UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04519

T. Rowe Price Capital Appreciation Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

Capital Appreciation Fund

This annual shareholder report contains important information about Capital Appreciation Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Capital Appreciation Fund - Investor Class | $74 | 0.70% |

|---|

What drove fund performance during the past 12 months?

U.S. stocks produced strong gains for the second consecutive year in 2024, and various equity indexes reached all-time highs during the year. The equity market was buoyed by generally favorable corporate earnings and by continuing interest in companies expected to benefit from artificial intelligence developments.

Versus the all-equity S&P 500 Index, the leading contributor to relative performance was an underweight allocation to consumer staples, as the traditionally defensive sector lagged the broader benchmark in a market that strongly favored growth-oriented names. Stock selection in materials also added value, driven by our favorable position in multinational chemical company Linde, which outpaced sector peers.

On the negative side, an overweight allocation to health care was the leading detractor from relative results. While the health care sector advanced, it lagged amid investor preference for more growth-oriented sectors. Stock selection in the information technology sector also weighed on relative results, driven primarily by an average underweight allocation to NVIDIA. While we were underweight to the stock relative to the benchmark, our absolute position in the name was significant and reflected our favorable view of the company.

The fund seeks long-term capital appreciation by investing primarily in common stocks. It also holds fixed income and other securities to help preserve principal value. Notable changes in positioning during the period included adding exposure to health care and information technology and reducing exposure to financials and industrials and business services.

How has the fund performed?

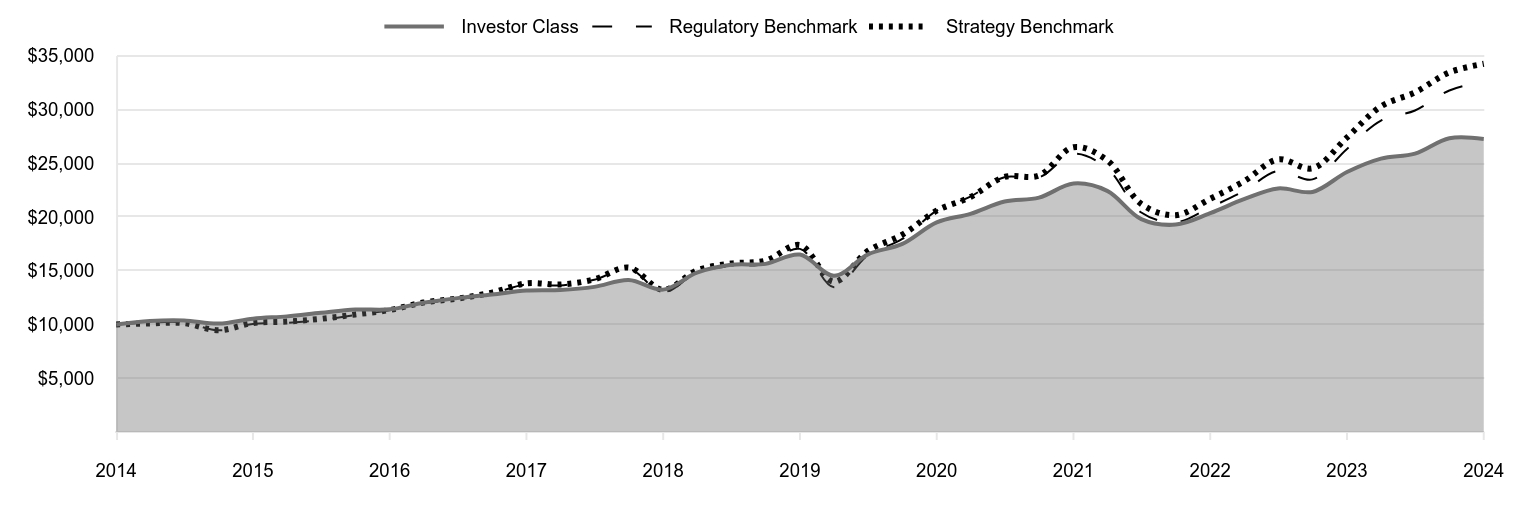

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

|---|

| 2015 | 10,321 | 10,180 | 10,095 |

|---|

| 2015 | 10,371 | 10,194 | 10,123 |

|---|

| 2015 | 10,084 | 9,455 | 9,471 |

|---|

| 2015 | 10,542 | 10,048 | 10,138 |

|---|

| 2016 | 10,756 | 10,145 | 10,275 |

|---|

| 2016 | 11,089 | 10,412 | 10,527 |

|---|

| 2016 | 11,392 | 10,870 | 10,933 |

|---|

| 2016 | 11,408 | 11,327 | 11,351 |

|---|

| 2017 | 12,018 | 11,978 | 12,039 |

|---|

| 2017 | 12,454 | 12,339 | 12,411 |

|---|

| 2017 | 12,785 | 12,903 | 12,967 |

|---|

| 2017 | 13,163 | 13,721 | 13,829 |

|---|

| 2018 | 13,218 | 13,633 | 13,724 |

|---|

| 2018 | 13,498 | 14,163 | 14,195 |

|---|

| 2018 | 14,135 | 15,172 | 15,290 |

|---|

| 2018 | 13,244 | 13,002 | 13,223 |

|---|

| 2019 | 14,821 | 14,828 | 15,027 |

|---|

| 2019 | 15,550 | 15,435 | 15,674 |

|---|

| 2019 | 15,640 | 15,614 | 15,940 |

|---|

| 2019 | 16,503 | 17,035 | 17,386 |

|---|

| 2020 | 14,526 | 13,475 | 13,979 |

|---|

| 2020 | 16,524 | 16,443 | 16,850 |

|---|

| 2020 | 17,497 | 17,957 | 18,355 |

|---|

| 2020 | 19,499 | 20,593 | 20,585 |

|---|

| 2021 | 20,294 | 21,900 | 21,856 |

|---|

| 2021 | 21,437 | 23,705 | 23,724 |

|---|

| 2021 | 21,803 | 23,681 | 23,863 |

|---|

| 2021 | 23,113 | 25,877 | 26,494 |

|---|

| 2022 | 22,431 | 24,512 | 25,276 |

|---|

| 2022 | 19,805 | 20,418 | 21,206 |

|---|

| 2022 | 19,292 | 19,506 | 20,170 |

|---|

| 2022 | 20,353 | 20,907 | 21,696 |

|---|

| 2023 | 21,653 | 22,408 | 23,322 |

|---|

| 2023 | 22,653 | 24,288 | 25,361 |

|---|

| 2023 | 22,331 | 23,497 | 24,531 |

|---|

| 2023 | 24,185 | 26,334 | 27,399 |

|---|

| 2024 | 25,433 | 28,973 | 30,291 |

|---|

| 2024 | 25,897 | 29,904 | 31,589 |

|---|

| 2024 | 27,323 | 31,767 | 33,448 |

|---|

| 2024 | 27,253 | 32,604 | 34,254 |

|---|

202501-4140694, 202502-4108205

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Capital Appreciation Fund (Investor Class) | 12.69% | 10.55% | 10.55% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 12.55 |

|---|

| S&P 500 Index (Strategy Benchmark) | 25.02 | 14.53 | 13.10 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$64,235,830

- Number of Portfolio Holdings294

- Investment Advisory Fees Paid (000s)$345,888

- Portfolio Turnover Rate85.0%

What did the fund invest in?

Security Allocation (as a % of Net Assets)

| Common and Preferred Stocks | 61.8% |

| Bonds | 34.3 |

| Reserves | 3.9 |

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 14.7% |

| Microsoft | 5.2 |

| Amazon.com | 3.3 |

| Becton Dickinson & Company | 2.9 |

| HUB International | 2.8 |

| NVIDIA | 2.8 |

| Roper Technologies | 2.6 |

| Fortive | 2.5 |

| UnitedHealth Group | 2.5 |

| Revvity | 2.3 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" and S&P do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Capital Appreciation Fund

Investor Class (PRWCX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

Capital Appreciation Fund

This annual shareholder report contains important information about Capital Appreciation Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Capital Appreciation Fund - Advisor Class | $102 | 0.96% |

|---|

What drove fund performance during the past 12 months?

U.S. stocks produced strong gains for the second consecutive year in 2024, and various equity indexes reached all-time highs during the year. The equity market was buoyed by generally favorable corporate earnings and by continuing interest in companies expected to benefit from artificial intelligence developments.

Versus the all-equity S&P 500 Index, the leading contributor to relative performance was an underweight allocation to consumer staples, as the traditionally defensive sector lagged the broader benchmark in a market that strongly favored growth-oriented names. Stock selection in materials also added value, driven by our favorable position in multinational chemical company Linde, which outpaced sector peers.

On the negative side, an overweight allocation to health care was the leading detractor from relative results. While the health care sector advanced, it lagged amid investor preference for more growth-oriented sectors. Stock selection in the information technology sector also weighed on relative results, driven primarily by an average underweight allocation to NVIDIA. While we were underweight to the stock relative to the benchmark, our absolute position in the name was significant and reflected our favorable view of the company.

The fund seeks long-term capital appreciation by investing primarily in common stocks. It also holds fixed income and other securities to help preserve principal value. Notable changes in positioning during the period included adding exposure to health care and information technology and reducing exposure to financials and industrials and business services.

How has the fund performed?

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Advisor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

|---|

| 2015 | 10,313 | 10,180 | 10,095 |

|---|

| 2015 | 10,355 | 10,194 | 10,123 |

|---|

| 2015 | 10,062 | 9,455 | 9,471 |

|---|

| 2015 | 10,512 | 10,048 | 10,138 |

|---|

| 2016 | 10,715 | 10,145 | 10,275 |

|---|

| 2016 | 11,041 | 10,412 | 10,527 |

|---|

| 2016 | 11,334 | 10,870 | 10,933 |

|---|

| 2016 | 11,342 | 11,327 | 11,351 |

|---|

| 2017 | 11,937 | 11,978 | 12,039 |

|---|

| 2017 | 12,361 | 12,339 | 12,411 |

|---|

| 2017 | 12,675 | 12,903 | 12,967 |

|---|

| 2017 | 13,041 | 13,721 | 13,829 |

|---|

| 2018 | 13,087 | 13,633 | 13,724 |

|---|

| 2018 | 13,357 | 14,163 | 14,195 |

|---|

| 2018 | 13,977 | 15,172 | 15,290 |

|---|

| 2018 | 13,091 | 13,002 | 13,223 |

|---|

| 2019 | 14,635 | 14,828 | 15,027 |

|---|

| 2019 | 15,343 | 15,435 | 15,674 |

|---|

| 2019 | 15,423 | 15,614 | 15,940 |

|---|

| 2019 | 16,259 | 17,035 | 17,386 |

|---|

| 2020 | 14,300 | 13,475 | 13,979 |

|---|

| 2020 | 16,259 | 16,443 | 16,850 |

|---|

| 2020 | 17,201 | 17,957 | 18,355 |

|---|

| 2020 | 19,152 | 20,593 | 20,585 |

|---|

| 2021 | 19,925 | 21,900 | 21,856 |

|---|

| 2021 | 21,027 | 23,705 | 23,724 |

|---|

| 2021 | 21,374 | 23,681 | 23,863 |

|---|

| 2021 | 22,641 | 25,877 | 26,494 |

|---|

| 2022 | 21,958 | 24,512 | 25,276 |

|---|

| 2022 | 19,377 | 20,418 | 21,206 |

|---|

| 2022 | 18,862 | 19,506 | 20,170 |

|---|

| 2022 | 19,884 | 20,907 | 21,696 |

|---|

| 2023 | 21,140 | 22,408 | 23,322 |

|---|

| 2023 | 22,103 | 24,288 | 25,361 |

|---|

| 2023 | 21,777 | 23,497 | 24,531 |

|---|

| 2023 | 23,566 | 26,334 | 27,399 |

|---|

| 2024 | 24,766 | 28,973 | 30,291 |

|---|

| 2024 | 25,196 | 29,904 | 31,589 |

|---|

| 2024 | 26,573 | 31,767 | 33,448 |

|---|

| 2024 | 26,492 | 32,604 | 34,254 |

|---|

202501-4140694, 202502-4108205

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Capital Appreciation Fund (Advisor Class) | 12.41% | 10.26% | 10.23% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 12.55 |

|---|

| S&P 500 Index (Strategy Benchmark) | 25.02 | 14.53 | 13.10 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$64,235,830

- Number of Portfolio Holdings294

- Investment Advisory Fees Paid (000s)$345,888

- Portfolio Turnover Rate85.0%

What did the fund invest in?

Security Allocation (as a % of Net Assets)

| Common and Preferred Stocks | 61.8% |

| Bonds | 34.3 |

| Reserves | 3.9 |

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 14.7% |

| Microsoft | 5.2 |

| Amazon.com | 3.3 |

| Becton Dickinson & Company | 2.9 |

| HUB International | 2.8 |

| NVIDIA | 2.8 |

| Roper Technologies | 2.6 |

| Fortive | 2.5 |

| UnitedHealth Group | 2.5 |

| Revvity | 2.3 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" and S&P do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Capital Appreciation Fund

Advisor Class (PACLX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

Capital Appreciation Fund

This annual shareholder report contains important information about Capital Appreciation Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Capital Appreciation Fund - I Class | $61 | 0.57% |

|---|

What drove fund performance during the past 12 months?

U.S. stocks produced strong gains for the second consecutive year in 2024, and various equity indexes reached all-time highs during the year. The equity market was buoyed by generally favorable corporate earnings and by continuing interest in companies expected to benefit from artificial intelligence developments.

Versus the all-equity S&P 500 Index, the leading contributor to relative performance was an underweight allocation to consumer staples, as the traditionally defensive sector lagged the broader benchmark in a market that strongly favored growth-oriented names. Stock selection in materials also added value, driven by our favorable position in multinational chemical company Linde, which outpaced sector peers.

On the negative side, an overweight allocation to health care was the leading detractor from relative results. While the health care sector advanced, it lagged amid investor preference for more growth-oriented sectors. Stock selection in the information technology sector also weighed on relative results, driven primarily by an average underweight allocation to NVIDIA. While we were underweight to the stock relative to the benchmark, our absolute position in the name was significant and reflected our favorable view of the company.

The fund seeks long-term capital appreciation by investing primarily in common stocks. It also holds fixed income and other securities to help preserve principal value. Notable changes in positioning during the period included adding exposure to health care and information technology and reducing exposure to financials and industrials and business services.

How has the fund performed?

Cumulative Returns of a Hypothetical $500,000 Investment as of December 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 12/17/15 | 500,000 | 500,000 | 500,000 |

|---|

| 12/31/15 | 502,204 | 501,104 | 500,805 |

|---|

| 3/31/16 | 512,425 | 505,956 | 507,555 |

|---|

| 6/30/16 | 528,657 | 519,265 | 520,017 |

|---|

| 9/30/16 | 543,086 | 542,101 | 540,048 |

|---|

| 12/31/16 | 544,074 | 564,920 | 560,701 |

|---|

| 3/31/17 | 573,343 | 597,365 | 594,714 |

|---|

| 6/30/17 | 594,309 | 615,379 | 613,080 |

|---|

| 9/30/17 | 610,085 | 643,510 | 640,548 |

|---|

| 12/31/17 | 628,290 | 684,291 | 683,111 |

|---|

| 3/31/18 | 631,177 | 679,881 | 677,925 |

|---|

| 6/30/18 | 644,724 | 706,321 | 701,204 |

|---|

| 9/30/18 | 675,373 | 756,638 | 755,272 |

|---|

| 12/31/18 | 633,044 | 648,422 | 653,161 |

|---|

| 3/31/19 | 708,628 | 739,483 | 742,304 |

|---|

| 6/30/19 | 743,439 | 769,766 | 774,252 |

|---|

| 9/30/19 | 747,969 | 778,714 | 787,401 |

|---|

| 12/31/19 | 789,437 | 849,557 | 858,818 |

|---|

| 3/31/20 | 695,179 | 672,002 | 690,507 |

|---|

| 6/30/20 | 790,953 | 820,028 | 832,359 |

|---|

| 9/30/20 | 837,703 | 895,532 | 906,684 |

|---|

| 12/31/20 | 933,968 | 1,027,010 | 1,016,830 |

|---|

| 3/31/21 | 972,268 | 1,092,194 | 1,079,619 |

|---|

| 6/30/21 | 1,027,255 | 1,182,188 | 1,171,913 |

|---|

| 9/30/21 | 1,045,311 | 1,180,986 | 1,178,735 |

|---|

| 12/31/21 | 1,108,310 | 1,290,553 | 1,308,715 |

|---|

| 3/31/22 | 1,075,951 | 1,222,431 | 1,248,534 |

|---|

| 6/30/22 | 950,408 | 1,018,271 | 1,047,506 |

|---|

| 9/30/22 | 926,139 | 972,809 | 996,360 |

|---|

| 12/31/22 | 977,115 | 1,042,677 | 1,071,695 |

|---|

| 3/31/23 | 1,039,911 | 1,117,544 | 1,152,041 |

|---|

| 6/30/23 | 1,088,241 | 1,211,271 | 1,252,754 |

|---|

| 9/30/23 | 1,073,117 | 1,171,858 | 1,211,746 |

|---|

| 12/31/23 | 1,162,586 | 1,313,323 | 1,353,419 |

|---|

| 3/31/24 | 1,222,944 | 1,444,909 | 1,496,285 |

|---|

| 6/30/24 | 1,245,578 | 1,491,377 | 1,560,382 |

|---|

| 9/30/24 | 1,314,510 | 1,584,277 | 1,652,235 |

|---|

| 12/31/24 | 1,311,824 | 1,625,996 | 1,692,040 |

|---|

202501-4140694, 202502-4108205

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 12/17/15 |

|---|

| Capital Appreciation Fund (I Class) | 12.84% | 10.69% | 11.26% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 13.94 |

|---|

| S&P 500 Index (Strategy Benchmark) | 25.02 | 14.53 | 14.44 |

|---|

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$64,235,830

- Number of Portfolio Holdings294

- Investment Advisory Fees Paid (000s)$345,888

- Portfolio Turnover Rate85.0%

What did the fund invest in?

Security Allocation (as a % of Net Assets)

| Common and Preferred Stocks | 61.8% |

| Bonds | 34.3 |

| Reserves | 3.9 |

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 14.7% |

| Microsoft | 5.2 |

| Amazon.com | 3.3 |

| Becton Dickinson & Company | 2.9 |

| HUB International | 2.8 |

| NVIDIA | 2.8 |

| Roper Technologies | 2.6 |

| Fortive | 2.5 |

| UnitedHealth Group | 2.5 |

| Revvity | 2.3 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" and S&P do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Capital Appreciation Fund

I Class (TRAIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | |

| | | 2024 | | | 2023 | | | |

Audit Fees | | $ | 46,029 | | | $ | 46,733 | |

Audit-Related Fees | | | - | | | | - | |

Tax Fees | | | - | | | | - | |

All Other Fees | | | - | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

PRWCX

Capital

Appreciation

Fund

PACLX

Capital

Appreciation

Fund–

.

Advisor Class

TRAIX

Capital

Appreciation

Fund–

.

I Class

T.

ROWE

PRICE

Capital

Appreciation

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

33.91

$

29.73

$

36.96

$

34.11

$

31.22

Investment

activities

Net

investment

income

(1)(2)

0.81

0.77

0.49

0.35

0.40

Net

realized

and

unrealized

gain/loss

3.49

4.81

(4.91)

5.91

5.21

Total

from

investment

activities

4.30

5.58

(4.42)

6.26

5.61

Distributions

Net

investment

income

(0.80)

(0.71)

(0.47)

(0.35)

(0.40)

Net

realized

gain

(2.79)

(0.69)

(2.34)

(3.06)

(2.32)

Total

distributions

(3.59)

(1.40)

(2.81)

(3.41)

(2.72)

NET

ASSET

VALUE

End

of

period

$

34.62

$

33.91

$

29.73

$

36.96

$

34.11

Ratios/Supplemental

Data

Total

return

(2)(3)

12.69%

18.83%

(11.94)%

18.53%

18.16%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.72%

0.73%

0.73%

0.70%

0.70%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.70%

0.70%

0.71%

0.68%

0.69%

Net

investment

income

2.23%

2.38%

1.45%

0.95%

1.26%

Portfolio

turnover

rate

85.0%

65.1%

83.9%

47.8%

87.3%

Net

assets,

end

of

period

(in

millions)

$34,860

$31,624

$26,104

$40,460

$35,253

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Capital

Appreciation

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Advisor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

33.39

$

29.30

$

36.49

$

33.70

$

30.88

Investment

activities

Net

investment

income

(1)(2)

0.70

0.68

0.40

0.24

0.31

Net

realized

and

unrealized

gain/loss

3.45

4.73

(4.85)

5.84

5.13

Total

from

investment

activities

4.15

5.41

(4.45)

6.08

5.44

Distributions

Net

investment

income

(0.71)

(0.63)

(0.40)

(0.23)

(0.30)

Net

realized

gain

(2.79)

(0.69)

(2.34)

(3.06)

(2.32)

Total

distributions

(3.50)

(1.32)

(2.74)

(3.29)

(2.62)

NET

ASSET

VALUE

End

of

period

$

34.04

$

33.39

$

29.30

$

36.49

$

33.70

Ratios/Supplemental

Data

Total

return

(2)(3)

12.41%

18.52%

(12.18)%

18.22%

17.80%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.99%

0.99%

0.99%

0.99%

1.00%

Net

expenses

after

waivers/payments

by

Price

Associates

0.96%

0.96%

0.97%

0.97%

0.99%

Net

investment

income

1.96%

2.12%

1.22%

0.66%

0.97%

Portfolio

turnover

rate

85.0%

65.1%

83.9%

47.8%

87.3%

Net

assets,

end

of

period

(in

millions)

$790

$759

$654

$795

$770

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Capital

Appreciation

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

33.90

$

29.72

$

36.99

$

34.14

$

31.24

Investment

activities

Net

investment

income

(1)(2)

0.85

0.81

0.56

0.40

0.44

Net

realized

and

unrealized

gain/loss

3.50

4.82

(4.95)

5.91

5.22

Total

from

investment

activities

4.35

5.63

(4.39)

6.31

5.66

Distributions

Net

investment

income

(0.85)

(0.76)

(0.54)

(0.40)

(0.44)

Net

realized

gain

(2.79)

(0.69)

(2.34)

(3.06)

(2.32)

Total

distributions

(3.64)

(1.45)

(2.88)

(3.46)

(2.76)

NET

ASSET

VALUE

End

of

period

$

34.61

$

33.90

$

29.72

$

36.99

$

34.14

Ratios/Supplemental

Data

Total

return

(2)(3)

12.84%

18.98%

(11.84)%

18.67%

18.31%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.60%

0.60%

0.60%

0.59%

0.59%

Net

expenses

after

waivers/payments

by

Price

Associates

0.57%

0.58%

0.58%

0.57%

0.58%

Net

investment

income

2.35%

2.50%

1.67%

1.06%

1.37%

Portfolio

turnover

rate

85.0%

65.1%

83.9%

47.8%

87.3%

Net

assets,

end

of

period

(in

millions)

$28,586

$24,084

$18,698

$12,654

$8,901

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Capital

Appreciation

Fund

December

31,

2024

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

ASSET-BACKED

SECURITIES

0.0%

Domino's

Pizza

Master

Issuer

Series 2017-1A,

Class

A23

4.118%,

7/25/47 (1)

22,249,988

21,659

Domino's

Pizza

Master

Issuer

Series 2019-1A,

Class

A2

3.668%,

10/25/49 (1)

17,777,472

16,468

Total

Asset-Backed

Securities

(Cost

$39,847)

38,127

BANK

LOANS

7.8%

(2)

ADMI,

FRN

1M

TSFR

+

3.38%,

7.846%,

12/23/27

20,608,447

20,136

ADMI,

FRN

1M

TSFR

+

3.75%,

8.221%,

12/23/27

58,858,541

57,755

ADMI,

FRN

1M

TSFR

+

5.75%,

10.107%,

12/23/27

5,695,064

5,706

Alliant

Holdings

Intermediate,

FRN

1M

TSFR

+

2.75%,

7.106%,

9/19/31

74,632,460

74,749

AmWINS

Group,

FRN

1M

TSFR

+

2.25%,

6.721%,

2/19/28 (3)

145,508,930

145,879

Applied

Systems,

FRN

3M

TSFR

+

3.00%,

7.329%,

2/24/31 (3)

504,752,121

509,285

Applied

Systems,

FRN

3M

TSFR

+

5.25%,

9.579%,

2/23/32

68,596,360

70,483

AssuredPartners,

FRN

1M

TSFR

+

3.50%,

7.857%,

2/14/31

241,947,521

242,264

AthenaHealth

Group,

FRN

1M

TSFR

+

3.25%,

7.607%,

2/15/29

167,798,917

167,979

Avantor

Funding,

FRN

1M

TSFR

+

2.00%,

6.457%,

11/8/27

739,565

743

Azalea

Topco,

FRN

1M

TSFR

+

3.25%,

7.607%,

4/30/31

114,815,243

115,031

BroadStreet

Partners,

FRN

1M

TSFR

+

3.00%,

7.357%,

6/13/31 (3)

206,033,421

206,538

CCC

Intelligent

Solutions,

FRN

1M

TSFR

+

2.25%,

6.721%,

9/21/28 (3)

8,852,684

8,878

CPI

Holdco,

FRN

1M

TSFR

+

2.25%,

5/29/31 (3)

85,334,000

85,227

Ellucian

Holdings,

FRN

1M

TSFR

+

3.00%,

7.357%,

10/9/29

105,911,000

106,520

Epicor

Software,

FRN

1M

TSFR

+

2.75%,

7.107%,

5/30/31

107,660,651

108,344

Filtration

Group,

FRN

1M

EURIBOR

+

4.25%,

7.113%,

10/21/28

(EUR)

65,339,526

68,105

T.

ROWE

PRICE

Capital

Appreciation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Filtration

Group,

FRN

1M

TSFR

+

3.50%,

7.971%,

10/21/28

289,349,415

291,303

Heartland

Dental,

FRN

1M

TSFR

+

4.50%,

8.857%,

4/28/28

26,978,579

26,998

Hilton

Domestic

Operating,

FRN

1M

TSFR

+

1.75%,

6.088%,

11/8/30

159,708,459

160,408

HUB

International,

FRN

3M

TSFR

+

2.75%,

7.367%,

6/20/30

821,720,475

825,829

Icon

Parent,

FRN

1M

TSFR

+

3.00%,

7.516%,

11/13/31

95,146,500

95,414

Icon

Parent,

FRN

1M

TSFR

+

5.00%,

9.516%,

11/12/32 (3)

56,930,700

57,714

Informatica,

FRN

1M

TSFR

+

2.25%,

6.607%,

10/27/28

28,429,383

28,524

IRB

Holding,

FRN

1M

TSFR

+

2.50%,

6.857%,

12/15/27

96,964,074

96,985

Loire

Finco

Luxembourg,

FRN

1M

TSFR

+

3.50%,

7.957%,

4/21/27

153,617,931

152,563

Loire

Finco

Luxembourg,

FRN

1M

TSFR

+

3.75%,

8.207%,

4/21/27

28,574,720

28,360

Medline

Borrower,

FRN

1M

TSFR

+

2.25%,

6.607%,

10/23/28 (3)

42,886,267

43,002

Quartz

Acquireco,

FRN

3M

TSFR

+

2.75%,

7.079%,

6/28/30

29,840,248

30,027

SBA

Senior

Finance

II,

FRN

1M

TSFR

+

1.75%,

6.11%,

1/25/31

102,244,231

102,209

SkyMiles

IP,

FRN

3M

TSFR

+

3.75%,

8.367%,

10/20/27

57,977,287

58,947

Storable,

FRN

1M

TSFR

+

3.50%,

7.857%,

4/17/28

65,332,118

65,720

TIH

Insurance

Holdings,

FRN

3M

TSFR

+

4.75%,

9.079%,

5/6/32

38,225,703

39,046

Trans

Union,

FRN

1M

TSFR

+

1.75%,

6.207%,

11/16/26

7,273,252

7,271

TransDigm,

FRN

3M

TSFR

+

2.75%,

7.079%,

8/24/28

11,861,910

11,894

TransDigm,

FRN

3M

TSFR

+

2.75%,

7.079%,

3/22/30 (3)

92,645,042

92,898

UKG,

FRN

3M

TSFR

+

3.00%,

7.617%,

2/10/31

323,242,090

325,291

USI,

FRN

1M

TSFR

+

2.25%,

11/23/29 (3)

125,216,555

124,889

USI,

FRN

1M

TSFR

+

2.25%,

9/27/30 (3)

185,792,939

185,282

T.

ROWE

PRICE

Capital

Appreciation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Varsity

Brands,

FRN

3M

TSFR

+

3.75%,

8.271%,

8/26/31

168,249,000

168,291

Total

Bank

Loans

(Cost

$4,979,310)

5,012,487

BOND

MUTUAL

FUNDS

1.4%

T.

Rowe

Price

Institutional

Floating

Rate

Fund

–

Institutional

Class,

7.37% (4)(5)

96,908,711

919,663

Total

Bond

Mutual

Funds

(Cost

$935,296)

919,663

COMMON

STOCKS

60.5%

COMMUNICATION

SERVICES

3.3%

Interactive

Media

&

Services

3.3%

Alphabet,

Class

A (6)

7,225,408

1,367,770

Meta

Platforms,

Class

A (6)

1,300,429

761,414

Total

Communication

Services

2,129,184

CONSUMER

DISCRETIONARY

5.2%

Broadline

Retail

3.4%

Amazon.com (6)(7)

9,834,107

2,157,505

2,157,505

Diversified

Consumer

Services

0.7%

Service

Corp.

International

5,906,494

471,456

471,456

Hotels,

Restaurants

&

Leisure

1.1%

Hilton

Worldwide

Holdings

1,299,246

321,122

Yum!

Brands (6)

2,736,400

367,115

688,237

Total

Consumer

Discretionary

3,317,198

ENERGY

1.4%

Oil,

Gas

&

Consumable

Fuels

1.4%

Canadian

Natural

Resources

22,066,648

681,198

Expand

Energy

2,117,802

210,827

Total

Energy

892,025

FINANCIALS

2.5%

Financial

Services

2.3%

Mastercard,

Class

A

1,466,069

771,988

Visa,

Class

A (6)

2,287,246

722,861

1,494,849

T.

ROWE

PRICE

Capital

Appreciation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Insurance

0.2%

Hockey

Parent

Holdings,

Acquisition

Date:

9/14/23,

Cost $123,055 (7)(8)(9)

123,055

135,379

135,379

Total

Financials

1,630,228

HEALTH

CARE

15.0%

Biotechnology

0.1%

Biogen (7)

246,970

37,767

37,767

Health

Care

Equipment

&

Supplies

4.0%

Abbott

Laboratories

5,425,878

613,721

Becton

Dickinson

&

Company (6)

7,982,344

1,810,954

GE

HealthCare

Technologies

2,031,600

158,831

2,583,506

Health

Care

Providers

&

Services

4.6%

Humana

1,038,611

263,506

McKesson

1,885,838

1,074,758

UnitedHealth

Group

3,130,788

1,583,740

2,922,004

Life

Sciences

Tools

&

Services

5.7%

Danaher

5,078,136

1,165,686

Revvity (4)

13,158,721

1,468,645

Thermo

Fisher

Scientific (6)

2,028,398

1,055,234

3,689,565

Pharmaceuticals

0.6%

Eli

Lilly

502,122

387,638

387,638

Total

Health

Care

9,620,480

INDUSTRIALS

&

BUSINESS

SERVICES

8.1%

Aerospace

&

Defense

1.2%

RTX

6,803,871

787,344

787,344

Commercial

Services

&

Supplies

1.4%

Veralto

4,129,208

420,560

Waste

Connections

2,804,672

481,225

901,785

Industrial

Conglomerates

2.6%

Roper

Technologies (6)

3,151,726

1,638,425

1,638,425

T.

ROWE

PRICE

Capital

Appreciation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Machinery

2.9%

Fortive (4)

21,417,926

1,606,345

Ingersoll

Rand

2,609,974

236,098

1,842,443

Total

Industrials

&

Business

Services

5,169,997

INFORMATION

TECHNOLOGY

17.4%

Electronic

Equipment,

Instruments

&

Components

0.4%

Teledyne

Technologies (7)

593,319

275,377

275,377

Semiconductors

&

Semiconductor

Equipment

4.2%

Advanced

Micro

Devices (7)

2,926,949

353,546

Broadcom

1,417,100

328,541

Marvell

Technology

1,895,287

209,334

NVIDIA (6)

13,353,160

1,793,196

2,684,617

Software

10.9%

Aurora

Innovation (4)(7)

133,974,250

844,038

Autodesk (7)

1,526,457

451,175

Intuit

1,185,511

745,094

Microsoft (6)

7,982,639

3,364,682

PTC (4)(7)

7,107,093

1,306,781

Salesforce

916,267

306,335

7,018,105

Technology

Hardware,

Storage

&

Peripherals

1.9%

Apple

4,897,396

1,226,406

1,226,406

Total

Information

Technology

11,204,505

UTILITIES

4.0%

Multi-Utilities

4.0%

Ameren (6)

11,107,293

990,104

CenterPoint

Energy

30,474,880

966,968

DTE

Energy

932,569

112,608

NiSource

13,872,077

509,937

Total

Utilities

2,579,617

Total

Miscellaneous

Common

Stocks

3.6% (10)

2,352,800

Total

Common

Stocks

(Cost

$27,467,103)

38,896,034

T.

ROWE

PRICE

Capital

Appreciation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

CONVERTIBLE

PREFERRED

STOCKS

1.0%

INFORMATION

TECHNOLOGY

0.7%

Software

0.7%

Waymo,

Series

A-2,

Acquisition

Date:

5/8/20,

Cost $183,922 (7)

(8)(9)

2,141,932

171,997

Waymo,

Series

B-2,

Acquisition

Date:

6/11/21,

Cost $16,282 (7)

(8)(9)

177,514

14,381

Waymo,

Series

C-2,

Acquisition

Date:

1/12/24

-

9/27/24,

Cost $279,599 (7)(8)(9)

3,575,381

279,599

Total

Information

Technology

465,977

Total

Miscellaneous

Convertible

Preferred

Stocks

0.3% (10)

172,490

Total

Convertible

Preferred

Stocks

(Cost

$621,628)

638,467

CORPORATE

BONDS

10.4%

Alliant

Holdings

Intermediate,

5.875%,

11/1/29 (1)

17,837,000

17,034

Alliant

Holdings

Intermediate,

6.75%,

10/15/27 (1)

50,618,000

50,112

Alliant

Holdings

Intermediate,

6.75%,

4/15/28 (1)

112,411,000

112,130

Alliant

Holdings

Intermediate,

7.00%,

1/15/31 (1)

81,458,000

81,763

American

Tower,

1.50%,

1/31/28

5,752,000

5,188

American

Tower,

1.875%,

10/15/30

25,734,000

21,507

American

Tower,

2.10%,

6/15/30

20,076,000

17,204

American

Tower,

2.90%,

1/15/30

20,560,000

18,513

American

Tower,

3.80%,

8/15/29

29,517,000

27,955

AmWINS

Group,

6.375%,

2/15/29 (1)

37,102,000

37,241

AssuredPartners,

7.50%,

2/15/32 (1)

16,331,000

17,597

Avantor

Funding,

3.875%,

11/1/29 (1)

96,931,000

88,449

Avantor

Funding,

4.625%,

7/15/28 (1)

144,048,000

136,846

Ball,

6.00%,

6/15/29

54,640,000

54,913

Becton

Dickinson

&

Company,

3.70%,

6/6/27

20,154,000

19,662

Biogen,

3.15%,

5/1/50

89,552,000

56,227

Biogen,

3.25%,

2/15/51

4,277,000

2,685

Biogen,

5.20%,

9/15/45

24,647,000

22,042

Booz

Allen

Hamilton,

3.875%,

9/1/28 (1)

33,575,000

31,764

Booz

Allen

Hamilton,

4.00%,

7/1/29 (1)

21,029,000

19,817

Booz

Allen

Hamilton,

5.95%,

8/4/33

34,622,000

35,411

Broadcom,

4.15%,

4/15/32 (1)

25,887,000

24,331

Broadridge

Financial

Solutions,

2.60%,

5/1/31

9,451,000

8,063

BroadStreet

Partners,

5.875%,

4/15/29 (1)

60,561,000

58,593

CCO

Holdings,

5.00%,

2/1/28 (1)

256,263,000

246,333

CCO

Holdings,

5.125%,

5/1/27 (1)

335,581,000

329,708

CCO

Holdings,

5.50%,

5/1/26 (1)

17,243,000

17,157

T.

ROWE

PRICE

Capital

Appreciation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Cedar

Fair,

5.25%,

7/15/29

57,540,000

55,167

Cedar

Fair,

5.375%,

4/15/27

94,597,000

93,296

Cedar

Fair,

6.50%,

10/1/28

63,975,000

63,975

Charles

River

Laboratories

International,

3.75%,

3/15/29 (1)

48,673,000

44,597

Charles

River

Laboratories

International,

4.00%,

3/15/31 (1)

39,694,000

35,328

Charles

River

Laboratories

International,

4.25%,

5/1/28 (1)

46,316,000

43,942

Clarios

Global,

6.25%,

5/15/26 (1)

21,386,000

21,386

Clarios

Global,

8.50%,

5/15/27 (1)

76,251,000

76,632

Clarivate

Science

Holdings,

3.875%,

7/1/28 (1)

10,482,000

9,735

Clarivate

Science

Holdings,

4.875%,

7/1/29 (1)

7,480,000

6,947

Crowdstrike

Holdings,

3.00%,

2/15/29

5,722,000

5,178

Crown

Castle,

4.30%,

2/15/29

7,805,000

7,552

Crown

Castle,

4.90%,

9/1/29

29,930,000

29,560

Crown

Castle,

5.20%,

9/1/34

49,885,000

48,510

Crown

Castle,

5.60%,

6/1/29

5,974,000

6,091

Delta

Air

Lines,

4.75%,

10/20/28 (1)

63,966,120

62,973

Ellucian

Holdings,

6.50%,

12/1/29 (1)

35,120,000

35,208

Gartner,

3.625%,

6/15/29 (1)

40,068,000

37,195

Gartner,

3.75%,

10/1/30 (1)

19,418,000

17,711

Gartner,

4.50%,

7/1/28 (1)

30,844,000

29,988

GE

HealthCare

Technologies,

5.65%,

11/15/27

14,651,000

15,016

GFL

Environmental,

4.00%,

8/1/28 (1)

19,224,000

18,167

GFL

Environmental,

4.375%,

8/15/29 (1)

20,383,000

19,211

GFL

Environmental,

4.75%,

6/15/29 (1)

57,536,000

55,234

GFL

Environmental,

6.75%,

1/15/31 (1)

16,221,000

16,667

Hilton

Domestic

Operating,

3.625%,

2/15/32 (1)

100,484,000

87,170

Hilton

Domestic

Operating,

3.75%,

5/1/29 (1)

79,240,000

72,802

Hilton

Domestic

Operating,

4.00%,

5/1/31 (1)

106,155,000

95,540

Hilton

Domestic

Operating,

4.875%,

1/15/30

64,939,000

62,179

Hilton

Domestic

Operating,

5.375%,

5/1/25 (1)

32,300,000

32,260

Hilton

Domestic

Operating,

5.75%,

5/1/28 (1)

74,282,000

74,003

Hilton

Domestic

Operating,

5.875%,

4/1/29 (1)

39,383,000

39,186

Hilton

Worldwide

Finance,

4.875%,

4/1/27

31,752,000

31,236

Hologic,

3.25%,

2/15/29 (1)

23,463,000

21,205

Howmet

Aerospace,

3.00%,

1/15/29

34,288,000

31,822

Howmet

Aerospace,

5.90%,

2/1/27

34,720,000

35,429

HUB

International,

5.625%,

12/1/29 (1)

34,495,000

33,331

HUB

International,

7.25%,

6/15/30 (1)

590,152,000

604,906

HUB

International,

7.375%,

1/31/32 (1)

325,788,000

330,675

IQVIA,

5.00%,

5/15/27 (1)

42,949,000

42,144

IQVIA,

5.70%,

5/15/28

70,797,000

71,505

IQVIA,

6.50%,

5/15/30 (1)

27,385,000

27,796

KFC

Holding,

4.75%,

6/1/27 (1)

138,818,000

136,042

T.

ROWE

PRICE

Capital

Appreciation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

Korn

Ferry,

4.625%,

12/15/27 (1)

32,930,000

31,613

Lamar

Media,

3.625%,

1/15/31

4,629,000

4,056

Lamar

Media,

3.75%,

2/15/28

29,070,000

27,217

Lamar

Media,

4.875%,

1/15/29

5,192,000

4,978

Life

Time,

5.75%,

1/15/26 (1)

51,846,000

51,820

Life

Time,

6.00%,

11/15/31 (1)

13,703,000

13,532

Marriott

International,

Series R,

3.125%,

6/15/26

4,100,000

4,006

Martin

Marietta

Materials,

2.40%,

7/15/31

6,639,000

5,668

Medline

Borrower,

6.25%,

4/1/29 (1)

43,328,000

43,761

Mileage

Plus

Holdings,

6.50%,

6/20/27 (1)

49,207,419

49,330

Mirant,

EC,

7.90%,

7/15/09 (1)(7)(8)

16,000,000

—

Motorola

Solutions,

2.30%,

11/15/30

6,639,000

5,687

Motorola

Solutions,

2.75%,

5/24/31

4,648,000

4,011

MSCI,

3.25%,

8/15/33 (1)

54,831,000

46,476

MSCI,

3.625%,

9/1/30 (1)

77,654,000

70,602

MSCI,

3.625%,

11/1/31 (1)

59,421,000

53,267

MSCI,

3.875%,

2/15/31 (1)

61,356,000

56,308

MSCI,

4.00%,

11/15/29 (1)

65,412,000

61,501

Panther

Escrow

Issuer,

7.125%,

6/1/31 (1)

8,972,000

9,039

PRA

Health

Sciences,

2.875%,

7/15/26 (1)

16,684,000

16,100

PTC,

4.00%,

2/15/28 (1)(4)

29,864,000

28,259

Revvity,

3.30%,

9/15/29 (4)

9,362,000

8,615

Ryan

Specialty,

4.375%,

2/1/30 (1)

13,021,000

12,207

Ryan

Specialty,

5.875%,

8/1/32 (1)

34,437,000

33,963

SBA

Communications,

3.125%,

2/1/29

106,254,000

96,027

SBA

Communications,

3.875%,

2/15/27

94,438,000

90,424

SBA

Tower

Trust,

6.599%,

1/15/28 (1)

2,575,000

2,637

Sensata

Technologies,

3.75%,

2/15/31 (1)

26,891,000

23,462

Sensata

Technologies,

4.00%,

4/15/29 (1)

9,024,000

8,260

Sensata

Technologies,

4.375%,

2/15/30 (1)

12,280,000

11,175

Sensata

Technologies,

5.875%,

9/1/30 (1)

19,842,000

19,285

Service

Corp.

International,

3.375%,

8/15/30

25,630,000

22,426

Service

Corp.

International,

4.625%,

12/15/27

5,256,000

5,105

Service

Corp.

International,

5.75%,

10/15/32

34,093,000

33,028

Six

Flags

Entertainment,

5.50%,

4/15/27 (1)

115,407,000

114,253

Six

Flags

Theme

Parks,

7.00%,

7/1/25 (1)

16,312,000

16,312

Surgery

Center

Holdings,

7.25%,

4/15/32 (1)

35,491,000

36,112

Teleflex,

4.25%,

6/1/28 (1)

5,399,000

5,102

Teleflex,

4.625%,

11/15/27

37,154,000

35,900

TransDigm,

4.625%,

1/15/29

20,636,000

19,243

TransDigm,

5.50%,

11/15/27

72,122,000

70,680

TransDigm,

6.375%,

3/1/29 (1)

163,459,000

163,663

TransDigm,

6.625%,

3/1/32 (1)

128,153,000

129,274

T.

ROWE

PRICE

Capital

Appreciation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

TransDigm,

7.125%,

12/1/31 (1)

77,268,000

79,103

UKG,

6.875%,

2/1/31 (1)

31,658,000

31,975

USI,

7.50%,

1/15/32 (1)

130,102,000

134,656

Vail

Resorts,

6.50%,

5/15/32 (1)

32,891,000

33,055

VICI

Properties,

3.75%,

2/15/27 (1)

19,848,000

19,178

VICI

Properties,

4.125%,

8/15/30 (1)

14,953,000

13,860

VICI

Properties,

4.625%,

12/1/29 (1)

4,979,000

4,772

VICI

Properties,

5.125%,

5/15/32

13,278,000

12,939

VICI

Properties,

5.75%,

2/1/27 (1)

14,033,000

14,110

VICI

Properties,

5.75%,

4/1/34

36,053,000

36,299

VMware,

4.70%,

5/15/30

15,546,000

15,223

Yum!

Brands,

3.625%,

3/15/31

58,638,000

51,821

Yum!

Brands,

4.625%,

1/31/32

103,021,000

95,294

Yum!

Brands,

4.75%,

1/15/30 (1)

46,941,000

44,829

Yum!

Brands,

5.35%,

11/1/43

73,445,000

70,691

Yum!

Brands,

5.375%,

4/1/32

121,538,000

117,740

Yum!

Brands,

6.875%,

11/15/37

36,517,000

39,712

Total

Miscellaneous

Corporate

Bonds

0.1% (10)

35,309

Total

Corporate

Bonds

(Cost

$6,612,912)

6,637,692

PREFERRED

STOCKS

0.3%

FINANCIALS

0.2%

Insurance

0.2%

AH

Parent,

Series

A,

Acquisition

Date:

9/27/24,

Cost $140,396 (7)(8)(9)

142,534

139,708

Total

Financials

139,708

UTILITIES

0.1%

Electric

Utilities

0.1%

CMS

Energy,

5.875%,

10/15/78 (4)

1,186,805

27,213

CMS

Energy,

5.875%,

3/1/79 (4)

1,463

34

Total

Utilities

27,247

Total

Preferred

Stocks

(Cost

$170,103)

166,955

U.S.

GOVERNMENT

AGENCY

OBLIGATIONS

(EXCLUDING

MORTGAGE-BACKED)

14.7%

U.S.

Treasury

Obligations

14.7%

U.S.

Treasury

Notes,

3.50%,

9/30/29

666,434,300

641,547

U.S.

Treasury

Notes,

3.625%,

8/31/29

2,679,572,000

2,595,835

U.S.

Treasury

Notes,

4.125%,

10/31/29

5,403,973,000

5,344,023

T.

ROWE

PRICE

Capital

Appreciation

Fund

Shares/Par

$

Value

(Cost

and

value

in

$000s)

‡

U.S.

Treasury

Notes,

4.25%,

11/15/34

866,651,000

844,579

9,425,984

Total

U.S.

Government

Agency

Obligations

(Excluding

Mortgage-Backed)

(Cost

$9,583,478)

9,425,984

SHORT-TERM

INVESTMENTS

4.2%

Money

Market

Funds

4.2%

T.

Rowe

Price

Government

Reserve

Fund,

4.53% (4)(11)

2,718,235,044

2,718,235

Total

Short-Term

Investments

(Cost

$2,718,235)

2,718,235

Total

Investments

in

Securities

100.3%

of

Net

Assets

(Cost

$53,127,912)

$

64,453,644

‡

Shares/Par

and

Notional

Amount

are

denominated

in

U.S.

dollars

unless

otherwise

noted.

(1)

Security

was

purchased

pursuant

to

Rule

144A

under

the

Securities

Act

of

1933

and

may

be

resold

in

transactions

exempt

from

registration

only

to

qualified

institutional

buyers.

Total

value

of

such

securities

at

period-end

amounts

to

$4,917,834

and

represents

7.7%

of

net

assets.

(2)

Bank

loan

positions

may

involve

multiple

underlying

tranches.

In

those

instances,

the

position

presented

reflects

the

aggregate

of

those

respective

underlying

tranches

and

the

rate

presented

reflects

the

weighted

average

rate

of

the

settled

positions.

(3)

All

or

a

portion

of

this

loan

is

unsettled

as

of

December

31,

2024.

The

interest

rate

for

unsettled

loans

will

be

determined

upon

settlement

after

period

end.

(4)

Affiliated

Companies

(5)

SEC

30-day

yield

(6)

At

December

31,

2024,

all

or

a

portion

of

this

security

is

pledged

as

collateral

and/or

margin

deposit

to

cover

future

funding

obligations.

(7)

Non-income

producing

(8)

See

Note

2.

Level

3

in

fair

value

hierarchy.

(9)

Security

cannot

be

offered

for

public

resale

without

first

being

registered

under

the

Securities

Act

of

1933

and

related

rules

("restricted

security").

Acquisition

date

represents

the

day

on

which

an

enforceable

right

to

acquire

such

security

is

obtained

and

is

presented

along

with

related

cost

in

the

security

description.

The

fund

may

have

registration

rights

for

certain

restricted

securities.

Any

costs

related

to

such

registration

are

generally

borne

by

the

issuer.

The

aggregate

value

of

restricted

securities

(excluding

144A

holdings)

at

period

end

amounts

to

$741,064

and

represents

1.2%

of

net

assets.

(10)

The

identity

of

certain

securities

has

been

concealed

to

protect

the

fund

while

it

completes

a

purchase

or

selling

program

for

the

securities.

T.

ROWE

PRICE

Capital

Appreciation

Fund

.

.

.

.

.

.

.

.

.

.

(11)

Seven-day

yield

1M

EURIBOR

One

month

EURIBOR

(Euro

interbank

offered

rate)

1M

TSFR

One

month

term

SOFR

(Secured

overnight

financing

rate)

3M

TSFR

Three

month

term

SOFR

(Secured

overnight

financing

rate)

EC

Escrow

CUSIP;

represents

a

beneficial

interest

in

a

residual

pool

of

assets;

the

amount

and

timing

of

future

distributions,

if

any,

is

uncertain;

when

presented,

interest

rate

and

maturity

date

are

those

of

the

original

security.

EUR

Euro

FRN

Floating

Rate

Note

OTC

Over-the-counter

VR

Variable

Rate;

rate

shown

is

effective

rate

at

period-end.

The

rates

for

certain

variable

rate

securities

are

not

based

on

a

published

reference

rate

and

spread

but

are

determined

by

the

issuer

or

agent

and

based

on

current

market

conditions.

T.

ROWE

PRICE

Capital

Appreciation

Fund

(Amounts

in

000s,

except

for

contracts)

OPTIONS

WRITTEN

(0.2)%

OTC

Options

Written (0.2)%

Counterparty

Description

Contracts

Notional

Amount

$

Value

Bank

of

America

Intuit,

Call,

1/17/25

@

$660.00

684

42,989

(

270

)

Bank

of

America

Intuit,

Call,

1/17/25

@

$700.00

341

21,432

(

23

)

Bank

of

America

Intuit,

Call,

1/17/25

@

$740.00

341

21,432

(

10

)

Bank

of

America

Meta

Platforms,

Class

A,

Call,

1/17/25

@

$590.00

681

39,873

(

938

)

Bank

of

America

Meta

Platforms,

Class

A,

Call,

1/17/25

@

$600.00

2,049

119,971

(

1,952

)

Barclays

Bank

DTE

Energy,

Call,

1/17/25

@

$130.00

852

10,288

(

23

)

Barclays

Bank

DTE

Energy,

Call,

1/17/25

@

$135.00

2,904

35,066

(

58

)

Barclays

Bank

Hilton

Worldwide

Holdings,

Call,

1/17/25

@

$220.00

1,651

40,806

(

4,672

)

Barclays

Bank

Hilton

Worldwide

Holdings,

Call,

1/17/25

@

$230.00

1,651

40,806

(

3,005

)

Barclays

Bank

Hilton

Worldwide

Holdings,

Call,

1/17/25

@

$250.00

2,736

67,623

(

903

)

Citibank

UnitedHealth

Group,

Call,

1/17/25

@

$580.00

2,096

106,028

(

164

)

Citibank

Waste

Connections,

Call,

3/21/25

@

$190.00

1,707

29,289

(

213

)

Goldman

Sachs

Abbott

Laboratories,

Call,

1/17/25

@

$120.00

1,704

19,274

(

42

)

Goldman

Sachs

Abbott

Laboratories,

Call,

1/17/25

@

$125.00

1,704

19,274

(

15

)

Goldman

Sachs

McKesson,

Call,

1/17/25

@

$600.00

1,061

60,468

(

220

)

Goldman

Sachs

McKesson,

Call,

1/17/25

@

$620.00

1,061

60,468

(

172

)

Goldman

Sachs

McKesson,

Call,

1/17/25

@

$640.00

223

12,709

(

19

)

Goldman

Sachs

McKesson,

Call,

1/17/25

@

$680.00

222

12,652

(

49

)

Goldman

Sachs

RTX,

Call,

1/17/25

@

$115.00

2,642

30,573

(

736

)

Goldman

Sachs

RTX,

Call,

1/17/25

@

$120.00

2,642

30,573

(

193

)

Goldman

Sachs

RTX,

Call,

1/17/25

@

$125.00

1,703

19,707

(