SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | |

| | ¨ Confidential, for Use of the Commission Only (as permittedby Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | |

¨ Definitive Additional Materials | | |

¨ Soliciting Material Pursuant to Section 240.14a-12 | | |

X-Rite, Inc.

(Name of Registrant as Specified In Its Charter)

[NOT APPLICABLE]

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

[Not Applicable]

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

[Not Applicable]

X-RITE, INCORPORATED

4300 44TH Street, S.E.

Grand Rapids, Michigan 49512

Notice of Annual Meeting of Shareholders

The Annual Meeting of Shareholders of X-Rite, Incorporated, a Michigan corporation, will be held at Western Michigan University Conference Center, 200 Ionia Avenue, N.W., Grand Rapids, Michigan, on Tuesday, May 22, 2007, at 8:30 a.m., for the following purposes:

| | 1. | Election of directors as set forth in the accompanying Proxy Statement. |

| | 2. | Such other matters as may properly come before the meeting. |

Shareholders of record as of the close of business on April 9, 2007, are entitled to notice of, and to vote at the meeting. We are pleased to offer multiple options for voting your shares. As detailed in the “Solicitation of Proxies” section of this Notice and Proxy Statement, you can vote your shares via the Internet, by telephone, by mail or by written ballot at the Annual Meeting. We encourage you to vote by the Internet as it is the most cost-effective method. Whether or not you expect to be present at this meeting, you are requested to vote your shares using one of the methods discussed above. If you attend the meeting and wish to vote in person, you may withdraw your Proxy in the manner set forth in the accompanying Proxy Statement.

By Order of the Board of Directors

Mary E. Chowning

Secretary

April 24, 2007

Grand Rapids, Michigan

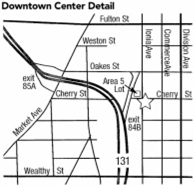

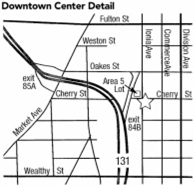

Directions to Annual Meeting

Located in downtown Grand Rapids, The Western Michigan University Conference Center is at the corner of Ionia Avenue and Cherry Street with parking on the diagonal corner opposite the Center.

South of Interstate 196 from U.S. 131, use exit 85A if southbound on 131, or exit 84B if northbound on 131.

X-RITE, INCORPORATED

4300 44TH Street

Grand Rapids, Michigan 49512

PROXY STATEMENT

April 24, 2007

Solicitation of Proxies

This Proxy Statement, which was first mailed to shareholders on or about April 24, 2007, is furnished in connection with the solicitation of proxies by the Board of Directors of X-Rite, Incorporated (the “Company” or “X-Rite”), to be voted at the Annual Meeting of the shareholders of the Company, which will be held at 8:30 a.m. on Tuesday, May 22, 2007, at the Western Michigan University Conference Center, 200 Ionia Avenue, N.W., Grand Rapids, Michigan, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

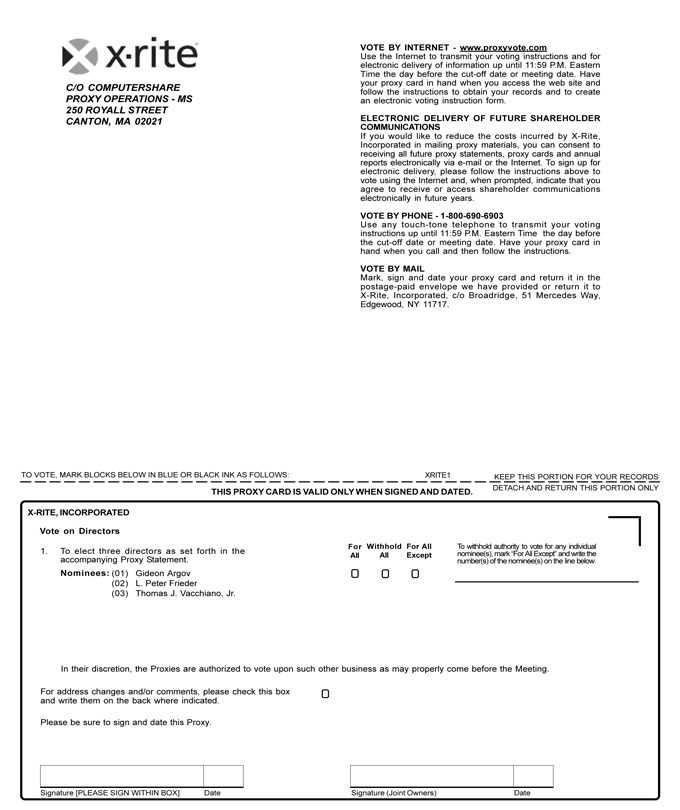

Each shareholder, as an owner of the Company, is entitled to vote on matters scheduled to come before the Annual Meeting. The use of a Proxy allows a shareholder of the Company to be represented at the Annual Meeting if he or she is unable to attend the meeting in person. There are four (4) ways to vote your shares:

| | 1. | By the Internet at www.proxyvote.com |

| | 2. | By toll-free telephone at 1-800-690-6903 |

| | 3. | By completing and mailing your Proxy Card |

| | 4. | By written ballot at the Annual Meeting |

If the enclosed Proxy Card is properly executed using any of the methods described above, the shares represented by the Proxy will be voted at the Annual Meeting of Shareholders or at any adjournment of that meeting. Where shareholders specify a choice, the Proxy will be voted as specified. If no choice is specified on a properly executed Proxy Card, the shares represented by the Proxy will be voted for the election of the directors listed as nominees in the Proxy and at the discretion of the Proxy voters on any other matters voted upon at the meeting. A Proxy may be revoked prior to its exercise by (1) delivering a written notice of revocation to the Secretary of the Company, (2) delivery of a later-dated Proxy, including by telephone or Internet vote, or (3) attending the meeting and voting in person. Attendance at the Annual Meeting, in and of itself, will not constitute a revocation of a Proxy.

The cost of the solicitation of Proxies will be borne by the Company. In addition to the use of the mails, Proxies may be solicited personally or by telephone or facsimile by a few regular employees of the Company without additional compensation. In addition, brokers, nominees, custodians, and other fiduciaries will be reimbursed by the Company for their expenses in connection with sending proxy materials to beneficial owners.

Voting Securities and Record Date

The Board of Directors has fixed April 9, 2007 as the record date for determining shareholders entitled to vote at the Annual Meeting. On that date approximately 29,053,065 shares of the Company’s common stock, par value $.10 per share, were issued and outstanding. Shareholders are entitled to one vote for each share of the Company’s common stock registered in their names at the close of business on the record date. A majority of the shares entitled to vote represented in person or by proxy will constitute a quorum for action at the Annual Meeting. Abstentions and broker non-votes are counted for the purposes of determining the presence or absence of a quorum for the transactions of business. However, abstentions and broker non-votes will be disregarded in tabulating the votes on all matters brought before the meeting.

Electronic Delivery of Proxy Statement and Annual Report

The Proxy Statement and the 2006 Annual Report are available on the Company’s Internet site at www.xrite.com/company_investor_relations.aspx.

Most shareholders can elect to receivefuture Proxy Statements and Annual Reports over the Internet instead of receiving paper copies in the mail. If you are a shareholder of record, you can choose this option and save the Company the cost of producing and mailing these documents by:

| • | | Following the instructions provided when you vote over the Internet, or |

| • | | Going to www.xrite.com/company_investor_relations.aspx and following the instructions provided. |

1

If you are a shareholder of record and you choose to receive future Proxy Statements and Annual Reports over the Internet, you will receive an e-mail message next year containing the Internet address to access the Company’s Proxy Statement and Annual Report. The e-mail also will include instructions for voting over the Internet. Your choice will remain in effect until you tell us otherwise.

If you hold your shares in “street name”, and choose to receive future Proxy Statements and Annual Reports over the Internet and your bank, broker or other holder of record participates in the service you will receive an e-mail message next year containing the Internet address to use to access the Company’s Proxy Statement and Annual Report.

ELECTION OF DIRECTORS AND MANAGEMENT INFORMATION

The Company’s Articles of Incorporation specify that the Board of Directors shall consist of at least six (6), but not more than nine (9) members, with the exact number to be fixed by the Board from time to time. The Board has fixed the number of directors at nine (9). The Articles also specify that the Board of Directors be divided into three classes, with the directors of the classes to hold office for staggered terms of three (3) years each.

Unless otherwise specifically directed by a marking on a shareholder’s Proxy, the persons named as proxy voters in the accompanying Proxy will vote for the nominees described below. If any of these nominees were to become unable to serve as a director, which is not now anticipated, the Board of Directors may designate a substitute nominee, in which case the accompanying Proxy will be voted for the substituted nominee. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Directors are elected by a plurality of the votes cast by shareholders entitled to vote on their election at a meeting at which a quorum is present. A “plurality” means that the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors to be elected at the Annual Meeting. Any shares for which authority is withheld to vote for director nominees and broker non-votes have no effect on the election of directors except to the extent that the failure to vote for a director nominee results in another nominee receiving a larger number of votes.

NOMINEES

The Board of Directors has nominated Gideon Argov, L. Peter Frieder and Thomas J. Vacchiano, Jr. for election as directors to three-year terms expiring in 2010. Each of these director nominees is presently serving as a director of the Company. Mr. Vacchiano was appointed to the Board of Directors on October 1, 2006 to fill the vacancy created by the resignation of Michael C. Ferrara. The Company’s Articles of Incorporation require that directors, who were appointed to the Board of Directors, like Mr. Vacchiano, stand for reelection at the first annual meeting of shareholders after their appointment.

The Board of Directors recommends a vote FOR the election of all the persons nominated by the Board.

The content of the following table relating to age and business experience is based upon information furnished to the Company by the nominees and directors.

| | |

Names, (Ages), Positions and Backgrounds of Directors & Director Nominees | | Service as a Director |

Nominees For Election with Terms to Expire in 2010 |

| |

| Gideon Argov (50) is President and CEO of Entegris, a materials integrity management company serving high technology industries. Mr. Argov became President and CEO of Entegris immediately after its merger with Mykrolis on August 5, 2005. He had served as CEO of Mykrolis since November 2004. Prior to joining Mykrolis, Mr. Argov was a special limited partner of Parthenon Capital, a Boston-based private equity partnership, since 2001. Prior to the Company’s acquisition of Amazys Holding AG, Mr. Argov served on its Board of Directors since 1997. Mr. Argov currently serves on the Boards of Director for Fundtech Corporation and Interline Brands, Inc. | | Director since July 2006 Member of the Compensation Committee |

2

| | |

Nominees For Election with Terms to Expire in 2010 |

| |

| L. Peter Frieder (63) is the President and CEO of Gentex Corporation, a designer, developer and manufacturer of integrated life support systems for human protection and enhanced human performance headquartered in Carbondale, Pennsylvania. He has held that position for more than five years. Mr. Frieder also serves as a Senior Vice President for U.S. Business Development for Essilor, which designs and manufactures corrective lenses worldwide. | | Director since November 2003 Member of the Nominating & Governance Committee |

| |

| Thomas J. Vacchiano, Jr. (55) is the President and CEO of the Company and has held that position since October 1, 2006. He joined X-Rite as its President in July 2006 as part of Amazys acquisition. Beginning in January 2001, he served as President and the CEO for Amazys Holding AG. Amazys was a color technology company headquartered in Switzerland and publicly traded on the Swiss Stock Exchange. | | Director since October 2006 |

|

Directors Whose Terms Expire in 2008 |

| |

| Stanley W. Cheff (65) retired in 2004 as Chairman of the Board of Wolverine Building Group, a construction firm headquartered in Michigan. Previously, Mr. Cheff served as President and Chief Executive Officer of Wolverine Building Group, holding that position for more than five years. | | Director since 1996 Chairman of Nominating & Governance Committee and Member of the Compensation Committee |

| |

| Dr. Massimo S. Lattmann (63) is a Founder, Senior Partner and Chairman of Venture Partners AG since 1997. Prior to 1997, he held several senior management positions in industry and was the founder and CEO of the Instrumatic Group from 1977 until its sale in 1991. Prior to the Company’s acquisition of Amazys Holding AG, Dr. Lattmann served on its Board of Directors since 1997. | | Director since July 2006 |

| |

| John E. Utley (66) retired in 1999 as Acting Deputy President of Lucas Varity Automotive. Lucas Varity was headquartered in London, England before being sold to TRW, Inc. Prior to that, he served in several senior management positions for more than five years, including Senior Vice President Strategic Marketing for Varity Corporation and served as Chairman of the Board of both Kelsey Hayes Co. and Walbro Corporation. | | Director since 2000 Chairman of the Board of Directors and Member of the Audit Committee and Nominating & Governance Committee, and Ex-officio member of the Compensation Committee |

|

Directors Whose Terms Expire in 2009 |

| |

| Mario Fontana (60) has served as a member of the board of directors of various public companies over the past seven years. Prior to the Company’s acquisition of Amazys Holding AG, Mr. Fontana served as the Chairman of its Board of Directors since 2004.Mr. Fontana currently serves on the board of directors of Swissquote, Inficon and Dufry AG. He also serves on the board of SBB, the Swiss Railways Company and Hexagon AB. Prior to his board activities, Mr. Fontana held senior executive positions at Hewlett-Packard for over 15 years. | | Director since July 2006 Member of the Nominating & Governance Committee |

| |

| Paul R. Sylvester (47) is CEO and Co-Chairman of the Board of Manatron, Inc. headquartered in Michigan that specializes in local government property tax software and services. He became President and Chief Executive Officer of Manatron in March of 1996. Mr. Sylvester is a CPA and has been a director at Manatron since 1987. | | Director since January 2003 Chairman of the Audit Committee and Member of Compensation Committee |

| |

| Mark D. Weishaar (49) is CEO and President of Sturgis Molded Products, a custom injection molding company headquartered in Michigan, and has held that position since 1997. Mr. Weishaar is a CPA and served as a Partner and Member of the board of directors for BDO Seidman, LLP where he worked for 15 years in various capacities. | | Director since January 2003 Chairman of the Compensation Committee and Member of the Audit Committee |

3

NOMINATION OF DIRECTORS

The Nominating and Governance Committee (“NGC”) annually reviews with the Board the applicable skills and characteristics required of Board nominees in the context of current Board composition and Company circumstances. In making its recommendations to the Board, the NGC considers, among other things, the qualifications of individual director candidates.

The objective of the NGC is to have a Board comprised of members with diverse backgrounds. Characteristics expected of all directors include independence, integrity, high personal and professional ethics, sound business judgment, and the ability and willingness to commit sufficient time to Board activities. Although there are no stated minimum criteria for director nominees, the Board takes into account many factors, including general understanding of technology, marketing, finance, and other disciplines relevant to the success of a publicly-traded company in today’s business environment; understanding of the Company’s business and technology; educational and professional background; personal accomplishment; and geographic, gender, age, and ethnic diversity. The Board does, however, believe it is appropriate for at least one, and, preferably, several, members of the Board to meet the criteria for an “audit committee financial expert” as defined by Securities and Exchange Commission (“SEC”) rules, and that a majority of the members of the Board meet the definition of “independent director” under The NASDAQ Stock Market (“NASDAQ”) rules. The Board evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best perpetuate the success of the Company’s business and represent shareholder interests through the exercise of sound judgment using its diversity of experience. In determining whether to recommend a director for re-election, the NGC also considers the director’s past attendance at meetings, participation in and contributions to the activities of the Board, and the results of the most recent Board self-evaluation.

Although the Company does not have a formal policy concerning shareholder recommendations, the NGC will consider shareholder recommendations for candidates for the Board. To date, the Company has not received any recommendations from shareholders requesting that the NGC consider a candidate for inclusion in the slate of nominees in the Company’s proxy statement. Recommendations should be submitted in writing to the Company indicating the name of any recommended candidate for director, together with a brief biographical sketch, and a document indicating the candidate’s willingness to serve, if elected, to the attention of the Corporate Secretary of the Company. To be included in the Company’s proxy statement relating to the 2008 annual meeting of shareholders or to be considered at the meeting, recommendations must be received in the manner specified under “Shareholder Proposal – Annual Meeting” below.

DIRECTOR INDEPENDENCE

The Board has determined that a majority of the Directors are “independent” for purposes of compliance with NASDAQ listing standards and SEC rules adopted to implement provisions of the Sarbanes-Oxley Act of 2002. Further, all of the members of the Audit Committee are also “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934 and NASDAQ listing standards. The Board based these determinations primarily on a review of the responses of the Directors to questions regarding employment and compensation history, affiliations and family and other relationships and on discussions with the Directors.

Accordingly, the Board has determined that each of the non-employee Directors, other than Mr. Cheff, is independent and has no relationship with the Company, except as a Director and stockholder of the Company. The independent Directors are as follows:

| | |

| Gideon Argov | | Paul R. Sylvester |

| Mario M. Fontana | | John E. Utley |

| L. Peter Frieder | | Mark D. Weishaar |

| Dr. Massimo S. Lattmann | | |

INFORMATION ABOUT THE BOARD AND ITS COMMITTEES

The Board has adopted a charter for each of the three standing committees that addresses the make-up and functioning of the committees, along with a procedure for shareholder communications and the selection process for Board candidates. The Board has also adopted an Ethical Conduct Policy that applies to all of our employees, officers and Directors; a Whistleblower’s Protection Policy; and a Code of Ethics for Senior Executive Officers. The Company intends to satisfy the requirements under Item 5.05 of Form 8-K regarding disclosure of amendments to, or waivers from, provisions of its code of ethics that apply to the Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer by posting

4

such information on the Company’s website. The following documents may be viewed on the Company’s internet page athttp://www.xrite.com/company_investor_relations.aspx and are available in print to our shareholders by writing to our Corporate Secretary at X-Rite, Incorporated, 4300 44th Street, S.E., Grand Rapids, Michigan 49512.

| | • | | Overview – Board Candidates |

| | • | | Position Profile – Board Members |

| | • | | Whistleblowers’ Protection Policy |

Each member of the Board of Directors is expected to make a reasonable effort to attend all meetings of the Board of Directors, all applicable committee meetings, and each Annual Meeting of Shareholders. All members of the Board attended the 2006 Annual Meeting of Shareholders and each of the current members of the Board is expected to attend the 2007 Annual Meeting of Shareholders. During fiscal 2006, the Board held five meetings and the committees held a total of 15 meetings. Each director attended at least 75 percent of the aggregate of the number of meetings of the Board plus the total number of meetings of all committees on which such director served.

The table below shows current membership for each of the standing Board committees:

| | | | |

Audit Committee | | Nominating and Governance Committee | | Compensation Committee |

| Paul R. Sylvester* | | Stanley W. Cheff* | | Gideon Argov |

| Mark D. Weishaar | | Mario Fontana | | Stanley W. Cheff |

| John E. Utley | | L. Peter Frieder | | Paul R. Sylvester |

| | John E. Utley | | Mark D. Weishaar* |

| | | | John E. Utley, ex-officio member |

Below is a description of each standing committee of the Board of Directors. Each committee has the authority to engage legal counsel or other advisors or consultants as it deems appropriate to carry out its responsibilities.

Audit Committee. The primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities for management’s conduct of the Company’s accounting and financial reporting processes and the Company’s system of internal controls regarding finance, accounting, legal compliance and ethics. The Company’s management is responsible for preparing the Company’s financial statements, and the independent auditors are responsible for auditing the Company’s financial statements. The Audit Committee’s role is one of oversight and does not provide any expert assurance or certification as to the Company’s financial statements or the work of the independent auditors. The Committee’s specific responsibilities are delineated in the Audit Committee Charter which includes the authority to engage and change auditors. The Audit Committee Charter can be viewed on the Company’s website. The Board of Directors has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the Committee. In addition, the Board has determined that each of Paul R. Sylvester and Mark D. Weishaar is an “audit committee financial expert” as defined in Item 407(d) of Regulation S-K, and “independent” for purposes of NASDAQ listing standards and Section 10A(m)(3) of the Securities Exchange Act of 1934. The Audit Committee is comprised entirely of independent directors. During 2006, the Audit Committee held six meetings.

Compensation Committee. The primary function of the Compensation Committee is to assist the Board of Directors, and in certain circumstances the independent directors, in matters relating to compensation as may be appropriately delegated to it by the Board, or by the independent directors, as applicable. The Compensation Committee has a role in helping the Board of Directors, and in certain circumstances the independent directors, ensure a clear relationship between total compensation, organization performance, and returns to shareholders. This is based on the Board’s belief that total compensation programs, properly aligned with economic value creation and the values and goals of the Company, are essential tools in the delivery of sustainable value to shareholders. The Compensation Committee is currently comprised of four members, and all of the members are non-employee directors of the Company. The Compensation Committee is comprised of independent directors with the exception of Mr. Cheff. Until the Compensation Committee is comprised entirely of independent directors, the independent directors of the Board of Directors determine executive officer compensation as required by applicable laws, rules, regulations, and listing standards. During 2006, The Compensation Committee held five meetings.

5

Nominating and Governance Committee. The primary function of the Nominating and Governance Committee (“NGC”) is to assist the Board of Directors by (1) recommending qualifications and standards to serve as a director of the Company; (2) identifying individuals qualified to become directors of the Company, and (3) developing and evaluating corporate governance standards and policies for the Company. The NGC also reviews and evaluates the CEO’s performance and advises the Company’s Compensation Committee on its findings. The NGC is composed of independent directors with the exception of Mr. Cheff. Until the NGC is comprised entirely of independent directors, the independent directors of the Board of Directors select the director nominees as required by applicable laws, rules, regulations, and listing standards. During 2006, the NGC held four meetings.

Director Compensation

Currently, each outside Director, that is, a Director who is not an employee of X-Rite, Incorporated, receives a quarterly retainer of $10,000 ($16,000 for the chairperson), plus an additional quarterly retainer of $300 for each member of the Audit Committee ($750 for the chairperson) or the Compensation Committee ($750 for the chairperson), and an additional quarterly retainer of $500 for the chairperson of the NGC. In addition, each outside Director immediately following each Annual Meeting of Shareholders is granted 4,500 shares of restricted stock (7,000 for the chairperson) and an option to purchase 3,000 shares of the Company’s common stock (4,500 for the chairperson) at a price per share equal to the fair market value on the date of grant. The restricted shares and options vest after one year and have a ten year term.

Prior to July 1, 2006, each outside Director received an annual retainer of $20,000 ($37,000 for the chairperson), plus a meeting fee of $1,000 ($1,500 for chairpersons) for each meeting of the Board or a committee attended with the exception of the Audit Committee where a meeting fee of $1,500 ($2,000 for the chairperson) was paid. In addition, each outside director immediately following each Annual Meeting of Shareholders was granted an option to purchase 8,000 shares of the Company’s common stock at a price per share equal to the fair market value on the previous day. Each option had a term of ten years and was exercisable six months following the date of issue.

Mr. Vacchiano receives no compensation for serving as a director, except that he, like all directors, is eligible to receive reimbursement of any expenses incurred in attending Board and committee meetings.

DIRECTOR COMPENSATION IN FISCAL YEAR 2006

| | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($) | | Stock Awards

($)(1) | | Option Awards

($)(2) | | Total

($) |

Current Directors | | | | | | | | |

Gideon Argov | | 20,600 | | 13,800 | | 11,826 | | 46,225 |

Stanley W. Cheff | | 36,600 | | 13,800 | | 5,168 | | 55,568 |

Mario Fontana | | 20,000 | | 13,800 | | 11,826 | | 45,625 |

L.Peter Frieder | | 37,500 | | 13,800 | | 5,168 | | 56,468 |

Massimo S. Lattmann | | 20,000 | | 13,800 | | 11,826 | | 45,625 |

Paul R. Sylvester | | 45,100 | | 13,800 | | 5,168 | | 64,068 |

John E. Utley | | 54,100 | | 21,466 | | 7,752 | | 83,318 |

Mark D. Weishaar | | 43,600 | | 13,800 | | 5,168 | | 62,568 |

Former Directors | | | | | | | | |

Peter M. Banks(3) | | 26,000 | | — | | 38,696 | | 64,696 |

Ronald A VandenBerg(4) | | 27,000 | | — | | 38,696 | | 65,696 |

(1) | Reflects the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 30, 2006, in accordance with the FAS 123(R) and thus may include amounts from awards granted in and prior to 2006. Assumptions used in the calculation of these amounts are included in footnote 9 to the Company’s audited financial statements for the fiscal year ended December 31, 2006 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 14, 2007. |

(2) | Reflects the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 30, 2006, in accordance with the FAS 123(R) and thus may include amounts from awards granted in and prior to 2006. Each current non-employee Director has the following number of options outstanding: Mr. Argov: 4,052; Mr. Cheff: 85,000; Mr. Fontana: 4,052; Mr. Frieder: 22,551; Mr. Lattmann: 4,052; Mr. Sylvester: 29,455; Mr. Utley: 58,500; and Mr. Weishaar: 29,455. The outstanding options that are exercisable are included in the Securities Ownership of Management and Directors table. Assumptions used in the calculation of these amounts are included in footnote 9 to the Company’s audited financial statements for the fiscal year ended December 31, 2006 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 14, 2007. |

6

(3) | On July 5, 2006, the Company entered into a Separation Agreement with Dr. Banks. Under the Agreement, (i) Dr. Banks resigned from the Company’s Board of Directors, (ii) Dr. Banks received 8,000 stock options on May 22, 2007, and (iii) Dr. Banks will be paid a Director Emeritus fee of $20,000 per year for a period of five years concluding on June 30, 2011. |

(4) | On July 5, 2006, the Company accepted the resignation of Mr. VandenBerg from the Board of Directors. Under the terms of the Director Emeritus program, Mr. VandenBerg is eligible to receive Director Emeritus fees in the amount of $20,000 per year for a period of fifteen years. |

Shareholder Communications with Directors

The Board has adopted a process for shareholder communications and the selection of new Board candidates. You can find links to these materials on the Company’s website under Investor Relations at:www.xrite.com. Generally, shareholders who want to communicate with the Board or any individual Director can write to X-Rite, Incorporated, Corporate Secretary, 4300 44th Street, S.E, Grand Rapids, Michigan 49512.

Your letter should indicate that you are an X-Rite, Incorporated shareholder. Depending on the subject matter, management will forward the communication to the Director or Directors to whom it is addressed; attempt to handle the inquiry directly, for example where it is a request for information about the Company or it is a stock-related matter; or not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic.

At each Board meeting, a member of management presents a summary of all communications received since the last meeting that were not forwarded and makes those communications available to the Directors on request.

SECURITIES OWNERSHIP OF PRINCIPAL SHAREHOLDERS

The following table contains information regarding ownership of the Company’s common stock by persons or entities known to the Company to beneficially own more than five percent (5%) of the Company's common stock. The content of this table is based upon information contained in Schedules 13G furnished to the Company as well as information provided by The NASDAQ Stock Market and represents the Company’s understanding of circumstances in existence as of March 31, 2007.

| | | | |

Name & Address of Beneficial Owner | | Amount

and Nature of Beneficial

Ownership | | Percent of Class(1) |

| | |

Lord, Abbett & Co. LLC 90 Hudson Street, Jersey City, NJ 07302 | | 2,317,883 | | 8.09 |

| | |

Daruma Asset Management, Inc. 80 West 40th Street, New York, NY 10018 | | 2,085,500 | | 7.28 |

| | |

State of Wisconsin Investment Board 121 East Wilson Street, Madison, WI 53703 | | 1,512,183 | | 5.28 |

| | |

Putnam Investment Management, Inc. 1 Post Office Square, Boston, MA 02109 | | 1,455,620 | | 5.08 |

| | |

Barclays Global Investors NA (CA) 45 Fremont Street, San Francisco, CA 94105 | | 1,434,406 | | 5.01 |

(1) | The percentages are calculated on the basis of the number of outstanding shares of common stock plus common stock deemed outstanding pursuant to Rule 13d-3 of the Securities Exchange Act of 1934. |

7

SECURITIES OWNERSHIP OF MANAGEMENT AND DIRECTORS

The following table contains information regarding ownership of the Company’s common stock by each director, each named executive officer and all directors and executive officers as a group. The content of this table is based upon information supplied by the persons identified in the table or known to the Company and represents the Company’s understanding of circumstances in existence as of March 31, 2007.

| | | | | | | | | |

Name | | Shares

Beneficially

Owned(1) | | Exercisable

Options(2) | | Total | | Percent of

Class(3) | |

Chief Executive Officer & Named Executive Officers | | | | | | | | | |

Thomas J. Vacchiano, Jr. | | 146,569 | | — | | 146,569 | | * | |

Michael C. Ferrara(4) | | 77,510 | | 112,810 | | 190,320 | | * | |

Mary E. Chowning | | 63,172 | | 82,860 | | 146,032 | | * | |

Bernard J. Berg | | 51,374 | | 155,240 | | 206,614 | | * | |

Jeffrey L. Smolinski | | 45,976 | | 110,240 | | 156,216 | | * | |

James M. Weaver(5) | | 31,454 | | 73,240 | | 104,694 | | * | |

Non-Employee Directors | | | | | | | | | |

Gideon Argov | | 29,565 | | 1,052 | | 30,617 | | * | |

Stanley W. Cheff | | 9,500 | | 82,000 | | 91,500 | | * | |

Mario Fontana | | 44,500 | | 1,052 | | 45,552 | | * | |

L.Peter Frieder | | 9,750 | | 19,551 | | 29,301 | | * | |

Massimo S. Lattmann | | 35,000 | | 1,052 | | 36,052 | | * | |

Paul R. Sylvester | | 5,000 | | 26,455 | | 31,455 | | * | |

John E. Utley | | 22,000 | | 54,000 | | 76,000 | | * | |

Mark D. Weishaar | | 9,500 | | 26,455 | | 35,955 | | * | |

All Directors and Executive Officers as a Group (15 persons) | | 646,559 | | 746,007 | | 1,392,566 | | 4.62 | % |

(1) | Each person named in the table has sole voting and investment power with respect to the issued shares listed in this column. Excludes shares issuable pursuant to options exercisable as of March 31, 2007, or within 60 days thereafter. |

(2) | This column reflects shares subject to options exercisable as of March 31, 2007, or within 60 days thereafter. |

(3) | The percentages are calculated on the basis of the number of outstanding shares of common stock plus common stock deemed outstanding pursuant to Rule 13d-3 of the Securities Exchange Act of 1934. |

(4) | On October 1, 2006, Mr. Ferrara retired from his position of Chief Executive Officer and member of the Board of Directors. Mr. Ferrara remains a non-officer employee of the Company. |

(5) | Mr. Weaver resigned from the Company effective December 30, 2006. |

8

COMPENSATION DISCUSSION & ANALYSIS

Role and Composition of the Committee

The Compensation Committee (the “Committee”) administers and approves all elements of compensation for corporate officers and periodically reviews them with management. The Nominating and Governance Committee (“NGC”) has the direct responsibility to review the corporate goals and objectives relevant to the Chief Executive Officer’s compensation, evaluates the Chief Executive Officer’s (“CEO”) performance in light of those goals and objectives and together with the independent directors, determines and approves the CEO’s compensation level based on this evaluation. The Committee reviews the NGC’s determination with respect to the CEO’s compensation level with the independent non-employee members of the Board who are responsible for the final approval.

All members of the Committee are non-employee directors. While the Compensation Committee is not currently composed entirely of independent directors, it is the goal of the Board of Directors for the Compensation Committee to be comprised of all independent members as quickly as is practical. Until the Compensation Committee is comprised entirely of independent directors, the independent directors of the Board of Directors determine executive officer compensation as required by applicable laws, rules, regulations, and listing standards. With the exception of annual stock option and stock grant awards as outlined under the Director Compensation discussion in this Proxy Statement, Committee members are not eligible to participate in any of the plans or programs that the Committee administers. The Committee has the sole authority to retain consultants and advisors as it may deem appropriate in its discretion, and sole authority to approve related fees and retention terms for these advisors. The Committee reports to the Board of Directors on its actions and recommendations following every meeting, and periodically meets in executive session without members of management or management directors present.

Compensation Philosophy and Practices

The key objectives of the Company’s executive compensation programs are to attract, motivate and retain talented executives who drive X-Rite’s success and industry leadership. The Company’s programs support these objectives by rewarding individuals for advancing business strategies and aligning Company interests and expectations with those of the stockholders. The programs are designed to provide executives with competitive compensation that maintains a balance between cash and equity compensation and provides a significant portion of total compensation at risk, tied both to annual and long-term financial performance of the Company as well as to the creation of shareholder value. It is the Committee’s strong belief that its compensation philosophy will encourage executives to manage from the perspective of owners with an equity stake in the Company.

In constructing and applying these policies, a conscious effort is made to identify and evaluate programs for comparable employers, considering factors such as geography and industry influences, relative sizes, growth stages, and market capitalization. In fulfilling its role to assist the Board of Directors and the independent directors, the Compensation Committee has enlisted the assistance of a consulting firm to establish a peer group of corporations that can be used for compensation comparison and benchmarking purposes. In 2006, this information was provided to the Company by Hewitt Associates, a major consulting firm experienced in all aspects of executive compensation analysis and design.

In making compensation decisions, the Committee compares each element of total compensation against a peer group of U.S. publicly-traded companies in the electronic test and measurement industry (collectively, the “Compensation Peer Group”). The Compensation Peer Group, which is periodically reviewed and updated by the Committee, consists of companies against which the Committee believes the Company competes for talent and for stockholder investment. The companies comprising the Compensation Peer Group are:

| | |

| Analogic Corporation | | Lecroy Corporation |

| Calamp Corporation | | Measuement Specialities Inc. |

| Cohu Inc. | | Mercury Computer Systems Inc. |

| Daktronics Inc. | | Microsemi Corporation |

| Dionex Corporation | | Mts Systems Corp. |

| Electro Scientific Industries Inc. | | Newport Corporation |

| Finisar Corporation | | Park Electrochemical Corp. |

| Heico Corp. | | Photon Dynamics Inc. |

| Intermagnetics General Corp. | | Planar System Inc. |

| Jaco Electonics Inc. | | Zygo Corporation |

9

Market data is only one factor used in determining executive compensation. Other factors that are considered include (i) the value of the position to the Company, (ii) what other peer executives within the Company are paid, (iii) how the job relates to those peers, and (iv) the contribution of the executive including tenure, skills, performance, and industry knowledge. The Company competes with many larger companies for top executive-level talent. As such, the Committee generally sets compensation for executive officers at the 50th percentile of compensation paid to similarly situated executives of the companies comprising the Compensation Peer Group. Variations to this objective may occur as dictated by the experience level of the individual and market factors.

Role of Executive Officers in Compensation Decisions

The independent directors, based on the recommendations of the Committee, make all compensation decisions and equity awards for the executive officers of the Company, which consist of the Chief Executive Officer (“CEO”), Chief Financial Officer, and Chief Technology Officer. The Committee also reviews and approves recommendations made by the CEO regarding compensation decisions and equity awards to other leadership team members (which includes other actively employed executives).

The Compensation Committee reviews the annual salary plan with the CEO for all of the Company's executive officers and provides input to the independent directors and the entire Board of Directors to make such adjustments as the independent directors and Board of Directors determine appropriate based upon salary survey data for comparable employers, economic conditions in general, and evaluations by the CEO. Annual salary for the CEO is reviewed by the independent directors and the entire Board of Directors and adjusted based on the same considerations for other executive salaries, plus input from the NGC and its evaluation of the CEO’s performance.

Components of Executive Compensation

The compensation program for executive officers consists of the following components:

| | • | | Annual Cash Incentive (Bonus) Awards |

| | • | | Long Term Equity Awards (including stock options and performance-based restricted shares) |

Salaries

Salaries are used to provide a fixed amount of compensation for the executive’s regular work. The salaries of the named executive officers are reviewed on an annual basis, as well as at the time of a promotion or other change in responsibilities. Increases in salary are based on an evaluation of the individual’s performance, responsibilities and the Company’s need to be competitive in the market for executive services. Compensation recommendations are benchmarked and targeted to be in line with the 50th percentile of comparable positions with the Compensation Peer Group. Any salary increase for an executive officer must be approved by the Committee and the independent members of the Board of Directors.

Annual Cash Incentive Awards

Executive officers may be awarded annual cash bonuses which are earned based on Company performance criteria. Annual cash incentive awards are designed to reward short-term performance and achievement of designated strategic growth results. The Committee sets the minimum, target and maximum levels for the financial component of the short-term cash incentive award (“STIA”) award at its regularly scheduled fourth quarter meeting for the next year. The target bonus is set based on an analysis of compensation for comparable positions with the Compensation Peer Group and is intended to provide a competitive level of compensation if the executive achieves higher performance objectives. Bonus levels are determined as a percentage of each executive’s base salary.

As a result of the Amazys Holding AG (“Amazys”) acquisition, the Committee modified the short term cash incentive program performance metric to better align short term targets with the integration plan. As such, for fiscal year 2006 the “STIA” was based on the achievement of two key metrics – revenue and adjusted EBITDA (earnings before income tax depreciation and amortization). The award is considered annually using financial performance targets that are approved by the Committee. The metric for the 2006 STIA is weighted using 50 percent adjusted EBITDA and 50 percent revenue. Adjusted EBITDA is defined as U.S. GAAP EBITDA with adjustments for restructuring and integration related expenses, FASB 123(R) expenses, and other non-recurring items.

10

For fiscal year 2007, the STIA performance components are comprised of 60 percent adjusted EBITDA and 40 percent revenue. The named executive officers participating in the STIA program receive:

| | • | | no payment for the Company’s financial objective portion of the STIA unless the Company achieves 90 percent of the target adjusted EBITDA and 95 percent of the target revenue performance level; |

| | • | | payments that range from 20 percent for achieving the minimum target performance level of 95 percent to a maximum of 200 percent for achieving 110 percent or more of the target performance level. |

Upon completion of the fiscal year, the Committee will assess the performance of the Company for each corporate financial objectives of the STIA, comparing the actual results to the pre-determined target.

In March of 2007, the Company paid a short-term incentive bonus relative to the Company’s 2006 performance. The STIA, adjusted EBITDA and revenue targets were established to reflect the acquisition of Amazys for the second half of 2006 and were approved by the Board of Directors. STIA financial targets for the first half of 2006 were not met. The payouts under the plan reflect a 95 percent adjusted EBITDA level with no value awarded for revenue for the second half of 2006. In addition, the Board of Directors awarded discretionary bonuses in 2006 totaling $525,000 in connection with the acquisition and integration of Amazys. In determining this cash award, the Committee took into account each recipient’s personal performance and commitment to the project, as well as each individual’s role in designing the strategic rationale for successfully combining the two companies. These cash bonuses were paid as follows:

| | | | | | |

| | | STIA

($) | | Discretionary

Bonus ($) | | 2006

Total Cash

Bonus ($) |

Thomas J. Vacchiano, Jr. | | 46,500 | | — | | 46,500 |

Michael C. Ferrara | | 76,500 | | 205,000 | | 281,500 |

Mary E. Chowning | | 34,200 | | 155,000 | | 189,200 |

Bernard J. Berg | | 24,700 | | 55,000 | | 79,700 |

Jeffrey L. Smolinski | | 27,600 | | 55,000 | | 82,600 |

James M. Weaver | | 25,200 | | 55,000 | | 80,200 |

Long Term Equity Incentive Awards

Equity-based compensation and ownership ensures that the Company’s executive officers have a continuing stake in the long term success of the Company. The Company’s approach to equity compensation is designed to balance business objectives for executive pay for performance, retention, competitive market practices, and stockholder interests. Long-term stock incentive awards (“LTIA”) are comprised of a mix of stock options and performance-based restricted stock. Stock options provide a material incentive to employees by providing an opportunity for a stock ownership stake in the Company. Performance shares provide a material incentive to executives by offering potential increased stock ownership in the Company tied directly to relative total shareholder return.

These awards are considered annually and currently use an adjusted EBITDA growth objective target to determine the underlying value of the award. The LTIA adjusted EBITDA targets are established to reflect expected growth for a 3 year horizon. The restricted stock awards made in 2007 reflect the first true performance-based LTIA awards as all previous equity awards vested on a time-based schedule. LTIA provide senior management with an incentive opportunity linked to multiple year corporate financial performance and stockholder value. Equity awards are also granted periodically to a select group of non-executive employees whose contributions and skills are critical to the Company’s long-term success.

In general, annual LTIA compensation awards are determined at the Committee’s regularly scheduled first quarter meeting and are reflected in the Summary Compensation Table on page 19 and the Grants of Plan Based Awards Table on page 20. The underlying value of the LTIA to named-executive officers was determined based on a dollar amount indicated by the “50th percentile” of long-term compensation for the Compensation Peer Group for the applicable position as indicated in the peer market data with 40 percent of this amount to be in the form of stock options that vest on the first anniversary of grant and 60 percent of this amount to be in the form of restricted stock which would vest at the earlier of the third year or achievement of certain financial goals, using performance components such as adjusted EBITDA and revenue. For purposes of determining the number of shares issued or options granted, the Company uses a modified Black-Scholes valuation applied on a consistent basis from year to year.

11

In February of 2006, LTIA grants were as follows:

| | | | |

| | | 2006 |

| | | Restricted

Shares (#) | | Stock

Options (#) |

Michael C. Ferrara | | 34,770 | | 50,810 |

Mary E. Chowning | | 15,650 | | 22,860 |

Jeffrey L. Smolinski | | 10,430 | | 15,240 |

Bernard J. Berg | | 10,430 | | 15,240 |

James M. Weaver | | 10,430 | | 15,240 |

In August 2006, the independent directors of Company’s Board of Directors approved certain modifications to the February 2006 LTIA restricted stock grant vesting for the executive officers of the Company in consideration of the completed acquisition of Amazys by the Company. The Company had proposed an LTIA program for 2006 applicable to all executive officers which was based on Company-wide economic performance defined to be roughly the average return on assets. The LTIA vesting for restricted shares granted in February 2006 for executive officers was modified to vest over a three-year period. Restricted stock granted under the LTIA plan in March of 2007 will vest based upon Company performance during a three-year period as reflected in cumulative revenue growth and the cumulative adjusted EBITDA growth.

In November 2006, the Committee reviewed the 2007 LTIA compensation program for executive officers and established an LTIA level based on the 50th percentile of market for the position based on the Compensation Peer Group, consisting of 40 percent in a stock option grant vesting after one year and 60 percent in performance stock cliff vesting after three years based upon the achievement of the cumulative revenue and the cumulative adjusted EBITDA growth objective as outlined below. The executive officers participating in the LTIA program receive:

| | | | | | | | | | | | |

Revenue (3 Year Cumulative Total) (weighted 33 %) ($ millions) | | Adjusted EBITDA (3 Year Cumulative Total) (weighted 67%) ($ millions) | | Vesting

Threshold

(% of Target) |

| Less than | | 785 | | Less than | | 176 | | 0 |

| 786 | | to | | 793 | | 177 | | to | | 178 | | 20 |

| 794 | | to | | 801 | | 179 | | to | | 180 | | 40 |

| 802 | | to | | 810 | | 181 | | to | | 182 | | 60 |

| 811 | | to | | 818 | | 183 | | to | | 184 | | 80 |

| Greater than | | 818 | | Greater than | | 184 | | 100 |

In March of 2007, the LTIA grants were awarded as follows:

| | | | |

| | | 2007 |

| | | Restricted

Shares (#) | | Stock Options (#) |

Thomas J. Vacchiano, Jr. | | 39,247 | | 52,330 |

Michael C. Ferrara | | 39,247 | | 52,330 |

Mary E. Chowning | | 14,718 | | 19,624 |

Bernard J. Berg | | 9,812 | | 13,082 |

Jeffrey L. Smolinski | | 9,812 | | 13,082 |

Beginning in the third quarter of 2006, the Company changed its policy and now uses the closing price of the Company’s common stock on the grant date as the exercise price of the option awards. The Company previously used the closing price of its common stock as quoted on the NASDAQ Stock Market on the day prior to the grant date to determine the exercise price of option awards. This change was made to simplify the Company’s internal processes and has no material impact on any financial disclosures.

12

In-Service Benefits

The Company provides a number of benefit plans including the X-Rite, Incorporated Retirement Savings Plan and related supplemental plans to its executives and certain other U.S. based employees. The Company also provides other benefits such as medical, dental, life insurance and long-term disability coverage, as well as vacation and other paid holidays. These benefits are available to all U.S. based employees, including each named executive officer, and are comparable to those provided at other peer group companies. These programs are designed to provide certain basic quality of life benefits and protections to all Company employees and at the same time enhance the Company’s attractiveness as an employer of choice.

The Committee periodically reviews the levels of personal benefits provided to named executive officers. A detailed analysis of these benefits is included in footnote #4 to the Summary Compensation Table.

Perquisites

The Company provides certain other small perquisites to its executives. These benefits in 2006 and 2007 include moving expenses, personal use of company paid automobile and country club memberships. A detailed analysis of these benefits is included in footnote #4 to the Summary Compensation Table.

Establishing STIA and LTIA Targets

Generally, the Committee sets the STIA targets for adjusted EBITDA and revenue based on the annual operating plan. The LTIA threshold level for adjusted EBITDA and revenue is based on the Company’s long-term financial objectives. In making the annual determination, the Committee may consider the specific circumstances facing the Company during the coming year. Revenue and adjusted EBITDA targets are set in alignment with the Company’s strategic plan and the expectations regarding Company performance. The Committee believes that it has established targets that are achievable and in line with the current global economic and competitive environment in which the Company operates.

While performance targets are established at levels that are intended to be achievable, a maximum STIA and LTIA payout would require very high levels of Company performance. Overall, we believe that a payout at the 80% level should be achievable, payout at the 100% level is challenging and payout at the 110% level is difficult.

Employment Agreements and Change in Control Agreements

Certain executive officers are parties to employment agreements with the Company. In January of 2006 in connection with the Amazys transaction, the Company entered into employment agreements with Thomas J. Vacchiano, Jr., Mary E. Chowning, and Francis Lamy. In February 2007, the Company entered into an employment and consulting agreement with Bernard J. Berg. A detailed discussion of the terms and conditions of these agreements can be found under the heading “Agreements and Other Arrangements” in this Proxy Statement. When evaluating the value of these agreements, the Company considered such factors as retention, competitive advantage through non-compete and non-solicitation clauses, best practices with peer group companies, and continued dedication and support of a cohesive management team and concluded that it was in the best interest of the Company to enter into these agreements.

All executive officers are parties to change in control agreements with the Company, details of which are outlined under the heading “Change in Control Agreement” in this Proxy Statement. The Company believes that it is in the best interest of the Company and its shareholders to foster senior management’s objectivity in making decisions with respect to any potential change in control of the Company and to ensure that the Company will have their continued dedication and availability. Accordingly, the Company believes that it is appropriate to provide executive officers with compensation arrangements upon a change in control.

Ethical Conduct

To help ensure that stock-based grants reward only those executives who benefit the Company, the Company’s equity plans and agreements provide that awards will be cancelled and that certain gains must be repaid if an executive violates certain provisions of the award agreement. These provisions include prohibitions against engaging in activity that is detrimental to the Company, such as performing services for a competitor, disclosing confidential information or violating the Company’s Business Conduct Guidelines (annual cash incentive payments are also conditioned on compliance with these Guidelines).

Every executive is held accountable to uphold and comply with these Guidelines. Upholding the Guidelines contributes to the success of the individual executive, and to the Company as a whole.

13

Tax and Accounting Implications

Deductibility under Section 162(m)

Section 162(m) of the U.S. Internal Revenue Code of 1986 limits deductibility of compensation in excess of $1 million paid to the Company’s chief executive officer and to each of the other four highest-paid executive officers unless this compensation qualifies as “performance-based.” Based on the applicable tax regulations, any taxable compensation derived from the exercise of stock options by senior executives under the Company’s Incentive Performance Plan for Certain Executives should qualify as performance-based. The Plan permits an executive officer who is subject to Section 162(m) and whose salary is above $1 million to defer payment of a sufficient amount of the salary to bring it below the section 162(m) limit. The Company’s stockholders have approved terms under which the Company’s annual and long-term performance incentive awards should qualify as performance-based on May 3, 2005, as required by the Internal Revenue Service. These terms do not preclude the Committee from making any payments or granting any awards, whether or not such payments or awards qualify for tax deductibility under Section 162(m), which may be appropriate to retain and motivate key executives. The Company will generally seek to comply with Section 162(m) to the extent such compliance is practicable and in the best interests of the Company and its stockholders.

Accounting for Stock-Based Compensation

Beginning on January 1, 2006, the Company began accounting for stock-based payments for all stock option and stock grant programs in accordance with the requirements of FASB Statement 123(R).

Compensation Committee Report

We, the Compensation Committee of the Board of Directors of X-Rite, Incorporated, have reviewed and discussed the Compensation Discussion and Analysis set forth above with the management of the Company, and, based on such review and discussion, have recommended to the Board of Directors inclusion of the Compensation Discussion and Analysis in this Proxy Statement and, through incorporation by reference from this Proxy Statement, the Company’s Annual Report on Form 10-K for the year ended December 30, 2006.

| | | | |

| | | | Compensation Committee: |

| | | | Mark D. Weishaar, Chairman |

| | | | Gideon Argov |

| | | | Stanley W. Cheff |

| | | | Paul R. Sylvester |

| | |

| | | | Independent Directors: |

| | | | John E. Utley |

| | | | Gideon Argov |

| | | | Mario Fontana |

| | | | L. Peter Frieder |

| | | | Dr. Massimo Lattmann |

| | | | Paul R. Sylvester |

| | | | Mark D. Weishaar |

Compliance

During 2006, the Company complied with current NASDAQ rules with respect to independent director and/or entire Board of Directors approval of CEO compensation in an executive session where the CEO is not present as well as independent director and/or entire Board of Directors approval requirements of all executive officer compensation.

14

AGREEMENTS AND OTHER ARRANGEMENTS

Change in Control Agreements

The Company’s Board of Directors approved a new X-Rite Change In Control Severance Plan for Senior Executives (“Change in Control Plan”) for certain of its executive officers effective April 1, 2007. Under the terms of the Change in Control Plan, following a change in control, if a participant's employment is terminated (1) by the Company other than for cause, disability or death of the participant or (2) by the participant with good reason (“Qualifying Termination”), the Company is obligated to pay the participant a lump-sum in cash equal to (i) the participant’s unpaid base salary, accrued vacation pay and expenses, (ii) amounts unpaid to the participant under the annual short-term incentive plan in respect of the most recently completed fiscal year, (iii) an amount equal to two times the greater of the participant’s base salary for the year in which the participant is terminated or as in effect prior to the change in control, (iv) a bonus amount equal to two times the greater of participant’s target incentive opportunity for the year the participant is terminated or as in effect prior to the change in control, (v) a pro rata portion of the participant’s target incentive opportunity for the year the participant is terminated or as in effect prior to the change in control, whichever is greater, (vi) payment of continuation health coverage premiums for twenty-four (24) months following the date of the Qualifying Termination, and (vii) excise tax gross-up on severance payments, if triggered. In addition, upon a Qualifying Termination, unless otherwise provided in a plan document, award agreement or otherwise, all of the participant’s outstanding equity-based long-term incentive vehicles (including stock options stock appreciation rights, restricted stock, and restricted stock units) shall vest, and where applicable, all target levels of performance shall be treated as being achieved as of the date of the change in control.

Thomas J. Vacchiano, Jr., the Company’s President and Chief Executive Officer, and Francis Lamy, the Company’s Executive Vice President and Chief Technology Officer, are covered under the new Change in Control Plan effective April 1, 2007.

The Company currently has change in control agreements with Messrs. Ferrara, Berg and Smolinski, and Ms. Chowning that provide for the payment of post-termination benefits if their employment is terminated following a change in control. Under the terms of these agreements, following a change in control, the Company agrees to continue to employ the executive for a three year period (the “Employment Term”) in the same position and with the base salary, annual bonus, benefits, vacation and sick leave no less favorable to the executive than as in effect at any time within ninety (90) days preceding the change in control. If during the Employment Term, the executive’s employment is terminated (1) by the Company other than for cause, disability or death of the executive or (2) by the executive with good reason or during the period commencing one hundred eighty (180) days after the commencement of the Employment Term and ending on the first anniversary of the Employment Term, the Company is obligated to pay the executive (i) the executive’s accrued but unpaid base salary and expenses, (ii) at the Company’s election, the executive’s base salary in normal installments for the remainder of the Employment Term, or a single payment that would otherwise be payable in installments for the remainder of the Employment Term, (iii) a bonus amount equal to the three year historical average of the annual bonuses paid or payable to the executive prior to the change in control, times the sum of the number of full fiscal years remaining in the Employment Term and the fraction equal to the pro-rata portion of the then current fiscal year up to such termination, (iv) the continuation of life insurance, disability, medical, dental and hospitalization payment benefits on behalf of the executive, (v) the immediate vesting of, and lapse of restrictions on all outstanding incentive awards (including stock options and restricted shares granted to the executive), which shall remain exercisable to the extent provided for in the stock option and restricted stock agreements to which they relate and (vi) an excise tax gross-up on severance payments, if triggered.

On April 1, 2007, the Company notified Messrs. Ferrara, Berg, and Smolinski, and Ms. Chowning of its intention to terminate the Agreements pursuant to the required one (1) year notification period. The Agreements will expire on April 1, 2008. On that date, these executives will be covered under the Change of Control Plan for Senior Executives discussed above.

Long-Term Incentive Plans

In September 2005, the Company established a Long-Term Incentive Plan for certain executive officers of the Company which is governed by the X-Rite, Incorporated 2006 Omnibus Long Term Incentive Plan. Long-term stock incentive is comprised of a mix of both stock options and performance-based restricted stock for future long-term incentive (“LTIA”) awards to executives. The equity awards under the LTIA consist of 40 percent in the form of stock options that vest on the first anniversary of grant and 60 percent in the form of restricted stock which would vest after three years based upon the achievement of financial goals as discussed in the Compensation Discussion and Analysis section of this proxy.

15

Employment, Severance and Other Agreements

Thomas J. Vacchiano, Jr.

Effective October 1, 2006, Mr. Vacchiano was appointed President and CEO as well as a member of the Board of Directors. Mr. Vacchiano was the President and CEO of Amazys from January 2001 until the acquisition of Amazys by the Company in July 2006.

Mr. Vacchiano entered into an employment agreement with X-Rite in connection with the acquisition of Amazys under which Mr. Vacchiano had agreed to serve as President and COO of the Company for a period of three years from the completion of the Amazys acquisition (July 5, 2006) unless earlier terminated in accordance with its terms. Currently, Mr. Vacchiano’s annual base salary is $320,000. Under the terms of his existing employment agreement Mr. Vacchiano is (i) entitled to participate in any bonus plan or other incentive compensation program applicable to X-Rite’s executives, and (ii) entitled to participate in any long-term incentive compensation program applicable to X-Rite’s executives, with 60 percent to consist of restricted stock awards and 40 percent to consist of stock option awards.

In the event of termination of Mr. Vacchiano’s employment by the Company without cause or by Mr. Vacchiano for good reason, Mr. Vacchiano will receive as outlined in the Employment Agreement (i) severance pay equal to his monthly salary for the last full month immediately preceding his termination for twelve (12) months, if terminated by Mr. Vacchiano for good reason, and for the greater of (a) the number of months remaining in the initial three (3) year term of his Employment Agreement or (b) twelve (12) months, if terminated by the Company without cause, (ii) a pro rata portion of any annual performance bonus to which Mr. Vacchiano would have been entitled for the year in which the Employment Period is terminated, (iii) payment of continuation health coverage premiums under the Consolidated Omnibus Budget Reconciliation Act of 1986, as amended, for eighteen (18) months following the date of termination, and (iv) immediate vesting of all stock options and restricted shares held by Mr. Vacchiano, which shall remain exercisable to the extent provided for in the stock option and restricted stock agreements to which they relate. Mr. Vacchiano is also a participant in the Change in Control Plan discussed above in “Change in Control Agreements”.

Michael C. Ferrara

Effective October 1, 2006, Michael C. Ferrara retired from his positions of Chief Executive Officer (CEO) and member of the Board of Directors of the Company. Under Mr. Ferrara’s employment agreement, Mr. Ferrara will continue to receive the annual salary, annual bonuses and other fringe benefits provided under the Employment Agreement to which he would have been entitled had his role and/or duties as the CEO of the Company not been changed. At the time of the CEO transition, Mr. Ferrara’s annual base salary was $425,000. Other principal terms of Mr. Ferrara’s employment agreement include the vesting of restricted stock grants and certain minimal financial planning benefits to Mr. Ferrara for the years 2005 and beyond. The agreement also defines the method by which either party may terminate it prior to expiration of the then current term, as well as the basis for severance pay and benefits calculations.

The Company has also entered into an agreement to provide certain medical, dental and prescription drug benefits to Mr. Ferrara following his employment with the Company. These benefits are comparable to those provided the Company's employees and will be secondary to all Medicare benefits for which Mr. Ferrara is eligible. The Company's obligation under this agreement will expire on December 31, 2015.

Mary E. Chowning

In connection with the acquisition of Amazys, the Company and Mary E. Chowning entered into an Employment Agreement. Ms. Chowning currently serves as the Company’s Executive Vice President and Chief Financial Officer, and receives an annual base salary of $295,000. Under the terms of the existing employment agreement, Ms. Chowning is (i) entitled to participate in any bonus plan or other incentive compensation program applicable to the Company’s executives, and (ii) entitled to participate in any long-term incentive compensation program applicable to the Company’s executives, with 60 percent to consist of restricted stock awards and 40 percent to consist of stock option awards.

In the event of termination of Ms. Chowning’s employment by the Company without cause or by Ms. Chowning for good reason, Ms. Chowning will receive as outlined in the Employment Agreement (i) severance pay equal to her monthly salary for the last full month immediately preceding her termination for twelve (12) months, (ii) a pro rata portion of any annual performance bonus to which Ms. Chowning would have been entitled for the year in which the Employment Period is terminated, (iii) payment of continuation health coverage premiums under the Consolidated Omnibus Budget Reconciliation Act of 1986, as amended, for twelve (12) months following the date of termination, and (iv) immediate vesting of all stock

16

options and restricted shares held by Ms. Chowning, which shall remain exercisable to the extent provided for in the stock option and restricted stock agreements to which they relate. Additionally, if Ms. Chowning terminates her employment by giving written notice to the Company (whether with or without “good reason”) at any time after the one (1) year anniversary of the date on which Mr. Ferrara leaves active employment with X-Rite, Ms. Chowning will be entitled to receive the severance pay and benefits set forth in the previous sentence. Ms. Chowning has also entered into a change in control agreement with the Company as discussed above in “Change in Control Agreements”.

Bernard J. Berg

On February 20, 2007, the Company entered into an Employment Agreement with Bernard J. Berg, the Company’s Senior Vice President of Engineering for an employment period terminating on December 31, 2008. Under the terms of the agreement, Mr. Berg (i) will receive a base salary of $216,000 per year, (ii) is entitled to participate in any bonus plan or other incentive compensation program applicable to the Company’s executives, (iii) is entitled to participate in any short-term incentive compensation program applicable to the Company’s executives, with an initial annual performance bonus potential of 40 percent of his base salary if the Company achieves target performance and up to 80 percent of his base salary if the Company achieves exceptional performance, (iv) is entitled to participate in any long-term incentive compensation program applicable to the Company’s executives, with 60 percent to consist of restricted stock awards and 40 percent to consist of stock option awards, and (v) is entitled to insurance and other fringe benefits pursuant to the Company’s plans and policies in effect for its executives.

In the event of termination of Mr. Berg’s employment by the Company without cause or by Mr. Berg for good reason, Mr. Berg will receive as outlined in the Employment Agreement (i) severance pay equal to his monthly salary for the last full month immediately preceding his termination, payable until December 31, 2008, (ii) a pro rata portion of any annual performance bonus to which Mr. Berg would have been entitled for the year in which the Employment Period is terminated, (iii) payment of Mr. Berg’s continuation health coverage premiums under the Consolidated Omnibus Budget Reconciliation Act of 1986, as amended, for eighteen (18) months following the date of termination, and (iv) any unvested stock options and restricted stock held by Mr. Berg will continue to vest, which shall remain exercisable to the extent provided for in the stock option agreements to which they relate. Mr. Berg has also entered into a change in control agreement with the Company as discussed above in “Change in Control Agreements” and according to his employment agreement is entitled to participate in the Change in Control Plan once the plan becomes effective.

On February 20, 2007, the Company entered into a Consulting Agreement with Mr. Berg which becomes effective January 1, 2009 after the expiration of the term of his Employment Agreement, and lasts for a term of two (2) years. Under the terms of the Consulting Agreement, Mr. Berg will provide consulting services as requested by the chief executive officer and/or the chief technology officer. Mr. Berg will not be obligated to provide consulting services for more than seven (7) days per month during the first year of the term and four (4) business days per month during the second year of the term. In consideration of Mr. Berg’s performance, the Company will (i) pay Mr. Berg an annual consulting fee in the amount of $100,000, and (ii) pay Mr. Berg’s continuation health coverage premiums under the Consolidated Omnibus Budget Reconciliation Act of 1986, as amended, for eighteen (18) months following the effective date.

Francis Lamy

In connection with the acquisition of Amazys, the Company and Mr. Lamy entered into an Employment Agreement on January 30, 2006. Mr. Lamy currently serves as the Company’s Executive Vice President and Chief Technology Officer. His annual base salary is CHF 325,000 (equal to $266,500 on December 31, 2006). Under the terms of the existing Employment Agreement, Mr. Lamy is (i) entitled to participate in any bonus plan or other incentive compensation program applicable to the Company’s executives, and (ii) entitled to participate in any long-term incentive compensation program applicable to the Company’s executives, with 60 percent to consist of restricted stock awards and 40 percent to consist of stock option awards.

Additionally, under the Employment Agreement, Mr. Lamy is entitled to (i) a CHF 32,500 (equal to $26,650 on December 31, 2006) per year allowance as a contribution to Mr. Lamy’s personal health insurance, and (ii) a CHF 5,000 (equal to $4,100 on December 31, 2006) per year allowance for obtaining tax consulting advice associated with being an officer of a U.S. based corporation, and (iv) a pension scheme in accordance with the applicable provisions of Swiss law, the premiums for which shall be apportioned between the Company and Mr. Lamy in accordance with the contribution levels provided for in the pension scheme of Amazys.

In the event of termination of Mr. Lamy’s employment by the Company without cause or by Mr. Lamy for good reason, Mr. Lamy will receive as outlined in the Employment Agreement (i) severance pay equal to his monthly salary for the last full month immediately preceding his termination for twelve (12) months, (ii) a pro rata portion of any annual

17

performance bonus to which Mr. Lamy would have been entitled for the year in which the Employment Period is terminated, (iii) the continuation of his health insurance allowance for twelve (12) months following the date of termination, and (iv) immediate vesting of all stock options and restricted shares held by Mr. Lamy, which shall remain exercisable to the extent provided for in the stock option and restricted stock agreements to which they relate. Mr. Lamy is also a participant in the Change in Control Plan discussed above in “Change in Control Agreements”.

James M. Weaver

On December 30, 2006, the Company entered into a Severance Agreement with Mr. Weaver in connection with his resignation. Previously, Mr. Weaver served as the Company’s Senior Vice President and General Manager of the Retail Business. Under the Severance Agreement, Mr. Weaver will receive (i) severance pay equal to his monthly salary for the last full month immediately preceding his termination, payable until December 29, 2007, (ii) any incentive compensation to which he is entitled for his employment through December 29, 2006 under and pursuant to the terms and conditions of the X-Rite Second – Half 2006 Officers Compensation Plan, (iii) payment of Mr. Weaver’s continuation health coverage premiums under the Consolidated Omnibus Budget Reconciliation Act of 1986, as amended, until December 29, 2007, and (iv) immediate vesting of any unvested stock options and restricted stock held by Mr. Weaver, which shall remain exercisable to the extent provided for in the stock option agreement to which they relate. On December 29, 2006, the Company accelerated the vesting of previously granted options to purchase 15,240 shares and the vesting of 10,430 shares of previously granted restricted stock.

Director Emeritus Program