UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4707

Fidelity Advisor Series II

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | December 31 |

Date of reporting period: | June 30, 2007 |

Item 1. Reports to Stockholders

(Fidelity Investment logo)(registered trademark)

Fidelity® Advisor

Strategic Income

Fund - Class A, Class T, Class B

and Class C

Semiannual Report

June 30, 2007

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | Ned Johnson's message to shareholders. | |

Shareholder Expense Example | An example of shareholder expenses. | |

Investment Changes | A summary of major shifts in the fund's investments over the past six months. | |

Investments | A complete list of the fund's investments with their market values. | |

Financial Statements | Statements of assets and liabilities, operations, and changes in net assets, | |

Notes | Notes to the financial statements. | |

Board Approval of Investment Advisory Contracts and Management Fees |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com (search for "proxy voting guidelines") or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings report, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Stocks are currently on pace to register their fifth-straight year of positive returns, although gains could be trimmed if the U.S. economy continues to slow. While financial markets are always unpredictable, there are a number of time-tested principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third investment principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces unconstructive "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2007 to June 30, 2007).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semiannual Report

Investments - continued

Beginning | Ending | Expenses Paid | |

Class A | |||

Actual | $ 1,000.00 | $ 1,016.40 | $ 5.05 |

HypotheticalA | $ 1,000.00 | $ 1,019.79 | $ 5.06 |

Class T | |||

Actual | $ 1,000.00 | $ 1,016.40 | $ 5.00 |

HypotheticalA | $ 1,000.00 | $ 1,019.84 | $ 5.01 |

Class B | |||

Actual | $ 1,000.00 | $ 1,012.70 | $ 8.73 |

HypotheticalA | $ 1,000.00 | $ 1,016.12 | $ 8.75 |

Class C | |||

Actual | $ 1,000.00 | $ 1,012.50 | $ 8.98 |

HypotheticalA | $ 1,000.00 | $ 1,015.87 | $ 9.00 |

Institutional Class | |||

Actual | $ 1,000.00 | $ 1,017.40 | $ 3.90 |

HypotheticalA | $ 1,000.00 | $ 1,020.93 | $ 3.91 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annualized | |

Class A | 1.01% |

Class T | 1.00% |

Class B | 1.75% |

Class C | 1.80% |

Institutional Class | .78% |

Semiannual Report

Investment Changes

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of its investments in each Fidelity Central Fund.

Top Five Holdings as of June 30, 2007 | ||

(by issuer, excluding cash equivalents) | % of fund's | % of fund's net assets |

U.S. Treasury Obligations | 12.1 | 13.2 |

Fannie Mae | 10.3 | 10.8 |

Freddie Mac | 7.3 | 4.3 |

French Republic | 3.0 | 3.7 |

Japan Government | 2.2 | 2.5 |

34.9 | ||

Top Five Market Sectors as of June 30, 2007 | ||

% of fund's | % of fund's net assets | |

Consumer Discretionary | 9.3 | 8.7 |

Financials | 7.2 | 6.0 |

Telecommunication Services | 5.4 | 5.9 |

Information Technology | 4.3 | 4.6 |

Energy | 4.1 | 5.1 |

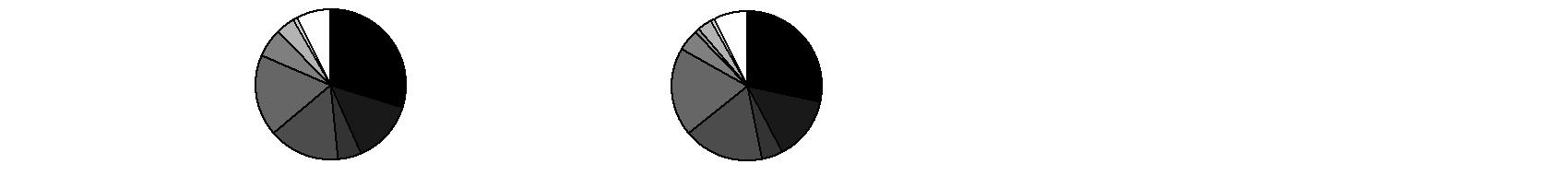

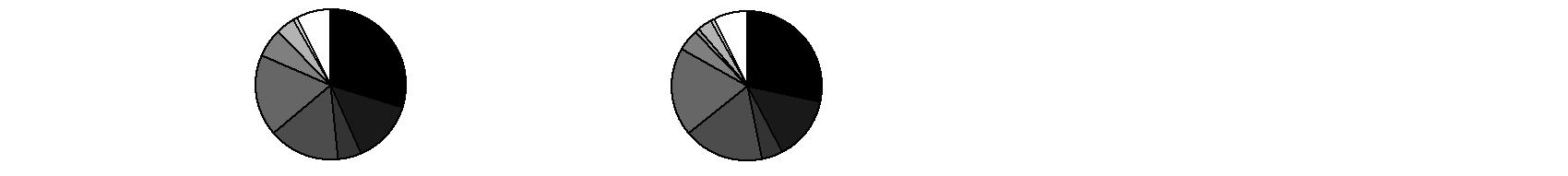

Quality Diversification (% of fund's net assets) as of June 30, 2007 | |||||||

As of June 30, 2007* | As of December 31, 2006** | ||||||

| U.S.Government |  | U.S.Government | ||||

| AAA,AA,A 13.7% |  | AAA,AA,A 14.1% | ||||

| BBB 5.0% |  | BBB 4.7% | ||||

| BB 15.5% |  | BB 17.7% | ||||

| B 17.7% |  | B 19.2% | ||||

| CCC,CC,C 6.1% |  | CCC,CC,C 4.7% | ||||

| D 0.0% |  | D 0.1% | ||||

| Not Rated 4.0% |  | Not Rated 3.0% | ||||

| Equities 0.6% |  | Equities 0.5% | ||||

| Short-Term |  | Short-Term | ||||

We have used ratings from Moody's® Investors Services, Inc. Where Moody's ratings are not available, we have used S&P® ratings. |

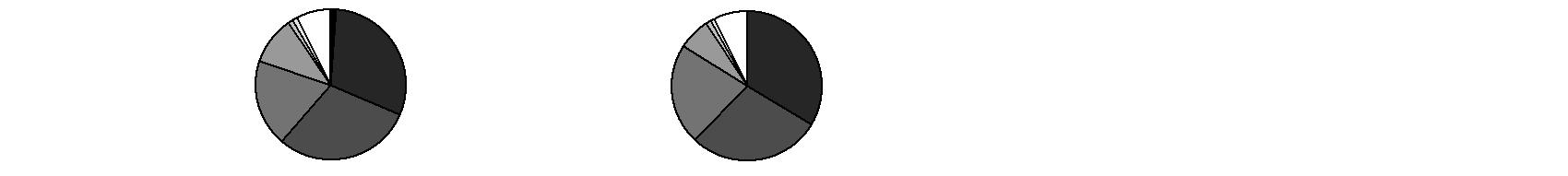

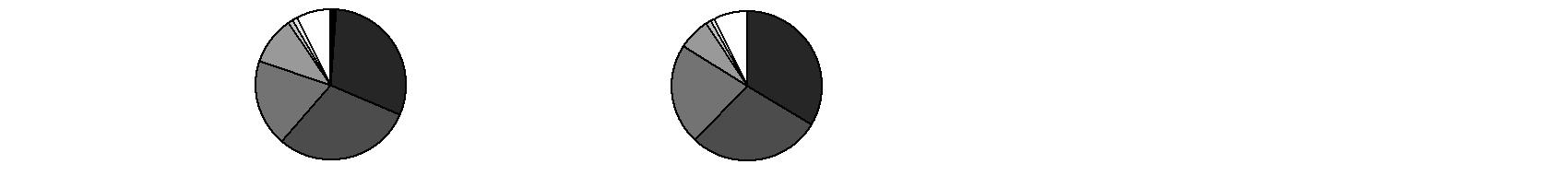

Asset Allocation (% of fund's net assets) | |||||||

As of June 30, 2007 | As of December 31, 2006 | ||||||

| Preferred Securities 0.8% |  | Preferred Securities 0.0% | ||||

| Corporate Bonds 30.6% |  | Corporate Bonds 33.9% | ||||

| U.S. Government |  | U.S. Government | ||||

| Foreign Government & Government Agency Obligations 18.9% |  | Foreign Government & Government Agency Obligations 21.9% | ||||

| Floating Rate Loans 10.3% |  | Floating Rate Loans 6.8% | ||||

| Stocks 0.6% |  | Stocks 0.5% | ||||

| Other Investments 1.4% |  | Other Investments 0.9% | ||||

| Short-Term |  | Short-Term | ||||

* Foreign | 28.5% | ** Foreign | 32.7% | ||||

* Swaps | 1.7% | ** Swaps | 0.0% | ||||

A holdings listing for the Fund, which presents direct holdings as well as the pro rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds is available at advisor.fidelity.com.

Semiannual Report

Investments June 30, 2007 (Unaudited)

Showing Percentage of Net Assets

Corporate Bonds - 30.1% | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Convertible Bonds - 0.2% | ||||

CONSUMER DISCRETIONARY - 0.1% | ||||

Media - 0.1% | ||||

Liberty Media Corp. (Sprint Corp. PCS Series 1) 3.75% 2/15/30 | $ 6,685 | $ 4,153 | ||

INFORMATION TECHNOLOGY - 0.1% | ||||

Semiconductors & Semiconductor Equipment - 0.1% | ||||

Advanced Micro Devices, Inc. 6% 5/1/15 (g) | 9,390 | 9,038 | ||

ON Semiconductor Corp. 0% 4/15/24 | 450 | 543 | ||

9,581 | ||||

TOTAL CONVERTIBLE BONDS | 13,734 | |||

Nonconvertible Bonds - 29.9% | ||||

CONSUMER DISCRETIONARY - 5.1% | ||||

Auto Components - 0.1% | ||||

Affinia Group, Inc. 9% 11/30/14 | 2,950 | 2,884 | ||

Delco Remy International, Inc.: | ||||

9.375% 4/15/12 (c) | 590 | 596 | ||

11% 5/1/09 (c) | 695 | 716 | ||

Visteon Corp. 7% 3/10/14 | 4,185 | 3,620 | ||

7,816 | ||||

Automobiles - 0.4% | ||||

General Motors Corp.: | ||||

8.375% 7/5/33 | EUR | 1,000 | 1,266 | |

8.375% 7/15/33 | 21,450 | 19,466 | ||

20,732 | ||||

Diversified Consumer Services - 0.1% | ||||

Affinion Group, Inc. 11.5% 10/15/15 | 2,990 | 3,229 | ||

Hotels, Restaurants & Leisure - 1.0% | ||||

Carrols Corp. 9% 1/15/13 | 4,095 | 4,023 | ||

Gaylord Entertainment Co.: | ||||

6.75% 11/15/14 | 3,690 | 3,616 | ||

8% 11/15/13 | 920 | 941 | ||

Landry's Seafood Restaurants, Inc. 7.5% 12/15/14 | 2,935 | 2,847 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

CONSUMER DISCRETIONARY - continued | ||||

Hotels, Restaurants & Leisure - continued | ||||

Mandalay Resort Group: | ||||

6.375% 12/15/11 | $ 4,220 | $ 4,209 | ||

6.5% 7/31/09 | 1,995 | 2,005 | ||

MGM Mirage, Inc.: | ||||

6% 10/1/09 | 1,050 | 1,038 | ||

6.625% 7/15/15 | 1,595 | 1,463 | ||

6.75% 9/1/12 | 1,310 | 1,269 | ||

6.75% 4/1/13 | 1,020 | 978 | ||

6.875% 4/1/16 | 1,935 | 1,804 | ||

7.5% 6/1/16 | 1,965 | 1,847 | ||

8.5% 9/15/10 | 435 | 458 | ||

Mohegan Tribal Gaming Authority 6.875% 2/15/15 | 2,140 | 2,081 | ||

Scientific Games Corp. 6.25% 12/15/12 | 660 | 632 | ||

Shingle Springs Tribal Gaming Authority 9.375% 6/15/15 (g) | 1,540 | 1,540 | ||

Six Flags, Inc.: | ||||

9.625% 6/1/14 | 1,095 | 1,013 | ||

9.75% 4/15/13 | 7,360 | 6,918 | ||

Speedway Motorsports, Inc. 6.75% 6/1/13 | 3,495 | 3,425 | ||

Town Sports International Holdings, Inc. 0% 2/1/14 (e) | 3,328 | 3,062 | ||

Universal City Development Partners Ltd./UCDP Finance, Inc. 11.75% 4/1/10 | 2,555 | 2,708 | ||

Vail Resorts, Inc. 6.75% 2/15/14 | 5,060 | 4,934 | ||

Virgin River Casino Corp./RBG LLC/B&BB, Inc.: | ||||

0% 1/15/13 (e) | 1,070 | 819 | ||

9% 1/15/12 | 575 | 592 | ||

Waterford Gaming LLC/Waterford Gaming Finance Corp. 8.625% 9/15/12 (g) | 413 | 432 | ||

Wheeling Island Gaming, Inc. 10.125% 12/15/09 | 735 | 744 | ||

55,398 | ||||

Household Durables - 0.0% | ||||

Urbi, Desarrollos Urbanos, SA de CV 8.5% 4/19/16 (g) | 1,660 | 1,746 | ||

Leisure Equipment & Products - 0.0% | ||||

Riddell Bell Holdings, Inc. 8.375% 10/1/12 | 720 | 709 | ||

Media - 2.7% | ||||

AMC Entertainment, Inc. 11% 2/1/16 | 2,610 | 2,923 | ||

Cablemas SA de CV (Reg. S) 9.375% 11/15/15 | 5,010 | 5,486 | ||

CanWest Media, Inc. 8% 9/15/12 | 860 | 860 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

CONSUMER DISCRETIONARY - continued | ||||

Media - continued | ||||

Charter Communications Holdings I LLC/Charter Communications Holdings I Capital Corp. 11% 10/1/15 | $ 9,708 | $ 10,059 | ||

Charter Communications Holdings II LLC/Charter Communications Holdings II Capital Corp.: | ||||

Series B, 10.25% 9/15/10 | 3,850 | 4,033 | ||

10.25% 9/15/10 | 2,720 | 2,836 | ||

CSC Holdings, Inc.: | ||||

7.25% 4/15/12 | 7,060 | 6,866 | ||

7.625% 4/1/11 | 2,580 | 2,561 | ||

7.625% 7/15/18 | 10,760 | 10,222 | ||

7.875% 2/15/18 | 12,905 | 12,357 | ||

EchoStar Communications Corp.: | ||||

6.375% 10/1/11 | 3,705 | 3,640 | ||

6.625% 10/1/14 | 9,095 | 8,731 | ||

7% 10/1/13 | 3,800 | 3,743 | ||

7.125% 2/1/16 | 4,615 | 4,523 | ||

Haights Cross Communications, Inc. 0% 8/15/11 (e) | 1,550 | 1,163 | ||

iesy Repository GmbH 10.375% 2/15/15 (g) | 2,090 | 2,153 | ||

Liberty Media Corp.: | ||||

8.25% 2/1/30 | 5,895 | 5,717 | ||

8.5% 7/15/29 | 13,390 | 13,372 | ||

Livent, Inc. yankee 9.375% 10/15/04 (c) | 300 | 3 | ||

MediMedia USA, Inc. 11.375% 11/15/14 (g) | 850 | 893 | ||

PanAmSat Corp.: | ||||

6.375% 1/15/08 | 490 | 488 | ||

9% 8/15/14 | 2,860 | 2,982 | ||

9% 6/15/16 | 2,240 | 2,358 | ||

Rainbow National LLC & RNS Co. Corp.: | ||||

8.75% 9/1/12 (g) | 3,280 | 3,428 | ||

10.375% 9/1/14 (g) | 14,415 | 15,857 | ||

Sun Media Corp. Canada 7.625% 2/15/13 | 635 | 640 | ||

The Reader's Digest Association, Inc. 9% 2/15/17 (g) | 3,000 | 2,805 | ||

TL Acquisitions, Inc.: | ||||

0% 7/15/15 (e)(g) | 10,390 | 7,805 | ||

10.5% 1/15/15 (g) | 10,480 | 10,166 | ||

Videotron Ltee 6.875% 1/15/14 | 550 | 534 | ||

149,204 | ||||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

CONSUMER DISCRETIONARY - continued | ||||

Multiline Retail - 0.2% | ||||

Dollar General Corp. 10.625% 7/15/15 (g) | $ 13,060 | $ 12,538 | ||

Specialty Retail - 0.4% | ||||

AutoNation, Inc. 7.3556% 4/15/13 (h) | 1,000 | 1,003 | ||

Claire's Stores, Inc. 10.5% 6/1/17 (g) | 2,110 | 1,946 | ||

Michaels Stores, Inc.: | ||||

0% 11/1/16 (e)(g) | 445 | 284 | ||

10% 11/1/14 (g) | 4,990 | 5,152 | ||

11.375% 11/1/16 (g) | 4,820 | 5,025 | ||

Sally Holdings LLC: | ||||

9.25% 11/15/14 (g) | 1,460 | 1,460 | ||

10.5% 11/15/16 (g) | 4,840 | 4,852 | ||

19,722 | ||||

Textiles, Apparel & Luxury Goods - 0.2% | ||||

Levi Strauss & Co.: | ||||

8.875% 4/1/16 | 7,535 | 7,723 | ||

9.75% 1/15/15 | 3,880 | 4,190 | ||

11,913 | ||||

TOTAL CONSUMER DISCRETIONARY | 283,007 | |||

CONSUMER STAPLES - 0.5% | ||||

Beverages - 0.0% | ||||

Cerveceria Nacional Dominicana C por A 16% 3/27/12 (g) | 1,560 | 1,728 | ||

Food & Staples Retailing - 0.1% | ||||

Rite Aid Corp.: | ||||

9.375% 12/15/15 (g) | 2,870 | 2,762 | ||

9.5% 6/15/17 (g) | 4,310 | 4,154 | ||

6,916 | ||||

Food Products - 0.3% | ||||

Bertin Ltda 10.25% 10/5/16 (g) | 1,685 | 1,849 | ||

Gruma SA de CV 7.75% | 5,310 | 5,390 | ||

Hines Nurseries, Inc. 10.25% 10/1/11 | 370 | 297 | ||

Michael Foods, Inc. 8% 11/15/13 | 420 | 422 | ||

National Beef Packing Co. LLC/National Beef Finance Corp. 10.5% 8/1/11 | 900 | 927 | ||

Reddy Ice Holdings, Inc. 0% 11/1/12 (e) | 3,250 | 3,023 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

CONSUMER STAPLES - continued | ||||

Food Products - continued | ||||

Smithfield Foods, Inc. 7.75% 7/1/17 | $ 2,810 | $ 2,789 | ||

Swift & Co. 10.125% 10/1/09 | 915 | 942 | ||

15,639 | ||||

Household Products - 0.0% | ||||

Central Garden & Pet Co. 9.125% 2/1/13 | 260 | 267 | ||

Personal Products - 0.0% | ||||

Elizabeth Arden, Inc. 7.75% 1/15/14 | 470 | 475 | ||

Tobacco - 0.1% | ||||

BAT Holdings BV 4.375% 9/15/14 | EUR | 1,500 | 1,925 | |

TOTAL CONSUMER STAPLES | 26,950 | |||

ENERGY - 3.3% | ||||

Energy Equipment & Services - 0.4% | ||||

Allis-Chalmers Energy, Inc. 8.5% 3/1/17 | 1,200 | 1,199 | ||

CHC Helicopter Corp. 7.375% 5/1/14 | 3,185 | 3,105 | ||

Complete Production Services, Inc. 8% 12/15/16 (g) | 4,670 | 4,717 | ||

Hanover Compressor Co.: | ||||

7.5% 4/15/13 | 530 | 531 | ||

8.625% 12/15/10 | 490 | 505 | ||

9% 6/1/14 | 4,260 | 4,505 | ||

Ocean Rig Norway AS 8.375% 7/1/13 (g) | 1,020 | 1,061 | ||

Petroliam Nasional BHD (Petronas) 7.625% 10/15/26 (Reg. S) | 2,920 | 3,432 | ||

Seabulk International, Inc. 9.5% 8/15/13 | 3,290 | 3,516 | ||

22,571 | ||||

Oil, Gas & Consumable Fuels - 2.9% | ||||

ANR Pipeline, Inc. 7.375% 2/15/24 | 2,165 | 2,306 | ||

Atlas Pipeline Partners LP 8.125% 12/15/15 | 4,710 | 4,739 | ||

Berry Petroleum Co. 8.25% 11/1/16 | 2,930 | 2,952 | ||

Chaparral Energy, Inc.: | ||||

8.5% 12/1/15 | 2,530 | 2,473 | ||

8.875% 2/1/17 (g) | 2,070 | 2,044 | ||

Chesapeake Energy Corp.: | ||||

6.5% 8/15/17 | 8,855 | 8,390 | ||

6.875% 11/15/20 | 7,280 | 6,971 | ||

7% 8/15/14 | 865 | 860 | ||

7.5% 6/15/14 | 850 | 867 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

ENERGY - continued | ||||

Oil, Gas & Consumable Fuels - continued | ||||

Chesapeake Energy Corp.: - continued | ||||

7.625% 7/15/13 | $ 8,300 | $ 8,508 | ||

Colorado Interstate Gas Co. 6.8% 11/15/15 | 5,320 | 5,466 | ||

Drummond Co., Inc. 7.375% 2/15/16 (g) | 4,000 | 3,760 | ||

Encore Acquisition Co. 6.25% 4/15/14 | 1,500 | 1,343 | ||

EXCO Resources, Inc. 7.25% 1/15/11 | 570 | 564 | ||

Forest Oil Corp. 8% 12/15/11 | 480 | 492 | ||

Gaz Capital SA (Luxembourg) 6.58% 10/31/13 | GBP | 900 | 1,784 | |

Harvest Operations Corp. 7.875% 10/15/11 | 1,170 | 1,147 | ||

InterNorth, Inc. 9.625% 3/16/06 (c) | 935 | 276 | ||

Mariner Energy, Inc. 8% 5/15/17 | 1,420 | 1,452 | ||

Massey Energy Co. 6.875% 12/15/13 | 6,330 | 5,760 | ||

Northwest Pipeline Corp. 6.625% 12/1/07 | 285 | 285 | ||

OPTI Canada, Inc. 7.875% 12/15/14 (g) | 5,250 | 5,263 | ||

Pan American Energy LLC 7.75% 2/9/12 (g) | 6,265 | 6,296 | ||

Peabody Energy Corp.: | ||||

7.375% 11/1/16 | 5,640 | 5,767 | ||

7.875% 11/1/26 | 5,640 | 5,866 | ||

Pemex Project Funding Master Trust: | ||||

5.5% 2/24/25 (g) | EUR | 750 | 988 | |

6.625% 6/15/35 | 6,020 | 6,110 | ||

Petrohawk Energy Corp. 9.125% 7/15/13 | 6,000 | 6,345 | ||

Petroleos de Venezuela SA 5.25% 4/12/17 | 3,385 | 2,564 | ||

Petrozuata Finance, Inc.: | ||||

7.63% 4/1/09 (g) | 7,420 | 7,291 | ||

8.22% 4/1/17 (g) | 6,748 | 6,579 | ||

Pogo Producing Co.: | ||||

6.875% 10/1/17 | 4,290 | 4,247 | ||

7.875% 5/1/13 | 2,605 | 2,664 | ||

Range Resources Corp. 7.375% 7/15/13 | 2,190 | 2,206 | ||

Ship Finance International Ltd. 8.5% 12/15/13 | 7,015 | 7,225 | ||

Southern Star Central Corp. 6.75% 3/1/16 | 1,560 | 1,513 | ||

Targa Resources, Inc./Targa Resources Finance Corp. 8.5% 11/1/13 (g) | 1,220 | 1,238 | ||

Tennessee Gas Pipeline Co.: | ||||

7% 10/15/28 | 550 | 561 | ||

7.5% 4/1/17 | 7,600 | 8,132 | ||

7.625% 4/1/37 | 1,035 | 1,128 | ||

8.375% 6/15/32 | 1,155 | 1,346 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

ENERGY - continued | ||||

Oil, Gas & Consumable Fuels - continued | ||||

Transcontinental Gas Pipe Line Corp.: | ||||

7% 8/15/11 | $ 330 | $ 343 | ||

8.875% 7/15/12 | 1,455 | 1,630 | ||

Venoco, Inc. 8.75% 12/15/11 | 1,470 | 1,525 | ||

W&T Offshore, Inc. 8.25% 6/15/14 (g) | 5,300 | 5,221 | ||

YPF SA 10% 11/2/28 | 4,335 | 5,478 | ||

159,965 | ||||

TOTAL ENERGY | 182,536 | |||

FINANCIALS - 6.1% | ||||

Capital Markets - 0.2% | ||||

E*TRADE Financial Corp. 7.375% 9/15/13 | 4,570 | 4,707 | ||

Mizuho Capital Investment Europe 1 Ltd. 5.02% (h) | EUR | 800 | 1,070 | |

Morgan Stanley 4.279% 7/20/12 (h) | EUR | 2,880 | 3,891 | |

9,668 | ||||

Commercial Banks - 1.4% | ||||

Banca Popolare di Bergamo 8.364% (h) | EUR | 1,000 | 1,490 | |

Banca Popolare di Lodi Investor Trust III 6.742% (h) | EUR | 1,300 | 1,839 | |

Banco Nacional de Desenvolvimento Economico e Social 5.84% 6/16/08 (h) | 18,175 | 18,039 | ||

Bank of Tokyo-Mitsubishi Ltd. 3.5% 12/16/15 (h) | EUR | 1,150 | 1,483 | |

BBVA Bancomer SA (Cayman Islands) (Reg. S) 4.799% 5/17/17 (h) | EUR | 1,725 | 2,289 | |

Caja Madrid SA 4.24% 10/17/16 (h) | EUR | 1,500 | 2,030 | |

Credit Agricole SA 4.184% 9/30/08 (h) | EUR | 1,000 | 1,353 | |

Development Bank of Philippines 8.375% (h) | 5,155 | 5,490 | ||

DnB NOR Bank ASA 4.5971% 8/11/09 (h) | CAD | 1,500 | 1,413 | |

Export-Import Bank of India 1.1944% 6/7/12 (h) | JPY | 320,000 | 2,594 | |

HBOS Treasury Services PLC 4.5571% 1/19/10 (h) | CAD | 1,500 | 1,412 | |

JPMorgan Chase Bank 4.375% 11/30/21 (h) | EUR | 1,500 | 1,894 | |

Korea Development Bank (Reg.) 0.87% 6/28/10 | JPY | 600,000 | 4,784 | |

Kyivstar GSM: | ||||

7.75% 4/27/12 (Issued by Dresdner Bank AG for Kyivstar GSM) (g) | 3,260 | 3,309 | ||

10.375% 8/17/09 (Issued by Dresdner Bank AG for Kyivstar GSM) (g) | 7,090 | 7,551 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

FINANCIALS - continued | ||||

Commercial Banks - continued | ||||

Santander Finance Preferred SA Unipersonal 7.005% (h) | GBP | 800 | $ 1,597 | |

Santander Issuances SA Unipersonal 5.75% 1/31/18 (h) | GBP | 800 | 1,550 | |

SMFG Finance Ltd. 6.164% (h) | GBP | 600 | 1,136 | |

Standard Chartered Bank: | ||||

3.625% 2/3/17 (f) | EUR | 385 | 491 | |

4.462% 3/28/18 (h) | EUR | 1,250 | 1,693 | |

Sumitomo Mitsui Banking Corp.: | ||||

(Reg. S) 4.375% (h) | EUR | 2,000 | 2,501 | |

1.6413% (h) | JPY | 100,000 | 819 | |

TuranAlem Finance BV 6.25% 9/27/11 | EUR | 1,750 | 2,306 | |

UniCredito Italiano Capital Trust I 4.028% (h) | EUR | 2,750 | 3,341 | |

Vimpel Communications: | ||||

8% 2/11/10 (Issued by UBS Luxembourg SA for Vimpel Communications) | 3,940 | 4,056 | ||

8.25% 5/23/16 (Issued by UBS Luxembourg SA for Vimpel Communications) | 3,170 | 3,309 | ||

79,769 | ||||

Consumer Finance - 1.3% | ||||

ACE Cash Express, Inc. 10.25% 10/1/14 (g) | 1,420 | 1,438 | ||

Ford Credit Europe PLC 5.164% 9/30/09 (h) | EUR | 1,500 | 2,002 | |

Ford Motor Credit Co. LLC 9.875% 8/10/11 | 7,610 | 7,988 | ||

General Motors Acceptance Corp.: | ||||

6.75% 12/1/14 | 9,520 | 9,092 | ||

6.875% 9/15/11 | 5,190 | 5,073 | ||

6.875% 8/28/12 | 6,460 | 6,314 | ||

8% 11/1/31 | 32,045 | 32,686 | ||

HSBC Finance Corp. 4.875% 5/30/17 | EUR | 2,450 | 3,221 | |

SLM Corp.: | ||||

4.295% 6/15/09 (h) | EUR | 550 | 726 | |

4.345% 12/15/10 (h) | EUR | 1,100 | 1,405 | |

69,945 | ||||

Diversified Financial Services - 1.9% | ||||

BA Covered Bond 4.125% 4/5/12 | EUR | 11,350 | 14,946 | |

Caisse d'Amort de la Dette Societe 4.125% 4/25/17 | EUR | 11,500 | 14,833 | |

Canada Housing Trust No.1 4.65% 9/15/09 | CAD | 16,600 | 15,561 | |

CCO Holdings LLC/CCO Holdings Capital Corp. 8.75% 11/15/13 | 4,520 | 4,588 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

FINANCIALS - continued | ||||

Diversified Financial Services - continued | ||||

CEMEX Finance Europe BV 4.75% 3/5/14 | EUR | 1,250 | $ 1,627 | |

Cerro Negro Finance Ltd.: | ||||

(Reg. S) 7.33% 12/1/09 | 1,845 | 1,817 | ||

7.33% 12/1/09 (g) | 1,788 | 1,761 | ||

CHR Intermediate Holding Corp. 12.61% 6/1/13 pay-in-kind (g)(h) | 1,340 | 1,335 | ||

Citigroup, Inc. 4.25% 2/25/30 (h) | EUR | 1,500 | 1,748 | |

DaimlerChrysler NA Holding Corp. 4.375% 3/16/10 | EUR | 1,350 | 1,802 | |

ExIm Ukraine 7.65% 9/7/11 (Issued by Credit Suisse London Branch for ExIm Ukraine) | 5,305 | 5,405 | ||

Getin Finance PLC 6.036% 5/13/09 (h) | EUR | 650 | 884 | |

Global Cash Access LLC/Global Cash Access Finance Corp. 8.75% 3/15/12 | 2,056 | 2,133 | ||

Hyundai Capital Services, Inc. 1.6% 3/14/08 | JPY | 300,000 | 2,443 | |

IFIL Finanziaria di Partecipazioni SpA 5.375% 6/12/17 | EUR | 1,450 | 1,931 | |

Imperial Tobacco Finance 4.375% 11/22/13 | EUR | 900 | 1,165 | |

KAR Holdings, Inc.: | ||||

8.75% 5/1/14 (g) | 1,990 | 1,950 | ||

10% 5/1/15 (g) | 2,100 | 2,048 | ||

Pakistan International Sukuk Co. Ltd. 7.6% 1/27/10 (h) | 5,110 | 5,219 | ||

Red Arrow International Leasing PLC 8.375% 3/31/12 | RUB | 37,575 | 1,514 | |

ROSBANK (OJSC JSCB) 8% 9/30/09 (Issued by Dali Capital PLC for ROSBANK (OJSC JSCB)) | RUB | 26,200 | 1,034 | |

OAO TMK 8.5% 9/29/09 (Issued by TMK Capital SA for OAO TMK) | 12,400 | 12,710 | ||

TransCapitalInvest Ltd. (Reg. S) 5.381% 6/27/12 | EUR | 1,400 | 1,881 | |

WaMu Covered Bond Program 4.375% 5/19/14 | EUR | 3,900 | 5,141 | |

105,476 | ||||

Insurance - 0.2% | ||||

Amlin PLC 6.5% 12/19/26 (h) | GBP | 1,000 | 1,867 | |

Eureko BV 5.125% (h) | EUR | 1,500 | 1,967 | |

Fukoku Mutual Life Insurance Co. 4.5% 9/28/25 (h) | EUR | 1,200 | 1,503 | |

Muenchener Rueckversicherungs-Gesellschaft AG 5.767% (h) | EUR | 1,800 | 2,393 | |

Novae Group plc 8.375% 4/27/17 (h) | GBP | 450 | 894 | |

Old Mutual plc 4.5% 1/18/17 (h) | EUR | 1,000 | 1,313 | |

Wuerttembergische Lebens AG 5.375% 6/1/26 (h) | EUR | 800 | 1,029 | |

10,966 | ||||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

FINANCIALS - continued | ||||

Real Estate Investment Trusts - 0.3% | ||||

BF Saul REIT 7.5% 3/1/14 | $ 3,400 | $ 3,400 | ||

Rouse Co. LP/TRC, Inc. 6.75% 5/1/13 (g) | 6,640 | 6,574 | ||

Senior Housing Properties Trust 7.875% 4/15/15 | 6,211 | 6,428 | ||

16,402 | ||||

Real Estate Management & Development - 0.8% | ||||

American Real Estate Partners/American Real Estate Finance Corp.: | ||||

7.125% 2/15/13 | 3,265 | 3,126 | ||

8.125% 6/1/12 | 2,590 | 2,577 | ||

Inversiones y Representaciones SA 8.5% 2/2/17 (g) | 5,590 | 5,338 | ||

Realogy Corp.: | ||||

10.5% 4/15/14 (g) | 16,525 | 15,781 | ||

11% 4/15/14 pay-in-kind (g) | 11,595 | 10,928 | ||

12.375% 4/15/15 (g) | 5,060 | 4,624 | ||

WT Finance (Aust) Pty Ltd./Westfield Europe Finance PLC/WEA Finance 3.625% 6/27/12 | EUR | 1,250 | 1,584 | |

43,958 | ||||

Thrifts & Mortgage Finance - 0.0% | ||||

China Development Bank 5% 10/15/15 | 175 | 166 | ||

Residential Capital Corp. 6.375% 5/17/13 | GBP | 500 | 939 | |

1,105 | ||||

TOTAL FINANCIALS | 337,289 | |||

HEALTH CARE - 1.0% | ||||

Health Care Equipment & Supplies - 0.0% | ||||

Invacare Corp. 9.75% 2/15/15 (g) | 1,530 | 1,538 | ||

Health Care Providers & Services - 0.9% | ||||

Cardinal Health 409, Inc. 9.5% 4/15/15 pay-in-kind (g) | 5,520 | 5,396 | ||

CRC Health Group, Inc. 10.75% 2/1/16 | 1,880 | 2,059 | ||

Fresenius Medical Care Capital Trust IV 7.875% 6/15/11 | 1,000 | 1,028 | ||

HCA, Inc.: | ||||

9.125% 11/15/14 (g) | 4,310 | 4,536 | ||

9.25% 11/15/16 (g) | 8,660 | 9,223 | ||

9.625% 11/15/16 pay-in-kind (g) | 10,995 | 11,833 | ||

Rural/Metro Corp. 9.875% 3/15/15 | 1,355 | 1,396 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

HEALTH CARE - continued | ||||

Health Care Providers & Services - continued | ||||

Skilled Healthcare Group, Inc. 11% 1/15/14 | $ 3,652 | $ 4,054 | ||

Sun Healthcare Group, Inc. 9.125% 4/15/15 (g) | 310 | 321 | ||

Team Finance LLC/Health Finance Corp. 11.25% 12/1/13 | 3,040 | 3,291 | ||

U.S. Oncology, Inc. 9% 8/15/12 | 1,300 | 1,333 | ||

Vanguard Health Holding Co. II LLC 9% 10/1/14 | 7,390 | 7,279 | ||

51,749 | ||||

Life Sciences Tools & Services - 0.0% | ||||

Bio-Rad Laboratories, Inc. 7.5% 8/15/13 | 1,770 | 1,788 | ||

Pharmaceuticals - 0.1% | ||||

Elan Finance PLC/Elan Finance Corp. 7.75% 11/15/11 | 1,585 | 1,597 | ||

Leiner Health Products, Inc. 11% 6/1/12 | 1,885 | 1,772 | ||

Mylan Laboratories, Inc. 6.375% 8/15/15 | 640 | 653 | ||

4,022 | ||||

TOTAL HEALTH CARE | 59,097 | |||

INDUSTRIALS - 2.0% | ||||

Aerospace & Defense - 0.2% | ||||

Alion Science & Technology Corp. 10.25% 2/1/15 | 800 | 830 | ||

Hawker Beechcraft Acquisition Co. LLC: | ||||

8.5% 4/1/15 (g) | 2,790 | 2,888 | ||

8.875% 4/1/15 pay-in-kind (g) | 2,790 | 2,853 | ||

9.75% 4/1/17 (g) | 2,790 | 2,909 | ||

Hexcel Corp. 6.75% 2/1/15 | 2,350 | 2,268 | ||

Orbimage Holdings, Inc. 14.8669% 7/1/12 (h) | 1,720 | 1,892 | ||

13,640 | ||||

Airlines - 0.1% | ||||

Continental Airlines, Inc. 6.903% 4/19/22 | 820 | 802 | ||

Delta Air Lines, Inc.: | ||||

7.9% 12/15/09 (a) | 16,400 | 1,148 | ||

10% 8/15/08 (a) | 1,255 | 88 | ||

Northwest Airlines Corp. 10% 2/1/09 (a) | 1,895 | 237 | ||

Northwest Airlines Trust 10.23% 6/21/14 | 229 | 234 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

INDUSTRIALS - continued | ||||

Airlines - continued | ||||

Northwest Airlines, Inc.: | ||||

7.875% 3/15/08 (a) | $ 1,365 | $ 177 | ||

8.875% 6/1/06 (a) | 1,355 | 166 | ||

2,852 | ||||

Building Products - 0.0% | ||||

Compagnie de St. Gobain 4.196% 4/11/12 (h) | EUR | 1,250 | 1,689 | |

Commercial Services & Supplies - 0.5% | ||||

ALH Finance LLC/ALH Finance Corp. 8.5% 1/15/13 | 160 | 159 | ||

Allied Security Escrow Corp. 11.375% 7/15/11 | 2,255 | 2,255 | ||

Allied Waste North America, Inc.: | ||||

6.5% 11/15/10 | 830 | 817 | ||

7.125% 5/15/16 | 5,645 | 5,525 | ||

Browning-Ferris Industries, Inc.: | ||||

7.4% 9/15/35 | 3,085 | 2,807 | ||

9.25% 5/1/21 | 680 | 721 | ||

FTI Consulting, Inc.: | ||||

7.625% 6/15/13 | 720 | 727 | ||

7.75% 10/1/16 | 1,390 | 1,423 | ||

Mac-Gray Corp. 7.625% 8/15/15 | 680 | 690 | ||

NCO Group, Inc. 11.875% 11/15/14 (g) | 2,930 | 2,989 | ||

R.H. Donnelley Finance Corp. I 10.875% 12/15/12 (g) | 550 | 587 | ||

West Corp.: | ||||

9.5% 10/15/14 | 5,850 | 5,974 | ||

11% 10/15/16 | 2,875 | 2,990 | ||

27,664 | ||||

Construction & Engineering - 0.0% | ||||

Blount, Inc. 8.875% 8/1/12 | 1,250 | 1,263 | ||

Electrical Equipment - 0.1% | ||||

Coleman Cable, Inc. 9.875% 10/1/12 (g) | 1,040 | 1,092 | ||

General Cable Corp. 7.125% 4/1/17 (g) | 680 | 680 | ||

Polypore International, Inc. 0% 10/1/12 (e) | 1,950 | 1,892 | ||

Sensus Metering Systems, Inc. 8.625% 12/15/13 | 900 | 923 | ||

4,587 | ||||

Industrial Conglomerates - 0.0% | ||||

Siemens Financieringsmaatschap NV 6.125% 9/14/66 (h) | GBP | 1,075 | 2,048 | |

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

INDUSTRIALS - continued | ||||

Machinery - 0.3% | ||||

Chart Industries, Inc. 9.125% 10/15/15 | $ 1,160 | $ 1,218 | ||

Cummins, Inc. 7.125% 3/1/28 | 2,250 | 2,239 | ||

Invensys PLC 9.875% 3/15/11 (g) | 56 | 59 | ||

RBS Global, Inc. / Rexnord Corp.: | ||||

8.875% 9/1/16 | 800 | 824 | ||

9.5% 8/1/14 | 4,100 | 4,346 | ||

11.75% 8/1/16 | 4,895 | 5,433 | ||

14,119 | ||||

Marine - 0.2% | ||||

CMA CGM SA (Reg. S) 5.5% 5/16/12 | EUR | 875 | 1,143 | |

H-Lines Finance Holding Corp. 0% 4/1/13 (e) | 1,424 | 1,367 | ||

Navios Maritime Holdings, Inc. 9.5% 12/15/14 (g) | 4,460 | 4,683 | ||

Ultrapetrol (Bahamas) Ltd. 9% 11/24/14 | 1,795 | 1,849 | ||

US Shipping Partners LP 13% 8/15/14 | 3,185 | 3,472 | ||

12,514 | ||||

Road & Rail - 0.3% | ||||

Kansas City Southern de Mexico, SA de CV: | ||||

7.375% 6/1/14 (g) | 3,480 | 3,445 | ||

7.625% 12/1/13 (g) | 1,700 | 1,700 | ||

Kansas City Southern Railway Co.: | ||||

7.5% 6/15/09 | 3,165 | 3,165 | ||

9.5% 10/1/08 | 1,350 | 1,404 | ||

TFM SA de CV 9.375% 5/1/12 | 6,450 | 6,885 | ||

16,599 | ||||

Trading Companies & Distributors - 0.3% | ||||

Glencore Finance (Europe) SA: | ||||

5.375% 9/30/11 | EUR | 800 | 1,085 | |

6.5% 2/27/19 | GBP | 600 | 1,152 | |

Neff Corp. 10% 6/1/15 (g) | 1,530 | 1,522 | ||

Penhall International Corp. 12% 8/1/14 (g) | 1,515 | 1,636 | ||

VWR Funding, Inc. 10.25% 7/15/15 (g) | 8,530 | 8,530 | ||

13,925 | ||||

TOTAL INDUSTRIALS | 110,900 | |||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

INFORMATION TECHNOLOGY - 3.3% | ||||

Communications Equipment - 0.7% | ||||

Hughes Network Systems LLC / HNS Finance Corp. 9.5% 4/15/14 | $ 6,290 | $ 6,573 | ||

Lucent Technologies, Inc.: | ||||

6.45% 3/15/29 | 17,840 | 15,432 | ||

6.5% 1/15/28 | 6,810 | 5,959 | ||

Nortel Networks Corp.: | ||||

9.6056% 7/15/11 (g)(h) | 3,760 | 3,995 | ||

10.125% 7/15/13 (g) | 3,730 | 4,000 | ||

10.75% 7/15/16 (g) | 3,760 | 4,127 | ||

40,086 | ||||

Electronic Equipment & Instruments - 0.1% | ||||

Celestica, Inc. 7.875% 7/1/11 | 2,960 | 2,849 | ||

IT Services - 0.6% | ||||

Iron Mountain, Inc.: | ||||

6.625% 1/1/16 | 10,955 | 10,024 | ||

7.75% 1/15/15 | 4,830 | 4,721 | ||

8.25% 7/1/11 | 535 | 535 | ||

8.625% 4/1/13 | 2,900 | 2,929 | ||

8.75% 7/15/18 | 5,160 | 5,315 | ||

SunGard Data Systems, Inc.: | ||||

9.125% 8/15/13 | 5,280 | 5,392 | ||

10.25% 8/15/15 | 3,620 | 3,810 | ||

32,726 | ||||

Office Electronics - 0.5% | ||||

Xerox Capital Trust I 8% 2/1/27 | 4,585 | 4,654 | ||

Xerox Corp.: | ||||

6.4% 3/15/16 | 8,000 | 8,032 | ||

7.2% 4/1/16 | 3,345 | 3,445 | ||

7.625% 6/15/13 | 12,425 | 12,906 | ||

29,037 | ||||

Semiconductors & Semiconductor Equipment - 1.4% | ||||

Amkor Technology, Inc. 9.25% 6/1/16 | 8,085 | 8,287 | ||

ASML Holding NV 5.75% 6/13/17 | EUR | 2,000 | 2,653 | |

Avago Technologies Finance Ltd.: | ||||

10.86% 6/1/13 (h) | 4,560 | 4,685 | ||

11.875% 12/1/15 | 8,045 | 8,950 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

INFORMATION TECHNOLOGY - continued | ||||

Semiconductors & Semiconductor Equipment - continued | ||||

Freescale Semiconductor, Inc.: | ||||

8.875% 12/15/14 (g) | $ 12,640 | $ 12,119 | ||

9.125% 12/15/14 pay-in-kind (g) | 22,855 | 21,571 | ||

10.125% 12/15/16 (g) | 14,445 | 13,578 | ||

MagnaChip Semiconductor SA/MagnaChip Semiconductor Finance Co. 8.61% 12/15/11 (h) | 735 | 671 | ||

New ASAT Finance Ltd. 9.25% 2/1/11 | 2,100 | 1,796 | ||

Viasystems, Inc. 10.5% 1/15/11 | 4,065 | 4,126 | ||

78,436 | ||||

Software - 0.0% | ||||

Open Solutions, Inc. 9.75% 2/1/15 (g) | 870 | 870 | ||

TOTAL INFORMATION TECHNOLOGY | 184,004 | |||

MATERIALS - 2.9% | ||||

Chemicals - 0.7% | ||||

America Rock Salt Co. LLC 9.5% 3/15/14 | 3,940 | 4,009 | ||

Bayer AG: | ||||

4.044% 4/10/10 (h) | EUR | 1,250 | 1,691 | |

5.625% 5/23/18 | GBP | 750 | 1,417 | |

Huntsman LLC 11.625% 10/15/10 | 466 | 500 | ||

JohnsonDiversey Holdings, Inc. 10.67% 5/15/13 | 6,095 | 6,278 | ||

MacDermid, Inc. 9.5% 4/15/17 (g) | 500 | 503 | ||

Momentive Performance Materials, Inc.: | ||||

9.75% 12/1/14 (g) | 4,390 | 4,401 | ||

10.125% 12/1/14 pay-in-kind (g) | 4,655 | 4,643 | ||

11.5% 12/1/16 (g) | 10,895 | 10,977 | ||

Phibro Animal Health Corp. 10% 8/1/13 (g) | 685 | 716 | ||

SABIC Europe BV 4.5% 11/28/13 | EUR | 1,250 | 1,603 | |

Sterling Chemicals, Inc. 10.25% 4/1/15 (g) | 1,600 | 1,656 | ||

38,394 | ||||

Construction Materials - 0.0% | ||||

Imerys 5% 4/18/17 | EUR | 1,450 | 1,898 | |

Containers & Packaging - 0.5% | ||||

AEP Industries, Inc. 7.875% 3/15/13 | 640 | 640 | ||

BWAY Corp. 10% 10/15/10 | 1,175 | 1,218 | ||

Constar International, Inc. 11% 12/1/12 | 2,530 | 2,391 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

MATERIALS - continued | ||||

Containers & Packaging - continued | ||||

Crown Cork & Seal, Inc.: | ||||

7.375% 12/15/26 | $ 355 | $ 339 | ||

7.5% 12/15/96 | 3,685 | 3,095 | ||

8% 4/15/23 | 2,980 | 2,920 | ||

Owens-Brockway Glass Container, Inc.: | ||||

6.75% 12/1/14 | 895 | 868 | ||

7.75% 5/15/11 | 320 | 328 | ||

8.25% 5/15/13 | 3,390 | 3,509 | ||

8.875% 2/15/09 | 1,029 | 1,042 | ||

Tekni-Plex, Inc. 10.875% 8/15/12 | 980 | 1,095 | ||

Vitro SAB de CV: | ||||

8.625% 2/1/12 (g) | 7,760 | 7,876 | ||

9.125% 2/1/17 (g) | 2,210 | 2,262 | ||

27,583 | ||||

Metals & Mining - 1.6% | ||||

Aleris International, Inc. 9% 12/15/14 (g) | 2,790 | 2,818 | ||

CAP SA 7.375% 9/15/36 (g) | 1,730 | 1,722 | ||

Compass Minerals International, Inc.: | ||||

0% 12/15/12 (e) | 1,330 | 1,370 | ||

0% 6/1/13 (e) | 2,260 | 2,249 | ||

Corporacion Nacional del Cobre (Codelco) 6.15% 10/24/36 (g) | 9,190 | 9,111 | ||

CSN Islands VIII Corp. 9.75% 12/16/13 (g) | 5,830 | 6,544 | ||

Evraz Group SA (Reg. S) 8.25% 11/10/15 | 5,200 | 5,317 | ||

Evraz Securities SA 10.875% 8/3/09 | 3,600 | 3,890 | ||

FMG Finance Property Ltd.: | ||||

10% 9/1/13 (g) | 2,285 | 2,516 | ||

10.625% 9/1/16 (g) | 2,285 | 2,688 | ||

Freeport-McMoRan Copper & Gold, Inc.: | ||||

6.875% 2/1/14 | 4,200 | 4,295 | ||

8.25% 4/1/15 | 4,070 | 4,284 | ||

8.375% 4/1/17 | 11,870 | 12,642 | ||

8.5463% 4/1/15 (h) | 6,945 | 7,292 | ||

Gerdau AmeriSteel Corp./GUSAP Partners 10.375% 7/15/11 | 1,335 | 1,402 | ||

Gerdau SA 8.875% (g) | 2,590 | 2,720 | ||

International Steel Group, Inc. 6.5% 4/15/14 | 10,550 | 10,946 | ||

Ispat Inland ULC 9.75% 4/1/14 | 932 | 1,025 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

MATERIALS - continued | ||||

Metals & Mining - continued | ||||

PNA Intermediate Holding Corp. 12.36% 2/15/13 pay-in-kind (g)(h) | $ 1,680 | $ 1,697 | ||

RathGibson, Inc. 11.25% 2/15/14 | 5,905 | 6,215 | ||

90,743 | ||||

Paper & Forest Products - 0.1% | ||||

Glatfelter 7.125% 5/1/16 | 550 | 547 | ||

NewPage Corp. 11.6063% 5/1/12 (h) | 1,770 | 1,938 | ||

2,485 | ||||

TOTAL MATERIALS | 161,103 | |||

TELECOMMUNICATION SERVICES - 4.6% | ||||

Diversified Telecommunication Services - 3.5% | ||||

British Telecommunications plc 5.25% 6/23/14 | EUR | 1,550 | 2,094 | |

Citizens Communications Co.: | ||||

7.875% 1/15/27 | 3,700 | 3,714 | ||

9% 8/15/31 | 8,370 | 8,621 | ||

Deutsche Telekom International Finance BV 4.5% 10/25/13 | EUR | 750 | 976 | |

Embarq Corp.: | ||||

7.082% 6/1/16 | 1,116 | 1,122 | ||

7.995% 6/1/36 | 16,780 | 17,029 | ||

Eschelon Operating Co. 8.375% 3/15/10 | 2,196 | 2,122 | ||

France Telecom SA 4.375% 2/21/12 | EUR | 550 | 724 | |

Intelsat Ltd.: | ||||

9.25% 6/15/16 | 2,240 | 2,369 | ||

11.25% 6/15/16 | 8,860 | 9,923 | ||

Level 3 Financing, Inc.: | ||||

8.75% 2/15/17 (g) | 8,590 | 8,472 | ||

12.25% 3/15/13 | 9,580 | 10,969 | ||

MobiFon Holdings BV 12.5% 7/31/10 | 7,225 | 7,695 | ||

Nordic Telephone Co. Holdings ApS 8.875% 5/1/16 (g) | 5,425 | 5,778 | ||

NTL Cable PLC: | ||||

8.75% 4/15/14 | 6,865 | 7,088 | ||

9.125% 8/15/16 | 3,065 | 3,218 | ||

PT Indosat International Finance Co. BV 7.125% 6/22/12 (g) | 1,845 | 1,859 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

TELECOMMUNICATION SERVICES - continued | ||||

Diversified Telecommunication Services - continued | ||||

Qwest Capital Funding, Inc.: | ||||

7.625% 8/3/21 | $ 370 | $ 348 | ||

7.75% 2/15/31 | 370 | 357 | ||

Qwest Corp.: | ||||

7.5% 10/1/14 | 760 | 777 | ||

7.875% 9/1/11 | 2,980 | 3,107 | ||

8.61% 6/15/13 (h) | 9,470 | 10,370 | ||

8.875% 3/15/12 | 24,535 | 26,436 | ||

Telecom Egypt SAE: | ||||

9.672% 2/4/10 (h) | EGP | 3,565 | 619 | |

10.95% 2/4/10 | EGP | 3,565 | 638 | |

Telefonica de Argentina SA 9.125% 11/7/10 | 2,817 | 2,972 | ||

Telenet Group Holding NV 0% 6/15/14 (e)(g) | 6,992 | 6,590 | ||

U.S. West Capital Funding, Inc.: | ||||

6.5% 11/15/18 | 285 | 257 | ||

6.875% 7/15/28 | 1,855 | 1,621 | ||

U.S. West Communications: | ||||

6.875% 9/15/33 | 27,138 | 25,510 | ||

7.125% 11/15/43 | 220 | 210 | ||

7.2% 11/10/26 | 875 | 886 | ||

7.25% 9/15/25 | 1,780 | 1,776 | ||

7.25% 10/15/35 | 5,830 | 5,619 | ||

7.5% 6/15/23 | 1,880 | 1,871 | ||

Wind Acquisition Finance SA 10.75% 12/1/15 (g) | 7,315 | 8,412 | ||

192,149 | ||||

Wireless Telecommunication Services - 1.1% | ||||

American Tower Corp. 7.125% 10/15/12 | 10,745 | 10,987 | ||

Centennial Cellular Operating Co./Centennial Communications Corp. 10.125% 6/15/13 | 7,015 | 7,524 | ||

Centennial Communications Corp./Centennial Cellular Operating Co. LLC/Centennial Puerto Rico Operations Corp. 8.125% 2/1/14 | 6,050 | 6,186 | ||

Digicel Ltd. 9.25% 9/1/12 (g) | 1,880 | 1,976 | ||

MetroPCS Wireless, Inc. 9.25% 11/1/14 (g) | 5,800 | 5,974 | ||

Millicom International Cellular SA 10% 12/1/13 | 8,835 | 9,575 | ||

Mobile Telesystems Finance SA 8.375% 10/14/10 (g) | 6,290 | 6,560 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

TELECOMMUNICATION SERVICES - continued | ||||

Wireless Telecommunication Services - continued | ||||

Pakistan Mobile Communications Ltd. 8.625% 11/13/13 (g) | $ 3,565 | $ 3,645 | ||

Telecom Personal SA 9.25% 12/22/10 (g) | 8,390 | 8,820 | ||

61,247 | ||||

TOTAL TELECOMMUNICATION SERVICES | 253,396 | |||

UTILITIES - 1.1% | ||||

Electric Utilities - 0.6% | ||||

Abu Dhabi National Energy Co. Pjsc 4.375% 10/28/13 | EUR | 1,250 | 1,619 | |

AES Gener SA 7.5% 3/25/14 | 3,410 | 3,546 | ||

Chivor SA E.S.P. 9.75% 12/30/14 (g) | 3,255 | 3,694 | ||

Compania de Transporte de Energia Electica de Alta Tension Transener SA 8.875% 12/15/16 (g) | 3,385 | 3,368 | ||

Edison Mission Energy: | ||||

7.5% 6/15/13 | 7,300 | 7,227 | ||

7.75% 6/15/16 | 3,710 | 3,678 | ||

National Power Corp. 6.875% 11/2/16 (g) | 1,715 | 1,706 | ||

Reliant Energy, Inc.: | ||||

7.625% 6/15/14 | 4,630 | 4,514 | ||

7.875% 6/15/17 | 3,680 | 3,588 | ||

32,940 | ||||

Gas Utilities - 0.3% | ||||

Southern Natural Gas Co.: | ||||

7.35% 2/15/31 | 7,350 | 7,718 | ||

8% 3/1/32 | 4,170 | 4,670 | ||

Transportadora de Gas del Sur SA 7.875% 5/14/17 (g) | 4,135 | 3,964 | ||

16,352 | ||||

Independent Power Producers & Energy Traders - 0.2% | ||||

Enron Corp.: | ||||

Series A, 8.375% 5/23/05 (c) | 2,500 | 725 | ||

6.4% 7/15/06 (c) | 9,815 | 2,895 | ||

6.625% 11/15/05 (c) | 2,200 | 649 | ||

6.725% 11/17/08 (c)(h) | 684 | 205 | ||

6.75% 8/1/09 (c) | 550 | 162 | ||

6.875% 10/15/07 (c) | 1,330 | 392 | ||

6.95% 7/15/28 (c) | 1,204 | 361 | ||

7.125% 5/15/49 (c) | 235 | 69 | ||

Corporate Bonds - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Nonconvertible Bonds - continued | ||||

UTILITIES - continued | ||||

Independent Power Producers & Energy Traders - continued | ||||

Enron Corp.: - continued | ||||

7.375% 5/15/19 (c) | $ 1,400 | $ 417 | ||

7.875% 6/15/03 (c) | 235 | 69 | ||

9.125% 4/1/03 (c) | 50 | 15 | ||

9.875% 6/5/03 (c) | 4,720 | 1,392 | ||

Tenaska Alabama Partners LP 7% 6/30/21 (g) | 1,108 | 1,130 | ||

8,481 | ||||

Multi-Utilities - 0.0% | ||||

Aquila, Inc. 14.875% 7/1/12 | 1,615 | 2,043 | ||

Utilicorp United, Inc. 9.95% 2/1/11 (h) | 39 | 42 | ||

2,085 | ||||

TOTAL UTILITIES | 59,858 | |||

TOTAL NONCONVERTIBLE BONDS | 1,658,140 | |||

TOTAL CORPORATE BONDS (Cost $1,642,298) | 1,671,874 | |||

U.S. Government and Government Agency Obligations - 20.8% | ||||

U.S. Government Agency Obligations - 8.7% | ||||

Fannie Mae: | ||||

3.25% 1/15/08 | 89,580 | 88,580 | ||

3.25% 2/15/09 | 40 | 39 | ||

4.125% 5/15/10 | 6,500 | 6,316 | ||

4.25% 5/15/09 | 4,940 | 4,859 | ||

4.75% 12/15/10 | 71,058 | 70,057 | ||

4.875% 4/15/09 | 13,935 | 13,856 | ||

5.125% 9/2/08 | 7,695 | 7,681 | ||

5.375% 6/12/17 | 21,150 | 20,983 | ||

6% 5/15/11 | 6,400 | 6,568 | ||

6.375% 6/15/09 | 1,650 | 1,686 | ||

6.625% 9/15/09 | 12,448 | 12,814 | ||

7.25% 1/15/10 | 17,761 | 18,615 | ||

Federal Home Loan Bank: | ||||

4.5% 10/14/08 | 5,975 | 5,919 | ||

5.8% 9/2/08 | 1,680 | 1,690 | ||

U.S. Government and Government Agency Obligations - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

U.S. Government Agency Obligations - continued | ||||

Freddie Mac: | ||||

3.625% 9/15/08 | $ 49,805 | $ 48,858 | ||

4% 8/17/07 | 521 | 520 | ||

4.125% 10/18/10 | 67,500 | 65,324 | ||

4.75% 3/5/09 | 49,987 | 49,612 | ||

4.875% 2/17/09 | 2,851 | 2,835 | ||

5.125% 4/18/08 | 14,000 | 13,976 | ||

5.125% 4/18/11 | 2,380 | 2,371 | ||

5.625% 3/15/11 | 15,000 | 15,200 | ||

5.75% 3/15/09 | 15,000 | 15,125 | ||

Israeli State (guaranteed by U.S. Government through Agency for International Development) 5.5% 9/18/23 | 4,750 | 4,712 | ||

Private Export Funding Corp.: | ||||

secured 5.685% 5/15/12 | 1,285 | 1,307 | ||

4.974% 8/15/13 | 1,515 | 1,488 | ||

Small Business Administration guaranteed development participation certificates Series 2003 P10B, 5.136% 8/10/13 | 1,128 | 1,107 | ||

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | 482,098 | |||

U.S. Treasury Inflation Protected Obligations - 0.7% | ||||

U.S. Treasury Inflation-Indexed Notes: | ||||

1.875% 7/15/13 | 17,417 | 16,700 | ||

2.375% 4/15/11 | 13,170 | 13,022 | ||

2.5% 7/15/16 | 7,674 | 7,591 | ||

TOTAL U.S. TREASURY INFLATION PROTECTED OBLIGATIONS | 37,313 | |||

U.S. Treasury Obligations - 11.4% | ||||

U.S. Treasury Bonds: | ||||

6.125% 8/15/29 | 100,150 | 112,340 | ||

6.25% 8/15/23 | 61,500 | 68,289 | ||

U.S. Treasury Notes: | ||||

4.25% 8/15/14 | 67,500 | 64,568 | ||

4.5% 11/15/15 | 30,500 | 29,418 | ||

4.625% 11/15/16 | 55,100 | 53,400 | ||

4.75% 2/28/09 | 63,000 | 62,808 | ||

4.75% 5/31/12 (m) | 167,602 | 166,293 | ||

U.S. Government and Government Agency Obligations - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

U.S. Treasury Obligations - continued | ||||

U.S. Treasury Notes: - continued | ||||

4.875% 4/30/08 | $ 61,537 | $ 61,455 | ||

5.125% 5/15/16 | 17,000 | 17,096 | ||

TOTAL U.S. TREASURY OBLIGATIONS | 635,667 | |||

TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $1,171,241) | 1,155,078 | |||

U.S. Government Agency - Mortgage Securities - 7.0% | ||||

Fannie Mae - 4.8% | ||||

3.585% 9/1/33 (h) | 814 | 800 | ||

3.72% 6/1/33 (h) | 2,502 | 2,497 | ||

3.75% 4/1/34 (h) | 2,593 | 2,549 | ||

3.783% 6/1/33 (h) | 2,981 | 2,987 | ||

3.902% 5/1/34 (h) | 1,365 | 1,345 | ||

3.91% 5/1/33 (h) | 904 | 909 | ||

3.918% 9/1/33 (h) | 2,460 | 2,439 | ||

3.944% 5/1/34 (h) | 1,052 | 1,037 | ||

3.962% 9/1/33 (h) | 1,882 | 1,862 | ||

3.998% 4/1/34 (h) | 2,399 | 2,366 | ||

4% 9/1/13 to 5/1/20 | 5,040 | 4,710 | ||

4.003% 8/1/33 (h) | 1,155 | 1,141 | ||

4.031% 3/1/34 (h) | 4,503 | 4,445 | ||

4.036% 6/1/34 (h) | 1,928 | 1,901 | ||

4.068% 3/1/35 (h) | 3,537 | 3,503 | ||

4.12% 4/1/34 (h) | 2,975 | 2,941 | ||

4.126% 5/1/34 (h) | 2,377 | 2,351 | ||

4.188% 11/1/34 (h) | 2,587 | 2,599 | ||

4.205% 6/1/34 (h) | 2,112 | 2,085 | ||

4.288% 6/1/34 (h) | 2,339 | 2,318 | ||

4.355% 10/1/19 (h) | 261 | 258 | ||

4.4% 8/1/34 (h) | 5,380 | 5,403 | ||

4.419% 8/1/34 (h) | 5,588 | 5,529 | ||

4.482% 1/1/35 (h) | 1,240 | 1,223 | ||

4.484% 12/1/34 (h) | 97 | 96 | ||

4.485% 11/1/33 (h) | 304 | 302 | ||

4.5% 5/1/18 to 12/1/18 | 7,695 | 7,333 | ||

4.638% 8/1/35 (h) | 1,308 | 1,302 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Fannie Mae - continued | ||||

4.655% 10/1/34 (h) | $ 733 | $ 726 | ||

4.688% 2/1/35 (h) | 3,630 | 3,590 | ||

4.733% 12/1/35 (h) | 8,706 | 8,652 | ||

4.784% 12/1/35 (h) | 926 | 924 | ||

4.79% 6/1/35 (h) | 1,524 | 1,506 | ||

4.799% 4/1/35 (h) | 2,413 | 2,416 | ||

4.8% 7/1/35 (h) | 1,046 | 1,033 | ||

4.809% 1/1/36 (h) | 5,203 | 5,149 | ||

4.812% 11/1/35 (h) | 2,003 | 2,008 | ||

4.848% 7/1/35 (h) | 2,191 | 2,165 | ||

4.878% 7/1/34 (h) | 1,234 | 1,229 | ||

4.883% 10/1/35 (h) | 285 | 284 | ||

4.893% 5/1/35 (h) | 348 | 344 | ||

4.896% 11/1/35 (h) | 2,154 | 2,153 | ||

4.946% 8/1/34 (h) | 1,189 | 1,186 | ||

5% 1/1/14 to 7/1/35 | 31,074 | 30,124 | ||

5.004% 2/1/34 (h) | 1,839 | 1,817 | ||

5.016% 5/1/35 (h) | 2,868 | 2,847 | ||

5.047% 12/1/32 (h) | 1,763 | 1,756 | ||

5.092% 5/1/35 (h) | 373 | 376 | ||

5.102% 10/1/35 (h) | 1,640 | 1,626 | ||

5.108% 10/1/35 (h) | 884 | 877 | ||

5.114% 1/1/36 (h) | 3,241 | 3,212 | ||

5.135% 7/1/34 (h) | 453 | 452 | ||

5.136% 8/1/36 (h) | 6,221 | 6,228 | ||

5.152% 7/1/35 (h) | 3,457 | 3,436 | ||

5.167% 3/1/36 (h) | 2,797 | 2,783 | ||

5.26% 5/1/35 (h) | 1,118 | 1,114 | ||

5.263% 11/1/36 (h) | 528 | 529 | ||

5.273% 4/1/36 (h) | 1,127 | 1,137 | ||

5.311% 3/1/36 (h) | 7,478 | 7,450 | ||

5.365% 2/1/36 (h) | 1,854 | 1,859 | ||

5.371% 2/1/36 (h) | 193 | 194 | ||

5.379% 12/1/36 (h) | 712 | 711 | ||

5.394% 7/1/35 (h) | 522 | 521 | ||

5.407% 2/1/37 (h) | 688 | 688 | ||

5.439% 2/1/37 (h) | 3,260 | 3,266 | ||

5.483% 6/1/47 (h) | 540 | 541 | ||

5.5% 5/1/11 to 3/1/20 | 23,487 | 23,242 | ||

5.533% 11/1/36 (h) | 1,047 | 1,050 | ||

5.612% 2/1/36 (h) | 781 | 782 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Fannie Mae - continued | ||||

5.668% 4/1/36 (h) | $ 2,752 | $ 2,759 | ||

5.672% 6/1/36 (h) | 1,810 | 1,815 | ||

5.672% 4/1/37 (h) | 2,982 | 2,996 | ||

5.755% 4/1/36 (h) | 1,456 | 1,461 | ||

5.797% 3/1/36 (h) | 1,960 | 1,969 | ||

5.807% 5/1/36 (h) | 723 | 727 | ||

5.816% 1/1/36 (h) | 408 | 408 | ||

5.834% 3/1/36 (h) | 1,559 | 1,567 | ||

5.839% 5/1/36 (h) | 4,312 | 4,334 | ||

5.847% 6/1/35 (h) | 2,683 | 2,697 | ||

5.895% 12/1/36 (h) | 1,046 | 1,051 | ||

5.925% 6/1/36 (h) | 15,800 | 15,899 | ||

5.937% 6/1/36 (h) | 3,882 | 3,908 | ||

5.946% 5/1/36 (h) | 1,875 | 1,888 | ||

6% 10/1/08 to 1/1/26 | 2,639 | 2,655 | ||

6.044% 4/1/36 (h) | 11,302 | 11,399 | ||

6.226% 3/1/37 (h) | 330 | 333 | ||

6.5% 12/1/12 to 3/1/35 | 3,565 | 3,625 | ||

7% 9/1/25 | 4 | 4 | ||

7.5% 1/1/28 to 5/1/37 | 1,038 | 1,076 | ||

TOTAL FANNIE MAE | 262,785 | |||

Freddie Mac - 2.2% | ||||

3.378% 7/1/33 (h) | 1,862 | 1,845 | ||

4% 5/1/19 to 11/1/20 | 5,497 | 5,097 | ||

4.004% 5/1/33 (h) | 3,773 | 3,765 | ||

4.179% 1/1/35 (h) | 3,592 | 3,559 | ||

4.5% 2/1/18 to 8/1/33 | 4,527 | 4,285 | ||

4.569% 6/1/33 (h) | 1,179 | 1,179 | ||

4.663% 2/1/35 (h) | 9,011 | 8,870 | ||

4.701% 9/1/36 (h) | 749 | 745 | ||

4.705% 9/1/35 (h) | 4,517 | 4,501 | ||

4.794% 2/1/36 (h) | 315 | 310 | ||

4.842% 5/1/35 (h) | 6,127 | 6,041 | ||

4.873% 10/1/35 (h) | 1,500 | 1,501 | ||

4.924% 10/1/36 (h) | 3,780 | 3,769 | ||

5% 3/1/18 to 7/1/19 | 6,467 | 6,275 | ||

5.013% 7/1/35 (h) | 3,655 | 3,625 | ||

5.021% 4/1/35 (h) | 103 | 101 | ||

5.126% 7/1/35 (h) | 1,015 | 1,005 | ||

5.289% 2/1/36 (h) | 63 | 62 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Freddie Mac - continued | ||||

5.362% 3/1/37 (h) | $ 500 | $ 498 | ||

5.489% 2/1/37 (h) | 2,722 | 2,703 | ||

5.498% 1/1/36 (h) | 851 | 848 | ||

5.5% 8/1/14 to 11/1/19 | 7,863 | 7,765 | ||

5.586% 3/1/36 (h) | 4,614 | 4,604 | ||

5.625% 5/1/37 (h) | 2,410 | 2,383 | ||

5.673% 8/1/36 (h) | 4,824 | 4,818 | ||

5.732% 4/1/36 (h) | 11,518 | 11,526 | ||

5.806% 5/1/37 (h) | 5,606 | 5,613 | ||

5.858% 5/1/37 (h) | 540 | 542 | ||

5.863% 5/1/37 (h) | 3,355 | 3,364 | ||

6% 7/1/16 to 2/1/19 | 2,873 | 2,889 | ||

6.084% 2/1/37 (h) | 5,250 | 5,283 | ||

6.157% 12/1/36 (h) | 5,772 | 5,802 | ||

6.5% 10/1/10 to 3/1/22 | 7,591 | 7,731 | ||

8.5% 3/1/20 | 11 | 12 | ||

TOTAL FREDDIE MAC | 122,916 | |||

Government National Mortgage Association - 0.0% | ||||

6% 1/15/09 to 5/15/09 | 25 | 25 | ||

6.5% 4/15/26 to 5/15/26 | 47 | 48 | ||

7% 9/15/25 to 8/15/31 | 85 | 88 | ||

7.5% 2/15/22 to 8/15/28 | 149 | 156 | ||

8% 9/15/26 to 12/15/26 | 33 | 35 | ||

TOTAL GOVERNMENT NATIONAL MORTGAGE ASSOCIATION | 352 | |||

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $387,808) | 386,053 | |||

Asset-Backed Securities - 0.5% | ||||

Amstel Corp. Loan Offering BV: | ||||

Series 2006-1 Class C, 4.566% 5/25/16 (h) | EUR | 500 | 678 | |

Series 2007-1: | ||||

Class B, 4.429% 3/25/17 (h) | EUR | 1,100 | 1,489 | |

Class C, 4.609% 3/25/17 (h) | EUR | 800 | 1,083 | |

Auto ABS Compartiment Series 2006-1 Class B, 4.242% 7/25/17 (h) | EUR | 1,000 | 1,354 | |

Clock Finance BV Series 2007-1: | ||||

Class B2, 4.256% 2/25/15 (h) | EUR | 700 | 947 | |

Asset-Backed Securities - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Clock Finance BV Series 2007-1: - continued | ||||

Class C2, 4.436% 2/25/15 (h) | EUR | 400 | $ 541 | |

Driver One GmbH Series 1 Class B, 4.343% 5/21/10 (h) | EUR | 176 | 239 | |

FCC SPARC Series 2007-1 Class D, 0% 7/15/10 (h) | EUR | 500 | 677 | |

Geldilux Ltd. Series 2007-TS Class C, 4.517% 9/8/14 (h) | EUR | 400 | 541 | |

GLS Ltd. Series 2006-1 Class C, 4.257% 7/15/14 (h) | EUR | 500 | 677 | |

Greene King Finance PLC Series A1, 6.23% 6/15/31 (h) | GBP | 1,000 | 2,001 | |

Lambda Finance BV Series 2005-1X Class C1, 6.374% 11/15/29 (h) | GBP | 500 | 1,008 | |

Leek Finance PLC Series 18X Class BC, 4.292% 9/21/38 (h) | EUR | 600 | 812 | |

Mermaid Secured Finance Ltd. Series 2007-1: | ||||

Class C, 4.416% 1/30/40 (h) | EUR | 400 | 542 | |

Class D, 4.616% 1/30/40 (h) | EUR | 550 | 745 | |

Prime Bricks Series 2007-1: | ||||

Class B, 4.416% 1/30/40 (h) | EUR | 550 | 745 | |

Class C, 4.616% 1/30/40 (h) | EUR | 450 | 609 | |

Promise K 2006-1 GmbH Series I 2006-1 Class D, 4.805% 3/20/17 (h) | EUR | 1,000 | 1,354 | |

Provide Bricks Series 2007-1 Class B, 4.365% 1/30/40 (h) | EUR | 1,400 | 1,895 | |

Punch Taverns Finance PLC 5.92% 4/15/09 (h) | GBP | 410 | 822 | |

Sedna Finance Corp.: | ||||

4.779% 12/23/14 (h) | EUR | 500 | 677 | |

4.895% 3/15/16 (h) | EUR | 1,150 | 1,560 | |

Stichting Mars Series 2006 Class C, 4.163% 8/28/14 (h) | EUR | 1,000 | 1,353 | |

Unique Public Finance Co. PLC Series A4, 5.659% 6/30/27 | GBP | 60 | 117 | |

Whinstone Capital Management Ltd. Series 2005-1X Class B1, 6.5963% 10/25/45 (h) | GBP | 1,168 | 2,356 | |

TOTAL ASSET-BACKED SECURITIES (Cost $23,720) | 24,822 | |||

Collateralized Mortgage Obligations - 2.3% | ||||

Private Sponsor - 0.2% | ||||

EPIC PLC Series BROD Class D, 4.465% 1/22/16 (h) | EUR | 400 | 541 | |

Granite Mortgages PLC 4.349% 1/20/43 (h) | EUR | 341 | 463 | |

Collateralized Mortgage Obligations - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Private Sponsor - continued | ||||

Holmes Financing No. 8 PLC floater Series 3 Class C, 4.818% 7/15/40 (h) | EUR | 500 | $ 680 | |

RMAC PLC Series 2005-NS4X Class M2A, 6.3675% 12/12/43 (h) | GBP | 1,700 | 3,409 | |

RMAC Securities PLC 2006 floater Series 2006-NS4X Class M1A, 6.1075% 6/12/44 (h) | GBP | 1,250 | 2,509 | |

Shield BV Series 1 Class C, 4.369% 1/20/14 (h) | EUR | 1,500 | 2,037 | |

TOTAL PRIVATE SPONSOR | 9,639 | |||

U.S. Government Agency - 2.1% | ||||

Fannie Mae planned amortization class Series 2002-83 Class ME, 5% 12/25/17 | 8,925 | 8,633 | ||

Fannie Mae Grantor Trust sequential payer Series 2005-93 Class HD, 4.5% 11/25/19 | 272 | 263 | ||

Fannie Mae subordinate REMIC pass-thru certificates: | ||||

floater Series 2005-45 Class XA, 5.66% 6/25/35 (h) | 7,424 | 7,417 | ||

planned amortization class: | ||||

Series 2002-11 Class UC, 6% 3/25/17 | 2,787 | 2,807 | ||

Series 2003-113: | ||||

Class PD, 4% 2/25/17 | 4,890 | 4,622 | ||

Class PE, 4% 11/25/18 | 1,515 | 1,356 | ||

Series 2003-128 Class NE, 4% 12/25/16 | 2,550 | 2,409 | ||

Series 2003-70 Class BJ, 5% 7/25/33 | 890 | 812 | ||

Series 2003-85 Class GD, 4.5% 9/25/18 | 1,225 | 1,159 | ||

Series 2004-80 Class LD, 4% 1/25/19 | 1,980 | 1,850 | ||

Series 2004-81: | ||||

Class KC, 4.5% 4/25/17 | 1,395 | 1,360 | ||

Class KD, 4.5% 7/25/18 | 3,035 | 2,894 | ||

Series 2006-4 Class PB, 6% 9/25/35 | 6,570 | 6,570 | ||

sequential payer: | ||||

Series 2002-58 Class HC, 5.5% 9/25/17 | 13 | 13 | ||

Series 2003-18 Class EY, 5% 6/25/17 | 3,771 | 3,711 | ||

Series 2004-95 Class AN, 5.5% 1/25/25 | 2,260 | 2,240 | ||

Series 2005-117, Class JN, 4.5% 1/25/36 | 808 | 692 | ||

Series 2005-29 Class KA, 4.5% 2/25/35 | 2,857 | 2,740 | ||

Series 2005-47 Class AK, 5% 6/25/20 | 7,595 | 7,237 | ||

Freddie Mac planned amortization class Series 2115 Class PE, 6% 1/15/14 | 215 | 215 | ||

Freddie Mac Multi-class participation certificates guaranteed: | ||||

floater Series 2630 Class FL, 5.82% 6/15/18 (h) | 104 | 105 | ||

Collateralized Mortgage Obligations - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

U.S. Government Agency - continued | ||||

Freddie Mac Multi-class participation certificates guaranteed: - continued | ||||

planned amortization class: | ||||

Series 2378 Class PE, 5.5% 11/15/16 | $ 2,927 | $ 2,921 | ||

Series 2622 Class PE, 4.5% 5/15/18 | 9,410 | 8,918 | ||

Series 2628 Class OP, 3.5% 11/15/13 | 1,869 | 1,853 | ||

Series 2649 Class TQ, 3.5% 12/15/21 | 1,178 | 1,168 | ||

Series 2695 Class DG, 4% 10/15/18 | 3,865 | 3,522 | ||

Series 2743 Class HE, 4.5% 2/15/19 | 4,390 | 4,126 | ||

Series 2773 Class EG, 4.5% 4/15/19 | 14,395 | 13,553 | ||

Series 2831 Class PB, 5% 7/15/19 | 3,990 | 3,839 | ||

Series 2996 Class MK, 5.5% 6/15/35 | 942 | 936 | ||

Series 3013 Class AF, 5.57% 5/15/35 (h) | 8,995 | 8,989 | ||

sequential payer: | ||||

Series 2570 Class CU, 4.5% 7/15/17 | 386 | 375 | ||

Series 2572 Class HK, 4% 2/15/17 | 580 | 561 | ||

Series 2617 Class GW, 3.5% 6/15/16 | 554 | 544 | ||

Series 2627: | ||||

Class BG, 3.25% 6/15/17 | 256 | 240 | ||

Class KP, 2.87% 12/15/16 | 268 | 251 | ||

Series 2685 Class ND, 4% 10/15/18 | 1,745 | 1,554 | ||

Series 2773 Class TA, 4% 11/15/17 | 3,195 | 3,058 | ||

Series 2849 Class AL, 5% 5/15/18 | 1,541 | 1,506 | ||

Series 2860 Class CP, 4% 10/15/17 | 506 | 490 | ||

Series 2937 Class HJ, 5% 10/15/19 | 1,822 | 1,787 | ||

Series 2863 Class DB, 4% 9/15/14 | 266 | 250 | ||

TOTAL U.S. GOVERNMENT AGENCY | 119,546 | |||

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $129,305) | 129,185 | |||

Commercial Mortgage Securities - 0.4% | ||||

Broadgate PLC 6.435% 10/5/25 (h) | GBP | 955 | 1,889 | |

Bruntwood Alpha PLC Series 2007-1 Class C, 6.09% 1/15/17 (h) | GBP | 700 | 1,406 | |

Canary Wharf Finance II plc Series 3MUK Class C2, 6.2244% 10/22/37 (h) | GBP | 1,000 | 2,007 | |

European Property Capital Series 4 Class C, 5.9494% 7/20/14 (h) | GBP | 442 | 888 | |

Commercial Mortgage Securities - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

German Residential Asset Note Distributor PLC Series 1 Class A, 4.219% 7/20/16 (h) | EUR | 1,371 | $ 1,862 | |

JLOC 36 LLC Reg. S: | ||||

Class A1, 0.9348% 2/16/16 (h) | JPY | 100,000 | 812 | |

Class B, 1.1048% 2/16/16 (h) | JPY | 100,000 | 812 | |

JLOC 37 LLC (Reg. S) 0% 1/15/15 (h) | JPY | 110,000 | 893 | |

Opera Finance (CMH) PLC Class B, 4.268% 1/15/15 (h) | EUR | 1,100 | 1,488 | |

Opera Finance PLC 5.9763% 7/31/13 (h) | GBP | 991 | 1,992 | |

Paris Prime Community Real Estate Series 2006-1 Class B, 4.235% 4/22/14 (g)(h) | EUR | 1,000 | 1,352 | |

Real Estate Capital Foundation Ltd. Series 3 Class A, 5.8% 7/15/16 (h) | GBP | 2,000 | 4,009 | |

Rivoli Pan Europe PLC Series 2006-1 Class B 4.297% 8/3/18 (h) | EUR | 650 | 879 | |

Skyline BV Series 2007-1 Class D, 0% 7/22/43 (h) | EUR | 1,100 | 1,489 | |

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $20,700) | 21,778 | |||

Foreign Government and Government Agency Obligations - 18.9% | ||||

Arab Republic 8.6002% 10/9/07 | EGP | 5,150 | 888 | |

Argentine Republic: | ||||

discount (with partial capitalization through 12/31/13) 8.28% 12/31/33 | 9,218 | 8,992 | ||

5.475% 8/3/12 (h) | 13,114 | 12,458 | ||

7% 3/28/11 | 10,620 | 10,365 | ||

7% 9/12/13 | 18,845 | 17,536 | ||

10.4173% 3/5/08 (h) | ARS | 5,964 | 1,938 | |

Austrian Republic 5% 12/20/24 (g) | CAD | 2,000 | 1,894 | |

Banco Central del Uruguay: | ||||

value recovery A rights 1/2/21 (a) (j) | 1,000,000 | 0 | ||

value recovery B rights 1/2/21 (a) (j) | 750,000 | 0 | ||

Brazilian Federative Republic: | ||||

6% 9/15/13 | 1,842 | 1,840 | ||

7.125% 1/20/37 | 4,355 | 4,721 | ||

8.25% 1/20/34 | 5,500 | 6,765 | ||

8.75% 2/4/25 | 5,440 | 6,773 | ||

10% 1/1/10 | BRL | 3,682 | 1,879 | |

11% 8/17/40 | 20,355 | 26,706 | ||

12.25% 3/6/30 | 8,910 | 15,102 | ||

12.75% 1/15/20 | 4,685 | 7,262 | ||

Bulgarian Republic 8.25% 1/15/15 (Reg. S) | 180 | 207 | ||

Foreign Government and Government Agency Obligations - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Canadian Government: | ||||

4% 6/1/17 | CAD | 20,000 | $ 17,954 | |

4.5% 9/1/07 | CAD | 27,000 | 25,336 | |

5.25% 6/1/12 | CAD | 50,300 | 48,645 | |

5.5% 6/1/09 | CAD | 15,500 | 14,792 | |

5.75% 6/1/29 | CAD | 9,750 | 10,704 | |

Central Bank of Nigeria: | ||||

promissory note 5.092% 1/5/10 | 3,058 | 2,945 | ||

warrants 11/15/20 (a)(j) | 2,750 | 641 | ||

Colombian Republic: | ||||

7.375% 9/18/37 | 8,075 | 8,992 | ||

11.75% 2/25/20 | 1,825 | 2,687 | ||

Dominican Republic: | ||||

Brady 6.3125% 8/30/09 (h) | 1,603 | 1,605 | ||

6.25% 8/30/24 (h) | 12,873 | 12,854 | ||

9.04% 1/23/18 (g) | 4,585 | 5,188 | ||

9.5% 9/27/11 | 3,429 | 3,639 | ||

Ecuador Republic: | ||||

10% 8/15/30 (Reg. S) | 9,525 | 7,811 | ||

euro par 5% 2/28/25 | 1,580 | 1,130 | ||

Finnish Government 3.875% 9/15/17 | EUR | 49,700 | 63,208 | |

French Republic: | ||||

3% 1/12/10 | EUR | 800 | 1,044 | |

3.5% 7/12/11 | EUR | 88,350 | 115,057 | |

3.75% 4/25/17 | EUR | 33,730 | 42,575 | |

4% 4/25/55 | EUR | 750 | 882 | |

5.5% 4/25/29 | EUR | 4,200 | 6,256 | |

German Federal Republic: | ||||

3.75% 12/12/08 | EUR | 5,175 | 6,934 | |

4% 4/13/12 | EUR | 3,920 | 5,186 | |

4% 7/4/16 | EUR | 1,300 | 1,690 | |

Indonesian Republic: | ||||

6.625% 2/17/37 (g) | 4,125 | 3,960 | ||

6.75% 3/10/14 | 3,275 | 3,341 | ||

Islamic Republic of Pakistan: | ||||

6.75% 2/19/09 | 1,050 | 1,050 | ||

7.125% 3/31/16 (g) | 2,125 | 2,104 | ||

Japan Government: | ||||

0.78% 7/20/20 (h) | JPY | 825,000 | 6,261 | |

0.9% 12/22/08 | JPY | 1,370,000 | 11,121 | |

0.9% 11/20/20 (h) | JPY | 1,300,000 | 10,090 | |

1.4% 3/21/11 | JPY | 2,275,000 | 18,547 | |

Foreign Government and Government Agency Obligations - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

Japan Government: - continued | ||||

1.5% 3/20/14 | JPY | 1,865,000 | $ 15,006 | |

1.8% 3/20/16 | JPY | 1,872,000 | 15,205 | |

2.4% 12/20/34 | JPY | 1,500,000 | 12,089 | |

Real Return Bond 1.1% 12/10/16 | JPY | 3,871,630 | 31,037 | |

Lebanese Republic: | ||||

7.125% 3/5/10 | 1,140 | 1,100 | ||

7.875% 5/20/11 (Reg. S) | 4,320 | 4,169 | ||

8.625% 6/20/13 | 1,540 | 1,509 | ||

8.63% 11/30/09 (g)(h) | 2,180 | 2,166 | ||

8.63% 11/30/09 (h) | 9,170 | 9,113 | ||

Peruvian Republic: | ||||

3% 3/7/27 (f) | 900 | 646 | ||

6.1425% 3/7/27 (h) | 1,545 | 1,541 | ||

euro Brady past due interest 6.125% 3/7/17 (h) | 8,497 | 8,497 | ||

Philippine Republic: | ||||

8.25% 1/15/14 | 7,120 | 7,788 | ||

8.875% 3/17/15 | 3,120 | 3,569 | ||

9% 2/15/13 | 4,645 | 5,197 | ||

9.5% 2/2/30 | 1,305 | 1,701 | ||

9.875% 1/15/19 | 6,125 | 7,733 | ||

10.625% 3/16/25 | 4,275 | 5,958 | ||

Polish Government 5% 10/19/15 | 180 | 170 | ||

Republic of Fiji 6.875% 9/13/11 | 2,635 | 2,477 | ||

Republic of Hungary 4.75% 2/3/15 | 180 | 169 | ||

Republic of Iraq 5.8% 1/15/28 (g) | 3,780 | 2,306 | ||

Republic of Serbia 3.75% 11/1/24 (f)(g) | 2,700 | 2,548 | ||

Russian Federation: | ||||

7.5% 3/31/30 (g) | 3,881 | 4,273 | ||

7.5% 3/31/30 (Reg. S) | 40,407 | 44,498 | ||

12.75% 6/24/28 (Reg. S) | 7,145 | 12,629 | ||

South African Republic 6.5% 6/2/14 | 180 | 186 | ||

Turkish Republic: | ||||

Indexed Linked CPI 10% 2/15/12 | TRY | 2,353 | 1,841 | |

6.875% 3/17/36 | 7,625 | 7,234 | ||

7% 9/26/16 | 14,275 | 14,446 | ||

7.375% 2/5/25 | 5,265 | 5,407 | ||

11% 1/14/13 | 11,625 | 13,956 | ||

11.875% 1/15/30 | 7,575 | 11,618 | ||

Ukraine Cabinet of Ministers 6.58% 11/21/16 (g) | 11,430 | 11,370 | ||

United Kingdom, Great Britain & Northern Ireland: | ||||

4.25% 3/7/11 | GBP | 5,570 | 10,618 | |

Foreign Government and Government Agency Obligations - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

United Kingdom, Great Britain & Northern Ireland: - continued | ||||

4.25% 6/7/32 | GBP | 850 | $ 1,542 | |

4.25% 3/7/36 | GBP | 18,380 | 33,599 | |

4.75% 9/7/15 | GBP | 5,145 | 9,805 | |

5% 3/7/18 | GBP | 450 | 874 | |

5% 3/7/25 | GBP | 7,370 | 14,519 | |

8% 6/7/21 | GBP | 11,790 | 29,775 | |

United Mexican States: | ||||

6.75% 9/27/34 | 1,725 | 1,841 | ||

7.5% 4/8/33 | 7,695 | 8,926 | ||

8.3% 8/15/31 | 12,285 | 15,433 | ||

9% 12/20/12 | MXN | 18,350 | 1,797 | |

Uruguay Republic: | ||||

5% 9/14/18 | UYU | 37,816 | 1,778 | |

8% 11/18/22 | 6,292 | 7,078 | ||

Venezuelan Republic: | ||||

oil recovery rights 4/15/20 (j) | 3,260 | 119 | ||

6% 12/9/20 | 3,050 | 2,471 | ||

6.355% 4/20/11 (h) | 9,110 | 8,818 | ||

7.65% 4/21/25 | 6,305 | 5,722 | ||

8.5% 10/8/14 | 3,190 | 3,238 | ||

9.25% 9/15/27 | 8,485 | 8,846 | ||

9.375% 1/13/34 | 3,730 | 3,907 | ||

10.75% 9/19/13 | 7,788 | 8,684 | ||

13.625% 8/15/18 | 6,305 | 8,638 | ||

Vietnamese Socialist Republic Brady par 4% 3/12/28 (f) | 1,890 | 1,578 | ||

TOTAL FOREIGN GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $1,016,291) | 1,048,313 | |||

Supranational Obligations - 0.2% | ||||

European Investment Bank: | EUR | 2,600 | 3,064 | |

4.75% 10/15/17 | EUR | 5,875 | 7,940 | |

Inter-American Development Bank 6.625% 4/17/17 | PEN | 8,000 | 2,668 | |

TOTAL SUPRANATIONAL OBLIGATIONS (Cost $13,668) | 13,672 | |||

Common Stocks - 0.4% | |||

Shares | Value (000s) | ||

CONSUMER DISCRETIONARY - 0.2% | |||

Auto Components - 0.0% | |||

Intermet Corp. (a)(k) | 113,725 | $ 206 | |

Diversified Consumer Services - 0.1% | |||

Coinmach Service Corp. unit | 330,000 | 6,557 | |

Hotels, Restaurants & Leisure - 0.1% | |||

Centerplate, Inc. unit | 165,925 | 2,912 | |

Media - 0.0% | |||

Virgin Media, Inc. warrants 1/10/11 (a) | 6 | 0 | |

TOTAL CONSUMER DISCRETIONARY | 9,675 | ||

INDUSTRIALS - 0.2% | |||

Airlines - 0.2% | |||

Delta Air Lines, Inc. (a) | 593,040 | 11,683 | |

Northwest Airlines Corp. (a) | 113,943 | 2,530 | |

14,213 | |||

TELECOMMUNICATION SERVICES - 0.0% | |||

Wireless Telecommunication Services - 0.0% | |||

DigitalGlobe, Inc. (a)(g) | 895 | 2 | |

UTILITIES - 0.0% | |||

Electric Utilities - 0.0% | |||

Portland General Electric Co. | 7,275 | 200 | |

TOTAL COMMON STOCKS (Cost $20,287) | 24,090 | ||

Preferred Stocks - 0.2% | |||

Convertible Preferred Stocks - 0.0% | |||

MATERIALS - 0.0% | |||

Chemicals - 0.0% | |||

Celanese Corp. 4.25% | 6,600 | 331 | |

Nonconvertible Preferred Stocks - 0.2% | |||

CONSUMER DISCRETIONARY - 0.1% | |||

Media - 0.1% | |||

Spanish Broadcasting System, Inc. Class B, 10.75% | 1,690 | 1,834 | |

Preferred Stocks - continued | |||

Shares | Value (000s) | ||

Nonconvertible Preferred Stocks - continued | |||

HEALTH CARE - 0.0% | |||

Health Care Providers & Services - 0.0% | |||

Fresenius Medical Care Capital Trust II 7.875% (a) | 1,260 | $ 1,288 | |

TELECOMMUNICATION SERVICES - 0.1% | |||

Diversified Telecommunication Services - 0.0% | |||

PTV, Inc. Series A, 10.00% | 119 | 1 | |

Wireless Telecommunication Services - 0.1% | |||

Rural Cellular Corp. 12.25% pay-in-kind | 5,078 | 6,195 | |

TOTAL TELECOMMUNICATION SERVICES | 6,196 | ||

TOTAL NONCONVERTIBLE PREFERRED STOCKS | 9,318 | ||

TOTAL PREFERRED STOCKS (Cost $8,873) | 9,649 | ||

Floating Rate Loans - 4.9% | ||||

Principal Amount (000s)(d) | ||||

CONSUMER DISCRETIONARY - 1.7% | ||||

Auto Components - 0.2% | ||||

Dana Corp. term loan 7.88% 4/13/08 (h) | $ 2,390 | 2,387 | ||

Delphi Corp. term loan 8.125% 12/31/07 (h) | 2,220 | 2,220 | ||

Lear Corp. term loan: | ||||

7.832% 4/25/12 (h) | 2,463 | 2,419 | ||

The Goodyear Tire & Rubber Co. Tranche 3, term loan 8.82% 3/1/11 (h) | 3,550 | 3,550 | ||

10,576 | ||||

Automobiles - 0.6% | ||||

AM General LLC: | ||||

Tranche B, term loan 8.38% 9/30/13 (h) | 3,835 | 3,855 | ||

8.32% 9/30/12 (h) | 132 | 133 | ||

Ford Motor Co. term loan 8.36% 12/15/13 (h) | 25,004 | 25,036 | ||

General Motors Corp. term loan 7.725% 11/29/13 (h) | 978 | 980 | ||

30,004 | ||||

Diversified Consumer Services - 0.1% | ||||

Affinion Group Holdings, Inc. term loan 11.6596% 3/1/12 (h) | 4,150 | 4,109 | ||

Floating Rate Loans - continued | ||||

Principal Amount (000s)(d) | Value (000s) | |||

CONSUMER DISCRETIONARY - continued | ||||

Hotels, Restaurants & Leisure - 0.0% | ||||

Green Valley Ranch Gaming LLC Tranche 1LN, term loan 7.36% 2/16/14 (h) | $ 144 | $ 144 | ||

OSI Restaurant Partners, Inc.: | ||||

term loan 7.625% 6/14/14 (h) | 499 | 500 | ||

7.61% 6/14/13 (h) | 41 | 41 | ||

Six Flags, Inc. Tranche B, term loan 7.61% 4/30/15 (h) | 730 | 721 | ||

1,406 | ||||

Household Durables - 0.0% | ||||

Yankee Candle Co., Inc. term loan 7.36% 2/6/14 (h) | 279 | 280 | ||

Media - 0.4% | ||||