | 0.48 | (0.60)% | 5.52 | 4.95% |

| Investor B | 6.89 | 33.29 | 28.79 | (0.57) | (0.88) | 4.79 | 4.79 |

| Investor C | 6.96 | 33.37 | 32.37 | (0.54) | (0.54) | 4.58 | 4.58 |

| Class R | 7.24 | 34.24 | N/A | 0.13 | N/A | 5.26 | N/A |

| MSCI EAFE Index | 4.98 | 30.36 | N/A | 1.48 | N/A | 5.66 | N/A |

4 Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund

Performance” on page 12 for a detailed description of share classes, including any related sales charges and fees.

N/A — Not applicable as share class and index do not have a sales charge.

Past performance is not indicative of future results.

Expense Example

| Actual | Hypothetical6 | ||||||

| Beginning | Ending | Beginning | Ending | ||||

| Account Value | Account Value | Expenses Paid | Account Value | Account Value | Expenses Paid | Annualized | |

| January 1, 2011 | June 30, 2011 | During the Period5 | January 1, 2011 | June 30, 2011 | During the Period5 | Expense Ratio | |

| Institutional | $1,000.00 | $1,076.70 | $ 4.74 | $1,000.00 | $1,020.23 | $ 4.61 | 0.92% |

| Investor A | $1,000.00 | $1,075.00 | $ 6.64 | $1,000.00 | $1,018.40 | $ 6.46 | 1.29% |

| Investor B | $1,000.00 | $1,068.90 | $12.31 | $1,000.00 | $1,012.89 | $11.98 | 2.40% |

| Investor C | $1,000.00 | $1,069.60 | $11.80 | $1,000.00 | $1,013.39 | $11.48 | 2.30% |

| Class R | $1,000.00 | $1,072.40 | $ 8.58 | $1,000.00 | $1,016.51 | $ 8.35 | 1.67% |

5 For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average accountvalue over the period, multiplied by 181/365

(to reflect the one-half year period shown).

6 Hypothetical 5% annual return before expenses is calculated by pro rating the number of days in the most recent fiscal half yeardivided by 365.

See “Disclosure of Expenses” on page 12 for further information on how expenses were calculated.

| ANNUAL | REPORT | JUNE | 30, 2011 | 11 |

About Fund Performance

• Institutional Shares are not subject to any sales charge. Institutional

Shares bear no ongoing distribution or service fees and are available only to

eligible investors.

• Investor A Shares incur a maximum initial sales charge (front-end load) of

5.25% and a service fee of 0.25% per year (but no distribution fee).

• Investor B Shares are subject to a maximum contingent deferred sales

charge of 4.50% declining to 0% after six years. In addition, Investor B

Shares are subject to a distribution fee of 0.75% per year and a service fee

of 0.25% per year. These shares automatically convert to Investor A Shares

after approximately eight years. (There is no initial sales charge for auto-

matic share conversions.) All returns for periods greater than eight years

reflect this conversion. Investor B Shares of the Funds are only available

through exchanges, dividend reinvestment by existing shareholders or for

purchase by certain qualified employee benefit plans.

• Investor C Shares are subject to a 1% contingent deferred sales charge if

redeemed within one year of purchase. In addition, Investor C Shares are

subject to a distribution fee of 0.75% per year and a service fee of 0.25%

per year.

• Class R Shares do not incur a maximum initial sales charge (front-end

load) or deferred sales charge. These shares are subject to a distribution fee

of 0.25% per year and a service fee of 0.25% per year. Class R Shares are

available only to certain retirement plans. Prior to January 3, 2003 for

BlackRock EuroFund, BlackRock Focus Value Fund, Inc. and BlackRock

International Value Fund, and February 4, 2003 for BlackRock Global

SmallCap Fund, Inc., Class R Share performance results are those of the

Institutional Shares (which have no distribution or service fees) restated to

reflect Class R Share fees.

Performance information reflects past performance and does not guarantee

future results. Current performance may be lower or higher than the perform-

ance data quoted. Refer to www.blackrock.com/funds to obtain performance

data current to the most recent month end. Performance results do not

reflect the deduction of taxes that a shareholder would pay on fund distri-

butions or the redemption of fund shares. Figures shown in the performance

tables on the previous pages assume reinvestment of all dividends and cap-

ital gain distributions, if any, at net asset value on the ex-dividend date.

Investment return and principal value of shares will fluctuate so that shares,

when redeemed, may be worth more or less than their original cost.

Dividends paid to each class of shares will vary because of the different lev-

els of service, distribution and transfer agency fees applicable to each class,

which are deducted from the income available to be paid to shareholders.

Disclosure of Expenses

Shareholders of these Funds may incur the following charges: (a) expenses

related to transactions, including sales charges and exchange fees; and

(b) operating expenses including advisory fees, service and distribution

fees, including 12b-1 fees, and other Fund expenses. The expense exam-

ples on the previous pages (which are based on hypothetical investments

of $1,000 invested on January 1, 2011 and held through June 30, 2011)

are intended to assist shareholders both in calculating expenses based on

investments in the Funds and in comparing these expenses with similar

costs of investing in other mutual funds.

The tables provide information about actual account values and actual

expenses. In order to estimate the expenses a shareholder paid during

the period covered by this report, shareholders can divide their account

value by $1,000 and then multiply the result by the number correspond-

ing to their share class under the heading entitled “Expenses Paid During

the Period.”

The tables also provide information about hypothetical account values and

hypothetical expenses based on each Fund’s actual expense ratio and an

assumed rate of return of 5% per year before expenses. In order to assist

shareholders in comparing the ongoing expenses of investing in these

Funds and other funds, compare the 5% hypothetical example with the 5%

hypothetical examples that appear in other funds’ shareholder reports.

The expenses shown in the table are intended to highlight shareholders’

ongoing costs only and do not reflect any transactional expenses, such

as sales charges or exchange fees, if any. Therefore, the hypothetical exam-

ples are useful in comparing ongoing expenses only, and will not help share-

holders determine the relative total expenses of owning different funds. If

these transactional expenses were included, shareholder expenses would

have been higher.

| 12 | ANNUAL REPORT | JUNE | 30, 2011 |

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments, including

foreign currency exchange contracts, as specified in Note 2 of the Notes

to Financials Statements, which may constitute forms of economic lever-

age. Such instruments are used to obtain exposure to a market without

owning or taking physical custody of securities or to hedge market and/or

foreign currency exchange rate risk. Such derivative financial instruments

involve risks, including the imperfect correlation between the value of a

derivative financial instrument and the underlying asset, possible default

of the counterparty to the transaction or illiquidity of the derivative finan-

cial instrument. The Funds’ ability to use a derivative financial instrument

successfully depends on the investment advisor’s ability to predict

pertinent market movements accurately, which cannot be assured. The

use of derivative financial instruments may result in losses greater than

if they had not been used, may require the Funds to sell or purchase

portfolio investments at inopportune times or for distressed values, may

limit the amount of appreciation the Funds can realize on an investment,

may result in lower dividends paid to shareholders or may cause the

Funds to hold an investment that they might otherwise sell. The Funds’

investments in these instruments are discussed in detail in the Notes to

Financial Statements.

| ANNUAL | REPORT | JUNE | 30, 2011 | 13 |

BlackRock EuroFund

Schedule of Investments June 30, 2011 (Percentages shown are based on Net Assets)

| Common Stocks | Shares | Value |

| Belgium — 1.8% | ||

| KBC Bancassurance Holding | 157,666 | $ 6,186,657 |

| Denmark — 5.8% | ||

| Carlsberg A/S, Class B�� | 86,485 | 9,416,736 |

| Christian Hansen Holding A/S | 152,613 | 3,626,218 |

| Novo-Nordisk A/S, Class B | 58,792 | 7,365,418 |

| 20,408,372 | ||

| Finland — 2.2% | ||

| Kone Oyj, Class B | 78,061 | 4,904,054 |

| Nokian Renkaat Oyj | 59,425 | 2,983,935 |

| 7,887,989 | ||

| France — 17.1% | ||

| AXA SA | 395,816 | 8,985,080 |

| BNP Paribas SA | 104,063 | 8,024,189 |

| Cie de Saint-Gobain | 54,241 | 3,515,794 |

| Cie Generale de Geophysique — Veritas (a) | 237,246 | 8,694,882 |

| Danone | 139,512 | 10,415,003 |

| Legrand Promesses | 198,126 | 8,339,613 |

| Schneider Electric SA | 46,025 | 7,684,873 |

| Technip SA | 42,929 | 4,601,622 |

| 60,261,056 | ||

| Germany — 16.4% | ||

| Bayer AG, Registered Shares | 135,967 | 10,920,400 |

| Continental AG (a) | 91,726 | 9,665,903 |

| Deutsche Bank AG, Registered Shares | 131,241 | 7,745,909 |

| Deutsche Telekom AG, Registered Shares | 337,435 | 5,265,381 |

| K+S AG | 26,593 | 2,042,031 |

| Kabel Deutschland Holding AG (a) | 127,696 | 7,866,141 |

| Linde AG | 50,560 | 8,870,567 |

| SAP AG | 86,812 | 5,263,261 |

| 57,639,593 | ||

| Greece — 0.3% | ||

| Coca Cola Hellenic Bottling Co. SA | 35,024 | 940,778 |

| Italy — 3.5% | ||

| Intesa Sanpaolo SpA | 2,629,842 | 7,002,677 |

| Saipem SpA | 100,965 | 5,213,863 |

| 12,216,540 | ||

| Luxembourg — 1.5% | ||

| AZ Electronic Materials SA (a) | 1,068,125 | 5,243,413 |

| Netherlands — 4.7% | ||

| ING Groep NV CVA (a) | 570,740 | 7,033,516 |

| Koninklijke KPN NV | 400,017 | 5,818,248 |

| TNT Express NV (a) | 347,086 | 3,599,792 |

| 16,451,556 | ||

| Norway — 1.7% | ||

| DnB NOR ASA | 419,774 | 5,848,083 |

| Common Stocks | Shares | Value |

| Spain — 1.6% | ||

| Amadeus IT Holding SA, Class A (a) | 275,090 | $ 5,717,959 |

| Sweden — 1.4% | ||

| Swedbank AB, Class A | 290,306 | 4,881,764 |

| Switzerland — 7.2% | ||

| Julius Baer Group Ltd. | 149,253 | 6,165,347 |

| Nestlé SA, Registered Shares | 97,785 | 6,085,013 |

| The Swatch Group AG, Bearer Shares | 11,967 | 6,039,833 |

| Syngenta AG, Registered Shares | 20,621 | 6,968,874 |

| 25,259,067 | ||

| United Kingdom — 34.1% | ||

| BP Plc | 1,200,723 | 8,840,914 |

| Burberry Group Plc | 283,390 | 6,590,138 |

| Centrica Plc | 1,303,298 | 6,767,341 |

| GlaxoSmithKline Plc | 591,847 | 12,685,802 |

| Imperial Tobacco Group Plc | 307,734 | 10,245,228 |

| International Power Plc | 839,702 | 4,336,849 |

| Johnson Matthey Plc | 107,415 | 3,392,057 |

| Prudential Plc | 523,121 | 6,040,377 |

| Rio Tinto Plc, Registered Shares | 157,601 | 11,379,697 |

| Royal Dutch Shell Plc, Class B | 368,894 | 13,164,327 |

| Tullow Oil Plc | 199,798 | 3,978,799 |

| Vodafone Group Plc | 3,632,241 | 9,631,398 |

| William Morrison Supermarkets Plc | 1,384,970 | 6,624,262 |

| Wolseley Plc | 212,035 | 6,921,140 |

| Xstrata Plc | 421,152 | 9,276,039 |

| 119,874,368 | ||

| Total Long-Term Investments | ||

| (Cost — $315,678,372) — 99.3% | 348,817,195 | |

| Short-Term Securities | ||

| Money Market Funds — 1.8% | ||

| BlackRock Liquidity Funds, TempFund, | ||

| Institutional Class, 0.08% (b)(c) | 6,324,977 | $6,324,977 |

| Par | ||

| (000) | ||

| Time Deposits | ||

| United Kingdom — 0.1% | ||

| Brown Brothers Harriman & Co., 0.10%, 7/01/11 | GBP 108 | 173,402 |

| Total Short-Term Securities | ||

| (Cost — $6,498,509) — 1.9% | 6,498,379 | |

| Total Investments (Cost — $322,176,881*) — 101.2% | 355,315,574 | |

| Liabilities in Excess of Other Assets — (1.2)% | (4,063,419) | |

| Net Assets — 100.0% | $ 351,252,155 |

| Portfolio Abbreviations | ||||

| To simplify the listings of portfolio holdings in | ADR | American Depositary Receipts | JPY | Japanese Yen |

| the Schedules of Investments, the names and | AUD | Australian Dollar | NOK | Norwegian Krone |

| descriptions of many of the securities have been | CHF | Swiss Franc | REIT | Real Estate Investment Trusts |

| abbreviated according to the following list: | EUR | Euro | SEK | Swedish Krona |

| GBP | British Pound | SGD | Singapore Dollar | |

| HKD | Hong Kong Dollar | USD | US Dollar | |

| INR | Indian Rupee | |||

| See Notes to Financial Statements. |

| 14 | ANNUAL REPORT | JUNE | 30, 2011 |

BlackRock EuroFund

Schedule of Investments (concluded)

* The cost and unrealized appreciation (depreciation) of investments as of June 30,

2011, as computed for federal income tax purposes, were as follows:

| Aggregate cost | $ 324,597,487 |

| Gross unrealized appreciation | $ 34,374,360 |

| Gross unrealized depreciation | (3,656,273) |

| Net unrealized appreciation | $ 30,718,087 |

(a) Non-income producing security.

(b) Investments in companies considered to be an affiliate of the Fund during the

year, for purposes of Section 2(a)(3) of the Investment Company Act of 1940,

as amended, were as follows:

| Shares Held | Shares Held | |||

| at June 30, | Net | at June 30, | ||

| Affiliate | 2010 | Activity | 2011 | Income |

| BlackRock Liquidity | ||||

| Funds, TempFund, | ||||

| Institutional Class | 893,336 | 5,431,641 | 6,324,977 | $ 6,073 |

(c) Represents the current yield as of report date.

• Foreign currency exchange contracts as of June 30, 2011 were as follows:

| Unrealized | ||||||

| Currency | Currency | Settlement Appreciation | ||||

| Purchased | Sold | Counterparty | Date | (Depreciation) | ||

| EUR | 18,211 | USD | 26,352 | Citibank NA | 7/01/11 | $ 57 |

| EUR | 6,234,531 | USD | 8,970,866 | Goldman Sachs | ||

| International | 7/01/11 | 70,136 | ||||

| GBP | 307,250 | USD | 491,107 | Citibank NA | 7/01/11 | 2,015 |

| USD | 173,386 | GBP | 108,042 | Goldman Sachs | ||

| International | 7/01/11 | (16) | ||||

| USD 5,677,809 | SEK 36,337,980 | Goldman Sachs | ||||

| International | 7/01/11 | (67,144) | ||||

| Total | $ 5,048 | |||||

• Fair Value Measurements — Various inputs are used in determining the fair value

of investments and derivative financial instruments. These inputs are categorized

in three broad levels for financial statement purposes as follows:

• Level 1 — price quotations in active markets/exchanges for identical assets

and liabilities

• Level 2 — other observable inputs (including, but not limited to: quoted prices for

similar assets or liabilities in markets that are active, quoted prices for identical

or similar assets or liabilities in markets that are not active, inputs other than

quoted prices that are observable for the assets or liabilities (such as interest

rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and

default rates) or other market-corroborated inputs)

• Level 3 — unobservable inputs based on the best information available in the

circumstances, to the extent observable inputs are not available (including the

Fund’s own assumptions used in determining the fair value of investments and

derivative financial instruments)

The categorization of a value determined for investments and derivative financial

instruments is based on the pricing transparency of the investment and derivative

financial instrument and does not necessarily correspond to the Fund’s perceived

risk of investing in those securities. For information about the Fund’s policy regarding

valuation of investments and derivative financial instruments and other significant

accounting policies, please refer to Note 1 of the Notes to Financial Statements.

The following tables summarize the inputs used as of June 30, 2011 in determining

the fair valuation of the Fund’s investments and derivative financial instruments:

| Valuation Inputs | Level 1 | Level 2 | Level 3 | Total |

| Assets: | ||||

| Investments: | ||||

| Common Stocks: | ||||

| Long-Term | ||||

| Investments | ||||

| Belgium | — | $ 6,186,657 | — | $ 6,186,657 |

| Denmark | — | 20,408,372 | — | 20,408,372 |

| Finland | — | 7,887,989 | — | 7,887,989 |

| France | — | 60,261,056 | — | 60,261,056 |

| Germany | — | 57,639,593 | — | 57,639,593 |

| Greece | — | 940,778 | — | 940,778 |

| Italy | — | 12,216,540 | — | 12,216,540 |

| Luxembourg | — | 5,243,413 | — | 5,243,413 |

| Netherlands | $ 9,418,040 | 7,033,516 | — | 16,451,556 |

| Norway | — | 5,848,083 | — | 5,848,083 |

| Spain | — | 5,717,959 | — | 5,717,959 |

| Sweden | — | 4,881,764 | — | 4,881,764 |

| Switzerland | — | 25,259,067 | — | 25,259,067 |

| United Kingdom . | — | 119,874,368 | — | 119,874,368 |

| Short-Term | ||||

| Securities: | ||||

| Money Market | ||||

| Funds | 6,324,977 | — | — | 6,324,977 |

| Time Deposits | — | 173,402 | — | 173,402 |

| Total | $15,743,017 | $ 339,572,557 | — | $ 355,315,574 |

| Valuation Inputs | Level 1 | Level 2 | Level 3 | Total | |

| Derivative Financial Instruments1 | |||||

| Assets: | |||||

| Foreign currency | |||||

| exchange | |||||

| contracts | — | $ 72,208 | — | $ 72,208 | |

| Liabilities: | |||||

| Foreign currency | |||||

| exchange | |||||

| contracts | — | (67,160) | — | (67,160) | |

| Total | — | $ 5,048 | — | $ 5,048 | |

1 Derivative financial instruments are foreign currency exchange contracts, which

are valued at the unrealized appreciation/depreciation on the instrument.

See Notes to Financial Statements.

| ANNUAL | REPORT | JUNE | 30, 2011 | 15 |

BlackRock Focus Value Fund, Inc.

Schedule of Investments June 30, 2011 (Percentages shown are based on Net Assets)

| Common Stocks | Shares | Value |

| Above-Average Yield* — 8.0% | ||

| Industrial Conglomerates — 3.2% | ||

| Tyco International Ltd. | 101,950 | $ 5,039,388 |

| Metals & Mining — 2.1% | ||

| Alcoa, Inc. | 209,700 | 3,325,842 |

| Pharmaceuticals — 2.7% | ||

| Merck & Co., Inc. | 123,300 | 4,351,257 |

| Total Above-Average Yield | 12,716,487 | |

| Below-Average Price/Earnings Ratio* — 2.2% | ||

| Oil, Gas & Consumable Fuels — 2.2% | ||

| Devon Energy Corp. | 43,400 | 3,420,354 |

| Total Below-Average Price/Earnings Ratio | 3,420,354 | |

| Discount to Assets* — 4.8% | ||

| Diversified Telecommunication Services — 2.4% | ||

| Verizon Communications, Inc. | 101,600 | 3,782,568 |

| Hotels, Restaurants & Leisure — 2.4% | ||

| Carnival Corp. | 99,600 | 3,747,948 |

| Total Discount to Assets | 7,530,516 | |

| Earnings Turnaround* — 24.9% | ||

| Aerospace & Defense — 3.2% | ||

| Honeywell International, Inc. | 85,200 | 5,077,068 |

| Capital Markets — 1.6% | ||

| Morgan Stanley | 108,100 | 2,487,381 |

| Commercial Banks — 2.2% | ||

| Wells Fargo & Co. | 122,400 | 3,434,544 |

| Diversified Financial Services — 1.7% | ||

| Bank of America Corp. | 247,600 | 2,713,696 |

| Energy Equipment & Services — 3.3% | ||

| Halliburton Co. | 104,200 | 5,314,200 |

| Food Products — 2.3% | ||

| Unilever NV — ADR | 109,400 | 3,593,790 |

| Industrial Conglomerates — 2.2% | ||

| General Electric Co. | 184,600 | 3,481,556 |

| Insurance — 1.4% | ||

| Hartford Financial Services Group, Inc. | 83,300 | 2,196,621 |

| Oil, Gas & Consumable Fuels — 2.4% | ||

| Peabody Energy Corp. | 64,900 | 3,823,259 |

| Semiconductors & Semiconductor | ||

| Equipment — 4.6% | ||

| Intel Corp. | 168,400 | 3,731,744 |

| LSI Corp. (a) | 496,200 | 3,532,944 |

| 7,264,688 | ||

| Total Earnings Turnaround | 39,386,803 | |

| Financial Restructuring* — 0.00% | ||

| Semiconductors & Semiconductor | ||

| Equipment — 0.0% | ||

| Legacy Holdings, Inc. (a) | 1,500 | 3 |

| Total Financial Restructuring | 3 | |

| Low Price-to-Book Value* — 2.1% | ||

| Metals & Mining — 2.1% | ||

| United States Steel Corp. | 73,000 | 3,360,920 |

| Total Low Price-to-Book Value | 3,360,920 |

| Common Stocks | Shares | Value |

| Operational Restructuring* — 10.5% | ||

| Aerospace & Defense — 1.8% | ||

| Raytheon Co. | 56,000 | $ 2,791,600 |

| Chemicals — 2.7% | ||

| E.I. du Pont de Nemours & Co. | 79,400 | 4,291,570 |

| Computers & Peripherals — 1.7% | ||

| Hewlett-Packard Co. | 76,200 | 2,773,680 |

| Diversified Financial Services — 2.7% | ||

| JPMorgan Chase & Co. | 103,400 | 4,233,196 |

| Household Products — 1.6% | ||

| Kimberly-Clark Corp. | 37,200 | 2,476,032 |

| Total Operational Restructuring | 16,566,078 | |

| Price-to-Book Value* — 4.7% | ||

| Diversified Financial Services — 2.6% | ||

| Citigroup, Inc. | 100,680 | 4,192,315 |

| Semiconductors & Semiconductor | ||

| Equipment — 2.1% | ||

| Lam Research Corp. (a) | 72,400 | 3,205,872 |

| Total Price-to-Book Value | 7,398,187 | |

| Price-to-Cash Flow* — 9.0% | ||

| Communications Equipment — 0.9% | ||

| Motorola Mobility Holdings, Inc. (a) | 63,600 | 1,401,744 |

| Media — 4.8% | ||

| Comcast Corp., Special Class A | 201,500 | 4,882,345 |

| Viacom, Inc., Class B | 54,000 | 2,754,000 |

| 7,636,345 | ||

| Wireless Telecommunication Services — 3.3% | ||

| Sprint Nextel Corp. (a) | 951,500 | 5,128,585 |

| Total Price-to-Cash Flow | 14,166,674 | |

| Price-to-Earnings Per Share* — 27.1% | ||

| Capital Markets — 1.2% | ||

| The Goldman Sachs Group, Inc. | 15,000 | 1,996,350 |

| Energy Equipment & Services — 2.7% | ||

| Ensco Plc — ADR | 79,600 | 4,242,680 |

| Health Care Equipment & Supplies — 3.6% | ||

| Baxter International, Inc. | 54,100 | 3,229,229 |

| Medtronic, Inc. | 63,900 | 2,462,067 |

| 5,691,296 | ||

| Insurance — 8.2% | ||

| ACE Ltd. | 65,100 | 4,284,882 |

| MetLife, Inc. | 103,100 | 4,522,997 |

| The Travelers Cos., Inc. | 70,600 | 4,121,628 |

| 12,929,507 | ||

| Media — 4.5% | ||

| CBS Corp., Class B | 129,800 | 3,698,002 |

| Time Warner, Inc. | 94,200 | 3,426,054 |

| 7,124,056 | ||

| Oil, Gas & Consumable Fuels — 4.8% | ||

| Marathon Oil Corp. | 63,100 | 3,324,108 |

| Occidental Petroleum Corp. | 40,600 | 4,224,024 |

| 7,548,132 | ||

| Pharmaceuticals — 2.1% | ||

| Pfizer, Inc. | 161,500 | 3,326,900 |

| Total Price-to-Earnings Per Share | 42,858,921 |

See Notes to Financial Statements.

| 16 | ANNUAL REPORT | JUNE | 30, 2011 |

BlackRock Focus Value Fund, Inc.

Schedule of Investments (concluded) (Percentages shown are based on Net Assets)

| Common Stocks | Shares | Value |

| Special Situations* — 5.3% | ||

| Capital Markets — 2.8% | ||

| Invesco Ltd. | 188,900 | $ 4,420,260 |

| IT Services — 2.5% | ||

| International Business Machines Corp. | 22,700 | 3,894,185 |

| Total Special Situations | 8,314,445 | |

| Total Long-Term Investments | ||

| (Cost — $119,229,414) — 98.6% | 155,719,388 | |

| Short-Term Securities | ||

| Money Market Fund* — 1.5% | ||

| BlackRock Liquidity Funds, TempCash, | ||

| Institutional Class, 0.07% (b)(c) | 2,408,520 | 2,408,520 |

| Total Short-Term Securities | ||

| (Cost — $2,408,520) — 1.5% | 2,408,520 | |

| Total Investments (Cost — $121,637,934**) — 100.1% | 158,127,908 | |

| Liabilities in Excess of Other Assets — (0.1)% | (174,179) | |

| Net Assets — 100.0% | $ 157,953,729 | |

* Classification is unaudited.

** The cost and unrealized appreciation (depreciation) of investments as of June 30,

2011, as computed for federal income tax purposes, were as follows:

| Aggregate cost | $ 123,081,185 |

| Gross unrealized appreciation | $ 37,790,542 |

| Gross unrealized depreciation | (2,743,819) |

| Net unrealized appreciation | $ 35,046,723 |

(a) Non-income producing security.

(b) Investments in companies considered to be an affiliate of the Fund during the

year, for purposes of Section 2(a)(3) of the Investment Company Act of 1940,

as amended, were as follows:

| Shares Held | Shares Held | |||

| at June 30, | Net | at June 30, | ||

| Affiliate | 2010 | Activity | 2011 | Income |

| BlackRock Liquidity | ||||

| Funds, TempCash, | ||||

| Institutional Class | 1,199,007 | 1,209,513 | 2,408,520 | $ 3,551 |

| BlackRock Liquidity | ||||

| Series, LLC, | ||||

| Money Market | ||||

| Series | $1,960,000 | ($1,960,000) | �� | $ 8,992 |

(c) Represents the current yield as of report date.

• For Fund compliance purposes, the Fund’s industry classifications refer to any one

or more of the industry sub-classifications used by one or more widely recognized

market indexes or rating group indexes, and/or as defined by Fund management.

These definitions may not apply for purposes of this report, which may combine

such industry sub-classifications for reporting ease.

• Fair Value Measurements — Various inputs are used in determining the fair value

of investments. These inputs are categorized in three broad levels for financial

statement purposes as follows:

• Level 1 — quotations in active markets/exchanges for identical assets

and liabilities

• Level 2 — other observable inputs (including, but not limited to: quoted prices for

similar assets or liabilities in markets that are active, quoted prices for identical

or similar assets or liabilities in markets that are not active, inputs other than

quoted prices that are observable for the assets or liabilities (such as interest

rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and

default rates) or other market-corroborated inputs)

• Level 3 — unobservable inputs based on the best information available in the

circumstances, to the extent observable inputs are not available (including the

Fund’s own assumptions used in determining the fair value of investments)

The categorization of a value determined for investments is based on the pricing

transparency of the investment and does not necessarily correspond to the Fund’s

perceived risk of investing in those securities. For information about the Fund’s

policy regarding valuation of investments and other significant accounting policies,

please refer to Note 1 of the Notes to Financial Statements.

The following table summarizes the inputs used as of June 30, 2011 in determining

the fair valuation of the Fund’s investments:

| Valuation Inputs | Level 1 | Level 2 | Level 3 | Total |

| Assets: | ||||

| Investments: | ||||

| Long-Term | ||||

| Investments1 | $ 155,719,388 | — | — | $ 155,719,388 |

| Short-Term | ||||

| Securities | 2,408,520 | — | — | 2,408,520 |

| Total | $ 158,127,908 | — | — | $ 158,127,908 |

1 See above Schedule of Investments for values in each industry.

See Notes to Financial Statements.

| ANNUAL | REPORT | JUNE | 30, 2011 | 17 |

BlackRock Global SmallCap Fund, Inc.

Schedule of Investments June 30, 2011 (Percentages shown are based on Net Assets)

| Common Stocks | Shares | Value |

| Australia — 2.4% | ||

| Ansell Ltd. | 380,800 | $ 5,790,160 |

| Cochlear Ltd. | 63,100 | 4,883,790 |

| Dexus Property Group | 3,318,300 | 3,143,757 |

| iSOFT Group, Ltd. | 19,154,700 | 3,292,751 |

| Mirvac Group | 3,487,500 | 4,690,668 |

| Mount Gibson Iron Ltd. (a) | 2,027,600 | 4,031,815 |

| Myer Holdings Ltd. | 661,000 | 1,876,437 |

| Paladin Energy Ltd. (a) | 773,600 | 2,101,542 |

| 29,810,920 | ||

| Austria — 0.6% | ||

| Schoeller-Bleckmann Oilfield Equipment AG | 63,200 | 5,474,222 |

| Wienerberger AG | 101,800 | 1,875,247 |

| 7,349,469 | ||

| Belgium — 0.4% | ||

| D’ieteren SA | 64,200 | 4,387,364 |

| Bermuda — 0.9% | ||

| Dominion Petroleum Ltd. (a)(b) | 31,955,100 | 1,864,260 |

| Hoegh Liquified Natural Gas Holdings Ltd. (a) | 471,100 | 3,318,128 |

| Lazard Ltd., Class A | 162,300 | 6,021,330 |

| 11,203,718 | ||

| Brazil — 1.2% | ||

| Anhanguera Educacional Participacoes SA | 241,800 | 5,137,659 |

| Santos Brasil Participacoes SA | 527,400 | 9,472,350 |

| 14,610,009 | ||

| Canada — 4.5% | ||

| Cathedral Energy Services Ltd. | 872,900 | 6,471,289 |

| DiagnoCure, Inc. (a)(c) | 4,371,580 | 4,079,446 |

| Dollarama, Inc. | 70,600 | 2,391,521 |

| Dollarama, Inc. (d) | 182,500 | 6,182,047 |

| Eastern Platinum Ltd. (a) | 4,472,800 | 3,710,135 |

| Eldorado Gold Corp. | 430,500 | 6,351,822 |

| Lundin Mining Corp. (a) | 917,500 | 7,039,764 |

| Open Text Corp. (a) | 148,200 | 9,487,764 |

| Quadra FNX Mining Ltd. (a) | 614,600 | 9,125,483 |

| SunOpta, Inc. (a) | 160,169 | 1,138,802 |

| 55,978,073 | ||

| China — 1.1% | ||

| Parkson Retail Group Ltd. | 2,415,800 | 3,545,194 |

| Shenzhen Expressway Co., Ltd. | 8,423,100 | 4,794,161 |

| WuXi PharmaTech Cayman, Inc. — ADR (a) | 299,400 | 5,257,464 |

| 13,596,819 | ||

| Denmark — 1.0% | ||

| Bavarian Nordic A/S (a) | 188,300 | 2,419,144 |

| Topdanmark A/S (a) | 55,100 | 10,288,896 |

| 12,708,040 | ||

| Finland — 1.0% | ||

| Pohjola Bank Plc | 433,300 | 5,605,273 |

| Ramirent Oyj | 558,249 | 7,204,947 |

| 12,810,220 | ||

| France — 2.9% | ||

| Bonduelle SA | 64,900 | 6,526,855 |

| Eurofins Scientific SA | 76,275 | 7,025,958 |

| GameLoft (a) | 1,028,783 | 7,473,425 |

| Ingenico | 258,500 | 12,578,997 |

| Ipsen SA | 70,700 | 2,507,204 |

| 36,112,439 | ||

| Germany — 4.1% | ||

| Asian Bamboo AG | 27,200 | 1,025,546 |

| Deutsche Euroshop AG | 99,487 | 3,935,941 |

| GEA Group AG | 356,650 | 12,772,559 |

| Gerresheimer AG | 195,500 | 9,333,819 |

| Common Stocks | Shares | Value |

| Germany (concluded) | ||

| Paion AG (a) | 475,886 | $ 1,511,332 |

| Rheinmetall AG | 153,800 | 13,605,545 |

| Salzgitter AG | 51,500 | 3,926,684 |

| Symrise AG | 165,700 | 5,276,652 |

| 51,388,078 | ||

| Hong Kong — 1.7% | ||

| AMVIG Holdings Ltd. | 3,261,100 | 2,457,014 |

| Clear Media Ltd. (a) | 4,052,000 | 2,280,705 |

| Emperor Watch & Jewellery Ltd. | 21,485,000 | 4,027,085 |

| Ming Fai International Holdings Ltd. | 7,455,300 | 2,130,790 |

| Ports Design Ltd. | 1,816,400 | 4,312,398 |

| Techtronic Industries Co. | 4,920,500 | 5,894,254 |

| 21,102,246 | ||

| India — 1.0% | ||

| Container Corp. of India | 156,300 | 3,646,048 |

| Motherson Sumi Systems Ltd. | 582,775 | 2,943,898 |

| United Phosphorus Ltd. | 1,774,300 | 6,080,601 |

| 12,670,547 | ||

| Ireland — 1.0% | ||

| Elan Corp. Plc (a) | 294,041 | 3,375,029 |

| Ryanair Holdings Plc — ADR | 314,396 | 9,224,379 |

| 12,599,408 | ||

| Israel — 0.8% | ||

| NICE Systems Ltd. — ADR (a) | 273,500 | 9,944,460 |

| Italy — 1.3% | ||

| Azimut Holding SpA | 141,100 | 1,317,305 |

| DiaSorin SpA | 69,300 | 3,326,014 |

| Hera SpA | 3,096,200 | 6,560,154 |

| Salvatore Ferragamo Italia SpA (a) | 345,500 | 5,160,575 |

| 16,364,048 | ||

| Japan — 3.7% | ||

| Asics Corp. | 432,950 | 6,462,343 |

| CMIC Co., Ltd. | 196,400 | 3,446,437 |

| Don Quijote Co., Ltd. | 189,000 | 6,572,696 |

| Hisaka Works Ltd. | 298,500 | 4,032,812 |

| Itoham Foods, Inc. | 865,200 | 3,517,972 |

| JSR Corp. | 425,700 | 8,251,403 |

| Japan Petroleum Exploration Co. | 61,700 | 2,896,636 |

| Koito Manufacturing Co., Ltd. | 174,200 | 3,044,213 |

| NGK Insulators Ltd. | 208,400 | 3,882,398 |

| Shinsei Bank Ltd. | 3,532,000 | 3,532,890 |

| 45,639,800 | ||

| Malaysia — 0.6% | ||

| AirAsia Bhd | 5,994,200 | 7,008,821 |

| Netherlands — 0.5% | ||

| InterXion Holding NV (a) | 292,400 | 4,426,936 |

| TomTom NV (a) | 314,300 | 1,663,872 |

| 6,090,808 | ||

| Norway — 0.1% | ||

| Renewable Energy Corp. ASA (a) | 524,700 | 899,530 |

| Sevan Marine ASA (a)(b) | 3,996,300 | 288,345 |

| 1,187,875 | ||

| Singapore — 2.1% | ||

| Avago Technologies Ltd. | 329,700 | 12,528,600 |

| Cityspring Infrastructure Trust | 15,891,300 | 6,926,850 |

| Straits Asia Resources Ltd. | 2,714,700 | 6,635,363 |

| 26,090,813 | ||

| South Korea — 1.5% | ||

| Dongbu Insurance Co., Ltd. | 202,200 | 10,557,750 |

| Kangwon Land, Inc. | 290,657 | 7,803,216 |

| 18,360,966 |

See Notes to Financial Statements.

| 18 | ANNUAL REPORT | JUNE | 30, 2011 |

BlackRock Global SmallCap Fund, Inc.

Schedule of Investments (continued) (Percentages shown are based on Net Assets)

| Common Stocks | Shares | Value |

| Spain — 1.2% | ||

| Grifols SA | 376,400 | $ 7,550,832 |

| Laboratorios Farmaceuticos Rovi SA | 923,794 | 7,341,225 |

| 14,892,057 | ||

| Switzerland — 5.3% | ||

| Addex Pharmaceuticals Ltd. (a) | 100,700 | 1,316,426 |

| Aryzta AG | 210,200 | 11,289,413 |

| Basilea Pharmaceutica (a) | 40,000 | 2,923,924 |

| Clariant AG (a) | 467,300 | 8,940,101 |

| Foster Wheeler AG (a) | 223,000 | 6,774,740 |

| Lindt & Spruengli AG ‘R’ | 242 | 8,820,803 |

| Lonza Group AG | 48,700 | 3,815,306 |

| Straumann Holding AG, Registered Shares | 31,600 | 7,620,522 |

| Sulzer AG | 71,400 | 11,641,757 |

| Vontobel Holding AG | 81,084 | 2,748,610 |

| 65,891,602 | ||

| Taiwan — 1.1% | ||

| D-Link Corp. | 8,765,000 | 8,040,945 |

| Lite-On Technology Corp. | 3,917,862 | 5,171,568 |

| 13,212,513 | ||

| Thailand — 0.2% | ||

| Mermaid Maritime PCL | 7,639,205 | 2,118,957 |

| United Arab Emirates — 0.5% | ||

| Polarcus Ltd. (a) | 5,761,625 | 5,660,012 |

| United Kingdom — 5.3% | ||

| Britvic Plc | 685,100 | 4,341,835 |

| Charter International Plc (b) | 799,900 | 10,170,879 |

| Chemring Group Plc | 54,500 | 560,485 |

| EasyJet Plc (a) | 701,200 | 4,044,978 |

| F&C Asset Management Plc | 207,458 | 249,720 |

| G4S Plc | 1,588,997 | 7,142,981 |

| GKN Plc | 901,800 | 3,362,157 |

| Guinness Peat Group Plc (a) | 6,277,500 | 4,084,657 |

| Halfords Group Plc | 726,500 | 4,331,045 |

| Inchcape Plc | 856,900 | 5,754,185 |

| Intertek Group Plc | 242,900 | 7,697,963 |

| Mothercare Plc | 390,400 | 2,493,049 |

| Premier Foods Plc (a) | 6,312,800 | 1,927,056 |

| Rexam Plc | 1,486,472 | 9,138,687 |

| 65,299,677 | ||

| United States — 46.1% | ||

| Aegerion Pharmaceuticals, Inc. (a) | 171,700 | 2,704,275 |

| Albemarle Corp. | 150,600 | 10,421,520 |

| American Superconductor Corp. (a)(b) | 275,700 | 2,492,328 |

| Aqua America, Inc. | 106,400 | 2,338,672 |

| Arcos Dorados Holdings, Inc. | 274,000 | 5,778,660 |

| Ariba, Inc. (a) | 141,100 | 4,863,717 |

| Arris Group, Inc. (a) | 708,800 | 8,229,168 |

| Autoliv, Inc. | 56,700 | 4,448,115 |

| BMC Software, Inc. (a) | 181,600 | 9,933,520 |

| Bill Barrett Corp. (a) | 223,400 | 10,354,590 |

| BioMed Realty Trust, Inc. | 500,100 | 9,621,924 |

| Blackboard, Inc. (a)(b) | 186,800 | 8,105,252 |

| BorgWarner, Inc. (a) | 80,150 | 6,475,318 |

| Brocade Communications Systems, Inc. (a) | 1,350,900 | 8,726,814 |

| Brown & Brown, Inc. | 230,900 | 5,924,894 |

| CB Richard Ellis Group, Inc. (a) | 220,600 | 5,539,266 |

| Cabot Oil & Gas Corp., Class A | 67,100 | 4,449,401 |

| Cadence Design Systems, Inc. (a) | 410,950 | 4,339,632 |

| Camden Property Trust | 96,200 | 6,120,244 |

| CardioNet, Inc. (a) | 212,400 | 1,127,844 |

| Celanese Corp., Series A | 212,900 | 11,349,699 |

| Cepheid, Inc. (a) | 145,600 | 5,043,584 |

| Checkpoint Systems, Inc. (a) | 341,500 | 6,106,020 |

| Common Stocks | Shares | Value |

| United States (continued) | ||

| CommonWealth REIT | 140,800 | $ 3,638,272 |

| ComScore, Inc. (a) | 167,400 | 4,335,660 |

| Covanta Holding Corp. | 292,550 | 4,824,150 |

| Coventry Health Care, Inc. (a) | 335,100 | 12,221,097 |

| Cullen/Frost Bankers, Inc. | 102,800 | 5,844,180 |

| Cytec Industries, Inc. | 154,600 | 8,841,574 |

| DSP Group, Inc. (a) | 776,849 | 6,758,586 |

| Developers Diversified Realty Corp. | 318,500 | 4,490,850 |

| Discover Financial Services, Inc. | 236,000 | 6,313,000 |

| Drew Industries, Inc. | 174,000 | 4,301,280 |

| Duke Realty Corp. | 523,900 | 7,339,839 |

| East-West Bancorp, Inc. | 245,300 | 4,957,513 |

| Electronic Arts, Inc. (a) | 450,200 | 10,624,720 |

| Flowers Foods, Inc. | 235,950 | 5,200,338 |

| Foot Locker, Inc. | 221,900 | 5,272,344 |

| The Fresh Market, Inc. (a) | 10,200 | 394,536 |

| Frontier Oil Corp. | 214,600 | 6,933,726 |

| Guess?, Inc. | 111,650 | 4,695,999 |

| Health Net, Inc. (a) | 253,300 | 8,128,397 |

| Healthways, Inc. (a) | 162,600 | 2,468,268 |

| IAC/InterActiveCorp. (a) | 97,700 | 3,729,209 |

| IDEX Corp. | 249,350 | 11,432,697 |

| IPC The Hospitalist Co., Inc. (a) | 171,500 | 7,949,025 |

| j2 Global Communications, Inc. (a) | 321,300 | 9,070,299 |

| Kennametal, Inc. | 52,600 | 2,220,246 |

| Kilroy Realty Corp. | 128,600 | 5,078,414 |

| LKQ Corp. (a) | 298,763 | 7,794,727 |

| Landstar System, Inc. | 164,250 | 7,634,340 |

| LifePoint Hospitals, Inc. (a) | 110,300 | 4,310,524 |

| Manpower, Inc. | 85,600 | 4,592,440 |

| Marshall & Ilsley Corp. | 873,200 | 6,959,404 |

| Maxim Integrated Products, Inc. | 148,700 | 3,800,772 |

| Meadowbrook Insurance Group, Inc. | 559,900 | 5,548,609 |

| Mentor Graphics Corp. (a) | 152,950 | 1,959,290 |

| Mistras Group, Inc. (a) | 241,600 | 3,913,920 |

| Molex, Inc. | 212,900 | 5,486,433 |

| NRG Energy, Inc. (a) | 241,500 | 5,936,070 |

| Nordson Corp. | 162,900 | 8,935,065 |

| Northwest Bancshares, Inc. | 689,700 | 8,676,426 |

| Nuance Communications, Inc. (a) | 502,800 | 10,795,116 |

| Oasis Petroleum, Inc. (a) | 268,000 | 7,954,240 |

| Omnicare, Inc. | 301,900 | 9,627,591 |

| Owens & Minor, Inc. | 78,300 | 2,700,567 |

| PMC-Sierra, Inc. (a) | 1,047,700 | 7,931,089 |

| Packaging Corp. of America | 129,200 | 3,616,308 |

| PartnerRe Ltd. | 55,900 | 3,848,715 |

| Patterson-UTI Energy, Inc. | 100,100 | 3,164,161 |

| PetroHawk Energy Corp. (a) | 285,700 | 7,048,219 |

| Pharmaceutical Product Development, Inc. | 276,500 | 7,421,260 |

| Phillips-Van Heusen Corp. | 69,700 | 4,563,259 |

| QLogic Corp. (a) | 439,200 | 6,992,064 |

| Radiant Systems, Inc. (a) | 553,400 | 11,566,060 |

| Regis Corp. | 259,800 | 3,980,136 |

| SVB Financial Group (a) | 130,400 | 7,786,184 |

| Silgan Holdings, Inc. | 136,200 | 5,580,114 |

| Steel Dynamics, Inc. | 256,700 | 4,171,375 |

| Stratasys, Inc. (a)(b) | 63,400 | 2,136,580 |