Consideration should be given to the risks of investing, including potential loss of value, market risk, interest rate risk, credit risk, and geographic concentration. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. For certain investors, some dividends may be subject to Federal and state taxes.

NOT A PART OF THE ANNUAL REPORT

| Serving Oregon Investors for More Than Two Decades Tax-Free Trust of Oregon ANNUAL REPORT Management Discussion | |

In the past 12 months there has been a deluge of information regarding the fiscal health of municipalities. Economists, politicians, municipal industry analysts, think tanks, and even equity analysts have written and publicized their opinions as to the fiscal state of municipalities. While no one questions the fiscal stress that municipalities are experiencing, and will likely continue to experience, the ultimate outcome is strongly debated. Concerns for the past year have been well documented as budget struggles seem to be reported daily. Leaders in Oregon have had to address budget shortfalls numerous times as revenue continues to fall short of what was expected.

Despite all the negative press, municipal bonds continue to perform and pay tax-free income. The Trust’s net asset value (Class A shares) started the fiscal year at $11.05, saw some weakness in October, November, and December and then started a slow progression to end the current fiscal year at $11.18 per share. This was near the fiscal year high of $11.22 reached a couple of times in late August and early September. The fiscal year low of $10.81 was seen in mid-November 2009. The September 30, 2010 net asset value of $11.18 provided a small return on principal, but more importantly the income return was $0.40 per share versus $0.42 per share for the 2009 fiscal year. As such, our 12-month total return for Class A shares was 4.95%, without sales charge.

While the Class A Shares total return of 4.95% was less than the 13.74% return of fiscal year 2009 (without sales charge) we view the total return in fiscal 2010 very positively. Our objective remains to seek to provide you as high a level of current income exempt from Oregon state and regular Federal income taxes as is consistent with preservation of capital. It appears that we did just that in the fiscal year that ended on September 30, 2010. We have consistently provided annual income of at least $0.40 per share or more for the last five years.

Holding the income per share consistent has been proving to be more difficult as bond calls and older holdings mature and the proceeds are reinvested in a lower interest rate environment. The high absolute yields seen during late 2008 and 2009 were fleeting, but some of the ramifications are still seen in the market. One example is a much steeper yield curve. Investors expect to be paid a higher rate of return for adding the risk of higher interest rates in the future. At fiscal year-end 2010 the difference between investing in one year maturities (0.3%) and investing in 30 year maturities (3.70%) was 340 basis points (bps). At the end of the 2007 fiscal year this difference was a mere 103 bps. At fiscal year-end 2007 the average maturity of the portfolio was 11.37 years versus the 13.95 average maturity a t fiscal year-end 2010. Investors are being paid more to buy bonds with longer maturities and the Trust has extended portfolio maturities in an effort to maintain income.

MANAGEMENT DISCUSSION (continued)

In addition to the investor being paid to extend into longer maturities, the premium that lower rated issuers must pay to investors has also increased. This is called the credit spread. In other words, investors expect to be paid more to take on a greater credit risk. We only have to look back to 2008 to see how different asset classes respond when the economy is struggling. What are perceived to be the strongest credits, U.S. Treasuries, are currently in great demand and when bond prices rise, yields decrease. This is the type of market that may create opportunities for an investor who is prepared to take advantage of them as they occur. We believe we were able to do that as the Portfolio Manager and the Credit Analysts routinely monitor Oregon credits so that when attractive issues came to market we were able to invest. We did add some lower rated credits during the period to augment the income in the portfolio while maintaining the overall high credit quality of the Trust. The role of the Credit Analyst is even more crucial given the current economic environment, the diminished role of bond insurance companies and the fact that rating agency methodologies are being questioned.

Opinions regarding the future direction of the economy over the next year are extremely muddled at best. The debate between professional economic pundits is mixed and has stimulated some heated, and highly-publicized discussions. We currently have positively sloped yield curves in the Treasury market and the municipal market, with long-term rates substantially higher than short-term rates. The slope of the Treasury yield curve historically has been a leading indicator of economic activity. A sharply positive curve generally indicates that investors are anticipating higher inflation from perceived future economic growth. Although we believe that growth will be positive, we do not expect a sharp increase in the economic growth rate, but rather slow forward momentum. The severity of the economic slowdown in u nemployment and housing will take time to work itself through the system. Our expectation is that interest rates, while biased to increase, will not do so on a substantial scale over the next fiscal year.

Over the coming months, we expect to see a recovery and some reestablishment of a foundation from which economic growth will develop. Oregon and its municipalities will likely continue to struggle with budgets and are also likely to have lower revenues to support infrastructure and municipal services. Historically, municipal coffers are one of the last benefactors of increased economic growth as tax revenues generally take time to work their way through the system. We have always sought to not only review each credit in the portfolio but also to take a conservative approach to our evaluations.

As always, our goal is to seek to provide as high a level of current income exempt from State and Federal income taxes as is consistent with preservation of capital.

Performance data represents past performance, but does not guarantee future results. Investment return and principal value will fluctuate; shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the data presented.

NOT FDIC INSURED – NO BANK GUARANTEE – MAY LOSE VALUE

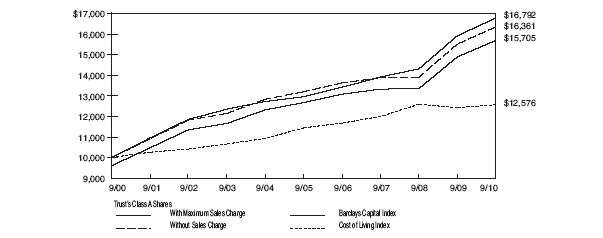

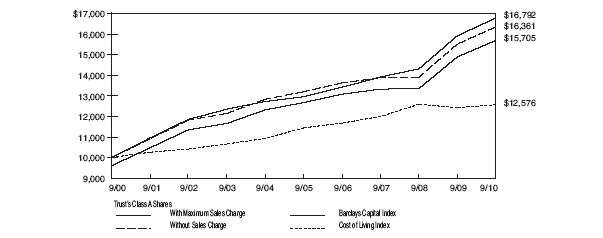

The following graph illustrates the value of $10,000 invested in the Class A shares of Tax-Free Trust of Oregon for the 10-year period ended September 30, 2010 as compared with the Barclays Capital Quality Intermediate Municipal Bond Index (the “Barclays Capital Index”) (formerly known as the Lehman Brothers Quality Intermediate Municipal Bond Index) and the Consumer Price Index (a cost of living index). The performance of each of the other classes is not shown in the graph but is included in the table below. It should be noted that the Barclays Capital Index does not include any operating expenses nor sales charges and being nationally oriented, does not reflect state specific bond market performance.

| | | Average Annual Total Return for periods ended September 30, 2010 | | |

| | | | | | | | | | | | Since | | |

| Class and Inception Date | | 1 Year | | | 5 Years | | | 10 Years | | | Inception | | |

| Class A (commenced operations on 6/16/86) | | | | | | | | | | | | | |

| With Maximum Sales Charge | | | 0.76 | % | | | 3.62 | % | | | 4.62 | % | | | 5.71 | % | |

| Without Sales Charge | | | 4.95 | | | | 4.46 | | | | 5.05 | | | | 5.89 | | |

| Class C (commenced operations on 4/5/96) | | | | | | | | | | | | | | | | | |

| With CDSC | | | 3.04 | | | | 3.58 | | | | 4.16 | | | | 4.15 | | |

| Without CDSC | | | 4.07 | | | | 3.58 | | | | 4.16 | | | | 4.15 | | |

| Class Y (commenced operations on 4/5/96) | | | | | | | | | | | | | | | | | |

| No Sales Charge | | | 5.21 | | | | 4.64 | | | | 5.21 | | | | 5.20 | | |

| Barclays Capital Index | | | 5.43 | | | | 5.31 | | | | 5.32 | | | | 5.96 | * | (Class A) |

| | | | | | | | | | | | | | | | 5.28 | | (Class C&Y) |

* From commencement of the index on 1/1/87.

Total return figures shown for the Trust reflect any change in price and assume all distributions within the period were invested in additional shares. Returns for Class A shares are calculated with and without the effect of the initial 4% maximum sales charge. Returns for Class C shares are calculated with and without the effect of the 1% contingent deferred sales charge (CDSC) imposed on redemptions made within the first 12 months after purchase. Class Y shares are sold without any sales charge. The rates of return will vary and the principal value of an investment will fluctuate with market conditions. Shares, if redeemed, may be worth more or less than their original cost. A portion of each class’s income may be subject to Federal and state income taxes. Past performance is not predictive of future investment results.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of Tax-Free Trust of Oregon:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Tax-Free Trust of Oregon as of September 30, 2010 and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes exa mining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2010, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Tax-Free Trust of Oregon as of September 30, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

November 24, 2010

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon General Obligation Bonds (44.3%) | | (unaudited) | | Value | |

| | | Benton and Linn Counties, Oregon School District | | | | | |

| | | #509J (Assured Guaranty Municipal Corp. Insured) | | | |

| $ | 4,670,000 | | 5.000%, 06/01/21 pre-refunded | | Aa1/NR/NR | | $ | 5,196,075 | |

| | | | Central Oregon Community College District | | | | | | |

| | | | (School Bond Guaranty Program) | | | | | | |

| | 1,850,000 | | 4.750%, 06/15/22 | | NR/AA/NR | | | 2,135,658 | |

| | 2,195,000 | | 4.750%, 06/15/23 | | NR/AA/NR | | | 2,517,950 | |

| | 2,175,000 | | 4.750%, 06/15/26 | | NR/AA/NR | | | 2,444,352 | |

| | | | Chemeketa, Oregon Community College District | | | | | | |

| | | | (Financial Guaranty Insurance Corporation Insured) | | | | | | |

| | 1,385,000 | | 5.500%, 06/01/14 Escrowed to Maturity | | NR/NR/NR* | | | 1,589,841 | |

| | | | Chemeketa, Oregon Community College District | | | | | | |

| | | | (School Bond Guaranty Program) | | | | | | |

| | 1,010,000 | | 5.500%, 06/15/24 | | NR/AA/NR | | | 1,189,134 | |

| | 1,235,000 | | 5.000%, 06/15/25 | | NR/AA/NR | | | 1,398,094 | |

| | 1,540,000 | | 5.000%, 06/15/26 | | NR/AA/NR | | | 1,734,379 | |

| | | | City of Lake Oswego, Oregon Series A | | | | | | |

| | 3,000,000 | | 4.500%, 12/01/34 | | Aa1/AAA/NR | | | 3,131,010 | |

| | | | Clackamas, Oregon Community College District | | | | | | |

| | | | (National Public Finance Guarantee Insured) | | | | | | |

| | 1,535,000 | | 5.000%, 05/01/25 | | Aa3/AA/NR | | | 1,676,588 | |

| | | | Clackamas County, Oregon School District #12 (North | | | | | | |

| | | | Clackamas) Convertible Capital Appreciation Bonds | | | | | | |

| | | | (Assured Guaranty Municipal Corp. Insured) (School | | | | | | |

| | | | Bond Guaranty Program) (converts to a 5% coupon | | | | | | |

| | | | on 06/15/11) | | | | | | |

| | 8,000,000 | | zero coupon, 06/15/27 Series B | | Aa1/AAA/NR | | | 8,453,520 | |

| | 9,250,000 | | zero coupon, 06/15/29 | | Aa1/AAA/NR | | | 9,677,165 | |

| | | | Clackamas County, Oregon School District #46 | | | | | | |

| | | | (Oregon Trail) (School Bond Guaranty Program) | | | | | | |

| | 1,000,000 | | 5.000%, 06/15/22 | | NR/AA/NR | | | 1,155,330 | |

| | 1,865,000 | | 5.000%, 06/15/28 Series A | | NR/AA/NR | | | 2,070,094 | |

| | 1,800,000 | | 5.000%, 06/15/29 Series A | | NR/AA/NR | | | 1,989,432 | |

| | 2,000,000 | | 4.500%, 06/15/30 | | Aa1/AAA/NR | | | 2,090,400 | |

| | 3,115,000 | | 4.750%, 06/15/31 | | Aa1/AAA/NR | | | 3,284,549 | |

| | 2,000,000 | | 5.000%, 06/15/32 Series A | | NR/AA/NR | | | 2,174,640 | |

| | 3,780,000 | | 4.750%, 06/15/32 Series A | | NR/AA/NR | | | 4,029,140 | |

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | Clackamas County, Oregon School District #86 (Canby) | | | | | |

| | | (Assured Guaranty Municipal Corp. Insured) | | | | | |

| $ | 2,240,000 | | 5.000%, 06/15/19 | | Aa1/AAA/NR | | $ | 2,508,666 | |

| | | | Clackamas County, Oregon School District #108 | | | | | | |

| | | | (Estacada) (Assured Guaranty Municipal | | | | | | |

| | | | Corp. Insured) | | | | | | |

| | 1,295,000 | | 5.375%, 06/15/17 pre-refunded | | Aa3/AAA/NR | | | 1,340,364 | |

| | 2,000,000 | | 5.000%, 06/15/25 pre-refunded | | Aa3/AAA/NR | | | 2,064,860 | |

| | | | Clackamas County, Oregon School District #115 | | | | | | |

| | | | (Gladstone) (National Public Finance Guarantee | | | | | | |

| | | | Insured) (State School Bond Guaranty Program) | | | | | | |

| | 5,000,000 | | zero coupon, 06/15/27 | | Baa1/AA/NR | | | 2,358,300 | |

| | | | Clackamas County, Oregon Tax Allocation | | | | | | |

| | 705,000 | | 6.500%, 05/01/20 | | NR/NR/NR* | | | 705,472 | |

| | | | Clackamas & Washington Counties, Oregon School | | | | | | |

| | | | District No. 003 (West Linn-Wilsonville) (School | | | | | | |

| | | | Bond Guaranty Program) | | | | | | |

| | 1,110,000 | | 5.000%, 06/15/26 | | Aa1/AA/NR | | | 1,263,258 | |

| | 500,000 | | 5.000%, 06/15/34 | | Aa1/AA/NR | | | 543,275 | |

| | | | Clackamas & Washington Counties, Oregon School | | | | | | |

| | | | District #3J (West Linn - Wilsonville) (State School | | | | |

| | | | Bond Guaranty Program) | | | | | | |

| | 2,850,000 | | 5.000%, 06/15/27 | | Aa1/AA/NR | | | 3,224,974 | |

| | 2,000,000 | | 4.500%, 06/15/29 | | Aa1/AA/NR | | | 2,153,380 | |

| | 1,965,000 | | 5.000%, 06/15/30 | | Aa1/AA/NR | | | 2,182,663 | |

| | 2,000,000 | | 4.750%, 06/15/32 | | Aa1/AA/NR | | | 2,161,000 | |

| | 3,000,000 | | 5.000%, 06/15/33 | | Aa1/AA/NR | | | 3,266,580 | |

| | | | Columbia County, Oregon School District #502 | | | | | | |

| | | | (National Public Finance Guarantee Financial | | | | | | |

| | | | Guaranty Insurance Corporation Insured) | | | | | | |

| | 2,070,000 | | zero coupon, 06/01/15 | | Aa3/A/NR | | | 1,829,549 | |

| | | | Columbia & Washington Counties, Oregon School | | | | | | |

| | | | District #47J (Vernonia) (State School Bond | | | | | | |

| | | | Guaranty Program) | | | | | | |

| | 3,430,000 | | 5.00%, 06/15/27 | | NR/AA/NR | | | 3,934,793 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | Deschutes County, Oregon (Assured Guaranty | | | | | |

| | | Municipal Corp. Insured) | | | | | |

| $ | 2,260,000 | | 5.000%, 12/01/16 | | Aa2/NR/NR | | $ | 2,445,704 | |

| | | | Deschutes County, Oregon Administrative School | | | | | | |

| | | | District #1 (Bend-LaPine) (Assured Guaranty | | | | | | |

| | | | Municipal Corp. Insured) | | | | | | |

| | 1,300,000 | | 5.500%, 06/15/16 pre-refunded | | Aa1/NR/NR | | | 1,346,670 | |

| | 1,355,000 | | 5.500%, 06/15/18 pre-refunded | | Aa1/NR/NR | | | 1,403,645 | |

| | 3,000,000 | | 5.125%, 06/15/21 pre-refunded | | Aa1/NR/NR | | | 3,099,900 | |

| | | | Deschutes County, Oregon School District #6 (Sisters) | | | | | | |

| | | | (Assured Guaranty Municipal Corp. Insured) | | | | | | |

| | 1,735,000 | | 5.250%, 06/15/19 | | Aa3/AAA/NR | | | 2,099,680 | |

| | 1,030,000 | | 5.250%, 06/15/21 | | Aa3/AAA/NR | | | 1,254,334 | |

| | | | Deschutes and Jefferson Counties, Oregon School | | | | | | |

| | | | District #02J (Redmond) (National Public Finance | | | | | | |

| | | | Guarantee- Financial Guaranty Insurance | | | | | | |

| | | | Corporation Insured) | | | | | | |

| | 1,000,000 | | 5.000%, 06/15/21 | | Aa1/NR/NR | | | 1,079,590 | |

| | 2,330,000 | | zero coupon, 06/15/22 | | Aa1/NR/NR | | | 1,536,891 | |

| | | | Deschutes and Jefferson Counties, Oregon School | | | | | | |

| | | | District #02J (Redmond) (School Bond Guaranty | | | | | | |

| | | | Program) | | | | | | |

| | 1,025,000 | | zero coupon, 06/15/23 | | Aa1/NR/NR | | | 642,778 | |

| | 2,775,000 | | zero coupon, 06/15/29 | | Aa1/NR/NR | | | 1,280,524 | |

| | 5,000,000 | | 6.000%, 06/15/31 | | Aa1/NR/NR | | | 5,899,300 | |

| | | | Gresham, Oregon (Assured Guaranty Municipal | | | | | | |

| | | | Corp. Insured) | | | | | | |

| | 1,155,000 | | 5.375%, 06/01/18 | | Aa3/NR/NR | | | 1,227,303 | |

| | | | Independence, Oregon City Hall Project (Assured | | | | | | |

| | | | Guaranty Municipal Corp. Insured) | | | | | | |

| | 2,435,000 | | 5.00%, 06/15/30 | | NR/AAA/NR | | | 2,643,217 | |

| | | | Jackson County, Oregon School District #4 | | | | | | |

| | | | (Phoenix-Talent) (Assured Guaranty Municipal | | | | | | |

| | | | Corp. Insured) | | | | | | |

| | 1,395,000 | | 5.500%, 06/15/18 pre-refunded | | Aa3/AAA/NR | | | 1,445,583 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | Jackson County, Oregon School District #9 (Eagle | | | | | |

| | | Point) (National Public Finance Guarantee Insured) | | | | | |

| $ | 2,080,000 | | 5.500%, 06/15/15 | | Aa1/NR/NR | | $ | 2,417,771 | |

| | 1,445,000 | | 5.500%, 06/15/16 | | Aa1/NR/NR | | | 1,719,304 | |

| | | | Jackson County, Oregon School District #9 (Eagle | | | | | | |

| | | | Point) (State School Bond Guaranty Program) | | | | | | |

| | 1,120,000 | | 5.625%, 06/15/17 pre-refunded | | Aa1/NR/NR | | | 1,161,574 | |

| | 1,880,000 | | 5.000%, 06/15/21 pre-refunded | | Aa1/NR/NR | | | 1,941,645 | |

| | | | Jackson County, Oregon School District #549 | | | | | | |

| | | | (Medford) (State School Bond Guaranty Program) | | | | | | |

| | 1,750,000 | | 5.000%, 06/15/12 | | Aa1/NR/NR | | | 1,880,848 | |

| | | | Jackson County, Oregon School District #549C | | | | | | |

| | | | (Medford) (Assured Guaranty Municipal Corp. | | | | | | |

| | | | Insured) | | | | | | |

| | 2,000,000 | | 4.750%, 12/15/29 | | Aa1/AAA/NR | | | 2,145,860 | |

| | 3,000,000 | | 5.000%, 12/15/32 | | Aa1/AAA/NR | | | 3,234,390 | |

| | | | Jackson County, Oregon School District #549C | | | | | | |

| | | | (Medford) (School Bond Guaranty Program) | | | | | | |

| | 1,000,000 | | 4.625%, 06/15/27 | | Aa1/AA/NR | | | 1,075,270 | |

| | 1,000,000 | | 4.625%, 06/15/30 | | Aa1/AA/NR | | | 1,062,090 | |

| | 1,000,000 | | 5.000%, 06/15/33 | | Aa1/AA/NR | | | 1,077,280 | |

| | | | Jefferson County, Oregon School District #509J | | | | | | |

| | | | (National Public Finance Guarantee Financial | | | | | | |

| | | | Guaranty Insurance Corporation Insured) | | | | | | |

| | 1,215,000 | | 5.250%, 06/15/14 | | NR/AA/NR | | | 1,307,729 | |

| | 1,025,000 | | 5.250%, 06/15/17 | | NR/AA/NR | | | 1,104,130 | |

| | | | Josephine County, Oregon Three Rivers School District | | | | | | |

| | | | (Assured Guaranty Municipal Corp. Insured) | | | | | | |

| | 1,780,000 | | 5.250%, 06/15/18 pre-refunded | | Aa1/NR/NR | | | 1,840,823 | |

| | | | Keizer, Oregon | | | | | | |

| | 2,270,000 | | 5.200%, 06/01/31 | | A1/NR/NR | | | 2,353,945 | |

| | | | Lane County, Oregon School District #19 (Springfield) | | | | | | |

| | | | (Assured Guaranty Municipal Corp. Insured) | | | | | | |

| | 3,425,000 | | zero coupon, 06/15/29 | | Aa1/NR/NR | | | 1,443,501 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | Linn County, Oregon School District #9 (Lebanon) | | | |

| | | (Financial Guaranty Insurance Corporation Insured) | | | |

| | | (State School Bond Guaranty Program) | | | | | |

| $ | 3,000,000 | | 5.600%, 06/15/30 pre-refunded | | NR/AA/NR | | $ | 3,386,490 | |

| | | | Linn County, Oregon School District #9 (Lebanon) | | | | |

| | | | (National Public Finance Guarantee Insured) (State | | | | |

| | | | School Bond Guaranty Program) | | | | | | |

| | 2,500,000 | | 5.000%, 06/15/30 | | Baa1/AA/NR | | | 2,537,975 | |

| | | | Metro, Oregon | | | | | | |

| | 1,100,000 | | 5.000%, 06/01/18 | | Aaa/AAA/NR | | | 1,304,655 | |

| | | | Morrow County, Oregon School District #1 (Assured | | | | |

| | | | Guaranty Municipal Corp. Insured) | | | | | | |

| | 1,710,000 | | 5.250%, 06/15/19 | | Aa3/AAA/NR | | | 2,069,425 | |

| | | | Multnomah County, Oregon School District #7 | | | | |

| | | | (Reynolds) (State School Bond Guaranty Program) | | | | |

| | 500,000 | | 5.625%, 06/15/17 pre-refunded | | Aa1/AA/NR | | | 518,380 | |

| | 2,375,000 | | 5.125%, 06/15/19 pre-refunded | | Aa1/AA/NR | | | 2,454,087 | |

| | | | Multnomah County, Oregon School District #7 | | | | |

| | | | (Reynolds) Refunding | | | | | | |

| | 1,165,000 | | 5.000%, 06/01/29 | | Aa3/NR/NR | | | 1,309,111 | |

| | | | Multnomah and Clackamas Counties, Oregon School | | | | |

| | | | District #10 (Gresham-Barlow) (Assured Guaranty | | | | |

| | | | Municipal Corp. Insured) | | | | | | |

| | 1,500,000 | | 5.500%, 06/15/18 pre-refunded | | Aa2/AAA/NR | | | 1,554,390 | |

| | 4,275,000 | | 5.250%, 06/15/19 | | Aa1/AAA/NR | | | 5,210,797 | |

| | 2,650,000 | | 5.000%, 06/15/21 pre-refunded | | Aa2/AAA/NR | | | 2,736,894 | |

| | | | Multnomah and Clackamas Counties, Oregon School | | | | |

| | | | District #28JT (Centennial) (Assured Guaranty | | | | |

| | | | Municipal Corp. Insured) | | | | | | |

| | 2,680,000 | | 5.250%, 12/15/18 | | Aa1/NR/NR | | | 3,249,473 | |

| | | | Multnomah and Clackamas Counties, Oregon School | | | | |

| | | | District #51J (Riverdale) (State School Bond | | | | | | |

| | | | Guaranty Program) | | | | | | |

| | 1,250,000 | | zero coupon, 06/15/31 | | NR/AA/NR | | | 487,713 | |

| | 1,300,000 | | zero coupon, 06/15/32 | | NR/AA/NR | | | 477,529 | |

| | 1,025,000 | | zero coupon, 06/15/33 | | NR/AA/NR | | | 353,994 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | Newport, Oregon Urban Renewal Obligations, | | | | | |

| | | Refunding, Series B | | | | | |

| $ | 565,000 | | 4.500%, 06/15/22 | | NR/A+/NR | | $ | 624,291 | |

| | | | Newport, Oregon Wastewater Obligations, | | | | | | |

| | | | Refunding, Series A | | | | | | |

| | 525,000 | | 4.250%, 06/15/22 | | NR/A+/NR | | | 569,247 | |

| | 255,000 | | 4.250%, 06/15/23 | | NR/A+/NR | | | 274,949 | |

| | | | Oregon Coast Community College District (National | | | | | | |

| | | | Public Finance Guarantee Insured (State School | | | | | | |

| | | | Bond Guaranty Program) | | | | | | |

| | 1,590,000 | | 5.250%, 06/15/17 | | Aa1/NR/NR | | | 1,799,800 | |

| | | | Oregon State Alternative Energy Project | | | | | | |

| | 1,255,000 | | 4.750%, 04/01/29 Series B | | Aa1/AA/AA | | | 1,373,208 | |

| | | | Oregon State Department of Administrative Services, | | | | |

| | | | Oregon Opportunity Refunding | | | | | | |

| | 6,210,000 | | 5.000%, 12/01/19 | | Aa1/AA/AA+ | | | 7,518,509 | |

| | | | Pacific City, Oregon Joint Water - Sanitary Authority | | | | | | |

| | 1,830,000 | | 4.800%, 07/01/27 | | NR/NR/NR* | | | 1,881,844 | |

| | | | Polk, Marion & Benton Counties, Oregon School | | | | | | |

| | | | District #13J (Central) (Assured Guaranty Municipal | | | | | | |

| | | | Corp. Insured) | | | | | | |

| | 1,520,000 | | 5.000%, 06/15/21 | | Aa3/AAA/NR | | | 1,710,927 | |

| | | | Polk Marion & Benton Counties, Oregon School | | | | | | |

| | | | District No. 13J (Central) Series B (State School | | | | | | |

| | | | Bond Guaranty Program) | | | | | | |

| | 5,650,000 | | zero coupon, 06/15/32 | | NR/AA/NR | | | 2,124,400 | |

| | | | Portland, Oregon | | | | | | |

| | 2,975,000 | | zero coupon, 06/01/15 | | Aa1/NR/NR | | | 2,678,244 | |

| | 8,055,000 | | 4.350%, 06/01/23 | | Aa1/NR/NR | | | 8,378,408 | |

| | | | Portland, Oregon Community College District | | | | | | |

| | | | Financial Guaranty Insurance Corporation Insured) | | | | | | |

| | 1,395,000 | | 5.000%, 06/01/17 pre-refunded | | Aa1/AA/NR | | | 1,437,715 | |

| | | | Redmond, Oregon Terminal Expansion Project | | | | | | |

| | 500,000 | | 5.000%, 06/01/34 | | A1/NR/NR | | | 511,965 | |

| | | | City of Salem, Oregon | | | | | | |

| | 1,750,000 | | 5.000%, 06/01/29 | | Aa2/AA-/NR | | | 1,915,742 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | Salem-Keizer, Oregon School District #24J (Assured | | | | | |

| | | Guaranty Municipal Corp. Insured) | | | | | |

| $ | 1,000,000 | | 5.000%, 06/15/19 | | Aa1/AAA/NR | | $ | 1,119,950 | |

| | | | Salem-Keizer, Oregon School District #24J (State | | | | | | |

| | | | School Bond Guaranty Program) | | | | | | |

| | 4,000,000 | | zero coupon, 06/15/28 | | Aa1/AA/NR | | | 1,871,160 | |

| | 3,090,000 | | zero coupon, 06/15/29 | | Aa1/AA/NR | | | 1,362,134 | |

| | 3,500,000 | | zero coupon, 06/15/30 | | Aa1/AA/NR | | | 1,456,945 | |

| | | | State of Oregon | | | | | | |

| | 500,000 | | 6.000%, 10/01/29 | | Aa1/AA/AA+ | | | 594,510 | |

| | | | State of Oregon Board of Higher Education | | | | | | |

| | 820,000 | | zero coupon, 08/01/16 | | Aa1/AA/AA+ | | | 706,307 | |

| | 2,000,000 | | 5.000%, 08/01/21 | | Aa1/AA/AA+ | | | 2,219,020 | |

| | 500,000 | | 5.750%, 08/01/29 Series A | | Aa1/AA/AA+ | | | 587,210 | |

| | 1,000,000 | | 5.000%, 08/01/34 | | Aa1/AA/AA+ | | | 1,101,100 | |

| | 1,000,000 | | 5.000%, 08/01/38 | | Aa1/AA/AA+ | | | 1,092,520 | |

| | | | State of Oregon Veterans' Welfare | | | | | | |

| | 495,000 | | 5.200%, 10/01/18 | | Aa1/AA/AA+ | | | 495,505 | |

| | 550,000 | | 4.800%, 12/01/22 | | Aa1/AA/AA+ | | | 590,073 | |

| | 400,000 | | 4.900%, 12/01/26 | | Aa1/AA/AA+ | | | 417,744 | |

| | | | The Dalles, Oregon | | | | | | |

| | 230,000 | | 4.000%, 06/01/20 | | NR/A+/NR | | | 247,742 | |

| | 155,000 | | 4.000%, 06/01/21 | | NR/A+/NR | | | 165,528 | |

| | 130,000 | | 4.125%, 06/01/22 | | NR/A+/NR | | | 139,107 | |

| | 100,000 | | 4.200%, 06/01/23 | | NR/A+/NR | | | 107,160 | |

| | | | Tualatin Hills, Oregon Park & Recreational District | | | | | | |

| | 1,000,000 | | 4.250%, 06/01/24 | | Aa1/AA/NR | | | 1,085,890 | |

| | | | Wasco County, Oregon School District #12 (The Dalles) | | | | |

| | | | (Assured Guaranty Municipal Corp. Insured) | | | | | | |

| | 1,400,000 | | 5.500%, 06/15/17 | | Aa3/AAA/NR | | | 1,711,430 | |

| | 1,790,000 | | 5.500%, 06/15/20 | | Aa3/AAA/NR | | | 2,237,446 | |

| | | | Washington County, Oregon | | | | | | |

| | 2,465,000 | | 5.000%, 06/01/23 | | Aa1/NR/NR | | | 2,786,091 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | Washington County, Oregon School District #15 | | | | | |

| | | (Forest Grove) (Assured Guaranty Municipal Corp. | | | | | |

| | | Insured) | | | | | |

| $ | 1,760,000 | | 5.375%, 06/15/16 pre-refunded | | Aa1/NR/NR | | $ | 1,821,653 | |

| | 2,000,000 | | 5.000%, 06/15/21 pre-refunded | | Aa1/NR/NR | | | 2,064,860 | |

| | | | Washington County, Oregon School District #48J | | | | | | |

| | | | (Beaverton) (Assured Guaranty Corporation Insured) | | | | |

| | 1,280,000 | | 5.000%, 06/01/31 | | Aa2/AAA/NR | | | 1,405,210 | |

| | 1,000,000 | | 5.125%, 06/01/36 | | Aa2/AAA/NR | | | 1,086,140 | |

| | | | Yamhill County, Oregon School District #40 | | | | | | |

| | | | (McMinnville) (Assured Guaranty Municipal Corp. | | | | | | |

| | | | Insured) (School Bond Guaranty Program) | | | | | | |

| | 1,205,000 | | 5.000%, 06/15/19 | | Aa1/NR/NR | | | 1,408,199 | |

| | 1,375,000 | | 5.000%, 06/15/22 | | Aa1/NR/NR | | | 1,565,644 | |

| | | | Total State of Oregon General Obligation Bonds | | | | | 232,542,204 | |

| | | | | | | | | | |

| | | | State of Oregon Revenue Bonds (49.6%) | | | | | | |

| | | | | | | | | | |

| | | | Airport Revenue Bonds (0.3%) | | | | | | |

| | | | Jackson County, Oregon Airport Revenue (Syncora | | | | | | |

| | | | Guarantee, Inc.) | | | | | | |

| | 750,000 | | 5.250%, 12/01/32 | | Baa1/NR/NR | | | 756,623 | |

| | | | Redmond, Oregon Airport Revenue | | | | | | |

| | 550,000 | | 6.000%, 06/01/34 | | Baa3/NR/NR | | | 572,919 | |

| | | | Total Airport Revenue Bonds | | | | | 1,329,542 | |

| | | | | | | | | | |

| | | | Certificates of Participation Revenue Bonds (5.8%) | | | | | | |

| | | | Oregon State Department of Administrative Services | | | | | | |

| | 3,270,000 | | 5.000%, 11/01/27 Series C | | Aa2/AA-/AA | | | 3,642,976 | |

| | 2,155,000 | | 5.000%, 11/01/28 Series C | | Aa2/AA-/AA | | | 2,386,684 | |

| | 5,000,000 | | 5.125%, 05/01/33 | | Aa2/AA-/AA | | | 5,393,400 | |

| | | | Oregon State Department of Administration Services | | | | | | |

| | | | (American Municipal Bond Assurance Corp. Insured) | | | | |

| | 500,000 | | 5.375%, 05/01/14 pre-refunded | | Aa2/AA-/AA | | | 519,575 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Oregon State Department of Administrative Services | | | | | |

| | | (Assured Guaranty Municipal Corp. Insured) | | | | | |

| $ | 2,280,000 | | 4.500%, 11/01/32 | | Aa2/AAA/AA | | $ | 2,342,495 | |

| | 1,645,000 | | 4.750%, 05/01/33 | | Aa2/AAA/AA | | | 1,710,701 | |

| | | | Oregon State Department of Administrative Services | | | | | | |

| | | | (National Public Finance Guarantee- Financial | | | | | | |

| | | | Guaranty Insurance Corporation Insured) | | | | | | |

| | 2,000,000 | | 5.000%, 11/01/20 | | Aa2/AA-/AA | | | 2,229,700 | |

| | 2,660,000 | | 5.000%, 11/01/23 | | Aa2/AA-/AA | | | 2,945,471 | |

| | 2,945,000 | | 5.000%, 11/01/24 | | Aa2/AA-/AA | | | 3,238,793 | |

| | 1,475,000 | | 5.000%, 11/01/26 | | Aa2/AA-/AA | | | 1,608,532 | |

| | 3,880,000 | | 5.000%, 11/01/27 | | Aa2/AA-/AA | | | 4,213,486 | |

| | | | Total Certificates of Participation Revenue Bonds | | | | | 30,231,813 | |

| | | | | | | | | | |

| | | | Development Revenue Bonds (1.1%) | | | | | | |

| | | | Oregon State Bond Bank Revenue, Oregon Economic | | | | | | |

| | | | & Community Development Series A | | | | | | |

| | 250,000 | | 4.750%, 01/01/34 | | Aa3/AA+/NR | | | 262,498 | |

| | | | Portland, Oregon Economic Development (Broadway | | | | | | |

| | | | Project) | | | | | | |

| | 5,000,000 | | 6.500%, 04/01/35 | | A1/A+/NR | | | 5,660,300 | |

| | | | Total Development Revenue Bonds | | | | | 5,922,798 | |

| | | | | | | | | | |

| | | | Hospital Revenue Bonds (11.4%) | | | | | | |

| | | | Clackamas County, Oregon Hospital Facilities | | | | | | |

| | | | Authority (Legacy Health System) | | | | | | |

| | 4,025,000 | | 5.250%, 05/01/21 | | A2/A+/NR | | | 4,103,689 | |

| | | | Clackamas County, Oregon Hospital Facility Authority | | | | | | |

| | | | (Legacy Health System) Series A | | | | | | |

| | 750,000 | | 5.500%, 07/15/35 | | A2/A+/NR | | | 800,978 | |

| | | | Deschutes County, Oregon Hospital Facilities Authority | | | | | | |

| | | | (Cascade Health) | | | | | | |

| | 2,000,000 | | 5.600%, 01/01/27 pre-refunded | | A3/NR/NR | | | 2,127,600 | |

| | 3,500,000 | | 8.000%, 01/01/28 | | A3/NR/NR | | | 4,278,435 | |

| | 3,000,000 | | 5.600%, 01/01/32 pre-refunded | | A3/NR/NR | | | 3,191,400 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| | State of Oregon Revenue Bonds (continued) | | Moody’s/S&P/Fitch (unaudited) | | Value | |

| | | Deschutes County, Oregon Hospital Facilities Authority | | | | | |

| | | (Cascade Health) (American Municipal Bond | | | | | |

| | | Assurance Corp. Insured) | | | | | |

| $ | 3,250,000 | | 5.375%, 01/01/35 | | A3/NR/NR | | $ | 3,458,227 | |

| | | | Medford, Oregon Hospital Facilities Authority Revenue | | | | | | |

| | | | Refunding, Asante Health Systems (Assured Guaranty | | | | | | |

| | | | Municipal Corp. Insured) | | | | | | |

| | 9,000,000 | | 5.500%, 08/15/28 | | NR/AAA/NR | | | 9,860,040 | |

| | | | Multnomah County, Oregon Hospital Facilities | | | | | | |

| | | | Authority (Adventist Health/West) | | | | | | |

| | 500,000 | | 5.000%, 09/01/21 | | NR/A/A | | | 556,540 | |

| | 2,000,000 | | 5.125%, 09/01/40 | | NR/A/A | | | 2,083,800 | |

| | | | Multnomah County, Oregon Hospital Facilities | | | | | | |

| | | | Authority (Providence Health System) | | | | | | |

| | 1,390,000 | | 5.250%, 10/01/22 | | Aa2/AA/AA | | | 1,489,454 | |

| | | | Multnomah County, Oregon Hospital Facilities | | | | | | |

| | | | Authority (Terwilliger Plaza Project) | | | | | | |

| | 1,250,000 | | 5.250%, 12/01/36 | | NR/NR/NR* | | | 1,146,937 | |

| | | | Oregon Health Sciences University Series B (National | | | | | | |

| | | | Public Finance Guarantee Insured) | | | | | | |

| | 1,400,000 | | 5.250%, 07/01/15 | | A1/A/NR | | | 1,404,158 | |

| | | | Oregon State Facilities Authority Revenue, Refunding, | | | | | | |

| | | | Legacy Health Systems | | | | | | |

| | 2,000,000 | | 4.250%, 03/15/17 | | A2/A+/NR | | | 2,115,420 | |

| | 3,000,000 | | 4.500%, 03/15/18 | | A2/A+/NR | | | 3,197,100 | |

| | 1,000,000 | | 4.750%, 03/15/24 | | A2/A+/NR | | | 1,051,250 | |

| | 1,000,000 | | 5.000%, 03/15/30 | | A2/A+/NR | | | 1,045,150 | |

| | | | Oregon State Facilities Authority Revenue, Refunding, | | | | | | |

| | | | Samaritan Health Services | | | | | | |

| | 1,500,000 | | 4.375%, 10/01/20 | | NR/A-/NR | | | 1,555,950 | |

| | 2,000,000 | | 4.500%, 10/01/21 | | NR/A-/NR | | | 2,078,340 | |

| | 1,520,000 | | 5.000%, 10/01/23 | | NR/A-/NR | | | 1,615,821 | |

| | 1,795,000 | | 4.875%, 10/01/25 | | NR/A-/NR | | | 1,872,167 | |

| | 2,000,000 | | 5.000%, 10/01/30 | | NR/A-/NR | | | 2,045,780 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Salem, Oregon Hospital Facility Authority (Salem | | | | | |

| | | Hospital) | | | | | |

| $ | 2,000,000 | | 5.750%, 08/15/23 | | NR/A+/A+ | | $ | 2,231,120 | |

| | 3,300,000 | | 4.500%, 08/15/30 | | NR/A+/A+ | | | 3,274,161 | |

| | | | State of Oregon Health Housing Educational and | | | | | | |

| | | | Cultural Facilities Authority (Peacehealth) (American | | | | | | |

| | | | Municipal Bond Assurance Corp. Insured) | | | | | | |

| | 1,835,000 | | 5.250%, 11/15/17 | | NR/AA-/AA | | | 1,903,023 | |

| | 1,430,000 | | 5.000%, 11/15/32 | | NR/AA-/AA | | | 1,450,792 | |

| | | | Total Hospital Revenue Bonds | | | | | 59,937,332 | |

| | |

| | | | Housing, Educational and Cultural Revenue Bonds (8.6%) | | | | | | |

| | | | Forest Grove, Oregon Campus Improvement (Pacific | | | | | | |

| | | | University Project) | | | | | | |

| | 1,500,000 | | 6.000%, 05/01/30 | | NR/BBB/NR | | | 1,571,415 | |

| | | | Forest Grove, Oregon (Pacific University) (Radian | | | | | | |

| | | | Insured) | | | | | | |

| | 4,000,000 | | 5.000%, 05/01/22 | | NR/BBB/NR | | | 4,150,280 | |

| | | | Forest Grove, Oregon Student Housing (Oak Tree | | | | | | |

| | | | Foundation) | | | | | | |

| | 5,750,000 | | 5.500%, 03/01/37 | | NR/NR/NR* | | | 5,432,772 | |

| | | | Oregon Health Sciences University (National Public | | | | | | |

| | | | Finance Guarantee Insured) | | | | | | |

| | 11,550,000 | | zero coupon, 07/01/21 | | A1/A/NR | | | 7,093,779 | |

| | 2,890,000 | | 5.250%, 07/01/22 | | A1/A/NR | | | 2,965,834 | |

| | | | Oregon Health Science University Series A | | | | | | |

| | 4,500,000 | | 5.750%, 07/01/39 | | A2/A/A | | | 4,868,595 | |

| | | | Oregon State Facilities Authority Revenue (Linfield | | | | | | |

| | | | College Project), Series A 2005 | | | | | | |

| | 2,115,000 | | 5.000%, 10/01/25 | | Baa1/NR/NR | | | 2,205,903 | |

| | | | Oregon State Facilities Authority Revenue (Linfield | | | | | | |

| | | | College Project), Series A 2010 | | | | | | |

| | 1,220,000 | | 5.000%, 10/01/31 | | Baa1/NR/NR | | | 1,252,818 | |

| | | | Oregon State Facilities Authority Revenue (University | | | | | | |

| | | | of Portland) | | | | | | |

| | 5,000,000 | | 5.000%, 04/01/32 | | NR/BBB+/NR | | | 5,077,950 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Oregon State Facilities Authority Revenue (Willamette | | | | | |

| | | University) | | | | | |

| $ | 1,000,000 | | 4.000%, 10/01/24 | | NR/A/NR | | $ | 1,030,280 | |

| | 5,000,000 | | 5.000%, 10/01/32 | | NR/A/NR | | | 5,088,450 | |

| | | | State of Oregon Housing and Community Services | | | | | | |

| | 2,360,000 | | 4.650%, 07/01/25 | | Aa2/NR/NR | | | 2,412,180 | |

| | 1,885,000 | | 5.350%, 07/01/30 | | Aa2/NR/NR | | | 1,994,858 | |

| | | | Total Housing, Educational, and Cultural Revenue Bonds | | | | | 45,145,114 | |

| | |

| | | | Transportation Revenue Bonds (5.2%) | | | | | | |

| | | | Oregon State Department Transportation Highway Usertax | | | | |

| | 3,025,000 | | 5.500%, 11/15/18 pre-refunded | | Aa1/AAA/AA+ | | | 3,343,563 | |

| | 2,555,000 | | 5.375%, 11/15/18 pre-refunded | | Aa1/AAA/AA+ | | | 2,569,538 | |

| | 1,200,000 | | 5.000%, 11/15/22 | | Aa1/AAA/AA+ | | | 1,320,924 | |

| | 1,865,000 | | 5.000%, 11/15/23 Series A | | Aa1/AAA/AA+ | | | 2,147,678 | |

| | 1,260,000 | | 5.000%, 11/15/23 | | Aa1/AAA/AA+ | | | 1,382,825 | |

| | 4,545,000 | | 5.125%, 11/15/26 pre-refunded | | Aa1/AAA/AA+ | | | 4,987,865 | |

| | 2,155,000 | | 5.000%, 11/15/28 | | Aa1/AAA/AA+ | | | 2,368,690 | |

| | 1,000,000 | | 5.000%, 11/15/29 | | Aa1/AAA/AA+ | | | 1,071,180 | |

| | 2,165,000 | | 4.500%, 11/15/32 | | Aa1/AAA/AA+ | | | 2,258,593 | |

| | 3,510,000 | | 5.000%, 11/15/33 | | Aa1/AAA/AA+ | | | 3,835,588 | |

| | | | Tri-County Metropolitan Transportation District, Oregon | | | | | | |

| | 1,775,000 | | 5.000%, 09/01/16 | | Aa2/AAA/NR | | | 1,910,716 | |

| | | | Total Transportation Revenue Bonds | | | | | 27,197,160 | |

| | |

| | | | Urban Renewal Revenue Bonds (2.3%) | | | | | | |

| | | | Portland, Oregon River District Urban Renewal and | | | | | | |

| | | | Redevelopment (American Municipal Bond | | | | | | |

| | | | Assurance Corp. Insured) | | | | | | |

| | 1,915,000 | | 5.000%, 06/15/20 | | A2/NR/NR | | | 2,015,882 | |

| | | | Portland, Oregon Urban Renewal and Redevelopment, | | | | |

| | | | Refunding, North Macadam, Series B | | | | | | |

| | 1,000,000 | | 4.000%, 06/15/25 | | A1/NR/NR | | | 987,910 | |

| | | | Portland, Oregon Urban Renewal Tax Allocation | | | | | | |

| | | | (American Municipal Bond Assurance Corp. | | | | | | |

| | | | Insured) (Convention Center) | | | | | | |

| | 1,150,000 | | 5.750%, 06/15/18 | | Aa3/NR/NR | | | 1,165,306 | |

| | 2,000,000 | | 5.450%, 06/15/19 | | Aa3/NR/NR | | | 2,026,100 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Portland, Oregon Urban Renewal Tax Allocation | | | | | |

| | | (Interstate Corridor) (National Public Finance | | | | | |

| | | Guarantee- Financial Guaranty Insurance | | | | | |

| | | Corporation Insured) | | | | | |

| $ | 1,890,000 | | 5.250%, 06/15/20 | | A2/NR/NR | | $ | 2,019,276 | |

| | 1,810,000 | | 5.250%, 06/15/21 | | A2/NR/NR | | | 1,920,971 | |

| | 2,030,000 | | 5.000%, 06/15/23 | | A2/NR/NR | | | 2,112,459 | |

| | | | Total Urban Renewal Revenue Bonds | | | | | 12,247,904 | |

| | | | | | | | | | |

| | | | Utility Revenue Bonds (1.5%) | | | | | | |

| | | | Emerald Peoples Utility District, Oregon (Assured | | | | | | |

| | | | Guaranty Municipal Corp. Insured) | | | | | | |

| | 1,455,000 | | 5.250%, 11/01/22 | | Aa3/NR/NR | | | 1,590,199 | |

| | | | Eugene, Oregon Electric Utility | | | | | | |

| | 5,635,000 | | 5.000%, 08/01/30 | | Aa2/AA-/AA- | | | 6,136,290 | |

| | | | Total Utility Revenue Bonds | | | | | 7,726,489 | |

| | | | | | | | | | |

| | | | Water and Sewer Revenue Bonds (11.7%) | | | | | | |

| | | | Klamath Falls, Oregon Water (Assured Guaranty | | | | | | |

| | | | Municipal Corp. Insured) | | | | | | |

| | 1,575,000 | | 5.500%, 07/01/16 | | Aa3/AAA/NR | | | 1,790,444 | |

| | | | Lane County, Oregon Metropolitan Wastewater | | | | | | |

| | 2,500,000 | | 5.250%, 11/01/28 | | Aa2/AA-/NR | | | 2,786,675 | |

| | | | Lebanon, Oregon Wastewater (Assured Guaranty | | | | | | |

| | | | Municipal Corp. Insured) | | | | | | |

| | 1,000,000 | | 5.700%, 03/01/20 | | Aa3/AAA/NR | | | 1,003,500 | |

| | | | Molalla, Oregon Sewer Revenue Refunding | | | | | | |

| | 210,000 | | 4.000%, 03/01/18 | | NR/A/NR | | | 229,832 | |

| | 240,000 | | 4.000%, 03/01/19 | | NR/A/NR | | | 260,683 | |

| | 250,000 | | 4.000%, 03/01/20 | | NR/A/NR | | | 270,350 | |

| | 260,000 | | 4.000%, 03/01/21 | | NR/A/NR | | | 276,554 | |

| | 270,000 | | 4.000%, 03/01/22 | | NR/A/NR | | | 284,945 | |

| | 280,000 | | 4.000%, 03/01/23 | | NR/A/NR | | | 293,650 | |

| | 290,000 | | 4.000%, 03/01/24 | | NR/A/NR | | | 302,238 | |

| | 300,000 | | 4.000%, 03/01/25 | | NR/A/NR | | | 310,464 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Portland, Oregon Sewer System | | | | | |

| $ | 5,000,000 | | 5.000%, 06/15/33 | | Aa3/AA/NR | | $ | 5,386,400 | |

| | | | Portland, Oregon Sewer System (Assured Guaranty | | | | | | |

| | | | Municipal Corp. Insured) | | | | | | |

| | 2,760,000 | | 5.250%, 06/01/17 | | Aa3/AAA/NR | | | 3,021,593 | |

| | 4,595,000 | | 5.000%, 06/01/17 | | Aa2/AAA/NR | | | 5,244,319 | |

| | 3,470,000 | | 5.000%, 06/01/21 | | Aa3/AAA/NR | | | 3,721,991 | |

| | | | Portland, Oregon Sewer System (National Public | | | | | | |

| | | | Finance Guarantee Insured) | | | | | | |

| | 4,410,000 | | 5.000%, 06/15/25 | | Aa3/AA/NR | | | 4,844,120 | |

| | 4,630,000 | | 5.000%, 06/15/26 | | Aa3/AA/NR | | | 5,065,544 | |

| | 1,610,000 | | 5.000%, 06/15/27 | | Aa3/AA/NR | | | 1,762,322 | |

| | | | Portland, Oregon Water System (National Public | | | | | | |

| | | | Finance Guarantee Insured) | | | | | | |

| | 2,725,000 | | 4.500%, 10/01/27 | | Aa1/NR/NR | | | 2,883,159 | |

| | | | Portland, Oregon Water System Revenue, Refunding, | | | | | | |

| | | | Series A | | | | | | |

| | 1,920,000 | | 4.000%, 05/01/14 | | Aaa/NR/NR | | | 2,133,773 | |

| | 1,275,000 | | 4.000%, 05/01/25 | | Aaa/NR/NR | | | 1,358,500 | |

| | | | Salem, Oregon Water & Sewer (Assured Guaranty | | | | | | |

| | | | Municipal Corp. Insured) | | | | | | |

| | 1,000,000 | | 5.375%, 06/01/15 | | Aa3/AAA/NR | | | 1,160,880 | |

| | | | Sunrise Water Authority, Oregon (Assured Guaranty | | | | | | |

| | | | Municipal Corp. Insured) | | | | | | |

| | 2,630,000 | | 5.000%, 03/01/19 | | Aa3/AAA/NR | | | 2,835,271 | |

| | 1,350,000 | | 5.250%, 03/01/24 | | Aa3/AAA/NR | | | 1,444,432 | |

| | | | Sunrise Water Authority, Oregon (Syncora Guarantee, | | | | | | |

| | | | Inc.) | | | | | | |

| | 1,000,000 | | 5.000%, 09/01/25 | | NR/NR/NR* | | | 1,023,960 | |

| | | | Washington County, Oregon Clean Water Services | | | | | | |

| | 4,000,000 | | 5.000%, 10/01/28 | | Aa2/AA-/NR | | | 4,459,320 | |

| | | | Washington County, Oregon Clean Water Services | | | | | | |

| | | | (National Public Finance Guarantee- Financial | | | | | | |

| | | | Guaranty Insurance Corporation Insured) | | | | | | |

| | 995,000 | | 5.000%, 10/01/13 | | Aa2/AA/NR | | | 1,035,775 | |

| | 3,525,000 | | 5.125%, 10/01/17 | | Aa2/AA/NR | | | 3,658,809 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| | | | | Rating | | | |

| Principal | | | | Moody’s/S&P/Fitch | | | |

| Amount | | State of Oregon Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Washington County, Oregon Clean Water Services | | | | | |

| | | (National Public Finance Guarantee Insured) | | | | | |

| $ | 2,235,000 | | 5.250%, 10/01/15 | | Aa2/AA/NR | | $ | 2,644,675 | |

| | | | Total Water and Sewer Revenue Bonds | | | | | 61,494,178 | |

| | |

| | | | Other Revenue Bonds (1.7%) | | | | | | |

| | | | Oregon State Department of Administration Services | | | | | | |

| | | | (Lottery Revenue) | | | | | | |

| | 2,500,000 | | 5.000%, 04/01/29 | | Aa2/AAA/NR | | | 2,775,275 | |

| | | | Oregon State Department of Administration Services | | | | | | |

| | | | (Lottery Revenue) (Assured Guaranty Municipal | | | | | | |

| | | | Corp. Insured) | | | | | | |

| | 2,700,000 | | 5.000%, 04/01/19 | | Aa2/AAA/AA- | | | 2,958,255 | |

| | 3,000,000 | | 5.000%, 04/01/27 | | Aa2/AAA/AA- | | | 3,292,020 | |

| | | | Total Other Revenue Bonds | | | | | 9,025,550 | |

| | | | Total State of Oregon Revenue Bonds | | | | | 260,257,880 | |

| | |

| | | | U.S. Territory (1.6%) | | | | | | |

| | | | Puerto Rico Commonwealth Aqueduct & Sewer | | | | | | |

| | | | Authority (Assured Guaranty Municipal Corporation | | | | | | |

| | | | Insured) | | | | | | |

| | 3,000,000 | | 5.000%, 07/01/28 | | Aa3/AAA/BBB | | | 3,214,290 | |

| | | | Puerto Rico Commonwealth General Obligation | | | | | | |

| | | | (National Public Finance Guarantee Insured) | | | | | | |

| | 1,270,000 | | 6.000%, 07/01/28 | | A3/A/NR | | | 1,387,158 | |

| | | | Puerto Rico Electric Power Authority | | | | | | |

| | 1,000,000 | | 5.250%, 07/01/33 | | A3/BBB+/BBB+ | | | 1,043,830 | |

| | | | Puerto Rico Municipal Finance Agency (Assured | | | | | | |

| | | | Guaranty Municipal Corp. Insured) | | | | | | |

| | 500,000 | | 5.250%, 08/01/16 | | Aa3/AAA/NR | | | 527,445 | |

| | | | Puerto Rico Sales Tax Financing Corp., Sales Tax | | | | | | |

| | | | Revenue First Subordinate Series A | | | | | | |

| | 2,000,000 | | 5.750%, 08/01/37 | | A1/A+/A+ | | | 2,178,720 | |

| | | | Total U.S. Territory Bonds | | | | | 8,351,443 | |

| | |

| | | | Total Investments (cost $466,084,680-note 4) | | 95.5% | | | 501,151,527 | |

| | | | Other assets less liabilities | | 4.5 | | | 23,814,343 | |

| | | | Net Assets | | 100.0% | | $ | 524,965,870 | |

TAX-FREE TRUST OF OREGON

SCHEDULE OF INVESTMENTS (continued)

SEPTEMBER 30, 2010

| * Any security not rated (NR) by any of the approved credit rating services has been determined by the Investment Sub-Adviser to have sufficient quality to be ranked in the top four ratings if a credit rating were to be assigned by a rating service. |

| |

Fitch Rated ** AA *** A |

| | | Percent of | |

| Portfolio Distribution by Quality Rating | | Portfolio† | |

| Aaa of Moody’s or AAA of S&P | | | 25.0 | % |

| Pre-refunded bonds †† / Escrowed to Maturity bonds | | | 11.0 | |

| Aa of Moody’s, AA of S&P or Fitch | | | 41.7 | |

| A of Moody’s, S&P or Fitch | | | 17.2 | |

| Baa of Moody’s or BBB of S&P | | | 3.1 | |

| Not rated* | | | 2.0 | |

| | | | 100.0 | % |

| † | Calculated using the highest rating of the three rating services. |

| †† | Pre-refunded bonds are bonds for which U.S. Government Obligations have been placed in escrow to retire the bonds at their earliest call date. |

See accompanying notes to financial statements.

TAX-FREE TRUST OF OREGON

STATEMENT OF ASSETS AND LIABILITIES

SEPTEMBER 30, 2010

| ASSETS | | | |

| Investments at value (cost $466,084,680) | | $ | 501,151,527 | |

| Cash | | | 17,564,813 | |

| Interest receivable | | | 6,868,219 | |

| Receivable for Trust shares sold | | | 880,524 | |

| Other assets | | | 24,290 | |

| Total assets | | | 526,489,373 | |

| LIABILITIES | | | | |

| Payable for Trust shares redeemed | | | 839,585 | |

| Dividends payable | | | 431,850 | |

| Management fees payable | | | 172,007 | |

| Distribution and service fees payable | | | 2,449 | |

| Accrued expenses | | | 77,612 | |

| Total liabilities | | | 1,523,503 | |

| NET ASSETS | | $ | 524,965,870 | |

| Net Assets consist of: | | | | |

| Capital Stock - Authorized an unlimited number of shares, par value $0.01 per share | | $ | 469,510 | |

| Additional paid-in capital | | | 489,309,674 | |

| Net unrealized appreciation on investments (note 4) | | | 35,066,847 | |

| Undistributed net investment income | | | 236,284 | |

| Accumulated net realized loss on investments | | | (116,445 | ) |

| | | $ | 524,965,870 | |

| | | | | |

| CLASS A | | | | |

| Net Assets | | $ | 400,433,222 | |

| Capital shares outstanding | | | 35,806,772 | |

| Net asset value and redemption price per share | | $ | 11.18 | |

| Maximum offering price per share (100/96 of $11.18 adjusted to nearest cent) | | $ | 11.65 | |

| | | | | |

| CLASS C | | | | |

| Net Assets | | $ | 29,255,813 | |

| Capital shares outstanding | | | 2,618,382 | |

| Net asset value and offering price per share | | $ | 11.17 | |

| Redemption price per share (* a charge of 1% is imposed on the redemption | | | | |

| proceeds of the shares, or on the original price, whichever is lower, if redeemed | | | | |

| during the first 12 months after purchase) | | $ | 11.17 | * |

| | | | | |

| CLASS Y | | | | |

| Net Assets | | $ | 95,276,835 | |

| Capital shares outstanding | | | 8,525,855 | |

| Net asset value, offering and redemption price per share | | $ | 11.18 | |

See accompanying notes to financial statements.

TAX-FREE TRUST OF OREGON

STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2010

| Investment Income: | | | | | | |

| | |

| Interest income | | | | | $ | 21,568,357 | |

| | |

| | |

| Expenses: | | | | | | | |

| | |

| Management fees (note 3) | | $ | 1,973,984 | | | | | |

| Distribution and service fees (note 3) | | | 827,093 | | | | | |

| Transfer and shareholder servicing agent fees | | | 230,343 | | | | | |

| Trustees’ fees and expenses (note 7) | | | 214,298 | | | | | |

| Legal fees (note 3) | | | 158,225 | | | | | |

| Shareholders’ reports and proxy statements | | | 88,064 | | | | | |

| Custodian fees (note 6) | | | 37,468 | | | | | |

| Insurance | | | 24,735 | | | | | |

| Auditing and tax fees | | | 24,101 | | | | | |

| Registration fees and dues | | | 17,403 | | | | | |

| Chief compliance officer (note 3) | | | 4,504 | | | | | |

| Miscellaneous | | | 35,052 | | | | | |

| | | | 3,635,270 | | | | | |

| Expenses paid indirectly (note 6) | | | (1,239 | ) | | | | |

| Net expenses | | | | | | | 3,634,031 | |

| Net investment income | | | | | | | 17,934,326 | |

| | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | |

| | |

| Net realized gain (loss) from securities transactions | | | 469,057 | | | | | |

| Change in unrealized appreciation on investments | | | 6,367,757 | | | | | |

| | |

| Net realized and unrealized gain (loss) on investments | | | | | | | 6,836,814 | |

| Net change in net assets resulting from operations | | | | | | $ | 24,771,140 | |

See accompanying notes to financial statements.

TAX-FREE TRUST OF OREGON

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended September 30, 2010 | | | Year Ended September 30, 2009 | |

| | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 17,934,326 | | | $ | 16,788,363 | |

| Net realized gain (loss) from securities transactions | | | 469,057 | | | | (404,931 | ) |

| Change in unrealized appreciation (depreciation) on investments | | | 6,367,757 | | | | 38,092,055 | |

| Change in net assets resulting from operations | | | 24,771,140 | | | | 54,475,487 | |

| | |

| DISTRIBUTIONS TO SHAREHOLDERS (note 10): | | | | | | | | |

| Class A Shares: | | | | | | | | |

| Net investment income | | | (13,893,914 | ) | | | (13,489,974 | ) |

| | |

| Class C Shares: | | | | | | | | |

| Net investment income | | | (724,866 | ) | | | (563,484 | ) |

| | |

| Class Y Shares: | | | | | | | | |

| Net investment income | | | (3,389,719 | ) | | | (2,684,060 | ) |

| Change in net assets from distributions | | | (18,008,499 | ) | | | (16,737,518 | ) |

| | |

| CAPITAL SHARE TRANSACTIONS (note 8): | | | | | | | | |

| Proceeds from shares sold | | | 87,301,291 | | | | 98,215,834 | |

| Reinvested dividends and distributions | | | 10,787,566 | | | | 9,702,017 | |

| Cost of shares redeemed | | | (56,381,161 | ) | | | (68,906,971 | ) |

| Change in net assets from capital share transactions | | | 41,707,696 | | | | 39,010,880 | |

| | |

| Change in net assets | | | 48,470,337 | | | | 76,748,849 | |

| | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 476,495,533 | | | | 399,746,684 | |

| End of period* | | $ | 524,965,870 | | | $ | 476,495,533 | |

| | |

| * Includes undistributed net investment income of: | | $ | 236,284 | | | $ | 355,792 | |

See accompanying notes to financial statements.

TAX-FREE TRUST OF OREGON

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2010

1. Organization

Tax-Free Trust of Oregon (the “Trust”) is a separate portfolio of The Cascades Trust. The Cascades Trust (the “Business Trust”) is an open-end investment company, which was organized on October 17, 1985, as a Massachusetts business trust and is authorized to issue an unlimited number of shares. The Trust is a non-diversified portfolio which commenced operations on June 16, 1986 and until April 5, 1996, offered only one class of shares. On that date, the Trust began offering two additional classes of shares, Class C and Class Y Shares. All shares outstanding prior to that date were designated as Class A Shares and are sold at net asset value plus a sales charge (of varying size depending upon a variety of factors) paid at the time of purchase and bear a distribution fee. Class C Shar es are sold at net asset value with no sales charge payable at the time of purchase but with a level charge for service and distribution fees for six years thereafter. Class C Shares automatically convert to Class A Shares after six years. Class Y Shares are sold only through institutions acting for investors in a fiduciary, advisory, agency, custodial or similar capacity, and are not offered directly to retail customers. Class Y Shares are sold at net asset value with no sales charge, no redemption fee, no contingent deferred sales charge (“CDSC”) and no distribution fee. On January 31, 1998, the Trust established Class I Shares which are offered and sold only through financial intermediaries and are not offered directly to retail customers. Class I Shares are sold at net asset value with no sales charge and no redemption fee or CDSC, although a financial intermediary may charge a fee for effecting a purchase or other transaction on behalf of its customers. Class I Shares may carry a distributio n and a service fee. As of the report date, there were no Class I Shares outstanding. All classes of shares represent interests in the same portfolio of investments and are identical as to rights and privileges but differ with respect to the effect of sales charges, the distribution and/or service fees borne by each class, expenses specific to each class, voting rights on matters affecting a single class and the exchange privileges of each class.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America for investment companies.

| a) | Portfolio valuation: Municipal securities which have remaining maturities of more than 60 days are valued each business day based upon information provided by a nationally prominent independent pricing service and periodically verified through other pricing services. In the case of securities for which market quotations are readily available, securities are valued by the pricing service at the mean of bid and asked quotations. If market quotations or a valuation from the pricing service is not readily available, the security is valued at fair value determined in good faith under procedures established by and under the general supervision of the Board of Trustees. Securities which mature in 60 days or less are valued at amortized cost if their term to maturity at purchase is 60 da ys or less, or |

TAX-FREE TRUST OF OREGON

NOTES TO FINANCIAL STATEMENTS (continued)

SEPTEMBER 30, 2010

by amortizing their unrealized appreciation or depreciation on the 61st day prior to maturity, if their term to maturity at purchase exceeds 60 days.

| b) | Fair Value Measurements: The Trust follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Trust’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Trust’s investments and are summarized in the following fair value hierarchy: |

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Trust has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Trust’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the valuation inputs, representing 100% of the Trust’s investments, used to value the Trust’s net assets as of September 30, 2010:

| Valuation Inputs | | Investments in Securities | |

| Level 1 – Quoted Prices | | $ | – | |

| Level 2 – Other Significant Observable Inputs – | | | | |

| Municipal Bonds* | | | 501,151,527 | |

| Level 3 – Significant Unobservable Inputs | | | – | |

| Total | | $ | 501,151,527 | |

* See schedule of investments for a detailed listing of securities.

| c) | Subsequent Events: In preparing these financial statements, the Trust has evaluated events and transactions for potential recognition or disclosure through the date these financial statements were issued. |

| d) | Securities transactions and related investment income: Securities transactions are recorded on the trade date. Realized gains and losses from securities transactions are reported on the identified cost |

TAX-FREE TRUST OF OREGON

NOTES TO FINANCIAL STATEMENTS (continued)

SEPTEMBER 30, 2010

basis. Interest income is recorded daily on the accrual basis and is adjusted for amortization of premium and accretion of original issue and market discount.

| e) | Federal income taxes: It is the policy of the Trust to continue to qualify as a regulated investment company by complying with the provisions of the Internal Revenue Code applicable to certain investment companies. The Trust intends to make distributions of income and securities profits sufficient to relieve it from all, or substantially all, Federal income and excise taxes. |

Management has reviewed the tax positions for each of the open tax years (2007-2009) or expected to be taken in the Trust’s 2010 tax returns and has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements.

| f) | Multiple class allocations: All income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares based on the relative net assets of each class. Class-specific expenses, which include distribution and service fees and any other items that are specifically attributed to a particular class, are also charged directly to such class on a daily basis. |

| g) | Use of estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| h) | Reclassification of capital accounts: Accounting principles generally accepted in the United States of America require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. On September 30, 2010, the Trust decreased undistributed net investment income by $45,335 and increased paid-in capital by $45,335 due primarily to differing book/tax treatment of distributions and bond amortization. These reclassifications had no effect on net assets or net asset value per share. |

| i) | Accounting pronouncement: In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update “Improving Disclosures about Fair Value Measurements” (“ASU”). The ASU requires enhanced disclosures about a) transfers into and out of Levels 1 and 2, and b) purchases, sales, issuances, and settlements on a gross basis relating to Level 3 measurements. The first disclosure became effective for the first reporting period beginning after December 15, 2009, and for interim periods within those fiscal years. There were no significant transfers into and out of Levels 1 and 2 during the current period presented. |

TAX-FREE TRUST OF OREGON

NOTES TO FINANCIAL STATEMENTS (continued)

SEPTEMBER 30, 2010

The second disclosure will become effective for fiscal year ends beginning after December 15, 2010, and for interim periods within those fiscal years. Management is currently evaluating the impact this disclosure may have on the Trust’s financial statements.

3. Fees and Related Party Transactions

a) Management Arrangements:

Aquila Investment Management LLC (the “Manager”), a wholly-owned subsidiary of Aquila Management Corporation, the Trust’s founder and sponsor, serves as the Manager for the Trust under an Advisory and Administration Agreement with the Trust. The portfolio management of the Trust has been delegated to a Sub-Adviser as described below. Under the Advisory and Administrative Agreement, the Manager provides all administrative services to the Trust, other than those relating to the day-to-day portfolio management. The Manager’s services include providing the office of the Trust and all related services as well as overseeing the activities of the Sub-Adviser and managing relationships with all the various support organizations to the Trust such as the shareholder servicing agent, custodian , legal counsel, auditors and distributor and additionally maintaining the Trust’s accounting books and records. For its services, the Manager is entitled to receive a fee which is payable monthly and computed as of the close of business each day at the annual rate of 0.40% of the Trust’s net assets.

FAF Advisors, Inc. (the “Sub-Adviser”) serves as the Investment Sub-Adviser for the Trust under a Sub-Advisory Agreement between the Manager and the Sub-Adviser. Under this agreement, the Sub-Adviser continuously provides, subject to oversight of the Manager and the Board of Trustees of the Trust, the investment program of the Trust and the composition of its portfolio, arranges for the purchases and sales of portfolio securities, and provides for daily pricing of the Trust’s portfolio. For its services, the Sub-Adviser is entitled to receive a fee from the Manager which is payable monthly and computed as of the close of business each day at the annual rate of 0.18% of the Trust’s net assets (see note 12).

Under a Compliance Agreement with the Manager, the Manager is compensated for Chief Compliance Officer related services provided to enable the Trust to comply with Rule 38a-1 of the Investment Company Act of 1940.

Specific details as to the nature and extent of the services provided by the Manager and the Sub-Adviser are more fully defined in the Trust’s Prospectus and Statement of Additional Information.

b) Distribution and Service Fees:

The Trust has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 (the “Rule”) under the Investment Company Act of 1940. Under one part of the Plan, with respect to Class A Shares, the Trust is authorized to make distribution fee payments to broker-dealers or others (“Qualified Recipients”) selected by Aquila Distributors, Inc. (the “Distributor”), including, but not limited to, any

TAX-FREE TRUST OF OREGON

NOTES TO FINANCIAL STATEMENTS (continued)

SEPTEMBER 30, 2010

principal underwriter of the Trust, with which the Distributor has entered into written agreements contemplated by the Rule and which have rendered assistance in the distribution and/or retention of the Trust’s shares or servicing of shareholder accounts. The Trust makes payment of this distribution fee at the annual rate of 0.15% of the Trust’s average net assets represented by Class A Shares. For the year ended September 30, 2010, distribution fees on Class A Shares amounted to $568,194 of which the Distributor retained $31,351.

Under another part of the Plan, the Trust is authorized to make payments with respect to Class C Shares to Qualified Recipients which have rendered assistance in the distribution and/or retention of the Trust’s Class C shares or servicing of shareholder accounts. These payments are made at the annual rate of 0.75% of the Trust’s average net assets represented by Class C Shares and for the year ended September 30, 2010, amounted to $194,174. In addition, under a Shareholder Services Plan, the Trust is authorized to make service fee payments with respect to Class C Shares to Qualified Recipients for providing personal services and/or maintenance of shareholder accounts. These payments are made at the annual rate of 0.25% of the Trust’s average net assets represented by Class C Shares and fo r the year ended September 30, 2010, amounted to $64,725. The total of these payments made with respect to Class C Shares amounted to $258,899 of which the Distributor retained $34,028.

Specific details about the Plans are more fully defined in the Trust’s Prospectus and Statement of Additional Information.

Under a Distribution Agreement, the Distributor serves as the exclusive distributor of the Trust’s shares. Through agreements between the Distributor and various brokerage and advisory firms (“intermediaries”), the Trust’s shares are sold primarily through the facilities of these intermediaries having offices within Oregon, with the bulk of any sales commissions inuring to such intermediaries. For the year ended September 30, 2010, total commissions on sales of Class A Shares amounted to $1,125,680 of which the Distributor received $206,772.

c) Other Related Party Transactions

For the year ended September 30, 2010, the Trust incurred $158,225 of legal fees allocable to Butzel Long PC, counsel to the Trust, for legal services in conjunction with the Trust’s ongoing operations. The Secretary of the Trust is Of Counsel to that firm.

4. Purchases and Sales of Securities

During the year ended September 30, 2010, purchases of securities and proceeds from the sales of securities aggregated $79,523,814 and $44,063,201, respectively.

At September 30, 2010, the aggregate tax cost for all securities was $465,848,396. At September 30, 2010, the aggregate gross unrealized appreciation for all securities in which there is an excess of

TAX-FREE TRUST OF OREGON

NOTES TO FINANCIAL STATEMENTS (continued)

SEPTEMBER 30, 2010

value over tax cost amounted to $35,796,888 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value amounted to $493,757 for a net unrealized appreciation of $35,303,131.

5. Portfolio Orientation

Since the Trust invests principally and may invest entirely in double tax-free municipal obligations of issuers within Oregon, it is subject to possible risks associated with economic, political, or legal developments or industrial or regional matters specifically affecting Oregon and whatever effects these may have upon Oregon issuers’ ability to meet their obligations. Two such developments, Measure 5, a 1990 amendment to the Oregon Constitution, as well as Measures 47 and 50, limit the taxing and spending authority of certain Oregon governmental entities. These amendments could have an adverse effect on the general financial condition of certain municipal entities that would impair the ability of certain Oregon issuers to pay interest and principal on their obligations.

6. Expenses

The Trust has negotiated an expense offset arrangement with its custodian, wherein it receives credit toward the reduction of custodian fees and other Trust expenses whenever there are uninvested cash balances. The Statement of Operations reflects the total expenses before any offset, the amount of offset and the net expenses.

7. Trustees’ Fees and Expenses

At September 30, 2010 there were 7 Trustees, one of whom is affiliated with the Manager and is not paid any fees. The total amount of Trustees’ service fees (for carrying out their responsibilities) and attendance fees paid during the year ended September 30, 2010 was $169,100. Attendance fees are paid to those in attendance at regularly scheduled quarterly Board Meetings and meetings of the Independent Trustees held prior to each quarterly Board Meeting, as well as additional meetings (such as Audit, Nominating, Shareholder and special meetings). Trustees are reimbursed for their expenses such as travel, accommodations, and meals incurred in connection with attendance at Board Meetings and at the Annual Meeting of Shareholders. For the year ended September 30, 2010, such meeting-related expenses amo unted to $45,198.

TAX-FREE TRUST OF OREGON

NOTES TO FINANCIAL STATEMENTS (continued)

SEPTEMBER 30, 2010

| 8. Capital Share Transactions | |

| | |

| Transactions in Capital Shares of the Trust were as follows: | |

| | |

| | | Year Ended | | | Year Ended | |

| | | September 30, 2010 | | | September 30, 2009 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Class A Shares: | | | | | | | | | | | | |

| Proceeds from shares sold | | | 4,473,622 | | | $ | 48,902,418 | | | | 4,697,244 | | | $ | 49,345,864 | |

| Reinvested dividends and | | | | | | | | | | | | | | | | |

| distributions | | | 813,690 | | | | 8,901,500 | | | | 798,336 | | | | 8,395,301 | |

| Cost of shares redeemed | | | (2,939,280 | ) | | | (32,145,652 | ) | | | (4,047,184 | ) | | | (41,864,254 | ) |

| Net change | | | 2,348,032 | | | | 25,658,266 | | | | 1,448,396 | | | | 15,876,911 | |

| Class C Shares: | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 1,121,113 | | | | 12,232,462 | | | | 935,602 | | | | 9,948,051 | |

| Reinvested dividends and | | | | | | | | | | | | | | | | |

| distributions | | | 45,661 | | | | 499,481 | | | | 33,668 | | | | 353,605 | |

| Cost of shares redeemed | | | (536,556 | ) | | | (5,876,357 | ) | | | (730,007 | ) | | | (7,654,529 | ) |

| Net change | | | 630,218 | | | | 6,855,586 | | | | 239,263 | | | | 2,647,127 | |