SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Investment Company Act file number 811-04750

________________

Fenimore Asset Management Trust

________________________________________________________________

(Exact name of registrant as specified in charter)

384 North Grand Street

P.O. Box 399

Cobleskill, New York 12043

________________________________________________________________

(Address of principal executive offices) (Zip code)

Thomas O. Putnam

Fenimore Asset Management Trust

384 North Grand Street

Cobleskill, New York 12043

________________________________________________________________

Name and address of agent for service

Registrant’s telephone number, including area code: 1-800-453-4392

_________________

Date of fiscal year end: December 31

_________________

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

The Commission may use the information provided on Form N-CSR in its regulatory disclosure review, inspection, and policymaking roles. A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requiresments of 44 U.S.C. ss. 3507.

Item 1. Report to Stockholders.

The annual report to stockholders is filed herewith.

In-depth research. Insightful investing.

ANNUAL REPORT

DECEMBER 31, 2015

VALUE FUND

EQUITY-INCOME FUND

SMALL CAP FUND

Table of Contents

Chairman’s Commentary | 1 |

| FAM Value Fund |

| Letter to Shareholders | 4 |

| Performance Summary | 9 |

| Portfolio Data | 11 |

| Statement of Investments | 12 |

| FAM Equity-Income Fund |

| Letter to Shareholders | 17 |

| Performance Summary | 23 |

| Portfolio Data | 25 |

| Statement of Investments | 26 |

| FAM Small Cap Fund |

| Letter to Shareholders | 30 |

| Performance Summary | 35 |

| Portfolio Data | 37 |

| Statement of Investments | 38 |

| Statements of Assets and Liabilities | 42 |

| Statements of Operations | 43 |

| Statements of Changes in Net Assets | 44 |

| Notes to Financial Statements | 46 |

| Report of Independent Registered Public Accounting Firm | 57 |

| Investment Advisor Contract Renewal Disclosure | 58 |

| Information About Trustees and Officers | 63 |

| Expense Data | 65 |

| Supplemental Information | 66 |

FAM Funds has adopted a Code of Ethics that applies to its principal executive and principal financial officers. You may obtain a copy of this Code without charge, by calling FAM Funds at (800) 932-3271. |

Chairman’s Commentary

December 31, 2015

Dear Fellow Shareholder,

Financial market commentaries are replete with sports analogies. Among the most common are “playing offense” or “playing defense.” Typically, the authors of the articles are goading the audience to get more aggressive (offense) in their portfolio positioning or more conservative (defense) in an effort to maximize returns. Do not be fooled, it is market timing wrapped in a sports uniform. The authors view the investing environment as black or white and the time to switch from offense to defense – or vice versa – is clear-cut. We view the investing environment, and our mandate, quite differently. The environment is always ambiguous and our mission in the context of uncertainty is to first protect the capital entrusted to us, then to grow it over the long term. We are constantly playing “defensive offense.” We do not field the offense to try to make a big play, then send in the defense. Our offense is always on the field steadily powering the ball forward and being careful to avoid a turnover. A defensive offense has served us well and we think it may be even more important in the months and years ahead.

2015 Recap

After a stumble off the line in 2015, the U.S. stock market, as measured by the S&P 500 Index, was relatively calm for the first two-thirds of the year, vacillating between flat and +3 %. Then, in August, fears about a slowing Chinese economy erupted to the surface when The Peoples Bank of China unexpectedly devalued their currency in an effort to, among other things, boost growth through exports. The S&P 500 fell -11% in the following days, bottoming -12.4% below its 2015 peak. The aftershocks of this surprise move, along with the continued slide in prices of oil and other commodities and strengthening dollar, led to increased volatility in the final months of the year.

Despite the volatility, the S&P 500 Index finished the year nearly where it started falling -0.70%; however, including dividends (total return) the index returned 1.38%. The Russell 3000 Index, a broader measure of the market which includes the 3000 largest companies, finished at 0.48% (total return). Similar to a calm body of water belying strong crosscurrents beneath a smooth surface, there was significant, disparate performance within subsets of the market. Large companies, as represented by the Russell 1000 Index, ended 2015 at 0.92%, outperforming smaller companies represented by the Russell 2000 Index which dropped -4.41%. Even starker was the difference between stocks deemed growth versus those con- sidered value. The Russell 3000 Growth Index was up 5.09% while the Russell 3000 Value Index fell -4.13%. This more than 9% point difference is the widest gap in years and presented challenges for investors who, like us, seek to invest in businesses at a discount to their intrinsic value.

1

Chairman’s Commentary

With this as our backdrop, our three Funds performed well in 2015 relative to both our benchmarks and our peers (please read the Fund letters that follow for more detail). On an absolute basis, we strive to do better than we did. But after three strong years in the markets and the Funds, it isn’t a surprise to have a flat-to-down year. One consequence of the more volatile markets is that we were more active in the Funds than past years. On several occasions we took the opportunity to sell richly-valued holdings and buy positions in businesses that we believe have better risk/reward profiles. Also adding to our portfolio activity, several of our holdings were acquired or announced the intention to be acquired. Throughout the year, we initiated positions in 14 new companies and sold or were bought out of 16 holdings. If volatility persists, which we think is probable, we will continue to be more active than usual.

Oil prices finished the year -30% below where they started and -70% from their mid-2014 peak. At this time last year, we were pondering the effects of the then six-month-old bear market in oil. Most of the outside commentary was positive, anticipating the beneficial effects on consumers’ budgets with many predicting higher prices by year-end. We had no point of view as to future price movements but we cautioned that while it might make for a more pleasant trip to the gas station for many people, the drop in oil would not come without costs. Even with our cautious stance, we have been surprised by how harmful lower oil has been on the U.S. economy. When you drop a stone in calm water, the ripple wave emanates far from the point of impact. Similarly, the ripple wave of lower oil is being felt far beyond exploration and production companies and oil service firms. “Oil and gas exposure” has become a primary topic of conversation between Wall Street and managements of businesses ranging from industrial manufacturers to real estate services. As prospects for a quick rebound in oil prices (appear to) fade, many investors are shunning corporations that might feel effects, regardless of their quality or long-term prospects. These “oil ripple” businesses are just one area we are finding interesting opportunities. While we continue to monitor companies with direct exposure to oil and gas, we are excited about those increasingly unloved businesses with indirect exposure.

After months of investor anticipation and fixation, Janet Yellen and her colleagues at the Federal Reserve ripped off the proverbial “Band-Aid” and raised the target Fed Funds rates a quarter of a point during their final meeting of 2015. While metaphorically appealing, calling seven years of near-zero interest rates a Band-Aid might be deemed an understatement for the ages. Some would call it a tourniquet, others a noose. Regardless, the process of normalizing short-term rates has begun. I stress short-term, because the Fed does not control medium- and long-term rates. Indeed, between the rate hike on December 16 and the end of the year, the yield on the 10-Year Treasury fell three basis points to 2.27%. The Federal Open Market Committee will meet eight times in 2016; some likely resulting in further rate increases, all likely preceded by market skittishness. Of course, we do not know at what speed or to what extent short-term rates may increase or what will happen to longer term rates, but we continue to be

2

Chairman’s Commentary

vigilant about both the risks and opportunities of higher rates, including their effects on the dollar. We will also be ready to take advantage of stock market volatility surrounding the meetings as it often leads to indiscriminate buying and selling. This can create opportunities for us to invest in quality businesses at attractive prices.

One of the outcomes of the challenges in developing markets, Europe, and the oil patch is that revenue growth has become harder to achieve. With fewer opportunities to grow sales organically (i.e. by doing more of the same thing) and access to cheap capital, companies are opting to “buy growth” by merging with or acquiring other businesses. In fact, 2015 was a record-setting year for mergers and acquisitions (M&A) with almost $3 trillion in announced and/or consummated transactions in just North America. Our Funds benefitted from this trend in a couple of ways. First, as I mentioned, we had several companies acquired at prices above – sometimes well above – our cost. Next, a couple of our holdings have exploited the frothy M&A market by selling non-core segments and redeploying or returning the capital. Lastly, some of our businesses have been acquirers, using low-cost capital to make accretive acquisitions. Even with short-term rates on the rise, we expect to continue to benefit from heightened acquisition activity in 2016.

Outlook

We have no view on where the market will end in 2016 and do not know if the volatility that surfaced at the end of 2015 will carry into this year. What we do know is that when you are a long-term, patient investor with a solid playbook of defensive offense, volatility is opportunity.

Thank you for your continued trust in us.

| Thomas O. Putnam, Chairman |

| |

| Research Team: |

| Andrew F. Boord |

John D. Fox, CFA |

| Kevin D. Gioia, CFA |

| Paul C. Hogan, CFA |

| Drew P. Wilson, CFA |

3

FAM Value Fund

December 31, 2015

Dear Fellow Value Fund Shareholder:

The U.S. stock market reached an all-time high in May 2015, but declined over the sum- mer as concerns about a slowing economy in China reduced stock prices. From the peak in May to the trough in August stock prices declined -12%. This was the first decline of -10% or more in four years. Looking back on the year it was a difficult time to make money in financial markets. The stock market, as measured by the S&P 500 Index, was up about 1% and the bond market, as measured by the Barclays U.S. Aggregate Bond Index, delivered a total return of less than -1%. In some areas there were considerable losses. Previous market darlings like emerging markets were down more than -10% last year. One of the S&P 500’s worst areas was energy and commodity stocks – the largest energy ETF (exchange traded fund), Energy Select Sector SPDR Fund, was down more than -20% for the year.

Performance Detail

At December 31, 2015 the net asset value of the FAM Value Fund was $60.06 representing a decrease of -1.74% from the beginning of the year. For comparison, the S&P 500 Index increased 1.38% and the Russell Midcap Index declined -2.44%.

Best Performers

The best performer for the year, on a dollar-weighted basis, was Markel Corporation with a gain of $13.06 million. Markel is an insurance company with headquarters in Richmond, VA. Originally a family business started in 1930 by Sam Markel in Norfolk, today Markel is a global corporation selling almost $5 billion a year of insurance premiums. The company has offices in the United States, London, and Singapore. Markel focuses on underwriting profits and a unique approach to investing with a much larger percentage of their invested assets in stocks than the typical insurer.

The second-best performer was MEDNAX, Inc. with a gain of almost $6.89 million. MEDNAX is a healthcare service company that runs neonatal intensive care units at hospitals and provides anesthesia services. Over the last year, MEDNAX has expanded into new healthcare businesses such as virtual radiology and hospital revenue management. Earnings growth over the last decade has been terrific due to a combination of internal growth and many profitable acquisitions.

The third-best performer was Ross Stores, Inc. with a gain of more than $6.72 million. Ross is one of the best stocks we have owned in the 29-year history of the Fund. Shoppers continue to be attracted to Ross’ offering of brand-name clothes at discount prices. The current fiscal year (ending January 2016) will be the eleventh year in a row of positive earnings per share growth. In addition to providing growth, the business maintains its excellent financial strength. Ross Stores ended the last quarter

4

FAM Value Fund

with more than $500 million of cash in the bank. Management continues to allocate profits wisely with shareholders receiving significant dividends and share buybacks over the last five years.

Worst Performers

The worst performer for the year, on a dollar-weighted basis, was Franklin Resources, Inc. with a loss of -$8.38 million. Franklin Resources is an investment management firm and its brands include Franklin Bond Funds and Templeton Global Funds. Over the past year, the company experienced large redemptions out of its bond and global stock funds. Investors are worried about a slowdown in China and related emerging markets. As a result, they are pulling money out of their global funds. As conditions change around the world, we think these funds can do well in the future and recapture investors’ interest. While Franklin’s stock price declined sharply, we believe it remains financially strong with more than $9 billion in net cash and the stock is undervalued at about 7x earnings net of the cash per share.

The second-worst performer was CarMax, Inc. with a loss of -$7.08 million. CarMax is the nation’s largest used car superstore. Founded in Richmond, VA in 1983, CarMax management believed there was a real opportunity to improve the car buying process. Management designed a car retailing model based on integrity and trust. The CarMax business model includes fixed prices for their cars, transparent financing options, and a cash offer for your car with no obligation. We first purchased CarMax in the Fund in May 2004 at around $12.50 per share when the company had 52 stores and a plan to expand nationally. In the most recent quarter, they had 153 stores with plans to open at least 36 new stores over the next three years. We continue to like the CarMax business model based on transparency and their ability to continue opening new stores to drive growth.

The third-worst performer was EOG Resources, Inc. with a loss of more than -$6.31 million. EOG is an energy producer which has been impacted by the sharp decline in the price of oil and natural gas. We continue to like EOG’s low-cost structure, strong balance sheet, and management’s focus on return on capital versus growth. While all energy companies are struggling with low commodity prices, we think EOG should continue to generate cash and be in a strong position when commodity prices increase.

Portfolio Activity

Purchases

We invested in five new companies during the year: DSW Inc., Fossil Group, Inc., Keysight Technologies, Inc., Precision Castparts Corp. and Xilinx, Inc.

DSW is the operator of more than 400 Designer Shoe Warehouse stores in 42 states. In addition, DSW runs shoe departments for other retailers. Each retail location has more than 20,000 pairs of shoes. The company offers shoppers convenience, selection, and

5

FAM Value Fund

great prices. At the time of our first purchase the stock price had declined -40% from its all-time high. The stock declined due to concerns about retail sales being affected by warm weather and online sales impacting brick and mortar retailers. Living in Upstate New York, we have experienced the very warm winter weather and estimate that this has had a real impact on cold weather products like coats and boots. DSW normally sells a lot of boots this time of year, but those sales have not materialized due to the weather. We believe that the unusual climate is temporary and DSW is somewhat insulated from online sales as the need to try on shoes is an important part of a customer’s buying experience. The business has an excellent financial profile with a debt-free balance sheet and 15% return on equity.

Fossil Group designs, markets, and distributes fashion accessories, primarily watches, while having an extremely diverse product and distribution portfolio. The company’s watch brands include Fossil, Michael Kors, Kate Spade, and Burberry. Their products are sold in Fossil stores, department stores, jewelry stores, and online. Their financial profile is excellent with high profit margins, returns on equity in excess of 25%, and a strong balance sheet. We also like the fact that the CEO takes no salary and owns 12% of Fossil.

Keysight Technologies provides electronic measurement solutions to the Communications and Electronics industries. The test equipment operation was the original business of the Hewlett-Packard Corporation in Palo Alto, CA. While Hewlett-Packard has been around for more than 50 years, Keysight is relatively new as a public company and became an independent entity in October of 2014. We believe that, as an independent firm, management should be able to focus its resources on product development and growth. Keysight meets our financial criteria with 19% operating margins, considerable free cash flow generation, and a strong balance sheet.

Precision Castparts manufactures metal components and products. It provides investment castings, forgings, fasteners, and fastener systems for critical aerospace and industrial gas turbine applications. Some of Precision’s products are sold into the energy business, which is currently experiencing a severe slowdown. As a result of the weakening in Precision’s sales, the stock declined from a high of $275 to below $200 per share this past summer. While we acknowledged its earnings power had declined, we thought the company had terrific products and a strong competitive advantage. We began buying the stock below $200 a share in July. Unknown to us, Precision was in talks to be acquired by another one of our holdings – Berkshire Hathaway. The acquisition was announced on August 10, 2015 and we sold our shares for a relatively quick gain.

Xilinx is a semiconductor business that designs and markets programmable circuits and chips. We purchased a position in the Fund in January after a disappointing earnings re- port caused the stock to decline below what we thought it was worth. Xilinx is extremely profitable with a gross profit margin of almost 70%. The company generates significant free cash flow which has been used to pay dividends and reduce the shares outstanding. Additionally, it has an extremely strong balance sheet

6

FAM Value Fund

with cash balances in excess of $3 billion. Xilinx is one of two businesses that specialize in programmable chips. The other, Altera, was recently acquired by Intel.

Sales

We sold our entire position in five holdings during the year: Bed Bath & Beyond, Inc., Evolution Petroleum Corporation, Southwestern Energy Company, Protective Life Corporation, and Precision Castparts Corp.

Bed Bath & Beyond is a well-known retailer that specializes in merchandise for the home. The company’s brands include Bed Bath & Beyond, Christmas Tree Shops, and buybuy Baby. We had owned stock in Bed Bath for many years. We originally liked its strong balance sheet and management’s skill at merchandising in its stores. While this had been a profitable holding for the Fund in recent years, we have become concerned about the long- term profitability of the business due to increased competition from online retailers. Not only are online retailers taking sales from physical stores, but the increased competition is requiring retailers like Bed Bath & Beyond to invest in their own online capabilities. We estimate that the combination of these two forces will reduce profit margins over time.

We sold all of our shares in two energy names: Evolution Petroleum and Southwestern Energy. Both positions were very small and would not have a material effect on Fund performance if they rebounded. To maintain a similar exposure to commodity prices, we invested a comparable dollar amount from these sales into additional shares of EOG Resources which should benefit from higher commodity prices. We believe that EOG’s superior land position and strong balance sheet should allow it to do well when oil prices rise. These trades allowed us to reduce the capital gains paid to shareholders and maintain some exposure to rising commodity prices.

Protective Life was acquired by a Japanese insurance company on February 1, 2015 and the Fund received $70 a share in cash for its shares. This acquisition capped a successful investment that the Fund had owned for more than 15 years.

Finally, as mentioned above within “Purchases,” Precision Castparts is in the process of being acquired by Berkshire Hathaway so we sold our position.

Our Investment Approach: Value Is In Our Name

One of the most important parts of our investment process is the belief that every business has an intrinsic value (economic worth). This value is derived by the amount of cash a company generates, its profitability, and the ability to grow in the future. Businesses that generate more cash, are more profitable, and have better growth prospects are more valuable. It’s important to note that at certain points in time, intrinsic value is different from the current stock price. Our investment process is designed to find these situations. When a quality company is selling below its intrinsic value, we seek to invest in it for the Fund. Once we own a stock we monitor the relationship between the market price

7

FAM Value Fund

and our assessment of intrinsic value. When we believe a stock is selling far above its own value, we will sell some or all of our shares. As good businesses usually get more valuable over time, we tend to hold stocks for a long time resulting in low turnover and the generation of long- term capital gains when we do sell. For example, 100% of this year’s capital gains distribution was from long-term profits which are taxed at a lower rate than short-term gains.

Notice above we said good businesses get more valuable over time. This is an important point. Our strategy is to invest in companies that have certain qualities that allow them to increase in value. The first of these characteristics is that it has some kind of competitive advantage that allows it to earn strong profits and continue to do so in the future. Second, the company must be financially strong with limited debt, high profitability, and the ability to generate cash profits. Finally, the business must be well-managed. Management is critical as they are responsible for allocating profits for the benefit of their shareholders. We assess management by analyzing the financial statements and meeting face-to-face with the corporate executives. Our objective for the Fund is to invest in a relatively small number of well-managed businesses selling at or below intrinsic value.

Outlook

As we enter the New Year, the most important question is about the pace of worldwide growth. Since the middle of 2015, the primary question for investors has been the rate of growth for the Chinese economy. This is an important consideration as China is a large source of demand for many commodities and industrial products. Therefore, to some extent, in the short term as China goes so goes the world economy. Here in the U.S.A. we see continued slow growth driven by job creation, low interest rates, and low energy prices. We don’t expect anything spectacular. As we look at the stock prices of many businesses compared to their intrinsic values, we don’t see a lot of bargains but perhaps a few more than one year ago.

Thank you for investing with us in the FAM Value Fund.

| John D. Fox | Thomas O. Putnam |

| Co-Manager | Co-Manager |

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

8

FAM Value Fund - Performance Summary (Unaudited)

Annual Total Investment Returns:

| JANUARY 2, 1987 TO DECEMBER 31, 2015 |

| | FAM VALUE FUND | RUSSELL MIDCAP INDEX | S&P 500 INDEX |

| FISCAL YEAR | TOTAL RETURN | TOTAL RETURN | TOTAL RETURN |

| 1987 | -17.40% | 0.23% | 5.25% |

| 1988 | 35.50% | 19.80% | 16.61% |

| 1989 | 20.32% | 26.27% | 31.69% |

| 1990 | -5.36% | -11.50% | -3.11% |

| 1991 | 47.63% | 41.51% | 30.47% |

| 1992 | 25.08% | 16.34% | 7.60% |

| 1993 | 0.21% | 14.30% | 10.06% |

| 1994 | 6.82% | -2.09% | 1.31% |

| 1995 | 19.71% | 34.45% | 37.53% |

| 1996 | 11.23% | 19.00% | 22.95% |

| 1997 | 39.06% | 29.01% | 33.35% |

| 1998 | 6.19% | 10.09% | 28.58% |

| 1999 | -4.84% | 18.23% | 21.04% |

| 2000 | 19.21% | 8.25% | -9.10% |

| 2001 | 15.07% | -5.62% | -11.88% |

| 2002 | -5.33% | -16.19% | -22.09% |

| 2003 | 24.98% | 40.06% | 28.67% |

| 2004 | 16.86% | 20.22% | 10.88% |

| 2005 | 5.56% | 12.65% | 4.91% |

| 2006 | 8.73% | 15.26% | 15.79% |

| 2007 | -0.79% | 5.60% | 5.49% |

| 2008 | -28.68% | -41.46% | -37.00% |

| 2009 | 22.18% | 40.48% | 26.46% |

| 2010 | 17.02% | 25.48% | 14.76% |

| 2011 | -0.41% | -1.55% | 2.11% |

| 2012 | 11.39% | 17.28% | 16.00% |

| 2013 | 32.96% | 34.76% | 32.44% |

| 2014 | 13.41% | 13.22% | 13.69% |

| 2015 | -1.74% | -2.44% | 1.38% |

9

FAM Value Fund - Performance Summary (Unaudited)

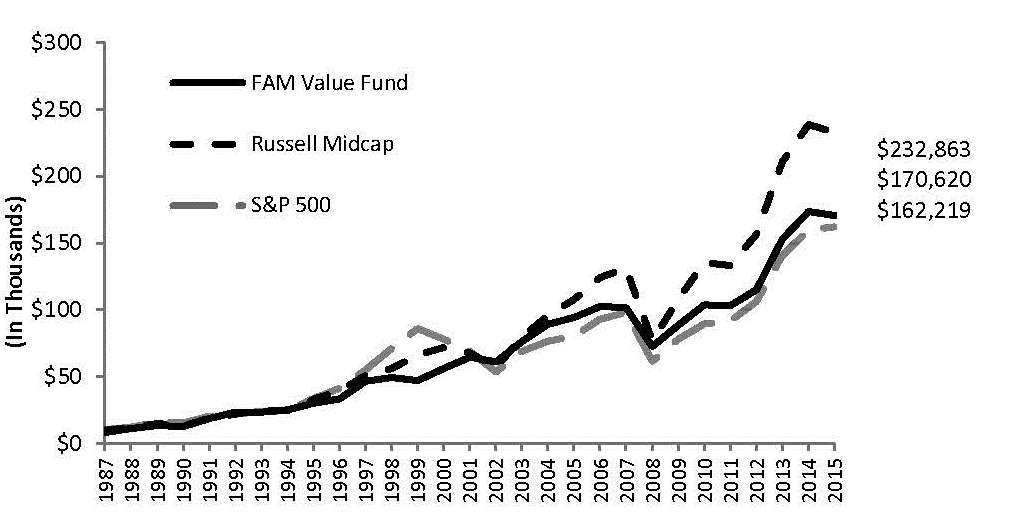

The chart below depicts the change in value of a $10,000 investment in the FAM Value Fund since inception on January 2, 1987, as compared with the growth of the Russell Midcap Index, the Fund’s primary benchmark index, and the Standard & Poor’s 500 Index, an additional comparative index, during the same period. The information assumes reinvestment of dividends and capital gain distributions. The Russell Midcap Index is an unmanaged index generally representative of the market for the stocks of mid-size U.S. companies. The Standard & Poor’s 500 Index is an unmanaged index generally representative of the market for the stocks of large size U.S. companies.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FAM VALUE FUND, THE RUSSELL MIDCAP INDEX, AND THE S&P 500 INDEX

This information represents past performance of the FAM Value Fund and is not indicative of future results. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| Average Annual Total Returns as of December 31, 2015 |

| | 1-Year | 3-Year | 5-Year | 10-Year | Life of Fund (1/2/87) |

| FAM Value Fund | -1.74% | 14.01% | 10.45% | 6.10% | 10.28% |

| Russell Midcap Index | -2.44% | 14.18% | 11.44% | 8.00% | 11.47% |

| S&P 500 Index | 1.38% | 15.13% | 12.57% | 7.31% | 10.10% |

| The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

10

FAM Value Fund — Portfolio Data (Unaudited)

December 31, 2015

| TOP TEN EQUITY HOLDINGS |

| (% of Total Investments) |

| Markel Corporation | 5.7% |

| Ross Stores, Inc. | 5.3% |

| Brown & Brown, Inc. | 4.7% |

| IDEX Corporation | 4.6% |

| White Mountains Insurance Group, Ltd. | 3.8% |

| CDW Corporation | 3.8% |

Brookfield Asset Management Inc. - Class A | 3.6% |

| MEDNAX, Inc. | 3.4% |

| Berkshire Hathaway Inc. - Class A | 3.4% |

| Illinois Tool Works Inc. | 3.3% |

| COMPOSITION OF TOTAL INVESTMENTS |

| Fire, Marine & Casualty Insurance | 13.9% |

| Money Market Fund | 7.5% |

| State Commercial Banks | 6.6% |

| Pumps & Pumping Equipment | 6.0% |

| Retail - Family Clothing Stores | 5.3% |

| Insurance Agents, Brokers & Service | 4.7% |

| Retail - Catalog & Mail-Order Houses | 3.8% |

| Operators of NonResidential Buildings | 3.6% |

| Services - Hospitals | 3.4% |

| General Industrial Machinery & Equip | 3.3% |

| Retail - Auto & Home Store | 3.2% |

| Retail - Auto Dealers | 3.1% |

| Services - Advertising Agencies | 2.9% |

| Retail - Eating Places | 2.5% |

| Crude Petroleum & Natural Gas | 2.5% |

| Security & Commodity Brokers, Dealers, Exchanges Services | 2.1% |

| Wholesale - Medical, Dental Hospital Equipment Supplies | 2.1% |

| Surgical & Medical Instruments Apparatus | 2.1% |

| Carpets & Rugs | 2.0% |

| Other | 19.4% |

Statement Regarding Availability of Quarterly Portfolio Schedule. Please note that (i) the Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q; (ii) the Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov; (iii) the Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330; and (iv) the Fund makes the information on Form N-Q available to shareholders, upon request, by calling FAM Funds at 1-800-932-3271.

11

FAM Value Fund — Statement of Investments

December 31, 2015

| | SHARES | VALUE |

| COMMON STOCKS (92.5%) |

| Books: Publishing or Publishing & Printing (1.0%) |

John Wiley & Sons, Inc. - Class A • publisher of print and electronic products, specializing in scientific, technical, professional and medical books and journals | 217,000 | $ 9,771,510 |

| Carpets & Rugs (2.0%) |

Mohawk Industries, Inc.* • produces floor covering products for residential and commercial applications | 103,100 | 19,526,109 |

| Crude Petroleum & Natural Gas (2.5%) |

EOG Resources, Inc. • engages in the exploration, development, production and marketing of natural gas and crude oil | 335,000 | 23,714,650 |

| Fire, Marine & Casualty Insurance (13.9%) |

Berkshire Hathaway Inc. – Class A* • holding company for various insurance and industrial companies | 269,700 | 10,356,480 |

Loews Corporation • operates primarily as a commercial property and casualty insurance company | 269,700 | 10,356,480 |

Markel Corporation* • sells specialty insurance products 61,850 54,635,197 |

White Mountain Insurance Group, Ltd. • personal property and casualty insurance, and reinsurance | 49,897 | 36,265,639 133,498,716 |

| General Industrial Machinery & Equipment (3.3%) |

Illinois Tool Works Inc. • manufactures engineered products such as plastic and metal components and fasteners | 339,950 | 31,506,566 |

| Industrial & Commercial Fans & Blowers & Air Purifing Equipment (1.9%) |

Donaldson Company, Inc. • designs, manufactures and sells filtration systems and replacement parts | 642,400 | 18,411,184 |

See Notes to Financial Statements

12

FAM Value Fund — Statement of Investments continued

| December 31, 2015 | SHARES | VALUE |

| Industrial Instruments For Measurement, Display, and Control (1.3%) |

Keysight Technologies, Inc.* • provides electronic measurement solutions to the communications and electronics industries in the United States and internationally | 433,000 | $ 12,266,890 |

| Insurance Agents, Brokers & Service (4.7%) |

Brown & Brown, Inc. • one of the largest independent general insurance agencies in the U.S. | 1,409,696 | 45,251,242 |

| Investment Advice (1.8%) |

Franklin Resources, Inc. • provides investment management and fund administration services as well as retail-banking and consumer lending services | 480,000 | 17,673,600 |

| Laboratory Analytical Instruments (1.8%) |

Waters Corporation* • designs, manufactures, sells and services analytical instruments used in a wide range of scientific research | 125,000 | 16,822,500 |

| Operators of NonResidential Buildings (3.6%) |

Brookfield Asset Management Inc. - Class A • asset management holding company that invests in property, power and infrastructure | 1,102,500 | 34,761,825 |

| Pumps & Pumping Equipment (6.0%) |

Graco Inc. • supplies systems and equipment for the management of fluids in industrial, commercial and vehicle lubrication applications | 180,550 | 13,012,239 |

IDEX Corporation • manufactures proprietary, highly engineered industrial products and pumps | 576,750 | 44,184,817 57,197,056 |

| Real Estate Investment Trusts (1.2%) |

Starwood Hotels & Resorts Worldwide, Inc. • operates as a hotel and leisure company | 161,000 | 11,154,080 |

| Retail - Auto & Home Stores (3.2%) |

AutoZone, Inc.* • retail and distribution of automotive replacement parts and accessories | 41,700 | 30,937,647 |

See Notes to Financial Statements

13

FAM Value Fund — Statement of Investments continued

| December 31, 2015 | SHARES | VALUE |

| Retail - Auto Dealers (3.1%) |

CarMax, Inc.* • specialty retailer of used cars and light-trucks in the USA | 550,000 | $ 29,683,500 |

| Retail - Catalog & Mail-Order Houses (3.8%) |

CDW Corporation • provides information technology (IT) solutions | 858,000 | 36,070,320 |

| Retail - Eating Places (2.5%) |

YUM! Brands, Inc. • quick service restaurants including KFC, Pizza Hut and Taco Bell | 330,600 | 24,150,330 |

| Retail - Family Clothing Stores (5.3%) |

Ross Stores, Inc. • chain of off-price retail apparel and home accessories stores | 939,688 | 50,564,611 |

| Retail - Shoe Stores (1.2%) |

DSW Inc. - Class A • operates as a branded footwear and accessories retailer | 495,000 | 11,810,700 |

| Operators of Non-Residential Buildings (1.4%) |

Forest City Enterprises, Inc. - Class A* • acquires, owns, develops, and manages commercial and residential real estate and land in the United States | 600,000 | 13,158,000 |

| Search, Detection, Navigation, Guidance, Aeronautical Systems (1.7%) |

FLIR Systems, Inc. • designs, manufactures, and markets thermal imaging systems worldwide | 564,728 | 15,851,915 |

| Security & Commodity Brokers, Dealers, Exchanges & Services (2.1%) |

T Rowe Price Group, Inc. • publicly owned asset managment holding company providing its services to individual and institutional investors, retirement plans, and financial intermediaries | 284,500 | 20,338,905 |

See Notes to Financial Statements

14

FAM Value Fund — Statement of Investments continued

December 31, 2015

| | SHARES | VALUE |

| Semiconductors & Related Devices (1.7%) |

Microchip Technology Incorporated • develops, manufactures and sells semiconductor products for various embedded control applications | 260,000 | $12,100,400 |

Xilinx, Inc. • worldwide leader of programmable logic solutions | 100,000 | 4,697,000 |

| 16,797,400 |

| Services - Advertising Agencies (2.9%) |

Interpublic Group of Companies, Inc. • provides advertising and marketing services | 1,182,700 | 27,533,256 |

| Services - Equipment Rental & Leasing (0.9%) |

McGrath RentCorp • modular building and electronic test equipment rentals, subsidiary classroom manufacturing | 347,000 | 8,740,930 |

| Services - Hospitals (3.4%) |

MEDNAX, Inc.* • health care services company focused on physician services for newborn, maternal-fetal and other pediatric subspecialty care | 451,400 | 32,347,324 |

| State Commercial Banks (6.6%) |

Bank of the Ozarks, Inc. • retail and commercial banking services in the Southeast | 506,000 | 25,026,760 |

M&T Bank Corporation • commercial and retail banking services to individuals, businesses, corporations and institutions in the Northeast and Mid-Atlantic | 174,000 | 21,085,320 |

South State Corporation • banking services to individual and corporate customers in the Carolinas | 234,110 | 16,844,215 |

| | | 62,956,295 |

| Surgical & Medical Instruments & Apparatus (2.1%) |

Stryker Corporation • operates a medical technology company offering Orthopedic Implants and MedSurg Equipment | 216,000 | 20,075,040 |

See Notes to Financial Statements

15

FAM Value Fund — Statement of Investments continued

December 31, 2015

| | SHARES | VALUE |

| Transportation of Freight & Cargo (1.7%) |

Forward Air Corporation • provides surface transportation and related logistics services to the deferred air freight market in North America | 389,233 | $ 16,740,911 |

| Trucking (No Local) (1.5%) |

Knight Transportation, Inc. • transportation of general commodities in the U.S. | 576,900 | 13,978,287 |

| Watches, Clocks, Clockwork Operated Devices/Parts (0.3%) |

Fossil Group, Inc.* • designs, develops, markets, and distributes consumer fashion accessories | 75,000 | 2,742,000 |

| Wholesale - Medical, Dental & Hospital Equipment & Supplies (2.1%) |

Patterson Companies, Inc. • operates as a distributor serving dental, companion-pet, veterinarian, and rehabilitation supply markets in the USA and Canada | 445,000 | 20,118,450 |

Total Common Stocks (Cost $377,342,140) | | $886,151,749 |

| TEMPORARY INVESTMENTS (7.5%) |

| Money Market Fund (7.5%) |

Invesco Short Term Treasury Fund (Institutional Class) ($0.02%)** | 71,555,901 | 71,555,901 |

| Total Temporary Investments (Cost $71,555,901) | | $ 71,555,901 |

| Total Investments (Cost $448,898,041) | | $957,707,650 |

* Non-income producing securities ** The rate shown represents the effective yield at 12/31/15 |

See Notes to Financial Statements

16

FAM Equity-Income Fund

December 31, 2015

Dear Fellow Equity-Income Fund Shareholder, Highlights

| · Holdings in the Fund increased their dividends more than 11%, on average, for the last 12 months. |

| · The 5-Year compounded annualized growth rate of the dividends for the Fund’s holdings was 11% as of 12/31/2015. |

The FAM Equity-Income Fund focuses on investing in companies that pay a growing dividend over time and each holding pays a dividend. We invest in businesses that are primarily in the mid-cap spectrum as they tend to grow faster than larger capitalization corporations. Our Investment Research Team strives to generate investment returns with lower volatility and less risk than the overall market by investing in financially solid enterprises with strong balance sheets that have little or no debt. In other words, we like to purchase shares in companies that allow our investors and us to sleep well at night.

Performance Detail

We are pleased with the performance of the FAM Equity-Income Fund in 2015 outperforming its benchmark, the Russell Midcap Index, by 171 basis points or 1.71%. The FAM Equity-Income Fund declined less than -1%. Mid- and small-cap indices posted negative returns for the year, while only large-cap stocks, as represented by the S&P 500 Index, eked out a modestly positive return for the year.

| Performance | 1 Year | 3 Year | 5 Year | 10 Years |

| FAM Equity-Income Fund | -0.73% | 11.59% | 10.50% | 5.53% |

| Russell Midcap Index | -2.44% | 14.18% | 11.44% | 8.00% |

| S&P 500 Index | 1.38% | 15.13% | 12.57% | 7.31% |

One of the major benefits to the FAM Equity-Income Fund’s performance in 2015 came from other companies buying ones held in the portfolio. We had two investments in the Fund which were bought for cash at considerable premiums. Altera Corporation agreed to be purchased by Intel, and Airgas, Inc. agreed to be purchased by Air Liquide. In addition, a number of holdings in the portfolio made acquisitions of other businesses that makes them more valuable to shareholders and should likely drive future earnings growth. Examples are: Flowers Foods, Inc. bought Dave’s Killer Bread; Patterson Companies, Inc. purchased Animal Health International; and Microchip Technology Incorporated bought Micrel Inc.

17

FAM Equity-Income Fund

Best Performers

The best performing company for the year, on a dollar-weighted basis, was Airgas, Inc. which increased the value of the portfolio by $2.53 million. The reason behind the strong stock performance was because Airgas agreed to be purchased by Air Liquide for a significant premium. This was a new position in the Fund in 2015 after we followed it for several years and waited for an attractive valuation to surface. We put our toe in the water during the middle part of the year, buying a few shares at a price that was a little higher than we would have liked with the intention of averaging down our cost if we got the chance. We were given this opportunity when the market sold-off in the early fall and aggressively added to the position at attractive prices. At the same time, a larger player in the industry also thought Airgas was trading at an attractive price and offered to buy the entire business for $143 per share in cash.

CDW Corporation was the second-best performing stock in the portfolio, contributing

$1.56 million to the value of the Fund. This is the second year in a row that CDW has been one of the best performing businesses in the Fund. CDW is a reseller of Information Tech- nology (IT) products and services. Management has done a nice job growing the enterprise faster than the overall IT market as well as expanding their profitability. For the first nine months of 2015, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) had grown more than 11%. In addition, management utilized cash flow to pay down their high-cost debt which was associated with the company going public again two years ago. CDW also made a well-targeted investment in a UK business that gives them a way to serve their international customers. CDW is doing so well that the board raised the dividend by 59% this year. Additionally, management is buying back stock. These actions are all characteristics we like to see in a corporation. We believe CDW has a long runway for growth because they continue to take share from smaller Value Added Resellers (VARs) and these VARs represent more than 50% of the market.

Flowers Foods, Inc. was the third-best performing company contributing $1.53 million to the value of the Fund. Flowers is one of the largest bread, bun, and snack cake businesses in the U.S. Their primary bread brands are Nature’s Own, Wonder, and Whitewheat. They also make snack cakes under the TastyKake and Mrs. Freshly’s brands. Flowers continued to make nice market share gains and augmented their growth with the recent acquisitions of Dave’s Killer Bread and Alpine Valley Bread Co. – this allowed Flowers to enter into the organic bread market. The organic bread market is attractive because it is the fastest growing segment in breads and management plans to take these brands nationwide. This should allow Flowers to grow earnings faster than the overall market. Separately, Flowers also benefitted from lower commodity input prices, such as wheat, as well as lower natural gas prices (used to power their ovens).

18

FAM Equity-Income Fund

Worst Performers

The worst performer, on a dollar-weighted basis, was DSW Inc. declining -$1.76 million. DSW is a retailer of shoes and accessories at prices that are significantly below department stores. The retail industry was hurt in 2015 by the mild weather during the fall and early winter months. Since temperatures were warmer than usual, DSW customers delayed buying winter boots and seasonal footwear. This negatively impacted same-store sales as well as margins and earnings. We think DSW is a well-run operation and offers consumers compelling bargains. The business is making it easier for customers to shop by giving them the capability to order shoes online and have them shipped to their homes or the nearest store. This helps mitigate the threat of Internet competitors. During the year, management increased the dividend by 6.4% and bought back shares at an attractive price during the third quarter. In 2015, DSW opened 38 new stores and we estimate that management may open a similar number in 2016. Over the next 12 months, we expect expenses related to IT initiatives to moderate which should help earnings growth. We added to the position in DSW as the price fell back into our buy range.

EOG Resources, Inc. was the second-worst performing investment in the Fund, detracting from the value by -$1.61 million. EOG is an Oil & Gas Exploration Company that is financially strong and well-run. The decline in the stock price was solely due to the decline in the price of oil. We still hold the position and believe that EOG is well-positioned for the future. The balance sheet is rock solid so there is little risk of the business not being able to pay their bills like many of their competitors. It is likely that they could be a consolidator in the industry when the dust settles which should be financially rewarding for shareholders over the long term. The one unknown is how long this process will take.

McGrath RentCorp was the third-worst performer with a loss of -$1.36 million. The stock traded down after reporting poor second quarter results and reducing the earnings outlook for the year. The shortfall was in the TRS Rentelco operation where test and measurement equipment used in deploying next generation communications networks was sluggish. This type of equipment is rented out at a high price so any drop-off negatively impacts earnings. The second area of weakness was in the Adler Tank business where rental rates for large fracking tanks have declined due to lower activity levels in the Exploration & Production Industry within the Energy Sector. On a positive note their largest operation, Modular Buildings, had a terrific year and is seeing nice growth in utilization. Despite the strength in this operation, it wasn’t enough to overcome the weakness in TRS Rentelco and Adler Tanks. The dividend was increased over the prior year, but only by a modest 2%. We did buy more shares after a large stock price decline because the valuation was exceptionally attractive. We felt we could earn a nice return on those shares even if McGrath was slow to recover from the current environment. Overall, we have this investment on a short leash as we have become a little more skeptical that it will be able to meet our return hurdles going forward.

19

FAM Equity-Income Fund

Portfolio Activity

Purchases

We purchased four new holdings in the portfolio in 2015: Airgas, Inc., Ingersoll-Rand, Joy Global Inc., and Macquarie Infrastructure Company.

Ingersoll-Rand is an industrial conglomerate which is best known for their air compressors. For several years the company has been in transition mode as they sold off a number of businesses that didn’t meet their goals for return on invested capital (ROIC). Ingersoll also spun off their security operation, Allegion PLC, to shareholders. Management wanted to focus more on the climate control business, which has attractive investment characteristics, so they purchased Trane Inc., one of the leading HVAC companies in the U.S. This fit in nicely with Thermo King, their transportation refrigeration operation. We expect cash flow to keep growing as they continue to buy back shares and grow the dividend.

We purchased a small position in Joy Global after the stock had fallen more than 60% from its 52-week high. In fact, at the time of our initial purchase the stock was down more than 80% from its all-time high set in 2011. Joy manufactures mining equipment used in above and below ground mining. This includes mining for coal, iron ore, gold, and copper. Since the price of these commodities are all down significantly, the demand for new mining equipment has dried up. The replacement parts business, however, is their crown jewel and is much more stable than new equipment. At the current price, we are only paying for the replacement parts operation and getting everything else for free. It’s also likely that Joy could get purchased by another company since they are the only quality pure play equipment manufacturer left after Caterpillar bought Bucyrus a number of years ago. We previously owned Joy in one of our other portfolios and our shareholders benefitted handsomely when the outlook was just as murky as it is today.

We initiated a position in Macquarie Infrastructure which owns, operates, and invests in a portfolio of infrastructure businesses consisting of services to private jet terminals at airports, bulk liquid terminalling, gas processing and distribution, and solar power generation facilities. The common thread to these enterprises is that they tend to have relatively inelastic demand characteristics and have long-term contracts with escalators. This allows assets to generate predictable and growing cash flow while not being exposed to commodity price risk. This cash flow is used to buy more assets if prices are attractive as well as pay dividends to shareholders. We believe the assets are conservatively financed unlike many of the infrastructure companies which have too much debt on the balance sheet.

20

FAM Equity-Income Fund

Sales

We sold Destination Maternity Corporation and Landauer, Inc. because the risk of loss was higher than any potential return in the future. Both of these investments were mistakes which resulted in a loss.

We sold all our shares in Physicians Realty Trust, Questar Corporation, The Western Union Company, and Winthrop Realty Trust because they reached our sell prices and we believed that all future expectations were already reflected in the stock prices. Each of these names made a substantial contribution to performance.

Two other names came out of the portfolio because they were being acquired: Altera Corporation and Sigma-Aldrich Corporation.

Dividend-Growth Strategy

There has been extensive research conducted on the benefits of investing in companies that pay dividends. In fact, Standard & Poors published an in-depth article in 2013, “Dividend Investing And A Look Inside The S&P Dow Jones Dividend Indices,” on how dividends contribute to investor returns. They concluded that over the 87-year period from 1926 to 2012, dividend income contributed approximately one-third to equity returns for the S&P 500 Index. We view these annual dividends as giving the investor a “head start” on investment returns. Every holding in the FAM Equity-Income Fund pays a dividend. We invest in a mix of high dividend-paying businesses as well as ones that are growing their dividend quickly. On average, the Fund’s holdings increased their dividends at more than an 11% annualized growth rate over the past five years (as of 12/31/15). This growth is broad-based across the portfolio. In fact, 70% of the companies represented in the Fund raised their dividend in the last 12 months. We favor investing in businesses that are growing their dividends swiftly because it means the underlying operation is expanding. It also means that they are generating more cash than needed to reinvest back into the company. These growing dividends contribute to stock price appreciation.

Outlook

We believe the majority of the Fund’s holdings could grow their cash flow in 2016. This in turn should increase the intrinsic values for these holdings. We are also confident that the holdings should continue growing their dividends paid to shareholders. In addition, the Fund is trading at a slight discount to intrinsic value. Taken together, future returns should be similar to the growth rate in earnings for the companies in the Fund.

We continue to invest in businesses that have a long runway for growth; however, we pay as much attention to the downside risk as we do upside potential. As always, we continue to work diligently on your behalf and appreciate your continued support.

21

FAM Equity-Income Fund

| Paul Hogan, CFA | Thomas O. Putnam |

| Co-Manager | Co-Manager |

The opinions expressed herein are those of the portfolio managers as of the date of the report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Performance data quoted above is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost.

22

FAM Equity-Income Fund - Performance Summary (Unaudited)

Annual Total Investment Returns:

| APRIL 1, 1996 TO DECEMBER 31, 2015 |

| | FAM EQUITY-INCOME FUND | RUSSELL MIDCAP INDEX | S&P 500 INDEX |

| FISCAL YEAR | TOTAL RETURN | TOTAL RETURN | TOTAL RETURN |

| 4/1/96-12/31/96 | 11.84% | 12.00% | 15.20% |

| 1997 | 26.90% | 29.01% | 33.35% |

| 1998 | 4.67% | 10.09% | 28.58% |

| 1999 | -6.98% | 18.23% | 21.04% |

| 2000 | 17.18% | 8.25% | -9.10% |

| 2001 | 20.79% | -5.62% | -11.88% |

| 2002 | -2.25% | -16.19% | -22.09% |

| 2003 | 20.30% | 40.06% | 28.67% |

| 2004 | 14.04% | 20.22% | 10.88% |

| 2005 | 5.75% | 12.65% | 4.91% |

| 2006 | 6.57% | 15.26% | 15.79% |

| 2007 | -3.64% | 5.60% | 5.49% |

| 2008 | -29.04% | -41.46% | -37.00% |

| 2009 | 21.43% | 40.48% | 26.46% |

| 2010 | 17.47% | 25.48% | 14.76% |

| 2011 | 6.79% | -1.55% | 2.11% |

| 2012 | 11.02% | 17.28% | 16.00% |

| 2013 | 29.79% | 34.76% | 32.44% |

| 2014 | 7.85% | 13.22% | 13.69% |

| 2015 | -0.73% | -2.44% | 1.38% |

23

FAM Equity-Income Fund - Performance Summary (Unaudited)

The chart below depicts the change in value of a $10,000 investment in the FAM Equity-Income Fund since inception on April 1, 1996, as compared with the growth of the Russell Midcap Index, the Fund’s primary benchmark index, and the Standard and Poor’s 500 Index, an additional comparative index, during the same period. The information assumes reinvestment of dividends and capital gain distributions. The Russell Midcap Index is an unmanaged index generally representative of the market for the stocks of mid-size U.S. companies. The Standard and Poor’s 500 Index is an unmanaged index generally representative of the market for the stocks of large size U.S. companies.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FAM EQUITY-INCOME FUND, THE RUSSELL MIDCAP INDEX AND THE S&P 500 INDEX

This information represents past performance of the FAM Equity-Income Fund and is not indicative of future results. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost.

| Average Annual Total Returns as of December 31, 2015 |

| | 1-Year | 3-Year | 5-Year | 10-Year | Life of Fund (4/1/96) |

| FAM Equity-Income Fund | -0.73% | 11.59% | 10.50% | 5.53% | 8.20% |

| Russell MidCap Index | -2.44% | 14.18% | 11.44% | 8.00% | 10.03% |

| S&P 500 Index | 1.38% | 15.13% | 12.57% | 7.31% | 7.92% |

| The graph and performance table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

24

FAM Equity-Income Fund — Portfolio Data (Unaudited)

December 31, 2015 TOP TEN EQUITY HOLDINGS |

| (% of Total Investments) |

| Ross Stores, Inc. | 7.2% |

| CDW Corporation | 6.1% |

| Stryker Corporation | 6.0% |

| Airgas, Inc. | 5.3% |

| Xilinx, Inc. | 4.9% |

| US Ecology, Inc. | 4.3% |

| Flowers Foods, Inc. | 4.1% |

| DSW Inc. | 4.0% |

| Aqua America, Inc. | 4.0% |

| Digital Realty Trust, Inc. | 3.9% |

| COMPOSITION OF TOTAL INVESTMENTS |

| Retail - Family Clothing | 8.4% |

| Semiconductors & Related Devices | 8.1% |

| Retail - Catalog & Mail-Order Houses | 6.1% |

| Surgical & Medical Instruments & App | 6.0% |

| Wholesale – Industrial Mach & Equip | 5.3% |

| Refuse Systems | 4.3% |

| Food and Kindred Products | 4.1% |

| State Commercial Banks | 4.0% |

| Retail - Shoe Stores | 4.0% |

| Water Supply | 4.0% |

| Real Estate Investment Trusts | 3.9% |

| Insurance Agents, Brokers & Service | 3.8% |

| Crude Petroleum & Natural Gas | 3.7% |

| Money Market Fund | 3.5% |

| Pumps & Pumping Equipment | 3.2% |

| Wholesale – Petroleum & Petro Prod | 3.2% |

| Fire, Marine & Casualty Insurance | 3.0% |

Wholesale – Medical, Dental & Hospital Equipment & Supplies | 2.9% |

| Plastics Products | 2.5% |

| Industrial & Commercial Fans & Blowers & Air Purifing Equipment | 2.4% |

| Services - Prepackaged Software | 2.4% |

| Services - Equip Rental & Leasing | 2.4% |

| Investment Advice | 2.2% |

| Other | 6.6% |

Statement Regarding Availability of Quarterly Portfolio Schedule. Please note that (i) the Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q; (ii) the Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov; (iii) the Fund’s Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC, and information on the operation of the Pub- lic Reference Room may be obtained by calling 1-800-SEC-0330; and (iv) the Fund makes the information on Form N-Q available to shareholders, upon request, by calling FAM Funds at 1-800-932-3271.

25

FAM Equity-Income Fund — Statement of Investments

December 31, 2015

| | SHARES | VALUE |

| COMMON STOCKS (96.5%) |

| Crude Petroleum & Natural Gas (3.7%) |

EOG Resources, Inc. • engages in the exploration, development, production and marketing of natural gas and crude oil | 78,000 | $5,521,620 |

| Dolls & Stuffed Toys (1.8%) |

Mattel, Inc. • designs, manufactures, and markets various toy products | 98,299 | 2,670,784 |

| Fire, Marine & Casualty Insurance (3.0%) |

OneBeacon Insurance Group, Ltd. • commercial, personal and specialty insurance products | 355,866 | 4,416,297 |

| Food and Kindred Products (4.1%) |

Flowers Foods, Inc. • produces and markets bakery products in the USA | 282,850 | 6,078,446 |

| General Industrial Machinery & Equipment (1.4%) |

Ingersoll-Rand • designs, manufactures, sells, and services a portfolio of industrial and commercial products | 38,000 | 2,101,020 |

| In Vitro & In Vivo Diagnostic Substances (1.1%) |

Meridian Bioscience, Inc. • life science company that manufactures, markets and distributes a broad range of innovative diagnostic test kits | 78,000 | 1,600,560 |

| Industrial & Commercial Fans & Blowers & Air Purifing Equipment (2.4%) |

Donaldson Company, Inc. • designs, manufactures and sells filtration systems and replacement parts | 125,600 | 3,599,696 |

| Insurance Agents, Brokers & Service (3.8%) |

Arthur J. Gallagher & Co. • provides insurance brokerage and risk management services to commercial, industrial, institutional, and governmental organizations | 137,920 | 5,646,445 |

| Investment Advice (2.2%) |

Franklin Resources, Inc. • provides investment management and fund administration services as well as retail-banking and consumer lending services | 89,900 | 3,310,118 |

See Notes to Financial Statements

26

FAM Equity-Income Fund — Statement of Investments continued

December 31, 2015

| | SHARES | VALUE |

| Mining Machinery & Equipment (1.0%) |

Joy Global Inc. • manufactures and services mining equipment | 118,000 | $ 1,487,980 |

| Miscellaneous Food Preparations & Kindred Products (1.3%) |

McCormick & Company • manufactures, markets and distributes spices, seasonings, specialty foods and flavorings to the entire food industry | 22,000 | 1,882,320 |

| Plastics Products (2.5%) |

Tupperware Brands Corporation • manufacture and sales of preparation, storage, and serving solutions for the kitchen and home | 66,000 | 3,672,900 |

| Pumps & Pumping Equipment (3.2%) |

IDEX Corporation • manufactures proprietary, highly engineered industrial products and pumps | 62,984 | 4,825,204 |

| Real Estate Invesment Trusts (3.9%) |

Digital Realty Trust, Inc. • engages in the ownership, acquisition, development, redevelopment and management of technology-related real estate | 77,000 | 5,822,740 |

| Refuse Systems (4.3%) |

US Ecology, Inc. • provides radioactive, pcb, hazardous and non-hazardous waste services to commercial and government customers | 176,569 | 6,434,174 |

| Retail - Catalog & Mail-Order Houses (6.1%) |

CDW Corporation • provides information technology (IT) solutions | 217,000 | 9,122,680 |

| Retail - Family Clothing Stores (8.4%) |

American Eagle Outfitters, Inc. • specialty retailer of clothing, accessories, and personal care products | 114,000 | 1,767,000 |

Ross Stores, Inc. • chain of off-price retail apparel and home accessories stores | 197,686 | 10,637,484 |

| 12,404,484 |

See Notes to Financial Statements

27

FAM Equity-Income Fund — Statement of Investments continued

December 31, 2015

| December 31, 2015 | SHARES | VALUE |

| Retail - Shoe Stores (4.0%) |

DSW Inc. • operates as a branded footwear and accessories retailer | 250,201 | $ 5,969,796 |

| Semiconductors & Related Devices (8.1%) |

Microchip Technology Incorporated • develops, manufactures and sells semiconductor products for various embedded control applications | 101,000 | 4,700,540 |

Xilinx, Inc. • worldwide leader of programmable logic solutions | 156,414 | 7,346,766 |

| 12,047,306 |

| Services - Equipment Rental & Leasing (2.4%) |

McGrath RentCorp • modular building and electronic test equipment rentals, subsidiary classroom manufacturing | 138,819 | 3,496,851 |

| Services - Prepackaged Software (2.4%) |

National Instruments • manufactures and supplies measurement and automation products | 122,000 | 3,500,180 |

| State Commercial Banks (4.0%) |

M&T Bank Corporation • commercial and retail banking services to individuals, businesses, corporations and other institutions in the Northeast and Mid-Atlantic | 15,000 | 1,817,700 |

South State Corporation • banking services to individual and corporate customers in the Carolinas | 58,000 | 4,173,100 |

| | | 5,990,800 |

| Surgical & Medical Instruments & Apparatus (6.0%) |

Stryker Corporation • operates a medical technology company offering Orthopedic Implants and MedSurg Equipment | 95,500 | 8,875,770 |

See Notes to Financial Statements

28

FAM Equity-Income Fund — Statement of Investments continued

| December 31, 2015 | SHARES | VALUE |

| Water Supply (4.0%) |

Aqua America, Inc. • water and waste water utility | 198,750 | $ 5,922,750 |

| Wholesale - Industrial Machinery & Equipment (5.3%) |

Airgas, Inc. • supplies industrial, medical, and specialty gases; and welding equip- ment and related products | 57,000 | 7,884,240 |

| Wholesale - Medical, Dental & Hospital Equipment & Supplies (2.9%) |

Patterson Companies, Inc. • operates as a distributor serving dental, companion-pet, veterinarian, and rehabilitation supply markets in the USA and Canada | 96,000 | 4,340,160 |

| Wholesale - Petroleum & Petroleum Products (No Bulk Stations) (3.2%) |

Macquarie Infrastructure Company • owns, operates, and invests in infrastructure businesses that provide services to businesses and individuals | 66,000 | 4,791,600 |

Total Common Stocks (Cost $91,023,404) | | $143,416,921 |

| TEMPORARY INVESTMENTS (3.5%) |

| Money Market Fund (3.5%) |

Invesco Short Term Treasury Fund (Institutional Class) ($0.02%)** | 5,166,147 | 5,166,147 |

| Total Temporary Investments (Cost $5,166,147) | | $ 5,166,147 |

| Total Investments (Cost $96,189,551) | | $148,583,068 |

* Non-income producing securities ** The rate shown represents the effective yield at 12/31/15 |

See Notes to Financial Statements

29

FAM Small Cap Fund

December 31, 2015

Dear Fellow Small Cap Fund Shareholder,

This past year was a challenge for many investors. Interest rates remained stubbornly low, most commodity prices collapsed, many emerging markets continued to slow, and “potholes” surfaced in several sectors of the equity markets. Prudence allowed us to miss many of these potholes completely and in other cases at least avoid their center. At FAM Funds, we do not invest by “looking through the rearview mirror” or look to what has been “working” to guide us in allocating capital. Rather, we stick to our time-tested process with a dual focus on both absolute returns and capital preservation.

While our “driving record” is not unblemished, and we are not satisfied with our absolute returns for the year, on a portfolio basis we avoided the large destruction of capital from which it is extremely difficult to recover. This is due to our continued focus on businesses with solid balance sheets, free cash flow generation, and quality management teams. Fur- thermore we estimate that, in aggregate, the intrinsic value (economic worth) of the Fund grew in 2015. We continue to believe that over the long term, stock prices follow intrinsic value.

Performance Detail

The FAM Small Cap Fund has outperformed its benchmark, the Russell 2000 Index (a collection of smaller companies), over the past 1 Year, 3 Year, and Since Inception time periods. Results versus the S&P 500 Index, an index of much larger businesses, are less impressive as larger company stocks have generally outperformed their smaller counterparts the past few years.

As of 12/31/2015 | 1 Year | 3 Year (annualized) | Since Inception 3/1/2012 (annualized) |

| FAM Small Cap Fund | -3.49% | 12.70% | 12.65% |

| Russell 2000 Index | -4.41% | 11.65% | 10.55% |

| S&P 500 Index | 1.38% | 15.13% | 13.29% |

Best Performers

The Fund’s best performer, on a dollar-weighted basis, was Fabrinet with a gain of $1.65 million for the 12 months ending December 31, 2015. Fabrinet is a contract manufacturer of sophisticated optoelectronics (electronic devices for emitting, modulating, transmitting, and sensing light). We purchased our first shares in 2012, after their primary factory suffered a tremendous flood and

30

FAM Small Cap Fund

then added more over the years when we felt the stock was attractively priced. We have done very well in this investment for shareholders, especially as the business rebounded. Fabrinet is in the process of constructing their new manufacturing campus. If plans go ahead to build three new buildings at this location, it has the potential to increase their current capacity by 150%.

The second-best performing stock was JBT Corporation with a gain of $727,004. JBT was originally purchased in 2012 when few investors seemed to follow the company and management’s execution was not as crisp as desired. Thankfully, JBT executed very well and both the earnings and stock price accelerated. However, the stock reached a valuation level where the logical response was to sell the position.

The third-best performing stock was Diamond Hill Investment Group, Inc. with a gain of $714,901. Diamond Hill is an investment manager, obviously a business we understand well. We purchased shares in the winter of 2014-2015. Our profits came from a combination of both rising profits and improved valuation metrics. As the bulk of their assets are weighted toward the equity markets, assets under management have grown quite significantly in recent years; as a result, so has cash flow.

Worst Performers

The worst performing stock, on a dollar-weighted basis, was Destination Maternity Corporation with a loss of -$1.47 million for the 12 months ending December 31, 2015. Owning this stock was a mistake and our failure to recognize earlier resulted in a loss for the Fund. Business results for Destination Maternity deteriorated greatly over the past couple of years and although we believe new CEO Tony Romano could turn the company around, we believe it is in shareholders’ best interests for us to reinvest the capital elsewhere. We strive to avoid mistakes, but unfortunately this will not be our last. We certainly learned from this, although regrettably this lesson came at a cost.

The second-worst performing stock was Houston Wire & Cable Company with a loss of

-$1.29 million. Unfortunately, the company has been in the crosshairs of not one, but two falling commodities: oil and copper. Houston Wire supplies specialty wire and cable pre- dominantly for America’s infrastructure projects. Over time, their exposure to oil-related infrastructure became a larger piece of their business, as it has for many industrial companies. With oil prices down dramatically, demand for wire and cable is off considerably. Furthermore, copper is a major input cost for Houston Wire and falling copper prices mean lower selling prices, so higher cost copper purchased earlier is sold at lower gross margins. While we think Houston Wire should do fine over time, we took advantage of the commodity downturn to upgrade the portfolio by selling most of our position in Houston Wire and investing in another business temporarily struggling with lower commodity prices – Franklin Electric Co., Inc. By year-end, we held a small position in Houston Wire as we established a position in Franklin Electric. We believe Franklin Electric, a maker of water

31

FAM Small Cap Fund

and fuel pumps for many applications including energy, should outperform Houston Wire over the long term, especially from our initial buy price.

The third-worst performing stock was Echo Global Logistics, Inc. with a loss of -$1.26 million. Echo has taken us on an inconsistent ride since our initial purchases in the fall of 2013. While they have done a great job growing the volume of truckload brokerage they handle, and thus the intrinsic value of the business, results are quite uneven. Over the past few years we have seen wonderful and disappointing quarters, usually due to vagaries like weather, often allowing us to trim or add to our position. The latest results were disap- pointing. However, we estimated that the stock was attractively priced and recently added to our position.

Portfolio Activity

In 2015 we added seven new holdings. These included: two high-performing southern banks, Stonegate Bank and National Commerce Corporation; the above mentioned Franklin Electric Co., Inc.; a specialty materials maker, Ferro Corporation; an owner of neighborhood shopping centers, Retail Opportunity Investments; and an owner of highend hotels, Ashford Hospitality Prime. Additionally, we added to several existing holdings. With each of these we believe we invested in a great business in solid financial shape and run by top-notch managers at a price that we estimate was below the true intrinsic value.

We also sold eight holdings completely. Five were winners that simply reached valuations where we felt selling was the only prudent decision. Examples include Physicians Realty Trust, an owner of medical office buildings and clinics and US Physical Therapy, Inc., an operator of physical therapy clinics. We sold out of JBT Corporation, part of our original portfolio. This was a good investment for the Fund as detailed above. The others positions we sold were mistakes, including the previously mentioned Destination Maternity Corporation and Rosetta Stone Inc.

One holding has the dubious honor of both being purchased and sold in the same calendar year. We purchased shares in Joy Global Inc., a maker of mining equipment, which is experiencing a major downturn due to soft demand from mine operators. During a previous mining down cycle, we purchased Joy shares in one of our other portfolios and eventually made a handsome return. The current fears over commodity prices and growth in China created what we thought was another opportunity to buy shares at a discount to our estimate of intrinsic value. However, we ultimately decided that the situation is more severe than we realized.

32

FAM Small Cap Fund

During the year we invested roughly $26 million, net of sales. However, a good amount of net inflows largely offset these efforts. At year-end our cash balance stood at 12.6%, a bit higher than we would like. We are poised to put this cash to good use and invest in quality businesses when their stock prices fall within our buy prices.

Outlook

We remain comfortable with our strategy of closely monitoring macro factors while still focusing our efforts on understanding a modest number of high-quality, smaller companies. After a year of relatively flat stock prices in aggregate, but a wide variation in per- formance of underlying industries and specific companies, we believe we are beginning to see more opportunities to deploy capital. Near-term results, both macroeconomic and stock market returns, remain completely unpredictable. However, we remain convinced that opportunistically purchasing shares in well-run, excellent enterprises should create value for shareholders over time.

New Institutional Shares Class

Effective as of January 1, 2016, the FAM Small Cap Fund Institutional Shares provides an opportunity to invest at a lower expense ratio in exchange for a higher minimum investment. The minimum investment for the newly launched share class is $1 million and the ticker symbol for the Institutional Shares is FAMDX.

A Message from Tom Putnam, Founder & Chairman

I would like to inform you of a management change that has occurred with your Fund. Marc Roberts, who was Co-Manager of the FAM Small Cap Fund and had been with us since he graduated from college eight years ago, left the firm as of December 31, 2015. When Marc first informed John Fox, our Chief Investment Officer, and me of his decision to pursue another opportunity, we of course were disappointed. Upon further reflection of Marc’s announcement, I realized that I made a similar decision when I was his age. I took a risk and opted for a new career path – the result of which was the creation of Fenimore Asset Management in 1974 – so I understand the choice he made. On behalf of the whole team, I wish Marc all the best. We enjoyed working with him and greatly appreciated his contributions to the Investment Research Team and firm.

As to the status of the FAM Small Cap Fund’s investment management, I can assure you that the transition has occurred very smoothly and will continue on the same path. I remain as a Co-Manager of the Fund and am pleased to announce that Andrew Boord has joined me as fellow Co-Manager.

Andrew has been with us for 11 of his 21 years in the Investment Industry and offers considerable small-cap and portfolio management experience. He is a firm Principal, has been the Portfolio Manager overseeing Fenimore Asset Management’s separately man- aged account portfolios (which

33

FAM Small Cap Fund

encompasses a small-cap strategy), and is well-versed in the area of fund management. Between running the separately managed account version of the strategy and contributing many of the Fund’s positions, Andrew is uniquely qualified to join me as Co-Manager.

Additionally, we have a strong, experienced Investment Research Team. We foster a collaborative investment process and all of our analysts contribute investment ideas and insights to our mutual fund managers. Our team is dedicated to the success of each of our funds and remains focused on the continued success of your FAM Small Cap Fund.

We search diligently for high-quality, bargain-priced opportunities on your behalf. Thank you for investing with us in the FAM Small Cap Fund.

| Andrew F. Boord | Thomas O. Putnam |

| Co-Manager | Co-Manager |