EXHIBIT 99.3

Investor Relations Supplemental Schedules

Investor Relations Supplemental Schedules

Summary

($ Millions)

| | | 1Q 2010 | | | 1Q 2009 |

| | | | | | |

| Reported Net Income | | $1,064 | | | $368 |

| EPS - Diluted | | $1.31 | | | $0.45 |

| | | | | | |

| Core Results | | $1,071 | | | $407 |

| EPS - Diluted | | $1.32 | | | $0.50 |

| | | | | | |

| Total Worldwide Sales Volumes (mboe/day) | | 726 | | | 713 |

| | | | | | |

| Total Worldwide Crude Oil Realizations ($/BBL) | | $71.88 | | | $39.29 |

| Domestic Natural Gas Realizations ($/MCF) | | $5.62 | | | $3.54 |

| | | | | | |

| Wtd. Average Basic Shares O/S (mm) | | 812.1 | | | 810.7 |

| Wtd. Average Diluted Shares O/S (mm) | | 813.5 | | | 813.3 |

| | | | | | |

| Shares Outstanding (mm) | | 812.2 | | | 810.6 |

| | | | | | |

| Cash Flow from Operations | $ | 2,200 | | $ | 800 |

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

2010 First Quarter

Net Income (Loss)

($ millions)

| | Reported | | | | | | | | | Core |

| | Income | | Significant Items Affecting Income | | Results |

| Oil & Gas | $ | 1,819 | | | | | | | | | | $ | 1,819 | |

| | | | | | | | | | | | | | | |

| Chemical | | 30 | | | | | | | | | | | 30 | |

| | | | | | | | | | | | | | | |

| Midstream, marketing and other | | 94 | | | | | | | | | | | 94 | |

| | | | | | | | | | | | | | | |

| Corporate | | | | | | | | | | | | | | |

| Interest expense, net | | (36 | ) | | | | | | | | | | (36 | ) |

| | | | | | | | | | | | | | | |

| Other | | (107 | ) | | | | | | | | | | (107 | ) |

| | | | | | | | | | | | | | | |

| Taxes | | (729 | ) | | | | | | | | | | (729 | ) |

| | | | | | | | | | | | | | | |

| Income from continuing operations | | 1,071 | | | | - | | | | | | | 1,071 | |

| Discontinued operations, net of tax | | (7 | ) | | | 7 | | | Discontinued operations, net | | | | - | |

| Net Income | $ | 1,064 | | | $ | 7 | | | | | | $ | 1,071 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Basic Earnings Per Common Share | | | | | | | | | | | | | | |

| Income from continuing operations | $ | 1.32 | | | | | | | | | | | | |

| Discontinued operations, net | | (0.01 | ) | | | | | | | | | | | |

| Net Income | $ | 1.31 | | | | | | | | | | $ | 1.32 | |

| | | | | | | | | | | | | | | |

| Diluted Earnings Per Common Share | | | | | | | | | | | | | | |

| Income from continuing operations | $ | 1.32 | | | | | | | | | | | | |

| Discontinued operations, net | | (0.01 | ) | | | | | | | | | | | |

| Net Income | $ | 1.31 | | | | | | | | | | $ | 1.32 | |

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

2009 First Quarter

Net Income (Loss)

($ millions)

| | Reported | | | | | | | | | | Core |

| | Income | | | Significant Items Affecting Income | | Results |

| Oil & Gas | $ | 545 | | | | 8 | | | Rig contract terminations | | | $ | 553 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Chemical | | 169 | | | | | | | | | | | 169 | |

| | | | | | | | | | | | | | | |

| Midstream, marketing and other | | 14 | | | | | | | | | | | 14 | |

| | | | | | | | | | | | | | | |

| Corporate | | | | | | | | | | | | | | |

| Interest expense, net | | (20 | ) | | | | | | | | | | (20 | ) |

| | | | | | | | | | | | | | | |

| Other | | (96 | ) | | | 32 | | | Severance | | | | (49 | ) |

| | | | | | | 15 | | | Railcar leases | | | | | |

| | | | | | | | | | | | | | | |

| Taxes | | (241 | ) | | | (19 | ) | | Tax effect of adjustments | | | | (260 | ) |

| | | | | | | | | | | | | | | |

| Income from continuing operations | | 371 | | | | 36 | | | | | | | 407 | |

| Discontinued operations, net of tax | | (3 | ) | | | 3 | | | Discontinued operations, net | | | | - | |

| Net Income | $ | 368 | | | $ | 39 | | | | | | $ | 407 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Basic Earnings Per Common Share | | | | | | | | | | | | | | |

| Income from continuing operations | $ | 0.45 | | | | | | | | | | | | |

| Discontinued operations, net | | - | | | | | | | | | | | | |

| Net Income | $ | 0.45 | | | | | | | | | | $ | 0.50 | |

| Diluted Earnings Per Common Share | | | | | | | | | | | | | | |

| Income from continuing operations | $ | 0.45 | | | | | | | | | | | | |

| Discontinued operations, net | | - | | | | | | | | | | | | |

| Net Income | $ | 0.45 | | | | | | | | | | $ | 0.50 | |

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

Items Affecting Comparability of Core Results Between Periods

The item(s) below are included in core results and are shown in this table

because they affect the comparability between periods.

| Pre-tax | | | | | | | | |

| Income / (Expense) | First Quarter | |

| | 2010 | | 2009 | |

| | | | | | | | | |

| Foreign Exchange Gains & (Losses) * | | (5 | ) | | | 37 | | |

| | | | | | | | | |

| *Amounts shown after-tax | | | | | | | | |

| | | | | | | | | |

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

Worldwide Effective Tax Rate

| | | QUARTERLY |

| | | 2010 | | 2009 | | 2009 |

| REPORTED INCOME | | QTR 1 | | QTR 4 | | QTR 1 |

| Oil & Gas | | | 1,819 | | | | 1,643 | | | | 545 | |

| Chemicals | | | 30 | | | | 33 | | | | 169 | |

| Midstream, marketing and other | | | 94 | | | | 81 | | | | 14 | |

| Corporate & other | | | (143 | ) | | | (141 | ) | | | (116 | ) |

| Pre-tax income | | | 1,800 | | | | 1,616 | | | | 612 | |

| | | | | | | | | | | | | |

| Income tax expense | | | | | | | | | | | | |

| Federal and state | | | 307 | | | | 338 | | | | 12 | |

| Foreign | | | 422 | | | | 335 | | | | 229 | |

| Total | | | 729 | | | | 673 | | | | 241 | |

| | | | | | | | | | | | | |

| Income from continuing operations | | | 1,071 | | | | 943 | | | | 371 | |

| | | | | | | | | | | | | |

| Worldwide effective tax rate | | | 41% | | | 42% | | | 39% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | 2010 | | 2009 | | 2009 |

| CORE RESULTS | | QTR 1 | | QTR 4 | | QTR 1 |

| Oil & Gas | | | 1,819 | | | | 1,813 | | | | 553 | |

| Chemicals | | | 30 | | | | 33 | | | | 169 | |

| Midstream, marketing and other | | | 94 | | | | 81 | | | | 14 | |

| Corporate & other | | | (143 | ) | | | (141 | ) | | | (69 | ) |

| Pre-tax income | | | 1,800 | | | | 1,786 | | | | 667 | |

| | | | | | | | | | | | | |

| Income tax expense | | | | | | | | | | | | |

| Federal and state | | | 307 | | | | 338 | | | | 31 | |

| Foreign | | | 422 | | | | 390 | | | | 229 | |

| Total | | | 729 | | | | 728 | | | | 260 | |

| | | | | | | | | | | | | |

| Core results | | | 1,071 | | | | 1,058 | | | | 407 | |

| | | | | | | | | | | | | |

| Worldwide effective tax rate | | | 41% | | | 41% | | | 39% |

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

2010 First Quarter Net Income (Loss)

Reported Income Comparison

| | | First | | Fourth | | | | |

| | | Quarter | | Quarter | | | | |

| | | 2010 | | 2009 | | B / (W) |

| Oil & Gas | | $ | 1,819 | | | $ | 1,643 | | | $ | 176 | |

| Chemical | | | 30 | | | | 33 | | | | (3 | ) |

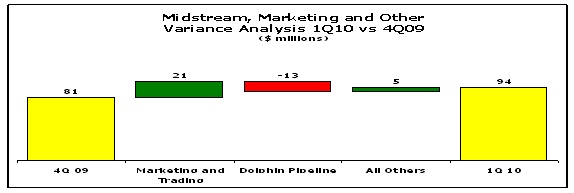

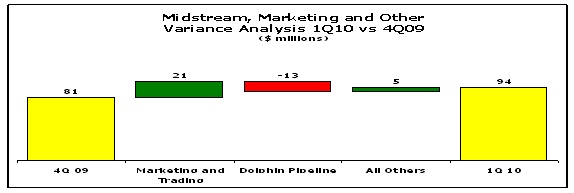

| Midstream, marketing and other | | | 94 | | | | 81 | | | | 13 | |

| Corporate | | | | | | | | | | | | |

| Interest expense, net | | | (36 | ) | | | (33 | ) | | | (3 | ) |

| Other | | | (107 | ) | | | (108 | ) | | | 1 | |

| Taxes | | | (729 | ) | | | (673 | ) | | | (56 | ) |

| Income from continuing operations | | | 1,071 | | | | 943 | | | | 128 | |

| Discontinued operations, net | | | (7 | ) | | | (5 | ) | | | (2 | ) |

| Net Income | | $ | 1,064 | | | $ | 938 | | | $ | 126 | |

| | | | | | | | | | | | | |

| Earnings Per Common Share | | | | | | | | | | | | |

| Basic | | $ | 1.31 | | | $ | 1.15 | | | $ | 0.16 | |

| Diluted | | $ | 1.31 | | | $ | 1.15 | | | $ | 0.16 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Worldwide Effective Tax Rate | | | 41% | | | 42% | | | 1% |

OCCIDENTAL PETROLEUM

2010 First Quarter Net Income (Loss)

Core Results Comparison

| | | First | | Fourth | | | | |

| | | Quarter | | Quarter | | | | |

| | | 2010 | | 2009 | | B / (W) |

| Oil & Gas | | $ | 1,819 | | | $ | 1,813 | | | $ | 6 | |

| Chemical | | | 30 | | | | 33 | | | | (3 | ) |

| Midstream, marketing and other | | | 94 | | | | 81 | | | | 13 | |

| Corporate | | | | | | | | | | | | |

| Interest expense, net | | | (36 | ) | | | (33 | ) | | | (3 | ) |

| Other | | | (107 | ) | | | (108 | ) | | | 1 | |

| Taxes | | | (729 | ) | | | (728 | ) | | | (1 | ) |

| Core Results | | $ | 1,071 | | | $ | 1,058 | | | $ | 13 | |

| | | | | | | | | | | | | |

| Core Results Per Common Share | | | | | | | | | | | | |

| Basic | | $ | 1.32 | | | $ | 1.30 | | | $ | 0.02 | |

| Diluted | | $ | 1.32 | | | $ | 1.30 | | | $ | 0.02 | |

| | | | | | | | | | | | | |

| Worldwide Effective Tax Rate | | | 41% | | | 41% | | | 0% |

Investor Relations Supplemental Schedules

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

2010 First Quarter Net Income (Loss)

Reported Income Comparison

| | | First | | First | | | | |

| | | Quarter | | Quarter | | | | |

| | | 2010 | | 2009 | | B / (W) |

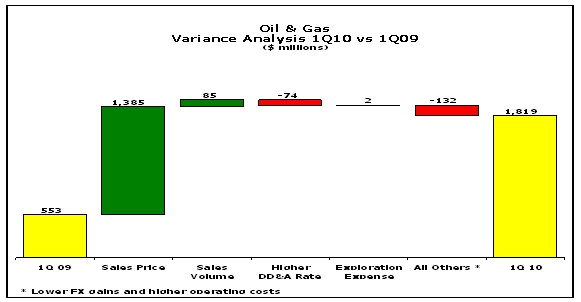

| Oil & Gas | | $ | 1,819 | | | $ | 545 | | | $ | 1,274 | |

| Chemical | | | 30 | | | | 169 | | | | (139 | ) |

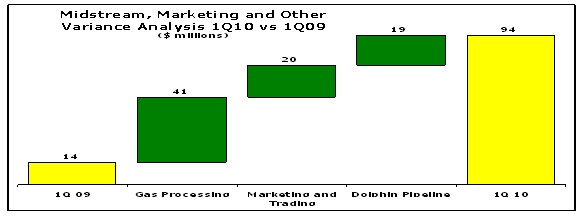

| Midstream, marketing and other | | | 94 | | | | 14 | | | | 80 | |

| Corporate | | | | | | | | | | | | |

| Interest expense, net | | | (36 | ) | | | (20 | ) | | | (16 | ) |

| Other | | | (107 | ) | | | (96 | ) | | | (11 | ) |

| Taxes | | | (729 | ) | | | (241 | ) | | | (488 | ) |

| Income from continuing operations | | | 1,071 | | | | 371 | | | | 700 | |

| Discontinued operations, net | | | (7 | ) | | | (3 | ) | | | (4 | ) |

| Net Income | | $ | 1,064 | | | $ | 368 | | | $ | 696 | |

| | | | | | | | | | | | | |

| Earnings Per Common Share | | | | | | | | | | | | |

| Basic | | $ | 1.31 | | | $ | 0.45 | | | $ | 0.86 | |

| Diluted | | $ | 1.31 | | | $ | 0.45 | | | $ | 0.86 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Worldwide Effective Tax Rate | | | 41% | | | 39% | | | -2% |

OCCIDENTAL PETROLEUM

2010 First Quarter Net Income (Loss)

Core Results Comparison

| | | First | | First | | | | |

| | | Quarter | | Quarter | | | | |

| | | 2010 | | 2009 | | B / (W) |

| Oil & Gas | | $ | 1,819 | | | $ | 553 | | | $ | 1,266 | |

| Chemical | | | 30 | | | | 169 | | | | (139 | ) |

| Midstream, marketing and other | | | 94 | | | | 14 | | | | 80 | |

| Corporate | | | | | | | | | | | | |

| Interest expense, net | | | (36 | ) | | | (20 | ) | | | (16 | ) |

| Other | | | (107 | ) | | | (49 | ) | | | (58 | ) |

| Taxes | | | (729 | ) | | | (260 | ) | | | (469 | ) |

| Core Results | | $ | 1,071 | | | $ | 407 | | | $ | 664 | |

| | | | | | | | | | | | | |

| Core Results Per Common Share | | | | | | | | | | | | |

| Basic | | $ | 1.32 | | | $ | 0.50 | | | $ | 0.82 | |

| Diluted | | $ | 1.32 | | | $ | 0.50 | | | $ | 0.82 | |

| | | | | | | | | | | | | |

| Worldwide Effective Tax Rate | | | 41% | | | 39% | | | -2% |

Investor Relations Supplemental Schedules

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

SUMMARY OF OPERATING STATISTICS

| | | First Quarter |

| | | 2010 | | 2009 |

| NET SALES VOLUMES PER DAY: | | | | | | |

| United States | | | | | | |

| Crude Oil and Liquids (MBBL) | | | | | | |

| California | | 94 | | | 97 | |

| Permian | | 160 | | | 166 | |

| Midcontinent Gas | | 17 | | | 13 | |

| Total | | 271 | | | 276 | |

| Natural Gas (MMCF) | | | | | | |

| California | | 295 | | | 216 | |

| Permian | | 125 | | | 124 | |

| Midcontinent Gas | | 255 | | | 280 | |

| Total | | 675 | | | 620 | |

| Latin America | | | | | | |

| Crude Oil (MBBL) | | | | | | |

| Argentina | | 36 | | | 45 | |

| Colombia | | 33 | | | 41 | |

| Total | | 69 | | | 86 | |

| Natural Gas (MMCF) | | | | | | |

| Argentina | | 31 | | | 33 | |

| Bolivia | | 12 | | | 15 | |

| Total | | 43 | | | 48 | |

| Middle East / North Africa | | | | | | |

| Crude Oil and Liquids (MBBL) | | | | | | |

| Bahrain | | 2 | | | - | |

| Dolphin | | 23 | | | 23 | |

| Libya | | 4 | | | 6 | |

| Oman | | 56 | | | 46 | |

| Qatar | | 74 | | | 75 | |

| Yemen | | 33 | | | 42 | |

| Total | | 192 | | | 192 | |

| Natural Gas (MMCF) | | | | | | |

| Bahrain | | 166 | | | - | |

| Dolphin | | 228 | | | 233 | |

| Oman | | 52 | | | 53 | |

| Total | | 446 | | | 286 | |

| | | | | | | |

| Barrels of Oil Equivalent (MBOE) | | 726 | | | 713 | |

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

SUMMARY OF OPERATING STATISTICS

| | | First Quarter |

| | | 2010 | | 2009 |

| NET PRODUCTION PER DAY: | | | | | | |

| United States | | | | | | |

| Crude Oil and Liquids (MBBL) | | 271 | | | 276 | |

| Natural Gas (MMCF) | | 675 | | | 620 | |

| | | | | | | |

| Latin America | | | | | | |

Crude Oil (MBBL) | | | | | | |

| Argentina | | 37 | | | 39 | |

| Colombia | | 34 | | | 42 | |

| Total | | 71 | | | 81 | |

| | | | | | | |

Natural Gas (MMCF) | | 43 | | | 48 | |

| | | | | | | |

| Middle East / North Africa | | | | | | |

Crude Oil and Liquids (MBBL) | | | | | | |

| Bahrain | | 3 | | | - | |

| Dolphin | | 23 | | | 24 | |

| Libya | | 14 | | | 9 | |

| Oman | | 57 | | | 45 | |

| Qatar | | 75 | | | 79 | |

| Yemen | | 35 | | | 38 | |

| Total | | 207 | | | 195 | |

| | | | | | | |

Natural Gas (MMCF) | | 446 | | | 286 | |

| | | | | | | |

| Barrels of Oil Equivalent (MBOE) | | 743 | | | 711 | |

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

SUMMARY OF OPERATING STATISTICS

| | | First Quarter |

| | | 2010 | | 2009 |

| | | | | | | |

| OIL & GAS: | | | | | | |

| PRICES | | | | | | |

| United States | | | | | | |

| Crude Oil ($/BBL) | | 73.08 | | | 37.66 | |

| Natural gas ($/MCF) | | 5.62 | | | 3.54 | |

| | | | | | | |

| Latin America | | | | | | |

| Crude Oil ($/BBL) | | 61.00 | | | 39.59 | |

| Natural Gas ($/MCF) | | 3.34 | | | 3.50 | |

| | | | | | | |

| Middle East / North Africa | | | | | | |

| Crude Oil ($/BBL) | | 74.96 | | | 41.55 | |

| | | | | | | |

| Total Worldwide | | | | | | |

| Crude Oil ($/BBL) | | 71.88 | | | 39.29 | |

| Natural Gas ($/MCF) | | 3.69 | | | 2.90 | |

| | | First Quarter |

| | | 2010 | | 2009 |

| Exploration Expense | | | | | | | | |

| United States | | $ | 30 | | | $ | 27 | |

| Latin America | | | 1 | | | | 2 | |

| Middle East / North Africa | | | 25 | | | | 29 | |

| TOTAL REPORTED | | $ | 56 | | | $ | 58 | |

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

SUMMARY OF OPERATING STATISTICS

| | | First Quarter |

| Capital Expenditures ($MM) | | 2010 | | 2009 |

| Oil & Gas | | | | | | | | |

| California | | $ | 149 | | | $ | 156 | |

| Permian | | | 73 | | | | 189 | |

| Midcontinent Gas | | | 37 | | | | 56 | |

| Latin America | | | 103 | | | | 190 | |

| Middle East / North Africa | | | 263 | | | | 272 | |

| Exploration | | | 57 | | | | 48 | |

| Chemicals | | | 30 | | | | 31 | |

| Midstream, marketing and other | | | 124 | | | | 122 | |

| Corporate | | | 12 | | | | 7 | |

| TOTAL | | $ | 848 | | | $ | 1,071 | |

| Depreciation, Depletion & | | First Quarter |

| Amortization of Assets ($MM) | | 2010 | | 2009 |

| Oil & Gas | | | | | | | | |

| Domestic | | $ | 351 | | | $ | 311 | |

| Latin America | | | 142 | | | | 168 | |

| Middle East / North Africa | | | 259 | | | | 208 | |

| Chemicals | | | 80 | | | | 71 | |

| Midstream, marketing and other | | | 37 | | | | 23 | |

| Corporate | | | 5 | | | | 5 | |

| TOTAL | | $ | 874 | | | $ | 786 | |

Investor Relations Supplemental Schedules

OCCIDENTAL PETROLEUM

CORPORATE

($ millions)

| | | 31-Mar-10 | | 31-Dec-09 |

| | | | | | | | | | | | | |

| CAPITALIZATION | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Long-Term Debt (including current maturities) | | | $ | 2,569 | | | | | $ | 2,796 | | |

| | | | | | | | | | | | | |

| Others | | | | 25 | | | | | | 25 | | |

| | | | | | | | | | | | | |

| Total Debt | | | $ | 2,594 | | | | | $ | 2,821 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| EQUITY | | | $ | 30,037 | | | | | $ | 29,159 | | |

| | | | | | | | | | | | | |

| Total Debt To Total Capitalization | | | | 8% | | | | | 9% | |

Investor Relations Supplemental Schedules

| | | OCCIDENTAL PETROLEUM | |

| | | SUMMARY OF OPERATING STATISTICS | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

| SALES VOLUMES PER DAY: | | | | | | | | | | | | | | | |

| United States | | | | | | | | | | | | | | | |

| Crude Oil and Liquids (MBBL) | | | | | | | | | | | | | | | |

| California | | 76 | | | 86 | | | 89 | | | 89 | | | 93 | |

| Permian | | 158 | | | 161 | | | 163 | | | 164 | | | 164 | |

| Midcontinent Gas | | 6 | | | 9 | | | 8 | | | 10 | | | 14 | |

| Total | | 240 | | | 256 | | | 260 | | | 263 | | | 271 | |

| Natural Gas (MMCF) | | | | | | | | | | | | | | | |

| California | | 242 | | | 256 | | | 254 | | | 235 | | | 250 | |

| Permian | | 111 | | | 117 | | | 112 | | | 116 | | | 125 | |

| Midcontinent Gas | | 192 | | | 215 | | | 227 | | | 236 | | | 260 | |

| Total | | 545 | | | 588 | | | 593 | | | 587 | | | 635 | |

| Latin America | | | | | | | | | | | | | | | |

| Crude Oil (MBBL) | | | | | | | | | | | | | | | |

| Argentina | | - | | | 33 | | | 32 | | | 32 | | | 37 | |

| Colombia | | 32 | | | 33 | | | 37 | | | 37 | | | 39 | |

| Total | | 32 | | | 66 | | | 69 | | | 69 | | | 76 | |

| Natural Gas (MMCF) | | | | | | | | | | | | | | | |

| Argentina | | - | | | 17 | | | 22 | | | 21 | | | 30 | |

| Bolivia | | - | | | 17 | | | 18 | | | 21 | | | 16 | |

| Total | | - | | | 34 | | | 40 | | | 42 | | | 46 | |

| Middle East / North Africa | | | | | | | | | | | | | | | |

| Crude Oil and Liquids (MBBL) | | | | | | | | | | | | | | | |

| Oman | | 27 | | | 28 | | | 31 | | | 34 | | | 50 | |

| Dolphin | | - | | | - | | | 5 | | | 26 | | | 25 | |

| Qatar | | 71 | | | 73 | | | 81 | | | 80 | | | 79 | |

| Yemen | | 39 | | | 40 | | | 37 | | | 32 | | | 35 | |

| Libya | | 8 | | | 23 | | | 22 | | | 19 | | | 12 | |

| Bahrain | | - | | | - | | | - | | | - | | | - | |

| Total | | 145 | | | 164 | | | 176 | | | 191 | | | 201 | |

| Natural Gas (MMCF) | | | | | | | | | | | | | | | |

| Oman | | 70 | | | 67 | | | 67 | | | 53 | | | 49 | |

| Dolphin | | - | | | - | | | 67 | | | 231 | | | 257 | |

| Bahrain | | - | | | - | | | - | | | - | | | 10 | |

| Total | | 70 | | | 67 | | | 134 | | | 284 | | | 316 | |

| | | | | | | | | | | | | | | | |

| Barrels of Oil Equivalent (MBOE) | | 519 | | | 601 | | | 633 | | | 675 | | | 714 | |

*This schedule reflects what production volumes would have been for the prior 5 years if all production had been

represented on a pre-tax basis and Permian gas properties as part of Midcontinent Gas

Investor Relations Supplemental Schedules

| | OCCIDENTAL PETROLEUM | |

| | SUMMARY OF OPERATING STATISTICS | |

| | | | | | | | | | | |

| | | 2009 |

| | | Qtr 1 | | Qtr 2 | | Qtr 3 | | Qtr 4 | | Total |

| SALES VOLUMES PER DAY: | | | | | | | | | | | | | | | |

| United States | | | | | | | | | | | | | | | |

| Crude Oil and Liquids (MBBL) | | | | | | | | | | | | | | | |

| California | | 97 | | | 90 | | | 92 | | | 92 | | | 93 | |

| Permian | | 166 | | | 163 | | | 162 | | | 164 | | | 164 | |

| Midcontinent Gas | | 13 | | | 14 | | | 15 | | | 15 | | | 14 | |

| Total | | 276 | | | 267 | | | 269 | | | 271 | | | 271 | |

| Natural Gas (MMCF) | | | | | | | | | | | | | | | |

| California | | 216 | | | 232 | | | 269 | | | 282 | | | 250 | |

| Permian | | 124 | | | 124 | | | 133 | | | 122 | | | 125 | |

| Midcontinent Gas | | 280 | | | 265 | | | 251 | | | 241 | | | 260 | |

| Total | | 620 | | | 621 | | | 653 | | | 645 | | | 635 | |

| Latin America | | | | | | | | | | | | | | | |

| Crude Oil (MBBL) | | | | | | | | | | | | | | | |

| Argentina | | 45 | | | 37 | | | 30 | | | 37 | | | 37 | |

| Colombia | | 41 | | | 42 | | | 39 | | | 36 | | | 39 | |

| Total | | 86 | | | 79 | | | 69 | | | 73 | | | 76 | |

| Natural Gas (MMCF) | | | | | | | | | | | | | | | |

| Argentina | | 33 | | | 30 | | | 27 | | | 30 | | | 30 | |

| Bolivia | | 15 | | | 19 | | | 18 | | | 12 | | | 16 | |

| Total | | 48 | | | 49 | | | 45 | | | 42 | | | 46 | |

| Middle East/North Africa | | | | | | | | | | | | | | | |

| Crude Oil and Liquids (MBBL) | | | | | | | | | | | | | | | |

| Oman | | 46 | | | 49 | | | 50 | | | 54 | | | 50 | |

| Dolphin | | 23 | | | 29 | | | 26 | | | 26 | | | 25 | |

| Qatar | | 75 | | | 82 | | | 77 | | | 80 | | | 79 | |

| Yemen | | 42 | | | 32 | | | 34 | | | 32 | | | 35 | |

| Libya | | 6 | | | 14 | | | 9 | | | 15 | | | 12 | |

| Bahrain | | - | | | - | | | - | | | 1 | | | - | |

| Total | | 192 | | | 206 | | | 196 | | | 208 | | | 201 | |

| Natural Gas (MMCF) | | | | | | | | | | | | | | | |

| Oman | | 53 | | | 50 | | | 48 | | | 42 | | | 49 | |

| Dolphin | | 233 | | | 282 | | | 258 | | | 256 | | | 257 | |

| Bahrain | | - | | | - | | | - | | | 40 | | | 10 | |

| Total | | 286 | | | 332 | | | 306 | | | 338 | | | 316 | |

| | | | | | | | | | | | | | | | |

| Barrels of Oil Equivalent (MBOE) | | 713 | | | 719 | | | 702 | | | 722 | | | 714 | |

*This schedule reflects what production volumes would have been for the 4 quarters of 2009 if all production had been

represented on a pre-tax basis and Permian gas properties as part of Midcontinent Gas

16