UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-04615

HARTFORD HLS SERIES FUND II, INC.

(Exact name of registrant as specified in charter)

5 Radnor Corporate Center, Suite 300, 100 Matsonford Road, Radnor, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Edward P. Macdonald, Esquire

Hartford Funds Management Company, LLC

5 Radnor Corporate Center, Suite 300

100 Matsonford Road

Radnor, Pennsylvania 19087

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (610) 386-4068

Date of fiscal year end: December 31

Date of reporting period: June 30, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F. Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

A MESSAGE FROM THE PRESIDENT

Dear Fellow Shareholders:

Thank you for investing in Hartford HLS Funds.

Market Review

The now six-year-old bull market in equities continued through the six months ended June 30, 2015, the period of this report, after the S&P 500 notched its sixth-consecutive

calendar year of positive returns in 2014. From its financial-crisis low in March 2009, the S&P 500 Index1 has grown more than 200%.

Returns have been modest so far in 2015, with the S&P 500 Index gaining 1.23% through June, yet the Index generally managed to stay in positive territory during the period.

A stronger U.S. dollar, a result of divergent domestic and foreign central-bank policies, and cheaper oil due to a supply glut unmatched by demand were market drivers during the period.

In addition, central banks around the globe continued to play an important role in influencing investor behavior and market movement.

On the domestic front, the U.S. Federal Reserve (Fed) ended its bond-buying quantitative-easing (QE) program in late 2014. Now, investor focus is centered on Fed meetings to determine the timeline for future rate hikes, which is dependent on the rate of economic growth, employment rates, and inflation expectations. Currently, Fed guidance suggests that rate increases are expected to take place in late 2015. When the Fed begins to raise rates, the shift is likely to be felt by fixed-income investors in particular, as bonds are generally more sensitive to shifting rates than equities.

Though QE ended in the U.S., it is still in use overseas. The Bank of Japan ramped up its existing QE program to stimulate growth by increasing the amount of purchases in its bond-buying program. The European Central Bank started its own program of bond purchases in early 2015 to lower borrowing costs in hopes of stimulating the sluggish economies in the eurozone.

As we enter the second half of the year, the continuing role of central banks and macroeconomic events in financial markets serves as an important reminder to maintain a strong relationship with a financial advisor who can help guide you through shifting markets with confidence. Whether you’re seeking growth, income, or a way to mitigate volatility with your investments, your financial advisor can help you find a fit within our family of more than 45 mutual funds that were designed with you, and your investment goals, in mind.

Thank you again for investing with Hartford HLS Funds.

James Davey

President

Hartford HLS Funds

| 1 | The S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks. |

Hartford HLS Funds

Table of Contents

The views expressed in each Fund’s Manager Discussion under “Why did the Fund perform this way?” and “What is the outlook?” are views of the Fund’s sub-adviser and portfolio management team through the end of the period and are subject to change based on market and other conditions. Each Fund’s Manager Discussion is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell any security. The specific securities identified and described, if any, do not represent all of the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable.

Hartford Balanced HLS Fund inception 03/31/1983

| | |

| (sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks long-term total return. |

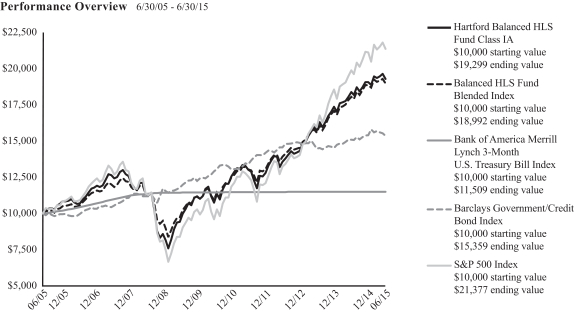

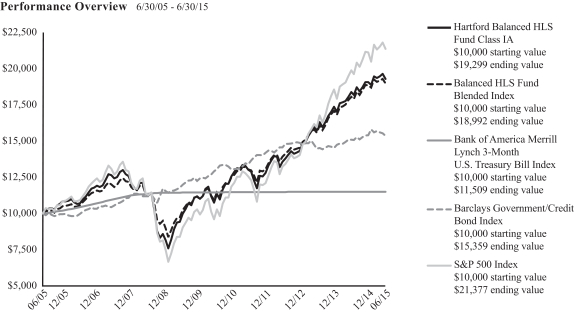

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 6/30/15)

| | | | | | | | | | | | | | | | |

| | | 6 Months1 | | | 1 Year | | | 5 Years | | | 10 Years | |

Balanced IA | | | 1.22% | | | | 4.90% | | | | 12.42% | | | | 6.80% | |

Balanced IB | | | 1.09% | | | | 4.66% | | | | 12.14% | | | | 6.53% | |

Balanced HLS Fund Blended Index | | | 0.74% | | | | 5.14% | | | | 11.66% | | | | 6.62% | |

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.01% | | | | 0.02% | | | | 0.08% | | | | 1.42% | |

Barclays Government/Credit Bond Index | | | -0.30% | | | | 1.69% | | | | 3.52% | | | | 4.38% | |

S&P 500 Index | | | 1.23% | | | | 7.42% | | | | 17.34% | | | | 7.89% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2015, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Balanced HLS Fund Blended Index is calculated by Hartford Funds Management Company, LLC and represents the weighted return of 60% S&P 500 Index, 35% Barclays Government/Credit Bond Index and 5% Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index.

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged index that tracks the performance of U.S. dollar denominated U.S. Treasury bills publicly issued in the U.S. domestic markets with maturities of 90 days or less that assumes reinvestment of all income.

Barclays Government/Credit Bond Index is an unmanaged, market-value-weighted index of all debt obligations of the U.S. Treasury and U.S. Government agencies (excluding mortgaged-backed securities) and of all publicly-issued fixed-rate, nonconvertible, investment grade domestic corporate debt.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The indices are unmanaged, and their results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2015, the total annual fund operating expense ratios for Class IA and Class IB were 0.65% and 0.90%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2015.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Balanced HLS Fund |

Manager Discussion

June 30, 2015 (Unaudited)

Karen H. Grimes, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

John C. Keogh

Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

Michael E. Stack, CFA

Senior Managing Director and Fixed Income Portfolio Manager

Wellington Management Company LLP

How did the Fund perform?

The Class IA shares of the Hartford Balanced HLS Fund returned 1.22% for the six-month period ended June 30, 2015, outperforming the Fund’s blended benchmark, 60% S&P 500 Index, 35% Barclays Government/Credit Bond Index, and 5% Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index, which returned 0.74% for the same period. The S&P 500, Barclays Government/Credit Bond, and Bank of America Merrill Lynch 3-Month U.S. Treasury Bill indices returned 1.23%, -0.30% and 0.01%, respectively. The Fund also underperformed the 1.63% average return of the Lipper Mixed-Asset Target Allocation Growth Funds peer group, a group of funds that hold between 60%-80% in equity securities, with the remainder invested in bonds, cash, and cash equivalents.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, rose for the period, notwithstanding significant volatility. The S&P 500 Index finished 2014 with strong gains, retreated briefly, but then reached new all-time highs on March 2, April 24, and May 21. U.S. equities fell 1.9% in June despite promising data releases and an upbeat economic assessment by the U.S. Federal Reserve (Fed). Within the S&P 500 Index, five of the ten sectors posted positive gains. Healthcare (+10%), Consumer Discretionary (+7%), and Telecommunication Services (+3%) posted the largest gains while Utilities (-11%), Energy (-5%), and Industrials (-3%) lagged the broader index.

Fixed income markets were volatile over the six-month period as investors grappled with a mixed global economic backdrop, accommodative monetary policies, and the increased risk of a Greek exit from the Eurozone. Meanwhile, oil prices stabilized in the second quarter, having rebounded from record lows at the start of the year. After declining in the first quarter, government bond yields moved sharply higher in the second quarter as economic outlooks brightened in the U.S. and the Eurozone. Global deflation fears eased, and the Fed appeared on track to raise rates later this year. Greece took center stage at the end of the period after debt negotiations broke down and the country defaulted on its payment to the International Monetary Fund, triggering a risk-off tone throughout global financial markets. Most global government bond yields were

up over the six-month period and yield curves generally steepened led by the long-end of the curve. Absolute returns across the major fixed income sectors were mixed, with some sectors posting negative absolute returns amid rising interest rates. Spreads in the higher beta credit sectors like high yield and bank loans tightened, while investment grade corporate spreads widened. The Barclays Government/Credit Bond Index returned -0.30% for the period.

The Fund has three primary levers to generate investment performance: equity investments, fixed income investments, and asset allocation among stocks, bonds, and cash. During the period, the equity portion of the Fund outperformed the S&P 500 Index and the fixed income portion of the Fund slightly outperformed the Barclays Government/Credit Bond Index. Asset allocation had neutral impact during the period. The Fund was generally overweight equities and underweight fixed income and cash relative to the Barclays Government/Credit Bond Index.

Equity outperformance versus the S&P 500 Index was driven primarily by security selection. Selection was strongest in Consumer staples, Financials, and Utilities; this was partially offset by negative selection in Healthcare and Consumer Discretionary. Sector allocation, which is a result of our bottom-up stock selection process, contributed to performance relative to the S&P 500 Index over the period. An overweight to Healthcare and an underweight to Utilities aided results, while an underweight to Consumer Discretionary detracted during the period.

Top contributors to relative performance in the equity portion of the Fund during the period were Kraft Foods (Consumer Staples), Procter & Gamble (Consumer Staples), and Analog Devices (Information Technology). Kraft Foods, a packaged food company, outperformed following the news that the company would merge with Heinz in a deal led by 3G Capital and Berkshire Hathaway.

Not owning benchmark constituent Procter & Gamble, a U.S.-based global leader focused on providing consumer packaged goods, contributed to benchmark-relative results. The company’s stock declined due to weakness attributable to a strengthening U.S. Dollar negatively affecting exports and making future growth difficult.

|

| Hartford Balanced HLS Fund |

Manager Discussion – (continued)

June 30, 2015 (Unaudited)

Shares of Analog Devices, an analog semiconductor company focused on industrial, communications, and automotive end markets, rose after the company reported strong earnings that beat expectations on favorable revenue results from its industrial, auto, and consumer verticals. The Fund’s holdings in Apple (Information Technology) and Gilead Sciences (Healthcare) also contributed on an absolute basis.

Stocks that detracted the most from relative returns in the equity portion of the Fund during the period were Amazon.com (Consumer Discretionary), EMC (Information Technology), and Intel (Information Technology). Shares of Amazon.com, a U.S.-based global ecommerce company, rose after the company reported better-than-expected first-quarter results, particularly in Amazon Web Services (AMZ), the company’s cloud computing platform. Not owning benchmark constituent Amazon.com detracted from benchmark-relative results. Shares of EMC, the largest data storage provider in the U.S., fell due to concerns over potentially increasing competitive challenges. Shares of Intel, a U.S.-based designer and manufacturer of chips for PCs and servers with a growth strategy in mobile handsets, tablets, and the Internet of Things, fell as a result of a slowdown in demand for business desktop PCs, lower inventory levels in the PC supply chain, and negative macro and a strengthening U.S. Dollar negatively affecting exports in Europe. Union Pacific (Industrials) also detracted from absolute results during the period.

Outperformance of the fixed income portion of the Fund relative to the Barclays Government/Credit Bond Index during the period was driven by security selection in investment grade credit, particularly within Industrials. Out-of-benchmark allocations to Asset Backed Securities (ABS) and Commercial Mortgage Backed Securities (CMBS) also contributed to relative returns during the period. The Fund’s duration and yield curve positioning detracted from results relative to the Barclays Government/Credit Bond Index due to our overweight to 30-year portion of the curve, as long rates rose over the period.

Derivatives are not used in a significant manner in this Fund and did not have a material impact on performance during the period.

What is the outlook?

Looking forward to the second half of 2015, we perceive increased geopolitical uncertainty globally, with Greece and China being key recent examples. While we believe that conditions within the U.S. have been tracking positively, we remain diligent in applying our process to seek to find what we believe are quality companies with a combination of superior total return potential, stable dividends, and discounted valuations. We are monitoring developments and focusing on company specific catalysts as a basis for each position and believe our portfolio holdings are balanced and well-positioned to weather uncertainty in the markets. Healthcare and Industrials represented our largest sector overweight and underweight, respectively, in the equity portion of the Fund at the end of the period.

On the fixed income side we ended the period with a moderate bias towards economically sensitive securities, continuing to favor financial issuers within investment grade credit. Relative to the Barclays Government/Credit Bond Index, we continued to hold out-of-benchmark allocations to agency Mortgage Backed Security (MBS), CMBS, and ABS.

At the end of the period, the Fund’s equity exposure was at 64%, compared to 60% in the S&P 500 Index and at the upper end of the Fund’s 50-70% normal range.

Diversification by Security Type

as of June 30, 2015 (Unaudited)

| | | | |

| Category | | Percentage of

Net Assets | |

Equity Securities | | | | |

Common Stocks | | | 64.0 | % |

Preferred Stocks | | | 0.4 | |

| | | | |

Total | | | 64.4 | % |

| | | | |

Fixed Income Securities | | | | |

Asset & Commercial Mortgage Backed Securities | | | 1.6 | % |

Corporate Bonds | | | 14.2 | |

Foreign Government Obligations | | | 0.1 | |

Municipal Bonds | | | 1.2 | |

U.S. Government Agencies | | | 1.5 | |

U.S. Government Securities | | | 15.4 | |

| | | | |

Total | | | 34.0 | % |

| | | | |

Short-Term Investments | | | 1.8 | |

Other Assets & Liabilities | | | (0.2 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

Credit Exposure

as of June 30, 2015 (Unaudited)

| | | | |

| Credit Rating* | | Percentage of

Net Assets | |

Aaa / AAA | | | 18.0 | % |

Aa / AA | | | 3.3 | |

A | | | 7.1 | |

Baa / BBB | | | 5.1 | |

Not Rated | | | 0.5 | |

Non-Debt Securities and Other Short-Term Instruments | | | 66.2 | |

Other Assets & Liabilities | | | (0.2 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| * | Credit exposure is the long-term credit ratings for the Fund’s holdings, as of the date noted, as provided by Standard and Poor’s (S&P) or Moody’s Investors Service (Moody’s) and typically range from AAA/Aaa (highest) to C/D (lowest). Presentation of S&P and Moody’s credit ratings in this report have been selected for informational purposes for shareholders, as well as the Fund’s consideration of industry practice. If Moody’s and S&P assign different ratings, the lower rating is used. Fixed income securities that are not rated by either agency are listed as “Not Rated.” Ratings do not apply to the Fund itself or to the Fund’s shares. Ratings may change. |

Hartford Capital Appreciation HLS Fund inception 04/02/1984

| | |

| (sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks growth of capital. |

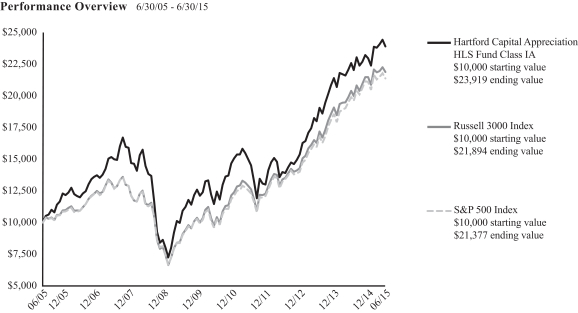

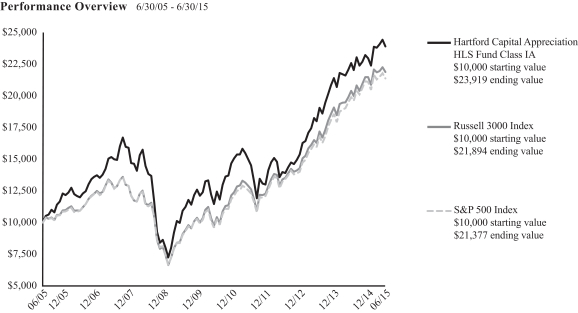

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 6/30/15)

| | | | | | | | | | | | | | | | |

| | | 6 Months1 | | | 1 Year | | | 5 Years | | | 10 Years | |

Capital Appreciation IA | | | 4.13% | | | | 5.85% | | | | 15.82% | | | | 9.11% | |

Capital Appreciation IB | | | 4.00% | | | | 5.59% | | | | 15.53% | | | | 8.84% | |

Capital Appreciation IC | | | 3.87% | | | | 5.33% | | | | 15.24% | | | | 8.57% | |

Russell 3000 Index | | | 1.94% | | | | 7.29% | | | | 17.54% | | | | 8.15% | |

S&P 500 Index | | | 1.23% | | | | 7.42% | | | | 17.34% | | | | 7.89% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2015, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class IC shares commenced operations on April 30, 2014. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

Russell 3000 Index is an unmanaged index that measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The indices are unmanaged, and their results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2015, the total annual fund operating expense ratios for Class IA, Class IB and Class IC were 0.66%, 0.91% and 1.16%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2015.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Capital Appreciation HLS Fund |

Manager Discussion

June 30, 2015 (Unaudited)

Kent M. Stahl, CFA

Senior Managing Director, Director of Investments and Risk Management

Wellington Management Company LLP

Gregg R. Thomas, CFA

Senior Managing Director, Director of Risk Management

Wellington Management Company LLP

Saul J. Pannell, CFA

Senior Managing Director, Equity Portfolio Manager

Wellington Management Company LLP

Francis J. Boggan, CFA

Senior Managing Director, Equity Portfolio Manager

Wellington Management Company LLP

Nicolas M. Choumenkovitch

Senior Managing Director, Equity Portfolio Manager

Wellington Management Company LLP

Peter I. Higgins, CFA

Senior Managing Director, Equity Portfolio Manager

Wellington Management Company LLP

Donald J. Kilbride

Senior Managing Director, Equity Portfolio Manager

Wellington Management Company LLP

Philip W. Ruedi, CFA

Senior Managing Director, Equity Portfolio Manager

Wellington Management Company LLP

Stephen Mortimer

Senior Managing Director, Equity Portfolio Manager

Wellington Management Company LLP

David W. Palmer, CFA

Senior Managing Director, Equity Portfolio Manager

Wellington Management Company LLP

How did the Fund perform?

The Class IA shares of the Hartford Capital Appreciation HLS Fund returned 4.13% for the six-month period ended June 30, 2015, outperforming the Fund’s benchmarks, the Russell 3000 Index and the S&P 500 Index, which returned 1.94% and 1.23%, respectively, for the same period. The Fund also outperformed the 1.87% average return of the Lipper Multi-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, rose for the period, notwithstanding significant volatility. The S&P 500 Index

finished 2014 with strong gains, retreated briefly, but then reached new all-time highs on March 2, April 24, and May 21. Stocks fell in January, which was the worst monthly return for U.S. stocks in a year. Despite a positive overall scorecard, earnings sentiment was fairly negative among many investors, in part due to a strengthening U.S. Dollar negatively affecting exports and making future growth difficult and some accompanying high-profile earnings guidance disappointments. Equities rebounded in February, posting their best monthly gain since October 2011. The market pulled back again in early March as soft manufacturing data, potentially negative currency- and oil-related earnings and valuation concerns weighed on investors’ minds. However, risk appetites increased after the

|

| Hartford Capital Appreciation HLS Fund |

Manager Discussion – (continued)

June 30, 2015 (Unaudited)

March 18 Federal Open Market Committee statement underlined the U.S. Federal Reserve’s (Fed) hesitation to raise rates as U.S. domestic inflation remained subdued and other major central banks maintained an easing bias. In April, the tech-heavy Nasdaq Composite topped the 5,000 mark for the first time since the dot-com bubble and broke its closing record from March 2000. Continued strong merger and acquisition (M&A) activity, a rebound in hiring, and solid housing data helped to fuel risk appetites. May marked the second-best month ever for M&A activity involving U.S. companies with $234 billion in announcements. Stocks ended the period on a sour note after negotiations between Greece and its creditors broke down in late June. U.S. equities fell 1.9% in June despite promising data releases and an upbeat economic assessment by the Fed.

Returns varied noticeably by market-cap, as small- and mid-cap stocks outperformed large-cap stocks. Within the Russell 3000 Index, six of ten sectors posted positive gains. Healthcare (+12%), Consumer Discretionary (+6%), and Telecommunication Services (+4%) led the index higher while Utilities (-11%), Energy (-4%), and Industrials (-2%) lagged on a relative basis.

The Fund outperformed the Russell 3000 Index due to security selection and sector allocation. Security selection was strongest within the Financials, Consumer Staples, and Energy sectors. This was partially offset by weak selection within the Consumer Discretionary and Industrials sectors. Sector allocation, a result of our bottom-up security selection process, also contributed to performance relative to the Russell 3000 Index during the period. An overweight to the Healthcare sector and an underweight to the Utilities sector contributed to returns relative to the Russell 3000 Index, which was partially offset by an underweight to Telecommunication Services.

The top contributors to performance relative to the Russell 3000 Index during the period included Bristol-Myers (Healthcare), NXP Semiconductors (Information technology) and Activision Blizzard (Information technology). Shares of Bristol-Myers, a U.S.-based pharmaceutical company, rose during the period due to reports of promising clinical trial data for skin cancer drug Opdivo (nivolumab), along with a positive U.S. Food and Drug Administration (FDA) announcement, sending the stock price higher. Shares of NXP Semiconductors, a Netherlands-based semiconductor company, outperformed following the announcement of a synergistic merger with semiconductor company Freescale, which would make the combined company one of the largest firms in the industry. Shares of Activision Blizzard, a U.S.-based electronic entertainment company, outperformed after it beat earnings forecasts. Apple (Information technology) and Amazon.com (Consumer Discretionary) were among top absolute contributors during the period.

The largest detractors from returns relative to the Russell 3000 Index over the period were Micron Technology (Information technology), Hertz Global Holding (Industrials), and Applied Materials (Information

technology). Shares of Micron Technology, a semiconductor manufacturer specializing in NAND Flash, DRAM, and NOR Flash memory devices, fell amid investor concerns about demand and pricing in the PC market. Hertz Global Holding, a U.S.-based global car and equipment rental company, fell after the current year earnings consensus moved lower over the period. Shares of Applied Materials, a U.S.-based manufacturer of equipment and software for the semiconductor industry underperformed after the company announced the termination of its $9.4 billion acquisition of Tokyo Electron Ltd. after facing a regulatory obstruction. Intel (Information technology) was among top absolute detractors during the period.

Derivatives are not used in a significant manner in this Fund and did not have a material impact on performance during the period.

What is the outlook?

We believe that the U.S. is still on a self-sustaining path to recovery. We believe economic fundamentals continue to strengthen and the growth outlook remains positive. We believe that recent events in Greece along with an expected hike in rates by the Fed should not derail the positive momentum we have seen over the last several quarters. While we believe equity valuations remain stretched, we are not overly concerned at this point. We believe that potential continued improvement in economic fundamentals should support equity valuations.

As a result of our bottom-up investment process, at the end of the period the Fund was most overweight the Information technology, Healthcare, and Consumer Discretionary sectors relative to the Russell 3000 Index. The Fund was most underweight the Consumer Staples, Energy, and Utilities sectors at the end of the period relative to the Russell 3000 Index.

Diversification by Sector

as of June 30, 2015 (Unaudited)

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Consumer Discretionary | | | 16.5 | % |

Consumer Staples | | | 4.0 | |

Energy | | | 4.7 | |

Financials | | | 16.9 | |

Health Care | | | 19.0 | |

Industrials | | | 9.9 | |

Information Technology | | | 22.9 | |

Materials | | | 2.7 | |

Telecommunication Services | | | 0.6 | |

Utilities | | | 1.4 | |

| | | | |

Total | | | 98.6 | % |

| | | | |

Short-Term Investments | | | 1.7 | |

Other Assets & Liabilities | | | (0.3 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system and these sector classifications are used for reporting ease.

Hartford Disciplined Equity HLS Fund inception 05/29/1998

| | |

| (sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks growth of capital. |

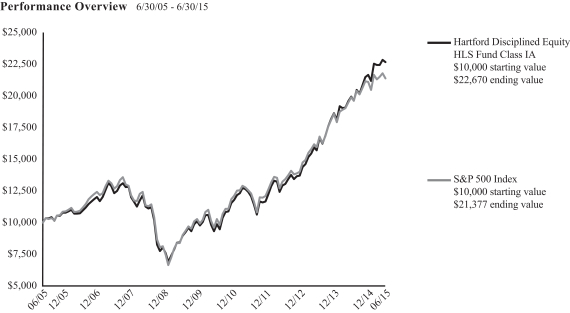

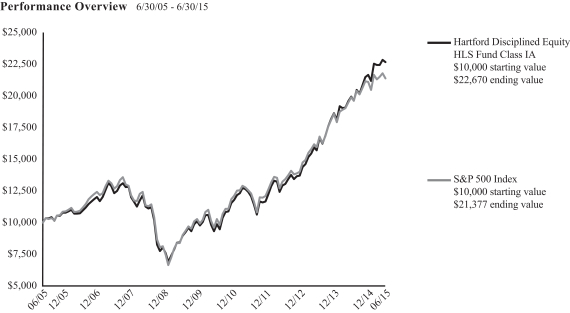

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 6/30/15)

| | | | | | | | | | | | | | | | |

| | | 6 Months1 | | | 1 Year | | | 5 Years | | | 10 Years | |

Disciplined Equity IA | | | 4.67% | | | | 13.68% | | | | 19.45% | | | | 8.53% | |

Disciplined Equity IB | | | 4.60% | | | | 13.43% | | | | 19.16% | | | | 8.26% | |

S&P 500 Index | | | 1.23% | | | | 7.42% | | | | 17.34% | | | | 7.89% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2015, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2015, the total annual fund operating expense ratios for Class IA and Class IB were 0.75% and 1.00%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2015.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Disciplined Equity HLS Fund |

Manager Discussion

June 30, 2015 (Unaudited)

Mammen Chally, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

How did the Fund perform?

The Class IA shares of the Hartford Disciplined Equity HLS Fund returned 4.67% for the six-month period ended June 30, 2015, outperforming the Fund’s benchmark, the S&P 500 Index, which returned 1.23% for the same period. The Fund also outperformed the 1.00% average return of the Lipper Large-Cap Core Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, rose for the period, notwithstanding significant volatility. The S&P 500 Index finished 2014 with strong gains, retreated briefly, but then reached new all-time highs on March 2, April 24, and May 21. Stocks fell in January, which was the worst monthly return for U.S. stocks in a year. Despite a positive overall scorecard, earnings sentiment was fairly negative among many investors, in part due to a strengthening U.S. Dollar negatively affecting exports and making future growth difficult, and some accompanying high-profile earnings guidance disappointments. Equities rebounded in February, posting their best monthly gain since October 2011. The market pulled back again in early March as soft manufacturing data, potentially negative currency- and oil-related earnings, and valuation concerns weighed on investors’ minds. However, risk appetites increased after the March 18 Federal Open Market Committee statement underlined the U.S. Federal Reserve’s (Fed) hesitation to raise rates as U.S. domestic inflation remained subdued and other major central banks maintained an easing bias. In April, the tech-heavy Nasdaq Composite topped the 5,000 mark for the first time since the dot-com bubble and broke its closing record from March 2000. Continued strong merger and acquisition activity (M&A), a rebound in hiring, and solid housing data helped to fuel risk appetites. May marked the second-best month ever for M&A activity involving U.S. companies with $234 billion in announcements. Stocks ended the period on a sour note after negotiations between Greece and its creditors broke down in late June. U.S. equities fell 1.9% in June despite promising data releases and an upbeat economic assessment by the Fed. Returns varied noticeably by market-cap, as small-cap stocks (+5%) and mid-cap stocks (+4%) outperformed large-cap stocks (+1%), as represented by the Russell 2000, S&P MidCap 400, and S&P 500 Indices respectively. During the six-month period, five of the ten sectors within the S&P 500 Index posted positive returns, led by Healthcare (+10%), Consumer Discretionary (+7%), and Telecommunication Services (+3%).

The Fund outperformed the S&P 500 Index during the period primarily due to strong security selection. Strong selection within

Consumer Staples, Healthcare, and Industrials more than offset weaker selection within Consumer Discretionary. Sector allocation, which is a fallout of our bottom-up stock selection process, also contributed to relative returns during the period. An overweight allocation to the Healthcare sector and an underweight allocation to the Energy sector more than offset the negative impact from an overweight to the Utilities sector.

The largest contributors to performance relative to the S&P 500 Index over the period were Aetna (Healthcare), Omnicare (Healthcare), and Coty (Consumer Staples). Shares of Aetna, a U.S.-based diversified health care company, rose during the period amid speculation that Aetna would acquire Humana. Earlier speculation that United Healthcare would acquire Aetna also positively affected the stock price, but that proved to be untrue. Shares of Omnicare, a U.S.-based healthcare services company offering long term and specialty care services, rose during the period after it was announced the company was going to be acquired by CVS. Shares of Coty, a U.S.-based cosmetics and personal care company, rose during the period on news that it reached an agreement with Proctor & Gamble (PG) to acquire PG’s fragrance, color cosmetics, and hair products business, a move viewed favorably by the market. Owning Eli Lily (Healthcare), a U.S.-based drug manufacturing business, also contributed to absolute returns during the period.

The largest detractors from performance relative to the S&P 500 Index over the period were Ralph Lauren (Consumer Discretionary), Amazon.com (Consumer Discretionary), and PVH (Consumer Discretionary). Shares of Ralph Lauren, a U.S.-based producer of apparel, accessories, fragrances, and home furnishings, fell during the period after the company lowered its fiscal-year 2015 revenues guidance. Shares of Amazon.com, a U.S.-based global ecommerce company, rose during the period, due largely to better-than-expected first-quarter results, particularly in Amazon Web Services, the company’s cloud computing program. Not owning the strong performing benchmark constituent detracted from relative returns during the period. Shares of PVH, a U.S.-based global apparel company, underperformed during the period due to worries about foreign currency translation amid the strong U.S. dollar. The company generates approximately 45% of revenue and 55% of profits outside of the U.S. so the strength of the dollar weighed on performance. Chevron (Energy), a U.S.-based integrated oil and gas company, also detracted on an absolute basis.

Derivatives are not used in a significant manner in this Fund and did not have a material impact on performance during the period.

|

| Hartford Disciplined Equity HLS Fund |

Manager Discussion – (continued)

June 30, 2015 (Unaudited)

What is the outlook?

We believe we are still in a period of moderate global economic growth and the U.S. expansion is increasingly driven by domestic factors. Consumption and housing are two key growth drivers of the U.S. economy. Real disposable income is growing around 4%, allowing a 3% consumption increase, even giving households some additional room to repair their balance sheets. The housing recovery is helped by demographic factors. We believe household formation is picking up, with the younger cohorts seeing some of the strongest employment gains. On the investment side, the decline in oil rigs appears to be nearing its end, reducing a drag on the economy in the earlier part of the year.

The second quarter of 2015 should mark the bottom of inflation, which appears to be a prerequisite for the Fed to start the rate normalization process later this year. There is now mounting evidence that wages are responding to an improving labor market, which may give the Fed the confidence that the U.S. economy is now on a sustainable expansion path. We believe the Fed will naturally remain sensitive to the financial and economic ramifications of the Greece crisis.

Overall, we continue to find what we consider to be attractively valued stocks with the characteristics we seek. We are cautiously optimistic about the outlook for the U.S. economy and for equity markets, and we continue to monitor policy decisions and economic trends which may impact our holdings. We remain consistent in adhering to our disciplined portfolio construction process that allows us to assess risk, weight individual positions accordingly, and in the process build a portfolio where stock selection is designed to be the primary driver of performance relative to the S&P 500 Index. Based on individual stock decisions, the Fund ended the period most overweight the Healthcare, Consumer Staples, and Utilities sectors, and most underweight Financials, Energy, and Telecommunication Services relative to the S&P 500 Index.

Diversification by Sector

as of June 30, 2015 (Unaudited)

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Consumer Discretionary | | | 12.9 | % |

Consumer Staples | | | 13.7 | |

Energy | | | 4.7 | |

Financials | | | 11.4 | |

Health Care | | | 21.5 | |

Industrials | | | 8.2 | |

Information Technology | | | 18.9 | |

Materials | | | 3.4 | |

Utilities | | | 4.1 | |

| | | | |

Total | | | 98.8 | % |

| | | | |

Short-Term Investments | | | 1.2 | |

Other Assets & Liabilities | | | 0.0 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system and these sector classifications are used for reporting ease.

Hartford Dividend and Growth HLS Fund inception 03/09/1994

| | |

| (sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks a high level of current income consistent with growth of capital. |

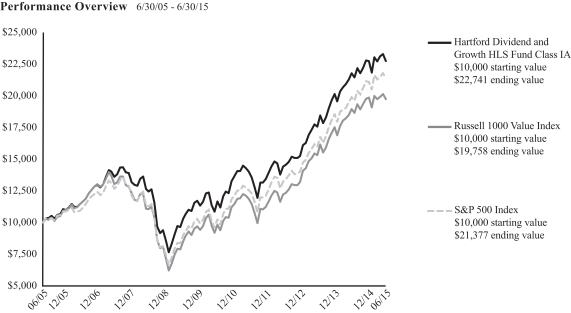

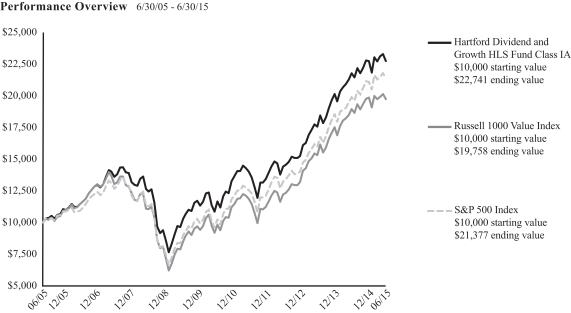

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 6/30/15)

| | | | | | | | | | | | | | | | |

| | | 6 Months1 | | | 1 Year | | | 5 Years | | | 10 Years | |

Dividend and Growth IA | | | -0.04% | | | | 4.42% | | | | 15.92% | | | | 8.56% | |

Dividend and Growth IB | | | -0.15% | | | | 4.18% | | | | 15.63% | | | | 8.29% | |

Russell 1000 Value Index | | | -0.61% | | | | 4.13% | | | | 16.50% | | | | 7.05% | |

S&P 500 Index | | | 1.23% | | | | 7.42% | | | | 17.34% | | | | 7.89% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2015, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Russell 1000 Value Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 1000 Index is an unmanaged index that measures the performance of the 1,000 largest companies in the Russell 3000 Index, which measures the performance of the 3,000 largest U.S. companies, based on total market capitalizations.

S&P 500 Index is a market capitalization-weighted price index composed of 500 widely held common stocks.

The indices are unmanaged, and their results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2015, the total annual fund operating expense ratios for Class IA and Class IB were 0.67% and 0.92%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2015.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Dividend and Growth HLS Fund |

Manager Discussion

June 30, 2015 (Unaudited)

Edward P. Bousa, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Donald J. Kilbride

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew G. Baker

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

How did the Fund perform?

The Class IA shares of the Hartford Dividend and Growth HLS Fund returned -0.04% for the six-month period ended June 30, 2015, underperforming the Fund’s benchmark, the S&P 500 Index, which returned 1.23% for the same period. The Fund outperformed the Russell 1000 Value Index, which returned -0.61% for the same period. The Fund also outperformed the -0.49% average return of the Lipper Equity Income Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, rose for the period, notwithstanding significant volatility. The S&P 500 Index finished 2014 with strong gains, retreated briefly, but then reached new all-time highs on March 2, April 24, and May 21. Stocks fell in January, which was the worst monthly return for U.S. stocks in a year. Despite a positive overall scorecard, earnings sentiment was fairly negative among many investors, in part due to a strengthening U.S. Dollar negatively affecting exports and making future growth difficult, and some accompanying high-profile earnings guidance disappointments. Equities rebounded in February, posting their best monthly gain since October 2011. The market pulled back again in early March as soft manufacturing data, potentially negative currency- and oil-related earnings, and valuation concerns weighed on investors’ minds. However, risk appetites increased after the March 18 Federal Open Market Committee statement underlined the U.S. Federal Reserve’s (Fed) hesitation to raise rates as U.S. domestic inflation remained subdued and other major central banks maintained an easing bias. In April, the tech-heavy Nasdaq Composite topped the 5,000 mark for the first time since the dot-com bubble and broke its closing record from March 2000. Continued strong merger and acquisition (M&A) activity, a rebound in hiring, and solid housing data helped to fuel risk appetites. May marked the second-best month ever for M&A activity involving U.S. companies with $234 billion in announcements. Stocks ended the period on a sour note after negotiations between Greece and its creditors broke down in late June. U.S. equities fell 1.9% in June despite promising data releases and an upbeat economic assessment by the Fed. Returns varied noticeably by market-cap, as small-cap stocks (+5%) and mid-cap stocks (+4%) outperformed large-cap stocks

(+1%), as represented by the Russell 2000, the S&P MidCap 400, and the S&P 500, indices respectively. During the six-month period five of the ten sectors within the S&P 500 Index posted positive returns, led by Healthcare (+10%), Consumer Discretionary (+7%), and Telecommunication Services (+3%).

Security selection was the primary detractor from returns relative to the S&P 500 Index during the period. Weak selection within Healthcare, Consumer Discretionary, and Energy was only partially offset by strong selection within Financials and Industrials. Sector allocation, a result of our bottom up stock selection process, also detracted from relative returns during the period. An underweight to the Consumer Discretionary sector and an overweight to the Industrials sector offset the positive impact of an overweight to the Healthcare sector and an underweight to the Consumer Staples sector.

The Fund’s top detractors from returns relative to the S&P 500 Index were Amazon.com (Consumer Discretionary), Apple (Information Technology), and ACE (Financials). Shares of Amazon.com, a U.S.-based global ecommerce company, rose during the period, due largely to better-than-expected first-quarter results, particularly in Amazon Web Services, the company’s cloud computing program. Not owning the strong performing benchmark constituent detracted from relative returns during the period. Shares of Apple, a U.S.-based designer and manufacturer of consumer electronics, software, and computers, rose during the period after the company reported record numbers due to better than expected revenue and an increase in gross margins. Our underweight position in the strong performing S&P 500 Index constituent detracted from relative returns. Shares of ACE, a U.S.-based global insurance and reinsurance organization, fell during the period after reporting weak first quarter earnings. The company reported weaker than expected earnings per share due to the impact of a strong U.S. dollar. Intel (Information Technology) and Chevron (Energy) also detracted from absolute returns.

The Fund’s top contributors to performance relative to the S&P 500 Index during the period were Eli Lily (Healthcare), Celanese (Materials), and Equifax (Industrials). Shares of Eli Lily, a U.S.-based company engaged in the drug manufacturing business, rose during

|

| Hartford Dividend and Growth HLS Fund |

Manager Discussion – (continued)

June 30, 2015 (Unaudited)

the period as investors anticipated the company would announce positive long-term data on its Alzheimer’s drug. Shares of Celanese, a U.S.-based integrated producer of chemicals and advanced materials, rose during the period as the company reported better than expected earnings and raised guidance, citing improved productivity and lower costs. Shares of Equifax, a U.S.-based provider of information solutions and human resources business process outsourcing services, rose during the period after the company announced second quarter earnings estimates which were around analysts’ expectations. Investors viewed this news favorably and the stock rose as a result. Apple (Information Technology) and UnitedHealth Group (Healthcare) were among the top contributors to absolute performance.

Derivatives are not used in a significant manner in this Fund and did not have a material impact on performance during the period.

What is the outlook?

We believe we are well positioned for what we view as a tepid economic environment and we believe that we have a solid portfolio comprised of firms with strong management teams, good balance sheets, and a commitment to returning cash to shareholders via dividends and share repurchases. We continue to search for investment ideas that fit with our process and philosophy. We remain focused on the significance of dividends, positive capital stewardship, and franchise value. We believe we have a solid portfolio of undervalued market leaders, stocks in industries with improving supply/demand trends, and solid companies that are temporarily out of favor. At the end of the period, our largest overweights were to the Financials and Industrials sectors, while we remained underweight the Consumer Discretionary and Information Technology sectors, relative to the S&P 500 Index.

Diversification by Sector

as of June 30, 2015 (Unaudited)

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Consumer Discretionary | | | 6.6 | % |

Consumer Staples | | | 7.6 | |

Energy | | | 9.3 | |

Financials | | | 22.2 | |

Health Care | | | 16.4 | |

Industrials | | | 13.5 | |

Information Technology | | | 15.5 | |

Materials | | | 1.7 | |

Telecommunication Services | | | 2.5 | |

Utilities | | | 3.5 | |

| | | | |

Total | | | 98.8 | % |

| | | | |

Short-Term Investments | | | 0.9 | |

Other Assets & Liabilities | | | 0.3 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

A sector may be comprised of several industries. For Fund compliance purposes, the Fund may not use the same classification system and these sector classifications are used for reporting ease.

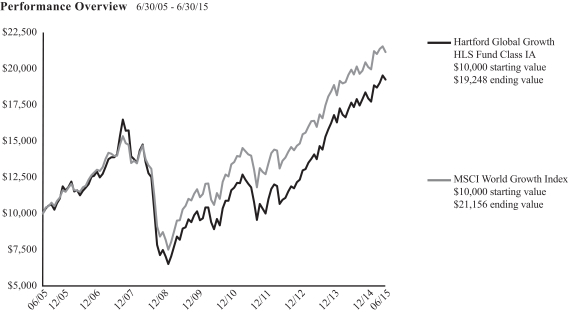

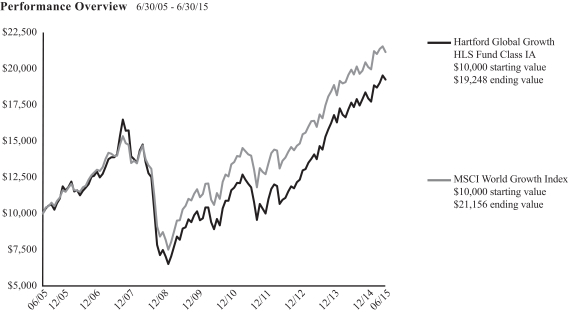

Hartford Global Growth HLS Fund inception 09/30/1998

| | |

| (sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks growth of capital. |

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 6/30/15)

| | | | | | | | | | | | | | | | |

| | | 6 Months1 | | | 1 Year | | | 5 Years | | | 10 Years | |

Global Growth IA | | | 7.25% | | | | 9.01% | | | | 16.62% | | | | 6.77% | |

Global Growth IB | | | 7.09% | | | | 8.74% | | | | 16.33% | | | | 6.50% | |

MSCI World Growth Index | | | 5.21% | | | | 6.19% | | | | 14.83% | | | | 7.78% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2015, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

MSCI World Growth Index is a broad-based unmanaged market capitalization-weighted total return index which measures the performance of growth securities in 23 developed-country global equity markets including the United States, Canada, Europe, Australia, New Zealand and the Far East.

The index is unmanaged, and its results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2015, the total annual fund operating expense ratios for Class IA and Class IB were 0.81% and 1.06%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2015.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Global Growth HLS Fund |

Manager Discussion

June 30, 2015 (Unaudited)

John A. Boselli, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Matthew D. Hudson, CFA

Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

How did the Fund perform?

The Class IA shares of the Hartford Global Growth HLS Fund returned 7.25% for the six-month period ended June 30, 2015, outperforming its benchmark, the MSCI World Growth Index, which returned 5.21% for the same period. The Fund also outperformed the 4.80% average return of the Lipper Global Large-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

The rally in stocks marched on as global equities rose for the overall period as measured by the MSCI World Index. However, there was no shortage of headlines for investors to fret over: Europe’s economy remained near stall speed, oil prices plunged, Chinese manufacturing data disappointed, and Greece’s future in the European Union is being questioned again. Despite the negative headlines, Europe was a bright spot during the beginning of the period due to further accommodative monetary policy and encouraging economic data, including positive trends in manufacturing, exports, and economic sentiment. The Bank of Japan expanded its quantitative easing policy, the People’s Bank of China surprised markets with further rate cuts, and the European Central Bank announced a €1.14 trillion open-ended sovereign quantitative easing program to combat record-low inflation and stimulate growth in Europe. Global equities fell modestly at the end of the period, declining for the first quarter in the past twelve quarters. In June, the Greek debt crisis took center stage. Negotiations between Greece and its creditors broke down and Greece missed its scheduled payment due to the International Monetary Fund on June 30th. Despite the Greek default and fears of contagion to the European peripheral countries as well as a significant sell off in the Chinese equity market in June, global economic data remained constructive with continued signs of a gradual recovery in the U.S. and Europe. A continued boom in corporate takeovers also fueled bullish sentiment. Global merger and acquisition activity remained robust, with 2015 on pace to be the second-highest year of deal volume, trailing only 2007. During the period, U.S. equities underperformed non-U.S. equities and emerging market equities underperformed their developed market counterparts.

For the semi-annual period, growth stocks (+5.2%) outperformed value stocks (+0.7%) as measured by the MSCI World Growth Index and the MSCI World Value Index, respectively. Within the MSCI World Growth Index, nine of ten sectors posted positive returns. Healthcare (+12%), Consumer Discretionary (+8%), and

Telecommunications Services (+6%) gained the most, while the Energy (-2%), Industrials (-1%), and Materials (-2%) sectors lagged the most on a relative basis.

The Fund’s outperformance versus the MSCI World Growth Index was driven primarily by security selection, which contributed positively to relative results within all but two sectors; selection within Consumer Staples and Financials was especially strong, more than offsetting weak selection within Energy and Utilities. Sector allocation also contributed to relative results over the period. Underweights to Industrials, Energy, and Materials offset overweights to Financials and Information Technology as well as an underweight to Consumer Discretionary which detracted from performance.

Top contributors to relative performance included Aetna (Healthcare), Largan Precision (Information Technology), and Pandora (Consumer Discretionary). Shares of Aetna, a U.S.-based diversified health care benefits company, rose amid robust mergers and acquisitions activity in the health care industry as speculation abounded that Aetna would acquire Humana, sending Aetna’s stock price higher. Aetna also benefited from earlier rumors that United Healthcare would acquire the company, although those rumors proved to be untrue. Shares of Taiwan-based Largan Precision, a manufacturer of camera lenses for smartphones, outperformed as the company continued to benefit from demand for complex lenses in camera phones. Shares of Denmark-based jewelry maker Pandora rose over the period. Pandora’s products, particularly bracelets and charms, benefited from repeat customer purchases. The company also experienced high organic revenue growth, which was driven by product expansion and store growth, particularly in underpenetrated regions. Top absolute contributors included shares of Apple (Information Technology) and Novo Nordisk (Healthcare).

The top detractors from the Fund’s relative performance were Baidu (Information Technology), Stratasys (Information Technology), and Alibaba (Information Technology). Baidu, a Chinese-language Internet search provider, underperformed due to lower than expected earnings and continued concern around its ability to crystalize margin expansion. Stratasys, a fast growing 3D printing company, accelerated its investments and pushed out its earnings model by a few years, dampening the stock price. Shares of Alibaba, a Chinese e-commerce company, declined due to the concern of more stock becoming ‘unlocked’ after the company’s initial public offering. Top absolute detractors also included American Express (Financials).

|

| Hartford Global Growth HLS Fund |

Manager Discussion – (continued)

June 30, 2015 (Unaudited)

Derivatives are not used in a significant manner in this Fund and did not have a material impact on performance during the period.

What is the outlook?

While global equity performance finished relatively flat in the second quarter of 2015, underneath the seemingly benign performance was volatility intra quarter as well as dispersion of returns among regions. We expect volatility to continue and that it will not be isolated to any one region. The portfolio ended the period with an overweight in its exposure to the U.S., which continues to generate the strongest growth globally. We are cognizant of potential contagion risks as the Chinese economy was already slowing and we believe this could have further negative impacts both within China and the rest of the world. We are closely monitoring developments in Europe and whether or not Greece will remain in the European Union, which may add to fears of contagion risk. While the world at large continues to experience variability, we believe that in periods without large macro dislocations, fundamental stock picking can be recognized.

Our focus remains on stock selection that is driven by bottom-up, fundamental research, diligent meetings with the managements of high quality, leading companies globally, and leveraging the deep research capabilities of our firm. At the end of the period, our largest sector overweights continued to be to the Information Technology and Financials while we were most underweight Industrials, Consumer Discretionary, and Materials, relative to the MSCI World Growth Index.

Diversification by Country

as of June 30, 2015 (Unaudited)

| | | | |

| Country | | Percentage of

Net Assets | |

Belgium | | | 1.6 | % |

British Virgin Islands | | | 0.0 | |

China | | | 3.9 | |

Denmark | | | 1.9 | |

France | | | 1.5 | |

Germany | | | 2.3 | |

Hong Kong | | | 1.0 | |

India | | | 0.5 | |

Ireland | | | 1.0 | |

Israel | | | 1.3 | |

Italy | | | 0.5 | |

Japan | | | 5.0 | |

Netherlands | | | 0.8 | |

Spain | | | 0.5 | |

Sweden | | | 0.7 | |

Switzerland | | | 5.6 | |

Taiwan | | | 1.4 | |

United Kingdom | | | 6.7 | |

United States | | | 62.8 | |

Short-Term Investments | | | 1.0 | |

Other Assets & Liabilities | | | 0.0 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

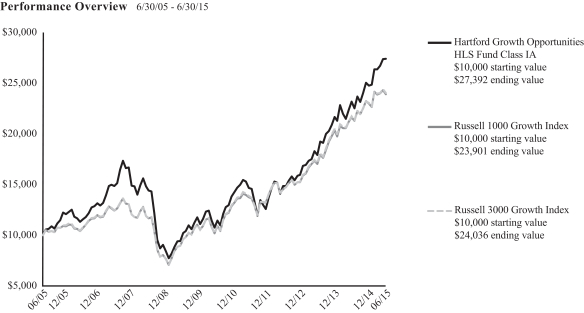

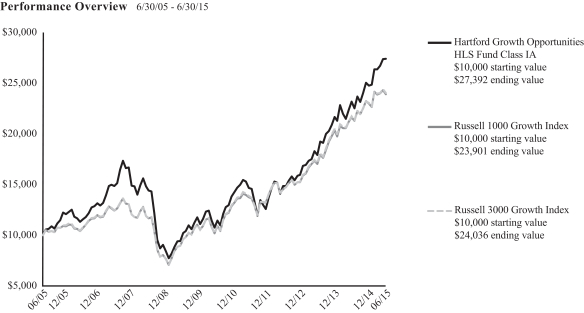

Hartford Growth Opportunities HLS Fund inception 03/24/1987

| | |

(sub-advised by Wellington Management Company LLP) | | Investment objective – The Fund seeks capital appreciation. |

The chart above represents the hypothetical growth of a $10,000 investment in Class IA. Growth results in classes other than Class IA will vary from what is seen above due to differences in the expenses charged to those share classes.

Average Annual Total Return (as of 6/30/15)

| | | | | | | | | | | | | | | | |

| | | 6 Months1 | | | 1 Year | | | 5 Years | | | 10 Years | |

Growth Opportunities IA | | | 10.70% | | | | 18.23% | | | | 20.58% | | | | 10.60% | |

Growth Opportunities IB | | | 10.57% | | | | 17.94% | | | | 20.27% | | | | 10.33% | |

Growth Opportunities IC | | | 10.43% | | | | 17.66% | | | | 19.98% | | | | 10.06% | |

Russell 1000 Growth Index | | | 3.96% | | | | 10.56% | | | | 18.59% | | | | 9.10% | |

Russell 3000 Growth Index | | | 4.33% | | | | 10.69% | | | | 18.64% | | | | 9.17% | |

PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The investment return and principal value of the investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website www.hartfordfunds.com.

Total returns presented above were calculated using the Fund’s net asset value available to shareholders for sale or redemption of Fund shares on June 30, 2015, which may exclude investment transactions as of this date. All share class returns assume the reinvestment of all distributions at net asset value and the deduction of all fund expenses.

Class IC shares commenced operations on April 30, 2014. Class IC shares performance prior to that date reflects Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. The performance after such date reflects actual Class IC shares performance.

Russell 1000 Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index is an unmanaged index that measures the performance of the 1,000 largest companies in the Russell 3000 Index, which measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

Russell 3000 Growth Index is an unmanaged index that measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Index is an unmanaged index that measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

The indices are unmanaged, and their results include reinvested dividends and/or distributions, but do not reflect the effect of sales charges, commissions, expenses or taxes.

You cannot invest directly in an index.

As shown in the Fund’s current prospectus dated May 1, 2015, the total annual fund operating expense ratios for Class IA, Class IB and Class IC were 0.64%, 0.89% and 1.14%, respectively. Actual expenses may be higher. Please see the accompanying Financial Highlights for expense ratios for the six-month period ended June 30, 2015.

All investments are subject to risk including the possible loss of principal. For a discussion of the Fund’s risks, please see the Main Risks section of this report. For more detailed information on the risks associated with an investment in the Fund, please see the prospectus.

The chart and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable life insurance, variable annuity or qualified retirement plan product level. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance.

|

| Hartford Growth Opportunities HLS Fund |

Manager Discussion

June 30, 2015 (Unaudited)

Michael T. Carmen, CFA

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

Mario E. Abularach, CFA

Senior Managing Director and Equity Research Analyst

Wellington Management Company LLP

Stephen Mortimer

Senior Managing Director and Equity Portfolio Manager

Wellington Management Company LLP

How did the Fund perform?

The Class IA shares of the Hartford Growth Opportunities HLS Fund returned 10.70% for the six-month period ended June 30, 2015, outperforming the Fund’s benchmarks, the Russell 3000 Growth Index and the Russell 1000 Growth Index, which returned 4.33% and 3.96%, respectively, for the same period. The Fund also outperformed the 4.70% average return of the Lipper Multi-Cap Growth Funds peer group, a group of funds with investment strategies similar to those of the Fund.

Why did the Fund perform this way?

U.S. equities, as measured by the S&P 500 Index, rose for the period, notwithstanding significant volatility. The S&P 500 Index finished 2014 with strong gains, retreated briefly, but then reached new all-time highs on March 2, April 24, and May 21. Stocks fell in January, which was the worst monthly return for U.S. stocks in a year. Despite a positive overall scorecard, earnings sentiment was fairly negative among many investors, in part due to a strengthening U.S. Dollar negatively affecting exports and making future growth difficult, and some accompanying high-profile earnings guidance disappointments. Equities rebounded in February, posting their best monthly gain since October 2011. The market pulled back again in early March as soft manufacturing data, potentially negative currency- and oil-related earnings, and valuation concerns weighed on investors’ minds. However, risk appetites increased after the March 18 Federal Open Market Committee statement underlined the U.S. Federal Reserve’s (Fed) hesitation to raise rates as U.S. domestic inflation remained subdued and other major central banks maintained an easing bias. In April, the tech-heavy Nasdaq Composite topped the 5,000 mark for the first time since the dot-com bubble and broke its closing record from March 2000. Continued strong merger and acquisition (M&A) activity, a rebound in hiring, and solid housing data helped to fuel risk appetites. May marked the second-best month ever for M&A activity involving U.S. companies with $234 billion in announcements. Stocks ended the period on a sour note after negotiations between Greece and its creditors broke down in late June. U.S. equities fell 1.9% in June despite promising data releases and an upbeat economic assessment by the Fed. Returns varied noticeably by market-cap, as small- and mid-cap stocks outperformed large-cap stocks.

Seven out of ten sectors in the Russell 3000 Growth Index rose during the period. The Healthcare (+12%), Consumer Discretionary (+8%), and Information Technology (+5%) sectors gained the most while Utilities (-10%) and Industrials (-4%) lagged on a relative basis.

Security selection was the main driver of outperformance relative to the Russell 3000 Growth Index during the period. Security selection was strongest in the Consumer Discretionary, Information Technology, and Industrials sectors. Sector allocation, a result of the bottom-up stock selection process, also contributed meaningfully to performance relative to the Russell 3000 Growth Index over the period, largely due to an overweight in Healthcare and underweight in Consumer Staples, which was only partially offset by the negative impact of an overweight to Financials.

The top contributors to performance relative to the Russell 3000 Growth Index during the period were Nomad Foods (Consumer Staples), Netflix (Consumer Discretionary), and Amazon.com (Consumer Discretionary). Shares of Nomad Foods, a UK-based special purpose acquisition company, recently completed a reverse merger of Iglo, a European frozen food company. The stock price increased once investors realized that the acquisition would generate considerable incremental earnings and free cash flow. We believe the global frozen food industry is in the early stages of consolidation, providing ample investing opportunities for the company to add value. Within the Consumer Discretionary sector, Netflix was the top contributor to relative returns over the period. The subscription-based internet streaming company had a brief period of earnings weakness that caused a bearish sentiment among investors towards the end of 2014. Relative performance has since recovered, primarily driven by a strong quarter of earnings both domestically and abroad. Shares of Amazon.com, a U.S.-based global ecommerce company, outperformed as investors reacted favorably to strong profitability and improved gross margins, sending the shares higher over the period. Apple (Information Technology) and Bristol-Myers Squibb (Healthcare) were also among other top absolute contributors to performance.

The top detractors from performance relative to the Russell 3000 Growth Index during the period included Alibaba (Information

|

| Hartford Growth Opportunities HLS Fund |

Manager Discussion – (continued)

June 30, 2015 (Unaudited)

Technology), GoPro (Consumer Discretionary) and Gilead Sciences (Healthcare). Shares of Alibaba, a China-based internet company that facilitates the vast majority of ecommerce in China, decreased amidst a controversy between the company and the Chinese government. Shares of GoPro, a U.S.-based company that produces mountable and wearable cameras and accessories, declined due to stretched valuations, conservative guidance, and concerns over the expiration of the stock’s lock up period. Shares of Gilead Sciences, a research-based biopharmaceutical company that discovers, develops and commercializes innovative medicines outperformed on better-than-expected first-quarter results, highlighted by strong sales of hepatitis C drugs Sovaldi and Harvoni. Not owning this benchmark constituent detracted from returns relative to the Russell 3000 Growth Index over the period. 21st Century Fox (Consumer Discretionary) and Workday (Information Technology) were among other top detractors relative to the Russell 3000 Growth Index.

Derivatives are not used in a significant manner in this Fund and did not have a material impact on performance during the period.

What is your outlook?

We believe the portfolio is well positioned for what we view as future growth in 2015 and we believe that high quality growth companies within industries displaying positive secular growth trends will continue to be rewarded. We think the global macro environment’s impact on the U.S. economy, relatively high valuation levels, and the potential for rising domestic interest rates are all obstacles to be aware of and we will be monitoring the situation closely. While we cannot predict market outcomes, we can continue to seek to identify companies that we believe are attractively valued with accelerating revenues that we believe will add value to the portfolio in the long run.

At the end of the period, the Fund was most overweight the Information Technology and Healthcare sectors and most underweight the Consumer Staples and Materials sectors relative to the Russell 3000 Growth Index.

Diversification by Sector

as of June 30, 2015 (Unaudited)

| | | | |

| Sector | | Percentage of

Net Assets | |

Equity Securities | | | | |

Consumer Discretionary | | | 19.1 | % |

Consumer Staples | | | 4.7 | |

Financials | | | 6.6 | |

Health Care | | | 23.2 | |

Industrials | | | 11.1 | |

Information Technology | | | 33.9 | |

Materials | | | 1.2 | |

| | | | |

Total | | | 99.8 | % |

| | | | |

Short-Term Investments | | | 1.3 | |

Other Assets & Liabilities | | | (1.1 | ) |

| | | | |

Total | | | 100.0 | % |

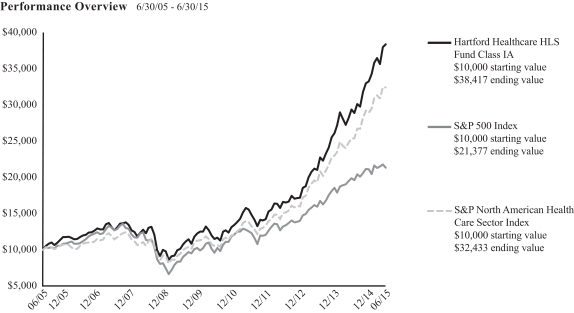

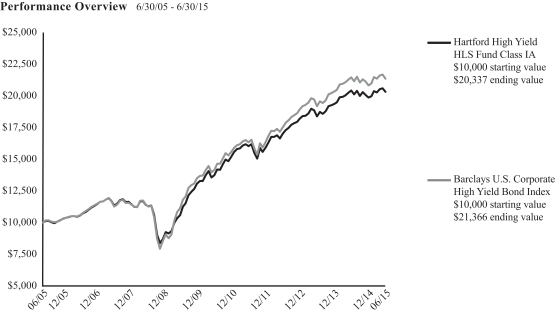

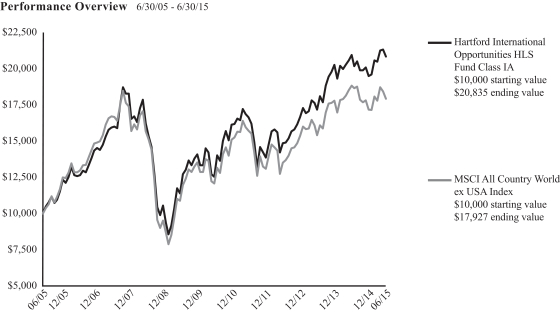

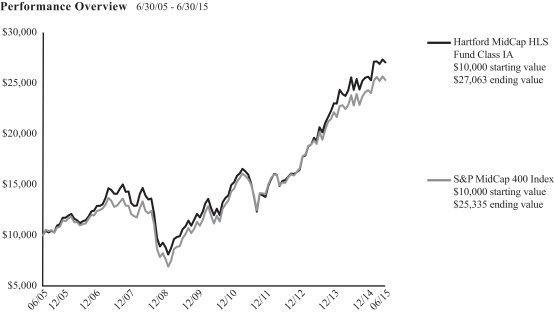

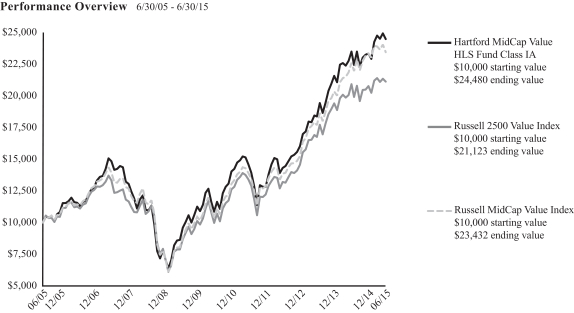

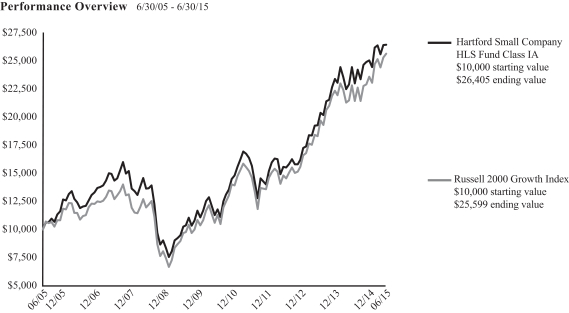

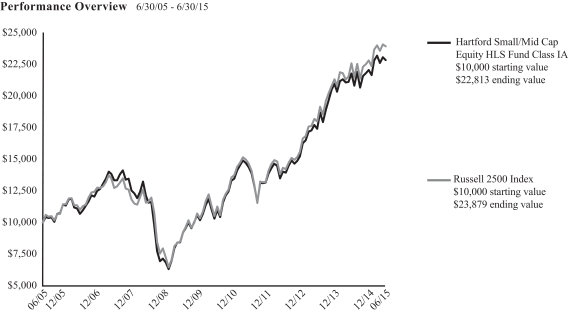

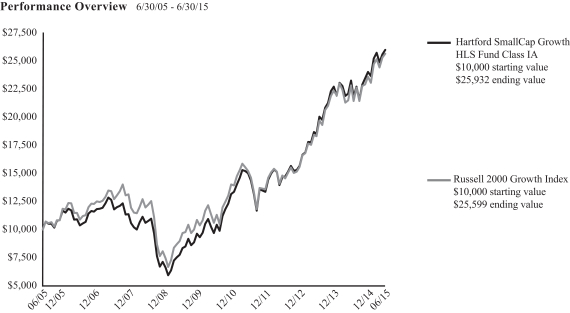

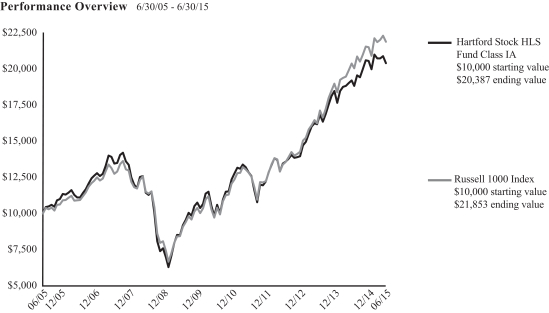

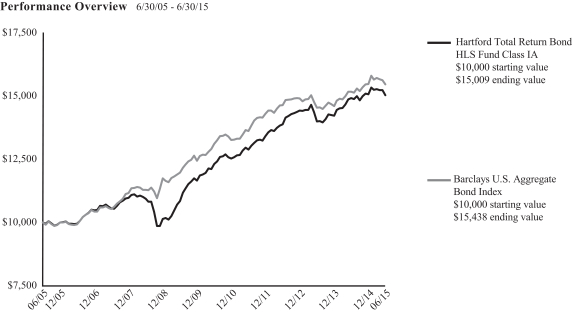

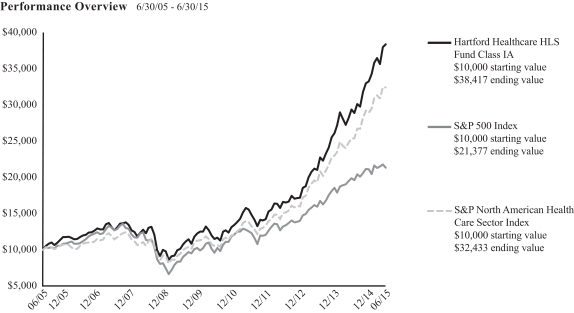

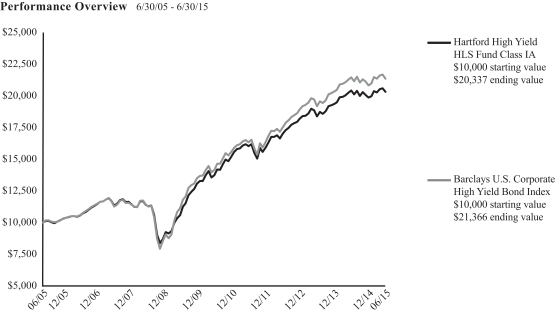

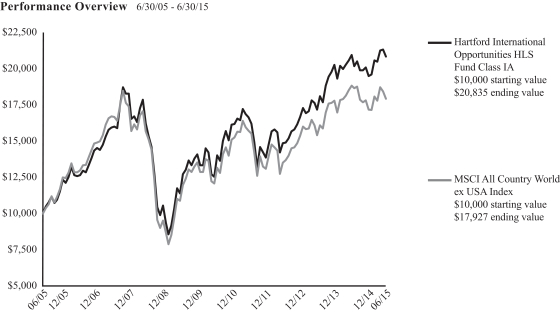

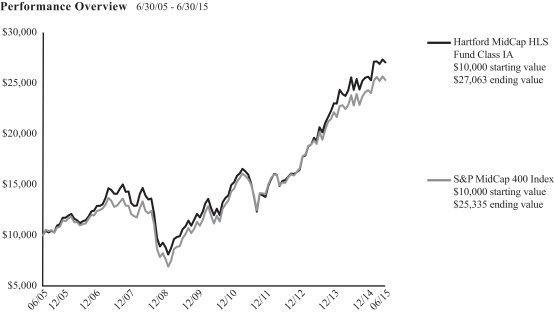

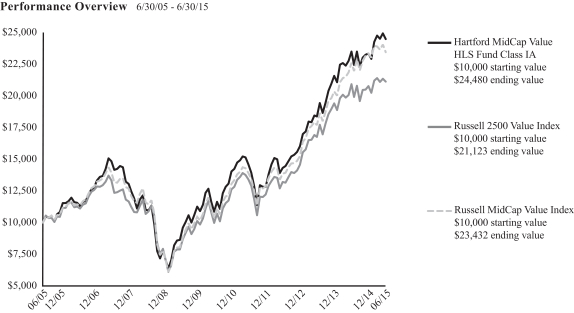

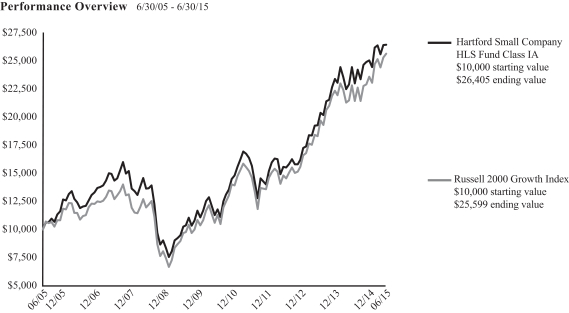

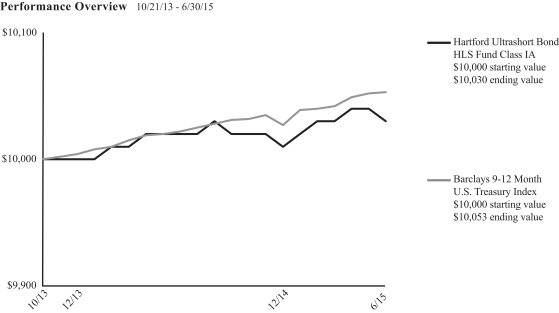

| | | | |