UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4707

Fidelity Advisor Series II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | August 31 |

|

|

Date of reporting period: | February 28, 2013 |

Item 1. Reports to Stockholders

(Fidelity Investment logo)(registered trademark)

Fidelity Advisor®

Intermediate Bond

Fund - Class A, Class T, Class B

and Class C

Semiannual Report

February 28, 2013

(Fidelity Cover Art)

Contents

Shareholder Expense Example | An example of shareholder expenses. | |

Investment Changes | A summary of major shifts in the fund's investments over the past six months. | |

Investments | A complete list of the fund's investments with their market values. | |

Financial Statements | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. | |

Notes | Notes to the financial statements. | |

Board Approval of Investment Advisory Contracts and Management Fees |

|

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2013 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2012 to February 28, 2013).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semiannual Report

Shareholder Expense Example - continued

| Annualized | Beginning | Ending | Expenses Paid |

Class A | .83% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,008.90 | $ 4.13 |

Hypothetical A |

| $ 1,000.00 | $ 1,020.68 | $ 4.16 |

Class T | .81% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,009.00 | $ 4.03 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.78 | $ 4.06 |

Class B | 1.56% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,005.30 | $ 7.76 |

Hypothetical A |

| $ 1,000.00 | $ 1,017.06 | $ 7.80 |

Class C | 1.59% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,005.20 | $ 7.91 |

Hypothetical A |

| $ 1,000.00 | $ 1,016.91 | $ 7.95 |

Institutional Class | .58% |

|

|

|

Actual |

| $ 1,000.00 | $ 1,010.10 | $ 2.89 |

Hypothetical A |

| $ 1,000.00 | $ 1,021.92 | $ 2.91 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The fees and expenses of the underlying Fidelity Central Funds in which the Fund invests are not included in the Fund's annualized expense ratio.

Semiannual Report

Investment Changes (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's fixed-income central funds. |

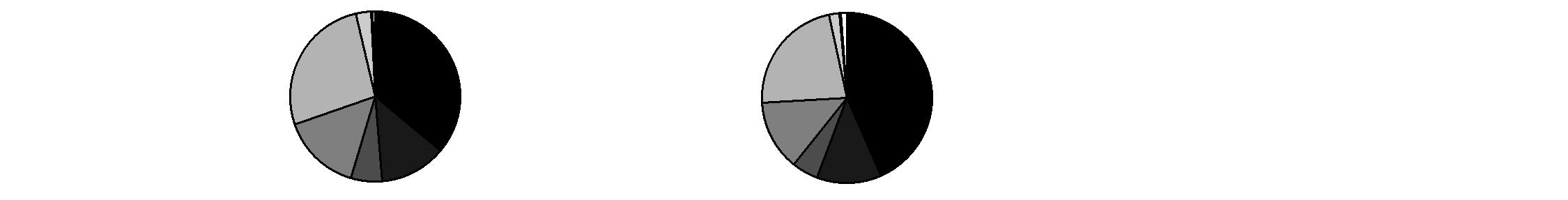

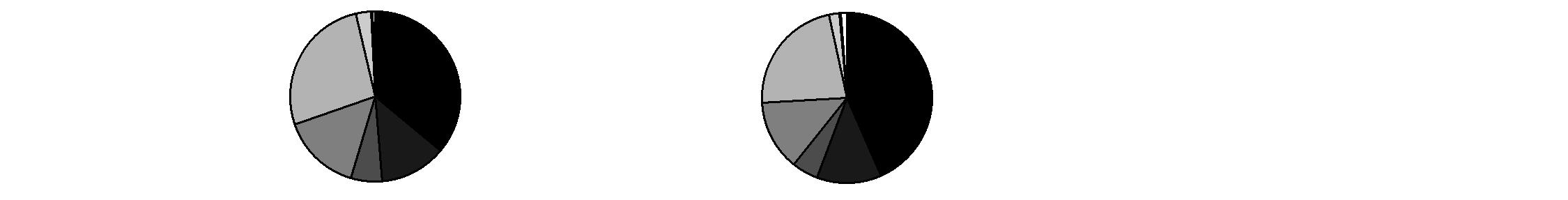

Quality Diversification (% of fund's net assets) | |||||||

As of February 28, 2013 | As of August 31, 2012 | ||||||

| U.S. Government and |

|  | U.S. Government and |

| ||

| AAA 12.7% |

|  | AAA 12.4% |

| ||

| AA 5.9% |

|  | AA 5.0% |

| ||

| A 15.0% |

|  | A 13.3% |

| ||

| BBB 26.7% |

|  | BBB 22.6% |

| ||

| BB and Below 2.9% |

|  | BB and Below 2.0% |

| ||

| Not Rated 0.2% |

|  | Not Rated 0.3% |

| ||

| Short-Term |

|  | Short-Term |

| ||

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. Securities rated BB or below were rated investment grade at the time of acquisition. |

Weighted Average Maturity as of February 28, 2013 | ||

|

| 6 months ago |

Years | 4.5 | 4.4 |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and market changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Duration as of February 28, 2013 | ||

|

| 6 months ago |

Years | 3.9 | 3.9 |

Duration estimates how much a bond fund's price will change with a change in comparable interest rates. If rates rise 1%, for example, a fund with a 5-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. Duration takes into account any call or put option embedded in the bonds. |

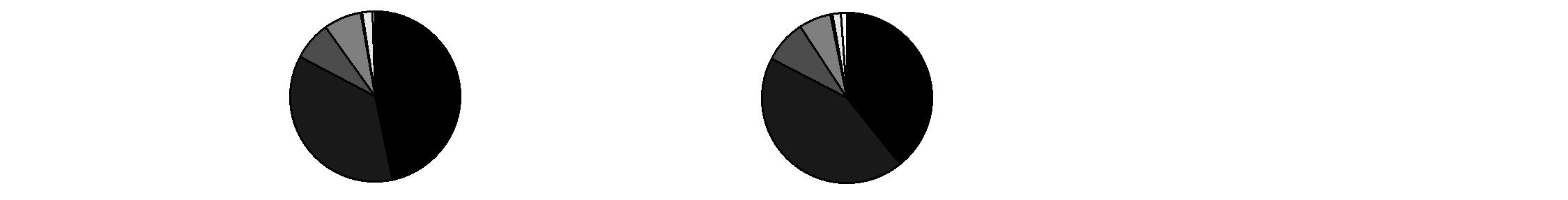

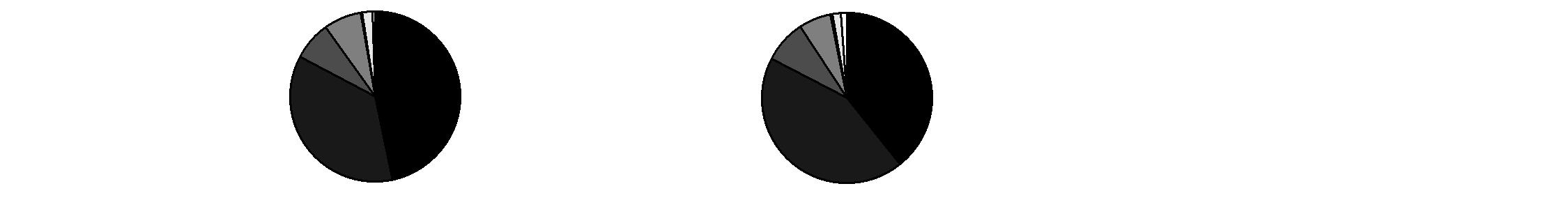

Asset Allocation (% of fund's net assets) | |||||||

As of February 28, 2013* | As of August 31, 2012** | ||||||

| Corporate Bonds 46.8% |

|  | Corporate Bonds 39.3% |

| ||

| U.S. Government and |

|  | U.S. Government and |

| ||

| Asset-Backed |

|  | Asset-Backed |

| ||

| CMOs and Other |

|  | CMOs and Other |

| ||

| Municipal Bonds 0.3% |

|  | Municipal Bonds 0.4% |

| ||

| Other Investments 1.9% |

|  | Other Investments 1.6% |

| ||

| Short-Term |

|  | Short-Term |

| ||

* Foreign investments | 12.3% |

| ** Foreign investments | 10.6% |

| ||

† Includes NCUA Guaranteed Notes |

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at advisor.fidelity.com. |

Semiannual Report

Investments February 28, 2013 (Unaudited)

Showing Percentage of Net Assets

Nonconvertible Bonds - 45.9% | ||||

| Principal | Value | ||

CONSUMER DISCRETIONARY - 3.7% | ||||

Automobiles - 1.1% | ||||

Daimler Finance North America LLC: | ||||

1.25% 1/11/16 (d) | $ 1,220,000 | $ 1,222,860 | ||

1.3% 7/31/15 (d) | 1,260,000 | 1,266,912 | ||

1.65% 4/10/15 (d) | 620,000 | 627,074 | ||

1.95% 3/28/14 (d) | 790,000 | 798,610 | ||

Volkswagen International Finance NV: | ||||

1.6% 11/20/17 (d) | 620,000 | 622,551 | ||

1.625% 3/22/15 (d) | 1,180,000 | 1,195,352 | ||

2.375% 3/22/17 (d) | 600,000 | 620,436 | ||

| 6,353,795 | |||

Diversified Consumer Services - 0.1% | ||||

Yale University 2.9% 10/15/14 | 530,000 | 550,750 | ||

Media - 1.9% | ||||

Comcast Corp.: | ||||

4.95% 6/15/16 | 326,000 | 367,913 | ||

5.15% 3/1/20 | 693,000 | 818,171 | ||

5.7% 5/15/18 | 42,000 | 50,552 | ||

COX Communications, Inc. 4.625% 6/1/13 | 674,000 | 680,909 | ||

Discovery Communications LLC: | ||||

3.7% 6/1/15 | 875,000 | 929,415 | ||

5.05% 6/1/20 | 322,000 | 369,525 | ||

NBCUniversal Media LLC: | ||||

3.65% 4/30/15 | 66,000 | 70,024 | ||

5.15% 4/30/20 | 1,000,000 | 1,187,385 | ||

News America, Inc.: | ||||

5.3% 12/15/14 | 132,000 | 142,663 | ||

6.9% 3/1/19 | 750,000 | 944,427 | ||

Time Warner Cable, Inc.: | ||||

5.85% 5/1/17 | 996,000 | 1,158,568 | ||

6.2% 7/1/13 | 404,000 | 411,110 | ||

6.75% 7/1/18 | 1,141,000 | 1,397,202 | ||

Time Warner, Inc.: | ||||

3.15% 7/15/15 | 24,000 | 25,294 | ||

4.875% 3/15/20 | 731,000 | 837,993 | ||

5.875% 11/15/16 | 685,000 | 798,858 | ||

Viacom, Inc.: | ||||

3.5% 4/1/17 | 455,000 | 490,272 | ||

6.125% 10/5/17 | 679,000 | 806,672 | ||

| 11,486,953 | |||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

CONSUMER DISCRETIONARY - continued | ||||

Multiline Retail - 0.2% | ||||

Target Corp. 3.875% 7/15/20 | $ 1,000,000 | $ 1,118,720 | ||

Specialty Retail - 0.4% | ||||

AutoZone, Inc. 3.7% 4/15/22 | 494,000 | 509,690 | ||

Home Depot, Inc. 4.4% 4/1/21 | 610,000 | 708,555 | ||

Lowe's Companies, Inc. 4.625% 4/15/20 | 750,000 | 867,287 | ||

| 2,085,532 | |||

TOTAL CONSUMER DISCRETIONARY | 21,595,750 | |||

CONSUMER STAPLES - 2.8% | ||||

Beverages - 1.1% | ||||

Anheuser-Busch InBev Worldwide, Inc.: | ||||

1.375% 7/15/17 | 650,000 | 655,398 | ||

1.5% 7/14/14 | 551,000 | 558,088 | ||

5.375% 11/15/14 | 111,000 | 119,748 | ||

Beam, Inc. 1.875% 5/15/17 | 735,000 | 748,595 | ||

FBG Finance Ltd. 5.125% 6/15/15 (d) | 510,000 | 557,398 | ||

Fortune Brands, Inc.: | ||||

5.375% 1/15/16 | 466,000 | 518,376 | ||

6.375% 6/15/14 | 272,000 | 290,952 | ||

Heineken NV: | ||||

1.4% 10/1/17 (d) | 321,000 | 320,023 | ||

2.75% 4/1/23 (d) | 335,000 | 326,508 | ||

PepsiCo, Inc. 7.9% 11/1/18 | 815,000 | 1,090,036 | ||

SABMiller Holdings, Inc. 2.45% 1/15/17 (d) | 1,280,000 | 1,335,297 | ||

| 6,520,419 | |||

Food & Staples Retailing - 0.4% | ||||

CVS Caremark Corp. 4.125% 5/15/21 | 620,000 | 687,715 | ||

Wal-Mart Stores, Inc. 2.25% 7/8/15 | 820,000 | 854,576 | ||

Walgreen Co.: | ||||

1.8% 9/15/17 | 267,000 | 270,857 | ||

3.1% 9/15/22 | 386,000 | 387,456 | ||

| 2,200,604 | |||

Food Products - 0.6% | ||||

Cargill, Inc.: | ||||

3.25% 11/15/21 (d) | 600,000 | 615,833 | ||

6% 11/27/17 (d) | 106,000 | 126,784 | ||

ConAgra Foods, Inc.: | ||||

1.9% 1/25/18 | 222,000 | 224,605 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

CONSUMER STAPLES - continued | ||||

Food Products - continued | ||||

ConAgra Foods, Inc.: - continued | ||||

3.2% 1/25/23 | $ 258,000 | $ 257,473 | ||

General Mills, Inc. 5.2% 3/17/15 | 650,000 | 708,526 | ||

Kraft Foods Group, Inc. 2.25% 6/5/17 | 610,000 | 633,392 | ||

Kraft Foods, Inc.: | ||||

5.375% 2/10/20 | 660,000 | 787,269 | ||

6.5% 8/11/17 | 140,000 | 169,451 | ||

6.75% 2/19/14 | 82,000 | 86,653 | ||

| 3,609,986 | |||

Tobacco - 0.7% | ||||

Altria Group, Inc.: | ||||

2.85% 8/9/22 | 620,000 | 608,201 | ||

9.7% 11/10/18 | 454,000 | 633,713 | ||

Philip Morris International, Inc. 4.5% 3/26/20 | 1,000,000 | 1,151,428 | ||

Reynolds American, Inc.: | ||||

1.05% 10/30/15 | 707,000 | 706,297 | ||

3.25% 11/1/22 | 326,000 | 324,279 | ||

6.75% 6/15/17 | 513,000 | 619,458 | ||

| 4,043,376 | |||

TOTAL CONSUMER STAPLES | 16,374,385 | |||

ENERGY - 4.5% | ||||

Energy Equipment & Services - 0.9% | ||||

Cameron International Corp. 1.6% 4/30/15 | 468,000 | 472,084 | ||

DCP Midstream LLC 5.35% 3/15/20 (d) | 633,000 | 697,767 | ||

El Paso Pipeline Partners Operating Co. LLC 6.5% 4/1/20 | 768,000 | 928,111 | ||

FMC Technologies, Inc.: | ||||

2% 10/1/17 | 80,000 | 80,702 | ||

3.45% 10/1/22 | 146,000 | 148,169 | ||

Halliburton Co. 6.15% 9/15/19 | 425,000 | 535,126 | ||

National Oilwell Varco, Inc. 1.35% 12/1/17 | 620,000 | 622,584 | ||

Noble Holding International Ltd. 2.5% 3/15/17 | 262,000 | 269,001 | ||

Weatherford International Ltd.: | ||||

4.95% 10/15/13 | 303,000 | 310,765 | ||

5.15% 3/15/13 | 1,469,000 | 1,470,638 | ||

| 5,534,947 | |||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

ENERGY - continued | ||||

Oil, Gas & Consumable Fuels - 3.6% | ||||

Anadarko Petroleum Corp.: | ||||

5.95% 9/15/16 | $ 45,000 | $ 51,745 | ||

6.375% 9/15/17 | 555,000 | 662,819 | ||

Apache Corp. 1.75% 4/15/17 | 172,000 | 175,234 | ||

BG Energy Capital PLC 2.875% 10/15/16 (d) | 620,000 | 657,584 | ||

Cenovus Energy, Inc. 5.7% 10/15/19 | 650,000 | 793,768 | ||

DCP Midstream Operating LP 2.5% 12/1/17 | 292,000 | 295,272 | ||

Duke Energy Field Services 5.375% 10/15/15 (d) | 212,000 | 231,027 | ||

El Paso Natural Gas Co. 5.95% 4/15/17 | 21,000 | 24,303 | ||

Enbridge Energy Partners LP 4.2% 9/15/21 | 615,000 | 650,498 | ||

Encana Holdings Finance Corp. 5.8% 5/1/14 | 502,000 | 529,679 | ||

Enterprise Products Operating LP: | ||||

1.25% 8/13/15 | 480,000 | 483,950 | ||

4.05% 2/15/22 | 610,000 | 663,707 | ||

5.6% 10/15/14 | 339,000 | 364,663 | ||

5.65% 4/1/13 | 105,000 | 105,349 | ||

Gulfstream Natural Gas System LLC 6.95% 6/1/16 (d) | 20,000 | 23,436 | ||

Marathon Petroleum Corp. 3.5% 3/1/16 | 875,000 | 934,284 | ||

Midcontinent Express Pipeline LLC 5.45% 9/15/14 (d) | 877,000 | 914,354 | ||

Nexen, Inc. 5.2% 3/10/15 | 158,000 | 170,900 | ||

Petro-Canada 6.05% 5/15/18 | 326,000 | 393,881 | ||

Petrobras International Finance Co. Ltd.: | ||||

2.875% 2/6/15 | 630,000 | 642,978 | ||

5.75% 1/20/20 | 816,000 | 905,813 | ||

7.875% 3/15/19 | 647,000 | 792,054 | ||

Petroleos Mexicanos: | ||||

3.5% 1/30/23 (d) | 485,000 | 475,300 | ||

4.875% 1/24/22 | 700,000 | 768,950 | ||

6% 3/5/20 | 59,000 | 69,384 | ||

Phillips 66 2.95% 5/1/17 | 1,260,000 | 1,333,375 | ||

Plains All American Pipeline LP/PAA Finance Corp.: | ||||

3.95% 9/15/15 | 375,000 | 403,638 | ||

5.75% 1/15/20 | 962,000 | 1,152,335 | ||

Schlumberger Investment SA 1.25% 8/1/17 (d) | 1,000,000 | 999,185 | ||

Southeast Supply Header LLC 4.85% 8/15/14 (d) | 862,000 | 895,066 | ||

Spectra Energy Capital, LLC 5.65% 3/1/20 | 28,000 | 32,870 | ||

Suncor Energy, Inc. 6.1% 6/1/18 | 944,000 | 1,144,514 | ||

Texas Eastern Transmission LP 6% 9/15/17 (d) | 1,096,000 | 1,295,340 | ||

TransCapitalInvest Ltd. 5.67% 3/5/14 (d) | 489,000 | 507,093 | ||

Transcontinental Gas Pipe Line Corp. 6.4% 4/15/16 | 394,000 | 453,814 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

ENERGY - continued | ||||

Oil, Gas & Consumable Fuels - continued | ||||

Western Gas Partners LP 5.375% 6/1/21 | $ 600,000 | $ 678,521 | ||

XTO Energy, Inc.: | ||||

5% 1/31/15 | 264,000 | 287,043 | ||

5.65% 4/1/16 | 181,000 | 208,566 | ||

| 21,172,292 | |||

TOTAL ENERGY | 26,707,239 | |||

FINANCIALS - 23.4% | ||||

Capital Markets - 2.6% | ||||

Bear Stearns Companies, Inc. 5.3% 10/30/15 | 374,000 | 414,245 | ||

BlackRock, Inc. 4.25% 5/24/21 | 650,000 | 730,220 | ||

Goldman Sachs Group, Inc.: | ||||

1.6% 11/23/15 | 650,000 | 656,089 | ||

2.375% 1/22/18 | 600,000 | 607,916 | ||

3.3% 5/3/15 | 620,000 | 648,257 | ||

3.7% 8/1/15 | 712,000 | 752,195 | ||

5.25% 7/27/21 | 750,000 | 853,850 | ||

5.95% 1/18/18 | 1,693,000 | 1,980,416 | ||

6.15% 4/1/18 | 402,000 | 475,076 | ||

JPMorgan Chase & Co. 1.1% 10/15/15 | 620,000 | 622,104 | ||

Lazard Group LLC: | ||||

6.85% 6/15/17 | 669,000 | 771,089 | ||

7.125% 5/15/15 | 239,000 | 265,007 | ||

Merrill Lynch & Co., Inc.: | ||||

6.4% 8/28/17 | 40,000 | 46,965 | ||

6.875% 4/25/18 | 726,000 | 880,244 | ||

Morgan Stanley: | ||||

1.75% 2/25/16 | 510,000 | 512,270 | ||

4.1% 1/26/15 | 1,320,000 | 1,384,061 | ||

4.75% 4/1/14 | 138,000 | 142,754 | ||

5.45% 1/9/17 | 200,000 | 223,916 | ||

5.625% 9/23/19 | 112,000 | 129,587 | ||

5.75% 1/25/21 | 647,000 | 750,244 | ||

5.95% 12/28/17 | 383,000 | 443,524 | ||

6% 4/28/15 | 130,000 | 141,913 | ||

7.3% 5/13/19 | 603,000 | 748,080 | ||

The Bank of New York Mellon Corp. 2.4% 1/17/17 | 1,250,000 | 1,307,771 | ||

| 15,487,793 | |||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

FINANCIALS - continued | ||||

Commercial Banks - 7.8% | ||||

ANZ Banking Group Ltd. 2.125% 1/10/14 (d) | $ 740,000 | $ 750,721 | ||

Australia & New Zealand Banking Group Ltd. 1.875% 10/6/17 | 620,000 | 635,846 | ||

Bank of America NA 5.3% 3/15/17 | 250,000 | 280,237 | ||

Bank of Montreal 2.5% 1/11/17 | 640,000 | 669,752 | ||

Bank of Nova Scotia 1.375% 12/18/17 | 935,000 | 935,253 | ||

Bank of Tokyo-Mitsubishi UFJ Ltd. 1.65% 2/26/18 (d) | 590,000 | 590,870 | ||

BB&T Corp. 3.95% 3/22/22 | 940,000 | 1,007,139 | ||

Comerica, Inc. 3% 9/16/15 | 2,000 | 2,105 | ||

Commonwealth Bank of Australia: | ||||

1.95% 3/16/15 | 630,000 | 646,262 | ||

2.9% 9/17/14 (d) | 3,000,000 | 3,115,680 | ||

Credit Suisse 6% 2/15/18 | 1,680,000 | 1,938,419 | ||

Discover Bank 2% 2/21/18 | 1,200,000 | 1,204,008 | ||

Fifth Third Bancorp: | ||||

3.5% 3/15/22 | 700,000 | 730,415 | ||

3.625% 1/25/16 | 361,000 | 386,995 | ||

4.5% 6/1/18 | 63,000 | 70,134 | ||

8.25% 3/1/38 | 68,000 | 94,934 | ||

Fifth Third Bank: | ||||

1.45% 2/28/18 | 580,000 | 579,472 | ||

4.75% 2/1/15 | 308,000 | 329,453 | ||

Fifth Third Capital Trust IV 6.5% 4/15/67 (f) | 7,000 | 7,009 | ||

First Niagara Financial Group, Inc. 6.75% 3/19/20 | 625,000 | 743,704 | ||

HBOS PLC 6.75% 5/21/18 (d) | 509,000 | 564,144 | ||

HSBC Holdings PLC: | ||||

4% 3/30/22 | 567,000 | 610,599 | ||

5.1% 4/5/21 | 610,000 | 710,656 | ||

Huntington Bancshares, Inc. 7% 12/15/20 | 180,000 | 223,197 | ||

JPMorgan Chase Bank 6% 10/1/17 | 1,762,000 | 2,086,326 | ||

KeyBank NA: | ||||

1.65% 2/1/18 | 397,000 | 401,141 | ||

5.8% 7/1/14 | 1,351,000 | 1,441,545 | ||

KeyCorp. 5.1% 3/24/21 | 622,000 | 723,321 | ||

Marshall & Ilsley Bank 5% 1/17/17 | 778,000 | 855,301 | ||

Mizuho Corporate Bank Ltd. 1.55% 10/17/17 (d) | 940,000 | 936,901 | ||

National Australia Bank Ltd. 2% 3/9/15 | 630,000 | 646,506 | ||

National Bank of Canada 1.5% 6/26/15 | 830,000 | 842,533 | ||

PNC Bank NA 2.7% 11/1/22 | 1,560,000 | 1,523,033 | ||

PNC Funding Corp. 3.625% 2/8/15 | 717,000 | 757,199 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

FINANCIALS - continued | ||||

Commercial Banks - continued | ||||

Rabobank (Netherlands) NV: | ||||

1.85% 1/10/14 | $ 1,720,000 | $ 1,740,537 | ||

2.125% 10/13/15 | 278,000 | 286,982 | ||

3.95% 11/9/22 | 1,240,000 | 1,260,526 | ||

Regions Bank 7.5% 5/15/18 | 770,000 | 939,400 | ||

Regions Financial Corp.: | ||||

5.75% 6/15/15 | 4,000 | 4,345 | ||

7.75% 11/10/14 | 20,000 | 22,050 | ||

Royal Bank of Canada 1.5% 1/16/18 | 1,220,000 | 1,229,212 | ||

Royal Bank of Scotland Group PLC 2.55% 9/18/15 | 1,492,000 | 1,535,807 | ||

Sumitomo Mitsui Banking Corp. 1.8% 7/18/17 | 940,000 | 956,318 | ||

SunTrust Banks, Inc.: | ||||

3.5% 1/20/17 | 853,000 | 918,015 | ||

3.6% 4/15/16 | 525,000 | 562,427 | ||

The Toronto Dominion Bank 2.375% 10/19/16 | 1,230,000 | 1,290,190 | ||

Union Bank NA 2.125% 6/16/17 | 700,000 | 718,683 | ||

UnionBanCal Corp. 5.25% 12/16/13 | 115,000 | 119,182 | ||

Wachovia Corp. 5.625% 10/15/16 | 590,000 | 675,540 | ||

Wells Fargo & Co.: | ||||

1.25% 2/13/15 | 2,229,000 | 2,250,066 | ||

3.5% 3/8/22 | 700,000 | 738,546 | ||

3.676% 6/15/16 | 620,000 | 672,412 | ||

Westpac Banking Corp.: | ||||

1.125% 9/25/15 | 1,200,000 | 1,209,906 | ||

1.85% 12/9/13 | 687,000 | 694,851 | ||

2% 8/14/17 | 1,121,000 | 1,152,845 | ||

| 46,018,650 | |||

Consumer Finance - 3.3% | ||||

American Express Credit Corp.: | ||||

0.875% 11/13/15 | 620,000 | 619,785 | ||

2.75% 9/15/15 | 1,561,000 | 1,632,692 | ||

2.8% 9/19/16 | 599,000 | 633,904 | ||

American Honda Finance Corp. 1.5% 9/11/17 (d) | 620,000 | 625,449 | ||

Capital One Financial Corp.: | ||||

1% 11/6/15 | 620,000 | 617,755 | ||

2.125% 7/15/14 | 1,309,000 | 1,331,568 | ||

2.15% 3/23/15 | 620,000 | 633,820 | ||

3.15% 7/15/16 | 605,000 | 644,859 | ||

7.375% 5/23/14 | 232,000 | 250,286 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

FINANCIALS - continued | ||||

Consumer Finance - continued | ||||

Discover Financial Services: | ||||

3.85% 11/21/22 (d) | $ 30,000 | $ 30,698 | ||

5.2% 4/27/22 | 93,000 | 105,246 | ||

6.45% 6/12/17 | 399,000 | 468,633 | ||

Ford Motor Credit Co. LLC: | ||||

2.75% 5/15/15 | 930,000 | 950,165 | ||

3% 6/12/17 | 1,000,000 | 1,025,458 | ||

4.25% 9/20/22 | 620,000 | 639,438 | ||

General Electric Capital Corp.: | ||||

1% 1/8/16 | 727,000 | 729,319 | ||

1.6% 11/20/17 | 1,860,000 | 1,871,032 | ||

2.25% 11/9/15 | 886,000 | 918,096 | ||

2.9% 1/9/17 | 640,000 | 678,792 | ||

2.95% 5/9/16 | 255,000 | 269,805 | ||

3.35% 10/17/16 | 610,000 | 655,244 | ||

3.5% 6/29/15 | 1,263,000 | 1,339,967 | ||

6.375% 11/15/67 (f) | 1,275,000 | 1,348,313 | ||

HSBC USA, Inc.: | ||||

1.625% 1/16/18 | 543,000 | 545,428 | ||

2.375% 2/13/15 | 511,000 | 526,873 | ||

Hyundai Capital America 2.125% 10/2/17 (d) | 224,000 | 225,912 | ||

| 19,318,537 | |||

Diversified Financial Services - 3.4% | ||||

ABB Finance (USA), Inc. 1.625% 5/8/17 | 238,000 | 241,239 | ||

Bank of America Corp.: | ||||

1.5% 10/9/15 | 1,250,000 | 1,253,869 | ||

4.5% 4/1/15 | 1,230,000 | 1,308,173 | ||

5.75% 12/1/17 | 1,150,000 | 1,331,097 | ||

5.875% 1/5/21 | 980,000 | 1,164,503 | ||

BP Capital Markets PLC: | ||||

2.248% 11/1/16 | 620,000 | 645,366 | ||

3.125% 10/1/15 | 60,000 | 63,563 | ||

3.2% 3/11/16 | 610,000 | 651,172 | ||

3.245% 5/6/22 | 620,000 | 637,905 | ||

Citigroup, Inc.: | ||||

1.25% 1/15/16 | 1,220,000 | 1,216,717 | ||

3.953% 6/15/16 | 610,000 | 655,726 | ||

4.5% 1/14/22 | 1,190,000 | 1,324,583 | ||

4.75% 5/19/15 | 1,605,000 | 1,722,505 | ||

5.125% 5/5/14 | 150,000 | 157,017 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

FINANCIALS - continued | ||||

Diversified Financial Services - continued | ||||

Citigroup, Inc.: - continued | ||||

6.125% 5/15/18 | $ 12,000 | $ 14,359 | ||

6.5% 8/19/13 | 1,750,000 | 1,797,345 | ||

JPMorgan Chase & Co.: | ||||

3.15% 7/5/16 | 600,000 | 635,160 | ||

3.4% 6/24/15 | 2,482,000 | 2,622,613 | ||

4.5% 1/24/22 | 640,000 | 712,582 | ||

5.4% 1/6/42 | 266,000 | 313,781 | ||

RBS Citizens Financial Group, Inc. 4.15% 9/28/22 (d) | 300,000 | 307,041 | ||

TECO Finance, Inc.: | ||||

4% 3/15/16 | 171,000 | 184,209 | ||

5.15% 3/15/20 | 252,000 | 291,558 | ||

USAA Capital Corp. 3.5% 7/17/14 (d) | 932,000 | 970,193 | ||

| 20,222,276 | |||

Insurance - 2.7% | ||||

American International Group, Inc.: | ||||

3% 3/20/15 | 310,000 | 322,319 | ||

4.25% 9/15/14 | 970,000 | 1,018,920 | ||

4.875% 6/1/22 | 604,000 | 685,167 | ||

Aon Corp.: | ||||

3.5% 9/30/15 | 911,000 | 959,394 | ||

5% 9/30/20 | 600,000 | 686,209 | ||

Assurant, Inc. 5.625% 2/15/14 | 332,000 | 346,242 | ||

Axis Capital Holdings Ltd. 5.75% 12/1/14 | 84,000 | 89,663 | ||

Berkshire Hathaway Finance Corp. 1.6% 5/15/17 | 620,000 | 633,209 | ||

Great-West Life & Annuity Insurance Co. 7.153% 5/16/46 (d)(f) | 259,000 | 266,770 | ||

Hartford Financial Services Group, Inc.: | ||||

5.125% 4/15/22 | 284,000 | 327,289 | ||

5.375% 3/15/17 | 18,000 | 20,520 | ||

Liberty Mutual Group, Inc.: | ||||

5% 6/1/21 (d) | 599,000 | 654,545 | ||

6.5% 3/15/35 (d) | 104,000 | 117,098 | ||

Marsh & McLennan Companies, Inc. 4.8% 7/15/21 | 361,000 | 409,032 | ||

MetLife, Inc.: | ||||

1.756% 12/15/17 (c) | 269,000 | 272,181 | ||

2.375% 2/6/14 | 876,000 | 891,292 | ||

4.125% 8/13/42 | 600,000 | 570,427 | ||

5% 6/15/15 | 175,000 | 191,563 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

FINANCIALS - continued | ||||

Insurance - continued | ||||

Metropolitan Life Global Funding I: | ||||

1.5% 1/10/18 (d) | $ 1,431,000 | $ 1,427,729 | ||

2.5% 9/29/15 (d) | 750,000 | 780,552 | ||

Monumental Global Funding III 5.5% 4/22/13 (d) | 382,000 | 384,549 | ||

Northwestern Mutual Life Insurance Co. 6.063% 3/30/40 (d) | 48,000 | 60,950 | ||

Pacific Life Global Funding 5.15% 4/15/13 (d) | 1,218,000 | 1,224,376 | ||

Pacific LifeCorp 6% 2/10/20 (d) | 321,000 | 369,099 | ||

Prudential Financial, Inc.: | ||||

4.5% 11/15/20 | 700,000 | 784,716 | ||

5.4% 6/13/35 | 68,000 | 73,286 | ||

QBE Insurance Group Ltd. 5.647% 7/1/23 (d)(f) | 29,000 | 28,874 | ||

Symetra Financial Corp. 6.125% 4/1/16 (d) | 892,000 | 991,336 | ||

Unum Group: | ||||

5.625% 9/15/20 | 370,000 | 428,152 | ||

7.125% 9/30/16 | 704,000 | 822,939 | ||

| 15,838,398 | |||

Real Estate Investment Trusts - 1.5% | ||||

Alexandria Real Estate Equities, Inc. 4.6% 4/1/22 | 189,000 | 204,159 | ||

AvalonBay Communities, Inc. 4.95% 3/15/13 | 55,000 | 55,066 | ||

Boston Properties, Inc. 3.85% 2/1/23 | 580,000 | 614,372 | ||

BRE Properties, Inc. 5.5% 3/15/17 | 61,000 | 69,301 | ||

Camden Property Trust 5.375% 12/15/13 | 326,000 | 337,178 | ||

DDR Corp. 4.625% 7/15/22 | 200,000 | 216,223 | ||

Developers Diversified Realty Corp.: | ||||

4.75% 4/15/18 | 290,000 | 320,692 | ||

7.5% 4/1/17 | 389,000 | 463,868 | ||

Duke Realty LP: | ||||

3.875% 10/15/22 | 461,000 | 473,432 | ||

4.625% 5/15/13 | 122,000 | 122,906 | ||

5.4% 8/15/14 | 498,000 | 526,042 | ||

6.25% 5/15/13 | 1,166,000 | 1,178,447 | ||

6.75% 3/15/20 | 35,000 | 42,804 | ||

8.25% 8/15/19 | 7,000 | 9,115 | ||

Equity One, Inc.: | ||||

3.75% 11/15/22 | 1,300,000 | 1,276,683 | ||

6% 9/15/17 | 509,000 | 582,490 | ||

6.25% 1/15/17 | 74,000 | 84,300 | ||

Federal Realty Investment Trust: | ||||

5.4% 12/1/13 | 85,000 | 87,901 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

FINANCIALS - continued | ||||

Real Estate Investment Trusts - continued | ||||

Federal Realty Investment Trust: - continued | ||||

5.9% 4/1/20 | $ 5,000 | $ 5,958 | ||

6.2% 1/15/17 | 94,000 | 109,553 | ||

Health Care REIT, Inc. 2.25% 3/15/18 | 193,000 | 194,740 | ||

HRPT Properties Trust: | ||||

5.75% 11/1/15 | 211,000 | 229,063 | ||

6.25% 6/15/17 | 186,000 | 203,260 | ||

6.65% 1/15/18 | 95,000 | 108,042 | ||

UDR, Inc. 5.5% 4/1/14 | 1,107,000 | 1,158,305 | ||

Washington (REIT) 5.25% 1/15/14 | 30,000 | 30,948 | ||

| 8,704,848 | |||

Real Estate Management & Development - 2.1% | ||||

AMB Property LP 5.9% 8/15/13 | 389,000 | 396,785 | ||

BioMed Realty LP: | ||||

3.85% 4/15/16 | 1,000,000 | 1,064,994 | ||

4.25% 7/15/22 | 277,000 | 290,133 | ||

6.125% 4/15/20 | 6,000 | 7,011 | ||

Brandywine Operating Partnership LP: | ||||

3.95% 2/15/23 | 623,000 | 627,241 | ||

5.7% 5/1/17 | 369,000 | 417,359 | ||

ERP Operating LP: | ||||

4.625% 12/15/21 | 470,000 | 527,689 | ||

4.75% 7/15/20 | 446,000 | 502,407 | ||

5.375% 8/1/16 | 240,000 | 272,938 | ||

5.75% 6/15/17 | 1,003,000 | 1,176,749 | ||

Liberty Property LP: | ||||

4.125% 6/15/22 | 301,000 | 315,832 | ||

4.75% 10/1/20 | 1,045,000 | 1,151,149 | ||

5.125% 3/2/15 | 170,000 | 182,089 | ||

5.5% 12/15/16 | 260,000 | 294,709 | ||

6.625% 10/1/17 | 582,000 | 692,618 | ||

Mack-Cali Realty LP: | ||||

2.5% 12/15/17 | 439,000 | 444,855 | ||

4.5% 4/18/22 | 185,000 | 196,853 | ||

7.75% 8/15/19 | 64,000 | 81,052 | ||

Post Apartment Homes LP 3.375% 12/1/22 | 412,000 | 409,643 | ||

Prime Property Funding, Inc.: | ||||

5.125% 6/1/15 (d) | 189,000 | 199,781 | ||

5.5% 1/15/14 (d) | 144,000 | 148,345 | ||

5.7% 4/15/17 (d) | 295,000 | 325,592 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

FINANCIALS - continued | ||||

Real Estate Management & Development - continued | ||||

Regency Centers LP: | ||||

4.95% 4/15/14 | $ 92,000 | $ 95,912 | ||

5.25% 8/1/15 | 522,000 | 568,876 | ||

5.875% 6/15/17 | 160,000 | 184,235 | ||

Simon Property Group LP: | ||||

2.8% 1/30/17 | 142,000 | 149,841 | ||

4.2% 2/1/15 | 234,000 | 247,267 | ||

Tanger Properties LP: | ||||

6.125% 6/1/20 | 606,000 | 742,332 | ||

6.15% 11/15/15 | 115,000 | 130,414 | ||

Ventas Realty LP 2% 2/15/18 | 393,000 | 394,096 | ||

| 12,238,797 | |||

TOTAL FINANCIALS | 137,829,299 | |||

HEALTH CARE - 1.9% | ||||

Biotechnology - 0.1% | ||||

Amgen, Inc. 5.85% 6/1/17 | 446,000 | 528,021 | ||

Celgene Corp. 2.45% 10/15/15 | 56,000 | 58,076 | ||

| 586,097 | |||

Health Care Providers & Services - 1.1% | ||||

Aetna, Inc.: | ||||

1.5% 11/15/17 | 77,000 | 77,277 | ||

2.75% 11/15/22 | 310,000 | 302,645 | ||

Coventry Health Care, Inc.: | ||||

5.95% 3/15/17 | 264,000 | 307,398 | ||

6.3% 8/15/14 | 546,000 | 586,096 | ||

Express Scripts, Inc.: | ||||

3.125% 5/15/16 | 555,000 | 585,764 | ||

6.25% 6/15/14 | 299,000 | 319,519 | ||

McKesson Corp. 0.95% 12/4/15 | 120,000 | 120,364 | ||

Medco Health Solutions, Inc. 2.75% 9/15/15 | 1,108,000 | 1,158,035 | ||

UnitedHealth Group, Inc.: | ||||

1.4% 10/15/17 | 128,000 | 128,576 | ||

2.75% 2/15/23 | 105,000 | 103,790 | ||

3.875% 10/15/20 | 759,000 | 831,791 | ||

WellPoint, Inc.: | ||||

1.25% 9/10/15 | 180,000 | 181,392 | ||

1.875% 1/15/18 | 326,000 | 329,413 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

HEALTH CARE - continued | ||||

Health Care Providers & Services - continued | ||||

WellPoint, Inc.: - continued | ||||

3.125% 5/15/22 | $ 620,000 | $ 621,017 | ||

4.35% 8/15/20 | 760,000 | 842,750 | ||

| 6,495,827 | |||

Pharmaceuticals - 0.7% | ||||

AbbVie, Inc.: | ||||

1.75% 11/6/17 (d) | 1,062,000 | 1,075,413 | ||

2.9% 11/6/22 (d) | 620,000 | 619,778 | ||

Merck & Co., Inc. 5% 6/30/19 | 348,000 | 415,628 | ||

Novartis Capital Corp. 2.4% 9/21/22 | 500,000 | 495,187 | ||

Teva Pharmaceutical Finance II BV 3% 6/15/15 | 1,000,000 | 1,050,993 | ||

Watson Pharmaceuticals, Inc.: | ||||

1.875% 10/1/17 | 210,000 | 211,803 | ||

5% 8/15/14 | 66,000 | 69,837 | ||

Zoetis, Inc.: | ||||

1.875% 2/1/18 (d) | 96,000 | 96,340 | ||

3.25% 2/1/23 (d) | 235,000 | 236,475 | ||

| 4,271,454 | |||

TOTAL HEALTH CARE | 11,353,378 | |||

INDUSTRIALS - 0.8% | ||||

Aerospace & Defense - 0.0% | ||||

BAE Systems Holdings, Inc. 4.95% 6/1/14 (d) | 53,000 | 55,377 | ||

Airlines - 0.2% | ||||

Continental Airlines, Inc.: | ||||

6.648% 3/15/19 | 389,087 | 416,829 | ||

6.795% 2/2/20 | 14,595 | 15,179 | ||

6.9% 7/2/19 | 110,025 | 117,177 | ||

U.S. Airways pass-thru trust certificates: | ||||

6.85% 1/30/18 | 225,095 | 236,349 | ||

8.36% 1/20/19 | 185,844 | 203,035 | ||

| 988,569 | |||

Industrial Conglomerates - 0.3% | ||||

Covidien International Finance SA: | ||||

3.2% 6/15/22 | 620,000 | 647,661 | ||

6% 10/15/17 | 442,000 | 531,622 | ||

General Electric Co. 2.7% 10/9/22 | 512,000 | 510,962 | ||

| 1,690,245 | |||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

INDUSTRIALS - continued | ||||

Machinery - 0.2% | ||||

Deere & Co. 2.6% 6/8/22 | $ 1,300,000 | $ 1,310,004 | ||

Road & Rail - 0.1% | ||||

Burlington Northern Santa Fe LLC 3.45% 9/15/21 | 600,000 | 637,589 | ||

TOTAL INDUSTRIALS | 4,681,784 | |||

INFORMATION TECHNOLOGY - 0.9% | ||||

Computers & Peripherals - 0.1% | ||||

Hewlett-Packard Co. 2.625% 12/9/14 | 630,000 | 644,614 | ||

Electronic Equipment & Components - 0.2% | ||||

Tyco Electronics Group SA: | ||||

5.95% 1/15/14 | 526,000 | 549,339 | ||

6.55% 10/1/17 | 356,000 | 425,589 | ||

| 974,928 | |||

IT Services - 0.0% | ||||

The Western Union Co. 2.375% 12/10/15 | 277,000 | 281,512 | ||

Office Electronics - 0.4% | ||||

Xerox Corp. 4.25% 2/15/15 | 2,064,000 | 2,172,030 | ||

Software - 0.2% | ||||

Oracle Corp. 3.875% 7/15/20 | 1,000,000 | 1,119,444 | ||

TOTAL INFORMATION TECHNOLOGY | 5,192,528 | |||

MATERIALS - 1.2% | ||||

Chemicals - 0.3% | ||||

Ecolab, Inc. 1.45% 12/8/17 | 335,000 | 333,482 | ||

Sherwin-Williams Co. 1.35% 12/15/17 | 620,000 | 621,456 | ||

The Dow Chemical Co.: | ||||

4.125% 11/15/21 | 594,000 | 641,954 | ||

4.25% 11/15/20 | 321,000 | 352,680 | ||

7.6% 5/15/14 | 32,000 | 34,606 | ||

| 1,984,178 | |||

Construction Materials - 0.1% | ||||

CRH America, Inc. 6% 9/30/16 | 319,000 | 363,381 | ||

Metals & Mining - 0.8% | ||||

Anglo American Capital PLC: | ||||

2.15% 9/27/13 (d) | 1,000,000 | 1,006,189 | ||

9.375% 4/8/14 (d) | 459,000 | 499,772 | ||

9.375% 4/8/19 (d) | 630,000 | 843,775 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

MATERIALS - continued | ||||

Metals & Mining - continued | ||||

Corporacion Nacional del Cobre de Chile (Codelco) 3.875% 11/3/21 (d) | $ 630,000 | $ 665,150 | ||

Rio Tinto Finance USA PLC 1.625% 8/21/17 | 940,000 | 947,934 | ||

Vale Overseas Ltd. 6.25% 1/23/17 | 403,000 | 461,010 | ||

| 4,423,830 | |||

TOTAL MATERIALS | 6,771,389 | |||

TELECOMMUNICATION SERVICES - 2.6% | ||||

Diversified Telecommunication Services - 1.7% | ||||

AT&T Broadband Corp. 8.375% 3/15/13 | 390,000 | 390,866 | ||

AT&T, Inc.: | ||||

1.4% 12/1/17 | 620,000 | 618,611 | ||

2.5% 8/15/15 | 562,000 | 585,247 | ||

CenturyLink, Inc. 6.15% 9/15/19 | 592,000 | 638,077 | ||

Deutsche Telekom International Financial BV: | ||||

3.125% 4/11/16 (d) | 923,000 | 974,126 | ||

5.25% 7/22/13 | 370,000 | 376,517 | ||

France Telecom SA 2.125% 9/16/15 | 220,000 | 226,515 | ||

Qwest Corp. 3.558% 6/15/13 (f) | 1,080,000 | 1,083,181 | ||

SBC Communications, Inc. 5.1% 9/15/14 | 950,000 | 1,013,589 | ||

Telefonica Emisiones S.A.U. 3.729% 4/27/15 | 1,278,000 | 1,313,590 | ||

Verizon Communications, Inc.: | ||||

1.1% 11/1/17 | 620,000 | 615,832 | ||

2% 11/1/16 | 1,279,000 | 1,325,914 | ||

3% 4/1/16 | 621,000 | 660,699 | ||

| 9,822,764 | |||

Wireless Telecommunication Services - 0.9% | ||||

America Movil S.A.B. de CV: | ||||

2.375% 9/8/16 | 646,000 | 668,929 | ||

3.125% 7/16/22 | 434,000 | 431,930 | ||

3.625% 3/30/15 | 600,000 | 632,227 | ||

DIRECTV Holdings LLC/DIRECTV Financing, Inc.: | ||||

2.4% 3/15/17 | 700,000 | 714,902 | ||

4.75% 10/1/14 | 1,360,000 | 1,441,595 | ||

5.875% 10/1/19 | 34,000 | 40,126 | ||

Vodafone Group PLC: | ||||

1.5% 2/19/18 | 600,000 | 599,171 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

TELECOMMUNICATION SERVICES - continued | ||||

Wireless Telecommunication Services - continued | ||||

Vodafone Group PLC: - continued | ||||

4.15% 6/10/14 | $ 346,000 | $ 360,956 | ||

5% 12/16/13 | 398,000 | 412,127 | ||

| 5,301,963 | |||

TOTAL TELECOMMUNICATION SERVICES | 15,124,727 | |||

UTILITIES - 4.1% | ||||

Electric Utilities - 2.6% | ||||

AmerenUE 6.4% 6/15/17 | 519,000 | 628,802 | ||

American Electric Power Co., Inc. 1.65% 12/15/17 | 257,000 | 257,834 | ||

Cleveland Electric Illuminating Co. 5.65% 12/15/13 | 714,000 | 739,823 | ||

Commonwealth Edison Co. 4% 8/1/20 | 600,000 | 671,943 | ||

Duke Capital LLC 5.668% 8/15/14 | 357,000 | 380,901 | ||

Duquesne Light Holdings, Inc. 6.4% 9/15/20 (d) | 48,000 | 57,725 | ||

Edison International 3.75% 9/15/17 | 431,000 | 468,384 | ||

Exelon Corp. 4.9% 6/15/15 | 415,000 | 449,999 | ||

FirstEnergy Corp.: | ||||

4.25% 3/15/23 | 600,000 | 599,556 | ||

7.375% 11/15/31 | 55,000 | 65,320 | ||

FirstEnergy Solutions Corp.: | ||||

4.8% 2/15/15 | 552,000 | 589,656 | ||

6.05% 8/15/21 | 655,000 | 779,667 | ||

Hydro-Quebec 2% 6/30/16 | 2,500,000 | 2,603,168 | ||

LG&E and KU Energy LLC: | ||||

2.125% 11/15/15 | 479,000 | 490,735 | ||

3.75% 11/15/20 | 2,000 | 2,126 | ||

Nevada Power Co.: | ||||

6.5% 5/15/18 | 1,562,000 | 1,937,680 | ||

6.5% 8/1/18 | 273,000 | 341,215 | ||

NextEra Energy Capital Holdings, Inc. 1.611% 6/1/14 | 1,040,000 | 1,050,528 | ||

Pacific Gas & Electric Co. 3.25% 9/15/21 | 95,000 | 101,163 | ||

Pennsylvania Electric Co. 6.05% 9/1/17 | 115,000 | 134,367 | ||

Pepco Holdings, Inc. 2.7% 10/1/15 | 456,000 | 473,413 | ||

PPL Capital Funding, Inc. 4.2% 6/15/22 | 700,000 | 739,411 | ||

Progress Energy, Inc. 4.4% 1/15/21 | 732,000 | 814,980 | ||

Sierra Pacific Power Co. 5.45% 9/1/13 | 270,000 | 276,333 | ||

Tampa Electric Co.: | ||||

4.1% 6/15/42 | 108,000 | 112,015 | ||

Nonconvertible Bonds - continued | ||||

| Principal | Value | ||

UTILITIES - continued | ||||

Electric Utilities - continued | ||||

Tampa Electric Co.: - continued | ||||

5.4% 5/15/21 | $ 238,000 | $ 293,128 | ||

Wisconsin Electric Power Co. 2.95% 9/15/21 | 110,000 | 115,212 | ||

| 15,175,084 | |||

Gas Utilities - 0.0% | ||||

Southern Natural Gas Co. / Southern Natural Issuing Corp. 4.4% 6/15/21 | 188,000 | 206,174 | ||

Independent Power Producers & Energy Traders - 0.3% | ||||

Exelon Generation Co. LLC 5.35% 1/15/14 | 231,000 | 240,063 | ||

PPL Energy Supply LLC 6.3% 7/15/13 | 1,500,000 | 1,530,185 | ||

PSEG Power LLC 2.75% 9/15/16 | 148,000 | 154,095 | ||

| 1,924,343 | |||

Multi-Utilities - 1.2% | ||||

Ameren Illinois Co. 6.125% 11/15/17 | 62,000 | 74,641 | ||

Consolidated Edison Co. of New York, Inc. 4.45% 6/15/20 | 680,000 | 787,109 | ||

Dominion Resources, Inc.: | ||||

2.611% 9/30/66 (f) | 651,000 | 608,093 | ||

7.5% 6/30/66 (f) | 567,000 | 629,398 | ||

National Grid PLC 6.3% 8/1/16 | 248,000 | 288,308 | ||

NiSource Finance Corp.: | ||||

3.85% 2/15/23 | 700,000 | 718,612 | ||

5.25% 9/15/17 | 402,000 | 462,062 | ||

5.4% 7/15/14 | 234,000 | 248,151 | ||

5.45% 9/15/20 | 43,000 | 50,418 | ||

6.4% 3/15/18 | 230,000 | 276,115 | ||

San Diego Gas & Electric Co. 3% 8/15/21 | 600,000 | 634,238 | ||

Sempra Energy: | ||||

2.3% 4/1/17 | 1,435,000 | 1,490,049 | ||

2.875% 10/1/22 | 256,000 | 255,380 | ||

Wisconsin Energy Corp. 6.25% 5/15/67 (f) | 454,000 | 492,817 | ||

| 7,015,391 | |||

TOTAL UTILITIES | 24,320,992 | |||

TOTAL NONCONVERTIBLE BONDS (Cost $251,238,607) |

| |||

U.S. Government and Government Agency Obligations - 29.0% | ||||

| Principal | Value | ||

U.S. Government Agency Obligations - 3.0% | ||||

Fannie Mae: | ||||

0.5% 9/28/15 | $ 5,802,000 | $ 5,815,907 | ||

0.875% 12/20/17 | 1,142,000 | 1,143,772 | ||

0.875% 2/8/18 | 1,363,000 | 1,363,581 | ||

1.625% 10/26/15 | 1,941,000 | 2,003,027 | ||

Freddie Mac: | ||||

0.75% 1/12/18 | 3,200,000 | 3,180,390 | ||

1% 9/29/17 | 3,158,000 | 3,186,337 | ||

1.75% 9/10/15 | 980,000 | 1,013,410 | ||

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | 17,706,424 | |||

U.S. Treasury Obligations - 25.8% | ||||

U.S. Treasury Notes: | ||||

0.75% 6/30/17 | 11,000,000 | 11,058,432 | ||

0.875% 11/30/16 | 13,269,000 | 13,454,554 | ||

0.875% 4/30/17 | 25,246,000 | 25,543,827 | ||

0.875% 1/31/18 | 2,943,000 | 2,960,935 | ||

0.875% 7/31/19 | 22,403,000 | 22,073,945 | ||

1.25% 2/29/20 | 31,682,000 | 31,672,112 | ||

1.625% 8/15/22 | 26,205,000 | 25,785,301 | ||

1.875% 9/30/17 | 9,226,000 | 9,725,505 | ||

3.125% 1/31/17 (e) | 8,719,000 | 9,593,620 | ||

TOTAL U.S. TREASURY OBLIGATIONS | 151,868,231 | |||

Other Government Related - 0.2% | ||||

National Credit Union Administration Guaranteed Notes Master Trust 1.4% 6/12/15 (NCUA Guaranteed) | 850,000 | 869,712 | ||

TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $169,517,439) |

| |||

U.S. Government Agency - Mortgage Securities - 4.6% | ||||

| ||||

Fannie Mae - 3.1% | ||||

2.207% 7/1/35 (f) | 17,421 | 18,342 | ||

2.214% 2/1/33 (f) | 39,496 | 41,404 | ||

2.225% 10/1/33 (f) | 46,496 | 48,843 | ||

2.239% 3/1/35 (f) | 32,530 | 34,294 | ||

2.281% 12/1/34 (f) | 37,800 | 39,721 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

| Principal | Value | ||

Fannie Mae - continued | ||||

2.302% 10/1/33 (f) | $ 20,046 | $ 21,133 | ||

2.332% 3/1/35 (f) | 21,705 | 23,081 | ||

2.367% 12/1/33 (f) | 1,184,021 | 1,258,599 | ||

2.38% 7/1/35 (f) | 129,084 | 137,312 | ||

2.425% 3/1/35 (f) | 5,969 | 6,185 | ||

2.441% 10/1/35 (f) | 33,563 | 35,058 | ||

2.524% 10/1/33 (f) | 45,348 | 48,349 | ||

2.559% 6/1/36 (f) | 33,388 | 35,725 | ||

2.583% 5/1/35 (f) | 90,538 | 97,179 | ||

2.605% 7/1/34 (f) | 22,879 | 24,254 | ||

2.741% 7/1/35 (f) | 195,323 | 209,449 | ||

2.769% 11/1/36 (f) | 244,057 | 262,434 | ||

2.911% 4/1/35 (f) | 680,814 | 727,153 | ||

2.944% 7/1/37 (f) | 61,350 | 65,108 | ||

3.189% 1/1/40 (f) | 354,537 | 370,515 | ||

3.476% 3/1/40 (f) | 267,640 | 279,780 | ||

3.5% 12/1/25 to 1/1/26 | 7,419,245 | 7,869,713 | ||

3.528% 12/1/39 (f) | 105,367 | 110,086 | ||

3.617% 3/1/40 (f) | 363,584 | 382,230 | ||

4% 8/1/18 | 365,989 | 391,428 | ||

4.5% 6/1/19 to 3/1/35 | 422,354 | 454,619 | ||

5.5% 11/1/34 | 2,127,339 | 2,339,289 | ||

6% 5/1/16 to 4/1/17 | 117,230 | 124,992 | ||

6.5% 12/1/13 to 8/1/36 | 1,319,718 | 1,485,153 | ||

7% 9/1/18 to 6/1/33 | 574,256 | 663,964 | ||

7.5% 8/1/17 to 3/1/28 | 182,081 | 211,896 | ||

8.5% 5/1/21 to 9/1/25 | 32,652 | 37,938 | ||

9.5% 2/1/25 | 1,125 | 1,232 | ||

10.5% 8/1/20 | 9,586 | 11,177 | ||

12.5% 12/1/13 to 4/1/15 | 2,645 | 2,818 | ||

TOTAL FANNIE MAE | 17,870,453 | |||

Freddie Mac - 1.5% | ||||

2.373% 1/1/35 (f) | 66,687 | 71,031 | ||

2.399% 4/1/35 (f) | 358,123 | 379,591 | ||

3% 8/1/21 | 956,215 | 1,005,631 | ||

3.134% 3/1/33 (f) | 5,745 | 6,118 | ||

3.439% 10/1/35 (f) | 48,690 | 52,364 | ||

3.5% 1/1/26 | 429,070 | 458,022 | ||

3.573% 4/1/40 (f) | 250,018 | 262,796 | ||

3.604% 4/1/40 (f) | 198,748 | 209,585 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

| Principal | Value | ||

Freddie Mac - continued | ||||

3.611% 2/1/40 (f) | $ 428,323 | $ 447,820 | ||

4.5% 8/1/18 | 726,435 | 774,366 | ||

5% 3/1/19 | 1,220,344 | 1,305,912 | ||

5.5% 3/1/34 to 7/1/35 | 3,515,885 | 3,861,009 | ||

8.5% 9/1/24 to 8/1/27 | 39,328 | 47,021 | ||

11.5% 10/1/15 | 884 | 916 | ||

TOTAL FREDDIE MAC | 8,882,182 | |||

Ginnie Mae - 0.0% | ||||

7% 7/15/28 to 11/15/28 | 137,378 | 159,420 | ||

7.5% 2/15/28 to 10/15/28 | 4,019 | 4,735 | ||

8% 6/15/24 | 146 | 170 | ||

8.5% 10/15/21 | 33,053 | 38,208 | ||

11% 7/20/19 to 8/20/19 | 2,462 | 2,764 | ||

TOTAL GINNIE MAE | 205,297 | |||

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $26,169,710) |

| |||

Asset-Backed Securities - 7.3% | ||||

| ||||

Accredited Mortgage Loan Trust Series 2005-1 Class M1, 0.6717% 4/25/35 (f) | 67,559 | 62,564 | ||

ACE Securities Corp. Home Equity Loan Trust: | ||||

Series 2004-HE1 Class M2, 1.8517% 3/25/34 (f) | 49,572 | 48,453 | ||

Series 2005-HE2 Class M2, 0.8767% 4/25/35 (f) | 5,581 | 5,523 | ||

Ally Auto Receivables Trust: | ||||

Series 2010-4 Class A4, 1.35% 12/15/15 | 570,000 | 575,276 | ||

Series 2010-5 Class A4, 1.75% 3/15/16 | 240,000 | 243,252 | ||

Series 2011-1 Class A4, 2.23% 3/15/16 | 1,090,000 | 1,111,020 | ||

Series 2011-2 Class A3, 1.18% 4/15/15 | 345,237 | 346,213 | ||

Series 2011-3 Class A3, 0.97% 8/17/15 | 580,230 | 581,920 | ||

Series 2012-1 Class A2, 0.71% 9/15/14 | 364,520 | 364,945 | ||

Series 2012-SN1 Class A3, 0.57% 8/20/15 | 860,000 | 860,519 | ||

Ally Master Owner Trust: | ||||

Series 2010-3 Class A, 2.88% 4/15/15 (d) | 320,000 | 320,932 | ||

Series 2011-1 Class A2, 2.15% 1/15/16 | 2,260,000 | 2,291,215 | ||

Series 2011-3 Class A2, 1.81% 5/15/16 | 1,240,000 | 1,258,657 | ||

Series 2011-5 Class A1, 0.8512% 6/15/15 (f) | 1,240,000 | 1,241,125 | ||

Series 2012-1 Class A2, 1.44% 2/15/17 | 1,260,000 | 1,275,478 | ||

Asset-Backed Securities - continued | ||||

| Principal | Value | ||

Ally Master Owner Trust: - continued | ||||

Series 2012-2 Class A, 0.7012% 3/15/16 (f) | $ 700,000 | $ 700,271 | ||

Series 2012-3 Class A2, 1.21% 6/15/17 | 1,250,000 | 1,256,822 | ||

Series 2012-5 Class A, 1.54% 9/16/19 | 1,500,000 | 1,508,225 | ||

AmeriCredit Auto Receivables Trust: | ||||

Series 2010-4 Class A3, 1.27% 4/8/15 | 419,548 | 420,089 | ||

Series 2011-1 Class A3, 1.39% 9/8/15 | 300,204 | 301,117 | ||

Series 2011-2 Class A3, 1.61% 10/8/15 | 815,587 | 818,884 | ||

Series 2011-3 Class A3, 1.17% 1/8/16 | 330,000 | 331,265 | ||

Series 2011-4 Class AS, 0.92% 3/9/15 | 263,815 | 264,040 | ||

Series 2011-5 Class A2, 1.19% 8/8/15 | 127,617 | 127,915 | ||

Series 2012-2 Class A3, 1.05% 10/11/16 | 380,000 | 383,181 | ||

Series 2012-5 Class A3, 0.92% 6/8/17 | 920,000 | 919,995 | ||

Ameriquest Mortgage Securities, Inc. pass-thru certificates: | ||||

Series 2003-10 Class M1, 0.9017% 12/25/33 (f) | 8,192 | 7,426 | ||

Series 2004-R2 Class M3, 1.0267% 4/25/34 (f) | 11,219 | 8,595 | ||

Series 2005-R2 Class M1, 0.6517% 4/25/35 (f) | 176,341 | 172,015 | ||

Argent Securities, Inc. pass-thru certificates: | ||||

Series 2003-W7 Class A2, 0.9817% 3/25/34 (f) | 4,092 | 3,537 | ||

Series 2004-W11 Class M2, 1.2517% 11/25/34 (f) | 63,962 | 58,443 | ||

Series 2004-W7 Class M1, 1.0267% 5/25/34 (f) | 185,706 | 173,860 | ||

Series 2006-W4 Class A2C, 0.3617% 5/25/36 (f) | 144,843 | 51,083 | ||

Asset Backed Securities Corp. Home Equity Loan Trust: | ||||

Series 2004-HE2 Class M1, 1.0267% 4/25/34 (f) | 191,012 | 176,822 | ||

Series 2006-HE2 Class M1, 0.5717% 3/25/36 (f) | 6,627 | 74 | ||

Bear Stearns Asset Backed Securities I Trust Series 2005-HE2 Class M2, 1.3267% 2/25/35 (f) | 427,000 | 314,999 | ||

BMW Floorplan Master Owner Trust Series 2012-1A Class A, 0.6057% 9/15/17 (d)(f) | 1,900,000 | 1,897,419 | ||

Capital Trust Ltd. Series 2004-1: | ||||

Class A2, 0.6507% 7/20/39 (d)(f) | 6,296 | 5,753 | ||

Class B, 0.9507% 7/20/39 (d)(f) | 30,070 | 13,731 | ||

Class C, 1.3007% 7/20/39 (d)(f) | 38,684 | 12 | ||

Carrington Mortgage Loan Trust Series 2007-RFC1 Class A3, 0.3417% 12/25/36 (f) | 205,465 | 105,917 | ||

Chase Issuance Trust Series 2012-A8 Class A8, 0.54% 10/16/17 | 2,500,000 | 2,493,417 | ||

Countrywide Asset-Backed Certificates Trust Series 2007-4 Class A1A, 0.3237% 9/25/37 (f) | 5,644 | 5,633 | ||

Countrywide Home Loans, Inc.: | ||||

Series 2003-BC1 Class B1, 5.4322% 3/25/32 (MGIC Investment Corp. Insured) (f) | 28,427 | 27,449 | ||

Asset-Backed Securities - continued | ||||

| Principal | Value | ||

Countrywide Home Loans, Inc.: - continued | ||||

Series 2004-3 Class M4, 1.6567% 4/25/34 (f) | $ 18,137 | $ 8,591 | ||

Series 2004-4 Class M2, 0.9967% 6/25/34 (f) | 50,135 | 44,474 | ||

Discover Card Master Trust Series 2012-A1 Class A1, 0.81% 8/15/17 | 1,410,000 | 1,419,722 | ||

Enterprise Fleet Financing LLC Series 2012-1 Class A2, 1.14% 11/20/17 (d) | 780,000 | 784,436 | ||

Fannie Mae Series 2004-T5 Class AB3, 1.0332% 5/28/35 (f) | 4,436 | 3,424 | ||

Fieldstone Mortgage Investment Corp. Series 2004-3 Class M5, 2.3767% 8/25/34 (f) | 33,155 | 24,171 | ||

Ford Credit Auto Lease Trust Series 2012-A Class A3, 0.85% 1/15/15 | 400,000 | 401,252 | ||

Ford Credit Auto Owner Trust Series 2011-B Class A4, 1.35% 12/15/16 | 510,000 | 517,079 | ||

Ford Credit Floorplan Master Owner Trust: | ||||

Series 2010-5 Class A1, 1.5% 9/15/15 | 640,000 | 643,707 | ||

Series 2012-2 Class A, 1.92% 1/15/19 | 1,310,000 | 1,350,999 | ||

Series 2012-4 Class A1, 0.74% 9/15/16 | 1,470,000 | 1,474,246 | ||

Series 2013-1 Class A1, 0.85% 1/15/18 | 1,320,000 | 1,319,306 | ||

Fremont Home Loan Trust Series 2005-A: | ||||

Class M3, 0.9367% 1/25/35 (f) | 81,136 | 34,613 | ||

Class M4, 1.2217% 1/25/35 (f) | 41,438 | 4,892 | ||

GCO Education Loan Funding Master Trust II Series 2007-1A Class C1L, 0.6681% 2/25/47 (d)(f) | 335,000 | 227,968 | ||

GE Business Loan Trust: | ||||

Series 2003-1 Class A, 0.6312% 4/15/31 (d)(f) | 17,527 | 16,687 | ||

Series 2006-2A: | ||||

Class A, 0.3812% 11/15/34 (d)(f) | 183,811 | 169,669 | ||

Class B, 0.4812% 11/15/34 (d)(f) | 66,692 | 56,689 | ||

Class C, 0.5812% 11/15/34 (d)(f) | 110,070 | 79,250 | ||

Class D, 0.9512% 11/15/34 (d)(f) | 41,751 | 27,973 | ||

GE Capital Credit Card Master Note Trust: | ||||

Series 2012-1 Class A, 1.03% 1/15/18 | 1,190,000 | 1,202,149 | ||

Series 2012-5 Class A, 0.97% 6/15/18 | 1,560,000 | 1,574,441 | ||

GSAMP Trust Series 2004-AR1 Class B4, 3.4154% 6/25/34 (d)(f) | 54,683 | 15,249 | ||

Guggenheim Structured Real Estate Funding Ltd. Series 2006-3 Class C, 0.7517% 9/25/46 (d)(f) | 154,789 | 152,854 | ||

Home Equity Asset Trust: | ||||

Series 2003-2 Class M1, 1.5217% 8/25/33 (f) | 44,731 | 43,584 | ||

Series 2003-3 Class M1, 1.4917% 8/25/33 (f) | 54,587 | 50,190 | ||

Series 2003-5 Class A2, 0.9017% 12/25/33 (f) | 2,817 | 2,367 | ||

Asset-Backed Securities - continued | ||||

| Principal | Value | ||

Honda Auto Receivables Owner Trust: | ||||

Series 2011-1 Class A4, 1.8% 4/17/17 | $ 330,000 | $ 334,432 | ||

Series 2011-2 Class A4, 1.55% 8/18/17 | 820,000 | 833,614 | ||

HSI Asset Securitization Corp. Trust Series 2007-HE1 Class 2A3, 0.3917% 1/25/37 (f) | 141,116 | 68,655 | ||

John Deere Owner Trust Series 2011-A Class A4, 1.96% 4/16/18 | 260,000 | 265,139 | ||

JPMorgan Mortgage Acquisition Trust: | ||||

Series 2006-NC2 Class M2, 0.5017% 7/25/36 (f) | 25,000 | 417 | ||

Series 2007-CH1 Class AV4, 0.3317% 11/25/36 (f) | 176,698 | 171,079 | ||

Keycorp Student Loan Trust: | ||||

Series 1999-A Class A2, 0.64% 12/27/29 (f) | 38,139 | 36,431 | ||

Series 2006-A Class 2C, 1.46% 3/27/42 (f) | 392,000 | 18,950 | ||

MASTR Asset Backed Securities Trust Series 2007-HE1 Class M1, 0.5017% 5/25/37 (f) | 75,858 | 849 | ||

Mercedes-Benz Auto Lease Trust Series 2011-B Class A3, 1.07% 8/15/14 (d) | 670,000 | 672,030 | ||

Mercedes-Benz Master Owner Trust Series 2012-AA Class A, 0.79% 11/15/17 (d) | 1,600,000 | 1,600,534 | ||

Meritage Mortgage Loan Trust Series 2004-1 Class M1, 0.9517% 7/25/34 (f) | 19,277 | 15,696 | ||

Merrill Lynch Mortgage Investors Trust: | ||||

Series 2003-OPT1 Class M1, 1.1767% 7/25/34 (f) | 61,301 | 53,115 | ||

Series 2006-FM1 Class A2B, 0.3117% 4/25/37 (f) | 107,393 | 89,900 | ||

Series 2006-OPT1 Class A1A, 0.4617% 6/25/35 (f) | 285,142 | 254,423 | ||

Morgan Stanley ABS Capital I Trust: | ||||

Series 2004-HE6 Class A2, 0.5417% 8/25/34 (f) | 4,895 | 4,257 | ||

Series 2004-NC8 Class M6, 2.0767% 9/25/34 (f) | 78,383 | 39,339 | ||

Series 2005-NC1 Class M1, 0.6417% 1/25/35 (f) | 45,571 | 41,495 | ||

Series 2005-NC2 Class B1, 1.3717% 3/25/35 (f) | 47,458 | 1,934 | ||

New Century Home Equity Loan Trust Series 2005-4 Class M2, 0.7117% 9/25/35 (f) | 162,650 | 133,264 | ||

Nissan Auto Lease Trust: | ||||

Series 2011-A Class A3, 1.04% 8/15/14 | 910,000 | 912,130 | ||

Series 2011-B Class A3, 0.92% 2/16/15 | 460,000 | 461,531 | ||

Ocala Funding LLC: | ||||

Series 2005-1A Class A, 1.7007% 3/20/10 (b)(d)(f) | 64,000 | 0 | ||

Series 2006-1A Class A, 1.6007% 3/20/11 (b)(d)(f) | 134,000 | 0 | ||

Park Place Securities, Inc.: | ||||

Series 2004-WCW1: | ||||

Class M3, 1.4517% 9/25/34 (f) | 60,741 | 48,611 | ||

Class M4, 1.6517% 9/25/34 (f) | 77,891 | 22,885 | ||

Series 2005-WCH1 Class M4, 1.0317% 1/25/36 (f) | 126,217 | 102,532 | ||

Asset-Backed Securities - continued | ||||

| Principal | Value | ||

Salomon Brothers Mortgage Securities VII, Inc. Series 2003-HE1 Class A, 1.0017% 4/25/33 (f) | $ 582 | $ 542 | ||

Santander Drive Auto Receivables Trust: | ||||

Series 2011-3 Class A2, 1.11% 8/15/14 | 104,626 | 104,727 | ||

Series 2011-4 Class A2, 1.37% 3/16/15 | 228,337 | 228,918 | ||

Series 2012-1 Class A2, 1.25% 4/15/15 | 302,965 | 303,865 | ||

Series 2012-3 Class A3, 1.08% 4/15/16 | 420,000 | 422,599 | ||

Series 2012-4 Class A3, 1.04% 8/15/16 | 500,000 | 503,388 | ||

Saxon Asset Securities Trust Series 2004-1 Class M1, 0.9967% 3/25/35 (f) | 135,706 | 112,730 | ||

Sierra Receivables Funding Co. Series 2007-1A Class A2, 0.3547% 3/20/19 (FGIC Insured) (d)(f) | 36,798 | 36,554 | ||

SLM Private Credit Student Loan Trust Series 2004-A Class C, 1.258% 6/15/33 (f) | 143,893 | 98,324 | ||

Structured Asset Investment Loan Trust Series 2004-8 Class M5, 1.9267% 9/25/34 (f) | 6,568 | 2,739 | ||

SVO VOI Mortgage Corp. Series 2006-AA Class A, 5.28% 2/20/24 (d) | 48,689 | 49,495 | ||

Terwin Mortgage Trust Series 2003-4HE Class A1, 1.0617% 9/25/34 (f) | 2,472 | 2,239 | ||

Trapeza CDO XII Ltd./Trapeza CDO XII, Inc. Series 2007-12A Class B, 0.865% 4/6/42 (d)(f) | 314,337 | 3,929 | ||

Whinstone Capital Management Ltd. Series 1A Class B3, 2.101% 10/25/44 (d)(f) | 203,978 | 178,481 | ||

TOTAL ASSET-BACKED SECURITIES (Cost $41,882,320) |

| |||

Collateralized Mortgage Obligations - 3.1% | ||||

| ||||

Private Sponsor - 1.1% | ||||

Arran Residential Mortgages Funding PLC floater Series 2011-1A Class A1C, 1.4901% 11/19/47 (d)(f) | 159,271 | 159,602 | ||

Credit Suisse Mortgage Capital Certificates: | ||||

floater Series 2011-7R Class A1, 1.4597% 8/28/47 (d)(f) | 269,848 | 267,975 | ||

sequential payer Series 2010-16 Class A1, 3% 6/25/50 (d) | 143,179 | 144,107 | ||

Granite Master Issuer PLC floater: | ||||

Series 2005-4 Class C2, 1.3007% 12/20/54 (f) | 25,291 | 21,522 | ||

Series 2006-1A: | ||||

Class A5, 0.3407% 12/20/54 (d)(f) | 1,239,109 | 1,214,326 | ||

Class C2, 1.4007% 12/20/54 (d)(f) | 578,000 | 491,878 | ||

Series 2006-2 Class C1, 1.1407% 12/20/54 (f) | 463,000 | 394,013 | ||

Collateralized Mortgage Obligations - continued | ||||

| Principal | Value | ||

Private Sponsor - continued | ||||

Granite Master Issuer PLC floater: - continued | ||||

Series 2006-3 Class C2, 1.2007% 12/20/54 (f) | $ 128,000 | $ 108,928 | ||

Series 2006-4: | ||||

Class B1, 0.3807% 12/20/54 (f) | 521,000 | 486,093 | ||

Class C1, 0.9607% 12/20/54 (f) | 319,000 | 271,469 | ||

Class M1, 0.5407% 12/20/54 (f) | 137,000 | 122,615 | ||

Series 2007-1: | ||||

Class 1C1, 0.8007% 12/20/54 (f) | 258,000 | 219,558 | ||

Class 1M1, 0.5007% 12/20/54 (f) | 172,000 | 153,940 | ||

Class 2C1, 1.0607% 12/20/54 (f) | 117,000 | 99,567 | ||

Class 2M1, 0.7007% 12/20/54 (f) | 222,000 | 198,690 | ||

Series 2007-2 Class 2C1, 1.0622% 12/17/54 (f) | 308,000 | 262,108 | ||

Granite Mortgages Series 2003-2 Class 1A3, 0.802% 7/20/43 (f) | 252,254 | 249,315 | ||

Granite Mortgages PLC floater: | ||||

Series 2003-3 Class 1C, 2.752% 1/20/44 (f) | 36,767 | 35,318 | ||

Series 2004-1 Class 2A1, 0.629% 3/20/44 (f) | 1,146,017 | 1,132,666 | ||

MASTR Adjustable Rate Mortgages Trust Series 2007-3 Class 22A2, 0.4117% 5/25/47 (f) | 57,838 | 42,282 | ||

Merrill Lynch Alternative Note Asset Trust floater Series 2007-OAR1 Class A1, 0.3717% 2/25/37 (f) | 117,564 | 101,518 | ||

RESI Finance LP/RESI Finance DE Corp. floater Series 2003-B: | ||||

Class B5, 2.5492% 7/10/35 (d)(f) | 109,416 | 96,254 | ||

Class B6, 3.0492% 7/10/35 (d)(f) | 182,025 | 156,781 | ||

Residential Funding Securities Corp. floater Series 2003-RP2 Class A1, 0.6517% 6/25/33 (d)(f) | 12,504 | 12,169 | ||

Sequoia Mortgage Trust floater Series 2004-6 Class A3B, 1.3885% 7/20/34 (f) | 3,625 | 3,395 | ||

TOTAL PRIVATE SPONSOR | 6,446,089 | |||

U.S. Government Agency - 2.0% | ||||

Fannie Mae: | ||||

pass-thru certificates Series 2012-127 Class DH, 4% 11/25/27 | 936,411 | 1,005,508 | ||

planned amortization class Series 2002-9 Class PC, 6% 3/25/17 | 30,161 | 32,144 | ||

sequential payer: | ||||

Series 2002-56 Class MC, 5.5% 9/25/17 | 100,819 | 106,448 | ||

Series 2004-86 Class KC, 4.5% 5/25/19 | 53,697 | 55,007 | ||

Series 2010-123 Class DL, 3.5% 11/25/25 | 303,719 | 316,720 | ||

Collateralized Mortgage Obligations - continued | ||||

| Principal | Value | ||

U.S. Government Agency - continued | ||||

Fannie Mae: - continued | ||||

Series 2010-143 Class B, 3.5% 12/25/25 | $ 474,159 | $ 498,613 | ||

Series 2013-16 Class GP, 3% 3/25/33 | 3,000,000 | 3,221,250 | ||

Freddie Mac: | ||||

floater Series 3346 Class FA, 0.4312% 2/15/19 (f) | 416,909 | 417,492 | ||

planned amortization class: | ||||

Series 2356 Class GD, 6% 9/15/16 | 107,887 | 115,107 | ||

Series 2363 Class PF, 6% 9/15/16 | 133,943 | 142,055 | ||

Series 3820 Class DA, 4% 11/15/35 | 495,836 | 540,882 | ||

Series 3777 Class AC, 3.5% 12/15/25 | 1,087,661 | 1,148,475 | ||

Series 3949 Class MK, 4.5% 10/15/34 | 340,000 | 380,816 | ||

Ginnie Mae guaranteed REMIC pass-thru certificates: | ||||

floater: | ||||

Series 2010-53 Class FC, 1.0247% 4/20/40 (f) | 453,994 | 461,347 | ||

Series 2012-149 Class MF, 0.4547% 12/20/42 (f) | 1,883,260 | 1,882,322 | ||

floater sequential payer Series 2011-150 Class D, 3% 4/20/37 | 349,599 | 358,264 | ||

Series 2012-97 Class JF, 0.4517% 8/16/42 (f) | 815,971 | 817,046 | ||

TOTAL U.S. GOVERNMENT AGENCY | 11,499,496 | |||

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $15,304,071) |

| |||

Commercial Mortgage Securities - 6.4% | ||||

| ||||

7 WTC Depositor LLC Trust Series 2012-7WTC Class A, 4.0824% 3/13/31 (d) | 890,000 | 934,203 | ||

Asset Securitization Corp. Series 1997-D5 Class PS1, 1.4302% 2/14/43 (f)(h) | 92,757 | 3,044 | ||

Banc of America Commercial Mortgage Trust: | ||||

sequential payer: | ||||

Series 2004-2 Class A4, 4.153% 11/10/38 | 217,288 | 219,109 | ||

Series 2006-2 Class AAB, 5.7141% 5/10/45 (f) | 146,580 | 154,079 | ||

Series 2006-5 Class A3, 5.39% 9/10/47 | 301,000 | 316,577 | ||

Series 2006-6 Class A3, 5.369% 10/10/45 | 432,000 | 468,078 | ||

Series 2007-4 Class A3, 5.806% 2/10/51 (f) | 144,747 | 152,315 | ||

Series 2001-3 Class H, 6.562% 4/11/37 (d) | 121,000 | 121,684 | ||

Series 2006-6 Class E, 5.619% 10/10/45 (d) | 125,000 | 12,102 | ||

Series 2007-3 Class A3, 5.5925% 6/10/49 (f) | 361,000 | 361,007 | ||

Banc of America Large Loan, Inc. floater Series 2006-BIX1 Class G, 0.5312% 10/15/19 (d)(f) | 48,471 | 47,987 | ||

Commercial Mortgage Securities - continued | ||||

| Principal | Value | ||

Banc of America REMIC Trust Series 2012-CLRN Class A1, 1.3512% 8/15/17 (d)(f) | $ 1,080,000 | $ 1,089,792 | ||

Bayview Commercial Asset Trust: | ||||

floater: | ||||

Series 2003-2 Class M1, 1.0517% 12/25/33 (d)(f) | 6,164 | 4,508 | ||

Series 2005-3A: | ||||

Class A2, 0.6017% 11/25/35 (d)(f) | 57,417 | 48,069 | ||

Class M1, 0.6417% 11/25/35 (d)(f) | 6,744 | 4,376 | ||

Class M2, 0.6917% 11/25/35 (d)(f) | 8,563 | 5,463 | ||

Class M3, 0.7117% 11/25/35 (d)(f) | 7,663 | 4,790 | ||

Class M4, 0.8017% 11/25/35 (d)(f) | 9,548 | 4,625 | ||

Series 2005-4A: | ||||

Class A2, 0.5917% 1/25/36 (d)(f) | 135,035 | 106,510 | ||

Class B1, 1.6017% 1/25/36 (d)(f) | 11,669 | 1,801 | ||

Class M1, 0.6517% 1/25/36 (d)(f) | 43,560 | 24,205 | ||

Class M2, 0.6717% 1/25/36 (d)(f) | 13,068 | 6,862 | ||

Class M3, 0.7017% 1/25/36 (d)(f) | 19,085 | 9,833 | ||

Class M4, 0.8117% 1/25/36 (d)(f) | 10,555 | 5,123 | ||

Class M5, 0.8517% 1/25/36 (d)(f) | 10,555 | 3,722 | ||

Class M6, 0.9017% 1/25/36 (d)(f) | 11,211 | 3,015 | ||

Series 2006-1: | ||||

Class A2, 0.5617% 4/25/36 (d)(f) | 20,926 | 16,946 | ||

Class M1, 0.5817% 4/25/36 (d)(f) | 7,485 | 4,823 | ||

Class M2, 0.6017% 4/25/36 (d)(f) | 7,908 | 4,898 | ||

Class M3, 0.6217% 4/25/36 (d)(f) | 6,804 | 4,053 | ||

Class M4, 0.7217% 4/25/36 (d)(f) | 3,856 | 2,217 | ||

Class M5, 0.7617% 4/25/36 (d)(f) | 3,742 | 2,058 | ||

Class M6, 0.8417% 4/25/36 (d)(f) | 7,462 | 3,140 | ||

Series 2006-2A: | ||||

Class A1, 0.4317% 7/25/36 (d)(f) | 324,918 | 254,695 | ||

Class A2, 0.4817% 7/25/36 (d)(f) | 18,666 | 14,682 | ||

Class B1, 1.0717% 7/25/36 (d)(f) | 6,989 | 1,255 | ||

Class M1, 0.5117% 7/25/36 (d)(f) | 19,585 | 9,313 | ||

Class M2, 0.5317% 7/25/36 (d)(f) | 13,818 | 6,185 | ||

Class M3, 0.5517% 7/25/36 (d)(f) | 11,462 | 4,871 | ||

Class M4, 0.6217% 7/25/36 (d)(f) | 7,740 | 1,917 | ||

Class M5, 0.6717% 7/25/36 (d)(f) | 9,513 | 2,229 | ||

Class M6, 0.7417% 7/25/36 (d)(f) | 14,193 | 2,969 | ||

Series 2006-3A: | ||||

Class M4, 0.6317% 10/25/36 (d)(f) | 15,624 | 2,364 | ||

Class M5, 0.6817% 10/25/36 (d)(f) | 18,450 | 978 | ||

Series 2006-4A Class M6, 0.7217% 12/25/36 (d)(f) | 13,743 | 440 | ||

Commercial Mortgage Securities - continued | ||||

| Principal | Value | ||

Bayview Commercial Asset Trust: - continued | ||||

floater: | ||||

Series 2007-1 Class A2, 0.4717% 3/25/37 (d)(f) | $ 89,293 | $ 51,646 | ||

Series 2007-2A: | ||||

Class A1, 0.4717% 7/25/37 (d)(f) | 86,314 | 60,455 | ||

Class A2, 0.5217% 7/25/37 (d)(f) | 80,696 | 39,373 | ||

Class M1, 0.5717% 7/25/37 (d)(f) | 28,337 | 7,790 | ||

Class M2, 0.6117% 7/25/37 (d)(f) | 15,309 | 2,613 | ||

Class M3, 0.6917% 7/25/37 (d)(f) | 15,443 | 1,553 | ||

Class M4, 0.8517% 7/25/37 (d)(f) | 31,478 | 1,930 | ||

Class M5, 0.9517% 7/25/37 (d)(f) | 27,733 | 1,234 | ||

Class M6, 1.2017% 7/25/37 (d)(f) | 17,783 | 155 | ||

Series 2007-3: | ||||

Class A2, 0.4917% 7/25/37 (d)(f) | 79,886 | 41,585 | ||

Class B1, 1.1517% 7/25/37 (d)(f) | 19,656 | 1,502 | ||

Class B2, 1.8017% 7/25/37 (d)(f) | 8,391 | 448 | ||

Class M1, 0.5117% 7/25/37 (d)(f) | 17,721 | 5,985 | ||

Class M2, 0.5417% 7/25/37 (d)(f) | 19,013 | 5,309 | ||

Class M3, 0.5717% 7/25/37 (d)(f) | 29,331 | 6,373 | ||

Class M4, 0.7017% 7/25/37 (d)(f) | 46,409 | 7,826 | ||

Class M5, 0.8017% 7/25/37 (d)(f) | 24,124 | 3,453 | ||

Class M6, 1.0017% 7/25/37 (d)(f) | 18,274 | 2,207 | ||

Series 2007-4A: | ||||

Class M1, 1.1517% 9/25/37 (d)(f) | 33,246 | 3,091 | ||

Class M2, 1.2517% 9/25/37 (d)(f) | 33,246 | 2,557 | ||

Class M4, 1.8017% 9/25/37 (d)(f) | 83,833 | 4,092 | ||

Class M5, 1.9517% 9/25/37 (d)(f) | 53,327 | 1,700 | ||

Series 2007-5A, Class IO, 4.186% 10/25/37 (d)(f)(h) | 863,773 | 71,919 | ||

Bear Stearns Commercial Mortgage Securities Trust: | ||||

floater: | ||||

Series 2006-BBA7: | ||||

Class H, 0.8512% 3/15/19 (d)(f) | 111,360 | 110,275 | ||

Class J, 1.0512% 3/15/19 (d)(f) | 146,405 | 139,191 | ||

Series 2007-BBA8: | ||||

Class D, 0.4512% 3/15/22 (d)(f) | 76,569 | 72,317 | ||

Class E, 0.5012% 3/15/22 (d)(f) | 394,020 | 364,257 | ||

Class F, 0.5512% 3/15/22 (d)(f) | 241,475 | 218,405 | ||

Class G, 0.6012% 3/15/22 (d)(f) | 62,931 | 55,660 | ||

Class H, 0.7512% 3/15/22 (d)(f) | 76,569 | 66,191 | ||

Class J, 0.9012% 3/15/22 (d)(f) | 76,569 | 64,277 | ||

sequential payer Series 2004-PWR3 Class A3, 4.487% 2/11/41 | 6,369 | 6,368 | ||

Commercial Mortgage Securities - continued | ||||

| Principal | Value | ||

Bear Stearns Commercial Mortgage Securities Trust: - continued | ||||

Series 2006-PW14 Class X2, 0.6687% 12/11/38 (d)(f)(h) | $ 2,038,198 | $ 11,375 | ||

Series 2006-T24 Class X2, 0.4454% 10/12/41 (d)(f)(h) | 367,020 | 1,192 | ||

Series 2007-PW18 Class X2, 0.3087% 6/11/50 (d)(f)(h) | 13,976,215 | 120,126 | ||

Series 2007-T28 Class X2, 0.1575% 9/11/42 (d)(f)(h) | 7,618,124 | 35,188 | ||

C-BASS Trust floater Series 2006-SC1 Class A, 0.4717% 5/25/36 (d)(f) | 73,860 | 68,881 | ||

CDC Commercial Mortgage Trust Series 2002-FX1: | ||||

Class G, 6.625% 5/15/35 (d) | 254,000 | 264,748 | ||

Class XCL, 1.3266% 5/15/35 (d)(f)(h) | 852,830 | 13,391 | ||

Citigroup Commercial Mortgage Trust: | ||||

floater Series 2006-FL2 Class H, 0.5712% 8/15/21 (d)(f) | 9,315 | 8,952 | ||

Series 2008-C7 Class A2B, 6.0632% 12/10/49 (f) | 128,953 | 130,080 | ||

Citigroup/Deutsche Bank Commercial Mortgage Trust Series 2007-CD4 Class A3, 5.293% 12/11/49 | 210,000 | 217,097 | ||

Cobalt CMBS Commercial Mortgage Trust: | ||||

sequential payer Series 2007-C3 Class A3, 5.8027% 5/15/46 (f) | 216,000 | 230,146 | ||

Series 2006-C1 Class B, 5.359% 8/15/48 | 648,000 | 73,682 | ||

Series 2007-C2 Class B, 5.617% 4/15/47 (f) | 241,000 | 107,438 | ||

COMM Mortgage Trust Series 2013-LC6 Class ASB, 2.478% 1/10/46 | 1,180,000 | 1,204,296 | ||

COMM pass-thru certificates: | ||||

floater: | ||||

Series 2001-J2A Class A2F, 0.7022% 7/16/34 (d)(f) | 205 | 205 | ||

Series 2005-F10A Class J, 1.0512% 4/15/17 (d)(f) | 14,447 | 12,887 | ||

Series 2005-FL11: | ||||

Class C, 0.5012% 11/15/17 (d)(f) | 132,785 | 126,055 | ||

Class D, 0.5412% 11/15/17 (d)(f) | 6,961 | 6,468 | ||

Class E, 0.5912% 11/15/17 (d)(f) | 24,362 | 22,396 | ||

Class F, 0.6512% 11/15/17 (d)(f) | 17,061 | 15,514 | ||

Class G, 0.7012% 11/15/17 (d)(f) | 11,826 | 10,517 | ||

Series 2006-FL12 Class AJ, 0.3312% 12/15/20 (d)(f) | 308,000 | 295,232 | ||

sequential payer: | ||||

Series 2006-C8: | ||||

Class A3, 5.31% 12/10/46 | 615,000 | 630,782 | ||

Commercial Mortgage Securities - continued | ||||

| Principal | Value | ||

COMM pass-thru certificates: - continued | ||||

sequential payer: | ||||

Series 2006-C8: | ||||

Class A4, 5.306% 12/10/46 | $ 790,000 | $ 892,819 | ||

Series 2006-CN2A: | ||||

Class A2FX, 5.449% 2/5/19 (d) | 266,721 | 268,127 | ||

Class AJFX, 5.478% 2/5/19 (d) | 380,000 | 381,300 | ||

Series 2006-C8 Class XP, 0.4673% 12/10/46 (f)(h) | 1,954,241 | 7,807 | ||

Commercial Mortgage pass-thru certificates Series 2004-LB4A Class A5, 4.84% 10/15/37 | 2,720,000 | 2,854,602 | ||

Credit Suisse Commercial Mortgage Trust: | ||||

sequential payer: | ||||

Series 2007-C2 Class A3, 5.542% 1/15/49 (f) | 432,000 | 493,528 | ||

Series 2007-C3 Class A4, 5.6803% 6/15/39 (f) | 130,000 | 149,346 | ||

Series 2006-C5 Class ASP, 0.6649% 12/15/39 (f)(h) | 1,217,736 | 7,053 | ||

Credit Suisse First Boston Mortgage Capital Certificates floater Series 2007-TF2A Class B, 0.5512% 4/15/22 (d)(f) | 771,000 | 676,812 | ||

Credit Suisse First Boston Mortgage Securities Corp.: | ||||

sequential payer Series 2004-C1 Class A4, 4.75% 1/15/37 | 92,331 | 94,404 | ||

Series 2001-CK6 Class AX, 1.0608% 8/15/36 (f)(h) | 45,831 | 57 | ||

Series 2001-CKN5 Class AX, 1.5108% 9/15/34 (d)(f)(h) | 192,272 | 291 | ||

Series 2003-C4 Class A4, 5.137% 8/15/36 | 348,007 | 350,231 | ||

Credit Suisse Mortgage Capital Certificates: | ||||

floater Series 2007-TFL1: | ||||

Class B, 0.3512% 2/15/22 (d)(f) | 82,000 | 79,527 | ||

Class C: | ||||

0.3712% 2/15/22 (d)(f) | 212,546 | 199,760 | ||

0.4712% 2/15/22 (d)(f) | 75,912 | 71,118 | ||

Class F, 0.5212% 2/15/22 (d)(f) | 151,805 | 142,142 | ||

Series 2007-C1: | ||||

Class ASP, 0.381% 2/15/40 (f)(h) | 3,133,099 | 11,558 | ||

Class B, 5.487% 2/15/40 (d)(f) | 330,000 | 47,685 | ||

Extended Stay America Trust floater Series 2013-ESFL: | ||||

Class A1FL, 1.008% 12/5/31 (d)(f) | 480,000 | 480,144 | ||

Class A2FL, 0.908% 12/5/31 (d)(f) | 630,000 | 630,778 | ||

Freddie Mac: | ||||

Multi-family pass-thru certificates sequential payer Series K017 Class A1, 1.891% 12/25/20 | 1,320,608 | 1,365,359 | ||

Series K707 Class A1, 1.615% 9/25/18 | 820,470 | 841,443 | ||

GE Capital Commercial Mortgage Corp.: | ||||

sequential payer Series 2007-C1 Class A4, 5.543% 12/10/49 | 1,136,000 | 1,288,959 | ||

Commercial Mortgage Securities - continued | ||||

| Principal | Value | ||

GE Capital Commercial Mortgage Corp.: - continued | ||||

Series 2001-1 Class X1, 1.8773% 5/15/33 (d)(f)(h) | $ 99,949 | $ 1,521 | ||

Series 2007-C1 Class XP, 0.1604% 12/10/49 (f)(h) | 2,818,779 | 6,227 | ||

GMAC Commercial Mortgage Securities, Inc. sequential payer Series 2003-C2 Class A2, 5.4417% 5/10/40 (f) | 266,688 | 269,233 | ||

Greenwich Capital Commercial Funding Corp.: | ||||

floater Series 2006-FL4 Class B, 0.3892% 11/5/21 (d)(f) | 81,000 | 77,908 | ||

sequential payer: | ||||

Series 2007-GG11 Class A2, 5.597% 12/10/49 | 272,274 | 275,630 | ||

Series 2007-GG9 Class A4, 5.444% 3/10/39 | 1,090,000 | 1,241,897 | ||

Series 2007-GG11 Class A1, 0.2381% 12/10/49 (d)(f)(h) | 3,452,552 | 16,987 | ||

GS Mortgage Securities Corp. II: | ||||

floater: | ||||

Series 2006-FL8A: | ||||

Class E, 0.5777% 6/6/20 (d)(f) | 39,222 | 39,139 | ||

Class F, 0.6477% 6/6/20 (d)(f) | 95,176 | 94,858 | ||

Series 2007-EOP: | ||||

Class A1, 1.1031% 3/6/20 (d)(f) | 553,670 | 554,191 | ||

Class A2, 1.2601% 3/6/20 (d)(f) | 260,000 | 260,457 | ||

Class C, 2.0056% 3/6/20 (d)(f) | 806,000 | 809,865 | ||

Class D, 2.2018% 3/6/20 (d)(f) | 467,000 | 469,301 | ||

Class F, 2.6334% 3/6/20 (d)(f) | 19,000 | 19,111 | ||

Class G, 2.7903% 3/6/20 (d)(f) | 10,000 | 10,059 | ||

Class H, 3.3004% 3/6/20 (d)(f) | 7,000 | 7,045 | ||

Class J, 4.0852% 3/6/20 (d)(f) | 11,000 | 11,077 | ||

sequential payer Series 2005-GG4 Class A3, 4.607% 7/10/39 | 3,245 | 3,261 | ||

GS Mortgage Securities Trust: | ||||

sequential payer: | ||||

Series 2006-GG8 Class A2, 5.479% 11/10/39 | 78,171 | 79,305 | ||

Series 2007-GG10 Class A2, 5.778% 8/10/45 | 46,936 | 47,602 | ||

Series 2012-GC6 Class A1, 1.282% 1/10/45 | 186,506 | 188,064 | ||

JPMorgan Chase Commercial Mortgage Securities Corp.: | ||||

floater Series 2011-CCHP Class A, 2.6% 7/15/28 (d)(f) | 169,405 | 169,476 | ||

Series 2003-CB7 Class A4, 4.879% 1/12/38 (f) | 219,647 | 224,173 | ||

JPMorgan Chase Commercial Mortgage Securities Trust: | ||||

floater Series 2006-FLA2: | ||||

Class B, 0.3712% 11/15/18 (d)(f) | 120,756 | 117,314 | ||

Commercial Mortgage Securities - continued | ||||

| Principal | Value | ||

JPMorgan Chase Commercial Mortgage Securities Trust: - continued | ||||

floater Series 2006-FLA2: | ||||

Class C, 0.4112% 11/15/18 (d)(f) | $ 86,034 | $ 83,115 | ||

Class D, 0.4312% 11/15/18 (d)(f) | 23,239 | 21,986 | ||

Class E, 0.4812% 11/15/18 (d)(f) | 33,957 | 31,447 | ||

Class F, 0.5312% 11/15/18 (d)(f) | 50,739 | 44,959 | ||

Class G, 0.5612% 11/15/18 (d)(f) | 44,105 | 37,317 | ||

Class H, 0.7012% 11/15/18 (d)(f) | 33,965 | 27,378 | ||

sequential payer: | ||||

Series 2006-LDP9 Class A2, 5.134% 5/15/47 (f) | 60,506 | 63,456 | ||

Series 2007-LD11 Class A2, 5.7974% 6/15/49 (f) | 296,049 | 305,360 | ||

Series 2007-LDPX: | ||||

Class A2 S, 5.305% 1/15/49 | 678,313 | 686,110 | ||

Class A3, 5.42% 1/15/49 | 594,000 | 678,056 | ||

Series 2006-CB17 Class A3, 5.45% 12/12/43 | 41,434 | 41,450 | ||

Series 2007-CB18 Class A3, 5.447% 6/12/47 (f) | 146,889 | 151,256 | ||

Series 2007-CB19: | ||||

Class B, 5.7259% 2/12/49 (f) | 18,000 | 6,425 | ||

Class C, 5.7259% 2/12/49 (f) | 48,000 | 13,277 | ||