ADVISORY AGREEMENT APPROVALS—Continued

The Trustees considered the expertise of Jennison Associates LLC (“Jennison”) in managing assets generally and specifically with respect to the Fund’s asset class, noting that Jennison managed approximately $56.99 billion in assets in this asset class, out of a firm-wide total of approximately $174 billion in assets under management. The Trustees also noted the significant experience of the Fund’s portfolio managers in this asset class, noting that one was a founding member of Jennison.

The Trustees observed that the Broadridge comparison of contractual management fees for the Fund’s expense group, assuming an asset level of $27.525 billion, showed that the Fund’s contractual management fee was slightly above the group median for the Institutional Class. The actual total expense ratio for the Institutional Class of the Fund, however, was below both the group and universe medians. The Trustees also considered the Adviser’s proposal for a modified voluntary advisory fee waiver breakpoint schedule for the Fund until at least February 28, 2017. It was noted that the revised breakpoints would have both an immediate further fee reduction effect, and, as the Fund grows, a future continuing one. The Trustees noted that Adviser’s profitability in operating the Fund was not excessive.

Harbor Mid Cap Growth Fund. In consideration of the Investment Advisory Agreement and Subadvisory Agreement for the Harbor Mid Cap Growth Fund (inception date November 1, 2000), the Trustees noted that, according to the Broadridge report, the Fund’s Institutional Class had outperformed its Broadridge group median for the four-year period ended December 31, 2015, underperformed its group medians for the one-, two- and five-year periods ended December 31, 2015, and performed at its group median for the three-year period ended December 31, 2015. The Trustees further noted that, according to the Broadridge report, the Fund had outperformed its Broadridge universe medians for the one-, two-, three-, four- and five-year periods ended December 31, 2015. The Trustees considered the fact that, in comparison to its universe of other mid cap growth funds, as identified by Morningstar, the Fund’s one-, three- and five-year rolling returns each ranked in the second quartile as of December 31, 2015. The Trustees also considered that the Fund had underperformed its benchmark, the Russell Midcap® Growth Index, for the three-, five- and ten-year periods ended December 31, 2015 but had outperformed its benchmark index for the one-year period ended December 31, 2015.

The Trustees considered the expertise of Wellington Management Company LLP (“Wellington”) in managing assets generally and in the mid cap growth asset class specifically, noting that Wellington managed approximately $3.24 billion in assets in this asset class, out of a firm-wide total of approximately $927 billion in assets under management. The Trustees noted the significant experience of the Fund’s portfolio managers.

The Trustees observed that the Broadridge comparison of contractual management fees for the Fund’s expense group, assuming an asset level of $600 million, showed that the Fund’s contractual management fee was below the group median for the Institutional Class. The Broadridge data also showed that the actual total expense ratio for the Fund’s Institutional Class was below both the group and universe medians. The Trustees noted that Adviser’s profitability in managing the Fund was not excessive.

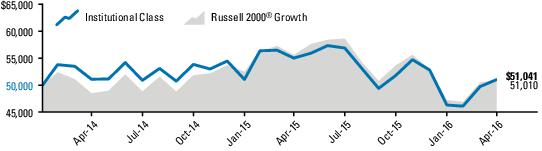

Harbor Small Cap Growth Fund. In consideration of the Investment Advisory Agreement and Subadvisory Agreement for the Harbor Small Cap Growth Fund (inception date November 1, 2000), the Trustees noted that, according to the Broadridge report, the Fund’s Institutional Class performance exceeded both its group and universe medians for the one-, two-, three-, four- and five-year periods ended December 31, 2015. The Morningstar data presented ranked the Fund’s one- and five-year rolling returns as of December 31, 2015 in the second quartile and its three-year rolling return as of December 31, 2015 in the first quartile. The Trustees also considered the fact that Harbor Small Cap Growth Fund had outperformed its benchmark, the Russell 2000® Growth Index, for the one-, three- and ten-year periods ended December 31, 2015 while underperforming the benchmark index for the five-year period ended December 31, 2015.

The Trustees considered the expertise of Westfield Capital Management Company, L.P. (“Westfield”) in managing assets generally and in the small cap growth asset class specifically, noting that Westfield managed approximately $1.75 billion in assets in this asset class, out of a firm-wide total of approximately $15.39 billion in assets under management. The Trustees also discussed the experience of the Fund’s portfolio managers in this asset class.

The Trustees observed that the Broadridge comparison of contractual management fees for the Fund’s expense group, assuming an asset level of $625 million, showed the Fund’s contractual management fee was below the group median for the Institutional Class. The Trustees also noted that the Fund’s actual total expense ratio for the Institutional Class was below the Broadridge group and universe median expense ratios. The Trustees noted that Adviser’s profitability in operating the Fund was not excessive.

Harbor Small Cap Growth Opportunities Fund. In consideration of the Investment Advisory Agreement and Subadvisory Agreement for the Harbor Small Cap Growth Opportunities Fund (inception date February 1, 2014), the Trustees noted that, according to the Broadridge report, the Fund’s Institutional Class performance underperformed both its group and universe medians for the one-year period ended December 31, 2015 and outperformed both its group and universe medians for the