UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Materials Pursuant to §240.14a-12 |

Ryerson Inc.

(Exact Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

On August 10, 2007, Ryerson Inc. sent the following letter and attachments to Institutional Shareholder Services (“ISS”) in response to questions from ISS. On August 13, 2007, Ryerson also sent the following discussion notes to ISS.

Important Information

In connection with its proposed merger with an affiliate of Platinum Equity, LLC, Ryerson plans to file with the Securities and Exchange Commission (the “SEC”) a preliminary proxy statement and a definitive proxy statement. The definitive proxy statement will be mailed to stockholders of Ryerson. Stockholders of Ryerson are urged to read the proxy statement relating to the merger and other relevant materials when they become available because they will contain important information about the merger and Ryerson.

Security holders may obtain a free copy of the proxy statement and any other relevant documents (when available) that Ryerson files with the SEC at the SEC’s web site at http://www.sec.gov. The definitive proxy statement and these other documents may be accessed at www.ryerson.com or obtained free from Ryerson by directing a request to Ryerson Inc., ATTN: Investor Relations, 2621 West 15th Place, Chicago, IL 60608.

Certain Information Regarding Participants

Ryerson, its directors and executive officers may be deemed to be participants in the solicitation of the Company’s security holders in connection with the proposed merger. Security holders may obtain information regarding the names, affiliations and interests of such individuals in the Company’s proxy statement in connection with its 2007 annual meeting of stockholders, which was filed with the SEC on July 31, 2007. To the extent holdings of the Company’s equity securities have changed since the amounts reflected in such proxy statement, such changes have been reflected on Statements of Change in Ownership on Form 4 filed with the SEC.

| Neil S. Novich Chairman, President & Chief Executive Officer |

Via Email

August 10, 2007

Mr. Waheed Hassan, CFA

Senior Research Analyst

Institutional Shareholder Services

2099 Gaither Road, Suite 501

Rockville, MD 20850-4045

Dear Mr. Hassan:

Attached you will see an analysis of Ryerson performance as contrasted to the competitor group as originally defined by Harbinger. The competitors included A.M. Castle, Central Steel & Wire, Earle M. Jorgensen, Gibraltar Industries, Olympic Steel, Metals USA, Novamerican, PNA Group, Reliance Steel & Aluminum, Russel Metals, Samuel Manu-Tech, Shiloh Industries, Steel Technologies and Worthington Industries. We did not pick and choose individual companies.

In order to facilitate your analysis we have included all stock price data we have for the companies back to 2000. Please note that public data prior to 2000 for Ryerson is unreliable as it refers to Inland Steel Industries, a predecessor company in the steel manufacturing as well as metal distributor business (refer to attached explanations).

During our meeting you asked why we chose the period starting with 2004 to compare competitors. The reason has to do with the impact of the recession and restructuring activities prior to that time. In any case, here we are providing data from 2000 forward, a chronology of activities during period and the methodology used for calculating the numbers.

We believe this data shows that Ryerson has performed in line with its peers and is moving ahead. We readily admit Reliance has outperformed us but we are closing the gap and do not believe that it is appropriate to use the best performing company alone as the basis to make a decision of this magnitude.

We have also included an explanation of the Harbinger calculation which allows you to see why their numbers do not match ours. You can judge for yourself the correct methodology.

Please call with any questions or comments.

| Sincerely, |

| /s/ Neil S. Novich |

Neil S. Novich /mch |

Enclosures

neil.novich@ryerson.com

2621 W. 15th Place

Chicago, IL 60608

Phone 773.788.3580

Fax 773.788.4206

1998-1999 and prior years stock prices: • The “Ryerson” stock prices available in public data bases are unreliable prior to 2000 as they refer to Inland Steel Industries. • During this period “Ryerson Tull” was a publicly traded subsidiary of ISI with limited (13%) float. In 1999, after the sale of the Inland Steel Company (another ISI sub) to Ispat International (today, Arcelor Mittal), “Ryerson Tull” was merged back into the ISI holding company and ISI was renamed Ryerson Tull. • The first full year of Ryerson trading as Ryerson in public databases is 2000. When you look at public databases, the “Ryerson” stock prices are Ryerson back to partway through 1999, and then are the old ISI prices from part of 99 and earlier. • Proceeds of the sale of the Inland Steel Company were returned to shareholders in a dutch auction during 1999, further obscuring the underlying stock price. This is why we look at 2000 and later. • Ryerson Tull was simply renamed Ryerson after the Integris acquisition in 2005; clearly, the renaming would have no stock price impact, but takes us through today. |

1999 and prior years operations: • Prior to 2000, Ryerson was managed as a constrained subsidiary of ISI. • ISI had made a number of acquisitions in the service center space, all unintegrated, so there were duplicated overhead structures, duplicate market locations and no scale in procurement. These acquisitions also did not fit together in any strategic or product sense, so it was difficult to get any synergies. • We had steel industry benefits, including an expensive defined benefit pension plan and expensive retiree healthcare. No one else in our industry had such benefits and these legacy costs were one major reason why so many mills went bankrupt during 2000-2003 (over 30 steel producers) • The IT infrastructure was badly degraded due to a lack of investment. • We were a captive ISI customer for some products and because of channel conflicts had difficulty obtaining market competitive pricing from Inland Steel Company competitors, as well as difficulty importing offshore metal when Inland was fighting foreign steel. |

2000 and on-restructuring: • First step was taken actually in 1999, freezing the pension plan (which we could only do when the pension assets were segregated between Inland Steel Company and Ryerson.) • As you can understand this was a major change for the company…as part of the transition, we grandfathered many employees for 5 years so their benefits would continue to increase. This was the right thing to do, but costly. • During 2000 through 2003 interest rates fell substantially…when rates fall, pension liabilities increase (future value calculations) and annual expenses also rise. In 2004 we started to see the benefits decrease as the grandfathering period ended. • Recession began roughly early 2Q 2000 and we began to implement other restructuring programs (these are just a sample). – Reduced personnel by 1/3 (multiple waves as market deteriorated into 01 and 02) – Closed/downsized 26 of 60 facilities. (same time period above) – Centralized all the multiple regional overhead functions. (completed 2000) – Resourced all purchases to low cost mills (negotiations with hundreds of mills took through early 2002) |

2000 and on-restructuring (con’t): • Many actions were taken in 2000, but some were taken or expanded in later years, as industry volume declined from 2000 to 2001, then 01 to 02…industry volume also declined again through most of 2003 There was a slight up tick at the end of 03. Metal pricing was also very weak during this period (30 mill bankruptcies in the US) • All actions were completed by sometime in 2003, however much of the $85MM in annual savings was achieved during 2000. • Ryerson 2000 financial performance was 0.9% FIFO ROIC, dipped down in 2001 and began to recover from there. During 2000, our stock price also performed poorly given restructuring charges, etc. • Because the underlying business structure and performance improved so much, we were able to acquire Integris Metals in 2005 and fully integrate it without any disruption to our business. • We were also able to begin implementing SAP in 2004 so close down the multiple high cost legacy systems. Mostly complete by end of 2007, with some smaller business units to be done in 2008. • I would note that we rolled out SAP and integrated Integris simultaneously from 2005 through 2007 without disrupting the operations or financial performance…this is not a small achievement. |

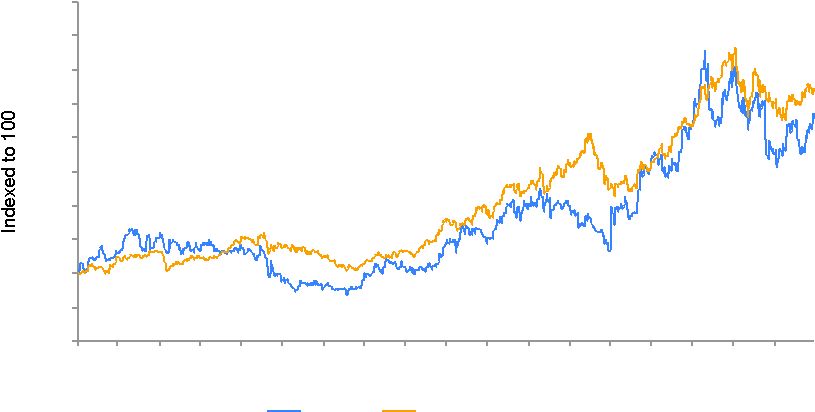

2001 through 2006 stock price: • We tend to look at stock price comparisons from the end of 2003 to today, as some restructuring actions were not completed until 2003. • However, we also provided you a chart from 2001 to 2006 since more than 1/2 of the restructuring was completed during 2000 through mid 2001: – Our performance closely tracks the weight average over this period. – You should note that during this full period, Metals USA went bankrupt, so is excluded from the calculation…however, you could include it as a stock that dropped to zero. – We use a market capitalization weighted stock price because the industry has a number of small cap competitors and their stock prices are volatile. In the weighting Reliance, the most profitable peer company, represents 36% of the total weight. • We did provide the full data file, so if you want to cut the data differently with different years or weighting you can easily do so |

Stock Performance since 2001 Peers include: A.M. Castle, Gibraltar, Novamerican, Olympic, Reliance, Russel, Samuel Manu-Tech, Shiloh Industries, Steel Technologies and Worthington: market cap weighted 0 50 100 150 200 250 300 350 400 450 500 Jan- 01 May- 01 Sep- 01 Jan- 02 May- 02 Sep- 02 Jan- 03 May- 03 Sep- 03 Jan- 04 May- 04 Sep- 04 Jan- 05 May- 05 Sep- 05 Jan- 06 May- 06 Sep- 06 Ryerson Peers Mkt Cap Wtd |

Stock Performance since 2004 Price = $25.09 Transaction w/Platinum Price = $34.50 Peers include: A.M. Castle, Gibraltar, Novamerican, Olympic, Reliance, Russel, Samuel Manu-Tech, Shiloh Industries, Steel Technologies and Worthington: market cap weighted Dec-06 0 50 100 150 200 250 300 350 Dec-03 Jul-04 Feb-05 Aug-05 Mar-06 Sep-06 Ryerson Peers S&P 500 $34.50 |

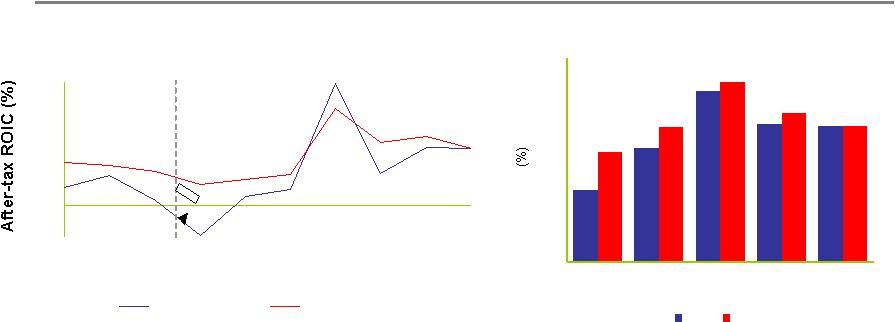

1998-1H2007 ROIC% (FIFO basis) • We are also providing you the data file on all the peers that Harbinger originally picked. • You should know that Harbinger, in its ROIC calculations, excludes good will. As an example Reliance, the most profitable peer, has $700MM of good will on its balance sheet from acquisitions. The attached calculations show how much this distorts the numbers. • We of course include good will…these are real investments, just like buildings and equipment, and it is inappropriate not to include them. • Please let us know if you have any questions. |

ROIC Performance v Peers $85mm Restructuring $50mm of annualized synergies from Integris acquisition Source: Company reports Notes: 1 Calculated as tax-effected FIFO EBIT/average invested capital 2 Includes A.M. Castle, Central Steel & Wire, Earle M. Jorgensen, Gibraltar Industries, Olympic Steel, Metals USA, Novamerican, PNA Group, Reliance Steel & Aluminum, Russel Metals, Samuel Manu-Tech, Shiloh Industries, Steel Technologies and Worthington Industries After Tax Return on Invested Capital 1 (LIFO companies adjusted to FIFO) 1H 2007 (7.0) (4.0) (1.0) 2.0 5.0 8.0 11.0 14.0 17.0 20.0 23.0 26.0 1998 1999 2000 2001 2002 2003 2004 2005 2006 Q2 2007 RYI Peers² Post- Restructuring Pre- Restructuring 10.0 15.1 12.2 6.3 12.0 11.9 9.7 13.1 15.8 11.9 0.0 3.0 6.0 9.0 12.0 15.0 18.0 10-Year 5-Year 3-Year 1-Year Average RYI Peers² $50mm of annualized synergies from Integris acquisition 1H 2007 |

Reliance 2006 ROIC Calculation Methodology Difference - Goodwill Ryerson Harbinger Methodology Methodology Reported EBIT 627.4 627.4 LIFO Expense 94.1 94.1 FIFO EBIT 721.5 721.5 Tax Rate 0.35 0.35 A/T FIFO EBIT 469.0 469.0 Avg Working Capital 819.1 819.1 LIFO Reserve adj 122.7 122.7 FIFO Working Capital 941.7 941.7 Avg Fixed Assets 611.2 611.2 Avg Goodwill/Intangibles 784.1 - Avg Other Assets (89.0) - Avg Invested Capital 2,248.0 1,552.9 ROIC % 20.9% 30.2% |

Notes on Harbinger “Discussion Materials”

August 13, 2007

We have reviewed the latest “Discussion Materials” prepared by Harbinger dated August 10, which were filed this morning. We believe that there are some basic factual and conceptual errors which we wish to bring to your attention.

p 2 – Harbinger’s own calculation indicates that Ryerson’s organic sales have grown by over 3% over the period in an industry that is showing low growth (1-2% in volume) at best.

| • | We believe that Ryerson has maintained its market share over this period (adjusted for the acquisitions), despite the fact that holding onto all sales when combining two companies the size of Ryerson and Integris always puts some customer relationships at risk where we may have represented 100% of supply prior to the acquisition and where they prefer dual suppliers. |

| • | We have disclosed publicly that we did lose two large customers in early 2006 due to one moving off-shore and the other deciding to buy directly from the mill. Since that time through 2006 and into 2007, we believe that our sales have moved with the industry. |

p 3 – We continue to believe that ROIC is still the best measure for evaluating performance and do not believe that Harbinger has refuted this. In order for this chart to be meaningful, it would have to be argued that sales revenue translates directly into EBITDA and market capitalization which is never the case.

p 4 – We continue to be troubled by the fact that Harbinger has chosen to selectively remove several of the companies that were in their original peer group whenever it suits their purpose.

| • | This chart does not include Gibraltar, Shiloh, Steel Technologies, Samuel Manutech and Worthington, which were part of the original peer group identified by Harbinger in their filling of January 2, 2007. The share prices and profitability of this group of excluded companies have generally underperformed during the time period. |

| • | We have sent you the data which shows that Ryerson has actually slightly outperformed the larger peer group for the 3 year period ending 12/31/06. |

| • | Including Metals USA for a portion of the period does not seem to be meaningful given their company’s history over a longer period of time. As we have mentioned, an investment in MUSA going back pre-bankruptcy would actually result in a 100% loss. |

p 5 – There is still a meaningful difference between Ryerson and Reliance in product mix given the wide variations in selling prices between carbon products and stainless or aluminum.

| • | As an example, we would target a 30% gross profit margin on a small carbon order while we would be happy with 8% on a large stainless contract. Similarly, program accounts, which represent a higher proportion of sales for Ryerson, tend to have lower margins than transactional accounts but we believe they can still have attractive returns. We do not have the data to complete a direct comparison using tons instead of sales dollars, but believe that the results would be much closer in that case. |

| • | More importantly, this chart continues to focus on margins rather than ROIC, which results in there not being any recognition for the high premiums that Reliance has paid to purchase companies which we acknowledge are historically strong performers with strong market positions. Reliance now has over $1 billion of goodwill and capitalized intangibles resulting from these acquisitions, while Ryerson has less than $100 million from the purchase of Integris and the other series of acquisitions that we have completed. |

p 6 – We have sent you all of the information behind our ROIC calculations.

| • | Harbinger does not define the “long-term average” that they are referring to on this page, but we cannot come up with these figures using any chosen period of time. It’s possible that they are continuing to calculate ROIC for the “long-term” without consideration of goodwill (as we noted in our last communication to you), but it is interesting that they now show an ROIC of 20.9% for Reliance in 2006 which we agree is the correct number adjusted for goodwill, but well below the figure of over 30% that they had previously submitted. |

| • | Moreover, we believe that Harbinger’s increased focus on comparisons between Ryerson and Reliance, who we both acknowledge is the top performer in the industry, rather than with the entire industry or the larger peer group does not constitute a reason to turn over control of the Board. While we aspire to become number 1, we believe that we have demonstrated that we have performed very well over time when measured against the larger population. |

p 9 – Harbinger tries to make a point that the DCF value does not include the value of excess inventory sold in 2Q of approximately $150 million.

| • | First of all, the reduction in inventory in 2Q was $40 million. |

| • | More importantly, the DCF definitelydoes include the cash flow benefit of achieving 5 turns during 2007 which is our objective. |

| ��� | While we would like to believe that the exit multiple in 5 years would be over 9, we have no reason to assume that it will be above the average industry multiple that has been experienced over time, which we have showed has range from 3.5 – 7.4 with an average of 5.5. The fact that the Platinum multiple is significantly higher than this average simply supports our position that the proposed transaction is attractive to shareholders now rather than later. |

p 12 – As mentioned before, we do not believe that any attempt to draw conclusions based on difference in EBITDA margins is meaningful.

p 13 – Focusing on tangible book value just completing ignores the real economics. Since Reliance’s growth model is based on acquisitions, it is not appropriate to ignore the premiums to book value paid to purchase these companies. We believe that the difference in trading multiples is reflected in the transaction price.

The substance of Harbinger’s position now seems to have evolved into a stance against the proposed transaction with Platinum and for executing the existing plan. If that is what they recommend, we believe that they should make an explicit recommendation in that direction. We would find this to be an interesting core platform if that is indeed the case. It would apparently totally validate the strategy and plans developed by the existing Board and management, since Harbinger has not presented one specific new idea that would change the results from the execution of this plan other than to replace the Board that developed it. They have not presented any detail on the changes, if any, that they would make in the top management of Ryerson, nor on how these changes would be made without disrupting the continued execution of the plan. Therefore, if their recommendation would be to continue as is, there does not seem to be any reason to change the leadership group that developed it.

We believe that that the proposed transaction with Platinum represents an attractive deal to shareholders that reflects a premium to previous market prices for Ryerson that were not influenced by deal speculation and relative to similar transactions in this industry. While we respect Harbinger’s right to express their opinion on its merits, we believe that the clearly best course of action at this point in time is to allow the entire shareholder base to decide this by allowing them to vote on the transaction. Changing the Board at this time does not seem warranted based on Harbinger’s own support for the continued execution for the existing plan and could impose Harbinger’s flawed judgment about the transaction instead of the will of the shareholders.

With all the data, analyses and letters that will be available, why should anybody deny the share holders the right to vote? Ideally, a deal vote would occur first and then a director vote if the deal was to be voted down.