Exhibit 99.2

Petro-Canada is one of Canada's largest oil and gas companies, operating in both the upstream and the downstream sectors of the industry in Canada and internationally. The Company creates value by responsibly developing energy resources and providing world class petroleum products and services. Petro-Canada is proud to be a National Partner to the Vancouver 2010 Olympic and Paralympic Winter Games. The Company's common shares trade on the Toronto Stock Exchange (TSX) under the symbol PCA and on the New York Stock Exchange (NYSE) under the symbol PCZ. For more information, please visit www.petro-canada.ca.

Table of Contents

Notice of Annual Meeting of Shareholders of Petro-Canada | 1 |

Invitation to Shareholders of Petro-Canada | 2 |

Legal Notice – Forward-Looking Information | 3 |

Management Proxy Circular | 6 |

Questions and Answers on Voting | 6 |

Business of the Meeting | 10 |

Nominees for Election to the Board of Directors | 11 |

Compensation of the Board of Directors | 18 |

Compensation Discussion and Analysis | 22 |

Management Resources and Compensation Committee | 22 |

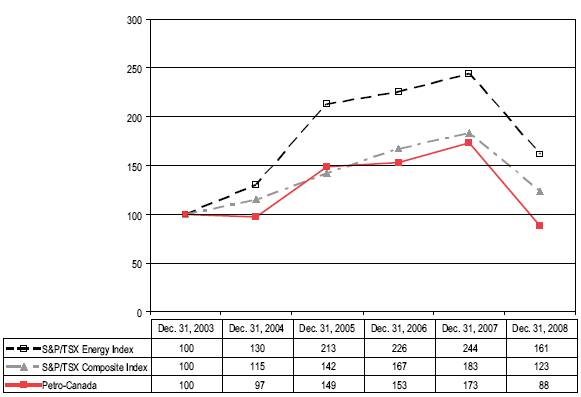

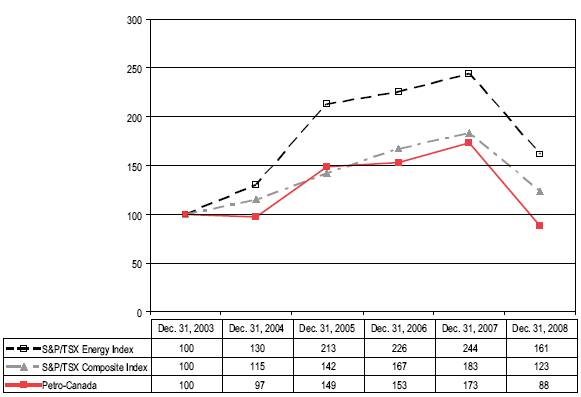

Stock Performance Graph | 35 |

Total Compensation | 36 |

Summary Compensation Table | 36 |

Equity Compensation Plans | 38 |

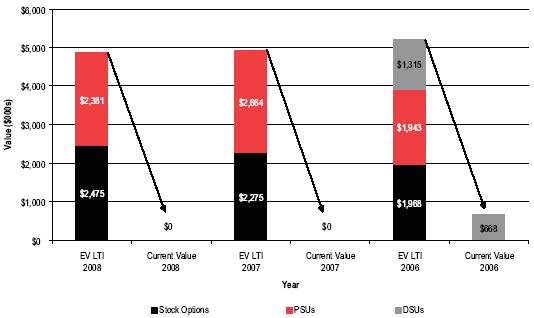

Incentive Plan Awards | 40 |

Pension Plans | 43 |

Contracts Relating to Termination of Employment | 47 |

Indebtedness of Directors and Executive and Senior Officers | 49 |

Directors and Officers Insurance Program | 49 |

Returning Cash to Shareholders | 49 |

Corporate Governance Summary | 50 |

Governance Committee Responsibilities | 50 |

2008 Governance Initiatives | 50 |

Corporate Governance Practices | 51 |

Board Composition and Independence | 51 |

Board Roles and Responsibilities | 52 |

Board Committees | 52 |

Position Descriptions | 54 |

Board Compensation | 54 |

Director Orientation and Continuing Education | 54 |

Director Retirement | 55 |

Performance Evaluation | 55 |

Ethical Business Conduct | 56 |

Other Business | 57 |

Submission Date for 2010 Shareholder Proposals | 57 |

Annual Disclosure Documents | 57 |

Board of Directors Approval | 57 |

Appendix A Board of Directors Mandate | 58 |

Cover design: The Design Centre of Canada; Inside: Platinum Creative Solutions Inc.

This report was printed on paper that is acid-free and recyclable. Inks are based on linseed oil and contain no heavy metals. The printing process was alcohol-free. Volatile organic compounds associated with printing were reduced by 50% to 75% from the levels that would have been produced using traditional inks and processes.

Notice of Annual Meeting of Shareholders of Petro-Canada

The Board of Directors of Petro-Canada (the Company) advises our shareholders of the upcoming Annual Meeting:

| Tuesday, April 28, 2009

11:00 a.m. Calgary time MacLeod D of the Telus Convention Centre 120 – 9 Avenue S.E., Calgary, Alberta | |

At the Annual Meeting, you will:

· receive the Consolidated Financial Statements of the Company for the year ended December 31, 2008, and the auditors’ report on those statements

· elect the Board of Directors of the Company for a term ending at the close of the next Annual Meeting

· appoint auditors of the Company until the close of the next Annual Meeting

· transact other business properly brought before the Annual Meeting

The Management Proxy Circular provides detailed information on the business of the Annual Meeting and forms part of this Notice.

If you were a shareholder at the close of business on February 27, 2009, you are entitled to vote at the Annual Meeting.

Shareholders who cannot attend the Annual Meeting in person, or are attending but prefer the convenience of voting in advance, may vote by Proxy Form. Your deadline for getting the completed Proxy Form to our transfer agent and registrar, CIBC Mellon Trust Company (CIBC Mellon), is 11:00 a.m. Calgary time on Friday, April 24, 2009. If the Annual Meeting is adjourned, the deadline is at least 48 hours (excluding Saturdays, Sundays and holidays) before the adjourned Annual Meeting.

Send your completed Proxy Form to:

CIBC Mellon

600 The Dome Tower

333 – 7 Avenue S.W.,

Calgary, Alberta T2P 2Z1

Hugh L. Hooker

Corporate Secretary

Calgary, Alberta

March 5, 2009

| Management Proxy Circular PETRO-CANADA | 1 |

Invitation to Shareholders of Petro-Canada

Dear Shareholder:

Your invitation

Petro-Canada's Board of Directors, management team and employees invite you to come to our Annual Meeting of Shareholders. It will be held at 11:00 a.m. on Tuesday, April 28, 2009 at the Telus Convention Centre in Calgary. Both the Notice of Meeting and this Management Proxy Circular describe the business to be conducted at the Annual Meeting.

Come and ask questions and meet us

After the formal part of the Annual Meeting, Ron Brenneman, President and Chief Executive Officer of Petro-Canada, will describe the past year's Company highlights. You will also have an opportunity to ask questions and meet the Board of Directors and management team.

Exercise your right to vote

As a shareholder, you may choose to vote either in person or by proxy. No matter which method you choose, we appreciate your participation in the Annual Meeting process. The Annual Meeting is an important forum for our shareholders and we encourage you to use your voting power.

If you cannot attend

We have arranged other options for you to learn about the Annual Meeting if you cannot attend. We will:

· provide live audio coverage of the Annual Meeting at www.petro-canada.ca

· make available online a video recording of the Annual Meeting after its conclusion.

We look forward to seeing you at the Annual Meeting.

Sincerely,

| |

|

Brian F. MacNeill

Chairman of the Board | | Ron A. Brenneman

President and Chief Executive Officer |

2 | PETRO-CANADA Management Proxy Circular |

|

Legal Notice – Forward-Looking Information

This Circular contains forward-looking information. You can usually identify this information by such words as "plan," "anticipate," "forecast," "believe," "target," "intend," "expect," "estimate," "budget" or other terms that suggest future outcomes or references to outlooks. Forward-looking information in this Circular includes references to:

· business strategies and goals · future investment decisions · outlook (including operational updates and strategic milestones) · future capital, exploration and other expenditures · future cash flows · future resource purchases and sales · anticipated construction and repair activities · anticipated turnarounds at refineries and other facilities · anticipated refining margins · future oil and natural gas production levels and the sources of their growth · project development, and expansion schedules and results · future exploration activities and results, and dates by which certain areas may be developed or come on-stream | | · anticipated retail throughputs · anticipated pre-production and operating costs · reserves and resources estimates · future royalties and taxes payable · production life-of-field estimates · natural gas export capacity · future financing and capital activities (including purchases of Petro-Canada common shares under the Company's normal course issuer bid (NCIB) program) · contingent liabilities (including potential exposure to losses related to retail licensee agreements) · the impact and cost of compliance with existing and potential environmental regulations · future regulatory approvals · expected rates of return |

Such forward-looking information is based on a number of assumptions and analysis made by the Company. These assumptions and analysis are described in greater detail throughout this Circular and include, without limitation, assumptions with respect to future commodity prices, the state of the economy, required capital expenditures, levels of cash flow, regulatory requirements, industry capacity, the results of exploration and development drilling and the ability of suppliers to meet commitments.

Undue reliance should not be placed on forward-looking information. Such forward-looking information is subject to known and unknown risks and uncertainties, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. Such risks and uncertainties include, but are not limited to:

· changes in industry capacity · imprecise reserves estimates of recoverable quantities of oil, natural gas and liquids from resource plays, and other sources not currently classified as reserves · the effects of weather and climate conditions · the results of exploration and development drilling, and related activities · the ability of suppliers to meet commitments · decisions or approvals from administrative tribunals · risks associated with domestic and international oil and natural gas operations · changes in general economic, market and business conditions | | · competitive action by other companies · fluctuations in oil and natural gas prices · changes in refining and marketing margins · the ability to produce and transport crude oil and natural gas to markets · fluctuations in interest rates and foreign currency exchange rates · actions by governmental authorities (including changes in taxes, royalty rates and resource-use strategies) · changes in environmental and other regulations · international political events · nature and scope of actions by stakeholders and/or the general public |

Many of these and other similar factors are beyond the control of Petro-Canada. Petro-Canada discusses these factors in greater detail in filings with the Canadian provincial securities commissions and the United States (U.S.) Securities and Exchange Commission (SEC). See also "Risk Management – Risks Relating to Petro-Canada's Business" in the annual report for a discussion of factors that could impact Petro-Canada's operations or results.

Readers are cautioned that this list of important factors affecting forward-looking information is not exhaustive. Furthermore, the forward-looking information in this Circular is made as of March 5, 2009 and, except as required by applicable law, will not be publicly updated or revised. This cautionary statement expressly qualifies the forward-looking information in this Circular.

| Management Proxy Circular PETRO-CANADA | 3 |

Petro-Canada disclosure of reserves

Petro-Canada's qualified reserves evaluators prepare the reserves estimates the Company uses. The Canadian provincial securities commissions do not consider Petro-Canada's reserves staff and management as independent of the Company. Petro-Canada has obtained an exemption from certain Canadian reserves disclosure requirements that allows Petro-Canada to make disclosure in accordance with SEC standards where noted in this Circular. This exemption allows comparisons with U.S. and other international issuers.

As a result, Petro-Canada formally discloses its proved reserves data using U.S. requirements and practices, and these may differ from Canadian domestic standards and practices. The use of the terms such as "probable," "possible," "resources" and "life-of-field production" in this Circular does not meet the SEC guidelines for SEC filings. To disclose reserves in SEC filings, oil and natural gas companies must prove they are economically and legally producible under existing economic and operating conditions. Note that when the term barrels of oil equivalent (boe) is used in this Circular, it may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet (Mcf) to one barrel (bbl) is based on an energy equivalency conversion method. This method primarily applies at the burner tip and does not represent a value equivalency at the wellhead.

The table below describes the industry definitions that Petro-Canada currently uses:

Definitions Petro-Canada uses | | Reference |

Proved oil and natural gas reserves (includes both proved developed and proved undeveloped) | | SEC reserves definition (Accounting Rules Regulation S-X 210.4-10, U.S. Financial Accounting Standards Board (FASB) Statement No. 69)

SEC Guide 7 for Oil Sands Mining |

Unproved reserves, probable and possible reserves | | Canadian Securities Administrators: Canadian Oil and Gas Evaluation (COGE) Handbook, Vol. 1 Section 5 prepared by the Society of Petroleum Evaluation Engineers (SPEE) and the Canadian Institute of Mining Metallurgy and Petroleum (CIM) |

Contingent and Prospective Resources | | Petroleum Resources Management System: Society of Petroleum Engineers, SPEE, World Petroleum Congress and American Association of Petroleum Geologist definitions (approved March 2007)

Canadian Securities Administrators: COGE Handbook Vol. 1 Section 5 |

Although the Society of Petroleum Engineers resource classification has categories of 1C, 2C and 3C for Contingent Resources, and low, best and high estimates for Prospective Resources, Petro-Canada will only refer to the unrisked 2C for Contingent Resources and the partially risked best estimate for Prospective Resources, when referencing resources in this Circular. Estimates of resources in this Circular include Contingent Resources that have not been adjusted for risk based on the chance of development and partially risked Prospective Resources that have been risked for chance of discovery, but have not been risked for chance of development. Such estimates are not estimates of volumes that may be recovered and actual recovery is likely to be less and may be substantially less or zero. If a discovery is made, there is no certainty that it will be developed or, if it is developed, there is no certainty as to the timing of such development.

Canadian Oil Sands represents approximately 68% of Petro-Canada's total for Contingent and Prospective Resources. The balance of Petro-Canada's resources is spread out across the business, most notably in the North American frontier and International areas. Also, when Petro-Canada references resources for the Company, unrisked Contingent Resources are approximately 70% of the Company's total resources and partially risked Prospective Resources are approximately 30% of the Company's total resources.

4 | PETRO-CANADA Management Proxy Circular |

|

Cautionary statement: In the case of discovered resources or a subcategory of discovered resources other than reserves, there is no certainty that it will be commercially viable to produce any portion of the resources. In the case of undiscovered resources or a subcategory of undiscovered resources, there is no certainty that any portion of the resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources.

For movement of resources to reserves categories, all projects must have an economic depletion plan and may require:

· additional delineation drilling and/or new technology for unrisked Contingent Resources

· exploration success with respect to partially risked Prospective Resources

· project sanction and regulatory approvals

Reserves and resources information contained in this Circular is as at December 31, 2008.

| Management Proxy Circular PETRO-CANADA | 5 |

Management Proxy Circular

All information in this Management Proxy Circular (Circular) is as of March 5, 2009, unless otherwise indicated.

Petro-Canada provides this Circular in connection with its solicitation of voting proxies for the Annual Meeting.

QUESTIONS AND ANSWERS ON VOTING

Your vote is very important to Petro-Canada. We encourage you to exercise your right to vote by proxy if:

1) you cannot attend the Annual Meeting, or

2) you plan to attend but prefer the convenience of voting in advance.

The questions and answers below give general guidance for voting your common shares. Unless otherwise noted, all answers relate to both registered and beneficial shareholders.

Am I entitled to vote?

You are entitled to vote if you were a holder of common shares of Petro-Canada as of the close of business on February 27, 2009. Each common share entitles its holder to one vote.

Am I a registered shareholder?

You are a registered shareholder if you hold any common shares of Petro-Canada in your own name. Your common shares are represented by a share certificate.

You can inspect the Company's list of registered shareholders on request after March 9, 2009, between 8:00 a.m. and 4:00 p.m., at the Company's registered office at 150 – 6 Avenue S.W., Calgary, Alberta. This list will also be available at the Annual Meeting.

Am I a beneficial shareholder (also commonly referred to as a non-registered shareholder)?

You are a beneficial shareholder if your common shares are held in an account in the name of a nominee (bank, trust company, securities broker or other nominee). Your common shares are not represented by a share certificate but are recorded on an electronic system.

How do I vote?

The two ways you can vote your shares if you are a registered shareholder are:

1) by voting in person at the Annual Meeting, or

2) by signing and returning the enclosed Proxy Form appointing the named persons or some other person you choose, who need not be a shareholder, to represent you as proxyholder and vote your shares at the Annual Meeting.

If you are a beneficial shareholder, you will have received voting instructions from your nominee.

Should you hold some common shares as a registered shareholder and others as a beneficial shareholder, you will have to use both voting methods described above.

6 | PETRO-CANADA Management Proxy Circular |

|

If I am a beneficial shareholder, can I vote in person at the Annual Meeting?

Yes. To vote in person at the Annual Meeting, print your own name in the space provided on the Voting Instruction Form and return it by following the instructions included. Your vote will be taken at the Annual Meeting. Please register with the Company's transfer agent, CIBC Mellon, when you arrive at the Annual Meeting. Petro-Canada has no access to the names of its beneficial shareholders; if you attend the Annual Meeting without following this procedure, we will have no record of your shareholding or entitlement to vote.

What am I voting on?

You are voting:

· to elect nominees to the Board of Directors (Board) of the Company until the close of the next Annual Meeting, or until their successors are duly elected or appointed; and

· to appoint auditors of the Company until the close of the next Annual Meeting.

What if amendments are made to these matters or if other business matters are brought before the Annual Meeting?

If you attend the Annual Meeting in person, you may vote on the business matters as you choose.

If you have completed and returned a Proxy Form, the persons named in the Proxy Form will have discretionary authority to vote on amendments or variations to the business matters identified in the Notice of the Annual Meeting, and on other matters that may properly come before the Annual Meeting. As of the date of this Circular, the management of the Company is not aware of any amendments, variations or additional matters to come before the Annual Meeting. If any additional matters properly come before the Annual Meeting, the persons named in the Proxy Form will vote on them following their best judgment.

Who is soliciting my proxy?

The management of Petro-Canada is soliciting your proxy.

We solicit proxies primarily by mail. The Company's employees or agents might also use telephone or other forms of contact, at nominal cost. The Company bears all costs of solicitation.

Who votes my shares and how will they be voted if I return a Proxy Form?

By properly completing and returning a Proxy Form, you are authorizing the persons named in the Proxy Form to attend the Annual Meeting and to vote your shares. You can use the enclosed Proxy Form, or any other proper Proxy Form, to appoint your proxyholder.

The shares represented by your proxy must be voted as you instruct in the Proxy Form. If you properly complete and return your proxy but do not specify how you wish the votes cast, your proxyholder will vote your shares as they see fit.

NOTE: Unless you provide contrary instructions, shares represented by proxies that management receives will be voted: · FOR the election as Directors of those nominees set out in this Circular; and · FOR the appointment of Deloitte & Touche LLP as the auditors of the Company. |

| Management Proxy Circular PETRO-CANADA | 7 |

Can I appoint someone other than those named in the enclosed Proxy Form to vote my shares?

Yes, you have the right to appoint another person of your choice. They do not need to be a shareholder to attend and act on your behalf at the Annual Meeting. To appoint someone who is not named in the enclosed Proxy Form, strike out those printed names appearing on it and print in the space providing the name of the person you choose.

NOTE: | It is important for you to ensure that any other person you appoint will attend the Annual Meeting and know of your appointment of them. On arriving at the Annual Meeting, proxyholders must present themselves to a representative of CIBC Mellon. |

What if my shares are registered in more than one name or in the name of a company?

If the shares are registered in more than one name, all registered persons must sign the Proxy Form. If the shares are registered in a company's name or any name other than your own, you must provide documents proving your authorization to sign the Proxy Form for that company or name. For any questions about the proper supporting documents, contact CIBC Mellon before submitting your Proxy Form.

Can I revoke a proxy or voting instruction?

Yes. If you are a registered shareholder and have returned a Proxy Form, you may revoke it by:

1) completing and signing another Proxy Form with a later date and delivering it to CIBC Mellon before:

(a) 11:00 a.m. on April 24, 2009; or

(b) if the Annual Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) before the day the meeting is adjourned to; or

2) delivering a written statement revoking the original proxy or voting instruction, signed by you or your authorized representative, to:

(a) the Corporate Secretary of Petro-Canada at 150 – 6 Avenue S.W., Calgary, Alberta T2P 3E3 before:

(i) the close of business on April 27, 2009; or

(ii) if the Annual Meeting is adjourned, up to the close of business on the last business day before the day the meeting is adjourned to; or

(b) the Chairman of the Annual Meeting:

(i) before the Annual Meeting begins; or

(ii) if the meeting is adjourned, before the adjourned Annual Meeting begins.

If you are a beneficial shareholder, contact your nominee.

Is my vote confidential?

Yes. Petro-Canada's transfer agent, CIBC Mellon, receives, counts and tabulates proxies. CIBC Mellon does not tell Petro-Canada how an individual shareholder voted.

8 | PETRO-CANADA Management Proxy Circular |

|

Are there any voting or ownership restrictions?

Yes. Under the Petro-Canada Public Participation Act, the Company's Articles must include certain restrictions on the ownership of Company shares. Below are details of the current ownership restrictions:

No person, together with associates of that person, may hold, beneficially own or control, directly or indirectly, other than by way of security only, in the aggregate, voting shares to which are attached more than 20% of the votes that may ordinarily be cast to elect Directors of the Company.

How many shares are entitled to vote?

As of the date of this Circular, there were 484,852,311 Petro-Canada common shares outstanding. Each shareholder has one vote for each common share of Petro-Canada held as of the close of business on February 27, 2009.

The investment firm of Alliance Bernstein L.P. exercises control or direction over 51,029,472 common shares of the Company as at November 10, 2008, representing approximately 10.5% of the total issued and outstanding common shares of the Company as at December 31, 2008.

Except as described above, the Board of Directors and the officers of Petro-Canada know of no person who beneficially owns or exercises control or direction over shares carrying 10% or more of the voting rights for any class of the Company's voting shares.

What if ownership of Petro-Canada shares has been transferred after February 27, 2009?

The new owner must produce properly endorsed share certificates or other proof of ownership to vote the shares at the Annual Meeting. The new owner must also ask Petro-Canada to include their name on the list of shareholders. Please provide proof of share ownership to the Corporate Secretary of Petro-Canada at 150 – 6 Avenue S.W., Calgary, Alberta T2P 3E3 by 11:00 a.m. Calgary time on April 24, 2009.

What if I have other questions?

If you have any questions regarding the Annual Meeting, please contact:

Transfer Agent: | | CIBC Mellon Trust Company

1-800-387-0825

416-643-5500 (outside North America)

www.cibcmellon.com |

| | |

the Company: | | Petro-Canada

Hugh L. Hooker, Corporate Secretary

403-296-7778

hhooker@Petro-Canada.ca |

| Management Proxy Circular PETRO-CANADA | 9 |

1. Consolidated Financial Statements

The Consolidated Financial Statements for the year ended December 31, 2008 are included in the Annual Report, which is available to all shareholders upon request or on the Company's website at www.petro-canada.ca.

2. Election of the Board of Directors

The following persons are the nominees proposed by the Corporate Governance and Nominating Committee and approved by the Board of Directors for election as Directors. If elected, the nominees will hold office until the close of the next Annual Meeting, or until their successors are duly elected or appointed:

Ron A. Brenneman Hans Brenninkmeyer Claude Fontaine Paul Haseldonckx Thomas E. Kierans Brian F. MacNeill | | Maureen McCaw Paul D. Melnuk Guylaine Saucier James W. Simpson Daniel L. Valot |

You will find the nominees' biographies starting on page 11 of this Circular under the heading Nominees for Election to the Board of Directors.

3. Appointment of Auditors

The Board of Directors proposes that Deloitte & Touche LLP be appointed as Petro-Canada's auditors until the close of the next Annual Meeting.

Deloitte & Touche LLP has served continuously as auditors of the Company since June 7, 2002. The fees paid to the auditors during the years ended December 31, 2008 and 2007 were as follows:

| | 2008 | | 2007 | |

Audit fees | | 4,310,000 | | 5,548,000 | |

Audit-related fees for pension plan and attest services | | 633,000 | | 705,000 | |

TOTAL | | 4,943,000 | | 6,253,000 | |

The Audit, Finance and Risk Committee pre-approves all services that the auditors provide. These services comply with professional standards and securities regulations governing auditor independence. The Board of Directors limits the auditors from providing services not related to the audit.

10 | PETRO-CANADA Management Proxy Circular |

|

Nominees for Election to the Board of Directors

Shareholders will be voting to elect 11 Directors of the Company at the Annual Meeting. Petro-Canada's Articles require the Board to have between nine and 13 Directors. Resolutions of the Board of Directors set the number of Directors of the Company from time to time (including the nominees for election as Directors at the Annual Meeting). The Board has passed a resolution proposing the nominees for election to the Board. Between Annual Meetings, the Board of Directors may appoint additional Directors, as the Corporate Governance and Nominating Committee recommends. Nominees for the Board of Directors are elected for a term of one year, expiring at the next Annual Meeting. The Board of Directors has adopted a majority voting policy.

Below are the names and biographies of the nominees for election as Directors. The Board has exceptionally strong experience in leading growth, participating in the oil and gas industry, both internationally and domestically, and board governance. All Directors, except Mr. Brenneman, are independent. Those named in the enclosed Proxy Form intend to vote FOR these nominees unless authority to do so is withheld. Management does not expect that any of these nominees will be unable to serve as a Director; however, if that occurs, those named in the Proxy Form may vote for another nominee, unless the shareholder has directed that the shares be withheld from voting in the election of Directors.

HANS BRENNINKMEYER8 Independent1 Age: 63 Toronto, Ontario, Canada Director since July 2008 | | Hans Brenninkmeyer has been the Chairman of Porticus N.A. (a charitable foundation) since 2005. Prior to that he was Chairman and President of American Retail Group and the former Chief Executive Officer of Comark Canada. Mr. Brenninkmeyer sits on the Board of Governors of The New School University in New York City. He holds a Master of Business Administration from New York University. |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 4 of 4 | 100% |

| | | |

| Audit, Finance and Risk Committee | 3 of 3 | 100% |

| | | |

| Pension Committee | 1 of 1 | 100% |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| Year | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| | | | | (Cdn $) | (Cdn $) |

| 2008 | – | 2,033 | 2,033 | $ 61,250 | $420,000 |

| |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| |

| Other Public Board Directorships: None |

| | | | | | | | | |

CLAUDE FONTAINE, Q.C. Independent1 Age: 67 Montréal, Quebec, Canada Director since 1987 | | Claude Fontaine, Corporate Director, is a former partner of Ogilvy Renault LLP (barristers and solicitors). He serves as a Director or on the advisory board of a number of for–profit and not–for–profit organizations, including AAER inc. and the Montreal Heart Institute Foundation. Mr. Fontaine holds a Bachelor of Arts (BA), a Licence in Law (LL.L), and an Institute of Corporate Directors certification (ICD.D). |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 7 of 8 | 88% |

| | | |

| Environment, Health and Safety Committee | 3 of 3 | 100% |

| | | |

| Management Resources and Compensation Committee (Chair) | 6 of 7 | 86% |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| Year | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| | | | | (Cdn $) | (Cdn $) |

| | | | | | |

| 2008 | 20,585 | 30,864 | 51,449 | $1,530,283 | $420,000 |

| | | | | |

| 2007 | 16,598 | 30,535 | 47,133 | $2,482,961 |

| |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| |

| Other Public Board Directorships: AAER inc. |

| | | | | | | | | |

| Management Proxy Circular PETRO-CANADA | 11 |

PAUL HASELDONCKX Independent1 Age: 60 Essen, Germany Director since 2002 | | Paul Haseldonckx, Corporate Director, is the past Chairman of the Executive Board of Veba Oil & Gas GmbH (global upstream) and its predecessor companies. He has also been a Member of the Management Board of Veba Oel AG, Germany's largest downstream company, including Aral. Mr. Haseldonckx represented Veba's interests at the Board of the Cerro Negro joint venture, an in situ oil sands development including an upgrader, during the construction and early production phase. Mr. Haseldonckx holds a Master of Science. |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 8 of 8 | 100% |

| | | |

| Audit, Finance and Risk Committee | 7 of 7 | 100% |

| | | |

| Environment, Health and Safety Committee (Chair) | 3 of 3 | 100% |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| Year | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| | | | | (Cdn $) | (Cdn $) |

| | | | | | |

| 2008 | 8,089 | 6,249 | 14,338 | $ 548,060 | $420,000 |

| | | | | |

| 2007 | 8,047 | 6,186 | 14,233 | $ 752,464 |

| |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| |

| Other Public Board Directorships: None |

| | | | | | | | | |

THOMAS E. KIERANS, O.C.6 Independent1,6 Age: 68 Toronto, Ontario, Canada Director since 1991 | | Tom Kierans is Chair of Council and Vice-President of the Social Sciences and Humanities Research Council and a Senior Fellow of Massey College in the University of Toronto. Before that he was Chair of the Canadian Journalism Foundation and Chair of CSI Global Markets. Mr. Kierans holds a Bachelor of Arts (Honours) and a Master of Business Administration (Finance, Dean's Honours List), and is a Fellow of the Canadian Institute of Corporate Directors. He serves as a Director of Manulife Financial Corporation, Mount Sinai Hospital and the Canadian Institute for Advanced Research. Mr. Kierans also sits on a number of advisory boards of for-profit and not-for-profit organizations, including the Schulich School of Business, York University. |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 7 of 8 | 88% |

| | | |

| Corporate Governance and Nominating Committee | 3 of 4 | 75% |

| | | |

| Management Resources and Compensation Committee | 7 of 7 | 100% |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| Year | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| | | | | (Cdn $) | (Cdn $) |

| | | | | | |

| 2008 | 50,000 | 6,855 | 56,855 | $1,554,354 | $420,000 |

| | | | | |

| 2007 | 50,000 | 6,780 | 56,780 | $3,017,569 |

| |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| |

| Other Public Board Directorships: Manulife Financial Corporation |

| | | | | | | | | |

12 | PETRO-CANADA Management Proxy Circular |

|

BRIAN F. MACNEILL, C.M. Independent1 Age: 69 Calgary, Alberta, Canada Director since 1995 | | Brian MacNeill is the Chairman of the Board of Directors of Petro-Canada. Prior to that he was President and CEO of Enbridge Inc. Mr. MacNeill is a Chartered Accountant and a Certified Public Accountant and holds a Bachelor of Commerce. He is a member of the Canadian Institute of Chartered Accountants and the Financial Executives Institute. He is also a Fellow of the Alberta Institute of Chartered Accountants and of the Institute of Corporate Directors. |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 8 of 8 | 100% |

| | | |

| As Chair of the Board, Mr. MacNeill is an ex-officio member of all Committees. | | |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| Year | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| | | | | (Cdn $) | (Cdn $) |

| | | | | | |

| 2008 | 10,200 | 55,659 | 65,839 | $2,214,487 | $1,095,000 |

| | | | | |

| 2007 | 10,200 | 47,798 | 57,998 | $3,046,331 |

| |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| |

| Other Public Board Directorships: Toronto-Dominion Bank, Telus Corp. and West-Fraser Timber Co. Ltd. |

| | | | | | | | | |

MAUREEN MCCAW Independent1 Age: 54 Edmonton, Alberta, Canada Director since 2004 | | Maureen McCaw is Senior Vice-President (Edmonton) of Leger Marketing (marketing research), formerly Criterion Research Corp., a company she founded in 1986. Ms. McCaw holds a Bachelor of Arts from the University of Alberta and an Institute of Corporate Directors certification (ICD.D). She is a past Chair of the Edmonton Chamber of Commerce and also serves on a number of Alberta boards and advisory committees. |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 8 of 8 | 100% |

| | | |

| Corporate Governance and Nominating Committee | 4 of 4 | 100% |

| | | |

| Pension Committee | 2 of 2 | 100% |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| Year | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| | | | | (Cdn $) | (Cdn $) |

| | | | | | |

| 2008 | 2,610 | 9,410 | 12,020 | $ 495,291 | $420,000 |

| | | | | |

| 2007 | 2,414 | 5,824 | 8,238 | $ 433,548 |

| |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| |

| Other Public Board Directorships: None |

| | | | | | | | | |

| Management Proxy Circular PETRO-CANADA | 13 |

PAUL D. MELNUK Independent1 Age: 54 Winter Garden, Florida, U.S. Director since 2000 | | Paul Melnuk is Chairman and Chief Executive Officer of Thermadyne Holdings Corporation (industrial products) and Managing Partner of FTL Capital Partners LLC (merchant banking). He is past President and Chief Executive Officer of Bracknell Corporation and Barrick Gold Corporation and Clark USA Inc (an oil refining and marketing company). Mr. Melnuk holds a Bachelor of Commerce. He is a member of the Canadian Institute of Chartered Accountants and of the World Presidents' Organization, St. Louis chapter. |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 8 of 8 | 100% |

| | | |

| Audit, Finance and Risk Committee (Chair) | 7 of 7 | 100% |

| | | |

| Environment, Health and Safety Committee | 3 of 3 | 100% |

| |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| Year | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| | | | | (Cdn $) | (Cdn $) |

| | | | | | |

| 2008 | 4,400 | 29,436 | 33,836 | $1,228,580 | $420,000 |

| | | | | |

| 2007 | 4,400 | 23,320 | 27,720 | $1,455,568 |

| |

| |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| |

| Other Public Board Directorships: Thermadyne Holdings Corporation |

| | |

| | |

GUYLAINE SAUCIER, F.C.A., C.M. 7 Independent1 Age: 62 Montréal, Quebec, Canada Director since 1991 | | Guylaine Saucier, Corporate Director, is a former Chair of the Board of Directors of the Canadian Broadcasting Corporation, a former Director of the Bank of Canada, a former Chair of the Canadian Institute of Chartered Accountants, a former Director of the International Federation of Accountants and former Chair of the Joint Committee on Corporate Governance established by the CICA, the Toronto Stock Exchange and the Canadian Venture Exchange. She was also the first woman to serve as President of the Quebec Chamber of Commerce. Mme. Saucier obtained a Bachelor of Arts from Collège Marguerite-Bourgeois and a Bachelor of Commerce from the École des Hautes Études Commerciales, Université de Montréal. She is a Fellow of "Ordre des compatables agréés due Québec" and a Member of the Order of Canada. In 2004, she received the Fellowship Award from the Institute of Corporate Directors. |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 7 of 8 | 88% |

| | | |

| Corporate Governance and Nominating Committee (Chair) | 4 of 4 | 100% |

| | | |

| Management Resources and Compensation Committee9 | 3 of 3 | 100% |

| | | |

| Pension Committee | 2 of 2 | 100% |

| |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| Year | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| | | | | (Cdn $) | (Cdn $) |

| | | | | | |

| 2008 | 4,520 | 37,205 | 41,725 | $1,323,937 | $420,000 |

| | | | | |

| 2007 | 4,520 | 36,804 | 43,324 | $2,168,115 |

| |

| |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| |

| Other Public Board Directorship: AXA Assurance Inc., Bank of Montreal, Groupe Danone and Groupe Areva |

| | | | | | | | | | | | | |

14 PETRO-CANADA Management Proxy Circular |

|

JAMES W. SIMPSON Independent1 Age: 64 Danville, California, U.S. Director since 2004 | | Jim Simpson is past President of Chevron Canada Resources (oil and gas). He serves as Lead Director for Canadian Utilities Limited and is on its Corporate Governance, Nomination, Compensation and Succession Committee and Risk Review Committee, as well as being the Chairman for the Audit Committee. Mr. Simpson holds a Bachelor of Science and Master of Science, and graduated from the Program for Senior Executives at M.I.T.'s Sloan School of Business. He is also past Chairman of the Canadian Association of Petroleum Producers and past Vice-Chairman of the Canadian Association of the World Petroleum Congresses. |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 8 of 8 | 100% |

| | | |

| Audit, Finance and Risk Committee | 7 of 7 | 100% |

| | | |

| Management Resources and Compensation Committee | 7 of 7 | 100% |

| |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| Year | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| | | | | (Cdn $) | (Cdn $) |

| | | | | | |

| 2008 | 3,700 | 8,693 | 12,393 | | $ 469,735 | $420,000 |

| | | | | | |

| 2007 | 3,700 | 5,814 | 7,814 | | $ 606,244 |

| |

| |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| |

| Other Public Board Directorships: Canadian Utilities Limited |

| | | | | | | | | | |

DANIEL L. VALOT Independent1 Age: 64 Boulogne-Billancourt, France Director since 2007 | | Daniel Valot, Corporate Director, is the past Chairman and Chief Executive Officer of Technip S.A. (oil and gas, engineering and construction). Prior to that, Mr. Valot held a number of leadership roles in exploration and production, refining, and North American operations with Total. A former student of the National School of Administration, Mr. Valot served as a civil servant in various positions. He holds a degree from the Paris Institute of Political Science and from the National School of Administration (ENA). |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 8 of 8 | 100% |

| | | |

| Audit, Finance and Risk Committee | 7 of 7 | 100% |

| | | |

| Environment, Health and Safety Committee | 3 of 3 | 100% |

| |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| Year | | | | (Cdn $) | (Cdn $) |

| | | | | | |

| 2008 | 1,375 | 5,695 | | 7,070 | | $ 265,836 | $420,000 |

| | | | | | | |

| 2007 | 1,375 | 640 | | 2,015 | | $ 106,736 |

| |

| |

| Options Held: None. Non-employee Directors are not eligible to participate in the Company's stock option plan. |

| |

| Other Public Board Directorships: CGGVeritas and SCOR |

| | | | | | | | | | | |

| Management Proxy Circular PETRO-CANADA 15 |

RON A. BRENNEMAN Non-independent, Management Age: 62 Calgary, Alberta, Canada Director since 2000 | | Ron Brenneman is the President and Chief Executive Officer of the Company. Prior to joining the Company in 2000, he held various positions within Exxon Corporation and its affiliated companies. He leads the Company's Executive Leadership Team (ELT). He is responsible for the overall strategic direction of the Company and its sound management and performance. Mr. Brenneman holds a Bachelor of Science and a Master of Science. He is a member of the Board of Directors of the Canadian Council of Chief Executives. |

| Board and Committee Membership | Attendance |

| | |

| Board of Directors | 8 of 8 | 100% |

| |

| As a member of management, Mr. Brenneman is not a member of any Committee of the Board, but he is invited to attend all Committee meetings other than in camera sessions. |

| |

| |

| Securities Held |

| |

| | Common | | Total of Common | Total Market Value of | Minimum |

| Year | Shares2 | DSUs3 | Shares and DSUs | Common Shares and DSUs4 | Required5 |

| | | | | (Cdn $) | (Cdn $) |

| | | | | | |

| 2008 | 88,547 | 221,215 | 309,762 | $ 9,563,988 | $5,250,000 |

| | | | | |

| 2007 | 84,457 | 219,823 | 304,280 | $16,009,466 |

| |

| |

| Options Held: 1,319,800 |

| |

| Other Public Board Directorships: Bank of Nova Scotia and BCE Inc. |

| | | | | | | | | |

1 | Independent: refers to the standards of independence established under Section 303A.02 of the NYSE Listed Company Manual, Section 301 and Rule 10A-3 of the Sarbanes-Oxley Act of 2002 and Section 1.2 of Canadian Securities Administrators' National Instrument 58-101. |

2 | Common Shares refers to the number of common shares beneficially owned, controlled or directed, directly or indirectly, by the Director, as of December 31, 2008. |

3 | DSUs refers to the number of Deferred Stock Units held by the Director as of December 31, 2008. |

4 | The Total Market Value of Common Shares and DSUs for 2008 is based on the greater of purchase price, grant price or market value for the shares/units held by that Director. The Total Market Value of Common Shares for 2007 is determined by multiplying the number of common shares held by the closing price of the common shares on the TSX on December 31, 2007 of $53.25. The Total Market Value of DSUs is based on the previous five-day average market value of Petro-Canada's common shares as of December 31, 2007 of $52.37. Dividend equivalents are used to purchase additional DSUs and are credited on a quarterly basis. |

5 | Each non-employee Director is required to hold a minimum number of Company shares or share equivalents equal in value to three times the annual retainer ($420,000 for non-employee Directors and $1,095,000 for the Chair). Non-employee Directors have until December 31, 2011 or five years (if later) from being appointed a Director to achieve the required share ownership guidelines. Mr. Brenneman, as an employee Director, participates in the Company's Officer Share Ownership Program and is required to hold four times his annual base salary. Refer to Compensation Discussion and Analysis beginning on page 22. |

6 | Mr. Kierans was a Director of Teleglobe Inc. from December 2000 until April 2002. Teleglobe Inc. filed for court protection under insolvency statutes on May 28, 2002. |

7 | Mme. Saucier was a Director of Nortel Networks Corporation until June 2005, and was subject to a cease trade order issued on May 17, 2004 as a result of Nortel's failure to file financial statements. The cease trade order was cancelled on June 21, 2005. |

8 | Mr. Brenninkmeyer was appointed to the Board of Directors in July 2008. |

9 | Mme. Saucier joined the Management Resources and Compensation Committee in September 2008. |

16 PETRO-CANADA Management Proxy Circular |

|

Compensation of the Board of Directors

2008 Compensation

The compensation of Petro-Canada's Board of Directors is intended to attract highly qualified Directors who are able to meet the demanding responsibilities of being Board members, and is structured in a way that encourages Directors to act in the long-term interest of the Company. On a regular basis, the Corporate Governance and Nominating Committee retains an outside consultant, Towers, Perrin, Forster & Crosby Inc. (Towers Perrin) to assess the competitiveness of Director and Chair of the Board compensation arrangements using a similar process and approach as is used in assessing competitiveness of executive pay (e.g. market comparators and target pay philosophy). The last comprehensive review was undertaken in the fall of 2007, was updated in the summer of 2008 and is reflected in the compensation structure outlined below.

Only non-employee Directors are compensated for Board services; the President and Chief Executive Officer is not paid for his services as a Director.

Compensation Components for all Non-Employee Directors except the Chair of the Board of Directors

Compensation Structure | | January 1, 2008 | |

Annual Retainer For Directors1 | | $140,000 | |

Board Meeting Fee | | $1,500 | |

Committee Meeting Fee | | $1,500 | |

Annual Committee Member Retainer (all Committees excluding Audit, Finance and Risk Committee – AFRC) | | $4,000 | |

Annual Committee Member Retainer for AFRC | | $10,500 | |

Annual Committee Chair Retainer (all Committees excluding AFRC) | | $10,000 | |

Annual Committee Chair Retainer for AFRC | | $25,000 | |

Out-of-Province Travel Fee2 (per round trip) | | $1,500 | |

Out-of-Country Travel Fee3 (per round trip) | | $3,000 | |

Compensation Components for the Chair of the Board

Compensation Structure | | January 1, 2008 | |

Annual Retainer4 | | $365,000 | |

No other compensation is payable to the Chair of the Board of Directors.

1 | A Director may elect to take the annual retainer in cash, common shares and/or DSUs once he/she has reached the share ownership guideline level. A description of the share ownership guideline level can be found on page 21. Except for the Chair of the Board, a Director who has not reached the guideline level receives the annual retainer in the form of $70,000 in DSUs and the remaining $70,000 in cash, common shares and/or DSUs for a total of $140,000. As of December 9, 2008, for a Director who has not reached the guideline level and is not a Canadian resident, he/she may choose to receive the annual retainer in the form of $140,000 in cash, with the requirement that they must purchase $70,000 in Petro-Canada common shares on the market during the year. |

2 | Provided to Directors who travel to a Board or Committee meeting held outside their province of permanent residence. |

3 | Provided to Directors who travel to a Board or Committee meeting held outside their country of permanent residence. |

4 | The Chair of the Board of Directors can choose to take the annual retainer in cash, common shares and/or DSUs once he/she has reached the share ownership guideline level. If the Chair has not met the share ownership guideline level, he/she will receive the annual retainer payable in the form of $75,000 in DSUs and the remaining $290,000 in cash, common shares and/or DSUs for a total of $365,000. As of December 9, 2008, for a Chair who has not reached the guideline level and is not a Canadian resident, he/she may choose to receive the annual retainer in the form of $365,000 in cash, with the requirement that they must purchase $75,000 in Petro-Canada common shares on the market during the year. |

| Management Proxy Circular PETRO-CANADA 17 |

Deferred Stock Unit (DSU) Plan

· | Once he/she has reached the share ownership guideline level, a Director may annually elect to take his/her compensation in the form of cash, common shares and/or DSUs. If the share ownership guidelines are not satisfied, then $70,000 of his/her compensation is delivered in DSUs. A Director who is not a Canadian resident and has not reached the guideline level may choose to receive his/her compensation in cash, with the requirement that they must purchase and retain a minimum of $70,000 in Petro-Canada common shares on the market during the year. |

| |

· | Once he/she has reached the share ownership guideline level, the Chair of the Board of Directors may annually elect to take his/her compensation in the form of cash, common shares and/or DSUs. If the share ownership guidelines are not satisfied then $75,000 of his/her compensation is delivered in DSUs. A Chair who is not a Canadian resident and has not reached the guideline level may choose to receive his/her compensation in cash, with the requirement that they must purchase and retain a minimum of $70,000 in Petro-Canada common shares on the market during the year. |

| |

· | Under the Company's DSU Plan, dividend equivalents are used to purchase additional DSUs and are credited to the Directors' notional DSU accounts on a quarterly basis. |

| |

· | A Director is entitled to the benefit of his/her DSUs upon ceasing to be a Director. The Director can then choose to receive the value of the DSUs granted after December 31, 2003 in the form of common shares purchased on the open market or in the form of cash at any time, but no later than the end of the first calendar year following retirement. Directors that are tax filers in the U.S. may choose to receive the value of the DSUs granted after December 31, 2003 in the form of common shares purchased on the open market or in the form of cash at any time up to 15 days prior to the end of the six months following retirement. The value of DSUs granted before January 1, 2004 can only be paid out in the form of Company common shares purchased on the open market. |

| |

· | The DSU value will be based on the five-day average market price of the common shares immediately before the conversion of the DSUs to cash or common shares. If a Director chooses or is required to receive common shares, the value of his/her DSU entitlement is used to purchase common shares of the Company on the open market for the benefit of the Director. The Company covers the brokerage costs associated with acquiring these shares. |

2008 Election of Payment

The following table shows the percentages of each form of payment that each non-employee Director received during the year ended December 31, 2008.

| | Cash | | Petro-Canada Common

Shares | | DSUs |

Director | | Annual

Retainer | | Committee

Retainer(s)/

Meeting and

Travel Fees | | Annual

Retainer | | Committee

Retainer(s)/

Meeting and

Travel Fees | | Annual

Retainer | | Committee

Retainer(s)/

Meeting and

Travel Fees | |

Hans Brenninkmeyer1 | | 12.5 | % | | 100 | % | | | | | | 87.5 | % | | | | |

Gail Cook-Bennett2 | | 100 | % | | 100 | % | | | | | | | | | | | |

Richard Currie3 | | 100 | % | | 100 | % | | | | | | | | | | | |

Claude Fontaine | | | | | 100 | % | | 100% | | | | | | | | | |

Paul Haseldonckx | | 100 | % | | 100 | % | | | | | | | | | | | |

Thomas Kierans | | 100 | % | | 100 | % | | | | | | | | | | | |

Brian MacNeill | | 25 | % | | | | | | | | | 75 | % | | | | |

Maureen McCaw | | 25 | % | | 25 | % | | | | | | 75 | % | | 75 | % | |

Paul Melnuk | | | | | | | | | | | | 100 | % | | 100 | % | |

Guylaine Saucier | | 100 | % | | 100 | % | | | | | | | | | | | |

James Simpson | | 25 | % | | 100 | % | | | | | | 75 | % | | | | |

Daniel Valot | | | | | | | | | | | | 100 | % | | 100 | % | |

1 | Hans Brenninkmeyer was appointed to the Board of Directors on July 1, 2008. |

2 | Not standing for re-election to the Board of Directors. |

3 | Richard Currie retired from the Board of Directors on April 29, 2008. |

18 PETRO-CANADA Management Proxy Circular |

|

Directors' Remuneration

The total amount paid to non-employee Directors of the Company for the year ended December 31, 2008 was $2,311,667 as follows:

| | | | | | | | Non-Equity | | | | | | |

| | Fees | | Share-Based | | Option-Based | | Incentive Plans | | Pension | | All Other | | |

Director | | Earned | | Awards1 | | Awards1 | | Compensation1 | | Value1 | | Compensation1 | | Total |

| | (Cdn $) | | | | | | | | | | | | (Cdn $) |

Hans Brenninkmeyer2 | | $ 94,333 | | | – | | – | | – | | – | | – | | $ 94,333 | |

Gail Cook-Bennett3 | | $195,000 | | | – | | – | | – | | – | | – | | $195,000 | |

Richard Currie4 | | $ 65,834 | | | – | | – | | – | | – | | – | | $ 65,834 | |

Claude Fontaine | | $197,500 | | | – | | – | | – | | – | | – | | $197,500 | |

Paul Haseldonckx | | $211,500 | | | – | | – | | – | | – | | – | | $211,500 | |

Thomas Kierans | | $182,500 | | | – | | – | | – | | – | | – | | $182,500 | |

Brian MacNeill | | $365,000 | | | – | | – | | – | | – | | – | | $365,000 | |

Maureen McCaw | | $175,000 | | | – | | – | | – | | – | | – | | $175,000 | |

Paul Melnuk | | $217,000 | | | – | | – | | – | | – | | – | | $217,000 | |

Guylaine Saucier | | $194,000 | | | – | | – | | – | | – | | – | | $194,000 | |

James Simpson | | $208,500 | | | – | | – | | – | | – | | – | | $208,500 | |

Daniel Valot | | $205,500 | | | – | | – | | – | | – | | – | | $205,500 | |

Total | | $2,311,667 | | | – | | – | | – | | – | | – | | $2,311,667 | |

1 | Non-employee directors are not eligible for these programs. |

2 | Hans Brenninkmeyer was appointed to the Board of Directors on July 1, 2008. |

3 | Not standing for re-election to the Board of Directors. |

4 | Richard Currie retired from the Board of Directors on April 29, 2008. |

Director

| | Board

Retainer

(Cdn $) | | Committee

Chair

Retainer

(Cdn $) | | Committee

Member

Retainer

(Cdn $) | | Non-

Executive

Chairman

Retainer

(Cdn $) | | Board

Attendance

Fee1

(Cdn $) | | Committee

Attendance

Fee1

(Cdn $) | | Out-of-

Country /

Province

Travel Fee

(Cdn $) | | Fees Earned /

Total

Compensation

(Cdn $) |

Hans Brenninkmeyer2 | | $ 70,000 | | | | | $ 4,833 | | | | $ 6,000 | | $ 7,500 | | $ 6,000 | | $ 94,333 | |

Gail Cook-Bennett3 | | $140,000 | | | $10,000 | | $10,500 | | | | $12,000 | | $15,000 | | $ 7,500 | | $195,000 | |

Richard Currie4 | | $ 46,667 | | | | | $ 2,667 | | | | $ 6,000 | | $ 6,000 | | $ 4,500 | | $ 65,834 | |

Claude Fontaine | | $140,000 | | | $10,000 | | $ 4,000 | | | | $10,500 | | $22,500 | | $10,500 | | $197,500 | |

Paul Haseldonckx | | $140,000 | | | $10,000 | | $10,500 | | | | $12,000 | | $18,000 | | $21,000 | | $211,500 | |

Thomas Kierans | | $140,000 | | | | | $ 8,000 | | | | $10,500 | | $16,500 | | $ 7,500 | | $182,500 | |

Brian MacNeill | | | | | | | | | $365,000 | | | | | | | | $365,000 | |

Maureen McCaw | | $140,000 | | | | | $ 8,000 | | | | $12,000 | | $13,500 | | $ 1,500 | | $175,000 | |

Paul Melnuk | | $140,000 | | | $25,000 | | $ 4,000 | | | | $12,000 | | $15,000 | | $21,000 | | $217,000 | |

Guylaine Saucier | | $140,000 | | | $10,000 | | $ 5,000 | | | | $10,500 | | $19,500 | | $ 9,000 | | $194,000 | |

James Simpson | | $140,000 | | | | | $14,500 | | | | $12,000 | | $24,000 | | $18,000 | | $208,500 | |

Daniel Valot | | $140,000 | | | | | $14,500 | | | | $10,500 | | $19,500 | | $21,000 | | $205,500 | |

Total | | $1,376,667 | | | $65,000 | | $86,500 | | $365,000 | | $114,000 | | $177,000 | | $127,500 | | $2,311,667 | |

1 | Petro-Canada holds a number of in-house education sessions for Directors. A meeting fee of $1,500 is paid to each Director attending each session that is offered. Extra meeting fees are also paid for multi-day Board meetings, telephone conferences, occasional ad hoc meetings and, from time to time, participation in a Committee meeting of which a Director is not a member. |

2 | Hans Brenninkmeyer was appointed to the Board of Directors on July 1, 2008. |

3 | Not standing for re-election to the Board of Directors. |

4 | Richard Currie retired from the Board of Directors on April 29, 2008. |

| Management Proxy Circular PETRO-CANADA 19 |

2009 Compensation

No changes to the non-employee Director or Chair compensation are anticipated for 2009.

Share Ownership Guidelines

· | As of January 1, 2008, the Company increased the share ownership guidelines for the Board. The 2007 guidelines required each non-employee Director to hold Company shares or share equivalents equal in value to $300,000. These guidelines were increased to require each non-employee Director to hold Company shares or share equivalents equal in value to at least three times the annual retainer ($420,000 for Directors and $1,095,000 for the Chair). |

| |

· | As of December 9, 2008, Directors will have until December 31, 2011 or the fifth anniversary (if later) of having been appointed a Director to establish the required share ownership status. In addition, the test used to determine the Total Market Value of Common Shares and DSUs is based on the greater of purchase price, grant price or market value for the shares/units held by that Director. Shares held notionally in the DSU Plan count toward a Director's holdings for this purpose. |

| |

· | As of December 31, 2008, all non-employee Directors who joined the Board before 2006 had attained their share ownership guidelines; Mr. Brenninkmeyer has until July 1, 2013 and Mr. Valot has until July 1, 2012 to obtain their ownership guidelines. |

| |

· | Non-employee Directors cannot participate in the Company's stock option plan. |

20 | PETRO-CANADA Management Proxy Circular |

|

Compensation Discussion and Analysis

MANAGEMENT RESOURCES AND COMPENSATION COMMITTEE

The Management Resources and Compensation Committee (the Compensation Committee) is made up entirely of independent Directors and reports to the Board on human resources matters. The Compensation Committee which consists of Claude Fontaine (Chair), Thomas E. Kierans, Guylaine Saucier, James W. Simpson and Brian F. MacNeill (ex-officio member) reviews and recommends compensation, pension and benefit practices, and management development and succession plans to the Board. Key focus areas are President and Chief Executive Officer and executive officer performance, succession and recruitment. The Charter of the Compensation Committee can be found on the Company's website at www.petro-canada.ca.

The Compensation Committee met seven times in 2008 and held in-camera sessions during each meeting. Key Compensation Committee activities in 2008 were:

· Chief Executive Officer Compensation

· assessed the Chief Executive Officer goals/objectives

· assessed Chief Executive Officer performance

· reviewed and recommended Chief Executive Officer compensation including base salary, annual incentive and mid- and long-term incentives

· Executive staffing, development and compensation

· reviewed performance assessments of the members of the ELT

· reviewed and recommended annual compensation for the members of the ELT

· reviewed and recommended 2008 Annual Incentive payouts to the members of the ELT

· reviewed and recommended mid- and long-term incentive grants to members of the ELT

· reviewed succession plans for all executive positions

· Compensation programs and structure

· sponsored an education session for the full Board of Directors related to current trends in executive compensation

· reviewed competitive data for all executive positions

· approved the performance targets for the 2008 Annual Incentive program

· reviewed the ownership guidelines for executives

· reviewed and recommended the redesign of the Mid-term Incentive program

· Management Proxy Circular

· reviewed and approved the Compensation Discussion and Analysis

Compensation Philosophy

Petro-Canada's success depends on the Company's ability to attract, retain and motivate high performing employees at all levels of the organization. The Company regularly reviews its compensation policies relative to these objectives.

The Compensation Committee reviews overall compensation policies and makes recommendations to the Board of Directors on the compensation programs for the executive officers of Petro-Canada, including the Named Executive Officers (see Summary Compensation Table on page 36). Compensation programs are designed to:

· attract, retain and motivate key personnel;

· encourage commitment to the Company and its goals;

· align executive officer interests with interests of shareholders; and

· reward executive officers for demonstrated leadership and for performance related to predetermined and quantifiable goals.

| Management Proxy Circular PETRO-CANADA | 21 |

When developing the total compensation structure for executive officers, the Compensation Committee considers information it acquires through third-party compensation surveys, which compares the compensation paid for similar positions in a comparator group of companies that compete with Petro-Canada for executive talent. The comparator group for Canadian executive officers consists of major Canadian oil and gas companies and other large Canadian industrial and resource companies with a reasonable degree of autonomy. The primary reference group is energy sector specific and includes BP Canada, Canadian Natural Resources Ltd., Canadian Oil Sands Limited, Chevron Canada Resources, EnCana Corporation, ExxonMobil Canada, Husky Energy Inc., Imperial Oil Limited, Nexen Inc., Shell Canada Limited, Suncor Energy Inc., Syncrude Canada Limited and Talisman Energy Inc. This group was selected because its members are similar to Petro-Canada in size, scope and complexity. It includes Canadian oil and gas companies with both upstream and downstream operations, as well as larger exploration and production companies.

If a general industry perspective is required, a larger group, which includes Abitibi Bowater, Agrium Inc., Barrick Gold Corporation, BCE Inc., Bombardier, Canadian National Railway, Canadian Natural Resources Ltd., Canadian Oil Sands Limited, Canadian Pacific Railway Limited, Canadian Tire Corporation Limited, Canfor Corporation, Celestica Inc., CGI Group Inc., Domtar Corporation, Enbridge Inc., EnCana Corporation, Finning International Inc., Husky Energy Inc., Imperial Oil Limited, Irving Oil Limited, Maple Leaf Foods Inc., McCain Foods Limited, Nexen Inc., Nortel, NOVA Chemicals, Potash Corporation of Saskatchewan Inc., Research In Motion Ltd, SNC-LAVALIN, Suncor Energy Inc., Syncrude Canada Limited, Talisman Energy Inc., Teck, Transat A.T. Inc. and TransCanada Corp., is used.

Compensation programs are designed to deliver competitive base salaries and incentive payments when corporate, business unit and individual performance meet specific, predetermined objectives. These programs also provide an opportunity for top quartile pay relative to the Company's comparator groups, when an executive officer delivers superior performance. Competitiveness of the compensation structure is assessed regularly, using compensation surveys conducted by the independent consulting firm, Towers Perrin, and supplemented by competitive survey information from other consulting firms, as required.

Towers Perrin is retained by the Compensation Committee to provide expertise and advice in regard to executive compensation. This includes advising on compensation policies, as well as the design and implementation of executive compensation programs for the Compensation Committee's review and approval. Towers Perrin periodically updates the Compensation Committee on executive compensation "best practices" and trends in executive compensation. Towers Perrin is also retained by the Company to provide advice on pensions, including actuarial pension advice, and on its health and welfare programs.

As a result of the broad relationship, the Compensation Committee has agreed with Towers Perrin on a formal mandate that outlines Towers Perrin's role and terms of reference as an independent advisor to the Compensation Committee. An important feature includes a clear reporting relationship between the Towers Perrin executive compensation consultant and the Compensation Committee. Additional work by the consultant for the Company is documented in the "Letter of Independence" and reviewed by the Compensation Committee Chair. There are also assurances that the executive compensation consultants have an internal reporting relationship and compensation, which are determined separately from those Towers Perrin and Petro-Canada activities that are not connected to executive compensation. The Compensation Committee annually reviews these processes. In 2008, Towers Perrin's fees for executive compensation services to the Compensation Committee were $398,224. In 2008, Towers Perrin also earned $1,387,419 by providing pension and benefit consulting, administration and actuarial services to the Company. From time to time, the Compensation Committee will access the services of other consultants as occurred in the autumn of 2008 when Hugessen Consulting Incorporated (Hugessen) was retained by the Compensation Committee to provide it with independent advice regarding proposed upgrades to the mid- and long-term incentive program. Hugessen is not engaged in providing ongoing consulting services and does not provide advice to Petro-Canada on any other matters. Hugessen was paid $98,522 for the services, which were provided from December 1, 2008 to December 31, 2008, inclusive.

The compensation structure for executive officers consists of a base salary, plus significant pay-at-risk. Pay-at-risk is made up of an annual incentive, as well as mid- and long-term incentives (stock options, Stock Appreciation Rights (SARs), Performance Stock Units (PSUs) and Deferred Stock Units (DSUs)).

22 | PETRO-CANADA Management Proxy Circular |

|

Key Elements of Compensation

Element | | Fixed / Variable | | Type | | Performance Period |

Base Salary | | Fixed | | Cash | | 1 year |

Annual Incentive | | Variable | | Cash | | 1 year |

Mid-Term Incentive | | Variable | | PSUs | | 3 years |

Long-Term Incentive | | Variable | | Stock Options/SARs | | 7 years |

Significant portions of the Company's senior executives' compensation depend on both the Company's and their individual performance and are at risk as illustrated below.

| | | | Variable/At Risk Pay | | | | | |

Title | | Base Pay | | Annual

Incentive | | Mid-Term

Incentive | | Long-Term

Incentive | | Total

Compensation

at Risk | | Total | |

| | | | | | | | | | | | | |

President & Chief Executive Officer | | 17% | | 22% | | 30% | | 31% | | 83% | | 100% | |

Executive Vice-President /

Executive Vice-President &

Chief Financial Officer | | 23% | | 24% | | 24% | | 29% | | 77% | | 100% | |

Senior Vice-President | | 24% | | 20% | | 25% | | 31% | | 76% | | 100% | |

| | | | | | | | | | | | | |

Base Salary

Each year, the Compensation Committee reviews each Named Executive Officer's base salary and makes adjustments based on the position's duties and responsibilities, the degree of special skill and knowledge required, and the performance and contribution of the officer. For reference, the Compensation Committee uses the median base salaries for positions with similar responsibilities in its comparator groups, which consist of major Canadian oil and gas companies and other large Canadian industrial and resource companies with a reasonable degree of autonomy, and are described under the Compensation Philosophy section on page 22 of this Circular.

Annual Incentive Program

Awards paid under the annual incentive program are based on the degree of achievement of specific predetermined corporate, business unit and individual objectives. Each executive officer is assigned a target incentive level that represents the amount that would be paid if all objectives were achieved at planned levels. If planned results are not achieved or are exceeded, actual payments could vary from zero to double the target award for corporate and business unit performance and from zero to triple the target award for individual performance. In 2008, target awards ranged from 55% to 80% of base salary, depending on the level of the executive officer. The highest target was for the President and Chief Executive Officer.

2008 Annual Incentive Targets (% of Base Salary)

| | | | | | Maximum Payout | |

Position | | Minimum Payout | | Target Payout | | % of Base Salary | | % of Target | |

| | | | | | | | | |

President & Chief Executive Officer | | 0 | | 80% | | 176% | | 220% | |

Executive Vice-President / Executive Vice-President & Chief Financial Officer | | 0 | | 60% | | 132% | | 220% | |

Senior Vice-President | | 0 | | 55% | | 121% | | 220% | |

| | | | | | | | | |

| Management Proxy Circular PETRO-CANADA | 23 |

The 2008 annual incentive award depended on performance at the corporate, business unit and individual levels as follows:

· 30% corporate performance;

· 50% business operating measures; and

· 20% personal performance.

Corporate performance has a profit-sharing focus and is based on earnings from operations, which is a key measure of corporate performance.

Business operating measures are connected to controllable objectives and drive excellence in operations. Each business unit has operating measures tied to the business objectives. Examples of these measures include such items as safety, reliability, production volumes and operating costs. Scores for each measure were aggregated to a total business unit score for the senior executive responsible for that unit. The score for the President and Chief Executive Officer and the Executive Vice-President and Chief Financial Officer was the average of the results of all business units.

The remaining 20% of each target award is based on the assessment of the executive officer's individual performance against personal objectives. The Compensation Committee assesses the performance of the President and Chief Executive Officer. The Compensation Committee also considers and reviews the assessment of the performance of the other executives as proposed by the President and Chief Executive Officer.

Executive officers may elect to convert a portion of their annual incentive into DSUs under the DSU Plan established for key employees. This plan links short-term cash incentive awards to the future value of the Company's shares.

Executive officers who elect to convert a portion of their annual incentive into DSUs must do so by December 31 of the year preceding payment. For U.S. tax payers, the election is required in writing by June 30 of the year preceding payment.

Mid- and Long-Term Incentive Plan

The mid- and long-term incentives are designed to:

· link executive compensation with the creation of shareholder value;

· align the interests of executive officers with those of the Company's shareholders; and

· reward executive officers for achievement relative to peer companies.

The Compensation Committee uses its discretion to grant these awards and considers data for similar positions and companies as a reference point. Starting in 2006, the Compensation Committee used a binomial valuation model to estimate the value of mid- and long-term incentive awards. In setting yearly awards, the Compensation Committee considers the number and value of awards granted in the previous year, the competitiveness of the overall compensation structure and individual performance. The Board of Directors reviews the expected values of the proposed mid- and long-term incentive awards against competitive data. The expected value of these awards is determined with the assistance of the external consultant.

The Company employs a variety of mid- and long-term incentive vehicles, including PSUs, stock options, SARs and DSUs depending on the prevailing market practice and objective in providing the incentive.

The Compensation Committee sets the date for granting of mid- and long-term incentives in advance. The grant date complies with applicable securities agencies regulatory standards and Petro-Canada's Code of Business Conduct. The date also aligns with the timing of performance assessments and other compensation decisions. This timing is important because performance assessments significantly impact not only mid- and long-term incentive grants but, also, other aspects of executive officer compensation, including base salary changes and annual incentive awards.

The Board of Directors believes mid- and long-term awards enable the Company to promote employee commitment to Petro-Canada and to retain the key employees necessary for Petro-Canada's long-term success.

Non-employee Directors are not eligible to participate in the employee incentive plans.

24 | PETRO-CANADA Management Proxy Circular |

|

PSUs