UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4707

Fidelity Advisor Series II

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | August 31 |

| |

Date of reporting period: | August 31, 2017 |

Item 1.

Reports to Stockholders

Fidelity Advisor® Mortgage Securities Fund Class A, Class M (formerly Class T), Class C and Class I

Annual Report August 31, 2017 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended August 31, 2017 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 4.00% sales charge) | (3.47)% | 0.99% | 3.12% |

| Class M (incl. 4.00% sales charge) | (3.47)% | 0.98% | 3.13% |

| Class C (incl. contingent deferred sales charge) | (1.18)% | 1.06% | 2.79% |

| Class I | 0.76% | 2.10% | 3.85% |

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

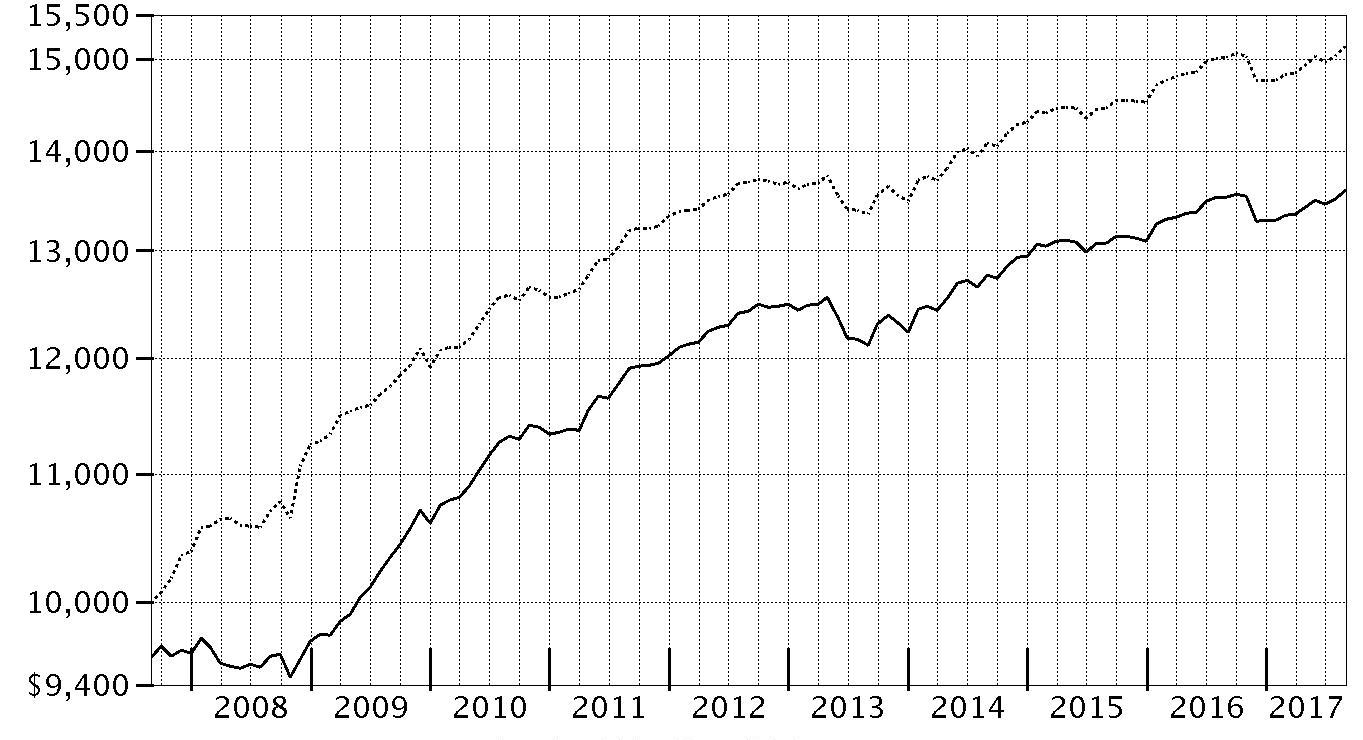

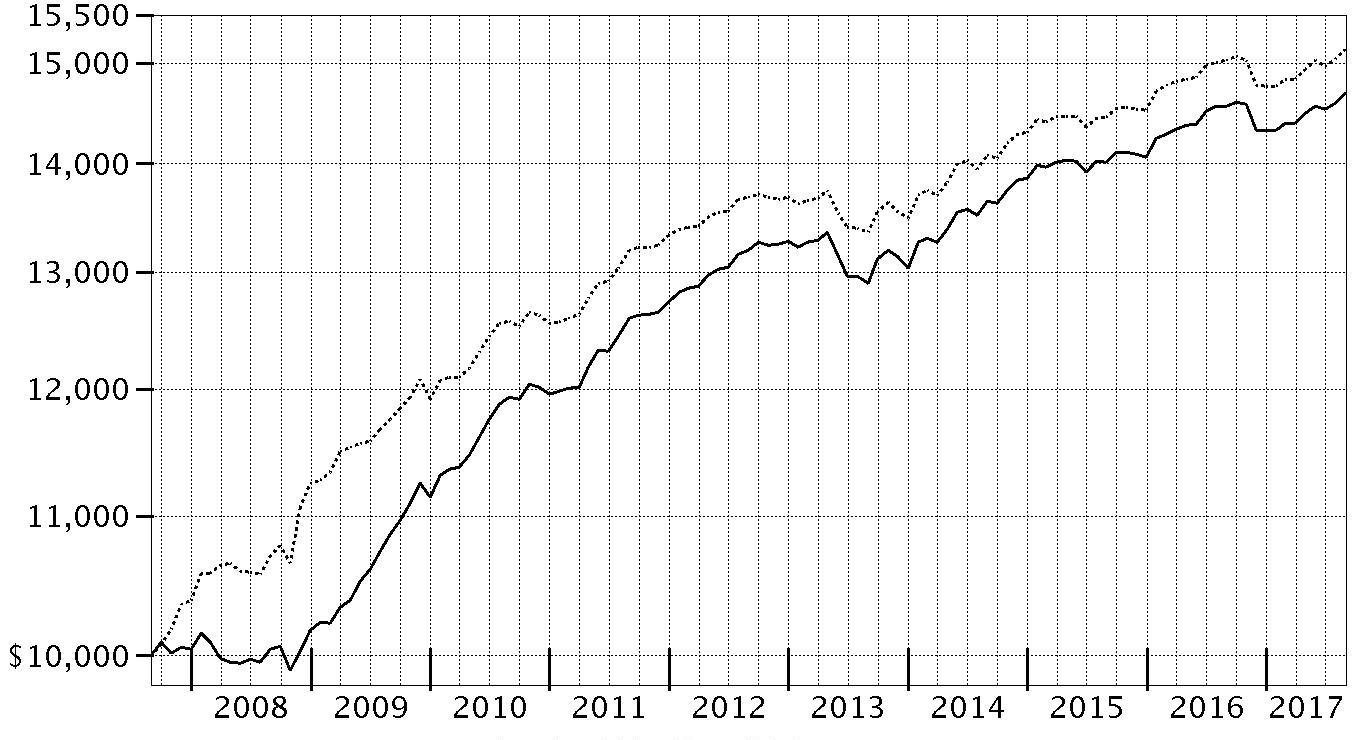

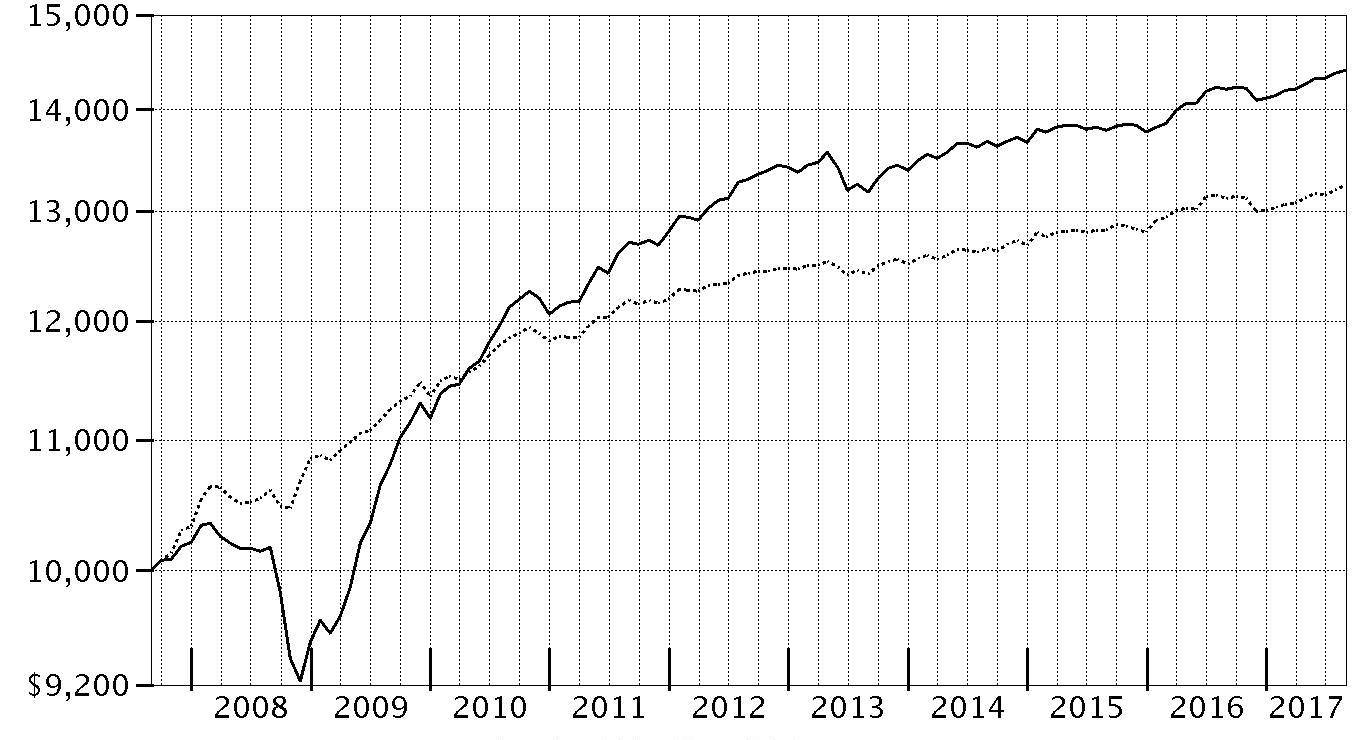

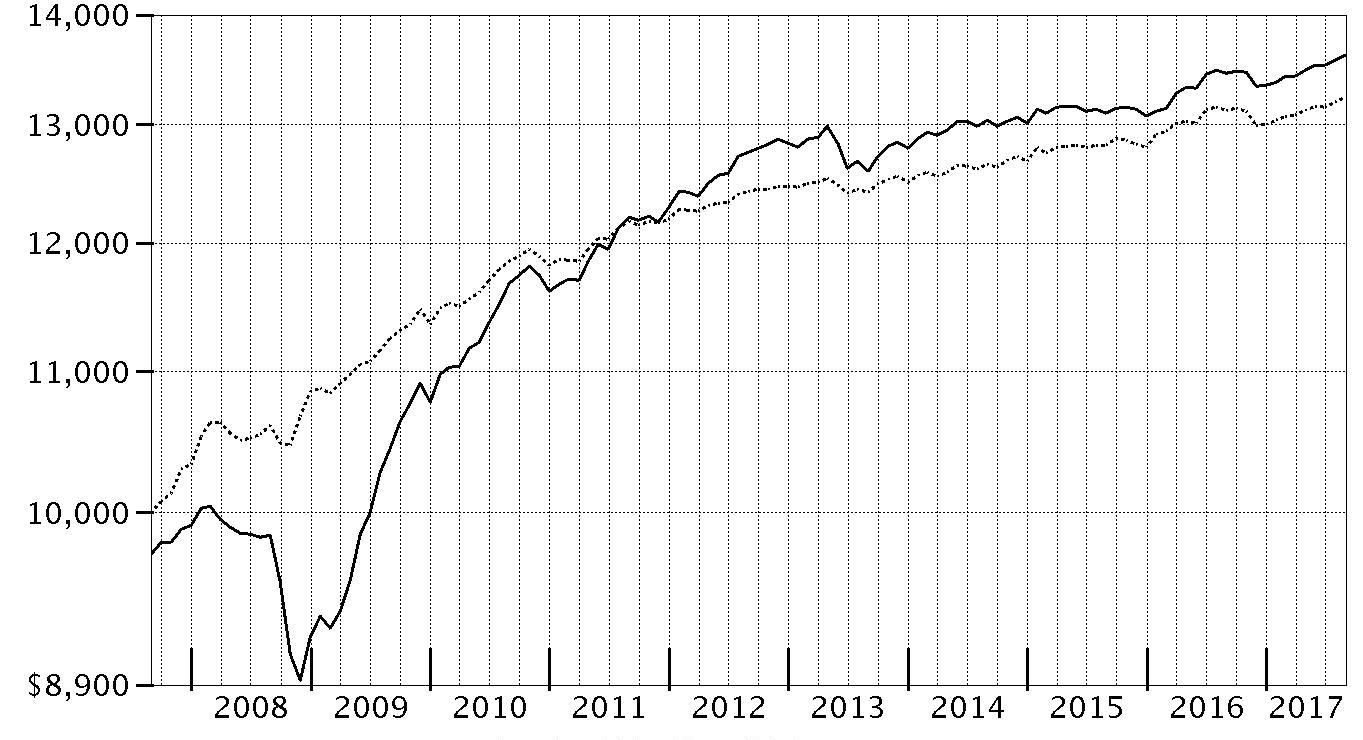

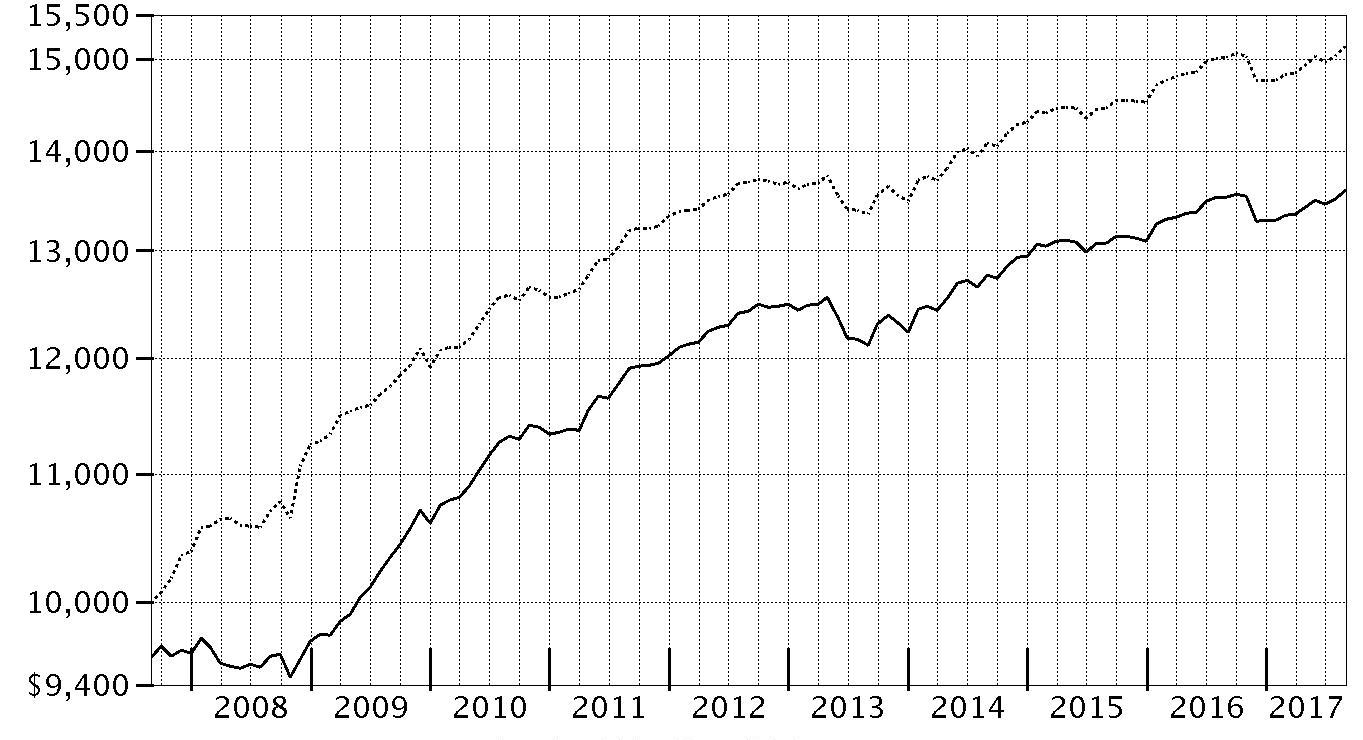

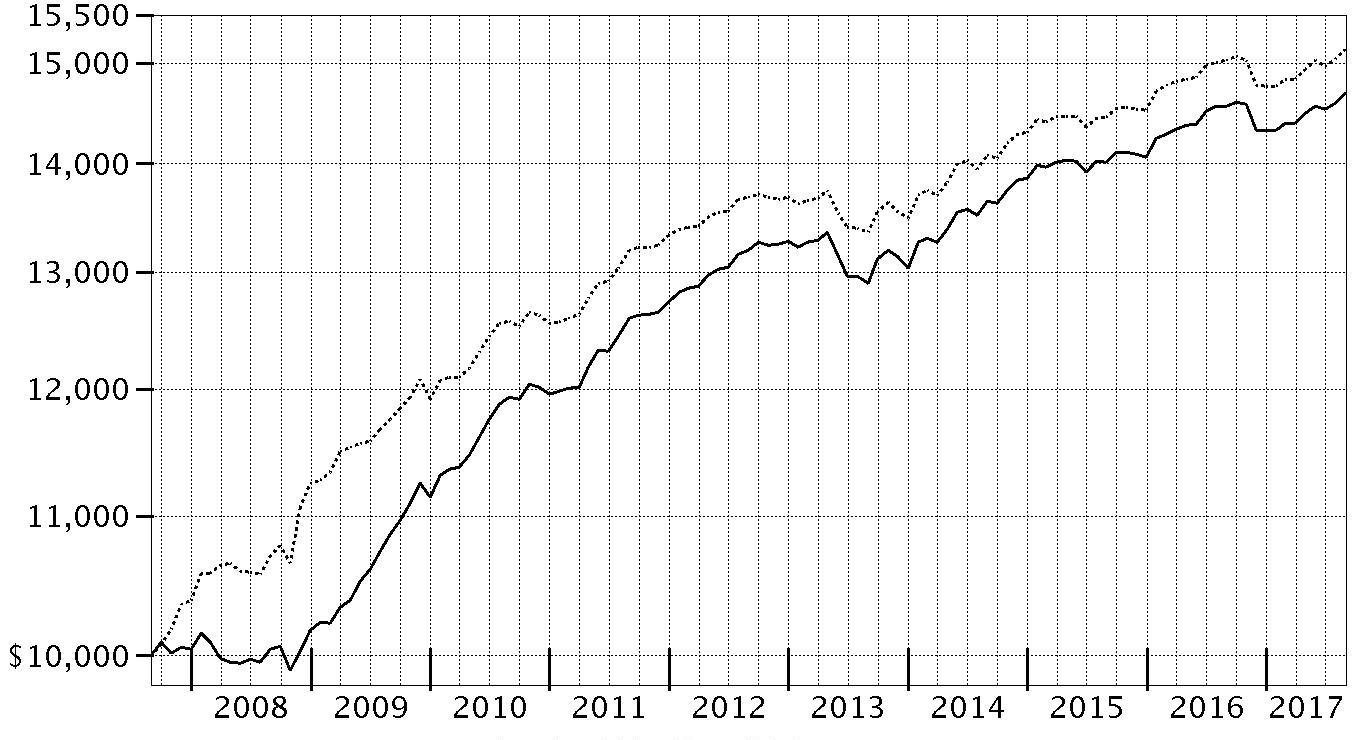

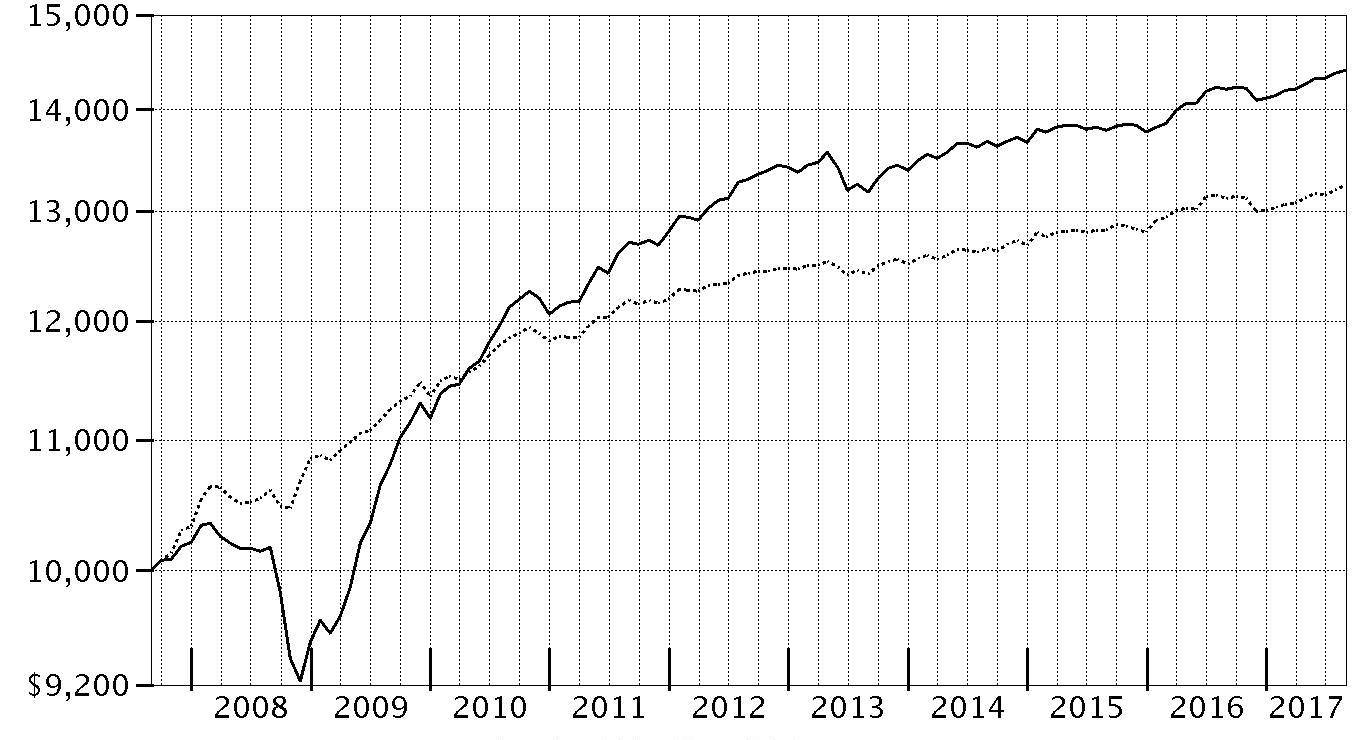

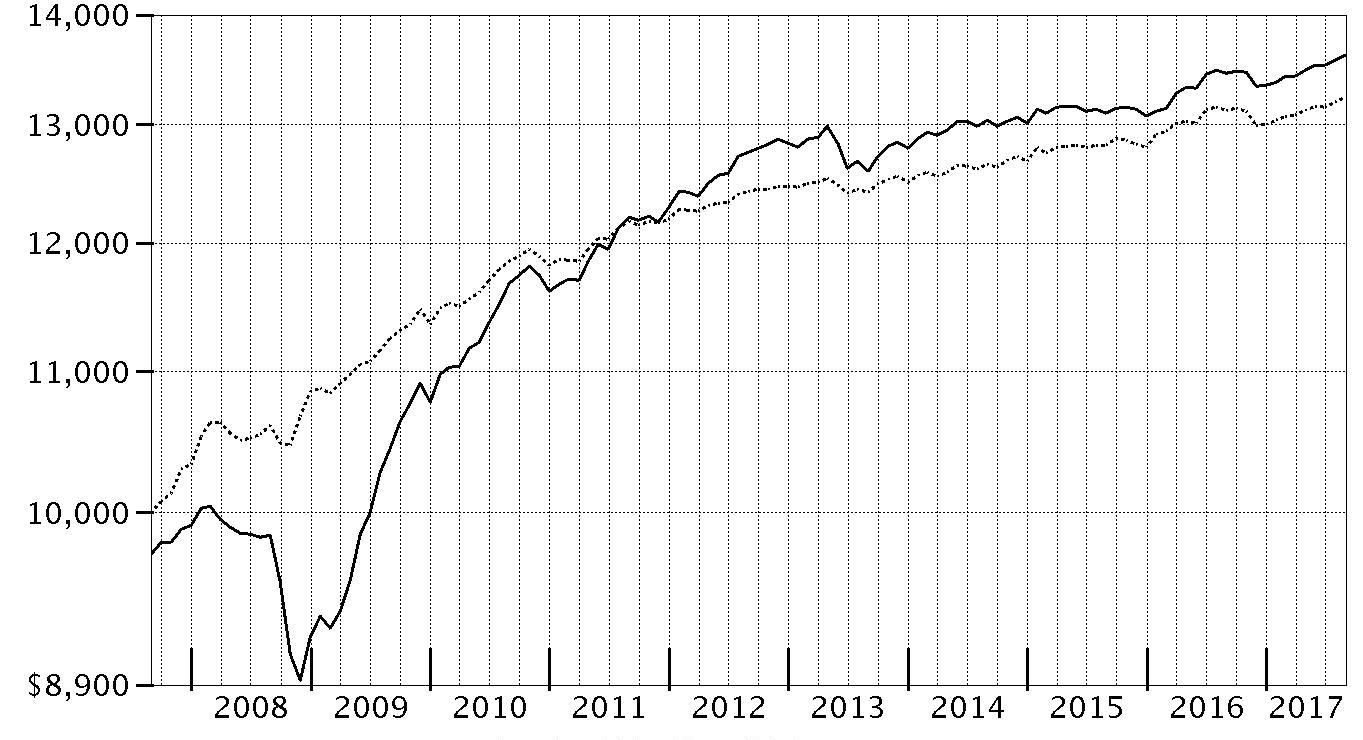

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® Mortgage Securities Fund - Class A on August 31, 2007, and the current 4.00% sales charge was paid.

The chart shows how the value of your investment would have changed, and also shows how the Bloomberg Barclays U.S. MBS Index performed over the same period.

| Period Ending Values |

| $13,600 | Fidelity Advisor® Mortgage Securities Fund - Class A |

| $15,144 | Bloomberg Barclays U.S. MBS Index |

Effective August 24, 2016, all Barclays benchmark indices were co-branded as the Bloomberg Barclays Indices for a period of five years.

Management's Discussion of Fund Performance

Market Recap: U.S. taxable investment-grade bonds rose slightly for the 12 months ending August 31, 2017, as yields increased markedly following the U.S. presidential election then moderated as the period progressed. The Bloomberg Barclays U.S. Aggregate Bond Index gained 0.49% for the year. Bond yields rose slightly early in the period, prior to the U.S. election, then surged in November and December, as many investors viewed then-President-elect Donald Trump’s economic agenda as stimulative and potentially inflationary. Yields also rode the Fed’s decision in December to raise policy interest rates. Longer-term bond yields declined slightly in the first half of 2017, even though the Fed raised rates in June 2017 for the third time in as many quarters, as it became clear that changes to tax, health care and fiscal policies would take time to develop and implement. Fairly cool inflation readings also held back yields late in the period. Within the Bloomberg Barclays index, investment-grade corporate bonds led all major market segments, up 2.13%, while U.S. Treasuries returned -0.95%. Securitized sectors advanced more modestly than corporates. Outside the index, riskier, non-core fixed-income segments led the broader market, while Treasury Inflation-Protected Securities (TIPS) rose 0.46%, according to Bloomberg Barclays.

Comments from Lead Portfolio Manager William Irving and Co-Portfolio Manager Franco Castagliuolo: For the fiscal year, the fund’s share classes (excluding sales charges, if applicable) had roughly breakeven returns, net of fees, about in line with the 0.80% return of the benchmark Bloomberg Barclays U.S. MBS Index. We continued to execute our strategy of attempting to exploit market inefficiencies and identify attractively priced securities. Relative contributors and detractors had only a minor effect this period. Our out-of-benchmark allocations to non-agency MBS and non-agency commercial mortgage-backed securities added some value. These “private label” bonds—issued by financial institutions—outpaced many agency MBS. In terms of security selection, our overweighting in 30-year fixed-rate agency MBS with a measure of resistance to prepayment was beneficial. Our decision to hold TBA (to be announced) securities, which we typically paired with floating-rate securities, added value. As expected, this pair combination outperformed many of the MBS in the index. That said, some of the securities we used in tandem were very short-term, fixed rate securities Their interest payments didn’t adjust higher with rising rates and, as such, lagged the index.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

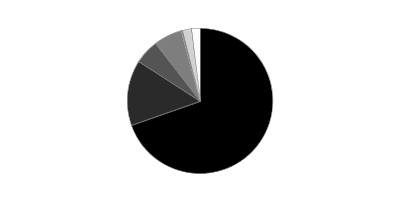

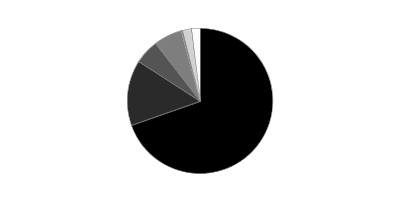

Coupon Distribution as of August 31, 2017

| | % of fund's investments | % of fund's investments 6 months ago |

| Zero coupon bonds | 0.0 | 0.0 |

| 0.01 - 0.99% | 0.2 | 1.0 |

| 1 - 1.99% | 3.7 | 4.5 |

| 2 - 2.99% | 8.1 | 5.9 |

| 3 - 3.99% | 53.6 | 52.7 |

| 4 - 4.99% | 19.1 | 20.9 |

| 5 - 5.99% | 6.0 | 6.1 |

| 6 - 6.99% | 1.9 | 1.9 |

| 7% and above | 0.9 | 1.0 |

Coupon distribution shows the range of stated interest rates on the fund's investments, excluding short-term investments.

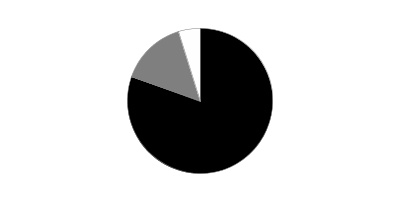

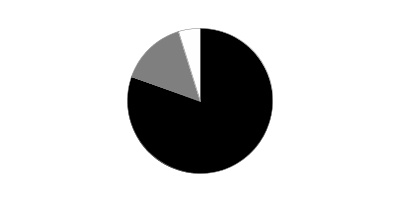

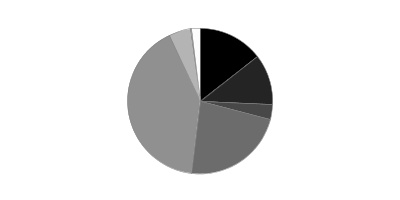

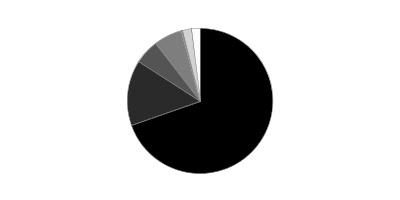

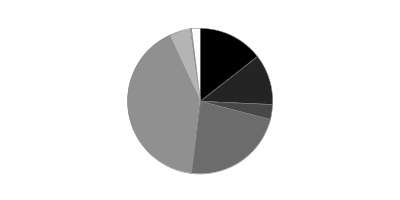

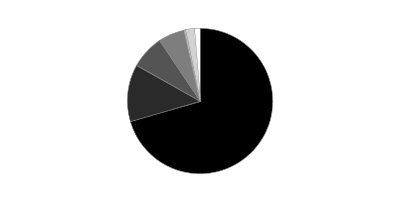

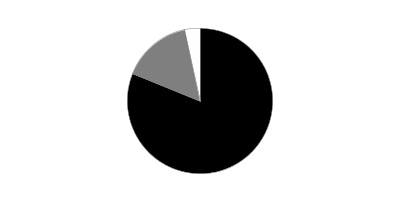

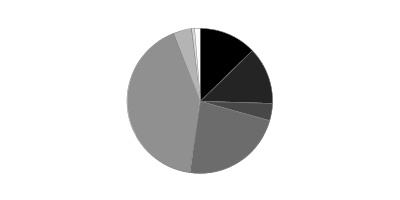

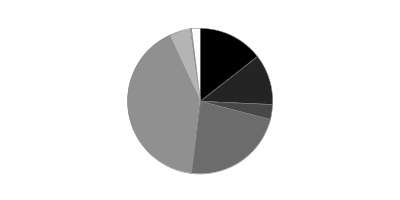

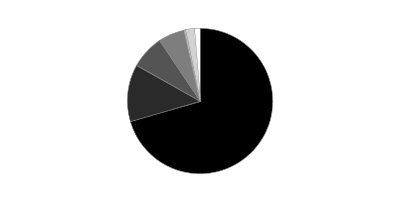

Asset Allocation (% of fund's net assets)

| As of August 31, 2017* |

| | Mortgage Securities | 86.4% |

| | CMOs and Other Mortgage Related Securities | 15.9% |

| | Asset-Backed Securities | 5.2% |

| | Short-Term Investments and Net Other Assets (Liabilities)** | (7.5)% |

* Futures and Swaps - 4.6%

** Short-Term Investments and Net Other Assets (Liabilities) are not included in the pie chart

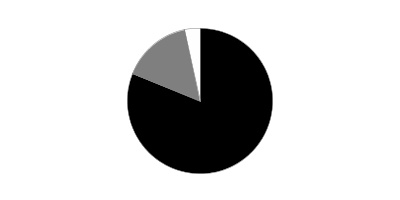

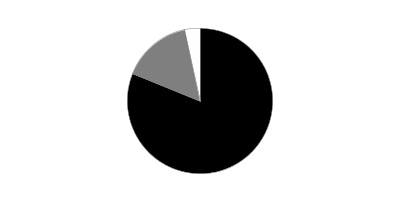

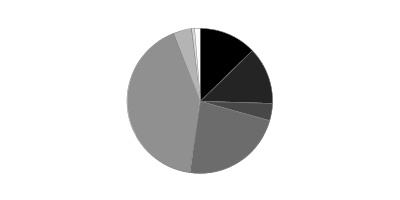

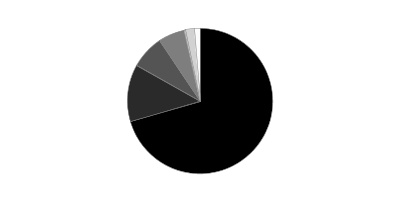

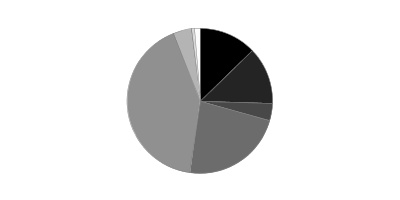

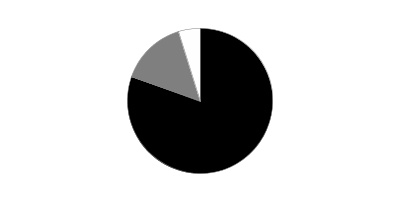

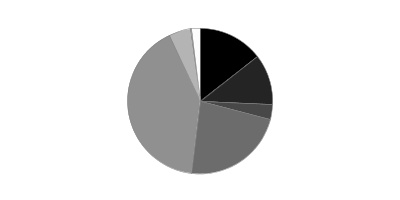

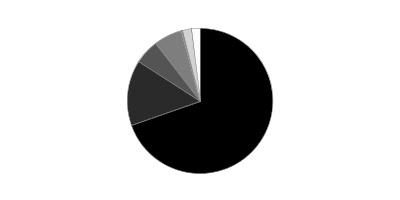

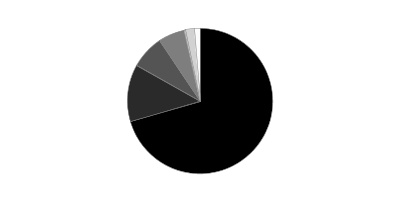

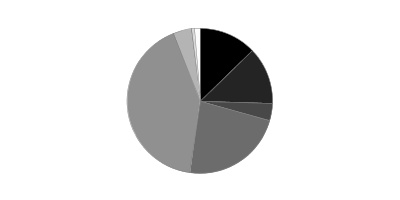

| As of February 28, 2017* |

| | Mortgage Securities | 90.0% |

| | CMOs and Other Mortgage Related Securities | 17.3% |

| | Asset-Backed Securities | 3.7% |

| | Short-Term Investments and Net Other Assets (Liabilities)** | (11.0)% |

* Futures and Swaps - 2.7%

** Short-Term Investments and Net Other Assets (Liabilities) are not included in the pie chart

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments.

Percentages shown as 0.0% may reflect amounts less than 0.05%.

Investments August 31, 2017

Showing Percentage of Net Assets

| U.S. Government Agency - Mortgage Securities - 91.8% | | | |

| | | Principal Amount (000s) | Value (000s) |

| Fannie Mae - 50.3% | | | |

| 12 month U.S. LIBOR + 1.445% 3.195% 4/1/37 (a)(b) | | 64 | 67 |

| 12 month U.S. LIBOR + 1.495% 2.963% 1/1/35 (a)(b) | | 117 | 121 |

| 12 month U.S. LIBOR + 1.523% 3.219% 3/1/36 (a)(b) | | 89 | 93 |

| 12 month U.S. LIBOR + 1.553% 3.338% 6/1/36 (a)(b) | | 23 | 23 |

| 12 month U.S. LIBOR + 1.594% 3.448% 5/1/36 (a)(b) | | 149 | 156 |

| 12 month U.S. LIBOR + 1.643% 2.815% 9/1/36 (a)(b) | | 31 | 32 |

| 12 month U.S. LIBOR + 1.685% 3.435% 4/1/36 (a)(b) | | 64 | 67 |

| 12 month U.S. LIBOR + 1.690% 3.121% 8/1/35 (a)(b) | | 194 | 205 |

| 12 month U.S. LIBOR + 1.728% 3.314% 11/1/36 (a)(b) | | 23 | 24 |

| 12 month U.S. LIBOR + 1.741% 3.332% 3/1/40 (a)(b) | | 128 | 136 |

| 12 month U.S. LIBOR + 1.745% 3.374% 7/1/35 (a)(b) | | 30 | 31 |

| 12 month U.S. LIBOR + 1.750% 3.031% 8/1/41 (a)(b) | | 240 | 254 |

| 12 month U.S. LIBOR + 1.800% 2.759% 1/1/42 (a)(b) | | 287 | 301 |

| 12 month U.S. LIBOR + 1.812% 3.471% 12/1/40 (a)(b) | | 2,753 | 2,875 |

| 12 month U.S. LIBOR + 1.815% 3.109% 9/1/41 (a)(b) | | 85 | 89 |

| 12 month U.S. LIBOR + 1.818% 2.695% 2/1/42 (a)(b) | | 403 | 423 |

| 12 month U.S. LIBOR + 1.851% 3.573% 5/1/36 (a)(b) | | 22 | 23 |

| 12 month U.S. LIBOR + 1.875% 3.375% 10/1/36 (a)(b) | | 167 | 177 |

| 6 month U.S. LIBOR + 1.439% 2.689% 9/1/36 (a)(b) | | 81 | 84 |

| U.S. TREASURY 1 YEAR INDEX + 2.158% 3.095% 7/1/35 (a)(b) | | 3 | 3 |

| U.S. TREASURY 1 YEAR INDEX + 2.208% 3.083% 3/1/35 (a)(b) | | 15 | 16 |

| U.S. TREASURY 1 YEAR INDEX + 2.270% 2.899% 6/1/36 (a)(b) | | 248 | 262 |

| U.S. TREASURY 1 YEAR INDEX + 2.295% 2.798% 10/1/33 (a)(b) | | 31 | 32 |

| 2.5% 2/1/30 | | 108 | 110 |

| 2.5% 9/1/32 (c) | | 4,500 | 4,563 |

| 3% 8/1/27 to 8/1/47 | | 142,863 | 145,765 |

| 3% 9/1/32 (c) | | 13,000 | 13,422 |

| 3% 9/1/32 (c) | | 12,200 | 12,596 |

| 3% 9/1/32 (c) | | 32,300 | 33,349 |

| 3% 9/1/32 (c) | | 6,600 | 6,814 |

| 3% 9/1/32 (c) | | 6,500 | 6,711 |

| 3% 9/1/47 (c) | | 4,000 | 4,046 |

| 3.5% 9/1/29 to 10/1/56 (c) | | 109,144 | 113,774 |

| 3.5% 9/1/47 (c) | | 17,750 | 18,390 |

| 3.5% 9/1/47 (c) | | 16,950 | 17,561 |

| 3.5% 9/1/47 (c) | | 7,300 | 7,563 |

| 4% 11/1/31 to 10/1/46 | | 76,891 | 81,702 |

| 4.5% 5/1/25 to 8/1/56 | | 15,623 | 16,885 |

| 5% 5/1/20 to 8/1/56 | | 30,495 | 33,546 |

| 5.255% 8/1/41 | | 673 | 747 |

| 5.5% 2/1/18 to 4/1/39 | | 2,335 | 2,616 |

| 6% 7/1/39 | | 1,148 | 1,310 |

| 6.309% 2/1/39 | | 1,012 | 1,100 |

| 6.5% 2/1/20 to 8/1/39 | | 6,261 | 7,250 |

| 7% 9/1/21 to 5/1/30 | | 696 | 800 |

| 7.5% 8/1/22 to 9/1/32 | | 487 | 575 |

| 8% 12/1/29 to 3/1/37 | | 14 | 17 |

| 8.5% 2/1/22 to 3/1/23 | | 40 | 44 |

| 9% 10/1/30 | | 187 | 232 |

| 9.5% 10/1/21 to 8/1/22 | | 0 | 1 |

| | | | 536,983 |

| Freddie Mac - 21.8% | | | |

| 12 month U.S. LIBOR + 1.500% 3.129% 3/1/36 (a)(b) | | 215 | 225 |

| 12 month U.S. LIBOR + 1.515% 2.93% 11/1/35 (a)(b) | | 104 | 108 |

| 12 month U.S. LIBOR + 1.750% 3.394% 12/1/40 (a)(b) | | 1,362 | 1,418 |

| 12 month U.S. LIBOR + 1.754% 3.098% 9/1/41 (a)(b) | | 394 | 417 |

| 12 month U.S. LIBOR + 1.793% 3.32% 4/1/37 (a)(b) | | 38 | 40 |

| 12 month U.S. LIBOR + 1.874% 3.432% 10/1/42 (a)(b) | | 244 | 256 |

| 12 month U.S. LIBOR + 1.961% 3.807% 6/1/33 (a)(b) | | 488 | 518 |

| 12 month U.S. LIBOR + 2.045% 3.81% 7/1/36 (a)(b) | | 62 | 66 |

| 12 month U.S. LIBOR + 2.200% 3.7% 12/1/36 (a)(b) | | 139 | 146 |

| 12 month U.S. LIBOR + 2.280% 3.53% 10/1/36 (a)(b) | | 9 | 9 |

| 6 month U.S. LIBOR + 1.445% 2.82% 3/1/35 (a)(b) | | 44 | 46 |

| 6 month U.S. LIBOR + 1.675% 3.05% 6/1/37 (a)(b) | | 28 | 29 |

| 6 month U.S. LIBOR + 1.720% 3.095% 8/1/37 (a)(b) | | 52 | 54 |

| 6 month U.S. LIBOR + 1.746% 2.967% 5/1/37 (a)(b) | | 26 | 27 |

| 6 month U.S. LIBOR + 2.010% 3.385% 6/1/37 (a)(b) | | 20 | 21 |

| 6 month U.S. LIBOR + 2.040% 3.415% 6/1/37 (a)(b) | | 122 | 127 |

| 6 month U.S. LIBOR + 2.066% 3.428% 6/1/37 (a)(b) | | 362 | 383 |

| 6 month U.S. LIBOR + 2.755% 4.096% 10/1/35 (a)(b) | | 30 | 32 |

| U.S. TREASURY 1 YEAR INDEX + 2.231% 3.231% 5/1/34 (a)(b) | | 4 | 4 |

| 2.5% 7/1/31 | | 1,642 | 1,667 |

| 3% 3/1/32 to 2/1/47 | | 50,775 | 51,551 |

| 3.5% 6/1/27 to 9/1/46 (d) | | 97,750 | 101,969 |

| 3.5% 8/1/47 | | 1,066 | 1,106 |

| 4% 2/1/41 to 6/1/47 | | 40,809 | 43,362 |

| 4% 9/1/47 (c) | | 4,900 | 5,178 |

| 4.5% 7/1/25 to 3/1/44 | | 5,860 | 6,344 |

| 5% 7/1/33 to 7/1/41 | | 3,312 | 3,631 |

| 5.5% 10/1/17 to 10/1/39 | | 5,886 | 6,520 |

| 6% 11/1/17 to 6/1/39 | | 1,423 | 1,612 |

| 6.5% 4/1/21 to 9/1/39 | | 2,551 | 2,880 |

| 7% 6/1/21 to 9/1/36 | | 973 | 1,125 |

| 7.5% 1/1/27 to 7/1/34 | | 1,188 | 1,403 |

| 8% 4/1/21 to 1/1/37 | | 6 | 7 |

| 8.5% 9/1/20 | | 0 | 0 |

| 9% 10/1/19 to 5/1/21 | | 1 | 1 |

| | | | 232,282 |

| Ginnie Mae - 19.7% | | | |

| 3% 6/15/42 to 5/20/47 | | 50,368 | 51,495 |

| 3% 9/1/47 (c) | | 25,000 | 25,517 |

| 3.5% 11/20/41 to 6/20/46 (d) | | 60,717 | 63,644 |

| 4% 7/20/33 to 12/20/44 | | 33,546 | 35,755 |

| 4.5% 8/15/33 to 6/15/41 | | 24,703 | 26,821 |

| 5% 9/20/33 to 6/15/41 | | 4,314 | 4,820 |

| 5.5% 12/15/38 to 9/15/39 | | 694 | 784 |

| 6.5% 10/15/34 to 7/15/36 | | 173 | 201 |

| 7% 2/15/24 to 4/20/32 | | 705 | 828 |

| 7.5% 12/15/21 to 12/15/29 | | 191 | 219 |

| 8% 6/15/21 to 12/15/25 | | 102 | 116 |

| 8.5% 11/15/27 to 10/15/28 | | 97 | 113 |

| | | | 210,313 |

| TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES | | | |

| (Cost $973,726) | | | 979,578 |

|

| Asset-Backed Securities - 5.2% | | | |

| American Credit Acceptance Receivable Trust Series 2016-1A Class A, 2.37% 5/12/20 (e) | | $269 | $269 |

| Avis Budget Rental Car Funding (AESOP) LLC Series 2012-3A Class A, 2.1% 3/20/19 (e) | | 5,560 | 5,566 |

| CAM Mortgage Trust Series 2017-1 Class A1, 3.22% 8/1/57 (e) | | 4,383 | 4,387 |

| Citi Mortgage Loan Trust Series 2007-1 Class 1A, 1 month U.S. LIBOR + 1.350% 2.5844% 10/25/37 (a)(b)(e) | | 4,820 | 4,788 |

| CLUB Credit Trust Series 2017-NP1 Class A, 2.39% 4/17/23 (e) | | 258 | 258 |

| Countrywide Home Loans, Inc. Series 2005-3 Class MV4, 1 month U.S. LIBOR + 0.620% 1.8544% 8/25/35 (a)(b) | | 148 | 148 |

| CPS Auto Trust Series 2015-C Class A, 1.77% 6/17/19 (e) | | 1,130 | 1,131 |

| Exeter Automobile Receivables Trust: | | | |

| Series 2016-1A Class A, 2.8% 7/15/20 (e) | | 1,165 | 1,166 |

| Series 2017-2A Class A, 2.22% 6/15/21 (e) | | 1,161 | 1,163 |

| Fannie Mae Series 2017-T1 Class A, 2.898% 6/25/27 | | 11,699 | 11,846 |

| Flagship Credit Auto Trust Series 2015-3 Class A, 2.38% 10/15/20 (e) | | 1,089 | 1,090 |

| GSAMP Trust Series 2004-AR1 Class B4, 5.5% 6/25/34 (e) | | 29 | 2 |

| Merrill Lynch Mortgage Investors Trust Series 2006-FF1 Class M2, 1 month U.S. LIBOR + 0.290% 1.5244% 8/25/36 (a)(b) | | 5,300 | 5,269 |

| Nationstar HECM Loan Trust Series 2017-1A Class A, 1.9679% 5/25/27 (e)(f) | | 4,844 | 4,844 |

| OneMain Financial Issuance Trust Series 2014-1A Class A, 2.43% 6/18/24 (e) | | 42 | 42 |

| Prosper Marketplace Issuance Trust: | | | |

| Series 2017-1A Class A, 2.56% 6/15/23 (e) | | 2,937 | 2,946 |

| Series 2017-2A Class A, 2.42% 9/15/23 (e) | | 2,097 | 2,101 |

| Structured Asset Securities Corp. Series 2005-NC2 Class M3, 1 month U.S. LIBOR + 0.430% 1.6622% 5/25/35 (a)(b) | | 1,286 | 1,285 |

| Towd Point Mortgage Trust Series 2017-1 Class A1, 2.75% 10/25/56 (a)(e) | | 7,538 | 7,628 |

| Vericrest Opportunity Loan Trust Series 2014-NP11 Class A1, 3.875% 4/25/55 (e) | | 130 | 130 |

| TOTAL ASSET-BACKED SECURITIES | | | |

| (Cost $55,634) | | | 56,059 |

|

| Collateralized Mortgage Obligations - 12.9% | | | |

| Private Sponsor - 5.1% | | | |

| Banc of America Funding Corp. Series 2015-R3 Class 10A1, 1 month U.S. LIBOR + 0.140% 1.3561% 6/27/36 (a)(b)(e) | | 4,424 | 4,311 |

| Banc of America Funding Trust sequential payer Series 2010-R3 Class 1A1, 3.3685% 12/26/35 (a)(e) | | 589 | 591 |

| BCAP LLC Trust sequential payer: | | | |

| Series 2010-RR11 Class 6A1, 3.2852% 3/27/36 (a)(e) | | $1,785 | $1,783 |

| Series 2010-RR2 Class 5A2, 5% 12/26/36 (e) | | 270 | 276 |

| Series 2012-RR5 Class 8A5, 1.4122% 7/26/36 (a)(e) | | 586 | 566 |

| Citigroup Mortgage Loan Trust sequential payer Series 2014-8 Class 2A1, 3.45% 6/27/37 (a)(e) | | 4,412 | 4,406 |

| Citigroup Mortgage Loan Trust, Inc. sequential payer Series 2009-5 Class 5A1, 3.4927% 1/25/37 (a)(e) | | 652 | 665 |

| Credit Suisse Commercial Mortgage Trust Series 2014-15R Class 7A3, 1.8991% 10/26/37 (a)(e) | | 119 | 118 |

| Credit Suisse Mortgage Trust: | | | |

| Series 2010-9R Class 2A5, 4% 2/27/38 (e) | | 1,812 | 1,860 |

| Series 2012-2R Class 1A1, 3.2057% 5/27/35 (a)(e) | | 318 | 320 |

| CSMC: | | | |

| floater Series 2015-1R Class 6A1, 1 month U.S. LIBOR + 0.280% 1.4945% 5/27/37 (a)(b)(e) | | 2,962 | 2,838 |

| Series 2011-2R Class 2A1, 3.3199% 7/27/36 (a)(e) | | 405 | 405 |

| Series 2014-3R Class 2A1, 1 month U.S. LIBOR + 0.700% 1.9161% 5/27/37 (a)(b)(e) | | 657 | 635 |

| Exeter Automobile Receivables Trust Series 2015-2A Class A, 1.54% 11/15/19 (e) | | 294 | 294 |

| First Horizon Mortgage pass-thru Trust Series 2004-AR5 Class 2A1, 3.1125% 10/25/34 (a) | | 204 | 205 |

| Freddie Mac Seasoned Credit Risk Transfer Series sequential payer Series 2017-1 Class MA, 3% 1/25/56 | | 3,782 | 3,848 |

| JP Morgan Resecuritization Trust floater Series 2012-2 Class 6A1, 1 month U.S. LIBOR + 0.210% 1.4182% 6/21/36 (a)(b)(e) | | 1,463 | 1,447 |

| MASTR Alternative Loan Trust Series 2004-6 Class 5A1, 5.4262% 7/25/19 (a) | | 477 | 480 |

| Merrill Lynch Alternative Note Asset Trust floater Series 2007-OAR1 Class A1, 1 month U.S. LIBOR + 0.170% 1.3861% 2/25/37 (a)(b) | | 709 | 690 |

| Morgan Stanley Re-REMIC Trust Series 2010-R6 Class 1A, 3.1187% 2/26/37 (a)(e) | | 733 | 735 |

| Mortgage Repurchase Agreement Funding Trust floater Series 2016-5 Class A, 1 month U.S. LIBOR + 1.170% 2.4006% 6/10/19 (a)(b)(e) | | 11,230 | 11,212 |

| Nomura Resecuritization Trust sequential payer Series 2011-3RA Class 2A1, 3.2922% 3/26/37 (a)(e) | | 590 | 590 |

| Structured Asset Securities Corp. Series 2003-15A Class 4A, 3.368% 4/25/33 (a) | | 54 | 53 |

| Thornburg Mortgage Securities Trust floater Series 2003-4 Class A1, 1 month U.S. LIBOR + 0.640% 1.8744% 9/25/43 (a)(b) | | 3,019 | 2,916 |

| Towd Point Mortgage Trust: | | | |

| Series 2015-5 Class A1B, 2.75% 5/25/55 (e) | | 1,125 | 1,136 |

| Series 2017-2 Class A1, 2.75% 4/25/57 (a)(e) | | 6,756 | 6,827 |

| WaMu Mortgage pass-thru certificates sequential payer: | | | |

| Series 2002-S8 Class 2A7, 5.25% 1/25/18 | | 48 | 48 |

| Series 2003-MS5 Class 1A1, 5% 3/25/18 | | 42 | 42 |

| Wells Fargo Mortgage Backed Securities Trust: | | | |

| Series 2003-I Class A1, 3.0527% 9/25/33 (a) | | 570 | 581 |

| Series 2005-AR10 Class 2A15, 3.1989% 6/25/35 (a) | | 3,544 | 3,577 |

| Series 2005-AR2 Class 1A2, 3.1522% 3/25/35 (a) | | 154 | 154 |

| Series 2006-AR10 Class 3A1, 3.2467% 7/25/36 (a) | | 87 | 87 |

| Wells Fargo Mortgage Loan Trust sequential payer Series 2011-RR4: | | | |

| Class 1A1, 3.5051% 6/27/36 (a)(e) | | 336 | 337 |

| Class 2A1, 3.3412% 6/27/36 (a)(e) | | 478 | 476 |

| | | | 54,509 |

| U.S. Government Agency - 7.8% | | | |

| Fannie Mae: | | | |

| floater Series 2003-118 Class S, 8.100% - 1 month U.S. LIBOR 6.8656% 12/25/33 (a)(g)(h) | | 240 | 58 |

| planned amortization class: | | | |

| Series 1999-17 Class PG, 6% 4/25/29 | | 422 | 466 |

| Series 1999-32 Class PL, 6% 7/25/29 | | 410 | 454 |

| Series 1999-33 Class PK, 6% 7/25/29 | | 283 | 314 |

| Series 2001-52 Class YZ, 6.5% 10/25/31 | | 34 | 40 |

| Series 2005-39 Class TE, 5% 5/25/35 | | 635 | 696 |

| Series 2005-73 Class SA, 17.500% - 1 month U.S. LIBOR 14.3404% 8/25/35 (a)(h) | | 42 | 53 |

| sequential payer: | | | |

| Series 2001-20 Class Z, 6% 5/25/31 | | 436 | 479 |

| Series 2001-31 Class ZC, 6.5% 7/25/31 | | 196 | 223 |

| Series 2002-16 Class ZD, 6.5% 4/25/32 | | 67 | 78 |

| Series 2002-74 Class SV, 1 month U.S. LIBOR + 7.550% 6.3156% 11/25/32 (a)(b)(g) | | 167 | 28 |

| Series 2012-67 Class AI, 4.5% 7/25/27 (g) | | 527 | 56 |

| Series 06-116 Class SG, 6.640% - 1 month U.S. LIBOR 5.4056% 12/25/36 (a)(g)(h) | | 164 | 35 |

| Series 07-40 Class SE, 6.440% - 1 month U.S. LIBOR 5.2056% 5/25/37 (a)(g)(h) | | 89 | 16 |

| Series 1993-165 Class SH, 19.800% - 1 month U.S. LIBOR 16.3081% 9/25/23 (a)(h) | | 21 | 27 |

| Series 2003-21 Class SK, 8.100% - 1 month U.S. LIBOR 6.8656% 3/25/33 (a)(g)(h) | | 65 | 14 |

| Series 2003-35 Class TQ, 7.500% - 1 month U.S. LIBOR 6.2656% 5/25/18 (a)(g)(h) | | 6 | 0 |

| Series 2005-79 Class ZC, 5.9% 9/25/35 | | 356 | 409 |

| Series 2007-57 Class SA, 40.600% - 1 month U.S. LIBOR 33.2134% 6/25/37 (a)(h) | | 319 | 645 |

| Series 2007-66 Class SB, 39.600% - 1 month U.S. LIBOR 32.1934% 7/25/37 (a)(h) | | 98 | 179 |

| Series 2008-12 Class SG, 6.350% - 1 month U.S. LIBOR 5.1156% 3/25/38 (a)(g)(h) | | 491 | 84 |

| Series 2009-16 Class SA, 6.250% - 1 month U.S. LIBOR 5.0156% 3/25/24 (a)(g)(h) | | 1 | 0 |

| Series 2009-76 Class MI, 5.5% 9/25/24 (g) | | 15 | 0 |

| Series 2009-85 Class IB, 4.5% 8/25/24 (g) | | 37 | 2 |

| Series 2009-93 Class IC, 4.5% 9/25/24 (g) | | 54 | 2 |

| Series 2010-12 Class AI, 5% 12/25/18 (g) | | 84 | 1 |

| Series 2010-135 Class LS, 6.050% - 1 month U.S. LIBOR 4.8156% 12/25/40 (a)(g)(h) | | 464 | 76 |

| Series 2010-139 Class NI, 4.5% 2/25/40 (g) | | 562 | 61 |

| Series 2010-150 Class ZC, 4.75% 1/25/41 | | 1,331 | 1,487 |

| Series 2010-23: | | | |

| Class AI, 5% 12/25/18 (g) | | 24 | 0 |

| Class HI, 4.5% 10/25/18 (g) | | 32 | 1 |

| Series 2010-29 Class LI, 4.5% 6/25/19 (g) | | 80 | 1 |

| Series 2010-95 Class ZC, 5% 9/25/40 | | 2,810 | 3,163 |

| Series 2010-97 Class CI, 4.5% 8/25/25 (g) | | 138 | 8 |

| Series 2011-110 Class SA, 6.610% - 1 month U.S. LIBOR 5.3756% 4/25/41 (a)(g)(h) | | 918 | 132 |

| Series 2011-112 Class SA, 6.550% - 1 month U.S. LIBOR 5.3156% 11/25/41 (a)(g)(h) | | 863 | 151 |

| Series 2011-123 Class SD, 6.600% - 1 month U.S. LIBOR 5.3656% 8/25/39 (a)(g)(h) | | 780 | 102 |

| Series 2011-4 Class PZ, 5% 2/25/41 | | 583 | 666 |

| Series 2011-67 Class AI, 4% 7/25/26 (g) | | 147 | 14 |

| Series 2011-83 Class DI, 6% 9/25/26 (g) | | 186 | 18 |

| Series 2012-100 Class WI, 3% 9/25/27 (g) | | 1,402 | 129 |

| Series 2012-14 Class JS, 6.650% - 1 month U.S. LIBOR 5.4156% 12/25/30 (a)(g)(h) | | 519 | 67 |

| Series 2012-47 Class SD, 6.450% - 1 month U.S. LIBOR 5.2156% 5/25/42 (a)(g)(h) | | 1,803 | 344 |

| Series 2012-9 Class SH, 6.550% - 1 month U.S. LIBOR 5.3156% 6/25/41 (a)(g)(h) | | 662 | 95 |

| Series 2013-133 Class IB, 3% 4/25/32 (g) | | 965 | 89 |

| Series 2013-134 Class SA, 6.050% - 1 month U.S. LIBOR 4.8156% 1/25/44 (a)(g)(h) | | 418 | 70 |

| Series 2013-51 Class GI, 3% 10/25/32 (g) | | 309 | 33 |

| Series 2013-N1 Class A, 6.720% - 1 month U.S. LIBOR 5.4856% 6/25/35 (a)(g)(h) | | 514 | 97 |

| Series 2015-42: | | | |

| Class IL, 6% 6/25/45 (g) | | 2,049 | 477 |

| Class LS, 6.200% - 1 month U.S. LIBOR 4.9656% 6/25/45 (a)(g)(h) | | 2,288 | 379 |

| Series 2015-70 Class JC, 3% 10/25/45 | | 2,596 | 2,666 |

| Series 2016-78 Class CS, 6.100% - 1 month U.S. LIBOR 4.8656% 5/25/39 (a)(g)(h) | | 3,947 | 692 |

| Series 2017-30 Class AI, 5.5% 5/25/47 (g) | | 987 | 221 |

| Fannie Mae Stripped Mortgage-Backed Securities: | | | |

| Series 339 Class 29, 5.5% 8/25/18 (g) | | 8 | 0 |

| Series 348 Class 14, 6.5% 8/25/34 (a)(g) | | 134 | 31 |

| Series 351: | | | |

| Class 12, 5.5% 4/25/34 (a)(g) | | 86 | 14 |

| Class 13, 6% 3/25/34 (g) | | 119 | 24 |

| Series 359 Class 19, 6% 7/25/35 (a)(g) | | 78 | 15 |

| Series 384 Class 6, 5% 7/25/37 (g) | | 272 | 48 |

| Freddie Mac: | | | |

| planned amortization class: | | | |

| Series 2095 Class PE, 6% 11/15/28 | | 471 | 522 |

| Series 2104 Class PG, 6% 12/15/28 | | 134 | 148 |

| Series 2121 Class MG, 6% 2/15/29 | | 197 | 218 |

| Series 2154 Class PT, 6% 5/15/29 | | 342 | 381 |

| Series 2162 Class PH, 6% 6/15/29 | | 51 | 55 |

| Series 2520 Class BE, 6% 11/15/32 | | 232 | 251 |

| Series 2585 Class KS, 7.600% - 1 month U.S. LIBOR 6.3733% 3/15/23 (a)(g)(h) | | 19 | 2 |

| Series 2693 Class MD, 5.5% 10/15/33 | | 4,157 | 4,633 |

| Series 2802 Class OB, 6% 5/15/34 | | 1,033 | 1,133 |

| Series 3002 Class NE, 5% 7/15/35 | | 380 | 415 |

| Series 3189 Class PD, 6% 7/15/36 | | 378 | 433 |

| Series 3415 Class PC, 5% 12/15/37 | | 111 | 121 |

| Series 3786 Class HI, 4% 3/15/38 (g) | | 547 | 43 |

| Series 3806 Class UP, 4.5% 2/15/41 | | 1,009 | 1,077 |

| Series 3832 Class PE, 5% 3/15/41 | | 960 | 1,075 |

| Series 70 Class C, 9% 9/15/20 | | 0 | 0 |

| sequential payer: | | | |

| Series 2114 Class ZM, 6% 1/15/29 | | 66 | 74 |

| Series 2135 Class JE, 6% 3/15/29 | | 259 | 288 |

| Series 2274 Class ZM, 6.5% 1/15/31 | | 117 | 133 |

| Series 2281 Class ZB, 6% 3/15/30 | | 94 | 101 |

| Series 2357 Class ZB, 6.5% 9/15/31 | | 228 | 264 |

| Series 2502 Class ZC, 6% 9/15/32 | | 239 | 259 |

| Series 3871 Class KB, 5.5% 6/15/41 | | 1,045 | 1,216 |

| Series 06-3115 Class SM, 6.600% - 1 month U.S. LIBOR 5.3733% 2/15/36 (a)(g)(h) | | 132 | 27 |

| Series 1658 Class GZ, 7% 1/15/24 | | 263 | 284 |

| Series 2013-4281 Class AI, 4% 12/15/28 (g) | | 1,201 | 105 |

| Series 2017-4683 Class LM, 3% 5/15/47 | | 2,032 | 2,087 |

| Series 2380 Class SY, 8.200% - 1 month U.S. LIBOR 6.9733% 11/15/31 (a)(g)(h) | | 936 | 159 |

| Series 2587 Class IM, 6.5% 3/15/33 (g) | | 134 | 31 |

| Series 2844: | | | |

| Class SC, 46.800% - 1 month U.S. LIBOR 38.8266% 8/15/24 (a)(h) | | 7 | 11 |

| Class SD, 86.400% - 1 month U.S. LIBOR 70.5033% 8/15/24 (a)(h) | | 11 | 21 |

| Series 2933 Class ZM, 5.75% 2/15/35 | | 760 | 885 |

| Series 2935 Class ZK, 5.5% 2/15/35 | | 1,312 | 1,481 |

| Series 2947 Class XZ, 6% 3/15/35 | | 486 | 541 |

| Series 2996 Class ZD, 5.5% 6/15/35 | | 603 | 692 |

| Series 3055 Class CS, 1 month U.S. LIBOR + 6.590% 5.3633% 10/15/35 (a)(b)(g) | | 180 | 36 |

| Series 3237 Class C, 5.5% 11/15/36 | | 892 | 1,014 |

| Series 3244 Class SG, 6.660% - 1 month U.S. LIBOR 5.4333% 11/15/36 (a)(g)(h) | | 359 | 71 |

| Series 3284 Class CI, 1 month U.S. LIBOR + 6.120% 4.8933% 3/15/37 (a)(b)(g) | | 771 | 147 |

| Series 3287 Class SD, 6.750% - 1 month U.S. LIBOR 5.5233% 3/15/37 (a)(g)(h) | | 494 | 102 |

| Series 3297 Class BI, 6.760% - 1 month U.S. LIBOR 5.5333% 4/15/37 (a)(g)(h) | | 743 | 158 |

| Series 3336 Class LI, 1 month U.S. LIBOR + 6.580% 5.3533% 6/15/37 (a)(b)(g) | | 299 | 53 |

| Series 3772 Class BI, 4.5% 10/15/18 (g) | | 64 | 1 |

| Series 3949 Class MK, 4.5% 10/15/34 | | 272 | 292 |

| Series 3955: | | | |

| Class GS, 5.950% - 1 month U.S. LIBOR 4.7233% 9/15/41 (a)(g)(h) | | 783 | 122 |

| Class YI, 3% 11/15/21 (g) | | 776 | 34 |

| Series 4055 Class BI, 3.5% 5/15/31 (g) | | 885 | 86 |

| Series 4149 Class IO, 3% 1/15/33 (g) | | 132 | 17 |

| Series 4314 Class AI, 5% 3/15/34 (g) | | 337 | 37 |

| Series 4427 Class LI, 3.5% 2/15/34 (g) | | 1,514 | 177 |

| Series 4471 Class PA 4% 12/15/40 | | 3,685 | 3,861 |

| Freddie Mac Manufactured Housing participation certificates guaranteed planned amortization class Series 2043 Class CJ, 6.5% 4/15/28 | | 186 | 211 |

| Freddie Mac Multi-family Structured pass-thru certificates Series 4386 Class AZ, 4.5% 11/15/40 | | 2,721 | 2,915 |

| Ginnie Mae guaranteed REMIC pass-thru certificates: | | | |

| floater: | | | |

| Series 2007-37 Class TS, 6.690% - 1 month U.S. LIBOR 5.4622% 6/16/37 (a)(g)(h) | | 177 | 37 |

| Series 2010-H17 Class FA, 1 month U.S. LIBOR + 0.330% 1.5628% 7/20/60 (a)(b)(i) | | 251 | 249 |

| Series 2010-H18 Class AF, 1 month U.S. LIBOR + 0.300% 1.5239% 9/20/60 (a)(b)(i) | | 315 | 312 |

| Series 2010-H19 Class FG, 1 month U.S. LIBOR + 0.300% 1.5239% 8/20/60 (a)(b)(i) | | 350 | 347 |

| Series 2011-H13 Class FA, 1 month U.S. LIBOR + 0.500% 1.7239% 4/20/61 (a)(b)(i) | | 141 | 141 |

| Series 2012-H21 Class DF, 1 month U.S. LIBOR + 0.650% 1.8739% 5/20/61 (a)(b)(i) | | 934 | 936 |

| planned amortization class Series 2011-136 Class WI, 4.5% 5/20/40 (g) | | 332 | 38 |

| sequential payer: | | | |

| Series 2002-24 Class SK, 7.950% - 1 month U.S. LIBOR 6.7222% 4/16/32 (a)(g)(h) | | 882 | 174 |

| Series 2002-42 Class ZA, 6% 6/20/32 | | 304 | 344 |

| Series 2004-24 Class ZM, 5% 4/20/34 | | 601 | 658 |

| Series 2010-160 Class DY, 4% 12/20/40 | | 3,841 | 4,115 |

| Series 2010-170 Class B, 4% 12/20/40 | | 868 | 930 |

| Series 2001-3 Class S, 1 month U.S. LIBOR + 8.100% 6.8722% 2/16/31 (a)(b)(g) | | 191 | 33 |

| Series 2001-36: | | | |

| Class SB, 8.100% - 1 month U.S. LIBOR 6.8722% 12/16/23 (a)(g)(h) | | 457 | 64 |

| Class SP, 1 month U.S. LIBOR + 8.750% 7.5222% 9/16/26 (a)(b)(g) | | 263 | 32 |

| Series 2001-38 Class SB, 7.580% - 1 month U.S. LIBOR 6.3522% 8/16/31 (a)(g)(h) | | 317 | 54 |

| Series 2001-49: | | | |

| Class SC, 7.600% - 1 month U.S. LIBOR 6.3722% 12/16/25 (a)(g)(h) | | 617 | 83 |

| Class SL, 7.600% - 1 month U.S. LIBOR 6.3722% 5/16/30 (a)(g)(h) | | 883 | 150 |

| Class SV, 8.250% - 1 month U.S. LIBOR 7.0222% 12/16/28 (a)(g)(h) | | 74 | 9 |

| Series 2001-50: | | | |

| Class SD, 8.200% - 1 month U.S. LIBOR 6.9694% 11/20/31 (a)(g)(h) | | 455 | 101 |

| Class ST, 7.700% - 1 month U.S. LIBOR 6.4722% 8/16/27 (a)(g)(h) | | 201 | 35 |

| Series 2002-5 Class SP, 7.450% - 1 month U.S. LIBOR 6.2222% 1/16/32 (a)(g)(h) | | 315 | 47 |

| Series 2004-32 Class GS, 6.500% - 1 month U.S. LIBOR 5.2722% 5/16/34 (a)(g)(h) | | 306 | 56 |

| Series 2004-73 Class AL, 7.200% - 1 month U.S. LIBOR 5.9722% 8/17/34 (a)(g)(h) | | 118 | 27 |

| Series 2011-52 Class HI, 7% 4/16/41 (g) | | 1,251 | 294 |

| Series 2012-76 Class GS, 6.700% - 1 month U.S. LIBOR 5.4722% 6/16/42 (a)(g)(h) | | 551 | 106 |

| Series 2013-124: | | | |

| Class ES, 8.667% - 1 month U.S. LIBOR 7.0259% 4/20/39 (a)(h) | | 1,077 | 1,134 |

| Class ST, 8.800% - 1 month U.S. LIBOR 7.1593% 8/20/39 (a)(h) | | 2,498 | 2,683 |

| Series 2013-149 Class MA, 2.5% 5/20/40 | | 4,648 | 4,685 |

| Series 2015-H13 Class HA, 2.5% 8/20/64 (i) | | 10,796 | 10,879 |

| Series 2015-H17 Class HA, 2.5% 5/20/65 (i) | | 4,374 | 4,409 |

| Series 2017-H06 Class FA, U.S. TREASURY 1 YEAR INDEX + 0.350% 1.57% 8/20/66 (a)(b)(i) | | 6,336 | 6,351 |

| | | | 83,743 |

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | | | |

| (Cost $137,318) | | | 138,252 |

|

| Commercial Mortgage Securities - 3.0% | | | |

| Asset Securitization Corp. Series 1997-D5 Class PS1, 1.6895% 2/14/43 (a)(g) | | 113 | 1 |

| Barclays Commercial Mortgage Securities LLC Series 2015-STP Class A, 3.3228% 9/10/28 (e) | | 1,642 | 1,693 |

| Bayview Commercial Asset Trust floater Series 2007-3: | | | |

| Class M1, 1 month U.S. LIBOR + 0.310% 1.5261% 7/25/37 (a)(b)(e) | | 30 | 27 |

| Class M2, 1 month U.S. LIBOR + 0.340% 1.5561% 7/25/37 (a)(b)(e) | | 31 | 28 |

| Class M3, 1 month U.S. LIBOR + 0.370% 1.5861% 7/25/37 (a)(b)(e) | | 50 | 38 |

| Citigroup Commercial Mortgage Trust: | | | |

| Series 2015-GC33 Class XA, 0.968% 9/10/58 (a)(g) | | 22,734 | 1,345 |

| Series 2016-P6 Class XA, 0.8365% 12/10/49 (a)(g) | | 22,587 | 1,118 |

| COMM Mortgage Trust: | | | |

| Series 2014-CR19 Class XA, 1.2398% 8/10/47 (a)(g) | | 27,988 | 1,517 |

| Series 2014-CR20 Class XA, 1.1713% 11/10/47 (a)(g) | | 6,165 | 359 |

| Series 2014-LC17 Class XA, 1.143% 10/10/47 (a)(g) | | 25,285 | 986 |

| Series 2014-UBS4 Class XA, 1.2342% 8/10/47 (a)(g) | | 28,487 | 1,612 |

| Series 2014-UBS6 Class XA, 1.0295% 12/10/47 (a)(g) | | 15,073 | 748 |

| Series 2015-DC1 Class XA, 1.1664% 2/10/48 (a)(g) | | 37,457 | 2,145 |

| CSMC Series 2015-TOWN: | | | |

| Class A, 1 month U.S. LIBOR + 1.250% 2.4756% 3/15/28 (a)(b)(e) | | 7,804 | 7,798 |

| Class B, 1 month U.S. LIBOR + 1.900% 3.1256% 3/15/28 (a)(b)(e) | | 185 | 185 |

| Class C, 1 month U.S. LIBOR + 2.250% 3.4756% 3/15/28 (a)(b)(e) | | 180 | 180 |

| Class D, 1 month U.S. LIBOR + 3.200% 4.4256% 3/15/28 (a)(b)(e) | | 273 | 273 |

| GAHR Commercial Mortgage Trust floater Series 2015-NRF Class AFL1, 1 month U.S. LIBOR + 1.300% 2.459% 12/15/34 (a)(b)(e) | | 2,082 | 2,086 |

| GE Capital Commercial Mortgage Corp. Series 2007-C1 Class A1A, 5.483% 12/10/49 | | 713 | 712 |

| GS Mortgage Securities Trust: | | | |

| Series 2013-GC12 Class XA, 1.5475% 6/10/46 (a)(g) | | 7,462 | 455 |

| Series 2014-GC20 Class XA, 1.0078% 4/10/47 (a)(g) | | 6,624 | 341 |

| Series 2015-GC34 Class XA, 1.3631% 10/10/48 (a)(g) | | 10,576 | 872 |

| JPMBB Commercial Mortgage Securities Trust Series 2014-C19 Class XA, 1.1728% 4/15/47 (a)(g) | | 6,634 | 197 |

| JPMorgan Chase Commercial Mortgage Securities Trust Series 2016-WP Class TA, 1 month U.S. LIBOR + 1.450% 2.6089% 10/15/33 (a)(b)(e) | | 769 | 772 |

| Morgan Stanley BAML Trust Series 2015-C25 Class XA, 1.14% 10/15/48 (a)(g) | | 13,714 | 941 |

| MSCG Trust Series 2016-SNR Class A, 3.348% 11/15/34 (a)(e) | | 1,220 | 1,233 |

| SCG Trust Series 2013-SRP1 Class A, 1 month U.S. LIBOR + 1.400% 2.8089% 11/15/26 (a)(b)(e) | | 2,783 | 2,763 |

| Wells Fargo Commercial Mortgage Trust Series 2015-C31 Class XA, 1.1023% 11/15/48 (a)(g) | | 11,045 | 738 |

| WF-RBS Commercial Mortgage Trust Series 2014-C24 Class XA, 0.9591% 11/15/47 (a)(g) | | 8,573 | 429 |

| TOTAL COMMERCIAL MORTGAGE SECURITIES | | | |

| (Cost $31,658) | | | 31,592 |

| | | Shares | Value (000s) |

|

| Money Market Funds - 2.1% | | | |

| Fidelity Cash Central Fund, 1.11% (j) | | | |

| (Cost $22,471) | | 22,466,534 | 22,471 |

| TOTAL INVESTMENT IN SECURITIES - 115.0% | | | |

| (Cost $1,220,807) | | | 1,227,952 |

| NET OTHER ASSETS (LIABILITIES) - (15.0)% | | | (160,480) |

| NET ASSETS - 100% | | | $1,067,472 |

| TBA Sale Commitments | | |

| | Principal Amount (000s) | Value (000s) |

| Fannie Mae | | |

| 3% 9/1/47 | $(1,300) | $(1,315) |

| 3% 9/1/47 | (2,000) | (2,023) |

| 3% 9/1/47 | (5,200) | (5,260) |

| 3.5% 9/1/47 | (7,300) | (7,563) |

| 3.5% 9/1/47 | (7,300) | (7,563) |

| 3.5% 9/1/47 | (29,400) | (30,461) |

|

| TOTAL FANNIE MAE | | (54,185) |

|

| Ginnie Mae | | |

| 3% 9/1/47 | (2,700) | (2,756) |

| TOTAL TBA SALE COMMITMENTS | | |

| (Proceeds $56,762) | | $(56,941) |

| Futures Contracts | | | | | |

| | Number of contracts | Expiration Date | Notional amount (000s) | Value (000s) | Unrealized Appreciation/(Depreciation) (000s) |

| Purchased | | | | | |

| Treasury Contracts | | | | | |

| CBOT 5-Year U.S. Treasury Note Contracts (United States) | 56 | Dec. 2017 | $6,636 | $9 | $9 |

| CBOT Long Term U.S. Treasury Bond Contracts (United States) | 3 | Dec. 2017 | 468 | 4 | 4 |

| CBOT Ultra Long Term U.S. Treasury Bond Contracts (United States) | 6 | Dec. 2017 | 1,014 | 6 | 6 |

| TOTAL PURCHASED | | | | | 19 |

| Sold | | | | | |

| Treasury Contracts | | | | | |

| CBOT 10-Year U.S. Treasury Note Contracts (United States) | 202 | Dec. 2017 | 25,651 | (74) | (74) |

| CBOT 2-Year U.S. Treasury Note Contracts (United States) | 148 | Dec. 2017 | 32,014 | (10) | (10) |

| TOTAL SOLD | | | | | (84) |

| TOTAL FUTURES CONTRACTS | | | | | $(65) |

The notional amount of futures purchased as a percentage of Net Assets is 0.8%

The notional amount of futures sold as a percentage of Net Assets is 5.4%

For the period, the average monthly notional amount for futures contracts in the aggregate was $50,111,000.

Values shown as $0 may reflect amounts less than $500.

Legend

(a) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(b) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(c) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(d) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $240,000.

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $96,415,000 or 9.0% of net assets.

(f) Level 3 instrument

(g) Security represents right to receive monthly interest payments on an underlying pool of mortgages or assets. Principal shown is the outstanding par amount of the pool as of the end of the period.

(h) Coupon is inversely indexed to a floating interest rate multiplied by a specified factor. The price may be considerably more volatile than the price of a comparable fixed rate security.

(i) Represents an investment in an underlying pool of reverse mortgages which typically do not require regular principal and interest payments as repayment is deferred until a maturity event.

(j) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| | (Amounts in thousands) |

| Fidelity Cash Central Fund | $190 |

| Fidelity Mortgage Backed Securities Central Fund | 1 |

| Total | $191 |

Additional information regarding the Fund's fiscal year to date purchases and sales, including the ownership percentage, of the non Money Market Central Funds is as follows:

| Fund (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Mortgage Backed Securities Central Fund | $86 | $1 | $84 | $(3) | $-- | $-- | 0.0% |

| Total | $86 | $1 | $84 | $(3) | $-- | $-- | |

Investment Valuation

The following is a summary of the inputs used, as of August 31, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | | | | |

| Investments in Securities: | | | | |

| U.S. Government Agency - Mortgage Securities | $979,578 | $-- | $979,578 | $-- |

| Asset-Backed Securities | 56,059 | -- | 51,215 | 4,844 |

| Collateralized Mortgage Obligations | 138,252 | -- | 138,252 | -- |

| Commercial Mortgage Securities | 31,592 | -- | 31,592 | -- |

| Money Market Funds | 22,471 | 22,471 | -- | -- |

| Total Investments in Securities: | $1,227,952 | $22,471 | $1,200,637 | $4,844 |

| Derivative Instruments: | | | | |

| Assets | | | | |

| Futures Contracts | $19 | $19 | $-- | $-- |

| Total Assets | $19 | $19 | $-- | $-- |

| Liabilities | | | | |

| Futures Contracts | $(84) | $(84) | $-- | $-- |

| Total Liabilities | $(84) | $(84) | $-- | $-- |

| Total Derivative Instruments: | $(65) | $(65) | $-- | $-- |

| Other Financial Instruments: | | | | |

| TBA Sale Commitments | $(56,941) | $-- | $(56,941) | $-- |

| Total Other Financial Instruments: | $(56,941) | $-- | $(56,941) | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of August 31, 2017. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value |

| | Asset | Liability |

| (Amounts in thousands) | | |

| Interest Rate Risk | | |

| Futures Contracts(a) | $19 | $(84) |

| Total Interest Rate Risk | 19 | (84) |

| Total Value of Derivatives | $19 | $(84) |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. In the Statement of Assets and Liabilities, the period end daily variation margin is included in receivable or payable for daily variation margin on futures contracts, and the net cumulative appreciation (depreciation) is included in net unrealized appreciation (depreciation).

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | | August 31, 2017 |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $1,198,336) | $1,205,481 | |

| Fidelity Central Funds (cost $22,471) | 22,471 | |

| Total Investment in Securities (cost $1,220,807) | | $1,227,952 |

| Cash | | 90 |

| Receivable for investments sold | | 154 |

| Receivable for TBA sale commitments | | 56,762 |

| Receivable for fund shares sold | | 261 |

| Interest receivable | | 3,166 |

| Distributions receivable from Fidelity Central Funds | | 21 |

| Total assets | | 1,288,406 |

| Liabilities | | |

| TBA sale commitments, at value | $56,941 | |

| Payable for investments purchased on a delayed delivery basis | 162,685 | |

| Payable for fund shares redeemed | 669 | |

| Distributions payable | 188 | |

| Accrued management fee | 272 | |

| Distribution and service plan fees payable | 22 | |

| Payable for daily variation margin on futures contracts | 23 | |

| Other affiliated payables | 134 | |

| Total liabilities | | 220,934 |

| Net Assets | | $1,067,472 |

| Net Assets consist of: | | |

| Paid in capital | | $1,067,393 |

| Distributions in excess of net investment income | | (4,158) |

| Accumulated undistributed net realized gain (loss) on investments | | (2,664) |

| Net unrealized appreciation (depreciation) on investments | | 6,901 |

| Net Assets | | $1,067,472 |

| Calculation of Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($35,227 ÷ 3,118 shares) | | $11.30 |

| Maximum offering price per share (100/96.00 of $11.30) | | $11.77 |

| Class M: | | |

| Net Asset Value and redemption price per share ($19,615 ÷ 1,733 shares) | | $11.32 |

| Maximum offering price per share (100/96.00 of $11.32) | | $11.79 |

| Class C: | | |

| Net Asset Value and offering price per share ($13,221 ÷ 1,172 shares)(a) | | $11.28 |

| Fidelity Mortgage Securities Fund: | | |

| Net Asset Value, offering price and redemption price per share ($926,057 ÷ 81,769 shares) | | $11.33 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($73,352 ÷ 6,500 shares) | | $11.28 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | | Year ended August 31, 2017 |

| Investment Income | | |

| Interest | | $26,132 |

| Income from Fidelity Central Funds | | 191 |

| Total income | | 26,323 |

| Expenses | | |

| Management fee | $3,350 | |

| Transfer agent fees | 1,185 | |

| Distribution and service plan fees | 314 | |

| Fund wide operations fee | 442 | |

| Independent trustees' fees and expenses | 4 | |

| Miscellaneous | 5 | |

| Total expenses before reductions | 5,300 | |

| Expense reductions | (1) | 5,299 |

| Net investment income (loss) | | 21,024 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (2,598) | |

| Fidelity Central Funds | (2) | |

| Futures contracts | 871 | |

| Swaps | 25 | |

| Total net realized gain (loss) | | (1,704) |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | (10,375) | |

| Fidelity Central Funds | (1) | |

| Futures contracts | (130) | |

| Swaps | (42) | |

| Delayed delivery commitments | (190) | |

| Total change in net unrealized appreciation (depreciation) | | (10,738) |

| Net gain (loss) | | (12,442) |

| Net increase (decrease) in net assets resulting from operations | | $8,582 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Year ended August 31, 2017 | Year ended August 31, 2016 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $21,024 | $23,905 |

| Net realized gain (loss) | (1,704) | 10,209 |

| Change in net unrealized appreciation (depreciation) | (10,738) | 6,345 |

| Net increase (decrease) in net assets resulting from operations | 8,582 | 40,459 |

| Distributions to shareholders from net investment income | (22,676) | (25,324) |

| Distributions to shareholders from net realized gain | – | (552) |

| Total distributions | (22,676) | (25,876) |

| Share transactions - net increase (decrease) | (36,959) | 101,086 |

| Total increase (decrease) in net assets | (51,053) | 115,669 |

| Net Assets | | |

| Beginning of period | 1,118,525 | 1,002,856 |

| End of period | $1,067,472 | $1,118,525 |

| Other Information | | |

| Distributions in excess of net investment income end of period | $(4,158) | $(2,421) |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Mortgage Securities Fund Class A

| Years ended August 31, | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $11.44 | $11.29 | $11.24 | $10.89 | $11.34 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .185 | .217 | .223 | .239 | .169 |

| Net realized and unrealized gain (loss) | (.124) | .173 | .047 | .341 | (.457) |

| Total from investment operations | .061 | .390 | .270 | .580 | (.288) |

| Distributions from net investment income | (.201) | (.234) | (.217) | (.230) | (.162) |

| Distributions from net realized gain | – | (.006) | (.003) | – | – |

| Total distributions | (.201) | (.240) | (.220) | (.230) | (.162) |

| Net asset value, end of period | $11.30 | $11.44 | $11.29 | $11.24 | $10.89 |

| Total ReturnB,C | .56% | 3.49% | 2.41% | 5.37% | (2.57)% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .79% | .79% | .81% | .81% | .79% |

| Expenses net of fee waivers, if any | .79% | .79% | .81% | .81% | .79% |

| Expenses net of all reductions | .79% | .79% | .81% | .81% | .79% |

| Net investment income (loss) | 1.64% | 1.92% | 1.97% | 2.15% | 1.51% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $35 | $49 | $38 | $41 | $50 |

| Portfolio turnover rateF | 357% | 404% | 439% | 398% | 474% |

A Calculated based on average shares outstanding during the period.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Total returns do not include the effect of the sales charges.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses of any underlying non-money market Fidelity Central Funds were less than .005%.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Mortgage Securities Fund Class M

| Years ended August 31, | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $11.46 | $11.31 | $11.27 | $10.92 | $11.37 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .184 | .218 | .225 | .242 | .173 |

| Net realized and unrealized gain (loss) | (.123) | .172 | .037 | .340 | (.458) |

| Total from investment operations | .061 | .390 | .262 | .582 | (.285) |

| Distributions from net investment income | (.201) | (.234) | (.219) | (.232) | (.165) |

| Distributions from net realized gain | – | (.006) | (.003) | – | – |

| Total distributions | (.201) | (.240) | (.222) | (.232) | (.165) |

| Net asset value, end of period | $11.32 | $11.46 | $11.31 | $11.27 | $10.92 |

| Total ReturnB,C | .55% | 3.48% | 2.33% | 5.38% | (2.54)% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | .79% | .80% | .79% | .79% | .77% |

| Expenses net of fee waivers, if any | .79% | .79% | .79% | .79% | .77% |

| Expenses net of all reductions | .79% | .79% | .79% | .79% | .77% |

| Net investment income (loss) | 1.63% | 1.92% | 1.98% | 2.17% | 1.53% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $20 | $25 | $20 | $22 | $26 |

| Portfolio turnover rateF | 357% | 404% | 439% | 398% | 474% |

A Calculated based on average shares outstanding during the period.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Total returns do not include the effect of the sales charges.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses of any underlying non-money market Fidelity Central Funds were less than .005%.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Mortgage Securities Fund Class C

| Years ended August 31, | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $11.42 | $11.27 | $11.23 | $10.88 | $11.33 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .100 | .133 | .141 | .160 | .088 |

| Net realized and unrealized gain (loss) | (.123) | .172 | .037 | .342 | (.457) |

| Total from investment operations | (.023) | .305 | .178 | .502 | (.369) |

| Distributions from net investment income | (.117) | (.149) | (.135) | (.152) | (.081) |

| Distributions from net realized gain | – | (.006) | (.003) | – | – |

| Total distributions | (.117) | (.155) | (.138) | (.152) | (.081) |

| Net asset value, end of period | $11.28 | $11.42 | $11.27 | $11.23 | $10.88 |

| Total ReturnB,C | (.19)% | 2.72% | 1.59% | 4.64% | (3.28)% |

| Ratios to Average Net AssetsD,E | | | | | |

| Expenses before reductions | 1.54% | 1.54% | 1.53% | 1.52% | 1.52% |

| Expenses net of fee waivers, if any | 1.54% | 1.54% | 1.53% | 1.52% | 1.52% |

| Expenses net of all reductions | 1.54% | 1.54% | 1.53% | 1.52% | 1.52% |

| Net investment income (loss) | .89% | 1.17% | 1.25% | 1.44% | .78% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $13 | $19 | $16 | $17 | $17 |

| Portfolio turnover rateF | 357% | 404% | 439% | 398% | 474% |

A Calculated based on average shares outstanding during the period.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Total returns do not include the effect of the contingent deferred sales charge.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses of any underlying non-money market Fidelity Central Funds were less than .005%.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Mortgage Securities Fund

| Years ended August 31, | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $11.47 | $11.31 | $11.27 | $10.92 | $11.37 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .223 | .257 | .264 | .279 | .209 |

| Net realized and unrealized gain (loss) | (.123) | .182 | .037 | .341 | (.458) |

| Total from investment operations | .100 | .439 | .301 | .620 | (.249) |

| Distributions from net investment income | (.240) | (.273) | (.258) | (.270) | (.201) |

| Distributions from net realized gain | – | (.006) | (.003) | – | – |

| Total distributions | (.240) | (.279) | (.261) | (.270) | (.201) |

| Net asset value, end of period | $11.33 | $11.47 | $11.31 | $11.27 | $10.92 |

| Total ReturnB | .90% | 3.93% | 2.68% | 5.73% | (2.23)% |

| Ratios to Average Net AssetsC,D | | | | | |

| Expenses before reductions | .45% | .45% | .45% | .45% | .45% |

| Expenses net of fee waivers, if any | .45% | .45% | .45% | .45% | .45% |

| Expenses net of all reductions | .45% | .45% | .45% | .45% | .45% |

| Net investment income (loss) | 1.98% | 2.26% | 2.33% | 2.51% | 1.85% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $926 | $948 | $856 | $785 | $778 |

| Portfolio turnover rateE | 357% | 404% | 439% | 398% | 474% |

A Calculated based on average shares outstanding during the period.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses of any underlying non-money market Fidelity Central Funds were less than .005%.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Advisor Mortgage Securities Fund Class I

| Years ended August 31, | 2017 | 2016 | 2015 | 2014 | 2013 |

| Selected Per–Share Data | | | | | |

| Net asset value, beginning of period | $11.43 | $11.27 | $11.23 | $10.88 | $11.33 |

| Income from Investment Operations | | | | | |

| Net investment income (loss)A | .218 | .250 | .256 | .271 | .200 |

| Net realized and unrealized gain (loss) | (.134) | .182 | .038 | .342 | (.456) |

| Total from investment operations | .084 | .432 | .294 | .613 | (.256) |

| Distributions from net investment income | (.234) | (.266) | (.251) | (.263) | (.194) |

| Distributions from net realized gain | – | (.006) | (.003) | – | – |

| Total distributions | (.234) | (.272) | (.254) | (.263) | (.194) |

| Net asset value, end of period | $11.28 | $11.43 | $11.27 | $11.23 | $10.88 |

| Total ReturnB | .76% | 3.88% | 2.64% | 5.69% | (2.30)% |

| Ratios to Average Net AssetsC,D | | | | | |

| Expenses before reductions | .49% | .50% | .50% | .51% | .51% |

| Expenses net of fee waivers, if any | .49% | .50% | .50% | .51% | .51% |

| Expenses net of all reductions | .49% | .50% | .50% | .51% | .51% |

| Net investment income (loss) | 1.94% | 2.21% | 2.28% | 2.45% | 1.79% |

| Supplemental Data | | | | | |

| Net assets, end of period (in millions) | $73 | $79 | $72 | $48 | $34 |

| Portfolio turnover rateE | 357% | 404% | 439% | 398% | 474% |

A Calculated based on average shares outstanding during the period.

B Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. Based on their most recent shareholder report date, the expenses of any underlying non-money market Fidelity Central Funds were less than .005%.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended August 31, 2017

(Amounts in thousands except percentages)

1. Organization.

Fidelity Advisor Mortgage Securities Fund (the Fund) is a fund of Fidelity Advisor Series II (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M (formerly Class T), Class C, Fidelity Mortgage Securities Fund and Class I shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class.

After the close of business on June 24, 2016, all outstanding Class B shares were converted to Class A shares. All prior fiscal period dollar and share amounts for Class B presented in the Notes to Financial Statements are for the period September 1, 2015 through June 24, 2016.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Asset backed securities, collateralized mortgage obligations, commercial mortgage securities and U.S. government agency mortgage securities are valued by pricing vendors who utilize matrix pricing which considers prepayment speed assumptions, attributes of the collateral, yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. Brokers which make markets in asset backed securities, collateralized mortgage obligations and commercial mortgage securities may also consider such factors as the structure of the issue, cash flow assumptions, the value of underlying assets as well as any guarantees. These pricing sources may utilize inputs such as interest rate curves, credit spread curves, default possibilities and recovery rates. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of August 31, 2017 is included at the end of the Fund's Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of August 31, 2017, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to short-term gain distributions from the Underlying Funds, futures contracts, swaps, market discount, partnerships (including allocations from Fidelity Central Funds), deferred trustees compensation, expiring capital loss carryforwards, losses deferred due to wash sales and excise tax regulations.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $6,304 |

| Gross unrealized depreciation | (8,285) |

| Net unrealized appreciation (depreciation) | $(1,981) |

| Tax Cost | $1,229,754 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $4,790 |

| Net unrealized appreciation (depreciation) on securities and other investments | $(1,981) |

The Fund intends to elect to defer to its next fiscal year $2,728 of capital losses recognized during the period November 1, 2016 to August 31, 2017.

The tax character of distributions paid was as follows:

| | August 31, 2017 | August 31, 2016 |

| Ordinary Income | $22,676 | $ 25,876 |

Delayed Delivery Transactions and When-Issued Securities. During the period, the Fund transacted in securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. The securities purchased on a delayed delivery or when-issued basis are identified as such in the Fund's Schedule of Investments. The Fund may receive compensation for interest forgone in the purchase of a delayed delivery or when-issued security. With respect to purchase commitments, the Fund identifies securities as segregated in its records with a value at least equal to the amount of the commitment. Losses may arise due to changes in the value of the underlying securities or if the counterparty does not perform under the contract's terms, or if the issuer does not issue the securities due to political, economic, or other factors.

To-Be-Announced (TBA) Securities and Mortgage Dollar Rolls. During the period, the Fund transacted in TBA securities that involved buying or selling mortgage-backed securities (MBS) on a forward commitment basis. A TBA transaction typically does not designate the actual security to be delivered and only includes an approximate principal amount; however delivered securities must meet specified terms defined by industry guidelines, including issuer, rate and current principal amount outstanding on underlying mortgage pools. The Fund may enter into a TBA transaction with the intent to take possession of or deliver the underlying MBS, or the Fund may elect to extend the settlement by entering into either a mortgage or reverse mortgage dollar roll. Mortgage dollar rolls are transactions where a fund sells TBA securities and simultaneously agrees to repurchase MBS on a later date at a lower price and with the same counterparty. Reverse mortgage dollar rolls involve the purchase and simultaneous agreement to sell TBA securities on a later date at a lower price. Transactions in mortgage dollar rolls and reverse mortgage dollar rolls are accounted for as purchases and sales and may result in an increase to the Fund's portfolio turnover rate.

Purchases and sales of TBA securities involve risks similar to those discussed above for delayed delivery and when-issued securities. Also, if the counterparty in a mortgage dollar roll or a reverse mortgage dollar roll transaction files for bankruptcy or becomes insolvent, the Fund's right to repurchase or sell securities may be limited. Additionally, when a fund sells TBA securities without already owning or having the right to obtain the deliverable securities (an uncovered forward commitment to sell), it incurs a risk of loss because it could have to purchase the securities at a price that is higher than the price at which it sold them. A fund may be unable to purchase the deliverable securities if the corresponding market is illiquid.