UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4707

Fidelity Advisor Series II

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | April 30, 2007 |

Item 1. Reports to Stockholders

Fidelity

Floating Rate High Income

Fund

(A Class of Fidelity® Advisor

Floating Rate High Income Fund)

Semiannual Report

April 30, 2007

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | <Click Here> | Ned Johnson's message to shareholders. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Board Approval of Investment Advisory Contracts and Management Fees | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Substantial single-day losses are not uncommon in the equity markets, and when they occur - as in late February - investors can be better served in the long term by buying good stocks at lower prices than by moving their money to the sidelines. While financial markets are always unpredictable, there are a number of time-tested principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third investment principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces unconstructive "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2006 to April 30, 2007).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Semiannual Report

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

Account Value

November 1, 2006 | Ending

Account Value

April 30, 2007 | Expenses Paid

During Period*

November 1, 2006

to April 30, 2007 |

Class A | | | |

Actual | $ 1,000.00 | $ 1,034.50 | $ 5.15 |

Hypothetical A | $ 1,000.00 | $ 1,019.74 | $ 5.11 |

Class T | | | |

Actual | $ 1,000.00 | $ 1,034.40 | $ 5.35 |

Hypothetical A | $ 1,000.00 | $ 1,019.54 | $ 5.31 |

Class B | | | |

Actual | $ 1,000.00 | $ 1,031.70 | $ 7.96 |

Hypothetical A | $ 1,000.00 | $ 1,016.96 | $ 7.90 |

Class C | | | |

Actual | $ 1,000.00 | $ 1,031.20 | $ 8.41** |

Hypothetical A | $ 1,000.00 | $ 1,016.51 | $ 8.35** |

Floating Rate High Income | | | |

Actual | $ 1,000.00 | $ 1,035.90 | $ 3.84** |

Hypothetical A | $ 1,000.00 | $ 1,021.03 | $ 3.81** |

Institutional Class | | | |

Actual | $ 1,000.00 | $ 1,035.80 | $ 3.99** |

Hypothetical A | $ 1,000.00 | $ 1,020.88 | $ 3.96** |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| Annualized

Expense Ratio |

Class A | 1.02% |

Class T | 1.06% |

Class B | 1.58% |

Class C | 1.67%** |

Floating Rate High Income | .76%** |

Institutional Class | .79%** |

Semiannual Report

** If distribution fees and changes to voluntary expense limitations, effective April 1, 2007 for Class C, and management fees effective February 1, 2007 for all classes had been in effect during the entire period, the annualized expense ratios and the expenses paid in the actual and hypothetical examples above would have been as follows:

| Annualized

Expense Ratio | Expenses

Paid |

Class C | 1.79% | |

Actual | | $ 9.01 |

HypotheticalA | | $ 8.95 |

Floating Rate High Income | .71% | |

Actual | | $ 3.58 |

HypotheticalA | | $ 3.56 |

Institutional Class | .74% | |

Actual | | $ 3.74 |

HypotheticalA | | $ 3.71 |

A 5% return per year before expenses

Semiannual Report

Investment Changes

Top Five Holdings as of April 30, 2007 |

(by issuer, excluding cash equivalents) | % of fund's

net assets | % of fund's net assets

6 months ago |

HCA, Inc. | 2.4 | 0.6 |

NRG Energy, Inc. | 2.3 | 2.5 |

CSC Holdings, Inc. | 2.2 | 2.2 |

Georgia-Pacific Corp. | 1.8 | 2.1 |

UPC Broadband Holding BV | 1.7 | 1.0 |

| 10.4 | |

Top Five Market Sectors as of April 30, 2007 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Healthcare | 9.4 | 7.8 |

Cable TV | 8.7 | 8.8 |

Telecommunications | 7.6 | 7.7 |

Technology | 5.5 | 5.4 |

Electric Utilities | 5.4 | 4.9 |

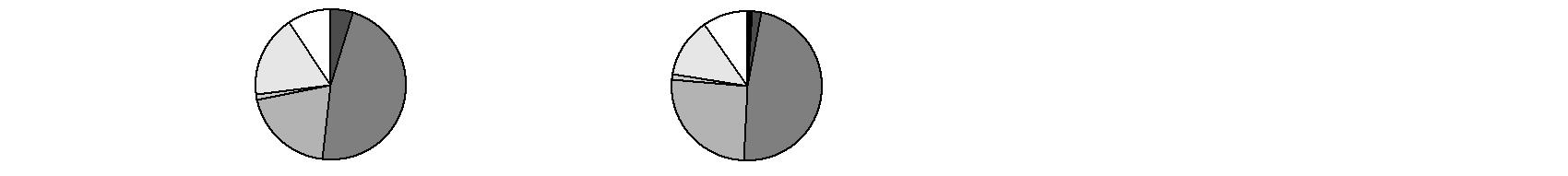

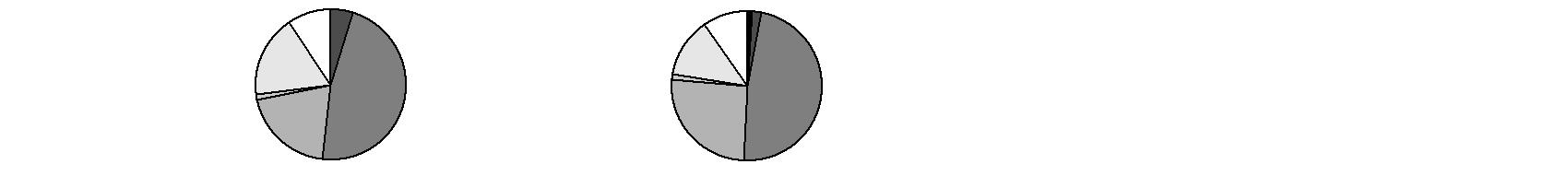

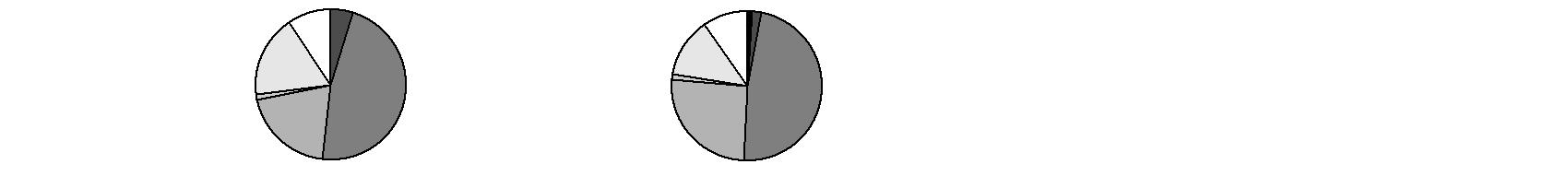

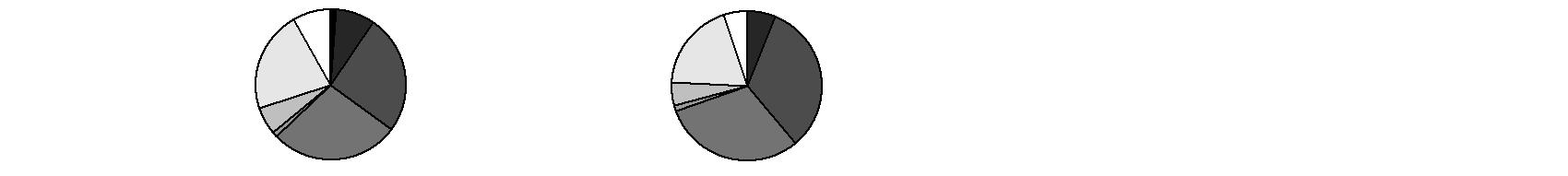

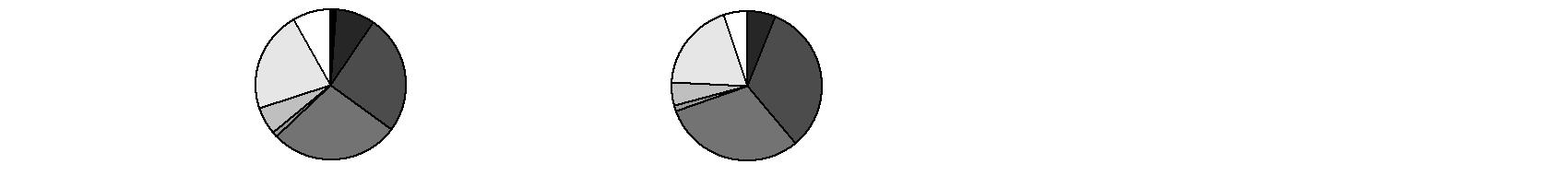

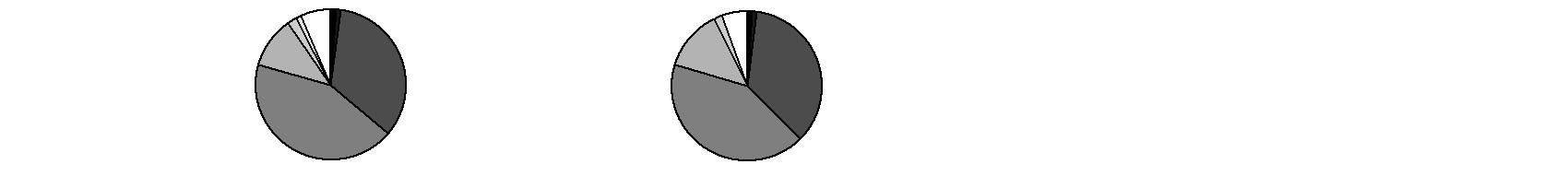

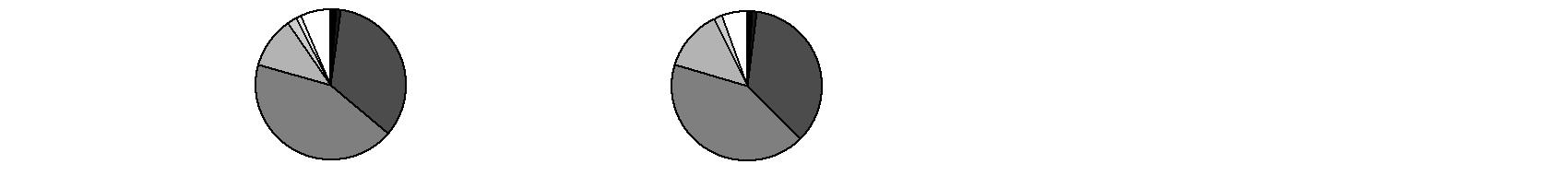

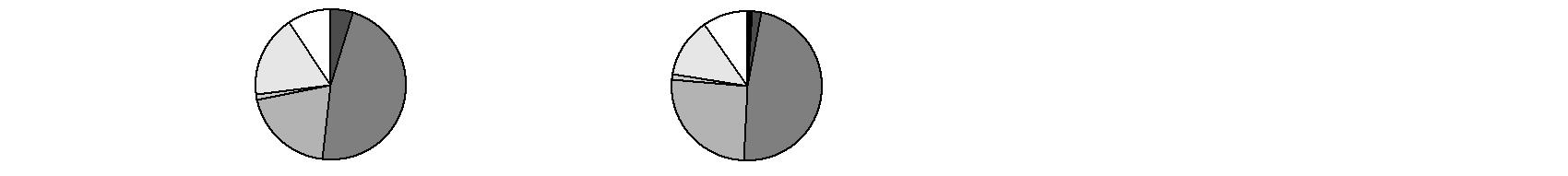

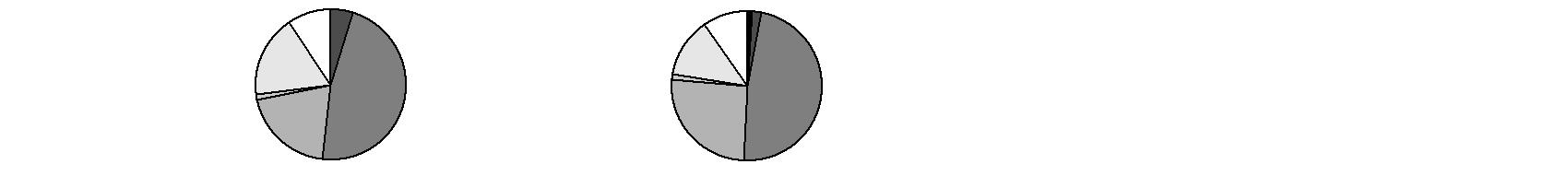

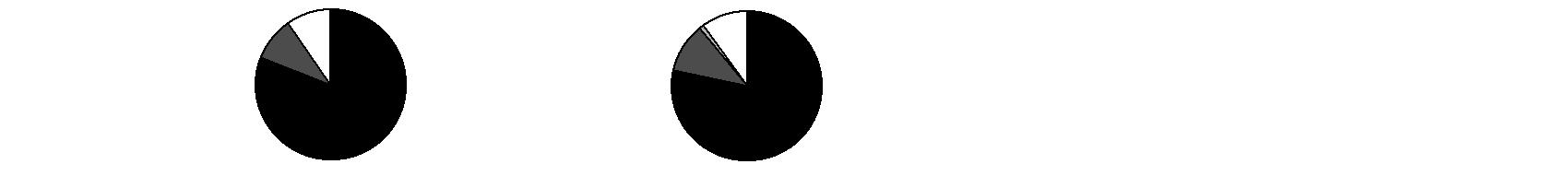

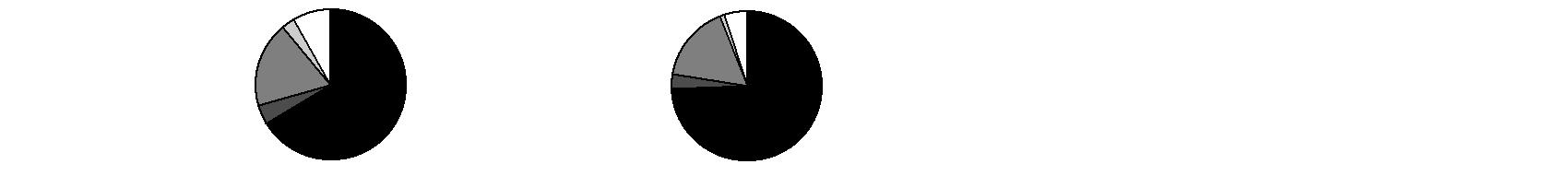

Quality Diversification (% of fund's net assets) |

As of April 30, 2007 | As of October 31, 2006 |

| U.S.Government and U.S.Government Agency Obligations 0.0% | |  | U.S.Government and U.S.Government Agency Obligations 0.4% | |

| AAA, AA, A 0.0% | |  | AAA, AA, A 0.0% | |

| BBB 4.8% | |  | BBB 2.0% | |

| BB 47.5% | |  | BB 48.5% | |

| B 20.1% | |  | B 26.0% | |

| CCC,CC,C 0.1% | |  | CCC,CC,C 0.2% | |

| Not Rated 17.9% | |  | Not Rated 13.0% | |

| Short-Term

Investments and

Net Other Assets 9.6% | |  | Short-Term

Investments and

Net Other Assets 9.9% | |

We have used ratings from Moody's® Investors Services, Inc. Where Moody's ratings are not available, we have used S&P® ratings. |

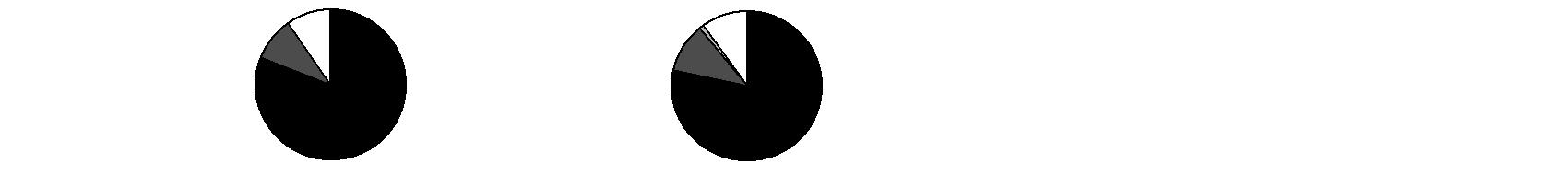

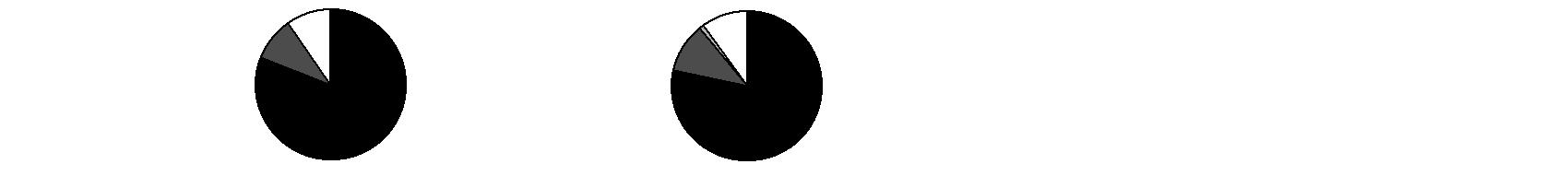

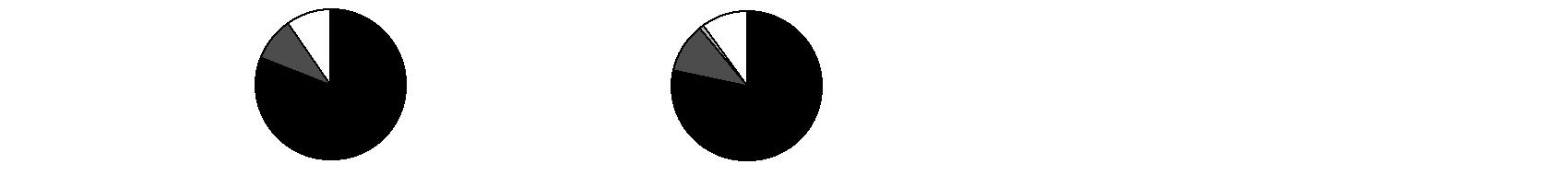

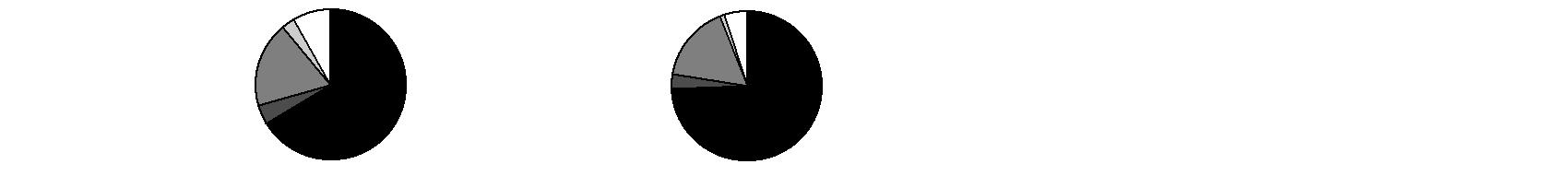

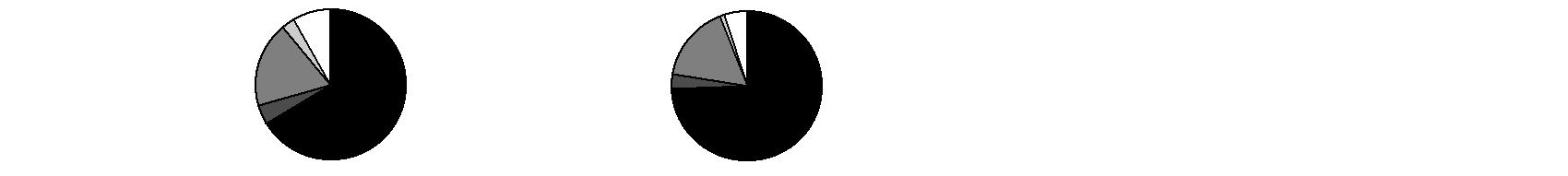

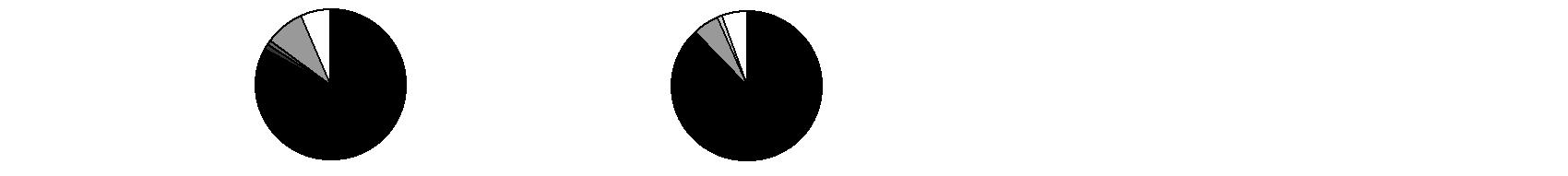

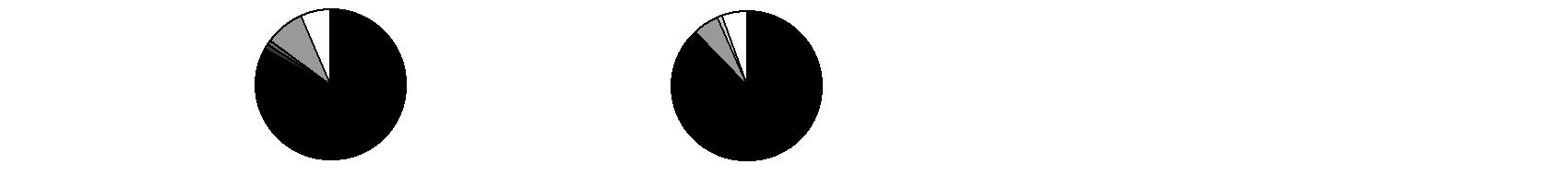

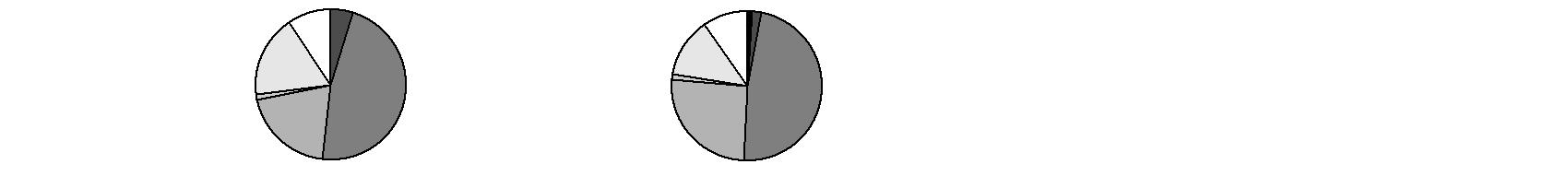

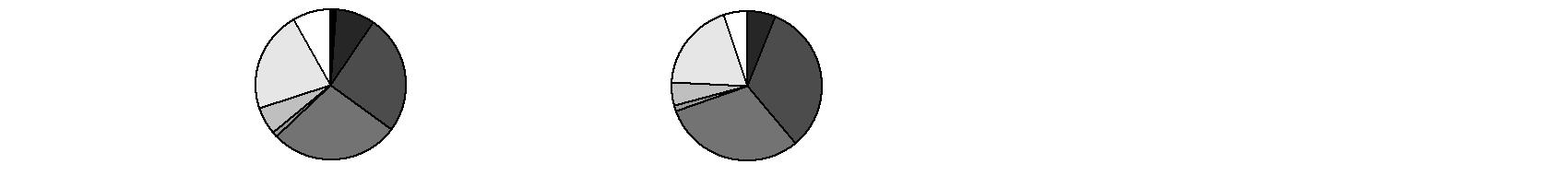

Asset Allocation (% of fund's net assets) |

As of April 30, 2007 * | As of October 31, 2006 ** |

| Floating Rate

Loans 80.9% | |  | Floating Rate

Loans 78.8% | |

| Nonconvertible

Bonds 9.5% | |  | Nonconvertible

Bonds 10.9% | |

| U.S. Government

and U.S. Government Agency Obligations 0.0% | |  | U.S. Government

and U.S. Government Agency Obligations 0.4% | |

| Short-Term

Investments and

Net Other Assets 9.6% | |  | Short-Term

Investments and

Net Other Assets 9.9% | |

* Foreign investments | 5.2% | | ** Foreign investments | 5.9% | |

Semiannual Report

Investments April 30, 2007

Showing Percentage of Net Assets

Floating Rate Loans (d) - 80.9% |

| Principal Amount (000s) | | Value (000s) |

Aerospace - 0.9% |

BE Aerospace, Inc. term loan B 6.88% 8/24/12 (c) | | $ 5,935 | | $ 5,950 |

DRS Technologies, Inc. term loan 6.8583% 1/31/13 (c) | | 1,398 | | 1,398 |

Mid-Western Aircraft Systems, Inc. Tranche B, term loan 7.105% 12/31/11 (c) | | 11,917 | | 11,992 |

Transdigm, Inc. term loan 7.3479% 6/23/13 (c) | | 15,340 | | 15,455 |

Wesco Aircraft Hardware Corp. Tranche 1LN, term loan 7.6% 9/29/13 (c) | | 7,719 | | 7,786 |

| | 42,581 |

Air Transportation - 0.2% |

Delta Air Lines, Inc. Tranche 1LN, Revolving Credit-Linked Deposit 7.355% 4/25/14 (c) | | 6,000 | | 6,023 |

Northwest Airlines Corp. Tranche B, term loan 8.85% 12/31/13 (c) | | 1,941 | | 1,950 |

United Air Lines, Inc. Tranche B, term loan 7.375% 2/1/14 (c) | | 4,000 | | 3,995 |

| | 11,968 |

Auto Parts Distribution - 1.6% |

Navistar International Corp.: | | | | |

term loan 8.6099% 1/19/12 (c) | | 11,000 | | 11,165 |

8.5994% 1/19/12 (c) | | 4,000 | | 4,060 |

Oshkosh Truck Co. Tranche B, term loan 7.1% 12/6/13 (c) | | 28,928 | | 29,000 |

Tenneco, Inc. Credit-Linked Deposit 6.82% 3/16/14 (c) | | 6,000 | | 6,000 |

The Goodyear Tire & Rubber Co. Tranche 2LN, term loan 7.1% 4/30/14 (c) | | 27,000 | | 27,000 |

| | 77,225 |

Automotive - 3.3% |

AM General LLC: | | | | |

Tranche B, term loan 8.3808% 9/30/13 (c) | | 2,855 | | 2,880 |

8.32% 9/30/12 (c) | | 97 | | 98 |

Dana Corp. term loan 7.88% 4/13/08 (c) | | 14,120 | | 14,120 |

Delphi Corp. term loan: | | | | |

7.625% 12/31/07 (c) | | 14,000 | | 14,035 |

8.125% 12/31/07 (c) | | 34,000 | | 34,128 |

Ford Motor Co. term loan 8.36% 12/15/13 (c) | | 27,920 | | 28,060 |

General Motors Corp. term loan 7.725% 11/29/13 (c) | | 27,222 | | 27,426 |

Rexnord Corp. Tranche B, term loan 7.8575% 7/19/13 (c) | | 10,639 | | 10,706 |

TRW Automotive Holdings Corp.: | | | | |

Tranche B, term loan 6.9375% 6/30/12 (c) | | 2,260 | | 2,260 |

Tranche B2, term loan 6.875% 6/30/12 (c) | | 1,975 | | 1,975 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Automotive - continued |

TRW Automotive Holdings Corp.: - continued | | | | |

Tranche E, term loan 6.875% 10/31/10 (c) | | $ 14,663 | | $ 14,663 |

Visteon Corp. term loan 8.38% 6/13/13 (c) | | 10,000 | | 10,075 |

| | 160,426 |

Broadcasting - 1.7% |

Cumulus Media, Inc. term loan 7.3231% 6/7/13 (c) | | 1,904 | | 1,913 |

Emmis Operating Co. Tranche B, term loan 7.35% 11/1/13 (c) | | 7,000 | | 7,044 |

Entravision Communication Corp. term loan 6.85% 3/29/13 (c) | | 5,910 | | 5,917 |

Montecito Broadcast Group LLC Tranche 1, term loan 7.86% 1/27/13 (c) | | 1,975 | | 1,987 |

Nexstar Broadcasting, Inc. Tranche B, term loan 7.1% 10/1/12 (c) | | 17,863 | | 18,087 |

Paxson Communications Corp. term loan 8.6056% 1/15/12 (c) | | 6,000 | | 6,120 |

Raycom TV Broadcasting, Inc. Tranche B, term loan 6.875% 8/28/13 (c) | | 3,927 | | 3,918 |

Spanish Broadcasting System, Inc. Tranche 1, term loan 7.1% 6/10/12 (c) | | 2,840 | | 2,836 |

VNU, Inc. term loan 7.61% 8/9/13 (c) | | 33,748 | | 34,043 |

| | 81,865 |

Building Materials - 0.2% |

Goodman Global Holdings, Inc. Tranche C, term loan 7.125% 12/23/11 (c) | | 2,834 | | 2,834 |

Nortek Holdings, Inc. Tranche B, term loan 7.3649% 8/27/11 (c) | | 5,726 | | 5,747 |

| | 8,581 |

Cable TV - 8.3% |

Charter Communications Operating LLC Tranche B 1LN, term loan 7.35% 3/6/14 (c) | | 23,000 | | 22,971 |

CSC Holdings, Inc. Tranche B, term loan 7.0838% 3/29/13 (c) | | 95,092 | | 95,449 |

DIRECTV Holdings LLC Tranche B, term loan 6.82% 4/13/13 (c) | | 34,066 | | 34,193 |

Insight Midwest Holdings LLC Tranche B, term loan 7.35% 4/6/14 (c) | | 10,000 | | 10,056 |

Liberty Cablevision of Puerto Rico LTC term loan 7.61% 3/1/13 (c) | | 4,950 | | 4,962 |

Mediacom Broadband LLC/Mediacom Broadband Corp. Tranche D1, term loan 7.1037% 1/31/15 (c) | | 3,920 | | 3,916 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Cable TV - continued |

Mediacom LLC Tranche C1, term loan 7.1004% 1/31/15 (c) | | $ 6,808 | | $ 6,799 |

NTL Cable PLC Tranche B, term loan 7.3556% 1/10/13 (c) | | 23,680 | | 23,858 |

PanAmSat Corp. Tranche B2, term loan 7.3494% 1/3/14 (c) | | 29,850 | | 30,037 |

San Juan Cable, Inc. Tranche 1, term loan 7.3475% 10/31/12 (c) | | 5,925 | | 5,918 |

Univision Communications, Inc.: | | | | |

Tranche 1LN, term loan 7.605% 9/16/14 (c) | | 74,228 | | 74,135 |

Tranche DD 1LN, term loan 9/16/14 (e) | | 4,772 | | 4,766 |

UPC Broadband Holding BV: | | | | |

Tranche J2, term loan 7.37% 3/31/13 (c) | | 20,504 | | 20,504 |

Tranche K2, term loan 7.37% 12/31/13 (c) | | 20,504 | | 20,504 |

Tranche N1, term loan 7.08% 12/31/14 (c) | | 44,008 | | 43,964 |

Wide Open West Finance LLC Tranche 1, term loan 7.6057% 5/1/13 (c) | | 2,790 | | 2,804 |

| | 404,836 |

Capital Goods - 2.2% |

AGCO Corp. term loan 7.1% 7/3/09 (c) | | 2,480 | | 2,489 |

Amsted Industries, Inc.: | | | | |

term loan 7.35% 4/5/13 (c) | | 5,792 | | 5,821 |

Tranche DD, term loan 7.35% 4/5/13 (c) | | 3,111 | | 3,127 |

Ashtead Group PLC term loan 7.125% 8/31/11 (c) | | 5,000 | | 5,000 |

Baldor Electric Co. term loan 7.125% 12/31/13 (c) | | 10,565 | | 10,605 |

Chart Industries, Inc. Tranche B, term loan 7.375% 10/17/12 (c) | | 4,209 | | 4,209 |

Dresser, Inc. term loan 10% 10/31/13 (c) | | 9,300 | | 9,300 |

EnergySolutions, Inc.: | | | | |

Credit-Linked Deposit 7.57% 6/7/13 (c) | | 189 | | 190 |

term loan 7.63% 6/7/13 (c) | | 5,654 | | 5,696 |

Flowserve Corp. term loan 6.875% 8/10/12 (c) | | 23,715 | | 23,745 |

Hexcel Corp. Tranche B, term loan 7.12% 3/1/12 (c) | | 4,040 | | 4,050 |

Invensys International Holding Ltd.: | | | | |

term loan 7.36% 12/15/10 (c) | | 1,920 | | 1,934 |

Tranche B, term loan 7.3467% 1/15/11 (c) | | 2,080 | | 2,096 |

Kinetek Industries, Inc. Tranche B, term loan 7.82% 11/10/13 (c) | | 3,292 | | 3,308 |

Mueller Group, Inc. term loan 7.3475% 10/3/12 (c) | | 2,122 | | 2,136 |

Rexnord Corp. Tranche B A0, term loan 7.64% 7/19/13 (c) | | 4,938 | | 4,962 |

Sensus Metering Systems, Inc. Tranche B term loan 7.36% 12/17/10 (c) | | 1,919 | | 1,924 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Capital Goods - continued |

Terex Corp. term loan 7.1% 7/14/13 (c) | | $ 11,900 | | $ 11,915 |

Walter Industries, Inc. term loan 7.0897% 10/3/12 (c) | | 3,171 | | 3,175 |

| | 105,682 |

Chemicals - 4.0% |

Basell USA, Inc.: | | | | |

Tranche B2, term loan 7.57% 8/1/13 (c) | | 1,730 | | 1,741 |

Tranche C2, term loan 8.32% 8/1/14 (c) | | 1,730 | | 1,741 |

Celanese Holding LLC: | | | | |

Revolving Credit-Linked Deposit 5.32% 4/2/13 (c) | | 5,786 | | 5,815 |

term loan 7.099% 4/2/14 (c) | | 34,824 | | 34,998 |

Georgia Gulf Corp. term loan 7.82% 10/3/13 (c) | | 2,954 | | 2,965 |

Hercules, Inc. Tranche B, term loan 6.82% 10/8/10 (c) | | 4,874 | | 4,874 |

Huntsman International LLC Tranche B, term loan 7.07% 8/16/12 (c) | | 27,730 | | 27,817 |

INEOS US Finance: | | | | |

Tranche B, term loan 7.5799% 1/31/13 (c) | | 4,777 | | 4,819 |

Tranche C, term loan 8.0799% 1/31/14 (c) | | 4,777 | | 4,819 |

Innophos, Inc. Tranche B, term loan 7.57% 8/13/10 (c) | | 2,820 | | 2,834 |

ISP Chemco, Inc. Tranche B, term loan 7.125% 2/16/13 (c) | | 7,920 | | 7,960 |

Lyondell Chemical Co. term loan 6.86% 8/16/13 (c) | | 31,840 | | 31,959 |

MacDermid, Inc. Tranche B, term loan 7.32% 4/12/14 (c) | | 5,240 | | 5,240 |

Momentive Performance Materials, Inc. Tranche B1, term loan 7.625% 12/4/13 (c) | | 17,955 | | 18,045 |

Nalco Co. Tranche B, term loan 7.1959% 11/4/10 (c) | | 17,259 | | 17,366 |

Rockwood Specialties Group, Inc. Tranche E, term loan 7.355% 7/30/12 (c) | | 13,411 | | 13,512 |

The Mosaic Co. Tranche B, term loan 7.115% 12/1/13 (c) | | 10,103 | | 10,166 |

| | 196,671 |

Consumer Products - 1.0% |

Central Garden & Pet Co. Tranche B, term loan 6.82% 9/12/12 (c) | | 4,950 | | 4,950 |

Chattem, Inc. term loan 7.11% 1/2/13 (c) | | 1,720 | | 1,728 |

Jarden Corp.: | | | | |

term loan 7.1% 1/24/12 (c) | | 5,056 | | 5,062 |

Tranche B2, term loan 7.1% 1/24/12 (c) | | 2,646 | | 2,649 |

Jostens IH Corp. Tranche C, term loan 7.3297% 10/4/11 (c) | | 12,148 | | 12,208 |

NPI Merger Corp. term loan 7.349% 4/26/13 (c) | | 1,686 | | 1,678 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Consumer Products - continued |

Sealy Mattress Co. Tranche E, term loan 6.8527% 8/25/12 (c) | | $ 5,107 | | $ 5,120 |

Spectrum Brands, Inc.: | | | | |

Tranche B1, term loan 9.3326% 3/30/13 (c) | | 1,629 | | 1,654 |

Tranche B2, term loan 9.32% 3/30/13 (c) | | 290 | | 294 |

9.17% 3/30/13 (c) | | 81 | | 82 |

Weight Watchers International, Inc. Tranche B, term loan 6.875% 1/26/14 (c) | | 7,980 | | 8,020 |

Yankee Candle Co., Inc. term loan 7.35% 2/6/14 (c) | | 5,000 | | 5,025 |

| | 48,470 |

Containers - 1.7% |

Berry Plastics Holding Corp. Tranche C, term loan 7.32% 4/3/15 (c) | | 3,000 | | 3,000 |

Bluegrass Container Co. LLC Tranche 1, term loan 7.5909% 6/30/13 (c) | | 12,813 | | 12,941 |

BWAY Corp. Tranche B, term loan 7.125% 7/17/13 (c) | | 4,104 | | 4,114 |

Crown Holdings, Inc.: | | | | |

term loan B 7.11% 11/15/12 (c) | | 15,345 | | 15,422 |

Tranche B, term loan 7.11% 11/15/12 (c) | | 9,697 | | 9,745 |

Owens-Brockway Glass Container, Inc. Tranche B, term loan 6.82% 6/14/13 (c) | | 25,425 | | 25,488 |

Solo Cup Co.: | | | | |

term loan 11.57% 3/31/12 (c) | | 3,000 | | 3,064 |

Tranche B1, term loan 8.847% 2/27/11 (c) | | 9,248 | | 9,375 |

| | 83,149 |

Diversified Financial Services - 1.3% |

Ameritrade Holding Corp. Tranche B, term loan 6.82% 1/23/13 (c) | | 14,768 | | 14,787 |

Energy Investors Funds term loan 7.082% 4/11/14 (c) | | 5,000 | | 5,019 |

LPL Holdings, Inc. Tranche C, term loan 7.85% 6/28/13 (c) | | 4,988 | | 5,037 |

LS Power Acquisition Corp.: | | | | |

Tranche 1LN, term loan 7.32% 4/30/14 (c) | | 16,000 | | 16,050 |

Tranche 2LN, term loan 8.07% 10/30/14 (c) | | 3,000 | | 3,034 |

The NASDAQ Stock Market, Inc.: | | | | |

Tranche B, term loan 7.07% 4/18/12 (c) | | 10,737 | | 10,777 |

Tranche C, term loan 7.07% 4/18/12 (c) | | 6,224 | | 6,247 |

| | 60,951 |

Diversified Media - 0.7% |

Lamar Media Corp. Tranche F, term loan 6.875% 3/31/14 (c) | | 6,650 | | 6,675 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Diversified Media - continued |

LBI Media, Inc. Tranche B, term loan 6.8494% 3/31/12 (c) | | $ 2,277 | | $ 2,254 |

NextMedia Operating, Inc. Tranche 1, term loan 7.32% 11/18/12 (c) | | 4,220 | | 4,220 |

Quebecor Media, Inc. Tranche B, term loan 7.3556% 1/17/13 (c) | | 4,938 | | 4,968 |

R.H. Donnelley Corp.: | | | | |

Tranche A4, term loan 6.57% 12/31/09 (c) | | 545 | | 545 |

Tranche D1, term loan 6.85% 6/30/11 (c) | | 9,740 | | 9,740 |

Thomson Media, Inc. Tranche B1, term loan 7.6% 11/8/11 (c) | | 3,157 | | 3,189 |

| | 31,591 |

Electric Utilities - 4.6% |

AES Corp. term loan 7.345% 8/10/11 (c) | | 8,429 | | 8,460 |

Boston Generating LLC: | | | | |

Credit-Linked Deposit 7.475% 12/20/13 (c) | | 1,724 | | 1,735 |

Tranche 1LN, revolver loan 7.475% 12/20/13 (c) | | 483 | | 486 |

Tranche B 1LN, term loan 7.6% 12/20/13 (c) | | 7,774 | | 7,822 |

Calpine Corp. Tranche D, term loan 7.57% 3/29/09 (c) | | 21,500 | | 21,608 |

Covanta Energy Corp.: | | | | |

term loan 6.875% 2/9/14 (c) | | 8,041 | | 8,051 |

6.72% 2/9/14 (c) | | 3,959 | | 3,964 |

Dynegy Holdings, Inc.: | | | | |

Revolving Credit-Linked Deposit 6.82% 4/2/13 (c) | | 15,319 | | 15,319 |

Tranche B, term loan 6.82% 4/2/13 (c) | | 2,681 | | 2,681 |

HCP Acquisition, Inc. Tranche 1LN, term loan 7.6% 2/13/14 (c) | | 3,990 | | 4,000 |

LSP Gen Finance Co. LLC Tranche B1, term loan 7.1% 5/4/13 (c) | | 8,031 | | 8,031 |

MACH Gen LLC: | | | | |

term loan 7.36% 2/22/14 (c) | | 3,616 | | 3,609 |

7.35% 2/22/13 (c) | | 375 | | 374 |

Midwest Generation LLC term loan 6.845% 4/27/11 (c) | | 895 | | 895 |

Mirant North America LLC term loan 7.07% 1/3/13 (c) | | 20,035 | | 20,035 |

NRG Energy, Inc.: | | | | |

Credit-Linked Deposit 7.35% 2/1/13 (c) | | 30,566 | | 30,796 |

term loan 7.35% 2/1/13 (c) | | 71,508 | | 72,044 |

NSG Holdings LLC: | | | | |

term loan 6.86% 6/15/14 (c) | | 6,286 | | 6,278 |

6.86% 6/15/14 (c) | | 714 | | 713 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Electric Utilities - continued |

Reliant Energy, Inc.: | | | | |

term loan 7.695% 12/1/10 (c) | | $ 4,560 | | $ 4,600 |

7.5617% 12/1/10 (c) | | 3,429 | | 3,459 |

| | 224,960 |

Energy - 2.8% |

Alon USA, Inc. term loan 7.605% 6/22/13 (c) | | 3,970 | | 3,990 |

Ashmore Energy International: | | | | |

Revolving Credit-Linked Deposit 8.25% 3/30/12 (c) | | 1,160 | | 1,163 |

term loan 8.35% 3/30/14 (c) | | 8,840 | | 8,862 |

Citgo Petroleum Corp. Tranche B, term loan 6.695% 11/15/12 (c) | | 12,051 | | 12,051 |

Coffeyville Resources LLC: | | | | |

Credit-Linked Deposit 8.2494% 12/28/13 (c) | | 486 | | 489 |

Tranche D, term loan 8.3495% 12/28/13 (c) | | 2,507 | | 2,520 |

Colonial Pipeline Co. term loan 7.359% 2/27/12 (c) | | 2,490 | | 2,515 |

Compagnie Generale de Geophysique SA term loan 7.35% 1/12/14 (c) | | 9,975 | | 10,050 |

El Paso Corp. 7.254% 7/31/11 (c) | | 27,981 | | 28,156 |

Energy Transfer Equity LP term loan 7.08% 11/1/12 (c) | | 4,000 | | 4,025 |

Energy XXI Gulf Coast, Inc. Tranche 2LN, term loan 10.875% 4/4/10 (c) | | 3,000 | | 3,000 |

MEG Energy Corp.: | | | | |

term loan 7.35% 4/3/13 (c) | | 2,475 | | 2,494 |

Tranche DD, term loan 4/3/13 (e) | | 2,500 | | 2,494 |

Nebraska Energy, Inc.: | | | | |

Tranche B 1LN, term loan 7.85% 11/1/13 (c) | | 7,548 | | 7,586 |

Tranche B, Credit-Linked Deposit 7.85% 11/1/13 (c) | | 892 | | 896 |

Sandridge Energy, Inc. term loan 8.975% 4/1/14 (c) | | 8,000 | | 8,130 |

Targa Resources, Inc./Targa Resources Finance Corp.: | | | | |

Credit-Linked Deposit 7.225% 10/31/12 (c) | | 3,290 | | 3,315 |

term loan 7.3565% 10/31/12 (c) | | 13,504 | | 13,605 |

Vulcan/Plains Resources, Inc. term loan 6.86% 8/12/11 (c) | | 2,884 | | 2,887 |

W&T Offshore, Inc. Tranche B, term loan 7.6% 8/24/10 (c) | | 4,810 | | 4,846 |

Western Refining, Inc.: | | | | |

term loan LIBOR +1.75 4/6/14 (c) | | 11,877 | | 11,877 |

Tranche DD, term loan 4/6/14 (e) | | 2,903 | | 2,903 |

| | 137,854 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Entertainment/Film - 1.7% |

Alliance Atlantis Communications, Inc. Tranche C, term loan 6.85% 12/19/11 (c) | | $ 3,920 | | $ 3,915 |

AMC Entertainment, Inc. term loan 7.07% 1/26/13 (c) | | 10,369 | | 10,408 |

Cinemark USA, Inc. term loan 7.383% 10/5/13 (c) | | 13,930 | | 13,965 |

MGM Holdings II, Inc. Tranche B, term loan 8.6% 4/8/12 (c) | | 14,261 | | 14,261 |

National CineMedia LLC term loan 7.09% 2/13/15 (c) | | 14,000 | | 14,000 |

Regal Cinemas Corp. term loan 7.1% 10/27/13 (c) | | 27,203 | | 27,203 |

| | 83,752 |

Environmental - 1.4% |

Allied Waste Industries, Inc.: | | | | |

Credit-Linked Deposit 7.07% 3/28/14 (c) | | 17,424 | | 17,511 |

term loan 7.0966% 3/28/14 (c) | | 39,292 | | 39,488 |

Brickman Group Holdings, Inc. Tranche B, term loan 7.3986% 1/23/14 (c) | | 3,000 | | 3,000 |

Casella Waste Systems, Inc. Tranche B, term loan 7.36% 4/28/10 (c) | | 2,000 | | 2,008 |

Synagro Technologies, Inc. Tranche 1LN, term loan 7.32% 3/30/14 (c) | | 470 | | 472 |

Waste Services, Inc. Tranche E, term loan 7.82% 3/31/11 (c) | | 3,885 | | 3,904 |

| | 66,383 |

Food and Drug Retail - 0.9% |

Jean Coutu Group (PJC) USA, Inc. Tranche B, term loan 7.875% 7/30/11 (c) | | 28,753 | | 28,753 |

SUPERVALU, Inc. Tranche B, term loan 6.84% 6/2/12 (c) | | 15,771 | | 15,850 |

| | 44,603 |

Food/Beverage/Tobacco - 2.0% |

B&G Foods, Inc. Tranche C, term loan 7.36% 2/26/13 (c) | | 2,800 | | 2,814 |

Bumble Bee Foods LLC Tranche B, term loan 7.1088% 5/2/12 (c) | | 3,000 | | 3,000 |

Constellation Brands, Inc. Tranche B, term loan 6.875% 6/5/13 (c) | | 36,492 | | 36,583 |

Dean Foods Co. Tranche B, term loan 6.875% 4/2/14 (c) | | 24,000 | | 24,030 |

Del Monte Corp. Tranche B, term loan 6.8379% 2/8/12 (c) | | 10,248 | | 10,235 |

Herbalife International, Inc. term loan 6.82% 7/21/13 (c) | | 3,738 | | 3,738 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Food/Beverage/Tobacco - continued |

Michael Foods, Inc. Tranche B, term loan 7.36% 11/21/10 (c) | | $ 4,020 | | $ 4,040 |

Reddy Ice Group, Inc. term loan 7.105% 8/12/12 (c) | | 2,000 | | 2,005 |

Reynolds American, Inc. Tranche B, term loan 7.1136% 5/31/12 (c) | | 11,910 | | 11,970 |

| | 98,415 |

Gaming - 2.8% |

Alliance Gaming Corp. term loan 8.61% 9/5/09 (c) | | 3,651 | | 3,647 |

Ameristar Casinos, Inc. term loan 6.82% 11/10/12 (c) | | 5,974 | | 5,974 |

Boyd Gaming Corp. term loan 6.82% 6/30/11 (c) | | 13,143 | | 13,160 |

Choctaw Resort Development Enterprise term loan 7.0738% 11/4/11 (c) | | 1,876 | | 1,883 |

Green Valley Ranch Gaming LLC Tranche 1LN, term loan 7.36% 2/16/14 (c) | | 3,797 | | 3,820 |

Greenwood Racing, Inc. term loan 7.57% 11/28/11 (c) | | 1,995 | | 2,005 |

Kerzner International Ltd.: | | | | |

term loan 8.34% 9/1/13 (c) | | 1,809 | | 1,805 |

Class DD, term loan 8.3418% 9/1/13 (c)(e) | | 941 | | 938 |

Penn National Gaming, Inc. Tranche B, term loan 7.114% 10/31/12 (c) | | 18,292 | | 18,475 |

Pinnacle Entertainment, Inc. Tranche B, term loan 7.32% 12/14/11 (c) | | 5,350 | | 5,397 |

Seminole Tribe of Florida: | | | | |

Tranche B1, term loan 6.875% 3/5/14 (c)(e) | | 777 | | 777 |

Tranche B2, term loan 6.875% 3/5/14 (c) | | 2,623 | | 2,623 |

Tranche B3, term loan 6.875% 3/5/14 (c) | | 2,599 | | 2,599 |

Tropicana Entertainment term loan 7.85% 7/3/08 (c) | | 8,700 | | 8,765 |

Trump Entertainment Resorts Holdings LP Tranche B, term loan 7.864% 5/20/12 (c)(e) | | 14,394 | | 14,484 |

Venetian Casino Resort LLC Tranche B, term loan 7.09% 6/15/11 (c) | | 24,200 | | 24,200 |

Venetian Macau Ltd. Tranche B, term loan: | | | | |

7.6% 5/26/12 (c)(e) | | 3,369 | | 3,395 |

7.85% 5/26/13 (c) | | 7,631 | | 7,707 |

Venetian Macau US Finance, Inc. Tranche B, term loan 7.6% 5/25/13 (c) | | 4,000 | | 4,030 |

Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp. term loan B 7.225% 8/15/13 (c) | | 9,180 | | 9,255 |

| | 134,939 |

Healthcare - 9.4% |

Advanced Medical Optics, Inc. term loan 7.093% 4/2/14 (c) | | 2,540 | | 2,553 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Healthcare - continued |

AmeriPath, Inc. Tranche B, term loan 7.36% 10/31/12 (c) | | $ 2,970 | | $ 2,970 |

AMR HoldCo, Inc./EmCare HoldCo, Inc. term loan 7.3798% 2/7/12 (c) | | 10,017 | | 10,054 |

Community Health Systems, Inc. term loan 7.1% 8/19/11 (c) | | 43,587 | | 43,587 |

Concentra Operating Corp. term loan 7.3321% 9/30/11 (c) | | 3,119 | | 3,134 |

CONMED Corp. Tranche B, term loan 7.07% 4/12/13 (c) | | 2,111 | | 2,111 |

DaVita, Inc. Tranche B1, term loan 6.8418% 10/5/12 (c) | | 45,257 | | 45,313 |

DJO, Inc. Tranche B, term loan 6.875% 4/7/13 (c) | | 2,478 | | 2,478 |

Emdeon Business Services term loan 7.6% 11/16/13 (c) | | 1,962 | | 1,967 |

Fresenius Medical Care Holdings, Inc. Tranche B, term loan 6.7262% 3/31/12 (c) | | 40,607 | | 40,557 |

Gentiva Health Services, Inc. term loan 7.5853% 3/31/13 (c) | | 1,800 | | 1,809 |

HCA, Inc. Tranche B, term loan 7.6% 11/17/13 (c) | | 116,708 | | 117,870 |

Health Management Associates, Inc. Tranche B, term loan 7.1% 2/28/14 (c) | | 26,820 | | 26,921 |

HealthSouth Corp. term loan 7.847% 3/10/13 (c) | | 27,239 | | 27,409 |

IASIS Healthcare Corp.: | | | | |

term loan 7.356% 3/15/14 (c) | | 10,183 | | 10,208 |

Tranche DD, term loan 3/15/14 (e) | | 3,479 | | 3,488 |

7.32% 3/15/14 (c) | | 928 | | 930 |

Kinetic Concepts, Inc. Tranche B2, term loan 6.85% 8/11/10 (c) | | 4,126 | | 4,126 |

LifePoint Hospitals, Inc. Tranche B, term loan 6.985% 4/15/12 (c) | | 21,728 | | 21,755 |

National Renal Institutes, Inc. term loan 7.625% 3/31/13 (c) | | 3,434 | | 3,430 |

Psychiatric Solutions, Inc. term loan 7.0881% 7/1/12 (c) | | 8,314 | | 8,314 |

PTS Acquisition Corp. term loan 7.6% 4/5/14 (c) | | 14,000 | | 14,018 |

Renal Advantage, Inc. Tranche B, term loan 7.85% 9/30/12 (c) | | 6,617 | | 6,658 |

Skilled Healthcare Group, Inc. Tranche 1, term loan 7.57% 6/15/12 (c) | | 3,930 | | 3,940 |

Sun Healthcare Group, Inc.: | | | | |

Tranche B, term loan 7.355% 4/19/14 (c) | | 4,276 | | 4,276 |

Tranche DD, term loan 4/19/14 (e) | | 759 | | 759 |

5.255% 4/19/13 (c) | | 966 | | 966 |

Team Health, Inc. term loan 7.86% 11/22/12 (c) | | 16,294 | | 16,294 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Healthcare - continued |

U.S. Oncology, Inc.: | | | | |

Tranche B, term loan 7.6153% 8/20/11 (c) | | $ 8,461 | | $ 8,493 |

Tranche C, term loan 7.6% 8/20/11 (c) | | 1,945 | | 1,952 |

Vanguard Health Holding Co. I term loan 7.6% 9/23/11 (c) | | 5,720 | | 5,755 |

Vicar Operating, Inc. term loan 6.875% 5/16/11 (c) | | 9,816 | | 9,791 |

VWR Corp. Tranche B, term loan 7.61% 4/7/11 (c) | | 5,819 | | 5,863 |

| | 459,749 |

Homebuilding/Real Estate - 1.7% |

Apartment Investment & Management Co. term loan 6.855% 3/22/11 (c) | | 2,100 | | 2,105 |

Blount, Inc. Tranche B1, term loan 7.0849% 8/9/10 (c) | | 1,640 | | 1,640 |

Capital Automotive (REIT) Tranche B, term loan 7.07% 12/16/10 (c) | | 7,442 | | 7,498 |

CB Richard Ellis Group, Inc. Tranche B, term loan 6.82% 12/20/13 (c) | | 6,983 | | 6,991 |

EOP Operating LP term loan 7.57% 2/28/09 (c) | | 13,626 | | 13,626 |

General Growth Properties, Inc. Tranche A1, term loan 6.57% 2/24/10 (c) | | 25,803 | | 25,787 |

LandSource Communities Development LLC Tranche B 1LN, term loan 8.07% 2/27/13 (c) | | 7,980 | | 8,080 |

Realogy Corp.: | | | | |

Tranche B, term loan 8.35% 10/10/13 (c) | | 9,455 | | 9,478 |

8.32% 10/10/13 (c) | | 2,545 | | 2,552 |

Tishman Speyer Properties term loan 7.07% 12/27/12 (c) | | 5,000 | | 5,019 |

| | 82,776 |

Hotels - 0.2% |

Hilton Hotels Corp. Tranche B, term loan 6.6948% 2/22/13 (c) | | 7,317 | | 7,317 |

Leisure - 1.2% |

Cedar Fair LP term loan 7.32% 8/30/12 (c) | | 9,925 | | 10,012 |

London Arena & Waterfront Finance LLC Tranche A, term loan 7.84% 3/8/12 (c) | | 2,970 | | 2,985 |

Six Flags Theme Park, Inc. Tranche B1, term loan 8.6037% 6/30/09 (c) | | 25,878 | | 25,878 |

Town Sports International LLC term loan 7.125% 2/27/14 (c) | | 3,990 | | 4,000 |

Universal City Development Partners Ltd. term loan 7.3599% 6/9/11 (c) | | 16,741 | | 16,783 |

| | 59,658 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Metals/Mining - 1.9% |

Aleris International, Inc. term loan 7.375% 12/19/13 (c) | | $ 3,990 | | $ 3,995 |

Alpha National Resources LLC/Alpha National Resources Capital Corp. Tranche B, term loan 7.1% 10/26/12 (c) | | 14,825 | | 14,880 |

Compass Minerals Tranche B, term loan 6.8453% 12/22/12 (c) | | 11,879 | | 11,879 |

Freeport-McMoRan Copper & Gold, Inc. Tranche B, term loan 7.07% 3/19/14 (c) | | 40,890 | | 40,993 |

Novelis, Inc. term loan 7.61% 1/7/12 (c) | | 16,178 | | 16,219 |

Stillwater Mining Co. term loan 7.625% 7/30/10 (c) | | 2,124 | | 2,129 |

| | 90,095 |

Paper - 3.7% |

Appleton Papers, Inc. term loan 7.6047% 6/11/10 (c) | | 3,039 | | 3,039 |

Boise Cascade Holdings LLC Tranche D, term loan 6.82% 10/26/11 (c) | | 20,632 | | 20,632 |

Buckeye Technologies, Inc. term loan 7.8441% 3/15/08 (c) | | 1,674 | | 1,676 |

Domtar Corp. Tranche B, term loan 6.735% 3/7/14 (c) | | 4,000 | | 3,990 |

Georgia-Pacific Corp.: | | | | |

term loan 7.09% 12/29/13 (c) | | 14,963 | | 15,037 |

Tranche B1, term loan 7.3199% 12/23/12 (c) | | 74,063 | | 74,433 |

Graphic Packaging International, Inc. Tranche C, term loan 7.8325% 8/8/10 (c) | | 14,663 | | 14,663 |

NewPage Corp. term loan 7.625% 5/2/11 (c) | | 4,172 | | 4,203 |

Smurfit-Stone Container Enterprises, Inc.: | | | | |

Credit-Linked Deposit 7.32% 11/1/10 (c) | | 4,164 | | 4,195 |

Tranche B, term loan 7.375% 11/1/11 (c) | | 16,207 | | 16,328 |

Tranche C, term loan 7.375% 11/1/11 (c) | | 8,710 | | 8,775 |

Tranche C1, term loan 7.375% 11/1/11 (c) | | 2,795 | | 2,819 |

Verso Paper Holdings LLC Tranche B, term loan 7.125% 8/1/13 (c) | | 5,444 | | 5,464 |

Xerium Technologies, Inc. Tranche B, term loan 8.1% 5/18/12 (c) | | 4,499 | | 4,494 |

| | 179,748 |

Publishing/Printing - 3.3% |

CBD Media, Inc. Tranche D, term loan 7.82% 12/31/09 (c) | | 1,747 | | 1,754 |

Cenveo Corp.: | | | | |

term loan 7.1% 6/21/13 (c) | | 7,448 | | 7,458 |

Tranche DD, term loan 7.1% 6/21/13 (c) | | 248 | | 249 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Publishing/Printing - continued |

Dex Media East LLC/Dex Media East Finance Co.: | | | | |

Tranche A, term loan 6.5956% 11/8/08 (c) | | $ 1,735 | | $ 1,733 |

Tranche B, term loan 6.8469% 5/8/09 (c) | | 13,998 | | 13,998 |

Dex Media West LLC/Dex Media West Finance Co.: | | | | |

Tranche A, term loan 6.5988% 9/9/09 (c) | | 3,238 | | 3,238 |

Tranche B, term loan 6.85% 3/9/10 (c) | | 12,838 | | 12,838 |

Tranche B1, term loan 6.8593% 3/10/10 (c) | | 12,959 | | 12,959 |

Idearc, Inc. term loan 7.35% 11/17/14 (c) | | 38,895 | | 39,138 |

MediMedia USA, Inc. Tranche B, term loan 7.833% 10/5/13 (c) | | 2,776 | | 2,786 |

R.H. Donnelley Corp. Tranche D2, term loan 6.8511% 6/30/11 (c) | | 27,468 | | 27,434 |

Sun Media Corp. Canada Tranche B, term loan 7.105% 2/7/09 (c) | | 1,567 | | 1,567 |

The Reader's Digest Association, Inc. term loan 7.3391% 3/2/14 (c) | | 12,610 | | 12,626 |

Yell Group PLC Tranche B1, term loan 7.32% 2/10/13 (c) | | 24,200 | | 24,351 |

| | 162,129 |

Railroad - 0.3% |

Kansas City Southern Railway Co. Tranche B, term loan 7.0731% 4/28/13 (c) | | 16,873 | | 16,873 |

Restaurants - 0.6% |

Arby's Restaurant Group, Inc. Tranche B, term loan 7.2076% 7/25/12 (c) | | 4,501 | | 4,524 |

Burger King Corp. Tranche B1, term loan 6.875% 6/30/12 (c) | | 17,994 | | 18,039 |

Del Taco Tranche B, term loan 7.6% 3/29/13 (c) | | 4,950 | | 4,944 |

El Pollo Loco, Inc. Tranche B, term loan 7.855% 11/18/11 (c) | | 1,969 | | 1,981 |

| | 29,488 |

Services - 3.1% |

Acosta, Inc. term loan 7.57% 7/28/13 (c) | | 2,978 | | 3,002 |

Adesa, Inc. term loan 7.57% 10/18/13 (c) | | 6,000 | | 6,038 |

Aramark Corp.: | | | | |

term loan 7.475% 1/26/14 (c) | | 62,067 | | 62,378 |

7.445% 1/26/14 (c) | | 4,436 | | 4,458 |

Brand Energy & Infrastructure Services, Inc. Tranche B 1LN, term loan 7.625% 2/7/14 (c) | | 4,790 | | 4,790 |

Coinmach Corp. Tranche B1, term loan 7.875% 12/19/12 (c) | | 5,970 | | 6,007 |

Coinstar, Inc. term loan 7.35% 7/1/11 (c) | | 5,520 | | 5,547 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Services - continued |

Education Management LLC/Education Management Finance Corp. Tranche B, term loan 7.375% 6/1/13 (c) | | $ 3,963 | | $ 3,977 |

Hertz Corp.: | | | | |

Credit-Linked Deposit 7.35% 12/21/12 (c) | | 1,444 | | 1,453 |

Tranche B, term loan 7.0822% 12/21/12 (c) | | 8,069 | | 8,119 |

Iron Mountain, Inc. term loan 6.865% 4/16/14 (c) | | 10,000 | | 10,025 |

McJunkin Corp. term loan 7.6% 1/31/14 (c) | | 1,995 | | 2,000 |

RSC Equipment Rental term loan 8.9332% 11/30/12 (c) | | 2,985 | | 2,989 |

The Geo Group, Inc. term loan 6.8245% 1/24/14 (c) | | 1,798 | | 1,803 |

United Rentals, Inc.: | | | | |

term loan 7.32% 2/14/11 (c) | | 4,681 | | 4,704 |

Tranche B, Credit-Linked Deposit 7.32% 2/14/11 (c) | | 1,937 | | 1,946 |

US Investigations Services, Inc.: | | | | |

term loan 7.85% 10/14/12 (c) | | 5,910 | | 5,954 |

term loan D 7.85% 10/14/12 (c) | | 1,990 | | 2,005 |

West Corp. term loan 7.7497% 10/24/13 (c) | | 14,663 | | 14,773 |

| | 151,968 |

Shipping - 0.2% |

Baker Tanks, Inc. Tranche B, term loan 9.5% 11/23/12 (c) | | 879 | | 879 |

Laidlaw International, Inc. Tranche B, term loan 7.09% 7/31/13 (c) | | 8,955 | | 8,966 |

| | 9,845 |

Specialty Retailing - 0.2% |

GNC Corp. term loan 7.6% 9/16/13 (c) | | 7,000 | | 7,000 |

Sally Holdings LLC Tranche B, term loan 7.86% 11/16/13 (c) | | 4,970 | | 5,009 |

| | 12,009 |

Super Retail - 1.6% |

Buhrmann US, Inc. Tranche D1, term loan 7.1001% 12/31/10 (c) | | 5,534 | | 5,547 |

FTD, Inc. term loan 7.36% 7/28/13 (c) | | 3,661 | | 3,670 |

Gold Toe Investment Corp. Tranche 1LN, term loan 8.109% 10/30/13 (c) | | 5,985 | | 6,030 |

J. Crew Group, Inc. term loan 7.1227% 5/15/13 (c) | | 3,911 | | 3,921 |

Michaels Stores, Inc. Tranche B, term loan 8.125% 10/31/13 (c) | | 16,563 | | 16,563 |

Neiman Marcus Group, Inc. term loan 7.3463% 4/6/13 (c) | | 9,239 | | 9,308 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Super Retail - continued |

PETCO Animal Supplies, Inc. term loan 7.9772% 10/26/13 (c) | | $ 9,925 | | $ 10,000 |

The Pep Boys - Manny, Moe & Jack term loan 7.36% 10/27/13 (c) | | 3,691 | | 3,709 |

Toys 'R' US, Inc. term loan 8.32% 12/9/08 (c) | | 19,000 | | 19,166 |

| | 77,914 |

Technology - 4.7% |

Acxiom Corp. term loan 7.0828% 9/15/12 (c) | | 4,549 | | 4,572 |

Advanced Micro Devices, Inc. term loan 7.34% 12/31/13 (c) | | 8,336 | | 8,347 |

Affiliated Computer Services, Inc.: | | | | |

term loan 7.32% 3/20/13 (c) | | 13,163 | | 13,196 |

Tranche B2, term loan 7.32% 3/20/13 (c) | | 7,920 | | 7,940 |

AMI Semiconductor, Inc. term loan 6.82% 4/1/12 (c) | | 1,480 | | 1,473 |

Eastman Kodak Co.: | | | | |

term loan 7.57% 10/18/12 (c) | | 9,985 | | 9,997 |

Tranche DD, term loan 7.57% 10/20/12 (c) | | 1,985 | | 1,988 |

Freescale Semiconductor, Inc. term loan 7.11% 12/1/13 (c) | | 43,900 | | 43,900 |

Global Tel*Link Corp.: | | | | |

term loan 8.85% 2/14/13 (c)(e) | | 1,557 | | 1,569 |

8.76% 2/14/13 (c)(e) | | 435 | | 438 |

Itron, Inc. term loan 7.358% 4/18/14 (c) | | 2,410 | | 2,428 |

K & F Industries, Inc. term loan 7.32% 11/18/12 (c) | | 7,734 | | 7,734 |

ON Semiconductor Corp. term loan 7.1% 9/6/13 (c) | | 1,286 | | 1,286 |

Open Solutions, Inc. term loan 7.485% 1/23/14 (c) | | 4,490 | | 4,507 |

Open Text Corp. term loan 7.86% 10/2/13 (c) | | 5,970 | | 6,000 |

PGS Solutions, Inc. term loan 7.61% 2/14/13 (c) | | 1,230 | | 1,241 |

Riverdeep Interactive Learning USA, Inc. term loan: | | | | |

8.1% 12/20/13 (c) | | 17,127 | | 17,170 |

11.55% 12/21/07 (c) | | 9,000 | | 9,000 |

Serena Software, Inc. term loan 7.5856% 3/10/13 (c) | | 5,175 | | 5,194 |

SunGard Data Systems, Inc. term loan 7.36% 2/28/14 (c) | | 70,540 | | 71,069 |

Verifone, Inc. Tranche B, term loan 7.109% 10/31/13 (c) | | 8,978 | | 9,011 |

| | 228,060 |

Telecommunications - 4.8% |

Alaska Communications Systems Holding term loan 7.1% 2/1/12 (c) | | 3,000 | | 3,008 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Telecommunications - continued |

American Cellular Corp.: | | | | |

term loan 3/15/14 (e) | | $ 774 | | $ 773 |

Tranche B, term loan 7.32% 3/15/14 (c) | | 7,226 | | 7,244 |

Centennial Cellular Operating Co. LLC term loan 7.3507% 2/9/11 (c) | | 15,635 | | 15,713 |

Cincinnati Bell, Inc. Tranche B, term loan 6.8236% 8/31/12 (c) | | 7,930 | | 7,940 |

Consolidated Communications, Inc. Tranche D, term loan 7.1024% 10/14/11 (c) | | 2,000 | | 2,000 |

Crown Castle International Corp. Tranche B, term loan 6.89% 3/6/14 (c) | | 9,000 | | 9,011 |

Digicel International Finance Ltd. term loan 7.85% 3/23/12 (c) | | 16,000 | | 16,020 |

Intelsat Bermuda Ltd. term loan 7.855% 1/12/14 (c) | | 20,000 | | 20,075 |

Intelsat Ltd. Tranche B, term loan 7.3494% 7/3/13 (c) | | 29,519 | | 29,703 |

Iowa Telecommunication Services, Inc. Tranche B, term loan 7.0975% 11/23/11 (c) | | 4,000 | | 4,010 |

Knology, Inc. term loan 7.57% 4/6/12 (c) | | 3,000 | | 3,008 |

Leap Wireless International, Inc. Tranche B, term loan 7.6% 6/16/13 (c) | | 6,948 | | 6,991 |

Level 3 Communications, Inc. term loan 7.605% 3/13/14 (c) | | 14,000 | | 14,070 |

MetroPCS Wireless, Inc. Tranche B, term loan 7.625% 11/3/13 (c) | | 17,920 | | 18,010 |

NTELOS, Inc. Tranche B1, term loan 7.57% 8/24/11 (c) | | 6,775 | | 6,805 |

Paetec Communications, Inc. Tranche B, term loan 8.82% 2/28/13 (c) | | 4,000 | | 4,055 |

Qwest Corp. Tranche B, term loan 6.95% 6/30/10 (c) | | 11,000 | | 11,303 |

Time Warner Telecom, Inc. Tranche B, term loan 7.32% 1/7/13 (c) | | 5,985 | | 6,022 |

Triton PCS, Inc. term loan 8.57% 11/18/09 (c) | | 7,768 | | 7,807 |

Wind Telecomunicazioni Spa: | | | | |

Tranche B, term loan 7.84% 9/21/13 (c) | | 7,500 | | 7,538 |

Tranche C, term loan 8.59% 9/21/14 (c) | | 7,500 | | 7,538 |

Windstream Corp. Tranche B1, term loan 6.86% 7/17/13 (c) | | 23,556 | | 23,673 |

| | 232,317 |

Textiles & Apparel - 0.7% |

Hanesbrands, Inc. Tranche B 1LN, term loan 7.105% 9/5/13 (c) | | 18,521 | | 18,614 |

Levi Strauss & Co. term loan 7.59% 4/4/14 (c) | | 3,000 | | 2,976 |

Floating Rate Loans (d) - continued |

| Principal Amount (000s) | | Value (000s) |

Textiles & Apparel - continued |

Warnaco Group, Inc. term loan 6.84% 1/31/13 (c) | | $ 4,986 | | $ 4,979 |

William Carter Co. term loan 6.846% 6/29/12 (c) | | 6,883 | | 6,883 |

| | 33,452 |

TOTAL FLOATING RATE LOANS (Cost $3,924,239) | 3,938,300 |

Nonconvertible Bonds - 9.5% |

|

Air Transportation - 0.1% |

Continental Airlines, Inc. 8.4731% 6/2/13 (c) | | 2,000 | | 2,055 |

Delta Air Lines, Inc. 8.3% 12/15/29 (f) | | 3,000 | | 1,575 |

| | 3,630 |

Auto Parts Distribution - 0.0% |

The Goodyear Tire & Rubber Co. 9.14% 12/1/09 (b)(c) | | 2,000 | | 2,010 |

Automotive - 1.2% |

Ford Motor Credit Co.: | | | | |

4.95% 1/15/08 | | 2,000 | | 1,978 |

6.18% 9/28/07 (c) | | 16,000 | | 16,000 |

8.105% 1/13/12 (c) | | 31,620 | | 31,264 |

8.36% 11/2/07 (c) | | 4,000 | | 4,038 |

General Motors Acceptance Corp. 6.3056% 7/16/07 (c) | | 4,000 | | 4,000 |

| | 57,280 |

Broadcasting - 0.2% |

Radio One, Inc. 8.875% 7/1/11 | | 7,000 | | 7,210 |

Building Materials - 0.1% |

General Cable Corp. 7.725% 4/1/15 (b)(c) | | 5,030 | | 5,080 |

Cable TV - 0.4% |

CSC Holdings, Inc.: | | | | |

7.25% 7/15/08 | | 2,000 | | 2,025 |

7.875% 12/15/07 | | 8,000 | | 8,092 |

DirecTV Holdings LLC/DirecTV Financing, Inc. 8.375% 3/15/13 | | 1,963 | | 2,071 |

EchoStar Communications Corp.: | | | | |

5.75% 10/1/08 | | 4,000 | | 4,000 |

7% 10/1/13 | | 3,000 | | 3,116 |

| | 19,304 |

Nonconvertible Bonds - continued |

| Principal Amount (000s) | | Value (000s) |

Capital Goods - 0.1% |

Case New Holland, Inc. 9.25% 8/1/11 | | $ 2,000 | | $ 2,100 |

Esco Corp. 9.2299% 12/15/13 (b)(c) | | 2,000 | | 2,070 |

| | 4,170 |

Chemicals - 0.1% |

Equistar Chemicals LP/Equistar Funding Corp. 10.625% 5/1/11 | | 2,000 | | 2,110 |

Georgia Gulf Corp. 9.5% 10/15/14 (b) | | 1,360 | | 1,360 |

| | 3,470 |

Containers - 0.3% |

Impress Holdings BV 8.4806% 9/15/13 (b)(c) | | 7,720 | | 7,952 |

Owens-Brockway Glass Container, Inc. 8.875% 2/15/09 | | 5,000 | | 5,100 |

| | 13,052 |

Electric Utilities - 0.8% |

AES Corp. 8.75% 6/15/08 | | 3,000 | | 3,090 |

CMS Energy Corp. 9.875% 10/15/07 | | 12,000 | | 12,180 |

NRG Energy, Inc. 7.375% 2/1/16 | | 9,000 | | 9,360 |

Reliant Energy, Inc. 9.25% 7/15/10 | | 3,000 | | 3,150 |

TECO Energy, Inc.: | | | | |

6.125% 5/1/07 | | 4,000 | | 3,993 |

7.36% 5/1/10 (c) | | 5,000 | | 5,106 |

| | 36,879 |

Energy - 1.2% |

Mariner Energy, Inc. 8% 5/15/17 | | 3,930 | | 3,950 |

Parker Drilling Co. 10.11% 9/1/10 (c) | | 4,703 | | 4,797 |

Pemex Project Funding Master Trust 6.6549% 6/15/10 (b)(c) | | 18,000 | | 18,459 |

Premcor Refining Group, Inc. 9.5% 2/1/13 | | 2,000 | | 2,165 |

Southern Natural Gas Co. 6.125% 9/15/08 | | 2,000 | | 2,015 |

Williams Companies, Inc. 7.3494% 10/1/10 (b)(c) | | 17,000 | | 17,446 |

Williams Companies, Inc. Credit Linked Certificate Trust IV 8.61% 5/1/09 (b)(c) | | 7,000 | | 7,184 |

| | 56,016 |

Gaming - 0.2% |

Mandalay Resort Group: | | | | |

9.5% 8/1/08 | | 2,000 | | 2,084 |

10.25% 8/1/07 | | 2,000 | | 2,020 |

Nonconvertible Bonds - continued |

| Principal Amount (000s) | | Value (000s) |

Gaming - continued |

Mirage Resorts, Inc. 6.75% 8/1/07 | | $ 3,000 | | $ 3,008 |

Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp. 6.625% 12/1/14 | | 3,000 | | 3,000 |

| | 10,112 |

Leisure - 0.1% |

Universal City Florida Holding Co. I/II 10.11% 5/1/10 (c) | | 5,140 | | 5,313 |

Metals/Mining - 0.4% |

Freeport-McMoRan Copper & Gold, Inc.: | | | | |

8.5463% 4/1/15 (c) | | 12,000 | | 12,630 |

10.125% 2/1/10 | | 8,470 | | 8,894 |

| | 21,524 |

Paper - 0.0% |

Boise Cascade LLC/Boise Cascade Finance Corp. 8.2306% 10/15/12 (c) | | 2,190 | | 2,195 |

Publishing/Printing - 0.2% |

Dex Media East LLC/Dex Media East Finance Co. 9.875% 11/15/09 | | 6,000 | | 6,270 |

R.H. Donnelley Corp. 8.875% 1/15/16 | | 4,000 | | 4,340 |

| | 10,610 |

Services - 0.1% |

Aramark Corp. 8.86% 2/1/15 (b)(c) | | 3,360 | | 3,473 |

Avis Budget Car Rental LLC/Avis Budget Finance, Inc. 7.86% 5/15/14 (b)(c) | | 1,650 | | 1,695 |

| | 5,168 |

Shipping - 0.1% |

OMI Corp. 7.625% 12/1/13 | | 2,000 | | 2,060 |

Ship Finance International Ltd. 8.5% 12/15/13 | | 3,620 | | 3,765 |

| | 5,825 |

Super Retail - 0.3% |

GSC Holdings Corp./Gamestop, Inc. 9.2244% 10/1/11 (c) | | 16,000 | | 16,540 |

Technology - 0.8% |

Freescale Semiconductor, Inc. 9.2299% 12/15/14 (b)(c) | | 10,000 | | 10,025 |

Nortel Networks Corp. 9.6056% 7/15/11 (b)(c) | | 17,380 | | 18,640 |

NXP BV 8.1056% 10/15/13 (b)(c) | | 9,000 | | 9,293 |

| | 37,958 |

Telecommunications - 2.8% |

Centennial Communications Corp. 11.0994% 1/1/13 (c) | | 2,000 | | 2,100 |

Nonconvertible Bonds - continued |

| Principal Amount (000s) | | Value (000s) |

Telecommunications - continued |

Embarq Corp. 6.738% 6/1/13 | | $ 7,111 | | $ 7,391 |

Intelsat Ltd. 11.3544% 6/15/13 (c) | | 2,000 | | 2,130 |

IPCS, Inc. 7.48% 5/1/13 (b)(c) | | 3,000 | | 3,015 |

Level 3 Financing, Inc. 9.15% 2/15/15 (b)(c) | | 4,000 | | 4,045 |

Qwest Communications International, Inc. 8.86% 2/15/09 (c) | | 9,000 | | 9,101 |

Qwest Corp. 8.6049% 6/15/13 (c) | | 56,150 | | 61,344 |

Rogers Communications, Inc.: | | | | |

6.375% 3/1/14 | | 3,000 | | 3,094 |

8.4799% 12/15/10 (c) | | 38,450 | | 39,219 |

Rural Cellular Corp. 8.25% 3/15/12 | | 6,000 | | 6,330 |

| | 137,769 |

TOTAL NONCONVERTIBLE BONDS (Cost $450,625) | 461,115 |

Money Market Funds - 8.5% |

| Shares | | |

Fidelity Cash Central Fund, 5.29% (a) | 415,566,681 | | 415,567 |

Fidelity Money Market Central Fund, 5.4% (a) | 280,351 | | 280 |

TOTAL MONEY MARKET FUNDS (Cost $415,847) | 415,847 |

Cash Equivalents - 3.2% |

| Maturity Amount (000s) | | |

Investments in repurchase agreements in a joint trading account at 5.12%, dated 4/30/07 due 5/1/07 (Collateralized by U.S. Treasury Obligations) #

(Cost $155,246) | $ 155,268 | | 155,246 |

TOTAL INVESTMENT PORTFOLIO - 102.1% (Cost $4,945,957) | | 4,970,508 |

NET OTHER ASSETS - (2.1)% | | (103,306) |

NET ASSETS - 100% | $ 4,867,202 |

Legend |

(a) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. |

(b) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $111,747,000 or 2.3% of net assets. |

(c) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

(d) Remaining maturities of floating rate loans may be less than the stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. |

(e) Position or a portion of the position represents an unfunded loan commitment. At period end, the total principal amount and market value of unfunded commitments totaled $26,456,000 and $26,517,000 respectively. The coupon rate will be determined at time of settlement. |

(f) Non-income producing - Issuer is in default. |

# Additional Information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value

(Amounts in thousands) |

$155,246,000 due 5/01/07 at 5.12% |

Banc of America Securities LLC | $ 23,714 |

Barclays Capital, Inc. | 52,884 |

Fortis Securities LLC | 33,900 |

Lehman Brothers, Inc. | 44,748 |

| $ 155,246 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Cash Central Fund | $ 8,468 |

Fidelity Money Market Central Fund | 1,015 |

Total | $ 9,483 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | April 30, 2007 |

Assets | | |

Investment in securities, at value (including repurchase agreements of $155,246) - See accompanying schedule: Unaffiliated issuers (cost $4,530,110) | $ 4,554,661 | |

Fidelity Central Funds (cost $415,847) | 415,847 | |

Total Investments (cost $4,945,957) | | $ 4,970,508 |

Receivable for investments sold | | 66,914 |

Receivable for fund shares sold | | 18,076 |

Interest receivable | | 35,526 |

Distributions receivable from Fidelity Central Funds | | 2,003 |

Prepaid expenses | | 15 |

Total assets | | 5,093,042 |

| | |

Liabilities | | |

Payable to custodian bank | $ 5,407 | |

Payable for investments purchased | 190,953 | |

Payable for fund shares redeemed | 21,314 | |

Distributions payable | 4,675 | |

Accrued management fee | 2,282 | |

Distribution fees payable | 558 | |

Other affiliated payables | 556 | |

Other payables and accrued expenses | 95 | |

Total liabilities | | 225,840 |

| | |

Net Assets | | $ 4,867,202 |

Net Assets consist of: | | |

Paid in capital | | $ 4,839,614 |

Undistributed net investment income | | 1,622 |

Accumulated undistributed net realized gain (loss) on investments | | 1,415 |

Net unrealized appreciation (depreciation) on investments | | 24,551 |

Net Assets | | $ 4,867,202 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Assets and Liabilities - continued

Amounts in thousands (except per-share amounts) | April 30, 2007 |

| | |

Calculation of Maximum Offering Price

Class A:

Net Asset Value and redemption price per share ($271,342 ÷ 27,204 shares) | | $ 9.97 |

| | |

Maximum offering price per share (100/97.25 of $9.97) | | $ 10.25 |

Class T:

Net Asset Value and redemption price per share ($413,766 ÷ 41,530 shares) | | $ 9.96 |

| | |

Maximum offering price per share (100/97.25 of $9.96) | | $ 10.24 |

Class B:

Net Asset Value and offering price per share ($124,556 ÷ 12,502 shares)A | | $ 9.96 |

| | |

Class C:

Net Asset Value and offering price per share ($409,646 ÷ 41,078 shares)A | | $ 9.97 |

| | |

Floating Rate High Income:

Net Asset Value, offering price and redemption price per share ($3,331,832 ÷ 334,382 shares) | | $ 9.96 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($316,060 ÷ 31,736 shares) | | $ 9.96 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Operations

Amounts in thousands | Six months ended April 30, 2007 |

| | |

Investment Income | | |

Interest | | $ 161,409 |

Income from Fidelity Central Funds | | 9,483 |

Total income | | 170,892 |

| | |

Expenses | | |

Management fee | $ 14,478 | |

Transfer agent fees | 2,650 | |

Distribution fees | 3,011 | |

Accounting fees and expenses | 691 | |

Custodian fees and expenses | 59 | |

Independent trustees' compensation | 7 | |

Registration fees | 119 | |

Audit | 82 | |

Legal | 30 | |

Miscellaneous | 15 | |

Total expenses before reductions | 21,142 | |

Expense reductions | (53) | 21,089 |

Net investment income | | 149,803 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 1,995 |

Change in net unrealized appreciation (depreciation) on investment securities | | 11,565 |

Net gain (loss) | | 13,560 |

Net increase (decrease) in net assets resulting from operations | | $ 163,363 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Changes in Net Assets

Amounts in thousands | Six months ended April 30,

2007 | Year ended

October 31,

2006 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income | $ 149,803 | $ 258,782 |

Net realized gain (loss) | 1,995 | 3,037 |

Change in net unrealized appreciation (depreciation) | 11,565 | (12,428) |

Net increase (decrease) in net assets resulting

from operations | 163,363 | 249,391 |

Distributions to shareholders from net investment income | (151,995) | (254,554) |

Distributions to shareholders from net realized gain | (932) | - |

Total distributions | (152,927) | (254,554) |

Share transactions - net increase (decrease) | 242,986 | 327,553 |

Redemption fees | 97 | 305 |

Total increase (decrease) in net assets | 253,519 | 322,695 |

| | |

Net Assets | | |

Beginning of period | 4,613,683 | 4,290,988 |

End of period (including undistributed net investment income of $1,622 and undistributed net investment income of $3,814, respectively) | $ 4,867,202 | $ 4,613,683 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class A

| Six months ended April 30, | Years ended October 31, |

| 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 9.95 | $ 9.96 | $ 9.97 | $ 9.88 | $ 9.45 | $ 9.70 |

Income from Investment Operations | | | | | | |

Net investment income E | .313 | .571 | .404 | .285 | .292 | .352 |

Net realized and unrealized gain (loss) | .026 | (.022) | (.008) | .098 | .447 | (.264) |

Total from investment operations | .339 | .549 | .396 | .383 | .739 | .088 |

Distributions from net investment income | (.317) | (.560) | (.397) | (.295) | (.311) | (.339) |

Distributions from net realized gain | (.002) | - | (.010) | - | - | - |

Total distributions | (.319) | (.560) | (.407) | (.295) | (.311) | (.339) |

Redemption fees added to paid in capitalE | - I | .001 | .001 | .002 | .002 | .001 |

Net asset value, end of period | $ 9.97 | $ 9.95 | $ 9.96 | $ 9.97 | $ 9.88 | $ 9.45 |

Total ReturnB, C, D | 3.45% | 5.66% | 4.05% | 3.96% | 7.95% | .90% |

Ratios to Average Net AssetsF, H | | | | | |

Expenses before reductions | 1.02% A | 1.05% | 1.06% | 1.08% | 1.10% | 1.12% |

Expenses net of fee waivers, if any | 1.02% A | 1.05% | 1.06% | 1.08% | 1.10% | 1.10% |

Expenses net of all reductions | 1.01% A | 1.05% | 1.06% | 1.08% | 1.09% | 1.09% |

Net investment income | 6.33% A | 5.73% | 4.05% | 2.90% | 3.04% | 3.64% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 271 | $ 285 | $ 312 | $ 299 | $ 88 | $ 37 |

Portfolio turnover rate G | 71% A | 61% | 66% | 61% | 55% | 77% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class T

| Six months ended April 30, | Years ended October 31, |

| 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.94 | $ 9.95 | $ 9.96 | $ 9.87 | $ 9.44 | $ 9.69 |

Income from Investment Operations | | | | | | |

Net investment income E | .311 | .564 | .396 | .276 | .285 | .342 |

Net realized and unrealized gain (loss) | .026 | (.022) | (.007) | .098 | .446 | (.263) |

Total from investment operations | .337 | .542 | .389 | .374 | .731 | .079 |

Distributions from net investment income | (.315) | (.553) | (.390) | (.286) | (.303) | (.330) |

Distributions from net realized gain | (.002) | - | (.010) | - | - | - |

Total distributions | (.317) | (.553) | (.400) | (.286) | (.303) | (.330) |

Redemption fees added to paid in capital E | - I | .001 | .001 | .002 | .002 | .001 |

Net asset value, end of period | $ 9.96 | $ 9.94 | $ 9.95 | $ 9.96 | $ 9.87 | $ 9.44 |

Total Return B, C, D | 3.44% | 5.60% | 3.98% | 3.87% | 7.87% | .80% |

Ratios to Average Net Assets F, H | | | | | |

Expenses before reductions | 1.06% A | 1.11% | 1.13% | 1.17% | 1.18% | 1.20% |

Expenses net of fee waivers, if any | 1.06% A | 1.11% | 1.13% | 1.17% | 1.18% | 1.19% |

Expenses net of all reductions | 1.06% A | 1.11% | 1.13% | 1.17% | 1.18% | 1.19% |

Net investment income | 6.29% A | 5.67% | 3.98% | 2.81% | 2.96% | 3.54% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 414 | $ 472 | $ 511 | $ 389 | $ 113 | $ 75 |

Portfolio turnover rate G | 71% A | 61% | 66% | 61% | 55% | 77% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class B

| Six months ended April 30, | Years ended October 31, |

| 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.94 | $ 9.95 | $ 9.96 | $ 9.87 | $ 9.44 | $ 9.69 |

Income from Investment Operations | | | | | | |

Net investment income E | .285 | .513 | .346 | .231 | .243 | .298 |

Net realized and unrealized gain (loss) | .027 | (.022) | (.008) | .096 | .444 | (.263) |

Total from investment operations | .312 | .491 | .338 | .327 | .687 | .035 |

Distributions from net investment income | (.290) | (.502) | (.339) | (.239) | (.259) | (.286) |

Distributions from net realized gain | (.002) | - | (.010) | - | - | - |

Total distributions | (.292) | (.502) | (.349) | (.239) | (.259) | (.286) |

Redemption fees added to paid in capital E | - I | .001 | .001 | .002 | .002 | .001 |

Net asset value, end of period | $ 9.96 | $ 9.94 | $ 9.95 | $ 9.96 | $ 9.87 | $ 9.44 |

Total Return B, C, D | 3.17% | 5.06% | 3.46% | 3.38% | 7.38% | .35% |

Ratios to Average Net Assets F, H | | | | | |

Expenses before reductions | 1.58% A | 1.63% | 1.64% | 1.65% | 1.64% | 1.65% |

Expenses net of fee waivers, if any | 1.58% A | 1.63% | 1.64% | 1.65% | 1.63% | 1.64% |

Expenses net of all reductions | 1.58% A | 1.62% | 1.64% | 1.65% | 1.63% | 1.64% |

Net investment income | 5.76% A | 5.16% | 3.47% | 2.33% | 2.50% | 3.09% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 125 | $ 143 | $ 173 | $ 184 | $ 134 | $ 118 |

Portfolio turnover rate G | 71% A | 61% | 66% | 61% | 55% | 77% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class C

| Six months ended April 30, | Years ended October 31, |

| 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.95 | $ 9.96 | $ 9.97 | $ 9.87 | $ 9.45 | $ 9.70 |

Income from Investment Operations | | | | | | |

Net investment income E | .281 | .508 | .341 | .224 | .235 | .290 |

Net realized and unrealized gain (loss) | .026 | (.022) | (.008) | .107 | .434 | (.263) |

Total from investment operations | .307 | .486 | .333 | .331 | .669 | .027 |

Distributions from net investment income | (.285) | (.497) | (.334) | (.233) | (.251) | (.278) |

Distributions from net realized gain | (.002) | - | (.010) | - | - | - |

Total distributions | (.287) | (.497) | (.344) | (.233) | (.251) | (.278) |

Redemption fees added to paid in capital E | - I | .001 | .001 | .002 | .002 | .001 |

Net asset value, end of period | $ 9.97 | $ 9.95 | $ 9.96 | $ 9.97 | $ 9.87 | $ 9.45 |

Total Return B, C, D | 3.12% | 5.00% | 3.40% | 3.41% | 7.18% | .26% |

Ratios to Average Net Assets F, H | | | | | |

Expenses before reductions | 1.67% A | 1.68% | 1.69% | 1.71% | 1.72% | 1.73% |

Expenses net of fee waivers, if any | 1.67% A | 1.68% | 1.69% | 1.71% | 1.71% | 1.73% |

Expenses net of all reductions | 1.67% A | 1.68% | 1.69% | 1.71% | 1.71% | 1.73% |

Net investment income | 5.68% A | 5.10% | 3.42% | 2.27% | 2.42% | 3.00% |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 410 | $ 450 | $ 539 | $ 524 | $ 269 | $ 235 |

Portfolio turnover rate G | 71% A | 61% | 66% | 61% | 55% | 77% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Floating Rate High Income

| Six months ended April 30, | Years ended October 31, |

| 2007 | 2006 | 2005 | 2004 | 2003 | 2002 I |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 9.94 | $ 9.95 | $ 9.96 | $ 9.87 | $ 9.44 | $ 9.52 |

Income from Investment Operations | | | | | | |

Net investment income D | .325 | .593 | .427 | .309 | .311 | .040 |

Net realized and unrealized gain (loss) | .027 | (.021) | (.008) | .099 | .450 | (.084) |

Total from investment operations | .352 | .572 | .419 | .408 | .761 | (.044) |

Distributions from net investment income | (.330) | (.583) | (.420) | (.320) | (.333) | (.037) |

Distributions from net realized gain | (.002) | - | (.010) | - | - | - |

Total distributions | (.332) | (.583) | (.430) | (.320) | (.333) | (.037) |

Redemption fees added to paid in capital D | - H | .001 | .001 | .002 | .002 | .001 |

Net asset value, end of period | $ 9.96 | $ 9.94 | $ 9.95 | $ 9.96 | $ 9.87 | $ 9.44 |

Total Return B, C | 3.59% | 5.92% | 4.30% | 4.22% | 8.20% | (.45)% |

Ratios to Average Net Assets E, G | | | | | |

Expenses before reductions | .76% A | .81% | .82% | .84% | .86% | 1.15% A |

Expenses net of fee waivers, if any | .76% A | .81% | .82% | .84% | .86% | .95% A |

Expenses net of all reductions | .76% A | .81% | .82% | .84% | .86% | .94% A |

Net investment income | 6.59% A | 5.97% | 4.29% | 3.14% | 3.27% | 3.99% A |

Supplemental Data | | | | | | |

Net assets, end of period (in millions) | $ 3,332 | $ 2,989 | $ 2,471 | $ 1,982 | $ 811 | $ 18 |

Portfolio turnover rate F | 71% A | 61% | 66% | 61% | 55% | 77% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.