UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4676

Harbor Funds

(Exact name of Registrant as specified in charter)

111 South Wacker Drive, 34th Floor

Chicago, Illinois 60606-4302

(Address of principal executive offices) (Zip code)

| | |

| David G. Van Hooser | | Christopher P. Harvey, Esq. |

| HARBOR FUNDS | | DECHERT LLP |

111 South Wacker Drive, 34th Floor Chicago, Illinois 60606-4302 | | One International Place – 40th Floor

100 Oliver Street |

| | Boston, MA 02110-2605 |

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 443-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2015

ITEM 1 – REPORTS TO STOCKHOLDERS

The following are copies of reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1):

Semi-Annual Report

April 30, 2015

Domestic Equity Funds

| | | | | | |

| | | | |

| | | Institutional

Class | | Administrative

Class | | Investor Class |

| | | |

| Growth | | | | | | |

| | | |

| Harbor Capital Appreciation Fund | | HACAX | | HRCAX | | HCAIX |

| | | |

| Harbor Mid Cap Growth Fund | | HAMGX | | HRMGX | | HIMGX |

| | | |

| Harbor Small Cap Growth Fund | | HASGX | | HRSGX | | HISGX |

| | | |

| Harbor Small Cap Growth Opportunities Fund | | HASOX | | HRSOX | | HISOX |

| | | |

| Value | | | | | | |

| | | |

| Harbor Large Cap Value Fund | | HAVLX | | HRLVX | | HILVX |

| | | |

| Harbor Mid Cap Value Fund | | HAMVX | | HRMVX | | HIMVX |

| | | |

| Harbor Small Cap Value Fund | | HASCX | �� | HSVRX | | HISVX |

Table of Contents

This document must be preceded or accompanied by a Prospectus.

Harbor Domestic Equity Funds

SEMI-ANNUAL REPORT OVERVIEW (Unaudited)

The first half of the fiscal year ended April 30, 2015. The performance figures for each of the Harbor Funds shown below assume the reinvestment of dividends and capital gains, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of shares of the Funds. From time to time, certain fees and/or expenses have been voluntarily or contractually waived or reimbursed, which has resulted in higher returns. Without these waivers or reimbursements, the returns would have been lower. Voluntary waivers or reimbursements may be discontinued at any time without notice. For information on the different share classes, please refer to the current prospectus. The returns of the unmanaged indices assume the reinvestment of dividends but do not reflect fees and expenses. The indices are not available for direct investment.

Performance data shown represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the past performance data shown. Investment returns and the value of an investment will fluctuate, and an investor’s shares, when sold, may be worth more or less than their original cost. You can obtain performance data current to the most recent month-end (available within seven business days after the most recent month-end) by calling 800-422-1050 or by visiting harborfunds.com.

| | | | | | | | | | | | |

| | | Unannualized Total Return

6 Months Ended April 30, 2015 | |

| | | Institutional

Class | | | Administrative

Class | | | Investor

Class | |

GROWTH FUNDS | | | | | | | | | | | | |

Harbor Capital Appreciation Fund | | | 7.47 | % | | | 7.32 | % | | | 7.27 | % |

Harbor Mid Cap Growth Fund | | | 7.06 | | | | 6.97 | | | | 6.90 | |

Harbor Small Cap Growth Fund | | | 10.39 | | | | 10.23 | | | | 10.10 | |

Harbor Small Cap Growth Opportunities Fund | | | 2.19 | | | | 2.10 | | | | 1.91 | |

VALUE FUNDS | | | | | | | | | | | | |

Harbor Large Cap Value Fund | | | 6.99 | % | | | 6.85 | % | | | 6.75 | % |

Harbor Mid Cap Value Fund | | | 4.87 | | | | 4.71 | | | | 4.68 | |

Harbor Small Cap Value Fund | | | 3.94 | | | | 3.81 | | | | 3.75 | |

| | | | |

| COMMONLY USED MARKET INDICES | | Unannualized Total Return

6 Months Ended

April 30, 2015 | |

Standard & Poor’s 500 (S&P 500); large cap, domestic equity | | | 4.40 | % |

Russell 1000® Growth; large cap, domestic equity | | | 6.54 | |

Russell Midcap® Growth; mid cap, domestic equity | | | 7.77 | |

Russell 2000® Growth; small cap, domestic equity | | | 7.25 | |

Russell 1000® Value; large cap, domestic equity | | | 2.89 | |

Russell Midcap® Value; mid cap, domestic equity | | | 3.83 | |

Russell 2000® Value; small cap, domestic equity | | | 2.05 | |

1

Harbor Domestic Equity Funds

SEMI-ANNUAL REPORT OVERVIEW—Continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE RATIOS1 | | | Morningstar

Average2

(Unaudited) | |

| | | 2011* | | | 2012* | | | 2013* | | | 2014* | | | 2015b | | |

HARBOR DOMESTIC EQUITY FUNDS | | | | | | | | | | | | | | | | | | | | | | | | |

Harbor Capital Appreciation Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 0.66 | % | | | 0.66 | % | | | 0.65 | % | | | 0.65 | % | | | 0.64 | % | | | 0.90 | % |

Administrative Class | | | 0.91 | | | | 0.91 | | | | 0.90 | | | | 0.90 | | | | 0.89 | | | | 1.21 | |

Investor Class | | | 1.03 | | | | 1.03 | | | | 1.02 | | | | 1.02 | | | | 1.01 | | | | 1.27 | |

Harbor Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 0.85 | % | | | 0.85 | % | | | 0.84 | % | | | 0.83 | % | | | 0.84 | % | | | 1.04 | % |

Administrative Class | | | 1.10 | | | | 1.10 | | | | 1.09 | | | | 1.08 | | | | 1.09 | | | | 1.35 | |

Investor Class | | | 1.22 | | | | 1.22 | | | | 1.21 | | | | 1.20 | | | | 1.21 | | | | 1.36 | |

Harbor Small Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 0.84 | % | | | 0.84 | % | | | 0.83 | % | | | 0.83 | % | | | 0.83 | % | | | 1.13 | % |

Administrative Class | | | 1.09 | | | | 1.09 | | | | 1.08 | | | | 1.08 | | | | 1.08 | | | | 1.44 | |

Investor Class | | | 1.21 | | | | 1.21 | | | | 1.20 | | | | 1.20 | | | | 1.20 | | | | 1.47 | |

Harbor Small Cap Growth Opportunities Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | N/A | | | | N/A | | | | N/A | | | | 0.90 | %a | | | 0.90 | % | | | 1.13 | % |

Administrative Class | | | N/A | | | | N/A | | | | N/A | | | | 1.15 | a | | | 1.15 | | | | 1.44 | |

Investor Class | | | N/A | | | | N/A | | | | N/A | | | | 1.27 | a | | | 1.27 | | | | 1.47 | |

Harbor Large Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 0.68 | % | | | 0.68 | % | | | 0.68 | % | | | 0.68 | % | | | 0.68 | % | | | 0.87 | % |

Administrative Class | | | 0.93 | | | | 0.93 | | | | 0.93 | | | | 0.93 | | | | 0.93 | | | | 1.16 | |

Investor Class | | | 1.05 | | | | 1.05 | | | | 1.05 | | | | 1.05 | | | | 1.05 | | | | 1.20 | |

Harbor Mid Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 0.95 | % | | | 0.95 | % | | | 0.93 | % | | | 0.89 | % | | | 0.85 | % | | | 0.96 | % |

Administrative Class | | | 1.20 | | | | 1.20 | | | | 1.18 | | | | 1.14 | | | | 1.11 | | | | 1.28 | |

Investor Class | | | 1.32 | | | | 1.32 | | | | 1.30 | | | | 1.26 | | | | 1.23 | | | | 1.31 | |

Harbor Small Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 0.84 | % | | | 0.85 | % | | | 0.84 | % | | | 0.84 | % | | | 0.84 | % | | | 1.08 | % |

Administrative Class | | | 1.09 | | | | 1.10 | | | | 1.09 | | | | 1.09 | | | | 1.09 | | | | 1.47 | |

Investor Class | | | 1.21 | | | | 1.22 | | | | 1.21 | | | | 1.21 | | | | 1.21 | | | | 1.53 | |

| 1 | Harbor Funds’ expense ratios are for operating expenses for the fiscal years ended October 31 (unless otherwise noted) and are shown net of all expense offsets, waivers and reimbursements (see Financial Highlights). |

| 2 | The Morningstar Average includes all actively managed no-load funds in the April 30, 2015 Morningstar Universe with the same investment style as the comparable Harbor fund’s portfolio and with the following additional characteristics for each Harbor Funds share class: Institutional Class contains funds with 12b-1 fees less than or equal to 0.25%; Administrative Class contains funds with 12b-1 fees and which are restricted primarily for use by retirement plans; and Investor Class contains funds with 12b-1 fees and a minimum investment less than $50,000. |

| a | Annualized figures for the period February 1, 2014 (inception) through October 31, 2014. |

| b | Unaudited annualized figures for the six-month period ended April 30, 2015. |

2

Letter from the Chairman

|

David G. Van Hooser Chairman |

Dear Fellow Shareholder:

U.S. stock indices had positive returns for the first half of fiscal 2015, supported by accommodative monetary policies of the Federal Reserve and central banks of other countries. The Wilshire 5000 Total Market Index, a measure of the broad domestic equity market, had a return of 4.64% for the six months ended April 30, 2015. Growth stocks outperformed value stocks across all capitalization ranges.

The positive market performance was achieved despite several investor concerns, including the strength of the U.S. dollar that tends to reduce reported foreign earnings of U.S. headquartered multinational companies and makes U.S. exports more expensive to foreign buyers. Sluggish global economic activity and continuing geopolitical tensions added to investor concerns. The sharp decline in crude oil prices in 2014 was expected to favorably affect consumer spending although severe winter weather in many parts of the country dampened consumer spending.

Harbor Domestic Equity Funds

Harbor’s domestic equity funds generally performed well in the fiscal first half with most funds outperforming their benchmarks.

Harbor Capital Appreciation Fund returned 7.47%, beating its Russell 1000® Growth Index benchmark by 93 basis points, or 0.93 percentage point, while Harbor Mid Cap Growth Fund returned 7.06%, lagging its Russell Midcap® Growth Index benchmark by 71 basis points. (All Harbor returns cited are for each fund’s Institutional Class shares.) Harbor Small Cap Growth Fund recorded a return of 10.39%, beating its Russell 2000® Growth Index benchmark by 314 basis points, while Harbor Small Cap Growth Opportunities Fund returned 2.19%, trailing its Russell 2000® Growth Index benchmark by 506 basis points.

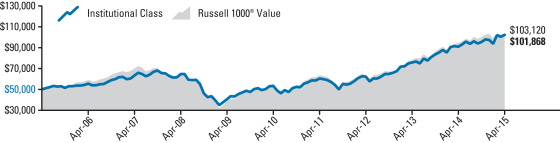

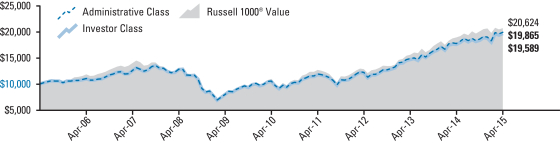

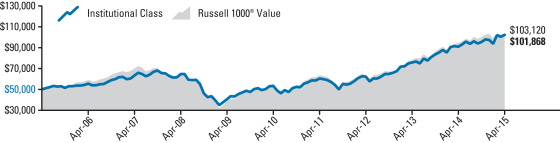

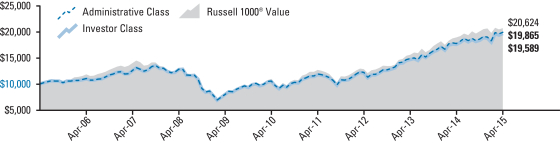

Each of our value-style domestic equity funds outperformed its benchmark index, led by Harbor Large Cap Value Fund, which posted a return of 6.99%, beating its benchmark, the Russell 1000® Value Index, by 410 basis points. Harbor Mid Cap Value Fund returned 4.87%, outpacing its Russell Midcap® Value Index benchmark by 104 basis points, while Harbor Small Cap Value Fund returned 3.94%, outperforming its Russell 2000® Value Index benchmark by 189 basis points.

As always, we recommend that shareholders maintain a long-term perspective in evaluating all of their investments, including Harbor Funds. Comments by the portfolio managers of each domestic equity fund can be found in the pages preceding each Fund’s portfolio of investments.

| | | | | | | | | | | | | | | | | | | | |

| | | RETURNS FOR PERIODS ENDED APRIL 30, 2015 | |

| | | Unannualized | | | | | | Annualized | |

Domestic Equities | �� | 6 Months | | | 1 Year | | | 5 Years | | | 10 Years | | | 30 Years | |

Wilshire 5000 Total Market (entire U.S. stock market) | | | 4.64 | % | | | 12.52 | % | | | 14.26 | % | | | 8.88 | % | | | 11.00 | % |

S&P 500 (large cap stocks) | | | 4.40 | | | | 12.98 | | | | 14.33 | | | | 8.32 | | | | 11.09 | |

Russell Midcap® (mid cap stocks) | | | 5.87 | | | | 13.30 | | | | 15.09 | | | | 10.27 | | | | 12.55 | |

Russell 2000® (small cap stocks) | | | 4.65 | | | | 9.71 | | | | 12.73 | | | | 9.18 | | | | 9.90 | |

Russell 3000® Growth | | | 6.59 | | | | 16.50 | | | | 15.45 | | | | 9.69 | | | | 10.41 | |

Russell 3000® Value | | | 2.82 | | | | 8.96 | | | | 13.15 | | | | 7.54 | | | | 11.24 | |

| | | | | |

International & Global | | | | | | | | | | | | | | | |

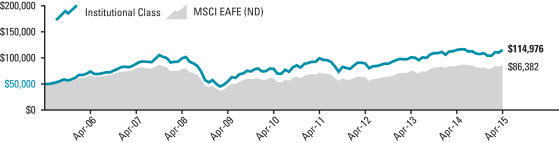

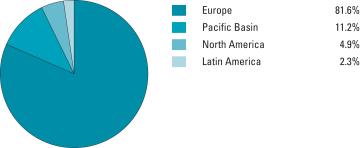

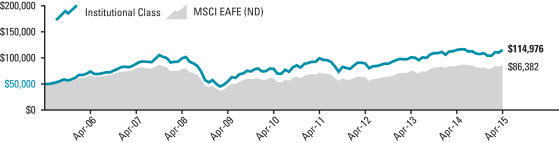

MSCI EAFE (ND) (foreign stocks) | | | 6.81 | % | | | 1.66 | % | | | 7.40 | % | | | 5.62 | % | | | 9.04 | % |

MSCI World (ND) (global stocks) | | | 5.09 | | | | 7.41 | | | | 10.51 | | | | 6.87 | | | | 9.44 | |

MSCI Emerging Markets (ND) (emerging markets) | | | 3.92 | | | | 7.80 | | | | 3.02 | | | | 9.58 | | | | N/A | |

| | | | | |

Strategic Markets | | | | | | | | | | | | | | | |

Bloomberg Commodity Index Total ReturnSM | | | -11.87 | % | | | -24.69 | % | | | -5.02 | % | | | -2.44 | % | | | N/A | |

| | | | | |

Fixed Income | | | | | | | | | | | | | | | |

BofA Merrill Lynch U.S. High-Yield (high-yield bonds) | | | 1.51 | % | | | 2.57 | % | | | 8.18 | % | | | 8.28 | % | | | N/A | |

Barclays U.S. Aggregate Bond (domestic bonds) | | | 2.06 | | | | 4.46 | | | | 4.12 | | | | 4.75 | | | | 7.33 | % |

BofA Merrill Lynch 3-Month U.S. Treasury Bill (proxy for money market returns) | | | 0.01 | | | | 0.02 | | | | 0.09 | | | | 1.47 | | | | 3.90 | |

Barclays U.S. TIPS (inflation-linked bonds) | | | 1.28 | | | | 2.48 | | | | 3.96 | | | | 4.43 | | | | N/A | |

3

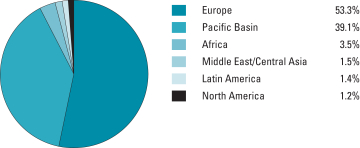

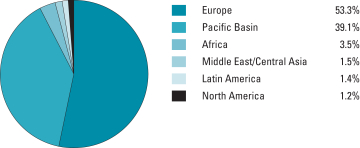

International Equity, Strategic Markets, and Fixed Income

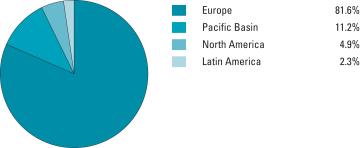

International stock markets moved higher in the first half of fiscal 2015 as investors responded favorably to new monetary easing initiatives by central banks in Europe, Japan and other countries. The U.S. dollar strengthened against most international currencies, boosting the competitiveness of foreign exporters. Shares of companies based in developed overseas markets returned 6.81%, as measured by the MSCI EAFE (ND) Index, while emerging markets equities returned 3.92%, as measured by the MSCI Emerging Markets (ND) Index. The MSCI World (ND) Index, a measure of global equities including the U.S., returned 5.09%. (All international and global returns are in U.S. dollars.)

Commodity markets finished broadly lower for the first half of fiscal 2015, driven in part by the decline in crude oil prices and the stronger U.S. dollar. The Bloomberg Commodity Index Total ReturnSM, an unmanaged index of futures contracts on a diversified group of physical commodities, returned -11.87%.

Fixed income markets generated modest gains in the first half of fiscal 2015. The Federal Reserve indicated its willingness to begin gradually raising short-term rates if warranted by certain signs of continued economic growth in the U.S. By contrast, against a backdrop of economic weakness and subdued inflation, a number of central banks outside the U.S., including Europe and Japan, introduced new monetary stimulus measures.

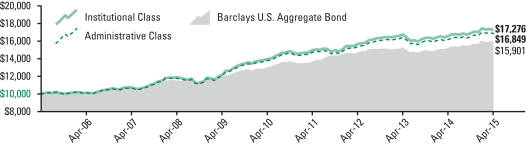

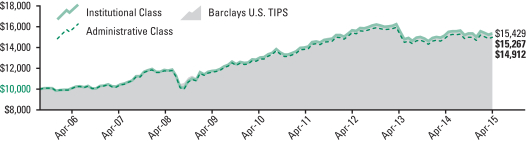

The broad U.S. investment-grade bond market returned 2.06% for the fiscal first half, as measured by the Barclays U.S. Aggregate Bond Index. Below investment-grade bonds returned 1.51%, as measured by the BofA Merrill Lynch U.S. High Yield Index. Inflation-linked bonds, as measured by the Barclays U.S. TIPS Index, returned 1.28%. Money market investments again produced barely positive returns as the Federal Reserve continued to hold its federal funds target rate at the 0.0% to 0.25% range.

Disciplined Approach

Although stocks and bonds may provide solid long-term returns, as indicated in the table on the preceding page, financial markets can be very volatile in the short run. Given the uncertainty of markets, a disciplined approach and a diversified portfolio can be useful tools in helping investors to manage risk. At Harbor Funds, we offer a range of actively-managed equity, strategic markets and fixed income funds to assist investors in establishing an investment plan to help achieve their long-term goals.

Thank you for your investment in Harbor Funds.

June 24, 2015

David G. Van Hooser

Chairman

4

Harbor Capital Appreciation Fund

MANAGERS’ COMMENTARY (Unaudited)

SUBADVISER

Jennison Associates LLC

466 Lexington Avenue New York, NY 10017

PORTFOLIO MANAGERS

Spiros Segalas

Since 1990

Kathleen A. McCarragher

Since 2013

Jennison has subadvised the Fund since 1990.

INVESTMENT OBJECTIVE

The Fund seeks long-term growth of capital.

PRINCIPAL STYLE CHARACTERISTICS

Mid to large cap growth stocks

Spiros Segalas

Kathleen A. McCarragher

Management’s Discussion of

Fund Performance

MARKET REVIEW

Weak energy prices and a strong U.S. dollar were key influences on the global economic landscape in the six months ended April 30, 2015. The U.S. remained the strongest of the major global economies. Europe struggled to avert Greece’s looming default even as the country’s new government called for less economic austerity. Tensions between Russia and Ukraine remained elevated with little hint of improvement. China’s growth continued to slow despite talk of stimulus and easing in lending markets. Brazil flirted with recession. Japan showed little economic improvement, although its stock market made steady progress as investors hoped a weaker yen would boost exports. These challenges, combined with uncertainty about the timing and pace of anticipated monetary tightening in the U.S., contributed to continued volatility in global financial markets.

PERFORMANCE

Harbor Capital Appreciation Fund advanced 7.47% (Institutional Class), 7.32% (Administrative Class), and 7.27% (Investor Class) in the six months ended April 30, 2015, outperforming the Russell 1000® Growth Index benchmark, which rose 6.54%. From a longer-term perspective, the Fund outperformed the benchmark for the 10 years ended April 30, 2015, and since its inception in 1987.

With the exception of Energy and Utilities, every sector in the benchmark advanced, but only Consumer Discretionary, Information Technology, and Health Care outpaced the index as a whole. With substantial weights in these three sectors, the Fund posted strong returns and outperformed the benchmark.

In Consumer Discretionary, major contributors to Fund returns included Amazon.com, Netflix, and Starbucks. Amazon continued to invest in its business to drive unit growth, not only in its core retail operations but also in digital commerce via the mobile market. We like Amazon’s potential for long-term revenue growth and margin expansion, as well as its business opportunities in cloud-computing infrastructure. Internet television network Netflix added millions of net new subscribers. We believe several factors have strengthened the long-term competitive positioning of the company, including a shift toward exclusive deals and original content, increasing pricing power, international expansion, and the company’s scale advantage. The strength of the Starbucks brand and the company’s innovation in mobile and loyalty programs helped drive customer traffic and robust sales.

In the Information Technology sector, Apple’s strength reflected expanding global acceptance of its platform. We expect that new products and updates will sustain the company’s attractive revenue growth. Red Hat, the market-leading vendor of Linux, an open-source computer operating system, benefited from several secular trends, including a shift from the UNIX operating system to Linux, increased use of open-source programs and services, and cloud computing. Tencent Holdings performed well thanks to its leading position in China’s online gaming and instant-messaging markets as well as its growing e-commerce, advertising, and payment-service efforts. In contrast, another Chinese Internet company, Alibaba, was hurt by worries related to changes in keyword search, the

5

Harbor Capital Appreciation Fund

MANAGERS’ COMMENTARY—Continued

| | | | |

TOP TEN HOLDINGS (% of net assets) | |

Apple Inc. | | | 6.2% | |

Facebook Inc. | | | 3.4% | |

MasterCard Inc. | | | 3.4% | |

Amazon.com Inc. | | | 3.3% | |

Visa Inc. | | | 2.6% | |

Biogen Inc. | | | 2.4% | |

NIKE Inc. | | | 2.4% | |

Bristol-Myers Squibb Co. | | | 2.2% | |

Walt Disney Co. | | | 2.2% | |

Actavis plc | | | 2.1% | |

transition to more mobile-device-based transactions, and an at-times-unsettled relationship with its main corporate regulator in China. We believe Alibaba, with its dominant market share, offers an attractive opportunity to invest in the long-term growth of the Chinese e-commerce market, which in our view is meaningfully under-penetrated.

In the Health Care sector, Actavis completed its acquisition of Allergan, which makes dermatology and eye-care products. After several acquisitions, Actavis is now a major pharmaceutical company with a global scope and a product line including both branded and generic drugs. We believe the Allergan acquisition should enhance the rate and duration of Actavis’s growth. Novo Nordisk, the world’s leading maker of insulin, rose as a new insulin product, already available in Europe and other markets, moved closer to approval in the U.S.

Declines in Gilead Sciences and Alexion Pharmaceuticals during the fiscal first half followed strong outperformance by both stocks in the preceding months. Gilead’s weakness reflected indications that hepatitis C drug pricing, as a result of contracts with pharmacy benefits managers, is declining. Gilead’s Sovaldi and Harvoni drugs have set a new standard for hepatitis C treatment, curing the vast majority of patients in about 12 weeks with few side effects. Gilead’s oncology pipeline also looks promising, in our view. We believe the decline in Alexion was probably related to delays in the launch of a new product for a rare genetic metabolic disorder and concerns about competition for its lead product, Soliris. Soliris treats two rare, genetic and potentially life-threatening blood disorders. Alexion is pursuing label-expansion opportunities for Soliris for treatment of other autoimmune and inflammatory diseases.

The Fund’s Energy positions advanced in a difficult environment and outperformed the benchmark sector. Shares of energy exploration and production company Concho Resources performed well. The company has assets in the West Texas Permian Basin, one of the most prolific oil-producing areas in the U.S. Oil equipment and services provider Schlumberger, on the other hand, was pressured as falling energy prices caused its customers to curtail future spending.

OUTLOOK AND STRATEGY

Corporate profit estimates have been reduced to reflect the effects of lower oil prices and the strong dollar. The toll of energy prices on energy companies should have only a minor impact on the Fund’s overall reported earnings, as exposure to the Energy sector is limited.

We believe that the strength of the U.S. dollar is apt to have a broader and meaningful impact on profits of the companies in the portfolio. With a sizable percentage of company earnings coming from international markets, we have lowered our earnings estimates to reflect unfavorable currency translation. Our view is that the translation impact, while detrimental to reported profits, does little to diminish a company’s competitive position or future growth outlook.

As fundamental investors, we examine company and industry prospects over the intermediate and long term, working to understand and anticipate how industries and businesses will change over time. Our goal is to identify companies with sustainable above-average growth. We have constructed a portfolio of companies with what we believe are differentiated products and market opportunities. We have confidence in their ability to deliver earnings growth that outpaces that of the broad market.

This report contains the current opinions of Jennison Associates LLC at the time of its publication and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Such opinions are subject to change without notice and securities described herein may no longer be included in, or may at any time be removed from, the Fund’s portfolio. This report is distributed for informational purposes only. Information contained herein has been obtained from sources believed reliable, but not guaranteed.

Equity securities, such as common stocks, are affected by company specific events and by movements in the overall stock markets in which those securities principally trade. An adverse company specific event, or downturn in those stock markets, can depress the value of a particular company’s equity securities. For information on the different share classes and the risks associated with an investment in the Fund, please refer to the current prospectus.

6

Harbor Capital Appreciation Fund

FUND SUMMARY—April 30, 2015 (Unaudited)

| | | | |

INSTITUTIONAL CLASS |

| | | | |

| Fund # | | | | 2012 |

| | |

| Cusip | | | | 411511504 |

| | |

| Ticker | | | | HACAX |

| | |

| Inception Date | | | | 12/29/1987 |

| | |

| Net Expense Ratio | | | | 0.64%a,b |

| | |

| Total Net Assets (000s) | | | | $24,050,556 |

| | | | |

ADMINISTRATIVE CLASS |

| | | | |

| Fund # | | | | 2212 |

| | |

| Cusip | | | | 411511827 |

| | |

| Ticker | | | | HRCAX |

| | |

| Inception Date | | | | 11/01/2002 |

| | |

| Net Expense Ratio | | | | 0.89%a,b |

| | |

| Total Net Assets (000s) | | | | $655,759 |

| | | | |

INVESTOR CLASS |

| | | | |

| Fund # | | | | 2412 |

| | |

| Cusip | | | | 411511819 |

| | |

| Ticker | | | | HCAIX |

| | |

| Inception Date | | | | 11/01/2002 |

| | |

| Net Expense Ratio | | | | 1.01%a,b |

| | |

| Total Net Assets (000s) | | | | $1,963,242 |

| b | Reflective of a contractual fee waiver effective through February 29, 2016. |

PORTFOLIO STATISTICS

| | | | | | | | |

| | | Portfolio | | | Benchmark | |

| | |

Weighted Average Market Cap (MM) | | | $126,525 | | | | $132,262 | |

| | |

Price/Earning Ratio (P/E) | | | 33.2x | | | | 23.9x | |

| | |

Price/Book Ratio (P/B) | | | 8.2x | | | | 6.6x | |

| | |

Beta vs. Russell 1000® Growth Index | | | 1.11 | | | | 1.00 | |

| | |

Portfolio Turnover (6-Month Period Ended 04/30/2015) | | | 21% | c | | | N/A | |

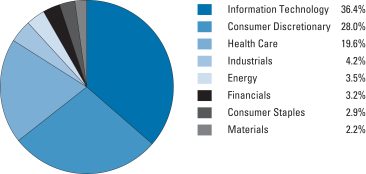

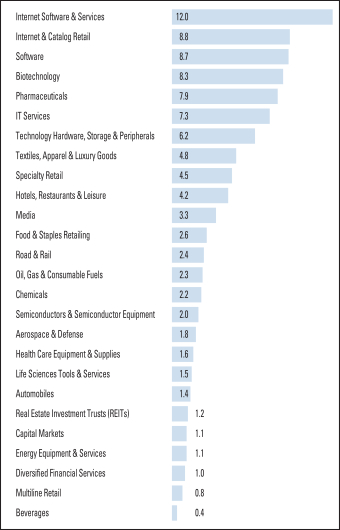

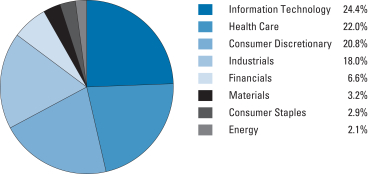

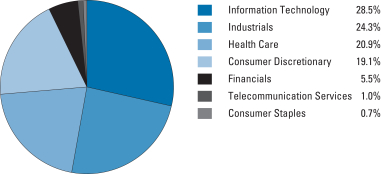

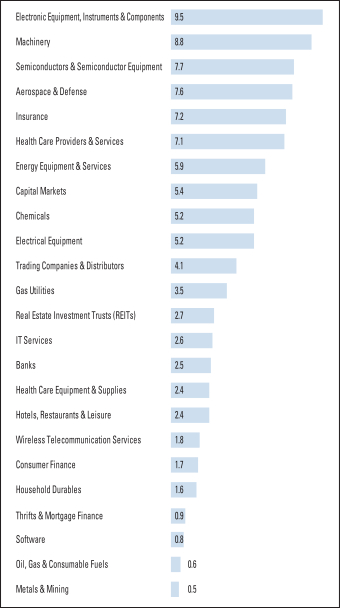

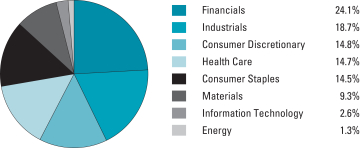

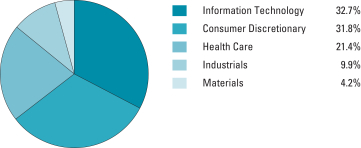

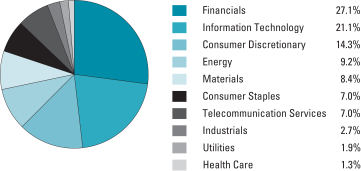

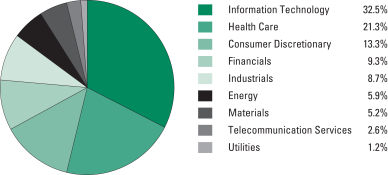

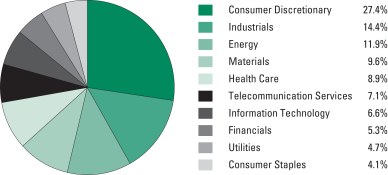

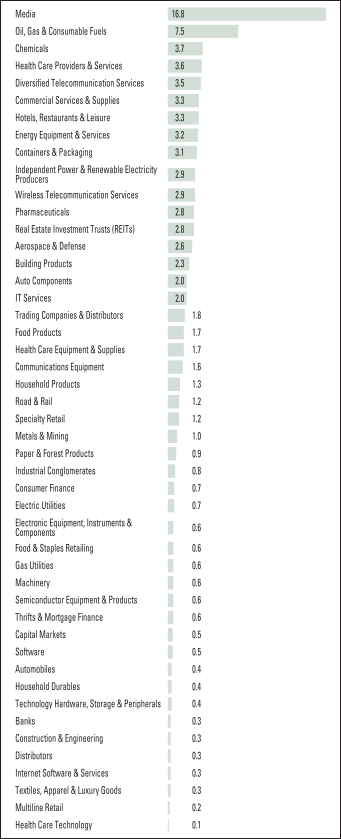

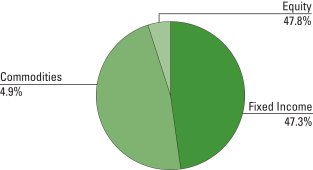

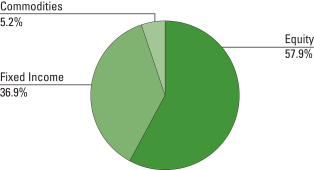

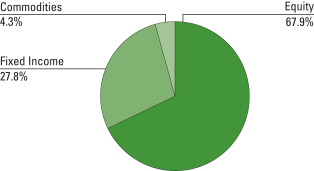

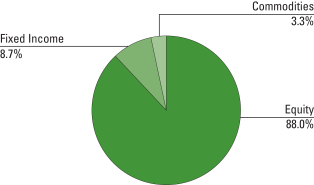

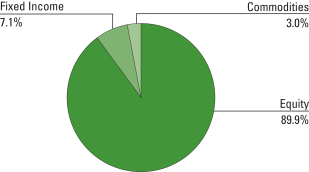

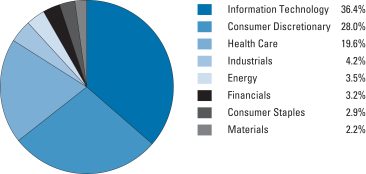

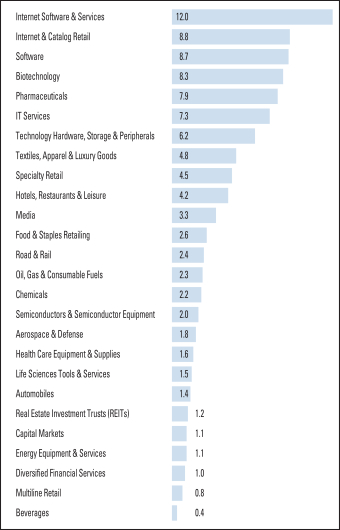

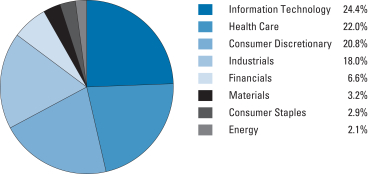

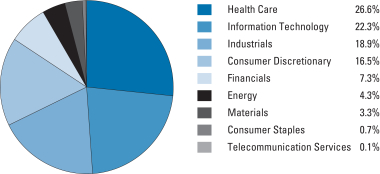

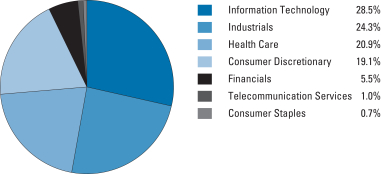

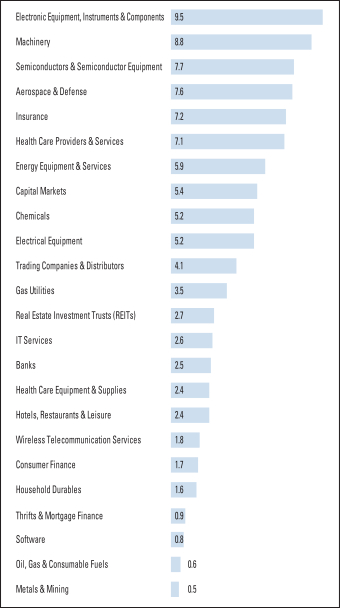

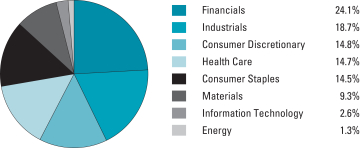

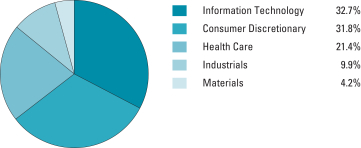

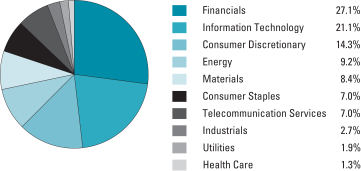

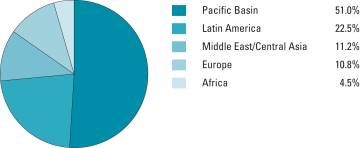

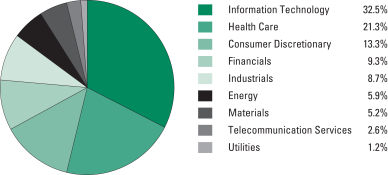

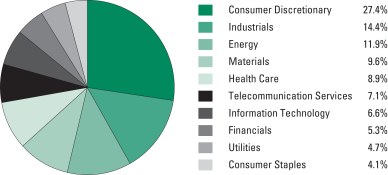

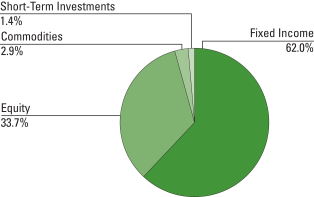

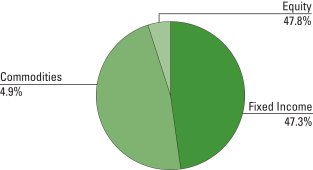

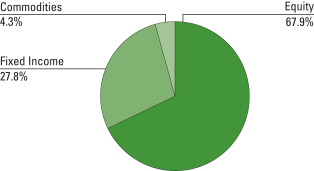

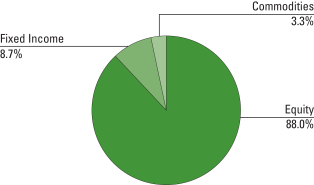

SECTOR ALLOCATION (% of investments)

(Excludes cash and short-term investments)

7

Harbor Capital Appreciation Fund

FUND PERFORMANCE SUMMARY (Unaudited)

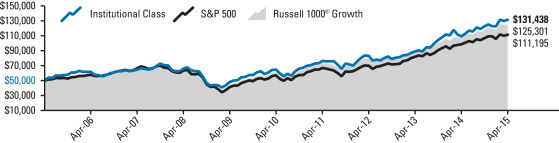

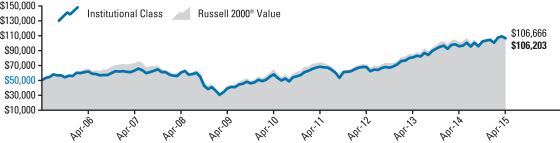

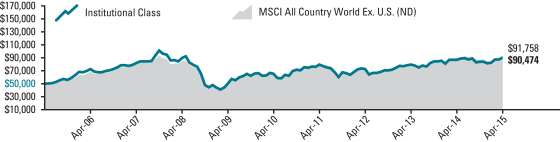

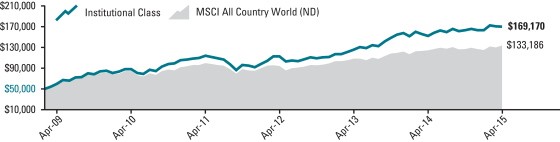

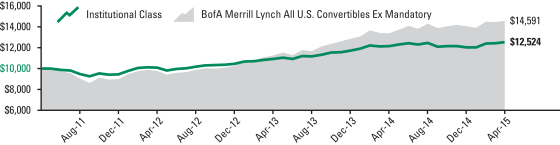

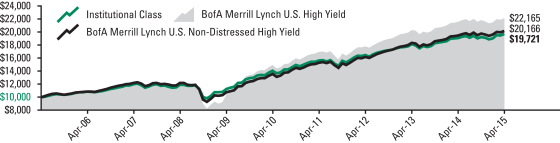

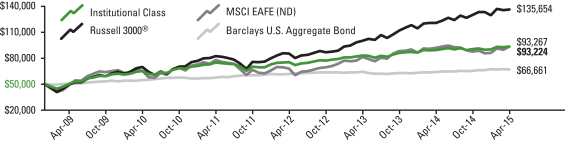

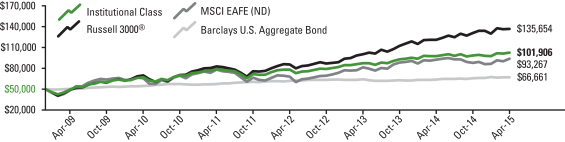

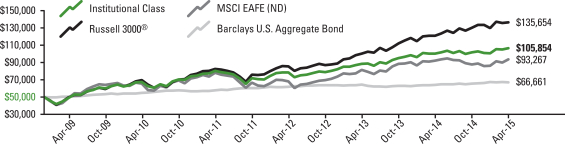

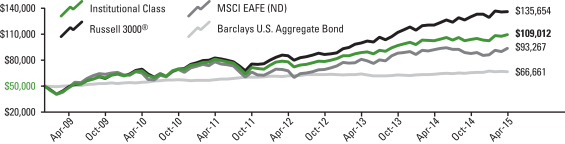

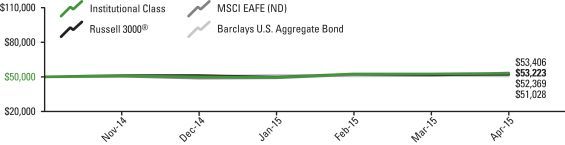

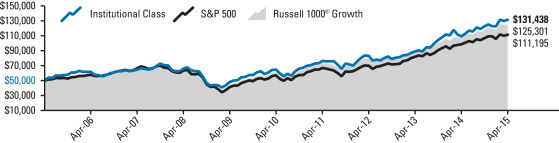

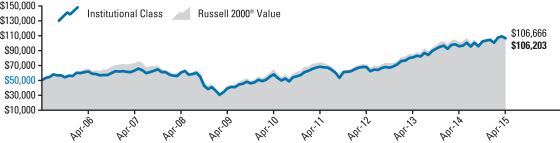

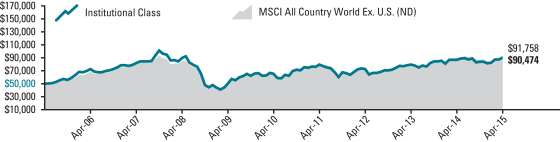

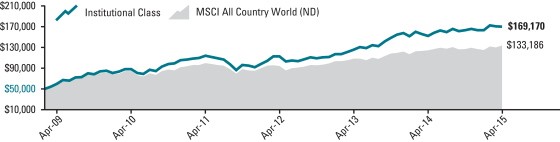

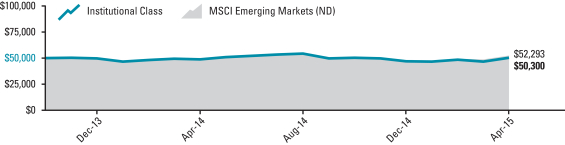

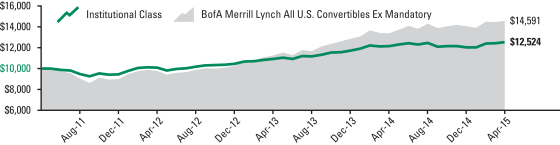

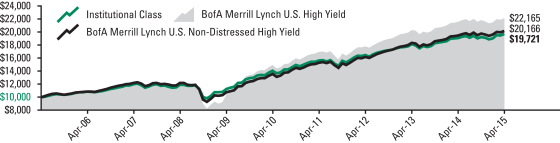

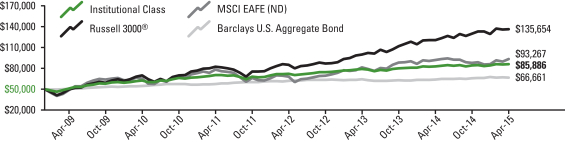

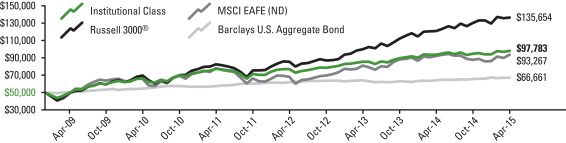

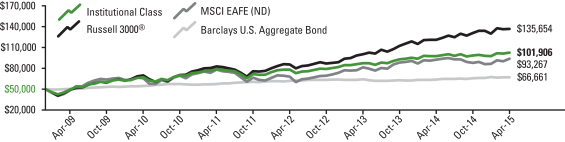

Institutional Class

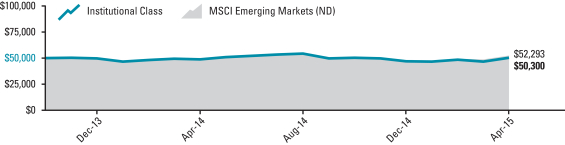

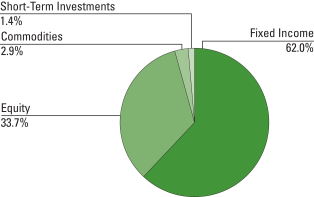

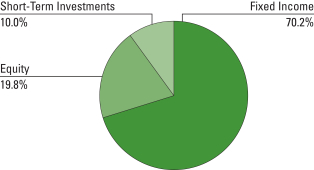

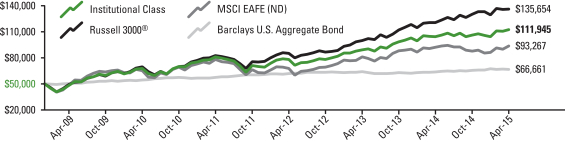

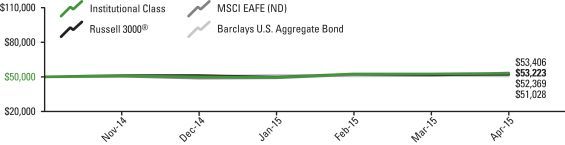

CHANGE IN A $50,000 INVESTMENT

For the period 05/01/2005 through 04/30/2015

| | |

The graph compares a $50,000 investment in the Fund with the performance of the Russell 1000® Growth Index and the S&P 500 Index. The Fund’s performance includes the reinvestment of all dividend and capital gain distributions. | |  |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Returns For the periods ended 04/30/2015 | |  | |

| Harbor Capital Appreciation Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 7.47% | | | | | | 20.46% | | | | | | 15.23% | | | | | | 10.15% | | | | | | 12/29/1987 | | | | | $ | 131,438 | |

| Comparative Indices | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Russell 1000® Growth | | | 6.54% | | | | | | 16.67% | | | | | | 15.49% | | | | | | 9.62% | | | | | | — | | | | | $ | 125,301 | |

S&P 500 | | | 4.40% | | | | | | 12.98% | | | | | | 14.33% | | | | | | 8.32% | | | | | | — | | | | | $ | 111,195 | |

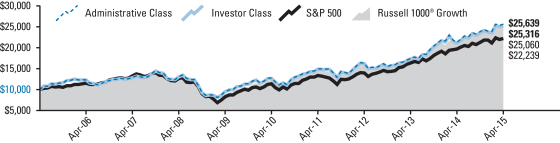

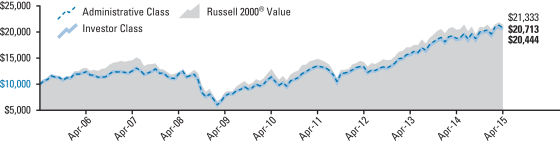

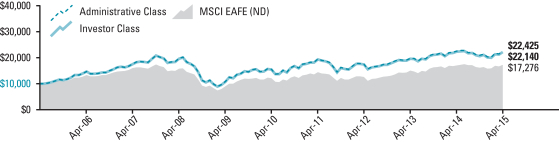

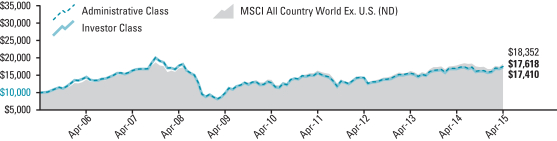

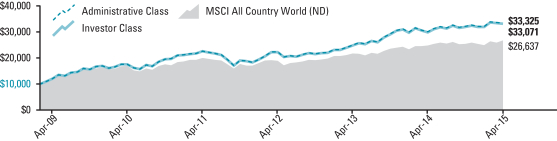

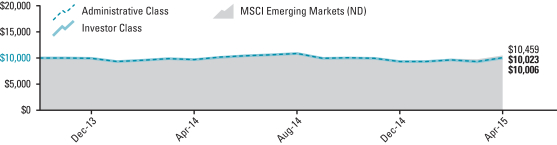

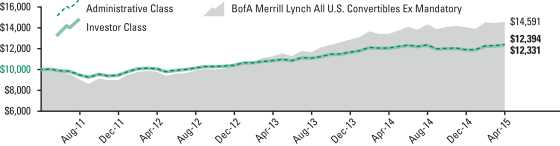

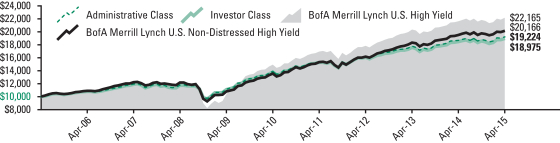

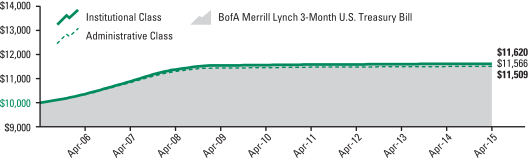

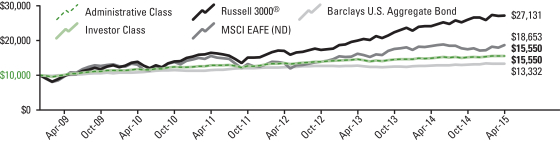

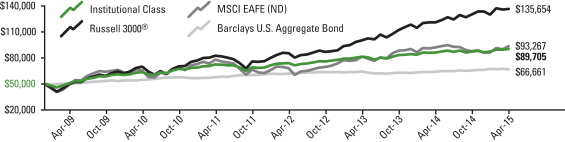

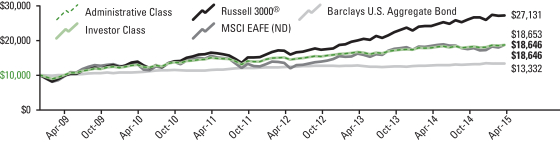

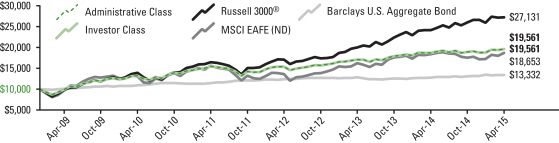

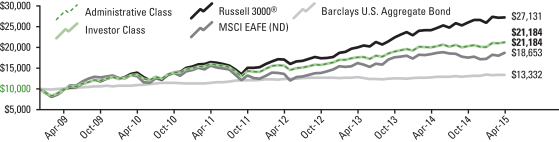

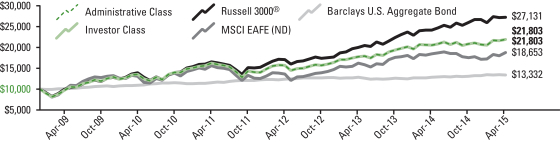

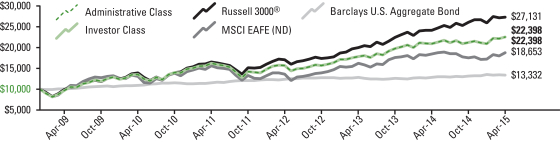

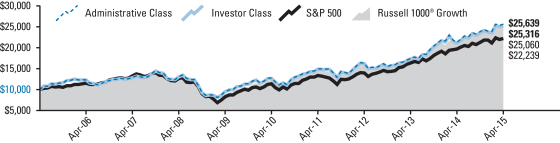

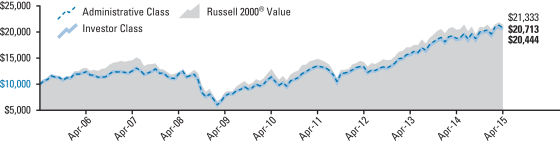

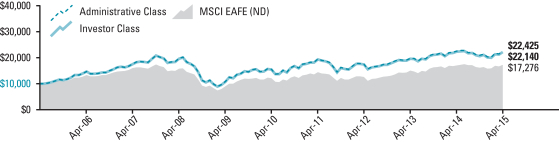

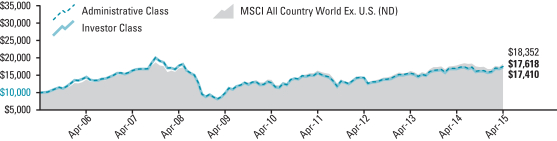

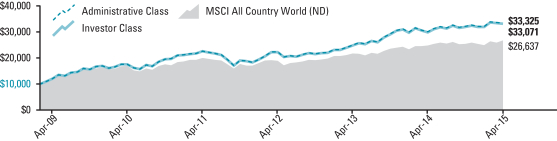

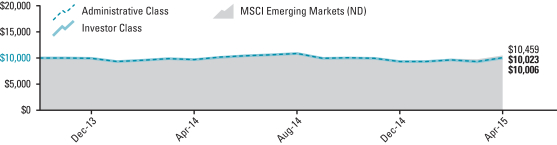

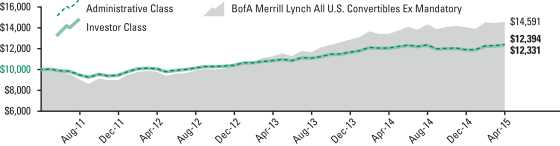

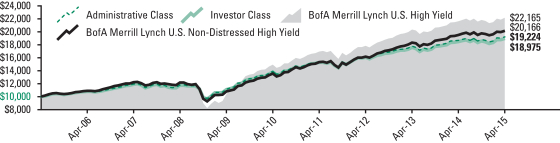

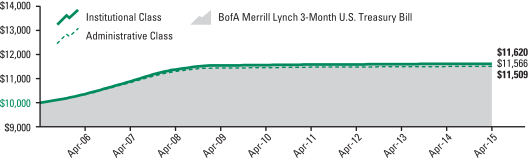

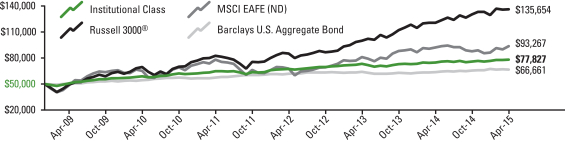

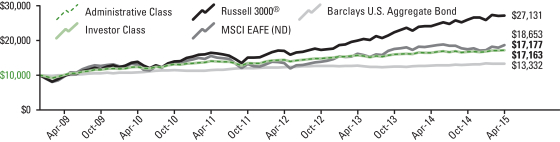

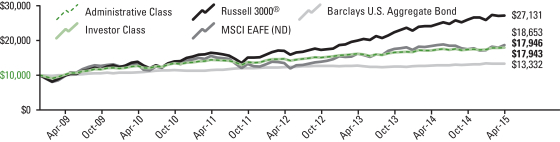

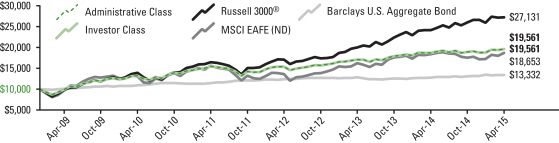

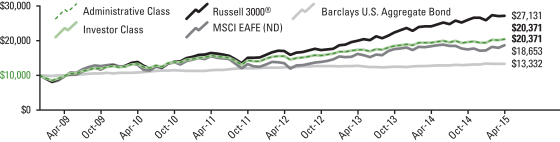

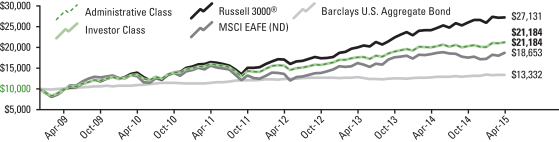

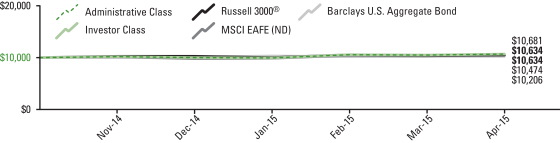

Administrative and Investor Classes

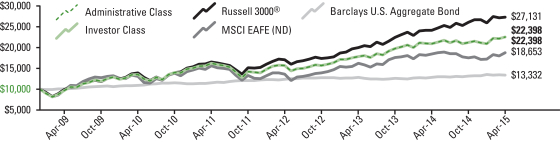

CHANGE IN A $10,000 INVESTMENT

For the period 05/01/2005 through 04/30/2015

| | |

The graph compares a $10,000 investment in the Fund with the performance of the Russell 1000® Growth Index and the S&P 500 Index. The Fund’s performance includes the reinvestment of all dividend and capital gain distributions. | |  |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Returns For the periods ended 04/30/2015 | |  | |

| Harbor Capital Appreciation Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Administrative Class | | | 7.32% | | | | | | 20.14% | | | | | | 14.95% | | | | | | 9.87% | | | | | | 11/01/2002 | | | | | $ | 25,639 | |

Investor Class | | | 7.27% | | | | | | 20.00% | | | | | | 14.80% | | | | | | 9.73% | | | | | | 11/01/2002 | | | | | $ | 25,316 | |

| Comparative Indices | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Russell 1000® Growth | | | 6.54% | | | | | | 16.67% | | | | | | 15.49% | | | | | | 9.62% | | | | | | — | | | | | $ | 25,060 | |

S&P 500 | | | 4.40% | | | | | | 12.98% | | | | | | 14.33% | | | | | | 8.32% | | | | | | — | | | | | $ | 22,239 | |

As stated in the Fund’s current prospectus, the expense ratios were 0.66% (Net) and 0.68% (Gross) (Institutional Class); 0.91% (Net) and 0.93% (Gross) (Administrative Class); and 1.03% (Net) and 1.05% (Gross) (Investor Class). The net expense ratios reflect a contractual management fee waiver effective through 02/29/2016. The expense ratios in the prospectus may differ from the actual expense ratios for the period disclosed within this report. The expense ratios shown in the prospectus are based on the prior fiscal year, adjusted to reflect changes, if any, in contractual arrangements that occurred prior to the date of the prospectus.

Performance data shown represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the past performance data shown. Investment returns and the value of an investment will fluctuate, and an investor’s shares, when sold, may be worth more or less than their original cost. You can obtain performance data current to the most recent month-end (available within seven business days after the most recent month-end) by calling 800-422-1050 or visiting harborfunds.com.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. From time to time, certain fees and/or expenses have been waived or reimbursed, which has resulted in higher returns. Without these waivers and reimbursements, the returns would have been lower.

8

Harbor Capital Appreciation Fund

PORTFOLIO OF INVESTMENTS—April 30, 2015 (Unaudited)

Equity Holdings (% of net assets)

(Excludes net cash and short-term investments of 0.6%)

| | | | | | | | |

COMMON STOCKS—99.4% | |

| | |

| Shares | | | | | Value

(000s) | |

| | AEROSPACE & DEFENSE—1.8% | |

| | 3,290,651 | | | Boeing Co. | | $ | 471,682 | |

| | | | | | | | |

| | AUTOMOBILES—1.4% | |

| | 1,635,392 | | | Tesla Motors Inc.* | | | 369,680 | |

| | | | | | | | |

| | BEVERAGES—0.4% | |

| | 688,569 | | | Monster Beverage Corp.* | | | 94,410 | |

| | | | | | | | |

| | BIOTECHNOLOGY—8.3% | |

| | 1,802,160 | | | Alexion Pharmaceuticals Inc.* | | | 304,979 | |

| | 1,696,755 | | | Biogen Inc.* | | | 634,468 | |

| | 3,994,613 | | | Celgene Corp.* | | | 431,658 | |

| | 3,310,688 | | | Gilead Sciences Inc.* | | | 332,757 | |

| | 880,049 | | | Incyte Corp.* | | | 85,506 | |

| | 367,169 | | | Regeneron Pharmaceuticals Inc.* | | | 167,965 | |

| | 2,141,365 | | | Vertex Pharmaceuticals Inc.* | | | 263,987 | |

| | | | | | | | |

| | | | | | | 2,221,320 | |

| | | | | | | | |

| | CAPITAL MARKETS—1.1% | |

| | 7,571,365 | | | Morgan Stanley | | | 282,488 | |

| | | | | | | | |

| | CHEMICALS—2.2% | |

| | 3,308,789 | | | Monsanto Co. | | | 377,069 | |

| | 773,488 | | | Sherwin-Williams Co. | | | 215,030 | |

| | | | | | | | |

| | | | | | | 592,099 | |

| | | | | | | | |

| | DIVERSIFIED FINANCIAL SERVICES—1.0% | |

| | 2,619,117 | | | McGraw Hill Financial Inc. | | | 273,174 | |

| | | | | | | | |

| | ENERGY EQUIPMENT & SERVICES—1.1% | |

| | 3,111,472 | | | Schlumberger Ltd. | | | 294,376 | |

| | | | | | | | |

| | FOOD & STAPLES RETAILING—2.6% | |

| | 2,953,817 | | | Costco Wholesale Corp. | | | 422,543 | |

| | 3,856,186 | | | Kroger Co. | | | 265,730 | |

| | | | | | | | |

| | | | | | | 688,273 | |

| | | | | | | | |

| | HEALTH CARE EQUIPMENT & SUPPLIES—1.6% | |

| | 9,393,669 | | | Abbott Laboratories | | | 436,054 | |

| | | | | | | | |

| | HOTELS, RESTAURANTS & LEISURE—4.2% | |

| | 418,261 | | | Chipotle Mexican Grill Inc.* | | | 259,882 | |

| | 5,354,215 | | | Marriott International Inc. | | | 428,605 | |

| | 8,976,940 | | | Starbucks Corp. | | | 445,077 | |

| | | | | | | | |

| | | | | | | 1,133,564 | |

| | | | | | | | |

| | INTERNET & CATALOG RETAIL—8.8% | |

| | 2,087,313 | | | Amazon.com Inc.* | | | 880,387 | |

| | 5,406,176 | | | JD.com Inc. ADR (CHN)*,1 | | | 181,431 | |

| | 991,438 | | | Netflix Inc.* | | | 551,735 | |

| | 404,232 | | | Priceline Group Inc.* | | | 500,363 | |

| | 1,660,550 | | | TripAdvisor Inc.* | | | 133,658 | |

| | 3,573,608 | | | Vipshop Holdings Ltd. ADR (CHN)*,1 | | | 101,097 | |

| | | | | | | | |

| | | | | | | 2,348,671 | |

| | | | | | | | |

| | INTERNET SOFTWARE & SERVICES—12.0% | |

| | 3,177,355 | | | Alibaba Group Holding Ltd. ADR (CHN)*,1 | | | 258,287 | |

| | 11,603,414 | | | Facebook Inc.* | | | 914,001 | |

| | 709,529 | | | Google Inc. Class A* | | | 389,368 | |

| | 813,365 | | | Google Inc. Class C | | | 437,053 | |

| | 545,296 | | | LendingClub Corp.* | | | 9,516 | |

| | 2,080,644 | | | LinkedIn Corp.* | | | 524,593 | |

| | 21,978,832 | | | Tencent Holdings Ltd. (CHN) | | | 453,618 | |

| | 5,407,286 | | | Twitter Inc.* | | | 210,668 | |

| | | | | | | | |

| | | | | | | 3,197,104 | |

| | | | | | | | |

| | IT SERVICES—7.3% | |

| | 2,165,607 | | | FleetCor Technologies Inc.* | | | 348,424 | |

| | 10,008,350 | | | MasterCard Inc. | | | 902,853 | |

| | 10,443,553 | | | Visa Inc. | | | 689,797 | |

| | | | | | | | |

| | | | | | | 1,941,074 | |

| | | | | | | | |

| | LIFE SCIENCES TOOLS & SERVICES—1.5% | |

| | 2,234,771 | | | Illumina Inc.* | | | 411,757 | |

| | | | | | | | |

| | MEDIA—3.3% | |

| | 3,183,140 | | | Time Warner Inc. | | | 268,689 | |

| | 5,532,481 | | | Walt Disney Co. | | | 601,491 | |

| | | | | | | | |

| | | | | | | 870,180 | |

| | | | | | | | |

| | MULTILINE RETAIL—0.8% | |

| | 2,872,728 | | | Dollar General Corp. | | | 208,876 | |

| | | | | | | | |

| | OIL, GAS & CONSUMABLE FUELS—2.3% | |

| | 2,737,076 | | | Concho Resources Inc.* | | | 346,678 | |

| | 2,785,603 | | | EOG Resources Inc. | | | 275,636 | |

| | | | | | | | |

| | | | | | | 622,314 | |

| | | | | | | | |

9

Harbor Capital Appreciation Fund

PORTFOLIO OF INVESTMENTS—Continued

| | | | | | | | |

COMMON STOCKS—Continued | |

| | |

| Shares | | | | | Value

(000s) | |

| | PHARMACEUTICALS—7.9% | |

| | 2,016,078 | | | Actavis plc* | | $ | 570,268 | |

| | 9,094,929 | | | Bristol-Myers Squibb Co. | | | 579,620 | |

| | 8,655,555 | | | Novo Nordisk AS ADR (DEN)1 | | | 487,048 | |

| | 1,974,310 | | | Shire plc ADR (IE)1 | | | 480,764 | |

| | | | | | | | |

| | | | | | | 2,117,700 | |

| | | | | | | | |

| | REAL ESTATE INVESTMENT TRUSTS (REITs)—1.2% | |

| | 3,255,332 | | | American Tower Corp. | | | 307,727 | |

| | | | | | | | |

| | ROAD & RAIL—2.4% | |

| | 1,618,915 | | | Canadian Pacific Railway Ltd. (CAN) | | | 308,533 | |

| | 3,064,123 | | | Union Pacific Corp. | | | 325,502 | |

| | | | | | | | |

| | | | | | | 634,035 | |

| | | | | | | | |

| | SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT— 2.0% | |

| | 6,986,221 | | | ARM Holdings plc ADR (UK)1 | | | 356,227 | |

| | 1,837,586 | | | NXP Semiconductors NV (NET)* | | | 176,629 | |

| | | | | | | | |

| | | | | | | 532,856 | |

| | | | | | | | |

| | SOFTWARE—8.7% | |

| | 6,036,493 | | | Adobe Systems Inc.* | | | 459,135 | |

| | 3,791,043 | | | FireEye Inc.* | | | 156,570 | |

| | 5,185,815 | | | Red Hat Inc.* | | | 390,284 | |

| | 7,504,102 | | | Salesforce.com Inc.* | | | 546,449 | |

| | 4,215,008 | | | Splunk Inc.* | | | 279,645 | |

| | 2,068,058 | | | VMware Inc.* | | | 182,196 | |

| | 3,343,941 | | | Workday Inc.* | | | 305,001 | |

| | | | | | | | |

| | | | | | | 2,319,280 | |

| | | | | | | | |

| | SPECIALTY RETAIL—4.5% | |

| | 14,063,845 | | | Inditex SA (SP) | | | 451,295 | |

| | 1,558,329 | | | O’Reilly Automotive Inc.* | | | 339,451 | |

| | 1,641,728 | | | Tiffany & Co. | | | 143,618 | |

| | 4,215,815 | | | TJX Cos. Inc. | | | 272,089 | |

| | | | | | | | |

| | | | | | | 1,206,453 | |

| | | | | | | | |

| | TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS—6.2% | |

| | 13,203,835 | | | Apple Inc. | | | 1,652,460 | |

| | | | | | | | |

| | TEXTILES, APPAREL & LUXURY GOODS—4.8% | |

| | 4,281,580 | | | Luxottica Group SpA (IT) | | | 281,972 | |

| | 6,573,927 | | | NIKE Inc. | | | 649,767 | |

| | 4,528,615 | | | Under Armour Inc.* | | | 351,194 | |

| | | | | | | | |

| | | | | | | 1,282,933 | |

| | | | | | | | |

| TOTAL COMMON STOCKS

(Cost $16,338,124) | | | 26,510,540 | |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS—0.7% | |

| (Cost $194,030) | | | | |

Principal Amount (000s) | | | | | | |

| | REPURCHASE AGREEMENTS | | | | |

| $ | 194,030 | | | Repurchase Agreement with State Street Corp. dated April 30, 2015 due May 01, 2015 at 0.000% collateralized by U.S. Treasury Notes (market value $197,913) | | | 194,030 | |

| | | | | | | | |

| TOTAL INVESTMENTS—100.1%

(Cost $16,532,154) | | | 26,704,570 | |

| | | | | | | | |

| | CASH AND OTHER ASSETS, LESS LIABILITIES—(0.1)% | | | (35,013 | ) |

| | | | | | | | |

| | TOTAL NET ASSETS—100.0% | | $ | 26,669,557 | |

| | | | | | | | |

FAIR VALUE MEASUREMENTS

The following table summarizes the Fund’s investments as of April 30, 2015 based on the inputs used to value them.

| | | | | | | | | | | | | | | | | | | | |

Asset Category | | Quoted Prices

Level 1

(000s) | | Other Significant

Observable Inputs

Level 2

(000s) | | Significant

Unobservable Inputs

Level 3

(000s) | | Total

(000s) |

Common Stocks | | | | | | | | | | | | | | | | | | | | |

Aerospace & Defense | | | $ | 471,682 | | | | $ | — | | | | $ | — | | | | $ | 471,682 | |

Automobiles | | | | 369,680 | | | | | — | | | | | — | | | | | 369,680 | |

Beverages | | | | 94,410 | | | | | — | | | | | — | | | | | 94,410 | |

Biotechnology | | | | 2,221,320 | | | | | — | | | | | — | | | | | 2,221,320 | |

Capital Markets | | | | 282,488 | | | | | — | | | | | — | | | | | 282,488 | |

Chemicals | | | | 592,099 | | | | | — | | | | | — | | | | | 592,099 | |

Diversified Financial Services | | | | 273,174 | | | | | — | | | | | — | | | | | 273,174 | |

Energy Equipment & Services | | | | 294,376 | | | | | — | | | | | — | | | | | 294,376 | |

Food & Staples Retailing | | | | 688,273 | | | | | — | | | | | — | | | | | 688,273 | |

Health Care Equipment & Supplies | | | | 436,054 | | | | | — | | | | | — | | | | | 436,054 | |

Hotels, Restaurants & Leisure | | | | 1,133,564 | | | | | — | | | | | — | | | | | 1,133,564 | |

Internet & Catalog Retail | | | | 2,348,671 | | | | | — | | | | | — | | | | | 2,348,671 | |

Internet Software & Services | | | | 2,743,486 | | | | | 453,618 | | | | | — | | | | | 3,197,104 | |

IT Services | | | | 1,941,074 | | | | | — | | | | | — | | | | | 1,941,074 | |

Life Sciences Tools & Services | | | | 411,757 | | | | | — | | | | | — | | | | | 411,757 | |

Media | | | | 870,180 | | | | | — | | | | | — | | | | | 870,180 | |

Multiline Retail | | | | 208,876 | | | | | — | | | | | — | | | | | 208,876 | |

Oil, Gas & Consumable Fuels | | | | 622,314 | | | | | — | | | | | — | | | | | 622,314 | |

Pharmaceuticals | | | | 2,117,700 | | | | | — | | | | | — | | | | | 2,117,700 | |

10

Harbor Capital Appreciation Fund

PORTFOLIO OF INVESTMENTS—Continued

FAIR VALUE MEASUREMENTS—Continued

| | | | | | | | | | | | | | | | | | | | |

Asset Category | | Quoted Prices

Level 1

(000s) | | Other Significant

Observable Inputs

Level 2

(000s) | | Significant

Unobservable Inputs

Level 3

(000s) | | Total

(000s) |

Real Estate Investment Trusts (REITs) | | | $ | 307,727 | | | | $ | — | | | | $ | — | | | | $ | 307,727 | |

Road & Rail | | | | 634,035 | | | | | — | | | | | — | | | | | 634,035 | |

Semiconductors & Semiconductor | | | | | | | | | | | | | | | | | | | | |

Equipment | | | | 532,856 | | | | | — | | | | | — | | | | | 532,856 | |

Software | | | | 2,319,280 | | | | | — | | | | | — | | | | | 2,319,280 | |

Specialty Retail | | | | 755,158 | | | | | 451,295 | | | | | — | | | | | 1,206,453 | |

Technology Hardware, Storage & | | | | | | | | | | | | | | | | | | | | |

Peripherals | | | | 1,652,460 | | | | | — | | | | | — | | | | | 1,652,460 | |

Textiles, Apparel & Luxury Goods | | | | 1,000,961 | | | | | 281,972 | | | | | — | | | | | 1,282,933 | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | |

Repurchase Agreements | | | | — | | | | | 194,030 | | | | | — | | | | | 194,030 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investments in Securities | | | $ | 25,323,655 | | | | $ | 1,380,915 | | | | $ | — | | | | $ | 26,704,570 | |

| | | | | | | | | | | | | | | | | | | | |

There were no Level 3 holdings at October 31, 2014 or April 30, 2015, and no transfers between levels during the period.

For more information on valuation inputs and their aggregation into the levels used in the table above, please refer to the Fair Value Measurements and Disclosures in Note 2 of the accompanying Notes to Financial Statements.

| * | Non-income producing security. |

| 1 | ADR after the name of a foreign holding stands for American Depositary Receipts representing ownership of foreign securities. ADRs are issued by U.S. banking institutions. |

The accompanying notes are an integral part of the Financial Statements.

11

Harbor Mid Cap Growth Fund

MANAGERS’ COMMENTARY (Unaudited)

SUBADVISER

Wellington

Management

Company, LLP

280 Congress Street

Boston, MA 02210

PORTFOLIO MANAGERS

Michael T. Carmen, CFA

Since 2005

Stephen Mortimer

Since 2010

Mario E. Abularach, CFA

Since 2006

Wellington

Management

has subadvised

the Fund since 2005.

INVESTMENT OBJECTIVE

The Fund seeks long-term growth of capital.

PRINCIPAL STYLE

CHARACTERISTICS

Mid cap companies

with significant capital

appreciation potential

Michael T. Carmen

Management’s Discussion of

Fund Performance

MARKET REVIEW

The rally in stocks continued into the end of calendar 2014 as global equities rose for the 10th consecutive quarter. The U.S. Federal Reserve helped to support riskier assets after it stated it could be “patient” with regards to starting its policy normalization process. During the fourth quarter of 2014, U.S. equities outperformed non-U.S. equities and emerging market stocks underperformed their developed market counterparts. Global equities continued to surge during the first quarter of 2015, rising for the 11th consecutive quarter. Upon reaching the bull market’s sixth anniversary, the MSCI All Country World Index ended March up 189.5% from its closing low on March 9, 2009. Europe was a bright spot during the first quarter due to further accommodative monetary policy and encouraging economic data, including positive trends in manufacturing, exports, and economic sentiment. Investors responded positively after the European Central Bank announced a €1.14 trillion ($1.3 trillion) open-ended quantitative easing program to combat record-low inflation and stimulate growth in Europe. There were a few worrisome items, including disappointing manufacturing data from China and Japan and fears about Greece’s future in the European Union. U.S. stocks lagged the broader market as some market participants voiced concerns about potential headwinds such as valuations, near-term Federal Reserve tightening, and the strong U.S. dollar’s impact on exports.

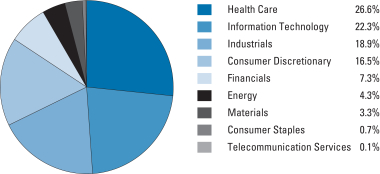

In this environment, the Russell Midcap® Growth Index recorded a positive return of 7.77%. Within the index, 8 of 10 sectors posted positive returns. Health Care, Information Technology, and Consumer Staples were the strongest-performing sectors, while Utilities, Energy, and Industrials lagged the broader index.

PERFORMANCE

For the six months ended April 30, 2015, Harbor Mid Cap Growth Fund returned 7.06% (Institutional Class), 6.97% (Administrative Class), and 6.90% (Investor Class), underperforming the 7.77% return of the Russell Midcap® Growth benchmark. Sector allocation, a residual of our bottom-up stock selection process, was the primary detractor from relative performance. An underweighted allocation to the poor-performing Energy sector and an overweight to the strong-performing Health Care sector contributed to relative performance, but were more than offset by a cash position that had a positive return but lagged well behind the overall return of the index. Security selection had a neutral impact on Fund performance. Stock selection was strongest in Consumer Discretionary, Financials, Information Technology, and Energy. Offsetting these positive results was weak selection in Industrials, Health Care, and Materials.

Consumer Discretionary holding Zulily, an online shopping website, was the top detractor from relative results during the fiscal first half. The company had email delivery issues that negatively impacted orders and revenues. The position was eliminated from the Fund prior to the end of the period. Insulet, in the Health Care sector, a manufacturer and developer of a new insulin infusion system for diabetes patients, was also among the top relative detractors, as disappointing recent new-patient growth trends weighed on the stock. The Fund continued to hold the security as we have high expectations and confidence that the company will deliver strong results in coming quarters.

The top contributor to relative performance was Health Care holding DexCom, a developer and manufacturer of continuous glucose monitoring systems for diabetes

12

Harbor Mid Cap Growth Fund

MANAGERS’ COMMENTARY—Continued

| | | | |

TOP TEN HOLDINGS (% of net assets) | |

Netflix Inc. | | | 2.4% | |

DexCom Inc. | | | 2.2% | |

Workday Inc. | | | 2.0% | |

CoStar Group Inc. | | | 1.9% | |

NXP Semiconductors NV | | | 1.9% | |

Akamai Technologies Inc. | | | 1.8% | |

Diamond Resorts International Inc. | | | 1.8% | |

IMAX Corp. | | | 1.8% | |

Actavis plc | | | 1.7% | |

Mylan NV | | | 1.7% | |

management. The company’s pediatric launch proceeded better than expected, and its recently approved “DexCom SHARE” system will utilize Bluetooth technology to allow for glucose monitoring on smartphones. Netflix, a Consumer Discretionary holding, was also among the top contributors. We believe that announcements about plans to address subscriber growth, the most important indicator for the stock, support an outlook for better growth over the coming years. Even after recent strong performance, we believe Netflix has room for continued growth, and we maintain a modestly overweighted position in the stock relative to the index. As of April 30, Netflix and DexCom were the Fund’s two largest holdings.

OUTLOOK AND STRATEGY

Our investment philosophy is based on four key underlying premises. First, we believe that changes in earnings expectations drive security prices. Second, we believe that tangible operating momentum precedes earnings momentum. Third, we believe that quality management will provide us with an opportunity to identify companies that will achieve operating excellence. Finally, we believe that our valuation discipline helps control portfolio risk.

We employ this philosophy, together with a bottom-up fundamental analysis and opportunistic investment approach, in managing the Fund. We consider a broad universe of available stocks within the mid cap market, typically focusing on companies with expected earnings growth of 15% or higher. To narrow the universe of available companies, we rely on intensive bottom-up fundamental proprietary research.

The Fund is largely constructed without regard to benchmark weightings by sector; however, we typically do not expect to exceed the benchmark weight by more than two times in any given sector. Bottom-up investment decisions resulted in increased exposure to Health Care and Information Technology, the Fund’s largest overweight sectors as of April 30. The Fund decreased its exposure to Consumer Discretionary stocks, moving from an overweighted allocation to an underweight during the period. As of April 30, the Fund was most underweight relative to the index in Consumer Staples, Energy, and Financials.

The rally in global equity markets, and particularly in growth stocks, continued in the first half of fiscal 2015. We believe equity markets will continue rewarding quality growth-oriented companies that are attractively valued, which in our view would provide a tailwind for the portfolio. We are confident that the Fund is well-positioned for future growth, with major holdings in undervalued stocks trading at attractive multiples. We believe that many of these holdings have ample room for future acceleration of earnings and that this growth will ultimately be recognized and rewarded in the market.

This report contains the current opinions of Wellington Management Company, LLP at the time of its publication and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Such opinions are subject to change without notice and securities described herein may no longer be included in, or may at any time be removed from, the Fund’s portfolio. This report is distributed for informational purposes only. Information contained herein has been obtained from sources believed reliable, but not guaranteed.

Stocks of mid cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. Equity securities, such as common stocks, are affected by company specific events and by movements in the overall stock markets in which those securities principally trade. An adverse company specific event, or downturn in those stock markets, can depress the value of a particular company’s equity securities. For information on the different share classes and the risks associated with an investment in the Fund, please refer to the current prospectus.

13

Harbor Mid Cap Growth Fund

FUND SUMMARY—April 30, 2015 (Unaudited)

| | | | |

INSTITUTIONAL CLASS |

| | | | |

| Fund # | | | | 2019 |

| | |

| Cusip | | | | 411511876 |

| | |

| Ticker | | | | HAMGX |

| | |

| Inception Date | | | | 11/01/2000 |

| | |

| Net Expense Ratio | | | | 0.84%a |

| | |

| Total Net Assets (000s) | | | | $312,289 |

| | | | |

ADMINISTRATIVE CLASS |

| | | | |

| Fund # | | | | 2219 |

| | |

| Cusip | | | | 411511793 |

| | |

| Ticker | | | | HRMGX |

| | |

| Inception Date | | | | 11/01/2002 |

| | |

| Net Expense Ratio | | | | 1.09%a |

| | |

| Total Net Assets (000s) | | | | $387,870 |

| | | | |

INVESTOR CLASS |

| | | | |

| Fund # | | | | 2419 |

| | |

| Cusip | | | | 411511785 |

| | |

| Ticker | | | | HIMGX |

| | |

| Inception Date | | | | 11/01/2002 |

| | |

| Net Expense Ratio | | | | 1.21%a |

| | |

| Total Net Assets (000s) | | | | $34,903 |

PORTFOLIO STATISTICS

| | | | | | | | |

| | | Portfolio | | | Benchmark | |

| | |

Weighted Average Market Cap (MM) | | | $12,736 | | | | $14,635 | |

| | |

Price/Earning Ratio (P/E) | | | 46.8x | | | | 27.8x | |

| | |

Price/Book Ratio (P/B) | | | 5.9x | | | | 6.4x | |

| | |

Beta vs. Russell Midcap® Growth Index | | | 1.06 | | | | 1.00 | |

| | |

Portfolio Turnover (6-Month Period Ended 04/30/2015) | | | 42% | b | | | N/A | |

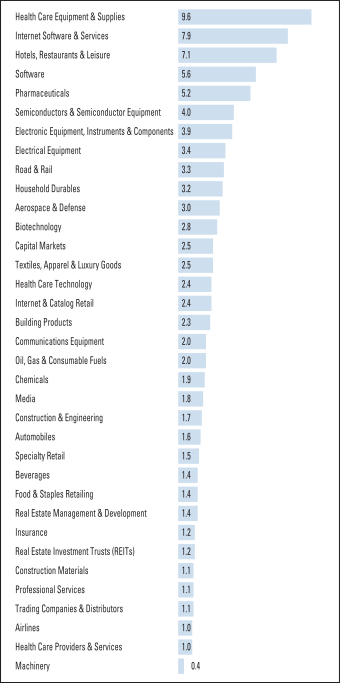

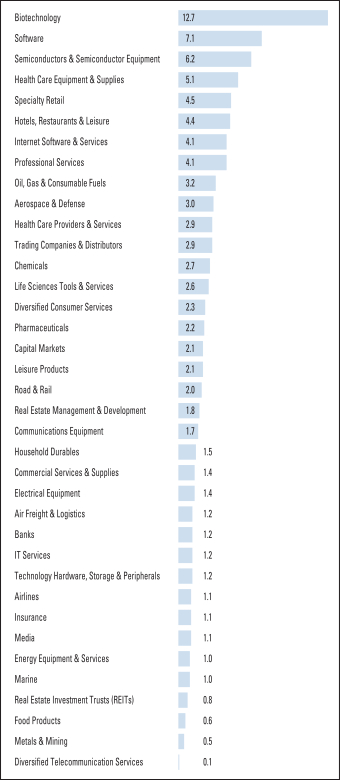

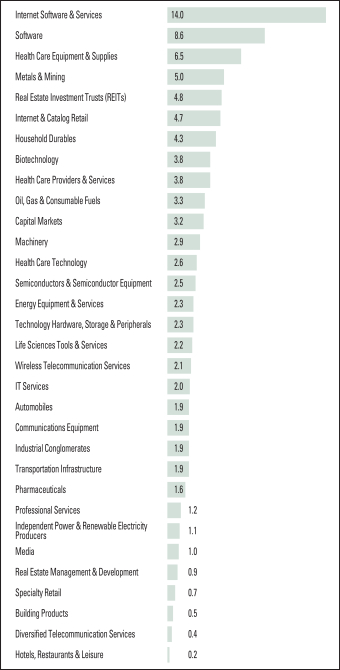

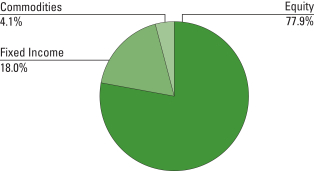

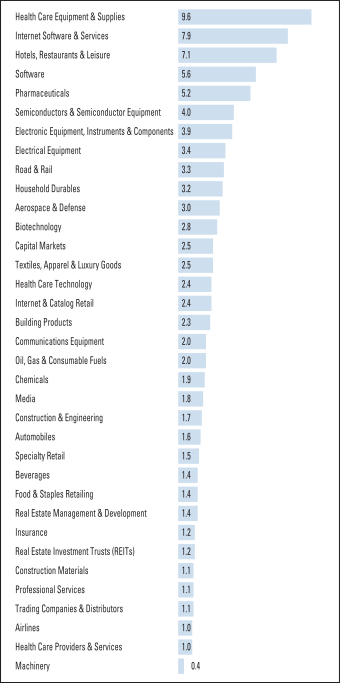

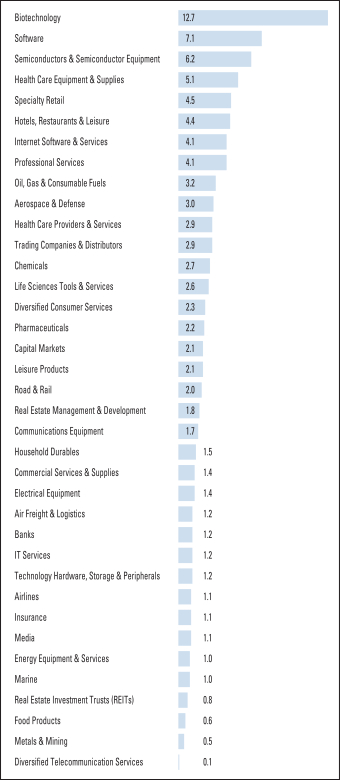

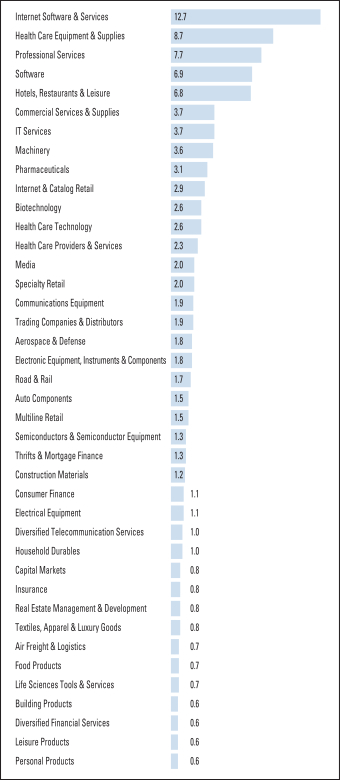

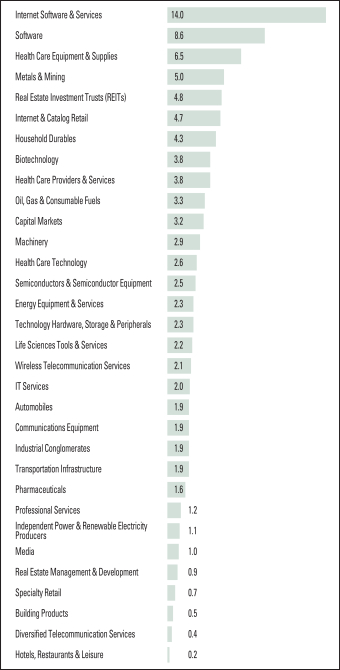

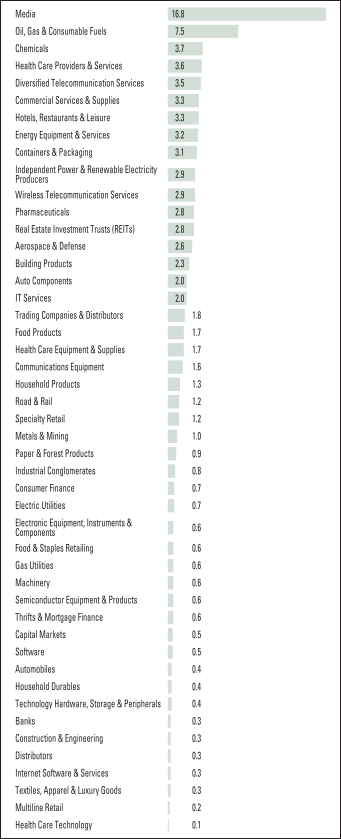

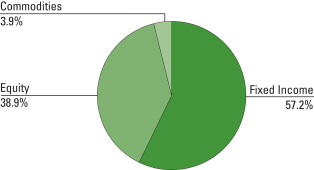

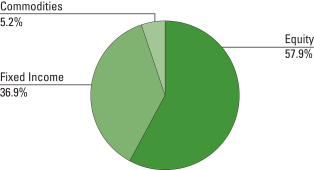

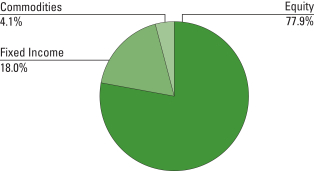

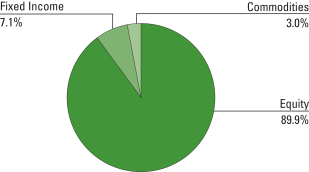

SECTOR ALLOCATION (% of investments)

(Excludes cash and short-term investments)

14

Harbor Mid Cap Growth Fund

FUND PERFORMANCE SUMMARY (Unaudited)

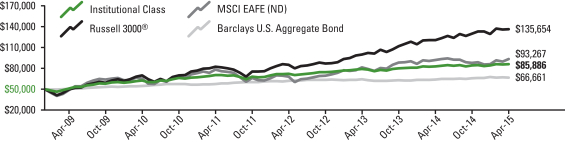

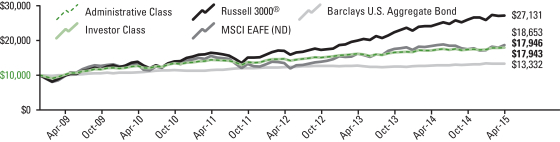

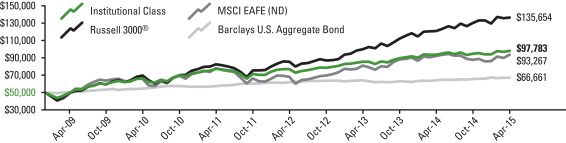

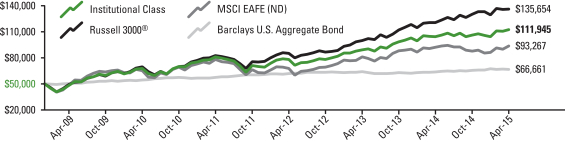

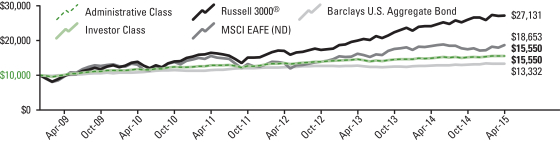

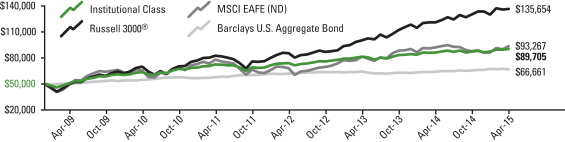

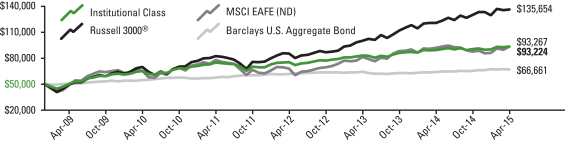

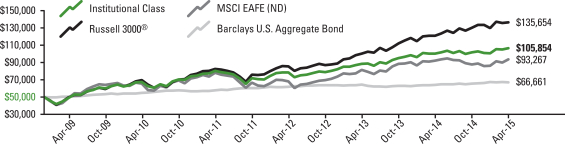

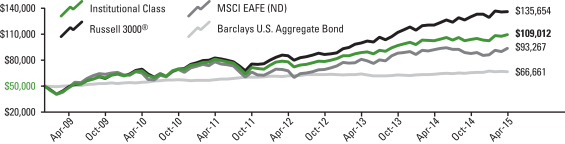

Institutional Class

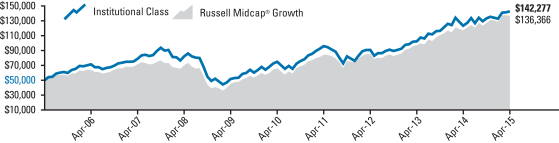

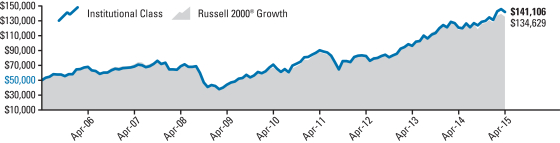

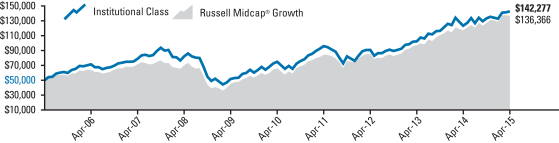

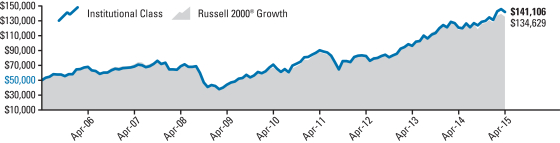

CHANGE IN A $50,000 INVESTMENT

For the period 05/01/2005 through 04/30/2015

| | |

The graph compares a $50,000 investment in the Fund with the performance of the Russell Midcap® Growth Index. The Fund’s performance includes the reinvestment of all dividend and capital gain distributions. | |  |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Returns For the periods ended 04/30/2015 | |  | |

| Harbor Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | 7.06% | | | | | | 15.77% | | | | | | 13.78% | | | | | | 11.02% | | | | | 11/01/2000 | | | | $ | 142,277 | |

| Comparative Index | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Russell Midcap® Growth | | | 7.77% | | | | | | 16.46% | | | | | | 15.59% | | | | | | 10.55% | | | | | — | | | | $ | 136,366 | |

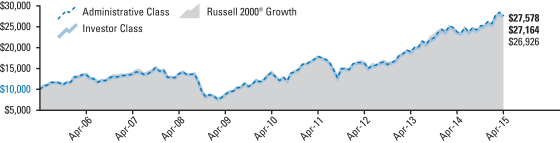

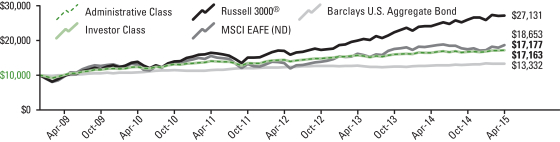

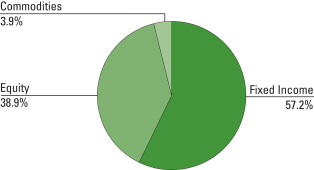

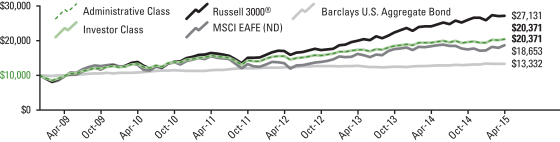

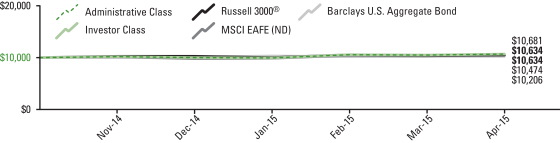

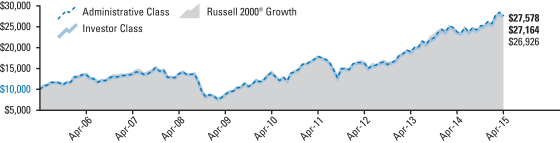

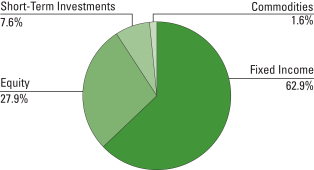

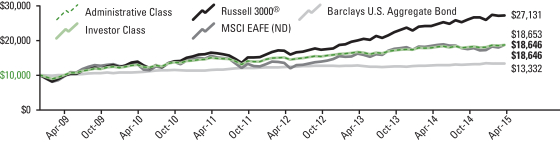

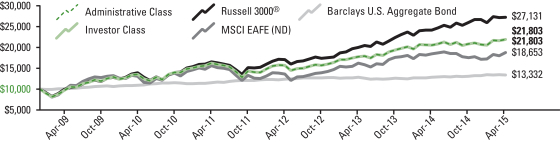

Administrative and Investor Classes

CHANGE IN A $10,000 INVESTMENT

For the period 05/01/2005 through 04/30/2015

| | |

The graph compares a $10,000 investment in the Fund with the performance of the Russell Midcap® Growth Index. The Fund’s performance includes the reinvestment of all dividend and capital gain distributions. | |  |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Returns For the periods ended 04/30/2015 | |  | |

| Harbor Mid Cap Growth Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Administrative Class | | | 6.97% | | | | | | 15.57% | | | | | | 13.52% | | | | | | 10.76% | | | | | 11/01/2002 | | | | $ | 27,796 | |

Investor Class | | | 6.90% | | | | | | 15.33% | | | | | | 13.37% | | | | | | 10.62% | | | | | 11/01/2002 | | | | $ | 27,436 | |

| Comparative Index | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Russell Midcap® Growth | | | 7.77% | | | | | | 16.46% | | | | | | 15.59% | | | | | | 10.55% | | | | | — | | | | $ | 27,273 | |

As stated in the Fund’s current prospectus, the expense ratios were 0.85% (Institutional Class); 1.10% (Administrative Class); and 1.22% (Investor Class). The expense ratios in the prospectus may differ from the actual expense ratios for the period disclosed within this report. The expense ratios shown in the prospectus are based on the prior fiscal year, adjusted to reflect changes, if any, in contractual arrangements that occurred prior to the date of the prospectus.

Performance data shown represents past performance, which is no guarantee of future results. Current performance may be higher or lower than the past performance data shown. Investment returns and the value of an investment will fluctuate, and an investor’s shares, when sold, may be worth more or less than their original cost. You can obtain performance data current to the most recent month-end (available within seven business days after the most recent month-end) by calling 800-422-1050 or visiting harborfunds.com.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. From time to time, certain fees and/or expenses have been waived or reimbursed, which has resulted in higher returns. Without these waivers and reimbursements, the returns would have been lower.

15

Harbor Mid Cap Growth Fund

PORTFOLIO OF INVESTMENTS—April 30, 2015 (Unaudited)

Equity Holdings (% of net assets)

(Excludes net cash and short-term investments of 4.1%)

| | | | | | | | |

COMMON STOCKS—95.8% | |

| | |

| Shares | | | | | Value

(000s) | |

| | AEROSPACE & DEFENSE—3.0% | |

| | 350,525 | | | DigitalGlobe Inc.* | | $ | 11,277 | |

| | 236,816 | | | Textron Inc. | | | 10,415 | |

| | | | | | | | |

| | | | | | | 21,692 | |

| | | | | | | | |

| | AIRLINES—1.0% | |

| | 111,421 | | | Spirit Airlines Inc.* | | | 7,629 | |

| | | | | | | | |

| | AUTOMOBILES—1.6% | |

| | 50,716 | | | Tesla Motors Inc.* | | | 11,464 | |

| | | | | | | | |

| | BEVERAGES—1.4% | |

| | 73,413 | | | Monster Beverage Corp.* | | | 10,066 | |

| | | | | | | | |

| | BIOTECHNOLOGY—2.8% | |

| | 33,867 | | | Alnylam Pharmaceuticals Inc.* | | | 3,450 | |

| | 6,500 | | | Blueprint Medicines Corp.* | | | 123 | |

| | 49,011 | | | Incyte Corp.* | | | 4,762 | |

| | 59,909 | | | Isis Pharmaceuticals Inc.* | | | 3,398 | |

| | 19,826 | | | Regeneron Pharmaceuticals Inc.* | | | 9,069 | |

| | | | | | | | |

| | | | | | | 20,802 | |

| | | | | | | | |

| | BUILDING PRODUCTS—2.3% | |

| | 222,454 | | | Fortune Brands Home & Security Inc. | | | 9,921 | |

| | 185,300 | | | Owens Corning Inc. | | | 7,164 | |

| | | | | | | | |

| | | | | | | 17,085 | |

| | | | | | | | |

| | CAPITAL MARKETS—2.5% | |

| | 149,085 | | | Julius Baer Group Ltd. (SWS)* | | | 7,803 | |

| | 139,286 | | | Northern Trust Corp. | | | 10,189 | |

| | | | | | | | |

| | | | | | | 17,992 | |

| | | | | | | | |

| | CHEMICALS—1.9% | |

| | 378,916 | | | Platform Specialty Products Corp.* | | | 10,208 | |

| | 144,483 | | | Platform Specialty Products Corp. PIPE*,1 | | | 3,892 | |

| | | | | | | | |

| | | | | | | 14,100 | |

| | | | | | | | |

| | COMMUNICATIONS EQUIPMENT—1.9% | |

| | 124,900 | | | Arista Networks Inc.* | | | 7,995 | |

| | 324,200 | | | Nomad Holdings Ltd. (VG)* | | | 5,835 | x |

| | | | | | | | |

| | | | | | | 13,830 | |

| | | | | | | | |

| | CONSTRUCTION & ENGINEERING—1.7% | |

| | 388,626 | | | AECOM Technology Corp.* | | | 12,265 | |

| | | | | | | | |

| | CONSTRUCTION MATERIALS—1.1% | |

| | 56,927 | | | Martin Marietta Materials Inc. | | | 8,121 | |

| | | | | | | | |

| | ELECTRICAL EQUIPMENT—3.4% | |

| | 57,038 | | | Acuity Brands Inc. | | | 9,523 | |

| | 113,836 | | | AMETEK Inc. | | | 5,967 | |

| | 222,942 | | | Generac Holdings Inc.* | | | 9,294 | |

| | | | | | | | |

| | | | | | | 24,784 | |

| | | | | | | | |

| | ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS—3.9% | |

| | 272,142 | | | CDW Corp. | | | 10,428 | |

| | 160,835 | | | Cognex Corp.* | | | 7,220 | |

| | 160,462 | | | TE Connectivity Ltd. (SWS) | | | 10,679 | |

| | | | | | | | |

| | | | | | | 28,327 | |

| | | | | | | | |

| | FOOD & STAPLES RETAILING—1.4% | |

| | 221,374 | | | Whole Foods Market Inc. | | | 10,573 | |

| | | | | | | | |

| | HEALTH CARE EQUIPMENT & SUPPLIES—9.6% | |

| | 82,995 | | | Becton Dickinson and Co. | | | 11,691 | |

| | 557,160 | | | Boston Scientific Corp.* | | | 9,929 | |

| | 236,898 | | | DexCom Inc.* | | | 16,007 | |

| | 109,464 | | | HeartWare International Inc.* | | | 8,287 | |

| | 225,400 | | | Hologic Inc.* | | | 7,605 | |

| | 316,704 | | | Insulet Corp.* | | | 9,454 | |

| | 14,954 | | | Intuitive Surgical Inc.* | | | 7,417 | |

| | | | | | | | |

| | | | | | | 70,390 | |

| | | | | | | | |

16

Harbor Mid Cap Growth Fund

PORTFOLIO OF INVESTMENTS—Continued

| | | | | | | | |

COMMON STOCKS—Continued | |

| | |

| Shares | | | | | Value

(000s) | |

| | HEALTH CARE PROVIDERS & SERVICES—1.0% | |

| | 202,266 | | | Envision Healthcare Holdings Inc.* | | $ | 7,678 | |

| | | | | | | | |

| | HEALTH CARE TECHNOLOGY—2.4% | |

| | 104,862 | | | Cerner Corp.* | | | 7,530 | |

| | 388,493 | | | Veeva Systems Inc.* | | | 10,315 | |

| | | | | | | | |

| | | | | | | 17,845 | |

| | | | | | | | |

| | HOTELS, RESTAURANTS & LEISURE—7.1% | |

| | 19,697 | | | Chipotle Mexican Grill Inc.* | | | 12,238 | |

| | 412,276 | | | Diamond Resorts International Inc.* | | | 13,197 | |

| | 263,748 | | | Hilton Worldwide Holdings Inc.* | | | 7,638 | |

| | 58,213 | | | Panera Bread Co.* | | | 10,623 | |

| | 98,031 | | | Wyndham Worldwide Corp. | | | 8,372 | |

| | | | | | | | |

| | | | | | | 52,068 | |

| | | | | | | | |

| | HOUSEHOLD DURABLES—3.2% | |

| | 169,190 | | | GoPro Inc.* | | | 8,473 | |

| | 54,812 | | | Harman International Industries Inc. | | | 7,146 | |

| | 43,991 | | | Whirlpool Corp. | | | 7,725 | |

| | | | | | | | |

| | | | | | | 23,344 | |

| | | | | | | | |

| | INSURANCE—1.2% | |

| | 335,150 | | | Assured Guaranty Ltd. (BM) | | | 8,710 | |

| | | | | | | | |

| | INTERNET & CATALOG RETAIL—2.4% | |

| | 32,050 | | | Netflix Inc.* | | | 17,836 | |

| | | | | | | | |

| | INTERNET SOFTWARE & SERVICES—7.9% | |

| | 178,186 | | | Akamai Technologies Inc.* | | | 13,147 | |

| | 23,000 | | | Apigee Corp.* | | | 333 | |

| | 69,875 | | | CoStar Group Inc.* | | | 14,284 | |

| | 34,313 | | | Equinix Inc. | | | 8,782 | |

| | 11,300 | | | Godaddy Inc.* | | | 283 | |

| | 18,100 | | | New Relic Inc.* | | | 588 | |

| | 161,421 | | | Shutterstock Inc.* | | | 10,894 | |

| | 101,385 | | | Zillow Group Inc.* | | | 9,899 | |

| | | | | | | | |

| | | | | | | 58,210 | |

| | | | | | | | |

| | MACHINERY—0.4% | |

| | 29,800 | | | Middleby Corp.* | | | 3,020 | |

| | | | | | | | |

| | MEDIA—1.8% | |

| | 347,018 | | | IMAX Corp. (CAN)* | | | 12,965 | |

| | | | | | | | |

| | OIL, GAS & CONSUMABLE FUELS—2.0% | |

| | 61,482 | | | Diamondback Energy Inc.* | | | 5,077 | |

| | 69,024 | | | Energen Corp. | | | 4,912 | |

| | 29,255 | | | Pioneer Natural Resources Co. | | | 5,055 | |

| | | | | | | | |

| | | | | | | 15,044 | |

| | | | | | | | |

| | PHARMACEUTICALS—5.2% | |

| | 43,607 | | | Actavis plc* | | | 12,335 | |

| | 88,800 | | | Eisai Co. Ltd. (JP) | | | 5,919 | |

| | 170,759 | | | Mylan NV (NET)* | | | 12,339 | |

| | 72,300 | | | Ono Pharmaceutical Co. Ltd. (JP) | | | 7,836 | |

| | | | | | | | |

| | | | | | | 38,429 | |

| | | | | | | | |

| | PROFESSIONAL SERVICES—1.1% | |

| | 63,109 | | | IHS Inc.* | | | 7,918 | |

| | | | | | | | |

| | REAL ESTATE INVESTMENT TRUSTS (REITs)—1.2% | |

| | 485,110 | | | Paramount Group Inc. | | | 8,887 | |

| | | | | | | | |

| | REAL ESTATE MANAGEMENT & DEVELOPMENT—1.4% | |

| | 276,185 | | | CBRE Group Inc.* | | | 10,589 | |

| | | | | | | | |

| | ROAD & RAIL—3.3% | |

| | 74,708 | | | Genesee & Wyoming Inc.* | | | 6,944 | |

| | 73,472 | | | Kansas City Southern | | | 7,530 | |

| | 154,286 | | | Landstar System Inc. | | | 9,614 | |

| | | | | | | | |

| | | | | | | 24,088 | |

| | | | | | | | |

| | SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT—4.0% | |

| | 75,272 | | | First Solar Inc.* | | | 4,492 | |

| | 141,260 | | | NXP Semiconductors NV (NET)* | | | 13,578 | |

| | 351,800 | | | Sumco Corp. (JP) | | | 5,308 | |

| | 242,751 | | | SunEdison Inc.* | | | 6,146 | |

| | | | | | | | |

| | | | | | | 29,524 | |

| | | | | | | | |

| | SOFTWARE—5.6% | |

| | 205,774 | | | Mobileye NV (NET)* | | | 9,231 | |

| | 29,505 | | | ServiceNow Inc.* | | | 2,209 | |

| | 173,067 | | | Solera Holdings Inc. | | | 8,397 | |

| | 57,071 | | | Tyler Technologies Inc.* | | | 6,960 | |

| | 158,633 | | | Workday Inc.* | | | 14,469 | |

| | | | | | | | |

| | | | | | | 41,266 | |

| | | | | | | | |

| | SPECIALTY RETAIL—1.5% | |

| | 76,029 | | | Advance Auto Parts Inc. | | | 10,872 | |

| | | | | | | | |

| | TEXTILES, APPAREL & LUXURY GOODS—2.5% | |

| | 260,615 | | | Kate Spade & Co.* | | | 8,522 | |

| | 2,700,330 | | | Samsonite International SA (HK) | | | 9,849 | |

| | | | | | | | |

| | | | | | | 18,371 | |

| | | | | | | | |

| | TRADING COMPANIES & DISTRIBUTORS—1.1% | |

| | 245,416 | | | HD Supply Holdings Inc.* | | | 8,099 | |

| | | | | | | | |

| TOTAL COMMON STOCKS

(Cost $597,064) | | | 703,883 | |

| | | | | | | | |

| | | | | | | | |

RIGHTS/WARRANTS—0.1% | |

| (Cost $3) | | | | |

No. of

Contracts | | | | | | |

| | COMMUNICATIONS EQUIPMENT—0.1% | |

| | 324,200 | | | Nomad Holdings Ltd. (VG)*

$10.50—04/10/2017 | | | 811 | y |

| | | | | | | | |

| | | | | | | | |

SHORT-TERM INVESTMENTS—4.3% | |

| (Cost $31,635) | | | | |

Principal

Amount

(000s) | | | | | | |

| | REPURCHASE AGREEMENTS | | | | |

| $ | 31,635 | | | Repurchase Agreement with Bank of America Corp.

dated April 30, 2015 due May 01, 2015 at 0.090% collateralized by U.S. Treasury Notes

(market value $32,523) | | | 31,635 | |

| | | | | | | | |

| TOTAL INVESTMENTS—100.2%

(Cost $628,702) | | | 736,329 | |

| | | | | | | | |

| | CASH AND OTHER ASSETS, LESS LIABILITIES—(0.2)% | | | (1,267 | ) |

| | | | | | | | |

| | TOTAL NET ASSETS—100.0% | | $ | 735,062 | |

| | | | | | | | |

17

Harbor Mid Cap Growth Fund

PORTFOLIO OF INVESTMENTS—Continued

FAIR VALUE MEASUREMENTS

The following table summarizes the Fund’s investments as of April 30, 2015 based on the inputs used to value them.

| | | | | | | | | | | | | | | | | | | | |

Asset Category | | Quoted Prices

Level 1

(000s) | | Other Significant

Observable Inputs

Level 2

(000s) | | Significant

Unobservable Inputs

Level 3

(000s) | | Total

(000s) |

Common Stocks | | | | | | | | | | | | | | | | | | | | |

Aerospace & Defense | | | $ | 21,692 | | | | $ | — | | | | $ | — | | | | $ | 21,692 | |

Airlines | | | | 7,629 | | | | | — | | | | | — | | | | | 7,629 | |

Automobiles | | | | 11,464 | | | | | — | | | | | — | | | | | 11,464 | |

Beverages | | | | 10,066 | | | | | — | | | | | — | | | | | 10,066 | |

Biotechnology | | | | 20,679 | | | | | 123 | | | | | — | | | | | 20,802 | |

Building Products | | | | 17,085 | | | | | — | | | | | — | | | | | 17,085 | |

Capital Markets | | | | 10,189 | | | | | 7,803 | | | | | — | | | | | 17,992 | |

Chemicals | | | | 10,208 | | | | | 3,892 | | | | | — | | | | | 14,100 | |

Communications Equipment | | | | 7,995 | | | | | — | | | | | 5,835 | | | | | 13,830 | |

Construction & Engineering | | | | 12,265 | | | | | — | | | | | — | | | | | 12,265 | |

Construction Materials | | | | 8,121 | | | | | — | | | | | — | | | | | 8,121 | |

Electrical Equipment | | | | 24,784 | | | | | — | | | | | — | | | | | 24,784 | |

Electronic Equipment, Instruments & Components | | | | 28,327 | | | | | — | | | | | — | | | | | 28,327 | |

Food & Staples Retailing | | | | 10,573 | | | | | — | | | | | — | | | | | 10,573 | |

Health Care Equipment & Supplies | | | | 70,390 | | | | | — | | | | | — | | | | | 70,390 | |

Health Care Providers & Services | | | | 7,678 | | | | | — | | | | | — | | | | | 7,678 | |

Health Care Technology | | | | 17,845 | | | | | — | | | | | — | | | | | 17,845 | |

Hotels, Restaurants & Leisure | | | | 52,068 | | | | | — | | | | | — | | | | | 52,068 | |

Household Durables | | | | 23,344 | | | | | — | | | | | — | | | | | 23,344 | |

Insurance | | | | 8,710 | | | | | — | | | | | — | | | | | 8,710 | |

Internet & Catalog Retail | | | | 17,836 | | | | | — | | | | | — | | | | | 17,836 | |

Internet Software & Services | | | | 58,210 | | | | | — | | | | | — | | | | | 58,210 | |

Machinery | | | | 3,020 | | | | | — | | | | | — | | | | | 3,020 | |

Media | | | | 12,965 | | | | | — | | | | | — | | | | | 12,965 | |

Oil, Gas & Consumable Fuels | | | | 15,044 | | | | | — | | | | | — | | | | | 15,044 | |

Pharmaceuticals | | | | 24,674 | | | | | 13,755 | | | | | — | | | | | 38,429 | |

Professional Services | | | | 7,918 | | | | | — | | | | | — | | | | | 7,918 | |

Real Estate Investment Trusts (REITs) | | | | 8,887 | | | | | — | | | | | — | | | | | 8,887 | |

Real Estate Management & Development | | | | 10,589 | | | | | — | | | | | — | | | | | 10,589 | |

Road & Rail | | | | 24,088 | | | | | — | | | | | — | | | | | 24,088 | |

Semiconductors & Semiconductor Equipment | | | | 24,216 | | | | | 5,308 | | | | | — | | | | | 29,524 | |

Software | | | | 41,266 | | | | | — | | | | | — | | | | | 41,266 | |

Specialty Retail | | | | 10,872 | | | | | — | | | | | — | | | | | 10,872 | |

Textiles, Apparel & Luxury Goods | | | | 8,522 | | | | | 9,849 | | | | | — | | | | | 18,371 | |

Trading Companies & Distributors | | | | 8,099 | | | | | — | | | | | — | | | | | 8,099 | |

Rights/Warrants | | | | | | | | | | | | | | | | | | | | |

Communications Equipment | | | | — | | | | | — | | | | | 811 | | | | | 811 | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | |

Repurchase Agreements | | | | — | | | | | 31,635 | | | | | — | | | | | 31,635 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investments in Securities | | | $ | 657,318 | | | | $ | 72,365 | | | | $ | 6,646 | | | | $ | 736,329 | |

| | | | | | | | | | | | | | | | | | | | |

The following is a rollforward of the Fund’s Level 3 investments during the period ended April 30, 2015.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Valuation Description | | Balance

Beginning at

11/01/2014

(000s) | | Purchases

(000s) | | Sales

(000s) | | Accrued

Discount/

(Premium)

(000s) | | Total

Realized

Gain/(Loss)w

(000s) | | Change in

Unrealized

Appreciation/

(Depreciation)w

(000s) | | Transfers In

Level 3

(000s) | | Transfers

Out of

Level 3

(000s) | | Ending

Balance

as of

04/30/2015w

(000s) |

Common Stocks | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Communications Equipment | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | 5,835 | | | | $ | — | | | | $ | 5,835 | |

Rights/Warrants | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Communications Equipment | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | 811 | | | | | — | | | | | 811 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | — | | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | 6,646 | | | | $ | — | | | | $ | 6,646 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

There were no transfers between Levels 1 and 2 during the period.

18

Harbor Mid Cap Growth Fund

PORTFOLIO OF INVESTMENTS—Continued

FAIR VALUE MEASUREMENTS—Continued

The following is a summary of significant unobservable inputs used in the fair valuations of assets and liabilities categorized within Level 3 of the fair value hierarchy.

| | | | | | | | | | | | |

Valuation Descriptions | | Ending Balance

as of 04/30/2015

(000s) | | | Valuation Technique | | Unobservable Inputs | | Input

Value(s) | |

| Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Nomad Holdings Ltd. (VG)* | | $ | 5,835 | | | Market Approach | | Last Traded Price | | $ | 18.00 | |

| | | | | | | | | | | | |

Rights/Warrants | | | | | | | | | | | | |

Nomad Holdings Ltd. (VG)* | | $ | 811 | | | Market Approach | | Last Traded Price of Underlying Security | | $ | 2.50 | |

| | | | | | | | | | | | |

For more information on valuation inputs and their aggregation into the levels used in the table above, please refer to the Fair Value Measurements and Disclosures in Note 2 of the accompanying Notes to Financial Statements.

| * | Non-income producing security. |

| 1 | PIPE after the name of a security stands for Private Investment in Public Equity and there are some restrictions on reselling this security within a certain period. |

| w | The amounts in this category are included in the “Realized and Change in Unrealized Gain/(Loss) on Investment Transactions” section of the Statement of Operations. The net unrealized appreciation/(depreciation) per investment type is below: |

| | | | | |

Valuation Description | | Unrealized

Gain/(Loss)

as of

04/30/2015

(000s) |

Common Stocks | | | $ | 2,597 | |

Rights/Warrants | | | | 808 | |

| | | | | |

| | | $ | 3,405 | |

| | | | | |

| x | Fair Valued in accordance with Harbor Funds Valuation Procedures using last traded price, which is a Level 3 input. |

| y | Fair Valued in accordance with Harbor Funds Valuation Procedures using last traded price of underlying security, which is a Level 3 input. |

The accompanying notes are an integral part of the Financial Statements.

19

Harbor Small Cap Growth Fund

MANAGERS’ COMMENTARY (Unaudited)

SUBADVISER

Westfield Capital Management Company, L.P.

One Financial Center 23rd Floor

Boston, MA 02111

PORTFOLIO MANAGERS

William Muggia

Lead Portfolio Manager Since 2000

Ethan Meyers, CFA

Since 2000

John Montgomery

Since 2011

Bruce Jacobs, CFA

Since 2011

Hamlen Thompson

Since 2011

Westfield has subadvised the Fund since its inception in 2000.

INVESTMENT OBJECTIVE

The Fund seeks long-term growth of capital.

PRINCIPAL STYLE CHARACTERISTICS

Small cap growth stocks demonstrating consistent or accelerating earnings growth

William Muggia

Ethan Meyers

John Montgomery

Bruce Jacobs

Hamlen Thompson

Management’s Discussion of Fund Performance

MARKET REVIEW

Domestic equities rose in the six months ended April 30, 2015. However, the pace of their advance was not uniform, reflecting a variety of investor worries. The U.S. dollar strength weakened the earnings outlooks of most multinational firms. The dramatic collapse of crude oil prices pushed Energy stocks into negative territory. After steady acceleration in 2014, the U.S. economy stalled in the first quarter of 2015, surprising investors and economists to the downside and placing a question mark on the timing of the Federal Reserve’s first rate increase. At the same time, the economies of Europe, Japan, and even China began to show signs of improvement, as massive stimulus by central banks around the world began to have an impact on global economies and risk assets. These factors led to a significant disparity in returns across all financial assets. Prices of long-term U.S. government bonds reached fresh highs, domestically-focused small capitalization stocks outpaced large capitalization multinationals, and Health Care stocks surged across the market capitalization spectrum, leaving economically-sensitive Energy, Materials, and Industrials far behind. Within the Russell universe of indices, growth-style benchmarks considerably outperformed their value counterparts. The performance dichotomy highlighted investors’ sharpened focus on segments that they believe are able to deliver earnings growth against an uncertain economic backdrop.

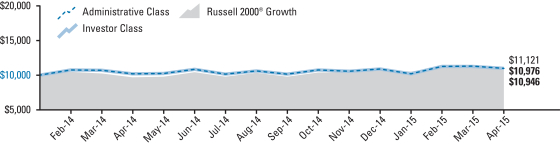

PERFORMANCE

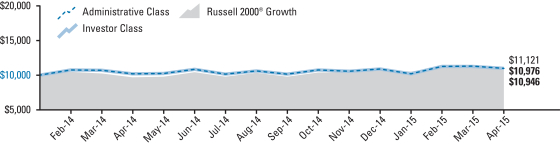

Harbor Small Cap Growth Fund returned 10.39% (Institutional Class), 10.23% (Administrative Class), and 10.10% (Investor Class) for the six months ended April 30, 2015, outperforming the 7.25% return of the Russell 2000® Growth Index. Health Care was the biggest driver of outperformance, but the portfolio’s holdings in the Industrials, Materials, and Energy sectors also contributed materially to excess returns.