To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

| Municipal Bonds - 97.8% | | | |

| | | Principal Amount | Value |

| Alabama - 0.2% | | | |

| Montgomery Med. Clinic Facilities 5% 3/1/33 | | 1,000,000 | 1,075,250 |

| Univ. of Alabama at Birmingham Hosp. Rev. Series 2008 A, 5.75% 9/1/22 (Pre-Refunded to 9/1/18 @ 100) | | 1,000,000 | 1,062,890 |

|

| TOTAL ALABAMA | | | 2,138,140 |

|

| Alaska - 0.2% | | | |

| Alaska Int'l. Arpts. Revs. Series 2016 B, 5% 10/1/35 | | 2,600,000 | 2,916,160 |

| Arizona - 1.5% | | | |

| Arizona Board of Regents Ctfs. of Prtn. Series 2015 A, 5% 6/1/22 | | 1,925,000 | 2,223,625 |

| Arizona Ctfs. of Prtn. Series 2010 A: | | | |

| 5% 10/1/18 (FSA Insured) | | $1,000,000 | $1,055,170 |

| 5.25% 10/1/20 (FSA Insured) | | 1,600,000 | 1,749,920 |

| 5.25% 10/1/21 (FSA Insured) | | 850,000 | 929,433 |

| 5.25% 10/1/26 (FSA Insured) | | 500,000 | 546,100 |

| 5.25% 10/1/28 (FSA Insured) | | 1,600,000 | 1,746,720 |

| Glendale Gen. Oblig. Series 2015, 4% 7/1/20 (FSA Insured) | | 400,000 | 431,268 |

| Maricopa County Indl. Dev. Auth. Sr. Living Facilities Series 2016: | | | |

| 5.75% 1/1/36 (a) | | 155,000 | 147,664 |

| 6% 1/1/48 (a) | | 555,000 | 532,461 |

| Maricopa County Poll. Cont. Rev. (Southern California Edison Co. Proj.) Series 2000 A, 5% 6/1/35 | | 700,000 | 761,936 |

| Mesa Util. Sys. Rev. Series 2017, 4% 7/1/25 | | 5,000,000 | 5,660,900 |

| Pima County Swr. Sys. Rev. Series 2012 A, 5% 7/1/26 | | 500,000 | 579,580 |

| Salt Verde Finl. Corp. Sr. Gas Rev.: | | | |

| Series 2007, 5.5% 12/1/29 | | 1,000,000 | 1,226,100 |

| 5.25% 12/1/22 | | 1,500,000 | 1,746,585 |

| Scottsdale Indl. Dev. Auth. Hosp. Rev. (Scottsdale Healthcare Proj.) Series 2006 C, 5% 9/1/35 (FSA Insured) | | 205,000 | 224,698 |

|

| TOTAL ARIZONA | | | 19,562,160 |

|

| California - 9.0% | | | |

| Bay Area Toll Auth. San Francisco Bay Toll Bridge Rev. Bonds: | | | |

| Series A, 2.95%, tender 4/1/26 (b) | | 1,980,000 | 2,027,500 |

| Series B, 2.85%, tender 4/1/25 (b) | | 1,620,000 | 1,658,119 |

| Series C, 2.1%, tender 4/1/22 (b) | | 1,510,000 | 1,518,245 |

| California Gen. Oblig.: | | | |

| Series 2007, 5.625% 5/1/20 | | 20,000 | 20,065 |

| Series 2016, 5% 9/1/29 | | 630,000 | 751,048 |

| 5% 11/1/24 | | 2,400,000 | 2,446,872 |

| 5% 8/1/29 | | 1,590,000 | 1,894,517 |

| 5% 9/1/31 | | 1,440,000 | 1,694,549 |

| 5.25% 12/1/33 | | 20,000 | 20,055 |

| 5.25% 4/1/35 | | 2,200,000 | 2,516,206 |

| 5.25% 3/1/38 | | 1,280,000 | 1,320,499 |

| 5.25% 11/1/40 | | 700,000 | 786,240 |

| 5.5% 8/1/30 | | 2,000,000 | 2,106,380 |

| 5.5% 3/1/40 | | 1,000,000 | 1,110,020 |

| 5.6% 3/1/36 | | 400,000 | 446,176 |

| 6% 3/1/33 | | 3,460,000 | 3,905,856 |

| 6% 4/1/38 | | 5,300,000 | 5,795,020 |

| 6% 11/1/39 | | 11,700,000 | 13,119,093 |

| 6.5% 4/1/33 | | 1,535,000 | 1,694,087 |

| California Health Facilities Fing. Auth. Rev.: | | | |

| (Catholic Healthcare West Proj.) Series 2009 E, 5.625% 7/1/25 | | 2,000,000 | 2,166,720 |

| (Providence Health and Svcs. Proj.) Series C, 6.5% 10/1/38 (Pre-Refunded to 10/1/18 @ 100) | | 25,000 | 26,933 |

| California Pub. Works Board Lease Rev.: | | | |

| (Coalinga State Hosp. Proj.) Series 2013 E, 5% 6/1/26 | | 2,400,000 | 2,789,208 |

| (Dept. of Forestry & Fire Protection Proj.) Series 2007 E: | | | |

| 5% 11/1/19 | | 1,600,000 | 1,631,168 |

| 5% 11/1/21 | | 1,760,000 | 1,794,109 |

| (Office of Emergency Svcs. Proj.) Series 2007 A, 5% 3/1/22 | | 1,000,000 | 1,002,730 |

| (Porterville Developmental Ctr. Hsg. Expansion and Recreation Complex Proj.) Series 2009 C, 6.25% 4/1/34 (Pre-Refunded to 4/1/19 @ 100) | | 1,700,000 | 1,870,561 |

| (Various Cap. Projs.): | | | |

| Series 2012 A, 5% 4/1/24 | | 3,190,000 | 3,662,854 |

| Series 2012 G, 5% 11/1/24 | | 650,000 | 754,657 |

| Series 2009 G1, 5.75% 10/1/30 (Pre-Refunded to 10/1/19 @ 100) | | 600,000 | 666,048 |

| Series 2009 I: | | | |

| 6.125% 11/1/29 (Pre-Refunded to 11/1/19 @ 100) | | 400,000 | 449,640 |

| 6.375% 11/1/34 (Pre-Refunded to 11/1/19 @ 100) | | 1,000,000 | 1,130,240 |

| Series 2010 A, 5.75% 3/1/30 (Pre-Refunded to 3/1/20 @ 100) | | 1,000,000 | 1,128,800 |

| California Statewide Cmntys. Dev. Auth. Series 2016: | | | |

| 3.25% 5/15/31 | | 520,000 | 499,528 |

| 5% 5/15/29 | | 1,250,000 | 1,415,850 |

| 5% 5/15/30 | | 1,000,000 | 1,125,190 |

| Folsom Cordova Union School District No. 4 Series A, 0% 10/1/31 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,835,000 | 1,095,752 |

| Golden State Tobacco Securitization Corp. Tobacco Settlement Rev. Series 2017 A1: | | | |

| 5% 6/1/21 | | 465,000 | 521,879 |

| 5% 6/1/22 | | 650,000 | 741,338 |

| 5% 6/1/23 | | 745,000 | 859,842 |

| 5% 6/1/24 | | 420,000 | 489,497 |

| Long Beach Unified School District Series 2009, 5.5% 8/1/29 | | 60,000 | 65,710 |

| Los Angeles Dept. Arpt. Rev. Series 2016 B: | | | |

| 5% 5/15/32 (c) | | 1,830,000 | 2,105,214 |

| 5% 5/15/33 (c) | | 1,620,000 | 1,854,009 |

| 5% 5/15/46 (c) | | 6,400,000 | 7,137,920 |

| Los Angeles Muni. Impt. Corp. Lease Rev. Series 2012 C, 5% 3/1/25 | | 1,455,000 | 1,663,531 |

| Los Angeles Wastewtr. Sys. Rev. Series 2009 A, 5.75% 6/1/34 | | 890,000 | 973,811 |

| Madera County Ctfs. of Prtn. (Children's Hosp. Central California Proj.) Series 2010, 5.375% 3/15/36 | | 1,000,000 | 1,073,570 |

| Monterey County Pub. Impt. Corp. Ctfs. of Prtn. Series 2007, 5% 8/1/19 (AMBAC Insured) | | 1,000,000 | 1,009,570 |

| Oakland Gen. Oblig. Series 2012, 5% 1/15/24 | | 2,500,000 | 2,819,500 |

| Palomar Health Rev. Series 2016, 5% 11/1/31 | | 1,000,000 | 1,098,240 |

| Poway Unified School District: | | | |

| (District #2007-1 School Facilities Proj.) Series 2008 A, 0% 8/1/32 | | 1,000,000 | 561,670 |

| Series B, 0% 8/1/39 | | 3,700,000 | 1,464,571 |

| Poway Unified School District Pub. Fing. 5% 9/1/24 | | 1,000,000 | 1,161,330 |

| Sacramento City Fing. Auth. Rev. Series A, 0% 12/1/26 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 800,000 | 593,040 |

| Sacramento Muni. Util. District Elec. Rev. Series 2012 Y, 5% 8/15/28 | | 2,200,000 | 2,556,840 |

| San Bernardino County Ctfs. of Prtn. (Arrowhead Proj.) Series 2009 A, 5.25% 8/1/26 | | 1,000,000 | 1,074,840 |

| San Diego Convention Ctr. Expansion Series 2012 A, 5% 4/15/24 | | 2,200,000 | 2,547,776 |

| San Diego Unified School District Series 2008 E, 0% 7/1/47 (d) | | 1,300,000 | 741,130 |

| San Francisco City & County Arpts. Commission Int'l. Arpt. Rev. Series 2014 A, 5% 5/1/44 (c) | | 2,200,000 | 2,410,320 |

| San Jose Int'l. Arpt. Rev. Series 2017 A: | | | |

| 5% 3/1/20 (c) | | 2,080,000 | 2,287,459 |

| 5% 3/1/23 (c) | | 1,500,000 | 1,745,445 |

| 5% 3/1/24 (c) | | 1,700,000 | 1,999,013 |

| 5% 3/1/26 (c) | | 1,750,000 | 2,070,233 |

| San Marcos Unified School District Series 2010 B, 0% 8/1/47 | | 11,900,000 | 3,039,260 |

| Santa Monica-Malibu Unified School District Series 1999, 0% 8/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | 948,390 |

| Union Elementary School District Series A, 0% 9/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | 947,720 |

| Washington Township Health Care District Gen. Oblig. Series 2013 B, 5.5% 8/1/38 | | 1,000,000 | 1,204,240 |

| Washington Township Health Care District Rev. Series 2010 A, 5.25% 7/1/30 | | 1,100,000 | 1,188,572 |

| West Contra Costa Unified School District Series 2012, 5% 8/1/26 | | 2,000,000 | 2,299,400 |

|

| TOTAL CALIFORNIA | | | 121,295,415 |

|

| Colorado - 0.9% | | | |

| Colorado Health Facilities Auth. (Parkview Med. Ctr., Inc. Proj.) Series 2016: | | | |

| 4% 9/1/36 | | 1,300,000 | 1,304,979 |

| 5% 9/1/46 | | 1,300,000 | 1,430,065 |

| Colorado Health Facilities Auth. Retirement Hsg. Rev. (Liberty Heights Proj.) Series B, 0% 7/15/20 (Escrowed to Maturity) | | 1,200,000 | 1,141,788 |

| Colorado Health Facilities Auth. Rev. (Valley View Hosp. Proj.) Series 2008, 5.75% 5/15/36 | | 2,000,000 | 2,060,700 |

| Colorado Univ. Co. Hosp. Auth. Rev. Bonds: | | | |

| Series 2017C-1, 4%, tender 3/1/20 (b) | | 2,155,000 | 2,281,822 |

| Series 2017C-2, 5%, tender 3/1/22 (b) | | 1,615,000 | 1,838,597 |

| E-470 Pub. Hwy. Auth. Rev.: | | | |

| Series 2000 B, 0% 9/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,500,000 | 1,409,910 |

| Series 2010 C, 5.25% 9/1/25 | | 1,000,000 | 1,073,010 |

|

| TOTAL COLORADO | | | 12,540,871 |

|

| Connecticut - 0.4% | | | |

| Connecticut Health & Edl. Facilities Auth. Rev. Series 2016 K, 4% 7/1/46 | | 1,520,000 | 1,519,924 |

| Eastern Connecticut Resources Recovery Auth. Solid Waste Rev. (Wheelabrator Lisbon Proj.) Series A, 5.5% 1/1/20 (c) | | 2,190,000 | 2,221,054 |

| New Haven Gen. Oblig. Series 2016 A: | | | |

| 5% 8/15/20 (FSA Insured) | | 1,000,000 | 1,091,510 |

| 5% 8/15/26 (FSA Insured) | | 500,000 | 577,415 |

|

| TOTAL CONNECTICUT | | | 5,409,903 |

|

| District Of Columbia - 0.6% | | | |

| District of Columbia Rev. Series B, 4.75% 6/1/32 | | 500,000 | 538,975 |

| Metropolitan Washington Arpts. Auth. Dulles Toll Road Rev. Series 2009 B: | | | |

| 0% 10/1/28 (Assured Guaranty Corp. Insured) | | 2,000,000 | 1,322,180 |

| 0% 10/1/33 (Assured Guaranty Corp. Insured) | | 5,000,000 | 2,576,950 |

| Metropolitan Washington DC Arpts. Auth. Sys. Rev.: | | | |

| Series 2012 A, 5% 10/1/22 (c) | | 1,450,000 | 1,680,086 |

| Series 2014 A, 5% 10/1/23 (c) | | 1,990,000 | 2,326,628 |

|

| TOTAL DISTRICT OF COLUMBIA | | | 8,444,819 |

|

| Florida - 11.2% | | | |

| Brevard County School Board Ctfs. of Prtn. Series 2015 C, 5% 7/1/26 | | 750,000 | 885,195 |

| Broward County Arpt. Sys. Rev.: | | | |

| Series 2012 P-1, 5% 10/1/22 (c) | | 965,000 | 1,109,547 |

| Series 2012 P-2, 5% 10/1/21 | | 685,000 | 782,859 |

| Series A: | | | |

| 5% 10/1/23 (c) | | 1,425,000 | 1,665,127 |

| 5% 10/1/28 (c) | | 500,000 | 571,840 |

| 5% 10/1/31 (c) | | 1,000,000 | 1,124,730 |

| 5% 10/1/32 (c) | | 400,000 | 447,708 |

| Broward County School Board Ctfs. of Prtn.: | | | |

| (Broward County School District Proj.) Series 2016 A, 5% 7/1/28 | | 670,000 | 791,920 |

| Series 2012 A, 5% 7/1/24 | | 4,400,000 | 5,055,776 |

| Series 2015 A: | | | |

| 5% 7/1/24 | | 325,000 | 383,799 |

| 5% 7/1/26 | | 1,200,000 | 1,420,188 |

| 5% 7/1/27 | | 1,000,000 | 1,173,820 |

| Series 2015 B, 5% 7/1/24 | | 815,000 | 962,450 |

| Series 2016, 5% 7/1/32 | | 430,000 | 495,446 |

| Citizens Property Ins. Corp.: | | | |

| Series 2011 A1, 5% 6/1/20 | | 1,000,000 | 1,108,070 |

| Series 2012 A1, 5% 6/1/21 | | 2,100,000 | 2,386,083 |

| Collier County Indl. Dev. Auth. Healthcare Facilities Rev. (NCH Healthcare Sys. Proj.) Series 2011, 6.25% 10/1/39 | | 2,560,000 | 2,892,058 |

| Duval County School Board Ctfs. of Prtn.: | | | |

| Series 2015 B, 5% 7/1/28 | | 2,060,000 | 2,399,962 |

| Series 2016 A: | | | |

| 5% 7/1/31 | | 1,305,000 | 1,507,001 |

| 5% 7/1/33 | | 1,340,000 | 1,530,159 |

| Florida Board of Ed. Pub. Ed. Cap. Outlay Series A, 5.5% 6/1/38 | | 400,000 | 422,128 |

| Florida Mid-Bay Bridge Auth. Rev.: | | | |

| Series 2015 A, 5% 10/1/35 | | 1,000,000 | 1,107,680 |

| Series 2015 C, 5% 10/1/40 | | 1,000,000 | 1,079,690 |

| Florida Muni. Pwr. Agcy. Rev.: | | | |

| (Requirements Pwr. Supply Proj.) Series 2016 A: | | | |

| 5% 10/1/30 | | 350,000 | 410,463 |

| 5% 10/1/31 | | 380,000 | 443,601 |

| (St. Lucie Proj.) Series 2012 A, 5% 10/1/26 | | 600,000 | 688,554 |

| Series 2009 A, 6.25% 10/1/31 (Pre-Refunded to 10/1/19 @ 100) | | 500,000 | 560,970 |

| Greater Orlando Aviation Auth. Arpt. Facilities Rev. Series 2016: | | | |

| 5% 10/1/20 (c) | | 200,000 | 221,710 |

| 5% 10/1/21 (c) | | 1,545,000 | 1,741,833 |

| 5% 10/1/22 (c) | | 1,000,000 | 1,144,280 |

| 5% 10/1/23 (c) | | 2,545,000 | 2,954,032 |

| Halifax Hosp. Med. Ctr. Rev.: | | | |

| 4% 6/1/27 | | 205,000 | 217,038 |

| 5% 6/1/24 | | 275,000 | 320,697 |

| 5% 6/1/26 | | 250,000 | 290,490 |

| 5% 6/1/46 | | 425,000 | 453,773 |

| Highlands County Health Facilities Auth. Rev. (Adventist Health Sys./Sunbelt, Inc. Prog.) Series 2008 B, 6% 11/15/37 | | 2,000,000 | 2,193,000 |

| Hillsborough County Indl. Dev. Auth. Indl. Dev. Rev. (Health Facilities/Univ. Cmnty. Hosp. Proj.) Series 2008 B, 8% 8/15/32 (Pre-Refunded to 8/15/19 @ 101) | | 1,000,000 | 1,162,900 |

| Jacksonville Sales Tax Rev. Series 2012, 5% 10/1/25 | | 1,000,000 | 1,148,140 |

| Lake County School Board Ctfs. of Prtn. Series 2014 A, 5% 6/1/30 (FSA Insured) | | 600,000 | 677,628 |

| Lee County Arpt. Rev. Series 2011 A, 5.375% 10/1/32 (c) | | 1,050,000 | 1,157,930 |

| Miami-Dade County Aviation Rev.: | | | |

| Series 2010 A, 5.375% 10/1/41 | | 1,500,000 | 1,669,245 |

| Series 2010, 5.5% 10/1/30 | | 760,000 | 859,081 |

| Series 2012 A: | | | |

| 5% 10/1/21 (c) | | 1,900,000 | 2,160,148 |

| 5% 10/1/22 (c) | | 1,000,000 | 1,154,780 |

| 5% 10/1/31 (c) | | 1,500,000 | 1,688,655 |

| Series 2014 A: | | | |

| 5% 10/1/28 (c) | | 1,000,000 | 1,147,020 |

| 5% 10/1/36 (c) | | 3,100,000 | 3,433,126 |

| 5% 10/1/37 | | 1,825,000 | 2,042,723 |

| Series 2015 A, 5% 10/1/35 (c) | | 2,100,000 | 2,332,953 |

| Miami-Dade County Cap. Asset Acquisition Series 2012 A, 5% 10/1/23 | | 750,000 | 864,840 |

| Miami-Dade County Expressway Auth.: | | | |

| Series 2014 A, 5% 7/1/44 | | 500,000 | 549,445 |

| Series 2014 B, 5% 7/1/28 | | 1,000,000 | 1,150,220 |

| Series A: | | | |

| 5% 7/1/32 | | 4,300,000 | 4,943,366 |

| 5% 7/1/33 | | 3,650,000 | 4,174,213 |

| Miami-Dade County School Board Ctfs. of Prtn.: | | | |

| Series 2008 A, 5% 8/1/21 (AMBAC Insured) | | 2,000,000 | 2,086,200 |

| Series 2015 A: | | | |

| 5% 5/1/27 (FSA Insured) | | 780,000 | 914,956 |

| 5% 5/1/29 | | 4,075,000 | 4,684,824 |

| Series 2015 B: | | | |

| 5% 5/1/27 | | 4,650,000 | 5,418,041 |

| 5% 5/1/28 | | 2,530,000 | 2,928,171 |

| Series 2016 A, 5% 5/1/30 | | 3,620,000 | 4,187,037 |

| Series 2016 B, 5% 8/1/26 | | 1,595,000 | 1,906,248 |

| Miami-Dade County Transit Sales Surtax Rev. Series 2012, 5% 7/1/42 | | 300,000 | 332,718 |

| Miami-Dade County Wtr. & Swr. Rev. Series 2008 A, 5.25% 10/1/22 (FSA Insured) | | 4,000,000 | 4,726,520 |

| North Brevard County Hosp. District Rev.: | | | |

| 5.75% 10/1/38 | | 600,000 | 626,004 |

| 5.75% 10/1/38 (Pre-Refunded to 10/1/18 @ 100) | | 1,500,000 | 1,599,135 |

| Orange County Health Facilities Auth. Series 2012 A, 5% 10/1/42 | | 2,350,000 | 2,507,709 |

| Orange County School Board Ctfs. of Prtn.: | | | |

| Series 2015 C, 5% 8/1/30 | | 1,500,000 | 1,754,625 |

| Series 2016 C, 5% 8/1/33 | | 3,770,000 | 4,335,198 |

| Palm Beach County Arpt. Sys. Rev. Series 2016: | | | |

| 5% 10/1/34 (c) | | 4,505,000 | 5,004,559 |

| 5% 10/1/35 (c) | | 4,745,000 | 5,247,211 |

| 5% 10/1/36 (c) | | 4,980,000 | 5,490,400 |

| Palm Beach County Health Facilities Auth. Hosp. Rev. Series 2014, 5% 12/1/31 | | 500,000 | 544,320 |

| Palm Beach County School Board Ctfs. of Prtn.: | | | |

| Series 2014 B, 5% 8/1/22 | | 2,000,000 | 2,326,480 |

| Series 2015 D: | | | |

| 5% 8/1/28 | | 680,000 | 796,525 |

| 5% 8/1/29 | | 2,330,000 | 2,710,536 |

| 5% 8/1/30 | | 2,405,000 | 2,786,265 |

| 5% 8/1/31 | | 2,415,000 | 2,784,423 |

| South Florida Wtr. Mgmt. District Ctfs. of Prtn. Series 2015: | | | |

| 5% 10/1/27 | | 1,500,000 | 1,775,505 |

| 5% 10/1/29 | | 1,000,000 | 1,165,550 |

| 5% 10/1/32 | | 1,165,000 | 1,335,195 |

| South Lake County Hosp. District (South Lake Hosp., Inc.) Series 2009 A, 6% 4/1/29 | | 1,400,000 | 1,491,938 |

| Tallahassee Health Facilities Rev.: | | | |

| (Tallahassee Memorial Healthcare, Inc. Proj.) Series 2016 A, 5% 12/1/41 | | 1,100,000 | 1,168,497 |

| Series 2015 A, 5% 12/1/40 | | 300,000 | 318,177 |

| Tampa Tax Allocation (H. Lee Moffitt Cancer Ctr. Proj.) Series 2012 A, 5% 9/1/25 | | 410,000 | 468,737 |

| Volusia County School Board Ctfs. of Prtn.: | | | |

| (Florida Master Lease Prog.) Series 2016 A, 5% 8/1/29 (Build America Mutual Assurance Insured) | | 1,000,000 | 1,166,170 |

| (Master Lease Prog.) Series 2014 B, 5% 8/1/26 | | 340,000 | 400,428 |

|

| TOTAL FLORIDA | | | 150,248,392 |

|

| Georgia - 1.6% | | | |

| Burke County Indl. Dev. Auth. Poll. Cont. Rev. Bonds (Oglethorpe Pwr. Corp. Vogtle Proj.) Series 2013 A, 2.4%, tender 4/1/20 (b) | | 1,120,000 | 1,127,224 |

| Colquitt County Dev. Auth. Rev.: | | | |

| Series A, 0% 12/1/21 (Escrowed to Maturity) | | 1,100,000 | 1,016,125 |

| Series C, 0% 12/1/21 (Escrowed to Maturity) | | 1,800,000 | 1,662,750 |

| DeKalb County Hosp. Auth. Rev. (DeKalb Med. Ctr., Inc. Proj.) Series 2010: | | | |

| 6% 9/1/30 | | 1,400,000 | 1,532,930 |

| 6.125% 9/1/40 | | 2,385,000 | 2,580,689 |

| Main Street Natural Gas, Inc. Georgia Gas Proj. Rev. Series A, 5.5% 9/15/21 | | 930,000 | 1,059,577 |

| Metropolitan Atlanta Rapid Transit Auth. Sales Tax Rev. Third Series 2009 A, 5.25% 7/1/36 | | 2,500,000 | 2,704,150 |

| Private Colleges & Univs. Auth. Rev. (The Savannah College of Art and Design Projs.) Series 2014: | | | |

| 5% 4/1/30 | | 800,000 | 893,792 |

| 5% 4/1/44 | | 3,815,000 | 4,057,443 |

| Richmond County Hosp. Auth. (Univ. Health Svcs., Inc. Proj.) Series 2009, 5.5% 1/1/36 (Pre-Refunded to 1/1/19 @ 100) | | 2,600,000 | 2,791,776 |

| Washington Wilkes Payroll Dev. Auth. Rev. Series C, 0% 12/1/21 (Escrowed to Maturity) | | 2,310,000 | 2,143,588 |

|

| TOTAL GEORGIA | | | 21,570,044 |

|

| Hawaii - 0.6% | | | |

| Hawaii Arpts. Sys. Rev. Series 2015 A, 5% 7/1/45 (c) | | 5,370,000 | 5,917,257 |

| State of Hawaii Dept. of Trans. Series 2013, 5% 8/1/22 (c) | | 1,575,000 | 1,807,391 |

|

| TOTAL HAWAII | | | 7,724,648 |

|

| Idaho - 0.2% | | | |

| Idaho Health Facilities Auth. Rev.: | | | |

| (St. Luke's Health Sys. Proj.) Series 2008 A, 6.75% 11/1/37 | | 1,200,000 | 1,285,536 |

| (Trinity Health Group Proj.) 2008 B, 6.25% 12/1/33 (Pre-Refunded to 12/1/18 @ 100) | | 400,000 | 432,524 |

| Series 2015 ID, 5% 12/1/24 | | 1,000,000 | 1,198,290 |

|

| TOTAL IDAHO | | | 2,916,350 |

|

| Illinois - 15.6% | | | |

| Chicago Board of Ed.: | | | |

| Series 1999 A: | | | |

| 0% 12/1/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | 957,520 |

| 5.25% 12/1/21 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 470,000 | 505,527 |

| Series 2008 C: | | | |

| 5.25% 12/1/23 | | 360,000 | 320,234 |

| 5.25% 12/1/24 | | 245,000 | 214,456 |

| Series 2010 F, 5% 12/1/20 | | 195,000 | 177,487 |

| Series 2011 A: | | | |

| 5% 12/1/41 | | 2,190,000 | 1,759,840 |

| 5.25% 12/1/41 | | 605,000 | 485,186 |

| Series 2012 A, 5% 12/1/42 | | 1,415,000 | 1,128,250 |

| Series 2015 C, 5.25% 12/1/39 | | 300,000 | 243,753 |

| Series 2016 B, 6.5% 12/1/46 | | 150,000 | 140,322 |

| Chicago Midway Arpt. Rev.: | | | |

| Series 2014 A, 5% 1/1/28 (c) | | 4,200,000 | 4,719,792 |

| Series 2016 A, 5% 1/1/28 (c) | | 2,000,000 | 2,257,440 |

| Series 2016 B: | | | |

| 5% 1/1/36 | | 400,000 | 444,476 |

| 5% 1/1/37 | | 500,000 | 554,020 |

| 5% 1/1/46 | | 1,275,000 | 1,391,867 |

| Chicago O'Hare Int'l. Arpt. Rev.: | | | |

| Series 2011 C, 6.5% 1/1/41 (Pre-Refunded to 1/1/21 @ 100) | | 2,335,000 | 2,769,544 |

| Series 2012 A, 5% 1/1/22 (c) | | 1,140,000 | 1,293,079 |

| Series 2013 D, 5% 1/1/27 | | 2,200,000 | 2,492,314 |

| Series 2015 A: | | | |

| 5% 1/1/25 (c) | | 905,000 | 1,057,013 |

| 5% 1/1/31 (c) | | 1,040,000 | 1,147,671 |

| 5% 1/1/32 (c) | | 2,100,000 | 2,302,587 |

| Series 2015 C, 5% 1/1/24 (c) | | 1,435,000 | 1,668,159 |

| Series 2016 B, 5% 1/1/34 | | 1,200,000 | 1,349,652 |

| Series 2016 G, 5% 1/1/42 (c) | | 700,000 | 756,770 |

| Chicago Transit Auth.: | | | |

| Series 2014, 5.25% 12/1/49 | | 5,000,000 | 5,476,800 |

| Series 2017, 5% 12/1/46 | | 700,000 | 754,642 |

| Cmnty. College District #525 Gen. Oblig.: | | | |

| 5.75% 6/1/28 | | 625,000 | 652,869 |

| 5.75% 6/1/28 (Pre-Refunded to 6/1/18 @ 100) | | 375,000 | 394,088 |

| Cook County Forest Preservation District Series 2012 C, 5% 12/15/21 | | 1,000,000 | 1,108,800 |

| Cook County Gen. Oblig.: | | | |

| Series 2006 B, 5% 11/15/18 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | 1,020,300 |

| Series 2010 A: | | | |

| 5.25% 11/15/22 | | 690,000 | 760,421 |

| 5.25% 11/15/33 | | 3,250,000 | 3,475,355 |

| Series 2012 C, 5% 11/15/24 | | 1,700,000 | 1,895,075 |

| Series 2016 A: | | | |

| 5% 11/15/27 | | 1,560,000 | 1,761,770 |

| 5% 11/15/28 | | 1,900,000 | 2,134,232 |

| 5% 11/15/30 | | 1,000,000 | 1,110,410 |

| Illinois Fin. Auth. Hosp. Rev. (KishHealth Sys. Proj.) Series 2008, 5.75% 10/1/35 (Pre-Refunded to 10/1/18 @ 100) | | 1,600,000 | 1,703,408 |

| Illinois Fin. Auth. Rev.: | | | |

| (Advocate Health Care Proj.) Series 2008 D, 6.5% 11/1/38 (Pre-Refunded to 11/1/18 @ 100) | | 1,000,000 | 1,080,130 |

| (Central DuPage Health Proj.) Series 2009 B, 5.375% 11/1/39 | | 1,200,000 | 1,288,356 |

| (Depaul Univ. Proj.) Series 2016 A: | | | |

| 5% 10/1/30 | | 1,000,000 | 1,155,800 |

| 5% 10/1/35 | | 2,000,000 | 2,248,960 |

| (Edward Hosp. Obligated Group Proj.) Series 2008 A, 5.5% 2/1/40 (Pre-Refunded to 2/1/18 @ 100) | | 1,485,000 | 1,535,653 |

| (Palos Cmnty. Hosp. Proj.) Series 2010 C: | | | |

| 5.375% 5/15/25 | | 5,000,000 | 5,512,850 |

| 5.375% 5/15/30 | | 1,110,000 | 1,213,541 |

| (Presence Health Proj.) Series 2016 C, 5% 2/15/26 | | 600,000 | 669,924 |

| (Provena Health Proj.) Series 2010 A, 6% 5/1/28 (Pre-Refunded to 5/1/20 @ 100) | | 2,700,000 | 3,072,357 |

| (Rush Univ. Med. Ctr. Proj.): | | | |

| Series 2009 D, 6.625% 11/1/39 (Pre-Refunded to 5/1/19 @ 100) | | 705,000 | 782,374 |

| Series B, 5.25% 11/1/35 (Pre-Refunded to 11/1/18 @ 100) | | 2,905,000 | 3,088,567 |

| (Silver Cross Hosp. and Med. Ctr. Proj.) Series 2008 A, 5.5% 8/15/30 | | 350,000 | 361,680 |

| (Southern Illinois Healthcare Enterprises, Inc. Proj.) Series 2005, 5.25% 3/1/30 | | 1,100,000 | 1,192,400 |

| Bonds (Ascension Health Cr. Group Proj.) Series 2012 E2, 1.75%, tender 4/1/21 (b) | | 440,000 | 439,996 |

| Series 2008 A, 5.625% 1/1/37 (Pre-Refunded to 1/1/18 @ 100) | | 5,115,000 | 5,274,588 |

| Series 2009 A, 7.25% 11/1/38 (Pre-Refunded to 11/1/18 @ 100) | | 700,000 | 764,953 |

| Series 2010 A: | | | |

| 5.5% 8/15/24 (Pre-Refunded to 2/15/20 @ 100) | | 545,000 | 608,313 |

| 5.75% 8/15/29 (Pre-Refunded to 2/15/20 @ 100) | | 360,000 | 404,276 |

| Series 2012 A: | | | |

| 5% 5/15/20 | | 500,000 | 548,575 |

| 5% 5/15/23 | | 300,000 | 339,354 |

| Series 2012: | | | |

| 4% 9/1/32 | | 1,315,000 | 1,301,561 |

| 5% 9/1/32 | | 1,900,000 | 2,010,808 |

| 5% 9/1/38 | | 2,300,000 | 2,378,016 |

| 5% 11/15/43 | | 820,000 | 871,619 |

| Series 2013: | | | |

| 5% 11/15/24 | | 500,000 | 570,320 |

| 5% 11/15/27 | | 100,000 | 111,747 |

| 5% 5/15/43 | | 1,700,000 | 1,785,476 |

| Series 2015 A: | | | |

| 5% 11/15/21 | | 600,000 | 684,624 |

| 5% 11/15/45 | | 455,000 | 490,344 |

| Series 2015 C: | | | |

| 5% 8/15/35 | | 1,035,000 | 1,111,083 |

| 5% 8/15/44 | | 5,600,000 | 5,930,456 |

| Series 2016 A: | | | |

| 5% 8/15/22 | | 1,000,000 | 1,112,500 |

| 5% 7/1/24 | | 1,395,000 | 1,631,285 |

| 5% 7/1/31 | | 510,000 | 573,322 |

| 5% 7/1/33 | | 650,000 | 722,592 |

| 5% 8/15/35 | | 510,000 | 542,681 |

| 5% 8/15/36 | | 2,035,000 | 2,154,149 |

| 5.25% 8/15/31 | | 600,000 | 669,972 |

| Series 2016 B, 5% 8/15/32 | | 5,000,000 | 5,638,650 |

| Series 2016 C: | | | |

| 4% 2/15/36 | | 400,000 | 362,508 |

| 5% 2/15/30 | | 3,000,000 | 3,268,650 |

| 5% 2/15/41 | | 1,800,000 | 1,880,622 |

| Illinois Gen. Oblig.: | | | |

| Series 2006: | | | |

| 5% 1/1/19 | | 1,000,000 | 1,035,760 |

| 5.5% 1/1/31 | | 1,400,000 | 1,500,170 |

| Series 2010: | | | |

| 5% 1/1/18 | | 1,900,000 | 1,935,929 |

| 5% 1/1/21 (FSA Insured) | | 500,000 | 529,055 |

| 5% 1/1/23 (FSA Insured) | | 1,300,000 | 1,373,489 |

| Series 2012 A, 5% 1/1/33 | | 800,000 | 803,576 |

| Series 2012: | | | |

| 5% 8/1/19 | | 465,000 | 485,948 |

| 5% 8/1/21 | | 400,000 | 422,808 |

| 5% 3/1/23 | | 1,000,000 | 1,051,070 |

| 5% 8/1/23 | | 700,000 | 742,665 |

| 5% 3/1/28 | | 220,000 | 224,998 |

| 5% 3/1/36 | | 1,000,000 | 997,510 |

| Series 2013 A, 5% 4/1/35 | | 300,000 | 299,283 |

| Series 2013: | | | |

| 5% 1/1/22 | | 2,925,000 | 3,037,700 |

| 5.5% 7/1/24 | | 1,000,000 | 1,083,410 |

| 5.5% 7/1/25 | | 745,000 | 801,233 |

| Series 2014: | | | |

| 5% 2/1/22 | | 1,060,000 | 1,120,346 |

| 5% 4/1/28 | | 200,000 | 206,114 |

| 5% 5/1/32 | | 500,000 | 504,105 |

| 5.25% 2/1/29 | | 1,600,000 | 1,669,968 |

| 5.25% 2/1/30 | | 1,300,000 | 1,341,574 |

| 5.25% 2/1/31 | | 435,000 | 449,168 |

| Series 2016: | | | |

| 5% 6/1/25 | | 1,515,000 | 1,595,128 |

| 5% 6/1/26 | | 210,000 | 220,301 |

| 5% 2/1/27 | | 1,490,000 | 1,557,721 |

| 5% 2/1/28 | | 1,200,000 | 1,249,716 |

| 5% 2/1/29 | | 1,125,000 | 1,165,309 |

| 5% 2/1/26 | | 415,000 | 431,579 |

| Illinois Health Facilities Auth. Rev. (Delnor-Cmnty. Hosp. Proj.): | | | |

| Series 2002 D, 5.25% 5/15/32 (FSA Insured) | | 2,000,000 | 2,068,640 |

| 5.25% 5/15/32 (FSA Insured) | | 360,000 | 372,355 |

| Illinois Muni. Elec. Agcy. Pwr. Supply Series 2015 A: | | | |

| 5% 2/1/26 | | 7,545,000 | 8,819,652 |

| 5% 2/1/31 | | 795,000 | 897,945 |

| Illinois Toll Hwy. Auth. Toll Hwy. Rev.: | | | |

| Series 2015 A: | | | |

| 5% 1/1/37 | | 700,000 | 777,623 |

| 5% 1/1/40 | | 2,300,000 | 2,542,972 |

| Series 2015 B, 5% 1/1/40 | | 1,300,000 | 1,445,574 |

| Series 2016 A: | | | |

| 5% 12/1/31 | | 400,000 | 459,288 |

| 5% 12/1/32 | | 2,400,000 | 2,740,032 |

| Joliet School District #86 Gen. Oblig. Series 2002, 0% 11/1/19 (FSA Insured) | | 2,000,000 | 1,910,680 |

| Kane, McHenry, Cook & DeKalb Counties Unit School District #300: | | | |

| 0% 12/1/17 (AMBAC Insured) | | 905,000 | 899,389 |

| 6.5% 1/1/20 (AMBAC Insured) | | 385,000 | 433,622 |

| 6.5% 1/1/20 (Escrowed to Maturity) | | 650,000 | 740,318 |

| Kendall, Kane & Will Counties Cmnty. Unit School District #308 Series 2016, 5% 2/1/36 | | 3,400,000 | 3,706,238 |

| Lake County Cmnty. High School District #117, Antioch Series 2000 B, 0% 12/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,805,000 | 1,656,160 |

| McHenry & Kane Counties Cmnty. Consolidated School District #158 Series 2004, 0% 1/1/24 (FSA Insured) | | 800,000 | 666,488 |

| Metropolitan Pier & Exposition: | | | |

| (McCormick Place Expansion Proj.): | | | |

| Series 1994 A, 0% 6/15/19 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 3,710,000 | 3,527,320 |

| Series 1996 A, 0% 6/15/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | 824,500 |

| Series 2002 A: | | | |

| 0% 12/15/30 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 5,900,000 | 3,296,861 |

| 0% 6/15/36 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,080,000 | 438,588 |

| Series 2010 B1: | | | |

| 0% 6/15/43 (FSA Insured) | | 5,310,000 | 1,530,661 |

| 0% 6/15/44 (FSA Insured) | | 4,700,000 | 1,288,411 |

| 0% 6/15/45 (FSA Insured) | | 2,600,000 | 677,638 |

| 0% 6/15/47 (FSA Insured) | | 2,085,000 | 490,955 |

| Series 2012 B, 0% 12/15/51 | | 2,900,000 | 407,508 |

| Series A: | | | |

| 0% 6/15/22 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,265,000 | 1,086,774 |

| 0% 12/15/24 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 3,090,000 | 2,381,278 |

| Series 2002 A: | | | |

| 0% 12/15/33 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 5,730,000 | 2,700,033 |

| 0% 12/15/34 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,540,000 | 685,223 |

| Quincy Hosp. Rev. Series 2007, 5% 11/15/18 | | 1,000,000 | 1,021,760 |

| Univ. of Illinois Rev.: | | | |

| (Auxiliary Facilities Sys. Proj.) Series 1999 A, 0% 4/1/20 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,600,000 | 1,503,424 |

| Series 2010 A: | | | |

| 5% 4/1/25 | | 1,000,000 | 1,082,640 |

| 5.25% 4/1/30 | | 1,000,000 | 1,087,890 |

| Series 2013: | | | |

| 6% 10/1/42 | | 900,000 | 1,032,633 |

| 6.25% 10/1/38 | | 900,000 | 1,053,954 |

| Will County Cmnty. Unit School District #365-U: | | | |

| 0% 11/1/19 (Escrowed to Maturity) | | 790,000 | 763,551 |

| 0% 11/1/19 (FSA Insured) | | 5,085,000 | 4,843,513 |

|

| TOTAL ILLINOIS | | | 209,468,485 |

|

| Indiana - 2.0% | | | |

| Indiana Fin. Auth. Health Sys. Rev. (Sisters of Saint Francis Health Svcs., Inc. Obligated Group Proj.) Series 2009 A, 5.25% 11/1/39 | | 1,000,000 | 1,070,110 |

| Indiana Fin. Auth. Rev.: | | | |

| (Trinity Health Cr. Group Proj.) Series 2009 A, 5.25% 12/1/38 | | 2,000,000 | 2,156,720 |

| Series 2012: | | | |

| 5% 3/1/30 | | 675,000 | 732,382 |

| 5% 3/1/41 | | 1,290,000 | 1,385,279 |

| Series 2015 A, 5.25% 2/1/32 | | 1,040,000 | 1,214,710 |

| Series 2016: | | | |

| 5% 9/1/23 | | 450,000 | 520,871 |

| 5% 9/1/26 | | 225,000 | 264,168 |

| 5% 9/1/27 | | 650,000 | 756,210 |

| 5% 9/1/29 | | 500,000 | 572,930 |

| Indiana Fin. Auth. Wastewtr. Util. Rev. (CWA Auth. Proj.): | | | |

| Series 2012 A, 5% 10/1/24 | | 400,000 | 462,804 |

| Series 2015 A: | | | |

| 5% 10/1/28 | | 1,000,000 | 1,182,240 |

| 5% 10/1/45 | | 4,340,000 | 4,906,674 |

| Indianapolis Local Pub. Impt. Series 2016: | | | |

| 4% 1/1/34 (c) | | 1,000,000 | 1,013,760 |

| 5% 1/1/21 (c) | | 810,000 | 904,778 |

| 5% 1/1/22 (c) | | 1,590,000 | 1,809,595 |

| 5% 1/1/23 (c) | | 540,000 | 623,786 |

| Purdue Univ. Ctfs. of Prtn. Series 2016 A, 5% 7/1/30 | | 3,000,000 | 3,559,260 |

| Univ. of Southern Indiana Rev. Series J, 5.75% 10/1/28 (Assured Guaranty Corp. Insured) | | 2,695,000 | 2,968,569 |

|

| TOTAL INDIANA | | | 26,104,846 |

|

| Iowa - 0.4% | | | |

| Iowa Fin. Auth. Health Facilities Rev. Series 2008 A, 5.625% 8/15/37 (Pre-Refunded to 8/15/19 @ 100) | | 1,200,000 | 1,322,664 |

| Iowa Higher Ed. Ln. Auth. Rev. (Grinnell College Proj.) Series 2017, 5% 12/1/46 | | 2,880,000 | 3,322,656 |

|

| TOTAL IOWA | | | 4,645,320 |

|

| Kansas - 0.6% | | | |

| Johnson City Usd # 232 Series 2015 A, 5% 9/1/22 | | 585,000 | 684,222 |

| Kansas Dev. Fin. Agcy. (Adventist Health Sys./Sunbelt Obligated Group Proj.) Series 2009 C, 5.75% 11/15/38 | | 1,900,000 | 2,071,190 |

| Wyandotte County/Kansas City Unified Govt. Util. Sys. Rev.: | | | |

| Series 2012 A, 5% 9/1/26 | | 1,950,000 | 2,229,357 |

| Series 2016 A: | | | |

| 5% 9/1/40 | | 1,400,000 | 1,554,770 |

| 5% 9/1/45 | | 1,800,000 | 1,992,132 |

|

| TOTAL KANSAS | | | 8,531,671 |

|

| Kentucky - 0.2% | | | |

| Ashland Med. Ctr. Rev. (Ashland Hosp. Corp. d/b/a Kings Daughters Med. Ctr. Proj.) Series 2016 A, 5% 2/1/29 | | 1,000,000 | 1,089,290 |

| Louisville & Jefferson County Series 2013 A: | | | |

| 5.5% 10/1/33 | | 500,000 | 579,345 |

| 5.75% 10/1/38 | | 1,355,000 | 1,567,396 |

|

| TOTAL KENTUCKY | | | 3,236,031 |

|

| Louisiana - 0.9% | | | |

| Louisiana Citizens Property Ins. Corp. Assessment Rev. Series 2015, 5% 6/1/20 | | 1,250,000 | 1,381,100 |

| Louisiana Pub. Facilities Auth. Hosp. Rev. (Franciscan Missionaries of Our Lady Health Sys. Proj.) Series 2009, 6.75% 7/1/39 (Pre-Refunded to 7/1/19 @ 100) | | 400,000 | 446,116 |

| Louisiana Pub. Facilities Auth. Rev. (Tulane Univ. of Louisiana Proj.) Series 2016 A: | | | |

| 5% 12/15/25 | | 185,000 | 220,017 |

| 5% 12/15/26 | | 1,000,000 | 1,193,630 |

| 5% 12/15/29 | | 1,085,000 | 1,263,103 |

| New Orleans Aviation Board Rev.: | | | |

| (North Term. Proj.) Series 2015 B: | | | |

| 5% 1/1/27 (c) | | 1,400,000 | 1,598,548 |

| 5% 1/1/30 (c) | | 2,335,000 | 2,611,744 |

| 5% 1/1/40 (c) | | 1,400,000 | 1,512,616 |

| Series 2007 A, 5.25% 1/1/19 (FSA Insured) (c) | | 1,570,000 | 1,603,614 |

|

| TOTAL LOUISIANA | | | 11,830,488 |

|

| Maine - 0.7% | | | |

| Maine Health & Higher Ed. Facilities Auth. Rev. (Eastern Maine Healthcare Systems Proj.) Series 2013, 5% 7/1/43 | | 400,000 | 405,688 |

| Maine Health & Higher Edl. Facilities Auth. Rev.: | | | |

| Series 2008 D: | | | |

| 5.75% 7/1/38 | | 770,000 | 808,700 |

| 5.75% 7/1/38 (Pre-Refunded to 7/1/18 @ 100) | | 330,000 | 348,044 |

| Series 2016 A: | | | |

| 4% 7/1/41 | | 455,000 | 387,028 |

| 4% 7/1/46 | | 600,000 | 494,052 |

| 5% 7/1/41 | | 1,600,000 | 1,616,304 |

| 5% 7/1/46 | | 4,970,000 | 5,002,355 |

| Maine Tpk. Auth. Tpk. Rev. Series 2015, 5% 7/1/38 | | 670,000 | 759,077 |

|

| TOTAL MAINE | | | 9,821,248 |

|

| Maryland - 0.7% | | | |

| Baltimore Proj. Rev. (Wtr. Projs.) Series 2009 A: | | | |

| 5.375% 7/1/34 (Pre-Refunded to 7/1/19 @ 100) | | 185,000 | 201,757 |

| 5.375% 7/1/34 (Pre-Refunded to 7/1/19 @ 100) | | 315,000 | 343,889 |

| City of Westminster Series 2016: | | | |

| 5% 11/1/27 | | 1,000,000 | 1,135,850 |

| 5% 11/1/31 | | 1,245,000 | 1,387,304 |

| Maryland Econ. Dev. Corp. (Purple Line Lt. Rail Proj.) Series 2016 D, 5% 3/31/41 (c) | | 1,815,000 | 1,990,383 |

| Maryland Health & Higher Edl. Facilities Auth. Rev.: | | | |

| (Doctors Cmnty. Hosp. Proj.) Series 2010, 5.75% 7/1/38 (Pre-Refunded to 7/1/20 @ 100) | | 1,010,000 | 1,150,087 |

| (Univ. of Maryland Med. Sys. Proj.): | | | |

| Series 2008 F, 5.25% 7/1/21 | | 1,000,000 | 1,046,660 |

| Series 2010, 5.125% 7/1/39 (Pre-Refunded to 7/1/19 @ 100) | | 900,000 | 977,742 |

| (Upper Chesapeake Hosp. Proj.) Series 2008 C, 5.5% 1/1/18 (Escrowed to Maturity) | | 130,000 | 133,905 |

| Series 2010, 5.625% 7/1/30 (Pre-Refunded to 7/1/20 @ 100) | | 500,000 | 567,420 |

| Series 2016 A: | | | |

| 4% 7/1/42 | | 275,000 | 267,328 |

| 5% 7/1/35 | | 120,000 | 127,044 |

|

| TOTAL MARYLAND | | | 9,329,369 |

|

| Massachusetts - 2.5% | | | |

| Massachusetts Bay Trans. Auth. Sales Tax Rev. Series 2015 A: | | | |

| 5% 7/1/40 | | 310,000 | 350,737 |

| 5% 7/1/45 | | 305,000 | 343,912 |

| Massachusetts Dev. Fin. Agcy. Rev.: | | | |

| (Boston College Proj.) Series T: | | | |

| 5% 7/1/37 | | 2,000,000 | 2,319,520 |

| 5% 7/1/38 | | 3,240,000 | 3,748,453 |

| 5% 7/1/42 | | 1,875,000 | 2,158,688 |

| (Boston Univ. Proj.) Series U4, 5.7% 10/1/40 (Pre-Refunded to 10/1/19 @ 100) | | 1,400,000 | 1,552,446 |

| (Wentworth Institute of Technology Proj.) Series 2017, 5% 10/1/28 | | 1,055,000 | 1,189,038 |

| Series 2011 I, 6.75% 1/1/36 | | 1,000,000 | 1,140,230 |

| Series 2015 D, 5% 7/1/44 | | 890,000 | 942,501 |

| Series 2016 A, 5% 1/1/47 | | 2,395,000 | 2,613,328 |

| Massachusetts Gen. Oblig.: | | | |

| Series 2016 A, 5% 3/1/46 | | 445,000 | 497,813 |

| Series 2016 B: | | | |

| 5% 7/1/31 | | 470,000 | 556,363 |

| 5% 7/1/36 | | 3,000,000 | 3,459,210 |

| Massachusetts Health & Edl. Facilities Auth. Rev. (CareGroup, Inc. Proj.) Series 2008 E1, 5.125% 7/1/33 (Pre-Refunded to 7/1/18 @ 100) | | 1,000,000 | 1,048,080 |

| Massachusetts Port Auth. Rev.: | | | |

| Series 2016 A, 5% 7/1/34 | | 2,260,000 | 2,625,510 |

| Series 2016 B: | | | |

| 4% 7/1/46 (c) | | 5,200,000 | 5,243,524 |

| 5% 7/1/43 (c) | | 3,185,000 | 3,524,967 |

|

| TOTAL MASSACHUSETTS | | | 33,314,320 |

|

| Michigan - 2.0% | | | |

| Detroit Swr. Disp. Rev. Series 2001 E, 5.75% 7/1/31 (Pre-Refunded to 7/1/18 @ 100) | | 385,000 | 406,283 |

| Detroit Wtr. Supply Sys. Rev. Series 2006 B, 7% 7/1/36 (Pre-Refunded to 7/1/19 @ 100) | | 1,000,000 | 1,125,180 |

| Grand Rapids Pub. Schools: | | | |

| Series 2016, 5% 5/1/26 (FSA Insured) | | 3,065,000 | 3,687,011 |

| 5% 5/1/20 (FSA Insured) | | 480,000 | 528,566 |

| Lansing Board of Wtr. & Lt. Util. Rev. 5.5% 7/1/41 | | 500,000 | 570,815 |

| Michigan Bldg. Auth. Rev.: | | | |

| (Facilities Prog.): | | | |

| Series 2015 I, 5% 4/15/30 | | 5,000,000 | 5,773,750 |

| Series 2016 I, 5% 4/15/24 | | 295,000 | 350,259 |

| 5% 4/15/33 | | 2,500,000 | 2,838,750 |

| Michigan Fin. Auth. Rev.: | | | |

| Series 2012 A: | | | |

| 4.125% 6/1/32 (Pre-Refunded to 6/1/22 @ 100) | | 1,150,000 | 1,293,451 |

| 5% 6/1/21 (Escrowed to Maturity) | | 350,000 | 399,767 |

| 5% 6/1/27 (Pre-Refunded to 6/1/22 @ 100) | | 500,000 | 583,650 |

| 5% 6/1/39 (Pre-Refunded to 6/1/22 @ 100) | | 1,100,000 | 1,284,030 |

| Series 2012, 5% 11/15/42 | | 2,175,000 | 2,357,156 |

| Michigan Hosp. Fin. Auth. Rev.: | | | |

| (McLaren Health Care Corp. Proj.) Series 2008 A, 5.75% 5/15/38 (Pre-Refunded to 5/15/18 @ 100) | | 1,000,000 | 1,049,450 |

| Bonds (Ascension Health Cr. Group Proj.) Series F5: | | | |

| 1.9%, tender 4/1/21 (b) | | 1,855,000 | 1,865,462 |

| 2.4%, tender 3/15/23 (b) | | 725,000 | 737,746 |

| 6.5% 12/1/33 (Pre-Refunded to 12/1/18 @ 100) | | 435,000 | 471,349 |

| 6.5% 12/1/33 (Pre-Refunded to 12/1/18 @ 100) | | 80,000 | 86,357 |

| Portage Pub. Schools Series 2016, 5% 11/1/33 | | 1,130,000 | 1,284,098 |

| Royal Oak Hosp. Fin. Auth. Hosp. Rev. (William Beaumont Hosp. Proj.) Series 2009 V, 8.25% 9/1/39 (Pre-Refunded to 9/1/18 @ 100) | | 600,000 | 657,054 |

|

| TOTAL MICHIGAN | | | 27,350,184 |

|

| Minnesota - 0.5% | | | |

| Duluth Independent School District #709 Ctfs. of Prtn. Series 2009 B, 4% 3/1/20 | | 1,620,000 | 1,687,635 |

| Minneapolis & Saint Paul Hsg. & Redev. Auth. Health Care Sys. Rev. (Allina Health Sys. Proj.) Series 2017 A, 5% 11/15/23 | | 1,500,000 | 1,775,310 |

| Minneapolis Health Care Sys. Rev.: | | | |

| 6.5% 11/15/38 | | 845,000 | 902,528 |

| 6.5% 11/15/38 (Pre-Refunded to 11/15/18 @ 100) | | 155,000 | 167,865 |

| Minnesota Gen. Oblig. 5% 8/1/22 (Pre-Refunded to 8/1/17 @ 100) | | 25,000 | 25,249 |

| St. Louis Park Health Care Facilities Rev. (Park Nicollet Health Svcs. Proj.) Series 2009, 5.75% 7/1/39 (Pre-Refunded to 7/1/19 @ 100) | | 1,600,000 | 1,761,328 |

|

| TOTAL MINNESOTA | | | 6,319,915 |

|

| Missouri - 0.2% | | | |

| Missouri Health & Edl. Facilities Auth. Edl. Facilities Rev. Series 2015 B: | | | |

| 3.125% 2/1/27 | | 200,000 | 198,250 |

| 3.25% 2/1/28 | | 200,000 | 198,380 |

| 4% 2/1/40 | | 100,000 | 100,134 |

| 5% 2/1/29 | | 1,240,000 | 1,406,334 |

| 5% 2/1/36 | | 400,000 | 437,528 |

| 5% 2/1/45 | | 600,000 | 647,874 |

|

| TOTAL MISSOURI | | | 2,988,500 |

|

| Nebraska - 0.5% | | | |

| Central Plains Energy Proj. Rev. (Nebraska Gas Proj.) Series 2007 B, 1.207% 12/1/17 (b) | | 555,000 | 553,751 |

| Douglas County Hosp. Auth. #2 Health Facilities Rev. 6% 8/15/24 | | 740,000 | 750,686 |

| Nebraska Pub. Pwr. District Rev.: | | | |

| Series 2016 A, 5% 1/1/41 | | 2,000,000 | 2,235,060 |

| Series 2016 B, 5% 1/1/40 | | 1,130,000 | 1,263,713 |

| Omaha Arpt. Auth. Arpt. Rev.: | | | |

| Series 2017 A: | | | |

| 5% 12/15/22 (c) | | 750,000 | 868,958 |

| 5% 12/15/23 (c) | | 750,000 | 879,645 |

| Series 2017 C, 5% 12/15/21 (c) | | 410,000 | 468,257 |

|

| TOTAL NEBRASKA | | | 7,020,070 |

|

| Nevada - 1.4% | | | |

| Clark County Arpt. Rev. (Sub Lien Proj.) Series 2017 A-1: | | | |

| 5% 7/1/20 (c) | | 1,375,000 | 1,523,459 |

| 5% 7/1/21 (c) | | 1,370,000 | 1,552,621 |

| Clark County McCarran Int'l. Arpt. Passenger Facility Charge Rev.: | | | |

| ( Clark County Arpt. Rev. Proj.) Series 2017 B: | | | |

| 5% 7/1/20 (c) | | 1,960,000 | 2,171,621 |

| 5% 7/1/23 (c) | | 3,000,000 | 3,509,700 |

| (Clark County Arpt. Rev. Proj.) Series 2017 B: | | | |

| 5% 7/1/21 (c) | | 2,405,000 | 2,725,587 |

| 5% 7/1/22 (c) | | 2,250,000 | 2,596,095 |

| Las Vegas Valley Wtr. District Wtr. Impt. Gen. Oblig. Series 2016 B, 5% 6/1/36 | | 4,530,000 | 5,202,524 |

|

| TOTAL NEVADA | | | 19,281,607 |

|

| New Hampshire - 0.7% | | | |

| New Hampshire Bus. Fin. Auth. Rev. Series 2009 A, 6.125% 10/1/39 (Pre-Refunded to 10/1/19 @ 100) | | 1,830,000 | 2,045,391 |

| New Hampshire Health & Ed. Facilities Auth. Rev.: | | | |

| Series 2007, 5% 10/1/37 | | 255,000 | 258,111 |

| Series 2012: | | | |

| 4% 7/1/32 | | 400,000 | 402,396 |

| 5% 7/1/27 | | 500,000 | 542,730 |

| Series 2016: | | | |

| 3% 10/1/20 | | 110,000 | 114,569 |

| 4% 10/1/38 | | 480,000 | 476,573 |

| 5% 10/1/22 | | 1,000,000 | 1,123,620 |

| 5% 10/1/29 | | 2,675,000 | 3,012,585 |

| 5% 10/1/38 | | 1,200,000 | 1,298,184 |

|

| TOTAL NEW HAMPSHIRE | | | 9,274,159 |

|

| New Jersey - 4.7% | | | |

| New Jersey Ctfs. of Prtn. Series 2009 A, 5.25% 6/15/28 (Pre-Refunded to 6/15/19 @ 100) | | 1,000,000 | 1,086,360 |

| New Jersey Econ. Dev. Auth. Rev.: | | | |

| (New Jersey Gen. Oblig. Proj.): | | | |

| Series 2015 XX, 5% 6/15/25 | | 1,995,000 | 2,109,353 |

| Series 2017 B: | | | |

| 5% 11/1/23 | | 7,200,000 | 7,680,312 |

| 5% 11/1/24 | | 2,800,000 | 2,985,360 |

| Series 2009 AA: | | | |

| 5.5% 12/15/29 | | 330,000 | 350,981 |

| 5.5% 12/15/29 (Pre-Refunded to 6/15/19 @ 100) | | 670,000 | 731,352 |

| Series 2013 NN, 5% 3/1/27 | | 11,810,000 | 12,237,640 |

| Series 2013: | | | |

| 5% 3/1/23 | | 3,270,000 | 3,483,793 |

| 5% 3/1/24 | | 3,000,000 | 3,159,210 |

| 5% 3/1/25 | | 300,000 | 314,013 |

| Series 2015 XX, 5% 6/15/22 | | 640,000 | 681,504 |

| Series 2016 AAA, 5% 6/15/41 | | 865,000 | 862,552 |

| Series 2016 BBB: | | | |

| 5% 6/15/21 | | 1,000,000 | 1,064,510 |

| 5% 6/15/22 | | 1,620,000 | 1,725,057 |

| 5% 6/15/23 | | 2,600,000 | 2,771,678 |

| 6% 12/15/34 (Pre-Refunded to 12/15/18 @ 100) | | 25,000 | 26,496 |

| New Jersey Edl. Facility Series 2016 A, 5% 7/1/31 | | 1,000,000 | 1,105,910 |

| New Jersey Health Care Facilities Fing. Auth. Rev.: | | | |

| Series 2008, 6.625% 7/1/38 (Pre-Refunded to 7/1/18 @ 100) | | 1,700,000 | 1,810,092 |

| Series 2016 A: | | | |

| 5% 7/1/20 | | 500,000 | 547,325 |

| 5% 7/1/21 | | 65,000 | 72,526 |

| 5% 7/1/22 | | 65,000 | 73,493 |

| 5% 7/1/23 | | 230,000 | 262,637 |

| 5% 7/1/24 | | 180,000 | 206,914 |

| 5% 7/1/25 | | 195,000 | 224,104 |

| 5% 7/1/26 | | 65,000 | 74,669 |

| 5% 7/1/27 | | 100,000 | 113,680 |

| 5% 7/1/28 | | 365,000 | 424,031 |

| 5% 7/1/29 | | 700,000 | 782,824 |

| 5% 7/1/30 | | 275,000 | 305,487 |

| New Jersey Trans. Trust Fund Auth.: | | | |

| Series 2005 B, 5.25% 12/15/22 (AMBAC Insured) | | 400,000 | 439,676 |

| Series 2010 D, 5.25% 12/15/23 | | 6,295,000 | 6,874,329 |

| Series 2014 AA, 5% 6/15/23 | | 5,250,000 | 5,650,103 |

| Series 2016 A: | | | |

| 5% 6/15/27 | | 400,000 | 431,876 |

| 5% 6/15/29 | | 1,650,000 | 1,755,485 |

| Series 2016 A-2, 5% 6/15/23 | | 1,050,000 | 1,143,251 |

|

| TOTAL NEW JERSEY | | | 63,568,583 |

|

| New Mexico - 0.2% | | | |

| New Mexico Edl. Assistance Foundation Series 2010 A1, 5% 12/1/19 | | 2,000,000 | 2,184,300 |

| New York - 6.2% | | | |

| Dorm. Auth. New York Univ. Rev.: | | | |

| Series 2017 4% 12/1/20 (a) | | 1,000,000 | 1,053,470 |

| Series 2017: | | | |

| 4% 12/1/21 (a) | | 1,100,000 | 1,165,549 |

| 5% 12/1/22 (a) | | 1,700,000 | 1,891,862 |

| Hudson Yards Infrastructure Corp. New York Rev. Series 2012 A, 5.75% 2/15/47 | | 2,700,000 | 3,063,906 |

| MTA Hudson Rail Yards Trust Oblig. Series 2016 A, 5% 11/15/56 | | 3,400,000 | 3,683,118 |

| New York City Gen. Oblig.: | | | |

| Series 2008: | | | |

| 5.25% 8/15/27 | | 400,000 | 421,140 |

| 5.25% 8/15/27 (Pre-Refunded to 8/15/18 @ 100) | | 1,100,000 | 1,159,741 |

| Series 2009: | | | |

| 5.625% 4/1/29 | | 25,000 | 27,104 |

| 5.625% 4/1/29 (Pre-Refunded to 4/1/19 @ 100) | | 255,000 | 277,216 |

| Series 2012 A1, 5% 8/1/24 | | 1,300,000 | 1,480,648 |

| Series 2012 E, 5% 8/1/24 | | 5,000,000 | 5,707,200 |

| Series 2012 G1, 5% 4/1/25 | | 2,500,000 | 2,868,025 |

| Series 2014 J, 5% 8/1/23 | | 1,425,000 | 1,695,935 |

| Series 2015 C, 5% 8/1/27 | | 700,000 | 827,358 |

| New York City Muni. Wtr. Fin. Auth. Wtr. & Swr. Sys. Rev.: | | | |

| Series 2009 CC, 5% 6/15/34 | | 2,100,000 | 2,185,344 |

| Series 2009 FF 2, 5.5% 6/15/40 | | 3,000,000 | 3,264,150 |

| Series 2011 EE, 5.375% 6/15/43 | | 4,000,000 | 4,520,960 |

| Series 2013 CC, 5% 6/15/47 | | 4,000,000 | 4,443,920 |

| New York City Transitional Fin. Auth. Bldg. Aid Rev.: | | | |

| Series 2009 S3: | | | |

| 5.25% 1/15/34 | | 2,500,000 | 2,663,275 |

| 5.25% 1/15/39 | | 1,000,000 | 1,063,560 |

| Series 2009 S4: | | | |

| 5.5% 1/15/39 | | 850,000 | 909,815 |

| 5.75% 1/15/39 | | 1,600,000 | 1,722,112 |

| Series 2015 S1, 5% 7/15/43 | | 5,000,000 | 5,591,600 |

| Series 2015 S2, 5% 7/15/35 | | 1,770,000 | 2,017,287 |

| New York City Transitional Fin. Auth. Rev. Series 2015 E1, 5% 2/1/41 | | 510,000 | 573,995 |

| New York Dorm. Auth. Personal Income Tax Rev.: | | | |

| (Ed. Proj.) Series 2008 B, 5.75% 3/15/36 | | 3,400,000 | 3,684,002 |

| 5% 2/15/34 | | 1,100,000 | 1,168,882 |

| New York Dorm. Auth. Sales Tax Rev. Series 2016 A: | | | |

| 5% 3/15/31 | | 1,830,000 | 2,179,567 |

| 5% 3/15/32 | | 800,000 | 946,992 |

| 5% 3/15/34 | | 1,300,000 | 1,522,482 |

| New York Metropolitan Trans. Auth. Dedicated Tax Fund Rev. Series 2009 B, 5% 11/15/34 | | 1,200,000 | 1,307,772 |

| New York Metropolitan Trans. Auth. Rev.: | | | |

| Series 2010 D, 5.25% 11/15/40 | | 1,400,000 | 1,564,108 |

| Series 2012 D, 5% 11/15/25 | | 4,600,000 | 5,371,926 |

| Series 2014 B, 5% 11/15/44 | | 1,500,000 | 1,660,860 |

| Series 2015 A1, 5% 11/15/45 | | 2,600,000 | 2,901,886 |

| Series 2016, 6.5% 11/15/28 | | 190,000 | 205,436 |

| New York Thruway Auth. Gen. Rev. Series 2013 A, 5% 5/1/19 | | 1,800,000 | 1,935,882 |

| New York Trans. Dev. Corp. (Laguardia Arpt. Term. Redev. Proj.) Series 2016 A, 5% 7/1/41 (c) | | 2,100,000 | 2,250,465 |

| Rockland County Gen. Oblig. Series 2014 A, 4% 3/1/23 (FSA Insured) | | 1,125,000 | 1,239,694 |

| Tobacco Settlement Fing. Corp. Series 2013 B, 5% 6/1/21 | | 15,000 | 15,019 |

| Triborough Bridge & Tunnel Auth. Revs. Series 2015 A, 5.25% 11/15/45 | | 1,000,000 | 1,147,250 |

|

| TOTAL NEW YORK | | | 83,380,513 |

|

| North Carolina - 0.4% | | | |

| Nash Health Care Sys. Health Care Facilities Rev.: | | | |

| Series 2012, 5% 11/1/41 | | 800,000 | 847,776 |

| 5% 11/1/30 (FSA Insured) | | 1,275,000 | 1,328,537 |

| North Carolina Med. Care Cmnty. Health Series 2017, 5% 10/1/33 (e) | | 560,000 | 634,178 |

| North Carolina Med. Care Commission Health Care Facilities Rev. (Rex Healthcare Proj.) Series 2010 A, 5% 7/1/30 | | 1,600,000 | 1,737,568 |

| North Carolina Muni. Pwr. Agcy. #1 Catawba Elec. Rev. Series 2009 A: | | | |

| 5% 1/1/30 | | 285,000 | 302,317 |

| 5% 1/1/30 (Pre-Refunded to 1/1/19 @ 100) | | 715,000 | 761,868 |

|

| TOTAL NORTH CAROLINA | | | 5,612,244 |

|

| North Dakota - 0.3% | | | |

| Cass County Health Care Facilities Rev. (Essentia Health Obligated Group Proj.) Series 2008, 5.125% 2/15/37 (Assured Guaranty Corp. Insured) | | 750,000 | 802,800 |

| McLean County Solid Waste Facilities Rev. (Great River Energy Projs.) Series 2010 B, 5.15% 7/1/40 | | 2,300,000 | 2,462,334 |

|

| TOTAL NORTH DAKOTA | | | 3,265,134 |

|

| Ohio - 1.4% | | | |

| Akron Bath Copley Hosp. District Rev. Series 2016, 5.25% 11/15/46 | | 1,500,000 | 1,642,395 |

| American Muni. Pwr., Inc. Rev.: | | | |

| (Greenup Hydroelectric Proj.) Series 2016, 5% 2/15/46 | | 1,900,000 | 2,104,725 |

| (Prairie State Energy Campus Proj.) Series 2015, 5% 2/15/28 | | 2,000,000 | 2,285,960 |

| Columbus City School District 5% 12/1/29 | | 300,000 | 358,149 |

| Franklin County Hosp. Facilities Rev. (Ohiohealth Corp. Proj.) Series 2015, 5% 5/15/40 | | 1,600,000 | 1,758,560 |

| Hamilton County Convention Facilities Auth. Rev. Series 2014, 5% 12/1/26 | | 670,000 | 761,857 |

| Lake County Hosp. Facilities Rev.: | | | |

| Series 2015, 5% 8/15/29 | | 400,000 | 453,876 |

| 5.75% 8/15/38 | | 165,000 | 172,709 |

| 5.75% 8/15/38 (Pre-Refunded to 8/15/18 @ 100) | | 835,000 | 884,774 |

| Lucas County Hosp. Rev. (ProMedica Healthcare Oblig. Group Proj.) Series 2011 A, 6.5% 11/15/37 | | 1,200,000 | 1,429,464 |

| Muskingum County Hosp. Facilities (Genesis Healthcare Sys. Obligated Group Proj.) Series 2013, 5% 2/15/48 | | 2,000,000 | 2,070,880 |

| Ohio Tpk. Commission Tpk. Rev. (Infastructure Proj.) Series 2005 A, 0% 2/15/42 | | 2,600,000 | 921,362 |

| Ross County Hosp. Facilities Rev. (Adena Health Sys. Proj.) Series 2008, 5.75% 12/1/35 | | 1,400,000 | 1,464,162 |

| Scioto County Hosp. Facilities Rev. Series 2016, 5% 2/15/34 | | 445,000 | 492,241 |

| Univ. of Akron Gen. Receipts Series 2016 A, 5% 1/1/35 | | 1,995,000 | 2,242,699 |

|

| TOTAL OHIO | | | 19,043,813 |

|

| Oklahoma - 0.3% | | | |

| Oklahoma City Pub. Property Auth. Hotel Tax Rev. Series 2015: | | | |

| 5% 10/1/29 | | 700,000 | 795,571 |

| 5% 10/1/39 | | 150,000 | 164,094 |

| Oklahoma Dev. Fin. Auth. Rev. (Saint John Health Sys. Proj.) Series 2012, 5% 2/15/42 | | 1,775,000 | 1,885,618 |

| Oklahoma Pwr. Auth. Pwr. Supply Sys. Rev. Series 2014 A, 5% 1/1/38 | | 1,295,000 | 1,431,817 |

|

| TOTAL OKLAHOMA | | | 4,277,100 |

|

| Oregon - 0.1% | | | |

| Yamhill County School District #029J Newberg 5.5% 6/15/19 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | 1,090,910 |

| Pennsylvania - 5.9% | | | |

| Allegheny County Hosp. Dev. Auth. Rev. (Univ. of Pittsburgh Med. Ctr. Proj.) Series 2009 A, 5.625% 8/15/39 | | 1,100,000 | 1,199,627 |

| Centre County Hosp. Auth. Rev. (Mount Nittany Med. Ctr. Proj.) Series 2011, 7% 11/15/46 (Pre-Refunded to 11/15/21 @ 100) | | 500,000 | 619,340 |

| Cumberland County Muni. Auth. Rev. (Dickinson College Proj.) Series 2017, 5% 5/1/47 | | 4,920,000 | 5,476,403 |

| Dauphin County Gen. Auth. (Pinnacle Health Sys. Proj.) Series 2016 A: | | | |

| 5% 6/1/21 | | 350,000 | 394,723 |

| 5% 6/1/22 | | 500,000 | 573,900 |

| 5% 6/1/23 | | 500,000 | 582,010 |

| Lehigh County Gen. Purp. Auth. Rev. (Muhlenberg College Proj.) Series 2017, 5% 2/1/39 | | 2,585,000 | 2,895,872 |

| Monroe County Hosp. Auth. Rev. Series 2016, 5% 7/1/41 | | 1,000,000 | 1,081,600 |

| Montgomery County Higher Ed. & Health Auth. Hosp. Rev. (Abington Memorial Hosp. Proj.) Series 2012 A, 5% 6/1/24 | | 600,000 | 684,000 |

| Montgomery County Higher Ed. & Health Auth. Rev.: | | | |

| Series 2014 A, 5% 10/1/25 | | 1,045,000 | 1,171,863 |

| Series 2016 A: | | | |

| 5% 10/1/28 | | 1,515,000 | 1,671,545 |

| 5% 10/1/36 | | 1,140,000 | 1,205,710 |

| 5% 10/1/40 | | 700,000 | 735,910 |

| Northampton County Gen. Purp. Auth. Hosp. Rev.: | | | |

| (St Lukes Hosp. & Health Ntw Proj.) Series 2016 A, 5% 8/15/36 | | 745,000 | 822,316 |

| Series 2016 A, 5% 8/15/46 | | 5,125,000 | 5,585,276 |

| Pennsylvania Gen. Oblig. Series 2016: | | | |

| 5% 2/1/21 | | 2,590,000 | 2,911,756 |

| 5% 2/1/22 | | 2,720,000 | 3,118,045 |

| 5% 2/1/23 | | 2,665,000 | 3,103,046 |

| 5% 2/1/24 | | 3,000,000 | 3,527,850 |

| Pennsylvania Higher Edl. Facilities Auth. Rev. Series 2016, 5% 5/1/28 | | 500,000 | 580,460 |

| Philadelphia Gas Works Rev.: | | | |

| Series 2016, 5% 10/1/20 | | 695,000 | 770,199 |

| Series 9: | | | |

| 5.25% 8/1/40 | | 490,000 | 528,387 |

| 5.25% 8/1/40 (Pre-Refunded to 8/1/20 @ 100) | | 310,000 | 349,088 |

| 5% 10/1/19 | | 310,000 | 335,364 |

| Philadelphia School District Series 2016 D: | | | |

| 5% 9/1/25 | | 8,790,000 | 9,822,473 |

| 5% 9/1/26 | | 9,180,000 | 10,244,146 |

| 5% 9/1/27 | | 9,690,000 | 10,895,242 |

| Scranton-Lackawanna Health & Welfare Auth. Rev. (Marywood Univ. Proj.) Series 2016, 5% 6/1/36 | | 4,000,000 | 3,971,880 |

| Westmoreland County Muni. Auth. Muni. Svc. Rev. Series A, 0% 8/15/21 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 5,000,000 | 4,572,050 |

|

| TOTAL PENNSYLVANIA | | | 79,430,081 |

|

| Rhode Island - 1.0% | | | |

| Rhode Island Comm Corp. Rev. Series 2016 A: | | | |

| 5% 6/15/21 | | 3,000,000 | 3,386,850 |

| 5% 6/15/22 | | 5,000,000 | 5,747,000 |

| Rhode Island Health & Edl. Bldg. Corp. Higher Ed. Facilities Rev.: | | | |

| Series 2016 B: | | | |

| 5% 9/1/31 | | 140,000 | 150,916 |

| 5% 9/1/36 | | 1,400,000 | 1,473,472 |

| Series 2016: | | | |

| 5% 5/15/34 | | 1,000,000 | 1,070,480 |

| 5% 5/15/39 | | 1,000,000 | 1,054,990 |

|

| TOTAL RHODE ISLAND | | | 12,883,708 |

|

| South Carolina - 2.8% | | | |

| Beaufort-Jasper Wtr. & Swr. Sys. Series 2016 B, 5% 3/1/20 | | 735,000 | 813,719 |

| Horry County School District (South Carolina Gen. Oblig. Proj.) Series 2016, 5% 3/1/23 | | 1,490,000 | 1,766,231 |

| Lancaster County School District ( South Carolina Gen. Oblig. Proj.) Series 2017, 5% 3/1/23 | | 1,000,000 | 1,185,390 |

| Scago Edl. Facilities Corp. for Colleton School District (School District of Colleton County Proj.) Series 2015, 5% 12/1/26 | | 1,400,000 | 1,615,782 |

| South Carolina Jobs-Econ. Dev. Auth. Econ. Dev. Rev. Series 2013, 5% 11/1/27 | | 1,400,000 | 1,597,932 |

| South Carolina Ports Auth. Ports Rev.: | | | |

| Series 2015 (AMT), 5% 7/1/45 (c) | | 5,215,000 | 5,635,120 |

| Series 2015, 5.25% 7/1/55 (c) | | 6,000,000 | 6,539,340 |

| South Carolina Pub. Svc. Auth. Rev.: | | | |

| Series 2012 B, 5% 12/1/20 | | 2,500,000 | 2,747,675 |

| Series 2013 E, 5.5% 12/1/53 | | 6,100,000 | 6,598,736 |

| Series 2014 A: | | | |

| 5% 12/1/49 | | 1,340,000 | 1,413,392 |

| 5.5% 12/1/54 | | 2,500,000 | 2,717,850 |

| Series 2014 C, 5% 12/1/46 | | 720,000 | 763,265 |

| Series 2015 A, 5% 12/1/50 | | 2,175,000 | 2,306,849 |

| Series 2015 E, 5.25% 12/1/55 | | 1,100,000 | 1,191,498 |

| South Carolina Trans. Infrastructure Bank Rev. Series 2015 A, 5% 10/1/23 | | 600,000 | 712,158 |

|

| TOTAL SOUTH CAROLINA | | | 37,604,937 |

|

| Tennessee - 0.2% | | | |

| Jackson Hosp. Rev. 5.75% 4/1/41 | | 270,000 | 278,991 |

| Memphis-Shelby County Arpt. Auth. Arpt. Rev. Series 2010 B, 5.75% 7/1/24 (c) | | 1,600,000 | 1,760,128 |

|

| TOTAL TENNESSEE | | | 2,039,119 |

|

| Texas - 10.5% | | | |

| Aledo Independent School District Series 2016, 5% 2/15/43 | | 1,500,000 | 1,701,555 |

| Austin Arpt. Sys. Rev. Series 2014: | | | |

| 5% 11/15/28 (c) | | 500,000 | 569,505 |

| 5% 11/15/39 (c) | | 1,700,000 | 1,864,016 |

| 5% 11/15/44 (c) | | 4,405,000 | 4,808,718 |

| Austin Cmnty. College District Pub. Facilities Lease Rev. (Round Rock Campus Proj.) Series 2008, 5.5% 8/1/20 (Pre-Refunded to 8/1/18 @ 100) | | 1,000,000 | 1,056,010 |

| Austin Wtr. & Wastewtr. Sys. Rev. Series 2016, 5% 11/15/37 | | 1,400,000 | 1,613,094 |

| Central Reg'l. Mobility Auth.: | | | |

| Series 2015 A: | | | |

| 5% 1/1/28 | | 1,300,000 | 1,491,997 |

| 5% 1/1/31 | | 475,000 | 534,874 |

| 5% 1/1/45 | | 1,000,000 | 1,093,750 |

| Series 2016: | | | |

| 5% 1/1/40 | | 1,000,000 | 1,099,430 |

| 5% 1/1/46 | | 685,000 | 750,445 |

| Comal County Tex Series 2017, 4% 2/1/23 | | 1,660,000 | 1,858,420 |

| Comal Independent School District 5.25% 2/1/23 | | 35,000 | 36,089 |

| Corpus Christi Util. Sys. Rev. 5% 7/15/23 | | 1,600,000 | 1,835,888 |

| Cypress-Fairbanks Independent School District: | | | |

| Series 2014 C, 5% 2/15/44 | | 1,100,000 | 1,234,068 |

| Series 2016, 5% 2/15/27 | | 795,000 | 962,689 |

| Dallas Area Rapid Transit Sales Tax Rev. Series 2016 A, 5% 12/1/33 | | 700,000 | 810,334 |

| Dallas County Cmnty. College Series 2016, 5% 2/15/26 | | 10,040,000 | 12,157,737 |

| Dallas Fort Worth Int'l. Arpt. Rev.: | | | |

| Series 2012 D, 5% 11/1/42 (c) | | 400,000 | 428,880 |

| Series 2012 H, 5% 11/1/42 (c) | | 1,000,000 | 1,072,200 |

| Series 2014 D, 5% 11/1/23 (c) | | 575,000 | 670,427 |

| Dallas Independent School District Bonds Series 2016 B6, 5%, tender 2/15/22 (b) | | 825,000 | 942,604 |

| Frisco Independent School District Series 2008 A, 6% 8/15/33 | | 1,200,000 | 1,275,660 |

| Grand Parkway Trans. Corp. Series 2013 B: | | | |

| 5% 4/1/53 | | 220,000 | 245,212 |

| 5.25% 10/1/51 | | 8,500,000 | 9,666,030 |

| 5.5% 4/1/53 | | 1,000,000 | 1,115,150 |

| Harris County Gen. Oblig. Series 2002, 0% 8/15/24 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | 858,240 |

| Houston Arpt. Sys. Rev.: | | | |

| Series 2011 A, 5% 7/1/24 (c) | | 1,250,000 | 1,388,938 |

| Series 2012 A, 5% 7/1/23 (c) | | 600,000 | 676,524 |

| Lewisville Independent School District 0% 8/15/19 | | 2,340,000 | 2,279,534 |

| Love Field Arpt. Modernization Rev.: | | | |

| Series 2015: | | | |

| 5% 11/1/26 (c) | | 1,000,000 | 1,176,030 |

| 5% 11/1/28 (c) | | 3,325,000 | 3,847,391 |

| Series 2017: | | | |

| 5% 11/1/22 (c) | | 750,000 | 860,213 |

| 5% 11/1/23 (c) | | 1,100,000 | 1,277,496 |

| 5% 11/1/29 (c) | | 1,250,000 | 1,452,975 |

| 5% 11/1/36 (c) | | 1,000,000 | 1,119,430 |

| Newark Higher Ed. Fin. Corp. (Abilene Christian Univ. Proj.) Series 2016 A, 5% 4/1/27 | | 720,000 | 837,965 |

| North Texas Tollway Auth. Rev.: | | | |

| Series 2008 I, 6.2% 1/1/42 (Assured Guaranty Corp. Insured) | | 1,100,000 | 1,342,649 |

| Series 2009 A, 6.25% 1/1/39 (Pre-Refunded to 1/1/19 @ 100) | | 1,465,000 | 1,587,298 |

| Series 2009, 6.25% 1/1/39 | | 335,000 | 360,654 |

| Series 2011 A: | | | |

| 5.5% 9/1/41 | | 2,300,000 | 2,648,588 |

| 6% 9/1/41 | | 1,200,000 | 1,415,484 |

| Series 2011 D, 5% 9/1/28 | | 2,300,000 | 2,636,053 |

| Series 2014 A: | | | |

| 5% 1/1/23 | | 400,000 | 466,712 |

| 5% 1/1/25 | | 1,000,000 | 1,181,410 |

| Series 2015 A, 5% 1/1/32 | | 655,000 | 742,606 |

| Series 2015 B, 5% 1/1/40 | | 2,000,000 | 2,211,140 |

| Series 2016 A, 5% 1/1/36 | | 1,250,000 | 1,414,938 |

| 6% 1/1/24 | | 230,000 | 237,383 |

| Northside Independent School District Bonds 2%, tender 6/1/21 (b) | | 495,000 | 499,455 |

| San Antonio Arpt. Sys. Rev. 5.25% 7/1/18 (FSA Insured) (c) | | 2,505,000 | 2,519,855 |

| San Antonio Elec. & Gas Sys. Rev.: | | | |

| Series 2012, 5.25% 2/1/25 | | 800,000 | 983,072 |

| Series 2016, 5% 2/1/21 | | 1,225,000 | 1,388,660 |

| San Antonio Independent School District Series 2016, 5% 8/15/31 | | 850,000 | 1,004,190 |

| Tarrant County Cultural Ed. Facilities Fin. Corp. Hosp. Rev.: | | | |

| (Hendrick Med. Ctr. Proj.) Series 2009 B, 5.25% 9/1/28 (Assured Guaranty Corp. Insured) | | 1,235,000 | 1,331,083 |

| 5.75% 11/15/24 (Pre-Refunded to 11/15/18 @ 100) | | 480,000 | 513,994 |

| 5.75% 11/15/24 (Pre-Refunded to 11/15/18 @ 100) | | 620,000 | 664,894 |

| Tarrant County Cultural Ed. Facilities Fin. Corp. Rev. Series 2016 A, 5% 2/15/25 | | 165,000 | 196,706 |

| Texas Gen. Oblig.: | | | |

| Series 2016 A, 5% 4/1/23 | | 4,580,000 | 5,432,155 |

| Series 2017 A, 5% 10/1/33 | | 2,700,000 | 3,217,023 |

| Series 2017 B, 5% 10/1/31 | | 10,000,000 | 12,085,200 |

| 5% 4/1/25 (Pre-Refunded to 4/1/18 @ 100) | | 75,000 | 77,741 |

| Texas Private Activity Bond Surface Trans. Corp.: | | | |

| (LBJ Infrastructure Group LLC IH-635 Managed Lanes Proj.) Series 2010, 7% 6/30/40 | | 1,200,000 | 1,360,608 |

| Series 2013, 6.75% 6/30/43 (c) | | 2,400,000 | 2,697,120 |

| Texas State Univ. Sys. Fing. Rev. Series 2017 A: | | | |

| 5% 3/15/28 | | 1,280,000 | 1,552,000 |

| 5% 3/15/29 | | 1,035,000 | 1,244,929 |

| Univ. of Houston Univ. Revs. Series 2017 A: | | | |

| 5% 2/15/26 | | 3,170,000 | 3,844,259 |

| 5% 2/15/32 | | 1,545,000 | 1,788,430 |

| 5% 2/15/33 | | 1,000,000 | 1,151,710 |

| 5% 2/15/34 | | 1,000,000 | 1,145,900 |

| 5% 2/15/35 | | 1,000,000 | 1,140,940 |

| 5% 2/15/36 | | 2,000,000 | 2,275,300 |

| Univ. of North Texas Univ. Rev. Series 2017 A, 5% 4/15/32 | | 5,000,000 | 5,873,450 |

| Univ. of Texas Board of Regents Sys. Rev. Series 2016 D, 5% 8/15/21 | | 935,000 | 1,075,708 |

| Univ. of Texas Permanent Univ. Fund Rev. Series 2016 B, 5% 7/1/29 | | 395,000 | 471,113 |

| Waller Independent School District 5.5% 2/15/28 (Pre-Refunded to 2/15/18 @ 100) | | 1,670,000 | 1,729,936 |

|

| TOTAL TEXAS | | | 140,179,864 |

|

| Utah - 1.3% | | | |

| Salt Lake City Arpt. Rev. Series 2017 A: | | | |

| 5% 7/1/22 (c) | | 400,000 | 462,380 |

| 5% 7/1/27 (c) | | 1,645,000 | 1,982,455 |

| 5% 7/1/29 (c) | | 700,000 | 831,936 |

| 5% 7/1/30 (c) | | 500,000 | 589,890 |

| 5% 7/1/31 (c) | | 600,000 | 702,690 |

| 5% 7/1/32 (c) | | 700,000 | 814,478 |

| 5% 7/1/33 (c) | | 800,000 | 925,544 |

| 5% 7/1/34 (c) | | 700,000 | 805,259 |

| 5% 7/1/35 (c) | | 800,000 | 916,568 |

| 5% 7/1/36 (c) | | 1,100,000 | 1,255,177 |

| 5% 7/1/37 (c) | | 800,000 | 909,896 |

| 5% 7/1/42 (c) | | 4,800,000 | 5,419,728 |

| Utah Associated Muni. Pwr. Sys. Rev. (Payson Pwr. Proj.) 5% 9/1/20 | | 850,000 | 942,404 |

| Utah Transit Auth. Sales Tax Rev. Series 2008 A, 5.25% 6/15/38 (Pre-Refunded to 6/15/18 @ 100) | | 1,200,000 | 1,257,300 |

|

| TOTAL UTAH | | | 17,815,705 |

|

| Vermont - 0.1% | | | |

| Vermont Edl. & Health Bldg. Fin. Agcy. Rev. (Champlain College Proj.) Series 2016 A: | | | |

| 5% 10/15/41 | | 600,000 | 620,538 |

| 5% 10/15/46 | | 1,000,000 | 1,030,350 |

|

| TOTAL VERMONT | | | 1,650,888 |

|

| Virginia - 1.2% | | | |

| Fredericksburg Econ. Dev. Auth. Rev. Series 2014, 5% 6/15/30 | | 1,250,000 | 1,407,388 |

| Stafford County Econ. Dev. Auth. Hosp. Facilities Rev. Series 2016: | | | |

| 4% 6/15/37 | | 120,000 | 118,201 |

| 5% 6/15/30 | | 400,000 | 450,796 |

| 5% 6/15/33 | | 425,000 | 468,792 |

| 5% 6/15/34 | | 805,000 | 881,411 |

| Univ. of Virginia Gen. Rev. Series 2017 A, 5% 4/1/38 | | 9,200,000 | 10,810,276 |

| Virginia College Bldg. Auth. Edl. Facilities Rev. Series 2015 A, 5% 1/1/40 | | 500,000 | 563,230 |

| Winchester Econ. Dev. Auth. Series 2015, 5% 1/1/44 | | 1,000,000 | 1,093,210 |

|

| TOTAL VIRGINIA | | | 15,793,304 |

|

| Washington - 4.9% | | | |

| Chelan County Pub. Util. District #1 Columbia River-Rock Island Hydro-Elec. Sys. Rev. Series 1997 A, 0% 6/1/17 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | | 1,000,000 | 999,130 |

| King County Swr. Rev. Series 2009, 5.25% 1/1/42 (Pre-Refunded to 1/1/19 @ 100) | | 780,000 | 834,327 |

| Port of Seattle Rev.: | | | |

| Series 2016 B, 5% 10/1/30 (c) | | 1,000,000 | 1,161,290 |

| Series 2016: | | | |

| 5% 2/1/25 | | 500,000 | 595,640 |

| 5% 2/1/30 | | 1,000,000 | 1,172,940 |

| Port of Seattle Spl. Facility Rev. Series 2013, 5% 6/1/24 (c) | | 560,000 | 638,814 |

| Seattle Gen. Oblig. Series 2016 A, 5% 4/1/24 | | 4,990,000 | 6,023,229 |

| Spokane Pub. Facilities District Hotel/Motel Tax & Sales/Use Tax Rev. Series 2013 B, 5% 12/1/27 | | 1,500,000 | 1,723,875 |

| Washington Gen. Oblig.: | | | |

| Series 2013 D, 5% 2/1/21 | | 5,695,000 | 6,464,793 |

| Series 2015 C: | | | |

| 5% 2/1/33 | | 670,000 | 770,949 |

| 5% 2/1/34 | | 1,000,000 | 1,144,690 |

| Series 2017 D: | | | |

| 5% 2/1/33 | | 900,000 | 1,056,888 |

| 5% 2/1/36 | | 18,305,000 | 21,193,321 |

| Series R 2017 A, 5% 8/1/33 | | 6,115,000 | 7,133,331 |

| Series R 97A, 0% 7/1/19 (Escrowed to Maturity) | | 1,200,000 | 1,170,120 |

| Series R-2015 B, 5% 7/1/24 | | 1,000,000 | 1,208,100 |

| Series R-2017 A: | | | |

| 5% 8/1/27 | | 400,000 | 487,232 |

| 5% 8/1/28 | | 400,000 | 483,536 |

| 5% 8/1/30 | | 400,000 | 475,524 |

| Washington Health Care Facilities Auth. Rev.: | | | |

| (Catholic Health Initiatives Proj.) Series 2008 D, 6.375% 10/1/36 | | 3,000,000 | 3,172,140 |

| (MultiCare Health Sys. Proj.) Series 2008 B, 6% 8/15/39 (Pre-Refunded to 8/15/19 @ 100) | | 1,000,000 | 1,109,450 |

| (Overlake Hosp. Med. Ctr.) Series 2010, 5.7% 7/1/38 | | 2,270,000 | 2,506,875 |

| (Seattle Children's Hosp. Proj.) Series 2009, 5.625% 10/1/38 (Pre-Refunded to 10/1/19 @ 100) | | 1,400,000 | 1,548,190 |

| Series 2015, 5% 1/1/27 | | 700,000 | 814,968 |

| Washington Higher Ed. Facilities Auth. Rev. (Whitworth Univ. Proj.) Series 2016 A: | | | |

| 5% 10/1/36 | | 1,000,000 | 1,079,770 |

| 5% 10/1/40 | | 570,000 | 603,938 |

|

| TOTAL WASHINGTON | | | 65,573,060 |

|

| West Virginia - 0.3% | | | |

| West Virginia Econ. Dev. Auth. Solid Waste Disp. Facilities Rev. Bonds (Appalachian Pwr. Co. Amos Proj.) Series 2011 A, 1.7%, tender 9/1/20 (b)(c) | | 1,360,000 | 1,340,008 |

| West Virginia Hosp. Fin. Auth. Hosp. Rev. (West Virginia United Health Sys. Proj.) Series 2008 E, 5.625% 6/1/35 (Pre-Refunded to 12/1/18 @ 100) | | 1,000,000 | 1,071,560 |

| West Virginia Univ. Revs. (West Virginia Univ. Projs.) Series 2014 A, 5% 10/1/44 | | 1,100,000 | 1,216,688 |

|

| TOTAL WEST VIRGINIA | | | 3,628,256 |

|

| Wisconsin - 0.6% | | | |

| Pub. Fin. Auth. Sr Liv Rev.: | | | |

| ( Mary's Woods At Marylhurst, Inc. Proj.) Series 2017 B-1 3.95% 11/15/24 (a) | | 80,000 | 80,306 |

| (Mary's Woods At Marylhurst, Inc. Proj.): | | | |

| Series 2017 A: | | | |

| 5% 5/15/21 (a) | | 300,000 | 325,599 |

| 5% 5/15/28 (a) | | 300,000 | 322,533 |

| 5.25% 5/15/37 (a) | | 80,000 | 84,535 |

| 5.25% 5/15/42 (a) | | 100,000 | 105,175 |

| 5.25% 5/15/47 (a) | | 95,000 | 99,528 |

| 5.25% 5/15/52 (a) | | 185,000 | 193,062 |

| Series 2017 B-2, 3.5% 11/15/23 (a) | | 105,000 | 105,204 |

| Series 2017 B-3, 3% 11/15/22 (a) | | 145,000 | 145,280 |

| Pub. Fin. Auth. Wis Edl. Facilities Series 2016: | | | |

| 5% 1/1/37 | | 1,100,000 | 1,107,964 |

| 5% 1/1/42 | | 900,000 | 901,251 |

| Wisconsin Health & Edl. Facilities: | | | |

| Series 2014, 4% 5/1/33 | | 510,000 | 483,373 |

| Series 2016 A, 5% 2/15/42 | | 1,000,000 | 1,065,760 |

| Series 2016, 5% 2/15/29 | | 435,000 | 498,371 |

| Wisconsin Health & Edl. Facilities Auth. Rev.: | | | |

| (Agnesian HealthCare, Inc. Proj.): | | | |

| Series 2010: | | | |

| 5.5% 7/1/40 | | 500,000 | 543,075 |

| 5.75% 7/1/30 | | 500,000 | 552,930 |

| Series 2013 B, 5% 7/1/36 | | 925,000 | 1,002,857 |

| Series 2012, 5% 6/1/27 | | 300,000 | 330,135 |

|

| TOTAL WISCONSIN | | | 7,946,938 |

|

| Wyoming - 0.1% | | | |

| Campbell County Solid Waste Facilities Rev. (Basin Elec. Pwr. Coop. - Dry Fork Station Facilities Proj.) Series 2009 A, 5.75% 7/15/39 | | 1,700,000 | 1,814,835 |

| TOTAL MUNICIPAL BONDS | | | |

| (Cost $1,281,466,535) | | | 1,312,066,407 |

|

| Municipal Notes - 0.2% | | | |

| California - 0.1% | | | |

| San Jose Int'l. Arpt. Rev. Participating VRDN Series 2017, 1.1% 5/5/17 (Liquidity Facility Citibank NA) (b)(c)(f) | | 1,400,000 | $1,400,000 |

| Kentucky - 0.1% | | | |

| Kentucky Pub. Trans. BAN Series 2013 A, 5% 7/1/17 | | 1,500,000 | 1,508,310 |

| TOTAL MUNICIPAL NOTES | | | |

| (Cost $2,907,211) | | | 2,908,310 |

| TOTAL INVESTMENT PORTFOLIO - 98.0% | | | |

| (Cost $1,284,373,746) | | | 1,314,974,717 |

| NET OTHER ASSETS (LIABILITIES) - 2.0% | | | 26,355,938 |

| NET ASSETS - 100% | | | $1,341,330,655 |

VRDN – Variable Rate Demand Note (A debt instrument that is payable upon demand, either daily, weekly or monthly)

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $6,252,228 or 0.5% of net assets.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

(d) Security initially issued in zero coupon form which converts to coupon form at a specified rate and date. The rate shown is the rate at period end.

(e) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(f) Provides evidence of ownership in one or more underlying municipal bonds.

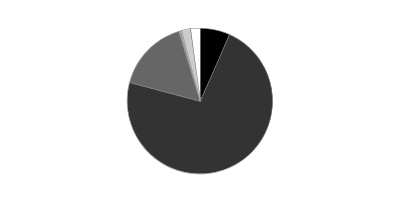

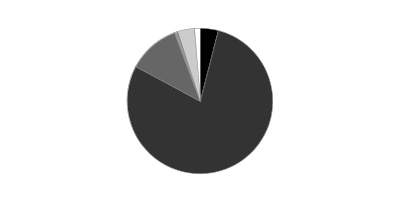

The distribution of municipal securities by revenue source, as a percentage of total Net Assets, is as follows (Unaudited):

See accompanying notes which are an integral part of the financial statements.

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

See accompanying notes which are an integral part of the financial statements.

1. Organization.

Fidelity Advisor Municipal Income Fund (the Fund) is a fund of Fidelity Advisor Series II (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M (formerly Class T), Class C and Class I shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

After the close of business on June 24, 2016, all outstanding Class B shares were converted to Class A shares. All prior fiscal period dollar and share amounts for Class B presented in the Notes to Financial Statements are for the period November 1, 2015 through June 24, 2016.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Municipal securities are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to market discount and deferred trustees compensation.

The Fund purchases municipal securities whose interest, in the opinion of the issuer, is free from federal income tax. There is no assurance that the IRS will agree with this opinion. In the event the IRS determines that the issuer does not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued.