Fidelity Advisor® Strategic Income Fund

Semi-Annual Report

June 30, 2021

Includes Fidelity and Fidelity Advisor share classes

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

Neither the Fund nor Fidelity Distributors Corporation is a bank.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, 2020 the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Fixed-Income Central Funds.

Top Five Holdings as of June 30, 2021

| (by issuer, excluding cash equivalents) | % of fund's net assets |

| U.S. Treasury Obligations | 19.2 |

| German Federal Republic | 3.1 |

| CCO Holdings LLC/CCO Holdings Capital Corp. | 1.4 |

| Japan Government | 1.1 |

| JPMorgan Chase & Co. | 1.1 |

| | 25.9 |

Top Five Market Sectors as of June 30, 2021

| | % of fund's net assets |

| Energy | 9.9 |

| Financials | 9.0 |

| Communication Services | 8.5 |

| Consumer Discretionary | 6.7 |

| Industrials | 6.2 |

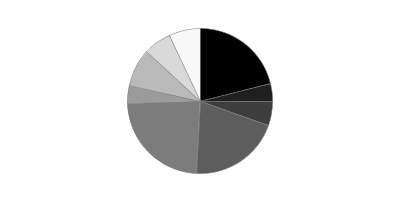

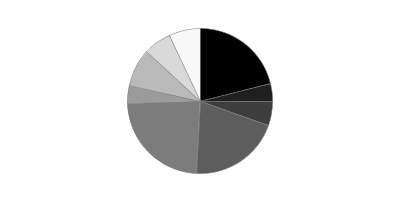

Quality Diversification (% of fund's net assets)

| As of June 30, 2021 |

| | U.S. Government and U.S. Government Agency Obligations* | 21.2% |

| | AAA,AA,A | 4.0% |

| | BBB | 5.3% |

| | BB | 20.3% |

| | B | 23.6% |

| | CCC,CC,C | 4.0% |

| | Not Rated | 8.5% |

| | Equities | 6.2% |

| | Short-Term Investments and Net Other Assets | 6.9% |

* Includes NCUA Guaranteed Notes

We have used ratings from Moody’s Investors Service, Inc. Where Moody’s® ratings are not available, we have used S&P® ratings. All ratingsare as of the date indicated and do not reflect subsequent changes.

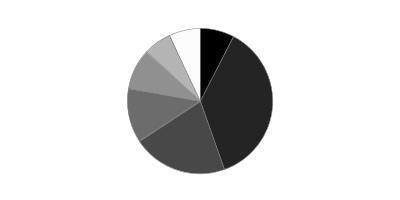

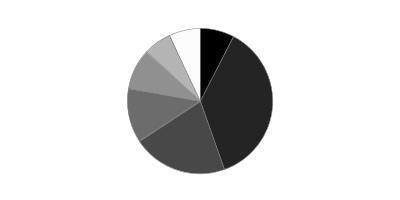

Asset Allocation (% of fund's net assets)

| As of June 30, 2021*,**,***,† |

| | Preferred Securities | 7.7% |

| | Corporate Bonds | 36.8% |

| | U.S. Government and U.S. Government Agency Obligations†† | 21.2% |

| | Foreign Government & Government Agency Obligations | 12.0% |

| | Bank Loan Obligations | 9.1% |

| | Stocks | 6.2% |

| | Other Investments | 0.1% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 6.9% |

* Foreign investments – 28.2%

** Futures and Swaps – 2.9%

*** Written options – (0.0)%

† Forward Currency Contracts – (8.2)%

†† Includes NCUA Guaranteed Notes

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or advisor.fidelity.com, as applicable.

Schedule of Investments June 30, 2021 (Unaudited)

Showing Percentage of Net Assets

| Corporate Bonds - 30.2% | | | |

| | | Principal Amount (000s)(a) | Value (000s) |

| Convertible Bonds - 0.1% | | | |

| ENERGY - 0.1% | | | |

| Energy Equipment & Services - 0.0% | | | |

| Forum Energy Technologies, Inc. 9% 8/4/25 | | $2,098 | $2,095 |

| Oil, Gas & Consumable Fuels - 0.1% | | | |

| Mesquite Energy, Inc.: | | | |

| 15% 7/15/23 (b)(c) | | 1,303 | 4,886 |

| 15% 7/15/23 (b)(c) | | 2,249 | 7,646 |

| | | | 12,532 |

| TOTAL ENERGY | | | 14,627 |

| Nonconvertible Bonds - 30.1% | | | |

| COMMUNICATION SERVICES - 6.0% | | | |

| Diversified Telecommunication Services - 2.3% | | | |

| Altice France SA: | | | |

| 5.125% 7/15/29 (d) | | 38,465 | 38,653 |

| 5.5% 1/15/28 (d) | | 13,345 | 13,848 |

| 7.375% 5/1/26 (d) | | 27,675 | 28,780 |

| 8.125% 2/1/27 (d) | | 4,495 | 4,897 |

| C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (d) | | 21,480 | 22,957 |

| Cablevision Lightpath LLC: | | | |

| 3.875% 9/15/27 (d) | | 3,300 | 3,262 |

| 5.625% 9/15/28 (d) | | 2,610 | 2,658 |

| Frontier Communications Holdings LLC: | | | |

| 5% 5/1/28 (d) | | 11,730 | 12,127 |

| 5.875% 10/15/27 (d) | | 6,300 | 6,749 |

| 6.75% 5/1/29 (d) | | 7,510 | 7,985 |

| Lumen Technologies, Inc. 5.375% 6/15/29 (d) | | 7,120 | 7,222 |

| Qwest Corp. 7.25% 9/15/25 | | 955 | 1,130 |

| Sable International Finance Ltd. 5.75% 9/7/27 (d) | | 12,405 | 13,022 |

| Sprint Capital Corp.: | | | |

| 6.875% 11/15/28 | | 78,162 | 100,243 |

| 8.75% 3/15/32 | | 39,078 | 59,399 |

| Telenet Finance Luxembourg Notes SARL 5.5% 3/1/28 (d) | | 9,200 | 9,678 |

| Virgin Media Finance PLC 5% 7/15/30 (d) | | 14,025 | 14,095 |

| Windstream Escrow LLC 7.75% 8/15/28 (d) | | 19,370 | 19,951 |

| Zayo Group Holdings, Inc. 4% 3/1/27 (d) | | 9,545 | 9,479 |

| | | | 376,135 |

| Entertainment - 0.1% | | | |

| Allen Media LLC 10.5% 2/15/28 (d) | | 6,415 | 6,816 |

| Netflix, Inc. 4.875% 4/15/28 | | 13,960 | 16,211 |

| | | | 23,027 |

| Media - 3.3% | | | |

| Altice Financing SA 5% 1/15/28 (d) | | 6,470 | 6,342 |

| Block Communications, Inc. 4.875% 3/1/28 (d) | | 4,405 | 4,493 |

| CCO Holdings LLC/CCO Holdings Capital Corp.: | | | |

| 4.25% 2/1/31 (d) | | 10,205 | 10,396 |

| 4.5% 8/15/30 (d) | | 16,805 | 17,498 |

| 4.5% 5/1/32 | | 6,745 | 6,990 |

| 4.75% 3/1/30 (d) | | 51,010 | 53,943 |

| 5% 2/1/28 (d) | | 54,720 | 57,388 |

| 5.125% 5/1/27 (d) | | 42,005 | 44,059 |

| 5.375% 6/1/29 (d) | | 34,085 | 37,258 |

| Clear Channel International BV 6.625% 8/1/25 (d) | | 9,800 | 10,298 |

| Clear Channel Outdoor Holdings, Inc. 7.5% 6/1/29 (d) | | 5,745 | 5,948 |

| CSC Holdings LLC: | | | |

| 4.5% 11/15/31 (d) | | 14,440 | 14,529 |

| 5% 11/15/31 (d) | | 4,330 | 4,351 |

| 5.375% 2/1/28 (d) | | 13,855 | 14,658 |

| 5.75% 1/15/30 (d) | | 61,690 | 64,080 |

| 6.5% 2/1/29 (d) | | 15,380 | 17,035 |

| 7.5% 4/1/28 (d) | | 8,475 | 9,301 |

| Diamond Sports Group LLC/Diamond Sports Finance Co. 5.375% 8/15/26 (d) | | 24,690 | 15,987 |

| LCPR Senior Secured Financing DAC: | | | |

| 5.125% 7/15/29 (d) | | 7,310 | 7,542 |

| 6.75% 10/15/27 (d) | | 6,785 | 7,311 |

| Nexstar Broadcasting, Inc.: | | | |

| 4.75% 11/1/28 (d) | | 13,395 | 13,763 |

| 5.625% 7/15/27 (d) | | 14,270 | 15,126 |

| Quebecor Media, Inc. 5.75% 1/15/23 | | 14,205 | 15,202 |

| Radiate Holdco LLC/Radiate Financial Service Ltd. 6.5% 9/15/28 (d) | | 6,500 | 6,829 |

| Scripps Escrow II, Inc. 3.875% 1/15/29 (d) | | 1,655 | 1,642 |

| Sirius XM Radio, Inc.: | | | |

| 4% 7/15/28 (d) | | 11,260 | 11,598 |

| 5% 8/1/27 (d) | | 8,740 | 9,157 |

| Townsquare Media, Inc. 6.875% 2/1/26 (d) | | 3,305 | 3,536 |

| Univision Communications, Inc. 4.5% 5/1/29 (d) | | 5,760 | 5,803 |

| Videotron Ltd. 5.125% 4/15/27 (d) | | 7,325 | 7,655 |

| Ziggo Bond Co. BV: | | | |

| 5.125% 2/28/30 (d) | | 3,375 | 3,454 |

| 6% 1/15/27 (d) | | 7,930 | 8,287 |

| Ziggo BV: | | | |

| 4.875% 1/15/30 (d) | | 4,805 | 4,925 |

| 5.5% 1/15/27 (d) | | 14,342 | 14,898 |

| | | | 531,282 |

| Wireless Telecommunication Services - 0.3% | | | |

| Intelsat Jackson Holdings SA: | | | |

| 5.5% 8/1/23 (e) | | 19,430 | 11,124 |

| 8% 2/15/24 (d) | | 12,960 | 13,385 |

| Millicom International Cellular SA 4.5% 4/27/31 (d) | | 1,040 | 1,082 |

| Sprint Corp. 7.625% 3/1/26 | | 3,615 | 4,410 |

| T-Mobile U.S.A., Inc.: | | | |

| 3.375% 4/15/29 | | 5,905 | 6,094 |

| 3.5% 4/15/31 | | 5,905 | 6,109 |

| | | | 42,204 |

| TOTAL COMMUNICATION SERVICES | | | 972,648 |

| CONSUMER DISCRETIONARY - 3.4% | | | |

| Auto Components - 0.1% | | | |

| Allison Transmission, Inc. 5.875% 6/1/29 (d) | | 4,830 | 5,289 |

| Exide Technologies: | | | |

| 11% 10/31/24 pay-in-kind (c)(d)(e)(f) | | 1,280 | 0 |

| 11% 10/31/24 pay-in-kind (c)(d)(e)(f) | | 632 | 285 |

| Nesco Holdings II, Inc. 5.5% 4/15/29 (d) | | 7,155 | 7,468 |

| | | | 13,042 |

| Automobiles - 0.0% | | | |

| Ford Motor Co. 7.45% 7/16/31 | | 565 | 743 |

| Tesla, Inc. 5.3% 8/15/25 (d) | | 835 | 863 |

| | | | 1,606 |

| Diversified Consumer Services - 0.2% | | | |

| BidFair Holdings, Inc. 5.875% 6/1/29 (d) | | 4,315 | 4,380 |

| GEMS MENASA Cayman Ltd. 7.125% 7/31/26 (d) | | 5,300 | 5,475 |

| Service Corp. International 4% 5/15/31 | | 5,750 | 5,869 |

| Sotheby's 7.375% 10/15/27 (d) | | 2,970 | 3,204 |

| TKC Holdings, Inc.: | | | |

| 6.875% 5/15/28 (d) | | 5,780 | 5,961 |

| 10.5% 5/15/29 (d) | | 5,780 | 6,257 |

| WASH Multifamily Acquisition, Inc. 5.75% 4/15/26 (d) | | 4,750 | 4,959 |

| | | | 36,105 |

| Hotels, Restaurants & Leisure - 2.1% | | | |

| 1011778 BC Unlimited Liability Co./New Red Finance, Inc.: | | | |

| 3.875% 1/15/28 (d)(g) | | 5,685 | 5,756 |

| 4% 10/15/30 (d) | | 23,490 | 22,727 |

| 4.375% 1/15/28 (d) | | 6,265 | 6,351 |

| Affinity Gaming LLC 6.875% 12/15/27 (d) | | 2,520 | 2,674 |

| Bloomin Brands, Inc. / OSI Restaurant Partners LLC 5.125% 4/15/29 (d) | | 2,720 | 2,795 |

| Boyd Gaming Corp. 4.75% 6/15/31 (d) | | 7,140 | 7,408 |

| Caesars Entertainment, Inc.: | | | |

| 6.25% 7/1/25 (d) | | 25,535 | 27,067 |

| 8.125% 7/1/27 (d) | | 34,045 | 37,865 |

| Caesars Resort Collection LLC 5.75% 7/1/25 (d) | | 8,510 | 8,967 |

| Carnival Corp.: | | | |

| 7.625% 3/1/26 (d) | | 5,040 | 5,475 |

| 9.875% 8/1/27 (d) | | 10,150 | 11,850 |

| 10.5% 2/1/26 (d) | | 7,395 | 8,610 |

| 11.5% 4/1/23 (d) | | 20,180 | 22,829 |

| Choice Hotels International, Inc. 5.75% 7/1/22 | | 2,690 | 2,803 |

| Hilton Domestic Operating Co., Inc.: | | | |

| 3.75% 5/1/29 (d) | | 3,350 | 3,384 |

| 4% 5/1/31 (d) | | 5,020 | 5,065 |

| 4.875% 1/15/30 | | 11,025 | 11,769 |

| Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp. 4.875% 4/1/27 | | 5,210 | 5,431 |

| MCE Finance Ltd.: | | | |

| 4.875% 6/6/25 (d) | | 17,840 | 18,259 |

| 5.25% 4/26/26 (d) | | 7,345 | 7,606 |

| 5.375% 12/4/29 (d) | | 4,785 | 5,048 |

| 5.75% 7/21/28 (d) | | 3,385 | 3,571 |

| Merlin Entertainments PLC 5.75% 6/15/26 (d) | | 4,580 | 4,809 |

| MGM Resorts International 4.75% 10/15/28 | | 6,740 | 7,161 |

| NCL Corp. Ltd.: | | | |

| 5.875% 3/15/26 (d) | | 6,935 | 7,264 |

| 12.25% 5/15/24 (d) | | 9,110 | 11,002 |

| NCL Finance Ltd. 6.125% 3/15/28 (d) | | 2,690 | 2,819 |

| Peninsula Pacific Entertainment LLC 8.5% 11/15/27 (d) | | 6,740 | 7,239 |

| Royal Caribbean Cruises Ltd.: | | | |

| 10.875% 6/1/23 (d) | | 8,545 | 9,731 |

| 11.5% 6/1/25 (d) | | 12,420 | 14,314 |

| SeaWorld Parks & Entertainment, Inc. 9.5% 8/1/25 (d) | | 5,505 | 5,904 |

| Studio City Finance Ltd. 5% 1/15/29 (d) | | 3,255 | 3,284 |

| Vail Resorts, Inc. 6.25% 5/15/25 (d) | | 3,855 | 4,126 |

| Viking Cruises Ltd.: | | | |

| 5.875% 9/15/27 (d) | | 3,395 | 3,355 |

| 13% 5/15/25 (d) | | 5,740 | 6,753 |

| Voc Escrow Ltd. 5% 2/15/28 (d) | | 6,285 | 6,354 |

| Wynn Macau Ltd. 5.125% 12/15/29 (d) | | 9,840 | 10,135 |

| Yum! Brands, Inc. 4.625% 1/31/32 | | 5,905 | 6,200 |

| | | | 343,760 |

| Household Durables - 0.3% | | | |

| Brookfield Residential Properties, Inc./Brookfield Residential U.S. Corp. 4.875% 2/15/30 (d) | | 4,370 | 4,328 |

| LGI Homes, Inc. 6.875% 7/15/26 (d) | | 7,205 | 7,468 |

| Taylor Morrison Communities, Inc./Monarch Communities, Inc. 5.625% 3/1/24 (d) | | 775 | 840 |

| Tempur Sealy International, Inc. 4% 4/15/29 (d) | | 7,905 | 8,003 |

| TopBuild Corp. 3.625% 3/15/29 (d) | | 3,030 | 3,000 |

| TRI Pointe Group, Inc./TRI Pointe Holdings, Inc. 5.875% 6/15/24 | | 11,770 | 13,095 |

| TRI Pointe Homes, Inc. 5.7% 6/15/28 | | 8,715 | 9,608 |

| | | | 46,342 |

| Internet & Direct Marketing Retail - 0.2% | | | |

| Angi Group LLC 3.875% 8/15/28 (d) | | 3,385 | 3,364 |

| Terrier Media Buyer, Inc. 8.875% 12/15/27 (d) | | 23,835 | 25,772 |

| | | | 29,136 |

| Specialty Retail - 0.5% | | | |

| Ambience Merger Sub, Inc.: | | | |

| 4.875% 7/15/28 (d)(g) | | 2,840 | 2,847 |

| 7.125% 7/15/29 (d)(g) | | 4,235 | 4,277 |

| Asbury Automotive Group, Inc.: | | | |

| 4.5% 3/1/28 | | 1,987 | 2,042 |

| 4.75% 3/1/30 | | 1,980 | 2,069 |

| Carvana Co. 5.5% 4/15/27 (d) | | 5,905 | 6,098 |

| L Brands, Inc.: | | | |

| 6.625% 10/1/30 (d) | | 3,355 | 3,883 |

| 6.75% 7/1/36 | | 15,890 | 19,902 |

| 6.875% 11/1/35 | | 4,345 | 5,502 |

| 7.5% 6/15/29 | | 5,030 | 5,923 |

| Magic MergerCo, Inc.: | | | |

| 5.25% 5/1/28 (d) | | 6,875 | 7,053 |

| 7.875% 5/1/29 (d) | | 7,300 | 7,528 |

| Party City Holdings, Inc. 8.75% 2/15/26 (d) | | 3,075 | 3,283 |

| Victoria's Secret & Co. 4.625% 7/15/29 (d)(g) | | 4,895 | 4,895 |

| | | | 75,302 |

| Textiles, Apparel & Luxury Goods - 0.0% | | | |

| Crocs, Inc. 4.25% 3/15/29 (d) | | 4,325 | 4,412 |

| TOTAL CONSUMER DISCRETIONARY | | | 549,705 |

| CONSUMER STAPLES - 1.3% | | | |

| Beverages - 0.0% | | | |

| Triton Water Holdings, Inc. 6.25% 4/1/29 (d) | | 3,135 | 3,143 |

| Food & Staples Retailing - 0.5% | | | |

| Albertsons Companies LLC/Safeway, Inc./New Albertson's, Inc./Albertson's LLC: | | | |

| 3.5% 3/15/29 (d) | | 5,285 | 5,226 |

| 4.625% 1/15/27 (d) | | 13,797 | 14,431 |

| 4.875% 2/15/30 (d) | | 23,423 | 24,981 |

| C&S Group Enterprises LLC 5% 12/15/28 (d) | | 5,155 | 5,110 |

| KeHE Distributors LLC / KeHE Finance Corp. 8.625% 10/15/26 (d) | | 5,292 | 5,783 |

| Performance Food Group, Inc. 5.5% 10/15/27 (d) | | 5,345 | 5,617 |

| SEG Holding LLC/SEG Finance Corp. 5.625% 10/15/28 (d) | | 6,735 | 7,070 |

| United Natural Foods, Inc. 6.75% 10/15/28 (d) | | 4,680 | 5,036 |

| | | | 73,254 |

| Food Products - 0.8% | | | |

| Chobani LLC/Finance Corp., Inc. 4.625% 11/15/28 (d) | | 3,790 | 3,927 |

| Del Monte Foods, Inc. 11.875% 5/15/25 (d) | | 3,895 | 4,440 |

| JBS U.S.A. Food Co.: | | | |

| 5.75% 1/15/28 (d) | | 6,485 | 6,937 |

| 7% 1/15/26 (d) | | 6,745 | 7,150 |

| JBS U.S.A. LLC/JBS U.S.A. Finance, Inc. 6.75% 2/15/28 (d) | | 10,725 | 11,784 |

| JBS U.S.A. Lux SA / JBS Food Co.: | | | |

| 5.5% 1/15/30 (d) | | 12,225 | 13,672 |

| 6.5% 4/15/29 (d) | | 17,835 | 20,131 |

| Lamb Weston Holdings, Inc.: | | | |

| 4.625% 11/1/24 (d) | | 5,230 | 5,412 |

| 4.875% 11/1/26 (d) | | 5,285 | 5,463 |

| Pilgrim's Pride Corp. 4.25% 4/15/31 (d) | | 10,220 | 10,590 |

| Post Holdings, Inc.: | | | |

| 4.5% 9/15/31 (d) | | 12,110 | 12,090 |

| 4.625% 4/15/30 (d) | | 6,415 | 6,523 |

| 5.5% 12/15/29 (d) | | 9,145 | 9,797 |

| 5.75% 3/1/27 (d) | | 4,885 | 5,111 |

| Simmons Foods, Inc. 4.625% 3/1/29 (d) | | 4,295 | 4,332 |

| TreeHouse Foods, Inc. 4% 9/1/28 | | 2,250 | 2,233 |

| | | | 129,592 |

| Household Products - 0.0% | | | |

| Spectrum Brands Holdings, Inc. 3.875% 3/15/31 (d) | | 4,310 | 4,235 |

| TOTAL CONSUMER STAPLES | | | 210,224 |

| ENERGY - 4.1% | | | |

| Energy Equipment & Services - 0.2% | | | |

| CGG SA 8.75% 4/1/27 (d) | | 5,895 | 6,101 |

| Exterran Energy Solutions LP 8.125% 5/1/25 | | 3,270 | 2,894 |

| Nabors Industries Ltd.: | | | |

| 7.25% 1/15/26 (d) | | 6,565 | 6,434 |

| 7.5% 1/15/28 (d) | | 5,660 | 5,434 |

| Nine Energy Service, Inc. 8.75% 11/1/23 (d) | | 3,620 | 1,846 |

| NuStar Logistics LP 6% 6/1/26 | | 7,285 | 7,904 |

| Summit Midstream Holdings LLC 5.75% 4/15/25 | | 3,405 | 3,124 |

| | | | 33,737 |

| Oil, Gas & Consumable Fuels - 3.9% | | | |

| Antero Midstream Partners LP/Antero Midstream Finance Corp.: | | | |

| 5.375% 6/15/29 (d) | | 4,305 | 4,488 |

| 5.75% 1/15/28 (d) | | 10,640 | 11,196 |

| Callon Petroleum Co.: | | | |

| 6.125% 10/1/24 | | 2,855 | 2,814 |

| 6.25% 4/15/23 | | 5,395 | 5,401 |

| Cheniere Energy Partners LP 4% 3/1/31 (d) | | 9,070 | 9,478 |

| Cheniere Energy, Inc. 4.625% 10/15/28 (d) | | 13,395 | 14,132 |

| Chesapeake Energy Corp.: | | | |

| 5.875% 2/1/29 (d) | | 3,115 | 3,372 |

| 7% 10/1/24 (c)(e) | | 3,985 | 0 |

| 8% 1/15/25 (c)(e) | | 1,955 | 0 |

| 8% 6/15/27 (c)(e) | | 1,240 | 0 |

| Citgo Holding, Inc. 9.25% 8/1/24 (d) | | 16,430 | 16,759 |

| Citgo Petroleum Corp.: | | | |

| 6.375% 6/15/26 (d) | | 4,665 | 4,863 |

| 7% 6/15/25 (d) | | 13,580 | 14,151 |

| CNX Midstream Partners LP 6.5% 3/15/26 (d) | | 3,935 | 4,128 |

| CNX Resources Corp. 6% 1/15/29 (d) | | 3,200 | 3,460 |

| Colgate Energy Partners III LLC 5.875% 7/1/29 (d) | | 4,055 | 4,207 |

| Comstock Resources, Inc.: | | | |

| 5.875% 1/15/30 (d) | | 11,860 | 12,097 |

| 6.75% 3/1/29 (d) | | 8,110 | 8,639 |

| 7.5% 5/15/25 (d) | | 2,246 | 2,330 |

| CQP Holdco LP / BIP-V Chinook Holdco LLC 5.5% 6/15/31 (d) | | 7,140 | 7,440 |

| Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp.: | | | |

| 5.625% 5/1/27 (d) | | 11,025 | 11,314 |

| 5.75% 4/1/25 | | 2,960 | 3,043 |

| 6% 2/1/29 (d) | | 16,880 | 17,682 |

| CrownRock LP/CrownRock Finance, Inc. 5% 5/1/29 (d) | | 2,450 | 2,573 |

| CVR Energy, Inc.: | | | |

| 5.25% 2/15/25 (d) | | 9,740 | 9,745 |

| 5.75% 2/15/28 (d) | | 24,505 | 24,694 |

| DCP Midstream Operating LP 5.85% 5/21/43 (d)(f) | | 10,780 | 9,972 |

| DT Midstream, Inc.: | | | |

| 4.125% 6/15/29 (d) | | 4,285 | 4,351 |

| 4.375% 6/15/31 (d) | | 4,285 | 4,378 |

| EG Global Finance PLC 8.5% 10/30/25 (d) | | 9,545 | 10,094 |

| Endeavor Energy Resources LP/EER Finance, Inc.: | | | |

| 5.5% 1/30/26 (d) | | 4,090 | 4,248 |

| 5.75% 1/30/28 (d) | | 10,149 | 10,821 |

| 6.625% 7/15/25 (d) | | 3,395 | 3,633 |

| Energy Transfer LP 5.5% 6/1/27 | | 12,065 | 13,371 |

| EQT Corp. 3.9% 10/1/27 | | 15,848 | 16,977 |

| Hess Midstream Partners LP: | | | |

| 5.125% 6/15/28 (d) | | 6,600 | 6,922 |

| 5.625% 2/15/26 (d) | | 9,140 | 9,533 |

| Hilcorp Energy I LP/Hilcorp Finance Co.: | | | |

| 5.75% 2/1/29 (d) | | 3,250 | 3,388 |

| 6% 2/1/31 (d) | | 3,250 | 3,445 |

| 6.25% 11/1/28 (d) | | 7,130 | 7,576 |

| Holly Energy Partners LP/Holly Energy Finance Corp. 5% 2/1/28 (d) | | 4,350 | 4,448 |

| MEG Energy Corp. 7.125% 2/1/27 (d) | | 6,490 | 6,914 |

| Mesquite Energy, Inc. 7.25% 2/15/23 (c)(d)(e) | | 12,834 | 0 |

| Murphy Oil U.S.A., Inc.: | | | |

| 4.75% 9/15/29 | | 4,155 | 4,363 |

| 5.625% 5/1/27 | | 3,665 | 3,867 |

| New Fortress Energy, Inc.: | | | |

| 6.5% 9/30/26 (d) | | 10,330 | 10,555 |

| 6.75% 9/15/25 (d) | | 27,005 | 27,646 |

| NGL Energy Partners LP/NGL Energy Finance Corp.: | | | |

| 6.125% 3/1/25 | | 7,480 | 6,788 |

| 7.5% 4/15/26 | | 9,630 | 8,787 |

| NGPL PipeCo LLC 4.875% 8/15/27 (d) | | 1,800 | 2,062 |

| Occidental Petroleum Corp.: | | | |

| 2.9% 8/15/24 | | 8,270 | 8,456 |

| 3.2% 8/15/26 | | 515 | 519 |

| 3.4% 4/15/26 | | 670 | 685 |

| 3.5% 8/15/29 | | 3,820 | 3,834 |

| 4.4% 4/15/46 | | 5,820 | 5,590 |

| 4.4% 8/15/49 | | 14,725 | 14,136 |

| 4.625% 6/15/45 | | 4,795 | 4,675 |

| 5.875% 9/1/25 | | 6,775 | 7,537 |

| 6.2% 3/15/40 | | 3,565 | 4,031 |

| 6.375% 9/1/28 | | 6,775 | 7,910 |

| 6.45% 9/15/36 | | 11,875 | 14,198 |

| 6.6% 3/15/46 | | 9,520 | 11,316 |

| 6.625% 9/1/30 | | 13,550 | 16,376 |

| 7.2% 3/15/29 | | 2,440 | 2,806 |

| 7.5% 5/1/31 | | 680 | 857 |

| Ovintiv Exploration, Inc. 5.375% 1/1/26 | | 6,813 | 7,678 |

| Parkland Corp. 4.5% 10/1/29 (d) | | 4,420 | 4,492 |

| PBF Holding Co. LLC/PBF Finance Corp.: | | | |

| 6% 2/15/28 | | 15,760 | 10,796 |

| 7.25% 6/15/25 | | 13,580 | 10,321 |

| 9.25% 5/15/25 (d) | | 15,055 | 15,130 |

| PBF Logistics LP/PBF Logistics Finance, Inc. 6.875% 5/15/23 | | 6,110 | 6,003 |

| PDC Energy, Inc.: | | | |

| 6.125% 9/15/24 | | 2,480 | 2,536 |

| 6.25% 12/1/25 | | 4,370 | 4,523 |

| Renewable Energy Group, Inc. 5.875% 6/1/28 (d) | | 3,025 | 3,167 |

| SM Energy Co.: | | | |

| 5.625% 6/1/25 | | 4,400 | 4,356 |

| 6.625% 1/15/27 | | 12,830 | 13,183 |

| 6.75% 9/15/26 | | 3,175 | 3,231 |

| Southwestern Energy Co.: | | | |

| 6.45% 1/23/25 (f) | | 1,095 | 1,212 |

| 7.5% 4/1/26 | | 12,420 | 13,150 |

| 7.75% 10/1/27 | | 7,830 | 8,495 |

| Sunoco LP/Sunoco Finance Corp.: | | | |

| 4.5% 5/15/29 (d) | | 5,515 | 5,612 |

| 5.5% 2/15/26 | | 6,865 | 7,074 |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp. 7.5% 10/1/25 (d) | | 5,035 | 5,513 |

| Targa Resources Partners LP/Targa Resources Partners Finance Corp. 4.875% 2/1/31 (d) | | 6,345 | 6,868 |

| Teine Energy Ltd. 6.875% 4/15/29 (d) | | 4,420 | 4,536 |

| Tennessee Gas Pipeline Co. 7.625% 4/1/37 | | 2,585 | 3,716 |

| Ultra Resources, Inc. 11% 7/12/24 pay-in-kind (c)(e) | | 6,493 | 325 |

| Vine Energy Holdings LLC 6.75% 4/15/29 (d) | | 4,415 | 4,647 |

| | | | 631,635 |

| TOTAL ENERGY | | | 665,372 |

| FINANCIALS - 3.1% | | | |

| Banks - 0.1% | | | |

| Barclays PLC 1.106% 5/12/32 (Reg. S) (f) | EUR | 15,045 | 17,982 |

| Capital Markets - 0.2% | | | |

| AssuredPartners, Inc.: | | | |

| 5.625% 1/15/29 (d) | | 3,905 | 3,905 |

| 7% 8/15/25 (d) | | 2,930 | 2,992 |

| Broadstreet Partners, Inc. 5.875% 4/15/29 (d) | | 3,375 | 3,443 |

| Lions Gate Capital Holdings LLC 5.5% 4/15/29 (d) | | 4,420 | 4,647 |

| MSCI, Inc. 4% 11/15/29 (d) | | 3,780 | 3,988 |

| UBS Group AG 0.25% 11/5/28 (Reg. S) (f) | EUR | 9,024 | 10,583 |

| | | | 29,558 |

| Consumer Finance - 1.9% | | | |

| Ally Financial, Inc.: | | | |

| 8% 11/1/31 | | 16,761 | 23,576 |

| 8% 11/1/31 | | 83,872 | 120,528 |

| Ford Motor Credit Co. LLC: | | | |

| 3.375% 11/13/25 | | 15,970 | 16,560 |

| 3.625% 6/17/31 | | 7,380 | 7,523 |

| 4% 11/13/30 | | 25,360 | 26,565 |

| 5.113% 5/3/29 | | 6,160 | 6,896 |

| OneMain Finance Corp.: | | | |

| 4% 9/15/30 | | 3,340 | 3,311 |

| 5.375% 11/15/29 | | 5,560 | 6,048 |

| 6.625% 1/15/28 | | 4,415 | 5,061 |

| 6.875% 3/15/25 | | 30,605 | 34,541 |

| 7.125% 3/15/26 | | 41,215 | 48,004 |

| | | | 298,613 |

| Diversified Financial Services - 0.6% | | | |

| Enviva Partners LP / Enviva Partners Finance Corp. 6.5% 1/15/26 (d) | | 6,600 | 6,897 |

| Hightower Holding LLC 6.75% 4/15/29 (d) | | 2,870 | 2,927 |

| Icahn Enterprises LP/Icahn Enterprises Finance Corp.: | | | |

| 4.375% 2/1/29 (d) | | 6,375 | 6,343 |

| 5.25% 5/15/27 | | 17,335 | 17,855 |

| 5.25% 5/15/27 (d) | | 5,840 | 6,015 |

| 6.25% 5/15/26 | | 14,625 | 15,517 |

| 6.375% 12/15/25 | | 18,820 | 19,360 |

| 6.75% 2/1/24 | | 6,490 | 6,629 |

| James Hardie International Finance Ltd. 5% 1/15/28 (d) | | 5,270 | 5,581 |

| OEC Finance Ltd.: | | | |

| 4.375% 10/25/29 pay-in-kind (d) | | 3,905 | 433 |

| 5.25% 12/27/33 pay-in-kind (d) | | 3,654 | 406 |

| 7.125% 12/26/46 pay-in-kind (d) | | 1,874 | 208 |

| Shift4 Payments LLC / Shift4 Payments Finance Sub, Inc. 4.625% 11/1/26 (d) | | 2,265 | 2,364 |

| VMED O2 UK Financing I PLC 4.75% 7/15/31 (d)(g) | | 7,105 | 7,212 |

| | | | 97,747 |

| Insurance - 0.3% | | | |

| Acrisure LLC / Acrisure Finance, Inc.: | | | |

| 7% 11/15/25 (d) | | 20,290 | 20,696 |

| 10.125% 8/1/26 (d) | | 6,810 | 7,678 |

| Alliant Holdings Intermediate LLC: | | | |

| 4.25% 10/15/27 (d) | | 6,740 | 6,841 |

| 6.75% 10/15/27 (d) | | 10,080 | 10,594 |

| HUB International Ltd. 7% 5/1/26 (d) | | 6,980 | 7,239 |

| | | | 53,048 |

| Thrifts & Mortgage Finance - 0.0% | | | |

| MGIC Investment Corp. 5.25% 8/15/28 | | 4,725 | 5,009 |

| TOTAL FINANCIALS | | | 501,957 |

| HEALTH CARE - 1.9% | | | |

| Health Care Equipment & Supplies - 0.0% | | | |

| Hologic, Inc. 4.625% 2/1/28 (d) | | 2,505 | 2,630 |

| Health Care Providers & Services - 1.6% | | | |

| Akumin, Inc. 7% 11/1/25 (d) | | 4,910 | 5,098 |

| AMN Healthcare 4.625% 10/1/27 (d) | | 1,695 | 1,761 |

| Centene Corp.: | | | |

| 4.25% 12/15/27 | | 6,820 | 7,187 |

| 4.625% 12/15/29 | | 23,795 | 26,169 |

| 5.375% 8/15/26 (d) | | 4,655 | 4,864 |

| Community Health Systems, Inc.: | | | |

| 4.75% 2/15/31 (d) | | 8,770 | 8,803 |

| 5.625% 3/15/27 (d) | | 3,305 | 3,528 |

| 6% 1/15/29 (d) | | 4,940 | 5,286 |

| 6.125% 4/1/30 (d) | | 11,530 | 11,703 |

| 6.625% 2/15/25 (d) | | 7,415 | 7,841 |

| 8% 3/15/26 (d) | | 37,390 | 40,288 |

| DaVita HealthCare Partners, Inc.: | | | |

| 3.75% 2/15/31 (d) | | 2,075 | 1,992 |

| 4.625% 6/1/30 (d) | | 15,850 | 16,297 |

| Horizon Pharma U.S.A., Inc. 5.5% 8/1/27 (d) | | 7,300 | 7,747 |

| Jaguar Holding Co. II/Pharmaceutical Product Development LLC 5% 6/15/28 (d) | | 7,220 | 7,826 |

| Molina Healthcare, Inc.: | | | |

| 3.875% 11/15/30 (d) | | 6,345 | 6,607 |

| 4.375% 6/15/28 (d) | | 4,690 | 4,889 |

| Radiology Partners, Inc. 9.25% 2/1/28 (d) | | 11,755 | 12,989 |

| RP Escrow Issuer LLC 5.25% 12/15/25 (d) | | 6,200 | 6,471 |

| Tenet Healthcare Corp.: | | | |

| 4.625% 7/15/24 | | 3,640 | 3,694 |

| 4.625% 9/1/24 (d) | | 7,305 | 7,498 |

| 4.875% 1/1/26 (d) | | 18,260 | 18,939 |

| 5.125% 11/1/27 (d) | | 10,955 | 11,489 |

| 6.125% 10/1/28 (d) | | 11,515 | 12,271 |

| 6.25% 2/1/27 (d) | | 20,050 | 20,927 |

| Vizient, Inc. 6.25% 5/15/27 (d) | | 1,690 | 1,787 |

| | | | 263,951 |

| Health Care Technology - 0.0% | | | |

| IQVIA, Inc. 5% 5/15/27 (d) | | 5,660 | 5,929 |

| Life Sciences Tools & Services - 0.1% | | | |

| Charles River Laboratories International, Inc.: | | | |

| 3.75% 3/15/29 (d) | | 4,745 | 4,810 |

| 4% 3/15/31 (d) | | 6,035 | 6,278 |

| 4.25% 5/1/28 (d) | | 2,045 | 2,114 |

| Syneos Health, Inc. 3.625% 1/15/29 (d) | | 5,025 | 4,975 |

| | | | 18,177 |

| Pharmaceuticals - 0.2% | | | |

| Bausch Health Companies, Inc. 5% 2/15/29 (d) | | 1,195 | 1,114 |

| Bayer AG 0.375% 1/12/29 (Reg. S) | EUR | 5,100 | 5,927 |

| Catalent Pharma Solutions 5% 7/15/27 (d) | | 2,295 | 2,398 |

| Organon & Co. / Organon Foreign Debt Co-Issuer BV: | | | |

| 4.125% 4/30/28 (d) | | 10,200 | 10,402 |

| 5.125% 4/30/31 (d) | | 8,890 | 9,158 |

| | | | 28,999 |

| TOTAL HEALTH CARE | | | 319,686 |

| INDUSTRIALS - 3.7% | | | |

| Aerospace & Defense - 1.6% | | | |

| Bombardier, Inc.: | | | |

| 7.125% 6/15/26 (d) | | 5,695 | 5,937 |

| 7.5% 12/1/24 (d) | | 5,505 | 5,753 |

| 7.5% 3/15/25 (d) | | 9,175 | 9,435 |

| 7.875% 4/15/27 (d) | | 28,965 | 30,051 |

| BWX Technologies, Inc.: | | | |

| 4.125% 6/30/28 (d) | | 6,400 | 6,520 |

| 5.375% 7/15/26 (d) | | 4,990 | 5,122 |

| Moog, Inc. 4.25% 12/15/27 (d) | | 2,025 | 2,096 |

| Rolls-Royce PLC 5.75% 10/15/27 (d) | | 6,560 | 7,226 |

| Spirit Aerosystems, Inc. 7.5% 4/15/25 (d) | | 9,205 | 9,826 |

| TransDigm UK Holdings PLC 6.875% 5/15/26 | | 21,085 | 22,245 |

| TransDigm, Inc.: | | | |

| 4.625% 1/15/29 (d) | | 9,290 | 9,293 |

| 5.5% 11/15/27 | | 68,140 | 71,121 |

| 6.25% 3/15/26 (d) | | 11,120 | 11,732 |

| 6.375% 6/15/26 | | 20,230 | 20,958 |

| 7.5% 3/15/27 | | 11,028 | 11,731 |

| Wolverine Escrow LLC: | | | |

| 8.5% 11/15/24 (d) | | 12,893 | 12,506 |

| 9% 11/15/26 (d) | | 13,492 | 13,155 |

| | | | 254,707 |

| Air Freight & Logistics - 0.1% | | | |

| Cargo Aircraft Management, Inc. 4.75% 2/1/28 (d) | | 3,960 | 4,044 |

| XPO Logistics, Inc. 6.25% 5/1/25 (d) | | 11,590 | 12,329 |

| | | | 16,373 |

| Airlines - 0.4% | | | |

| Delta Air Lines, Inc. 7% 5/1/25 (d) | | 2,860 | 3,338 |

| Hawaiian Airlines pass-thru certificates Series 2013-1 Class B, 4.95% 7/15/23 | | 2,563 | 2,560 |

| Mileage Plus Holdings LLC 6.5% 6/20/27 (d) | | 20,660 | 22,747 |

| Spirit Loyalty Cayman Ltd. / Spirit IP Cayman Ltd. 8% 9/20/25 (d) | | 4,670 | 5,282 |

| United Airlines, Inc.: | | | |

| 4.375% 4/15/26 (d) | | 14,560 | 15,072 |

| 4.625% 4/15/29 (d) | | 8,725 | 9,030 |

| | | | 58,029 |

| Building Products - 0.1% | | | |

| Advanced Drain Systems, Inc. 5% 9/30/27 (d) | | 1,400 | 1,453 |

| CP Atlas Buyer, Inc. 7% 12/1/28 (d) | | 3,280 | 3,399 |

| Shea Homes Ltd. Partnership/Corp. 4.75% 4/1/29 (d) | | 4,830 | 4,960 |

| Victors Merger Corp. 6.375% 5/15/29 (d) | | 5,760 | 5,803 |

| | | | 15,615 |

| Commercial Services & Supplies - 0.5% | | | |

| Allied Universal Holdco LLC / Allied Universal Finance Corp. 6% 6/1/29 (d) | | 3,180 | 3,224 |

| Atlas Luxco 4 SARL / Allied Universal Holdco LLC / Allied Universal Finance Corp.: | | | |

| 4.625% 6/1/28 (d) | | 10,374 | 10,382 |

| 4.625% 6/1/28 (d) | | 6,871 | 6,896 |

| CoreCivic, Inc. 8.25% 4/15/26 | | 5,695 | 5,910 |

| Covanta Holding Corp.: | | | |

| 5% 9/1/30 | | 6,775 | 7,114 |

| 5.875% 7/1/25 | | 1,995 | 2,062 |

| 6% 1/1/27 | | 7,080 | 7,363 |

| GFL Environmental, Inc. 4.75% 6/15/29 (d) | | 5,705 | 5,924 |

| IAA Spinco, Inc. 5.5% 6/15/27 (d) | | 2,830 | 2,971 |

| KAR Auction Services, Inc. 5.125% 6/1/25 (d) | | 6,210 | 6,373 |

| Madison IAQ LLC: | | | |

| 4.125% 6/30/28 (d) | | 5,345 | 5,398 |

| 5.875% 6/30/29 (d) | | 4,265 | 4,340 |

| Nielsen Finance LLC/Nielsen Finance Co.: | | | |

| 4.5% 7/15/29 (d) | | 2,855 | 2,863 |

| 4.75% 7/15/31 (d) | | 2,870 | 2,877 |

| Pitney Bowes, Inc.: | | | |

| 6.875% 3/15/27 (d) | | 2,960 | 3,127 |

| 7.25% 3/15/29 (d) | | 2,960 | 3,145 |

| The Brink's Co. 4.625% 10/15/27 (d) | | 7,200 | 7,506 |

| | | | 87,475 |

| Construction & Engineering - 0.2% | | | |

| AECOM 5.125% 3/15/27 | | 7,490 | 8,354 |

| Arcosa, Inc. 4.375% 4/15/29 (d) | | 4,130 | 4,202 |

| Pike Corp. 5.5% 9/1/28 (d) | | 5,315 | 5,528 |

| SRS Distribution, Inc.: | | | |

| 4.625% 7/1/28 (d) | | 5,520 | 5,644 |

| 6.125% 7/1/29 (d) | | 3,035 | 3,123 |

| | | | 26,851 |

| Electrical Equipment - 0.0% | | | |

| Sensata Technologies BV 4% 4/15/29 (d) | | 5,910 | 5,999 |

| Machinery - 0.0% | | | |

| ATS Automation Tooling System, Inc. 4.125% 12/15/28 (d) | | 4,630 | 4,740 |

| Stevens Holding Co., Inc. 6.125% 10/1/26 (d) | | 1,880 | 2,016 |

| | | | 6,756 |

| Professional Services - 0.1% | | | |

| ASGN, Inc. 4.625% 5/15/28 (d) | | 5,670 | 5,939 |

| Booz Allen Hamilton, Inc.: | | | |

| 3.875% 9/1/28 (d) | | 6,270 | 6,395 |

| 4% 7/1/29 (d) | | 2,820 | 2,883 |

| TriNet Group, Inc. 3.5% 3/1/29 (d) | | 4,545 | 4,481 |

| | | | 19,698 |

| Road & Rail - 0.6% | | | |

| Hertz Corp.: | | | |

| 5.5% 10/15/24 (d)(e) | | 6,540 | 6,573 |

| 6% 1/15/28 (d)(e) | | 5,785 | 6,219 |

| 6.25% 10/15/22 (e) | | 6,775 | 6,809 |

| 7.125% 8/1/26 (d)(e) | | 6,315 | 6,773 |

| Uber Technologies, Inc.: | | | |

| 6.25% 1/15/28 (d) | | 5,520 | 5,941 |

| 7.5% 9/15/27 (d) | | 31,625 | 34,755 |

| 8% 11/1/26 (d) | | 29,170 | 31,431 |

| | | | 98,501 |

| Trading Companies & Distributors - 0.1% | | | |

| Foundation Building Materials, Inc. 6% 3/1/29 (d) | | 3,110 | 3,079 |

| H&E Equipment Services, Inc. 3.875% 12/15/28 (d) | | 10,040 | 9,879 |

| | | | 12,958 |

| TOTAL INDUSTRIALS | | | 602,962 |

| INFORMATION TECHNOLOGY - 1.2% | | | |

| Electronic Equipment & Components - 0.0% | | | |

| TTM Technologies, Inc. 4% 3/1/29 (d) | | 4,540 | 4,568 |

| IT Services - 0.4% | | | |

| Acuris Finance U.S. 5% 5/1/28 (d) | | 4,315 | 4,301 |

| Banff Merger Sub, Inc. 9.75% 9/1/26 (d) | | 5,645 | 5,941 |

| Camelot Finance SA 4.5% 11/1/26 (d) | | 6,365 | 6,659 |

| Gartner, Inc.: | | | |

| 3.625% 6/15/29 (d) | | 4,040 | 4,101 |

| 3.75% 10/1/30 (d) | | 6,920 | 7,080 |

| Go Daddy Operating Co. LLC / GD Finance Co., Inc.: | | | |

| 3.5% 3/1/29 (d) | | 6,060 | 6,021 |

| 5.25% 12/1/27 (d) | | 5,665 | 5,948 |

| Northwest Fiber LLC/Northwest Fiber Finance Sub, Inc.: | | | |

| 6% 2/15/28 (d) | | 2,355 | 2,360 |

| 10.75% 6/1/28 (d) | | 3,695 | 4,157 |

| Rackspace Hosting, Inc. 5.375% 12/1/28 (d) | | 3,845 | 3,941 |

| Square, Inc.: | | | |

| 2.75% 6/1/26 (d) | | 4,310 | 4,385 |

| 3.5% 6/1/31 (d) | | 5,745 | 5,795 |

| Unisys Corp. 6.875% 11/1/27 (d) | | 3,685 | 4,027 |

| | | | 64,716 |

| Semiconductors & Semiconductor Equipment - 0.1% | | | |

| ON Semiconductor Corp. 3.875% 9/1/28 (d) | | 6,765 | 6,969 |

| Synaptics, Inc. 4% 6/15/29 (d) | | 3,500 | 3,518 |

| | | | 10,487 |

| Software - 0.5% | | | |

| Ascend Learning LLC: | | | |

| 6.875% 8/1/25 (d) | | 7,330 | 7,467 |

| 6.875% 8/1/25 (d) | | 2,480 | 2,527 |

| Black Knight InfoServ LLC 3.625% 9/1/28 (d) | | 6,975 | 6,940 |

| Clarivate Science Holdings Corp.: | | | |

| 3.875% 6/30/28 (d) | | 5,025 | 5,071 |

| 4.875% 6/30/29 (d) | | 4,755 | 4,880 |

| Elastic NV 0% 6/30/29 (d) | | 3,755 | 3,755 |

| Fair Isaac Corp. 4% 6/15/28 (d) | | 6,420 | 6,636 |

| ION Trading Technologies Ltd. 5.75% 5/15/28 (d) | | 5,780 | 6,001 |

| MicroStrategy, Inc. 6.125% 6/15/28 (d) | | 5,200 | 5,200 |

| NortonLifeLock, Inc. 5% 4/15/25 (d) | | 6,360 | 6,449 |

| Open Text Corp.: | | | |

| 3.875% 2/15/28 (d) | | 3,220 | 3,264 |

| 5.875% 6/1/26 (d) | | 6,000 | 6,211 |

| Open Text Holdings, Inc. 4.125% 2/15/30 (d) | | 3,220 | 3,284 |

| PTC, Inc.: | | | |

| 3.625% 2/15/25 (d) | | 3,755 | 3,868 |

| 4% 2/15/28 (d) | | 3,715 | 3,838 |

| Veritas U.S., Inc./Veritas Bermuda Ltd. 7.5% 9/1/25 (d) | | 11,835 | 12,323 |

| | | | 87,714 |

| Technology Hardware, Storage & Peripherals - 0.2% | | | |

| NCR Corp.: | | | |

| 5% 10/1/28 (d) | | 3,385 | 3,500 |

| 5.25% 10/1/30 (d) | | 13,370 | 13,871 |

| 5.75% 9/1/27 (d) | | 5,480 | 5,799 |

| 6.125% 9/1/29 (d) | | 5,480 | 5,973 |

| 8.125% 4/15/25 (d) | | 2,910 | 3,182 |

| | | | 32,325 |

| TOTAL INFORMATION TECHNOLOGY | | | 199,810 |

| MATERIALS - 2.6% | | | |

| Chemicals - 1.2% | | | |

| CF Industries Holdings, Inc.: | | | |

| 4.95% 6/1/43 | | 29,598 | 34,987 |

| 5.15% 3/15/34 | | 7,243 | 8,764 |

| 5.375% 3/15/44 | | 22,914 | 28,395 |

| Consolidated Energy Finance SA: | | | |

| 3 month U.S. LIBOR + 3.750% 3.8689% 6/15/22 (d)(f)(h) | | 1,820 | 1,800 |

| 6.5% 5/15/26 (d) | | 31,160 | 31,966 |

| 6.875% 6/15/25 (d) | | 6,400 | 6,519 |

| Ingevity Corp. 3.875% 11/1/28 (d) | | 6,715 | 6,665 |

| Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc.: | | | |

| 5% 12/31/26 (d) | | 2,100 | 2,132 |

| 7% 12/31/27 (d) | | 6,250 | 6,264 |

| LSB Industries, Inc. 9.625% 5/1/23 (d) | | 3,600 | 3,690 |

| Neon Holdings, Inc. 10.125% 4/1/26 (d) | | 8,860 | 9,657 |

| OCI NV 5.25% 11/1/24 (d) | | 9,240 | 9,524 |

| SCIH Salt Holdings, Inc. 4.875% 5/1/28 (d) | | 8,705 | 8,704 |

| The Chemours Co. LLC: | | | |

| 5.375% 5/15/27 | | 18,470 | 20,032 |

| 5.75% 11/15/28 (d) | | 10,075 | 10,778 |

| The Scotts Miracle-Gro Co. 4% 4/1/31 (d) | | 5,930 | 5,911 |

| Tronox, Inc. 6.5% 5/1/25 (d) | | 5,410 | 5,725 |

| Valvoline, Inc. 4.25% 2/15/30 (d) | | 4,680 | 4,832 |

| | | | 206,345 |

| Construction Materials - 0.1% | | | |

| Summit Materials LLC/Summit Materials Finance Corp.: | | | |

| 5.125% 6/1/25 (d) | | 3,060 | 3,085 |

| 5.25% 1/15/29 (d) | | 6,525 | 6,932 |

| U.S. Concrete, Inc. 5.125% 3/1/29 (d) | | 5,035 | 5,501 |

| | | | 15,518 |

| Containers & Packaging - 0.4% | | | |

| ARD Finance SA 6.5% 6/30/27 pay-in-kind (d)(f) | | 6,625 | 6,956 |

| Ardagh Metal Packaging Finance U.S.A. LLC/Ardagh Metal Packaging Finance PLC: | | | |

| 3.25% 9/1/28 (d) | | 3,025 | 3,016 |

| 4% 9/1/29 (d) | | 6,050 | 5,999 |

| Cascades, Inc.: | | | |

| 5.125% 1/15/26 (d) | | 3,310 | 3,525 |

| 5.375% 1/15/28 (d) | | 3,310 | 3,480 |

| Crown Cork & Seal, Inc.: | | | |

| 7.375% 12/15/26 | | 16,535 | 20,255 |

| 7.5% 12/15/96 | | 7,695 | 8,662 |

| Graham Packaging Co., Inc. 7.125% 8/15/28 (d) | | 3,720 | 4,008 |

| Intelligent Packaging Ltd. Finco, Inc. 6% 9/15/28 (d) | | 2,570 | 2,673 |

| Intertape Polymer Group, Inc. 4.375% 6/15/29 (d) | | 4,310 | 4,371 |

| Trivium Packaging Finance BV 5.5% 8/15/26 (d) | | 4,195 | 4,408 |

| | | | 67,353 |

| Metals & Mining - 0.9% | | | |

| Alcoa Nederland Holding BV: | | | |

| 4.125% 3/31/29 (d) | | 7,735 | 8,054 |

| 6.125% 5/15/28 (d) | | 2,110 | 2,309 |

| 7% 9/30/26 (d) | | 4,430 | 4,629 |

| Algoma Steel SCA 0% 12/31/23 (c) | | 1,518 | 1,275 |

| Arconic Corp.: | | | |

| 6% 5/15/25 (d) | | 4,090 | 4,359 |

| 6.125% 2/15/28 (d) | | 9,123 | 9,786 |

| Cleveland-Cliffs, Inc.: | | | |

| 4.625% 3/1/29 (d) | | 4,615 | 4,856 |

| 4.875% 3/1/31 (d) | | 4,615 | 4,846 |

| 5.875% 6/1/27 | | 11,010 | 11,574 |

| Compass Minerals International, Inc. 6.75% 12/1/27 (d) | | 9,315 | 10,014 |

| First Quantum Minerals Ltd.: | | | |

| 6.5% 3/1/24 (d) | | 6,560 | 6,691 |

| 6.875% 3/1/26 (d) | | 14,330 | 15,018 |

| 7.25% 4/1/23 (d) | | 1,985 | 2,020 |

| 7.5% 4/1/25 (d) | | 12,105 | 12,544 |

| FMG Resources (August 2006) Pty Ltd.: | | | |

| 4.375% 4/1/31 (d) | | 4,420 | 4,718 |

| 4.5% 9/15/27 (d) | | 5,450 | 5,927 |

| HudBay Minerals, Inc. 4.5% 4/1/26 (d) | | 3,600 | 3,605 |

| Infrabuild Australia Pty Ltd. 12% 10/1/24 (d) | | 6,320 | 6,676 |

| Kaiser Aluminum Corp. 4.625% 3/1/28 (d) | | 6,615 | 6,834 |

| Mineral Resources Ltd. 8.125% 5/1/27 (d) | | 11,025 | 12,114 |

| Murray Energy Corp.: | | | |

| 11.25% 12/31/49 (c)(d)(e) | | 5,925 | 0 |

| 12% 4/15/24 pay-in-kind (c)(d)(e)(f) | | 6,364 | 0 |

| United States Steel Corp. 6.25% 3/15/26 | | 7,180 | 7,420 |

| | | | 145,269 |

| TOTAL MATERIALS | | | 434,485 |

| REAL ESTATE - 1.3% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.9% | | | |

| Iron Mountain, Inc.: | | | |

| 4.875% 9/15/29 (d) | | 14,590 | 15,060 |

| 5% 7/15/28 (d) | | 6,370 | 6,612 |

| 5.25% 7/15/30 (d) | | 5,915 | 6,262 |

| 5.625% 7/15/32 (d) | | 5,915 | 6,331 |

| MGM Growth Properties Operating Partnership LP 3.875% 2/15/29 (d) | | 6,695 | 6,799 |

| MPT Operating Partnership LP/MPT Finance Corp.: | | | |

| 3.5% 3/15/31 | | 6,700 | 6,767 |

| 4.625% 8/1/29 | | 10,950 | 11,722 |

| 5% 10/15/27 | | 15,435 | 16,330 |

| SBA Communications Corp. 3.875% 2/15/27 | | 9,720 | 9,982 |

| The GEO Group, Inc.: | | | |

| 5.125% 4/1/23 | | 7,555 | 7,177 |

| 5.875% 10/15/24 | | 8,575 | 7,675 |

| 6% 4/15/26 | | 5,755 | 4,662 |

| Uniti Group LP / Uniti Group Finance, Inc. 6.5% 2/15/29 (d) | | 11,420 | 11,449 |

| Uniti Group, Inc. 7.875% 2/15/25 (d) | | 9,940 | 10,648 |

| VICI Properties, Inc.: | | | |

| 4.25% 12/1/26 (d) | | 12,650 | 13,159 |

| 4.625% 12/1/29 (d) | | 7,220 | 7,671 |

| | | | 148,306 |

| Real Estate Management & Development - 0.4% | | | |

| DTZ U.S. Borrower LLC 6.75% 5/15/28 (d) | | 6,575 | 7,091 |

| Realogy Group LLC/Realogy Co-Issuer Corp.: | | | |

| 5.75% 1/15/29 (d) | | 8,505 | 8,891 |

| 7.625% 6/15/25 (d) | | 20,305 | 22,025 |

| Taylor Morrison Communities, Inc./Monarch Communities, Inc.: | | | |

| 5.125% 8/1/30 (d) | | 6,480 | 7,024 |

| 5.875% 6/15/27 (d) | | 5,610 | 6,346 |

| Vonovia SE 1.5% 6/14/41 (Reg. S) | EUR | 7,200 | 8,613 |

| Weekley Homes LLC/Weekley Finance Corp. 4.875% 9/15/28 (d) | | 3,045 | 3,152 |

| | | | 63,142 |

| TOTAL REAL ESTATE | | | 211,448 |

| UTILITIES - 1.5% | | | |

| Electric Utilities - 1.2% | | | |

| Clearway Energy Operating LLC 4.75% 3/15/28 (d) | | 4,055 | 4,253 |

| NextEra Energy Partners LP 4.25% 9/15/24 (d) | | 258 | 272 |

| NRG Energy, Inc.: | | | |

| 3.375% 2/15/29 (d) | | 3,080 | 3,015 |

| 3.625% 2/15/31 (d) | | 6,110 | 6,004 |

| 5.75% 1/15/28 | | 20,240 | 21,556 |

| Pacific Gas & Electric Co.: | | | |

| 3.75% 8/15/42 | | 6,290 | 5,723 |

| 3.95% 12/1/47 | | 13,510 | 12,565 |

| 4% 12/1/46 | | 14,690 | 13,749 |

| 4.25% 3/15/46 | | 1,475 | 1,402 |

| 4.3% 3/15/45 | | 3,690 | 3,541 |

| 4.55% 7/1/30 | | 49,355 | 52,788 |

| PG&E Corp.: | | | |

| 5% 7/1/28 | | 13,615 | 13,766 |

| 5.25% 7/1/30 | | 5,150 | 5,199 |

| Vistra Operations Co. LLC: | | | |

| 4.375% 5/1/29 (d) | | 11,110 | 11,166 |

| 5% 7/31/27 (d) | | 13,800 | 14,167 |

| 5.5% 9/1/26 (d) | | 9,975 | 10,287 |

| 5.625% 2/15/27 (d) | | 17,455 | 18,110 |

| | | | 197,563 |

| Gas Utilities - 0.3% | | | |

| Southern Natural Gas Co. LLC: | | | |

| 7.35% 2/15/31 | | 14,890 | 19,953 |

| 8% 3/1/32 | | 9,400 | 13,415 |

| Suburban Propane Partners LP/Suburban Energy Finance Corp. 5% 6/1/31 (d) | | 5,750 | 5,887 |

| | | | 39,255 |

| Independent Power and Renewable Electricity Producers - 0.0% | | | |

| Atlantica Sustainable Infrastructure PLC 4.125% 6/15/28 (d) | | 3,735 | 3,805 |

| TOTAL UTILITIES | | | 240,623 |

|

| TOTAL NONCONVERTIBLE BONDS | | | 4,908,920 |

|

| TOTAL CORPORATE BONDS | | | |

| (Cost $4,557,856) | | | 4,923,547 |

|

| U.S. Government and Government Agency Obligations - 19.4% | | | |

| U.S. Government Agency Obligations - 0.1% | | | |

| Fannie Mae 0.625% 4/22/25 | | 2,128 | 2,125 |

| Tennessee Valley Authority: | | | |

| 5.25% 9/15/39 | | $2,106 | $3,014 |

| 5.375% 4/1/56 | | 3,503 | 5,642 |

|

| TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | | | 10,781 |

|

| U.S. Treasury Obligations - 19.2% | | | |

| U.S. Treasury Bonds: | | | |

| 2.375% 5/15/51 | | 192,158 | 205,159 |

| 2.5% 2/15/45 (i)(j)(k) | | 216,056 | 233,762 |

| 3% 5/15/45 | | 20,100 | 23,704 |

| 3% 2/15/49 | | 145,860 | 174,627 |

| 4.75% 2/15/37 (i)(j) | | 74,200 | 105,329 |

| 5.25% 2/15/29 (i) | | 5,406 | 6,972 |

| 6.125% 8/15/29 (i) | | 3,663 | 5,035 |

| U.S. Treasury Notes: | | | |

| 0.125% 5/31/22 | | 59,623 | 59,642 |

| 0.125% 6/30/22 | | 46,344 | 46,355 |

| 0.125% 8/31/22 | | 82,000 | 82,003 |

| 0.125% 10/31/22 | | 55,500 | 55,476 |

| 0.125% 11/30/22 | | 35,000 | 34,977 |

| 0.125% 12/31/22 | | 33,500 | 33,471 |

| 0.125% 2/28/23 | | 89,000 | 88,889 |

| 0.125% 3/31/23 | | 30,000 | 29,954 |

| 0.125% 5/31/23 | | 38,200 | 38,118 |

| 0.125% 8/15/23 | | 2,411 | 2,404 |

| 0.125% 10/15/23 | | 2,852 | 2,840 |

| 0.25% 5/15/24 | | 470 | 467 |

| 0.25% 7/31/25 | | 35,866 | 35,188 |

| 0.25% 9/30/25 | | 26,037 | 25,489 |

| 0.25% 10/31/25 | | 17,600 | 17,207 |

| 0.375% 3/31/22 | | 92,800 | 93,003 |

| 0.375% 4/30/25 | | 82,771 | 81,882 |

| 0.375% 12/31/25 | | 167,057 | 163,892 |

| 0.375% 1/31/26 | | 13,900 | 13,621 |

| 0.75% 3/31/26 | | 46,052 | 45,845 |

| 1.25% 6/30/28 | | 490,830 | 491,597 |

| 1.375% 8/31/23 | | 11,000 | 11,260 |

| 1.5% 8/31/21 | | 22,000 | 22,053 |

| 1.5% 9/30/21 | | 25,180 | 25,270 |

| 1.5% 10/31/24 | | 480 | 495 |

| 1.5% 1/31/27 | | 34,389 | 35,352 |

| 1.625% 11/15/22 | | 14,901 | 15,201 |

| 1.625% 5/31/23 | | 19,717 | 20,238 |

| 1.625% 9/30/26 | | 3,093 | 3,205 |

| 1.625% 5/15/31 (l) | | 162,726 | 165,218 |

| 1.75% 7/31/21 | | 9,325 | 9,338 |

| 1.875% 7/31/22 | | 43,433 | 44,261 |

| 2.125% 3/31/24 | | 56,643 | 59,303 |

| 2.125% 7/31/24 | | 118,408 | 124,365 |

| 2.125% 5/15/25 (m) | | 12,033 | 12,706 |

| 2.25% 7/31/21 | | 52,019 | 52,114 |

| 2.25% 4/30/24 | | 24,428 | 25,680 |

| 2.25% 3/31/26 | | 34,717 | 37,001 |

| 2.5% 1/15/22 | | 136,816 | 138,612 |

| 2.5% 2/28/26 | | 38,997 | 41,989 |

| 2.625% 12/31/23 | | 56,283 | 59,469 |

| 2.75% 6/30/25 | | 197 | 213 |

| 3.125% 11/15/28 | | 31,330 | 35,443 |

|

| TOTAL U.S. TREASURY OBLIGATIONS | | | 3,135,694 |

|

| Other Government Related - 0.1% | | | |

| Private Export Funding Corp. Secured 1.75% 11/15/24 | | 11,520 | 11,920 |

| TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS | | | |

| (Cost $3,039,532) | | | 3,158,395 |

|

| U.S. Government Agency - Mortgage Securities - 1.8% | | | |

| Ginnie Mae - 1.5% | | | |

| 2.5% 7/1/51 (g) | | 18,400 | 19,042 |

| 3% 7/1/51 (g) | | 8,200 | 8,554 |

| 3% 7/1/51 (g) | | 25,900 | 27,019 |

| 3% 7/1/51 (g) | | 13,450 | 14,031 |

| 3% 7/1/51 (g) | | 13,425 | 14,005 |

| 3% 7/1/51 (g) | | 11,025 | 11,502 |

| 3.5% 7/1/51 (g) | | 4,200 | 4,411 |

| 3.5% 7/1/51 (g) | | 11,550 | 12,131 |

| 3.5% 7/1/51 (g) | | 13,900 | 14,600 |

| 3.5% 7/1/51 (g) | | 21,950 | 23,055 |

| 3.5% 7/1/51 (g) | | 19,750 | 20,744 |

| 3.5% 7/1/51 (g) | | 11,750 | 12,342 |

| 3.5% 7/1/51 (g) | | 1,850 | 1,943 |

| 3.5% 7/1/51 (g) | | 3,600 | 3,781 |

| 3.5% 7/1/51 (g) | | 12,150 | 12,762 |

| 3.5% 7/1/51 (g) | | 4,050 | 4,254 |

| 3.5% 7/1/51 (g) | | 8,100 | 8,508 |

| 3.5% 7/1/51 (g) | | 4,050 | 4,254 |

| 3.5% 7/1/51 (g) | | 8,100 | 8,508 |

| 3.5% 8/1/51 (g) | | 1,400 | 1,471 |

| 3.5% 8/1/51 (g) | | 2,300 | 2,417 |

| 3.5% 8/1/51 (g) | | 4,350 | 4,571 |

| 3.5% 8/1/51 (g) | | 7,200 | 7,566 |

| 3.5% 8/1/51 (g) | | 8,800 | 9,248 |

|

| TOTAL GINNIE MAE | | | 250,719 |

|

| Uniform Mortgage Backed Securities - 0.3% | | | |

| 2.5% 7/1/51 (g) | | 18,400 | 19,031 |

| 2.5% 7/1/51 (g) | | 6,650 | 6,878 |

| 2.5% 8/1/51 (g) | | 6,650 | 6,865 |

| 3.5% 7/1/51 (g) | | 11,400 | 11,998 |

| 3.5% 8/1/51 (g) | | 1,350 | 1,422 |

| 3.5% 8/1/51 (g) | | 1,850 | 1,948 |

|

| TOTAL UNIFORM MORTGAGE BACKED SECURITIES | | | 48,142 |

|

| TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES | | | |

| (Cost $299,041) | | | 298,861 |

|

| Commercial Mortgage Securities - 0.7% | | | |

Freddie Mac floater:

(Cost $109,725) | | $ | $ |

| Series 2021-F108 Class A/S, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 0.250% 0.26% 2/25/31 (f)(h) | | 19,100 | 19,117 |

| Series 2021-F109 Class A/S, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 0.240% 0.2593% 3/25/31 (f)(h) | | 16,500 | 16,511 |

| Series 2021-F110 Class A/S, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 0.240% 0.2593% 3/25/31 (f)(h) | | 18,900 | 18,913 |

| Series 2021-F111 Class A/S, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 0.240% 0.2593% 3/25/31 (f)(h) | | 23,500 | 23,516 |

| Series 2021-F112 Class A/S, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 0.250% 0.2493% 4/25/31 (f)(h) | | 15,800 | 15,845 |

| Series 2021-F113 Class A/S, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Indx + 0.220% 0.24% 5/25/28 (f)(h) | | 15,925 | 15,967 |

| TOTAL COMMERCIAL MORTGAGE SECURITIES | | | |

| (Cost $109,725) | | | 109,869 |

|

| Foreign Government and Government Agency Obligations - 8.3% | | | |

| Buoni del Tesoro Poliennali: | | | |

| 0.6% 8/1/31 (Reg. S) (d) | EUR | 45,000 | 52,224 |

| 0.95% 12/1/31 (Reg. S) (d) | EUR | 78,586 | 93,965 |

| Canadian Government: | | | |

| 0.25% 11/1/22 | CAD | 127,490 | 102,700 |

| 1.5% 6/1/31 | CAD | 65,900 | 53,429 |

| 2% 12/1/51 | CAD | 12,000 | 10,035 |

| Dutch Government 0% 7/15/30 (Reg. S) (d) | EUR | 84,520 | 101,822 |

| German Federal Republic: | | | |

| 0% 9/16/22 (Reg. S) | EUR | 295,110 | 352,815 |

| 0% 4/10/26 (Reg. S) | EUR | 55,000 | 67,076 |

| 0% 2/15/31 (Reg. S) | EUR | 17,330 | 21,051 |

| 0% 8/15/50 | EUR | 60,087 | 65,492 |

| Israeli State (guaranteed by U.S. Government through Agency for International Development): | | | |

| 5.5% 9/18/23 | | 54,954 | 61,157 |

| 5.5% 12/4/23 | | 19,812 | 22,111 |

| Japan Government: | | | |

| 0.1% 9/20/29 | JPY | 7,655,450 | 69,570 |

| 0.1% 12/20/30 | JPY | 8,544,650 | 77,309 |

| 0.4% 3/20/56 | JPY | 4,039,750 | 32,671 |

| Spanish Kingdom: | | | |

| 0.5% 10/31/31 (Reg. S) (d) | EUR | 17,636 | 20,939 |

| 1% 10/31/50 (Reg. S) (d) | EUR | 15,000 | 16,060 |

| Ukraine Government 1.471% 9/29/21 | | 6,753 | 6,774 |

| United Kingdom, Great Britain and Northern Ireland: | | | |

| 0.375% 10/22/30 (Reg. S) | GBP | 50,000 | 66,813 |

| 0.625% 10/22/50 (Reg. S) | GBP | 49,000 | 57,594 |

| TOTAL FOREIGN GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS | | | |

| (Cost $1,353,584) | | | 1,351,607 |

|

| Supranational Obligations - 0.1% | | | |

European Union 0.7% 7/6/51 (Reg. S)

(Cost $21,129) | EUR | 17,908 | 21,471 |

| | | Shares | Value (000s) |

|

| Common Stocks - 6.0% | | | |

| COMMUNICATION SERVICES - 0.6% | | | |

| Entertainment - 0.0% | | | |

| New Cotai LLC/New Cotai Capital Corp. (b)(c) | | 2,242,893 | 7,110 |

| Interactive Media & Services - 0.3% | | | |

| Alphabet, Inc. Class A (n) | | 5,100 | 12,453 |

| Facebook, Inc. Class A (n) | | 77,900 | 27,087 |

| Tencent Holdings Ltd. sponsored ADR | | 120,900 | 9,104 |

| | | | 48,644 |

| Media - 0.2% | | | |

| Altice U.S.A., Inc. Class A (n) | | 404,800 | 13,820 |

| iHeartMedia, Inc. (n) | | 26 | 1 |

| Nexstar Broadcasting Group, Inc. Class A | | 115,000 | 17,006 |

| | | | 30,827 |

| Wireless Telecommunication Services - 0.1% | | | |

| T-Mobile U.S., Inc. | | 79,900 | 11,572 |

|

| TOTAL COMMUNICATION SERVICES | | | 98,153 |

|

| CONSUMER DISCRETIONARY - 0.8% | | | |

| Auto Components - 0.0% | | | |

| Exide Technologies (c) | | 280 | 182 |

| Exide Technologies (c)(n) | | 7,093 | 7 |

| Exide Technologies (c)(n) | | 418,807 | 0 |

| UC Holdings, Inc. (c)(n) | | 560,355 | 6,399 |

| | | | 6,588 |

| Hotels, Restaurants & Leisure - 0.4% | | | |

| Boyd Gaming Corp. (n) | | 229,500 | 14,112 |

| Caesars Entertainment, Inc. (n) | | 290,400 | 30,129 |

| Penn National Gaming, Inc. (n) | | 183,906 | 14,067 |

| Studio City International Holdings Ltd. ADR (n) | | 133,400 | 1,537 |

| | | | 59,845 |

| Household Durables - 0.2% | | | |

| Tempur Sealy International, Inc. | | 555,048 | 21,752 |

| Whirlpool Corp. | | 45,100 | 9,833 |

| | | | 31,585 |

| Internet & Direct Marketing Retail - 0.1% | | | |

| Alibaba Group Holding Ltd. sponsored ADR (n) | | 40,500 | 9,185 |

| Amazon.com, Inc. (n) | | 4,100 | 14,105 |

| | | | 23,290 |

| Specialty Retail - 0.1% | | | |

| Lowe's Companies, Inc. | | 72,800 | 14,121 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 135,429 |

|

| CONSUMER STAPLES - 0.3% | | | |

| Food & Staples Retailing - 0.1% | | | |

| Southeastern Grocers, Inc. (b)(c)(n) | | 584,047 | 10,863 |

| Food Products - 0.2% | | | |

| Darling Ingredients, Inc. (n) | | 202,700 | 13,682 |

| JBS SA | | 3,785,700 | 22,149 |

| Reddy Ice Holdings, Inc. (c)(n) | | 133,255 | 7 |

| Reddy Ice Holdings, Inc. (c)(n) | | 331,236 | 0 |

| | | | 35,838 |

|

| TOTAL CONSUMER STAPLES | | | 46,701 |

|

| ENERGY - 1.3% | | | |

| Energy Equipment & Services - 0.1% | | | |

| Diamond Offshore Drilling, Inc. (c)(n) | | 66,694 | 341 |

| Forbes Energy Services Ltd. (n) | | 135,187 | 9 |

| Jonah Energy Parent LLC (c) | | 183,159 | 8,574 |

| Superior Energy Services, Inc. Class A (c) | | 66,115 | 1,693 |

| | | | 10,617 |

| Oil, Gas & Consumable Fuels - 1.2% | | | |

| California Resources Corp. (n) | | 1,717,974 | 51,780 |

| California Resources Corp. warrants 10/27/24 (n) | | 34,633 | 266 |

| Chaparral Energy, Inc.: | | | |

| Series A warrants 10/1/24 (c)(n) | | 289 | 0 |

| Series B warrants 10/1/25 (c)(n) | | 289 | 0 |

| Cheniere Energy, Inc. (n) | | 89,200 | 7,737 |

| Chesapeake Energy Corp. | | 611,478 | 31,748 |

| Chesapeake Energy Corp. (b) | | 15,902 | 826 |

| Chesapeake Energy Corp.: | | | |

| warrants 2/9/26 (n) | | 70,147 | 1,886 |

| warrants 2/9/26 (n) | | 77,942 | 1,857 |

| warrants 2/9/26 (n) | | 48,655 | 1,015 |

| Denbury, Inc. (n) | | 212,935 | 16,349 |

| Denbury, Inc. warrants 9/18/25 (n) | | 288,114 | 13,368 |

| EP Energy Corp. (c) | | 611,545 | 56,959 |

| Extraction Oil & Gas, Inc. (n) | | 30,558 | 1,678 |

| Mesquite Energy, Inc. (c) | | 185,122 | 6,705 |

| Unit Corp. (n) | | 26,886 | 453 |

| Whiting Petroleum Corp. (n) | | 77,283 | 4,216 |

| | | | 196,843 |

|

| TOTAL ENERGY | | | 207,460 |

|

| FINANCIALS - 0.2% | | | |

| Capital Markets - 0.0% | | | |

| Penson Worldwide, Inc. Class A (c)(n) | | 7,403,098 | 0 |

| Consumer Finance - 0.1% | | | |

| OneMain Holdings, Inc. | | 313,800 | 18,800 |

| Diversified Financial Services - 0.0% | | | |

| Axis Energy Services, LLC Class A (c) | | 8,127 | 3 |

| Insurance - 0.1% | | | |

| Arthur J. Gallagher & Co. | | 67,600 | 9,469 |

|

| TOTAL FINANCIALS | | | 28,272 |

|

| HEALTH CARE - 0.6% | | | |

| Biotechnology - 0.0% | | | |

| Regeneron Pharmaceuticals, Inc. (n) | | 900 | 503 |

| Health Care Providers & Services - 0.3% | | | |

| HCA Holdings, Inc. | | 84,900 | 17,552 |

| Humana, Inc. | | 31,400 | 13,901 |

| Rotech Healthcare, Inc. (c)(n) | | 129,242 | 1,345 |

| UnitedHealth Group, Inc. | | 43,000 | 17,219 |

| | | | 50,017 |

| Life Sciences Tools & Services - 0.3% | | | |

| Charles River Laboratories International, Inc. (n) | | 37,800 | 13,983 |

| IQVIA Holdings, Inc. (n) | | 73,200 | 17,738 |

| Thermo Fisher Scientific, Inc. | | 32,800 | 16,547 |

| | | | 48,268 |

|

| TOTAL HEALTH CARE | | | 98,788 |

|

| INDUSTRIALS - 0.4% | | | |

| Air Freight & Logistics - 0.1% | | | |

| XPO Logistics, Inc. (n) | | 83,900 | 11,737 |

| Airlines - 0.0% | | | |

| Air Canada (n) | | 182,000 | 3,744 |

| Building Products - 0.1% | | | |

| Carrier Global Corp. | | 384,800 | 18,701 |

| Commercial Services & Supplies - 0.0% | | | |

| Novus Holdings Ltd. (n) | | 48,111 | 9 |

| Electrical Equipment - 0.0% | | | |

| Array Technologies, Inc. | | 500 | 8 |

| Machinery - 0.0% | | | |

| Allison Transmission Holdings, Inc. | | 126,600 | 5,031 |

| Marine - 0.0% | | | |

| U.S. Shipping Partners Corp. (c)(n) | | 22,876 | 0 |

| U.S. Shipping Partners Corp. warrants 12/31/29 (c)(n) | | 214,176 | 0 |

| | | | 0 |

| Professional Services - 0.1% | | | |

| ASGN, Inc. (n) | | 84,800 | 8,220 |

| Trading Companies & Distributors - 0.1% | | | |

| Penhall Acquisition Co.: | | | |

| Class A (c)(n) | | 11,553 | 1,343 |

| Class B (c)(n) | | 3,850 | 448 |

| United Rentals, Inc. (n) | | 33,870 | 10,805 |

| | | | 12,596 |

| Transportation Infrastructure - 0.0% | | | |

| Tricer Holdco SCA: | | | |

| Class A1 (b)(c)(n) | | 403,760 | 0 |

| Class A2 (b)(c)(n) | | 403,760 | 0 |

| Class A3 (b)(c)(n) | | 403,760 | 0 |

| Class A4 (b)(c)(n) | | 403,760 | 0 |

| Class A5 (b)(c)(n) | | 403,760 | 0 |

| Class A6 (b)(c)(n) | | 403,760 | 0 |

| Class A7 (b)(c)(n) | | 403,760 | 0 |

| Class A8 (b)(c)(n) | | 403,760 | 0 |

| Class A9 (b)(c)(n) | | 403,760 | 0 |

| | | | 0 |

|

| TOTAL INDUSTRIALS | | | 60,046 |

|

| INFORMATION TECHNOLOGY - 1.3% | | | |

| Electronic Equipment & Components - 0.1% | | | |

| CDW Corp. | | 51,000 | 8,907 |

| Zebra Technologies Corp. Class A (n) | | 28,000 | 14,826 |

| | | | 23,733 |

| IT Services - 0.4% | | | |

| Global Payments, Inc. | | 102,700 | 19,260 |

| GoDaddy, Inc. (n) | | 95,100 | 8,270 |

| MasterCard, Inc. Class A | | 38,400 | 14,019 |

| PayPal Holdings, Inc. (n) | | 27,300 | 7,957 |

| Visa, Inc. Class A | | 59,200 | 13,842 |

| | | | 63,348 |

| Semiconductors & Semiconductor Equipment - 0.3% | | | |

| Lam Research Corp. | | 32,400 | 21,083 |

| Microchip Technology, Inc. | | 63,700 | 9,538 |

| Micron Technology, Inc. (n) | | 112,500 | 9,560 |

| ON Semiconductor Corp. (n) | | 201,800 | 7,725 |

| | | | 47,906 |

| Software - 0.5% | | | |

| Adobe, Inc. (n) | | 47,400 | 27,759 |

| Microsoft Corp. | | 73,900 | 20,020 |

| Palo Alto Networks, Inc. (n) | | 36,000 | 13,358 |

| SS&C Technologies Holdings, Inc. | | 162,539 | 11,713 |

| | | | 72,850 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 207,837 |

|

| MATERIALS - 0.4% | | | |

| Chemicals - 0.1% | | | |

| CF Industries Holdings, Inc. | | 225,700 | 11,612 |

| The Chemours Co. LLC | | 403,410 | 14,039 |

| | | | 25,651 |

| Containers & Packaging - 0.2% | | | |

| Berry Global Group, Inc. (n) | | 207,500 | 13,533 |

| WestRock Co. | | 234,700 | 12,491 |

| | | | 26,024 |

| Metals & Mining - 0.1% | | | |

| Algoma Steel GP (c)(n) | | 151,792 | 2 |

| Algoma Steel SCA (c)(n) | | 151,792 | 12 |

| Elah Holdings, Inc. (n) | | 517 | 49 |

| First Quantum Minerals Ltd. | | 595,000 | 13,713 |

| | | | 13,776 |

|

| TOTAL MATERIALS | | | 65,451 |

|

| UTILITIES - 0.1% | | | |

| Electric Utilities - 0.1% | | | |

| NRG Energy, Inc. | | 275,800 | 11,115 |

| PG&E Corp. (n) | | 756,168 | 7,690 |

| Portland General Electric Co. | | 13,962 | 643 |

| | | | 19,448 |

| Independent Power and Renewable Electricity Producers - 0.0% | | | |

| Vistra Corp. | | 405,700 | 7,526 |

|

| TOTAL UTILITIES | | | 26,974 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $579,342) | | | 975,111 |

|

| Nonconvertible Preferred Stocks - 0.0% | | | |

| CONSUMER DISCRETIONARY - 0.0% | | | |

| Auto Components - 0.0% | | | |

| Exide Technologies (c) | | 624 | 581 |

| INDUSTRIALS - 0.0% | | | |

| Transportation Infrastructure - 0.0% | | | |

| Tricer Holdco SCA (b)(c)(n) | | 193,792,711 | 65 |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | |

| (Cost $7,489) | | | 646 |

| | | Principal Amount (000s)(a) | Value (000s) |

|

| Bank Loan Obligations - 1.3% | | | |

| COMMUNICATION SERVICES - 0.2% | | | |

| Diversified Telecommunication Services - 0.1% | | | |

| Connect Finco SARL Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 4.5% 12/12/26 (f)(h)(o) | | 5,397 | 5,400 |

| Frontier Communications Corp.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 5/1/28 (f)(h)(o) | | 1,879 | 1,879 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 4/14/28 (f)(h)(o) | | 825 | 825 |

| Securus Technologies Holdings Tranche B, term loan 3 month U.S. LIBOR + 4.500% 5.5% 11/1/24 (f)(h)(o) | | 4,247 | 3,974 |

| Zayo Group Holdings, Inc. 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.1043% 3/9/27 (f)(h)(o) | | 4,347 | 4,298 |

| | | | 16,376 |

| Entertainment - 0.0% | | | |

| Allen Media LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.500% 5.6473% 2/10/27 (f)(h)(o) | | 4,749 | 4,751 |

| Media - 0.1% | | | |

| Nexstar Broadcasting, Inc. Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.5921% 9/19/26 (f)(h)(o) | | 2,338 | 2,332 |

| Univision Communications, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 5/6/28 (f)(h)(o)(p) | | 3,580 | 3,564 |

| | | | 5,896 |

| Wireless Telecommunication Services - 0.0% | | | |

| Intelsat Jackson Holdings SA Tranche DD 1LN, term loan 3 month U.S. LIBOR + 5.500% 6.5% 7/13/22 (f)(h)(o) | | 3,215 | 3,233 |

|

| TOTAL COMMUNICATION SERVICES | | | 30,256 |

|

| CONSUMER DISCRETIONARY - 0.2% | | | |

| Auto Components - 0.0% | | | |

| Midas Intermediate Holdco II LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 6.750% 7.5% 12/16/25 (f)(h)(o) | | 502 | 489 |

| Diversified Consumer Services - 0.1% | | | |

| KUEHG Corp. Tranche B 2LN, term loan 3 month U.S. LIBOR + 8.250% 9.25% 8/22/25 (f)(h)(o) | | 3,640 | 3,595 |

| Sotheby's Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.5% 1/15/27 (f)(h)(o) | | 6,693 | 6,724 |

| | | | 10,319 |

| Hotels, Restaurants & Leisure - 0.0% | | | |

| Travelport Finance Luxembourg SARL 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.2025% 5/29/26 (f)(h)(o) | | 5,683 | 5,175 |

| Specialty Retail - 0.1% | | | |

| Michaels Companies, Inc. 1LN, term loan 3 month U.S. LIBOR + 4.250% 5% 4/15/28 (f)(h)(o) | | 2,710 | 2,720 |

| Wand NewCo 3, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.1043% 2/5/26 (f)(h)(o) | | 11,209 | 11,065 |

| | | | 13,785 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 29,768 |

|

| ENERGY - 0.0% | | | |

| Energy Equipment & Services - 0.0% | | | |

| Forbes Energy Services LLC Tranche B, term loan 0% 12/31/49 (c)(f)(o) | | 1,532 | 0 |

| Oil, Gas & Consumable Fuels - 0.0% | | | |

| Citgo Holding, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 7.000% 8% 8/1/23 (f)(h)(o) | | 835 | 828 |

| Mesquite Energy, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 8.000% 0% (c)(e)(f)(h)(o)(q) | | 3,423 | 0 |

| term loan 3 month U.S. LIBOR + 0.000% 0% (c)(e)(f)(h)(o)(q) | | 1,476 | 0 |

| | | | 828 |

|

| TOTAL ENERGY | | | 828 |

|

| FINANCIALS - 0.1% | | | |

| Capital Markets - 0.0% | | | |

| Citadel Securities LP Tranche B 1LN, term loan 3 month U.S. LIBOR + 2.500% 2.6043% 2/27/28 (f)(h)(o) | | 5,362 | 5,302 |

| Diversified Financial Services - 0.0% | | | |

| New Cotai LLC 1LN, term loan 3 month U.S. LIBOR + 12.000% 14% 9/9/25 (c)(f)(h)(o) | | 652 | 652 |

| Insurance - 0.1% | | | |

| Alliant Holdings Intermediate LLC Tranche B3 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.25% 11/5/27 (f)(h)(o) | | 6,496 | 6,502 |

|

| TOTAL FINANCIALS | | | 12,456 |

|

| HEALTH CARE - 0.2% | | | |

| Health Care Equipment & Supplies - 0.0% | | | |

| CPI Holdco LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8543% 11/4/26 (f)(h)(o) | | 356 | 356 |

| Health Care Providers & Services - 0.2% | | | |

| Gainwell Acquisition Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.75% 10/1/27 (f)(h)(o) | | 9,851 | 9,873 |

| U.S. Renal Care, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 5.000% 5.125% 6/13/26 (f)(h)(o) | | 26,076 | 26,168 |

| | | | 36,041 |

| Pharmaceuticals - 0.0% | | | |

| Valeant Pharmaceuticals International, Inc. Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.1043% 6/1/25 (f)(h)(o) | | 986 | 982 |

|

| TOTAL HEALTH CARE | | | 37,379 |

|

| INDUSTRIALS - 0.2% | | | |

| Air Freight & Logistics - 0.0% | | | |

| Dynasty Acquisition Co., Inc.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6473% 4/8/26 (f)(h)(o) | | 1,529 | 1,488 |

| Tranche B2 1LN, term loan 3 month U.S. LIBOR + 3.500% 3.6473% 4/4/26 (f)(h)(o) | | 822 | 800 |

| | | | 2,288 |

| Airlines - 0.0% | | | |

| SkyMiles IP Ltd. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.75% 10/20/27 (f)(h)(o) | | 2,095 | 2,212 |

| Building Products - 0.1% | | | |

| Acproducts Holdings, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.250% 4.75% 5/17/28 (f)(h)(o) | | 11,460 | 11,395 |

| Commercial Services & Supplies - 0.1% | | | |

| Madison IAQ LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 3.75% 6/15/28 (f)(h)(o) | | 1,420 | 1,420 |

| Sabert Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.500% 5.5% 12/10/26 (f)(h)(o) | | 4,666 | 4,658 |

| | | | 6,078 |

| Construction & Engineering - 0.0% | | | |

| SRS Distribution, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.750% 4.25% 5/20/28 (f)(h)(o) | | 3,095 | 3,092 |

|

| TOTAL INDUSTRIALS | | | 25,065 |

|

| INFORMATION TECHNOLOGY - 0.3% | | | |

| Electronic Equipment & Components - 0.0% | | | |

| DG Investment Intermediate Holdings, Inc.: | | | |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.5% 3/31/28 (f)(h)(o) | | 827 | 829 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 3.750% 4.32% 3/31/28 (f)(h)(o)(r) | | 173 | 174 |

| | | | 1,003 |

| IT Services - 0.1% | | | |

| Acuris Finance U.S., Inc. 1LN, term loan 3 month U.S. LIBOR + 4.000% 4.5% 2/16/28 (f)(h)(o) | | 603 | 604 |

| Camelot Finance SA Tranche B, term loan 3 month U.S. LIBOR + 3.000% 3.1043% 10/31/26 (f)(h)(o) | | 680 | 676 |

| GTT Communications, Inc.: | | | |

| 1LN, term loan 3 month U.S. LIBOR + 5.000% 8.5% 5/31/25 (f)(h)(o) | | 1,041 | 1,049 |

| Tranche B, term loan 3 month U.S. LIBOR + 2.750% 2.9% 5/31/25 (f)(h)(o) | | 15,420 | 12,112 |

| Tranche DD 1LN, term loan 3 month U.S. LIBOR + 5.000% 8.5% 12/31/21 (f)(h)(o) | | 1,281 | 1,292 |

| | | | 15,733 |

| Software - 0.2% | | | |

| Boxer Parent Co., Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.750% 3.8543% 10/2/25 (f)(h)(o) | | 19,208 | 19,088 |

| McAfee LLC Tranche B, term loan 3 month U.S. LIBOR + 3.750% 3.8461% 9/29/24 (f)(h)(o) | | 2,452 | 2,451 |

| Polaris Newco LLC Tranche B 1LN, term loan 1 month U.S. LIBOR + 4.000% 4.5% 6/2/28 (f)(h)(o) | | 3,185 | 3,193 |

| Proofpoint, Inc. Tranche B 1LN, term loan 1 month U.S. LIBOR + 3.250% 6/9/28 (f)(h)(o)(p) | | 3,105 | 3,086 |

| RealPage, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 3.75% 4/24/28 (f)(h)(o) | | 3,105 | 3,094 |

| UKG, Inc.: | | | |

| 2LN, term loan 3 month U.S. LIBOR + 6.750% 7.5% 5/3/27 (f)(h)(o) | | 1,430 | 1,453 |

| Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.250% 4% 5/4/26 (f)(h)(o) | | 6,754 | 6,758 |

| VS Buyer LLC Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.1043% 2/28/27 (f)(h)(o) | | 1,294 | 1,288 |

| | | | 40,411 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 57,147 |

|

| MATERIALS - 0.0% | | | |

| Containers & Packaging - 0.0% | | | |

| Kloeckner Pentaplast of America, Inc. Tranche B 1LN, term loan 3 month U.S. LIBOR + 4.750% 5.25% 2/4/26 (f)(h)(o) | | 798 | 802 |

| UTILITIES - 0.1% | | | |

| Electric Utilities - 0.1% | | | |

| PG&E Corp. Tranche B 1LN, term loan 3 month U.S. LIBOR + 3.000% 3.5% 6/23/25 (f)(h)(o) | | 16,845 | 16,603 |

| TOTAL BANK LOAN OBLIGATIONS | | | |

| (Cost $214,095) | | | 210,304 |

| | | Shares | Value (000s) |

|

| Fixed-Income Funds - 23.7% | | | |

| Fidelity Emerging Markets Debt Central Fund (s) | | 268,759,308 | 2,477,961 |

| Fidelity Floating Rate Central Fund (s) | | 13,698,528 | 1,377,387 |

| Fidelity Mortgage Backed Securities Central Fund (s) | | 194 | 21 |

| TOTAL FIXED-INCOME FUNDS | | | |

| (Cost $3,940,605) | | | 3,855,369 |

| | | Principal Amount (000s)(a) | Value (000s) |

|

| Preferred Securities - 4.3% | | | |

| ENERGY - 0.5% | | | |

| Oil, Gas & Consumable Fuels - 0.5% | | | |

| DCP Midstream Partners LP 7.375% (f)(q) | | 8,965 | 8,815 |

| Energy Transfer LP: | | | |

| 6.25% (f)(q) | | 40,712 | 36,884 |

| 6.625% (f)(q) | | 15,640 | 15,697 |

| MPLX LP 6.875% (f)(q) | | 18,000 | 18,796 |

| Summit Midstream Partners LP 9.5% (f)(q) | | 1,711 | 1,363 |

| Total SA 2.125% (Reg. S) (f)(q) | EUR | 2,922 | 3,440 |

| | | | 84,995 |

| FINANCIALS - 3.8% | | | |

| Banks - 3.4% | | | |

| Bank of America Corp.: | | | |

| 5.2% (f)(q) | | 48,090 | 50,231 |

| 5.875% (f)(q) | | 60,475 | 70,260 |

| 6.25% (f)(q) | | 18,480 | 20,814 |

| Citigroup, Inc.: | | | |

| 4.7% (f)(q) | | 8,755 | 9,205 |

| 5% (f)(q) | | 36,455 | 38,704 |

| 5.9% (f)(q) | | 25,875 | 27,880 |

| 5.95% (f)(q) | | 46,925 | 50,498 |

| 6.3% (f)(q) | | 4,120 | 4,464 |

| Huntington Bancshares, Inc. 5.7% (f)(q) | | 7,660 | 8,040 |

| JPMorgan Chase & Co.: | | | |

| 3 month U.S. LIBOR + 3.320% 3.5216% (f)(h)(q) | | 30,810 | 31,158 |

| 3 month U.S. LIBOR + 3.800% 3.9756% (f)(h)(q) | | 12,280 | 12,389 |

| 4% (f)(q) | | 19,100 | 19,542 |

| 4.6% (f)(q) | | 13,385 | 14,125 |

| 5% (f)(q) | | 18,675 | 20,123 |

| 6% (f)(q) | | 54,840 | 59,665 |

| 6.125%(f)(q) | | 12,865 | 14,076 |

| 6.75% (f)(q) | | 6,270 | 7,128 |

| Wells Fargo & Co.: | | | |

| 5.875% (f)(q) | | 36,775 | 41,279 |

| 5.9% (f)(q) | | 46,445 | 50,164 |

| | | | 549,745 |

| Capital Markets - 0.4% | | | |

| Goldman Sachs Group, Inc.: | | | |

| 4.4% (f)(q) | | 4,530 | 4,766 |

| 4.95% (f)(q) | | 7,885 | 8,580 |

| 5% (f)(q) | | 50,754 | 51,747 |

| | | | 65,093 |

| Diversified Financial Services - 0.0% | | | |

| OEC Finance Ltd. 7.5% pay-in-kind (d)(q) | | 1,027 | 118 |

|

| TOTAL FINANCIALS | | | 614,956 |

|

| TOTAL PREFERRED SECURITIES | | | |

| (Cost $665,452) | | | 699,951 |

| | | Shares | Value (000s) |

|

| Money Market Funds - 6.3% | | | |

| Fidelity Cash Central Fund 0.06% (t) | | 870,990,710 | 871,165 |

| Fidelity Securities Lending Cash Central Fund 0.06% (t)(u) | | 160,176,834 | 160,193 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $1,031,315) | | | 1,031,358 |

| Purchased Swaptions - 0.0% | | | | |

| | | Expiration Date | Notional Amount (000s) | Value (000s) |

| Put Options - 0.0% | | | | |

| Option on an interest rate swap with Goldman Sachs Bank U.S.A. to pay semi-annually a fixed rate of 1.4025% and receive quarterly a floating rate based on 3-month LIBOR, expiring February 2030 | | 2/26/25 | 20,100 | $735 |

| Option on an interest rate swap with JPMorgan Chase Bank N.A. to pay semi-annually a fixed rate of 1.57125% and receive quarterly a floating rate based on 3-month LIBOR, expiring September 2029 | | 9/5/24 | 19,800 | 576 |

|

| TOTAL PUT OPTIONS | | | | 1,311 |

|

| Call Options - 0.0% | | | | |

| Option on an interest rate swap with Goldman Sachs Bank U.S.A. to receive semi-annually a fixed rate of 1.4025% and pay quarterly a floating rate based on 3-month LIBOR, expiring February 2030 | | 2/26/25 | 20,100 | 324 |

| Option on an interest rate swap with JPMorgan Chase Bank N.A. to receive semi-annually a fixed rate of 1.57125% and pay quarterly a floating rate based on 3-month LIBOR, expiring September 2029 | | 9/5/24 | 19,800 | 376 |

|

| TOTAL CALL OPTIONS | | | | 700 |

|

| TOTAL PURCHASED SWAPTIONS | | | | |

| (Cost $2,272) | | | | 2,011 |

| TOTAL INVESTMENT IN SECURITIES - 102.1% | | | | |

| (Cost $15,821,437) | | | | 16,638,500 |

| NET OTHER ASSETS (LIABILITIES) - (2.1)% | | | | (337,247) |

| NET ASSETS - 100% | | | | $16,301,253 |

| TBA Sale Commitments | | |

| | Principal Amount (000s) | Value (000s) |

| Ginnie Mae | | |

| 2.5% 7/1/51 | $(18,400) | $(19,042) |

| 3% 7/1/51 | (36,050) | (37,608) |

| 3% 7/1/51 | (35,950) | (37,504) |

| 3.5% 7/1/51 | (11,400) | (11,975) |

| 3.5% 7/1/51 | (1,400) | (1,470) |

| 3.5% 7/1/51 | (2,300) | (2,416) |

| 3.5% 7/1/51 | (4,350) | (4,569) |

| 3.5% 7/1/51 | (7,200) | (7,562) |

| 3.5% 7/1/51 | (8,800) | (9,243) |

|

| TOTAL GINNIE MAE | | (131,389) |

|

| Uniform Mortgage Backed Securities | | |

| 2.5% 7/1/51 | (6,650) | (6,878) |

| 2.5% 7/1/51 | (6,650) | (6,878) |

| 3.5% 7/1/51 | (1,350) | (1,421) |

| 3.5% 7/1/51 | (1,850) | (1,947) |

|

| TOTAL UNIFORM MORTGAGE BACKED SECURITIES | | (17,124) |

|

| TOTAL TBA SALE COMMITMENTS | | |

| (Proceeds $148,482) | | $(148,513) |

| Futures Contracts | | | | | |

| | Number of contracts | Expiration Date | Notional Amount (000s) | Value (000s) | Unrealized Appreciation/(Depreciation) (000s) |

| Purchased | | | | | |

| Treasury Contracts | | | | | |

| CBOT 10-Year U.S. Treasury Note Contracts (United States) | 1,560 | Sept. 2021 | $206,700 | $1,463 | $1,463 |

| CBOT 2-Year U.S. Treasury Note Contracts (United States) | 976 | Sept. 2021 | 215,033 | (232) | (232) |

| CBOT 5-Year U.S. Treasury Note Contracts (United States) | 349 | Sept. 2021 | 43,077 | (66) | (66) |

| CBOT Long Term U.S. Treasury Bond Contracts (United States) | 22 | Sept. 2021 | 3,537 | 112 | 112 |

| TOTAL FUTURES CONTRACTS | | | | | $1,277 |

The notional amount of futures purchased as a percentage of Net Assets is 2.9%