| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM N-CSR |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| Investment Company Act File Number: 811-4521 |

| T. Rowe Price State Tax-Free Income Trust |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| Date of fiscal year end: February 28 |

| Date of reporting period: August 31, 2010 |

Item 1: Report to Shareholders

|

| Georgia Tax-Free Bond Fund | August 31, 2010 |

The views and opinions in this report were current as of August 31, 2010. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

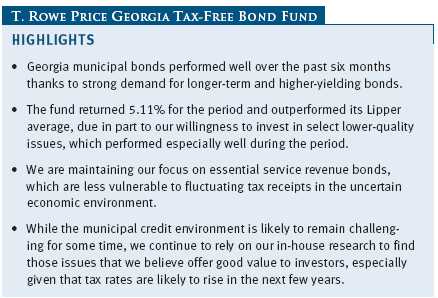

Georgia tax-free municipal bonds produced strong returns in the six-month period ended August 31, 2010, mostly keeping up with taxable bonds and faring much better than equities in a challenging economic environment. Continuing recent trends, longer-term and lower-quality securities fared much better than shorter-term and higher-quality munis, as investors sought attractive yields from assets perceived to be relatively safe. Investor demand for municipal securities remained strong as investors braced for higher federal and possibly higher state and local income tax rates in 2011. The Georgia Tax-Free Bond Fund posted a strong return in this environment and outpaced its peer group average.

MARKET ENVIRONMENT

The U.S. economic recovery, which started in the third quarter of 2009, has decelerated in recent months, and some fear that the economy is at risk of slipping into a new recession—a so-called “double dip.” According to the most recent estimates, gross domestic product grew at a meager pace of 1.6% in the second quarter of 2010. While national unemployment remains stubbornly above 9% and the housing recovery is far from robust, we currently believe the economy is likely to grow at a sluggish pace in the months ahead and not relapse into recession. Encouraging signs include continued growth in industrial production, modest expansion of payrolls, and rising capital goods shipments.

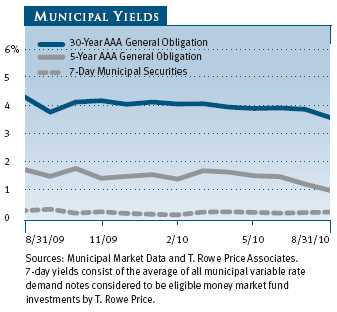

In the last six months, Fed officials consistently reassured investors that an increase in the fed funds target rate—which remained in the 0.00% to 0.25% range established in late 2008—was not imminent. Most recently, with economic growth weakening, the central bank acted to avoid a passive tightening of policy stemming from activities related to its balance sheet. On August 10, the Fed adopted a policy of reinvesting principal payments from other maturing securities into Treasury securities. As a result, longer-term Treasury yields tumbled to levels not seen since the depth of the financial crisis in late 2008. Intermediate- and longer-term Georgia municipal yields also declined, but not as much as Treasury interest rates.

With municipal yields at reasonable levels relative to Treasury yields, tax-free securities are an attractive alternative to taxable bonds, particularly for investors in the highest tax brackets. For example, as of August 31, the 3.67% yield offered by a 30-year tax-free municipal bond rated AAA was 104% of the 3.52% pretax yield offered by a 30-year Treasury. An investor in the 28% federal tax bracket would need to invest in a taxable bond yielding about 5.10% in order to receive the same after-tax income from a 30-year AAA muni bond yielding 3.67%. Nonetheless, as in all other fixed income markets, municipal yields are at or near historic lows across the curve. (To calculate a municipal bond’s taxable-equivalent yield, divide the municipal bond’s yield by the quantity of 1.00 minus your federal tax bracket expressed as a decimal—in this case, 1.00 – 0.28, or 0.72.)

MUNICIPAL MARKET NEWS

Year-to-date municipal bond supply through August totaled about $262 billion, according to The Bond Buyer. New supply this year reflects a steady pace of municipal borrowings for ongoing capital needs. Investor demand has remained strong, bolstered by concerns about higher federal, state, and local taxes. About one-fourth of this year’s new supply represented taxable municipal issuance under the Build America Bond (BAB) program, which constricts the supply of new tax-exempt securities. While we expect this year’s overall issuance to be in line with that of recent years, the expansion of the BAB program could make aggregate new tax-exempt issuance in 2010 somewhat lower than it was in 2009.

Georgia and other states continue to face fiscal difficulties and have been forced to take drastic actions—including some combination of tax and fee increases and/or spending cuts—to close budget deficits. Despite the increasing negative press regarding their fiscal health, we do not see a near-term threat to the states’ ability to continue servicing their outstanding debts, though we have longer-term concerns about potentially onerous future pension obligations. In any event, the fiscal woes of state governments do not necessarily limit our tax-free investment opportunities. The municipal market is made up of thousands of unique issuers in a variety of sectors, many of which continue to maintain good credit profiles.

Most municipal sectors produced good returns in the last six months, with life-care and hospital revenue bonds among the top-performing segments. We remain cautious on the health care sector, in part because the reform legislation passed earlier this year will lead to tighter reimbursement policies and state budget cuts could impact Medicaid payments to providers. However, we believe the sector offers select attractive investment opportunities with reasonable credit risks. Industrial revenue and pollution control revenue bonds also did well. In contrast, prerefunded and escrowed-to-maturity bonds, which are backed by U.S. Treasuries, produced mild gains. Tobacco bonds also lagged. We are underweighting this sector because fundamentals are poor, and longer-term consumption trends do not appear to be especially positive for tobacco bonds.

Georgia Market News

While Georgia’s economy has felt the full force of the national economic recession, conditions within the state have improved somewhat recently. The state’s unemployment rate fell to 9.9% in July 2010 from a peak of 10.5% in February 2010, leaving it marginally higher than the national rate of 9.5%. Indicative of the tapering unemployment problem, Georgia’s personal income rose by 1.1% in the first quarter of 2010, which outpaced the 0.9% increase for the nation as a whole. The state’s median household income level is now slightly below the U.S. average but appears more favorable when taking into account cost-of-living and quality-of-life indicators.

Similarly, although the tough economic times continue to have an impact on the state’s finances, recent months have witnessed some improvement. During fiscal year 2010 (which ended June 30), the state’s general fund revenue collections were down 9% (or $1.6 billion) versus one year ago. During the first two months of fiscal year 2011, however, net tax collections increased 9% over the same period the year before. Governor Perdue and state legislators have imposed spending cuts, drawn down reserves, and used federal stimulus monies in response to the economic slowdown. Georgia has a history of making prompt spending cuts in response to revenue shortfalls. Georgia’s finances have benefited as well from prudent management during the last economic expansion. The state entered the recession with a rainy day fund that peaked at $2.1 billion as of June 30, 2007. As of June 30, 2009, the fund still had $271 million, or 2% of the 2010 budget. Figures for the latest fiscal year are not yet available.

Georgia’s constitution should also guarantee that the state’s debt levels remain acceptable. The state’s maximum annual debt service is limited to 10% of total revenue receipts of the state treasury. As of the state’s most recent debt offering, this ratio stood at 7%. The state has also established “debt affordability” limits, which provide that outstanding debt will not exceed 2.7% of personal income and that maximum annual debt service will not exceed 5% of the prior year’s revenues. Given the drop-off in revenues, however, this latter limit may be exceeded.

Responsible fiscal management and the safeguards provided by the state constitution have allowed Georgia to maintain its high credit ratings even in the face of the sharp economic slowdown. As of the end of our reporting period, the state’s general obligation bonds were rated AAA by all three of the major rating agencies.

PERFORMANCE AND PORTFOLIO STRATEGY

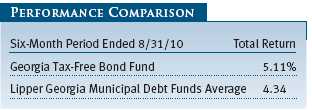

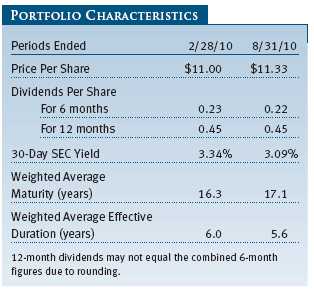

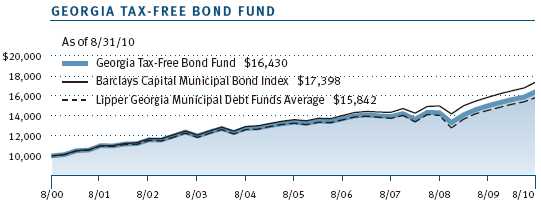

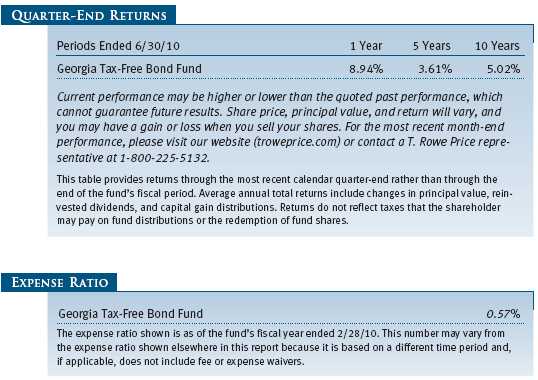

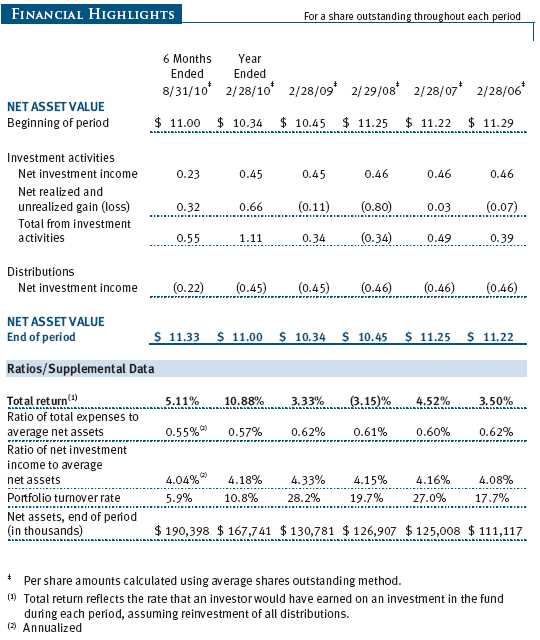

The Georgia Tax-Free Bond Fund returned 5.11% for the six-month period ended August 31, 2010. Dividends per share declined by $0.01 to $0.22, while the fund’s net asset value increased by $0.33. We are pleased to report that our returns exceeded those of our Lipper peer group average and helped place the fund in or near the top quartile of its peer group for all longer time periods. (Based on cumulative total return, Lipper ranked the Georgia Tax-Free Bond Fund 4 out of 18, 5 out of 16, 4 out of 15, and 4 out of 14 funds in the Georgia municipal debt funds category for the 1-, 3-, 5-, and 10-year periods ended August 31, 2010, respectively. Results will vary for other time periods. Past performance cannot guarantee future results.)

Technical factors, including supply/demand dynamics and a steep yield curve, kept us bullish on munis for the most recent period. We continued to invest new cash in longer-maturity bonds, as we judged the longer portion of the yield curve more attractive than short- and intermediate-term bonds. We also extended cash and other short-term holdings into longer-term bonds to pick up income, as yields on short-term holdings stayed at extreme low levels. These measures pushed our average maturity from 16.3 years to 17.1 years. In order to mitigate an increase in interest rate risk of a longer-maturity portfolio, we sold Treasury futures to protect against a sharp rise in rates. We anticipate making continued efforts to keep interest rate risk in the portfolio in line with the Georgia market.

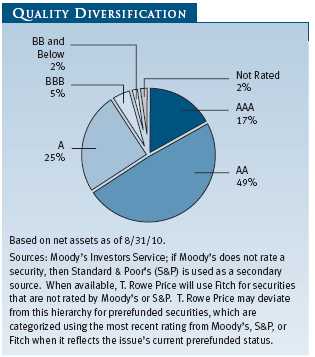

Credit spreads (the difference in yield between high- and low-quality bonds) compressed slightly during the first six months of the fiscal year. We continued to look for attractive lower- and medium-quality bonds during the most recent period. The highest-quality bonds are trading at or near historic low yields (and thus high valuations), and we simply do not see the opportunity for further price gains. For much of the past year and a half, including the most recent period, our best returns have come from low- and medium-quality bonds. In this environment, extensive credit research capability and a long-term perspective are especially important. We will continue to rely on our careful, research-driven process to capitalize on investment opportunities in this marketplace.

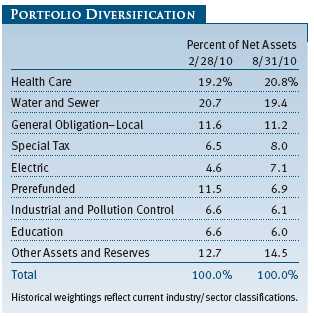

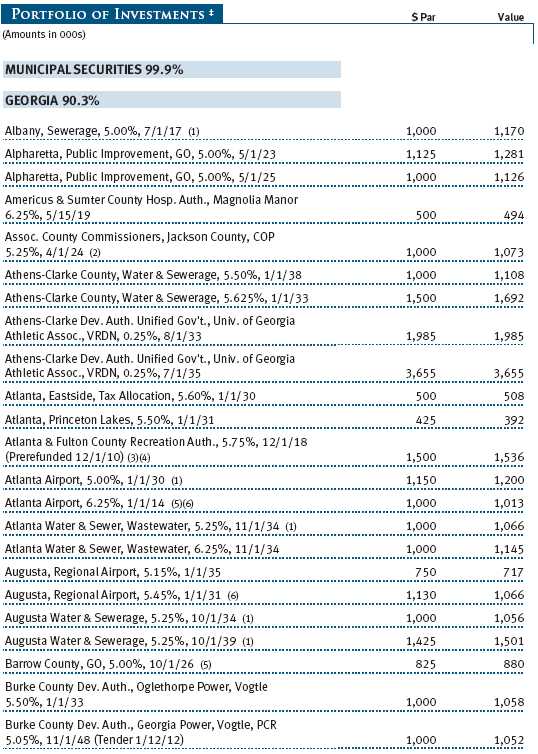

In terms of our sector allocation, we kept a significant weighting in hospitals. Despite concerns on the long-term effect of health care reform on hospital finances generally, we still believe select investments in this sector represent good value. We are optimistic that our portfolio additions, including Children’s Healthcare of Atlanta and Archbold Medical Center in Thomasville, will continue to perform well financially in a challenging fiscal environment. On the downside, we eliminated a one-time significant position in Memorial Health of Chatham County. While this was not a money loser for the portfolio, disappointing financial results, management turnover, and bondholder-unfriendly disclosure practices led us to take this action. (Please refer to the fund’s portfolio of investments for a complete listing of our holdings and the amount each represents in the portfolio.)

Despite our willingness to invest in select lower-quality issues when we see the opportunity, we have maintained our overall focus on controlling risk in this uncertain environment. Most notably, we kept our emphasis on essential service revenue bonds as the payments on these bonds are not sensitive to fluctuations in tax receipts. Our most significant sector weighting increase came from the utility sector. We believe that, all things being equal, these bonds will hold up better than tax-backed bonds in a tough economy.

OUTLOOK

The municipal credit environment could remain challenging for some time. Ongoing economic sluggishness, the housing market downturn, and high unemployment have reduced the tax revenues collected by state and local municipalities—a trend that could get worse over the next 12 months—and municipal bond defaults, which historically have been rare, could increase moderately. Maintaining balanced budgets requires careful and dedicated work by state and local officials. Many issuers are trying to make the difficult but necessary fiscal decisions as they adjust to high unemployment, slow economic growth, lower tax revenues, and other tough conditions.

We continue to believe that the municipal market is a high-quality market and that many longer-term municipal securities offer good value, especially considering that tax rates are expected to rise in the next few years. Longer-term and lower-rated investment-grade municipal bond valuations, though they have rebounded significantly from the lows of 2008, remain attractive and could improve further. In contrast, short- and intermediate-term securities appear to be fully valued and could be vulnerable if shorter-term interest rates increase, though that does not appear likely as long as inflation remains very low and the economy remains weak. We believe increased demand for munis due to higher anticipated tax rates and other factors, along with reduced tax-exempt issuance, will help cushion the effect of any rise in Treasury rates on the municipal market.

We believe T. Rowe Price’s strong credit research capabilities have been and will remain an asset for our investors. We continue to conduct our own thorough research and assign our own independent credit ratings before making investment decisions. As always, we are on the lookout for attractively valued bonds issued by municipalities with good fundamentals. We think such investments will continue to help us generate excellent long-term relative returns for our clients.

Respectfully submitted,

Hugh D. McGuirk

Chairman of the Investment Advisory Committee

September 17, 2010

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF INVESTING

As with all mutual funds, the fund’s share price can fall because of weakness in the markets, a particular industry, or specific holdings. Yield and share price will vary with interest rate changes. Investors should note that if interest rates rise significantly from current levels, the fund’s share price will decline and may even turn negative in the short term. There is also a chance that some of the fund’s holdings may have their credit rating downgraded or may default. The fund is less diversified than one investing nationally. Some income may be subject to state and local taxes and the federal alternative minimum tax.

GLOSSARY

30-day SEC yield: A method of calculating a fund’s yield that assumes all portfolio securities are held until maturity. The Securities and Exchange Commission (SEC) requires all bond funds to calculate this yield. Yield will vary and is not guaranteed.

Barclays Capital Municipal Bond Index: An unmanaged index that includes investment-grade, tax-exempt, and fixed rate bonds.

Basis point: One one-hundredth of one percentage point, or 0.01%.

Duration: A measure of a bond fund’s sensitivity to changes in interest rates. For example, a fund with a duration of six years would fall about 6% in price in response to a one-percentage-point rise in interest rates, and vice versa.

Escrowed-to-maturity bond: A bond that has the funds necessary for repayment at maturity, or a call date, set aside in a separate or “escrow” account.

Federal funds rate: The interest rate charged on overnight loans of reserves by one financial institution to another in the United States. The Federal Reserve sets a target federal funds rate to affect the direction of interest rates.

General obligation debt: A government’s strongest pledge that obligates its full faith and credit, including, if necessary, its ability to raise taxes.

Gross domestic product: The total market value of all goods and services produced in a country in a given year.

Investment grade: High-quality bonds as measured by one of the major credit rating agencies. For example, Standard & Poor’s designates the bonds in its top four categories (AAA to BBB) as investment grade.

Libor: The London Interbank Offered Rate is a benchmark for short-term taxable rates.

Lipper averages: The averages of available mutual fund performance returns for specified time periods in defined categories as tracked by Lipper Inc.

Prerefunded bond: A bond that originally may have been issued as a general obligation or revenue bond but that is now secured by an escrow fund consisting entirely of direct U.S. government obligations that are sufficient for paying the bondholders.

Weighted average maturity: In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account the interest rate readjustment dates for certain securities.

Yield curve: A graphic depiction of the relationship between yields and maturity dates for a set of similar securities, such as Treasuries or municipal securities. Securities with longer maturities usually have a higher yield. If short-term securities offer a higher yield, then the curve is said to be “inverted.” If short- and long-term bonds are offering equivalent yields, then the curve is said to be “flat.”

Performance and Expenses

| GROWTH OF $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

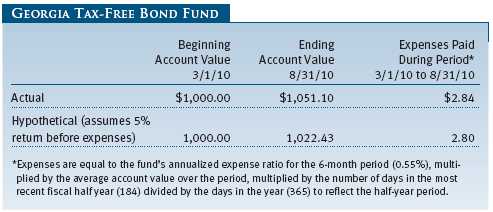

| FUND EXPENSE EXAMPLE |

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

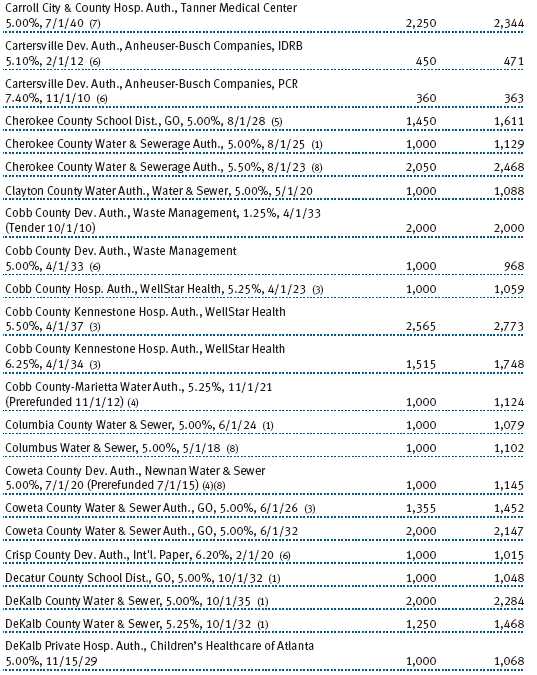

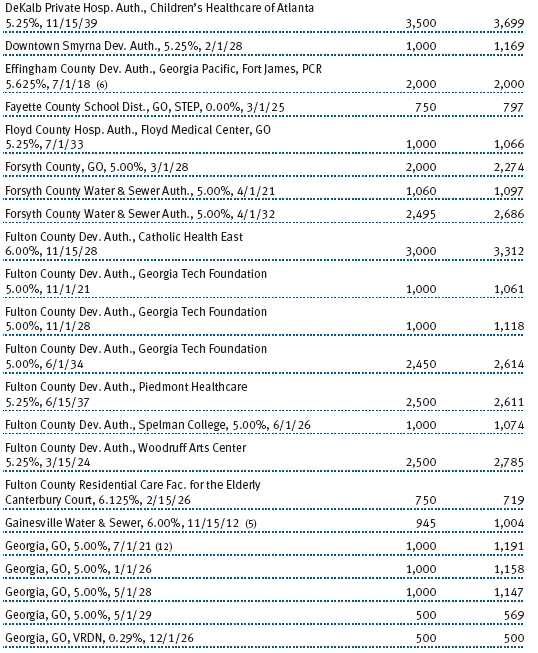

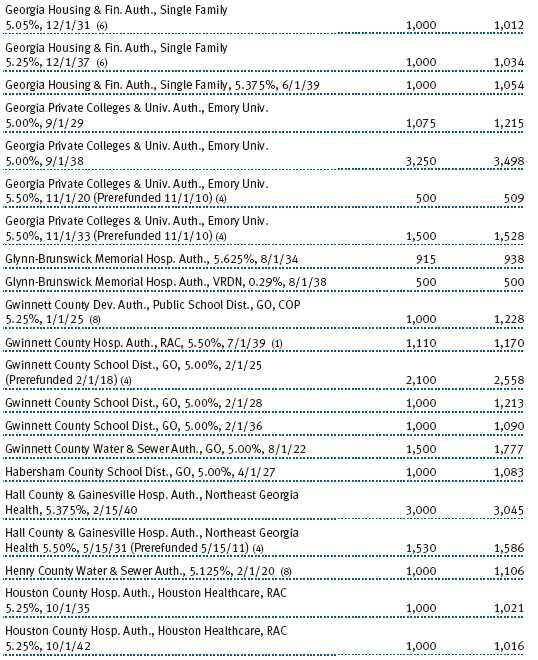

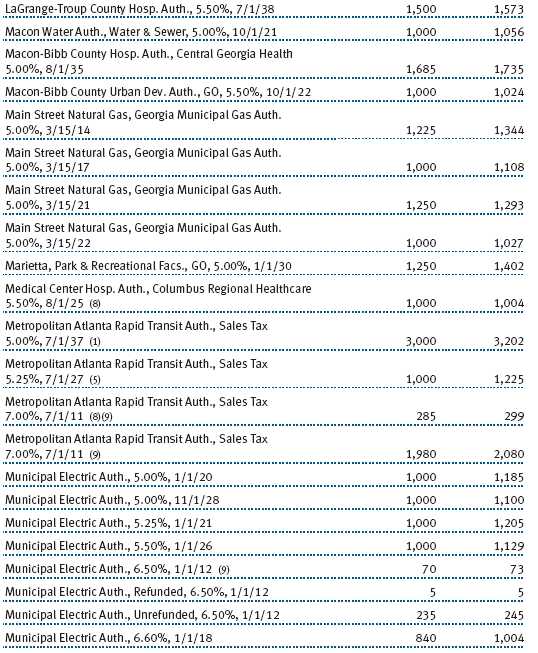

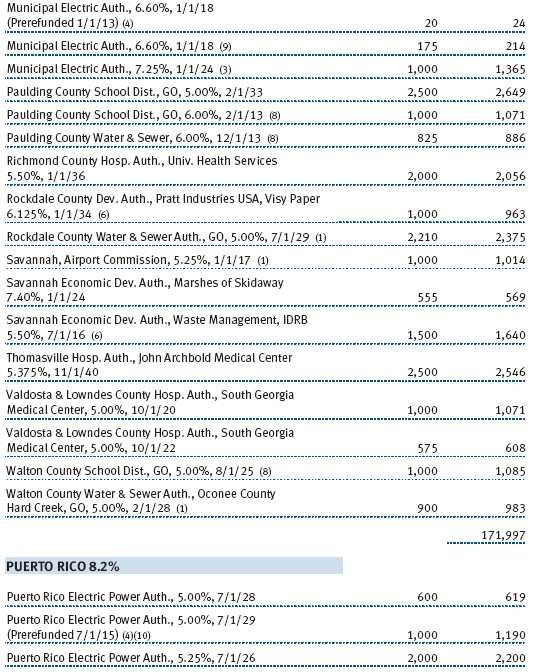

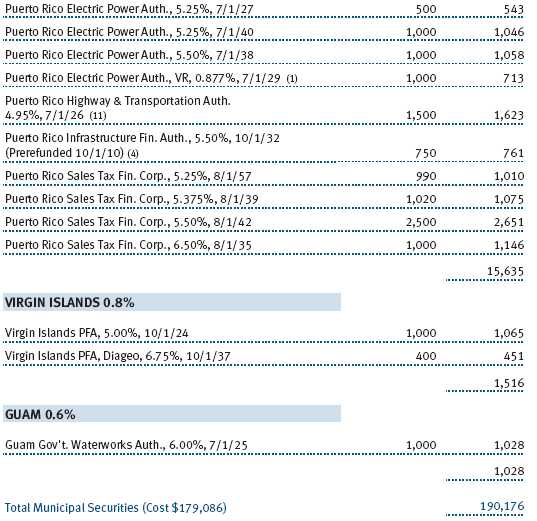

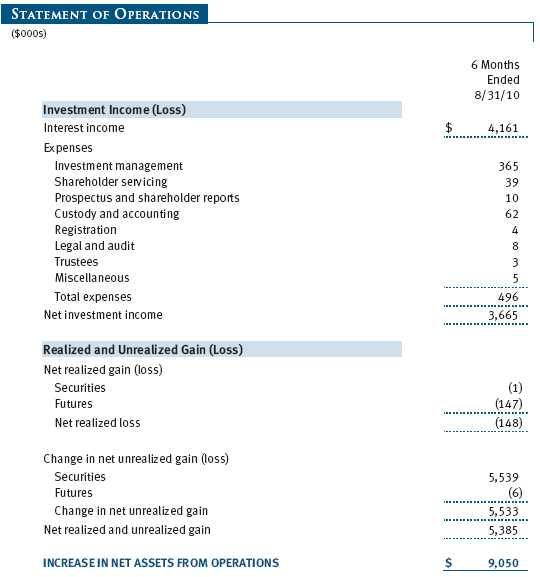

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

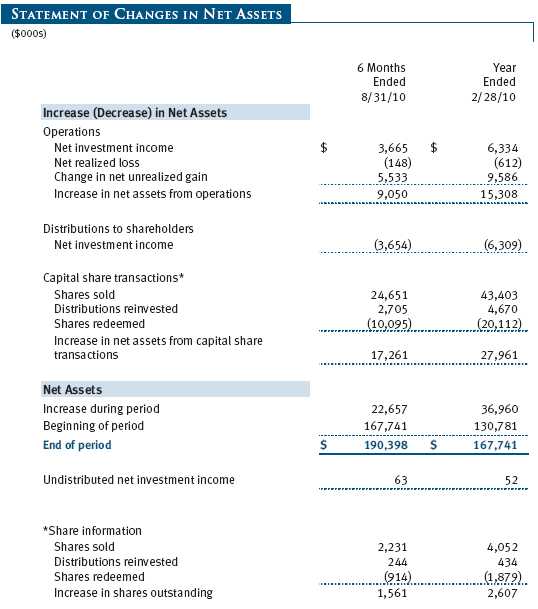

Unaudited

The accompanying notes are an integral part of these financial statements.

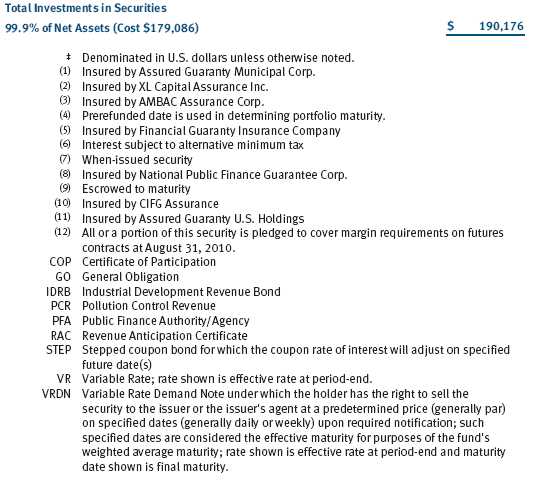

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

T. Rowe Price State Tax-Free Income Trust (the trust), is registered under the Investment Company Act of 1940 (the 1940 Act). The Georgia Tax-Free Bond Fund (the fund), a nondiversified, open-end management investment company, is one portfolio established by the trust. The fund commenced operations on March 31, 1993. The fund seeks to provide, consistent with prudent portfolio management, the highest level of income exempt from federal and Georgia state income taxes by investing primarily in investment-grade Georgia municipal bonds.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by fund management. Fund management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale of securities.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared daily and paid monthly. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Credits The fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits.

New Accounting Pronouncement On March 1, 2010, the fund adopted new accounting guidance that requires enhanced disclosures about fair value measurements in the financial statements. Adoption of this guidance had no impact on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined by GAAP. The fund determines the values of its assets and liabilities and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Debt securities are generally traded in the over-the-counter (OTC) market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Financial futures contracts are valued at closing settlement prices.

Other investments, including restricted securities, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Trustees.

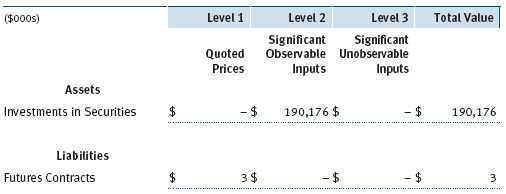

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. The following table summarizes the fund’s financial instruments, based on the inputs used to determine their values on August 31, 2010:

NOTE 3 - DERIVATIVE INSTRUMENTS

During the six months ended August 31, 2010, the fund invested in derivative instruments. As defined by GAAP, a derivative is a financial instrument whose value is derived from an underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable; it requires little or no initial investment and permits or requires net settlement. The fund invests in derivatives only if the expected risks and rewards are consistent with its investment objectives, policies, and overall risk profile, as described in its prospectus and Statement of Additional Information. The fund may use derivatives for a variety of purposes, such as seeking to hedge against declines in principal value, increase yield, invest in an asset with greater efficiency and at a lower cost than is possible through direct investment, or to adjust portfolio duration and credit exposure. The risks associated with the use of derivatives are different from, and potentially much greater than, the risks associated with investing directly in the instruments on which the derivatives are based. Investments in derivatives can magnify returns positively or negatively; however, the fund at all times maintains sufficient cash reserves, liquid assets, or other SEC-permitted asset types to cover the settlement obligations under its open derivative contracts.

The fund values its derivatives at fair value, as described below and in Note 2, and recognizes changes in fair value currently in its results of operations. Accordingly, the fund does not follow hedge accounting, even for derivatives employed as economic hedges. The fund does not offset the fair value of derivative instruments against the right to reclaim or obligation to return collateral. As of August 31, 2010, the fund held interest rate futures with cumulative unrealized loss of $6,000; the value reflected on the accompanying Statement of Assets and Liabilities is the related unsettled variation margin.

Additionally, during the six months ended August 31, 2010, the fund recognized $147,000 of realized loss on Futures and a $6,000 change in unrealized loss on Futures related to its investments in interest rate derivatives; such amounts are included on the accompanying Statement of Operations.

Counterparty risk related to exchange-traded derivatives, including futures and options contracts, is minimal because the exchange’s clearinghouse provides protection against defaults. Additionally, for exchange-traded derivatives, each broker, in its sole discretion, may change margin requirements applicable to the fund.

Futures Contracts The fund is subject to interest rate risk in the normal course of pursuing its investment objectives and uses futures contracts to help manage such risk. The fund may enter into futures contracts to manage exposure to interest rate and yield curve movements, security prices, foreign currencies, credit quality, and mortgage prepayments; as an efficient means of adjusting exposure to all or part of a target market; to enhance income; as a cash management tool; and/or to adjust portfolio duration and credit exposure. A futures contract provides for the future sale by one party and purchase by another of a specified amount of a particular underlying financial instrument at an agreed-upon price, date, time, and place. The fund currently invests only in exchange-traded futures, which generally are standardized as to maturity date, underlying financial instrument, and other contract terms. Upon entering into a futures contract, the fund is required to deposit with the broker cash or securities in an amount equal to a certain percentage of the contract value (initial margin deposit); the margin deposit must then be maintained at the established level over the life of the contract. Subsequent payments are made or received by the fund each day to settle daily fluctuations in the value of the contract (variation margin), which reflect changes in the value of the underlying financial instrument. Variation margin is recorded as unrealized gain or loss until the contract is closed. The value of a futures contract included in net assets is the amount of unsettled variation margin; net variation margin receivable is reflected as an asset, and net variation margin payable is reflected as a liability on the accompanying Statement of Assets and Liabilities. Risks related to the use of futures contracts include possible illiquidity of the futures markets, contract prices that can be highly volatile and imperfectly correlated to movements in hedged security values and/or interest rates, and potential losses in excess of the fund’s initial investment. During the six months ended August 31, 2010, the fund’s exposure to futures, based on underlying notional amounts, was generally between 0% and 1% of net assets.

NOTE 4 - OTHER INVESTMENT TRANSACTIONS

Purchases and sales of portfolio securities other than short-term securities aggregated $23,249,000 and $10,176,000, respectively, for the six months ended August 31, 2010.

NOTE 5 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. As of February 28, 2010, the fund had $2,803,000 of unused capital loss carryforwards, which expire: $320,000 in fiscal 2016, $1,554,000 in fiscal 2017, and $929,000 in fiscal 2018.

At August 31, 2010, the cost of investments for federal income tax purposes was $179,004,000. Net unrealized gain aggregated $11,166,000 at period-end, of which $11,675,000 related to appreciated investments and $509,000 related to depreciated investments.

NOTE 6 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.10% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At August 31, 2010, the effective annual group fee rate was 0.30%.

In addition, the fund has entered into service agreements with Price Associates and a wholly owned subsidiary of Price Associates (collectively, Price). Price Associates computes the daily share price and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. For the six months ended August 31, 2010, expenses incurred pursuant to these service agreements were $43,000 for Price Associates and $21,000 for T. Rowe Price Services, Inc.. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s website, www.sec.gov. The description of our proxy voting policies and procedures is also available on our website, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT |

On March 9, 2010, the fund’s Board of Directors (Board) unanimously approved the continuation of the investment advisory contract (Contract) between the fund and its investment manager, T. Rowe Price Associates, Inc. (Adviser). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Adviser during the course of the year, as discussed below:

Services Provided by the Adviser

The Board considered the nature, quality, and extent of the services provided to the fund by the Adviser. These services included, but were not limited to, management of the fund’s portfolio and a variety of related activities, as well as financial and administrative services, reporting, and communications. The Board also reviewed the background and experience of the Adviser’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Adviser.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total returns over the 1-, 3-, 5-, and 10-year periods, as well as the fund’s year-by-year returns, and compared these returns with a wide variety of previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the severity of the market turmoil during 2008 and 2009, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Adviser under the Contract and other benefits that the Adviser (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Adviser may receive some benefit from its soft-dollar arrangements pursuant to which it receives research from broker-dealers that execute the applicable fund’s portfolio transactions. The Board also received information on the estimated costs incurred and profits realized by the Adviser and its affiliates from advising T. Rowe Price mutual funds, as well as estimates of the gross profits realized from managing the fund in particular. The Board concluded that the Adviser’s profits were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Adviser. Under the Contract, the fund pays a fee to the Adviser composed of two components—a group fee rate based on the aggregate assets of certain T. Rowe Price mutual funds (including the fund) that declines at certain asset levels and an individual fund fee rate that is assessed on the assets of the fund. The Board concluded that the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees

The Board reviewed the fund’s management fee rate, operating expenses, and total expense ratio and compared them with fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board indicated that the fund’s management fee rate was at or below the median for comparable funds and the fund’s total expense ratio was below the median for comparable funds. The Board also reviewed the fee schedules for institutional accounts of the Adviser and its affiliates with smaller mandates. Management informed the Board that the Adviser’s responsibilities for institutional accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise and that the Adviser performs significant additional services and assumes greater risk for the fund and other T. Rowe Price mutual funds that it advises than it does for institutional accounts. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board was assisted by the advice of independent legal counsel and concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES | |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the | |

| undersigned, thereunto duly authorized. | |

| T. Rowe Price State Tax-Free Income Trust | |

| By | /s/ Edward C. Bernard |

| Edward C. Bernard | |

| Principal Executive Officer | |

| Date | October 18, 2010 |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, this report has been signed below by the following persons on behalf of | |

| the registrant and in the capacities and on the dates indicated. | |

| By | /s/ Edward C. Bernard |

| Edward C. Bernard | |

| Principal Executive Officer | |

| Date | October 18, 2010 |

| By | /s/ Gregory K. Hinkle |

| Gregory K. Hinkle | |

| Principal Financial Officer | |

| Date | October 18, 2010 |