UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| |

Investment Company Act file number: | | 811-04710 |

| |

Exact name of registrant as specified in charter: | | The Asia Pacific Fund, Inc. |

| |

Address of principal executive offices: | | Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

Name and address of agent for service: | | Deborah A. Docs Gateway Center 3, 100 Mulberry Street, Newark, New Jersey 07102 |

| |

Registrant’s telephone number, including area code: | | 973-367-7521 |

| |

Date of fiscal year end: | | 3/31/2012 |

| |

Date of reporting period: | | 3/31/2012 |

Item 1 – Reports to Stockholders

ANNUAL REPORT

March 31, 2012

The Asia Pacific Fund, Inc.

Contents

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that The Asia Pacific Fund, Inc. (the “Fund”) may purchase, from time to time, shares of its common stock at market prices.

This report, including the financial statements herein, is transmitted to the shareholders of the Fund for their information. This is not a prospectus, circular or representation intended for use in the purchase of shares of the Fund or any securities mentioned in this report.

The Asia Pacific Fund, Inc.

Gateway Center Three

100 Mulberry Street

Newark, NJ 07102-4077

For general information on the Fund, please call (toll-free) the Pristine Advisers, our shareholders’ servicing agent, at: 1-(888) 4-ASIA-PAC

Current information about the Fund is available on its website (http://www.asiapacificfund.com). This website includes monthly updates of the Fund’s performance and other data as well as the Manager’s quarterly presentation of performance and asset allocations and comments on the current Asian outlook.

The Fund’s CUSIP number is 044901106.

1

The Asia Pacific Fund, Inc.

Share Price, Net Asset Value and Distribution History (Unaudited)

| | | | | | | | | | | | |

| | | |

| Quarter End | | Closing Price

at Quarter End | | | Net Asset Value

per Share

at Quarter End | | | Dividends and

Distributions During Quarter* | |

| Financial Year 2011/2012 | | | | | | | | | | | | |

| June | | $ | 12.12 | | | $ | 13.21 | | | | — | |

| September | | | 9.36 | | | | 10.00 | | | | — | |

| December | | | 9.40 | | | | 10.37 | | | | — | |

| March | | | 10.58 | | | | 11.67 | | | | — | |

| | | | | | | | | | | | |

| Financial Year 2010/2011 | | | | | | | | | | | | |

| June | | $ | 9.19 | | | $ | 10.08 | | | | — | |

| September | | | 11.02 | | | | 12.10 | | | | — | |

| December | | | 11.95 | | | | 12.94 | | | | — | |

| March | | | 11.83 | | | | 13.06 | | | | — | |

| | | | | | | | | | | | |

| Financial Year 2009/2010 | | | | | | | | | | | | |

| June | | $ | 8.38 | | | $ | 8.89 | | | | — | |

| September | | | 9.68 | | | | 10.24 | | | | — | |

| December | | | 10.40 | | | | 11.08 | | | | — | |

| March | | | 9.95 | | | | 10.97 | | | | — | |

| | | | | | | | | | | | |

| Financial Year 2008/2009 | | | | | | | | | | | | |

| June | | $ | 17.97 | | | $ | 19.81 | | | | — | |

| September | | | 13.22 | | | | 15.21 | | | | — | |

| December | | | 6.42 | | | | 6.98 | | | $ | 5.10 | |

| March | | | 6.23 | | | | 6.75 | | | | — | |

| | | | | | | | | | | | |

| Financial Year 2007/2008 | | | | | | | | | | | | |

| June | | $ | 25.31 | | | $ | 28.75 | | | | — | |

| September | | | 32.45 | | | | 35.86 | | | | — | |

| December | | | 24.27 | | | | 25.40 | | | $ | 8.15 | |

| March | | | 19.75 | | | | 21.70 | | | | — | |

| * | Total per share distributions over the 5 years to March 31, 2012 amounted to $13.25. Total per share distributions over the Fund’s life (commencement of operations: May 4, 1987) have amounted to $30.78. |

2

The Asia Pacific Fund, Inc.

The Fund’s Management

Directors

Michael J. Downey, Chairman

Jessica M. Bibliowicz

Robert H. Burns

Robert F. Gunia

Douglas Tong Hsu

Duncan M. McFarland

David G. P. Scholfield

Nicholas T. Sibley

Officers

Brian A. Corris, President

Grace C. Torres, Vice-President

M. Sadiq Peshimam, Treasurer and Chief Financial Officer

Deborah A. Docs, Secretary and Chief Legal Officer

Andrew R. French, Assistant Secretary

Valerie M. Simpson, Chief Compliance Officer

Theresa C. Thompson, Deputy Chief Compliance Officer

Investment Manager

Baring Asset Management (Asia) Limited

1901 Edinburgh Tower

15 Queen’s Road Central

Hong Kong

Administrator

Prudential Investments LLC

Gateway Center Three

100 Mulberry Street

Newark, NJ 07102-4077

Custodian

The Bank of New York Mellon

One Wall Street

New York, NY 10286

Transfer Agent

Computershare Trust Company N.A.

P.O. Box 43011

Providence, RI 02940-3011

Independent Registered Public Accounting Firm

KPMG LLP

345 Park Avenue

New York, NY 10154

Legal Counsel

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

3

The Asia Pacific Fund, Inc.

Report of the Investment Manager (Unaudited)

for the fiscal year ended March 31, 2012

Overview

During the fiscal year ended March 31, 2012, the Fund’s net asset value (NAV) per share, fell by 10.6%.

This compares with a decrease of 6.8% in the Fund’s reference benchmark, the MSCI All Countries (AC) Asia Ex-Japan Gross Index. By way of international comparison, the returns of the S&P 500 Price and MSCI World Gross indices were +6.2% and +1.1% respectively.

The top three performing markets, as measured by the MSCI country indices in US dollar terms over the period, were the Philippines (+25.2%), Thailand (+13.5%) and Indonesia (+5.8%). The bottom three were Sri Lanka (-28.6%), India (-20.5%) and Vietnam (-18.8%). Most of the Asian currencies weakened against the US dollar, and in particular, the Indian and Sri Lankan Rupees.

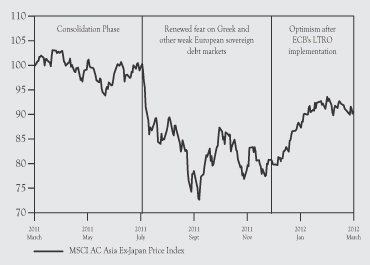

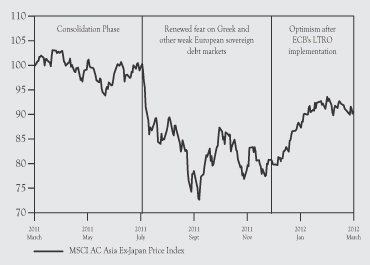

An analysis of Asian markets over the fiscal year to March 31, 2012 shows three distinct phases, as highlighted in Chart 1.

Chart 1. MSCI AC Asia Ex-Japan Price Index (March 2011 – March 2012)

Index re-based to 100 as at March 31, 2011.

Source: Factset

4

The Asia Pacific Fund, Inc.

The nadir of a challenging year for the Asian markets occurred in August/September, when they fell by nearly 25% across the region. Negative factors included a mix of external debt headwinds (Greek and other indebted European sovereign debt issues, US fiscal debt ceiling) and domestic macro challenges such as monetary tightening and other policy measures to curb inflation and potential asset bubbles in China and India. However, Asian markets ended the fiscal year on a more positive note, helped by a robust rally in the first quarter of this year. Investors’ sentiment was boosted by a number of positive developments, including signs of stabilization in the European banking system following the implementation of two long-term refinancing options (LTRO) by the European Central Bank, stronger than expected US economic data, and hopes that the worst of the tightening in China was over. Investors were also heartened by a 50bp cut in the reserve requirement ratio (RRR) by the Chinese authorities.

At a geographical level, the ASEAN markets were the clear out-performers over the review period, whereas the markets impacted by high inflation, namely India and China, suffered. Among sectors, defensive ones including Telecoms, Consumer Staples and Utilities out-performed, while economically sensitive ones including Materials, Industrials and Energy lagged. An analysis of the various styles shows that value and small-cap styles again dominated over the fiscal year.

Through the period under review, we favored companies with strong franchises that are well positioned to benefit from the long-term secular growth in domestic demand across the region. In terms of strategy, China, Korea and Thailand were our preferred markets. We retained our cautious view on India and Hong Kong.

Over the period, the major performance detractor was stock selection in Hong Kong and India, while Taiwan and the Philippines added value. This was offset to some extent by positive country allocation decisions which favored ASEAN and Korea, as well as our cautious stance on India.

5

The Asia Pacific Fund, Inc.

Report of the Investment Manager (Unaudited)

continued

Table 1. Stock Market Performance

April 2011 – March 2012 (MSCI free indices on a gross basis in USD terms)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Country - Index | | 2Q 2011 % | | | 3Q 2011 % | | | 4Q 2011 % | | | 1Q 2012 % | | | 1 Yr to 03/31/2012 % | |

| North Asia | | | | | | | | | | | | | | | | | | | | |

| Hong Kong | | | –1.0 | | | | –19.9 | | | | 6.3 | | | | 13.4 | | | | –4.4 | |

| Taiwan | | | 1.7 | | | | –17.7 | | | | –0.4 | | | | 14.5 | | | | –4.5 | |

| Korea | | | 0.9 | | | | –23.2 | | | | 5.9 | | | | 15.5 | | | | –5.3 | |

| China | | | –1.7 | | | | –25.2 | | | | 8.1 | | | | 9.9 | | | | –12.7 | |

| ASEAN | | | | | | | | | | | | | | | | | | | | |

| Philippines | | | 3.3 | | | | –6.9 | | | | 7.0 | | | | 21.6 | | | | 25.2 | |

| Thailand | | | –1.9 | | | | –14.3 | | | | 11.5 | | | | 21.1 | | | | 13.5 | |

| Indonesia | | | 8.0 | | | | –11.0 | | | | 5.8 | | | | 4.1 | | | | 5.8 | |

| Malaysia | | | 3.5 | | | | –17.0 | | | | 11.7 | | | | 8.5 | | | | 4.2 | |

| Singapore | | | 2.0 | | | | –18.2 | | | | –1.0 | | | | 19.3 | | | | –1.5 | |

| South Asia | | | | | | | | | | | | | | | | | | | | |

| Vietnam | | | –3.8 | | | | –12.8 | | | | –21.8 | | | | 23.7 | | | | –18.8 | |

| India | | | –3.6 | | | | –19.9 | | | | –14.2 | | | | 20.1 | | | | –20.5 | |

| Sri Lanka | | | –8.7 | | | | –2.0 | | | | –17.2 | | | | –3.6 | | | | –28.6 | |

| Region | | | | | | | | | | | | | | | | | | | | |

| MSCI AC Asia Ex-Japan Gross | | | 0.1 | | | | –20.8 | | | | 3.3 | | | | 13.8 | | | | –6.8 | |

| Source: Baring Asset Management, Factset. | |

Table 2. Currency Market Performance vs USD (Month-ends)*

March 2011 – March 2012

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Currency US$/local rate | | March 2011 | | | June

2011 | | | Sept 2011 | | | Dec 2011 | | | March 2012 | | | 12M

Change

(%) | |

| North Asia | | | | | | | | | | | | | | | | | | | | | | | | |

| Chinese Renminbi | | | 6.55 | | | | 6.46 | | | | 6.39 | | | | 6.29 | | | | 6.30 | | | | 4.0 | |

| Hong Kong Dollar | | | 7.78 | | | | 7.78 | | | | 7.78 | | | | 7.77 | | | | 7.76 | | | | 0.3 | |

| New Taiwan Dollar | | | 29.41 | | | | 28.72 | | | | 30.48 | | | | 30.28 | | | | 29.51 | | | | –0.3 | |

| South Korean Won | | | 1,097 | | | | 1,068 | | | | 1,178 | | | | 1,152 | | | | 1,133 | | | | –3.2 | |

| ASEAN | | | | | | | | | | | | | | | | | | | | | | | | |

| Philippine Peso | | | 43.40 | | | | 43.34 | | | | 43.73 | | | | 43.86 | | | | 42.94 | | | | 1.1 | |

| Singapore Dollar | | | 1.26 | | | | 1.23 | | | | 1.30 | | | | 1.30 | | | | 1.26 | | | | — | |

| Malaysian Ringgit | | | 3.03 | | | | 3.02 | | | | 3.19 | | | | 3.17 | | | | 3.06 | | | | –1.0 | |

| Thai Baht | | | 30.25 | | | | 30.73 | | | | 31.09 | | | | 31.55 | | | | 30.85 | | | | –1.9 | |

| Indonesian Rupiah | | | 8,708 | | | | 8,576 | | | | 8,790 | | | | 9,068 | | | | 9,144 | | | | –4.8 | |

| South Asia | | | | | | | | | | | | | | | | | | | | | | | | |

| Vietnamese Dong | | | 20,895 | | | | 20,585 | | | | 20,830 | | | | 21,034 | | | | 20,850 | | | | 0.2 | |

| Indian Rupee | | | 44.60 | | | | 44.70 | | | | 48.98 | | | | 53.11 | | | | 50.95 | | | | –12.5 | |

| Sri Lankan Rupee | | | 110.40 | | | | 109.50 | | | | 110.20 | | | | 113.90 | | | | 128.25 | | | | –13.9 | |

Source: Baring Asset Management, Factset. | | | | | |

| * | Rounded up to the nearest tenth of one percent |

6

The Asia Pacific Fund, Inc.

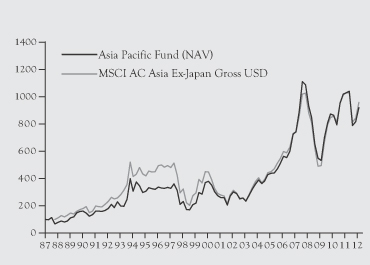

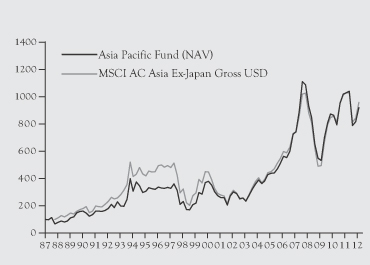

Chart 2. Performance of the Asia Pacific Fund’s NAV against its Benchmark Index*

| * | Investment involves risk and past performance figures shown are not indicative of future performance. |

| Note: | The chart above compares the growth of a $100 investment in the Asia Pacific Fund with a similar investment in the MSCI AC Asia Ex-Japan Gross Index (the “Index”), beginning with the start date of the index on December 31, 1987. |

| Source: | Baring Asset Management, Factset. |

Performance

During the 12-month period ended March 31, 2012, the Fund’s NAV per share was down $1.39, from $13.06 to $11.67. In percentage terms, the Fund’s total return performance was -10.6%. This compares with a decline of -6.8% by the reference benchmark index, the MSCI AC Asia Ex-Japan Gross Index. The Fund’s share price fell by 10.6% over the period, from $11.83 to $10.58. As the portfolio continued to carry forward losses in the fiscal year, the Fund did not make any distributions.

Over the fiscal year to March 31, 2012, the attribution analysis showed that stock selection in Hong Kong and India detracted value, caused by a number of specific stock holdings which under-performed. This was offset to some extent by positive stock selection contribution from Taiwan and Korea, with our exposure to Korean consumer stocks and smartphone-related stocks in Taiwan/Korea adding the most value. With regard to country allocation, our increased exposure to ASEAN and Korea added value, as did our cautious stance on India.

As far as the Fund’s detailed performance attribution is concerned, the top five stock contributors were Catcher Technology (Taiwan), AirAsia (Malaysia), Hyundai Department Store (Korea), Samsung Electronics (Korea) and Lenovo Group (China). The top five stock detractors

7

The Asia Pacific Fund, Inc.

Report of the Investment Manager (Unaudited)

continued

were China High Precision Automation (Hong Kong), CSR Corp. (China), China Mobile (China), Borneo Lumbung Energi & Metal (Indonesia) and Hyundai Heavy Industries (Korea).

Table 3. Performance of Asia Pacific Fund, the Region and Major World Markets* (on a gross (dividend reinvested) basis to March 31, 2012, in USD terms)

| | | | | | | | | | | | | | | | |

| | | | |

| | | 1 Yr

% | | | 3 Yrs

% | | | 5 Yrs

% | | | 10 Yrs

% | |

| Asia Pacific Fund – NAV | | | –10.6 | | | | 72.9 | | | | 23.6 | | | | 205.5 | |

| Asia Pacific Fund – Price | | | –10.6 | | | | 69.8 | | | | 26.9 | | | | 219.4 | |

| MSCI AC Asia Ex-Japan | | | –6.8 | | | | 93.9 | | | | 29.7 | | | | 206.3 | |

| S&P Composite 500 (Price) | | | 6.2 | | | | 76.5 | | | | –0.9 | | | | 22.8 | |

| MSCI Europe | | | –6.9 | | | | 65.7 | | | | –15.9 | | | | 78.8 | |

| MSCI Japan | | | 0.4 | | | | 40.8 | | | | –22.9 | | | | 49.0 | |

| * | Investment involves risk and past performance figures shown are not indicative of future performance. |

| Source: | Baring Asset Management, Factset |

Portfolio Strategy

Over the first half of the review period, we raised cash by trimming some portfolio holdings and locking in profits in Korea and Indonesia following a period of strong performance. After the market sell-off in September, we reinvested the cash, reduced exposure to China and Taiwan and added to holdings in Hong Kong, ASEAN and India. Korea remained one of our preferred markets through most of the fiscal year. The Indian market was a major underperformer relative to the region for most of 2011. Nevertheless, as we became less negative on its outlook, we took advantage of the low stock prices to reduce our underweight exposure. Lastly, over the final two months of the fiscal year, as the valuation of a number of stocks on our investment radar screen looked particularly attractive, we introduced a degree of leverage in the portfolio to take advantage of this.

As far as sectors are concerned, as mentioned above, we placed emphasis on sectors which are likely to benefit from the long-term secular growth in domestic demand across the region. These included Consumer Discretionary, Industrials and Information Technology.

8

The Asia Pacific Fund, Inc.

Table 4. Asset Allocation at Quarter Ends (% of Fund’s Net Assets)*

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| Country | | Mar 31,

2011

% | | | June 30,

2011

% | | | Sept 30,

2011

% | | | Dec 31,

2011

% | | | Mar 31,

2012

% | |

| North Asia | | | 73.5 | | | | 75.1 | | | | 73.6 | | | | 73.7 | | | | 79.4 | |

| Hong Kong/China | | | 35.3 | | | | 37.2 | | | | 35.2 | | | | 38.2 | | | | 38.6 | |

| South Korea | | | 23.9 | | | | 23.4 | | | | 22.5 | | | | 23.0 | | | | 24.2 | |

| Taiwan | | | 14.3 | | | | 14.5 | | | | 15.9 | | | | 12.5 | | | | 16.6 | |

| ASEAN | | | 17.0 | | | | 16.6 | | | | 10.3 | | | | 16.5 | | | | 16.6 | |

| Indonesia | | | 5.6 | | | | 5.4 | | | | 3.9 | | | | 5.8 | | | | 5.0 | |

| Philippines | | | 1.8 | | | | 1.1 | | | | — | | | | 1.4 | | | | — | |

| Malaysia | | | 2.8 | | | | 3.0 | | | | 1.1 | | | | 1.2 | | | | 2.7 | |

| Singapore | | | 5.6 | | | | 5.4 | | | | 3.9 | | | | 4.8 | | | | 4.9 | |

| Thailand | | | 1.2 | | | | 1.7 | | | | 1.4 | | | | 3.3 | | | | 4.0 | |

| South Asia | | | 9.3 | | | | 7.5 | | | | 8.5 | | | | 8.9 | | | | 8.9 | |

| India | | | 7.1 | | | | 5.8 | | | | 6.4 | | | | 7.2 | | | | 7.4 | |

| Vietnam | | | 0.8 | | | | 0.7 | | | | 0.7 | | | | 0.6 | | | | 0.7 | |

| Sri Lanka | | | 1.4 | | | | 1.0 | | | | 1.4 | | | | 1.1 | | | | 0.8 | |

| Cash & Other | | | 0.2 | | | | 0.8 | | | | 7.6 | | | | 0.9 | | | | –4.9 | |

| * | Rounded up to the nearest tenth of one percent |

While the outlook for growth in Asian economies remains relatively positive and equity valuations remain relatively attractive, in the short term, global and regional macro uncertainties are likely to keep Asian equity markets volatile and confined to a +/- 20% trading range. In this environment, we prefer to hold steady growth companies with quality management and strong balance sheets at fair to low valuations.

Baring Asset Management (Asia) Limited

April 15, 2012

9

The Asia Pacific Fund, Inc.

Portfolio of Investments

March 31, 2012

| | | | | | | | | | | | |

| Shares | | | Description | | | | | Value

(Note 1) | |

| | | | LONG-TERM INVESTMENTS – 104.9% | | | | | | | | |

| | | |

| | | | EQUITIES – 104.2% | | | | | | | | |

| | | |

| | | | CHINA (INCLUDING HONG KONG) – 38.6% | | | | | | | | |

| | 586,000 | | | AIA Group Ltd. (Diversified Financials) | | | $ | | | | 2,146,880 | |

| | 766,000 | | | Anhui Conch Cement Co. Ltd. (Class “H” Shares) (Materials) | | | | | | | 2,426,563 | |

| | 926,500 | | | Baoxin Auto Group Ltd.* (Consumer Discretionary) | | | | | | | 1,108,381 | |

| | 1,326,000 | | | Belle International Holdings Ltd. (Consumer Discretionary) | | | | | | | 2,380,313 | |

| | 1,200,500 | | | BOC Hong Kong Holdings Ltd. (Banking) | | | | | | | 3,316,021 | |

| | 146,000 | | | Cheung Kong Holdings Ltd. (Real Estate-Developers) | | | | | | | 1,885,739 | |

| | 2,443,000 | | | China High Precision Automation Group Ltd. (Information Technology) | | | | | | | 421,557 | |

| | 1,466,000 | | | China Longyuan Power Group Corp. (Class “H” Shares) (Utilities) | | | | | | | 1,225,198 | |

| | 225,000 | | | China Mobile Ltd. (Diversified Telecommunications) | | | | | | | 2,475,839 | |

| | 303,000 | | | China Shenhua Energy Co. Ltd. (Class “H” Shares) (Energy) | | | | | | | 1,277,855 | |

| | 918,000 | | | CNOOC Ltd. (Energy) | | | | | | | 1,886,702 | |

| | 1,438,000 | | | Dongfeng Motor Group Co. Ltd. (Class “H” Shares) (Consumer Discretionary) | | | | | | | 2,596,179 | |

| | 197,500 | | | Hengan International Group Co. Ltd. (Consumer Staples) | | | | | | | 1,996,478 | |

| | 8,418,000 | | | Industrial & Commercial Bank of China (Class “H” Shares) (Banking) | | | | | | | 5,430,933 | |

| | 1,542,000 | | | Lenovo Group Ltd. (Information Technology) | | | | | | | 1,388,000 | |

| | 587,750 | | | L’Occitane International SA (Hong Kong Exchange) (Consumer Discretionary) | | | | | | | 1,391,124 | |

| | 423,000 | | | Luk Fook Holdings (International) Ltd. (Consumer Discretionary) | | | | | | | 1,285,524 | |

| | 1,394,000 | | | PetroChina Co. Ltd. (Class “H” Shares) (Energy) | | | | | | | 1,971,028 | |

| | 135,000 | | | Sun Hung Kai Properties Ltd. (Real Estate-Developers) | | | | | | | 1,677,602 | |

| | 55,300 | | | Tencent Holdings Ltd. (Information Technology) | | | | | | | 1,542,451 | |

| | 728,000 | | | Tingyi Cayman Islands Holding Corp. (Consumer Staples) | | | | | | | 2,104,629 | |

| | 1,100,000 | | | Want Want China Holdings Ltd. (Consumer Staples) | | | | | | | 1,229,533 | |

| | 438,000 | | | Wharf Holdings Ltd. (Real Estate-Developers) | | | | | | | 2,380,205 | |

| | 629,500 | | | Zhaojin Mining Industry Co. Ltd. (Class “H” Shares) (Materials) | | | | | | | 1,055,442 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 46,600,176 | |

| | | | | | | | | | | | |

| | | | INDIA – 7.4% | | | | | | | | |

| | 35,037 | | | Bajaj Auto Ltd. (Consumer Discretionary) | | | | | | | 1,154,581 | |

| | 267,089 | | | Bharat Heavy Electricals Ltd. (Industrials) | | | | | | | 1,348,159 | |

See Notes to Financial Statements.

10

The Asia Pacific Fund, Inc.

| | | | | | | | | | | | |

| Shares | | | Description | | | | | Value

(Note 1) | |

| | 122,965 | | | ICICI Bank Ltd. (Banking) | | | $ | | | | 2,148,659 | |

| | 48,978 | | | Larsen & Toubro Ltd. (Industrials) | | | | | | | 1,258,459 | |

| | 100,828 | | | Reliance Industries Ltd. (Energy) | | | | | | | 1,485,553 | |

| | 68,143 | | | Tata Consultancy Services Ltd. (Information Technology) | | | | | | | 1,563,363 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,958,774 | |

| | | | | | | | | | | | |

| | | | INDONESIA – 5.0% | | | | | | | | |

| | 9,807,000 | | | PT Alam Sutera Realty Tbk (Real Estate-Developers) | | | | | | | 664,954 | |

| | 152,000 | | | PT Astra International Tbk (Consumer Discretionary) | | | | | | | 1,229,265 | |

| | 2,474,500 | | | PT Bank Rakyat Indonesia Persero Tbk (Banking) | | | | | | | 1,880,772 | |

| | 1,117,000 | | | PT Indocement Tunggal Prakarsa Tbk (Materials) | | | | | | | 2,253,789 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,028,780 | |

| | | | | | | | | | | | |

| | | | MALAYSIA – 2.7% | | | | | | | | |

| | 537,100 | | | CIMB Group Holdings Bhd (Banking) | | | | | | | 1,348,229 | |

| | 347,000 | | | Genting Bhd (Consumer Discretionary) | | | | | | | 1,227,837 | |

| | 587,100 | | | Kencana Petroleum Bhd* (Energy) | | | | | | | 603,677 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,179,743 | |

| | | | | | | | | | | | |

| | | | SINGAPORE – 4.9% | | | | | | | | |

| | 216,000 | | | DBS Group Holdings Ltd. (Banking) | | | | | | | 2,436,562 | |

| | 254,210 | | | Keppel Corp. Ltd. (Industrials) | | | | | | | 2,222,479 | |

| | 671,000 | | | Olam International Ltd. (Consumer Staples) | | | | | | | 1,259,743 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,918,784 | |

| | | | | | | | | | | | |

| | | | SOUTH KOREA – 24.2% | | | | | | | | |

| | 2,061 | | | CJ CheilJedang Corp. (Consumer Staples) | | | | | | | 611,179 | |

| | 23,490 | | | Hana Financial Group, Inc. (Banking) | | | | | | | 885,242 | |

| | 11,265 | | | Hyundai Heavy Industries Co. Ltd. (Industrials) | | | | | | | 3,196,414 | |

| | 9,468 | | | Hyundai Home Shopping Network Corp. (Consumer Discretionary) | | | | | | | 1,119,732 | |

| | 5,659 | | | Hyundai Mobis (Consumer Discretionary) | | | | | | | 1,430,920 | |

| | 13,434 | | | Hyundai Motor Co. (Consumer Discretionary) | | | | | | | 2,762,563 | |

| | 59,576 | | | KB Financial Group, Inc. (Banking) | | | | | | | 2,174,191 | |

| | 5,576 | | | LG Chem Ltd. (Materials) | | | | | | | 1,820,855 | |

| | 3,646 | | | Lotte Shopping Co. Ltd. (Consumer Discretionary) | | | | | | | 1,142,341 | |

| | 7,918 | | | NHN Corp. (Information Technology) | | | | | | | 1,816,937 | |

| | 7,441 | | | Samsung Electronics Co. Ltd. (Information Technology) | | | | | | | 8,373,218 | |

| | 7,050 | | | Samsung Engineering Co. Ltd. (Industrials) | | | | | | | 1,505,759 | |

| | 6,291 | | | Samsung Fire & Marine Insurance Co. Ltd. (Insurance) | | | | | | | 1,188,186 | |

| | 30,420 | | | Shinhan Financial Group Co. Ltd. (Banking) | | | | | | | 1,174,595 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 29,202,132 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

11

The Asia Pacific Fund, Inc.

Portfolio of Investments

continued

| | | | | | | | | | | | |

| Shares | | | Description | | | | | Value

(Note 1) | |

| | | | SRI LANKA – 0.8% | | | | | | | | |

| | 711,745 | | | Sampath Bank PLC (Banking) | | | $ | | | | 997,830 | |

| | | | | | | | | | | | |

| | | | TAIWAN – 16.6% | | | | | | | | |

| | 183,000 | | | Asustek Computer, Inc. (Information Technology) | | | | | | | 1,726,795 | |

| | 129,000 | | | Catcher Technology Co. Ltd. (Information Technology) | | | | | | | 911,298 | |

| | 2,753,000 | | | Chinatrust Financial Holding Co. Ltd. (Diversified Financials) | | | | | | | 1,730,273 | |

| | 2,780,000 | | | Eva Airways Corp. (Industrials) | | | | | | | 1,709,567 | |

| | 1,152,000 | | | Far Eastern Department Stores Co. Ltd. (a) (Consumer Discretionary) | | | | | | | 1,473,445 | |

| | 321,000 | | | Formosa Chemicals & Fibre Corp. (Materials) | | | | | | | 937,512 | |

| | 724,000 | | | Hon Hai Precision Industry Co. Ltd. (Information Technology) | | | | | | | 2,808,721 | |

| | 91,000 | | | MediaTek, Inc. (Information Technology) | | | | | | | 871,013 | |

| | 1,677,000 | | | Pegatron Corp. (Information Technology) | | | | | | | 2,613,698 | |

| | 390,000 | | | Radiant Opto-Electronics Corp. (Information Technology) | | | | | | | 1,731,014 | |

| | 812,000 | | | Taiwan Semiconductor Manufacturing Co. Ltd. (Information Technology) | | | | | | | 2,335,760 | |

| | 2,358,000 | | | Yuanta Financial Holding Co. Ltd. (Diversified Financials) | | | | | | | 1,226,357 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 20,075,453 | |

| | | | | | | | | | | | |

| | | | THAILAND – 4.0% | | | | | | | | |

| | 670,135 | | | PTT Global Chemical PCL (Materials) | | | | | | | 1,542,288 | |

| | 173,800 | | | PTT PCL (Energy) | | | | | | | 1,994,334 | |

| | 1,315,600 | | | Supalai PCL (Real Estate-Developers) | | | | | | | 665,263 | |

| | 263,200 | | | Thai Union Frozen Products PCL (Consumer Staples) | | | | | | | 603,611 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,805,496 | |

| | | | | | | | | | | | |

| | | | Total equities

(cost $107,110,656) | | | | | | | 125,767,168 | |

| | | | | | | | | | | | |

| | | | EXCHANGE TRADED FUND – 0.7% | | | | | | | | |

| | | |

| | | | VIETNAM | | | | | | | | |

| | 44,250 | | | Market Vectors Vietnam ETF (New York Stock Exchange)

(cost $1,066,605) | | | | | | | 844,290 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

12

The Asia Pacific Fund, Inc.

| | | | | | | | | | | | |

| Units | | | Description | | | | | Value

(Note 1) | |

| | | | RIGHTS | | | | | | | | |

| | | |

| | | | TAIWAN | | | | | | | | |

| | 137,557 | | | Chinatrust Financial Holding Co. Ltd. (Diversified Financials) (cost $0) | | | $ | | | | 10,487 | |

| | | | | | | | | | | | |

| | | | Total long-term investments

(cost $108,177,261) | | | | | | | 126,621,945 | |

| | | | | | | | | | | | |

| | | |

| Shares | | | | | | | | | |

| | | | SHORT-TERM INVESTMENTS – 0.9% | | | | | | | | |

| | | |

| | | | MONEY MARKET MUTUAL FUND | | | | | | | | |

| | | |

| | | | UNITED STATES | | | | | | | | |

| | 1,114,403 | | | JPMorgan Prime Money Market Fund/Premier

(cost $1,114,403) | | | | | | | 1,114,403 | |

| | | | | | | | | | | | |

| | | | Total Investments – 105.8%

(cost $109,291,664; Note 4) | | | | | | | 127,736,348 | |

| | | | Liabilities in excess of other assets – (5.8%) | | | | | | | (7,021,655 | ) |

| | | | | | | | | | | | |

| | | | Net Assets – 100.0% | | | $ | | | | 120,714,693 | |

| | | | | | | | | | | | |

The following annotation is used in the Portfolio of Investments:

ETF – Exchange Traded Fund

* Non income producing security.

(a) An independent director of the Fund is Chairman of the Company.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1 – quoted prices generally for securities actively traded on a regulated securities exchange and for open-end mutual funds which trade at daily net asset value.

Level 2 – other significant observable inputs (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, foreign currency exchange rates, and amortized cost) generally for debt securities, swaps, forward foreign currency contracts and for foreign stocks priced using vendor modeling tools.

Level 3 – significant unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

See Notes to Financial Statements.

13

The Asia Pacific Fund, Inc.

Portfolio of Investments

continued

The following is a summary of the inputs used as of March 31, 2012 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

| Investments in Securities | | | | | | | | | | | | |

| Equities | | | | | | | | | | | | |

China (including Hong Kong) | | $ | 46,178,619 | | | $ | — | | | $ | 421,557 | |

India | | | 8,958,774 | | | | — | | | | — | |

Indonesia | | | 6,028,780 | | | | — | | | | — | |

Malaysia | | | 3,179,743 | | | | — | | | | — | |

Singapore | | | 5,918,784 | | | | — | | | | — | |

South Korea | | | 29,202,132 | | | | — | | | | — | |

Sri Lanka | | | 997,830 | | | | — | | | | — | |

Taiwan | | | 20,075,453 | | | | — | | | | — | |

Thailand | | | 4,805,496 | | | | — | | | | — | |

| Exchange Traded Fund | | | | | | | | | | | | |

Vietnam | | | 844,290 | | | | — | | | | — | |

| Rights | | | | | | | | | | | | |

Taiwan | | | — | | | | 10,487 | | | | — | |

| Money Market Mutual Fund | | | 1,114,403 | | | | — | | | | — | |

| | | | | | | | | | | | |

| Total | | $ | 127,304,304 | | | $ | 10,487 | | | $ | 421,557 | |

| | | | | | | | | | | | |

The industry classification of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of March 31, 2012 was as follows:

| | | | |

| Information Technology | | | 23.3 | % |

| Banking | | | 18.1 | |

| Consumer Discretionary | | | 16.8 | |

| Industrials | | | 9.3 | |

| Materials | | | 8.3 | |

| Energy | | | 7.6 | |

| Consumer Staples | | | 6.5 | |

| Real Estate-Developers | | | 6.0 | |

| Diversified Financials | | | 4.2 | |

| Diversified Telecommunications | | | 2.1 | |

| Insurance | | | 1.0 | |

| Utilities | | | 1.0 | |

| Money Market Mutual Fund | | | 0.9 | |

| Exchange Traded Fund | | | 0.7 | |

| | | | |

| | | 105.8 | |

| Liabilities in excess of other assets | | | (5.8 | ) |

| | | | |

| Total | | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

14

The Asia Pacific Fund, Inc.

The Fund invested in derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is equity risk. The effect of such derivative instruments on the Fund’s financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

Fair values of derivative instruments as of March 31, 2012 as presented in the Statement of Assets and Liabilities:

| | | | | | | | | | | | |

| | | |

| | | Asset Derivatives | | | Liability Derivatives | |

Derivatives not designated as

hedging instruments, carried at

fair value | | Balance

Sheet Location | | Fair

Value | | | Balance Sheet Location | | Fair

Value | |

| Equity contracts | | Investments, at value | | $ | 10,487 | | | — | | $ | — | |

| | | | | | | | | | | | |

The effects of derivative instruments on the Statement of Operations for the year ended March 31, 2012 are as follows:

| | | | |

| |

| Amount of Realized Gain or (Loss) on Derivatives Recognized in Income | |

Derivatives not designated as hedging instruments, carried at fair value | | Futures | |

| Equity contracts | | $ | 437,051 | |

| | | | |

| | | | |

| |

Change in Unrealized Appreciation or (Depreciation) on Derivatives

Recognized in Income | |

Derivatives not designated as hedging instruments, carried at fair value | | Rights | |

| Equity contracts | | $ | 10,487 | |

| | | | |

See Notes to Financial Statements.

15

The Asia Pacific Fund, Inc.

Statement of Assets and Liabilities

March 31, 2012

| | | | | | | | |

| Assets | | | | | | | | |

| Investments, at value (cost $109,291,664) | | | $ | | | | 127,736,348 | |

| Foreign currency (cost $1,127,436) | | | | | | | 1,126,913 | |

| Receivable for investments sold | | | | | | | 1,634,027 | |

| Dividends and interest receivable | | | | | | | 279,259 | |

| Prepaid assets | | | | | | | 53,875 | |

| | | | | | | | |

Total assets | | | | | | | 130,830,422 | |

| | | | | | | | |

| | |

| Liabilities | | | | | | | | |

| Loan payable | | | | | | | 8,000,000 | |

| Payable for investments purchased | | | | | | | 1,747,651 | |

| Accrued expenses and other liabilities | | | | | | | 243,550 | |

| Investment management fee payable | | | | | | | 98,444 | |

| Administration fee payable | | | | | | | 26,084 | |

| | | | | | | | |

Total liabilities | | | | | | | 10,115,729 | |

| | | | | | | | |

| Net Assets | | | $ | | | | 120,714,693 | |

| | | | | | | | |

| Net assets comprised: | | | | | | | | |

Common stock, at par | | | $ | | | | 103,441 | |

Paid-in capital in excess of par | | | | | | | 128,801,669 | |

| | | | | | | | |

| | | | | | | 128,905,110 | |

| Accumulated net investment loss | | | | | | | (349,964 | ) |

| Accumulated net realized loss on investment and foreign currency transactions | | | | | | | (26,279,832 | ) |

| Net unrealized appreciation on investments and foreign currencies | | | | | | | 18,439,379 | |

| | | | | | | | |

| Net Assets, March 31, 2012 | | | $ | | | | 120,714,693 | |

| | | | | | | | |

Net Asset Value per share: ($120,714,693 / 10,344,073 shares of common stock outstanding) | | | $ | | | | 11.67 | |

| | | | | | | | |

See Notes to Financial Statements.

16

The Asia Pacific Fund, Inc.

Statement of Operations

Year Ended March 31, 2012

| | | | | | | | |

| Net Investment Loss | | | | | | | | |

| | |

| Income | | | | | | | | |

| Dividends (net of foreign withholding taxes of $269,201) | | | $ | | | | 2,169,790 | |

| | | | | | | | |

| | |

| Expenses | | | | | | | | |

| Investment management fee | | | | | | | 1,165,208 | |

| Administration fee | | | | | | | 309,003 | |

| Directors’ fees and expenses | | | | | | | 298,000 | |

| Custodian’s fees and expenses | | | | | | | 206,000 | |

| Legal fees and expenses | | | | | | | 205,000 | |

| Insurance expense | | | | | | | 148,000 | |

| Reports to shareholders | | | | | | | 125,000 | |

| Audit fees and expenses | | | | | | | 41,000 | |

| Transfer agent’s fees and expenses | | | | | | | 30,000 | |

| Loan interest and commitment fees (Note 6) | | | | | | | 29,133 | |

| Registration expenses | | | | | | | 25,000 | |

| Miscellaneous | | | | | | | 76,424 | |

| | | | | | | | |

Total expenses | | | | | | | 2,657,768 | |

| | | | | | | | |

| Net investment loss | | | | | | | (487,978 | ) |

| | | | | | | | |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investments, Foreign Currency and Futures Transactions | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

Investment transactions | | | | | | | 954,860 | |

Foreign currency transactions | | | | | | | (385,366 | ) |

Financial futures transactions | | | | | | | 437,051 | |

| | | | | | | | |

| | | | | | | 1,006,545 | |

| | | | | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | | | | | (14,870,046 | ) |

Foreign currencies | | | | | | | (10,205 | ) |

| | | | | | | | |

| | | | | | | (14,880,251 | ) |

| | | | | | | | |

| Net loss on investments, foreign currency and futures transactions | | | | | | | (13,873,706 | ) |

| | | | | | | | |

Net Decrease In Net Assets

Resulting From Operations | | | $ | | | | (14,361,684 | ) |

| | | | | | | | |

See Notes to Financial Statements.

17

The Asia Pacific Fund, Inc.

Statement of Changes in Net Assets

| | | | | | | | | | | | | | | | |

| | | | | | Year Ended March 31, | |

| Increase (Decrease) In Net Assets | | | | | 2012 | | | | | | 2011 | |

| | | | |

| Operations | | | | | | | | | | | | | | | | |

| Net investment loss | | | $ | | | | (487,978 | ) | | | $ | | | | (612,531 | ) |

| Net realized gain on investments, foreign currency and futures transactions | | | | | | | 1,006,545 | | | | | | | | 11,019,856 | |

| Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | | | | | (14,880,251 | ) | | | | | | | 11,228,872 | |

| | | | | | | | | | | | | | | | |

| Net increase (decrease) in net assets resulting from operations | | | | | | | (14,361,684 | ) | | | | | | | 21,636,197 | |

| | | | | | | | | | | | | | | | |

Total increase (decrease) | | | | | | | (14,361,684 | ) | | | | | | | 21,636,197 | |

| | | | |

| Net Assets | | | | | | | | | | | | | | | | |

| Beginning of year | | | $ | | | | 135,076,377 | | | | $ | | | | 113,440,180 | |

| | | | | | | | | | | | | | | | |

| End of year | | | $ | | | | 120,714,693 | | | | $ | | | | 135,076,377 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

18

The Asia Pacific Fund, Inc.

Notes to Financial Statements

The Asia Pacific Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end, management investment company. The Fund’s investment objective is to achieve long-term capital appreciation through investment of at least 80% of investable assets in equity securities of companies in the Asia Pacific countries.

| Note 1. | Accounting Policies |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

The Fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from these estimates and assumptions.

Securities Valuation

Securities for which the primary market is on an exchange are valued at the last sale price on such exchange or market on the day of valuation or, if there was no sale on such day, at the last bid price quoted on such day. Securities for which reliable market quotations are not readily available, or whose value have been affected by events occurring after the close of the security’s foreign market and before the Fund’s normal pricing time, are valued at fair value in accordance with the Board of Director’s approved fair valuation procedures. When determining the fair valuation of securities, some of the factors influencing the valuation include, the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst, media or other reports or information regarding the issuer or the markets or industry in which it operates; other analytical data; and consistency with valuation of similar securities held by other funds managed by Baring Asset Management (Asia) Limited. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

Investments in open-end, non-exchange-traded mutual funds are valued at their net asset value as of the close of the New York Stock Exchange on the date of valuation.

Foreign Currency Translation

The books and records of the Fund are maintained in United States dollars. Foreign currency amounts are translated into United States dollars on the following basis:

(i) market value of investment securities, other assets and liabilities—at the current rate of exchange.

19

The Asia Pacific Fund, Inc.

Notes to Financial Statements

continued

(ii) purchases and sales of investment securities, income and expenses—at the rate of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the fiscal period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of securities held at fiscal period end. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of portfolio securities sold during the fiscal period. Accordingly, these realized foreign currency gains (losses) are included in the reported net realized gains (losses) on investment transactions.

Net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from sales and maturities of short-term securities, holding of foreign currencies, currency gains (losses) realized between the trade and settlement dates on security transactions, and the difference between the amounts of dividends, interest and foreign taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net currency gains (losses) from valuing foreign currency denominated assets, other than investment securities, and liabilities at fiscal period end exchange rates are reflected as a component of unrealized appreciation (depreciation) on investments and foreign currencies.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. companies as a result of, among other factors, the level of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

Stock Index Futures Contracts

A stock index futures contract is an agreement to purchase (long) or sell (short) an agreed amount of securities at a set price for delivery on a future date. Upon entering into a stock index futures contract, the Fund is required to pledge to the broker an amount of cash and/or other assets equal to a certain percentage of the contract amount. This amount is known as the “initial margin.” Subsequent payments known as “variation margin,” are made or received by the Fund each day, depending on the daily fluctuations in the value of the underlying security. Such variation margin is recorded for financial statement purposes on a daily basis as unrealized gain or loss. When the contract expires or is closed, the gain or loss is realized and is presented in the Statement of Operations as net realized gain or loss on stock index futures contracts.

The Fund may utilize stock index futures contracts for hedging and investment purposes. Should market prices for the futures contracts or the underlying assets move in ways not anticipated by the Fund, losses may result. The use of futures contracts for hedging and investment purposes involves the risk of imperfect correlation in the movements in

20

The Asia Pacific Fund, Inc.

prices of futures contracts and the underlying assets being hedged or the exposures desired by the Fund.

Security Transactions and Net Investment Income

Security transactions are recorded on the trade date. Realized and unrealized gains (losses) from security and foreign currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date, and interest income and expenses are recorded on an accrual basis. Expenses are recorded on the accrual basis which may require the use of certain estimates by management. Actual results may differ from such estimates.

Dividends and Distributions

Dividends from net investment income, if any, are declared and paid at least annually in a manner that qualifies for the dividends-paid deduction. The Fund’s current intention is to distribute at least annually any net capital gains in excess of net capital loss carryforwards in a manner that avoids income and excise taxes being imposed on the Fund. Dividends and distributions are recorded on the ex-dividend date. The Fund may choose to satisfy the foregoing by making distributions in cash, additional Fund shares, or both.

The Fund could determine in the future to retain net long-term capital gains in respect of any fiscal year without affecting the ability of the Fund to qualify as a regulated investment company. In that case, the Fund would be subject to taxation on the retained amount and shareholders subject to U.S. federal income taxation would be required to include in income for tax purposes their shares of the undistributed amount and would be entitled to credits or refunds against their U.S. federal income tax liabilities with respect to their proportionate shares of the tax paid by the Fund.

Income distributions and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

Taxes

It is the Fund’s current intention to continue to meet the requirements of the U.S. Internal Revenue Code of 1986, as amended (“the Code”) applicable to regulated investment companies and to distribute all of its taxable income and capital gain to shareholders. Therefore, no federal income tax provision is required. If the Fund determines in the future to retain capital gains, the Fund will provide for all required taxes.

Withholding tax on foreign dividends and interest and foreign capital gains tax is accrued in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

21

The Asia Pacific Fund, Inc.

Notes to Financial Statements

continued

| Note 2. | Investment Management and Administration Agreements |

The Fund has a management agreement with Baring Asset Management (Asia) Limited (the “Investment Manager”) and an administration agreement with Prudential Investments LLC (the “Administrator”).

The investment management fee is computed weekly and payable monthly at the following annual rates: 1.00% of the Fund’s average weekly net assets up to $100 million and 0.70% of such assets in excess of $100 million.

The administration fee is also computed weekly and payable monthly at the following annual rates: 0.25% of the Fund’s average weekly net assets up to $200 million and 0.20% of such assets in excess of $200 million.

Pursuant to the agreements, the Investment Manager provides continuous supervision of the investment portfolio and the Administrator provides occupancy and certain clerical, administrative and accounting services for the Fund. Both the Investment Manager and the Administrator pay the cost of compensation of certain directors and officers of the Fund. The Fund bears all other costs and expenses.

| Note 3. | Portfolio Securities |

Purchases and sales of investment securities, other than short-term investments, for the year ended March 31, 2012 aggregated $175,292,839 and $169,489,311, respectively. 157 index futures contracts were bought and sold/closed with an aggregate value of $10.96 million and $11.39 million, respectively.

| Note 4. | Distributions and Tax Information |

Distributions to shareholders are determined in accordance with United States federal income tax regulations, which may differ from generally accepted accounting principles. In order to present accumulated net investment loss, accumulated net realized loss on investment and foreign currency transactions and paid-in capital in excess of par on the Statement of Assets and Liabilities that more closely represent their tax character, certain adjustments have been made to accumulated net investment loss, accumulated net realized loss on investment and foreign currency transactions and paid-in capital in excess of par. For the year ended March 31, 2012, the adjustments were to decrease accumulated net investment loss by $180,827, decrease accumulated net realized loss on investment and foreign currency transactions by $385,366 and decrease paid-in capital in excess of par by $566,193 due to differences in the treatment for book and tax purposes of certain transactions involving foreign securities and currencies, net operating

22

The Asia Pacific Fund, Inc.

loss and other book to tax differences. Net investment loss, net realized gain and net assets were not affected by these adjustments.

In the absence of taxable earnings for the years ended March 31, 2012 and March 31, 2011, the Fund did not make any distributions to shareholders.

In addition, as of March 31, 2012, there were no distributable earnings on a tax basis.

Under the Regulated Investment Company Modernization Act of 2010 (“the Act”), the Fund is permitted to carryforward capital losses incurred in the fiscal year ended March 31, 2012 (“post-enactment losses”) for an unlimited period. Post enactment losses are required to be utilized before the utilization of losses incurred prior to the effective date of the Act. As a result of this ordering rule, capital loss carryforwards related to taxable years beginning before March 31, 2012 (“pre-enactment losses”) may have an increased likelihood to expire unused. The Fund utilized approximately $1,851,000 of its pre-enactment losses to offset net taxable gains realized in the fiscal year ended March 31, 2012. No capital gains distributions are expected to be paid to shareholders until net gains have been realized in excess of such losses. As of March 31, 2012, the pre and post-enactment losses were approximately:

| | | | | | |

| Post-Enactment Losses: | | | | $ | 0 | |

| | | | | | |

| Pre- Enactment Losses: | | | | | | |

Expiring 2017 | | | | | 9,777,000 | |

Expiring 2018 | | | | | 15,355,000 | |

| | | | | | |

| | | | $ | 25,132,000 | |

| | | | | | |

The Fund elected to treat post-October capital losses of approximately $407,000 and certain late-year ordinary income losses of approximately $332,000 as having been incurred in the fiscal year ending March 31, 2013.

The United States federal income tax basis of the Fund’s investments and the net unrealized appreciation as of March 31, 2012 were as follows:

| | | | | | | | | | | | | | |

| Tax Basis | | | Appreciation | | | Depreciation | | | Total Net

Unrealized

Appreciation | |

| $ | 110,049,528 | | | $ | 23,344,326 | | | $ | (5,657,506 | ) | | $ | 17,686,820 | |

The difference between book basis and tax basis is attributable to deferred losses on wash sales and investments in passive foreign investment companies.

The adjusted net unrealized appreciation on a tax basis was $17,681,515, which included other tax basis adjustments of $5,305 that were primarily attributable to appreciation/depreciation of foreign currency.

23

The Asia Pacific Fund, Inc.

Notes to Financial Statements

continued

Management has analyzed the Funds’ tax positions taken on federal income tax returns for all open tax years and has concluded that no provision for income tax is required in the Funds’ financial statements for the current reporting period. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

There are 30 million shares of $0.01 par value common stock authorized.

The Fund currently is a party to a committed credit facility with a bank. The credit facility provides for a maximum commitment of $20,000,000 (prior to July 27, 2011: $10,000,000). Interest on any borrowings under the credit facility is at contracted market rates. The Fund pays a commitment fee on the unused portion of the facility. The commitment fee is accrued daily and paid quarterly. The Fund’s obligations under the credit facility are secured by substantially all the assets of the Fund. The purpose of the credit facility is to assist the Fund with its general cash flow requirements, including the provision of portfolio leverage.

During the year ended March 31, 2012, the Fund utilized the credit facility and had an average daily outstanding loan balance of $3,684,932 during the 73 day period that the facility was utilized, at an average interest rate of 0.62%. The maximum amount of loan outstanding during the period was $8,000,000. There was a balance of $8,000,000 outstanding at March 31, 2012.

| Note 7. | New Accounting Pronouncements |

In April 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2011-03 “Reconsideration of Effective Control for Repurchase Agreements.” The objective of ASU No. 2011-03 is to improve the accounting for repurchase agreements and other agreements that both entitle and obligate a transferor to repurchase or redeem financial assets before their maturity. Under previous guidance, whether or not to account for a transaction as a sale was based on, in part, if the entity maintained effective control over the transferred financial assets. ASU No. 2011-03 removes the transferor’s ability criterion from the effective control assessment. This guidance is effective prospectively for interim and annual reporting periods beginning on or after December 15, 2011. At

24

The Asia Pacific Fund, Inc.

this time, management is evaluating the implications of ASU No. 2011-03 and its impact on the financial statements has not been determined.

In May 2011, the FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs.” ASU No. 2011-04 includes common requirements for measurement of and disclosure about fair value between U.S. GAAP and IFRS. ASU No. 2011-04 will require reporting entities to disclose quantitative information about the unobservable inputs used in the fair value measurements categorized within Level 3 of the fair value hierarchy. In addition, ASU No. 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements. The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. At this time, management is evaluating the implications of ASU No. 2011-04 and its impact on the financial statements has not been determined.

25

The Asia Pacific Fund, Inc.

Financial Highlights

| | | | | | | | |

| | | Year Ended March 31, | |

| Per Share Operating Performance: | | 2012 | | | 2011 | |

Net asset value, beginning of year | | | $13.06 | | | | $10.97 | |

| | | | | | | | |

Net investment income (loss) | | | (0.05 | ) | | | (0.06 | ) |

Net realized and unrealized gain (loss) on

investment and foreign currency

transactions | | | (1.34 | ) | | | 2.15 | |

| | | | | | | | |

Total from investment operations | | | (1.39 | ) | | | 2.09 | |

| | | | | | | | |

Less dividends and distributions: | | | | | | | | |

Dividends from net investment income | | | — | | | | — | |

| | |

Distributions paid from capital gains | | | — | | | | — | |

| | | | | | | | |

Total dividends and distributions | | | — | | | | — | |

| | | | | | | | |

Net asset value, end of year | | | $11.67 | | | | $13.06 | |

| | | | | | | | |

Market value, end of year | | | $10.58 | | | | $11.83 | |

| | | | | | | | |

Total investment return (a): | | | (10.57 | )% | | | 18.89 | % |

| | | | | | | | |

| | | | | | | | | |

| | |

| Ratios to Average Net Assets: | | | | | | | | |

Total expenses (including loan interest) (c) | | | 2.15 | %(b) | | | 2.01 | %(b) |

Net investment income (loss) | | | (0.40 | )% | | | (0.51 | )% |

| | |

| Supplemental Data: | | | | | | | | |

Average net assets (000 omitted) | | | $123,601 | | | | $120,668 | |

Portfolio turnover rate | | | 137 | % | | | 136 | % |

Net assets, end of year (000 omitted) | | | $120,715 | | | | $135,076 | |

| (a) | Total investment return is calculated assuming a purchase of common stock at the current market value on the first day and a sale at the current market value on the last day of each fiscal year reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. These calculations do not include brokerage commissions. |

| (b) | The expense ratio without loan interest expense would have been 2.15%, 2.00%, 2.21%, and 1.52% for the fiscal years ended March 31, 2012, 2011, 2010, and 2008, respectively. |

| (c) | Does not include expenses of the underlying funds in which the Fund invests. |

| | Shown above is selected data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for the years indicated. This information has been determined based upon information provided in the financial statements and market price data for the Fund’s share. |

See Notes to Financial Statements.

26

The Asia Pacific Fund, Inc.

| | | | | | | | | | | | |

| | | Year Ended March 31, | |

| Per Share Operating Performance: | | 2010 | | | 2009 | | | 2008 | |

Net asset value, beginning of year | | | $6.75 | | | | $21.70 | | | | $24.03 | |

| | | | | | | | | | | | |

Net investment income (loss) | | | (0.06 | ) | | | 0.12 | | | | 0.09 | |

Net realized and unrealized gain (loss) on investment and foreign currency transactions | | | 4.28 | | | | (9.97 | ) | | | 5.73 | |

| | | | | | | | | | | | |

Total from investment operations | | | 4.22 | | | | (9.85 | ) | | | 5.82 | |

| | | | | | | | | | | | |

Less dividends and distributions: | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.04 | ) | | | (0.91 | ) |

| | | |

Distributions paid from capital gains | | | — | | | | (5.06 | ) | | | (7.24 | ) |

| | | | | | | | | | | | |

Total dividends and distributions | | | — | | | | (5.10 | ) | | | (8.15 | ) |

| | | | | | | | | | | | |

Net asset value, end of year | | | $10.97 | | | | $6.75 | | | | $21.70 | |

| | | | | | | | | | | | |

Market value, end of year | | | $9.95 | | | | $6.23 | | | | $19.75 | |

| | | | | | | | | | | | |

Total investment return (a): | | | 59.71 | % | | | (41.95 | )% | | | 28.68 | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | |

Total expenses (including loan interest) (c) | | | 2.22 | %(b) | | | 1.95 | % | | | 1.54 | %(b) |

Net investment income (loss) | | | (0.61 | )% | | | 0.79 | % | | | 0.31 | % |

| | | |

| Supplemental Data: | | | | | | | | | | | | |

Average net assets (000 omitted) | | | $100,915 | | | | $151,467 | | | | $297,765 | |

Portfolio turnover rate | | | 184 | % | | | 220 | % | | | 105 | % |

Net assets, end of year (000 omitted) | | | $113,440 | | | | $69,864 | | | | $224,476 | |

See Notes to Financial Statements.

27

The Asia Pacific Fund, Inc.

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders

The Asia Pacific Fund, Inc.:

We have audited the accompanying statement of assets and liabilities of The Asia Pacific Fund, Inc. (hereafter referred to as the “Fund”), including the portfolio of investments, as of March 31, 2012, and the related statement of operations for the year then ended, and the statement of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2012, by correspondence with the custodian, transfer agent and brokers or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of March 31, 2012, and the results of its operations, the changes in its net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

May 29, 2012

28

The Asia Pacific Fund, Inc.

Tax Information (Unaudited)

For the fiscal year ended March 31, 2012, the Fund made an election to pass through the maximum amount of the portion of the ordinary income dividends derived from foreign source income as well as any foreign taxes paid by the Fund in accordance with Section 853 of the Internal Revenue Code or the following amounts: $269,201 foreign tax credit from recognized foreign source income of $2,414,096.

In January 2013, shareholders will be advised on IRS Form 1099-DIV or Substitute Form 1099-DIV as to the federal tax status of dividends and distributions received in calendar year 2012.

29

The Asia Pacific Fund, Inc.

Dividend Reinvestment Plan (Unaudited)

Shareholders may elect to have all distributions of dividends and capital gains automatically re-invested in Fund shares (“Shares”) pursuant to the Fund’s Dividend Reinvestment Plan (“the Plan”). Shareholders who do not participate in the Plan will receive all distributions in cash paid by check in United States Dollars mailed directly to the shareholders of record (or if the shares are held in street or other nominee name, then to the nominee) by the custodian, as dividend disbursing agent. Shareholders who wish to participate in the Plan should complete the attached enrollment card or contact the Fund at 1-(800) 451-6788.

After the Fund declares a dividend or determines to make a capital gains distribution, if (1) the market price is lower than net asset value, the participants in the Plan will receive the equivalent in Shares valued at the market price determined as of the time of purchase (generally, following the payment date of the dividend or distribution); or if (2) the market price of Shares on the payment date of the dividend or distribution is equal to or exceeds their net asset value, participants will be issued Shares at the higher of net asset value or 95% of the market price.

There is no charge to participants for reinvesting dividends or capital gain distributions, except for certain brokerage commissions, as described below. The Plan Agent’s (Computershare Trust Co., formerly known as Equiserve) fees for the handling of the reinvestment of dividends and distributions will be paid by the Fund. There will be no brokerage commissions charged with respect to shares issued directly by the Fund. However, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open market purchases in connection with the reinvestment of dividends and distributions. The automatic reinvestment of dividends and distributions will not relieve participants of any federal income tax that may be payable on such dividends or distributions.

The Fund reserves the right to amend or terminate the Plan upon 90 days’ written notice to shareholders of the Fund.

Participants in the Plan may withdraw from the Plan upon written notice to the Plan Agent and will receive certificates for whole Shares and cash for fractional Shares.

30

The Asia Pacific Fund, Inc.

Miscellaneous Information (Unaudited)

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available:

| • | | Without charge, by calling the Fund’s toll-free telephone number (888) “ASIA-PAC”. |

| • | | On the Securities and Exchange Commission website, http://www.sec.gov. |

Information regarding the Fund’s proxy voting record for the 12-month period ending June 30 of each year is filed with the SEC on Form N-PX no later than August 31 of each year. The Fund’s Form N-PX is available without charge, upon request, by calling the Fund at its toll free number 1-(888) 4-ASIA-PAC and on the SEC’s website (http://www.sec.gov).

New York Stock Exchange and Securities and Exchange Commission Certifications

The Fund is listed on the New York Stock Exchange. As a result, it is subject to certain corporate governance rules and related interpretations issued by the Exchange. Pursuant to those requirements, the Fund must include information in this report regarding certain certifications.

The Fund’s President and Treasurer file certifications with the Securities and Exchange Commission regarding the quality of the Fund’s public disclosure. The certifications are made pursuant to Section 302 of the Sarbanes-Oxley Act (“Section 302 Certifications”). The section 302 Certifications are filed as exhibits to the Fund’s annual report on Form N-CSR, which include a copy of the annual report together with certain other information about the Fund.

Availability of Quarterly Portfolio Schedule

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s N-Q Forms are available on the Commission’s website at http://www.sec.gov. The Fund’s N-Q Forms may also be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330 (732-0330).

31

The Asia Pacific Fund, Inc.

Directors and Officers of the Fund (Unaudited)

Information pertaining to the Directors of the Fund is set forth below. Directors who are not deemed to be “interested persons” of the Fund as defined in the Investment Company Act of 1940, as amended (the 1940 Act) are referred to as “Independent Directors.” Directors who are deemed to be “interested persons” of the Fund are referred to as “Interested Directors.” The “Fund Complex” consists of the Fund and any other investment companies managed by Baring Asset Management (Asia) Limited (the Investment Manager).

Independent Directors

| | | | | | |

Name, Address** and Age | | Positions with Fund | |

Term of Office***

and Length of Time Served | | |

| | | |

| Jessica M. Bibliowicz (52) | | Director (Class II***) | | Since 2006 | | |

| | | |

| Robert H. Burns (82) | | Director (Class I***) | | Since 1986 | | |

| | | |

| Michael J. Downey (68) | | Director and

Chairman

(Class I***) | | Since 1986 Since 1999 | | |

| | | |

| Robert F. Gunia (65) | | Director (Class III***) | | Since 1989 | | |

| | | |

| Douglas Tong Hsu (69) | | Director (Class II***) | | Since 1986 | | |

| | | |

| Duncan M. McFarland (68) | | Director (Class I***) | | Since 2005 | | |

32

The Asia Pacific Fund, Inc.

| | | | | | |

Principal Occupations During Past 5 Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | | Other Directorships Held by the

Director**** |

| | |

| President and Chief Executive Officer of National Financial Partners. (NYSE:NFP), an independent distributor of financial services products. Formerly, President and Chief Operating Officer of John A. Levin & Co., a registered investment advisor. | | | 1 | | | |

| | |

| Chairman, Robert H. Burns Holdings Limited (an investment business), Hong Kong; formerly, Chairman and Chief Executive Officer, Regent International Hotels Limited, Hong Kong. | | | 1 | | | |

| | |

| Private Investor. | | | 1 | | | Director, Alliance Capital L.P. Mutual Fund Complex (96 funds); Trustee, Merger Fund. |

| | |

| Independent Consultant (since October 2009); formerly Chief Administrative Officer (September 1999-September 2009) and Executive Vice President (December 1996-September 2009) of Prudential Investments LLC; formerly Executive Vice President (March 1999-September 2009) and Treasurer (May 2000-September 2009) of Prudential Mutual Fund Services LLC; formerly President (April 1999-December 2008) and Executive Vice President and Chief Operating Officer (December 2008-December 2009) of Prudential Investment Management Services LLC; formerly Chief Administrative Officer, Executive Vice President and Director (May 2003-September 2009) of AST Investment Services, Inc.; | | | 1 | | | Director of Advanced Series Trust, Prudential’s Gibraltar Fund, Inc. and The Prudential Series Fund. |

| | |

| Chairman and Chief Executive Officer, Far Eastern New Century Corp., Taiwan. | | | 1 | | | |

| | |

| Formerly, Managing Partner and Chief Executive Officer, Wellington Management Company, LLP. (1994-2004); formerly Trustee, Financial Accounting Foundation (2001-2009). | | | 1 | | | Director of Gannett Co., Inc. and NYSE Euronext. |

33

The Asia Pacific Fund, Inc.

Directors and Officers of the Fund (Unaudited)

continued

Independent Directors continued

| | | | | | |

Name, Address** and Age | | Positions

with Fund | |

Term of Office***

and Length of

Time Served | | |

| | | |

| David G. P. Scholfield (68) | | Director (Class II***) | | Since 1988 | | |

| | | |

| Nicholas T. Sibley (73) | | Director (Class III***) | | Since 2001 | | |

34

The Asia Pacific Fund, Inc.

| | | | | | |

Principal Occupations

During Past 5 Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director | | | Other Directorships

Held by the

Director**** |

| | |

| Chairman, Acru China+ and Taiwan Absolute Return Funds; Senior Independent Director, Thames River Multi-Hedge; Director, Bank of China HK RMB Bond and RMB High Yield Bond Funds; Trustee and Investment Committee Member of two UK-registered Charitable Trusts; formerly, Managing Director Bank of Bermuda, Hong Kong (1998-2004) and Bank of Bermuda Country Head, Asia (2001-2004). | | | 1 | | | |

| | |

| Fellow of the Institute of Chartered Accountants in England and Wales; Chairman of Aquarius Platinum Ltd. | | | 1 | | | Director of Richland Resources Limited. |

35

The Asia Pacific Fund, Inc.

Directors and Officers of the Fund (Unaudited)

continued

Information pertaining to the Officers of the Fund is set forth below.

Officers

| | | | | | |

Name, Address** and Age | | Positions

with Fund | | Term of Office and Length of

Time Served | | |

| | | |

| Brian A. Corris (53) | | President | | Since 2007 | | |

| | | |

| Grace C. Torres (52) | | Vice President | | Since 2008 | | |

| | | |

| M. Sadiq Peshimam (48) | | Treasurer and Chief Financial Officer Assistant Treasurer | | Since 2008 2005-2008 | | |

| | | |

| Deborah A. Docs (54) | | Secretary Chief Legal Officer Assistant Secretary | | Since 1998 Since 2006 1989-1998 | | |

| | | |

| Andrew R. French (49) | | Assistant Secretary | | Since 2007 | | |

| | | |

| Valerie M. Simpson (53) | | Chief Compliance Officer | | Since 2007 | | |

| | | |

| Theresa C. Thompson (49) | | Deputy Chief Compliance Officer | | Since 2008 | | |

| ** | The address of the Directors and Officers is c/o: Prudential Investments LLC, Gateway Center Three, 100 Mulberry Street, Newark, New Jersey, 07102-4077. |

36

The Asia Pacific Fund, Inc.

|

Principal Occupations During Past 5 Years |

|

| Director of Institutional Group of Baring Asset Management (since October 2005); formerly Head of Institutional Pension Funds at Isis Asset Management (2000-2005), previously worked at Citigroup Asset Management, Credit Lyonnaise Securities (USA), Indosuez Capital Securities, James Capel & Co and Barclays de Zoete Wedd Ltd.; President of the Greater China Fund, Inc. (since 2008) |

|

Assistant Treasurer (since March 1999) and Senior Vice President (since September 1999) of PI; Assistant Treasurer (since May 2003) and Vice President (since June 2005) of AST Investment Services, Inc.; Senior Vice President and Assistant Treasurer (since May 2003) of Prudential Annuities Advisory Services, Inc.; Treasurer and Principal Financial and Accounting Officer of The Greater China Fund, Inc. (since June 2007). |

|

| Assistant Treasurer and Vice President (since 2005) and Director (2000-2005) within Prudential Mutual Fund Administration. |

|

Vice President and Corporate Counsel (since January 2001) of Prudential; Vice President (since December 1996) and Assistant Secretary (since March 1999) of PI.; Chief Legal-Officer and Secretary of The Greater China Fund, Inc. (since January 2007). |

|

| Vice President and Corporate Counsel (since February 2010) of Prudential; formerly Director and Corporate Counsel (2006-2010) of Prudential; Vice President and Assistant Secretary (since January 2007) of PI; Vice President and Assistant Secretary of PMFS; and Assistant Secretary of The Greater China Fund, Inc. (since June 2007). |

|

| Chief Compliance Officer (since April 2007) of Prudential Investments and AST Investment Services, Inc.; formerly Vice President – Financial Reporting (June 1999-March 2006) for Prudential Life and Annuities Finance (2007-2009); Chief Compliance Officer of The Greater China Fund, Inc. (since June 2007). |

|

| Vice President, Compliance, PI (since April 2004); and Director, Compliance, PI (2001-2004); Deputy Chief Compliance Officer of The Greater China Fund, Inc. (since December 2007). |

| *** | The Fund’s Charter and Bylaws provide that the Board of Directors is divided into three classes of Directors, as nearly equal in number as possible. Each Director serves for a term of three years, with one class being elected each year. Each year the term of office of one class will expire. |

| **** | This column includes all directorships of companies required to register, or file reports with the Commission under the Securities Exchange Act of 1934 (the Exchange Act) (i.e., “public companies”) and other investment companies registered under the 1940 Act. |

37

Privacy Notice