UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | | | |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | | |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | | | |

X-RITE INCORPORATED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

X-Rite, Incorporated

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS AND

PROXY STATEMENT

May 3, 2005

X-RITE, INCORPORATED

3100 44TH Street, S.W.

Grandville, Michigan 49418

Notice of Annual Meeting of Shareholders - May 3, 2005

The Annual Meeting of Shareholders of X-Rite, Incorporated, a Michigan Corporation, will be held at Western Michigan University Conference Center, 200 Ionia Avenue, S.W., Grand Rapids, Michigan, on Tuesday, May 3, 2005, at 9:00 a.m., for the following purposes:

| | 1. | Election of directors as set forth in the accompanying Proxy Statement. |

| | 2. | Approval of Incentive Performance Plan for Certain Executives. |

| | 3. | Such other matters as may properly come before the meeting. |

Shareholders of record as of the close of business on March 24, 2005, are entitled to notice of, and to vote at the meeting. We are pleased to offer multiple options for voting your shares. As detailed in the “Solicitation of Proxies” section of this Notice and Proxy Statement, you can vote your shares via the Internet, by telephone, by mail or by written ballot at the Annual Meeting. We encourage you to vote by the Internet as it is the most cost-effective method. Whether or not you expect to be present at this meeting, you are requested to vote your shares using one of the methods discussed above. If you attend the meeting and wish to vote in person, you may withdraw your Proxy.

|

By Order of the Board of Directors |

Mary E. Chowning |

Secretary |

April 4, 2005

Grandville, Michigan

| | |

| | |  |

| | |

| | |

| | |

| | |

| | |

| | |

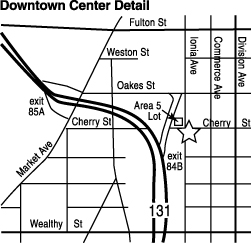

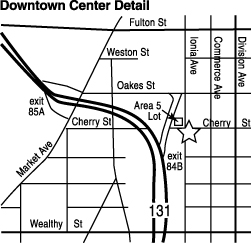

Directions to Annual Meeting Located in downtown Grand Rapids, The Western Michigan University Conference Center is at the corner of Ionia Avenue and Cherry Street with parking on the corner opposite the Center. South of Interstate 196 from U.S. 131, use exit 85A if southbound on 131, or exit 84B if northbound on 131. | |

X-RITE, INCORPORATED

3100 44TH Street, S.W.

Grandville, Michigan 49418

PROXY STATEMENT

April 4, 2005

Solicitation of Proxies

This Proxy Statement, which was first mailed to shareholders on or about April 4, 2005, is furnished in connection with the solicitation of proxies by the Board of Directors of X-Rite, Incorporated (the “Company” or “X-Rite”), to be voted at the Annual Meeting of the shareholders of the Company, which will be held at 9:00 a.m. on Tuesday, May 3, 2005, at the Western Michigan University Conference Center, 200 Ionia Avenue, S.W., Grand Rapids, Michigan, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

Each shareholder, as an owner of the Company, is entitled to vote on matters scheduled to come before the Annual Meeting. The use of a Proxy allows a shareholder of the Company to be represented at the Annual Meeting if he or she is unable to attend the meeting in person. There are four (4) ways to vote your shares:

| | 1. | By the Internet at www.proxyvote.com |

| | 2. | By toll-free telephone at 1-800-690-6903 |

| | 3. | By completing and mailing your Proxy Card or Voter Instruction Form |

| | 4. | By written ballot at the Annual Meeting |

If the enclosed Proxy Card is properly executed using any of the methods described above, the shares represented by the Proxy will be voted at the Annual Meeting of Shareholders or at any adjournment of that meeting. Where shareholders specify a choice, the Proxy will be voted as specified. If no choice is specified, the shares represented by the Proxy will be voted for the election of the directors listed as nominees named in the Proxy, in favor of the approval of Incentive Performance Plan for Certain Executives, and at the discretion of the Proxy voters on any other matters voted upon at the meeting. A Proxy may be revoked prior to its exercise by (1) delivering a written notice of revocation to the Secretary of the Company, (2) delivery of a later-dated Proxy, including by telephone or Internet vote, or (3) attending the meeting and voting in person. Attendance at the Annual Meeting, in and of itself, will not constitute a revocation of a Proxy.

The cost of the solicitation of Proxies will be borne by the Company. In addition to the use of the mails, Proxies may be solicited personally or by telephone or facsimile by a few regular employees of the Company without additional compensation. In addition, brokers, nominees, custodians, and other fiduciaries will be reimbursed by the Company for their expenses in connection with sending proxy materials to beneficial owners.

Voting Securities and Record Date

The Board of Directors has fixed March 24, 2005, as the record date for determining shareholders entitled to vote at the Annual Meeting. On that date 21,121,268 shares of the Company’s common stock, par value $.10 per share, were issued and outstanding. Shareholders are entitled to one vote for each share of the Company’s common stock registered in their names at the close of business on the record date. A majority of the shares entitled to vote represented in person or by proxy will constitute a quorum for action at the Annual Meeting. Abstentions and broker non-votes are counted for the purposes of determining the presence or absence of a quorum for the transactions of business. Abstentions are counted in tabulations of the votes cast on proposals presented to shareholders, whereas broker non-votes are not counted for purposes of determining whether a proposal has been approved.

Electronic Delivery of Proxy Statement and Annual Report

The Proxy Statement and the 2004 Annual Report are available on the Company’s Internet site at www.xrite.com/company_investor_relations.aspx.

1

Most shareholders can elect to receivefuture Proxy Statements and Annual Reports over the Internet instead of receiving paper copies in the mail. If you are a shareholder of record, you can choose this option and save the Company the cost of producing and mailing these documents by:

| • | | Following the instructions provided when you vote over the Internet, or |

| • | | Going to www.xrite.com/company_investor_relations.aspx and following the instructions provided. If you are a shareholder of record and you choose to receive future Proxy Statements and Annual Reports over the Internet, you will receive an e-mail message next year containing the Internet address to access the Company’s Proxy Statement and Annual Report. The e-mail also will include instructions for voting over the Internet. Your choice will remain in effect until you tell us otherwise. |

If you hold your shares in “street name”, and choose to receive future Proxy Statements and Annual Reports over the Internet and your bank, broker or other holder of record participates in the service, you will receive an e-mail message next year containing the Internet address to use to access the Company’s Proxy Statement and Annual Report.

Election of Directors

The Company’s Articles of Incorporation specify that the Board of Directors shall consist of at least six (6), but not more than nine (9) members, with the exact number to be fixed by the Board from time to time. The Board has fixed the number of directors at eight (8). The Articles also specify that the Board of Directors be divided into three classes, with the directors of the classes to hold office for staggered terms of three (3) years each. The Board of Directors has nominated Stanley W. Cheff and John E. Utley for election as directors to three-year terms expiring in 2008. Each of the director nominees is presently serving as a director of the Company.

Unless otherwise specifically directed by a marking on a shareholder’s Proxy, the persons named as proxy voters in the accompanying Proxy will vote for the nominees described below. If any of these nominees were to become unable to serve as a director, which is not now anticipated, the Board of Directors may designate a substitute nominee, in which case the accompanying Proxy will be voted for the substituted nominee. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Directors are elected by a plurality of the votes cast by shareholders entitled to vote on their election at a meeting at which a quorum is present. A “plurality” means that the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors to be elected at the Annual Meeting. Shares for which authority is withheld to vote for director nominees and broker non-votes have no effect on the election of directors except to the extent that the failure to vote for a director nominee results in another nominee receiving a larger number of votes.

The Board of Directors recommends a vote FOR the election of all the persons nominated by the Board.

The content of the following table relating to age and business experience is based upon information furnished to the Company by the nominees and directors.

| | |

| Director Nominees | | |

| |

| Names, (Ages), Positions and Backgrounds of Nominees | | Service as a Director |

|

| Nominees For Terms to Expire in 2008 |

| |

| Stanley W. Cheff (63) retired in 2004 as Chairman of the Board of Wolverine Building Group, a construction firm headquartered in Michigan. Previously, Mr. Cheff served as President and Chief Executive Officer of Wolverine Building Group, holding that position for more than five years. | | Director since 1996 Chairman of Nominating & Governance Committee and Member of the Compensation Committee |

| |

| John E. Utley (64) retired in 1999 as Acting Deputy President of Lucas Varity Automotive. Lucas Varity was headquartered in London, England prior to being sold to TRW, Inc. Prior to that, he served in several senior management positions for more than five years, including Senior Vice President Strategic Marketing for Varity Corporation and served as Chairman of the Board of both Kelsey Hayes Co. and Walbro Corporation. | | Director Since 2000 Chairman of the Board of Directors and Member of the Audit Committee Ex-officio member of all other Board Committees |

2

| | |

| Directors Remaining in Office | | |

| |

| Names, (Ages), Positions and Backgrounds of Nominees | | Service as a Director |

|

| Directors Whose Terms Expire in 2005 and Not Continuing in Office |

| |

| James A. Knister (67) served in several senior management positions for more than five years, including Chief Financial Officer, for Donnelly Corporation (now Magna Donnelly Corporation) until his retirement in 1999. Magna Corporation is a manufacturer of glass related products for the automotive and electronics industries, headquartered in Michigan. | | Director since 1996 Member of the Nominating & Governance Committee |

|

| Directors Whose Terms Expire in 2006 |

| |

| Michael C. Ferrara (62) is the CEO and President of X-Rite, Incorporated and has held that position since July of 2003. For the period June 2001 to 2003, he served as President and COO of X-Rite, Incorporated. Previously, he was the President of Marine Optical Group, a worldwide design and marketing company in the eyewear business headquartered in Boston, Massachusetts, and he held that position for more than five years. | | Director since July 2003 |

| |

| Paul R. Sylvester (45) is CEO and President of Manatron, Inc., a publicly traded company headquartered in Michigan, that specializes in local government software and services. He has held that position since 1996, and originally joined Manatron in 1987 as its Vice President of Finance and CFO. He is a CPA and has served on Manatron’s Board of Directors since 1987. | | Director since January 2003 Chairman of the Audit Committee and Member of Compensation Committee |

| |

| Mark D. Weishaar (47) is CEO and President of Sturgis Molded Products, a custom injection molding company headquartered in Michigan, and has held that position since 1997. Previously, he was Vice President of Business Development at Moore Corporation Limited, a multi-national business forms printer. Mr. Weishaar is a CPA and served as a Partner and Member of the Board of Directors for BDO Seidman, LLP where he worked for 15 years in various capacities. | | Director since January 2003 Member of the Audit Committee |

|

| Directors Whose Terms Expire in 2007 |

| |

| Peter M. Banks (67) is the President of the Institute for the Future, a non-profit research group located in Menlo Park, CA. From April 2003 to January 2004, he was a co-founder, director and CEO of Akonni Biosystems, Inc., a startup venture headquartered in Gregory, Michigan. Prior to that, he had retired in 2000 from ERIM International Inc., a high technology research and development defense systems company headquartered in Michigan, following its purchase by the Veridian Corporation of Washington, D.C. He continued to work as a part-time consultant with Veridian through September of 2002. He currently serves as a director of Tecumseh Products Company, a publicly traded company. | | Director since 1998 Member of the Nominating & Governance Committee and Compensation Committee |

| |

| L. Peter Frieder (61) is the President and CEO of Gentex Corporation, a designer, developer and manufacturer of integrated life support systems for human protection and enhanced human performance headquartered in Carbondale, Pennsylvania. He has held that position for more than five years. Mr. Frieder also serves as a Senior Vice President for U.S. Business Development for Essilor, a publicly traded company on the Paris Exchange, which designs and manufactures corrective lenses worldwide. | | Director since November 2003 Member of the Nominating & Governance Committee |

| |

| Ronald A. VandenBerg (65) is a general business consultant. He served in several senior management positions for more than five years, including Senior Vice President at Donnelly Corporation (now Magna Donnelly Corporation) until his retirement in 1999. Magna Corporation is a manufacturer of glass related products for the automotive and electronics industries, headquartered in Michigan. | | Director since 1989 Chairman of the Compensation Committee |

3

Proposal to approve the Incentive Performance Plan for Certain Executives

Shareholders of the Company are being asked to approve the X-Rite, Incorporated Incentive Performance Plan for Certain Executives, which we refer to as the plan. The board of directors has determined that it is advisable and in the best interests of the Company and the shareholders to adopt the plan. The board of directors has adopted the plan, subject to shareholder approval. The purpose of the plan is to promote the success of the Company by (i) compensating and rewarding participating executives with annual cash bonuses for the achievement of performance targets and (ii) motivating such executives by giving them opportunities to receive bonuses directly related to such performance. The plan is intended to provide bonuses that qualify as performance-based compensation within the meaning of Section 162(m) of the Internal Revenue Code. A copy of the plan is attached hereto as Exhibit A. The following summary of the material features of the Plan is qualified in its entirety by reference to the complete text of the plan.

Section 162(m) generally provides that the Company may not take a federal income tax deduction for compensation in excess of $1,000,000 paid to certain executive officers in any one year. Certain performance-based compensation is exempt from this limit. That is, Section 162(m) does not preclude the Company from taking a federal income tax deduction for certain qualifying performance-based compensation paid to an executive officer in a year even if that compensation exceeds $1,000,000. The plan is structured to satisfy the requirements for performance-based compensation within the meaning of Section 162(m) and related IRS regulations. Section 162(m) requires that certain material terms of the plan, including the business criteria and maximum amounts payable, be approved by the Company’s shareholders.

Eligibility. The persons eligible to participate in the plan are key employees (including elected officers) who are or in the opinion of the compensation committee of the board of directors may be “covered employees” for purposes of Section 162(m).

The Committee. The plan will be administered by the members of the compensation committee of the board of directors who are “outside directors” within the meaning of Section 162(m), which we refer to as the committee. The committee will have the sole authority to establish and administer the business criteria and performance targets and the responsibility of determining the time or times at which and the form and manner in which bonuses will be paid (which may include elective or mandatory deferral alternatives) and will otherwise be responsible for the administration of the plan.

Subject to the limitations of the plan and compliance with Section 162(m), the committee will have the authority to accelerate payment of a bonus (after the attainment of the applicable performance targets) and to waive restrictive conditions for a bonus (including any forfeiture conditions, but not performance targets), in such circumstances as the committee deems appropriate. The committee will have the authority to provide under the terms of an award that payment or vesting will be accelerated upon the death or disability of a participant, a change in control of the Company, or upon termination of the participant’s employment without cause or as a constructive termination, as and in the manner provided by the committee, subject to such provision not causing the award to fail to satisfy the requirements for performance-based compensation under Section 162(m) generally.

Business Criteria. The business criteria applicable to an award may be established with respect to the Company or any applicable subsidiary, division, segment, or unit, on a consolidated or separate basis. Performance targets may be based on one or more of the following business criteria: adjusted operating profit, combined management measure (i.e., EBITA or divisional profit less an asset carrying charge and an R&D adjustment), diluted earnings per share, EBITA, EBITDA, EVA measure, free cash flow, net assets employed, operating profit, profit margin, return on assets, return on equity, return on net assets, revenues, stock appreciation, total revenue growth and total stockholder return.

Bonus. The committee will establish the specific performance targets with respect to an award while the performance relating to the performance targets remains substantially uncertain within the meaning of Section 162(m) and in no event more than 90 days after the commencement of the applicable fiscal year. Each participant may receive a bonus only if the performance targets established by the committee for the award, relative to the applicable business criteria, are attained in the applicable fiscal year. Notwithstanding the fact that the performance targets have been attained, the committee may, in its sole discretion, decide to pay a bonus of less than the amount determined by the formula or standard established by the committee. The maximum aggregate bonus that may be paid pursuant to all awards granted in any fiscal year to any one executive under the plan is four times such executive’s base salary for that fiscal year.

Adjustments. To preserve the intended incentives and benefits of an award, the committee will (a) adjust performance targets or other features of an award to reflect any material change in corporate capitalization, any material corporate transaction (such as a reorganization, combination, separation, merger, acquisition, or any combination of the foregoing), or any complete or partial liquidation of the Company (or any material portion of the Company), and (b) adjust

4

the business criteria and performance targets or other features of an award to reflect the effects of any special charges to the Company’s earnings, in each case only to the extent consistent with generally accepted accounting principles and the requirements of Section 162(m) to qualify such award as performance-based compensation.

Amendments. The committee may, at any time, terminate or, from time to time, amend, modify or suspend the plan, in whole or in part. Notwithstanding the foregoing, no amendment may be effective without board and/or stockholder approval if such approval is necessary to comply with the applicable rules of Section 162(m).

The affirmative vote of holders of a majority of the shares cast at the Meeting, in person or by proxy, will be required for the approval of the Plan.

The X-Rite Board of Directors unanimously recommends that you vote FOR approval of the Plan.

Governance of the Company

The Board has determined that a majority of the Directors are “independent” for purposes of compliance to The Nasdaq Stock Market (“Nasdaq”) listing standards and Securities and Exchange Commission rules adopted to implement provisions of the Sarbanes-Oxley Act of 2002, and that all of the members of the Audit Committee are also “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934 and Nasdaq listing standards. The Board based these determinations primarily on a review of the responses of the Directors to questions regarding employment and compensation history, affiliations and family and other relationships and on discussions with the Directors.

The Board has adopted a charter for each of the three standing committees that address the make-up and functioning of the Board, along with a procedure for shareholder communications and the selection process for Board candidates. The Board has also adopted an Ethical Conduct Policy that applies to all of our employees, officers and Directors; a Code of Ethics for Senior Executive Officers; and a Whistleblower’s Protection Policy. You can find links to these materials on the Company’s website under Investor Relations at www.xrite.com.

Board Attendance

Each member of the Board of Directors is expected to make a reasonable effort to attend all meetings of the Board of Directors, all applicable committee meetings, and each Annual Meeting of Shareholders. While no formal policy with respect to attendance has been adopted, attendance at these meetings is encouraged and expected. All members of the Board attended the 2004 Annual Meeting of Shareholders and each of the current members of the Board is expected to attend the 2005 Annual Meeting of Shareholders. During fiscal 2004, the Board held six (6) meetings and the committees held a total of thirteen (13) meetings. Each director attended at least 75 percent of the aggregate total of the number of meetings of the Board plus the total number of meetings of all applicable committees on which such director served.

Audit Committee

The Audit Committee focuses its efforts on the following three areas:

| | • | | The adequacy of X-Rite, Incorporated’s internal control over financial reporting and the integrity of X-Rite, Incorporated’s consolidated financial statements; |

| | • | | The performance of X-Rite, Incorporated’s internal auditors, if any, and the qualifications, independence and performance of X-Rite, Incorporated’s independent auditors; and |

| | • | | X-Rite, Incorporated’s compliance with legal and regulatory requirements. |

The committee meets periodically with management to consider the adequacy of X-Rite, Incorporated’s internal control over financial reporting. It also discusses these matters with X-Rite, Incorporated’s independent auditors and with appropriate company financial personnel. The committee reviews X-Rite’s consolidated financial statements quarterly and discusses them with management and the independent auditors before those financial statements are filed with the Securities and Exchange Commission. During 2004, the Audit Committee held five (5) meetings.

The committee regularly meets privately with the independent auditors, has the sole authority to retain and dismiss the independent auditors and periodically reviews their performance and independence from management. The independent auditors have unrestricted access and report directly to the committee.

5

Audit Committee Financial Expert.The Board has determined that the Chairman of the committee, Mr. Sylvester and Mr. Weishaar are “audit committee financial experts,” as that term is defined in Item 401(h) of Regulation S-K, and “independent” for purposes of Nasdaq listing standards and Section 10A(m)(3) of the Securities Exchange Act of 1934. The Audit Committee operates under an Audit Committee Charter. The Charter is available on the Company’s website under Investor Relations at www.xrite.com.

Report of the Audit Committee

We have reviewed X-Rite, Incorporated’s audited consolidated financial statements as of and for the fiscal year ended January 1, 2005, and met with both management and Ernst & Young LLP, X-Rite, Incorporated’s independent auditors, to discuss those financial statements. Management has represented to us that the financial statements were prepared in accordance with accounting principles generally accepted in the United States.

Management has primary responsibility for the Company’s consolidated financial statements and the overall reporting process, including the Company’s system of internal controls. The independent auditors audit the annual financial statements prepared by management, express an opinion as to whether those financial statements present fairly, in all material respects, the financial position, results of operations and cash flows of the company in conformity with accounting principles generally accepted in the United States and discuss with us their independence and any other matters they are required to discuss with us or that they believe should be raised with us. We oversee these processes, although we must rely on the information provided to us and on the representations made by management and the independent auditors.

We have received from and discussed with Ernst & Young LLP the written disclosure and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and have discussed with Ernst & Young LLP its independence. These items relate to that firm’s independence from the company. We also discussed with Ernst & Young LLP any matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees).

Based on these reviews and discussions, we recommended to the Board that the Company’s audited financial statements be included in X-Rite, Incorporated’s annual report on Form 10-K for the fiscal year ended January 1, 2005.

|

Paul R. Sylvester, Chairman John E. Utley Mark D. Weishaar |

Nominating and Governance Committee

The Nominating and Governance Committee (the “NGC”) is currently comprised of four (4) members, and all of the members are nonemployee directors of the Company. The primary functions of the NGC include assisting the Board of Directors and the independent directors in matters related to Board composition and size, Board policies (e.g., term limits, service requirements, and retirement), nominations, evaluation of the Board and Board and management succession, director orientation and education, and other corporate governance matters, as are appropriately delegated to it by the Board.

The NGC has a role in identifying director candidates consistent with criteria established by the Board, including the slate of directors presented for election at this Annual Meeting of Shareholders. Historically, the Company has not had a formal policy concerning stockholder recommendations to the NGC (or its predecessors). To date, the Company has not received any recommendations from shareholders requesting that the NGC (or any predecessor) consider a candidate for inclusion among the Committee’s slate of nominees in the Company’s proxy statement. The absence of such a policy does not mean, however, that a recommendation would not have been considered had one been received. The NGC will consider this matter fully during the upcoming year with a view to adopting and publishing a policy on stockholder recommendations for director nominees prior to the 2006 Annual Meeting of Shareholders.

6

In evaluating director nominees, the NGC considers the following factors:

| | • | | the appropriate size of the Company’s Board of Directors; |

| | • | | the needs of the Company with respect to the particular talents and experience of its directors; |

| | • | | the knowledge, skills and experience of nominees, including experience in technology, business, finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; |

| | • | | familiarity with national and international business matters; |

| | • | | experience with accounting rules and practices; |

| | • | | appreciation of the relationship of the Company’s business to the changing needs of society; and |

| | • | | the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members. |

The NGC’s goal is to assemble a Board of Directors that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience. In doing so the NGC also considers candidates with appropriate non-business backgrounds.

Other than the foregoing there are no stated minimum criteria for director nominees, although the NGC may also consider such other factors as it may deem are in the best interests of the Company and its shareholders. The NGC does, however, believe it appropriate for at least one, and, preferably, several, members of the Board to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and that a majority of the members of the Board meet the definition of “independent director” under NASDAQ rules. The NGC also believes it appropriate for certain key members of the Company’s management to participate as members of the Board.

The NGC identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the NGC or the Board decides not to re-nominate a member for re-election, the NGC identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the NGC and Board of Directors are polled for suggestions as to individuals meeting the criteria of the NGC. Research may also be performed to identify qualified individuals. To date, the Company has not engaged third parties to identify or evaluate or assist in identifying potential nominees, although the Company reserves the right in the future to retain a third party search firm, if necessary.

While the NGC is not currently composed entirely of independent directors, it is the goal of the Board of Directors for the NGC to be comprised of all independent members as quickly as is practical. Until the NGC is comprised entirely of independent directors, the independent directors oversee the activities of the NGC as required by applicable laws, rules, regulations, and listing standards. The NGC operates under a Nominating and Governance Committee Charter which is available on the Company’s website under Investor Relations at www.xrite.com. During 2004, the NGC held four (4) meetings.

Compensation Committee - Report on Executive Compensation

The Compensation Committee is currently comprised of four (4) members, and all of the members are nonemployee directors of the Company. The primary function of the Compensation Committee is to assist the Board of Directors and the independent directors on the Board in matters related to compensation as may be appropriately delegated to it by the Board. While the Compensation Committee is not currently comprised entirely of independent directors, it is the goal of the Board for the Compensation Committee to be comprised of all independent members as quickly as is practical. Until the Compensation Committee is comprised entirely of independent directors, the independent directors oversee the activities of the Compensation Committee as required by applicable law, rule, regulation, or listing standard.

7

Compensation Philosophy. The Company’s compensation policies are designed to enhance the Company’s ability to attract, motivate, and retain competent and dedicated management. In constructing and applying these policies, a conscious effort is made to identify and evaluate programs for comparable employers, considering factors such as geography and industry influences, relative sizes, growth stages, and market capitalization. In fulfilling its role to assist the Board of Directors and the independent directors, the Compensation Committee has, at times, enlisted the assistance of a consulting firm to establish a peer group of corporations that can be used for compensation comparison purposes.

Components of Compensation. In general, compensation packages for executive officers are composed of three elements: base salary; annual bonus; and stock-based incentives. Base salary for an executive is determined by the executive’s responsibilities and the Company’s need to be competitive in the market for executive services. Bonus compensation is based on achievement of individual and corporate goals. Stock-based incentives are intended to strengthen the alignment of the interest between the shareholders and senior management and to address long-term performance. The Board of Directors believes the stock ownership of management is of critical importance to the ongoing success of the Company. In the early part of 2004, the Compensation Committee reviewed the annual salary plan with the Chief Executive Officer (“CEO”) for all of the Company’s executive officers, and provided input to the independent directors and the entire Board of Directors to make such adjustments as the independent directors and Board of Directors determined appropriate based upon salary survey data for comparable employers, economic conditions in general, and evaluations by the CEO. Annual salary for the CEO was reviewed by the independent directors and the entire Board of Directors and adjusted based on the same considerations for other executive salaries, plus input from the NGC and its evaluation of the CEO’s performance. The Company established a bonus program for 2004 applicable to all executive officers of the Company. The program has two components. One component is based on individual performance as determined by the independent directors and the entire Board of Directors based on the input of the Compensation Committee, in conjunction with the CEO with respect to other officers. The second component is based on Company-wide economic performance defined to be roughly the return on average assets. Bonuses for the Company’s named executive officers, if any, are reported in the Summary of Compensation Table contained in this Proxy Statement.

The Company, by its independent directors and the entire Board of Directors (with the input of the Compensation Committee), also awarded stock options to six (6) executive officers during 2004 under the Company’s Employee Stock Option Plan, including grants to the named executive officers detailed in the table captioned “Option Grants in Last Fiscal Year” contained herein. The options awarded to the executives other than the CEO were based on evaluations provided by the CEO, and input provided by the Compensation Committee and the NGC to the independent directors and the entire Board of Directors. Each executive’s contribution to achieving agreed upon goals, his or her ability and willingness to influence success, and striving to achieve individual and corporate goals were key factors in the independent directors and Board of Directors determinations. The CEO was also awarded options based primarily on the concept that it is in the best interest of the shareholders to provide incentives for the CEO in the form of stock options, in an amount appropriate relative to the options granted to other executives considering their abilities to influence performance.

Compliance. During 2004, the Company complied with current NASDAQ rules with respect to independent director and/or entire Board of Directors approval of CEO compensation in an executive session where the CEO is not present as well as independent director and/or entire Board of Directors approval requirements of all executive officer compensation. The Compensation Committee operates under a Compensation Committee Charter which is available on the Company’s website under Investor Relations at www.xrite.com. During 2004, the Compensation Committee held four (4) meetings.

|

Compensation Committee: |

Ronald A. VandenBerg, Chairman |

Peter M. Banks |

Stanley W. Cheff |

Paul R. Sylvester |

|

Independent Directors: |

John E. Utley |

L. Peter Frieder |

Paul R. Sylvester |

Ronald A. VandenBerg |

Mark D. Weishaar |

8

Compensation of Directors

Our outside Directors, that is Directors who are not employees of X-Rite, Incorporated, receive an annual retainer of $20,000 ($37,000 for chairperson), plus a meeting fee of $1,000 ($1,500 for chairpersons) for each meeting of the Board or a committee attended with the exception of the Audit Committee where a meeting fee of $1,500 ($2,000 for chairperson) is paid. In addition, each outside director immediately following each Annual Meeting of Shareholders is entitled to receive an option to purchase 8,000 shares of the Company’s common stock at a price per share equal to the fair market value on the previous day. Each option has a term of ten years and becomes exercisable six months following the date of issue.

Shareholder Communications with Directors

The Board has adopted a process for shareholder communications and the selection of new Board candidates. You can find links to these materials on the Company’s website under Investor Relations at: www.xrite.com. Generally, shareholders who want to communicate with the Board or any individual Director can write to:

X-Rite, Incorporated

Corporate Secretary

3100 44th Street, S.W.

Grandville, Michigan 49418

Your letter should indicate that you are an X-Rite, Incorporated shareholder. Depending on the subject matter, management will:

| | • | | Forward the communication to the Director or Directors to whom it is addressed; |

| | • | | Attempt to handle the inquiry directly, for example where it is a request for information about the Company or it is a stock-related matter; or |

| | • | | Not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. |

At each Board meeting, a member of management presents a summary of all communications received since the last meeting that were not forwarded and makes those communications available to the Directors on request.

Our Relationship with Our Independent Auditors

The consolidated financial statements of the Company and its subsidiaries for the year ended January 1, 2005, have been audited by Ernst & Young LLP, independent public accountants

The aggregate fees billed by Ernst & Young LLP for the 2004 and 2003 fiscal years are as follows:

| | | | | | |

| | | 2004

| | 2003

|

Audit Fees | | $ | 567,344 | | $ | 290,184 |

Audit Related Fees | | | 5,500 | | | 61,200 |

Tax Fees | | | 13,095 | | | 42,971 |

Other Fees | | | — | | | — |

| | |

|

| |

|

|

| | | $ | 585,939 | | $ | 394,355 |

| | |

|

| |

|

|

Audit fees include amounts incurred for the annual audits of the Company’s consolidated financial statement, interim reviews of quarterly financial information and statutory audits. Other audit related fees include amounts billed for services that are unrelated to the annual audit, such as S-8 filings and accounting research tool fees. Fees billed for tax services primarily include tax compliance services.

Preapproval Policy for Auditor Services

The Audit Committee’s policy is to preapprove all audit and nonaudit services provided by the Company’s independent auditors. These services may include audit services, audit related services, tax services, and other services. Preapproval is generally provided for up to one (1) year and any preapproval is detailed as to a particular service or category of services and is generally subject to a specific budget. The Audit Committee has delegated preapproval authority to its Chairperson when expedition of service is necessary. Both the Company’s independent auditors and management are required to periodically report to the whole Audit Committee regarding the extent of services provided by the Company’s independent auditors in accordance with this preapproval policy, and the fees for such services.

9

Appointment of Auditors for Fiscal 2005

The Audit Committee has reappointed Ernst & Young LLP as the independent public accounting firm to audit our consolidated financial statements for fiscal 2005.

Representatives of Ernst & Young LLP will be present at the meeting. They will be given the opportunity to make a statement if they desire to do so, and they will be available to respond to appropriate questions.

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of Forms 3, 4, and 5 furnished to the Company during or with respect to the preceding fiscal year and written representations from certain reporting persons, the Company is not aware of any failure by any reporting person to make timely filings of those Forms as required by Section 16(a) of the Securities Exchange Act of 1934.

Securities Ownership of Management

The following table contains information regarding ownership of the Company’s common stock by each director and nominee for election as a director, each executive officer named in the tables under the caption Executive Compensation, and all directors and executive officers as a group. The content of this table is based upon information supplied by the persons identified in the table or known to the Company and represents the Company’s understanding of circumstances in existence as of March 1, 2005.

Amount and Nature of Ownership

| | | | | | | | |

Preliminary

Name of Beneficial Owner | | Shares

Beneficially

Owned(1) | | Exercisable

Options(2) | | Total | | Percent of

Class(3) |

| | | | |

Joan Mariani Andrew | | 39,119 | | 145,000 | | 184,119 | | * |

| | | | |

Peter M. Banks | | 1,000 | | 46,000 | | 47,000 | | * |

| | | | |

Bernard J. Berg | | 30,925 | | 150,000 | | 180,925 | | * |

| | | | |

Stanley W. Cheff | | 3,000 | | 86,000 | | 89,000 | | * |

| | | | |

Mary E. Chowning | | 12,095 | | 35,000 | | 47,095 | | * |

| | | | |

Michael C. Ferrara | | 38,630 | | 122,500 | | 161,130 | | * |

| | | | |

L. Peter Frieder | | 5,250 | | 11,551 | | 16,801 | | * |

| | | | |

James A. Knister | | 2,000 | | 86,000 | | 88,000 | | * |

| | | | |

Jeffrey L. Smolinski | | 24,700 | | 105,000 | | 129,700 | | * |

| | | | |

Paul R. Sylvester | | 500 | | 18,455 | | 18,955 | | * |

| | | | |

John E. Utley | | 5,000 | | 46,000 | | 51,000 | | * |

| | | | |

Ronald A. VandenBerg | | 6,666 | | 66,000 | | 72,666 | | * |

| | | | |

Mark D. Weishaar | | 3,000 | | 18,455 | | 21,455 | | * |

| | | | |

All Directors and Executive Officers as a Group (14 persons) | | 185,899 | | 968,961 | | 1,154,860 | | 5.2 |

*Less than one percent

| (1) | Each person named in the table has sole voting and investment power with respect to the issued shares listed in this column. |

| (2) | This column reflects shares subject to options exercisable as of March 1, 2005, or within 60 days thereafter. |

| (3) | The percentages are calculated on the basis of the number of outstanding shares of common stock plus common stock deemed outstanding pursuant to Rule 13d-3 of the Securities Exchange Act of 1934. |

10

Securities Ownership of Certain Beneficial Owners

The following table contains information regarding ownership of the Company’s common stock by persons or entities beneficially owning more than five percent (5%) of the Company’s common stock. The content of this table is based upon information contained in Schedules 13G furnished to the Company and represents the Company’s understanding of circumstances in existence as of March 1, 2005.

| | | | |

| | | |

Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial Ownership | | Percent of

Class(1) |

| | |

Downtown Associates 674 Unionville Road Kennett Square PA 19348 | | 1,682,700 | | 8.1 |

| | |

Putnam Investments, Inc. One Post Office Square Boston, MA 02109 | | 1,489,754 | | 7.1 |

| | |

Ted Thompson 1980 76th Street, SW Byron Center, MI 49315 | | 1,455,800(2) | | 6.9 |

| | |

Rufus S. Teesdale 3152 East Gatehouse, S.E. Grand Rapids, MI 49546 | | 1,344,942(3) | | 6.4 |

| (1) | The percentages are calculated on the basis of the number of outstanding shares of common stock plus common stock deemed outstanding pursuant to Rule 13d-3 of the Securities Exchange Act of 1934. |

| (2) | Mr. Thompson is one of the original founders of the Company. His holdings include 87,500 shares subject to options exercisable within 60 days of March 1, 2005. His holdings include 160,000 shares held by a trust established by Mr. Thompson’s wife, as to which he disclaims beneficial ownership. |

| (3) | Mr. Teesdale is one of the original founders of the Company. His holdings include 80,000 shares subject to options exercisable within 60 days of March 1, 2005. |

11

Executive Compensation

The following table contains information regarding compensation paid by the Company with respect to each of the last three fiscal years to its chief executive officer and to the four other most highly compensated executive officers who were serving at the end of fiscal year 2004 for services rendered to the Company (the “named executive officers”).

| | | | | | | | | | | | | | |

| Summary Compensation Table |

| | | | | | | | | | Long Term

Compensation

| | |

| | | | | Annual Compensation

| | Restricted

Stock Award(s)

($) | | | Securities

Underlying Options

(#) | | All Other

Compensation

( $)(3) |

| | | Year | | Salary

($) | | | Bonus

($)(2) | | | |

Michael C. Ferrara(1)

Chief Executive Officer | | 2004

2003

2002 | | 372,019

323,029

267,500 |

| | 519,965

591,974

20,000 | | 233,590

137,988

— | (1)(2)

(1)(2)

| | 30,000

75,000

17,500 | | 11,949

10,114

14,431 |

| | | | | | |

Mary E. Chowning

Vice President - Finance

Chief Financial Officer | | 2004

2003 | | 229,231

88,846 |

(4) | | 213,684

175,177 | | 83,280

— | (2)

| | 30,000

5,000 | | 8,601

5,434 |

| | | | | | |

Joan Mariani Andrew

Vice President -

Global Sales | | 2004

2003

2002 | | 220,654

311,425

302,075 |

(5)

(5) | | 206,087

232,126

— | | 232,108

—

— | (2)

| | 20,000

20,000

15,000 | | 17,880

8,153

11,138 |

| | | | | | |

Bernard J. Berg

Senior Vice President -

Engineering | | 2004

2003

2002 | | 203,846

200,000

200,000 |

| | 189,942

244,343

10,000 | | —

—

— |

| | 20,000

20,000

15,000 | | 20,759

19,865

13,629 |

| | | | | | |

Jeffrey L. Smolinski

Vice President -

Operations | | 2004

2003

2002 | | 218,654

189,904

185,000 |

| | 204,187

232,008

— | | —

—

— |

| | 20,000

20,000

15,000 | | 19,004

10,157

11,138 |

| (1) | As part of Mr. Ferrara revised employment contract, he received an award of 10,000 shares of restricted stock on December 31, 2004 and on December 31, 2003. These restricted shares will become fully vested on December 31, 2006. The price used to calculate the value of the shares was $16.36 for the 2004 award and $$11.80 for the 2003 award, representing the closing prices of X-Rite stock on the day prior to grant. The shares were issued under the Company’s Second Restricted Stock Plan and are subject to certain restrictions on transfer and risks of forfeiture. Dividends are paid on these shares to the same extent paid on the Company’s common stock. |

| (2) | Bonuses paid to the executive officers in 2005 with respect to the Company’s 2004 fiscal year may be converted into common stock of the Company, at the election of the executive, pursuant to the Company’s Cash Bonus Conversion Plan. Bonuses are converted at a discount of 50 percent from the market value of the stock at the time the bonus is determined. The shares received are subject to certain restrictions on transfer and risks of forfeiture. Restrictions lapse as to 20 percent of the shares six months after grant and as to 20 percent on each of the first four anniversaries of the grant date, or as to all shares in the event of death, disability, retirement, or change in control of the Company. Dividends are paid on these shares to the same extent paid on the Company’s common stock. Restricted shares issued under the Cash Bonus Conversion Plan and held at the close of the Company’s fiscal year were Mr. Ferrara 3,198 shares in 2003 and 8,068 shares in 2004; Ms. Chowning 9,600 shares in 2004; and Ms. Andrew 3,102 shares in 2001 and 26,756 shares in 2004. Corresponding market values net of purchase price paid as of that same date were Mr. Ferrara $39,207 for 2003 and $73,177 for 2004; Ms. Chowning $87,072 for 2004; and Ms. Andrew $37,100 for 2001 and $242,677 for 2004. |

| (3) | These amounts represent “matching” contributions by the Company pursuant to its 401(k) Plan, annual premiums for term life insurance, and auto allowance attributable to each named executive officer. |

| (4) | Mary E. Chowning joined the Company on July 28, 2003 as its Vice President Finance and Chief Financial Officer. |

| (5) | Included in this amount is base compensation of $190,000 and cost of living, currency and tax differential payments for assignment outside of the U.S. |

12

The following table contains information regarding stock options granted to the named executive officers during the preceding fiscal year.

| | | | | | | | | | |

Option Grants in Last Fiscal Year |

| | | Number of

Securities

Underlying

Options

Granted (1) | | Percent of Options

Granted to

All Employees

In Fiscal Year | | Exercise

Price

($/sh)(2) | | Expiration

Date | | Grant Date

Present Value

($)(3) |

| | | | | |

Michael C. Ferrara | | 30,000 | | 11.7 | | 13.41 | | 2/10/14 | | 201,900 |

| | | | | |

Mary E. Chowning | | 30,000 | | 11.7 | | 13.41 | | 2/10/14 | | 201,900 |

| | | | | |

Joan Mariani Andrew | | 20,000 | | 7.8 | | 13.41 | | 2/10/14 | | 134,600 |

| | | | | |

Bernard J. Berg | | 20,000 | | 7.8 | | 13.41 | | 2/10/14 | | 134,600 |

| | | | | |

Jeffrey L. Smolinski | | 20,000 | | 7.8 | | 13.41 | | 2/10/14 | | 134,600 |

| (1) | Options become exercisable one year after the date of grant and are subject to certain restrictions on transfer and risks of forfeiture. Should a Change of Control event occur, under the terms of the Company’s Employment Arrangement Effective Upon a Change of Control agreement with executive officers, all stock options and stock appreciation rights granted to the executive officer will become fully vested and will not be subject to forfeiture. |

| (2) | The exercise price is the closing price of the Company’s stock on the day prior to the grant date. The price may be paid in cash or by the surrender of outstanding shares. |

| (3) | Present value calculated under the Black-Scholes Valuation Model, assuming a risk-free rate of return of 3.13 percent, 1.18 percent dividend yield, 55 percent volatility, and exercise in 5 years. This model is an alternative suggested by the Securities and Exchange Commission, and the Company neither endorses this particular model nor necessarily agrees with the method for valuing options. The future performance of the Company and the price of its shares will ultimately determine the value of these options. |

The following table contains information regarding the exercise of options during fiscal 2004 by the named executive officers, as well as unexercised options held by them at fiscal year-end.

| | | | | | | | | | | | |

| |

| Aggregate Option Exercises in Last Fiscal Year and Year-end Values |

| | | | | |

| | | Shares

Acquired

on

Exercise(#) | | Value

Realized

($) | | Number of Securities

Underlying Unexercised

Options at Fiscal

Year-End

| | Value of Unexercised

In-the-Money Options at

FiscalYear-End(1)

|

| | | | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Michael C. Ferrara | | — | | — | | 92,500 | | 30,000 | | 681,175 | | 78,000 |

| | | | | | |

Mary E. Chowning | | — | | — | | 5,000 | | 30,000 | | 28,900 | | 78,000 |

| | | | | | |

Joan Mariani Andrew | | — | | — | | 125,000 | | 20,000 | | 724,800 | | 52,000 |

| | | | | | |

Bernard J. Berg | | 10,000 | | 27,518 | | 130,000 | | 20,000 | | 718,500 | | 52,000 |

| | | | | | |

Jeffrey L. Smolinski | | 45,000 | | 308,921 | | 85,000 | | 20,000 | | 321,450 | | 52,000 |

| (1) | Based upon the closing price of $16.01 per share of common stock on December 31, 2004, which is the last trading day of fiscal year 2004. |

13

The following table provides information about the Company’s equity compensation plans as of January 1, 2005.

| | | | | | | | | |

| |

Equity Compensation Plan Summary | |

| | | Number of securities

to be issued upon

exercise of

outstanding options | | | Weighted-average

exercise price of

outstanding options | | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in the first column) | |

Equity compensation plans approved by shareholders | | 2,058,461 | (1) | | $ | 11.93 | | 4,325,677 | (2) |

| | | |

Equity compensation plans not approved by shareholders | | 0 | | | | n/a | | 0 | |

| | |

|

| | | | |

|

|

Total | | 2,058,461 | | | | | | 4,325,677 | |

| (1) | Represents outstanding options to purchase the Company’s Common Stock granted under the X-Rite, Incorporated 2003 and 1993 Employee Stock Option Plans, as amended and restated, and the X-Rite, Incorporated 2003 and 1993 Outside Directors Stock Option Plans, as amended and restated. |

| (2) | Represents options available to purchase the Company’s common stock under the X-Rite, Incorporated 2003 Employee Stock Option Plan and the X-Rite Incorporated 2003 Outside Director Stock Option Plan. Included are 991,138 shares available for issuance under the February 10, 2004 Amended and Restated Employee Stock Purchase Plan. |

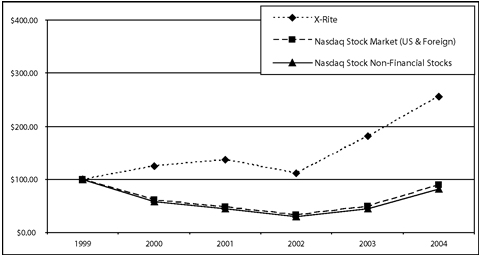

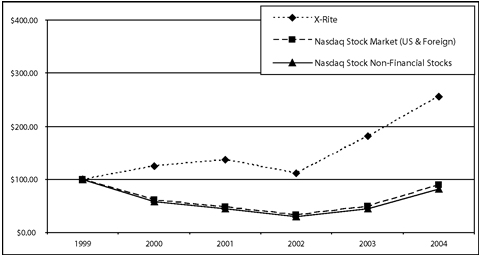

Stock Performance Graph

The following graph depicts the cumulative total return on the Company’s common stock compared to the cumulative total return on the indices for NASDAQ Stock Market (U.S. and foreign) and NASDAQ nonfinancial stocks which is considered to be the Company’s peer group. The graph assumes an investment of $100 on the last trading day of 1999, and reinvestment of dividends in all cases.

Comparison of Five-Year Cumulative Total Returns

Performance Report for X-Rite, Incorporated

| | | | | | | | | | | | |

| | | Year Ended December 31

Cumulative Total Return

|

| | | 12/99

| | 12/00

| | 12/01

| | 12/02

| | 12/03

| | 12/04

|

X-Rite, Incorporated | | 100 | | 125 | | 136 | | 112 | | 181 | | 256 |

Nasdaq Stock Market (U.S. & Foreign) | | 100 | | 60 | | 48 | | 33 | | 49 | | 89 |

Nasdaq Stock Non-Financial Stocks | | 100 | | 58 | | 45 | | 29 | | 45 | | 82 |

14

Other Arrangements

The Company has not adopted any long-term incentive plan or any defined benefit or actuarial plan, as those terms are defined in the applicable regulations promulgated by the Securities and Exchange Commission.

Effective as of a change in control of the Company, the Company has made available to its executive officers’ contracts assuring them of continued employment for a period of three years. In the event of a change in control and the executive’s employment is terminated by the Company during the three-year employment term without good cause, either actually or constructively, the executive is entitled to receive continued compensation and employee benefits for the remainder of the term.

CEO Ferrara has an Employment Agreement with the Company for an initial term of approximately four years, ending December 31, 2007, renewable annually thereafter for three successive one-year periods unless terminated by either party as of the end of the initial term or any renewal term. During its continuation, either party may terminate the Agreement for specified reasons. Mr. Ferrara is entitled to receive cash compensation for a minimum of eighteen months and certain perquisites for the unexpired portion of the then current term if his employment is terminated for any reason other than death, disability, voluntary quit, or discharge for good cause. Mr. Ferrara is obligated not to compete with the Company or solicit its employees for a period of two years after termination of his employment. Mr. Ferrara’s Agreement has been coordinated with the above-described change in control arrangement in the event a change in control of the Company occurs.

At the time former Chairman Ted Thompson retired from his position as the Company’s Chief Executive Officer and retired from day-to-day management of the Company’s affairs, the Company entered into an agreement with Mr. Thompson for the purpose of defining an ongoing relationship with the Company. In addition to specifying his responsibilities, compensation, and benefits, the agreement provided for compensation and insurance benefits for a period of five years after conclusion of his service as Chairman. On September 13, 2001, Mr. Thompson retired as Chairman of the Company and an amendment to that agreement was entered into providing Mr. Thompson certain health benefits in lieu of certain compensation. Mr. Thompson is obligated not to compete with the Company for a period ending two years after termination of the agreement.

Any director of the Corporation serving prior to February 10, 2004, who serves the shorter of at least: (i) nine years or (ii) three maximum length terms of office as a director and who either resigns as a director or does not stand for reelection, shall be entitled to be considered for the position of “Director Emeritus.” If nominated by the Nominating and Governance Committee and elected by the Board of Directors, a Director Emeritus shall continue in that position for a period equal to the time served as a regular director prior to February 10, 2004, or until an earlier resignation or death. During their tenure, Directors Emeritus shall be given notices of all meetings of the Board of Directors, and they shall perform such consulting services for the Corporation as the Board of Directors may reasonably request from time to time. Directors Emeritus shall be entitled to attend and participate in all such meetings of the Board of Directors, except that they may not vote and they shall not be counted for purposes of determining a quorum. Directors Emeritus shall receive an annual cash retainer fee equal to the lesser of: (i) the annual cash retainer fee in place at the time the director resigned as a director or did not stand for reelection; or (ii) the annual cash retainer fee in place at any time during the period such director holds the position of Director Emeritus, and shall be entitled to reimbursement for expenses of attendance at meetings of the Board, but they shall receive no other compensation from the Corporation. Currently, there are five (5) individuals who hold the Director Emeritus position and receive an annual cash retainer fee of $20,000 each. They are Marvin DeVries, Rufus Teesdale, Ted Thompson, Charles VanNamen and Glenn Walters. Messrs. Teesdale and Thompson each beneficially own more than five percent (5%) of the Company’s common stock as reported in the Securities Ownership of Certain Beneficial Owners chart that appears in this Proxy Statement.

Certain Relationships and Related Transactions

XR Ventures, LLC is a joint venture between the Company and Peter M. Banks and James A. Knister. The main focus of XR Ventures was to find, acquire, develop, and operate interests in businesses or technologies important to the growth of new markets for the Company. Prior to December 2003, Dr. Banks and Mr. Knister were responsible for the day-to-day operations of XR Ventures with input from the Company. The Company funded all acquisitions made by XR Ventures and, in exchange, will receive its investment back in full before any distributions are made. The Company will receive 80 percent of the gains on investments. Dr. Banks and Mr. Knister will receive 20 percent of the gains on investments. Dr. Banks and Mr. Knister are reimbursed for their expenses, but receive no salary or additional Board fees relating to XR Ventures. The Company reached the XR Ventures arrangement with Dr. Banks and Mr. Knister through arms-length negotiation, in which the Company was represented by it regular counsel and Dr. Banks and Mr. Knister were represented by separate counsel. In December of 2003, the Company, Dr. Banks and Mr. Knister amended the XR

15

Ventures, LLC agreement, and Dr. Banks and Mr. Knister resigned as managing members in XR Ventures, LLC. Dr. Banks and Mr. Knister remain members of XR Ventures, LLC, but have no formal day to day operating duties.

The Company entered into a five year lease on October 2, 2000 on a facility owned by a partnership in which Stanley W. Cheff is a fifty percent partner. The Company paid $199,833 of rent during 2004 for this facility. The lease agreement was reached through arms-length negotiation with the partnership which was represented by its own counsel. The Board of Directors believes the terms of this lease are at least as favorable to the Company as could have been obtained from unrelated parties.

Shareholder Proposals – Annual Meeting

Any proposal of a shareholder must be received by the Company at its headquarters, 3100 44th Street, S.W., Grandville, Michigan 49418, no later than December 5, 2005 in order to be considered for inclusion in the Company’s Proxy Statement relating to the 2006 Annual Meeting. Shareholders who wish to submit a proposal not intended to be included in the Company’s Proxy Statement relating to the 2006 Annual Meeting, but to be presented at that meeting, and who propose to nominate a director for election at that meeting, are required by the Company’s Articles of Incorporation and Bylaws to provide notice of such proposal or nomination to the Company. Nominations for directors must be received not later than thirty days prior to the date of the Annual Meeting (or within seven days after the Company mails, or otherwise gives notice of the date of such meeting, if such notice is given less than forty days prior to the meeting date). All other proposals must be received not less than sixty nor more than ninety days prior to the scheduled meeting date, provided, that if less than seventy days notice, or prior public disclosure of the date of a scheduled meeting is given or made, notice by the shareholder to be timely must be received not later than the close of business on the tenth day following the earlier of the day on which such notice of the date of the scheduled meeting was mailed or the day on which such public disclosure was made. This notice must contain the information required by the Company’s Articles Incorporation and Bylaws and must be submitted in accordance with the procedures outlined therein.

Miscellaneous

The Company’s Annual Report to Shareholders including financial statements, as well as the Company’s annual report on Form 10-K, is being mailed to shareholders with this Proxy Statement.

Management is not aware of any matters to be presented for action at the Annual Meeting other than as set forth in this Proxy Statement. If other business should come before the meeting, the persons named as proxy holders in the accompanying Proxy intend to vote the shares in accordance with their judgment, and discretionary authority to do so is included in the Proxy.

SHAREHOLDERS ARE URGED TO PROMPTLY DATE, SIGN, AND RETURN

THE ACCOMPANYING PROXY IN THE ENCLOSED ENVELOPE.

|

| By Order of the Board of Directors |

Mary E. Chowning |

Secretary |

April 4, 2005

Grandville, Michigan

16

Exhibit A

X-RITE, INCORPORATED

INCENTIVE PERFORMANCE PLAN FOR CERTAIN EXECUTIVES

The purpose of X-Rite, Incorporated Incentive Performance Plan for Certain Executives (the “Plan”) is to promote the success of X-Rite, Incorporated by (i) compensating and rewarding participating executives with annual cash bonuses for the achievement of performance goals and (ii) motivating such executives by giving them opportunities to receive bonuses directly related to such performance. This Plan is intended to provide bonuses that qualify as performance-based compensation within the meaning of Section 162(m) of the Internal Revenue Code.

“Award ” means an award under this Plan of an opportunity to receive a Bonus if the applicable Performance Target(s) are achieved for the applicable Fiscal Year.

“Award Notice ” means a notice in writing (delivered either in hard copy or electronically) evidencing the grant of an Award under this Plan that has been authorized by the Compensation Committee of the Board of Directors.

“Base Salary ” in respect of any Fiscal Year means the annual base salary of a Participant from the Company and all affiliates of the Company in effect at the time Participant is selected to participate for that Fiscal Year, exclusive of any commissions or other actual or imputed income from any Company-provided benefits or perquisites, but prior to any reductions for salary deferred pursuant to any deferred compensation plan or for contributions to a plan qualifying under Section 401(k) of the Code or contributions to a cafeteria plan under Section 125 of the Code.

“Board ” means the Board of Directors of X-Rite, Incorporated.

“Bonus ” means a cash payment under this Plan.

“Business Criteria ” means any one or a combination of the business criteria set forth on Appendix A hereto.

“Code ” means the Internal Revenue Code of 1986, as amended from time to time.

“Committee ” means the members of the Compensation Committee of the Board who are “outside directors” within the meaning of Section 162(m) of the Code.

“Company ” means X-Rite, Incorporated and its Subsidiaries.

“X-Rite, Incorporated ” means X-Rite, Incorporated, a Michigan corporation, and any successor entity which shall have assumed the rights and obligations of this Plan by operation of law or otherwise.

“Executive ” means a key employee (including any elected officer) of the Company who is (or in the opinion of the Committee may become) a “covered employee” for purposes of Section 162(m).

“Participant ” means an Executive selected to participate in the Plan by the Committee for the applicable Fiscal Year.

“Performance Target(s) ” means the specific objective goal or goals that are timely set in writing by the Committee pursuant to Section 4.2 for each Participant for the Fiscal Year in respect of any one or more of the Business Criteria.

“Plan ” means X-Rite, Incorporated Executive Officer Bonus Plan, as amended from time to time.

“Fiscal Year ” means the twelve months ended December 31.

“Section 162(m) ” means Section 162(m) of the Code, and the regulations promulgated thereunder, all as amended from time to time.

“Subsidiary ” means a corporation, partnership, limited liability company or other entity in which X-Rite, Incorporated owns, directly or indirectly, capital stock or other interests having ordinary voting power to elect a majority of the Board of Directors or other governing body.

A-1

| 3. | Administration of the Plan. |

3.1The Committee.This Plan shall be administered by the Committee, which shall consist solely of two or more members of the Board who are “outside directors” within the meaning of Section 162(m). Action of the Committee with respect to the administration of this Plan shall be taken pursuant to a majority vote or by written consent of its members.

3.2Powers of the Committee.Subject to the express provisions of this Plan and Section 4.8 of the Plan, the Committee shall have the sole authority to establish and administer the Business Criteria and Performance Target(s) and the responsibility of determining the time or times at which and the form and manner in which Bonuses will be paid (which may include elective or mandatory deferral alternatives) and shall otherwise be responsible for the administration of this Plan in accordance with its terms. The Committee shall have the authority to construe and interpret this Plan and any agreements or other document relating to Awards under this Plan, may adopt rules and regulations relating to the administration of this Plan, and shall exercise all other duties and powers conferred on it by this Plan.

3.3Express Authority (and Limitations on Authority) to Change Terms and Conditions of Awards; Acceleration of Payment. Without limiting the Committee’s authority under other provisions of this Plan, but subject to any express limitations of this Plan and compliance with Section 162(m), the Committee shall have the authority to accelerate payment of a Bonus (after the attainment of the applicable Performance Target(s)) and to waive restrictive conditions for a Bonus (including any forfeiture conditions, but not Performance Target(s)), in such circumstances as the Committee deems appropriate. In addition, and notwithstanding anything in this Plan to the contrary, the Committee shall have the authority to provide under the terms of an Award that payment or vesting shall be accelerated upon the death or disability of a Participant, a change in control of the Company, or upon termination of the Participant’s employment without cause or as a constructive termination, as and in the manner provided by the Committee, subject to such provision not causing the Award to fail to satisfy the requirements for performance-based compensation under Section 162(m) generally.

4.1Provision for Bonus.Each Participant may receive a Bonus if and only if the Performance Target(s) established by the Committee for the Award, relative to the applicable Business Criteria, are attained in the applicable Fiscal Year. Notwithstanding the fact that the Performance Target(s) have been attained, the Committee may, in its sole discretion, decide to pay a Bonus of less than the amount determined by the formula or standard established pursuant to Section 4.2 or to pay no Bonus at all.

4.2Determination of Performance Target(s).The Committee must establish the specific Performance Target(s) with respect to an Award while the performance relating to the Performance Target(s) remains substantially uncertain within the meaning of Section 162(m) and in no event more than 90 days after the commencement of the applicable Fiscal Year. At the time the Performance Target(s) for an Award are selected, the Committee shall provide, in terms of an objective formula or standard for each Participant, the method of computing the specific amount of Bonus and maximum amount of Bonus that will be payable to the Participant if the Performance Target(s) are attained, subject to Sections 4.1, 4.3, 4.6 and 4.7.

4.3Maximum Individual Bonus.Notwithstanding any other provision hereof, the maximum aggregate Bonus that may be paid pursuant to all Awards granted in any Fiscal Year to any one Executive under this Plan is four times such Executive’s Base Salary for that Fiscal Year.

4.4Effective Mid-Year Commencement of Service; Termination of Employment.To the extent compatible with Sections 4.2 and 5.5, if an individual’s services as an Executive commence after the Performance Target(s) are established for a Fiscal Year, the Committee may establish Performance Target(s), grant an Award and pay a Bonus to such Executive for a performance period equal to the period of time from the date such individual is selected to participate in the Plan to the end of the Fiscal Year; provided, however, that the Committee must establish such Performance Target(s) while the performance relating to such Performance Target(s) remains substantially uncertain within the meaning of Section 162(m) and in no event after 25% of such performance period has elapsed. The amount of any Bonus to such Executive shall not exceed that proportionate amount of the applicable maximum individual bonus under Section 4.3. In the event of the termination of employment of a Participant prior to the end of the Fiscal Year, the Participant shall not be entitled to any payment in respect of the Bonus, unless otherwise expressly provided by the terms of the Award Notice or other written contract with the Company.

4.5Adjustments.To preserve the intended incentives and benefits of an Award, the Committee shall (a) adjust Performance Target(s) or other features of an Award to reflect any material change in corporate capitalization, any material corporate transaction (such as a reorganization, combination, separation, merger, acquisition, or any combination of the foregoing), or any complete or partial liquidation of the Company (or any material portion of the Company), and (b) adjust Business Criteria and Performance Target(s) or other features of an Award to reflect the effects of any special charges to the Company’s earnings, in each case only to the extent consistent with generally accepted accounting principles and the requirements of Section 162(m) to qualify such Award as performance-based compensation.

A-2

4.6Committee Discretion to Determine Bonuses.The Committee has the sole discretion to determine the standard or formula pursuant to which each Participant’s Bonus shall be calculated (in accordance with Sections 4.1 and 4.2) and whether all or any portion of the amount so calculated will be paid, subject in all cases to the terms, conditions and limits of this Plan and of any other written commitment authorized by the Committee. The Committee may not increase the maximum amount permitted to be paid to any individual under Section 4.2 or 4.3 of this Plan or pay a Bonus under this Plan if the applicable Performance Target(s) have not been satisfied.

4.7Committee Certification.No Participant shall receive any payment under this Plan unless the Committee has certified, by resolution or other appropriate action in writing, that the amount thereof has been accurately determined in accordance with the terms, conditions and limits of this Plan and that the Performance Target(s) and any other material terms previously established by the Committee or set forth in this Plan or the applicable Award Notice were in fact satisfied.