UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-4946

THOMPSON IM FUNDS, INC.

(Exact name of registrant as specified in charter)

1255 Fourier Drive, Suite 200

Madison, Wisconsin 53717

(Address of principal executive offices)--(Zip code)

Jason L. Stephens

Chief Executive Officer

Thompson IM Funds, Inc.

1255 Fourier Drive, Suite 200

Madison, Wisconsin 53717

(Name and address of agent for service)

With a copy to:

Matthew C. Vogel, Esq.

Quarles & Brady LLP

411 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Registrant’s telephone number, including area code: (608) 827-5700

Date of fiscal year end: November 30, 2024

Date of reporting period: November 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, N.E., Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Item 1(a):

| | Thompson LargeCap Fund THPGX Annual Shareholder Report | November 30, 2024 |  |

This annual shareholder report contains important information about the Thompson LargeCap Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at http://www.thompsonim.com/forms/index. html. You can also request this information by contacting us at 1-800-999-0887 or thompsonimfunds@usbank.com.

| | WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment) | |

| | | | | |

| | | Costs of a $10,000 | Costs paid as a percentage of | | |

| | | Fund Name | investment | a $10,000 investment | | |

| | | Thompson LargeCap Fund | $114 | 0.99% | | |

| | | | | |

| | HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE? For the fiscal year ended November 30, 2024, the Fund returned 31.13%, as compared to its benchmark, the S&P 500 Index, which returned 33.89%. The S&P 500 has performed well, but the returns have been driven by a small group of companies nicknamed “the Magnificent 7” (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla). Due to valuation concerns the Fund chose to underweight these stocks relative to the benchmark. This difference was the primary explanation for the Fund’s relative performance during the fiscal year. Top contributors to performance: Financials were the best performing sector during the fiscal year for the Fund, as both an overweight plus positive issue selection added to performance. Industrials and Real Estate were also among the top contributors to performance. Top detractors to performance: The underweight in Magnificent 7 stocks led to underperformance in Information Technology and Communication Services. Weakness in Walgreens also detracted from performance within Consumer Staples. | |

| | | | | | | |

| Thompson LargeCap Fund | PAGE 1 | TSR_AR_884891300 |

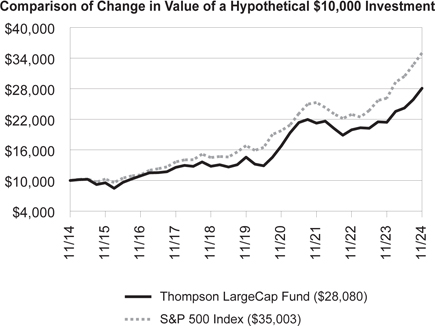

| | FUND PERFORMANCE

| |

| | | | | | |

| Year | Thompson LargeCap Fund | S&P 500 Index |

| 11/30/2014 | 10,000 | 10,000 |

| 11/30/2015 | 9,548.09 | 10,274.92 |

| 11/30/2016 | 10,900.39 | 11,102.04 |

| 11/30/2017 | 12,570.23 | 13,642.73 |

| 11/30/2018 | 12,786.97 | 14,498.05 |

| 11/30/2019 | 14,568.79 | 16,835.65 |

| 11/30/2020 | 16,766.02 | 19,772.43 |

| 11/30/2021 | 21,244.29 | 25,292.46 |

| 11/30/2022 | 19,941.62 | 22,964.16 |

| 11/30/2023 | 21,413.50 | 26,142.94 |

| 11/30/2024 | 28,079.52 | 35,003.23 |

AVERAGE ANNUAL RETURNS | 1 Year | 5 Years | 10 Years |

| Thompson LargeCap Fund | 31.13% | 14.02% | 10.88% |

| S&P 500 Index | 33.89% | 15.77% | 13.35% |

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| | KEY FUND STATISTICS (as of November 30, 2024) | |

| | Net Assets | $ 190,258,018 | |

| | Number of Holdings | 77 | |

| | Portfolio Turnover | 21% | |

| | Total Advisory Fees Paid | $ 1,625,418 | |

| | | | |

| Thompson LargeCap Fund | PAGE 2 | TSR_AR_884891300 |

WHAT DID THE FUND INVEST IN? (as of November 30, 2024)

(Expressed as a percentage of net assets)

| Top Holdings | (%) |

| Alphabet Inc. Class A | 4.3% |

| Microsoft Corp. | 4.1% |

| Warner Bros. Discovery, Inc. | 3.0% |

| Apple Inc. | 2.9% |

| Exact Sciences Corp. | 2.4% |

| PayPal Holdings, Inc. | 2.3% |

| Citigroup Inc. | 2.2% |

| Meta Platforms, Inc. Class A | 2.2% |

| Visa Inc. Class A | 2.2% |

| The Charles Schwab Corp. | 2.2% |

| Sector Weightings | (%) |

| Information Technology | 22.9% |

| Financials | 19.4% |

| Health Care | 19.0% |

| Communication Services | 13.2% |

| Consumer Discretionary | 6.5% |

| Consumer Staples | 5.9% |

| Industrials | 4.2% |

| Energy | 3.7% |

| Materials | 2.5% |

| Cash & Other | 2.7% |

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit http://www.thompsonim.com/forms/index.html |

| HOUSEHOLDING |

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Thompson IM Funds, Inc. documents not be householded, please contact Thompson IM Funds, Inc. at 1-800-999-0887 or thompsonimfunds@usbank.com, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Thompson IM Funds, Inc. or your financial intermediary. |

| Thompson LargeCap Fund | PAGE 3 | TSR_AR_884891300 |

| | Thompson MidCap Fund THPMX Annual Shareholder Report | November 30, 2024 |  |

This annual shareholder report contains important information about the Thompson MidCap Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at http://www.thompsonim.com/forms/index. html. You can also request this information by contacting us at 1-800-999-0887 or thompsonimfunds@usbank.com.

| | WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment) | |

| | | | | |

| | | Costs of a $10,000 | Costs paid as a percentage of | | |

| | | Fund Name | investment | a $10,000 investment | | |

| | | Thompson MidCap Fund | $130 | 1.15% | | |

| | | | | |

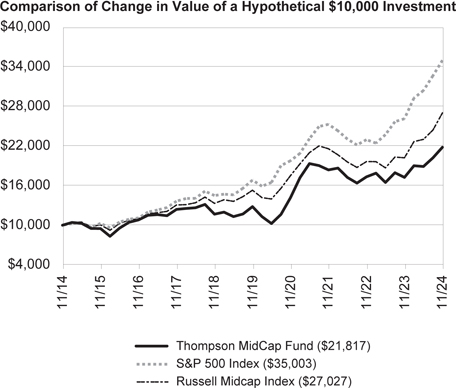

| | HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE? For the fiscal year ended November 30, 2024, the Fund returned 26.47%, compared to 33.89% for the Fund’s broad-based market index, the S&P 500 Index. The Russell Midcap Index, which is a securities market index with investment characteristics similar to those of the Fund, returned 33.66% over the same period. Equity returns during the fiscal year were correlated with market capitalization size, with Large Cap stocks outperforming Mid Cap stocks, which in turn outperformed Small Cap stocks. Some of this was driven by strength in a small group of companies nicknamed “the Magnificent 7” (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla). The Fund’s underperformance was largely driven by a higher exposure to smaller stocks, as over 40% of holdings had a market capitalization of around $10 billion or less. This compares to roughly 20% of the Russell Midcap index and even less of the S&P 500 index. Top contributors to performance: Financials were the top performing sector for the Fund, followed by Information Technology. Performance was broad based in each sector, with numerous individual holdings acting as top contributors. Top detractors to performance: Healthcare was the Fund’s biggest laggard, due to both an overweight of a sector with poor performance, and individual holdings such as AMN Healthcare and Acadia Healthcare. Consumer Discretionary and Communication Services holdings were also among the larger detractors to performance. | |

| | | | | | | |

| Thompson MidCap Fund | PAGE 1 | TSR_AR_884891607 |

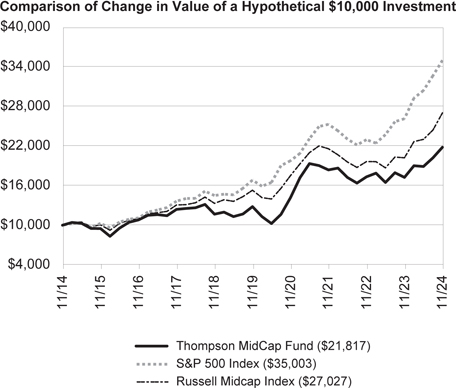

| | FUND PERFORMANCE

| |

| | | | | | |

| Year | Thompson MidCap Fund | S&P 500 Index | Russell Midcap Index |

| 11/30/2014 | 10,000 | 10,000 | 10,000 |

| 11/30/2015 | 9,489.83 | 10,274.92 | 10,045.84 |

| 11/30/2016 | 10,800.87 | 11,102.04 | 11,000.33 |

| 11/30/2017 | 12,397.70 | 13,642.73 | 13,064.49 |

| 11/30/2018 | 11,672.37 | 14,498.05 | 13,310.72 |

| 11/30/2019 | 12,814.21 | 16,835.65 | 15,301.95 |

| 11/30/2020 | 14,167.47 | 19,772.43 | 17,510.57 |

| 11/30/2021 | 18,382.19 | 25,292.46 | 21,589.64 |

| 11/30/2022 | 17,331.81 | 22,964.16 | 19,641.59 |

| 11/30/2023 | 17,250.51 | 26,142.94 | 20,219.33 |

| 11/30/2024 | 21,816.57 | 35,003.23 | 27,026.54 |

| AVERAGE ANNUAL RETURNS | 1 Year | 5 Years | 10 Years |

| Thompson MidCap Fund | 26.47% | 11.23% | 8.11% |

| S&P 500 Index | 33.89% | 15.77% | 13.35% |

| Russell Midcap Index | 33.66% | 12.05% | 10.45% |

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| | KEY FUND STATISTICS (as of November 30, 2024) | |

| | Net Assets | $59,171,497 | |

| | Number of Holdings | 83 | |

| | Portfolio Turnover | 27% | |

| | Total Advisory Fees Paid | $ 542,614 | |

| | | | |

| Thompson MidCap Fund | PAGE 2 | TSR_AR_884891607 |

WHAT DID THE FUND INVEST IN? (as of November 30, 2024)

(Expressed as a percentage of net assets)

| Top Holdings | (%) |

| Warner Bros. Discovery, Inc. | 2.9% |

| Exact Sciences Corp. | 2.4% |

| Viatris Inc. | 2.2% |

| The Charles Schwab Corp. | 2.2% |

| Marvell Technology, Inc. | 2.1% |

| Performance Food Group Co. | 2.1% |

| Neurocrine Biosciences, Inc. | 2.1% |

| O-I Glass, Inc. | 2.1% |

| Take-Two Interactive Software, Inc. | 2.1% |

| Concentrix Corp. | 2.0% |

| Sector Weightings | (%) |

| Financials | 20.9% |

| Industrials | 14.5% |

| Health Care | 13.7% |

| Information Technology | 12.6% |

| Consumer Discretionary | 9.6% |

| Communication Services | 6.7% |

| Real Estate | 6.3% |

| Materials | 4.6% |

| Consumer Staples | 3.9% |

| Cash & Other | 7.2% |

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit http://www.thompsonim.com/forms/index.html |

| HOUSEHOLDING |

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Thompson IM Funds, Inc. documents not be householded, please contact Thompson IM Funds, Inc. at 1-800-999-0887 or thompsonimfunds@usbank.com, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Thompson IM Funds, Inc. or your financial intermediary. |

| Thompson MidCap Fund | PAGE 3 | TSR_AR_884891607 |

| | Thompson Bond Fund THOPX Annual Shareholder Report | November 30, 2024 |  |

This annual shareholder report contains important information about the Thompson Bond Fund for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at http://www.thompsonim.com/forms/index. html. You can also request this information by contacting us at 1-800-999-0887 or thompsonimfunds@usbank.com.

| | WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment) | |

| | | | | |

| | | Costs of a $10,000 | Costs paid as a percentage of | | |

| | | Fund Name | investment | a $10,000 investment | | |

| | | Thompson Bond Fund | $79 | 0.74% | | |

| | | | | |

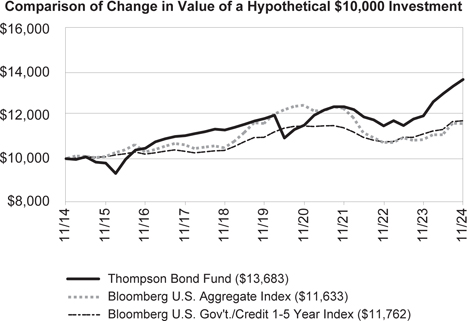

| | HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE? For the fiscal year ended November 30, 2024, the Fund returned 14.11%, compared to 6.88% for the Fund’s broad-based market index, the Bloomberg US Aggregate Bond Index. The Bloomberg U.S. Government/Credit 1-5 Year Index, which is a securities market index with investment characteristics similar to those of the Fund, returned 5.56% over the same period. The Fund outperformed due to its overweight in corporate bonds, asset backed securities (ABS) and Commercial Mortgage Backed Securities (CMBS) against an underweight in Treasury bonds. Corporate bonds and ABS were particularly strong as both benefited from a narrowing of spreads during the fiscal year. A higher current yield also contributed to performance. At period end, corporates made up about 64% of Fund assets, up from roughly 58% a year ago and notably overweight versus the broad-based index of 25%. Exposure to U.S. Treasuries stood at 6% as of November 30, 2024, compared with 44% for the index. Top contributors to performance: Corporate bonds and ABS bonds were the biggest contributors. Within corporate bonds, fixed to float hybrid bonds were significant contributors, although most holdings benefited from a narrowing of spreads. Within ABS bonds, bonds backed by aircraft performed the strongest. Top detractors to performance: There were no significant detractors from performance, as even the Fund’s Treasury holdings performed in line with their benchmark equivalents. | |

| | | | | | | |

| Thompson Bond Fund | PAGE 1 | TSR_AR_884891201 |

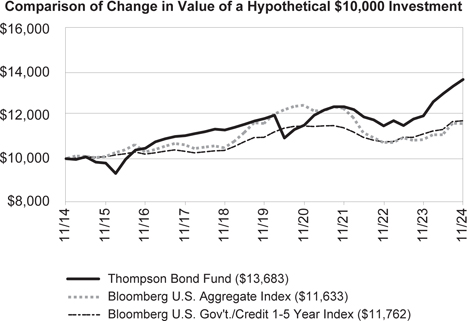

| | FUND PERFORMANCE

| |

| | | | | | | |

| Year | Thompson Bond Fund | Bloomberg Barclays US Aggregate Index | Bloomberg Barclays 1-5 Year Gov't/Credit Index |

| 11/30/2014 | 10,000 | 10,000 | 10,000 |

| 11/30/2015 | 9,795.69 | 10,097.07 | 10,084.07 |

| 11/30/2016 | 10,486.71 | 10,316.29 | 10,213.84 |

| 11/30/2017 | 11,070.63 | 10,647.90 | 10,346.16 |

| 11/30/2018 | 11,333.47 | 10,504.97 | 10,383.82 |

| 11/30/2019 | 11,866.51 | 11,638.56 | 10,994.77 |

| 11/30/2020 | 11,558.56 | 12,486.27 | 11,517.38 |

| 11/30/2021 | 12,416.99 | 12,342.18 | 11,441.85 |

| 11/30/2022 | 11,526.73 | 10,757.37 | 10,790.47 |

| 11/30/2023 | 11,990.59 | 10,884.24 | 11,142.05 |

| 11/30/2024 | 13,682.58 | 11,632.59 | 11,761.87 |

| AVERAGE ANNUAL RETURNS | 1 Year | 5 Years | 10 Years |

| Thompson Bond Fund | 14.11% | 2.89% | 3.19% |

| Bloomberg U.S. Aggregate Index | 6.88% | -0.01% | 1.52% |

| Bloomberg U.S. Gov’t./Credit 1-5 Year Index | 5.56% | 1.36% | 1.64% |

The fund’s past performance is not a good predictor of how the fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| | KEY FUND STATISTICS (as of November 30, 2024) | |

| | Net Assets | $1,602,419,200 | |

| | Number of Holdings | 407 | |

| | Portfolio Turnover | 21% | |

| | Average Credit Quality+ | BBB | |

| | Effective Duration | 2.00 yrs | |

| | Total Advisory Fees Paid | $ 8,041,459 | |

| | | | |

| Thompson Bond Fund | PAGE 2 | TSR_AR_884891201 |

WHAT DID THE FUND INVEST IN? (as of November 30, 2024)

(Expressed as a percentage of net assets)

| Top 10 Issuers | (%) |

| U.S. Treasury Bills | 5.9% |

| Lincoln National Corp. | 2.8% |

| JPMBB Commercial Mortgage Securities Trust | 1.7% |

| Labrador Aviation Finance Ltd. | 1.7% |

| Morgan Stanley Bank of America Merrill Lynch Trust | 1.5% |

| Wells Fargo Commercial Mortgage Trust | 1.5% |

| Coinstar Funding, LLC | 1.5% |

| COMM Mortgage Trust | 1.4% |

| Ginnie Mae REMIC Trust | 1.4% |

| WFRBS Commercial Mortgage Trust | 1.3% |

| Asset Allocation | (%) |

| Corporate Bonds | 63.5% |

| Commercial Mortgage- Backed Securities | 12.7% |

| Asset-Backed Securities | 12.0% |

| U.S. Government & Agency Securities | 7.4% |

| U.S. Government Agency Mortgage-Backed Securities | % |

| Net Other Assets & Liabilities | 2.1% |

| Credit Rating Description+ | (%) |

| AAA AAA Rating [Member] | 0.2% |

| AA AA Rating [Member] | 9.9% |

| A A Rating [Member] | 11.7% |

| BBB BBB Rating [Member] | 59.7% |

| BB and Below BB and Below Rating [Member] | 15.2% |

| Not Rated | 1.2% |

| Other Net Assets and Liabilities | 2.1% |

| + | Ratings provided by Standard & Poor’s, Moody’s, and Fitch. When ratings are available from multiple rating agencies, a conservative methodology is to be adopted: For cases where there are three distinct ratings available, use the middle- quality rating (dropping the highest and lowest ratings); if two different ratings are available, use the lower rating; if only one agency rates a holding, then use that rating. For certain securities that are not rated by any of these three agencies, credit ratings from other agencies may be used. For cases where there is not a rating available from any agency, the holding is classified as Not Rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). |

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit http://www.thompsonim.com/forms/index.html |

| HOUSEHOLDING |

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Thompson IM Funds, Inc. documents not be householded, please contact Thompson IM Funds, Inc. at 1-800-999-0887 or thompsonimfunds@usbank.com, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Thompson IM Funds, Inc. or your financial intermediary. |

| Thompson Bond Fund | PAGE 3 | TSR_AR_884891201 |

Item (b): Not applicable.

Item 2. Code of Ethics.

(a)

The registrant, as of the end of the period covered by the report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller or any persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, on behalf of the registrant.

(b)

For purposes of this item, “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote:

| | (1) | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| | (2) | Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant; |

| | (3) | Compliance with applicable governmental laws, rules, and regulations; |

| | (4) | The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and |

| | (5) | Accountability for adherence to the code. |

| (c) | During the period covered by this report, no material amendments were made to the provisions of the code of ethics adopted in 2(a) above. |

| (d) | During the period covered by this report, no implicit or explicit waivers to the provisions of the code of ethics adopted in 2(a) above were granted. |

| (e) | Not applicable. |

| (f) | The registrant’s Code of Ethics is filed herewith as Exhibit 19(a)(1) |

Item 3. Audit Committee Financial Expert.

(a)(1)

The registrant’s board of directors has determined that the registrant has at least one audit committee financial expert serving on the audit committee.

(a)(2)

The audit committee financial expert is Joyce Minor, who is independent as defined in Form N-CSR Item 3(a)(2)

Item 4. Principal Accountant Fees and Services.

(a)

Audit Fees: For the registrant’s fiscal years ended November 30, 2024 and November 30, 2023, the aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements were $54,000 and $53,810, respectively.

(b)

Audit-Related Fees: For the registrant’s fiscal years ended November 30, 2024 and November 30, 2023, the aggregate fees billed for professional services rendered by the principal accountant for assurance and related services that were reasonably related to the performance of the audit of the registrant’s financial statements not otherwise included under “Audit Fees” above were $0 and $0, respectively.

(c)

Tax Fees: For the registrant’s fiscal years ended November 30, 2024 and November 30, 2023, aggregate fees of $9,000 and $9,000, respectively, were billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning.

(d)

All Other Fees: For the registrant’s fiscal years ended November 30, 2024 and November 30, 2023, aggregate fees of $0 and $0, respectively, were billed to registrant by the principal accountant for services other than the services reported in paragraphs (a) through (c) of this item. These services were related to International Reclaim Tax Services.

(e)(1)

Audit Committee Pre-Approval Policies and Procedures: All services to be performed by the registrant’s principal auditors must be pre-approved by the registrant’s audit committee.

(e)(2)

No services described in paragraphs (b) through (d) were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f)

Not applicable.

(g)

The aggregate non-audit fees billed by the registrant’s principal accountant for the fiscal years ended November 30, 2024 and November 30, 2023 were $9,000 and $9,000, respectively.

(h)

Not applicable.

(i)

Not applicable.

(j)

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable to this Registrant because it is not a “listed issuer” within the meaning of Rule 10A-3 under the Securities Exchange Act of 1934.

Item 6. Investments.

(a). Notes to the financial statements are an integral part of the Schedules of Investments. The registrant’s schedules of investments are included in the financial statements and financial highlights for open-end management investment companies in item 7 below.

(b). Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

THOMPSON IM FUNDS, INC.

TABLE OF CONTENTS

This report contains information for existing shareholders of Thompson IM Funds, Inc.

It does not constitute an offer to sell. This Report is authorized for distribution to prospective investors

only when preceded or accompanied by a Fund Prospectus, which contains information about

the Funds’ objectives and policies, risks, management, expenses and other information.

A Prospectus can be obtained by calling 1-800-999-0887.

Please read your Prospectus carefully.

| LARGECAP FUND SCHEDULE OF INVESTMENTS |

| November 30, 2024 |

| | Shares | Value |

| COMMON STOCKS - 99.8% | | $189,967,483 |

| (COST $127,910,936) | | |

| | | |

| Communication Services - 13.2% | | 25,128,482 |

| Media & Entertainment - 13.2% | | |

| Alphabet Inc. Class A | 48,650 | 8,219,417 |

| Electronic Arts Inc. | 13,275 | 2,172,719 |

| Meta Platforms, Inc. Class A | 7,325 | 4,206,894 |

| Paramount Global Class B | 252,125 | 2,735,556 |

| The Walt Disney Co. | 17,550 | 2,061,598 |

| Warner Bros. Discovery, Inc. (a) | 546,975 | 5,732,298 |

| | | |

| Consumer Discretionary - 6.5% | | 12,364,457 |

| Consumer Discretionary Distribution & Retail - 4.5% | | |

| Chewy, Inc. Class A (a) | 84,050 | 2,808,110 |

| eBay Inc. | 44,720 | 2,830,329 |

| LKQ Corp. | 71,650 | 2,815,128 |

| Consumer Durables & Apparel - 1.0% | | |

| TopBuild Corp. (a) | 3,840 | 1,500,058 |

| Topgolf Callaway Brands Corp. (a) | 53,475 | 450,260 |

| Consumer Services - 1.0% | | |

| Starbucks Corp. | 19,135 | 1,960,572 |

| | | |

| Consumer Staples - 5.9% | | 11,277,563 |

| Consumer Staples Distribution & Retail - 3.3% | | |

| Performance Food Group Co. (a) | 35,175 | 3,103,842 |

| Target Corp. | 11,960 | 1,582,428 |

| Walgreens Boots Alliance, Inc. | 169,625 | 1,530,018 |

| Food, Beverage & Tobacco - 1.6% | | |

| PepsiCo, Inc. | 10,850 | 1,773,432 |

| Tyson Foods, Inc. Class A | 21,175 | 1,365,788 |

| Household & Personal Products - 1.0% | | |

| Kimberly-Clark Corp. | 13,793 | 1,922,055 |

| | | |

| Energy - 3.7% | | 7,003,556 |

| Cheniere Energy, Inc. | 10,425 | 2,335,304 |

| Chevron Corp. | 14,245 | 2,306,693 |

| Exxon Mobil Corp. | 20,020 | 2,361,559 |

| | | |

| Financials - 19.4% | | 36,926,385 |

| Banks - 7.2% | | |

| Bank of America Corp. | 66,750 | 3,171,292 |

| Citigroup Inc. | 59,425 | 4,211,450 |

| Citizens Financial Group, Inc. | 25,775 | 1,240,809 |

| JPMorgan Chase & Co. | 12,145 | 3,032,849 |

| PNC Financial Services Group, Inc. | 9,945 | 2,135,390 |

| Financial Services - 12.2% | | |

| Bread Financial Holdings Inc. | 23,749 | 1,397,154 |

| Discover Financial Services | 5,295 | 965,967 |

| Fiserv, Inc. (a) | 8,774 | 1,938,703 |

| Intercontinental Exchange, Inc. | 11,400 | 1,834,944 |

| Northern Trust Corp. | 18,810 | 2,090,920 |

| PayPal Holdings, Inc. (a) | 50,510 | 4,382,753 |

| State Street Corp. | 22,625 | 2,228,789 |

| The Charles Schwab Corp. | 49,675 | 4,111,103 |

| Visa Inc. Class A | 13,280 | 4,184,262 |

See Notes to Financial Statements.

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Shares | Value |

| COMMON STOCKS (continued) | | |

| | | |

| Health Care - 19.0% | | $36,120,954 |

| Health Care Equipment & Services - 8.6% | | |

| AMN Healthcare Services, Inc. (a) | 58,100 | 1,512,343 |

| CVS Health Corp. | 53,650 | 3,210,952 |

| GE HealthCare Technologies Inc. | 24,050 | 2,001,441 |

| HCA Healthcare, Inc. | 4,525 | 1,480,671 |

| McKesson Corp. | 2,960 | 1,860,360 |

| The Cigna Group | 6,275 | 2,119,695 |

| UnitedHealth Group Inc. | 6,735 | 4,109,697 |

| Pharmaceuticals, Biotechnology & Life Sciences - 10.4% | | |

| AbbVie Inc. | 12,425 | 2,272,905 |

| Amgen Inc. | 6,275 | 1,775,009 |

| Bristol-Myers Squibb Co. | 41,925 | 2,482,798 |

| Exact Sciences Corp. (a) | 74,575 | 4,629,616 |

| Johnson & Johnson | 11,400 | 1,767,114 |

| Merck & Co., Inc. | 14,700 | 1,494,108 |

| Pfizer Inc. | 146,575 | 3,841,731 |

| Viatris Inc. | 119,367 | 1,562,514 |

| | | |

| Industrials - 4.2% | | 8,108,291 |

| Capital Goods - 2.4% | | |

| Kornit Digital Ltd. (a) | 98,585 | 3,135,003 |

| The Boeing Co. (a) | 9,550 | 1,484,452 |

| Commercial & Professional Services - 1.0% | | |

| Concentrix Corp. | 35,700 | 1,604,715 |

| Transportation - 0.8% | | |

| FedEx Corp. | 6,225 | 1,884,121 |

| | | |

| Information Technology - 22.9% | | 43,581,832 |

| Semiconductors & Semiconductor Equipment - 7.4% | | |

| Analog Devices, Inc. | 9,395 | 2,048,580 |

| Infineon Technologies A.G. ADR | 60,925 | 1,980,062 |

| Marvell Technology, Inc. | 25,675 | 2,379,816 |

| Microchip Technology Inc. | 28,800 | 1,963,296 |

| NXP Semiconductors N.V. | 12,430 | 2,851,069 |

| Qualcomm Inc. | 17,730 | 2,810,737 |

| Software & Services - 6.6% | | |

| Adobe Inc. (a) | 3,925 | 2,025,025 |

| Microsoft Corp. | 18,286 | 7,743,390 |

| Oracle Corp. | 14,975 | 2,767,979 |

| Technology Hardware & Equipment - 8.9% | | |

| Apple Inc. | 22,970 | 5,451,470 |

| Calix, Inc. (a) | 61,325 | 1,994,902 |

| Cisco Systems, Inc. | 40,910 | 2,422,281 |

| Coherent Corp. (a) | 19,225 | 1,925,576 |

| Keysight Technologies, Inc. (a) | 12,475 | 2,131,229 |

| Lumentum Holdings Inc. (a) | 22,375 | 1,945,954 |

| Viavi Solutions Inc. (a) | 114,735 | 1,140,466 |

See Notes to Financial Statements.

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Shares | Value |

| COMMON STOCKS (continued) | | |

| | | |

| Materials - 2.5% | | $4,703,839 |

| Berry Global Group, Inc. | 14,400 | 1,041,264 |

| Freeport-McMoRan Inc. | 33,775 | 1,492,855 |

| O-I Glass, Inc. (a) | 172,200 | 2,169,720 |

| | | |

| Real Estate - 0.8% | | 1,478,689 |

| Real Estate Management & Development - 0.8% | | |

| Colliers Int’l. Group Inc. | 9,625 | 1,478,689 |

| | | |

| Utilities - 1.7% | | 3,273,435 |

| Alliant Energy Corp. | 15,500 | 979,600 |

| WEC Energy Group, Inc. | 22,700 | 2,293,835 |

| | | |

| Short-Term Investments - 0.1% | | 100,000 |

| (COST $100,000) | | |

| | | |

| Money Market Funds - 0.1% | | 100,000 |

| First American Government Obligations Fund Class X, 4.56% (b) | 100,000 | 100,000 |

| | | |

| TOTAL INVESTMENTS - 99.9% (COST $128,010,936) | | 190,067,483 |

| | | |

| NET OTHER ASSETS & LIABILITIES - 0.1% | | 190,535 |

| | | |

| NET ASSETS - 100% | | $190,258,018 |

| (a) | Non-income producing security. |

| (b) | Represents the 7-day yield at November 30, 2024. |

| Abbreviations: |

| ADR | American Depositary Receipt |

| A.G. | Aktiengesellschaft is the German term for a public limited liability corporation. |

| N.V. | Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”) and is licensed for use by Thompson Investment Management Inc. Neither MSCI, S&P, nor any other party involved in making or compiling the GICS or any GICS classifications makes any warranties with respect there to or the results to be obtained by the use thereof, and no such party shall have any liability whatsoever with respect thereto.

See Notes to Financial Statements.

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2024:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Communication services | | $ | 25,128,482 | | | $ | – | | | $ | – | | | $ | 25,128,482 | |

| Consumer discretionary | | | 12,364,457 | | | | – | | | | – | | | | 12,364,457 | |

| Consumer staples | | | 11,277,563 | | | | – | | | | – | | | | 11,277,563 | |

| Energy | | | 7,003,556 | | | | – | | | | – | | | | 7,003,556 | |

| Financials | | | 36,926,385 | | | | – | | | | – | | | | 36,926,385 | |

| Health care | | | 36,120,954 | | | | – | | | | – | | | | 36,120,954 | |

| Industrials | | | 8,108,291 | | | | – | | | | – | | | | 8,108,291 | |

| Information technology | | | 43,581,832 | | | | – | | | | – | | | | 43,581,832 | |

| Materials | | | 4,703,839 | | | | – | | | | – | | | | 4,703,839 | |

| Real estate | | | 1,478,689 | | | | – | | | | – | | | | 1,478,689 | |

| Utilities | | | 3,273,435 | | | | – | | | | – | | | | 3,273,435 | |

| Total common stocks | | | 189,967,483 | | | | – | | | | – | | | | 189,967,483 | |

| Short-term investments | | | | | | | | | | | | | | | | |

| Money market funds | | | 100,000 | | | | – | | | | – | | | | 100,000 | |

| Total short-term investments | | | 100,000 | | | | – | | | | – | | | | 100,000 | |

| Total investments | | $ | 190,067,483 | | | $ | – | | | $ | – | | | $ | 190,067,483 | |

The Fund did not invest in any level-3 investments as of and during the fiscal year ended November 30, 2024.

For more information on valuation inputs, see financial statement Note 2 - Significant Accounting Policies.

See Notes to Financial Statements.

| MIDCAP FUND SCHEDULE OF INVESTMENTS |

| November 30, 2024 |

| | Shares | Value |

| COMMON STOCKS - 99.4% | | $58,840,210 |

| (COST $43,643,709) | | |

| | | |

| Communication Services - 6.7% | | 3,936,223 |

| Media & Entertainment - 6.7% | | |

| Paramount Global Class B | 35,835 | 388,810 |

| Take-Two Interactive Software, Inc. (a) | 6,445 | 1,214,109 |

| Ubisoft Entertainment S.A. ADR (a) | 245,000 | 633,815 |

| Warner Bros. Discovery, Inc. (a) | 162,165 | 1,699,489 |

| | | |

| Consumer Discretionary - 9.6% | | 5,655,154 |

| Consumer Discretionary Distribution & Retail - 4.9% | | |

| Chewy, Inc. Class A (a) | 26,355 | 880,521 |

| eBay Inc. | 9,100 | 575,939 |

| LKQ Corp. | 29,590 | 1,162,591 |

| Pool Corp. | 725 | 273,390 |

| Consumer Durables & Apparel - 4.7% | | |

| Hasbro, Inc. | 5,600 | 364,840 |

| Levi Strauss & Co. Class A | 34,200 | 597,132 |

| Mattel, Inc. (a) | 16,780 | 319,156 |

| Skechers U.S.A., Inc. Class A (a) | 9,155 | 584,272 |

| TopBuild Corp. (a) | 1,355 | 529,317 |

| Topgolf Callaway Brands Corp. (a) | 43,705 | 367,996 |

| | | |

| Consumer Staples - 3.9% | | 2,324,587 |

| Consumer Staples Distribution & Retail - 3% | | |

| Performance Food Group Co. (a) | 14,160 | 1,249,478 |

| Walgreens Boots Alliance, Inc. | 57,695 | 520,409 |

| Food, Beverage & Tobacco - 0.9% | | |

| Tyson Foods, Inc. Class A | 8,600 | 554,700 |

| | | |

| Energy - 3.2% | | 1,921,414 |

| Cameco Corp. | 6,515 | 387,317 |

| Cheniere Energy, Inc. | 3,900 | 873,639 |

| Exxon Mobil Corp. | 5,599 | 660,458 |

| | | |

| Financials - 20.9% | | 12,397,323 |

| Banks - 7.8% | | |

| Associated Banc-Corp | 36,708 | 979,737 |

| Citizens Financial Group, Inc. | 15,120 | 727,877 |

| Flagstar Financial, Inc. | 50,042 | 599,003 |

| PNC Financial Services Group, Inc. | 3,230 | 693,546 |

| Truist Financial Corp. | 13,931 | 664,230 |

| Zions Bancorporation, N.A. | 15,810 | 956,821 |

| Financial Services - 13.1% | | |

| Annaly Capital Management, Inc. | 39,956 | 796,323 |

| Bread Financial Holdings Inc. | 12,775 | 751,553 |

| Discover Financial Services | 4,809 | 877,306 |

| Fiserv, Inc. (a) | 5,083 | 1,123,140 |

| Intercontinental Exchange, Inc. | 2,220 | 357,331 |

| Northern Trust Corp. | 9,510 | 1,057,132 |

| PayPal Holdings, Inc. (a) | 9,350 | 811,299 |

| State Street Corp. | 7,045 | 694,003 |

| The Charles Schwab Corp. | 15,805 | 1,308,022 |

See Notes to Financial Statements.

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Shares | Value |

| COMMON STOCKS (continued) | | |

| | | |

| Health Care - 13.7% | | $8,098,529 |

| Health Care Equipment & Services - 4.2% | | |

| Acadia Healthcare Co., Inc. (a) | 6,285 | 255,360 |

| Accelerate Diagnostics, Inc. (a) | 10,390 | 17,247 |

| AMN Healthcare Services, Inc. (a) | 36,140 | 940,724 |

| Premier, Inc. Class A | 26,030 | 596,087 |

| Teleflex Inc. | 3,340 | 644,119 |

| Pharmaceuticals, Biotechnology & Life Sciences - 9.5% | | |

| Bausch Health Cos., Inc. (a) | 50,780 | 425,029 |

| Exact Sciences Corp. (a) | 22,790 | 1,414,803 |

| Green Thumb Industries Inc. (a) | 48,150 | 447,314 |

| Jazz Pharmaceuticals PLC (a) | 6,670 | 811,005 |

| Neurocrine Biosciences, Inc. (a) | 9,750 | 1,235,812 |

| Viatris Inc. | 100,155 | 1,311,029 |

| | | |

| Industrials - 14.5% | | 8,578,571 |

| Capital Goods - 8.9% | | |

| A.O. Smith Corp. | 8,290 | 617,522 |

| Hillenbrand, Inc. | 11,090 | 377,393 |

| Kornit Digital Ltd. (a) | 26,745 | 850,491 |

| MasTec, Inc. (a) | 4,055 | 584,163 |

| Mueller Water Products, Inc. Class A | 18,775 | 470,126 |

| Regal Rexnord Corp. | 3,715 | 641,618 |

| The AZEK Co. Inc. (a) | 8,765 | 465,597 |

| WillScot Holdings Corp. (a) | 17,591 | 672,680 |

| Xylem, Inc. | 4,499 | 570,248 |

| Commercial & Professional Services - 5.6% | | |

| Concentrix Corp. | 25,925 | 1,165,329 |

| Equifax Inc. | 2,225 | 581,971 |

| SS&C Technologies Holdings, Inc. | 13,125 | 1,015,087 |

| Steelcase Inc. Class A | 42,045 | 566,346 |

| | | |

| Information Technology - 12.6% | | 7,468,415 |

| Semiconductors & Semiconductor Equipment - 6.3% | | |

| Infineon Technologies A.G. ADR | 26,020 | 845,650 |

| Marvell Technology, Inc. | 13,725 | 1,272,170 |

| Microchip Technology Inc. | 8,850 | 603,304 |

| NXP Semiconductors N.V. | 4,395 | 1,008,081 |

| Technology Hardware & Equipment - 6.3% | | |

| Calix, Inc. (a) | 25,615 | 833,256 |

| Coherent Corp. (a) | 5,900 | 590,944 |

| Keysight Technologies, Inc. (a) | 3,525 | 602,211 |

| Lumentum Holdings Inc. (a) | 6,940 | 603,572 |

| Pure Storage, Inc. Class A (a) | 9,415 | 498,901 |

| Viavi Solutions Inc. (a) | 61,401 | 610,326 |

See Notes to Financial Statements.

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Shares | Value |

| COMMON STOCKS (continued) | | |

| | | |

| Materials - 4.6% | | $2,710,122 |

| Berry Global Group, Inc. | 14,000 | 1,012,340 |

| Freeport-McMoRan Inc. | 10,660 | 471,172 |

| O-I Glass, Inc. (a) | 97,350 | 1,226,610 |

| | | |

| Real Estate - 6.3% | | 3,754,567 |

| Equity Real Estate Investment Trusts (REITs) - 4.6% | | |

| Alexandria Real Estate Equities, Inc. | 4,985 | 549,497 |

| Global Net Lease, Inc. (a) | 61,295 | 454,196 |

| Host Hotels & Resorts Inc. | 30,125 | 554,902 |

| Omega Healthcare Investors, Inc. | 14,060 | 570,977 |

| Park Hotels & Resorts Inc. | 39,100 | 608,005 |

| Real Estate Management & Development - 1.7% | | |

| Colliers Int’l. Group Inc. | 4,275 | 656,768 |

| FirstService Corp. | 1,855 | 360,222 |

| | | |

| Utilities - 3.4% | | 1,995,305 |

| Alliant Energy Corp. | 9,700 | 613,040 |

| WEC Energy Group, Inc. | 6,800 | 687,140 |

| Xcel Energy, Inc. | 9,580 | 695,125 |

| | | |

| Short-Term Investments - 0.2% | | 100,000 |

| (COST $100,000) | | |

| | | |

| Money Market Funds - 0.2% | | 100,000 |

| First American Government Obligations Fund Class X, 4.56% (b) | 100,000 | 100,000 |

| | | |

| TOTAL INVESTMENTS - 99.6% (COST $43,743,709) | | 58,940,210 |

| | | |

| NET OTHER ASSETS & LIABILITIES - 0.4% | | 231,287 |

| | | |

| NET ASSETS - 100% | | $59,171,497 |

| (a) | Non-income producing security. |

| (b) | Represents the 7-day yield at November 30, 2024. |

| Abbreviations: |

| ADR | American Depositary Receipt |

| A.G. | Aktiengesellschaft is the German term for a public limited liability corporation. |

| N.V. | Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

| PLC | Public Limited Company |

| S.A. | Generally designates corporations in various countries, mostly those employing civil law. This translates literally as anonymous company. |

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”) and is licensed for use by Thompson Investment Management Inc. Neither MSCI, S&P, nor any other party involved in making or compiling the GICS or any GICS classifications makes any warranties with respect there to or the results to be obtained by the use thereof, and no such party shall have any liability whatsoever with respect thereto.

See Notes to Financial Statements.

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2024:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Communication services | | $ | 3,936,223 | | | $ | – | | | $ | – | | | $ | 3,936,223 | |

| Consumer discretionary | | | 5,655,154 | | | | – | | | | – | | | | 5,655,154 | |

| Consumer staples | | | 2,324,587 | | | | – | | | | – | | | | 2,324,587 | |

| Energy | | | 1,921,414 | | | | – | | | | – | | | | 1,921,414 | |

| Financials | | | 12,397,323 | | | | – | | | | – | | | | 12,397,323 | |

| Health care | | | 8,098,529 | | | | – | | | | – | | | | 8,098,529 | |

| Industrials | | | 8,578,571 | | | | – | | | | – | | | | 8,578,571 | |

| Information technology | | | 7,468,415 | | | | – | | | | – | | | | 7,468,415 | |

| Materials | | | 2,710,122 | | | | – | | | | – | | | | 2,710,122 | |

| Real estate | | | 3,754,567 | | | | – | | | | – | | | | 3,754,567 | |

| Utilities | | | 1,995,305 | | | | – | | | | – | | | | 1,995,305 | |

| Total common stocks | | | 58,840,210 | | | | – | | | | – | | | | 58,840,210 | |

| Short-term investments | | | | | | | | | | | | | | | | |

| Money market funds | | | 100,000 | | | | – | | | | – | | | | 100,000 | |

| Total short-term investments | | | 100,000 | | | | – | | | | – | | | | 100,000 | |

| Total investments | | $ | 58,940,210 | | | $ | – | | | $ | – | | | $ | 58,940,210 | |

The Fund did not invest in any level-3 investments as of and during the fiscal year ended November 30, 2024.

For more information on valuation inputs, see financial statement Note 2 - Significant Accounting Policies.

See Notes to Financial Statements.

| BOND FUND SCHEDULE OF INVESTMENTS |

| November 30, 2024 |

| | Rate (%) | Maturity Date | Principal Amount | Value |

| BONDS - 92.0% | | | | $1,474,916,363 |

| (COST $1,654,509,149) | | | | |

| | | | | |

| Asset-Backed Securities - 12.0% | | | | 191,974,654 |

| AASET Trust, Series 2018-2A A (h) | 4.454 | 11/18/38 | 248,093 | 243,131 |

| AASET Trust, Series 2022-1A A (h) | 6.000 | 05/16/47 | 5,553,752 | 5,518,033 |

| AASET Trust, Series 2024-1A A1 (h) | 6.261 | 05/16/49 | 1,949,014 | 1,981,977 |

| American Airlines, Series 2017-1 A | 4.000 | 08/15/30 | 200,568 | 189,080 |

| Blackbird Capital Aircraft Lease Securitization Ltd., Series 2016-1A A (4.213% to 12/15/24, then 6.213%) (h)(k) | 4.213 | 12/16/41 | 2,966,995 | 2,960,943 |

| Blackbird Capital Aircraft Lease Securitization Ltd., Series 2016-1A B (5.682% to 12/15/24, then 7.682%) (h)(k) | 5.682 | 12/16/41 | 676,847 | 674,457 |

| Business Jet Securities, LLC, Series 2022-1A A (h) | 4.455 | 06/15/37 | 4,258,867 | 4,152,833 |

| Business Jet Securities, LLC, Series 2022-1A B (h) | 5.192 | 06/15/37 | 608,410 | 589,297 |

| Castle Aircraft Securitization Trust, Series 2019-1A A (h) | 3.967 | 04/15/39 | 2,536,820 | 2,333,957 |

| Castle Aircraft Securitization Trust, Series 2021-1A B (h) | 6.656 | 01/15/46 | 1,603,768 | 1,542,561 |

| Centerline Logistics Corp., Series CLC 2023-1 A2 (h) | 9.750 | 12/15/27 | 7,093,060 | 7,189,539 |

| Coinstar Funding, LLC, Series 2017-1A A2 (h) | 5.216 | 04/25/47 | 26,172,875 | 24,157,477 |

| CVS Pass-Through Trust | 6.943 | 01/10/30 | 1,334,830 | 1,371,725 |

| DCAL Aviation Finance Ltd., Series 2015-1A A1 (f)(h)(k) | 6.213 | 02/15/40 | 654,733 | 602,368 |

| ECAF I Ltd., Series 2015-1A A2 (h) | 4.947 | 06/15/40 | 6,626,632 | 5,019,833 |

| ECAF I Ltd., Series 2015-1A B1 (h)(i) | 5.802 | 06/15/40 | 19,177,362 | 5,849,556 |

| GAIA Aviation Ltd. (TAILWIND), Series 2019-1 B (h) | 5.193 | 12/15/44 | 2,888,439 | 2,600,913 |

| HOA Funding LLC, Series 2021-1A A2 (h) | 4.723 | 08/20/51 | 12,601,918 | 9,876,596 |

| Horizon Aircraft Finance I Ltd., Series 2018-1 B (h) | 5.270 | 12/15/38 | 2,702,399 | 1,972,735 |

| Horizon Aircraft Finance II Ltd., Series 2019-1 A (h) | 3.721 | 07/15/39 | 2,418,950 | 2,298,003 |

| Icon Brand Holdings LLC, Series 2012-1A A (h)(i) | 4.229 | 01/25/43 | 7,009,399 | 3,380,360 |

| JOL Air Limited, Series 2019-1 B (h) | 4.948 | 04/15/44 | 706,037 | 672,006 |

| KDAC Aviation Finance Ltd., Series 2017-1A A (h) | 4.212 | 12/15/42 | 1,719,609 | 1,665,957 |

| KDAC Aviation Finance Ltd., Series 2017-1A B (h) | 5.926 | 12/15/42 | 17,132,629 | 13,706,103 |

| Kestrel Aircraft Funding Ltd., Series 2018-1A A (h) | 4.250 | 12/15/38 | 1,212,149 | 1,191,300 |

| Kestrel Aircraft Funding Ltd., Series 2018-1A B (h) | 5.500 | 12/15/38 | 1,928,838 | 1,552,869 |

| Labrador Aviation Finance Ltd., Series 2016-1A B1 (h) | 5.682 | 01/15/42 | 33,166,314 | 26,698,525 |

| MACH 1 Cayman Ltd., Series 2019-1 B (h) | 4.335 | 10/15/39 | 4,341,879 | 3,559,776 |

| MAPS Ltd., Series 2018-1A B (h) | 5.193 | 05/15/43 | 333,946 | 323,150 |

| METAL LLC, Series 2017-1 A (h) | 4.581 | 10/15/42 | 12,707,907 | 7,879,284 |

| METAL LLC, Series 2017-1 B (h) | 6.500 | 10/15/42 | 26,657,035 | 8,264,480 |

| Pioneer Aircraft Finance Ltd., Series 2019-1 B (h) | 4.948 | 06/15/44 | 1,419,643 | 1,093,395 |

| Project Silver, Series 2019-1 A (h) | 3.967 | 07/15/44 | 3,945,543 | 3,653,692 |

| PROP Limited, Series 2017-1 B (h)(i) | 6.900 | 03/15/42 | 3,836,109 | 1,506,939 |

| Sapphire Aviation Finance I Ltd., Series 2018-1A B (h) | 5.926 | 03/15/40 | 896,490 | 865,193 |

| SMB Private Education Loan Trust, Series 2014-A C (h) | 4.500 | 09/15/45 | 7,000,000 | 6,217,955 |

| Sprite Limited, Series 2021-1 A (h) | 3.750 | 11/15/46 | 5,973,654 | 5,693,962 |

| Sprite Limited, Series 2021-1 B (h) | 5.100 | 11/15/46 | 2,985,601 | 2,855,481 |

| TGIF Funding LLC, Series 2017-1A A2 (h)(i) | 6.202 | 04/30/47 | 10,990,469 | 8,831,362 |

| Thunderbolt Aircraft Lease Ltd., Series 2019-1 B (h) | 4.750 | 11/15/39 | 4,314,678 | 3,236,051 |

| United Air Lines, Series 2020-1 A | 5.875 | 04/15/29 | 2,274,667 | 2,329,547 |

| WAVE Trust, Series 2017-1A A (h) | 3.844 | 11/15/42 | 1,322,484 | 1,223,353 |

| Willis Engine Structured Trust IV, Series 2018-A A (h) | 4.750 | 09/15/43 | 4,531,882 | 4,448,900 |

See Notes to Financial Statements.

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Rate (%) | Maturity Date | Principal Amount | Value |

| BONDS (continued) | | | | |

| | | | | |

| Commercial Mortgage-Backed Securities - 12.7% | | | | $203,617,964 |

| BBCMS Mortgage Trust, Series 2015-VFM A2 (h) | 3.375 | 03/12/36 | 3,000,000 | 2,732,145 |

CG-CCRE Commercial Mortgage Trust, Series 2014-FL1 B

(1 times (TSFR1M + 1.26448%), floor 1.150%) (d)(h) | 5.874 | 06/15/31 | 5,608,848 | 5,370,295 |

| Citigroup Commercial Mortgage Trust, Series 2015-GC35 C (d) | 4.457 | 11/10/48 | 7,000,000 | 4,769,328 |

| Citigroup Commercial Mortgage Trust, Series 2016-GC36 C (d) | 4.745 | 02/10/49 | 5,000,000 | 3,980,834 |

| COMM Mortgage Trust, Series 2012-CR4 AM (f) | 3.251 | 10/15/45 | 3,000,000 | 2,675,837 |

| COMM Mortgage Trust, Series 2014-CR16 C (d) | 4.782 | 04/10/47 | 5,000,000 | 4,677,838 |

| COMM Mortgage Trust, Series 2014-UBS4 D (d)(f)(h) | 4.707 | 08/10/47 | 9,740,000 | 3,414,909 |

| COMM Mortgage Trust, Series 2014-UBS5 B | 4.514 | 09/10/47 | 3,270,000 | 3,159,668 |

| COMM Mortgage Trust, Series 2014-UBS5 C (d) | 4.615 | 09/10/47 | 6,500,000 | 5,906,035 |

| COMM Mortgage Trust, Series 2015-DC1 C (d) | 4.272 | 02/10/48 | 540,000 | 464,655 |

| COMM Mortgage Trust, Series 2015-PC1 D (d) | 4.282 | 07/10/50 | 2,500,000 | 2,141,078 |

Credit Suisse Commercial Mortgage Securities Corp.,

Series 2016-NXSR C (d) | 4.421 | 12/15/49 | 3,000,000 | 2,563,924 |

| CSAIL Commercial Mortgage Trust, Series 2015-C1 C (d) | 4.064 | 04/15/50 | 1,780,000 | 1,576,770 |

| CSAIL Commercial Mortgage Trust, Series 2015-C2 B (d) | 4.179 | 06/15/57 | 5,000,000 | 4,628,108 |

| CSAIL Commercial Mortgage Trust, Series 2015-C2 C (d) | 4.179 | 06/15/57 | 3,579,000 | 2,954,988 |

| CSAIL Commercial Mortgage Trust, Series 2015-C3 B (d) | 4.112 | 08/15/48 | 3,905,000 | 3,522,456 |

| CSAIL Commercial Mortgage Trust, Series 2015-C3 D (d) | 3.362 | 08/15/48 | 5,795,000 | 3,936,230 |

| DBUBS Mortgage Trust, Series 2011-LC3A PM1 (h) | 4.452 | 05/10/44 | 7,476,810 | 6,321,063 |

| DBUBS Mortgage Trust, Series 2011-LC3A PM2 (d)(h) | 5.098 | 05/10/44 | 4,197,000 | 3,173,259 |

| GS Mortgage Securities Trust, Series 2014-GC24 B (d) | 4.419 | 09/10/47 | 4,340,000 | 3,920,800 |

| GS Mortgage Securities Trust, Series 2018-3PCK A (1 times (TSFR1M + 2.06448%), floor 1.950%) (d)(h) | 6.424 | 09/15/31 | 2,412,403 | 2,388,858 |

| HMH Trust, Series 2017-NSS A (h) | 3.062 | 07/05/31 | 5,850,000 | 4,563,000 |

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2011-C3 B (h) | 5.013 | 02/15/46 | 2,564,667 | 2,425,335 |

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2011-C3 C (h) | 5.360 | 02/15/46 | 9,250,000 | 8,381,914 |

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2012-LC9 C (d)(h) | 3.567 | 12/15/47 | 1,538,545 | 1,415,569 |

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2014-C20 D (d)(h)(i) | 4.513 | 07/15/47 | 5,000,000 | 2,995,113 |

| JPMBB Commercial Mortgage Securities Trust, Series 2013-C12 C (d) | 3.939 | 07/15/45 | 2,710,857 | 2,549,480 |

| JPMBB Commercial Mortgage Securities Trust, Series 2013-C14 C (d) | 4.038 | 08/15/46 | 2,885,566 | 2,656,386 |

| JPMBB Commercial Mortgage Securities Trust, Series 2014-C18 C (d) | 4.536 | 02/15/47 | 5,060,000 | 4,720,809 |

| JPMBB Commercial Mortgage Securities Trust, Series 2014-C22 D (d)(f)(h) | 4.512 | 09/15/47 | 4,966,000 | 2,919,965 |

| JPMBB Commercial Mortgage Securities Trust, Series 2014-C24 B (f) | 4.116 | 11/15/47 | 10,400,000 | 9,438,883 |

| JPMBB Commercial Mortgage Securities Trust, Series 2015-C28 C (d) | 4.067 | 10/15/48 | 5,496,426 | 5,087,953 |

| JPMBB Commercial Mortgage Securities Trust, Series 2015-C32 B | 4.389 | 11/15/48 | 500,000 | 405,060 |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C10 C (d) | 3.981 | 07/15/46 | 2,750,000 | 2,273,347 |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C11 AS (d) | 4.077 | 08/15/46 | 4,615,222 | 4,077,336 |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C12 C (d) | 4.803 | 10/15/46 | 1,783,131 | 1,668,044 |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2014-C16 C (d) | 4.707 | 06/15/47 | 7,015,936 | 6,063,991 |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2015-C21 C (d) | 4.096 | 03/15/48 | 8,000,000 | 7,165,325 |

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2015-C22 D (d)(h) | 4.189 | 04/15/48 | 5,000,000 | 3,062,254 |

| Morgan Stanley Capital I Trust, Series 2011-C2 D (d)(h) | 5.211 | 06/15/44 | 423,856 | 418,767 |

| Morgan Stanley Capital I Trust, Series 2015-UBS8 C (d) | 4.576 | 12/15/48 | 6,500,000 | 5,790,994 |

| Morgan Stanley Capital I Trust, Series 2016-UB12 C (d) | 4.124 | 12/15/49 | 5,000,000 | 3,575,836 |

| Wells Fargo Commercial Mortgage Trust, Series 2015-C27 C | 3.894 | 02/15/48 | 6,982,500 | 6,118,880 |

| Wells Fargo Commercial Mortgage Trust, Series 2015-C31 C (d) | 4.591 | 11/15/48 | 5,000,000 | 4,747,502 |

| Wells Fargo Commercial Mortgage Trust, Series 2015-C31 D | 3.852 | 11/15/48 | 5,189,370 | 4,310,921 |

| Wells Fargo Commercial Mortgage Trust, Series 2015-LC22 B (d) | 4.541 | 09/15/58 | 800,000 | 774,518 |

| Wells Fargo Commercial Mortgage Trust, Series 2015-SG1 C (d) | 4.445 | 09/15/48 | 5,000,000 | 4,363,601 |

| Wells Fargo Commercial Mortgage Trust, Series 2016-C36 C (d) | 4.114 | 11/15/59 | 3,000,000 | 2,390,908 |

| Wells Fargo Commercial Mortgage Trust, Series 2017-SMP A (1 times (TSFR1M + 0.921%), floor 0.875%) (d)(h) | 5.531 | 12/15/34 | 1,625,000 | 1,504,363 |

| WFRBS Commercial Mortgage Trust, Series 2012-C10 B | 3.744 | 12/15/45 | 937,179 | 859,120 |

| WFRBS Commercial Mortgage Trust, Series 2012-C10 C (d) | 4.310 | 12/15/45 | 7,000,000 | 5,751,624 |

| WFRBS Commercial Mortgage Trust, Series 2013-C14 B (d) | 3.836 | 06/15/46 | 1,500,000 | 1,351,320 |

| WFRBS Commercial Mortgage Trust, Series 2013-C15 B (d) | 4.186 | 08/15/46 | 3,800,000 | 3,306,760 |

| WFRBS Commercial Mortgage Trust, Series 2014-C20 C (f) | 4.513 | 05/15/47 | 4,500,000 | 2,710,977 |

| WFRBS Commercial Mortgage Trust, Series 2014-C21 C | 4.234 | 08/15/47 | 3,000,000 | 2,757,598 |

| WFRBS Commercial Mortgage Trust, Series 2014-C21 D (h) | 3.497 | 08/15/47 | 5,000,000 | 4,019,691 |

| WP Glimcher Mall Trust, Series 2015-WPG B (d)(h) | 3.516 | 06/05/35 | 2,900,000 | 2,715,742 |

See Notes to Financial Statements.

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Rate (%) | Maturity Date | Principal Amount | Value |

| BONDS (continued) | | | | |

| | | | | |

| Convertible Bonds - 0.0%^ | | | | $100,000 |

| FedNat Holding Co. (e)(f)(h)(i)(j) | 5.000 | 04/19/26 | 5,000,000 | 100,000 |

| | | | | |

| Corporate Bonds - 63.5% | | | | 1,017,669,877 |

| 3M Co. | 2.650 | 04/15/25 | 500,000 | 495,866 |

| 3M Co. (TSFR3M - 0.08839%) (d) | 4.665 | 12/21/40 | 3,863,000 | 3,824,903 |

| 3M Co. (TSFR3M - 0.08839%) (d) | 4.858 | 12/15/44 | 1,350,000 | 1,336,873 |

| A10 Capital, LLC (h) | 5.875 | 08/17/26 | 5,000,000 | 4,759,964 |

| A10 Capital, LLC (h) | 5.875 | 08/17/26 | 1,500,000 | 1,427,989 |

| ACRES Commercial Realty Corp. | 5.750 | 08/15/26 | 8,000,000 | 7,606,841 |

| Actavis Funding SCS | 3.800 | 03/15/25 | 3,559,000 | 3,526,112 |

| Albemarle Corp. | 5.050 | 06/01/32 | 1,750,000 | 1,706,701 |

| Alexandria Real Estate Equities, Inc. | 4.700 | 07/01/30 | 1,350,000 | 1,334,797 |

| Amerant Bancorp Inc. | 5.750 | 06/30/25 | 10,000,000 | 9,925,000 |

| American Coastal Insurance Corp. (c) | 7.250 | 12/15/27 | 2,250,000 | 2,095,312 |

| American Honda Finance Corp. | 1.500 | 01/13/25 | 5,000,000 | 4,979,998 |

| American Tower Corp. | 4.000 | 06/01/25 | 2,000,000 | 1,989,759 |

| Amgen Inc. | 1.900 | 02/21/25 | 1,619,000 | 1,608,405 |

| Amgen Inc. | 5.507 | 03/02/26 | 238,000 | 238,003 |

| Aptiv PLC / Aptiv Global Financing DAC | 4.650 | 09/13/29 | 7,000,000 | 6,852,340 |

| Arrow Electronics, Inc. | 4.000 | 04/01/25 | 2,623,000 | 2,611,810 |

| Arrow Electronics, Inc. | 5.875 | 04/10/34 | 5,420,000 | 5,521,626 |

| Assured Guaranty US Holdings Inc. (TSFR3M + 2.64161%) (d) | 7.588 | 12/15/66 | 12,356,000 | 12,139,749 |

| AT&T Inc. | 7.700 | 05/01/32 | 1,000,000 | 1,133,499 |

| Avnet, Inc. | 6.250 | 03/15/28 | 2,000,000 | 2,070,797 |

| Avnet, Inc. | 3.000 | 05/15/31 | 580,000 | 502,736 |

| Avnet, Inc. | 5.500 | 06/01/32 | 4,549,000 | 4,563,268 |

| Axos Financial, Inc. (4.875% to 10/01/25, then TSFR3M + 4.760%) (d) | 4.875 | 10/01/30 | 8,000,000 | 7,800,000 |

| BAC Capital Trust XIII (Greater of 4.000% or (TSFR3M + 0.66161%), floor 4.000%) (d)(g) | 5.608 | 12/15/24 | 2,200,000 | 1,779,528 |

| Banc of California, Inc. (4.375% to 10/30/25, then TSFR3M + 4.195%) (d) | 4.375 | 10/30/30 | 12,500,000 | 12,028,381 |

| Bank of America Corp. (5.400% to 12/14/24, 5.750% to 12/14/26, 6.500% to 12/14/28, then 7.000%) (k) | 5.400 | 12/14/29 | 2,853,000 | 2,845,441 |

| Bank of America Corp. (4.0 times (USISDA10 - USISDA02 - 0.250%), floor 0.000%, cap 10.000%) (d)(e) | 0.000 | 11/19/30 | 671,000 | 524,531 |

| Bank of Montreal (6.699% to 08/25/29, then H15T5Y + 2.979%) (d)(g) | 6.699 | 02/25/25 | 6,977,000 | 6,970,146 |

| Bank of New York Mellon Corp. (3.700% to 03/20/26, then H15T5Y + 3.352%) (d)(g) | 3.700 | 03/20/26 | 1,000,000 | 975,501 |

| Baxter Int’l. Inc. | 2.539 | 02/01/32 | 1,000,000 | 852,434 |

| Bay Banks of Virginia, Inc. (TSFR3M + 4.335%, floor 4.335%) (d)(h) | 8.982 | 10/15/29 | 3,000,000 | 2,978,604 |

| BayCom Corp. (5.250% to 09/15/25, then TSFR3M + 5.210%) (d) | 5.250 | 09/15/30 | 8,460,000 | 8,290,800 |

| BCB Bancorp, Inc. (9.250% to 09/01/29, then TSFR3M + 5.820%) (d)(h) | 9.250 | 09/01/34 | 5,000,000 | 5,018,750 |

| Berry Global, Inc. | 5.500 | 04/15/28 | 3,550,000 | 3,608,858 |

| Boeing Co. | 5.150 | 05/01/30 | 2,300,000 | 2,290,114 |

| Boeing Co. | 6.125 | 02/15/33 | 1,000,000 | 1,036,923 |

| Boeing Co. | 3.300 | 03/01/35 | 1,881,000 | 1,516,449 |

| BOKF Merger Corp. Number Sixteen (5.625% to 06/25/25, then 3 month LIBOR + 3.170%) (d) | 5.625 | 06/25/30 | 10,000,000 | 9,700,000 |

| BorgWarner, Inc. | 5.400 | 08/15/34 | 2,000,000 | 2,016,555 |

| Boston Properties LP | 3.650 | 02/01/26 | 1,213,000 | 1,194,553 |

| Boston Properties LP | 3.250 | 01/30/31 | 4,085,000 | 3,628,382 |

| Boston Properties LP | 5.750 | 01/15/35 | 2,755,000 | 2,764,146 |

| Brandywine Operating Partnership, L.P. | 3.950 | 11/15/27 | 1,250,000 | 1,180,829 |

| Broadmark Realty Capital Inc. (h) | 5.000 | 11/15/26 | 5,000,000 | 4,630,093 |

See Notes to Financial Statements.

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Rate (%) | Maturity Date | Principal Amount | Value |

| BONDS (continued) | | | | |

| | | | | |

| Corporate Bonds (continued) | | | | |

| Brunswick Corp. | 2.400 | 08/18/31 | 1,250,000 | $1,044,326 |

| Brunswick Corp. | 4.400 | 09/15/32 | 3,600,000 | 3,374,362 |

| Byline Bancorp, Inc. (6.000% to 07/01/25, then TSFR3M + 5.880%) (d) | 6.000 | 07/01/30 | 12,000,000 | 11,640,000 |

| Cabot Corp. | 3.400 | 09/15/26 | 732,000 | 713,183 |

| Carrington Holding Co., LLC (h) | 9.250 | 05/15/29 | 5,000,000 | 5,000,700 |

| Carrington Holding Co., LLC (h) | 9.750 | 05/15/31 | 5,000,000 | 5,059,896 |

| CDW LLC / CDW Finance Corp. | 4.125 | 05/01/25 | 675,000 | 670,731 |

| CDW LLC / CDW Finance Corp. | 3.569 | 12/01/31 | 1,750,000 | 1,567,789 |

| CDW LLC / CDW Finance Corp. | 5.550 | 08/22/34 | 750,000 | 746,406 |

| Celanese US Holdings LLC (6.165% to 01/15/25, then 6.415%) (c) | 6.165 | 07/15/27 | 5,000,000 | 5,101,352 |

| Change Co. CDFI LLC (4.750% to 09/30/26, then SOFRRATE + 4.080%) (d)(h) | 4.750 | 09/30/31 | 7,000,000 | 6,615,000 |

| Cheniere Energy Partners, L.P. | 4.500 | 10/01/29 | 4,500,000 | 4,380,935 |

| Choice Hotels Int’l., Inc. | 3.700 | 01/15/31 | 1,102,000 | 1,007,467 |

| Choice Hotels Int’l., Inc. | 5.850 | 08/01/34 | 1,400,000 | 1,430,059 |

| Citigroup, Inc. (4.0 times (USISDA30 - USISDA05), floor 0.000%, cap 10.000%) (d)(e) | 0.000 | 07/09/28 | 740,000 | 621,780 |

| Citigroup, Inc. (4.0 times (USISDA30 - USISDA05), floor 0.000%, cap 10.000%) (d)(e) | 0.000 | 11/15/28 | 245,000 | 208,842 |

| Citigroup, Inc. (4.0 times (USISDA30 - USISDA02), floor 0.000%, cap 10.000%) (d)(e) | 0.000 | 12/23/29 | 1,152,000 | 910,651 |

| Citigroup, Inc. (4.0 times (USISDA10 - USISDA02 - 0.250%), floor 0.000%, cap 10.000%) (d)(e) | 0.000 | 11/19/30 | 727,000 | 567,236 |

| Citigroup, Inc. (4.35 times (USISDA30 - USISDA05), floor 0.000%, cap 10.000%) (d)(e) | 0.000 | 07/09/33 | 1,394,000 | 979,490 |

| Citigroup, Inc. (5.0 times (USISDA30 - USISDA05), floor 0.000%, cap 10.000%) (d)(e) | 0.000 | 12/20/33 | 2,863,000 | 1,983,297 |

| Citigroup, Inc. (TSFR3M + 0.81161%) (d) | 5.332 | 08/25/36 | 868,000 | 777,835 |

| CNO Financial Group, Inc. | 5.250 | 05/30/25 | 1,407,000 | 1,407,040 |

| Colgate-Palmolive Co. (TSFR3M - 0.03839%) (d) | 4.560 | 04/04/45 | 448,000 | 446,484 |

| Colgate-Palmolive Co. (TSFR3M - 0.03839%) (d) | 4.978 | 12/04/46 | 1,375,000 | 1,357,169 |

| Comerica Bank (5.332% to 08/25/32, then SOFRRATE + 2.610%) (d) | 5.332 | 08/25/33 | 8,000,000 | 7,752,814 |

| Comerica Inc. | 4.000 | 02/01/29 | 2,000,000 | 1,919,133 |

| Concentrix Corp. | 6.850 | 08/02/33 | 7,056,000 | 7,242,772 |

| Congressional Bancshares, Inc. (5.750% to 12/01/24, then TSFR3M + 4.390%) (d)(h) | 5.750 | 12/01/29 | 5,000,000 | 4,900,000 |

| ConnectOne Bancorp, Inc. (5.750% to 06/15/25, then TSFR3M + 5.605%) (d) | 5.750 | 06/15/30 | 7,780,000 | 7,624,400 |

| Cox Communications, Inc. | 7.625 | 06/15/25 | 3,565,000 | 3,611,108 |

| Crown Capital Holdings LLC (e)(f)(h)(i) | 12.500 | 01/15/25 | 7,000,000 | 4,480,000 |

| Crown Castle Inc. | 3.300 | 07/01/30 | 1,217,000 | 1,115,977 |

| CVS Health Corp. | 5.300 | 06/01/33 | 250,000 | 248,089 |

| CVS Health Corp. | 4.875 | 07/20/35 | 3,770,000 | 3,583,627 |

| Darden Restaurants, Inc. | 6.300 | 10/10/33 | 3,500,000 | 3,719,974 |

| Darden Restaurants, Inc. | 6.000 | 08/15/35 | 40,000 | 39,948 |

| Dentsply Sirona Inc. | 3.250 | 06/01/30 | 8,183,000 | 7,336,711 |

| Digital Realty Trust, L.P. | 5.550 | 01/15/28 | 2,000,000 | 2,046,919 |

| Digital Realty Trust, L.P. | 3.600 | 07/01/29 | 489,000 | 466,954 |

| Dollar General Corp. | 5.000 | 11/01/32 | 1,750,000 | 1,701,191 |

| Dollar General Corp. | 5.450 | 07/05/33 | 2,560,000 | 2,557,302 |

| Dollar Tree, Inc. | 4.000 | 05/15/25 | 1,688,000 | 1,679,876 |

| Eagle Bancorp, Inc. (h) | 10.000 | 09/30/29 | 6,000,000 | 6,000,000 |

| Enact Holdings, Inc. | 6.250 | 05/28/29 | 500,000 | 512,741 |

| Enstar Group Ltd. | 3.100 | 09/01/31 | 7,782,000 | 6,684,777 |

| Enterprise Products Operating LLC (TSFR3M + 3.03911%) (d) | 8.055 | 06/01/67 | 8,538,000 | 8,492,563 |

| EPR Properties | 3.600 | 11/15/31 | 5,047,000 | 4,455,506 |

| Equifax Inc. | 2.600 | 12/01/24 | 2,243,000 | 2,243,000 |

| EverBank Financial Corp. (8.375% to 03/01/30, then TSFR3M + 5.020%) (d)(h) | 8.375 | 09/01/34 | 4,000,000 | 3,948,853 |

| Everest Reinsurance Holdings Inc. (TSFR3M + 2.64661%) (d) | 7.170 | 05/01/67 | 11,955,000 | 11,738,740 |

See Notes to Financial Statements.

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Rate (%) | Maturity Date | Principal Amount | Value |

| BONDS (continued) | | | | |

| | | | | |

| Corporate Bonds (continued) | | | | |

| F&G Annuities & Life, Inc. | 6.250 | 10/04/34 | 6,948,000 | $6,915,029 |

| F&M Financial Services Corp. (TSFR3M + 4.840%, floor 4.840%) (d)(h) | 9.781 | 09/17/29 | 9,000,000 | 8,954,990 |

| FedNat Holding Co. (e)(f)(i)(j) | 7.750 | 03/15/29 | 17,000,000 | 340,000 |

| Fidelity Federal Bancorp (TSFR3M + 4.05161%, floor 3.790%) (d)(h) | 8.708 | 10/15/28 | 6,500,000 | 6,376,829 |

| Fidelity Federal Bancorp (TSFR3M + 4.650%) (d)(h) | 9.204 | 11/01/29 | 7,000,000 | 6,930,000 |

| Fifth Third Bancorp (TSFR3M + 3.39061%) (d)(g) | 7.994 | 12/30/24 | 4,498,000 | 4,478,927 |

| First Financial Bancorp (5.250% to 05/15/25, then TSFR3M + 5.090%) (d) | 5.250 | 05/15/30 | 3,000,000 | 2,963,892 |

| First Horizon Corp. | 4.000 | 05/26/25 | 2,410,000 | 2,396,545 |

| Flex Ltd. | 4.750 | 06/15/25 | 4,207,000 | 4,199,585 |

| Flex Ltd. | 6.000 | 01/15/28 | 500,000 | 514,435 |

| Flex Ltd. | 4.875 | 06/15/29 | 2,497,000 | 2,477,092 |

| Flowserve Corp. | 3.500 | 10/01/30 | 899,000 | 831,711 |

| FMC Corp. | 5.150 | 05/18/26 | 825,000 | 827,095 |

| FNB Corp. | 4.875 | 10/02/25 | 2,000,000 | 1,978,298 |

| FNB Corp. (TSFR3M + 3.28161%) (d)(h) | 8.276 | 12/06/28 | 3,000,000 | 2,884,330 |

| FPL Group, Inc. (TSFR3M + 2.32911%) (d) | 6.922 | 10/01/66 | 2,035,000 | 1,988,482 |

| GATX Corp. | 3.250 | 03/30/25 | 500,000 | 496,960 |

| GE Capital Funding, LLC | 3.450 | 05/15/25 | 200,000 | 198,631 |

| Genpact Luxembourg Sarl | 3.375 | 12/01/24 | 1,759,000 | 1,759,000 |

| Genuine Parts Co. | 1.750 | 02/01/25 | 931,000 | 926,152 |

| Georgia-Pacific LLC | 7.375 | 12/01/25 | 421,000 | 432,087 |

| Global Payments Inc. | 2.900 | 05/15/30 | 1,000,000 | 900,178 |

| Global Payments Inc. | 2.900 | 11/15/31 | 1,154,000 | 1,007,393 |

| Globe Life Inc. | 5.850 | 09/15/34 | 4,500,000 | 4,631,358 |

| GLP Capital L.P. / GLP Financing II, Inc. | 5.250 | 06/01/25 | 500,000 | 499,595 |

| Goldman Sachs Group, Inc. (TSFR3M + 1.96161%) (d) | 6.551 | 04/05/26 | 1,000,000 | 1,002,218 |

| Great Ajax Operating Partnership L.P. (h) | 8.875 | 09/01/27 | 3,500,000 | 3,381,667 |

| Hallmark Financial Services, Inc. | 6.250 | 08/15/29 | 13,000,000 | 2,535,000 |

| Hasbro, Inc. | 3.550 | 11/19/26 | 250,000 | 244,534 |

| Hasbro, Inc. | 6.050 | 05/14/34 | 6,350,000 | 6,535,254 |

| HCA Inc. | 5.250 | 06/15/26 | 2,000,000 | 2,005,245 |

| HCA Inc. | 7.500 | 11/06/33 | 2,530,000 | 2,836,750 |

| Healthcare Realty Holdings LP | 2.050 | 03/15/31 | 1,705,000 | 1,407,251 |

| HF Sinclair Corp. | 6.375 | 04/15/27 | 5,000,000 | 5,073,189 |

| Highwoods Realty L.P. | 3.050 | 02/15/30 | 1,834,000 | 1,636,674 |

| Highwoods Realty L.P. | 7.650 | 02/01/34 | 4,850,000 | 5,494,093 |

| Hilltop Holdings Inc. (5.750% to 05/15/25, then TSFR3M + 5.680%) (d) | 5.750 | 05/15/30 | 8,000,000 | 7,880,000 |

| Horizon Bancorp, Inc. (5.625% to 07/01/25, then TSFR3M + 5.490%) (d) | 5.625 | 07/01/30 | 6,750,000 | 6,581,250 |

| Host Hotels & Resorts LP | 5.500 | 04/15/35 | 3,660,000 | 3,676,144 |

| Humana Inc. | 5.375 | 04/15/31 | 2,000,000 | 2,020,865 |

| Humana Inc. | 5.950 | 03/15/34 | 750,000 | 778,445 |

| Huntington Ingalls Industries, Inc. | 2.043 | 08/16/28 | 2,000,000 | 1,806,532 |

| Huntsman Int’l. LLC | 2.950 | 06/15/31 | 3,307,000 | 2,814,532 |

| Huntsman Int’l. LLC | 5.700 | 10/15/34 | 4,550,000 | 4,440,722 |

| Hyatt Hotels Corp. | 5.500 | 06/30/34 | 350,000 | 352,581 |

| IIP Operating Partnership, LP | 5.500 | 05/25/26 | 3,619,000 | 3,549,852 |

| Illumina, Inc. | 5.800 | 12/12/25 | 2,000,000 | 2,016,999 |

| Independent Bank Group, Inc. (4.000% to 09/15/25, then TSFR3M + 3.885%) (d) | 4.000 | 09/15/30 | 2,000,000 | 1,925,000 |

| Intel Corp. | 3.700 | 07/29/25 | 2,000,000 | 1,985,282 |

| International Business Machines Corp. | 4.000 | 07/27/25 | 2,000,000 | 1,991,071 |

See Notes to Financial Statements.

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Rate (%) | Maturity Date | Principal Amount | Value |

| BONDS (continued) | | | | |

| | | | | |

| Corporate Bonds (continued) | | | | |

| Jabil Inc. | 3.950 | 01/12/28 | 2,250,000 | $2,190,634 |

| JBS USA Holding Lux. Sarl/ JBS USA Food Co./ JBS Lux. Co. Sarl | 5.750 | 04/01/33 | 2,500,000 | 2,548,598 |

| JPMorgan Chase & Co. (4.000% to 04/01/25, then TSFR3M + 2.745%) (d)(g) | 4.000 | 04/01/25 | 4,250,000 | 4,197,145 |

| JPMorgan Chase & Co. | 6.300 | 10/31/33 | 2,000,000 | 2,019,111 |

| Juniper Networks, Inc. | 1.200 | 12/10/25 | 2,000,000 | 1,927,917 |

| KeyBank N.A. | 4.900 | 08/08/32 | 7,000,000 | 6,777,606 |

| Kilroy Realty, L.P. | 2.650 | 11/15/33 | 9,155,000 | 7,198,906 |

| Kinder Morgan Energy Partners, L.P. | 5.800 | 03/15/35 | 2,750,000 | 2,846,118 |

| Kinder Morgan Inc. | 5.300 | 12/01/34 | 500,000 | 501,000 |

| Leggett & Platt, Inc. | 4.400 | 03/15/29 | 6,415,000 | 6,090,597 |

| Liberty Property LP | 3.250 | 10/01/26 | 5,000,000 | 4,860,115 |

| Lincoln National Corp. (TSFR3M + 2.61911%) (d) | 7.105 | 05/17/66 | 29,378,000 | 24,609,113 |

| Lincoln National Corp. (TSFR3M + 2.30161%) (d) | 6.919 | 04/20/67 | 25,384,000 | 20,365,408 |

| LKQ Corp. | 6.250 | 06/15/33 | 6,775,000 | 7,108,845 |

| Magna Int’l Inc. | 5.980 | 03/21/26 | 1,070,000 | 1,069,979 |

| Manufacturers & Traders Trust Co. | 5.400 | 11/21/25 | 1,000,000 | 1,005,038 |

| Marvell Technology, Inc. | 4.875 | 06/22/28 | 6,000,000 | 5,998,209 |

| MasTec, Inc. | 5.900 | 06/15/29 | 6,000,000 | 6,157,648 |

| Medallion Financial Corp. (h) | 9.250 | 09/30/28 | 5,000,000 | 5,025,000 |

| Meridian Corp. (5.375% to 12/30/24, then TSFR3M + 3.950%) (d) | 5.375 | 12/30/29 | 10,000,000 | 9,800,000 |

| Midland States Bancorp, Inc. (TSFR3M + 3.610%, floor 0.000%) (d) | 8.203 | 09/30/29 | 5,500,000 | 5,472,715 |

| Minnwest Corp. (TSFR3M + 3.24161%) (d)(h) | 7.898 | 07/15/28 | 6,000,000 | 5,826,247 |

| MS Transverse Insurance Group, LLC (h) | 6.000 | 12/15/26 | 5,000,000 | 4,849,699 |

| National Health Investors, Inc. | 3.000 | 02/01/31 | 8,121,000 | 6,995,150 |

| New York Mortgage Trust, Inc. | 5.750 | 04/30/26 | 5,000,000 | 4,784,538 |

| Newport Realty Trust, Inc. (6.250% to 12/01/24, then 15.000%) (h)(k) | 6.250 | 12/01/25 | 10,000,000 | 10,000,000 |

| Newport Realty Trust, Inc. (6.250% to 12/01/24, then 15.000%) (k) | 6.250 | 12/01/25 | 1,000,000 | 1,000,000 |

| NexBank Capital, Inc. (TSFR3M + 4.84661%, floor 0.000%) (d)(h) | 9.450 | 09/30/27 | 5,000,000 | 4,905,042 |

| Nexpoint Real Estate Finance, Inc. | 5.750 | 05/01/26 | 9,000,000 | 8,657,061 |

| NextEra Energy Capital Holdings, Inc. | 6.051 | 03/01/25 | 4,105,000 | 4,116,493 |

| Northeast Utilities | 3.150 | 01/15/25 | 820,000 | 818,182 |

| Northpointe Bancshares, Inc. (9.000% to 09/01/29, then TSFR3M + 5.500%) (d)(h) | 9.000 | 09/01/34 | 3,000,000 | 3,000,000 |

| Northpointe Bank (TSFR3M + 4.02661%) (d)(h) | 8.620 | 10/01/28 | 5,000,000 | 4,895,495 |

| OceanFirst Financial Corp. (5.250% to 05/15/25, then TSFR3M + 5.095%) (d) | 5.250 | 05/15/30 | 6,000,000 | 5,910,000 |

| Omega Healthcare Investors, Inc. | 4.500 | 01/15/25 | 500,000 | 499,314 |

| Omega Healthcare Investors, Inc. | 3.625 | 10/01/29 | 1,150,000 | 1,073,027 |

| Omega Healthcare Investors, Inc. | 3.375 | 02/01/31 | 3,675,000 | 3,309,580 |

| Omega Healthcare Investors, Inc. | 3.250 | 04/15/33 | 2,350,000 | 2,018,857 |

| Orange & Rockland Utilities, Inc. | 6.500 | 12/01/27 | 2,300,000 | 2,365,171 |

| Orrstown Financial Services, Inc. (3 month LIBOR + 3.160%) (d) | 8.025 | 12/30/28 | 1,750,000 | 1,662,779 |

| Pacific Premier Bancorp, Inc. (5.375% to 06/15/25, then TSFR3M + 5.170%) (d) | 5.375 | 06/15/30 | 5,000,000 | 4,918,750 |

| Parkway Bancorp, Inc. (6.000% to 03/31/25, then 3 month LIBOR + 5.390%) (d)(h) | 6.000 | 03/31/30 | 10,000,000 | 9,900,000 |

| Pathfinder Bancorp, Inc. (5.500% to 10/15/25, then TSFR3M + 5.320%) (d) | 5.500 | 10/15/30 | 9,650,000 | 8,781,500 |

| PCAP Holdings LP (h) | 6.500 | 07/15/28 | 10,000,000 | 9,304,233 |

| Peapack-Gladstone Financial Corp. (3.500% to 12/30/25, then TSFR3M + 3.260%) (d) | 3.500 | 12/30/30 | 3,000,000 | 2,760,000 |

| Pedcor Bancorp (TSFR3M + 4.86161%, floor 0.000%) (d)(h) | 9.385 | 02/15/29 | 3,000,000 | 2,896,448 |

| Pelorus Fund REIT LLC (h) | 7.000 | 09/30/26 | 5,000,000 | 4,891,791 |

| Philips Electronics N.V. | 7.200 | 06/01/26 | 2,581,000 | 2,647,762 |

| Piedmont Operating Partnership, LP | 2.750 | 04/01/32 | 8,854,000 | 7,111,847 |

| Pilgrim’s Pride Corp. | 3.500 | 03/01/32 | 2,750,000 | 2,417,487 |

See Notes to Financial Statements.

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Rate (%) | Maturity Date | Principal Amount | Value |

| BONDS (continued) | | | | |

| | | | | |

| Corporate Bonds (continued) | | | | |

| Pinnacle Financial Partners, Inc. (3 month LIBOR + 2.775%, floor 2.775%) (d) | 7.983 | 09/15/29 | 5,000,000 | $4,912,470 |

| Polaris Inc. | 6.950 | 03/15/29 | 5,750,000 | 6,110,307 |

| Post Brothers Holdings LLC (h) | 9.000 | 08/18/25 | 5,000,000 | 4,926,922 |

| Public Service Co. of New Mexico | 3.850 | 08/01/25 | 2,500,000 | 2,477,304 |

| PVH Corp. | 4.625 | 07/10/25 | 5,680,000 | 5,655,698 |

| Radian Group Inc. | 6.200 | 05/15/29 | 5,249,000 | 5,419,826 |

| Ready Capital Corp. | 6.125 | 04/30/25 | 5,000,000 | 4,979,312 |

| Ready Capital Corp. | 5.500 | 12/30/28 | 10,000,000 | 8,758,225 |

| ReadyCap Holdings, LLC (h) | 4.500 | 10/20/26 | 10,000,000 | 9,515,622 |

| Realty Income Corp. | 5.050 | 01/13/26 | 203,000 | 202,715 |

| Reinsurance Group of America, Inc. (TSFR3M + 2.92661%) (d) | 7.873 | 12/15/65 | 17,848,000 | 17,675,868 |

| Reliant Bancorp Inc. (5.125% to 12/15/24, then TSFR3M + 3.765%) (d) | 5.125 | 12/15/29 | 13,000,000 | 12,966,276 |

| RenaissanceRe Finance Inc. | 3.700 | 04/01/25 | 625,000 | 622,562 |

| Retail Opportunity Investments Partnership, LP | 4.000 | 12/15/24 | 410,000 | 409,739 |

| Ryder System, Inc. | 4.625 | 06/01/25 | 737,000 | 735,445 |

| Sabra Health Care LP | 3.200 | 12/01/31 | 3,050,000 | 2,670,067 |

| SCRE Intermediate Holdco, LLC (h) | 6.500 | 02/15/27 | 8,000,000 | 7,503,092 |

| Scripps Networks Interactive, Inc. | 3.950 | 06/15/25 | 491,000 | 484,422 |

| Signature Bank New York (e)(f) | 4.000 | 10/15/30 | 2,595,000 | 1,472,367 |

| Sonoco Products Co. | 1.800 | 02/01/25 | 2,000,000 | 1,988,061 |

| South Street Securities Funding LLC (h) | 6.250 | 12/30/26 | 5,000,000 | 4,651,038 |

| Southern National Bancorp of Virginia, Inc. (TSFR3M + 4.21161%) (d)(h) | 8.801 | 01/31/27 | 2,000,000 | 1,948,476 |

| Southern National Bancorp of Virginia, Inc. (5.400% to 09/01/25, then TSFR3M + 5.310%) (d) | 5.400 | 09/01/30 | 2,000,000 | 1,927,500 |

| SouthState Corp. (5.750% to 06/01/25, then TSFR3M + 5.617%) (d) | 5.750 | 06/01/30 | 690,000 | 680,513 |

| Southwest Airlines Co. | 5.250 | 05/04/25 | 1,000,000 | 1,000,155 |

| Stanley Black & Decker Inc. | 6.272 | 03/06/26 | 3,000,000 | 2,998,828 |

| Synchrony Bank | 5.400 | 08/22/25 | 1,000,000 | 1,000,955 |

| Synchrony Financial | 4.875 | 06/13/25 | 2,576,000 | 2,572,711 |

| Take-Two Interactive Software, Inc. | 3.550 | 04/14/25 | 3,385,000 | 3,366,267 |

| Targa Resources Partners LP / Targa Resources Partners Finance Corp. | 6.875 | 01/15/29 | 5,000,000 | 5,119,201 |

| Texas State Bankshares, Inc. (TSFR3M + 3.81161%, floor 3.550%) (d)(h) | 8.758 | 06/15/29 | 4,000,000 | 3,923,170 |

| Textron Inc. | 3.875 | 03/01/25 | 500,000 | 498,429 |

| Textron Inc. | 6.100 | 11/15/33 | 1,850,000 | 1,966,086 |

| Time Warner Inc. | 7.700 | 05/01/32 | 2,500,000 | 2,726,097 |

| Toll Brothers Finance Corp. | 4.350 | 02/15/28 | 3,000,000 | 2,949,272 |

| TransCanada PipeLines Ltd. (TSFR3M + 2.47161%) (d) | 6.995 | 05/15/67 | 19,723,000 | 18,450,870 |

| Trinitas Capital Management, LLC (h) | 6.000 | 07/30/26 | 3,000,000 | 2,910,000 |

| TriState Capital Holdings, Inc. (5.750% to 05/15/25, then 3 month LIBOR + 5.360%) (d) | 5.750 | 05/15/30 | 10,775,000 | 10,667,250 |

| Truist Financial Corp. (TSFR3M + 3.36361%) (d)(g) | 8.310 | 12/16/24 | 3,000,000 | 3,001,398 |

| Truist Financial Corp. (6.669% to 09/01/29, then H15T5Y + 3.003%) (d)(g) | 6.669 | 03/01/25 | 10,552,000 | 10,509,909 |

| UBS AG, Stamford Branch | 7.500 | 07/15/25 | 1,000,000 | 1,013,307 |

| Universal Insurance Holdings, Inc. | 5.625 | 11/30/26 | 7,000,000 | 6,814,870 |

| Unum Group | 3.875 | 11/05/25 | 830,000 | 822,054 |

| Upjohn Inc. | 2.700 | 06/22/30 | 7,700,000 | 6,755,811 |

| UTB Financial Holding Co. (TSFR3M + 3.88161%) (d)(h) | 8.897 | 09/01/28 | 6,000,000 | 5,769,234 |

| V.F. Corp. | 2.400 | 04/23/25 | 2,236,000 | 2,208,457 |

| V.F. Corp. | 2.800 | 04/23/27 | 5,967,000 | 5,621,769 |

| Valero Energy Corp. | 3.650 | 03/15/25 | 2,836,000 | 2,819,895 |

| Valley National Bancorp | 4.550 | 06/30/25 | 8,000,000 | 7,917,521 |

See Notes to Financial Statements.

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2024 |

| | Rate (%) | Maturity Date | Principal Amount | Value |

| BONDS (continued) | | | | |

| | | | | |

| Corporate Bonds (continued) | | | | |

| VeriSign, Inc. | 5.250 | 04/01/25 | 500,000 | $499,638 |

| VeriSign, Inc. | 2.700 | 06/15/31 | 1,000,000 | 864,747 |

| VMware LLC | 4.500 | 05/15/25 | 2,000,000 | 1,995,446 |

| Volunteer State Bancshares, Inc. (TSFR3M + 4.365%, floor 4.365%) (d)(h) | 8.850 | 11/15/29 | 9,000,000 | 8,820,000 |

| W.P. Carey Inc. | 4.000 | 02/01/25 | 650,000 | 648,347 |

| Warner Media, LLC | 7.625 | 04/15/31 | 1,200,000 | 1,293,752 |

| Warnermedia Holdings, Inc. | 4.279 | 03/15/32 | 5,954,000 | 5,372,744 |

| Washington Gas Light Co. | 5.440 | 08/11/25 | 3,700,000 | 3,691,221 |

| Waypoint Residential LLC (e)(f)(h)(i) | 13.000 | 12/15/26 | 10,000,000 | 7,540,303 |