UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-04692

Emerging Markets Growth Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: June 30

Date of reporting period: December 31, 2019

Gregory F. Niland

Emerging Markets Growth Fund, Inc.

5300 Robin Hood Road

Norfolk, Virginia 23513

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

| Emerging Markets

Semi-annual report |

Beginning January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, we intend to no longer mail paper copies of the fund’s shareholder reports, unless specifically requested from the fund or your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the fund’s website (capitalgroup.com/us/investments/emerging-markets-growth-fund.html); you will be notified by mail and provided with a website link to access the report each time a report is posted.

You may elect to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the fund, you may inform the fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 421-4225. Your election to receive paper reports will apply to all funds held with the fund’s transfer agent or through your financial intermediary.

Emerging Markets Growth Fund seeks long-term growth of capital and invests primarily in common stock and other equity securities of issuers in developing countries.

Fund results shown in this report are for past periods and are not predictive of results for future periods. The results shown are before taxes on fund distributions and sale of fund shares. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, please call (800) 421-4989.

Investing in developing markets may be subject to risks, such as significant currency and price fluctuations, political instability, differing securities regulations and periods of illiquidity, which are detailed in the fund’s prospectus. Investments in developing markets have been more volatile than investments in developed markets, reflecting the greater uncertainties of investing in less established economies. Individuals investing in developing markets should have a long-term perspective and be able to tolerate potentially sharp declines in the value of their investments.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

| 1 | Letter to investors | |

| 2 | 20 largest equity holdings | |

| 7 | Investment portfolio | |

| 13 | Financial statements | |

| 16 | Notes to financial statements |

Fellow investors:

Emerging markets stocks advanced during the second half of 2019, overcoming bouts of volatility tied to global trade tensions, an overall slowdown in the global economy and a strong U.S. dollar.

Boosted by stock selection — especially in India and China — Emerging Markets Growth Fund increased 8.42% in value for the six months ended December 31, 2019, assuming reinvestment of the dividend of 13 cents a share and capital gain of 36 cents a share. By comparison, the fund’s benchmark, the unmanaged MSCI Emerging Markets Investable Market Index (IMI), rose 6.81%.*

Market review

During the six-month period, China’s economy continued to slow, global manufacturing activity declined, and trade tariffs increased, all of which kept pressure on equity prices. The uncertainty over the timing and scope of a potential U.S.-China trade deal also affected sentiment.

In mid-December, the U.S. and China agreed to a phase-one trade pact, which improved overall market sentiment and lifted emerging markets stocks. The deal, signed January 15, includes provisions for China to purchase more U.S. agricultural products and for the U.S. to scale back tariffs on Chinese goods.

| * | Unless otherwise noted, country and sector returns are based on MSCI EM IMI indices, expressed in U.S. dollars, and assume the reinvestment of dividends. Results reflect dividends net of withholding taxes. |

Results at a glance

| Cumulative total returns | Average annual total returns | |||||||||||||||||||||||

| For periods ended December 31, 2019, | ||||||||||||||||||||||||

| with distributions reinvested | 6 months | 1 year | 3 years | 5 years | 10 years | Lifetime1 | ||||||||||||||||||

| Emerging Markets Growth Fund (Class M shares) | 8.42 | % | 23.96 | % | 14.37 | % | 6.80 | % | 3.05 | % | 12.96 | % | ||||||||||||

| MSCI Emerging Markets IMI2,3 | 6.81 | 17.64 | 11.00 | 5.30 | 3.60 | 10.02 | 4 | |||||||||||||||||

| MSCI Emerging Markets Index3,5 | 7.09 | 18.42 | 11.57 | 5.61 | 3.68 | 10.00 | 4 | |||||||||||||||||

| 1 | Since May 30, 1986. |

| 2 | Returns for the MSCI Emerging Markets Investable Market Index (IMI) were calculated using the MSCI Emerging Markets Index with dividends gross of withholding taxes from December 31, 1987, to December 31, 2000, and with dividends net of withholding taxes from January 1, 2001, to November 30, 2007, and using the MSCI Emerging Markets IMI with dividends net of withholding taxes thereafter. |

| 3 | The indices are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Source: MSCI. |

| 4 | The MSCI Emerging Markets Index did not start until December 31, 1987. As a result, the International Finance Corporation (IFC) Global Composite Index was used in lieu of the MSCI Emerging Markets Index from May 30, 1986, to December 31, 1987. |

| 5 | Results reflect dividends gross of withholding taxes through December 31, 2000, and dividends net of withholding taxes thereafter. |

The total annual fund operating expense ratio is 0.84% for Class M shares as of the most recent fiscal year-end, and is 0.88% including “acquired fund” fees and expenses.

| Emerging Markets Growth Fund | 1 |

20 largest equity holdings

| Price change | ||||||||

| Percent of | for the | |||||||

| net assets as | 6 months ended | |||||||

| of 12/31/19 | 12/31/19* | |||||||

| Taiwan Semiconductor Manufacturing | 4.6 | % | 43.9 | % | ||||

| Tencent Holdings | 4.1 | 6.9 | ||||||

| Samsung Electronics | 3.7 | 18.3 | ||||||

| Jiangsu Hengrui Medicine | 3.5 | 30.9 | ||||||

| AIA Group | 3.4 | –2.4 | ||||||

| China Overseas Land & Investment | 2.8 | 5.9 | ||||||

| Longfor Properties | 2.8 | 24.6 | ||||||

| Trip.com Group | 2.6 | –9.1 | ||||||

| BeiGene | 2.3 | 33.7 | ||||||

| HDFC Bank | 2.2 | –0.6 | ||||||

| Galaxy Entertainment Group | 2.1 | 9.4 | ||||||

| China Resources Land | 2.1 | 13.2 | ||||||

| Sberbank of Russia | 2.0 | 7.4 | ||||||

| ICICI Bank | 1.9 | 19.8 | ||||||

| Hutchison China MediTech | 1.9 | 13.9 | ||||||

| Ping An Insurance Group | 1.9 | –1.3 | ||||||

| Petróleo Brasileiro SA Petrobras | 1.6 | 4.3 | ||||||

| Alibaba Group Holding | 1.6 | 25.2 | ||||||

| Hangzhou Tigermed Consulting | 1.4 | 21.2 | ||||||

| Bank Central Asia | 1.4 | 13.2 | ||||||

| Total | 49.9 | % | ||||||

| * | The percent change is reflected in U.S. dollars. The actual gain or loss on the total position in the fund may differ from the percentage shown. |

Most emerging markets currencies weakened against the dollar during the period. In particular, the Argentine peso plunged 29% after market-friendly President Mauricio Macri trailed in the August primary election and eventually lost the general election in late October.

Chinese stocks rose 8.86%. But the period was volatile due to trade tensions with the United States and weakness in China’s economy. The consumer discretionary and information technology sectors advanced the most. With its economy slowing, Chinese officials took steps to boost market confidence, including easing credit for infrastructure projects, lowering reserve requirements for banks to help boost lending, and cutting taxes for businesses and individuals. Overall, China’s gross domestic product growth slowed to 6% on an annualized basis in the July–September quarter, well under the pace of growth in years past.

Indian equities declined 1.04%. Prime Minister Narendra Modi was overwhelmingly re-elected in May, and India’s central bank cut rates several times. However, India’s fast-growing economy slowed considerably after a liquidity crunch among nonbank lenders hurt consumer spending. The government also experienced difficulties implementing a new sales tax system, undermining business confidence. In a bid to jump-start growth, the government cut the country’s corporate tax rate to 22% from 30%.

Elsewhere in Asia, Indonesian stocks finished largely flat as economic growth slowed to around 5%. President Joko Widodo plans to boost government spending in 2020 and has pledged to enact more reforms aimed at attracting foreign investment. Taiwanese stocks surged 22.51% on signs of a rebound for the country’s semiconductor industry.

Brazilian stocks climbed 11.06%. Legislators approved a landmark pension reform bill in late October after several years of failed attempts. It was a major victory for first-year President Jair Bolsonaro, who also seeks to gain support for other fiscal and economic reforms to revive growth. Brazil’s economy, Latin America’s largest, has struggled since emerging from a long recession in 2017.

Russian stocks produced some of the strongest gains, rising 14.87%. Higher dividend payments from some of the country’s largest state-owned energy and banking companies, an improving economy and rising oil prices all helped to boost sentiment.

Portfolio review

Several Chinese companies in the health care sector boosted relative returns, led by Jiangsu Hengrui Medicine. Hengrui operates a stable and cash-generative generic drug business, and among Chinese companies it has the deepest pipeline of drugs under development.

| 2 | Emerging Markets Growth Fund |

Where the fund’s assets were invested

| Value of holdings | ||||||||||||||||||||||||

| Percent of net assets | MSCI EM IMI1 | 12/31/19 | ||||||||||||||||||||||

| 12/31/18 | 6/30/19 | 12/31/19 | 6/30/19 | 12/31/19 | (in thousands) | |||||||||||||||||||

| Asia-Pacific | ||||||||||||||||||||||||

| China | 27.2 | % | 32.3 | % | 33.7 | % | 29.2 | % | 31.8 | % | $ | 649,564 | ||||||||||||

| Hong Kong | 7.7 | 9.2 | 9.5 | — | — | 182,414 | ||||||||||||||||||

| India | 12.8 | 10.8 | 11.0 | 9.7 | 9.1 | 211,685 | ||||||||||||||||||

| Indonesia | 6.5 | 6.7 | 6.7 | 2.2 | 2.0 | 129,849 | ||||||||||||||||||

| Malaysia | — | — | — | 2.2 | 2.0 | — | ||||||||||||||||||

| Pakistan | — | — | — | .1 | .1 | — | ||||||||||||||||||

| Philippines | 3.1 | 2.2 | 1.9 | 1.1 | .9 | 36,470 | ||||||||||||||||||

| Singapore | .7 | .7 | .5 | — | — | 8,879 | ||||||||||||||||||

| South Korea | 4.9 | 4.8 | 4.7 | 12.7 | 12.1 | 91,420 | ||||||||||||||||||

| Taiwan | 6.0 | 5.2 | 5.6 | 11.7 | 12.6 | 108,617 | ||||||||||||||||||

| Thailand | — | .2 | .3 | 3.2 | 2.7 | 5,747 | ||||||||||||||||||

| Vietnam | 1.7 | 1.3 | 1.0 | — | — | 18,713 | ||||||||||||||||||

| 70.6 | 73.4 | 74.9 | 72.1 | 73.3 | 1,443,358 | |||||||||||||||||||

| Latin America | ||||||||||||||||||||||||

| Argentina | .6 | .5 | .8 | .4 | .2 | 16,230 | ||||||||||||||||||

| Brazil | 6.4 | 5.7 | 7.1 | 7.7 | 7.8 | 137,063 | ||||||||||||||||||

| Chile | .7 | .1 | .2 | 1.0 | .8 | 3,325 | ||||||||||||||||||

| Colombia | — | — | — | .4 | .4 | — | ||||||||||||||||||

| Mexico | 2.1 | 1.2 | 1.6 | 2.6 | 2.3 | 30,685 | ||||||||||||||||||

| Peru | 1.3 | 1.1 | .1 | .4 | .3 | 1,260 | ||||||||||||||||||

| 11.1 | 8.6 | 9.8 | 12.5 | 11.8 | 188,563 | |||||||||||||||||||

| Eastern Europe and Middle East | ||||||||||||||||||||||||

| Czech Republic | — | — | — | .1 | .1 | — | ||||||||||||||||||

| Greece | — | — | — | .4 | .3 | — | ||||||||||||||||||

| Hungary | .2 | .2 | .3 | .3 | .3 | 4,411 | ||||||||||||||||||

| Kazakhstan | — | — | .6 | — | — | 11,107 | ||||||||||||||||||

| Poland | — | — | — | 1.1 | .9 | — | ||||||||||||||||||

| Qatar | — | — | — | 1.0 | .9 | — | ||||||||||||||||||

| Romania | .1 | .2 | .2 | — | — | 3,281 | ||||||||||||||||||

| Russia | 5.5 | 5.5 | 6.2 | 3.7 | 3.6 | 119,409 | ||||||||||||||||||

| Saudi Arabia | .1 | .1 | .1 | 1.4 | 2.6 | 2,418 | ||||||||||||||||||

| Slovenia | .5 | .4 | .4 | — | — | 7,401 | ||||||||||||||||||

| Turkey | 1.1 | 1.2 | 1.2 | .6 | .6 | 23,929 | ||||||||||||||||||

| United Arab Emirates | .5 | .4 | .2 | .7 | .6 | 4,421 | ||||||||||||||||||

| 8.0 | 8.0 | 9.1 | 9.3 | 9.9 | 176,377 | |||||||||||||||||||

| Africa | ||||||||||||||||||||||||

| Egypt | — | — | — | .2 | .2 | — | ||||||||||||||||||

| Nigeria | — | .1 | .5 | — | — | 10,089 | ||||||||||||||||||

| South Africa | 4.4 | 3.4 | 1.7 | 5.9 | 4.8 | 32,336 | ||||||||||||||||||

| 4.4 | 3.5 | 2.2 | 6.1 | 5.0 | 42,425 | |||||||||||||||||||

| Other markets3 | ||||||||||||||||||||||||

| Australia | .2 | .2 | — | — | ||||||||||||||||||||

| Belgium | — | .1 | .1 | 914 | ||||||||||||||||||||

| Denmark | 1.5 | .6 | .2 | 3,986 | ||||||||||||||||||||

| France | — | 2 | .2 | .2 | 2,850 | |||||||||||||||||||

| Netherlands | — | — | — | 2 | 317 | |||||||||||||||||||

| Norway | .1 | — | — | — | ||||||||||||||||||||

| Portugal | — | .1 | .1 | 2,300 | ||||||||||||||||||||

| United Kingdom | .4 | .9 | .8 | 16,257 | ||||||||||||||||||||

| United States | 1.7 | 1.0 | .5 | 10,098 | ||||||||||||||||||||

| 3.9 | 3.1 | 1.9 | 36,722 | |||||||||||||||||||||

| Short-term securities and other assets less liabilities | 2.0 | 3.4 | 2.1 | 40,074 | ||||||||||||||||||||

| Total net assets | 100.0 | % | 100.0 | % | 100.0 | % | $ | 1,927,519 | ||||||||||||||||

| 1 | A dash indicates that the market is not included in the index. Source: MSCI. |

| 2 | Amount less than .1% |

| 3 | Includes investments in companies incorporated in other regions that have significant operations in emerging markets. |

| Emerging Markets Growth Fund | 3 |

Another leading contributor was pharmaceutical company BeiGene, which primarily develops and sells drugs in China. It announced a partnership with U.S.-based Amgen to develop 20 cancer drugs in Amgen’s pipeline in October. Amgen will also take a stake of approximately 20% in BeiGene. Separately in November, BeiGene received approval from U.S. regulators to market its lymphoma treatment drug.

Investments in Chinese real estate companies supported returns. Property developer Longfor Group Holdings, which operates in more than 50 Chinese cities, reported a 21% year-over-year increase in contracted sales for 2019. China Resources Land also contributed.

Specialty semiconductor maker MediaTek boosted relative returns. Shares of the Taiwan-based company rose as demand picked up for its components used in smartphones that will run on 5G telecommunications networks. Shares of CCR, one of Brazil’s largest operators of toll roads, gained in anticipation of more infrastructure being built or privatized under President Jair Bolsonaro.

In contrast, positioning in the consumer discretionary sector detracted from relative returns. Shares of Trip.com, formerly known as Ctrip.com, zigzagged throughout the six-month period. The company posted a second-quarter loss and lowered revenue guidance in early September, partly due to the protests in Hong Kong. However, the stock recovered as Trip.com reported stronger results for the quarter ended September 30. A below-index investment in Alibaba weighed on returns. Shares of the Chinese e-commerce giant gained despite a slowdown in China’s economy, posting a double-digit revenue gain for the third quarter.

Certain investments in the financials sector also detracted. Noah Holdings, a wealth and asset management firm in China, posted weak third-quarter results and announced changes to its product mix. Shares of Hong Kong–listed insurer AIA Group edged lower. The company reported a slowdown in the value of new business for the quarter ended September 30, hurt by a substantial decline in retail business at its Hong Kong locations due to anti-government protests.

Outlook

Uncertainty remains about the pace of global growth and the long-term ramifications of ongoing negotiations between the U.S. and China regarding trade and intellectual property issues for technology products. However, there are potential catalysts that may help support emerging markets equities.

| Six months ended 12/31/19 | ||||||||

| Expressed in | Expressed in | |||||||

| Percent change in key markets* | U.S. dollars | local currency | ||||||

| Asia-Pacific | ||||||||

| China | 8.86 | % | 8.68 | % | ||||

| India | –1.04 | 2.33 | ||||||

| Indonesia | –0.02 | –1.76 | ||||||

| Malaysia | –2.50 | –3.49 | ||||||

| Pakistan | 25.65 | 21.81 | ||||||

| Philippines | –2.65 | –3.77 | ||||||

| South Korea | 7.18 | 7.35 | ||||||

| Taiwan | 22.51 | 18.24 | ||||||

| Thailand | –7.40 | –9.55 | ||||||

| Latin America | ||||||||

| Argentina | –33.70 | –33.70 | ||||||

| Brazil | 11.06 | 16.57 | ||||||

| Chile | –16.96 | –8.03 | ||||||

| Colombia | 7.41 | 9.90 | ||||||

| Mexico | 4.96 | 3.17 | ||||||

| Peru | –3.80 | –3.80 | ||||||

| Eastern Europe and Middle East | ||||||||

| Czech Republic | –1.49 | –0.18 | ||||||

| Greece | 8.79 | 10.37 | ||||||

| Hungary | 15.96 | 20.54 | ||||||

| Poland | –8.10 | –6.67 | ||||||

| Qatar | 0.89 | 0.88 | ||||||

| Russia | 14.87 | 13.31 | ||||||

| Saudi Arabia | –5.04 | –5.01 | ||||||

| Turkey | 12.69 | 15.95 | ||||||

| United Arab Emirates | –0.78 | –0.78 | ||||||

| Africa | ||||||||

| Egypt | 6.97 | 2.83 | ||||||

| South Africa | 0.67 | –0.17 | ||||||

| * | The market indices, which are based on the MSCI Emerging Markets Investable Market Index, reflect dividends net of withholding taxes and are unmanaged and therefore, have no expenses. Investors cannot invest directly in the indices. Source: MSCI. |

| 4 | Emerging Markets Growth Fund |

Inflation is under control, central banks in several developing countries have room to cut benchmark interest rates, and countries such as India, Indonesia and Brazil are pursuing structural reforms that have the potential to bolster future growth. Furthermore, corporate profit growth in emerging markets is projected to outpace developed markets over the next 12 months, and valuations look reasonable.

In this environment, portfolio managers are focused on identifying companies that are more closely tied to longer term secular growth trends in developing countries, those with leading market share positions and those less affected by risks to global growth.

We believe longer term trends such as the growth of mobile services on internet-connected devices, an expanding consumer class in Asia and widening demand for specialty semiconductors look sustainable.

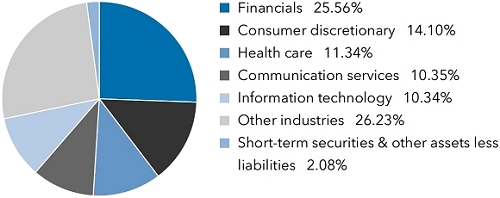

On a sector basis, approximately 26% of the portfolio is invested in financial stocks. Managers are attracted to banks operating in countries where interest rates are higher relative to developed markets, and countries that show more potential for banks to grow their deposit franchises. Asian-based insurers selling products to China’s middle class and high-net-worth individuals is another area of emphasis.

Holdings in consumer discretionary companies — particularly businesses involved in online travel services, e-commerce and entertainment — make up more than 14% of the fund’s net assets. Chinese health care–related companies that are either developing new drug treatments or focused on clinical research services are well-represented in the portfolio.

Investments in Chinese property developers as well as semiconductor companies with dominant market share positions in the manufacture and design of components are also among the fund’s largest holdings.

We thank you for the trust you have placed in us and for your continued investment in the fund, and look forward to reporting to you again in six months.

Cordially,

Victor D. Kohn

President

February 14, 2020

| Emerging Markets Growth Fund | 5 |

About the fund and its adviser

Emerging Markets Growth Fund was organized in 1986 by the International Finance Corporation (IFC), an affiliate of the World Bank, as a vehicle for investing in the securities of companies based in developing countries. The premise behind the formation of the fund was that rapid growth in these countries could create very attractive investment opportunities. It also was felt that the availability of equity capital would stimulate the development of capital markets and encourage countries to liberalize their investment regulations.

Capital International, Inc., the fund’s investment adviser, is part of The Capital Group Companies,SMInc., one of the world’s most experienced investment advisory organizations, with roots dating back to 1931. The fund has been managed by Capital International or an affiliate since 1986. Capital Group employs a research-driven approach to investing and has a global investment research network spanning three continents. This network of analysts and portfolio managers travels the world, scrutinizing thousands of companies and keeps a close watch on industry trends and government actions.

Capital Group has devoted substantial resources to the task of evaluating and managing investments in developing countries. It is an intensive effort that combines company and industry analysis with broader political and macroeconomic views. We believe that our extensive worldwide research capabilities and integrated global investment process continue to provide Emerging Markets Growth Fund with a competitive edge.

| 6 | Emerging Markets Growth Fund |

| Investment portfolioDecember 31, 2019 | unaudited |

| Industry sector diversification | Percent of net assets |

| Common stocks 95.67% | Shares | Value (000) | ||||||

| Asia-Pacific 74.88% | ||||||||

| China 33.70% | ||||||||

| Alibaba Group Holding Ltd. (ADR)1 | 141,921 | $ | 30,101 | |||||

| BOC Aviation Ltd.2 | 763,100 | 7,752 | ||||||

| Cansino Biologics Inc., Class H1,2 | 693,000 | 5,255 | ||||||

| China Gas Holdings Ltd.2 | 2,335,200 | 8,754 | ||||||

| China Merchants Bank Co., Ltd., Class H2 | 4,663,000 | 24,035 | ||||||

| China Oilfield Services Ltd., Class H2 | 10,001,339 | 15,701 | ||||||

| China Overseas Land & Investment Ltd.2 | 13,853,950 | 54,107 | ||||||

| China Overseas Property Holdings Ltd.2 | 3,421,000 | 2,154 | ||||||

| China Resources Land Ltd.2 | 8,214,787 | 40,932 | ||||||

| China Tower Corp. Ltd., Class H2 | 29,780,000 | 6,587 | ||||||

| Chongqing Fuling Zhacai Group Co., Ltd., Class A2 | 212,940 | 817 | ||||||

| CNOOC Ltd.2 | 983,000 | 1,638 | ||||||

| CNOOC Ltd. (ADR) | 15,500 | 2,583 | ||||||

| ENN Energy Holdings Ltd.2 | 470,700 | 5,147 | ||||||

| Gree Electric Appliances, Inc. of Zhuhai, Class A2 | 1,383,856 | 13,003 | ||||||

| Hangzhou Tigermed Consulting Co., Ltd., Class A2 | 3,040,994 | 27,582 | ||||||

| Huazhu Group Ltd. (ADR)1 | 537,800 | 21,550 | ||||||

| Hutchison China MediTech Ltd.2 | 22,480 | 112 | ||||||

| Hutchison China MediTech Ltd. (ADR)1 | 1,451,267 | 36,383 | ||||||

| HUYA, Inc. (ADR)1 | 542,700 | 9,741 | ||||||

| IMAX China Holding, Inc.2 | 1,342,729 | 2,836 | ||||||

| Jiangsu Hengrui Medicine Co., Ltd., Class A2 | 5,358,106 | 67,378 | ||||||

| Kweichow Moutai Co., Ltd., Class A2 | 56,958 | 9,684 | ||||||

| Longfor Group Holdings Ltd.2 | 11,478,613 | 53,910 | ||||||

| Midea Group Co., Ltd., Class A2 | 1,089,623 | 9,089 | ||||||

| Oneconnect Financial Technology Co., Ltd. (ADR)1 | 1,281,900 | 12,857 | ||||||

| Ping An Insurance (Group) Co. of China, Ltd., Class H2 | 3,061,700 | 36,270 | ||||||

| Poly Property Development Co., Ltd., Class H1,2 | 452,800 | 2,717 | ||||||

| Tencent Holdings Ltd.2 | 1,649,000 | 79,545 | ||||||

| Trip.com Group Ltd. (ADR)1 | 1,506,817 | 50,539 | ||||||

| Venustech Group Inc., Class A2 | 938,387 | 4,562 | ||||||

| Viomi Technology Co., Ltd. (ADR) | 237,800 | 1,912 | ||||||

| Yunnan Energy New Material Co., Ltd., Class A2 | 597,173 | 4,331 | ||||||

| 649,564 | ||||||||

| Hong Kong 9.46% | ||||||||

| AIA Group Ltd.2 | 6,189,400 | 65,123 | ||||||

| BeiGene, Ltd. (ADR)1 | 266,800 | 44,225 | ||||||

| ESR Cayman Ltd.1,2 | 2,631,600 | 5,944 | ||||||

| Galaxy Entertainment Group Ltd.2 | 5,604,000 | 41,306 | ||||||

| Hong Kong Exchanges and Clearing Ltd.2 | 313,600 | 10,164 | ||||||

| Jardine Matheson Holdings Ltd.2 | 15,700 | 873 | ||||||

| Wynn Macau, Ltd.2 | 5,974,629 | 14,779 | ||||||

| 182,414 | ||||||||

| Emerging Markets Growth Fund | 7 |

| Common stocks(continued) | Shares | Value (000) | �� | |||||

| Asia-Pacific (continued) | ||||||||

| India 10.98% | ||||||||

| Asian Paints Ltd.2 | 171,459 | $ | 4,289 | |||||

| Axis Bank Ltd.2 | 76,521 | 809 | ||||||

| Berger Paints India Ltd.2 | 913,848 | 6,606 | ||||||

| Bharti Airtel Ltd.1,2 | 3,298,869 | 21,076 | ||||||

| Bharti Infratel Ltd.2 | 1,001,680 | 3,550 | ||||||

| City Union Bank Ltd.2 | 1,816,034 | 5,961 | ||||||

| Colgate-Palmolive (India) Ltd.2 | 51,099 | 1,049 | ||||||

| Godrej Consumer Products Ltd.2 | 114,870 | 1,103 | ||||||

| HDFC Bank Ltd.2 | 2,315,469 | 41,266 | ||||||

| HDFC Bank Ltd. (ADR) | 6,700 | 424 | ||||||

| Housing Development Finance Corp. Ltd.2 | 536,689 | 18,174 | ||||||

| ICICI Bank Ltd.2 | 2,002,341 | 15,168 | ||||||

| ICICI Bank Ltd. (ADR) | 1,451,870 | 21,909 | ||||||

| Indian Energy Exchange Ltd.1,2 | 723,004 | 1,447 | ||||||

| IndusInd Bank Ltd.2 | 610,082 | 12,913 | ||||||

| Info Edge (India) Ltd.2 | 178,779 | 6,340 | ||||||

| ITC Ltd.2 | 210,950 | 703 | ||||||

| Kotak Mahindra Bank Ltd.2 | 756,631 | 17,845 | ||||||

| Maruti Suzuki India Ltd.2 | 68,023 | 7,025 | ||||||

| Nestlé India Ltd.2 | 11,858 | 2,461 | ||||||

| TeamLease Services Ltd.2 | 306,763 | 10,670 | ||||||

| United Spirits Ltd.1,2 | 901,605 | 7,587 | ||||||

| Varun Beverages Ltd.2 | 333,045 | 3,310 | ||||||

| 211,685 | ||||||||

| Indonesia 6.74% | ||||||||

| Astra International Tbk PT2 | 40,857,800 | 20,292 | ||||||

| Bank Central Asia Tbk PT2 | 11,345,300 | 27,256 | ||||||

| Bank Mandiri (Persero) Tbk PT, Series B2 | 33,435,508 | 18,433 | ||||||

| Bank Rakyat Indonesia (Persero) Tbk PT2 | 44,081,900 | 13,912 | ||||||

| Elang Mahkota Teknologi Tbk PT2 | 35,394,100 | 14,217 | ||||||

| Indocement Tunggal Prakarsa Tbk PT2 | 983,400 | 1,349 | ||||||

| Matahari Department Store Tbk PT2 | 10,184,803 | 3,082 | ||||||

| PT Bank Tabungan Pensiunan Nasional Syariah Tbk1,2 | 64,383,200 | 19,689 | ||||||

| PT Surya Citra Media Tbk2 | 67,634,644 | 6,861 | ||||||

| Semen Indonesia (Persero) Tbk PT2 | 5,514,700 | 4,758 | ||||||

| 129,849 | ||||||||

| Philippines 1.89% | ||||||||

| Ayala Corp.2 | 633,640 | 9,814 | ||||||

| Bloomberry Resorts Corp.2 | 67,072,364 | 14,955 | ||||||

| International Container Terminal Services, Inc.2 | 4,613,386 | 11,701 | ||||||

| 36,470 | ||||||||

| Singapore 0.46% | ||||||||

| Yoma Strategic Holdings Ltd.2 | 34,108,532 | 8,879 | ||||||

| South Korea 4.74% | ||||||||

| Hugel, Inc.1,2 | 22,554 | 7,748 | ||||||

| Hyundai Motor Co.2 | 52,160 | 5,423 | ||||||

| NAVER Corp.2 | 27,935 | 4,500 | ||||||

| Samsung Electronics Co., Ltd.2 | 1,221,316 | 58,848 | ||||||

| Samsung Electronics Co., Ltd. (GDR)2,3 | 10,121 | 12,148 | ||||||

| SK hynix, Inc.2 | 33,872 | 2,753 | ||||||

| 91,420 | ||||||||

| Taiwan 5.64% | ||||||||

| Delta Electronics, Inc.2 | 414,521 | 2,096 | ||||||

| Gourmet Master Co. Ltd.2 | 275,000 | 1,133 | ||||||

| MediaTek Inc.2 | 812,042 | 12,019 | ||||||

| Taiwan Semiconductor Manufacturing Co., Ltd.2 | 8,061,094 | 89,272 | ||||||

| Vanguard International Semiconductor Corp.2 | 1,548,000 | 4,097 | ||||||

| 108,617 | ||||||||

| 8 | Emerging Markets Growth Fund |

| Shares | Value (000) | |||||||

| Thailand 0.30% | ||||||||

| TISCO Financial Group PCL, foreign registered2 | 1,736,000 | $ | 5,747 | |||||

| Vietnam 0.97% | ||||||||

| Masan Group Corp.1,2 | 3,130,420 | 7,635 | ||||||

| Vinhomes JSC2 | 3,026,045 | 11,078 | ||||||

| 18,713 | ||||||||

| Total Asia-Pacific | 1,443,358 | |||||||

| Eastern Europe and Middle East 9.15% | ||||||||

| Hungary 0.23% | ||||||||

| Wizz Air Holdings PLC1,2 | 85,429 | 4,411 | ||||||

| Kazakhstan 0.58% | ||||||||

| Halyk Savings Bank Of Kazakhstan OJSC (GDR)1,2,3 | 832,987 | 11,107 | ||||||

| Kingdom of Saudi Arabia 0.13% | ||||||||

| Al Rajhi Banking and Investment Corp., non-registered shares2 | 138,646 | 2,418 | ||||||

| Romania 0.17% | ||||||||

| OMV Petrom SA2 | 31,326,589 | 3,281 | ||||||

| Russian Federation 6.19% | ||||||||

| Aeroflot - Russian Airlines PJSC2 | 477,700 | 797 | ||||||

| Alrosa PJSC2 | 10,120,845 | 13,749 | ||||||

| Baring Vostok Capital Fund IV Supplemental Fund, LP1,2,4,5,6,7 | 43,189,451 | 12,862 | ||||||

| Baring Vostok Private Equity Fund IV, LP1,2,4,5,6,7 | 23,570,820 | 8,997 | ||||||

| Detsky Mir PJSC2 | 5,296,730 | 8,534 | ||||||

| Moscow Exchange MICEX-RTS PJSC2 | 2,041,170 | 3,543 | ||||||

| New Century Capital Partners, LP1,2,4,5,7 | 5,247,900 | 340 | ||||||

| Rosneft Oil Co. PJSC (GDR)2 | 1,074,400 | 7,754 | ||||||

| Sberbank of Russia PJSC2 | 1,932,825 | 7,933 | ||||||

| Sberbank of Russia PJSC (ADR)2 | 1,841,500 | 30,300 | ||||||

| TCS Group Holding PLC (GDR)2,3 | 73,697 | 1,587 | ||||||

| TCS Group Holding PLC (GDR)2 | 119,003 | 2,563 | ||||||

| Yandex NV, Class A1 | 470,235 | 20,450 | ||||||

| 119,409 | ||||||||

| Slovenia 0.38% | ||||||||

| Nova Ljubljanska banka dd (GDR)2 | 545,394 | 7,401 | ||||||

| Turkey 1.24% | ||||||||

| Akbank TAS1,2 | 17,539,846 | 23,929 | ||||||

| Aktas Elektrik Ticaret AS1,2,4 | 4,273 | — | 8 | |||||

| 23,929 | ||||||||

| United Arab Emirates 0.23% | ||||||||

| DP World PLC2 | 224,436 | 2,937 | ||||||

| First Abu Dhabi Bank PJSC, non-registered shares2 | 360,034 | 1,484 | ||||||

| 4,421 | ||||||||

| Total Eastern Europe and Middle East | 176,377 | |||||||

| Latin America 7.53% | ||||||||

| Argentina 0.84% | ||||||||

| Despegar.com, Corp.1 | 355,300 | 4,790 | ||||||

| Globant SA1 | 6,900 | 732 | ||||||

| Loma Negra Compania Industrial Argentina SA (ADR)1 | 1,369,366 | 10,708 | ||||||

| 16,230 | ||||||||

| Emerging Markets Growth Fund | 9 |

| Common stocks (continued) | Shares | Value (000) | ||||||

| Latin America (continued) | ||||||||

| Brazil 4.86% | ||||||||

| BR Malls Participacoes SA, ordinary nominative | 268,300 | $ | 1,204 | |||||

| CCR SA, ordinary nominative | 4,732,689 | 22,330 | ||||||

| Centro de Imagem Diagnosticos SA | 1,634,755 | 7,380 | ||||||

| Cyrela Brazil Realty SA, ordinary nominative | 631,572 | 4,661 | ||||||

| ENGIE Brasil Energia SA, ordinary nominative (ADR) | 6 | — | 8 | |||||

| Estre Ambiental Inc.3 | 591,120 | 207 | ||||||

| Gerdau SA (ADR) | 888,100 | 4,352 | ||||||

| Hypera SA, ordinary nominative | 2,137,117 | 18,961 | ||||||

| Lojas Americanas SA, ordinary nominative | 1,103,677 | 5,405 | ||||||

| Nexa Resources SA | 612,600 | 4,987 | ||||||

| OdontoPrev SA, ordinary nominative | 839,100 | 3,519 | ||||||

| Omega Geracao SA | 649,800 | 5,896 | ||||||

| Petróleo Brasileiro SA (Petrobras), ordinary nominative (ADR) | 388,300 | 6,189 | ||||||

| Vale SA, ordinary nominative | 285,427 | 3,782 | ||||||

| Vale SA, ordinary nominative (ADR) | 158,623 | 2,094 | ||||||

| XP Inc., Class A1 | 70,500 | 2,716 | ||||||

| 93,683 | ||||||||

| Chile 0.17% | ||||||||

| Enel Américas SA | 408,012 | 90 | ||||||

| Enel Américas SA (ADR) | 294,597 | 3,235 | ||||||

| 3,325 | ||||||||

| Mexico 1.59% | ||||||||

| América Móvil, SAB de CV, Series L (ADR) | 971,546 | 15,545 | ||||||

| Bolsa Mexicana de Valores, SAB de CV, Series A | 5,714,082 | 12,493 | ||||||

| Fomento Económico Mexicano, SAB de CV | 280,100 | 2,647 | ||||||

| 30,685 | ||||||||

| Peru 0.07% | ||||||||

| Credicorp Ltd. | 5,913 | 1,260 | ||||||

| Total Latin America | 145,183 | |||||||

| Africa 2.20% | ||||||||

| Federal Republic of Nigeria 0.52% | ||||||||

| Guaranty Trust Bank PLC2 | 123,276,471 | 10,089 | ||||||

| South Africa 1.68% | ||||||||

| AngloGold Ashanti Ltd.2 | 147,138 | 3,298 | ||||||

| Dis-Chem Pharmacies Ltd.2 | 3,368,921 | 6,375 | ||||||

| Discovery Ltd.2 | 1,684,389 | 14,525 | ||||||

| JSE Ltd.2 | 333,036 | 2,850 | ||||||

| Naspers Ltd., Class N2 | 6,577 | 1,075 | ||||||

| Shoprite Holdings Ltd.2 | 467,975 | 4,213 | ||||||

| 32,336 | ||||||||

| Total Africa | 42,425 | |||||||

| Other markets 1.91% | ||||||||

| Belgium 0.05% | ||||||||

| Anheuser-Busch InBev SA/NV2 | 11,149 | 914 | ||||||

| Denmark 0.21% | ||||||||

| Carlsberg A/S, Class B2 | 26,719 | 3,986 | ||||||

| France 0.15% | ||||||||

| Edenred SA2 | 55,083 | 2,850 | ||||||

| Netherlands 0.02% | ||||||||

| Prosus NV1,2 | 4,237 | 317 | ||||||

| 10 | Emerging Markets Growth Fund |

| Shares | Value (000) | |||||||

| Portugal 0.12% | ||||||||

| Galp Energia, SGPS, SA, Class B2 | 137,508 | $ | 2,300 | |||||

| United Kingdom 0.84% | ||||||||

| Airtel Africa PLC2 | 7,732,500 | 8,209 | ||||||

| British American Tobacco PLC2 | 94,000 | 4,005 | ||||||

| PZ Cussons PLC2 | 754,520 | 2,082 | ||||||

| Sedibelo Platinum Mines Ltd.1,2,4 | 17,665,800 | 1,961 | ||||||

| 16,257 | ||||||||

| United States 0.52% | ||||||||

| MercadoLibre, Inc.1 | 13,358 | 7,640 | ||||||

| Samsonite International SA2 | 1,026,165 | 2,458 | ||||||

| 10,098 | ||||||||

| Total Other markets | 36,722 | |||||||

| Total common stocks (cost: $1,306,889,000) | 1,844,065 | |||||||

| Preferred securities 2.25% | ||||||||

| Latin America 2.25% | ||||||||

| Brazil 2.25% | ||||||||

| Azul SA, preferred nominative (ADR)1 | 38,400 | 1,644 | ||||||

| Cia. Energética de Minas Gerais - CEMIG, preferred nominative | 639,490 | 2,192 | ||||||

| GOL Linhas Aéreas Inteligentes SA, preferred nominative1 | 169,400 | 1,550 | ||||||

| GOL Linhas Aéreas Inteligentes SA, preferred nominative (ADR) | 571,000 | 10,318 | ||||||

| Lojas Americanas SA, preferred nominative | 416,200 | 2,681 | ||||||

| Petróleo Brasileiro SA (Petrobras), preferred nominative | 3,046,400 | 22,855 | ||||||

| Petróleo Brasileiro SA (Petrobras), preferred nominative (ADR) | 141,520 | 2,111 | ||||||

| 43,351 | ||||||||

| Total preferred securities (cost: $32,568,000) | 43,351 | |||||||

| Rights & warrants 0.00% | ||||||||

| Latin America 0.00% | ||||||||

| Brazil 0.00% | ||||||||

| Lojas Americanas SA1 | 14,667 | 29 | ||||||

| Total rights & warrants (cost: $0) | 29 | |||||||

| Convertible bonds 0.00% | Principal amount (000) | |||||||

| Asia-Pacific 0.00% | ||||||||

| China 0.00% | ||||||||

| Fu Ji Food and Catering Services Holdings Ltd., convertible notes, 0% 20202,4,9 | CNY | 97,700 | — | 8 | ||||

| Total convertible bonds (cost: $0) | — | 8 | ||||||

| Short-term securities 1.63% | Shares | |||||||

| Money market investments 1.63% | ||||||||

| Capital Group Central Cash Fund 1.73%10 | 313,675 | 31,368 | ||||||

| Total short-term securities (cost: $31,325,000) | 31,368 | |||||||

| Total investment securities 99.55 % (cost: $1,370,782,000) | 1,918,813 | |||||||

| Other assets less liabilities 0.45% | 8,706 | |||||||

| Net assets 100.00% | 1,927,519 | |||||||

| Emerging Markets Growth Fund | 11 |

Investments in affiliates

A company is an affiliate of the fund under the Investment Company Act of 1940 if the fund’s holdings represent 5% or more of the outstanding voting shares of that company. In addition, Capital International Private Equity Fund IV, LP was considered an affiliate since this issuer had the same investment adviser as the fund. Further details on this holding and related transactions during the six months ended December 31, 2019, appear below.

| Beginning shares | Additions | Reductions | Ending shares | Net realized loss (000) | Net unrealized appreciation (000) | Dividend income (000) | Value of affiliates at 12/31/2019 (000) | |||||||||||||||||||||||||

| Common stocks 0.00% | ||||||||||||||||||||||||||||||||

| Other markets 0.00% | ||||||||||||||||||||||||||||||||

| United States 0.00% | ||||||||||||||||||||||||||||||||

| Capital International Private Equity Fund IV, LP1,11 | 50,842,740 | 14,506 | 50,857,246 | — | $ | (7,005 | ) | $ | 6,991 | $ | — | $ | — | |||||||||||||||||||

| 1 | Security did not produce income during the last 12 months. |

| 2 | Valued under fair value procedures adopted by authority of the board of directors. The total value of all such securities was $1,438,568,000, which represented 74.63% of the net assets of the fund. This amount includes $1,414,408,000 related to certain securities trading outside the U.S. whose values were adjusted as a result of significant market movements following the close of local trading. |

| 3 | Acquired in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $25,049,000, which represented 1.30% of the net assets of the fund. |

| 4 | Value determined using significant unobservable inputs. |

| 5 | Cost and market value do not include prior distributions to the fund from income or proceeds realized from securities held by the private equity fund. Therefore, the cost and market value may not be indicative of the private equity fund’s performance. For private equity funds structured as limited partnerships, shares are not applicable and therefore the fund’s interest in the partnership is reported. |

| 6 | Excludes an unfunded capital commitment representing an agreement which obligates the fund to meet capital calls in the future. Capital calls can only be made if and when certain requirements have been fulfilled; thus, the timing and the amount of such capital calls cannot readily be determined. |

| 7 | Acquired through a private placement transaction exempt from registration under the Securities Act of 1933. May be subject to legal or contractual restrictions on resale. Further details on these holdings appear below. |

| 8 | Amount less than one thousand. |

| 9 | Scheduled interest and/or principal payment was not received. |

| 10 | Rate represents the seven-day yield at 12/31/2019. |

| 11 | Unaffiliated issuer at 12/31/2019. |

| Private placement securities | Acquisition date(s) | Cost (000) | Value (000) | Percent of net assets | ||||||||||

| Baring Vostok Capital Fund IV Supplemental Fund, LP | 10/8/2007-8/29/2019 | $ | 36,198 | $ | 12,862 | .67 | % | |||||||

| Baring Vostok Private Equity Fund IV, LP | 4/25/2007-8/29/2019 | 17,808 | 8,997 | .46 | ||||||||||

| New Century Capital Partners, LP | 12/7/1995 | — | 340 | .02 | ||||||||||

| Total private placement securities | $ | 54,006 | $ | 22,199 | 1.15 | % | ||||||||

Key to abbreviations

ADR = American Depositary Receipts

CNY = Chinese yuan renminbi

GDR = Global Depositary Receipts

See notes to financial statements.

| 12 | Emerging Markets Growth Fund |

Financial statements

| Statement of assets and liabilities at December 31, 2019 | unaudited (dollars in thousands) |

| Assets: | ||||||||

| Investment securities in unaffiliated issuers, at value (cost: $1,370,782) | $ | 1,918,813 | ||||||

| Cash | 1,223 | |||||||

| Cash denominated in currencies other than U.S. dollars (cost: $866) | 870 | |||||||

| Receivables for: | ||||||||

| Sales of investments | $ | 10,977 | ||||||

| Sales of fund’s shares | 149 | |||||||

| Services provided by related parties | 94 | |||||||

| Dividends | 3,107 | |||||||

| Other | 2 | 14,329 | ||||||

| 1,935,235 | ||||||||

| Liabilities: | ||||||||

| Payables for: | ||||||||

| Purchases of investments | 2,217 | |||||||

| Repurchases of fund’s shares | 61 | |||||||

| Investment advisory services | 1,237 | |||||||

| Services provided by related parties | 3 | |||||||

| Directors’ deferred compensation | 1,624 | |||||||

| Non-U.S. taxes | 2,486 | |||||||

| Other | 88 | 7,716 | ||||||

| Net assets at December 31, 2019 | $ | 1,927,519 | ||||||

| Net assets consist of: | ||||||||

| Capital paid in on shares of capital stock | $ | 1,278,603 | ||||||

| Total distributable earnings | 648,916 | |||||||

| Net assets at December 31, 2019 | $ | 1,927,519 | ||||||

(dollars and shares in thousands, except per-share amounts)

Total authorized capital stock — 2,000,000 shares,

$.01 par value (233,599 total shares outstanding)

| Net assets | Shares outstanding | Net asset value per share | ||||||||||

| Class M | $ | 1,855,929 | 224,910 | $ | 8.25 | |||||||

| Class F-3 | 66,467 | 8,067 | 8.24 | |||||||||

| Class R-6 | 5,123 | 622 | 8.24 | |||||||||

See notes to financial statements.

| Emerging Markets Growth Fund | 13 |

| Statement of operations for the six months ended December 31, 2019 | unaudited (dollars in thousands) |

| Investment income: | ||||||||

| Income: | ||||||||

| Dividends (net of non-U.S. taxes of $1,369) | $ | 16,901 | ||||||

| Interest (net of non-U.S. taxes of $19) | 2,537 | $ | 19,438 | |||||

| Fees and expenses*: | ||||||||

| Investment advisory services | 8,007 | |||||||

| Transfer agent services | 2 | |||||||

| Administrative services | 8 | |||||||

| Reports to shareholders | 7 | |||||||

| Registration statement and prospectus | 43 | |||||||

| Directors’ compensation | 242 | |||||||

| Auditing and legal | 68 | |||||||

| Custodian | 519 | |||||||

| State and local taxes | 1 | |||||||

| Other | 26 | |||||||

| Total fees and expenses before reimbursements | 8,923 | |||||||

| Less miscellaneous fee reimbursements | 654 | |||||||

| Total fees and expenses after reimbursements | 8,269 | |||||||

| Net investment income | 11,169 | |||||||

| Net realized gain and unrealized appreciation: | ||||||||

| Net realized gain (loss) on: | ||||||||

| Investments: | ||||||||

| Unaffiliated issuers | 142,613 | |||||||

| Affiliated issuers | (7,005 | ) | ||||||

| Currency transactions | 111 | 135,719 | ||||||

| Net unrealized appreciation (depreciation) on: | ||||||||

| Investments (net of non-U.S. taxes of $2,296): | ||||||||

| Unaffiliated issuers | 3,419 | |||||||

| Affiliated issuers | 6,991 | |||||||

| Currency translations | (101 | ) | 10,309 | |||||

| Net realized gain and unrealized appreciation | 146,028 | |||||||

| Net increase in net assets resulting from operations | $ | 157,197 |

| * | Additional information related to class-specific fees and expenses is included in the notes to financial statements. |

See notes to financial statements.

| 14 | Emerging Markets Growth Fund |

Statements of changes in net assets

(dollars in thousands)

| Six months ended December 31, 2019* | Year ended June 30, 2019 | |||||||

| Operations: | ||||||||

| Net investment income | $ | 11,169 | $ | 28,113 | ||||

| Net realized gain | 135,719 | 97,849 | ||||||

| Net unrealized appreciation (depreciation) | 10,309 | (34,071 | ) | |||||

| Net increase in net assets resulting from operations | 157,197 | 91,891 | ||||||

| Distributions paid to shareholders | (108,460 | ) | (47,816 | ) | ||||

| Net capital share transactions | (375,776 | ) | (282,868 | ) | ||||

| Total decrease in net assets | (327,039 | ) | (238,793 | ) | ||||

| Net assets: | ||||||||

| Beginning of period | 2,254,558 | 2,493,351 | ||||||

| End of period | $ | 1,927,519 | $ | 2,254,558 | ||||

| * | Unaudited. |

See notes to financial statements.

| Emerging Markets Growth Fund | 15 |

| Notes to financial statements | unaudited |

1. Organization

Emerging Markets Growth Fund, Inc. (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. The fund seeks long-term growth of capital and invests primarily in common stock and other equity securities of issuers in developing countries.

The fund has three share classes consisting of two retail share classes (Classes M and F-3), and one retirement plan share class (Class R-6). The retirement plan share class is generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are described further in the following table:

| Share class | Initial sales charge | Contingent deferred sales charge upon redemption | Conversion feature | ||||

| Classes M* and F-3 | None | None | None | ||||

| Class R-6 | None | None | None |

| * | Class M shares of the fund are not available for purchase. |

Holders of all share classes have equal pro rata rights to the assets, dividends and liquidation proceeds of the fund. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, transfer agent and administrative services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). These principles require the fund’s investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class.

Distributions paid to shareholders — Income dividends and capital gain distributions are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

Shares redeemed — The fund normally redeems shares in cash; however, under certain conditions and circumstances, payment of the redemption price wholly or partly with portfolio securities or other fund assets may be permitted. A redemption of shares in-kind is based upon the closing value of the shares being redeemed as of the trade date. Realized gains/losses resulting from redemptions of shares in-kind are reflected separately in the statement of operations.

| 16 | Emerging Markets Growth Fund |

3. Valuation

Capital International, Inc. (“CIInc”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | Examples of standard inputs | |

| All | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) | |

| Corporate bonds & notes; convertible securities | Standard inputs and underlying equity of the issuer | |

| Bonds & notes of governments & government agencies | Standard inputs and interest rate volatilities |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or deemed to be not representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. The Capital Group Central Cash Fund (“CCF”), a fund within the Capital Group Central Fund Series (“Central Funds”), is valued based upon a floating net asset value, which fluctuates with changes in the value of CCF’s portfolio securities. The underlying securities are valued based on the policies and procedures in CCF’s statement of additional information.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of directors as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of directors has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as

| Emerging Markets Growth Fund | 17 |

deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of directors. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The following table presents the fund’s valuation levels as of December 31, 2019 (dollars in thousands):

| Investment securities | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: | ||||||||||||||||

| Common stocks: | ||||||||||||||||

| Asia-Pacific | $ | 232,224 | $ | 1,211,134 | $ | — | $ | 1,443,358 | ||||||||

| Eastern Europe and Middle East | 20,450 | 134,642 | 22,199 | 177,291 | ||||||||||||

| Latin America | 145,183 | — | — | 145,183 | ||||||||||||

| Africa | — | 42,425 | — | 42,425 | ||||||||||||

| Other markets | 7,640 | 26,207 | 1,961 | 35,808 | ||||||||||||

| Preferred securities | 43,351 | — | — | 43,351 | ||||||||||||

| Rights & warrants | 29 | — | — | 29 | ||||||||||||

| Convertible bonds | — | — | — | 1 | — | 1 | ||||||||||

| Short-term securities | 31,368 | — | — | 31,368 | ||||||||||||

| Total | $ | 480,245 | $ | 1,414,408 | $ | 24,160 | $ | 1,918,813 | ||||||||

| 1 | Amount less than one thousand. |

The following table reconciles the valuation of the fund’s Level 3 investment securities and related transactions for the year ended December 31, 2019 (dollars in thousands):

| Beginning | Transfers | Net | Transfers | Ending | ||||||||||||||||||||||||||||

| value at | into | realized | Unrealized | out of | value at | |||||||||||||||||||||||||||

| 7/1/2019 | Level 32 | Purchases | Sales | loss3 | appreciation3 | Level 32 | 12/31/2019 | |||||||||||||||||||||||||

| Private equity funds | $ | 24,987 | $ | — | $ | 273 | $ | (107 | ) | $ | (7,005 | ) | $ | 4,051 | $ | — | $ | 22,199 | ||||||||||||||

| Other securities | 3,642 | — | — | — | — | (1,681 | ) | — | 1,961 | |||||||||||||||||||||||

| Total | $ | 28,629 | $ | — | $ | 273 | $ | (107 | ) | $ | (7,005 | ) | $ | 2,370 | $ | — | $ | 24,160 | ||||||||||||||

| Net unrealized appreciation during the period on Level 3 investment securities held at December 31, 2019 | $ | 2,369 | ||||||||||||||||||||||||||||||

| 2 | Transfers into or out of Level 3 are based on the beginning market value of the quarter in which they occurred. |

| 3 | Net realized loss and unrealized appreciation are included in the related amounts on investments in the statement of operations. |

| 18 | Emerging Markets Growth Fund |

Unobservable inputs — Valuation of the fund’s Level 3 securities is based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The fund owns an interest in multiple private equity funds, which are considered alternative investments and are classified as Level 3 investment securities. The private equity funds are fair valued using the net asset value based on the fund’s financial statements adjusted for known company or market events, updated market pricing for underlying securities, and/or fund transactions (i.e., drawdowns and distributions) and may include other unobservable inputs.

The other unobservable inputs used in the fair value measurements of the fund’s private equity investments are directional adjustments based on relevant market data (such as significant movement of a country-specific exchange-traded fund or index after the financial statement date of the private equity fund). Significant increases (decreases) of these inputs could result in significantly higher (lower) fair valuation. There were no other unobservable inputs as of December 31, 2019.

The following table provides additional information used by the fund’s investment adviser to fair value the fund’s Level 3 securities (dollars in thousands):

| Investment strategy | Fair Value | Unfunded commitment* | Remaining life† | Redemption terms | Unobservable input | Range | ||||||||||||||

| Private equity funds | Primarily private sector equity investments (i.e., expansion capital, buyouts) in emerging markets | $ | 22,199 | $ | 1,714 | ≤ 0 to 2 years | Redemptions are not permitted. These funds distribute proceeds from the liquidation of underlying assets of the funds. | Market index adjustment | 0 to 15% | |||||||||||

| * | Unfunded capital commitments represent agreements which obligate the fund to meet capital calls in the future. Payment would be made when a capital call is requested. Capital calls can only be made if and when certain requirements have been fulfilled; thus, the timing of such capital calls cannot readily be determined. |

| † | Represents the remaining life of the fund term or the estimated period of liquidation. |

4. Risk factors

Investing in the fund may involve certain risks including, but not limited to, those described below.

Market conditions — The prices of, and the income generated by, the common stocks and other securities held by the fund may decline –sometimes rapidly or unpredictably – due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental, governmental agency or central bank responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance, major litigation related to the issuer, changes in government regulations affecting the issuer or its competitive environment and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in growth-oriented stocks — Growth-oriented common stocks and other equity-type securities (such as preferred stocks, convertible preferred stocks and convertible bonds) may involve larger price swings and greater potential for loss than other types of investments. These risks may be even greater in the case of smaller capitalization stocks.

Investing outside the U.S. — Securities of issuers domiciled outside the U.S., or with significant operations or revenues outside the U.S., may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as nationalization, currency blockage or the imposition of price controls or punitive taxes, each of which could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the U.S. Investments outside the U.S. may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the U.S. In addition, the value of investments outside the U.S. may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. The risks of investing outside the U.S. may be heightened in connection with investments in developing countries.

| Emerging Markets Growth Fund | 19 |

Investing in developing countries — Investing in countries with developing economies and/or markets may involve risks in addition to and greater than those generally associated with investing in the securities markets of developed countries. For instance, emerging market countries may have less developed legal and accounting systems than those in developed countries. The governments of these countries may be less stable and more likely to impose capital controls, nationalize a company or industry, place restrictions on foreign ownership and on withdrawing sale proceeds of securities from the country, and/or impose punitive taxes that could adversely affect the prices of securities. In addition, the economies of these countries may be dependent on relatively few industries that are more susceptible to local and global changes. Securities markets in these countries can also be relatively small and have substantially lower trading volumes. As a result, securities issued in these countries may be more volatile and less liquid, and may be more difficult to value, than securities issued in countries with more developed economies and/or markets. Less certainty with respect to security valuations may lead to additional challenges and risks in calculating the fund’s net asset value. Additionally, emerging markets are more likely to experience problems with the clearing and settling of trades and the holding of securities by banks, agents and depositories that are less established than those in developed countries.

Investing in small companies — Investing in smaller companies may pose additional risks. For example, it is often more difficult to value or dispose of small company stocks and more difficult to obtain information about smaller companies than about larger companies. Furthermore, smaller companies often have limited product lines, operating histories, markets and/or financial resources, may be dependent on one or a few key persons for management, and can be more susceptible to losses. Moreover, the prices of their stocks may be more volatile than stocks of larger, more established companies, particularly during times of market turmoil.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses, including models, tools and data, employed by the investment adviser in this process may be flawed or incorrect and may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

5. Taxation and distributions

Federal income taxation — The fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable to mutual funds and intends to distribute substantially all of its net taxable income and net capital gains each year. The fund is not subject to income taxes to the extent such distributions are made. Therefore, no federal income tax provision is required.

As of and during the period ended December 31, 2019, the fund did not have a liability for any unrecognized tax benefits. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the fund did not incur any significant interest or penalties.

The fund’s tax returns are not subject to examination by federal, state and, if applicable, non-U.S. tax authorities after the expiration of each jurisdiction’s statute of limitations, which is generally three years after the date of filing but can be extended in certain jurisdictions.

Non-U.S. taxation — Dividend and interest income are recorded net of non-U.S. taxes paid. The fund may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. As a result of rulings from European courts, the fund filed for additional reclaims related to prior years. These reclaims are recorded when the amount is known and there are no significant uncertainties on collectability. Gains realized by the fund on the sale of securities in certain countries, if any, may be subject to non-U.S. taxes. If applicable, the fund records an estimated deferred tax liability based on unrealized gains to provide for potential non-U.S. taxes payable upon the sale of these securities.

Distributions — Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences are due primarily to different treatment for items such as currency gains and losses; short-term capital gains and losses; capital losses related to sales of certain securities within 30 days of purchase; unrealized appreciation of certain investments in securities outside the U.S.; deferred expenses; cost of investments sold and income on certain investments. The fiscal year in which amounts are distributed may differ from the year in which the net investment income and net realized gains are recorded by the fund for financial reporting purposes. The fund may also designate a portion of the amount paid to redeeming shareholders as a distribution for tax purposes.

The components of distributable earnings on a tax basis are reported as of the fund’s most recent year-end. As of June 30, 2019, the components of distributable earnings on a tax basis were as follows (dollars in thousands):

| Undistributed ordinary income | $ | 13,749 | ||

| Undistributed long-term capital gains | 58,165 |

| 20 | Emerging Markets Growth Fund |

As of December 31, 2019, the tax basis unrealized appreciation (depreciation) and cost of investments were as follows (dollars in thousands):

| Gross unrealized appreciation on investments | $ | 644,075 | ||

| Gross unrealized depreciation on investments | (108,763 | ) | ||

| Net unrealized appreciation on investments | 535,312 | |||

| Cost of investments | 1,383,501 |

Distributions paid were characterized for tax purposes as follows (dollars in thousands):

| Six months ended December 31, 2019 | Year ended June 30, 2019 | |||||||||||||||||||||||

| Share class | Ordinary income | Long-term capital gains | Total distributions paid | Ordinary income | Long-term capital gains | Total distributions paid | ||||||||||||||||||

| Class M | $ | 27,756 | $ | 76,700 | $ | 104,456 | $ | 27,966 | $ | 19,452 | $ | 47,418 | ||||||||||||

| Class F-3 | 978 | 2,741 | 3,719 | 233 | 165 | 398 | ||||||||||||||||||

| Class R-6 | 75 | 210 | 285 | — | * | — | * | — | * | |||||||||||||||

| Total | $ | 28,809 | $ | 79,651 | $ | 108,460 | $ | 28,199 | $ | 19,617 | $ | 47,816 | ||||||||||||

| * | Amount less than one thousand. |

6. Fees and transactions with related parties

CIInc is the fund’s investment adviser. American Funds Distributors®, Inc. (“AFD”), the fund’s principal underwriter, and American Funds Service Company® (“AFS”), the fund’s transfer agent are affiliated with CIInc. CIInc, AFD and AFS are considered related parties to the fund.

Investment advisory services — The fund has an investment advisory and service agreement with CIInc that provides for monthly fees accrued daily. These fees are based on a series of decreasing annual rates beginning with 0.900% on the first $400 million of daily net assets and decreasing to 0.520% on such assets in excess of $20 billion. For the six months ended December 31, 2019, the investment advisory services fee was $8,007,000, which was equivalent to an annualized rate of 0.762% of average daily net assets.

Class-specific fees and expenses — Expenses that are specific to individual share classes are accrued directly to the respective share class. The principal class-specific fees and expenses are further described below:

Distribution services — American Funds Distributors®, Inc. (“AFD”), an affiliate of CIInc, is the principal underwriter of the fund’s shares. AFD does not receive any compensation related to the sale of shares of the fund.

Transfer agent services — The fund has a shareholder services agreement with AFS under which the fund compensates AFS for providing transfer agent services to each of the fund’s share classes. These services include recordkeeping, shareholder communications and transaction processing. In addition, the fund reimburses AFS for amounts paid to third parties for performing transfer agent services on behalf of fund shareholders.

Administrative services — The fund has an administrative services agreement with CIInc under which the fund compensates CIInc for providing administrative services to Class F-3 and R-6 shares. Administrative services are provided by CIInc and its affiliates to help assist third parties providing non-distribution services to fund shareholders. These services include providing in depth information on the fund and market developments that impact fund investments. Administrative services also include, but are not limited to, coordinating, monitoring and overseeing third parties that provide services to fund shareholders. The agreement provides the fund the ability to charge an administrative services fee at the annual rate of 0.05% of the daily net assets attributable to Class F-3 and R-6 shares. Currently the fund pays CIInc an administrative services fee at the annual rate of 0.03% of daily net assets attributable to Class F-3 and R-6 shares for CIInc’s provision of administrative services.

| Emerging Markets Growth Fund | 21 |

For the six months ended December 31, 2019, class-specific expenses under the agreements were as follows (dollars in thousands):

| Share class | Transfer agent services | Administrative services | ||||||

| Class M | $ | 2 | $ | — | ||||

| Class F-3 | — | * | 7 | |||||

| Class R-6 | — | * | 1 | |||||

| Total class-specific expenses | $ | 2 | $ | 8 | ||||

| * | Amount less than one thousand. |

Directors’ deferred compensation — Directors who were unaffiliated with CIInc may have elected to defer the cash payment of part or all of their compensation. These deferred amounts, which remain as liabilities of the fund, are treated as if invested in shares of the fund or other American Funds. These amounts represent general, unsecured liabilities of the fund and vary according to the total returns of the selected funds. Directors’ compensation of $242,000 in the fund’s statement of operations reflects $102,000 in current fees and a net increase of $140,000 in the value of the deferred amounts.

Affiliated officers and directors — Officers and certain directors of the fund are or may be considered to be affiliated with CIInc, AFD and AFS. No affiliated officers or directors received any compensation directly from the fund.

Investment in CCF — The fund holds shares of CCF, an institutional prime money market fund managed by Capital Research and Management Company (“CRMC”), an affiliate of CIInc. CCF invests in high-quality, short-term money market instruments. CCF is used as the primary investment vehicle for the fund’s short-term investments. CCF shares are only available for purchase by CRMC, its affiliates, and other funds managed by CRMC or its affiliates, and are not available to the public. CRMC does not receive an investment advisory services fee from CCF.

Security transactions with related funds — The fund may purchase securities from, or sell securities to, other funds managed by CIInc (or funds managed by certain affiliates of CIInc) under procedures adopted by the fund’s board of directors. The funds involved in such transactions are considered related by virtue of having a common investment adviser (or affiliated investment advisers), common directors and/or common officers. When such transactions occur, each transaction is executed at the current market price of the security and no brokerage commissions or fees are paid in accordance with Rule 17a-7 of the 1940 Act.