SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | |

| | ¨ Confidential, for Use of the Commission Only (as permittedby Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

¨ Definitive Additional Materials | | |

¨ Soliciting Material Pursuant to Section 240.14a-12 | | |

X-Rite

(Name of Registrant as Specified In Its Charter)

[NOT APPLICABLE]

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

[Not Applicable]

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

[Not Applicable]

X-RITE, INCORPORATED

3100 44TH Street, S.W.

Grandville, Michigan 49418

Notice of Annual Meeting of Shareholders

The Annual Meeting of Shareholders of X-Rite, Incorporated, a Michigan Corporation, will be held at Western Michigan University Conference Center, 200 Ionia Avenue, S.W., Grand Rapids, Michigan, on Tuesday, August 22, 2006, at 8:00 a.m., for the following purposes:

| | 1. | Election of directors as set forth in the accompanying Proxy Statement. |

| | 2. | Approval of the X-Rite, Incorporated 2006 Omnibus Long Term Incentive Plan |

| | 3. | Such other matters as may properly come before the meeting. |

Shareholders of record as of the close of business on July 14, 2006, are entitled to notice of, and to vote at the meeting. We are pleased to offer multiple options for voting your shares. As detailed in the “Solicitation of Proxies” section of this Notice and Proxy Statement, you can vote your shares via the Internet, by telephone, by mail or by written ballot at the Annual Meeting. We encourage you to vote by the Internet as it is the most cost-effective method. Whether or not you expect to be present at this meeting, you are requested to vote your shares using one of the methods discussed above. If you attend the meeting and wish to vote in person, you may withdraw your Proxy.

|

By Order of the Board of Directors Mary E. Chowning Secretary |

July 24, 2006

Grandville, Michigan

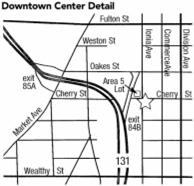

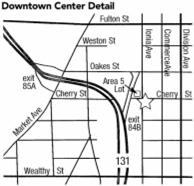

Directions to Annual Meeting

Located in downtown Grand Rapids, The Western Michigan University Conference Center is at the corner of Ionia Avenue and Cherry Street with parking on the diagonal corner opposite the Center.

South of Interstate 196 from U.S. 131, use exit 85A if southbound on 131, or exit 84B if northbound on 131.

X-RITE, INCORPORATED

3100 44TH Street, S.W.

Grandville, Michigan 49418

PROXY STATEMENT

July 24, 2006

Solicitation of Proxies

This Proxy Statement, which was first mailed to shareholders on or about July 24, 2006, is furnished in connection with the solicitation of proxies by the Board of Directors of X-Rite, Incorporated (the “Company” or “X-Rite”), to be voted at the Annual Meeting of the shareholders of the Company, which will be held at 8:00 a.m. on Tuesday, August 22, 2006, at the Western Michigan University Conference Center, 200 Ionia Avenue, S.W., Grand Rapids, Michigan, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

Each shareholder, as an owner of the Company, is entitled to vote on matters scheduled to come before the Annual Meeting. The use of a Proxy allows a shareholder of the Company to be represented at the Annual Meeting if he or she is unable to attend the meeting in person. There are four (4) ways to vote your shares:

| | 1. | By the Internet at www.proxyvote.com |

| | 2. | By toll-free telephone at 1-800-690-6903 |

| | 3. | By completing and mailing your Proxy Card |

| | 4. | By written ballot at the Annual Meeting |

If the enclosed Proxy Card is properly executed using any of the methods described above, the shares represented by the Proxy will be voted at the Annual Meeting of Shareholders or at any adjournment of that meeting. Where shareholders specify a choice, the Proxy will be voted as specified. If no choice is specified on a properly executed Proxy Card, the shares represented by the Proxy will be voted for the election of the directors listed as nominees named in the Proxy, in favor of the approval of the X-Rite, Incorporated 2006 Omnibus Long Term Incentive Plan, and at the discretion of the Proxy voters on any other matters voted upon at the meeting. A Proxy may be revoked prior to its exercise by (1) delivering a written notice of revocation to the Secretary of the Company, (2) delivery of a later-dated Proxy, including by telephone or Internet vote, or (3) attending the meeting and voting in person. Attendance at the Annual Meeting, in and of itself, will not constitute a revocation of a Proxy.

The cost of the solicitation of Proxies will be borne by the Company. In addition to the use of the mails, Proxies may be solicited personally or by telephone or facsimile by a few regular employees of the Company without additional compensation. In addition, brokers, nominees, custodians, and other fiduciaries will be reimbursed by the Company for their expenses in connection with sending proxy materials to beneficial owners.

Voting Securities and Record Date

The Board of Directors has fixed July 14, 2006 as the record date for determining shareholders entitled to vote at the Annual Meeting. On that date 28,582,868 shares of the Company’s common stock, par value $.10 per share, were issued and outstanding. Shareholders are entitled to one vote for each share of the Company’s common stock registered in their names at the close of business on the record date. A majority of the shares entitled to vote represented in person or by proxy will constitute a quorum for action at the Annual Meeting. Abstentions and broker non-votes are counted for the purposes of determining the presence or absence of a quorum for the transactions of business. Abstentions are counted in tabulations of the votes cast on proposals presented to shareholders, whereas broker non-votes are not counted for purposes of determining whether a proposal has been approved.

1

Electronic Delivery of Proxy Statement and Annual Report

The Proxy Statement and the 2005 Annual Report are available on the Company’s website under Investor Relations at www.xrite.com.

Most shareholders can elect to receivefuture Proxy Statements and Annual Reports over the Internet instead of receiving paper copies in the mail. If you are a shareholder of record, you can choose this option and save the Company the cost of producing and mailing these documents by:

| | • | | Following the instructions provided when you vote over the Internet, or |

| | • | | Going to the Company’s website under Investor Relations at www.xrite.com and following the instructions provided. |

If you are a shareholder of record and you choose to receive future Proxy Statements and Annual Reports over the Internet, you will receive an e-mail message next year containing the Internet address to access the Company’s Proxy Statement and Annual Report. The e-mail also will include instructions for voting over the Internet. Your choice will remain in effect until you tell us otherwise.

If you hold your shares in “street name”, and choose to receive future Proxy Statements and Annual Reports over the Internet and your bank, broker or other holder of record participates in the service, you will receive an e-mail message next year containing the Internet address to use to access the Company’s Proxy Statement and Annual Report.

Election of Directors

The Company’s Articles of Incorporation specify that the Board of Directors shall consist of at least six (6), but not more than nine (9) members, with the exact number to be fixed by the Board from time to time. The Board has fixed the number of directors at nine (9). The Articles also specify that the Board of Directors be divided into three classes, with the directors of the classes to hold office for staggered terms of three (3) years each. The Board of Directors has nominated Paul R. Sylvester and Mark D. Weishaar for election as directors to three-year terms expiring in 2009, and Michael C. Ferrara for election as a director to a one-year term expiring in 2007. Each of these director nominees is presently serving as a director of the Company. The Board of Directors has nominated Mario M. Fontana for election as a director to a three-year term expiring in 2009, Dr. Massimo S. Lattmann for election as a director to a two-year term expiring in 2008, and Gideon Argov for election as a director to a one-year term expiring in 2007. Messrs. Fontana, Lattmann and Argov were appointed to the Board of Directors in July 2006 in connection with the Company’s acquisition of Amazys Holding AG to fill the vacancies created by the resignations of Peter M. Banks and Ronald A. VandenBerg and the increase in the size of the Board from eight (8) members to nine (9). The Company’s Articles of Incorporation require that directors like Messrs. Fontana, Lattmann and Argov, who were appointed to the Board of Directors, stand for reelection at the first annual meeting of shareholders after their appointment.

Unless otherwise specifically directed by a marking on a shareholder’s Proxy, the persons named as proxy voters in the accompanying Proxy will vote for the nominees described below. If any of these nominees were to become unable to serve as a director, which is not now anticipated, the Board of Directors may designate a substitute nominee, in which case the accompanying Proxy will be voted for the substituted nominee. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Directors are elected by a plurality of the votes cast by shareholders entitled to vote on their election at a meeting at which a quorum is present. A “plurality” means that the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors to be elected at the Annual Meeting. Any shares for which authority is withheld to vote for director nominees and broker non-votes have no effect on the election of directors except to the extent that the failure to vote for a director nominee results in another nominee receiving a larger number of votes.

The Board of Directors recommends a vote FOR the election of all the persons nominated by the Board.

2

The content of the following table relating to age and business experience is based upon information furnished to the Company by the nominees and directors.

Director Nominees

| | |

Names, (Ages), Positions and Backgrounds of Nominees | | Service as a Director |

|

| Nominees For Terms to Expire in 2009 |

| |

| Mario M. Fontana (59) has served as Chairman of Amazys’ board of directors since 2004. In the past 6 years, Mr. Fontana has served as a member of the board of directors of various public companies. Mr. Fontana currently serves on the board of directors of Swissquote, Inficon and Dufry, all listed on the Swiss Stock Exchange. He also serves on the board of SBB, the Swiss Railways Company and Hexagon, a company listed on the Swedish Stock Exchange. Prior to his board activities, Mr. Fontana held senior executive positions at Hewlett-Packard for over 15 years. Mr. Fontana received a Master of Science Degree from ETH Zurich and the Georgia Institute of Technology. | | Director since July 2006 Member of the Nominating & Governance Committee |

| |

| Paul R. Sylvester (46) is CEO and President of Manatron, Inc., a publicly traded company headquartered in Michigan that specializes in local government software and services. He has held that position since 1996, and originally joined Manatron in 1987 as its Vice President of Finance and CFO. He is a CPA and has served on Manatron’s board of directors since 1987. | | Director since January 2003 Chairman of the Audit Committee and Member of Compensation Committee |

| |

| Mark D. Weishaar (48) is CEO and President of Sturgis Molded Products, a custom injection molding company headquartered in Michigan, and has held that position since 1997. Previously, he was Vice President of Business Development at Moore Corporation Limited, a multi-national business forms printer. Mr. Weishaar is a CPA and served as a Partner and Member of the board of directors for BDO Seidman, LLP where he worked for 15 years in various capacities. | | Director since January 2003 Chairman of the Compensation Committee and Member of the Audit Committee |

|

| Nominees For Terms to Expire in 2008 |

| |

| Dr. Massimo S. Lattmann (63) has served on Amazys’ board of directors since 1997. Since 1997, Dr. Lattmann has been Founder, Senior Partner and Chairman of Venture Partners AG. Dr. Lattmann received a Dr. sc. techn. and a M.Sc. from ETH Zurich. | | Director since July 2006 Member of the Audit Committee |

|

| Nominees For Terms to Expire in 2007 |

| |

| Gideon Argov (49) served on Amazys’ board of directors since 1997. Mr. Argov is President and CEO of Entegris, taking the helm of the company immediately after its merger with Mykrolis finalized on August 5, 2005. He had served as CEO of Mykrolis since November 2004. Prior to joining Mykrolis, Mr. Argov was managing director of Parthenon Capital, a Boston- based private equity partnership, since 2001. Mr. Argov currently serves on the boards of directors for Fundtech Corporation and Interline Brands, Inc. Mr. Argov received a BA in Economics from Harvard University and an MBA from Stanford University. | | Director since July 2006 Member of the Compensation Committee |

| |

| Michael C. Ferrara (63) is the CEO and President of the Company and has held that position since July of 2003. For the period June 2001 to 2003, he served as President and COO of the Company. Previously, he was the President of Marine Optical Group, a worldwide design and marketing company in the eyewear business headquartered in Boston, Massachusetts, and he held that position for more than five years. Mr. Ferrara is a graduate of Villanova University where he received a Bachelor of Science in Electrical Engineering. Additionally, Mr. Ferrara was nominated to and successfully completed the Professional Management Degree Program at Harvard Business School, as well as completing the Carnegie-Mellon Senior Executive Management Program. | | Director since July 2003 |

3

| | |

| Directors Whose Terms Expire in 2007 |

| |

| L. Peter Frieder (63) is the President and CEO of Gentex Corporation, a designer, developer and manufacturer of integrated life support systems for human protection and enhanced human performance headquartered in Carbondale, Pennsylvania. He has held that position for more than five years. Mr. Frieder also serves as a Senior Vice President for U.S. Business Development for Essilor, a publicly traded company on the Paris Stock Exchange, which designs and manufactures corrective lenses worldwide. | | Director since November 2003 Member of the Nominating & Governance Committee |

|

| Directors Whose Terms to Expire in 2008 |

| |

| Stanley W. Cheff (65) retired in 2004 as Chairman of the Board of Wolverine Building Group, a construction firm headquartered in Michigan. Previously, Mr. Cheff served as President and Chief Executive Officer of Wolverine Building Group, holding that position for more than five years. | | Director since 1996 Chairman of Nominating & Governance Committee and Member of the Compensation Committee |

| |

| John E. Utley (65) retired in 1999 as Acting Deputy President of Lucas Varity Automotive. Lucas Varity was headquartered in London, England prior to being sold to TRW, Inc. Prior to that, he served in several senior management positions for more than five years, including Senior Vice President Strategic Marketing for Varity Corporation and served as Chairman of the Board of both Kelsey Hayes Co. and Walbro Corporation. | | Director since 2000 Chairman of the Board of Directors and Member of the Audit Committee, Nominating & Governance Committee, and Ex-officio member of all other Board Committees |

Proposal to approve the X-Rite, Incorporated 2006 Omnibus Long Term Incentive Plan

The Board of Directors of X-Rite, Incorporated (the “Board”) believes that the continued growth and profitability of X-Rite, Incorporated (the “Company”) depends, in part, on the ability of the Company to attract and retain highly qualified employees. In order to achieve this objective, the Board has determined that it is in the best interests of the Company and its shareholders to adopt the X-Rite, Incorporated 2006 Omnibus Long Term Incentive Plan (the “Plan”). The Board believes that the Plan will encourage stock ownership among officers and certain management employees, which will provide an incentive for such employees to expand and improve the profits and prosperity of the Company. The Board also believes the Plan will make service on the Board more attractive to present and prospective outside directors, as well as provide directors additional incentive to direct the Company effectively. Further, the Board believes the Plan will encourage stock ownership by certain consultants and advisors, which will provide an incentive to expand and improve the profits and prosperity of the Company and make continued service to the Company more attractive. Accordingly, on June 30, 2006, the Board adopted the Plan, subject to shareholder approval. A copy of the Plan is attached hereto asExhibit A. The following summary of the material features of the Plan is qualified in its entirety by reference to the complete text of the Plan.

The affirmative vote of holders of a majority of the shares cast at the Meeting, in person or by proxy, will be required for the approval of the Plan.

The Board unanimously recommends that you vote FOR approval of the Plan.

Summary of the 2006 Omnibus Long Term Incentive Plan

The purpose of the Plan is to provide officers and key employees of the Company and its subsidiaries, members of the Board, and certain consultants and advisors who perform services for the Company or its subsidiaries with the opportunity to be granted shares of Common Stock of the Company (“Common Stock”) or receive monetary payments based on the long term economic performance of the Company. If the Plan is approved by the shareholders, no further grants shall be made under the following previously approved plans: the X-Rite, Incorporated Amended and Restated Employee Stock Option Plan, effective January 26, 2003; the X-Rite, Incorporated Amended and Restated Outside Director Stock Option Plan, effective January 26, 2003; and the X-Rite, Incorporated Second Restricted Stock Plan, effective as of March 13, 1999. Instead, all grants to individuals eligible for this Plan shall be made under this Plan.

4

The Plan will be administered by a compensation committee (the “Committee”), which may consist of two or more “outside directors” as defined under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and “non-employee directors” as defined under Rule 16b-3 of the Securities Exchange Act of 1934, as amended. The Committee has the sole authority (consistent with the Plan document) to determine who receives an Award (defined below), the type, size and terms of the Award, the time when an Award will be granted, the duration of any applicable exercise and vesting period of an Award, and the ability to accelerate an Award. The aggregate number of shares of Common Stock that may be subject to Awards shall be 3,500,000 shares of Common Stock; provided that the maximum number of shares of Common Stock that may be subject to Restricted Stock Awards and Restricted Stock Units shall be 1,000,000. The maximum number of shares of Common Stock with respect to which Restricted Stock Awards and Restricted Stock Units may be granted in any one calendar year shall be 200,000. The maximum number of shares of Common Stock that may be granted to any individual participant in one calendar year shall be 125,000.

All employees, officers and directors of the Company and its subsidiaries, as well as consultants and advisors to the Company or its subsidiaries are eligible to participate in the Plan as determined by the Committee. Awards may be granted in any combination of (a) Stock Options, (b) Stock Appreciation Rights, (c) Restricted Stock; and (d) Restricted Stock Units (collectively, “Awards”):

Stock Options. Stock Options may be (i) “incentive stock options” within the meaning of Section 422(b) of the Code (“Incentive Stock Options”) or (ii) Stock Options that do not qualify as Incentive Stock Options (“Nonqualified Stock Options”). The exercise price per share of Common Stock subject to a Stock Option shall be determined by the Committee and may not be less than fair market value. The exercise period of each Stock Option granted will be no greater than 10 years. Incentive Stock Options may be granted only to employees of the Company or its subsidiaries, but may not be granted to a participant who, at the time of the grant, owns stock possessing more than 10% of the total combined voting power of all outstanding Company Stock except under certain conditions. In no event shall any outstanding Stock Option be cancelled with an exercise price greater than the then current fair market value of the Common Stock for purposes of reissuing any other Award to a participant at a lower exercise price, nor shall the exercise price of an outstanding Stock Option be reduced, without shareholder approval.

Stock Appreciation Rights. Stock Appreciation Rights provide a participant with the right to receive a payment in an amount equal to the excess of the (i) fair market value, or other specified value, of a specified number of shares of Common Stock, over (ii) the fair market value of such shares on the date of grant, or other specified value. Stock Appreciation Rights must expire no later than 10 years from the date of their grant. In no event shall any outstanding Stock Appreciation Right be cancelled with a grant price greater than the then current fair market value of the Common Stock for purposes of reissuing any other Award to a participant at a lower grant price, nor shall the grant price of an outstanding Stock Appreciation Right be reduced, without shareholder approval.

Restricted Stock Awards. Restricted Stock Awards consist of Common Stock transferred to participants, which may be subject to restrictions such as the ability to sell or the right of the Company to reacquire the shares for no consideration upon termination of the participant’s employment within specified periods or prior to becoming vested.

Restricted Stock Units. Restricted Stock Units consist of the right to receive Common Stock at a date on or after vesting in accordance with terms and conditions established by the Committee, including the attainment of performance criteria specified by the Committee.

Awards may be granted under the Plan such that they qualify for the performance based compensation exemption of Section 162(m) of the Code (“Performance-Based Awards”). The granting, vesting or payment of such Performance-Based Awards will only be based on one or more of the following factors to be used by the Committee for creating performance-based goals applicable to a given period: net sales; pretax income before allocation of corporate overhead and bonus; budget; earnings per share; net income; division, group or corporate financial goals; return on stockholders’ equity; return on assets; attainment of strategic and operational initiatives; appreciation in and/or maintenance of the price of Common Stock or any other publicly-traded securities of the Company; market share; gross profits; earnings before interest and taxes; earnings before interest, taxes, depreciation and amortization; economic value-added models and comparisons with various stock market indices; reductions in costs; or any combination of the foregoing.

5

The Board may determine that, upon the occurrence of a change in control of the Company, all or a portion of each outstanding Award shall become exercisable, payable in full, or terminate within a specified number of days after notice to the participant. The Board may amend or terminate any or all of the provisions of the Plan; provided, however, that no such action will be made without shareholder approval where the amendment would (i) increase the total number of shares which may be issued under the Plan or (ii) increase the maximum number of shares which may be issued to any individual participant under the Plan. No amendment or termination of the Plan may adversely affect in a material manner any right of any participant with respect to any Award previously granted without such participant’s written consent.

The Company will indemnify the Board, the Committee and Plan participants against any and all liabilities for actions taken in conjunction with the Plan or failure to act with respect to duties under the Plan, except in circumstances involving bad faith, gross negligence or willful misconduct.

Shareholder approval of the Plan is sought so that the compensation payable under the Plan will qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code. If the Plan is approved by the shareholders, payment of the full amounts calculated under the Plan should be deductible by the Company for federal income tax purposes.

Governance of the Company

The Board has determined that a majority of the Directors are “independent” for purposes of compliance with The NASDAQ Stock Market (“NASDAQ”) listing standards and Securities and Exchange Commission rules adopted to implement provisions of the Sarbanes-Oxley Act of 2002, and that all of the members of the Audit Committee are also “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934 and NASDAQ listing standards. The Board based these determinations primarily on a review of the responses of the Directors to questions regarding employment and compensation history, affiliations and family and other relationships and on discussions with the Directors.

The Board has adopted a charter for each of the three standing committees that address the make-up and functioning of the committees, along with a procedure for shareholder communications and the selection process for Board candidates. The Board has also adopted an Ethical Conduct Policy that applies to all of our employees, officers and Directors; a Whistleblower’s Protection Policy; and a Code of Ethics for Senior Executive Officers. The Company intends to satisfy the requirements under Item 5.05 of Form 8-K regarding disclosure of amendments to, or waivers from, provisions of its code of ethics that apply to the Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer by posting such information on the Company’s website. You can find links to these materials on the Company’s website under Investor Relations at www.xrite.com. Copies of the code of ethics will be provided free of charge upon written request directed to Investor Relations at the Company’s corporate headquarters.

Board Attendance

Each member of the Board of Directors is expected to make a reasonable effort to attend all meetings of the Board of Directors, all applicable committee meetings, and each Annual Meeting of Shareholders. While no formal policy with respect to attendance has been adopted, attendance at these meetings is encouraged and expected. All members of the Board attended the 2005 Annual Meeting of Shareholders and each of the current members of the Board is expected to attend the 2006 Annual Meeting of Shareholders. During fiscal 2005, the Board held eight (8) meetings and the committees held a total of 14 meetings. Each director attended at least 75 percent of the aggregate total of the number of meetings of the Board plus the total number of meetings of all applicable committees on which such director served.

6

Audit Committee

The Audit Committee focuses its efforts on the following three areas:

| | • | | The adequacy of the Company’s internal control over financial reporting and the integrity of the Company’s consolidated financial statements; |

| | • | | The performance of the Company’s internal auditors, if any, and the qualifications, independence and performance of the Company’s independent auditors; and |

| | • | | The Company’s compliance with legal and regulatory requirements. |

The committee meets periodically with management to consider the adequacy of the Company’s internal control over financial reporting. It also discusses these matters with the Company’s independent auditors and with appropriate company financial personnel. The committee reviews the Company’s consolidated financial statements quarterly and discusses them with management and the independent auditors before those financial statements are filed with the Securities and Exchange Commission. During 2005, the Audit Committee held six (6) meetings.

The committee regularly meets privately with the independent auditors, has the sole authority to retain and dismiss the independent auditors and periodically reviews their performance and independence from management. The independent auditors have unrestricted access and report directly to the committee.

Audit Committee Financial Expert.The Board has determined that the Chairman of the committee, Mr. Sylvester and Mr. Weishaar are “audit committee financial experts,” as that term is defined in Item 401(h) of Regulation S-K, and “independent” for purposes of NASDAQ listing standards and Section 10A(m)(3) of the Securities Exchange Act of 1934. The Audit Committee operates under an Audit Committee Charter. The Charter is available on the Company’s website under Investor Relations at www.xrite.com.

Report of the Audit Committee

We have reviewed X-Rite, Incorporated’s audited consolidated financial statements as of and for the fiscal year ended December 31, 2005, and met with both management and Ernst & Young LLP, X-Rite, Incorporated’s independent auditors, to discuss those financial statements. Management has represented to us that the financial statements were prepared in accordance with accounting principles generally accepted in the United States.

Management has primary responsibility for the Company’s consolidated financial statements and the overall reporting process, including the Company’s system of internal controls. The independent auditors audit the annual financial statements prepared by management, express an opinion as to whether those financial statements present fairly, in all material respects, the financial position, results of operations and cash flows of the Company in conformity with accounting principles generally accepted in the United States and discuss with us their independence and any other matters they are required to discuss with us or that they believe should be raised with us. We oversee these processes, although we must rely on the information provided to us and on the representations made by management and the independent auditors.

We have received from and discussed with Ernst & Young LLP the written disclosure and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and have discussed with Ernst & Young LLP its independence. These items relate to that firm’s independence from the Company. We also discussed with Ernst & Young LLP any matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees).

Based on these reviews and discussions, we recommended to the Board that the Company’s audited financial statements be included in X-Rite, Incorporated’s annual report on Form 10-K for the fiscal year ended December 31, 2005.

|

Paul R. Sylvester, Chairman John E. Utley Mark D. Weishaar |

7

Nominating and Governance Committee

The Nominating and Governance Committee (the “NGC”) is currently comprised of four (4) members, and all of the members are nonemployee directors of the Company. The primary functions of the NGC include assisting the Board of Directors and the independent directors in matters related to Board composition and size, Board policies (e.g., term limits, service requirements, and retirement), nominations, evaluation of the Board and Board and management succession, director orientation and education, and other corporate governance matters, as are appropriately delegated to it by the Board.

The NGC has a role in identifying director candidates consistent with criteria established by the Board, including the slate of directors presented for election at this Annual Meeting of Shareholders. Historically, the Company has not had a formal policy concerning stockholder recommendations to the NGC (or its predecessors). To date, the Company has not received any recommendations from shareholders requesting that the NGC (or any predecessor) consider a candidate for inclusion among the Committee’s slate of nominees in the Company’s proxy statement. The absence of such a policy does not mean, however, that a recommendation would not have been considered had one been received. The NGC will consider recommendations from shareholders concerning the nomination of directors. Recommendations should be submitted in writing to the Company and state the shareholder’s name and address, the name and address of the candidate, and the qualifications of and other detailed background information regarding the candidate. To be included in the Company’s proxy statement relating to the 2007 annual meeting of shareholders or to be considered at the meeting, recommendations must be received in the manner specified under “Shareholder Proposals – Annual Meeting” below.

In evaluating director nominees, the NGC considers the following factors:

| | • | | the appropriate size of the Company’s Board of Directors; |

| | • | | the needs of the Company with respect to the particular talents and experience of its directors; |

| | • | | the knowledge, skills and experience of nominees, including experience in technology, business, finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; |

| | • | | familiarity with national and international business matters; |

| | • | | experience with accounting rules and practices; |

| | • | | appreciation of the relationship of the Company’s business to the changing needs of society; and |

| | • | | desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members. |

The NGC’s goal is to assemble a Board of Directors that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience. In doing so the NGC also considers candidates with appropriate non-business backgrounds.

Other than the foregoing there are no stated minimum criteria for director nominees, although the NGC may also consider such other factors as it may deem are in the best interests of the Company and its shareholders. The NGC does, however, believe it appropriate for at least one, and, preferably, several, members of the Board to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and that a majority of the members of the Board meet the definition of “independent director” under NASDAQ rules. The NGC also believes it appropriate for certain key members of the Company’s management to participate as members of the Board.

The NGC identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the NGC or the Board decides not to re-nominate a member for re-election, the NGC identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the NGC and Board of Directors are polled for suggestions as to individuals meeting the criteria of the

8

NGC. Research may also be performed to identify qualified individuals. To date, the Company has not engaged third parties to identify or evaluate or assist in identifying potential nominees, although the Company reserves the right in the future to retain a third party search firm, if necessary.

While the NGC is not currently composed entirely of independent directors, it is the goal of the Board of Directors for the NGC to be comprised of all independent members as quickly as is practical. Until the NGC is comprised entirely of independent directors, the independent directors oversee the activities of the NGC as required by applicable laws, rules, regulations, and listing standards. The NGC operates under a Nominating and Governance Committee Charter which is available on the Company’s website under Investor Relations at www.xrite.com. During 2005, the NGC held three (3) meetings.

Compensation Committee

The Compensation Committee is currently comprised of four (4) members, and all of the members are nonemployee directors of the Company. The primary function of the Compensation Committee is to assist the Board of Directors and the independent directors on the Board in matters related to compensation as may be appropriately delegated to it by the Board. While the Compensation Committee is not currently comprised entirely of independent directors, it is the goal of the Board for the Compensation Committee to be comprised of all independent members as quickly as is practical. Until the Compensation Committee is comprised entirely of independent directors, the independent directors oversee the activities of the Compensation Committee as required by applicable law, rule, regulation, or listing standard.

Report on Executive Compensation

Compensation Philosophy. The Company’s compensation policies are designed to enhance the Company’s ability to attract, motivate, and retain competent and dedicated management. In constructing and applying these policies, a conscious effort is made to identify and evaluate programs for comparable employers, considering factors such as geography and industry influences, relative sizes, growth stages, and market capitalization. In fulfilling its role to assist the Board of Directors and the independent directors, the Compensation Committee has, at times, enlisted the assistance of a consulting firm to establish a peer group of corporations that can be used for compensation comparison purposes.

Components of Compensation. In general, compensation packages for executive officers are composed of three elements: base salary; annual bonus; and stock-based incentives. Base salary for an executive is determined by the executive’s responsibilities and the Company’s need to be competitive in the market for executive services. Bonus compensation is based on achievement of individual and corporate goals. Stock-based incentives are intended to strengthen the alignment of the interest between the shareholders and senior management and to address long-term performance. The Board of Directors believes the stock ownership of management is of critical importance to the ongoing success of the Company. On November 14, 2005, the Compensation Committee reviewed the annual salary plan with the Chief Executive Officer (“CEO”) for all of the Company’s executive officers, and provided input to the independent directors and the entire Board of Directors to make such adjustments as the independent directors and Board of Directors determined appropriate based upon salary survey data for comparable employers, economic conditions in general, and evaluations by the CEO. Annual salary for the CEO was reviewed by the independent directors and the entire Board of Directors and adjusted based on the same considerations for other executive salaries, plus input from the NGC and its evaluation of the CEO’s performance. The Company established a bonus program for 2006 applicable to all executive officers of the Company. The program has two components. One component is based on individual performance as determined by the independent directors and the entire Board of Directors based on the input of the Compensation Committee, in conjunction with the CEO with respect to other officers. The second component is based on Company-wide economic performance defined to be roughly the return on average assets. Bonuses for the Company’s named executive officers, if any, are reported in the Summary of Compensation Table contained in this Proxy Statement.

The Company, by its independent directors and the entire Board of Directors (with the input of the Compensation Committee), also awarded stock options to six (6) executive officers during 2005 under the Company’s Employee Stock Option Plan, including grants to the named executive officers detailed in the table captioned “Option Grants in Last Fiscal Year” contained herein. The options awarded to the executives other than the CEO were based on evaluations provided by the CEO, and input provided by the Compensation Committee and the NGC to the independent directors and the entire Board of Directors. Each executive’s contribution to achieving agreed upon goals, his or her ability and willingness to influence success, and striving to achieve individual and corporate goals were

9

key factors in the independent directors and Board of Directors determinations. The CEO was also awarded options based primarily on the concept that it is in the best interest of the shareholders to provide incentives for the CEO in the form of stock options, in an amount appropriate relative to the options granted to other executives considering their abilities to influence performance.

Compliance. During 2005, the Company complied with current NASDAQ rules with respect to independent director and/or entire Board of Directors approval of CEO compensation in an executive session where the CEO is not present as well as independent director and/or entire Board of Directors approval requirements of all executive officer compensation. The Compensation Committee operates under a Compensation Committee Charter which is available on the Company’s website under Investor Relations at www.xrite.com. During 2005, the Compensation Committee held five (5) meetings.

|

Compensation Committee: |

|

Ronald A. VandenBerg, Chairman |

Peter M. Banks |

Stanley W. Cheff |

Paul R. Sylvester |

|

Independent Directors: |

|

John E. Utley |

L. Peter Frieder |

Paul R. Sylvester |

Ronald A. VandenBerg |

Mark D. Weishaar |

Compensation of Directors

Our outside Directors, that is Directors who are not employees of X-Rite, Incorporated, receive an annual retainer of $20,000 ($37,000 for chairperson), plus a meeting fee of $1,000 ($1,500 for chairpersons) for each meeting of the Board or a committee attended with the exception of the Audit Committee where a meeting fee of $1,500 ($2,000 for chairperson) is paid. In addition, each outside director immediately following each Annual Meeting of Shareholders is granted an option to purchase 8,000 shares of the Company’s common stock at a price per share equal to the fair market value on the previous day. Each option has a term of ten years and becomes exercisable six months following the date of issue.

Shareholder Communications with Directors

The Board has adopted a process for shareholder communications and the selection of new Board candidates. You can find links to these materials on the Company’s website under Investor Relations at: www.xrite.com. Generally, shareholders who want to communicate with the Board or any individual Director can write to X-Rite, Incorporated, Corporate Secretary, 3100 44th Street, S.W., Grandville, Michigan 49418.

Your letter should indicate that you are an X-Rite, Incorporated shareholder. Depending on the subject matter, management will:

| | • | | Forward the communication to the Director or Directors to whom it is addressed; |

| | • | | Attempt to handle the inquiry directly, for example where it is a request for information about the Company or it is a stock-related matter; or |

| | • | | Not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. |

At each Board meeting, a member of management presents a summary of all communications received since the last meeting that were not forwarded and makes those communications available to the Directors on request.

10

Our Relationship with Our Independent Auditors

The consolidated financial statements of the Company and its subsidiaries for the year ended December 31, 2005 , have been audited by Ernst & Young LLP, independent public accountants.

The aggregate fees billed by Ernst & Young LLP for the 2005 and 2004 fiscal years are as follows:

| | | | | | |

| | | 2005 | | 2004 |

Audit Fees | | $ | 405,391 | | $ | 567,344 |

Audit Related Fees | | | 39,130 | | | 5,500 |

Tax Fees | | | — | | | 13,095 |

Other Fees | | | 11,000 | | | — |

| | | | | | |

| | $ | 455,521 | | $ | 585,939 |

| | | | | | |

Audit fees include amounts incurred for the annual audits of the Company’s consolidated financial statements, interim reviews of quarterly financial information and statutory audits. Other audit related fees include amounts billed for services that are unrelated to the annual audit, such as S-8 filings and accounting research tool fees. Fees billed for tax services primarily include tax compliance services.

Preapproval Policy for Auditor Services

The Audit Committee’s policy is to preapprove all audit and nonaudit services provided by the Company’s independent auditors. These services may include audit services, audit related services, tax services, and other services. Preapproval is generally provided for up to one (1) year and any preapproval is detailed as to a particular service or category of services and is generally subject to a specific budget. The Audit Committee has delegated preapproval authority to its Chairperson when expedition of service is necessary. Both the Company’s independent auditors and management are required to periodically report to the whole Audit Committee regarding the extent of services provided by the Company’s independent auditors in accordance with this preapproval policy, and the fees for such services.

Appointment of Auditors for Fiscal 2006

The Audit Committee has reappointed Ernst & Young LLP as the independent public accounting firm to audit our consolidated financial statements for fiscal 2006.

Representatives of Ernst & Young LLP will be present at the meeting. They will be given the opportunity to make a statement if they desire to do so, and they will be available to respond to appropriate questions.

Section 16(a) Beneficial Ownership Reporting Compliance

Based upon a review of Forms 3, 4, and 5 furnished to the Company during or with respect to the preceding fiscal year and written representations from certain reporting persons, the Company is not aware of any failure by any reporting person to make timely filings of those Forms as required by Section 16(a) of the Securities Exchange Act of 1934.

Securities Ownership of Management

The following table contains information regarding ownership of the Company’s common stock by each director, each named executive officer and all directors and executive officers as a group. The content of this table is based upon information supplied by the persons identified in the table or known to the Company and represents the Company’s understanding of circumstances in existence as of July 5, 2006.

11

Amount and Nature of Ownership

| | | | | | | | |

Name of Beneficial Owner | | Shares

Beneficially

Owned(1) | | Exercisable

Options(2) | | Total | | Percent of

Class(3) |

Chief Executive Officer & Named Executive Officers | | | | | | | | |

Michael C. Ferrara | | 87,849 | | 154,500 | | 242,349 | | * |

Joan Mariani Andrew | | 55,446 | | 165,000 | | 220,446 | | * |

Bernard J. Berg | | 41,509 | | 155,000 | | 196,509 | | * |

Mary E. Chowning | | 38,312 | | 60,000 | | 98,312 | | * |

Jeffrey L. Smolinski | | 35,897 | | 120,000 | | 155,897 | | * |

Non-Employee Directors and Director Nominees | | | | | | | | |

John E. Utley | | 7,000 | | 54,000 | | 61,000 | | * |

Gideon Argov | | 1,065 | | — | | 1,065 | | * |

Stanley W. Cheff | | 5,000 | | 82,000 | | 87,000 | | * |

Mario M. Fontana | | — | | — | | — | | * |

L. Peter Frieder | | 5,250 | | 19,551 | | 24,801 | | * |

Dr. Massimo S. Lattmann | | 21,100 | | — | | 21,100 | | * |

Paul R. Sylvester | | 500 | | 26,455 | | 26,955 | | * |

Mark D. Weishaar | | 3,000 | | 26,455 | | 29,455 | | * |

All Directors and Executive Officers as a Group (16 persons) | | 493,168 | | 920,961 | | 1,414,129 | | 4.8 |

| (1) | Each person named in the table has sole voting and investment power with respect to the issued shares listed in this column. |

| (2) | This column reflects shares subject to options exercisable as of July 5, 2006, or within 60 days thereafter. |

| (3) | The percentages are calculated on the basis of the number of outstanding shares of common stock plus common stock deemed outstanding pursuant to Rule 13d-3 of the Securities Exchange Act of 1934. |

Securities Ownership of Certain Beneficial Owners

The following table contains information regarding ownership of the Company’s common stock by persons or entities known to the Company to beneficially own more than five percent (5%) of the Company’s common stock. The content of this table is based upon information contained in Schedules 13G furnished to the Company as well as information provided by The NASDAQ Stock Market and represents the Company’s understanding of circumstances in existence as of July 5, 2006.

| | | | |

Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial

Ownership | | Percent of

Class(1) |

Lord, Abbett & Co. LLC 90 Hudson Street, Jersey City, NJ 07302 | | 2,146,568 | | 7.5 |

Putnam Investment Management, Inc. One Post Office Square, Boston, MA 02109 | | 1,896,470 | | 6.6 |

Ted Thompson 1980 76th Street, Byron Center, MI 49315 | | 1,435,800 | | 5.0 |

| (1) | The percentages are calculated on the basis of the number of outstanding shares of common stock plus common stock deemed outstanding pursuant to Rule 13d-3 of the Securities Exchange Act of 1934. |

12

Executive Compensation

The following table contains information regarding compensation paid by the Company with respect to each of the last three fiscal years to its chief executive officer and to the four other most highly compensated executive officers who were serving at the end of fiscal year 2005 for services rendered to the Company (the “named executive officers”).

| | | | | | | | | | | | | | |

| Summary Compensation Table |

| | | | |

| | | Year | | Annual

Compensation | | Long Term

Compensation | | All Other

Compensation ($)(3) |

| | | | Salary ($) | | | Bonus ($)(2) | | Restricted

Stock

Award(s)

($) | | | Securities

Underlying

Options (#) | |

Michael C. Ferrara(1) | | 2005 | | 389,519 | | | — | | 141,000 | (1)(2) | | 32,000 | | 10,708 |

Chief Executive Officer | | 2004 | | 372,019 | | | 519,965 | | 233,590 | (1)(2) | | 30,000 | | 11,949 |

| | 2003 | | 323,029 | | | 591,974 | | 137,988 | (1)(2) | | 75,000 | | 10,114 |

Mary E. Chowning | | 2005 | | 270,288 | | | — | | 100,040 | (2) | | 25,000 | | 13,025 |

Vice President - Finance | | 2004 | | 229,231 | | | 213,684 | | 83,280 | (2) | | 30,000 | | 8,601 |

Chief Financial Officer | | 2003 | | 88,846 | (4) | | 175,177 | | — | | | 5,000 | | 5,434 |

Joan Mariani Andrew | | 2005 | | 221,904 | | | — | | 206,082 | (2) | | 25,000 | | 12,871 |

Vice President | | 2004 | | 220,654 | | | 206,087 | | 232,108 | (2) | | 20,000 | | 17,880 |

| | 2003 | | 311,425 | (5) | | 232,126 | | — | | | 20,000 | | 8,153 |

Bernard J. Berg | | 2005 | | 205,885 | | | — | | — | | | 25,000 | | 21,555 |

Senior Vice President - Engineering | | 2004 | | 203,846 | | | 189,942 | | — | | | 20,000 | | 20,759 |

| | 2003 | | 200,000 | | | 244,343 | | — | | | 20,000 | | 19,865 |

Jeffrey L. Smolinski Vice President - Operations | | 2005 | | 219,904 | | | — | | — | | | 25,000 | | 22,768 |

| | 2004 | | 218,654 | | | 204,187 | | — | | | 20,000 | | 19,004 |

| | 2003 | | 189,904 | | | 232,008 | | — | | | 20,000 | | 10,157 |

| (1) | As part of Mr. Ferrara revised employment contract, he received an award of 10,000 shares of restricted stock on December 31, 2005, December 31, 2004 and on December 31, 2003. These restricted shares will become fully vested on December 31, 2006. The price used to calculate the value of the shares was $10.00 for the 2005 award, $16.36 for the 2004 award and $11.80 for the 2003 award, representing the closing prices of X-Rite stock on the day prior to grant. The corresponding market value for the 2005, 2004 and 2003 awards was $300,000 as of December 31, 2005. The shares were issued under the Company’s Second Restricted Stock Plan and are subject to certain restrictions on transfer and risks of forfeiture. Dividends are paid on these shares to the same extent paid on the Company’s common stock. |

| (2) | Pursuant to the Company’s Cash Bonus Conversion Plan, executive officers had the option to convert their bonuses into common stock. Bonuses were converted at a discount of 50 percent from the market value of the stock at the time the bonus was determined. The Cash Bonus Conversion Plan expired with respect to bonuses for the 2004 fiscal year and was not renewed. The shares received are subject to certain restrictions on transfer and risks of forfeiture. Restrictions lapse as to 20 percent of the shares six months after grant and as to 20 percent on each of the first four anniversaries of the grant date, or as to all shares in the event of death, disability, retirement, or change in control of the Company. Dividends are paid on these shares to the same extent paid on the Company’s common stock. Restricted shares issued under the Cash Bonus Conversion Plan and held at the close of the Company’s fiscal year were Mr. Ferrara 2,132 shares in 2003, 6,051 shares in 2004, and 4,000 shares in 2005; Ms. Chowning 7,200 shares in 2004 and 9,760 shares in 2005; and Ms. Andrew 20,067 shares in 2004, and 20,104 shares in 2005. Corresponding market values net of purchase price paid as of that same date were Mr. Ferrara $13,325 for 2003 and $18,516 for 2004, and $7,200 for 2005; Ms. Chowning $22,032 for 2004 and $17,568 for 2005; and Ms. Andrew $61,405 for 2004 and $36,187 for 2005. |

| (3) | These amounts represent “matching” contributions by the Company pursuant to its 401(k) Plan, annual premiums for term life insurance, and auto allowance attributable to each named executive officer. |

| (4) | Mary E. Chowning joined the Company on July 28, 2003 as its Vice President Finance and Chief Financial Officer. |

| (5) | Included in this amount is base compensation of $190,000 and cost of living, currency and tax differential payments for assignment outside of the U.S. |

13

The following table contains information regarding stock options granted to the named executive officers during the preceding fiscal year.

| | | | | | | | | | | | | |

| Option Grants in Last Fiscal Year |

| | | | | |

| | | Number of

Securities

Underlying

Options

Granted(1) | | Percent of Options

Granted to All

Employees In

Fiscal Year | | | Exercise

Price ($/sh)(2) | | Expiration

Date | | Grant Date

Present Value ($)(3) |

Michael C. Ferrara | | 32,000 | | 11.0 | % | | $ | 16.40 | | 2/8/15 | | $ | 253,760 |

Mary E. Chowning | | 25,000 | | 8.6 | % | | $ | 16.40 | | 2/8/15 | | $ | 198,250 |

Joan Mariani Andrew | | 25,000 | | 8.6 | % | | $ | 16.40 | | 2/8/15 | | $ | 198,250 |

Bernard J. Berg | | 25,000 | | 8.6 | % | | $ | 16.40 | | 2/8/15 | | $ | 198,250 |

Jeffrey L. Smolinski | | 25,000 | | 8.6 | % | | $ | 16.40 | | 2/8/15 | | $ | 198,250 |

| (1) | These options are fully vested. On December 27, 2005, the Board of Directors of the Company approved the acceleration of vesting of all unvested and out-of-the-money (i.e. exercise price above the then-current market price) stock options. The decision to accelerate the vesting of these options was made primarily to reduce the Company’s non-cash compensation expense that would have been recorded in future periods following the Company’s adoption of SFAS No. 123(R), Share Based Payment. |

| (2) | The exercise price is the closing price of the Company’s stock on the day prior to the grant date. |

| (3) | Present value calculated under the Black-Scholes Valuation Model, assuming a risk-free rate of return of 3.68 percent, 1.02 percent dividend yield, 52 percent volatility, and exercise in 6.0 years. This model is an alternative suggested by the Securities and Exchange Commission, and the Company neither endorses this particular model nor necessarily agrees with the method for valuing options. The future performance of the Company and the price of its shares will ultimately determine the value of these options. |

The following table contains information regarding the exercise of options during fiscal 2005 by the named executive officers, as well as unexercised options held by them at fiscal year-end.

| | | | | | | | | | | | |

| Aggregate Option Exercises in Last Fiscal Year and Year-end Values |

| | | | |

| | | Shares

Acquired

on Exercise(#) | | Value

Realized

($) | | Number of Securities Underlying Unexercised Options at Fiscal Year-End | | Value of Unexercised In-the-Money Options at Fiscal Year-End(1) |

| | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Michael C. Ferrara | | — | | — | | 154,500 | | — | | 125,250 | | — |

Mary E. Chowning | | — | | — | | 60,000 | | — | | — | | — |

Joan Mariani Andrew | | — | | — | | 165,000 | | — | | 216,900 | | — |

Bernard J. Berg | | — | | — | | 165,000 | | — | | 216,900 | | — |

Jeffrey L. Smolinski | | — | | — | | 120,000 | | — | | 90,300 | | — |

| (1) | Based upon the closing price of $10.00 per share of common stock on December 30, 2005, which is the last trading day of fiscal year 2005. |

14

The following table provides information about the Company’s equity compensation plans as of December 31, 2005.

| | | | | | | | | |

| Equity Compensation Plan Summary | |

| | | |

| | | Number of securities to be issued upon exercise of outstanding options | | | Weighted-average exercise price of outstanding options | | Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in the first

column) | |

Equity compensation plans approved by shareholders | | 2,096,461 | (1) | | $ | 12.22 | | 4,114,495 | (2) |

Equity compensation plans not approved by shareholders | | 0 | | | | n/a | | 0 | |

| | | | | | | | | |

Total | | 2,096,461 | | | $ | 12.22 | | 4,114,495 | |

| | | | | | | | | |

| (1) | Represents outstanding options to purchase the Company’s Common Stock granted under the X-Rite, Incorporated 2003 and 1993 Employee Stock Option Plans, as amended and restated, and the X-Rite, Incorporated 2003 and 1993 Outside Directors Stock Option Plans, as amended and restated. |

| (2) | Represents options available to purchase the Company’s common stock under the X-Rite, Incorporated 2003 Employee Stock Option Plan and the X-Rite, Incorporated 2003 Outside Director Stock Option Plan. Included are 955,456 shares available for issuance under the 2004 Amended and Restated Employee Stock Purchase Plan. |

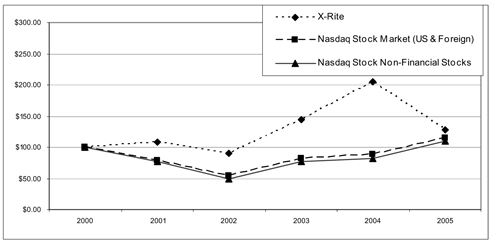

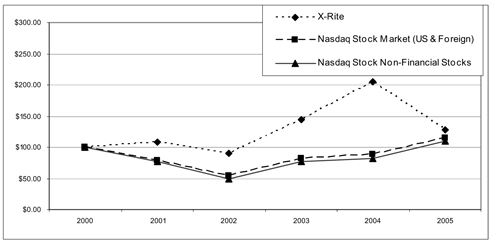

Stock Performance Graph

The following graph depicts the cumulative total return on the Company’s common stock compared to the cumulative total return on the indices for NASDAQ Stock Market (U.S. and foreign) and NASDAQ nonfinancial stocks which is considered to be the Company’s peer group. The graph assumes an investment of $100 on the last trading day of 2000, and reinvestment of dividends in all cases.

Comparison of Five-Year Cumulative Total Returns

Performance Report for X-Rite, Incorporated

| | | | | | | | | | | | |

| | | Year Ended December 31 Cumulative Total Return |

| | | 12/00 | | 12/01 | | 12/02 | | 12/03 | | 12/04 | | 12/05 |

X-Rite | | 100 | | 109 | | 89 | | 145 | | 205 | | 128 |

NASDAQ Stock Market (US & Foreign) | | 100 | | 79 | | 54 | | 82 | | 89 | | 115 |

NASDAQ Stock Non-Financial Stocks | | 100 | | 76 | | 50 | | 76 | | 82 | | 110 |

15

Other Arrangements

The Company has not adopted any long-term incentive plan or any defined benefit or actuarial plan, as those terms are defined in the applicable regulations promulgated by the Securities and Exchange Commission.

Effective as of a change in control of the Company, the Company has made available to its executive officers’ contracts assuring them of continued employment for a period of three years. Following a change in control, if the executive’s employment is terminated by the Company during the three-year employment term without good cause, either actually or constructively, the executive is entitled to receive continued compensation and employee benefits for the remainder of the term.

Ferrara Employment Agreement

CEO Ferrara has an Employment Agreement with the Company for an initial term of approximately four years, ending December 31, 2007, renewable annually thereafter for three successive one-year periods unless terminated by either party as of the end of the initial term or any renewal term. During its continuation, either party may terminate the Agreement for specified reasons. Mr. Ferrara is entitled to receive cash compensation for a minimum of eighteen months and certain perquisites for the unexpired portion of the then current term if his employment is terminated for any reason other than death, disability, voluntary quit, or discharge for good cause. Mr. Ferrara is obligated not to compete with the Company or solicit its employees for a period of two years after termination of his employment. Mr. Ferrara’s Agreement has been coordinated with the above-described change in control arrangement in the event a change in control of the Company occurs.

On October 3, 2005, the Company entered into two employment-related agreements with Michael C. Ferrara, its Chief Executive Officer. The first agreement is Amendment No. 1 to the Employment Agreement between X-Rite and Michael C. Ferrara. The amendment modifies provisions of the Employment Agreement entered into between the Company and Mr. Ferrara dated September 30, 2003. The amendment extends the term of the original agreement by twelve months and provides for automatic renewal periods should both parties elect to do so. Furthermore, it defines the vesting period of restricted stock grants during the extension period and provides certain minimal financial planning benefits to Mr. Ferrara for the years 2005 and beyond. The amendment also defines the method by which either party may terminate it prior to expiration of the then current term, as well as describe the basis for severance pay and benefits calculations.

The Company has also entered into an agreement to provide certain medical, dental and prescription drug benefits to Mr. Ferrara following his employment with the Company. These benefits are comparable to those provided the Company’s employees and will be secondary to all Medicare benefits for which Mr. Ferrara is eligible. The Company’s obligation under this agreement will expire on December 31, 2015. Should Mr. Ferrara’s employment terminate at the completion of his current Employment Agreement on December 31, 2008 this health plan will be active for a period of seven years.

In connection with the acquisition of Amazys Holding AG, X-Rite and Mr. Ferrara entered into an amendment to Mr. Ferrara’s Employment Agreement dated as of January 30, 2006. In the amendment, the parties acknowledge that X-Rite may terminate Mr. Ferrara’s role and/or duties as Chief Executive Officer of X-Rite at any time prior to December 31, 2008, other than as a result of his death, disability or for cause (as defined in the Employment Agreement), by giving written notice to Mr. Ferrara of the effective date of termination (a “CEO Transition”). Following a CEO Transition, Mr. Ferrara agrees to (i) cooperate fully in the transition of his responsibilities and duties as directed by X-Rite’s Board of Directors, (ii) promptly resign from any position as a member of the Board of Directors of X-Rite and any of its subsidiaries, and (iii) upon the reasonable request of X-Rite’s Board of Directors, provide to X-Rite consulting services during any period during which he receives compensation under the Employment Agreement. The amendment further provides that, following a CEO Transition through December 31, 2008 (subject to termination for death, disability or cause as provided in the Employment Agreement), Mr. Ferrara will continue to receive the annual salary, annual bonuses and other fringe benefits provided under the Employment Agreement to which he would have been entitled had his role and/or duties as the Chief Executive Officer of X-Rite not been changed.

16

Vacchiano Employment Agreement

In connection with the acquisition of Amazys Holding AG, X-Rite and Thomas J. Vacchiano Jr., entered into an Employment Agreement under which Mr. Vacchiano has agreed to serve as President and Chief Operating Officer of X-Rite for a period of three years from the completion of the Amazys acquisition (July 5, 2006) unless earlier terminated in accordance with its terms. Mr. Vacchiano will (i) receive an annual base salary of $310,000, (ii) be entitled to participate in any bonus plan or other incentive compensation program applicable to X-Rite’s executives, and (iii) be further entitled to participate in any long-term incentive compensation program applicable to X-Rite’s executives, with 60 percent to consist of restricted stock awards and 40 percent to consist of stock option awards.

Under the Employment Agreement, X-Rite’s Board of Directors will determine, within eighteen months whether to promote Mr. Vacchiano to the position of Chief Executive Officer of X-Rite. If the Board of Directors determines to promote Mr. Vacchiano, X-Rite and Mr. Vacchiano will negotiate a new Employment Agreement for Mr. Vacchiano. In addition, it is expected that if the Board of Directors determines to promote Mr. Vacchiano, upon such promotion, Mr. Vacchiano will become a member of X-Rite’s Board of Directors. If the Board of Directors determines not to promote Mr. Vacchiano, Mr. Vacchiano will be entitled to terminate the Employment Agreement by providing written notice to X-Rite and to receive the severance pay and benefits as outlined in the Employment Agreement. If the Board of Directors determines to promote Mr. Vacchiano and Mr. Vacchiano declines such promotion, X-Rite will have the right to terminate the Employment Agreement by providing written notice to Mr. Vacchiano. In the event of such termination by X-Rite, Mr. Vacchiano will be entitled to receive his salary accrued up to the termination date but will not be entitled to receive any further salary, bonus, severance, compensation or benefits.

Chowning Employment Agreement

In connection with the acquisition of Amazys Holding AG, X-Rite and Mary E. Chowning entered into an Employment Agreement under which Ms. Chowning agreed to serve as the Company’s Vice President and Chief Financial Officer until terminated as provided in her Employment Agreement. Ms. Chowning will (i) receive an annual base salary of $275,000, (ii) be entitled to participate in any bonus plan or other incentive compensation program applicable to X-Rite’s executives, and (iii) will be further entitled to participate in any long-term incentive compensation program applicable to X-Rite’s executives, with 60 percent to consist of restricted stock awards and 40 percent to consist of stock option awards.

In the event of termination of Ms. Chowning’s employment by X-Rite without cause or by Ms. Chowning for good reason, Ms. Chowning will receive the severance pay and benefits as outlined in the Employment Agreement. Additionally, if Ms. Chowning terminates her employment by giving written notice to the Company (whether with or without “Good Reason”) at any time after the one (1) year anniversary of the date on which Michael C. Ferrara leaves the employ of X-Rite, Ms. Chowning will be entitled to receive the severance pay and benefits set in the Employment Agreement.

Lamy Employment Agreement

In connection with the acquisition of Amazys Holding AG, X-Rite and Francis M. Lamy entered into an Employment Agreement under which Mr. Lamy agreed to serve as the Company’s Vice President and Chief Technology Officer until terminated as provided in his Employment Agreement. Mr. Lamy will (i) receive an annual base salary of CHF 325,000 (equal to $263,457 on July 5, 2006), (ii) be entitled to participate in any bonus plan or other incentive compensation program applicable to X-Rite’s executives, and (iii) will be further entitled to participate in any long-term incentive compensation program applicable to X-Rite’s executives, with 60 percent to consist of restricted stock awards and 40 percent to consist of stock option awards.

Additionally, under the Employment Agreement, Mr. Lamy is entitled to (i) a CHF 32,500 (equal to $26,345 on July 5, 2006) per year allowance as a contribution to Mr. Lamy’s personal health insurance, (ii) a CHF 20,000 (equal to $16,212 on July 5, 2006) per year allowance for expenses incurred by Mr. Lamy consistent with performing his duties and responsibilities as an officer of X-Rite, and (iii) a CHF 5,000 (equal to $4,050 on July 5, 2006) per year allowance for obtaining tax consulting advice associated with being an officer of a U.S. based corporation.

17

In addition to termination in the event of death or disability, Mr. Lamy’s employment may be terminated by X-Rite for “cause” (as defined in the Employment Agreement), by Mr. Lamy for “good reason” (as defined in the Employment Agreement) or by either party, without cause, by giving the other party at least three months’ written notice. In the event of termination by X-Rite without cause or by Mr. Lamy for good reason, Mr. Lamy will receive the severance pay and benefits as outlined in the Employment Agreement.

Director Emeritus Program

Any director of the Corporation serving prior to February 10, 2004, who serves the shorter of at least: (i) nine years or (ii) three maximum length terms of office as a director and who either resigns as a director or does not stand for reelection, shall be entitled to be considered for the position of “Director Emeritus.” If nominated by the Nominating and Governance Committee and elected by the Board of Directors, a Director Emeritus shall continue in that position for a period equal to the time served as a regular director prior to February 10, 2004, or until an earlier resignation or death. During their tenure, Directors Emeritus shall be given notices of all meetings of the Board of Directors, and they shall perform such consulting services for the Corporation as the Board of Directors may reasonably request from time to time. Directors Emeritus shall be entitled to attend and participate in all such meetings of the Board of Directors, except that they may not vote and they shall not be counted for purposes of determining a quorum. Directors Emeritus shall receive an annual cash retainer fee equal to the lesser of: (i) the annual cash retainer fee in place at the time the director resigned as a director or did not stand for reelection; or (ii) the annual cash retainer fee in place at any time during the period such director holds the position of Director Emeritus, and shall be entitled to reimbursement for expenses of attendance at meetings of the Board, but they shall receive no other compensation from the Corporation. Currently, there are seven (7) individuals who hold the Director Emeritus position and receive an annual cash retainer fee of $20,000 each. They are currently Marvin DeVries, James Knister, Rufus Teesdale, Ted Thompson, Charles VanNamen, Ronald A. VandenBerg, and Peter M. Banks.

Thompson Agreement

At the time former Chairman Ted Thompson retired from his position as the Company’s Chief Executive Officer and retired from day-to-day management of the Company’s affairs, the Company entered into an agreement with Mr. Thompson for the purpose of defining an ongoing relationship with the Company. In addition to specifying his responsibilities, compensation, and benefits, the agreement provided for compensation and insurance benefits for a period of five years after conclusion of his service as Chairman. On September 13, 2001, Mr. Thompson retired as Chairman of the Company and an amendment to that agreement was entered into providing Mr. Thompson certain health benefits in lieu of certain compensation. Mr. Thompson is obligated not to compete with the Company for a period ending two years after termination of the agreement.

Banks Separation Agreement

On July 5, 2006, the Company entered into a Separation Agreement with Dr. Peter M. Banks. Under the Separation Agreement, Dr. Banks agreed to resign from the Company’s Board of Directors. Dr. Banks further agreed to perform such consulting services for the Company as the Board of Directors or Chief Executive Officer of the Company may reasonably request from time to time. In consideration of Dr. Banks’ past service and his performance as a consultant, the Company agreed to provide to Dr. Banks (i) a cash payment in the amount of $1,000 for each day Dr. Banks provides consulting services and (ii) an option to acquire 8,000 shares of the Company’s common stock at a price per share equal to the fair market value of such shares on the day immediately preceding the Company’s 2006 annual meeting of shareholders, which option will be granted to Dr. Banks promptly following the annual meeting. The Company further agreed to take such action as is necessary to cause Dr. Banks to attain Director Emeritus status in accordance with the Company’s Amended and Restated Bylaws, effective as of the Closing and continuing for a period of five (5) years thereafter.

18

Certain Relationships, Related Transactions and Other Matters

XR Ventures, LLC is a joint venture between the Company and Peter M. Banks and James A. Knister. The main focus of XR Ventures was to find, acquire, develop, and operate interests in businesses or technologies important to the growth of new markets for the Company. Prior to December 2003, Dr. Banks and Mr. Knister were responsible for the day-to-day operations of XR Ventures with input from the Company. The Company funded all acquisitions made by XR Ventures and, in exchange, will receive its investment back in full before any distributions are made. The Company will receive 80 percent of the gains on investments. Dr. Banks and Mr. Knister will receive 20 percent of the gains on investments. Dr. Banks and Mr. Knister are reimbursed for their expenses, but receive no salary or additional Board fees relating to XR Ventures. The Company reached the XR Ventures arrangement with Dr. Banks and Mr. Knister through arms-length negotiation, in which the Company was represented by it regular counsel and Dr. Banks and Mr. Knister were represented by separate counsel. In December of 2003, the Company, Dr. Banks and Mr. Knister amended the XR Ventures, LLC agreement, and Dr. Banks and Mr. Knister resigned as managing members in XR Ventures, LLC. Dr. Banks and Mr. Knister remain members of XR Ventures, LLC, but have no formal day to day operating duties.

The Company entered into a five year lease on October 2, 2000 on a facility owned by a partnership in which Stanley W. Cheff is a fifty percent partner. The Company paid $198,416 of rent during 2005 for this facility. As of January 1, 2006, the Company is no longer leasing the facility and has vacated the premises.

Prior to his employment with the Company, Mr. Ferrara was the President of Marine Optical Group from March 1990 to June 2001. Following Mr. Ferrara’s service as President of Marine Optical Group, Marine Optical Group commenced bankruptcy proceedings in October 2001 under Chapter 7 of the Bankruptcy Code.

Shareholder Proposals – Annual Meeting