Exhibit 99.5

Legal Notice – Forward-Looking Information | 1 |

About Petro-Canada | 4 |

Q&A with the President | 5 |

Management's Discussion and Analysis | 8 |

Business Environment | 8 |

Business Environment in 2008 | 8 |

Competitive Conditions | 10 |

Outlook for Business Environment in 2009 | 10 |

Economic Sensitivities | 11 |

Business Strategy | 12 |

Value Proposition and Strategy | 12 |

Execution of the Strategy in 2008 | 12 |

Improving Base Business Profitability | 12 |

Long-Term Profitable Growth | 13 |

Following our Principles for Responsible Investment and Operations | 15 |

Business Strategy Looking Forward | 17 |

Risk Management | 18 |

Consolidated Financial Results | 21 |

Analysis of Consolidated Earnings and Cash Flow | 21 |

Consolidated Financial Results | 21 |

Quarterly Information | 22 |

Liquidity and Capital Resources | 23 |

Operating Activities | 24 |

Investing Activities | 24 |

Financing Activities and Dividends | 25 |

Upstream | 28 |

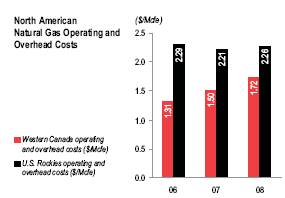

North American Natural Gas | 28 |

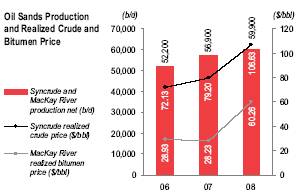

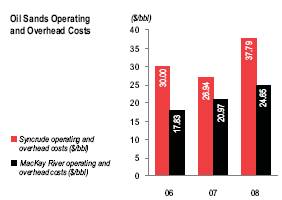

Oil Sands | 32 |

International & Offshore | 37 |

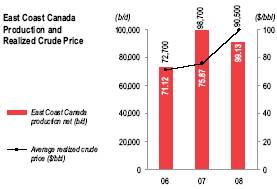

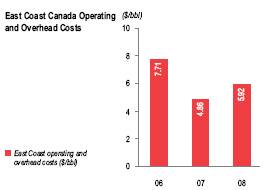

East Coast Canada | 37 |

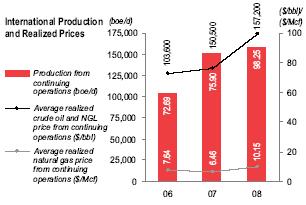

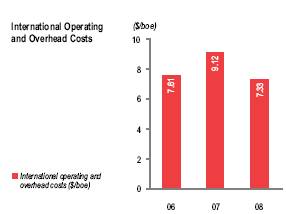

International | 41 |

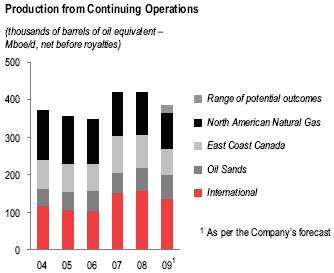

Upstream Production | 48 |

Reserves Summary | 50 |

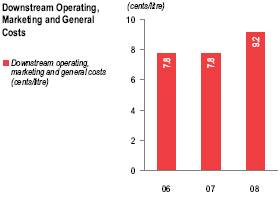

Downstream | 52 |

Shared Services and Eliminations | 57 |

Financial Reporting | 58 |

Management, Audit, Finance and Risk Committee, and Auditor Reports | 61 |

Consolidated Financial Statements and Notes | 65 |

Reserves of Crude Oil, Natural Gas Liquids, Natural Gas, and Bitumen | 103 |

Quarterly Financial and Stock Trading Information | 108 |

Three-Year Financial and Operating Summary | 110 |

Glossary of Terms, Ratios and Acronyms | 114 |

Executives and Board of Directors | 115 |

Investor Information | 116 |

Cover design: The Design Centre of Canada; Inside: Platinum Creative Solutions Inc.

This report was printed on paper that is acid-free and recyclable. Inks are based on linseed oil and contain no heavy metals. The printing process was alcohol-free.

Volatile organic compounds associated with printing were reduced by 50% to 75% from the levels that would have been produced using traditional inks and processes.

Legal Notice – Forward-Looking Information |

This annual report contains forward-looking information. You can usually identify this information by such words as "plan," "anticipate," "forecast," "believe," "target," "intend," "expect," "estimate," "budget" or other terms that suggest future outcomes or references to outlooks. Forward-looking information in this annual report includes references to:

· business strategies and goals · future investment decisions · outlook (including operational updates and strategic milestones) · future capital, exploration and other expenditures · future cash flows · future resource purchases and sales · anticipated construction and repair activities · anticipated turnarounds at refineries and other facilities · anticipated refining margins · future oil and natural gas production levels and the sources of their growth · project development, and expansion schedules and results · future exploration activities and results, and dates by which certain areas may be developed or come on-stream | | · anticipated retail throughputs · anticipated pre-production and operating costs · reserves and resources estimates · future royalties and taxes payable · production life-of-field estimates · natural gas export capacity · future financing and capital activities (including purchases of Petro-Canada common shares under the Company's normal course issuer bid (NCIB) program) · contingent liabilities (including potential exposure to losses related to retail licensee agreements) · the impact and cost of compliance with existing and potential environmental regulations · future regulatory approvals · expected rates of return |

Such forward-looking information is based on a number of assumptions and analysis made by the Company. These assumptions and analysis are described in greater detail throughout this annual report and include, without limitation, assumptions with respect to future commodity prices, the state of the economy, required capital expenditures, levels of cash flow, regulatory requirements, industry capacity, the results of exploration and development drilling and the ability of suppliers to meet commitments.

Undue reliance should not be placed on forward-looking information. Such forward-looking information is subject to known and unknown risks and uncertainties which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such information. Such risks and uncertainties include, but are not limited to:

· changes in industry capacity · imprecise reserves estimates of recoverable quantities of oil, natural gas and liquids from resource plays, and other sources not currently classified as reserves · the effects of weather and climate conditions · the results of exploration and development drilling, and related activities · the ability of suppliers to meet commitments · decisions or approvals from administrative tribunals · risks associated with domestic and international oil and natural gas operations · changes in general economic, market and business conditions | | · competitive action by other companies · fluctuations in oil and natural gas prices · changes in refining and marketing margins · the ability to produce and transport crude oil and natural gas to markets · fluctuations in interest rates and foreign currency exchange rates · actions by governmental authorities (including changes in taxes, royalty rates and resource-use strategies) · changes in environmental and other regulations · international political events · nature and scope of actions by stakeholders and/or the general public |

Many of these and other similar factors are beyond the control of Petro-Canada. Petro-Canada discusses these factors in greater detail in filings with the Canadian provincial securities commissions and the United States (U.S.) Securities and Exchange Commission (SEC). See also "Risk Management – Risks Relating to Petro-Canada's Business" in this annual report for a discussion of factors that could impact Petro-Canada's operations or results.

| 2008 Annual Report PETRO-CANADA | 1 |

Readers are cautioned that this list of important factors affecting forward-looking information is not exhaustive. Furthermore, the forward-looking information in this annual report is made as of February 23, 2009 and, except as required by applicable law, will not be publicly updated or revised. This cautionary statement expressly qualifies the forward-looking information in this annual report.

Petro-Canada disclosure of reserves

Petro-Canada's qualified reserves evaluators prepare the reserves estimates the Company uses. The Canadian provincial securities commissions do not consider Petro-Canada's reserves staff and management as independent of the Company. Petro-Canada has obtained an exemption from certain Canadian reserves disclosure requirements that allows Petro-Canada to make disclosure in accordance with SEC standards where noted in this annual report. This exemption allows comparisons with U.S. and other international issuers.

As a result, Petro-Canada formally discloses its proved reserves data using U.S. requirements and practices, and these may differ from Canadian domestic standards and practices. The use of the terms such as "probable," "possible," "resources" and "life-of-field production" in this annual report does not meet the SEC guidelines for SEC filings. To disclose reserves in SEC filings, oil and natural gas companies must prove they are economically and legally producible under existing economic and operating conditions. Note that when the term barrels of oil equivalent (boe) is used in this annual report, it may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet (Mcf) to one barrel (bbl) is based on an energy equivalency conversion method. This method primarily applies at the burner tip and does not represent a value equivalency at the wellhead. The table below describes the industry definitions that Petro-Canada currently uses:

Definitions Petro-Canada uses | | Reference |

| | |

Proved oil and natural gas reserves (includes both proved developed and proved undeveloped) | | SEC reserves definition (Accounting Rules Regulation S-X 210.4-10, U.S. Financial Accounting Standards Board (FASB) Statement No. 69) |

| | |

| | SEC Guide 7 for Oil Sands Mining |

| | |

Unproved reserves, probable and possible reserves | | Canadian Securities Administrators: Canadian Oil and Gas Evaluation (COGE) Handbook, Vol. 1 Section 5 prepared by the Society of Petroleum Evaluation Engineers (SPEE) and the Canadian Institute of Mining Metallurgy and Petroleum (CIM) |

| | |

Contingent and Prospective Resources | | Petroleum Resources Management System: Society of Petroleum Engineers, SPEE, World Petroleum Congress and American Association of Petroleum Geologist definitions (approved March 2007) |

| | |

| | Canadian Securities Administrators: COGE Handbook Vol. 1 Section 5 |

| | |

Although the Society of Petroleum Engineers resource classification has categories of 1C, 2C and 3C for Contingent Resources, and low, best and high estimates for Prospective Resources, Petro-Canada will only refer to the unrisked 2C for Contingent Resources and the partially risked best estimate for Prospective Resources when referencing resources in this annual report. Estimates of resources in this annual report include contingent resources that have not been adjusted for risk based on the chance of development and partially risked prospective resources that have been risked for chance of discovery, but have not been risked for chance of development. Such estimates are not estimates of volumes that may be recovered and actual recovery is likely to be less and may be substantially less or zero. If a discovery is made, there is no certainty that it will be developed or, if it is developed, there is no certainty as to the timing of such development.

Canadian Oil Sands represents approximately 68% of Petro-Canada's total for Contingent and Prospective Resources. The balance of Petro-Canada's resources is spread out across the business, most notably in the North American frontier and International areas. Also, when Petro-Canada references resources for the Company, unrisked Contingent Resources are approximately 70% of the Company's total resources and partially risked Prospective Resources are approximately 30% of the Company's total resources.

2 | PETRO-CANADA 2008 Annual Report |

|

Cautionary statement: In the case of discovered resources or a subcategory of discovered resources other than reserves, there is no certainty that it will be commercially viable to produce any portion of the resources. In the case of undiscovered resources or a subcategory of undiscovered resources, there is no certainty that any portion of the resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources.

For movement of resources to reserves categories, all projects must have an economic depletion plan and may require:

· additional delineation drilling and/or new technology for unrisked Contingent Resources

· exploration success with respect to partially risked Prospective Resources

· project sanction and regulatory approvals

Reserves and resources information contained in this annual report is as at December 31, 2008.

| 2008 Annual Report PETRO-CANADA | 3 |

Petro-Canada (the Company) is one of Canada's largest oil and gas companies, operating in both the upstream and the downstream sectors of the industry in Canada and internationally. The Company creates value by responsibly developing energy resources and providing world class petroleum products and services. Petro-Canada is proud to be a National Partner to the Vancouver 2010 Olympic and Paralympic Winter Games. Petro-Canada's common shares trade on the Toronto Stock Exchange (TSX) under the symbol PCA and on the New York Stock Exchange (NYSE) under the symbol PCZ.

With a market capitalization of approximately $13.6 billion1, Petro-Canada is a mid-sized energy company. Our roots are in Canada, a country rich in resources and part of the large and growing North American market.

In 2008, Petro-Canada continued to execute its business strategy to focus on operational execution, resulting in the delivery of base business targets, and to advance our major growth projects for future long-term profitability.

This annual report provides details of Petro-Canada's operational and financial capabilities. The Report to the Community, which the Company will publish mid-2009, will elaborate on Petro-Canada's commitment to corporate responsibility objectives and performance.

Financial and Operating Highlights

| | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

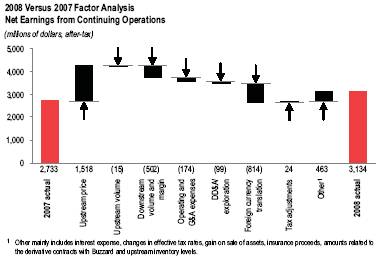

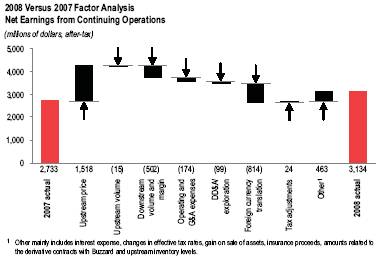

Net earnings from continuing operations ($ millions) | | 3,134 | | 2,733 | | 1,588 | | 1,693 | | 1,698 | |

Cash flow from continuing operating activities ($ millions)1 | | 6,522 | | 3,339 | | 3,608 | | 3,783 | | 3,928 | |

Expenditures on property, plant and equipment and exploration from continuing operations ($ millions) | | 6,344 | | 3,988 | | 3,434 | | 3,560 | | 3,893 | |

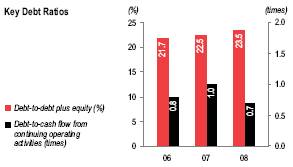

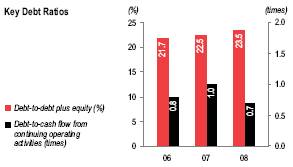

Debt-to-debt plus equity (%)2 | | 23.5 | | 22.5 | | 21.7 | | 23.5 | | 22.8 | |

Debt-to-cash flow from continuing operating activities (times) | | 0.7 | | 1.0 | | 0.8 | | 0.8 | | 0.8 | |

Return on capital employed (%)2 | | 18.6 | | 19.8 | | 14.3 | | 16.0 | | 17.5 | |

Upstream proved reserves before royalties (millions of barrels of oil equivalent – MMboe)3 | | 1,286 | | 1,315 | | 1,274 | | 1,232 | | 1,213 | |

1 Cash flow from continuing operating activities in 2007 was reduced by the payment of $1,145 million after-tax to settle the hedged portion of Buzzard production.

2 Includes results from discontinued operations.

3 The reporting of working interest reserves before royalties, MMboe and combining oil and gas and oil sands mining activities together does not conform to SEC standards.

1 As of February 27, 2009.

1 | PETRO-CANADA 2008 Annual Report |

|

Q&A with the President

At the beginning of 2008, we set two key priorities for Petro-Canada: to meet base business targets and to advance our major growth projects. I want to take this opportunity to explain how the Company performed against these priorities, and to share with you why I believe Petro-Canada has the strength to deliver.

How reliable were Petro-Canada's operations in 2008?

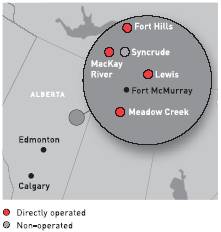

We had solid results in 2008, particularly at Terra Nova and MacKay River, with both facilities running at 90% reliability or better. At MacKay River, we exited the year at nameplate capacity of about 30,000 barrels/day. Our other operated facilities also had excellent reliability, including our natural gas plants, lubricants plant and the Montreal refinery. The Edmonton refinery had some challenges, including an unplanned outage in August and a small fire in late January 2009 after having a stellar run through four to five years of continuous construction; all in all, a very good year that resulted in our production coming in at the high end of our guidance range.

What about safety performance in 2008?

Our total recordable injury frequency improved over 2007 and was again among the industry's best. But as long as we continue to have incidents, there is still room to improve. We're continuing to look for ways to reduce injuries, particularly among our contractors. We remain committed to our goal of Zero-Harm.

What progress did Petro-Canada make on its growth projects in 2008?

We achieved many of our planned milestones, including completing construction of the Edmonton refinery conversion project. We also made a final investment decision on the Syria Ebla gas development and it's on target for a 2010 startup. In Libya, we signed agreements on attractive terms for the Exploration and Production Sharing Agreements, adding significantly to our reserves position. At Fort Hills, our front-end engineering and design work is essentially complete. However, escalating costs and the collapse of the financial markets impacted the project. We are looking for ways to reduce these costs, while working with the Alberta government to extend the mine lease. Fort Hills is a quality initiative and will proceed when the time is right.

How strong is Petro-Canada's financial position given the economic downturn and lower commodity prices?

We've always been financially conservative and this has paid off. In mid-2008, we shored up our balance sheet with a substantial debt issue. We entered 2009 with a year-end cash balance of $1.4 billion, and $4.7 billion in unused credit, leading our Canadian peers when it comes to liquidity. As well, the two metrics used to measure our financial strength (the debt-to-debt plus equity and debt-to-cash flow ratios) are well below our long-term ranges.

What is Petro-Canada's financial strategy to manage through the market uncertainty?

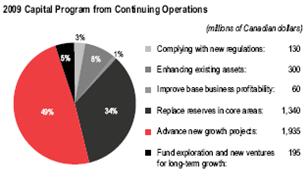

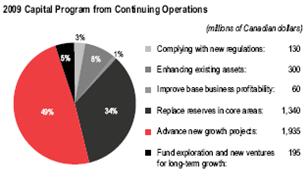

In 2009, we have a planned capital program of $4 billion, down significantly from the $6 to $7 billion range we were looking at for 2009 a year ago. We're prioritizing our capital spending so that no matter how the year unfolds, we can fund most of our capital program from cash flow, cash and, if necessary, a drawdown of available credit facilities. With a strong balance sheet, low debt ratios and diverse businesses able to generate stable cash flows, we're in a great financial position for the times.

How are low commodity prices expected to impact Petro-Canada's business?

We are following the business environment and financial markets closely to manage within our financial means. One of the strengths of our diverse asset base is that we can generate good cash flow even at low oil prices. In our upstream business, 80% of our production will generate positive cash flow at prices well below what we've seen so far this year. Our East Coast and North Sea assets have positive cash flows at crude oil prices of $10/bbl or less.

| PETRO-CANADA Q&A with the President | 5 |

What cost reductions are management contemplating for Petro-Canada in 2009?

As our number one priority is to focus on operational execution in our base business, we're looking at all our discretionary expenses to reduce spending and lower our overall cost structure across the organization. We are doing this without compromising safety or reliability. We are also appropriately pacing our growth projects for the times, looking for ways to reduce capital costs and improve project economics.

How has the downturn impacted Petro-Canada's suite of growth projects?

We are pacing our growth projects through these challenging times to maintain growth in shareholder value. We intend to advance our three Board of Directors-approved projects as originally planned. These are our Libya Exploration and Production Sharing Agreements, the North Amethyst portion of the White Rose Extensions and our Syria Ebla gas development. For our three unsanctioned projects (Fort Hills, the MacKay River expansion and the Montreal coker), we're waiting to see a recovery in commodity prices and financial markets before moving ahead. In the meantime, we're working to reduce project costs and execution risk.

Is Petro-Canada actively pursuing mergers and/or acquisitions?

Petro-Canada has a strong liquidity position and our focus in 2009 is to preserve our capital. However, we do have some financial flexibility to take advantage of opportunities that would complement our existing assets.

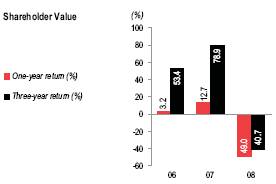

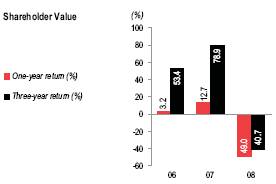

What is management's approach to return cash to shareholders in 2009?

With respect to our use of cash in 2009, our first priority is to fund long-term growth projects. Our second priority is to return cash to shareholders in the form of dividends or share buyback programs. Over the past few years, we have been able to do both, thanks to strong operations and a robust business environment. In 2009, we expect to use most of our free cash to fund operations and projects, so share buybacks will likely not come into play. Paying dividends is a way we return sustainable and growing cash directly to shareholders, a long-term commitment that must be preserved. In that regard, we raised our dividend last July by 54% to $0.20 per share each quarter.

Why do you think Petro-Canada's stock price has underperformed that of its peers?

I believe this is largely due to our strategy of being focused on consistently creating shareholder value over time. Increasingly, equity investors are becoming more short-term oriented, moving in and out of stocks in search of short-term gains. Because we invest in large, long-life projects, our growth tends to come in stages. We are in this business for the long run and are well positioned to succeed in both good and tough economic times. The excellent position we're in during the current circumstances is a good illustration of that.

One specific issue that impacted shareholder sentiment in 2008 was the extraordinary run-up in costs for the Fort Hills project, resulting in one of our key growth projects becoming uneconomic. However, we're addressing that by moving from a schedule-driven to a cost-driven project focus, and taking advantage of the current softening in the construction market to bring capital and operating costs back down.

What is your response to those in the investment community critical of Petro-Canada's strategy?

We are always open to dialogue with existing and prospective shareholders about the Company's strategy and plans. We share their objective of creating long-term shareholder value.

I remain confident that Petro-Canada has the right strategy and plan in place. Our strategy positions the Company well to weather this tough business environment, because it maintains our financial strength and preserves our growth opportunities.

6 | PETRO-CANADA Q&A with the President |

|

How is management keeping employees engaged during these uncertain times?

Employees are our most valuable resource. Over the years, we have enhanced and increased our focus on leadership development and internal communications to keep employees engaged and up to date on Petro-Canada. We have accelerated development for some strong performers and facilitated face-to-face and online discussions between leaders and their teams. Employees actively participate in many of these discussions.

What is your perspective on the debate between energy development and environmental impact, particularly related to the oil sands?

We recognize both energy development and environmental protection are integral to our success. The oil sands, in particular, play a big role in our future. This supply source makes up a significant portion of global energy supply from non state-controlled countries, but it also presents environmental challenges. We're committed to working with industry, government, regulators and subject experts to respond to these challenges, address stakeholders concerns and work toward minimizing our environmental impact. I believe we can continue to develop this important resource in a way that meets society's expectations.

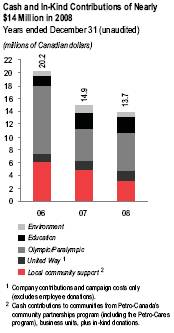

Is Petro-Canada considering scaling back its community partnership program or Olympic Games sponsorship?

Petro-Canada's success as an energy company depends on the support of people in many communities. We remain committed to all our partnerships, both at the local community grassroots level and the larger scale Olympic Games.

What is Petro-Canada's position on climate change actions and evolving regulations?

Climate change is one of the toughest environmental issues we face today and in the foreseeable future. It's a complex issue, which requires integrated solutions – solutions we want to be a part of. We're working to minimize our environmental footprint, including efforts to reduce greenhouse gases in Canada and abroad. We're working with our industry association and government officials to develop a climate change framework. And we're encouraging candid, two-way dialogue with our stakeholders.

What are the key factors to Petro-Canada's short- and long-term success?

First, the need for operational execution (safe and reliable operations) is as great as ever. This is how we will generate maximum cash flow in this environment. Second, we must use our financial strength prudently to manage our way through this economic downturn and come out well positioned on the other side. And finally, it's imperative to have quality growth projects for future development that will produce stable, long-term cash flows and help secure further opportunities. Plain and simple, Petro-Canada is strong on all three fronts.

We have a track record of solid operational reliability, businesses that generate robust cash flows, a strong financial position and a quality portfolio of assets. I am confident that Petro-Canada has the strength to deliver.

|

|

Ron Brenneman |

President and Chief Executive Officer |

| Q&A with the President PETRO-CANADA | 7 |

Management's Discussion and Analysis

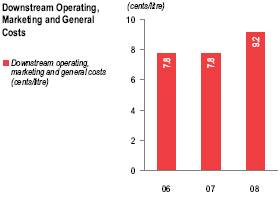

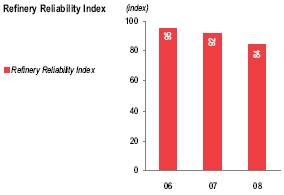

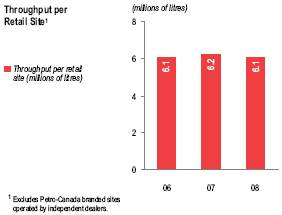

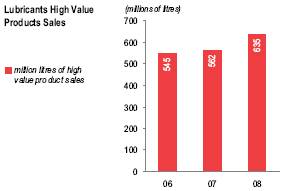

This Management's Discussion and Analysis (MD&A), dated effective as of February 23, 2009, should be read in conjunction with the audited Consolidated Financial Statements and Notes for the year ended December 31, 2008, included within this 2008 annual report and the 2008 Annual Information Form (AIF). Financial data has been prepared in accordance with Canadian generally accepted accounting principles (GAAP), unless otherwise specified. All dollar values are Canadian (Cdn) dollars, unless otherwise indicated. All oil and natural gas production and reserves volumes are stated before deduction of royalties, unless otherwise indicated. Graphs accompanying the text portray performance of the Company within its “value drivers,” which are the key measures of performance in each segment of Petro-Canada's business. A glossary of financial terms, ratios and acronyms can be found on page 114 of this report.

BUSINESS ENVIRONMENT

The major economic factors influencing Petro-Canada's upstream financial performance include crude oil and natural gas prices and foreign exchange, particularly the Cdn dollar/U.S. dollar rates (US). Crude oil and natural gas prices are affected by a number of factors, including the balance of supply and demand, weather and political events. Economic factors influencing Downstream financial performance include the level and volatility of crude oil prices, industry refining margins, levels of crude oil price differentials, demand for refined petroleum products, the degree of market competition and foreign exchange, particularly the Cdn dollar/U.S. dollar rates.

Business Environment in 2008

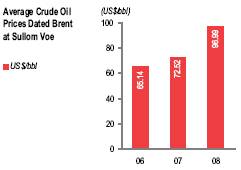

The year 2008 was one of the most volatile on record for oil markets. The first half of the year saw significant upward momentum in oil prices as weak supply growth fell short of robust demand growth in non-Organization of Economic Co-operation and Development (OECD) countries. Economic momentum slowed dramatically in the second half of the year as the global financial crisis intensified, depressing crude oil demand appreciably. By the end of 2008, demand was negative. The swings in oil prices through 2008 were also accompanied by record inflows, followed by record outflows, of investment dollars from commodity market funds. The price of North Sea Brent (Dated Brent) opened the year at just under $100 US/barrel (bbl),

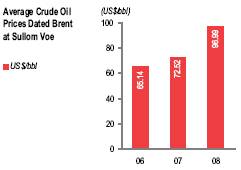

climbed to record highs of over $140 US/bbl in early July, and then fell steadily to under $45 US/bbl by early December. Despite the declines in the latter half of the year, the annual average price of Dated Brent was the highest ever at $96.99 US/bbl, approximately one-third above the 2007 average. | | |

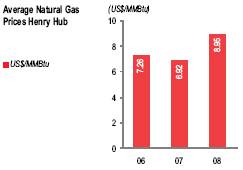

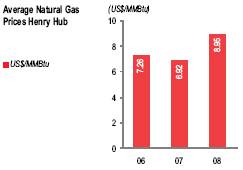

In 2008, the international light/heavy crude (Dated Brent/Mexican Maya) price differential averaged $13.15 US/bbl, somewhat wider than the $12.67 US/bbl posted in 2007. Canadian light/heavy crude (Edmonton Light/Western Canada Select (WCS)) spreads narrowed in 2008 to $19.91 Cdn/bbl from $24.07 Cdn/bbl in 2007. Canadian heavy crudes continued to be sold at a greater discount to light crudes, compared with international heavy crudes. This is due to Canadian heavy crude oil production growing at a faster rate than North American investment to convert refineries to process heavy feedstock. The Canadian discount narrowed in 2008, however, as the supply of competing heavy oil imports from Mexico and Venezuela declined. North American natural gas prices were very volatile in 2008. Natural gas prices at the Henry Hub ranged from over $13.50 US/million British thermal units (MMBtu) in July to under $6.50 US/MMBtu in November. Overall, Henry Hub prices averaged $8.95 US/MMBtu in 2008, about 30% higher than in 2007. The increase was due to higher crude oil prices, which raised the cost of distillate fuels that in turn competed with natural gas. In 2008, the Canadian natural gas price at the AECO-C hub rose 23%, somewhat less than U.S. prices, as the strength of the | |

|

8 | PETRO-CANADA Management's Discussion and Analysis |

|

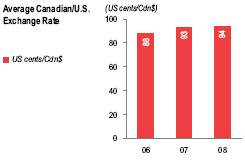

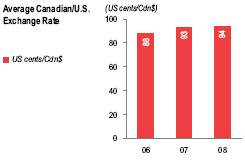

Canadian dollar in the first half of the year offset some of the gains in natural gas prices. The Canadian dollar was also extremely volatile in 2008, falling from parity with the U.S. dollar in the first half of the year to under 80 cents US by December. Overall, the Canadian dollar averaged 94 cents US in 2008, compared with 93 cents US in 2007. The strength of the Canadian currency in the first half of the year reduced some of the impact of stronger international prices on Canadian crude oil and natural gas prices. Similarly, the decline in the Canadian dollar in the second half of the year offset some of the impact from the declines in international crude oil and natural gas prices. In the downstream sector, refined petroleum products sales in Canada increased by 0.5% in 2008, compared with a gain of 3.4% in 2007. Demand growth in 2008 was relatively stronger in Canada than in the U.S., but momentum slowed steadily through the year. The New York Harbor 3-2-1 crack spread, an indicator of overall refining margins, averaged $9.58 US/bbl in 2008, compared with $14.15 US/bbl in 2007. Declines in gasoline cracking margins more than offset gains in distillate cracking margins. With the exception of relatively brief hurricane-induced spikes in September, gasoline cracking margins were pressured downward by declining U.S. consumption. Distillate margins rose markedly, averaging over $19.61 US/bbl, as strong demand for diesel fuel from non-OECD countries and commodity producers led to sharply higher product exports from the U.S. | |

|

Commodity Price Indicators and Exchange Rates

(averages for the years indicated) | | | | 2008 | | 2007 | | 2006 | |

Crude oil price indicators (per bbl) | | | | | | | | | |

Dated Brent at Sullom Voe | | US$ | | 96.99 | | 72.52 | | 65.14 | |

West Texas Intermediate (WTI) at Cushing | | US$ | | 99.65 | | 72.31 | | 66.22 | |

WTI/Dated Brent price differential | | US$ | | 2.66 | | (0.21 | ) | 1.08 | |

Dated Brent/Mexican Maya price differential | | US$ | | 13.15 | | 12.67 | | 13.94 | |

Edmonton Light | | Cdn$ | | 102.83 | | 76.84 | | 73.23 | |

Edmonton Light/WCS (heavy) price differential | | Cdn$ | | 19.91 | | 24.07 | | 22.40 | |

Natural gas price indicators | | | | | | | | | |

Henry Hub (per MMBtu) | | US$ | | 8.95 | | 6.92 | | 7.26 | |

AECO-C spot (per thousand cubic feet – Mcf) | | Cdn$ | | 8.47 | | 6.89 | | 7.28 | |

Henry Hub/AECO basis differential (per MMBtu) | | US$ | | 1.15 | | 0.80 | | 1.09 | |

New York Harbor 3-2-1 refinery crack spread (per bbl)1 | | US$ | | 9.58 | | 14.15 | | 9.80 | |

US$/Cdn$ exchange rate | | US$ | | 0.94 | | 0.93 | | 0.88 | |

1 On January 1, 2007, the New York Harbor 3-2-1 crack spread calculation changed. It is now based on Reformulated Gasoline Blendstock for Oxygenate Blending (RBOB) gasoline (the base for blending gasoline with 10% denatured ethanol) as opposed to conventional gasoline. Due to this change in specification, the 2007 and 2008 crack spread values are not directly comparable to 2006 values.

| Management's Discussion and Analysis PETRO-CANADA | 9 |

Competitive Conditions

It is increasingly challenging for the energy sector to find new sources of oil and natural gas. Petro-Canada is well positioned to successfully increase production of oil and natural gas and compete for new opportunities that could complement existing upstream resources. The Company has an estimated 14 billion barrels of oil equivalent (boe) of resources from which to develop new production, with approximately 68% of the resources located in Alberta's oil sands. With upstream business operations in Canada and internationally, the Company has the flexibility to pursue a wide range of opportunities. While the Company has significant operational scope, as measured by production levels, it remains a mid-sized global company. This means Petro-Canada has the operational capability and balance sheet strength to invest in large projects, but smaller investments can also have a meaningful impact on the Company's production levels and financial returns.

Petro-Canada is well positioned to compete in the petroleum product refining and marketing business in Canada. Petro-Canada has the second largest downstream business in Canada and is the “brand of choice.” The Company conducts business in the downstream throughout Canada as an integrated business unit and participates in the refining, distribution and marketing of petroleum products. The Company also offers a wide range of ancillary non-petroleum goods and services, such as convenience retailing, automotive repair and car washes.

The Company's strong financial position, track record of successfully executing large capital projects and depth of management experience should enable it to continue to compete effectively in the current business environment.

Outlook for Business Environment in 2009

Prices for energy commodities are expected to remain volatile in 2009, reflecting the high degree of uncertainty associated with the global financial crisis and the unprecedented scale and scope of official stimulus measures being implemented around the world. On the demand side, the world economy has moved into recession in 2009 following one of the strongest and longest global expansions since the Second World War.

The global financial crisis has led to a marked increase in the cost and a large decrease in the availability of capital. The petroleum industry is highly capital intensive, requiring significant reinvestment rates in order to maintain output to offset natural reservoir declines. Reduced cash flows from lower commodity prices coupled with capital constraints will lead to lower supply growth over the coming years. Supply may also be influenced by the Organization of the Petroleum Exporting Countries (OPEC) production decisions.

More stringent environmental regulations are anticipated which, relative to the situation, will slow the growth rate of energy demand by directly or indirectly increasing the cost of consuming fossil fuels.

There are several downside risks for North American natural gas markets in 2009. Higher residential demand due to colder-than-normal temperatures this winter across most of North America has been offset by very weak industrial demand, the latter of which is expected to persist until the economy recovers. Slower economic growth in both Europe and Asia, where relatively higher natural gas prices attracted virtually all of the global liquefied natural gas (LNG) supply in 2008, could push some of these shipments back into the U.S. market in 2009. U.S. domestic natural gas supply rose strongly over the past year owing to innovative applications of horizontal drilling and fracturing technologies in non-conventional reservoirs (especially shale and tight-sands gas deposits). Although drilling activity declined sharply alongside the collapse in commodity prices and rising cost of capital, this is not expected to reverse the upward trend in domestic supplies until late 2009 at the earliest.

Barring refinery mishaps or accidents of nature, 2009 refining margins in the downstream are expected to be weaker than in 2008. North American refined petroleum products demand will likely remain well below aggregate refining capacity until the economy begins to recover.

Finally, the Canadian dollar is expected to remain loosely correlated with crude oil prices in 2009, providing some offset to fluctuations in international crude oil and natural gas prices.

10 | PETRO-CANADA Management's Discussion and Analysis |

|

Economic Sensitivities

The following table illustrates the estimated after-tax effects that changes in certain factors would have had on Petro-Canada's 2008 net earnings had these changes occurred.

Sensitivities Affecting Net Earnings

Factor1, 2 | | Change (+) | | Annual Net

Earnings

Impact | | Annual Net

Earnings

Impact | |

| | | (millions of Canadian

dollars) | | ($/share)3 | |

Upstream | | | | | | | |

Price received for crude oil and natural gas liquids (NGL)4 | | $ | 1.00/bbl | | $ | 54 | | $ | 0.11 | |

Price received for natural gas | | $ | 0.25/Mcf | | 30 | | 0.06 | |

Exchange rate: US$/Cdn$ refers to impact on upstream earnings5 | | $ | 0.01 | | (60 | ) | (0.12 | ) |

Crude oil and NGL production (barrels/day – b/d) | | 1,000 b/d | | 15 | | 0.03 | |

Natural gas production (million cubic feet/day – MMcf/d) | | 10 MMcf/d | | 11 | | 0.02 | |

Downstream | | | | | | | |

New York Harbor 3-2-1 crack spread | | $ | 1.00 US/bbl | | 22 | | 0.05 | |

Chicago 3-2-1 crack spread | | $ | 1.00 US/bbl | | 20 | | 0.04 | |

Seattle 3-2-1 crack spread | | $ | 1.00 US/bbl | | 9 | | 0.02 | |

WTI/Dated Brent price differential | | $ | 1.00 US/bbl | | 25 | | 0.05 | |

Dated Brent/Maya FOB price differential | | $ | 1.00 US/bbl | | 5 | | 0.01 | |

WTI/synthetic price differential | | $ | 1.00 US/bbl | | 14 | | 0.03 | |

Exchange rate: US$/Cdn$ refers to impact on downstream cracking margins and crude price differentials6 | | $ | 0.01 | | (11 | ) | (0.02 | ) |

Natural gas fuel cost – AECO natural gas price | | $ | 1.00 Cdn/Mcf | | (10 | ) | (0.02 | ) |

Asphalt –% of Maya crude oil price | | 1% | | 2 | | – | |

Heavy fuel oil –% of WTI crude oil price | | 1% | | 2 | | – | |

Corporate | | | | | | | |

Exchange rate: US$/Cdn$ refers to impact of the revaluation of U.S. dollar-denominated, long-term debt7 | | $ | 0.01 | | $ | 31 | | $ | 0.06 | |

1 The impact of a change in one factor may be compounded or offset by changes in other factors. This table does not consider the impact of any inter-relationship among the factors.

2 The impact of these factors is illustrative.

3 Per share amounts are based on the number of shares outstanding at December 31, 2008.

4 This sensitivity is based upon an equivalent change in the price of WTI and Dated Brent.

5 A strengthening Canadian dollar compared with the U.S. dollar has a negative effect on upstream net earnings.

6 A strengthening Canadian dollar compared with the U.S. dollar has a negative effect on downstream cracking margins and crude price differentials.

7 A strengthening Canadian dollar versus the U.S. dollar has a positive effect on corporate earnings with respect to the Company's U.S. dollar-denominated debt. The impact refers to gains or losses on $2.9 billion US of the Company's U.S. dollar-denominated long-term debt and interest costs on U.S. dollar-denominated debt. Gains or losses on $1.1 billion US of the Company's U.S. dollar-denominated long-term debt, associated with the self-sustaining International business segment and the U.S. Rockies operations included in the North American Natural Gas business segment, are deferred and included as part of shareholders' equity.

| Management's Discussion and Analysis PETRO-CANADA | 11 |

BUSINESS STRATEGY

Value Proposition and Strategy

The value proposition Petro-Canada offers to its investors can best be summarized as “Integrated Value from a Diversified Resource Base.” The Company's business strategy continues to be:

· improving the profitability of the base business

· meeting annual production guidance

· selecting the right assets to develop and then driving for first quartile performance1

· taking a disciplined approach to profitable growth

· leveraging existing assets

· accessing new opportunities with a focus on long-life assets

· building a balanced exploration program

The Company believes its structure and scope strategically position Petro-Canada to deliver long-term shareholder value. With a base in Canada, Petro-Canada is situated in a stable, resource-rich and demand-driven market. An ever-increasing international presence and integration across businesses provide the Company access to more value-adding growth opportunities and an ability to better manage risk through a diversified portfolio. As a mid-sized global company, even smaller sized investments can have a material impact. Through its major growth projects, Petro-Canada has visible and flexible growth over the next several years. The Company remains committed to developing energy resources responsibly and providing growth opportunities for employees.

Execution of the Strategy in 2008

Improving Base Business Profitability

For 2008, Petro-Canada focused on two areas to deliver improved base business profitability, delivering upstream production in line with updated annual guidance and continuing to improve safety and reliability performance. Safety, reliability and cost management are measures that are continuously tracked, reported and improved upon.

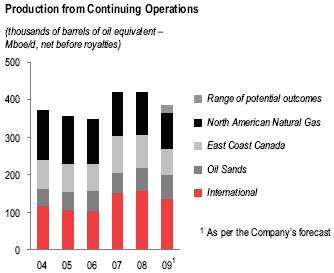

Through a focus on execution, the Company achieved upstream production at the high end of its guidance range of 400,000 to 420,000 barrels of oil equivalent/day (boe/d) in 2008. This strong production growth was largely due to strong reliability at most of the Company's major facilities.

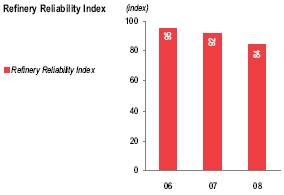

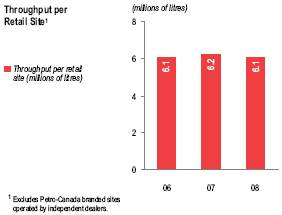

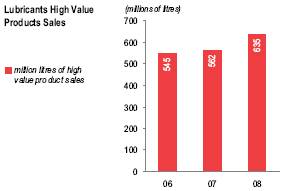

Western Canada natural gas processing facilities operated at reliability rates of 99%. The two Downstream refineries and lubricants plant had a combined reliability index of 86. The lower Downstream reliability in 2008 was due to unplanned outages at the Edmonton refinery. The most significant improvements in 2008 were at the Terra Nova facility and the Oil Sands' MacKay River in situ operation, with reliabilities of 90% and 97%, respectively. The Company has a continued focus to improve facility reliability in 2009.

Corporate-wide, Petro-Canada views safety as an indicator of operational excellence. The Company has a Zero-Harm philosophy. This means the Company believes that work-related injuries and illnesses are foreseeable and preventable. The Company is committed to maintaining a first quartile safety record. In 2008, Petro-Canada achieved a Total Recordable Injury Frequency (TRIF) of 0.73, a 16% improvement over the previous year, and one of the best safety records in the sector.

Managing costs is another key to improving base business profitability. Petro-Canada has a disciplined approach to financial management with efforts constantly made across the Company to responsibly manage expenses and improve efficiencies. Petro-Canada entered 2009 with a strong liquidity position, providing the Company with flexibility to execute its capital program.

1 References to first quartile operations in this report do not refer to industry-wide benchmarks or externally known measures. The Company has a variety of internal metrics that define and track first quartile operational performance.

12 | PETRO-CANADA Management's Discussion and Analysis |

|

Maintaining Financial Discipline and Flexibility

PRIORITY | | | 2008 GOALS | | | 2008 RESULTS | | | 2009 GOALS | |

Fund Capital

Expenditures with

Cash Flow and Debt

As Required | | | · fund $5.3 billion capital expenditure

program through a combination of

cash flow and access to capital

markets, as needed · prioritize execution of projects · maintain investment grade credit ratings | | | · funded capital expenditure program of $6.4 billion from liquidity sources · exercised flexibility within major

projects in response to business

environment · maintained investment grade credit

ratings of Baa2 from Moody's

Investors Services (Moody's), BBB

from Standard & Poor's (S&P) and A (low) from DBRS Limited (DBRS) · ended 2008 strong, with debt levels at 23.5% of total capital and a ratio of 0.7 times debt-to-cash flow from

operating activities · maintained adequate liquidity, with a year-end cash balance of $1.4 billion and unutilized credit facility capacity of $4.7 billion | | | · fund $4.0 billion capital expenditure

program from expected cash flow,

cash on hand and accessing balance sheet strength, as needed · manage operating and capital costs

within budgets · maintain investment-grade credit ratings | |

Fund Profitable

Growth | | | · identify and invest in long-life assets | | | · made final investment decision (FID)

on Syria Ebla gas project, signed

Libya Exploration and Production

Sharing Agreements (EPSAs), funded Edmonton refinery conversion project (RCP) and received approval for North Amethyst portion of White Rose

Extensions · postponed making FID on Fort Hills Phase 1, MacKay River expansion (MRX) and Montreal coker | | | · invest in additional growth

opportunities when there is a strong

business case | |

Return Cash to

Shareholders | | | · regularly review the dividend strategy to align with financial and growth objectives and shareholder

expectations · buy back shares, when appropriate

with priority to first fund profitable

growth | | | · increased quarterly dividend by 54% to $0.20/share · renewed normal course issuer bid

(NCIB) program in June 2008,

entitling the Company to purchase up to 5 of the outstanding common

shares, subject to certain conditions · purchased zero shares during 2008 | | | · regularly review the dividend strategy to align with financial and growth objectives, and shareholder

expectations · buy back shares when appropriate,

with priority to first fund profitable

growth | |

Long-Term Profitable Growth

Adding new material opportunities is fundamental to long-term growth. In 2008, one of Petro-Canada's priorities was to advance its seven major growth projects. Highlights included completing construction of the Edmonton RCP, signing six new Libya EPSAs and making a FID on the Syria Ebla gas development. In the East Coast business, project partners received regulatory approval for the North Amethyst development of the White Rose Extensions project to proceed. The Company also completed preliminary front-end engineering and design (FEED) work on the Fort Hills project, received regulatory approval for expansion of the MacKay River facility and progressed engineering on the Montreal coker project.

In pursuing these growth projects, Petro-Canada is seeking to increase the relative proportion of long-life resources in the portfolio as a means to deliver sustainable cash flow and earnings. With the exception of the White Rose Extensions, all of

| Management's Discussion and Analysis PETRO-CANADA | 13 |

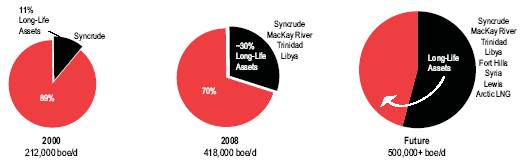

these major growth projects are considered long-life assets. In the upstream, Petro-Canada defines long-life assets as those projects that have more than 10 years of peak production and sustainable cash flow. In the Downstream, refineries and gasoline stations share the same long-life characteristics. These kinds of assets provide sustainable cash flow and make the Company less dependent on exploration success for growth. The Company also seeks to expand long-life assets from existing infrastructure.

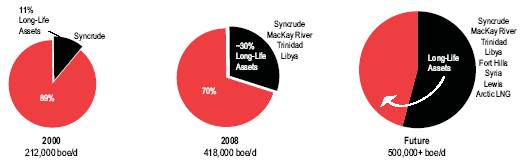

Long-Life Production (%)

In 2008, about 30% of Petro-Canada's production came from assets considered long-life. Successful execution of the business strategy will mean a higher proportion of long-life resources in the future.

Along with long-life assets, the Company pursues profitable growth through a balanced exploration program. A balanced exploration program is one that provides a balanced risk/reward profile and that collectively adds to reserves over time. In 2008, Petro-Canada and its partners drilled 14 exploration wells.

Five of these wells were completed as discoveries and two were completed as successful appraisal wells. Drilling of an Alaskan well was suspended, and there is a plan for re-entry in 2009. Six wells were abandoned as dry holes or non-commercial discoveries and were written off. At year-end 2008, operations continued on one well.

This table represents exploration in International, East Coast Canada, Alaska and the Northwest Territories (NWT) but does not include Western Canada and U.S. Rockies.

| | 2008 Results | | 2009 Outlook | |

(number of wells) | | Discoveries –

Oil | | Discoveries –

Natural Gas | | Still being

evaluated | | Dry and

abandoned | | | |

North Sea | | 2 | | 2 | | – | | 2 | | 4 | |

Syria | | – | | – | | – | | – | | – | |

Libya | | 1 | | – | | – | | – | | 4 | |

Trinidad and Tobago | | – | | 4 | | – | | 2 | | – | |

Alaska | | – | | 1 | | 1 | | – | | 3 | |

NWT | | – | | – | | – | | 1 | | – | |

East Coast Canada | | – | | – | | – | | – | | 1 | |

Total1 | | 3 | | 7 | | 1 | | 5 | | 12 | |

1 Two wells were carried over into 2008 from 2007.

14 | PETRO-CANADA Management's Discussion and Analysis |

|

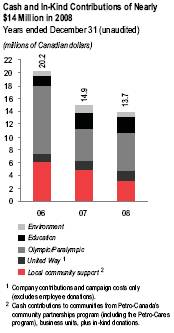

Following our Principles for Responsible Investment and Operations

| Our principles guide our actions and track our performance in the areas of business conduct, community support, environment, working conditions and human rights. Petro-Canada's Community Partnerships Program supports significant community initiatives relating to key business areas. Education and capacity building are themes that underpin all the Company's investments. The Company's community initiatives aim to create long-term programs with a measurable investment return for the Company and its partners. There is a growing concern about the impact the energy sector has on the environment. The Company shares this concern and actively seeks to minimize the impact of Petro-Canada's operations on land, water and air. The Company's areas of focus are use of water, and management of greenhouse gas (GHG) emissions and air emissions. Petro-Canada had approximately 6,100 employees and many contractors working on its behalf at year-end 2008. In 2008, Petro-Canada recruited more than 950 new employees. The Company is committed to providing them with a safe and rewarding place to work where they can learn and make a difference. |

Following our Principles for Responsible Investment and Operations

PRIORITY | | | PRINCIPLES | | | 2008 GOALS | | | 2008 RESULTS | | | 2009 GOALS |

Business Conduct | | | · comply with applicable laws

and regulations · apply our Code of Business

Conduct wherever we

operate · seek contractors, suppliers

and agents whose practices

are consistent with our

principles | | | · update Code of Business

Conduct and introduce

interactive web-based

training on the new Code of Business Conduct · continue to strengthen

communication of Code of

Business Conduct

expectations with an

increasing contractor

workforce · improve new employee

orientation process across

the Company to emphasize Zero-Harm and Total Loss Management (TLM) culture

and principles · implement online TLM

training to strengthen

employee understanding | | | · updated Code of Business

Conduct · interactive web-based training completed by 4,419

employees and 408

contractors · delivered workshop-style anti-corruption training at nine Company locations, training both employees and

contractors · implemented new employee

orientation process,

integrating TLM and Zero-

Harm to reduce the risk of

loss or injury · conducted online TLM training modules in four priority elements for 4,869

employees · developed online training to

strengthen risk assessment

capability | | | · update policy for the

Prevention of Improper

Payments · introduce interactive web-

based training on the Policy for the Prevention

of Improper Payments · review and update the

Company's anti-trust and fair competition

compliance program · integrate risk assessment

methodology into all TLM

processes, including the

event management

system |

| Management's Discussion and Analysis PETRO-CANADA | 15 |

Following our Principles for Responsible Investment and Operations (continued)

PRIORITY | | PRINCIPLES | | 2008 GOALS | | 2008 RESULTS | | 2009 GOALS |

Community | | | · strive within our sphere of

influence to ensure a fair

share of benefits to

stakeholders impacted by

our activities · conduct meaningful and

transparent consultation with

all stakeholders · endeavour to integrate our activities with, and participate in, local communities as good corporate citizens | | | · improve the consistency

and capability relative to

engaging with stakeholders · solicit feedback from

external stakeholders

regarding the effectiveness

of the Company's

interactions · initiate and implement a

social investment program

that is integral to the Libya

EPSAs · introduce a number of new

key community

partnerships in our

education, environment and

local community support

areas · advance Olympic initiatives

in anticipation of the 2010

Winter Olympics | | | · delivered training based on

Stakeholder and Community

Engagement principles to 134

stakeholder practitioners

across all business units · integrated stakeholder issue

management system into key

projects and emergency

response plans

· solicited focused stakeholder

feedback on specific projects · piloted a World Business

Council for Sustainable

Development (WBCSD)

framework to guide

investment proposals for

Libya sustainable

development program · extended long-term

sponsorships, introduced new

community partnerships and

deepened existing

partnerships · supported the Canadian

Olympic and Paralympic

teams in Beijing, and

announced Petro-Canada

Athlete Family Program for

2010 Games in Vancouver · launched Employee Olympic

Centre website | | | · continue to broaden

stakeholder engagement

capability across operational

roles and with contractors · update TLM standards and

audit criteria to reflect

stakeholder management

framework expectations · integrate stakeholder

engagement practices into

North African development

and exploration projects · work jointly with the Libya

National Oil Corporation

(NOC) on identifying projects for the Libya

sustainable development

program · enhance content of key

community partnerships,

identify synergies and

increase stakeholder

awareness of initiatives · launch 2010 Olympic

glassware campaign to

support Canadian athletes,

and develop operations plan

to “Fuel the Games" in

Vancouver |

Environment | | | · conduct our activities with

sound environmental

management and

conservation practices · strive to minimize the

environmental impact of our

operations · work diligently to prevent

any risk to community health

and safety from our

operations or our products · seek opportunities to transfer expertise in

environmental protection to

host communities | | | · integrate Water Principles

into the environmental

stewardship process · pilot carbon intensity

performance measures · continue to review internal

and external GHG

mitigation opportunities · meet 2008 auditable

emissions reporting

requirements · commence development of

second phase of

environmental information

management system for

water and waste

management · advance major water-

related community

partnership projects | | | · experienced 43 environmental

regulatory exceedances,

compared with 21 in 2007 · advanced water management

plans through water risk

assessments based on Water

Principles · made limited progress on

carbon performance

measures · strengthened resources and

capability in managing carbon

mitigation opportunities · participated in Alberta carbon

market · complied with Alberta

regulations for verified

emissions reporting · improved emission

functionality of first phase of

environmental information

management system · created program content and

materials for major water

partnerships | | | · reinforce senior

management focus on

environmental regulatory

exceedances in 2009 · develop and integrate

relevant water measurement

and reporting functionality

into next phase of

environmental information

management system · pursue viable opportunities

to purchase carbon credits · participate in WBCSD

protocol development to

better understand

Petro-Canada's broader

GHG emissions footprint · initiate work on development

of ecosystem principles · build strength in water

partnerships and promote

publicly |

16 | PETRO-CANADA Management's Discussion and Analysis |

|

Following our Principles for Responsible Investment and Operations (continued)

PRIORITY | | PRINCIPLES | | 2008 GOALS | | 2008 RESULTS | | 2009 GOALS |

Working Conditions and Human Rights | | | · provide a healthy, safe and

secure work environment · honour internationally

accepted labour standards

prohibiting child labour,

forced labour and

discrimination in

employment · respect freedom of

association and expression in the workplace · not be complicit in human

rights abuses · support and respect the

protection of human rights

within our sphere of

influence | | | · establish enterprise-wide

contractor engagement

process for selection,

performance monitoring

and management · attract 925 new employees · develop capability in

managing the social issues of a temporary foreign workforce · pilot a social risk

assessment that will apply to new operations · enhance management,

systems and work

processes related to

process safety · strengthen process for

communicating and

learning from internal high potential and serious events | | | · achieved TRIF of 0.73 in

2008, compared with 0.87 in 2007 · experienced a contractor

work-related fatality at the

Edmonton RCP in September 2008 · assessed current state, and best practices for contractor engagement and identified quick wins · attracted 951 new employees · assessed and developed

mitigation plans for social

risks related to bringing

temporary foreign workers

into Oil Sands project camps · developing standards,

incorporating process safety

criteria into TLM audits and

capturing event data · established a formal process for reviewing

internal and external

events and ensuring

that learnings reach the

front line · conducted emergency

response exercises in four out of five business groups | | | · develop enterprise-wide

training for front-line

supervisors to enhance their ability to execute work safely · develop processes, tools

and expectations for

stronger contractor

engagement on safety · enhance emergency

response advisor capability

through increased training · upgrade emergency

response command centre

facility · implement new corporate

standards for management

of change and process

safety competency · integrate use of social risk

assessment process into

project delivery model · review and strengthen

Company's human rights

management framework |

| | | | | | | | | | | | |

Business Strategy Looking Forward

Key priorities for Petro-Canada in 2009 are striving to ensure that existing facilities run safely, reliably and efficiently through excellent execution and prudently managing the Company's financial strength. This same focus on execution and cost management will apply to the advancement of Petro-Canada's major projects over the next several years. Capital expenditures are expected to be $4.0 billion in 2009, down 38% from 2008, reflecting the Company's focus on the preservation of cash. In 2009, growth highlights are expected to include moving the Company's Board of Directors-approved projects (Libya EPSAs, which came on-stream in 2008, the North Amethyst portion of the White Rose Extensions project and the Syria Ebla gas development) ahead, as originally planned.

Major Approved Project | | Target On-Stream Date | |

Libya EPSAs | | 2008 | |

White Rose Extensions | | 2009 | |

Syria Ebla Gas Development | | 2010 | |

The three unsanctioned projects (Montreal coker, MRX and Fort Hills Phase 1) are on hold until the commodity and financial markets strengthen. The Company is reworking costs to improve project economics.

The Company also plans on drilling up to 12 exploration wells in the North Sea, Libya, East Coast Canada and the Alaska Foothills.

| Management's Discussion and Analysis PETRO-CANADA | 17 |

RISK MANAGEMENT

Risks Relating to Petro-Canada's Business

Petro-Canada's results are impacted by several risks and management's strategies for handling these risks. Management believes each major risk requires a unique response based on Petro-Canada's business strategy and financial tolerance. Some risks can be effectively managed through internal controls, business processes, insurance and hedging. Hedging is used in limited circumstances, mainly to mitigate Downstream risks associated with refinery feedstock costs. Petro-Canada's business risks include, but are not limited to, the following items. These risks could have a material adverse effect on the Company's business, financial conditions and results of operations.

A substantial or extended decline in crude oil or natural gas prices could have a material adverse effect on Petro-Canada.

The Company's financial condition depends substantially on the market prices of crude oil and natural gas. Fluctuations in crude oil or natural gas prices could have a material adverse effect on Petro-Canada's financial condition, as well as the value and amount of the Company's reserves. Prices for crude oil and natural gas fluctuate in response to changes in the supply of and demand for crude oil and natural gas, market uncertainty and a variety of other factors beyond Petro-Canada's control. These factors include, but are not limited to, the actions of OPEC, world economic conditions, government regulation, political developments, the foreign supply of oil, the price of foreign imports, the availability of alternate fuel sources and weather conditions. Canadian natural gas prices are primarily affected by North American supply and demand, weather conditions, the level of industry inventories, political events, and, to a lesser extent, the price of alternate sources of energy.

Any substantial or extended decline in the prices of crude oil or natural gas could result in a delay or cancellation of existing or future drilling, development or construction programs, curtailment in production at some properties and unused long-term transportation commitments.

The margins realized for Petro-Canada's refined products are also affected by factors such as crude oil price fluctuations due to the impact on refinery feedstock costs, third-party refined product purchases and the demand for refined petroleum products. The Company's ability to maintain product margins in an environment of higher feedstock costs depends upon its ability to pass higher costs on to customers.

Petro-Canada's operations are subject to physical damage, business interruption and casualty losses.

Petro-Canada is subject to the operating risks associated with exploring for, and producing, oil and natural gas, as well as operating midstream and downstream facilities. These risks include blowouts, explosions, fires, gaseous leaks, equipment failures, migration of harmful substances, adverse weather conditions and oil spills. These risks could cause personal injury, could result in damage or destruction to oil and natural gas wells, formations, production facilities, other property and equipment, and the environment, and could interrupt operations. In addition, Petro-Canada's operations are subject to the risks related to transporting, processing and storing of oil, natural gas and other related products, drilling of oil and natural gas wells, and operating and developing oil and natural gas properties.

Factors that affect Petro-Canada's ability to execute projects could adversely affect business results.

Petro-Canada manages a variety of projects to support operations and future growth. Significant project cost overruns could make certain projects uneconomic. The Company's ability to execute projects depends upon numerous factors, which may include, but are not limited to, changes in project scope, labour availability and productivity, staff resourcing, availability and cost of material and services, design and/or construction errors, delays in regulatory approvals, the ability of partners to deliver on project commitments and access to capital funding. As a result, Petro-Canada may not be able to execute projects on time, on budget or at all.

Fluctuations in exchange rates create foreign currency exposure.

Due to the fact that energy commodity prices are primarily in U.S. dollars, Petro-Canada's revenue stream is affected by the Cdn/U.S. dollar exchange rate. The Company's net earnings are negatively affected by a strengthening Canadian dollar. Petro-Canada is also exposed to fluctuations in other foreign currencies, such as the euro and British pounds sterling.

18 | PETRO-CANADA Management's Discussion and Analysis |

|

Reduced liquidity in capital markets can limit the availability of capital and raise borrowing costs.

From time to time, Petro-Canada accesses the debt and/or equity markets to raise capital. The reasons may include, among other things, the need to raise financing for new operations, mergers, acquisitions and expansions. Reduced liquidity in the capital markets may restrict the Company's ability to raise the required financing and/or may significantly increase the associated cost of that capital. An inability to raise capital could jeopardize the ability of the Company to undertake a certain project and a higher cost of capital would reduce the profitability of that project.

A failure to acquire or find additional reserves would cause a decline in Petro-Canada's reserves and production levels.

The Company's future oil and natural gas reserves and production and, therefore, cash flows, are highly dependent upon success in exploiting Petro-Canada's current reserves and resources base and acquiring or discovering additional reserves and resources. Without reserves additions through exploration, acquisition or development activities, Petro-Canada's reserves and production will decline over time. Exploring for, developing or acquiring reserves is capital intensive. To the extent cash flows from operations are insufficient to fund the Company's capital expenditures and external sources of capital become limited or unavailable, Petro-Canada's ability to make the necessary capital investments to maintain oil and natural gas reserves will be impaired. Costs to find and develop or acquire additional reserves also depend on success rates, which vary over time.

Petro-Canada's oil and natural gas reserves data and future net revenue estimates are subject to variability.

There are many uncertainties inherent in estimating quantities of oil and natural gas reserves, including many factors beyond the Company's control. Estimates of economically recoverable oil and natural gas reserves are based upon a number of variables and assumptions. These include geoscientific interpretation, commodity prices, operating and capital costs and historical production from properties. These estimates have some degree of uncertainty and reserves classifications are best estimates. For these reasons, estimates of the economically recoverable oil and natural gas reserves attributed to properties and classification of reserves based on recovery risk may vary substantially. Petro-Canada's actual production, revenues, taxes and development and operating expenditures related to reserves may vary materially from estimates.

Changes in governmental regulation affecting the oil and natural gas industry could have a material adverse impact on Petro-Canada.

The petroleum industry is subject to regulation and intervention by governments, including the awarding of exploration and production interests, the imposition of specific drilling obligations, environmental protection controls, regulation of the development and abandonment of fields (including restrictions on production) and, possibly, expropriation or cancellation of contract rights. As well, governments may regulate or intervene on prices, taxes, royalties and the exportation of oil and natural gas. Regulations may be changed in response to economic or political conditions. New regulations or changes to existing regulations that affect the oil and natural gas industry could reduce demand for natural gas or crude oil and increase Petro-Canada's costs.

Petro-Canada's foreign operations may expose the Company to risks, which could negatively affect results of operations.

The Company has operations in a number of countries with different political, economic and social systems. As a result, Petro-Canada's operations and related assets are subject to a number of risks, which may include, among other things, currency restrictions and exchange rate fluctuations, loss of revenue, property and equipment as a result of expropriation, nationalization, war, insurrection and geopolitical and other political risks, increases in taxes and governmental royalties, renegotiation of contracts with governmental entities and quasi-governmental agencies, changes in laws and policies governing operations of foreign-based companies, economic and legal sanctions (such as restrictions against countries that the U.S. government may deem to sponsor terrorism) and other uncertainties arising from foreign government sovereignty over Petro-Canada's international operations. If a dispute arises in Petro-Canada's foreign operations, the Company may be subject to the exclusive jurisdiction of foreign courts or may not be able to subject foreign persons to the jurisdiction of a court in the U.S. or Canada.

The Company has operations in Libya, which is a member of OPEC. Petro-Canada may operate in other OPEC-member countries in the future. Production in those countries may be constrained by OPEC quotas.

| Management's Discussion and Analysis PETRO-CANADA | 19 |

Petro-Canada's oil and natural gas production and refining operations impact communities and surrounding environments.

Those impacted by Petro-Canada's operations can become concerned over the use of resources, such as land and water, the perceived or real threat to human health, the potential impact on biodiversity, and/or possible societal changes to surrounding communities. The Company must secure and maintain formal regulatory approvals and licences in order to conduct operations. In addition, broader societal acceptance of Petro-Canada's activities is necessary for resource development. An inability for the Company to secure local community support, necessary regulatory approvals and licences, and broader societal acceptance can result in projects being delayed or stopped, resulting in higher project costs. Lack of local community and stakeholder support can lead to pressure to limit or shut down operations.

Petro-Canada is subject to environmental legislation in all jurisdictions where it operates. Changes in this legislation could negatively affect the Company's results of operations.

Petro-Canada is subject to environmental regulation under a variety of Canadian, U.S. and other foreign, federal, provincial, territorial, state and municipal laws and regulations. This is collectively referred to below as environmental legislation.

Environmental legislation imposes, among other things, restrictions, liabilities and obligations in connection with the generation, handling, use, storage, transportation, treatment and disposal of hazardous and non-hazardous substances, including natural resources and waste, and in connection with spills, releases and emissions of various substances to the environment. Environmental legislation requires that wells, facility sites and other properties associated with Petro-Canada's operations be operated, maintained, abandoned and reclaimed to the satisfaction of the applicable regulatory authorities. Certain types of operations, including exploration and development projects, and changes to certain existing projects, may require submitting and seeking the approval of environmental impact assessments (EIAs) or permit applications. Complying with environmental legislation can require significant expenditures, including costs for cleanup and damages due to contaminated properties. Failure to comply with environmental legislation may result in fines and penalties. Petro-Canada is also exposed to civil and criminal liability for environmental matters, including private parties commencing actions, new theories of liability and new heads of damages. Although it is not expected that the costs of complying with environmental legislation or dealing with environmental liabilities, as they are known today, will have a material adverse effect on Petro-Canada's financial condition or results of operations, no assurance can be made that the costs of complying with future environmental legislation will not have a material effect.

Petro-Canada operates in jurisdictions that have regulated or have proposed to regulate industrial GHG emissions. Jurisdictions that currently regulate GHG emissions include Alberta and the European Union. Jurisdictions that have proposed to regulate GHG emissions include the U.S., British Columbia (B.C.), Quebec, Ontario and Canada. Those jurisdictions that have announced the intent to regulate GHG emissions support cap-and-trade systems and, in some cases, have also proposed implementing complementary measures, including low carbon fuel standards. To date, these jurisdictions have started or have announced plans to start consultations on the design of their regulations, as well as explore opportunities to harmonize regulations across jurisdictions within North America. Petro-Canada participates in these consultations, either directly or through industry associations. In 2007, Petro-Canada established an internal senior management team to steward these activities and, in 2008, this organization was enhanced by creating the role of Director, Climate Change. While these jurisdictions have not published details on their proposed regulations or on their compliance mechanisms, many, most notably the U.S., have identified the importance of balancing the environment, economy and energy security when developing regulations. While it is premature to predict what impact these anticipated regulations may have on Petro-Canada and the broader oil and gas sector, Petro-Canada will likely face increased capital and operating costs in order to comply with these regulations, and these costs could be material. Petro-Canada is actively following policy development to ensure the Company is prepared to operate within a new framework.

Reduced asset reliability could adversely affect Petro-Canada's business.

Petro-Canada operates facilities in both the upstream and downstream sectors of the industry. A reduction in the reliability of these facilities as a result of, but not limited to, damage to equipment, plant or material, loss of production capability or operational integrity, or the extension of shutdown time could contribute to reduced profitability.

Counterparties exposure.

Petro-Canada is exposed to credit risk, and operational risk associated with counterparties' abilities to fulfil their obligations to the Company.

20 | PETRO-CANADA Management's Discussion and Analysis |

|

CONSOLIDATED FINANCIAL RESULTS Analysis of Consolidated Earnings and Cash Flow Consolidated Financial Results On January 31, 2006, Petro-Canada closed the sale of the Company's producing assets in Syria. These assets and associated results are reported as discontinued operations and are excluded from continuing operations. |

|

(millions of Canadian dollars, unless otherwise indicated) | | 2008 | | 2007 | | 2006 | |

Net earnings | | $ | 3,134 | | $ | 2,733 | | $ | 1,740 | |

Net earnings from discontinued operations | | – | | – | | 152 | |

Net earnings from continuing operations | | $ | 3,134 | | $ | 2,733 | | $ | 1,588 | |

Earnings per share from continuing operations (dollars) | – basic | | $ | 6.47 | | $ | 5.59 | | $ | 3.15 | |

| – diluted | | 6.43 | | 5.53 | | 3.11 | |

Earnings per share (dollars) | – basic | | $ | 6.47 | | $ | 5.59 | | $ | 3.45 | |

| – diluted | | 6.43 | | 5.53 | | 3.41 | |

Cash flow from continuing operating activities 1 | | 6,522 | | 3,339 | | 3,608 | |

Debt | | 4,749 | | 3,450 | | 2,894 | |

Cash and cash equivalents 2 | | 1,445 | | 231 | | 499 | |