UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04615

HARTFORD HLS SERIES FUND II, INC.

(Exact name of registrant as specified in charter)

5 Radnor Corporate Center, Suite 300, 100 Matsonford Road, Radnor, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Edward P. Macdonald, Esquire

Hartford Funds Management Company, LLC

5 Radnor Corporate Center, Suite 300

100 Matsonford Road

Radnor, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: December 31

Date of reporting period: June 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F. Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

HARTFORDFUNDS

| | HARTFORD GROWTH OPPORTUNITIES HLS FUND 2014 Semi Annual Report |

A MESSAGE FROM THE PRESIDENT

Dear Fellow Shareholders:

Thank you for investing in Hartford HLS Funds.

Market Review

U.S. equities (as represented by the S&P 500 Index) started 2014 on a shaky note after posting a strong 32.39% gain in 2013. However, stocks managed to maintain modest gains throughout the first quarter and returned to a generally steady climb in the second quarter. Through June 30, 2014, the S&P 500 Index advanced 7.14%. It appears that much of the market volatility during the year can be attributed to heightened international tensions. In particular, the Russian annexation of Ukraine’s Crimean Peninsula and increased tensions in Iraq were cause for concern.

On the domestic front, subdued economic and employment reports slowed stocks’ progress early in the new year, although much of the weakness seemed to dissipate as the year’s unusually harsh winter subsided. And despite initial reactions to the idea, when the U.S. Federal Reserve began tapering its quantitative-easing program in January by reducing its bond purchases by $10 billion a month, the markets took the policy change in stride.

Despite a rough start to the year for financial markets, the global economy seems to be settling into a slow-but-steady recovery. While first-quarter U.S. gross domestic product (GDP) growth was disappointing at -2.9%, U.S. consumer spending, which is a significant contributor toward economic growth, rose by 3% during the quarter. It appears that Europe is also maintaining its own recovery: The International Monetary Fund projects that Europe’s full-year GDP growth may breach positive territory for the first time since 2011.

The impact of international affairs on stocks so far this year is an important reminder to stay informed about both domestic and international economic developments, and any effects they may have on your individual investment goals. If you have not already had a mid-year review of your portfolio, it may be a good time to meet with your financial advisor to review your progress and make certain your investments are prepared for all market environments:

| • | Is your portfolio properly diversified with an appropriate mix of stocks and bonds? |

| • | Is your portfolio positioned to take advantage of the global economic recovery, with investments in both domestic and international holdings? |

| • | Are your investments still in line with your risk tolerance and investment time horizon? |

Your financial professional can help you choose options within our fund family to help you reach your investment goals with confidence.

Thank you again for investing with Hartford HLS Funds.

James Davey

President

Hartford HLS Funds

1 The S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

2 The Dow Jones Industrial Average is an unmanaged, price-weighted index of 30 of the largest, most widely held stocks traded on the New York Stock Exchange.

Hartford Growth Opportunities HLS Fund

Table of Contents

This report is prepared for the general information of contract owners and qualified retirement plan participants. It is not an offer of contracts or of qualified retirement plans. It should not be used in connection with any offer, except in conjunction with the appropriate product prospectus which contains all pertinent information including the applicable sales, administrative and other charges.

The views expressed in the Fund’s Manager Discussion under ‘‘Why did the Fund perform this way?’’ and ‘‘What is the outlook?’’ are views of the Fund’s sub-adviser and portfolio management team through the end of the period and are subject to change based on market and other conditions. The Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable.

Hartford Growth Opportunities HLS Fund inception 03/24/1987

(sub-advised by Wellington Management Company, LLP)

Investment objective – The Fund seeks capital appreciation.

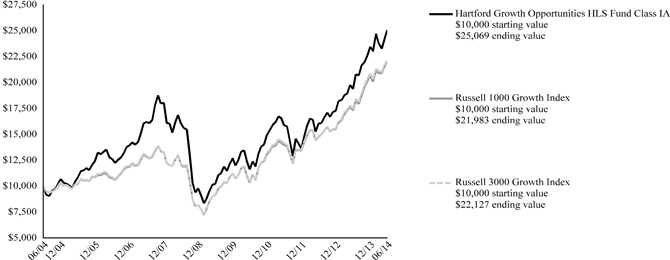

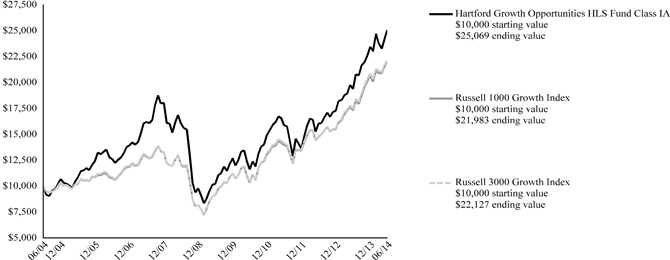

Performance Overview 6/30/04 - 6/30/14

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Returns (as of 6/30/14)

| | | 6 Month† | | 1 Year | | 5 Years | | 10 Years |

| Growth Opportunities IA | | | 6.88 | % | | | 29.29 | % | | | 19.69 | % | | | 9.63 | % |

| Growth Opportunities IB | | | 6.71 | % | | | 28.94 | % | | | 19.39 | % | | | 9.35 | % |

| Growth Opportunities IC | | | 6.63 | % | | | 28.66 | % | | | 19.10 | % | | | 9.08 | % |

| Russell 1000 Growth Index | | | 6.31 | % | | | 26.92 | % | | | 19.24 | % | | | 8.20 | % |

| Russell 3000 Growth Index | | | 5.98 | % | | | 26.75 | % | | | 19.34 | % | | | 8.27 | % |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2014, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class IC shares commenced operations on April 30, 2014. Returns prior to the inception date of Class IC shares reflect the returns of Class IA shares adjusted to reflect the estimated fees and expenses of Class IC shares.

Russell 1000 Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index is an unmanaged index that measures the performance of the 1,000 largest companies in the Russell 3000 Index, which measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

Russell 3000 Growth Index is an unmanaged index that measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Index is an unmanaged index that measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund's current prospectus dated May 1, 2014, the total annual operating expense ratios for Class IA, Class IB and IC were 0.65%, 0.90% and 1.15%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2014.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

Hartford Growth Opportunities HLS Fund

Manager Discussion

June 30, 2014 (Unaudited)

| Portfolio Managers | | |

| Michael T. Carmen, CFA | Mario E. Abularach, CFA | Stephen Mortimer |

Senior Vice President and Equity Portfolio

Manager | Senior Vice President and Equity Research

Analyst | Senior Vice President and Equity Portfolio Manager |

| |

How did the Fund perform?

The Class IA shares of the Hartford Growth Opportunities HLS Fund returned 6.88% for the six-month period ended June 30, 2014, outperforming the Fund’s benchmark, the Russell 3000 Growth Index, which returned 5.98% for the same period. The Fund also outperformed the 4.78% average return of the Lipper Multi-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities surged during the period, ending June near an all-time high. After finishing 2013 with their best year since 1997, U.S. stocks began 2014 with their worst month in nearly two years. Worries about a slowdown in China and general concern surrounding emerging markets overshadowed a fairly benign domestic environment. However, robust merger and acquisition activity and an uncontested increase in the debt ceiling from Congress helped stoke investors' risk appetites in February. Earnings season in April provided a varied yet encouraging picture, with companies generally reporting healthy earnings but more subdued revenues. The rally continued in May amid renewed signs of life in the housing market and the best payroll gains in more than two years. In June, strong manufacturing activity, coupled with continued positive momentum in housing and employment data, helped to offset a large negative revision to first quarter economic growth.

Growth stocks (+6.3%) underperformed Value stocks (+8.3%) during the period, as measured by the Russell 1000 Growth and Russell 1000 Value Indices. Nine out of ten sectors in the Russell 3000 Growth Index rose during the period. The Energy (+25%), Utilities (+18%), and Healthcare (+9%) sectors gained the most while Consumer Discretionary (0%) and Industrials (+4%) lagged on a relative basis.

Security selection was the main driver of relative outperformance during the period. Security selection was strongest in the Information Technology, Healthcare, and Materials sectors, with weaker selection in the Consumer Discretionary, Consumer Staples, and Industrials sectors. Sector allocation, a result of the bottom-up stock selection process, detracted from relative performance, in part due to an overweight in Consumer Discretionary and underweight in Energy.

The top relative contributors to performance in the Fund during the period were Platform Specialty (Materials), Forest Labs (Healthcare), and NXP Semiconductors (Information Technology). Shares of Platform Specialty, a company that develops, produces, and markets a range of specialty chemical and printing products, outperformed as investors have become increasingly optimistic about the firm’s ability to expand in the very large, unconsolidated specialty chemical market. Shares of Forest Labs, a U.S.-based pharmaceutical company, outperformed as it was announced that Acatives would be buying Forest Labs. Shares of NXP Semiconductors, a Netherlands-based semiconductor company, rose on speculation that NXP will provide NFC technology (short-range communications between compatible devices) to Apple's iPhone 6 and iWatch. Apple (Information Technology) was also among other top absolute contributors to performance.

The top relative and absolute detractors from performance during the period included DigitalGlobe (Industrials), Lululemon Athletica (Consumer Discretionary) and Whole Foods (Consumer Staples). Shares of DigitalGlobe, a leading player in satellite digital imagery, decreased due to more conservative earnings guidance for 2014. Shares of Lululemon Athletica, a manufacturer and retailer of premium athletic apparel, declined due to image challenges, a poor showing on analyst day, and new management additions which have continued to be disruptive to the business. Shares of Whole Foods, a natural foods grocery store chain operator, declined after it reported second quarter profit that was below analysts' estimates.

Derivatives are not used in a significant manner in this Fund and did not have a material impact on performance during the period.

What is your outlook?

Looking ahead, we think the global macro environment is as good as it has been in a number of years. Our biggest present day macro concern is the continuing conflict in the Middle East; we think the market may be too complacent about the potential contagion effects of an escalation in the current conflict in Iraq. We will watch the situation closely.

At the end of the period, the Fund was most overweight the Information Technology, Consumer Discretionary, and Healthcare sectors and most underweight the Consumer Staples, Materials, and Telecommunication Services sectors relative to the Russell 3000 Growth Index.

Hartford Growth Opportunities HLS Fund

Manager Discussion – (continued)

June 30, 2014 (Unaudited)

| Diversification by Sector |

| as of June 30, 2014 |

| |

| Sector | | Percentage of

Net Assets | |

| Equity Securities | | | | |

| Consumer Discretionary | | | 19.8% | |

| Consumer Staples | | | 5.3 | |

| Energy | | | 4.9 | |

| Financials | | | 7.2 | |

| Health Care | | | 14.4 | |

| Industrials | | | 13.4 | |

| Information Technology | | | 34.5 | |

| Materials | | | 0.9 | |

| Services | | | 0.2 | |

| Total | | | 100.6% | |

| Other Assets and Liabilities | | | (0.6) | |

| Total | | | 100.0% | |

A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system and these sector classifications are used for reporting ease.

Hartford Growth Opportunities HLS Fund

Schedule of Investments

June 30, 2014 (Unaudited)

(000’s Omitted)

| Shares or Principal Amount | | Market Value ╪ | |

Common Stocks - 100.6% | | | | |

| | | | | Capital Goods - 7.7% | | | | |

| | 130 | | | Acuity Brands, Inc. | | $ | 17,966 | |

| | 234 | | | Danaher Corp. | | | 18,385 | |

| | 507 | | | DigitalGlobe, Inc. ● | | | 14,103 | |

| | 671 | | | HD Supply Holdings, Inc. ● | | | 19,044 | |

| | 1,458 | | | Lithium Technology Corp. ⌂●† | | | 8,050 | |

| | 105 | | | Owens Corning, Inc. | | | 4,062 | |

| | 136 | | | Pall Corp. | | | 11,635 | |

| | 431 | | | Textron, Inc. | | | 16,506 | |

| | | | | | | | 109,751 | |

| | | | | Commercial and Professional Services - 4.5% | | | | |

| | 223 | | | IHS, Inc. ● | | | 30,274 | |

| | 219 | | | Manpowergroup, Inc. | | | 18,565 | |

| | 295 | | | Nielsen N.V. | | | 14,299 | |

| | | | | | | | 63,138 | |

| | | | | Consumer Durables and Apparel - 4.1% | | | | |

| | 154 | | | Harman International Industries, Inc. | | | 16,501 | |

| | 213 | | | Lennar Corp. | | | 8,956 | |

| | 4,504 | | | Samsonite International S.A. | | | 14,847 | |

| | 133 | | | Whirlpool Corp. | | | 18,533 | |

| | | | | | | | 58,837 | |

| | | | | Consumer Services - 5.6% | | | | |

| | 709 | | | Diamond Resorts International, Inc. ● | | | 16,506 | |

| | 118 | | | Panera Bread Co. Class A ● | | | 17,699 | |

| | 1,672 | | | Sands China Ltd. | | | 12,619 | |

| | 228 | | | Starwood Hotels & Resorts, Inc. | | | 18,398 | |

| | 186 | | | Wyndham Worldwide Corp. | | | 14,105 | |

| | | | | | | | 79,327 | |

| | | | | Diversified Financials - 3.9% | | | | |

| | 59 | | | BlackRock, Inc. | | | 18,932 | |

| | 321 | | | Julius Baer Group Ltd. | | | 13,223 | |

| | 494 | | | Nomad Holdings Ltd. ●† | | | 5,150 | |

| | 631 | | | Platform Specialty Products Corp. ● | | | 17,688 | |

| | | | | | | | 54,993 | |

| | | | | Energy - 4.9% | | | | |

| | 146 | | | Baker Hughes, Inc. | | | 10,857 | |

| | 223 | | | Energen Corp. | | | 19,778 | |

| | 127 | | | EOG Resources, Inc. | | | 14,849 | |

| | 104 | | | Pioneer Natural Resources Co. | | | 23,959 | |

| | | | | | | | 69,443 | |

| | | | | Food and Staples Retailing - 3.2% | | | | |

| | 181 | | | CVS Caremark Corp. | | | 13,609 | |

| | 333 | | | Sprouts Farmers Markets, Inc. ● | | | 10,899 | |

| | 537 | | | Whole Foods Market, Inc. | | | 20,738 | |

| | | | | | | | 45,246 | |

| | | | | Food, Beverage and Tobacco - 2.1% | | | | |

| | 120 | | | Anheuser-Busch InBev N.V. ADR | | | 13,841 | |

| | 126 | | | Keurig Green Mountain, Inc. | | | 15,674 | |

| | | | | | | | 29,515 | |

| | | | | Health Care Equipment and Services - 1.9% | | | | |

| | 459 | | | Envision Healthcare Holdings ● | | | 16,471 | |

| | 113 | | | Universal Health Services, Inc. Class B | | | 10,801 | |

| | | | | | | | 27,272 | |

| | | | | Insurance - 2.2% | | | | |

| | 323 | | | American International Group, Inc. | | | 17,637 | |

| | 427 | | | XL Group plc | | | 13,991 | |

| | | | | | | | 31,628 | |

| | | | | Materials - 0.9% | | | | |

| | 926 | | | Cemex S.A.B. de C.V. ADR ● | | | 12,248 | |

| | | | | | | | | |

| | | | | Pharmaceuticals, Biotechnology and Life Sciences - 12.5% | | | | |

| | 61 | | | Actavis plc ● | | | 13,560 | |

| | 67 | | | Alnylam Pharmaceuticals, Inc. ● | | | 4,243 | |

| | 118 | | | Amgen, Inc. | | | 13,923 | |

| | 883 | | | Bristol-Myers Squibb Co. | | | 42,815 | |

| | 159 | | | Covance, Inc. ● | | | 13,592 | |

| | 91 | | | Forest Laboratories, Inc. ● | | | 9,026 | |

| | 133 | | | Incyte Corp. ● | | | 7,484 | |

| | 236 | | | Merck & Co., Inc. | | | 13,662 | |

| | 162 | | | Novartis AG | | | 14,662 | |

| | 184 | | | Ono Pharmaceutical Co., Ltd. | | | 16,154 | |

| | 47 | | | Regeneron Pharmaceuticals, Inc. ● | | | 13,350 | |

| | 466 | | | Zoetis, Inc. | | | 15,026 | |

| | | | | | | | 177,497 | |

| | | | | Real Estate - 1.1% | | | | |

| | 476 | | | CBRE Group, Inc. ● | | | 15,235 | |

| | | | | | | | | |

| | | | | Retailing - 10.1% | | | | |

| | 54 | | | Amazon.com, Inc. ● | | | 17,514 | |

| | 27 | | | AutoZone, Inc. ● | | | 14,471 | |

| | 525 | | | Lowe's Cos., Inc. | | | 25,173 | |

| | 59 | | | Netflix, Inc. ● | | | 26,191 | |

| | 24 | | | Priceline (The) Group, Inc. ● | | | 28,990 | |

| | 139 | | | Signet Jewelers Ltd. | | | 15,341 | |

| | 95 | | | Tory Burch LLC ⌂●† | | | 6,397 | |

| | 87 | | | TripAdvisor, Inc. ● | | | 9,496 | |

| | | | | | | | 143,573 | |

| | | | | Semiconductors and Semiconductor Equipment - 3.0% | | | | |

| | 146 | | | First Solar, Inc. ● | | | 10,402 | |

| | 311 | | | NXP Semiconductors N.V. ● | | | 20,558 | |

| | 493 | | | SunEdison, Inc. ● | | | 11,150 | |

| | | | | | | | 42,110 | |

| | | | | Software and Services - 18.4% | | | | |

| | 841 | | | Activision Blizzard, Inc. | | | 18,759 | |

| | 376 | | | Akamai Technologies, Inc. ● | | | 22,939 | |

| | 1,364 | | | Apigee Corp. ⌂●† | | | 3,572 | |

| | 260 | | | Autodesk, Inc. ● | | | 14,676 | |

| | 84 | | | Baidu, Inc. ADR ● | | | 15,728 | |

| | 827 | | | Cadence Design Systems, Inc. ● | | | 14,466 | |

| | 266 | | | Concur Technologies, Inc. ● | | | 24,796 | |

| | 1,872 | | | Essence Holding Group ⌂●† | | | 2,664 | |

| | 535 | | | Facebook, Inc. ● | | | 36,026 | |

| | 15 | | | Google, Inc. Class A ● | | | 8,933 | |

| | 92 | | | Google, Inc. Class C ● | | | 53,069 | |

| | 64 | | | New Relic, Inc. ⌂●† | | | 1,665 | |

| | 280 | | | Salesforce.com, Inc. ● | | | 16,286 | |

| | 48 | | | Tableau Software, Inc. ● | | | 3,436 | |

| | 190 | | | Uber Technologies, Inc. ⌂●† | | | 10,609 | |

| | 177 | | | Yelp, Inc. ● | | | 13,552 | |

| | | | | | | | 261,176 | |

| | | | | Technology Hardware and Equipment - 13.1% | | | | |

| | 863 | | | Apple, Inc. | | | 80,169 | |

| | 464 | | | DataLogix Holdings ⌂●† | | | 4,300 | |

| | 160 | | | F5 Networks, Inc. ● | | | 17,851 | |

| | 178 | | | Palo Alto Networks, Inc. ● | | | 14,928 | |

| | 268 | | | Pure Storage, Inc. ⌂●† | | | 3,798 | |

| | 430 | | | Qualcomm, Inc. | | | 34,023 | |

| | 132 | | | SanDisk Corp. | | | 13,774 | |

| | 285 | | | TE Connectivity Ltd. | | | 17,619 | |

| | | | | | | | 186,462 | |

The accompanying notes are an integral part of these financial statements.

Hartford Growth Opportunities HLS Fund

Schedule of Investments – (continued)

June 30, 2014 (Unaudited)

(000’s Omitted)

| Shares or Principal Amount | | | | | | Market Value ╪ | |

Common Stocks - 100.6% - (continued) | | | | | | | | |

| | | | | Telecommunication Services - 0.2% | | | | | | | | |

| | 164 | | | DocuSign, Inc. ⌂●† | | | | | | $ | 3,344 | |

| | | | | | | | | | | | 3,344 | |

| | | | | Transportation - 1.2% | | | | | | | | |

| | 115 | | | FedEx Corp. | | | | | | | 17,401 | |

| | | | | | | | | | | | | |

| | | | | Total Common Stocks | | | | | | | | |

| | | | | ( Cost $1,239,025) | | | | | | $ | 1,428,196 | |

| | | | | | | | | | | | | |

Warrants - 0.0% | | | | | | | | |

| | | | | Diversified Financials - 0.0% | | | | | | | | |

| | 493 | | | Nomad Holdings Ltd. † | | | | | | $ | 223 | |

| | | | | | | | | | | | | |

| | | | | Total Warrants | | | | | | | | |

| | | | | (Cost $5) | | | | | | $ | 223 | |

| | | | | | | | | | | | | |

| | | | | Total Long-Term Investments | | | | | | | | |

| | | | | (Cost $1,239,030) | | | | | | $ | 1,428,419 | |

| | | | | | | | | | | | | |

| | | | | Total Investments | | | | | | | | |

| | | | | (Cost $1,239,030) ▲ | | | 100.6 | % | | $ | 1,428,419 | |

| | | | | Other Assets and Liabilities | | | (0.6 | )% | | | (7,847 | ) |

| | | | | Total Net Assets | | | 100.0 | % | | $ | 1,420,572 | |

The accompanying notes are an integral part of these financial statements.

Hartford Growth Opportunities HLS Fund

Schedule of Investments – (continued)

June 30, 2014 (Unaudited)

(000’s Omitted)

| Note: | Percentage of investments as shown is the ratio of the total market value to total net assets. |

| | Prices of foreign equities that are principally traded on certain foreign markets may be adjusted daily pursuant to a fair value pricing service approved by the Board of Directors in order to reflect an adjustment for factors occurring after the close of certain foreign markets but before the close of the New York Stock Exchange. |

| ▲ | At June 30, 2014, the cost of securities for federal income tax purposes was $1,236,200 and the aggregate gross unrealized appreciation and depreciation based on that cost were: |

| Unrealized Appreciation | | $ | 202,288 | |

| Unrealized Depreciation | | | (10,069 | ) |

| Net Unrealized Appreciation | | $ | 192,219 | |

| † | These securities were valued in good faith at fair value as determined under policies and procedures established by and under the supervision of the Board of Directors. At June 30, 2014, the aggregate value of these securities was $49,772, which represents 3.5% of total net assets. This amount excludes securities that are principally traded in certain foreign markets and whose prices are adjusted pursuant to a third party pricing service methodology approved by the Board of Directors. |

| ⌂ | The following securities are considered illiquid. Illiquid securities are often purchased in private placement transactions, are often not registered under the Securities Act of 1933, as amended, and may have contractual restrictions on resale. A security may also be considered illiquid if the security lacks a readily available market or if its valuation has not changed for a certain period of time. |

| Period Acquired | | Shares/ Par | | | Security | | Cost Basis | |

| 04/2014 | | | 1,364 | | | Apigee Corp. | | $ | 3,969 | |

| 05/2014 | | | 464 | | | DataLogix Holdings | | | 4,778 | |

| 02/2014 | | | 164 | | | DocuSign, Inc. | | | 2,149 | |

| 05/2014 | | | 1,872 | | | Essence Holding Group | | | 2,960 | |

| 08/2013 | | | 1,458 | | | Lithium Technology Corp. | | | 7,108 | |

| 04/2014 | | | 64 | | | New Relic, Inc. | | | 1,850 | |

| 04/2014 | | | 268 | | | Pure Storage, Inc. | | | 4,220 | |

| 11/2013 | | | 95 | | | Tory Burch LLC | | | 7,409 | |

| 06/2014 | | | 190 | | | Uber Technologies, Inc. | | | 11,788 | |

| | At June 30, 2014, the aggregate value of these securities was $44,399, which represents 3.1% of total net assets. |

| Foreign Currency Contracts Outstanding at June 30, 2014 | |

| | | | | | | | | | | | | | | | | Unrealized Appreciation/(Depreciation) | |

| Currency | | Buy / Sell | | Delivery Date | | | Counterparty | | | Contract Amount | | | Market Value ╪ | | | Asset | | | Liability | |

| CHF | | Buy | | | 07/01/2014 | | | | CSFB | | | $ | 455 | | | $ | 458 | | | $ | 3 | | | $ | — | |

| ╪ | See Significant Accounting Policies of accompanying Notes to Financial Statements regarding valuation of securities. |

| GLOSSARY: (abbreviations used in preceding Schedule of Investments) |

| |

| Counterparty Abbreviations: |

| CSFB | Credit Suisse First Boston Corp. |

| |

| Currency Abbreviations: |

| CHF | Swiss Franc |

| |

| Other Abbreviations: |

| ADR | American Depositary Receipt |

The accompanying notes are an integral part of these financial statements.

Hartford Growth Opportunities HLS Fund

Investment Valuation Hierarchy Level Summary

June 30, 2014 (Unaudited)

(000’s Omitted)

| | | Total | | | Level 1 ♦ | | | Level 2 ♦ | | | Level 3 | |

| Assets: | | | | | | | | | | | | | | | | |

| Common Stocks ‡ | | $ | 1,428,196 | | | $ | 1,312,292 | | | $ | 71,505 | | | $ | 44,399 | |

| Warrants | | | 223 | | | | 223 | | | | — | | | | — | |

| Total | | $ | 1,428,419 | | | $ | 1,312,515 | | | $ | 71,505 | | | $ | 44,399 | |

| Foreign Currency Contracts * | | $ | 3 | | | $ | — | | | $ | 3 | | | $ | — | |

| Total | | $ | 3 | | | $ | — | | | $ | 3 | | | $ | — | |

| ♦ | For the six-month period ended June 30, 2014, there were no transfers between Level 1 and Level 2. |

| ‡ | The Fund has all or primarily all of the equity securities categorized in a particular level. Refer to the Schedule of Investments for further industry breakout. |

| * | Derivative instruments (excluding purchased and written options, if applicable) are valued at the unrealized appreciation/depreciation on the investments. |

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value:

| | | Balance as

of

December

31, 2013 | | | Realized

Gain

(Loss) | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Net

Amortization | | | Purchases | | | Sales | | | Transfers

Into

Level 3 * | | | Transfers

Out of

Level 3 * | | | Balance as

of June 30,

2014 | |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stocks | | $ | 40,454 | | | $ | — | | | $ | (2,376 | )† | | $ | — | | | $ | 33,616 | | | $ | — | | | $ | — | | | $ | (27,295 | ) | | $ | 44,399 | |

| Warrants | | | 323 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (323 | ) | | | — | |

| Total | | $ | 40,777 | | | $ | — | | | $ | (2,376 | ) | | $ | — | | | $ | 33,616 | | | $ | — | | | $ | — | | | $ | (27,618 | ) | | $ | 44,399 | |

| * | Investments are transferred into and out of Level 3 for a variety of reasons including, but not limited to: |

| 1) | Investments where trading has been halted (transfer into Level 3) or investments where trading has resumed (transfer out of Level 3). |

| 2) | Broker quoted investments (transfer into Level 3) or quoted prices in active markets (transfer out of Level 3). |

| 3) | Investments that have certain restrictions on trading (transfer into Level 3) or investments where trading restrictions have expired (transfer out of Level 3). |

| † | Change in unrealized appreciation (depreciation) in the current period relating to assets still held at June 30, 2014 was $(2,376). |

| Note: | For purposes of reporting transfers between different hierarchy levels, both transfers in and out of each level, as applicable, are shown as if they occurred at the beginning of the period. |

The accompanying notes are an integral part of these financial statements.

Hartford Growth Opportunities HLS Fund

Statement of Assets and Liabilities

June 30, 2014 (Unaudited)

(000’s Omitted)

| Assets: | | | | |

| Investments in securities, at market value (cost $1,239,030) | | $ | 1,428,419 | |

| Foreign currency on deposit with custodian (cost $158) | | | 158 | |

| Unrealized appreciation on foreign currency contracts | | | 3 | |

| Receivables: | | | | |

| Investment securities sold | | | 28,727 | |

| Fund shares sold | | | 13 | |

| Dividends and interest | | | 464 | |

| Other assets | | | 1 | |

| Total assets | | | 1,457,785 | |

| Liabilities: | | | | |

| Bank overdraft | | | 1,347 | |

| Payables: | | | | |

| Investment securities purchased | | | 33,204 | |

| Fund shares redeemed | | | 2,344 | |

| Investment management fees | | | 118 | |

| Administrative fees | | | — | |

| Distribution fees | | | 6 | |

| Accrued expenses | | | 194 | |

| Total liabilities | | | 37,213 | |

| Net assets | | $ | 1,420,572 | |

| Summary of Net Assets: | | | | |

| Capital stock and paid-in-capital | | $ | 843,385 | |

| Undistributed net investment income | | | 3,181 | |

| Accumulated net realized gain | | | 384,617 | |

| Unrealized appreciation of investments and the translations of assets and liabilities denominated in foreign currency | | | 189,389 | |

| Net assets | | $ | 1,420,572 | |

| Shares authorized | | | 900,000 | |

| Par value | | $ | 0.001 | |

| Class IA: Net asset value per share | | $ | 43.37 | |

| Shares outstanding | | | 28,764 | |

| Net assets | | $ | 1,247,619 | |

| Class IB: Net asset value per share | | $ | 42.46 | |

| Shares outstanding | | | 4,070 | |

| Net assets | | $ | 172,828 | |

| Class IC: Net asset value per share | | $ | 43.34 | |

| Shares outstanding | | | 3 | |

| Net assets | | $ | 125 | |

The accompanying notes are an integral part of these financial statements.

Hartford Growth Opportunities HLS Fund

Statement of Operations

For the Six-Month Period Ended June 30, 2014 (Unaudited)

(000’s Omitted)

| Investment Income: | | | | |

| Dividends | | $ | 5,259 | |

| Interest | | | 3 | |

| Less: Foreign tax withheld | | | (231 | ) |

| Total investment income, net | | | 5,031 | |

| | | | | |

| Expenses: | | | | |

| Investment management fees | | | 3,608 | |

| Administrative service fees | | | — | |

| Transfer agent fees | | | 3 | |

| Distribution fees - Class IB | | | 138 | |

| Distribution fees - Class IC | | | — | |

| Custodian fees | | | 11 | |

| Accounting services fees | | | 59 | |

| Board of Directors' fees | | | 14 | |

| Audit fees | | | 9 | |

| Other expenses | | | 124 | |

| Total expenses (before fees paid indirectly) | | | 3,966 | |

| Commission recapture | | | (22 | ) |

| Total fees paid indirectly | | | (22 | ) |

| Total expenses, net | | | 3,944 | |

| Net Investment Income | | | 1,087 | |

| | | | | |

| Net Realized Gain on Investments and Foreign Currency Transactions: | | | | |

| Net realized gain on investments | | | 168,108 | |

| Net realized loss on purchased option contracts | | | (687 | ) |

| Net realized loss on foreign currency contracts | | | (12 | ) |

| Net realized loss on other foreign currency transactions | | | (28 | ) |

| Net Realized Gain on Investments and Foreign Currency Transactions | | | 167,381 | |

| | | | | |

| Net Changes in Unrealized Depreciation of Investments and Foreign Currency Transactions: | | | | |

| Net unrealized depreciation of investments | | | (88,751 | ) |

| Net unrealized appreciation of purchased option contracts | | | 687 | |

| Net unrealized appreciation of foreign currency contracts | | | 3 | |

| Net unrealized depreciation on translation of other assets and liabilities in foreign currencies | | | (3 | ) |

| Net Changes in Unrealized Depreciation of Investments and Foreign Currency Transactions | | | (88,064 | ) |

| Net Gain on Investments and Foreign Currency Transactions | | | 79,317 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 80,404 | |

The accompanying notes are an integral part of these financial statements.

Hartford Growth Opportunities HLS Fund

Statement of Changes in Net Assets

(000’s Omitted)

| | | For the

Six-Month

Period Ended

June 30, 2014

(Unaudited) | | | For the

Year Ended

December 31,

2013 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 1,087 | | | $ | 2,058 | |

| Net realized gain on investments and foreign currency transactions | | | 167,381 | | | | 263,798 | |

| Net unrealized appreciation (depreciation) of investments and foreign currency transactions | | | (88,064 | ) | | | 80,326 | |

| Net Increase in Net Assets Resulting from Operations | | | 80,404 | | | | 346,182 | |

| Distributions to Shareholders: | | | | | | | | |

| From net investment income | | | | | | | | |

| Class IA | | | — | | | | (91 | ) |

| Total distributions | | | — | | | | (91 | ) |

| Capital Share Transactions: | | | | | | | | |

| Class IA | | | | | | | | |

| Sold | | | 9,142 | | | | 66,025 | |

| Issued in merger | | | 160,101 | | | | — | |

| Issued on reinvestment of distributions | | | — | | | | 91 | |

| Redeemed | | | (93,493 | ) | | | (232,985 | ) |

| Total capital share transactions | | | 75,750 | | | | (166,869 | ) |

| Class IB | | | | | | | | |

| Sold | | | 7,299 | | | | 22,177 | |

| Issued in merger | | | 61,940 | | | | — | |

| Redeemed | | | (13,548 | ) | | | (52,667 | ) |

| Total capital share transactions | | | 55,691 | | | | (30,490 | ) |

| Class IC | | | | | | | | |

| Sold | | | 117 | | | | — | |

| Redeemed | | | — | | | | — | |

| Total capital share transactions | | | 117 | | | | — | |

| Net increase (decrease) from capital share transactions | | | 131,558 | | | | (197,359 | ) |

| Net Increase in Net Assets | | | 211,962 | | | | 148,732 | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 1,208,610 | | | | 1,059,878 | |

| End of period | | $ | 1,420,572 | | | $ | 1,208,610 | |

| Undistributed (distribution in excess of) net investment income | | $ | 3,181 | | | $ | 2,094 | |

| Shares: | | | | | | | | |

| Class IA | | | | | | | | |

| Sold | | | 261 | | | | 1,923 | |

| Issued in merger | | | 3,722 | | | | — | |

| Issued on reinvestment of distributions | | | — | | | | 2 | |

| Redeemed | | | (2,260 | ) | | | (6,705 | ) |

| Total share activity | | | 1,723 | | | | (4,780 | ) |

| Class IB | | | | | | | | |

| Sold | | | 139 | | | | 654 | |

| Issued in merger | | | 1,470 | | | | — | |

| Redeemed | | | (335 | ) | | | (1,551 | ) |

| Total share activity | | | 1,274 | | | | (897 | ) |

| Class IC | | | | | | | | |

| Sold | | | 3 | | | | — | |

| Redeemed | | | — | | | | — | |

| Total share activity | | | 3 | | | | — | |

The accompanying notes are an integral part of these financial statements.

Hartford Growth Opportunities HLS Fund

Notes to Financial Statements

June 30, 2014 (Unaudited)

(000’s Omitted)

Organization:

Hartford Growth Opportunities HLS Fund (the "Fund") serves as an underlying investment option for certain variable annuity and variable life insurance separate accounts of Hartford Life Insurance Company (“HLIC”) and its affiliates and certain qualified retirement plans. The Fund may also serve as an underlying investment option for certain variable annuity and variable life separate accounts of other insurance companies. Owners of variable annuity contracts and policyholders of variable life insurance contracts may choose the funds permitted in the variable insurance contract prospectus. In addition, participants in certain qualified retirement plans may choose the Fund if permitted by their plans.

Hartford HLS Series Fund II, Inc. (the “Company”) is an open-end registered management investment company comprised of four portfolios. Financial statements for the Fund, a series of the Company, are included in this report.

The Company is organized under the laws of the State of Maryland and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (“1940 Act”). The Fund is a diversified open-end management investment company.

The Fund is divided into Class IA, Class IB and Class IC shares. Each class is offered at the per share net asset value (“NAV”) without a sales charge and is subject to the same expenses, except that the Class IB shares are subject to distribution and service fees charged pursuant to a Distribution Plan adopted in accordance with Rule 12b-1 under the 1940 Act and Class IC shares are subject to distribution fees charged pursuant to a Distribution Plan adopted in accordance with Rule 12b-1 under the 1940 Act and are also subject to an administrative service fee.

Significant Accounting Policies:

The following is a summary of significant accounting policies of the Fund in the preparation of its financial statements, which are in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”). The preparation of financial statements in accordance with U.S. GAAP may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Determination of Net Asset Value – The NAV of each class of the Fund's shares is determined as of the close of regular trading (normally 4:00 p.m. Eastern Time) (the “NYSE Close”) on each day that the New York Stock Exchange (the “Exchange”) is open (“Valuation Date”). Information that becomes known to the Fund after the NAV has been calculated on a particular day will not generally be used to retroactively adjust the NAV determined earlier that day.

Investment Valuation and Fair Value Measurements – For purposes of calculating the NAV, portfolio investments and other assets held by the Fund's portfolio for which market quotes are readily available are valued at market value. Market value is generally determined on the basis of last reported sales prices or official close price. If no sales are reported, market value is based on quotes obtained from a quotation reporting system, established market makers, or independent pricing services. If market prices are not readily available or are deemed unreliable, the Fund will use the fair value of the investment as determined in good faith under policies and procedures established by and under the supervision of the Company's Board of Directors. Market quotes are considered not readily available where there is an absence of current or reliable market-based data (e.g., trade information or indicative market quotes), including where events occur after the close of the relevant market, but prior to the NYSE Close, that materially affect the values of the Fund's portfolio investments or assets. In addition, market quotes are considered not readily available when, due to extraordinary circumstances, the exchanges or markets on which the investments trade do not open for trading for the entire day and no other market prices are available. In addition, prices of foreign equities that are principally traded on certain foreign markets may be adjusted daily pursuant to a fair value pricing service approved by the Board of Directors in order to reflect an adjustment for the factors occurring after the close of certain foreign markets but before the NYSE Close. Investments that are primarily traded on foreign markets may trade on days that are not business days of the Fund. The value of the foreign investments in which the Fund invests may change on days when a shareholder will not be able to purchase or redeem shares of the Fund. Fair value pricing is subjective in nature and the use of fair value pricing by the Fund may cause the NAV of its shares to differ significantly from the NAV that would have been calculated using market prices at the close of the exchange on which a portfolio investment is primarily

Hartford Growth Opportunities HLS Fund

Notes to Financial Statements – (continued)

June 30, 2014 (Unaudited)

(000’s Omitted)

traded. There can be no assurance that the Fund could obtain the fair market value assigned to an investment if the Fund were to sell the investment at approximately the time at which the Fund determines its NAV.

Exchange traded options, futures and options on futures are valued at the settlement price or last trade price determined by the relevant exchange as of the NYSE Close. If the last trade price for exchange traded options does not fall between the bid and ask prices, the value will be the mean of the bid and ask prices as of the NYSE Close. If a last trade price is not available, the value will be the mean of the bid and ask prices as of the NYSE Close. If a mean of the bid and ask prices cannot be calculated for the day, the value will be the bid price as of the NYSE Close. In the case of over-the-counter ("OTC") options and such instruments that do not trade on an exchange, values may be supplied by a pricing service using a formula or other objective method that may take into consideration the style, direction, expiration, strike price, notional value and volatility or other special adjustments.

Investments valued in currencies other than U.S. dollars are converted to U.S. dollars using exchange rates obtained from independent pricing services for calculation of the NAV. As a result, the NAV of the Fund’s shares may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of investments traded in markets outside the United States or denominated in currencies other than the U.S. dollar may be affected significantly on a day that the NYSE is closed and the market value may change on days when an investor is not able to purchase, redeem or exchange shares of the Fund.

Foreign currency contracts represent agreements to exchange currencies on specific future dates at predetermined rates. Foreign currency contracts are valued using foreign currency exchange rates and forward rates as provided by an independent pricing service on the Valuation Date.

Financial instruments for which prices are not available from an independent pricing service may be valued using market quotations obtained from one or more dealers that make markets in the respective financial instrument in accordance with procedures established by the Company's Board of Directors.

U.S. GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants. The U.S. GAAP fair value measurement standards require disclosure of a fair value hierarchy for each major category of assets and liabilities. Various inputs are used in determining the fair value of the Fund’s investments. These inputs are summarized into three broad hierarchy levels. This hierarchy is based on whether the valuation inputs are observable or unobservable. These levels are:

Level 1 – Quoted prices in active markets for identical investments. Level 1 may include exchange traded instruments, such as domestic equities, some foreign equities, options, futures, mutual funds, exchange traded funds, rights and warrants.

Level 2 – Observable inputs other than Level 1 prices, such as quoted prices for similar investments; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data. Level 2 may include debt investments that are traded less frequently than exchange traded instruments and which are valued using independent pricing services; foreign equities, which are principally traded on certain foreign markets and are adjusted daily pursuant to a fair value pricing service in order to reflect an adjustment for the factors occurring after the close of certain foreign markets but before the NYSE Close; senior floating rate interests, which are valued using an aggregate of dealer bids; short-term investments, which are valued at amortized cost; and swaps, which are valued based upon the terms of each swap contract.

Level 3 – Significant unobservable inputs that are supported by limited or no market activity. Level 3 may include financial instruments whose values are determined using indicative market quotes or require significant management judgment or estimation. These unobservable valuation inputs may include estimates for current yields, maturity/duration, prepayment speed, and indicative market quotes for comparable investments along with other assumptions relating to credit quality, collateral value, complexity of the investment structure, general market conditions and liquidity. This category may include investments where trading has been halted or there are certain restrictions on trading. While these investments are priced using unobservable inputs, the valuation of these investments reflects the best available data and management believes the prices are a reasonable representation of exit price. For more information on specific valuation techniques and unobservable inputs, please see table below titled "Quantitative Information about Level 3 Fair Value Measurements."

Hartford Growth Opportunities HLS Fund

Notes to Financial Statements – (continued)

June 30, 2014 (Unaudited)

(000’s Omitted)

The Board of Directors of the Company generally reviews and approves the “Procedures for Valuation of Portfolio Securities” at least once a year. These procedures define how investments are to be valued, including the formation and activities of a Valuation Committee. The Valuation Committee is responsible for determining in good faith the fair value of investments when the value cannot be obtained from primary pricing services or alternative sources or if the valuation of an investment as provided by the primary pricing service or alternative source is believed not to reflect the investment’s fair value as of the Valuation Date. Voting members of the Valuation Committee include the Fund’s Treasurer or designee and a Vice President of the investment manager or designee. An Assistant Vice President of the Fund with legal expertise or designee is also included on the Valuation Committee as a non-voting advisory member. In addition, the Fund’s Chief Compliance Officer shall designate a member of the compliance group to attend Valuation Committee meetings as a non-voting resource, to monitor for and provide guidance with respect to compliance with these procedures. Two members of the Valuation Committee or their designees, representing different departments, shall constitute a quorum for purposes of permitting the Valuation Committee to take action. The Valuation Committee will consider all relevant factors in determining an investment’s fair value, and may seek the advice of the Fund’s sub-adviser, knowledgeable brokers, and legal counsel in making such determination. The Valuation Committee reports to the Audit Committee of the Company’s Board of Directors. The Audit Committee receives quarterly written reports which include details of all fair-valued investments, including the reason for the fair valuation, and an indication, when possible, of the accuracy of the valuation by disclosing the next available reliable public price quotation or the disposition price of such investments (the “look-back” test). The Board of Directors then must consider for ratification all of the fair value determinations made during the previous quarter.

Valuation levels are not necessarily indicative of the risk associated with investing in such investments. Individual investments within any of the above mentioned asset classes may be assigned a different hierarchical level than those presented above, as individual circumstances dictate.

For additional information, refer to the Investment Valuation Hierarchy Level Summary and the Level 3 roll-forward reconciliation, if applicable, which follow the Schedule of Investments.

Quantitative Information about Level 3 Fair Value Measurements:

| Security Type/Valuation Technique | | Unobservable Input * | | Input Value(s) Range (Weighted Average) ‡ | | | Fair Value at

June 30, 2014 | |

| Assets: | | | | | | | | | | |

| Common Stocks: | | | | | | | | | | |

| Cost Δ | | Recent trade price | | | $2.62 - $55.85 ($27.91) | | | $ | 26,608 | |

| | | Date | | | 4/16/2014 - 6/5/2014 | | | | | |

| Model Δ | | Enterprise Value/2014 EBITDA | | | 12.39x to 19.65x | | | | 6,397 | |

| Model Δ | | Enterprise Value/2015 EBITDA ◄ | | | 5.67x to 13.81x | | | | 3,344 | |

| Model Δ | | Enterprise Value/2015 Revenue ■ | | | 2.63x to 4.58x | | | | 8,050 | |

| Total | | | | | | | | $ | 44,399 | |

| * | Significant changes to any unobservable inputs may result in a significant change to the fair value. |

| ‡ | Unless otherwise noted, inputs were weighted based on the fair value of the investments included in the range. |

| Δ | Includes illiquidity discount of 10%. |

| ◄ | The Option Pricing Method ("OPM") is used to allocate enterprise value between multiple tiers of equity. Inputs for the OPM include: |

| | Volatility - 40% |

| | Term to Liquidity Event - 1.5 years |

| | Risk-free rate - 0.10% |

| ■ | The OPM is used to allocate enterprise values between multiple tiers of equity. Inputs for the OPM include: |

| | Volatility - 40.0% |

| | Term to Liquidity Event - 1.0 years |

| | Risk-free rate - 0.10% |

Investment Transactions and Investment Income – Investment transactions are recorded as of the trade date (the date the order to buy or sell is executed) for financial reporting purposes. Investments purchased or sold on a when-issued or delayed-delivery basis may be settled a month or more after the trade date. Realized gains and losses are determined on the basis of identified cost.

Hartford Growth Opportunities HLS Fund

Notes to Financial Statements – (continued)

June 30, 2014 (Unaudited)

(000’s Omitted)

Dividend income from domestic securities is accrued on the ex-dividend date. In general, dividend income from foreign securities is recorded on the ex-date; however, dividend notifications in certain foreign jurisdictions may not be available in a timely manner and as a result, the Fund will record the dividend as soon as the relevant details (i.e., rate per share, payment date, shareholders of record, etc.) are publicly available. Interest income, including amortization of premium, accretion of discounts and additional principal received in-kind in lieu of cash, is accrued on a daily basis.

Foreign Currency Transactions – Assets and liabilities denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates in effect on the valuation date. Purchases and sales of investments, income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions.

The Fund does not isolate that portion of portfolio investment valuation resulting from fluctuations in the foreign currency exchange rates from the fluctuations arising from changes in the market prices of investments held. Exchange rate fluctuations are included with the net realized and unrealized gain or loss on investments in the accompanying financial statements.

Net realized foreign exchange gains or losses arise from sales of foreign currencies and the difference between asset and liability amounts initially stated in foreign currencies and the U.S. dollar value of the amounts actually received or paid. Net unrealized foreign exchange gains or losses arise from changes in the value of other assets and liabilities at the end of the reporting period, resulting from changes in the exchange rates.

Joint Trading Account – The Fund may invest cash balances into a joint trading account that may be invested in one or more repurchase agreements.

Fund Share Valuation and Dividend Distributions to Shareholders – Orders for the Fund’s shares are executed in accordance with the investment instructions of the contract holders and plan participants. The NAV of the Fund’s shares is determined as of the close of business on each business day of the Exchange. The NAV is determined separately for each class of shares of the Fund by dividing the Fund’s net assets attributable to that class by the number of shares of the class outstanding. Each class of shares offered by the Fund has equal rights as to assets and voting privileges (except that shareholders of a class have exclusive voting rights regarding any matter relating solely to that class of shares). Income and non-class specific expenses are allocated daily to each class on the basis of the relative net assets of the class. Realized and unrealized gains and losses are allocated daily based on the relative net assets of each class of shares of the Fund.

Orders for the purchase of the Fund’s shares received prior to the close of the Exchange on any day the Exchange is open for business are priced at the NAV determined as of the close of the Exchange. Orders received after the close of the Exchange, or on a day on which the Exchange and/or the Fund is not open for business, are priced at the next determined NAV.

Dividends are declared pursuant to a policy adopted by the Company's Board of Directors based upon the investment performance of the Fund. The policy of the Fund is to pay dividends from net investment income and realized gains, if any, at least once a year.

Distributions from net investment income, net realized gains and capital are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP with respect to character and timing. These differences may include, but are not limited to, losses deferred due to wash sale adjustments, foreign currency gains and losses, adjustments related to Passive Foreign Investment Companies ("PFICs"), Real Estate Investment Trusts ("REITs"), Regulated Investment Companies ("RICs"), certain derivatives and partnerships. Permanent book and federal income tax basis differences relating to shareholder distributions will result in reclassifications to certain of the Fund’s capital accounts (see Federal Income Taxes: Reclassification of Capital Accounts note).

Securities and Other Investments:

Repurchase Agreements – A repurchase agreement is an agreement by which a counterparty agrees to sell an investment and agrees to repurchase the investment sold from the buyer at a mutually agreed upon time and price. During the period of the repurchase agreement, the counterparty will deposit cash and or securities in a third party custodial account to serve as collateral. At the time the Fund enters into a repurchase agreement, the value of the underlying collateral, including accrued interest, will be equal to or exceed the value of the repurchase agreement. Repurchase agreements expose the Fund to counterparty risk - that is, the risk

Hartford Growth Opportunities HLS Fund

Notes to Financial Statements – (continued)

June 30, 2014 (Unaudited)

(000’s Omitted)

that the counterparty will not fulfill its obligations. To minimize counterparty risk, the investments that serve to collateralize the repurchase agreement are held by the Fund’s custodian in book entry or physical form in the custodial account of the Fund or in a third party custodial account. Repurchase agreements are valued at cost plus accrued interest, which approximates fair value. Repurchase agreements have master netting arrangements which allow the Fund to offset amounts owed to a counterparty with amounts owed by the counterparty, including any collateral. Upon an event of default under a master repurchase agreement, the non-defaulting party may close out all transactions traded under such agreement and net amounts owed under each transaction to one net amount payable by one party to the other. Absent an event of default, the master repurchase agreement does not result in an offset of reported amounts of assets and liabilities in the Statement of Assets and Liabilities across transactions between the Fund and the applicable counterparty. The Fund had no outstanding repurchase agreements and related collateral as of June 30, 2014.

Illiquid and Restricted Investments – The Fund is permitted to invest up to 15% of its net assets in illiquid investments. Illiquid investments are those that may not be sold or disposed of in the ordinary course of business within seven days, at approximately the price used to determine the Fund’s NAV. The Fund may not be able to sell illiquid investments when its sub-adviser considers it desirable to do so or may have to sell such investments at a price that is lower than the price that could be obtained if the investments were more liquid. A sale of illiquid investments may require more time and may result in higher dealer discounts and other selling expenses than does the sale of those that are liquid. Illiquid investments also may be more difficult to value due to the unavailability of reliable market quotations for such investments, and an investment in them may have an adverse impact on the Fund’s NAV. The Fund may also purchase certain restricted investments that can only be resold to certain qualified investors and may be determined to be liquid pursuant to policies and guidelines established by the Company's Board of Directors. The Fund, as shown on the Schedule of Investments, had illiquid or restricted investments as of June 30, 2014.

Investments Purchased on a When-Issued or Delayed-Delivery Basis – Delivery and payment for investments that have been purchased by the Fund on a forward commitment, or when-issued or delayed-delivery basis, take place beyond the customary settlement period. The Fund may dispose of or renegotiate a delayed-delivery transaction after it is entered into, and may sell delayed-delivery investments before they are delivered, which may result in a realized gain or loss. During this period, such investments are subject to market fluctuations, and the Fund identifies investments segregated in its records with a value at least equal to the amount of the commitment. The Fund had no when-issued or delayed-delivery investments as of June 30, 2014.

Financial Derivative Instruments:

The following disclosures contain information on how and why the Fund uses derivative instruments, the credit-risk-related contingent features in certain derivative instruments, and how derivative instruments affect the Fund’s financial position and results of operations. The location and fair value amounts of these instruments on the Statement of Assets and Liabilities and the realized gains and losses and changes in unrealized gains and losses on the Statement of Operations, each categorized by type of derivative contract, are included in the following Additional Derivative Instrument Information footnote. The derivative instruments outstanding as of period-end are disclosed in the notes to or within the Schedule of Investments for purchased options, if applicable. The amounts of realized gains and losses and changes in unrealized gains and losses on derivative instruments during the period are disclosed in the Statement of Operations.

Foreign Currency Contracts – The Fund may enter into foreign currency contracts that obligate the Fund to purchase or sell currencies at specified future dates. Foreign currency contracts are used to hedge the currency exposure associated with some or all of the Fund’s investments and/or as part of an investment strategy. Foreign currency contracts are marked to market daily and the change in value is recorded by the Fund as an unrealized gain or loss. The Fund will record a realized gain or loss when the foreign currency contract is settled.

Foreign currency contracts involve elements of market risk in excess of the amounts reflected in the Statement of Assets and Liabilities. In addition, risks may arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of the contracts and from unanticipated movements in the value of the foreign currencies relative to the U.S. dollar. The Fund, as shown on the Schedule of Investments, had outstanding foreign currency contracts as of June 30, 2014.

Options Contracts – An option contract is a contract sold by one party to another party that offers the buyer the right, but not the obligation, to buy (call) or sell (put) an investment or other financial asset at an agreed-upon price during a specific period of time or on a specific date. The Fund may write (sell) covered call and put options on futures, swaps (“swaptions”), securities, commodities or

Hartford Growth Opportunities HLS Fund

Notes to Financial Statements – (continued)

June 30, 2014 (Unaudited)

(000’s Omitted)

currencies. “Covered” means that so long as the Fund is obligated as the writer of an option, it will own either the underlying investments or currency or an option to purchase the same underlying investments or currency having an expiration date of the covered option and an exercise price equal to or less than the exercise price of the covered option, or will pledge cash or other liquid investments having a value equal to or greater than the fluctuating market value of the option investment or currency. Writing put options increases the Fund’s exposure to the underlying instrument. Writing call options decreases the Fund’s exposure to the underlying instrument. Premiums received from writing options that expire are treated as realized gains. Premiums received from writing options that are exercised or closed are added to the proceeds or offset amounts paid on the underlying futures, swap, investment or currency transaction to determine the realized gain or loss. The Fund as a writer of an option has no control over whether the underlying instrument may be sold (call) or purchased (put) and as a result bears the market risk of an unfavorable change in the price of the instrument underlying the written option. There is the risk the Fund may not be able to enter into a closing transaction because of an illiquid market. The Fund may also purchase put and call options. Purchasing call options increases the Fund’s exposure to the underlying instrument. Purchasing put options decreases the Fund’s exposure to the underlying instrument. The Fund pays a premium, which is included on the Fund’s Statement of Assets and Liabilities as an investment and is subsequently marked to market to reflect the current value of the option. Premiums paid for purchasing options that expire are treated as realized losses. Certain options may be purchased with premiums to be determined on a future date. The premiums for these options are based upon implied volatility parameters at specified terms. The risk associated with purchasing put and call options is generally limited to the premium paid. Premiums paid for purchasing options that are exercised or closed are added to the amounts paid or offset against the proceeds on the underlying investment transaction to determine the realized gain or loss. Entering into over-the-counter options also exposes the Fund to counterparty risk. Counterparty risk is the possibility that the counterparty to the agreements may default on its obligation to perform or disagree as to the meaning of the contractual terms in the agreements.

As of June 30, 2014 the Fund had no outstanding purchased option or written option contracts. There were no transactions involving written option contracts during the six-month period ended June 30, 2014.

Additional Derivative Instrument Information:

| Fair Value of Derivative Instruments on the Statement of Assets and Liabilities as of June 30, 2014: |

| | | Risk Exposure Category | |

| | | Interest Rate

Contracts | | | Foreign

Exchange

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Commodity

Contracts | | | Other

Contracts | | | Total | |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Unrealized appreciation on foreign currency contracts | | $ | — | | | $ | 3 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 3 | |

| Total | | $ | — | | | $ | 3 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 3 | |

The volume of derivatives that is presented in the Schedule of Investments is consistent with the derivative activity during the six-month period ended June 30, 2014.

Hartford Growth Opportunities HLS Fund

Notes to Financial Statements – (continued)

June 30, 2014 (Unaudited)

(000’s Omitted)

The Effect of Derivative Instruments on the Statement of Operations for the six-month period ended June 30, 2014:

| | | Risk Exposure Category | |

| | | Interest Rate

Contracts | | | Foreign

Exchange

Contracts | | | Credit

Contracts | | | Equity

Contracts | | | Commodity

Contracts | | | Other

Contracts | | | Total | |

| Realized Loss on Derivatives Recognized as a Result of Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net realized loss on purchased option contracts | | $ | — | | | $ | — | | | $ | — | | | $ | (687 | ) | | $ | — | | | $ | — | | | $ | (687 | ) |

| Net realized loss on foreign currency contracts | | | — | | | | (12 | ) | | | — | | | | — | | | | — | | | | — | | | | (12 | ) |

| Total | | $ | — | | | $ | (12 | ) | | $ | — | | | $ | (687 | ) | | $ | — | | | $ | — | | | $ | (699 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized as a Result of Operations: |

| Net change in unrealized appreciation of investments in purchased option contracts | | $ | — | | | $ | — | | | $ | — | | | $ | 687 | | | $ | — | | | $ | — | | | $ | 687 | |

| Net change in unrealized appreciation of foreign currency contracts | | | — | | | | 3 | | | | — | | | | — | | | | — | | | | — | | | | 3 | |

| Total | | $ | — | | | $ | 3 | | | $ | — | | | $ | 687 | | | $ | — | | | $ | — | | | $ | 690 | |

The derivatives held by the Fund as of June 30, 2014 are not subject to a master netting arrangement; therefore, no balance sheet offsetting disclosure is presented.

Principal Risks:

The Fund may be exposed to counterparty risk, or the risk that an institution or other entity with which the Fund has unsettled or open transactions will default.

If the Fund invests directly in foreign currencies or in securities that trade in, and receive revenues in, foreign currencies, or in derivatives that provide exposure to foreign currencies, it will be subject to the risk that those currencies will decline in value relative to the base currency (U.S. dollars) of the Fund, or, in the case of hedging positions, that the Fund’s base currency will decline in value relative to the currency being hedged. Currency rates in foreign countries may fluctuate significantly over short periods of time for a number of reasons, including changes in interest rates, intervention (or the failure to intervene) by U.S. or foreign governments, central banks or supranational entities, such as the International Monetary Fund, or by the imposition of currency controls or other political developments in the United States or abroad. As a result, the Fund’s investments in foreign currency denominated securities may reduce the returns of the Fund. The market values of equity securities, such as common stocks and preferred stocks, or equity related investments, such as futures and options, may decline due to general market conditions which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. The market value of equity securities may also decline due to factors which affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. Equity securities and equity related investments generally have greater market price volatility than fixed income securities.

Federal Income Taxes:

Federal Income Taxes – For federal income tax purposes, the Fund intends to continue to qualify as a RIC under Subchapter M of the Internal Revenue Code (“IRC”) by distributing substantially all of its taxable net investment income and net realized capital gains to its shareholders and otherwise complying with the requirements of the IRC. The Fund has distributed substantially all of its income and capital gains in prior years, if applicable, and intends to distribute substantially all of its income and capital gains prior to the next fiscal year-end. Accordingly, no provision for federal income or excise taxes has been made in the accompanying financial statements. Distributions from short-term capital gains are treated as ordinary income distributions for federal income tax purposes.

Net Investment Income (Loss), Net Realized Gains (Losses) and Distributions – Net investment income (loss) and net realized gains (losses) may differ for financial statement and tax purposes primarily because of losses deferred due to wash sale adjustments, foreign currency gains and losses, adjustments related to PFICs, REITs, RICs, certain derivatives and partnerships. The character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for

Hartford Growth Opportunities HLS Fund

Notes to Financial Statements – (continued)

June 30, 2014 (Unaudited)

(000’s Omitted)

federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the year that the income or realized gains (losses) were recorded by the Fund.

Distributions and Components of Distributable Earnings – The tax character of distributions paid by the Fund for the periods indicated is as follows (as adjusted for dividends payable, if applicable):

| | | For the Year Ended

December 31, 2013 | | | For the Year Ended

December 31, 2012 | |

| Ordinary Income | | $ | 91 | | | $ | — | |

As of December 31, 2013, the Fund’s components of distributable earnings (deficit) on a tax basis are as follows:

| | | Amount | |

| Undistributed Ordinary Income | | $ | 78,977 | |

| Undistributed Long-Term Capital Gain | | | 139,576 | |

| Accumulated Capital and Other Losses* | | | (1,911 | ) |

| Unrealized Appreciation† | | | 225,055 | |

| Total Accumulated Earnings | | $ | 441,697 | |

| * | The Fund has capital loss carryforwards that are identified in the Capital Loss Carryforward note that follows. |

| † | Differences between book-basis and tax-basis unrealized appreciation (depreciation) may be attributable to the losses deferred due to wash sale adjustments, foreign currency gains and losses, adjustments related to PFICs, REITs, RICs, certain derivatives and partnerships. |

Reclassification of Capital Accounts – The Fund may record reclassifications in its capital accounts. These reclassifications have no impact on the total net assets of the Fund. The reclassifications are a result of permanent differences between U.S. GAAP and tax accounting for such items as foreign currency, PFICs, expiration or utilization of capital loss carryforwards or net operating losses. Adjustments are made to reflect the impact these items have on current and future distributions to shareholders. Therefore, the source of the Fund’s distributions may be shown in the accompanying Statement of Changes in Net Assets as from undistributed net investment income, from accumulated net realized gains on investments or from capital depending on the type of book and tax differences that exist. For the year ended December 31, 2013, the Fund recorded reclassifications to increase (decrease) the accounts listed below:

| | | Amount | |

| Undistributed Net Investment Income (Loss) | | $ | (613 | ) |

| Accumulated Net Realized Gain (Loss) | | | 613 | |

Capital Loss Carryforward – On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “Act”) was enacted, which made changes to the capital loss carryforward rules. The changes are effective for taxable years beginning after the date of enactment. Under the Act, funds are permitted to carry forward capital losses for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years, which carry an expiration date. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital loss carryforwards retain their character as either short-term or long-term capital losses rather than being considered all short-term as permitted under prior regulation.

Hartford Growth Opportunities HLS Fund

Notes to Financial Statements – (continued)

June 30, 2014 (Unaudited)

(000’s Omitted)

At December 31, 2013 (tax year end), the Fund had capital loss carryforwards for U.S. federal income tax purposes as follows:

| Year of Expiration | | Amount | |

| 2016 | | $ | 1,911 | |

| Total | | $ | 1,911 | |

As a result of mergers in the Fund, certain provisions in the IRC may limit the future utilization of capital losses. During the year ended December 31, 2013, the Fund utilized $47,332 of prior year capital loss carryforwards.

Accounting for Uncertainty in Income Taxes – The Fund has adopted financial reporting rules that require the Fund to analyze all open tax years, as defined by the statute of limitations, for all major jurisdictions. Generally, tax authorities can examine all tax returns filed for the last three years. The Fund does not have an examination in progress.

The Fund has reviewed all open tax years and major jurisdictions and concluded that these financial reporting rules had no effect on the Fund’s financial position or results of operations. There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on the tax return for the fiscal year ended December 31, 2013. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Expenses: