UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4707

Fidelity Advisor Series II

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | April 30, 2006 |

Item 1. Reports to Stockholders

Fidelity® Advisor

Intermediate Bond

Fund - Class A, Class T, Class B

and Class C

|

| | Semiannual Report

April 30, 2006

|

| Contents | | | | |

| |

| Chairman’s Message | | 3 | | Ned Johnson’s message to shareholders. |

| Shareholder Expense | | 4 | | An example of shareholder expenses. |

| Example | | | | |

| Investment Changes | | 6 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months. |

| Investments | | 7 | | A complete list of the fund’s investments |

| | | | | with their market values. |

| Financial Statements | | 39 | | Statements of assets and liabilities, |

| | | | | operations, and changes in net assets, |

| | | | | as well as financial highlights. |

| Notes | | 48 | | Notes to the financial statements. |

| Board Approval of | | 58 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

| | To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended

June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commis

sion’s (SEC) web site at www.sec.gov. You may also call 1-877-208-0098 to request a free copy of

the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies,

Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks

of FMR Corp. or an affiliated company.

|

| | This report and the financial statements contained herein are submitted for the general information

of the shareholders of the fund. This report is not authorized for distribution to prospective investors

in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third

quarters of each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at

http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public

Reference Room in Washington, DC. Information regarding the operation of the SEC’s Public

Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s

portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual

report on Fidelity’s web site at http://www.advisor.fidelity.com.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

|

Chairman’s Message

(photograph of Edward C. Johnson)

Dear Shareholder:

Although many securities markets made gains in early 2006, there is only one certainty when it comes to investing: There is no sure thing. There are, however, a number of time tested, fundamental investment principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets’ inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets’ best days can significantly diminish investor returns. Patience also affords the benefits of compounding of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn’t eliminate risk, it can considerably lessen the effect of short term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio’s long term success. The right mix of stocks, bonds and cash aligned to your particular risk tolerance and investment objective is very important. Age appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities which historically have been the best performing asset class over time is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more stable fixed investments (bonds or savings plans).

A third investment principle investing regularly can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won’t pay for all your shares at market highs. This strategy known as dollar cost averaging also reduces unconstructive “emotion” from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

3 Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees, distribution and/or service (12b 1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2005 to April 30, 2006).

The first line of the table below for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. In addition, the fund, as a shareholder in the underlying affiliated central funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying affiliated central funds. These fees and expenses are not included in the fund’s annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the table below for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the fund, as a shareholder in the underlying affiliated central funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying affiliated central funds. These fees and expenses are not included in the fund’s annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | Ending | | | | During Period* |

| | | | | Account Value | | Account Value | | | | November 1, 2005 |

| | | | | November 1, 2005 | | April 30, 2006 | | | | to April 30, 2006 |

| Class A | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | $ 1,007.70 | | | | $ 3.78 |

| HypotheticalA | | | | $ 1,000.00 | | $ 1,021.03 | | | | $ 3.81 |

| |

| |

| |

| Semiannual Report | | | | 4 | | | | | | |

| | | | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | | | Ending | | | | During Period* |

| | | | | Account Value | | | | Account Value | | | | November 1, 2005 |

| | | | | November 1, 2005 | | | | April 30, 2006 | | | | to April 30, 2006 |

| Class T | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 1,007.30 | | | | $ 4.23 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,020.58 | | | | $ 4.26 |

| Class B | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 1,003.80 | | | | $ 7.65 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,017.16 | | | | $ 7.70 |

| Class C | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 1,003.40 | | | | $ 8.05 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,016.76 | | | | $ 8.10 |

| Institutional Class | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 1,008.60 | | | | $ 2.89 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,021.92 | | | | $ 2.91 |

A 5% return per year before expenses | | | | | | | | |

* Expenses are equal to each Class’ annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The fees and expenses of the underlying affiliated central funds in which the fund invests are not included in the fund’s annualized expense ratio.

| | | Annualized |

| | | Expense Ratio |

| Class A | | 76% |

| Class T | | 85% |

| Class B | | 1.54% |

| Class C | | 1.62% |

| Institutional Class | | 58% |

5 Semiannual Report

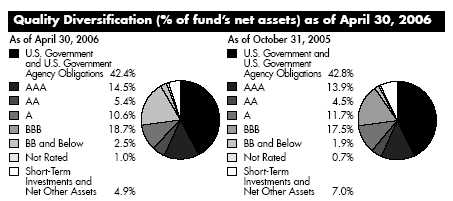

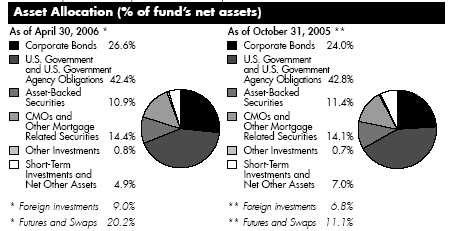

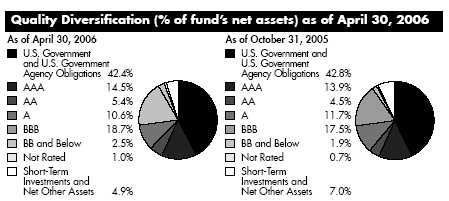

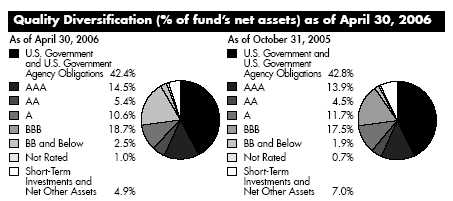

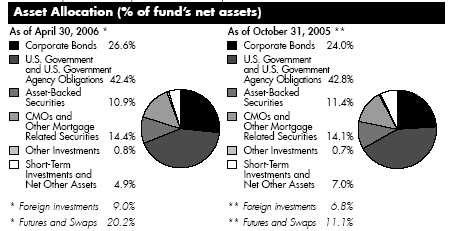

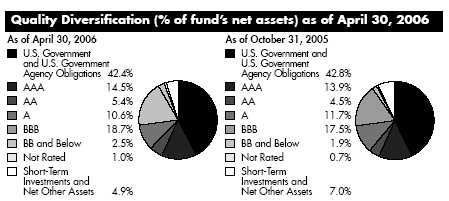

Investment Changes

We have used ratings from Moody’s® Investors Services, Inc. Where Moody’s ratings are not available, we have used S&P® ratings.

| Average Years to Maturity as of April 30, 2006 | | |

| | | | | 6 months ago |

| Years | | 4.6 | | 4.7 |

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund’s bonds, weighted by dollar amount.

| Duration as of April 30, 2006 | | | | |

| | | | | | | 6 months ago |

| Years | | | | 3.4 | | 3.4 |

Duration shows how much a bond fund’s price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund’s performance and share price. Accordingly, a bond fund’s actual performance may differ from this example.

The information in the above tables is based on the combined investments of the fund and its pro rata share of the investments of Fidelity’s fixed income central funds.

For an unaudited list of holdings for each fixed income central fund, visit advisor.fidelity.com.

Semiannual Report 6

| Investments April 30, 2006 (Unaudited) |

| Showing Percentage of Net Assets | | | | | | | | |

| |

| Nonconvertible Bonds 24.7% | | | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | | | |

| |

| CONSUMER DISCRETIONARY – 2.3% | | | | | | | | |

| Automobiles – 0.1% | | | | | | | | |

| Ford Motor Co. 6.625% 10/1/28 | | | | $ 1,895,000 | | | | $ 1,298,075 |

| Household Durables – 0.2% | | | | | | | | |

| Fortune Brands, Inc. 5.125% 1/15/11 | | | | 2,375,000 | | | | 2,318,211 |

| Media – 1.8% | | | | | | | | |

| AOL Time Warner, Inc. 6.875% 5/1/12 | | | | 1,180,000 | | | | 1,230,799 |

| British Sky Broadcasting Group PLC (BSkyB) yankee 7.3% | | | | | | | | |

| 10/15/06 | | | | 2,000,000 | | | | 2,014,514 |

| BSKYB Finance UK PLC 5.625% 10/15/15 (c) | | | | 3,035,000 | | | | 2,903,336 |

| Comcast Corp.: | | | | | | | | |

| 4.95% 6/15/16 | | | | 1,855,000 | | | | 1,678,769 |

| 5.9% 3/15/16 | | | | 3,000,000 | | | | 2,925,636 |

| Cox Communications, Inc. 4.625% 6/1/13 | | | | 3,735,000 | | | | 3,394,405 |

| Hearst-Argyle Television, Inc. 7% 11/15/07 | | | | 1,000,000 | | | | 1,016,207 |

| Liberty Media Corp.: | | | | | | | | |

| 5.7% 5/15/13 (b) | | | | 1,500,000 | | | | 1,395,000 |

| 8.25% 2/1/30 | | | | 1,665,000 | | | | 1,595,533 |

| News America Holdings, Inc. 7.375% 10/17/08 | | | | 2,000,000 | | | | 2,083,080 |

| News America, Inc. 4.75% 3/15/10 | | | | 2,000,000 | | | | 1,939,710 |

| Time Warner, Inc. 9.125% 1/15/13 | | | | 1,545,000 | | | | 1,778,592 |

| Univision Communications, Inc. 3.875% 10/15/08 | | | | 1,600,000 | | | | 1,526,322 |

| Viacom, Inc. 5.75% 4/30/11 (c) | | | | 1,615,000 | | | | 1,603,162 |

| | | | | | | | | 27,085,065 |

| Multiline Retail – 0.2% | | | | | | | | |

| The May Department Stores Co. 4.8% 7/15/09 | | | | 3,065,000 | | | | 2,999,955 |

| |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | | 33,701,306 |

| |

| CONSUMER STAPLES 0.6% | | | | | | | | |

| Beverages – 0.1% | | | | | | | | |

| FBG Finance Ltd. 5.125% 6/15/15 (c) | | | | 1,620,000 | | | | 1,495,838 |

| Food Products 0.1% | | | | | | | | |

| H.J. Heinz Co. 6.428% 12/1/08 (c)(h) | | | | 1,655,000 | | | | 1,681,794 |

| Personal Products 0.1% | | | | | | | | |

| Avon Products, Inc. 5.125% 1/15/11 | | | | 1,335,000 | | | | 1,306,833 |

| Tobacco 0.3% | | | | | | | | |

| Philip Morris Companies, Inc. 7.65% 7/1/08 | | | | 4,635,000 | | | | 4,830,657 |

| |

| TOTAL CONSUMER STAPLES | | | | | | | | 9,315,122 |

See accompanying notes which are an integral part of the financial statements.

7 Semiannual Report

| Investments (Unaudited) continued | | | | | | | | |

| |

| |

| Nonconvertible Bonds continued | | | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | | | |

| |

| ENERGY 2.4% | | | | | | | | |

| Energy Equipment & Services – 0.6% | | | | | | | | |

| Cooper Cameron Corp. 2.65% 4/15/07 | | | | $ 1,555,000 | | | | $ 1,506,571 |

| Petronas Capital Ltd. 7% 5/22/12 (c) | | | | 4,495,000 | | | | 4,794,668 |

| Weatherford International Ltd. 4.95% 10/15/13 | | | | 2,315,000 | | | | 2,190,916 |

| | | | | | | | | 8,492,155 |

| Oil, Gas & Consumable Fuels – 1.8% | | | | | | | | |

| Canadian Oil Sands Ltd. 4.8% 8/10/09 (c) | | | | 1,965,000 | | | | 1,905,254 |

| Duke Capital LLC 6.25% 2/15/13 | | | | 3,250,000 | | | | 3,305,868 |

| EnCana Holdings Finance Corp. 5.8% 5/1/14 | | | | 1,040,000 | | | | 1,034,160 |

| Enterprise Products Operating LP: | | | | | | | | |

| 4.625% 10/15/09 | | | | 1,290,000 | | | | 1,246,094 |

| 4.95% 6/1/10 | | | | 760,000 | | | | 735,732 |

| 5.6% 10/15/14 | | | | 380,000 | | | | 363,960 |

| Kerr-McGee Corp. 6.875% 9/15/11 | | | | 1,595,000 | | | | 1,662,788 |

| Kinder Morgan Energy Partners LP: | | | | | | | | |

| 5.125% 11/15/14 | | | | 2,100,000 | | | | 1,966,627 |

| 5.35% 8/15/07 | | | | 1,070,000 | | | | 1,064,263 |

| Kinder Morgan Finance Co. ULC 5.35% 1/5/11 | | | | 3,850,000 | | | | 3,782,413 |

| Nexen, Inc.: | | | | | | | | |

| 5.05% 11/20/13 | | | | 1,485,000 | | | | 1,409,477 |

| 5.2% 3/10/15 | | | | 1,185,000 | | | | 1,120,604 |

| Pemex Project Funding Master Trust: | | | | | | | | |

| 5.75% 12/15/15 (c) | | | | 980,000 | | | | 929,040 |

| 6.125% 8/15/08 | | | | 1,000,000 | | | | 1,006,000 |

| 7.375% 12/15/14 | | | | 2,020,000 | | | | 2,141,200 |

| 7.875% 2/1/09 (h) | | | | 3,000,000 | | | | 3,145,500 |

| | | | | | | | | 26,818,980 |

| |

| TOTAL ENERGY | | | | | | | | 35,311,135 |

| |

| FINANCIALS – 11.1% | | | | | | | | |

| Capital Markets 1.4% | | | | | | | | |

| Bank of New York Co., Inc.: | | | | | | | | |

| 3.4% 3/15/13 (h) | | | | 1,300,000 | | | | 1,250,532 |

| 4.25% 9/4/12 (h) | | | | 1,510,000 | | | | 1,486,628 |

| Goldman Sachs Group, Inc.: | | | | | | | | |

| 5.25% 10/15/13 | | | | 3,000,000 | | | | 2,896,893 |

| 6.6% 1/15/12 | | | | 3,000,000 | | | | 3,130,122 |

| Legg Mason, Inc. 6.75% 7/2/08 | | | | 4,235,000 | | | | 4,348,320 |

| Lehman Brothers Holdings E-Capital Trust I 5.55% | | | | | | | | |

| 8/19/65 (c)(h) | | | | 1,100,000 | | | | 1,103,230 |

See accompanying notes which are an integral part of the financial statements.

| Nonconvertible Bonds continued | | | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | | | |

| |

| FINANCIALS – continued | | | | | | | | |

| Capital Markets continued | | | | | | | | |

| Merrill Lynch & Co., Inc. 4.25% 2/8/10 | | | | $ 2,740,000 | | | | $ 2,625,432 |

| Morgan Stanley 5.05% 1/21/11 | | | | 4,100,000 | | | | 4,001,703 |

| | | | | | | | | 20,842,860 |

| Commercial Banks – 1.6% | | | | | | | | |

| Bank of America Corp.: | | | | | | | | |

| 4.5% 8/1/10 | | | | 6,132,000 | | | | 5,918,459 |

| 7.4% 1/15/11 | | | | 4,400,000 | | | | 4,730,972 |

| Export-Import Bank of Korea 5.125% 2/14/11 | | | | 2,955,000 | | | | 2,887,880 |

| FleetBoston Financial Corp. 3.85% 2/15/08 | | | | 1,000,000 | | | | 975,174 |

| Korea Development Bank: | | | | | | | | |

| 3.875% 3/2/09 | | | | 2,900,000 | | | | 2,780,044 |

| 4.75% 7/20/09 | | | | 1,300,000 | | | | 1,272,651 |

| Wachovia Bank NA 4.875% 2/1/15 | | | | 2,600,000 | | | | 2,419,734 |

| Wachovia Corp. 4.875% 2/15/14 | | | | 1,970,000 | | | | 1,848,725 |

| Woori Bank 6.125% 5/3/16 (c)(h) | | | | 1,315,000 | | | | 1,314,211 |

| | | | | | | | | 24,147,850 |

| Consumer Finance – 1.2% | | | | | | | | |

| Capital One Bank 6.5% 6/13/13 | | | | 2,315,000 | | | | 2,397,926 |

| Capital One Financial Corp. 5.5% 6/1/15 | | | | 2,000,000 | | | | 1,921,220 |

| Ford Motor Credit Co. 7.875% 6/15/10 | | | | 3,500,000 | | | | 3,232,299 |

| Household Finance Corp. 4.125% 11/16/09 | | | | 5,990,000 | | | | 5,735,671 |

| Household International, Inc. 5.836% 2/15/08 | | | | 2,550,000 | | | | 2,570,788 |

| MBNA America Bank NA 7.125% 11/15/12 | | | | 1,000,000 | | | | 1,076,994 |

| | | | | | | | | 16,934,898 |

| Diversified Financial Services – 1.1% | | | | | | | | |

| Alliance Capital Management LP 5.625% 8/15/06 | | | | 1,495,000 | | | | 1,496,411 |

| Citigroup, Inc. 5.125% 2/14/11 | | | | 2,611,000 | | | | 2,569,903 |

| International Lease Finance Corp. 4.375% 11/1/09 | | | | 2,000,000 | | | | 1,914,222 |

| JPMorgan Chase & Co.: | | | | | | | | |

| 4.875% 3/15/14 | | | | 2,190,000 | | | | 2,049,144 |

| 5.75% 1/2/13 | | | | 7,500,000 | | | | 7,499,123 |

| | | | | | | | | 15,528,803 |

| Insurance – 1.1% | | | | | | | | |

| Aegon NV 4.75% 6/1/13 | | | | 3,400,000 | | | | 3,191,420 |

| Axis Capital Holdings Ltd. 5.75% 12/1/14 | | | | 2,100,000 | | | | 2,008,304 |

| Marsh & McLennan Companies, Inc.: | | | | | | | | |

| 5.15% 9/15/10 | | | | 1,300,000 | | | | 1,261,878 |

| 7.125% 6/15/09 | | | | 1,480,000 | | | | 1,536,530 |

See accompanying notes which are an integral part of the financial statements.

9 Semiannual Report

| Investments (Unaudited) continued | | | | | | | | |

| |

| |

| Nonconvertible Bonds continued | | | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | | | |

| |

| FINANCIALS – continued | | | | | | | | |

| Insurance – continued | | | | | | | | |

| Pennsylvania Mutual Life Insurance Co. 6.65% 6/15/34 (c) | | | | $ 3,000,000 | | | | $ 3,042,027 |

| Symetra Financial Corp. 6.125% 4/1/16 (c) | | | | 1,335,000 | | | | 1,305,395 |

| The St. Paul Travelers Companies, Inc.: | | | | | | | | |

| 6.38% 12/15/08 | | | | 2,200,000 | | | | 2,236,927 |

| 8.125% 4/15/10 | | | | 1,750,000 | | | | 1,894,510 |

| | | | | | | | | 16,476,991 |

| Real Estate 4.2% | | | | | | | | |

| Archstone Smith Operating Trust: | | | | | | | | |

| 5.25% 12/1/10 | | | | 4,350,000 | | | | 4,267,911 |

| 5.25% 5/1/15 | | | | 1,540,000 | | | | 1,459,441 |

| Arden Realty LP: | | | | | | | | |

| 5.2% 9/1/11 | | | | 1,200,000 | | | | 1,185,292 |

| 7% 11/15/07 | | | | 3,460,000 | | | | 3,552,157 |

| AvalonBay Communities, Inc. 5% 8/1/07 | | | | 1,380,000 | | | | 1,367,013 |

| Boston Properties, Inc. 6.25% 1/15/13 | | | | 1,905,000 | | | | 1,947,661 |

| Brandywine Operating Partnership LP: | | | | | | | | |

| 4.5% 11/1/09 | | | | 3,310,000 | | | | 3,172,506 |

| 5.625% 12/15/10 | | | | 2,095,000 | | | | 2,066,841 |

| 5.75% 4/1/12 | | | | 1,035,000 | | | | 1,022,279 |

| BRE Properties, Inc.: | | | | | | | | |

| 4.875% 5/15/10 | | | | 1,765,000 | | | | 1,711,069 |

| 5.95% 3/15/07 | | | | 875,000 | | | | 875,045 |

| Camden Property Trust: | | | | | | | | |

| 4.375% 1/15/10 | | | | 1,450,000 | | | | 1,392,505 |

| 5.875% 11/30/12 | | | | 1,700,000 | | | | 1,692,003 |

| CarrAmerica Realty Corp.: | | | | | | | | |

| 5.25% 11/30/07 | | | | 1,940,000 | | | | 1,934,867 |

| 5.5% 12/15/10 | | | | 2,070,000 | | | | 2,061,656 |

| Colonial Properties Trust 4.75% 2/1/10 | | | | 2,315,000 | | | | 2,231,466 |

| Developers Diversified Realty Corp.: | | | | | | | | |

| 4.625% 8/1/10 | | | | 2,325,000 | | | | 2,223,618 |

| 5.25% 4/15/11 | | | | 4,660,000 | | | | 4,522,721 |

| EOP Operating LP: | | | | | | | | |

| 4.65% 10/1/10 | | | | 6,440,000 | | | | 6,173,738 |

| 4.75% 3/15/14 | | | | 1,070,000 | | | | 981,604 |

| 6.75% 2/15/12 | | | | 670,000 | | | | 697,018 |

| Equity Residential 5.125% 3/15/16 | | | | 1,530,000 | | | | 1,429,271 |

| Heritage Property Investment Trust, Inc. 4.5% 10/15/09 | | | | 4,145,000 | | | | 3,968,759 |

See accompanying notes which are an integral part of the financial statements.

| Nonconvertible Bonds continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| |

| FINANCIALS – continued | | | | | | |

| Real Estate continued | | | | | | |

| iStar Financial, Inc.: | | | | | | |

| 5.375% 4/15/10 | | | | $ 695,000 | | $ 682,592 |

| 5.8% 3/15/11 | | | | 3,895,000 | | 3,863,135 |

| Mack Cali Realty LP 7.25% 3/15/09 | | | | 800,000 | | 829,087 |

| Post Apartment Homes LP 5.45% 6/1/12 | | | | 1,800,000 | | 1,721,394 |

| Simon Property Group LP: | | | | | | |

| 4.6% 6/15/10 | | | | 1,215,000 | | 1,170,605 |

| 5.1% 6/15/15 | | | | 1,800,000 | | 1,684,771 |

| | | | | | | 61,888,025 |

| Thrifts & Mortgage Finance – 0.5% | | | | | | |

| Countrywide Home Loans, Inc. 4% 3/22/11 | | | | 1,890,000 | | 1,748,242 |

| Independence Community Bank Corp.: | | | | | | |

| 3.5% 6/20/13 (h) | | | | 500,000 | | 478,179 |

| 3.75% 4/1/14 (h) | | | | 2,610,000 | | 2,471,657 |

| Washington Mutual, Inc. 4.625% 4/1/14 | | | | 3,080,000 | | 2,791,931 |

| | | | | | | 7,490,009 |

| |

| TOTAL FINANCIALS | | | | | | 163,309,436 |

| |

| INDUSTRIALS – 1.8% | | | | | | |

| Aerospace & Defense – 0.2% | | | | | | |

| BAE Systems Holdings, Inc. 4.75% 8/15/10 (c) | | | | 1,995,000 | | 1,917,113 |

| Bombardier, Inc. 6.3% 5/1/14 (c) | | | | 1,575,000 | | 1,452,938 |

| | | | | | | 3,370,051 |

| Airlines – 1.0% | | | | | | |

| American Airlines, Inc. pass thru trust certificates: | | | | | | |

| 6.855% 10/15/10 | | | | 179,494 | | 182,300 |

| 6.978% 10/1/12 | | | | 473,028 | | 484,675 |

| 7.024% 4/15/11 | | | | 1,370,000 | | 1,407,675 |

| 7.324% 4/15/11 | | | | 500,000 | | 485,000 |

| 7.858% 4/1/13 | | | | 2,000,000 | | 2,126,822 |

| Continental Airlines, Inc. pass thru trust certificates: | | | | | | |

| 6.648% 3/15/19 | | | | 2,675,732 | | 2,679,822 |

| 7.056% 3/15/11 | | | | 1,330,000 | | 1,368,354 |

| Delta Air Lines, Inc. pass thru trust certificates 7.57% | | | | | | |

| 11/18/10 | | | | 2,020,000 | | 2,020,000 |

| U.S. Airways pass thru trust certificates 6.85% 7/30/19 | | | | 978,139 | | 998,925 |

| United Airlines pass thru Certificates: | | | | | | |

| 6.071% 9/1/14 | | | | 1,055,492 | | 1,042,014 |

See accompanying notes which are an integral part of the financial statements.

11 Semiannual Report

| Investments (Unaudited) continued | | | | | | |

| |

| |

| Nonconvertible Bonds continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| |

| INDUSTRIALS – continued | | | | | | |

| Airlines – continued | | | | | | |

| United Airlines pass thru Certificates: – continued | | | | | | |

| 6.201% 3/1/10 | | | | $ 447,887 | | $ 447,887 |

| 6.602% 9/1/13 | | | | 1,326,853 | | 1,321,686 |

| | | | | | | 14,565,160 |

| Industrial Conglomerates – 0.3% | | | | | | |

| Hutchison Whampoa International 03/13 Ltd. 6.5% | | | | | | |

| 2/13/13 (c) | | | | 4,330,000 | | 4,429,521 |

| Road & Rail 0.3% | | | | | | |

| Canadian Pacific Railway Co. yankee 6.25% 10/15/11 | | | | 2,700,000 | | 2,774,731 |

| Norfolk Southern Corp. 5.257% 9/17/14 | | | | 1,731,000 | | 1,672,999 |

| | | | | | | 4,447,730 |

| |

| TOTAL INDUSTRIALS | | | | | | 26,812,462 |

| |

| MATERIALS 0.5% | | | | | | |

| Metals & Mining – 0.4% | | | | | | |

| Corporacion Nacional del Cobre (Codelco) 6.375% | | | | | | |

| 11/30/12 (c) | | | | 5,580,000 | | 5,734,929 |

| Paper & Forest Products 0.1% | | | | | | |

| International Paper Co. 4.25% 1/15/09 | | | | 1,165,000 | | 1,125,622 |

| |

| TOTAL MATERIALS | | | | | | 6,860,551 |

| |

| TELECOMMUNICATION SERVICES – 2.4% | | | | | | |

| Diversified Telecommunication Services – 1.9% | | | | | | |

| Ameritech Capital Funding Corp. 6.25% 5/18/09 | | | | 1,100,000 | | 1,112,718 |

| AT&T Broadband Corp. 8.375% 3/15/13 | | | | 3,000,000 | | 3,358,449 |

| British Telecommunications PLC: | | | | | | |

| 8.375% 12/15/10 | | | | 295,000 | | 327,719 |

| 8.875% 12/15/30 | | | | 775,000 | | 979,595 |

| Deutsche Telekom International Finance BV 5.25% 7/22/13 | | | | 1,445,000 | | 1,380,565 |

| SBC Communications, Inc. 4.125% 9/15/09 | | | | 5,000,000 | | 4,781,870 |

| Sprint Capital Corp. 8.375% 3/15/12 | | | | 2,050,000 | | 2,304,895 |

| Telecom Italia Capital: | | | | | | |

| 4% 1/15/10 | | | | 4,940,000 | | 4,651,736 |

| 4.95% 9/30/14 | | | | 1,780,000 | | 1,629,348 |

| Telefonos de Mexico SA de CV 4.75% 1/27/10 | | | | 4,695,000 | | 4,521,797 |

See accompanying notes which are an integral part of the financial statements.

| Nonconvertible Bonds continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| |

| TELECOMMUNICATION SERVICES – continued | | | | | | |

| Diversified Telecommunication Services – continued | | | | | | |

| TELUS Corp. yankee 7.5% 6/1/07 | | | | $ 1,310,000 | | $ 1,337,245 |

| Verizon Global Funding Corp. 7.25% 12/1/10 | | | | 1,697,000 | | 1,798,632 |

| | | | | | | 28,184,569 |

| Wireless Telecommunication Services – 0.5% | | | | | | |

| America Movil SA de CV 4.125% 3/1/09 | | | | 1,010,000 | | 968,113 |

| AT&T Wireless Services, Inc. 7.875% 3/1/11 | | | | 2,820,000 | | 3,086,295 |

| Vodafone Group PLC 5.5% 6/15/11 | | | | 2,540,000 | | 2,511,796 |

| | | | | | | 6,566,204 |

| |

| TOTAL TELECOMMUNICATION SERVICES | | | | | | 34,750,773 |

| |

| UTILITIES – 3.6% | | | | | | |

| Electric Utilities – 2.0% | | | | | | |

| Cleveland Electric Illuminating Co. 5.65% 12/15/13 | | | | 2,265,000 | | 2,215,714 |

| Exelon Corp.: | | | | | | |

| 4.9% 6/15/15 | | | | 1,075,000 | | 988,630 |

| 6.75% 5/1/11 | | | | 970,000 | | 1,012,360 |

| Exelon Generation Co. LLC 5.35% 1/15/14 | | | | 3,000,000 | | 2,881,047 |

| FirstEnergy Corp. 6.45% 11/15/11 | | | | 2,980,000 | | 3,073,045 |

| Monongahela Power Co. 5% 10/1/06 | | | | 1,370,000 | | 1,366,394 |

| Niagara Mohawk Power Corp. 8.875% 5/15/07 | | | | 400,000 | | 413,378 |

| Pepco Holdings, Inc.: | | | | | | |

| 4% 5/15/10 | | | | 1,270,000 | | 1,190,455 |

| 6.45% 8/15/12 | | | | 950,000 | | 967,573 |

| PPL Energy Supply LLC 5.7% 10/15/35 | | | | 3,070,000 | | 2,946,727 |

| Progress Energy, Inc.: | | | | | | |

| 5.625% 1/15/16 | | | | 4,000,000 | | 3,865,136 |

| 7.1% 3/1/11 | | | | 1,800,000 | | 1,901,599 |

| PSI Energy, Inc. 6.65% 6/15/06 | | | | 3,775,000 | | 3,780,632 |

| TXU Energy Co. LLC 7% 3/15/13 | | | | 3,210,000 | | 3,324,514 |

| | | | | | | 29,927,204 |

| Gas Utilities 0.2% | | | | | | |

| Texas Eastern Transmission Corp. 7.3% 12/1/10 | | | | 1,010,000 | | 1,074,663 |

| Transcontinental Gas Pipe Line Corp. 6.4% 4/15/16 (c) | | | | 1,180,000 | | 1,168,200 |

| | | | | | | 2,242,863 |

See accompanying notes which are an integral part of the financial statements.

13 Semiannual Report

| Investments (Unaudited) continued | | | | |

| |

| |

| Nonconvertible Bonds continued | | | | |

| | | Principal | | Value (Note 1) |

| | | Amount | | |

| |

| UTILITIES – continued | | | | |

| Independent Power Producers & Energy Traders – 0.3% | | | | |

| Constellation Energy Group, Inc. 7% 4/1/12 | | $ 3,052,000 | | $ 3,232,553 |

| TXU Corp. 5.55% 11/15/14 | | 1,645,000 | | 1,530,344 |

| | | | | 4,762,897 |

| Multi-Utilities – 1.1% | | | | |

| Dominion Resources, Inc.: | | | | |

| 4.75% 12/15/10 | | 2,050,000 | | 1,966,018 |

| 6.25% 6/30/12 | | 5,295,000 | | 5,362,066 |

| MidAmerican Energy Holdings, Inc. 5.875% 10/1/12 | | 3,400,000 | | 3,404,461 |

| PSEG Funding Trust I 5.381% 11/16/07 | | 3,392,000 | | 3,379,650 |

| Sempra Energy 7.95% 3/1/10 | | 830,000 | | 893,844 |

| TECO Energy, Inc. 7% 5/1/12 | | 1,170,000 | | 1,205,100 |

| | | | | 16,211,139 |

| |

| TOTAL UTILITIES | | | | 53,144,103 |

| |

| TOTAL NONCONVERTIBLE BONDS | | | | |

| (Cost $371,524,406) | | | | 363,204,888 |

| |

| U.S. Government and Government Agency Obligations 29.7% | | | | |

| |

| U.S. Government Agency Obligations 10.9% | | | | |

| Fannie Mae: | | | | |

| 3.25% 2/15/09 | | 18,000,000 | | 17,116,614 |

| 4.375% 7/17/13 | | 4,850,000 | | 4,560,930 |

| 5.25% 8/1/12 | | 30,000,000 | | 29,507,850 |

| 5.5% 3/15/11 | | 10,790,000 | | 10,888,826 |

| 6% 5/15/11 | | 17,655,000 | | 18,201,934 |

| 6.25% 2/1/11 | | 735,000 | | 759,681 |

| Freddie Mac: | | | | |

| 5.25% 11/5/12 | | 1,405,000 | | 1,370,429 |

| 5.75% 1/15/12 | | 24,318,000 | | 24,843,366 |

| 5.875% 3/21/11 | | 2,655,000 | | 2,701,120 |

| 6.625% 9/15/09 | | 48,400,000 | | 50,541,894 |

| |

| TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | | | | 160,492,644 |

| U.S. Treasury Inflation Protected Obligations 6.4% | | | | |

| U.S. Treasury Inflation-Indexed Notes: | | | | |

| 0.875% 4/15/10 | | 29,365,840 | | 27,921,320 |

See accompanying notes which are an integral part of the financial statements.

| U.S. Government and Government Agency Obligations continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| U.S. Treasury Inflation Protected Obligations continued | | | | | | |

| U.S. Treasury Inflation-Indexed Notes: – continued | | | | | | |

| 2% 1/15/14 | | | | $41,076,078 | | $40,082,114 |

| 2% 7/15/14 | | | | 27,405,560 | | 26,707,980 |

| |

| TOTAL U.S. TREASURY INFLATION PROTECTED OBLIGATIONS | | | | | | 94,711,414 |

| U.S. Treasury Obligations – 12.4% | | | | | | |

| U.S. Treasury Bonds 6.25% 5/15/30 | | | | 970,000 | | 1,096,251 |

| U.S. Treasury Notes: | | | | | | |

| 3.125% 4/15/09 | | | | 25,000,000 | | 23,803,700 |

| 3.375% 10/15/09 | | | | 51,000,000 | | 48,549,603 |

| 4.25% 8/15/13 | | | | 35,902,000 | | 34,248,533 |

| 4.375% 12/15/10 | | | | 8,910,000 | | 8,710,567 |

| 4.75% 5/15/14 | | | | 67,425,000 | | 66,168,649 |

| |

| TOTAL U.S. TREASURY OBLIGATIONS | | | | | | 182,577,303 |

| |

| TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY | | | | | | |

| OBLIGATIONS | | | | | | |

| (Cost $456,431,065) | | | | | | 437,781,361 |

| |

| U.S. Government Agency Mortgage Securities 8.7% | | | | | | |

| |

| Fannie Mae – 7.6% | | | | | | |

| 3.749% 12/1/34 (h) | | | | 228,158 | | 224,295 |

| 3.75% 9/1/33 (h) | | | | 1,008,635 | | 983,731 |

| 3.75% 1/1/34 (h) | | | | 194,875 | | 189,557 |

| 3.752% 10/1/33 (h) | | | | 198,035 | | 193,207 |

| 3.752% 10/1/33 (h) | | | | 232,082 | | 226,106 |

| 3.792% 6/1/34 (h) | | | | 883,509 | | 854,282 |

| 3.829% 1/1/35 (h) | | | | 195,348 | | 192,223 |

| 3.833% 4/1/33 (h) | | | | 614,130 | | 603,088 |

| 3.847% 1/1/35 (h) | | | | 564,620 | | 555,224 |

| 3.853% 11/1/34 (h) | | | | 1,174,872 | | 1,156,850 |

| 3.854% 10/1/33 (h) | | | | 5,148,804 | | 5,040,679 |

| 3.869% 1/1/35 (h) | | | | 335,913 | | 330,720 |

| 3.913% 5/1/34 (h) | | | | 74,803 | | 74,795 |

| 3.917% 12/1/34 (h) | | | | 171,370 | | 168,774 |

| 3.957% 1/1/35 (h) | | | | 241,103 | | 237,583 |

| 3.96% 5/1/33 (h) | | | | 66,966 | | 65,892 |

| 3.978% 12/1/34 (h) | | | | 244,973 | | 241,541 |

| 3.983% 12/1/34 (h) | | | | 1,234,154 | | 1,216,888 |

See accompanying notes which are an integral part of the financial statements.

15 Semiannual Report

| Investments (Unaudited) continued | | | | | | |

| |

| |

| U.S. Government Agency Mortgage Securities continued | | | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | | | |

| Fannie Mae continued | | | | | | | | |

| 3.988% 1/1/35 (h) | | | | $ 160,209 | | | | $ 157,908 |

| 4% 8/1/18 | | | | 3,398,429 | | | | 3,177,463 |

| 4.006% 2/1/35 (h) | | | | 170,684 | | | | 168,211 |

| 4.021% 2/1/35 (h) | | | | 155,188 | | | | 153,103 |

| 4.048% 10/1/18 (h) | | | | 172,072 | | | | 168,864 |

| 4.05% 1/1/35 (h) | | | | 102,451 | | | | 100,985 |

| 4.066% 4/1/33 (h) | | | | 63,154 | | | | 62,315 |

| 4.09% 2/1/35 (h) | | | | 114,413 | | | | 112,808 |

| 4.091% 2/1/35 (h) | | | | 314,121 | | | | 309,830 |

| 4.092% 2/1/35 (h) | | | | 109,656 | | | | 108,233 |

| 4.106% 2/1/35 (h) | | | | 596,215 | | | | 588,798 |

| 4.109% 1/1/35 (h) | | | | 344,355 | | | | 339,799 |

| 4.115% 2/1/35 (h) | | | | 400,325 | | | | 394,977 |

| 4.122% 1/1/35 (h) | | | | 601,313 | | | | 593,820 |

| 4.144% 1/1/35 (h) | | | | 507,565 | | | | 502,910 |

| 4.153% 2/1/35 (h) | | | | 312,009 | | | | 308,025 |

| 4.166% 11/1/34 (h) | | | | 86,029 | | | | 85,098 |

| 4.176% 1/1/35 (h) | | | | 287,910 | | | | 284,420 |

| 4.178% 1/1/35 (h) | | | | 621,266 | | | | 614,358 |

| 4.178% 1/1/35 (h) | | | | 408,744 | | | | 397,462 |

| 4.188% 10/1/34 (h) | | | | 501,026 | | | | 497,158 |

| 4.22% 3/1/34 (h) | | | | 162,871 | | | | 159,550 |

| 4.223% 1/1/35 (h) | | | | 175,535 | | | | 173,531 |

| 4.248% 1/1/34 (h) | | | | 535,756 | | | | 526,177 |

| 4.25% 2/1/35 (h) | | | | 213,007 | | | | 207,247 |

| 4.267% 2/1/35 (h) | | | | 115,353 | | | | 114,128 |

| 4.27% 10/1/34 (h) | | | | 61,910 | | | | 61,340 |

| 4.28% 8/1/33 (h) | | | | 390,529 | | | | 385,823 |

| 4.283% 3/1/35 (h) | | | | 189,868 | | | | 187,599 |

| 4.287% 7/1/34 (h) | | | | 149,474 | | | | 149,011 |

| 4.294% 3/1/33 (h) | | | | 243,062 | | | | 240,432 |

| 4.299% 5/1/35 (h) | | | | 263,968 | | | | 261,230 |

| 4.315% 10/1/33 (h) | | | | 91,368 | | | | 90,031 |

| 4.316% 3/1/33 (h) | | | | 96,997 | | | | 94,373 |

| 4.339% 9/1/34 (h) | | | | 277,689 | | | | 275,143 |

| 4.345% 6/1/33 (h) | | | | 119,787 | | | | 118,468 |

| 4.354% 9/1/34 (h) | | | | 1,720,730 | | | | 1,705,725 |

| 4.354% 9/1/34 (h) | | | | 650,598 | | | | 648,594 |

| 4.356% 1/1/35 (h) | | | | 210,893 | | | | 205,657 |

| 4.357% 4/1/35 (h) | | | | 134,853 | | | | 133,322 |

| 4.362% 2/1/34 (h) | | | | 459,843 | | | | 452,292 |

See accompanying notes which are an integral part of the financial statements.

| U.S. Government Agency Mortgage Securities continued | | | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | | | |

| Fannie Mae continued | | | | | | | | |

| 4.392% 1/1/35 (h) | | | | $ 235,428 | | | | $ 233,173 |

| 4.393% 11/1/34 (h) | | | | 2,614,213 | | | | 2,591,391 |

| 4.395% 5/1/35 (h) | | | | 590,490 | | | | 583,971 |

| 4.398% 2/1/35 (h) | | | | 302,032 | | | | 294,593 |

| 4.434% 10/1/34 (h) | | | | 961,170 | | | | 953,749 |

| 4.436% 4/1/34 (h) | | | | 305,131 | | | | 301,754 |

| 4.438% 3/1/35 (h) | | | | 274,251 | | | | 267,622 |

| 4.465% 8/1/34 (h) | | | | 599,071 | | | | 589,720 |

| 4.474% 5/1/35 (h) | | | | 152,742 | | | | 151,246 |

| 4.481% 1/1/35 (h) | | | | 284,072 | | | | 281,904 |

| 4.495% 3/1/35 (h) | | | | 648,333 | | | | 633,629 |

| 4.5% 8/1/33 to 3/1/35 | | | | 1,597,059 | | | | 1,468,140 |

| 4.512% 10/1/35 (h) | | | | 91,797 | | | | 90,674 |

| 4.521% 3/1/35 (h) | | | | 602,893 | | | | 589,714 |

| 4.526% 2/1/35 (h) | | | | 3,233,648 | | | | 3,189,444 |

| 4.54% 2/1/35 (h) | | | | 1,263,500 | | | | 1,253,960 |

| 4.541% 7/1/34 (h) | | | | 289,589 | | | | 289,962 |

| 4.543% 2/1/35 (h) | | | | 133,953 | | | | 132,967 |

| 4.545% 7/1/35 (h) | | | | 715,812 | | | | 708,668 |

| 4.546% 2/1/35 (h) | | | | 192,810 | | | | 191,323 |

| 4.555% 1/1/35 (h) | | | | 421,585 | | | | 418,567 |

| 4.559% 9/1/34 (h) | | | | 768,836 | | | | 763,931 |

| 4.579% 2/1/35 (h) | | | | 583,887 | | | | 572,922 |

| 4.579% 7/1/36 (h) | | | | 1,432,680 | | | | 1,428,540 |

| 4.584% 8/1/34 (h) | | | | 273,607 | | | | 273,732 |

| 4.584% 7/1/35 (h) | | | | 784,072 | | | | 776,749 |

| 4.587% 2/1/35 (h) | | | | 1,912,538 | | | | 1,874,192 |

| 4.618% 7/1/34 (h) | | | | 7,699,230 | | | | 7,658,348 |

| 4.626% 11/1/34 (h) | | | | 626,080 | | | | 615,575 |

| 4.629% 9/1/34 (h) | | | | 87,347 | | | | 87,464 |

| 4.633% 3/1/35 (h) | | | | 103,162 | | | | 102,481 |

| 4.641% 1/1/33 (h) | | | | 137,769 | | | | 136,929 |

| 4.668% 11/1/34 (h) | | | | 675,191 | | | | 664,597 |

| 4.677% 3/1/35 (h) | | | | 1,574,836 | | | | 1,565,639 |

| 4.704% 3/1/35 (h) | | | | 343,155 | | | | 337,002 |

| 4.705% 10/1/32 (h) | | | | 49,341 | | | | 49,225 |

| 4.726% 7/1/34 (h) | | | | 559,626 | | | | 551,976 |

| 4.728% 1/1/35 (h) | | | | 938,451 | | | | 934,087 |

| 4.731% 2/1/33 (h) | | | | 42,253 | | | | 42,045 |

| 4.74% 10/1/34 (h) | | | | 760,031 | | | | 749,512 |

| 4.746% 1/1/35 (h) | | | | 36,192 | | | | 36,010 |

See accompanying notes which are an integral part of the financial statements.

17 Semiannual Report

| Investments (Unaudited) continued | | | | | | |

| |

| |

| U.S. Government Agency Mortgage Securities continued | | | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | | | |

| Fannie Mae continued | | | | | | | | |

| 4.747% 10/1/32 (h) | | | | $ 52,188 | | | | $ 51,927 |

| 4.78% 12/1/34 (h) | | | | 530,595 | | | | 522,997 |

| 4.798% 12/1/32 (h) | | | | 280,191 | | | | 279,163 |

| 4.798% 12/1/34 (h) | | | | 209,646 | | | | 206,854 |

| 4.812% 6/1/35 (h) | | | | 939,094 | | | | 933,469 |

| 4.815% 2/1/33 (h) | | | | 281,648 | | | | 280,547 |

| 4.815% 5/1/33 (h) | | | | 10,604 | | | | 10,567 |

| 4.83% 8/1/34 (h) | | | | 219,981 | | | | 219,592 |

| 4.844% 11/1/34 (h) | | | | 613,570 | | | | 606,096 |

| 4.873% 10/1/34 (h) | | | | 2,294,151 | | | | 2,267,975 |

| 4.969% 12/1/32 (h) | | | | 19,747 | | | | 19,709 |

| 4.984% 11/1/32 (h) | | | | 149,880 | | | | 149,638 |

| 5% 2/1/35 (h) | | | | 93,989 | | | | 93,812 |

| 5.042% 7/1/34 (h) | | | | 117,285 | | | | 116,460 |

| 5.063% 11/1/34 (h) | | | | 57,052 | | | | 56,987 |

| 5.081% 9/1/34 (h) | | | | 1,919,448 | | | | 1,906,472 |

| 5.103% 9/1/34 (h) | | | | 200,573 | | | | 199,351 |

| 5.104% 5/1/35 (h) | | | | 1,350,337 | | | | 1,349,014 |

| 5.172% 5/1/35 (h) | | | | 775,530 | | | | 770,303 |

| 5.177% 5/1/35 (h) | | | | 2,090,430 | | | | 2,075,839 |

| 5.197% 8/1/33 (h) | | | | 291,344 | | | | 290,310 |

| 5.197% 6/1/35 (h) | | | | 962,823 | | | | 963,140 |

| 5.221% 5/1/35 (h) | | | | 2,147,709 | | | | 2,134,179 |

| 5.231% 3/1/35 (h) | | | | 120,681 | | | | 120,162 |

| 5.318% 7/1/35 (h) | | | | 133,982 | | | | 134,180 |

| 5.343% 12/1/34 (h) | | | | 353,956 | | | | 353,347 |

| 5.5% 9/1/10 to 5/1/25 | | | | 8,381,346 | | | | 8,267,553 |

| 5.505% 2/1/36 (h) | | | | 3,561,337 | | | | 3,548,872 |

| 5.636% 1/1/36 (h) | | | | 994,562 | | | | 994,900 |

| 6% 5/1/16 to 4/1/17 | | | | 1,241,282 | | | | 1,257,354 |

| 6.5% 12/1/13 to 3/1/35 | | | | 12,139,975 | | | | 12,394,410 |

| 6.5% 5/1/36 (d) | | | | 2,360,481 | | | | 2,399,736 |

| 7% 2/1/09 to 6/1/33 | | | | 3,125,518 | | | | 3,214,450 |

| 7.5% 8/1/17 to 9/1/28 | | | | 980,666 | | | | 1,024,510 |

| 8.5% 6/1/11 to 9/1/25 | | | | 148,794 | | | | 157,937 |

| 9.5% 2/1/25 | | | | 28,046 | | | | 30,253 |

| 10.5% 8/1/20 | | | | 21,402 | | | | 24,301 |

| 11% 8/1/15 | | | | 182,605 | | | | 194,954 |

| 12.5% 12/1/13 to 4/1/15 | | | | 14,440 | | | | 16,760 |

| |

| TOTAL FANNIE MAE | | | | | | 111,946,860 |

See accompanying notes which are an integral part of the financial statements.

| U.S. Government Agency Mortgage Securities continued | | | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | | | |

| Freddie Mac – 1.0% | | | | | | | | |

| 4.05% 12/1/34 (h) | | | | $ 201,667 | | | | $ 198,293 |

| 4.106% 12/1/34 (h) | | | | 299,820 | | | | 295,107 |

| 4.152% 1/1/35 (h) | | | | 888,904 | | | | 875,348 |

| 4.263% 3/1/35 (h) | | | | 273,597 | | | | 269,720 |

| 4.294% 5/1/35 (h) | | | | 470,290 | | | | 464,030 |

| 4.304% 12/1/34 (h) | | | | 279,514 | | | | 271,643 |

| 4.353% 2/1/35 (h) | | | | 591,190 | | | | 583,439 |

| 4.359% 3/1/35 (h) | | | | 442,661 | | | | 430,085 |

| 4.379% 2/1/35 (h) | | | | 539,616 | | | | 524,669 |

| 4.443% 3/1/35 (h) | | | | 275,676 | | | | 268,029 |

| 4.45% 2/1/34 (h) | | | | 278,593 | | | | 273,623 |

| 4.462% 6/1/35 (h) | | | | 416,698 | | | | 410,876 |

| 4.482% 3/1/35 (h) | | | | 317,536 | | | | 309,385 |

| 4.484% 3/1/35 (h) | | | | 1,963,369 | | | | 1,930,286 |

| 4.552% 2/1/35 (h) | | | | 451,647 | | | | 440,401 |

| 4.768% 10/1/32 (h) | | | | 38,461 | | | | 38,185 |

| 4.869% 3/1/33 (h) | | | | 108,324 | | | | 107,720 |

| 5.007% 4/1/35 (h) | | | | 1,489,482 | | | | 1,482,124 |

| 5.069% 9/1/32 (h) | | | | 784,165 | | | | 781,350 |

| 5.143% 4/1/35 (h) | | | | 1,323,704 | | | | 1,309,196 |

| 5.338% 6/1/35 (h) | | | | 978,967 | | | | 973,387 |

| 5.571% 1/1/36 (h) | | | | 1,745,175 | | | | 1,736,693 |

| 5.588% 4/1/32 (h) | | | | 55,507 | | | | 55,933 |

| 8.5% 9/1/24 to 8/1/27 | | | | 97,746 | | | | 104,865 |

| 10% 5/1/09 | | | | 3,938 | | | | 4,064 |

| 10.5% 5/1/21 | | | | 27,438 | | | | 28,882 |

| 11% 12/1/11 | | | | 1,804 | | | | 1,935 |

| 11.5% 10/1/15 | | | | 6,826 | | | | 7,733 |

| 11.75% 10/1/10 | | | | 9,446 | | | | 10,336 |

| |

| TOTAL FREDDIE MAC | | | | | | | | 14,187,337 |

| Government National Mortgage Association 0.1% | | | | | | | | |

| 4.25% 7/20/34 (h) | | | | 731,883 | | | | 721,417 |

| 7% 3/15/28 to 11/15/28 | | | | 778,477 | | | | 811,766 |

| 7.5% 2/15/28 to 10/15/28 | | | | 13,381 | | | | 14,071 |

| 8% 11/15/06 to 10/15/24 | | | | 34,257 | | | | 34,850 |

See accompanying notes which are an integral part of the financial statements.

19 Semiannual Report

| Investments (Unaudited) continued | | | | |

| |

| |

| U.S. Government Agency Mortgage Securities continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Government National Mortgage Association continued | | | | | | |

| 8.5% 4/15/17 to 10/15/21 | | | | $ 144,959 | | $ 155,348 |

| 11% 7/20/19 to 8/20/19 | | | | 7,757 | | 8,957 |

| |

| TOTAL GOVERNMENT NATIONAL MORTGAGE ASSOCIATION | | | | | | 1,746,409 |

| |

| TOTAL U.S. GOVERNMENT AGENCY MORTGAGE SECURITIES | | | | | | |

| (Cost $129,230,022) | | | | | | 127,880,606 |

| |

| Asset Backed Securities 5.8% | | | | | | |

| |

| ACE Securities Corp. Series 2004-HE1: | | | | | | |

| Class M1, 5.4594% 2/25/34 (h) | | | | 525,000 | | 526,512 |

| Class M2, 6.0594% 2/25/34 (h) | | | | 600,000 | | 604,071 |

| Aircraft Lease Securitization Ltd. Series 2005-1 Class C1, | | | | | | |

| 8.75% 9/9/30 (c)(h) | | | | 392,923 | | 397,834 |

| American Express Credit Account Master Trust Series 2004-1 | | | | | | |

| Class B, 5.1513% 9/15/11 (h) | | | | 1,430,000 | | 1,435,770 |

| AmeriCredit Automobile Receivables Trust: | | | | | | |

| Series 2005-1 Class E, 5.82% 6/6/12 (c) | | | | 733,694 | | 731,361 |

| Series 2005-DA Class A4, 5.02% 11/6/12 | | | | 2,895,000 | | 2,865,684 |

| Series 2006-1: | | | | | | |

| Class A3, 5.11% 10/6/10 | | | | 58,000 | | 57,751 |

| Class B1, 5.2% 3/6/11 | | | | 175,000 | | 174,720 |

| Class C1, 5.28% 11/6/11 | | | | 1,085,000 | | 1,076,585 |

| Class D, 5.49% 4/6/12 | | | | 1,245,000 | | 1,233,794 |

| Class E1, 6.62% 5/6/13 (c) | | | | 1,335,000 | | 1,334,012 |

| Ameriquest Mortgage Securities, Inc. Series 2004-R2: | | | | | | |

| Class M1, 5.3894% 4/25/34 (h) | | | | 300,000 | | 299,984 |

| Class M2, 5.4394% 4/25/34 (h) | | | | 225,000 | | 224,988 |

| Asset Backed Securities Corp. Home Equity Loan Trust Series | | | | | | |

| 2003-HE7 Class A3, 5.2613% 12/15/33 (h) | | | | 296,899 | | 297,821 |

| Bank One Issuance Trust: | | | | | | |

| Series 2002-B1 Class B1, 5.2813% 12/15/09 (h) | | | | 1,290,000 | | 1,293,358 |

| Series 2002-C1 Class C1, 5.8613% 12/15/09 (h) | | | | 1,840,000 | | 1,853,033 |

| Series 2004-B2 Class B2, 4.37% 4/15/12 | | | | 3,100,000 | | 3,005,245 |

| Bear Stearns Asset Backed Securities I Series 2005-HE2: | | | | | | |

| Class M1, 5.4594% 2/25/35 (h) | | | | 1,555,000 | | 1,561,797 |

| Class M2, 5.7094% 2/25/35 (h) | | | | 570,000 | | 574,260 |

| Capital Auto Receivables Asset Trust Series 2006-1: | | | | | | |

| Class A3, 5.03% 10/15/09 | | | | 585,000 | | 582,289 |

| Class B, 5.26% 10/15/10 | | | | 560,000 | | 555,539 |

See accompanying notes which are an integral part of the financial statements.

| Asset Backed Securities continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Capital One Master Trust: | | | | | | |

| Series 2001-1 Class B, 5.4113% 12/15/10 (h) | | | | $ 2,130,000 | | $ 2,142,449 |

| Series 2001-8A Class B, 5.4513% 8/17/09 (h) | | | | 3,015,000 | | 3,019,310 |

| Capital One Multi-Asset Execution Trust: | | | | | | |

| Series 2003-B5 Class B5, 4.79% 8/15/13 | | | | 1,470,000 | | 1,422,764 |

| Series 2004-6 Class B, 4.15% 7/16/12 | | | | 2,560,000 | | 2,462,342 |

| Cendant Timeshare Receivables Funding LLC Series 2005-1A | | | | | | |

| Class A1, 4.67% 5/20/17 (c) | | | | 865,951 | | 848,672 |

| Chase Credit Card Owner Trust Series 2004-1 Class B, | | | | | | |

| 5.1013% 5/15/09 (h) | | | | 1,020,000 | | 1,019,930 |

| CIT Equipment Collateral Trust Series 2006-VT1 Class A3, | | | | | | |

| 5.13% 12/21/08 | | | | 1,990,000 | | 1,983,781 |

| Citibank Credit Card Issuance Trust: | | | | | | |

| Series 2005-B1 Class B1, 4.4% 9/15/10 | | | | 1,040,000 | | 1,016,645 |

| Series 2006-B2 Class B2, 5.15% 3/7/11 | | | | 1,315,000 | | 1,305,754 |

| CNH Equipment Trust Series 2006-A Class A3, 5.2% 8/16/10 | | | | 1,420,000 | | 1,417,316 |

| Countrywide Home Loans, Inc.: | | | | | | |

| Series 2004-2 Class M1, 5.4594% 5/25/34 (h) | | | | 1,770,000 | | 1,775,189 |

| Series 2004-3 Class M1, 5.4594% 6/25/34 (h) | | | | 350,000 | | 351,216 |

| Crown Castle Towers LLC/Crown Atlantic Holdings Sub | | | | | | |

| LLC/Crown Communication, Inc. Series 2005-1A: | | | | | | |

| Class B, 4.878% 6/15/35 (c) | | | | 1,150,000 | | 1,109,639 |

| Class C, 5.074% 6/15/35 (c) | | | | 1,044,000 | | 1,003,730 |

| Fieldstone Mortgage Investment Corp. Series 2003-1: | | | | | | |

| Class M1, 5.6394% 11/25/33 (h) | | | | 18,996 | | 19,003 |

| Class M2, 6.7094% 11/25/33 (h) | | | | 200,000 | | 201,046 |

| First Franklin Mortgage Loan Trust Series 2004-FF2: | | | | | | |

| Class M3, 5.5094% 3/25/34 (h) | | | | 100,000 | | 100,250 |

| Class M4, 5.8594% 3/25/34 (h) | | | | 75,000 | | 75,506 |

| Ford Credit Auto Owner Trust Series 2006-A Class A3, 5.05% | | | | | | |

| 11/15/09 | | | | 1,375,000 | | 1,369,574 |

| Fremont Home Loan Trust: | | | | | | |

| Series 2004 A: | | | | | | |

| Class M1, 5.5094% 1/25/34 (h) | | | | 1,100,000 | | 1,106,500 |

| Class M2, 6.1094% 1/25/34 (h) | | | | 1,275,000 | | 1,286,496 |

| Series 2005 A: | | | | | | |

| Class M1, 5.3894% 1/25/35 (h) | | | | 375,000 | | 377,114 |

| Class M2, 5.4194% 1/25/35 (h) | | | | 550,000 | | 552,330 |

| Class M3, 5.4494% 1/25/35 (h) | | | | 300,000 | | 301,677 |

| Class M4, 5.6394% 1/25/35 (h) | | | | 225,000 | | 227,131 |

| GCO Slims Trust Series 2006-1A, 5.72% 3/1/22 (c) | | | | 1,700,000 | | 1,670,781 |

See accompanying notes which are an integral part of the financial statements.

21 Semiannual Report

| Investments (Unaudited) continued | | | | | | |

| |

| |

| Asset Backed Securities continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| GSAMP Trust Series 2004-FM2: | | | | | | |

| Class M1, 5.4594% 1/25/34 (h) | | | | $ 577,042 | | $ 577,011 |

| Class M2, 6.0594% 1/25/34 (h) | | | | 400,000 | | 399,979 |

| Class M3, 6.2594% 1/25/34 (h) | | | | 400,000 | | 399,979 |

| Home Equity Asset Trust: | | | | | | |

| Series 2003-2 Class M1, 5.8394% 8/25/33 (h) | | | | 634,210 | | 636,463 |

| Series 2003-4: | | | | | | |

| Class M1, 5.7594% 10/25/33 (h) | | | | 1,045,000 | | 1,049,331 |

| Class M2, 6.8594% 10/25/33 (h) | | | | 1,240,000 | | 1,249,052 |

| Series 2004-3 Class M2, 6.1594% 8/25/34 (h) | | | | 535,000 | | 542,757 |

| HSBC Home Equity Loan Trust Series 2005-2: | | | | | | |

| Class M1, 5.2363% 1/20/35 (h) | | | | 475,979 | | 476,650 |

| Class M2, 5.2663% 1/20/35 (h) | | | | 357,828 | | 358,701 |

| Hyundai Auto Receivables Trust: | | | | | | |

| Series 2004-1 Class A4, 5.26% 11/15/12 | | | | 1,180,000 | | 1,176,791 |

| Series 2006-1: | | | | | | |

| Class A3, 5.13% 6/15/10 | | | | 440,000 | | 439,208 |

| Class B, 5.29% 11/15/12 | | | | 185,000 | | 184,570 |

| Class C, 5.34% 11/15/12 | | | | 235,000 | | 234,411 |

| Long Beach Mortgage Loan Trust Series 2003-3 Class M1, | | | | | | |

| 5.7094% 7/25/33 (h) | | | | 2,441,358 | | 2,453,165 |

| MBNA Credit Card Master Note Trust Series 2003-B2 Class | | | | | | |

| B2, 5.2913% 10/15/10 (h) | | | | 350,000 | | 352,110 |

| Meritage Mortgage Loan Trust Series 2004-1: | | | | | | |

| Class M1, 5.4594% 7/25/34 (h) | | | | 500,000 | | 499,974 |

| Class M2, 5.5094% 7/25/34 (h) | | | | 100,000 | | 99,995 |

| Class M3, 5.9094% 7/25/34 (h) | | | | 200,000 | | 199,989 |

| Class M4, 6.0594% 7/25/34 (h) | | | | 125,000 | | 125,200 |

| Morgan Stanley ABS Capital I, Inc.: | | | | | | |

| Series 2002-HE3 Class M1, 6.0594% 12/27/32 (h) | | | | 460,000 | | 464,940 |

| Series 2003-NC8 Class M1, 5.6594% 9/25/33 (h) | | | | 664,956 | | 667,946 |

| Morgan Stanley Dean Witter Capital I Trust: | | | | | | |

| Series 2001-NC4 Class M1, 5.9594% 1/25/32 (h) | | | | 856,671 | | 857,539 |

| Series 2002-NC1 Class M1, 5.7594% 2/25/32 (c)(h) | | | | 706,794 | | 707,356 |

| Series 2002-NC3 Class M1, 5.6794% 8/25/32 (h) | | | | 375,000 | | 375,799 |

| National Collegiate Student Loan Trust: | | | | | | |

| Series 2004-2 Class AIO, 9.75% 10/25/14 (j) | | | | 1,960,000 | | 884,764 |

| Series 2005-GT1 Class AIO, 6.75% 12/25/09 (j) | | | | 950,000 | | 214,510 |

| Nissan Auto Lease Trust Series 2003-A Class A3B, 2.57% | | | | | | |

| 6/15/09 | | | | 2,219,145 | | 2,207,594 |

| NovaStar Home Equity Loan Series 2004-1: | | | | | | |

| Class M1, 5.4094% 6/25/34 (h) | | | | 350,000 | | 350,417 |

| Class M4, 5.9344% 6/25/34 (h) | | | | 585,000 | | 588,952 |

See accompanying notes which are an integral part of the financial statements.

| Asset Backed Securities continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Onyx Acceptance Owner Trust Series 2005-B Class A4, 4.34% | | | | |

| 5/15/12 | | | | $ 1,045,000 | | $ 1,018,686 |

| Ownit Mortgage Loan Asset-Backed Certificates Series 2005-3 | | | | |

| Class A2A, 5.0794% 6/25/36 (h) | | | | 2,487,617 | | 2,487,878 |

| Providian Master Note Trust Series 2006-B1A Class B1, 5.35% | | | | |

| 3/15/13 (c) | | | | 2,690,000 | | 2,680,753 |

| SLM Private Credit Student Loan Trust Series 2004-A Class C, | | | | |

| 5.86% 6/15/33 (h) | | | | 1,190,000 | | 1,204,585 |

| Superior Wholesale Inventory Financing Trust VII Series | | | | |

| 2003-A8 Class CTFS, 5.3513% 3/15/11 (c)(h) | | | | 2,320,000 | | 2,319,638 |

| Superior Wholesale Inventory Financing Trust XII Series | | | | | | |

| 2005-A12: | | | | | | |

| Class B, 5.3813% 6/15/10 (h) | | | | 1,425,000 | | 1,421,763 |

| Class C, 6.1013% 6/15/10 (h) | | | | 710,000 | | 711,649 |

| Volkswagen Auto Lease Trust Series 2005-A Class A4, 3.94% | | | | |

| 10/20/10 | | | | 3,815,000 | | 3,748,578 |

| West Penn Funding LLC Series 1999-A Class A3, 6.81% | | | | |

| 9/25/08 | | | | 550,042 | | 551,591 |

| WFS Financial Owner Trust Series 2005-1 Class D, 4.09% | | | | |

| 8/15/12 | | | | 585,625 | | 575,072 |

| World Omni Auto Receivables Trust Series 2006-A Class A3, | | | | |

| 5.01% 10/15/10 | | | | 1,315,000 | | 1,309,819 |

| TOTAL ASSET BACKED SECURITIES | | | | | | |

| (Cost $86,004,140) | | | | | | 85,657,718 |

| |

| Collateralized Mortgage Obligations 6.4% | | | | | | |

| |

| Private Sponsor 4.4% | | | | | | |

| Adjustable Rate Mortgage Trust floater Series 2005-2 Class | | | | |

| 6A2, 5.2394% 6/25/35 (h) | | | | 358,001 | | 358,368 |

| Bank of America Mortgage Securities, Inc.: | | | | | | |

| Series 2003-K: | | | | | | |

| Class 1A1, 3.3678% 12/25/33 (h) | | | | 279,953 | | 279,856 |

| Class 2A1, 4.1685% 12/25/33 (h) | | | | 1,174,898 | | 1,147,188 |

| Series 2003-L Class 2A1, 3.9757% 1/25/34 (h) | | | | 2,207,988 | | 2,144,713 |

| Series 2004-B: | | | | | | |

| Class 1A1, 3.4268% 3/25/34 (h) | | | | 613,572 | | 605,704 |

| Class 2A2, 4.1079% 3/25/34 (h) | | | | 871,558 | | 845,771 |

| Series 2004-C Class 1A1, 3.3621% 4/25/34 (h) | | | | 1,316,387 | | 1,296,345 |

| Series 2004 D: | | | | | | |

| Class 1A1, 3.5351% 5/25/34 (h) | | | | 1,628,140 | | 1,595,860 |

| Class 2A2, 4.1994% 5/25/34 (h) | | | | 2,287,700 | | 2,218,332 |

| Series 2004-G Class 2A7, 4.5675% 8/25/34 (h) | | | | 1,743,893 | | 1,702,684 |

See accompanying notes which are an integral part of the financial statements.

23 Semiannual Report

| Investments (Unaudited) continued | | | | | | |

| |

| |

| Collateralized Mortgage Obligations continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Private Sponsor continued | | | | | | |

| Bank of America Mortgage Securities, Inc.: – continued | | | | | | |

| Series 2004-H Class 2A1, 4.4764% 9/25/34 (h) | | | | $ 1,854,415 | | $ 1,806,254 |

| Series 2005-E Class 2A7, 4.6134% 6/25/35 (h) | | | | 1,570,000 | | 1,525,844 |

| Bear Stearns Adjustable Rate Mortgage Trust Series 2005-6 | | | | |

| Class 1A1, 5.1215% 8/25/35 (h) | | | | 3,468,618 | | 3,442,170 |

| CS First Boston Mortgage Securities Corp. floater: | | | | | | |

| Series 2004-AR3 Class 6A2, 5.3294% 4/25/34 (h) | | | | 245,898 | | 246,112 |

| Series 2004-AR6 Class 9A2, 5.3294% 10/25/34 (h) | | | | 506,436 | | 507,561 |

| Granite Master Issuer PLC floater Series 2006-1A Class C2, | | | | |

| 5.2569% 12/20/54 (c)(h) | | | | 1,200,000 | | 1,199,652 |

| Granite Mortgages PLC floater Series 2004-2 Class 1C, 5.63% | | | | |

| 6/20/44 (h) | | | | 300,174 | | 300,439 |

| JPMorgan Mortgage Trust Series 2005-A8 Class 2A3, | | | | | | |

| 4.9624% 11/25/35 (h) | | | | 445,000 | | 433,926 |

| Master Asset Securitization Trust Series 2004-9 Class 7A1, | | | | | | |

| 6.332% 5/25/17 (h) | | | | 1,712,096 | | 1,707,554 |

| Master Seasoned Securitization Trust Series 2004-1 Class 1A1, | | | | |

| 6.237% 8/25/17 (h) | | | | 1,287,603 | | 1,295,566 |

| Merrill Lynch Mortgage Investors, Inc.: | | | | | | |

| floater Series 2005-B Class A2, 4.79% 7/25/30 (h) | | | | 1,498,857 | | 1,497,821 |

| Series 2003-E Class XA1, 0.9967% 10/25/28 (h)(j) | | | | 7,784,879 | | 70,927 |

| Series 2003-G Class XA1, 1% 1/25/29 (j) | | | | 6,860,339 | | 69,342 |

| Series 2003-H Class XA1, 1% 1/25/29 (c)(j) | | | | 5,977,081 | | 61,894 |

| Opteum Mortgage Acceptance Corp. floater Series 2005-3 | | | | | | |

| Class APT, 5.2494% 7/25/35 (h) | | | | 1,175,716 | | 1,176,818 |

| Residential Asset Mortgage Products, Inc. sequential pay: | | | | | | |

| Series 2003-SL1 Class A31, 7.125% 4/25/31 | | | | 1,854,381 | | 1,854,361 |

| Series 2004-SL2 Class A1, 6.5% 10/25/16 | | | | 244,609 | | 247,204 |

| Series 2004-SL3 Class A1, 7% 8/25/16 | | | | 3,124,414 | | 3,193,362 |

| Residential Finance LP/Residential Finance Development Corp. | | | | |

| floater: | | | | | | |

| Series 2003-B: | | | | | | |

| Class B3, 6.3988% 7/10/35 (c)(h) | | | | 2,282,368 | | 2,334,301 |

| Class B4, 6.5988% 7/10/35 (c)(h) | | | | 1,711,776 | | 1,750,690 |

| Class B5, 7.1988% 7/10/35 (c)(h) | | | | 1,616,677 | | 1,657,356 |

| Class B6, 7.6988% 7/10/35 (c)(h) | | | | 760,789 | | 781,792 |

| Series 2003-CB1: | | | | | | |

| Class B3, 6.2988% 6/10/35 (c)(h) | | | | 797,852 | | 813,549 |

| Class B4, 6.4988% 6/10/35 (c)(h) | | | | 712,367 | | 727,255 |

| Class B5, 7.0988% 6/10/35 (c)(h) | | | | 484,410 | | 496,010 |

| Class B6, 7.5988% 6/10/35 (c)(h) | | | | 289,696 | | 297,340 |

See accompanying notes which are an integral part of the financial statements.

| Collateralized Mortgage Obligations continued | | |

| | | Principal | | Value (Note 1) |

| | | Amount | | |

| Private Sponsor continued | | | | |

| Residential Finance LP/Residential Finance Development Corp. | | | | |

| floater: – continued | | | | |

| Series 2004-B: | | | | |

| Class B4, 5.9488% 2/10/36 (c)(h) | | $ 291,324 | | $ 295,891 |

| Class B5, 6.3988% 2/10/36 (c)(h) | | 291,324 | | 295,694 |

| Class B6, 6.8488% 2/10/36 (c)(h) | | 97,108 | | 98,565 |

| Series 2004-C: | | | | |

| Class B4, 5.7988% 9/10/36 (h) | | 391,214 | | 397,082 |

| Class B5, 6.1988% 9/10/36 (h) | | 489,017 | | 492,685 |

| Class B6, 6.5988% 9/10/36 (h) | | 97,803 | | 98,292 |

| Residential Funding Securities Corp. Series 2003-RP2 Class | | | | |

| A1, 5.4094% 6/25/33 (c)(h) | | 702,459 | | 705,422 |

| Sequoia Mortgage Funding Trust Series 2003-A Class AX1, | | | | |

| 0.8% 10/21/08 (c)(j) | | 23,441,194 | | 110,579 |

| Sequoia Mortgage Trust floater Series 2004-8 Class A2, 5.31% | | | | |

| 9/20/34 (h) | | 1,006,715 | | 1,007,729 |

| Wachovia Mortgage Loan Trust LLC Series 2005-B Class 2A4, | | | | |

| 5.1893% 10/20/35 (h) | | 355,000 | | 349,250 |

| WAMU Mortgage pass thru certificates: | | | | |

| floater Series 2005-AR13 Class A1C1, 5.1494% | | | | |

| 10/25/45 (h) | | 1,994,881 | | 1,993,801 |

| sequential pay Series 2002-S6 Class A25, 6% 10/25/32 | | 560,526 | | 558,734 |

| Series 2003-AR12 Class A5, 4.043% 2/25/34 | | 5,000,000 | | 4,854,005 |

| Washington Mutual Mortgage Securities Corp. sequential pay: | | | | |

| Series 2003-MS9 Class 2A1, 7.5% 12/25/33 | | 233,917 | | 236,929 |

| Series 2004-RA2 Class 2A, 7% 7/25/33 | | 361,689 | | 369,263 |

| Wells Fargo Mortgage Backed Securities Trust: | | | | |

| Series 2004-T Class A1, 3.4532% 9/25/34 (h) | | 1,883,068 | | 1,884,139 |

| Series 2005-AR10 Class 2A2, 4.1095% 6/25/35 (h) | | 2,797,144 | | 2,731,908 |

| Series 2005-AR4 Class 2A2, 4.5306% 4/25/35 (h) | | 2,371,288 | | 2,308,001 |

| Series 2005-AR9 Class 2A1, 4.3623% 5/25/35 (h) | | 1,267,866 | | 1,247,449 |

| Series 2006-AR8 Class 2A6, 5.24% 4/25/36 (h) | | 3,615,000 | | 3,574,678 |

| |

| TOTAL PRIVATE SPONSOR | | | | 65,300,017 |

| U.S. Government Agency 2.0% | | | | |

| Fannie Mae planned amortization class Series 2003-39 Class | | | | |

| PV, 5.5% 9/25/22 | | 3,045,000 | | 3,014,664 |

| Fannie Mae Grantor Trust floater Series 2005-90 Class FG, | | | | |

| 5.2094% 10/25/35 (h) | | 5,572,035 | | 5,558,080 |

See accompanying notes which are an integral part of the financial statements.

25 Semiannual Report

| Investments (Unaudited) continued | | | | |

| |

| |

| Collateralized Mortgage Obligations continued | | |

| | | Principal | | Value (Note 1) |

| | | Amount | | |

| U.S. Government Agency continued | | | | |

| Fannie Mae guaranteed REMIC pass thru certificates: | | | | |

| planned amortization class: | | | | |

| Series 2003-84 Class GC, 4.5% 5/25/15 | | $ 1,540,000 | | $ 1,492,771 |

| Series 2005-67 Class HD, 5.5% 12/25/30 | | 2,835,000 | | 2,812,125 |

| sequential pay: | | | | |

| Series 2004-3 Class BA, 4% 7/25/17 | | 174,967 | | 167,060 |

| Series 2004-45 Class AV, 4.5% 10/25/22 | | 1,355,000 | | 1,334,753 |

| Series 2004-86 Class KC, 4.5% 5/25/19 | | 763,498 | | 734,953 |

| Series 2004-91 Class AH, 4.5% 5/25/29 | | 1,582,291 | | 1,536,538 |

| Freddie Mac planned amortization class: | | | | |

| Series 2104 Class PG, 6% 12/15/28 | | 1,590,000 | | 1,593,584 |

| Series 3033 Class UD, 5.5% 10/15/30 | | 1,075,000 | | 1,066,131 |

| Freddie Mac Multi-class participation certificates guaranteed: | | | | |

| planned amortization class: | | | | |

| Series 2702 Class WB, 5% 4/15/17 | | 2,480,000 | | 2,433,283 |

| Series 3018 Class UD, 5.5% 9/15/30 | | 1,735,000 | | 1,720,242 |

| Series 3102 Class OH, 1/15/36 (k) | | 1,665,000 | | 1,190,475 |

| sequential pay: | | | | |

| Series 2777 Class AB, 4.5% 6/15/29 | | 3,588,994 | | 3,483,806 |

| Series 2809 Class UA, 4% 12/15/14 | | 1,067,671 | | 1,041,986 |

| |

| TOTAL U.S. GOVERNMENT AGENCY | | | | 29,180,451 |

| |

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | | | | |

| (Cost $95,385,697) | | | | 94,480,468 |

| |

| Commercial Mortgage Securities 7.7% | | | | |

| |

| Asset Securitization Corp.: | | | | |

| sequential pay Series 1995-MD4 Class A1, 7.1% 8/13/29 . | | 78,274 | | 79,206 |

| Series 1997-D5: | | | | |

| Class A2, 6.3148% 2/14/43 (h) | | 1,230,000 | | 1,298,665 |

| Class A3, 6.3648% 2/14/43 (h) | | 1,320,000 | | 1,362,488 |

| Class PS1, 1.107% 2/14/43 (h)(j) | | 16,993,224 | | 712,485 |

| Banc of America Commercial Mortgage, Inc. Series 2002-2 | | | | |

| Class XP, 1.7835% 7/11/43 (c)(h)(j) | | 10,961,126 | | 565,984 |

| Banc of America Large Loan, Inc.: | | | | |

| floater Series 2003-BBA2: | | | | |

| Class C, 5.3713% 11/15/15 (c)(h) | | 265,000 | | 265,564 |

| Class D, 5.4513% 11/15/15 (c)(h) | | 410,000 | | 411,971 |

See accompanying notes which are an integral part of the financial statements.

| Commercial Mortgage Securities continued | | | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | | | |

| Banc of America Large Loan, Inc.: – continued | | | | | | | | |

| floater Series 2003-BBA2: | | | | | | | | |

| Class F, 5.8013% 11/15/15 (c)(h) | | | | $ 295,000 | | | | $ 295,994 |

| Class H, 6.3013% 11/15/15 (c)(h) | | | | 265,000 | | | | 266,550 |

| Class J, 6.8513% 11/15/15 (c)(h) | | | | 275,000 | | | | 277,254 |

| Class K, 7.5013% 11/15/15 (c)(h) | | | | 245,000 | | | | 243,926 |

| Series 2006-ESH: | | | | | | | | |

| Class A, 5.74% 7/14/11 (c)(h) | | | | 731,304 | | | | 728,408 |

| Class B, 5.84% 7/14/11 (c)(h) | | | | 364,678 | | | | 363,236 |

| Class C, 5.99% 7/14/11 (c)(h) | | | | 730,330 | | | | 727,446 |

| Class D, 6.62% 7/14/11 (c)(h) | | | | 424,462 | | | | 423,071 |

| Bank of America Large Loan, Inc. floater: | | | | | | | | |

| Series 2005 ESHA: | | | | | | | | |

| Class E, 5.46% 7/14/20 (c)(h) | | | | 725,000 | | | | 727,702 |

| Class F, 5.63% 7/14/20 (c)(h) | | | | 435,000 | | | | 436,618 |

| Class G, 5.76% 7/14/20 (c)(h) | | | | 215,000 | | | | 215,798 |

| Class H, 5.98% 7/14/20 (c)(h) | | | | 290,000 | | | | 291,074 |

| Series 2005-MIB1: | | | | | | | | |

| Class C, 5.2113% 3/15/22 (c)(h) | | | | 335,000 | | | | 334,799 |

| Class D, 5.2613% 3/15/22 (c)(h) | | | | 340,000 | | | | 339,792 |

| Class F, 5.3713% 3/15/22 (c)(h) | | | | 330,000 | | | | 329,798 |

| Class G, 5.4313% 3/15/22 (c)(h) | | | | 215,000 | | | | 214,869 |

| Bayview Commercial Asset Trust floater: | | | | | | | | |

| Series 2004-1: | | | | | | | | |

| Class A, 5.3194% 4/25/34 (c)(h) | | | | 1,324,438 | | | | 1,326,094 |

| Class B, 6.8594% 4/25/34 (c)(h) | | | | 139,415 | | | | 140,722 |

| Class M1, 5.5194% 4/25/34 (c)(h) | | | | 139,415 | | | | 139,763 |

| Class M2, 6.1594% 4/25/34 (c)(h) | | | | 69,707 | | | | 70,404 |

| Series 2004-2 Class A, 5.3894% 8/25/34 (c)(h) | | | | 1,296,892 | | | | 1,300,945 |

| Series 2004-3: | | | | | | | | |

| Class A1, 5.3294% 1/25/35 (c)(h) | | | | 1,447,843 | | | | 1,451,462 |

| Class A2, 5.3794% 1/25/35 (c)(h) | | | | 212,918 | | | | 213,184 |

| Class M1, 5.4594% 1/25/35 (c)(h) | | | | 255,502 | | | | 255,981 |

| Class M2, 5.9594% 1/25/35 (c)(h) | | | | 170,334 | | | | 172,144 |

| Series 2005-4A: | | | | | | | | |

| Class A2, 5.3494% 1/25/36 (c)(h) | | | | 1,863,582 | | | | 1,864,746 |

| Class B1, 6.3594% 1/25/36 (c)(h) | | | | 98,083 | | | | 99,064 |

| Class M1, 5.4094% 1/25/36 (c)(h) | | | | 588,500 | | | | 589,971 |

| Class M2, 5.4294% 1/25/36 (c)(h) | | | | 196,167 | | | | 196,780 |

| Class M3, 5.4594% 1/25/36 (c)(h) | | | | 294,250 | | | | 295,169 |

| Class M4, 5.5694% 1/25/36 (c)(h) | | | | 98,083 | | | | 98,451 |

| Class M5, 5.6094% 1/25/36 (c)(h) | | | | 98,083 | | | | 98,451 |

| Class M6, 5.6594% 1/25/36 (c)(h) | | | | 98,083 | | | | 98,451 |

See accompanying notes which are an integral part of the financial statements.

27 Semiannual Report

| Investments (Unaudited) continued | | | | | | |

| |

| |

| Commercial Mortgage Securities continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Bear Stearns Commercial Mortgage Securities, Inc.: | | | | | | |

| sequential pay Series 2004-ESA Class A3, 4.741% | | | | | | |

| 5/14/16 (c) | | | | $ 770,000 | | $ 758,153 |

| Series 2003-T12 Class X2, 0.7259% 8/13/39 (c)(h)(j) | | | | 6,003,816 | | 128,745 |

| Series 2004 ESA: | | | | | | |

| Class B, 4.888% 5/14/16 (c) | | | | 1,410,000 | | 1,390,282 |

| Class C, 4.937% 5/14/16 (c) | | | | 880,000 | | 868,902 |

| Class D, 4.986% 5/14/16 (c) | | | | 320,000 | | 316,404 |

| Class E, 5.064% 5/14/16 (c) | | | | 995,000 | | 987,078 |

| Class F, 5.182% 5/14/16 (c) | | | | 240,000 | | 238,424 |

| CDC Commercial Mortgage Trust Series 2002-FX1 Class XCL, | | | | | | |

| 0.6989% 5/15/35 (c)(h)(j) | | | | 23,215,319 | | 1,272,169 |

| Chase Commercial Mortgage Securities Corp. Series | | | | | | |

| 2001-245 Class A2, 5.8567% 2/12/16 (c)(h) | | | | 980,000 | | 1,016,834 |

| COMM floater Series 2002-FL7 Class D, 5.4713% | | | | | | |

| 11/15/14 (c)(h) | | | | 137,143 | | 137,361 |

| Commercial Mortgage Asset Trust sequential pay Series | | | | | | |

| 1999-C2 Class A1, 7.285% 11/17/32 | | | | 1,318,471 | | 1,340,908 |

| Commercial Mortgage pass thru certificates floater Series | | | | | | |

| 2005-FL11: | | | | | | |

| Class B, 5.1513% 11/15/17 (c)(h) | | | | 734,833 | | 734,731 |

| Class E, 5.2913% 11/15/17 (c)(h) | | | | 329,925 | | 329,812 |

| Class F, 5.3513% 11/15/17 (c)(h) | | | | 299,932 | | 299,911 |

| CS First Boston Mortgage Securities Corp.: | | | | | | |

| floater Series 2004-HC1: | | | | | | |

| Class A2, 5.4013% 12/15/21 (c)(h) | | | | 365,000 | | 364,999 |

| Class B, 5.6513% 12/15/21 (c)(h) | | | | 945,000 | | 944,995 |

| sequential pay: | | | | | | |

| Series 1997-C2 Class A3, 6.55% 1/17/35 | | | | 1,239,578 | | 1,258,207 |

| Series 1998-C1 Class A1B, 6.48% 5/17/40 | | | | 2,725,864 | | 2,777,889 |

| Series 1999-C1 Class A2, 7.29% 9/15/41 | | | | 7,524,217 | | 7,880,318 |

| Series 1997-C2 Class D, 7.27% 1/17/35 | | | | 755,000 | | 786,318 |

| Series 2001-CK6 Class AX, 0.645% 9/15/18 (j) | | | | 32,849,056 | | 998,730 |

| Deutsche Mortgage & Asset Receiving Corp. sequential pay | | | | | | |

| Series 1998-C1 Class D, 7.231% 6/15/31 | | | | 635,000 | | 658,607 |

| DLJ Commercial Mortgage Corp. sequential pay: | | | | | | |

| Series 1998-CF1 Class A1B, 6.41% 2/18/31 | | | | 4,066,028 | | 4,117,415 |

| Series 2000-CF1: | | | | | | |

| Class A1A, 7.45% 6/10/33 | | | | 345,298 | | 346,455 |

| Class A1B, 7.62% 6/10/33 | | | | 1,855,000 | | 1,992,448 |

| Equitable Life Assurance Society of the United States: | | | | | | |

| sequential pay Series 174 Class A1, 7.24% 5/15/06 (c) | | | | 1,500,000 | | 1,501,375 |

See accompanying notes which are an integral part of the financial statements.

| Commercial Mortgage Securities continued | | | | | | |

| | | | | Principal | | Value (Note 1) |

| | | | | Amount | | |

| Equitable Life Assurance Society of the United States: - | | | | | | |

| continued | | | | | | |

| Series 174 Class C1, 7.52% 5/15/06 (c) | | | | $ 1,000,000 | | $ 1,000,988 |

| First Union-Lehman Brothers Commercial Mortgage Trust | | | | | | |

| sequential pay Series 1997-C2 Class A3, 6.65% 11/18/29 | | | | 371,084 | | 375,639 |

| GE Capital Commercial Mortgage Corp. Series 2001-1 Class | | | | | | |

| X1, 0.4789% 5/15/33 (c)(h)(j) | | | | 22,228,651 | | 759,606 |

| GGP Mall Properties Trust sequential pay Series 2001-C1A | | | | | | |

| Class A2, 5.007% 11/15/11 (c) | | | | 4,781,083 | | 4,775,420 |

| Ginnie Mae guaranteed Multi-family pass thru securities | | | | | | |

| sequential pay Series 2002-35 Class C, 5.8884% | | | | | | |

| 10/16/23 (h) | | | | 323,344 | | 327,457 |

| Ginnie Mae guaranteed REMIC pass thru securities: | | | | | | |

| sequential pay: | | | | | | |

| Series 2003-22 Class B, 3.963% 5/16/32 | | | | 2,030,000 | | 1,915,362 |

| Series 2003-47 Class C, 4.227% 10/16/27 | | | | 2,941,320 | | 2,836,485 |

| Series 2003-59 Class D, 3.654% 10/16/27 | | | | 3,060,000 | | 2,811,124 |

| Series 2003-47 Class XA, 0.0207% 6/16/43 (h)(j) | | | | 7,707,544 | | 409,405 |

| GMAC Commercial Mortgage Securities, Inc. Series 2004-C3 | | | | | | |

| Class X2, 0.7315% 12/10/41 (h)(j) | | | | 13,163,132 | | 328,140 |

| Greenwich Capital Commercial Funding Corp. Series | | | | | | |

| 2005-GG3 Class XP, 0.8029% 8/10/42 (c)(h)(j) | | | | 61,434,000 | | 1,877,706 |

| GS Mortgage Securities Corp. II: | | | | | | |

| sequential pay Series 2003-C1 Class A2A, 3.59% 1/10/40 | | | | 1,560,000 | | 1,518,904 |

| Series 2001-LIBA Class C, 6.733% 2/14/16 (c) | | | | 815,000 | | 858,365 |

| Series 2005-GG4 Class XP, 0.7342% 7/10/39 (c)(h)(j) | | | | 47,170,000 | | 1,523,464 |

| Series 2006-GG6 Class A2, 5.506% 4/10/38 (h) | | | | 2,895,000 | | 2,895,079 |

| Heller Financial Commercial Mortgage Asset Corp. sequential | | | | | | |

| pay Series 2000-PH1 Class A1, 7.715% 1/17/34 | | | | 517,556 | | 519,256 |

| Hilton Hotel Pool Trust: | | | | | | |

| sequential pay Series 2000-HLTA Class A1, 7.055% | | | | | | |

| 10/3/15 (c) | | | | 1,145,581 | | 1,188,792 |

| Series 2000-HLTA Class D, 7.555% 10/3/15 (c) | | | | 1,405,000 | | 1,459,136 |

| Host Marriott Pool Trust sequential pay Series 1999-HMTA | | | | | | |

| Class B, 7.3% 8/3/15 (c) | | | | 530,000 | | 558,717 |

| JPMorgan Chase Commercial Mortgage Securities Corp. Series | | | | | | |

| 2004-C1 Class X2, 0.9964% 1/15/38 (c)(h)(j) | | | | 4,615,357 | | 163,511 |

| LB-UBS Commercial Mortgage Trust: | | | | | | |

| sequential pay Series 2000-C3 Class A1, 7.95% 7/15/09 . | | | | 1,693,592 | | 1,717,875 |

| Series 2001-C3 Class B, 6.512% 6/15/36 | | | | 1,065,000 | | 1,113,205 |

See accompanying notes which are an integral part of the financial statements.

29 Semiannual Report

| Investments (Unaudited) continued | | | | |

| |

| |

| Commercial Mortgage Securities continued | | | | |

| | | Principal | | Value (Note 1) |

| | | Amount | | |

| Leafs CMBS I Ltd./Leafs CMBS I Corp. Series 2002-1A Class B, | | | | |

| 4.13% 11/20/37 (c) | | $ 4,000,000 | | $ 3,621,712 |

| Lehman Brothers Floating Rate Commercial Mortgage Trust | | | | |

| floater Series 2003-LLFA: | | | | |

| Class J, 6.9513% 12/16/14 (c)(h) | | 1,480,000 | | 1,470,366 |

| Class K1, 7.4513% 12/16/14 (c)(h) | | 770,000 | | 764,149 |

| Morgan Stanley Capital I, Inc. Series 2005-IQ9 Class X2, | | | | |

| 1.0698% 7/15/56 (c)(h)(j) | | 15,702,244 | | 687,666 |

| Morgan Stanley Dean Witter Capital I Trust sequential pay | | | | |

| Series 2001-PPM Class A2, 6.4% 2/15/31 | | 1,633,218 | | 1,666,698 |

| Mortgage Capital Funding, Inc. sequential pay Series | | | | |

| 1998-MC2 Class A2, 6.423% 6/18/30 | | 1,160,586 | | 1,179,061 |

| Nationslink Funding Corp. sequential pay Series 1999-2 Class | | | | |

| A1C, 7.03% 6/20/31 | | 198,164 | | 198,919 |

| Thirteen Affiliates of General Growth Properties, Inc. sequential | | | | |

| pay Series 1 Class A2, 6.602% 11/15/07 (c) | | 2,500,000 | | 2,543,818 |

| Trizechahn Office Properties Trust Series 2001-TZHA: | | | | |

| Class C3, 6.522% 3/15/13 (c) | | 2,004,216 | | 2,034,451 |

| Class C4, 6.893% 5/15/16 (c) | | 8,000,000 | | 8,430,578 |

| Wachovia Bank Commercial Mortgage Trust sequential pay: | | | | |

| Series 2003-C7 Class A1, 4.241% 10/15/35 (c) | | 2,723,663 | | 2,626,458 |

| Series 2003-C8 Class A3, 4.445% 11/15/35 | | 4,050,000 | | 3,887,907 |

| TOTAL COMMERCIAL MORTGAGE SECURITIES | | | | |