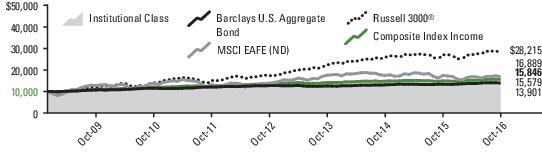

World (ND) Index, BofA Merrill Lynch U.S. Non-Distressed High Yield Index (prior to March 31, 2015, the BofA Merrill Lynch U.S. High Yield Index), Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays U.S. TIPS Index, BofA Merrill Lynch 3-Month U.S. Treasury Bill Index. The weights of the Composite Index Income match the Fund’s historical target asset allocation and are adjusted as changes are made to this asset allocation. Refer to the Target Retirement Funds Prospectus for the Fund’s target asset allocation. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Composite Index 2015—The Composite Index 2015 is derived by applying the Fund’s target asset allocation to the results of the underlying funds’ benchmarks: Russell 1000® Growth Index, Russell Midcap® Growth Index, Russell 2000® Growth Index, Russell 1000® Value Index, Russell Midcap® Value Index, Russell 2000® Value Index, MSCI EAFE (ND) Index, MSCI All Country World Ex. U.S. (ND) Index (prior to May 28, 2013, the MSCI EAFE Growth (ND) Index), MSCI All Country World (ND) Index, Bloomberg Commodity Index Total ReturnSM, BofA Merrill Lynch U.S. Non-Distressed High Yield Index (prior to March 31, 2015, the BofA Merrill Lynch U.S. High Yield Index), Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays U.S. TIPS Index, BofA Merrill Lynch 3-Month U.S. Treasury Bill Index. The weights of the Composite Index 2015 match the Fund’s historical target asset allocation and are adjusted as changes are made to this asset allocation. Refer to the Target Retirement Funds Prospectus for the Fund’s target asset allocation. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Composite Index 2020—The Composite Index 2020 is derived by applying the Fund’s target asset allocation to the results of the underlying funds’ benchmarks: Russell 1000® Growth Index, Russell Midcap® Growth Index, Russell 2000® Growth Index, Russell 1000® Value Index, Russell Midcap® Value Index, Russell 2000® Value Index, MSCI EAFE (ND) Index, MSCI All Country World Ex. U.S. (ND) Index (prior to May 28, 2013, the MSCI EAFE Growth (ND) Index), MSCI All Country World (ND) Index, Bloomberg Commodity Index Total ReturnSM, BofA Merrill Lynch All U.S. Convertibles Ex Mandatory Index, BofA Merrill Lynch U.S. Non-Distressed High Yield Index (prior to March 31, 2015, the BofA Merrill Lynch U.S. High Yield Index), Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays U.S. TIPS Index, BofA Merrill Lynch 3-Month U.S. Treasury Bill Index. The weights of the Composite Index 2020 match the Fund’s historical target asset allocation and are adjusted as changes are made to this asset allocation. Refer to the Target Retirement Funds Prospectus for the Fund’s target asset allocation. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

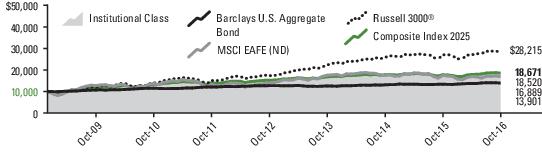

Composite Index 2025—The Composite Index 2025 is derived by applying the Fund’s target asset allocation to the results of the underlying funds’ benchmarks: Russell 1000® Growth Index, Russell Midcap® Growth Index, Russell 2000® Growth Index, Russell 1000® Value Index, Russell Midcap® Value Index, Russell 2000® Value Index, MSCI EAFE (ND) Index, MSCI All Country World Ex. U.S. (ND) Index (prior to May 28, 2013, the MSCI EAFE Growth (ND) Index), MSCI All Country World (ND) Index, Bloomberg Commodity Index Total ReturnSM, BofA Merrill Lynch All U.S. Convertibles Ex Mandatory Index, BofA Merrill Lynch U.S. Non-Distressed High Yield Index (prior to March 31, 2015, the BofA Merrill Lynch U.S. High Yield Index), Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays U.S. TIPS Index. The weights of the Composite Index 2025 match the Fund’s historical target asset allocation and are adjusted as changes are made to this asset allocation. Refer to the Target Retirement Funds Prospectus for the Fund’s target asset allocation. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

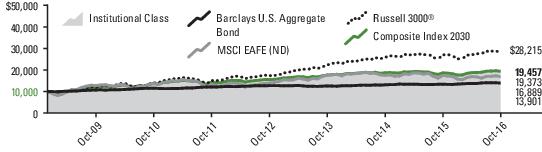

Composite Index 2030—The Composite Index 2030 is derived by applying the Fund’s target asset allocation to the results of the underlying funds’ benchmarks: Russell 1000® Growth Index, Russell Midcap® Growth Index, Russell 2000® Growth Index, Russell 1000® Value Index, Russell Midcap® Value Index, Russell 2000® Value Index, MSCI EAFE (ND) Index, MSCI All Country World Ex. U.S. (ND) Index (prior to May 28, 2013, the MSCI EAFE Growth (ND) Index), MSCI All Country World (ND) Index, Bloomberg Commodity Index Total ReturnSM, BofA Merrill Lynch All U.S. Convertibles Ex Mandatory Index, BofA Merrill Lynch U.S. Non-Distressed High Yield Index (prior to March 31, 2015, the BofA Merrill Lynch U.S. High Yield Index), Bloomberg Barclays U.S. Aggregate Bond Index, Bloomberg Barclays U.S. TIPS Index. The weights of the Composite Index 2030 match the Fund’s historical target asset allocation and are adjusted as changes are made to this asset allocation. Refer to the Target Retirement Funds Prospectus for the Fund’s target asset allocation. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Composite Index 2035—The Composite Index 2035 is derived by applying the Fund’s target asset allocation to the results of the underlying funds’ benchmarks: Russell 1000® Growth Index, Russell Midcap® Growth Index, Russell 2000® Growth Index, Russell 1000® Value Index, Russell Midcap® Value Index, Russell 2000® Value Index, MSCI EAFE (ND) Index, MSCI All Country World Ex. U.S. (ND) Index (prior to May 28, 2013, the MSCI EAFE Growth (ND) Index), MSCI All Country World (ND) Index, Bloomberg Commodity Index Total ReturnSM, BofA Merrill Lynch All U.S. Convertibles Ex Mandatory Index, BofA Merrill Lynch U.S. Non-Distressed High Yield Index (prior to March 31, 2015, the BofA Merrill Lynch U.S. High Yield